As filed with the Securities and Exchange Commission on [date]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-10487 |

|

Hotchkis & Wiley Funds |

(Exact name of registrant as specified in charter) |

|

725 South Figueroa Street, 39th Floor Los Angeles, California | | 90017-5439 |

(Address of principal executive offices) | | (Zip code) |

|

Anna Marie Lopez Hotchkis & Wiley Capital Management, LLC 725 South Figueroa Street, 39th Floor Los Angeles, California 90017-5439 |

(Name and address of agent for service) |

|

Copies to: Karin Jagel Flynn, Esq. Vedder Price P.C. 222 North LaSalle Street Chicago, IL 60601 |

(Counsel for the Registrant) |

|

Registrant’s telephone number, including area code: | (213) 430-1000 | |

|

Date of fiscal year end: | June 30, 2013 | |

|

Date of reporting period: | July 1, 2012 – June 30, 2013 | |

| | | | | | | | |

Updated August 1, 2011

Item 1. Reports to Stockholders.

Hotchkis & Wiley Funds

Annual Report

JUNE 30, 2013

DIVERSIFIED VALUE FUND

LARGE CAP VALUE FUND

MID-CAP VALUE FUND

SMALL CAP VALUE FUND

GLOBAL VALUE FUND

VALUE OPPORTUNITIES FUND

CAPITAL INCOME FUND

HIGH YIELD FUND

SHAREHOLDER LETTER | | | 3 | | |

| FUND PERFORMANCE DATA | | | 6 | | |

SCHEDULE OF INVESTMENTS: | |

| DIVERSIFIED VALUE FUND | | | 15 | | |

| LARGE CAP VALUE FUND | | | 17 | | |

| MID-CAP VALUE FUND | | | 19 | | |

| SMALL CAP VALUE FUND | | | 22 | | |

| GLOBAL VALUE FUND | | | 25 | | |

| VALUE OPPORTUNITIES FUND | | | 28 | | |

CAPITAL INCOME FUND | | | 31 | | |

HIGH YIELD FUND | | | 39 | | |

| STATEMENTS OF ASSETS & LIABILITIES | | | 45 | | |

| STATEMENTS OF OPERATIONS | | | 47 | | |

| STATEMENTS OF CHANGES IN NET ASSETS | | | 49 | | |

| FINANCIAL HIGHLIGHTS | | | 53 | | |

| NOTES TO THE FINANCIAL STATEMENTS | | | 57 | | |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 68 | | |

| FUND EXPENSE EXAMPLES | | | 69 | | |

BOARD CONSIDERATIONS IN APPROVING CONTINUATION OF

INVESTMENT ADVISORY AGREEMENTS | | | 71 | | |

BOARD CONSIDERATIONS IN APPROVING THE INVESTMENT ADVISORY

AGREEMENT FOR THE GLOBAL VALUE FUND | | | 74 | | |

| MANAGEMENT | | | 75 | | |

| PRIVACY POLICY | | | 76 | | |

INFORMATION ABOUT THE FUNDS | | | BACK COVER | | |

DEAR SHAREHOLDER:

The following investment review and annual report relates to the activities of the Hotchkis & Wiley Funds for the twelve months ended June 30, 2013.

OVERVIEW

Ten year U.S. Treasury bond yields increased rapidly after the Fed suggested it might taper its proactive bond purchasing program. The swift interest rate rise has focused attention on "low risk" bond portfolios and reminded investors that it is possible to lose money in high grade fixed income. Over the 12-month period, the BofA Merrill Lynch U.S. Treasury and Agency Index returned –1.89% and the BofA Merrill Lynch U.S. Corporate Index (investment grade only) returned +1.76%. High yield corporates, which have been typically less interest rate sensitive than investment grade alternatives, outperformed considerably as the BofA Merrill Lynch U.S. High Yield Master II Index returned +9.57%. Equities did even better, as the S&P 500® Index returned an impressive +20.60%.

While an extended rise in equity prices would normally portend a cautious outlook, corporate earnings have improved such that valuation multiples remain below historical averages — particularly considering widespread balance sheet deleveraging and improved capital allocation policies. Our search for compelling valuation opportunities in equity markets requires a bit more exertion than it did 12 months ago. Yet we continued to find attractive risk/return prospects across an array of sectors, though we found fewer compelling opportunities in commodity-tied sectors (e.g., materials). We also have an aversion to certain market segments that we believe investors may have erroneously perceived as bond substitutes. Many REITs and large U.S. telecommunication stocks, for example, pay considerable dividends but have weak valuation support.

The high yield market's yield-to-worst declined about 0.75% and spreads tightened by more than 100 basis points over the 12 month period — though both are notably higher than the lows reached in May 2013. Spreads over Treasuries are about 515 basis points, which is only slightly lower than the historical median despite the benign default rate environment. High yield bonds' excess spread, or spread adjusted for the default rate environment, remains well above historical median at 421 basis points (vs. historical median of 265 basis points). Record refinancing has extended maturities and financial leverage remains well below peak levels — both facilitate the continuation of a low default rate environment.

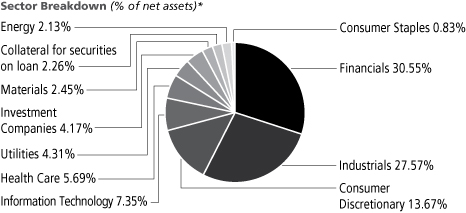

HOTCHKIS & WILEY DIVERSIFIED VALUE FUND

The Fund's Class I, Class A, and Class C shares had total returns for the 12-month period ended June 30, 2013 of 29.65%, 29.25%, and 28.28%, respectively, compared to the S&P 500® Index return of 20.60%, the Russell 1000® Index return of 21.24%, and the Russell 1000® Value Index return of 25.32%. (Fund results shown do not reflect sales charges and would be lower if sales charges were included. More complete performance information can be found on page 7 of this report to shareholders.)

More than 75% of the outperformance over the 12-month period is attributable to positive stock selection. Stock selection in financials, energy, and health care were the largest contributors to relative performance. The underweight in energy and overweight in consumer

discretionary and information technology were marginally beneficial. The largest individual contributors were Citigroup, Magna International, and AIG. Stock selection in information technology and consumer staples detracted from performance over the period. The largest individual detractors were JC Penney, Exelon, and Royal Dutch Shell.

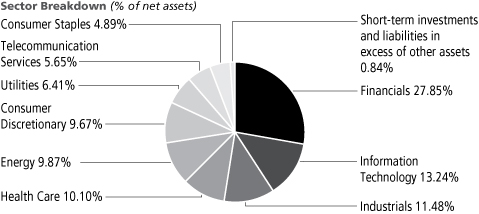

HOTCHKIS & WILEY LARGE CAP VALUE FUND

The Fund's Class I, Class A, Class C, and Class R shares had total returns for the 12-month period ended June 30, 2013 of 30.48%, 30.16%, 29.12%, and 29.79%, respectively, compared to the S&P 500® Index return of 20.60%, the Russell 1000® Index return of 21.24%, and the Russell 1000® Value Index return of 25.32%. (Fund results shown do not reflect sales charges and would be lower if sales charges were included. More complete performance information can be found on page 8 of this report to shareholders.)

Outperformance for the 12-month period was primarily due to positive stock selection, which drove nearly 80% of the excess return. The largest contributions came from stock selection in financials, health care, and industrials. An underweight in the energy sector and an overweight in the information technology and consumer discretionary sectors were marginal contributors as well. The largest individual contributors were Citigroup, H&R Block, and Unum Group. Stock selection in consumer staples and information technology detracted from performance over the 12 months; the largest individual detractors were JC Penney, Exelon, and Royal Dutch Shell.

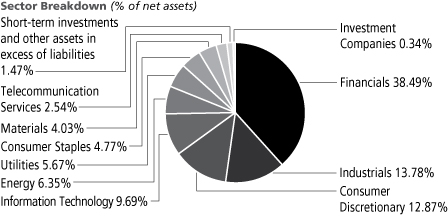

HOTCHKIS & WILEY MID-CAP VALUE FUND

The Fund's Class I, Class A, Class C, and Class R shares had total returns for the 12-month period ended June 30, 2013 of 36.51%, 36.16%, 35.13%, and 35.82%, respectively, compared to the Russell Midcap® Index return of 25.41% and the Russell Midcap® Value Index return of 27.65%. (Fund results shown do not reflect sales charges and would be lower if sales charges were included. More complete performance information can be found on page 9 of this report to shareholders.)

The Fund outperformed the Russell Midcap® Value Index over the 12-month period by a considerable margin. Two-thirds of the outperformance is attributable to positive stock selection, led by financials, utilities, and health care. An overweight in the consumer discretionary sector and an underweight in the utilities sector benefited relative performance modestly. The top individual contributors over the period were H&R Block, Magna International, and NRG Energy. Stock selection in consumer staples and energy detracted from performance over the period. The largest individual detractors were SuperValu, Kosmos Energy, and Con-way.

HOTCHKIS & WILEY SMALL CAP VALUE FUND

The Fund's Class I, Class A, and Class C shares had total returns for the 12-month period ended June 30, 2013 of 31.88%, 31.55%, and 30.55%, respectively, compared to the Russell 2000® Index return of 24.21% and the Russell 2000® Value Index return of 24.77%. (Fund results shown do not reflect sales charges and would be lower if sales charges were included. More complete performance information can be found on page 10 of this report to shareholders.)

Over the 12-month period, the Fund outperformed the Russell 2000® Value Index by a wide margin. Positive stock selection in financials, health care, and consumer discretionary were the largest contributors

3

to relative performance over the period. An overweight position in the consumer discretionary and industrials sectors combined with an underweight in energy was marginally beneficial to relative performance. The largest individual contributors were Quiksilver, Avis Budget Group, and CNO Financial. Stock selection in materials and energy detracted from performance over the 12-month period. The largest individual detractors were Noranda Aluminum, Hudson Global, and Con-way.

