As filed with the Securities and Exchange Commission on August 29, 2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-10487 |

|

Hotchkis & Wiley Funds |

(Exact name of registrant as specified in charter) |

|

725 South Figueroa Street, 39th Floor Los Angeles, California | | 90017-5439 |

(Address of principal executive offices) | | (Zip code) |

|

Anna Marie Lopez Hotchkis & Wiley Capital Management, LLC 725 South Figueroa Street, 39th Floor Los Angeles, California 90017-5439 |

(Name and address of agent for service) |

|

Copies to: Karin Jagel Flynn, Esq. Vedder Price P.C. 222 North LaSalle Street Chicago, IL 60601 |

(Counsel for the Registrant) |

|

Registrant’s telephone number, including area code: | (213) 430-1000 | |

|

Date of fiscal year end: | June 30, 2014 | |

|

Date of reporting period: | July 1, 2013 – June 30, 2014 | |

| | | | | | | | | |

Item 1. Reports to Stockholders.

Hotchkis & Wiley Funds

Annual Report

JUNE 30, 2014

DIVERSIFIED VALUE FUND

LARGE CAP VALUE FUND

MID-CAP VALUE FUND

SMALL CAP VALUE FUND

GLOBAL VALUE FUND

VALUE OPPORTUNITIES FUND

CAPITAL INCOME FUND

HIGH YIELD FUND

SHAREHOLDER LETTER | | | 3 | | |

FUND PERFORMANCE DATA | | | 6 | | |

SCHEDULE OF INVESTMENTS: | |

DIVERSIFIED VALUE FUND | | | 15 | | |

LARGE CAP VALUE FUND | | | 18 | | |

MID-CAP VALUE FUND | | | 20 | | |

SMALL CAP VALUE FUND | | | 23 | | |

GLOBAL VALUE FUND | | | 26 | | |

VALUE OPPORTUNITIES FUND | | | 28 | | |

CAPITAL INCOME FUND | | | 31 | | |

| HIGH YIELD FUND | | | 41 | | |

| STATEMENTS OF ASSETS & LIABILITIES | | | 48 | | |

| STATEMENTS OF OPERATIONS | | | 50 | | |

| STATEMENTS OF CHANGES IN NET ASSETS | | | 52 | | |

| FINANCIAL HIGHLIGHTS | | | 56 | | |

| NOTES TO THE FINANCIAL STATEMENTS | | | 60 | | |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 71 | | |

| FUND EXPENSE EXAMPLES | | | 72 | | |

BOARD CONSIDERATIONS IN APPROVING CONTINUATION OF

INVESTMENT ADVISORY AGREEMENTS | | | 74 | | |

MANAGEMENT | | | 77 | | |

PRIVACY POLICY | | | 78 | | |

INFORMATION ABOUT THE FUNDS | | | BACK COVER | | |

DEAR SHAREHOLDER:

The following investment review and annual report relates to the activities of the Hotchkis & Wiley Funds for the twelve-month period ended June 30, 2014.

OVERVIEW

Despite several incidences of geopolitical unrest, the equity market, as represented by the S&P 500® Index, gained +24.61% and the high yield market, as represented by the BofA Merrill Lynch US High Yield Index, gained +11.8% over the twelve months ended June 30, 2014. Investors appeared to largely dismiss the Russia/Ukraine and various other global conflicts as economically inconsequential. Economic activity has been predominantly positive and seems to have reignited investor confidence in risky assets. The unemployment rate fell to a post-financial crisis low, and now stands at 6.1% compared to 10.0% at the end of 2009. The housing market demonstrated signs of improvement, with new home sales reaching six-year highs and pending sales of existing homes reaching four-year highs. Corporate performance continued to be relatively robust with most companies exceeding rising consensus earnings estimates. In response to these developments, the Federal Open Market Committee's most recent statement struck an increasingly optimistic tone, which helped boost equity and high yield fixed income markets.

While the yield curve has flattened over the past couple of quarters, the curve remained normal, which has been a constructive signal for economic growth historically. An inverted yield curve has preceded nearly every recession over the past century, but it would take a dramatic move from the current interest rate environment for this to occur. The yield-to-worst on the high yield market declined, finishing the period at 4.9%. The market's spread over similar duration Treasuries tightened, finishing the period at 350 basis points. Spreads are narrower than average, which should not be surprising given the sturdy economic and corporate foundation, low default rate environment, and extended debt maturities.

In the equity market, all sectors posted positive returns over the twelve-month period, but dispersion between the best and worst performers was notable. Materials, information technology, and health care led the way while telecommunication services, consumer staples, and financials lagged. In addition, growth stocks outperformed value stocks but by a slight margin. In aggregate, large cap stocks and small cap stocks performed similarly, and international developed markets performed in line with U.S. markets after adjusting for modest currency movements.

Given the rise in both equity and high yield prices, our expectations have been somewhat tempered as valuations have risen. We continued to find interesting opportunities selectively, and believe our focus on risk is particularly important in today's environment.

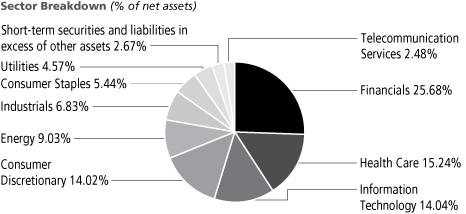

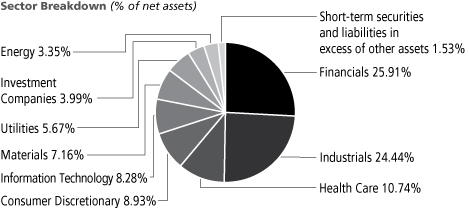

HOTCHKIS & WILEY DIVERSIFIED VALUE FUND

The Fund's Class I shares had a total return of 24.98% for the twelve-month period ended June 30, 2014 compared to the Russell 1000® Value Index return of 23.81%.

More than 95% of the outperformance was due to positive stock selection. Stock selection was particularly favorable in financials, industrials, utilities, and telecommunication services. The largest individual performance contributors were Corning, Total, and Lockheed Martin. Stock selection in energy and a lack of exposure to materials, the Index's top-performing sector, detracted from performance over the period. The largest individual detractors were Cobalt International Energy, Target, and Citigroup.

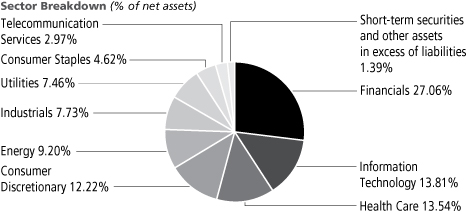

HOTCHKIS & WILEY LARGE CAP VALUE FUND

The Fund's Class I shares had a total return of 26.52% for the twelve-month period ended June 30, 2014, compared to the Russell 1000® Value Index return of 23.81%.

All of the Fund's outperformance over the period was due to positive stock selection. Stock selection was strongest in energy, industrials, financials, and health care. The overweight position in information technology was also a modest performance contributor over the period. The largest individual contributors to performance over the period were Total, Corning, and Hewlett-Packard. Stock selection in consumer staples, and no exposure to materials — the top-performing sector in the Russell 1000® Value Index — detracted from performance. The largest individual detractors to relative performance over the period were Target, Citigroup, and Wal-Mart.

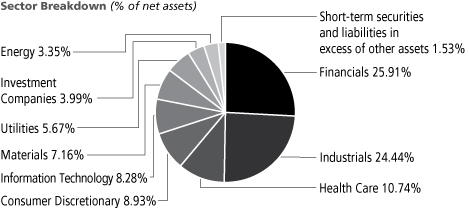

HOTCHKIS & WILEY MID-CAP VALUE FUND

The Fund's Class I shares had a total return of 28.10% for the twelve-month period ended June 30, 2014, compared to the Russell Midcap® Value Index return of 27.76%.

More than 2/3 of the outperformance was due to positive stock selection, which was particularly strong in industrials, utilities, and information technology. The underweight in Real Estate Investment Trusts (REITs), which is a substantial portion of the Index, also helped performance, as REITs lagged the broad market by a substantial margin. ARRIS Group, Goodyear Tire, and Valassis Communications were the largest individual performance contributors. Stock selection in energy and information technology, along with an underweight position in health care, detracted from performance over the period. Cobalt International Energy, Rent-A-Center, and Willis Group Holdings were the largest individual performance detractors.

HOTCHKIS & WILEY SMALL CAP VALUE FUND

The Fund's Class I shares had a total return of 32.40% for the twelve-month period ended June 30, 2014, compared to the Russell 2000® Value Index return of 22.54%, outperforming the Index by nearly 1,000 basis points.

Positive stock selection drove the majority of the outperformance over the period, with industrials, information technology, and financials particularly compelling. The overweight in industrials and underweight in REITs were secondary performance contributors. Over the twelve months, ARRIS Group, Taro Pharmaceutical, and Huntington Ingalls were the three largest individual performance contributors. An underweight and stock selection in energy detracted from performance. Rent-A-Center, First Horizon National, and Quiksilver were the three largest individual performance detractors.

3

HOTCHKIS & WILEY GLOBAL VALUE FUND

The Fund's Class I shares had a total return of 25.98% for the twelve-month period ended June 30, 2014, compared to the Russell Developed Index return of 25.43%.

All of the Fund's outperformance is attributable to positive stock selection, which was positive across all major geographic regions. Stock selection was especially strong in consumer discretionary, industrials, and information technology. An underweight position in Japan was also beneficial, as it lagged the global developed equity market by about 10 percentage points (in U.S. dollar terms). The largest individual contributors to performance over the period were Taro Pharmaceutical, Direct Line Insurance, and Corning. Stock selection in energy and telecommunication services detracted from performance over the period. The largest individual detractors from performance over the period were Cobalt International Energy, Citigroup, and Mobistar.

