UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-21120 | | |

| Conestoga Funds |

| (Exact name of registrant as specified in charter) |

| 550 E. Swedesford Road, Suite 120 Wayne, PA | 19087 |

| (Address of principal executive offices) | (Zip code) |

| Conestoga Capital Advisors 550 E. Swedesford Road, Suite 120 Wayne, PA 19087 |

| (Name and address of agent for service) |

| |

| With Copy To: |

| Josh Deringer, Esq. |

| Faegre Drinker Biddle & Reath LLP |

| One Logan Square, Suite 2000 |

| Philadelphia, PA 19103 |

| Registrant's telephone number, including area code: | (800) 320-7790 | |

| Date of fiscal year end: | September 30 | |

| | | |

| Date of reporting period: | September 30, 2022 | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles. A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public.

A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Conestoga Funds

SMALL CAP FUND

SMID CAP FUND

MID CAP FUND

MICRO CAP FUND

M a n a g e d B y

ANNUAL REPORT

September 30, 2022

CONESTOGA FUNDS

CHAIRMAN’S LETTER (Unaudited) | November 28, 2022 |

Dear Fellow Shareholders of the Conestoga Funds,

U.S. equity markets have moved sharply lower over the Conestoga Funds’ fiscal year ended September 30, 2022. Inflation has been higher and more persistent than the Federal Reserve forecasted, and they now find themselves playing catch up with increasing interest rates. Higher rates pushed the U.S. dollar significantly higher versus major currencies, and emerging markets’ currencies were hit even harder. There have been few places to hide – bonds, like stocks, have generated negative returns as interest rates move higher.

Investors’ confidence has been shaken by the combination of an uncertain economic outlook and tighter monetary policy. Earnings forecasts for the remainder of 2022 and the full year 2023 have been trimmed (and may need to be reduced further) as the likelihood of a recession rises. Further, continued inflationary pressures are expected to dampen profit margins as companies may be challenged to pass along higher prices to their customers.

The performance of the four Conestoga Funds over the last twelve months has been mixed. Relative to their respective benchmarks, our Micro Cap Fund outperformed, our Small Cap Fund modestly outperformed, and our SMid Cap Fund and Mid Cap Fund modestly underperformed. In the Managers’ Letters that follow, we discuss in detail the factors that led to the relative performance, but broadly speaking, we note that the unusual nature of this downdraft has impacted our results. Surging commodity prices have benefited the sectors that in turn sell these goods and services: Energy, Basic Materials, and Utilities. Meanwhile, the more traditional growth sectors of Technology, Health Care, and Consumer Discretionary have lagged the broad market indices.

Our Conestoga Small Cap Fund remains in soft close and is only available to shareholders and advisors with current investments in the Small Cap Fund. The Small Cap Fund has experienced modest net outflows of just over $50 million over the fiscal year ended September 30, 2022. The SMid Cap Fund received net inflows of $36 million over the fiscal year ended September 30, 2022. Our relatively new Micro Cap Fund and Mid Cap Fund have been mostly flat, with small inflows over the fiscal year ended September 30, 2022. The total net assets of the Conestoga Funds was $3.3 billion as of September 30, 2022.

While the past year has been challenging, I have every confidence in our team at Conestoga. We continue to implement our high-quality and conservative growth investment strategy, and we seek to build on our successful long-term track record.

We thank you for your investment in the Conestoga Funds, it is greatly appreciated.

Sincerely,

Robert M. Mitchell.

Robert M. Mitchell

Chairman and Chief Executive Officer

1

CONESTOGA FUNDS

MANAGER’S LETTER (Unaudited) | November 28, 2022 |

Dear Fellow Shareholders,

A combination of persistent inflation, rising interest rates, recessionary signals and geopolitical uncertainty has put strong downward pressure on equity markets over the Conestoga Funds’ fiscal year ended September 30, 2022. Valuations for growth equities – particularly the traditional growth sectors of Technology, Health Care and Consumer Discretionary – have fallen significantly, impacting the holdings of the Conestoga Funds. Meanwhile, the smaller-weighted Energy, Basic Materials and Utilities sectors have generally outperformed as they are more easily able to pass along the underlying commodity inflation to their customer base.

The uneven performance of small and mid capitalization stocks over the last 12 months has been accompanied by historic levels of volatility. Through the first nine months of 2022, 63% of trading days in the Russell 2000 Index were either up or down more than +/- 1%. Only 2008 has seen more days of positive/negative 1% swings in the index (source: Furey Research Partners). These elevated levels of volatility combined with an unprecedented spike in 10-year Treasury yields, narrow sector leadership, and the recent outperformance of loss-makers has made this an increasingly difficult environment to navigate. The Conestoga Funds have not been immune to this less-than-ideal backdrop for active equity managers. Our Funds have experienced higher-than-usual swings in daily relative performance as evidenced by the number of times the Funds outperform or underperform their respective indices by more than 1% in a single day. We expect this type of market volatility to persist until there is more clarity on when the Fed will pause their current tightening cycle, bond yields begin to normalize, and profitable companies assume market leadership.

While we aspire to outperform in volatile and down markets such as the past year, this has been more challenging in the current environment. Relative to their respective benchmarks, the Conestoga Micro Cap Fund (Micro Cap Fund) outperformed, the Conestoga Small Cap Fund (Small Cap Fund) modestly outperformed, and the Conestoga SMid Cap Fund (SMid Cap Fund) and the Conestoga Mid Cap Fund (Mid Cap Fund) modestly underperformed. We detail the factors behind our relative performance in the sections that follow.

SMALL CAP FUND PERFORMANCE REVIEW

For the twelve months ended September 30, 2022, the Conestoga Small Cap Fund (Investors Class Shares) modestly outperformed the Russell 2000 Growth Index. The Small Cap Fund declined -28.78% versus the Russell 2000 Growth Index decline of -29.27%. Most of the outperformance for the year was due to positive sector allocation effects while stock selection effects were mixed. The biggest contributions to relative performance came from the Technology, Telecommunications and Utilities sectors with Industrials and Energy being the largest laggards.

Stock selection was most positive in the Technology sector with our positions in Model N. Inc. (MODN), Simulations Plus, Inc. (SLP), and Paycor HCM, Inc. (PYCR) being the most additive. MODN has outperformed after noting that the strength in bookings have

2

come from new logos and cross-sells to customers, providing a nice compliment to SaaS transitions, of which there were three new signings during the year. The strategy also benefited from an underweight to the poorly performing semiconductor industry.

Our lone position in the Telecommunications sector, Vocera Communications, Inc. (VCRA), was up sharply after announcing a definitive agreement to be acquired by Stryker Corp. (SYK) in an all-cash transaction for $79.25. This price represented a 27% premium to the prior day’s close. The acquisition closed on February 23, 2022. Utilities was another bright spot in the portfolio with our positions in Casella Waste Systems, Inc. (CWST) and Evoqua Water Technologies Corp. (AQUA) both adding value to the portfolio.

The Industrials sector was the biggest detractor from relative returns with our positions in Trex Company, Inc. (TREX) and Mesa Laboratories, Inc. (MLAB) declining the most. TREX has corrected due to concerns about the housing market given higher interest rates and the pull forward in demand during the pandemic. In addition, our lack of exposure to the strong performing Energy sector was a headwind for relative results.

SMID CAP FUND PERFORMANCE REVIEW

The Conestoga SMid Cap Fund (Investors Class Shares) declined -31.46% over the twelve months ended September 30, 2022. This modestly trails the Russell 2500 Growth Index decline of -29.39%. The underperformance for the year was largely attributable to negative stock selection effects while sector allocation effects were slightly positive. The biggest detractors from relative performance came from the Energy and Health Care sectors with Industrials and Utilities being the largest contributors.

The Fund’s lack of exposure to the Energy sector continues to weigh on relative returns as it was the Index’s best performer for the trailing 12 months and now makes up more than 6% of the benchmark. The SMid Cap Fund has no holdings in the Energy sector. We typically find limited candidates for investment in the types of profitable and sustainable growth companies we seek for the Fund, and we shy away from companies that are dependent on a commodity price input (such as oil or natural gas).

Negative stock selection effects within the Health Care sector were broad-based with 9 of 12 portfolio holdings detracting from relative returns. Neogen Corp. (NEOG), CareDx, Inc. (CDNA), and Definitive Healthcare Corp. (DH) were the biggest laggards. Long-time holding Neogen Corp. (NEOG) was down significantly as earnings declined more than expected and the company continues to work through the operational issues of its food safety business merger with 3M. DH continues to be impacted by macroeconomic factors such as lengthened sales cycles, particularly when signing new business. Demand for the company’s offerings remain strong, but the near-term continues to be impacted by the increased scrutiny on each deal.

On the positive side, the Industrials sector benefited from positive stock selection, particularly from our positions in Jack Henry & Associates, Inc. (JKHY) and Fair Isaac Corp. (FICO). Casella Waste Systems, Inc. (CWST), our lone holding in the Utilities sector, was also additive over the Fund’s fiscal year.

3

MID CAP FUND PERFORMANCE REVIEW

The Conestoga Mid Cap Fund (Investors Class Shares) declined -31.33% over the 12 months ended September 30, 2022. This trailed the Russell Midcap Growth Index return of -29.50%. Sector allocations detracted from relative returns, while stock selection effects were modestly positive.

The lower growth-oriented sectors of the benchmark Russell Midcap Growth Index outperformed over the Fund’s fiscal year, led by the Energy sector, which rose over 40% during the period. While the Energy sector represents less than 5% of the Index, it contributed significantly to return in a sharply down period. The Conestoga Mid Cap Fund has no positions in this sector, which we typically underweight given its slower growth and dependence on an underlying commodity price.

The Health Care sector was the most difficult sector from a stock selection perspective. Our position in Align Technology Inc. (ALGN), maker of the Invisalign clear aligner systems, fell as demand dropped for their elective/non-essential offerings. Other positions in the Health Care sector which lagged the Index Health Care returns included Masimo Corp. (MASI), IDEXX Laboratories Inc. (IDXX), and Teleflex Inc. (TFX). A bright spot in the sector was our long-time position Repligen Corp. (RGEN), which we originally purchased in the Small Cap Fund in 2014.

Stock selection effects were most positive in the Consumer Discretionary sector, led by Rollins Inc. (ROL). The parent company of Orkin Pest Control and Western Pest Services continued to grow its revenues and earnings and benefited from a more recession-proof industry. We originally purchased ROL into the Small Cap Fund nearly 20 years ago, and we are pleased that the stock still has a home in our Mid Cap Fund. Also benefiting relative return in the Consumer Discretionary sector was Tractor Supply Co. (TSCO), a retailer that has delivered better-than-expected revenues and earnings despite a challenging macro environment.

Other better performing sectors include the Utilities, Basic Materials and Consumer Staples sectors, each of which hold companies which benefited from underlying inflation in the goods they sell and/or have more defensive positions. The Mid Cap Fund does have one position in the Utilities sector – Waste Connections Inc. (WCN) – a waste hauler with a strong competitive position.

