UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21128

Legg Mason Partners Variable Equity Trust

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 49th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-721-1926

Date of fiscal year end: December 31

Date of reporting period: June 30, 2016

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Semi-Annual Report to Stockholders is filed herewith.

June 30, 2016

Semi-Annual Repor t

QS

Variable Asset Allocation Series

QS Variable Growth

QS Variable Moderate Growth

QS Variable Conservative Growth

INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

QS Variable Asset Allocation Series

QS Variable Asset Allocation Series (“Variable Asset Allocation Series”) consists of separate investment Portfolios, each with its own investment objective and policies. Each Portfolio is a “fund of funds,” investing in other mutual funds, and is managed as an asset allocation program.

The Portfolios are separate investment series of Legg Mason Partners Variable Equity Trust, a Maryland statutory trust.

| | | | |

| Letter from the president | | |  | |

Dear Shareholder,

We are pleased to provide the semi-annual report of QS Variable Asset Allocation Series for the six-month reporting period ended June 30, 2016. Please read on for performance information for each Portfolio and a detailed look at prevailing economic and market conditions during the Portfolios’ reporting period.

Special shareholder notice

Effective April 1, 2016, QS Investors, LLC (“QS Investors”) became a subadviser, and QS Legg Mason Global Asset Allocation, LLC ceased to be a subadviser, to each Portfolio. Additionally, effective April 1, 2016, the Portfolios’ names changed from QS Legg Mason Variable Growth to QS Variable Growth, QS Legg Mason Variable Moderate Growth to QS Variable Moderate Growth and QS Legg Mason Variable Conservative Growth to QS Variable Conservative Growth.

QS Investors utilizes a team management approach, which effective June 14, 2016, is headed by Adam J. Petryk, CFA, Thomas Picciochi and Ellen Tesler to manage the assets of each Portfolio. Mr. Petryk, CFA, has served as a portfolio manager of each Portfolio since June 2016. Mr. Picciochi and Ms. Tesler have served as portfolio managers for each Portfolio since May 2014. For more information, please see the prospectus supplement dated June 3, 2016.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.leggmason.com. Here you can gain immediate access to market and investment information, including:

| • | | Market insights and commentaries from our portfolio managers and |

| • | | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

July 29, 2016

| | |

| II | | QS Variable Asset Allocation Series |

Investment commentary

Economic review

The pace of U.S. economic activity fluctuated during the six months ended June 30, 2016 (the “reporting period”). Looking back, the U.S. Department of Commerce’s revised figures showed that fourth quarter 2015 U.S. gross domestic product (“GDP”)i growth was 0.9%. First quarter 2016 GDP growth then decelerated to 0.8%. The U.S. Department of Commerce’s initial reading for second quarter 2016 GDP growth — released after the reporting period ended — was 1.2%. The improvement in GDP growth in the second quarter reflected an acceleration in personal consumption expenditures (“PCE”), an upturn in exports and smaller decreases in nonresidential fixed investment and in federal government spending.

While there was a pocket of weakness in May 2016, job growth in the U.S. was solid overall and a tailwind for the economy during the reporting period. When the period ended in June 2016, unemployment was 4.9%, as reported by the U.S. Department of

Labor. The percentage of longer-term unemployed also declined over the period. In June 2016, 25.8% of Americans looking for a job had been out of work for more than six months, versus 26.9% when the period began.

Turning to the global economy, in its July 2016 World Economic Outlook Update, released after the reporting period ended, the International Monetary Fund (“IMF”) said, “The outcome of the UK [Brexit] vote, which surprised global financial markets, implies the materialization of an important downside risk for the world economy. As a result, the global outlook for 2016-17 has worsened, despite the better-than-expected performance in early 2016.” From a regional perspective, the IMF currently estimates 2016 growth in the Eurozone will be 1.6%, versus 1.7% in 2015. Japan’s economy is expected to expand 0.3% in 2016, down from 0.5% in 2015. Elsewhere, the IMF projects that overall growth in emerging market countries will tick up to 4.1% in 2016, versus 4.0% in 2015.

| | |

| QS Variable Asset Allocation Series | | III |

Investment commentary (cont’d)

Market review

Q. How did the Federal Reserve Board (the “Fed”)ii respond to the economic environment?

A. Looking back, after an extended period of maintaining the federal funds rateiii at a historically low range between zero and 0.25%, the Fed increased the rate at its meeting on December 16, 2015. This marked the first rate hike since 2006. In particular, the U.S. central bank raised the federal funds rate to a range between 0.25% and 0.50%. In its official statement after the December 2015 meeting, the Fed said, “The stance of monetary policy remains accommodative after this increase, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation….The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run.” At its meetings that concluded on January 27, 2016, March 16, 2016, April 27, 2016, June 15, 2016 and July 27, 2016 (after the reporting period ended), the Fed kept rates on hold.

Q. What actions did international central banks take during the reporting period?

A. Given the economic challenges in the Eurozone, the European Central Bank (“ECB”)iv took a number of actions to stimulate growth and ward off deflation. In January 2015, before the reporting period began, the ECB announced that, beginning in March 2015, it would start a €60 billion-a-month bond buying program that is expected to run until September 2016. In December 2015, the ECB extended its monthly bond buying program until at least March 2017. Finally, in March 2016 the ECB announced that it would increase its bond purchasing program to €80 billion a month. It also cut its deposit rate to -0.4% and its main interest rate to 0%. In other developed countries, the Bank of England (“BoE”)v kept rates on hold at 0.50% during the reporting period, its lowest level since 2006. However, in the aftermath of the June 23, 2016 U.K. referendum to leave the European Union (“Brexit”), BoE’s Governor Carney said that further interest rate cuts would be needed. After holding rates steady at 0.10% for more than five years, in January 2016 the Bank of Japan announced that it cut the rate on current accounts that commercial banks hold with it to -0.10%. Elsewhere, the People’s Bank of China kept rates steady at 4.35%.

Q. What factors impacted the U.S. stock market during the reporting period?

A. The U.S. stock market was volatile over the six months ended June 30, 2016. The market declined during the first two months of the reporting period. This weakness was triggered by a number of factors, including concerns about the fallout from moderating economic growth in China, uncertainties surrounding future Fed actions and several geopolitical issues. However, the market then rallied over the next three months of the period. Investor sentiment improved as U.S. economic data was generally positive, oil prices

moved higher and the Fed reduced its expectations for rate hikes in 2016. The market then gyrated in June 2016. After initially rising, the market fell sharply in the immediate wake of Brexit. However, the market largely recouped those losses at the end of the month. All told, for the six months ended June 30, 2016, the S&P 500 Indexvi gained 3.84%.

Looking at the U.S. stock market more closely, mid-cap stocks, as measured by the Russell Midcap Indexvii, generated the strongest returns, as they gained 5.50% over the reporting period. In contrast, small-cap stocks generated the weakest results with the Russell 2000 Indexviii rising 2.22%, whereas large-cap stocks, as measured by the Russell 1000 Indexix, returned 3.74%. From an investment style perspective, growth and value stocks, as measured by the Russell 3000 Growthx and Russell 3000 Valuexi Indices, returned 1.14% and 6.29%, respectively, during the six months ended June 30, 2016.

Q. How did the international stock market perform during the reporting period?

A. International equities were also volatile during the reporting period. Developed market equities, as measured by the MSCI EAFE Indexxii, declined during the first two months of the period, rose over the next two months and then moved lower over the last two months. These fluctuations were partially driven by the uncertainties leading up to and following Brexit. All told, the MSCI EAFE Index declined 4.42% during the reporting period. Emerging market equities were not immune to the market’s gyrations. For the first five months of the reporting period, the MSCI Emerging Markets Indexxiii rose and fell in the same pattern as developed market equities. However, emerging market equities rallied in June 2016. For the six months ended June 30, 2016, the MSCI Emerging Markets Index gained 6.41%.

Q. Did Treasury yields trend higher or lower during the six months ended June 30, 2016?

A. Both short- and long-term Treasury yields moved sharply lower during the six months ended June 30, 2016. Two-year Treasury yields fell from a peak of 1.06% at the beginning of the period to a low of 0.58% at the end of the period. Ten-year Treasury yields began the reporting period at a peak of 2.27% and ended the period at 1.49%. Their low of 1.46% occurred on June 27 and June 28, 2016.

