United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 20-F

(Mark One) | |

| | | | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | | OR |

| | X | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | | For the fiscal year ended_____________________________________________ |

| | | | OR |

| | | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | | OR |

| | | | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | | Date of event requiring this shell company report __________________________________ |

| | | | |

| | | | For the transition period from ________________ to ______________________ |

| | | | |

Commission file number | 0-31172 | | |

| | | | |

ALBERTA STAR DEVELOPMENT CORP. |

(Exact name of registrant as specified in this charter)

|

Province of Alberta, Canada |

(Jurisdiction of incorporation or organization)

|

506 - 675 West Hastings Street, Vancouver, British Columbia V6B 1N2 Canada |

(Address of principal executive offices) |

i

Securities registered or to be registered pursuant to section 12(b) of the Act:

|

| | Title of each Class | | Name of each exchange on which registered | |

| | None | | Not Applicable | |

| |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

|

| | Common Shares Without Par Value | |

| | (Title of Class) | |

Securities registered or to be registered pursuant to Section 15(D) of the Act:

|

| | None | |

| | (Title of Class) |

|

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close |

Of the period covered by the annual report. | 96,901,357 |

| | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. |

| | Yes | | | No | X |

If this report is an annual or transitional report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. |

| | Yes | | | No | X |

| | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. |

| | Yes | X | | No | |

| | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" on Rule 12b-2 of the Exchange Act. (Check One): |

| |

Large accelerated filer | | | Accelerated filer | | | Non-accelerated filer | X |

| |

Indicate by check mark which financial statement item the registrant has elected to follow. |

| | Item 17 | X | | Item 18 | |

| |

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). |

| | Yes | | | No | X |

ii

Table of Contents

PART I

PART II

PART III

iii

FORWARD-LOOKING STATEMENTS

We caution you that certain important factors (including without limitation those set forth in this Form 20-F) may affect our actual results and could cause such results to differ materially from any forward-looking statements that may be deemed to have been made in this Form 20-F annual report, or that are otherwise made by or on our behalf. For this purpose, any statements contained in this annual report that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words such as "may," "except," "believe," "anticipate," "intend," "could," estimate," or "continue," or the negative or other variations of comparable terminology, are intended to identify forward-looking statements.

PART I

ITEM 1 - Identity of Directors, Senior Management and Advisers

All items in this section are not required, as this 20-F filing is made as an annual report.

ITEM 2 - Offer Statistics and Expected Timetable

All items in this section are not required, as this 20-F filing is made as an annual report.

ITEM 3 - Key Information

A. Selected Financial Data

The following tables set forth the data of our fiscal years ended November 30, 2006, 2005, 2004, 2003, and 2002. We derived all figures from our financial statements as prepared by our management, approved by our audit committee and audited by our independent auditor. This information should be read in conjunction with our financial statements included in this annual report.

Our financial statements included in this annual report have been prepared in accordance with accounting principles generally accepted ("GAAP") in Canada. All amounts are expressed in Canadian dollars. The first table presents this financial data in accordance with United States ("US") GAAP; the second table presents the data in accordance with Canadian GAAP.

All amounts within this annual report are in Canadian funds (CDN), unless otherwise indicated.

1

US GAAP | Fiscal Year Ended November 30 |

| | 2006 | 2005 | 2004 | 2003 | 2002

(Restated) |

Net operating revenue | Nil | Nil | Nil | Nil | Nil |

Loss from operations | ($13,060,169) | ($2,832,810) | ($1,889,340) | ($2,043,936) | ($694,904) |

Loss from continuing operations | ($13,060,169) | ($2,832,810) | ($1,889,340) | ($2,043,936) | ($694,904) |

Net income (loss) | ($13,060,169) | ($2,832,810) | ($1,889,340) | ($2,043,936) | ($694,904) |

Loss from operations per share | ($0.16) | ($0.06) | ($0.07) | ($0.13) | ($ 0.12) |

Loss from continuing operations per share | ($0.16) | ($0.06) | ($0.07) | ($0.13) | ($ 0.12) |

Total assets | $30,798,020 | $11,978,824 | $2,155,878 | $442,927 | $184,409 |

Net assets | $30,332,098 | $11,899,236 | $2,071,876 | $157,242 | $19,034 |

Capital stock | $51,039,462 | $20,976,391 | $8,316,221 | $4,512,247 | $2,330,103 |

Number of shares | 96,251,717 | 70,914,983 | 37,527,290 | 20,735,499 | 9,826,169 |

Dividends per common share | Nil | Nil | Nil | Nil | Nil |

Diluted net income (loss) per share | ($0.16) | ($0.06) | ($0.07) | ($0.13) | ($ 0.12) |

Canadian GAAP | Fiscal Year Ended November 30 |

| | 2006 | 2005 | 2004 | 2003 | 2002

(Restated) |

Net operating revenue | Nil | Nil | Nil | Nil | Nil |

Loss from operations | ($11,630,209) | ($2,832,810) | ($957,202) | ($1,941,606) | ($608,910) |

Loss from continuing operations | ($11,630,209) | ($2,832,810) | ($957,202) | ($1,941,606) | ($608,910) |

Net income (loss) | ($11,630,209) | ($2,832,810) | ($957,202) | ($1,941,606) | ($608,910) |

Loss from operations per share | ($0.14) | ($0.06) | ($0.03) | ($0.12) | ($0.10) |

Loss from continuing operations per share | ($0.14) | ($0.06) | ($0.03) | ($0.12) | ($0.10) |

Total assets | $30,798,020 | $11,978,824 | $2,155,878 | $442,927 | $184,409 |

Net assets | $30,332,098 | $11,899,236 | $2,071,876 | $224,842 | $73,034 |

Capital stock | $49,775,818 | $19,712,747 | $7,052,577 | $4,248,341 | $2,154,927 |

Number of shares | 96,251,717 | 70,914,983 | 37,527,290 | 20,735,499 | 9,826,169 |

Dividends per share | Nil | Nil | Nil | Nil | Nil |

Diluted net income (loss) per share | ($0.14) | ($0.06) | ($0.03) | ($0.12) | ($0.10) |

| | | | | | |

Since June 1, 1970, the Government of Canada has permitted a floating exchange rate to determine the value of the Canadian dollar as compared to the US dollar. On February 12, 2007, the exchange rate in effect for Canadian dollars exchanged for US dollars, expressed in terms of Canadian dollars was $1.1746. This exchange rate is based on the noon buying rates of the Bank of Canada, as obtained from the website www.bankofcanada.ca.

For the past five fiscal years ended November 30, 2006 and for the six month period between August 31, 2006 and January 31, 2007, the following exchange rates were in effect for Canadian dollars exchanged for US dollars, calculated in the same manner as above:

Period | | Average |

Year ended Nov 30, 2002 | $ | 1.5713 |

Year ended Nov 30, 2003 | $ | 1.4216 |

Year ended Nov 30, 2004 | $ | 1.3093 |

Year ended Nov 30, 2005 | $ | 1.2163 |

Year ended Nov 30, 2006 | $ | 1.1350 |

2

Period | | Low | | High |

Month ended August 31, 2006 | $ | 1.1157 | $ | 1.1221 |

Month ended September 30, 2006 | $ | 1.1131 | $ | 1.1191 |

Month ended October 31, 2006 | $ | 1.1260 | $ | 1.1317 |

Month ended Nov. 30, 2006 | $ | 1.1337 | $ | 1.1386 |

Month ended Dec. 31, 2006 | $ | 1.1494 | $ | 1.1548 |

Month ended Jan. 31, 2007 | $ | 1.1732 | $ | 1.1789 |

B. Capitalization and Indebtedness

Not required, as this 20-F filing is made as an annual report.

C. Reasons for the Offer and Use of Proceeds

Not required, as this 20-F filing is made as an annual report.

D. Risk Factors

Any investment in our common shares involves a high degree of risk. You should consider carefully the following information before you decide to buy our common shares.

If any of the events discussed in the following risk factors actually occurs, our business, financial condition or results of operations would likely suffer. In this case, the market price of our common shares could decline, and you could lose all or part of your investment in our shares. In particular, you should consider carefully the following risk factors:

We have a history of losses.

We have incurred losses in our business operations since inception, and we expect that we will continue to lose money for the foreseeable future. Since our incorporation on September 6, 1996 to November 30, 2006, we incurred losses determined under United States GAAP totalling $22,137,324. Very few junior mining resource companies ever become profitable. Failure to achieve and maintain profitability may adversely affect the market price of our common stock.

We generally have limited financial resources and no source of cash flow.

With the exception of funds recently raised through private placements and the exercise of options and warrants, we generally have limited financial resources, no source of operating cash flow and no assurance that additional funding will be available to us for further exploration of our projects or to fulfil our obligations under any applicable agreements. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration of our projects with the possible loss of such properties. We have secured funds that will enable us to meet our current obligations. Raising additional capital resources in the future can not be depended upon.

3

Very few mineral properties are ultimately developed into producing mines.

The business of exploration for minerals and mining involves a high degree of risk. Few properties that are explored are ultimately developed into producing mines. At present, our mineral properties have no known significant body of commercial ore. Most exploration projects do not result in the discovery of commercially mineable deposits of ore. The occurrence of unsuccessful exploration efforts may eventually lead to us needing to cease operations.

Substantial expenditures are required for us to establish ore reserves through drilling, to develop metallurgical processes, to extract the metal from the ore and, in the case of new properties, to develop the mining and processing facilities and infrastructure at any site chosen for mining.

Although substantial benefits may be derived from the discovery of a major mineral deposit, no assurance can be given that we will discover minerals in sufficient quantities to justify commercial operations or that we can obtain the funds required for development on a timely basis.

The economics of developing precious and base metal mineral properties is affected by many factors including the cost of operations, variations in the grade of ore mined, fluctuations in metal markets, costs of processing equipment and other factors such as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals and environmental protection. We have no producing mines at this time.

If we do not obtain additional financing, our business will fail.

Our current operating funds are less than necessary to complete exploration of our mineral claims, and therefore we will need to obtain additional financing in order to complete our business plan. As at November 30, 2006, we had $30,149,153 in cash on hand. Subsequent to our fiscal year end, we raised further capital through the exercise of warrants and options resulting in an increase in our cash on hand to $30,438,340 as of the date of filing of this annual report.

Our business plan calls for significant expenses in connection with the exploration of our mineral claims. We will require additional financing in order to complete these activities. In addition, we will require additional financing to sustain our business operations if we are not successful in earning revenues once exploration is complete. We do not currently have any arrangements for financing and we can provide no assurance to investors that we will be able to find such financing if required.

We believe the only realistic source of future funds presently available to us is through the sale of equity capital. Any sale of equity capital will result in dilution to existing shareholders. The only other alternative for the financing of further exploration would be the offering by us of an interest in our properties to be earned by another party or parties carrying out further exploration thereof.

4

Dilution through contractor, director and consultant options could adversely affect our stockholders.

Because our success is highly dependant on our contractors, we grant some or all of our key contractors, officers, directors and consultants options to purchase common shares, as non-cash incentives. If significant numbers of these options are granted and exercised, the interests of other stockholders may be diluted.

There are currently options outstanding to purchase an additional 5,917,500 common shares, which upon exercise would result in a total of 102,818,857 common shares being issued and outstanding.

Because management has only limited experience in resource exploration, the business has a higher risk of failure.

Our management, while experienced in business operations, has only limited experience in resource exploration. While we try to hire and maintain management with the proper expertise, as we have management with diverse business backgrounds, none of our directors or officers have any significant technical training or experience in resource exploration or mining. Management may not fully be aware of the specific requirements related to working in mineral exploration, whether technical or operational. Therefore, our managerial decisions and choices may not always reflect standard engineering or mineral exploration practices commonly used. We rely on the opinions of consulting geologists and mining experts that we retain from time to time for specific exploration projects or property reviews.

We cannot be certain that the measures we take will ensure that we implement and maintain adequate financial resources or profitability. Management's lack of experience may cause failure to implement appropriate financial decisions, or cause difficulties in implementing proper decisions, ultimately harming our operating results.

As a foreign private issuer, our shareholders may have less complete and timely data.

The submission of proxy and annual meeting of shareholder information (prepared to Canadian standards) in Form 6-K may result in shareholders having less complete and timely information in connection with shareholder actions. The exemption from Section 16 rules regarding reports of beneficial ownership and purchases and sales of common shares by insiders and restrictions on insider trading in our securities may result in shareholders having less data and there being fewer restrictions on insiders' activities in our securities.

Mineral exploration involves a high degree of risk against which we are not currently insured.

Unusual or unexpected rock formations, formation pressures, fires, power outages, labour disruptions, flooding, cave-ins, landslides and the inability to obtain suitable or adequate machinery, equipment or labour are risks involved in the operation of mines and the conduct of exploration programs. We have relied on and will continue to rely upon consultants and others for exploration expertise.

5

It is not always possible to fully insure against such risks and we may decide not to take out insurance against such risks as a result of high premiums or other reasons. Should such liabilities arise, they could reduce or eliminate any future profitability and result in increasing costs and a decline in the value of our common shares. We do not currently maintain insurance against environmental risks relating to our mineral property interests, though we have obtained third party liability insurance, to counter the effects of these risks.

There is no assurance of the title to or boundaries of our resource properties.

Our mineral property interests may be subject to prior unregistered agreements of transfers or native land claims and title may be affected by undetected defects. We have not conducted surveys on the property and there is a risk that the boundaries could be challenged.

We may require permits and licenses that we may not be able to obtain.

Our operations may require licenses and permits from various governmental authorities. There can be no assurance that we will be able to obtain all of the necessary licenses and permits that may be required to conduct exploration, development and mining operations at our projects on certain properties in the Northwest Territories.

Metal prices fluctuate widely.

Factors beyond our control may affect the marketability of any resource we discover. Metal prices have fluctuated widely, particularly in recent years. The effect of these factors cannot accurately be predicted.

The resource industry is very competitive.

The resource industry is intensely competitive in all its phases. We compete with many companies possessing greater financial resources and technical facilities than us for the acquisition of mineral concessions, claims, leases and other mineral interests as well as for the recruitment and retention of qualified exploration personnel and independent contractors.

Our operations may be adversely affected by government and environmental regulations.

Our operations may be subject to environmental regulations promulgated by government agencies from time to time. Environmental legislation provides for restrictions and prohibitions on spills, release or emissions of various substances produced in association with certain mining industry operations, such as seepage from tailings disposal areas, which would result in environmental pollution. A breach of such legislation may result in the imposition of fines and penalties. In addition, certain types of operations require the submission and approval of environmental impact assessments.

6

Environmental legislation is evolving in a manner which means that standards, enforcements, fines and penalties for non-compliance are more stringent. Environmental assessments of proposed projects carry a heightened degree of responsibility for us and our directors, officers and consultants. The cost of compliance with changes in governmental regulations has a potential to reduce the profitability of our operations. We do not maintain environmental liability insurance.

The trading market for our shares is not always liquid.

Although our shares trade on the TSX Venture Exchange ("TSX-V") and the NASD Over the Counter Bulletin Board ("OTCBB"), the volume of shares traded at any one time can be limited, and, as a result, there may not be a liquid trading market for our shares.

Our securities may be subject to penny stock regulation in the US.

Because the current market price of our common stock is below US $5.00 per share, we are subject to "penny stock" regulation under US securities laws. "Penny stock" rules impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 together with a spouse).

For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser's written consent to the transaction prior to the purchase. Additionally, for any transaction involving a penny stock, unless exempt, the rules require the delivery, prior to the transaction, of a disclosure schedule prescribed by the Securities and Exchange Commission ("SEC") relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements must be sent disclosing recent price information on the limited market in penny stocks. Consequently, the "penny stock" rules restrict the ability of broker-dealers to sell our shares of common stock.

Certain directors may be in a position of conflicts of interest.

Certain members of our board also serve as directors of other companies involved in natural resource exploration and development. Consequently, there exists the possibility that those directors may be in a position of conflict. Any decision made by those directors will be made in accordance with their duties and obligations to deal fairly and in good faith of our company and such other companies. In addition, such directors will declare, and refrain from voting on, any matter in which such directors may have a conflict of interest.

Enforcement of legal process may be difficult.

All members of our board of directors and management reside in Canada. As well, our address for service is a Canadian address. Accordingly, service of process upon us, or upon individuals related to us, may be difficult or impossible to obtain within the US.

7

All of our assets are located outside of the US. Any judgment obtained in the US against us may not be collectible within the US.

As we are incorporated pursuant to the laws of the Province of Alberta, Canada, duties of our directors and officers, and the ability of shareholders to initiate a lawsuit on our behalf, are governed by the Alberta Business Corporations Act.

ITEM 4 - Information on the Company

A. History and Development of the Company

We were incorporated under the name "Alberta Star Mining Corp." pursuant to the Business Corporations Act in the Province of Alberta, Canada by registration of our articles of incorporation and the issuance by the Registrar of Corporations of a Certificate of Incorporation on September 6, 1996. On September 20, 2001, we consolidated our share capital such that every five common shares in our capital stock pre-consolidation were exchanged for one post-consolidation common share. Concurrently, we changed our name to "Alberta Star Development Corp."

Our head office is located at 506 - 675 West Hastings Street, Vancouver, British Columbia, Canada, V6B 1N2. Our telephone number is (604) 488 0860.

We have not been involved in any bankruptcy, receivership or similar proceedings, nor have we been a party to any material reclassification, merger, consolidation or purchase or sale of a significant amount of assets.

We are engaged in the business of the acquisition, exploration and development of resource properties. At present, our properties are in the exploration stage and further exploration will be required before final evaluations as to the economic and legal feasibility can be determined.

Our properties have no known significant body of commercial ore, nor are any such properties at the commercial development or production stage. No assurance can be given that commercially viable mineral deposits exist on any of our properties. Further, our interest in joint ventures which own properties will be subject to dilution if we fail to expend further funds on the projects. We have not generated cash flows from operations. These facts increase the uncertainty and risks faced by investors in our company. For more information see Item 3D - Risk Factors.

