UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THESECURITIES EXCHANGE ACT OF 1934 |

OR

| R | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2012 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER 000-49751

Catalyst Paper Corporation

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

2nd Floor, 3600 Lysander Lane

Richmond

British Columbia, Canada V7B 1C3

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

None.

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Common Shares.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None.

The number of outstanding shares of each of the issuer’s classes of capital or common stock as of

December 31, 2012 was:

14,527,571

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes£ NoR

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes£ NoR

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YesR No£

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes£ No£

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer £ | Accelerated filer£ | Non-accelerated filerR |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP R | International Financial Reporting Standards as issued | Other£ |

| | by the International Accounting Standards Board £ | |

Indicate by check which financial statement item the registrant has elected to follow. Item 17R Item 18£

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes£ NoR

TABLE OF CONTENTS

| PART I |

| |

| ITEM 1. | Identity of Directors, Senior Managements, Advisors and Auditors | 1 |

| ITEM 2. | Offer Statistics and Expected Timetable | 1 |

| ITEM 3. | Key Information | 1 |

| | Cautionary Statement with Regard to Forward-Looking Statements | 1 |

| | A. | Selected Financial Data | 3 |

| | | Exchange Rate Data | 6 |

| | D. | Risk Factors | 7 |

| ITEM 4. | Information on the Corporation | 15 |

| | A. | History and Development of the Corporation | 15 |

| | B. | Business Overview | 21 |

| | | Competition | 23 |

| | | Fibre Supply | 24 |

| | | Competitive Strengths | 24 |

| | | Business Strategy | 25 |

| | C. | Organizational Structure | 26 |

| | D. | Property, Plant and Equipment | 26 |

| | | Paper | 26 |

| | | Pulp | 28 |

| | | Properties | 29 |

| | | Environment | 29 |

| | | Social Responsibility | 31 |

| ITEM 4A. | Unresolved Staff Comments | 32 |

| ITEM 5. | Operating and Financial Review and Prospects | 32 |

| | A. | Operating Results | 32 |

| | | · | Segmented Results – Annual | 39 |

| | | · | Financial Condition | 46 |

| | | · | Outlook | 47 |

| | Critical Accounting Policies and Estimates | 50 |

| | Changes in Accounting Policies | 55 |

| | Impact of Accounting Pronouncements Affecting Future Periods | 55 |

| | B. | Liquidity and Capital Resources | 55 |

| | C. | Research and Development, Patents and Licences | 59 |

| | D. | Trend Information | 59 |

| | E. | Off Balance Sheet Arrangements | 59 |

| | F. | Tabular Disclosure of Contractual Obligations | 60 |

| ITEM 6. | Directors, Senior Management and Employees | 60 |

| | A. | Directors and Senior Management | 60 |

| | B. | Compensation | 62 |

| | | Compensation of Directors | 62 |

| | | Executive Compensation Strategy | 65 |

| | C. | Board Practices | 69 |

| | D. | Employees | 71 |

| | E. | Share Ownership | 71 |

| ITEM 7. | Major Shareholders and Related Party Transactions | 72 |

| | A. | Major Shareholders | 72 |

| | B. | Related Party Transactions | 72 |

| PART I… continued |

| |

| ITEM 8. | Consolidated Statements and Other Financial Information | 72 |

| | A. | Consolidated Statements and other Financial Information | 72 |

| | B. | Significant Changes | 73 |

| ITEM 9. | The Offer and Listing | 73 |

| | A. | Offer and Listing Details | 73 |

| | B. | Plan of Distribution | 74 |

| | C. | Markets | 74 |

| ITEM 10. | Additional Information | 74 |

| | B. | Memorandum and Articles of Association | 74 |

| | C. | Material Contracts | 75 |

| | D. | Exchange Controls | 76 |

| | E. | Taxation | 77 |

| | H. | Documents on Display | 80 |

| ITEM 11. | Quantitative and Qualitative Disclosures about Market Risk | 80 |

| ITEM 12. | Description of Securities Other than Equities Securities | 83 |

| | | |

| PART II |

| |

| ITEM 13. | Defaults, Dividend Arrearages and Delinquencies | 83 |

| | A. | Indebtedness | 83 |

| | B. | Dividends | 83 |

| ITEM 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | 83 |

| ITEM 15. | Controls and Procedures | 84 |

| | A. | Disclosure Controls and Procedures | 84 |

| | B. | Internal Control over Financial Reporting | 84 |

| | C. | Report of the Independent Public Accounting Firm | 84 |

| | D. | Changes in Internal Control over Financial Reporting | 84 |

| ITEM 16A. | Audit Committee Financial Expert | 84 |

| ITEM 16B. | Code of Ethics | 84 |

| ITEM 16C. | Principal Accountant Fees and Services | 85 |

| | | |

| PART III |

| |

| ITEM 17. | Financial Statements | 86 |

| ITEM 18. | Financial Statements | 86 |

| ITEM 19. | Exhibits | 86 |

PART I

Unless otherwise specified, “Catalyst”, the “company”, “we”, “us”, “our” and similar terms refer to Catalyst Paper Corporation and its subsidiaries and affiliates. Unless otherwise indicated, all dollar amounts are expressed in Canadian dollars, references to “$” and “dollars” are to Canadian dollars and references to “U.S.$” and “U.S. dollars” are to United States dollars. As used in this annual report references to “tonnes” means metric tonnes, which is equivalent to 1,000 kilograms or 2,204 pounds (1.1023 tons) and the term “ton”, or the symbol “ST”, refers to a short ton, an imperial unit of measurement equal to 0.9072 metric tonnes.

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT, ADVISERS AND AUDITORS |

| A. | Directors and Senior Management |

Information not required for an annual report.

Information not required for an annual report.

Information not required for an annual report.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Information not required for an annual report.

Cautionary Statement with Regard to Forward-Looking Statements

Certain statements and information in this annual report are not based on historical facts and constitute forward-looking statements or forward looking information within the meaning of Canadian securities laws and the U.S. Private Securities Litigation Reform Act of 1995 (“forward looking statements”), including but not limited to, statements about our strategy, plans, future operating performance, contingent liabilities and outlook.

Forward-looking statements:

| · | are statements that address or discuss activities, events or developments that we expect or anticipate may occur in the future; |

| · | can be identified by the use of words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “likely”, “predicts”, “estimates”, “forecasts”, and similar words or phrases or the negative of such words or phrases; |

| · | reflect our current beliefs, intentions or expectations based on certain assumptions and estimates, including those identified below, which could prove to be significantly incorrect: |

| o | our ability to develop, manufacture and sell new products and services that meet the needs of our customers and gain commercial acceptance; |

| o | our ability to continue to sell our products and services in the expected quantities at the expected prices and expected times; |

| o | our ability to successfully obtain cost savings from our cost reduction initiatives; |

| o | our ability to implement business strategies and pursue opportunities; |

| o | expected cost of goods sold; |

| o | expected component supply costs and constraints; and |

| o | expected foreign exchange and tax rates; |

| · | while considered reasonable by management, are inherently subject to known and unknown risks and uncertainties and other factors that could cause actual results or events to differ from historical or anticipated results or events. These risk factors and others are discussed in this annual report and in Management’s Discussion and Analysis for the financial year ended December 31, 2012, which may be found on SEDAR atwww.sedar.comand on EDGAR atwww.sec.gov. Certain of these risks are: |

| o | the impact of general economic conditions in the countries in which we do business; |

| o | conditions in the capital markets and our ability to obtain financing and refinance existing debt; |

| o | market conditions and demand for our products (including declines in advertising and circulation); |

| o | the implementation of trade restrictions in jurisdictions where our products are marketed; |

| o | fluctuations in foreign exchange or interest rates; |

| o | raw material prices (including wood fibre, chemicals and energy); |

| o | the effect of, or change in, environmental and other governmental regulations; |

| o | uncertainty relating to labour relations; |

| o | the availability of qualified personnel; |

| o | the availability of wood fibre |

| o | the effects of competition from domestic and foreign producers; |

| o | the risk of natural disaster and other factors many of which are beyond our control. |

As a result, no assurance can be given that any of the events or results anticipated by such forward looking statements will occur or, if they do occur, what benefit they will have on our operations or financial condition. Readers are cautioned not to place undue reliance on these forward-looking statements. We disclaim any intention or obligation to update or revise any forward looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Market and Industry Data and Forecast

This annual report includes market share and industry data and other statistical information and forecasts that we have obtained from independent industry publications, government publications, market research reports and other published independent sources. Some data are also based on our good faith estimates, which are derived from our internal surveys, as well as independent sources. RISI, Inc., an independent paper and forest products industry research firm (“RISI”), is the source of a considerable amount of the third party industry data and forecasts contained herein. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. However, we cannot and do not provide any assurance as to the accuracy or completeness of included information and do not guarantee the accuracy or completeness of such information.

Forecasts are particularly likely to be inaccurate, especially over long periods of time. Although we believe these sources to be reliable, we have not independently verified any of the data nor have we ascertained the underlying economic assumptions relied upon therein.