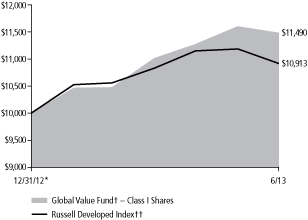

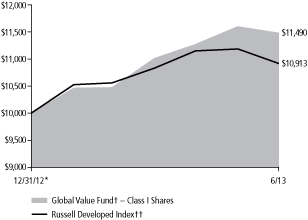

HOTCHKIS & WILEY GLOBAL VALUE FUND

The Fund commenced operations on December 31, 2012. The investment review below discusses the Fund's performance since inception through June 30, 2013.

The Fund's Class I shares had total returns for the 6-month period ended June 30, 2013 of 14.90% compared to the Russell Developed Index return of 9.13%. (More complete performance information can be found on page 11 of this report to shareholders.)

The Fund outperformed the index considerably over the 6-month period (since the Fund's inception). Positive stock selection drove nearly 80% of the outperformance. Stock selection in financials, information technology, and consumer staples were the largest performance contributors over the period. Relative to the benchmark, the underweight exposure to the Japanese yen and the Australian dollar were marginally beneficial. The largest individual contributors were Hewlett-Packard, AIG, and Unum Group. Stock selection in energy and consumer discretionary detracted from performance over the 6-month period. The largest individual detractors were Kosmos Energy, Mobistar, and Valassis Communications.

HOTCHKIS & WILEY VALUE OPPORTUNITIES FUND

The Fund's Class I, Class A, and Class C shares had total returns for the 12-month period ended June 30, 2013 of 32.28%, 31.98%, and 30.97%, respectively, compared to the S&P 500® Index return of 20.60%. (Fund results shown do not reflect sales charges and would be lower if sales charges were included. More complete performance information can be found on page 12 of this report to shareholders.)

The Fund outperformed the S&P 500® considerably over the 12-month period. Positive security selection drove more than 75% of the outperformance. Positive selection in health care, financials, and information technology were the largest contributors to relative performance. An overweight in financials and an underweight in information technology also benefited performance. The largest individual contributors were Quiksilver, Motors Liquidation Trust, and AIG. Security selection in telecommunication services and materials, along with an underweight in health care, detracted from relative performance over the period. The largest individual detractors were Verizon put options, Mobistar, and Freddie Mac preferred shares.

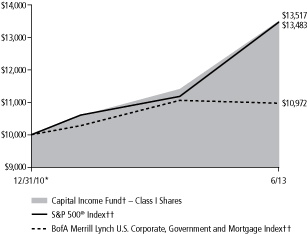

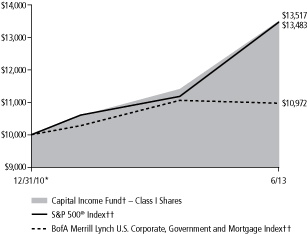

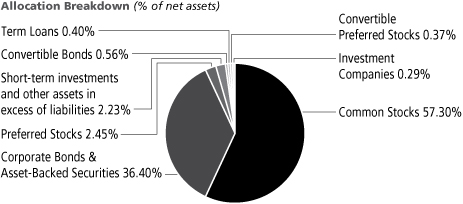

HOTCHKIS & WILEY CAPITAL INCOME FUND

The Fund's Class I and Class A shares had total returns for the 12-month period ended June 30, 2013 of 18.45% and 20.34%, respectively, compared to the S&P 500® Index return of 20.60% and BofA Merrill Lynch U.S. Corporate, Government and Mortgage Index return of –0.79%. (Fund results shown do not reflect sales charges and would be lower if sales charges were included. More complete performance information can be found on page 13 of this report to shareholders.)

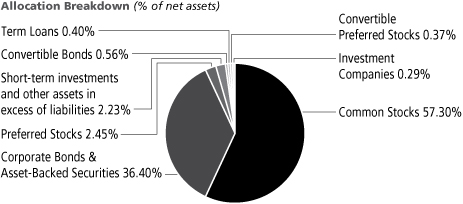

The equity portion of the Fund outperformed the S&P 500® and the high yield portion of the Fund outperformed the BofA Merrill Lynch U.S. Corporate, Government and Mortgage Index over the period. The Fund was also overweight equities relative to its 50/50 long-term target. The Fund's average allocation was 57%/43% equities/high yield, respectively. This helped performance as equities outperformed.

Positive stock selection drove all of the outperformance of the equity portion of the Fund relative to the S&P 500® over the 12-month period. Stock selection in information technology, consumer discretionary, and industrials was the largest contributor; H&R Block, JPMorgan Chase, and Hewlett-Packard were the largest individual contributors. Stock selection in energy and an overweight in utilities detracted from performance over the period; Exelon, Royal Dutch Shell, and Vodafone were the largest individual detractors.

The fixed income portion of the Fund outperformed the BofA Merrill Lynch U.S. Corporate, Government and Mortgage benchmark for the 12-month period. The fixed income portion of the Fund is invested in high yielding below investment grade rated corporate fixed income securities which generally have a shorter duration and greater credit sensitivity than the sovereign, mortgage backed and investment grade corporate securities which comprise the majority of the fixed income benchmark.

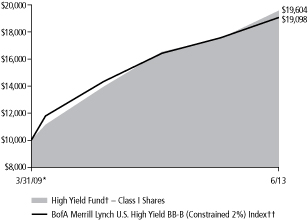

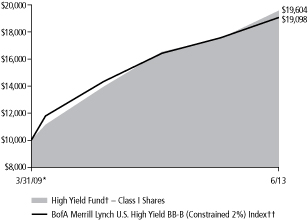

HOTCHKIS & WILEY HIGH YIELD FUND

The Fund's Class I, Class A, and Class C shares had total returns for the 12-month period ended June 30, 2013 of 11.70%, 11.37%, and 10.44%, respectively, compared to the BofA Merrill Lynch U.S. High Yield BB-B (Constrained 2%) Index return of 8.51%. (Fund results shown do not reflect sales charges and would be lower if sales charges were included. More complete performance information can be found on page 14 of this report to shareholders.)

The Fund outperformed the benchmark considerably over the 12-month period. Credit selection was positive in 15 of the 16 BofA Merrill Lynch sectors, which drove all of the outperformance over the period. Positive credit selection in the basic industry, health care, and automotive sectors were the largest contributors to relative performance. The strategy emphasizes small cap credits and fallen angels, which also benefitted performance over the period. A modest cash allocation was a slight drag on relative performance, along with an underweight position in telecommunications.

4

CONCLUSION

We appreciate your continued support of the Hotchkis & Wiley Funds, and we look forward to serving your investment needs in the future.

Sincerely,

| | | | | |

| |

| |

Anna Marie Lopez

President | | George Davis

Fund Manager | | Sheldon Lieberman

Fund Manager | |

| | | | | |

| |

| |

Patty McKenna

Fund Manager | | James Miles

Fund Manager | | Stan Majcher

Fund Manager | |

| | | | | |

| |

| |

David Green

Fund Manager | | Scott McBride

Fund Manager | | Judd Peters

Fund Manager | |

| | | | | |

| |

| |

Ray Kennedy

Fund Manager | | Mark Hudoff

Fund Manager | | Patrick Meegan

Fund Manager | |

| | | | | | | | | |

Scott Rosenthal

Fund Manager | | | | | |

Past performance does not guarantee future results.

The above reflects opinions of Fund managers as of June 30, 2013. They are subject to change and any forecasts made cannot be guaranteed. The Funds might not continue to hold any securities mentioned and have no obligation to disclose purchases or sales in these securities. Please refer to the Schedule of Investments in this report for a complete list of fund holdings for June 30, 2013. Indexes do not incur expenses or sales loads and are not available for investment.

The Global Industry Classification Standard (GICS®) was developed by MSCI, an independent provider of global indices and benchmark-related products and services, and Standard & Poor's (S&P), an independent international financial data and investment services company. The GICS methodology has been widely accepted as an industry analysis framework for investment research, portfolio management and asset allocation. The GICS structure consists of 10 sectors, 24 industry groups, 68 industries and 154 sub-industries. Each stock that is classified will have a coding at all four of these levels.

A basis point is one hundredth of one percent (0.01%).

Duration—a measure of the sensitivity of the price of a fixed-income investment to a change in interest rates.

Yield-to-Worst—the lowest potential yield that can be received on a bond without the issuer actually defaulting.

5

ABOUT FUND PERFORMANCE

The Large Cap Value Fund and Mid-Cap Value Fund have four classes of shares. The Diversified Value Fund, Small Cap Value Fund, Global Value Fund, Value Opportunities Fund, Capital Income Fund and High Yield Fund have three classes of shares. Each share class has its own sales charge and expense structure, allowing you to invest in the way that best suits your needs. Currently, the Global Value Fund is not offering Class C shares to investors. During the fiscal year ended June 30, 2013, the Global Value Fund did not offer Class A or Class C shares to investors and the Capital Income Fund did not offer Class C shares to investors.

Class I shares have no initial sales charge and bear no ongoing distribution and service fees under a 12b-1 plan. Class I shares are available only to eligible investors.

Class A shares incur a maximum initial sales charge of 5.25% for the Diversified Value Fund, Large Cap Value Fund, Mid-Cap Value Fund, Small Cap Value Fund, Global Value Fund and Value Opportunities Fund, 4.75% for the Capital Income Fund and 3.75% for the High Yield Fund and an annual distribution and service fee of 0.25%.

Class C shares are subject to an annual distribution and service fee of 1.00%. In addition, Class C shares are subject to a 1.00% contingent deferred sales charge (CDSC) if redeemed within one year after purchase. Class C shares automatically convert to Class A shares approximately eight years after purchase and will then be subject to lower distribution and service fees.

Class R shares have no initial sales charge or CDSC and are subject to an annual distribution and service fee of 0.50%. Class R shares are offered only by the Large Cap Value Fund and Mid-Cap Value Fund and are available only to certain retirement plans.