8

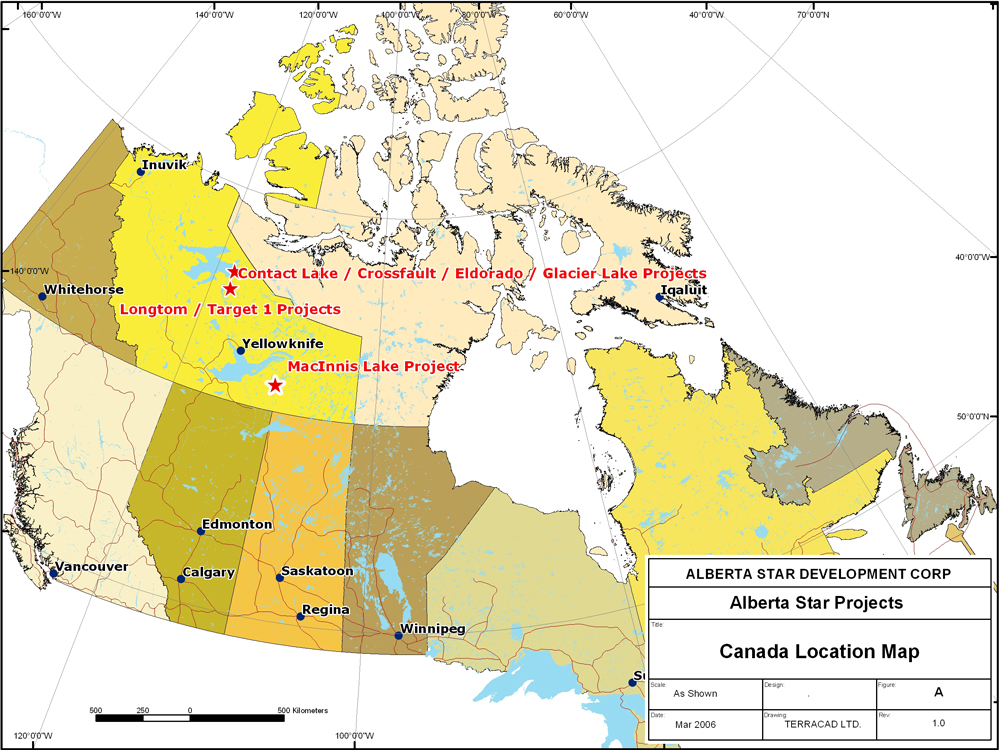

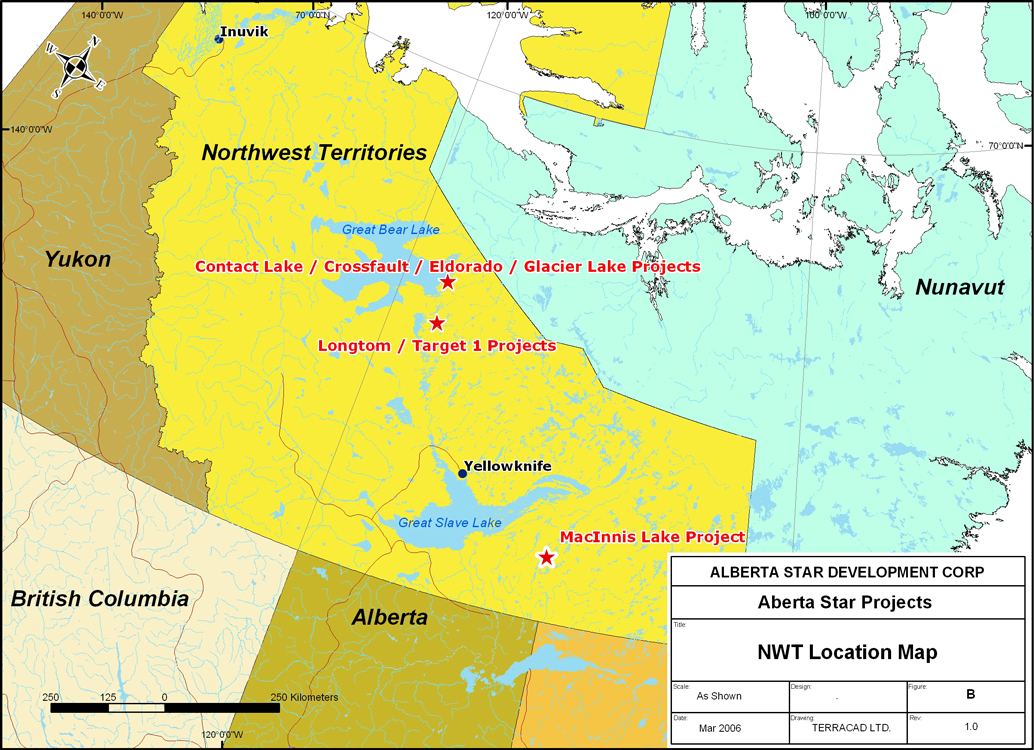

Our principal mineral property assets are located in the Northwest Territories and include an interest in:

- the Contact Lake Mineral Claims;

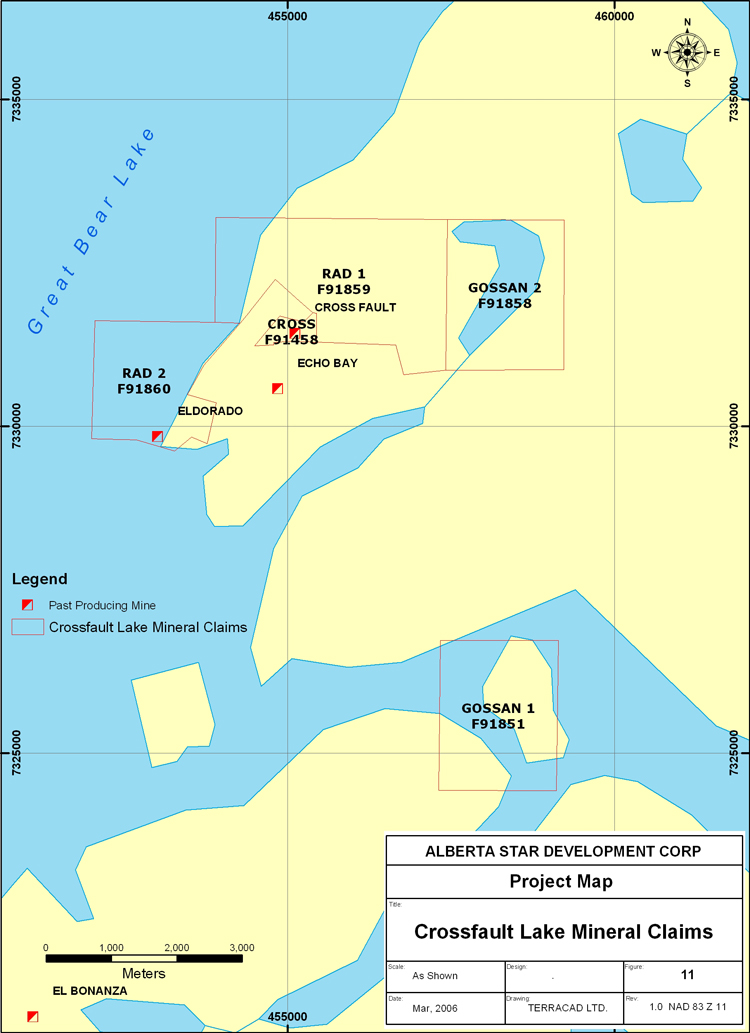

- the Port Radium - Glacier Lake Mineral Claims;

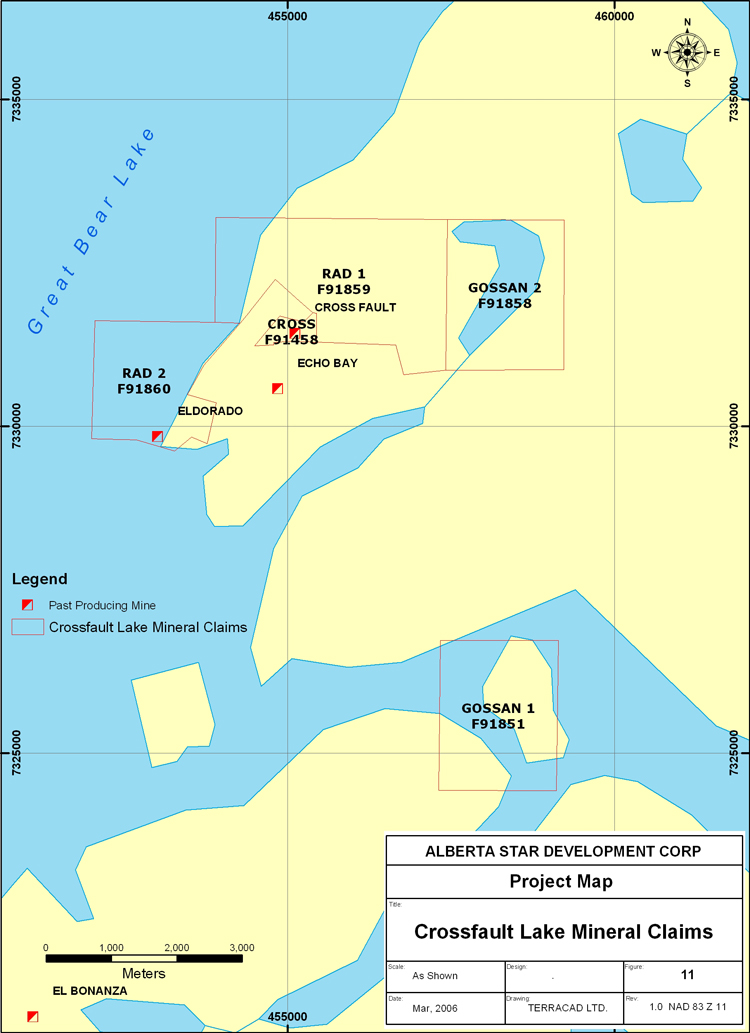

- the Port Radium - Crossfault Lake Mineral Claims;

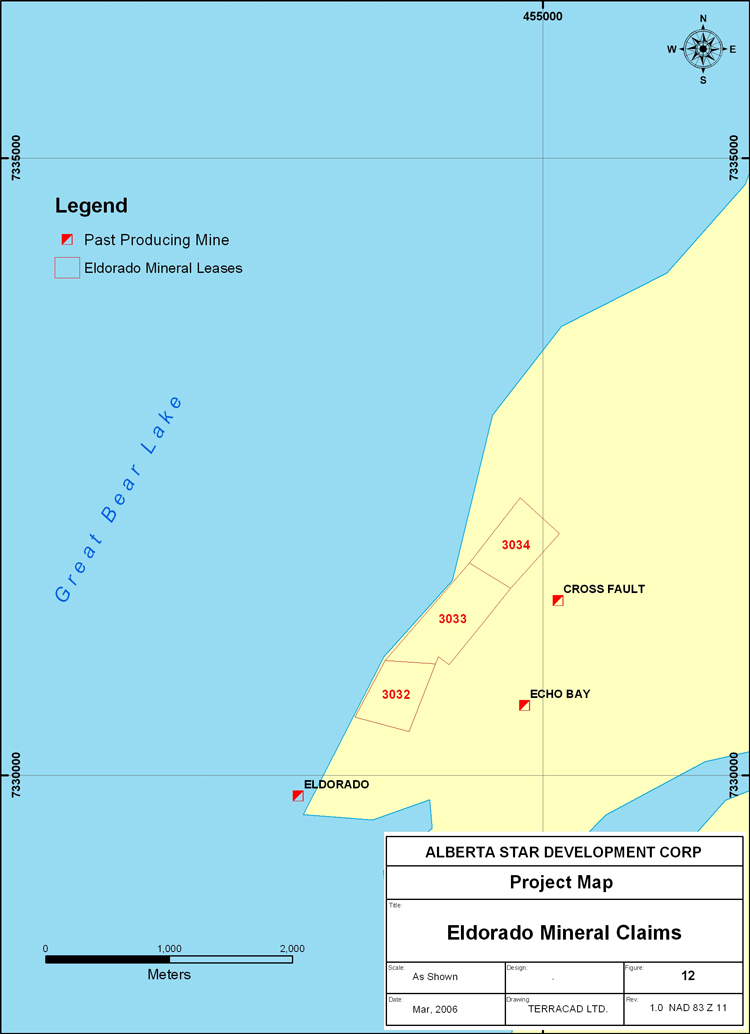

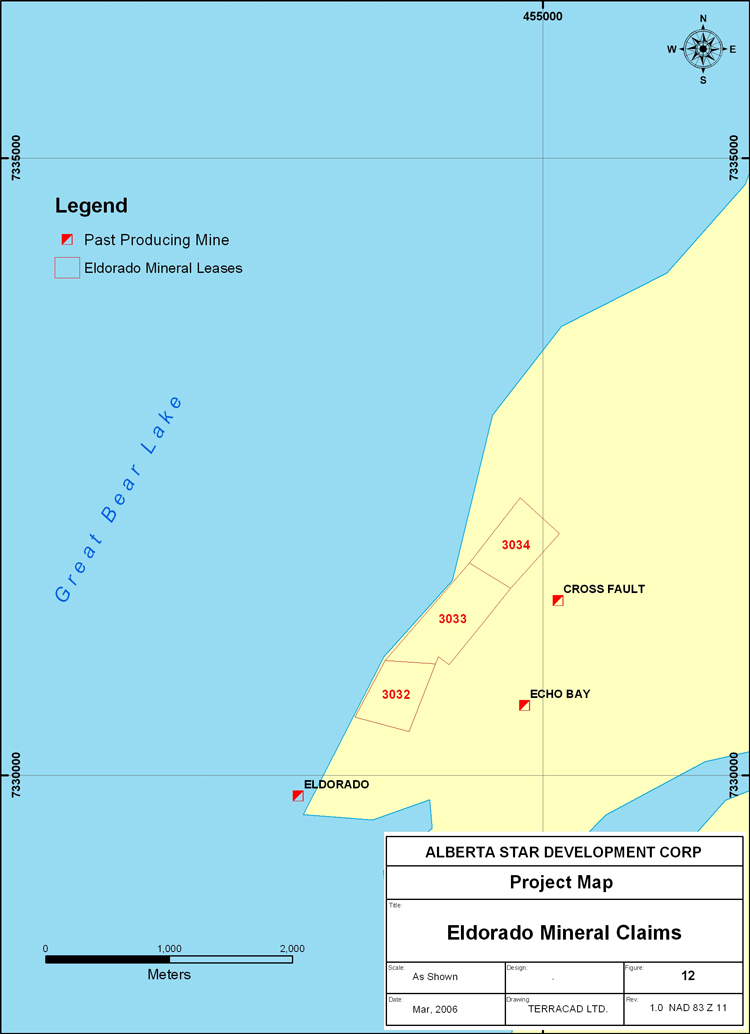

- the Port Radium - Eldorado Mineral Claims (Uranium Lease Claims);

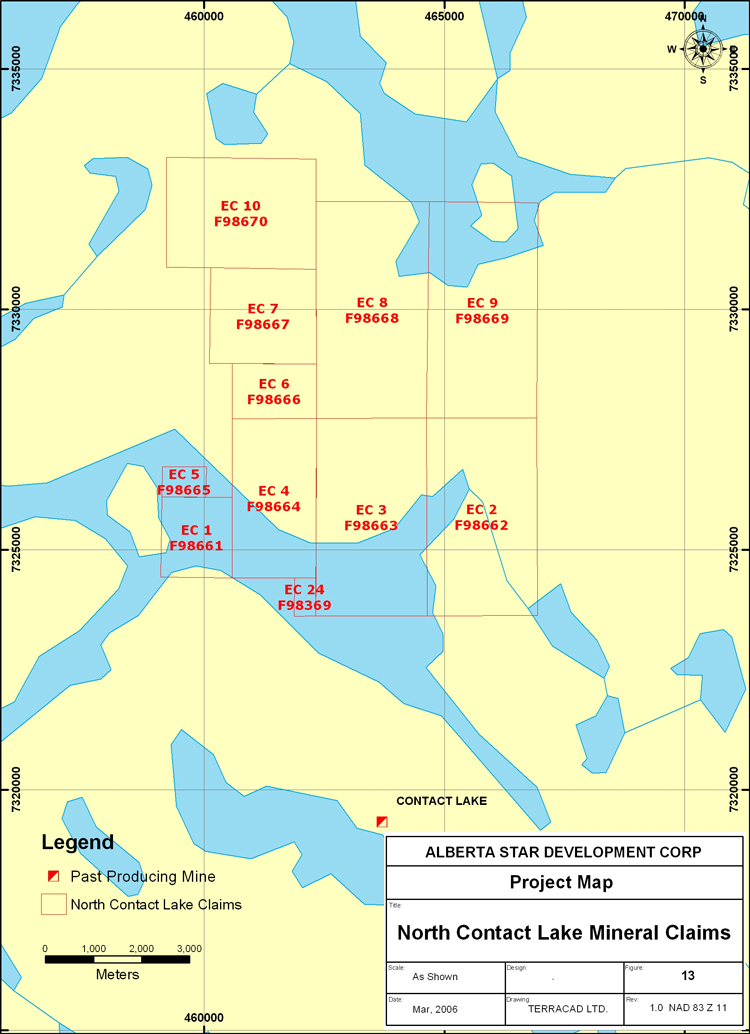

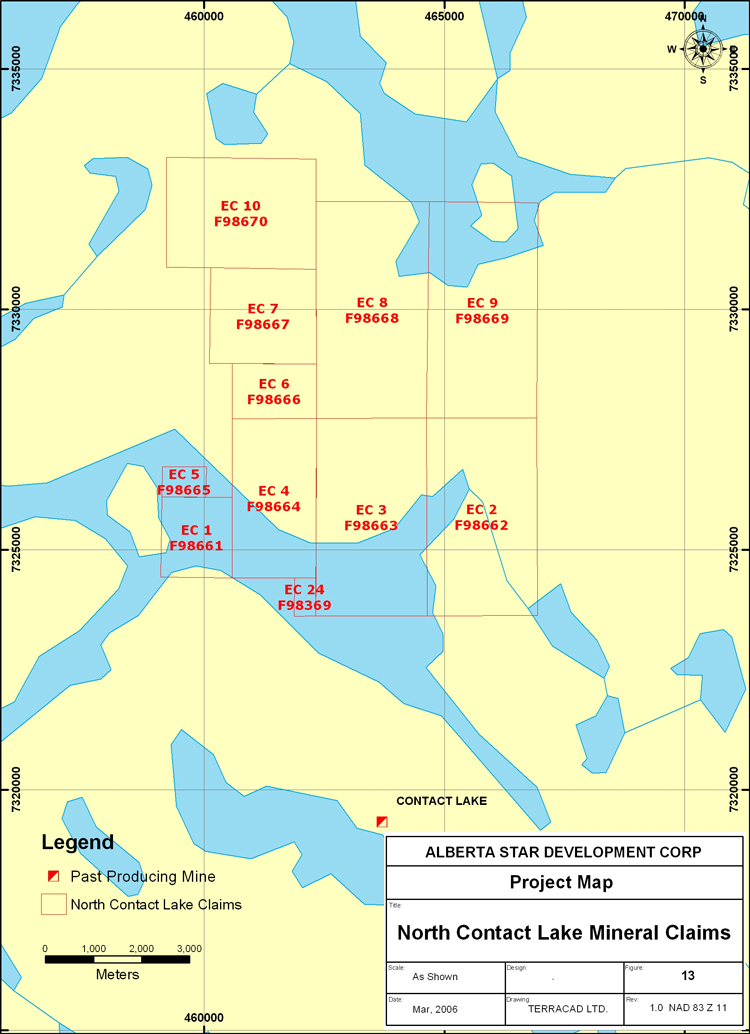

- the North Contact Lake Mineral Claims;