Presentation of Financial Information

Effective for the year ended December 31, 2009, we adopted U.S. generally accepted accounting principles (“U.S. GAAP”) for the presentation of our consolidated financial statements for Canadian and United States reporting requirements. Prior to 2009, we had presented our annual and interim consolidated financial statements in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”) with reconciliation in our annual consolidated financial statements to U.S. GAAP for material recognition, measurement and presentation differences.

In accordance with U.S. GAAP, an enterprise value was established for the company as of September 30, 2012, the end of the quarter following our emergence from protection under theCompanies’ Creditors Arrangement Act, under fresh start accounting. This enterprise value was determined with the assistance of an independent financial advisor. For a discussion of the valuation methods used to determine enterprise value and additional information on fresh start accounting, see note 6, Creditor protection proceedings related disclosures in our annual consolidated financial statements for the year ended December 31, 2012.

Companies’ Creditors Arrangement Act Proceedings

On January 31, 2012, Catalyst Paper Corporation and certain of its subsidiaries obtained an order from the Supreme Court of British Columbia under theCompanies’ Creditors Arrangement Act (“CCAA”) and subsequently received a recognition order from the United States court under Chapter 15 of the US Bankruptcy Code.

The company’s secured and unsecured creditors approved the company’s proposed plan of arrangement under the CCAA (“Plan”) at meetings held on June 25, 2012. The Plan was approved by the Canadian Court on June 28, 2012 under the CCAA process and by the United States Court on July 27, 2012 under the Chapter 15 process. The restructuring under the Plan completed on September 13, 2012. See Item 4.ACreditor Protection and Restructuring Process.

| A. | Selected Financial Data |

The following table sets forth consolidated historical financial and operating data for Catalyst Paper Corporation for the periods indicated. The financial statement data as of December 31 and September 30, 2012, and December 31, 2011, 2010 and 2009 and for the three months ended December 31 and nine months ended September 30, 2012, and the years ended December 31, 2011, 2010 and 2009 is derived from our audited consolidated financial statementsin our annual report. The financial data as of December 31, 2008 and for the year ended December 31, 2008 has been derived from our audited financial statements and related notes thereto and have been restated to be in accordance with U.S. GAAP. These financial statements are not included inthe annual report. This information should be read in conjunction with Operating and Financial Review and Prospects, which is included inthe annual report. The financial information has been derived from consolidated financial statements that have been prepared in accordance with U.S. GAAP. All information provided below is in millions of Canadian dollars, except information related to volume, information per share, and revenue per tonne.

| | | Predecessor 6 | | | Successor 6 | |

| | | Years ended December 31 | | | Nine months

ended

September 30 | | | Three months

ended

December 31 | |

| (In millions, except per share amounts) | | 2008 4 5 | | | 2009 4 5 | | | 2010 5 | | | 2011 5 | | | 2012 5 | | | 2012 5 | |

| Consolidated Statements of Earnings (Loss) Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales | | $ | 1,696.9 | | | $ | 1,077.7 | | | $ | 1,051.4 | | | $ | 1079.7 | | | $ | 797.7 | | | $ | 260.5 | |

| Operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

| Cost of sales, excluding depreciation and amortization | | | 1,456.5 | | | | 890.0 | | | | 930.1 | | | | 970.7 | | | | 718.0 | | | | 245.6 | |

| Depreciation and amortization | | | 159.8 | | | | 137.3 | | | | 109.7 | | | | 105.5 | | | | 23.4 | | | | 12.9 | |

| Selling, general and administrative | | | 46.9 | | | | 44.8 | | | | 43.4 | | | | 40.3 | | | | 26.2 | | | | 7.7 | |

| Restructuring and change-of-control | | | 30.1 | | | | 17.9 | | | | 25.3 | | | | 5.9 | | | | 5.3 | | | | – | |

| Impairment | | | 151.0 | | | | 17.4 | | | | 294.5 | | | | 661.8 | | | | – | | | | – | |

| | | | 1,844.3 | | | | 1,107.4 | | | | 1,403.0 | | | | 1,784.2 | | | | 772.9 | | | | 266.2 | |

| Operating earnings (loss) | | | (147.4 | ) | | | (29.7 | ) | | | (351.6 | ) | | | (704.5 | ) | | | 24.8 | | | | (5.7 | ) |

| Interest expense, net | | | (74.8 | ) | | | (69.1 | ) | | | (71.9 | ) | | | (73.2 | ) | | | (60.3 | ) | | | (11.6 | ) |

| Gain on cancellation of long-term debt | | | – | | | | 30.7 | | | | – | | | | – | | | | – | | | | – | |

| Foreign exchange gain (loss) on long-term debt | | | (82.2 | ) | | | 75.3 | | | | 27.6 | | | | (9.7 | ) | | | 24.0 | | | | (3.2 | ) |

| Other income (expense), net | | | (15.7 | ) | | | (28.6 | ) | | | (2.6 | ) | | | (2.1 | ) | | | (2.6 | ) | | | 0.1 | |

| Earnings (loss) before reorganization items and income taxes | | | (320.1 | ) | | | (21.4 | ) | | | (398.5 | ) | | | (789.5 | ) | | | (14.1 | ) | | | (20.4 | ) |

| Reorganization items, net | | | – | | | | – | | | | – | | | | – | | | | 666.9 | | | | (3.2 | ) |

| Income (loss) before income taxes | | | (320.1 | ) | | | (21.4 | ) | | | (398.5 | ) | | | (789.5 | ) | | | 652.8 | | | | (23.6 | ) |

| Income tax expense (recovery) | | | (90.7 | ) | | | (23.1 | ) | | | (19.8 | ) | | | (8.4 | ) | | | (1.1 | ) | | | 0.2 | |

| Earnings (loss) from continuing operations | | | (229.4 | ) | | | 1.7 | | | | (378.7 | ) | | | (781.1 | ) | | | 653.9 | | | | (23.8 | ) |

| Gain (loss) from discontinued operations net of tax | | | 10.4 | | | | (7.3 | ) | | | (19.5 | ) | | | (195.5 | ) | | | (3.6 | ) | | | (12.9 | ) |

| Net earnings (loss) | | | (219.0 | ) | | | (5.6 | ) | | | (398.2 | ) | | | (976.6 | ) | | | 650.3 | | | | (36.7 | ) |

| Net (earnings) loss attributable to non-controlling interest | | | (0.8 | ) | | | 1.2 | | | | 1.3 | | | | 2.6 | | | | (31.9 | ) | | | 1.5 | |

| Net earnings (loss) attributable to the Company | | $ | (219.8 | ) | | $ | (4.4 | ) | | $ | (396.9 | ) | | $ | (974.0 | ) | | $ | 618.4 | | | $ | (35.2 | ) |

| Basic and diluted earnings (loss) per share | | | | | | | | | | | | | | | | | | | | | | | | |

| - continuing operations | | $ | (0.67 | ) | | $ | 0.01 | | | $ | (0.99 | ) | | $ | (2.04 | ) | | $ | 1.63 | | | $ | (1.55 | ) |

| - discontinued operations | | | 0.03 | | | | (0.02 | ) | | | (0.05 | ) | | | (0.51 | ) | | | (0.01 | ) | | | (0.89 | ) |

| Weighted average common shares outstanding (in millions) | | | 336.1 | | | | 381.8 | | | | 381.8 | | | | 381.9 | | | | 381.9 | | | | 14.4 | |

| | | Predecessor 6 | | | Successor 6 | |

| | | As at December 31 | | | As at

September

30 | | | As at

December

31 | |

| (In millions) | | 20085 | | | 20095 | | | 20105 | | | 20115 | | | 20125 | | | 20125 | |

| Consolidated Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Working capital1 | | $ | 201.5 | | | $ | 214.8 | | | $ | 212.0 | | | $ | 152.4 | | | $ | 203.7 | | | $ | 151.4 | |

| Property, plant and equipment | | | 1,854.4 | | | | 1,664.7 | | | | 1,285.6 | | | | 386.3 | | | | 614.1 | | | | 611.6 | |

| Total assets | | | 2,390.3 | | | | 2,090.8 | | | | 1,696.2 | | | | 737.6 | | | | 1,040.1 | | | | 978.8 | |

| Current portion of long-term debt | | | 75.8 | | | | 1.0 | | | | 27.0 | | | | 466.8 | | | | 6.7 | | | | 6.6 | |

| Total debt1 | | | 969.9 | | | | 775.6 | | | | 810.9 | | | | 842.3 | | | | 465.6 | | | | 428.6 | |

| Shareholders’ equity (deficiency) | | | 822.5 | | | | 813.6 | | | | 423.5 | | | | (593.6 | ) | | | 144.9 | | | | 116.3 | |

