UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10575

ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: October 31, 2015

Date of reporting period: April 30, 2015

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

APR 04.30.15

SEMI-ANNUAL REPORT

ALLIANCE CALIFORNIA

MUNICIPAL INCOME FUND

(NYSE: AKP)

Investment Products Offered

|

• Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed |

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abglobal.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227-4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AB family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the Adviser of the funds.

The [A/B] logo is service mark of AllianceBernstein and AllianceBernstein® is a registered trademark used by permission of the owner, AllianceBernstein L.P.

June 15, 2015

Semi-Annual Report

This report provides management’s discussion of fund performance for Alliance California Municipal Income Fund (the “Fund”) for the semi-annual reporting period ended April 30, 2015. The Fund is a closed-end fund and its shares are listed and traded on the New York Stock Exchange.

Investment Objectives and Policies

This Fund seeks to provide high current income exempt from regular federal and California state income tax by investing substantially all of its net assets in municipal securities that are exempt from state taxes. The Fund will normally invest at least 80%, and normally substantially all, of its net assets in municipal securities paying interest that is exempt from regular federal and California state income tax. In addition, the Fund normally invests at least 75% of its net assets in investment-grade municipal securities or unrated municipal securities considered to be of comparable quality as determined by the Fund’s investment adviser, AllianceBernstein L.P. (the “Adviser”). The Fund may invest up to 25% of its net assets in municipal securities rated below investment-grade and unrated municipal securities considered to be of comparable quality. The Fund intends to invest primarily in municipal securities that pay interest that is not subject to the federal Alternative Minimum Tax (“AMT”), but may invest without limit in municipal securities paying interest that is subject to the federal AMT. For more information regarding the Fund’s risks, please see “Disclosures and Risks” on pages 4-5 and “Note G—Risks Involved in Investing in the Fund” of the Notes to Financial Statements on pages 28-30.

Investment Results

The table on page 6 provides performance data for the Fund and its benchmark, the Barclays Municipal Bond Index, for the six- and 12-month periods ended April 30, 2015.

The Fund outperformed its benchmark for both periods. During the six-month period, security selection within the leasing and insured sectors contributed to performance versus the benchmark, as did an underweight in the state general obligation sector. Detracting from returns were security selection in the water, transportation and local general obligation sectors and an underweight in health care. For the 12-month period, security selection in the leasing, education and local general obligation sectors contributed, as did an underweight in the state general obligation sector. Security selection in the transportation sector and an underweight in health care detracted from performance.

Leverage, achieved through the usage of both auction rate preferred stock and tender option bonds (“TOBs”), benefited the Fund’s total return and income over both periods. The Fund used interest rate swaps for hedging purposes over both periods, which had an immaterial impact on absolute performance.

Market Review and Investment Strategy

Bond markets experienced substantial volatility during the 12-month period ended April 30, 2015. Oil prices plunged, prompting concerns about global economic growth and deflation

| | | | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | | 1 | |

in many oil-producing regions. So far in 2015, more than 20 central banks worldwide have eased monetary policy and several have engaged in some form of quantitative easing. In response, 10-year Treasury yields fell 29 basis points (“bps”) during the six-month period and 50 bps over the 12-month period. High-grade municipal yields rose slightly by 5 bps over the six-month period and declined 32 bps for the 12-month period. While long-maturity bond yields have fallen, the market has also started to anticipate an increase in the U.S. Federal Funds target rate; consequently, short-maturity municipal yields rose over both periods. Investor demand for municipals has remained positive, but new supply also increased as municipal issuers sold bonds to lower their interest costs by refinancing existing bonds.

Mid-grade and high-yield municipal bonds outperformed comparable high-grade credits as investors seemed to view lower oil prices and easing monetary policy globally to be ultimately beneficial to the health of the U.S. economy.

The State of California’s fiscal situation continues to strengthen with a growing economy, a strong recovery in tax revenues, and continued sound financial management. The State’s economy is growing more rapidly than the rest of the nation, despite negative headlines related to the State’s drought. California, which faced $26 billion deficit in January 2010, has since restrained spending and passed a series of tax increases which together has balanced the State’s budget. As a result, California’s bond ratings have been rising

and the Municipal Bond Investment Team (the “Team”) believes this will continue through 2015. Over the next 12 months, steady revenue collections, which are historically volatile in California due to its progressive income tax, should be a key factor to continued credit improvement. Ongoing fiscal discipline in the budgetary process will also be important, and several events in 2014 signaled continued progress on that front. First, the legislature acted to improve funding of the underfunded teachers’ retirement system by increasing contributions from both the State and local districts. Second, California voters passed an initiative last November which will increase contributions to the State’s rainy day fund and pay down debt more rapidly. California has a history of strained finances, weak governance and more headline risk than most states, yet the State’s general obligation bonds are constitutionally protected and debt service is paid second only after education.

The Fund may purchase municipal securities that are insured under policies issued by certain insurance companies. Historically, insured municipal securities typically received a higher credit rating, which meant that the issuer of the securities paid a lower interest rate. As a result of declines in the credit quality and associated downgrades of most fund insurers, insurance has less value than it did in the past. The market now values insured municipal securities primarily based on the credit quality of the issuer of the security with little value given to the insurance feature. In purchasing such insured securities, the Adviser evaluates the risk and

| | |

| 2 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

return of municipal securities through its own research. If an insurance company’s rating is downgraded or the company becomes insolvent, the prices of municipal securities insured by the insurance company may decline. As of April 30, 2015, the Fund’s percentages of investments in municipal bonds that are insured and in insured municipal bonds that have been pre-refunded or escrowed to maturity were 14.75% and 0.00%, respectively.

Since February 2008, auctions of the Preferred Shares have had fewer buyers than sellers and, as a result, the auctions have “failed”. The failed auctions did not lower the credit quality of the Preferred Shares, but rather meant that a holder was unable to sell the Preferred Shares in the auctions, so that there was a loss of liquidity for the holders of the Preferred Shares. When an auction fails, the Preferred Shares pay interest on a formula-based maximum rate based on AA-commercial paper and short-term municipal bond rates. In the extremely low short-term interest rate environment of recent years, the interest rates resulting from such formula have been much lower than the returns on the Fund’s investments and the cost of alternative forms of leverage available to the Fund. However, to the extent that the cost of this leverage increases in the

future and earnings from the Fund’s investments do not increase, the Fund’s net investment returns may decline. On May 5, 2015, the Fund announced that the Fund’s Board of Directors had unanimously approved a voluntary tender offer to purchase up to 100% of the Fund’s outstanding auction rate preferred shares (“APS”) at a price per share equal to 90% of the liquidation preference of $25,000 per share (or $22,500 per share), plus any unpaid dividends accrued through the expiration date of the tender offer.

The Fund’s tender offer will be conditioned upon the successful private placement of new preferred shares and certain other conditions as will be set forth in the Fund’s offer to purchase and related letter of transmittal. Additional terms of each tender offer will be set forth in each Fund’s tender offer materials when they are filed and become available. The new preferred shares, if successfully placed, will allow the Fund to replace the leverage currently obtained through tendered APS with new preferred shares. The Adviser and the Board of Directors of the Fund believe the tender offer and proposed issuance of preferred shares is in the best interests of the Fund and its stockholders.

| | | | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | | 3 | |

DISCLOSURES AND RISKS

Alliance California Municipal Income Fund Shareholder Information

Weekly comparative net asset value (“NAV”) and market price information about the Fund is published each Saturday in Barron’s and in other newspapers in a table called “Closed End Funds”. Daily NAVs and market price information, and additional information regarding the Fund, is available at www.abglobal.com and www.nyse.com. For additional shareholder information regarding this Fund, please see page 41.