MICRO CAP FUND PERFORMANCE REVIEW

The Conestoga Micro Cap Fund (Investors Class Shares) outperformed the Russell Microcap Growth Index over the Fund’s fiscal year ended September 30, 2022. The Micro Cap Fund (Investors Class) declined -31.88% versus the Russell Microcap Growth Index decline of -37.06%. We expect our investment strategy to outperform in down markets, and we are pleased that the Micro Cap Fund was able to achieve this goal. The outperformance was largely driven by stock selection, although sector allocations also added to relative return.

Stock selection was strongest in the Telecommunications sector, where the Fund’s two positions both experienced sharp appreciation. Vocera Communications Inc. (VCRA) was acquired by Stryker Corp. (SYK) in an all-cash transaction at a 27% premium to VCRA’s

4

closing price prior to the announcement. Digi International Inc. (DGII) rose over 40% during the third quarter of 2022 after reporting quarterly results which included higher levels of recurring revenue.

The Technology sector also provided significant positive stock selection effects, led by the Fund’s positions in SiTime Corporation (SITM) and Simulations Plus Inc. (SLP). SITM has benefited from the restructuring of the global supply chain, as many manufacturers shift from quartz to the more widely available and scalable silicon timing solutions. Partially offsetting these positive effects was the weaker performance of UserTesting Inc. (USER), which had reported revenue and earnings below investor expectations. We note that USER announced a plan to become a private company in October, after the Fund’s fiscal year-end, and the stock appreciated significantly.

Stock selection proved most challenging in the Health Care sector. Among the laggards was Alpha Teknova Inc. (TKNO) which declined on weaker-than-expected revenues and earnings as its customer base (early-stage biotechnology and pharmaceutical companies) deferred orders due to macroeconomic and funding uncertainty. Health Catalyst Inc. (HCAT), a provider of data analytics to healthcare systems, moved steadily lower over the Fund’s fiscal year as hospitals tighten their budgets. On the positive side, the Fund’s position in IntriCon Corporation (IIN) rose sharply following the announcement of an agreement to be acquired by private equity firm Altaris Capital in the first quarter of 2022.

Our position in Laird Superfood Inc. (LSF), our sole holding in the Consumer Staples sector, also detracted from relative returns over the Fund’s fiscal year. LSF’s use of cash as it seeks to grow its specialty plant-based foods business became a drag on its results and we removed the stock from the Fund in early 2022.

OUR OUTLOOK

With equity markets at multi-year lows and the outlook for the economy uncertain, we remain focused on identifying those companies that we believe can grow their earnings through the business cycle. In our opinion, there is growing reason for optimism for investing in small and mid capitalization stocks. The price-earnings ratio of the Russell 2000 Growth stands near 10-year lows. After underperforming large capitalization stocks for over ten years (largely due to the outsized performance of the mega capitalization FAANG technology stocks), small capitalization stocks’ relative valuation is also at historically low levels. While the economic outlook, inflation, and global events may cause continuing investor frustration in the near- to mid-term, we believe small capitalization stocks are beginning to look much more attractive for long-term investors.

5

On behalf of all the members of Conestoga Capital Advisors, we thank you for your investment in the Funds.

Sincerely,

Robert M. Mitchell, CFA | Joseph F. Monahan III, CFA |

Managing Partner – Co-Portfolio Manager | Managing Partner – Co-Portfolio Manager |

Small and SMid Cap Funds | Small, SMid and Micro Cap Funds |

| | |

Derek S. Johnston, CFA | David R. Neiderer, CFA |

Partner – Co-Portfolio Manager | Partner – Co-Portfolio Manager |

SMid and Mid Cap Funds | Micro Cap Fund |

| | |

Ted Chang | |

Co-Portfolio Manager | |

Mid Cap Fund | |

6

CONESTOGA SMALL CAP FUND - INSTITUTIONAL CLASS

PERFORMANCE INFORMATION

September 30, 2022 (Unaudited) |

Comparison of the Change in Value of a $250,000 Investment in

Conestoga Small Cap Fund – Institutional Class (since inception on 08/13/2014)

versus the Russell 2000® Growth Index

Average Annual Total Returns for the Periods Ended September 30, 2022 |

| | 1 Year | 3 Years | 5 Years | Since

Inception

(8/13/2014) | |

Conestoga Small Cap Fund - Institutional Class | -28.62% | 2.86% | 6.25% | 10.06% | |

Russell 2000® Growth Index | -29.27% | 2.94% | 3.60% | 6.29% | |

The Fund’s past performance does not predict its future performance. The graph and table shown above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares but do reflect the reinvestment of all dividends and distributions. The Fund’s benchmark, the Russell 2000® Growth Index, measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000® companies with higher price-to-value ratios and higher forecasted growth values. The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities in the Russell 3000® Index based on a combination of their market capitalization and current index membership.

7

CONESTOGA SMALL CAP FUND - INVESTORS CLASS

PERFORMANCE INFORMATION

September 30, 2022 (Unaudited) |

10 Year Comparison of the Change in Value of a $10,000

Investment in Conestoga Small Cap Fund – Investors Class

versus the Russell 2000® Growth Index

Average Annual Total Returns for the Periods Ended September 30, 2022 |

| | 1 Year | 3 Years | 5 Years | 10 Years | 15 Years | Since

Inception

(10/1/2002) | |

Conestoga Small Cap Fund - Investors Class | -28.78% | 2.65% | 6.03% | 10.98% | 9.06% | 10.74% | |

Russell 2000® Growth Index | -29.27% | 2.94% | 3.60% | 8.81% | 6.82% | 9.60% | |

The Fund’s past performance does not predict its future performance. The graph and table shown above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares but do reflect the reinvestment of all dividends and distributions. The Fund’s benchmark, the Russell 2000® Growth Index, measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000® companies with higher price-to-value ratios and higher forecasted growth values. The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities in the Russell 3000® Index based on a combination of their market capitalization and current index membership.

8

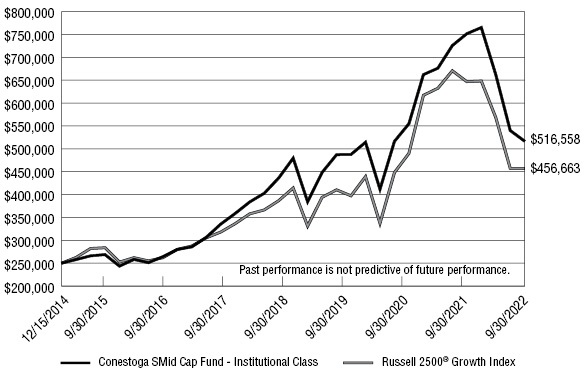

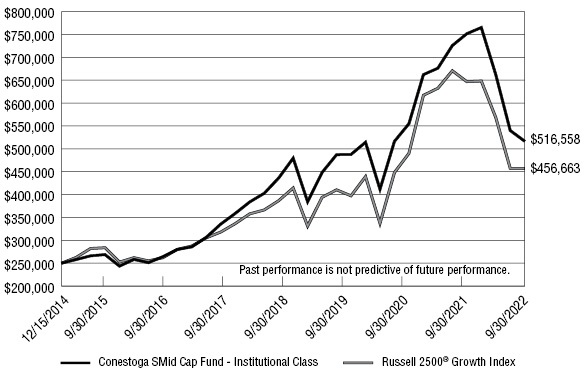

CONESTOGA SMID CAP FUND - INSTITUTIONAL CLASS

PERFORMANCE INFORMATION

September 30, 2022 (Unaudited) |

Comparison of the Change in Value of a $250,000 Investment in

Conestoga SMid Cap Fund – Institutional Class (since inception on 12/15/2014)

versus the Russell 2500® Growth Index

Average Annual Total Returns for the Periods Ended September 30, 2022 |

| | 1 Year | 3 Years | 5 Years | Since

Inception

(12/15/2014) | |

Conestoga SMid Cap Fund - Institutional Class | -31.27% | 1.94% | 7.56% | 9.76% | |

Russell 2500® Growth Index | -29.39% | 4.76% | 6.30% | 8.04% | |

The Fund’s past performance does not predict its future performance. The graph and table shown above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares but do reflect the reinvestment of all dividends and distributions. The Fund’s benchmark, the Russell 2500® Growth Index, measures the performance of the small- to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500® companies with higher growth earnings potential as defined by Russell’s leading style methodology. The Russell 2500® Index measures the performance of the small- to mid-cap segment of the U.S. equity universe, commonly referred to as “smid” cap. The Russell 2500® Index is a subset of the Russell 3000® Index. It includes approximately 2500 of the smallest securities in the Russell 3000® Index based on a combination of their market capitalization and current index membership.

9

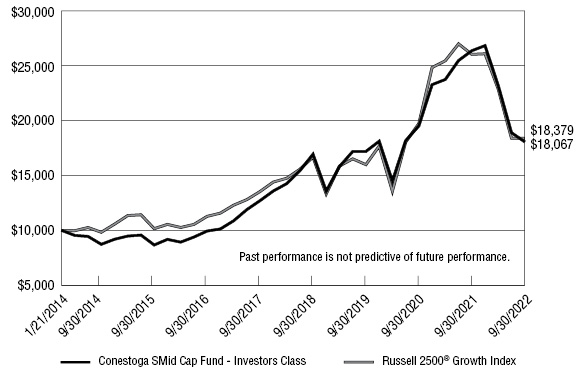

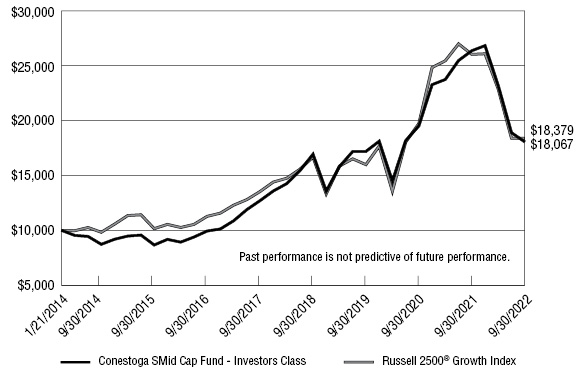

CONESTOGA SMID CAP FUND - INVESTORS CLASS

PERFORMANCE INFORMATION

September 30, 2022 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in

Conestoga SMid Cap Fund – Investors Class (since inception on 01/21/2014)

versus the Russell 2500® Growth Index

Average Annual Total Returns for the Periods Ended September 30, 2022 |

| | 1 Year | 3 Years | 5 Years | Since

Inception

(1/21/2014) | |

Conestoga SMid Cap Fund - Investors Class | -31.46% | 1.67% | 7.29% | 7.04% | |

Russell 2500® Growth Index | -29.39% | 4.76% | 6.30% | 7.25% | |

The Fund’s past performance does not predict its future performance. The graph and table shown above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares but do reflect the reinvestment of all dividends and distributions. The Fund’s benchmark, the Russell 2500® Growth Index, measures the performance of the small- to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500® companies with higher growth earnings potential as defined by Russell’s leading style methodology. The Russell 2500® Index measures the performance of the small- to mid-cap segment of the U.S. equity universe, commonly referred to as “smid” cap. The Russell 2500® Index is a subset of the Russell 3000® Index. It includes approximately 2500 of the smallest securities in the Russell 3000® Index based on a combination of their market capitalization and current index membership.

