UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10405

Alpine Series Trust

(Exact name of registrant as specified in charter)

2500 Westchester Avenue, Suite 215

Purchase, New York 10577

(Address of principal executive offices)(Zip code)

(Name and Address of Agent for

Service) | | Copy to: |

| | | |

Samuel A. Lieber

Alpine Woods Capital Investors, LLC

2500 Westchester Avenue, Suite 215

Purchase, New York 10577 | | Rose DiMartino

Attorney at Law

Willkie Farr & Gallagher

787 7th Avenue, 40th Floor

New York, New York 10019 |

Registrant’s telephone number, including area code: (914) 251-0880

Date of fiscal year end: October 31

Date of reporting period: November 1, 2016 - October 31, 2017

Item 1: Shareholder Report

Table of Contents

| Additional Alpine Funds are offered in the Alpine Equity Trust. These Funds include: |

| |

| Alpine International Real Estate Equity Fund | Alpine Global Infrastructure Fund |

| Alpine Realty Income & Growth Fund | |

Alpine’s Real Estate Funds’ investment objectives, risks, charges and expenses must be considered carefully before investing in funds of the Alpine Equity Trust. The statutory and summary prospectuses contain this and other important information about the investment company, and it may be obtained by calling 1-888-785-5578, or visiting www.alpinefunds.com. Read it carefully before investing.

Mutual fund investing involves risk. Principal loss is possible.

Alpine’s Investment Outlook

Dear Shareholders:

During the fiscal year ended October 31, 2017, the equity markets finally side-stepped their broad apprehension, which has been a characteristic of market sentiment since the great financial collapse of 2008. As we pointed out in prior reports to shareholders, the market was greatly concerned about either the risks of imminent inflation due to the stimulative effects of loose monetary policy, or alternatively, a deflation drag due to over-capacity and structural imbalances remaining from prior expansions. Following the U.S. Federal Reserve’s (Fed) warning of an imminent transition from quantitative easing (QE) towards normalization back in May of 2013, the capital markets suffered from a ‘taper tantrum’ before assuming an alternating risk-on/risk-off mode that persisted well into 2015. However, in the fourth quarter of 2015, a speculative commodity boom that had become a bust lasting into February of 2016, re-engaged persistent fears of global economic deflation. As it turned out, the economy found its footing and markets recovered through 2016, and ultimately produced double-digit returns this year, as investors have bought equities to capture corporate growth. Strong economic reports have become more consistent and corporate earnings and revenue growth appears more sustainable as we approach 2018.

The equity markets focus this year has been particularly strong for growth stocks, as opposed to value stocks or stocks of stable defensive companies. In particular, the market has been focused on top-line revenue growth and companies with strong profitability. Interestingly, the market has also favored companies with relatively low financial leverage and, thus, a greater margin of safety. Stocks which combined these characteristics performed particularly well. Notably, we appear to be in the midst of a synchronized global economic recovery in which Gross Domestic Product (GDP) has been supported by strong orders for goods and services, witness regional and national purchasing managers’ indices (PMI) and improving employment data. This has given corporations the ability to increase sales volumes, which has historically improved profit margins, and in combination with tightening labor markets, is leading to the first signs of wage growth in select sectors and geographies. Wage growth may lead to increased consumption patterns as growing job confidence and incomes induce people to spend more freely, which in turn can stimulate

corporations to increase their capital expenditures for new production facilities and equipment. This, in turn, leads to more jobs and new products for consumers. Since the U.S. accounts for roughly 25% of the global GDP, it is natural for us to lead the rest of the world out of periods of economic doldrums. China is almost 15% of the global GDP and it too has been growing quite strongly, until the past quarter or so when it has shown signs of moderating. That said, the Eurozone, which is slightly larger than China, and Japan, which is roughly half its size, are both picking up the slack, so we expect continued global recovery over the next several quarters at a minimum.

TAX CUTS

An element of uncertainty has been introduced by the U.S. Republican Congress which is planning to put forth an economic stimulative program, packaged as tax reform. This has been cooked up in old school D.C. style, in back rooms with no transparency, nor based on specific intellectual precepts or schools of thought, this grab bag restructuring of the tax code is in some ways progressive, in other ways regressive, both positive and negative, and which will no doubt be beneficial to some and negative for others in our economy. On the surface, it is positive for corporations, many of whom should see lower tax rates and it is intended to stimulate capital investment in the short-term through accelerated depreciation of new investments (as low as one year down from five to twenty!), which offsets taxes. Companies which repatriate capital from overseas will have very low (6-12%) recapture rates if they bring money home (estimates that $1-2 trillion may come back over several years). However, investment in research and development (R&D) for better future products do not receive such benefit. This should be positive for stocks in that it will no doubt lead to more corporate buy-backs and special dividends for shareholders, and we may well see a short-term investment boom over the next 12-18 months. Such a jumpstart would have been useful back in 2009 or 2010 but may create a boom/bust surge in activity which could induce the Fed to rapidly defend against inflation. Of course, we do not know what percentage of the trillions held abroad held by companies such as Apple and Microsoft, among others, will be repatriated nor, the final

1

details of the tax rates. So, we await and hope it will be more rational than feared. Nevertheless, the significance will likely be a short-term stimulus effect, with potential negative implications for the long-term when the payback for these tax cuts could come in the form of deficits which need to be reduced. That said capital markets may take a long-term perspective, pushing interest rates higher to reflect this. Fundamentally, just as the U.S. (and global) economy is getting stronger, we believe it would be better to stimulate future growth by targeting better infrastructure and education and R&D for promising technologies and products, rather than to get a quick boost followed by rapidly rising interest rates.

INTEREST RATES

The Fed has made it clear that they are looking forward to raising interest rates in December 2017 and then again up to four times in 2018. We believe that it may only be two or three increases after the Fed Funds Rate rises from 1.16% today to above 1.25% in December, probably to 1.5% by early Summer 2018, and at least 1.75% by year-end 2018. It should be noted that the Fed’s dot plot has rates rising to over 2% by year end 2018 and over 2.5% by year end 2019. Much depends on the impact of the aforementioned new tax plan and the rate at which other central banks begin to withdraw from quantitative easing. Our concern is that the current ‘Goldilocks’ environment of very low interest rates and moderate economic activity, which has been so beneficial for the stock market, may be upset if interest rates rise more quickly than the Fed has guided and if funds retreat from the capital markets.

EQUITIES

In Alpine’s view, the fundamental reason for the growth in stock market performance for the past year lies principally with the growth in corporate earnings. Particular focus on companies growing business sales which can provide double-digit earnings growth has been very appealing at a time when many investment returns, notably interest or rental yields, are producing low single-digit returns. For next year, the equity markets are forecast to grow earnings on the order of 6-12% depending on whether or not there will be a notable tax benefit. This compares with about 8-15% for emerging markets, which have also performed strongly in the past year. So even though stock market multiples appear high by historical standards, we are still enjoying the rare combination of double-digit earnings growth and single-digit interest rates. Thus, dividends could provide an attractive support for equity prices. Our focus will continue to be on what we have in the past called growth values, and on the transformative potential of mispriced stocks.

SECTORS

We believe that certain sectors of the equity market are now more favored than others as the markets rotate more thoroughly towards growth. This could be perceived as a very positive environment for financial stocks which showed a spurt from investor interest at the beginning of the fiscal year and now may find a more sustained interest with a steeper yield curve and continued growing demand for capital. Industrial companies should certainly perform well as general consumption and strengthening business patterns continue. Needless to say, this could be further stimulated by a potentially lower tax regime. Also typical of strengthening economic conditions is demand for both raw materials and processed products ready for production. Admittedly all these groups have already run higher a bit this year, but we think there is potentially more upside from earnings growth. We are generally positive for selected information technology stocks and energy companies which will be asked to fuel the prospective economic recovery. Nevertheless, we think the environment will be mixed for consumer discretionary, healthcare and real estate companies, favoring those with greater sensitivity to economic expansion or highly desired products and services. In general, we are more cautious on consumer staples and utilities which are perceived as defensive.

SENTIMENT

While we continue to favor growth, we believe value will be sustained selectively by merger and acquisition (M&A) activity. Many companies see such M&A opportunities as a short cut through which to expand or reinvigorate their business. Since the current global business cycle may last for another two to even perhaps several more years, we think many companies will focus on strategic realignments in order to achieve longer-term growth. Such mature cycle strategies could become a major factor in driving equity market sentiment over the next year.

