UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-21120 | |

| Conestoga Funds |

| (Exact name of registrant as specified in charter) |

| 550 E. Swedesford Road, Suite 120 Wayne, PA | 19087 |

| (Address of principal executive offices) | (Zip code) |

| Conestoga Capital Advisors 550 E. Swedesford Road, Suite 120 Wayne, PA 19087 |

| (Name and address of agent for service) |

| |

| With Copy To: |

| Josh Deringer, Esq. |

| Faegre Drinker Biddle & Reath LLP |

| One Logan Square, Suite 2000 |

| Philadelphia, PA 19103 |

| Registrant's telephone number, including area code: | (800) 320-7790 |

| Date of fiscal year end: | September 30 | |

| | | |

| Date of reporting period: | September 30, 2024 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles. A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public.

A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

Institutional Class (CCALX)

Annual Shareholder Report - September 30, 2024

This annual shareholder report contains important information about Conestoga Small Cap Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://conestogacapital.com/forms-information/. You can also request this information by contacting us at (800) 494-2755.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $99 | 0.90% |

How did the Fund perform in the past 12 months and what affected its performance?

Equity markets moved higher over the Fund's fiscal year ended September 30, 2024. Optimism rose over the period that the economy may achieve the always elusive soft landing as economic growth and employment remained positive, while inflation moved lower, albeit stubbornly. Confident in their progress to tame inflation and to sustain growth and employment, the U.S. Federal Reserve cut the Federal Funds rate by 50 basis points at its September 2024 meeting. The S&P 500 Index reached an all-time high on September 26th, before cooling in the final trading days of the Fund's fiscal year. The Russell 2000 Index remained roughly 10% below its peak achieved in November 2021. Relative valuations between large cap and small cap stocks remain at historically wide margins. Conestoga Capital Advisors, LLC continues to believe that small and mid-capitalization stocks are well positioned to outperform large caps in the years ahead.

For the twelve months ended September 30, 2024, the Fund underperformed the Russell 3000 Total Return Index and the Russell 2000 Growth Index. The underperformance was mainly due to negative stock selection in the Technology, Health Care, and Consumer Discretionary sectors. However, positive stock selection in the Industrials and Basic Materials sectors, along with no exposure to the underperforming Energy sector, provided some offset.

In Technology, the lack of exposure to Super Micro Computer, Inc. and MicroStrategy, Inc. was the biggest detractor. Positions in PROS Holdings, Inc. and Paycor HCM, Inc. also negatively impacted performance. In Consumer Discretionary, Fox Factory, Inc. and SiteOne Landscape Supply, Inc. led the decline. In Health Care, Stevenato Group was the largest detractor.

On the positive side, stock selection in Industrials and Basic Materials was strong. AAON, Inc., Construction Partners, Inc., and CSW Industrials, Inc. were the largest contributors. Balchem Corp. was the largest contributor in the Basic Materials sector.

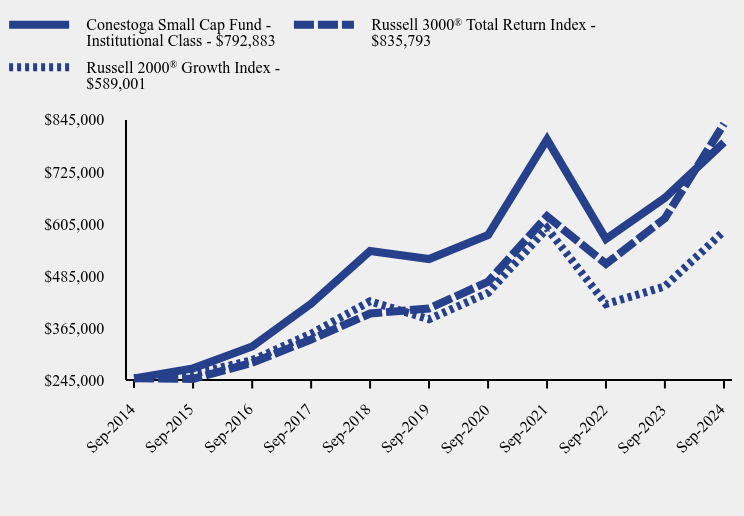

How has the Fund performed over the last ten years?

Total Return Based on $250,000 Investment

| Conestoga Small Cap Fund - Institutional Class | Russell 3000® Total Return Index | Russell 2000® Growth Index |

|---|

| Sep-2014 | $250,000 | $250,000 | $250,000 |

| Sep-2015 | $272,942 | $248,763 | $260,110 |

| Sep-2016 | $323,262 | $285,988 | $291,644 |

| Sep-2017 | $421,643 | $339,487 | $352,834 |

| Sep-2018 | $542,851 | $399,168 | $427,158 |

| Sep-2019 | $524,459 | $410,814 | $386,006 |

| Sep-2020 | $579,672 | $472,442 | $446,665 |

| Sep-2021 | $799,743 | $623,035 | $595,248 |

| Sep-2022 | $570,820 | $513,211 | $421,008 |

| Sep-2023 | $665,231 | $618,220 | $461,390 |

| Sep-2024 | $792,883 | $835,793 | $589,001 |

Average Annual Total Returns

(period ended September 30, 2024)

| 1 Year | 5 Years | 10 Years |

|---|

| Conestoga Small Cap Fund - Institutional Class | 19.19% | 8.62% | 12.23% |

Russell 3000® Total Return Index | 35.19% | 15.26% | 12.83% |

Russell 2000® Growth Index | 27.66% | 8.82% | 8.95% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Fund Statistics

(as of September 30, 2024)

- Net Assets$4,306,073,856

- Total Number of Portfolio Holdings46

- Advisory Fee (net of waivers)$31,056,644

- Portfolio Turnover Rate16%

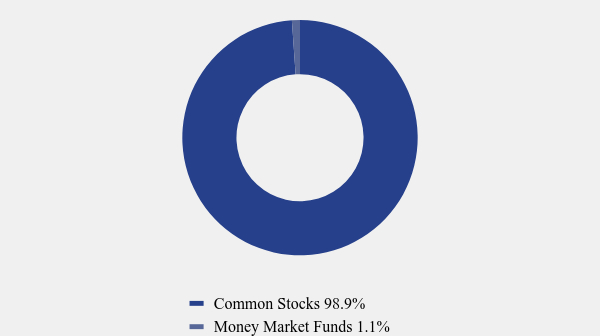

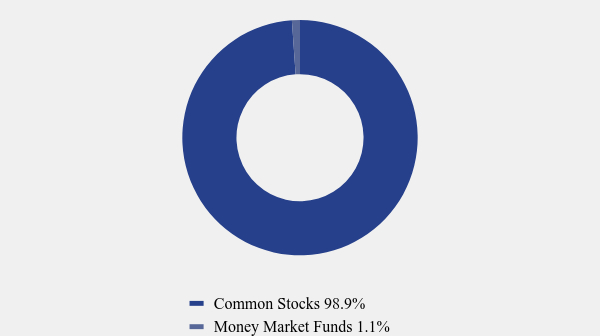

Asset Weighting (% of total investments)

(as of September 30, 2024)

| Value | Value |

|---|

| Common Stocks | 98.9% |

| Money Market Funds | 1.1% |

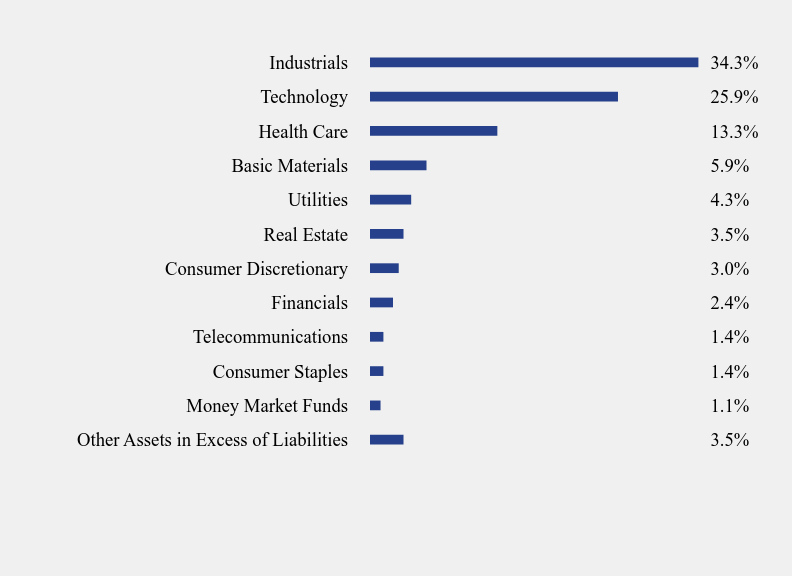

What did the Fund invest in?

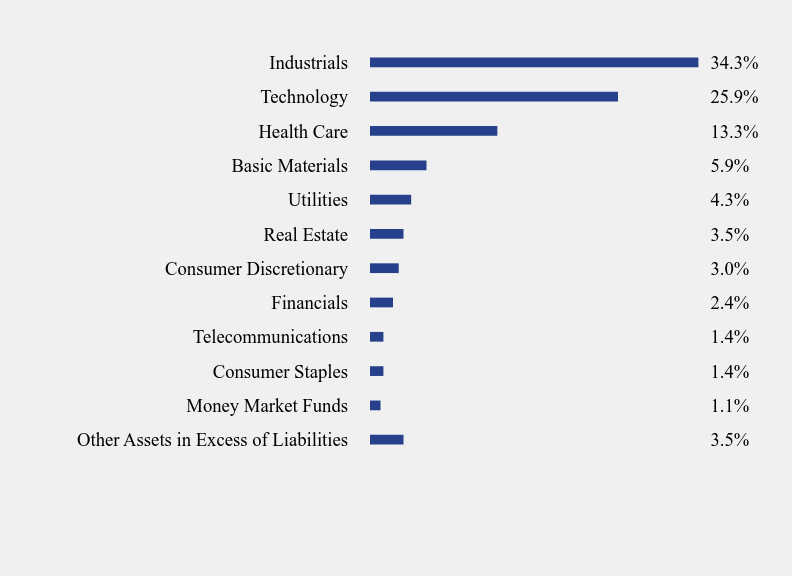

Sector Weighting (% of net assets)

(as of September 30, 2024)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 3.5% |

| Money Market Funds | 1.1% |

| Consumer Staples | 1.4% |

| Telecommunications | 1.4% |

| Financials | 2.4% |

| Consumer Discretionary | 3.0% |

| Real Estate | 3.5% |

| Utilities | 4.3% |

| Basic Materials | 5.9% |

| Health Care | 13.3% |

| Technology | 25.9% |

| Industrials | 34.3% |

Top 10 Holdings (% of net assets)

(as of September 30, 2024)

| Holding Name | % of Net Assets |

| Descartes Systems Group, Inc. (The) | 4.6% |

| Exponent, Inc. | 4.4% |

| Casella Waste Systems, Inc. - Class A | 4.3% |

| Simpson Manufacturing Company, Inc. | 4.0% |

| AAON, Inc. | 3.8% |

| Altair Engineering, Inc. - Class A | 3.5% |

| FirstService Corporation | 3.5% |

| SPS Commerce, Inc. | 3.4% |

| Novanta, Inc. | 3.4% |

| Construction Partners, Inc. - Class A | 3.3% |

No material changes occurred for the Fund during the year ended September 30, 2024.

