into a refining contract with Argor-Heraeus SA (‘‘Argor’’) whereby Bong Mieu delivers dore bars which contain gold and silver to Argor’s delivery point at which point the risks of ownership pass to Argor. Argor purchases the gold and silver from Bong Mieu at an amount equal to the value of the gold and silver shipment less any refining and transport charges. The value of the gold and silver is determined by a number of factors such as the market price of gold and silver and assuming a specified return rate on gold and silver equal to 99.95% and 98%, respectively. The price of gold used in the calculation is equal to the London Bullion market AM-fixing in US dollars per troy ounce and the price of silver used is equal to the silver-fixing of the London Bullion market in US dollars per troy ounce. The contract is valid from November 1, 2005 until October 31, 2007, with an option to extend the contract if agreed upon by both parties.

At Bong Mieu Underground (‘‘BM Underground’’), an underground deposit mined in the 1940s, the Company has rehabilitated some 500 meters of previous workings since October 2005 and has built a stockpile of 60 tonnes of ore grading on average three grams per tonne during the process. Subject to further metallurgical testing, the Company believes that higher gold grade ore from the BM Underground could be processed at the current plant at a rate of approximately 200 tonnes per day and will result in increased cash flows. BM Underground is fully permitted to mine and is located within one kilometre of the BM Central plant. In early 2005, drilling at BM Underground confirmed the extension of the main structure.

Elsewhere on the property, surface prospecting and trenching have new areas of prospective alteration and mineralisation on the property which will be further evaluated and tested by drilling during 2006.

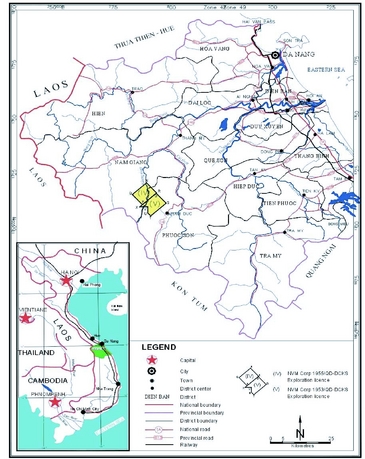

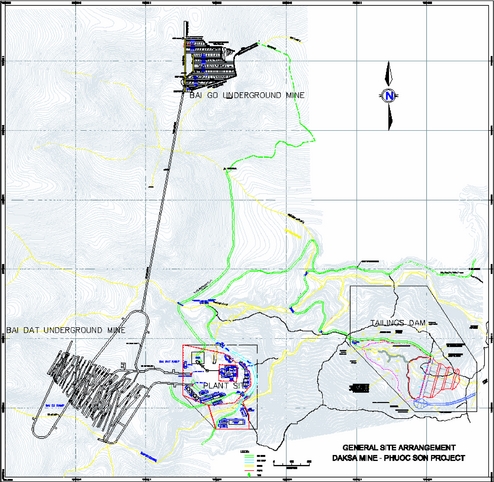

On January 25, 2006, the Company received approval of its Mining Licence for the Dak Sa Underground deposits located on the Phuoc Son property. The Dak Sa Underground is now fully permitted and the Company expects to complete an inhouse feasibility study by the end of November 2006. The purpose of the in-house feasibility study is to ascertain the costs associated with the construction and operation of a mine to process the ore, determine the process that will maximize gold recovery and assess the financial viability of such a project. The feasibility study will be carried out to a standard that would permit a positive independent review for the purposes of acquiring project financing. Once the preliminary feasibility study is completed indicating economic viability and all required licenses are obtained, the construction of the mine and production should follow within 18 to 24 months.

Management’s Discussion and Analysis Three and Six Months Periods Ended June 30, 2006 Compared to Three and Six Months Periods Ended June 30, 2005

The Bong Mieu plant does not have significant revenues or cash flows from operations as the plant is not expected to reach commercial production until fourth quarter 2006. The Company has produced and sold 616 ounces in the first half of 2006. The related revenues of $404,000 have been netted against deferred development costs.

During the quarter ended June 30, 2006, the Company’s total operating expenses were $797,150 representing an increase of $281,618 compared to $515,532 for the same period a year earlier. The difference is principally due to: a non-cash increase of $82,400 in stock-based compensation related to the grant of options which vested during the year; $66,060 in management fees and salaries mainly related to the staffing increases; $38,921 of increased investor relations and promotion activity; and $78,485 of professional fees related to audit, legal and tax work.

During the six-month period ended June 30, 2006, the Company’s total operating expenses were $1,719,111, representing an increase of $759,550 from $959,561 for the same period a year earlier. The difference is principally due to: a non-cash increase of $226,599 in stock-based compensation related to the grant of options which vested during the year; $145,035 in regulatory fees for the TSX listing,

Table of Contents$163,095 in management fees and salaries mainly related to the staffing increases; $38,677 in travel expenses related to increased executive travel and the temporary relocation costs of our CEO to Toronto; $73,987 of increased investor relations and promotion activity; and $74,122 of professional fees related to audit, legal and tax work.

Other items for the three and six-month period ended contributed to income in 2006 and expense in 2005 as a result of foreign exchange gains (losses) and interest income fluctuations. Foreign exchange gains of $21,961 were experienced in 2006 in comparison to foreign exchange losses of $471,243 in 2005 as a result of the favourable exchange rates that occurred between Canada and United States in 2006. Interest income increased by $89,862 to $91,682 in Q2 2006 when compared to Q2 2005 and by $86,055 to $93,846 for the six-month period ended June 30, 2006, when compared to the 2005 same period, as the average invested cash balance was significantly higher than 2005 as a result of a private placement in March 2006.

Twelve Months Ended December 31, 2005 Compared to Twelve Months Ended December 31, 2004

As at December 31, 2005, the Company had not begun production on any of its properties and does not have revenues or cash flows from operations.

During the year ended December 31, 2005, the Company’s total operating expenses of $3,063,799 were higher than in 2004 ($2,083,370). The difference is principally due to a non-cash increase of $780,000 in stock-based compensation related to the grant of options which vested during the year. Management fees also increased by $138,000 due to the addition of one officer and to another position becoming full time. Consulting fees increased $81,000 over the previous year in relation to an agreement with a previous officer of the Company.

Other items such as interest income decreased by $8,700 compared to 2004 as the average invested cash balance was lower during 2005.

Twelve Months Ended December 31, 2004 Compared to Twelve Months Ended December 31, 2003

During the year ended December 31, 2004, the Company’s total operating expenses were $2,083,370 compared to $1,414,199 in 2003. The major components of this increase are as follows: management fees and salaries and stock-based compensation increased by $296,094 and $147,824, respectively, as senior officers were added to the management team. Travel has also increased $211,536 as a result of more frequent visits to the properties by the senior staff and travel related to investor relations efforts. The above variations are reflective of the increased level of activity of the Company.

As the Company has no production the only revenue the Company receives is interest revenue and miscellaneous income. Other items such as interest income increased by $12,766 compared to 2003 as the average invested cash balance was higher. The Company has recorded an $18,000 gain in 2004 from the sale of marketable securities. Also in 2004, $20,632 related to applications for mineral properties in countries other than Vietnam have been expensed.

|  |

| 5B. | Liquidity and Capital Resources |

The Company receives cash for use in exploration, development and future operations mainly from the issuance of common shares, debt financing, exercise of warrants/stock options, investment income generated by its cash position, gold sales and the occasional sale of selected assets.

As at June 30, 2006, the cash and cash equivalents’ balance is $11,543,466 compared to $1,191,582 as at June 30, 2005. The increase was mainly due to a $15,660,000 private placement closed on March 31, 2006 where the Company issued 27,000,000 shares at $0.58. The net proceeds are being directed mainly to exploration activities in Southeast Asia, the rehabilitation of the Bong Mieu Underground, early stage development of the Dak Sa deposits at Phuoc Son and for general corporate purposes. In February 2006, the Company also entered into a US$2.0 million loan facility (the ‘‘Facility’’) with Macquarie Bank Limited (‘‘MBL’’) of Sydney, Australia. The Company drew down the US$2.0 million in the first quarter. The Facility bears an interest rate of LIBOR plus 2.75% and is

35

Table of Contentsrepayable on July 31, 2007 (amended from June 30, 2007) but may be extended to June 30, 2008 at the option of MBL. In consideration for setting up the facility, MBL was paid a US$50,000 fee and was granted 5,376,092 purchase warrants to acquire the same number of common shares of the Company at an exercise price of $0.4347 until July 31, 2007 and $0.4514 until June 30, 2008, if the loan is extended. The Company can also accelerate exercise of the warrants if its common shares trade at a 100% premium to the exercise price for 30 consecutive trading sessions.

During the three and six-month period ended June 30, 2006, Olympus invested $2,411,740 and $3,854,179, respectively, in exploration and development expenses and $352,748 and $447,295, respectively, in acquisitions of capital assets.

