UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-10487 |

|

Hotchkis and Wiley Funds |

(Exact name of registrant as specified in charter) |

|

725 S. Figueroa Street, 39th Floor Los Angeles, California 90071 |

(Address of principal executive offices) (Zip code) |

|

Anna Marie Lopez Hotchkis and Wiley Capital Management, LLC 725 S. Figueroa Street, 39th Floor Los Angeles, California 90071 |

(Name and address of agent for service) |

|

Copies to: Mitchell Nichter, Esq. Paul, Hastings, Janofsky & Walker, LLP 55 Second Street, Twenty-Fourth Floor San Francisco, California 94105 |

(Counsel for the Registrant) |

|

Registrant’s telephone number, including area code: | (213) 430-1000 | |

|

Date of fiscal year end: | June 30, 2010 | |

|

Date of reporting period: | July 1, 2009 - June 30, 2010 | |

| | | | | | |

Item 1 - Report to Shareholders

Diversified Value Fund

Large Cap Value Fund

Mid-Cap Value Fund

Small Cap Value Fund

Value Opportunities Fund

High Yield Fund

HOTCHKIS AND WILEY FUNDS

JUNE 30, 2010

ANNUAL REPORT

TABLE OF CONTENTS

| SHAREHOLDER LETTER | | | 3 | | |

|

| FUND PERFORMANCE DATA | | | 6 | | |

|

| SCHEDULE OF INVESTMENTS: | |

|

| DIVERSIFIED VALUE FUND | | | 13 | | |

|

| LARGE CAP VALUE FUND | | | 15 | | |

|

| MID-CAP VALUE FUND | | | 17 | | |

|

| SMALL CAP VALUE FUND | | | 19 | | |

|

| VALUE OPPORTUNITIES FUND | | | 21 | | |

|

| HIGH YIELD FUND | | | 23 | | |

|

| STATEMENTS OF ASSETS AND LIABILITIES | | | 28 | | |

|

| STATEMENTS OF OPERATIONS | | | 29 | | |

|

| STATEMENTS OF CHANGES IN NET ASSETS | | | 30 | | |

|

| FINANCIAL HIGHLIGHTS | | | 32 | | |

|

| NOTES TO THE FINANCIAL STATEMENTS | | | 35 | | |

|

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 42 | | |

|

| FUND EXPENSE EXAMPLES | | | 43 | | |

|

BOARD CONSIDERATIONS IN APPROVING CONTINUATION

OF INVESTMENT ADVISORY AGREEMENTS | | | 44 | | |

|

| MANAGEMENT | | | 46 | | |

|

| PRIVACY POLICY | | | 47 | | |

|

| INFORMATION ABOUT THE FUNDS | | | BACK COVER | | |

|

DEAR SHAREHOLDER:

The following investment review and annual report relates to the activities of the Hotchkis and Wiley Funds for the twelve months ended June 30, 2010.

OVERVIEW

Equity markets continued to recover from unprecedented valuation levels, which bottomed in early 2009. Despite its retreat in the past quarter, the S&P 500 Index returned +14.43% over the twelve months ended June 30, 2010. During this period, value outperformed growth and small cap outperformed large cap. Cyclical stocks, whose valuations had been disproportionately depressed, performed exceptionally well. The consumer discretionary, industrials, and materials sectors were top-performers while telecommunications, energy, and utilities lagged.

Several dynamics helped support the market's recovery. Persistent negative economic news subsided, calming skittish investors. As panic waned, investors refocused on long-term company fundamentals which revealed promising signs of recovery. Aggressive corporate retrenchment supported earnings and cash flows — both remained resilient despite revenue declines. This cost-cutting put considerable cash on balance sheets, much of which is anticipated to be returned to shareholders via dividends and/or share repurchases. Corporate America's retrenchment has also established tremendous operating leverage. This should result in disproportionately accretive earnings, even if there is only modest improvement in demand.

Over the most recent quarter, concerns surrounding global economic stability continued to unnerve investors. Worries over European sovereign debt, an apparent moderation of explosive Chinese economic growth, and the wide conjecture over domestic financial regulation kept investors guarded. These systemic uncertainties may prolong the recovery as consumers and businesses remain cautious. Meanwhile, even with the recent equity market recovery, the S&P 500 remains roughly 30% below its 2007 peak. Earnings multiples (i.e. P/E ratios) remain well below historical trends.

As a disciplined, research-driven value manager, we remain confident in current opportunities. Corporate earnings and the U.S. economy are recovering from one of the deepest recessions since the Great Depression, which should amplify the magnitude of the recovery — particularly given equities' embedded operating leverage. Also, the recovery of value stocks has tended to carry on for several successive years following sizable market dislocations. We believe these characteristics provide a persuasive case for value investor optimism going forward.

HOTCHKIS AND WILEY DIVERSIFIED VALUE FUND

The Fund's Class I, Class A, and Class C shares had total returns for the 12-month period of 20.22%, 19.84%, and 19.17%, respectively, compared to the S&P 500 Index return of 14.43% and the Russell 1000 Value Index return of 16.92%. (Fund results shown do not reflect sales charges and would be lower if sales charges were included. More complete performance information can be found on page 7 of this report to shareholders.)

Positive stock selection in seven of the ten GICS sectors drove outperformance relative to the Russell 1000 Value Index. The financials sector was the largest performance contributor, led by stock selection in insurance. A lack of exposure to the poor-performing capital markets companies (Goldman Sachs, Morgan Stanley, etc.) also helped relative to the index. An underweight in energy, the worst-performing sector over the course of the year, aided performance. Stock selection in the energy sector boosted returns due to the large weight in the top-performing large integrated oil company — ConocoPhillips. Stock selection in utilities hurt performance as Exelon and NextEra Energy (formerly FPL Group) underperformed. An overweight position and weak stock selection in consumer staples also hindered returns.

HOTCHKIS AND WILEY LARGE CAP VALUE FUND

The Fund's Class I, Class A, Class C, and Class R shares had total returns for the 12-month period of 20.08%, 19.82%, 18.91%, and 19.55%, respectively, compared to the S&P 500 Index return of 14.43% and the Russell 1000 Value Index return of 16.92%. (Fund results shown do not reflect sales charges and would be lower if sales charges were included. More complete performance information can be found on page 8 of this report to shareholders.)

Positive stock selection in financials, particularly insurance, was the largest contributor to outperformance relative to the Russell 1000 Value Index over the past year — Genworth, XL Capital, and MetLife were large performance contributors within insurance. Positive stock selection in energy was the next best performance contributor due to the large weight in ConocoPhillips, which was the top-performer among the large integrated oil companies. Positive stock selection in telecommunications, industrials, materials, and healthcare also aided performance. The largest performance detractor for the year was stock selection in utilities as Exelon and NextEra Energy (formerly FPL Group) underperformed. Stock selection in consumer discretionary also detracted from performance with J.C. Penney the largest underperformer.

HOTCHKIS AND WILEY MID-CAP VALUE FUND

The Fund's Class I, Class A, Class C, and Class R shares had total returns for the 12-month period of 33.00%, 32.67%, 31.67%, and 32.36%, respectively, compared to the Russell Midcap Index return of 25.13% and the Russell Midcap Value Index return of 28.91%. (Fund results shown do not reflect sales charges and would be lower if sales charges were included. More complete performance information can be found on page 9 of this report to shareholders.)

Positive stock selection in financials was the largest contributor to outperformance relative to the Russell Midcap Value Index over the past year. Stock selection in banks and insurance were both large contributors to performance. The largest individual contributors within financials were Fifth Third and Capital One Financial. Positive stock selection in the consumer discretionary sector was the next best performance contributor with Valassis Communications (advertising), Limited Brands (apparel/retailer), and Jones Apparel (apparel/retailer) leading the way. The information technology sector was the largest performance detractor as CA and BMC Software lagged the benchmark. Stock selection in consumer staples and energy also detracted from performance.

3

HOTCHKIS AND WILEY SMALL CAP VALUE FUND

The Fund's Class I, Class A, and Class R shares had total returns for the 12-month period of 49.02%, 48.70%, and 47.56%, respectively, compared to the Russell 2000 Index return of 21.48% and the Russell 2000 Value Index return of 25.07%. (Fund results shown do not reflect sales charges and would be lower if sales charges were included. More complete performance information can be found on page 10 of this report to shareholders.)

Positive stock selection drove outperformance relative to the Russell 2000 Value Index for the year. Stock selection was positive in eight sectors, neutral in one sector, and negative in one sector. The consumer discretionary sector was the largest performance contributor as Valassis (advertising) and several retailers performed well. The financials sector was the next best performer as stock selection in banks and insurance aided performance for the year. The sole negative sector was utilities — two of the four portfolio holdings lagged the index's sector return.

HOTCHKIS AND WILEY VALUE OPPORTUNITIES FUND

The Fund's Class I, Class A, and Class R shares had total returns for the 12-month period of 38.72%, 38.43%, and 37.38%, respectively, compared to the Russell 3000 Index return of 15.72% and the Russell 3000 Value Index return of 17.57%. (Fund results shown do not reflect sales charges and would be lower if sales charges were included. More complete performance information can be found on page 11 of this report to shareholders.)

Positive stock selection drove outperformance relative to the Russell 3000 Value Index for the year. Stock selection was positive in eight of the ten GICS sectors. The consumer discretionary sector was the largest performance contributor, as Valassis (advertising) and several retailers performed well. The industrials sector was the next best performer, as professional services and machinery holdings aided performance. While positive in absolute terms, returns in the consumer staples sector lagged the benchmark during the year; this was the largest detractor from performance.

HOTCHKIS AND WILEY HIGH YIELD FUND

The Fund's Class I and Class A shares had total returns for the 12-month period of 25.45% and 24.76%, respectively, compared to the BofA Merrill Lynch U.S. High Yield BB-B (Constrained 2%) Index return of 21.65%. (Fund results shown do not reflect sales charges and would be lower if sales charges were included. More complete performance information can be found on page 12 of this report to shareholders.)