While some market participants are concerned that market sentiment might be too buoyant, we just wish to comment on the bitcoin frenzy, which we think represents a true bubble. The introduction of bitcoin trading to futures and derivative markets is perhaps leading some investors to equate it with currencies or commodities. In fact, these exchanges are allowing speculators to buy or sell derivatives based on a synthetic instrument (the bitcoin) which does not have a traditional store of value or represent sovereign strength or wealth as do currencies. Rather, it is simply a potential method of commerce which is benefiting from significant scarcity value. Notably, of the 16 million bitcoin units in existence,

2

| |  |

estimates that only half are believed to be in active trading accounts so the daily volume traded is not significant. Like prior booms of yesteryear, such as railroads, canals and even dot.com internet stocks, the appeal is in a future potential, which may hold great promise. However, one can only imagine what continued innovation and new competition (other coins or digital measures) and broader access can do to impact what may be more concept than reality.

The reality of the current extended stock market up-cycle is that it is based on rising earnings, which have continued to grow. The long climb to recovery from the losses of 2008, and recently positive returns reflecting the current and prospective growth of corporate earnings appears to be increasingly durable. Indeed, since the S&P 500® Index (S&P) peak in October 2007 through, as recently as, May of 2015, the Index had generated a total return of 36.14% or only 4.13% per annum. Since that peak in May of 2015, through the end of October of this year, the S&P has gained almost 21%, or an annualized 8.04%. Note that this last period includes the commodity bust in late 2015 which culminated in the S&P decline of 14% from May of 2015 through mid-February, 2016. Thus, we think the markets have accelerated beyond their prior caution and uncertainty over long term trends.

2018: STILL A BIT UNCLEAR

Despite market enthusiasm at the end of 2017 for a tax policy boost to the economy, no meaningful policies have yet been put in place by the Trump Administration in a manner that has yet had significant economic impact. Certainly, a ‘feel good’ factor over the potential of lessened regulation, lower taxes and potentially increased spending on our infrastructure has been supportive, but not actionable. In fact, it is not clear that the U.S. economy needs this stimulus at this time. The policies do not appear fully thought out, as they are not focused plans with targeted benefits and impact. Rather, we suspect that many decisions are made to accommodate the wishes of select groups or special interests and meet the needs of targeted lawmakers. It seems the “swamp” is as mucky as ever, if not worse.

While the tax stimulus (or so-called “reform”) on top of the growing U.S. economy could provide an extra boost

over the next 12 - 18 months, we are mindful that it could risk bringing a sharper adjustment by the Fed than is currently expected by the capital markets. That could lead to a negative short-term impact on equity prices if pronounced. Frankly, we would view such an event as an opportunity for renewed investments as such dislocations inevitably re-shuffle the deck. In essence, we believe that active management will continue to be presented with a range of opportunities from market shifts, initial public offerings (IPOs), M&A and the potential for businesses benefitting from longer-term economic growth. For 2017, we benefitted from the dynamics of this unique investment environment and we view 2018 as another year of potential opportunity.

For now, we remain positive on equity markets, cautious on fixed income with a bias towards the short end of the curve and low duration. Our only caveat is that one must be flexible and able to adjust to changes in the economic, political, and increasingly differentiated world.

We appreciate your continued interest in our Funds and your support for our efforts to provide meaningful investment alternatives for you.

Sincerely,

Samuel A. Lieber

President

Past performance is not a guarantee of future results. The specific market, sector or investment conditions that contribute to a Fund’s performance may not be replicated in future periods.

Mutual fund investing involves risk. Principal loss is possible. Please refer to individual letters for risks specific to that Fund.

This letter and the letters that follow represent the opinions of the Funds’ management and are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security. The information provided is not intended to be, and is not, a forecast of future events, a guarantee of results, or investment advice.

3

| Disclosures and Definitions |  |

Please refer to the Schedule of Portfolio Investments for each Fund’s holding information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security.

Favorable tax treatment of Fund distributions may be adversely affected, changed or repealed by future changes in tax laws. Alpine may not be able to anticipate the level of dividends that companies will pay in any given timeframe.

The Funds’ monthly distributions may consist of net investment income, net realized capital gains and/or a return of capital. If a distribution includes anything other than net investment income, the Funds will provide a notice of the best estimate of its distribution sources when distributed, which will be posted on the Funds’ website: www.alpinefunds.com, or can be obtained by calling 1-800-617-7616. We estimate that in fiscal year ending October 31, 2017, 4.06% of distributions paid by the Alpine Dynamic Dividend Fund were through a return of capital. All other Funds in the Alpine Series Trust and the Income Trust did not pay any distributions during the fiscal year ending October 31, 2017 through a return of capital. A return of capital distribution does not necessarily reflect the Funds’ performance and should not be confused with “yield” or “income.” Final determination of the Federal income tax characteristics of distributions paid during the calendar year will be provided on U.S. Form 1099-DIV, which will be mailed to shareholders. Please consult your tax advisor for further information.

All investments involve risk. Principal loss is possible. A small portion of the S&P 500 yield may include return of capital; the 10-year Treasury yield does not include return of capital; Corporate bonds and High Yield Bonds generally do not have return of capital; a portion of the dividend paid by REITs and REIT preferred stock may be deemed a return of capital for tax purposes in the event the company pays a dividend greater than its taxable income. A stock may trade with more or less liquidity than a bond depending on the number of shares and bonds outstanding, the size of the company, and the demand for the securities. The REIT and REIT preferred stock market are smaller than the broader equity and bond markets and often trade with less liquidity than these markets depending upon the size of the individual issue and the demand of the securities. Treasury notes are guaranteed by the U.S. Government and thus they are considered to be safer than other asset classes. Tax features of a Treasury Note, Corporate bond, Stock, High Yield bond, REITs and REIT preferred stock may vary based on an individual circumstances. Consult a tax professional for additional information. Neither the Fund nor any of its representatives may give tax advice. Investors should consult their tax advisor for information concerning their particular situation.

S&P Ratings is a financial services company, a division of S&P Global Inc. that publishes financial research and analysis on stocks and bonds. S&P is considered one of the Big Three credit-rating agencies, which also include Moody’s Investor Service and Fitch Ratings.

S&P assigns rating on a scale of ‘D’ to ‘AAA’, with ‘D’ the lowest/weakest rating, indicating a default, and ‘AAA’ the highest/strongest rating, indicating the strongest credit quality in S&P’s spectrum of credit ratings.

S&P incorporates a broad number of credit areas of each entity/municipality when assigning a bond rating to an entity’s debt instrument, including: (a) financial position, which encompasses liquidity metrics, cash reserves, non-liquid assets, liabilities, and other financial metrics; (b) debt position, which includes long and short-term bonded debt and other privately-placed notes/bonds, leases and other off-balance sheet liabilities; (c) pension and Other Post-Employment Benefits (OPEB); (d) socioeconomic indices; (e) the aptitude and sophistication of management.

Earnings Growth and EPS Growth are not measures of the Funds’ future performance.

Diversification does not assure a profit or protect against loss in a declining market.

Must be preceded or accompanied by a prospectus.

Quasar Distributors, LLC, distributor.

Definitions

Basis Point is a value equaling one one-hundredth of a percent (1/100 of 1%).

Bloomberg Barclays Municipal Bond: High Yield (non-Investment Grade) Index is the Muni High Yield component of the Barclays Municipal Bond Index. The Barclays Municipal Bond Index is a rules-based, market-value-weighted index engineered for the long-term tax-exempt bond market.

BVAL Muni Benchmark 10Y – The index represents the 10-year maturity point on the BVAL Muni AAA Benchmark Yield Curve (the “Curve”). The Curve is the baseline curve for BVAL tax-exempt municipals. It is populated with high quality US municipal bonds with an average rating of AAA from Moody’s and S&P. The yield curve is built using non-parametric fit of market data obtained from the Municipal Securities Rulemaking Board.

BVAL Muni Benchmark 1Y – The index represents the 1-year maturity point on the BVAL Muni AAA Benchmark Yield Curve (the “Curve”). The Curve is the baseline curve for BVAL tax-exempt municipals. It is populated with high quality US municipal bonds with an average rating of AAA from Moody’s and S&P. The yield curve is built using non-parametric fit of market data obtained from the Municipal Securities Rulemaking Board.

BVAL Muni Benchmark 6M – The index represents the six-month maturity point on the BVAL Muni AAA Benchmark Yield Curve (the “Curve”). The Curve is the baseline curve for BVAL tax-exempt municipals. It is populated with high quality US municipal bonds with an average rating of AAA from Moody’s and S&P. The yield curve is built using non-parametric fit of market data obtained from the Municipal Securities Rulemaking Board.

Duration is a commonly used measure of the potential volatility of the price of a debt securities, prior to maturity. Securities with a longer duration generally have more

4

| |  |

volatile prices than securities of comparable quality with a shorter duration.

Free cash flow is a measure of financial performance calculated as operating cash flow minus capital expenditures. Free cash flow (FCF) represents the cash that a company is able to generate after laying out the money required to maintain or expand its asset base. Free cash flow is important because it allows a company to pursue opportunities that enhance shareholder value.