Q. What factors impacted the spread sectors (non-Treasuries) during the reporting period?

A. The spread sectors generally posted positive results during the reporting period. Performance fluctuated with investor sentiment given signs of moderating global growth, shifting expectations for future Fed monetary policy, Brexit and several geopolitical issues. The broad U.S. bond market, as measured by the Barclays U.S. Aggregate Indexxiv, gained 5.31% during the six months ended June 30, 2016. Higher risk segments of the market generated the best returns during the reporting period.

| | |

| IV | | QS Variable Asset Allocation Series |

Q. How did the high-yield bond market perform over the six months ended June 30, 2016?

A. The U.S. high-yield bond market, as measured by the Barclays U.S. Corporate High Yield — 2% Issuer Cap Indexxv, gained 9.06% for the six months ended June 30, 2016. The high-yield market was weak during the first month of the reporting period, due to falling oil prices and poor investor demand. After stabilizing in February 2016, the high-yield market rallied sharply over the last four months of the reporting period. This turnaround occurred as oil prices rebounded and the Fed reduced its expectations for rate hikes in 2016.

Q. How did the emerging markets debt asset class perform over the reporting period?

A. The JPMorgan Emerging Markets Bond Index Global (“EMBI Global”)xvi gained 10.90% during the six months ended June 30, 2016. The asset class declined during the first month of the reporting period given concerns over economic growth in China, falling commodity prices and expectations for future Fed rate hikes. While there were periods of weakness, the asset class rallied sharply over the last five months of the reporting period as a whole. This turnaround was driven by rising oil prices, accommodative global monetary policy and solid investor demand.

| | |

| QS Variable Asset Allocation Series | | V |

Investment commentary (cont’d)

QS Variable Growth1

QS Variable Growth seeks capital appreciation. The Portfolio organizes its investments in underlying funds into two main asset classes: the equity class (equity securities of all types) and the fixed income class (fixed income securities of all types). The portfolio managers may invest across all asset classes and strategies. The portfolio managers will allocate between 70% to 100% of the Portfolio’s assets to underlying funds that invest in equity and equity-like strategies and between 0% to 30% to underlying funds that invest in fixed-income strategies. The portfolio managers may, however, allocate assets to any underlying funds in varying amounts in a manner consistent with the Portfolio’s investment objective. The Portfolio’s allocation to each asset class will be measured at the time of purchase and may vary thereafter as a result of market movements.

Performance review

For the six months ended June 30, 2016, QS Variable Growth1 returned 0.71%. The Portfolio’s unmanaged benchmarks, the Barclays U.S. Aggregate Index and the Russell 3000 Indexxvii, and the Variable Growth Composite Benchmarkxviii, returned 5.31%, 3.62% and 2.25%, respectively, over the same time frame. The Lipper Variable Mixed-Asset Target Allocation Aggressive Growth Funds Category Average2 returned 1.37% for the same period.

| | | | |

| Performance Snapshot as of June 30, 2016 (unaudited) | |

| | | 6 months | |

| QS Variable Growth1 | | | 0.71 | % |

| Barclays U.S. Aggregate Index | | | 5.31 | % |

| Russell 3000 Index | | | 3.62 | % |

| Variable Growth Composite Benchmark | | | 2.25 | % |

| Lipper Variable Mixed-Asset Target Allocation Aggressive Growth Funds Category Average2 | | | 1.37 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost.

Portfolio return assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value and the deduction of all Portfolio expenses. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

The portfolio managers periodically adjust the allocation of the Portfolio’s assets among different Legg Mason-affiliated funds depending upon the portfolio managers’ outlook for the equity and bond markets in general, particular sectors of such markets and the performance outlook for the underlying funds. In assessing the equity and fixed income markets, the portfolio managers consider a broad range of market and economic trends and quantitative factors.

Total Annual Operating Expenses† (unaudited)

As of the Portfolio’s current prospectus dated May 1, 2016, the gross total annual operating expense ratio for the Portfolio was 0.90%.

Actual expenses may be higher. For example, expenses may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Portfolio expense ratios are more likely to increase when markets are volatile.

As a result of an expense limitation arrangement, the ratio of expenses, other than interest, brokerage, taxes, extraordinary expenses and acquired fund fees and expenses (fees and expenses of underlying funds), to average net assets will not exceed 0.20%. This expense limitation arrangement cannot be terminated prior to December 31, 2017 without the Board of Trustees’ consent.

The manager is permitted to recapture amounts waived and/or reimbursed to the Portfolio during the same fiscal year if the Portfolio’s total annual operating expenses have fallen to a level below the expense limitation (“expense cap”) in effect at the time the fees were earned or the expenses incurred. In no case will the manager recapture any amount that would result, on any particular business day of the Portfolio, in the Portfolio’s total annual operating expenses exceeding the expense cap or any other lower limit then in effect.

| 1 | The Portfolio is an underlying investment option of various variable annuity and variable life insurance products. The Portfolio’s performance returns do not reflect the deduction of expenses imposed in connection with investing in variable annuity or variable life insurance contracts, such as administrative fees, account charges and surrender charges, which, if reflected, would reduce the performance of the Portfolio. Past performance is no guarantee of future results. |

| 2 | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the six-month period ended June 30, 2016, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 57 funds in the Portfolio’s Lipper category. |

| † | Includes expenses of the underlying funds in which the Portfolio invests. |

| | |

| VI | | QS Variable Asset Allocation Series |

QS Variable Moderate Growth1

QS Variable Moderate Growth seeks long-term growth of capital. The Portfolio organizes its investments in underlying funds into two main asset classes: the equity class (equity securities of all types) and the fixed income class (fixed income securities of all types). The portfolio managers may invest across all asset classes and strategies. The portfolio managers will allocate between 55% to 85% of the Portfolio’s assets to underlying funds that invest in equity and equity-like strategies and between 15% to 45% to underlying funds that invest in fixed-income strategies. The portfolio managers may, however, allocate assets to any underlying funds in varying amounts in a manner consistent with the Portfolio’s investment objective. The Portfolio’s allocation to each asset class will be measured at the time of purchase and may vary thereafter as a result of market movements.

Performance review

For the six months ended June 30, 2016, QS Variable Moderate Growth1 returned 1.83%. The Portfolio’s unmanaged benchmarks, the Barclays U.S. Aggregate Index and the Russell 3000 Index, and the Variable Moderate Growth Composite Benchmarkxix, returned 5.31%, 3.62% and 3.02%, respectively, for the same period. The Lipper Variable Mixed-Asset Target Allocation Growth Funds Category Average2 returned 2.31% over the same time frame.

| | | | |

| Performance Snapshot as of June 30, 2016 (unaudited) | |

| | | 6 months | |

| QS Variable Moderate Growth1 | | | 1.83 | % |

| Barclays U.S. Aggregate Index | | | 5.31 | % |

| Russell 3000 Index | | | 3.62 | % |

| Variable Moderate Growth Composite Benchmark | | | 3.02 | % |

| Lipper Variable Mixed-Asset Target Allocation Growth Funds Category Average2 | | | 2.31 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost.

Portfolio return assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value and the deduction of all Portfolio expenses. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Portfolio performance figures reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

The portfolio managers periodically adjust the allocation of the Portfolio’s assets among different Legg Mason-affiliated funds depending upon the portfolio managers’ outlook for the equity and bond markets in general, particular sectors of such markets and the performance outlook for the underlying funds. In assessing the equity and fixed income markets, the portfolio managers consider a broad range of market and economic trends and quantitative factors.

Total Annual Operating Expenses† (unaudited)

As of the Portfolio’s current prospectus dated May 1, 2016, the gross total annual operating expense ratio for the Portfolio was 1.01%.

Actual expenses may be higher. For example, expenses may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Portfolio expense ratios are more likely to increase when markets are volatile.

As a result of an expense limitation arrangement, the ratio of expenses, other than interest, brokerage, taxes, extraordinary expenses and acquired fund fees and expenses (fees and expenses of underlying funds), to average net assets will not exceed 0.20%. This expense limitation arrangement cannot be terminated prior to December 31, 2017 without the Board of Trustees’ consent.

