Table of ContentsUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F-A

|  |

![[X]](https://capedge.com/proxy/20FR12GA/0000950136-07-007732/xbox.gif) | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

|  |

![[ ]](https://capedge.com/proxy/20FR12GA/0000950136-07-007732/ebox.gif) | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934 |

For the fiscal year ended

OR

|  |

![[ ]](https://capedge.com/proxy/20FR12GA/0000950136-07-007732/ebox.gif) | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934 |

For the transition period from to

Olympus Pacific Minerals Inc.

(Exact name of Registrant as specified in its charter)

Canada

(Jurisdiction of incorporation or organization)

Suite 500 – 10 King Street East Toronto, Ontario Canada, M5C 1C3

(Address of principal executive offices)

|  |  |  |

| Securities to be registered pursuant to Section 12(b) of the Act: |  |  | None |

| Securities to be registered pursuant to Section 12(g) of the Act: |  |  | common shares

(Title of Class) |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: Not Applicable

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ![[ ]](https://capedge.com/proxy/20FR12GA/0000950136-07-007732/ebox.gif) No

No ![[X]](https://capedge.com/proxy/20FR12GA/0000950136-07-007732/xbox.gif)

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ![[ ]](https://capedge.com/proxy/20FR12GA/0000950136-07-007732/ebox.gif) No

No ![[ ]](https://capedge.com/proxy/20FR12GA/0000950136-07-007732/ebox.gif)

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrants was required to file such reports). And (2) has been subject to such filing requirements for the past 90 days.

Yes ![[ ]](https://capedge.com/proxy/20FR12GA/0000950136-07-007732/ebox.gif) No

No ![[X]](https://capedge.com/proxy/20FR12GA/0000950136-07-007732/xbox.gif)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of ‘‘accelerated filer and large accelerated filer’’ in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated file ![[ ]](https://capedge.com/proxy/20FR12GA/0000950136-07-007732/ebox.gif) Accelerated file

Accelerated file ![[ ]](https://capedge.com/proxy/20FR12GA/0000950136-07-007732/ebox.gif) Non-accelerated file

Non-accelerated file ![[X]](https://capedge.com/proxy/20FR12GA/0000950136-07-007732/xbox.gif)

Indicated by check mark which financial statement item the registrant has elected to follow.

Item 17 ![[X]](https://capedge.com/proxy/20FR12GA/0000950136-07-007732/xbox.gif) Item 18

Item 18 ![[ ]](https://capedge.com/proxy/20FR12GA/0000950136-07-007732/ebox.gif)

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act)

Yes ![[ ]](https://capedge.com/proxy/20FR12GA/0000950136-07-007732/ebox.gif) No

No ![[ ]](https://capedge.com/proxy/20FR12GA/0000950136-07-007732/ebox.gif)

Table of Contents

i

ii

Table of ContentsGLOSSARY

Following is a glossary of terms used throughout this Registration Statement.

|  |  |

| artisanal mining |  | mining at small-scale mines (and to a lesser extent quarries) that are labor intensive, with mechanization being at a low level and basic. Artisanal mining can encompass all small, medium, large, informal, legal and illegal miners who use rudimentary processes to extract valuable rocks and minerals from ore bodies. |

| | |

|  |  |

| bitumen |  | known as asphalt or tar, bitumen is the brown or black viscous residue from the vacuum distillation of crude petroleum |

| | |

|  |  |

| breccia |  | a rock in which angular fragments are surrounded by a mass of finer-grained material. |

| | |

|  |  |

| C-horizon soil |  | the soil parent material, either created in situ or transported into its present location. Beneath the C horizon lies bedrock. |

| | |

|  |  |

| concentrate |  | a concentrate of minerals produced by crushing, grinding and processing methods such as gravity, flotation or leaching. |

| | |

|  |  |

| exploration stage |  | the search for mineral deposits which are not in either the development or production stage. |

| | |

|  |  |

| Form 43-101 |  | technical report issued pursuant to Canadian securities rules, the objective of which is to provide a summary of scientific and technical information concerning mineral exploration, development and production activities on a mineral property that is material to an issuer. The Form 43-101F1 is prepared in accordance with the National Instrument 43-101Standards of Disclosure for Mineral Projects. The 43-101 Form sets out specific requirements for the preparation and contents of a technical report. |

| | |

|  |  |

| feasibility study |  | a comprehensive study of a mineral deposit in which all geological, engineering, legal, operating, economic, social, environmental and other relevant factors are considered in sufficient detail that it could reasonably serve as the basis for a final decision by a financial institution to finance the development of the deposit for mineral production. |

| | |

|  |  |

| grade |  | the metal content of rock with precious metals. Grade can be expressed as troy ounces or grams per tonne of rock. |

| | |

|  |  |

| granodiorite |  | a medium to coarse-grained intrusive igneous rock, intermediate in composition between quartz diorite and quartz monzonite. |

| | |

|  |  |

| gold deposit |  | a mineral deposit mineralized with gold |

| | |

|  |  |

| hydrothermal |  | the products or the actions of heated waters in a rock mass such as a mineral deposit precipitating from a hot solution. |

| | |

3

Table of Contents |  |  |

| igneous |  | a primary type of rock formed by the cooling of molten material. |

| | |

|  |  |

| inferred mineral resource |  | that part of a mineral resource for which quantity and grade or quality can be estimated on the basis of geological evidence and reasonable assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings, and drill holes. |

| | |

|  |  |

| intrusion |  | intrusive-molten rock which is intruded (injected) into spaces that are created by a combination of melting and displacement. |

| | |

|  |  |

| mafic |  | igneous rocks composed mostly of dark, iron- and magnesium-rich minerals. |

| | |

|  |  |

| metallurgical tests |  | scientific examinations of rock/material to determine the optimum extraction of metal contained. Core samples from diamond drill holes are used as representative samples of the mineralization for this test work. |

| | |

|  |  |

| mineral resource |  | a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge. Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories. |

| | |

|  |  |

| ore |  | a naturally occurring rock or material from which minerals, such as gold, can be extracted at a profit; a determination of whether a mineral deposit contains ore is often made by a feasibility study. |

| | |

|  |  |

| open pit |  | a mining method whereby the mineral reserves are accessed from surface by the successive removal of layers of material usually creating a large pit at the surface of the earth. |

| | |

|  |  |

| ounce or oz. |  | a troy ounce or 20 pennyweights or 480 grains or 31.103 grams |

| | |

|  |  |

| petrology |  | a field of geology which focuses on the study of rocks and the conditions by which they form. There are three branches of petrology, corresponding to the three types of rocks: igneous, metamorphic, and sedimentary. |

| | |

|  |  |

| pre-feasibility study |  | a comprehensive study of the viability of a mineral project that has advanced to a stage where the mining methods, in |

| | |

4

Table of Contents |  |  |

|  | the case of underground mining, or the pit configurations, in the case of an open pit, has been established, where effective methods of mineral processing has been determined, and includes a financial analysis based on reasonable assumptions of technical, engineering, legal, operating, and economic factors and evaluation of other relevant factors which are sufficient for a Qualified Person, acting reasonably, to determine if all or part of the Mineral Resource may be classified as a Mineral Reserve. |

| | |

|  |  |

| probable reserve |  | the economically mineable part of an indicated and, in some circumstances, a measured mineral resource demonstrated by a least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. |

| | |

|  |  |

| prospect |  | an area prospective for economic minerals based on geological, geophysical, geochemical and other criteria |

| | |

|  |  |

| production stage |  | all companies engaged in the exploitation of a mineral deposit (reserve). |

| | |

|  |  |

| proven reserve |  | the economically mineable part of a measured mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. |

| | |

|  |  |

| qualified person |  | an individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these; has experience relevant to the subject matter of the mineral project and the Technical Report; and is a member or licensee in good standing of a professional association. |

| | |

|  |  |

| reserve |  | that part of a mineral deposit, which could be economically and legally extracted or produced at the time of the reserve determination. Reserves are customarily stated in terms of ‘‘ore’’ when dealing with metalliferous minerals such as gold or silver. |

| | |

|  |  |

| shaft |  | a vertical or inclined tunnel in an underground mine driven downward from surface. |

| | |

|  |  |

| shear |  | a tabular zone of faulting within which the rocks are crushed and flattened. |

| | |

|  |  |

| stratigraphic units |  | sequences of bedded rocks in specific areas |

| | |

5

Table of Contents |  |  |

| strike |  | the direction of line formed by intersection of a rock surface with a horizontal plane. Strike is always perpendicular to direction of dip. |

| | |

|  |  |

| thrust fault |  | a particular type of fault, or break in the fabric of the Earth’s crust with resulting movement of each side against the other, in which a lower stratigraphic position is pushed up and over another. This is the result of compressional forces. |

