UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File number: 811-10405

Alpine Series Trust

(Exact name of registrant as specified in charter)

2500 Westchester Avenue, Suite 215

Purchase, New York 10577

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | | Copy to: |

| | | |

Samuel A. Lieber

Alpine Woods Capital Investors, LLC

2500 Westchester Avenue, Suite 215

Purchase, New York 10577 | | Rose DiMartino

Attorney at Law

Willkie Farr & Gallagher

787 7th Avenue, 40th Floor

New York, New York 10019 |

Registrant’s telephone number, including area code: (914) 251-0880

Date of fiscal year end: October 31, 2014

Date of reporting period: November 1, 2013 – October 31, 2014

Item 1: Shareholder Report.

Table of Contents

Additional Alpine Funds are offered in the Alpine Equity Trust. These Funds include:

| Alpine International Real Estate Equity Fund | | Alpine Global Infrastructure Fund |

| Alpine Realty Income & Growth Fund | | Alpine Global Consumer Growth Fund |

| Alpine Cyclical Advantage Property Fund | | |

| Alpine Emerging Markets Real Estate Fund | | |

Alpine’s Real Estate Funds’ investment objectives, risks, charges and expenses must be considered carefully before investing in funds of the Alpine Equity Trust. The statutory and summary prospectuses contain this and other important information about the investment company, and it may be obtained by calling 1-888-785-5578, or visiting www.alpinefunds.com. Read it carefully before investing.

Mutual fund investing involves risk. Principal loss is possible.

Alpine’s Investment Outlook

President’s Letter

Dear Shareholder:

“INTEREST RATES: HOW LOW, FOR HOW LONG?”

Alpine believes that over the next year, investors will be rewarded if they focus on long-term trends. This strategy has worked well for the extended period since the Great Financial Collapse of 2008. Despite news of distressing events, traumas, coups and even wars which have had short lived impacts, the positive long-term trend of capital markets around the world has been sustained by low interest rates and modest economic growth. Another factor has been the U.S. dollar, which reversed a nine and one-half year decline in mid-2011, with notable appreciation from August of 2014. The principle factor underpinning these trends has been Central Bank monetary policy, led by the U.S. Federal Reserve. In October of 2014, the Fed concluded its quantitative easing program while other countries have adopted similar supportive policies. On top of these measures, the price of oil and most raw material commodities have seen notable declines, lowering many production costs and enhancing potential profitability.

One can argue that Central Bank policy has been the primary force for economic recovery and growth in the absence of fiscal stimulus from most governments. Indeed, many believe that fiscal austerity around the world, most notably in Europe, has limited opportunities for job creation and reduced economic growth. Increasingly, the world’s central banks are adopting tools to increase money supply, but instead of boosting bank lending, much of the liquidity has flowed into capital markets. The Federal Reserve has completed its tapering of quantitative easing by phasing out the purchase of financial securities, making the U.S. the leader in normalizing this cycle. It should be noted that the Fed has accumulated a $4 trillion balance sheet which will not dramatically decline over the near term, so stimulus will not yet be reduced. Add to this expanded Japanese quantitative easing and the prospect of some form of European quantitative easing next year should more than make up for our Fed’s reduced level of monetary support.

After the close of the fiscal year in October, the financial markets received an early Thanksgiving gift from China via a reduction in China’s mortgage loan rates and a likely follow up of decreased reserve requirements for some of its banks, which should push increased liquidity into the capital markets. However, since China is not as open an economy (unlike other major nations), the flow of funds into the global liquidity pool will be more gradual. Nonetheless, the trend is clear, “do not fear, your friendly central banker will be here”.

Europe faces a prospect of continued GDP growth of less than 1% with inflation at similar low levels. This suggests that the possibility of a long-term (i.e., secular) period of minimal growth or possibly even stagnation could occur. Thus, the current Eurozone unemployment rate of 11.5% (Spain and Greece are more than two times that number) may not improve materially for some time. The International Monetary Fund (IMF) has suggested that countries should adopt more stimulative fiscal policies, such as significant infrastructure spending, but we think that is not enough. Indeed, outgoing European Council President Von Rompuy stated that “without jobs and growth, the European idea itself is in danger”. Clearly the political consequences of stagnant or even deflationary economies can create social upheavals, as Europe itself has witnessed over the past several hundred years. Just two years ago, the so called “Jasmine Revolution” spread political upheaval throughout the Arab world. This was largely the product of high unemployment rates and disenfranchised populations.

Japan is currently the only major country utilizing both monetary and fiscal stimulus. Indeed, their so called ‘three arrows’ approach of aggressive monetary policy, expansionary fiscal stimulus combined with structural reforms to the economy are key products of the political situation in Japan, brought on by over 20 years of substandard economic performance. In addition to Japan, there are a few emerging market economies, most notably India, which are in a position to reduce interest rates and expand domestic demand as well as utilize appropriate fiscal spending and structural reforms to spur growth. However, most countries are taking the

1

politically more expedient path of devaluing their currency in order to make exports cheaper and, hence, more competitive. Such currency devaluation can create inflation over time and cause long term problems if growth in output and wages does not increase materially.

The one country that is not in this position, of course, is the U.S.A. Indeed, the U.S. currency has been ascending over the past year, the U.S. banking sector is in a better position than those of most other countries, and larger companies are generally well capitalized by both the equity and debt markets. However, small companies in this country are not fully enjoying the benefits of the modest economic recovery we have enjoyed over the past few years. This is holding back the U.S. recovery, sustaining only moderate job growth over time. Thus, median real wages are in fact lower today than they were in 2007. Nonetheless, the prospects for small U.S. businesses are improving. However, Alpine believes productivity enhancements created by investments in new technology, production capabilities, and communication and physical infrastructure are still required for economic growth to accelerate.

In addition to the push for greater global liquidity, the other major driver of economic prospects and, hence, the markets, has been the continued expansion of U.S. oil and gas reserves. This has helped to bring about lower oil and gas prices at a time when global economic activity and demand for energy is slowing. Fundamentally, cheaper energy means the cost of economic activity has not only declined, but the transfer of economic wealth from goods producers and transporters to energy producers has also shifted. Countries whose economies are dependent on high oil prices, notably Russia and Iran, and to a lesser degree, Brazil, Canada, Mexico and Norway, may be hurt by an extended decline. On the other hand, Japan and much of Europe could be big beneficiaries. The resultant increase in many industries’ profitability due to lower fuel prices provides the possibility that some of the enhanced margins might be distributed to workers and some of the savings may also be distributed to consumers in the form of price stability. In other words, a major inflationary input has been limited, and this may stimulate economic activity. Alpine believes there will be minimal inflationary impulses globally over the next year or two until global aggregate demand starts to rise.

For 2015, Alpine believes that the prospects for modest economic growth supported by abundant cheap global liquidity, combined with lower energy costs, will continue to favor capital markets and global equities more broadly. We still expect significant regional differences in terms of growth, and individual companies may see their

prospects and share prices rise or decline based on management’s ability to utilize the capital markets during this period. This suggests continued expansion of mergers and acquisitions activities on a global basis. It could also lead to an increased number of IPOs in different industries, seeking both to capitalize on high historic valuations as well as position themselves to utilize capital markets for future growth.

Just as the U.S. stock market outperformed much of the world during 2014 as a result of the combination of cheap money and improving economic fundamentals, we believe that 2015 will see a global broadening of market performance to include small cap stocks in the U.S. as well as increased international opportunities. Finally, we should note that the extended period of low volatility, including 2013 and much of 2014, may not be fully over, but political and economic risks remain, as few of this year’s conflicts have resolved and more may surface. The market appears to be increasingly open to more risk if returns are commensurate. Fundamentally, the Fed is still our friend, even though many market participants have been waiting over a year for the proverbial ‘punch bowl’ to be removed and the party to end. Markets may well continue to climb a “wall of worry” as we enter 2015.

We appreciate your interest and support as we enter what appears to be a seventh year of economic and equity market recoveries.

Sincerely,

Samuel A. Lieber

President

Past performance is not a guarantee of future results. The specific market, sector or investment conditions that contribute to a Fund’s performance may not be replicated in future periods.

Mutual fund investing involves risk. Principal loss is possible. Please refer to individual fund letters for risks specific to that fund.