Hang Seng Index is a free float-adjusted market capitalization-weighted stock market index in Hong Kong. It is used to record and monitor daily changes of the largest companies of the Hong Kong stock market and is the main indicator of the overall market performance in Hong Kong. These 50 constituent companies represent about 58% of the capitalization of the Hong Kong Stock Exchange.

KBW Nasdaq Bank Index is designed to track the performance of the leading banks and thrifts that are publicly-traded in the U.S. The Index includes 24 banking stocks representing the large U.S. national money centers, regional banks and thrift institutions.

MSCI All Country World Index is a total return, free-float adjusted market capitalization weighted index that captures large and mid-cap representation across 24 Developed and 21 Emerging Markets countries. With 2,483 constituents, the index covers approximately 85% of the global investable equity opportunity set. Net total return indices reinvest dividends after the deduction of withholding taxes, using (for international indices) a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

MSCI Emerging Markets Index is a total return, free-float adjusted market capitalization weighted index that is designed to measure the equity market performance in the global emerging markets.

MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

The Nasdaq Composite Index is the market capitalization-weighted index of approximately 3,000 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities.

Purchasing Manager’s Index (PMI) is an indicator of the economic health of the manufacturing sector.

Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe and includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

Russell 2000 Financial Services Index serves as a benchmark for all Financial Services sector small cap stocks in the US specifically those with the Russell 2000.

Source: FTSE Russell Indexes. “FTSE®”, “Russell®”, “MTS®”, “FTSE TMX®” and “FTSE Russell” and other service marks and trademarks related to the FTSE or Russell indexes are trademarks of the London Stock Exchange Group companies and are used by FTSE, MTS, FTSE TMX and Russell under license.

SIFMA Municipal Swap Index is a 7-day high grade market index comprised of tax-exempt variable rate demand obligations’ reset rates that are reported to the Municipal Securities Rule Making Board’s SHORT reporting system.

Sistema Especial de Liquidacao e Custodia (SELIC) is the Brazilian Central Bank’s system for performing open market operations in execution of monetary policy.

S&P 500® Index is a total return, float-adjusted market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. Total return indexes include reinvestments of all dividends.

S&P 500® Financials Index – comprises those companies included in the S&P 500 that are classified as members of the GICS® financials sector.

S&P 500® Information Technology Index comprises those companies included in the S&P 500® that are classified as members of the GICS information technology sector.

S&P Municipal Bond Short Intermediate Index consists of bonds in the S&P Municipal Bond Index with a min maturity of 1 year and a max of 8 years.

S&P 500® Telecommunication Services Index comprises those companies included in the S&P 500® that are classified as members of the GICS telecommunications services sector.

The S&P 500® Index, S&P 500® Financials Index, S&P 500® Information Technology Index, S&P Municipal Bond Short Intermediate Index and S&P 500® Telecommunication Services Index (the “Indices”) are products of S&P Dow Jones Indices LLC and have been licensed for use by Alpine Woods Capital Investors, LLC. Copyright © 2017 by S&P Dow Jones Indices LLC. All rights reserved. Redistribution or reproductions in whole or in part are prohibited without written the permission of S&P Dow Jones Indices LLC. S&P Dow Jones Indices LLC, its affiliates, and third party licensors make no representation or warranty, express or implied, with respect to the Indices and none of such parties shall have any liability for any errors, omissions, or interruptions in the Indices or the data included therein.

An investor cannot invest directly in an index.

5

Equity Manager Reports

| | Alpine Dynamic Dividend Fund |

| | |

| | Alpine Rising Dividend Fund |

| | |

| | Alpine Financial Services Fund |

| | |

| | Alpine Small Cap Fund |

6

| Alpine Dynamic Dividend Fund |  |

| Comparative Annualized Returns as of 10/31/17 (Unaudited) | |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Since Inception(1) | |

| Alpine Dynamic Dividend Fund — Institutional Class | | 23.22% | | 8.54% | | 10.09% | | -0.01% | | 5.59% | |

| Alpine Dynamic Dividend Fund — Class A (Without Load) | | 22.92% | | 8.28% | | 9.83% | | N/A | | 9.85% | |

| Alpine Dynamic Dividend Fund — Class A (With Load) | | 16.26% | | 6.28% | | 8.61% | | N/A | | 8.80% | |

| MSCI All Country World Index | | 23.20% | | 7.92% | | 10.80% | | 3.70% | | 7.84% | |

| Lipper Global Equity Income Funds Average(2) | | 16.46% | | 5.41% | | 8.50% | | 2.53% | | 6.48% | |

| Lipper Global Equity Income Funds Ranking(2) | | 5/160 | | 5/140 | | 22/117 | | 51/55 | | 27/33 | |

| Gross Expense Ratio (Institutional Class): 1.31%(3) | | | | | | | | | | | |

| Net Expense Ratio (Institutional Class): 1.26%(3) | | | | | | | | | | | |

| Gross Expense Ratio (Class A): 1.56%(3) | | | | | | | | | | | |

| Net Expense Ratio (Class A): 1.51%(3) | | | | | | | | | | | |

| | | | | | | | | | | | |

| | (1) | Institutional Class shares commenced on September 22, 2003 and Class A shares commenced on December 30, 2011. Returns for indices are since September 22, 2003. |

| | (2) | The since inception return represents the period beginning September 25, 2003 (Institutional Class only). |

| | (3) | As disclosed in the prospectus dated February 28, 2017. |

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced. Returns for the Class A shares with sales charge reflect a maximum sales charge of 5.50%. Performance for the Class A shares without sales charges does not reflect this load.

MSCI All Country World Index is a total return, free-float adjusted market capitalization weighted index that captures large- and mid-cap representation across 24 developed and 21 emerging markets countries. With 2,483 constituents, the index covers approximately 85% of the global investable equity opportunity set. Net total return indices reinvest dividends after the deduction of withholding taxes, using (for international indices) a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties. (Source: MSCI.) MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. Lipper Analytical Services, Inc. is an independent mutual fund research and rating service. The Lipper Global Equity Income Funds Average is an average of funds that by prospectus language and portfolio practice seek relatively high current income and growth of income by investing at least 65% of their portfolio in dividend paying securities of domestic and foreign companies. The highest rank is 1 and the lowest is based on the total number of funds ranked in the category. Lipper rankings for the periods shown are based on fund total returns with dividends and distributions reinvested and do not reflect sales charges. The Lipper Global Equity Income Funds Average are unmanaged and do not reflect the deduction of direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Global Equity Income Funds Average reflects fees charged by the underlying funds. The performance for the Alpine Dynamic Dividend Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

Expense Ratios reflect the ratios reported in the Fund’s most recent prospectus (as supplemented). The Alpine Dynamic Dividend Fund has a contractual expense waiver that continues through February 28, 2018. Where a Fund’s gross and net expense ratios are the same for the period reported, the contractual expense reimbursement level was not reached as of the end of that period. To the extent the Fund’s expenses were reduced by waivers, the Fund’s total returns were increased. In these cases, in the absence of the expense waivers, the Fund’s total returns would have been lower.

To the extent that the Fund’s historical performance resulted from gains derived from participation in Initial Public Offerings (“IPOs”) and/or Secondary Offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary Offerings in the future.