FUND RISKS

Mutual fund investing involves risk; loss of principal is possible. The Small Cap Value Fund, Mid-Cap Value Fund, Global Value Fund and Value Opportunities Fund invest in small- and medium-capitalization companies which tend to have limited liquidity and greater price volatility than large-capitalization companies. The Value Opportunities Fund is a non-diversified fund which involves greater risk than investing in diversified funds, such as business risk, significant stock price fluctuations and sector concentration. Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales. The Value Opportunities Fund, Capital Income Fund and High Yield Fund invest in debt securities that decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment by the Value Opportunities Fund, Capital Income Fund and High Yield Fund in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. The Value Opportunities Fund, Capital Income Fund and High Yield Fund may utilize derivative instruments, which derive their performance from the performance of an underlying asset, index, interest rate or currency exchange rate. Derivatives can be volatile and involve various types and degrees of risks. Depending upon the characteristics of particular derivatives, they can suddenly become illiquid. Investments by the Capital Income Fund and High Yield Fund in asset-backed and mortgage-backed securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. The Funds may invest in foreign securities, including developed and emerging markets, which involve greater volatility and political, economic, and currency risks.

MARKET INDEXES

The following are definitions for indexes used in the shareholder letter and the performance summary tables on the following pages. These indexes are unmanaged and include the reinvestment of dividends, but do not reflect the payment of transaction costs and advisory and other fees associated with an investment in the Funds. The securities that comprise these indexes may differ substantially from the securities in the Funds' portfolios. The Funds' value disciplines may prevent or restrict investments in the benchmark indexes. It is not possible to invest directly in an index. Each index named is not the only index which may be used to characterize performance of a specific Fund and other indexes may portray different comparative performance.

S&P 500® Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general.

Russell 1000® Index, an unmanaged index, measures the performance of the 1,000 largest companies in the Russell 3000® Index.

Russell 1000® Value Index measures the performance of those Russell 1000® companies with lower price-to-book ratios and lower forecasted growth values.

Russell Midcap® Index, an unmanaged index, measures the performance of the 800 smallest companies in the Russell 1000® Index.

Russell Midcap® Value Index measures the performance of those Russell Midcap® companies with lower price-to-book ratios and lower forecasted growth values.

Russell 2000® Index, an unmanaged index, measures the performance of the 2,000 smallest companies in the Russell 3000® Index.

Russell 2000® Value Index measures the performance of those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values.

Russell Developed Index measures the performance of the investable securities in developed countries globally across all market capitalization ranges.

BofA Merrill Lynch U.S. Corporate, Government and Mortgage Index is a broad-based measure of the total rate of return performance of the U.S. investment grade bond markets. The Index is a capitalization weighted aggregation of outstanding U.S. Treasury, agency and supranational, mortgage pass-through and investment grade corporate bonds meeting specified selection criteria.

BofA Merrill Lynch U.S. High Yield BB-B (Constrained 2%) Index contains all securities in the BofA Merrill Lynch U.S. High Yield Index rated BB+ through B- by S&P (or equivalent as rated by Moody's or Fitch), but caps issuer exposure at 2%. Index constituents are capitalization-weighted, based on their current amount outstanding, provided the total allocation to an individual issuer does not exceed 2%.

BofA Merrill Lynch U.S. Treasury and Agency Index tracks the performance of U.S. dollar denominated U.S. Treasury and non-subordinated U.S. agency debt issued in the U.S. domestic market.

BofA Merrill Lynch U.S. Corporate Index tracks the performance of U.S. dollar denominated investment grade corporate debt publicly issued in the U.S. domestic market.

BofA Merrill Lynch U.S. High Yield Master II Index tracks the performance of below investment grade, but not in default, U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market, and includes issues with a credit rating of BBB or below, as rated by Moody's and S&P.

6

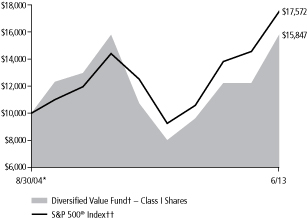

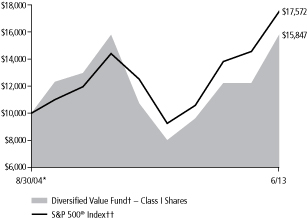

DIVERSIFIED VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2013 | | 1 Year | | 5 Years | | Since

8/30/04* | |

Class I | |

Average annual total return | | | 29.65 | % | | | 8.13 | % | | | 5.35 | % | |

Class A | |

Average annual total return (with sales charge) | | | 22.42 | % | | | 6.68 | % | | | 4.45 | % | |

Average annual total return (without sales charge) | | | 29.25 | % | | | 7.84 | % | | | 5.08 | % | |

Class C | |

Average annual total return (with CDSC) | | | 27.28 | % | | | 7.09 | % | | | 4.33 | % | |

Average annual total return (without CDSC) | | | 28.28 | % | | | 7.09 | % | | | 4.33 | % | |

S&P 500® Index†† | |

Average annual total return | | | 20.60 | % | | | 7.01 | % | | | 6.59 | % | |

Russell 1000® Index†† | |

Average annual total return | | | 21.24 | % | | | 7.12 | % | | | 6.99 | % | |

Russell 1000® Value Index†† | |

Average annual total return | | | 25.32 | % | | | 6.67 | % | | | 6.61 | % | |

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the sales charges of each specific class. Returns for Class A reflect the maximum initial sales charge of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in stocks of U.S. companies with market capitalizations similar to the Russell 1000® Index.

†† See index descriptions on page 6.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I, Class A and Class C.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

7

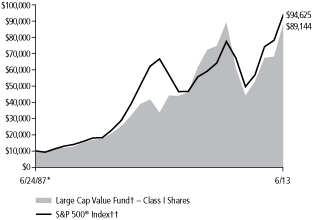

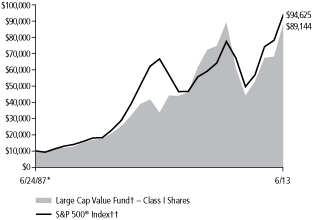

LARGE CAP VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2013 | | 1 Year | | 5 Years | | 10 Years | | Since

6/24/87* | |

Class I | |

Average annual total return | | | 30.48 | % | | | 7.88 | % | | | 6.79 | % | | | 8.77 | % | |

Class A | |

Average annual total return (with sales charge) | | | 23.35 | % | | | 6.44 | % | | | 5.94 | % | | | 8.30 | % | |

Average annual total return (without sales charge) | | | 30.16 | % | | | 7.60 | % | | | 6.51 | % | | | 8.53 | % | |

Class C | |

Average annual total return (with CDSC) | | | 28.12 | % | | | 6.88 | % | | | 5.77 | % | | | 7.71 | % | |

Average annual total return (without CDSC) | | | 29.12 | % | | | 6.88 | % | | | 5.77 | % | | | 7.71 | % | |

Class R | |

Average annual total return | | | 29.79 | % | | | 7.34 | % | | | 6.31 | % | | | 8.25 | % | |

S&P 500® Index†† | |

Average annual total return | | | 20.60 | % | | | 7.01 | % | | | 7.30 | % | | | 9.02 | % | |

Russell 1000® Index†† | |

Average annual total return | | | 21.24 | % | | | 7.12 | % | | | 7.67 | % | | | 9.16 | % | |

Russell 1000® Value Index†† | |

Average annual total return | | | 25.32 | % | | | 6.67 | % | | | 7.79 | % | | | n/a | | |

Returns shown for Class A, Class C, and Class R shares for the periods prior to their inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of each specific class. (Inception dates: Class A — 10/26/01; Class C — 2/4/02; Class R — 8/28/03.)

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the applicable sales charge of each specific class. Returns for Class A reflect the maximum initial sales charges of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in stocks of U.S. companies with market capitalizations similar to the Russell 1000® Index.

†† See index descriptions on page 6.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

8

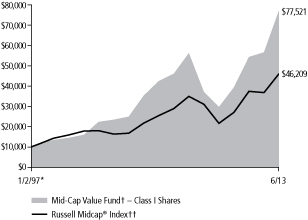

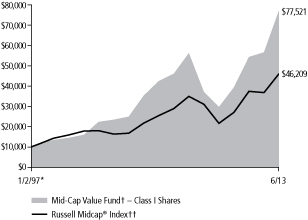

MID-CAP VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2013 | | 1 Year | | 5 Years | | 10 Years | | Since

1/2/97* | |

Class I | |

Average annual total return | | | 36.51 | % | | | 15.85 | % | | | 12.00 | % | | | 13.22 | % | |

Class A | |

Average annual total return (with sales charge) | | | 29.00 | % | | | 14.31 | % | | | 11.11 | % | | | 12.58 | % | |

Average annual total return (without sales charge) | | | 36.16 | % | | | 15.55 | % | | | 11.71 | % | | | 12.95 | % | |

Class C | |

Average annual total return (with CDSC) | | | 34.13 | % | | | 14.83 | % | | | 10.97 | % | | | 12.14 | % | |

Average annual total return (without CDSC) | | | 35.13 | % | | | 14.83 | % | | | 10.97 | % | | | 12.14 | % | |

Class R | |

Average annual total return | | | 35.82 | % | | | 15.27 | % | | | 11.61 | % | | | 12.76 | % | |

Russell Midcap® Index†† | |

Average annual total return | | | 25.41 | % | | | 8.28 | % | | | 10.65 | % | | | 9.72 | % | |

Russell Midcap® Value Index†† | |

Average annual total return | | | 27.65 | % | | | 8.87 | % | | | 10.92 | % | | | 10.26 | % | |

Returns shown for Class A, Class C, and Class R shares for the periods prior to their inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of each specific class. (Inception dates: Class A, Class C — 1/2/01; Class R — 8/28/03.)

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the applicable sales charge of each specific class. Returns for Class A reflect the maximum initial sales charges of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in stocks of U.S. companies with market capitalizations similar to the Russell Midcap® Index.

