UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-10487 |

|

Hotchkis and Wiley Funds |

(Exact name of registrant as specified in charter) |

|

725 S. Figueroa Street, 39th Floor

Los Angeles, California | | 90071 |

(Address of principal executive offices) | | (Zip code) |

|

Anna Marie Lopez

Hotchkis and Wiley Capital Management, LLC

725 S. Figueroa Street, 39th Floor

Los Angeles, California 90071 |

(Name and address of agent for service) |

|

Copies to:

Julie Allecta, Esq.

Paul, Hastings, Janofsky & Walker, LLP

55 Second Street, Twenty-Fourth Floor

San Francisco, California 94105 |

(Counsel for the Registrant) |

|

Registrant’s telephone number, including area code: | (213) 430-1000 | |

|

Date of fiscal year end: | June 30, 2008 | |

|

Date of reporting period: | July 1, 2007 - June 30, 2008 | |

| | | | | | | | |

Item 1 - Report to Shareholders

Core Value Fund

Large Cap Value Fund

Mid-Cap Value Fund

Small Cap Value Fund

All Cap Value Fund

HOTCHKIS AND WILEY FUNDS

JUNE 30, 2008

ANNUAL REPORT

TABLE OF CONTENTS

| SHAREHOLDER LETTER | | | | | 3 | | |

|

| FUND PERFORMANCE DATA | | | | | 5 | | |

|

| SCHEDULE OF INVESTMENTS: | |

|

| CORE VALUE FUND | | | | | 11 | | |

|

| LARGE CAP VALUE FUND | | | | | 13 | | |

|

| MID-CAP VALUE FUND | | | | | 15 | | |

|

| SMALL CAP VALUE FUND | | | | | 17 | | |

|

| ALL CAP VALUE FUND | | | | | 19 | | |

|

| STATEMENTS OF ASSETS AND LIABILITIES | | | | | 22 | | |

|

| STATEMENTS OF OPERATIONS | | | | | 23 | | |

|

| STATEMENTS OF CHANGES IN NET ASSETS | | | | | 24 | | |

|

| FINANCIAL HIGHLIGHTS | | | | | 26 | | |

|

| NOTES TO THE FINANCIAL STATEMENTS | | | | | 29 | | |

|

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | | | 35 | | |

|

| FUND EXPENSE EXAMPLES | | | | | 36 | | |

|

BOARD CONSIDERATIONS IN APPROVING CONTINUATION

OF INVESTMENT ADVISORY AGREEMENTS | | | | | 37 | | |

|

| MANAGEMENT | | | | | 40 | | |

|

| INFORMATION ABOUT THE FUNDS | | | | | BACK COVER | | |

|

DEAR SHAREHOLDER:

The following investment review and annual report relates to the activities of the Hotchkis and Wiley Funds for the one year period ended June 30, 2008.

OVERVIEW

The market environment is currently one of concentration and extremes. Performance has been concentrated in a few areas, leading to extreme valuation differentials and distorted results. For example, the Russell 1000 Value Index has risen about 11% cumulatively over the past three years. Without the benefit of energy stocks, the index would have declined –0.3%. Energy now represents more than 18% of the index, twice its weight in 2000. Soaring commodity stock prices and the severe downdraft in financial stocks have resulted in valuation differentials that have been exceeded only two times in the last fifty years.1

The year was a disappointing one in terms of investment performance for Hotchkis and Wiley. We significantly underperformed our benchmarks as the dynamics of the market unfolded. For traditional value managers, results have been discouraging, yet opportunities abound. History has shown that while the duration and magnitude of valuation dispersion is hard to predict, the closing of this gap can lead to sustained outperformance. Before the reversion occurs, short-term performance can be very volatile and frustrating as market emotions drive results. However, we believe fundamentals ultimately prevail and it is imperative to remain disciplined. We have endured similar cycles in the past as the principals of our investment team average two decades of experience and fourteen years working together as a group. Our experience and results affirm the benefits of our disciplined investment process, which relies on rigorous fundamental res earch, a focus on long-term earnings power, and an in-depth assessment of financial strength. Over the long term, the patient investor can benefit from the extreme valuation differentials of the current environment. We believe we are positioned to capitalize on these opportunities.

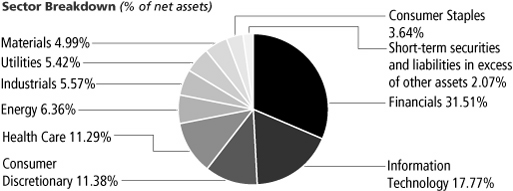

HOTCHKIS AND WILEY CORE VALUE FUND

The Fund's Class I, Class A, and Class C shares had total returns of –32.13%, –32.29%, and –32.81%, respectively, compared to the S&P 500 Index return of –13.12% and the Russell 1000 Value Index return of –18.78%. (Fund results shown do not reflect sales charges and would be lower if sales charges were included. More complete performance information can be found on page 6 of this report.)

Weakness versus the value benchmark was caused by an underweight in energy combined with an overweight and adverse stock selection in the financials and consumer discretionary sectors. Within the financials sector, thrift/mortgage stocks Washington Mutual and Freddie Mac, diversified financials companies Citigroup and Bank of America, as well as commercial bank Wachovia were sources of negative performance. Within the consumer discretionary sector, declines in homebuilders Pulte Homes and Lennar, home improvement giant Home Depot, and media company R.H. Donnelley contributed to weak performance. Top contributors to performance included discount retailer Wal-Mart, utilities operators Exelon, Entergy and FPL Group, as well as pharmaceuticals company Schering Plough.

1 Source: Empirical Research

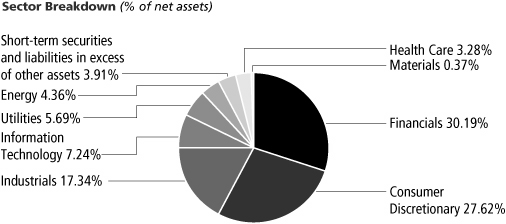

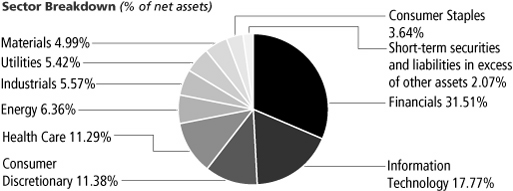

HOTCHKIS AND WILEY LARGE CAP

VALUE FUND

The Fund's Class I, Class A, Class C, and Class R shares had total returns of –31.84%, –32.06%, –32.59%, and –32.27%, respectively, compared to the S&P 500 Index return of –13.12% and the Russell 1000 Value Index return of –18.78%. (Fund results shown do not reflect sales charges and would be lower if sales charges were included. More complete performance information can be found on page 7 of this report.)

Weakness versus the value benchmark was split evenly between stock selection and sector allocation. Negative stock selection occurred in the consumer discretionary and financials sectors of the Fund. Declines in thrift/mortgage stocks Washington Mutual and Freddie Mac, diversified financials companies Citigroup and Bank of America, and commercial bank Wachovia detracted from performance. Other negative contributors included media company Idearc, homebuilders Lennar and Centex, and home improvement giant Home Depot. Our underweight in energy also detracted from performance. Top contributors to performance included discount retailer Wal-Mart, utilities operators Exelon, Entergy and FPL Group, as well as software manufacturer BMC Software.

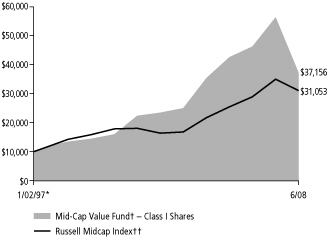

HOTCHKIS AND WILEY MID-CAP VALUE FUND

The Fund's Class I, Class A, Class C, and Class R shares had total returns of –34.05%, –34.20%, –34.68%, and –34.35%, respectively, compared to the Russell Midcap Index return of –11.19% and the Russell Midcap Value Index return of –17.09%. (Fund results shown do not reflect sales charges and would be lower if sales charges were included. More complete performance information can be found on page 8 of this report.)

Weakness versus the value benchmark was caused by an underweight in energy combined with both an overweight and adverse stock selection in the financials and consumer discretionary sectors. Within the financials sector, insurers Conseco and XL Capital, thrifts/mortgage company Washington Mutual and commercial banks Comerica, First Horizon and KeyCorp, were the main sources of negative performance. Within the consumer discretionary sector, declines in media companies R.H. Donnelley and Citadel Broadcasting and apparel manufacturer Jones Apparel Group contributed to weak performance. Top contributors to performance included BMC Software, ON Semiconductor, equipment manufacturer Flowserve, Eastman Chemical and utilities operator FPL Group.

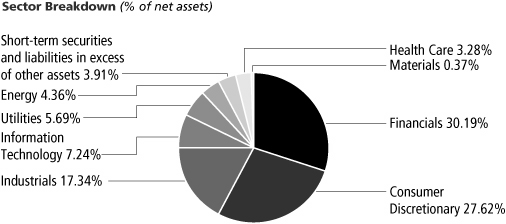

HOTCHKIS AND WILEY SMALL CAP VALUE FUND

The Fund's Class I, Class A, and Class C shares had total returns of –29.19%, –29.36%, and –29.88%, respectively, compared to the Russell 2000 Index return of –16.19% and the Russell 2000 Value Index return of –21.63%. (Fund results shown do not reflect sales charges and would be lower if sales charges were included. More complete performance information can be found on page 9 of this report to shareholders.)

Weakness versus the value benchmark was primarily due to an underweight in materials and energy combined with an overweight in the underperforming consumer discretionary sector. Primary detractors within consumer discretionary were media companies Westwood One and R.H. Donnelley as well as homebuilders WCI Communities and

3

California Coastal Communities. Top contributors to performance included Foundation Coal Holdings, ON Semiconductor, U-Store-It-Trust, and equipment manufacturer Flowserve.

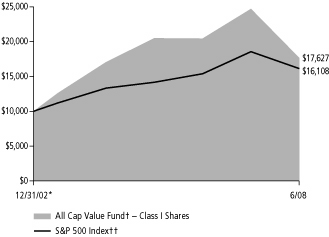

HOTCHKIS AND WILEY ALL CAP VALUE FUND

The Fund's Class I, Class A, and Class C shares had total returns of –28.58%, –28.80%, and –29.34%, respectively, compared to the S&P 500 Index return of –13.12% and the Russell 3000 Value Index return of –19.02%. (Fund results shown do not reflect sales charges and would be lower if sales charges were included. More complete performance information can be found on page 10 of this report to shareholders.)