Benchmark Disclosure

The unmanaged Barclays Municipal Bond Index does not reflect fees and expenses associated with the active management of a fund portfolio. The Barclays Municipal Bond Index represents the performance of the long-term tax-exempt bond market consisting of investment grade bonds. An investor cannot invest directly in an index, and its results are not indicative of the performance for any specific investment, including the Fund. In addition, the Index does not reflect the use of leverage, whereas the Fund utilizes leverage.

A Word About Risk

Among the risks of investing in the Fund are changes in the general level of interest rates or changes in bond credit quality ratings. Changes in interest rates have a greater effect on bonds with longer maturities than on those with shorter maturities. Please note, as interest rates rise, existing bond prices fall and can cause the value of your investment in the Fund to decline. While the Fund invests principally in bonds and other fixed-income securities, in order to achieve its investment objectives, the Fund may at times use certain types of investment derivatives, such as options, futures, forwards and swaps. These instruments involve risks different from, and in certain cases, greater than, the risks presented by more traditional investments. At the discretion of the Fund’s Adviser, the Fund may invest up to 25% of its net assets in municipal bonds that are rated below investment grade (i.e., “junk bonds”). These securities involve greater volatility and risk than higher-quality fixed-income securities. The Fund will invest substantially all of its net assets in California Municipal Bonds and is therefore susceptible to political, economic or regulatory factors specifically affecting California municipal bond issuers.

Leverage Risk: The Fund uses financial leverage for investment purposes, which involves leverage risk. The Fund’s outstanding APS results in leverage. The Fund may also use other types of financial leverage, including TOBs, either in combination with, or in lieu of, the APS. The Fund utilizes leverage to seek to enhance the yield and NAV attributable to its Common Stock. These objectives may not be achieved in all interest rate environments. Leverage creates certain risks for holders of Common Stock, including the likelihood of greater volatility of the net asset value and market price of the Common Stock. If income from the securities purchased from the funds made available by leverage is not sufficient to cover the cost of leverage, the Fund’s return will be less than if leverage had not been used. As a result, the amounts available for distribution to Common Stockholders as dividends and other distributions will be reduced. During periods of rising short-term interest rates, the interest paid on the APS or the floaters issued in connection with the Fund’s TOB transactions would increase. In addition, the interest paid on inverse floaters held by the Fund, whether issued in connection with the Fund’s TOB transactions or purchased in a secondary market transaction, would decrease. Under such circumstances, the Fund’s income and distributions to Common Stockholders may decline, which would adversely affect the Fund’s yield and possibly the market value of its shares.

Tax Risk: There is no guarantee that all of the Fund’s income will remain exempt from federal or state income taxes. From time to time, the U.S. Government and the U.S. Congress consider changes in federal tax law that could limit or eliminate the federal tax exemption for municipal bond income, which would in effect reduce the net income received by shareholders from the Fund by increasing taxes on that income. In such event, the Fund’s NAV could also decline as yields on municipal bonds, which are typically lower than those on taxable bonds, would be expected to increase to approximately the yield of comparable bonds.

(Disclosures, Risks and Note about Historical Performance continued on next page)

| | |

| 4 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Disclosures and Risks

DISCLOSURES AND RISKS

(continued from previous page)

Market Risk: The value of the Fund’s assets will fluctuate as the bond market fluctuates. The value of the Fund’s investments may decline, sometimes rapidly and unpredictably, simply because of economic changes or other events that affect large portions of the market.

Credit Risk: An issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other contract, may be unable or unwilling to make timely payments of interest or principal, or to otherwise honor its obligations. The issuer or guarantor may default, causing a loss of the full principal amount of a security. The degree of risk for a particular security may be reflected in its credit rating. There is the possibility that the credit rating of a fixed-income security may be downgraded after purchase, which may adversely affect the value of the security. Investments in fixed- income securities with lower ratings tend to have a higher probability that an issuer will default or fail to meet its payment obligations.

Interest Rate Risk: Changes in interest rates will affect the value of investments in fixed-income securities. When interest rates rise, the value of investments in fixed- income securities tends to fall and this decrease in value may not be offset by higher income from new investments. Interest rate risk is generally greater for fixed-income securities with longer maturities or durations.

Inflation Risk: This is the risk that the value of assets or income from investments will be less in the future as inflation decreases the value of money. As inflation increases, the value of the Fund’s assets can decline as can the value of the Fund’s distributions. This risk is significantly greater for fixed-income securities with longer maturities.

Liquidity Risk: Liquidity risk occurs when certain investments become difficult purchase or sell. Difficulty in selling less liquid securities may result in sales at disadvantageous prices affecting the value of your investment in the Fund. Causes of liquidity risk may include low trading volumes, large positions and heavy redemptions of Fund shares. Over recent years liquidity risk has also increased because the capacity of dealers in the secondary market for fixed-income securities to make markets in these securities has decreased, even as the overall bond market has grown significantly, due to, among other things, structural changes, additional regulatory requirements and capital and risk restraints that have led to reduced inventories. Liquidity risk may be higher in a rising interest rate environment, when the value and liquidity of fixed-income securities generally go down.

Duration Risk: Duration is a measure that relates the expected price volatility of a fixed-income security to changes in interest rates. The duration of a fixed-income security may be shorter than or equal to full maturity of a fixed-income security. Fixed-income securities with longer durations have more risk and will decrease in price as interest rates rise. For example, a fixed-income security with a duration of three years will decrease in value by approximately 3% if interest rates increase by 1%.

Derivatives Risk: Investments in derivatives may be illiquid, difficult to price, and leveraged so that small changes may produce disproportionate losses for the Fund, and may be subject to counterparty risk to a greater degree than more traditional investments.

Management Risk: The Fund is subject to management risk because it is an actively managed investment fund. The Adviser will apply its investment techniques and risk analyses in making investment decisions, but there is no guarantee that its techniques will produce the intended results.

An Important Note About Historical Performance

The performance on the following page represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. All fees and expenses related to the operation of the Fund have been deducted. Performance assumes reinvestment of distributions and does not account for taxes.

| | | | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | | 5 | |

Disclosures and Risks

HISTORICAL PERFORMANCE

| | | | | | | | | | |

| | | | | | | | | | |

THE FUND VS. ITS BENCHMARK PERIODS ENDED APRIL 30, 2015 (unaudited) | | Returns | | | |

| | 6 Months | | | 12 Months | | | |

| Alliance California Municipal Income Fund (NAV) | | | 1.94% | | | | 9.06% | | | |

|

| Barclays Municipal Bond Index | | | 1.17% | | | | 4.80% | | | |

|

| The Fund’s market price per share on April 30, 2015 was $14.07. The Fund’s NAV price per share on April 30, 2015 was $14.88. For additional Financial Highlights, please see page 32. |

| | | | | | | | | | |

See Disclosures, Risks and Note about Historical Performance on pages 4-5.

| | |

| 6 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Historical Performance

PORTFOLIO SUMMARY

April 30, 2015 (unaudited)

PORTFOLIO STATISTICS

Net Assets ($mil): $127.3

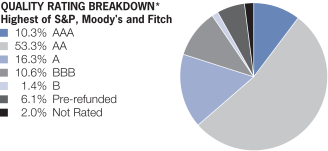

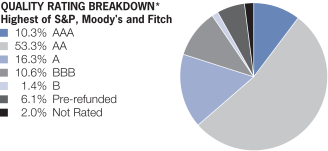

| * | | All data are as of April 30, 2015. The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the Standard & Poor’s Ratings Services (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Portfolio considers the credit ratings issued by S&P, Moody’s, and Fitch and uses the highest rating issued by the agencies. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by U.S. government securities and therefore are deemed high-quality investment grade by the Adviser. If applicable, Not Applicable (N/A) includes non credit worthy investments; such as, equities, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment. |

| | | | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | | 7 | |

Portfolio Summary

PORTFOLIO OF INVESTMENTS

April 30, 2015 (unaudited)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | |

MUNICIPAL OBLIGATIONS – 163.2% | | | | | | | | |

Long-Term Municipal Bonds – 163.2% | | | | | | | | |

California – 148.1% | | | | | | | | |

Abag Finance Authority for Nonprofit Corps.

