UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-10575

ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800)221-5672

Date of fiscal year end: October 31, 2019

Date of reporting period: April 30, 2019

ITEM 1. REPORTS TO STOCKHOLDERS.

APR 04.30.19

SEMI-ANNUAL REPORT

ALLIANCE CALIFORNIA

MUNICIPAL INCOME FUND

(NYSE: AKP)

Beginning January 1, 2021, as permitted by new regulations adopted by the Securities and Exchange Commission, the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website address to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically at any time by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor and your shares are held with our transfer agent, Computershare, you may log into your Investor Center account at www.computershare.com/investor and go to “Communication Preferences”. You may also call Computershare at (800) 219 4218.

You may elect to receive all future reports in paper form free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports; if you invest directly with the Fund, you can call Computershare at (800) 219 4218. Your election to receive reports in paper form will apply to all funds held in your account with your financial intermediary or, if you invest directly, to all AB Closed-end Funds you hold.

| | |

| |

| Investment Products Offered | | • Are Not FDIC Insured• May Lose Value• Are Not Bank Guaranteed |

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent12-month period ended June 30, without charge. Simply visit AB’s website at www.abfunds.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227 4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the Commission’s website at www.sec.gov. The Fund’s Forms N-PORT may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC 0330.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AB family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the Adviser of the funds.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

| | |

| FROM THE PRESIDENT | |  |

Dear Shareholder,

We are pleased to provide this report for Alliance California Municipal Income Fund (the “Fund”). Please review the discussion of Fund performance, the market conditions during the reporting period and the Fund’s investment strategy.

As always, AB strives to keep clients ahead of what’s next by:

| + | | Transforming uncommon insights into uncommon knowledge with a global research scope |

| + | | Navigating markets with seasoned investment experience and sophisticated solutions |

| + | | Providing thoughtful investment insights and actionable ideas |

Whether you’re an individual investor or a multi-billion-dollar institution, we put knowledge and experience to work for you.

AB’s global research organization connects and collaborates across platforms and teams to deliver impactful insights and innovative products. Better insights lead to better opportunities—anywhere in the world.

For additional information about AB’s range of products and shareholder resources, please log on to www.abfunds.com.

Thank you for your investment in the AB Mutual Funds.

Sincerely,

Robert M. Keith

President and Chief Executive Officer, AB Mutual Funds

| | |

| |

| abfunds.com | | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | 1 |

SEMI-ANNUAL REPORT

June 7, 2019

This report provides management’s discussion of fund performance for Alliance California Municipal Income Fund for the semi-annual reporting period ended April 30, 2019. The Fund is aclosed-end fund and its shares are listed and traded on the New York Stock Exchange.

The Fund’s Senior Investment Management Team (the “Team”) announced that stockholders of the Fund approved the proposed Plan of Liquidation and Dissolution of the Fund at the Special Meeting of Stockholders held April 26, 2019 (the “Liquidation”), and that the Fund would begin to transition its portfolio in anticipation of making its liquidating distributions. In connection with the Liquidation, the Fund closed its stock registry books and records at the close of business on Thursday, May 2, 2019. The proportionate interests of stockholders in the Fund’s assets were fixed on the basis of their respective stockholdings at the close of business on May 2, 2019. As of that time, the trading of the Fund’s shares on the New York Stock Exchange was suspended. After the letter’s reporting period, the Fund ceased operations on June 18, 2019 and the liquidating distributions to common stockholders were made on June 21, 2019. The Fund’s preferred stock was redeemed and preferred stockholders received the liquidation preference amount of each share plus accumulated, but unpaid, dividends and other distributions. The redemption of the Fund’s preferred stock took place on May 21, 2019.

The Fund seeks to provide high current income exempt from regular federal and California state income tax by investing substantially all of its net assets in municipal securities that are exempt from state taxes.

RETURNS AS OF APRIL 30, 2019(unaudited)

| | | | | | | | |

| | |

| | | 6 Months | | | 12 Months | |

| | |

| ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND (NAV) | | | 6.06% | | | | 5.82% | |

| | |

| Bloomberg Barclays Municipal Bond Index | | | 5.68% | | | | 6.16% | |

The Fund’s market price per share on April 30, 2019 was $14.87. The Fund’s NAV price per share on April 30, 2019 was $14.99. For additional Financial Highlights, please see pages37-39.

INVESTMENT RESULTS

The table above shows the Fund’s performance compared to its benchmark, the Bloomberg Barclays Municipal Bond Index, for thesix- and12-month periods ended April 30, 2019.

The Fund outperformed the benchmark for thesix-month period, but underperformed for the12-month period. During both periods, yield-curve positioning was the main driver of both top contributors and detractors,

| | |

| |

| 2 | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | | abfunds.com |

relative to the benchmark, contributing insix- to seven-year duration municipals, while detracting in four- to five-year duration municipals. Security selection within the multi-family housing sector contributed. For thesix-month period, security selection in water and sewer detracted; security selection in miscellaneous revenue detracted during the12-month period.

Leverage, achieved through the usage of auction rate preferred shares, tender option bonds (“TOBs”) and variable rate municipal term preferred shares, added to the Fund’s total return over both periods as yields fell. Leverage benefited the Fund’s income, as the spread between the Fund’s borrowing and investment rates remained positive.

The Fund did not utilize derivatives during thesix- or12-month periods.

MARKET REVIEW AND INVESTMENT STRATEGY

Though thesix-month period ended April 30, 2019 was volatile for financial markets, municipal bonds performed well on an absolute basis. Bond yield expectations continued to rise as economic growth was strong, stock market indices were up and the US Federal Reserve (the “Fed”) signaled a desire to move to a more neutral monetary policy, which included both higher interest rates and a smaller balance sheet. Perception changed at the end of 2018, following slow economic growth and a sharp drop in equity markets. The Fed decided to hold monetary policy steady, citing slower growth and modest inflation, which had been persistently below their stated target.

Perhaps in response to equity market volatility, investor demand for municipal bonds was strong, whilenet-new supply was unchanged; together, strong demand and no supply pushed municipal bond prices higher. Demand was particularly strong through the first four months of 2019. As a result,10-yearAAA-rated municipal yields declined 42 basis points, considerably more than10-year US Treasury yields, which declined 18 basis points.

The State of California’s fiscal strengthening continued as tax revenue growth remained strong, and the economy, particularly in the Bay Area, grew more rapidly than the rest of the nation. Governor Newsom, in his first five months in office, has largely continued the fiscal policies of his predecessor, Jerry Brown, by focusing on reserve accumulation, paying down debt, and controlling the growth of liabilities like pensions. The state now expects to finish fiscal 2019 with nearly $21 billion in fund balance and reserves, which is over 14% of annual state spending. The Team believes this is wise as a future downturn will likely cause a large decline in state tax revenues, necessitating a cash cushion to avoid drastic budget adjustments. While mindful of California’s history of strained finances during recessions, the Team also recognizes that the state’s general obligation bonds are constitutionally protected, and that debt service is paid second only after education. One of the governor’s key priorities is affordable housing and he has proposed grants, tax credits, and both aid to and

| | |

| |

| abfunds.com | | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | 3 |

mandates on, local governments. The Team believes this is an important focus as the state endeavors to attract and retain workers and businesses.

The Fund may purchase municipal securities that are insured under policies issued by certain insurance companies. Historically, insured municipal securities typically received a higher credit rating, which meant that the issuer of the securities paid a lower interest rate. As a result of declines in the credit quality and associated downgrades of most bond insurers, insurance has less value than it did in the past. The market now values insured municipal securities primarily based on the credit quality of the issuer of the security with little value given to the insurance feature. In purchasing such insured securities, the Adviser evaluates the risk and return of municipal securities through its own research. If an insurance company’s rating is downgraded or the company becomes insolvent, the prices of municipal securities insured by the insurance company may decline. As of April 30, 2019, the Fund’s percentages of investments in municipal bonds that are insured and in insured municipal bonds that have beenpre-refunded or escrowed to maturity were 5.48% and 0.00%, respectively.