Weakness versus the value benchmark was concentrated in a number of stocks including thrifts/mortgage company Washington Mutual, diversified financials company Bank of America, commercial bank Wachovia, equipment manufacturer Miller Industries, and real estate company MI Developments. Utilities operator Exelon, pharmaceuticals company AstraZeneca, and software manufacturer Microsoft were leading contributors to performance.

* * *

Despite the poor recent results, performance has been strong over the past eight years as we unwound the excesses of the tech-driven momentum-oriented market of the late 1990s. Our portfolios then had large exposure to energy, materials and industrials, all of which were struggling, and virtually no exposure to technology and healthcare. Today, that positioning has reversed. It is in those out-of-favor areas, as well as the financials and consumer discretionary sectors, that we are finding value at compelling prices.

Our portfolio exposures are a result of a rigorous, bottom-up review of individual stocks. We take a long-term view of what an individual company should produce in earnings and cash flow over several years, analyze the company's balance sheet, and weigh this value and the company's financial strength against the current stock price. Over time, economic principles have supported this value-oriented approach. Over shorter periods, though, sentiment and momentum can overwhelm these core tendencies.

Today, momentum is back as a strong technical factor. As a consequence, the past 12 months have been an unusually challenging period for us, with very disappointing results. However, our process mandates that we focus on long-term value. In momentum-oriented markets our portfolios tend to struggle, but the dislocation from fundamental value creates opportunity.

Hotchkis and Wiley has a disciplined investment process which we firmly believe to be effective and rewarding over time. Its 28-year history validates that. We appreciate your confidence in us, your continued support of the Hotchkis and Wiley Funds, and we look forward to serving your investment needs in the future.

Sincerely,

| |  | |  | |

|

Anna Marie Lopez

President | | George Davis

Portfolio Manager | | Sheldon Lieberman

Portfolio Manager | |

|

| |  | |  | |

|

Patty McKenna

Portfolio Manager | | James Miles

Portfolio Manager | | Stan Majcher

Portfolio Manager | |

|

| |  | |  | |

|

David Green

Portfolio Manager | | Scott McBride

Portfolio Manager | | Judd Peters

Portfolio Manager | |

|

The above reflects opinions of portfolio managers as of June 30, 2008. They are subject to change and any forecasts made cannot be guaranteed. The Funds might not continue to hold any securities mentioned and have no obligation to disclose purchases or sales in these securities. Please refer to the Schedule of Investments in this report for a complete list of Fund holdings for June 30, 2008. Past performance does not guarantee future results. Indexes do not incur expenses or sales loads and are not available for investment. Cash flow measures the cash generating capability of a company by adding non-cash charges (e.g., depreciation) and interest expense to pretax income.

4

Fund Performance Data

ABOUT FUND PERFORMANCE

The Large Cap Value Fund and Mid-Cap Value Fund have four classes of shares. The Core Value Fund, Small Cap Value Fund and All Cap Value Fund have three classes of shares. Each share class has its own sales charge and expense structure, allowing you to invest in the way that best suits your needs. The Large Cap Value Fund, Small Cap Value Fund and All Cap Value Fund are closed to new investors, except as described in the prospectuses.

Class I shares have no initial sales charge and bear no ongoing distribution and service fees under a 12b-1 plan. Class I shares are available only to eligible investors.

Class A shares incur a maximum initial sales charge of 5.25% and an annual distribution and service fee of 0.25%.

Class C shares are subject to an annual distribution and service fee of 1.00%. In addition, Class C shares are subject to a 1.00% contingent deferred sales charge (CDSC) if redeemed within one year after purchase. Class C shares automatically convert to Class A shares approximately eight years after purchase and will then be subject to lower distribution and service fees.

Class R shares have no initial sales charge or CDSC and are subject to an annual distribution and service fee of 0.50%. Class R shares are available only to certain retirement plans.

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, access the Funds' website at www.hwcm.com or call 1-866-HW-FUNDS.

Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Figures shown in the "Average Annual Total Return" tables assume reinvestment of all dividends and capital gains distributions at net asset value on the ex-dividend date. The Funds' investment advisor pays annual operating expenses of the Funds' Class I, Class A, Class C and Class R shares over certain levels. If the investment advisor did not pay such expenses during certain periods, net returns would be lower. Dividends paid by each class of shares will vary because of the different levels of distribution and service fees, if any, applicable to each class, which are deducted from the income available to be paid to shareholders. Performance of all Funds except the Core Value Fund and All Cap Value Fund includes that of predecessor funds, as referenced in Note 1 of the Notes to the Financ ial Statements.

FUND RISKS

Mutual fund investing involves risk; loss of principal is possible. The Small Cap Value Fund, Mid-Cap Value Fund and All Cap Value Fund invest in small- and medium-capitalization companies which tend to have limited liquidity and greater price volatility than large-capitalization companies. The All Cap Value Fund is a non-diversified fund which involves greater risk than investing in diversified funds, such as business risk, significant stock price fluctuations and sector concentration. Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales.

MARKET INDEXES

The following are definitions for indexes used in the shareholder letter and the performance summary tables on the following pages. These indexes are unmanaged and include the reinvestment of dividends, but do not reflect the payment of transaction costs and advisory and other fees associated with an investment in the Funds. The securities that comprise these indexes may differ substantially from the securities in the Funds' portfolios. The Funds' value disciplines may prevent or restrict investment in major stocks in the benchmark indexes. It is not possible to invest directly in an index. Each index named is not the only index which may be used to characterize performance of a specific Fund and other indexes may portray different comparative performance.

S&P 500® Index, a capital weighted, unmanaged index, represents the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange.

Russell 3000® Index, an unmanaged index, is comprised of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

Russell 3000® Value Index measures the performance of those Russell 3000® companies with lower price-to-book ratios and lower forecasted growth values.

Russell 1000® Index, an unmanaged index, measures the performance of the 1,000 largest companies in the Russell 3000® Index.

Russell 1000® Value Index measures the performance of those Russell 1000® companies with lower price-to-book ratios and lower forecasted growth values.

Russell Midcap® Index, an unmanaged index, measures the performance of the 800 smallest companies in the Russell 1000® Index.

Russell Midcap® Value Index measures the performance of those Russell Midcap® companies with lower price-to-book ratios and lower forecasted growth values.

Russell 2000® Index, an unmanaged index, is a stock market index comprised of the 2,000 smallest companies in the Russell 3000® Index.

Russell 2000® Value Index measures the performance of those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values.

5

Fund Performance Data

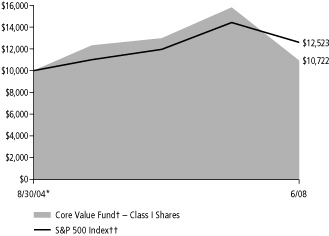

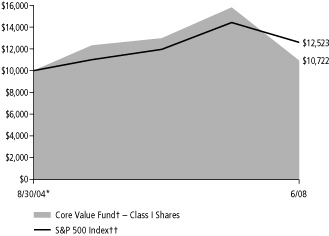

CORE VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

| For Periods ended June 30, 2008 | | 1 Year | | Since

8/30/04* | |

| Class I | |

| Average annual total return | | | –32.13 | % | | | 1.84 | % | |

| Class A | |

| Average annual total return (with sales charge) | | | –35.84 | % | | | 0.19 | % | |

| Average annual total return (without sales charge) | | | –32.29 | % | | | 1.60 | % | |

| Class C | |

| Average annual total return (with CDSC) | | | –33.81 | % | | | 0.85 | % | |

| Average annual total return (without CDSC) | | | –32.81 | % | | | 0.85 | % | |

| S&P 500 Index†† | |

| Average annual total return | | | –13.12 | % | | | 6.04 | % | |

| Russell 1000 Index†† | |

| Average annual total return | | | –12.36 | % | | | 6.82 | % | |

| Russell 1000 Value Index†† | |

| Average annual total return | | | –18.78 | % | | | 6.52 | % | |

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the current applicable sales charges of each specific class. Returns for Class A reflect the current maximum initial sales charges of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the current maximum sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in stocks of U.S. companies with market capitalizations similar to the Russell 1000 Index.

†† See index descriptions on page 5.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I, Class A and Class C.

Past performance is not indicative of future results and the table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

6

Fund Performance Data

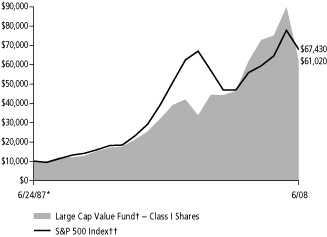

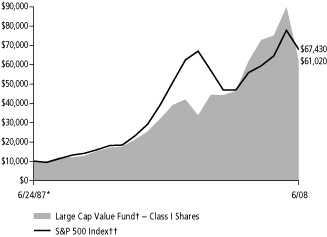

LARGE CAP VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

| For Periods ended June 30, 2008 | | 1 Year | | 5 Years | | 10 Years | | Since

6/24/87* | |

| Class I | |

| Average annual total return | | | –31.84 | % | | | 5.72 | % | | | 4.60 | % | | | 8.99 | % | |

| Class A | |

| Average annual total return (with sales charge) | | | –35.63 | % | | | 4.31 | % | | | 3.82 | % | | | 8.47 | % | |

| Average annual total return (without sales charge) | | | –32.06 | % | | | 5.43 | % | | | 4.38 | % | | | 8.75 | % | |

| Class C | |

| Average annual total return (with CDSC) | | | –33.59 | % | | | 4.68 | % | | | 3.58 | % | | | 7.90 | % | |

| Average annual total return (without CDSC) | | | –32.59 | % | | | 4.68 | % | | | 3.58 | % | | | 7.90 | % | |

| Class R | |

| Average annual total return | | | –32.27 | % | | | 5.28 | % | | | 4.12 | % | | | 8.46 | % | |

| S&P 500 Index†† | |

| Average annual total return | | | –13.12 | % | | | 7.58 | % | | | 2.88 | % | | | 9.85 | % | |

| Russell 1000 Index†† | |

| Average annual total return | | | –12.36 | % | | | 8.22 | % | | | 3.38 | % | | | 9.66 | % | |

| Russell 1000 Value Index†† | |

| Average annual total return | | | –18.78 | % | | | 8.92 | % | | | 4.91 | % | | | n/a | | |

Returns shown for Class A, Class C, and Class R shares for the periods prior to their inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of each specific class. (Inception dates: Class A — 10/26/01; Class C — 2/4/02; Class R — 8/28/03.)

