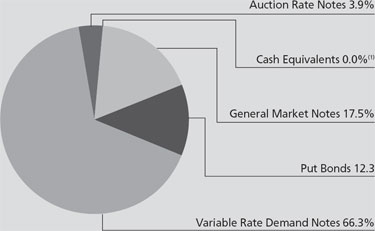

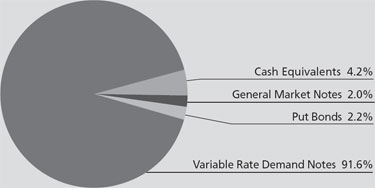

short-term rates so low we will most likely stay in this maturity range until short-term rates move higher. One aspect of this strategy is to hold more cash or near-cash investments in the portfolio. Currently we have a large portion of the fund in variable rate demand notes which provide the fund with an attractive yield relative to longer maturing securities and little if no volatility.

Other investments included purchasing put bonds in the three to 12 month range and general market notes maturing at the end of June, 2011. These purchases helped balance out the portfolio by extending ever so slightly on the yield curve.

We believe the front end of the municipal curve will remain relatively low until such time as the Federal Open Market Committee either begins to tighten its monetary policy or the issuance of tax-exempt securities increases significantly. Despite the expiration of the Build America Bond program the supply/demand imbalance has yet to unwind in 2011. This is the result of issuers hesitating to come to the market for fear of demand and trying to curb spending on new infrastructure. We anticipate the issuance to pick up in the second half of the year as states and municipalities re-enter the market after they balance their budgets and evaluate the spending needs.

ALPINE MUNICIPAL MONEY MARKET FUND

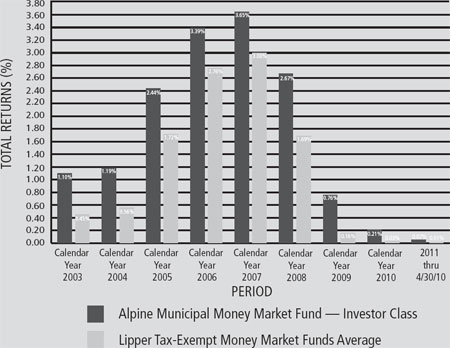

The Federal Reserve’s ongoing efforts to stimulate the economy continue to compress all money market rates towards the overnight rate of 0.00% to 0.25%. Benchmark rates such as the 90-day Treasury bill and the 90-day Libor show the impact of the Fed’s extraordinary policy measures on the money markets.

Municipal money markets were no different; as rates compress, tax exempt rates are showing little differentiation from broader money market rates despite their tax advantage. Instead, municipal money market rates have tended to trade above taxable rates and have remained fairly steady over the past six months.

We are finding money market-eligible municipal supply down sharply from years past for several reasons. As mentioned, short-dated variable rate demand note issuance is off year-to-date as issuers are

opportunistically locking in low rates through longer-dated borrowings in the bond market. Credit quality concerns have also removed a number of names from our approved list. The slow economy and budget pressures have forced us to reevaluate borrowers that we would normally purchase in past years.

With a relatively flat range-bound yield curve and our expectation of little change in rates for the foreseeable future, we continued to invest heavily in variable rate demand notes. Currently, all of our holdings fall into that category except for three securities and we do not anticipate deviating from this strategy anytime soon. As of 4/25/11, our average maturity of nine days was significantly shorter than our tax free peer group average of 25 days.

We expect money market rates to stay unchanged through the remainder of 2011. A rebounding economy will ultimately improve the near-term financial prospects of many municipal issuers, but for now we are cautious. Thus, we expect our investment posture to remain relatively unchanged for the next three to six months.

OUTLOOK

The last six months was a challenging period for the municipal bond market, but not because of defaults or credit-related issues. We understand that many of you continue to have concerns about the stability of the market and the potential widespread defaults. We do not agree with the dire predictions made in some media stories that there will be significant defaults in the near term. As always, we will rely on our ongoing analysis of the market to direct our investments to areas of the municipal market in which we see good value.

We continue to believe the municipal market is a high quality market with pockets of good investment opportunity for the long-term investor. Going forward, we will be on the look out for attractively valued bonds with good fundamentals-an investment strategy that has served our investors well in the past.

Sincerely,

Steven C. Shachat

Portfolio Manager

| |

Alpine Ultra Short Tax Optimized Income Fund /

Alpine Municipal Money Market Fund |

|

| | |

Mutual fund investing involves risk. Principal loss is possible. The Alpine Municipal Money Market Fund is subject to the following risks:

Fixed Income Securities Risk – Fixed income securities are subject to issuer risk, interest rate risk and market risk.

Interest Rate Risk – Interest rates may rise resulting in a decrease in the value of the securities held by the Fund, or may fall resulting in an increase in the value of such securities. Securities having longer maturities generally involve a greater risk of fluctuations in the value resulting from changes in interest rates.

Issuer Risk – Changes in the financial condition of the issuer of an obligation, changes in general economic conditions, or changes in economic conditions that affect the issuer may impact its actual or perceived willingness or ability to make timely payments of interest or principal.

Liquidity Risk – Some securities held by the fund may be difficult to sell, or illiquid, particularly during times of market turmoil. Illiquid securities may also be difficult to value. If the fund is forced to sell an illiquid asset to meet redemption requests or other cash needs, the fund may be forced to sell at a loss.

Management Risk – The Adviser’s security selections and other investment decisions might produce losses or cause the Fund to under perform when compared to other funds with similar investment goals.

Market Risk – The price of a security held by the Fund may fall due to changing market, economic or political conditions.

Municipal Securities Concentration Risk – From time to time the Fund may invest a substantial amount of its assets in municipal securities whose interest is paid solely from revenues of similar projects. If the Fund concentrates its investments in this manner, it assumes the economic risks relating to such projects and this may have a significant impact on the Fund’s investment performance.

Municipal Securities Risk – Municipal securities risks include the ability of the issuer to repay the obligation, the relative lack of information about certain issuers of municipal securities, and the possibility of future legislative changes which could affect the market for and value of municipal securities. Certain municipal securities, including private activity bonds, are not backed by the full faith, credit and taxing power of the issuer. Additionally, if events occur after the security is acquired that impact the security’s tax-exempt status, the Fund and its shareholders could be subject to substantial tax liabilities.

Redemption Risk – The fund may experience heavy redemptions, particularly during periods of declining or illiquid markets, that could cause the fund to liquidate its assets at inopportune times or at a loss or depressed value and that could affect the fund’s ability to maintain a $1.00 share price. In addition, the fund may suspend redemptions when permitted by applicable regulations.

Regulatory Risk – The SEC recently amended the rules governing money market funds. In addition, the SEC continues to review the regulation of such funds. Any further changes by the SEC or additional legislative developments may affect the Alpine Municipal Money Market Fund’s operations, investment strategies, performance and yield.

Variable Rate Demand Obligations Risks – Variable rate demand obligations are floating rate securities that combine an interest in a long-term municipal bond with a right to demand payment before maturity from a bank or other financial institution. There is the possibility that because of default or insolvency the right to demand payment from the bank or other financial institution may not be honored. If the bank or financial institution is unable to pay, the Fund may lose money. The absence of an active market for these securities could make it difficult for the Fund to dispose of them if the issuer defaults. During periods of declining interest rates, a Fund’s yield on a VRDO will decrease and its shareholders will forego the opportunity for capital appreciation.

The Alpine Ultra Short Tax Optimized Income Fund is subject to the following risks:

Derivative Securities Risk – The Fund may invest in municipal derivative securities which are subject to structural risks that could cause the Fund to receive taxable income or to lose money.

Fixed Income Securities Risk – Fixed income securities are subject to issuer risk, interest rate risk and market risk.

Interest Rate Risk – Interest rates may rise resulting in a decrease in the value of the securities held by the Fund, or may fall resulting in an increase in the value of such securities. Securities having longer maturities generally involve a greater risk of fluctuations in the value resulting from changes in interest rates.

Issuer Risk – Changes in the financial condition of the issuer of an obligation, changes in general economic conditions, or changes in economic conditions that affect the issuer may impact its actual or perceived willingness or ability to make timely payments of interest or principal.

44

| |

Alpine Ultra Short Tax Optimized Income Fund /

Alpine Municipal Money Market Fund |

|

| | |

Liquidity Risk – Some securities held by the fund may be difficult to sell, or illiquid, particularly during times of market turmoil. Illiquid securities may also be difficult to value. If the fund is forced to sell an illiquid asset to meet redemption requests or other cash needs, the fund may be forced to sell at a loss.

Management Risk – The Adviser’s security selections and other investment decisions might produce losses or cause the Fund to under perform when compared to other funds with similar investment goals.

Market Risk – The price of a security held by the Fund may fall due to changing market, economic or political conditions.

Portfolio Turnover Risk – High portfolio turnover necessarily results in greater transaction costs which may reduce Fund performance.

Mortgage Related and Asset Backed Securities Risk – These securities are subject to prepayment risk, which is the risk that the borrower will prepay some or all of the principal owed to the owner. This could reduce the Fund’s share price and its income distributions.

Tax Risk – Changes in tax laws or adverse determinations by the Internal Revenue Service may make the income from some municipal obligations taxable. Additionally, maximizing after-tax income may require trade-offs that reduce pre-tax income. The Fund’s tax-efficient strategies may reduce the taxable income of the Fund’s shareholders, but will not eliminate it. There can be no assurance that taxable distributions can always be avoided or that the Fund will achieve its investment objective.

Variable Rate Demand Obligations Risks – Variable rate demand obligations are floating rate securities that combine an interest in a long-term municipal bond with a right to demand payment before maturity from a bank or other financial institution. There is the possibility that because of default or insolvency the right to demand payment from the bank or other financial institution may not be honored. If the bank or financial institution is unable to pay, the Fund may lose money. The absence of an active market for these securities could make it difficult for the Fund to dispose of them if the issuer defaults. During periods of declining interest rates, a Fund’s yield on a VRDO will decrease and its shareholders will forego the opportunity for capital appreciation.

Please refer to page 5 for other important disclosures and definitions.

45

|

Alpine Dynamic Dividend Fund |

| |

|

Schedule of Portfolio Investments

April 30, 2011 (Unaudited) |

| | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | |

Common Stocks—96.5% |

Australia—1.0% | | | | |

64,000 | | BHP Billiton, Ltd.—ADR | | $ | 6,479,360 | |

| | | | | | |

Brazil—8.9% | | | | |

400,286 | | Anhanguera Educacional

Participacoes SA | | | 8,905,422 | |

542,600 | | Diagnosticos da America SA | | | 7,260,189 | |

785,000 | | Estacio Participacoes SA | | | 11,476,608 | |

568,372 | | Hypermarcas SA (a) | | | 7,623,093 | |

865,574 | | International Meal Co.