10

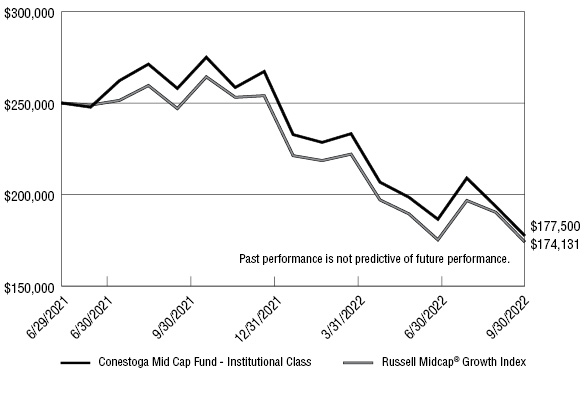

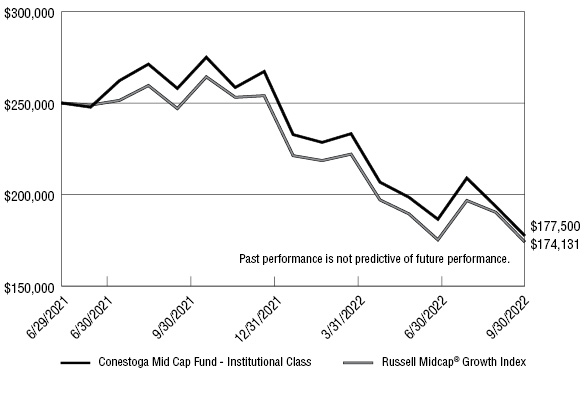

CONESTOGA MID CAP FUND - INSTITUTIONAL CLASS

PERFORMANCE INFORMATION

September 30, 2022 (Unaudited) |

Comparison of the Change in Value of a $250,000 Investment in

Conestoga Mid Cap Fund – Institutional Class (since inception on 6/29/2021)

versus the Russell Midcap® Growth Index

Average Annual Total Returns for the Periods Ended September 30, 2022 |

| | | | 1 Year | Since

Inception

(06/29/2021) | |

Conestoga Mid Cap Fund - Institutional Class | | | -31.20% | -23.89% | |

Russell Midcap® Growth Index | | | -29.50% | -25.04% | |

The Fund’s past performance does not predict its future performance. The graph and table shown above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares but do reflect the reinvestment of all dividends and distributions. The Fund’s benchmark, the Russell Midcap® Growth Index, measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap® Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell Midcap® Growth Index is constructed to provide a comprehensive and unbiased barometer of the mid-cap growth market. The index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true mid-cap growth market.

11

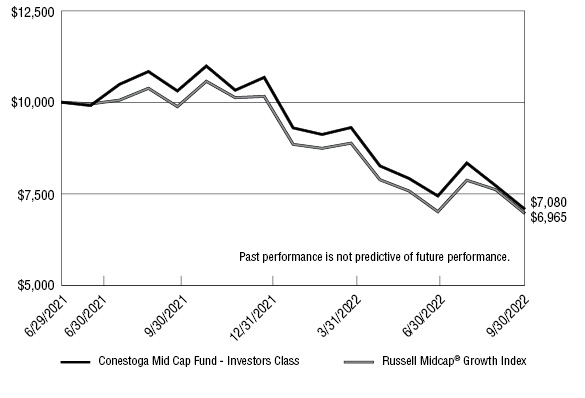

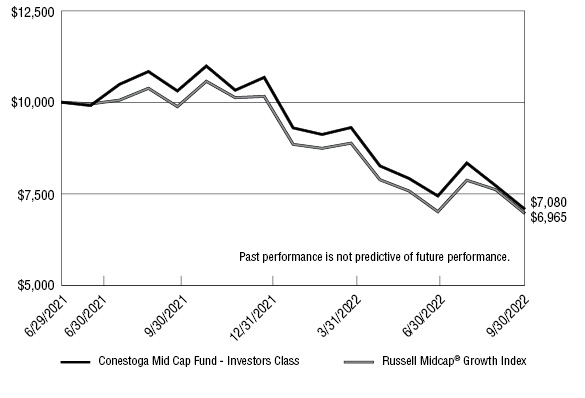

CONESTOGA MID CAP FUND - INVESTORS CLASS

PERFORMANCE INFORMATION

September 30, 2022 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in

Conestoga Mid Cap Fund – Investors Class (since inception on 6/29/2021)

versus the Russell Midcap® Growth Index

Average Annual Total Returns for the Periods Ended September 30, 2022 |

| | | | 1 Year | Since

Inception

(06/29/2021) | |

Conestoga Mid Cap Fund - Investors Class | | | -31.33% | -24.06% | |

Russell Midcap® Growth Index | | | -29.50% | -25.04% | |

The Fund’s past performance does not predict its future performance. The graph and table shown above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares but do reflect the reinvestment of all dividends and distributions. The Fund’s benchmark, the Russell Midcap® Growth Index, measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap® Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell Midcap® Growth Index is constructed to provide a comprehensive and unbiased barometer of the mid-cap growth market. The index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true mid-cap growth market.

12

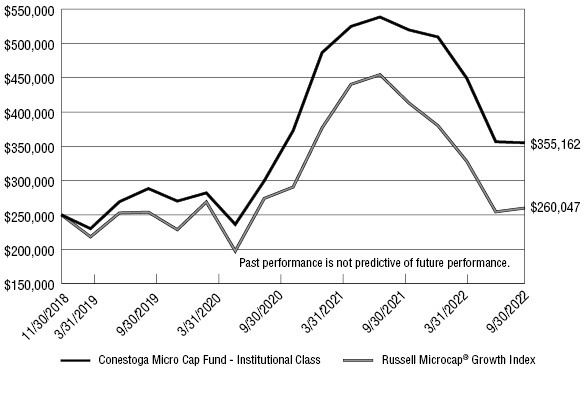

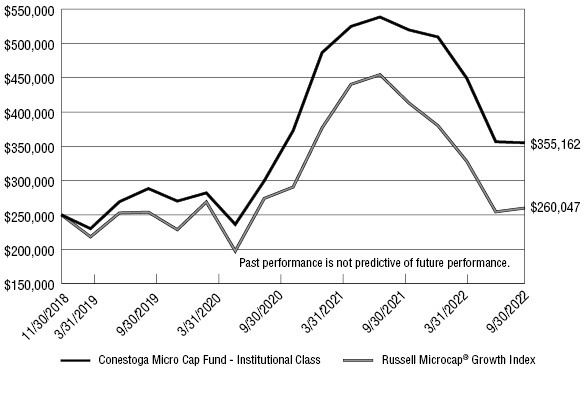

CONESTOGA MICRO CAP FUND - INSTITUTIONAL CLASS

PERFORMANCE INFORMATION

September 30, 2022 (Unaudited) |

Comparison of the Change in Value of a $250,000 Investment in

Conestoga Micro Cap Fund – Institutional Class (since inception on 11/30/2018)

versus the Russell Microcap® Growth Index

Average Annual Total Returns for the Periods Ended September 30, 2022 |

| | 1 Year | 3 Years | Since

Inception

(11/30/2018) | |

Conestoga Micro Cap Fund - Institutional Class | -31.65% | 9.54% | 9.59% | |

Russell Microcap® Growth Index | -37.06% | 4.40% | 1.03% | |

The Fund commenced operations as a series of Conestoga Funds on December 20, 2021, when all of the assets of Conestoga Micro Cap Fund, LP (the “Predecessor Fund”) transferred to Institutional Class and Investors Class shares of the Fund. The Fund’s investment objectives, policies, guidelines and restrictions are in all material respects equivalent to those of the Predecessor Fund, and the investment adviser and portfolio managers for the Fund are the same as those of the Predecessor Fund. Accordingly, the performance information shown for periods prior to December 20, 2021 is that of the Predecessor Fund. The Predecessor Fund was not registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and thus was not subject to certain investment and operational restrictions that are imposed by the 1940 Act. If the Predecessor Fund had been registered under the 1940 Act, its performance may have been adversely affected. Accordingly, future Fund performance may be different than the Predecessor Fund’s restated past performance. The graph and table shown above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares but do reflect the reinvestment of all dividends and distributions. The Fund’s benchmark, the Russell Microcap® Growth Index, measures the performance of those Russell Microcap® companies with higher price-to-book ratios and higher forecasted growth values.

13

CONESTOGA MICRO CAP FUND - INVESTORS CLASS

PERFORMANCE INFORMATION

September 30, 2022 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in

Conestoga Micro Cap Fund – Investors Class (since inception on 11/30/2018)

versus the Russell Microcap® Growth Index

Average Annual Total Returns for the Periods Ended September 30, 2022 |

| | 1 Year | 3 Years | Since

Inception

(11/30/2018) | |

Conestoga Micro Cap Fund - Investors Class | -31.88% | 9.23% | 9.29% | |

Russell Microcap® Growth Index | -37.06% | 4.40% | 1.03% | |

The Fund commenced operations as a series of Conestoga Funds on December 20, 2021, when all of the assets of Conestoga Micro Cap Fund, LP (the “Predecessor Fund”) transferred to Institutional Class and Investors Class shares of the Fund. The Fund’s investment objectives, policies, guidelines and restrictions are in all material respects equivalent to those of the Predecessor Fund, and the investment adviser and portfolio managers for the Fund are the same as those of the Predecessor Fund. Accordingly, the performance information shown for periods prior to December 20, 2021 is that of the Predecessor Fund. The Predecessor Fund was not registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and thus was not subject to certain investment and operational restrictions that are imposed by the 1940 Act. If the Predecessor Fund had been registered under the 1940 Act, its performance may have been adversely affected. Accordingly, future Fund performance may be different than the Predecessor Fund’s restated past performance. The graph and table shown above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares but do reflect the reinvestment of all dividends and distributions. The Fund’s benchmark, the Russell Microcap® Growth Index, measures the performance of those Russell Microcap® companies with higher price-to-book ratios and higher forecasted growth values.