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the current applicable sales charges of each specific class. Returns for Class A reflect the current maximum initial sales charges of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the current maximum sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in stocks of U.S. companies with market capitalizations similar to the Russell 1000 Index.

†† See index descriptions on page 5.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

7

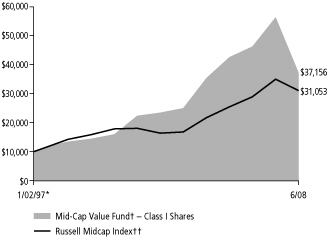

Fund Performance Data

MID-CAP VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

| For Periods ended June 30, 2008 | | 1 Year | | 5 Years | | 10 Years | | Since

1/2/97* | |

| Class I | |

| Average annual total return | | | –34.05 | % | | | 8.27 | % | | | 10.72 | % | | | 12.10 | % | |

| Class A | |

| Average annual total return (with sales charge) | | | –37.65 | % | | | 6.83 | % | | | 9.85 | % | | | 11.31 | % | |

| Average annual total return (without sales charge) | | | –34.20 | % | | | 8.00 | % | | | 10.45 | % | | | 11.84 | % | |

| Class C | |

| Average annual total return (with CDSC) | | | –35.68 | % | | | 7.24 | % | | | 9.65 | % | | | 11.00 | % | |

| Average annual total return (without CDSC) | | | –34.68 | % | | | 7.24 | % | | | 9.65 | % | | | 11.00 | % | |

| Class R | |

| Average annual total return | | | –34.35 | % | | | 8.06 | % | | | 10.33 | % | | | 11.69 | % | |

| Russell Midcap Index†† | |

| Average annual total return | | | –11.19 | % | | | 13.07 | % | | | 8.10 | % | | | 10.36 | % | |

| Russell Midcap Value Index†† | |

| Average annual total return | | | –17.09 | % | | | 13.00 | % | | | 8.45 | % | | | 10.87 | % | |

Returns shown for Class A, Class C, and Class R shares for the periods prior to their inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of each specific class. (Inception dates: Class A, Class C — 1/2/01; Class R — 8/28/03.)

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the current applicable sales charges of each specific class. Returns for Class A reflect the current maximum initial sales charges of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the current maximum sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in stocks of U.S. companies with market capitalizations similar to the Russell Midcap Index.

†† See index descriptions on page 5.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

8

Fund Performance Data

SMALL CAP VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

| For Periods ended June 30, 2008 | | 1 Year | | 5 Years | | 10 Years | | Since

9/20/85* | |

| Class I | |

| Average annual total return | | | –29.19 | % | | | 8.67 | % | | | 7.99 | % | | | 11.60 | % | |

| Class A | |

| Average annual total return (with sales charge) | | | –33.07 | % | | | 7.24 | % | | | 7.35 | % | | | 11.09 | % | |

| Average annual total return (without sales charge) | | | –29.36 | % | | | 8.41 | % | | | 7.93 | % | | | 11.36 | % | |

| Class C | |

| Average annual total return (with CDSC) | | | –30.88 | % | | | 7.69 | % | | | 6.99 | % | | | 10.54 | % | |

| Average annual total return (without CDSC) | | | –29.88 | % | | | 7.69 | % | | | 6.99 | % | | | 10.54 | % | |

| Russell 2000 Index†† | |

| Average annual total return | | | –16.19 | % | | | 10.29 | % | | | 5.53 | % | | | 9.89 | % | |

| Russell 2000 Value Index†† | |

| Average annual total return | | | –21.63 | % | | | 10.02 | % | | | 7.47 | % | | | n/a | | |

Returns shown for Class A and Class C shares for the periods prior to their inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of each specific class. (Inception dates: Class A — 10/6/00; Class C — 2/4/02.)

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the current applicable sales charges of each specific class. Returns for Class A reflect the current maximum initial sales charges of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the current maximum sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in stocks of U.S. companies with market capitalizations less than $3 billion.

†† See index descriptions on page 5.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

9

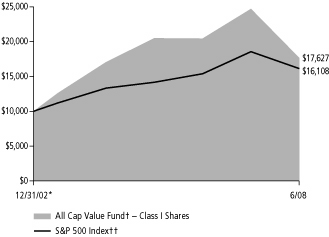

Fund Performance Data

ALL CAP VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

| For Periods ended June 30, 2008 | | 1 Year | | 5 Years | | Since

12/31/02* | |

| Class I | |

| Average annual total return | | | –28.58 | % | | | 6.98 | % | | | 10.86 | % | |

| Class A | |

| Average annual total return (with sales charge) | | | –32.53 | % | | | 5.62 | % | | | 9.66 | % | |

| Average annual total return (without sales charge) | | | –28.80 | % | | | 6.77 | % | | | 10.73 | % | |

| Class C | |

| Average annual total return (with CDSC) | | | –30.34 | % | | | 5.94 | % | | | 9.77 | % | |

| Average annual total return (without CDSC) | | | –29.34 | % | | | 5.94 | % | | | 9.77 | % | |

| S&P 500 Index†† | |

| Average annual total return | | | –13.12 | % | | | 7.58 | % | | | 9.05 | % | |

| Russell 3000 Index†† | |

| Average annual total return | | | –12.69 | % | | | 8.37 | % | | | 9.95 | % | |

| Russell 3000 Value Index†† | |

| Average annual total return | | | –19.02 | % | | | 8.99 | % | | | 10.37 | % | |

Returns shown for Class C shares for the periods prior to their inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of the class. (Inception date: Class C — 8/28/03.)

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the current applicable sales charges of each specific class. Returns for Class A reflect the current maximum initial sales charges of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the current maximum sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in stocks of U.S. companies.

†† See index descriptions on page 5.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I and Class A.

Past performance is not indicative of future results and the table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

10

Schedule of Investments — June 30, 2008

Hotchkis and Wiley Core Value Fund

| Largest Equity Holdings | | Percent of

net assets | |

| Royal Dutch Shell PLC - Class B - ADR | | | 5.47 | % | |

| CA, Inc. | | | 5.15 | % | |

| Wachovia Corporation | | | 4.14 | % | |

| Microsoft Corporation | | | 4.06 | % | |

| Freddie Mac | | | 3.48 | % | |

| Home Depot, Inc. | | | 3.23 | % | |

| The Dow Chemical Company | | | 3.03 | % | |

| Washington Mutual, Inc. | | | 2.96 | % | |

| National City Corporation | | | 2.94 | % | |

| Schering-Plough Corporation | | | 2.83 | % | |

| Bank of America Corporation | | | 2.63 | % | |

COMMON

STOCKS — 95.23% | | Shares

Held | | Value | |

CONSUMER DISCRETIONARY — 11.30%

Household Durables — 0.97% | |

| Centex Corporation | | | 974,800 | | | $ | 13,033,076 | | |

| Media — 2.57% | |

| Idearc, Inc. (b) | | | 627,700 | | | | 1,475,095 | | |

| Interpublic Group of Companies, Inc. (a) | | | 3,653,100 | | | | 31,416,660 | | |

| R.H. Donnelley Corporation (a) (b) | | | 582,200 | | | | 1,746,600 | | |

| | | | 34,638,355 | | |

| Multiline Retail — 1.61% | |

| J.C. Penney Company, Inc. | | | 598,700 | | | | 21,726,823 | | |

| Specialty Retail — 6.15% | |

| The Gap, Inc. | | | 1,493,900 | | | | 24,903,313 | | |

| Home Depot, Inc. | | | 1,859,000 | | | | 43,537,780 | | |

| Limited Brands, Inc. | | | 850,000 | | | | 14,322,500 | | |

| | | | 82,763,593 | | |

| TOTAL CONSUMER DISCRETIONARY | | | 152,161,847 | | |

CONSUMER STAPLES — 4.90%

Food & Staples Retailing — 2.72% | |

| Safeway, Inc. | | | 585,300 | | | | 16,710,315 | | |

| Wal-Mart Stores, Inc. | | | 354,900 | | | | 19,945,380 | | |

| | | | 36,655,695 | | |

| Tobacco — 2.18% | |

| Philip Morris International, Inc. (a) | | | 592,400 | | | | 29,258,636 | | |

| TOTAL CONSUMER STAPLES | | | 65,914,331 | | |

ENERGY — 6.43%

Oil, Gas & Consumable Fuels — 6.43% | |

| Royal Dutch Shell PLC — Class B — ADR | | | 918,800 | | | | 73,605,068 | | |

| Sunoco, Inc. | | | 320,300 | | | | 13,033,007 | | |

| | | | 86,638,075 | | |

| TOTAL ENERGY | | | 86,638,075 | | |

| | Shares

Held | | Value | |

FINANCIALS — 28.61%

Commercial Banks — 5.98% | |

| Comerica, Inc. | | | 232,300 | | | $ | 5,953,849 | | |

| KeyCorp | | | 1,330,103 | | | | 14,604,531 | | |

National City Corporation

(Acquired 4/21/2008; Cost $4,282,000) (r) | | | 856,400 | | | | 4,085,028 | | |

| Wachovia Corporation | | | 3,594,100 | | | | 55,816,373 | | |

| | | | 80,459,781 | | |

| Consumer Finance — 0.68% | |

| American Express Company | | | 188,400 | | | | 7,097,028 | | |

| Capital One Financial Corporation | | | 55,400 | | | | 2,105,754 | | |

| | | | 9,202,782 | | |

| Diversified Financial Services — 7.26% | |

| Bank of America Corporation | | | 1,483,122 | | | | 35,402,122 | | |

| Citigroup, Inc. | | | 1,923,100 | | | | 32,231,156 | | |

| JPMorgan Chase & Company | | | 878,800 | | | | 30,151,628 | | |

| | | | 97,784,906 | | |

| Insurance — 8.25% | |

| Conseco, Inc. (a) | | | 1,142,100 | | | | 11,329,632 | | |

| Genworth Financial, Inc. | | | 1,910,700 | | | | 34,029,567 | | |

| MetLife, Inc. | | | 364,000 | | | | 19,208,280 | | |

| The Travelers Companies, Inc. | | | 306,900 | | | | 13,319,460 | | |

| Unum Group | | | 1,052,100 | | | | 21,515,445 | | |

| XL Capital Limited | | | 569,100 | | | | 11,700,696 | | |

| | | | 111,103,080 | | |

| Thrifts & Mortgage Finance — 6.44% | |

| Freddie Mac | | | 2,858,800 | | | | 46,884,320 | | |

| Washington Mutual, Inc. (b) | | | 3,204,000 | | | | 15,795,720 | | |

Washington Mutual, Inc.