This letter and the letters that follow represent the opinions of the Funds’ management and are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security. The information provided is not intended to be, and is not, a forecast of future events, a guarantee of future results, or investment advice.

2

| Disclosures and Definitions |  |

Equity Income Disclosures –

Please refer to the Schedule of Portfolio Investments for each Fund’s holding information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security.

Favorable tax treatment of Fund distributions may be adversely affected, changed or repealed by future changes in tax laws. Alpine may not be able to anticipate the level of dividends that companies will pay in any given timeframe.

The Funds’ monthly distributions may consist of net investment income, net realized capital gains and/or a return of capital. If a distribution includes anything other than net investment income, the Funds will provide a notice of the best estimate of its distribution sources when distributed, which will be posted on the Funds’ website: www.alpinefunds.com, or can be obtained by calling 1-800-617-7616. We estimate that the Alpine Series and Income Trusts did not pay any distributions during the fiscal annual period ending October 31, 2014 through a return of capital. A return of capital distribution does not necessarily reflect the Funds’ performance and should not be confused with “yield” or “income.” Final determination of the Federal income tax characteristics of distributions paid during the calendar year will be provided on U.S. Form 1099-DIV, which will be mailed to shareholders. Please consult your tax advisor for further information.

All investments involve risk. Principal loss is possible. A small portion of the S&P 500 yield may include return of capital; the 10-year Treasury yield does not include return of capital; Corporate bonds and High Yield Bonds generally do not have return of capital; a portion of the dividend paid by REITs and REIT preferred stock may be deemed a return of capital for tax purposes in the event the company pays a dividend greater than its taxable income. A stock may trade with more or less liquidity than a bond depending on the number of shares and bonds outstanding, the size of the company, and the demand for the securities. The REIT and REIT preferred stock market are smaller than the broader equity and bond markets and often trade with less liquidity than these markets depending upon the size of the individual issue and the demand of the securities. Treasury notes are guaranteed by the U.S. Government and thus they are considered to be safer than other asset classes. Tax features of a Treasury Note, Corporate bond, Stock, High Yield bond, REITs and REIT preferred stock may vary based on an individual’s circumstances. Consult a tax professional for additional information. Neither the Fund nor any of its representatives may give tax advice. Investors should consult their tax advisor for information concerning their particular situation.

Standard & Poor’s Financial Services LLC (S&P) is a financial services company, a division of McGraw Hill Financial that publishes financial research and analysis on stocks and bonds. S&P is considered one of the Big Three credit-rating agencies, which also include Moody’s Investor Service and Fitch Ratings.

S&P assigns ratings on a scale of ‘D’ to ‘AAA’, with ‘D’ the lowest/weakest rating, indicating a default, and ‘AAA’ the highest/strongest rating, indicating the strongest credit quality in S&P’s spectrum of credit ratings.

S&P incorporates a broad number of credit areas of each entity/municipality when assigning a bond rating to an entity’s debt instrument, including: (a) financial position, which encompasses liquidity metrics, cash reserves, non-liquid assets, liabilities, and other financial metrics; (b) debt position, which includes long and short-term bonded debt and other privately-placed notes/bonds, leases and other off-balance sheet liabilities; (c) pension and Other Post-Employment Benefits (OPEB); (d) socioeconomic indices; (e) the aptitude and sophistication of management.

Earnings Growth and EPS Growth are not measures of the Funds’ future performance.

Diversification does not assure a profit or protect against loss in a declining market.

Must be preceded or accompanied by a prospectus.

Quasar Distributors, LLC, distributor.

Equity Income Funds – Definitions

Barclays Capital High Yield Municipal Bond Index is the Muni High Yield component of the Municipal Bond Index. The Barclays Municipal Bond Index is a rules-based, market-value-weighted index engineered for the long-term tax-exempt bond market.

Barclays Municipal One Year Bond Index is a total return benchmark of BAA3 ratings or better designed to measure returns for tax exempt assets.

Basis Point is a value equaling one one-hundredth of a percent (1/100 of 1%).

Beta measures the sensitivity of the investment to the movements of its benchmark. A beta higher than 1.0 indicates the investment has been more volatile than the benchmark and a beta of less than 1.0 indicates that the investment has been less volatile than the benchmark.

Bloomberg 10-Year U.S. Muni General Obligation AAA Index is populated with U.S. municipal general obligations (G.O.) with an average rating of AAA from Moody’s and S&P, with an average maturity of ten years. The option-free yield curve is built using an option-

3

| Disclosures and Definitions (Continued) |  |

adjusted spread (OAS) model. Furthermore, the index is derived from contributed pricing from the Municipal Securities Rulemaking Board (MSRB), new issues calendars and other proprietary contributed prices.

Custom Balanced Benchmark reflects an unmanaged portfolio (rebalanced monthly) of 60% of the S&P 500 Index, which is a market capitalization-weighted index of 500 large capitalization stocks commonly used to represent the U.S. equity market, and 40% of the Barclays Capital U.S. Aggregate Bond Index (BCAG), which is a widely recognized, unmanaged index of U.S. dollar-denominated investment-grade fixed income securities. The Fund may, however, invest up to 75% of its total assets in equity securities.

Effective Duration – Effective duration is a duration calculation for bonds with embedded options. Effective duration takes into account that expected cash flows will fluctuate as interest rates change. Please note, duration measures the sensitivity of the price (the value of principal) of a fixed-income investment to a change in interest rates.

Earnings Per Share is the portion of a company’s profit allocated to each outstanding share of common stock. Earnings per share serves as an indicator of a company’s profitability.

First Tier Security is any eligible security that: (i) is a rated security that has received a short-term rating from the requisite Nationally Recognized Statistical Rating Organizations in the highest short-term rating category for debt obligations (within which there may be sub-categories or gradations indicating relative standing); or (ii) is an unrated security that is of comparable quality to a security meeting the requirements for a rated security as determined by the Fund’s Board of Trustees; or (iii) is a security issued by a registered investment company that is a money market fund; or (iv) is a government security.

Free cash flow is a measure of financial performance calculated as operating cash flow minus capital expenditures. Free cash flow (FCF) represents the cash that a company is able to generate after laying out the money required to maintain or expand its asset base. Free cash flow is important because it allows a company to pursue opportunities that enhance shareholder value.

Hedge involves making an investment to reduce the risk of adverse price movements in an asset. Normally, a hedge consists of taking an offsetting position in a related security, such as a futures contract.

KBW Bank Index is a modified cap-weighted index consisting of 24 exchange-listed and National Market System stocks, representing national money center banks and leading regional institutions

Lipper Tax-Exempt Money Market Funds Average is an average of funds that invest in high quality municipal obligations with dollar-weighted average maturities of less than 90 days.

MSCI All Country World Daily TR (Net Div) Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

MSCI Emerging Markets Index USD is a free float-adjusted market cap weighted index that is designed to measure equity market performance in the global emerging markets. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

NASDAQ Financial-100 Index includes 100 of the largest domestic and international financial securities listed on the NASDAQ Stock Market based on market capitalization. They include companies classified according to the Industry Classification Benchmark as Financials, which are included within the NASDAQ Bank, NASDAQ Insurance, and NASDAQ Other Finance Indexes.

Return on Equity is the amount of net income returned as a percentage of shareholders equity. Return on equity measures a corporation’s profitability by revealing how much profit a company generates with the money shareholders have invested.

Russell 2000® Index is a small-cap stock market index of the bottom 2,000 stocks in the Russell 3000® Index. The Russell 2000 is by far the most common benchmark for mutual funds that identify themselves as “small-cap”,

4

| |  |

while the S&P 500® index is used primarily for large capitalization stocks. Source: Russell Investment Group. Russell is the owner of the trademarks and copyrights related to the Russell Indexes.

Russell 3000® Index measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market. Source: Russell Investment Group. Russell is the owner of the trademarks and copyrights related to the Russell Indexes.

S&P 500® Index is a float-adjusted, market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance.

Securities Industry and Financial Markets Association (SIFMA) is a United States industry trade group representing securities firms, banks, and asset management companies. SIFMA was formed on November 1, 2006, from the merger of the Bond Market Association and the Securities Industry Association.