| | |

|  |  |

| trenching |  | the surface excavation of a linear trench to expose mineralization for sampling |

| | |

|  |  |

| vein |  | a tabular body of rock typically of narrow thickness and mineralized occupying a fault, shear, fissure or fracture crosscutting another pre-existing rock. |

| | |

For ease of reference, the following conversion factors are provided:

|  |  |  |  |  |  |  |  |  |

| 1 mile (mi) |  |  | = 1.609 kilometres (km) |  |  | 2,204 pounds (lbs) |  |  | = 1 tonne |

| 1 yard (yd) |  |  | = 0.9144 meter (m) |  |  | 2,000 pounds/1 short ton |  |  | = 0.907 tonne |

| 1 acre |  |  | = 0.405 hectare (ha) |  |  | 1 troy ounce |  |  | = 31.103 grams |

| 1 kilometre (km) |  |  | = 1,000 meters |  |  | |  |  | |

6

Table of ContentsPART I

|  |

| ITEM 1: | Identity of Directors, Senior Management and Advisors |

1A. Directors and Senior Management

The names, business addresses and principal occupations of the directors and senior management of Olympus Pacific Minerals Inc. (the ‘‘Company’’ or ‘‘Olympus’’) as at June 30, 2007 are set forth below:

|  |  |  |  |  |  |  |  |  |

Name and

Municipality of Residence(1) |  |  | Position

with

Company |  |  | Business Address |  |  | Principal Occupation |

David A. Seton(3)(4)

Auckland, New Zealand |  |  | Executive Chairman and Director |  |  | 63 Fort Street

Level 2

Auckland 1015

New Zealand |  |  | Business Executive – Olympus Pacific Minerals Inc. |

Jon Morda(2)(3)(5)

Toronto, Canada |  |  | Director |  |  | Alamos Gold

120 Adelaide St. W.

Suite 2010

Toronto, ON,

M5H 1T1

Canada |  |  | Chartered Accountant

C.F.O.– Alamos Gold Inc. |

John A.G. Seton(4)

Auckland, New Zealand |  |  | Director |  |  | Level 2

Claymore House

63 Fort Street

Auckland 1140

New Zealand |  |  | Lawyer, Claymore Law

Part-time Executive Chairman of Zedex Minerals Limited |

| |  |  | |  |  | |  |  | |

T. Douglas Willock(2)(3)(5)

Toronto, Canada |  |  | Director |  |  | 1700 – 8 King Street

Toronto, ON

M5C 1B5

Canada |  |  | Resource Industry and

Capital Markets Consultant |

Kevin Flaherty(2)(3)(5)

Calgary, Alberta |  |  | Director |  |  | 407 – 2nd Street S.W.

#1000

Calgary, AB

T2P 2Y3

Canada |  |  | M.B.A., Chairman and CEO of Celtic Minerals Ltd. (also a Director), Director of Carpathian Gold, Director of Linear Gold Corp., Meritus Minerals Ltd., and Keeper Resources Inc. |

Colin D. Patterson

Sydney, Australia |  |  | CEO and President |  |  | Momentum Resources International

PO Box 260

Kenthurst NSW 2156

Australia |  |  | Professional Engineer

Mr. Patterson devotes about 90% of his time to Company affairs. |

Peter Tiedemann

Auckland, New Zealand |  |  | Chief Financial Officer,

Corporate Secretary |  |  | 63 Red Hills Road

Waitakere City

Auckland, NZ |  |  | Financial Executive

Mr. Tiedemann devotes about 80% of his time to Company affairs. |

7

Table of Contents

|  |  |  |  |  |  |  |  |  |

Name and

Municipality of Residence(1) |  |  | Position

with

Company |  |  | Business Address |  |  | Principal Occupation |

Pamela Campagnoni

Toronto, Ontario |  |  | Vice-President Finance |  |  | 10 King Street East

Suite 500

Toronto, ON

M5C 1C3

Canada |  |  | Chartered Accountant – Olympus Pacific Minerals Inc. |

| Charles Barclay |  |  | VP Operations |  |  | 644-646 Ngo Quyen Street

Son Tra District

Danang, Vietnam |  |  | VP Operations, – Olympus Pacific Minerals Inc. |

| T. Rodney P. Jones |  |  | Vice-President Exploration |  |  | 53 Churchlands Avenue

Churchlands 6018

Western Australia

Australia |  |  | VP Exploration, – Olympus Pacific Minerals Inc. |

| Russell Graham |  |  | Vice-President Finance Vietnam |  |  | 644-646 Ngo Quyen Street

Son Tra District

Danang, Vietnam |  |  | Chartered Accountant – Olympus Pacific Minerals Inc. |

Notes:

|  |

| (1) | The information as to the municipality of residence, not being within the knowledge of the Company, has been furnished by the respective directors individually. |

|  |

| (2) | Member of Audit Committee. |

|  |

| (3) | Member of Remuneration Committee. |

|  |

| (4) | Member of Corporate Governance Committee. |

|  |

| (5) | Independent Director |

|  |

| 1B. | Advisors |

The Company’s Attorneys are:

Gowling Lafleur Henderson LLP

Suite 2300, Four Bentall Centre

P.O. Box 49122

Vancouver, British Columbia, Canada

The Company’s main financial institution is:

TD Canada Trust

55 King Street West

Toronto, ON M5K 1A2

8

Table of Contents |  |

| 1C. | Auditor |

The Company’s auditors for the financial statements are:

Ernst &Young LLP, Chartered Accountants

Ernst & Young Tower

222 Bay Street

Toronto, Ontario, Canada M5K 1J7

Ernst & Young LLP is governed by the rules of the Institute of Chartered Accountants of Ontario, is a participating audit firm with the Canadian Public Accountability Board and is registered with the Public Company Accounting Oversight Board.

|  |

| ITEM 2: | Offer Statistics and Expected Timetable |

Not Applicable.

|  |

| ITEM 3: | Key Information |

|  |

| 3A. | Selected Financial Data |

Following is selected financial data of the Company, expressed in Canadian dollars, for the fiscal years ended December 31, 2002-2006 and six-month periods ended June 30, 2007 and 2006 which were prepared in accordance with Canadian generally accepted accounting principles (‘‘Canadian GAAP’’), which differ substantially from United States generally accepted accounting principles (‘‘US GAAP’’). Reference is made to Note 18 to the audited financial statements for the years ended December 31, 2006, 2005 and 2004 in ‘‘Item 17. Financial Statements’’ for a description of the differences between Canadian and United States generally accepted accounting principles, and how these differences could affect the Company’s financial statements .

The selected financial data should be read in conjunction with the financial statements and other financial information include elsewhere in the Registration Statement.

9

Table of ContentsTable No. 1: Selected Financial Data

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| (CAD$) |  |  | Six-month

period ended

June 30, 2007 |  |  | Six-month

period ended

June 30, 2006 |  |  | Year

Ended

December 31,

2006 |  |  | Year

Ended

December 31,

2005 |  |  | Year

Ended

December 31,

2004 |  |  | Year

Ended

December 31,

2003 |  |  | Year

Ended

December 31,

2002 |

| CANADIAN GAAP |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |

| Revenue |  |  |  |  | 2,759,715 |  |  |  | Nil |  |  |  |  | 1,644,040 |  |  |  | Nil |  |  | Nil |  |  | Nil |  |  | Nil |

| Income (Loss) for the Period |  |  |  |  | (5,210,316 | ) |  |  |  |  | (1,681,240 | ) |  |  |  |  | (9,478,887 | ) |  |  |  |  | (2,768,461 | ) |  |  |  |  | (2,182,459 | ) |  |  |  |  | (1,350,509 | ) |  |  |  |  | (6,870,911 | ) |

| Basic Earning (Loss) Per Share |  |  |  |  | (0.03 | ) |  |  |  |  | (0.01 | ) |  |  |  |  | (0.06 | ) |  |  |  |  | (0.02 | ) |  |  |  |  | (0.02 | ) |  |  |  |  | (0.02 | ) |  |  |  |  | (0.14 | ) |

| Diluted Earnings (Loss) per Share |  |  |  |  | (0.03 | ) |  |  |  |  | (0.01 | ) |  |  |  |  | (0.06 | ) |  |  |  |  | (0.02 | ) |  |  |  |  | (0.02 | ) |  |  |  |  | (0.02 | ) |  |  |  |  | (0.14 | ) |

| Dividends Per Share |  |  |  |  | Nil |  |  |  |  |  | Nil |  |  |  |  |  | Nil |  |  |  |  |  | Nil |  |  |  |  |  | Nil |  |  |  |  |  | Nil |  |  |  |  |  | Nil |  |

| Period-end Shares |  |  |  |  | 193,679,079 |  |  |  |  |  | 164,150,458 |  |  |  |  |  | 164,678,791 |  |  |  |  |  | 131,846,200 |  |  |  |  |  | 97,748,660 |  |  |  |  |  | 81,341,526 |  |  |  |  |  | 50,278,067 |  |