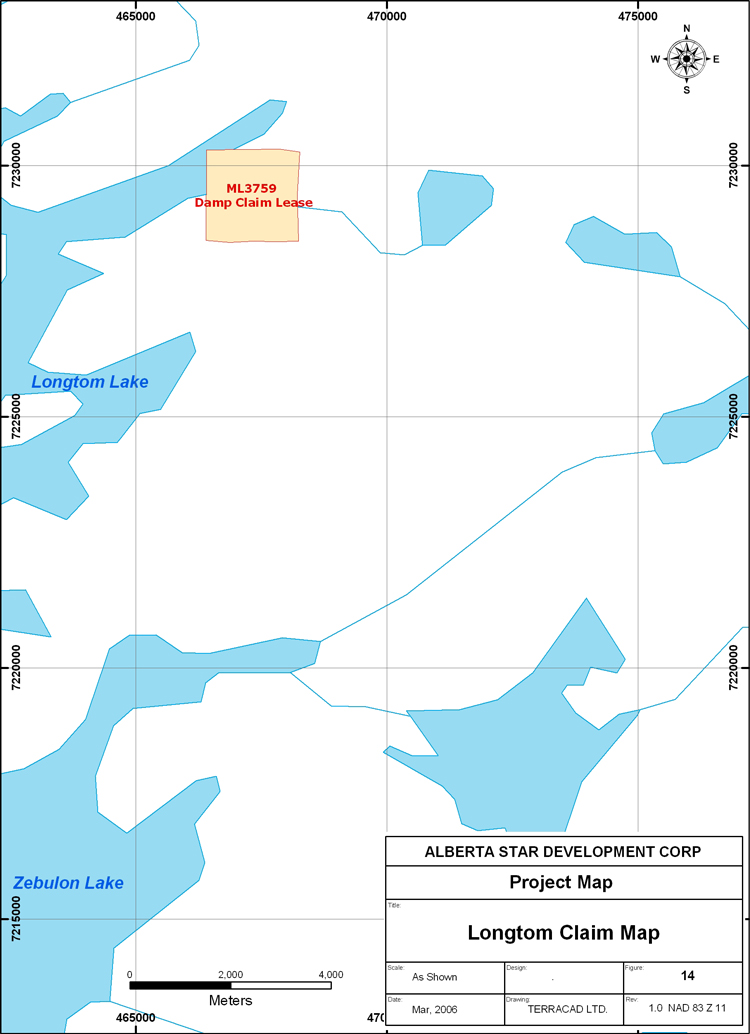

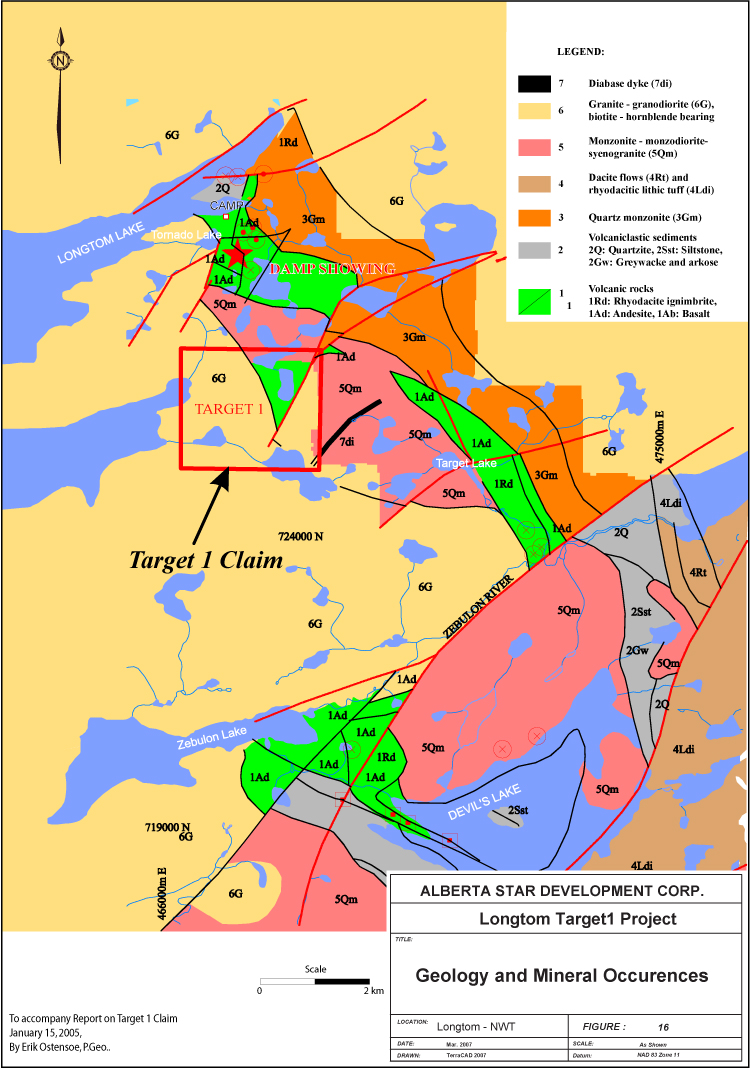

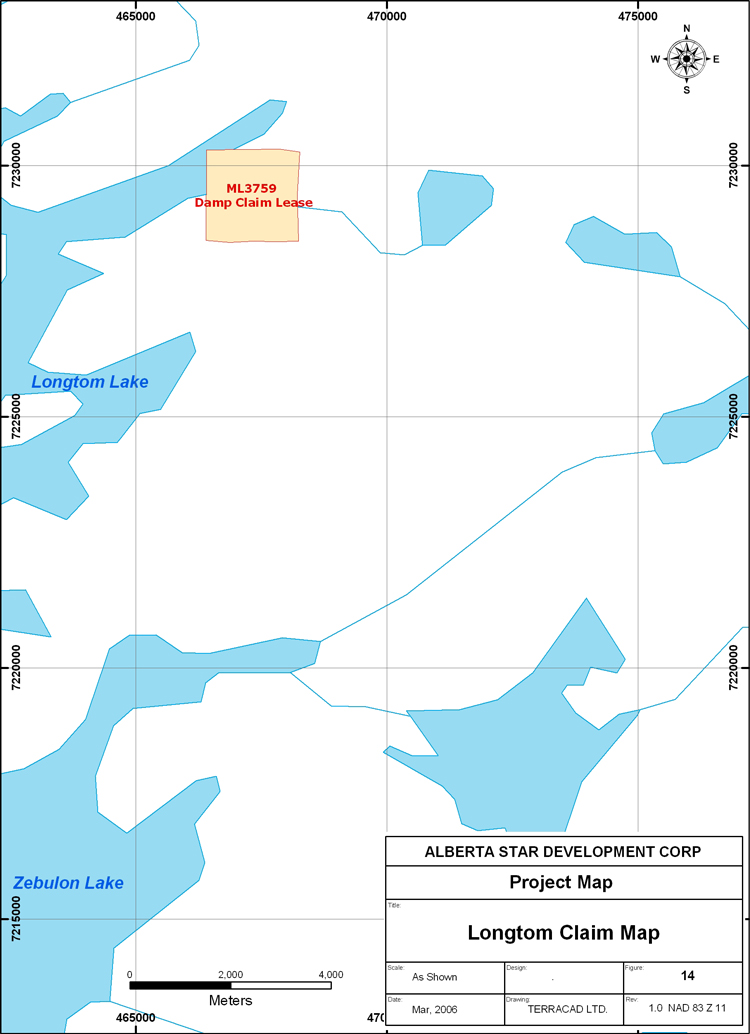

- the Longtom Property;

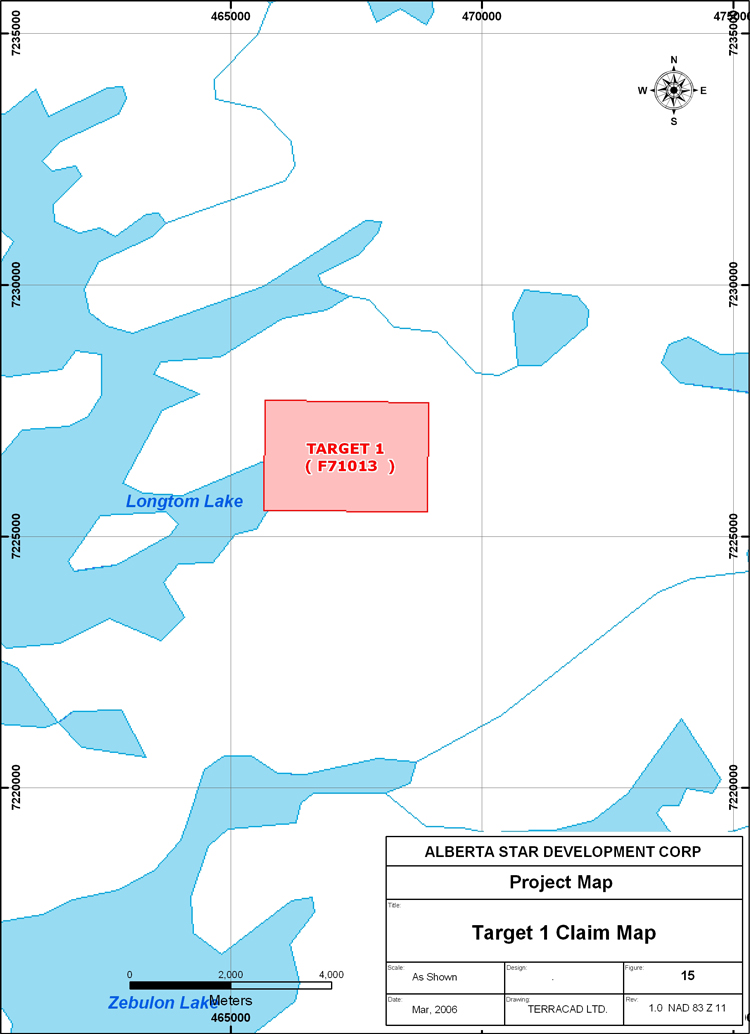

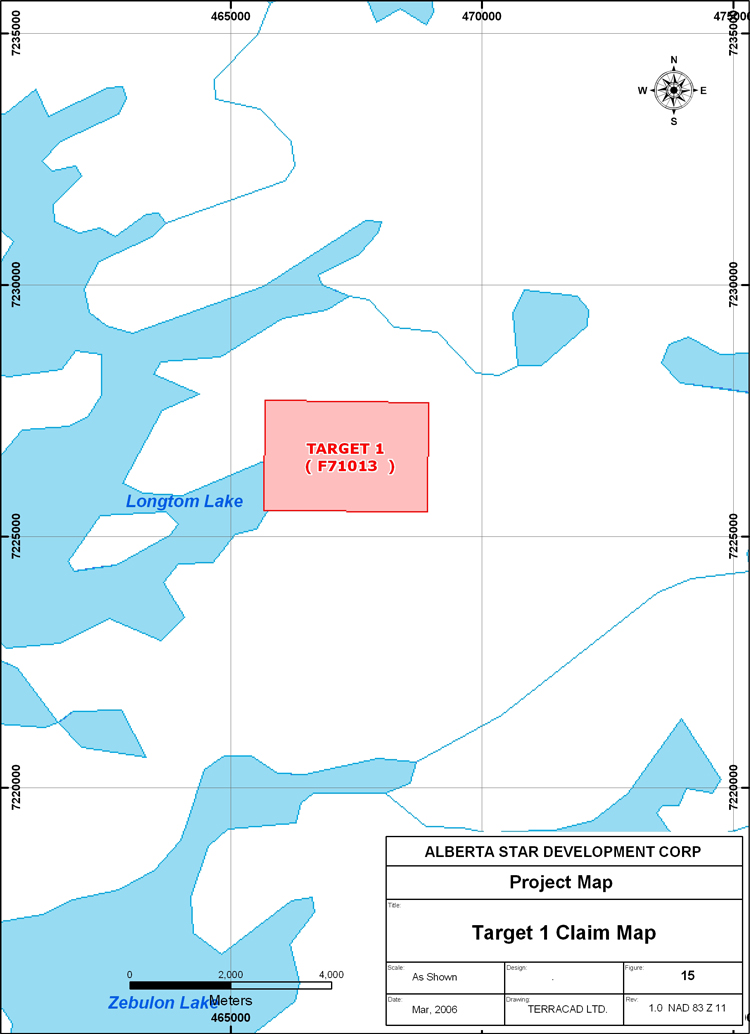

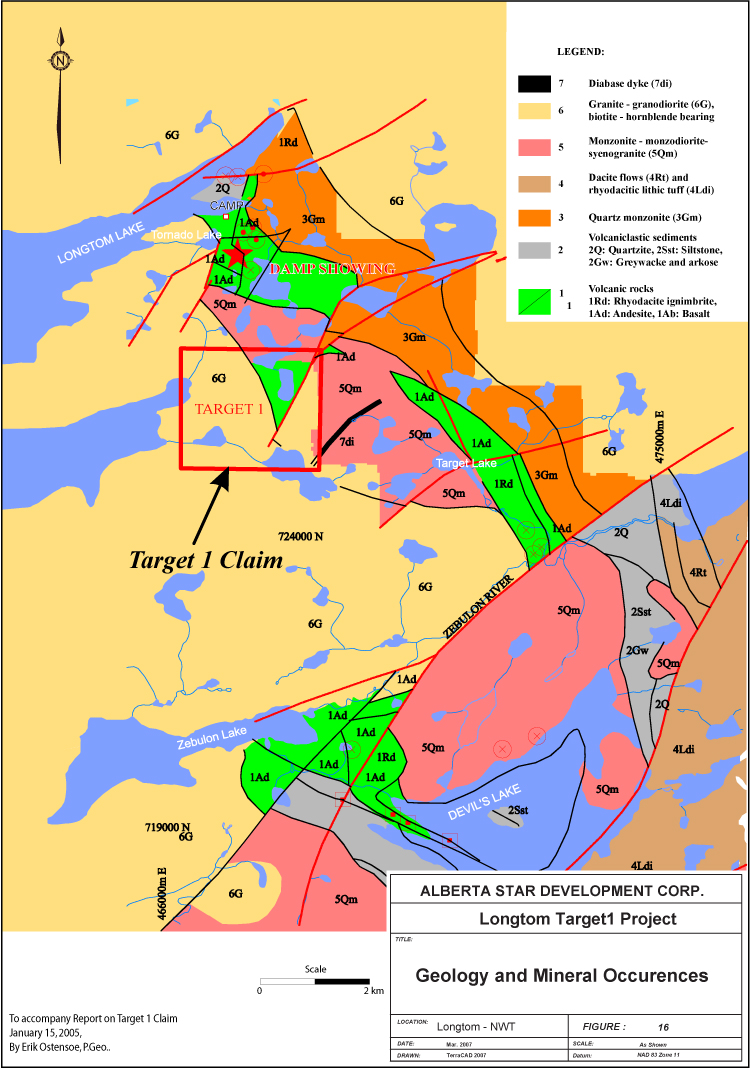

- the Longtom Property (Target 1); and

- the MacInnis Lake Property.

As these projects are in the exploration stage, we have no current operating income or cash flow.

B. Business Overview

Background

All disclosure about our exploration properties in this annual report conforms to the standards of US SEC Industry Guide 7, Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations, other than disclosure of "Mineral Resource", "Measured Mineral Resource", "Indicated Mineral Resource" and "Inferred Mineral Resource", which are geological and mining terms as defined in accordance with Canadian National Instrument 43-101 under the guidelines adopted by the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM"), as CIM Standards in Mineral Resources and Reserve Definition and Guidelines adopted by the CIM. US investors in particular are advised to read carefully the definitions of these terms as well as the cautionary notes below, regarding use of these terms.

We are engaged in the exploration and acquisition of mineral properties in Canada, and specifically, hold a majority of our interests in the Northwest Territories. We are a junior mining company in the exploration stage and none of our properties are currently beyond the initial exploration stage. There is no assurance that a commercially viable mineral deposit exists on any of our properties and further exploration work may be required before a final evaluation as to the economic and legal feasibility is determined. For further information, see Item 3D - Risk Factors.

We have conducted acquisitions and initial surveys for the purpose of determining the viability of exploration work on properties located in the Northwest Territories, Canada. We intend to develop our IOCG and uranium exploration projects in Canada. The equity markets for junior mineral exploration companies are unpredictable. We may also and have historically entered into cost sharing arrangements through joint venture agreements and interest agreements in the form of letters of intent. For detailed property descriptions please refer to Item 4D - Property, Plants and Equipment.

9

At present we have no income from our operations and none of our properties have significant reserves nor are in production. Our ability to finance the future acquisition, exploration and development, if warranted, of our mineral properties, to make concession payments and to fund general and administrative expenses is therefore dependent upon our ability to secure additional financing.

Competition

The mineral property exploration business, in general, is intensively competitive and there is not any assurance that even if commercial quantities of ore are discovered, a ready market will exist for sale of same. Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations; the proximity and capacity of natural resource markets and processing equipment; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of mineral and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may make it difficult for us to receive an adequate return on investment.

We compete with many companies possessing greater financial resources and technical facilities for the acquisition of mineral concessions, claims, leases and other mineral interests as well as for the recruitment and retention of qualified employees.

Management and Contractors

Our president and chief executive officer, Tim Coupland, devotes 80% of his business time to our affairs. We have a management agreement dated December 1, 2000 with a private company owned by Mr. Coupland whereby he provides management services to us for $5,000 per month. The initial term of this agreement was for one year. Thereafter, it continues in force on a month-to-month basis until terminated by us or Mr. Coupland on 30 days written notice. As of February 1, 2006, this fee has been increased to $12,500 per month. On February 22, 2007 this amount was increased to $16,667 per month, retroactive to January 1, 2007.

Office Space

We utilize about 1,467 square feet of office space in Vancouver, British Columbia. Our rent and related office expenses total approximately $3,575 per month. In May 2006, we negotiated with a property management firm to expand our office facility, due to the growth of our company; we moved office locations during September 2006.

Environmental Regulations

Mineral property exploration in the Northwest Territories is governed by Indian and Northern Affairs Canada, a Federal Government office which is responsible for negotiating the development of healthy and sustainable communities on behalf of the Native and Inuit peoples. Applicable statutes are the Canadian Environmental Assessment Act and the Canadian Environmental Protection Act.

