As filed with the U.S. Securities and Exchange Commission on [date]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10401

Trust for Professional Managers

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jay S. Fitton

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(513) 629-8104

Registrant’s telephone number, including area code

Date of fiscal year end: December 31, 2021

Date of reporting period: December 31, 2021

Item 1. Reports to Stockholders.

Marketfield Fund

Annual Report

December 31, 2021

Investment Adviser

Marketfield Asset Management LLC

369 Lexington Avenue

3rd Floor

New York, New York 10017

www.marketfield.com

Table of Contents

Marketfield Fund Annual Report 2021

Chairman’s Report

Class I shares of Marketfield Fund generated a return of 8.58% for the fiscal year ended December 31, 2021, compared to a total return of 28.71% for the S&P 500 (SPX) Index. Although happy to be in comfortable positive territory for 2021, we are disappointed that our relative return has lagged a passive index allocation to this degree, particularly since our actual economic thesis of strong cyclical growth and surging inflation has proved to be quite accurate over the last 12 months.

As far as the 4th quarter is concerned, most of our long side allocations performed quite strongly. Japan was the only significant allocation to fail to do so, with the very weak Japanese Yen (JPY) wiping out gains in local terms and leading to a flat performance. We reduced our exposure to unhedged Japanese equities toward the end of the quarter, but still believe that the high cyclical weights of this market should help it make further progress in 2022. Sector performance was led by Industrials (Transportation, Machinery and Conglomerates), Energy and Consumer Discretionary (Homebuilding). We continued to add to Industrials and Energy holdings over the course of the quarter, but reduced homebuilding, selling an underperforming builder in mid-quarter.

Short allocations rose somewhat less than the overall market, but were still a drag on performance. Toward the end of the quarter there were increasing signs that the high multiple Software sector was at risk of breaking down, but the majority of the recent decline in this sector did not happen until the year had been completed.

Looking at 2021 overall, the problem that we encountered was a long period of dislocation between economic data and corporate news in the cyclical portions of the global equity market. The year started off very strongly, and also closed quite nicely, but there was a sharp mid-year drawdown for the majority of our long sided exposure, which was followed by a long, dreary consolidation for many of our holdings. Very few of our positions gave us pause for concern in absolute terms, either in terms of corporate news or actual market performance, but they clearly failed to benefit from the strong allocations made to the market leading growth sectors that dominated global performance during the second half of 2021.

This performance reflected the consensus view that the very strong performance of the durable goods economy would start to ebb as spending on consumer services started to recover, and also that the inflationary pressures of early 2021 would prove to be “transitory”. This encouraged the belief that interest rates would stay lower for longer, and that the very high valuations of growth equities could be supported. As new investor allocations continued to take growth multiples higher, the relative performance gap opened up further and encouraged yet more new capital to follow this path. This resulted in a very frustrating period for holders of cyclical portfolios such as ourselves, with most of our positions consolidating over the second half of the year.

With 2021 now complete, it is clear that both assumptions have proved to be flawed, although it will require the release of Q4 2021 earnings to really hammer home how strongly cyclical demand for goods has been in recent months. The fears that logistical constraints would restrict sales or that costs would depress margins acted to dampen investor enthusiasm, but both risks look to have been exaggerated. Meanwhile, inflation has gone from being a problem that most assumed would “fix itself” to becoming a key influence on the Federal Reserve tearing up its dovish forward guidance right at the end of 2021.

This has created a significant vulnerability for highly valued growth equities, as the very early performance in 2022 has demonstrated. We believe that the story of the upcoming months will be a protracted struggle between the Federal Reserve and the inflationary forces that they have allowed to build up in recent quarters. It seems much more likely that their efforts will disrupt the progress of the growth equity bull market than they create an effective reversal of the inflationary impulse.

1

The portfolio also suffered to some degree from its non-U.S. dollar (USD) exposure. Markets such as the United Kingdom and Australia performed quite well in local currency terms, but currency losses trimmed this effect in USD returns. Again, this reflects the strong preference for global allocations towards growth (which is dominated by USD listed stocks) over cyclical exposure. We do not believe that the USD will continue to make strong gains against its G7 peers, and may actually lose ground if the market loses confidence in the ability of the Federal Reserve to close the gap between policy yields and inflation. It remains unclear whether yields, currencies or equities will see the greatest revaluation effect from a lengthy period of high inflation, and we therefore are willing to spread our bets out quite widely at the current time, and we remain patient with our non-U.S. allocations.

January 14, 2022

Michael Shaoul

Chairman, CEO & Portfolio Manager

2

Chief Investment Officer’s Report

CRYPTONIGHT

Every credit cycle and the asset deflations that follow are similar in form but distinct in content. The specifics of each episode are without direct precedent, allowing them to escape the scrutiny of modern risk management and macroeconomic models. Policy response is inevitably late and only assumes some measure of urgency once a full-blown emergency is at hand.

The only reliable indicia of coming calamity are mostly qualitative. They point more to the usual psychological antecedents of crisis rather than any quantitative danger signs. The latter normally fall into the vague category of “wow, that is a really big number” or “I’ve never seen anything like it.” The quantitative extremes of cresting credit cycles overtax the human imagination, inducing the sort of numbness that precludes much reasoned response.

Not many observers knew what to make of the fact that in 1989, the garden of the Emperor’s Palace in central Tokyo was presumably worth more than all of the land in the California. People confronted with this proposition were mostly in the “wow” camp, and continued ordering workers’ uniforms and commissioning writers to come up with a company song in the mold of the great Japanese enterprises. The Nikkei Index crested at 40,000, and 32 years on we have only 10,000 points left to return to that level.

Real manias have important features in common. All are built around truly outstanding cores, without which a broad, convincing thesis could not arise. Japan was and remains an excellent industrial and technological venue. The much-touted potential of the Internet proposed in 1999 and 2000 was probably not optimistic enough. Tulips are actually beautiful.

A backdrop of excess liquidity and credit availability allows ordinary speculative forays to metastasize. A telltale sign is the development of secondary and tertiary derivatives of lesser quality where different but related markets begin to reflect the enthusiasm of the core narrative.

Oil’s bull market in the 1970s gave rise to a housing mania in the oil belt, the development of the Denver Stock Exchange, the growth of commodity based hedge funds that formed the basis of the modern hedge fund industry and a decade long rotation from consumer growth stocks (the Nifty Fifty) into anything vaguely related to the industrial processes involved in finding, producing and distributing oil and gas. The whole episode ended in tears as Paul Volker’s team continued tightening until rates reached 20% on the short end and 16% on the 10 year bond. The climactic sequence was the rise and fall of the Hunt Brothers who, in 1980, had the means (on paper) to buy 40% of all of the long-term bonds issued by the U.S. Treasury. Instead, they bought more silver to add to their leveraged energy bets in the true style of the Texas hedge.

Credit fueled manias persist until the supply and cost of additional monetary leverage becomes insufficient to hold up the gigantic corpus of inflated assets. It is not possible to predict the point at which monetary abundance transitions to scarcity other than by observing the constellation of effects that always mark a dying credit cycle.

The tendency among central banks is to tighten until something breaks, and then back off. This sequence usually plays out in several acts.

A first foray into tightening usually spurs some final liquidation of the deflating remnants of a previous boom. The rise in rates during early 1984 led to the final liquidation of energy assets and a collapse of the financial institutions still nursing their oil-patch loans along. The Savings & Loan (S&L) crisis joined the collapse of Continental Illinois and Penn Square to prod the Fed into reversing its tightening mode on a dime and embark on a new cycle of rate cuts that lasted for the next two years.

3

Robust economic data and booming financial markets prompted an immediate turn toward tightening policy, which persisted for a year until the stock market crash in October of 1987. In spite of the strength in the real economy, the shock of the market collapse led the Fed to quickly reverse course.

The market sequence that followed shines a light on the typical path of manic progressions.

Rate cuts meant to address some unsettling occurrence prompted by a tightening cycle only serve to hyper-stimulate any themes already in favor. The resulting bull market on top of an existing bull market convinces investors that the assets or markets in question are invulnerable and invaluable. Enthusiasm breaks free of any boundaries of valuation.