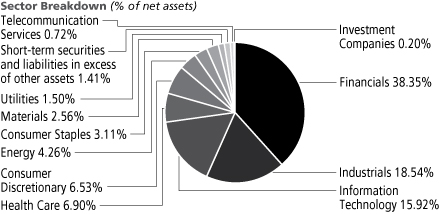

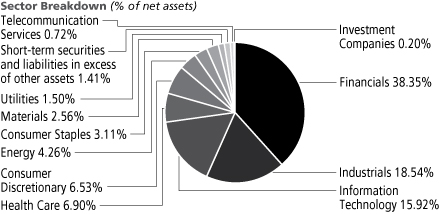

HOTCHKIS & WILEY VALUE OPPORTUNITIES FUND

The Fund's Class I shares had a total return of 25.67% for the twelve-month period ended June 30, 2014, compared to the S&P 500® Index return of 24.61%.

More than 80% of the Fund's outperformance over the twelve-month period was due to positive security selection. Positive selection in health care, financials, industrials, and information technology were each important performance contributors. An underweight in the consumer sectors was modestly beneficial also. The largest individual performance contributors were Direct Line Insurance, Taro Pharmaceutical, and Valassis Communications. Security selection in energy and an overweight position in financials were the primary performance detractors over the period. The largest individual performance detractors were Cobalt International Energy, Rent-A-Center, and Citigroup.

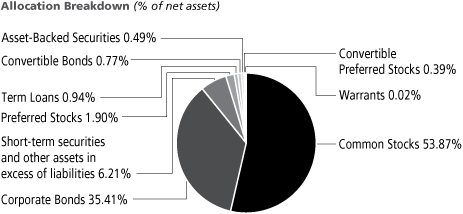

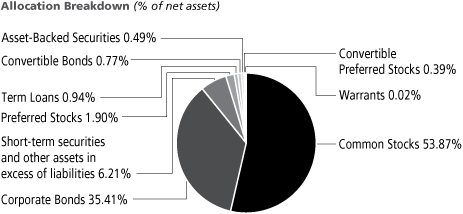

HOTCHKIS & WILEY CAPITAL INCOME FUND

The Fund's Class I shares had a total return of 19.71% for the twelve-month period ended June 30, 2014, compared to the 50/50 blended benchmark of the S&P 500® Index and the BofA Merrill Lynch U.S. Corporate, Government and Mortgage Index return of 14.26%. The equity portion of the Fund and the high yield portion of the Fund both outperformed their respective benchmarks over the period. Also, the Fund was overweight equities relative to the long-term target (56% average weight versus a long term target of 50%) which also helped performance as equities outperformed fixed income.

The equity portion of the Fund outperformed the S&P 500® Index, all of which can be attributed to positive stock selection. Being overweight telecommunication services and utilities while being underweight materials and information technology hurt relative performance, but positive selection more than compensated for this allocation. Stock selection was strongest in energy, industrials, and consumer discretionary. The largest individual contributors to performance were Total, Royal Dutch Shell, and Molson Coors, while the largest individual detractors from performance were Target, Wal-Mart, and Exelon.

The fixed income portion of the Fund outperformed the BofA Merrill Lynch U.S. Corporate, Government and Mortgage Index for the twelve-month period. It also outperformed the broad high yield (BofA

Merrill Lynch US High Yield Index) market due to positive credit selection, which drove all of the excess return. Credit selection was strongest in automotive, media, financial services, and services. The modest cash position was a slight performance drag along with credit selection in the banking sector.

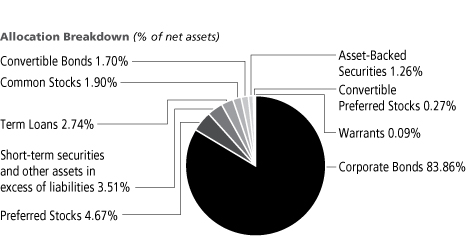

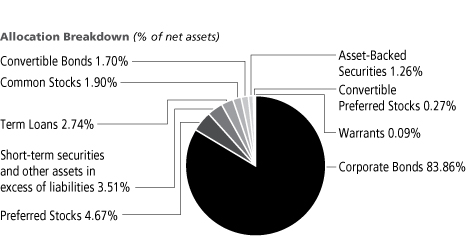

HOTCHKIS & WILEY HIGH YIELD FUND

The Fund's Class I shares had a total return of 11.51% for the twelve-month period ended June 30, 2014, compared to the BofA Merrill Lynch BB-B US High Yield Constrained Index return of 11.33%.

Credit selection was positive or neutral in 13 of the 16 BofA Merrill Lynch sectors. Automotive, financial services, media, and services were particularly strong. Credit selection in banking and consumer cyclicals along with an underweight position in telecommunications detracted from performance but by a small degree. Positive credit selection has been the predominant driver of excess returns since the Fund's inception, which now dates back more than five years.

CONCLUSION

We appreciate your continued support of the Hotchkis & Wiley Funds, and we look forward to serving your investment needs in the future.

Sincerely,

| |

| |

| |

Anna Marie Lopez

President | | George Davis

Fund Manager | | Sheldon Lieberman

Fund Manager | |

| |

| |

| |

Patty McKenna

Fund Manager | | James Miles

Fund Manager | | Stan Majcher

Fund Manager | |

| |

| |

| |

David Green

Fund Manager | | Scott McBride

Fund Manager | | Judd Peters

Fund Manager | |

| |

| |

| |

Ray Kennedy

Fund Manager | | Mark Hudoff

Fund Manager | | Patrick Meegan

Fund Manager | |

| |

| | | |

Scott Rosenthal

Fund Manager | | Richard Mak

Fund Manager | | | |

4

Past performance does not guarantee future results

The above reflects opinions of Fund managers as of June 30, 2014. They are subject to change and any forecasts made cannot be guaranteed. The Funds might not continue to hold any securities mentioned and have no obligation to disclose purchases or sales in these securities. Please refer to the Schedule of Investments in this report for a complete list of Fund holdings for June 30, 2014. Indexes do not incur expenses or sales loads and are not available for investment.

Performance attribution is an analysis of the portfolio's return relative to a selected benchmark and is calculated using daily holding information (and does not reflect payment of transaction costs, fees and expenses of the Funds). Specific securities identified are the largest contributors (or detractors) on a relative basis to a designated index. Securities' absolute performance may reflect different results.

The Global Industry Classification Standard (GICS®) was developed by MSCI, an independent provider of global indices and benchmark-related products and services, and Standard & Poor's (S&P), an independent international financial data and investment services company. The GICS methodology has been widely accepted as an industry analysis framework for investment research, portfolio management and asset allocation. The GICS structure consists of 10 sectors, 24 industry groups, 67 industries and 156 sub-industries. Each stock that is classified will have a coding at all four of these levels.

A basis point is one hundredth of one percent (0.01%).

Duration is a commonly used measure of the potential volatility of the price of a debt security, or the aggregate market value of a portfolio of debt securities, prior to maturity. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration.

Spread is the percentage point difference between yields of various classes of bonds compared to Treasury bonds.

Yield-to-Worst is the lowest possible yield from owning a bond considering all potential call dates prior to maturity.

The 50/50 blended benchmark is an average, equal weighted blend of the S&P 500® Index and the BofA Merrill Lynch U.S. Corporate, Government and Mortgage Index.

5

ABOUT FUND PERFORMANCE

The Large Cap Value Fund and Mid-Cap Value Fund have four classes of shares. The Diversified Value Fund, Small Cap Value Fund, Global Value Fund, Value Opportunities Fund, Capital Income Fund and High Yield Fund have three classes of shares. Each share class has its own sales charge and expense structure, allowing you to invest in the way that best suits your needs. Currently, the Global Value Fund and Capital Income Fund are not offering Class C shares to investors.

Class I shares have no initial sales charge and bear no ongoing distribution and service fees under a 12b-1 plan. Class I shares are available only to eligible investors.

Class A shares incur a maximum initial sales charge of 5.25% for the Diversified Value Fund, Large Cap Value Fund, Mid-Cap Value Fund, Small Cap Value Fund, Global Value Fund and Value Opportunities Fund, 4.75% for the Capital Income Fund and 3.75% for the High Yield Fund and an annual distribution and service fee of 0.25%.

Class C shares are subject to an annual distribution and service fee of 1.00%. In addition, Class C shares are subject to a 1.00% contingent deferred sales charge (CDSC) if redeemed within one year after purchase. Class C shares automatically convert to Class A shares approximately eight years after purchase and will then be subject to lower distribution and service fees.

Class R shares have no initial sales charge or CDSC and are subject to an annual distribution and service fee of 0.50%. Class R shares are offered only by the Large Cap Value Fund and Mid-Cap Value Fund and are available only to certain retirement plans.

FUND RISKS

Mutual fund investing involves risk; loss of principal is possible. The Small Cap Value Fund, Mid-Cap Value Fund, Global Value Fund and Value Opportunities Fund invest in small- and medium-capitalization companies which tend to have limited liquidity and greater price volatility than large-capitalization companies. The Value Opportunities Fund is a non-diversified fund which involves greater risk than investing in diversified funds, such as business risk, significant stock price fluctuations and sector concentration. Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales. The Value Opportunities Fund, Capital Income Fund and High Yield Fund invest in debt securities that decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment by the Value Opportunities Fund, Capital Income Fund and High Yield Fund in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. The Value Opportunities Fund, Capital Income Fund and High Yield Fund may utilize derivative instruments, which derive their performance from the performance of an underlying asset, index, interest rate or currency exchange rate. Derivatives can be volatile and involve various types and degrees of risks. Depending upon the characteristics of particular derivatives, they can suddenly become illiquid. Investments by the Capital Income Fund and High Yield Fund in asset-backed and mortgage-backed securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. The Funds may invest in foreign securities, including developed and emerging markets, which involve greater volatility and political, economic, and currency risks.