10

In order to conduct exploration on any of our properties, we obtain land use permits. When exploration ceases on a Northwest Territories property, the land affected needs to be reclaimed in order to protect public health and safety, to reduce or prevent environmental degradation and to allow future productive land use of the property.

The reclamation plan for any property is site specific. In general, the reclamation plan consists of ensuring that the physical structures that remain do not impose a long-term hazard to public health and safety and the environment, which includes ensuring that the land and watercourses are returned to a safe and environmentally sound state. We do not anticipate incurring any reclamation costs in connection with our other mineral property interests.

Organizational Structure

This item is not applicable, as we are not part of a group, nor do we hold any subsidiary companies.

Property, Plants and Equipment

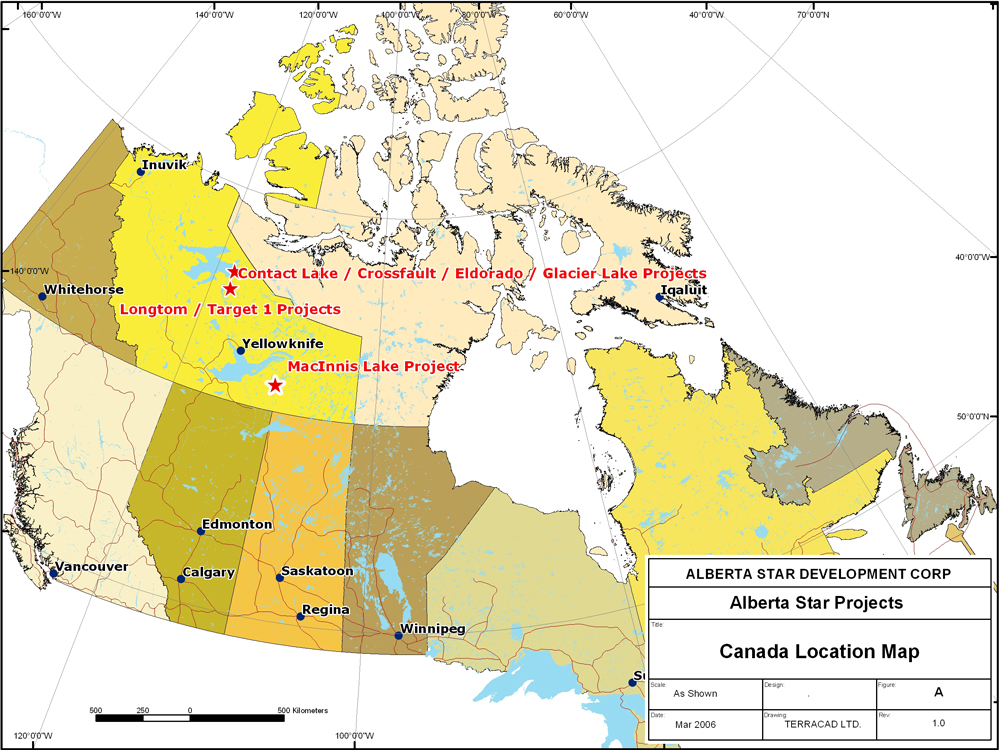

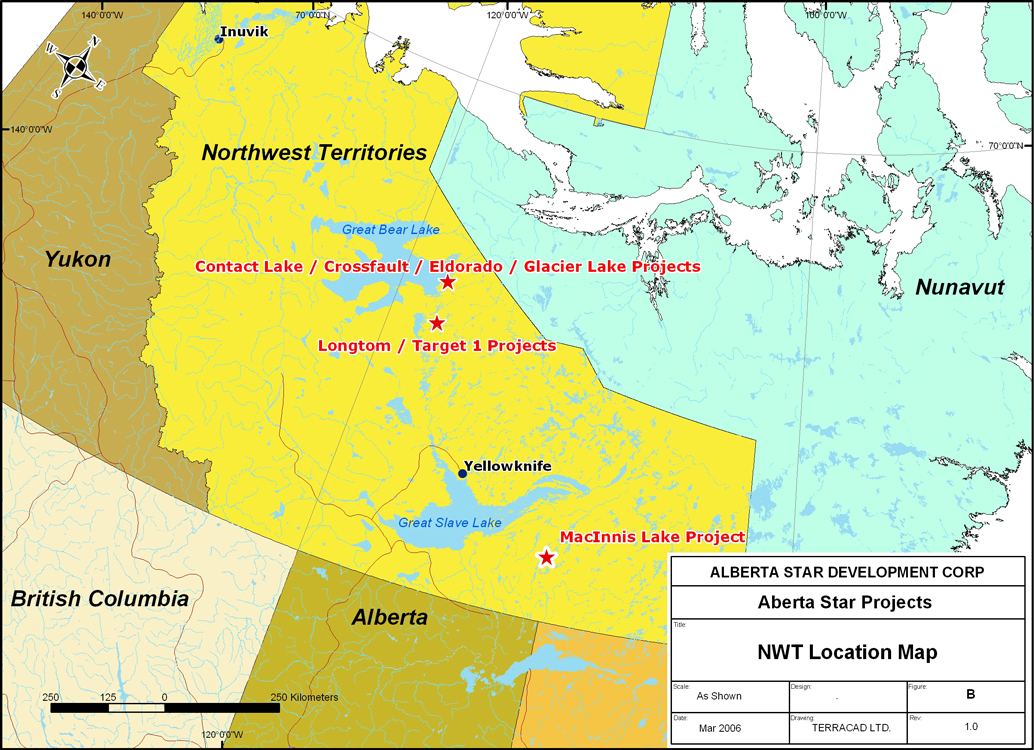

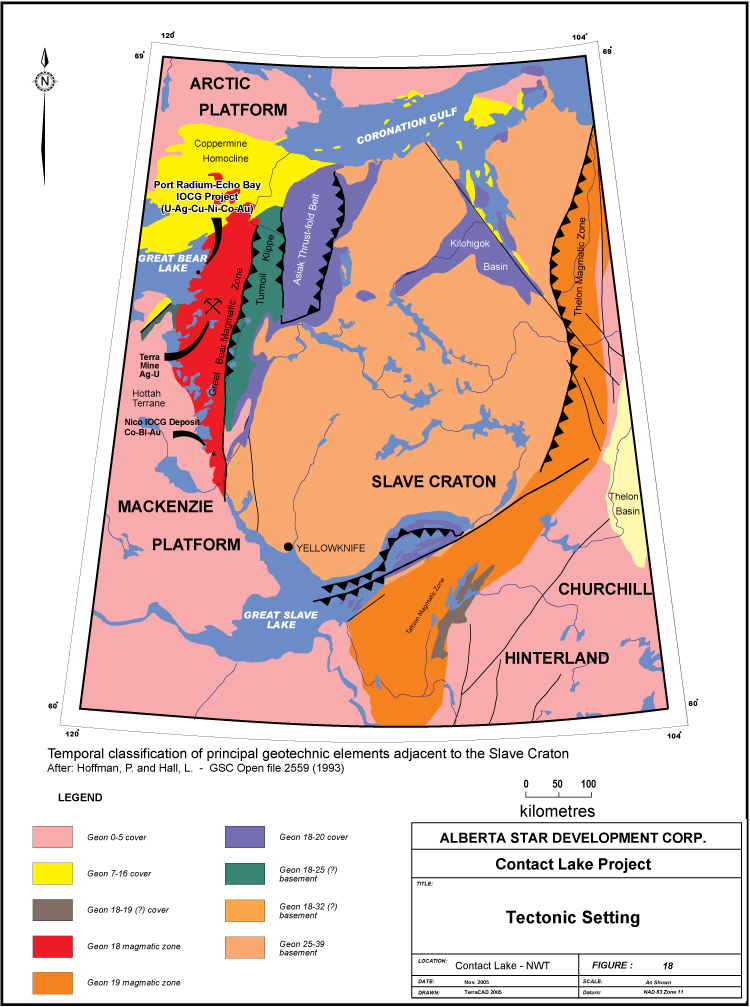

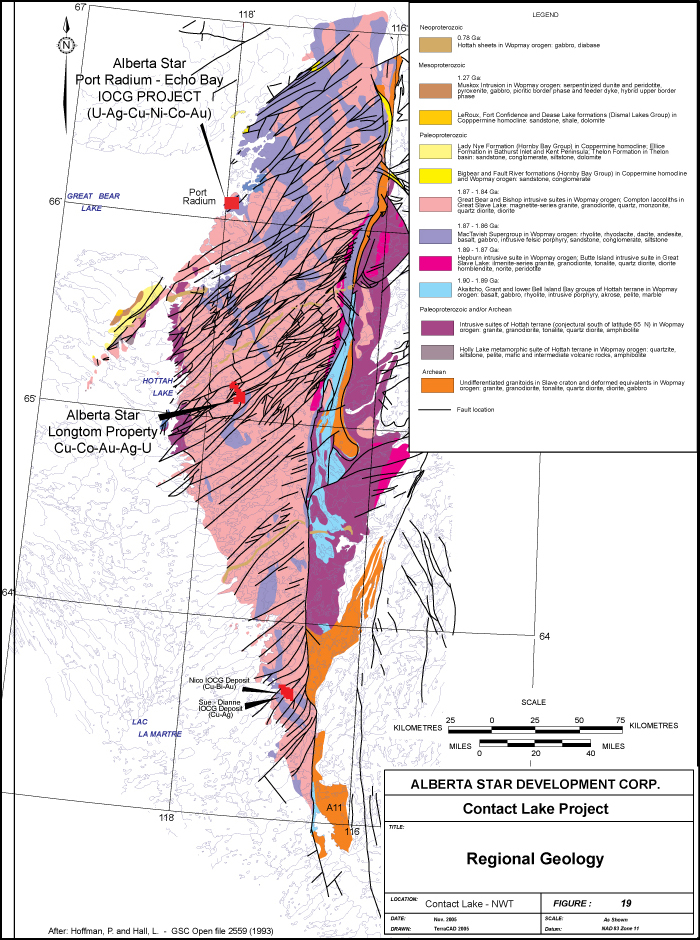

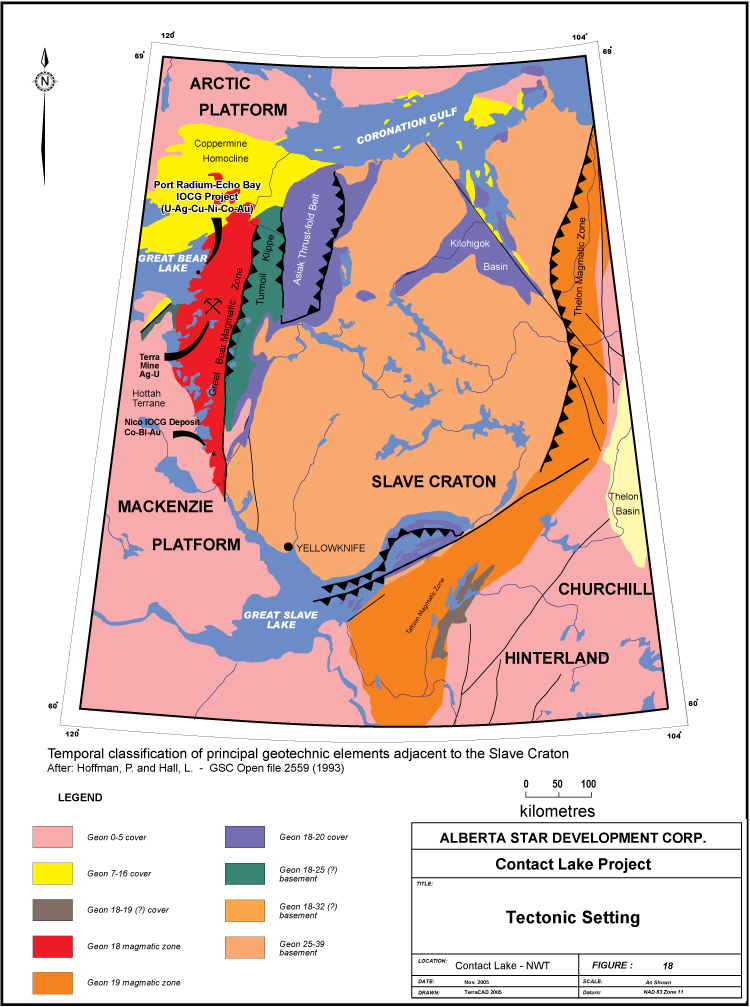

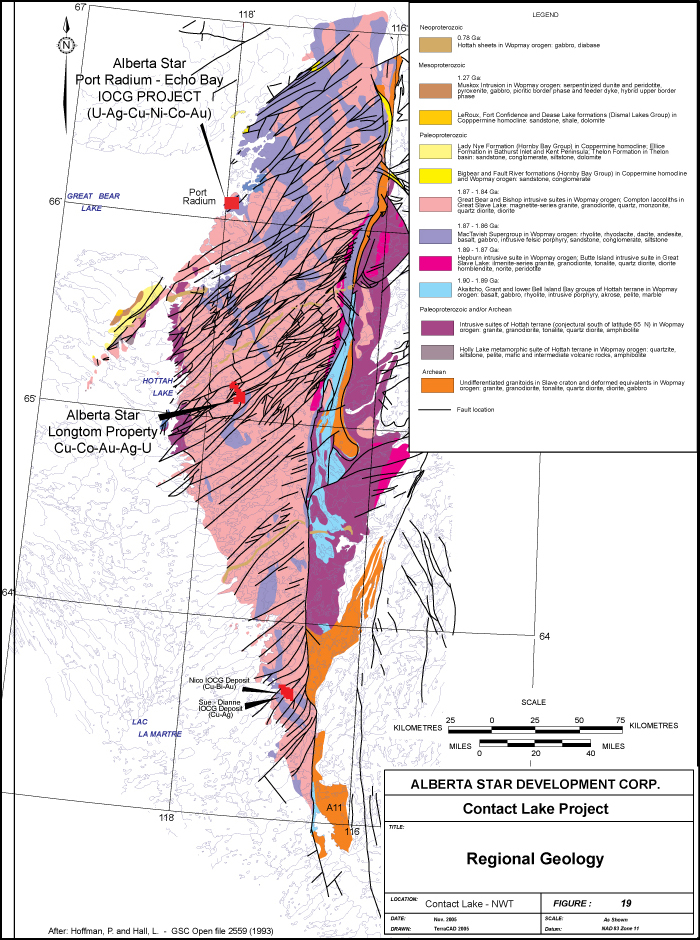

We are engaged in the acquisition and exploration of mineral property interests in Canada, and specifically hold all of our current property interests within the Northwest Territories, Canada (Figures A and B). What follows is a description of our current and former properties, including information on expenses for the years ended November 30, 2006 and, if applicable, November 30, 2005. We have also included information on exploration work completed and if applicable, planned for the upcoming fiscal year.

11

12

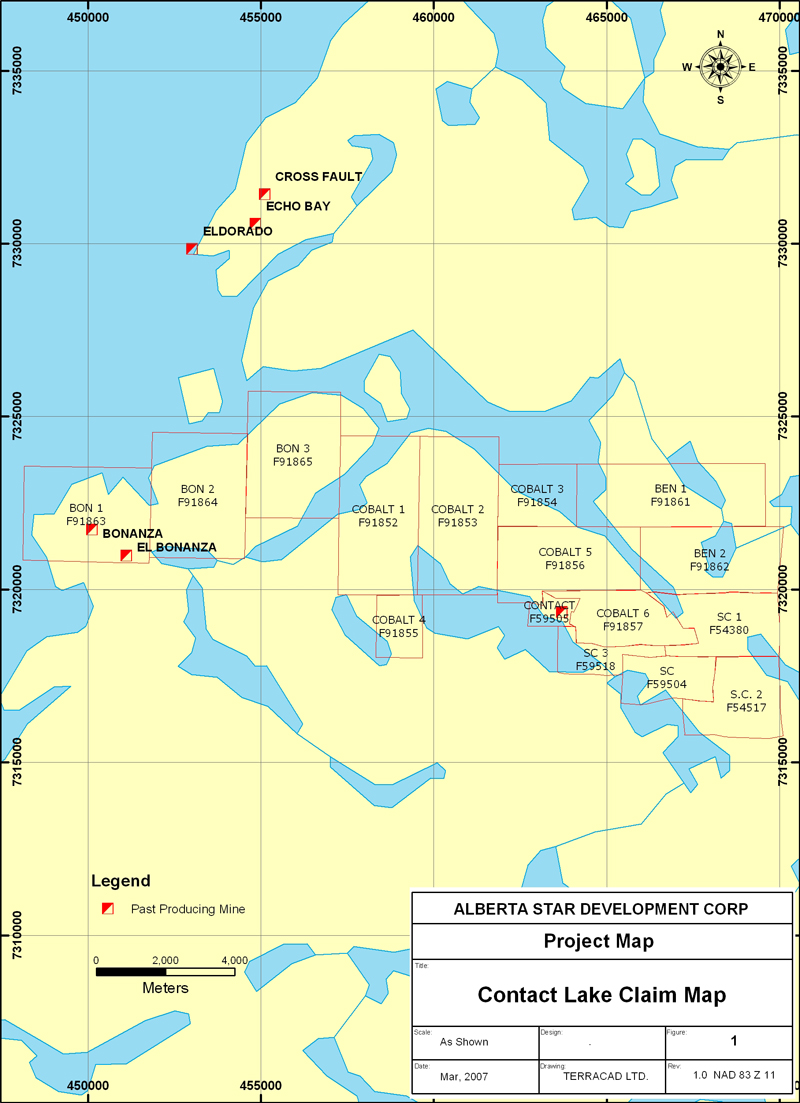

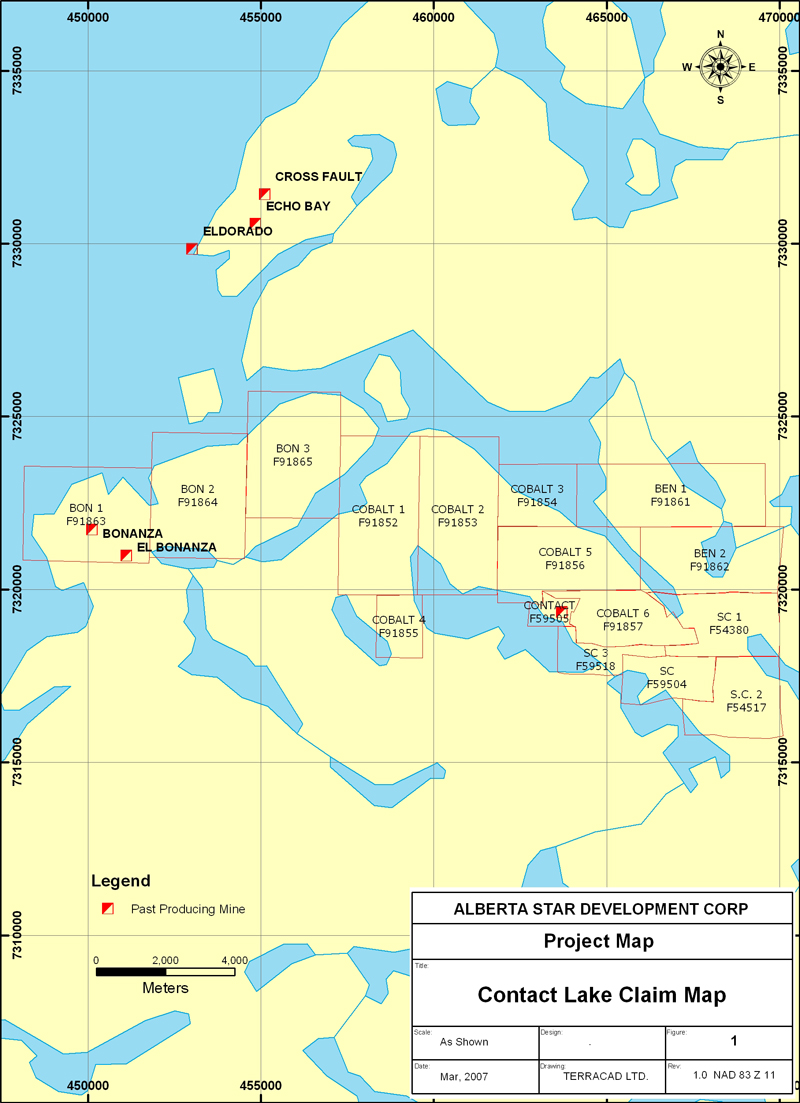

1. Contact Lake Mineral Claims - Contact Lake, Northwest Territories ("NT")

During the year ended November 30, 2005, we acquired a 100% undivided right, title and interest, subject to a 1% net smelter return royalty ("NSR"), in five mineral claims totalling 1,801.82 hectares ("ha") (4,450.50 acres) (figure 1) called the Contact Lake Mineral Claims, by making cash payments of $60,000 (paid) and issuing 300,000 of our common shares (issued and valued at $72,000). We may purchase the NSR for a one-time payment of $1,000,000.