| | | Predecessor 6 | | | Successor 6 | |

| | | Years ended December 31 | | | Nine

months

ended

September

30 | | | Three

months

ended

December

31 | |

| (In millions) | | 2008 4 5 | | | 2009 4 5 | | | 2010 5 | | | 2011 5 | | | 2012 5 | | | 2012 5 | |

| Consolidated Statements of Cash Flows Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash flows provided (used) by operations | | $ | 78.1 | | | $ | 103.6 | | | $ | (44.1 | ) | | $ | (71.5 | ) | | $ | (44.0 | ) | | $ | 52.1 | |

| Cash flows used by investing activities | | | (205.3 | ) | | | (2.9 | ) | | | (4.5 | ) | | | (17.7 | ) | | | (3.4 | ) | | | (6.2 | ) |

| Cash flows provided (used) by financing activities | | | 132.2 | | | | (22.6 | ) | | | 60.9 | | | | 18.9 | | | | 34.9 | | | | (40.0 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions , except per tonne) | | | | | | | | | | | | | | | | | | | | | | | | |

| Other Financial Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted EBITDA2 | | $ | 163.4 | | | $ | 125.0 | | | $ | 52.6 | | | $ | 62.8 | | | $ | 48.2 | | | $ | 7.2 | |

| Adjusted EBITDA margin2,3 | | | 9.6 | % | | | 11.6 | % | | | 5.0 | % | | | 5.8 | % | | | 6.0 | % | | | 2.8 | % |

| Additions to property, plant and equipment | | | 41.9 | | | | 11.5 | | | | 11.2 | | | | 19.7 | | | | 12.2 | | | | 10.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales (000 tonnes) | | | | | | | | | | | | | | | | | | | | | | | | |

| Specialty printing papers | | | 1,081 | | | | 892 | | | | 830 | | | | 838 | | | | 605 | | | | 207 | |

| Newsprint | | | 388 | | | | 261 | | | | 236 | | | | 205 | | | | 198 | | | | 66 | |

| Pulp | | | 507 | | | | 110 | | | | 277 | | | | 308 | | | | 251 | | | | 74 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Sales Revenue ($ per tonne) | | | | | | | | | | | | | | | | | | | | | | | | |

| Specialty printing papers | | | 936 | | | | 929 | | | | 812 | | | | 824 | | | | 833 | | | | 828 | |

| Newsprint | | | 762 | | | | 683 | | | | 644 | | | | 689 | | | | 678 | | | | 666 | |

| Pulp | | | 767 | | | | 641 | | | | 813 | | | | 804 | | | | 637 | | | | 604 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Production (000 tonnes) | | | | | | | | | | | | | | | | | | | | | | | | |

| Specialty printing papers | | | 1,060 | | | | 886 | | | | 836 | | | | 842 | | | | 613 | | | | 193 | |

| Newsprint | | | 377 | | | | 270 | | | | 225 | | | | 208 | | | | 200 | | | | 65 | |

| Pulp | | | 503 | | | | 87 | | | | 273 | | | | 315 | | | | 243 | | | | 75 | |

Notes to Selected Consolidated Financial Information

| 1 | Current portion of long term debt is included in total debt and excluded from working capital. |

| 2 | Adjusted EBITDA is a non-GAAP measure. Adjusted EBITDA does not have a standardized meaning. Adjusted EBITDA as set forth above represents net earnings (loss) before net interest expense, income taxes, depreciation and amortization and impairment, foreign exchange gain (loss) on long-term debt, loss on repayment of long-term debt, other income (expense), and non-controlling interests. We focus on adjusted EBITDA as we believe this measure enables comparison of our results between periods without regard to debt service, income taxes and capital expenditure requirements. Adjusted EBITDA is also useful in analyzing our ability to comply with our debt covenants. As such, we believe it would be useful for investors and other users to be aware of this measure so they can better assess our operating performance. Adjusted EBITDA should not be considered by an investor as an alternative to net income, an indicator of our financial performance or an alternative to cash flows as a measure of liquidity. As there are no generally accepted methods for calculating adjusted EBITDA, this measure as calculated by us might not be comparable to similarly titled measures reported by other companies. |

| 3 | AdjustedEBITDA margin is defined as adjusted EBITDA as a percentage of sales. |

| 4 | Refer to “Changes in accounting policies” under Item 5.Operating and Financial Review and Prospectsfor a discussion of the changes in the Corporation’s policy with respect to classification of gains and losses on certain of the company’s derivative financial instruments and translation of foreign currency-denominated working capital balances effective January 1, 2010. Prior period comparative information has been restated. |

| 5 | The Snowflake mill was permanently closed on September 30, 2012 and the sale of the mill was completed on January 30, 2013; comparative periods have been restated for the classification of the Snowflake mill’s results as discontinued operations. |

| 6 | The company’s reorganization pursuant to the CCAA proceedings and the application of fresh start accounting materially changed the carrying amounts and classifications reported in the financial statements. Accordingly, financial results for periods prior to September 30, 2012 are not comparable to results for periods subsequent to September 30, 2012. References to Successor or Successor company refer to the company on or after September 30, 2012 and references to Predecessor or Predecessor company refer to the company prior to September 30, 2012. |

Wehave provided below a reconciliation of adjusted EBITDA to net earnings (loss) attributable to the Company, which we believe is the most directly comparable U.S. GAAP measure.

| (In millions of dollars) | | 2008 1 | | | 2009 1 | | | 2010 | | | 2011 | | | 2012 | |

| Net earnings (loss) attributable to the Company | | $ | (219.8 | ) | | $ | (4.4 | ) | | $ | (396.9 | ) | | $ | (974.0 | ) | | $ | 583.2 | |

| Net earnings (loss) attributable to non-controlling interest | | | 0.8 | | | | (1.2 | ) | | | (1.3 | ) | | | (2.6 | ) | | | 30.4 | |

| Net earnings (loss) | | | (219.0 | ) | | | (5.6 | ) | | | (398.2 | ) | | | (976.6 | ) | | | 613.6 | |

| Depreciation and amortization | | | 159.8 | | | | 137.3 | | | | 109.7 | | | | 105.5 | | | | 36.3 | |

| Impairment | | | 151.0 | | | | 17.4 | | | | 294.5 | | | | 661.8 | | | | – | |

| Gain on cancellation of long-term debt | | | – | | | | (30.7 | ) | | | (0.6 | ) | | | – | | | | – | |

| Foreign exchange (gain) loss on long-term debt | | | 82.2 | | | | (75.3 | ) | | | (27.6 | ) | | | 9.7 | | | | (20.8 | ) |

| Loss on Powell River fire | | | – | | | | – | | | | – | | | | 2.4 | | | | – | |

| Other (income) expense, net | | | 15.7 | | | | 28.6 | | | | 3.2 | | | | (0.3 | ) | | | 2.5 | |

| Interest expense, net | | | 74.8 | | | | 69.1 | | | | 71.9 | | | | 73.2 | | | | 71.9 | |

| Income tax recovery | | | (90.7 | ) | | | (23.1 | ) | | | (19.8 | ) | | | (8.4 | ) | | | (0.9 | ) |

| Reorganization items, net | | | – | | | | – | | | | – | | | | – | | | | (663.7 | ) |

| (Earnings) loss from discontinued operations net of tax | | | (10.4 | ) | | | 7.3 | | | | 19.5 | | | | 195.5 | | | | 16.5 | |

| | | | | | | | | | | | | | | | | | | | | |

| Adjusted EBITDA2 | | $ | 163.4 | | | $ | 125.0 | | | $ | 52.6 | | | $ | 62.8 | | | $ | 55.4 | |

| 1 | Refer to “Changes in accounting policies” under Item 5.Operating and Financial Review and Prospectsfor a discussion of the changes in the company’s policy with respect to classification of gains and losses on certain of the company’s derivative financial instruments and translation of foreign currency-denominated working capital balances effective January 1, 2010. Prior period comparative information has been restated. |

| 2 | Adjusted EBITDA is a non-GAAP measure. Adjusted EBITDA does not have a standardized meaning. Adjusted EBITDA as set forth above represents net earnings (loss) before net interest expense, income taxes, depreciation and amortization and impairment, foreign exchange gain (loss) on long-term debt, loss on repayment of long-term debt, other income (expense), and non-controlling interests. We focus on adjusted EBITDA as we believe this measure enables comparison of our results between periods without regard to debt service, income taxes and capital expenditure requirements. Adjusted EBITDA is also useful in analyzing our ability to comply with our debt covenants. As such, we believe it would be useful for investors and other users to be aware of this measure so they can better assess our operating performance. Adjusted EBITDA should not be considered by an investor as an alternative to net income, an indicator of our financial performance or an alternative to cash flows as a measure of liquidity. As there are no generally accepted methods for calculating adjusted EBITDA, this measure as calculated by us might not be comparable to similarly titled measures reported by other companies. |

Exchange Rate Data

Bank of Canada

The following table sets forth certain exchange rates based upon the noon rate as quoted by the Bank of Canada. Such rates are set forth as, for the period indicated, U.S. dollars per Canadian $1.00. On March 14, 2013 the noon rate was 0.9746 U.S. dollars per Canadian $1.00.

| | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | |

| | | | | | | | | | | | | | | | |

| Low | | | 0.7711 | | | | 0.7692 | | | | 0.9278 | | | | 0.9430 | | | | 0.9599 | |

| High | | | 1.0289 | | | | 0.9716 | | | | 1.0054 | | | | 1.0583 | | | | 1.0299 | |

| Period-end | | | 0.8166 | | | | 0.9555 | | | | 1.0054 | | | | 0.9833 | | | | 1.0051 | |

| Average rate1 | | | 0.9381 | | | | 0.8757 | | | | 0.9710 | | | | 1.0110 | | | | 1.0004 | |

| | | 2012 | | | 2013 | |

| | | September | | | October | | | November | | | December | | | January | | | February | |

| Low | | | 1.0099 | | | | 0.9996 | | | | 0.9972 | | | | 1.0048 | | | | 0.9923 | | | | 0.9723 | |

| High | | | 1.0299 | | | | 1.0243 | | | | 1.0074 | | | | 1.0162 | | | | 1.0164 | | | | 1.0040 | |

| Period-end | | | 1.0166 | | | | 1.0004 | | | | 1.0068 | | | | 1.0051 | | | | 1.0008 | | | | 0.9723 | |

| Average rate1 | | | 1.0222 | | | | 1.0130 | | | | 1.0030 | | | | 1.0105 | | | | 1.0079 | | | | 0.9902 | |

| 1 | The average rate is derived by taking the average of the noon rate for each business day during the relevant period. |

| B. | Capitalization and Indebtedness |

Information not required for an annual report.

| C. | Reasons for the Offer and Use of Proceeds |

Information not required for an annual report.

D. Risk Factors

We face risks and uncertainties which fall into the general business areas of markets, international commodity prices, currency exchange rates, environmental issues, fibre supply, government regulation and policy and, for Canadian companies, trade barriers and potential impacts of Aboriginal rights, including unresolved Aboriginal land claims in the Province of British Columbia.

Subsequent to our restructuring under the CCAA proceedings, we may not be able to generate sufficient cash to service all of our indebtedness and may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful

Our ability to service our debt obligations or to refinance our debt obligations depends on our financial condition and operating performance, which are subject to prevailing economic and competitive conditions and certain financial, business, legislative, regulatory and other factors beyond our control. We may be unable to maintain a level of cash flows from operating activities sufficient to permit us to fund our day-to-day operations or to pay the principal, premium, if any, and interest on our indebtedness.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we could face substantial liquidity problems and could be forced to reduce or delay capital expenditures or to sell assets or operations, seek additional capital or restructure or refinance our indebtedness. We may not be able to affect any such alternative measures, if necessary, on commercially reasonable terms or at all and, even if successful, such alternative actions may not allow us to meet our scheduled debt service obligations. The credit agreement that governs the new ABL Facility and the note indentures that govern the 2017 Notes and the Exit Notes restrict our ability to dispose of assets and use the proceeds from any such dispositions and may also restrict our ability to raise debt or equity capital to be used to repay other indebtedness when it becomes due. We may not be able to consummate those dispositions or obtain proceeds in an amount sufficient to meet any debt service obligations when due. Our inability to generate sufficient cash flows to satisfy our debt obligations, or to refinance our indebtedness on commercially reasonable terms or at all, would materially and adversely affect our financial position and results of operations and our ability to satisfy our obligations under the 2017 Notes, the Exit Notes and the new ABL Facility.

If we cannot service our debt obligations, we will be in default and as a result, holders of the 2017 Notes and Exit Notes could declare all outstanding principal and interest to be due and payable, the lenders under the new ABL Facility could terminate their commitments to loan money, our secured lenders could foreclose against the assets securing such borrowings and we could be forced into bankruptcy or liquidation.

Our degree of leverage upon completion of our restructuring under the CCAA proceedings may limit our financial and operating activities

Our historical capital requirements have been considerable and our future capital requirements could vary significantly and may be affected by general economic conditions, wood fibre supply, currency exchange rates, industry trends, performance, interest rates and many other factors that are not within our control. Subject to the limits contained in the credit agreement that governs the new ABL Facility and the note indentures that govern the 2017 Notes and the Exit Notes, we may be able to incur additional debt from time to time to finance working capital, capital expenditures, investments or acquisitions, or for other purposes. If we do so, the risks related to our high level of debt could intensify. Our substantial level of indebtedness has had in the past, and could have in the future, important consequences, including the following:

| – | making it more difficult for us to satisfy our obligations with respect to our debt, |

| – | limiting our ability to obtain additional financing to fund future working capital, capital expenditures, product developments, acquisitions or other general corporate requirements, |

| – | requiring a substantial portion of our cash flows to be dedicated to debt service payments instead of other purposes, thereby reducing the amount of cash flows available for working capital, capital expenditures and other general corporate purposes, |

| – | increasing our vulnerability to general adverse economic and industry conditions, |

| – | exposing us to the risk of increased interest rates as certain of our borrowings, including the Exit Notes and borrowings under the new ABL Facility are at variable rates of interest, |

| – | limiting our flexibility in planning for and reacting to changes in our industry, |

| – | placing us at a disadvantage compared to other, less leveraged competitors, and |

| – | increasing our cost of borrowing. |

We may not realize our anticipated cost savings from our cost savings initiatives

As part of our restructuring under the CCAA proceedings, we have taken steps to lower operating costs by implementing various cost savings initiatives. Certain of these initiatives included, but were not limited to, new five-year competitive labour agreements in British Columbia to help reposition the business, lower property tax rates for all three mills located in British Columbia, provincial approval of our application for funding relief on our salaried pension plan solvency deficit, disposal of surplus assets, and closure of the Snowflake recycle mill operations. Estimates of cost savings are inherently uncertain, and we may not be able to achieve all of the cost savings or expense reductions that we have projected. Our ability to successfully realize savings and the timing of any realization may be affected by factors such as the need to ensure continuity in our operations, labour and other contracts, regulations and/or statutes governing employee/employer relationships, and other factors. In addition, our implementation of certain of these initiatives has and is expected to require upfront costs. There can be no assurances provided that we will be able to successfully contain our expenses or that even if our savings are achieved that implementation or other expenses will not offset any such savings. Our estimates of the future expenditures necessary to achieve the savings we have identified may not prove accurate, and any increase in such expenditures may affect our ability to achieve our anticipated savings. If these cost-control efforts do not reduce costs in line with our expectations, our financial position, results of operations and cash flows will be negatively affected.

There is a limited trading market for the company’s common shares

Although our new common shares are listed on the TSX certain holders of common shares may also be creditors of the company and there is no certainty that a viable trading market for the common shares will develop. The potential lack of liquidity for the common shares may make it more difficult for us to raise additional capital, if necessary, and it may affect the price volatility of the common shares. There can also be no assurance that a holder will be able to sell its common shares at a particular time or that the prices such holder receives when it sells will be favorable. Future trading prices of the common shares will depend on many factors, including our operating performance and financial condition.

As a result of the Plan, certain holders of common shares may also be creditors of the company and may seek to dispose of such securities to obtain liquidity. Such sales could cause the trading prices for these securities to be depressed. Further, the possibility that the holders of common shares may determine to sell all or a large portion of their shares in a short period of time may adversely affect the market price of the common shares.

Our business is of a cyclical nature and demand for our products may fluctuate significantly

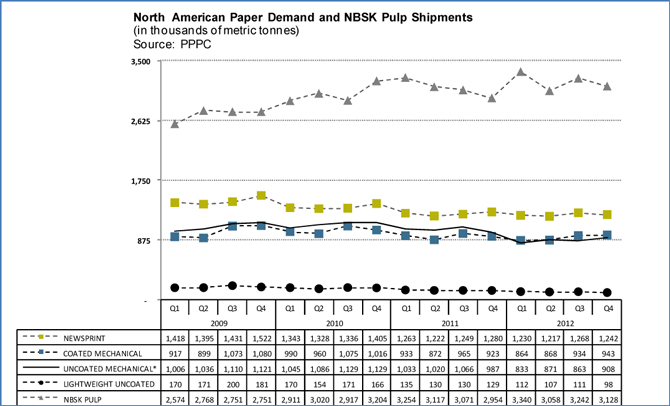

The markets for pulp and paper products are highly cyclical and are characterized by periods of excess product supply due to many factors, including additions to industry capacity, increased industry production, structural changes in the industry, periods of weak demand due to weak general economic activity or other causes, and reduced inventory levels maintained by customers.