Japan was the focus of the speculative fever before and especially after the 1987 crash. The Nikkei Index, spurred by the loosening of monetary policy and still strong economic activity, quickly rose to ever-higher records. The mania and the inevitable deflation to follow was fully entrenched.

The collapse of Long-Term Capital Management (LTCM) and the final remnants of the Asian crisis led the Fed to ease into a strong economy in the middle of 1998. Technology stocks in the U.S., immune from the fallout of Emerging Market (EM) bonds and currencies, took off in a straight line and never stopped until the bubble peaked in the first quarter of 2000.

Now to the current cycle. The Fed began tightening five years ago, beginning to pare back the balance sheet and moving the funds rate near neutral levels by late 2018. In response to weakness in Europe and concern that the inflation rate might not rise to the target level of 2% (sarcasm omitted), the Board, with rare multiple dissents, began another cycle of ease during the summer of 2019. Rates were cut three times into the first quarter of 2020, despite a strong and improving economy. Stocks took off and the economy accelerated.

And then came the virus.

In two months, a panic-stricken Fed cut rates to near zero, and began Mega- QE (Quantitative Easing). The balance sheet rapidly grew by more than $2.5 trillion. This was easing without precedent, on top of an historic cycle of central bank expansion.

Populations retreated. The Treasury Department pumped massive amounts of cash directly into private bank accounts and a brief market panic quickly morphed into euphoria.

Going into early 2020, the market was led higher by the large cap technology names that formed the backbone of the digital economy and supported countless applications that fed from it. The combination of a societal lockdown, negligible interest rates and oceans of cash flowing from governments to consumers was the equivalent of a supersonic tailwind for the SAP (stay and play) theme. Investing became just one more popular video game.

In 18 months, the market capitalization of the Nasdaq 100 grew by ten trillion dollars or, in appropriate notation, $1 x 1013. We can assume that the staff at the Fed now includes at least one member well versed in astrophysics in order to handle the numbers being generated by current policy.

Systemic manias produce a broad array of social and financial effects beyond the primary objects of adulation. It is why the aftermaths are so destructive and far-reaching. Rembrandt lost his townhouse to foreclosure in the wake of the Dutch Tulip episode. Longhorn hood ornaments, alligator boots and ranchland were plentiful at sheriff’s sales after the collapse of the oil boom, as were $400 neckties, bespoke suits and reservations at the most expensive New York restaurants, once the junk bond universe and its Masters imploded in the early 1990s.

4

The boom of the past decade has its own interesting morphology and ornamentation.

The progenitors and stewards of the modern digital universe comprise a cohort of young men (overwhelmingly so) displaying a particular phenotype. They are, for the most part, much more comfortable in front of a screen writing code or shooting down alien ships than they are in direct, face-to-face social interaction.

The recent confluence of unlimited liquidity, soaring stock prices, supercomputers for all and a world in which the entire population is forced into social isolation has brought forth Nirvana in the metaverse. We are all socially awkward now.

Emanating from the core of the digital world is a new galaxy of different but related pastimes and amusements. These form the basis of what might be termed a “Tribeca Hedge”, in which portfolios appear to be diversified but are really extending one thematic trade into increasingly risky and illiquid derivative themes.

Sports betting, marijuana farming, gaming, streaming, virtual reality, meme stock trading, antisocial media, constant gratification by delivery, non-fungible tokens (NFTs), aka invisible status symbols and the like all constitute a single, intertwined world.

Integral to the function (or dysfunction) of this parallel universe is crypto currency, the imaginary money for the imaginary world that knows no boundaries or rules. The core block chain technology at its heart has valuable features for recordkeeping and digitizing transactions, but the notion that it constitutes a robust store of value that can be assured by the assent of a group of anonymous “miners” laboring over ever more cumbersome factoring challenges if they care to, seems like a mass delusion.

Our purpose in scrutinizing this aspect of the contemporary financial scene rather than sports betting or some other sinkhole associated with the democratization of speculation is a matter of sheer size and breadth.

The notional balance of crypto currency holdings worldwide is somewhere in the neighborhood of $2 trillion. There is almost no way to put this into any useful context, other than to point out that it is about twice the size as all retail holdings of money market funds.

Crypto currency has, by dint of its notional size, immense leverage and lack of legal framework, the ability to precipitate a meaningful, global crisis should it experience the typical deflationary cycle endemic to the most novel, speculative elements of a hypertrophic credit boom.

“Why now?” one might ask.

The short answer is that the Fed is finally looking like it will take the inflation tsunami seriously and move away from the beach. Too little too late to check the price momentum in the real economy, but likely enough tightening to undermine the most fragile, leverage dependent elements of the boom.

Several qualitative indicators available at the outset of a new year are finally flashing red. The most important of these is the Super Bowl advertising lineup, and its close cousin, the stadium naming cycle.

Both are pretty reliable correlates of corporate hubris and access to piles of easy money. The record is good.

Many of the first time advertisers over the past three decades are no longer with us. The same is true for companies signing long-term stadium naming deals. This phenomenon is particularly evident when the corporate action is part of a larger foray within its peer group. We will not name individual names, but suffice it to say that a cursory research effort will confirm the indicator’s value.

5

A more conventional timing signal comes from the actions and intentions of central banks, particularly the Federal Reserve given the status of the dollar in global finance and commerce. We had thought that this process commenced five years ago, not appreciating the depth of the pointless fears about deflation that gripped the whole, inbred family of central bankers.

Now that they have piled on another bout of quantitative easing, balance sheet expansion and wealth transfers to borrowers from savers, the inflation die is cast. Four or five or six small rate hikes will not change anything in the real economy, other than destroying the enormous stock of notional wealth that has remained on paper and in the ether.

Deflation of the imaginary universe in which so many young people around the world are stranded will have profound effect in the investment realm.

The large, profit-making core companies in the technology arena will survive, albeit at reduced valuations. The coalition of the hopeful, including all-stage venture investing, Special Purpose Acquisition Companies (SPACS), a great deal of the private equity universe and the whole imaginary money system will suffer mightily. Certain portions of the luxury markets will seize up as those desperate to exchange their crypto currencies for some item or property of estimable value will be hamstrung by dwindling liquidity.

We are expecting a substantial number of Madoff-like scandals, where client monies have simply vanished into the surf on some Caribbean Island where accounts were supposedly held.

One important feature of the risks posed by a rush for the exits in unconventional assets is the likelihood that no lender of last resort, i.e., a central bank or sovereign treasury, will step in to alleviate the panic. We have no idea how many traditional financial institutions with implicit backing from monetary and fiscal authorities have taken the plunge into the meta-money pool, but it is probably a small enough list to preclude any systemic interventions, at least in the Western World.

2022 is likely to feature alternating hearings in Congress, oscillating between the “How could you have lost so much of your customers money?” and “How could you make so much money selling machine parts?” With a President who believes that inflation is being conjured by Big Meat, Big Vegetable, Big Oil, Big Tractor, Big Wood and the like, there is little prospect of any sane response to what is likely to be a bout of double digit inflation and critical shortages.

If the technology sector continues to run into valuation, regulatory and competitive pressures, its sheer weight in the major indices makes positive equity performance at the index level unlikely. However, it is quite possible for more generally cyclical sectors to continue to advance, together with non-U.S. indexes that have little or no technology weighting. We may be entering a cycle where active management can easily outperform passive simply by steering clear of the epicenter of the asset deflation that is likely as the tightening cycle progresses.

Jan. 14, 2022

Michael C. Aronstein

President, CIO & Portfolio Manager

The foregoing represents the opinions of the Chairman, CEO & Portfolio Manager and of the President, CIO & Portfolio Manager, respectively, and are not intended to be a forecast of future events, a guarantee of future results, or investment advice.

6

Definitions:

NASDAQ-100 is an index which includes 100 of the world’s largest non-financial companies listed on the wider NASDAQ stock market based on their market capitalization.