| Cash |  |  |  |  | 10,815,631 |  |  |  |  |  | 11,543,466 |  |  |  |  |  | 4,101,536 |  |  |  |  |  | 404,987 |  |  |  |  |  | 5,597,628 |  |  |  |  |  | 5,975,181 |  |  |  |  |  | 204,942 |  |

| Working Capital |  |  |  |  | 9,539,309 |  |  |  |  |  | 11,010,113 |  |  |  |  |  | 1,720,050 |  |  |  |  |  | (1,862,041 | ) |  |  |  |  | 717,921 |  |  |  |  |  | 4,991,885 |  |  |  |  |  | (455,401 | ) |

| Mineral Properties |  |  |  |  | 9,908,709 |  |  |  |  |  | 10,060,904 |  |  |  |  |  | 10,015,755 |  |  |  |  |  | 10,060,904 |  |  |  |  |  | 10,060,904 |  |  |  |  |  | 4,848,605 |  |  |  |  |  | 4,992,655 |  |

| Deferred Development and Exploration |  |  |  |  | 19,287,760 |  |  |  |  |  | 16,645,897 |  |  |  |  |  | 15,732,101 |  |  |  |  |  | 13,089,242 |  |  |  |  |  | 8,375,473 |  |  |  |  |  | 3,837,795 |  |  |  |  |  | 2,803,022 |  |

| Long-term Liabilities |  |  |  |  | 837,175 |  |  |  |  |  | 2,569,687 |  |  |  |  |  | 890,322 |  |  |  |  |  | 351,428 |  |  |  |  |  | 1,231,119 |  |  |  |  |  | 36,384 |  |  |  |  |  | 1,320,295 |  |

| Capital Stock |  |  |  |  | 81,745,340 |  |  |  |  |  | 65,883,460 |  |  |  |  |  | 66,074,507 |  |  |  |  |  | 49,709,671 |  |  |  |  |  | 38,749,225 |  |  |  |  |  | 32,330,552 |  |  |  |  |  | 22,846,485 |  |

| Shareholders’ Equity |  |  |  |  | 47,082,756 |  |  |  |  |  | 43,297,430 |  |  |  |  |  | 35,963,859 |  |  |  |  |  | 27,386,599 |  |  |  |  |  | 18,105,269 |  |  |  |  |  | 13,691,021 |  |  |  |  |  | 6,055,193 |  |

| Total Assets |  |  |  |  | 51,016,273 |  |  |  |  |  | 47,598,122 |  |  |  |  |  | 41,556,694 |  |  |  |  |  | 30,510,086 |  |  |  |  |  | 24,418,374 |  |  |  |  |  | 14,965,364 |  |  |  |  |  | 8,192,455 |  |

| US GAAP |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |

| Net Income (Loss) |  |  |  |  | (9,398,843 | ) |  |  |  |  | (5,318,748 | ) |  |  |  |  | (10,231,323 | ) |  |  |  |  | (7,434,680 | ) |  |  |  |  | (6,720,137 | ) |  |  |  |  | (2,385,282 | ) |  |  |  |  | (4,423,072 | ) |

| Income (Loss) Per Share – basic and diluted |  |  |  |  | (0.05 | ) |  |  |  |  | (0.04 | ) |  |  |  |  | (0.06 | ) |  |  |  |  | (0.06 | ) |  |  |  |  | (0.08 | ) |  |  |  |  | (0.04 | ) |  |  |  |  | (0.09 | ) |

| Mineral Properties |  |  |  |  | 9,871,209 |  |  |  |  |  | 10,060,904 |  |  |  |  |  | 9,978,255 |  |  |  |  |  | 10,060,904 |  |  |  |  |  | 10,060,904 |  |  |  |  |  | 4,848,605 |  |  |  |  |  | 4,992,655 |  |

| Deferred Development and Exploration |  |  |  |  | Nil |  |  |  |  |  | Nil |  |  |  |  |  | Nil |  |  |  |  |  | Nil |  |  |  |  |  | Nil |  |  |  |  |  | Nil |  |  |  |  |  | Nil |  |

| Shareholders’ Equity |  |  |  |  | 27,678,164 |  |  |  |  |  | 26,570,680 |  |  |  |  |  | 22,122,181 |  |  |  |  |  | 14,297,357 |  |  |  |  |  | 9,729,796 |  |  |  |  |  | 9,853,226 |  |  |  |  |  | 3,252,171 |  |

| Total Assets |  |  |  |  | 31,611,681 |  |  |  |  |  | 30,060,477 |  |  |  |  |  | 27,228,479 |  |  |  |  |  | 17,420,844 |  |  |  |  |  | 16,042,901 |  |  |  |  |  | 11,127,569 |  |  |  |  |  | 5,389,433 |  |

In this Registration Statement, unless otherwise specified, all dollar amounts are expressed in Canadian Dollars (CAD$).

Table No. 2 sets forth the exchange rates for the Canadian Dollar at the end of the five most recent fiscal years ended December 31, the average rates for the period and the range of high and low rates for the period. The data for each of the last six months is also disclosed.

For the purposes of this table, the rate of exchange means the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York. The table sets forth the number of Canadian Dollars required under that formula to buy one U.S. Dollar. The average rate means the average of the exchange rates on the last day of each month during the period.

10

Table of ContentsTable No. 2: U.S. Dollar/Canadian Dollar

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  |  | Average |  |  | High |  |  | Low |  |  | Close |

| October 2007 |  |  |  |  | 0.9786 |  |  |  |  |  | 0.9724 |  |  |  |  |  | 0.9747 |  |

| September 2007 |  |  |  |  | 1.0287 |  |  |  |  |  | 1.0222 |  |  |  |  |  | 1.0247 |  |

| August 2007 |  |  |  |  | — |  |  |  |  |  | 1.0627 |  |  |  |  |  | 1.0542 |  |  |  |  |  | 1.0589 |  |

| July 2007 |  |  |  |  | — |  |  |  |  |  | 1.0701 |  |  |  |  |  | 1.0341 |  |  |  |  |  | 1.0668 |  |

| June, 2007 |  |  |  |  | — |  |  |  |  |  | 1.0760 |  |  |  |  |  | 1.0536 |  |  |  |  |  | 1.0654 |  |

| May 2007 |  |  |  |  | — |  |  |  |  |  | 1.1163 |  |  |  |  |  | 1.0666 |  |  |  |  |  | 1.0696 |  |

| April 2007 |  |  |  |  | — |  |  |  |  |  | 1.1600 |  |  |  |  |  | 1.1048 |  |  |  |  |  | 1.1101 |  |

| March 2007 |  |  |  |  | — |  |  |  |  |  | 1.1817 |  |  |  |  |  | 1.1500 |  |  |  |  |  | 1.1546 |  |

| February 2007 |  |  |  |  | — |  |  |  |  |  | 1.1873 |  |  |  |  |  | 1.1564 |  |  |  |  |  | 1.1698 |  |

| January 2007 |  |  |  |  | — |  |  |  |  |  | 1.1848 |  |  |  |  |  | 1.1623 |  |  |  |  |  | 1.1770 |  |

| December 2006 |  |  |  |  | — |  |  |  |  |  | 1.1548 |  |  |  |  |  | 1.1494 |  |  |  |  |  | 1.1528 |  |

| Fiscal Years and Interim Periods Ended: |  |  |  |  | |  |  |  |  |  | |  |  |  |  |  | |  |

| 6/30/2007 |  |  |  |  | 1.1349 |  |  |  |  |  | — |  |  |  |  |  | — |  |  |  |  |  | 1.0654 |  |

| 12/31/2006 |  |  |  |  | 1.1362 |  |  |  |  |  | — |  |  |  |  |  | — |  |  |  |  |  | 1.1528 |  |

| 12/31/2005 |  |  |  |  | 1.2115 |  |  |  |  |  | — |  |  |  |  |  | — |  |  |  |  |  | 1.1656 |  |

| 12/31/2004 |  |  |  |  | 1.3017 |  |  |  |  |  | — |  |  |  |  |  | — |  |  |  |  |  | 1.2034 |  |

| 12/31/2003 |  |  |  |  | 1.4008 |  |  |  |  |  | — |  |  |  |  |  | — |  |  |  |  |  | 1.2923 |  |

| 12/31/2002 |  |  |  |  | 1.5704 |  |  |  |  |  | — |  |  |  |  |  | — |  |  |  |  |  | 1.5800 |  |

The exchange rates are based upon the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York. At November 12, 2007 , one U.S. dollar, as quoted by Reuters and other sources at 12 P.M. Eastern Time for New York foreign exchange selling rates, equalled $0.9452 in Canadian dollars (Source: Federal Reserve Bank of New York).