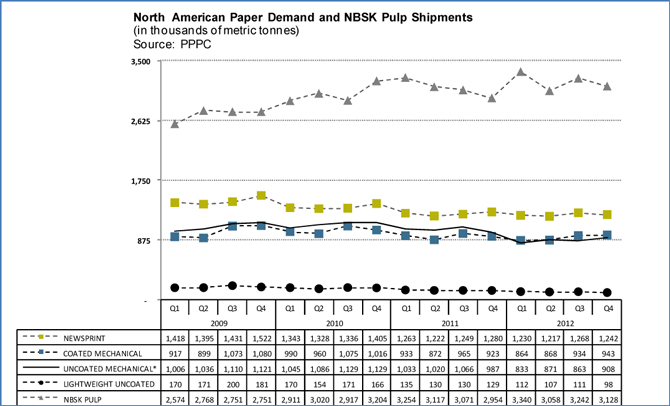

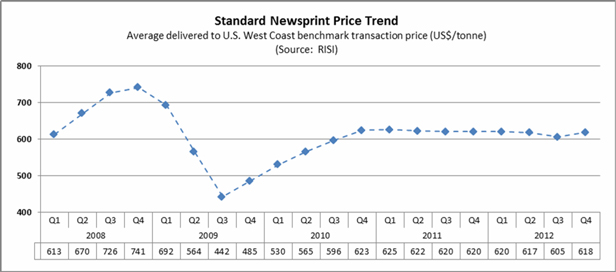

Demand for forest products generally correlates to global economic conditions. Demand for pulp and paper products in particular is driven primarily by levels of advertising. In periods of economic weakness, reduced spending by consumers and businesses results in decreased demand for forest products, causing lower product prices and possible manufacturing downtime. The North American newsprint and directory paper market is mature with demand for newsprint declining significantly in the last five years.

We believe these declines in newsprint and directory paper demand will continue long term, although we have the ability to partially mitigate the impact by switching production from newsprint and directory paper to other paper grades. Demand for our products is traditionally weaker in the first half of the year.

As at December 31, 2012, one of the paper machines at our Crofton mill has been indefinitely curtailed. Should demand for our products weaken, additional indefinite or periodic production curtailments may be required, which could have an adverse impact on our financial condition and ability to generate sufficient cash flows to satisfy our operational needs and debt service requirements.

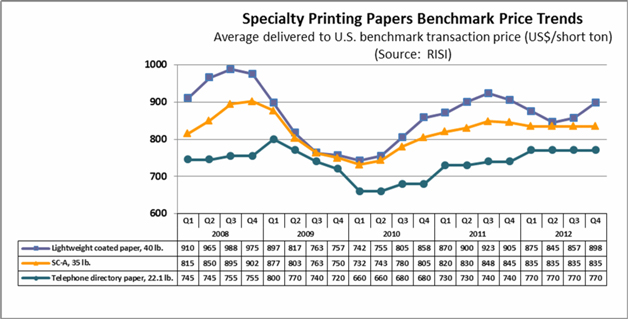

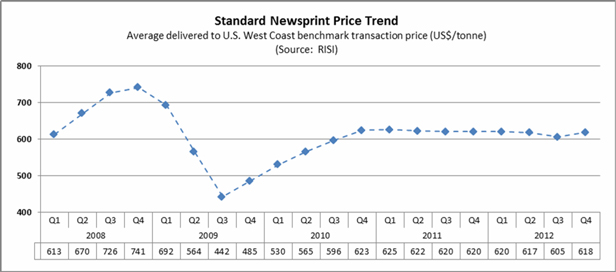

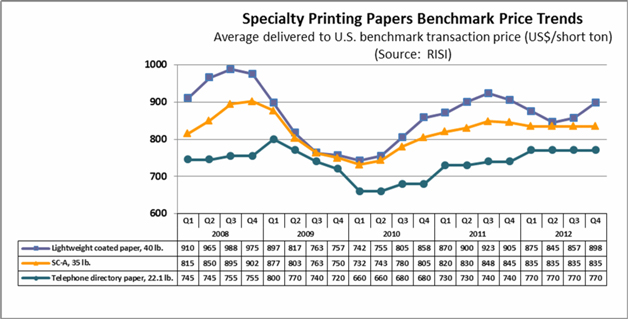

We operate in a commodity market where prices may fluctuate significantly

The pulp and paper industry is a commodity market in which producers compete primarily on the basis of price. Prices for our products have fluctuated significantly in the past and may fluctuate significantly in the future, principally as a result of market conditions of supply and demand, as well as changes in exchange rates. Our earnings are sensitive to price changes for our principal products, with the effect of price changes on newsprint and mechanical specialty printing paper grades being the greatest. Market prices for our products typically are not directly affected by input costs or other costs of sales and, consequently, we have limited ability to pass through increases in operating costs to our customers without an increase in market prices. Even though our costs may increase, our customers may not accept price increases for our products or the prices for our products may decline. As our financial performance is principally dependent on the prices we receive for our products, prolonged periods of low prices, customer refusal to accept announced price increases, or significant cost increases that cannot be passed on in product prices may be materially adverse to us.

Media trends may lead to long-term declines in demand for our products

Trends in advertising, Internet use and electronic data transmission and storage can have adverse effects on traditional print media. As our newsprint, telephone directory and retail customers increase their use of other forms of media and advertising, demand for our newsprint, uncoated mechanical and coated mechanical papers may decline on a long-term basis.

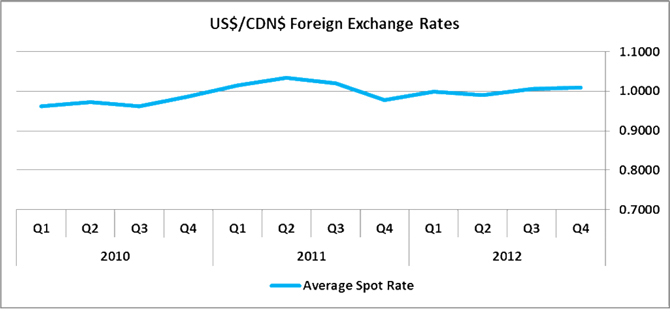

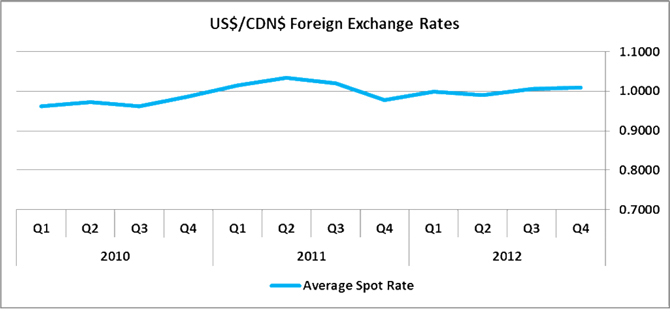

We are subject to exchange rate fluctuations

Nearly all of our sales are based upon prices set in U.S. dollars, while a substantial portion of our costs and expenses are incurred in Canadian dollars and our results of operations and financial condition are reported in Canadian dollars. The value of the Canadian dollar in relation to the U.S. dollar has increased significantly in recent years. Increases in the value of the Canadian dollar relative to the U.S. dollar reduce the amount of revenue in Canadian dollar terms from sales made in U.S. dollars, and would reduce cash flow available to fund operations and debt service obligations.

Since we have debt denominated in U.S. dollars, including our 2017 Notes and our Exit Notes, our reported earnings could fluctuate materially as a result of exchange rates given that changes in the value of the Canadian dollar against the U.S. dollar during a given financial reporting period result in a foreign currency gain or loss on the translation of U.S. dollar cash and debt into Canadian currency.

We have managed a part of our currency exposure in the past through the use of currency options and forward contracts to hedge anticipated future sales denominated in foreign currencies and U.S. dollar denominated debt. However, no assurance can be made that we will engage in any hedging transactions or, if we decide to engage in any such transactions, that we will be successful in eliminating or mitigating currency exchange risks. At March 5, 2013, we did not have any foreign currency options or forward contracts outstanding.

We face significant global competition

We compete with American, European and Asian producers in highly competitive global markets. Some of our competitors are larger and can accordingly achieve greater economies of scale, some have greater financial resources and some operate mills in locations that have lower energy, furnish or labour costs or have less stringent environmental and governmental regulations than the locations where we operate.

Our ability to compete is affected by a number of these factors as well as the quality of our products and customer service and our ability to maintain high plant efficiencies and operating rates and to control our manufacturing costs. If we were unable to compete effectively, there may be a materially adverse impact on our business.