Nikkei Index is a price-weighted index consisting of 225 prominent stocks on the Tokyo Stock Exchange.

The S&P 500® Index is a trademark of McGraw Hill Financial Inc. The S&P 500® Index is widely regarded as the standard index for measuring large-cap U.S. stock market performance. The securities holdings and volatility of the Fund differ significantly from the stocks that make up the S&P 500 Index. An investment cannot be made directly into an index.

Past performance does not guarantee future results

The Marketfield Fund is managed by Marketfield Asset Management LLC (the “Adviser”) and distributed by Quasar Distributors, LLC.

Must be preceded or accompanied by a current prospectus.

Mutual fund investing involves risk. Principal loss is possible. Before considering an investment in the Fund, you should understand that you could lose money.

The Fund regularly makes short sales of securities, which involves the risk that losses may exceed the original amount invested. The Fund may invest in derivatives, which may increase the volatility of the Fund’s NAV and may result in a loss to the Fund. The Fund may also use options and futures contracts, which have the risks of unlimited losses of the underlying holdings due to unanticipated market movements and failure to correctly predict the direction of securities prices, interest rates, and currency exchange rates. However, a mutual fund investor’s risk is limited to the amount invested in a fund. Investments in absolute return strategies are not intended to outperform stocks and bonds during strong market rallies. Investments in exchange-traded funds are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of the shares may trade at a discount to its net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact the Fund’s ability to sell such shares.

Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks. These risks may be greater for emerging markets. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. Investing in mid-cap stocks may carry more risk than investing in stocks of larger, more well-established companies. This risk is usually greater for longer term debt securities. Investment by the Fund in lower rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. Investments in asset-backed and mortgage-backed securities involve additional risks such as credit risk, prepayment risk, possible illiquidity and default, and increased susceptibility to adverse economic developments. Investing in the Fund involves the risk that the macroeconomic trends identified by portfolio management will not come to fruition and their advantageous duration may not last as long as portfolio management forecasts.

7

MARKETFIELD FUND

Expense Example

(Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees (as applicable), and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from July 1, 2021 to December 31, 2021.

This example illustrates the Fund’s ongoing costs in two ways:

The first lines of the following tables provide information about actual account values and actual expenses. If you purchase Class A shares of the Fund you will pay an initial sales charge of up to 5.50% when you invest. A contingent deferred sales charge (“CDSC”) may be imposed on certain redemptions of Class A shares redeemed within twelve months of purchase. Class C shares are subject to a CDSC of 1.00% for shares redeemed within twelve months of purchase. In addition, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. If you request that a redemption be made by wire transfer, currently a $15.00 fee is charged by the Fund’s transfer agent. IRA accounts will be charged a $15.00 annual maintenance fee. To the extent the Fund invests in shares of exchange-traded funds or other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example. The example includes, but is not limited to, management fees, fund administration and accounting, custody and transfer agent fees. You may use the information in these lines, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the fourth column under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| | Hypothetical | | Example for Comparison Purposes |

The second lines of the tables below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second lines of the tables are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

8

MARKETFIELD FUND

Expense Example (continued)

(Unaudited)

| | | | | | | | | | | | |

| | | Class A

| |

| | | Beginning

Account Value

July 1, 2021

| | | Ending

Account Value

December 31, 2021

| | | Expenses Paid

During Period

July 1, 2021 -

December 31, 2021*

| |

Actual | | $ | 1,000.00 | | | $ | 1,026.10 | | | $ | 11.08 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,014.27 | | | $ | 11.02 | |

| | * | | Expenses are equal to the Class A shares’ annualized expense ratio of 2.17%, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| | | | | | | | | | | | |

| | | Class C

| |

| | | Beginning

Account Value

July 1, 2021

| | | Ending

Account Value

December 31, 2021

| | | Expenses Paid

During Period

July 1, 2021 -

December 31, 2021*

| |

Actual | | $ | 1,000.00 | | | $ | 1,021.80 | | | $ | 14.98 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,010.38 | | | $ | 14.90 | |

| | * | | Expenses are equal to the Class C shares’ annualized expense ratio of 2.94%, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| | | | | | | | | | | | |

| | | Class I

| |

| | | Beginning

Account Value

July 1, 2021

| | | Ending

Account Value

December 31, 2021

| | | Expenses Paid

During Period

July 1, 2021 -

December 31, 2021*

| |

Actual | | $ | 1,000.00 | | | $ | 1,027.00 | | | $ | 9.86 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.48 | | | $ | 9.80 | |

| | * | | Expenses are equal to the Class I shares’ annualized expense ratio of 1.93%, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

9

MARKETFIELD FUND

Investment Highlights

(Unaudited)

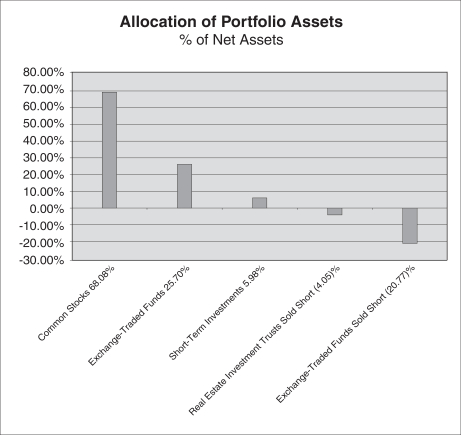

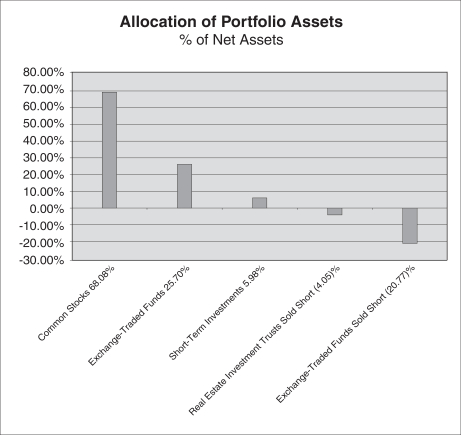

The investment objective of the Fund is capital appreciation. The Fund seeks to achieve its investment objective by allocating the Fund’s assets among investments in equity securities, fixed-income securities, and other investment companies, including exchange-traded funds (“ETFs”), in proportions consistent with Marketfield Asset Management LLC’s (the “Adviser”) evaluation of their expected risks and returns. In making these allocations, the Adviser considers various factors, including macroeconomic conditions, corporate earnings at a macroeconomic level, anticipated inflation and interest rates, consumer risk and the Adviser’s perception of the outlook of the capital markets as a whole. The Adviser may allocate the Fund’s investments between equity securities and fixed-income securities at its discretion, without limitation. The Fund may also engage in short sales of securities or other derivative type transactions. The Fund’s allocation of portfolio assets as of December 31, 2021 is shown below.

10

MARKETFIELD FUND

Investment Highlights (continued)

(Unaudited)

Average Annual Total Returns as of December 31, 2021

| | | | | | | | | | | | | | | | | | | | |

Class

| | Sales Charge

| | | | 1 Year

| | | 5 Years

| | | 10 Years

| | | Since

Inception

(7/31/2007)

| |

Class A(1) | | Maximum 5.5% Initial Sales Charge | | With sales charge | | | 2.37 | % | | | 7.51% | | | | 3.89 | % | | | 5.06 | % |

| | | | | Excluding sales charge | | | 8.32 | % | | | 8.73% | | | | 4.48 | % | | | 5.47 | % |

Class C(1) | | Maximum 1% CDSC if Redeemed within | | With sales charge | | | 6.51 | % | | | 7.91% | | | | 3.68 | % | | | 4.67 | % |

| | | One Year of Purchase | | Excluding sales charge | | | 7.51 | % | | | 7.91% | | | | 3.68 | % | | | 4.67 | % |

Class I(2) | | No Sales Charge | | | | | 8.58 | % | | | 9.00% | | | | 4.72 | % | | | 5.72 | % |

S&P 500 Index | | | | | | | 28.71 | % | | | 18.47% | | | | 16.55 | % | | | 10.84 | % |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (800) 311-MKTD (6583) or is available in the Fund’s website at www.marketfieldfund.com.