To avoid sending duplicate copies of materials to households, mailings for accounts held by members of your household may be combined so that only one copy of each annual and semi-annual shareholder report will be mailed. If you prefer to receive multiple copies of the shareholder reports, you may request that by contacting us at (800) 494-2755. Householding will be stopped within 30 days after we receive your request.

Conestoga Small Cap Fund - Institutional Class (CCALX)

Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://conestogacapital.com/forms-information/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Please scan to access the Fund's prospectus, financial information, and holdings.

Annual Shareholder Report - September 30, 2024

This annual shareholder report contains important information about Conestoga Small Cap Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://conestogacapital.com/forms-information/. You can also request this information by contacting us at (800) 494-2755.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investors Class | $120 | 1.10% |

How did the Fund perform in the past 12 months and what affected its performance?

Equity markets moved higher over the Fund's fiscal year ended September 30, 2024. Optimism rose over the period that the economy may achieve the always elusive soft landing as economic growth and employment remained positive, while inflation moved lower, albeit stubbornly. Confident in their progress to tame inflation and to sustain growth and employment, the U.S. Federal Reserve cut the Federal Funds rate by 50 basis points at its September 2024 meeting. The S&P 500 Index reached an all-time high on September 26th, before cooling in the final trading days of the Fund's fiscal year. The Russell 2000 Index remained roughly 10% below its peak achieved in November 2021. Relative valuations between large cap and small cap stocks remain at historically wide margins. Conestoga Capital Advisors, LLC continues to believe that small and mid-capitalization stocks are well positioned to outperform large caps in the years ahead.

For the twelve months ended September 30, 2024, the Fund underperformed the Russell 3000 Total Return Index and the Russell 2000 Growth Index. The underperformance was mainly due to negative stock selection in the Technology, Health Care, and Consumer Discretionary sectors. However, positive stock selection in the Industrials and Basic Materials sectors, along with no exposure to the underperforming Energy sector, provided some offset.

In Technology, the lack of exposure to Super Micro Computer, Inc. and MicroStrategy, Inc. was the biggest detractor. Positions in PROS Holdings, Inc. and Paycor HCM, Inc. also negatively impacted performance. In Consumer Discretionary, Fox Factory, Inc. and SiteOne Landscape Supply, Inc. led the decline. In Health Care, Stevenato Group was the largest detractor.

On the positive side, stock selection in Industrials and Basic Materials was strong. AAON, Inc., Construction Partners, Inc., and CSW Industrials, Inc. were the largest contributors. Balchem Corp. was the largest contributor in the Basic Materials sector.

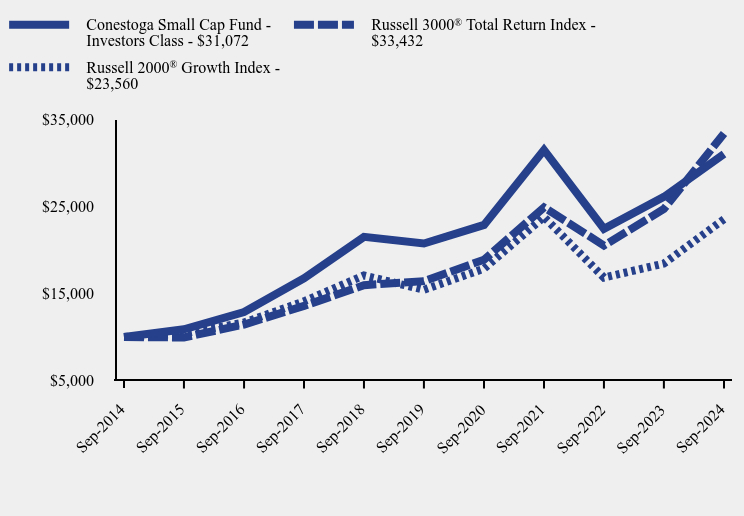

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Conestoga Small Cap Fund - Investors Class | Russell 3000® Total Return Index | Russell 2000® Growth Index |

|---|

| Sep-2014 | $10,000 | $10,000 | $10,000 |

| Sep-2015 | $10,895 | $9,951 | $10,404 |

| Sep-2016 | $12,876 | $11,440 | $11,666 |

| Sep-2017 | $16,759 | $13,579 | $14,113 |

| Sep-2018 | $21,530 | $15,967 | $17,086 |

| Sep-2019 | $20,762 | $16,433 | $15,440 |

| Sep-2020 | $22,899 | $18,898 | $17,867 |

| Sep-2021 | $31,533 | $24,921 | $23,810 |

| Sep-2022 | $22,458 | $20,528 | $16,840 |

| Sep-2023 | $26,125 | $24,729 | $18,456 |

| Sep-2024 | $31,072 | $33,432 | $23,560 |

Average Annual Total Returns

(period ended September 30, 2024)

| 1 Year | 5 Years | 10 Years |

|---|

| Conestoga Small Cap Fund - Investors Class | 18.94% | 8.40% | 12.00% |

Russell 3000® Total Return Index | 35.19% | 15.26% | 12.83% |

Russell 2000® Growth Index | 27.66% | 8.82% | 8.95% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Fund Statistics

(as of September 30, 2024)

- Net Assets$4,306,073,856

- Total Number of Portfolio Holdings46

- Advisory Fee (net of waivers)$31,056,644

- Portfolio Turnover Rate16%

Asset Weighting (% of total investments)

(as of September 30, 2024)

| Value | Value |

|---|

| Common Stocks | 98.9% |

| Money Market Funds | 1.1% |

What did the Fund invest in?

Sector Weighting (% of net assets)

(as of September 30, 2024)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 3.5% |

| Money Market Funds | 1.1% |

| Consumer Staples | 1.4% |

| Telecommunications | 1.4% |

| Financials | 2.4% |

| Consumer Discretionary | 3.0% |

| Real Estate | 3.5% |

| Utilities | 4.3% |

| Basic Materials | 5.9% |

| Health Care | 13.3% |

| Technology | 25.9% |

| Industrials | 34.3% |

Top 10 Holdings (% of net assets)

(as of September 30, 2024)

| Holding Name | % of Net Assets |

| Descartes Systems Group, Inc. (The) | 4.6% |

| Exponent, Inc. | 4.4% |

| Casella Waste Systems, Inc. - Class A | 4.3% |

| Simpson Manufacturing Company, Inc. | 4.0% |

| AAON, Inc. | 3.8% |

| Altair Engineering, Inc. - Class A | 3.5% |

| FirstService Corporation | 3.5% |

| SPS Commerce, Inc. | 3.4% |

| Novanta, Inc. | 3.4% |

| Construction Partners, Inc. - Class A | 3.3% |

No material changes occurred for the Fund during the year ended September 30, 2024.

To avoid sending duplicate copies of materials to households, mailings for accounts held by members of your household may be combined so that only one copy of each annual and semi-annual shareholder report will be mailed. If you prefer to receive multiple copies of the shareholder reports, you may request that by contacting us at (800) 494-2755. Householding will be stopped within 30 days after we receive your request.

Conestoga Small Cap Fund - Investors Class (CCASX)

Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://conestogacapital.com/forms-information/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Please scan to access the Fund's prospectus, financial information, and holdings.

Institutional Class (CCSGX)

Annual Shareholder Report - September 30, 2024

This annual shareholder report contains important information about Conestoga SMid Cap Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://conestogacapital.com/forms-information/. You can also request this information by contacting us at (800) 494-2755.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $96 | 0.85% |

How did the Fund perform in the past 12 months and what affected its performance?

Equity markets moved higher over the Fund's fiscal year ended September 30, 2024. Optimism rose over the period that the economy may achieve the always elusive soft landing as economic growth and employment remained positive, while inflation moved lower, albeit stubbornly. Confident in their progress to tame inflation and to sustain growth and employment, the U.S. Federal Reserve cut the Federal Funds rate by 50 basis points at its September 2024 meeting. The S&P 500 Index reached an all-time high on September 26th, before cooling in the final trading days of the Funds’ fiscal year. The Russell 2000 Index remained roughly 10% below its peak achieved in November 2021. Relative valuations between large cap and small cap stocks remain at historically wide margins. Conestoga Capital Advisors, LLC continues to believe that small and mid-capitalization stocks are well positioned to outperform large caps in the years ahead.

The Fund modestly outperformed the Russell 2500 Growth Index over the year ended September 30, 2024. Outperformance was driven by positive stock selection as well as sector allocation effects. Relative to the Russell 3000 Total Return Index, which is heavily weighted to large cap stocks, the Fund underperformed due to its emphasis on smaller cap stocks, which underperformed large cap stocks over the reporting period.

Stock selection effects were most positive in the Industrials and Technology sectors. Within the Industrials sector, Fair Isaac Corporation and Construction Partners Inc. were the top contributors. Within Technology, Q2 Holdings Inc. and Guidewire Software Inc. were the leading contributors. Stock selection was challenged in the Health Care sector, where Stevenato Group SpA and West Pharmaceutical Services were the largest detractors.

Positive sector allocation was largely driven by the Fund’s zero weighting in the Energy sector. Energy was the only sector to decline over the reporting period. An overweight to the Industrials sector also added to returns relative to the Russell 2500 Growth Index.

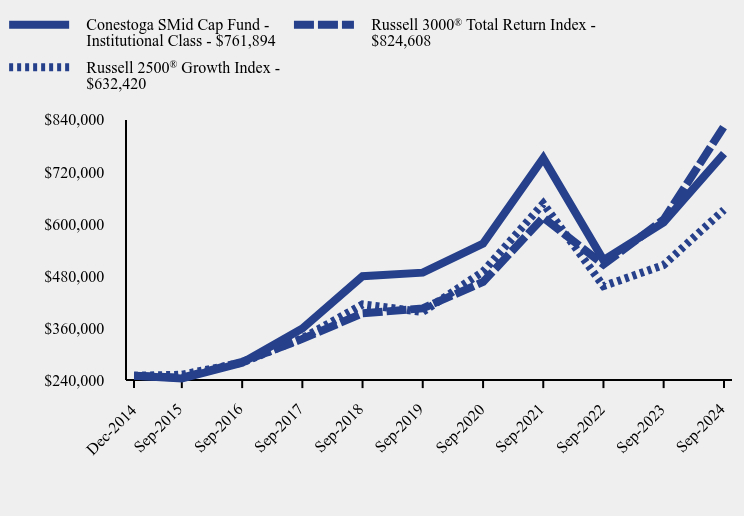

How has the Fund performed since inception?

Total Return Based on $250,000 Investment

| Conestoga SMid Cap Fund - Institutional Class | Russell 3000® Total Return Index | Russell 2500® Growth Index |

|---|

| Dec-2014 | $250,000 | $250,000 | $250,000 |

| Sep-2015 | $243,554 | $245,434 | $252,404 |

| Sep-2016 | $279,989 | $282,161 | $280,222 |

| Sep-2017 | $358,744 | $334,943 | $336,452 |

| Sep-2018 | $479,434 | $393,826 | $414,271 |

| Sep-2019 | $487,693 | $405,317 | $397,226 |

| Sep-2020 | $554,811 | $466,119 | $490,074 |

| Sep-2021 | $751,540 | $614,697 | $646,784 |

| Sep-2022 | $516,558 | $506,342 | $456,663 |

| Sep-2023 | $603,418 | $609,946 | $505,117 |

| Sep-2024 | $761,894 | $824,608 | $632,420 |

Average Annual Total Returns

(period ended September 30, 2024)

| 1 Year | 5 Years | Since Inception (December 15, 2014) |

|---|

| Conestoga SMid Cap Fund - Institutional Class | 26.26% | 9.33% | 12.05% |

Russell 3000® Total Return Index | 35.19% | 15.26% | 12.96% |

Russell 2500® Growth Index | 25.20% | 9.75% | 9.94% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Fund Statistics

(as of September 30, 2024)

- Net Assets$754,069,962

- Total Number of Portfolio Holdings48

- Advisory Fee (net of waivers)$3,530,119

- Portfolio Turnover Rate10%

Asset Weighting (% of total investments)

(as of September 30, 2024)

| Value | Value |

|---|

| Common Stocks | 100.0% |

What did the Fund invest in?