S&P Municipal Bond Short Intermediate Index consists of bonds in the S&P Municipal Bond Index with a minimum maturity of one year and a maximum maturity of up to, but not including, eight years as measured from the Rebalancing Date.

Weighted Average Maturity is the average time it takes for securities in a portfolio to mature, weighted in proportion to the dollar amount that is invested in the portfolio. Weighted average maturity (WAM) measures the sensitivity of fixed-income portfolios to interest rate changes. Portfolios with longer WAMs are more sensitive to changes in interest rates because the longer a bond is held, the greater the opportunity for interest rates to move up or down and affect the performance of the bonds in the portfolio.

The S&P 500® Index, and the S&P Municipal Bond Short Intermediate Index (the “Indices”) are products of S&P Dow Jones Indices LLC and have been licensed for use by Alpine Woods Capital Investors, LLC. Copyright (c) 2014 by S&P Dow Jones Indices LLC. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written the permission of S&P Dow Jones Indices LLC. S&P Dow Jones Indices LLC, its affiliates, and third party licensors make no representation or warranty, express or implied, with respect to the Index and none of such parties shall have any liability for any errors, omissions, or interruptions in the Index or the data included therein.

An investor cannot invest directly in an index.

5

Equity Manager Reports

| | Alpine Dynamic Dividend Fund |

| | |

| | Alpine Accelerating Dividend Fund |

| | |

| | Alpine Financial Services Fund |

| | |

| | Alpine Small Cap Fund |

| | |

| | Alpine Transformations Fund |

| | |

| | Alpine Equity Income Fund |

6

| Alpine Dynamic Dividend Fund |  |

| Comparative Annualized Returns as of 10/31/14 (Unaudited) | | | |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Since Inception(1) | |

| Alpine Dynamic Dividend Fund — Institutional Class | | | 8.09% | | | | 9.73% | | | | 7.53% | | | | 2.35% | | | | 4.80% | | | |

| Alpine Dynamic Dividend Fund — Class A (Without Load) | | | 7.83% | | | | N/A | | | | N/A | | | | N/A | | | | 11.56% | | | |

| Alpine Dynamic Dividend Fund — Class A (With Load) | | | 1.89% | | | | N/A | | | | N/A | | | | N/A | | | | 9.36% | | | |

| MSCI All Country World Daily Total Return Index (Net Div) | | | 7.77% | | | | 12.98% | | | | 10.57% | | | | 7.09% | | | | 7.82% | | | |

| Lipper Global Equity Income Funds Average(2) | | | 5.97% | | | | 12.07% | | | | 10.39% | | | | 5.35% | | | | 6.75% | | | |

| Lipper Global Equity Income Funds Ranking(2) | | | 31/139 | | | | 74/80 | | | | 68/69 | | | | 19/19 | | | | 15/15 | | | |

| Gross Expense Ratio (Institutional Class): 1.43%(3) | | | | | | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Institutional Class): 1.38%(3) | | | | | | | | | | | | | | | | | | | | | | |

| Gross Expense Ratio (Class A): 1.68%(3) | | | | | | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Class A): 1.63%(3) | | | | | | | | | | | | | | | | | | | | | | |

| | (1) | Institutional Class shares commenced on September 22, 2003 and Class A shares commenced on December 30, 2011. Returns for indices are since September 22, 2003. |

| | (2) | The since inception return represents the period beginning September 25, 2003 (Institutional Class only). |

| | (3) | As disclosed in the prospectus dated February 28, 2014. |

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced. Returns for the Class A shares with sales charge reflect a maximum sales charge of 5.50%. Performance for the Class A shares without sales charges does not reflect this load.

The MSCI All Country World Daily Total Return Index (net dividend) USD is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets. Source: MSCI. MSCI data may not be reproduced or used for any other purpose. The Lipper Global Equity Income Funds Average is an average of funds that by prospectus language and portfolio practice seek relatively high current income and growth of income by investing at least 65% of their portfolio in dividend-paying securities of domestic and foreign companies. Lipper rankings for the periods shown are based on fund total returns with dividends and distributions reinvested and do not reflect sales charges. The Lipper Global Equity Income Funds Average are unmanaged and do not reflect the deduction of direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Global Equity Income Funds Average reflects fees charged by the underlying funds. The performance for the Alpine Dynamic Dividend Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

Expense Ratios reflect the ratios reported in the Fund’s most recent prospectus. The Alpine Dynamic Dividend Fund has a contractual expense waiver that continues through February 28, 2015. Where a Fund’s gross and net expense ratios are the same for the period reported, the contractual expense reimbursement level was not reached as of the end of that period. To the extent the Fund’s expenses were reduced by waivers, the Fund’s total returns were increased. In these cases, in the absence of the expense waivers, the Fund’s total returns would have been lower.

To the extent that the Fund’s historical performance resulted from gains derived from participation in Initial Public Offerings (“IPOs”) and/or Secondary Offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary Offerings in the future.

7

| Alpine Dynamic Dividend Fund (Continued) |  |

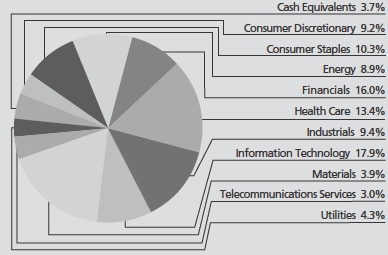

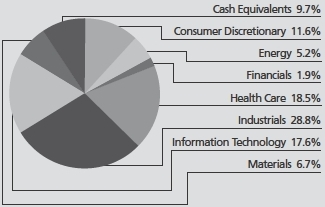

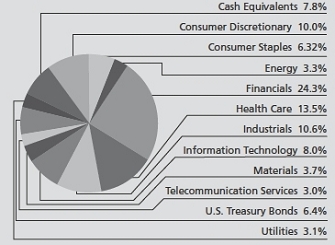

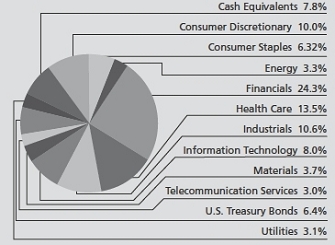

Portfolio Distributions* (Unaudited)

| Top 10 Holdings* (Unaudited) | | |

| 1. | | Apple, Inc. | 2.06 | % |

| 2. | | Avago Technologies, Ltd. | 1.67 | % |

| 3. | | Canadian Pacific Railway, Ltd. | 1.59 | % |

| 4. | | Novartis AG-ADR | 1.51 | % |

| 5. | | Covidien PLC | 1.47 | % |

| 6. | | McKesson Corp. | 1.45 | % |

| 7. | | Roche Holding AG | 1.40 | % |

| 8. | | HCA Holdings, Inc. | 1.34 | % |

| 9. | | Vodafone Group PLC-ADR | 1.31 | % |

| 10. | | QUALCOMM, Inc. | 1.26 | % |

| * | Portfolio Distributions percentages are based on total net investments. Top 10 Holdings do not include short-term investments and percentages are based on total net assets. Portfolio holdings sector distributions are as of 10/31/14 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. |