INVESTMENT POLICIES

The Fund will normally invest at least 80%, and normally substantially all, of its net assets in municipal securities paying interest that is exempt from regular federal and California state income tax. In addition, the Fund normally invests at least 75% of its net assets in investment-grade municipal securities or unrated municipal securities considered to be of comparable quality as determined by the Adviser. The Fund may invest up to 25% of its net assets in municipal securities rated below investment-grade and unrated municipal securities considered to be of comparable quality. The Fund intends to invest primarily in municipal securities that pay interest that is not subject to the federal alternative minimum tax (“AMT”), but may invest without limit in municipal securities paying interest that is subject to the federal AMT. For more information regarding the Fund’s risks, please see “Disclosures and Risks” on pages5-9 and “Note G—Risks Involved in Investing in the Fund” of the Notes to Financial Statements on pages31-34.

| | |

| |

| 4 | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | | abfunds.com |

DISCLOSURES AND RISKS

Alliance California Municipal Income Fund Shareholder Information

Weekly comparative net asset value (“NAV”) and market price information about the Fund is published each Saturday inBarron’sand in other newspapers in a table called“Closed-End Funds”. Daily NAVs and market price information, and additional information regarding the Fund, is available at www.abfunds.com and www.nyse.com. For additional shareholder information regarding this Fund, please see pages40-41.

Benchmark Disclosure

The Bloomberg Barclays Municipal Bond Index is unmanaged and does not reflect fees and expenses associated with the active management of a fund portfolio. The Bloomberg Barclays Municipal Bond Index represents the performance of the long-termtax-exempt bond market consisting of investment-grade bonds. An investor cannot invest directly in an index, and its results are not indicative of the performance for any specific investment, including the Fund. In addition, the Index does not reflect the use of leverage, whereas the Fund utilizes leverage.

A Word About Risk

Among the risks of investing in the Fund are changes in the general level of interest rates or changes in bond credit quality ratings. Changes in interest rates have a greater effect on bonds with longer maturities than on those with shorter maturities. Please note, as interest rates rise, existing bond prices fall and can cause the value of your investment in the Fund to decline. While the Fund invests principally in bonds and other fixed-income securities, in order to achieve its investment objectives, the Fund may at times use certain types of investment derivatives, such as options, futures, forwards and swaps. These instruments involve risks different from, and in certain cases, greater than, the risks presented by more traditional investments. At the discretion of the Fund’s Adviser, the Fund may invest up to 25% of its net assets in municipal bonds that are rated below investment-grade (i.e., “junk bonds”). These securities involve greater volatility and risk than higher-quality fixed-income securities. The Fund will invest substantially all of its net assets in California municipal bonds and is therefore susceptible to political, economic or regulatory factors specifically affecting California municipal bond issuers.

Financing and Related Transactions; Leverage and Other Risks: The Fund utilizes leverage to seek to enhance the yield and NAV attributable to its common stock. These objectives may not be achieved in all interest-rate environments. Leverage creates certain risks for holders of common stock, including the likelihood of greater volatility of the NAV and market price of the common stock. If income from the securities purchased from the funds made available by leverage is not sufficient to cover the cost of

| | |

| |

| abfunds.com | | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | 5 |

DISCLOSURES AND RISKS(continued)

leverage, the Fund’s return will be less than if leverage had not been used. As a result, the amounts available for distribution to common stockholders as dividends and other distributions will be reduced. During periods of rising short-term interest rates, the interest paid on the preferred shares or floaters in TOB transactions would increase, which may adversely affect the Fund’s income and distribution to common stockholders. A decline in distributions would adversely affect the Fund’s yield and possibly the market value of its shares. If rising short-term rates coincide with a period of rising long-term rates, the value of the long-term municipal bonds purchased with the proceeds of leverage would decline, adversely affecting the NAV attributable to the Fund’s common stock and possibly the market value of the shares.

The Fund’s outstanding auction preferred stock and Variable Rate MuniFund Term Preferred Shares result in leverage. The Fund may also use other types of financial leverage, including TOB transactions, either in combination with, or in lieu of, the preferred shares. In a TOB transaction, the Fund may transfer a highly rated fixed-rate municipal security into a special purpose vehicle (typically, a trust). The Fund receives cash and a residual interest security (sometimes referred to as an “inverse floater”) issued by the trust in return. The trust simultaneously issues securities, which pay an interest rate that is reset each week based on an index of high-grade short-termseven-day demand notes. These securities, sometimes referred to as “floaters”, are bought by third parties, includingtax-exempt money market funds, and can be tendered by these holders to a liquidity provider at par, unless certain events occur. The Fund continues to earn all the interest from the transferred bond less the amount of interest paid on the floaters and the expenses of the trust, which include payments to the trustee and the liquidity provider and organizational costs. The Fund also uses the cash received from the transaction for investment purposes or to retire other forms of leverage. Under certain circumstances, the trust may be terminated and collapsed, either by the Fund or upon the occurrence of certain events, such as a downgrade in the credit quality of the underlying bond, or in the event holders of the floaters tender their securities to the liquidity provider. See Note H to the financial statements for more information about TOB transactions.

The use of derivative instruments by the Fund, such as forwards, futures, options and swaps, may also result in a form of leverage.

Because the advisory fees received by the Adviser are based on the total net assets of the Fund (including assets supported by the proceeds of the Fund’s outstanding preferred shares), the Adviser has a financial incentive for the Fund to keep its preferred shares outstanding, which may create a conflict of interest between the Adviser and the common shareholders of the Fund.

| | |

| |

| 6 | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | | abfunds.com |

DISCLOSURES AND RISKS(continued)

Tax Risk: There is no guarantee that the income on the Fund’s municipal securities will be exempt from regular federal income and state income taxes. Unfavorable legislation, adverse interpretations by federal or state authorities, litigation or noncompliant conduct by the issuer of a municipal security could affect thetax-exempt status of municipal securities. If the Internal Revenue Service or a state authority determines that an issuer of a municipal security has not complied with applicable requirements, interest from the security could become subject to regular federal income tax and/or state personal income tax, possibly retroactively to the date the security was issued, the value of the security could decline significantly, and a portion of the distributions to Fund shareholders could be recharacterized as taxable. Recent federal legislation included reductions in tax rates for individuals, with relatively larger reductions in tax rates for corporations. These tax rate reductions may reduce the demand for municipal bonds which could reduce the value of municipal bonds held by the Fund.

Market Risk: The value of the Fund’s assets will fluctuate as the bond market fluctuates. The value of the Fund’s investments may decline, sometimes rapidly and unpredictably, simply because of economic changes or other events that affect large portions of the market.

Municipal Market Risk: This is the risk that special factors may adversely affect the value of the municipal securities and have a significant effect on the yield of value of the Fund’s investments in municipal securities. These factors include economic conditions, political or legislative changes, uncertainties related to the tax status of municipal securities, or the rights of investors in these securities. The Fund’s investment in California municipal securities may be vulnerable to events adversely affecting California’s economy. California, the largest of the 50 states, is relatively diverse, which makes it less vulnerable to events affecting a particular industry. Its economy, however, continues to be affected by fiscal constraints as a result of voter-passed initiatives that limit the ability of state and local governments to raise revenues, particularly with respect to real property taxes. California’s economy may also be affected by natural disasters, such as earthquakes or fires. The Fund’s investment in certain municipal securities with principal and interest payments that are made from the revenues of a specific project or facility, and not general tax revenues, may have increased risks. Factors affecting the project or facility, such as local business or economic conditions, could have a significant effect on the project’s ability to make payments of principal and interest on these securities.

Credit Risk: An issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other contract, may be unable or unwilling to make timely payments of interest or principal, or to otherwise honor its obligations. The issuer or guarantor may default, causing a loss of the full

| | |

| |

| abfunds.com | | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | 7 |

DISCLOSURES AND RISKS(continued)

principal amount of a security. The degree of risk for a particular security may be reflected in its credit rating. There is the possibility that the credit rating of a fixed-income security may be downgraded after purchase, which may adversely affect the value of the security. Investments in fixed-income securities with lower ratings tend to have a higher probability that an issuer will default or fail to meet its payment obligations.