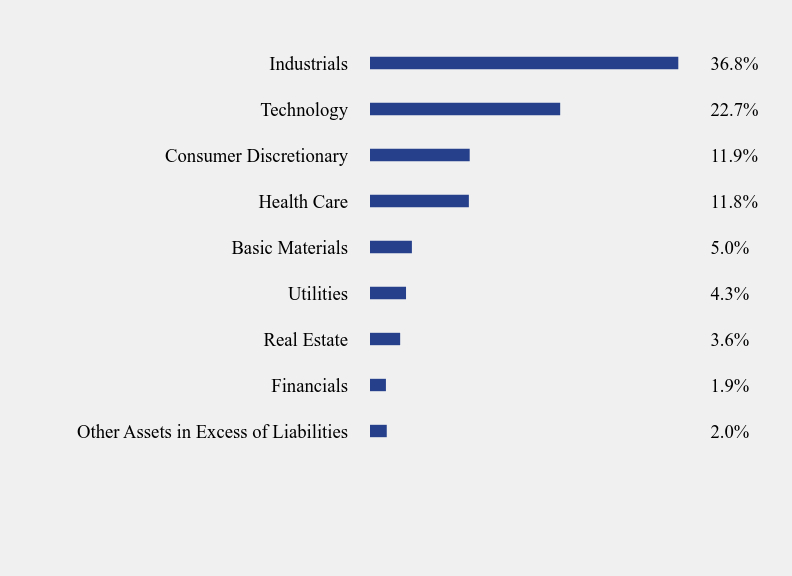

Sector Weighting (% of net assets)

(as of September 30, 2024)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 2.0% |

| Financials | 1.9% |

| Real Estate | 3.6% |

| Utilities | 4.3% |

| Basic Materials | 5.0% |

| Health Care | 11.8% |

| Consumer Discretionary | 11.9% |

| Technology | 22.7% |

| Industrials | 36.8% |

Top 10 Holdings (% of net assets)

(as of September 30, 2024)

| Holding Name | % of Net Assets |

| Casella Waste Systems, Inc. - Class A | 4.3% |

| Exponent, Inc. | 3.7% |

| FirstService Corporation | 3.6% |

| Tyler Technologies, Inc. | 3.2% |

| Rollins, Inc. | 3.2% |

| Descartes Systems Group, Inc. (The) | 3.2% |

| Construction Partners, Inc. - Class A | 3.1% |

| Watsco, Inc. | 3.0% |

| HEICO Corporation - Class A | 2.8% |

| Merit Medical Systems, Inc. | 2.8% |

No material changes occurred for the Fund during the year ended September 30, 2024.

To avoid sending duplicate copies of materials to households, mailings for accounts held by members of your household may be combined so that only one copy of each annual and semi-annual shareholder report will be mailed. If you prefer to receive multiple copies of the shareholder reports, you may request that by contacting us at (800) 494-2755. Householding will be stopped within 30 days after we receive your request.

Conestoga SMid Cap Fund - Institutional Class (CCSGX)

Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://conestogacapital.com/forms-information/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Please scan to access the Fund's prospectus, financial information, and holdings.

Annual Shareholder Report - September 30, 2024

This annual shareholder report contains important information about Conestoga SMid Cap Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://conestogacapital.com/forms-information/. You can also request this information by contacting us at (800) 494-2755.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investors Class | $124 | 1.10% |

How did the Fund perform in the past 12 months and what affected its performance?

Equity markets moved higher over the Fund's fiscal year ended September 30, 2024. Optimism rose over the period that the economy may achieve the always elusive soft landing as economic growth and employment remained positive, while inflation moved lower, albeit stubbornly. Confident in their progress to tame inflation and to sustain growth and employment, the U.S. Federal Reserve cut the Federal Funds rate by 50 basis points at its September 2024 meeting. The S&P 500 Index reached an all-time high on September 26th, before cooling in the final trading days of the Funds’ fiscal year. The Russell 2000 Index remained roughly 10% below its peak achieved in November 2021. Relative valuations between large cap and small cap stocks remain at historically wide margins. Conestoga Capital Advisors, LLC continues to believe that small and mid-capitalization stocks are well positioned to outperform large caps in the years ahead.

The Fund modestly outperformed the Russell 2500 Growth Index over the year ended September 30, 2024. Outperformance was driven by positive stock selection as well as sector allocation effects. Relative to the Russell 3000 Total Return Index, which is heavily weighted to large cap stocks, the Fund underperformed due to its emphasis on smaller cap stocks, which underperformed large cap stocks over the reporting period.

Stock selection effects were most positive in the Industrials and Technology sectors. Within the Industrials sector, Fair Isaac Corporation and Construction Partners Inc. were the top contributors. Within Technology, Q2 Holdings Inc. and Guidewire Software Inc. were the leading contributors. Stock selection was challenged in the Health Care sector, where Stevenato Group SpA and West Pharmaceutical Services were the largest detractors.

Positive sector allocation was largely driven by the Fund’s zero weighting in the Energy sector. Energy was the only sector to decline over the reporting period. An overweight to the Industrials sector also added to returns relative to the Russell 2500 Growth Index.

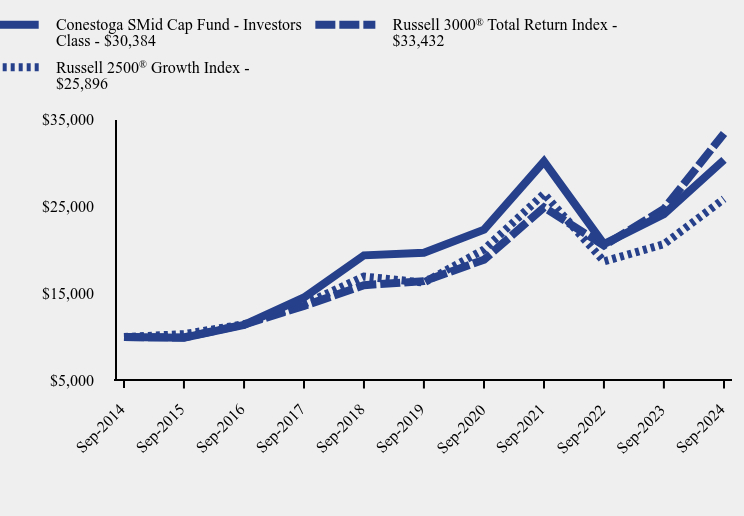

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Conestoga SMid Cap Fund - Investors Class | Russell 3000® Total Return Index | Russell 2500® Growth Index |

|---|

| Sep-2014 | $10,000 | $10,000 | $10,000 |

| Sep-2015 | $9,931 | $9,951 | $10,335 |

| Sep-2016 | $11,386 | $11,440 | $11,475 |

| Sep-2017 | $14,559 | $13,579 | $13,777 |

| Sep-2018 | $19,400 | $15,967 | $16,964 |

| Sep-2019 | $19,691 | $16,433 | $16,266 |

| Sep-2020 | $22,353 | $18,898 | $20,068 |

| Sep-2021 | $30,196 | $24,921 | $26,484 |

| Sep-2022 | $20,695 | $20,528 | $18,699 |

| Sep-2023 | $24,128 | $24,729 | $20,683 |

| Sep-2024 | $30,384 | $33,432 | $25,896 |

Average Annual Total Returns

(period ended September 30, 2024)

| 1 Year | 5 Years | 10 Years |

|---|

| Conestoga SMid Cap Fund - Investors Class | 25.93% | 9.06% | 11.75% |

Russell 3000® Total Return Index | 35.19% | 15.26% | 12.83% |

Russell 2500® Growth Index | 25.20% | 9.75% | 9.98% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Fund Statistics

(as of September 30, 2024)

- Net Assets$754,069,962

- Total Number of Portfolio Holdings48

- Advisory Fee (net of waivers)$3,530,119

- Portfolio Turnover Rate10%

Asset Weighting (% of total investments)

(as of September 30, 2024)

| Value | Value |

|---|

| Common Stocks | 100.0% |

What did the Fund invest in?

Sector Weighting (% of net assets)

(as of September 30, 2024)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 2.0% |

| Financials | 1.9% |

| Real Estate | 3.6% |

| Utilities | 4.3% |

| Basic Materials | 5.0% |

| Health Care | 11.8% |

| Consumer Discretionary | 11.9% |

| Technology | 22.7% |

| Industrials | 36.8% |

Top 10 Holdings (% of net assets)

(as of September 30, 2024)

| Holding Name | % of Net Assets |

| Casella Waste Systems, Inc. - Class A | 4.3% |

| Exponent, Inc. | 3.7% |

| FirstService Corporation | 3.6% |

| Tyler Technologies, Inc. | 3.2% |

| Rollins, Inc. | 3.2% |

| Descartes Systems Group, Inc. (The) | 3.2% |

| Construction Partners, Inc. - Class A | 3.1% |

| Watsco, Inc. | 3.0% |

| HEICO Corporation - Class A | 2.8% |

| Merit Medical Systems, Inc. | 2.8% |

No material changes occurred for the Fund during the year ended September 30, 2024.

To avoid sending duplicate copies of materials to households, mailings for accounts held by members of your household may be combined so that only one copy of each annual and semi-annual shareholder report will be mailed. If you prefer to receive multiple copies of the shareholder reports, you may request that by contacting us at (800) 494-2755. Householding will be stopped within 30 days after we receive your request.

Conestoga SMid Cap Fund - Investors Class (CCSMX)

Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://conestogacapital.com/forms-information/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Please scan to access the Fund's prospectus, financial information, and holdings.

Institutional Class (CCMAX)

Annual Shareholder Report - September 30, 2024

This annual shareholder report contains important information about Conestoga Mid Cap Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://conestogacapital.com/forms-information/. You can also request this information by contacting us at (800) 494-2755.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $89 | 0.80% |

How did the Fund perform in the past 12 months and what affected its performance?

Equity markets moved higher over the Fund's fiscal year ended September 30, 2024. Optimism rose over the period that the economy may achieve the always elusive soft landing as economic growth and employment remained positive, while inflation moved lower, albeit stubbornly. Confident in their progress to tame inflation and to sustain growth and employment, the U.S. Federal Reserve cut the Federal Funds rate by 50 basis points at its September 2024 meeting. The S&P 500 Index reached an all-time high on September 26th, before cooling in the final trading days of the Fund's fiscal year. The Russell 2000 Index remained roughly 10% below its peak achieved in November 2021. Relative valuations between large cap and small cap stocks remain at historically wide margins. Conestoga Capital Advisors, LLC continues to believe that small and mid-capitalization stocks are well positioned to outperform large caps in the years ahead.