(Bijou Woods Associates LP)

Series 2001A

5.30%, 12/01/31 | | $ | 2,735 | | | $ | 2,735,711 | |

Anaheim Public Financing Authority

(City of Anaheim CA Lease)

Series 2014A

5.00%, 5/01/33-5/01/39 | | | 4,750 | | | | 5,342,355 | |

Banning Utility Authority

NATL Series 2005

5.25%, 11/01/30 | | | 1,850 | | | | 1,966,476 | |

Bay Area Toll Authority

Series 2013S

5.00%, 4/01/33 | | | 5,000 | | | | 5,635,250 | |

Beaumont Financing Authority

AMBAC Series 2007C

5.00%, 9/01/26 | | | 755 | | | | 781,032 | |

Bellflower Redevelopment Agency

(9920 Flora Vista LP)

Series 2002A

5.50%, 6/01/35 | | | 2,850 | | | | 2,850,029 | |

California Econ Recovery

Series 2009A

5.25%, 7/01/19 (Pre-refunded/ETM) | | | 535 | | | | 623,987 | |

California Educational Facilities Authority

(University of the Pacific)

Series 2006

5.00%, 11/01/21 | | | 260 | | | | 265,769 | |

California Municipal Finance Authority

(Azusa Pacific University)

Series 2015B

5.00%, 4/01/35-4/01/41 | | | 2,040 | | | | 2,190,898 | |

California Pollution Control Financing Authority (Poseidon Resources Channelside LP)

Series 2012

5.00%, 7/01/37(a) | | | 3,450 | | | | 3,588,448 | |

California School Finance Authority

(Alliance College-Ready Public Schools Facilities Corp.)

Series 2015A

5.00%, 7/01/30(a) | | | 1,700 | | | | 1,842,137 | |

California State Public Works Board

Series 2011G

5.25%, 12/01/21 (Pre-refunded/ETM) | | | 6,000 | | | | 7,403,100 | |

| | |

| 8 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Portfolio of Investments

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | |

California State Public Works Board

(California State Public Works Board Lease)

XLCA Series 2005B

5.00%, 11/01/30 | | $ | 3,500 | | | $ | 3,571,750 | |

California Statewide Communities Development Authority

(Bentley School)

Series 2010A

7.00%, 7/01/40 | | | 2,625 | | | | 2,915,220 | |

California Statewide Communities Development Authority

(Buck Institute for Research on Aging) AGM Series 2014

5.00%, 11/15/44 | | | 4,000 | | | | 4,468,760 | |

California Statewide Communities Development Authority

(Collis P. and Howard Huntington Memorial Hospital Trust)

Series 2014B

5.00%, 7/01/44 | | | 1,000 | | | | 1,109,150 | |

City of Los Angeles Department of Airports

(Los Angeles Intl Airport)

Series 2009A

5.25%, 5/15/29 | | | 1,700 | | | | 1,947,537 | |

Series 2010A

5.00%, 5/15/27 | | | 1,440 | | | | 1,680,163 | |

City of San Francisco CA Public Utilities Commission Wastewater Revenue

Series 2013B

5.00%, 10/01/32 | | | 4,735 | | | | 5,383,127 | |

Fullerton Redevelopment Agency Successor Agency

(Marshall B Ketchum University)

AGC Series 2004

5.00%, 4/01/21 | | | 2,050 | | | | 2,193,480 | |

Garden Grove Unified School District

Series 2013C

5.00%, 8/01/34 | | | 3,650 | | | | 4,122,346 | |

Grossmont-Cuyamaca CCD CA GO

AGC

5.00%, 8/01/22-8/01/23(b) | | | 6,000 | | | | 6,744,670 | |

Jurupa Public Financing Authority

Series 2014A

5.00%, 9/01/30-9/01/32 | | | 2,475 | | | | 2,807,954 | |

Long Beach Bond Finance Authority

(Aquarium of the Pacific)

Series 2012

5.00%, 11/01/27 | | | 3,500 | | | | 4,055,170 | |

Los Angeles Community College District/CA

Series 2008F-1

5.00%, 8/01/18 (Pre-refunded/ETM) | | | 4,200 | | | | 4,739,784 | |

| | | | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | | 9 | |

Portfolio of Investments

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | |

Los Angeles Community Redevelopment Agency

AMBAC Series 2002A

5.375%, 12/01/26 | | $ | 6,635 | | | $ | 6,655,900 | |

Los Angeles County Metropolitan Transportation Authority

Series 2009

5.00%, 7/01/25 | | | 6,700 | | | | 7,711,298 | |

Series 2013B

5.00%, 7/01/33 | | | 1,675 | | | | 1,926,150 | |

Los Angeles County Sanitation Districts Financing Authority

Series 2015A

5.00%, 10/01/33(c) | | | 1,400 | | | | 1,568,966 | |

Los Angeles Department of Water & Power WTR

Series 2013B

5.00%, 7/01/32 | | | 6,185 | | | | 7,122,089 | |

Norco Community Redevelopment Agency Successor Agency

(Norco Redevelopment Agency Project No 1)

Series 2010

5.875%, 3/01/32 | | | 420 | | | | 483,382 | |

6.00%, 3/01/36 | | | 325 | | | | 375,284 | |

Peralta Community College District

Series 2014A

4.00%, 8/01/31 | | | 4,100 | | | | 4,323,450 | |

Port of Los Angeles

Series 2009C

5.00%, 8/01/26 | | | 5,550 | | | | 6,379,281 | |

Richmond Community Redevelopment Agency

Series 2010A

5.75%, 9/01/24-9/01/25 | | | 530 | | | | 624,108 | |

6.00%, 9/01/30 | | | 370 | | | | 437,788 | |

Riverside County Transportation Commission

Series 2013A

5.25%, 6/01/32 | | | 2,000 | | | | 2,348,640 | |

Sacramento City Unified School District/CA

Series 2011

5.50%, 7/01/29 | | | 4,000 | | | | 4,725,600 | |

San Bernardino County Transportation Authority

5.00%, 3/01/32-3/01/34(b) | | | 6,040 | | | | 6,941,698 | |

San Diego County Water Authority Financing Corp.

Series 2013

5.00%, 5/01/31 | | | 4,300 | | | | 4,988,645 | |

San Diego Public Facilities Financing Authority

Series 2010A

5.10%, 9/01/29 | | | 2,360 | | | | 2,700,619 | |

| | |

| 10 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Portfolio of Investments

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | |

San Diego Unified School District/CA

Series 2013C

5.00%, 7/01/32 | | $ | 5,125 | | | $ | 5,762,806 | |

San Francisco Bay Area Rapid Transit District

Series 2012A

5.00%, 7/01/36 | | | 3,730 | | | | 4,189,163 | |

San Francisco Municipal Transportation Agency

Series 2013

5.00%, 3/01/28-3/01/31 | | | 6,070 | | | | 6,976,529 | |

San Joaquin Hills Transportation Corridor Agency

Series 2014A

5.00%, 1/15/44 | | | 3,900 | | | | 4,282,980 | |

San Mateo Joint Powers Financing Authority

Series 2014

5.00%, 6/15/31 | | | 1,250 | | | | 1,442,588 | |

San Mateo Union High School District

Series 2013A

5.00%, 9/01/33 | | | 4,180 | | | | 4,758,470 | |

Southern California Public Power Authority

(Los Angeles Department of Water & Power PWR)

Series 2010

5.00%, 7/01/27 | | | 2,525 | | | | 2,895,190 | |

State of California

Series 2013

5.00%, 11/01/31 | | | 2,000 | | | | 2,314,020 | |

Turlock Irrigation District

Series 2011

5.50%, 1/01/41 | | | 1,200 | | | | 1,377,804 | |

University of California

Series 2012G

5.00%, 5/15/31 | | | 8,000 | | | | 9,231,440 | |

Walnut Energy Center Authority

Series 2014

5.00%, 1/01/33 | | | 2,500 | | | | 2,843,950 | |

Westlands Water District

AGM Series 2012A

5.00%, 9/01/34 | | | 2,000 | | | | 2,216,720 | |

| | | | | | | | |

| | | | | | | 188,568,861 | |

| | | | | | | | |

Florida – 2.4% | | | | | | | | |

Miami Beach Health Facilities Authority

(Mount Sinai Medical Center of Florida, Inc.)