The high yield bond market rallied over the past year outperforming equities and investment grade bonds by considerable margins. High yield spreads tightened at a blistering pace from the record levels reached in early 2009. Low-rated credits, which had been excessively punished in the downswing, led the recovery. Unlike the equity market, the high yield market did not retreat over the past quarter; the high yield market's fundamentals have improved significantly from a year ago. Default rates have moved from record highs to well below historical averages. The ratio of issuers upgraded relative to issuers downgraded has improved to a near-record level. The new issue market has been sporadic but robust — most of the newly raised capital has been used for refinancing, which has improved balance sheets. Also strengthening balance sheets has been sizable corporate retrenchment that has allowed Corporate America to become flush with cash. While we do not expect the extraordinary market returns to persist, fundamental improvements and still-attractive spreads provide high yield investors with reason for optimism.

The portfolio's weight in CCC-rated credits averaged 8% over the course of the year, which helped relative to the BofA Merrill Lynch U.S. High Yield BB-B (Constrained 2%) as these bonds tightened exceptionally. Positive credit selection across the quality spectrum also contributed to the portfolio's outperformance. The consumer cyclical sector was the portfolio's top-performer with clothing retailer Quiksilver and recreation retailer Brunswick performing well. The portfolio's insurance holdings returned +36% for the year, but this lagged the index's insurance holdings, which returned a spectacular +87% over the same period — this detracted from relative performance. Also, the portfolio averaged 2% in cash, which detracted about 70 basis points in relative return during the strong market.

4

CONCLUSION

We appreciate your continued support of the Hotchkis and Wiley Funds, and we look forward to serving your investment needs in the future.

Sincerely,

| |  | |  | |

|

Anna Marie Lopez

President | | George Davis

Fund Manager | | Sheldon Lieberman

Fund Manager | |

|

| |  | |  | |

|

Patty McKenna

Fund Manager | | James Miles

Fund Manager | | Stan Majcher

Fund Manager | |

|

| |  | |  | |

|

David Green

Fund Manager | | Scott McBride

Fund Manager | | Judd Peters

Fund Manager | |

|

| |  | | | |

|

Ray Kennedy

Fund Manager | | Mark Hudoff

Fund Manager | | | |

|

The above reflects opinions of Fund managers as of June 30, 2010. They are subject to change and any forecasts made cannot be guaranteed. The Funds might not continue to hold any securities mentioned and have no obligation to disclose purchases or sales in these securities. Please refer to the Schedule of Investments in this report for a complete list of fund holdings for June 30, 2010. Past performance does not guarantee future results. Indexes do not incur expenses or sales loads and are not available for investment.

Credit Quality weights by rating were derived from the highest bond rating as determined by S&P, Moody's or Fitch. Bond ratings are grades given to bonds that indicate their credit quality as determined by private independent rating services such as Standard & Poor's, Moody's and Fitch. These firms evaluate a bond issuer's financial strength, or its ability to pay a bond's principal and interest in a timely fashion. Ratings are expressed as letters ranging from 'AAA', which is the highest grade, to 'D', which is the lowest grade. In limited situations when none of the three rating agencies have issued a formal rating, the Advisor will determine an internal rating.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC ("S&P"), an independent international financial data and investment services company. GICS is a service mark of MSCI and S&P and has been licensed for use by Hotchkis and Wiley Capital Management, LLC. The GICS methodology is used by the MSCI indexes, which include domestic and international stocks, as well as by a large portion of the professional investment management community. The GICS hierarchy begins with 10 sectors and is followed by 24 industry groups, 67 industries and 147 sub-industries. Each stock that is classified will have a coding at all four of these levels.

Definitions: Basis point equals .01%.

Current and future portfolio holdings are subject to risk.

5

Fund Performance Data

ABOUT FUND PERFORMANCE

The Large Cap Value Fund and Mid-Cap Value Fund have four classes of shares. The Diversified Value Fund, Small Cap Value Fund, Value Opportunities Fund and High Yield Fund have three classes of shares. Each share class has its own sales charge and expense structure, allowing you to invest in the way that best suits your needs. Currently, the High Yield Fund is not offering Class C shares to investors.

Class I shares have no initial sales charge and bear no ongoing distribution and service fees under a 12b-1 plan. Class I shares are available only to eligible investors.

Class A shares incur a maximum initial sales charge of 5.25% for the Diversified Value Fund, Large Cap Value Fund, Mid-Cap Value Fund, Small Cap Value Fund and Value Opportunities Fund and 3.75% for the High Yield Fund and an annual distribution and service fee of 0.25%.

Class C shares are subject to an annual distribution and service fee of 1.00%. In addition, Class C shares are subject to a 1.00% contingent deferred sales charge (CDSC) if redeemed within one year after purchase. Class C shares automatically convert to Class A shares approximately eight years after purchase and will then be subject to lower distribution and service fees.

Class R shares have no initial sales charge or CDSC and are subject to an annual distribution and service fee of 0.50%. Class R shares are offered only by the Large Cap Value Fund and Mid-Cap Value Fund and are available only to certain retirement plans.

FUND RISKS

Mutual fund investing involves risk; loss of principal is possible. The Small Cap Value Fund, Mid-Cap Value Fund and Value Opportunities Fund invest in small- and medium-capitalization companies which tend to have limited liquidity and greater price volatility than large-capitalization companies. The Value Opportunities Fund is a non-diversified fund which involves greater risk than investing in diversified funds, such as business risk, significant stock price fluctuations and sector concentration. Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales. The Value Opportunities Fund and High Yield Fund invest in debt securities that decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment by the High Yield Fund in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. The High Yield Fund may invest in derivative securities, which derive their performance from the performance of an underlying asset, index, interest rate or currency exchange rate. Derivatives can be volatile and involve various types and degrees of risks. Depending upon the characteristics of particular derivatives, they can suddenly become illiquid. Investments in asset-backed and mortgage-backed securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments.

MARKET INDEXES

The following are definitions for indexes used in the shareholder letter and the performance summary tables on the following pages. These indexes are unmanaged and include the reinvestment of dividends, but do not reflect the payment of transaction costs and advisory and other fees associated with an investment in the Funds. The securities that comprise these indexes may differ substantially from the securities in the Funds' portfolios. The Funds' value disciplines may prevent or restrict investments in the benchmark indexes. It is not possible to invest directly in an index. Each index named is not the only index which may be used to characterize performance of a specific Fund and other indexes may portray different comparative performance.

S&P 500® Index, a capital weighted, unmanaged index, represents the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange.

Russell 3000® Index, an unmanaged index, is comprised of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

Russell 3000® Value Index measures the performance of those Russell 3000® companies with lower price-to-book ratios and lower forecasted growth values.

Russell 1000® Index, an unmanaged index, measures the performance of the 1,000 largest companies in the Russell 3000® Index.

Russell 1000® Value Index measures the performance of those Russell 1000® companies with lower price-to-book ratios and lower forecasted growth values.

Russell Midcap® Index, an unmanaged index, measures the performance of the 800 smallest companies in the Russell 1000® Index.

Russell Midcap® Value Index measures the performance of those Russell Midcap® companies with lower price-to-book ratios and lower forecasted growth values.

Russell 2000® Index, an unmanaged index, is a stock market index comprised of the 2,000 smallest companies in the Russell 3000® Index.

Russell 2000® Value Index measures the performance of those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values.

The BofA Merrill Lynch U.S. High Yield BB-B (Constrained 2%) Index contains all securities in the BofA Merrill Lynch U.S. High Yield Index rated BB+ through B- by S&P (or equivalent as rated by Moody's or Fitch), but caps issuer exposure at 2%. Index constituents are capitalization-weighted, based on their current amount outstanding, provided the total allocation to an individual issuer does not exceed 2%.

6

Fund Performance Data

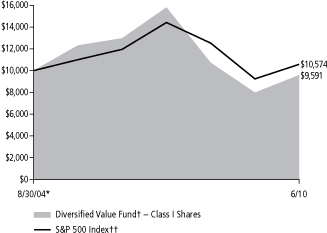

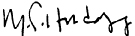

DIVERSIFIED VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

| For Periods ended June 30, 2010 | | 1 Year | | 5 Years | | Since

8/30/04* | |

| Class I | |

| Average annual total return | | | 20.22 | % | | | –4.88 | % | | | –0.71 | % | |

| Class A | |

| Average annual total return (with sales charge) | | | 13.49 | % | | | –6.15 | % | | | –1.88 | % | |

| Average annual total return (without sales charge) | | | 19.84 | % | | | –5.13 | % | | | –0.97 | % | |

| Class C | |

| Average annual total return (with CDSC) | | | 18.17 | % | | | –5.76 | % | | | –1.65 | % | |

| Average annual total return (without CDSC) | | | 19.17 | % | | | –5.76 | % | | | –1.65 | % | |

| S&P 500 Index†† | |

| Average annual total return | | | 14.43 | % | | | –0.79 | % | | | 0.96 | % | |

| Russell 1000 Index†† | |

| Average annual total return | | | 15.24 | % | | | –0.56 | % | | | 1.45 | % | |

| Russell 1000 Value Index†† | |

| Average annual total return | | | 16.92 | % | | | –1.64 | % | | | 0.96 | % | |

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the current applicable sales charges of each specific class. Returns for Class A reflect the current maximum initial sales charges of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the current maximum sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in stocks of U.S. companies with market capitalizations similar to the Russell 1000 Index.

†† See index descriptions on page 6.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I, Class A and Class C.