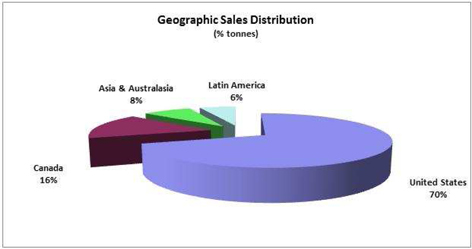

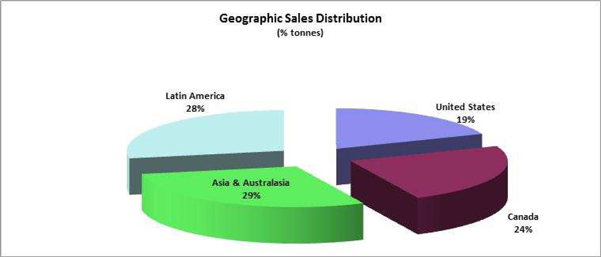

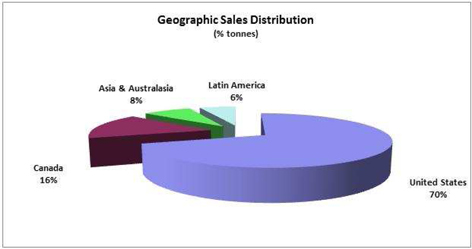

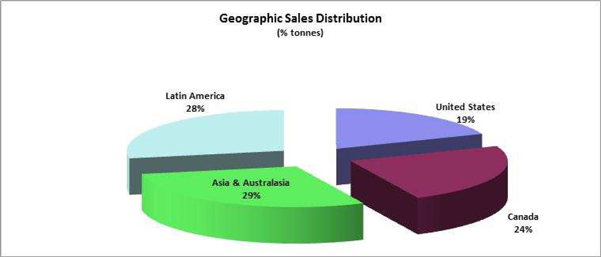

We face risks related to our international sales

A significant portion of our sales are outside of Canada and the United States 99% of our pulp sales and 24% of our paper sales in 2012. These international sales result in additional risks including restrictive government actions (including trade quotas, tariffs and other trade barriers and currency restrictions), local labour laws and regulations affecting our ability to hire, retain or dismiss employees, the need to comply with multiple and potentially conflicting laws and regulations, unfavourable national or regional business conditions or political or economic instability in some of these jurisdictions, higher transportation costs and difficulty in obtaining distribution and sales support.

We are exposed to fluctuations in the cost and supply of wood fibre

We have no significant timber holdings and are dependent on third parties for the supply of wood fibre required for our paper manufacturing operations.

Approximately 70% of our fibre is provided by five suppliers. Our fibre supply could be reduced as a result of events beyond our control, including industrial disputes, natural disasters and material curtailments and shutdown of operations by suppliers for market or other reasons. Market-related curtailments or shutdowns can be influenced by both seasonal and cyclical factors, such as raw material availability, finished goods inventory levels, interest rates and demand for lumber. Continued weakness in the U.S. housing market could lead to production curtailment for B.C. lumber producers and result in a reduction in residual fibre supply available to us.

We source a significant quantity of our fibre from the interior of B.C. The current mountain pine beetle infestation in the B.C. interior is expected to reduce the long-term fibre supply in the B.C. interior and could have a significant impact on the availability, quality and cost of fibre.

Approximately 69% of our fibre is sourced under long-term fibre agreements with third parties with pricing based on market prices or on prices determined under market-based formulas. Given that the market price for fibre varies due to external factors, there is a risk that we will not continue to have access to wood fibre at previous levels or pricing.

Aboriginal groups have claimed aboriginal title over substantial portions of B.C.’s timberlands, including areas where the forest tenures held by our suppliers are located. Although the renewal of forest tenures held by our suppliers may be adversely affected by claims of aboriginal title, the specific impact cannot be estimated at this time.

The permanent closure of our Snowflake mill, which produced 100% recycled newsprint from ONP, has eliminated our exposure to cost and supply fluctuations in ONP.

We are dependent on the supply of certain raw materials

In addition to wood fibre, we are dependent on the supply of certain chemicals and raw materials used in our manufacturing processes. Any material disruption in the supply of these chemicals or raw materials could affect our ability to meet customer demand in a timely manner and harm our reputation, and any material increase in the cost of these chemicals or other raw materials could negatively affect our business and the results of our operations.

We have incurred losses in recent periods and may incur losses in the future that may affect liquidity and ongoing operations

As of December 31, 2012, we had recorded net losses in 9 of the last 12 quarters. These losses were driven by reduced prices, weak market demand, production curtailments, general inflationary pressure and increased input costs and the strong Canadian dollar. Should we be unable to return to sustained profitability, cash generated through operations may be insufficient to meet operating cash requirements, requiring increased reliance on the ABL Facility to fund operating costs. If sufficient funding is not available under the ABL Facility, then additional funding sources may be required and there is no assurance that we will be able to access additional funding sources on favourable terms or at all to meet our cash requirements. The failure to obtain such funding could adversely affect our operations and our ability to maintain compliance with covenants under the ABL Facility, the 2017 Notes, and the Exit Notes.

Labour disruptions could have a negative impact on our business

Labour disruptions could occur and have a negative impact on our business. The new labour agreements with the CEP and PPWC expire on April 30, 2017 and the new labour agreement with CLAC expires on March 31, 2015. We do not anticipate labour disruptions in our operations in 2013.

Claims of aboriginal title and rights in Canada may affect our operations

The ability to operate our mills in Canada may be affected by claims of aboriginal rights and title by aboriginal groups. The governments of Canada and B.C. have established a formal process to negotiate settlements with aboriginal groups throughout B.C. in order to resolve these land claims. It is the policy of the governments that ownership of lands held in fee simple by third parties (such as us) will not be affected by treaty negotiations. The Powell River mill site has been included in areas to which an aboriginal group has asserted aboriginal title both through treaty negotiations with government and by commencing an action in 2005 in the Supreme Court of B.C. While we and other industrial companies have been named as parties in the court proceeding along with the governments of Canada and B.C., counsel for the aboriginal group has advised us that the plaintiffs are currently negotiating with these two governments and have no intention of proceeding with the action at this time. Based on the history of similar proceedings, we expect that it would be many years before a final court decision could be rendered if the proceeding were pursued.

Recent Supreme Court of Canada decisions have confirmed that the governments of Canada and B.C. are obligated to consult with and, in certain circumstances, accommodate aboriginal groups whenever there is a reasonable prospect decision, such as a decision to issue or amend a regulatory permit, which may affect aboriginal groups’ rights or title. This duty of consultation and accommodation may affect our ability to obtain or amend necessary regulatory permits on a timely basis and may influence the conditions set out in such permits.

Increases in energy costs could have a negative impact on our business

Our operations consume a significant amount of electricity, natural gas and fuel oil. Increases in prices for these commodities can increase manufacturing costs and have an adverse impact on our business and results of our operations.

Although our electricity supply agreements are provincially regulated and pricing has historically been stable, B.C. Hydro and Power Authority (“B.C. Hydro”) in recent years has sought, and to some extent achieved, rate increases above historical levels. B.C. Hydro raised its rates by 9.3% on an interim basis in April 2010 and a subsequent Negotiated Settlement Process resulted in the approval of a final effective rate increase of 7.3% on November 18, 2010. The difference between the interim and final approved rate increase was refunded through a credit on energy purchases in Q1 2011. The introduction of the Harmonized Sales Tax (“HST”) on July 1, 2010 substantially eliminated the 7% provincial sales tax on electricity, which reduced some of the impact of the rate increase. However, with the re-implementation of the BC provincial sales tax on April 1, 2013 and BC Hydro’s expressed intention to seek approval from the utilities commission to increase its rates in the range of 10% for the next three years in response to infrastructure maintenance and B.C. energy policy that includes mandating self-sufficiency by 2016, feed in tariffs, and the implementation of Smart Metering, our electricity prices could increase significantly and have an impact on our earnings. B.C. Hydro announced a 5.4% interim rate increase, effective April 1, 2012, subject to final approval by the British Columbia Utilities Commission (BCUC) later in the year. We have mitigated some of the impact of rate increases through reductions in usage at the highest incremental power rate and intend to further mitigate rate increases by implementing energy conservation projects and increasing our capacity to self-generate electricity, but there can be no assurance that we will be able to eliminate the effect of all such rate increases.

Since oil and natural gas are purchased on spot markets, their prices fluctuate significantly due to various external factors. We manage our exposure to the price volatility for these fuels through the use of financial instruments and physical supply agreements under a hedging program and also by using lower priced alternatives where feasible. There is, however, no assurance that we will be successful in eliminating or mitigating exposure to price volatility for these fuels.

We are subject to significant environmental regulation

We are subject to extensive environmental laws and regulations that impose stringent requirements on our operations, including, among other things, air emissions, liquid effluent discharges, the storage, handling and disposal of hazardous materials and wastes, remediation of contaminated sites and landfill operation and closure obligations. It may be necessary for us to incur substantial costs to comply with such environmental laws and regulations.

Some of our operations are subject to stringent permitting requirements and from time to time we face opposition to construction or expansion of proposed facilities, such as landfills. We may discover currently unknown environmental liabilities in relation to our past or present operations or at our current or former facilities, or we may be faced with difficulty in obtaining project approvals in the future. These occurrences may (i) require site or other remediation costs to maintain compliance or correct violations of environmental laws and regulations, (ii) result in denial of required permits, (iii) result in government or private claims for damage to person, property or the environment, or (iv) result in civil or criminal fines and penalties or other sanctions.