The manager is permitted to recapture amounts waived and/or reimbursed to the Portfolio during the same fiscal year if the Portfolio’s total annual operating expenses have fallen to a level below the expense limitation (“expense cap”) in effect at the time the fees were earned or the expenses incurred. In no case will the manager recapture any amount that would result, on any particular business day of the Portfolio, in the Portfolio’s total annual operating expenses exceeding the expense cap or any other lower limit then in effect.

| 1 | The Portfolio is an underlying investment option of various variable annuity and variable life insurance products. The Portfolio’s performance returns do not reflect the deduction of expenses imposed in connection with investing in variable annuity or variable life insurance contracts, such as administrative fees, account charges and surrender charges, which, if reflected, would reduce the performance of the Portfolio. Past performance is no guarantee of future results. |

| 2 | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the six-month period ended June 30, 2016, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 223 funds in the Portfolio’s Lipper category. |

| † | Includes expenses of the underlying funds in which the Portfolio invests. |

| | |

| QS Variable Asset Allocation Series | | VII |

Investment commentary (cont’d)

QS Variable Conservative Growth1

QS Variable Conservative Growth seeks balance of growth of capital and income. The Portfolio organizes its investments in underlying funds into two main asset classes: the equity class (equity securities of all types) and the fixed income class (fixed income securities of all types). The portfolio managers may invest across all asset classes and strategies. The portfolio managers will allocate between 35% to 65% of the Portfolio’s assets to underlying funds that invest in equity and equity-like strategies and between 35% to 65% to underlying funds that invest in fixed-income strategies. The portfolio managers may, however, allocate assets to any underlying funds in varying amounts in a manner consistent with the Portfolio’s investment objective. The Portfolio’s allocation to each asset class will be measured at the time of purchase and may vary thereafter as a result of market movements.

Performance review

For the six months ended June 30, 2016, QS Variable Conservative Growth1 returned 3.29%. The Portfolio’s unmanaged benchmarks, the Barclays U.S. Aggregate Index and the Russell 1000 Index, and the Variable Conservative Growth Composite Benchmarkxx, returned 5.31%, 3.74% and 3.90%, respectively, for the same period. The Lipper Variable Mixed-Asset Target Allocation Moderate Funds Category Average2 returned 2.86% over the same time frame.

| | | | |

| Performance Snapshot as of June 30, 2016 (unaudited) | |

| | | 6 months | |

| QS Variable Conservative Growth1 | | | 3.29 | % |

| Barclays U.S. Aggregate Index | | | 5.31 | % |

| Russell 1000 Index | | | 3.74 | % |

| Variable Conservative Growth Composite Benchmark | | | 3.90 | % |

| Lipper Variable Mixed-Asset Target Allocation Moderate Funds Category Average2 | | | 2.86 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost.

Portfolio return assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value and the deduction of all Portfolio expenses. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

The portfolio managers periodically adjust the allocation of the Portfolio’s assets among different Legg Mason-affiliated funds depending upon the portfolio managers’ outlook for the equity and bond markets in general, particular sectors of such markets and the performance outlook for the underlying funds. In assessing the equity and fixed income markets, the portfolio managers consider a broad range of market and economic trends and quantitative factors.

Total Annual Operating Expenses† (unaudited)

As of the Portfolio’s current prospectus dated May 1, 2016, the gross total annual operating expense ratio for the Portfolio was 0.83%.

Actual expenses may be higher. For example, expenses may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Portfolio expense ratios are more likely to increase when markets are volatile.

As a result of an expense limitation arrangement, the ratio of expenses, other than interest, brokerage, taxes, extraordinary expenses and acquired fund fees and expenses (fees and expenses of underlying funds), to average net assets will not exceed 0.20%. This expense limitation arrangement cannot be terminated prior to December 31, 2017 without the Board of Trustees’ consent.

The manager is permitted to recapture amounts waived and/or reimbursed to the Portfolio during the same fiscal year if the Portfolio’s total annual operating expenses have fallen to a level below the expense limitation (“expense cap”) in effect at the time the fees were earned or the expenses incurred. In no case will the manager recapture any amount that would result, on any particular business day of the Portfolio, in the Portfolio’s total annual operating expenses exceeding the expense cap or any other lower limit then in effect.

| 1 | The Portfolio is an underlying investment option of various variable annuity and variable life insurance products. The Portfolio’s performance returns do not reflect the deduction of expenses imposed in connection with investing in variable annuity or variable life insurance contracts, such as administrative fees, account charges and surrender charges, which, if reflected, would reduce the performance of the Portfolio. Past performance is no guarantee of future results. |

| 2 | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the six-month period ended June 30, 2016, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 237 funds in the Portfolio’s Lipper category. |

| † | Includes expenses of the underlying funds in which the Portfolio invests. |

| | |

| VIII | | QS Variable Asset Allocation Series |

As always, thank you for your confidence in our stewardship of your assets.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

July 29, 2016

RISKS: Equity securities are subject to price and market fluctuations. Fixed-income securities are subject to interest rate and credit risks. Foreign securities are subject to certain risks of overseas investing including currency fluctuations and political, social and economic uncertainties, which could increase volatility. These risks are magnified in emerging markets. Investments in small- and mid-capitalization companies may involve a higher degree of risk and volatility than

investments in larger, more established companies. As interest rates rise, bond prices fall, reducing the value of the Portfolios’ share prices. High-yield bonds (commonly known as “junk bonds”) involve greater credit and liquidity risks than investment grade bonds. There are additional risks and other expenses associated with investing in other mutual funds rather than directly in portfolio securities. Certain underlying funds may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Portfolio performance. Additionally, the portfolio managers may invest in underlying funds that have a limited performance history. Please see the Portfolios’ prospectuses for a more complete discussion of these and other risks, and the Portfolios’ investment strategies.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole. Forecasts and predictions are inherently limited and should not be relied upon as an indication of actual or future performance.

| i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| ii | The Federal Reserve Board (the “Fed”) is responsible for the formulation of U.S. policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| iii | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Fed) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| iv | The European Central Bank (“ECB”) is responsible for the monetary system of the European Union and the euro currency. |

| v | The Bank of England (“BoE”), formally the Governor and Company of the Bank of England, is the central bank of the United Kingdom. The BoE’s purpose is to maintain monetary and financial stability. |

| vi | The S&P 500 Index is an unmanaged index of 500 stocks and is generally representative of the performance of larger companies in the U.S. |

| vii | The Russell Midcap Index measures the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap is a subset of the Russell 1000 Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership. The Russell Midcap represents approximately 31% of the total market capitalization of the Russell 1000 companies. |

| viii | The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 is a subset of the Russell 3000 Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. |

| ix | The Russell 1000 Index measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000 Index and includes approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000 represents approximately 92% of the U.S. market. |

| x | The Russell 3000 Growth Index measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. (A price-to-book ratio is the price of a stock compared to the difference between a company’s assets and liabilities.) |

| xi | The Russell 3000 Value Index measures the performance of the broad value segment of the U.S. equity value universe. It includes those Russell 3000 Index companies with lower price-to-book ratios and lower forecasted growth values. |

| xii | The MSCI EAFE Index is a free float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. |

| xiii | The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. |

| xiv | The Barclays U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

| xv | The Barclays U.S. Corporate High Yield — 2% Issuer Cap Index is an index of the 2% Issuer Cap component of the Barclays U.S. Corporate High Yield Index, which covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market. |

| xvi | The JPMorgan Emerging Markets Bond Index Global (“EMBI Global”) tracks total returns for U.S. dollar-denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans, Eurobonds and local market instruments. |

| xvii | The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the U.S. equity market. |

| xviii | The Variable Growth Composite Benchmark is a hypothetical representation of the performance of the Portfolio’s major asset classes. It consists of 45% Russell 1000 Index, 20% Russell 2000 Index, 20% MSCI EAFE Index, 10% Barclays U.S. Aggregate Index and 5% Barclays U.S. Corporate High Yield — 2% Issuer Cap Index. |

| xix | The Variable Moderate Growth Composite Benchmark is a hypothetical representation of the performance of the Portfolio’s major asset classes. It consists of 40% Russell 1000 Index, 15% Russell 2000 Index, 15% MSCI EAFE Index, 25% Barclays U.S. Aggregate Index and 5% Barclays U.S. Corporate High Yield — 2% Issuer Cap Index. |

| xx | The Variable Conservative Growth Composite Benchmark is a hypothetical representation of the performance of the Portfolio’s major asset classes. It consists of 28% Russell 1000 Index, 12% Russell 2000 Index, 10% MSCI EAFE Index, 43% Barclays U.S. Aggregate Index and 7% Barclays U.S. Corporate High Yield — 2% Issuer Cap Index. |

| | |

| QS Variable Asset Allocation Series | | IX |

Portfolios at a glance (unaudited)