Interest-Rate Risk: Changes in interest rates will affect the value of investments in fixed-income securities. When interest rates rise, the value of investments in fixed-income securities tends to fall and this decrease in value may not be offset by higher income from new investments. Interest-rate risk is generally greater for fixed-income securities with longer maturities or durations.

Inflation Risk: This is the risk that the value of assets or income from investments will be less in the future as inflation decreases the value of money. As inflation increases, the value of the Fund’s assets can decline as can the value of the Fund’s distributions. This risk is significantly greater for fixed-income securities with longer maturities.

Derivatives Risk: The Fund may enter into derivative transactions such as forwards, options, futures and swaps. Derivatives may be difficult to price or unwind and leveraged so that small changes may produce disproportionate losses for the Fund, and may be subject to counterparty risk to a greater degree than more traditional investments. Derivatives may result in significant losses, including losses that are far greater than the value of the derivatives reflected on the statement of assets and liabilities.

Duration Risk: Duration is a measure that relates the expected price volatility of a fixed-income security to changes in interest rates. The duration of a fixed-income security may be shorter than or equal to full maturity of a fixed-income security. Fixed-income securities with longer durations have more risk and will decrease in price as interest rates rise.

Illiquid Investments Risk: Illiquid investments risk exists when particular investments are difficult to purchase or sell, possibly preventing the Fund from selling out of these securities at an advantageous price. Over recent years, regulatory changes have led to reduced liquidity in the marketplace, and the capacity of dealers to make markets in fixed-income securities has been outpaced by the growth in the size of the fixed-income markets. Illiquid investments risk may be magnified in a rising interest rate environment, where the value and liquidity of fixed-income securities generally go down. Derivatives and securities involving substantial market and credit risk may become illiquid. The Fund is subject to greater risk because the market for municipal securities is generally smaller than many other markets, which

| | |

| |

| 8 | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | | abfunds.com |

DISCLOSURES AND RISKS(continued)

may make municipal securities more difficult to trade or dispose of than other types of securities. Illiquid securities may also be difficult to value.

Management Risk: The Fund is subject to management risk because it is an actively managed investment fund. The Adviser will apply its investment techniques and risk analyses in making investment decisions, but there is no guarantee that its techniques will produce the intended results.

These risks are discussed in the Fund’s prospectus. As with all investments you may lose money by investing in the Fund.

An Important Note About Historical Performance

The performance shown in this report represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. All fees and expenses related to the operation of the Fund have been deducted. Performance assumes reinvestment of distributions and does not account for taxes.

| | |

| |

| abfunds.com | | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | 9 |

PORTFOLIO SUMMARY

April 30, 2019(unaudited)

PORTFOLIO STATISTICS

Net Assets ($mil): $128.3

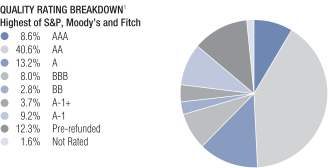

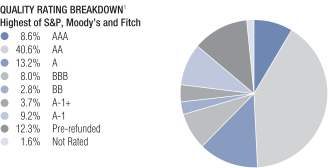

| 1 | All data are as of April 30, 2019. The Fund’s quality rating breakdown is expressed as a percentage of the Fund’s total investments in municipal securities and may vary over time. The quality ratings are determined by using the S&P Global Ratings (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). A measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is highest (best) and D is lowest (worst). If applicable, thepre-refunded category includes bonds which are secured by U.S. Government Securities and therefore have been deemed high-quality investment grade by the Adviser. If applicable, Not Applicable (N/A) includesnon-credit worthy investments; such as equities, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a Nationally Recognized Statistical Rating Organization. The Adviser evaluates the creditworthiness ofnon-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment. |

| | |

| |

| 10 | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS

April 30, 2019(unaudited)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

MUNICIPAL OBLIGATIONS – 127.1% | |

Long-Term Municipal Bonds – 106.6% | |

California – 98.6% | |

Anaheim Public Financing Authority

(City of Anaheim CA Lease)

Series 2014A

5.00%, 5/01/33-5/01/39 | | $ | 4,750 | | | $ | 5,399,047 | |

Bay Area Toll Authority

Series 2013S

5.00%, 4/01/33(Pre-refunded/ETM) | | | 5,000 | | | | 5,677,000 | |

Beaumont Financing Authority

AMBAC Series 2007C

5.00%, 9/01/26(a) | | | 145 | | | | 145,160 | |

California Educational Facilities Authority

(Loma Linda University)

Series 2017A

5.00%, 4/01/47 | | | 1,000 | | | | 1,145,580 | |

California Health Facilities Financing Authority

(California-Nevada Methodist Homes)

Series 2015

5.00%, 7/01/45 | | | 3,000 | | | | 3,401,040 | |

California Health Facilities Financing Authority

(Children’s Hospital Los Angeles)

Series 2017A

5.00%, 8/15/42 | | | 1,500 | | | | 1,712,610 | |

California Municipal Finance Authority

(Azusa Pacific University)

Series 2015B

5.00%,4/01/35-4/01/41 | | | 2,040 | | | | 2,147,796 | |

California Municipal Finance Authority

(Community Hospitals of Central California Obligated Group)

Series 2017A

5.00%, 2/01/42 | | | 1,000 | | | | 1,124,570 | |

California Public Finance Authority

(Henry Mayo Newhall Memorial Hospital)

Series 2017

5.00%, 10/15/47 | | | 1,085 | | | | 1,195,182 | |

California School Finance Authority

(Green DOT Public Schools Obligated Group) Series 2015A

5.00%, 8/01/45(b) | | | 1,500 | | | | 1,622,580 | |

California State Public Works Board

Series 2011G

5.25%, 12/01/26(Pre-refunded/ETM) | | | 3,700 | | | | 4,059,751 | |

| | |

| |

| abfunds.com | | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | 11 |

PORTFOLIO OF INVESTMENTS(continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

California Statewide Communities Development Authority

(Buck Institute for Research on Aging)

AGM Series 2014

5.00%, 11/15/44 | | $ | 4,000 | | | $ | 4,494,120 | |

California Statewide Communities Development Authority

(Collis P and Howard Huntington Memorial Hospital Obligated Group)

Series 2014B

5.00%, 7/01/44 | | | 1,000 | | | | 1,102,230 | |

California Statewide Communities Development Authority

(Methodist Hospital of Southern California Obligated Group)

Series 2018

5.00%, 1/01/48 | | | 1,000 | | | | 1,122,650 | |

California Statewide Communities Development Authority

(NCCD-Hooper Street LLC)

5.25%, 7/01/39-7/01/52(b) | | | 1,500 | | | | 1,623,809 | |

City of Irvine CA

(Irvine Community Facilities DistrictNo. 2013-3)

AGM Series 2018

5.00%, 9/01/51 | | | 1,250 | | | | 1,410,275 | |

City of Los Angeles Department of Airports

Series 2010A

5.00%, 5/15/27 | | | 1,440 | | | | 1,494,792 | |

City of San Jose CA Airport Revenue

(Norman Y Mineta San Jose International Airport SJC)

Series 2017A

5.00%, 3/01/37 | | | 1,500 | | | | 1,733,295 | |

County of Sacramento CA Airport System Revenue

Series 2016A

5.00%, 7/01/41 | | | 1,000 | | | | 1,156,520 | |

Garden Grove Unified School District

Series 2013C

5.00%, 8/01/34 | | | 3,650 | | | | 4,115,630 | |

Golden State Tobacco Securitization Corp.