Past performance is not indicative of future results and the table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

7

Fund Performance Data

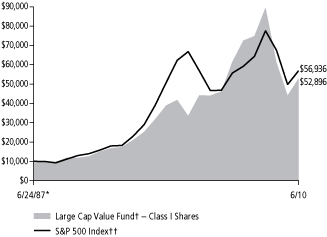

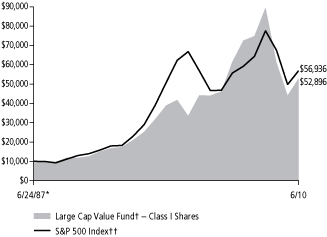

LARGE CAP VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

| For Periods ended June 30, 2010 | | 1 Year | | 5 Years | | 10 Years | | Since

6/24/87* | |

| Class I | |

| Average annual total return | | | 20.08 | % | | | –6.13 | % | | | 4.67 | % | | | 7.51 | % | |

| Class A | |

| Average annual total return (with sales charge) | | | 13.56 | % | | | –7.39 | % | | | 3.88 | % | | | 7.02 | % | |

| Average annual total return (without sales charge) | | | 19.82 | % | | | –6.38 | % | | | 4.44 | % | | | 7.27 | % | |

| Class C | |

| Average annual total return (with CDSC) | | | 17.91 | % | | | –6.98 | % | | | 3.69 | % | | | 6.45 | % | |

| Average annual total return (without CDSC) | | | 18.91 | % | | | –6.98 | % | | | 3.69 | % | | | 6.45 | % | |

| Class R | |

| Average annual total return | | | 19.55 | % | | | –6.61 | % | | | 4.19 | % | | | 6.99 | % | |

| S&P 500 Index†† | |

| Average annual total return | | | 14.43 | % | | | –0.79 | % | | | –1.59 | % | | | 7.84 | % | |

| Russell 1000 Index†† | |

| Average annual total return | | | 15.24 | % | | | –0.56 | % | | | –1.22 | % | | | 7.99 | % | |

| Russell 1000 Value Index†† | |

| Average annual total return | | | 16.92 | % | | | –1.64 | % | | | 2.38 | % | | | n/a | | |

Returns shown for Class A, Class C, and Class R shares for the periods prior to their inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of each specific class. (Inception dates: Class A — 10/26/01; Class C — 2/4/02; Class R — 8/28/03.)

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the current applicable sales charges of each specific class. Returns for Class A reflect the current maximum initial sales charges of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the current maximum sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in stocks of U.S. companies with market capitalizations similar to the Russell 1000 Index.

†† See index descriptions on page 6.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

8

Fund Performance Data

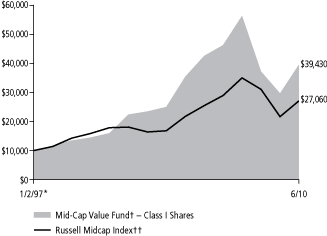

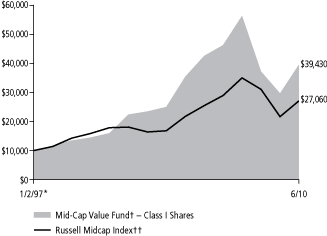

MID-CAP VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

| For Periods ended June 30, 2010 | | 1 Year | | 5 Years | | 10 Years | | Since

1/2/97* | |

| Class I | |

| Average annual total return | | | 33.00 | % | | | –1.53 | % | | | 9.47 | % | | | 10.70 | % | |

| Class A | |

| Average annual total return (with sales charge) | | | 25.69 | % | | | –2.82 | % | | | 8.60 | % | | | 10.00 | % | |

| Average annual total return (without sales charge) | | | 32.67 | % | | | –1.77 | % | | | 9.18 | % | | | 10.44 | % | |

| Class C | |

| Average annual total return (with CDSC) | | | 30.67 | % | | | –2.35 | % | | | 8.50 | % | | | 9.66 | % | |

| Average annual total return (without CDSC) | | | 31.67 | % | | | –2.35 | % | | | 8.50 | % | | | 9.66 | % | |

| Class R | |

| Average annual total return | | | 32.36 | % | | | –2.02 | % | | | 9.09 | % | | | 10.27 | % | |

| Russell Midcap Index†† | |

| Average annual total return | | | 25.13 | % | | | 1.22 | % | | | 4.24 | % | | | 7.65 | % | |

| Russell Midcap Value Index†† | |

| Average annual total return | | | 28.91 | % | | | 0.71 | % | | | 7.55 | % | | | 8.30 | % | |

Returns shown for Class A, Class C, and Class R shares for the periods prior to their inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of each specific class. (Inception dates: Class A, Class C — 1/2/01; Class R — 8/28/03.)

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the current applicable sales charges of each specific class. Returns for Class A reflect the current maximum initial sales charges of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the current maximum sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in stocks of U.S. companies with market capitalizations similar to the Russell Midcap Index.

†† See index descriptions on page 6.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

9

Fund Performance Data

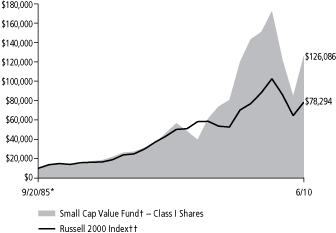

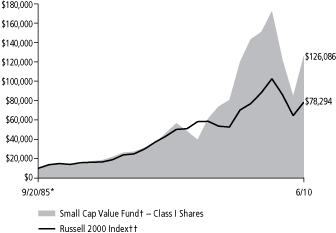

SMALL CAP VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

| For Periods ended June 30, 2010 | | 1 Year | | 5 Years | | 10 Years | | Since

9/20/85* | |

| Class I | |

| Average annual total return | | | 49.02 | % | | | –2.55 | % | | | 12.30 | % | | | 10.76 | % | |

| Class A | |

| Average annual total return (with sales charge) | | | 40.91 | % | | | –3.84 | % | | | 11.59 | % | | | 10.27 | % | |

| Average annual total return (without sales charge) | | | 48.70 | % | | | –2.79 | % | | | 12.19 | % | | | 10.52 | % | |

| Class C | |

| Average annual total return (with CDSC) | | | 46.56 | % | | | –3.34 | % | | | 11.32 | % | | | 9.72 | % | |

| Average annual total return (without CDSC) | | | 47.56 | % | | | –3.34 | % | | | 11.32 | % | | | 9.72 | % | |

| Russell 2000 Index†† | |

| Average annual total return | | | 21.48 | % | | | 0.37 | % | | | 3.00 | % | | | 8.65 | % | |

| Russell 2000 Value Index†† | |

| Average annual total return | | | 25.07 | % | | | –0.51 | % | | | 7.48 | % | | | n/a | | |

Returns shown for Class A and Class C shares for the periods prior to their inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of each specific class. (Inception dates: Class A — 10/6/00; Class C — 2/4/02.)

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the current applicable sales charges of each specific class. Returns for Class A reflect the current maximum initial sales charges of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the current maximum sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in stocks of U.S. companies with market capitalizations less than $3 billion.

†† See index descriptions on page 6.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

10

Fund Performance Data

VALUE OPPORTUNITIES FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

| For Periods ended June 30, 2010 | | 1 Year | | 5 Years | | Since

12/31/02* | |

| Class I | |

| Average annual total return | | | 38.72 | % | | | –0.63 | % | | | 9.57 | % | |

| Class A | |

| Average annual total return (with sales charge) | | | 31.17 | % | | | –1.94 | % | | | 8.63 | % | |

| Average annual total return (without sales charge) | | | 38.43 | % | | | –0.87 | % | | | 9.41 | % | |

| Class C | |

| Average annual total return (with CDSC) | | | 36.38 | % | | | –1.50 | % | | | 8.56 | % | |

| Average annual total return (without CDSC) | | | 37.38 | % | | | –1.50 | % | | | 8.56 | % | |

| S&P 500 Index†† | |

| Average annual total return | | | 14.43 | % | | | –0.79 | % | | | 4.19 | % | |

| Russell 3000 Index†† | |

| Average annual total return | | | 15.72 | % | | | –0.48 | % | | | 4.90 | % | |

| Russell 3000 Value Index†† | |

| Average annual total return | | | 17.57 | % | | | –1.56 | % | | | 5.00 | % | |

Returns shown for Class C shares for the periods prior to their inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of the class. (Inception date: Class C — 8/28/03.)

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the current applicable sales charges of each specific class. Returns for Class A reflect the current maximum initial sales charges of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the current maximum sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in securities of companies with strong capital appreciation potential.

†† See index descriptions on page 6.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I and Class A.

Past performance is not indicative of future results and the table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

11

Fund Performance Data

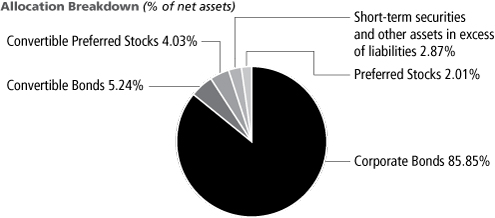

HIGH YIELD FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

| For Periods ended June 30, 2010 | | 1 Year | | Since

3/31/09* | |

| Class I | |

| Average annual total return | | | 25.45 | % | | | 30.73 | % | |

| Class A | |

| Average annual total return (with sales charge) | | | 20.08 | % | | | 25.96 | % | |

| Average annual total return (without sales charge) | | | 24.76 | % | | | 29.87 | % | |

| The BofA Merrill Lynch U.S. High Yield BB-B (Constrained 2%) Index | |

| Average annual total return | | | 21.65 | % | | | 33.55 | % | |

Returns shown for Class A shares for the periods prior to its inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of the class. (Inception date: Class A — 5/29/09.)

Average annual total returns with sales charge shown for Class A shares have been adjusted to reflect the current applicable sales charge of the class. Returns for Class A reflect the current maximum initial sales charge of 3.75%. Average annual total returns without sales charge do not reflect the current maximum sales charges. Had the sales charge been included, the Fund's returns would have been lower.

† The Fund invests primarily in high yield securities.