MARKET INDEXES

The following are definitions for indexes used in the shareholder letter and the performance summary tables on the following pages. These indexes are unmanaged and include the reinvestment of dividends, but do not reflect the payment of transaction costs and advisory and other fees associated with an investment in the Funds. The securities that comprise these indexes may differ substantially from the securities in the Funds' portfolios. The Funds' value disciplines may prevent or restrict investments in the benchmark indexes. It is not possible to invest directly in an index. Each index named is not the only index which may be used to characterize performance of a specific Fund and other indexes may portray different comparative performance.

S&P 500® Index, a capital weighted, unmanaged index, represents the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange.

Russell 1000® Index, an unmanaged index, measures the performance of the 1,000 largest companies in the Russell 3000® Index.

Russell 1000® Value Index measures the performance of those Russell 1000® companies with lower price-to-book ratios and lower forecasted growth values.

Russell Midcap® Index, an unmanaged index, measures the performance of the 800 smallest companies in the Russell 1000® Index.

Russell Midcap® Value Index measures the performance of those Russell Midcap® companies with lower price-to-book ratios and lower forecasted growth values.

Russell 2000® Index, an unmanaged index, measures the performance of the 2,000 smallest companies in the Russell 3000® Index.

Russell 2000® Value Index measures the performance of those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values.

Russell Developed Index measures the performance of the investable securities in developed countries globally across all market capitalization ranges.

BofA Merrill Lynch U.S. Corporate, Government and Mortgage Index is a broad-based measure of the total rate of return performance of the U.S. investment grade bond markets. The Index is a capitalization weighted aggregation of outstanding U.S. Treasury, agency and supranational, mortgage pass-through, and investment grade corporate bonds meeting specified selection criteria.

BofA Merrill Lynch BB-B US High Yield Constrained Index contains all securities in the BofA Merrill Lynch U.S. High Yield Index rated BB+ through B- by S&P (or equivalent as rated by Moody's or Fitch), but caps issuer exposure at 2%. Index constituents are capitalization-weighted, based on their current amount outstanding, provided the total allocation to an individual issuer does not exceed 2%.

BofA Merrill Lynch US High Yield Index tracks the performance of below investment grade, but not in default, U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market, and includes issues with a credit rating of BBB or below, as rated by Moody's and S&P.

6

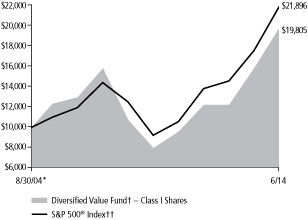

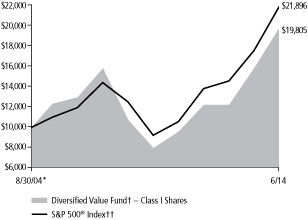

DIVERSIFIED VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2014 | | 1 Year | | 5 Years | | Since

8/30/04* | |

Class I | |

Average annual total return | | | 24.98 | % | | | 19.94 | % | | | 7.20 | % | |

Class A | |

Average annual total return (with sales charge) | | | 18.11 | % | | | 18.35 | % | | | 6.35 | % | |

Average annual total return (without sales charge) | | | 24.68 | % | | | 19.64 | % | | | 6.93 | % | |

Class C | |

Average annual total return (with CDSC) | | | 22.70 | % | | | 18.76 | % | | | 6.16 | % | |

Average annual total return (without CDSC) | | | 23.70 | % | | | 18.76 | % | | | 6.16 | % | |

S&P 500® Index†† | |

Average annual total return | | | 24.61 | % | | | 18.83 | % | | | 8.29 | % | |

Russell 1000® Index†† | |

Average annual total return | | | 25.35 | % | | | 19.25 | % | | | 8.73 | % | |

Russell 1000® Value Index†† | |

Average annual total return | | | 23.81 | % | | | 19.23 | % | | | 8.24 | % | |

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the applicable sales charges of each specific class. Returns for Class A reflect the maximum initial sales charge of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in equity securities of companies with market capitalizations similar to the Russell 1000® Index.

†† See index descriptions on page 6.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I, Class A and Class C.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

7

LARGE CAP VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2014 | | 1 Year | | 5 Years | | 10 Years | | Since

6/24/87* | |

Class I | |

Average annual total return | | | 26.52 | % | | | 20.69 | % | | | 6.25 | % | | | 9.38 | % | |

Class A | |

Average annual total return (with sales charge) | | | 19.57 | % | | | 19.11 | % | | | 5.40 | % | | | 8.92 | % | |

Average annual total return (without sales charge) | | | 26.22 | % | | | 20.39 | % | | | 5.97 | % | | | 9.14 | % | |

Class C | |

Average annual total return (with CDSC) | | | 24.29 | % | | | 19.49 | % | | | 5.24 | % | | | 8.31 | % | |

Average annual total return (without CDSC) | | | 25.29 | % | | | 19.49 | % | | | 5.24 | % | | | 8.31 | % | |

Class R | |

Average annual total return | | | 25.91 | % | | | 20.10 | % | | | 5.71 | % | | | 8.85 | % | |

S&P 500® Index†† | |

Average annual total return | | | 24.61 | % | | | 18.83 | % | | | 7.78 | % | | | 9.56 | % | |

Russell 1000® Index†† | |

Average annual total return | | | 25.35 | % | | | 19.25 | % | | | 8.19 | % | | | 9.72 | % | |

Russell 1000® Value Index†† | |

Average annual total return | | | 23.81 | % | | | 19.23 | % | | | 8.03 | % | | | n/a | | |

Returns shown for Class A, Class C, and Class R shares for the periods prior to their inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of each specific class. (Inception dates: Class A — 10/26/01; Class C — 2/4/02; Class R — 8/28/03.)

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the applicable sales charges of each specific class. Returns for Class A reflect the maximum initial sales charge of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in equity securities of companies with market capitalizations similar to the Russell 1000® Index.

†† See index descriptions on page 6.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

8

MID-CAP VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2014 | | 1 Year | | 5 Years | | 10 Years | | Since

1/2/97* | |

Class I | |

Average annual total return | | | 28.10 | % | | | 27.35 | % | | | 10.87 | % | | | 14.03 | % | |

Class A | |

Average annual total return (with sales charge) | | | 21.07 | % | | | 25.66 | % | | | 10.00 | % | | | 13.40 | % | |

Average annual total return (without sales charge) | | | 27.78 | % | | | 27.02 | % | | | 10.60 | % | | | 13.75 | % | |

Class C | |

Average annual total return (with CDSC) | | | 25.84 | % | | | 26.08 | % | | | 9.86 | % | | | 12.94 | % | |

Average annual total return (without CDSC) | | | 26.84 | % | | | 26.08 | % | | | 9.86 | % | | | 12.94 | % | |

Class R | |

Average annual total return | | | 27.47 | % | | | 26.73 | % | | | 10.33 | % | | | 13.55 | % | |

Russell Midcap® Index†† | |

Average annual total return | | | 26.85 | % | | | 22.07 | % | | | 10.43 | % | | | 10.64 | % | |

Russell Midcap® Value Index†† | |

Average annual total return | | | 27.76 | % | | | 22.97 | % | | | 10.66 | % | | | 11.19 | % | |

Returns shown for Class A, Class C, and Class R shares for the periods prior to their inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of each specific class. (Inception dates: Class A, Class C — 1/2/01; Class R — 8/28/03.)

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the applicable sales charges of each specific class. Returns for Class A reflect the maximum initial sales charge of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in equity securities of companies with market capitalizations similar to the Russell Midcap® Index.

†† See index descriptions on page 6.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

9

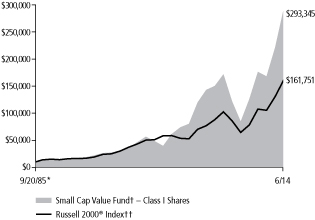

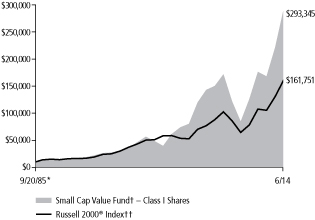

SMALL CAP VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2014 | | 1 Year | | 5 Years | | 10 Years | | Since

9/20/85* | |

Class I | |

Average annual total return | | | 32.40 | % | | | 28.31 | % | | | 9.38 | % | | | 12.46 | % | |

Class A | |

Average annual total return (with sales charge) | | | 25.13 | % | | | 26.63 | % | | | 8.52 | % | | | 12.00 | % | |

Average annual total return (without sales charge) | | | 32.06 | % | | | 28.00 | % | | | 9.11 | % | | | 12.21 | % | |

Class C | |

Average annual total return (with CDSC) | | | 30.09 | % | | | 27.05 | % | | | 8.40 | % | | | 11.40 | % | |

Average annual total return (without CDSC) | | | 31.09 | % | | | 27.05 | % | | | 8.40 | % | | | 11.40 | % | |

Russell 2000® Index†† | |

Average annual total return | | | 23.64 | % | | | 20.21 | % | | | 8.70 | % | | | 10.15 | % | |

Russell 2000® Value Index†† | |

Average annual total return | | | 22.54 | % | | | 19.88 | % | | | 8.24 | % | | | n/a | | |

Returns shown for Class A and Class C shares for the periods prior to their inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of each specific class. (Inception dates: Class A — 10/6/00; Class C — 2/4/02.)

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the applicable sales charges of each specific class. Returns for Class A reflect the maximum initial sales charge of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in equity securities of companies with market capitalizations similar to the Russell 2000® Index.

†† See index descriptions on page 6.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

10

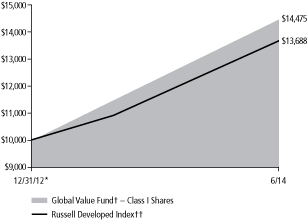

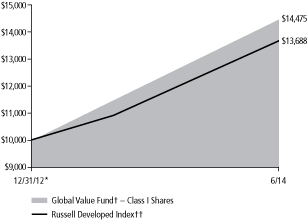

GLOBAL VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2014 | | 1 Year | | Since

12/31/12* | |

Class I | |

Average annual total return | | | 25.98 | % | | | 28.05 | % | |

Class A | |

Average annual total return (with sales charge) | | | 19.02 | % | | | 23.23 | % | |

Average annual total return (without sales charge) | | | 25.65 | % | | | 27.72 | % | |

Russell Developed Index†† | |

Average annual total return | | | 25.43 | % | | | 23.28 | % | |

Returns shown for Class A shares for the periods prior to its inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of the class. (Inception date: Class A — 8/30/13.)