3B. Capitalization and Indebtedness

Table No. 3 sets forth the capitalization and indebtedness of the Company at September 30, 2007. As at September 30, 2007 the Company had cash of approximately $30,191,214. The Company had issued and outstanding 232,367,011 shares of common stock (‘‘Shares’’) as at September 30, 2007. On June 27, 2007, the Company repaid a US$2.0 million loan facility with Macquarie Bank Limited of Sydney, Australia.

Table No. 3: Capitalization and indebtedness as at September 30, 2007:

|  |  |  |  |  |  |

| SHAREHOLDERS’ EQUITY |  |  |  |  | |  |

| Common-voting shares issued and outstanding |  |  |  | $ | 103,163,145 |  |

| Contributed Surplus |  |  |  |  | 7,192,179 |  |

| Retained earnings (deficit) |  |  |  |  | (41,950,488 | ) |

| Shareholders’ Equity |  |  |  | $ | 68,404,836 |  |

| TOTAL CAPITALIZATION AND INDEBTEDNESS |  |  |  |  | |  |

| Common-voting shares issued and outstanding |  |  |  |  | 232,367,011 |  |

| Warrants Outstanding |  |  |  |  | 21,344,716 |  |

| Stock Options Outstanding |  |  |  |  | 17,592,334 |  |

| Bonus Share Program |  |  |  |  | 544,120 |  |

| Preferred Shares Outstanding |  |  |  |  | Nil |  |

| Capital Lease Obligations |  |  |  | $ | 448,101 |  |

| Guaranteed Debt |  |  |  |  | Nil |  |

| Shareholders’ Equity |  |  |  | $ | 68,404,836 |  |

| Loan facility |  |  |  |  | Nil |  |

| Total Capitalization |  |  |  | $ | 68,852,937 |  |

11

Table of Contents |  |

| 3C. | Reasons For The Offer And Use Of Proceeds |

Not Applicable.

|  |

| 3D. | Risk Factors |

The Company faces risk factors and uncertainties including the following general description of significant risk factors:

|  |

| • | Not All of Our Mineral Properties Contain a Known Commercially Mineable Mineral Deposit: The business of mineral exploration and extraction involves a high degree of risk and few properties that are explored are ultimately developed into producing mines. Major expenses may be required to located and establish mineral reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. The long-term profitability of the Company’s operations will be in part directly related to the cost and success of its ability to develop the extraction and processing facilities and infrastructure at any sit e chosen for extraction. It is impossible to ensure that the exploration or development programs planned by the Company will result in a profitable commercial mining operation. Whether a mineral deposit is commercially viable in Vietnam or Philippines depends on a number of factors, including, but not limited to the following factors that are applicable to our properties: particular attributes of the deposit, such as grade, size and proximity to infrastructure; metal prices, which are volatile; and government regulations, including regulations relating to investment, mining, prices, taxes, royalties, land use and tenure, importing and exporting of minerals and environmental protection. |

|  |

| • | Because We Have Primarily Been an Exploration Company, We are Dependent Upon Our Ability to Raise Funds In Order to Carry Out Our Business: Even though the Company has produced and sold an incidental amount of gold (3,648 ounces) for the six-month period ended June 30, 2007, the Company is still primarily an exploration Company. The Company had an accumulated deficit of $39,668,954 as at June 30, 2007. With ongoing cash requirements for exploration, development and new operating activities, it will be necessary in the near and over the long- term to raise substantial funds from external sources. If we do not raise these funds, we wou ld be unable to pursue our business activities and investors could lose their investment. If we are able to raise funds, investors could experience a dilution of their interests which would negatively impact the market value of the shares. |

|  |

| • | We Will Not Be Able to Insure Against All Possible Risks: Exploration for natural resources involves many risks, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. The Company’s business is subject to a number of risks and hazards generally, including adverse environmental conditions, industrial accidents, unusual or unexpected geological conditions, ground or slope failures, cave-ins, changes in the regulatory environment and natural phenomena such as inclement weather conditions, namely typhoon season in Vietnam. None of our properties are in a flood or earthquake zone. Such occurrence s could result in damage to mineral properties or production facilities, personal injury or death, environmental damage to the Company’s properties or the properties of others, delays, monetary losses and possible legal liability. If any such catastrophic event occurs, investors could lose their entire investment. Obtained insurance will not cover all the potential risks associated with the activities of the Company. Moreover, the Company may also be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. Moreover, insurance against risks such as environmental pollution or other hazards as a result of exploration and production is not generally available to the Company or to other companies in the mining industry on acceptable terms. The Company might also become subject to liability for pollution or other hazards which may not be insured against or which the Company may elect not to insure against because of premium costs or other reasons. Losses from these events may cause the Company to incur significant costs that could have a material adverse effect upon its financial performance and results of operations. Should a catastrophic event arise, investors could lose their entire investment. |

|  |

| • | Commodity Price Fluctuations – if the Price of Gold Declines, Our Properties May Not Be Economically Viable: The Company’s revenues are expected to be in large part derived from the |

12

Table of Contents |  |

| | extraction and sale of base and precious metals such as gold. The price of those commodities has fluctuated widely, particularly in recent years, and is affected by numerous factors beyond the Company’s control including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumptive patterns, speculative activities and increased production due to new or improved mining and production methods. The effect of these factors on the price of base and precious metals cannot be predicted and the combination of these factors may result in us not receiving adequate returns on invested capital or the investments retaining their respective values. If the price of gold (including other base and precious metals) is below our cost to produce gold, our properties will not be mined at a profit. Fluctuations in the gold price affect the Company’s reserve estimates, its ability to obtain financing and its financial condition as well as requiring reassessments of feasibility and operational requirements of a project. Reassessments may cause substantial delays or interrupt operations until the reassessment is finished. |

|  |

| • | We May Not be Able to Compete with Other Mining Companies for Mineral Properties, Investment Funds, Personnel and Technical Expertise: The resource industry is intensely competitive in all of its phases, and the Company competes for mineral properties, investment funds and technical expertise with many companies possessing greater financial resources and technical facilities than it does. Competition could prevent the Company from conducting its business activities or prevent profitability of existing or future properties or operations if the Company were unable to obtain suitable properties for exploration in the future, secure financing for our operations or attract and retain mining experts. |

|  |

| • | If We do Not Comply with All Applicable Regulations, We May be Forced to Halt our Business Activities: Such activities are subject to various laws governing land use, the protection of the environment, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, mine safety and other matters. We may not be able to obtain all necessary licenses and permits required to carry out exploration at, developments of, or mining at our projects. The Company’s operations are subject to environmental regulation in Vietnam and in Philippines. Environmental legislation is still evolving in this jurisdiction and i t is expected to evolve in a manner which may require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. Unfavorable amendments to current laws, regulations and permits governing operations and activities of resource exploration companies, or more stringent implementation thereof, could have a materially adverse impact on the Company and cause increases in capital expenditures which could result in a cessation of operations by the Company. Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. Parties engaged in res ource exploration may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violation of applicable laws or regulations. If there are future changes in environmental regulation, they could impede the Company’s current and future business activities and negatively impact the profitability of operations. Large increases in capital expenditures resulting from any of the above factors could force the Company to cease business activities. |

|  |

| • | If We Are Unable to Obtain and Keep in Good Standing certain Licenses, We will be Unable to Explore, Develop or Mine any of our Property Interests: In order to explore, develop or conduct mining operations in Vietnam, the Company must establish or create an entity authorized to conduct Business in Vietnam via an Investment Licence. Then, the Company requires a prospecting licence, an exploration licence and a mining licence, depending on the level of work being conducted on the property. Without all the appropriate licenses, our activities could not occur. Our applications for exploration licenses for Bong Mieu and Phuoc Son are in progress. C urrently, the Company is engaging in exploration activities under the investment licenses. Under Vietnamese law, an exploration license is required in order to get new or amended mining licenses. The Company |