| | |

| (1) | Amount is less than 0.05%. |

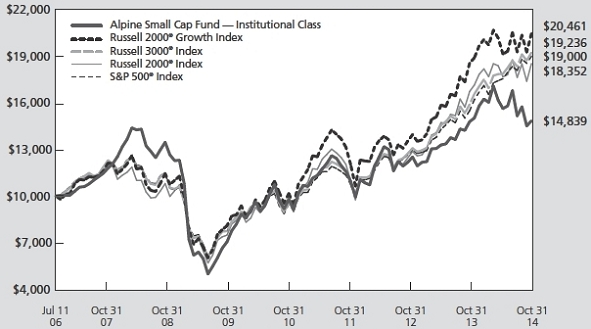

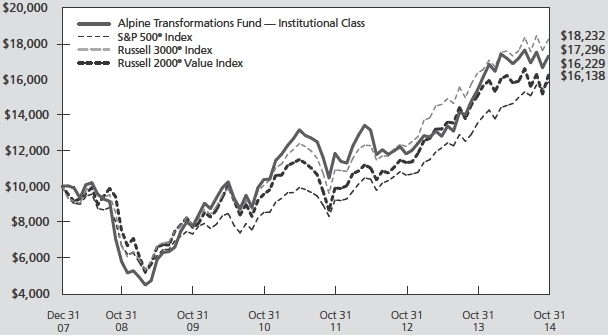

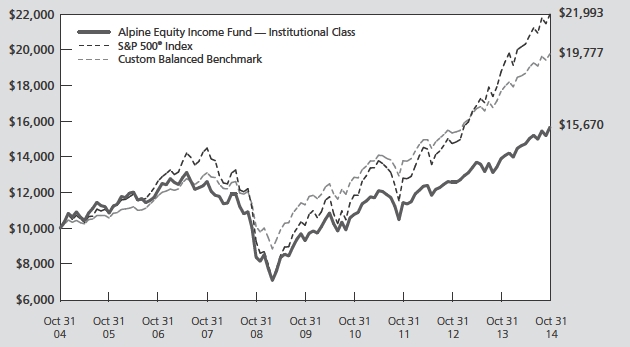

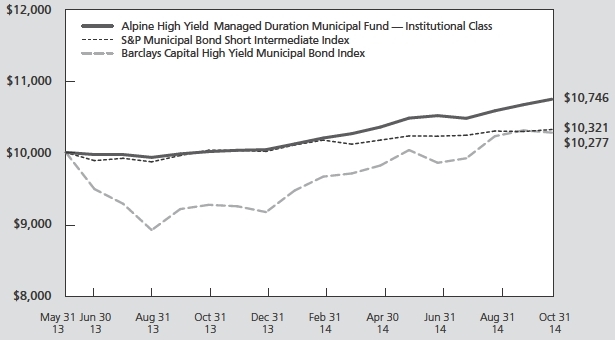

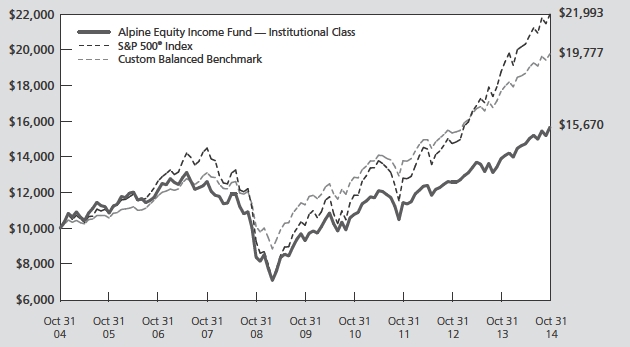

Value of a $10,000 Investment (Unaudited)

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmarks. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees, if applicable. Without the waiver and recovery of fees, the Fund’s total return would have differed.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost.

8

| Alpine Dynamic Dividend Fund (Continued) |  |

Commentary

Dear Investor:

For the fiscal year ended October 31, 2014, the Alpine Dynamic Dividend Fund generated a total return of 8.09% versus its benchmark, the MSCI All Country World Total Return Index (Net Div), which had a total return of 7.77%. All returns include the reinvestment of all distributions. The Fund distributed $0.24 per share during the fiscal year. All references in this letter to the Fund’s performance relate to the Fund’s Institutional Class.

PERFORMANCE DRIVERS

Global equities continued their impressive ascent during the 12-month period ended October 31, 2014, but the dispersion of returns among different geographic regions was striking. The total return of the S&P 500® Index, at 17.26% contrasted sharply with that of the MSCI Europe Index (down 0.52% in U.S. Dollar terms) and the MSCI Emerging Markets Index (up 0.64%). With economic prospects in the U.S. remaining relatively sanguine as compared to most other countries, particularly in Europe, the U.S. trade-weighted Dollar Index rose by about 8% during the period, driven largely by the 8% depreciation in the Euro and the 14% depreciation in the Japanese Yen against the Dollar.

On a sector basis, information technology, industrials, and health care had the greatest positive effect on the absolute total return of the Fund. The energy, consumer discretionary and materials sectors had the greatest negative effect on the absolute performance of the Fund. On a relative basis, the industrials sector generated the largest outperformance versus the MSCI All Country World Index, followed by information technology and utilities. The energy, consumer discretionary and financials sectors were the worst relative performers during the period.

PORTFOLIO ANALYSIS

The top five stock contributors to the Fund’s performance for the fiscal year ended October 31, 2014 based on contribution to total return were Avago Technologies, Adani Ports & Special Economic Zone, Apple, Inc., Canadian Pacific Railway, and The Williams Companies.

Several positive events led to the strong performance of semiconductor manufacturer Avago Technologies. The company’s purchase of LSI Corp. in Q4 2013 has been well received and was earnings accretive in the second half of 2014. Also in the merger & acquisitions (M&A) realm, two of Avago’s competitors in the wireless space agreed to merge, which we believe bodes well for future pricing

trends. Meanwhile, Avago’s core wireless business has benefited from the roll out of next generation (4G LTE) wireless networks.

Adani Ports & Special Economic Zone is the largest private port operator in India. The election of new Prime Minister Narendra Modi improved business sentiment in India and raised expectations for policy reform. Adani’s Port business experienced strong volume growth, with its largest port growing 15% year-over-year. The acquisition of Dhamra port was also positive, given its strategic value.

Apple has enjoyed an impressive turnaround in 2014. The shares began to improve midway through the year as the earnings outlook improved and investors began to anticipate the introduction of the iPhone 6 and 6 Plus. Further gains were fueled by speculation of a new product, in this case the Apple Watch. Earnings estimates and unit projections continue to climb for the company, leading to the continued outperformance of the shares.

Canadian Pacific Railway is a Class 1 transcontinental railway serving Canada and the United States. Canadian Pacific Railway is in the midst of an impressive turnaround, achieving a mid-60s (percent) operating ratio goal. At its analyst day in October 2014, the company positioned itself as a structural growth story, targeting 10% revenue growth, a low 60s operating ratio, and approximately doubling its earnings per share (EPS) growth by 2018. We believe Canadian Pacific should benefit from a number of powerful themes such as the energy renaissance, industrial resurgence, and tight trucking capacity in the U.S.

The Williams Companies is a diversified natural gas company in the United States. In June, WMB announced a transaction that had the effect of merging Access Midstream L.P. and Williams Partners L.P. The result of the transaction restored financial flexibility at Williams Partners L.P. and also created a higher and more visible distribution growth.

The bottom five stock contributors to the Fund’s performance for the fiscal year ended October 31, 2014 based on contribution to total return were Precision Drilling Corp, Pier 1 Imports, Energy XXI Bermuda, Trilogy Energy, and Sberbank of Russia.

Precision Drilling Corp is the largest contract driller in Canada and a top five onshore driller in the U.S. With declining day rates and utilization rates amidst a declining commodity price environment, the stock underperformed the market as well as its peer group, as investors questioned its earnings growth trajectory. As of

9

| Alpine Dynamic Dividend Fund (Continued) |  |

the writing of this shareholder letter, the Fund has exited the position.

Pier 1 Imports is a nationwide specialty retailer of a wide variety of furniture, decorative accessories, dining and kitchen products, and bed and bath products. The company was hit by weather-related issues that impacted much of the retail landscape in the first half of the year. As the year progressed, the company’s store traffic lagged expectations, eclipsing the strong growth in its nascent online business. The Fund has since exited the position.

Energy XXI Bermuda, an exploration and production company offering “pure-play” exposure to the Gulf of Mexico, announced a dilutive acquisition in the spring of EPL Oil and Gas, and issued disappointing fiscal year 2015 production guidance in early August, 2014. The Fund exited the position as we felt the investment thesis was significantly impaired following these events.

Trilogy Energy, an exploration and production company with significant exposure to the emerging Duvernay region in Canada, was another casualty of the declining commodity price environment. Beyond pricing headwinds, the company also faced production-related disappointments and material cost inflation. The Fund has exited the position.

Sberbank of Russia is Russia’s largest bank with a market share of roughly 30% in terms of loans and deposits. The stock underperformed as the escalation of political turmoil in Ukraine led to concerns about a slowdown in Russia and its impacts on loan growth and nonperforming loans. The downward pressure on oil prices put even further pressure on Sberbank due to Russia’s significant exposure to the oil market. The Fund has exited the position.