7

| Alpine Dynamic Dividend Fund (Continued) |  |

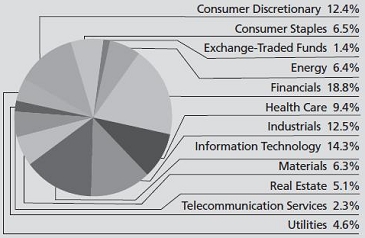

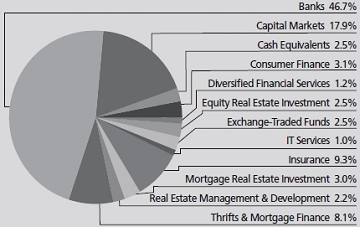

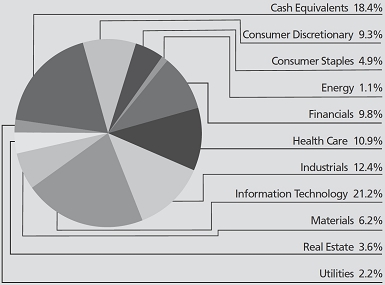

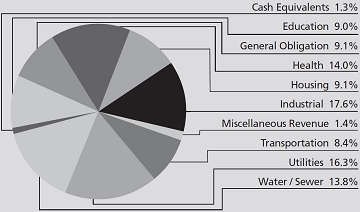

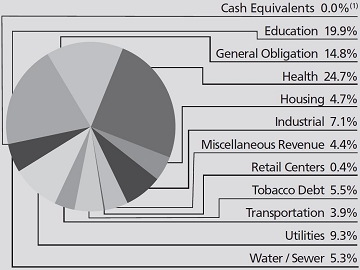

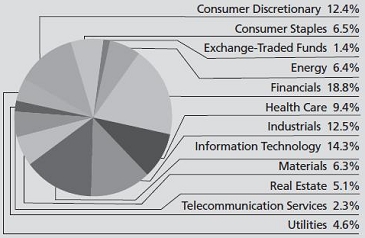

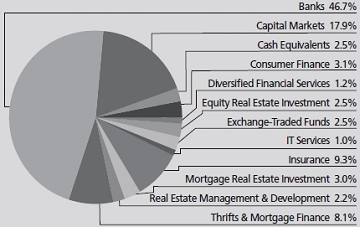

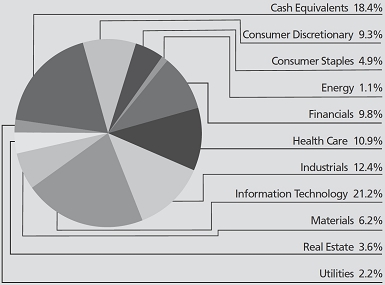

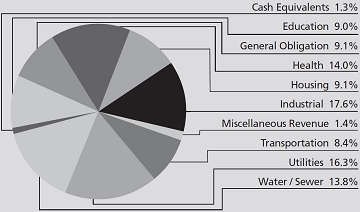

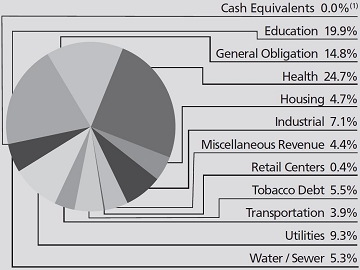

Portfolio Distributions* (Unaudited)

| Top 10 Holdings* (Unaudited) |

| 1. | | Apple, Inc. | 1.80 | % |

| 2. | | Intel Corp. | 1.48 | % |

| 3. | | Broadcom, Ltd. | 1.37 | % |

| 4. | | Cosan Logistica SA | 1.28 | % |

| 5. | | Applied Materials, Inc. | 1.27 | % |

| 6. | | Whirlpool Corp. | 1.26 | % |

| 7. | | Nomad Foods, Ltd. | 1.23 | % |

| 8. | | Veolia Environnement SA | 1.23 | % |

| 9. | | Ferrovial SA | 1.21 | % |

| 10. | | Thermo Fisher Scientific, Inc. | 1.19 | % |

| * | Portfolio Distributions percentages are based on total net investments. Top 10 Holdings do not include short-term investments and percentages are based on total net assets. Portfolio holdings sector distributions are as of 10/31/17 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. |

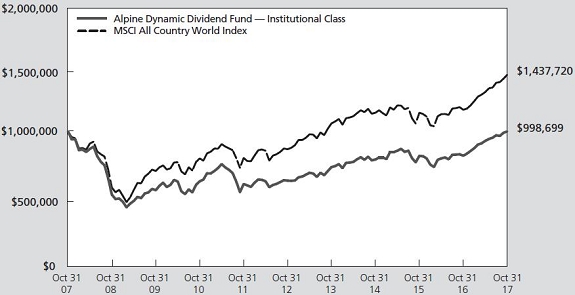

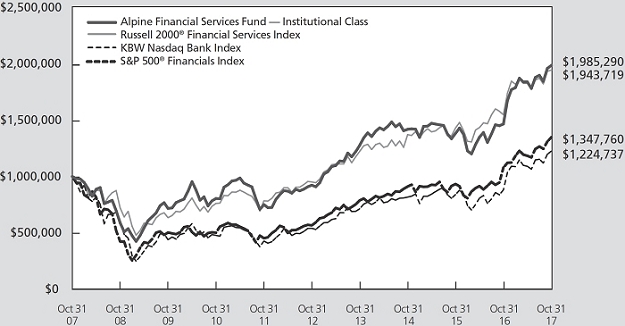

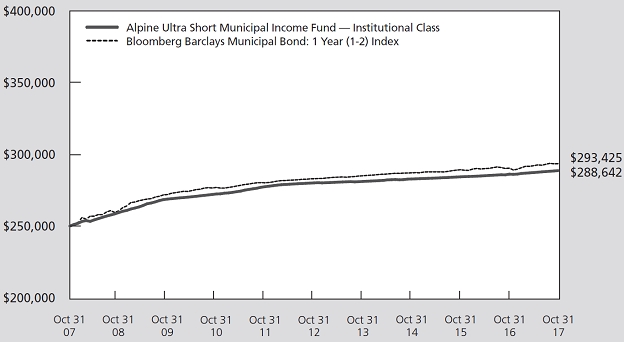

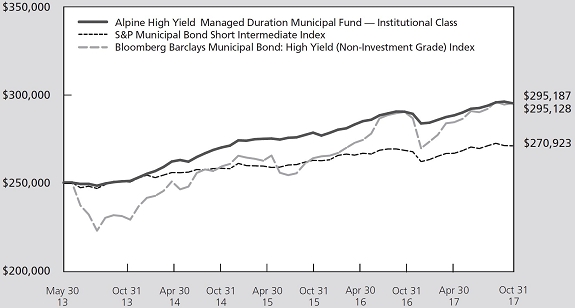

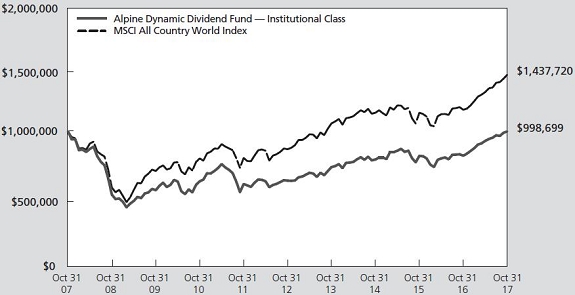

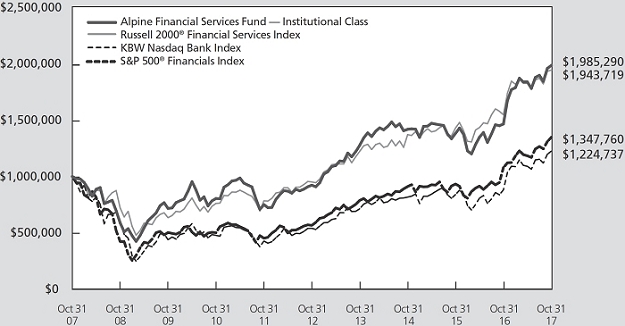

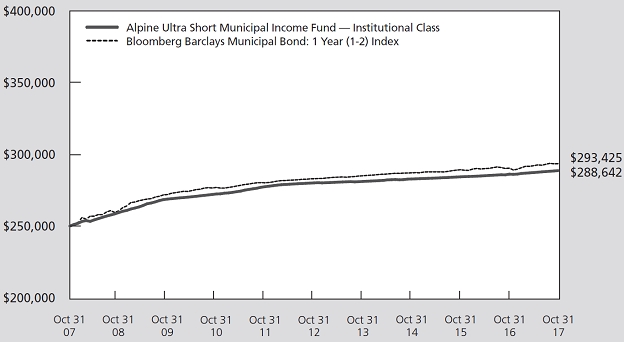

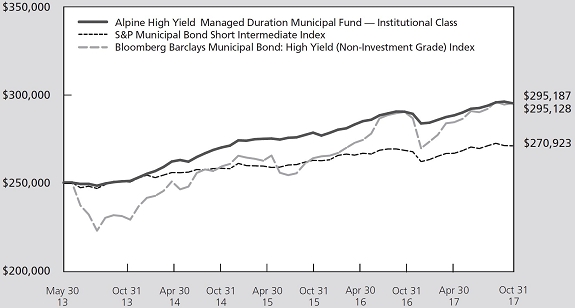

Value of a $1,000,000 Investment (Unaudited)

This chart represents a comparison of a hypothetical $1,000,000 investment in the Fund versus a similar investment in the Fund’s benchmark. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees, if applicable. Without the waiver and recovery of fees, the Fund’s total return would have differed.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost.

8

| Alpine Dynamic Dividend Fund (Continued) |  |

Commentary

Dear Shareholders:

For the fiscal year ended October 31, 2017, the Alpine Dynamic Dividend Fund generated a total return of 23.22% versus its benchmark, the MSCI All Country World Index, which had a total return of 23.20%. All returns include reinvestment of all distributions. The Fund distributed $0.24 per share during the fiscal year. All references in this letter to the Fund’s performance relate to the Fund’s Institutional Class.