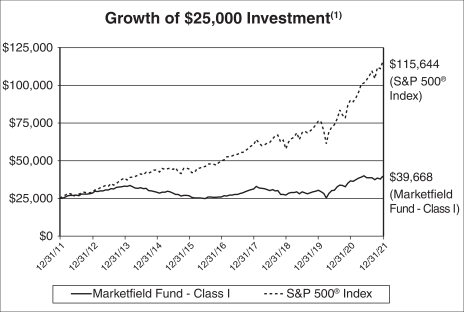

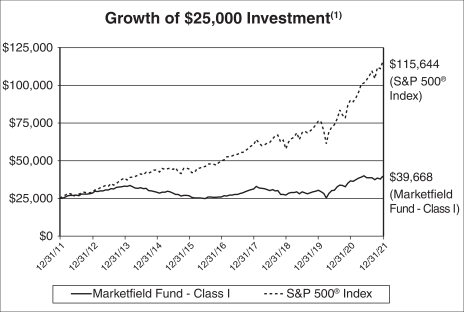

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The following graph illustrates performance of a hypothetical investment made in the Fund and certain broad-based securities indices on the Fund’s inception date. The graph does not reflect any future performance.

The Total Annual Fund Operating Expenses in the Prospectus dated April 30, 2021 are 2.91%, 3.62% and 2.63% for Class A, Class C and Class I shares, respectively.

The S&P 500® Index is a broad-based measurement of changes in stock market conditions based on a capitalization-weighted average of 500 leading companies representing all major industries in the U.S. economy. It is not possible to invest directly in an index.

| (1) | | Performance figures for Class A and Class C shares, first offered on October 5, 2012, include the historical performance of Class I shares through October 4, 2012 and are adjusted to reflect differences in fees and expenses. Performance data for the classes varies based on differences in their fee and expense structures. The Fund commenced operations on July 31, 2007. Unadjusted, the performance for the newer classes would likely have been different. |

| (2) | | Performance figures for Class I shares prior to April 8, 2016 reflect the historical performance of the then-existing shares of the MainStay Marketfield Fund, a series of MainStay Funds Trust (the predecessor to the Fund, which was subject to a different fee structure, and for which the Adviser served as the investment sub-adviser) for periods from October 5, 2012 to April 8, 2016. The performance figures also reflect the historical performance of the then-existing shares of the predecessor fund to the MainStay Marketfield Fund (which was subject to a different fee structure, and for which a predecessor entity to the Adviser served as the investment adviser) for periods prior to October 5, 2012. |

11

MARKETFIELD FUND

Investment Highlights (continued)

(Unaudited)

| (1) | | The minimum investment for Class I shares is $25,000 for individual investors. There is no minimum investment for Class I shares for institutional investors. The graph does not illustrate performance for a hypothetical investment made in Class A or Class C shares. If shown, the growth of the investment of Class A or Class C shares would have been lower than Class I shares to the extent those classes have lower minimum investments and sales loads. |

12

MARKETFIELD FUND

Schedule of Investments

December 31, 2021

| | | | | | | | |

| | |

| | | Shares

| | | Value

| |

| COMMON STOCKS — 68.08% | | | | | | | | |

| | |

| Auto Components — 0.22% | | | | | | | | |

Continental AG(a)(b) | | | 3,219 | | | $ | 341,232 | |

| | | | | | |

|

|

|

| Building Products — 1.11% | | | | | | | | |

TOTO Ltd.(a) | | | 37,586 | | | | 1,728,505 | |

| | | | | | |

|

|

|

| Chemicals — 2.89% | | | | | | | | |

The Sherwin-Williams Co. | | | 12,765 | | | | 4,495,322 | |

| | | | | | |

|

|

|

| Electrical Equipment — 4.33% | | | | | | | | |

Eaton Corp PLC | | | 16,680 | | | | 2,882,638 | |

Rockwell Automation, Inc. | | | 11,083 | | | | 3,866,304 | |

| | | | | | |

|

|

|

| | | | | | | | 6,748,942 | |

| | | | | | |

|

|

|

| Electronic Equipment, Instruments & Components — 3.32% | | | | | | | | |

Keyence Corp.(a) | | | 8,224 | | | | 5,167,615 | |

| | | | | | |

|

|

|

| Energy Equipment & Services — 1.97% | | | | | | | | |

Schlumberger Ltd. | | | 102,443 | | | | 3,068,168 | |

| | | | | | |

|

|

|

| Food & Staples Retailing — 2.58% | | | | | | | | |

Costco Wholesale Corp.(c) | | | 7,064 | | | | 4,010,233 | |

| | | | | | |

|

|

|

| Health Care Equipment & Supplies — 3.94% | | | | | | | | |

Intuitive Surgical, Inc.(b)(c) | | | 17,092 | | | | 6,141,156 | |

| | | | | | |

|

|

|

| Hotels, Restaurants & Leisure — 0.63% | | | | | | | | |

Dalata Hotel Group PLC(a)(b) | | | 230,917 | | | | 977,983 | |

| | | | | | |

|

|

|

| Household Durables — 6.53% | | | | | | | | |

DR Horton, Inc.(c) | | | 58,525 | | | | 6,347,036 | |

Lennar Corp. — Class A | | | 32,933 | | | | 3,825,498 | |

| | | | | | |

|

|

|

| | | | | | | | 10,172,534 | |

| | | | | | |

|

|

|

| Industrial Conglomerates — 2.46% | | | | | | | | |

Honeywell International, Inc. | | | 12,688 | | | | 2,645,575 | |

Siemens AG(a) | | | 6,813 | | | | 1,184,276 | |

| | | | | | |

|

|

|

| | | | | | | | 3,829,851 | |

| | | | | | |

|

|

|

| Machinery — 9.21% | | | | | | | | |

Caterpillar, Inc. | | | 17,593 | | | | 3,637,177 | |

Cummins, Inc. | | | 16,427 | | | | 3,583,386 | |

Deere & Co. | | | 12,516 | | | | 4,291,611 | |

The Toro Co. | | | 28,331 | | | | 2,830,550 | |

| | | | | | |

|

|

|

| | | | | | | | 14,342,724 | |

| | | | | | |

|

|

|

| Metals & Mining — 10.05% | | | | | | | | |

Barrick Gold Corp.(a)(c) | | | 151,120 | | | | 2,871,280 | |

Compania de Minas Buenaventura SAA — ADR(b) | | | 108,734 | | | | 795,933 | |

MMC Norilsk Nickel PJSC — ADR | | | 105,916 | | | | 3,275,982 | |

Newmont Corp.(c) | | | 57,768 | | | | 3,582,771 | |

Rio Tinto PLC — ADR(c) | | | 40,264 | | | | 2,695,272 | |

Vale SA — ADR | | | 172,547 | | | | 2,419,109 | |

| | | | | | |

|

|

|

| | | | | | | | 15,640,347 | |

| | | | | | |

|

|

|

The accompanying notes are an integral part of these financial statements.