Series 2018A

3.50%, 6/01/36 | | | 3,500 | | | | 3,482,325 | |

Inglewood Redevelopment Agency Successor Agency

BAM Series 2017A

5.00%, 5/01/34 | | | 365 | | | | 428,411 | |

| | |

| |

| 12 | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS(continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Jurupa Public Financing Authority

Series 2014A

5.00%,9/01/30-9/01/32 | | $ | 2,475 | | | $ | 2,817,364 | |

Long Beach Bond Finance Authority

(Aquarium of the Pacific)

Series 2012

5.00%, 11/01/27 | | | 3,500 | | | | 3,763,620 | |

Norco Community Redevelopment Agency Successor Agency

Series 2010

5.875%, 3/01/32(Pre-refunded/ETM)(a) | | | 420 | | | | 435,242 | |

6.00%, 3/01/36(Pre-refunded/ETM)(a) | | | 325 | | | | 337,129 | |

Palomar Health

(Palomar Health Obligated Group)

Series 2016

5.00%, 11/01/36 | | | 1,250 | | | | 1,386,675 | |

Port of Los Angeles

Series 2009C

5.00%, 8/01/26 | | | 5,550 | | | | 5,596,176 | |

Riverside County Infrastructure Financing Authority

(Riverside County Infrastructure Financing Authority Lease)

Series 2015A

4.00%, 11/01/37 | | | 1,225 | | | | 1,308,582 | |

Riverside County Transportation Commission

Series 2013A

5.25%, 6/01/32(Pre-refunded/ETM) | | | 2,000 | | | | 2,301,760 | |

Sacramento City Unified School District/CA

Series 2011

5.50%, 7/01/29 | | | 4,000 | | | | 4,301,160 | |

San Bernardino County Transportation Authority

Series2015-2

5.00%,3/01/32-3/01/34(c) | | | 6,040 | | | | 6,872,260 | |

San Diego County Water Authority

Series 2013

5.00%, 5/01/31 | | | 4,300 | | | | 4,788,050 | |

San Diego Public Facilities Financing Authority

Series 2010A

5.00%, 5/15/36(c) | | | 5,000 | | | | 5,912,800 | |

5.10%, 9/01/29(Pre-refunded/ETM) | | | 2,360 | | | | 2,475,310 | |

San Diego Unified School District/CA

Series 2013C

5.00%, 7/01/32 | | | 5,125 | | | | 5,769,674 | |

| | |

| |

| abfunds.com | | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | 13 |

PORTFOLIO OF INVESTMENTS(continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

San Francisco Bay Area Rapid Transit District

(San Francisco Bay Area Rapid Transit District Sales Tax Revenue)

Series 2012A

5.00%, 7/01/36 | | $ | 1,625 | | | $ | 1,789,808 | |

San Francisco Bay Area Rapid Transit District Sales Tax Revenue

Series 2012A

5.00%, 7/01/36(Pre-refunded/ETM)(a) | | | 605 | | | | 671,967 | |

San Francisco City & County Public Utilities Commission Wastewater Revenue

Series 2013B

5.00%, 10/01/32 | | | 4,735 | | | | 5,251,731 | |

San Francisco Municipal Transportation Agency

Series 2013

5.00%, 3/01/28 | | | 1,280 | | | | 1,437,990 | |

San Mateo Union High School District

Series 2013A

5.00%, 9/01/33 | | | 2,065 | | | | 2,345,365 | |

Southern California Public Power Authority

(Los Angeles Department of Water & Power PWR)

Series 2010

5.00%, 7/01/27 | | | 2,525 | | | | 2,581,409 | |

State of California

Series 2013

5.00%, 11/01/31 | | | 2,000 | | | | 2,261,580 | |

Stockton Public Financing Authority

(City of Stockton CA Water Revenue)

BAM Series 2018A

5.00%, 10/01/36 | | | 1,100 | | | | 1,304,512 | |

Successor Agency to Richmond Community Redevelopment Agency

Series 2010A

5.75%,9/01/24-9/01/25 | | | 530 | | | | 557,115 | |

6.00%, 9/01/30 | | | 370 | | | | 390,139 | |

Turlock Irrigation District

Series 2011

5.50%, 1/01/41 | | | 1,200 | | | | 1,269,144 | |

University of California

Series 2012G

5.00%, 5/15/31(Pre-refunded/ETM)(a) | | | 3,630 | | | | 4,015,942 | |

5.00%, 5/15/31 | | | 4,370 | | | | 4,776,978 | |

| | | | | | | | |

| | | | | | | 126,513,855 | |

| | | | | | | | |

| | |

| |

| 14 | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS(continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Guam – 0.6% | |

Territory of Guam

(Guam Section 30 Income Tax)

Series 2016A

5.00%, 12/01/46 | | $ | 780 | | | $ | 829,990 | |

| | | | | | | | |

|

Illinois – 0.9% | |

Chicago Board of Education

AGM Series 2018A

5.00%, 12/01/33 | | | 1,000 | | | | 1,154,370 | |

| | | | | | | | |

|

Missouri – 0.9% | |

Joplin Industrial Development Authority

(Freeman Health System Obligated Group)

Series 2015

5.00%, 2/15/35 | | | 1,000 | | | | 1,087,330 | |

| | | | | | | | |

|

New Jersey – 2.0% | |

New Jersey Transportation Trust Fund Authority

(New Jersey Transportation Fed Hwy Grant)

Series 2016

5.00%, 6/15/29 | | | 1,000 | | | | 1,146,270 | |

Tobacco Settlement Financing Corp./NJ

Series 2018A

5.00%, 6/01/46 | | | 1,355 | | | | 1,478,847 | |

| | | | | | | | |

| | | | | | | 2,625,117 | |

| | | | | | | | |

New York – 2.7% | |

Metropolitan Transportation Authority

Series 2014C

5.00%, 11/15/32 | | | 3,045 | | | | 3,453,639 | |

| | | | | | | | |

|

Pennsylvania – 0.9% | |

Pennsylvania Economic Development Financing Authority

(PA Bridges Finco LP)

Series 2015

5.00%, 6/30/42 | | | 1,000 | | | | 1,095,600 | |

| | | | | | | | |

| | |

Total Long-Term Municipal Bonds

(cost $128,710,985) | | | | | | | 136,759,901 | |

| | | | | | | | |

| | |

Short-Term Municipal Notes – 20.5% | | | | | | | | |

California – 20.5% | | | | | | | | |

California Statewide Communities Development Authority

(Rady Children’s Hospital/San Diego/CA)

Series 2018B

1.97%, 8/15/47(d) | | | 2,500 | | | | 2,500,000 | |

| | |

| |

| abfunds.com | | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | 15 |

PORTFOLIO OF INVESTMENTS(continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Irvine Unified School District

Series 2014

2.05%, 9/01/54(d) | | $ | 1,795 | | | $ | 1,795,000 | |

Regents of the University of California Medical Center Pooled Revenue

Series 2016B

2.05%, 5/15/32(a)(d) | | | 2,770 | | | | 2,770,000 | |

Southern California Public Power Authority

Series 2017

2.05%, 7/01/36(d) | | | 1,150 | | | | 1,150,000 | |

State of California

2.05%, 5/01/34(a)(d) | | | 3,020 | | | | 3,020,000 | |

Series 2004A5

1.99%, 5/01/34(d) | | | 7,500 | | | | 7,500,000 | |

Series 2009A

0.68%, 5/01/33(d) | | | 7,500 | | | | 7,500,000 | |

| | | | | | | | |

| | |

Total Short-Term Municipal Notes

(cost $26,235,000) | | | | | | | 26,235,000 | |

| | | | | | | | |

| | |

Total Municipal Obligations

(cost $154,945,985) | | | | | | | 162,994,901 | |

| | | | | | | | |

| | | | | | | | |

SHORT-TERM INVESTMENTS – 32.6% | | | | | | | | |

U.S. Treasury Bills – 32.6% | | | | | | | | |

U.S. Treasury Bill

Zero Coupon, 6/20/19

(cost $41,861,750) | | | 42,000 | | | | 41,860,875 | |

| | | | | | | | |

| | |

Total Investments – 159.7%

(cost $196,807,735) | | | | | | | 204,855,776 | |

Other assets less liabilities – (36.4)% | | | | | | | (46,704,901 | ) |

Preferred Shares at liquidation value – (23.3)% | | | | | | | (29,875,000 | ) |

| | | | | | | | |

| | |

Net Assets Applicable to Common Shareholders – 100.0%(e) | | | | | | $ | 128,275,875 | |

| | | | | | | | |

| (a) | Security in which significant unobservable inputs (Level 3) were used in determining fair value. |

| (b) | Security is exempt from registration under Rule 144A of the Securities Act of 1933. These securities are considered restricted, but liquid and may be resold in transactions exempt from registration, normally to qualified institutional buyers. At April 30, 2019, the aggregate market value of these securities amounted to $3,246,389 or 2.5% of net assets. |

| (c) | Security represents the underlying municipal obligation of an inverse floating rate obligation held by the Fund (see Note H). |

| (d) | Variable Rate Demand Notes are instruments whose interest rates change on a specific date (such as coupon date or interest payment date) or whose interest rates vary with changes in a designated base rate (such as the prime interest rate). This instrument is payable on demand and is secured by letters of credit or other credit support agreements from major banks. |

| | |

| |

| 16 | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | | abfunds.com |

PORTFOLIO OF INVESTMENTS(continued)

| (e) | Portfolio percentages are calculated based on net assets applicable to common shareholders. |