The Fund underperformed the Russell 3000 Total Return Index and the Russell Midcap Growth Index over the Fund's fiscal year ended September 30, 2024. Stock selection proved challenging over the period, which was the primary reason for the Fund’s underperformance.

Stock selection effects were negative in the Health Care, Industrials, Consumer Discretionary, and Real Estate sectors. Within Health Care, West Pharmaceutical Services Inc. was the leading detractor. Within Industrials, the Fund’s positions broadly performed well, within an average return of over 30% for the reporting period, but this failed to keep pace with the even stronger performance of the Russell Midcap Growth Index's Industrials holdings. This was also the case in the Consumer Discretionary sector, where the Fund’s holdings averaged a return of just under 30%, but this trailed the Russell Midcap Growth Index's Consumer Discretionary sector return of just under 40%.

Negative stock selection in the Real Estate sector was driven by a lack of exposure to real estate investment trusts which posted outsized returns, as these stocks benefited from falling interest rates.

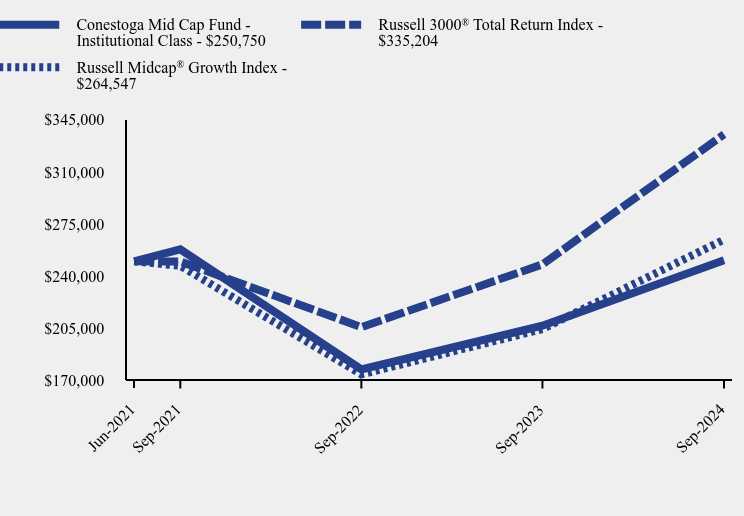

How has the Fund performed since inception?

Total Return Based on $250,000 Investment

| Conestoga Mid Cap Fund - Institutional Class | Russell 3000® Total Return Index | Russell Midcap® Growth Index |

|---|

| Jun-2021 | $250,000 | $250,000 | $250,000 |

| Sep-2021 | $258,000 | $249,875 | $246,988 |

| Sep-2022 | $177,500 | $205,829 | $174,131 |

| Sep-2023 | $206,750 | $247,944 | $204,545 |

| Sep-2024 | $250,750 | $335,204 | $264,547 |

Average Annual Total Returns

(period ended September 30, 2024)

| 1 Year | Since Inception (June 29, 2021) |

|---|

| Conestoga Mid Cap Fund - Institutional Class | 21.28% | 0.09% |

Russell 3000® Total Return Index | 35.19% | 9.43% |

Russell Midcap® Growth Index | 29.33% | 1.75% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Fund Statistics

(as of September 30, 2024)

- Net Assets$3,155,651

- Total Number of Portfolio Holdings33

- Advisory Fee (net of waivers)$0

- Portfolio Turnover Rate5%

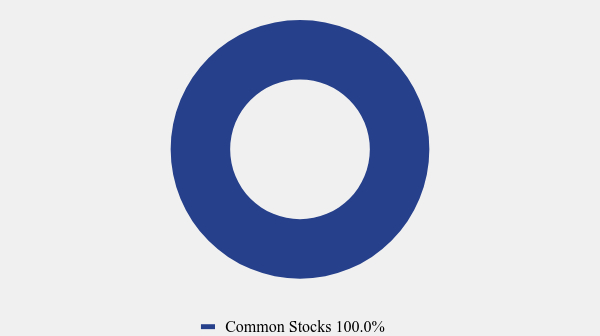

Asset Weighting (% of total investments)

(as of September 30, 2024)

| Value | Value |

|---|

| Common Stocks | 100.0% |

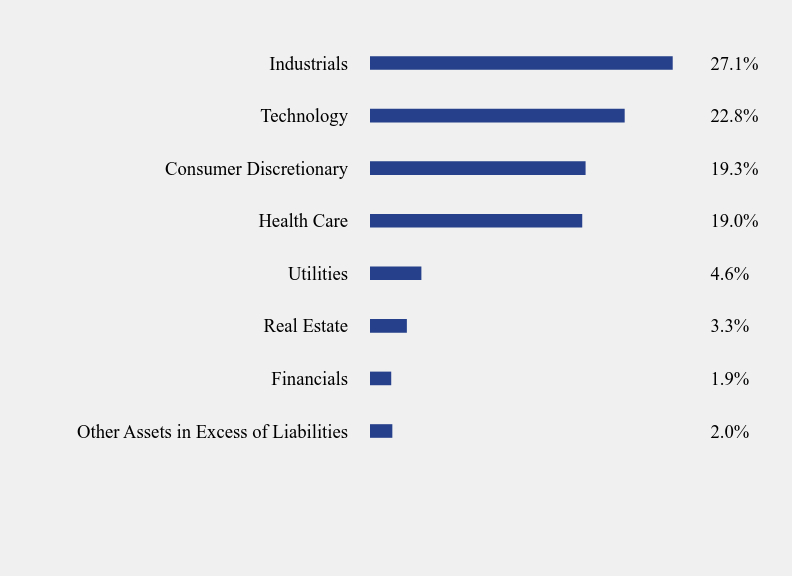

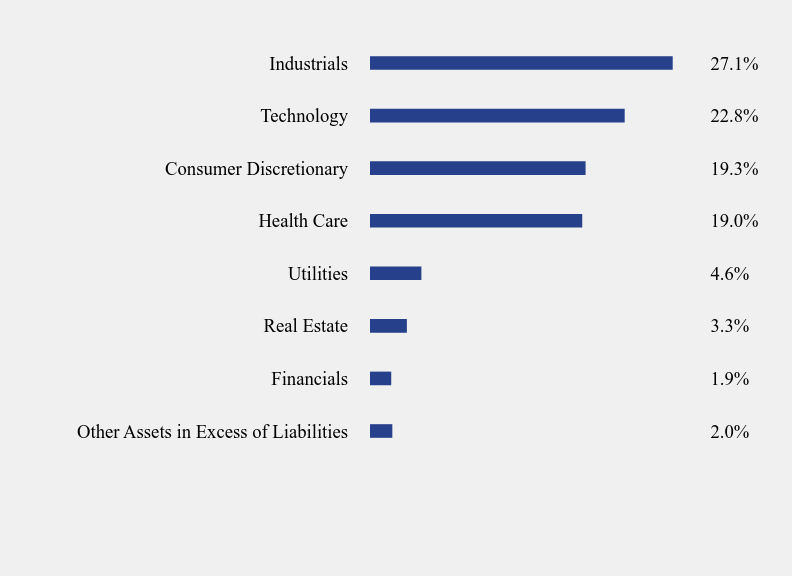

What did the Fund invest in?

Sector Weighting (% of net assets)

(as of September 30, 2024)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 2.0% |

| Financials | 1.9% |

| Real Estate | 3.3% |

| Utilities | 4.6% |

| Health Care | 19.0% |

| Consumer Discretionary | 19.3% |

| Technology | 22.8% |

| Industrials | 27.1% |

Top 10 Holdings (% of net assets)

(as of September 30, 2024)

| Holding Name | % of Net Assets |

| Copart, Inc. | 5.5% |

| HEICO Corporation - Class A | 5.2% |

| Rollins, Inc. | 5.1% |

| Tyler Technologies, Inc. | 4.6% |

| Waste Connections, Inc. | 4.6% |

| Verisk Analytics, Inc. | 4.5% |

| Gartner, Inc. | 4.0% |

| Roper Technologies, Inc. | 3.5% |

| IDEXX Laboratories, Inc. | 3.4% |

| Pool Corporation | 3.3% |

No material changes occurred for the Fund during the year ended September 30, 2024.

To avoid sending duplicate copies of materials to households, mailings for accounts held by members of your household may be combined so that only one copy of each annual and semi-annual shareholder report will be mailed. If you prefer to receive multiple copies of the shareholder reports, you may request that by contacting us at (800) 494-2755. Householding will be stopped within 30 days after we receive your request.

Conestoga Mid Cap Fund - Institutional Class (CCMAX)

Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://conestogacapital.com/forms-information/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Please scan to access the Fund's prospectus, financial information, and holdings.

Annual Shareholder Report - September 30, 2024

This annual shareholder report contains important information about Conestoga Mid Cap Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://conestogacapital.com/forms-information/. You can also request this information by contacting us at (800) 494-2755.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investors Class | $116 | 1.05% |

How did the Fund perform in the past 12 months and what affected its performance?

Equity markets moved higher over the Fund's fiscal year ended September 30, 2024. Optimism rose over the period that the economy may achieve the always elusive soft landing as economic growth and employment remained positive, while inflation moved lower, albeit stubbornly. Confident in their progress to tame inflation and to sustain growth and employment, the U.S. Federal Reserve cut the Federal Funds rate by 50 basis points at its September 2024 meeting. The S&P 500 Index reached an all-time high on September 26th, before cooling in the final trading days of the Fund's fiscal year. The Russell 2000 Index remained roughly 10% below its peak achieved in November 2021. Relative valuations between large cap and small cap stocks remain at historically wide margins. Conestoga Capital Advisors, LLC continues to believe that small and mid-capitalization stocks are well positioned to outperform large caps in the years ahead.

The Fund underperformed the Russell 3000 Total Return Index and the Russell Midcap Growth Index over the Fund's fiscal year ended September 30, 2024. Stock selection proved challenging over the period, which was the primary reason for the Fund’s underperformance.

Stock selection effects were negative in the Health Care, Industrials, Consumer Discretionary, and Real Estate sectors. Within Health Care, West Pharmaceutical Services Inc. was the leading detractor. Within Industrials, the Fund’s positions broadly performed well, within an average return of over 30% for the reporting period, but this failed to keep pace with the even stronger performance of the Russell Midcap Growth Index's Industrials holdings. This was also the case in the Consumer Discretionary sector, where the Fund’s holdings averaged a return of just under 30%, but this trailed the Russell Midcap Growth Index's Consumer Discretionary sector return of just under 40%.

Negative stock selection in the Real Estate sector was driven by a lack of exposure to real estate investment trusts which posted outsized returns, as these stocks benefited from falling interest rates.