13

Table of Contents |  |

| | currently has mining licenses to cover the area being mined but to further expand the mining area or cover a new mining area the Company would require an exploration license before obtaining the new or amended mining license. If we do not obtain needed exploration licenses, this could limit our ability to mine new additional areas and therefore negatively impact production and profitability of the Company. |

|  |

| • | If We Do Not Make Certain Payments or Fulfill Other Contractual Obligations, We May Lose Our Option Rights and Interests in Our Joint Ventures: The Company may, in the future, be unable to meet its share of costs incurred under any option or joint venture agreements to which it is presently or becomes a party in the future and the Company may have its interest in the properties subject to such agreements reduced as a result. Furthermore, if other parties to such agreements do not meet their share of such costs, the Company may be unable to finance the cost required to complete recommended programs. The loss of any option rights or interest in joint ventures would have a material, adverse effect on the Company. |

|  |

| • | Title to Assets Can Be Challenged or Impugned Which Could Prevent Us From Exploring, Developing or Operating at any of our Properties: There is no guarantee that title to concessions will be not challenged or impugned. In Vietnam or the Philippines, the system for recording title to the rights to explore, develop and mine natural resources is such that a title opinion provides only minimal comfort that the holder has title. In Vietnam, mining laws are in a state of flux, continuously being reviewed and updated, and the system is new and as yet untested. If title to assets is challenged or impugned, the Company may not be able to explore, devel op or operate its properties as permitted or enforce its rights with respect to the properties. |

|  |

| • | Political and Economic Instability In Vietnam or the Philippines Could Make it More Difficult or Impossible, for Us to Conduct Our Business Activities: The Company’s exploration, development and operation activities occur in Vietnam and, as such, the Company may be affected by possible political or economic instability in that country. The risks include, but are not limited to, terrorism, military repression, fluctuations in currency exchange rates and high rates of inflation. Changes in resource development or investment policies or shifts in political attitude in that country may prevent or hinder the Company’s business activitie s and render our properties unprofitable by preventing or impeding future property exploration, development or mining. Operations may be affected in varying degrees by government regulations with respect to restrictions on production, price controls, export controls, income taxes, expropriation of property, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety. The laws on foreign investment and mining are still evolving in Vietnam and it is not known to where they will evolve. The effect of these factors cannot be accurately predicted. |

|  |

| • | Exchange Rate and Interest Rate Fluctuations May Increase the Company’s Costs: The profitability of the Company may decrease when affected by fluctuations in the foreign currency exchange rates between the Canadian Dollars, Australian dollars, US Dollars and Vietnamese Dongs. Exchange rate fluctuations affect the costs in Canadian dollar terms the Company incurs in its exploration and development activities. For example, the appreciation of the US dollar against the Canadian dollar would increase costs in Canadian dollar terms. The Company does not currently take any steps to hedge against currency fluctuations. In the event of interest rates rising, the liabilities of the Company that are tied to market interest rates would increase the Company’s borrowing costs. Currently, the Company has no borrowings. |

|  |

| • | Our Stock Price Could be Volatile: The market price of our common shares has been and is likely to remain volatile. Results of exploration activities, the price of gold and silver, future operating results, changes in estimates of the Company’s performance by securities analysts, market conditions for natural resource shares in general, and other factors beyond the control of the Company, could cause a significant, decline of the market price of common shares. |

|  |

| • | Our Stock will be a Penny Stock which Imposes Significant Restrictions on Broker-Dealers Recommending the Stock For Purchase: Securities and Exchange Commission (SEC) regulations define ‘‘penny stock’’ to include common stock that has a market price of less than $5.00 per share, subject to certain exceptions. These regulations include the following requirements: broker-dealers |

14

Table of Contents |  |

| | must deliver, prior to the transaction, a disclosure schedule prepared by the SEC relating to the penny stock market; broker-dealers must disclose the commissions payable to the broker-dealer and its registered representative; broker-dealers must disclose current quotations for the securities; if a broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealers presumed control over the market; and a broker-dealer must furnish its customers with monthly statements disclosing recent price information for all penny stocks held in the customer’s account and information on the limited market in penny stocks. Additional sales practice requirements are imposed on broker-dealers who sell penny stocks to persons other than established customers and accredited investors. For these types of transactions, the broker-dealer must make a special suitability determination for the purchaser and must have received the purchaser’s written consent to the transaction prior to sale. If our Shares become subject to these penny stock rules these disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the Shares, if such trading market should ever develop. Accordingly, this may result in a lack of liquidity in the Shares and investors may be unable to sell their Shares at prices considered reasonable by them. |

|  |

| • | We Do Not Plan to Pay any Dividends in the Foreseeable Future: The Company has never paid a dividend and it is unlikely that the Company will declare or pay a dividend until warranted based on the factors outlined below. The declaration, amount and date of distribution of any dividends in the future will be decided by the Board of Directors from time-to-time, based upon, and subject to, the Company’s earnings, financial requirements and other conditions prevailing at the time. |

|  |

| • | Shareholders Could Experience Dilution of the Value of their Investment if We Issue Additional Shares: Sales of large quantities of our common shares in the public markets or the potential of such sales, could decrease the trading price of the common shares and could impair the Company’s ability to raise capital through future sales of common shares. As at September 30, 2007, the Company has issued 232,367,011 of outstanding common shares. As at September 30, 2007, there was 39,481,170 of securities are issuable in the future that are outstanding options, warrants and bonus shares under signed agreements. If these sha res are issued, this will result in further dilution to the Company’s shareholders. |

|  |

| • | In the Event that Key Employees Leave the Company, the Company Would Be Harmed Since We are Heavily Dependent Upon Them for All Aspects of Our Acitivities: The Company is heavily dependent on key employees and contractors, and on a relatively small number of key directors and officers, the loss of any of whom could have, in the short-term, an negative impact on our ability to conduct our activities and could cause a decline in profitability of our properties or additional costs from a delay in development or exploration of properties. The Company has consulting agreements with the Chief Executive Officer, President, Country Manager and Chief F inancial Officer. |

|  |

| • | Our Management May Not Be Subject to U.S. Legal Process Making it More Difficult for Investors to Sue Them: The enforcement by investors of civil liabilities under the United States federal securities laws may not be possible by the fact that all of our officers and directors are neither citizens nor residents of the United States. U.S. stockholders may not be able to effect service of process within the United States upon such persons. U.S. stockholders may not be able to enforce, in United States courts, judgments against such persons obtained in such courts predicated upon the civil liability provisions of United States federal securities l aws. Appropriate foreign courts may not be able to enforce judgments of United States courts obtained in actions against such persons predicated upon the civil liability provisions of the federal securities laws. The appropriate foreign courts may not be able to enforce, in original actions, liabilities against such persons predicated solely upon the United States federal securities laws. However, U.S. laws would generally be enforced by a Canadian court provided that those laws are not contrary to Canadian public policy, are not foreign penal laws or laws that deal with taxation or the taking of property by a foreign government and provided that they are in compliance with applicable Canadian legislation regarding the limitation of actions. |

|  |

| • | Management May Be Subject to Conflicts of Interest Due to Their Affiliations with Other Resource Companies: Because some of our directors and officers have private mining interests and also serve as officers and/or directors of other public mining companies, their personal interests are continually |

15

Table of Contents |  |

| | in conflict with the interests of the Company. Situations will arise where these persons are presented with mining opportunities, which may be desirable for the Company, as well as other companies in which they have an interest, to pursue. If the Company is unable to pursue such opportunities because of our officers’ and directors’ conflicts, this would reduce the Company’s opportunities to increase our future profitability and revenues. In addition to competition for suitable mining opportunities, the Company competes with these other companies for investment capital, and technical resources, including consulting geologists, metallurgist engineers and others. Similarly, if the Company is unable to obtain necessary investment capital and technical resources because of our officers’ and directors’ conflicts, the Company would not be able to obtain potential profitable properties or interests and reduce the Company’s opportunities to increase our future revenues and income. Such conflict of interests are permitted under Canadian regulations and will continue to subject the Company to the continuing risk that it may be unable to acquire certain mining opportunities, investment capital and the necessary technical resources because of competing personal interests of some of our officers and directors. |

|  |

| • | We used a Pre-Feasibility Study and did not Complete a Feasibility Study Before Making our Decision to Place the Ho Gan Mine into Production: The economic feasibility of our mining properties is based upon a number of factors, including estimations of reserves and mineralized material, extraction and process recoveries, engineering, capital and operating costs, future production rates and future prices of gold, and other precious metals that we may attempt to mine in the future. It is customary for a company to prepare a feasibility study on a property before making the decision to place the property into production. A feasibility study is a d etailed report assessing the feasibility, economics and engineering of placing a mineral deposit into commercial production. However, the Company did not have a feasibility study prepared before making its decision to place the Bong Mieu Central Gold Mine (‘‘Ho Gan Mine’’) into production. Instead, the Company prepared a pre-feasibility study, which is a less comprehensive report. Pre-feasibility studies can underestimate a project’s capital and operating costs, while at the same time overestimating the amount of reserves and mineralization. Accordingly, as the Company attempts to scale up the Ho Gan Mine to full production, it may learn that it has underestimated the amount of capital it will need and the costs involved in mining the deposit, as well as other issues affecting the project’s profitability. During fourth quarter 2006, management determined that the Bong Mieu Central mine was not reaching originally estimated future throughput. Consequently, an impairment cha rge of $4,280,000 was taken on the Bong Mieu Central (Ho Gan) deferred exploration and development costs. Had the Company prepared a full feasibility study, rather than just a pre-feasibility report, it is possible that the Company might have determined that the economics of the project were unfavorable and decided not to place the mine into production. |