As of April 30, 2019, the Fund’s percentages of investments in municipal bonds that are insured and in insured municipal bonds that have beenpre-refunded or escrowed to maturity are 5.5% and 0.0%, respectively.

Glossary:

AGM – Assured Guaranty Municipal

AMBAC – Ambac Assurance Corporation

BAM – Build American Mutual

DOT – Department of Transportation

ETM – Escrowed to Maturity

See notes to financial statements.

| | |

| |

| abfunds.com | | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | 17 |

STATEMENT OF ASSETS & LIABILITIES

April 30, 2019(unaudited)

| | | | |

| Assets | | | | |

Investments in securities, at value (cost $196,807,735) | | $ | 204,855,776 | |

Receivable for investment securities sold | | | 75,703,600 | |

Interest receivable | | | 2,059,527 | |

Affiliated dividends receivable | | | 603 | |

| | | | |

Total assets | | | 282,619,506 | |

| | | | |

| Liabilities | | | | |

Due to custodian | | | 26,369,596 | |

Payable for investment securities purchased | | | 49,835,417 | |

Variable Rate MuniFund Term Preferred Shares, at liquidation value (net of unamortized deferred offering cost of $136,464) | | | 39,988,536 | |

Payable for floating rate notes issued* | | | 7,950,000 | |

Advisory fee payable | | | 105,530 | |

Interest expense payable | | | 101,929 | |

Dividends payable—Auction Preferred Shares | | | 8,426 | |

Directors’ fees payable | | | 2,606 | |

Other liabilities | | | 15,932 | |

Accrued expenses | | | 90,659 | |

| | | | |

Total liabilities | | | 124,468,631 | |

| | | | |

| Auction Preferred Shares, at Liquidation Value | | | | |

Auction Preferred shares, $.001 par value per share; 3,240 shares authorized, 1,195 shares issued and outstanding at $25,000 per share liquidation preference | | $ | 29,875,000 | |

| | | | |

Net Assets Applicable to Common Shareholders | | $ | 128,275,875 | |

| | | | |

| Composition of Net Assets Applicable to Common Shareholders | | | | |

Common stock, $.001 par value per share; 1,999,996,760 shares authorized, 8,554,668 shares issued and outstanding | | $ | 8,555 | |

Additionalpaid-in capital | | | 121,762,097 | |

Distributable earnings | | | 6,505,223 | |

| | | | |

Net Assets Applicable to Common Shareholders | | $ | 128,275,875 | |

| | | | |

Net Asset Value Applicable to Common Shareholders(based on 8,554,668 common shares outstanding) | | $ | 14.99 | |

| | | | |

| * | Represents short-term floating rate certificates issued by tender option bond trusts (see Note H). |

See notes to financial statements.

| | |

| |

| 18 | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | | abfunds.com |

STATEMENT OF OPERATIONS

Six Months Ended April 30, 2019(unaudited)

| | | | | | | | |

| Investment Income | | | | | | | | |

Interest | | $ | 3,912,980 | | | | | |

Dividends—Affiliated issuers | | | 9,030 | | | $ | 3,922,010 | |

| | | | | | | | |

| Expenses | | | | | | | | |

Advisory fee (see Note B) | | | 630,253 | | | | | |

Auction Preferred Shares-auction agent’s fees | | | 7,416 | | | | | |

Legal | | | 146,405 | | | | | |

Custodian | | | 52,623 | | | | | |

Audit and tax | | | 33,006 | | | | | |

Transfer agency | | | 14,716 | | | | | |

Printing | | | 14,375 | | | | | |

Directors’ fees | | | 12,310 | | | | | |

Registration fees | | | 11,711 | | | | | |

Miscellaneous | | | 37,443 | | | | | |

| | | | | | | | |

Total expenses before interest expense, fees and amortization of offering costs | | | 960,258 | | | | | |

Interest expense, fees and amortization of offering costs | | | 697,515 | | | | | |

| | | | | | | | |

Total expenses | | | 1,657,773 | | | | | |

Less: expenses waived and reimbursed by the Adviser (see Note B) | | | (396 | ) | | | | |

| | | | | | | | |

Net expenses | | | | | | | 1,657,377 | |

| | | | | | | | |

Net investment income | | | | | | | 2,264,633 | |

| | | | | | | | |

| Realized and Unrealized Gain on Investment Transactions | | | | | | | | |

Net realized gain on investment transactions | | | | | | | 3,562,643 | |

Net change in unrealized appreciation/depreciation of investments | | | | | | | 1,925,358 | |

| | | | | | | | |

Net gain on investment transactions | | | | | | | 5,488,001 | |

| | | | | | | | |

| Dividends to Auction Preferred Shareholders from | | | | | | | | |

Net investment income | | | | | | | (398,167 | ) |

| | | | | | | | |

Net Increase in Net Assets Applicable to Common Shareholders Resulting from Operations | | | | | | $ | 7,354,467 | |

| | | | | | | | |

See notes to financial statements.

| | |

| |

| abfunds.com | | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | 19 |

STATEMENT OF CHANGES IN NET ASSETS

APPLICABLE TO COMMON SHAREHOLDERS

| | | | | | | | |

| | | Six Months Ended

April 30, 2019

(unaudited) | | | Year Ended

October 31,

2018 | |

| Increase (Decrease) in Net Assets Applicable to Common Shareholders Resulting from Operations | | | | | | | | |

Net investment income | | $ | 2,264,633 | | | $ | 4,845,191 | |

Net realized gain on investment transactions | | | 3,562,643 | | | | 361,206 | |

Net change in unrealized appreciation/depreciation of investments | | | 1,925,358 | | | | (8,660,075 | ) |

| Dividends to Auction Preferred Shareholders from | | | | | | | | |

Net investment income | | | (398,167 | ) | | | (638,808 | ) |

| | | | | | | | |

Net increase (decrease) in net assets applicable to common shareholders resulting from operations | | | 7,354,467 | | | | (4,092,486 | ) |

Distributions to Common Shareholders | | | (2,159,883 | ) | | | (4,246,801 | ) |

Return of capital to Common Shareholders | | | – 0 | – | | | (161,248 | ) |

| | | | | | | | |

Total increase (decrease) | | | 5,194,584 | | | | (8,500,535 | ) |

| Net Assets Applicable to Common Shareholders | | | | | | | | |

Beginning of period | | | 123,081,291 | | | | 131,581,826 | |

| | | | | | | | |

End of period | | $ | 128,275,875 | | | $ | 123,081,291 | |

| | | | | | | | |

See notes to financial statements.

| | |

| |

| 20 | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | | abfunds.com |

STATEMENT OF CASH FLOWS

For the six months ended April 30, 2019(unaudited)

| | | | | | | | |

| Cash flows from operating activities | | | | | | | | |

Net increase in net assets from operations | | | | | | $ | 7,752,634 | |

| Reconciliation of net increase in net assets from operations to net decrease in cash from operating activities | | | | | | | | |