Series 2014

5.00%, 11/15/39 | | | 2,750 | | | | 2,991,505 | |

| | | | | | | | |

| | |

Guam – 1.7% | | | | | | | | |

Guam Power Authority

Series 2012A

5.00%, 10/01/34 | | | 2,000 | | | | 2,171,560 | |

| | | | | | | | |

| | | | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | | 11 | |

Portfolio of Investments

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | |

Indiana – 0.9% | | | | | | | | |

Richmond Hospital Authority

(Reid Hospital & Health Care Services, Inc.)

Series 2015

5.00%, 1/01/39 | | $ | 1,000 | | | $ | 1,091,960 | |

| | | | | | | | |

| | |

Missouri – 0.9% | | | | | | | | |

Joplin Industrial Development Authority

(Freeman Health System)

Series 2015

5.00%, 2/15/35 | | | 1,000 | | | | 1,098,200 | |

| | | | | | | | |

| | |

Nevada – 1.6% | | | | | | | | |

Henderson Local Improvement Districts

AGM Series 2007A

5.00%, 3/01/18 | | | 1,880 | | | | 2,051,719 | |

| | | | | | | | |

| | |

New Jersey – 2.3% | | | | | | | | |

New Jersey State Turnpike Authority

Series 2014A

5.00%, 1/01/33 | | | 2,600 | | | | 2,940,132 | |

| | | | | | | | |

| | |

New York – 4.2% | | | | | | | | |

Metropolitan Transportation Authority

Series 2014C

5.00%, 11/15/32 | | | 4,745 | | | | 5,395,682 | |

| | | | | | | | |

| | |

Ohio – 0.3% | | | | | | | | |

Columbiana County Port Authority

(Apex Environmental LLC)

Series 2004

10.635%, 8/01/25 | | | 49 | | | | 38,958 | |

Series 2004A

7.125%, 8/01/25(d) | | | 500 | | | | 399,695 | |

| | | | | | | | |

| | | | | | | 438,653 | |

| | | | | | | | |

Pennsylvania – 0.8% | | | | | | | | |

Pennsylvania Economic Development Financing Authority

(PA Bridges Finco LP)

Series 2015

5.00%, 12/31/38 | | | 1,000 | | | | 1,078,930 | |

| | | | | | | | |

| | |

Total Investments – 163.2%

(cost $194,726,737) | | | | | | | 207,827,202 | |

Other assets less liabilities – (6.2)% | | | | | | | (7,951,200 | ) |

Preferred Shares at liquidation value – (57.0)% | | | | | | | (72,550,000 | ) |

| | | | | | | | |

| | |

Net Assets Applicable to Common Shareholders – 100.0%(e) | | | | | | $ | 127,326,002 | |

| | | | | | | | |

| | |

| 12 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Portfolio of Investments

INTEREST RATE SWAPS (see Note C)

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Rate Type | | | | |

Swap

Counterparty | | Notional

Amount

(000) | | | Termination

Date | | | Payments

made

by the Fund | | | Payments

received

by the

Fund | | | Unrealized

Appreciation/

(Depreciation) | |

Merrill Lynch Capital Services, Inc. | | $ | 2,300 | | | | 10/21/16 | | | | SIFMA | * | | | 4.129 | % | | $ | 133,654 | |

| * | | Variable interest rate based on the Securities Industry & Financial Markets Association (SIFMA) Municipal Swap Index. |

| (a) | | Security is exempt from registration under Rule 144A of the Securities Act of 1933. These securities are considered liquid and may be resold in transactions exempt from registration, normally to qualified institutional buyers. At April 30, 2015, the aggregate market value of these securities amounted to $5,430,585 or 4.3% of net assets. |

| (b) | | Security represents the underlying municipal obligation of an inverse floating rate obligation held by the Fund (see Note I). |

| (c) | | When-Issued or delayed delivery security. |

| (e) | | Portfolio percentages are calculated based on net assets applicable to common shareholders. |

As of April 30, 2015, the Fund’s percentages of investments in municipal bonds that are insured and in insured municipal bonds that have been pre-refunded or escrowed to maturity are 14.8% and 0.0%, respectively

Glossary:

AGC – Assured Guaranty Corporation

AGM – Assured Guaranty Municipal

AMBAC – Ambac Assurance Corporation

CCD – Community College District

ETM – Escrowed to Maturity

GO – General Obligation

NATL – National Interstate Corporation

XLCA – XL Capital Assurance Inc.

See notes to financial statements.

| | | | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | | 13 | |

Portfolio of Investments

STATEMENT OF ASSETS & LIABILITIES

April 30, 2015 (unaudited)

| | | | |

| Assets | | | | |

Investments in securities, at value | | | | |

Unaffiliated issuers (cost $194,726,737) | | $ | 207,827,202 | |

Interest receivable | | | 2,899,646 | |

Unrealized appreciation on interest rate swaps | | | 133,654 | |

| | | | |

Total assets | | | 210,860,502 | |

| | | | |

| Liabilities | | | | |

Due to custodian | | | 747,467 | |

Payable for floating rate notes issued* | | | 8,450,000 | |

Payable for investment securities purchased | | | 1,598,618 | |

Advisory fee payable | | | 107,764 | |

Dividends payable—preferred shares | | | 653 | |

Accrued expenses | | | 79,998 | |

| | | | |

Total liabilities | | | 10,984,500 | |

| | | | |

| Preferred Shares, at Liquidation Value | | | | |

Preferred shares, $.001 par value per share; 3,240 shares authorized, 2,902 shares issued and outstanding at $25,000 per share liquidation preference | | | 72,550,000 | |

| | | | |

Net Assets Applicable to Common Shareholders | | $ | 127,326,002 | |

| | | | |

| Composition of Net Assets Applicable to Common Shareholders | | | | |

Common stock, $.001 par value per share; 1,999,996,760 shares authorized, 8,554,668 shares issued and outstanding | | $ | 8,555 | |

Additional paid-in capital | | | 119,931,948 | |

Undistributed net investment income | | | 66,480 | |

Accumulated net realized loss on investment transactions | | | (5,915,100 | ) |

Net unrealized appreciation on investments | | | 13,234,119 | |

| | | | |

Net Assets Applicable to Common Shareholders | | $ | 127,326,002 | |

| | | | |

Net Asset Value Applicable to Common Shareholders

(based on 8,554,668 common shares outstanding) | | $ | 14.88 | |

| | | | |

| * | | Represents short-term floating rate certificates issued by tender option bond trusts (see Note H). |

See notes to financial statements.

| | |

| 14 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Statement of Assets & Liabilities

STATEMENT OF OPERATIONS

Six Months Ended April 30, 2015 (unaudited)

| | | | | | | | |

| Investment Income | | | | | | | | |

Interest | | $ | 4,100,097 | | | | | |

Dividends—Affiliated issuers | | | 181 | | | $ | 4,100,278 | |

| | | | | | | | |

| Expenses | | | | | | | | |

Advisory fee (see Note B) | | | 650,361 | | | | | |

Preferred Shares-auction agent’s fees | | | 22,478 | | | | | |

Custodian | | | 43,798 | | | | | |

Audit and tax | | | 30,697 | | | | | |

Directors’ fees | | | 27,724 | | | | | |

Printing | | | 14,922 | | | | | |

Legal | | | 12,625 | | | | | |

Registration fees | | | 11,779 | | | | | |

Transfer agency | | | 5,110 | | | | | |

Miscellaneous | | | 29,374 | | | | | |

| | | | | | | | |

Total expenses before interest expense and fees | | | 848,868 | | | | | |

Interest expense and fees | | | 30,827 | | | | | |

| | | | | | | | |

Total expenses | | | 879,695 | | | | | |

| | | | | | | | |

Net investment income | | | | | | | 3,220,583 | |

| | | | | | | | |

| Realized and Unrealized Gain (Loss) on Investment Transactions | | | | | | | | |