|  |

| • | The Company Conducted only Limited Drilling on its Bong Mieu Property so its Decision to Place the Ho Gan Mine into Production May be Based upon Incomplete Information: The Company conducted a limited amount of drilling before making its decision to place the Ho Gan Mine into production. As a result, the Company’s estimates of the mineralized material and reserves on the property, which played a large role in the Company’s production decision, may not be accurate. Furthermore, the Company’s determination of the character, location, size and accessibility of the mineralized material may be based upon incomplete data, rendering its conclusions potentially inaccurate about the commerciality of the property. |

|  |

| • | Because the Company’s Testing of its Mining Process at the Ho Gan Mine was Limited to Small Pilot Plant and Bench Scale Testing, it may be Unable to Obtain the Expected Metallurgical Recoveries when It Scales Up its Operations, Rendering the Project Unprofitable: Before the Company placed the Ho Gan Mine into production, it built a pilot plant and conducted bench scale testing. A pilot plant is a small-scale mill in which representative tonnages of ore can be tested under conditions which foreshadow or imitate those of the full-scale operation proposed for a given ore. Although a pilot plant can provide information on mining the deposit, very frequently a company will have difficulty duplicating the results from the pilot plant and bench scale testing when scaling the project up to a production level, which has been the case to date with the Company’s operations at the Ho Gan Mine. The mine commenced limited operations in 2006, pouring its first gold bar in March 2006. |

16

Table of Contents |  |

| | At that time, it was determined that the mining process had to be reconfigured. Consequently, the Company has taken steps to modify its mining process, causing Company not to meet its planned production goals. The current ore throughput at the mine is approximately 500 tons per day. The Company’s original estimates of future cash operating costs at the mine, which were based largely on the Company’s pilot plant and bench scale testing, have been increased to reflect the above factors. |

Since the Ho Gan Mine, as well as the Company’s other property interests, have no significant operating histories, estimates of mineralized material and reserves, mining and process recoveries and operating costs must be based, in addition to the information received from the pilot plant and bench scale testing, to a large extent upon the interpretation of geologic data obtained from drill holes, and upon scoping and feasibility estimates that derive forecasts of operating costs from anticipated tonnages and grades of mineralized material and reserves to be mined and processed, the configuration of the mineralized deposits, expected recovery rates of minerals, comparable facility and equipment costs, and climatic conditions and other factors. Commonly in new projects, such as the Ho Gan Mine, actual construction costs, operating costs and economic returns differ materially from those initially estimated. The Company cannot be certain that the Ho Gan Mine w ill ever achieve the production levels forecasted, that the expected operating cost levels will be achieved, or that funding will be available from internal and external sources in necessary amounts or on acceptable terms to continue the necessary development work. Failure to achieve the Company’s production forecasts would negatively affect the Company’s revenues, profits and cash flows. Accordingly, if the Ho Gan Mine, or any of the Company’s other properties, cannot be developed within the time frames or at the costs anticipated, or that any forecasted operating results can be achieved, the projects could possibly be rendered unprofitable.

17

Table of Contents |  |

| ITEM 4: | Information on the Company |

4A. History and Development of the Company

Olympus Pacific Minerals Inc. (the ‘‘Company’’ or ‘‘Olympus’’) was incorporated by registration of its memorandum and articles under the laws of the Province of Ontario on July 4, 1951 under the name ‘‘Meta Uranium Mines Limited’’. Effective August 24, 1978, the Company changed its name from ‘‘Meta Uranium Mines Limited’’ to ‘‘Metina Developments Inc.’’ The Company was continued under the Company Act (British Columbia) with the name ‘‘Olympus Holdings Ltd.’’ on November 5, 1992 and consolidated its share capital on a 4.5:1 basis. The Company further consolidated its share capital on a 3:1 basis and changed its name from ‘‘Olympus Holdings Ltd.’’ to ‘‘Olympus Pacific Minerals Inc.’’ on November 29, 1996.

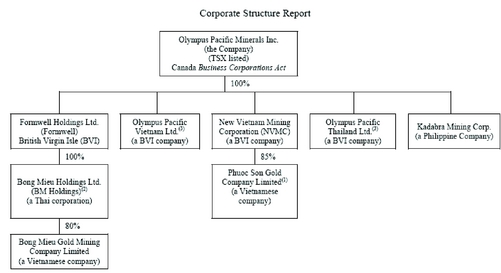

On February 26, 1997, and subsequently amended on August 18, 1997, the Company entered into the Ivanhoe agreement with Ivanhoe Mines Limited (‘‘Ivanhoe’’) (formerly Indochina Goldfields Ltd.) and Zedex Ltd. (‘‘Zedex’’) (formerly Iddison Group Vietnam Limited, Iddison Holdings Limited, Iddison Limited and IT Capital Limited). Pursuant to the Ivanhoe Agreement, which was completed on September 11, 1997, the Company acquired from Ivanhoe all of the shares of Formwell Holdings Limited (‘‘Formwell’’), which holds all the shares of Bong Mieu Holdings Limited, which in turn holds 80% of the shares of Bong Mieu Gold Mining Limited (‘‘Bogomin’’). Bogomin, together with other local and national branches of the government of Vietnam, holds various mining and exploration licenses comprising the Bong Mieu gold mine and the Tien Ha properties in Quang Nam-Da Nang Province, in the Socialist Republic of Vietnam. The Company also entered into a joint venture agreement with Ivanhoe and Zedex, whereby the Company had a 57.18% interest in New Vietnam Mining Corporation (‘‘NVMC’’) as at December 31, 2001. NVMC was comprised of Olympus (57.18%), Ivanhoe (32.64%) and Zedex (10.18%). The Phuoc Son Gold Project is held by NVMC. Olympus is the operator of the project.

In 2000, the Company was successful in raising $3.4 million in equity financings. During 2000, the Company accelerated its exploration activities at the Phuoc Son gold project in Central Vietnam. Exploration costs increased to $905,000 in 2000 from $316,000 in 1999.

In 2003, the Company’s subsidiary, NVMC entered into a strategic alliance with Mien Trung Industrial Company (‘‘Minco’’), a mining company controlled by the local provincial government, resulting in the formation of the Phuoc Son Gold Company (‘‘PSGC’’) for the purposes of exploration and extraction activities and any other related activities. The Company owns 100% of NVMC which, in turn, owns an 85% interest in the Phuoc Son Gold Company (‘‘PSGC’’). Minco, owns 15% of PSGC. Refer to Item 4D.1 for further details on the joint venture.

On March 1, 2004, the Company entered into a Vend-in Agreement and on June 21, 2004 an Extension of Vend-in Agreement with Ivanhoe Mines Ltd and Zedex Limited (the ‘‘vendors’’) to acquire the remaining interests held by the vendors in NVMC. In June 2004, the Company acquired the remaining 42.82% of the outstanding shares of NVMC from Zedex Limited (now referred to as ‘‘Zedex Minerals Limited’’ after a name change) and Ivanhoe.

In other areas in Vietnam, the Company is continuing broad regional geology programs to identify other potential exploration areas. Additional applications for exploration licenses have been filed in Vietnam and the Company has also lodged an application in Laos. These applications are in early stages of review by the respective government bodies. Based on the Company’s experience working in these countries, the timing of application approvals can vary significantly, and are expected to be granted within the next one to two years.

On November 23, 2006, the Company signed a Memorandum of Agreement and Supplement to Memorandum of Agreement (collectively, the ‘‘MOA’’) with Abra Mining and Industrial Corporation (‘‘AMIC’’) and Jabel Corporation (‘‘Jabel’’) which will allow the Grantee (defined as the Company and a Philippine national corporation to be identified by the Company) to acquire an option to earn a 60% interest in the Capcapo Property (as defined below) upon completing a specified level of expenditures on the Capcapo Property. The Capcapo Property consists of a Mineral Production Sharing Agreement (‘‘MPSA’’) No. 144-99-CAR (‘‘MPSA 144’’), which covers 756 hectares in Capcapo, Licuan-Baay, Abra Province, Philippines, and a two-kilometre radius buffer zone around MPSA 144, with an area of about

18

Table of Contents3,500 hectares, which falls under a neighbouring Exploration Permit Application (‘‘EXPA’’). Jabel holds the Property in its name and is a minority shareholder in AMC. AMIC has an operating agreement with Jabel in respect of the Capcapo Property.

The MOA is a binding agreement that is conditional on the Company’s completion of a due diligence program to validate historical drilling information. Under the MOA, the parties will form a joint venture corporation (‘‘Newco’’) that will develop, manage and conduct mining operations on the Property. Newco and Jabel will become co-holders of the titles to the Property. Although Jabel’s name will remain on the Capcapo Property titles, Jabel’s only economic interest in the Property will be a royalty. Aside from the royalty, all of the Capcapo Property’s proceeds shall flow through Newco.