Purchases of long-term investments | | $ | (10,996,803 | ) | | | | |

Purchases of short-term investments | | | (84,068,915 | ) | | | | |

Proceeds from disposition of long-term investments | | | 76,156,028 | | | | | |

Proceeds from disposition of short-term investments | | | 17,292,304 | | | | | |

Net realized gain on investment transactions | | | (3,562,643 | ) | | | | |

Net change in unrealized appreciation/depreciation on investment transactions | | | (1,925,358 | ) | | | | |

Net accretion of bond discount and amortization of bond premium | | | 697,979 | | | | | |

Decrease in deferred offering cost | | | 20,263 | | | | | |

Increase in receivable for investments sold | | | (75,703,600 | ) | | | | |

Decrease in interest receivable | | | 700,596 | | | | | |

Increase in affiliated dividends receivable | | | (419 | ) | | | | |

Increase in payable for investments purchased | | | 49,835,417 | | | | | |

Decrease in advisory fee payable | | | (1,303 | ) | | | | |

Increase in interest expense payable | | | 4,540 | | | | | |

Increase in directors’ fee payable | | | 535 | | | | | |

Increase in other liabilities | | | 10,726 | | | | | |

Decrease in accrued expenses | | | (28,569 | ) | | | | |

| | | | | | | | |

Total adjustments | | | | | | | (31,569,222 | ) |

| | | | | | | | |

Net cash provided by (used in) operating activities | | | | | | | (23,816,588 | ) |

| Cash flows from financing activities | | | | | | | | |

Increase in due to custodian | | | 26,369,596 | | | | | |

Cash dividends paid | | | (2,553,008 | ) | | | | |

| | | | | | | | |

Net cash provided by (used in) financing activities | | | | | | | 23,816,588 | |

| | | | | | | | |

Net increase in cash | | | | | | | — | |

Cash at beginning of period | | | | | | | — | |

| | | | | | | | |

Cash at end of period | | | | | | $ | — | |

| | | | | | | | |

| Supplemental disclosure of cash flow information | | | | | | | | |

Interest expense paid during the period | | $ | 672,712 | | | | | |

In accordance with U.S. GAAP, the Fund has included a Statement of Cash Flows as a result of its substantial investments in floating rate notes and Variable Rate MuniFund Term Preferred Shares throughout the period

See notes to financial statements.

| | |

| |

| abfunds.com | | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | 21 |

NOTES TO FINANCIAL STATEMENTS

April 30, 2019(unaudited)

NOTE A

Significant Accounting Policies

Alliance California Municipal Income Fund, Inc. (the “Fund”) was incorporated in the State of Maryland on November 9, 2001 and is registered under the Investment Company Act of 1940 as a diversified,closed-end management investment company. The financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) which require management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and amounts of income and expenses during the reporting period. Actual results could differ from those estimates. The Fund is an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies. The following is a summary of significant accounting policies followed by the Fund.

1. Security Valuation

Portfolio securities are valued at their current market value determined on the basis of market quotations or, if market quotations are not readily available or are deemed unreliable, at “fair value” as determined in accordance with procedures established by and under the general supervision of the Fund’s Board of Directors (the “Board”).

In general, the market values of securities which are readily available and deemed reliable are determined as follows: securities listed on a national securities exchange (other than securities listed on the NASDAQ Stock Market, Inc. (“NASDAQ”)) or on a foreign securities exchange are valued at the last sale price at the close of the exchange or foreign securities exchange. If there has been no sale on such day, the securities are valued at the last traded price from the previous day. Securities listed on more than one exchange are valued by reference to the principal exchange on which the securities are traded; securities listed only on NASDAQ are valued in accordance with the NASDAQ Official Closing Price; listed or over the counter (“OTC”) market put or call options are valued at the mid level between the current bid and ask prices. If either a current bid or current ask price is unavailable, AllianceBernstein L.P. (the “Adviser”) will have discretion to determine the best valuation (e.g., last trade price in the case of listed options); open futures are valued using the closing settlement price or, in the absence of such a price, the most recent quoted bid price. If there are no quotations available for the day of valuation, the last available closing settlement price is used; U.S. Government securities and any other debt instruments having 60 days or less remaining until maturity are generally valued at market by an independent pricing vendor, if a market price is available. If a market price is not available, the securities are valued

| | |

| |

| 22 | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | | abfunds.com |

NOTES TO FINANCIAL STATEMENTS(continued)

at amortized cost. This methodology is commonly used for short term securities that have an original maturity of 60 days or less, as well as short term securities that had an original term to maturity that exceeded 60 days. In instances when amortized cost is utilized, the Valuation Committee (the “Committee”) must reasonably conclude that the utilization of amortized cost is approximately the same as the fair value of the security. Such factors the Committee will consider include, but are not limited to, an impairment of the creditworthiness of the issuer or material changes in interest rates. Fixed-income securities, including mortgage-backed and asset-backed securities, may be valued on the basis of prices provided by a pricing service or at a price obtained from one or more of the major broker-dealers. In cases where broker-dealer quotes are obtained, the Adviser may establish procedures whereby changes in market yields or spreads are used to adjust, on a daily basis, a recently obtained quoted price on a security. Swaps and other derivatives are valued daily, primarily using independent pricing services, independent pricing models using market inputs, as well as third party broker-dealers or counterparties. Open end mutual funds are valued at the closing net asset value per share, while exchange traded funds are valued at the closing market price per share.

Securities for which market quotations are not readily available (including restricted securities) or are deemed unreliable are valued at fair value as deemed appropriate by the Adviser. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the issuer, analysts, analysis of the issuer’s financial statements or other available documents. In addition, the Fund may use fair value pricing for securities primarily traded innon-U.S. markets because most foreign markets close well before the Fund values its securities at 4:00 p.m., Eastern Time. The earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred in the interim and may materially affect the value of those securities. To account for this, the Fund generally values many of its foreign equity securities using fair value prices based on third party vendor modeling tools to the extent available.

2. Fair Value Measurements

In accordance with U.S. GAAP regarding fair value measurements, fair value is defined as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. U.S. GAAP establishes a framework for measuring fair value, and a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability (including those valued based on their market values as described in Note A.1 above). Inputs may be observable or unobservable

| | |

| |

| abfunds.com | | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | 23 |

NOTES TO FINANCIAL STATEMENTS(continued)

and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability based on the best information available in the circumstances. Each investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-tier hierarchy of inputs is summarized below.

| | • | | Level 1—quoted prices in active markets for identical investments |

| | • | | Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| | • | | Level 3—significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The fair value of debt instruments, such as bonds, andover-the-counter derivatives is generally based on market price quotations, recently executed market transactions (where observable) or industry recognized modeling techniques and are generally classified as Level 2. Pricing vendor inputs to Level 2 valuations may include quoted prices for similar investments in active markets, interest rate curves, coupon rates, currency rates, yield curves, option adjusted spreads, default rates, credit spreads and other unique security features in order to estimate the relevant cash flows which are then discounted to calculate fair values. If these inputs are unobservable and significant to the fair value, these investments will be classified as Level 3. In addition,non-agency rated investments are classified as Level 3.