Average annual total returns with sales charge shown for Class A shares have been adjusted to reflect the applicable sales charge of the class. Returns for Class A reflect the maximum initial sales charge of 5.25%. Average annual total returns without sales charge do not reflect the sales charges. Had the sales charge been included, the Fund's returns would have been lower.

† The Fund invests primarily in U.S. and non-U.S. companies.

†† See index descriptions on page 6.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

11

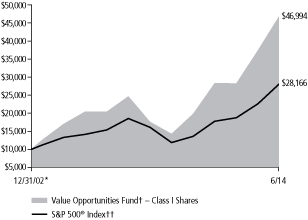

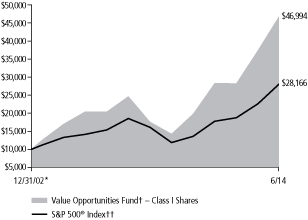

VALUE OPPORTUNITIES FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2014 | | 1 Year | | 5 Years | | 10 Years | | Since

12/31/02* | |

Class I | |

Average annual total return | | | 25.67 | % | | | 26.87 | % | | | 10.67 | % | | | 14.41 | % | |

Class A | |

Average annual total return (with sales charge) | | | 18.76 | % | | | 25.20 | % | | | 9.80 | % | | | 13.67 | % | |

Average annual total return (without sales charge) | | | 25.34 | % | | | 26.56 | % | | | 10.40 | % | | | 14.20 | % | |

Class C | |

Average annual total return (with CDSC) | | | 23.44 | % | | | 25.61 | % | | | 9.64 | % | | | 13.32 | % | |

Average annual total return (without CDSC) | | | 24.44 | % | | | 25.61 | % | | | 9.64 | % | | | 13.32 | % | |

S&P 500® Index†† | |

Average annual total return | | | 24.61 | % | | | 18.83 | % | | | 7.78 | % | | | 9.42 | % | |

Returns shown for Class C shares for the periods prior to their inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of the class. (Inception date: Class C — 8/28/03.)

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the applicable sales charges of each specific class. Returns for Class A reflect the maximum initial sales charge of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in securities of companies with strong capital appreciation potential.

†† See index descriptions on page 6.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I and Class A.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

12

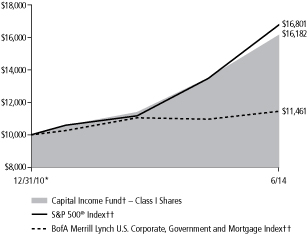

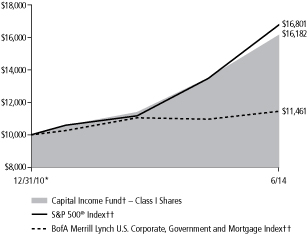

CAPITAL INCOME FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2014 | | 1 Year | | Since

12/31/10* | |

Class I | |

Average annual total return | | | 19.71 | % | | | 14.76 | % | |

Class A | |

Average annual total return (with sales charge) | | | 13.49 | % | | | 13.71 | % | |

Average annual total return (without sales charge) | | | 19.17 | % | | | 15.31 | % | |

S&P 500® Index†† | |

Average annual total return | | | 24.61 | % | | | 15.98 | % | |

BofA Merrill Lynch U.S. Corporate, Government and Mortgage Index†† | |

Average annual total return | | | 4.46 | % | | | 3.97 | % | |

Returns shown for Class A shares for the periods prior to its inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of the class. (Inception date: Class A — 2/28/11.)

Average annual total returns with sales charge shown for Class A shares have been adjusted to reflect the applicable sales charge of the class. Returns for Class A reflect the maximum initial sales charge of 4.75%. Average annual total returns without sales charge do not reflect the sales charges. Had the sales charge been included, the Fund's returns would have been lower.

† The Fund invests primarily in dividend-paying equities and high yield fixed income securities.

†† See index descriptions on page 6.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

13

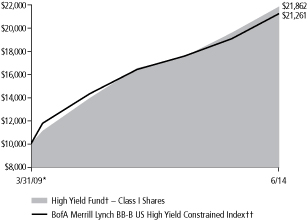

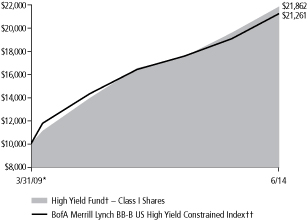

HIGH YIELD FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2014 | | 1 Year | | 5 Years | | Since

3/31/09* | |

Class I | |

Average annual total return | | | 11.51 | % | | | 14.43 | % | | | 16.07 | % | |

Class A | |

Average annual total return (with sales charge) | | | 7.10 | % | | | 13.18 | % | | | 14.80 | % | |

Average annual total return (without sales charge) | | | 11.28 | % | | | 14.05 | % | | | 15.63 | % | |

Class C | |

Average annual total return (with CDSC) | | | 9.40 | % | | | 13.27 | % | | | 14.89 | % | |

Average annual total return (without CDSC) | | | 10.40 | % | | | 13.27 | % | | | 14.89 | % | |

BofA Merrill Lynch BB-B US High Yield Constrained Index†† | |

Average annual total return | | | 11.33 | % | | | 12.49 | % | | | 15.45 | % | |

Returns shown for Class A and Class C shares for the periods prior to their inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of the class. (Inception dates: Class A — 5/29/09; Class C — 12/31/12.)

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the applicable sales charges of each specific class. Returns for Class A reflect the maximum initial sales charge of 3.75%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in high yield securities.

†† See index description on page 6.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

14

Schedule of Investments — June 30, 2014

Hotchkis & Wiley Diversified Value Fund

Largest Equity Holdings | | Percent of

net assets | |

JPMorgan Chase & Co. | | | 3.95 | % | |

Citigroup Inc. | | | 3.93 | % | |

American International Group, Inc. | | | 3.86 | % | |

Royal Dutch Shell PLC | | | 3.67 | % | |

Bank of America Corporation | | | 3.05 | % | |

Corning Incorporated | | | 2.97 | % | |

Microsoft Corporation | | | 2.85 | % | |

Oracle Corporation | | | 2.74 | % | |

Hewlett-Packard Company | | | 2.52 | % | |

Vodafone Group Public Limited

Company | | | 2.48 | % | |

COMMON

STOCKS — 97.33% | | Shares

Held | | Value | |

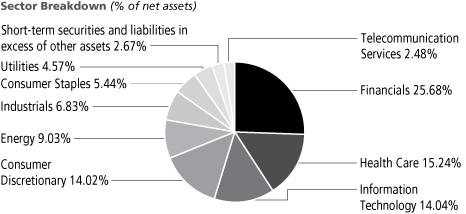

CONSUMER DISCRETIONARY — 14.02%

Auto Components — 2.12% | |

Johnson Controls, Inc. | | | 232,700 | | | $ | 11,618,711 | | |

Automobiles — 2.50% | |

General Motors Company | | | 229,300 | | | | 8,323,590 | | |

Honda Motor Co., Ltd. — ADR | | | 154,900 | | | | 5,419,951 | | |

| | | | 13,743,541 | | |

Hotels, Restaurants & Leisure — 1.19% | |

Carnival Corporation | | | 68,100 | | | | 2,563,965 | | |

McDonald's Corporation | | | 39,300 | | | | 3,959,082 | | |

| | | | 6,523,047 | | |

Media — 5.04% | |

Comcast Corporation | | | 137,300 | | | | 7,322,209 | | |

The Interpublic Group of Companies, Inc. | | | 371,000 | | | | 7,238,210 | | |

Omnicom Group Inc. | | | 38,700 | | | | 2,756,214 | | |

Time Warner Cable Inc. | | | 51,400 | | | | 7,571,220 | | |

Time Warner Inc. | | | 39,800 | | | | 2,795,950 | | |

| | | | 27,683,803 | | |

Multiline Retail — 2.50% | |

Nordstrom, Inc. | | | 40,100 | | | | 2,723,993 | | |

Target Corporation | | | 189,700 | | | | 10,993,115 | | |

| | | | 13,717,108 | | |

Specialty Retail — 0.67% | |

Lowe's Companies, Inc. | | | 77,100 | | | | 3,700,029 | | |

TOTAL CONSUMER DISCRETIONARY | | | 76,986,239 | | |

CONSUMER STAPLES — 5.44%

Beverages — 1.01% | |

Molson Coors Brewing Company | | | 37,300 | | | | 2,766,168 | | |

PepsiCo, Inc. | | | 30,900 | | | | 2,760,606 | | |

| | | | 5,526,774 | | |

Food & Staples Retailing — 2.21% | |

Wal-Mart Stores, Inc. | | | 162,000 | | | | 12,161,340 | | |

| | Shares

Held | | Value | |

Food Products — 1.74% | |

Kellogg Company | | | 61,400 | | | $ | 4,033,980 | | |

Mondelez International, Inc. | | | 146,100 | | | | 5,494,821 | | |

| | | | 9,528,801 | | |

Tobacco — 0.48% | |

Philip Morris International Inc. | | | 31,200 | | | | 2,630,472 | | |

TOTAL CONSUMER STAPLES | | | 29,847,387 | | |

ENERGY — 9.03%

Oil, Gas & Consumable Fuels — 9.03% | |

Cobalt International Energy, Inc. (a) | | | 696,400 | | | | 12,778,940 | | |

Kosmos Energy Ltd. (a) | | | 140,600 | | | | 1,578,938 | | |

Marathon Oil Corporation | | | 243,100 | | | | 9,704,552 | | |

Murphy Oil Corporation | | | 81,200 | | | | 5,398,176 | | |

Royal Dutch Shell PLC — ADR (c) | | | 244,519 | | | | 20,141,030 | | |

TOTAL ENERGY | | | 49,601,636 | | |

FINANCIALS — 25.68%

Banks — 14.32% | |

Bank of America Corporation | | | 1,089,522 | | | | 16,745,953 | | |

Citigroup Inc. | | | 458,174 | | | | 21,579,996 | | |

JPMorgan Chase & Co. | | | 376,200 | | | | 21,676,644 | | |

SunTrust Banks, Inc. | | | 191,700 | | | | 7,679,502 | | |

Wells Fargo & Company | | | 208,234 | | | | 10,944,779 | | |

| | | | 78,626,874 | | |

Capital Markets — 2.28% | |

The Bank of New York Mellon Corporation | | | 155,100 | | | | 5,813,148 | | |

The Goldman Sachs Group, Inc. | | | 16,400 | | | | 2,746,016 | | |

Morgan Stanley | | | 122,400 | | | | 3,957,192 | | |

| | | | 12,516,356 | | |

Consumer Finance — 1.84% | |

Capital One Financial Corporation | | | 122,100 | | | | 10,085,460 | | |

The accompanying notes are an integral part of these financial statements.