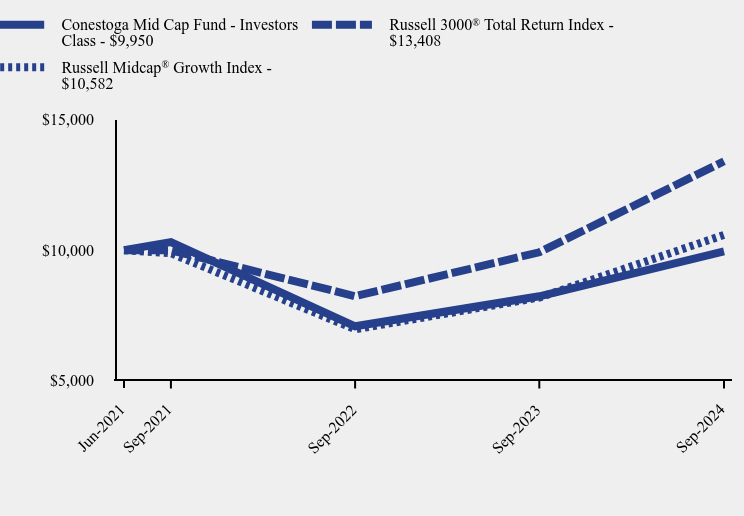

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Conestoga Mid Cap Fund - Investors Class | Russell 3000® Total Return Index | Russell Midcap® Growth Index |

|---|

| Jun-2021 | $10,000 | $10,000 | $10,000 |

| Sep-2021 | $10,310 | $9,995 | $9,880 |

| Sep-2022 | $7,080 | $8,233 | $6,965 |

| Sep-2023 | $8,230 | $9,918 | $8,182 |

| Sep-2024 | $9,950 | $13,408 | $10,582 |

Average Annual Total Returns

(period ended September 30, 2024)

| 1 Year | Since Inception (June 29, 2021) |

|---|

| Conestoga Mid Cap Fund - Investors Class | 20.90% | -0.15% |

Russell 3000® Total Return Index | 35.19% | 9.43% |

Russell Midcap® Growth Index | 29.33% | 1.75% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Fund Statistics

(as of September 30, 2024)

- Net Assets$3,155,651

- Total Number of Portfolio Holdings33

- Advisory Fee (net of waivers)$0

- Portfolio Turnover Rate5%

Asset Weighting (% of total investments)

(as of September 30, 2024)

| Value | Value |

|---|

| Common Stocks | 100.0% |

What did the Fund invest in?

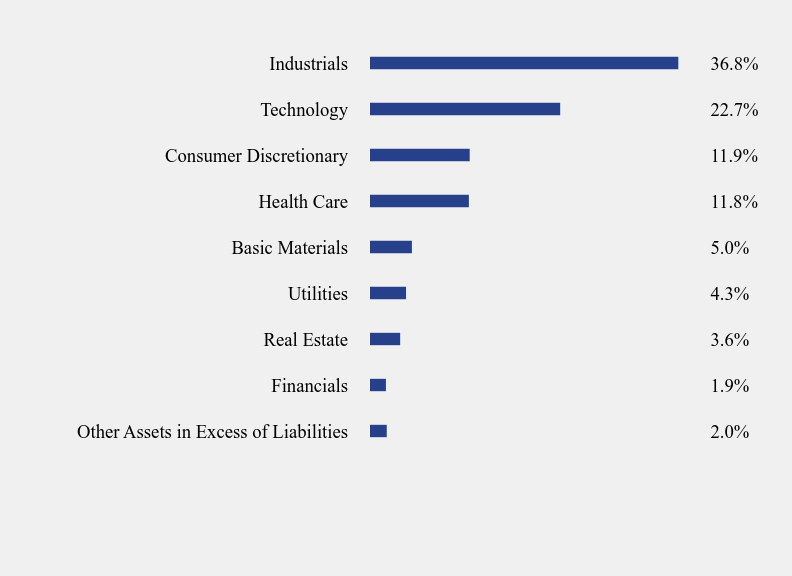

Sector Weighting (% of net assets)

(as of September 30, 2024)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 2.0% |

| Financials | 1.9% |

| Real Estate | 3.3% |

| Utilities | 4.6% |

| Health Care | 19.0% |

| Consumer Discretionary | 19.3% |

| Technology | 22.8% |

| Industrials | 27.1% |

Top 10 Holdings (% of net assets)

(as of September 30, 2024)

| Holding Name | % of Net Assets |

| Copart, Inc. | 5.5% |

| HEICO Corporation - Class A | 5.2% |

| Rollins, Inc. | 5.1% |

| Tyler Technologies, Inc. | 4.6% |

| Waste Connections, Inc. | 4.6% |

| Verisk Analytics, Inc. | 4.5% |

| Gartner, Inc. | 4.0% |

| Roper Technologies, Inc. | 3.5% |

| IDEXX Laboratories, Inc. | 3.4% |

| Pool Corporation | 3.3% |

No material changes occurred for the Fund during the year ended September 30, 2024.

To avoid sending duplicate copies of materials to households, mailings for accounts held by members of your household may be combined so that only one copy of each annual and semi-annual shareholder report will be mailed. If you prefer to receive multiple copies of the shareholder reports, you may request that by contacting us at (800) 494-2755. Householding will be stopped within 30 days after we receive your request.

Conestoga Mid Cap Fund - Investors Class (CCMMX)

Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://conestogacapital.com/forms-information/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Please scan to access the Fund's prospectus, financial information, and holdings.

Institutional Class (CMIRX)

Annual Shareholder Report - September 30, 2024

This annual shareholder report contains important information about Conestoga Discovery Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://conestogacapital.com/forms-information/. You can also request this information by contacting us at (800) 494-2755.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $135 | 1.25% |

How did the Fund perform in the past 12 months and what affected its performance?

Equity markets moved higher over the Fund's fiscal year ended September 30, 2024. Optimism rose over the period that the economy may achieve the always elusive soft landing as economic growth and employment remained positive, while inflation moved lower, albeit stubbornly. Confident in their progress to tame inflation and to sustain growth and employment, the U.S. Federal Reserve cut the Federal Funds rate by 50 basis points at its September 2024 meeting. The S&P 500 Index reached an all-time high on September 26th, before cooling in the final trading days of the Fund's fiscal year. The Russell 2000 Index remained roughly 10% below its peak achieved in November 2021. Relative valuations between large cap and small cap stocks remain at historically wide margins. Conestoga Capital Advisors, LLC continues to believe that small and mid-capitalization stocks are well positioned to outperform large caps in the years ahead.

For the twelve months ended September 30, 2024, the Fund underperformed the Russell 3000 Total Return Index and the Russell Micro Cap Growth Index. The underperformance was mainly due to negative stock selection in the Industrials and Health Care sectors. However, positive stock selection in the Financials sector, along with no exposure to the underperforming Basic Materials, Utilities, and Energy sectors, provided some offset.

In Industrials, our positions in SoundThinking, Inc. and Cryoport, Inc. were the biggest detractors. Positions in Montrose Environmental Group, Inc. also negatively impacted performance.

In Health Care, OrthoPediatrics Corp. and U.S. Physical Therapy, Inc. led the decline.

On the positive side, stock selection in Financials was strong. Our lone position in the space, Palomar Holdings, Inc. was the largest contributor. The Fund also benefited from being underweight the underperforming Consumer Discretionary sector.

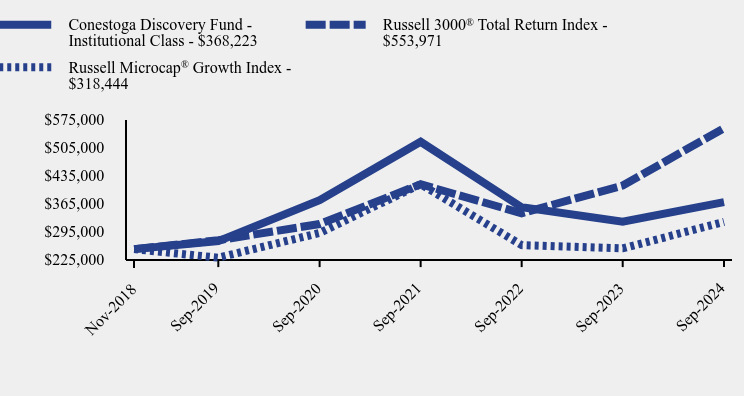

How has the Fund performed since inception?

Total Return Based on $250,000 Investment

| Conestoga Discovery Fund - Institutional Class | Russell 3000® Total Return Index | Russell Microcap® Growth Index |

|---|

| Nov-2018 | $250,000 | $250,000 | $249,999 |

| Sep-2019 | $270,213 | $272,292 | $228,531 |

| Sep-2020 | $372,904 | $313,139 | $290,702 |

| Sep-2021 | $519,635 | $412,953 | $413,116 |

| Sep-2022 | $355,162 | $340,161 | $260,047 |

| Sep-2023 | $318,993 | $409,761 | $251,975 |

| Sep-2024 | $368,223 | $553,971 | $318,444 |

Average Annual Total Returns

(period ended September 30, 2024)

| 1 Year | 5 Years | Since Inception (11/30/2018)* |

|---|

| Conestoga Discovery Fund - Institutional Class | 15.43% | 6.39% | 6.86% |

Russell 3000® Total Return Index | 35.19% | 15.26% | 14.61% |

Russell Microcap® Growth Index | 26.37% | 6.86% | 4.24% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

*Performance prior to December 20, 2021, is that of another investment vehicle (the “Predecessor Fund”) before the commencement of the Fund's operations. The Predecessor Fund was converted into the Fund on December 20, 2021. The Predecessor Fund was not registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and thus was not subject to certain investment and operational restrictions that are imposed by the 1940 Act on registered investment companies and by the Internal Revenue Code of 1986 on regulated investment companies. If the Predecessor Fund had been registered under the 1940 Act, its performance may have been adversely affected. Returns for the Fund's shares reflect all charges, expenses and fees of the Predecessor Fund.

Fund Statistics

(as of September 30, 2024)

- Net Assets$4,296,435

- Total Number of Portfolio Holdings29

- Advisory Fee (net of waivers)$0

- Portfolio Turnover Rate32%

Asset Weighting (% of total investments)

(as of September 30, 2024)

| Value | Value |

|---|

| Common Stocks | 100.0% |

What did the Fund invest in?

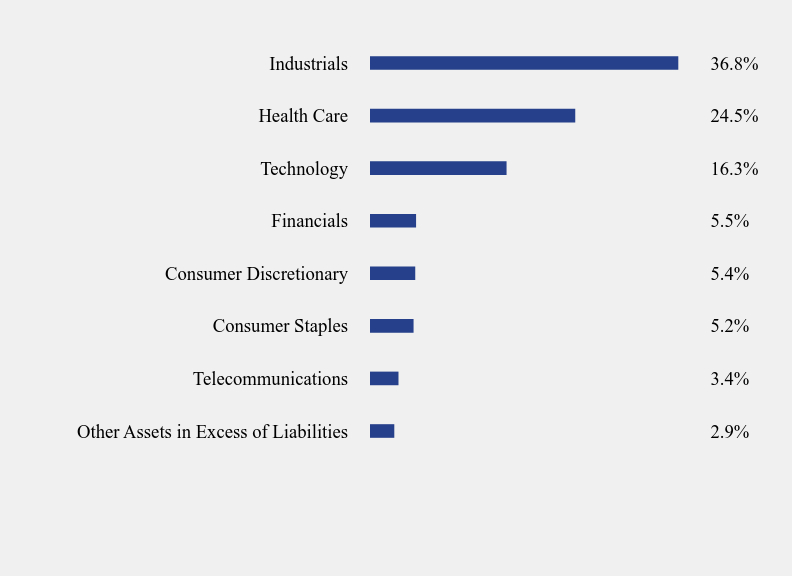

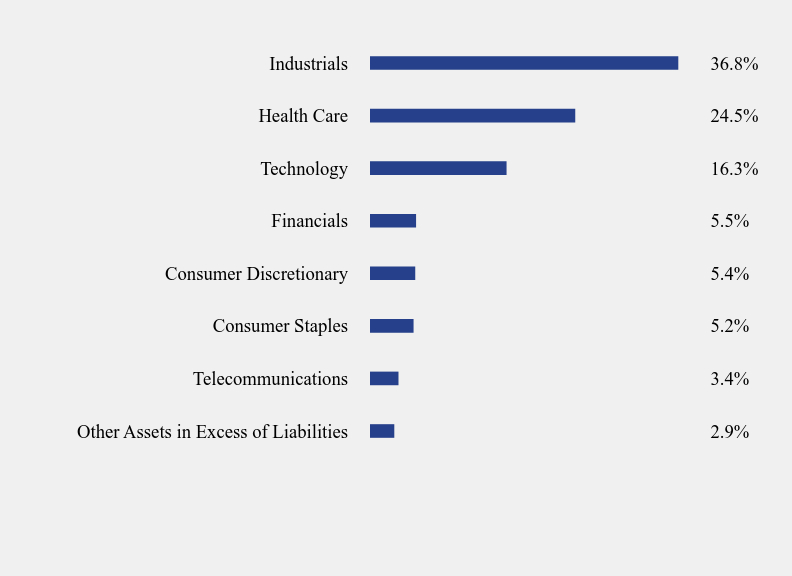

Sector Weighting (% of net assets)