14

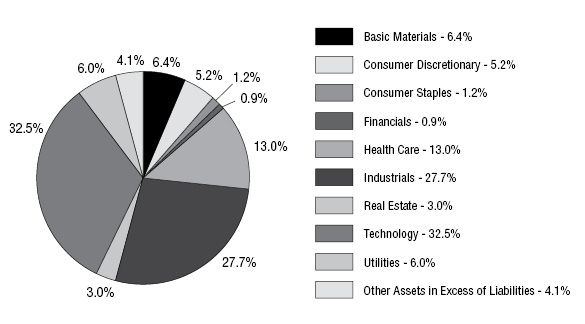

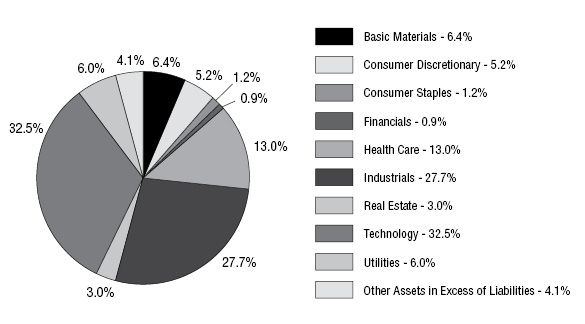

CONESTOGA SMALL CAP FUND

PORTFOLIO HOLDINGS

September 30, 2022 (Unaudited) |

Diversification*

(% of Net Assets)

Top Ten Equity Holdings

Security Description | | % of Net Assets |

Casella Waste Systems, Inc. - Class A | | 4.5% |

Exponent, Inc. | | 4.1% |

SPS Commerce, Inc. | | 4.1% |

Descartes Systems Group, Inc. (The) | | 3.9% |

Model N, Inc. | | 3.8% |

Novanta, Inc. | | 3.3% |

AAON, Inc. | | 3.1% |

Fox Factory Holding Corporation | | 3.0% |

FirstService Corporation | | 3.0% |

Omnicell, Inc. | | 2.8% |

* | Industry categories represent the industry assigned at the time of purchase. See Note 7 of the Notes to Financial Statements. |

15

CONESTOGA SMALL CAP FUND

SCHEDULE OF INVESTMENTS

September 30, 2022 |

COMMON STOCKS — 95.9% | | Shares | | | Value | |

Basic Materials — 6.4% | | | | | | | | |

Metal Fabricting — 3.8% | | | | | | | | |

Omega Flex, Inc. | | | 373,109 | | | $ | 34,557,356 | |

RBC Bearings, Inc. (a) | | | 389,675 | | | | 80,978,362 | |

| | | | | | | | 115,535,718 | |

Specialty Chemicals — 2.6% | | | | | | | | |

Balchem Corporation | | | 638,560 | | | | 77,636,125 | |

| | | | | | | | | |

Consumer Discretionary — 5.2% | | | | | | | | |

Home Improvement Retailers — 2.2% | | | | | | | | |

SiteOne Landscape Supply, Inc. (a) | | | 646,330 | | | | 67,308,806 | |

| | | | | | | | | |

Recreational Products — 3.0% | | | | | | | | |

Fox Factory Holding Corporation (a) | | | 1,146,388 | | | | 90,656,363 | |

| | | | | | | | | |

Consumer Staples — 1.2% | | | | | | | | |

Nondurable Household Products — 1.2% | | | | | | | | |

WD-40 Company | | | 200,351 | | | | 35,209,685 | |

| | | | | | | | | |

Financials — 0.9% | | | | | | | | |

Financial Data Providers — 0.9% | | | | | | | | |

Clearwater Analytics Holdings, Inc. - Class A (a) | | | 1,612,683 | | | | 27,076,948 | |

| | | | | | | | | |

Health Care — 13.0% | | | | | | | | |

Biotechnology — 0.5% | | | | | | | | |

Vericel Corporation (a) | | | 703,540 | | | | 16,322,128 | |

| | | | | | | | | |

Health Care Management Services — 0.7% | | | | | | | | |

National Research Corporation | | | 503,399 | | | | 20,035,280 | |

| | | | | | | | | |

Health Care Services — 2.8% | | | | | | | | |

Omnicell, Inc. (a) | | | 956,105 | | | | 83,209,818 | |

| | | | | | | | | |

Medical Equipment — 6.7% | | | | | | | | |

LeMaitre Vascular, Inc. (b) | | | 1,275,696 | | | | 64,652,273 | |

Merit Medical Systems, Inc. (a) | | | 1,200,295 | | | | 67,828,670 | |

Repligen Corporation (a) | | | 360,810 | | | | 67,511,159 | |

| | | | | | | | 199,992,102 | |

Medical Services — 0.0% (c) | | | | | | | | |

CareDx, Inc. (a) | | | 5,064 | | | | 86,189 | |

16

CONESTOGA SMALL CAP FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.9% (Continued) | | Shares | | | Value | |

Health Care — 13.0% (Continued) | | | | | | | | |

Medical Supplies — 2.3% | | | | | | | | |

Neogen Corporation (a) | | | 2,438,566 | | | $ | 34,066,767 | |

Stevanato Group S.p.A. (b) | | | 2,040,000 | | | | 34,557,600 | |

| | | | | | | | 68,624,367 | |

Industrials — 27.7% | | | | | | | | |

Building Materials: Other — 3.7% | | | | | | | | |

Simpson Manufacturing Company, Inc. | | | 856,790 | | | | 67,172,336 | |

Trex Company, Inc. (a) | | | 978,485 | | | | 42,994,631 | |

| | | | | | | | 110,166,967 | |

Building: Climate Control — 3.1% | | | | | | | | |

AAON, Inc. | | | 1,752,325 | | | | 94,415,271 | |

| | | | | | | | | |

Construction — 2.6% | | | | | | | | |

Construction Partners, Inc. - Class A (a)(b) | | | 3,035,866 | | | | 79,630,765 | |

| | | | | | | | | |

Defense — 4.0% | | | | | | | | |

Axon Enterprise, Inc. (a) | | | 573,110 | | | | 66,337,482 | |

Mercury Systems, Inc. (a) | | | 1,313,898 | | | | 53,344,259 | |

| | | | | | | | 119,681,741 | |

Diversified Industrials — 1.7% | | | | | | | | |

ESCO Technologies, Inc. | | | 676,430 | | | | 49,677,019 | |

| | | | | | | | | |

Electronic Equipment: Control & Filter — 1.8% | | | | | | | | |

Helios Technologies, Inc. | | | 1,068,183 | | | | 54,050,060 | |

| | | | | | | | | |

Electronic Equipment: Gauges & Meters — 2.7% | | | | | | | | |

Mesa Laboratories, Inc. (b) | | | 325,555 | | | | 45,847,911 | |

Transcat, Inc. (a)(b) | | | 483,824 | | | | 36,620,639 | |

| | | | | | | | 82,468,550 | |

Engineering & Contracting Services — 4.1% | | | | | | | | |

Exponent, Inc. | | | 1,418,105 | | | | 124,325,265 | |

| | | | | | | | | |

Industrial Suppliers — 1.0% | | | | | | | | |

Hillman Solutions Corporation (a) | | | 3,824,750 | | | | 28,838,615 | |

| | | | | | | | | |

Machinery: Construction & Handling — 1.4% | | | | | | | | |

Douglas Dynamics, Inc. (b) | | | 1,472,915 | | | | 41,271,078 | |

| | | | | | | | | |

Machinery: Industrial — 1.6% | | | | | | | | |

John Bean Technologies Corporation | | | 546,830 | | | | 47,027,380 | |

17

CONESTOGA SMALL CAP FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.9% (Continued) | | Shares | | | Value | |

Real Estate — 3.0% | | | | | | | | |

Real Estate Services — 3.0% | | | | | | | | |

FirstService Corporation | | | 750,235 | | | $ | 89,285,467 | |

| | | | | | | | | |

Technology — 32.5% | | | | | | | | |

Computer Services — 2.6% | | | | | | | | |

Computer Services, Inc. | | | 765,289 | | | | 42,664,862 | |

Workiva, Inc. (a) | | | 465,085 | | | | 36,183,613 | |

| | | | | | | | 78,848,475 | |

Consumer Digital Services — 0.7% | | | | | | | | |

Definitive Healthcare Corporation - Class A (a) | | | 1,319,354 | | | | 20,502,761 | |

Shutterstock, Inc. | | | 5,000 | | | | 250,850 | |

| | | | | | | | 20,753,611 | |

Production Technology Equipment — 4.5% | | | | | | | | |

Azenta, Inc. | | | 891,215 | | | | 38,197,475 | |

Novanta, Inc. (a) | | | 844,165 | | | | 97,627,682 | |

| | | | | | | | 135,825,157 | |

Software — 24.7% | | | | | | | | |

Altair Engineering, Inc. - Class A (a) | | | 1,466,230 | | | | 64,836,691 | |

BlackLine, Inc. (a) | | | 969,915 | | | | 58,097,908 | |

Descartes Systems Group, Inc. (The) (a) | | | 1,850,196 | | | | 117,542,952 | |

Model N, Inc. (a)(b) | | | 3,314,719 | | | | 113,462,831 | |

Paycor HCM, Inc. (a) | | | 2,794,930 | | | | 82,618,131 | |

PROS Holdings, Inc. (a) | | | 1,829,665 | | | | 45,192,726 | |

Q2 Holdings, Inc. (a) | | | 1,082,765 | | | | 34,865,033 | |

Simulations Plus, Inc. (b) | | | 1,510,746 | | | | 73,331,611 | |

SPS Commerce, Inc. (a) | | | 999,180 | | | | 124,128,131 | |

Vertex, Inc. - Class A (a) | | | 1,869,290 | | | | 25,553,194 | |

| | | | | | | | 739,629,208 | |

18

CONESTOGA SMALL CAP FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.9% (Continued) | | Shares | | | Value | |

Utilities — 6.0% | | | | | | | | |

Waste & Disposal Services — 4.5% | | | | | | | | |

Casella Waste Systems, Inc. - Class A (a) | | | 1,755,035 | | | $ | 134,067,124 | |

| | | | | | | | | |

Water — 1.5% | | | | | | | | |

Evoqua Water Technologies Corporation (a) | | | 1,337,075 | | | | 44,217,070 | |

| | | | | | | | | |

Total Investments at Value — 95.9% (Cost $2,237,490,138) | | | | | | $ | 2,875,872,352 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 4.1% | | | | | | | 124,506,911 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 3,000,379,263 | |

(a) | Non-income producing security. |

(b) | The Fund owned 5% or more of the company’s outstanding voting shares thereby making the company an affiliate of the Fund as that term is defined in the Investment Company Act of 1940 (Note 5). |

(c) | Percentage rounds to less than 0.1%. |

Schedule of Investments uses the Russell ICB Industry and Sector classification. |

See accompanying notes to financial statements. |

19

CONESTOGA SMID CAP FUND

PORTFOLIO HOLDINGS

September 30, 2022 (Unaudited) |

Diversification*

(% of Net Assets)