Other fixed income investments, includingnon-U.S. government and corporate debt, are generally valued using quoted market prices, if available, which are typically impacted by current interest rates, maturity dates and any perceived credit risk of the issuer. Additionally, in the absence of quoted market prices, these inputs are used by pricing vendors to derive a valuation based upon industry or proprietary models which incorporate issuer specific data with relevant yield/spread comparisons with more widely quoted bonds with similar key characteristics. Those investments for which there are observable inputs are classified as Level 2. Where the inputs are not observable, the investments are classified as Level 3.

| | |

| |

| 24 | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | | abfunds.com |

NOTES TO FINANCIAL STATEMENTS(continued)

The following table summarizes the valuation of the Fund’s investments by the above fair value hierarchy levels as of April 30, 2019:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | |

Long-Term Municipal Bonds | | $ | – 0 | – | | $ | 131,154,461 | | | $ | 5,605,440 | | | $ | 136,759,901 | |

Short-Term Investments: | | | | | | | | | | | | | | | | |

Short-Term Municipal Notes | | | – 0 | – | | | 20,445,000 | | | | 5,790,000 | | | | 26,235,000 | |

U.S. Treasury Bills | | | 41,860,875 | | | | – 0 | – | | | – 0 | – | | | 41,860,875 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | | 41,860,875 | | | | 151,599,461 | | | | 11,395,440 | | | | 204,855,776 | |

Liabilities: | |

Variable Rate MuniFund Term Preferred Shares(a) | | | – 0 | – | | | (39,988,536 | ) | | | – 0 | – | | | (39,988,536 | ) |

Floating Rate Notes(a) | | | (7,950,000 | ) | | | – 0 | – | | | – 0 | – | | | (7,950,000 | ) |

Other Financial Instruments(b) | | | – 0 | – | | | – 0 | – | | | – 0 | – | | | – 0 | – |

| | | | | | | | | | | | | | | | |

Total | | $ | 33,910,875 | | | $ | 111,610,925 | | | $ | 11,395,440 | | | $ | 156,917,240 | |

| | | | | | | | | | | | | | | | |

| (a) | The Fund may hold liabilities in which the fair value approximates the carrying amount for financial statement purposes. |

| (b) | Other financial instruments are derivative instruments, such as futures, forwards and swaps, which are valued at the unrealized appreciation/(depreciation) on the instrument. Other financial instruments may also include swaps with upfront premiums, options written and swaptions written which are valued at market value. |

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value.

| | | | | | | | | | | | |

| | | Long-Term

Municipal Bonds | | | Short-Term

Municipal Notes | | | Total | |

Balance as of 10/31/18 | | $ | 9,940,832 | | | $ | – 0 | – | | $ | 9,940,832 | |

Accrued discounts/(premiums) | | | (25,929 | ) | | | – 0 | – | | | (25,929 | ) |

Realized gain (loss) | | | 437,229 | | | | – 0 | – | | | 437,229 | |

Change in unrealized appreciation/depreciation | | | (355,617 | ) | | | – 0 | – | | | (355,617 | ) |

Purchases | | | – 0 | – | | | 5,790,000 | | | | 5,790,000 | |

Sales | | | (5,175,613 | ) | | | – 0 | – | | | (5,175,613 | ) |

Transfers in to Level 3 | | | 784,538 | | | | – 0 | – | | | 784,538 | (a) |

Transfers out of Level 3 | | | – 0 | – | | | – 0 | – | | | – 0 | – |

| | | | | | | | | | | | |

Balance as of 4/30/19 | | $ | 5,605,440 | | | $ | 5,790,000 | | | $ | 11,395,440 | |

| | | | | | | | | | | | |

Net change in unrealized appreciation/depreciation from investments held as of 4/30/19(b) | | $ | (355,617 | ) | | $ | – 0 | – | | $ | (355,617 | ) |

| | | | | | | | | | | | |

| (a) | There were de minimis transfers under 1% of net assets during the reporting period. |

| (b) | The unrealized appreciation/depreciation is included in net change in unrealized appreciation/depreciation on investments and other financial instruments in the accompanying statement of operations. |

| | |

| |

| abfunds.com | | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | 25 |

NOTES TO FINANCIAL STATEMENTS(continued)

As of April 30, 2019, all Level 3 securities were priced by third party vendors.

3. Taxes

It is the Fund’s policy to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its investment company taxable income and net realized gains, if any, to shareholders. Therefore, no provisions for federal income or excise taxes are required.

In accordance with U.S. GAAP requirements regarding accounting for uncertainties in income taxes, management has analyzed the Fund’s tax positions taken or expected to be taken on federal and state income tax returns for all open tax years (the current and the prior three tax years) and has concluded that no provision for income tax is required in the Fund’s financial statements.

4. Investment Income and Investment Transactions

Dividend income is recorded on theex-dividend date or as soon as the Fund is informed of the dividend. Interest income is accrued daily. Investment transactions are accounted for on the date the securities are purchased or sold. Investment gains or losses are determined on the identified cost basis. The Fund amortizes premiums and accretes original issue and market discounts as adjustments to interest income.

5. Dividends and Distributions

Dividends and distributions to shareholders, if any, are recorded on theex-dividend date. Income dividends and capital gains distributions are determined in accordance with federal tax regulations and may differ from those determined in accordance with U.S. GAAP. To the extent these differences are permanent, such amounts are reclassified within the capital accounts based on their federal tax basis treatment; temporary differences do not require such reclassification.

NOTE B

Advisory Fee and Other Transactions with Affiliates

Under the terms of an investment advisory agreement, the Fund pays the Adviser an advisory fee at the annual rate of .65% of the Fund’s adjusted average daily net assets. Such advisory fee, which is calculated on the basis of the assets attributable to the Fund’s common and preferred shareholders, is accrued daily and paid monthly. In computing daily net assets for purposes of determining the advisory fee payable, the Fund calculates daily the value of the total assets of the Fund, minus the value of the total liabilities of the Fund, except that the aggregate liquidation preference of the Variable Rate MuniFund Term Preferred Shares (the “VMTPS”), which is a liability for financial reporting purposes, is not deducted.

| | |

| |

| 26 | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | | abfunds.com |

NOTES TO FINANCIAL STATEMENTS(continued)

Under the terms of the shareholder inquiry agency agreement with AllianceBernstein Investor Services, Inc. (“ABIS”), a wholly-owned subsidiary of the Adviser, the Fund reimburses ABIS for costs relating to servicing phone inquiries on behalf of the Fund. During the six months ended April 30, 2019, there was no reimbursement paid to ABIS.

The Fund may invest in AB Government Money Market Portfolio (the “Government Money Market Portfolio”) which has a contractual annual advisory fee rate of ..20% of the portfolio’s average daily net assets and bears its own expenses. Effective August 1, 2018, the Adviser has contractually agreed to waive .10% of the advisory fee of Government Money Market Portfolio (resulting in a net advisory fee of .10%) until August 31, 2020. In connection with the investment by the Fund in Government Money Market Portfolio, the Adviser has contractually agreed to waive its advisory fee from the Fund in an amount equal to the Fund’s pro rata share of the effective advisory fee of Government Money Market Portfolio, as borne indirectly by the Fund as an acquired fund fee and expense. For the six months ended April 30, 2019, such waiver amounted to $396.

A summary of the Fund’s transactions in AB mutual funds for the six months ended April 30, 2019 is as follows:

| | | | | | | | | | | | | | | | | | | | |

Fund | | Market Value

10/31/18

(000) | | | Purchases

at Cost

(000) | | | Sales

Proceeds

(000) | | | Market Value

4/30/19

(000) | | | Dividend

Income

(000) | |

Government Money Market Portfolio | | $ | 1,320 | | | $ | 7,998 | | | $ | 9,318 | | | $ | – 0 | – | | $ | 9 | |

NOTE C

Investment Transactions

Purchases and sales of investment securities (excluding short-term investments) for the six months ended April 30, 2019 were as follows:

| | | | | | | | |

| | | Purchases | | | Sales | |

Investment securities (excluding

U.S. government securities) | | $ | 10,996,803 | | | $ | 76,166,758 | |

U.S. government securities | | | – 0 | – | | | – 0 | – |

The cost of investments for federal income tax purposes was substantially the same as the cost for financial reporting purposes. Accordingly, gross unrealized appreciation and unrealized depreciation are as follows:

| | | | |

Gross unrealized appreciation | | $ | 8,070,456 | |

Gross unrealized depreciation | | | (22,415 | ) |

| | | | |

Net unrealized appreciation | | $ | 8,048,041 | |

| | | | |

| | |

| |

| abfunds.com | | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | 27 |

NOTES TO FINANCIAL STATEMENTS(continued)

1. Derivative Financial Instruments

The Fund may use derivatives in an effort to earn income and enhance returns, to replace more traditional direct investments, to obtain exposure to otherwise inaccessible markets (collectively, “investment purposes”), or to hedge or adjust the risk profile of its portfolio.