Net realized gain on: | | | | | | | | |

Investment transactions | | | | | | | 1,269,382 | |

Swaps | | | | | | | 70,607 | |

Net change in unrealized

appreciation/depreciation of: | | | | | | | | |

Investments | | | | | | | (2,250,899 | ) |

Swaps | | | | | | | (62,358 | ) |

| | | | | | | | |

Net loss on investment transactions | | | | | | | (973,268 | ) |

| | | | | | | | |

| Dividends to Preferred Shareholders from | | | | | | | | |

Net investment income | | | | | | | (40,004 | ) |

| | | | | | | | |

Net Increase in Net Assets Applicable to Common Shareholders Resulting from Operations | | | | | | $ | 2,207,311 | |

| | | | | | | | |

See notes to financial statements.

| | | | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | | 15 | |

Statement of Operations

STATEMENT OF CHANGES IN NET ASSETS

APPLICABLE TO COMMON SHAREHOLDERS

| | | | | | | | |

| | | Six Months Ended

April 30, 2015

(unaudited) | | | Year Ended

October 31,

2014 | |

| Increase (Decrease) in Net Assets Applicable to Common Shareholders Resulting from Operations | | | | | | | | |

Net investment income | | $ | 3,220,583 | | | $ | 6,549,594 | |

Net realized gain (loss) on investment transactions | | | 1,339,989 | | | | (2,335,881 | ) |

Net change in unrealized appreciation/depreciation of investments | | | (2,313,257 | ) | | | 12,732,679 | |

| Dividends to Preferred Shareholders from | | | | | | | | |

Net investment income | | | (40,004 | ) | | | (75,495 | ) |

| | | | | | | | |

Net increase in net assets applicable to common shareholders resulting from operations | | | 2,207,311 | | | | 16,870,897 | |

| Dividends and Distributions to Common Shareholders from | | | | | | | | |

Net investment income | | | (3,218,266 | ) | | | (6,436,532 | ) |

| | | | | | | | |

Total increase (decrease) | | | (1,010,955 | ) | | | 10,434,365 | |

| Net Assets Applicable to Common Shareholders | | | | | | | | |

Beginning of period | | | 128,336,957 | | | | 117,902,592 | |

| | | | | | | | |

End of period (including undistributed net investment income of $66,480 and $104,167, respectively) | | $ | 127,326,002 | | | $ | 128,336,957 | |

| | | | | | | | |

See notes to financial statements.

| | |

| 16 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Statement of Changes in Net Assets

NOTES TO FINANCIAL STATEMENTS

April 30, 2015 (unaudited)

NOTE A

Significant Accounting Policies

Alliance California Municipal Income Fund, Inc. (the “Fund”) was incorporated in the State of Maryland on November 9, 2001 and is registered under the Investment Company Act of 1940 as a diversified, closed-end management investment company. The financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) which require management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and amounts of income and expenses during the reporting period. Actual results could differ from those estimates. The Fund is an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies. The following is a summary of significant accounting policies followed by the Fund.

1. Security Valuation

Portfolio securities are valued at their current market value determined on the basis of market quotations or, if market quotations are not readily available or are deemed unreliable, at “fair value” as determined in accordance with procedures established by and under the general supervision of the Fund’s Board of Directors (the “Board”).

In general, the market values of securities which are readily available and deemed reliable are determined as follows: securities listed on a national securities exchange (other than securities listed on the NASDAQ Stock Market, Inc. (“NASDAQ”)) or on a foreign securities exchange are valued at the last sale price at the close of the exchange or foreign securities exchange. If there has been no sale on such day, the securities are valued at the last traded price from the previous day. Securities listed on more than one exchange are valued by reference to the principal exchange on which the securities are traded; securities listed only on NASDAQ are valued in accordance with the NASDAQ Official Closing Price; listed or over the counter (“OTC”) market put or call options are valued at the mid level between the current bid and ask prices. If either a current bid or current ask price is unavailable, AllianceBernstein L.P. (the “Adviser”) will have discretion to determine the best valuation (e.g. last trade price in the case of listed options); open futures are valued using the closing settlement price or, in the absence of such a price, the most recent quoted bid price. If there are no quotations available for the day of valuation, the last available closing settlement price is used; U.S. Government securities and any other debt instruments having 60 days or less remaining until maturity are generally valued at market by an independent pricing vendor, if a market price is available. If a market price is not available, the securities are valued at amortized cost. This methodology is commonly used for short term securities that have an original maturity of 60 days or less, as well as short term securities that had an original term to maturity that exceeded 60 days. In instances when amortized cost is utilized, the Valuation Committee (the “Committee”) must reasonably conclude that the utilization of amortized cost is approximately

| | | | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | | 17 | |

Notes to Financial Statements

the same as the fair value of the security. Such factors the Committee will consider include, but are not limited to, an impairment of the creditworthiness of the issuer or material changes in interest rates. Fixed-income securities, including mortgage-backed and asset-backed securities, may be valued on the basis of prices provided by a pricing service or at a price obtained from one or more of the major broker-dealers. In cases where broker-dealer quotes are obtained, the Adviser may establish procedures whereby changes in market yields or spreads are used to adjust, on a daily basis, a recently obtained quoted price on a security. Swaps and other derivatives are valued daily, primarily using independent pricing services, independent pricing models using market inputs, as well as third party broker-dealers or counterparties. Investment companies are valued at their net asset value each day.

Securities for which market quotations are not readily available (including restricted securities) or are deemed unreliable are valued at fair value. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the issuer, analysts, analysis of the issuer’s financial statements or other available documents. In addition, the Fund may use fair value pricing for securities primarily traded in non-U.S. markets because most foreign markets close well before the Fund values its securities at 4:00 p.m., Eastern Time. The earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred in the interim and may materially affect the value of those securities.

2. Fair Value Measurements

In accordance with U.S. GAAP regarding fair value measurements, fair value is defined as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. U.S. GAAP establishes a framework for measuring fair value, and a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability (including those valued based on their market values as described in Note A.1 above). Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability based on the best information available in the circumstances. Each investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-tier hierarchy of inputs is summarized below.

| | • | | Level 1—quoted prices in active markets for identical investments |

| | • | | Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| | • | | Level 3—significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

| | |

| 18 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Notes to Financial Statements

The fair value of debt instruments, such as bonds, and over-the-counter derivatives is generally based on market price quotations, recently executed market transactions (where observable) or industry recognized modeling techniques and are generally classified as Level 2. Pricing vendor inputs to Level 2 valuations may include quoted prices for similar investments in active markets, interest rate curves, coupon rates, currency rates, yield curves, option adjusted spreads, default rates, credit spreads and other unique security features in order to estimate the relevant cash flows which are then discounted to calculate fair values. If these inputs are unobservable and significant to the fair value, these investments will be classified as Level 3. In addition, non-agency rated investments are classified as Level 3.

Other fixed income investments, including non-U.S. government and corporate debt, are generally valued using quoted market prices, if available, which are typically impacted by current interest rates, maturity dates and any perceived credit risk of the issuer. Additionally, in the absence of quoted market prices, these inputs are used by pricing vendors to derive a valuation based upon industry or proprietary models which incorporate issuer specific data with relevant yield/spread comparisons with more widely quoted bonds with similar key characteristics. Those investments for which there are observable inputs are classified as Level 2. Where the inputs are not observable, the investments are classified as Level 3.