13

MARKETFIELD FUND

Schedule of Investments (continued)

December 31, 2021

| | | | | | | | |

| | |

| | | Shares

| | | Value

| |

| Oil, Gas & Consumable Fuels — 8.18% | | | | | | | | |

Chevron Corp. | | | 26,293 | | | $ | 3,085,483 | |

ConocoPhillips | | | 45,389 | | | | 3,276,178 | |

Devon Energy Corp. | | | 73,831 | | | | 3,252,256 | |

EOG Resources, Inc. | | | 21,442 | | | | 1,904,693 | |

Golar LNG Ltd.(a)(b) | | | 98,478 | | | | 1,220,142 | |

| | | | | | |

|

|

|

| | | | | | | | 12,738,752 | |

| | | | | | |

|

|

|

| Real Estate Management & Development — 1.60% | | | | | | | | |

The St. Joe Co. | | | 47,721 | | | | 2,483,878 | |

| | | | | | |

|

|

|

| Road & Rail — 7.61% | | | | | | | | |

Norfolk Southern Corp.(c) | | | 22,286 | | | | 6,634,765 | |

Union Pacific Corp. | | | 20,663 | | | | 5,205,630 | |

| | | | | | |

|

|

|

| | | | | | | | 11,840,395 | |

| | | | | | |

|

|

|

| Semiconductors & Semiconductor Equipment — 1.45% | | | | | | | | |

Intel Corp. | | | 43,849 | | | | 2,258,223 | |

| | | | | | |

|

|

|

TOTAL COMMON STOCKS (Cost $56,959,162) | | | | | | | 105,985,860 | |

| | | | | | |

|

|

|

| EXCHANGE-TRADED FUNDS — 25.70% | | | | | | | | |

iShares MSCI Australia ETF(c) | | | 274,418 | | | | 6,813,799 | |

iShares MSCI Japan ETF | | | 33,250 | | | | 2,226,420 | |

iShares MSCI South Korea ETF | | | 47,791 | | | | 3,721,485 | |

iShares MSCI United Kingdom ETF(c) | | | 217,600 | | | | 7,211,264 | |

SPDR S&P Homebuilders ETF(c) | | | 60,327 | | | | 5,174,850 | |

SPDR S&P Oil & Gas Exploration & Production ETF | | | 25,280 | | | | 2,423,594 | |

VanEck Gold Miners ETF(c) | | | 141,263 | | | | 4,524,654 | |

VanEck Russia ETF | | | 81,903 | | | | 2,183,534 | |

WisdomTree Japan Hedged Equity Fund(c) | | | 91,584 | | | | 5,727,663 | |

| | | | | | |

|

|

|

TOTAL EXCHANGE-TRADED FUNDS (Cost $34,118,553) | | | | | | | 40,007,263 | |

| | | | | | |

|

|

|

| SHORT-TERM INVESTMENTS — 5.98% | | | | | | | | |

U.S. Bank Money Market Deposit Account, 0.003%(d) | | | 9,303,419 | | | | 9,303,419 | |

| | | | | | |

|

|

|

| TOTAL SHORT-TERM INVESTMENTS (Cost $9,303,419) | | | | | | | 9,303,419 | |

| | | | | | |

|

|

|

| Total Investments (Cost $100,381,134) — 99.76% | | | | | | | 155,296,542 | |

| Other Assets in Excess of Liabilities — 0.24% | | | | | | | 373,628 | |

| | | | | | |

|

|

|

| TOTAL NET ASSETS — 100.00% | | | | | | $ | 155,670,170 | |

| | | | | | |

|

|

|

| (a) | | Foreign issued security. |

| (b) | | Non-income producing security. |

| (c) | | All or a portion of this security is pledged as collateral for securities sold short with an aggregate fair value of $35,506,930 as of December 31, 2021. |

| (d) | | Seven day yield as of December 31, 2021. |

Abbreviations:

| | |

| ADR | | American Depositary Receipt |

| AG | | Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e. owned by shareholders. |

| Ltd. | | Limited is a term indicating a company is incorporated and shareholders have limited liability. |

| PLC | | Public Limited Company is a publicly traded company which signifies that shareholders have limited liability. |

| PJSC | | An abbreviation used by many countries to signify an open joint-stock company. |

| SA | | An abbreviation used by many countries to signify a stock company whereby shareholders have limited liability. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

14

MARKETFIELD FUND

Schedule of Securities Sold Short

December 31, 2021

| | | | | | | | |

| | |

| | | Shares

| | | Value

| |

| SECURITIES SOLD SHORT — (24.82)% | | | | | | | | |

| | |

| EXCHANGE-TRADED FUNDS — (20.77)% | | | | | | | | |

Invesco QQQ Trust Series 1 | | | (38,725 | ) | | $ | (15,406,741 | ) |

iShares Expanded Tech-Software Sector ETF | | | (23,120 | ) | | | (9,193,668 | ) |

iShares Russell 2000 ETF | | | (34,760 | ) | | | (7,732,362 | ) |

| | | | | | |

|

|

|

TOTAL EXCHANGE-TRADED FUNDS (Proceeds $23,652,089) | | | | | | | (32,332,771 | ) |

| | | | | | |

|

|

|

| REAL ESTATE INVESTMENT TRUSTS — (4.05)% | | | | | | | | |

AvalonBay Communities, Inc. | | | (3,669 | ) | | | (926,753 | ) |

Boston Properties, Inc. | | | (10,476 | ) | | | (1,206,626 | ) |

Equity Residential | | | (11,007 | ) | | | (996,134 | ) |

SL Green Realty Corp. | | | (29,873 | ) | | | (2,141,894 | ) |

Vornado Realty Trust | | | (24,854 | ) | | | (1,040,388 | ) |

| | | | | | |

|

|

|

TOTAL REAL ESTATE INVESTMENT TRUSTS (Proceeds $7,476,036) | | | | | | | (6,311,795 | ) |

| | | | | | |

|

|

|

Total Securities Sold Short (Proceeds $31,128,125) | | | | | | $ | (38,644,566 | ) |

| | | | | | |

|

|

|

The accompanying notes are an integral part of these financial statements.

15

MARKETFIELD FUND

| | |

| Statement of Assets & Liabilities | | |

| |

| | | December 31, 2021 |

| | | | |

| Assets | | | | |

Investments in securities, at value (cost $100,381,134) | | $ | 155,296,542 | |

Receivables: | | | | |

Fund shares sold | | | 34,093 | |

Dividends and interest | | | 81,626 | |

Dividend tax reclaim | | | 154,487 | |

Deposits at brokers(1) | | | 39,197,005 | |

Other assets | | | 23,123 | |

| | |

|

|

|

Total Assets | | | 194,786,876 | |

| | |

|

|

|

| Liabilities | | | | |

Securities sold short, at value (proceeds received $31,128,125) | | | 38,644,566 | |

Payables: | | | | |

Fund shares redeemed | | | 56,340 | |

To affiliates | | | 53,419 | |

To distributor | | | 15,877 | |

For shareholder servicing fees | | | 16,233 | |

To adviser | | | 144,048 | |

Dividends and interest on short positions | | | 104,883 | |

Accrued expenses and other liabilities | | | 81,340 | |

| | |

|

|

|

Total Liabilities | | | 39,116,706 | |

| | |

|

|

|

| Net Assets | | $ | 155,670,170 | |

| | |

|

|

|

Net assets consist of: | | | | |

Paid-in capital | | | 480,421,121 | |

Accumulated deficit | | | (324,750,951 | ) |

| | |

|

|

|

| Net Assets | | $ | 155,670,170 | |

| | |

|

|

|

| |

| Class A | | | | |

Net assets | | | $47,708,855 | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) | | | 2,206,741 | |

Net asset value, minimum offering, and redemption price per share | | | $21.62 | |

Maximum offering price per share (net asset value per share divided by 0.945)(2) | | | $22.88 | |

| |

| Class C | | | | |

Net assets | | | $17,520,902 | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) | | | 867,890 | |

Net asset value, offering, and redemption price per share(3) | | | $20.19 | |

| |

| Class I | | | | |

Net assets | | | $90,440,413 | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) | | | 4,104,711 | |

Net asset value, offering, and redemption price per share | | | $22.03 | |

| (1) | | Serves as collateral for securities sold short and derivative instruments including futures, swaps and options. |

| (2) | | Reflects a maximum sales charge of 5.50%. |

| (3) | | A contingent deferred sales charge (“CDSC”) of 1.00% may be charged on shares redeemed within twelve months of purchase. |

The accompanying notes are an integral part of these financial statements.