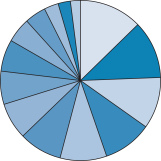

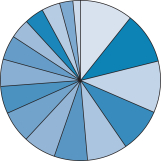

QS Variable Growth Breakdown† as of — June 30, 2016

As a Percent of Total Long-Term Investments

| | | | |

% of Total Long-Term

Investments | | Top 5 Sectors |

| | 12.7 Legg Mason Global Asset Management Trust — QS International Equity Fund, Class IS Shares | | Financials Industrials Health Care Consumer Discretionary Consumer Staples |

| | 11.7 Legg Mason Global Asset Management Trust — Legg Mason BW Diversified Large Cap Value Fund, Class IS Shares | | Financials Information Technology Health Care Industrials Energy |

| | 10.4 Legg Mason Partners Equity Trust — QS Global Dividend Fund, Class IS Shares | | Consumer Staples Financials Telecommunication Services Utilities Health Care |

| | 9.9 The Royce Fund — Royce Small-Cap Value Fund, Institutional Class Shares | | Consumer Discretionary Industrials Financials Information Technology Energy |

| | 9.4 Legg Mason Partners Equity Trust — ClearBridge Appreciation Fund, Class IS Shares | | Information Technology Health Care Financials Consumer Discretionary Consumer Staples |

| | 8.7 Legg Mason Partners Equity Trust — QS U.S. Large Cap Equity Fund, Class IS Shares | | Information Technology Financials Consumer Discretionary Health Care Industrials |

| | 7.4 Legg Mason Partners Equity Trust — ClearBridge Small Cap Growth Fund, Class IS Shares | | Information Technology Health Care Industrials Consumer Discretionary Financials |

| | 6.7 Legg Mason Partners Equity Trust — ClearBridge Aggressive Growth Fund, Class IS Shares | | Health Care Information Technology Consumer Discretionary Energy Industrials |

| | 6.4 Legg Mason Global Asset Management Trust — QS Strategic Real Return Fund, Class IS Shares | | U.S. Treasury Inflation Protected Securities Investments in Underlying Funds U.S. Government & Agency Obligations Financials Information Technology |

| † | Subject to change at any time. |

| ‡ | Represents less than 0.1%. |

| | | | |

% of Total Long-Term

Investments | | Top 5 Sectors |

| | 5.0 Legg Mason Partners Equity Trust — ClearBridge International Value Fund, Class IS Shares | | Financials Materials Industrials Energy Consumer Discretionary |

| | 4.3 Legg Mason Partners Equity Trust — ClearBridge Mid Cap Fund, Class IS Shares | | Financials Consumer Discretionary Information Technology Industrials Health Care |

| | 2.9 Legg Mason Partners Equity Trust — ClearBridge Large Cap Growth Fund, Class IS Shares | | Information Technology Health Care Consumer Discretionary Industrials Consumer Staples |

| | 2.5 Western Asset Funds, Inc. — Western Asset Macro Opportunities Fund, Class IS Shares | | Corporate Bonds & Notes Sovereign Bonds U.S. Government & Agency Obligations Collateralized Mortgage Obligations U.S. Treasury Inflation Protected Securities |

| | 2.0 Western Asset Funds, Inc. — Western Asset High Yield Fund, Class IS Shares | | Consumer Discretionary Energy Financials Industrials Health Care |

| | 0.0‡ Western Asset Funds, Inc. — Western Asset Core Plus Bond Fund, Class IS Shares | | Corporate Bonds & Notes U.S. Government & Agency Obligations Mortgage-backed Securities Collateralized Mortgage Obligations Sovereign Bonds |

| | |

| QS Variable Asset Allocation Series 2016 Semi-Annual Report | | 1 |

Portfolios at a glance (unaudited) (cont’d)

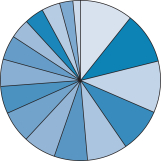

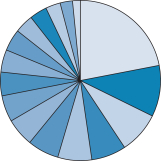

QS Variable Moderate Growth Breakdown† as of — June 30, 2016

As a Percent of Total Long-Term Investments

| | | | |

% of Total Long-Term

Investments | | Top 5 Sectors |

| | 10.7 Western Asset Funds, Inc. — Western Asset Core Plus Bond Fund, Class IS Shares | | Corporate Bonds & Notes U.S. Government & Agency Obligations Mortgage-backed Securities Collateralized Mortgage Obligations Sovereign Bonds |

| | 10.4 Legg Mason Partners Equity Trust — QS Global Dividend Fund, Class IS Shares | | Consumer Staples Financials Telecommunication Services Utilities Health Care |

| | 10.4 Legg Mason Global Asset Management Trust — Legg Mason BW Diversified Large Cap Value Fund, Class IS Shares | | Financials Information Technology Health Care Industrials Energy |

| | 8.9 Legg Mason Global Asset Management Trust — QS International Equity Fund, Class IS Shares | | Financials Industrials Health Care Consumer Discretionary Consumer Staples |

| | 8.2 Legg Mason Partners Equity Trust — ClearBridge Appreciation Fund, Class IS Shares | | Information Technology Health Care Financials Consumer Discretionary Consumer Staples |

| | 6.7 Legg Mason Partners Equity Trust — QS U.S. Large Cap Equity Fund, Class IS Shares | | Information Technology Financials Consumer Discretionary Health Care Industrials |

| | 6.6 The Royce Fund — Royce Small-Cap Value Fund, Institutional Class Shares | | Consumer Discretionary Industrials Financials Information Technology Energy |

| | 6.4 Legg Mason Global Asset Management Trust — QS Strategic Real Return Fund, Class IS Shares | | U.S. Treasury Inflation Protected Securities Investments in Underlying Funds U.S. Government & Agency Obligations Financials Information Technology |

| | 5.5 Legg Mason Partners Equity Trust — ClearBridge Small Cap Growth Fund, Class IS Shares | | Information Technology Health Care Industrials Consumer Discretionary Financials |

| † | Subject to change at any time. |

| | | | |

% of Total Long-Term

Investments | | Top 5 Sectors |

| | 5.5 Legg Mason Partners Equity Trust — ClearBridge Aggressive Growth Fund, Class IS Shares | | Health Care Information Technology Consumer Discretionary Energy Industrials |

| | 4.9 Western Asset Funds, Inc. — Western Asset High Yield Fund, Class IS Shares | | Consumer Discretionary Energy Financials Industrials Health Care |

| | 4.0 Legg Mason Partners Equity Trust — ClearBridge Mid Cap Fund, Class IS Shares | | Financials Consumer Discretionary Information Technology Industrials Health Care |

| | 3.9 Western Asset Funds, Inc. — Western Asset Macro Opportunities Fund, Class IS Shares | | Corporate Bonds & Notes Sovereign Bonds U.S. Government & Agency Obligations Collateralized Mortgage Obligations U.S. Treasury Inflation Protected Securities |

| | 3.7 Legg Mason Partners Equity Trust — ClearBridge International Value Fund, Class IS Shares | | Financials Materials Industrials Energy Consumer Discretionary |

| | 2.7 Legg Mason Partners Equity Trust — ClearBridge Large Cap Growth Fund, Class IS Shares | | Information Technology Health Care Consumer Discretionary Industrials Consumer Staples |

| | 1.5 Western Asset Funds, Inc. — Western Asset Core Bond Fund, Class IS Shares | | U.S. Government & Agency Obligations Corporate Bonds & Notes Mortgage-backed Securities Collateralized Mortgage Obligations Asset-backed Securities |