Holdings SA (a) | | | 8,610,624 | |

421,875 | | Magazine Luiza SA (a) | | | 4,290,618 | |

537,619 | | Multiplus SA | | | 11,038,071 | |

| | | | | | |

| | | | | 59,204,625 | |

| | | | | | |

Canada—0.0%* |

12,345 | | Dundee Capital Markets, Inc. (a) | | | 18,919 | |

| | | | | | |

China—1.4% |

1,433,900 | | China ZhengTong Auto Services

Holdings, Ltd. (a) | | | 1,611,839 | |

14,415,000 | | Global Dairy Holdings, Ltd. (a) | | | 6,236,524 | |

739,000 | | Zhongsheng Group Holdings,

Ltd. (a) | | | 1,394,977 | |

| | | | | | |

| | | | | 9,243,340 | |

| | | | | | |

Finland—2.3% |

72,900 | | Konecranes OYJ | | | 3,505,976 | |

1,289,800 | | Nokia OYJ—ADR | | | 11,904,854 | |

| | | | | | |

| | | | | 15,410,830 | |

| | | | | | |

France—3.1% |

139,500 | | Carrefour SA | | | 6,613,921 | |

73,100 | | Cie Generale des Etablissements

Michelin SA—B Shares | | | 7,326,771 | |

209,700 | | Vivendi SA | | | 6,580,001 | |

| | | | | | |

| | | | | 20,520,693 | |

| | | | | | |

India—1.2% |

717,200 | | Glenmark Pharmaceuticals, Ltd. | | | 4,832,969 | |

482,400 | | Orchid Chemicals &

Pharmaceuticals, Ltd. (a) | | | 3,302,555 | |

| | | | | | |

| | | | | 8,135,524 | |

| | | | | | |

Israel—0.9% |

2,151,900 | | Bezeq The Israeli

Telecommunication Corp., Ltd. | | | 6,372,463 | |

| | | | | | |

Norway—6.5% |

11,322,000 | | Marine Harvest ASA | | | 14,954,725 | |

3,583,229 | | North Atlantic Drilling, Ltd. (a) | | | 6,829,621 | |

419,200 | | Seadrill, Ltd. | | | 14,853,292 | |

236,000 | | Statoil ASA (a) | | | 6,904,662 | |

| | | | | | |

| | | | | 43,542,300 | |

| | | | | | |

South Korea—2.1% |

61,200 | | Hyundai Motor Co. | | | 14,077,171 | |

| | | | | | |

Spain—0.5% |

705,000 | | Iberdrola Renovables SA | | | 3,227,656 | |

| | | | | | |

Sweden—10.1% |

514,800 | | Atlas Copco AB—A Shares | | | 15,113,989 | |

320,400 | | Haldex AB (a) | | | 5,647,146 | |

454,400 | | JM AB | | | 12,972,222 | |

302,290 | | NCC AB—B Shares | | | 8,079,477 | |

740,100 | | Tele2 AB—B Shares | | | 18,580,736 | |

378,100 | | Volvo AB—B Shares | | | 7,421,271 | |

| | | | | | |

| | | | | 67,814,841 | |

| | | | | | |

| | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | |

Common Stocks—continued |

Turkey—2.6% |

4,056,400 | | Emlak Konut Gayrimenkul

Yatirim Ortakligi | | $ | 8,000,789 | |

547,815 | | Migros Ticaret AS (a) | | | 9,472,409 | |

| | | | | | |

| | | | | 17,473,198 | |

| | | | | | |

United Kingdom—5.5% |

258,000 | | Aggreko PLC | | | 7,701,081 | |

263,800 | | Antofagasta PLC (a) | | | 6,023,525 | |

1,672,939 | | Cairn Energy PLC (a) | | | 12,627,863 | |

868,300 | | John Wood Group PLC | | | 10,109,042 | |

| | | | | | |

| | | | | 36,461,511 | |

| | | | | | |

United States—50.4% |

52,379 | | Apache Corp. | | | 6,985,787 | |

94,130 | | Baker Hughes, Inc. | | | 7,286,603 | |

47,053 | | BlackRock, Inc. | | | 9,219,565 | |

1,039,559 | | Boise, Inc. | | | 10,208,469 | |

358,518 | | Cisco Systems, Inc. | | | 6,295,576 | |

47,986 | | Cummins, Inc. | | | 5,766,957 | |

33,227 | | Deere & Co. | | | 3,239,633 | |

210,800 | | Dollar Thrifty Automotive

Group, Inc. (a) | | | 14,530,444 | |

84,743 | | FirstEnergy Corp. | | | 3,386,330 | |

113,384 | | Freeport-McMoRan Copper &

Gold, Inc. | | | 6,239,522 | |

137,226 | | Halliburton Co. | | | 6,927,169 | |

140,894 | | Hasbro, Inc. | | | 6,599,475 | |

337,605 | | Healthcare Services Group, Inc. | | | 5,995,865 | |

39,350 | | Hess Corp. | | | 3,382,526 | |

301,767 | | Intel Corp. | | | 6,997,977 | |

78,526 | | International Business

Machines Corp. | | | 13,394,965 | |

267,910 | | ITC Holdings Corp. | | | 19,002,856 | |

279,868 | | JPMorgan Chase & Co. | | | 12,770,377 | |

832,130 | | KKR & Co. Guernsey LP | | | 15,777,185 | |

228,091 | | Lazard, Ltd.—Class A | | | 9,351,731 | |

126,300 | | McDonald’s Corp. | | | 9,890,553 | |

183,566 | | Merck & Co., Inc. | | | 6,599,198 | |

238,425 | | Meridian Bioscience, Inc. | | | 5,891,482 | |

138,527 | | Microchip Technology, Inc. | | | 5,685,148 | |

218,581 | | Morgan Stanley | | | 5,715,893 | |

86,210 | | NextEra Energy, Inc. | | | 4,876,900 | |

93,396 | | Norfolk Southern Corp. | | | 6,974,813 | |

62,987 | | Occidental Petroleum Corp. | | | 7,198,784 | |

493,813 | | Och-Ziff Capital Management

Group, LLC | | | 7,935,575 | |

906,448 | | Regal Entertainment

Group—Class A | | | 12,490,853 | |

124,695 | | Ryder System, Inc. | | | 6,671,183 | |

72,523 | | Schlumberger, Ltd. | | | 6,508,939 | |

55,286 | | Snap-On, Inc. | | | 3,415,016 | |

143,300 | | State Street Corp. | | | 6,670,615 | |

215,600 | | The Bank of New York

Mellon Corp. | | | 6,243,776 | |

71,599 | | The Boeing Co. | | | 5,712,168 | |

19,485 | | The Goldman Sachs Group, Inc. | | | 2,942,430 | |

254,211 | | The Kroger Co. | | | 6,179,869 | |

149,425 | | The Walt Disney Co. | | | 6,440,218 | |

175,926 | | Time Warner, Inc. | | | 6,660,558 | |

142,442 | | Tupperware Brands Corp. | | | 9,069,282 | |

85,477 | | United Parcel Service,

Inc.—Class B | | | 6,408,211 | |

The accompanying notes are an integral part of these financial statements.

46

|

Alpine Dynamic Dividend Fund |

| |

|

Schedule of Portfolio Investments—Continued

April 30, 2011 (Unaudited) |

| | | | | | | |

| Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—continued |

United States—continued |

| 76,043 | | United Technologies Corp. | | $ | 6,811,932 | |

| 85,864 | | Visa, Inc.—Class A | | | 6,707,696 | |

| 301,782 | | Wabash National Corp. (a) | | | 3,328,655 | |

| | | | | | | |

| | | | | | 336,388,759 | |

| | | | | | | |

| | | Total Common Stocks

(Cost $508,462,381) | | | 644,371,190 | |

| | | | | | | |

| | | | | | | |

Principal

Amount | | Security

Description | | | Value | |

| | | | | | | |

| | | | | | | |

Short-Term Investments—4.2% |

$ | 27,873,000 | | State Street Eurodollar

Time Deposit, 0.01% | | $ | 27,873,000 | |

| | | | | | | |

| | | Total Short-Term Investments

(Cost $27,873,000) | | | 27,873,000 | |

| | | | | | | |

| | | Total Investments

(Cost $536,335,381)—100.7% | | | 672,244,190 | |

| | | Liabilities in Excess of

Other Assets—(0.7)% | | | (4,522,699 | ) |

| | | | | | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 667,721,491 | |

| | | | | | | |

| | |

| | |

| | |

Percentages are stated as a percent of net assets. |

|

* | Amount is less than 0.05%. |

| |

(a) | Non-income producing security. |

|

AB—Aktiebolag is the Swedish equivalent of the term corporation. |

|

ADR—American Depositary Receipt |

|

AS—Aktieselskab is the Danish term for a stock-based corporation. |

|

ASA—Allmennaksjeselskap is the Norwegian term for a public limited company. |

|

OYJ—Osakeyhtio is the Finnish equivalent of a limited company. |

|

PLC—Public Limited Company |

|

SA—Generally designates corporations in various countries, mostly those employing the civil law. |

The accompanying notes are an integral part of these financial statements.