16

MARKETFIELD FUND

| | |

| Statement of Operations |

| |

| | | For the Year Ended December 31, 2021 |

| | | | |

| Investment Income | | | | |

Dividend income(1) | | $ | 3,604,312 | |

Interest income | | | 394 | |

| | |

|

|

|

Total Investment Income | | | 3,604,706 | |

| | |

|

|

|

| Expenses | | | | |

Management fees | | | 2,261,120 | |

Dividend expense | | | 627,352 | |

Broker interest expense | | | 262,296 | |

Transfer agent fees and expenses | | | 200,518 | |

Administration and accounting fees | | | 195,066 | |

Distribution fees — Class C | | | 184,329 | |

Distribution fees — Class A | | | 111,162 | |

Federal and state registration fees | | | 50,779 | |

Audit and tax fees | | | 47,826 | |

Shareholder servicing fees — Class C | | | 40,627 | |

Custody fees | | | 30,970 | |

Reports to shareholders | | | 25,351 | |

Legal fees | | | 25,164 | |

Trustees’ fees | | | 13,496 | |

Chief Compliance Officer fees | | | 11,999 | |

Insurance expense | | | 3,650 | |

Pricing fees | | | 1,723 | |

Other expenses | | | 3,737 | |

| | |

|

|

|

Total Expenses | | | 4,097,165 | |

| | |

|

|

|

Less waivers and reimbursement by Adviser (Note 4) | | | (333,102 | ) |

| | |

|

|

|

Net Expenses | | | 3,764,063 | |

| | |

|

|

|

| Net Investment Loss | | | (159,357 | ) |

| | |

|

|

|

| Realized and Unrealized Gain (Loss) on Investments and Foreign Currency | | | | |

Net realized gain (loss) on: | | | | |

Investments | | | 38,492,889 | |

Securities sold short | | | (5,494,803 | ) |

Foreign currency translations | | | (3,790 | ) |

Purchased options | | | (331,538 | ) |

| | |

|

|

|

| | | | 32,662,758 | |

| | |

|

|

|

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | (16,539,859 | ) |

Securities sold short | | | (3,066,252 | ) |

Foreign currency translations | | | (34,322 | ) |

| | |

|

|

|

| | | | (19,640,433 | ) |

| | |

|

|

|

| Net Realized and Unrealized Gain on Investments and Foreign Currency | | | 13,022,325 | |

| | |

|

|

|

| Net Increase in Net Assets From Operations | | $ | 12,862,968 | |

| | |

|

|

|

| (1) | | Net of $48,846 in foreign withholding taxes and issuance fees. |

The accompanying notes are an integral part of these financial statements.

17

MARKETFIELD FUND

| | | | | | | | |

| Statements of Changes in Net Assets | |

| | |

| | | Year Ended

December 31, 2021

| | | Year Ended

December 31, 2020

| |

| From Operations | | | | | | | | |

Net investment loss | | $ | (159,357 | ) | | $ | (1,523,743 | ) |

Net realized gain (loss) on: | | | | | | | | |

Investments | | | 38,492,889 | | | | 15,655,650 | |

Futures contracts | | | — | | | | (672,822 | ) |

Securities sold short | | | (5,494,803 | ) | | | (4,160,854 | ) |

Foreign currency translations | | | (3,790 | ) | | | 127,092 | |

Purchased options | | | (331,538 | ) | | | 647,908 | |

Written options | | | — | | | | (5,405 | ) |

Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

Investments | | | (16,539,859 | ) | | | 12,845,267 | |

Futures contracts | | | — | | | | (63,577 | ) |

Securities sold short | | | (3,066,252 | ) | | | 2,856,674 | |

Foreign currency translations | | | (34,322 | ) | | | 27,741 | |

Purchased options | | | — | | | | 17,769 | |

Written options | | | — | | | | 41,082 | |

| | |

|

|

| |

|

|

|

Net increase in net assets from operations | | | 12,862,968 | | | | 25,792,782 | |

| | |

|

|

| |

|

|

|

| From Capital Share Transactions | | | | | | | | |

Proceeds from shares sold — Class A | | | 8,238,975 | | | | 7,888,190 | |

Payments for shares redeemed — Class A | | | (6,710,571 | ) | | | (9,859,664 | ) |

Proceeds from shares sold — Class C | | | 35,455 | | | | 87,440 | |

Payments for shares redeemed — Class C | | | (12,260,520 | ) | | | (15,551,868 | ) |

Proceeds from shares sold — Class I | | | 6,116,986 | | | | 5,056,654 | |

Payments for shares redeemed — Class I | | | (14,817,719 | ) | | | (33,458,225 | ) |

Proceeds from shares sold — Class R6(1) | | | — | | | | 44,645 | |

Payments for shares redeemed — Class R6(1) | | | — | | | | (1,887,622 | ) |

| | |

|

|

| |

|

|

|

Net decrease in net assets from capital share transactions | | | (19,397,394 | ) | | | (47,680,450 | ) |

| | |

|

|

| |

|

|

|

| Total Decrease in Net Assets | | | (6,534,426 | ) | | | (21,887,668 | ) |

| | |

| Net Assets: | | | | | | | | |

Beginning of Year | | | 162,204,596 | | | | 184,092,264 | |

| | |

|

|

| |

|

|

|

End of Year | | $ | 155,670,170 | | | $ | 162,204,596 | |

| | |

|

|

| |

|

|

|

| (1) | | Class R6 shares of the Fund were liquidated as of the close of business on November 30, 2020. See Note 1 to the financial statements. |

The accompanying notes are an integral part of these financial statements.

18

MARKETFIELD FUND — CLASS A

| | | | | | | | | | | | | | | | | | | | |

| Financial Highlights | |

|

| Per Share Data for a Share Outstanding Throughout Each Year | |

| | | | | |

| | | Year Ended

December 31,

2021

| | | Year Ended

December 31,

2020

| | | Year Ended

December 31,

2019

| | | Year Ended

December 31,

2018

| | | Year Ended

December 31,

2017

| |

| Net Asset Value, Beginning of Year | | $ | 19.96 | | | $ | 16.65 | | | $ | 14.92 | | | $ | 17.23 | | | $ | 14.26 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(1) | | | (0.02 | ) | | | (0.16 | ) | | | 0.04 | | | | (0.05 | ) | | | (0.11 | ) |

Net realized and unrealized gain (loss) on investments and foreign currency | | | 1.68 | | | | 3.47 | | | | 1.73 | | | | (2.26 | ) | | | 3.08 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from investment operations | | | 1.66 | | | | 3.31 | | | | 1.77 | | | | (2.31 | ) | | | 2.97 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Less distributions paid: | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | | — | | | | (0.04 | ) | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total distributions paid | | | — | | | | — | | | | (0.04 | ) | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net Asset Value, End of Year | | $ | 21.62 | | | $ | 19.96 | | | $ | 16.65 | | | $ | 14.92 | | | $ | 17.23 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Total return(2) | | | 8.32 | % | | | 19.88 | % | | | 11.87 | % | | | -13.41 | % | | | 20.83 | % |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | |

| Supplemental Data and Ratios: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s) | | $ | 47,709 | | | $ | 42,483 | | | $ | 37,761 | | | $ | 46,183 | | | $ | 75,929 | |

| | | | | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of expenses(3) | | | 2.58 | % | | | 2.75 | % | | | 2.94 | % | | | 2.73 | % | | | 2.72 | % |

After waivers and reimbursements of expenses(4) | | | 2.36 | % | | | 2.47 | % | | | 2.70 | % | | | 2.52 | % | | | 2.54 | % |

| | | | | |

Ratio of net investment income (loss) to average net assets:(5) | | | | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of expenses | | | (0.30 | )% | | | (1.23 | )% | | | 0.02 | % | | | (0.51 | )% | | | (0.90 | )% |

After waivers and reimbursements of expenses | | | (0.08 | )% | | | (0.95 | )% | | | 0.26 | % | | | (0.30 | )% | | | (0.72 | )% |

| | | | | |

Portfolio turnover rate(6) | | | 26 | % | | | 12 | % | | | 17 | % | | | 40 | % | | | 5 | % |

| (1) | | Per share net investment income (loss) was calculated using average shares outstanding. |

| (2) | | Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. Based on net asset value, which does not reflect the applicable sales charges. |

| (3) | | Expense ratios of expenses to average net assets before waivers and reimbursements of expenses excluding dividend and interest expense on short positions were 2.02%, 2.08%, 2.04%, 2.01%, and 1.98% for the years ended December 31, 2021, 2020, 2019, 2018, and 2017, respectively. |

| (4) | | Expense ratios of expenses to average net assets after waivers and reimbursements of expenses excluding dividend and interest expense on short positions were 1.80%, 1.80%, 1.80%, 1.80%, and 1.80% for the years ended December 31, 2021, 2020, 2019, 2018, and 2017, respectively. |

| (5) | | The net investment income (loss) ratios include dividend and interest expense on short positions. |

| (6) | | Consists of long-term investments only; excludes securities sold short and derivative instruments. |

The accompanying notes are an integral part of these financial statements.