The following table summarizes the valuation of the Fund’s investments by the above fair value hierarchy levels as of April 30, 2015:

| | | | | | | | | | | | | | | | |

Investments in

Securities: | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | |

Long-Term Municipal Bonds | | $ | – 0 | – | | $ | 203,692,297 | | | $ | 4,134,905 | | | $ | 207,827,202 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | | – 0 | – | | | 203,692,297 | | | | 4,134,905 | | | | 207,827,202 | |

Other Financial Instruments*: | | | | | | | | | | | | | | | | |

Assets: | | | | | | | | | | | | | | | | |

Interest Rate Swaps | | | – 0 | – | | | 133,654 | | | | – 0 | – | | | 133,654 | |

Liabilities | | | – 0 | – | | | – 0 | – | | | – 0 | – | | | – 0 | – |

| | | | | | | | | | | | | | | | |

Total+ | | $ | – 0 | – | | $ | 203,825,951 | | | $ | 4,134,905 | | | $ | 207,960,856 | |

| | | | | | | | | | | | | | | | |

| * | | Other financial instruments are derivative instruments, such as futures, forwards and swaps, which are valued at the unrealized appreciation/depreciation on the instrument. |

| + | | There were no transfers between any levels during the reporting period. |

The Fund recognizes all transfers between levels of the fair value hierarchy assuming the financial instruments were transferred at the beginning of the reporting period.

| | | | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | | 19 | |

Notes to Financial Statements

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value.

| | | | | | | | |

| | | Long-Term Municipal

Bonds | | | Total | |

Balance as of 10/31/14 | | $ | 4,126,633 | | | $ | 4,126,633 | |

Accrued discounts/(premiums) | | | (1,022 | ) | | | (1,022 | ) |

Realized gain (loss) | | | – 0 | – | | | – 0 | – |

Change in unrealized appreciation/depreciation | | | (8,518 | ) | | | (8,518 | ) |

Purchases | | | 17,812 | | | | 17,812 | |

Sales | | | – 0 | – | | | – 0 | – |

Transfers in to Level 3 | | | – 0 | – | | | – 0 | – |

Transfers out of Level 3 | | | – 0 | – | | | – 0 | – |

| | | | | | | | |

Balance as of 4/30/15 | | $ | 4,134,905 | | | $ | 4,134,905 | |

| | | | | | | | |

Net change in unrealized appreciation/depreciation from Investments held as of 4/30/15* | | $ | (8,518 | ) | | $ | (8,518 | ) |

| | | | | | | | |

| * | | The unrealized appreciation/depreciation is included in net change in unrealized appreciation/depreciation of investments in the accompanying statement of operations. |

As of April 30, 2015 all Level 3 securities were priced by third party vendors or using prior transaction, which approximates fair value.

The Adviser established the Committee to oversee the pricing and valuation of all securities held in the Fund. The Committee operates under pricing and valuation policies and procedures established by the Adviser and approved by the Board, including pricing policies which set forth the mechanisms and processes to be employed on a daily basis to implement these policies and procedures. In particular, the pricing policies describe how to determine market quotations for securities and other instruments. The Committee’s responsibilities include: 1) fair value and liquidity determinations (and oversight of any third parties to whom any responsibility for fair value and liquidity determinations is delegated), and 2) regular monitoring of the Adviser’s pricing and valuation policies and procedures and modification or enhancement of these policies and procedures (or recommendation of the modification of these policies and procedures) as the Committee believes appropriate.

The Committee is also responsible for monitoring the implementation of the pricing policies by the Adviser’s Pricing Group (the “Pricing Group”) and a third party which performs certain pricing functions in accordance with the pricing policies. The Pricing Group is responsible for the oversight of the third party on a day-to-day basis. The Committee and the Pricing Group perform a series of activities to provide reasonable assurance of the accuracy of prices including: 1) periodic vendor due diligence meetings, review of methodologies, new developments and processes at vendors, 2) daily comparison of security valuation versus prior day for all securities that exceeded established thresholds, and 3) daily review of unpriced, stale, and variance reports with exceptions reviewed by senior management and the Committee.

| | |

| 20 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Notes to Financial Statements

In addition, several processes outside of the pricing process are used to monitor valuation issues including: 1) performance and performance attribution reports are monitored for anomalous impacts based upon benchmark performance, and 2) portfolio managers review all portfolios for performance and analytics (which are generated using the Adviser’s prices).

3. Taxes

It is the Fund’s policy to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its investment company taxable income and net realized gains, if any, to shareholders. Therefore, no provisions for federal income or excise taxes are required.

In accordance with U.S. GAAP requirements regarding accounting for uncertainties in income taxes, management has analyzed the Fund’s tax positions taken or expected to be taken on federal and state income tax returns for all open tax years (the current and the prior three tax years) and has concluded that no provision for income tax is required in the Fund’s financial statements.

4. Investment Income and Investment Transactions

Dividend income is recorded on the ex-dividend date or as soon as the Fund is informed of the dividend. Interest income is accrued daily. Investment transactions are accounted for on the date the securities are purchased or sold. Investment gains or losses are determined on the identified cost basis. The Fund amortizes premiums and accretes original issue discounts and market discounts as adjustments to interest income.

5. Dividends and Distributions

Dividends and distributions to shareholders, if any, are recorded on the ex-dividend date. Income dividends and capital gains distributions are determined in accordance with federal tax regulations and may differ from those determined in accordance with U.S. GAAP. To the extent these differences are permanent, such amounts are reclassified within the capital accounts based on their federal tax basis treatment; temporary differences do not require such reclassification.

NOTE B

Advisory Fee and Other Transactions with Affiliates

Under the terms of an investment advisory agreement, the Fund pays the Adviser an advisory fee at an annual rate of 0.65 of 1% of the Fund’s average daily net assets applicable to common and preferred shareholders. Such fee is accrued daily and paid monthly.

Under the terms of the Shareholder Inquiry Agency Agreement with AllianceBernstein Investor Services, Inc. (“ABIS”), a wholly-owned subsidiary of the Adviser, the Fund reimburses ABIS for costs relating to servicing phone inquiries on behalf of the Fund. During the six months ended April 30, 2015, there was no reimbursement paid to ABIS.

| | | | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | | 21 | |

Notes to Financial Statements

The Fund may invest in the AB Fixed-Income Shares, Inc. – Government STIF Portfolio (“Government STIF Portfolio”), an open-end management investment company managed by the Adviser. The Government STIF Portfolio is offered as a cash management option to mutual funds and other institutional accounts of the Adviser, and is not available for direct purchase by members of the public. The Government STIF Portfolio pays no investment management fees but does bear its own expenses. A summary of the Fund’s transactions in shares of the Government STIF Portfolio for the six months ended April 30, 2015 is as follows:

| | | | | | | | | | | | | | | | | | |

Market Value October 31, 2014 (000) | | | Purchases

at Cost

(000) | | | Sales

Proceeds

(000) | | | Market Value

April 30, 2015

(000) | | | Dividend

Income

(000) | |

| $ | – 0 | – | | $ | 9,421 | | | $ | 9,421 | | | $ | – 0 | – | | $ | – 0 | –* |

| * | | Amount is less than $500 |

NOTE C

Investment Transactions

Purchases and sales of investment securities (excluding short-term investments) for the six months ended April 30, 2015 were as follows:

| | | | | | | | |

| | | Purchases | | | Sales | |

Investment securities (excluding U.S. government securities) | | $ | 29,637,899 | | | $ | 28,917,404 | |

U.S. government securities | | | – 0 | – | | | – 0 | – |

The cost of investments for federal income tax purposes was substantially the same as the cost for financial reporting purposes. Accordingly, gross unrealized appreciation and unrealized depreciation (excluding swap transactions) are as follows:

| | | | |

Gross unrealized appreciation | | $ | 13,286,388 | |

Gross unrealized depreciation | | | (185,923 | ) |

| | | | |

Net unrealized appreciation | | $ | 13,100,465 | |

| | | | |

1. Derivative Financial Instruments

The Fund may use derivatives in an effort to earn income and enhance returns, to replace more traditional direct investments, to obtain exposure to otherwise inaccessible markets (collectively, “investment purposes”), or to hedge or adjust the risk profile of its portfolio.