Top Ten Equity Holdings

Security Description | | % of Net Assets |

Casella Waste Systems, Inc. - Class A | | 4.6% |

Exponent, Inc. | | 3.6% |

FirstService Corporation | | 3.5% |

Repligen Corporation | | 3.4% |

Rollins, Inc. | | 3.2% |

Jack Henry & Associates, Inc. | | 3.2% |

Omnicell, Inc. | | 3.0% |

Descartes Systems Group, Inc. (The) | | 2.9% |

Pool Corporation | | 2.8% |

RBC Bearings, Inc. | | 2.8% |

* | Industry categories represent the industry assigned at the time of purchase. See Note 7 of the Notes to Financial Statements. |

20

CONESTOGA SMID CAP FUND

SCHEDULE OF INVESTMENTS

September 30, 2022 |

COMMON STOCKS — 97.0% | | Shares | | | Value | |

Basic Materials — 4.5% | | | | | | | | |

Metal Fabricating — 2.8% | | | | | | | | |

RBC Bearings, Inc. (a) | | | 41,991 | | | $ | 8,726,150 | |

| | | | | | | | | |

Specialty Chemicals — 1.7% | | | | | | | | |

Balchem Corporation | | | 45,185 | | | | 5,493,592 | |

| | | | | | | | | |

Consumer Discretionary — 12.0% | | | | | | | | |

Consumer Services: Miscellaneous — 3.2% | | | | | | | | |

Rollins, Inc. | | | 296,787 | | | | 10,292,573 | |

| | | | | | | | | |

Education Services — 1.3% | | | | | | | | |

Bright Horizons Family Solutions, Inc. (a) | | | 71,145 | | | | 4,101,509 | |

| | | | | | | | | |

Home Improvement Retailers — 1.4% | | | | | | | | |

SiteOne Landscape Supply, Inc. (a) | | | 43,665 | | | | 4,547,273 | |

| | | | | | | | | |

Hotels & Motels — 2.0% | | | | | | | | |

Vail Resorts, Inc. | | | 28,670 | | | | 6,182,399 | |

| | | | | | | | | |

Recreational Products — 2.8% | | | | | | | | |

Pool Corporation | | | 28,095 | | | | 8,940,110 | |

| | | | | | | | | |

Leisure Goods — 1.3% | | | | | | | | |

LCI Industries | | | 38,850 | | | | 3,941,721 | |

| | | | | | | | | |

Financials — 0.9% | | | | | | | | |

Financial Data Providers — 0.9% | | | | | | | | |

Clearwater Analytics Holdings, Inc. - Class A (a) | | | 165,800 | | | | 2,783,782 | |

| | | | | | | | | |

Health Care — 16.2% | | | | | | | | |

Health Care Services — 3.0% | | | | | | | | |

Omnicell, Inc. (a) | | | 108,520 | | | | 9,444,496 | |

| | | | | | | | | |

Medical Equipment — 5.8% | | | | | | | | |

Merit Medical Systems, Inc. (a) | | | 132,108 | | | | 7,465,423 | |

Repligen Corporation (a) | | | 57,440 | | | | 10,747,598 | |

| | | | | | | | 18,213,021 | |

Medical Services — 0.4% | | | | | | | | |

CareDx, Inc. (a) | | | 81,489 | | | | 1,386,943 | |

21

CONESTOGA SMID CAP FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 97.0% (Continued) | | Shares | | | Value | |

Health Care — 16.2% (Continued) | | | | | | | | |

Medical Supplies — 7.0% | | | | | | | | |

Bio-Techne Corporation | | | 23,110 | | | $ | 6,563,240 | |

Neogen Corporation (a) | | | 183,561 | | | | 2,564,347 | |

Stevanato Group S.p.A. | | | 191,120 | | | | 3,237,573 | |

Teleflex, Inc. | | | 22,190 | | | | 4,470,397 | |

West Pharmaceutical Services, Inc. | | | 21,589 | | | | 5,312,621 | |

| | | | | | | | 22,148,178 | |

Industrials — 33.7% | | | | | | | | |

Aerospace — 2.4% | | | | | | | | |

HEICO Corporation - Class A | | | 65,430 | | | | 7,499,587 | |

| | | | | | | | | |

Building Materials: Other — 3.2% | | | | | | | | |

Simpson Manufacturing Company, Inc. | | | 50,000 | | | | 3,920,000 | |

Trex Company, Inc. (a) | | | 144,455 | | | | 6,347,353 | |

| | | | | | | | 10,267,353 | |

Building: Climate Control — 2.3% | | | | | | | | |

Watsco, Inc. | | | 28,005 | | | | 7,210,167 | |

| | | | | | | | | |

Construction — 2.4% | | | | | | | | |

Construction Partners, Inc. - Class A (a) | | | 289,140 | | | | 7,584,142 | |

| | | | | | | | | |

Defense — 4.0% | | | | | | | | |

Axon Enterprise, Inc. (a) | | | 57,720 | | | | 6,681,090 | |

Mercury Systems, Inc. (a) | | | 149,910 | | | | 6,086,346 | |

| | | | | | | | 12,767,436 | |

Electrical Equipment: Gauges & Meters — 1.3% | | | | | | | | |

Cognex Corporation | | | 100,000 | | | | 4,145,000 | |

| | | | | | | | | |

Engineering & Contracting Services — 3.6% | | | | | | | | |

Exponent, Inc. | | | 130,405 | | | | 11,432,606 | |

| | | | | | | | | |

Industrial Suppliers — 1.2% | | | | | | | | |

Hillman Solutions Corporation (a) | | | 515,895 | | | | 3,889,848 | |

| | | | | | | | | |

Machinery: Construction & Handling — 1.6% | | | | | | | | |

Douglas Dynamics, Inc. | | | 176,782 | | | | 4,953,432 | |

| | | | | | | | | |

Machinery: Engines — 0.9% | | | | | | | | |

Generac Holdings, Inc. (a) | | | 16,040 | | | | 2,857,366 | |

22

CONESTOGA SMID CAP FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 97.0% (Continued) | | Shares | | | Value | |

Industrials — 33.7% (Continued) | | | | | | | | |

Machinery: Industrial — 2.9% | | | | | | | | |

EVI Industries, Inc. (a) | | | 270,917 | | | $ | 4,914,434 | |

John Bean Technologies Corporation | | | 48,805 | | | | 4,197,230 | |

| | | | | | | | 9,111,664 | |

Machinery: Specialty — 2.1% | | | | | | | | |

Graco, Inc. | | | 112,915 | | | | 6,769,254 | |

| | | | | | | | | |

Professional Business Support Services — 2.6% | | | | | | | | |

Fair Isaac Corporation (a) | | | 20,295 | | | | 8,361,743 | |

| | | | | | | | | |

Transaction Processing Services — 3.2% | | | | | | | | |

Jack Henry & Associates, Inc. | | | 54,920 | | | | 10,010,268 | |

| | | | | | | | | |

Real Estate — 3.5% | | | | | | | | |

Real Estate Services — 3.5% | | | | | | | | |

FirstService Corporation | | | 93,575 | | | | 11,136,361 | |

| | | | | | | | | |

Technology — 21.6% | | | | | | | | |

Computer Services — 3.1% | | | | | | | | |

Gartner, Inc. (a) | | | 20,840 | | | | 5,766,220 | |

Workiva, Inc. (a) | | | 51,483 | | | | 4,005,377 | |

| | | | | | | | 9,771,597 | |

Consumer Digital Services — 1.2% | | | | | | | | |

Definitive Healthcare Corporation - Class A (a) | | | 257,755 | | | | 4,005,513 | |

| | | | | | | | | |

Production Technology Equipment — 2.5% | | | | | | | | |

Novanta, Inc. (a) | | | 68,645 | | | | 7,938,794 | |

| | | | | | | | | |

Software — 14.8% | | | | | | | | |

Altair Engineering, Inc. - Class A (a) | | | 84,070 | | | | 3,717,576 | |

Descartes Systems Group, Inc. (The) (a) | | | 145,075 | | | | 9,216,615 | |

Five9, Inc. (a) | | | 50,000 | | | | 3,749,000 | |

Guidewire Software, Inc. (a) | | | 69,445 | | | | 4,276,423 | |

Lightspeed Commerce, Inc. (a) | | | 110,000 | | | | 1,933,800 | |

Paycor HCM, Inc. (a) | | | 132,925 | | | | 3,929,263 | |

Q2 Holdings, Inc. (a) | | | 128,105 | | | | 4,124,981 | |

SPS Commerce, Inc. (a) | | | 68,334 | | | | 8,489,133 | |

Tyler Technologies, Inc. (a) | | | 21,205 | | | | 7,368,738 | |

| | | | | | | | 46,805,529 | |

23

CONESTOGA SMID CAP FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 97.0% (Continued) | | Shares | | | Value | |

Utilities — 4.6% | | | | | | | | |

Waste & Disposal Services — 4.6% | | | | | | | | |

Casella Waste Systems, Inc. - Class A (a) | | | 192,505 | | | $ | 14,705,457 | |

| | | | | | | | | |

Total Investments at Value — 97.0% (Cost $293,305,734) | | | | | | $ | 307,424,864 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 3.0% | | | | | | | 9,381,043 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 316,805,907 | |

(a) | Non-income producing security. |

Schedule of Investments uses the Russell ICB Industry and Sector classification. |

See accompanying notes to financial statements. |

24

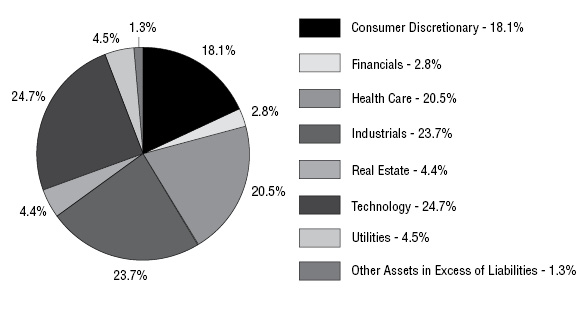

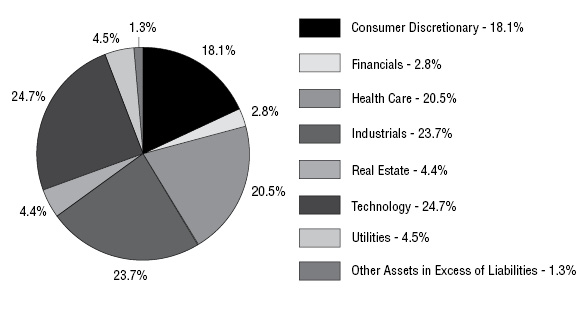

CONESTOGA MID CAP FUND

PORTFOLIO HOLDINGS

September 30, 2022 (Unaudited) |

Diversification*

(% of Net Assets)

Top Ten Equity Holdings

Security Description | | % of Net Assets |

Rollins, Inc. | | 4.6% |

Waste Connections, Inc. | | 4.5% |

CoStar Group, Inc. | | 4.4% |

Copart, Inc. | | 4.3% |

Tyler Technologies, Inc. | | 4.1% |

HEICO Corporation - Class A | | 4.0% |

Gartner, Inc. | | 3.9% |

Jack Henry & Associates, Inc. | | 3.9% |

Verisk Analytics, Inc. | | 3.8% |

Pool Corporation | | 3.7% |

* | Industry categories represent the industry assigned at the time of purchase. See Note 7 of the Notes to Financial Statements. |