The Company received its mining permit at Phuoc Son on January 25, 2006. The Company is evaluating project funding for Phuoc Son to determine whether it will be raised either through equity or debt financing. Although the Company has been successful in accessing the equity markets in the past, there is no guarantee that this will continue to be available. The ability of the Company to continue operations beyond 2006 is dependent upon obtaining the necessary funding to continue its exploration programs or the realization of proceeds from the sale of one or more of its properties and/or assets, of which there can be no assurance. The estimated amount to fund future exploration programs is approximately $8 to $10 million dollars; however, the Company’s capital requirements in the future are largely dependent on the success of the exploration activities.

|  |

| 5C. | Research and development, patents and licenses, etc |

The Company holds an Investment Licence and a Mining Licence covering 30 square km within the Bong Mieu Gold Property area. The Investment Licence area contains three deposits: Bong Mieu Central and Bong Mieu East (open-pit deposits) and Bong Mieu Underground. The Exploration Licence renewal application for the portion of the property not covered by the Mining Licence has been submitted and is being reviewed by the Vietnamese authorities.

On January 25, 2006, the Company received the granting of a Mining Licence by the Government of Vietnam to mine and develop its high-grade Dak Sa deposits within the Phuoc Son Gold property area. The Company is the process of obtaining two additional licenses, the construction license and the import license for mining equipment.

|  |

| 5D. | Trend Information |

Not Applicable

|  |

| 5E. | Off-Balance Sheet Arrangements |

The Company is not engaged in any off-balance sheet arrangements.

36

Table of Contents |  |

| 5F. | Tabular Disclosure of Contractual Obligations |

Table No. 5: Tabular Disclosure of Contractual Obligations as at September 30, 2006

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Payments Due by Period |

| Contractual Obligations |  |  | Total |  |  | Less than

One Year |  |  | 1-3 Years |  |  | 3-5 Years |  |  | More than

Five Years |

| Long-term debt |  |  |  |  | 2,233,160 | |  |  |  |  | 2,233,160 | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |

| Capital lease obligations |  |  |  |  | 140,882 | |  |  |  |  | 140,882 | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |

| Operating lease obligations |  |  |  |  | 1,707,905 | |  |  |  |  | 660,684 | |  |  |  |  | 1,047221 | |  |  |  |  | — | |  |  |  |  | — | |

| Purchase obligations – supplies and services |  |  |  |  | 1,220,115 | |  |  |  |  | 818,777 | |  |  |  |  | 401,338 | |  |  |  |  | — | |  |  |  |  | — | |

| Purchase obligations – capital |  |  |  |  | 5,681,873 | |  |  |  |  | 1,185,217 | |  |  |  |  | 4,496,656 | |  |  |  |  | — | |  |  |  |  | — | |

| Purchase obligations – power supply |  |  |  |  | 19,548 | |  |  |  |  | 19,548 | |  |  |  |  | — | |  |  |  |  | — | |  |  |  |  | — | |

| Asset retirement obligations |  |  |  |  | 387,771 | |  |  |  |  | 29,871 | |  |  |  |  | 357,900 | |  |  |  |  | — | |  |  |  |  | — | |

| Total |  |  |  |  | 11,391,253 | |  |  |  |  | 5,088,138 | |  |  |  |  | 6,303,115 | |  |  |  |  | — | |  |  |  |  | — | |

|

|  |

| ITEM 6: | DIRECTORS, SENIOR MANAGEMENT, AND EMPLOYEES |

|  |

| 6A. | Directors and Senior Management |

Table No. 6: Directors and Senior Management

|  |  |  |  |  |  |  |  |  |

| Name |  |  | Title |  |  | Date of Birth |  |  | Date of First

Election or

Appointment |

| David A. Seton |  |  | Chairman & CEO, director |  |  | Dec. 13, 1955 |  |  | Aug. 1, 1996 |

| Colin D. Patterson |  |  | President |  |  | Jan. 29, 1954 |  |  | Jul. 15, 2005 |

| Jon Morda |  |  | Director |  |  | Jan. 1, 1952 |  |  | Aug. 16, 2006 |

| John A.G. Seton |  |  | Director |  |  | Jan. 10, 1963 |  |  | Jul. 7, 1999 |

| Peter G. Meredith |  |  | Director |  |  | May 26, 1943 |  |  | Mar. 23, 2004 |

| T. Douglas Willock |  |  | Director |  |  | Jan 8,1953 |  |  | February 16, 2006 |

| Peter Tiedemann |  |  | CFO, Corporate Secretary |  |  | Sept 18,1942 |  |  | Jul. 25, 2006 |

| Roger F. Dahn |  |  | VP Exploration |  |  | Sep. 24, 1959 |  |  | Jan. 12, 2004 |

| Pamela Campagnoni |  |  | VP Finance |  |  | December 6, 1972 |  |  | August 1, 2006 |

| Charles Barclay |  |  | Country Manager (Vietnam) |  |  | December 18, 1950 |  |  | March 1,2006 |

|

A brief education and relevant work history of our Directors and Management follows:

David A. Seton

Mr. David Seton has served variously as a director or managing director of a number of companies listed on the New Zealand and Australian Stock Exchanges. He takes responsibility for the overall coordination of Olympus' strategic planning as Chairman and CEO of Olympus. He has seventeen years business experience in Vietnam and over 25 years in the mining industry.

Colin D. Patterson

Mr. Colin Patterson is a professional engineer and brings over thirty years' experience in the mining industry to the Applicant. He holds degrees in Mining Engineering from the University of Witwatersrand and Business Economics and Finance from the University of South Africa. In addition to having held senior positions, including Emperor Mines, Pan Palladium and Zedex Minerals Limited., Mr. Patterson has also owned and managed a consulting firm involved in numerous projects worldwide. He is a fellow of the Australian Institute of Mining and Metallurgy, a Chartered Professional Mining Engineer (Australia), and a member of the South African Council of Professional Engineers. Colin spends about 90% of his time on Olympus Pacific Minerals Inc.

37

Table of ContentsJon Morda

Jon Morda has a Bachelor of Arts degree from the University of Toronto (1975) and is a member of the Institute of Chartered Accountants of Ontario (1980). He has over 20 years' experience in the mining industry, with several positions as Chief Financial Officer of mineral exploration and gold producing companies listed on the Toronto Stock Exchange. Mr. Morda is presently Chief Financial Officer of Alamos Gold Inc. in Toronto, a TSX listed company.

John A.G. Seton

John Seton, a lawyer, is a former President of Olympus Pacific, and has extensive Business experience in Vietnam, serving at one time as Chairman of the Vietnam/New Zealand Business Council. He is or has been a director of a number of companies listed on the Australian Stock Exchange and the New Zealand Stock Exchange. He is currently the Chairman of Australian-listed Summit Resources Ltd. and Zedex Minerals Limited and a Director of New Zealand-listed SmartPay Limited.

Peter G. Meredith

A Canadian Chartered Accountant, Mr. Meredith is Deputy Chairman of Ivanhoe Mines Ltd. having served previously as CFO of Ivanhoe Mines Ltd. for 10 years. Previously, he spent 31 years with Deloitte and Touche LLP, on of the world’s largest accounting firms. He was a senior partner with Deloitte for 20 years and was a member of its board of directors. He brings extensive experience in regulatory compliance and corporate finance, with an emphasis on public resource companies.

T. Douglas Willock

Douglas Willock has over 20 years of experience in the investment banking industry having co-led the Canadian mining groups of National Bank Financial (formerly, Lévesque Beaubien Geoffrion Inc.) and Deutsche Bank Securities Inc. He was a vice-president of Scotia Capital Markets and an assistant vice-president at CIBC World Markets.

Peter Tiedemann

Peter Tiedemann received a Bachelor of Commerce degree from the University of Auckland and has considerable financial and consulting experience spanning some 40 years. His involvement with chief financial officer responsibilities has covered a wide range of companies including Fortune 500 corporations: Canon NZ, Pitney Bowes NZ and DRG New Zealand Ltd. Peter spends about 80% of his time on Olympus Pacific Minerals Inc.

Roger Dahn

Roger Dahn has a Bachelor of Science (geology) degree from Mount Allison University (1981) and is a member of the Association of Professional Engineers and Geoscientists of New Brunswick. He has over 20 years of experience in the mining exploration industry having worked for a number of major gold mining companies.

Pamela Campagnoni

Ms. Campagnoni received a Bachelor of Commerce degree from the University of Toronto. She went on to successfully obtain her CA designation in 1997 and received her CPA (Illinois) in 2000. Ms. Campagnoni spent 10 years in the Assurance practice with Ernst & Young LLP, leaving as a senior audit manager and the last two years with Barrick Gold Corp. as senior manager leading the Accounting Policy and Continuous Disclosure Group.