During the same period we staked on an additional 8,799.75 ha (21,735.38 acres) and increased the size of Contact Lake Mineral Claims to 10,601.57 contiguous ha (26,185.88 acres). Our claims now consist of 16 contiguous claims located 5 km southeast of Port Radium on the east side of Great Bear Lake and 680.75 km north of the city of Yellowknife, NT.

Our expenditures related to the Contact Lake Mineral Claims can be summarized as follows:

| | Cumulative

amounts from inception to

30 November

2006

$ | For the year ended November 30 |

| | 2006

$ | 2005

$ | 2004

$ |

Operating expenses | | | | | | | | |

Assaying | | 175,970 | | 165,073 | | 10,897 | | - |

Camp and field costs | | 1,927,147 | | 1,809,771 | | 117,376 | | - |

Consulting fees | | 570,598 | | 362,148 | | 208,450 | | - |

Drilling | | 1,458,060 | | 1,458,060 | | - | | - |

Geology and engineering | | 1,273,316 | | 1,088,850 | | 184,466 | | - |

Surveying | | 1,233,289 | | 1,004,991 | | 228,298 | | - |

Transportation | | 2,606,594 | | 2,420,519 | | 186,075 | | - |

Travel | | 69,243 | | 50,513 | | 18,730 | | - |

| | | | | | | | | |

| | | 9,314,217 | | 8,359,925 | | 954,292 | | - |

| | | | | | | | | |

Acquisition costs | | 132,000 | | - | | 132,000 | | - |

| | | | | | | | | |

| | | 9,446,217 | | 8,359,925 | | 1,086,292 | | - |

| | |

| |

| |

| |

|

Two former past-producing silver and radium mines, Echo Bay (produced 23,779,178 ounces of silver) and Eldorado (produced 15 million pounds of uranium and 8 million ounces of silver) are situated on claims, which the Company owns. The claim is comprised of extensive alteration zones that include intensely mineralized gossans, traceable for over one km in length and 200 meters in lateral extent.

The area has traditionally been underexplored, but encompasses a mineral rich portion of the Great Bear Magmatic Zone, and includes the Contact Lake Mineral Belt itself, approximately 15 km long and the same belt whose northern extension hosts Fortune Minerals NICO Gold deposit.

13

Accessibility, Local Resources and Infrastructure

The best access to the area is from Yellowknife, NT, using charter fixed wing aircraft which can land at the 900 meter long unmaintained gravel airstrip at the western shore of Glacier Lake, which lies in the centre of the project area. A road extends west from the airstrip to the area of the Echo Bay and Eldorado Mines. Bulk freight has also previously been mobilized by seasonal barge access along the Mackenzie River, from Waterways, Alberta to Tulita (Fort Norman), NT, on the western shore of Great Bear Lake. When mining was active in the area, a barge service also operated along the Bear River from Tulita to Deline, and across Great Bear Lake to the various mining operations. Lake barging service is in limited operation.

Currently, the Northwest Territories Department of Transport maintains a winter road from Yellowknife to Rae-Edzo and beyond, to Rae Lakes which is approximately 100 km south of the property. Recent records indicate that local conditions have allowed this road to be open for a period of approximately 6 weeks, from mid- February to late March/early April. During operation of the silver mines at Camsell River and Echo Bay prior to 1984, the winter road was extended to Port Radium, via Marian Lake and Camsell River.

Although there lacks major infrastructure in the immediate area of the property, significant logistical support and supplies are available from Yellowknife. Established fishing camps on the eastern side of Great Bear Lake also provide some support. The town of Yellowknife has a long history of mining, where the services of many experienced explorers can be obtained. As well, personnel may be available from several smaller communities within the Great Bear Lake area.

We planned for immediate airborne and radiometric surveying, including the completion of a National Instrument NI 43-101 compliant report, the results of which included the outline of five large anomalous zones with secondary anomalies that can be viewed on www.sedar.com.

In June 2005, we appointed Dr. Hamid Mumin as senior consulting geologist and qualified person on the project, to provide additional strategic expertise in planning for the summer's ground exploration, mapping, sampling, geophysics and locating of high-priority drilling targets.

Dr. Mumin graduated from the University of Toronto, specializing in mineral exploration, went on to complete a MASc in economic geology, then completed his doctorate and post-doctoral fellowship at the University of Western Ontario. He has worked for Noranda at Sturgeon Lake, Ontario; was Chief Geologist and site manager during the exploration and feasibility stages if the Bogosu Gold mine in Ghana; as well, he has participated in the discovery of iron oxide, copper, gold and poly-metallic deposits in the Northwest Territories. He is a professional engineer, Manitoba director to the Canadian Council of Professional Geoscientists, a member of the Manitoba Exploration Liaison Committee, and a member of server Canadian and International professional societies.

In a news release dated November 23, 2005, we announced our formal submission and filing of the legal plan of survey and application for lease, and notice of lease to the Government of Canada Mine Recorders office. The survey to lease was completed in accordance with Canadian Mining Regulations by Sub-Arctic Surveys Ltd. of Yellowknife, NT.

14

In fiscal 2006, a five-year Cooperation and Benefits Agreement was signed with the Deline Land Corporation, representing the Sahtu Dene and Metis people of the Deline District, located at Great Bear Lake, NT.

In April 2006, we were granted a 15,000 meter five year Sahtu Land & Water Board Class "A" Land Use Permit for diamond drilling on the Contact Lake Project. The diamond drilling permit is valid until August 24, 2010. We are the first mineral exploration company in over 10 years to receive a Class "A"-5 Year drill permit in the Great Bear Lake Sahtu Dene Land settlement area for mineral exploration and diamond drilling. We are fully permitted for diamond drilling in the Sahtu Dene Land Settlement Area at Contact Lake, NT.

In April 2006, we were granted permission to drill on the Contact Lake property by the Chief Inspector of Mines for the Northwest Territories. Dr. Hamid Mumin of Brandon University completed an interpretation report which recommended the execution of a comprehensive exploration program. The exploration program included additional ground and airborne geophysics such as localized Induced Polarization/Resistivity (IP/Res) geophysics over selected portions of the high-amplitude magnetic anomalies, mapping, line-cutting followed by a comprehensive 15,000 meter drill program at Contact Lake, targeting the high -priority areas.

In May 2006, we contracted the services of Mr. John Camier B.Sc. (Specialist) M.Sc., a principal of South Bay Exploration Ltd., a geological services company of Brandon, Manitoba, to supervise our Summer 2006 diamond drilling program at the Contact Lake and Eldorado IOCG and uranium projects "(the Projects)".

Drilling commenced on the Projects in early June 2006. Our drill contractor was Connor's Drilling Ltd., which operated three Boyles BBS-25A drills. The scheduled holes were drilled to an average depth of 200-500 meters per-hole.

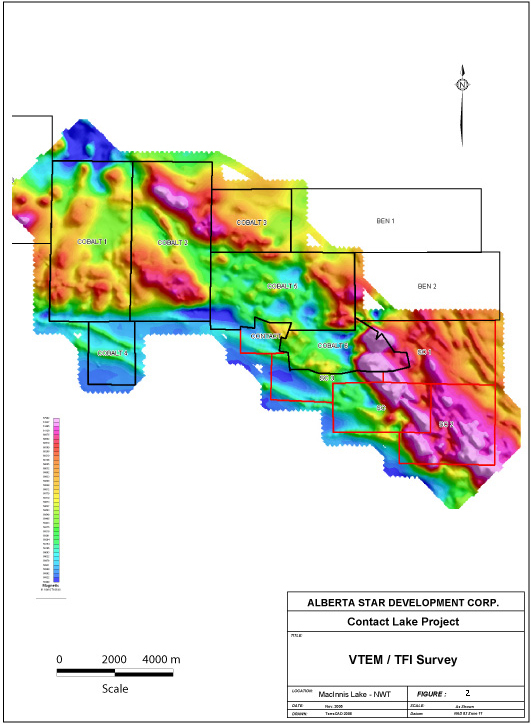

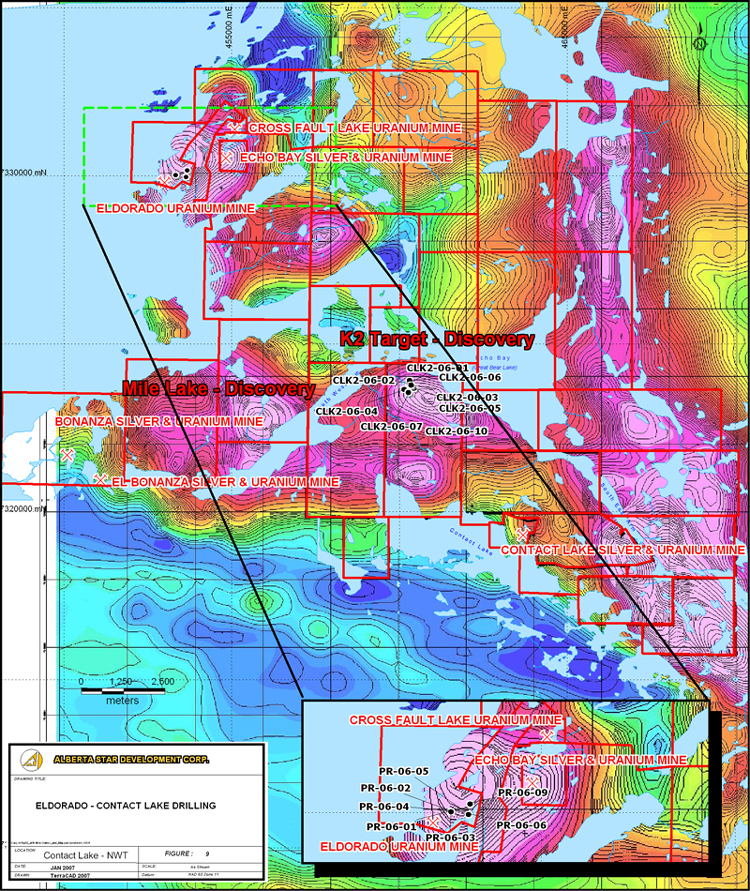

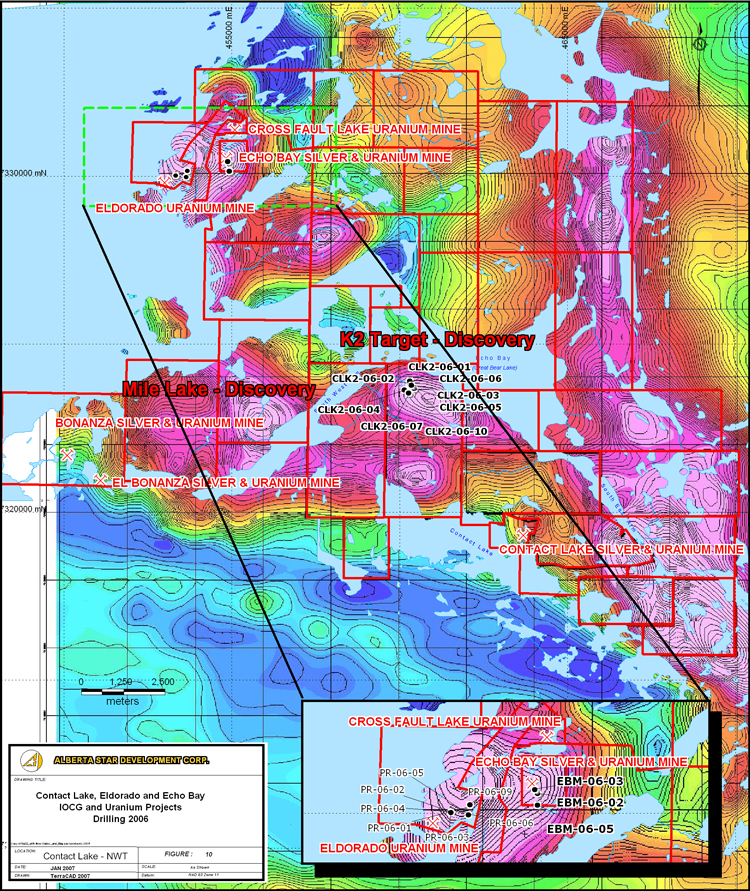

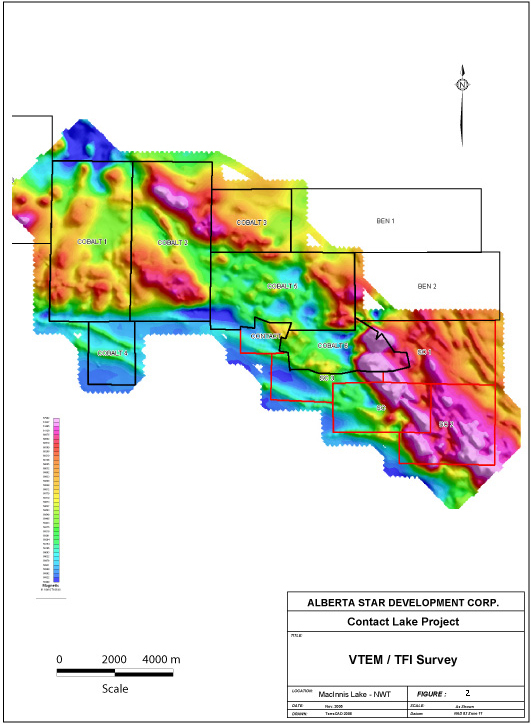

In July 2006, Geotech Ltd. completed a helicopter-borne VTEM geophysical survey at the Projects. The VTEM airborne survey covered an area that included four former past producing high grade silver & uranium mines, the Eldorado, Echo Bay, Bonanza and El Bonanza Mines. The survey area also included the Thompson Lake-Mile Lake region south of the Bonanza and El Bonanza silver and uranium mines.

A ground based study was also conducted over a three km by one km block of the Contact Lake belt along 100 meters spaced cut lines with 12.5 meter spaced stations. The surveys successfully identified five large anomalous zones with several secondary anomalies.

Detected were large, strongly anomalous zones that are coincident with known showings of IOGC-type and related poly-metallic mineralization, including uranium, and hosted within regionally extensive IOCG-type hydrothermal alteration.

The company targeted five large strongly anomalous zones with several secondary anomalies within the intensely altered target areas for detailed follow-up exploration and diamond drilling. These geophysical anomalies (figure 2) are coincident with large areas of exposed IOCG associated hydrothermal alterations, as well as zones of poly-metallic mineralization that include iron oxide, copper, gold, silver, uranium, cobalt and bismuth.

15

In August 2006, we were advised by the Surveyor-General's office of the Department of Natural Resources that the legal survey to lease at Contact Lake was approved. The survey to lease was performed in accordance with Canadian Mining Regulations by Sub-Arctic Surveys Ltd. of Yellowknife, NT on our behalf. The total lease claim survey are completed consisted of 1,801.82 ha (4,450.50 acres) and includes our Contact Lake Mine site.

In August 2006, Terraquest Ltd. completed a Regional High Resolution Aeromagnetic Gradiometer-Radiometric Survey over the entire Eldorado and Contact Lake uranium belt. This airborne geophysical survey consisted of 16,708 line-kilometres at 100 meter line spacing's and was completed under very favorable weather conditions. Several of the larger anomalies show uranium radiometric signatures of comparable or greater in strength, to the known zones of uranium mineralization already identified on our properties. In addition, the survey has also identified several secondary uranium anomalies. We also completed a detailed regional reconnaissance scale sampling and mapping program that has confirmed the uranium potential of the Eldorado & Contact Lake region. The results of this recent 5 month program will be released when assays have been received and compiled. This airborne survey will now allow us to properly evaluate the mineral potential of our properties and assist in our drill targeting of the Projects.

In October 2006, we completed Phase 1 & 2 drilling and field exploration work program at our Eldorado-Glacier Lake permit area located on the north side of Echo Bay and Contact Lake permit area located south of Echo Bay. Our work program has confirmed widespread poly-metallic mineralization at the various target areas in both drill core and exploration sampling. All drill core and surface exploration samples were prepared, bagged and sealed by the Company's supervised personnel and were transported by plane to ACME Analytical Laboratories Ltd. ("ACME") in Yellowknife, NT where they were crushed and pulped and then transported to ACME's main laboratories in Vancouver, British Columbia for assaying. ACME is a fully registered lab for analysis by ICP-MS and ICP-FA techniques. We have been reporting our drill results as we receive them.