25

CONESTOGA MID CAP FUND

SCHEDULE OF INVESTMENTS

September 30, 2022 |

COMMON STOCKS — 98.7% | | Shares | | | Value | |

Consumer Discretionary — 18.1% | | | | | | | | |

Consumer Services: Miscellaneous — 8.9% | | | | | | | | |

Copart, Inc. (a) | | | 720 | | | $ | 76,608 | |

Rollins, Inc. | | | 2,395 | | | | 83,059 | |

| | | | | | | | 159,667 | |

Education Services — 1.5% | | | | | | | | |

Bright Horizons Family Solutions, Inc. (a) | | | 465 | | | | 26,807 | |

| | | | | | | | | |

Hotels & Motels — 2.3% | | | | | | | | |

Vail Resorts, Inc. | | | 195 | | | | 42,050 | |

| | | | | | | | | |

Recreational Products — 3.7% | | | | | | | | |

Pool Corporation | | | 210 | | | | 66,824 | |

| | | | | | | | | |

Specialty Retail — 1.7% | | | | | | | | |

Tractor Supply Company | | | 165 | | | | 30,670 | |

| | | | | | | | | |

Financials — 2.8% | | | | | | | | |

Financial Data Providers- 2.8% | | | | | | | | |

FactSet Research Systems, Inc. | | | 125 | | | | 50,014 | |

| | | | | | | | | |

Health Care — 20.5% | | | | | | | | |

Health Care Services — 3.2% | | | | | | | | |

Veeva Systems, Inc. - Class A (a) | | | 355 | | | | 58,532 | |

| | | | | | | | | |

Medical Equipment — 7.6% | | | | | | | | |

IDEXX Laboratories, Inc. (a) | | | 150 | | | | 48,870 | |

Repligen Corporation (a) | | | 320 | | | | 59,875 | |

STERIS plc | | | 170 | | | | 28,268 | |

| | | | | | | | 137,013 | |

Medical Supplies — 9.7% | | | | | | | | |

Align Technology, Inc. (a) | | | 120 | | | | 24,853 | |

Bio-Techne Corporation | | | 205 | | | | 58,220 | |

Teleflex, Inc. | | | 140 | | | | 28,204 | |

West Pharmaceutical Services, Inc. | | | 255 | | | | 62,751 | |

| | | | | | | | 174,028 | |

Industrials — 23.7% | | | | | | | | |

Aerospace — 4.0% | | | | | | | | |

HEICO Corporation - Class A | | | 625 | | | | 71,638 | |

26

CONESTOGA MID CAP FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 98.7% (Continued) | | Shares | | | Value | |

Industrials — 23.7% (Continued) | | | | | | | | |

Building: Climate Control — 1.7% | | | | | | | | |

Watsco, Inc. | | | 120 | | | $ | 30,895 | |

| | | | | | | | | |

Containers & Packaging — 1.5% | | | | | | | | |

Ball Corporation | | | 570 | | | | 27,542 | |

| | | | | | | | | |

Electronic Equipment: Gauges & Meters — 1.2% | | | | | | | | |

Cognex Corporation | | | 540 | | | | 22,383 | |

| | | | | | | | | |

Electrical Equipment: Pollution Control — 1.5% | | | | | | | | |

Xylem, Inc. | | | 315 | | | | 27,518 | |

| | | | | | | | | |

Machinery: Engines — 1.5% | | | | | | | | |

Generac Holdings, Inc. (a) | | | 150 | | | | 26,721 | |

| | | | | | | | | |

Machinery: Specialty — 3.1% | | | | | | | | |

Graco, Inc. | | | 915 | | | | 54,854 | |

| | | | | | | | | |

Professional Business Support Services — 5.3% | | | | | | | | |

TransUnion | | | 450 | | | | 26,771 | |

Verisk Analytics, Inc. | | | 400 | | | | 68,212 | |

| | | | | | | | 94,983 | |

Transaction Processing Services — 3.9% | | | | | | | | |

Jack Henry & Associates, Inc. | | | 385 | | | | 70,174 | |

| | | | | | | | | |

Real Estate — 4.4% | | | | | | | | |

Real Estate Services — 4.4% | | | | | | | | |

CoStar Group, Inc. (a) | | | 1,135 | | | | 79,053 | |

| | | | | | | | | |

Technology — 24.7% | | | | | | | | |

Computer Services — 3.9% | | | | | | | | |

Gartner, Inc. (a) | | | 255 | | | | 70,556 | |

| | | | | | | | | |

Software — 20.8% | | | | | | | | |

ANSYS, Inc. (a) | | | 255 | | | | 56,534 | |

Avalara, Inc. (a) | | | 200 | | | | 18,360 | |

Coupa Software, Inc. (a) | | | 340 | | | | 19,992 | |

Five9, Inc. (a) | | | 275 | | | | 20,620 | |

Fortinet, Inc. (a) | | | 1,250 | | | | 61,413 | |

Guidewire Software, Inc. (a) | | | 395 | | | | 24,324 | |

27

CONESTOGA MID CAP FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 98.7% (Continued) | | Shares | | | Value | |

Technology — 24.7% (Continued) | | | | | | | | |

Software — 20.8% (Continued) | | | | | | | | |

Lightspeed Commerce, Inc. (a) | | | 1,075 | | | $ | 18,899 | |

Qualtrics International, Inc. - Class A (a) | | | 1,830 | | | | 18,629 | |

Roper Technologies, Inc. | | | 175 | | | | 62,937 | |

Tyler Technologies, Inc. (a) | | | 210 | | | | 72,974 | |

| | | | | | | | 374,682 | |

Utilities — 4.5% | | | | | | | | |

Waste & Disposal Services — 4.5% | | | | | | | | |

Waste Connections, Inc. | | | 595 | | | | 80,402 | |

| | | | | | | | | |

Total Investments at Value — 98.7% (Cost $2,361,572) | | | | | | $ | 1,777,006 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 1.3% | | | | | | | 24,465 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 1,801,471 | |

(a) | Non-income producing security. |

Schedule of Investments uses the Russell ICB Industry and Sector classification. |

See accompanying notes to financial statements. |

28

CONESTOGA MICRO CAP FUND

PORTFOLIO HOLDINGS

September 30, 2022 (Unaudited) |

Diversification*

(% of Net Assets)

Top Ten Equity Holdings

Security Description | | % of Net Assets |

Digi International, Inc. | | 5.2% |

Model N, Inc. | | 5.1% |

Palomar Holdings, Inc. | | 4.8% |

NV5 Global, Inc. | | 4.7% |

Transcat, Inc. | | 4.6% |

Construction Partners, Inc. - Class A | | 4.5% |

Computer Services, Inc. | | 4.5% |

BioLife Solutions, Inc. | | 4.2% |

Simulations Plus, Inc. | | 3.8% |

OrthoPediatrics Corporation | | 3.7% |

* | Industry categories represent the industry assigned at the time of purchase. See Note 7 of the Notes to Financial Statements. |

29

CONESTOGA MICRO CAP FUND

SCHEDULE OF INVESTMENTS

September 30, 2022 |

COMMON STOCKS — 98.9% | | Shares | | | Value | |

Basic Materials — 1.9% | | | | | | | | |

Metal Fabricating — 1.9% | | | | | | | | |

Omega Flex, Inc. | | | 471 | | | $ | 43,624 | |

| | | | | | | | | |

Consumer Discretionary — 3.4% | | | | | | | | |

Entertainment — 3.4% | | | | | | | | |

Thunderbird Entertainment Group, Inc. (a) | | | 33,801 | | | | 75,190 | |

| | | | | | | | | |

Financials — 4.8% | | | | | | | | |

Property & Casualty Insurance — 4.8% | | | | | | | | |

Palomar Holdings, Inc. (a) | | | 1,296 | | | | 108,501 | |

| | | | | | | | | |

Health Care — 25.1% | | | | | | | | |

Biotechnology — 8.3% | | | | | | | | |

Alpha Teknova, Inc. (a) | | | 11,311 | | | | 37,779 | |

Codexis, Inc. (a) | | | 4,071 | | | | 24,670 | |

NanoString Technologies, Inc. (a) | | | 4,230 | | | | 54,017 | |

Vericel Corporation (a) | | | 3,049 | | | | 70,737 | |

| | | | | | | | 187,203 | |

Health Care Facilities — 3.1% | | | | | | | | |

U.S. Physical Therapy, Inc. | | | 924 | | | | 70,242 | |

| | | | | | | | | |

Health Care Services — 2.0% | | | | | | | | |

Health Catalyst, Inc. (a) | | | 4,502 | | | | 43,669 | |

| | | | | | | | | |

Medical Equipment — 10.4% | | | | | | | | |

BioLife Solutions, Inc. (a) | | | 4,199 | | | | 95,527 | |

OrthoPediatrics Corporation (a) | | | 1,829 | | | | 84,390 | |

Semler Scientific, Inc. (a) | | | 1,471 | | | | 55,236 | |

| | | | | | | | 235,153 | |

Medical Services — 1.3% | | | | | | | | |

CareDx, Inc. (a) | | | 1,750 | | | | 29,785 | |

| | | | | | | | | |

Industrials — 34.5% | | | | | | | | |

Construction — 4.5% | | | | | | | | |

Construction Partners, Inc. - Class A (a) | | | 3,853 | | | | 101,064 | |

30

CONESTOGA MICRO CAP FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 98.9% (Continued) | | Shares | | | Value | |

Industrials — 34.5% (Continued) | | | | | | | | |

Electronic Equipment: Gauges & Meters — 6.9% | | | | | | | | |

Mesa Laboratories, Inc. | | | 371 | | | $ | 52,248 | |

Transcat, Inc. (a) | | | 1,365 | | | | 103,317 | |

| | | | | | | | 155,565 | |

Engineering & Contracting Services — 2.0% | | | | | | | | |

Willdan Group, Inc. (a) | | | 3,061 | | | | 45,333 | |

| | | | | | | | | |

Industrial Suppliers — 4.1% | | | | | | | | |

CryoPort, Inc. (a) | | | 2,432 | | | | 59,244 | |

Hillman Solutions Corporation (a) | | | 4,520 | | | | 34,081 | |

| | | | | | | | 93,325 | |

Machinery: Construction & Handling — 2.5% | | | | | | | | |

Douglas Dynamics, Inc. | | | 2,047 | | | | 57,357 | |

| | | | | | | | | |

Industrial Suppliers — 7.6% | | | | | | | | |

Montrose Environmental Group, Inc. (a) | | | 1,940 | | | | 65,281 | |

NV5 Global, Inc. (a) | | | 849 | | | | 105,123 | |

| | | | | | | | 170,404 | |

Security Services — 3.5% | | | | | | | | |

ShotSpotter, Inc. (a) | | | 2,740 | | | | 78,802 | |

| | | | | | | | | |

Transaction Processing Services — 3.4% | | | | | | | | |

I3 Verticals, Inc. - Class A (a) | | | 3,852 | | | | 77,156 | |

| | | | | | | | | |

Technology — 24.0% | | | | | | | | |

Industrial Suppliers — 4.5% | | | | | | | | |

Computer Services, Inc. | | | 1,807 | | | | 100,740 | |

| | | | | | | | | |

Software — 19.5% | | | | | | | | |

Model N, Inc. (a) | | | 3,363 | | | | 115,116 | |

Olo, Inc. - Class A (a) | | | 5,765 | | | | 45,544 | |

PROS Holdings, Inc. (a) | | | 3,053 | | | | 75,409 | |

Simulations Plus, Inc. | | | 1,753 | | | | 85,091 | |

TECSYS, Inc. | | | 2,925 | | | | 61,835 | |

UserTesting, Inc. (a) | | | 14,975 | | | | 58,702 | |

| | | | | | | | 441,697 | |

31

CONESTOGA MICRO CAP FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 98.9% (Continued) | | Shares | | | Value | |