(as of September 30, 2024)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 2.9% |

| Telecommunications | 3.4% |

| Consumer Staples | 5.2% |

| Consumer Discretionary | 5.4% |

| Financials | 5.5% |

| Technology | 16.3% |

| Health Care | 24.5% |

| Industrials | 36.8% |

Top 10 Holdings (% of net assets)

(as of September 30, 2024)

| Holding Name | % of Net Assets |

| Palomar Holdings, Inc. | 5.5% |

| TECSYS, Inc. | 4.4% |

| Transcat, Inc. | 4.4% |

| Hillman Solutions Corporation | 4.4% |

| Phreesia, Inc. | 4.3% |

| Willdan Group, Inc. | 4.2% |

| Construction Partners, Inc. - Class A | 3.9% |

| BioLife Solutions, Inc. | 3.8% |

| Olo, Inc. - Class A | 3.6% |

| Energy Recovery, Inc. | 3.6% |

No material changes occurred for the Fund during the year ended September 30, 2024.

To avoid sending duplicate copies of materials to households, mailings for accounts held by members of your household may be combined so that only one copy of each annual and semi-annual shareholder report will be mailed. If you prefer to receive multiple copies of the shareholder reports, you may request that by contacting us at (800) 494-2755. Householding will be stopped within 30 days after we receive your request.

Conestoga Discovery Fund - Institutional Class (CMIRX)

Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://conestogacapital.com/forms-information/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Please scan to access the Fund's prospectus, financial information, and holdings.

Annual Shareholder Report - September 30, 2024

This annual shareholder report contains important information about Conestoga Discovery Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://conestogacapital.com/forms-information/. You can also request this information by contacting us at (800) 494-2755.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investors Class | $161 | 1.50% |

How did the Fund perform in the past 12 months and what affected its performance?

Equity markets moved higher over the Fund's fiscal year ended September 30, 2024. Optimism rose over the period that the economy may achieve the always elusive soft landing as economic growth and employment remained positive, while inflation moved lower, albeit stubbornly. Confident in their progress to tame inflation and to sustain growth and employment, the U.S. Federal Reserve cut the Federal Funds rate by 50 basis points at its September 2024 meeting. The S&P 500 Index reached an all-time high on September 26th, before cooling in the final trading days of the Fund's fiscal year. The Russell 2000 Index remained roughly 10% below its peak achieved in November 2021. Relative valuations between large cap and small cap stocks remain at historically wide margins. Conestoga Capital Advisors, LLC continues to believe that small and mid-capitalization stocks are well positioned to outperform large caps in the years ahead.

For the twelve months ended September 30, 2024, the Fund underperformed the Russell 3000 Total Return Index and the Russell Micro Cap Growth Index. The underperformance was mainly due to negative stock selection in the Industrials and Health Care sectors. However, positive stock selection in the Financials sector, along with no exposure to the underperforming Basic Materials, Utilities, and Energy sectors, provided some offset.

In Industrials, our positions in SoundThinking, Inc. and Cryoport, Inc. were the biggest detractors. Positions in Montrose Environmental Group, Inc. also negatively impacted performance.

In Health Care, OrthoPediatrics Corp. and U.S. Physical Therapy, Inc. led the decline.

On the positive side, stock selection in Financials was strong. Our lone position in the space, Palomar Holdings, Inc. was the largest contributor. The Fund also benefited from being underweight the underperforming Consumer Discretionary sector.

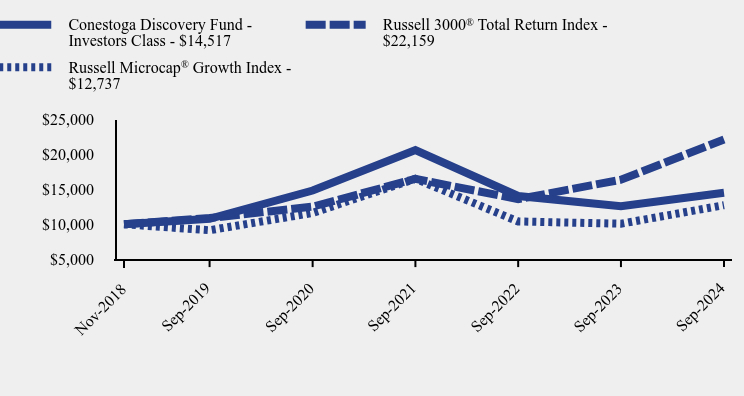

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Conestoga Discovery Fund - Investors Class | Russell 3000® Total Return Index | Russell Microcap® Growth Index |

|---|

| Nov-2018 | $10,000 | $10,000 | $9,999 |

| Sep-2019 | $10,786 | $10,892 | $9,141 |

| Sep-2020 | $14,848 | $12,526 | $11,627 |

| Sep-2021 | $20,638 | $16,518 | $16,524 |

| Sep-2022 | $14,059 | $13,606 | $10,401 |

| Sep-2023 | $12,603 | $16,390 | $10,079 |

| Sep-2024 | $14,517 | $22,159 | $12,737 |

Average Annual Total Returns

(period ended September 30, 2024)

| 1 Year | 5 Years | Since Inception (11/30/2018)* |

|---|

| Conestoga Discovery Fund - Investors Class | 15.19% | 6.12% | 6.60% |

Russell 3000® Total Return Index | 35.19% | 15.26% | 14.61% |

Russell Microcap® Growth Index | 26.37% | 6.86% | 4.24% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

*Performance prior to December 20, 2021, is that of another investment vehicle (the “Predecessor Fund”) before the commencement of the Fund's operations. The Predecessor Fund was converted into the Fund on December 20, 2021. The Predecessor Fund was not registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and thus was not subject to certain investment and operational restrictions that are imposed by the 1940 Act on registered investment companies and by the Internal Revenue Code of 1986 on regulated investment companies. If the Predecessor Fund had been registered under the 1940 Act, its performance may have been adversely affected. Returns for the Fund's shares reflect all charges, expenses and fees of the Predecessor Fund.

Fund Statistics

(as of September 30, 2024)

- Net Assets$4,296,435

- Total Number of Portfolio Holdings29

- Advisory Fee (net of waivers)$0

- Portfolio Turnover Rate32%

Asset Weighting (% of total investments)

(as of September 30, 2024)

| Value | Value |

|---|

| Common Stocks | 100.0% |

What did the Fund invest in?

Sector Weighting (% of net assets)

(as of September 30, 2024)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 2.9% |

| Telecommunications | 3.4% |

| Consumer Staples | 5.2% |

| Consumer Discretionary | 5.4% |

| Financials | 5.5% |

| Technology | 16.3% |

| Health Care | 24.5% |

| Industrials | 36.8% |

Top 10 Holdings (% of net assets)

(as of September 30, 2024)

| Holding Name | % of Net Assets |

| Palomar Holdings, Inc. | 5.5% |

| TECSYS, Inc. | 4.4% |

| Transcat, Inc. | 4.4% |

| Hillman Solutions Corporation | 4.4% |

| Phreesia, Inc. | 4.3% |

| Willdan Group, Inc. | 4.2% |

| Construction Partners, Inc. - Class A | 3.9% |

| BioLife Solutions, Inc. | 3.8% |

| Olo, Inc. - Class A | 3.6% |

| Energy Recovery, Inc. | 3.6% |

No material changes occurred for the Fund during the year ended September 30, 2024.

To avoid sending duplicate copies of materials to households, mailings for accounts held by members of your household may be combined so that only one copy of each annual and semi-annual shareholder report will be mailed. If you prefer to receive multiple copies of the shareholder reports, you may request that by contacting us at (800) 494-2755. Householding will be stopped within 30 days after we receive your request.

Conestoga Discovery Fund - Investors Class (CMCMX)

Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://conestogacapital.com/forms-information/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Please scan to access the Fund's prospectus, financial information, and holdings.

As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. Pursuant to Item 12(a)(1), a copy of registrant’s code of ethics is filed as an exhibit to this Form N-CSR. During the period covered by this report, the code of ethics has not been amended, and the registrant has not granted any waivers, including implicit waivers, from the provisions of the code of ethics.

| Item 3. | Audit Committee Financial Expert. |

The registrant’s board of trustees has determined that the registrant has at least one audit committee financial expert serving on its audit committee. The name of the audit committee financial expert is Nicholas J. Kovich. Mr. Kovich is “independent” for purposes of this Item.

| Item 4. | Principal Accountant Fees and Services. |

| (a) | Audit Fees. The aggregate fees billed for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements were $53,100 and $47,500 with respect to the registrant’s fiscal years ended September 30, 2024 and 2023, respectively. |

| (b) | Audit-Related Fees. No fees were billed in either of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item. |

| (c) | Tax Fees. The aggregate fees billed for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning were $12,000 and $12,000 with respect to the registrant’s fiscal years ended September 30, 2024 and 2023, respectively. The services comprising these fees are the preparation of the registrant’s federal income and excise tax returns. |

| (d) | All Other Fees. No fees were billed in either of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item. |

| (e)(1) | The audit committee has not adopted pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X. |

| (e)(2) | None of the services described in paragraph (b) through (d) of this Item were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| (f) | Less than 50% of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees. |

| (g) | During the fiscal years ended September 30, 2024 and 2023, aggregate non-audit fees of $12,000 and $12,000, respectively, were billed by the registrant’s accountant for services rendered to the registrant. No non-audit fees were billed in either of the last two fiscal years by the registrant’s accountant for services rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant. |

| (h) | The principal accountant has not provided any non-audit services to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant. |

| Item 5. | Audit Committee of Listed Registrants. |

Not applicable

| (a) | Not applicable [schedule filed under Item 7] |

| Item 7. | Financial Statements and Financial Highlights for Open-End Management Investment Companies |

(a)