| | |

| 2 | | QS Variable Asset Allocation Series 2016 Semi-Annual Report |

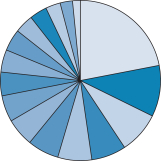

QS Variable Conservative Growth Breakdown† as of — June 30, 2016

As a Percent of Total Long-Term Investments

| | | | |

% of Total Long-Term

Investments | | Top 5 Sectors |

| | 22.0 Western Asset Funds, Inc. — Western Asset Core Plus Bond Fund, Class IS Shares | | Corporate Bonds & Notes U.S. Government & Agency Obligations Mortgage-backed Securities Collateralized Mortgage Obligations Sovereign Bonds |

| | 10.3 Legg Mason Partners Equity Trust — QS Global Dividend Fund, Class IS Shares | | Consumer Staples Financials Telecommunication Services Utilities Health Care |

| | 8.4 Western Asset Funds, Inc. — Western Asset Core Bond Fund, Class IS Shares | | U.S. Government & Agency Obligations Corporate Bonds & Notes Mortgage-backed Securities Collateralized Mortgage Obligations Asset-backed Securities |

| | 7.0 Western Asset Funds, Inc. — Western Asset High Yield Fund, Class IS Shares | | Consumer Discretionary Energy Financials Industrials Health Care |

| | 6.9 Legg Mason Global Asset Management Trust — Legg Mason BW Diversified Large Cap Value Fund, Class IS Shares | | Financials Information Technology Health Care Industrials Energy |

| | 6.3 Legg Mason Global Asset Management Trust — QS Strategic Real Return Fund, Class IS Shares | | U.S. Treasury Inflation Protected Securities Investments in Underlying Funds U.S. Government & Agency Obligations Financials Information Technology |

| | 5.7 Legg Mason Partners Equity Trust — ClearBridge Appreciation Fund, Class IS Shares | | Information Technology Health Care Financials Consumer Discretionary Consumer Staples |

| | 5.3 Legg Mason Partners Equity Trust — ClearBridge Small Cap Growth Fund, Class IS Shares | | Information Technology Health Care Industrials Consumer Discretionary Financials |

| † | Subject to change at any time. |

| | | | |

% of Total Long-Term

Investments | | Top 5 Sectors |

| | 4.8 Legg Mason Global Asset Management Trust — QS International Equity Fund, Class IS Shares | | Financials Industrials Health Care Consumer Discretionary Consumer Staples |

| | 4.5 The Royce Fund — Royce Small-Cap Value Fund, Institutional Class Shares | | Consumer Discretionary Industrials Financials Information Technology Energy |

| | 4.4 Western Asset Funds, Inc. — Western Asset Macro Opportunities Fund, Class IS Shares | | Corporate Bonds & Notes Sovereign Bonds U.S. Government & Agency Obligations Collateralized Mortgage Obligations U.S. Treasury Inflation Protected Securities |

| | 3.8 Legg Mason Partners Equity Trust — QS U.S. Large Cap Equity Fund, Class IS Shares | | Information Technology Financials Consumer Discretionary Health Care Industrials |

| | 3.5 Legg Mason Partners Equity Trust — ClearBridge Aggressive Growth Fund, Class IS Shares | | Health Care Information Technology Consumer Discretionary Energy Industrials |

| | 3.0 Legg Mason Partners Equity Trust — ClearBridge International Value Fund, Class IS Shares | | Financials Materials Industrials Energy Consumer Discretionary |

| | 2.5 Legg Mason Partners Equity Trust — ClearBridge Mid Cap Fund, Class IS Shares | | Financials Consumer Discretionary Information Technology Industrials Health Care |

| | 1.6 Legg Mason Partners Equity Trust — ClearBridge Large Cap Growth Fund, Class IS Shares | | Information Technology Health Care Consumer Discretionary Industrials Consumer Staples |

| | |

| QS Variable Asset Allocation Series 2016 Semi-Annual Report | | 3 |

Portfolios expenses (unaudited)

Example

As a shareholder of the Portfolios, you may incur two types of costs: (1) transaction costs and (2) ongoing costs, including other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolios and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on January 1, 2016 and held for the six months ended June 30, 2016.

Actual expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not each Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Portfolios and other portfolios. To do so, compare the 5.00% hypothetical example relating to the Portfolios with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Based on actual total return1 | | | | | | Based on hypothetical total return1 | |

| | | Actual Total

Return2 | | | Beginning

Account

Value | | | Ending

Account

Value | | | Annualized

Expense

Ratio3 | | | Expenses

Paid

During

the

Period4 | | | | | | | | Hypothetical

Annualized

Total

Return | | | Beginning

Account

Value | | | Ending

Account

Value | | | Annualized

Expense

Ratio3 | | | Expenses

Paid

During

the

Period4 | |

| QS Variable Growth | | | 0.71 | % | | $ | 1,000.00 | | | $ | 1,007.10 | | | | 0.11 | % | | $ | 0.55 | | | | | | | QS Variable Growth | | | 5.00 | % | | $ | 1,000.00 | | | $ | 1,024.32 | | | | 0.11 | % | | $ | 0.55 | |

| QS Variable Moderate Growth | | | 1.83 | | | | 1,000.00 | | | | 1,018.30 | | | | 0.20 | | | | 1.00 | | | | | | | QS Variable Moderate Growth | | | 5.00 | | | | 1,000.00 | | | | 1,023.87 | | | | 0.20 | | | | 1.01 | |

| QS Variable Conservative Growth | | | 3.29 | | | | 1,000.00 | | | | 1,032.90 | | | | 0.12 | | | | 0.61 | | | | | | | QS Variable Conservative Growth | | | 5.00 | | | | 1,000.00 | | | | 1,024.27 | | | | 0.12 | | | | 0.60 | |

| 1 | For the six months ended June 30, 2016. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Total returns do not reflect expenses associated with separate accounts such as administrative fees, account charges and surrender charges, which, if reflected, would reduce the total returns. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Does not include fees and expenses of the Underlying Funds in which each Portfolio invests. |

| 4 | Expenses (net of compensating balance arrangements, fee waivers and/or expense reimbursements) are equal to each Portfolio’s respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (182), then divided by 366. |

| | |

| 4 | | QS Variable Asset Allocation Series 2016 Semi-Annual Report |

Schedules of investments (unaudited)

June 30, 2016

QS Variable Growth

| | | | | | | | | | | | | | |

| Description | | | | | | | Shares | | | Value | |

| Investments in Underlying Funds(a) — 99.8% | | | | | | | | | | | | | | |

Legg Mason Global Asset Management Trust: | | | | | | | | | | | | | | |

Legg Mason BW Diversified Large Cap Value Fund, Class IS Shares | | | | | | | | | 698,734 | | | $ | 12,570,223 | |

QS International Equity Fund, Class IS Shares | | | | | | | | | 995,752 | | | | 13,592,011 | (b) |

QS Strategic Real Return Fund, Class IS Shares | | | | | | | | | 588,032 | | | | 6,850,578 | (c) |

Legg Mason Partners Equity Trust: | | | | | | | | | | | | | | |

ClearBridge Aggressive Growth Fund, Class IS Shares | | | | | | | | | 35,739 | | | | 7,185,280 | |

ClearBridge Appreciation Fund, Class IS Shares | | | | | | | | | 491,031 | | | | 10,125,059 | |

ClearBridge International Value Fund, Class IS Shares | | | | | | | | | 599,370 | | | | 5,400,324 | |

ClearBridge Large Cap Growth Fund, Class IS Shares | | | | | | | | | 85,695 | | | | 3,073,039 | |

ClearBridge Mid Cap Fund, Class IS Shares | | | | | | | | | 146,217 | | | | 4,616,061 | (d) |

ClearBridge Small Cap Growth Fund, Class IS Shares | | | | | | | | | 297,285 | | | | 7,955,350 | |

QS Global Dividend Fund, Class IS Shares | | | | | | | | | 937,644 | | | | 11,195,468 | (e) |

QS U.S. Large Cap Equity Fund, Class IS Shares | | | | | | | | | 603,273 | | | | 9,350,736 | (f) |

The Royce Fund — Royce Small-Cap Value Fund, Institutional Class Shares | | | | | | | | | 1,169,917 | | | | 10,576,046 | |