(Acquired 4/8/2008; Cost $42,662,500) (r) | | | 4,875,714 | | | | 24,037,269 | | |

| | | | 86,717,309 | | |

| TOTAL FINANCIALS | | | 385,267,858 | | |

The accompanying notes are an integral part of these financial statements.

11

Schedule of Investments — June 30, 2008

Hotchkis and Wiley Core Value Fund

| | Shares

Held | | Value | |

HEALTH CARE — 12.97%

Health Care Equipment & Supplies — 0.91% | |

| Covidien Limited | | | 254,100 | | | $ | 12,168,849 | | |

| Pharmaceuticals — 12.06% | |

| AstraZeneca PLC — ADR | | | 679,400 | | | | 28,894,882 | | |

| Bristol-Myers Squibb Company | | | 1,340,800 | | | | 27,526,624 | | |

| Eli Lilly & Company | | | 599,000 | | | | 27,649,840 | | |

| Johnson & Johnson | | | 198,100 | | | | 12,745,754 | | |

| Pfizer, Inc. | | | 1,571,600 | | | | 27,455,852 | | |

| Schering-Plough Corporation | | | 1,937,300 | | | | 38,145,437 | | |

| | | | 162,418,389 | | |

| TOTAL HEALTH CARE | | | 174,587,238 | | |

INDUSTRIALS — 7.74%

Aerospace & Defense — 2.80% | |

| Empresa Brasileira de Aeronautica SA — ADR | | | 352,500 | | | | 9,341,250 | | |

| Northrop Grumman Corporation | | | 424,800 | | | | 28,419,120 | | |

| | | | 37,760,370 | | |

| Air Freight & Logistics — 1.34% | |

| FedEx Corporation | | | 229,100 | | | | 18,050,789 | | |

| Industrial Conglomerates — 2.55% | |

| Tyco International Limited | | | 857,600 | | | | 34,338,304 | | |

| Machinery — 1.05% | |

| PACCAR, Inc. | | | 336,700 | | | | 14,084,161 | | |

| TOTAL INDUSTRIALS | | | 104,233,624 | | |

INFORMATION TECHNOLOGY — 15.93%

Communications Equipment — 1.47% | |

| Alcatel-Lucent — ADR (a) | | | 3,281,100 | | | | 19,817,844 | | |

| Electronic Equipment & Instruments — 2.10% | |

| Tyco Electronics Limited | | | 789,400 | | | | 28,276,308 | | |

| IT Services — 1.58% | |

| Electronic Data Systems Corporation | | | 863,300 | | | | 21,271,712 | | |

| Software — 10.78% | |

| CA, Inc. | | | 3,001,206 | | | | 69,297,846 | | |

| Microsoft Corporation | | | 1,989,000 | | | | 54,717,390 | | |

| Oracle Corporation (a) | | | 1,007,500 | | | | 21,157,500 | | |

| | | | 145,172,736 | | |

| TOTAL INFORMATION TECHNOLOGY | | | 214,538,600 | | |

MATERIALS — 3.29%

Chemicals — 3.29% | |

| The Dow Chemical Company | | | 1,169,900 | | | | 40,841,209 | | |

| Eastman Chemical Company | | | 51,000 | | | | 3,511,860 | | |

| | | | 44,353,069 | | |

| TOTAL MATERIALS | | | 44,353,069 | | |

| | Shares

Held | | Value | |

UTILITIES — 4.06%

Electric Utilities — 4.06% | |

| Entergy Corporation | | | 152,300 | | | $ | 18,349,104 | | |

| Exelon Corporation | | | 248,200 | | | | 22,328,072 | | |

| FPL Group, Inc. | | | 212,800 | | | | 13,955,424 | | |

| | | | 54,632,600 | | |

| TOTAL UTILITIES | | | 54,632,600 | | |

Total common stocks

(Cost $1,722,561,229) | | | 1,282,327,242 | | |

| CONVERTIBLE PREFERRED STOCKS — 2.63% | |

FINANCIALS — 2.63%

Commercial Banks — 2.63% | |

National City Corporation

(Acquired 4/21/2008; Cost $37,200,000) (f) (i) (r) | | | 372 | | | | 35,488,800 | | |

| TOTAL FINANCIALS | | | 35,488,800 | | |

Total convertible preferred stocks

(Cost $37,200,000) | | | 35,488,800 | | |

Total investments — 97.86%

(Cost $1,759,761,229) | | | 1,317,816,042 | | |

| Collateral for securities on loan^ — 1.20% | | | | | | | 16,192,365 | | |

| Time deposits* — 2.86% | | | | | | | 38,481,674 | | |

| Liabilities in excess of other assets — (1.92)% | | | | | | | (25,884,160 | ) | |

| Net assets — 100.00% | | $ | 1,346,605,921 | | |

(a) — Non-income producing security.

(b) — All or a portion of this security is on loan. The total market value of securites on loan was $15,852,983.

(f) — Fair valued security. The aggregate value of fair valued securities was $35,488,800, representing 2.63% of net assets.

(i) — Illiquid security.

(r) — Restricted security. Purchased in a private placement transaction; resale to the public may require registration. The total market value of restricted securities was $63,611,097, representing 4.72% of net assets.

ADR — American Depository Receipt.

^ — Collateral for securities on loan of $16,182,955 was invested in Royal Bank of Canada Repurchase Agreements which bear interest at 2.40% and mature on 7/1/2008. The repurchase proceeds are $16,184,034. The repurchase agreements are collateralized by United States Government & Agency Issues. The remaining collateral for securities on loan of $9,410 was held as cash.

* — Time deposits of $16,500,000 with JPMorgan Chase and $21,981,674 with Wells Fargo bear interest at 1.65% and mature on 7/1/2008. Invested through a cash management account administered by Brown Brothers Harriman & Co.

The accompanying notes are an integral part of these financial statements.

12

Schedule of Investments — June 30, 2008

Hotchkis and Wiley Large Cap Value Fund

| Largest Equity Holdings | | Percent of

net assets | |

| Royal Dutch Shell PLC - Class B - ADR | | | 5.20 | % | |

| CA, Inc. | | | 5.12 | % | |

| Microsoft Corporation | | | 4.28 | % | |

| Wachovia Corporation | | | 4.21 | % | |

| Freddie Mac | | | 3.46 | % | |

| Home Depot, Inc. | | | 3.44 | % | |

| Bank of America Corporation | | | 3.06 | % | |

| AstraZeneca PLC - ADR | | | 2.95 | % | |

| The Dow Chemical Company | | | 2.93 | % | |

| Eli Lilly & Company | | | 2.90 | % | |

COMMON

STOCKS — 97.93% | | Shares

Held | | Value | |

CONSUMER DISCRETIONARY — 11.38%

Household Durables — 1.04% | |

| Centex Corporation | | | 1,373,000 | | | $ | 18,357,010 | | |

| Lennar Corporation — Class B | | | 901,620 | | | | 10,007,982 | | |

| | | | 28,364,992 | | |

| Media — 0.37% | |

| Idearc, Inc. (b) | | | 4,282,100 | | | | 10,062,935 | | |

| Multiline Retail — 1.49% | |

| J.C. Penney Company, Inc. | | | 1,118,500 | | | | 40,590,365 | | |

| Specialty Retail — 7.07% | |

| AutoNation, Inc. (a) | | | 2,139,800 | | | | 21,440,796 | | |

| The Gap, Inc. | | | 2,894,200 | | | | 48,246,314 | | |

| Home Depot, Inc. | | | 4,008,747 | | | | 93,884,855 | | |

| Limited Brands, Inc. | | | 1,738,900 | | | | 29,300,465 | | |

| | | | 192,872,430 | | |

| Textiles, Apparel & Luxury Goods — 1.41% | |

| Jones Apparel Group, Inc. | | | 2,808,500 | | | | 38,616,875 | | |

| TOTAL CONSUMER DISCRETIONARY | | | 310,507,597 | | |

CONSUMER STAPLES — 3.64%

Food & Staples Retailing — 0.99% | |

| Wal-Mart Stores, Inc. | | | 482,700 | | | | 27,127,740 | | |

| Tobacco — 2.65% | |

| Altria Group, Inc. | | | 654,000 | | | | 13,446,240 | | |

| Philip Morris International, Inc. (a) | | | 1,191,200 | | | | 58,833,368 | | |

| | | | 72,279,608 | | |

| TOTAL CONSUMER STAPLES | | | 99,407,348 | | |

ENERGY — 6.36%

Oil, Gas & Consumable Fuels — 6.36% | |

| Royal Dutch Shell PLC — Class B — ADR | | | 1,770,700 | | | | 141,850,777 | | |

| Sunoco, Inc. | | | 774,100 | | | | 31,498,129 | | |

| | | | 173,348,906 | | |

| TOTAL ENERGY | | | 173,348,906 | | |

| | Shares

Held | | Value | |

FINANCIALS — 31.51%

Commercial Banks — 5.26% | |

| Comerica, Inc. | | | 906,200 | | | $ | 23,225,906 | | |

| National City Corporation | | | 1,099,800 | | | | 5,246,046 | | |

| Wachovia Corporation | | | 7,401,800 | | | | 114,949,954 | | |

| | | | 143,421,906 | | |

| Consumer Finance — 0.91% | |

| Capital One Financial Corporation | | | 649,900 | | | | 24,702,699 | | |

| Diversified Financial Services — 8.02% | |

| Bank of America Corporation | | | 3,497,833 | | | | 83,493,274 | | |

| Citigroup, Inc. | | | 3,728,800 | | | | 62,494,688 | | |

| JPMorgan Chase & Company | | | 2,118,200 | | | | 72,675,442 | | |

| | | | 218,663,404 | | |

| Insurance — 10.25% | |

| Genworth Financial, Inc. | | | 4,196,400 | | | | 74,737,884 | | |

| The Hanover Insurance Group, Inc. | | | 917,200 | | | | 38,981,000 | | |

| MetLife, Inc. | | | 1,313,300 | | | | 69,302,841 | | |

| Unum Group | | | 3,487,900 | | | | 71,327,555 | | |

| XL Capital Limited | | | 1,224,600 | | | | 25,177,776 | | |

| | | | 279,527,056 | | |

| Thrifts & Mortgage Finance — 7.07% | |

| Fannie Mae | | | 1,141,900 | | | | 22,278,469 | | |

| Freddie Mac | | | 5,752,300 | | | | 94,337,720 | | |

| Washington Mutual, Inc. (b) | | | 6,397,700 | | | | 31,540,661 | | |

Washington Mutual, Inc.