Charles Barclay

Charles Barclay is a former member of the association of Mine Managers of South Africa. He has 35 years experience in the gold mining sector, of which 25 years have been in senior management

38

Table of Contentsroles in developing and ‘third world’ jurisdictions. Since leaving the role of COO of Emperor Mines, Fiji, in 2000, he has worked in Malaysia and Papua New Guinea as an independent consultant designing mines and constructing one before joining Olympus in February 2006.

|  |

| 6B. | Compensation |

Table No. 7: Compensation of Directors, Management and Employees

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

Name and

Principal

Position |  |  | Year(1) |  |  | Annual Compensation |  |  | Long Term Compensation |  |  | All Other

Compensation

($) |

| Salary ($) |  |  | Bonus

($) |  |  | Other

Annual

Compensation

($) |  |  | Awards |  |  | Payouts |

| Securities

Under Options/

SARs Granted

(#)(2) |  |  | Restricted

Shares or

Restricted

Share Units

($) |  |  | LTIP

Payouts

($) |

David A. Seton(3)

Chairman & CEO |  |  | 2005

2004

2003 |  |  | 164,822

65,323

66,300 |  |  | 40,608

Nil

Nil |  |  | Nil

Nil

Nil |  |  | 2,000,000

Nil

100,000 |  |  | N/A

N/A

N/A |  |  | N/A

N/A

N/A |  |  | N/A

N/A

N/A |

Erik H. Martin(4)

Former CFO |  |  | 2005

2004

2003 |  |  | 136,171

49,000

N/A |  |  | 3,835

Nil

N/A |  |  | Nil

Nil

N/A |  |  | 300,000(5)

200,000

N/A |  |  | N/A

N/A

N/A |  |  | N/A

N/A

N/A |  |  | N/A

N/A

N/A |

Joseph J. Baylis(6)

Former President & CEO |  |  | 2005

2004

2003 |  |  | US$75,417

US$119,792

US$81,458 |  |  | Nil

Nil

Nil |  |  | Nil

Nil

Nil |  |  | 1,250,000(7)

Nil

500,000 |  |  | N/A

N/A

N/A |  |  | N/A

N/A

N/A |  |  | US$73,333

N/A

N/A |

Donald S. Robson(8)

Former CFO |  |  | 2005

2004

2003 |  |  | N/A

55,000

20,000 |  |  | N/A

Nil

Nil |  |  | N/A

Nil

Nil |  |  | N/A

Nil

260,000 |  |  | N/A

N/A

N/A |  |  | N/A

N/A

N/A |  |  | N/A

N/A

N/A |

|

Notes:

|  |

| (1) | Financial years ended December 31. |

|  |

| (2) | Figures represent options granted during a particular year. |

|  |

| (3) | Mr. Seton was appointed as Chief Executive Officer of the Company on July 15, 2005. |

|  |

| (4) | Mr. Martin ceased to be the Chief Financial Officer on July 25, 2006. |

|  |

| (5) | Subsequent to the year ended December 31, 2005, stock options in the amount of 12,110 shares exercisable at $0.65 per share until January 15, 2007 were granted to Mr. Martin. |

|  |

| (6) | Mr. Baylis ceased to be the President and Chief Executive Officer of the Company on July 12, 2005. |

|  |

| (7) | The options are subject to an exercise provision (the ‘‘Exercise Provision’’) whereby Mr. Baylis may not sell more than 500,000 optioned shares within any six month period upon exercise of all or any part of the option without the prior written consent of the Company and the Company, may within that ten day notice period (the ‘‘Exercise Sale Notice’’) pay to Mr. Baylis, in lieu of issued common shares of the Company upon such proposed exercise of the option, a cash amount equal to the spread between the exercise price of the option proposed to be exercised and the average of the closing price of the Company’s common share as reported on the Toronto Stock Exchange (‘‘TSX’’) for the five trading days preceding the date of the Exercise Sale Notice and, in the event of such election and payment by the Company, that portion of the option will be cancelled. If Mr. Baylis proposes in the Exercise Sale Notice to sell 100,000 or more shares within 7 days of the exercise of the option the Company will have the right, in lieu of the foregoing cash payment, to arrange for the purchase of such shares over the facilities of the TSX. |

|  |

| (8) | Mr. Robson ceased to be the Chief Financial Officer on June 16, 2005. |

|  |

| 6B.1. | Termination Agreements for Directors and Senior Officers |

The Company currently has the following arrangement set forth below in place with respect to remuneration received or that may be received by the executive officers or directors of the Company in respect of compensating such officer or director in the event of termination of employment (as a result of resignation, retirement, change of control, etc.) or a change in responsibilities following a change of control, where the value of such compensation exceeds $100,000 per officer or director.

On July 15, 2005, the Company entered into a management services agreement (‘‘the Agreement’’) with Mr. Joseph Baylis, the former President and Chief Executive Officer of the Company, doing Business as Wyndspire Advisors, which provides for a base salary of US$160,000 plus reimbursement of expenses (the ‘‘Fee’’) and the payment of up to $10,000 for reimbursement of all

39

Table of Contentslegal fees and disbursements incurred in connection with his resignation as President and Chief Executive Officer and the entering into the Agreement for the appointment as independent consultant. In the event of termination, without cause, or default by the Company, Mr. Baylis was entitled to receive a severance payment in lieu of notice, equal to the full compensation through to the date of termination plus a lump sum payment equal to the balance of the Fee which would otherwise have been paid for the remainder of the term, and any options were to remain in full force and effect for the balance of their term. The Agreement was for a term of a one year.

Under the terms of a management services agreement dated July 16, 2005, (the ‘‘Management Services Agreement’’), between the Company and Orangue Holdings Limited (‘‘Orangue’’), a company associated with David A. Seton, Chairman and Chief Executive Officer the Company, it was agreed that Orangue would provide a Manager — David A. Seton (the ‘‘Consultant’’) to serve as Chief Executive Officer of the Company for a period of two years at a rate of US$150,000 per year with annual bonus up to a maximum of $150,000 measured against objectives set by the Board. Under the Management Services Agreement, the Consultant received 1,000,000 fully vested stock options of the Company and an additional 1,000,000 vesting on achievement of set objectives. The Company can terminate the Management Services Agreement by paying a severance to Orangue equal to three months or six months of services depending if the termination occurs within the first 12 months or the last 12 months of the Management Services Agreement, respectively.

Under the terms of a management services agreement dated July 16, 2005 between the Company and Momentum Resources International Pty Ltd., a company owed by Colin Patterson, President of the Company, it was agreed that Colin Patterson would provide two years of service as President of the Company at an annual fee of US $156,000 per year with an annual bonus up to a maximum of 50% of the annual fee based on Board review and approval of set objectives. Under the agreement, Mr. Patterson would receive on two occasions options to purchase 1,000,000 shares at a specified price. The Company can terminate the agreement by paying a severance amount equal to three months or six months of services depending if the termination occurs within the first 12 months or the last 12 months of the Management Services Agreement, respectively.

Under the terms of a management services agreement dated June 5, 2006 between the Company and Action Management Ltd., a company owed by Charles Barclay, Country Manager (Vietnam), it was agreed that Mr. Barclay would provide two years of service as Country Manager (Vietnam) at an annual fee of US $151,800 with an semi-annual bonus of up to a maximum of 25% of the annual fee based on Board review and approval of set objectives. Under the agreement, Mr. Barclay would receive options to purchase 1,000,000 shares at a specified price based on specific criteria. The Company can terminate the agreement by paying a severance amount equal to three months or six months of services depending if the termination occurs within the first three months or after the first three months of the Management Services Agreement, respectively.

Under the terms of the service agreement dated March 1, 2005 between the Company and Roger Dahn, VP Exploration, it was agreed that Mr Dahn would provide three years of service as VP Exploration at an annual fee of $150,000 with a cash bonus of up to a maximum of one-third of the annual fee and would receive an annual options grant of no less than 300,000 options per annum. The Company can terminate the agreement by giving the service provider one lump sum equal to the term remaining on the agreement.

|  |

| 6B.2. | Stock Option Plan |

On September 12, 2003, the Company adopted a stock option plan which was re-approved by its shareholders on June 8, 2006. Under the plan, options to purchase shares of the Company may be granted to directors, officers, employees and consultants of the Company. The maximum number of shares that may be issued under the plan is 10% of the Company’s issued and outstanding shares. Options granted under the plan have a maximum term of five years and vesting dates are determined by the Board of Directors on an individual basis at the time of granting.

|  |  |

| 1. | The maximum number of options that can be issued at any one time cannot be higher than 10% of the Company’s issued and outstanding share capital. |