In November 2006, we appointed Roger Watson P. Eng as our Chief Geophysicist. He will assume this position as part of his consulting activities in the Canadian Uranium Exploration industry. Mr. Watson is a leading specialist in the collection and interpretation of airborne radiometric data used for advanced uranium exploration purposes. Mr. Watson was a founding partner of the firm Paterson, Grant and Watson Ltd., one of Canada's leading providers of geophysical consulting services. The addition of Mr. Watson to our experienced IOCG & Uranium technical team reinforces our commitment to retain industry professionals who have advanced Uranium exploration expertise.

In November 2006, we reported that we discovered a new high grade poly-metallic breccia that is rich in copper, molybdenum, lead, zinc, silver and tungsten, known as the Mile Lake Breccia situated on our Contact Lake property on the south side of Echo Bay (figure 3). Preliminary drilling of the Mile Lake Breccia has yielded some significant poly-metallic drill results from an 8 hole drill program. Drilling and field work has confirmed widespread poly-metallic mineralization at several target areas at Mile Lake, in both exploration rock sampling and in drill core.

16

The Mile Lake Breccia is a new discovery in which poly-metallic mineralization and alteration is intermittently exposed for over 2 kilometers in strike length, within a regionally extensive laminated volcaniclastic tuff. The mineralization occurs within the same suite of volcano-plutonic rocks that host other poly-metallic zones in the Eldorado & Contact lake mineral belt, including the former El Bonanza Silver- Uranium (U-Ag) and the Eldorado Uranium (U-Ag- Cu- Co- Ni- Bi) mines.

The accompanying table gives a summary of drilling highlights and assay results from the initial 2 drill holes of an 8 hole program reporting from Mile Lake, NT. As of November 15, 2006 the Company is awaiting assays of six more drill holes at Mile Lake:

Mile Lake Drill Summary

DRILL HOLE RESULTS |

Drill Hole | Length | Copper

(Cu) | Lead

(Pb) | Zinc

(Zn) | Silver

(Ag) | Molybdenum

(Mo) | Tungsten

(W) |

| m (ft) | wt % | Wt % | wt% | g/t(Ounces/t) | wt % | wt % |

CLMB 06-01 | 8.62 (28.3) | 1.81% | 0.64% | 1.19% | 29.1 (0.94) | 0.053% | 0.032% |

CLMB 06-02 | 9.90 (32.48) | 1.64% | 1.00% | 2.30% | 42.0 (1.35) | 0.071% | 0.164% |

The drill results confirm the poly-metallic nature of the mineralization and demonstrate the widespread distribution of IOCG associated mineralization in the Eldorado & Contact Lake district. The Mile Lake Breccia is open for drilling along a strike length of greater than 2 kilometers within a 100 to 200 meter wide horizon. This is one of a number of large IOCG & uranium targets that are emerging at Contact Lake, that are characterized by two to six different metals within a target horizon.

We collected over 60 surface rock samples from the Mile Lake property that were analyzed during the program which assayed values to a maximum of 15.34% copper, 1.90% lead, 5.71% zinc, and 293.0 g/ton (9.43 oz/ton) silver. In addition to grab sampling, chip sampling was carried out along an exposed trench which produced the following average values over 3 meters (9.84 feet). The samples returned values of 3.48% copper, 0.70% lead, 0.78% zinc, and 23.0 g/ton (0.74 oz/ton) silver and 0.12% molybdenum.

17

Summary of high-grade grab samples from Mile Lake, NT are listed below:

Mile Lake Breccia Surface Sample- Results

| | Copper | Lead | Zinc | Silver | Silver |

| | (Cu) | (Pb) | (Zn) | (Ag) | (Ag) |

Sample # | Location | wt % | wt % | wt% | g/t | Ounces/t |

158332 | Western area | 3.51 | 0.84 | 1.61 | 45.10 | 1.45 |

158333 | Western area | 0.35 | 0.04 | 0.2 | 26.30 | 0.85 |

158334 | Main showing | 0.07 | 0.03 | 0.04 | 0.70 | 0.02 |

158335 | Main showing | 0.14 | 0.04 | 0.07 | 10.20 | 0.33 |

160851 | Main showing | 0.4 | 0.1 | 0.26 | 4.20 | 0.14 |

160878 | Main showing | 11.72 | 0.98 | 0.11 | 84.30 | 2.71 |

160879 | Main showing | 15.34 | 0.99 | 0.06 | 95.50 | 3.07 |

160880 | Main showing | 1.28 | 0.8 | 0.38 | 12.50 | 0.40 |

160881 | Main showing | 5.64 | 1.74 | 5.71 | 126.90 | 4.08 |

160882 | Main showing | 11.5 | 1.90 | 4.07 | 293.00 | 9.42 |

160883 | Main showing | 1.28 | 1.20 | 2.37 | 23.00 | 0.74 |

368957 | Main showing | 0.64 | 0.22 | 1.32 | 13.00 | 0.42 |

368961 | Main showing | 0.69 | 0.72 | 0.34 | 9.00 | 0.29 |

368962 | Main showing | 1.38 | 0.26 | 0.72 | 10.90 | 0.35 |

368964 | Main showing | 0.21 | 0.02 | 0.03 | 1.20 | 0.04 |

368982 | Main showing | 0.45 | 0.42 | 0.06 | 11.50 | 0.37 |

368984 | Main showing | 0.27 | 0.03 | 0.21 | 43.80 | 1.41 |

368985 | Main showing | 0.71 | 0.21 | 0.21 | 12.40 | 0.40 |

368986 | Main showing | 0.56 | 0.26 | 0.31 | 5.50 | 0.18 |

368988 | Main showing | 0.86 | - | - | 2.20 | 0.07 |

368989 | Main showing | 0.11 | 0.01 | 0.06 | 3.00 | 0.10 |

368990 | Main showing | 0.12 | - | 0.09 | 0.20 | 0.01 |

434618 | Main showing | 0.28 | 0.11 | 0.07 | 1.90 | 0.06 |

434619 | Main showing | 0.39 | 0.02 | 0.42 | 6.20 | 0.20 |

434965 | Mile Lake | 0.08 | 0.14 | 0.11 | 23.40 | 0.75 |

434966 | Mile Lake | 0.03 | 0.18 | 0.21 | 2.30 | 0.07 |

434970 | Main showing | 0.33 | 0.01 | 0.1 | 4.90 | 0.16 |

18

19

20

21

A summary of our claims can be found below:

Name | | Tag Number | | Size (ha) |

CONTACT | | F59505 | | 100.33 |

SC | | F59504 | | 376.24 |

SC 1 | | F54380 | | 582.75 |

SC 2 | | F54517 | | 501.65 |

SC 3 | | F59518 | | 240.85 |

COBALT 1 | | F91852 | | 1,045.10 |

COBALT 2 | | F91853 | | 1,045.10 |

COBALT 3 | | F91854 | | 250.82 |

COBALT 4 | | F91855 | | 418.04 |

COBALT 5 | | F91856 | | 752.47 |

COBALT 6 | | F91857 | | 522.55 |

BEN 1 | | F91861 | | 1,003.30 |

BEN 2 | | F91862 | | 752.47 |

BON 1 | | F91863 | | 1,003.30 |

BON 2 | | F91864 | | 1,003.30 |

BON 3 | | F91865 | | 1,003.30 |

| | | | | |

| | | | | 10,601.57 |

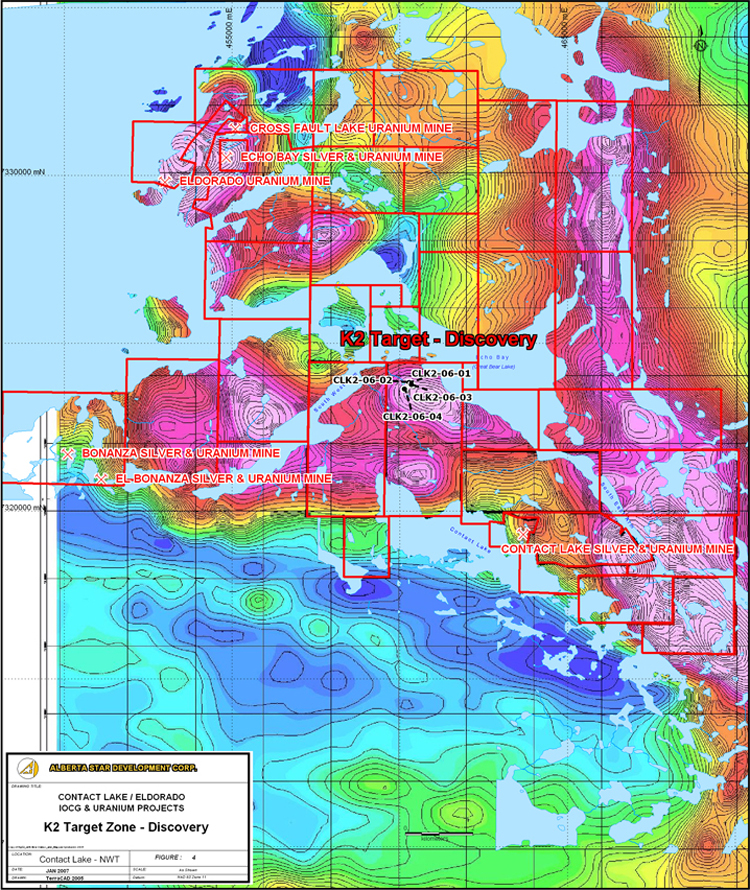

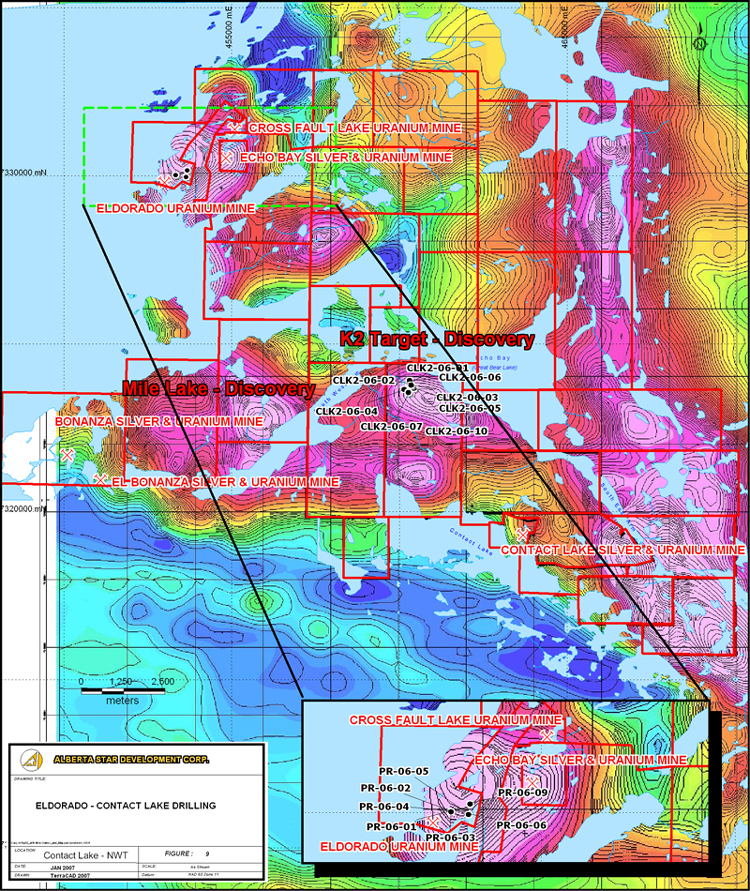

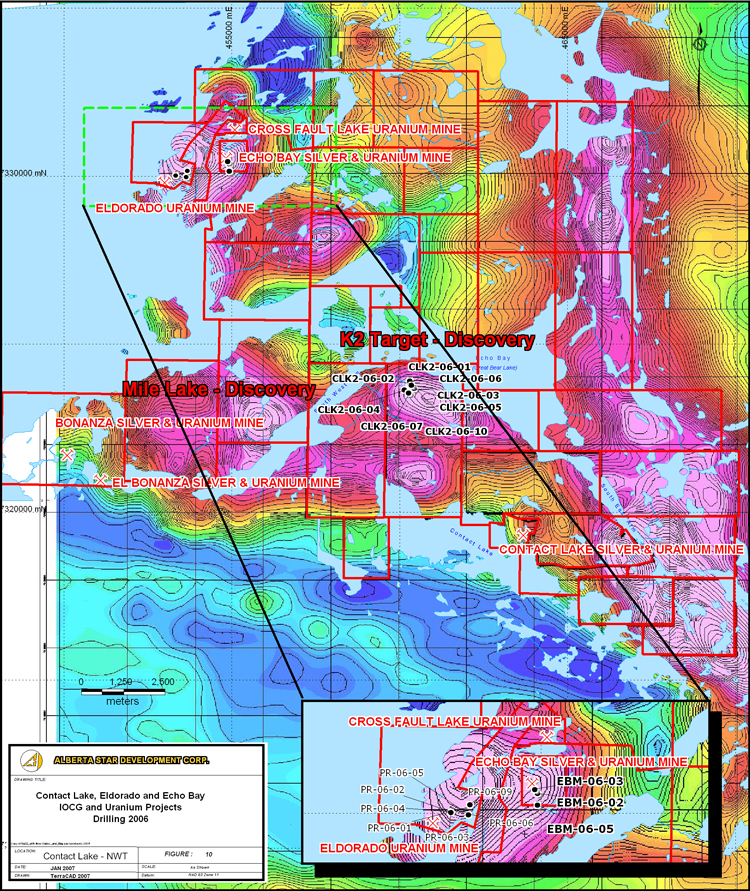

Subsequent to fiscal 2006, in December, we reported that we discovered a new large zone of hydrothermal and structurally controlled poly-metallic breccias. The breccias are enriched in copper, gold, silver and cobalt situated on our K2 target site. The K2 target is located on the Contact Lake property, on the south side of Echo Bay (figure 4). Preliminary drilling of the K2 Target area has yielded significant poly-metallic drill results from a recently completed eight hole drill program. Drilling and fieldwork has confirmed widespread poly-metallic mineralization at several areas at the K2 target. All four drill holes reporting from a recently completed eight hole summer 2006 drill program intersected multiple zones of altered and highly mineralized breccias with disseminated and vein hosted copper, gold, silver, cobalt sulphide mineralization. Assays are pending for an additional 4 holes from the K2 target zone.

Highlights from significant mineralized down hole intervals from the first four holes reporting, include 49.52 meters (162.47 feet) of .25% copper (including 19.5 meters (63.98 feet) of .37% copper, 2.6 g/ton silver and ..03% cobalt), 21.45 meters (70.37 feet) of .49% copper and 2.3 g/ton silver, 24.0 meters (78.74 feet)of .40% copper, 3.3 g/ton silver and 0.4 g/ton gold, 2 meters (6.56 feet) of .29% copper, 5.15 g/ton silver and 0.21% cobalt, and 1 meter (3.28 feet) of 3.19% copper, 0.44% lead, 0.75% zinc and 164.8 g/ton silver.

The K2 target area is a new discovery in which significant poly-metallic copper, gold, silver and cobalt mineralization was encountered in a preliminary drilling program along a 250 meter strike length to a vertical depth of 300 meters. The mineralized zone remains un-delineated and open at depth and along strike in both directions. The mineralized zone is part of a regionally extensive linear zone of phyllic, potassic, hematite and magnetite, magnetite-actinolite alteration zones, often appearing at surface as phyllic-potassic gossans. The mineralization occurs within the same suite of volcano-plutonic rocks that host other poly-metallic zones in the Eldorado & Contact lake mineral belt, including the former El Bonanza Silver- Uranium (U-Ag) and the Eldorado Uranium (U-Ag- Cu- Co- Ni- Bi) mines.

22

The accompanying table gives a summary of drilling highlights and assay results from the initial 4 drill holes of an 8 hole program reporting from the K2 Target Zone, NT:

K2 Discovery Zone -Drill Summary

| Interval | Length | Copper

(Cu) | Silver

(Ag) | Cobalt

(Co) | Gold

(Au) |

| From | To |

Drill Hole | (m) | (m) | (m) | (%) | (g/ton) | (%) | (g/ton) |

CLK2-06-01 | 12.30 | 13.20 | 0.90 | 0.18 | 0.46 | 0.00 | 0.00 |

| 21.18 | 70.70 | 49.52 | 0.25 | 1.86 | 0.02 | 0.04 |

| 49.99 | 69.52 | 19.53 | 0.37 | 2.63 | 0.03 | 0.06 |

| 77.42 | 88.82 | 11.40 | 0.17 | 1.09 | 0.00 | 0.00 |

| 99.24 | 108.82 | 9.58 | 0.34 | 1.16 | 0.02 | 0.02 |

| 136.90 | 146.20 | 9.30 | 0.42 | 0.83 | 0.01 | 0.00 |

| 175.40 | 203.10 | 27.70 | 0.20 | 0.90 | 0.01 | 0.00 |

| 245.00 | 250.20 | 5.20 | 0.28 | 3.06 | 0.00 | 0.00 |

| 401.92 | 402.32 | 0.40 | 0.02 | 2.00 | 0.27 | 0.00 |

| Interval | Length | Copper

(Cu) | Silver

(Ag) | Cobalt

(Co) | Gold

(Au) |

| From | To |

Drill Hole | (m) | (m) | (m) | (%) | (g/ton) | (%) | (g/ton) |

CLK2-06-02 | 14.10 | 17.10 | 3.00 | 0.24 | 0.63 | 0.00 | 0.00 |

| 57.90 | 59.05 | 1.15 | 0.53 | 0.50 | 0.00 | 0.00 |

| 264.05 | 277.00 | 12.95 | 0.29 | 1.95 | 0.00 | 0.01 |

| 272.00 | 276.00 | 4.00 | 0.54 | 3.48 | 0.00 | 0.03 |

| 282.55 | 304.00 | 21.45 | 0.49 | 2.32 | 0.01 | 0.04 |

| 310.00 | 312.00 | 2.00 | 0.36 | 1.33 | 0.01 | 0.53 |

| 347.30 | 347.60 | 0.30 | 2.29 | 8.20 | 0.02 | 0.20 |

| 410.50 | 414.50 | 4.00 | 0.18 | 2.60 | 0.10 | 0.08 |

| Interval | Length | Copper (Cu) | Silver (Ag) | Cobalt (Co) | Gold (Au) | Zinc (Zn) | Lead (Pb) |

| From | To | |

Drill Hole | (m) | (m) | (m) | (%) | (g/ton) | (%) | (g/ton) | (%) | (%) |

CLK2-06-03 | 32.0 | 40.0 | 8.0 | 0.36 | 1.9 | 0.03 | 0.1 | 0.01 | 0.00 |

| 68.5 | 74.5 | 6.0 | 0.25 | 2.3 | 0.01 | 0.1 | 0.01 | 0.00 |

| 80.0 | 81.0 | 1.0 | 0.53 | 3.8 | 0.04 | 0.2 | 0.01 | 0.00 |

| 151.6 | 154.6 | 3.0 | 0.24 | 6.3 | 0.10 | 0.2 | 0.01 | 0.00 |

| 267.7 | 271.8 | 4.1 | 0.84 | 42.3 | 0.00 | 0.0 | 0.20 | 0.12 |

| 270.2 | 271.2 | 1.0 | 3.19 | 164.8 | 0.00 | 0.0 | 0.75 | 0.44 |

| 279.0 | 295.5 | 16.5 | 0.15 | 6.2 | 0.01 | 0.0 | 0.04 | 0.02 |

| 300.0 | 300.5 | 0.5 | 0.17 | 7.6 | 0.01 | 0.0 | 0.07 | 0.05 |

| 319.5 | 320.3 | 0.8 | 0.45 | 10.0 | 0.08 | 0.0 | 0.08 | 0.05 |

| 421.0 | 445.0 | 24.0 | 0.40 | 3.3 | 0.01 | 0.4 | 0.01 | 0.00 |

| 421.0 | 434.0 | 13.0 | 0.45 | 4.7 | 0.01 | 0.6 | 0.01 | 0.01 |

| 427.5 | 434.0 | 6.5 | 0.73 | 3.6 | 0.01 | 0.9 | 0.01 | 0.00 |

| 461.5 | 469.5 | 8.0 | 0.38 | 3.6 | 0.01 | 0.1 | 0.01 | 0.00 |

23

| Interval | Length | Copper (Cu) | Silver (Ag) | Cobalt (Co) | Gold (Au) |

| From | To |

Drill Hole | (m) | (m) | (m) | (%) | (g/ton) | (%) | (g/ton) |

CLK2-06-04 | 13.00 | 18.90 | 5.90 | 0.23 | 1.60 | 0.08 | 0.14 |

| 38.00 | 42.50 | 4.50 | 0.44 | 3.26 | 0.03 | 0.03 |

| 45.80 | 58.00 | 12.20 | 0.17 | 0.87 | 0.01 | 0.00 |

| 65.90 | 68.50 | 2.60 | 0.67 | 4.11 | 0.04 | 0.08 |

| 95.80 | 97.20 | 1.40 | 0.52 | 3.16 | 0.04 | 0.09 |

| 120.00 | 122.00 | 2.00 | 0.29 | 5.15 | 0.21 | 0.10 |

| 128.65 | 134.10 | 5.45 | 0.25 | 4.20 | 0.02 | 0.05 |

| 175.50 | 178.80 | 3.30 | 0.26 | 10.37 | 0.01 | 0.00 |

| 205.90 | 208.90 | 3.00 | 0.36 | 3.35 | 0.00 | 0.00 |

Note: True thickness has not been calculated for these holes.