47

|

Alpine Accelerating Dividend Fund |

| |

|

Schedule of Portfolio Investments

April 30, 2011 (Unaudited) |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—93.3% |

Aerospace & Defense—1.9% |

| 650 | | United Technologies Corp. | | $ | 58,227 | |

| | | | | | | |

Beverages—4.0% |

| 800 | | Anheuser-Busch InBev NV—ADR | | | 51,176 | |

| 1,000 | | PepsiCo, Inc. | | | 68,890 | |

| | | | | | | |

| | | | | | 120,066 | |

| | | | | | | |

Capital Markets—4.4% |

| 225 | | BlackRock, Inc. | | | 44,086 | |

| 2,750 | | KKR & Co. Guernsey LP | | | 52,140 | |

| 900 | | Lazard, Ltd.—Class A | | | 36,900 | |

| | | | | | | |

| | | | | | 133,126 | |

| | | | | | | |

Chemicals—3.5% |

| 700 | | Air Products & Chemicals, Inc. | | | 66,864 | |

| 375 | | Praxair, Inc. | | | 39,908 | |

| | | | | | | |

| | | | | | 106,772 | |

| | | | | | | |

Commercial Banks—3.5% |

| 6,500 | | First Commonwealth

Financial Corp. | | | 40,300 | |

| 8,500 | | Grupo Financiero Banorte

SAB de CV | | | 42,457 | |

| 1,750 | | Union First Market Bankshares

Corp. | | | 22,277 | |

| | | | | | | |

| | | | | | 105,034 | |

| | | | | | | |

Communications Equipment—2.3% |

| 2,675 | | Cisco Systems, Inc. | | | 46,973 | |

| 2,500 | | Nokia OYJ—ADR | | | 23,075 | |

| | | | | | | |

| | | | | | 70,048 | |

| | | | | | | |

Computers & Peripherals—0.9% |

| 675 | | Hewlett-Packard Co. | | | 27,250 | |

| | | | | | | |

Construction & Engineering—1.8% |

| 2,500 | | Aecon Group, Inc. | | | 24,732 | |

| 30,000 | | China State Construction

International Holdings, Ltd. | | | 29,319 | |

| | | | | | | |

| | | | | | 54,051 | |

| | | | | | | |

Containers & Packaging—1.2% |

| 1,075 | | Sonoco Products Co. | | | 37,152 | |

| | | | | | | |

Diversified Financial Services—3.3% |

| 1,850 | | Bank of America Corp. | | | 22,718 | |

| 170 | | CME Group, Inc. | | | 50,281 | |

| 570 | | JPMorgan Chase & Co. | | | 26,009 | |

| | | | | | | |

| | | | | | 99,008 | |

| | | | | | | |

Electric Utilities—2.7% |

| 1,700 | | EVN AG | | | 32,608 | |

| 1,800 | | Light SA | | | 30,320 | |

| 8,000 | | Tauron Polska Energia SA (a) | | | 18,684 | |

| | | | | | | |

| | | | | | 81,612 | |

| | | | | | | |

Energy Equipment & Services—4.2% |

| 730 | | Schlumberger, Ltd. | | | 65,517 | |

| 1,750 | | Seadrill, Ltd. | | | 62,007 | |

| | | | | | | |

| | | | | | 127,524 | |

| | | | | | | |

Food & Staples Retailing—2.3% |

| 300 | | George Weston, Ltd. | | | 21,494 | |

| 1,100 | | Walgreen Co. | | | 46,992 | |

| | | | | | | |

| | | | | | 68,486 | |

| | | | | | | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—continued |

Food Products—3.5% |

| 880 | | General Mills, Inc. | | $ | 33,951 | |

| 500 | | The J.M. Smucker Co. | | | 37,535 | |

| 2,700 | | Viterra, Inc. | | | 32,446 | |

| | | | | | | |

| | | | | | 103,932 | |

| | | | | | | |

Gas Utilities—0.9% |

| 780 | | UGI Corp. | | | 25,974 | |

| | | | | | | |

Health Care Equipment & Supplies—1.7% |

| 600 | | Becton, Dickinson & Co. | | | 51,564 | |

| | | | | | | |

Health Care Providers & Services—1.7% |

| 1,025 | | UnitedHealth Group, Inc. | | | 50,461 | |

| | | | | | | |

Hotels, Restaurants & Leisure—1.1% |

| 850 | | Carnival Corp. | | | 32,360 | |

| | | | | | | |

Household Durables—1.1% |

| 12,000 | | Pace PLC | | | 32,291 | |

| | | | | | | |

Household Products—1.7% |

| 800 | | The Procter & Gamble Co. | | | 51,920 | |

| | | | | | | |

Industrial Conglomerates—2.8% |

| 475 | | 3M Co. | | | 46,175 | |

| 800 | | Tyco International, Ltd. | | | 38,992 | |

| | | | | | | |

| | | | | | 85,167 | |

| | | | | | | |

IT Services—3.8% |

| 400 | | International Business

Machines Corp. | | | 68,232 | |

| 580 | | Visa, Inc.—Class A | | | 45,310 | |

| | | | | | | |

| | | | | | 113,542 | |

| | | | | | | |

Machinery—4.2% |

| 800 | | Dover Corp. | | | 54,432 | |

| 3,000 | | Rocky Mountain Dealerships, Inc. | | | 31,517 | |

| 680 | | Snap-On, Inc. | | | 42,004 | |

| | | | | | | |

| | | | | | 127,953 | |

| | | | | | | |

Media—5.4% |

| 1,299 | | CBS Corp.—Class B | | | 32,761 | |

| 2,400 | | Comcast Corp.—Class A | | | 62,976 | |

| 1,425 | | SES SA | | | 37,422 | |

| 900 | | Vivendi SA | | | 28,240 | |

| | | | | | | |

| | | | | | 161,399 | |

| | | | | | | |

Metals & Mining—2.1% |

| 1,850 | | Vale SA—ADR | | | 61,790 | |

| | | | | | | |

Multi-Utilities—1.5% |

| 500 | | NorthWestern Corp. | | | 16,275 | |

| 900 | | Wisconsin Energy Corp. | | | 28,089 | |

| | | | | | | |

| | | | | | 44,364 | |

| | | | | | | |

Oil, Gas & Consumable Fuels—4.9% |

| 675 | | Chevron Corp. | | | 73,872 | |

| 2,000 | | El Paso Pipeline Partners LP | | | 74,080 | |

| | | | | | | |

| | | | | | 147,952 | |

| | | | | | | |

Personal Products—1.0% |

| 2,300 | | Hypermarcas SA (a) | | | 30,848 | |

| | | | | | | |

Pharmaceuticals—1.6% |

| 950 | | Abbott Laboratories | | | 49,438 | |

| | | | | | | |

Real Estate Investment Trusts—2.2% |

| 2,700 | | Chatham Lodging Trust | | | 43,605 | |

| 3,000 | | MFA Financial, Inc. | | | 23,940 | |

| | | | | | | |

| | | | | | 67,545 | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

48

|

Alpine Accelerating Dividend Fund |

| |

|

Schedule of Portfolio Investments—Continued

April 30, 2011 (Unaudited) |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | |

Common Stocks—continued |

Road & Rail—3.1% |

| 650 | | Norfolk Southern Corp. | | $ | 48,542 | |

| 2,700 | | Tegma Gestao Logistica SA | | | 46,287 | |

| | | | | | | |

| | | | | | 94,829 | |

| | | | | | | |

Semiconductors & Semiconductor Equipment—5.2% |

| 1,500 | | Avago Technologies, Ltd. | | | 50,190 | |

| 2,250 | | Intel Corp. | | | 52,177 | |

| 1,600 | | Linear Technology Corp. | | | 55,680 | |

| | | | | | | |

| | | | | | 158,047 | |

| | | | | | | |

Software—2.5% |

| 1,750 | | Microsoft Corp. | | | 45,535 | |

| 1,500 | | Totvs SA | | | 28,604 | |

| | | | | | | |

| | | | | | 74,139 | |

| | | | | | | |

Specialty Retail—1.9% |

| 1,300 | | Guess?, Inc. | | | 55,887 | |

| | | | | | | |

Textiles, Apparel & Luxury Goods—2.2% |

| 450 | | NIKE, Inc.—Class B | | | 37,044 | |

| 300 | | VF Corp. | | | 30,168 | |

| | | | | | | |

| | | | | | 67,212 | |

| | | | | | | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | |

Thrifts & Mortgage Finance—0.8% |

| 2,000 | | Home Federal Bancorp, Inc. | | $ | 24,300 | |

| | | | | | | |

Transportation Infrastructure—0.4% |

| 24,000 | | GZI Transport, Ltd. | | | 13,288 | |

| | | | | | | |

| | | Total Common Stocks

(Cost $2,346,110) | | | 2,814,558 | |

| | | | | | | |

| | | | | | | |

Principal

Amount | | | | | | |

| | | | | | | |

Short-Term Investments—3.3% |

| $ 101,000 | | State Street Eurodollar

Time Deposit, 0.01% | | | 101,000 | |

| | | | | | | |

| | | Total Short-Term Investments

(Cost $101,000) | | | 101,000 | |

| | | | | | | |

| | | Total Investments

(Cost $2,447,110)—96.6% | | | 2,915,558 | |

| | | Other Assets in Excess of

Liabilities—3.4% | | | 102,343 | |

| | | | | | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 3,017,901 | |

| | | | | | | |

| | |

| | |

| | |

Percentages are stated as a percent of net assets. |

| |

(a) | Non-income producing security. |

| |

ADR—American Depositary Receipt |

| |

AG—Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by shareholders. |

| |

NV—Naamloze Vennootschap is the Dutch term for a public limited liability corporation. |

| |

OYJ—Osakeyhtio is the Finnish equivalent of a limited company. |

| |

PLC—Public Limited Company |

| |

SA—Generally designates corporations in various countries, mostly those employing the civil law. |

| |

SAB de CV—Sociedad Anonima Bursátil de Capital Variable. Is the Spanish equivalent to Variable Capital Company. |

The accompanying notes are an integral part of these financial statements.