†† See index description on page 6.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

12

Schedule of Investments — June 30, 2010

Hotchkis and Wiley Diversified Value Fund

| Largest Equity Holdings | | Percent of

net assets | |

| ConocoPhillips | | | 4.58 | % | |

| JPMorgan Chase & Company | | | 4.49 | % | |

| Royal Dutch Shell PLC - Class B - ADR | | | 4.31 | % | |

| Wells Fargo & Company | | | 3.90 | % | |

| Bank of America Corporation | | | 3.79 | % | |

| CA, Inc. | | | 3.23 | % | |

| Exelon Corporation | | | 3.21 | % | |

| Vodafone Group PLC - ADR | | | 3.05 | % | |

| Citigroup, Inc. | | | 2.58 | % | |

| Lockheed Martin Corporation | | | 2.50 | % | |

COMMON

STOCKS — 99.18% | | Shares

Held | | Value | |

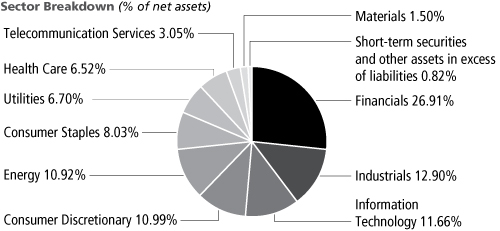

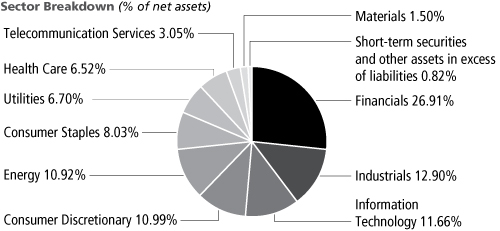

CONSUMER DISCRETIONARY — 10.99%

Auto Components — 1.01% | |

| Johnson Controls, Inc. | | | 147,000 | | | $ | 3,949,890 | | |

| Hotels, Restaurants & Leisure — 0.91% | |

| Carnival Corporation | | | 118,100 | | | | 3,571,344 | | |

| Media — 3.61% | |

| Comcast Corporation | | | 363,100 | | | | 5,965,733 | | |

| Interpublic Group of Companies, Inc. (a) | | | 479,300 | | | | 3,417,409 | | |

| Time Warner Cable, Inc. | | | 90,800 | | | | 4,728,864 | | |

| | | | 14,112,006 | | |

| Multiline Retail — 1.71% | |

| J.C. Penney Company, Inc. | | | 312,100 | | | | 6,703,908 | | |

| Specialty Retail — 3.75% | |

| The Gap, Inc. | | | 171,600 | | | | 3,339,336 | | |

| Home Depot, Inc. | | | 249,200 | | | | 6,995,044 | | |

| Limited Brands, Inc. | | | 195,900 | | | | 4,323,513 | | |

| | | | 14,657,893 | | |

| TOTAL CONSUMER DISCRETIONARY | | | 42,995,041 | | |

CONSUMER STAPLES — 8.03%

Food & Staples Retailing — 4.68% | |

| CVS Caremark Corporation | | | 173,300 | | | | 5,081,156 | | |

| Safeway, Inc. | | | 264,900 | | | | 5,207,934 | | |

| Wal-Mart Stores, Inc. | | | 166,800 | | | | 8,018,076 | | |

| | | | 18,307,166 | | |

| Food Products — 0.50% | |

| Kraft Foods, Inc. | | | 70,900 | | | | 1,985,200 | | |

| Tobacco — 2.85% | |

| Lorillard, Inc. | | | 41,800 | | | | 3,008,764 | | |

| Philip Morris International, Inc. | | | 177,500 | | | | 8,136,600 | | |

| | | | 11,145,364 | | |

| TOTAL CONSUMER STAPLES | | | 31,437,730 | | |

| | Shares

Held | | Value | |

ENERGY — 10.92%

Oil, Gas & Consumable Fuels — 10.92% | |

| ConocoPhillips | | | 365,400 | | | $ | 17,937,486 | | |

| Exxon Mobil Corporation | | | 103,800 | | | | 5,923,866 | | |

| Marathon Oil Corporation | | | 63,600 | | | | 1,977,324 | | |

| Royal Dutch Shell PLC — Class B — ADR | | | 349,400 | | | | 16,869,032 | | |

| TOTAL ENERGY | | | 42,707,708 | | |

FINANCIALS — 26.91%

Commercial Banks — 6.40% | |

| KeyCorp | | | 373,903 | | | | 2,875,314 | | |

| PNC Financial Services Group, Inc. | | | 85,215 | | | | 4,814,648 | | |

| SunTrust Banks, Inc. | | | 89,800 | | | | 2,092,340 | | |

| Wells Fargo & Company | | | 595,334 | | | | 15,240,550 | | |

| | | | 25,022,852 | | |

| Consumer Finance — 1.58% | |

| American Express Company | | | 48,700 | | | | 1,933,390 | | |

| Capital One Financial Corporation | | | 105,400 | | | | 4,247,620 | | |

| | | | 6,181,010 | | |

| Diversified Financial Services — 10.86% | |

| Bank of America Corporation | | | 1,032,522 | | | | 14,837,341 | | |

| Citigroup, Inc. (a) | | | 2,682,845 | | | | 10,087,497 | | |

| JPMorgan Chase & Company | | | 479,400 | | | | 17,550,834 | | |

| | | | 42,475,672 | | |

| Insurance — 8.07% | |

| The Allstate Corporation | | | 239,500 | | | | 6,880,835 | | |

| Genworth Financial, Inc. (a) | | | 486,900 | | | | 6,363,783 | | |

| Hartford Financial Services Group, Inc. | | | 86,300 | | | | 1,909,819 | | |

| MetLife, Inc. | | | 122,242 | | | | 4,615,858 | | |

| Prudential Financial, Inc. | | | 64,500 | | | | 3,461,070 | | |

| The Travelers Companies, Inc. | | | 36,300 | | | | 1,787,775 | | |

| XL Capital Limited | | | 410,800 | | | | 6,576,908 | | |

| | | | 31,596,048 | | |

| TOTAL FINANCIALS | | | 105,275,582 | | |

The accompanying notes are an integral part of these financial statements.

13

Schedule of Investments — June 30, 2010

Hotchkis and Wiley Diversified Value Fund

| | Shares

Held | | Value | |

HEALTH CARE — 6.52%

Pharmaceuticals — 6.52% | |

| AstraZeneca PLC — ADR (b) | | | 45,900 | | | $ | 2,163,267 | | |

| Bristol-Myers Squibb Company | | | 195,300 | | | | 4,870,782 | | |

| Eli Lilly & Company | | | 272,000 | | | | 9,112,000 | | |

| Johnson & Johnson | | | 34,600 | | | | 2,043,476 | | |

| Merck & Company, Inc. | | | 83,796 | | | | 2,930,346 | | |

| Pfizer, Inc. | | | 308,200 | | | | 4,394,932 | | |

| TOTAL HEALTH CARE | | | 25,514,803 | | |

INDUSTRIALS — 12.90%

Aerospace & Defense — 6.39% | |

| The Boeing Company | | | 36,200 | | | | 2,271,550 | | |

| Empresa Brasileira de Aeronautica SA — ADR | | | 209,600 | | | | 4,391,120 | | |

| Honeywell International, Inc. | | | 49,500 | | | | 1,931,985 | | |

| Lockheed Martin Corporation | | | 131,400 | | | | 9,789,300 | | |

| Northrop Grumman Corporation | | | 121,800 | | | | 6,630,792 | | |

| | | | 25,014,747 | | |

| Air Freight & Logistics — 1.58% | |

| FedEx Corporation | | | 88,000 | | | | 6,169,680 | | |

| Industrial Conglomerates — 1.60% | |

| Tyco International Limited | | | 177,800 | | | | 6,263,894 | | |

| Machinery — 3.33% | |

| Cummins, Inc. | | | 77,300 | | | | 5,034,549 | | |

| PACCAR, Inc. | | | 200,500 | | | | 7,993,935 | | |

| | | | 13,028,484 | | |

| TOTAL INDUSTRIALS | | | 50,476,805 | | |

INFORMATION TECHNOLOGY — 11.66%

Computers & Peripherals — 1.73% | |

| Hewlett-Packard Company | | | 156,700 | | | | 6,781,976 | | |

| Electronic Equipment, Instruments & Components — 1.84% | |

| Tyco Electronics Limited | | | 284,000 | | | | 7,207,920 | | |

| IT Services — 1.88% | |

| Accenture PLC | | | 51,500 | | | | 1,990,475 | | |

| International Business Machines Corporation | | | 43,500 | | | | 5,371,380 | | |

| | | | 7,361,855 | | |

| Software — 6.21% | |

| CA, Inc. | | | 687,206 | | | | 12,644,591 | | |

| Microsoft Corporation | | | 336,700 | | | | 7,747,467 | | |

| Oracle Corporation | | | 181,300 | | | | 3,890,698 | | |

| | | | 24,282,756 | | |

| TOTAL INFORMATION TECHNOLOGY | | | 45,634,507 | | |

| | Shares

Held | | Value | |

MATERIALS — 1.50%

Chemicals — 1.50% | |

| PPG Industries, Inc. | | | 97,000 | | | $ | 5,859,770 | | |

| TOTAL MATERIALS | | | 5,859,770 | | |

TELECOMMUNICATION SERVICES — 3.05%

Wireless Telecommunication Services — 3.05% | |

| Vodafone Group PLC — ADR | | | 577,900 | | | | 11,945,193 | | |

| TOTAL TELECOMMUNICATION SERVICES | | | 11,945,193 | | |

UTILITIES — 6.70%

Electric Utilities — 6.70% | |

| Edison International | | | 157,200 | | | | 4,986,384 | | |

| Entergy Corporation | | | 44,800 | | | | 3,208,576 | | |

| Exelon Corporation | | | 330,300 | | | | 12,541,491 | | |

| NextEra Energy, Inc. | | | 112,200 | | | | 5,470,872 | | |

| TOTAL UTILITIES | | | 26,207,323 | | |

Total investments — 99.18%

(Cost $525,053,138) | | | 388,054,462 | | |

| Collateral for securities on loan^ — 0.44% | | | | | | | 1,729,808 | | |

| Time deposit* — 0.09% | | | | | | | 348,052 | | |

| Other assets in excess of liabilities — 0.29% | | | | | | | 1,135,075 | | |

| Net assets — 100.00% | | $ | 391,267,397 | | |

(a) — Non-income producing security.

(b) — All or a portion of this security is on loan. The total market value of securities on loan was $1,694,690.

ADR — American Depositary Receipt

^ — Collateral for securities on loan of $1,725,119 was invested in JP Morgan Chase Repurchase Agreements which bear interest at 0.01% and mature on 7/1/2010. The repurchase proceeds are $1,725,119. The repurchase agreements are collateralized by United States Government & Agency Issues. The remaining collateral for securities on loan of $4,689 was held as cash.