In order to achieve its dividend, the Fund participated in a number of dividend capture strategies including (1) purchasing shares in the stock of a regular dividend payer before an upcoming ex-date and selling after the ex-date, (2) purchasing shares before an anticipated special dividend and selling opportunistically after the ex-date of the dividend, and (3) purchasing additional shares in stocks that the Fund already owns before the ex-date and selling the original shares after the ex-date, thus receiving a dividend on a larger position while still maintaining qualified dividend income eligibility (“QDI”) on its position. Although these strategies have resulted in higher turnover and associated transaction costs for the Fund overall the Fund’s turnover rate has decreased as we have relied less upon these strategies this year. While there is the potential for market loss on the shares that are held for a short period, we seek to use these strategies to generate additional income with limited impact on the construction of the core portfolio.

We have hedged a portion of our currency exposures to the Euro, the Swiss Franc, the Japanese Yen and the British Pound. The currency hedging mitigated the overall negative impact of currency on the portfolio. We have also used leverage at times both in the execution of the strategy of the Fund and to help manage net outflows during the fiscal year.

SUMMARY & OUTLOOK

As we look toward 2015, we see a market environment that remains fairly uncertain. While the U.S. economy appears to be in a sustained growth trajectory, it is challenged by a partisan environment in Washington, D.C. and numerous external headwinds including soft export markets and geopolitical uncertainties relating to key trading partners. The U.S. stock market nonetheless continues to grind higher, supported by a benign macro environment and solid corporate earnings growth, while, at the same time, wrestling with the prospect of the first Federal Funds rate hike in many years.

In Europe, growth continues to be quite sluggish and the specter of recession and/or deflation cannot be overlooked, as ongoing conflicts in Russia/Ukraine add to the numerous risk factors. Indeed, the European Central Bank (ECB) continues to strike a dovish tone with its commitment to accommodative short rates, and is now embarking on a path towards its own version of quantitative easing to combat the deflationary threat.

In Japan, the central bank recently increased the size and scope of its asset purchase program in an effort to steer the economy towards its 2% inflation target. As a result, the Yen has depreciated significantly versus the Dollar and many other currencies, a development that we believe will have global ramifications.

In emerging markets, government elections in Brazil, India, South Africa and Turkey have reached, or are near, resolutions. We believe this may improve the visibility in each country’s respective economic growth outlook and we continue to believe that urbanization will drive growth in emerging markets.

Beyond the macroeconomic environment, the Fund continues to emphasize its focus on what we view as high quality companies with strong balance sheets and a willingness to reward shareholders with dividends. We will continue to adapt our investment approach as economic conditions change and look forward to discussing the portfolio and the prospects for the Fund in future communications.

Sincerely,

Brian Hennessey

Joshua Duitz

Portfolio Managers

10

| Alpine Dynamic Dividend Fund (Continued) |  |

This letter represents the opinions of the Fund’s management and is subject to change, is not guaranteed and should not be considered a recommendation to buy or sell any security. The information provided is not intended to be, and is not, a forecast of future events, a guarantee of future results, or investment advice. Views expressed may vary from those of the firm as a whole. Past performance is no guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible. The fund is subject to risks, including the following:

Credit Risk – Credit risk refers to the possibility that the issuer of a security will not be able to make payments of interest and principal when due. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. The degree of credit risk depends on both the financial condition of the issuer and the terms of the obligation.

Currency Risk – The value of investments in securities denominated in foreign currencies increases or decreases as the rates of exchange between those currencies and the U.S. dollar change. Currency conversion costs and currency fluctuations could erase investment gains or add to investment losses. Currency exchange rates can be volatile, and are affected by factors such as general economic conditions, the actions of the U.S. and foreign governments or central banks, the imposition of currency controls and speculation.

Dividend Strategy Risk – The Fund’s strategy of investing in dividend-paying stocks involves the risk that such stocks may fall out of favor with investors and underperform the market. Companies that issue dividend paying-stocks are not required to continue to pay dividends on such stocks. Therefore, there is the possibility that such companies could reduce or eliminate the payment of dividends in the future. The Fund may hold securities for short periods of time related to the dividend payment periods and may experience loss during these periods.

Emerging Market Securities Risk – The risks of foreign investments are heightened when investing in issuers in emerging market countries. Emerging market countries tend to have economic, political and legal systems that are less fully developed and are less stable than those of more developed countries. They are often particularly sensitive to market movements because their market prices tend to reflect speculative expectations. Low trading volumes may result in a lack of liquidity and in extreme price volatility.

Equity Securities Risk – The stock or other security of a company may not perform as well as expected, and may decrease in value, because of factors related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry).

Foreign Currency Transactions Risk – Foreign securities are often denominated in foreign currencies. As a result, the value of the Fund’s shares is affected by changes in exchange rates. The Fund may enter into foreign currency transactions to try to manage this risk. The Fund’s ability to use foreign currency transactions successfully depends on a number of factors, including the foreign currency transactions being available at prices that are not too costly, the availability of liquid markets and the ability of the Adviser to accurately predict the direction of changes in currency exchange rates. The Fund may enter into forward foreign currency exchange contracts in order to protect against possible losses on foreign investments resulting from adverse changes in the relationship between the U.S. dollar and foreign currencies. Although this method attempts to protect the value of the Fund’s portfolio securities against a decline in the value of a currency, it does not eliminate fluctuations in the underlying prices of the securities and while such contracts tend to minimize the risk of loss due to a decline in the value of the hedged currency, they tend to limit any potential gain which might result should the value of such currency increase.

Foreign Securities Risk – The Fund’s investments in securities of foreign issuers or issuers with significant exposure to foreign markets involve additional risk. Foreign countries in which the Fund may invest may have markets that are less liquid, less regulated and more volatile than U.S. markets. The value of the Fund’s investments may decline because of factors affecting the particular issuer as well as foreign markets and issuers generally, such as unfavorable government actions, and political or financial instability. Lack of information may also affect the value of these securities. The risks of foreign investment are heightened when investing in issuers of emerging market countries.

Growth Stock Risk – Growth stocks are stocks of companies believed to have above-average potential for growth in revenue and earnings. Growth stocks typically are very sensitive to market movements because their market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically

11

| Alpine Dynamic Dividend Fund (Continued) |  |

fall. Growth stocks as a group may be out of favor and underperform the overall equity market while the market concentrates on undervalued stocks.

Initial Public Offerings and Secondary Offerings Risk – The Fund may invest a portion of its assets in shares of IPOs or secondary offerings of an issuer. IPOs and secondary offerings may have a magnified impact on the performance of a Fund with a small asset base. The impact of IPOs and secondary offerings on a Fund’s performance likely will decrease as the Fund’s asset size increases, which could reduce a Fund’s returns. IPOs and secondary offerings may not be consistently available to the Fund for investing. IPO and secondary offering shares frequently are volatile in price due to the absence of a prior public market, the small number of shares available for trading and limited information about the issuer. Therefore, the Fund may hold IPO and secondary offering shares for a very short period of time. This may increase the turnover of the Fund and may lead to increased expenses for the Fund, such as commissions and transaction costs. In addition, IPO and secondary offering shares can experience an immediate drop in value if the demand for the securities does not continue to support the offering price.

Leverage Risk – The Fund may use leverage to purchase securities. Increases and decreases in the value of the Fund’s portfolio will be magnified when the Fund uses leverage.

Management Risk – The Adviser’s judgment about the quality, relative yield or value of, or market trends affecting, a particular security or sector, or about interest rates generally, may be incorrect. The Adviser’s security selections and other investment decisions might produce losses or cause the Fund to underperform when compared to other funds with similar investment objectives and strategies.

Market Risk – The price of a security held by the Fund may fall due to changing market, economic or political conditions.

Portfolio Turnover Risk – High portfolio turnover necessarily results in greater transaction costs which may reduce Fund performance.

Qualified Dividend Tax Risk – Favorable U.S. federal tax treatment of Fund distributions may be adversely affected, changed or repealed by future changes in tax laws.

Small and Medium Capitalization Company Risk – Securities of small or medium capitalization companies are more likely to experience sharper swings in market values, less liquid markets, in which it may be more difficult for the Adviser to sell at times and at prices that the Adviser believes appropriate and generally are more volatile than those of larger companies.