Western Asset Funds, Inc.: | | | | | | | | | | | | | | |

Western Asset Core Plus Bond Fund, Class IS Shares | | | | | | | | | 2,079 | | | | 24,677 | |

Western Asset High Yield Fund, Class IS Shares | | | | | | | | | 282,347 | | | | 2,196,658 | |

Western Asset Macro Opportunities Fund, Class IS Shares | | | | | | | | | 256,075 | | | | 2,704,152 | |

Total Investments in Underlying Funds before Short-Term Investments (Cost — $86,460,531) | | | | 107,415,662 | |

| | | | |

| | | Rate | | | | | | | | | |

| Short-Term Investments — 0.1% | | | | | | | | | | | | | | |

State Street Institutional Liquid Reserves Fund, Premier Class (Cost — $88,727) | | | 0.479 | % | | | | | 88,727 | | | | 88,727 | |

Total Investments — 99.9% (Cost — $86,549,258#) | | | | | | | | | | | | | 107,504,389 | |

Other Assets in Excess of Liabilities — 0.1% | | | | | | | | | | | | | 74,746 | |

Total Net Assets — 100.0% | | | | | | | | | | | | $ | 107,579,135 | |

| (a) | Underlying Funds are affiliated with Legg Mason, Inc. and more information about the Underlying Funds is available at www.leggmason.com/mutualfunds. |

| (b) | Prior to April 1, 2016, QS Batterymarch International Equity Fund. |

| (c) | Prior to April 1, 2016, QS Legg Mason Strategic Real Return Fund. |

| (d) | Prior to January 4, 2016, ClearBridge Mid Cap Core Fund. |

| (e) | Prior to April 1, 2016, QS Batterymarch Global Dividend Fund. |

| (f) | Prior to April 1, 2016, QS Batterymarch U.S. Large Cap Equity Fund. |

| # | Aggregate cost for federal income tax purposes is substantially the same. |

See Notes to Financial Statements.

| | |

| QS Variable Asset Allocation Series 2016 Semi-Annual Report | | 5 |

Schedules of investments (unaudited) (cont’d)

June 30, 2016

QS Variable Moderate Growth

| | | | | | | | | | | | | | |

| Description | | | | | | | Shares | | | Value | |

| Investments in Underlying Funds(a) — 99.8% | | | | | | | | | | | | | | |

Legg Mason Global Asset Management Trust: | | | | | | | | | | | | | | |

Legg Mason BW Diversified Large Cap Value Fund, Class IS Shares | | | | | | | | | 217,720 | | | $ | 3,916,782 | |

QS International Equity Fund, Class IS Shares | | | | | | | | | 247,282 | | | | 3,375,396 | (b) |

QS Strategic Real Return Fund, Class IS Shares | | | | | | | | | 206,058 | | | | 2,400,577 | (c) |

Legg Mason Partners Equity Trust: | | | | | | | | | | | | | | |

ClearBridge Aggressive Growth Fund, Class IS Shares | | | | | | | | | 10,271 | | | | 2,064,950 | |

ClearBridge Appreciation Fund, Class IS Shares | | | | | | | | | 150,181 | | | | 3,096,729 | |

ClearBridge International Value Fund, Class IS Shares | | | | | | | | | 156,233 | | | | 1,407,659 | |

ClearBridge Large Cap Growth Fund, Class IS Shares | | | | | | | | | 28,163 | | | | 1,009,917 | |

ClearBridge Mid Cap Fund, Class IS Shares | | | | | | | | | 48,113 | | | | 1,518,921 | (d) |

ClearBridge Small Cap Growth Fund, Class IS Shares | | | | | | | | | 78,291 | | | | 2,095,065 | |

QS Global Dividend Fund, Class IS Shares | | | | | | | | | 328,165 | | | | 3,918,288 | (e) |

QS U.S. Large Cap Equity Fund, Class IS Shares | | | | | | | | | 163,612 | | | | 2,535,982 | (f) |

The Royce Fund — Royce Small-Cap Value Fund, Institutional Class Shares | | | | | | | | | 276,020 | | | | 2,495,223 | |

Western Asset Funds, Inc.: | | | | | | | | | | | | | | |

Western Asset Core Bond Fund, Class IS Shares | | | | | | | | | 45,109 | | | | 572,879 | |

Western Asset Core Plus Bond Fund, Class IS Shares | | | | | | | | | 339,894 | | | | 4,034,547 | |

Western Asset High Yield Fund, Class IS Shares | | | | | | | | | 237,749 | | | | 1,849,687 | |

Western Asset Macro Opportunities Fund, Class IS Shares | | | | | | | | | 140,053 | | | | 1,478,963 | |

Total Investments in Underlying Funds before Short-Term Investments (Cost — $30,252,660) | | | | | | | | | | 37,771,565 | |

| | | | |

| | | Rate | | | | | | | | | |

| Short-Term Investments — 0.1% | | | | | | | | | | | | | | |

State Street Institutional Liquid Reserves Fund, Premier Class (Cost — $29,848) | | | 0.479 | % | | | | | 29,848 | | | | 29,848 | |

Total Investments — 99.9% (Cost — $30,282,508#) | | | | | | | | | | | | | 37,801,413 | |

Other Assets in Excess of Liabilities — 0.1% | | | | | | | | | | | | | 21,467 | |

Total Net Assets — 100.0% | | | | | | | | | | | | $ | 37,822,880 | |

| (a) | Underlying Funds are affiliated with Legg Mason, Inc. and more information about the Underlying Funds is available at www.leggmason.com/mutualfunds. |

| (b) | Prior to April 1, 2016, QS Batterymarch International Equity Fund. |

| (c) | Prior to April 1, 2016, QS Legg Mason Strategic Real Return Fund. |

| (d) | Prior to January 4, 2016, ClearBridge Mid Cap Core Fund. |

| (e) | Prior to April 1, 2016, QS Batterymarch Global Dividend Fund. |

| (f) | Prior to April 1, 2016, QS Batterymarch U.S. Large Cap Equity Fund. |

| # | Aggregate cost for federal income tax purposes is substantially the same. |

See Notes to Financial Statements.

| | |

| 6 | | QS Variable Asset Allocation Series 2016 Semi-Annual Report |

QS Variable Conservative Growth

| | | | | | | | | | | | | | |

| Description | | | | | | | Shares | | | Value | |

| Investments in Underlying Funds(a) — 99.9% | | | | | | | | | | | | | | |

Legg Mason Global Asset Management Trust: | | | | | | | | | | | | | | |

Legg Mason BW Diversified Large Cap Value Fund, Class IS Shares | | | | | | | | | 365,270 | | | $ | 6,571,208 | |

QS International Equity Fund, Class IS Shares | | | | | | | | | 333,652 | | | | 4,554,354 | (b) |

QS Strategic Real Return Fund, Class IS Shares | | | | | | | | | 516,351 | | | | 6,015,490 | (c) |

Legg Mason Partners Equity Trust: | | | | | | | | | | | | | | |

ClearBridge Aggressive Growth Fund, Class IS Shares | | | | | | | | | 16,473 | | | | 3,311,917 | |

ClearBridge Appreciation Fund, Class IS Shares | | | | | | | | | 264,123 | | | | 5,446,224 | |

ClearBridge International Value Fund, Class IS Shares | | | | | | | | | 321,995 | | | | 2,901,175 | |

ClearBridge Large Cap Growth Fund, Class IS Shares | | | | | | | | | 41,250 | | | | 1,479,232 | |

ClearBridge Mid Cap Fund, Class IS Shares | | | | | | | | | 74,808 | | | | 2,361,678 | (d) |

ClearBridge Small Cap Growth Fund, Class IS Shares | | | | | | | | | 186,471 | | | | 4,989,975 | |

QS Global Dividend Fund, Class IS Shares | | | | | | | | | 818,619 | | | | 9,774,311 | (e) |

QS U.S. Large Cap Equity Fund, Class IS Shares | | | | | | | | | 232,858 | | | | 3,609,299 | (f) |

The Royce Fund — Royce Small-Cap Value Fund, Institutional Class Shares | | | | | | | | | 471,171 | | | | 4,259,383 | |

Western Asset Funds, Inc.: | | | | | | | | | | | | | | |

Western Asset Core Bond Fund, Class IS Shares | | | | | | | | | 626,229 | | | | 7,953,109 | |