15

Schedule of Investments — June 30, 2014

Hotchkis & Wiley Diversified Value Fund

| | Shares

Held | | Value | |

Insurance — 7.24% | |

The Allstate Corporation | | | 181,700 | | | $ | 10,669,424 | | |

American International Group, Inc. | | | 388,500 | | | | 21,204,330 | | |

Unum Group | | | 227,600 | | | | 7,911,376 | | |

| | | | 39,785,130 | | |

TOTAL FINANCIALS | | | 141,013,820 | | |

HEALTH CARE — 15.24%

Health Care Equipment & Supplies — 2.05% | |

Covidien Public Limited Company | | | 35,100 | | | | 3,165,318 | | |

Medtronic, Inc. | | | 83,000 | | | | 5,292,080 | | |

Zimmer Holdings, Inc. | | | 26,700 | | | | 2,773,062 | | |

| | | | 11,230,460 | | |

Health Care Providers & Services — 7.40% | |

Aetna Inc. | | | 37,800 | | | | 3,064,824 | | |

Express Scripts Holding Company (a) | | | 77,100 | | | | 5,345,343 | | |

Humana Inc. | | | 58,400 | | | | 7,458,848 | | |

Quest Diagnostics Inc. | | | 43,800 | | | | 2,570,622 | | |

UnitedHealth Group Incorporated | | | 159,700 | | | | 13,055,475 | | |

WellPoint, Inc. | | | 84,900 | | | | 9,136,089 | | |

| | | | 40,631,201 | | |

Pharmaceuticals — 5.79% | |

Eli Lilly and Company | | | 110,500 | | | | 6,869,785 | | |

GlaxoSmithKline plc — ADR | | | 118,700 | | | | 6,348,076 | | |

Johnson & Johnson | | | 26,200 | | | | 2,741,044 | | |

Novartis AG — ADR | | | 29,500 | | | | 2,670,635 | | |

Sanofi SA — ADR | | | 247,700 | | | | 13,170,209 | | |

| | | | 31,799,749 | | |

TOTAL HEALTH CARE | | | 83,661,410 | | |

INDUSTRIALS — 6.83%

Aerospace & Defense — 2.58% | |

The Boeing Company | | | 51,400 | | | | 6,539,622 | | |

Embraer S.A. — ADR | | | 71,700 | | | | 2,612,031 | | |

Lockheed Martin Corporation | | | 15,800 | | | | 2,539,534 | | |

Northrop Grumman Corporation | | | 20,800 | | | | 2,488,304 | | |

| | | | 14,179,491 | | |

Air Freight & Logistics — 0.52% | |

FedEx Corporation | | | 18,900 | | | | 2,861,082 | | |

Machinery — 3.73% | |

CNH Industrial N.V. (c) | | | 112,800 | | | | 1,152,816 | | |

Cummins Inc. | | | 58,400 | | | | 9,010,536 | | |

PACCAR Inc. | | | 76,700 | | | | 4,819,061 | | |

Stanley Black & Decker, Inc. | | | 62,600 | | | | 5,497,532 | | |

| | | | 20,479,945 | | |

TOTAL INDUSTRIALS | | | 37,520,518 | | |

| | Shares

Held | | Value | |

INFORMATION TECHNOLOGY — 14.04%

Communications Equipment — 0.79% | |

Telefonaktiebolaget LM Ericsson — ADR | | | 359,800 | | | $ | 4,346,384 | | |

Electronic Equipment, Instruments & Components — 3.44% | |

Corning Incorporated | | | 742,800 | | | | 16,304,460 | | |

TE Connectivity Ltd. | | | 41,500 | | | | 2,566,360 | | |

| | | | 18,870,820 | | |

IT Services — 1.22% | |

International Business Machines Corporation | | | 37,000 | | | | 6,706,990 | | |

Semiconductors & Semiconductor Equipment — 0.48% | |

Texas Instruments Incorporated | | | 54,900 | | | | 2,623,671 | | |

Software — 5.59% | |

Microsoft Corporation | | | 375,800 | | | | 15,670,860 | | |

Oracle Corporation | | | 371,100 | | | | 15,040,683 | | |

| | | | 30,711,543 | | |

Technology Hardware, Storage & Peripherals — 2.52% | |

Hewlett-Packard Company | | | 411,600 | | | | 13,862,688 | | |

TOTAL INFORMATION TECHNOLOGY | | | 77,122,096 | | |

TELECOMMUNICATION SERVICES — 2.48%

Wireless Telecommunication Services — 2.48% | |

Vodafone Group Public Limited Company — ADR | | | 407,163 | | | | 13,595,172 | | |

TOTAL TELECOMMUNICATION SERVICES | | | 13,595,172 | | |

UTILITIES — 4.57%

Electric Utilities — 0.98% | |

Edison International | | | 46,700 | | | | 2,713,737 | | |

Exelon Corporation | | | 74,300 | | | | 2,710,464 | | |

| | | | 5,424,201 | | |

Independent Power & Renewable Electricity

Producers — 1.43% | |

NRG Energy, Inc. | | | 210,900 | | | | 7,845,480 | | |

Multi-Utilities — 2.16% | |

Public Service Enterprise Group Incorporated | | | 290,500 | | | | 11,849,495 | | |

TOTAL UTILITIES | | | 25,119,176 | | |

Total common stocks

(Cost $482,941,350) | | | 534,467,454 | | |

Total long-term investments

(Cost $482,941,350) | | | | | 534,467,454 | | |

COLLATERAL FOR SECURITIES ON LOAN — 0.19% | |

Money Market Funds — 0.19% | |

Invesco Government Agency Portfolio, 0.01%^ | | | 1,065,210 | | | | 1,065,210 | | |

Total collateral for securities on loan

(Cost $1,065,210) | | | 1,065,210 | | |

The accompanying notes are an integral part of these financial statements.

16

Schedule of Investments — June 30, 2014

Hotchkis & Wiley Diversified Value Fund

SHORT-TERM

INVESTMENTS — 2.72% | | Principal

Amount | | Value | |

Time Deposits — 2.72% | |

Citibank, 0.03%, 07/01/2014* | | $ | 10,879,749 | | | $ | 10,879,749 | | |

Deutsche Bank, 0.03%, 07/01/2014* | | | 4,072,900 | | | | 4,072,900 | | |

Total short-term investments

(Cost $14,952,649) | | | 14,952,649 | | |

Total investments — 100.24%

(Cost $498,959,209) | | | 550,485,313 | | |

Liabilities in excess of other assets — (0.24)% | | | | | (1,342,134 | ) | |

Net assets — 100.00% | | $ | 549,143,179 | | |

(a) — Non-income producing security.

(c) — All or a portion of this security is on loan. The total market value of securities on loan was $1,042,147.

ADR — American Depositary Receipt

^ — Rate shown is the 7-day yield as of June 30, 2014.

* — Invested through a cash management account administered by Brown Brothers Harriman & Co.

The Global Industry Classification Standard (GICS®) was developed by MSCI, an independent provider of global indices and benchmark-related products and services, and Standard & Poor's (S&P), an independent international financial data and investment services company. The GICS methodology has been widely accepted as an industry analysis framework for investment research, portfolio management and asset allocation. The GICS structure consists of 10 sectors, 24 industry groups, 67 industries and 156 sub-industries. Each stock that is classified will have a coding at all four of these levels.

The accompanying notes are an integral part of these financial statements.