†† See index descriptions on page 6.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

9

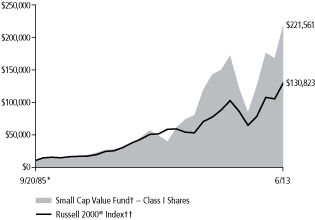

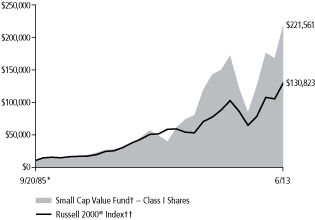

SMALL CAP VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2013 | | 1 Year | | 5 Years | | 10 Years | | Since

9/20/85* | |

Class I | |

Average annual total return | | | 31.88 | % | | | 12.73 | % | | | 10.68 | % | | | 11.80 | % | |

Class A | |

Average annual total return (with sales charge) | | | 24.64 | % | | | 11.24 | % | | | 9.81 | % | | | 11.34 | % | |

Average annual total return (without sales charge) | | | 31.55 | % | | | 12.45 | % | | | 10.41 | % | | | 11.55 | % | |

Class C | |

Average annual total return (with CDSC) | | | 29.55 | % | | | 11.73 | % | | | 9.69 | % | | | 10.75 | % | |

Average annual total return (without CDSC) | | | 30.55 | % | | | 11.73 | % | | | 9.69 | % | | | 10.75 | % | |

Russell 2000® Index†† | |

Average annual total return | | | 24.21 | % | | | 8.77 | % | | | 9.53 | % | | | 9.69 | % | |

Russell 2000® Value Index†† | |

Average annual total return | | | 24.77 | % | | | 8.59 | % | | | 9.30 | % | | | n/a | | |

Returns shown for Class A and Class C shares for the periods prior to their inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of each specific class. (Inception dates: Class A — 10/6/00; Class C — 2/4/02.)

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the applicable sales charge of each specific class. Returns for Class A reflect the maximum initial sales charges of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in stocks of U.S. companies with market capitalizations similar to the Russell 2000® Index.

†† See index descriptions on page 6.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

10

GLOBAL VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2013 | | Since

12/31/12* | |

Class I | |

Aggregate total return | | | 14.90 | % | |

Russell Developed Index | |

Aggregate total return | | | 9.13 | % | |

† The Fund invests primarily in U.S. and non-U.S. companies.

†† See index description on page 6.

††† Fund return during the period shown reflects a fee waiver and/or expense reimbursement. Without waiver/reimbursement, return would have been lower. Return shown includes the reinvestment of all dividends. Returns for periods less than one year are not annualized.

* Commencement of Class I.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

11

VALUE OPPORTUNITIES FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2013 | | 1 Year | | 5 Years | | 10 Years | | Since

12/31/02* | |

Class I | |

Average annual total return | | | 32.28 | % | | | 16.23 | % | | | 11.51 | % | | | 13.39 | % | |

Class A | |

Average annual total return (with sales charge) | | | 25.08 | % | | | 14.71 | % | | | 10.67 | % | | | 12.62 | % | |

Average annual total return (without sales charge) | | | 31.98 | % | | | 15.96 | % | | | 11.27 | % | | | 13.19 | % | |

Class C | |

Average annual total return (with CDSC) | | | 29.97 | % | | | 15.18 | % | | | 10.46 | % | | | 12.32 | % | |

Average annual total return (without CDSC) | | | 30.97 | % | | | 15.18 | % | | | 10.46 | % | | | 12.32 | % | |

S&P 500® Index†† | |

Average annual total return | | | 20.60 | % | | | 7.01 | % | | | 7.30 | % | | | 8.08 | % | |

Returns shown for Class C shares for the periods prior to their inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of the class. (Inception date: Class C — 8/28/03.)

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the applicable sales charge of each specific class. Returns for Class A reflect the maximum initial sales charges of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in securities of companies with strong capital appreciation potential.

†† See index description on page 6.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I and Class A.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

12

CAPITAL INCOME FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2013 | | 1 Year | | Since

12/31/10* | |

Class I | |

Average annual total return | | | 18.45 | % | | | 12.83 | % | |

Class A | |

Average annual total return (with sales charge) | | | 14.65 | % | | | 11.60 | % | |

Average annual total return (without sales charge) | | | 20.34 | % | | | 13.80 | % | |

S&P 500® Index†† | |

Average annual total return | | | 20.60 | % | | | 12.70 | % | |

BofA Merrill Lynch U.S. Corporate, Government and Mortgage Index†† | |

Average annual total return | | | –0.79 | % | | | 3.78 | % | |

Returns shown for Class A shares for the periods prior to its inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of the class. (Inception date: Class A — 2/28/11.)

Average annual total returns with sales charge shown for Class A shares have been adjusted to reflect the applicable sales charge of the class. Returns for Class A reflect the maximum initial sales charge of 4.75%. Average annual total returns without sales charge do not reflect the sales charges. Had the sales charge been included, the Fund's returns would have been lower.

† The Fund invests primarily in dividend-paying equities and high yield fixed income securities.

†† See index descriptions on page 6.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

13

HIGH YIELD FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2013 | | 1 Year | | Since

3/31/09* | |

Class I | |

Average annual total return | | | 11.70 | % | | | 17.17 | % | |

Class A | |

Average annual total return (with sales charge) | | | 7.19 | % | | | 15.64 | % | |

Average annual total return (without sales charge) | | | 11.37 | % | | | 16.68 | % | |

Class C | |

Average annual total return (with CDSC) | | | 9.44 | % | | | 15.97 | % | |

Average annual total return (without CDSC) | | | 10.44 | % | | | 15.97 | % | |

BofA Merrill Lynch U.S. High Yield BB-B (Constrained 2%) Index†† | |

Average annual total return | | | 8.51 | % | | | 16.44 | % | |

Returns shown for Class A and Class C shares for the periods prior to their inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of each specific class. (Inception dates: Class A — 5/29/09; Class C — 12/31/12.)

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the applicable sales charges of each specific class. Returns for Class A reflect the maximum initial sales charge of 3.75%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in high yield securities.

†† See index description on page 6.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

14

Schedule of Investments — June 30, 2013

Hotchkis & Wiley Diversified Value Fund

Largest Equity Holdings | | Percent of

net assets | |

JPMorgan Chase & Company | | | 4.00 | % | |

American International Group, Inc. | | | 3.97 | % | |

Hewlett-Packard Company | | | 3.57 | % | |

Microsoft Corporation | | | 3.30 | % | |

Citigroup, Inc. | | | 3.26 | % | |

Bank of America Corporation | | | 3.20 | % | |

Royal Dutch Shell PLC - Class B | | | 3.00 | % | |

Total SA | | | 2.89 | % | |

Vodafone Group PLC | | | 2.79 | % | |

Oracle Corporation | | | 2.54 | % | |

COMMON

STOCKS — 98.78% | | Shares

Held | | Value | |

CONSUMER DISCRETIONARY — 10.45%

Auto Components — 3.46% | |

Delphi Automotive PLC | | | 41,100 | | | $ | 2,083,359 | | |

Johnson Controls, Inc. | | | 254,200 | | | | 9,097,818 | | |

Magna International, Inc. | | | 44,500 | | | | 3,169,290 | | |

| | | | 14,350,467 | | |

Automobiles — 1.03% | |

General Motors Company (a) | | | 127,900 | | | | 4,260,349 | | |

Hotels, Restaurants & Leisure — 0.49% | |

Carnival Corporation | | | 59,100 | | | | 2,026,539 | | |

Media — 3.24% | |

Comcast Corporation | | | 53,800 | | | | 2,134,246 | | |

The Interpublic Group of Companies, Inc. | | | 355,800 | | | | 5,176,890 | | |

Time Warner Cable, Inc. | | | 54,400 | | | | 6,118,912 | | |

| | | | 13,430,048 | | |

Multiline Retail — 1.48% | |

Target Corporation | | | 89,500 | | | | 6,162,970 | | |

Specialty Retail — 0.75% | |

Lowe's Companies, Inc. | | | 76,600 | | | | 3,132,940 | | |

TOTAL CONSUMER DISCRETIONARY | | | 43,363,313 | | |

CONSUMER STAPLES — 4.21%

Beverages — 1.24% | |

Molson Coors Brewing Company | | | 42,600 | | | | 2,038,836 | | |

PepsiCo, Inc. | | | 38,000 | | | | 3,108,020 | | |

| | | | 5,146,856 | | |

Food & Staples Retailing — 1.98% | |

Wal-Mart Stores, Inc. | | | 110,200 | | | | 8,208,798 | | |

Food Products — 0.99% | |

Mondelez International, Inc. | | | 143,700 | | | | 4,099,761 | | |

TOTAL CONSUMER STAPLES | | | 17,455,415 | | |

| | Shares

Held | | Value | |

ENERGY — 10.59%

Oil, Gas & Consumable Fuels — 10.59% | |

Cobalt International Energy, Inc. (a) | | | 374,400 | | | $ | 9,947,808 | | |

Hess Corporation | | | 29,400 | | | | 1,954,806 | | |

Kosmos Energy Limited (a) | | | 119,200 | | | | 1,211,072 | | |

Marathon Oil Corporation | | | 105,100 | | | | 3,634,358 | | |

Murphy Oil Corporation | | | 45,400 | | | | 2,764,406 | | |

Royal Dutch Shell PLC — Class B — ADR | | | 187,800 | | | | 12,445,506 | | |

Total SA — ADR | | | 246,500 | | | | 12,004,550 | | |

TOTAL ENERGY | | | 43,962,506 | | |

FINANCIALS — 26.53%

Capital Markets — 1.71% | |

The Bank New York Mellon Corporation | | | 144,200 | | | | 4,044,810 | | |

Morgan Stanley | | | 124,300 | | | | 3,036,649 | | |

| | | | 7,081,459 | | |

Commercial Banks — 4.25% | |

SunTrust Banks, Inc. | | | 263,300 | | | | 8,312,381 | | |

Wells Fargo & Company | | | 226,034 | | | | 9,328,423 | | |

| | | | 17,640,804 | | |

Consumer Finance — 2.39% | |

Capital One Financial Corporation | | | 157,700 | | | | 9,905,137 | | |

Diversified Financial Services — 10.46% | |

Bank of America Corporation | | | 1,032,922 | | | | 13,283,377 | | |

Citigroup, Inc. | | | 281,874 | | | | 13,521,496 | | |

JPMorgan Chase & Company | | | 314,300 | | | | 16,591,897 | | |

| | | | 43,396,770 | | |

Insurance — 7.72% | |

The Allstate Corporation | | | 172,800 | | | | 8,315,136 | | |

American International Group, Inc. (a) | | | 368,500 | | | | 16,471,950 | | |

Unum Group | | | 247,600 | | | | 7,272,012 | | |

| | | | 32,059,098 | | |

TOTAL FINANCIALS | | | 110,083,268 | | |

The accompanying notes are an integral part of these financial statements.