* — Time deposit with Citibank bears interest at 0.03% and matures on 7/1/2010. Invested through a cash management account administered by Brown Brothers Harriman & Co.

The accompanying notes are an integral part of these financial statements.

14

Schedule of Investments — June 30, 2010

Hotchkis and Wiley Large Cap Value Fund

| Largest Equity Holdings | | Percent of

net assets | |

| Royal Dutch Shell PLC - Class B - ADR | | | 4.94 | % | |

| JPMorgan Chase & Company | | | 4.87 | % | |

| Bank of America Corporation | | | 4.30 | % | |

| Exelon Corporation | | | 4.20 | % | |

| Wells Fargo & Company | | | 4.05 | % | |

| ConocoPhillips | | | 3.93 | % | |

| CA, Inc. | | | 3.67 | % | |

| Vodafone Group PLC - ADR | | | 3.12 | % | |

| Citigroup, Inc. | | | 3.11 | % | |

| Lockheed Martin Corporation | | | 2.99 | % | |

COMMON

STOCKS — 99.20% | | Shares

Held | | Value | |

CONSUMER DISCRETIONARY — 10.85%

Automobiles — 0.96% | |

| Harley-Davidson, Inc. | | | 452,900 | | | $ | 10,067,967 | | |

| Household Durables — 0.46% | |

| Fortune Brands, Inc. | | | 122,800 | | | | 4,811,304 | | |

| Media — 2.55% | |

| Comcast Corporation | | | 1,621,100 | | | | 26,634,673 | | |

| Multiline Retail — 2.21% | |

| J.C. Penney Company, Inc. | | | 1,071,700 | | | | 23,020,116 | | |

| Specialty Retail — 4.14% | |

| The Gap, Inc. | | | 545,600 | | | | 10,617,376 | | |

| Home Depot, Inc. | | | 675,109 | | | | 18,950,309 | | |

| Limited Brands, Inc. | | | 616,300 | | | | 13,601,741 | | |

| | | | 43,169,426 | | |

| Textiles, Apparel & Luxury Goods — 0.53% | |

| Jones Apparel Group, Inc. | | | 350,100 | | | | 5,549,085 | | |

| TOTAL CONSUMER DISCRETIONARY | | | 113,252,571 | | |

CONSUMER STAPLES — 5.97%

Food & Staples Retailing — 3.84% | |

| CVS Caremark Corporation | | | 266,100 | | | | 7,802,052 | | |

| Safeway, Inc. | | | 776,900 | | | | 15,273,854 | | |

| Wal-Mart Stores, Inc. | | | 353,900 | | | | 17,011,973 | | |

| | | | 40,087,879 | | |

| Tobacco — 2.13% | |

| Philip Morris International, Inc. | | | 484,900 | | | | 22,227,816 | | |

| TOTAL CONSUMER STAPLES | | | 62,315,695 | | |

ENERGY — 8.87%

Oil, Gas & Consumable Fuels — 8.87% | |

| ConocoPhillips | | | 835,300 | | | | 41,004,877 | | |

| Royal Dutch Shell PLC — Class B — ADR | | | 1,067,300 | | | | 51,529,244 | | |

| TOTAL ENERGY | | | 92,534,121 | | |

| | Shares

Held | | Value | |

FINANCIALS — 28.80%

Commercial Banks — 6.41% | |

| PNC Financial Services Group, Inc. | | | 271,900 | | | $ | 15,362,350 | | |

| Regions Financial Corporation | | | 1,403,700 | | | | 9,236,346 | | |

| Wells Fargo & Company | | | 1,651,591 | | | | 42,280,730 | | |

| | | | 66,879,426 | | |

| Consumer Finance — 1.31% | |

| Capital One Financial Corporation | | | 340,600 | | | | 13,726,180 | | |

| Diversified Financial Services — 12.27% | |

| Bank of America Corporation | | | 3,120,889 | | | | 44,847,175 | | |

| Citigroup, Inc. (a) | | | 8,622,282 | | | | 32,419,780 | | |

| JPMorgan Chase & Company | | | 1,388,600 | | | | 50,836,646 | | |

| | | | 128,103,601 | | |

| Insurance — 8.81% | |

| The Allstate Corporation | | | 844,200 | | | | 24,253,866 | | |

| Genworth Financial, Inc. (a) | | | 1,277,800 | | | | 16,700,846 | | |

| MetLife, Inc. | | | 552,358 | | | | 20,857,038 | | |

| The Travelers Companies, Inc. | | | 111,800 | | | | 5,506,150 | | |

| Unum Group | | | 242,400 | | | | 5,260,080 | | |

| XL Capital Limited | | | 1,208,000 | | | | 19,340,080 | | |

| | | | 91,918,060 | | |

| TOTAL FINANCIALS | | | 300,627,267 | | |

HEALTH CARE — 6.82%

Pharmaceuticals — 6.82% | |

| Bristol-Myers Squibb Company | | | 748,700 | | | | 18,672,578 | | |

| Eli Lilly & Company | | | 864,300 | | | | 28,954,050 | | |

| Merck & Company, Inc. | | | 222,402 | | | | 7,777,398 | | |

| Pfizer, Inc. | | | 1,109,200 | | | | 15,817,192 | | |

| TOTAL HEALTH CARE | | | 71,221,218 | | |

The accompanying notes are an integral part of these financial statements.

15

Schedule of Investments — June 30, 2010

Hotchkis and Wiley Large Cap Value Fund

| | Shares

Held | | Value | |

INDUSTRIALS — 11.30%

Aerospace & Defense — 5.89% | |

| Empresa Brasileira de Aeronautica SA — ADR | | | 599,500 | | | $ | 12,559,525 | | |

| Lockheed Martin Corporation | | | 418,600 | | | | 31,185,700 | | |

| Northrop Grumman Corporation | | | 324,700 | | | | 17,676,668 | | |

| | | | 61,421,893 | | |

| Industrial Conglomerates — 1.62% | |

| Tyco International Limited | | | 480,125 | | | | 16,914,804 | | |

| Machinery — 3.79% | |

| Cummins, Inc. | | | 219,200 | | | | 14,276,496 | | |

| PACCAR, Inc. | | | 635,100 | | | | 25,321,437 | | |

| | | | 39,597,933 | | |

| TOTAL INDUSTRIALS | | | 117,934,630 | | |

INFORMATION TECHNOLOGY — 12.41%

Computers & Peripherals — 1.67% | |

| Hewlett-Packard Company | | | 403,700 | | | | 17,472,136 | | |

| Electronic Equipment, Instruments & Components — 2.61% | |

| Tyco Electronics Limited | | | 1,074,425 | | | | 27,268,907 | | |

| IT Services — 2.18% | |

| International Business Machines Corporation | | | 184,100 | | | | 22,732,668 | | |

| Software — 5.95% | |

| CA, Inc. | | | 2,082,481 | | | | 38,317,650 | | |

| Microsoft Corporation | | | 1,031,400 | | | | 23,732,514 | | |

| | | | 62,050,164 | | |

| TOTAL INFORMATION TECHNOLOGY | | | 129,523,875 | | |

MATERIALS — 3.76%

Chemicals — 3.76% | |

| Celanese Corporation | | | 737,500 | | | | 18,371,125 | | |

| PPG Industries, Inc. | | | 346,100 | | | | 20,907,901 | | |

| TOTAL MATERIALS | | | 39,279,026 | | |

TELECOMMUNICATION SERVICES — 3.12%

Wireless Telecommunication Services — 3.12% | |

| Vodafone Group PLC — ADR | | | 1,573,300 | | | | 32,520,111 | | |

| TOTAL TELECOMMUNICATION SERVICES | | | 32,520,111 | | |

| | Shares

Held | | Value | |

UTILITIES — 7.30%

Electric Utilities — 7.30% | |

| Edison International | | | 431,700 | | | $ | 13,693,524 | | |

| Exelon Corporation | | | 1,154,800 | | | | 43,847,756 | | |

| NextEra Energy, Inc. | | | 382,700 | | | | 18,660,452 | | |

| TOTAL UTILITIES | | | 76,201,732 | | |

Total investments — 99.20%

(Cost $1,369,552,522) | | | 1,035,410,246 | | |

| Time deposit* — 0.74% | | | | | | | 7,706,760 | | |

| Other assets in excess of liabilities — 0.06% | | | | | | | 642,547 | | |

| Net assets — 100.00% | | $ | 1,043,759,553 | | |

(a) — Non-income producing security.

ADR — American Depositary Receipt

* — Time deposit with Citibank bears interest at 0.03% and matures on 7/1/2010. Invested through a cash management account administered by Brown Brothers Harriman & Co.

The accompanying notes are an integral part of these financial statements.