(Acquired 4/8/2008; Cost $79,518,625) (r) | | | 9,087,842 | | | | 44,803,060 | | |

| | | | 192,959,910 | | |

| TOTAL FINANCIALS | | | 859,274,975 | | |

The accompanying notes are an integral part of these financial statements.

13

Schedule of Investments — June 30, 2008

Hotchkis and Wiley Large Cap Value Fund

| | Shares

Held | | Value | |

HEALTH CARE — 11.29%

Pharmaceuticals — 11.29% | |

| AstraZeneca PLC — ADR | | | 1,891,500 | | | $ | 80,445,495 | | |

| Bristol-Myers Squibb Company | | | 2,918,900 | | | | 59,925,017 | | |

| Eli Lilly & Company | | | 1,710,700 | | | | 78,965,912 | | |

| Johnson & Johnson | | | 239,600 | | | | 15,415,864 | | |

| Pfizer, Inc. | | | 4,180,800 | | | | 73,038,576 | | |

| | | | 307,790,864 | | |

| TOTAL HEALTH CARE | | | 307,790,864 | | |

INDUSTRIALS — 5.57%

Aerospace & Defense — 1.62% | |

| Northrop Grumman Corporation | | | 660,200 | | | | 44,167,380 | | |

| Industrial Conglomerates — 2.67% | |

| Tyco International Limited | | | 1,818,900 | | | | 72,828,756 | | |

| Machinery — 1.28% | |

| PACCAR, Inc. | | | 835,500 | | | | 34,948,965 | | |

| TOTAL INDUSTRIALS | | | 151,945,101 | | |

INFORMATION TECHNOLOGY — 17.77%

Communications Equipment — 1.73% | |

| Alcatel-Lucent — ADR (a) | | | 7,829,600 | | | | 47,290,784 | | |

| Electronic Equipment & Instruments — 2.17% | |

| Tyco Electronics Limited | | | 1,651,500 | | | | 59,156,730 | | |

| IT Services — 2.84% | |

| Electronic Data Systems Corporation | | | 3,138,700 | | | | 77,337,568 | | |

| Software — 11.03% | |

| BMC Software, Inc. (a) | | | 1,239,300 | | | | 44,614,800 | | |

| CA, Inc. | | | 6,044,741 | | | | 139,573,069 | | |

| Microsoft Corporation | | | 4,240,600 | | | | 116,658,906 | | |

| | | | 300,846,775 | | |

| TOTAL INFORMATION TECHNOLOGY | | | 484,631,857 | | |

MATERIALS — 4.99%

Chemicals — 4.99% | |

| The Dow Chemical Company | | | 2,285,500 | | | | 79,786,805 | | |

| Eastman Chemical Company | | | 816,800 | | | | 56,244,848 | | |

| | | | 136,031,653 | | |

| TOTAL MATERIALS | | | 136,031,653 | | |

| | Shares

Held | | Value | |

UTILITIES — 5.42%

Electric Utilities — 5.42% | |

| Entergy Corporation | | | 222,900 | | | $ | 26,854,992 | | |

| Exelon Corporation | | | 795,200 | | | | 71,536,192 | | |

| FPL Group, Inc. | | | 754,300 | | | | 49,466,994 | | |

| | | | 147,858,178 | | |

| TOTAL UTILITIES | | | 147,858,178 | | |

Total investments — 97.93%

(Cost $3,625,807,620) | | | 2,670,796,479 | | |

| Collateral for securities on loan^ — 1.21% | | | | | | | 32,986,230 | | |

| Time deposit* — 2.43% | | | | | | | 66,290,570 | | |

| Liabilities in excess of other assets — (1.57)% | | | | | | | (42,714,364 | ) | |

| Net assets — 100.00% | | $ | 2,727,358,915 | | |

(a) — Non-income producing security.

(b) — All or a portion of this security is on loan. The total market value of securities on loan was $32,310,749.

(r) — Restricted security. Purchased in a private placement transaction; resale to the public may require registration. The total market value of restricted securities was $44,803,060, representing 1.64% of net assets.

ADR — American Depository Receipt.

^ — Collateral for securities on loan of $32,967,061 was invested in Royal Bank of Canada Repurchase Agreements which bear interest at 2.40% and mature on 7/1/2008. The repurchase proceeds are $32,969,259. The repurchase agreements are collateralized by United States Government & Agency Issues. The remaining collateral for securities on loan of $19,169 was held as cash.

* — Time deposit with Bank of America bears interest at 1.65% and matures on 7/1/2008. Invested through a cash management account administered by Brown Brothers Harriman & Co.

The accompanying notes are an integral part of these financial statements.

14

Schedule of Investments — June 30, 2008

Hotchkis and Wiley Mid-Cap Value Fund

| Largest Equity Holdings | | Percent of

net assets | |

| CA, Inc. | | | 5.25 | % | |

| Electronic Data Systems Corporation | | | 4.21 | % | |

| National City Corporation | | | 4.17 | % | |

| Eastman Chemical Company | | | 4.10 | % | |

| Safeway, Inc. | | | 3.69 | % | |

| Limited Brands, Inc. | | | 3.68 | % | |

| Jones Apparel Group, Inc. | | | 3.40 | % | |

| BMC Software, Inc. | | | 3.22 | % | |

| Interpublic Group of Companies, Inc. | | | 3.18 | % | |

| FPL Group, Inc. | | | 3.16 | % | |

COMMON

STOCKS — 94.15% | | Shares

Held | | Value | |

CONSUMER DISCRETIONARY — 20.74%

Auto Components — 0.73% | |

| Magna International, Inc. | | | 252,300 | | | $ | 14,946,252 | | |

| Household Durables — 0.18% | |

| Centex Corporation | | | 273,200 | | | | 3,652,684 | | |

| Media — 5.38% | |

| Citadel Broadcasting Corporation (a) (b) (c) | | | 16,071,900 | | | | 19,607,718 | | |

| Idearc, Inc. | | | 367,900 | | | | 864,565 | | |

| Interpublic Group of Companies, Inc. (a) | | | 7,550,900 | | | | 64,937,740 | | |

| R.H. Donnelley Corporation (a) (b) | | | 1,141,866 | | | | 3,425,598 | | |

| Valassis Communications, Inc. (a) | | | 1,662,400 | | | | 20,813,248 | | |

| | | | 109,648,869 | | |

| Specialty Retail — 10.82% | |

| AutoNation, Inc. (a) | | | 4,072,500 | | | | 40,806,450 | | |

| Foot Locker, Inc. | | | 3,174,600 | | | | 39,523,770 | | |

| The Gap, Inc. | | | 623,600 | | | | 10,395,412 | | |

| Limited Brands, Inc. | | | 4,461,800 | | | | 75,181,330 | | |

| Rent-A-Center, Inc. (a) | | | 2,671,000 | | | | 54,942,470 | | |

| | | | 220,849,432 | | |

| Textiles, Apparel & Luxury Goods — 3.63% | |

| Jones Apparel Group, Inc. (c) | | | 5,045,300 | | | | 69,372,875 | | |

| Liz Claiborne, Inc. | | | 332,700 | | | | 4,707,705 | | |

| | | | 74,080,580 | | |

| TOTAL CONSUMER DISCRETIONARY | | | 423,177,817 | | |

CONSUMER STAPLES — 3.69%

Food & Staples Retailing — 3.69% | |

| Safeway, Inc. | | | 2,638,400 | | | | 75,326,320 | | |

| TOTAL CONSUMER STAPLES | | | 75,326,320 | | |

ENERGY — 2.20%

Oil, Gas & Consumable Fuels — 2.20% | |

| Sunoco, Inc. | | | 1,105,000 | | | | 44,962,450 | | |

| TOTAL ENERGY | | | 44,962,450 | | |

| | Shares

Held | | Value | |

FINANCIALS — 28.21%

Commercial Banks — 8.51% | |

| Comerica, Inc. | | | 1,693,300 | | | $ | 43,399,279 | | |

| Fifth Third Bancorp | | | 675,200 | | | | 6,873,536 | | |

| First Horizon National Corporation (b) | | | 6,041,500 | | | | 44,888,345 | | |

| KeyCorp | | | 5,862,320 | | | | 64,368,274 | | |

National City Corporation

(Acquired 4/21/2008; Cost $9,183,500) (r) | | | 1,836,700 | | | | 8,761,059 | | |

| SunTrust Banks, Inc. | | | 145,700 | | | | 5,277,254 | | |

| | | | 173,567,747 | | |

| Consumer Finance — 0.72% | |

| Discover Financial Services | | | 1,119,300 | | | | 14,741,181 | | |

| Diversified Financial Services — 0.65% | |

| CIT Group, Inc. | | | 1,956,000 | | | | 13,320,360 | | |

| Insurance — 12.16% | |

| CNA Financial Corporation | | | 1,302,824 | | | | 32,766,023 | | |

| Conseco, Inc. (a) | | | 6,197,000 | | | | 61,474,240 | | |

| Genworth Financial, Inc. | | | 3,061,700 | | | | 54,528,877 | | |

| The Hanover Insurance Group, Inc. | | | 870,100 | | | | 36,979,250 | | |

| Unum Group | | | 1,998,500 | | | | 40,869,325 | | |

| XL Capital Limited | | | 1,041,200 | | | | 21,407,072 | | |

| | | | 248,024,787 | | |

| Real Estate Management & Development — 2.79% | |

| MI Developments, Inc. (c) | | | 2,533,400 | | | | 56,976,166 | | |

| Thrifts & Mortgage Finance — 3.38% | |

| Sovereign Bancorp, Inc. | | | 662,300 | | | | 4,874,528 | | |

| Washington Mutual, Inc. | | | 50,500 | | | | 248,965 | | |

Washington Mutual, Inc.