15

Schedule of Investments — June 30, 2013

Hotchkis & Wiley Diversified Value Fund

| | Shares

Held | | Value | |

HEALTH CARE — 13.89%

Health Care Equipment & Supplies — 2.47% | |

Covidien PLC | | | 66,200 | | | $ | 4,160,008 | | |

Medtronic, Inc. | | | 78,900 | | | | 4,060,983 | | |

Zimmer Holdings, Inc. | | | 27,000 | | | | 2,023,380 | | |

| | | | 10,244,371 | | |

Health Care Providers & Services — 5.58% | |

Aetna, Inc. | | | 32,900 | | | | 2,090,466 | | |

Humana, Inc. | | | 41,700 | | | | 3,518,646 | | |

Quest Diagnostics, Inc. | | | 43,800 | | | | 2,655,594 | | |

UnitedHealth Group, Inc. | | | 134,100 | | | | 8,780,868 | | |

WellPoint, Inc. | | | 74,800 | | | | 6,121,632 | | |

| | | | 23,167,206 | | |

Pharmaceuticals — 5.84% | |

AstraZeneca PLC — ADR | | | 129,300 | | | | 6,115,890 | | |

Johnson & Johnson | | | 102,000 | | | | 8,757,720 | | |

Novartis AG — ADR | | | 59,200 | | | | 4,186,032 | | |

Sanofi — ADR | | | 100,700 | | | | 5,187,057 | | |

| | | | 24,246,699 | | |

TOTAL HEALTH CARE | | | 57,658,276 | | |

INDUSTRIALS — 9.59%

Aerospace & Defense — 4.27% | |

The Boeing Company | | | 61,500 | | | | 6,300,060 | | |

Embraer SA — ADR | | | 68,400 | | | | 2,523,276 | | |

Lockheed Martin Corporation | | | 62,700 | | | | 6,800,442 | | |

Northrop Grumman Corporation | | | 25,200 | | | | 2,086,560 | | |

| | | | 17,710,338 | | |

Air Freight & Logistics — 1.49% | |

FedEx Corporation | | | 62,700 | | | | 6,180,966 | | |

Machinery — 3.83% | |

Cummins, Inc. | | | 59,700 | | | | 6,475,062 | | |

PACCAR, Inc. | | | 98,500 | | | | 5,285,510 | | |

Stanley Black & Decker, Inc. | | | 53,500 | | | | 4,135,550 | | |

| | | | 15,896,122 | | |

TOTAL INDUSTRIALS | | | 39,787,426 | | |

INFORMATION TECHNOLOGY — 14.40%

Computers & Peripherals — 3.57% | |

Hewlett-Packard Company | | | 597,000 | | | | 14,805,600 | | |

Electronic Equipment, Instruments & Components — 3.53% | |

Corning, Inc. | | | 739,300 | | | | 10,520,239 | | |

TE Connectivity Limited | | | 90,800 | | | | 4,135,032 | | |

| | | | 14,655,271 | | |

IT Services — 0.72% | |

International Business Machines Corporation | | | 15,600 | | | | 2,981,316 | | |

| | Shares

Held | | Value | |

Semiconductors & Semiconductor Equipment — 0.74% | |

Texas Instruments, Inc. | | | 88,200 | | | $ | 3,075,534 | | |

Software — 5.84% | |

Microsoft Corporation | | | 396,800 | | | | 13,701,504 | | |

Oracle Corporation | | | 343,200 | | | | 10,543,104 | | |

| | | | 24,244,608 | | |

TOTAL INFORMATION TECHNOLOGY | | | 59,762,329 | | |

TELECOMMUNICATION SERVICES — 2.79%

Wireless Telecommunication Services — 2.79% | |

Vodafone Group PLC — ADR | | | 402,900 | | | | 11,579,346 | | |

TOTAL TELECOMMUNICATION SERVICES | | | 11,579,346 | | |

UTILITIES — 6.33%

Electric Utilities — 3.11% | |

Edison International | | | 57,200 | | | | 2,754,752 | | |

Exelon Corporation | | | 329,000 | | | | 10,159,520 | | |

| | | | 12,914,272 | | |

Independent Power Producers & Energy Traders — 1.43% | |

NRG Energy, Inc. | | | 222,500 | | | | 5,940,750 | | |

Multi-Utilities — 1.79% | |

Public Service Enterprise Group, Inc. | | | 227,600 | | | | 7,433,416 | | |

TOTAL UTILITIES | | | 26,288,438 | | |

Total common stocks

(Cost $416,862,284) | | | 409,940,317 | | |

Total long-term investments

(Cost $416,862,284) | | | | | 409,940,317 | | |

SHORT-TERM

INVESTMENTS — 2.90% | | Principal

Amount | | | |

Time Deposits — 2.90% | |

Wells Fargo, 0.03%, 07/01/2013* | | $ | 12,044,972 | | | | 12,044,972 | | |

Total short-term investments

(Cost $12,044,972) | | | 12,044,972 | | |

Total investments — 101.68%

(Cost $428,907,256) | | | 421,985,289 | | |

Liabilities in excess of other assets — (1.68)% | | | | | (6,956,850 | ) | |

Net assets — 100.00% | | $ | 415,028,439 | | |

(a) — Non-income producing security.

ADR — American Depositary Receipt

* — Invested through a cash management account administered by Brown Brothers Harriman & Co.

The Global Industry Classification Standard (GICS®) was developed by MSCI, an independent provider of global indices and benchmark-related products and services, and Standard & Poor's (S&P), an independent international financial data and investment services company. The GICS methodology has been widely accepted as an industry analysis framework for investment research, portfolio management and asset allocation. The GICS structure consists of 10 sectors, 24 industry groups, 68 industries and 154 sub-industries. Each stock that is classified will have a coding at all four of these levels.

The accompanying notes are an integral part of these financial statements.

16

Schedule of Investments — June 30, 2013

Hotchkis & Wiley Large Cap Value Fund

Largest Equity Holdings | | Percent of

net assets | |

American International Group, Inc. | | | 4.47 | % | |

JPMorgan Chase & Company | | | 4.09 | % | |

Microsoft Corporation | | | 3.92 | % | |

Hewlett-Packard Company | | | 3.80 | % | |

Royal Dutch Shell PLC - Class B | | | 3.72 | % | |

Citigroup, Inc. | | | 3.54 | % | |

Bank of America Corporation | | | 3.49 | % | |

Total SA | | | 3.32 | % | |

Capital One Financial Corporation | | | 3.02 | % | |

Vodafone Group PLC | | | 3.01 | % | |

COMMON

STOCKS — 98.31% | | Shares

Held | | Value | |

CONSUMER DISCRETIONARY — 8.68%

Auto Components — 3.90% | |

Johnson Controls, Inc. | | | 326,600 | | | $ | 11,689,014 | | |

Lear Corporation | | | 96,000 | | | | 5,804,160 | | |

Magna International, Inc. | | | 63,200 | | | | 4,501,104 | | |

| | | | 21,994,278 | | |

Media — 1.99% | |

Comcast Corporation | | | 140,000 | | | | 5,553,800 | | |

The Interpublic Group of Companies, Inc. | | | 389,300 | | | | 5,664,315 | | |

| | | | 11,218,115 | | |

Multiline Retail — 1.75% | |

Target Corporation | | | 142,700 | | | | 9,826,322 | | |

Specialty Retail — 1.04% | |

Lowe's Companies, Inc. | | | 143,500 | | | | 5,869,150 | | |

TOTAL CONSUMER DISCRETIONARY | | | 48,907,865 | | |

CONSUMER STAPLES — 2.96%

Beverages — 0.73% | |

PepsiCo, Inc. | | | 50,600 | | | | 4,138,574 | | |

Food & Staples Retailing — 1.77% | |

Wal-Mart Stores, Inc. | | | 133,500 | | | | 9,944,415 | | |

Food Products — 0.46% | |

Mondelez International, Inc. | | | 91,300 | | | | 2,604,789 | | |

TOTAL CONSUMER STAPLES | | | 16,687,778 | | |

ENERGY — 9.86%

Oil, Gas & Consumable Fuels — 9.86% | |

Marathon Oil Corporation | | | 203,000 | | | | 7,019,740 | | |

Murphy Oil Corporation | | | 145,800 | | | | 8,877,762 | | |

Royal Dutch Shell PLC — Class B — ADR | | | 316,100 | | | | 20,947,947 | | |

Total SA — ADR | | | 384,000 | | | | 18,700,800 | | |

TOTAL ENERGY | | | 55,546,249 | | |

| | Shares

Held | | Value | |

FINANCIALS — 26.81%

Commercial Banks — 3.09% | |

BB&T Corporation | | | 88,600 | | | $ | 3,001,768 | | |

Regions Financial Corporation | | | 309,600 | | | | 2,950,488 | | |

Wells Fargo & Company | | | 277,391 | | | | 11,447,927 | | |

| | | | 17,400,183 | | |

Consumer Finance — 3.02% | |

Capital One Financial Corporation | | | 270,800 | | | | 17,008,948 | | |

Diversified Financial Services — 11.12% | |

Bank of America Corporation | | | 1,528,489 | | | | 19,656,368 | | |

Citigroup, Inc. | | | 416,068 | | | | 19,958,782 | | |

JPMorgan Chase & Company | | | 436,700 | | | | 23,053,393 | | |

| | | | 62,668,543 | | |

Insurance — 9.58% | |

The Allstate Corporation | | | 304,100 | | | | 14,633,292 | | |

American International Group, Inc. (a) | | | 563,200 | | | | 25,175,040 | | |

Assurant, Inc. | | | 62,000 | | | | 3,156,420 | | |

Unum Group | | | 376,300 | | | | 11,051,931 | | |

| | | | 54,016,683 | | |

TOTAL FINANCIALS | | | 151,094,357 | | |

HEALTH CARE — 13.44%

Health Care Equipment & Supplies — 0.93% | |

Zimmer Holdings, Inc. | | | 70,000 | | | | 5,245,800 | | |

Health Care Providers & Services — 5.64% | |

Aetna, Inc. | | | 105,100 | | | | 6,678,054 | | |

UnitedHealth Group, Inc. | | | 229,400 | | | | 15,021,112 | | |

WellPoint, Inc. | | | 123,500 | | | | 10,107,240 | | |

| | | | 31,806,406 | | |

The accompanying notes are an integral part of these financial statements.