Swaps Risk – Swap agreements are derivative instruments that can be individually negotiated and structured to address exposure to a variety of different types of investments or market factors. Depending on their structure, swap agreements may increase or decrease the Fund’s exposure to long- or short-term interest rates, foreign currency values, mortgage securities, corporate borrowing rates, or other factors such as security prices or inflation rates. The Fund also may enter into swaptions, which are options to enter into a swap agreement. Since these transactions generally do not involve the delivery of securities or other underlying assets or principal, the risk of loss with respect to swap agreements and swaptions generally is limited to the net amount of payments that the Fund is contractually obligated to make. There is also a risk of a default by the other party to a swap agreement or swaption, in which case the Fund may not receive the net amount of payments that the Fund contractually is entitled to receive.

Undervalued Stock Risk – The Fund may pursue strategies that may include investing in securities, which, in the opinion of the Adviser, are undervalued. The identification of investment opportunities in undervalued securities is a difficult task and there is no assurance that such opportunities will be successfully recognized or acquired. While investments in undervalued securities offer opportunities for above-average capital appreciation, these investments involve a high degree of financial risk and can result in substantial losses.

Please refer to pages 3-5 for other important disclosures and definitions.

12

| Alpine Accelerating Dividend Fund |  |

| Comparative Annualized Returns as of 10/31/14 (Unaudited) | | | |

| | | 1 Year | | 3 Years | | 5 Years | | Since Inception(1) | |

| Alpine Accelerating Dividend Fund — Institutional Class | | | 12.25% | | | | 16.30% | | | | 14.21% | | | | 14.33% | | |

| Alpine Accelerating Dividend Fund — Class A (Without Load) | | | 12.04% | | | | N/A | | | | N/A | | | | 16.74% | | |

| Alpine Accelerating Dividend Fund — Class A (With Load) | | | 5.90% | | | | N/A | | | | N/A | | | | 14.43% | | |

| S&P 500® Index | | | 17.26% | | | | 19.77% | | | | 16.69% | | | | 14.82% | | |

| Dow Jones Industrial Average | | | 14.48% | | | | 16.22% | | | | 15.30% | | | | 13.43% | | |

| Lipper Equity Income Funds Average(2) | | | 12.58% | | | | 16.35% | | | | 14.57% | | | | 14.76% | | |

| Lipper Equity Income Funds Ranking(2) | | | 305/472 | | | | 211/330 | | | | 172/271 | | | | 164/266 | | |

| Gross Expense Ratio (Institutional Class): 3.43%(3) | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Institutional Class): 1.35%(3) | | | | | | | | | | | | | | | | | |

| Gross Expense Ratio (Class A): 3.68%(3) | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Class A): 1.60%(3) | | | | | | | | | | | | | | | | | |

| | (1) | Institutional Class shares commenced on November 5, 2008 and Class A shares commenced on December 30, 2011. Returns for indices are since November 5, 2008. |

| | (2) | The since inception data represents the period beginning November 6, 2008 (Institutional Class only). |

| | (3) | As disclosed in the prospectus dated February 28, 2014. |

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced. Returns for the Class A shares with sales charge reflect a maximum sales charge of 5.50%. Performance for the Class A shares without sales charges does not reflect this load.

The S&P 500® Index is a float-adjusted market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally the leaders in their industry. The Lipper Equity Income Funds Average is an average of funds that seek relatively high current income and income growth through investing 60% or more of their respective portfolios in equities. Lipper rankings for the periods shown are based on fund total returns with dividends and distributions reinvested and do not reflect sales charges. The S&P 500® Index, the Dow Jones Industrial Average, and the Lipper Equity Income Funds Average are unmanaged and do not reflect direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Equity Income Funds Average reflects fees charged by the underlying funds. The performance for the Alpine Accelerating Dividend Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

Expense Ratios reflect the ratios reported in the Fund’s most recent prospectus. The Alpine Accelerating Dividend Fund has a contractual expense waiver that continues through February 28, 2015. Where a Fund’s gross and net expense ratios are the same for the period reported, the contractual expense reimbursement level was not reached as of the end of that period. To the extent the Fund’s expenses were reduced by waivers, the Fund’s total returns were increased. In these cases, in the absence of the expense waivers, the Fund’s total returns would have been lower.

To the extent that the Fund’s historical performance resulted from gains derived from participation in Initial Public Offerings (“IPOs”) and/or Secondary Offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary Offerings in the future.

13

| Alpine Accelerating Dividend Fund (Continued) |  |

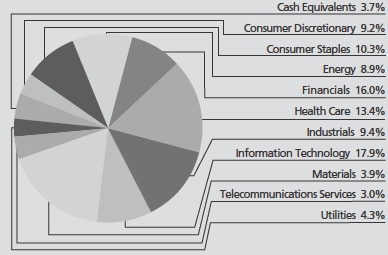

Portfolio Distributions* (Unaudited)

| Top 10 Holdings* (Unaudited) | | |

| 1. | | Apple, Inc. | 2.52 | % |

| 2. | | Becton, Dickinson & Co. | 1.80 | % |

| 3. | | AbbVie, Inc. | 1.72 | % |

| 4. | | Visa, Inc.-Class A | 1.71 | % |

| 5. | | Avago Technologies, Ltd. | 1.69 | % |

| 6. | | Amgen, Inc. | 1.67 | % |

| 7. | | Bristow Group, Inc. | 1.66 | % |

| 8. | | Marten Transport, Ltd. | 1.65 | % |

| 9. | | Yum! Brands, Inc. | 1.61 | % |

| 10. | | Territorial Bancorp, Inc. | 1.61 | % |

| * | Portfolio Distributions percentages are based on total net investments. Top 10 Holdings do not include short-term investments and percentages are based on total net assets. Portfolio holdings sector distributions are as of 10/31/14 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. |

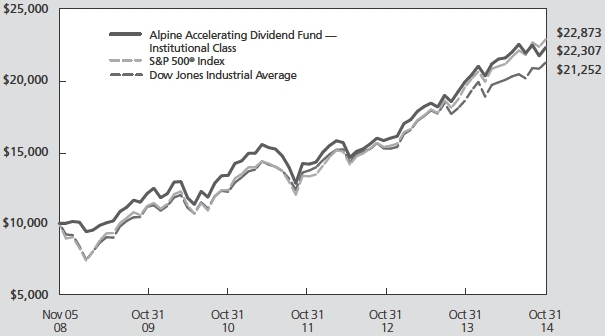

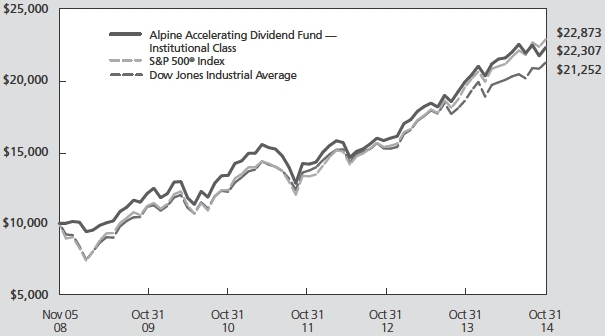

Value of a $10,000 Investment (Unaudited)

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmark. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees, if applicable. Without the waiver and recovery of fees, the Fund’s total return would have differed.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that shares, when redeemed, may be worth more or less than their original cost.

14

| Alpine Accelerating Dividend Fund (Continued) |  |

Commentary

For the twelve months ended October 31, 2014, the Alpine Accelerating Dividend Fund generated a total return of 12.25%. This compares with a total return of 17.26% for the S&P 500® Index for the same period. During the last twelve months, the Fund steadily increased its monthly per share distribution from $0.0409 in October, 2013 to $0.0421 in October, 2014. All references in this letter to the Fund’s performance relate to the performance of the Fund’s Institutional Class.

PERFORMANCE DRIVERS

The Fund generally prefers to take a conservative investment stance with regard to portfolio construction and security selection during times of economic and geopolitical uncertainty. We believe the twelve months ended October 31, 2014 was such a time. For this reason, the Fund had an average cash holding of 3.9% during the fiscal year and a portfolio beta of less than 1.0 during the same span.