19

MARKETFIELD FUND — CLASS C

| | | | | | | | | | | | | | | | | | | | |

| Financial Highlights | |

|

| Per Share Data for a Share Outstanding Throughout Each Year | |

| | | | | |

| | | Year Ended

December 31,

2021

| | | Year Ended

December 31,

2020

| | | Year Ended

December 31,

2019

| | | Year Ended

December 31,

2018

| | | Year Ended

December 31,

2017

| |

| Net Asset Value, Beginning of Year | | $ | 18.78 | | | $ | 15.79 | | | $ | 14.22 | | | $ | 16.56 | | | $ | 13.80 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss(1) | | | (0.20 | ) | | | (0.28 | ) | | | (0.08 | ) | | | (0.17 | ) | | | (0.22 | ) |

Net realized and unrealized gain (loss) on investments and foreign currency | | | 1.61 | | | | 3.27 | | | | 1.65 | | | | (2.17 | ) | | | 2.98 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from investment operations | | | 1.41 | | | | 2.99 | | | | 1.57 | | | | (2.34 | ) | | | 2.76 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net Asset Value, End of Year | | $ | 20.19 | | | $ | 18.78 | | | $ | 15.79 | | | $ | 14.22 | | | $ | 16.56 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Total return(2) | | | 7.51 | % | | | 18.94 | % | | | 11.04 | % | | | -14.13 | % | | | 20.00 | % |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | |

| Supplemental Data and Ratios: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s) | | $ | 17,521 | | | $ | 28,077 | | | $ | 38,675 | | | $ | 55,958 | | | $ | 92,518 | |

| | | | | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of

expenses(3) | | | 3.23 | % | | | 3.46 | % | | | 3.69 | % | | | 3.49 | % | | | 3.48 | % |

After waivers and reimbursements of expenses(4) | | | 3.11 | % | | | 3.20 | % | | | 3.46 | % | | | 3.30 | % | | | 3.30 | % |

| | | | | |

Ratio of net investment loss to average net assets:(5) | | | | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of expenses | | | (1.12 | )% | | | (2.00 | )% | | | (0.76 | )% | | | (1.27 | )% | | | (1.67 | )% |

After waivers and reimbursements of expenses | | | (1.00 | )% | | | (1.74 | )% | | | (0.53 | )% | | | (1.08 | )% | | | (1.49 | )% |

| | | | | |

Portfolio turnover rate(6) | | | 26 | % | | | 12 | % | | | 17 | % | | | 40 | % | | | 5 | % |

| (1) | | Per share net investment loss was calculated using average shares outstanding. |

| (2) | | Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. Based on net asset value, which does not reflect the applicable sales charges. |

| (3) | | Expense ratios of expenses to average net assets before waivers and reimbursements of expenses excluding dividend and interest expense on short positions were 2.69%, 2.83%, 2.80%, 2.76%, and 2.75% for the years ended December 31, 2021, 2020, 2019, 2018, and 2017, respectively. |

| (4) | | Expense ratios of expenses to average net assets after waivers and reimbursements of expenses excluding dividend and interest expense on short positions were 2.57%, 2.57%, 2.57%, 2.57%, and 2.57% for the years ended December 31, 2021, 2020, 2019, 2018, and 2017, respectively. |

| (5) | | The net investment loss ratios include dividend and interest expense on short positions. |

| (6) | | Consists of long-term investments only; excludes securities sold short and derivative instruments. |

The accompanying notes are an integral part of these financial statements.

20

MARKETFIELD FUND — CLASS I

| | | | | | | | | | | | | | | | | | | | |

| Financial Highlights | |

|

| Per Share Data for a Share Outstanding Throughout Each Year | |

| | | | | |

| | | Year Ended

December 31,

2021

| | | Year Ended

December 31,

2020

| | | Year Ended

December 31,

2019

| | | Year Ended

December 31,

2018

| | | Year Ended

December 31,

2017

| |

| Net Asset Value, Beginning of Year | | $ | 20.29 | | | $ | 16.88 | | | $ | 15.14 | | | $ | 17.44 | | | $ | 14.39 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(1) | | | 0.03 | | | | (0.12 | ) | | | 0.08 | | | | (0.02 | ) | | | (0.07 | ) |

Net realized and unrealized gain (loss) on investments and foreign currency | | | 1.71 | | | | 3.53 | | | | 1.75 | | | | (2.28 | ) | | | 3.12 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from investment operations | | | 1.74 | | | | 3.41 | | | | 1.83 | | | | (2.30 | ) | | | 3.05 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Less distributions paid: | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | | — | | | | (0.09 | ) | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total distributions paid | | | — | | | | — | | | | (0.09 | ) | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net Asset Value, End of Year | | $ | 22.03 | | | $ | 20.29 | | | $ | 16.88 | | | $ | 15.14 | | | $ | 17.44 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Total return(2) | | | 8.58 | % | | | 20.20 | % | | | 12.13 | % | | | -13.25 | % | | | 21.20 | % |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | |

| Supplemental Data and Ratios: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s) | | $ | 90,440 | | | $ | 91,645 | | | $ | 105,998 | | | $ | 163,260 | | | $ | 302,439 | |

| | | | | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of expenses(3) | | | 2.33 | % | | | 2.47 | % | | | 2.68 | % | | | 2.47 | % | | | 2.48 | % |

After waivers and reimbursements of expenses(4) | | | 2.11 | % | | | 2.20 | % | | | 2.44 | % | | | 2.27 | % | | | 2.30 | % |

| | | | | |

Ratio of net investment income (loss) to average net assets:(5) | | | | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of expenses | | | (0.09 | )% | | | (0.98 | )% | | | 0.25 | % | | | (0.29 | )% | | | (0.64 | )% |

After waivers and reimbursements of expenses | | | 0.13 | % | | | (0.71 | )% | | | 0.49 | % | | | (0.09 | )% | | | (0.46 | )% |

| | | | | |

Portfolio turnover rate(6) | | | 26 | % | | | 12 | % | | | 17 | % | | | 40 | % | | | 5 | % |

| (1) | | Per share net investment income (loss) was calculated using average shares outstanding. |

| (2) | | Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. Based on net asset value, which does not reflect the applicable sales charges. |

| (3) | | Expense ratios of expenses to average net assets before waivers and reimbursements of expenses excluding dividend and interest expense on short positions were 1.78%, 1.83%, 1.80%, 1.76%, and 1.74% for the years ended December 31, 2021, 2020, 2019, 2018, and 2017, respectively. |

| (4) | | Expense ratios of expenses to average net assets after waivers and reimbursements of expenses excluding dividend and interest expense on short positions were 1.56%, 1.56%, 1.56%, 1.56%, and 1.56% for the years ended December 31, 2021, 2020, 2019, 2018, and 2017, respectively. |

| (5) | | The net investment income (loss) ratios include dividend and interest expense on short positions. |

| (6) | | Consists of long-term investments only; excludes securities sold short and derivative instruments. |

The accompanying notes are an integral part of these financial statements.

21

MARKETFIELD FUND

Notes to Financial Statements

December 31, 2021

Trust for Professional Managers (the “Trust”) was organized as a Delaware statutory trust under a Declaration of Trust dated May 29, 2001. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Marketfield Fund (the “Fund”) represents a distinct series with its own investment objective and policies within the Trust. The investment objective of the Fund is capital appreciation. The Trust may issue an unlimited number of shares of beneficial interest at $0.001 par value. The assets of the Fund are segregated, and a shareholder’s interest is limited to the Fund in which shares are held.