17

Schedule of Investments — June 30, 2013

Hotchkis & Wiley Large Cap Value Fund

| | Shares

Held | | Value | |

Pharmaceuticals — 6.87% | |

AstraZeneca PLC — ADR | | | 176,000 | | | $ | 8,324,800 | | |

Johnson & Johnson | | | 172,100 | | | | 14,776,506 | | |

Merck & Company, Inc. | | | 56,800 | | | | 2,638,360 | | |

Novartis AG — ADR | | | 84,100 | | | | 5,946,711 | | |

Sanofi — ADR | | | 136,300 | | | | 7,020,813 | | |

| | | | 38,707,190 | | |

TOTAL HEALTH CARE | | | 75,759,396 | | |

INDUSTRIALS — 10.25%

Aerospace & Defense — 4.76% | |

The Boeing Company | | | 85,500 | | | | 8,758,620 | | |

Embraer SA — ADR | | | 76,300 | | | | 2,814,707 | | |

Lockheed Martin Corporation | | | 100,000 | | | | 10,846,000 | | |

Northrop Grumman Corporation | | | 53,200 | | | | 4,404,960 | | |

| | | | 26,824,287 | | |

Machinery — 4.55% | |

Cummins, Inc. | | | 103,600 | | | | 11,236,456 | | |

PACCAR, Inc. | | | 164,200 | | | | 8,810,972 | | |

Stanley Black & Decker, Inc. | | | 72,400 | | | | 5,596,520 | | |

| | | | 25,643,948 | | |

Professional Services — 0.94% | |

ManpowerGroup, Inc. | | | 96,800 | | | | 5,304,640 | | |

TOTAL INDUSTRIALS | | | 57,772,875 | | |

INFORMATION TECHNOLOGY — 14.98%

Computers & Peripherals — 3.80% | |

Hewlett-Packard Company | | | 862,200 | | | | 21,382,560 | | |

Electronic Equipment, Instruments & Components — 3.79% | |

Corning, Inc. | | | 1,001,900 | | | | 14,257,037 | | |

TE Connectivity Limited | | | 156,425 | | | | 7,123,595 | | |

| | | | 21,380,632 | | |

Semiconductors & Semiconductor Equipment — 0.71% | |

Texas Instruments, Inc. | | | 114,700 | | | | 3,999,589 | | |

Software — 6.68% | |

CA, Inc. | | | 204,081 | | | | 5,842,839 | | |

Microsoft Corporation | | | 639,500 | | | | 22,081,935 | | |

Oracle Corporation | | | 316,100 | | | | 9,710,592 | | |

| | | | 37,635,366 | | |

TOTAL INFORMATION TECHNOLOGY | | | 84,398,147 | | |

TELECOMMUNICATION SERVICES — 3.01%

Wireless Telecommunication Services — 3.01% | |

Vodafone Group PLC — ADR | | | 590,100 | | | | 16,959,474 | | |

TOTAL TELECOMMUNICATION SERVICES | | | 16,959,474 | | |

| | Shares

Held | | Value | |

UTILITIES — 8.32%

Electric Utilities — 4.34% | |

Edison International | | | 76,400 | | | $ | 3,679,424 | | |

Exelon Corporation | | | 542,900 | | | | 16,764,752 | | |

PPL Corporation | | | 131,600 | | | | 3,982,216 | | |

| | | | 24,426,392 | | |

Independent Power Producers & Energy Traders — 1.75% | |

NRG Energy, Inc. | | | 368,600 | | | | 9,841,620 | | |

Multi-Utilities — 2.23% | |

Public Service Enterprise Group, Inc. | | | 385,400 | | | | 12,587,164 | | |

TOTAL UTILITIES | | | 46,855,176 | | |

Total common stocks

(Cost $576,012,822) | | | 553,981,317 | | |

Total long-term investments

(Cost $576,012,822) | | | | | 553,981,317 | | |

SHORT-TERM

INVESTMENTS — 1.91% | | Principal

Amount | | | |

Time Deposits — 1.91% | |

The Bank of Tokyo — Mitsubishi UFJ,

0.03%, 07/01/2013* | | $ | 10,369,229 | | | | 10,369,229 | | |

Citibank, 0.03%, 07/01/2013* | | | 359,800 | | | | 359,800 | | |

Total short-term investments

(Cost $10,729,029) | | | 10,729,029 | | |

Total investments — 100.22%

(Cost $586,741,851) | | | 564,710,346 | | |

Liabilities in excess of other assets — (0.22)% | | | | | (1,212,327 | ) | |

Net assets — 100.00% | | $ | 563,498,019 | | |

(a) — Non-income producing security.

ADR — American Depositary Receipt

* — Invested through a cash management account administered by Brown Brothers Harriman & Co.

The Global Industry Classification Standard (GICS®) was developed by MSCI, an independent provider of global indices and benchmark-related products and services, and Standard & Poor's (S&P), an independent international financial data and investment services company. The GICS methodology has been widely accepted as an industry analysis framework for investment research, portfolio management and asset allocation. The GICS structure consists of 10 sectors, 24 industry groups, 68 industries and 154 sub-industries. Each stock that is classified will have a coding at all four of these levels.

The accompanying notes are an integral part of these financial statements.

18

Schedule of Investments — June 30, 2013

Hotchkis & Wiley Mid-Cap Value Fund

Largest Equity Holdings | | Percent of

net assets | |

Cobalt International Energy, Inc. | | | 3.79 | % | |

SunTrust Banks, Inc. | | | 3.61 | % | |

NRG Energy, Inc. | | | 3.57 | % | |

ARRIS Group, Inc. | | | 3.41 | % | |

The Goodyear Tire & Rubber Company | | | 3.41 | % | |

Great Plains Energy, Inc. | | | 3.27 | % | |

Valassis Communications, Inc. | | | 3.18 | % | |

Kosmos Energy Limited | | | 2.85 | % | |

Unum Group | | | 2.63 | % | |

Regions Financial Corporation | | | 2.62 | % | |

COMMON

STOCKS — 95.69% | | Shares

Held | | Value | |

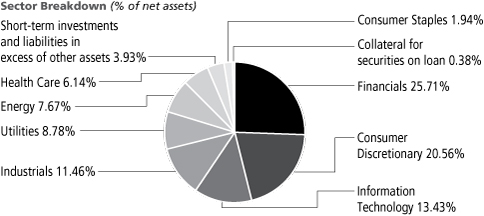

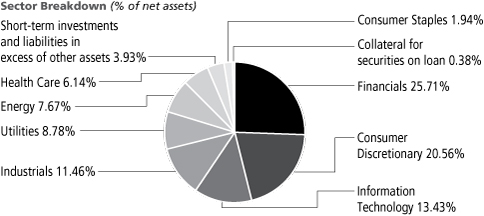

CONSUMER DISCRETIONARY — 20.56%

Auto Components — 8.98% | |

Delphi Automotive PLC | | | 532,000 | | | $ | 26,967,080 | | |

The Goodyear Tire & Rubber Company (a) | | | 4,691,600 | | | | 71,734,564 | | |

Lear Corporation | | | 609,200 | | | | 36,832,232 | | |

Magna International, Inc. | | | 753,100 | | | | 53,635,782 | | |

| | | | 189,169,658 | | |

Media — 5.60% | |

The Interpublic Group of Companies, Inc. | | | 3,507,200 | | | | 51,029,760 | | |