Telecommunications — 5.2% | | | | | | | | |

Telecommunications Equipment — 5.2% | | | | | | | | |

Digi International, Inc. (a) | | | 3,405 | | | $ | 117,711 | |

| | | | | | | | | |

Total Investments at Value — 98.9% (Cost $2,435,592) | | | | | | $ | 2,232,521 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 1.1% | | | | | | | 25,741 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 2,258,262 | |

(a) | Non-income producing security. |

Schedule of Investments uses the Russell ICB Industry and Sector classification. |

See accompanying notes to financial statements. |

32

CONESTOGA FUNDS

STATEMENTS OF ASSETS AND LIABILITIES

September 30, 2022 |

| | Conestoga

Small Cap Fund | | | Conestoga

SMid Cap Fund | |

ASSETS | | | | | | | | |

Investments in unaffiliated securities, at cost | | $ | 1,796,601,252 | | | $ | 293,305,734 | |

Investments in affiliated securities, at cost | | | 440,888,886 | | | | — | |

Total investments, at cost | | $ | 2,237,490,138 | | | $ | 293,305,734 | |

Investments in unaffiliated securities, at value (Note 2) | | $ | 2,386,497,644 | | | $ | 307,424,864 | |

Investments in affiliated securities, at value (Notes 2 & 5) | | | 489,374,708 | | | | — | |

Total investments, at value | | | 2,875,872,352 | | | | 307,424,864 | |

Cash (Note 2) | | | 131,590,372 | | | | 12,477,770 | |

Receivable for capital shares sold | | | 703,020 | | | | 192,170 | |

Receivable for investment securities sold | | | 444,209 | | | | 2,937,438 | |

Dividends and interest receivable | | | 377,458 | | | | 22,210 | |

Other assets | | | 40,665 | | | | 14,622 | |

Total assets | | | 3,009,028,076 | | | | 323,069,074 | |

| | | | | | | | | |

LIABILITIES | | | | | | | | |

Payable for capital shares redeemed | | | 3,332,555 | | | | 497,503 | |

Payable for investment securities purchased | | | 2,953,329 | | | | 5,487,219 | |

Payable to Adviser (Note 4) | | | 2,066,555 | | | | 162,967 | |

Accrued distribution fees (Note 4) | | | 116,439 | | | | 5,911 | |

Accrued Trustees’ fees (Note 4) | | | 50,175 | | | | 50,175 | |

Payable to administrator (Note 4) | | | 46,898 | | | | 10,217 | |

Other accrued expenses | | | 82,862 | | | | 49,175 | |

Total liabilities | | | 8,648,813 | | | | 6,263,167 | |

| | | | | | | | | |

NET ASSETS | | $ | 3,000,379,263 | | | $ | 316,805,907 | |

| | | | | | | | | |

NET ASSETS CONSIST OF: | | | | | | | | |

Paid-in capital | | $ | 2,263,635,293 | | | $ | 311,985,572 | |

Distributable earnings | | | 736,743,970 | | | | 4,820,335 | |

NET ASSETS | | $ | 3,000,379,263 | | | $ | 316,805,907 | |

| | | | | | | | | |

NET ASSET VALUE PER SHARE: | | | | | | | | |

INSTITUTIONAL CLASS | | | | | | | | |

Net assets applicable to Institutional Class | | $ | 2,358,873,956 | | | $ | 272,623,201 | |

Institutional Class shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 39,943,448 | | | | 15,183,345 | |

Net asset value, offering price and redemption price per share (Note 2) | | $ | 59.06 | | | $ | 17.96 | |

INVESTORS CLASS | | | | | | | | |

Net assets applicable to Investors Class | | $ | 641,505,307 | | | $ | 44,182,706 | |

Investors Class shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 11,065,566 | | | | 2,510,307 | |

Net asset value, offering price and redemption price per share (Note 2) | | $ | 57.97 | | | $ | 17.60 | |

See accompanying notes to financial statements. |

33

CONESTOGA FUNDS

STATEMENTS OF ASSETS AND LIABILITIES

September 30, 2022 (Continued) |

| | Conestoga

Mid Cap Fund | | | Conestoga

Micro Cap Fund | |

ASSETS | | | | | | | | |

Investments in unaffiliated securities, at cost | | $ | 2,361,572 | | | $ | 2,435,592 | |

Investments in unaffiliated securities, at value (Note 2) | | $ | 1,777,006 | | | $ | 2,232,521 | |

Cash (Note 2) | | | 80,704 | | | | 70,694 | |

Receivable due from Adviser (Note 4) | | | 13,995 | | | | 9,789 | |

Receivable for capital shares sold | | | 200 | | | | 100 | |

Receivable for investment securities sold | | | 32,498 | | | | 37,653 | |

Dividends and interest receivable | | | 94 | | | | 257 | |

Other assets | | | 13,624 | | | | 4,429 | |

Total assets | | | 1,918,121 | | | | 2,355,443 | |

| | | | | | | | | |

LIABILITIES | | | | | | | | |

Payable for investment securities purchased | | | 74,522 | | | | 57,188 | |

Accrued distribution fees (Note 4) | | | 2,548 | | | | 1,371 | |

Accrued Trustees’ fees (Note 4) | | | 483 | | | | 594 | |

Payable to administrator (Note 4) | | | 6,640 | | | | 4,270 | |

Other accrued expenses | | | 32,457 | | | | 33,758 | |

Total liabilities | | | 116,650 | | | | 97,181 | |

| | | | | | | | | |

NET ASSETS | | $ | 1,801,471 | | | $ | 2,258,262 | |

| | | | | | | | | |

NET ASSETS CONSIST OF: | | | | | | | | |

Paid-in capital | | $ | 2,426,445 | | | $ | 2,514,920 | |

Accumulated deficit | | | (624,974 | ) | | | (256,658 | ) |

NET ASSETS | | $ | 1,801,471 | | | $ | 2,258,262 | |

| | | | | | | | | |

NET ASSET VALUE PER SHARE: | | | | | | | | |

INSTITUTIONAL CLASS | | | | | | | | |

Net assets applicable to Institutional Class | | $ | 1,406,321 | | | $ | 2,074,576 | |

Institutional Class shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 197,957 | | | | 293,611 | |

Net asset value, offering price and redemption price per share (Note 2) | | $ | 7.10 | | | $ | 7.07 | |

INVESTORS CLASS | | | | | | | | |

Net assets applicable to Investors Class | | $ | 395,150 | | | $ | 183,686 | |

Investors Class shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 55,809 | | | | 26,046 | |

Net asset value, offering price and redemption price per share (Note 2) | | $ | 7.08 | | | $ | 7.05 | |

See accompanying notes to financial statements. |

34

CONESTOGA FUNDS

STATEMENTS OF OPERATIONS

For the Year Ended September 30, 2022 |

| | Conestoga

Small Cap Fund | | | Conestoga

SMid Cap Fund | |

INVESTMENT INCOME | | | | | | | | |

Dividend income from unaffiliated investments | | $ | 7,331,606 | | | $ | 1,661,860 | |

Dividend income from affiliated investments (Note 5) | | | 3,114,449 | | | | — | |

Foreign withholding taxes on dividends | | | (89,173 | ) | | | (9,656 | ) |

Interest | | | 232,461 | | | | 26,946 | |

Total investment income | | | 10,589,343 | | | | 1,679,150 | |

| | | | | | | | | |

EXPENSES | | | | | | | | |

Investment advisory fees (Note 4) | | | 34,109,594 | | | | 3,254,573 | |

Distribution fees - Investors Class (Note 4) | | | 2,053,133 | | | | 146,221 | |

Shareholder Servicing Fees (Note 4) | | | | | | | | |

Institutional Class | | | 1,484,477 | | | | 247,776 | |

Investors Class | | | 410,639 | | | | 29,245 | |

Trustees’ fees and expenses (Note 4) | | | 199,520 | | | | 199,520 | |

Transfer agent fees (Note 4) | | | 331,726 | | | | 41,230 | |

Fund accounting fees (Note 4) | | | 265,371 | | | | 89,266 | |

Custody and bank service fees | | | 191,409 | | | | 29,998 | |

Registration and filing fees | | | 136,202 | | | | 67,465 | |

Legal fees | | | 92,903 | | | | 92,903 | |

Postage and supplies | | | 105,871 | | | | 15,238 | |

Insurance expense | | | 35,536 | | | | 3,467 | |

Audit and tax services fees | | | 16,000 | | | | 14,500 | |

Shareholder reporting expenses | | | 12,824 | | | | 6,229 | |

Administration fees (Note 4) | | | 3,000 | | | | 3,000 | |

Borrowing expenses | | | 633 | | | | 1,083 | |

Other expenses | | | 21,154 | | | | 16,888 | |

Total expenses | | | 39,469,992 | | | | 4,258,602 | |

Fee reductions and expense reimbursements by the Adviser (Note 4) | | | (3,721,883 | ) | | | (857,808 | ) |

Net expenses | | | 35,748,109 | | | | 3,400,794 | |

| | | | | | | | | |

NET INVESTMENT LOSS | | | (25,158,766 | ) | | | (1,721,644 | ) |

| | | | | | | | | |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | | | | | |

Net realized gains (losses) from unaffiliated investments | | | 156,639,891 | | | | (5,628,511 | ) |

Net realized losses from affiliated investments (Note 5) | | | (16,370,774 | ) | | | — | |

Net change in unrealized appreciation (depreciation) on unaffiliated investments | | | (1,277,413,788 | ) | | | (133,534,114 | ) |

Net change in unrealized appreciation (depreciation) on affiliated investments (Note 5) | | | (75,680,351 | ) | | | — | |