16

Schedule of Investments — June 30, 2010

Hotchkis and Wiley Mid-Cap Value Fund

| Largest Equity Holdings | | Percent of

net assets | |

| Con-way, Inc. | | | 5.17 | % | |

| CA, Inc. | | | 4.61 | % | |

| Valassis Communications, Inc. | | | 4.38 | % | |

| Celanese Corporation | | | 3.10 | % | |

| KeyCorp | | | 3.03 | % | |

| XL Capital Limited | | | 2.94 | % | |

| Tyco Electronics Limited | | | 2.90 | % | |

| Manpower, Inc. | | | 2.89 | % | |

| Safeway, Inc. | | | 2.65 | % | |

| Cobalt International Energy, Inc. | | | 2.41 | % | |

COMMON

STOCKS — 99.94% | | Shares

Held | | Value | |

CONSUMER DISCRETIONARY — 18.00%

Auto Components — 2.96% | |

| The Goodyear Tire & Rubber Company (a) | | | 1,544,000 | | | $ | 15,347,360 | | |

| Magna International, Inc. | | | 273,500 | | | | 18,040,060 | | |

| | | | 33,387,420 | | |

| Automobiles — 0.49% | |

| Harley-Davidson, Inc. | | | 248,000 | | | | 5,513,040 | | |

| Diversified Consumer Services — 0.79% | |

| Weight Watchers International, Inc. | | | 344,200 | | | | 8,842,498 | | |

| Media — 8.34% | |

| Interpublic Group of Companies, Inc. (a) | | | 2,601,800 | | | | 18,550,834 | | |

| Liberty Global, Inc. (a) | | | 464,600 | | | | 12,074,954 | | |

| Time Warner Cable, Inc. | | | 270,100 | | | | 14,066,808 | | |

| Valassis Communications, Inc. (a) | | | 1,554,400 | | | | 49,305,568 | | |

| | | | 93,998,164 | | |

| Specialty Retail — 3.87% | |

| The Gap, Inc. | | | 1,029,300 | | | | 20,030,178 | | |

| Rent-A-Center, Inc. (a) | | | 1,162,200 | | | | 23,546,172 | | |

| | | | 43,576,350 | | |

| Textiles, Apparel & Luxury Goods — 1.55% | |

| Jones Apparel Group, Inc. | | | 1,105,000 | | | | 17,514,250 | | |

| TOTAL CONSUMER DISCRETIONARY | | | 202,831,722 | | |

CONSUMER STAPLES — 5.57%

Food & Staples Retailing — 3.56% | |

| Safeway, Inc. | | | 1,518,300 | | | | 29,849,778 | | |

| SUPERVALU, Inc. | | | 951,300 | | | | 10,312,092 | | |

| | | | 40,161,870 | | |

| Tobacco — 2.01% | |

| Lorillard, Inc. | | | 314,500 | | | | 22,637,710 | | |

| TOTAL CONSUMER STAPLES | | | 62,799,580 | | |

| | Shares

Held | | Value | |

ENERGY — 4.94%

Oil, Gas & Consumable Fuels — 4.94% | |

| Cobalt International Energy, Inc. (a) | | | 3,649,500 | | | $ | 27,188,775 | | |

| Forest Oil Corporation (a) | | | 99,700 | | | | 2,727,792 | | |

| Holly Corporation | | | 452,600 | | | | 12,030,108 | | |

| Stone Energy Corporation (a) | | | 1,232,700 | | | | 13,756,932 | | |

| TOTAL ENERGY | | | 55,703,607 | | |

FINANCIALS — 28.04%

Commercial Banks — 10.05% | |

| Fifth Third Bancorp | | | 1,598,600 | | | | 19,646,794 | | |

| First Horizon National Corporation (a) | | | 1 | | | | 7 | | |

| Huntington Bancshares, Inc. | | | 2,573,400 | | | | 14,256,636 | | |

| KeyCorp | | | 4,441,520 | | | | 34,155,289 | | |

| Regions Financial Corporation | | | 3,928,500 | | | | 25,849,530 | | |

| SunTrust Banks, Inc. | | | 829,200 | | | | 19,320,360 | | |

| | | | 113,228,616 | | |

| Consumer Finance — 3.50% | |

| Capital One Financial Corporation | | | 364,800 | | | | 14,701,440 | | |

| Discover Financial Services | | | 1,769,000 | | | | 24,730,620 | | |

| | | | 39,432,060 | | |

| Diversified Financial Services — 1.85% | |

| PHH Corporation (a) | | | 1,092,700 | | | | 20,805,008 | | |

| Insurance — 10.59% | |

| The Allstate Corporation | | | 244,200 | | | | 7,015,866 | | |

| CNA Financial Corporation (a) | | | 708,524 | | | | 18,109,873 | | |

| CNO Financial Group, Inc. (a) | | | 4,742,400 | | | | 23,474,880 | | |

| Genworth Financial, Inc. (a) | | | 1,832,800 | | | | 23,954,696 | | |

| Hartford Financial Services Group, Inc. | | | 619,700 | | | | 13,713,961 | | |

| XL Capital Limited | | | 2,069,600 | | | | 33,134,296 | | |

| | | | 119,403,572 | | |

The accompanying notes are an integral part of these financial statements.

17

Schedule of Investments — June 30, 2010

Hotchkis and Wiley Mid-Cap Value Fund

| | Shares

Held | | Value | |

| Real Estate Management & Development — 2.05% | |

| MI Developments, Inc. | | | 1,888,700 | | | $ | 23,098,801 | | |

| TOTAL FINANCIALS | | | 315,968,057 | | |

HEALTH CARE — 5.62%

Health Care Equipment & Supplies — 1.96% | |

| Kinetic Concepts, Inc. (a) | | | 604,600 | | | | 22,073,946 | | |

| Health Care Providers & Services — 0.51% | |

| LifePoint Hospitals, Inc. (a) | | | 182,100 | | | | 5,717,940 | | |

| Pharmaceuticals — 3.15% | |

| Endo Pharmaceuticals Holdings, Inc. (a) | | | 560,500 | | | | 12,230,110 | | |

| King Pharmaceuticals, Inc. (a) | | | 3,069,100 | | | | 23,294,469 | | |

| | | | 35,524,579 | | |

| TOTAL HEALTH CARE | | | 63,316,465 | | |

INDUSTRIALS — 10.92%

Aerospace & Defense — 1.64% | |

| Empresa Brasileira de Aeronautica SA — ADR | | | 880,900 | | | | 18,454,855 | | |

| Machinery — 1.22% | |

| PACCAR, Inc. | | | 278,000 | | | | 11,083,860 | | |

| Terex Corporation (a) | | | 141,800 | | | | 2,657,332 | | |

| | | | 13,741,192 | | |

| Professional Services — 2.89% | |

| Manpower, Inc. | | | 754,400 | | | | 32,574,992 | | |

| Road & Rail — 5.17% | |

| Con-way, Inc. | | | 1,940,400 | | | | 58,250,808 | | |

| TOTAL INDUSTRIALS | | | 123,021,847 | | |

INFORMATION TECHNOLOGY — 13.78%

Communications Equipment — 1.02% | |

| Arris Group, Inc. (a) | | | 1,124,500 | | | | 11,458,655 | | |

| Electronic Equipment, Instruments & Components — 2.90% | |

| Tyco Electronics Limited | | | 1,286,900 | | | | 32,661,522 | | |

| IT Services — 0.83% | |

| InfoGROUP, Inc. (a) | | | 1,174,100 | | | | 9,369,318 | | |

| Semiconductors & Semiconductor Equipment — 2.76% | |

| National Semiconductor Corporation | | | 1,049,200 | | | | 14,122,232 | | |

| ON Semiconductor Corporation (a) | | | 2,665,000 | | | | 17,002,700 | | |

| | | | 31,124,932 | | |

| Software — 6.27% | |

| CA, Inc. | | | 2,821,444 | | | | 51,914,570 | | |

| Novell, Inc. (a) | | | 2,426,200 | | | | 13,780,816 | | |

| Symantec Corporation (a) | | | 355,700 | | | | 4,937,116 | | |

| | | | 70,632,502 | | |

| TOTAL INFORMATION TECHNOLOGY | | | 155,246,929 | | |

| | Shares

Held | | Value | |

MATERIALS — 4.37%

Chemicals — 4.37% | |

| Celanese Corporation | | | 1,403,300 | | | $ | 34,956,203 | | |

| PPG Industries, Inc. | | | 141,300 | | | | 8,535,933 | | |

| RPM International, Inc. | | | 324,800 | | | | 5,794,432 | | |

| TOTAL MATERIALS | | | 49,286,568 | | |

UTILITIES — 8.70%

Electric Utilities — 7.08% | |

| Edison International | | | 665,900 | | | | 21,122,348 | | |

| Great Plains Energy, Inc. | | | 1,561,400 | | | | 26,575,028 | | |

| Portland General Electric Company | | | 1,273,300 | | | | 23,339,589 | | |

| Westar Energy, Inc. | | | 407,500 | | | | 8,806,075 | | |

| | | | 79,843,040 | | |

| Multi-Utilities — 1.62% | |

| Wisconsin Energy Corporation | | | 359,800 | | | | 18,256,252 | | |

| TOTAL UTILITIES | | | 98,099,292 | | |

Total investments — 99.94%

(Cost $1,492,509,312) | | | 1,126,274,067 | | |

| Time deposit* — 0.17% | | | | | | | 1,872,776 | | |

| Liabilities in excess of other assets — (0.11)% | | | | | | | (1,196,882 | ) | |

| Net assets — 100.00% | | $ | 1,126,949,961 | | |

(a) — Non-income producing security.

ADR — American Depositary Receipt

* — Time deposit with Citibank bears interest at 0.03% and matures on 7/1/2010. Invested through a cash management account administered by Brown Brothers Harriman & Co.

The accompanying notes are an integral part of these financial statements.