The K2 mineralized breccia is open for drilling along strike for a presently undetermined length, and within a 200 to 300 meter wide horizon. This is the second large poly-metallic IOCG target zone that has emerged within the Eldorado & Contact Lake districts that are characterized by six or more different metals within a target horizon. The K2 Zone will be drill tested in 2007, to determine its potential as a large bulk tonnage prospect.

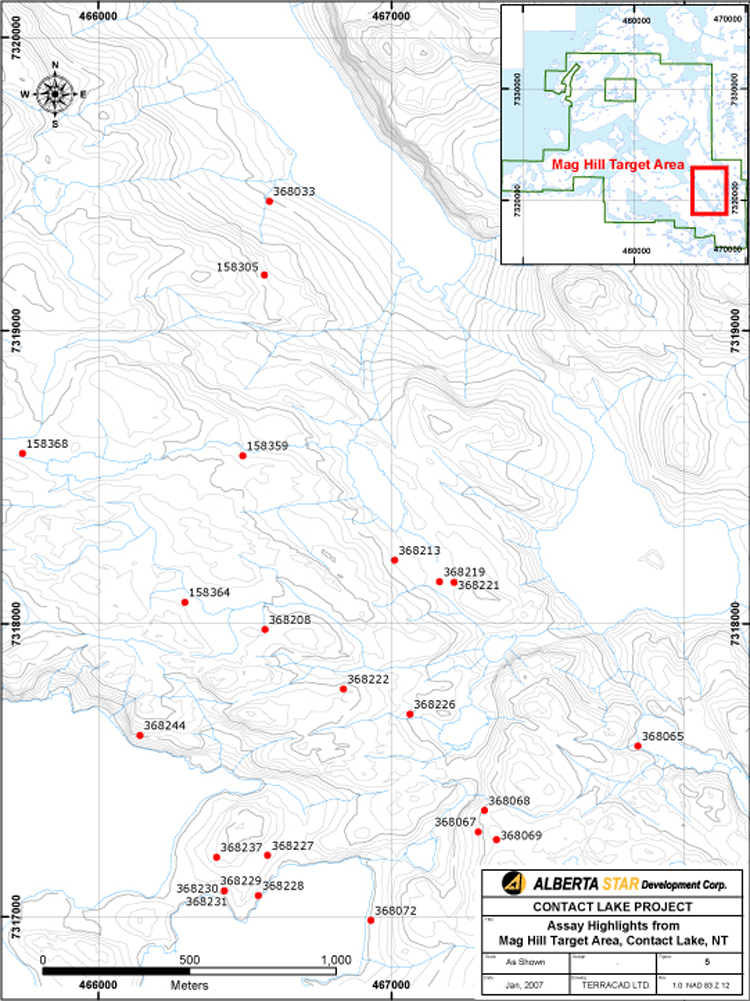

In January 2007, we reported the results of our summer 2006 surface exploration sampling program at the Mag Hill target area. The Mag Hill target area is located at the southern end of Echo Bay, approximately 15 kilometers from the Eldorado uranium mine and 3 kilometers east of the Contact Lake silver & uranium mine (figure 5). The Eldorado uranium mine (1933-1960) formerly mined and produced 15 million pounds of U3O8 at an average head grade of 0.75% U3O8 and 8 million ounces of silver, plus copper, cobalt, nickel and lead. (Normin NTGO: SENES Report 2005). The Mag Hill target area is an IOCG plus uranium drill prospect now emerging at Contact Lake.

The Mag Hill target is the site of the most extensive hydrothermal magnetite-actinolite- feldspar-apatite plus sulphide alteration along the Contact Lake Mineral Belt in the northern part of the Great Bear Magmatic Zone. The host rocks are alkali (sodic or potassic) and or actinolite-epidote altered andesites. The core zone comprises a pervasive alkali feldspar-scapolite-magnetite-actinolite-apatite hydrothermal assemblage.

The alteration signature and zone at Mag Hill is similar to that of the Port Radium- Eldorado uranium mine area situated on Labine Point, NT. The Mag Hill discovery zone and target area is defined by predominately pyrite mineralization, which is present intermittently throughout the Mag Hill region and in an extensive gossan at the southeast end of Echo Bay, with minor amounts of visible malachite. In addition, uranium, cobalt, nickel, copper, silver, lead and zinc enrichments are present locally as veins, veinlets and disseminations that extend outward in the southern and eastern extensions of the Mag Hill area.

24

Mag Hill Target area -Contact Lake, NT- grab samples assayed

- 0.69% U3O8 and 30.9 g/ton silver and 0.32% lead (the maximum uranium values returned from the assayed samples)

- 0.38% U3O8 and 30.5 g/ton silver and 0.24 % lead

- 0.31% U3O8 and 7.8 g/ton silver

This region is being targeted for detailed uranium exploration due to its notable similarities to the Port Radium-Eldorado mine region with regard to hydrothermal alteration and mineralization and large size of the associated hydrothermal system, 1-2 km2 core zone of magnetite-actinolite-apatite alteration, kilometre-scale surface gossans and distinct lenses of poly-metallic sulphide mineralization.

We analyzed over 121 surface grab samples from the Mag Hill Grid over a 5 square kilometer area in the southern portion of the Contact Lake belt. 25 samples collected were variably enriched in uranium, silver, copper, lead, zinc, nickel and cobalt. The rock samples assayed to a maximum of 0.69% uranium, 68.0 g/ton silver, 4.98% copper, 0.40% lead, 0.49% zinc, 0.23% nickel, 0.58% cobalt, 0.4 g/ton gold and 0.10% bismuth.

*(See table below for analytical results of surface grab samples)

Assay highlights from the Mag Hill IOCG Target Area, Contact Lake, NT

| Uranium

(U) | Silver

(Ag) | Copper

(Cu) | Lead

(Pb) | Zinc

(Zn) | Nickel

(Ni) | Cobalt

(Co) | Gold

(Au) | Bismuth

(Bi) |

Sample No. | % | g/ton | % | % | % | % | % | g/ton | % |

158305 | 0 | 3.7 | 0.03 | 0.04 | 0 | 0.23 | 0.06 | 0 | 0 |

158359 | 0 | 0.8 | 0.03 | 0.02 | 0.23 | 0.01 | 0.01 | 0 | 0 |

158364 | 0 | 1.7 | 0.81 | 0 | 0.01 | 0 | 0 | 0 | 0 |

158368 | 0 | 0.8 | 0.02 | 0.06 | 0.32 | 0 | 0 | 0 | 0 |

368065 | 0 | 8.2 | 3.82 | 0 | 0.02 | 0.01 | 0.03 | 0.4 | 0 |

368067 | 0.31 | 7.8 | 0.03 | 0.06 | 0.03 | 0 | 0.01 | 0 | 0 |

368068 | 0.69 | 30.9 | 0.02 | 0.32 | 0.08 | 0.01 | 0.01 | 0 | 0 |

368069 | 0.38 | 30.5 | 0.02 | 0.24 | 0.02 | 0.01 | 0.01 | 0.2 | 0 |

368072 | 0 | 0.4 | 0.26 | 0 | 0.01 | 0 | 0 | 0 | 0 |

368208 | 0 | 1.6 | 0.41 | 0 | 0.02 | 0 | 0 | 0 | 0 |

368213 | 0 | 1.1 | 0.04 | 0.17 | 0.36 | 0 | 0 | 0 | 0 |

368219 | 0 | 0.8 | 0.02 | 0 | 0.49 | 0 | 0 | 0 | 0 |

368221 | 0 | 3.3 | 0.5 | 0 | 0.02 | 0 | 0.04 | 0.2 | 0 |

368222 | 0 | 44.5 | 0.12 | 0.4 | 0.17 | 0.02 | 0.24 | 0.4 | 0.01 |

368226 | 0 | 0.7 | 0.18 | 0 | 0.02 | 0.01 | 0 | 0 | 0 |

368228 | 0 | 0.2 | 0.41 | 0 | 0.02 | 0 | 0 | 0 | 0 |

368229 | 0 | 9.2 | 1.21 | 0 | 0 | 0 | 0.01 | 0 | 0.02 |

368230 | 0.03 | 24.9 | 0.58 | 0 | 0.03 | 0.12 | 0.42 | 0.1 | 0.08 |

368231 | 0.01 | 29.3 | 1.33 | 0.01 | 0.08 | 0.13 | 0.58 | 0 | 0.09 |

368232 | 0 | 10.8 | 1.84 | 0 | 0.01 | 0 | 0.01 | 0 | 0.04 |

368233 | 0.03 | 21.9 | 4.98 | 0 | 0.05 | 0 | 0.03 | 0 | 0.1 |

368237 | 0 | 8.1 | 1.86 | 0 | 0 | 0 | 0.01 | 0 | 0.02 |

25

| Uranium

(U) | Silver

(Ag) | Copper

(Cu) | Lead

(Pb) | Zinc

(Zn) | Nickel

(Ni) | Cobalt

(Co) | Gold

(Au) | Bismuth

(Bi) |

| % | g/ton | % | % | % | % | % | g/ton | % |

368244 | 0 | 68 | 0.5 | 0 | 0.11 | 0 | 0 | 0 | 0 |

368033 | 0 | 0.7 | 0.03 | 0.12 | 0.24 | 0 | 0 | 0 | 0 |

| | | | | | | | | |

Maximum Values | 0.69 | 68 | 4.98 | 0.4 | 0.49 | 0.23 | 0.58 | 0.4 | 0.1 |

Also in January 2007, we reported that we received assays on a further four holes completing our eight hole summer/fall 2006 preliminary drill program at the K2 discovery at Contact Lake, NT (figure 6). Completion of an additional four drill holes has confirmed and expanded the widespread poly-metallic mineralization at the K2 target. All eight drill holes reporting from a recently completed eight hole summer 2006 drill program intersected multiple zones of altered and highly mineralized breccias with disseminated and vein hosted copper, gold, silver, cobalt sulphide mineralization. All drill cores were prepared, bagged and sealed by our supervised personnel and were transported by plane to Acme Analytical Laboratories Ltd. ("ACME") in Yellowknife, NT where they were crushed and pulped, and then transported to ACME's main laboratories in Vancouver, British Columbia for assaying. Acme is a fully registered analytical lab for analysis by ICP-MS and ICP-FA techniques.

Highlights from significant mineralized down hole intervals from the four new holes reporting, include 14.5 meters (47.85 feet) of .28% copper, 1.1 g/ton silver and .04% cobalt and 0.12 g/ton gold, 17.5 meters (57.75 feet) of .28% copper and 5.2 g/ton silver, 17.4 meters of .41% copper, 2.7 g/ton silver, 0.01 % cobalt (including 0.5 meters 3.13 % copper, 16.8 g/ton silver) 46.5 meters (153.45 feet) of .22% copper, 0.94 g/ton silver and 0.01 g/ton gold, 3 meters (9.9 feet) of .73% copper, 1.8 g/ton silver and 0.01% cobalt, and 1 meter (3.28 feet) of 3.19% copper.

The K2 target area is a new discovery in which significant IOCG style poly-metallic copper, gold, silver and cobalt mineralization was encountered in all eight drill holes in a preliminary drilling program along a 250 meter strike length to a vertical depth of 300 meters. The mineralized zone remains un-delineated and open at depth and along strike in both directions. The mineralized zone is part of a regionally extensive linear zone of phyllic, potassic, hematite and magnetite, magnetite-actinolite alteration zones, often appearing at surface as phyllic-potassic gossans. The mineralization occurs within the same suite of volcano-plutonic rocks that host other poly-metallic zones in the Eldorado & Contact lake mineral belt, including the former El Bonanza Silver- Uranium (U-Ag) and the Eldorado Uranium (U-Ag- Cu- Co- Ni- Bi) mines.

The accompanying table gives a summary of drilling highlights and assay results returned from the balance of holes from an 8 hole program reporting from the K2 Target Discovery Zone at Contact Lake, NT.

26

K2 Discovery Zone -Drill Summary (Holes 5-6-7-8)