40

Table of Contents |  |  |

| 2 | Options are subject to an accelerated expiry term (the ‘‘Accelerated Term’’) for those options held by individuals who are no longer associated with the Company. The Accelerated Term requires that options held by individuals who resign or are terminated from the Company expire on the earlier of: (i) the original expiry term; or (ii) 90 days from the date of resignation or termination and for those employed to perform investor relations services the Accelerated Term is the earlier of i) the original expiry term; or (ii) 30 days from the date of resignation or termination. |

|  |  |

| 3. | The maximum number of shares that may be reserved for option grant to any one individual in any 12 month period may not exceed 5% of the common shares issued and outstanding on the date of grant; |

|  |  |

| 4. | The maximum number of shares that may be reserved for issuance to insiders of the Company may not exceed 10% of the common shares issued and outstanding on the date of grant; |

|  |  |

| 5. | The maximum number of shares that may be issued to insiders, as a group, within a one year period may not exceed 10% of the common shares issued and outstanding on the date of issuance; |

|  |  |

| 6. | The maximum number of shares that may be issued to any one consultant during any 12 month period shall not exceed 2% of the common shares issued and outstanding on the date of grant; |

|  |  |

| 7. | The maximum number of shares that may be issued to persons, as a group, who perform investor relations services, during any 12 month period shall not exceed 2% of the common shares issued and outstanding on the date of grant; |

|  |  |

| 8. | The board of directors is authorized to amend, suspend or terminate the Plan in accordance with applicable legislation and subject to any required approval and may also amend or modify any outstanding option in any manner to the extent that the board of directors would have had authority to initially grant such option subject to consent of the affected participants, prior approval of the relevant stock exchanges and, if applicable, disinterested shareholder approval. |

During the year ended December 2005, 8,420,000 options were granted and were valued at $1,306,520. The total stock-based compensation expense recognized during the year ended December 31, 2005 for stock options granted in the current and prior years but vesting during 2005 was $961,075 using the fair value method and was credited to contributed surplus. Compensation cost for 2005 has been calculated using the Black-Scholes pricing model with the following weighted average assumptions: fair value of options granted of $0.155 (2004 — $0.21), expected life of options of 3 years (2004 — 3 years), expected stock price volatility of 78.7% (2004 — 78.7%), expected dividend yield of 0% (2004 — 0%) and risk-free interest rate of 2.98% (2004 — 3.45%).

|  |

| 6C. | Board Practices |

Each director is currently serving a (1) year term, renewable at the annual shareholder meeting.

The Company has an Audit Committee, which recommends to the Board of Directors the engagement of the independent auditors of the Company and reviews with the independent auditors the scope and results of the Olympus’ audits, the Company’s internal accounting controls, and the professional services furnished by the independent auditors to the Company. The current members of the Audit Committee, each of whom is independent, are as follows: Jon Morda (Chairman), Peter G. Meredith, and T. Douglas Willock.

The Company’s Compensation Committee is comprised of three independent directors: T. Douglas Willock (Chairman), Peter Meredith and Jon Morda.

Corporate Governance Committee is comprised of Peter Meredith (Chairman), John Seton and T. Douglas Willock.

41

Table of Contents |  |

| 6D. | Employees |

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | 2003 |  |  | 2004 |  |  | 2005 |

| Vietnam |  |  |  |  | 28 | |  |  |  |  | 34 | |  |  |  |  | 79 | |

| Toronto |  |  |  |  | 1 | |  |  |  |  | 2 | |  |  |  |  | 5 | |

| Total |  |  |  |  | 29 | |  |  |  |  | 36 | |  |  |  |  | 84 | |

|

In 2005, on average, there was also approximately 192 contract workers that were engaged in Vietnam that are not included in the above average employee headcount.

|  |

| 6E. | Share Ownership |

The following table shows the shareholdings of the Directors and Senior Management, as at August 31, 2006.

|  |

| 6E.1. | Details of Share Ownership |

Table No. 8: Shareholdings of Directors and Senior Management as at August 31, 2006

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Title of Class |  |  | Name of Beneficial Owner |  |  | Amount and Nature of

Beneficial Ownership *** |  |  | Percent of Class |

| Common |  |  | David A. Seton |  |  |  |  | 58,334 | |  |  |  |  | 0.0354 | |

| Common |  |  | John A. G. Seton |  |  |  |  | 88,745 | |  |  |  |  | 0.0539 | |

| Common |  |  | Colin D. Patterson |  |  |  |  | 155,000 | |  |  |  |  | 0.0942 | |

| Common |  |  | Peter Tiedemann |  |  |  |  | 20,000 | |  |  |  |  | 0.0122 | |

| Common |  |  | Jon Morda |  |  |  |  | 5,000 | |  |  |  |  | 0.0030 | |

| Common |  |  | Peter G. Meredith |  |  |  |  | Nil | |  |  |  |  | Nil | |

| Common |  |  | Douglas Willock |  |  |  |  | Nil | |  |  |  |  | Nil | |

| Common |  |  | Roger Dahn |  |  |  |  | Nil | |  |  |  |  | Nil | |

| Common |  |  | Pam Campagnoni |  |  |  |  | Nil | |  |  |  |  | Nil | |

| Common |  |  | Erik Martin |  |  |  |  | Nil | |  |  |  |  | Nil | |

| Common |  |  | Joseph Baylis |  |  |  |  | 50,000 | |  |  |  |  | 0.0303 | |

| Common |  |  | Donald Robson |  |  |  |  | Nil | |  |  |  |  | Nil | |

| Common |  |  | Charles Barclay |  |  |  |  | Nil | |  |  |  |  | Nil | |

|

|  |

| *** | This table does not reflect shares which can be acquired pursuant to exercise of stock options. |

42

Table of ContentsThe following table sets forth the Company’s outstanding stock options as at August 31, 2006 of Directors and Senior Management:

Table No. 9: Stock Options Outstanding as at August 31, 2006

|  |  |  |  |  |  |  |  |  |  |  |  |

| Name |  |  | Number of

Common-voting

Shares |  |  | Exercise Price |  |  | Grant Date |  |  | Expiration Date |

| David A. Seton |  |  | 320,000

100,000

1,000,000

1,000,000 |  |  | 0.60

0.50

0.32

0.32 |  |  | Feb 11, 2002

Jan 6, 2003

Aug 31, 2005

Sep 29, 2005 |  |  | Feb 11, 2007

Jan 6, 2008

Aug 31, 2010

Sep 29, 2010 |

| John A. G. Seton |  |  | 320,000

100,000

500,000 |  |  | 0.60

0.50

0.32 |  |  | Feb 11, 2002

Jan 6, 2003

Aug 31, 2005 |  |  | Feb 11, 2007

Jan 6, 2008

Aug 31, 2010 |

| Colin D. Patterson |  |  | 1,000,000

1,000,000 |  |  | 0.32

0.32 |  |  | Aug 31, 2005

Sep 29, 2005 |  |  | Aug 31, 2010

Sep 29, 2010 |

| Jon Morda |  |  | 250,000 |  |  | 0.32 |  |  | Aug 31, 2005 |  |  | Aug 31, 2010 |

| Peter G. Meredith |  |  | 200,000

500,000 |  |  | 0.44

0.32 |  |  | Apr 19, 2004

Aug 31, 2005 |  |  | April 19, 2009

Aug 31, 2010 |

| T. Douglas Willock |  |  | 250,000 |  |  | 0.55 |  |  | Feb16, 2006 |  |  | Feb 16, 2011 |

| Erik H. Martin |  |  | 200,000

100,000 |  |  | 0.50

0.32 |  |  | June 29, 2004

Aug 31, 2005 |  |  | June 29, 2009

Aug 31, 2010 |

| Roger Dahn |  |  | 16,140

250,000

197,500

300,000 |  |  | 0.65

0.50

0.32

0.50 |  |  | March 1, 2006

Feb 18, 2004

Aug 31, 2005

Aug 9, 2006 |  |  | Jan 15, 2007

Feb 18, 2009

Aug 31, 2010

August 9, 2011 |

| Pam Campagnoni |  |  | 100,000 |  |  | 0.55 |  |  | July 18, 2006 |  |  | July 18, 2011 |

| Jean Bailly |  |  | 66,667 |  |  | 0.32 |  |  | Aug 31, 2005 |  |  | Aug 31, 2006 |

| Joseph Baylis |  |  | 500,000

1,250,000 |  |  | 0.40

0.40 |  |  | Sept 12, 2003

July 15, 2005 |  |  | Sept 12, 2008

July 15, 2010 |

| Charles Barclay |  |  | 500,000 |  |  | 0.36 |  |  | Jan 25, 2006 |  |  | Jan 25, 2011 |

| Peter Tiedemann |  |  | 100,000 |  |  | 0.55 |  |  | July 18, 2006 |  |  | July 18, 2011 |

|

|  |

| ITEM 7: | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS |

|  |

| 7A. | Major Shareholders |

To the knowledge of the directors and senior officers of the Company, the only persons or companies who beneficially own, directly or indirectly or exercise control or direction over shares carrying more than 5% of the voting rights attached to all outstanding shares of the Company are as at August 31, 2006:

|  |  |  |  |  |  |  |  |  |  |  |  |

| Name |  |  | No. of Shares |  |  | Percentage |

Dragon Capital Group Limited

Ho Chi Minh City, Vietnam |  |  |  |  | 64,262,013(1 | |  |  |  |  | 39.05 | |

Zedex Minerals Limited

Auckland, New Zealand |  |  |  |  | 26,981,849(2 | |  |  |  |  | 16.39 | |

|

Notes:

|  |

| (1) | Of these securities 35,083,513 shares are registered in the name of Vietnam Growth Fund Limited, 19,708,500 shares are registered in the name of Vietnam Enterprise Investments Limited, 8,000,000 are registered in the name of Vietnam Dragon Fund Limited, 1,270,000 shares are registered in the name of Dragon Capital Markets Limited and 200,000 shares are registered in the name of Dragon Capital Management Limited. |

|  |

| (2) | Mr. John A. G. Seton, director, is an insider and director of Zedex Minerals Limited. |

43

Table of ContentsSince October 2004, the Dragon Capital Group Limited started to acquire an interest in the Company and has continued to increase its ownership over 2005 and 2006, resulting in an ownership percentage of 39.05% as at August 31, 2006.