Western Asset Core Plus Bond Fund, Class IS Shares | | | | | | | | | 1,760,469 | | | | 20,896,768 | |

Western Asset High Yield Fund, Class IS Shares | | | | | | | | | 848,672 | | | | 6,602,669 | |

Western Asset Macro Opportunities Fund, Class IS Shares | | | | | | | | | 391,947 | | | | 4,138,962 | |

Total Investments — 99.9% (Cost — $79,428,378#) | | | | | | | | | | | | | 94,865,754 | |

Other Assets in Excess of Liabilities — 0.1% | | | | | | | | | | | | | 109,081 | |

Total Net Assets — 100.0% | | | | | | | | | | | | $ | 94,974,835 | |

| (a) | Underlying Funds are affiliated with Legg Mason, Inc. and more information about the Underlying Funds is available at www.leggmason.com/mutualfunds. |

| (b) | Prior to April 1, 2016, QS Batterymarch International Equity Fund. |

| (c) | Prior to April 1, 2016, QS Legg Mason Strategic Real Return Fund. |

| (d) | Prior to January 4, 2016, ClearBridge Mid Cap Core Fund. |

| (e) | Prior to April 1, 2016, QS Batterymarch Global Dividend Fund. |

| (f) | Prior to April 1, 2016, QS Batterymarch U.S. Large Cap Equity Fund. |

| # | Aggregate cost for federal income tax purposes is substantially the same. |

See Notes to Financial Statements.

| | |

| QS Variable Asset Allocation Series 2016 Semi-Annual Report | | 7 |

Statements of assets and liabilities (unaudited)

June 30, 2016

| | | | | | | | | | | | |

| | | QS Variable

Growth | | | QS Variable

Moderate

Growth | | | QS Variable

Conservative

Growth | |

| | | |

| Assets: | | | | | | | | | | | | |

Investments in affiliated Underlying Funds, at cost | | $ | 86,460,531 | | | $ | 30,252,660 | | | $ | 79,428,378 | |

Short-term investments, at cost | | | 88,727 | | | | 29,848 | | | | — | |

Investments in affiliated Underlying Funds, at value | | $ | 107,415,662 | | | $ | 37,771,565 | | | $ | 94,865,754 | |

Short-term investments, at value | | | 88,727 | | | | 29,848 | | | | — | |

Receivable for Underlying Funds sold | | | 120,000 | | | | 50,000 | | | | 240,000 | |

Receivable for Portfolio shares sold | | | 235 | | | | 140 | | | | — | |

Interest receivable | | | 47 | | | | 19 | | | | 38 | |

Receivable from investment manager | | | — | | | | 1,338 | | | | — | |

Prepaid expenses | | | 439 | | | | 217 | | | | 408 | |

Total Assets | | | 107,625,110 | | | | 37,853,127 | | | | 95,106,200 | |

| | | |

| Liabilities: | | | | | | | | | | | | |

Payable for Portfolio shares repurchased | | | 10,220 | | | | 2,510 | | | | 42,956 | |

Trustees’ fees payable | | | 1,102 | | | | 391 | | | | 977 | |

Due to custodian | | | — | | | | — | | | | 50,720 | |

Accrued expenses | | | 34,653 | | | | 27,346 | | | | 36,712 | |

Total Liabilities | | | 45,975 | | | | 30,247 | | | | 131,365 | |

| Total Net Assets | | $ | 107,579,135 | | | $ | 37,822,880 | | | $ | 94,974,835 | |

| | | |

| Net Assets: | | | | | | | | | | | | |

Par value (Note 5) | | $ | 78 | | | $ | 27 | | | $ | 65 | |

Paid-in capital in excess of par value | | | 92,821,545 | | | | 32,822,281 | | | | 86,568,022 | |

Undistributed net investment income | | | 118,019 | | | | 102,135 | | | | 676,255 | |

Accumulated net realized loss on affiliated Underlying Funds and capital gain distributions from affiliated Underlying Funds | | | (6,315,638) | | | | (2,620,468) | | | | (7,706,883) | |

Net unrealized appreciation on affiliated Underlying Funds | | | 20,955,131 | | | | 7,518,905 | | | | 15,437,376 | |

| Total Net Assets | | $ | 107,579,135 | | | $ | 37,822,880 | | | $ | 94,974,835 | |

| | | |

| Shares Outstanding | | | 7,834,253 | | | | 2,689,174 | | | | 6,548,225 | |

| | | |

| Net Asset Value | | | $13.73 | | | | $14.06 | | | | $14.50 | |

See Notes to Financial Statements.

| | |

| 8 | | QS Variable Asset Allocation Series 2016 Semi-Annual Report |

Statements of operations (unaudited)

For the Six Months Ended June 30, 2016

| | | | | | | | | | | | |

| | | QS Variable

Growth | | | QS Variable

Moderate

Growth | | | QS Variable

Conservative

Growth | |

| | | |

| Investment Income: | | | | | | | | | | | | |

Income distributions from affiliated Underlying Funds | | $ | 216,810 | | | $ | 178,149 | | | $ | 778,373 | |

Interest | | | 285 | | | | 98 | | | | 246 | |

Total Investment Income | | | 217,095 | | | | 178,247 | | | | 778,619 | |

| | | |

| Expenses: | | | | | | | | | | | | |

Legal fees | | | 18,013 | | | | 16,442 | | | | 17,322 | |

Audit and tax fees | | | 14,525 | | | | 14,378 | | | | 14,498 | |

Shareholder reports | | | 12,879 | | | | 7,627 | | | | 15,854 | |

Fund accounting fees | | | 5,500 | | | | 1,940 | | | | 4,759 | |

Trustees’ fees | | | 3,897 | | | | 1,371 | | | | 3,428 | |

Insurance | | | 1,295 | | | | 637 | | | | 1,201 | |

Transfer agent fees | | | 265 | | | | 50 | | | | 49 | |

Custody fees | | | 7 | | | | 10 | | | | 13 | |

Miscellaneous expenses | | | 702 | | | | 640 | | | | 692 | |

Total Expenses | | | 57,083 | | | | 43,095 | | | | 57,816 | |

Less: Fee waivers and/or expense reimbursements (Note 2) | | | — | | | | (5,608) | | | | — | |

Net Expenses | | | 57,083 | | | | 37,487 | | | | 57,816 | |

| Net Investment Income | | | 160,012 | | | | 140,760 | | | | 720,803 | |

| | | |

Realized and Unrealized Loss on Affiliated Underlying Funds

and Capital Gain Distributions From Affiliated Underlying Funds (Notes 1 and 3): | | | | | | | | | | | | |

Net Realized Gain (Loss) From: | | | | | | | | | | | | |

Sale of affiliated Underlying Funds | | | (752,431) | | | | (263,873) | | | | (361,030) | |

Capital gain distributions from affiliated Underlying Funds | | | 2,256 | | | | 742 | | | | 1,153 | |

Net Realized Loss | | | (750,175) | | | | (263,131) | | | | (359,877) | |

Change in Net Unrealized Appreciation (Depreciation) | | | 1,339,189 | | | | 760,076 | | | | 2,635,979 | |

| Net Gain on Affiliated Underlying Funds and Capital Gain Distributions From Affiliated Underlying Funds | | | 589,014 | | | | 496,945 | | | | 2,276,102 | |

| Increase in Net Assets From Operations | | $ | 749,026 | | | $ | 637,705 | | | $ | 2,996,905 | |

See Notes to Financial Statements.

| | |

| QS Variable Asset Allocation Series 2016 Semi-Annual Report | | 9 |

Statements of changes in net assets

QS Variable Growth

| | | | | | | | |

For the Six Months Ended June 30, 2016 (unaudited)

and the Year Ended December 31, 2015 | | 2016 | | | 2015 | |

| | |

| Operations: | | | | | | | | |

Net investment income | | $ | 160,012 | | | $ | 1,415,380 | |

Net realized gain (loss) | | | (750,175) | | | | 15,123,539 | |

Change in net unrealized appreciation (depreciation) | | | 1,339,189 | | | | (18,986,953) | |