| Interval | Length | Copper | Silver | Cobalt | Gold |

| From | To | (Cu) | (Ag) | (Co) | (Au) |

Drill Hole | (m) | (m) | (m) | (%) | (g/ton) | (%) | (g/ton) |

CLK2-06-05 | 2.5 | 56.5 | 54 | 0.2 | 1.08 | 0.03 | 0.08 |

| 2.5 | 8.5 | 6 | 0.42 | 1.32 | 0.05 | 0.23 |

| 2.5 | 17 | 14.5 | 0.28 | 1.1 | 0.04 | 0.12 |

| 20 | 31 | 11 | 0.23 | 1.39 | 0.05 | 0.08 |

| 27.5 | 30 | 2.5 | 0.53 | 3 | 0.13 | 0.24 |

| 35.5 | 56.5 | 21 | 0.17 | 1.1 | 0.02 | 0.07 |

| 43 | 46 | 3 | 0.21 | 1.65 | 0.03 | 0.5 |

| 59 | 63 | 4 | 0.11 | 0.58 | 0.01 | 0.03 |

| 152 | 153.7 | 1.7 | 0.14 | 0.72 | 0.06 | 0 |

| 156.2 | 156.7 | 0.5 | 0.38 | 1.4 | 0.01 | 0 |

| 190.5 | 191.5 | 1 | 0.04 | 2.9 | 0.05 | 0 |

| 222 | 223.5 | 1.5 | 0.1 | 2.1 | 0 | 0 |

| 226 | 227.5 | 1.5 | 0.21 | 4.7 | 0 | 0 |

| Interval | Length | Copper | Silver | Cobalt | Gold |

| From | To | (Cu) | (Ag) | (Co) | (Au) |

Drill Hole | (m) | (m) | (m) | (%) | (g/ton) | (%) | (g/ton) |

CLK2-06-06 | 20.5 | 20.8 | 0.3 | 1.21 | 1.2 | 0.01 | 0.1 |

| 88 | 89 | 1 | 0.11 | 0.3 | 0 | 0 |

| 90 | 93.6 | 3.6 | 0.24 | 0.57 | 0 | 0 |

| 118.5 | 121.5 | 3 | 0.29 | 0.3 | 0 | 0 |

| 123 | 124.5 | 1.5 | 0.1 | 0.2 | 0 | 0 |

| 211 | 212 | 1 | 1.04 | 3.7 | 0 | 0 |

| 269 | 270.5 | 1.5 | 0.14 | 0.4 | 0.01 | 0 |

| 290 | 299 | 9 | 0.11 | 0.63 | 0.01 | 0 |

| 304.4 | 309 | 4.6 | 0.29 | 1.46 | 0.02 | 0.02 |

| 323.5 | 331 | 7.5 | 0.15 | 0.64 | 0 | 0 |

| 338.5 | 340 | 1.5 | 0.24 | 2.8 | 0.01 | 0 |

| 343 | 349 | 6 | 0.24 | 1.35 | 0.01 | 0 |

| 356.5 | 359.5 | 3 | 0.39 | 1.45 | 0.02 | 0 |

| 361 | 362.5 | 1.5 | 0.1 | 0.3 | 0 | 0 |

| 368.5 | 371.5 | 3 | 0.14 | 0.6 | 0.01 | 0 |

| 374.5 | 377 | 2.5 | 0.17 | 1.8 | 0.02 | 0 |

| 397.2 | 402.3 | 5.1 | 0.34 | 0.68 | 0.01 | 0 |

| 407.5 | 425 | 17.5 | 0.28 | 5.29 | 0.01 | 0.03 |

| 407.5 | 411.5 | 4 | 0.64 | 5.89 | 0.01 | 0.05 |

27

| Interval | Length | Copper | Silver | Cobalt | Gold | Bismuth |

| From | To | (Cu) | (Ag) | (Co) | (Au) | (Bi) |

Drill Hole | (m) | (m) | (m) | (%) | (g/ton) | (%) | (g/ton) | (%) |

CLK2-06-07 | 5 | 12.5 | 7.5 | 0.13 | 1 | 0.01 | 0 | |

| 24.5 | 25.5 | 1 | 1 | 5.6 | 0.04 | 0.2 | 0.11 |

| 34 | 45.3 | 11.3 | 0.2 | 1.8 | 0.01 | 0.01 | |

| 51.5 | 52.5 | 1 | 0.26 | 0.9 | 0.01 | 0 | |

| 69.5 | 72.5 | 3 | 0.27 | 1.5 | 0 | 0 | |

| 86 | 103.4 | 17.4 | 0.41 | 2.7 | 0.01 | 0.01 | |

| 94.1 | 94.6 | 0.5 | 3.13 | 16.8 | 0.01 | 0.1 | 0.19 |

| 104.4 | 108.9 | 4.5 | 0.15 | 1.1 | 0.02 | 0.03 | |

| 138 | 139 | 1 | 0.1 | 0.9 | 0.05 | 0 | |

| 168.4 | 170.9 | 2.5 | 0.18 | 2.5 | 0.03 | 0 | |

| 191 | 196.5 | 5.5 | 0.18 | 4.8 | 0.01 | 0.05 | |

| 202 | 203 | 1 | 0.11 | 2.9 | 0.02 | 0 | |

| 242 | 245 | 3 | 0.17 | 7.7 | 0 | 0 | |

| 266 | 267.5 | 1.5 | 0.11 | 0.8 | 0 | 0 | |

| 323 | 326 | 3 | 0.27 | 1.9 | 0.01 | 0.1 | |

| 347 | 348.5 | 1.5 | 0.12 | 2.3 | 0.03 | 0 | |

| 377 | 378.5 | 1.5 | 0.14 | 2.9 | 0 | 0 | |

| Interval | Length | Copper | Silver | Cobalt | Gold |

| From | To | (Cu) | (Ag) | (Co) | (Au) |

Drill Hole | (m) | (m) | (m) | (%) | (g/ton) | (%) | (g/ton) |

CLK2-06-10 | 5.5 | 6.5 | 1 | 0.14 | 1.6 | 0 | 0 |

| 17 | 54.5 | 37.5 | 0.2 | 1.26 | 0.01 | 0 |

| 30.5 | 33.5 | 3 | 0.73 | 1.8 | 0.01 | 0 |

| 71 | 83 | 12 | 0.18 | 1.53 | 0.03 | 0.06 |

| 71 | 74 | 3 | 0.59 | 2.85 | 0.03 | 0.25 |

| 93.5 | 140 | 46.5 | 0.22 | 0.94 | 0.03 | 0.01 |

| 93.5 | 125 | 31.5 | 0.27 | 1.15 | 0.02 | 0 |

| 99.5 | 119 | 19.5 | 0.33 | 1.28 | 0.02 | 0.01 |

| 128 | 140 | 12 | 0.12 | 0.5 | 0.02 | 0.03 |

| 150.5 | 155 | 4.5 | 0.25 | 0.47 | 0 | 0 |

| 162.5 | 182 | 19.5 | 0.22 | 0.67 | 0.01 | 0 |

| 162.5 | 170 | 7.5 | 0.35 | 0.98 | 0.01 | 0 |

| 192.5 | 195.5 | 3 | 0.16 | 0.75 | 0 | 0 |

| 203 | 204.5 | 1.5 | 0.11 | 0.7 | 0.01 | 0 |

| 218 | 219.5 | 1.5 | 0.21 | 0.7 | 0 | 0 |

| 287 | 288 | 1 | 0.18 | 2.2 | 0.03 | 0 |

| 320 | 324 | 4 | 0.02 | 0.79 | 0.03 | 0 |

| 381 | 382.5 | 1.5 | 0.51 | 8.9 | 0.03 | 0.1 |

| 393 | 394.5 | 1.5 | 0.09 | 1 | 0.02 | 0 |

| 465 | 473.7 | 8.7 | 0.11 | 3.09 | 0.04 | 0 |

| 503 | 506 | 3 | 0.12 | 0.55 | 0 | 0.2 |

| 510.5 | 516.5 | 6 | 0.16 | 1.23 | 0 | 0.1 |

Note: True thickness has not been calculated for these holes.

28

The K2 mineralized breccia is open for drilling along strike for a presently undetermined length, and within a 200 to 300 meter wide horizon. This is the second large poly-metallic IOCG target zone that has emerged within the Eldorado & Contact Lake districts that are characterized by two to six different metals within a target horizon. We intend to conduct further drilling on the K2 Discovery Zone in 2007, to determine its potential as a significant poly-metallic bulk tonnage prospect.

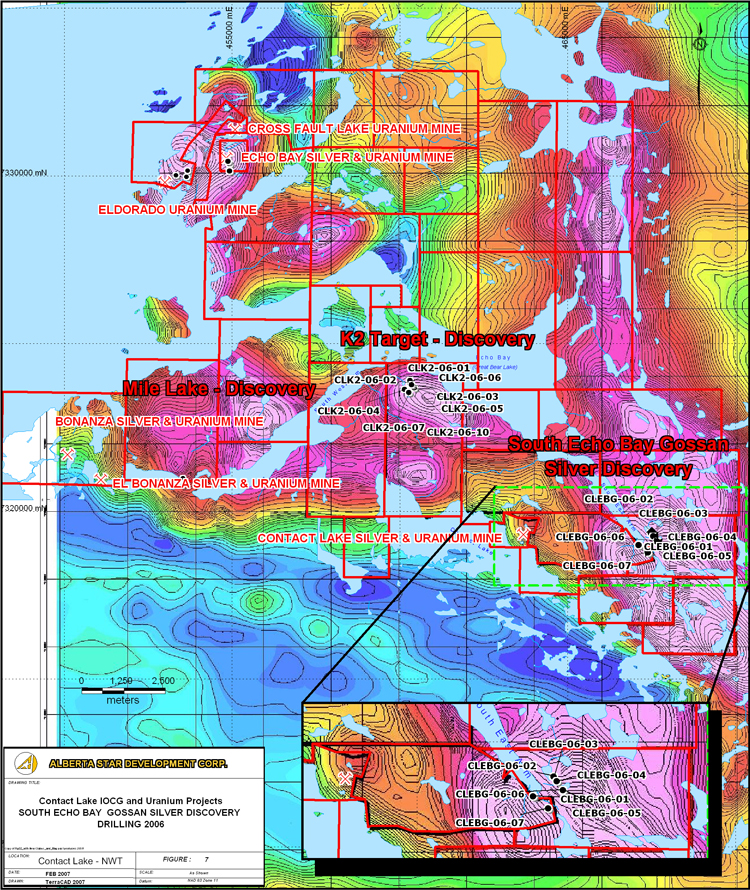

In March 2007, we reported that we received the assay results from an additional seven drill holes from the summer/fall drill program at the South Echo Bay gossan ("Echo Bay Program") and from the Mag Hill VTEM anomaly ("Mag Hill Program") (figure 7). The Echo Bay and Mag Hill drill programs were designed to evaluate the silver, uranium and poly-metallic potential of this newly emerging mineralized region. The region is situated at the southern end of the southeast arm of Echo Bay and is viewed by us as having the potential to host bulk tonnage mineralization. The drill results were successful in intercepting significant silver mineralization beneath a large pyretic gossan. The silver is contained in pyrite, chalcopyrite veins and disseminations within a kilometer scale phyllic and potassic alteration halo. The alteration zone is peripheral to an extensive zone of intense magnetite-actinolite-apatite alteration that was intersected in all holes drilled in the Mag Hill Program. The South Echo Bay gossan silver-uranium target is located on our property, on the southern end of Echo Bay and 3 km due east of the Contact Lake Silver & Uranium mine.

We intersected 133 meters (439 feet) of 8.78 g/ton silver in hole number six in the Echo Bay silver discovery in Canada's Northwest Territories. This interval also includes 13.5 meters (44.6 feet) of 17.73 g/t silver, 6.0 meters (19.8 feet) of 22.13 g/t silver, 7.5 meters (24.7 feet) of 20.54 g/t within this interval. Hole number four intersected 37.5 meters (123.7 feet) of 20.69 g/t silver including a 3.0 meter high grade zone of 195.7 g/ton silver (6.29 oz/t). A further 1.5 meters (44.6 feet) of 51.1 g/t (1.64 oz/t) silver were intersected in hole number five.

We believe that the results of the drill holes from the Echo Bay Program and the drill holes from the Mag Hill Program confirms the extensive nature of hydrothermal alteration and mineralization in the Port Radium-Echo Bay-Contact Lake poly-metallic belt. All drill cores from the Echo Bay Program and the Mag Hill Program were prepared, bagged and sealed by our supervised personnel and were transported by plane to Acme Analytical Laboratories Ltd. ("ACME") in Yellowknife, NT where they were crushed and pulped, and then transported to ACME's main laboratories in Vancouver, British Columbia for assaying. ACME is a fully registered analytical lab compliant with the International Standards Organization (ISO) for quality assurance.

Highlights from significant mineralized down-hole intervals from the Echo Bay Program reporting significant high grade silver values, include drill hole number:

- CLEBG-06-04 intersected 37.5 meters (123.75 Feet) of 20.69 g/ton silver (.65 oz/t).

- Including 12 meters (39.6 feet) of 55.7 g/ton silver (1.79 oz/t).

- Including 3.0 meters (9.9 feet) of 195.7 g/ton silver.(6.29 oz/t).

29

- CLEBG-06-05 intersected 13.5 meters (44.5 feet) of 11.53 g/ton silver (0.15 ounces/ton).

- Including 1.50 meters (4.95 feet) of 51.10 g/t silver (1.64 oz/t).

- Including 28.5 meters (94 feet) of 10.31 g/t silver.

- Including 10.5 meters (34.6 feet) of 17.14 g/t silver.

- CLEBG-06-06 intersected 133.0 meters (439 feet) of 8.78 g/t silver. (0.28 ounces/ton).

- Including 9.0 meters of 21.32 g/ton silver (0.67 oz/t).

- Including 6.0 meters of 22.13 g/ton silver (0.69 oz/t).

- Including 7.5 meters of 20.54 g/ton silver (0.64 oz/t).

The Contact Lake & Eldorado district is being targeted by us for silver and uranium and poly-metallic exploration. The mineralization occurs within the same suite of volcano-plutonic rocks that host other poly-metallic zones in the Eldorado & Contact lake mineral belt, including the former El Bonanza Silver (Ag) and the Eldorado Uranium (U-Ag-Cu-Co-Ni-Bi) mines. Veins of the former Eldorado and Echo Bay mines are situated in metasedimentary rocks, near the margins and apices of porphyry stocks, between underlying batholiths and overlying volcanic rocks. The cores and intermediate zones of the hydrothermal systems that are responsible for these veins are possible loci for larger, more typical, bulk-mineable IOCG-type deposits. Additional drill results are pending and will be released when we receive them.

The accompanying table gives a summary of drilling highlights and assay results returned from seven holes reporting from the south Echo Bay Program at Contact Lake, NT.

30

SOUTH ECHO BAY GOSSAN DRILL SUMMARY (Holes 2, 4, 5, and 6)

DRILL HOLE RESULTS |

| Interval | Length | Copper | Silver |

| From | To | (Cu) | (Ag) |

Drill Hole | (m) | (m) | (m) | (%) | (g/ton) |

CLEBG-06-02 | 66.20 | 69.20 | 3.00 | 0.02 | 7.65 |

CLEBG-06-04 | 57.00 | 94.50 | 37.5 | 0.04 | 20.69 |

81.00 | 93.0 | 12.0 | 0.01 | 55.70 |

90.00 | 93.00 | 3.00 | 0.02 | 195.70 |

CLEBG-06-05 | 9.00 | 22.5 | 13.5 | 0.12 | 11.53 |

18.0 | 19.5 | 1.5 | 0.58 | 51.10 |

49.5 | 78.0 | 28.5 | 0.04 | 10.31 |

55.5 | 66.0 | 10.5 | 0.04 | 17.14 |

93.0 | 99.0 | 6.0 | 0.01 | 9.83 |

135.0 | 139.5 | 4.5 | 0.04 | 5.2 |

173.0 | 177.5 | 4.5 | 0.02 | 7.0 |

CLEBG-06-06 | 19.5 | 20.0 | 0.5 | 0.73 | 0.40 |

19.5 | 20.5 | 1.0 | 0.42 | 0.30 |

28.0 | 29.5 | 1.5 | 0.04 | 3.60 |

34.0 | 35.5 | 1.5 | 0.04 | 3.10 |

37.0 | 40.0 | 3.0 | 0.35 | 1.75 |

47.5 | 180.5 | 133.0 | 0.02 | 8.78 |

90.5 | 99.5 | 9.0 | 0.02 | 21.32 |

90.5 | 104.5 | 13.5 | 0.01 | 17.73 |

126.5 | 132.5 | 6.0 | 0.02 | 22.13 |

144.5 | 152.0 | 7.5 | 0.01 | 20.54 |

204.5 | 212.0 | 7.5 | 0.01 | 4.46 |

298.0 | 300.5 | 2.5 | 0.27 | 0.48 |

No significant interval in drill holes number CLEBG-06-01, CLEBG-06-03, and CLEBG-06-07.

Note: True thickness has not been calculated for these holes.

31

32

33

34

35

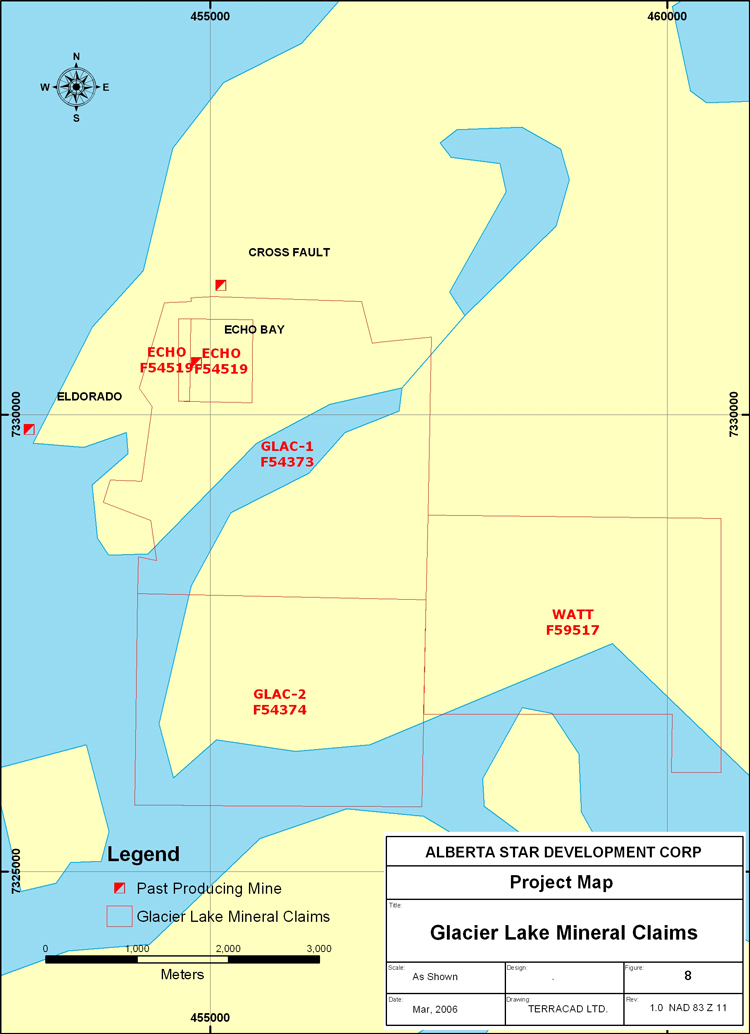

2. Port Radium - Glacier Lake Mineral Claims, NT

During the year ended November 30, 2005, we acquired a 100% undivided right, title and interest, subject to a 2% NSR, in four mineral claims, totalling 2,424.23 ha (5,987.85 acres) and located one half km southeast of Port Radium on Great Bear Lake, NT (figure 8), for a cash payments of $30,000 (paid) and the issuance of 360,000 of our common shares (issued and valued at $72,000). We may purchase one-half of the NSR for a one-time payment of $1,000,000.

The property contains a fully operational all-seasons airstrip and base camp, situated at Contact Lake. The Echo Bay claim (produced 23,779,178 ounces of silver) and the Port Radium - Eldorado claim (produced 15 million pounds of uranium and 8 million ounces of silver) are situated on our property. The Port Radium uranium belt was formerly one of Canada's principal producers of Pitchblende uranium in the 1930s and 1940s.

Our expenditures related to the Port Radium - Glacier Lake Mineral Claims can be summarized as follows:

| | Cumulative

amounts from

inception to

30 November

2006

$ | For the year ended November 30 |

2006

$ | 2005

$ | 2004

$ |

| |

Operating expenses | | | | | | | | |

Camp and field costs | | 320,762 | | 320,762 | | - | | - |

Consulting fees | | 27,477 | | 27,477 | | - | | - |

Geology and engineering | | 22,896 | | 22,896 | | - | | - |

Surveying | | 17,309 | | 17,309 | | - | | - |

Transportation | | 866,963 | | 866,963 | | - | | - |

Travel | | 6,274 | | 6,274 | | - | | - |

| | | | | | | | | |

| | | 1,261,681 | | 1,261,681 | | - | | - |

| | | | | | | | | |

Acquisition costs | | 102,000 | | - | | 102,000 | | - |

| | | | | | | | | |

Recoveries | | (417,099) | | (417,099) | | - | | - |

| | | | | | | | | |

| | | 946,582 | | 844,582 | | 102,000 | | - |

In May 2006, we received formal approval from the Sahtu Land and Water Board for a second 25,000 meter "Class A-5 year drill permit at the Eldorado Iron oxide, copper, gold, silver, and uranium Project. We have completed all of the requirements for our drill permitting which included the finalization of a comprehensive First Nations Traditional Educational Knowledge Report ("TEK"). The TEK report was completed in collaboration with the Deline Land Corporation and was prepared with detailed input from many of the Sahtu Dene Elders from the community of Deline, NT.

36

In August 2006, we successfully completed a formal legal and land survey on our Glacier Lake silver and uranium properties. We formally submitted our legal plan of survey and application for lease, and notice of lease for the Glacier Lake mineral properties to the Government of Canada Mine Recorders office. The survey to lease was performed in accordance with Canadian Mining Regulations by Sub-Arctic Surveys Ltd. of Yellowknife, NT. The total lease claim survey area consists of 2,424.23 hectares (5,987.85 acres) and includes our Echo Bay Gossan and the Echo Bay Mine site.

In November 2006, we completed a preliminary sampling of the uranium-silver tailings and waste dumps located at the Company's Eldorado IOCG and uranium project. The tailings are from the former producing Eldorado uranium mine (1933-1960) and Echo Bay Uranium, silver, copper mines (1962-1982). These mines are located in our project area.