The Fund currently offers three classes of shares. Class I shares commenced operations on July 31, 2007. Class A and Class C shares commenced operations on October 5, 2012. Class R6 shares commenced operations on June 17, 2013. Class R6 shares of the Fund were liquidated as of the close of business on November 30, 2020. Class A shares are subject to an initial maximum sales charge of 5.50% imposed at the time of purchase. The sales charge declines as the amount purchased increases in accordance with the Fund’s prospectus. A contingent deferred sales charge (“CDSC”) of 1.00% may be imposed on certain redemptions of Class A shares made within 12 months of the date of purchase of Class A shares. Class C shares are offered at NAV without an initial sales charge, although a 1.00% CDSC may be imposed on redemptions made within 12 months of the date of purchase of Class C shares. Class I shares are offered at NAV and are not subject to a sales charge. In addition, you generally may elect on a voluntary basis to convert your Class A or Class C shares that are no longer subject to a CDSC into Class A or Class I shares of the Fund, subject to satisfying the eligibility requirements of Class A or Class I shares, as applicable. Class C shares of the Fund automatically convert to Class A shares after 8 years. The three classes of shares have the same voting (except for issues that relate solely to one class), dividend, liquidation and other rights, and the same terms and conditions, except that Class C shares are subject to higher distribution and/or service (Rule 12b-1) fee rates than Class A shares under a distribution plan pursuant to Rule 12b-1 under the 1940 Act. Class I shares are not subject to a distribution and/or service (Rule 12b-1) fee.

The Fund is an investment company and accordingly follows the investment accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 “Financial Services — Investment Companies.”

| (2) | | Significant Accounting Policies |

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of these schedules of investments. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Each security owned by the Fund that is listed on a securities exchange, except securities listed on the NASDAQ Stock Market, LLC (“NASDAQ”), is valued at its last sale price on that exchange on the date as of which assets are valued. Swap agreements, such as credit default swaps, interest rate swaps and currency swaps, are priced by an approved independent pricing service (“Pricing Service”). Forward foreign currency contracts are valued at the mean between the bid and asked prices by a Pricing Service. Commodities futures contracts and options thereon traded on a commodities exchange or board of trade are valued at the last sale price at the close of trading.

If the security is listed on more than one exchange, the Fund will use the price of the exchange that the Fund generally considers to be the principal exchange on which the security is traded. Portfolio securities listed on NASDAQ will be valued at the NASDAQ Official Closing Price, which may not necessarily represent the last sale price. If there has been no sale on such exchange or on NASDAQ on such day, the security is valued at the mean between the most recent bid and ask prices at the close of the exchange on such day, or the

22

MARKETFIELD FUND

Notes to Financial Statements, continued

December 31, 2021

security shall be valued at the latest sales price on the “composite market” for the day such security is being valued. The composite market is defined as a consolidation of the trade information provided by national securities and foreign exchanges and over-the-counter markets as published by a Pricing Service for the day such security is being valued.

If market quotations are not readily available, any security or other asset will be valued at its fair value as determined under fair value pricing procedures approved by the Trust’s Board of Trustees. These fair value pricing procedures will also be used to price a security when corporate events, events in the securities market and/or world events cause Marketfield Asset Management, LLC (the “Adviser”) to believe that a security’s last sale price may not reflect its actual fair market value. The intended effect of using fair value pricing procedures is to ensure that the Fund’s shares are accurately priced. The Board of Trustees will regularly evaluate whether the Fund’s fair value pricing procedures continue to be appropriate in light of the specific circumstances of the Fund and the quality of prices obtained through the application of such procedures by the Trust’s valuation committee.

Redeemable securities issued by open-end, registered investment companies are valued at the NAVs of such companies for purchase and/or redemption orders placed on that day. If, on a particular day, a share of an investment company is not listed on NASDAQ, such security’s fair value will be determined as described above. All exchange-traded funds are valued at the last reported sale price on the exchange on which the security is principally traded. In the event market quotations are not readily available, such security’s fair value will be determined.

Debt securities, including short-term instruments having a maturity of 60 days or less, are valued at the mean in accordance with prices supplied by a Pricing Service. Pricing Services may use various valuation methodologies such as the mean between the bid and ask prices, matrix pricing method or other analytical pricing models as well as market transactions and dealer quotations. If a price is not available from a Pricing Service, the most recent quotation obtained from one or more broker-dealers known to follow the issue will be obtained. Quotations will be valued at the mean between the bid and the offer. Fixed income securities purchased on a delayed-delivery basis are typically marked to market daily until settlement at the forward settlement date. Any discount or premium is accreted or amortized using the constant yield method until maturity.

Money market funds, demand notes and repurchase agreements are valued at cost. If cost does not represent current market value the securities will be priced at fair value.

Exchange-traded options are valued at the composite price, using the National Best Bid and Offer quotes (“NBBO”). NBBO consists of the highest bid price and lowest ask price across any of the exchanges on which an option is quoted, thus providing a view across the entire U.S. options marketplace. Specifically, composite pricing looks at the last trades on the exchanges where the options are traded. If there are no trades for the option on a given business day, composite option pricing calculates the mean of the highest bid price and lowest ask price across the exchanges where the option is traded. Over-the-counter (“OTC”) option contracts on securities, currencies and other financial instruments with less than 180 days remaining until their expiration shall be valued at the evaluated price provided by the broker-dealer with which the option was traded. Option contracts on securities, currencies and other financial instruments traded in the OTC market with 180 days or more remaining until their expiration shall be valued at the prices provided by a recognized independent broker-dealer. Futures contracts and options thereon are valued at the last settlement price at the closing of trading on the relevant exchange or board of trade. Futures or options on futures positions for which reliable market quotations are not readily available shall be valued at a price supplied by a Pricing Service.

Swap agreements are generally traded over the counter and are valued by a Pricing Service using observable inputs. If a price provided by a Pricing Service differs from the price provided by an independent dealer by 10% or more or the Adviser otherwise believes that the price provided by the Pricing Service is inaccurately

23

MARKETFIELD FUND

Notes to Financial Statements, continued

December 31, 2021

stated, the Adviser shall price the swap using the average of two prices obtained by independent dealers. In the event the Adviser determines the price of a swap in this manner does not represent market value, the fair value of the subject swap shall be determined in accordance with the Trust’s fair value procedures.

FASB Accounting Standards Codification, “Fair Value Measurements” Topic 820 (“ASC 820”), establishes an authoritative definition of fair value and sets out a hierarchy for measuring fair value. ASC 820 requires an entity to evaluate certain factors to determine whether there has been a significant decrease in volume and level of activity for the security such that recent transactions and quoted prices may not be determinative of fair value and further analysis and adjustment may be necessary to estimate fair value. ASC 820 also requires enhanced disclosure regarding the inputs and valuation techniques used to measure fair value in those instances as well as expanded disclosure of valuation levels for major security types. These inputs are summarized in the three broad levels listed below:

Level 1 — Quoted prices in active markets for identical securities.

Level 2 — Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3 — Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Fund’s investments carried at fair value as of December 31, 2021:

| | | | | | | | | | | | | | | | |

| | | Level 1

| | | Level 2

| | | Level 3(2)

| | | Total

| |

| Assets: | | | | | | | | | | | | | | | | |

Common Stocks(1) | | $ | 105,985,860 | | | $ | — | | | $ | — | | | $ | 105,985,860 | |

Exchange-Traded Funds | | | 40,007,263 | | | | — | | | | — | | | | 40,007,263 | |

Short-Term Investments | | | 9,303,419 | | | | — | | | | — | | | | 9,303,419 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Total Assets | | $ | 155,296,542 | | | $ | — | | | $ | — | | | $ | 155,296,542 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Liabilities: | | | | | | | | | | | | | | | | |