Since December 31, 2002, as a result of share issuances, the percentage ownership by Zedex Minerals Limited of the Company has decreased from 19% to 16.39% as at August 31, 2006.

As at December 31, 2002, Ivanhoe Mines Ltd. owned 18% of the Company which increased to 19% in 2004 as a result of the Vend-In Agreement. On May 25, 2005, Ivanhoe Mines Ltd. entered an agreement to sell their interest in the Company to the Vietnam Growth Fund Limited, part of the Dragon Capital Group Limited, and as a result, Ivanhoe Mines Limited holds no shares in the Company.

As at August 31, 2006, the Company was aware of 420 record holders in the United States, the host country, representing ownership of 13 per cent of the outstanding shares of the Company. The number of record holders consists of 397 non-objecting beneficial owners and 23 registered owners representing 17,377,563 shares and 4,137,327 shares, respectively.

|  |

| 7B. | Related Party Transactions |

During the years ended December 31, 2005, 2004 and 2003 and for the eight-month period ended August 31, 2006, the Company entered into the following transactions with related parties:

|  |  |

| (a) | Paid $17,260 to Zedex Minerals in 2005 for a short-term loan of $1,500,000, bearing 10% interest. The loan was entered into and repaid during the third quarter of 2005. The Company also paid $3,852 to Zedex in 2005 as reimbursement of office expenses. The Company paid $126,371 to Zedex in 2004; comprised mainly of a refund of exploration contribution as stipulated in the Vend-In Agreement, net of amounts due by Zedex to the Company at the time of payment. In 2003, an amount of $115,108 was receivable from Zedex for their share of the exploration expense on the Phuoc Son project offset by a $52,989 accounts payable. One directors of the Company is related to Zedex; namely John Seton. |

|  |  |

| (b) | Paid or accrued $420,597 in 2005 [2004 — $453,611; 2003 — $387,229] for management fees and $214,702 in reimbursement of expenses incurred in 2005 on behalf of the Company to companies controlled by officers of the Company. For the eight-month period ended August 31, 2006, paid or accrued $294,762 for management fees and $83,973 in reimbursement of expenses incurred to companies controlled by officers of the Company. |

|  |  |

| (c) | Paid or accrued $26,536 in 2005 and $18,433 for the eight-month period ended August 31, 2006 in legal fees to a company associated with John Seton, a director of the Company. In 2004, paid $10,269 [2003 — $66,677] in consulting fees to a company controlled by an officer of the Company. |

|  |  |

| (d) | Paid or accrued $19,602 in royalties to Zedex for the eight-month period ended August 31, 2006, a shareholder of the company. |

|  |  |

| (e) | Paid $320,380 (US$261,537) in 2005 to Dragon Capital Management (‘‘Dragon’’) in arrangement fees in regards to the equity financing closed on January 12, 2005 and the debt financing entered into on June 7, 2005. |

|  |  |

| (f) | On June 7, 2005, the Company entered into a US$2.2 million debt financing with Vietnam Growth Funds (a fund controlled by Dragon). The loan was repaid in full on October 13, 2005. |

|  |  |

| (g) | Vend-In Agreement in 2004 with Zedex and Ivanhoe as referred to as an exhibit in Section 10C under material contracts. As at December 31, 2004, Ivanhoe owned 19.6% of the outstanding common shares of the Company. One director of the Company, Peter Meredith, is a senior officer of Ivanhoe. |

These transactions were in the normal course of operation and were measured at the exchange value which represented the amount of consideration established and agreed to by the related parties.

44

Table of Contents |  |

| 7C. | Interests of Experts and Counsel |

None.

|  |

| ITEM 8: | FINANCIAL INFORMATION |

|  |

| 8A. | Consolidated Statements and Other Financial Information |

Reference is made to Item 17 Financial Statements for the financial statements included in this Registration Statement.

There are no legal proceedings of a material nature pending against the Company, or its subsidiaries. The Company is unaware of any legal claim known to be contemplated by any governmental authorities.

The Company has never paid a dividend and it is unlikely that the Company will declare or pay a dividend until warranted.

|  |

| 8B. | Significant Changes |

During the first quarter of 2006, Olympus increased its cash position by $14,826,463. The increase was mainly due to a $15,660,000 private placement closed on March 31, 2006 where the Company issued 27,000,000 shares at $0.58.

In February 2006, the Company also entered into a US$2.0 million loan facility with Macquarie Bank Limited of Sydney, Australia. They Company drew down the US$2.0 million in the first quarter.

On March 21, 2006, the Company issued 3,406,758 common shares to Zedex in full repayment of the US$1,024,000 advance exploration contribution repayable. This amount was originally owed to Ivanhoe Mines Ltd., but on January 1, 2006, Ivanhoe assigned it to Zedex Minerals.

The Company received its mining permit at Phuoc Son on January 25, 2006.

|  |

| ITEM 9: | THE OFFER AND LISTING |

|  |

| 9A. | Common Share Trading Information |

The Company’s shares trade on the Toronto Stock Exchange (‘‘TSX’’) in Canada, under the symbol ‘‘OYM’’. The initial listing date was effective on the TSX on April 3, 2006.

Table No.10 lists the high and low sales prices on the TSX and the TSX Venture (‘‘TSXV’’) for actual trades of the Company’s shares. The Company’s shares started trading on the TSX on April 3, 2006 and prior to that they were listed on the TSXV. As of September 30 2006, the closing price for a Share was $0.41.

45

Table of ContentsTable No. 10: TSX and TSX-V Common-Voting Shares Trading Activity

|  |  |  |  |  |  |  |  |  |  |  |  |

| Period Ended |  |  | High (CAD$) |  |  | Low (CAD$) |

| Monthly: |  |  |  |  | | |  |  |  |  | | |

| 30-Sep-06 |  |  |  | $ | 0.41 | |  |  |  | $ | 0.30 | |

| 31-Aug-06 |  |  |  | $ | 0.53 | |  |  |  | $ | 0.45 | |

| 31-July-06 |  |  |  | $ | 0.56 | |  |  |  | $ | 0.50 | |

| 30-Jun-06 |  |  |  | $ | 0.73 | |  |  |  | $ | 0.31 | |

| 31-May-06 |  |  |  | $ | 0.70 | |  |  |  | $ | 0.45 | |

| 30-Apr06 |  |  |  | $ | 0.94 | |  |  |  | $ | 0.56 | |

| 31-Mar-06 |  |  |  | $ | 0.75 | |  |  |  | $ | 0.58 | |

| 28-Feb-06 |  |  |  | $ | 0.68 | |  |  |  | $ | 0.56 | |

| 31-Jan-06 |  |  |  | $ | 0.74 | |  |  |  | $ | 0.52 | |

| Quarterly |  |  |  |  | | |  |  |  |  | | |

| 30-June-06 |  |  |  | $ | 0.94 | |  |  |  | $ | 0.45 | |

| 31-Mar-06 |  |  |  | $ | 0.74 | |  |  |  | $ | 0.31 | |

| 31-Dec-05 |  |  |  | $ | 0.45 | |  |  |  | $ | 0.25 | |

| 30-Sep-05 |  |  |  | $ | 0.40 | |  |  |  | $ | 0.26 | |

| 30-June-05 |  |  |  | $ | 0.34 | |  |  |  | $ | 0.22 | |

| 31-Mar-05 |  |  |  | $ | 0.40 | |  |  |  | $ | 0.24 | |

| 31-Dec-04 |  |  |  | $ | 0.45 | |  |  |  | $ | 0.32 | |

| 30-Sep-04 |  |  |  | $ | 0.47 | |  |  |  | $ | 0.28 | |

| 30-June-04 |  |  |  | $ | 0.45 | |  |  |  | $ | 0.35 | |

| 31-Mar-04 |  |  |  | $ | 0.57 | |  |  |  | $ | 0.36 | |

| Annual (Fiscal Year): |  |  |  |  | | |  |  |  |  | | |

| Ended December 31, 2005 |  |  |  | $ | 0.45 | |  |  |  | $ | 0.215 | |

| Ended December 31, 2004 |  |  |  | $ | 0.57 | |  |  |  | $ | 0.28 | |

| Ended December 31, 2003 |  |  |  | $ | 0.87 | |  |  |  | $ | 0.27 | |

| Ended December 31, 2002 |  |  |  | $ | 1.65 | |  |  |  | $ | 0.34 | |

| Ended December 31, 2001 |  |  |  | $ | 0.81 | |  |  |  | $ | 0.31 | |

|

The Company plans to have its Shares traded on the OTC Bulletin Board in the United States during 2006, although there can be no assurance that its Shares will be accepted for trading on this facility. On April 3, 2006, the Company started trading its common shares on the Toronto Stock Exchange under the symbol ‘‘OYM’’ and, consequently, no longer trades on TSX Venture Exchange.

|  |

| 9B. | Plan of Distribution |

Not applicable.

|  |

| 9C. | Markets |

See 9A. above

|  |

| 9D. | Selling Shareholders |

Not applicable.

|  |

| 9E. | Dilution |

Not applicable.

|  |

| 9F. | Expenses of the Issue |

Not applicable.