Upon full exercise of the option, Newco will be 40% owned by Kadabra Mining Corp. (‘‘Kadabra’’), 20% owned by a Philippine national that the Company will identify (‘‘Philco’’), and 40% owned by AMIC. Collectively, the 40% ownership of Kadabra and the 20% ownership of Philco in Newco represent the 60% interest in the Property that is subject of the MOA. Under Philippine law, foreign-owned entities can only hold up to 40% of a Mineral Production Sharing Agreement (‘‘MPSA’’).

Under the MOA, once the due diligence procedures are complete with the drilling information being validated and a formal agreement is signed, a cash payment of U.S. $200,000 will be made by the Grantee to AMIC to be funded by the recent August 10, 2007 share placement with gross proceeds of $25,000,000. Six months after the signing of the formal agreement, the Grantee will issue Olympus common shares to AMIC with a total value of U.S. $350,000 based on the average of the trading price of the Company’s common shares for the five trading days preceding the date of the signing of the formal agreement. Once the Grantee has spent U.S. $3 million on exploration and development work on the property, the Grantee will issue to AMIC further common shares of Olympus with a total value of U.S. $450,000 based on the average of the trading price of the Company’s common shares for the five trading days preceding their date of issuance. To earn the 60 % interest, a cumulative spending of U.S. $6 million by the Grantee on exploration and development must occur by the end of the 5th year after the signing of the formal agreement. The Grantee earns a 20% interest after the first U.S. $1 million is spent, an additional 20% interest after an additional U.S. $2 million has been spent and an additional 20% interest after an additional U.S. $3 million has been spent. Once the 60% interest has been earned, a new joint venture company (‘‘NEWCO’’) would be formed of which the Grantee would hold a 60%. If the Grantee obtains less than the 60% interest, the Grantee would share in less than 60% of the results of the joint venture. One year after full commercial production is achieved on the property, a royalty would be paid to Jabel, the underlying title holder of the property, equ al to either 3% of gross value of production or 6% of annual Profit of NEWCO, as defined in the agreement, whichever is higher. In order to make the required cash payments and exploration and development expenditures if the formal agreement is signed, the Company intends to raise funding through equity issuance. Approximately $2.5 million of the August 10, 2007 share placement has been allocated to be used for the Capcapo exploration program If exploration results are favorable, then the focus would be to construct a mine in order to extract, process and produce gold, with the future impact on the Company of higher capital expenditures associated with mine construction and upon completion of the mine construction, increased production and sales.

On May 31, 2007, the Company registered a Philippine corporation with the Republic of the Philippines Securities and Exchange Commission under the corporate name of Kadabra Mining Corp (‘‘Kadabra’’). Kadabra has an authorized and outstanding stock of PHP30,000,000.00 and is 100% beneficially owned by the Company. Kadabra will hold the Company’s 40% interest in Newco and is used to track expenditures by the Company on the joint venture. Kadabra has articles of incorporation and authorized and outstanding stock of PHP30,000,000. Refer to exhibit 3.20 for Certificate of Incorporation and Articles of Incorporation.

As at June 5, 2007, drill results at Capcapo from the first hole, the second and third holes on the main Capcapo deposit continue to intersect significant shallow depth gold and copper mineralization, that is; 41 meters or 134 feet of 2.07 g/t gold, 0.60% copper and 7.75 g/t silver with higher-grade zones of 3.33 g/t gold, 1.45% copper and 26.48 g/t silver over 6 meters; and 4.02 g/t gold, 1.05% copper and 8.46 g/t silver over 10 meters; 27 meters or 89 feet of 2.55 g/t gold, 0.55% copper and 3.49 g/t silver including 4.05 g/t gold, 0.78% copper and 4.81g/t silver over 16 meters. On June 25, 2007, drilling from the three holes completed

19

Table of Contentson Capcapo Project, located in the Abra Province, Northern Luzon, Philippines resulted to: Hole DDH 07-12 which is a 50 meter step-out to the east of hole 07-11, intersected 3.06 g/t gold, 0.67% copper and 2.53 g/t silver over a core width of 28 meters or 92 feet including 4.43 g/t gold, 0.91% copper and 3.38 g/t silver over 18 meters; Holes DDH07-11 intersected 1.53 g/t gold 0.35% copper and 2.4 g/t silver over a copre width of 47 meters or 154 feet including 2.55 g/t gold, 0.78% copper and 1.81 g/t silver over 16 meters.

On September 21, 2007, the Company announced that it has completed its due diligence at Capcapo. During the next phase at Capcapo, the Company will complete formal joint venture documentation as well as fulfilling its legal, social and community responsibilities through the terms of the National Commission on Indigenous People. The Company will recommence exploration drilling once all outstanding agreements and legal parameters are signed with the various stakeholders.

In third quarter 2007, the Company signed a Framework of Laos and Cambodia Joint Venture Agreement with Zedex covering exploration activities in Laos and Cambodia. Refer to Exhibit 3.26. As this joint venture is in the early stages of set-up, there has been minimal activity in 2007 to date and there is minimal budgeted expenditures anticipated in 2008.

The Company’s executive office is located at:

Suite 500 – 10 King Street East

Toronto, Ontario, M5C 1C3

Canada

The Company’s registered and records office is located at Suite 500, 10 King Street East, Toronto, Ontario, Canada. Its telephone number is (416) 572- 2525.

The Company has financed its operations through the financings listed in the table shown below. All placements were made in Canada.

20

Table of ContentsTable No. 4: Financings

|  |  |  |  |  |  |  |  |  |  |  |  |

| Fiscal Year |  |  | Nature of Issuance |  |  | Number of Shares |  |  | Capital Raised |

| December 31, 2000 |  |  | Private Placement(1) |  |  | 6,625,000 |  |  |  | $ | 1,840,000 |  |

| December 31, 2001 |  |  | Private Placement(2) |  |  | 10,964,500 |  |  |  | $ | 3,944,000 |  |

| December 31, 2002 |  |  | Nil |  |  | Nil |  |  | Nil |

| December 31, 2003 |  |  | Private Placement(3) |  |  | 21,163,459 |  |  |  | $ | 6,832,063 |  |

| December 31, 2004 |  |  | Private Placement(4) |  |  | Nil |  |  | Nil |

| December 31, 2005 |  |  | Private Placement(5) |  |  | 32,645,000 |  |  |  | $ | 11,063,500 |  |

| December 31, 2006 |  |  | Private Placement(6) |  |  | 27,000,000 |  |  |  | $ | 15,660,000 |  |

| March 31, 2007 |  |  | Private Placement(7) |  |  | 21,428,571 |  |  |  | $ | 12,000,000 |  |

| August 10, 2007 |  |  | Public Placement(8) |  |  | 38,461,538 |  |  |  | $ | 25,000,000 |  |

| September 7, 2007 |  |  | Public Placement(8) |  |  | 216,394 |  |  |  | $ | 153,601 |  |

| (1) | In 2000, the Company raised a total of $1,840,000 through two separated financings: |

| (i.) | In March 2000, 4,500,000 units were sold for $0.22/unit. Each unit was comprised of one common share and one two-year share purchase warrant entitling the holders to acquire up to 4,500,000 shares at $0.30/unit during the first year and at $0.40/unit during the second year; |

| (ii.) | In August 2000, 2,125,000 common shares were issued at $0.40/share to various holders. |

| (2) | In 2001, the Company completed three financings and raised a total of $3,944,000: |

| (i.) | In February, 1,200,000 units were sold for $0.60/unit. Each unit was comprised of one common share and one share purchase warrant, each whole purchase warrant exercisable at an exercise price of $0.75/warrant for a one-year period, and $1.00/warrant for the second year; |

| (ii.) | In July, 552,000 units were sold for $0.50/unit. Each unit was comprised of one common share and one share purchase warrant, each whole purchase warrant exercisable at an exercise price of $0.65/warrant for a one-year period, and $1.00/warrant for the second year; |

| (iii.) | In December, 9,212,500 units were sold for $0.32/unit. Each unit was comprised of one common share and one share purchase warrant, each whole purchase warrant exercisable at an exercise price of $0.32. |

| (3) | In 2003, a total placement, raising $6,832,063 was completed in three closings: |

| (i.) | In February, 1,562,750 units were sold for 0.40/unit. Each unit was comprised of one common share and one share purchase warrant, each whole purchase warrant exercisable at an exercise price of $0.40/unit for a one-year period; |

| (ii.) | In March, 3,267,500 units were sold for $0.40/unit. Each unit was comprised of one common share and one share purchase warrant, each whole purchase warrant exercisable at an exercise price of $0.50/warrant for a one-year period; |

| (iii.) | In October, 16,333,209 units were sold for $0.30/unit. Each unit consists of one common share and one-half of one common share purchase warrant, each whole purchase warrant exercisable at an exercise price of $0.40/unit for a one-year period and thereafter at a price of $0.50/unit for a one-year period. |