18

Schedule of Investments — June 30, 2010

Hotchkis and Wiley Small Cap Value Fund

| Largest Equity Holdings | | Percent of

net assets | |

| Con-way, Inc. | | | 5.18 | % | |

| Great Plains Energy, Inc. | | | 4.00 | % | |

| Valassis Communications, Inc. | | | 3.77 | % | |

| Miller Industries, Inc. | | | 3.57 | % | |

| InfoGROUP, Inc. | | | 3.52 | % | |

| Kaiser Aluminum Corporation | | | 3.44 | % | |

| Symetra Financial Corporation | | | 3.30 | % | |

| Hudson Highland Group, Inc. | | | 3.30 | % | |

| PHH Corporation | | | 3.11 | % | |

United America Indemnity

Limited - Class A | | | 2.96 | % | |

COMMON

STOCKS — 97.31% | | Shares

Held | | Value | |

CONSUMER DISCRETIONARY — 13.73%

Auto Components — 1.92% | |

| The Goodyear Tire & Rubber Company (a) | | | 194,400 | | | $ | 1,932,336 | | |

| Hawk Corporation (a) | | | 87,100 | | | | 2,216,695 | | |

| | | | 4,149,031 | | |

| Diversified Consumer Services — 0.49% | |

| Weight Watchers International, Inc. | | | 41,400 | | | | 1,063,566 | | |

| Hotels, Restaurants & Leisure — 0.12% | |

| Lakes Entertainment, Inc. (a) | | | 175,900 | | | | 269,127 | | |

| Household Durables — 0.60% | |

| Furniture Brands International, Inc. (a) | | | 250,900 | | | | 1,309,698 | | |

| Media — 5.64% | |

| Interpublic Group of Companies, Inc. (a) | | | 556,000 | | | | 3,964,280 | | |

| Valassis Communications, Inc. (a) | | | 257,300 | | | | 8,161,556 | | |

| Westwood One, Inc. (a) (c) | | | 8,784 | | | | 86,698 | | |

| | | | 12,212,534 | | |

| Specialty Retail — 1.98% | |

| Rent-A-Center, Inc. (a) | | | 211,600 | | | | 4,287,016 | | |

| Textiles, Apparel & Luxury Goods — 2.98% | |

| Jones Apparel Group, Inc. | | | 299,300 | | | | 4,743,905 | | |

| Quiksilver, Inc. (a) | | | 462,900 | | | | 1,712,730 | | |

| | | | 6,456,635 | | |

| TOTAL CONSUMER DISCRETIONARY | | | 29,747,607 | | |

CONSUMER STAPLES — 2.12%

Food Products — 2.12% | |

| Overhill Farms, Inc. (a) | | | 780,200 | | | | 4,595,378 | | |

| TOTAL CONSUMER STAPLES | | | 4,595,378 | | |

ENERGY — 3.65%

Oil, Gas & Consumable Fuels — 3.65% | |

| Cobalt International Energy, Inc. (a) | | | 160,800 | | | | 1,197,960 | | |

| Holly Corporation | | | 46,800 | | | | 1,243,944 | | |

| Stone Energy Corporation (a) | | | 489,500 | | | | 5,462,820 | | |

| TOTAL ENERGY | | | 7,904,724 | | |

| | Shares

Held | | Value | |

FINANCIALS — 27.91%

Commercial Banks — 7.94% | |

| Associated Banc-Corp | | | 346,600 | | | $ | 4,249,316 | | |

| First Horizon National Corporation (a) | | | 139,187 | | | | 1,593,693 | | |

| First Interstate BancSystem, Inc. | | | 209,400 | | | | 3,293,862 | | |

| Synovus Financial Corporation | | | 1,258,700 | | | | 3,197,098 | | |

| Webster Financial Corporation | | | 271,400 | | | | 4,868,916 | | |

| | | | 17,202,885 | | |

| Diversified Financial Services — 3.11% | |

| PHH Corporation (a) | | | 354,100 | | | | 6,742,064 | | |

| Insurance — 12.34% | |

| CNO Financial Group, Inc. (a) | | | 1,102,900 | | | | 5,459,355 | | |

| Employers Holdings, Inc. | | | 287,300 | | | | 4,231,929 | | |

| The Hanover Insurance Group, Inc. | | | 49,500 | | | | 2,153,250 | | |

| PMA Capital Corporation (a) | | | 200,300 | | | | 1,311,965 | | |

| Symetra Financial Corporation (a) | | | 596,300 | | | | 7,155,600 | | |

| United America Indemnity Limited — Class A (a) | | | 872,027 | | | | 6,418,119 | | |

| | | | 26,730,218 | | |

| Real Estate Investment Trusts — 2.08% | |

| CapLease, Inc. | | | 615,800 | | | | 2,838,838 | | |

| Walter Investment Management Corporation | | | 101,700 | | | | 1,662,795 | | |

| | | | 4,501,633 | | |

| Real Estate Management & Development — 1.94% | |

| MI Developments, Inc. | | | 343,700 | | | | 4,203,451 | | |

| Thrifts & Mortgage Finance — 0.50% | |

| First Financial Holdings, Inc. | | | 87,900 | | | | 1,006,455 | | |

| Territorial Bancorp, Inc. | | | 4,600 | | | | 87,170 | | |

| | | | 1,093,625 | | |

| TOTAL FINANCIALS | | | 60,473,876 | | |

The accompanying notes are an integral part of these financial statements.

19

Schedule of Investments — June 30, 2010

Hotchkis and Wiley Small Cap Value Fund

| | Shares

Held | | Value | |

HEALTH CARE — 5.54%

Health Care Equipment & Supplies — 2.02% | |

| Kinetic Concepts, Inc. (a) | | | 120,000 | | | $ | 4,381,200 | | |

| Pharmaceuticals — 3.52% | |

| Endo Pharmaceuticals Holdings, Inc. (a) | | | 96,500 | | | | 2,105,630 | | |

| King Pharmaceuticals, Inc. (a) | | | 726,200 | | | | 5,511,858 | | |

| | | | 7,617,488 | | |

| TOTAL HEALTH CARE | | | 11,998,688 | | |

INDUSTRIALS — 18.67%

Aerospace & Defense — 0.77% | |

| Empresa Brasileira de Aeronautica SA — ADR | | | 79,200 | | | | 1,659,240 | | |

| Machinery — 4.82% | |

| Miller Industries, Inc. | | | 574,800 | | | | 7,742,556 | | |

| Terex Corporation (a) | | | 143,700 | | | | 2,692,938 | | |

| | | | 10,435,494 | | |

| Professional Services — 7.90% | |

| Heidrick & Struggles International, Inc. | | | 165,900 | | | | 3,785,838 | | |

| Hudson Highland Group, Inc. (a) (b) | | | 1,624,700 | | | | 7,148,680 | | |

| Manpower, Inc. | | | 143,400 | | | | 6,192,012 | | |

| | | | 17,126,530 | | |

| Road & Rail — 5.18% | |

| Con-way, Inc. | | | 373,700 | | | | 11,218,474 | | |

| TOTAL INDUSTRIALS | | | 40,439,738 | | |

INFORMATION TECHNOLOGY — 10.00%

Communications Equipment — 0.97% | |

| Arris Group, Inc. (a) | | | 207,500 | | | | 2,114,425 | | |

| Computers & Peripherals — 1.24% | |

| Hypercom Corporation (a) | | | 580,400 | | | | 2,693,056 | | |

| IT Services — 5.32% | |

| InfoGROUP, Inc. (a) | | | 954,900 | | | | 7,620,102 | | |

| Ness Technologies, Inc. (a) | | | 354,100 | | | | 1,526,171 | | |

| Wright Express Corporation (a) | | | 79,800 | | | | 2,370,060 | | |

| | | | 11,516,333 | | |

| Semiconductors & Semiconductor Equipment — 2.01% | |

| ON Semiconductor Corporation (a) | | | 681,700 | | | | 4,349,246 | | |

| Software — 0.46% | |

| Novell, Inc. (a) | | | 175,400 | | | | 996,272 | | |

| TOTAL INFORMATION TECHNOLOGY | | | 21,669,332 | | |

MATERIALS — 7.92%

Metals & Mining — 7.92% | |

| Haynes International, Inc. | | | 129,000 | | | | 3,977,070 | | |

| Kaiser Aluminum Corporation | | | 214,700 | | | | 7,443,649 | | |

| Noranda Aluminum Holding Corporation (a) | | | 675,700 | | | | 4,344,751 | | |

| Universal Stainless & Alloy (a) | | | 87,200 | | | | 1,394,328 | | |

| TOTAL MATERIALS | | | 17,159,798 | | |

| | Shares

Held | | Value | |

UTILITIES — 7.77%

Electric Utilities — 7.77% | |

| Great Plains Energy, Inc. | | | 508,800 | | | $ | 8,659,776 | | |

| Portland General Electric Company | | | 294,000 | | | | 5,389,020 | | |

| Westar Energy, Inc. | | | 128,400 | | | | 2,774,724 | | |

| TOTAL UTILITIES | | | 16,823,520 | | |

Total investments — 97.31%

(Cost $277,133,860) | | | 210,812,661 | | |

| Collateral for securities on loan^ — 0.03% | | | | | | | 69,649 | | |

| Time deposits* — 3.28% | | | | | | | 7,103,615 | | |

| Liabilities in excess of other assets — (0.62)% | | | | | | | (1,353,103 | ) | |

| Net assets — 100.00% | | $ | 216,632,822 | | |

(a) — Non-income producing security.

(b) — Affiliated issuer. See Note 6 in Notes to the Financial Statements.

(c) — All or a portion of this security is on loan. The total market value of securities on loan was $67,841.

ADR — American Depositary Receipt

^ — Collateral for securities on loan of $69,461 was invested in JP Morgan Chase Repurchase Agreements which bear interest at 0.01% and mature on 7/1/2010. The repurchase proceeds are $69,461. The repurchase agreements are collateralized by United States Government & Agency Issues. The remaining collateral for securities on loan of $188 was held as cash.

* — Time deposits of $3,500,000 with Citibank and $3,603,615 with Wells Fargo bear interest at 0.03% and mature on 7/1/2010. Invested through a cash management account administered by Brown Brothers Harriman & Co.

The accompanying notes are an integral part of these financial statements.