(Acquired 4/8/2008; Cost $113,325,125) (r) | | | 12,951,441 | | | | 63,850,606 | | |

| | | | 68,974,099 | | |

| TOTAL FINANCIALS | | | 575,604,340 | | |

The accompanying notes are an integral part of these financial statements.

15

Schedule of Investments — June 30, 2008

Hotchkis and Wiley Mid-Cap Value Fund

| | Shares

Held | | Value | |

HEALTH CARE — 3.67%

Health Care Providers & Services — 1.37% | |

| Lincare Holdings, Inc. (a) | | | 982,200 | | | $ | 27,894,480 | | |

| Pharmaceuticals — 2.30% | |

| King Pharmaceuticals, Inc. (a) | | | 4,481,700 | | | | 46,923,399 | | |

| TOTAL HEALTH CARE | | | 74,817,879 | | |

INDUSTRIALS — 7.76%

Aerospace & Defense — 1.13% | |

| Empresa Brasileira de Aeronautica SA — ADR | | | 874,200 | | | | 23,166,300 | | |

| Commercial Services & Supplies — 6.63% | |

| IKON Office Solutions, Inc. (c) | | | 5,061,281 | | | | 57,091,250 | | |

| Manpower, Inc. | | | 897,100 | | | | 52,247,104 | | |

| PHH Corporation (a) | | | 1,687,400 | | | | 25,901,590 | | |

| | | | 135,239,944 | | |

| TOTAL INDUSTRIALS | | | 158,406,244 | | |

INFORMATION TECHNOLOGY — 17.63%

Communications Equipment — 1.44% | |

| Alcatel-Lucent — ADR (a) | | | 3,602,000 | | | | 21,756,080 | | |

| Tellabs, Inc. (a) | | | 1,624,100 | | | | 7,552,065 | | |

| | | | 29,308,145 | | |

| Electronic Equipment & Instruments — 0.30% | |

| Tyco Electronics Limited | | | 172,100 | | | | 6,164,622 | | |

| IT Services — 4.33% | |

| Electronic Data Systems Corporation | | | 3,488,200 | | | | 85,949,248 | | |

| Unisys Corporation (a) | | | 587,700 | | | | 2,321,415 | | |

| | | | 88,270,663 | | |

| Semiconductor & Semiconductor Equipment — 2.33% | |

| Maxim Integrated Products, Inc. | | | 1,181,600 | | | | 24,990,840 | | |

| ON Semiconductor Corp. (a) | | | 2,459,700 | | | | 22,555,449 | | |

| | | | 47,546,289 | | |

| Software — 9.23% | |

| BMC Software, Inc. (a) | | | 1,826,900 | | | | 65,768,400 | | |

| CA, Inc. | | | 4,637,544 | | | | 107,080,891 | | |

| Novell, Inc. (a) | | | 2,646,900 | | | | 15,590,241 | | |

| | | | 188,439,532 | | |

| TOTAL INFORMATION TECHNOLOGY | | | 359,729,251 | | |

MATERIALS — 4.10%

Chemicals — 4.10% | |

| Eastman Chemical Company | | | 1,215,200 | | | | 83,678,672 | | |

| TOTAL MATERIALS | | | 83,678,672 | | |

| | Shares

Held | | Value | |

UTILITIES — 6.15%

Electric Utilities — 6.15% | |

| FPL Group, Inc. | | | 982,700 | | | $ | 64,445,466 | | |

| Great Plains Energy, Inc. | | | 1,349,800 | | | | 34,122,944 | | |

| Portland General Electric Company | | | 1,196,000 | | | | 26,933,920 | | |

| | | | 125,502,330 | | |

| TOTAL UTILITIES | | | 125,502,330 | | |

Total common stocks

(Cost $2,525,019,389) | | | 1,921,205,303 | | |

| CONVERTIBLE PREFERRED STOCKS — 3.74% | |

FINANCIALS — 3.74%

Commercial Banks — 3.74% | |

National City Corporation

(Acquired 4/21/2008; Cost $80,100,000) (f) (i) (r) | | | 801 | | | | 76,415,400 | | |

| TOTAL FINANCIALS | | | 76,415,400 | | |

Total convertible preferred stocks

(Cost $80,100,000) | | | 76,415,400 | | |

Total investments — 97.89%

(Cost $2,605,119,389) | | | 1,997,620,703 | | |

| Collateral for securities on loan^ — 2.06% | | | | | | | 42,078,445 | | |

| Time deposit* — 2.01% | | | | | | | 40,917,176 | | |

| Liabilities in excess of other assets — (1.96)% | | | | | | | (39,946,574 | ) | |

| Net assets — 100.00% | | $ | 2,040,669,750 | | |

(a) — Non-income producing security.

(b) — All or a portion of this security is on loan. The total market value of securities on loan was $40,777,607.

(c) — Affiliated issuer. See Note 6 in Notes to the Financial Statements.

(f) — Fair valued security. The aggregate value of fair valued securities was $76,415,400, representing 3.74% of net assets.

(i) — Illiquid security.

(r) — Restricted security. Purchased in a private placement transaction; resale to the public may require registration. The total market value of restricted securities was $149,027,065, representing 7.30% of net assets.

ADR — American Depository Receipt.

^ — Collateral for securities on loan of $42,053,992 was invested in Royal Bank of Canada Repurchase Agreements which bear interest at 2.40% and mature on 7/1/2008. The repurchase proceeds are $42,056,795. The repurchase agreements are collateralized by United States Government & Agency Issues. The remaining collateral for securities on loan of $24,453 was held as cash.

* — Time deposit with Bank of America bears interest at 1.65% and matures on 7/1/2008. Invested through a cash management account administered by Brown Brothers Harriman & Co.

The accompanying notes are an integral part of these financial statements.

16

Schedule of Investments — June 30, 2008

Hotchkis and Wiley Small Cap Value Fund

| Largest Equity Holdings | | Percent of

net assets | |

| MI Developments, Inc. | | | 4.89 | % | |

| Hudson Highland Group, Inc. | | | 4.68 | % | |

| Great Plains Energy, Inc. | | | 4.45 | % | |

| Foundation Coal Holdings, Inc. | | | 4.36 | % | |

| Quicksilver, Inc. | | | 4.19 | % | |

| Employers Holdings, Inc. | | | 3.92 | % | |

| CapLease, Inc. | | | 3.70 | % | |

| The Hanover Insurance Group, Inc. | | | 3.45 | % | |

| United America Indemnity Limited | | | 3.27 | % | |

| Sotheby's | | | 3.18 | % | |

COMMON

STOCKS — 96.09% | | Shares

Held | | Value | |

CONSUMER DISCRETIONARY — 27.62%

Diversified Consumer Services — 3.76% | |

| Corinthian Colleges, Inc. (a) | | | 170,000 | | | $ | 1,973,700 | | |

| Sotheby's (b) | | | 409,100 | | | | 10,787,967 | | |

| | | | 12,761,667 | | |

| Hotels, Restaurants & Leisure — 2.29% | |

| Lodgian, Inc. (a) | | | 994,109 | | | | 7,783,874 | | |

| Household Durables — 0.77% | |

| California Coastal Communities, Inc. (a) (b) | | | 341,200 | | | | 1,303,384 | | |

| Russ Berrie & Company, Inc. (a) | | | 166,200 | | | | 1,324,614 | | |

| | | | 2,627,998 | | |

| Media — 4.82% | |

| Valassis Communications, Inc. (a) | | | 762,500 | | | | 9,546,500 | | |

| Westwood One, Inc. (a) (c) | | | 5,487,500 | | | | 6,804,500 | | |

| | | | 16,351,000 | | |

| Specialty Retail — 4.95% | |

| Asbury Automotive Group, Inc. | | | 124,700 | | | | 1,602,395 | | |

| AutoNation, Inc. (a) | | | 430,100 | | | | 4,309,602 | | |

| Pacific Sunwear of California (a) | | | 105,900 | | | | 903,327 | | |

| Rent-A-Center, Inc. (a) | | | 486,000 | | | | 9,997,020 | | |

| | | | 16,812,344 | | |

| Textiles, Apparel & Luxury Goods — 11.03% | |

| Jones Apparel Group, Inc. | | | 455,900 | | | | 6,268,625 | | |

| K-Swiss, Inc. | | | 93,600 | | | | 1,375,920 | | |

| Phillips-Van Heusen | | | 131,000 | | | | 4,797,220 | | |

| Quiksilver, Inc. (a) | | | 1,449,200 | | | | 14,231,144 | | |

| Steven Madden Limited (a) | | | 66,000 | | | | 1,213,080 | | |

| The Warnaco Group, Inc. (a) | | | 217,600 | | | | 9,589,632 | | |

| | | | 37,475,621 | | |

| TOTAL CONSUMER DISCRETIONARY | | | 93,812,504 | | |

| | Shares

Held | | Value | |

CONSUMER STAPLES — 0.00%

Food & Staples Retailing — 0.00% | |

| The Great Atlantic & Pacific Tea Company, Inc. (a) | | | 72 | | | $ | 1,643 | | |

| TOTAL CONSUMER STAPLES | | | 1,643 | | |

ENERGY — 4.36%

Oil, Gas & Consumable Fuels — 4.36% | |

| Foundation Coal Holdings, Inc. | | | 167,300 | | | | 14,819,434 | | |

| TOTAL ENERGY | | | 14,819,434 | | |

FINANCIALS — 30.19%

Commercial Banks — 4.84% | |

| First Horizon National Corporation (b) | | | 926,000 | | | | 6,880,180 | | |

| Webster Financial Corporation | | | 513,000 | | | | 9,541,800 | | |

| | | | 16,421,980 | | |

| Insurance — 11.80% | |

| Employers Holdings, Inc. | | | 642,600 | | | | 13,301,820 | | |

| The Hanover Insurance Group, Inc. | | | 275,400 | | | | 11,704,500 | | |

| PMA Capital Corporation (a) | | | 376,900 | | | | 3,471,249 | | |

| Quanta Capital Holdings Limited | | | 186,000 | | | | 491,040 | | |

| United America Indemnity Limited (a) | | | 830,928 | | | | 11,109,507 | | |

| | | | 40,078,116 | | |

| Real Estate Investment Trusts — 8.53% | |

| CapLease, Inc. | | | 1,677,700 | | | | 12,565,973 | | |

| Lexington Realty Trust (b) | | | 414,000 | | | | 5,642,820 | | |

| U-Store-It Trust | | | 901,200 | | | | 10,769,340 | | |

| | | | 28,978,133 | | |

| Real Estate Management & Development — 4.89% | |

| MI Developments, Inc. | | | 738,400 | | | | 16,606,616 | | |

| Thrifts & Mortgage Finance — 0.13% | |

| Home Federal Bancorp, Inc. | | | 44,100 | | | | 434,826 | | |

| TOTAL FINANCIALS | | | 102,519,671 | | |

The accompanying notes are an integral part of these financial statements.