17

Schedule of Investments — June 30, 2014

Hotchkis & Wiley Large Cap Value Fund

Largest Equity Holdings | | Percent of

net assets | |

American International Group, Inc. | | | 4.72 | % | |

JPMorgan Chase & Co. | | | 4.19 | % | |

Citigroup Inc. | | | 4.15 | % | |

Royal Dutch Shell PLC | | | 4.04 | % | |

Bank of America Corporation | | | 3.30 | % | |

Corning Incorporated | | | 3.04 | % | |

Vodafone Group Public Limited

Company | | | 2.97 | % | |

Wal-Mart Stores, Inc. | | | 2.95 | % | |

Microsoft Corporation | | | 2.95 | % | |

Hewlett-Packard Company | | | 2.84 | % | |

COMMON

STOCKS — 98.61% | | Shares

Held | | Value | |

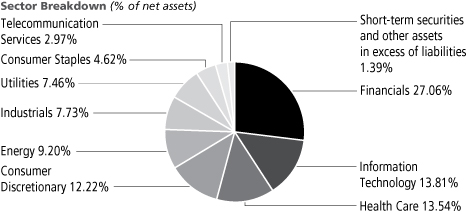

CONSUMER DISCRETIONARY — 12.22%

Auto Components — 3.24% | |

Johnson Controls, Inc. | | | 341,000 | | | $ | 17,026,130 | | |

Lear Corporation | | | 41,900 | | | | 3,742,508 | | |

Magna International Inc. | | | 36,000 | | | | 3,879,000 | | |

| | | | 24,647,638 | | |

Automobiles — 2.01% | |

General Motors Company | | | 214,700 | | | | 7,793,610 | | |

Honda Motor Co., Ltd. — ADR | | | 213,900 | | | | 7,484,361 | | |

| | | | 15,277,971 | | |

Hotels, Restaurants & Leisure — 0.73% | |

McDonald's Corporation | | | 55,300 | | | | 5,570,922 | | |

Media — 3.58% | |

Comcast Corporation | | | 222,000 | | | | 11,839,260 | | |

The Interpublic Group of Companies, Inc. | | | 389,600 | | | | 7,601,096 | | |

Time Warner Cable Inc. | | | 52,900 | | | | 7,792,170 | | |

| | | | 27,232,526 | | |

Multiline Retail — 2.66% | |

Target Corporation | | | 349,800 | | | | 20,270,910 | | |

TOTAL CONSUMER DISCRETIONARY | | | 92,999,967 | | |

CONSUMER STAPLES — 4.62%

Food & Staples Retailing — 2.95% | |

Wal-Mart Stores, Inc. | | | 299,200 | | | | 22,460,944 | | |

Food Products — 1.20% | |

Kellogg Company | | | 81,500 | | | | 5,354,550 | | |

Mondelez International, Inc. | | | 99,000 | | | | 3,723,390 | | |

| | | | 9,077,940 | | |

Tobacco — 0.47% | |

Philip Morris International Inc. | | | 42,500 | | | | 3,583,175 | | |

TOTAL CONSUMER STAPLES | | | 35,122,059 | | |

| | Shares

Held | | Value | |

ENERGY — 9.20%

Oil, Gas & Consumable Fuels — 9.20% | |

Marathon Oil Corporation | | | 384,800 | | | $ | 15,361,216 | | |

Murphy Oil Corporation | | | 243,300 | | | | 16,174,584 | | |

Royal Dutch Shell PLC — ADR (c) | | | 373,143 | | | | 30,735,789 | | |

Total S.A. — ADR | | | 107,200 | | | | 7,739,840 | | |

TOTAL ENERGY | | | 70,011,429 | | |

FINANCIALS — 27.06%

Banks — 14.63% | |

Bank of America Corporation | | | 1,631,689 | | | | 25,079,060 | | |

BB&T Corporation | | | 98,600 | | | | 3,887,798 | | |

Citigroup Inc. | | | 670,768 | | | | 31,593,173 | | |

JPMorgan Chase & Co. | | | 553,700 | | | | 31,904,194 | | |

Wells Fargo & Company | | | 358,691 | | | | 18,852,799 | | |

| | | | 111,317,024 | | |

Capital Markets — 1.58% | |

The Bank of New York Mellon Corporation | | | 217,300 | | | | 8,144,404 | | |

The Goldman Sachs Group, Inc. | | | 23,300 | | | | 3,901,352 | | |

| | | | 12,045,756 | | |

Consumer Finance — 1.97% | |

Capital One Financial Corporation | | | 181,500 | | | | 14,991,900 | | |

Insurance — 8.88% | |

The Allstate Corporation | | | 321,000 | | | | 18,849,120 | | |

American International Group, Inc. | | | 658,600 | | | | 35,946,388 | | |

Unum Group | | | 367,800 | | | | 12,784,728 | | |

| | | | 67,580,236 | | |

TOTAL FINANCIALS | | | 205,934,916 | | |

HEALTH CARE — 13.54%

Health Care Equipment & Supplies — 0.97% | |

Zimmer Holdings, Inc. | | | 71,300 | | | | 7,405,218 | | |

The accompanying notes are an integral part of these financial statements.

18

Schedule of Investments — June 30, 2014

Hotchkis & Wiley Large Cap Value Fund

| | Shares

Held | | Value | |

Health Care Providers & Services — 6.10% | |

Humana Inc. | | | 81,200 | | | $ | 10,370,864 | | |

UnitedHealth Group Incorporated | | | 262,600 | | | | 21,467,550 | | |

WellPoint, Inc. | | | 135,300 | | | | 14,559,633 | | |

| | | | 46,398,047 | | |

Pharmaceuticals — 6.47% | |

Eli Lilly and Company | | | 189,200 | | | | 11,762,564 | | |

GlaxoSmithKline plc — ADR | | | 207,700 | | | | 11,107,796 | | |

Johnson & Johnson | | | 73,300 | | | | 7,668,646 | | |

Sanofi SA — ADR | | | 352,400 | | | | 18,737,108 | | |

| | | | 49,276,114 | | |

TOTAL HEALTH CARE | | | 103,079,379 | | |

INDUSTRIALS — 7.73%

Aerospace & Defense — 2.74% | |

The Boeing Company | | | 82,500 | | | | 10,496,475 | | |

Embraer S.A. — ADR | | | 81,900 | | | | 2,983,617 | | |

Lockheed Martin Corporation | | | 23,000 | | | | 3,696,790 | | |

Northrop Grumman Corporation | | | 31,000 | | | | 3,708,530 | | |

| | | | 20,885,412 | | |

Machinery — 4.48% | |

Cummins Inc. | | | 115,800 | | | | 17,866,782 | | |

PACCAR Inc. | | | 137,000 | | | | 8,607,710 | | |

Stanley Black & Decker, Inc. | | | 86,300 | | | | 7,578,866 | | |

| | | | 34,053,358 | | |

Professional Services — 0.51% | |

Manpowergroup Inc. | | | 46,100 | | | | 3,911,585 | | |

TOTAL INDUSTRIALS | | | 58,850,355 | | |

INFORMATION TECHNOLOGY — 13.81%

Communications Equipment — 0.79% | |

Telefonaktiebolaget LM Ericsson — ADR | | | 498,300 | | | | 6,019,464 | | |

Electronic Equipment, Instruments & Components — 3.04% | |

Corning Incorporated | | | 1,053,500 | | | | 23,124,325 | | |

IT Services — 1.47% | |

International Business Machines Corporation | | | 61,600 | | | | 11,166,232 | | |

Software — 5.67% | |

Microsoft Corporation | | | 538,400 | | | | 22,451,280 | | |

Oracle Corporation | | | 510,000 | | | | 20,670,300 | | |

| | | | 43,121,580 | | |

Technology Hardware, Storage & Peripherals — 2.84% | |

Hewlett-Packard Company | | | 642,200 | | | | 21,629,296 | | |

TOTAL INFORMATION TECHNOLOGY | | | 105,060,897 | | |

TELECOMMUNICATION SERVICES — 2.97%

Wireless Telecommunication Services — 2.97% | |

Vodafone Group Public Limited Company — ADR | | | 676,754 | | | | 22,596,816 | | |

TOTAL TELECOMMUNICATION SERVICES | | | 22,596,816 | | |

| | Shares

Held | | Value | |

UTILITIES — 7.46%

Electric Utilities — 3.03% | |

Edison International | | | 66,800 | | | $ | 3,881,748 | | |

Exelon Corporation | | | 102,900 | | | | 3,753,792 | | |

PPL Corporation | | | 215,000 | | | | 7,638,950 | | |

The Southern Company | | | 171,400 | | | | 7,778,132 | | |

| | | | 23,052,622 | | |

Independent Power & Renewable Electricity

Producers — 1.66% | |

NRG Energy, Inc. | | | 339,700 | | | | 12,636,840 | | |

Multi-Utilities — 2.77% | |

Public Service Enterprise Group Incorporated | | | 517,200 | | | | 21,096,588 | | |

TOTAL UTILITIES | | | 56,786,050 | | |

Total common stocks

(Cost $714,016,298) | | | 750,441,868 | | |

Total long-term investments

(Cost $714,016,298) | | | | | 750,441,868 | | |

COLLATERAL FOR SECURITIES ON LOAN — 0.04% | |

Money Market Funds — 0.04% | |

Invesco Government Agency Portfolio, 0.01%^ | | | 311,269 | | | | 311,269 | | |

Total collateral for securities on loan

(Cost $311,269) | | | 311,269 | | |

SHORT-TERM

INVESTMENTS — 1.20% | | Principal

Amount | | | |

Time Deposits — 1.20% | |

SEB, 0.03%, 07/01/2014* | | $ | 9,078,974 | | | | 9,078,974 | | |

Total short-term investments

(Cost $9,078,974) | | | 9,078,974 | | |

Total investments — 99.85%

(Cost $723,406,541) | | | 759,832,111 | | |

Other assets in excess of liabilities — 0.15% | | | | | 1,177,923 | | |

Net assets — 100.00% | | $ | 761,010,034 | | |

(c) — All or a portion of this security is on loan. The total market value of securities on loan was $305,073.

ADR — American Depositary Receipt

^ — Rate shown is the 7-day yield as of June 30, 2014.

* — Invested through a cash management account administered by Brown Brothers Harriman & Co.

The Global Industry Classification Standard (GICS®) was developed by MSCI, an independent provider of global indices and benchmark-related products and services, and Standard & Poor's (S&P), an independent international financial data and investment services company. The GICS methodology has been widely accepted as an industry analysis framework for investment research, portfolio management and asset allocation. The GICS structure consists of 10 sectors, 24 industry groups, 67 industries and 156 sub-industries. Each stock that is classified will have a coding at all four of these levels.

The accompanying notes are an integral part of these financial statements.