49

|

Alpine Dynamic Financial Services Fund |

| |

Schedule of Portfolio Investments

April 30, 2011 (Unaudited)

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

|

Common Stocks—102.4% | | | | |

Capital Markets—18.4% | | | | |

| 10,000 | | Artio Global Investors, Inc. | | $ | 164,300 | |

| 20,000 | | BGC Partners, Inc.—Class A | | | 193,000 | |

| 20,000 | | Blackstone Group LP | | | 378,800 | |

| 52,033 | | Cowen Group, Inc.—Class A (a) | | | 216,457 | |

| 18,500 | | GFI Group, Inc. | | | 94,535 | |

| 30,000 | | Gleacher & Co., Inc. (a) | | | 56,700 | |

| 13,000 | | JMP Group, Inc. | | | 111,800 | |

| 25,100 | | MF Global Holdings, Ltd. (a) | | | 211,091 | |

| 2,000 | | Och-Ziff Capital Management

Group, LLC | | | 32,140 | |

| 30,300 | | Rodman & Renshaw Capital

Group, Inc. (a) | | | 59,691 | |

| 35,000 | | Sanders Morris Harris Group, Inc. | | | 302,050 | |

| | | | | | | |

| | | | | | 1,820,564 | |

| | | | | | | |

Commercial Banks—51.7% | | | | |

| 45,165 | | 1st United Bancorp, Inc. (a) | | | 314,800 | |

| 3,000 | | American River Bankshares (a) | | | 18,750 | |

| 13,500 | | Banco ABC Brasil SA | | | 115,847 | |

| 13,000 | | Banco Industrial e Comercial SA | | | 93,129 | |

| 53,940 | | Bank of Commerce Holdings | | | 234,100 | |

| 55,712 | | Bank of Virginia (a) | | | 108,638 | |

| 55,000 | | Banner Corp. | | | 151,250 | |

| 13,428 | | Barclays PLC | | | 63,318 | |

| 14,000 | | Boston Private Financial

Holdings, Inc. | | | 97,860 | |

| 15,000 | | California United Bank (a) | | | 185,250 | |

| 4,000 | | Cardinal Financial Corp. | | | 44,960 | |

| 80,000 | | Carolina Trust Bank (a) | | | 248,800 | |

| 23,800 | | Centerstate Banks, Inc. | | | 148,036 | |

| 34,337 | | Citizens First Corp. (a) | | | 279,160 | |

| 7,000 | | Columbia Banking System, Inc. | | | 132,020 | |

| 4,700 | | Community National Bank of

the Lakeway Area (a) | | | 12,103 | |

| 4,000 | | First Business Financial

Services, Inc. | | | 47,800 | |

| 80,000 | | First California Financial

Group, Inc. (a) | | | 308,000 | |

| 1,000 | | FirstMerit Corp. | | | 17,470 | |

| 3,200 | | KeyCorp | | | 27,744 | |

| 21,000 | | Mitsubishi UFJ Financial

Group, Inc. | | | 100,191 | |

| 37,000 | | National Bank of Greece SA—ADR | | | 58,830 | |

| 10,200 | | New Century Bancorp, Inc. (a) | | | 52,530 | |

| 400 | | North Valley Bancorp (a) | | | 4,038 | |

| 2,375 | | Old Point Financial Corp. | | | 27,693 | |

| 4,000 | | Oriental Financial Group, Inc. | | | 51,840 | |

| 19,750 | | Pacific Mercantile Bancorp (a) | | | 84,925 | |

| 18,276 | | Pacific Premier Bancorp, Inc. (a) | | | 127,932 | |

| 75,000 | | Republic First Bancorp, Inc. (a) | | | 209,250 | |

| 3,120 | | Rurban Financial Corp. (a) | | | 10,140 | |

| 100,000 | | Seacoast Banking Corp.

of Florida (a) | | | 179,000 | |

| 38,750 | | Southern National Bancorp of

Virginia, Inc. (a) | | | 274,737 | |

| 2,500 | | Sterling Bancorp | | | 25,875 | |

| 30,000 | | Sterling Bancshares, Inc. | | | 266,700 | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

|

Common Stocks—continued | | | | |

Commercial Banks—continued | | | | |

| 3,000 | | Sumitomo Mitsui Financial

Group, Inc. | | $ | 92,276 | |

| 6,000 | | Summit State Bank | | | 41,040 | |

| 3,810 | | SunTrust Banks, Inc. | | | 107,404 | |

| 152,347 | | Synovus Financial Corp. | | | 380,867 | |

| 5,000 | | The Savannah Bancorp, Inc. (a) | | | 39,300 | |

| 22,663 | | Tidelands Bancshares, Inc. (a) | | | 7,932 | |

| 34,300 | | United Community Banks, Inc. (a) | | | 82,320 | |

| 2,430 | | Valley Commerce Bancorp (a) | | | 23,219 | |

| 32,000 | | VTB Bank OJSC—GDR (b) | | | 207,040 | |

| 1,974 | | Yadkin Valley Financial Corp. (a) | | | 4,520 | |

| | | | | | | |

| | | | | | 5,108,634 | |

| | | | | | | |

Consumer Finance—2.9% | | | | |

| 1,000 | | Green Dot Corp.—Class A (a) | | | 43,160 | |

| 20,000 | | Imperial Holdings, Inc. (a) | | | 198,800 | |

| 4,000 | | Netspend Holdings, Inc. (a) | | | 46,440 | |

| | | | | | | |

| | | | | | 288,400 | |

| | | | | | | |

Diversified Financial Services—12.5% | | | | |

| 7,124 | | BM&F Bovespa SA | | | 53,480 | |

| 1,000 | | CBOE Holdings, Inc. | | | 26,820 | |

| 665 | | CME Group, Inc. | | | 196,687 | |

| 5,173 | | Interactive Brokers Group,

Inc.—Class A | | | 90,735 | |

| 4,315 | | IntercontinentalExchange, Inc. (a) | | | 519,310 | |

| 4,000 | | NYSE Euronext | | | 160,200 | |

| 7,000 | | The NASDAQ OMX Group, Inc. (a) | | | 189,700 | |

| | | | | | | |

| | | | | | 1,236,932 | |

| | | | | | | |

Health Care Providers & Services—0.7% | | | | |

| 25,000 | | Tempo Participacoes SA (a) | | | 65,472 | |

| | | | | | | |

Industrial Conglomerates—1.5% | | | | |

| 7,000 | | General Electric Co. | | | 143,150 | |

| | | | | | | |

Insurance—0.6% | | | | |

| 3,500 | | Assured Guaranty, Ltd. | | | 59,500 | |

| | | | | | | |

Real Estate Investment Trusts—2.4% | | | | |

| 10,000 | | ARMOUR Residential REIT, Inc. | | | 74,300 | |

| 3,700 | | Chatham Lodging Trust | | | 59,755 | |

| 5,625 | | Chesapeake Lodging Trust | | | 101,137 | |

| | | | | | | |

| | | | | | 235,192 | |

| | | | | | | |

Thrifts & Mortgage Finance—11.7% | | | | |

| 41,306 | | Alliance Bancorp, Inc. of

Pennsylvania | | | 460,562 | |

| 1,700 | | Astoria Financial Corp. | | | 24,599 | |

| 5,000 | | Central Federal Corp. (a) | | | 5,700 | |

| 2,144 | | Fidelity Bancorp, Inc. | | | 19,296 | |

| 5,895 | | First Pactrust Bancorp, Inc. | | | 91,313 | |

| 40,000 | | Flagstar Bancorp, Inc. (a) | | | 62,400 | |

| 8,650 | | HopFed Bancorp, Inc. | | | 77,504 | |

| 1,100 | | Parkvale Financial Corp. | | | 12,375 | |

| 50,000 | | Provident Financial Holdings, Inc. | | | 406,500 | |

| | | | | | | |

| | | | | | 1,160,249 | |

| | | | | | | |

| | | Total Common Stocks

(Cost $11,817,752) | | | 10,118,093 | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

50

|

Alpine Dynamic Financial Services Fund |

| |

Schedule of Portfolio Investments—Continued

April 30, 2011 (Unaudited)

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | |

Investment Companies—0.8% | | | | |

| 390 | | Direxion Daily Financial Bear

3X Shares (a) | | $ | 15,308 | |

| 800 | | Direxion Daily Large Cap Bear

3X Shares (a) | | | 25,928 | |

| 625 | | ProShares UltraShort Financials (a) | | | 35,256 | |

| | | | | | | |

| | | Total Investment Companies

(Cost $296,632) | | | 76,492 | |

| | | | | | | |

| | | Total Investments

(Cost $12,114,384)—103.2% (c) | | | 10,194,585 | |

| | | Liabilities in Excess of

Other Assets—(3.2)% | | | (313,837) | |

| | | | | | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 9,880,748 | |

| | | | | | | |

| | |

| | |

Percentages are stated as a percent of net assets. |

|

(a) | Non-income producing security. |

| |

(b) | Restricted under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. These securities have been determined to be liquid under guidelines established by the Board of Trustees. Liquid securities restricted under Rule 144A comprised 2.1% of the Fund’s net assets. |

| |

(c) | Includes securities pledged as collateral for line of credit outstanding as of April 30, 2011. |

| |

ADR—American Depositary Receipt |

|

GDR—Global Depositary Receipt |

|

OJSC—Open Joint Stock Company |

|

PLC—Public Limited Company |

|

REIT—Real Estate Investment Trust |

|

SA—Generally designates corporations in various countries, mostly those employing the civil law. |

The accompanying notes are an integral part of these financial statements.

51

|

Alpine Dynamic Innovators Fund |

| |

Schedule of Portfolio Investments

April 30, 2011 (Unaudited)