20

Schedule of Investments — June 30, 2010

Hotchkis and Wiley Value Opportunities Fund

| Largest Equity Holdings | | Percent of

net assets | |

| Con-way, Inc. | | | 7.06 | % | |

| Vodafone Group PLC - ADR | | | 6.38 | % | |

| Philip Morris International, Inc. | | | 5.64 | % | |

| Hudson Highland Group, Inc. | | | 4.82 | % | |

| Exelon Corporation | | | 4.69 | % | |

| CA, Inc. | | | 4.60 | % | |

| ConocoPhillips | | | 4.25 | % | |

| Royal Dutch Shell PLC - Class B - ADR | | | 3.91 | % | |

| JPMorgan Chase & Company | | | 3.73 | % | |

| Valassis Communications, Inc. | | | 3.41 | % | |

COMMON

STOCKS — 90.66% | | Shares

Held | | Value | |

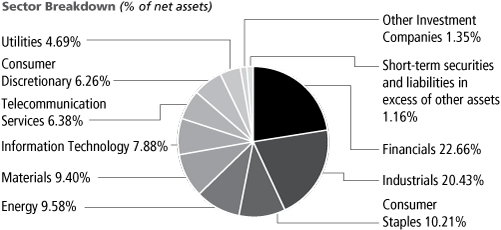

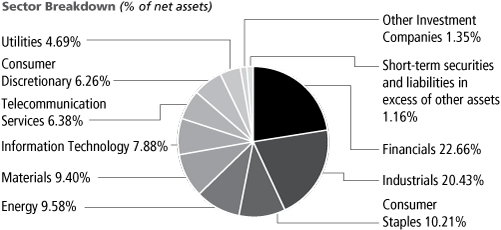

CONSUMER DISCRETIONARY — 6.26%

Auto Components — 1.14% | |

| The Goodyear Tire & Rubber Company (a) | | | 61,000 | | | $ | 606,340 | | |

| Distributors — 0.80% | |

| KSW, Inc. | | | 136,700 | | | | 423,770 | | |

| Hotels, Restaurants & Leisure — 0.37% | |

| Lakes Entertainment, Inc. (a) | | | 130,200 | | | | 199,206 | | |

| Household Durables — 0.52% | |

| Furniture Brands International, Inc. (a) | | | 53,400 | | | | 278,748 | | |

| Media — 3.43% | |

| Valassis Communications, Inc. (a) | | | 57,200 | | | | 1,814,384 | | |

| Westwood One, Inc. (a) (b) | | | 678 | | | | 6,692 | | |

| | | | 1,821,076 | | |

| TOTAL CONSUMER DISCRETIONARY | | | 3,329,140 | | |

CONSUMER STAPLES — 10.21%

Food & Staples Retailing — 2.32% | |

| Wal-Mart Stores, Inc. | | | 25,700 | | | | 1,235,399 | | |

| Food Products — 2.25% | |

| Overhill Farms, Inc. (a) | | | 203,200 | | | | 1,196,848 | | |

| Tobacco — 5.64% | |

| Philip Morris International, Inc. | | | 65,400 | | | | 2,997,936 | | |

| TOTAL CONSUMER STAPLES | | | 5,430,183 | | |

ENERGY — 8.16%

Oil, Gas & Consumable Fuels — 8.16% | |

| ConocoPhillips | | | 46,000 | | | | 2,258,140 | | |

| Royal Dutch Shell PLC — Class B — ADR | | | 43,100 | | | | 2,080,868 | | |

| TOTAL ENERGY | | | 4,339,008 | | |

FINANCIALS — 18.65%

Commercial Banks — 2.50% | |

| Wells Fargo & Company | | | 51,900 | | | | 1,328,640 | | |

| | Shares

Held | | Value | |

| Diversified Financial Services — 6.22% | |

| Bank of America Corporation | | | 91,900 | | | $ | 1,320,603 | | |

| JPMorgan Chase & Company | | | 54,200 | | | | 1,984,262 | | |

| | | | 3,304,865 | | |

| Insurance — 5.13% | |

| United America Indemnity Limited — Class A (a) | | | 201,569 | | | | 1,483,548 | | |

| XL Capital Limited | | | 77,800 | | | | 1,245,578 | | |

| | | | 2,729,126 | | |

| Real Estate Management & Development — 1.76% | |

| MI Developments, Inc. | | | 76,300 | | | | 933,149 | | |

| Thrifts & Mortgage Finance — 3.04% | |

| Tree.com, Inc. (a) | | | 256,000 | | | | 1,617,920 | | |

| TOTAL FINANCIALS | | | 9,913,700 | | |

INDUSTRIALS — 20.43%

Aerospace & Defense — 4.65% | |

| Lockheed Martin Corporation | | | 23,500 | | | | 1,750,750 | | |

| Northrop Grumman Corporation | | | 13,200 | | | | 718,608 | | |

| | | | 2,469,358 | | |

| Air Freight & Logistics — 0.68% | |

| Air T, Inc. | | | 34,800 | | | | 364,008 | | |

| Machinery — 3.22% | |

| Miller Industries, Inc. | | | 127,098 | | | | 1,712,010 | | |

| Professional Services — 4.82% | |

| Hudson Highland Group, Inc. (a) | | | 582,000 | | | | 2,560,800 | | |

| Road & Rail — 7.06% | |

| Con-way, Inc. | | | 125,000 | | | | 3,752,500 | | |

| TOTAL INDUSTRIALS | | | 10,858,676 | | |

INFORMATION TECHNOLOGY — 7.88%

IT Services — 3.28% | |

| InfoGROUP, Inc. (a) | | | 218,700 | | | | 1,745,226 | | |

The accompanying notes are an integral part of these financial statements.

21

Schedule of Investments — June 30, 2010

Hotchkis and Wiley Value Opportunities Fund

| | Shares

Held | | Value | |

| Software — 4.60% | |

| CA, Inc. | | | 132,700 | | | $ | 2,441,680 | | |

| TOTAL INFORMATION TECHNOLOGY | | | 4,186,906 | | |

MATERIALS — 8.00%

Containers & Packaging — 2.34% | |

| UFP Technologies, Inc. (a) | | | 135,300 | | | | 1,243,407 | | |

| Metals & Mining — 5.66% | |

| Haynes International, Inc. | | | 15,300 | | | | 471,699 | | |

| Kaiser Aluminum Corporation | | | 45,100 | | | | 1,563,617 | | |

| Noranda Aluminum Holding Corporation (a) | | | 151,700 | | | | 975,431 | | |

| | | | 3,010,747 | | |

| TOTAL MATERIALS | | | 4,254,154 | | |

TELECOMMUNICATION SERVICES — 6.38%

Wireless Telecommunication Services — 6.38% | |

| Vodafone Group PLC — ADR | | | 164,000 | | | | 3,389,880 | | |

| TOTAL TELECOMMUNICATION SERVICES | | | 3,389,880 | | |

UTILITIES — 4.69%

Electric Utilities — 4.69% | |

| Exelon Corporation | | | 65,600 | | | | 2,490,832 | | |

| TOTAL UTILITIES | | | 2,490,832 | | |

Total common stocks

(Cost $57,948,246) | | | | | | | 48,192,479 | | |

| OTHER INVESTMENT COMPANIES — 1.35% | |

| Equity Mutual Funds — 1.35% | |

| Diamond Hill Financial Trends Fund, Inc. | | | 86,100 | | | | 718,935 | | |

Total other investment companies

(Cost $644,142) | | | 718,935 | | |

| PREFERRED STOCKS — 3.40% | |

FINANCIALS — 3.40%

Real Estate Investment Trusts — 2.12% | |

| Strategic Hotels & Resorts, Inc. — Series A (a) | | | 52,100 | | | | 1,015,950 | | |

| Strategic Hotels & Resorts, Inc. — Series B (a) | | | 1,700 | | | | 32,725 | | |

| Strategic Hotels & Resorts, Inc. — Series C (a) | | | 3,900 | | | | 76,050 | | |

| | | | 1,124,725 | | |

| Thrifts & Mortgage Finance — 1.28% | |

Federal Home Loan Mortgage

Corporation — Series K (a) | | | 33,900 | | | | 20,340 | | |

Federal Home Loan Mortgage

Corporation — Series N (a) | | | 118,600 | | | | 77,090 | | |

Federal Home Loan Mortgage

Corporation — Series S (a) | | | 18,700 | | | | 11,220 | | |

Federal Home Loan Mortgage

Corporation — Series T (a) | | | 37,900 | | | | 24,256 | | |

Federal Home Loan Mortgage

Corporation — Series Z (a) | | | 1,608,600 | | | | 546,924 | | |

| | | | 679,830 | | |

| TOTAL FINANCIALS | | | 1,804,555 | | |

Total preferred stocks

(Cost $2,879,232) | | | | | | | 1,804,555 | | |

CORPORATE

BONDS — 1.42% | | Amount | | Value | |

ENERGY — 1.42%

Oil, Gas & Consumable Fuels — 1.42% | |

American Petroleum Tankers LLC/AP

Tankers Company

10.250%, 05/15/2015

(Acquired 05/06/2010, Cost $729,417) (r) | | $ | 750,000 | | | $ | 755,625 | | |

| TOTAL ENERGY | | | 755,625 | | |

Total corporate bonds

(Cost $729,417) | | | | | | | 755,625 | | |

| CONVERTIBLE BONDS — 1.40% | |

MATERIALS — 1.40%

Metals & Mining — 1.40% | |

Kaiser Aluminum Corporation

4.500%, 04/01/2015

(Acquired 03/24/2010, Cost $786,570) (r) | | | 781,000 | | | | 744,137 | | |

| TOTAL MATERIALS | | | 744,137 | | |

Total convertible bonds

(Cost $786,570) | | | | | | | 744,137 | | |

| WARRANTS — 0.61% | | Shares

Held | | | |

FINANCIALS — 0.61%

Diversified Financial Services — 0.61% | |

Bank of America Corporation

Expiration: January 2019,

Exercise Price: $13.30 (a) | | | 42,100 | | | | 322,065 | | |

| TOTAL FINANCIALS | | | 322,065 | | |

Total warrants

(Cost $357,429) | | | | | | | 322,065 | | |

Total investments — 98.84%

(Cost $63,345,036) | | | 52,537,796 | | |

| Collateral for securities on loan^ — 0.01% | | | | | | | 5,436 | | |

| Time deposits* — 1.15% | | | | | | | 613,872 | | |

| Liabilities in excess of other assets — 0.00% | | | | | | | (2,188 | ) | |

| Net assets — 100.00% | | $ | 53,154,916 | | |

(a) — Non-income producing security.

(b) — All or a portion of this security is on loan. The total market value of securities on loan was $5,309.

(r) — Restricted security under Rule 144A of the Securities Act of 1933. Purchased in a private placement transaction; resale to the public may require registration or be limited to qualified institutional buyers. The total market value of restricted securities was $1,499,762, representing 2.82% of net assets.

ADR — American Depositary Receipt

^ — Collateral for securities on loan of $5,421 was invested in JP Morgan Chase Repurchase Agreements which bear interest at 0.01% and mature on 7/1/2010. The repurchase proceeds are $5,421. The repurchase agreements are collateralized by United States Government & Agency Issues. The remaining collateral for securities on loan of $15 was held as cash.

* — Time deposits of $500,000 with Citibank and $113,872 with HSBC Bank bear interest at 0.03% and mature on 7/1/2010. Invested through a cash management account administered by Brown Brothers Harriman & Co.