On a sector basis, information technology, health care, and financials had the largest positive impact on the absolute performance of the Fund. The consumer discretionary, energy, and telecommunication services sectors had the largest negative impact. On a relative basis, the consumer staples sector generated the largest outperformance versus the S&P500®, followed by financials and health care. The consumer discretionary, energy, and industrials sectors were the worst relative performers.

PORTFOLIO ANALYSIS

The top five stock contributors to the Fund’s performance during the twelve months ended October 31, 2014, based on contribution to total return were Avago Technologies, Apple Inc., NorthStar Realty Finance, Amgen, and Teva Pharmaceutical Industries.

| • | Several positive events led to the strong performance of semiconductor manufacturer Avago Technologies. Late in 2013, the company announced the acquisition of LSI Corporation. The purchase has been well received and has begun to add to earnings in the second half of 2014. Also in the mergers and acquisition (M&A) realm, two of Avago’s competitors in the wireless space agreed to merge, which bodes well for future pricing trends. Meanwhile, Avago’s core wireless business has benefited from the roll out of next generation (4G LTE) wireless networks. The company is gaining share in the marketplace as a technology leader. |

| • | Apple Inc. stock has enjoyed a resurgence in 2014. The shares began to improve midway through the year as the earnings outlook improved and investors began to anticipate the introduction of the iPhone 6 and 6 Plus as well as speculation of a new product, which ended up being the Apple Watch. Earnings estimates and unit projections continue to rise for the company, which has led to the continued outperformance of the shares. |

| | |

| • | Shares of NorthStar Realty Finance, a commercial mortgage REIT, enjoyed a strong rally beginning in December 2013 when the company announced that it would be spinning off its asset management business into a separate publicly traded C-corp. Investors cheered the news as the new asset management company could trade at meaningfully higher multiples than the legacy REIT. Additionally, NRF unveiled several strategic initiatives including an investment into RXR Realty, a private real estate company focused on New York City and the tri-state area. |

| | |

| • | Amgen shares actually underperformed for much of the fiscal year before second quarter results reported at the end of July indicated that the company would initiate a $700 million cost restructuring and an August SEC filing revealed that activist hedge fund Third Point had taken a small stake in the company. From August onwards, the stock began to outperform the market as investors cheered the restructuring news and speculated about Third Point’s intentions. Towards the end of October, Third Point revealed that it had become one of Amgen’s largest shareholders and had suggesting breaking up the company in meetings with management, sending the shares to a new all-time high. |

| | |

| • | There were several events over the first half of the fiscal year that contributed to the strong performance in Teva Pharmaceuticals shares – activist shareholders have taken an interest in the company, Teva has been the subject of M&A speculation in the sector, and the CEO was replaced in early February by a well-regarded turnaround specialist. In addition, the underlying business has held up a bit better than expected. |

| | |

Dawson Geophysical, Pier 1 Imports, GNC Holdings, Adidas AG and Altisource Portfolio Solutions had the largest adverse impact on the performance of the Fund over the fiscal year.

15

| Alpine Accelerating Dividend Fund (Continued) |  |

| • | A stretch of bad weather this past winter as well as some operational hiccups has caused Dawson Geophysical to report a string of weaker than expected quarterly results. Additionally, the company is contending with a still challenging environment for its onshore seismic data acquisition service offering and a significant sell-off in crude oil prices that is pressuring stock prices across the energy complex. |

| | |

| • | The past twelve months have been difficult for retailer Pier 1. The company was hit by the weather-related issues that had an impact on much of the retail landscape to begin the year. This resulted in management reducing its outlook several times prior to spring. As the year progressed, the company’s web traffic grew strongly while the store traffic lagged expectations. Given the success of the web business, management stepped up investment in the segment, which had an adverse impact on margins. |

| | |

| • | Another retail casualty, GNC Holdings shares experienced a similar traffic slowdown to begin the year. The company then began to lap difficult comparisons driven by the launch of its loyalty program, which resulted in further sales disappointments. The shares were also hit by headlines about the safety of some of the products sold in their stores. |

| | |

| • | Several negative issues led to the underperformance of Adidas AG shares. Entering 2014, Adidas had reduced its outlook primarily due to adverse currency movements, which continued to have an impact in 2014. On top of these issues, the events in the Ukraine had a material impact on the firm’s Russian business and the collapse of the global golf market led to sharp declines in its Taylormade segment. |

| | |

| • | Altisource Portfolio Solutions has been hard hit by its close association with Ocwen Financial Corporation. Ocwen has been the subject of regulatory scrutiny by the New York Department of Financial Services for a variety of alleged misdeeds, several of which involve its business relationships with Altisource. As a result of its relationship with Ocwen, the stock has been unable to rally despite solid earnings and an attractive valuation. |

SUMMARY & OUTLOOK

As we look towards 2015, we see a market environment that remains fairly uncertain. In October, the Fed announced an end to the tapering of QE3 and will no longer be increasing the size of its balance sheet by purchasing agency mortgage backed securities and US Treasuries. While this decision was expected, it is still unclear if the lack of monetary stimulus from the Fed will have an impact on asset prices or the economy. In Europe, growth continues to be sluggish and the specter of deflation cannot be overlooked. Indeed, the ECB continues to strike a dovish tone with its commitment to accommodative short rates for as long as needed to stimulate the economy and combat too low inflation. In Japan, the central bank recently increased the size and scope of its QQE asset purchase program in an effort to steer the economy towards the 2% inflation target. As a result, the Yen has depreciated significantly versus the dollar and many other currencies, a development that is sure to have global ramifications. This macro backdrop together with our view that equity market valuations are fairly robust, lead us to continue to take a conservative investment stance.

As it relates to the Fund, we have decided to enhance the core strategy of focusing on quality companies with strong balance sheets that are increasing and/or accelerating dividends. We plan to emphasize stocks with a longer and consistent track record of dividend increases, as we believe these companies have the potential to outperform through the cycle. We aim to invest in stocks with multiple years of continuous dividend increases and make these stocks the foundation of the Fund. Many of the Fund’s holdings already fit into this category, but we are on the lookout for more such ideas. On top of this foundation, we will continue to invest in stocks with shorter, but what we believe are still meaningful track records of dividend increases. In conclusion, similar to the stocks in which we seek to invest, the Fund aims to provide a steadily rising distribution to its investors.

We thank our shareholders for their support.

Sincerely,

Bryan Keane

Andrew Kohl

Portfolio Managers

16

| Alpine Accelerating Dividend Fund (Continued) |  |

This letter represents the opinions of the Fund’s management and is subject to change, is not guaranteed and should not be considered a recommendation to buy or sell any security. The information provided is not intended to be, and is not, a forecast of future events, a guarantee of future results, or investment advice. Views expressed may vary from those of the firm as a whole. Past performance is no guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to risks, including the following:

Currency Risk – The value of investments in securities denominated in foreign currencies increases or decreases as the rates of exchange between those currencies and the U.S. dollar change. Currency conversion costs and currency fluctuations could erase investment gains or add to investment losses. Currency exchange rates can be volatile, and are affected by factors such as general economic conditions, the actions of the U.S. and foreign governments or central banks, the imposition of currency controls and speculation.

Dividend Strategy Risk – The Fund’s strategy of investing in dividend-paying stocks involves the risk that such stocks may fall out of favor with investors and underperform the market. Companies that issue dividend paying-stocks are not required to continue to pay dividends on such stocks. Therefore, there is the possibility that such companies could reduce or eliminate the payment of dividends in the future or the anticipated acceleration of dividends could not occur.

Equity Securities Risk – The stock or other security of a company may not perform as well as expected, and may decrease in value, because of factors related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry).

Foreign Currency Transactions Risk – Foreign securities are often denominated in foreign currencies. As a result, the value of the Fund’s shares is affected by changes in exchange rates. The Fund may enter into foreign currency transactions to try to manage this risk. The Fund’s ability to use foreign currency transactions successfully depends on a number of factors, including the foreign currency transactions being available at prices that are not too costly, the availability of liquid markets and the ability of the Adviser to accurately predict the direction of changes in currency exchange rates.