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | |

Common Stocks—110.4% | | | | |

Auto Components—6.7% | | | | |

| 32,857 | | Westport Innovations, Inc. (a) | | $ | 831,018 | |

| | | | | | | |

Biotechnology—0.9% | | | | |

| 5,000 | | Myriad Genetics, Inc. (a) | | | 107,200 | |

| | | | | | | |

Chemicals—6.8% | | | | |

| 7,000 | | Air Products & Chemicals, Inc. | | | 668,640 | |

| 20,000 | | Zagg, Inc. (a) | | | 177,600 | |

| | | | | | | |

| | | | | | 846,240 | |

| | | | | | | |

Commercial Banks—2.5% | | | | |

| 11,000 | | SunTrust Banks, Inc. | | | 310,090 | |

| | | | | | | |

Communications Equipment—1.5% | | | | |

| 5,000 | | DG FastChannel, Inc. (a) | | | 182,950 | |

| | | | | | | |

Computers & Peripherals—2.3% | | | | |

| 5,000 | | Hewlett-Packard Co. | | | 201,850 | |

| 3,000 | | Synaptics, Inc. (a) | | | 85,260 | |

| | | | | | | |

| | | | | | 287,110 | |

| | | | | | | |

Diversified Financial Services—1.9% | | | | |

| 800 | | CME Group, Inc. | | | 236,616 | |

| | | | | | | |

Diversified Telecommunication Services—1.3% | | | | |

| 2,500 | | AboveNet, Inc. | | | 166,875 | |

| | | | | | | |

Electrical Equipment—4.9% | | | | |

| 20,000 | | LSI Industries, Inc. | | | 165,800 | |

| 57,000 | | PowerSecure International,

Inc. (a) | | | 447,450 | |

| | | | | | | |

| | | | | | 613,250 | |

| | | | | | | |

Electronic Equipment, Instruments &

Components—12.4% | | | | |

| 21,000 | | FLIR Systems, Inc. | | | 739,620 | |

| 13,000 | | Itron, Inc. (a) | | | 707,590 | |

| 6,975 | | MOCON, Inc. | | | 101,068 | |

| | | | | | | |

| | | | | | 1,548,278 | |

| | | | | | | |

Health Care Equipment & Supplies—5.8% | | | | |

| 2,500 | | ABIOMED, Inc. (a) | | | 43,450 | |

| 5,000 | | Alere, Inc. (a) | | | 185,700 | |

| 1,400 | | Intuitive Surgical, Inc. (a) | | | 489,580 | |

| | | | | | | |

| | | | | | 718,730 | |

| | | | | | | |

Health Care Providers & Services—9.9% | | | | |

| 17,000 | | Bio-Reference Labs, Inc. (a) | | | 428,570 | |

| 3,000 | | HMS Holdings Corp. (a) | | | 236,130 | |

| 8,000 | | MEDNAX, Inc. (a) | | | 567,360 | |

| | | | | | | |

| | | | | | 1,232,060 | |

| | | | | | | |

Health Care Technology—2.5% | | | | |

| 6,428 | | Allscripts Healthcare Solutions,

Inc. (a) | | | 138,459 | |

| 2,000 | | Quality Systems, Inc. | | | 179,440 | |

| | | | | | | |

| | | | | | 317,899 | |

| | | | | | | |

Internet & Catalog Retail—13.2% | | | | |

| 3,000 | | priceline.com, Inc. (a) | | | 1,641,030 | |

| | | | | | | |

Internet Software & Services—4.4% | | | | |

| 700 | | Google, Inc.—Class A (a) | | | 380,870 | |

| 3,000 | | VistaPrint NV (a) | | | 163,200 | |

| | | | | | | |

| | | | | | 544,070 | |

| | | | | | | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | |

Common Stocks—continued | | | | |

Life Sciences Tools & Services—7.3% | | | | |

| 1,000 | | Bio-Rad Laboratories, Inc.—

Class A (a) | | $ | 125,120 | |

| 4,000 | | Charles River Laboratories

International, Inc. (a) | | | 168,760 | |

| 11,000 | | Life Technologies Corp. (a) | | | 607,200 | |

| 480 | | Sequenom, Inc. (a) | | | 3,384 | |

| | | | | | | |

| | | | | | 904,464 | |

| | | | | | | |

Machinery—6.5% | | | | |

| 4,000 | | Flowserve Corp. | | | 506,480 | |

| 25,000 | | ISE, Ltd. (a)(b) | | | 264 | |

| 3,391 | | Middleby Corp. (a) | | | 304,071 | |

| | | | | | | |

| | | | | | 810,815 | |

| | | | | | | |

Pharmaceuticals—2.2% | | | | |

| 7,000 | | Impax Laboratories, Inc. (a) | | | 191,660 | |

| 5,000 | | The Medicines Co. (a) | | | 78,500 | |

| | | | | | | |

| | | | | | 270,160 | |

| | | | | | | |

Semiconductors & Semiconductor Equipment—7.2% | | | | |

| 15,000 | | ARM Holdings PLC—ADR | | | 471,900 | |

| 15,000 | | DSP Group, Inc. (a) | | | 121,200 | |

| 6,000 | | Veeco Instruments, Inc. (a) | | | 306,780 | |

| | | | | | | |

| | | | | | 899,880 | |

| | | | | | | |

Software—10.2% | | | | |

| 16,400 | | ANSYS, Inc. (a) | | | 906,756 | |

| 6,000 | | Interactive Intelligence, Inc. (a) | | | 224,520 | |

| 20,600 | | Mitek Systems, Inc. (a) | | | 116,390 | |

| 8,000 | | Scientific Learning Corp. (a) | | | 24,800 | |

| | | | | | | |

| | | | | | 1,272,466 | |

| | | | | | | |

| | | Total Common Stocks

(Cost $11,189,255) | | | 13,741,201 | |

| | | | | | | |

| | | Total Investments

(Cost $11,189,255)—110.4% (c) | | | 13,741,201 | |

| | | Liabilities in Excess of

Other Assets—(10.4)% | | | (1,299,403) | |

| | | | | | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 12,441,798 | |

| | | | | | | |

| | |

| | |

Percentages are stated as a percent of net assets. |

| |

(a) | Non-income producing security. |

| |

(b) | Security fair valued in accordance with procedures approved by the Board of Trustees. This security comprised less than 0.05% of the Fund’s net assets. |

| |

(c) | Includes securities pledged as collateral for line of credit outstanding on April 30, 2011. |

|

ADR—American Depositary Receipt |

NV—Naamloze Vennootschap is the Dutch term for a public limited liability corporation. |

PLC—Public Limited Company |

The accompanying notes are an integral part of these financial statements.

52

|

Alpine Dynamic Transformations Fund |

| |

Schedule of Portfolio Investments

April 30, 2011 (Unaudited)

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | |

Common Stocks—103.7% | | | | |

Aerospace & Defense—2.0% | | | | |

| 2,500 | | ITT Corp. | | $ | 144,475 | |

| | | | | | | |

Air Freight & Logistics—6.8% | | | | |

| 3,100 | | Atlas Air Worldwide Holdings,

Inc. (a) | | | 213,621 | |

| 3,000 | | FedEx Corp. | | | 287,010 | |

| | | | | | | |

| | | | | | 500,631 | |

| | | | | | | |

Auto Components—4.7% | | | | |

| 5,000 | | Amerigon, Inc. (a) | | | 85,250 | |

| 2,000 | | Autoliv, Inc. | | | 160,260 | |

| 2,063 | | Tenneco, Inc. (a) | | | 95,331 | |

| | | | | | | |

| | | | | | 340,841 | |

| | | | | | | |

Biotechnology—1.5% | | | | |

| 5,000 | | Myriad Genetics, Inc. (a) | | | 107,200 | |

| | | | | | | |

Chemicals—5.0% | | | | |

| 2,000 | | Albemarle Corp. | | | 141,100 | |

| 1,000 | | Lubrizol Corp. | | | 134,520 | |

| 10,000 | | Zagg, Inc. (a) | | | 88,800 | |

| | | | | | | |

| | | | | | 364,420 | |

| | | | | | | |

Commercial Banks—1.6% | | | | |

| 1,000 | | PNC Financial Services Group, Inc. | | | 62,340 | |

| 1,991 | | Wells Fargo & Co. | | | 57,958 | |

| | | | | | | |

| | | | | | 120,298 | |

| | | | | | | |

Commercial Services & Supplies—0.5% | | | | |

| 1,500 | | Tetra Tech, Inc. (a) | | | 35,430 | |

| | | | | | | |

Diversified Financial Services—4.1% | | | | |

| 10,000 | | Bank of America Corp. | | | 122,800 | |

| 600 | | CME Group, Inc. | | | 177,462 | |

| | | | | | | |

| | | | | | 300,262 | |

| | | | | | | |

Electronic Equipment, Instruments &

Components—2.4% | | | | |

| 4,940 | | FLIR Systems, Inc. | | | 173,987 | |

| | | | | | | |

Energy Equipment & Services—1.4% | | | | |

| 8,000 | | ION Geophysical Corp. (a) | | | 101,120 | |

| | | | | | | |

Health Care Equipment & Supplies—7.1% | | | | |

| 2,000 | | Edwards Lifesciences Corp. (a) | | | 172,700 | |

| 1,000 | | Intuitive Surgical, Inc. (a) | | | 349,700 | |

| | | | | | | |

| | | | | | 522,400 | |

| | | | | | | |

Health Care Providers & Services—2.9% | | | | |

| 3,305 | | Emergency Medical Services

Corp. (a) | | | 210,859 | |

| | | | | | | |

Health Care Technology—0.4% | | | | |

| 1,428 | | Allscripts Healthcare Solutions,

Inc. (a) | | | 30,759 | |

| | | | | | | |

Hotels, Restaurants & Leisure—2.5% | | | | |

| 5,000 | | Starbucks Corp. | | | 180,950 | |

| | | | | | | |

Household Durables—5.2% | | | | |

| 6,000 | | Tempur-Pedic International,

Inc. (a) | | | 376,680 | |

| | | | | | | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | |

Common Stocks—continued | | | | |

Industrial Conglomerates—4.2% | | | | |

| 8,000 | | Cookson Group PLC (a) | | $ | 95,611 | |

| 10,300 | | General Electric Co. | | | 210,635 | |

| | | | | | | |

| | | | | | 306,246 | |

| | | | | | | |

Internet & Catalog Retail—6.0% | | | | |

| 800 | | priceline.com, Inc. (a) | | | 437,608 | |

| | | | | | | |

Internet Software & Services—1.5% | | | | |

| 200 | | Google, Inc.—Class A (a) | | | 108,820 | |

| | | | | | | |

Machinery—18.5% | | | | |

| 2,400 | | Cummins, Inc. | | | 288,432 | |

| 2,000 | | Eaton Corp. | | | 107,060 | |

| 11,000 | | Fenner PLC | | | 71,254 | |

| 40,000 | | Industrea, Ltd. | | | 65,327 | |

| 5,000 | | Pall Corp. | | | 292,200 | |

| 3,000 | | Snap-On, Inc. | | | 185,310 | |

| 10,000 | | Wabash National Corp. (a) | | | 110,300 | |

| 9,037 | | Westport Innovations, Inc. (a) | | | 228,636 | |

| | | | | | | |

| | | | | | 1,348,519 | |

| | | | | | | |

Metals & Mining—11.7% | | | | |

| 10,000 | | Globe Specialty Metals, Inc. | | | 225,100 | |

| 6,000 | | Northern Dynasty Minerals,

Ltd. (a) | | | 81,540 | |

| 2,400 | | Teck Resources, Ltd.—Class B | | | 130,200 | |

| 3,000 | | Walter Energy, Inc. | | | 414,660 | |

| | | | | | | |

| | | | | | 851,500 | |

| | | | | | | |

Oil, Gas & Consumable Fuels—0.7% | | | | |

| 372 | | Apache Corp. | | | 49,614 | |

| | | | | | | |

Real Estate Investment Trusts (REITs)—0.3% | | | | |

| 1,095 | | Walter Investment

Management Corp. | | | 19,513 | |

| | | | | | | |

Semiconductors & Semiconductor

Equipment—3.4% | | | | |

| 8,000 | | ARM Holdings PLC—ADR | | | 251,680 | |

| | | | | | | |

Software—4.1% | | | | |

| 20,600 | | Mitek Systems, Inc. (a) | | | 116,390 | |

| 5,000 | | Oracle Corp. | | | 180,250 | |

| | | | | | | |

| | | | | | 296,640 | |

| | | | | | | |

Specialty Retail—3.5% | | | | |

| 10,000 | | GameStop Corp.—Class A (a) | | | 256,800 | |

| | | | | | | |

Textiles, Apparel & Luxury Goods—1.7% | | | | |

| 4,000 | | Maidenform Brands, Inc. (a) | | | 126,640 | |

| | | | | | | |

| | | Total Common Stocks

(Cost $5,219,778) | | | 7,563,892 | |

| | | | | | | |

| | | Total Investments

(Cost $5,219,778)—103.7% (b) | | | 7,563,892 | |

| | | Liabilities in Excess of

Other Assets—(3.7)% | | | (272,888 | ) |

| | | | | | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 7,291,004 | |

| | | | | | | |

| |

| | |

Percentages are stated as a percent of net assets. |

|

(a) Non—income producing security. |

|

(b) Includes securities pledged as collateral for line of credit outstanding on April 30, 2011. |

|

ADR—American Depositary Receipt |

PLC—Public Limited Company |

The accompanying notes are an integral part of these financial statements.