19

Schedule of Investments — June 30, 2014

Hotchkis & Wiley Mid-Cap Value Fund

Largest Equity Holdings | | Percent of

net assets | |

SunTrust Banks, Inc. | | | 3.82 | % | |

ARRIS Group, Inc. | | | 3.36 | % | |

Great Plains Energy Incorporated | | | 3.30 | % | |

The Goodyear Tire & Rubber Company | | | 3.25 | % | |

Public Service Enterprise Group

Incorporated | | | 3.23 | % | |

Cobalt International Energy, Inc. | | | 3.19 | % | |

Willis Group Holdings Public Limited

Company | | | 3.18 | % | |

Avnet, Inc. | | | 3.10 | % | |

Kosmos Energy Ltd. | | | 3.09 | % | |

Kohl's Corporation | | | 3.01 | % | |

COMMON

STOCKS — 95.81% | | Shares

Held | | Value | |

CONSUMER DISCRETIONARY — 16.03%

Auto Components — 4.76% | |

The Goodyear Tire & Rubber Company | | | 4,186,900 | | | $ | 116,312,082 | | |

Lear Corporation | | | 606,500 | | | | 54,172,580 | | |

| | | | 170,484,662 | | |

Diversified Consumer Services — 0.76% | |

H & R Block, Inc. | | | 808,800 | | | | 27,110,976 | | |

Media — 2.32% | |

The Interpublic Group of Companies, Inc. | | | 3,301,500 | | | | 64,412,265 | | |

News Corporation (a) | | | 1,055,300 | | | | 18,932,082 | | |

| | | | 83,344,347 | | |

Multiline Retail — 3.01% | |

Kohl's Corporation | | | 2,049,700 | | | | 107,978,196 | | |

Specialty Retail — 5.18% | |

Bed Bath & Beyond Inc. (a) | | | 506,400 | | | | 29,057,232 | | |

Best Buy Co., Inc. | | | 699,800 | | | | 21,700,798 | | |

Office Depot, Inc. (a) | | | 3,255,500 | | | | 18,523,795 | | |

Rent-A-Center, Inc. | | | 2,185,600 | | | | 62,683,008 | | |

Staples, Inc. | | | 4,939,100 | | | | 53,539,844 | | |

| | | | 185,504,677 | | |

TOTAL CONSUMER DISCRETIONARY | | | 574,422,858 | | |

CONSUMER STAPLES — 2.80%

Food Products — 2.80% | |

Bunge Limited | | | 971,900 | | | | 73,514,516 | | |

Fresh Del Monte Produce Inc. | | | 873,400 | | | | 26,769,710 | | |

TOTAL CONSUMER STAPLES | | | 100,284,226 | | |

ENERGY — 8.70%

Energy Equipment & Services — 0.54% | |

McDermott International, Inc. (a) (c) | | | 2,371,300 | | | | 19,183,817 | | |

| | Shares

Held | | Value | |

Oil, Gas & Consumable Fuels — 8.16% | |

Cairn Energy PLC (a) (f) | | | 11,084,600 | | | $ | 37,927,137 | | |

Cobalt International Energy, Inc. (a) | | | 6,224,000 | | | | 114,210,400 | | |

Comstock Resources, Inc. | | | 1,031,600 | | | | 29,751,344 | | |

Kosmos Energy Ltd. (a) | | | 9,853,500 | | | | 110,654,805 | | |

| | | | 292,543,686 | | |

TOTAL ENERGY | | | 311,727,503 | | |

FINANCIALS — 27.20%

Banks — 13.14% | |

CIT Group Inc. | | | 837,000 | | | | 38,301,120 | | |

Comerica Incorporated | | | 326,300 | | | | 16,367,208 | | |

First Horizon National Corporation | | | 5,311,258 | | | | 62,991,515 | | |

KeyCorp | | | 3,181,120 | | | | 45,585,450 | | |

Regions Financial Corporation | | | 10,048,200 | | | | 106,711,884 | | |

SunTrust Banks, Inc. | | | 3,417,500 | | | | 136,905,050 | | |

Zions Bancorporation | | | 2,170,300 | | | | 63,958,741 | | |

| | | | 470,820,968 | | |

Capital Markets — 0.79% | |

Northern Trust Corporation | | | 440,900 | | | | 28,310,189 | | |

Diversified Financial Services — 2.00% | |

PHH Corporation (a) (b) | | | 3,128,000 | | | | 71,881,440 | | |

Insurance — 10.71% | |

Alleghany Corporation (a) | | | 81,800 | | | | 35,838,216 | | |

Aspen Insurance Holdings Limited | | | 622,700 | | | | 28,283,034 | | |

Unum Group | | | 2,308,400 | | | | 80,239,984 | | |

White Mountains Insurance Group, Ltd. | | | 176,300 | | | | 107,267,972 | | |

Willis Group Holdings Public Limited Company | | | 2,633,500 | | | | 114,030,550 | | |

XL Group Public Limited Company | | | 552,500 | | | | 18,083,325 | | |

| | | | 383,743,081 | | |

The accompanying notes are an integral part of these financial statements.

20

Schedule of Investments — June 30, 2014

Hotchkis & Wiley Mid-Cap Value Fund

| | Shares

Held | | Value | |

Real Estate Investment Trusts — 0.56% | |

The GEO Group, Inc. | | | 565,800 | | | $ | 20,216,034 | | |

TOTAL FINANCIALS | | | 974,971,712 | | |

HEALTH CARE — 6.23%

Health Care Providers & Services — 6.23% | |

Humana Inc. | | | 764,300 | | | | 97,616,396 | | |

LifePoint Hospitals, Inc. (a) | | | 578,600 | | | | 35,931,060 | | |

Quest Diagnostics Inc. | | | 1,036,300 | | | | 60,820,447 | | |

WellCare Health Plans, Inc. (a) | | | 388,500 | | | | 29,005,410 | | |

TOTAL HEALTH CARE | �� | | 223,373,313 | | |

INDUSTRIALS — 6.84%

Aerospace & Defense — 0.99% | |

Embraer S.A. — ADR | | | 968,900 | | | | 35,297,027 | | |

Airlines — 1.03% | |

JetBlue Airways Corporation (a) | | | 3,393,300 | | | | 36,817,305 | | |

Machinery — 1.93% | |

Navistar International Corporation (a) | | | 490,600 | | | | 18,387,688 | | |

Stanley Black & Decker, Inc. | | | 579,500 | | | | 50,891,690 | | |

| | | | 69,279,378 | | |

Road & Rail — 2.89% | |

Con-way Inc. | | | 2,057,500 | | | | 103,718,575 | | |

TOTAL INDUSTRIALS | | | 245,112,285 | | |

INFORMATION TECHNOLOGY — 15.36%

Communications Equipment — 3.36% | |

ARRIS Group, Inc. (a) | | | 3,703,300 | | | | 120,468,349 | | |

Electronic Equipment, Instruments & Components — 5.92% | |

Avnet, Inc. | | | 2,503,700 | | | | 110,938,947 | | |

CDW Corporation | | | 2,297,300 | | | | 73,237,924 | | |

Ingram Micro Inc. (a) | | | 954,400 | | | | 27,878,024 | | |

| | | | 212,054,895 | | |

IT Services — 1.16% | |

The Western Union Company | | | 2,390,200 | | | | 41,446,068 | | |

Semiconductors & Semiconductor Equipment — 2.74% | |

Marvell Technology Group Ltd. | | | 1,100,200 | | | | 15,765,866 | | |

ON Semiconductor Corporation (a) | | | 9,041,900 | | | | 82,642,966 | | |

| | | | 98,408,832 | | |

Software — 2.18% | |

CA, Inc. | | | 1,274,700 | | | | 36,634,878 | | |

Comverse, Inc. (a) | | | 152,680 | | | | 4,073,503 | | |

Symantec Corporation | | | 1,636,300 | | | | 37,471,270 | | |

| | | | 78,179,651 | | |

TOTAL INFORMATION TECHNOLOGY | | | 550,557,795 | | |

| | Shares

Held | | Value | |

UTILITIES — 12.65%

Electric Utilities — 7.17% | |

Great Plains Energy Incorporated | | | 4,401,900 | | | $ | 118,279,053 | | |

Pepco Holdings, Inc. | | | 1,492,700 | | | | 41,019,396 | | |

PPL Corporation | | | 2,743,600 | | | | 97,480,108 | | |

| | | | 256,778,557 | | |

Independent Power & Renewable Electricity

Producers — 2.25% | |

NRG Energy, Inc. | | | 2,170,500 | | | | 80,742,600 | | |

Multi-Utilities — 3.23% | |

Public Service Enterprise Group Incorporated | | | 2,838,700 | | | | 115,790,573 | | |

TOTAL UTILITIES | | | 453,311,730 | | |

Total common stocks

(Cost $2,978,129,969) | | | 3,433,761,422 | | |

Total long-term investments

(Cost $2,978,129,969) | | | 3,433,761,422 | | |

COLLATERAL FOR SECURITIES ON LOAN — 0.40% | |

Money Market Funds — 0.40% | |

Invesco Government Agency Portfolio, 0.01%^ | | | 14,602,452 | | | | 14,602,452 | | |

Total collateral for securities on loan

(Cost $14,602,452) | | | 14,602,452 | | |

SHORT-TERM

INVESTMENTS — 5.04% | | Principal

Amount | | | |

Time Deposits — 5.04% | |

Australia and New Zealand Banking Group Limited,

0.03%, 07/01/2014* | | $ | 62,649,036 | | | | 62,649,036 | | |

The Bank of Tokyo — Mitsubishi UFJ, Ltd.

0.03%, 07/01/2014* | | | 117,984,976 | | | | 117,984,976 | | |

Total short-term investments

(Cost $180,634,012) | | | 180,634,012 | | |

Total investments — 101.25%

(Cost $3,173,366,433) | | | 3,628,997,886 | | |

Liabilities in excess of other assets — (1.25)% | | | | | (44,956,035 | ) | |

Net assets — 100.00% | | $ | 3,584,041,851 | | |

(a) — Non-income producing security.

(b) — Affiliated issuer. See Note 6 in Notes to the Financial Statements.

(c) — All or a portion of this security is on loan. The total market value of securities on loan was $14,227,800.

(f) — Security was fair valued as a result of market movements following the close of local trading using a third-party vendor's proprietary fair value pricing model. The total market value of this security was $37,927,137, which represented 1.06% of net assets. See Security Valuation in Note 1 in Notes to the Financial Statements.

ADR — American Depositary Receipt

^ — Rate shown is the 7-day yield as of June 30, 2014.