Valassis Communications, Inc. (b) | | | 2,722,200 | | | | 66,938,898 | | |

| | | | 117,968,658 | | |

Multiline Retail — 2.44% | |

Kohl's Corporation | | | 1,017,700 | | | | 51,404,027 | | |

Specialty Retail — 3.54% | |

Rent-A-Center, Inc. | | | 958,700 | | | | 35,999,185 | | |

Staples, Inc. | | | 2,430,100 | | | | 38,541,386 | | |

| | | | 74,540,571 | | |

TOTAL CONSUMER DISCRETIONARY | | | 433,082,914 | | |

CONSUMER STAPLES — 1.94%

Beverages — 1.22% | |

Molson Coors Brewing Company | | | 536,400 | | | | 25,672,104 | | |

Food Products — 0.72% | |

Fresh Del Monte Produce, Inc. | | | 548,700 | | | | 15,297,756 | | |

TOTAL CONSUMER STAPLES | | | 40,969,860 | | |

ENERGY — 7.67%

Energy Equipment & Services — 0.26% | |

McDermott International, Inc. (a) | | | 678,100 | | | | 5,546,858 | | |

| | Shares

Held | | Value | |

Oil, Gas & Consumable Fuels — 7.41% | |

Cobalt International Energy, Inc. (a) | | | 3,005,200 | | | $ | 79,848,164 | | |

Kosmos Energy Limited (a) | | | 5,915,500 | | | | 60,101,480 | | |

Stone Energy Corporation (a) | | | 730,600 | | | | 16,095,118 | | |

| | | | 156,044,762 | | |

TOTAL ENERGY | | | 161,591,620 | | |

FINANCIALS — 25.71%

Capital Markets — 0.58% | |

E*TRADE Financial Corporation (a) | | | 968,600 | | | | 12,262,476 | | |

Commercial Banks — 12.49% | |

Comerica, Inc. | | | 295,500 | | | | 11,769,765 | | |

First Horizon National Corporation | | | 3,352,358 | | | | 37,546,405 | | |

KeyCorp | | | 3,921,920 | | | | 43,297,997 | | |

Regions Financial Corporation | | | 5,794,200 | | | | 55,218,726 | | |

SunTrust Banks, Inc. | | | 2,407,400 | | | | 76,001,618 | | |

Zions Bancorporation | | | 1,363,100 | | | | 39,366,328 | | |

| | | | 263,200,839 | | |

Diversified Financial Services — 2.27% | |

PHH Corporation (a) | | | 2,341,300 | | | | 47,715,694 | | |

Insurance — 10.37% | |

Assurant, Inc. | | | 832,600 | | | | 42,387,666 | | |

CNO Financial Group, Inc. | | | 3,813,600 | | | | 49,424,256 | | |

Torchmark Corporation | | | 335,700 | | | | 21,867,498 | | |

Unum Group | | | 1,886,300 | | | | 55,400,631 | | |

Willis Group Holdings PLC | | | 1,209,300 | | | | 49,315,254 | | |

| | | | 218,395,305 | | |

TOTAL FINANCIALS | | | 541,574,314 | | |

HEALTH CARE — 6.14%

Health Care Equipment & Supplies — 0.52% | |

Zimmer Holdings, Inc. | | | 144,700 | | | | 10,843,818 | | |

The accompanying notes are an integral part of these financial statements.

19

Schedule of Investments — June 30, 2013

Hotchkis & Wiley Mid-Cap Value Fund

| | Shares

Held | | Value | |

Health Care Providers & Services — 5.14% | |

Aetna, Inc. | | | 505,000 | | | $ | 32,087,700 | | |

Health Management Associates, Inc. (a) | | | 987,800 | | | | 15,528,216 | | |

Humana, Inc. | | | 515,200 | | | | 43,472,576 | | |

Quest Diagnostics, Inc. | | | 284,600 | | | | 17,255,298 | | |

| | | | 108,343,790 | | |

Pharmaceuticals — 0.48% | |

Questcor Pharmaceuticals, Inc. (c) | | | 224,600 | | | | 10,210,316 | | |

TOTAL HEALTH CARE | | | 129,397,924 | | |

INDUSTRIALS — 11.46%

Aerospace & Defense — 4.35% | |

Alliant Techsystems, Inc. | | | 335,900 | | | | 27,654,647 | | |

Embraer SA — ADR | | | 711,900 | | | | 26,261,991 | | |

Huntington Ingalls Industries, Inc. | | | 666,200 | | | | 37,626,976 | | |

| | | | 91,543,614 | | |

Airlines — 0.81% | |

JetBlue Airways Corporation (a) | | | 2,723,400 | | | | 17,157,420 | | |

Machinery — 1.36% | |

Navistar International Corporation (a) | | | 263,400 | | | | 7,311,984 | | |

Stanley Black & Decker, Inc. | | | 274,900 | | | | 21,249,770 | | |

| | | | 28,561,754 | | |

Professional Services — 1.95% | |

ManpowerGroup, Inc. | | | 750,800 | | | | 41,143,840 | | |

Road & Rail — 2.99% | |

Avis Budget Group, Inc. (a) | | | 549,000 | | | | 15,783,750 | | |

Con-way, Inc. | | | 1,209,700 | | | | 47,129,912 | | |

| | | | 62,913,662 | | |

TOTAL INDUSTRIALS | | | 241,320,290 | | |

INFORMATION TECHNOLOGY — 13.43%

Communications Equipment — 3.41% | |

ARRIS Group, Inc. (a) | | | 4,999,600 | | | | 71,744,260 | | |

Electronic Equipment, Instruments & Components — 4.18% | |

CDW Corporation (a) | | | 944,900 | | | | 17,594,038 | | |

Ingram Micro, Inc. (a) | | | 2,579,800 | | | | 48,990,402 | | |

TE Connectivity Limited | | | 472,600 | | | | 21,522,204 | | |

| | | | 88,106,644 | | |

IT Services — 0.60% | |

The Western Union Company | | | 742,300 | | | | 12,700,753 | | |

Semiconductors & Semiconductor Equipment — 3.76% | |

Marvell Technology Group Limited | | | 2,698,200 | | | | 31,595,922 | | |

ON Semiconductor Corporation (a) | | | 5,890,200 | | | | 47,592,816 | | |

| | | | 79,188,738 | | |

| | Shares

Held | | Value | |

Software — 1.48% | |

CA, Inc. | | | 582,100 | | | $ | 16,665,523 | | |

Comverse, Inc. (a) | | | 190,980 | | | | 5,683,565 | | |

Symantec Corporation | | | 395,700 | | | | 8,891,379 | | |

| | | | 31,240,467 | | |

TOTAL INFORMATION TECHNOLOGY | | | 282,980,862 | | |

UTILITIES — 8.78%

Electric Utilities — 4.22% | |

Great Plains Energy, Inc. | | | 3,059,800 | | | | 68,967,892 | | |

PPL Corporation | | | 659,600 | | | | 19,959,496 | | |

| | | | 88,927,388 | | |

Independent Power Producers & Energy Traders — 3.57% | |

NRG Energy, Inc. | | | 2,821,400 | | | | 75,331,380 | | |

Multi-Utilities — 0.99% | |

Public Service Enterprise Group, Inc. | | | 637,200 | | | | 20,810,952 | | |

TOTAL UTILITIES | | | 185,069,720 | | |

Total common stocks

(Cost $1,835,537,160) | | | 2,015,987,504 | | |

Total long-term investments

(Cost $1,835,537,160) | | | | | 2,015,987,504 | | |

COLLATERAL FOR SECURITIES ON LOAN — 0.38% | |

Money Market Funds — 0.38% | |

Invesco Government Agency Portfolio, 0.02%^ | | | 7,997,100 | | | | 7,997,100 | | |

Total collateral for securities on loan

(Cost $7,997,100) | | | 7,997,100 | | |

SHORT-TERM

INVESTMENTS — 4.26% | | Principal

Amount | | | |

Time Deposits — 4.26% | |

The Bank of Tokyo — Mitsubishi UFJ,

0.03%, 07/01/2013* | | $ | 3,527,089 | | | | 3,527,089 | | |

Nordea Bank, 0.03%, 07/01/2013* | | | 86,213,228 | | | | 86,213,228 | | |

Total short-term investments

(Cost $89,740,317) | | | 89,740,317 | | |

Total investments — 100.33%

(Cost $1,933,274,577) | | | 2,113,724,921 | | |

Liabilities in excess of other assets — (0.33)% | | | | | (7,014,306 | ) | |

Net assets — 100.00% | | $ | 2,106,710,615 | | |

The accompanying notes are an integral part of these financial statements.

20

Schedule of Investments — June 30, 2013

Hotchkis & Wiley Mid-Cap Value Fund

(a) — Non-income producing security.

(b) — Affiliated issuer. See Note 6 in Notes to the Financial Statements.

(c) — All or a portion of this security is on loan. The total market value of securities on loan was $7,822,006.

ADR — American Depositary Receipt

^ — Rate shown is the 7-day yield as of June 30, 2013.

* — Invested through a cash management account administered by Brown Brothers Harriman & Co.

The Global Industry Classification Standard (GICS®) was developed by MSCI, an independent provider of global indices and benchmark-related products and services, and Standard & Poor's (S&P), an independent international financial data and investment services company. The GICS methodology has been widely accepted as an industry analysis framework for investment research, portfolio management and asset allocation. The GICS structure consists of 10 sectors, 24 industry groups, 68 industries and 154 sub-industries. Each stock that is classified will have a coding at all four of these levels.

The accompanying notes are an integral part of these financial statements.

21

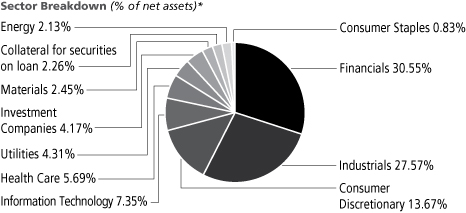

Schedule of Investments — June 30, 2013

Hotchkis & Wiley Small Cap Value Fund

* Sum of sectors shown is greater than 100% due to short-term investments and liabilities in excess of other assets of (0.98)%.