53

|

Alpine Dynamic Balance Fund |

| |

Schedule of Portfolio Investments

April 30, 2011 (Unaudited)

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | |

Common Stocks—73.5% | | | | |

Aerospace & Defense—1.3% | | | | |

| 15,000 | | Honeywell International, Inc. | | $ | 918,450 | |

| | | | | | | |

Auto Components—3.6% | | | | |

| 30,500 | | Autoliv, Inc. | | | 2,443,965 | |

| | | | | | | |

Beverages—0.5% | | | | |

| 5,000 | | Anheuser-Busch InBev NV—ADR | | | 319,850 | |

| | | | | | | |

Capital Markets—1.8% | | | | |

| 25,900 | | State Street Corp. | | | 1,205,645 | |

| | | | | | | |

Chemicals—2.8% | | | | |

| 3,200 | | Air Products & Chemicals, Inc. | | | 305,664 | |

| 6,000 | | Eastman Chemical Co. | | | 643,500 | |

| 10,000 | | E. I. duPont de Nemours & Co. | | | 567,900 | |

| 3,000 | | Lubrizol Corp. | | | 403,560 | |

| | | | | | | |

| | | | | | 1,920,624 | |

| | | | | | | |

Commercial Banks—5.9% | | | | |

| 18,000 | | Bancorp Rhode Island, Inc. | | | 798,480 | |

| 10,000 | | Pacific Continental Corp. | | | 95,500 | |

| 5,000 | | PNC Financial Services Group, Inc. | | | 311,700 | |

| 7,870 | | Southside Bancshares, Inc. | | | 171,167 | |

| 35,000 | | Sun Bancorp, Inc. (a) | | | 127,400 | |

| 7,293 | | Susquehanna Bancshares, Inc. | | | 67,241 | |

| 31,500 | | Valley National Bancorp | | | 451,080 | |

| 10,000 | | Washington Trust Bancorp, Inc. | | | 234,300 | |

| 69,501 | | Webster Financial Corp. | | | 1,495,662 | |

| 10,432 | | Wells Fargo & Co. | | | 303,676 | |

| | | | | | | |

| | | | | | 4,056,206 | |

| | | | | | | |

Computers & Peripherals—0.6% | | | | |

| 10,000 | | Hewlett-Packard Co. | | | 403,700 | |

| | | | | | | |

Containers & Packaging—0.4% | | | | |

| 30,000 | | Boise, Inc. | | | 294,600 | |

| | | | | | | |

Diversified Financial Services—6.4% | | | | |

| 63,041 | | Bank of America Corp. | | | 774,144 | |

| 143,670 | | Citigroup, Inc. (a) | | | 659,445 | |

| 2,600 | | CME Group, Inc. | | | 769,002 | |

| 45,600 | | JPMorgan Chase & Co. | | | 2,080,728 | |

| 10,406 | | Medallion Financial Corp. | | | 96,047 | |

| | | | | | | |

| | | | | | 4,379,366 | |

| | | | | | | |

Electric Utilities—2.0% | | | | |

| 34,017 | | FirstEnergy Corp. | | | 1,359,319 | |

| | | | | | | |

Electrical Equipment—3.7% | | | | |

| 22,500 | | AMETEK, Inc. | | | 1,035,900 | |

| 10,700 | | Emerson Electric Co. | | | 650,132 | |

| 7,700 | | Preformed Line Products Co. | | | 553,245 | |

| 4,000 | | Regal-Beloit Corp. | | | 303,160 | |

| | | | | | | |

| | | | | | 2,542,437 | |

| | | | | | | |

Food & Staples Retailing—2.0% | | | | |

| 15,000 | | CVS Caremark Corp. | | | 543,600 | |

| 20,000 | | Walgreen Co. | | | 854,400 | |

| | | | | | | |

| | | | | | 1,398,000 | |

| | | | | | | |

Food Products—0.7% | | | | |

| 10,000 | | H.J. Heinz Co. | | | 512,300 | |

| | | | | | | |

Health Care Equipment & Supplies—1.1% | | | | |

| 8,600 | | Becton, Dickinson & Co. | | | 739,084 | |

| | | | | | | |

Health Care Providers & Services—1.3% | | | | |

| 13,000 | | MEDNAX, Inc. (a) | | | 921,960 | |

| | | | | | | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | |

Common Stocks—continued | | | | |

Hotels, Restaurants & Leisure—0.7% | | | | |

| 10,000 | | Darden Restaurants, Inc. | | $ | 469,700 | |

| | | | | | | |

Household Durables—1.0% | | | | |

| 20,000 | | Hovnanian Enterprises,

Inc.—Class A (a) | | | 64,200 | |

| 28,000 | | Lennar Corp.—Class A | | | 531,720 | |

| 10,000 | | Pulte Group, Inc. (a) | | | 81,300 | |

| | | | | | | |

| | | | | | 677,220 | |

| | | | | | | |

Household Products—0.5% | | | | |

| 4,000 | | Colgate-Palmolive Co. | | | 337,400 | |

| | | | | | | |

Industrial Conglomerates—3.6% | | | | |

| 10,000 | | 3M Co. | | | 972,100 | |

| 74,600 | | General Electric Co. | | | 1,525,570 | |

| | | | | | | |

| | | | | | 2,497,670 | |

| | | | | | | |

Insurance—1.6% | | | | |

| 10,000 | | Aflac, Inc. | | | 561,900 | |

| 5,000 | | Chubb Corp. | | | 325,950 | |

| 12,227 | | Fidelity National Financial,

Inc.—Class A | | | 188,785 | |

| | | | | | | |

| | | | | | 1,076,635 | |

| | | | | | | |

IT Services—2.7% | | | | |

| 5,374 | | Fidelity National Information

Services, Inc.—Class A | | | 177,880 | |

| 10,000 | | International Business Machines

Corp. | | | 1,705,800 | |

| | | | | | | |

| | | | | | 1,883,680 | |

| | | | | | | |

Leisure Equipment & Products—0.7% | | | | |

| 10,000 | | Hasbro, Inc. | | | 468,400 | |

| | | | | | | |

Machinery—1.9% | | | | |

| 14,800 | | Lincoln Electric Holdings, Inc. | | | 1,162,984 | |

| 10,000 | | Wabash National Corp. (a) | | | 110,300 | |

| | | | | | | |

| | | | | | 1,273,284 | |

| | | | | | | |

Media—0.3% | | | | |

| 7,692 | | CBS Corp.—Class B | | | 193,992 | |

| | | | | | | |

Metals & Mining—0.3% | | | | |

| 5,000 | | Southern Copper Corp. | | | 187,300 | |

| | | | | | | |

Oil, Gas & Consumable Fuels—7.0% | | | | |

| 59,000 | | CONSOL Energy, Inc. | | | 3,191,310 | |

| 8,000 | | El Paso Pipeline Partners LP | | | 296,320 | |

| 8,000 | | Hess Corp. | | | 687,680 | |

| 20,000 | | Penn Virginia Corp. | | | 309,200 | |

| 7,547 | | World Fuel Services Corp. | | | 298,710 | |

| | | | | | | |

| | | | | | 4,783,220 | |

| | | | | | | |

Pharmaceuticals—3.1% | | | | |

| 7,000 | | Abbott Laboratories | | | 364,280 | |

| 27,000 | | Johnson & Johnson | | | 1,774,440 | |

| | | | | | | |

| | | | | | 2,138,720 | |

| | | | | | | |

Real Estate Investment Trusts—11.8% | | | | |

| 13,636 | | American Capital Agency Corp. | | | 396,944 | |

| 13,000 | | Boston Properties, Inc. | | | 1,358,890 | |

| 100,000 | | CBL & Associates Properties, Inc. | | | 1,857,000 | |

| 13,804 | | Developers Diversified Realty

Corp. | | | 203,471 | |

| 46,357 | | DiamondRock Hospitality Co. | | | 558,138 | |

| 4,286 | | DuPont Fabros Technology, Inc. | | | 104,836 | |

The accompanying notes are an integral part of these financial statements.

54

|

Alpine Dynamic Balance Fund |

| |

Schedule of Portfolio Investments—Continued

April 30, 2011 (Unaudited)