* — Invested through a cash management account administered by Brown Brothers Harriman & Co.

The accompanying notes are an integral part of these financial statements.

21

Schedule of Investments — June 30, 2014

Hotchkis & Wiley Mid-Cap Value Fund

The Global Industry Classification Standard (GICS®) was developed by MSCI, an independent provider of global indices and benchmark-related products and services, and Standard & Poor's (S&P), an independent international financial data and investment services company. The GICS methodology has been widely accepted as an industry analysis framework for investment research, portfolio management and asset allocation. The GICS structure consists of 10 sectors, 24 industry groups, 67 industries and 156 sub-industries. Each stock that is classified will have a coding at all four of these levels.

The accompanying notes are an integral part of these financial statements.

22

Schedule of Investments — June 30, 2014

Hotchkis & Wiley Small Cap Value Fund

Largest Equity Holdings | | Percent of

net assets | |

Masonite International Corporation | | | 5.18 | % | |

Con-way Inc. | | | 5.15 | % | |

Kaiser Aluminum Corporation | | | 4.01 | % | |

First Horizon National Corporation | | | 3.80 | % | |

Horace Mann Educators Corporation | | | 3.61 | % | |

WellCare Health Plans, Inc. | | | 3.39 | % | |

The GEO Group, Inc. | | | 3.23 | % | |

Matson, Inc. | | | 3.06 | % | |

Sonic Automotive, Inc. | | | 3.03 | % | |

Great Plains Energy Incorporated | | | 2.98 | % | |

COMMON

STOCKS — 94.48% | | Shares

Held | | Value | |

CONSUMER DISCRETIONARY — 8.93%

Hotels, Restaurants & Leisure — 0.59% | |

Lakes Entertainment, Inc. (a) | | | 197,000 | | | $ | 927,870 | | |

Ruby Tuesday, Inc. (a) | | | 677,800 | | | | 5,144,502 | | |

| | | | 6,072,372 | | |

Household Durables — 1.69% | |

M/I Homes, Inc. (a) | | | 433,600 | | | | 10,523,472 | | |

William Lyon Homes (a) | | | 228,700 | | | | 6,961,628 | | |

| | | | 17,485,100 | | |

Multiline Retail — 0.49% | |

Big Lots, Inc. (a) | | | 109,500 | | | | 5,004,150 | | |

Specialty Retail — 5.78% | |

Rent-A-Center, Inc. | | | 991,000 | | | | 28,421,880 | | |

Sonic Automotive, Inc. | | | 1,174,000 | | | | 31,322,320 | | |

| | | | 59,744,200 | | |

Textiles, Apparel & Luxury Goods — 0.38% | |

Quiksilver, Inc. (a) | | | 1,096,700 | | | | 3,926,186 | | |

TOTAL CONSUMER DISCRETIONARY | | | 92,232,008 | | |

ENERGY — 3.35%

Energy Equipment & Services — 0.84% | |

McDermott International, Inc. (a) (c) | | | 1,077,700 | | | | 8,718,593 | | |

Oil, Gas & Consumable Fuels — 2.51% | |

Cairn Energy PLC (a) (f) | | | 3,342,600 | | | | 11,437,061 | | |

Cobalt International Energy, Inc. (a) | | | 397,200 | | | | 7,288,620 | | |

Rockhopper Exploration PLC (a) | | | 4,768,500 | | | | 7,181,476 | | |

| | | | 25,907,157 | | |

TOTAL ENERGY | | | 34,625,750 | | |

| | Shares

Held | | Value | |

FINANCIALS — 25.91%

Banks — 7.84% | |

Associated Banc-Corp | | | 482,500 | | | $ | 8,723,600 | | |

Cascade Bancorp (a) | | | 413,765 | | | | 2,155,715 | | |

First Horizon National Corporation | | | 3,308,231 | | | | 39,235,623 | | |

First Niagara Financial Group, Inc. | | | 1,256,200 | | | | 10,979,188 | | |

Investors Bancorp, Inc. | | | 276,500 | | | | 3,055,325 | | |

Synovus Financial Corp. | | | 364,671 | | | | 8,890,679 | | |

Webster Financial Corporation | | | 254,300 | | | | 8,020,622 | | |

| | | | 81,060,752 | | |

Capital Markets — 0.22% | |

Oppenheimer Holdings Inc. | | | 96,800 | | | | 2,322,232 | | |

Diversified Financial Services — 2.34% | |

PHH Corporation (a) | | | 1,050,700 | | | | 24,145,086 | | |

Insurance — 10.97% | |

Aspen Insurance Holdings Limited | | | 351,000 | | | | 15,942,420 | | |

Employers Holdings, Inc. | | | 118,000 | | | | 2,499,240 | | |

Endurance Specialty Holdings Ltd. | | | 81,800 | | | | 4,220,062 | | |

Global Indemnity Public Limited Company (a) | | | 375,536 | | | | 9,760,181 | | |

The Hanover Insurance Group, Inc. | | | 97,200 | | | | 6,138,180 | | |

Horace Mann Educators Corporation | | | 1,192,200 | | | | 37,280,094 | | |

National Western Life Insurance Company | | | 5,800 | | | | 1,446,578 | | |

Platinum Underwriters Holdings, Ltd. | | | 314,400 | | | | 20,388,840 | | |

Symetra Financial Corporation | | | 691,100 | | | | 15,715,614 | | |

| | | | 113,391,209 | | |

Real Estate Investment Trusts — 4.54% | |

The GEO Group, Inc. | | | 934,996 | | | | 33,407,407 | | |

Granite Real Estate Investment Trust | | | 361,600 | | | | 13,455,136 | | |

| | | | 46,862,543 | | |

TOTAL FINANCIALS | | | 267,781,822 | | |

The accompanying notes are an integral part of these financial statements.

23

Schedule of Investments — June 30, 2014

Hotchkis & Wiley Small Cap Value Fund

| | Shares

Held | | Value | |

HEALTH CARE — 10.74%

Health Care Equipment & Supplies — 1.00% | |

Invacare Corporation | | | 562,600 | | | $ | 10,334,962 | | |

Health Care Providers & Services — 7.01% | |

Hanger, Inc. (a) | | | 313,300 | | | | 9,853,285 | | |

LifePoint Hospitals, Inc. (a) | | | 442,900 | | | | 27,504,090 | | |

WellCare Health Plans, Inc. (a) | | | 469,100 | | | | 35,023,006 | | |

| | | | 72,380,381 | | |

Pharmaceuticals — 2.73% | |

Taro Pharmaceutical Industries Ltd. (a) | | | 201,200 | | | | 28,216,288 | | |

TOTAL HEALTH CARE | | | 110,931,631 | | |

INDUSTRIALS — 24.44%

Aerospace & Defense — 0.85% | |

Embraer S.A. — ADR | | | 113,600 | | | | 4,138,448 | | |

Huntington Ingalls industries, Inc. | | | 48,800 | | | | 4,615,992 | | |

| | | | 8,754,440 | | |

Airlines — 1.34% | |

JetBlue Airways Corporation (a) | | | 1,278,000 | | | | 13,866,300 | | |

Building Products — 5.18% | |

Masonite International Corporation (a) | | | 950,400 | | | | 53,469,504 | | |

Commercial Services & Supplies — 1.06% | |

The Brink's Company | | | 389,800 | | | | 11,000,156 | | |

Machinery — 4.32% | |

Meritor, Inc. (a) | | | 2,149,500 | | | | 28,029,480 | | |

Miller Industries, Inc. (b) | | | 805,800 | | | | 16,583,364 | | |

| | | | 44,612,844 | | |

Marine — 3.06% | |

Matson, Inc. | | | 1,177,700 | | | | 31,609,468 | | |

Professional Services — 1.08% | |

Heidrick & Struggles International, Inc. | | | 121,400 | | | | 2,245,900 | | |

Hudson Global, Inc. (a) (b) | | | 2,266,700 | | | | 8,908,131 | | |

| | | | 11,154,031 | | |

Road & Rail — 5.15% | |

Con-way Inc. | | | 1,055,900 | | | | 53,227,919 | | |

Trading Companies & Distributors — 2.40% | |

Rush Enterprises, Inc. (a) | | | 715,600 | | | | 24,809,852 | | |

TOTAL INDUSTRIALS | | | 252,504,514 | | |

INFORMATION TECHNOLOGY — 8.28%

Communications Equipment — 2.85% | |

ARRIS Group, Inc. (a) | | | 906,700 | | | | 29,494,951 | | |

Semiconductors & Semiconductor Equipment — 3.30% | |

Diodes Incorporated (a) | | | 357,500 | | | | 10,353,200 | | |

ON Semiconductor Corporation (a) | | | 2,592,700 | | | | 23,697,278 | | |

| | | | 34,050,478 | | |

| | Shares

Held | | Value | |

Software — 1.19% | |

Comverse, Inc. (a) | | | 462,510 | | | $ | 12,339,767 | | |

Technology Hardware, Storage & Peripherals — 0.94% | |

QLogic Corporation (a) | | | 960,500 | | | | 9,691,445 | | |

TOTAL INFORMATION TECHNOLOGY | | | 85,576,641 | | |

MATERIALS — 7.16%

Metals & Mining — 7.16% | |

Horsehead Holding Corp. (a) | | | 1,249,100 | | | | 22,808,566 | | |

Kaiser Aluminum Corporation | | | 569,300 | | | | 41,484,891 | | |

Noranda Aluminum Holding Corporation | | | 2,739,100 | | | | 9,669,023 | | |

TOTAL MATERIALS | | | 73,962,480 | | |

UTILITIES — 5.67%

Electric Utilities — 3.17% | |

Great Plains Energy Incorporated | | | 1,147,200 | | | | 30,825,264 | | |

Westar Energy, Inc. | | | 52,300 | | | | 1,997,337 | | |

| | | | 32,822,601 | | |

Independent Power & Renewable Electricity Producers — 2.50% | |