PERFORMANCE DRIVERS

During the 12 month period ended October 31, 2017, the MSCI All Country World Index staged a rally that was impressive not just for its magnitude but also for its consistency; it posted 12 consecutive months of positive returns. Despite heightened geopolitical risk and political uncertainty in Europe, risk assets remained resilient as solid global economic data, a synchronized global recovery in corporate earnings, and tailwinds from continued accommodative monetary policy across most major regions bolstered investors’ optimism.

For the first time in a decade, all 45 of the economies tracked by the Organization for Economic Cooperation and Development (OECD) are growing, and that synchronicity has extended to the stock market. The total return of the MSCI Europe Index, at 27.66% in U.S. Dollars, and that of the MSCI Emerging Markets Index, at 26.89%, were remarkably close to that of the S&P 500® Index at 23.62%. Underneath the surface, returns were more uneven, however, with the S&P 500® Telecommunication Services Index down 1.37% while the S&P 500® Information Technology Index, at the other extreme, was up 38.96% during the period. Investors were arguably in a “risk on” mood, favoring economically-sensitive cyclical stocks over defensive stalwarts found in sectors like consumer staples and utilities.

The breadth of global growth has inspired previously skeptical investors to take bigger risks, extending beyond safe havens in the U S. We believe that the old cliché of a “Goldilocks” economy that is neither too hot nor too cold is quite pertinent to the setting as of today.

PORTFOLIO ANALYSIS

On a sector basis, financials, information technology, and industrials had the greatest positive effect on the absolute total return of the Fund. Telecom services, energy and consumer staples sectors had the greatest negative effect on the absolute performance of the Fund. On a relative basis, the financials sector generated the largest outperformance versus the MSCI All Country World Index, followed by information technology and industrials during the period. Telecom services, energy and consumer staples were the sectors with the worst

relative performance versus the MSCI All Country World Index during the period.

The top five contributors to the Fund’s performance for the fiscal year ended October 31, 2017 based on contribution to total return were Apple, Cosan Logistica, Bank of America, Applied Materials and SK Hynix.

| • | Iconic consumer electronics innovator Apple produced another solid year of earnings and product development as it launched two new iPhones and continued to profitably grow its services business. The company’s performance may have also reflected its status as a significant beneficiary of any potential tax repatriation holiday, given the vast majority of its cash is held overseas. |

| | | |

| • | Cosan Logistica is a holding company whose sole asset is shares of Rumo, a railway concession operator in Brazil, hence share performance correlates strongly with Rumo. The shares rallied as Rumo executed on its strategy of improved operating performance. In addition, the volume of agricultural products transported increased due to a record corn crop. The stock currently trades at a significant discount to its net asset value. |

| | | |

| • | Bank of America, is one of the more asset-sensitive banks based on their disclosed interest rate sensitivity analyses, in our view, and rallied in the aftermath of the Presidential election alongside the surge in bond yields and the Federal Reserve’s three rate hikes. In addition, the bank reported solid quarterly results during the fiscal year, leading analysts to revise their earnings estimates higher. |

| | | |

| • | Applied Materials, which supplies wafer fabrication equipment to the semiconductor industry, reported good results and an optimistic outlook for its business as the semiconductor and OLED screen industries are enjoying robust growth. The company’s performance also reflects its positioning for the shift towards higher resolution, thinner, less power consuming, foldable, stretchable displays in smart phones. |

| | | |

| • | SK Hynix is a Korean manufacturer of semiconductor devices. The stock rallied as DRAM and NAND markets experienced a stronger than expected upcycle and ASPs (average selling prices) continued to climb. |

The bottom five contributors to the Fund’s performance for the fiscal year ended October 31, 2017 based on contribution to total return were BRF SA, Kroger, CVS Health, Merrimack Pharmaceuticals and Teva Pharmaceutical Industries.

| • | Brazilian food company BRF SA underperformed due to its ill-advised and poorly executed strategy to gain |

9

| Alpine Dynamic Dividend Fund (Continued) |  |

| | | market share by cutting prices; margin pressure was exacerbated by stubbornly high corn prices. After the sudden and inexplicable departures of the Chief Financial Officer (CFO) and Vice President (VP) of Marketing, the Fund exited this position. |

| • | Kroger suffered early in the year from a lackluster sales report and then the blowback from Amazon’s announced acquisition of Whole Foods. Fear of Amazon entering the grocery business in a larger way and the potential negative impact on margins has hurt the shares. The Fund has exited this position. |

| | | |

| • | CVS Health Corporation reported disappointing quarterly results in November and offered poor 2017 earnings guidance that implied virtually no growth, a major departure from its 10% earnings growth targets. CVS was also a victim of Amazon’s potential business expansion plans. Investors began to fear its pharmacy benefit management business will suffer from a potential entrance by Amazon into the space. |

| | | |

| • | Biotechnology company, Merrimack Pharmaceuticals (“MACK”), paid a special dividend this year. Investors were concerned about the deal that was announced in January in which Ipsen, a French drugmaker, bought some assets of MACK, including Onivyde, a pancreatic cancer drug. They believed that the Onivyde transaction was dilutive and that any value-drivers (clinical readouts) would not occur until 2018. The Fund no longer holds the position. |

| | | |

| • | Teva Pharmaceutical Industries is a multinational generic and specialty pharmaceutical company. The stock underperformed due to pricing pressure in the generic drug business, fears over potential launches of competing generic versions of multiple sclerosis drug Copaxone, and the turnover in senior management at the firm. The Fund has exited the position. |

We hedged a portion of our currency exposures to the Euro, the Japanese Yen and the British Pound. We have also used leverage at times both in the execution of the strategy of the Fund and to help manage net outflows during the fiscal year.

SUMMARY & OUTLOOK

As we look toward the balance of 2017, we see reasons for cautious optimism. One by one we are seeing purchasing managers’ indices (PMI) across most major regions inflect positively. Some of the more notable improvements have been seen in France, where the PMI has improved from 48.0 in April 2016 to 56.1 in October 2017, in Japan where the PMI has surged from 48.2 to

52.8, and in Brazil where the PMI has moved from 42.6 to 51.2 over the same time period. While some of these indicators may prove to be overheated, based more on optimism over future prospects than on current macroeconomic conditions, animal spirits are clearly recovering, and we believe the positive tone in the global stock market is well supported by fundamentals.

That said, there is still some reason for caution; despite Republican control of both houses of Congress, President Trump has so far been unable to succeed on his, and the party’s longtime promise to repeal Obamacare, leading some to question the ability of this administration to push forward federal tax reform and infrastructure stimulus. The U.S. stock market’s strong performance since the election is arguably at least partly driven by expectations that these stimuli will be implemented successfully, and any disappointment with respect to these expectations could lead to downside volatility.

In Europe, with French and German presidential elections behind us, political uncertainty is waning and the stock market is now able to capitalize on the steadily improving macroeconomic data and corporate earnings trajectory. We are encouraged by the combination of robust fundamentals and an arguably discounted valuation relative to the U.S. market.

The Asia-Pacific region is also showing marked improvement. The Hong Kong Hang Seng Index is hitting on all cylinders, with a total return of 27.24% in USD for the 12 month period ended 10/31/17, boosted in part by euphoria around the historic 19th party congress where President Xi Jinping heralded the dawn of a “new era” of Chinese power and laid out his vision for an increasingly prosperous China, confident of its place on the world stage. Japan continues to benefit from twin tailwinds of structural reforms under Abenomics and a very accommodative monetary policy, with the Bank of Japan continuing to purchase domestic equities and government bonds at record levels.

Beyond the macroeconomic environment, the Fund continues to emphasize its focus on high quality companies with strong balance sheets and a willingness to reward shareholders with dividends.

Sincerely,

Brian Hennessey

Joshua Duitz

Portfolio Managers

This letter represents the opinions of the Fund’s management and is subject to change, is not guaranteed and should not be considered a recommendation to buy or sell any security. The information provided is not intended to be, and is not, a forecast of future events, a guarantee of future results, or investment advice. Views expressed may vary from those of the firm as a whole.

Earnings growth is not representative of the fund’s future performance.

10

| Alpine Dynamic Dividend Fund (Continued) |  |

Past performance is no guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to risks, including the following, which are provided in alphabetical order:

Credit Risk – Credit risk refers to the possibility that the issuer of a security will not be able to make payments of interest and principal when due. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. The degree of credit risk depends on both the financial condition of the issuer and the terms of the obligation.

Currency Risk – The value of investments in securities denominated in foreign currencies increases or decreases as the rates of exchange between those currencies and the U.S. dollar change. Currency conversion costs and currency fluctuations could erase investment gains or add to investment losses. Currency exchange rates can be volatile, and are affected by factors such as general economic conditions, the actions of the U.S. and foreign governments or central banks, the imposition of currency controls and speculation.