Conestoga Funds

SMALL CAP FUND

SMID CAP FUND

MID CAP FUND

DISCOVERY FUND

M a n a g e d B y

ANNUAL FINANCIAL STATEMENTS

September 30, 2024

Table of Contents

Schedule of Investments | 1 |

Statements of Assets and Liabilities | 15 |

Statements of Operations | 17 |

Statements of Changes in Net Assets | 19 |

Financial Highlights | 23 |

Notes to Financial Statements | 31 |

Report of Independent Registered Public Accounting Firm | 48 |

Other Information | 50 |

Federal Tax Information | 50 |

CONESTOGA SMALL CAP FUND

SCHEDULE OF INVESTMENTS

September 30, 2024 |

COMMON STOCKS — 95.4% | | Shares | | | Value | |

Basic Materials — 5.9% | | | | | | | | |

Metal Fabricating — 3.0% | | | | | | | | |

RBC Bearings, Inc. (a) | | | 430,000 | | | $ | 128,733,400 | |

| | | | | | | | | |

Specialty Chemicals — 2.9% | | | | | | | | |

Balchem Corporation | | | 705,210 | | | | 124,116,960 | |

| | | | | | | | | |

Consumer Discretionary — 3.0% | | | | | | | | |

Home Improvement Retailers — 2.3% | | | | | | | | |

SiteOne Landscape Supply, Inc. (a) | | | 653,930 | | | | 98,684,576 | |

| | | | | | | | | |

Recreational Products — 0.7% | | | | | | | | |

Fox Factory Holding Corporation (a) | | | 748,888 | | | | 31,078,852 | |

| | | | | | | | | |

Consumer Staples — 1.4% | | | | | | | | |

Nondurable Household Products — 1.4% | | | | | | | | |

WD-40 Company | | | 233,526 | | | | 60,221,685 | |

| | | | | | | | | |

Financials — 2.4% | | | | | | | | |

Financial Data Providers — 2.4% | | | | | | | | |

Clearwater Analytics Holdings, Inc. - Class A (a) | | | 4,037,438 | | | | 101,945,310 | |

| | | | | | | | | |

Health Care — 13.3% | | | | | | | | |

Biotechnology — 1.4% | | | | | | | | |

Vericel Corporation (a) | | | 1,473,225 | | | | 62,243,756 | |

| | | | | | | | | |

Medical Equipment — 7.8% | | | | | | | | |

LeMaitre Vascular, Inc. (b) | | | 1,420,521 | | | | 131,952,196 | |

Merit Medical Systems, Inc. (a) | | | 1,330,720 | | | | 131,515,058 | |

Repligen Corporation (a) | | | 479,310 | | | | 71,330,914 | |

| | | | | | | | 334,798,168 | |

Medical Supplies — 4.1% | | | | | | | | |

Neogen Corporation (a) | | | 5,411,741 | | | | 90,971,366 | |

Stevanato Group S.p.A. (b) | | | 4,326,581 | | | | 86,531,620 | |

| | | | | | | | 177,502,986 | |

Industrials — 34.3% | | | | | | | | |

Building Materials: Other — 5.6% | | | | | | | | |

Simpson Manufacturing Company, Inc. | | | 901,090 | | | | 172,351,485 | |

Trex Company, Inc. (a) | | | 1,053,485 | | | | 70,141,031 | |

| | | | | | | | 242,492,516 | |

1

CONESTOGA SMALL CAP FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.4% (Continued) | | Shares | | | Value | |

Industrials — 34.3% (Continued) | | | | | | | | |

Building: Climate Control — 3.8% | | | | | | | | |

AAON, Inc. | | | 1,524,362 | | | $ | 164,387,198 | |

| | | | | | | | | |

Commercial Vehicles and Parts — 2.2% | | | | | | | | |

Federal Signal Corporation | | | 992,750 | | | | 92,782,415 | |

| | | | | | | | | |

Construction — 3.3% | | | | | | | | |

Construction Partners, Inc. - Class A (a) | | | 2,018,217 | | | | 140,871,547 | |

| | | | | | | | | |

Defense — 0.7% | | | | | | | | |

Mercury Systems, Inc. (a) | | | 771,883 | | | | 28,559,671 | |

| | | | | | | | | |

Diversified Industrials — 5.2% | | | | | | | | |

CSW Industrials, Inc. | | | 344,425 | | | | 126,193,876 | |

ESCO Technologies, Inc. | | | 753,480 | | | | 97,183,850 | |

| | | | | | | | 223,377,726 | |

Electronic Equipment Other — 1.3% | | | | | | | | |

SPX Technologies, Inc. (a) | | | 362,110 | | | | 57,742,061 | |

| | | | | | | | | |

Electronic Equipment: Control & Filter — 2.2% | | | | | | | | |

Helios Technologies, Inc. | | | 1,139,597 | | | | 54,358,777 | |

MSA Safety, Inc. | | | 233,325 | | | | 41,377,855 | |

| | | | | | | | 95,736,632 | |

Electronic Equipment: Gauges & Meters — 2.9% | | | | | | | | |

Mesa Laboratories, Inc. (b) | | | 363,985 | | | | 47,267,092 | |

Transcat, Inc. (a)(b) | | | 643,499 | | | | 77,715,374 | |

| | | | | | | | 124,982,466 | |

Engineering & Contracting Services — 4.4% | | | | | | | | |

Exponent, Inc. | | | 1,656,230 | | | | 190,930,194 | |

| | | | | | | | | |

Industrial Suppliers — 1.0% | | | | | | | | |

Hillman Solutions Corporation (a) | | | 4,142,683 | | | | 43,746,733 | |

| | | | | | | | | |

Machinery: Industrial — 1.1% | | | | | | | | |

John Bean Technologies Corporation | | | 474,080 | | | | 46,701,621 | |

| | | | | | | | | |

Professional Business Support Services — 0.6% | | | | | | | | |

UL Solutions, Inc. - Class A | | | 509,870 | | | | 25,136,591 | |

2

CONESTOGA SMALL CAP FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 95.4% (Continued) | | Shares | | | Value | |

Real Estate — 3.5% | | | | | | | | |

Real Estate Services — 3.5% | | | | | | | | |

FirstService Corporation | | | 817,435 | | | $ | 149,149,190 | |

| | | | | | | | | |

Technology — 25.9% | | | | | | | | |

Computer Services — 1.0% | | | | | | | | |

Workiva, Inc. (a) | | | 533,179 | | | | 42,185,122 | |

| | | | | | | | | |

Production Technology Equipment — 4.0% | | | | | | | | |

Azenta, Inc. (a) | | | 578,312 | | | | 28,013,433 | |

Novanta, Inc. (a) | | | 806,765 | | | | 144,346,394 | |

| | | | | | | | 172,359,827 | |

Software — 20.9% | | | | | | | | |

Agilysys, Inc. (a) | | | 205,286 | | | | 22,370,015 | |

Altair Engineering, Inc. - Class A (a) | | | 1,600,130 | | | | 152,828,416 | |

BlackLine, Inc. (a) | | | 1,264,865 | | | | 69,744,656 | |

CCC Intelligent Solutions Holdings, Inc. (a) | | | 5,508,150 | | | | 60,865,058 | |

Descartes Systems Group, Inc. (The) (a) | | | 1,929,046 | | | | 198,614,576 | |

Paycor HCM, Inc. (a) | | | 2,781,762 | | | | 39,473,203 | |

Q2 Holdings, Inc. (a) | | | 1,327,761 | | | | 105,915,495 | |

Simulations Plus, Inc. (b) | | | 1,266,380 | | | | 40,549,488 | |

SPS Commerce, Inc. (a) | | | 756,280 | | | | 146,846,888 | |

Vertex, Inc. - Class A (a) | | | 1,636,242 | | | | 63,011,679 | |

| | | | | | | | 900,219,474 | |

Telecommunications — 1.4% | | | | | | | | |

Telecommunications Equipment — 1.4% | | | | | | | | |

Digi International, Inc. (a)(b) | | | 2,276,606 | | | | 62,674,963 | |

| | | | | | | | | |

Utilities — 4.3% | | | | | | | | |

Waste & Disposal Services — 4.3% | | | | | | | | |

Casella Waste Systems, Inc. - Class A (a) | | | 1,845,335 | | | | 183,592,379 | |

| | | | | | | | | |

Total Common Stocks (Cost $2,308,945,698) | | | | | | $ | 4,106,954,019 | |

3

CONESTOGA SMALL CAP FUND

SCHEDULE OF INVESTMENTS (Continued) |

MONEY MARKET FUNDS — 1.1% | | Shares | | | Value | |

Fidelity Investments Money Market Treasury Portfolio - Class I, 4.83% (c) (Cost $46,855,155) | | | 46,855,155 | | | $ | 46,855,155 | |

| | | | | | | | | |

Total Investments at Value — 96.5% (Cost $2,355,800,853) | | | | | | $ | 4,153,809,174 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 3.5% | | | | | | | 152,264,682 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 4,306,073,856 | |

(a) | Non-income producing security. |

(b) | The Fund owned 5% or more of the company’s outstanding voting shares thereby making the company an affiliate of the Fund as that term is defined in the Investment Company Act of 1940 (Note 5). |

(c) | The rate shown is the 7-day effective yield as of September 30, 2024. |

Schedule of Investments uses the Russell ICB Industry and Sector classification. |

See accompanying notes to financial statements. |

4

CONESTOGA SMID CAP FUND

SCHEDULE OF INVESTMENTS

September 30, 2024 |

COMMON STOCKS — 98.0% | | Shares | | | Value | |

Basic Materials — 5.0% | | | | | | | | |

Metal Fabricating — 2.8% | | | | | | | | |

RBC Bearings, Inc. (a) | | | 69,435 | | | $ | 20,787,450 | |

| | | | | | | | | |

Specialty Chemicals — 2.2% | | | | | | | | |

Balchem Corporation | | | 94,430 | | | | 16,619,680 | |

| | | | | | | | | |

Consumer Discretionary — 11.9% | | | | | | | | |

Consumer Services: Miscellaneous — 3.2% | | | | | | | | |

Rollins, Inc. | | | 473,730 | | | | 23,961,263 | |

| | | | | | | | | |

Education Services — 2.1% | | | | | | | | |

Bright Horizons Family Solutions, Inc. (a) | | | 114,075 | | | | 15,985,330 | |

| | | | | | | | | |

Home Improvement Retailers — 2.0% | | | | | | | | |

SiteOne Landscape Supply, Inc. (a) | | | 99,580 | | | | 15,027,618 | |

| | | | | | | | | |

Hotels & Motels — 1.1% | | | | | | | | |

Vail Resorts, Inc. | | | 45,905 | | | | 8,000,782 | |

| | | | | | | | | |

Recreational Products — 2.2% | | | | | | | | |

Pool Corporation | | | 44,815 | | | | 16,886,292 | |

| | | | | | | | | |

Recreational Vehicles & Boats — 1.3% | | | | | | | | |

LCI Industries | | | 79,485 | | | | 9,581,122 | |

| | | | | | | | | |

Financials — 1.9% | | | | | | | | |

Financial Data Providers — 1.9% | | | | | | | | |

Clearwater Analytics Holdings, Inc. - Class A (a) | | | 558,280 | | | | 14,096,570 | |

| | | | | | | | | |

Health Care — 11.8% | | | | | | | | |

Medical Equipment — 5.3% | | | | | | | | |

Merit Medical Systems, Inc. (a) | | | 214,113 | | | | 21,160,788 | |

Repligen Corporation (a) | | | 129,880 | | | | 19,328,741 | |

| | | | | | | | 40,489,529 | |

5

CONESTOGA SMID CAP FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 98.0% (Continued) | | Shares | | | Value | |