We permanently closed our Elk Falls paper mill in 2010. We may be required to conduct investigations and take remedial action for contaminated areas. We also permanently closed our paper recycling division in 2010 but do not currently expect any significant expenditures in respect of remediation of that site.

Our operations may be affected by the regulation of greenhouse gases (GHG) in Canada:

| · | The federal government has indicated its intent to regulate priority air pollutants, including particulate matter and sulphur oxides (SOx), and GHGs under theCanada Clean Air Act and theCanadian Environmental ProtectionAct. Under proposed targets, our Crofton mill may be required to reduce SOx emissions. The cost of making any such reductions is estimated between $4 and $8 million. The new standards are still being determined with compliance required within three to five years. In January 2010, the federal government, as part of its commitment to the Copenhagen Accord, announced a GHG reduction target of 17% by 2020 based on 2005 emissions. It is unknown what the federal government’s final position on these initiatives will be, as none have been enacted into law. |

| · | B.C. is a signatory to the Western Climate Initiative, a collaboration of four provinces and currently only one U.S. state (California), whose mandate is to achieve a 15% reduction in GHGs below 2005 levels among member entities by 2020. In addition, the B.C. government has announced its goal of reducing the provincial release of GHGs by 33% by 2020, based on 2007 levels, with interim reduction targets of 6% by 2012 and 18% by 2016. Quebec and California have initiated their regulatory processes in connection with implementation of a cap and trade system. B.C. has not issued regulations for its cap and trade program for GHGs and at this time is reviewing its climate change and clean energy policies. It is too early to determine the impact on the company under any such cap and trade scheme. |

| · | Effective January 1, 2010, a GHG reporting regulation was brought into effect by the B.C. government which affects our three paper mills in B.C. The regulation includes requirements for calculating and reporting GHG emissions from facilities that release 10,000 tonnes or more of GHGs per year plus third-party verification at facilities that release 25,000 tonnes or more per year. The first reports and verification audits were successfully completed in 2011. |

The finalization of Canadian federal and provincial climate change regulation may depend on regulatory initiatives undertaken in the U.S. The United States has indicated its intention to introduce more stringent environmental regulation and implement policies designed to reduce GHG emissions through the Clean Air Act but the timing of the implementation of any national limits is uncertain. When limits are developed, it is expected that they will focus on the electricity generating sector.

Effective July 1, 2012, the carbon tax rates under the B.C. government’s carbon tax on fossil fuels increased by 25%. The impact of increases in the carbon tax depends on our ability to decrease the use of fossil fuel. For the year ended December 31, 2012, we paid $6.5 million in carbon taxes on our fossil fuel purchases.

Additional regulatory initiatives may be implemented in other jurisdictions to address GHG emissions and other climate change-related concerns. If, to the extent we operate or offer our products for sale in such jurisdictions, we may be required to incur additional capital expenditures, operating costs or mitigating expenses, such as carbon taxes, to comply with any such initiatives.

Elimination of British Columbia Harmonized Sales Tax will negatively impact our future financial results

On April 1, 2013, the Province will revert back to provincial sales tax regime. We estimate that the additional annualized cost to our business from that date onward will be approximately $12 million, based on actual 2012 expenditures.

Equipment failures and the need to increase capital and maintenance expenditures could have a negative impact on our business

Our business is capital intensive. Our annual capital expenditure requirements vary due to differing requirements for current maintenance, expansion, business capital and environmental compliance and future projects. We regularly carry out maintenance on our manufacturing equipment but key components may still require repair or replacement. The costs associated with such maintenance and capital expenditures or our inability to source the necessary funds to enable us to maintain or upgrade our facilities as required could have an adverse effect on our business and operations.

In addition, we may from time to time temporarily suspend operations at one or more facilities to perform necessary maintenance or carry out capital projects. These temporary suspensions could affect the ability to meet customer demand in a timely manner and adversely affect our business.

We may be subject to litigation which could result in unexpected costs and expenditure of time and resources

We may from time to time be subject to claims and litigation proceedings generally associated with commercial and employment law issues. Given that these claims are subject to many uncertainties and the inability to predict with any certainty their outcomes and financial impacts, there is no guarantee that actions that may be brought against us in the future will be resolved in our favour or covered by our insurance. Any losses from settlements or adverse judgments arising out of these claims could be materially adverse to our operations and business.

The Snowflake mill sources water from groundwater wells in the vicinity of the Little Colorado River for its process requirements. The Little Colorado River Adjudication, filed in 1978, is pending in the Superior Court of Arizona, Apache County. The purpose of this adjudication is to determine the nature, extent and relative priority, if applicable, of the water rights of all claimants to the Little Colorado River system and sources. There are more than 3,500 participants, including Snowflake. Native American tribes and the United States government contend that Snowflake’s withdrawal and use of groundwater impermissibly interferes with water rights to the Little Colorado River. We dispute this contention. However, an adverse determination could result in claims for damages that may be materially adverse to us.

In addition, securities class-action litigation often has been brought against public companies following periods of volatility in the market price of their securities. It is possible that we could be the target of similar litigation in future. Securities litigation could result in substantial costs and damages and divert management’s attention and resources.

We extend trade credit to our customers and they may not pay us promptly or in full

We extend trade credit to many purchasers of our products and rely on their creditworthiness. Some of these customers operate in highly competitive, mature, cyclical or low-margin businesses and some are highly leveraged financially or are experiencing negative cash flows which may result in them needing to refinance, restructure or file for bankruptcy protection or bankruptcy. We will typically have a greater number of such customers during economic downturns. The failure of such customers to pay us promptly and in full under the credit terms we extend to them could have a material adverse impact on our operating cash flows.

We are dependent upon certain of our management personnel

The success of our operations is influenced to a significant degree by our ability to attract and retain senior management with relevant industry experience. Successful implementation of our business strategy is dependent on our ability to attract and retain our executive officers and management team. The unexpected loss of services of any key management personnel or the inability to recruit and retain qualified personnel in the future could have an adverse effect on our business and financial results.

Consumer boycotts or increases in costs due to chain-of-custody programs may adversely affect demand for our products

Some of our customers are sensitive to issues associated with harvesting of old growth forests and require us to supply products that are not produced from these forests. A growing number of customers want to purchase products that originate from sustainable managed forests as validated by certification programs. We have implemented The Forest Stewardship Council chain-of-custody system to verify that selected paper products at our Crofton, Port Alberni and Powell River mills contain 100% certified wood fibre, but we may be required to implement additional or more stringent chain-of-custody certification programs with increased costs to meet our customers’ demands. Demand for our products may be adversely affected if we don’t implement such programs or if we become subject to organized boycotts or similar actions by environmental or other groups.

Our insurance has limitations and exclusions

We maintain insurance coverage that we believe would ordinarily be maintained by an operator of facilities similar to our own. The insurance policies are subject to limits and exclusions. Damage to or destruction of our facilities could accordingly exceed the limits of our policies or be subject to policy exclusions.

Our mills are located in seismically active areas

Our three operating mills are situated adjacent to the ocean on the south coast of B.C. This is a seismically active area and these mills and the surrounding transportation infrastructure are accordingly susceptible to risk of damage or destruction caused by earthquakes and tsunamis. Our insurance may not cover the total losses associated with damage or destruction caused by an earthquake or tsunami, and this insurance is subject to limits and deductibles in respect of such damage that may limit the amount recoverable.

Post-retirement plan obligations may affect our financial condition

We maintain defined benefit pension plans and other post-retirement benefit plans for certain retired employees. As at December 31, 2012, the underfunded liability associated with the defined benefit pension plans was $53.5 million and the underfunded liability associated with the other post-retirement benefit plans was $149.2 million. Funding requirements for these plans are dependent on various factors, including interest rates, asset returns, regulatory requirements for funding purposes, and changes to plan benefits. In 2013, we are required to contribute $4.5 million towards the underfunded liability of the defined benefit pension plan. Although we expect to continue to make contributions to fund post-retirement plan obligations and to meet legal funding obligations for the defined benefit pension plan, no assurance can be made that the underfunded liability under these plans will not be materially adverse to us in the future.

A change in our legal control could be materially adverse

We have outstanding US$250 million of 2017 Notes and US$35million of Exit Notes. If a Change of Control (as such term is defined in the indenture governing these notes) occurs, we are required to make an offer to purchase all outstanding notes at a price equal to 101% of their principal amount, plus accrued and unpaid interest to the date of payment, in accordance with the procedures set out in the indenture. We may not have sufficient financial resources to fund any such repurchase.

| ITEM 4. | INFORMATION ON THE CORPORATION |

| A. | History and Development of the Corporation |

Incorporation

We were formed on September 1, 2001 by the amalgamation under theCanada Business Corporations Act of Norske Skog Canada Limited and Pacifica Papers Inc. On October 3, 2005 we changed our name to Catalyst Paper Corporation.