Cybersecurity Risk – Cybersecurity incidents may allow an unauthorized party to gain access to Fund assets, customer data (including private shareholder information), or proprietary information, or cause the Fund, the Adviser and/or its service providers (including, but not limited to, Fund accountants, custodians, sub-custodians, transfer agents and financial intermediaries) to suffer data breaches, data corruption or lose operational functionality.

Dividend Strategy Risk – There is no guarantee that the issuers of the stocks held by the Fund will declare dividends in the future or that, if dividends are declared, they will remain at their current levels or increase over time. The Fund’s emphasis on dividend paying stocks could cause the Fund to underperform similar funds that invest without consideration of a company’s track record of paying dividends or ability to pay dividends in the future. Dividend-paying stocks may not participate in a broad market advance to the same degree as other stocks, and a sharp rise in interest rates or economic downturn could cause a company to unexpectedly reduce or eliminate its dividend. The Fund may hold securities for short periods of time related to the dividend payment periods and may experience loss during these periods.

Equity Securities Risk – The stock or other security of a company may not perform as well as expected, and may decrease in value, because of factors related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry).Holders of common stock generally are subject to more risks than holders of preferred stock or debt securities because the right to repayment of common stockholders’ claims is subordinated to that of preferred stock and debt securities upon the bankruptcy of the issuer.

Foreign and Emerging Market Securities Risk – The Fund’s investments in securities of foreign issuers or issuers with significant exposure to foreign markets involve additional risk. Foreign countries in which the Fund may invest may have markets that are less liquid, less regulated and more volatile than U.S. markets. The value of the Fund’s investments may decline because of factors affecting the particular issuer as well as foreign markets and issuers generally, such as unfavorable or unsuccessful government actions, reduction of government or central bank support and political or financial instability. Lack of information may also affect the value of these securities. To the extent the Fund focuses its investments in a single country or only a few countries in a particular geographic region, economic, political, regulatory or other conditions affecting such country or region may have a greater impact on Fund performance relative to a more geographically diversified fund. The risks of foreign investments are heightened when investing in issuers in emerging market countries. Emerging market countries tend to have economic, political and legal systems that are less fully developed and are less stable than those of more developed countries. Less developed markets are more likely to experience problems with the clearing and settling of trades and the holding of securities by banks, agents and depositories are less developed than those in the United States. They are often particularly sensitive to market movements because their market prices tend to reflect speculative expectations. Low trading volumes may result in a lack of liquidity and in extreme price volatility.

Foreign Currency Transactions Risk – Foreign securities are often denominated in foreign currencies. As a result, the value of the Fund’s shares is affected by changes in exchange rates. The Fund may enter into foreign currency transactions to try to manage this risk. The Fund’s ability to use foreign currency transactions successfully depends on a number of factors, including the foreign currency transactions being available at prices that are not too costly, the availability of liquid markets and the ability of the Adviser to accurately predict the direction of changes in currency exchange rates. The Fund may enter into forward foreign currency exchange contracts in order to protect against possible losses on foreign investments resulting from adverse changes in the relationship between the U.S. dollar and foreign currencies. Although this method attempts to protect the value of the Fund’s portfolio securities against a decline in the value of a currency, it does not eliminate fluctuations in the underlying prices of the securities and while such contracts tend to minimize the risk of loss due to a decline in the value of the hedged currency, they tend to limit any potential gain which might result should the value of such currency increase.

11

| Alpine Dynamic Dividend Fund (Continued) |  |

Growth Stock Risk – Growth stocks typically are very sensitive to market movements because their market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall. Growth stocks as a group may be out of favor and underperform the overall equity market while the market concentrates on undervalued stocks.

Initial Public Offerings and Secondary Offerings Risk – The Fund may invest a portion of its assets in shares of IPOs or secondary offerings of an issuer. IPOs and secondary offerings may have a magnified impact on the performance of a fund with a small asset base. The impact of IPOs and secondary offerings on the Fund’s performance likely will decrease as the Fund’s asset size increases, which could reduce the Fund’s returns. IPOs and secondary offerings may not be consistently available to the Fund for investing. IPO and secondary offering shares frequently are volatile in price due to the absence of a prior public market, the small number of shares available for trading and limited information about the issuer. Therefore, the Fund may hold IPO and secondary offering shares for a very short period of time. This may increase the turnover of the Fund and may lead to increased expenses for the Fund, such as commissions and transaction costs. In addition, IPO and secondary offering shares can experience an immediate drop in value if the demand for the securities does not continue to support the offering price.

Leverage Risk – The Fund may use leverage to purchase securities. Increases and decreases in the value of the Fund’s portfolio will be magnified when the Fund uses leverage. The Fund may also have to sell assets at inopportune times to satisfy its obligations. The use of leverage is considered to be a speculative investment practice and may result in the loss of a substantial amount, and possibly all, of the Fund’s assets.

Liquidity Risk – Some assets held by the Fund may be impossible or difficult to sell, particularly during times of market turmoil. These illiquid assets may also be difficult to value. If the Fund is forced to sell an illiquid asset to meet redemption requests or other cash needs, the Fund may be forced to sell at a loss.

Management Risk – The Adviser’s judgment about the quality, relative yield or value of, or market trends affecting, a particular security or sector, or about interest rates generally, may be incorrect. The Adviser’s security selections and other investment decisions might produce losses or cause the Fund to underperform when compared to other funds with similar investment objectives and strategies.

Market Risk – The price of a security held by the Fund may fall due to changing market, economic or political conditions.

Operational Risk – Your ability to transact with the Fund or the valuation of your investment may be negatively impacted because of the operational risks arising from factors such as processing errors and human errors, inadequate or failed internal or external processes, failures in systems and technology, changes in personnel, and errors caused by third party service providers or trading counterparties. It is not possible to identify all of the operational risks that may affect the Fund or to develop processes and controls that completely eliminate or mitigate the occurrence of such failures. The Fund and its shareholders could be negatively impacted as a result.

Portfolio Turnover Risk – High portfolio turnover necessarily results in greater transaction costs which may reduce Fund performance.

Qualified Dividend Tax Risk – Favorable U.S. federal tax treatment of Fund distributions may be adversely affected, changed or repealed by future changes in tax laws.

Small and Medium Capitalization Company Risk – Securities of small or medium capitalization companies are more likely to experience sharper swings in market values, less liquid markets, in which it may be more difficult for the Adviser to sell at times and at prices that the Adviser believes appropriate and generally are more volatile than those of larger companies.

Swaps Risk – Swap agreements are derivative instruments that can be individually negotiated and structured to address exposure to a variety of different types of investments or market factors. Depending on their structure, swap agreements may increase or decrease the Fund’s exposure to long- or short-term interest rates, foreign currency values, mortgage securities, corporate borrowing rates, or other factors such as security prices or inflation rates. The Fund also may enter into swaptions, which are options to enter into a swap agreement. Since these transactions generally do not involve the delivery of securities or other underlying assets or principal, the risk of loss with respect to swap agreements and swaptions generally is limited to the net amount of payments that the Fund is contractually obligated to make. There is also a risk of a default by the other party to a swap agreement or swaption, in which case the Fund may not receive the net amount of payments that the Fund contractually is entitled to receive.

Undervalued Stock Risk – The Fund may pursue strategies that may include investing in securities, which, in the opinion of the Adviser, are undervalued. The identification of investment opportunities in undervalued securities is a difficult task and there is no assurance that such opportunities will be successfully recognized or acquired. While investments in undervalued securities offer opportunities for above-average capital appreciation, these investments involve a high degree of financial risk and can result in substantial losses.

Please refer to pages 4-5 for other important disclosures and definitions.

12

| Alpine Rising Dividend Fund(1) |  |

| Comparative Annualized Returns as of 10/31/17 (Unaudited) | |

| | | 1 Year | | 3 Years | | 5 Years | | Since Inception(2) |

| Alpine Rising Dividend Fund — Institutional Class | | 20.75% | | 7.91% | | 12.18% | | 12.15% | |

| Alpine Rising Dividend Fund — Class A (Without Load) | | 20.50% | | 7.66% | | 11.91% | | 11.97% | |

| Alpine Rising Dividend Fund — Class A (With Load) | | 13.84% | | 5.66% | | 10.65% | | 10.89% | |

| S&P 500® Index | | 23.63% | | 10.77% | | 15.18% | | 13.46% | |

| Dow Jones Industrial Average | | 20.90% | | 5.81% | | 18.32% | | 12.55% | |

| Lipper Equity Income Funds Average(3) | | 17.85% | | 7.39% | | 11.59% | | 12.40% | |

| Lipper Equity Income Funds Ranking(3) | | 150/537 | | 228/464 | | 152/361 | | 165/259 | |

| Gross Expense Ratio (Institutional Class): 1.19%(4) | | | | | | | | | |

| Net Expense Ratio (Institutional Class): 1.19%(4) | | | | | | | | | |

| Gross Expense Ratio (Class A): 1.44%(4) | | | | | | | | | |

| Net Expense Ratio (Class A): 1.44%(4) | | | | | | | | | |

| | (1) | Effective September 9, 2015 the Fund’s name was changed from the Alpine Accelerating Dividend Fund to Alpine Rising Dividend Fund. |

| | (2) | Institutional Class shares commenced on November 5, 2008 and Class A shares commenced on December 30, 2011. Returns for indices are since November 5, 2008. |

| | (3) | The since inception data represents the period beginning November 6, 2008 (Institutional Class only). |

| | (4) | As disclosed in the prospectus dated February 28, 2017. |

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced. Returns for the Class A shares with sales charge reflect a maximum sales charge of 5.50%. Performance for the Class A shares without sales charges does not reflect this load.