| (4) | On June 29, 2004, the Company closed a ‘‘Vend-In Agreement’’, whereby it acquired the remaining 42.82% interest in the NVMC joint venture. The acquisition resulted in the issuance of 13,483,133 common shares of the Company of which Zedex received 3,205,467 shares and Ivanhoe received 10,277,646 shares. No capital was raised in this transaction. |

| (5) | In 2005, a total placement, raising $11,063,500 was completed in two closings: |

| (i.) | In January, the Company closed a $5,080,000 private placement with Dragon Capital Markets Limited (‘‘Dragon Capital’’) by issuing 12.7 million common shares priced at $0.40/unit. In consideration for its service, Dragon Capital was paid a finders’ fee of US$261,471 and was granted 1,270,000 warrants exercisable at $0.40/unit for a period of one year from the date of closing; |

| (ii.) | In September, the Company received $5,983,500 from the closing of a private placement and issued 19,945,000 common shares priced at $0.30/share. |

| (6) | On March 31, 2006, a private placement closed where the Company issued 27,000,000 shares at $0.58 raising $15,660,000. |

| (7) | On March 19, 2007, the Company completed a non-brokered private placement, of 21,428,571 shares at a price of $0.56 per share, for gross proceeds of $12,000,000 and net proceeds of $11,967,772. All shares issued have a hold period in Canada of four months from the closing of the placement. The net proceeds are intended to be used for ongoing exploration, feasibility studies and development work on the Company’s mineral projects and for general corporate purposes. |

| (8) | On August 10, 2007, the Company closed its previously announced offering (the ‘‘Offering’’) of units of the Company (‘‘Units’’) for aggregate gross proceeds of $25,000,000 (the ‘‘Closing’’). Pursuant to the Offering, the Company issued and sold a total of 38,461,538 Units at a price of $0.65 per Unit. Each Unit is comprised of one common share of the Company (a ‘‘Share’’) and one-half of one common share purchase warrant (‘‘Warrant’’). Each whole Warrant will be exercisable at $0.80 until August 10, 2009. The Company granted the Agents an over-allotment option (the ‘‘Over-Allotment Option’’) exercisable in whole or in part at the sole discretion of the Agents , for a period of 30 days from closing of the Offering, to purchase up to an additional 5,769,230 Shares (‘‘Additional Shares’’) at a price of $0.62 per Additional Share and up to an additional 2,884,615 Warrants (‘‘Additional Warrants’’) at a price of $0.06 per Additional Warrant, for further gross proceeds |

21

Table of Contents | of up to $3,750,000, if exercised in full. In consideration for their services, the Corporation paid a fee of $1,500,000 to the Agents (equal to 6% of the gross proceeds realized from the sale of Units). The Agents were also granted non-transferable options (the ‘‘Compensation Options’’) to acquire 2,307,692 Units (each an ‘‘Agents’ Unit’’) (equal to 6% of the number of Units issued pursuant to the Offering). Each Compensation Option is exercisable to acquire one Agents’ Unit at $0.65 until August 10, 2009. Each Agent’s Unit consists of one common share of the Company and one-half of one common share purchase warrant (‘‘Agents’ Warrants’’). Each whole Agents’ Warrant will be exercisable to acquire one common share of the Company (a ‘‘Agents’ Warrant Share’’) at a price of $0.80 per Agents’ Warrant Share until August 10, 2009. On September 7, 2 007, the over-allotment option granted to the agents in connection with the Company’s previously announced public offering of units (the ‘‘Offering’’), was exercised in respect of 216,394 common shares (‘‘Additional Shares’’) at a price of $0.62 per Additional Share and 323,947 warrants (‘‘Additional Warrants’’) at a price of $0.06 per Additional Warrant, resulting in additional gross proceeds of $153,601. Each whole Warrant will be exercisable at $0.80 until August 10, 2009. The partial exercise of the over-allotment options brings the aggregate gross proceeds to the Company under the Offering to $25,153,601. The net proceeds from the Offering will be used for further exploration and feasibility studies at the Company’s Bong Mieu Gold and Phuoc Son Gold properties in Vietnam and the Capcapo property in the Philippines and for working capital and general corporate purposes. |

The Company does not have an agent in the United States.

Capital Expenditures

The table below shows the historical capital balances:

|  |  |  |  |  |  |

| As at December 31 |  |  | Capital Assets, Mineral Properties and

Deferred Exploration and Development Costs |

| 2000 |  |  |  | $ | 11,304,325 |  |

| 2001 |  |  |  |  | 11,241,723 |  |

| 2002 |  |  |  |  | 7,830,889 |  |

| 2003 |  |  |  |  | 8,735,520 |  |

| 2004 |  |  |  |  | 18,618,467 |  |

| 2005 |  |  |  |  | 29,600,068 |  |

| 2006 |  |  |  |  | 35,134,131 |  |

4.B Business Overview

General

Olympus Pacific Minerals Inc. (the ‘‘Company’’ or ‘‘Olympus’’) is an international mining exploration and development company focused on the mineral potential of Vietnam and the surrounding area. The Company is a public company listed on the TSX Exchange under the trading symbol OYM since April 3, 2006 (on the TSX Venture prior to April 3, 2006), and the Frankfurt Stock Exchange under the trading symbol OP6. Olympus has been active in Vietnam since the mid-1990s on its own account and through associated companies New Vietnam Mining Corporation and Bong Mieu Gold Mining Corporation and maintains an office in Danang in central Vietnam.

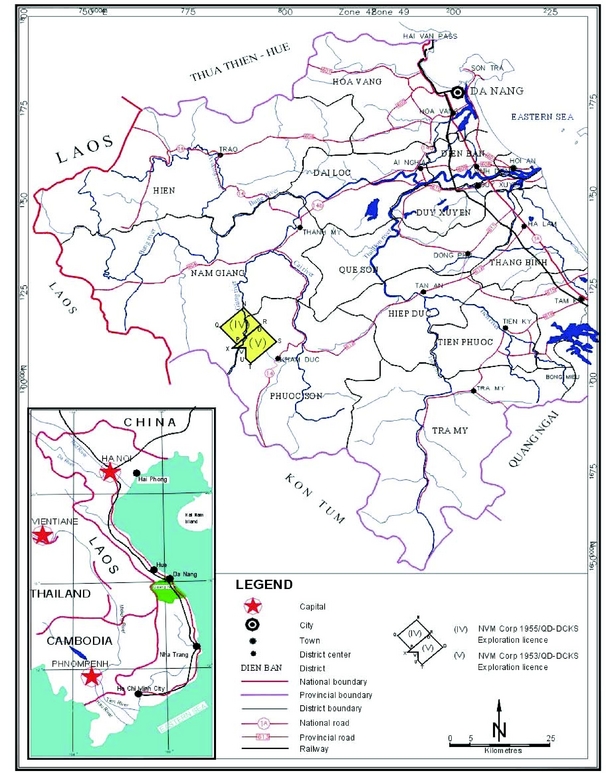

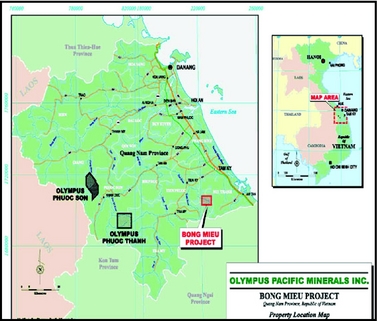

The Company’s two most advanced properties, covered by investment licenses, are the 70 square km Phuoc Son Gold property and the 30 square km Bong Mieu Gold property. Both properties are located in central Vietnam along the Phuoc Son-Sepon Suture that hosts such world-class deposits as the Sepon deposit of Oxiana Limited that is about 150 km to the west of the Company’s two properties. The Bong Mieu and Phuoc Son Gold properties are approximately 74 km apart. Proven and probable reserves exist for the Bong Mieu Central Gold Mine. In 2005 and 2006, the Company constructed a pilot plant at the Company’s Bong Mieu Central Gold Mine. As a result of ongoing mine construction and equipment upgrades in 2006 at Bong Mieu Central, an incidental amount of gold bars were poured and sold as of June 30, 2006.

Exploration work to date has resulted in one new significant discovery in the Bong Mieu East area (Thac Trang) as well as a number of new, surface showings. In addition, further exploration will be required to define the extent of the deposits in several directions. Based on results of the exploration work completed to date, management believes the potential for additional discoveries and resource expansion at the Bong Mieu property is positive. Underground evaluation studies are continuing at the Bong Mieu Underground mine, located within one kilometre of the operating Bong Mieu Central plant site.

The Phuoc Son Gold property is located in central Vietnam, 74 km away from the Bong Mieu Gold property. The property hosts over 30 known gold prospects and two known high-grade gold deposits in

22