The principal type of derivatives utilized by the Fund, as well as the methods in which they may be used are:

The Fund may enter into swaps to hedge its exposure to interest rates or credit risk. A swap is an agreement that obligates two parties to exchange a series of cash flows at specified intervals based upon or calculated by reference to changes in specified prices or rates for a specified amount of an underlying asset. The payment flows are usually netted against each other,

| | |

| 22 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Notes to Financial Statements

with the difference being paid by one party to the other. In addition, collateral may be pledged or received by the Fund in accordance with the terms of the respective swaps to provide value and recourse to the Fund or its counterparties in the event of default, bankruptcy or insolvency by one of the parties to the swap.

Risks may arise as a result of the failure of the counterparty to the swap to comply with the terms of the swap. The loss incurred by the failure of a counterparty is generally limited to the net interim payment to be received by the Fund, and/or the termination value at the end of the contract. Therefore, the Fund considers the creditworthiness of each counterparty to a swap in evaluating potential counterparty risk. This risk is mitigated by having a netting arrangement between the Fund and the counterparty and by the posting of collateral by the counterparty to the Fund to cover the Fund’s exposure to the counterparty. Additionally, risks may arise from unanticipated movements in interest rates or in the value of the underlying securities. The Fund accrues for the interim payments on swaps on a daily basis, with the net amount recorded within unrealized appreciation/depreciation of swaps on the statement of assets and liabilities, where applicable. Once the interim payments are settled in cash, the net amount is recorded as realized gain/(loss) on swaps on the statement of operations, in addition to any realized gain/(loss) recorded upon the termination of swaps. Upfront premiums paid or received are recognized as cost or proceeds on the statement of assets and liabilities and are amortized on a straight line basis over the life of the contract. Amortized upfront premiums are included in net realized gain/(loss) from swaps on the statement of operations. Fluctuations in the value of swaps are recorded as a component of net change in unrealized appreciation/depreciation of swaps on the statement of operations.

Interest Rate Swaps:

The Fund is subject to interest rate risk exposure in the normal course of pursuing its investment objectives. Because the Fund holds fixed rate bonds, the value of these bonds may decrease if interest rates rise. To help hedge against this risk and to maintain its ability to generate income at prevailing market rates, the Fund may enter into interest rate swaps. Interest rate swaps are agreements between two parties to exchange cash flows based on a notional amount. The Fund may elect to pay a fixed rate and receive a floating rate, or, receive a fixed rate and pay a floating rate on a notional amount.

In addition, a Fund may also enter into interest rate swap transactions to preserve a return or spread on a particular investment or portion of its portfolio, or protect against an increase in the price of securities the Fund anticipates purchasing at a later date. Interest rate swaps involve the exchange by a Fund with another party of their respective commitments to pay or receive interest (e.g., an exchange of floating rate payments for fixed rate payments) computed based on a contractually-based principal (or

| | | | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | | 23 | |

Notes to Financial Statements

“notional”) amount. Interest rate swaps are entered into on a net basis (i.e., the two payment streams are netted out, with the Fund receiving or paying, as the case may be, only the net amount of the two payments).

During the six months ended April 30, 2015, the Fund held interest rate swaps for non-hedging purposes.

The Fund typically enters into International Swaps and Derivatives Association, Inc. Master Agreements (“ISDA Master Agreement”) or similar master agreements (collectively, “Master Agreements”) with its OTC derivative contract counterparties in order to, among other things, reduce its credit risk to counterparties. ISDA Master Agreements include provisions for general obligations, representations, collateral and events of default or termination. Under an ISDA Master Agreement, the Fund typically may offset with the counterparty certain derivative financial instrument’s payables and/or receivables with collateral held and/or posted and create one single net payment (close-out netting) in the event of default or termination.

Various Master Agreements govern the terms of certain transactions with counterparties, including transactions such as exchange-traded derivative transactions, repurchase and reverse repurchase agreements. These Master Agreements typically attempt to reduce the counterparty risk associated with such transactions by specifying credit protection mechanisms and providing standardization that improves legal certainty. Cross-termination provisions under Master Agreements typically provide that a default in connection with one transaction between the Fund and a counterparty gives the non-defaulting party the right to terminate any other transactions in place with the defaulting party to create one single net payment due to/due from the defaulting party. In the event of a default by a Master Agreements counterparty, the return of collateral with market value in excess of the Fund’s net liability, held by the defaulting party, may be delayed or denied.

The Fund’s Master Agreements may contain provisions for early termination of OTC derivative transactions in the event the net assets of the Fund decline below specific levels (“net asset contingent features”). If these levels are triggered, the Fund’s counterparty has the right to terminate such transaction and require the Fund to pay or receive a settlement amount in connection with the terminated transaction. For additional details, please refer to netting arrangements by counterparty tables below.

At April 30, 2015, the Fund had entered into the following derivatives:

| | | | | | | | | | |

| | | Asset Derivatives | | | Liability Derivatives |

Derivative Type | | Statement of

Assets and

Liabilities

Location | | Fair Value | | | Statement of

Assets and

Liabilities

Location | | Fair Value |

Interest rate contracts | |

Unrealized appreciation on interest rate swaps | |

$ |

133,654 |

| | | | |

| | | | | | | | | | |

Total | | | | $ | 133,654 | | | | | |

| | | | | | | | | | |

| | |

| 24 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Notes to Financial Statements

The effect of derivative instruments on the statement of operations for the six months ended April 30, 2015:

| | | | | | | | | | |

Derivative Type | | Location of Gain or (Loss) on Derivatives | | Realized Gain

or (Loss) on

Derivatives | | | Change in

Unrealized

Appreciation or

(Depreciation) | |

Interest rate contracts | | Net realized gain (loss) on swaps; Net change in unrealized appreciation/depreciation of swaps | | $ | 70,607 | | | $ | (62,358 | ) |

| | | | | | | | | | |

Total | | | | $ | 70,607 | | | $ | (62,358 | ) |

| | | | | | | | | | |

The following table represents the average monthly volume of the Fund’s derivative transactions during the six months ended April 30, 2015:

| | | | |

Interest Rate Swaps: | | | | |

Average notional amount | | $ | 2,300,000 | |

For financial reporting purposes, the Fund does not offset derivative assets and derivative liabilities that are subject to netting arrangements in the statement of assets and liabilities.

All derivatives held at period end were subject to netting arrangements. The following table presents the Fund’s derivative assets and liabilities by counterparty net of amounts available for offset under Master Agreements (“MA”) and net of the related collateral received/ pledged by the Fund as of April 30, 2015:

| | | | | | | | | | | | | | | | | | | | |

Counterparty | | Derivative

Assets

Subject to a

MA | | | Derivative

Available for

Offset | | | Cash

Collateral

Received | | | Security

Collateral

Received | | | Net Amount

of Derivatives

Assets | |

OTC Derivatives: | | | | | | | | | | | | | |

Merrill Lynch Capital Services, Inc. | | $ | 133,654 | | | $ | – 0 | – | | $ | – 0 | – | | $ | – 0 | – | | $ | 133,654 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | $ | 133,654 | | | $ | – 0 | – | | $ | – 0 | – | | $ | – 0 | – | | $ | 133,654 | ^ |

| | | | | | | | | | | | | | | | | | | | |

| ^ | | Net amount represents the net receivable/payable that would be due from/to the counterparty in the event of default or termination. The net amount from OTC financial derivative instruments can only be netted across transactions governed under the same master agreement with the same counterparty. |

| | | | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | | 25 | |

Notes to Financial Statements

NOTE D

Common Stock

There are 8,554,668 shares of common stock outstanding at April 30, 2015. During the six months ended April 30, 2015 and the year ended October 31, 2014, the Fund did not issue any shares in connection with the Fund’s dividend reinvestment plan.