S&P 500® Index is a total return, float-adjusted market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. Total return indexes include reinvestments of all dividends. The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally the leaders in their industry. Lipper Analytical Services, Inc. is an independent mutual fund research and rating service. The Lipper Equity Income Funds Average is an average of funds that seek relatively high current income and income growth through investing 60% or more of their respective portfolios in equities. The highest rank is 1 and the lowest is based on the total number of funds ranked in the category. Lipper rankings for the periods shown are based on fund total returns with dividends and distributions reinvested and do not reflect sales charges. The S&P 500® Index, the Dow Jones Industrial Average, and the Lipper Equity Income Funds Average are unmanaged and do not reflect direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Equity Income Funds Average reflects fees charged by the underlying funds. The performance for the Alpine Rising Dividend Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

Expense Ratios reflect the ratios reported in the Fund’s most recent prospectus. The Alpine Rising Dividend Fund has a contractual expense waiver that continues through February 28, 2018. Where a Fund’s gross and net expense ratios are the same for the period reported, the contractual expense reimbursement level was not reached as of the end of that period. To the extent the Fund’s expenses were reduced by waivers, the Fund’s total returns were increased. In these cases, in the absence of the expense waivers, the Fund’s total returns would have been lower.

To the extent that the Fund’s historical performance resulted from gains derived from participation in Initial Public Offerings (“IPOs”) and/or Secondary Offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary Offerings in the future.

13

| Alpine Rising Dividend Fund (Continued) |  |

Portfolio Distributions* (Unaudited)

| Top 10 Holdings* (Unaudited) |

| 1. | | Apple, Inc. | 2.87% |

| 2. | | Microsoft Corp. | 2.66% |

| 3. | | AT&T, Inc. | 2.36% |

| 4. | | Pfizer, Inc. | 2.10% |

| 5. | | Johnson & Johnson | 2.02% |

| 6. | | JPMorgan Chase & Co. | 1.91% |

| 7. | | Citizens Financial Group, Inc. | 1.90% |

| 8. | | Oracle Corp. | 1.88% |

| 9. | | Aetna, Inc. | 1.87% |

| 10. | | Texas Instruments, Inc. | 1.79% |

| * | Portfolio Distributions percentages are based on total net investments. Top 10 Holdings do not include short-term investments and percentages are based on total net assets. Portfolio holdings sector distributions are as of 10/31/17 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. |

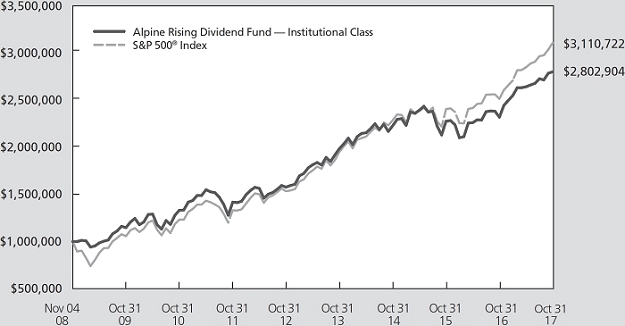

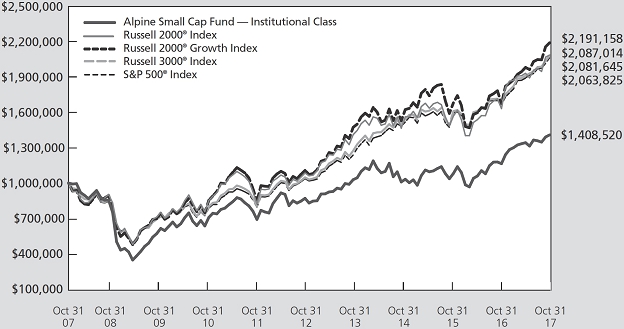

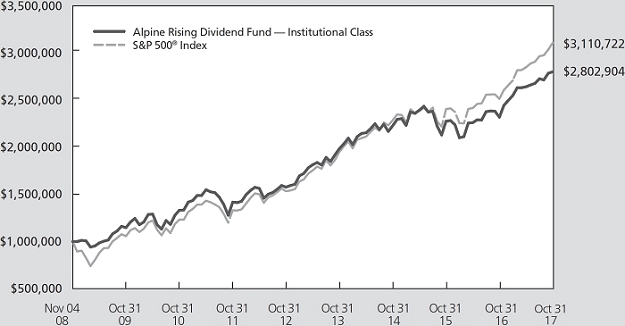

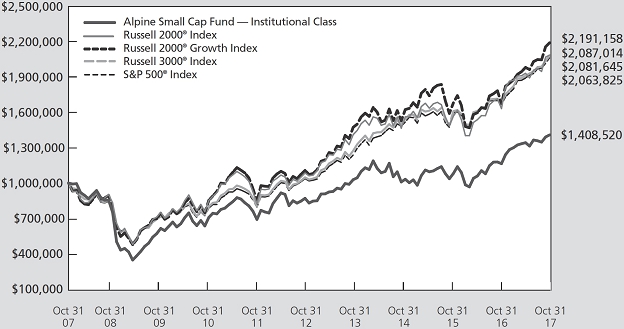

Value of a $1,000,000 Investment (Unaudited)

This chart represents a comparison of a hypothetical $1,000,000 investment in the Fund versus a similar investment in the Fund’s benchmarks. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees, if applicable. Without the waiver and recovery of fees, the Fund’s total return would have differed.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost.

14

| Alpine Rising Dividend Fund (Continued) |  |

Commentary

Dear Shareholders:

For the twelve months ended October 31, 2017, the Alpine Rising Dividend Fund generated a total return of 20.75% compared to the S&P 500® Index total return of 23.63% for the same period. The Fund distributed $0.5406 per share in ordinary distributions during the fiscal year. All references in this letter to the Fund’s performance relate to the performance of the Fund’s Institutional Class.

PERFORMANCE DRIVERS

Despite a plethora of potential risks and headwinds, equity markets, both domestically and abroad, continued the bull market rally that began in the aftermath of the financial crisis. These pitfalls include, but are by no means limited to, the surprise election of Donald Trump as the 45th President of the United States, repeated failed attempts to repeal the Affordable Care Act (i.e., Obamacare), heightened geopolitical tensions with North Korea, a spate of terrorist attacks in the U S and Europe, the aftershocks from Brexit, a string of rate increases by the Federal Reserve (Fed) and the flattening of the yield curve, the initiation of the Fed balance sheet reduction, and a flurry of destructive hurricanes and earthquakes.

However, what mattered for equities during the fiscal year was the continued growth of corporate profits, with consensus earnings estimates for the S&P 500® Index (S&P) rising about 10% coupled with price/earnings (P/E) multiple expansion driven by hopes of corporate tax reform, the prospect for deregulation, and a fiscal stimulus package. There are some secular forces at work as well, most notably in technology and the internet. Alphabet (via Google), Amazon.com, and Microsoft are driving the shift to Cloud computing, and companies like NVIDIA are producing chips that are enabling autonomous vehicles and artificial intelligence. With its tech-heavy exposure, the NASDAQ Composite Index delivered a 31.23% total return during the fiscal year.

On a sector basis, information technology, financials and industrials had the largest positive impact on the absolute performance of the Fund. The telecommunication, real estate, and consumer staples sectors had the largest negative impact on the absolute performance of the Fund. On a relative basis, financials, consumer discretionary, and industrials sectors generated the larges outperformance versus the S&P, while health care, information technology, and materials were the worst relative performers versus the S&P.