46

Table of Contents |  |

| ITEM 10: | ADDITIONAL INFORMATION |

|  |

| 10A. | Share Capital |

Table No. 11: History of Share Capital

Common share attributes: unlimited shares authorized, one vote per share, no par value per share.

|  |  |  |  |  |  |  |  |  |  |  |  |

| Fiscal Year (except for 2006) |  |  | Nature of

Share Issuance |  |  | Number of

Shares |  |  | Total Capital

Raised |

| Year to date August 31, 2006 |  |  | Private Placement

Issued upon exercise of options

Issued upon exercise of warrants

Issued upon debt repayment(3) |  |  | 27,000,000

1,055,833

1,270,000

3,406,758 |  |  |  | $ | 16,383,745 | |

| 2005 |  |  | Private Placement

Issued upon exercise of warrants |  |  | 32,645,000

1,452,540 |  |  |  | $ | 10,960,446 | |

| 2004 |  |  | Issued upon exercise of options

Issued upon exercise of warrants

Vend-In transaction(1) |  |  | 45,000

2,879,021

13,483,113 |  |  |  | $ | 6,418,673 | |

| 2003 |  |  | Private placements

Issued upon exercise of options

Issued upon exercise of warrants |  |  | 21,163,459

570,000

9,330,000 |  |  |  | $ | 10,031,063 | |

| 2002 |  |  | Settlement of debt(2)

Bonus shares for bridge loans(2)

Stock options exercised

Warrants exercised |  |  | 3,780,000

317,345

332,350

4,208,910 |  |  |  | $ | 3,912,886 | |

|

Notes:

|  |

| (1) | On June 29, 2004, the Company closed a ‘‘Vend-In Agreement’’, whereby it acquired the remaining 42.82% interest in the NVMC joint venture. The consideration for the acquisition was the issuance of 13,483,133 common shares of the Company: Zedex receiving 3,205,467 shares and Ivanhoe 10,277,646 shares. |

|  |

| (2) | In 2002, pursuant to a debt restructuring agreement to settle the remaining balance owing to Ivanhoe of US$3,750,000, the company issued 3,030,000 common shares at a value of $0.50 per share in exchange for debt of US$1,000,000, and 750,000 common shares as bonus shares at a value of $0.50 per share totalling $375,000. The Company issued 317,345 common shares as bonus shares at a value of $244,356 to lenders, of which 59,113 common shares were issued to Zedex at a value of $45,157. |

|  |

| (3) | In 2006, pursuant to an Assignment Agreement, dated January 1, 2006, a prepaid contribution of U.S. $1,024,226 due to Ivanhoe was assigned to Zedex Minerals Limited, a shareholder of the Company. On March 21, 2006, the Company issued 3,406,758 common shares to Zedex in full payment of the prepaid contribution. |

|  |

| 10B. | Memorandum and Articles of Association |

Common shares

The Company is authorized to issue an unlimited number of Common Shares (‘‘Shares’’), with no par value.

The holders of the Shares are entitled to one vote per Share at any meeting of the shareholders of the Corporation and to receive, out of all profits or surplus available for dividends, any dividend declared by the Corporation on the Shares. In the event of liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary, holders of Shares are entitled to receive the remaining property of the Corporation. All shares presently outstanding are duly authorized, validly issued and fully paid. Shares have no preference, conversion, exchange, pre-emptive or cumulative voting rights.

Provisions as to the modification, amendment or variation of such rights and provisions are contained in the Business Companies Act (Ontario) (the ‘‘Act’’) and the regulations promulgated

47

Table of Contentsthereunder. Certain fundamental changes to the articles of the Company will require the approval of two-thirds of the votes cast on a resolution submitted to a special meeting of the Company’s shareholders called for the purpose of considering the resolution. These items include (i) an amendment to the provisions relating to the outstanding capital of the Company, (ii) a sale of all or substantially all of the assets of the Company, (iii) an amalgamation of the Company with another company, other than a subsidiary, (iv) a winding-up of the Company, (v) a continuance of the Company into another jurisdiction, (vi) a statutory court approved arrangement under the Act (essentially a corporate reorganization such as an amalgamation, sale of assets, winding-up, etc.), and (vii) a change of name.

Although the Act does not specifically impose any restrictions on the repurchase or redemption of shares, under the Act a corporation cannot repurchase its shares or declare dividends if there are reasonable grounds for believing that (a) the corporation is, or after payment would be, unable to pay its liabilities as they become due, or (b) after the payment, the realizable value of the corporation’s assets would be less than the aggregate of (i) its liabilities and (ii) its stated capital of all classes of its securities. Generally, stated capital is the amount paid on the issuance of a share.

Articles and By-laws

The following presents a description of certain terms and provisions of the Company’s articles and by-laws.

General

The Company was incorporated in the Province of Ontario on July 4, 1951 under the name of Meta Uranium Mines Limited. The Company’s name was changed to Metina Developments Inc. on August 24, 1978 and then continued from Ontario into British Columbia under Company Act (B.C.) under the name Olympus Holdings Ltd. on November 5, 1992 under No. C-435269. The name was then changed to Olympus Pacific Minerals Inc. on November 29, 1996 and the Company was continued from B.C. into the Yukon under the Business Corporations Act (Yukon) on November 17, 1997 under No. 26213. The Company was continued from the Yukon into a Canadian Business Corporation under the Canadian Business Corporations Act (CBCA) on July 13, 2006 under Certificate of Continuance Number 659785-8.

The Company’s corporate objectives and purpose are unrestricted.

Directors

Pursuant to section 3.12 of the by-laws of the Company (the ‘‘By-Laws’’) and section 120(1) of the Canada Business Corporation Act (the ‘‘CBCA’’), a director or an officer of the Company shall disclose to the Company, in writing or by requesting to have it entered in the directors’ meeting minutes or the directors’ committee meeting minutes, the nature and extent of any interest that he or she has in a material contract or material transaction, whether made or proposed, with the Company, if the director or officer: (a) is a party to the contract or transaction; (b) is a director or an officer, or an individual acting in a similar capacity, of a party to the contract or transaction; or (c) has a material interest in a party to the contract or transaction. Section 3.12 of the By-Laws also provides that such a director or officer shall not vote on any resolution to approve such a contract or transaction except as provided under the CBCA. Section 120(5) of the CBCA permits sucha director to vote on any resolution to approve a contract or transaction if it: (a) relates primarily to his or her remuneration as a director, officer, employee or agent of the Company or an affiliate; (b) is to indemnify or insure a current or former director or officer, or another individual who acts or has acted at the Company’s request as a director or officer, or an individual acting in a similar capacity, of another entity; or (c) is with an affiliate.

If a quorum of directors is present, the directors are entitled to vote compensation to themselves. Section 125 of the CBCA provides that subject to the By-Laws, the articles or a unanimous shareholder agreement, the directors may fix the remuneration of directors, officers and employees of the Company. Section 3.13 of the By-Laws provides that the directors shall be paid such remuneration for their services as the board of directors may from time to time determine.

48

Table of ContentsSection 189 of the CBCA provides that unless the By-Laws, the articles or a unanimous shareholder agreement provide otherwise, the directors may, without authorization of the shareholders: (a) borrow money on the credit of the Company; (b) issue, reissue, sell or pledge debt obligations of the Company; (c) give a guarantee on behalf of the Company to secure the performance of an obligation of any person; and (d) mortgage, hypothecate, pledge or otherwise create a security interest in all or any property of the Company, owned or subsequently acquired, to secure any obligation of the Company.

There are no provisions in the By-Laws or the CBCA relating to the retirement or non-retirement of directors under an age limit requirement. Pursuant to section 105(2) of the CBCA, a director need not be a shareholder. Pursuant to section 3.3 of the By-Laws and section 105(3) of the CBCA, at least twenty-five per cent of the directors of the Company must be resident Canadians. However, if the Company has less than four directors, at least one director must be a resident Canadian. Section 102(2) of the CBCA requires that the Company shall have no fewer than three directors, at least two of whom are not officers or employees of the Company or of any of the Company's affiliates.