The Fund did not engage in derivatives transactions for the six months ended April 30, 2019.

NOTE D

Common Stock

There are 8,554,668 shares of common stock outstanding at April 30, 2019. During the six months ended April 30, 2019 and the year ended October 31, 2018, the Fund did not issue any shares in connection with the Fund’s dividend reinvestment plan.

NOTE E

Auction Preferred Shares

The Fund has 3,240 shares authorized, and 1,195 shares issued and outstanding of auction preferred stock (“APS”), consisting 771 shares of Series M and 424 shares of series T. The APS have a liquidation value of $25,000 per share plus accumulated, unpaid dividends. The dividend rate on the APS may change every 7 days as set by the auction agent for Series M and T. Due to the recent failed auctions, the dividend rate is the “maximum rate” set by the terms of the APS, which is based on AA commercial paper rates and short-term municipal bond rates. The dividend rate on Series M is 3.61% effective through May 6, 2019. The dividend rate on Series T is 3.61% effective through May 7, 2019.

At certain times, the Fund may voluntarily redeem the APS in certain circumstances. The Fund is not required to redeem any of its APS and expects to continue to rely on the APS for a portion of its leverage exposure. The Fund may also pursue other liquidity solutions for the APS.

Variable Rate MuniFund Term Preferred Shares

During the year ended October 31, 2015, the Fund completed a private offering of the VMTPS, having a liquidation preference of $25,000 per share. The Fund issued and sold 1,605 VMTPS in its offering. The net proceeds from the offering were used to repurchase the APS that were accepted for payment pursuant to the offer. The VMTPS rank pari passu with the remaining outstanding APS but are subject to a mandatory redemption by the Fund in September 2022. The cost of leverage to the Fund resulting from the issuance of the VMTPS is expected to vary over time and to differ from, and in some cases may exceed, the cost of leverage associated with the APS, as is the case at April 30, 2019, although the

| | |

| |

| 28 | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | | abfunds.com |

NOTES TO FINANCIAL STATEMENTS(continued)

Adviser anticipates that, in general, an increase in interest rates beyond a certain level may result in the VMTPS being more economical to the Fund.

The VMTPS generally do not trade, and market quotations are generally not available. The VMTPS are short-term or short/intermediate-term instruments that pay a variable dividend rate tied to the SIFMA Municipal Swap Index, plus an additional fixed “spread” amount of 1.30% established at the time of issuance. As of April 30, 2019, the dividend rate for the VMTPS was 3.60%. In the Fund’s statement of assets and liabilities, the aggregate liquidation preference of the VMTPS is shown as a liability in accordance with U.S. GAAP because the VMTPS have a stated mandatory redemption date. For the six months ended April 30, 2019, the average amount of the VMTPS outstanding and the daily weighted average dividend rate were $40,125,000 and 2.99%, respectively.

Dividends on the VMTPS (which are treated as interest payments for financial reporting purposes) are set weekly. Unpaid dividends on the VMTPS are recorded as “Interest expense payable” on the statement of assets and liabilities. Dividends accrued on the VMTPS are recorded as a component of “Interest expense, fees and amortization of offering costs” on the statement of operations.

Costs incurred by the Fund in connection with its offering of the VMTPS were recorded as a deferred charge, which are amortized over the life of the shares and the amortization is included within “Interest expense, fees and amortization of offering costs” on the statement of operations. The debt issuance costs related to a recognized debt liability are presented as a direct deduction from the debt liability rather than as an asset on the statement of assets and liabilities, consistent with debt discounts. The Fund included deferred offering costs in “Variable Rate MuniFund Term Preferred Shares, at liquidation value (net of unamortized deferred offering cost)” on the statement of assets and liabilities. The VMTPS are treated as equity for tax purposes. During the six months ended April 30, 2019, no additional costs were incurred and capitalized by the Fund.

The preferred shareholders, including the holders of both the APS and VMTPS, voting together as a separate class, have the right to elect at least two directors at all times and to elect a majority of the directors in the event two years’ dividends on the preferred shares are unpaid. In each case, the remaining directors will be elected by the common shareholders and preferred shareholders voting together as a single class. The preferred shareholders will vote as a separate class on certain other matters as required under the Fund’s Charter, the Investment Company Act of 1940 and Maryland law, and management regularly evaluates, and discusses with the Fund’s Board of Directors, the costs and potential benefits of alternative sources of leverage for the Fund.

| | |

| |

| abfunds.com | | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | 29 |

NOTES TO FINANCIAL STATEMENTS(continued)

NOTE F

Distributions to Common Shareholders

The tax character of distributions to be paid for the year ending October 31, 2019 will be determined at the end of the current fiscal year. The tax character of distributions paid during the fiscal years ended October 31, 2018 and October 31, 2017 were as follows:

| | | | | | | | |

| | | 2018 | | | 2017 | |

Distributions paid from: | | | | | | | | |

Ordinary income | | $ | 8,882 | | | $ | 22,750 | |

Tax-exempt income | | | 4,237,919 | | | | 4,738,877 | |

| | | | | | | | |

Distributions Paid | | | 4,246,801 | | | | 4,761,627 | |

Return of capital | | | 161,248 | | | | 240,459 | |

| | | | | | | | |

Total distributions paid | | $ | 4,408,049 | | | $ | 5,002,086 | |

| | | | | | | | |

As of October 31, 2018, the components of accumulated earnings/(deficit) on a tax basis were as follows:

| | | | |

Accumulated capital and other losses | | $ | (4,745,454 | )(a) |

Unrealized appreciation/(depreciation) | | | 6,059,478 | (b) |

| | | | |

Total accumulated earnings/(deficit) | | $ | 1,314,024 | (c) |

| | | | |

| (a) | As of October 31, 2018, the Fund had a net capital loss carryforward of $4,745,454. During the fiscal year, the Fund utilized $352,505 of capital loss carry forwards to offset current year net realized gains |

| (b) | The difference between book-basis andtax-basis unrealized appreciation/(depreciation) is attributable primarily to the tax treatment of tender option bonds. |

| (c) | The difference between book-basis andtax-basis components of accumulated earnings/(deficit) is attributable primarily to dividends payable. |

For tax purposes, net realized capital losses may be carried over to offset future capital gains, if any. Funds are permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an indefinite period. These post-December 22, 2010 capital losses must be utilized prior to the earlier capital losses, which are subject to expiration. Post-December 22, 2010 capital loss carryforwards will retain their character as either short-term or long-term capital losses rather than being considered short-term as under previous regulation.

As of October 31, 2018, the Fund had a net capital loss carryforward of $4,745,454 which will expire as follows:

| | | | |

Short-Term

Amount | | Long-Term

Amount | | Expiration |

| $ 2,248,276 | | n/a | | 2019 |

| $ 1,647,264 | | $849,914 | | No expiration |

| | |

| |

| 30 | ALLIANCE CALIFORNIA MUNICIPAL INCOME FUND | | abfunds.com |

NOTES TO FINANCIAL STATEMENTS(continued)

NOTE G

Risks Involved in Investing in the Fund

Interest Rate Risk—Changes in interest rates will affect the value of investments in fixed-income securities. When interest rates rise, the value of investments in fixed-income securities tends to fall and this decrease in value may not be offset by higher income from new investments. The Fund may be subject to heightened interest rate risk due to rising rates as the current period of historically low interest rates may be ending. Interest rate risk is generally greater for fixed-income securities with longer maturities or durations.

Credit Risk—An issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other contract, may be unable or unwilling to make timely payments of interest or principal, or to otherwise honor its obligations. The issuer or guarantor may default, causing a loss of the full principal amount of a security and accrued interest. The degree of risk for a particular security may be reflected in its credit rating. There is the possibility that the credit rating of a fixed-income security may be downgraded after purchase, which may adversely affect the value of the security. Investments in fixed-income securities with lower ratings tend to have a higher probability that an issuer will default or fail to meet its payment obligations.