17

Schedule of Investments — June 30, 2008

Hotchkis and Wiley Small Cap Value Fund

| | Shares

Held | | Value | |

HEALTH CARE — 3.28%

Health Care Providers & Services — 1.24% | |

| Lincare Holdings, Inc. (a) | | | 147,900 | | | $ | 4,200,360 | | |

| Pharmaceuticals — 2.04% | |

| King Pharmaceuticals, Inc. (a) | | | 663,200 | | | | 6,943,704 | | |

| TOTAL HEALTH CARE | | | 11,144,064 | | |

INDUSTRIALS — 17.34%

Commercial Services & Supplies — 14.57% | |

| Heidrick & Struggles International, Inc. | | | 66,000 | | | | 1,824,240 | | |

| Hudson Highland Group, Inc. (a) (c) | | | 1,517,900 | | | | 15,892,413 | | |

| IKON Office Solutions, Inc. | | | 930,300 | | | | 10,493,784 | | |

| Kelly Services, Inc. — Class A | | | 418,100 | | | | 8,081,873 | | |

| PHH Corporation (a) | | | 434,200 | | | | 6,664,970 | | |

| Spherion Corporation (a) | | | 1,412,700 | | | | 6,526,674 | | |

| | | | 49,483,954 | | |

| Machinery — 2.77% | |

| Miller Industries, Inc. (a) (c) | | | 946,400 | | | | 9,426,144 | | |

| TOTAL INDUSTRIALS | | | 58,910,098 | | |

INFORMATION TECHNOLOGY — 7.24%

IT Services — 1.41% | |

| Ness Technologies, Inc. (a) | | | 130,000 | | | | 1,315,600 | | |

| Patni Computer Systems Limited — ADR | | | 278,400 | | | | 2,795,136 | | |

| Unisys Corporation (a) | | | 173,900 | | | | 686,905 | | |

| | | | 4,797,641 | | |

| Semiconductor & Semiconductor Equipment — 2.73% | |

| ON Semiconductor Corporation (a) | | | 1,011,100 | | | | 9,271,787 | | |

| Software — 3.10% | |

| Lawson Software, Inc. (a) | | | 666,000 | | | | 4,841,820 | | |

| Novell, Inc. (a) | | | 961,800 | | | | 5,665,002 | | |

| | | | 10,506,822 | | |

| TOTAL INFORMATION TECHNOLOGY | | | 24,576,250 | | |

MATERIALS — 0.37%

Chemicals — 0.37% | |

| Tronox, Inc. — Class A (b) | | | 153,300 | | | | 484,428 | | |

| Tronox, Inc. — Class B | | | 255,100 | | | | 770,402 | | |

| | | | 1,254,830 | | |

| TOTAL MATERIALS | | | 1,254,830 | | |

| | Shares

Held | | Value | |

UTILITIES — 5.69%

Electric Utilities — 5.69% | |

| Great Plains Energy, Inc. | | | 598,000 | | | $ | 15,117,440 | | |

| Portland General Electric Company | | | 187,200 | | | | 4,215,744 | | |

| | | | 19,333,184 | | |

| TOTAL UTILITIES | | | 19,333,184 | | |

Total investments — 96.09%

(Cost $385,362,811) | | | 326,371,678 | | |

| Collateral for securities on loan^ — 4.48% | | | | | 15,204,828 | | |

| Time deposit* — 3.15% | | | | | 10,690,356 | | |

| Liabilities in excess of other assets — (3.72)% | | | | | (12,633,944 | ) | |

| Net assets — 100.00% | | $ | 339,632,918 | | |

(a) — Non-income producing security.

(b) — All or a portion of this security is on loan. The total market value of securities on loan was $14,752,126.

(c) — Affiliated issuer. See Note 6 in Notes to the Financial Statements.

ADR — American Depository Receipt.

^ — Collateral for securities on loan of $15,195,992 was invested in Royal Bank of Canada Repurchase Agreements which bear interest at 2.40% and mature on 7/1/2008. The repurchase proceeds are $15,197,005. The repurchase agreements are collateralized by United States Government & Agency Issues. The remaining collateral for securities on loan of $8,836 was held as cash.

* — Time deposit with Bank of America bears interest at 1.65% and matures on 7/1/2008. Invested through a cash management account administered by Brown Brothers Harriman & Co.

The accompanying notes are an integral part of these financial statements.

18

Schedule of Investments — June 30, 2008

Hotchkis and Wiley All Cap Value Fund

| Largest Equity Holdings | | Percent of

net assets | |

| Philip Morris International, Inc. | | | 11.87 | % | |

| Hudson Highland Group, Inc. | | | 10.57 | % | |

| Washington Mutual, Inc. | | | 8.36 | % | |

| MI Developments, Inc. | | | 7.99 | % | |

| CA, Inc. | | | 6.56 | % | |

| Exelon Corporation | | | 5.02 | % | |

| Miller Industries, Inc. | | | 4.90 | % | |

| Electronic Data Systems Corporation | | | 4.58 | % | |

| Microsoft Corporation | | | 4.54 | % | |

| American Express Company | | | 4.35 | % | |

COMMON

STOCKS — 98.87% | | Shares

Held | | Value | |

CONSUMER DISCRETIONARY — 4.75%

Hotels, Restaurants & Leisure — 2.45% | |

| Lodgian, Inc. (a) | | | 185,500 | | | $ | 1,452,465 | | |

| Media — 0.36% | |

| Westwood One, Inc. (a) | | | 172,600 | | | | 214,024 | | |

| Specialty Retail — 1.94% | |

| Home Depot, Inc. | | | 49,000 | | | | 1,147,580 | | |

| TOTAL CONSUMER DISCRETIONARY | | | 2,814,069 | | |

CONSUMER STAPLES — 11.87%

Tobacco — 11.87% | |

| Philip Morris International, Inc. (a) | | | 142,500 | | | | 7,038,075 | | |

| TOTAL CONSUMER STAPLES | | | 7,038,075 | | |

ENERGY — 2.41%

Oil, Gas & Consumable Fuels — 2.41% | |

| Royal Dutch Shell PLC — Class B — ADR | | | 17,800 | | | | 1,425,958 | | |

| TOTAL ENERGY | | | 1,425,958 | | |

FINANCIALS — 24.02%

Consumer Finance — 4.35% | |

| American Express Company | | | 68,400 | | | | 2,576,628 | | |

| Insurance — 3.32% | |

| Genworth Financial, Inc. | | | 89,100 | | | | 1,586,871 | | |

| XL Capital Limited | | | 18,400 | | | | 378,304 | | |

| | | | 1,965,175 | | |

| Real Estate Management & Development — 7.99% | |

| MI Developments, Inc. | | | 210,500 | | | | 4,734,145 | | |

| Thrifts & Mortgage Finance — 8.36% | |

Washington Mutual, Inc.

(Acquired 4/8/2008; Cost $8,800,000) (r) | | | 1,005,714 | | | | 4,958,171 | | |

| TOTAL FINANCIALS | | | 14,234,119 | | |

| | Shares

Held | | Value | |

HEALTH CARE — 7.37%

Pharmaceuticals — 7.37% | |

| AstraZeneca PLC — ADR | | | 59,800 | | | $ | 2,543,294 | | |

| Eli Lilly & Company | | | 12,200 | | | | 563,152 | | |

| Pfizer, Inc. | | | 72,400 | | | | 1,264,828 | | |

| | | | 4,371,274 | | |

| TOTAL HEALTH CARE | | | 4,371,274 | | |

INDUSTRIALS — 17.46%

Commercial Services & Supplies — 10.57% | |

| Hudson Highland Group, Inc. (a) | | | 598,700 | | | | 6,268,389 | | |

| Industrial Conglomerates — 1.99% | |

| Tyco International Limited | | | 29,425 | | | | 1,178,177 | | |

| Machinery — 4.90% | |

| Miller Industries, Inc. (a) | | | 291,398 | | | | 2,902,324 | | |

| TOTAL INDUSTRIALS | | | 10,348,890 | | |

INFORMATION TECHNOLOGY — 18.68%

IT Services — 4.58% | |

| Electronic Data Systems Corporation | | | 110,100 | | | | 2,712,864 | | |

| Software — 14.10% | |

| CA, Inc. | | | 168,300 | | | | 3,886,047 | | |

| Microsoft Corporation | | | 97,900 | | | | 2,693,229 | | |

| Oracle Corporation (a) | | | 84,700 | | | | 1,778,700 | | |

| | | | 8,357,976 | | |

| TOTAL INFORMATION TECHNOLOGY | | | 11,070,840 | | |

MATERIALS — 5.34%

Chemicals — 5.34% | |

| The Dow Chemical Company | | | 65,200 | | | | 2,276,132 | | |

| Eastman Chemical Company | | | 12,900 | | | | 888,294 | | |

| | | | 3,164,426 | | |

| TOTAL MATERIALS | | | 3,164,426 | | |

The accompanying notes are an integral part of these financial statements.

19

Schedule of Investments — June 30, 2008

Hotchkis and Wiley All Cap Value Fund

| | Shares

Held | | Value | |

UTILITIES — 6.97%

Electric Utilities — 6.97% | |

| Entergy Corporation | | | 9,600 | | | $ | 1,156,608 | | |

| Exelon Corporation | | | 33,100 | | | | 2,977,676 | | |

| | | | 4,134,284 | | |

| TOTAL UTILITIES | | | 4,134,284 | | |

Total investments — 98.87%

(Cost $68,753,172) | | | 58,601,935 | | |

| Time deposit* — 3.76% | | | | | 2,227,282 | | |

| Liabilities in excess of other assets — (2.63)% | | | | | (1,557,630 | ) | |

| Net assets — 100.00% | | $ | 59,271,587 | | |

(a) — Non-income producing security.