Annual and special meetings

The annual meeting and special meetings of shareholders are held at such time and place as the board of directors shall determine. Notice of meetings is sent out to shareholders not less than 10 days nor more than 50 days before the date of such meeting. All shareholders at the record date are entitled to notice of the meeting and have the right to attend the meeting. The directors do not stand for reelection at staggered intervals.

There are no provisions in either the Company’s Articles of Incorporation or Bylaws that would have the effect of delaying, deferring or preventing a change in control of the Company and that would operate only with respect to a merger, acquisition or corporate restructuring involving the Company or its subsidiary. There are no by-law provisions governing the ownership threshold above which shareholder ownership must be disclosed.

|  |

| 10C. | Material Contracts |

The following material contracts have been entered into by the Company within the past two years:

|  |  |

| 1) | Debt Finance Facility Agreement between Olympus Pacific Minerals Inc., Bong Mieu Gold Mining Company Limited, Formwell Holdings Limited and Macquarie Bank Limited, dated February 8, 2006. Refer to Item 5B for details on this agreement. |

|  |  |

| 2) | Joint Venture Agreement between Mien Trung Industrial Company (‘‘Minco’’) and New Vietnam Mining Corp (‘‘NVMC’’), dated March 5, 2003. Refer to Item 4A for details on this agreement. |

|  |  |

| 3) | Vend-In Agreement on March 1, 2004 and Extension of Vend-In Agreement on June 21, 2004 between the Company, Invanhoe Mines Ltd. and Zedex limited. Refer to Item 4A for details on these agreements. |

|  |  |

| 4) | Agreement for Fulfilment of Contract, dated September 16, 2006, between Phuoc Son Gold Co. Ltd. and Huong Toan Company Ltd. Refer to Item 4D.1 for details on this contract. |

|  |  |

| 5) | Purchase Contract CE0780, dated January 24, 2005, between the Company and Gekko System Pty. Ltd. of Australia. The purpose of the agreement is for the purchase of the grinding module, gravity and flotation circuits and for an Inline Leach Reactor required to bring the Ho Gan deposit on the Company’s 80% owned Bong Mieu Gold Property into production. |

|  |  |

| 6) | Mining License No 116 / GP- BTNMT — dated January 23, 2006. Refer to Item 4D.1 (a) for details on this license. |

|  |  |

| 7) | Gold Export Certificate — dated January 25, 2006. Refer to Item 4D.2 (a) for details on this license. |

49

Table of Contents |  |

| 10D. | Exchange Controls |

There are no laws, governmental decrees or regulations in Canada that restrict the export or import of capital or which affect the remittance of dividends, interest or other payments to non-resident holders of our shares, other than the withholding tax requirements (Reference is made to Item 10E) and the Proceeds of Crime (Money Laundering) and Terrorist Financing Act. The Proceeds of Crime (Money Laundering) and Terrorist Financing Act requires that persons and entities report the importation or exportation of currency or monetary instruments of a value equal to or greater than $10,000 to Canadian customers officers in the prescribed form and manner.

There are no limitations under the laws of Canada or the Province of Ontario, or in our constituting documents, with respect to the right of non-resident or foreign owners to hold or vote Shares other than those imposed by the Investment Canada Act.

The Investment Canada Act is a federal Canadian statute which regulates the acquisition of control of existing Canadian businesses and the establishment of new Canadian businesses by an individual, government or entity that is a ‘‘non-Canadian’’ as defined in the Investment Canada Act. Such investments are generally reviewable under the Investment Canada Act by the Minister, designated as being responsible for the administration of the Investment Canada Act. Reviewable investments, generally, may not be implemented prior to the Minister’s determining that the investment is likely to be of ‘‘net benefit to Canada’’ based on the criteria set out in the Investment Canada Act. Generally investments by non-Canadians consisting of the acquisition of control of Canadian businesses which are otherwise non-reviewable and the establishment of new Canadian businesses are subject to certain notification requirements under the Investment Canada Act in the prescribed form and manner.

Management of the Company believes that it is not currently a ‘‘non-Canadian’’ for purposes of the Investment Canada Act and therefore it is not subject to the Act. However, if the Company were to become a ‘‘non-Canadian’’ in the future, acquisitions of control of Canadian businesses by the Company would become subject to the Investment Canada Act. Generally, the direct acquisition by a ‘‘non-Canadian’’ of an existing Canadian business with gross assets of $5 million or more is reviewable under the Investment Canada Act, unless the business is acquired by a WTO investor in which the thresholds are $250 million and $265 million for transactions closing in 2005 and 2006, respectively. Generally, indirect acquisitions of existing Canadian businesses (with gross assets over $50 million) are reviewable under the Investment Canada Act, except in situations involving ‘‘WTO investors’’ where indirect acquisitions are generally not reviewable but are nonetheless subject to notification. In transactions involving Canadian businesses engaged in the production of uranium, providing financial services, providing transportation services or which are cultural businesses, the benefit of the higher ‘‘WTO investor’’ thresholds do not apply.

Acquisitions of businesses related to Canada’s cultural heritage or national identity (regardless of the value of assets involved) may also be reviewable under the Investment Canada Act. In addition, investments to establish new, unrelated businesses are not generally reviewable but are nonetheless subject to nofication. An investment to establish a new business that is related to the non-Canadian’s existing business in Canada is not subject to notification under the Investment Canada Act unless such investment relates to Canada’s cultural heritage or national identity.

Any proposed take-over of the Company by a ‘‘non-Canadian’’ would likely only be subject to the simple notification requirements of the Investment Canada Act, as in all likelihood that non-Canadian would be a ‘‘WTO investor’’ for purposes of the Investment Canada Act provided that the high WTO threshold is not met. Generally, a ‘‘WTO investor’’ is an individual, other than a Canadian, who is a national of a country that is a member of the World Trade Organization or a business entity controlled by such an individual. Virtually all countries of the Western world are members of the World Trade Organization. The Company would have to have a gross asset base of at least $5 million for a direct acquisition, and at least $50 million for an indirect acquisition, before the reviewable transaction provisions of the Investment Canada Act would apply to a third party non-Canadian acquirer that is not a WTO investor.

50

Table of Contents |  |

| 10E. | Taxation |

|  |

| 10E.1. | Certain Canadian Federal Income Tax Consequences — General |

The following is a brief summary of some of the principal Canadian federal income tax consequences to a holder of the common-voting shares of the Company (a ‘‘ Holder’’) who deals at arm's length with the Company, holds the shares as capital property and who, for the purposes of the Income Tax Act (Canada) (the ‘‘Act’’) and the Canada — United States Income Tax Convention (the ‘‘Treaty’’), is at all relevant times resident in the United States, is not and is not deemed to be resident in Canada and does not use or hold and is not deemed to use or hold the shares in carrying on a Business in Canada. Special rules, which are not discussed below, may apply to a U.S. Holder that is an insurer that carries on Business in Canada and elsewhere.

Under the Act and the Treaty, a. Holder of the common-voting shares will generally be subject to a 15% withholding tax on dividends paid or credited or deemed by the Act to have been paid or credited on such shares. The withholding tax rate is 5% where the Holder is a corporation that beneficially owns at least 10% of the voting shares of the Company and the dividends may be exempt from such withholding in the case of some Holders such as qualifying pension funds and charities. Reference is made to ‘‘Item 10E.4 — United States Taxation’’ for a more detailed discussion of the United States tax considerations relating to an investment in the Shares.

|  |

| 10E.2. | Dividends |

A Holder will be subject to Canadian withholding tax (‘‘Part XIII Tax’’) equal to 25%, or such lower rate as may be available under an applicable tax treaty, of the gross amount of any dividend paid or deemed to be paid on common shares. Under the Canada-U.S. Income Tax Convention (1980) as amended by the Protocols signed on 6/14/1983, 3/28/1984, 3/17/1995, and 7/29/1997 (the ‘‘Treaty’’), the rate of Part XIII Tax applicable to a dividend on common shares paid to a Holder who is a resident of the United States and who is the beneficial owner of the dividend, shall not exceed 15%. If the Holder is a company that owns at least 10% of the voting stock of the Company paying the dividend, the withholding tax rate is reduced to 5% and, in all other cases, the tax rate is 15% of the gross amount of the dividend (under the provisions of the Canada-US Income Tax Convention). The Company will be required to withhold the applicable amount of Part XIII Tax from each dividend so paid and remit the withheld amount directly to the Receiver General for Canada for the account of the Holder.

|  |

| 10E.3. | Disposition of Common Shares |

A Holder who disposes of a common share, including by deemed disposition on death, will not normally be subject to Canadian tax on any capital gain (or capital loss) thereby realized unless the common share constituted ‘‘taxable Canadian property’’ as defined by the Tax Act. Generally, a common share of a public corporation will not constitute taxable Canadian property of a Holder if the share is listed on a prescribed stock exchange unless the Holder or persons with whom the Holder did not deal at arm's length alone or together held or held options to acquire, at any time within the five years preceding the disposition, 25% or more of the shares of any class of the capital stock of the Company. The TSX is a prescribed stock exchange under the Tax Act. A Holder who is a resident of the United States and realizes a capital gain on a disposition of a common share that was taxable Canadian property will nevertheless, by virtue of the Treaty, generally be exempt from Canadian tax thereon unless (a) more than 50% of the value of the common shares is derived from, or from an interest in, Canadian real estate, including Canadian mineral resource properties, (b) the common share formed part of the Business property of a permanent establishment that the Holder has or had in Canada within the 12 month period preceding the disposition, or (c) the Holder is an individual who (i) was a resident of Canada at any time during the 10 years immediately preceding the disposition, and for a total of 120 months during any period of 20 consecutive years, preceding the disposition, and (ii) owned the common share when he ceased to be resident in Canada.