Health Care — 11.8% (Continued) | | | | | | | | |

Medical Supplies — 6.5% | | | | | | | | |

Bio-Techne Corporation | | | 147,655 | | | $ | 11,802,064 | |

Neogen Corporation (a) | | | 585,496 | | | | 9,842,188 | |

Stevanato Group S.p.A. | | | 671,497 | | | | 13,429,940 | |

Teleflex, Inc. | | | 32,780 | | | | 8,107,150 | |

West Pharmaceutical Services, Inc. | | | 19,190 | | | | 5,760,070 | |

| | | | | | | | 48,941,412 | |

Industrials — 36.8% | | | | | | | | |

Aerospace — 2.8% | | | | | | | | |

HEICO Corporation - Class A | | | 104,505 | | | | 21,293,939 | |

| | | | | | | | | |

Building Materials: Other — 4.0% | | | | | | | | |

Simpson Manufacturing Company, Inc. | | | 78,400 | | | | 14,995,568 | |

Trex Company, Inc. (a) | | | 222,065 | | | | 14,785,088 | |

| | | | | | | | 29,780,656 | |

Building: Climate Control — 3.0% | | | | | | | | |

Watsco, Inc. | | | 46,205 | | | | 22,727,315 | |

| | | | | | | | | |

Construction — 3.1% | | | | | | | | |

Construction Partners, Inc. - Class A (a) | | | 337,050 | | | | 23,526,090 | |

| | | | | | | | | |

Defense — 3.1% | | | | | | | | |

Axon Enterprise, Inc. (a) | | | 46,965 | | | | 18,767,214 | |

Mercury Systems, Inc. (a) | | | 127,305 | | | | 4,710,285 | |

| | | | | | | | 23,477,499 | |

Diversified Industrials — 2.3% | | | | | | | | |

CSW Industrials, Inc. | | | 47,215 | | | | 17,299,104 | |

| | | | | | | | | |

Electronic Equipment Other — 1.3% | | | | | | | | |

SPX Technologies, Inc. (a) | | | 60,950 | | | | 9,719,087 | |

| | | | | | | | | |

Electronic Equipment: Control & Filter — 1.3% | | | | | | | | |

MSA Safety, Inc. | | | 55,850 | | | | 9,904,439 | |

| | | | | | | | | |

Electronic Equipment: Gauges & Meters — 0.8% | | | | | | | | |

Cognex Corporation | | | 155,660 | | | | 6,304,230 | |

| | | | | | | | | |

Engineering & Contracting Services — 3.7% | | | | | | | | |

Exponent, Inc. | | | 240,575 | | | | 27,733,486 | |

6

CONESTOGA SMID CAP FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 98.0% (Continued) | | Shares | | | Value | |

Industrials — 36.8% (Continued) | | | | | | | | |

Industrial Suppliers — 1.5% | | | | | | | | |

Hillman Solutions Corporation (a) | | | 1,036,295 | | | $ | 10,943,275 | |

| | | | | | | | | |

Machinery: Engines — 1.6% | | | | | | | | |

Generac Holdings, Inc. (a) | | | 74,310 | | | | 11,806,373 | |

| | | | | | | | | |

Machinery: Industrial — 2.1% | | | | | | | | |

EVI Industries, Inc. | | | 438,172 | | | | 8,469,865 | |

John Bean Technologies Corporation | | | 76,125 | | | | 7,499,074 | |

| | | | | | | | 15,968,939 | |

Machinery: Specialty — 2.3% | | | | | | | | |

Graco, Inc. | | | 201,890 | | | | 17,667,394 | |

| | | | | | | | | |

Professional Business Support Services — 1.8% | | | | | | | | |

Fair Isaac Corporation (a) | | | 6,995 | | | | 13,594,922 | |

| | | | | | | | | |

Transaction Processing Services — 2.1% | | | | | | | | |

Jack Henry & Associates, Inc. | | | 87,815 | | | | 15,502,860 | |

| | | | | | | | | |

Real Estate — 3.6% | | | | | | | | |

Real Estate Services — 3.6% | | | | | | | | |

FirstService Corporation | | | 150,130 | | | | 27,392,720 | |

| | | | | | | | | |

Technology — 22.7% | | | | | | | | |

Computer Services — 2.0% | | | | | | | | |

Gartner, Inc. (a) | | | 14,290 | | | | 7,241,600 | |

Workiva, Inc. (a) | | | 104,983 | | | | 8,306,255 | |

| | | | | | | | 15,547,855 | |

Production Technology Equipment — 2.6% | | | | | | | | |

Novanta, Inc. (a) | | | 109,605 | | | | 19,610,527 | |

| | | | | | | | | |

Software — 18.1% | | | | | | | | |

Altair Engineering, Inc. - Class A (a) | | | 143,665 | | | | 13,721,444 | |

CCC Intelligent Solutions Holdings, Inc. (a) | | | 927,395 | | | | 10,247,715 | |

Descartes Systems Group, Inc. (The) (a) | | | 231,660 | | | | 23,851,714 | |

Guidewire Software, Inc. (a) | | | 112,360 | | | | 20,555,138 | |

Paycor HCM, Inc. (a) | | | 595,295 | | | | 8,447,236 | |

Q2 Holdings, Inc. (a) | | | 209,465 | | | | 16,709,023 | |

SPS Commerce, Inc. (a) | | | 95,644 | | | | 18,571,196 | |

Tyler Technologies, Inc. (a) | | | 41,560 | | | | 24,259,403 | |

| | | | | | | | 136,362,869 | |

7

CONESTOGA SMID CAP FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 98.0% (Continued) | | Shares | | | Value | |

Utilities — 4.3% | | | | | | | | |

Waste & Disposal Services — 4.3% | | | | | | | | |

Casella Waste Systems, Inc. - Class A (a) | | | 327,125 | | | $ | 32,545,666 | |

| | | | | | | | | |

Total Investments at Value — 98.0% (Cost $535,112,855) | | | | | | $ | 739,086,293 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 2.0% | | | | | | | 14,983,669 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 754,069,962 | |

(a) | Non-income producing security. |

Schedule of Investments uses the Russell ICB Industry and Sector classification. |

See accompanying notes to financial statements. |

8

CONESTOGA MID CAP FUND

SCHEDULE OF INVESTMENTS

September 30, 2024 |

COMMON STOCKS — 98.0% | | Shares | | | Value | |

Consumer Discretionary — 19.3% | | | | | | | | |

Consumer Services: Miscellaneous — 10.6% | | | | | | | | |

Copart, Inc. (a) | | | 3,320 | | | $ | 173,968 | |

Rollins, Inc. | | | 3,195 | | | | 161,603 | |

| | | | | | | | 335,571 | |

Education Services — 2.5% | | | | | | | | |

Bright Horizons Family Solutions, Inc. (a) | | | 555 | | | | 77,772 | |

| | | | | | | | | |

Recreational Products — 3.3% | | | | | | | | |

Pool Corporation | | | 280 | | | | 105,504 | |

| | | | | | | | | |

Specialty Retail — 2.9% | | | | | | | | |

Tractor Supply Company | | | 310 | | | | 90,189 | |

| | | | | | | | | |

Financials — 1.9% | | | | | | | | |

Financial Data Providers — 1.9% | | | | | | | | |

FactSet Research Systems, Inc. | | | 130 | | | | 59,780 | |

| | | | | | | | | |

Health Care — 19.0% | | | | | | | | |

Health Care Services — 2.8% | | | | | | | | |

Veeva Systems, Inc. - Class A (a) | | | 420 | | | | 88,145 | |

| | | | | | | | | |

Medical Equipment — 8.4% | | | | | | | | |

IDEXX Laboratories, Inc. (a) | | | 210 | | | | 106,096 | |

Repligen Corporation (a) | | | 510 | | | | 75,898 | |

STERIS plc | | | 345 | | | | 83,677 | |

| | | | | | | | 265,671 | |

Medical Supplies — 7.8% | | | | | | | | |

Align Technology, Inc. (a) | | | 140 | | | | 35,604 | |

Bio-Techne Corporation | | | 985 | | | | 78,731 | |

Teleflex, Inc. | | | 165 | | | | 40,808 | |

West Pharmaceutical Services, Inc. | | | 305 | | | | 91,549 | |

| | | | | | | | 246,692 | |

Industrials — 27.1% | | | | | | | | |

Aerospace — 5.2% | | | | | | | | |

HEICO Corporation - Class A | | | 800 | | | | 163,008 | |

| | | | | | | | | |

Building: Climate Control — 2.9% | | | | | | | | |

Watsco, Inc. | | | 185 | | | | 90,998 | |

9

CONESTOGA MID CAP FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 98.0% (Continued) | | Shares | | | Value | |

Industrials — 27.1% (Continued) | | | | | | | | |

Electronic Equipment: Gauges & Meters — 2.0% | | | | | | | | |

Mettler-Toledo International, Inc. (a) | | | 42 | | | $ | 62,987 | |

| | | | | | | | | |

Electronic Equipment: Pollution Control — 2.1% | | | | | | | | |

Xylem, Inc. | | | 485 | | | | 65,490 | |

| | | | | | | | | |

Engineering & Contracting Services — 2.3% | | | | | | | | |

Exponent, Inc. | | | 630 | | | | 72,626 | |

| | | | | | | | | |

Machinery: Engines — 2.2% | | | | | | | | |

Generac Holdings, Inc. (a) | | | 440 | | | | 69,907 | |

| | | | | | | | | |

Machinery: Specialty — 3.0% | | | | | | | | |

Graco, Inc. | | | 1,100 | | | | 96,261 | |

| | | | | | | | | |

Professional Business Support Services — 4.5% | | | | | | | | |

Verisk Analytics, Inc. | | | 535 | | | | 143,359 | |

| | | | | | | | | |

Transaction Processing Services — 2.9% | | | | | | | | |

Jack Henry & Associates, Inc. | | | 510 | | | | 90,035 | |

| | | | | | | | | |

Real Estate — 3.3% | | | | | | | | |

Real Estate Services — 3.3% | | | | | | | | |

CoStar Group, Inc. (a) | | | 1,365 | | | | 102,976 | |

| | | | | | | | | |

Technology — 22.8% | | | | | | | | |

Computer Services — 4.0% | | | | | | | | |

Gartner, Inc. (a) | | | 250 | | | | 126,690 | |

| | | | | | | | | |

Software — 18.8% | | | | | | | | |

ANSYS, Inc. (a) | | | 210 | | | | 66,912 | |

Bentley Systems, Inc. - Class B | | | 1,180 | | | | 59,956 | |

Fortinet, Inc. (a) | | | 1,275 | | | | 98,876 | |

Guidewire Software, Inc. (a) | | | 470 | | | | 85,982 | |

Procore Technologies, Inc. (a) | | | 405 | | | | 24,997 | |

Roper Technologies, Inc. | | | 200 | | | | 111,288 | |

Tyler Technologies, Inc. (a) | | | 250 | | | | 145,930 | |

| | | | | | | | 593,941 | |

10

CONESTOGA MID CAP FUND

SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 98.0% (Continued) | | Shares | | | Value | |

Utilities — 4.6% | | | | | | | | |

Waste & Disposal Services — 4.6% | | | | | | | | |

Waste Connections, Inc. | | | 805 | | | $ | 143,950 | |

| | | | | | | | | |

Total Investments at Value — 98.0% (Cost $2,677,309) | | | | | | $ | 3,091,552 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 2.0% | | | | | | | 64,099 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 3,155,651 | |

(a) | Non-income producing security. |

Schedule of Investments uses the Russell ICB Industry and Sector classification. |

See accompanying notes to financial statements. |

11

CONESTOGA DISCOVERY FUND

SCHEDULE OF INVESTMENTS