Catalyst’s principal predecessor was British Columbia Forest Products Limited, which was a company formed by the amalgamation under the laws of the Province of British Columbia on December 30, 1971 of its predecessor company, incorporated by certificate of incorporation, with memorandum and articles, under the laws of the Province of British Columbia on January 31, 1946, and 24 of its wholly owned subsidiaries. On September 2, 1988, British Columbia Forest Products Limited changed its name to Fletcher Challenge Canada Limited. Prior to July 2000, 50.76% of Fletcher Challenge Canada Limited was owned by Fletcher Challenge Limited of New Zealand (“Fletcher Challenge New Zealand”). In July 2000, Norske Skogindustrier ASA completed a transaction with Fletcher Challenge New Zealand whereby all of the business and assets of Fletcher Challenge New Zealand’s paper division worldwide were acquired by Norske Skogindustrier ASA. As part of this transaction, Norske Skogindustrier ASA acquired Fletcher Challenge New Zealand’s 50.76% interest in Fletcher Challenge Canada Limited. On December 15, 2000, Fletcher Challenge Canada Limited changed its name to Norske Skog Canada Limited.

As a result of the amalgamation with Pacifica Papers Inc. and subsequent equity issues, Norske Skogindustrier ASA’s interest in Catalyst decreased to 29.4%. On February 16, 2006 Norske Skogindustrier ASA sold its remaining 29.4% interest in Catalyst by way of a secondary offering.

Pacifica Papers Inc.’s predecessor was Pacifica Papers Limited Partnership. On June 8, 1998 Pacifica Papers Limited Partnership, through its indirect wholly owned subsidiary, Pacifica Papers Acquisition Company Ltd., acquired all the shares of MB Paper Limited from MacMillan Bloedel Limited. On March 12, 1999 the unitholders of Pacifica Papers Limited Partnership approved a reorganization pursuant to which Pacifica Papers Limited Partnership changed its corporate form from a partnership to a corporation. As part of this reorganization, 28,750,000 common shares of Pacifica Papers Inc. were distributed to all the unitholders of Pacifica Paper Limited Partnership in exchange for their partnership units on a one for one basis.

14,400,000 new common shares were issued from the treasury of the company to the holders of the 2016 Notes (as hereinafter defined) on September 13, 2012, in accordance with the company’s plan of arrangement under theCompanies’ Creditors Arrangement Act (the “Plan”) and a further 127,571 new common shares were issued from treasury on December 19, 2012 to certain unsecured creditors of the company who elected to receive their pro rata share of up to 600,000 common shares pursuant to the terms of the Plan. Under the terms of the Plan all former securities of the company issued and outstanding on September 13, 2012 were deemed automatically cancelled. See “Creditor Protection and Restructuring Process - Implementation of Plan”.

Our head and registered office is located at 2nd Floor, 3600 Lysander Lane, Richmond, British Columbia, V7B 1C3.

Creditor Protection and Restructuring Process

Proceedings under the CCAA

Following extensive discussions and negotiations in 2011 and early 2012 with certain holders of our 7.375% senior unsecured notes due 2014 (2014 Notes) and our 11.0% senior secured notes due 2016 (2016 Notes) in an effort to implement a recapitalization transaction that would reduce our indebtedness and improve the company’s capital structure, the Board of directors and management determined it was necessary to pursue a restructuring under court supervision.

On January 31, 2012 the company obtained an order from the Supreme Court of British Columbia under the CCAA and subsequently received a recognition order from the United States court under Chapter 15 of the US Bankruptcy Code. The company arranged debtor-in-possession financing (“DIP Facility”) of approximately $175 million to provide funding during the restructuring process under the CCAA for ongoing working capital, capital expenditure requirements and general corporate purposes. The company’s operating revenue combined with the DIP Facility provided sufficient liquidity to meet ongoing obligations to employees and suppliers and enabled normal operations to continue during the restructuring process. The DIP Facility was paid out on September 13, 2012.

The company’s secured and unsecured creditors approved the Plan at meetings held on June 25, 2012. The Plan was approved by the Canadian Court on June 28, 2012 under the CCAA process and by the United States Court on July 27, 2012 under the Chapter 15 process. The Plan became effective on September 12, 2012 and restructuring under the Plan completed on September 13, 2012.

Implementation of Plan

As a result of the reorganization under the Plan:

| · | Holders of 2016 Notes exchanged their US$390.4 million aggregate principal amount of 2016 Notes plus accrued and unpaid interest for: |

| - | US$250.0 million aggregate principal amount of senior secured notes due in 2017 (“2017 Notes”) that bear interest, at the option of the company, at a rate of 11% per annum in cash or 13% per annum payable 7.5% cash and 5.5% payment-in-kind (PIK); and |

| - | 14.4 million new common shares which represented 100% of the company’s issued and outstanding common shares subject to dilution for (i) the issuance of common shares to unsecured creditors who made an equity election pursuant to the terms of the Plan, and (ii) common shares that may be issued under a new management incentive plan should such a plan be adopted in the future. |

| · | Holders of 2014 Notes exchanged their US$250.0 million aggregate principal amount of 2014 Notes plus accrued and unpaid interest for: |

| - | Their pro rata share (calculated by reference to the aggregate amount of all claims of unsecured creditors allowed under the Plan) of 50% of the net proceeds (the “PREI Proceeds Pool”) following the sale of Catalyst Paper’s interest in Powell River Energy Inc. and Powell River Energy Limited Partnership (collectively “Powell River Energy”), or |

| - | If an equity election was made, their pro rata share of 600,000 new common shares (the “Unsecured Creditor Share Pool”). |

| · | General creditors exchanged their general unsecured claims for: |

| - | Their pro rata share of the PREI Proceeds Pool; or |

| - | If an equity election was made, their pro rata share of the Unsecured Creditor Share Pool; or |

| - | If the general unsecured claim was equal to or less than $10,000 (unless an equity election was made), or if a valid cash election were made and such creditor elected to reduce their claim to $10,000, cash in an amount equal to 50% of the creditor’s allowed claim (the “Cash Convenience Pool”). |

| · | On September 13, 2012 all previously outstanding common shares of the company were cancelled for no consideration and holders of such common shares did not, and will not, receive any distribution under the Plan. |

We distributed $1.0 million to unsecured creditors in November, 2012 as full and final settlement of claims under the Cash Convenience Pool. We issued 14,400,000 new common shares to holders of 2016 Notes on September 13, 2012 and issued a further 127,571 common shares on December 19, 2012 to unsecured creditorswho elected to receive common shares in lieu of participating in the PREI Proceeds Pool,as full and final settlement of their claims. We entered into an agreement on February 13, 2013 to sell our interest in Powell River Energy for $33 million and following completion of such sale will pay out approximately $13 million from the PREI Proceeds Pool to applicable unsecured creditors. We are required under the terms of the Exit Facility (defined below) to offer to purchase Exit Notes (defined below) at par from our portion of the proceeds from the sale of Powell River Energy.

Exit financing arrangements

On September 13, 2012, we entered into a new $175.0 million ABL Facility, which was a pre-condition for the Corporation to implement the Plan and exit from protection under the CCAA. The ABL Facility provided financing for general corporate purposes, and for the repayment on exit of the debtor-possession asset based lending facility (“DIP Facility”) that was in place throughout the CCAA proceedings. The Corporation also completed a US$35 million secured exit financing facility (“Exit Facility”) on September 13, 2012 and issued US$35 million of notes (“Exit Notes”) under that facility on its exit from protection under the CCAA. The Exit Facility provided the company with backstop financing to pay costs and expenses and manage other contingencies on exit from protection under CCAA.

Appointment of new board of directors

A new Board was appointed effective upon completion of the restructuring under the Plan on September 13, 2012, comprised of John Brecker, Giorgio Caputo, John Charles, Kevin J. Clarke, Todd Dillabough, Walter Jones, and Leslie Lederer. Mr. Clarke, the CEO of the Corporation, continued from the previous board. Mr. Lederer is the Chair of the Board.

Asset Sales

Closure and Sale of Snowflake Mill

The company permanently closed the Snowflake mill on September 30, 2012. The decision to close the Snowflake mill was driven by continued financial losses resulting from intense supply input and market pressures. Snowflake had generated negative adjusted EBITDA since 2009. The Snowflake mill and associated assets, including our shares in The Apache Railway Company, were sold to a third party on January 30, 2013. See -Impairment of Snowflake Assets and Canadian Operations.

Sale of Powell River Energy

We entered into an agreement on February 13, 2013 to sell our interest in Powell River Energy for $33 million. The sale is expected to complete in the first quarter of 2013 and is subject to various closing conditions. Electricity generated by Powell River Energy Inc. will continue to be sold to the company under the existing power purchase agreement which expires in 2016 with possible extension to 2021 in one year renewal term increments at the option of the company.

Sale of Elk Falls Mill

On August 16, 2012, the company and its subsidiaries, Catalyst Pulp Operations Limited and Elk Falls Pulp and Paper Limited entered into an agreement to sell the Elk Falls millsite and remaining plant and equipment and adjacent properties to a third party. This sale did not complete and the company is pursuing other sale opportunities for this site.

Other Asset Sales