PORTFOLIO ANALYSIS

The top five contributors to performance for the period included Apple, Microsoft, Applied Materials, Bank of America, and CSX.

| | • | Apple produced another solid year of earnings and product development as it launched two new iPhones and continued to profitably grow its services business. |

| | | |

| | • | Microsoft also rallied with the technology sector as new management has been successfully steering the company into Cloud computing and web services. |

| | | |

| | • | Applied Materials, a semiconductor equipment manufacturer, reported good results and an optimistic outlook for its business as the semiconductor and OLED screen industries are enjoying robust growth. |

| | | |

| | • | Bank of America shares have benefited from overall economic expansion for its commercial banking division, good results from its capital markets-based businesses and a dramatic cost-cutting program that began to benefit financial results. |

| | | |

| | • | Shares of CSX, a railroad operator, were driven by solid earnings as its new management team started to make an immediate impact on results via cost cuts. |

The top five detractors to performance for the period included General Electric (GE), Qualcomm, Kroger, Walgreens Boots Alliance, and CVS Health.

| | • | Shares of GE fell late in the fiscal year as its results fell below expectations, and it is in the midst of a CEO transition and overall strategic review of the conglomerate’s operations. While we remain cautiously optimistic that the results of new management’s well-needed review of GE’s expansive business portfolio could result in a restructuring in coming months that could unlock shareholder value, we reduced our position in GE near the end of the [fiscal] year. |

| | | |

| | • | Shares of Qualcomm, a semiconductor company, fell sharply in January in the wake of significant legal setbacks. The Federal Trade Commission (FTC) first accused the company of anti-competitive practices and then Apple, its most important customer, sued the company for monopolizing the baseband market shortly thereafter. Subsequently, Apple’s contract manufacturers for the iPhone began withholding royalty payments from Qualcomm. We ultimately sold our position in Qualcomm during the [fiscal] year. |

15

| Alpine Rising Dividend Fund (Continued) |  |

| | • | Shares of Kroger, a grocery chain, suffered early in the year from a lackluster sales report and then the blowback from Amazon’s announced acquisition of Whole Foods. Fear of Amazon entering the grocery business in a larger way and the potential negative impact on margins has hurt the shares. |

| | | |

| | • | Walgreens Boots Alliance was also a victim of Amazon’s potential business expansion plans. Investors began to fear its pharmacy business will suffer from a potential entrance by Amazon into the space. Walgreens recent results continued to look positive to us and we continued to hold the shares as we think they are oversold on these yet to be realized fears. |

| | | |

| | • | CVS Health Corporation reported disappointing quarterly results in November and offered poor 2017 earnings guidance that implied virtually no growth, a major departure from its 10% earnings growth targets. We sold the last portion of our position in February. |

SUMMARY & OUTLOOK

With the stock market at all-time highs, elevated valuation metrics, a less accommodative Federal Reserve, mounting global geopolitical tensions, and a seemingly stalled domestic economic agenda, we cannot help but think that caution is warranted at the moment. Still, we are cognizant of resilient earnings, global economic expansion, healthy consumer confidence, and the potential for some combination of tax reform/repatriation and fiscal stimulus to sustain the rally. Given these opposing forces, we plan to continue our measured approach to managing the Fund in fiscal 2018. As always, we will continue to focus on companies with track records of increasing dividends, as we believe these companies have the potential to outperform through the market cycle.

Sincerely,

Andrew Kohl

Mark Spellman

Portfolio Managers

This letter represents the opinions of the Fund’s management and is subject to change, is not guaranteed and should not be considered a recommendation to buy or sell any security. The information provided is not intended to be, and is not, a forecast of future events, a guarantee of future results, or investment advice. Views expressed may vary from those of the firm as a whole.

Earnings growth is not representative of the fund’s future performance.

Past performance is no guarantee of future results.

It is not possible to invest directly in an index.

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to risks, including the following, which are provided in alphabetical order:

Currency Risk – The value of investments in securities denominated in foreign currencies increases or decreases as the rates of exchange between those currencies and the U.S. dollar change. Currency conversion costs and currency fluctuations could erase investment gains or add to investment losses. Currency exchange rates can be volatile, and are affected by factors such as general economic conditions, the actions of the U.S. and foreign governments or central banks, the imposition of currency controls and speculation.

Cybersecurity Risk – Cybersecurity incidents may allow an unauthorized party to gain access to Fund assets, customer data (including private shareholder information), or proprietary information, or cause the Fund, the Adviser and/or its service providers (including, but not limited to, Fund accountants, custodians, sub-custodians, transfer agents and financial intermediaries) to suffer data breaches, data corruption or lose operational functionality.

Dividend Strategy Risk – There is no guarantee that the issuers of the stocks held by the Fund will declare dividends in the future or that, if dividends are declared, they will remain at their current levels or increase over time. The Fund’s emphasis on dividend- paying stocks could cause the Fund to underperform similar funds that invest without consideration of a company’s track record of paying dividends or ability to pay dividends in the future. Dividend-paying stocks may not participate in a broad market advance to the same degree as other stocks, and a sharp rise in interest rates or economic downturn could cause a company to unexpectedly reduce or eliminate its dividend. The Fund may hold securities for short periods of time related to the dividend payment periods and may experience loss during these periods.

16

| Alpine Rising Dividend Fund (Continued) |  |

Equity Securities Risk – The stock or other security of a company may not perform as well as expected, and may decrease in value, because of factors related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry). Holders of common stock generally are subject to more risks than holders of preferred stock or debt securities because the right to repayment of common stockholders’ claims is subordinated to that of preferred stock and debt securities upon the bankruptcy of the issuer.

Foreign Currency Transactions Risk – Foreign securities are often denominated in foreign currencies. As a result, the value of the Fund’s shares is affected by changes in exchange rates. The Fund may enter into foreign currency transactions to try to manage this risk. The Fund’s ability to use foreign currency transactions successfully depends on a number of factors, including the foreign currency transactions being available at prices that are not too costly, the availability of liquid markets and the ability of the Adviser to accurately predict the direction of changes in currency exchange rates.

Foreign Securities Risk – The Fund’s investments in securities of foreign issuers or issuers with significant exposure to foreign markets involve additional risk. Foreign countries in which the Fund may invest may have markets that are less liquid, less regulated and more volatile than U.S. markets. The value of the Fund’s investments may decline because of factors affecting the particular issuer as well as foreign markets and issuers generally, such as unfavorable or unsuccessful government actions, reduction of government or central bank support and political or financial instability. Lack of information may also affect the value of these securities. To the extent the Fund focuses its investments in a single country or only a few countries in a particular geographic region, economic, political, regulatory or other conditions affecting such country or region may have a greater impact on Fund performance relative to a more geographically diversified fund. The risks of foreign investments are heightened when investing in issuers of emerging market countries.

Growth Stock Risk – Growth stocks typically are very sensitive to market movements because their market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall. Growth stocks as a group may be out of favor and underperform the overall equity market while the market concentrates on undervalued stocks. Although the Fund will not concentrate its investments in any one industry or industry group, it may, like many growth funds, weight its investments toward certain industries, thus increasing its exposure to factors adversely affecting issuers within those industries.

Initial Public Offerings and Secondary Offerings Risk – The Fund may invest a portion of its assets in shares of IPOs or secondary offerings of an issuer. IPOs and secondary offerings may have a magnified impact on the performance of a fund with a small asset base. The impact of IPOs and secondary offerings on the Fund’s performance likely will decrease as the Fund’s asset size increases, which could reduce the Fund’s returns. IPOs and secondary offerings may not be consistently available to the Fund for investing. IPO and secondary offering shares frequently are volatile in price due to the absence of a prior public market, the small number of shares available for trading and limited information about the issuer. Therefore, the Fund may hold IPO and secondary offering shares for a very short period of time. This may increase the turnover of the Fund and may lead to increased expenses for the Fund, such as commissions and transaction costs. In addition, IPO and secondary offering shares can experience an immediate drop in value if the demand for the securities does not continue to support the offering price.

Liquidity Risk – Some assets held by the Fund may be impossible or difficult to sell, particularly during times of market turmoil. These illiquid assets may also be difficult to value. If the Fund is forced to sell an illiquid asset to meet redemption requests or other cash needs, the Fund may be forced to sell at a loss.

Management Risk – The Adviser’s judgment about the quality, relative yield or value of, or market trends affecting, a particular security or sector, or about interest rates generally, may be incorrect. The Adviser’s security selections and other investment decisions might produce losses or cause the Fund to underperform when compared to other funds with similar investment objectives and strategies.

Market Risk – The price of a security held by the Fund may fall due to changing market, economic or political conditions.

Micro Capitalization Company Risk – Stock prices of micro capitalization companies are significantly more volatile, and more vulnerable to adverse business and economic developments than those of larger companies. Micro capitalization companies often have narrower markets for their goods and/or services and more limited managerial and financial resources than larger, more established companies, including small or medium capitalization companies.

17

| Alpine Rising Dividend Fund (Continued) |  |