(r) — Restricted security. Purchased in a private placement transaction; resale to the public may require registration. The total market value of restricted securities was $4,958,171, representing 8.36% of net assets.

ADR — American Depository Receipt.

* — Time deposit with Wells Fargo bears interest at 1.65% and matures on 7/1/2008. Invested through a cash management account administered by Brown Brothers Harriman & Co.

The accompanying notes are an integral part of these financial statements.

20

(This page intentionally left blank)

Statements of Assets & Liabilities

JUNE 30, 2008

| | | Core Value

Fund | | Large Cap Value

Fund | | Mid-Cap Value

Fund | | Small Cap Value

Fund | | All Cap Value

Fund | |

| Assets: | |

| Investments, at value* | |

| Unaffiliated issuers | | $ | 1,317,816,042 | | | $ | 2,670,796,479 | | | $ | 1,794,572,694 | | | $ | 294,248,621 | | | $ | 58,601,935 | | |

| Affiliated issuers | | | — | | | | — | | | | 203,048,009 | | | | 32,123,057 | | | | — | | |

| Collateral for securities on loan | | | 16,192,365 | | | | 32,986,230 | | | | 42,078,445 | | | | 15,204,828 | | | | — | | |

| Time deposit | | | 38,481,674 | | | | 66,290,570 | | | | 40,917,176 | | | | 10,690,356 | | | | 2,227,282 | | |

| Dividends and interest receivable | | | 1,425,467 | | | | 3,031,379 | | | | 3,793,960 | | | | 752,998 | | | | 105,274 | | |

| Receivable for investments sold | | | 2,618,206 | | | | 14,242,976 | | | | 10,083,134 | | | | 2,175,686 | | | | 557,070 | | |

| Receivable for Fund shares sold | | | 4,887,545 | | | | 17,577,206 | | | | 3,245,860 | | | | 450,220 | | | | 3,056 | | |

| Other assets | | | 32,192 | | | | 99,741 | | | | 58,968 | | | | 17,649 | | | | 5,417 | | |

| Total assets | | $ | 1,381,453,491 | | | $ | 2,805,024,581 | | | $ | 2,097,798,246 | | | $ | 355,663,415 | | | $ | 61,500,034 | | |

| Liabilities: | |

| Collateral for securities on loan | | $ | 16,192,365 | | | $ | 32,986,230 | | | $ | 42,078,445 | | | $ | 15,204,828 | | | $ | — | | |

| Payable for investments purchased | | | 11,641,339 | | | | 8,712,714 | | | | 6,902,705 | | | | — | | | | 1,825,535 | | |

| Payable for Fund shares repurchased | | | 4,454,068 | | | | 30,434,619 | | | | 4,644,121 | | | | 303,147 | | | | 199,293 | | |

| Payable to Advisor | | | 875,029 | | | | 1,874,460 | | | | 1,390,542 | | | | 221,720 | | | | 39,892 | | |

| Accrued expenses and other liabilities | | | 1,684,769 | | | | 3,657,643 | | | | 2,112,683 | | | | 300,802 | | | | 163,727 | | |

| Total liabilities | | | 34,847,570 | | | | 77,665,666 | | | | 57,128,496 | | | | 16,030,497 | | | | 2,228,447 | | |

| Net assets | | $ | 1,346,605,921 | | | $ | 2,727,358,915 | | | $ | 2,040,669,750 | | | $ | 339,632,918 | | | $ | 59,271,587 | | |

| Net Assets consist of: | |

| Paid in capital | | $ | 1,954,052,526 | | | $ | 3,700,919,765 | | | $ | 2,833,432,202 | | | $ | 394,964,011 | | | $ | 70,159,402 | | |

| Undistributed net investment income | | | 14,792,750 | | | | 30,050,259 | | | | 7,583,445 | | | | 1,485,015 | | | | 96,308 | | |

| Undistributed net realized gain (loss) on securities | | | (180,294,168 | ) | | | (48,599,968 | ) | | | (192,847,211 | ) | | | 2,175,025 | | | | (832,886 | ) | |

| Net unrealized depreciation of securities | | | (441,945,187 | ) | | | (955,011,141 | ) | | | (607,498,686 | ) | | | (58,991,133 | ) | | | (10,151,237 | ) | |

| Net assets | | $ | 1,346,605,921 | | | $ | 2,727,358,915 | | | $ | 2,040,669,750 | | | $ | 339,632,918 | | | $ | 59,271,587 | | |

Calculation of Net Asset Value Per Share and

Public Offering Price Per Share — Class I | |

| Net assets | | $ | 1,132,685,155 | | | $ | 1,168,499,292 | | | $ | 1,551,863,173 | | | $ | 291,514,715 | | | $ | 22,921,314 | | |

Shares outstanding (unlimited shares $0.001

par value authorized) | | | 118,310,854 | | | | 71,544,741 | | | | 88,958,820 | | | | 9,203,486 | | | | 1,670,814 | | |

| Net asset value per share | | $ | 9.57 | | | $ | 16.33 | | | $ | 17.44 | | | $ | 31.67 | | | $ | 13.72 | | |

| Calculation of Net Asset Value Per Share — Class A | |

| Net assets | | $ | 168,159,853 | | | $ | 1,397,045,266 | | | $ | 415,674,377 | | | $ | 43,959,453 | | | $ | 22,729,392 | | |

Shares outstanding (unlimited shares $0.001

par value authorized) | | | 17,591,004 | | | | 85,993,042 | | | | 23,996,244 | | | | 1,387,231 | | | | 1,658,759 | | |

| Net asset value per share | | $ | 9.56 | | | $ | 16.25 | | | $ | 17.32 | | | $ | 31.69 | | | $ | 13.70 | | |

| Public Offering Price Per Share — Class A | |

| (Net asset value per share divided by 0.9475) | | $ | 10.09 | | | $ | 17.15 | | | $ | 18.28 | | | $ | 33.45 | | | $ | 14.46 | | |

Calculation of Net Asset Value Per Share and

Public Offering Price Per Share — Class C | |

| Net assets | | $ | 45,760,913 | | | $ | 116,946,916 | | | $ | 60,544,129 | | | $ | 4,158,750 | | | $ | 13,620,881 | | |

Shares outstanding (unlimited shares $0.001

par value authorized) | | | 4,864,047 | | | | 7,313,842 | | | | 3,691,206 | | | | 141,609 | | | | 1,033,174 | | |

| Net asset value per share | | $ | 9.41 | | | $ | 15.99 | | | $ | 16.40 | | | $ | 29.37 | | | $ | 13.18 | | |

Calculation of Net Asset Value Per Share and

Public Offering Price Per Share — Class R | |

| Net assets | | | | | | $ | 44,867,441 | | | $ | 12,588,071 | | | | | | | | | | |

Shares outstanding (unlimited shares $0.001

par value authorized) | | | | | | | 2,741,640 | | | | 719,878 | | | | | | | | | | |

| Net asset value per share | | | | | | $ | 16.37 | | | $ | 17.49 | | | | | | | | | | |

| *Cost of investments | |

| Unaffiliated issuers | | $ | 1,759,761,229 | | | $ | 3,625,807,620 | | | $ | 2,254,999,212 | | | $ | 308,567,444 | | | $ | 68,753,172 | | |

| Affiliated issuers | | | — | | | | — | | | | 350,120,177 | | | | 76,795,367 | | | | — | | |

The accompanying notes are an integral part of these financial statements.

22

Statements of Operations

FOR THE YEAR ENDED JUNE 30, 2008

| | | Core Value

Fund | | Large Cap Value

Fund | | Mid-Cap Value

Fund | | Small Cap Value

Fund | | All Cap Value

Fund | |

| Investment income: | |

Dividends*

Unaffiliated issuers | | $ | 46,695,272 | | | $ | 106,826,016 | | | $ | 43,847,045 | | | $ | 5,663,233 | | | $ | 1,546,269 | | |

| Affiliated issuers | | | — | | | | 3,161,545 | | | | 6,680,732 | | | | — | | | | — | | |

| Interest | | | 1,862,936 | | | | 1,840,957 | | | | 1,974,520 | | | | 442,260 | | | | 47,610 | | |

| Securities on loan | | | 48,357 | | | | 71,627 | | | | 1,598,175 | | | | 269,360 | | | | 611 | | |

| Total income | | | 48,606,565 | | | | 111,900,145 | | | | 54,100,472 | | | | 6,374,853 | | | | 1,594,490 | | |

| Expenses: | |

| Advisory fees | | | 15,312,765 | | | | 32,984,290 | | | | 24,208,987 | | | | 3,281,751 | | | | 711,417 | | |

| Professional fees and expenses | | | 74,484 | | | | 158,260 | | | | 125,524 | | | | 33,486 | | | | 21,952 | | |

| Custodian fees and expenses | | | 66,616 | | | | 163,108 | | | | 101,868 | | | | 22,475 | | | | 10,983 | | |

| Transfer agent fees and expenses | | | 2,815,394 | | | | 7,790,797 | | | | 6,381,771 | | | | 1,045,594 | | | | 123,365 | | |

| Accounting fees and expenses | | | 268,076 | | | | 602,599 | | | | 448,715 | | | | 81,955 | | | | 34,194 | | |

| Administration fees and expenses | | | 632,967 | | | | 1,353,146 | | | | 982,719 | | | | 134,953 | | | | 28,743 | | |

| Trustees' fees and expenses | | | 73,843 | | | | 166,056 | | | | 122,226 | | | | 16,455 | | | | 3,617 | | |

| Reports to shareholders | | | 620,517 | | | | 602,927 | | | | 632,756 | | | | 41,565 | | | | 21,579 | | |

| Registration fees | | | 69,558 | | | | 116,259 | | | | 74,915 | | | | 47,320 | | | | 48,234 | | |

| Distribution and service fees — Class A | | | 943,232 | | | | 5,393,790 | | | | 1,732,226 | | | | 173,330 | | | | 94,479 | | |

| Distribution and service fees — Class C | | | 958,966 | | | | 2,616,813 | | | | 1,315,180 | | | | 73,237 | | | | 262,080 | | |

| Distribution and service fees — Class R | | | — | | | | 369,319 | | | | 96,543 | | | | — | | | | — | | |