A Holder who is subject to Canadian tax in respect of a capital gain realized on a disposition of a common share must include one-half of the capital gain (taxable capital gain) in computing the

51

Table of ContentsHolder's taxable income earned in Canada. The Holder may, subject to certain limitations, deduct one-half of any capital loss (allowable capital loss) arising on a disposition of taxable Canadian property from taxable capital gains realized in the year of disposition in respect to taxable Canadian property and, to the extent not so deductible, from such taxable capital gains realized in any of the three preceding years or any subsequent year.

|  |

| 10E.4. | United States Taxation |

The following summary is a general discussion of the material United States Federal income tax considerations to US holders of our Shares under current law. It does not discuss all the tax consequences that may be relevant to particular holders in light of their circumstances or to holders subject to special rules, such as tax-exempt organizations, qualified retirement plans, financial institutions, insurance companies, real estate investment trusts, regulated investment companies, broker-dealers, non-resident alien individuals or foreign corporations whose ownership of our shares is not effectively connected with the conduct of a trade or Business in the United States, shareholders who acquired their stock through the exercise of employee stock options or otherwise as compensation, shareholders who hold their stock as ordinary assets and not capital assets and any other non-US holders.

The following discussion is based upon the sections of the Internal Revenue Code of 1986, as amended (the ‘‘Code’’), Treasury Regulations, published Internal Revenue Service (‘‘IRS’’) rulings, published administrative positions of the IRS and court decisions that are currently applicable, any or all of which could be materially and adversely changed, possibly on a retroactive basis, at any time. This discussion does not consider the potential effects, both adverse and beneficial, of any recently proposed legislation that, if enacted, could be applied, possibly on a retroactive basis, at any time. The following discussion is not intended to be, nor should it be construed to be, legal or tax advice to any holder or prospective holder of our shares and no opinion or representation with respect to the United States Federal income tax consequences to any such holder or prospective holder is made. Accordingly, holders and prospective holders of our shares should consult their own tax advisors about the Federal, state, local, estate and foreign tax consequences of purchasing, owning and disposing of our shares.

US Holders

As used herein, a ‘‘US Holder’’ includes a holder of shares of the Company who is a citizen or resident of the United States, a corporation created or organized in or under the laws of the United States or of any political subdivision thereof, any entity that is taxable as a corporation for US tax purposes and any other person or entity whose ownership of our shares is effectively connected with the conduct of a trade or Business in the United States. A US Holder does not include persons subject to special provisions of Federal income tax law, such as tax exempt organizations, qualified retirement plans, financial institutions, insurance companies, real estate investment trusts, regulated investment companies, broker-dealers, non-resident alien individuals or foreign corporations whose ownership of our shares is not effectively connected with conduct or trade or Business in the United States, shareholders who acquired their stock through the exercise of employee stock options or otherwise as compensation and shareholders who hold their stock as ordinary assets and not as capital assets.

Distributions on our Shares

US Holders receiving dividend distributions (including constructive dividends) with respect to our shares are required to include in gross income for United States Federal income tax purposes the gross amount of such distributions to the extent that we have current or accumulated earnings and profits as defined under US Federal tax law, without reduction for any Canadian income tax withheld from such distributions. Such Canadian tax withheld may be credited, subject to certain limitations, against the US Holder’s United States Federal income tax liability or, alternatively, may be deducted in computing the US Holder’s United States Federal taxable income by those who itemize deductions.

52

Table of Contents(See more detailed discussion at ‘‘Foreign Tax Credit’’ below). To the extent that distributions exceed our current or accumulated earnings and profits, they will be treated first as a return of capital up to the US Holder's adjusted basis in the shares and thereafter as gain from the sale or exchange of the shares. Preferential tax rates for net capital gains are applicable to a US Holder that is an individual, estate or trust. There are currently no preferential tax rates for long-term capital gains for a US Holder that is a corporation.

With effect from January 1, 2003 and ending December 31, 2010, the United States reduced the maximum tax rate on certain qualifying dividend distributions to 15% (tax rate for low income holders is 5% until 2007 and 0% for 2008 and thereafter). In order for dividends paid by foreign corporations to qualify for the reduced rates, (1) the foreign corporation must meet certain requirements, including that it not be classified as a foreign investment company or a passive foreign investment company for United States federal income tax purposes in either the taxable year of the distribution or the preceding taxable year, and (2) the US Holder must meet the required holding period. In order to meet the required holding period, the US Holder must hold our Common Shares for at least 60 days during the 121-day period beginning 60 days before the ex-dividend date.

Dividends paid on our shares will not generally be eligible for the dividends received deduction provided to corporations receiving dividends from certain United States corporations. A US Holder that is a corporation may, under certain circumstances, be entitled to a 70% deduction of the United States source portion of dividends received from us (unless we qualify as a ‘‘foreign personal holding company’’ or a ‘‘passive foreign investment company’’, as defined below) if such US Holder owns shares representing at least 10% of our voting power and value. The availability of this deduction is subject to several complex limitations that are beyond the scope of this discussion.

In the case of foreign currency received as a dividend that is not converted by the recipient into US dollars on the date of receipt, a US Holder will have a tax basis in the foreign currency equal to its US dollar value on the date of receipt. Generally, any gain or loss recognized upon a subsequent sale or other disposition of the foreign currency, including the exchange for US dollars, will be ordinary income or loss. However, for tax years after 1997, an individual whose realized foreign exchange gain does not exceed US $200 will not recognize that gain, to the extent that there are not expenses associated with the transaction that meet the requirement for deductibility as a trade or Business expense (other than travel expenses in connection with a Business trip or as an expense for the production of income).

Foreign Tax Credit

A US Holder who pays (or has withheld from distributions) Canadian income tax with respect to the ownership of our shares may be entitled, at-the option of the US Holder, to either a deduction or a tax credit for such foreign tax paid or withheld. Generally, it will be more advantageous to claim a credit because a credit reduces United States Federal income taxes on a dollar-for-dollar basis, while a deduction merely reduces the taxpayer’s income subject to tax. This election is made on a year-by-year basis and applies to all foreign taxes paid by (or withheld from) the US Holder during that year. There are significant and complex limitations that apply to the credit, among which is the general limitation that the credit cannot exceed the proportionate share of the US Holder’s United States Federal income tax liability that the US Holder's foreign source income bears to his or its worldwide taxable income. In the determination of the application of this limitation, the various items of income and deduction must be classified into foreign and domestic sources. Complex rules govern this classification process. There are further limitations on the foreign tax credit for certain types of income such as ‘‘passive income’’, ‘‘high withholding tax interest’’, ‘‘financial services income’’, ‘‘shipping income’’, and certain other classifications of income. The availability of the foreign tax credit and the application of the limitations on the credit are fact specific and holders and prospective holders of our shares should consult their own tax advisors regarding their individual circumstances.

Disposition of our Shares

A US Holder will recognize a gain or loss upon the sale of our shares equal to the difference, if any, between (i) the amount of cash plus the fair market value of any property received, and (ii) the

53

Table of Contentsshareholder's tax basis in our shares. This gain or loss will be a capital gain or loss if the shares are a capital asset in the hands of the US Holder, and will be a short-term or long-term capital gain or loss depending upon the holding period of the US Holder. Preferential tax rates for long-term gains are applicable to a U.S. Holder which is an individual, estate or trust. There are currently no preferential tax rates for long-term capital gains for a U.S. Holder which is a corporation.

Gains and losses are netted and combined according to special rules in arriving at the overall capital gain or loss for a particular tax year. Deductions for net capital losses are subject to significant limitations. Corporate capital losses (other than losses of corporations electing under Subchapter S or the Code) are deductible to the extent of capital gains. Non-corporate taxpayers may deduct net capital losses, whether short-term or long-term, up to US $3,000 a year (US $1,500 in the case of a married individual filing separately). For US Holders which are individuals, any unused portion of such net capital loss may be carried over to be used in later tax years until such net capital loss is thereby exhausted. For US Holders which are corporations (other than corporations subject to Subchapter S of the Code), an unused net capital loss may be carried back three years from the loss year and carried forward five years from the loss year to be offset against capital gains until such net capital loss is thereby exhausted.

Other Considerations