Largest Equity Holdings | | Percent of

net assets | |

CNO Financial Group, Inc. | | | 5.11 | % | |

Valassis Communications, Inc. | | | 4.98 | % | |

Huntington Ingalls Industries, Inc. | | | 4.47 | % | |

Con-way, Inc. | | | 4.47 | % | |

Rent-A-Center, Inc. | | | 4.16 | % | |

LifePoint Hospitals, Inc. | | | 4.12 | % | |

First Horizon National Corporation | | | 4.10 | % | |

Avis Budget Group, Inc. | | | 3.64 | % | |

ARRIS Group, Inc. | | | 3.24 | % | |

PHH Corporation | | | 2.97 | % | |

COMMON

STOCKS — 94.55% | | Shares

Held | | Value | |

CONSUMER DISCRETIONARY — 13.67%

Diversified Consumer Services — 0.97% | |

DeVry, Inc. | | | 183,400 | | | $ | 5,689,068 | | |

Hotels, Restaurants & Leisure — 0.65% | |

Lakes Entertainment, Inc. (a) | | | 197,000 | | | | 693,440 | | |

Ruby Tuesday, Inc. (a) | | | 333,100 | | | | 3,074,513 | | |

| | | | 3,767,953 | | |

Household Durables — 0.04% | |

Furniture Brands International, Inc. (a) | | | 63,142 | | | | 252,568 | | |

Media — 5.79% | |

The Interpublic Group of Companies, Inc. | | | 324,000 | | | | 4,714,200 | | |

Valassis Communications, Inc. | | | 1,185,400 | | | | 29,148,986 | | |

| | | | 33,863,186 | | |

Specialty Retail — 4.16% | |

Rent-A-Center, Inc. | | | 647,300 | | | | 24,306,115 | | |

Textiles, Apparel & Luxury Goods — 2.06% | |

Quiksilver, Inc. (a) | | | 1,871,000 | | | | 12,049,240 | | |

TOTAL CONSUMER DISCRETIONARY | | | 79,928,130 | | |

CONSUMER STAPLES — 0.83%

Food Products — 0.83% | |

Overhill Farms, Inc. (a) (b) | | | 982,900 | | | | 4,865,355 | | |

TOTAL CONSUMER STAPLES | | | 4,865,355 | | |

ENERGY — 2.13%

Energy Equipment & Services — 0.45% | |

McDermott International, Inc. (a) | | | 317,600 | | | | 2,597,968 | | |

Oil, Gas & Consumable Fuels — 1.68% | |

Cobalt International Energy, Inc. (a) | | | 114,000 | | | | 3,028,980 | | |

Stone Energy Corporation (a) | | | 308,800 | | | | 6,802,864 | | |

| | | | 9,831,844 | | |

TOTAL ENERGY | | | 12,429,812 | | |

| | Shares

Held | | Value | |

FINANCIALS — 30.55%

Commercial Banks — 9.31% | |

Associated Banc-Corp | | | 452,000 | | | $ | 7,028,600 | | |

First Financial Holdings, Inc. | | | 87,900 | | | | 1,864,359 | | |

First Horizon National Corporation | | | 2,141,631 | | | | 23,986,270 | | |

First Interstate BancSystem, Inc. | | | 282,300 | | | | 5,852,079 | | |

First Niagara Financial Group, Inc. | | | 261,300 | | | | 2,631,291 | | |

Synovus Financial Corporation | | | 2,393,100 | | | | 6,987,852 | | |

Webster Financial Corporation | | | 238,200 | | | | 6,116,976 | | |

| | | | 54,467,427 | | |

Diversified Financial Services — 2.97% | |

PHH Corporation (a) | | | 851,600 | | | | 17,355,608 | | |

Insurance — 15.12% | |

Argo Group International Holdings Limited | | | 257,510 | | | | 10,915,849 | | |

CNO Financial Group, Inc. | | | 2,303,500 | | | | 29,853,360 | | |

Endurance Specialty Holdings Limited | | | 98,800 | | | | 5,083,260 | | |

Global Indemnity PLC (a) | | | 375,536 | | | | 8,843,873 | | |

The Hanover Insurance Group, Inc. | | | 97,200 | | | | 4,755,996 | | |

Horace Mann Educators Corporation | | | 557,800 | | | | 13,599,164 | | |

National Western Life Insurance Company | | | 5,400 | | | | 1,025,190 | | |

Symetra Financial Corporation | | | 895,800 | | | | 14,323,842 | | |

| | | | 88,400,534 | | |

Real Estate Investment Trusts — 3.15% | |

CapLease, Inc. | | | 539,100 | | | | 4,550,004 | | |

The Geo Group, Inc. | | | 253,296 | | | | 8,599,399 | | |

Granite Real Estate Investment Trust | | | 153,100 | | | | 5,289,605 | | |

| | | | 18,439,008 | | |

TOTAL FINANCIALS | | | 178,662,577 | | |

The accompanying notes are an integral part of these financial statements.

22

Schedule of Investments — June 30, 2013

Hotchkis & Wiley Small Cap Value Fund

| | Shares

Held | | Value | |

HEALTH CARE — 5.69%

Health Care Providers & Services — 5.19% | |

LifePoint Hospitals, Inc. (a) | | | 492,900 | | | $ | 24,073,236 | | |

PharMerica Corporation (a) | | | 452,400 | | | | 6,270,264 | | |

| | | | 30,343,500 | | |

Pharmaceuticals — 0.50% | |

Questcor Pharmaceuticals, Inc. (c) | | | 64,100 | | | | 2,913,986 | | |

TOTAL HEALTH CARE | | | 33,257,486 | | |

INDUSTRIALS — 27.57%

Aerospace & Defense — 7.09% | |

Alliant Techsystems, Inc. | | | 165,100 | | | | 13,592,683 | | |

Embraer SA — ADR | | | 47,400 | | | | 1,748,586 | | |

Huntington Ingalls Industries, Inc. | | | 463,100 | | | | 26,155,888 | | |

| | | | 41,497,157 | | |

Airlines — 1.08% | |

JetBlue Airways Corporation (a) | | | 999,400 | | | | 6,296,220 | | |

Construction & Engineering — 0.90% | |

Tutor Perini Corporation (a) | | | 290,700 | | | | 5,258,763 | | |

Machinery — 4.83% | |

CIRCOR International, Inc. | | | 150,200 | | | | 7,639,172 | | |

Meritor, Inc. (a) | | | 1,249,500 | | | | 8,808,975 | | |

Miller Industries, Inc. (b) | | | 768,300 | | | | 11,816,454 | | |

| | | | 28,264,601 | | |

Professional Services — 3.07% | |

Heidrick & Struggles International, Inc. | | | 113,700 | | | | 1,901,064 | | |

Hudson Global, Inc. (a) (b) | | | 2,171,800 | | | | 5,386,064 | | |

Korn/Ferry International (a) | | | 181,800 | | | | 3,406,932 | | |

ManpowerGroup, Inc. | | | 132,100 | | | | 7,239,080 | | |

| | | | 17,933,140 | | |

Road & Rail — 8.11% | |

Avis Budget Group, Inc. (a) | | | 740,000 | | | | 21,275,000 | | |

Con-way, Inc. | | | 670,900 | | | | 26,138,264 | | |

| | | | 47,413,264 | | |

Trading Companies & Distributors — 2.49% | |

Rush Enterprises, Inc. (a) | | | 587,800 | | | | 14,548,050 | | |

TOTAL INDUSTRIALS | | | 161,211,195 | | |

INFORMATION TECHNOLOGY — 7.35%

Communications Equipment — 3.46% | |

ARRIS Group, Inc. (a) | | | 1,320,400 | | | | 18,947,740 | | |

Symmetricom, Inc. (a) | | | 293,200 | | | | 1,316,468 | | |

| | | | 20,264,208 | | |

Computers & Peripherals — 0.98% | |

QLogic Corporation (a) | | | 598,900 | | | | 5,725,484 | | |

IT Services — 0.06% | |

CIBER, Inc. (a) | | | 106,900 | | | | 357,046 | | |

| | Shares

Held | | Value | |

Semiconductors & Semiconductor Equipment — 1.88% | |

Intersil Corporation | | | 278,800 | | | $ | 2,180,216 | | |

ON Semiconductor Corporation (a) | | | 1,090,200 | | | | 8,808,816 | | |

| | | | 10,989,032 | | |

Software — 0.97% | |

Comverse, Inc. (a) | | | 190,310 | | | | 5,663,626 | | |

TOTAL INFORMATION TECHNOLOGY | | | 42,999,396 | | |

MATERIALS — 2.45%

Metals & Mining — 2.45% | |

Horsehead Holding Corporation (a) | | | 715,800 | | | | 9,169,398 | | |

Noranda Aluminum Holding Corporation | | | 1,596,100 | | | | 5,155,403 | | |

TOTAL MATERIALS | | | 14,324,801 | | |

UTILITIES — 4.31%

Electric Utilities — 2.63% | |

Great Plains Energy, Inc. | | | 614,200 | | | | 13,844,068 | | |

Westar Energy, Inc. | | | 49,100 | | | | 1,569,236 | | |

| | | | 15,413,304 | | |

Independent Power Producers & Energy Traders — 1.68% | |

NRG Energy, Inc. | | | 367,499 | | | | 9,812,223 | | |

TOTAL UTILITIES | | | 25,225,527 | | |

Total common stocks

(Cost $487,335,644) | | | | | 552,904,279 | | |

INVESTMENT COMPANIES — 4.17% | |

Exchange Traded Funds — 4.17% | |

iShares Russell 2000 Index Fund (c) | | | 125,400 | | | | 12,183,864 | | |

iShares Russell 2000 Value Index Fund (c) | | | 142,100 | | | | 12,206,390 | | |

Total investment companies

(Cost $22,127,962) | | | | | 24,390,254 | | |

Total long-term investments

(Cost $509,463,606) | | | | | 577,294,533 | | |

COLLATERAL FOR SECURITIES ON LOAN — 2.26% | |

Money Market Funds — 2.26% | |

Invesco Government Agency Portfolio, 0.02%^ | | | 13,226,446 | | | | 13,226,446 | | |

Total collateral for securities on loan

(Cost $13,226,446) | | | 13,226,446 | | |

SHORT-TERM

INVESTMENTS — 0.58% | | Principal

Amount | | | |

Time Deposits — 0.58% | |

Nordea Bank, 0.03%, 07/01/2013* | | $ | 3,389,076 | | | | 3,389,076 | | |

Total short-term investments

(Cost $3,389,076) | | | 3,389,076 | | |

Total investments — 101.56%

(Cost $526,079,128) | | | 593,910,055 | | |

Liabilities in excess of other assets — (1.56)% | | | | | (9,133,644 | ) | |

Net assets — 100.00% | | $ | 584,776,411 | | |

The accompanying notes are an integral part of these financial statements.

23

Schedule of Investments — June 30, 2013

Hotchkis & Wiley Small Cap Value Fund

(a) — Non-income producing security.