Foreign Securities Risk – The Fund’s investments in securities of foreign issuers or issuers with significant exposure to foreign markets involve additional risk. Foreign countries in which the Fund may invest may have markets that are less liquid, less regulated and more volatile than U.S. markets. The value of the Fund’s investments may decline because of factors affecting the particular issuer as well as foreign markets and issuers generally, such as unfavorable government actions, and political or financial instability. Lack of information may also affect the value of these securities. The risks of foreign investments are heightened when investing in issuers in emerging market countries.

Growth Stock Risk – Growth stocks typically are very sensitive to market movements because their market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall. Growth stocks as a group may be out of favor and underperform the overall equity market while the market concentrates on undervalued stocks. Although the Fund will not concentrate its investments in any one industry or industry group, it may, like many growth funds, weight its investments toward certain industries, thus increasing its exposure to factors adversely affecting issuers within those industries.

Initial Public Offerings and Secondary Offerings Risk – The Fund may invest a portion of its assets in shares of IPOs or secondary offerings of an issuer. IPOs and secondary offerings may have a magnified impact on the performance of a Fund with a small asset base. The impact of IPOs and secondary offerings on a Fund’s performance likely will decrease as the Fund’s asset size increases, which could reduce a Fund’s returns. IPOs and secondary offerings may not be consistently available to the Fund for investing. IPO and secondary offering shares frequently are volatile in price due to the absence of a prior public market, the small number of shares available for trading and limited information about the issuer. Therefore, the Fund may hold IPO and secondary offering shares for a very short period of time. This may increase the turnover of the Fund and may lead to increased expenses for the Fund, such as commissions and transaction costs. In addition, IPO and secondary offering shares can experience an immediate drop in value if the demand for the securities does not continue to support the offering price.

Management Risk – The Adviser’s judgment about the quality, relative yield or value of, or market trends affecting, a particular security or sector, or about interest rates generally, may be incorrect. The Adviser’s security selections and other investment decisions might produce losses or cause the Fund to underperform when compared to other funds with similar investment objectives and strategies.

17

| Alpine Accelerating Dividend Fund (Continued) |  |

Market Risk – The price of a security held by the Fund may fall due to changing market, economic or political conditions.

Micro Capitalization Company Risk – Stock prices of micro capitalization companies are significantly more volatile, and more vulnerable to adverse business and economic developments than those of larger companies. Micro capitalization companies often have narrower markets for their goods and/or services and more limited managerial and financial resources than larger, more established companies, including small or medium capitalization companies.

Portfolio Turnover Risk – High portfolio turnover necessarily results in greater transaction costs which may reduce Fund performance.

Small and Medium Capitalization Company Risk – Securities of small or medium capitalization companies are more likely to experience sharper swings in market values, less liquid markets, in which it may be more difficult for the Adviser to sell at times and at prices that the Adviser believes appropriate and generally are more volatile than those of larger companies.

Undervalued Stock Risk – The Fund may pursue strategies that may include investing in securities, which, in the opinion of the Adviser, are undervalued. The identification of investment opportunities in undervalued securities is a difficult task and there is no assurance that such opportunities will be successfully recognized or acquired. While investments in undervalued securities offer opportunities for above-average capital appreciation, these investments involve a high degree of financial risk and can result in substantial losses.

Please refer to pages 3-5 for other important disclosures and definitions.

18

| Alpine Financial Services Fund |  |

| Comparative Annualized Returns as of 10/31/14 (Unaudited) |

| | | 1 Year | | 3 Years | | 5 Years | | Since Inception(1) |

| Alpine Financial Services Fund — Institutional Class | | | 11.16 | % | | | 23.65 | % | | | 14.62 | % | | | 8.57 | % | |

| Alpine Financial Services Fund — Class A (Without Load) | | | 10.84 | % | | | N/A | | | N/A | | | 26.31 | % | |

| Alpine Financial Services Fund — Class A (With Load) | | | 4.77 | % | | | N/A | | | N/A | | | 23.83 | % | |

| KBW Bank Index | | | 14.54 | % | | | 24.13 | % | | | 13.24 | % | | | -1.05 | % | |

| NASDAQ Financial-100 Total Return Index | | | 8.82 | % | | | 19.46 | % | | | 13.17 | % | | | 3.27 | % | |

| S&P 500® Index | | | 17.26 | % | | | 19.77 | % | | | 16.69 | % | | | 8.15 | % | |

| Lipper Financial Services Funds Average(2) | | | 11.96 | % | | | 20.43 | % | | | 12.29 | % | | | 1.81 | % | |

| Lipper Financial Services Funds Ranking(2) | | | 53/83 | | | 6/75 | | | 14/68 | | | 1/52 | |

| Gross Expense Ratio (Institutional Class): 1.85%(3) | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Institutional Class): 1.48%(3) | | | | | | | | | | | | | | | | | |

| Gross Expense Ratio (Class A): 2.10%(3) | | | | | | | | | | | | | | | | | |

| Net Expense Ratio (Class A): 1.73%(3) | | | | | | | | | | | | | | | | | |

| | (1) | Institutional Class shares commenced on November 1, 2005 and Class A shares commenced on December 30, 2011. Returns for indices are since November 1, 2005. |

| | (2) | The since inception data represents the period beginning November 3, 2005 (Institutional Class only). |

| | (3) | As disclosed in the prospectus dated February 28, 2014. |

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced. Returns for the Class A shares with sales charge reflect a maximum sales charge of 5.50%. Performance for the Class A shares without sales charges does not reflect this load.

KBW Bank Index is a modified cap-weighted index consisting of 24 exchange-listed and National Market System stocks, representing national money center banks and leading regional institutions. The NASDAQ Financial-100 Index includes 100 of the largest domestic and international financial securities listed on the NASDAQ Stock Market based on market capitalization. They include companies classified according to the Industry Classification Benchmark as Financials, which are included within the NASDAQ Bank, NASDAQ Insurance, and NASDAQ Other Finance Indexes. The S&P 500® Index is a float-adjusted market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. The Lipper Financial Services Funds Average is an average of funds whose primary objective is to invest primarily in equity securities of companies engaged in providing financial services. Lipper rankings for the periods shown are based on fund total returns with dividends and distributions reinvested and do not reflect sales charges. The KBW Bank Index, the NASDAQ Financial-100 Index, the S&P 500® Index and the Lipper Financial Services Funds Average are unmanaged and do not reflect the deduction of direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Financial Services Fund Average reflects fees charged by the underlying funds. The performance for the Alpine Financial Services Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

Expense Ratios reflect the ratios reported in the Fund’s most recent prospectus. The Alpine Financial Services Fund has a contractual expense waiver that continues through February 28, 2015. Where a Fund’s gross and net expense ratios are the same for the period reported, the contractual expense reimbursement level was not reached as of the end of that period. To the extent the Fund’s expenses were reduced by waivers, the Fund’s total returns were increased. In these cases, in the absence of the expense waivers, the Fund’s total returns would have been lower.

The Fund’s past performance benefitted significantly from Initial Public Offerings (“IPOs”) and Secondary Offerings of certain issuers, and there is no assurance that the Fund can replicate this performance in the future or that the Fund will be able to participate to the same degree in IPO/Secondary Offerings in the future.

19

| Alpine Financial Services Fund (Continued) |  |

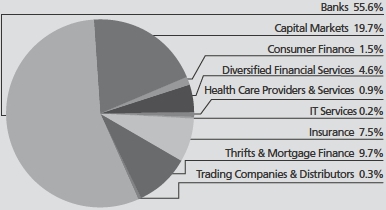

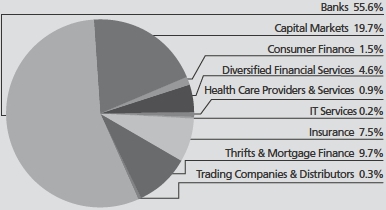

Portfolio Distributions* (Unaudited)

Top 10 Holdings* (Unaudited)

| 1. | | PennyMac Financial Services, Inc.-Class A | 3.68 | % |

| 2. | | Investar Holding Corp. | 3.59 | % |

| 3. | | Lloyds Banking Group PLC | 3.40 | % |

| 4. | | Banco de Chile-ADR | 3.29 | % |

| 5. | | Fifth Street Asset Management, Inc. | 3.22 | % |

| 6. | | National Bank of Greece SA | 2.65 | % |

| 7. | | TBC Bank JSC-GDR | 2.24 | % |