NET REALIZED AND UNREALIZED LOSSES ON INVESTMENTS | | | (1,212,825,022 | ) | | | (139,162,625 | ) |

| | | | | | | | | |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (1,237,983,788 | ) | | $ | (140,884,269 | ) |

See accompanying notes to financial statements. |

35

CONESTOGA FUNDS

STATEMENTS OF OPERATIONS

For the Year or Period Ended September 30, 2022 (Continued) |

| | Conestoga

Mid Cap Fund | | | Conestoga

Micro Cap Fund(a) | |

INVESTMENT INCOME | | | | | | | | |

Dividend income from unaffiliated investments | | $ | 7,829 | | | $ | 6,547 | |

Foreign withholding taxes on dividends | | | (67 | ) | | | — | |

Interest | | | 439 | | | | 520 | |

Total investment income | | | 8,201 | | | | 7,067 | |

| | | | | | | | | |

EXPENSES | | | | | | | | |

Legal fees | | | 97,653 | | | | 68,458 | |

Fund accounting fees (Note 4) | | | 38,059 | | | | 28,652 | |

Registration and filing fees | | | 30,605 | | | | 10,688 | |

Investment advisory fees (Note 4) | | | 14,828 | | | | 19,898 | |

Audit and tax services fees | | | 14,736 | | | | 14,000 | |

Transfer agent fees (Note 4) | | | 12,500 | | | | 9,550 | |

Shareholder reporting expenses | | | 4,370 | | | | 7,581 | |

Postage and supplies | | | 3,629 | | | | 2,830 | |

Administration fees (Note 4) | | | 3,000 | | | | 2,371 | |

Trustees’ fees and expenses (Note 4) | | | 1,987 | | | | 2,275 | |

Custody and bank service fees | | | 2,456 | | | | 1,577 | |

Shareholder Servicing Fees (Note 4) | | | | | | | | |

Institutional Class | | | 1,362 | | | | 1,857 | |

Investors Class | | | 246 | | | | 67 | |

Distribution fees - Investors Class (Note 4) | | | 1,229 | | | | 333 | |

Borrowing expenses | | | — | | | | 8 | |

Other expenses | | | 15,961 | | | | 16,600 | |

Total expenses | | | 242,621 | | | | 186,745 | |

Fee reductions and expense reimbursements by the Adviser (Note 4) | | | (226,565 | ) | | | (161,532 | ) |

Net expenses | | | 16,056 | | | | 25,213 | |

| | | | | | | | | |

NET INVESTMENT LOSS | | | (7,855 | ) | | | (18,146 | ) |

| | | | | | | | | |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | | | | | |

Net realized losses from unaffiliated investments | | | (34,733 | ) | | | (36,215 | ) |

Net change in unrealized appreciation (depreciation) on unaffiliated investments | | | (621,587 | ) | | | (854,041 | ) |

NET REALIZED AND UNREALIZED LOSSES ON INVESTMENTS | | | (656,320 | ) | | | (890,256 | ) |

| | | | | | | | | |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (664,175 | ) | | $ | (908,402 | ) |

(a) | Represents the period from commencement of operations (December 20, 2021) through September 30, 2022. |

See accompanying notes to financial statements. |

36

CONESTOGA SMALL CAP FUND

STATEMENTS OF CHANGES IN NET ASSETS |

| | Year Ended

September 30,

2022 | | | Year Ended

September 30,

2021 | |

FROM OPERATIONS | | | | | | | | |

Net investment loss | | $ | (25,158,766 | ) | | $ | (29,204,414 | ) |

Net realized gains from investments | | | 140,269,117 | | | | 229,435,633 | |

Net change in unrealized appreciation (depreciation) on investments | | | (1,353,094,139 | ) | | | 962,102,100 | |

Net increase (decrease) in net assets resulting from operations | | | (1,237,983,788 | ) | | | 1,162,333,319 | |

| | | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS (Note 2) | | | | | | | | |

Institutional Class | | | (174,426,787 | ) | | | — | |

Investors Class | | | (51,042,164 | ) | | | — | |

Decrease in net assets from distributions to shareholders | | | (225,468,951 | ) | | | — | |

| | | | | | | | | |

CAPITAL SHARE TRANSACTIONS (Note 6) | | | | | | | | |

Institutional Class | | | | | | | | |

Proceeds from shares sold | | | 685,880,670 | | | | 783,876,197 | |

Reinvestment of distributions to shareholders | | | 115,710,799 | | | | — | |

Payments for shares redeemed | | | (683,555,542 | ) | | | (470,707,498 | ) |

Net increase in Institutional Class net assets from capital share transactions | | | 118,035,927 | | | | 313,168,699 | |

| | | | | | | | | |

Investors Class | | | | | | | | |

Proceeds from shares sold | | | 125,440,330 | | | | 118,468,533 | |

Reinvestment of distributions to shareholders | | | 45,633,567 | | | | — | |

Payments for shares redeemed | | | (179,700,944 | ) | | | (248,225,990 | ) |

Net decrease in Investors Class net assets from capital share transactions | | | (8,627,047 | ) | | | (129,757,457 | ) |

| | | | | | | | | |

TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (1,354,043,859 | ) | | | 1,345,744,561 | |

| | | | | | | | |

NET ASSETS | | | | | | | | |

Beginning of year | | | 4,354,423,122 | | | | 3,008,678,561 | |

End of year | | $ | 3,000,379,263 | | | $ | 4,354,423,122 | |

See accompanying notes to financial statements. |

37

CONESTOGA SMID CAP FUND

STATEMENTS OF CHANGES IN NET ASSETS |

| | Year Ended

September 30,

2022 | | | Year Ended

September 30,

2021 | |

FROM OPERATIONS | | | | | | | | |

Net investment loss | | $ | (1,721,644 | ) | | $ | (1,749,829 | ) |

Net realized gains (losses) from investments | | | (5,628,511 | ) | | | 7,623,945 | |

Net change in unrealized appreciation (depreciation) on investments | | | (133,534,114 | ) | | | 87,198,122 | |

Net increase (decrease) in net assets resulting from operations | | | (140,884,269 | ) | | | 93,072,238 | |

| | | | | | | | | |

CAPITAL SHARE TRANSACTIONS (Note 6) | | | | | | | | |

Institutional Class | | | | | | | | |

Proceeds from shares sold | | | 111,657,408 | | | | 144,722,264 | |

Payments for shares redeemed | | | (76,820,766 | ) | | | (51,920,798 | ) |

Net increase in Institutional Class net assets from capital share transactions | | | 34,836,642 | | | | 92,801,466 | |

| | | | | | | | | |

Investors Class | | | | | | | | |

Proceeds from shares sold | | | 31,237,466 | | | | 15,006,418 | |

Payments for shares redeemed | | | (30,051,109 | ) | | | (18,625,647 | ) |

Net increase (decrease) in Investors Class net assets from capital share transactions | | | 1,186,357 | | | | (3,619,229 | ) |

| | | | | | | | | |

TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (104,861,270 | ) | | | 182,254,475 | |

| | | | | | | | | |

NET ASSETS | | | | | | | | |

Beginning of year | | | 421,667,177 | | | | 239,412,702 | |

End of year | | $ | 316,805,907 | | | $ | 421,667,177 | |

See accompanying notes to financial statements. |

38

CONESTOGA MID CAP FUND

STATEMENTS OF CHANGES IN NET ASSETS |

| | Year Ended

September 30,

2022 | | | Period Ended

September 30,

2021(a) | |

FROM OPERATIONS | | | | | | | | |

Net investment loss | | $ | (7,855 | ) | | $ | (2,357 | ) |

Net realized gains (losses) from investments | | | (34,733 | ) | | | 95 | |

Net change in unrealized appreciation (depreciation) on investments | | | (621,587 | ) | | | 37,021 | |

Net increase (decrease) in net assets resulting from operations | | | (664,175 | ) | | | 34,759 | |

| | | | | | | | | |

CAPITAL SHARE TRANSACTIONS (Note 6) | | | | | | | | |

Institutional Class | | | | | | | | |

Proceeds from shares sold | | | 727,504 | | | | 1,145,200 | |

Payments for shares redeemed | | | (1,249 | ) | | | — | |

Net increase in Institutional Class net assets from capital share transactions | | | 726,255 | | | | 1,145,200 | |

| | | | | | | | | |

Investors Class | | | | | | | | |

Proceeds from shares sold | | | 49,000 | | | | 614,658 | |

Payments for shares redeemed | | | (44,626 | ) | | | (59,600 | ) |

Net increase in Investors Class net assets from capital share transactions | | | 4,374 | | | | 555,058 | |

| | | | | | | | | |

TOTAL INCREASE IN NET ASSETS | | | 66,454 | | | | 1,735,017 | |

| | | | | | | | | |

NET ASSETS | | | | | | | | |

Beginning of period | | | 1,735,017 | | | | — | |

End of period | | $ | 1,801,471 | | | $ | 1,735,017 | |

(a) | Represents the period from commencement of operations (June 29, 2021) through September 30, 2021. |

| | |

See accompanying notes to financial statements. |

39

CONESTOGA MICRO CAP FUND

STATEMENT OF CHANGES IN NET ASSETS |

| | Period Ended

September 30,

2022(a) | |

FROM OPERATIONS | | | | |

Net investment loss | | $ | (18,146 | ) |

Net realized losses from investments | | | (36,215 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | (854,041 | ) |

Net decrease in net assets resulting from operations | | | (908,402 | ) |

| | | | | |

CAPITAL SHARE TRANSACTIONS (Note 6) | | | | |

Institutional Class | | | | |

Proceeds from shares sold | | | 148,375 | |

Payments for shares redeemed | | | (15 | ) |

Shares issued in connection with Fund Reorganization (Note 1) | | | 2,777,245 | |

Net increase in Institutional Class net assets from capital share transactions | | | 2,925,605 | |

| | | | | |

Investors Class | | | | |

Proceeds from shares sold | | | 97,357 | |

Payments for shares redeemed | | | (14,117 | ) |

Shares issued in connection with Fund Reorganization (Note 1) | | | 157,819 | |

Net increase in Investors Class net assets from capital share transactions | | | 241,059 | |

| | | | | |

TOTAL INCREASE IN NET ASSETS | | | 2,258,262 | |

| | | | | |

NET ASSETS | | | | |

Beginning of period | | | — | |

End of period | | $ | 2,258,262 | |

(a) | Represents the period from commencement of operations (December 20, 2021) through September 30, 2022. |

| | |

See accompanying notes to financial statements. |

40

CONESTOGA SMALL CAP FUND

INSTITUTIONAL CLASS

FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout Each Year: |

| | Year

Ended

Sept. 30,

2022 | | | Year

Ended

Sept. 30,

2021 | | | Year

Ended

Sept. 30,

2020 | | | Year

Ended

Sept. 30,

2019 | | | Year

Ended

Sept. 30,

2018 | |

Net asset value at beginning of year | | $ | 87.18 | | | $ | 63.19 | | | $ | 58.40 | | | $ | 61.27 | | | $ | 50.29 | |