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | |

Common Stocks—continued | | | | |

Real Estate Investment Trusts—continued | | | | |

| 20,000 | | Invesco Mortgage Capital, Inc. | | $ | 454,800 | |

| 12,700 | | ProLogis | | | 206,883 | |

| 23,823 | | Simon Property Group, Inc. | | | 2,728,686 | |

| 20,000 | | Two Harbors Investment Corp. | | | 209,200 | |

| | | | | | | |

| | | | | | 8,078,848 | |

| | | | | | | |

Road & Rail—1.6% | | | | |

| 15,000 | | Norfolk Southern Corp. | | | 1,120,200 | |

| | | | | | | |

Textiles, Apparel & Luxury Goods—1.1% | | | | |

| 5,000 | | Phillips-Van Heusen Corp. | | | 352,050 | |

| 4,000 | | VF Corp. | | | 402,240 | |

| | | | | | | |

| | | | | | 754,290 | |

| | | | | | | |

Thrifts & Mortgage Finance—0.8% | | | | |

| 75,600 | | Federal National Mortgage

Association (a) | | | 32,886 | |

| 31,500 | | New York Community

Bancorp, Inc. | | | 522,900 | |

| | | | | | | |

| | | | | | 555,786 | |

| | | | | | | |

Trading Companies & Distributors—0.7% | | | | |

| 3,000 | | WW Grainger, Inc. | | | 454,800 | |

| | | | | | | |

| | | Total Common Stocks

(Cost $46,064,364) | | | 50,366,651 | |

| | | | | | | |

| | | | | | | |

Principal

Amount | | Security

Description | | Value | |

| | | | | | |

| | | | | |

Bonds and Notes—20.5% | | | | |

U.S. Treasury Bonds—17.5% | | | | |

$ | 6,000,000 | | 6.000%, 02/15/2026 | | $ | 7,405,314 | |

| 4,000,000 | | 5.250%, 11/15/2028 | | | 4,575,624 | |

| | | | | | | |

| | | | | | 11,980,938 | |

| | | | | | | |

U.S. Treasury Notes—3.0% | | | | |

| 2,000,000 | | 5.000%, 08/15/2011 | | | 2,028,594 | |

| | | | | | | |

| | | Total Bonds and Notes

(Cost $14,053,261) | | | 14,009,532 | |

| | | | | | | |

Short-Term Investments—6.2% | | | | |

| 4,275,000 | | State Street Eurodollar Time

Deposit, 0.01% | | | 4,275,000 | |

| | | | | | | |

| | | Total Short-Term Investments

(Cost $4,275,000) | | | 4,275,000 | |

| | | | | | | |

| | | Total Investments

(Cost $64,392,625)—100.2% | | | 68,651,183 | |

| | | Liabilities in Excess of

Other Assets—(0.2)% | | | (157,547 | ) |

| | | | | | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 68,493,636 | |

| | | | | | | |

| |

| | |

Percentages are stated as a percent of net assets. |

|

(a) Non-income producing security. |

|

ADR—American Depositary Receipt |

NV—Naamloze Vennootschap is the Dutch term for a public limited liability corporation. |

The accompanying notes are an integral part of these financial statements.

55

|

Alpine Ultra Short Tax Optimized Income Fund |

| |

|

Schedule of Portfolio Investments

April 30, 2011 (Unaudited) |

| | | | | | | |

Principal

Amount | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Municipal Bonds—101.7% | | | | |

Alabama—3.7% | | | | |

$ | 5,000,000 | | Chatom Industrial Development

Board Gulf Opportunity Zone

Revenue, Powersouth Energy

Cooperative—Series A, VRDN

(SPA: National Rural Utilities

Finance)

0.830%, 11/15/2038

(Putable on 05/16/2011) (a) | | $ | 5,000,100 | |

| 2,000,000 | | Chatom Industrial Development

Board Pollution Control

Revenue, Electric—Series C, VRDN

(SPA: National Rural Utilities

Finance)

0.830%, 12/01/2024

(Putable on 06/01/2011) (a) | | | 2,000,140 | |

| 1,410,000 | | Madison Industrial Development

Board Revenue, WL Halsey

Grocery Co., VRDN

(LOC: Regions Bank)

2.180%, 04/01/2016

(Putable on 05/06/2011) (a) | | | 1,410,000 | |

| 6,070,000 | | Mobile Downtown

Redevelopment Authority

Revenue, Lafayette Plaza

Hotel Project—Series A, VRDN

(LOC: Regions Bank)

1.530%, 05/01/2032

(Putable on 05/05/2011) (a) | | | 6,070,000 | |

| 20,000,000 | | Mobile Industrial Development

Board Pollution Control Revenue,

Alabama Power Co.—Barry Plant,

VRDN

(CS: Alabama Power Co.)

1.000%, 07/15/2034

(Putable on 08/16/2011) (a) | | | 20,041,800 | |

| 4,750,000 | | Montgomery Alpha Special Care

Facilities Financing Authority,

Mizell Memorial Hospital, Inc.,

VRDN

(LOC: Regions Bank)

3.970%, 06/01/2022

(Putable on 05/06/2011) (a) | | | 4,750,000 | |

| 2,450,000 | | Montgomery Industrial

Development Board Revenue,

Kinpak, Inc., VRDN

(LOC: Regions Bank)

4.000%, 06/01/2017

(Putable on 05/06/2011) (a) | | | 2,450,000 | |

| 5,795,000 | | The Health Care Authority for

Baptist Health—Series A, VRDN

(CS: Baptist Health)

6.125%, 11/15/2036

(Putable on 05/15/2012) (a) | | | 5,941,903 | |

| 2,125,000 | | The Health Care Authority for

Baptist Health—Series B, ARN

(CS: Baptist Health)

1.200%, 11/15/2037 (a)(b) | | | 2,125,000 | |

| | | | | | | |

| | | | | | 49,788,943 | |

| | | | | | | |

| | | | | | | |

Principal

Amount | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Municipal Bonds—continued | | | | |

Arizona—2.6% | | | | |

$ | 13,200,000 | | Cochise County Pollution

Control Corp. Revenue,

Arizona Electric Power

Cooperative, Inc. Project, VRDN

(CS: National Rural Utilities)

1.250%, 09/01/2024

(Putable on 09/01/2011) (a) | | $ | 13,203,300 | |

| 4,120,000 | | Coconino County Pollution

Control Corp. Revenue,

Arizona Public Services

Navajo—Series A

(CS: Arizona Public Service Corp.)

3.625%, 10/01/2029

(Putable on 07/13/2013) | | | 4,100,554 | |

| 500,000 | | Flagstaff, Aspen Place Sawmill

Improvement District

(CS: Flagstaff Arizona Revenue)

5.000%, 01/01/2013 | | | 501,460 | |

| 3,300,000 | | Maricopa County Pollution

Control Corp., Arizona Public

Services Co.—Series B

(CS: Arizona Public Service Corp.)

5.500%, 05/01/2029

(Putable on 05/01/2012) | | | 3,419,460 | |

| 6,000,000 | | Navajo County Pollution Control

Corp.—Series A

(CS: Arizona Public Service Corp.)

5.000%, 06/01/2034

(Putable on 06/01/2012) | | | 6,203,400 | |

| 7,050,000 | | Scottsdale Industrial

Development Authority Hospital

Revenue, Scottsdale Healthcare—

Series F, ARN

(CS: Assured Guaranty)

1.050%, 09/01/2045 (a)(b) | | | 7,050,000 | |

| | | | | | | |

| | | | | | 34,478,174 | |

| | | | | | | |

Arkansas—2.6% | | | | |

| 1,000,000 | | Baxter County Revenue,

Baxter County Hospital

(CS: Baxter County Regional

Hospital, Inc.)

3.000%, 09/01/2011 | | | 1,002,580 | |

| 5,295,000 | | Pulaski County Public Facilities

Board Revenue, Anthony

School, VRDN

(LOC: Regions Bank)

1.630%, 06/01/2033

(Putable on 05/06/2011) (a) | | | 5,295,000 | |

| 5,425,000 | | Pulaski County Public Facilities

Board Revenue, Chapelridge,

VRDN

(LOC: Regions Bank)

2.080%, 03/01/2032

(Putable on 05/06/2011) (a) | | | 5,425,000 | |

| 6,350,000 | | Pulaski County Public Facilities

Board Revenue, Chapelridge

Southwest, VRDN

(LOC: Regions Bank)

2.030%, 11/01/2034

(Putable on 05/06/2011) (a) | | | 6,350,000 | |

The accompanying notes are an integral part of these financial statements.

56

|

Alpine Ultra Short Tax Optimized Income Fund |

| |

|

Schedule of Portfolio Investments—Continued

April 30, 2011 (Unaudited) |

| | | | | | | |

Principal

Amount | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Municipal Bonds—continued | | | | |

Arkansas—continued | | | | |

$ | 4,350,000 | | Pulaski County Public Facilities

Board Revenue, Valley Heights

Apartments II—Series C, VRDN

(LOC: Regions Bank)

2.080%, 04/01/2040

(Putable on 05/06/2011) (a) | | $ | 4,350,000 | |

| 5,200,000 | | State Development Finance

Authority, Capri

Apartments—Series F, VRDN

(LOC: Regions Bank)

2.080%, 10/01/2030

(Putable on 05/06/2011) (a) | | | 5,200,000 | |

| 7,500,000 | | State Development Finance

Authority, Chapelridge

Benton—Series C, VRDN

(LOC: Regions Bank)

2.030%, 06/01/2032

(Putable on 05/06/2011) (a) | | | 7,500,000 | |

| | | | | | | |

| | | | | | 35,122,580 | |

| | | | | | | |

California—11.2% | | | | |

| 800,000 | | Alameda Public Finance

Authority Revenue,

Harbor Bay—Series A

(CS: Alameda Public Finance

Authority)

4.000%, 09/02/2011 | | | 806,760 | |

| 10,050,000 | | Palomar Pomerado Health Care—

Series A, ARN

(CS: Assured Guaranty)

1.300%, 11/01/2036 (a)(b) | | | 10,050,000 | |

| 2,875,000 | | Palomar Pomerado Health Care—

Series B, ARN

(CS: Assured Guaranty)

1.290%, 11/01/2036 (a)(b) | | | 2,875,000 | |

| 14,250,000 | | Palomar Pomerado Health Care—

Series C, ARN

(CS: Assured Guaranty)

1.300%, 11/01/2036 (a)(b) | | | 14,250,000 | |

| 1,400,000 | | State Health Facilities Financing

Authority Revenue, Community

Program for Persons with

Developmental Disabilities—

Series A

(CS: A Home for Life LLC)

4.000%, 02/01/2012 | | | 1,420,790 | |

| 300,000 | | State Housing Finance Agency

Revenue, Multifamily Housing—

Series A, VRDN

(CS: Assured Guaranty)

3.850%, 02/01/2034

(Putable on 05/06/2011) (a) | | | 300,000 | |

| 15,785,000 | | State Municipal Finance

Authority Revenue, Vacaville

Christian Schools, VRDN

(LOC: Allied Irish Bank PLC)

4.510%, 08/01/2037

(Putable on 05/06/2011) (a) | | | 15,785,000 | |

| | | | | | | |

Principal

Amount | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Municipal Bonds—continued | | | | |

California—continued | | | | |

$ | 47,500,000 | | State Pollution Control Finance

Authority Solid Waste Revenue,

Republic Services, Inc.—Series A,

VRDN

(CS: Republic Services, Inc.)