NOTE E

Preferred Shares

The Fund has 3,240 shares authorized, and 2,902 shares issued and outstanding of auction preferred stock (the “Preferred Shares”), consisting of 1,451 shares each of series M and series T. The Preferred Shares have a liquidation value of $25,000 per share plus accumulated, unpaid dividends. The dividend rate on the Preferred Shares may change every 7 days as set by the auction agent for series M and T. Due to the recent failed auctions, the dividend rate is the “maximum rate” set by the terms of the Preferred Shares, which is based on AA commercial paper rates and short-term municipal bond rates. The dividend rate on series M is 0.13% effective through May 4, 2015. The dividend rate on series T is 0.13% effective through May 5, 2015.

At certain times, the Preferred Shares are redeemable by the Fund, in whole or in part, at $25,000 per share plus accumulated, unpaid dividends. The Fund voluntarily may redeem the Preferred Shares in certain circumstances.

The Fund is not required to redeem any of its Preferred Shares and expects to continue to rely on the Preferred Shares for a portion of its leverage exposure. The Fund may also pursue other liquidity solutions for the Preferred Shares.

The preferred shareholders, voting as a separate class, have the right to elect at least two directors at all times and to elect a majority of the directors in the event two years’ dividends on the Preferred Shares are unpaid. In each case, the remaining directors will be elected by the common shareholders and preferred shareholders voting together as a single class. The preferred shareholders will vote as a separate class on certain other matters as required under the Fund’s Charter, the Investment Company Act of 1940 and Maryland law, and management regularly evaluates, and discusses with the Fund’s Board of Directors, the costs and potential benefits of alternative sources of leverage for the Fund.

| | |

| 26 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Notes to Financial Statements

NOTE F

Distributions to Common Shareholders

The tax character of distributions to be paid for the year ending October 31, 2015 will be determined at the end of the current fiscal year. The tax character of distributions paid during the fiscal years ended October 31, 2014 and October 31, 2013 were as follows:

| | | | | | | | |

| | | 2014 | | | 2013 | |

Distributions paid from: | | | | | | | | |

Ordinary income | | $ | 81,559 | | | $ | 122,370 | |

Tax-exempt income | | | 6,354,973 | | | | 6,195,982 | |

| | | | | | | | |

Total distributions paid | | | 6,436,532 | | | | 6,318,352 | |

| | | | | | | | |

Tax return of capital | | | – 0 | – | | | 233,192 | |

| | | | | | | | |

Total distributions paid | | $ | 6,436,532 | | | $ | 6,551,544 | |

| | | | | | | | |

As of October 31, 2014, the components of accumulated earnings/(deficit) on a tax basis were as follows:

| | | | |

Undistributed tax-exempt income | | $ | 130,983 | |

Accumulated capital and other losses | | | (7,177,726 | )(a) |

Unrealized appreciation/(depreciation) | | | 15,443,735 | (b) |

| | | | |

Total accumulated earnings/(deficit) | | $ | 8,396,992 | (c) |

| | | | |

| (a) | | On October 31, 2014, the Fund had a net capital loss carryforward of $7,177,726. During the fiscal year, the Fund utilized $21,411 of capital loss carryforwards to offset current year net realized gains. |

| (b) | | The differences between book-basis and tax-basis unrealized appreciation/(depreciation) are attributable primarily to the tax treatment of tender option bonds and swaps. |

| (c) | | The difference between book-basis and tax-basis components of accumulated earnings/(deficit) is attributable primarily to dividends payable. |

For tax purposes, net capital losses may be carried over to offset future capital gains, if any. Funds are permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an indefinite period. These postenactment capital losses must be utilized prior to the pre-enactment capital losses, which are subject to expiration. Post-enactment capital loss carryforwards will retain their character as either short-term or long-term capital losses rather than being considered short-term as under previous regulation.

As of October 31, 2014, the Fund had a net capital loss carryforward of $7,177,726 which will expire as follows:

| | | | |

Short-Term

Amount | | Long-Term

Amount | | Expiration |

| $2,248,276 | | n/a | | 2019 |

| 1,229,551 | | $3,699,899 | | no expiration |

| | | | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND • | | | 27 | |

Notes to Financial Statements

NOTE G

Risks Involved in Investing in the Fund

Interest Rate Risk and Credit Risk—Interest rate risk is the risk that changes in interest rates will affect the value of the Fund’s investments in fixed-income debt securities such as bonds or notes. Increases in interest rates may cause the value of the Fund’s investments to decline. Credit risk is the risk that the issuer or guarantor of a debt security, or the counterparty to a derivative contract, will be unable or unwilling to make timely principal and/or interest payments, or to otherwise honor its obligations. The degree of risk for a particular security may be reflected in its credit rating. Credit risk is greater for medium quality and lower-rated securities. Lower-rated debt securities and similar unrated securities (commonly known as “junk bonds”) have speculative elements or are predominantly speculative risks.

Municipal Market Risk and Concentration of Credit Risk—This is the risk that special factors may adversely affect the value of municipal securities and have a significant effect on the yield or value of the Fund’s investments in municipal securities. These factors include economic conditions, political or legislative changes, uncertainties related to the tax status of municipal securities, or the rights of investors in these securities. The Fund invests primarily in securities issued by the State of California and its various political subdivisions. The Fund’s investments in California municipal securities may be vulnerable to events adversely affecting California’s economy. California, largest of the 50 states, is relatively diverse, which makes it less vulnerable to events affecting a particular industry. Its economy, however, continues to be affected by serious fiscal conditions as a result of voter passed initiatives that limit the ability of state and local governments to raise revenues, particularly with respect to real property taxes. California’s economy may also be affected by natural disasters, such as earthquakes or fires. The Fund’s investments in certain municipal securities with principal and interest payments that are made from the revenues of a specific project or facility, and not general tax revenues, may have increased risks. Factors affecting the project or facility, such as local business or economic conditions, could have a significant effect on the project’s ability to make payments of principal and interest on these securities.

Derivatives Risk—The Fund may enter into derivative transactions such as forwards, options, futures and swaps. Derivatives may be illiquid, difficult to price, and leveraged so that small changes may produce disproportionate losses for the Fund, and subject to counterparty risk to a greater degree than more traditional investments. Derivatives may result in significant losses, including losses that are far greater than the value of the derivatives reflected in the statement of assets and liabilities.

Financing and Related Transactions; Leverage and Other Risks—The Fund utilizes leverage to seek to enhance the yield and net asset value attributable to its common stock. These objectives may not be achieved in all interest rate environments. Leverage creates certain risks for holders of common stock, including the likelihood of greater volatility of the net asset value and market

| | |

| 28 | | • ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND |

Notes to Financial Statements

price of the common stock. If income from the securities purchased from the funds made available by leverage is not sufficient to cover the cost of leverage, the Fund’s return will be less than if leverage had not been used. As a result, the amounts available for distribution to common stockholders as dividends and other distributions will be reduced. During periods of rising short-term interest rates, the interest paid on the Preferred Shares or floaters in tender option bond transactions would increase, which may adversely affect the Fund’s income and distribution to common stockholders. A decline in distributions would adversely affect the Fund’s yield and possibly the market value of its shares. If rising short-term rates coincide with a period of rising long-term rates, the value of the long-term municipal bonds purchased with the proceeds of leverage would decline, adversely affecting the net asset value attributable to the Fund’s common stock and possibly the market value of the shares.