1.875%, 08/01/2023

(Putable on 08/01/2011) (a) | | $ | 47,500,000 | |

| 5,000,000 | | State Revenue Anticipation

Notes—Series A-1

3.000%, 05/25/2011 | | | 5,007,300 | |

| 25,000,000 | | State Revenue Anticipation

Notes—Series A-2

3.000%, 06/28/2011 | | | 25,089,000 | |

| 11,750,000 | | Statewide Communities

Development Authority

Revenue, Western University of

Health Sciences—Series A, VRDN

(LOC: Bank of New York Mellon,

BNP Paribas, Allied Irish Bank PLC)

4.150%, 06/01/2039

(Putable on 05/06/2011) (a) | | | 11,750,000 | |

| | | Twin Rivers Unified School District,

School Facilities Boarding Program

(CS: Assured Guaranty) | | | | |

| 10,000,000 | | 3.500%, 06/01/2027

(Putable on 05/31/2013) | | | 9,999,800 | |

| 5,000,000 | | 3.500%, 06/01/2035

(Putable on 05/01/2013) | | | 4,993,350 | |

| 125,000 | | Washington Township Health

Care District Revenue—Series A

(CS: Washington, California

Health Care Authority)

4.500%, 07/01/2011 | | | 125,732 | |

| | | | | | | |

| | | | | | 149,952,732 | |

| | | | | | | |

Colorado—0.9% | | | | |

| 6,520,000 | | Denver City & County Airport

Revenue—Series A

(CS: AMBAC)

6.000%, 11/15/2011 | | | 6,545,493 | |

| 1,900,000 | | Denver City & County Airport

Revenue—Subseries A3

(CS: Assured Guaranty)

5.000%, 11/15/2032

(Putable on 05/15/2011) | | | 1,902,755 | |

| 3,000,000 | | Denver City & County Airport

Revenue—Subseries A4

5.250%, 11/15/2032

(Putable on 05/15/2011) | | | 3,004,590 | |

| 1,000,000 | | E-470 Public Highway Authority

Revenue—Series A-2

(CS: MBIA)

5.000%, 09/01/2039

(Putable on 09/01/2011) | | | 1,009,070 | |

| | | | | | | |

| | | | | | 12,461,908 | |

| | | | | | | |

Connecticut—0.9% | | | | |

| 6,500,000 | | State Development Authority,

Light & Power—Series A, VRDN

(CS: Northeast Utilities)

1.250%, 05/01/2031 (a) | | | 6,504,095 | |

The accompanying notes are an integral part of these financial statements.

57

|

Alpine Ultra Short Tax Optimized Income Fund |

| |

|

Schedule of Portfolio Investments—Continued

April 30, 2011 (Unaudited) |

| | | | | | | |

Principal

Amount | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Municipal Bonds—continued | | | | |

Connecticut—continued | | | | |

$ | 5,765,000 | | State Health & Educational

Facilities Authority Revenue,

Kingswood-Oxford School—

Series B, VRDN

(LOC: Allied Irish Bank PLC)

5.000%, 07/01/2030

(Putable on 05/06/2011) (a) | | $ | 5,765,000 | |

| | | | | | | |

| | | | | | 12,269,095 | |

| | | | | | | |

Florida—4.2% | | | | |

| 1,000,000 | | Arcadia Housing Authority,

Arcadia Oaks Associated, Ltd.

(CS: TransAmerica Life

Insurance Co.)

4.250%, 01/01/2012 | | | 1,000,550 | |

| 7,920,000 | | Broward County Housing Finance

Authority, Golf View Gardens

Apartments, VRDN

(LOC: Regions Bank)

4.250%, 11/01/2043

(Putable on 05/06/2011) (a) | | | 7,920,000 | |

| 4,820,000 | | Cape Coral Water & Sewer Revenue

(CS: Cape Coral Water & Sewer)

6.000%, 10/01/2011 | | | 4,894,083 | |

| 3,005,000 | | Eustis Multi-Purpose Revenue,

Series A, VRDN

(LOC: SunTrust Bank)

0.850%, 12/01/2027

(Putable on 05/06/2011) (a) | | | 3,005,000 | |

| 7,895,000 | | Jackson County Industrial Revenue,

Ice River Springs, VRDN

(LOC: Regions Bank)

2.030%, 07/01/2023

(Putable on 05/06/2011) (a) | | | 7,895,000 | |

| 5,305,000 | | Lee County Housing Finance Authority Revenue,

Heron Pond Apartments, VRDN

(LOC: Regions Bank)

4.250%, 12/01/2043

(Putable on 05/06/2011) (a) | | | 5,305,000 | |

| 5,000,000 | | Lee County, Solid Waste Systems

(CS: MBIA)

5.625%, 10/01/2012 | | | 5,079,600 | |

| 1,245,000 | | Marion County Industrial

Development Authority Revenue,

Capris Furniture Industries, Inc.,

VRDN

(LOC: SunTrust Bank)

0.890%, 02/01/2025

(Putable on 05/06/2011) (a) | | | 1,245,000 | |

| 1,500,000 | | Marion County Industrial

Development Authority Revenue,

ESD Waste 2 Water, Inc., VRDN

(LOC: SunTrust Bank)

0.890%, 10/01/2026

(Putable on 05/06/2011) (a) | | | 1,500,000 | |

| 10,000,000 | | Miami-Dade County Industrial

Development Authority Revenue,

Waste Management, Inc.

(CS: Waste Management, Inc.)

5.400%, 08/01/2023

(Putable on 08/01/2011) | | | 10,093,900 | |

| | | | | | | |

Principal

Amount | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Municipal Bonds—continued | | | | |

Florida—continued | | | | |

$ | 5,185,000 | | Miami-Dade County State

Aviation—Series C

(CS: MBIA)

5.250%, 10/01/2012 | | $ | 5,199,000 | |

| 370,000 | | North Sumter County Utility

Dependent District Revenue

3.000%, 10/01/2011 | | | 371,413 | |

| 900,000 | | Saint Johns County Industrial

Development Authority,

Coastal Health Care Investor,

VRDN

(LOC: SunTrust Bank)

2.750%, 12/01/2016

(Putable on 05/06/2011) (a) | | | 900,000 | |

| 1,110,000 | | State Housing Finance Corp.

Revenue, Stuart Pointe

Apartments—Series B-3, VRDN

(LOC: SunTrust Bank)

1.100%, 04/01/2034

(Putable on 05/06/2011) (a) | | | 1,110,000 | |

| 320,000 | | University Athletic Association,

Inc., VRDN

(LOC: SunTrust Bank)

3.750%, 10/01/2027

(Putable on 10/01/2011) (a) | | | 323,258 | |

| | | | | | | |

| | | | | | 55,841,804 | |

| | | | | | | |

Georgia—4.5% | | | | |

| 11,240,000 | | Burke County Development

Authority Pollution Control

Revenue, Oglethorpe Power

Corp.—Vogtle Project—Series A,

(CS: Oglethorpe Power Corp.)

2.500%, 01/01/2040

(Putable on 03/01/2013) | | | 11,261,918 | |

| 1,310,000 | | DeKalb County Housing Authority,

Stone Mill Run Apartments,

VRDN

(LOC: Regions Bank)

2.180%, 08/01/2027

(Putable on 05/06/2011) (a) | | | 1,310,000 | |

| 1,300,000 | | Douglas County Development

Authority Revenue, Electrical

Fiber Systems, VRDN

(LOC: Regions Bank)

2.180%, 12/01/2021

(Putable on 05/06/2011) (a) | | | 1,300,000 | |

| 2,570,000 | | Gainesville & Hall County

Development Authority

Tax-Exempt Revenue, Atex, Inc.

Project, VRDN

(LOC: Regions Bank)

2.130%, 09/01/2023

(Putable on 05/06/2011) (a) | | | 2,570,000 | |

| 11,900,000 | | Gwinnett County Housing

Authority Multi-Family

Housing Revenue, Palisades

Apartments Project, VRDN

(LOC: SunTrust Bank)

1.350%, 03/01/2041

(Putable on 05/06/2011) (a) | | | 11,900,000 | |

The accompanying notes are an integral part of these financial statements.

58

|

Alpine Ultra Short Tax Optimized Income Fund |

| |

|

Schedule of Portfolio Investments—Continued

April 30, 2011 (Unaudited) |

| | | | | | | |

Principal

Amount | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Municipal Bonds—continued | | | | |

Georgia—continued | | | | |

$ | 1,180,000 | | Liberty County Industrial Authority,

HY Sil Manufacturing Co., Inc.—

Series A, VRDN

(LOC: SunTrust Bank)

0.890%, 03/01/2016

(Putable on 05/06/2011) (a) | | $ | 1,180,000 | |

| 14,450,000 | | Municipal Electric Authority of

Georgia, Project One Subordinated

Bonds—Series B, VRDN

(LOC: Dexia Credit Local)

0.900%, 01/01/2048

(Putable on 05/06/2011) (a) | | | 14,450,000 | |

| 1,975,000 | | Rome-Floyd County Development

Authority Revenue, Steel King

Industries, Inc., VRDN

(LOC: M&I Bank)

1.700%, 07/01/2020

(Putable on 05/06/2011) (a) | | | 1,975,000 | |

| 14,045,000 | | Walker Dade & Catoosa Counties

Hospital Authority, Anticipation

Certificates, Hutcheson Medical,

VRDN

(LOC: Regions Bank)

1.530%, 10/01/2028

(Putable on 05/06/2011) (a) | | | 14,045,000 | |

| | | | | | | |

| | | | | | 59,991,918 | |

| | | | | | | |

Illinois—8.0% | | | | |

| 26,760,000 | | Crestwood Tax Increment Revenue,

135th & Cicero Redevelopment,

VRDN

(LOC: Fifth Third Bank)

1.500%, 12/01/2023

(Putable on 05/06/2011) (a) | | | 26,760,000 | |

| 9,000,000 | | Finance Authority Industrial

Development Revenue,

Lutheran Home & Services, VRDN

(LOC: Allied Irish Bank PLC)

4.510%, 08/15/2031

(Putable on 05/06/2011) (a) | | | 9,000,000 | |

| 4,400,000 | | Springfield Airport Authority,

Allied-Signal, Inc., VRDN

6.500%, 09/01/2018

(Putable on 05/06/2011) (a) | | | 4,400,000 | |

| 1,000,000 | | State Finance Authority

Revenue, Provena Health—

Series A

(CS: Provena Health)

5.000%, 05/01/2011 | | | 1,000,000 | |

| 15,000,000 | | State General Obligation Bond

Unlimited

(CS: State of Illinois)

3.000%, 05/20/2011 | | | 15,012,150 | |

| 51,000,000 | | State General Obligation Bond

Unlimited—Series B, VRDN

(SPA: DEPFA Bank PLC)

3.250%, 10/01/2033

(Putable on 05/06/2011) (a) | | | 51,000,000 | |