Increase (Decrease) in Net Assets From Operations | | | 749,026 | | | | (2,448,034) | |

| | |

| Distributions to Shareholders From (Note 1): | | | | | | | | |

Net investment income | | | (60,004) | | | | (1,600,009) | |

Net realized gains | | | (3,763,375) | | | | (12,915,081) | |

Decrease in Net Assets From Distributions to Shareholders | | | (3,823,379) | | | | (14,515,090) | |

| | |

| Portfolio Share Transactions (Note 5): | | | | | | | | |

Net proceeds from sale of shares | | | 886,311 | | | | 1,560,143 | |

Reinvestment of distributions | | | 3,823,379 | | | | 14,515,090 | |

Cost of shares repurchased | | | (5,428,342) | | | | (12,192,039) | |

Increase (Decrease) in Net Assets From Portfolio Share Transactions | | | (718,652) | | | | 3,883,194 | |

Decrease in Net Assets | | | (3,793,005) | | | | (13,079,930) | |

| | |

| Net Assets: | | | | | | | | |

Beginning of period | | | 111,372,140 | | | | 124,452,070 | |

End of period* | | $ | 107,579,135 | | | $ | 111,372,140 | |

* Includes undistributed net investment income of: | | | $118,019 | | | | $18,011 | |

See Notes to Financial Statements.

| | |

| 10 | | QS Variable Asset Allocation Series 2016 Semi-Annual Report |

QS Variable Moderate Growth

| | | | | | | | |

For the Six Months Ended June 30, 2016 (unaudited)

and the Year Ended December 31, 2015 | | 2016 | | | 2015 | |

| | |

| Operations: | | | | | | | | |

Net investment income | | $ | 140,760 | | | $ | 628,242 | |

Net realized gain (loss) | | | (263,131) | | | | 6,159,358 | |

Change in net unrealized appreciation (depreciation) | | | 760,076 | | | | (7,439,052) | |

Increase (Decrease) in Net Assets From Operations | | | 637,705 | | | | (651,452) | |

| | |

| Distributions to Shareholders From (Note 1): | | | | | | | | |

Net investment income | | | (100,002) | | | | (725,001) | |

Net realized gains | | | (295,218) | | | | — | |

Decrease in Net Assets From Distributions to Shareholders | | | (395,220) | | | | (725,001) | |

| | |

| Portfolio Share Transactions (Note 5): | | | | | | | | |

Net proceeds from sale of shares | | | 60,956 | | | | 213,491 | |

Reinvestment of distributions | | | 395,220 | | | | 725,001 | |

Cost of shares repurchased | | | (2,495,684) | | | | (7,585,404) | |

Decrease in Net Assets From Portfolio Share Transactions | | | (2,039,508) | | | | (6,646,912) | |

Decrease in Net Assets | | | (1,797,023) | | | | (8,023,365) | |

| | |

| Net Assets: | | | | | | | | |

Beginning of period | | | 39,619,903 | | | | 47,643,268 | |

End of period* | | $ | 37,822,880 | | | $ | 39,619,903 | |

* Includes undistributed net investment income of: | | | $102,135 | | | | $61,377 | |

See Notes to Financial Statements.

| | |

| QS Variable Asset Allocation Series 2016 Semi-Annual Report | | 11 |

Statements of changes in net assets (cont’d)

QS Variable Conservative Growth

| | | | | | | | |

For the Six Months Ended June 30, 2016 (unaudited)

and the Year Ended December 31, 2015 | | 2016 | | | 2015 | |

| | |

| Operations: | | | | | | | | |

Net investment income | | $ | 720,803 | | | $ | 2,122,387 | |

Net realized gain (loss) | | | (359,877) | | | | 10,539,381 | |

Change in net unrealized appreciation (depreciation) | | | 2,635,979 | | | | (13,724,749) | |

Increase (Decrease) in Net Assets From Operations | | | 2,996,905 | | | | (1,062,981) | |

| | |

| Distributions to Shareholders From (Note 1): | | | | | | | | |

Net investment income | | | (215,006) | | | | (2,050,008) | |

Decrease in Net Assets From Distributions to Shareholders | | | (215,006) | | | | (2,050,008) | |

| | |

| Portfolio Share Transactions (Note 5): | | | | | | | | |

Net proceeds from sale of shares | | | 693,185 | | | | 3,544,796 | |

Reinvestment of distributions | | | 215,006 | | | �� | 2,050,008 | |

Cost of shares repurchased | | | (6,738,992) | | | | (18,655,969) | |

Decrease in Net Assets From Portfolio Share Transactions | | | (5,830,801) | | | | (13,061,165) | |

Decrease in Net Assets | | | (3,048,902) | | | | (16,174,154) | |

| | |

| Net Assets: | | | | | | | | |

Beginning of period | | | 98,023,737 | | | | 114,197,891 | |

End of period* | | $ | 94,974,835 | | | $ | 98,023,737 | |

* Includes undistributed net investment income of: | | | $676,255 | | | | $170,458 | |

See Notes to Financial Statements.

| | |

| 12 | | QS Variable Asset Allocation Series 2016 Semi-Annual Report |

Financial highlights

QS Variable Growth

| | | | | | | | | | | | | | | | | | | | | | | | |

| For a share of beneficial interest outstanding throughout each year ended December 31, unless otherwise noted: | |

| | | 20161,2 | | | 20151 | | | 20141 | | | 20131 | | | 20121 | | | 2011 | |

| | | | | | |

| Net asset value, beginning of period | | | $14.12 | | | | $16.45 | | | | $16.51 | | | | $13.26 | | | | $11.65 | | | | $12.11 | |

| | | | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.02 | | | | 0.19 | | | | 0.19 | | | | 0.15 | | | | 0.23 | 3 | | | 0.20 | 3 |

Net realized and unrealized gain (loss) | | | 0.09 | | | | (0.52) | | | | 0.59 | | | | 3.35 | | | | 1.61 | | | | (0.48) | |

Total income (loss) from operations | | | 0.11 | | | | (0.33) | | | | 0.78 | | | | 3.50 | | | | 1.84 | | | | (0.28) | |

| | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.01) | | | | (0.21) | | | | (0.30) | | | | (0.25) | | | | (0.23) | | | | (0.18) | |

Net realized gains | | | (0.49) | | | | (1.79) | | | | (0.54) | | | | — | | | | — | | | | — | |

Total distributions | | | (0.50) | | | | (2.00) | | | | (0.84) | | | | (0.25) | | | | (0.23) | | | | (0.18) | |

| | | | | | |

| Net asset value, end of period | | | $13.73 | | | | $14.12 | | | | $16.45 | | | | $16.51 | | | | $13.26 | | | | $11.65 | |

Total return4 | | | 0.71 | % | | | (2.23) | % | | | 4.69 | % | | | 26.50 | % | | | 15.89 | % | | | (2.31) | % |

| | | | | | |

| Net assets, end of period (000s) | | | $107,579 | | | | $111,372 | | | | $124,452 | | | | $129,601 | | | | $111,929 | | | | $100,037 | |

| | | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses5 | | | 0.11 | %6 | | | 0.12 | % | | | 0.08 | % | | | 0.11 | % | | | 0.11 | % | | | 0.11 | % |

Net expenses5,7 | | | 0.11 | 6 | | | 0.12 | | | | 0.08 | | | | 0.11 | | | | 0.11 | | | | 0.11 | |

Net investment income | | | 0.30 | 6 | | | 1.17 | | | | 1.12 | | | | 0.98 | | | | 1.85 | 3 | | | 1.64 | 3 |

| | | | | | |

| Portfolio turnover rate | | | 6 | % | | | 54 | %8 | | | 19 | % | | | 9 | % | | | 14 | % | | | 40 | % |

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | For the six months ended June 30, 2016 (unaudited). |

| 3 | Net investment income includes short-term capital gain distributions from Underlying Funds. |

| 4 | Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Total returns do not reflect expenses associated with separate accounts such as administrative fees, account charges and surrender charges which, if reflected, would reduce the total return for all periods shown. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 5 | Does not include fees and expenses of the Underlying Funds in which the Portfolio invests. |

| 7 | As a result of an expense limitation arrangement, the ratio of expenses, other than interest, brokerage, taxes, extraordinary expenses and acquired fund fees and expenses (fees and expenses of Underlying Funds), to average net assets of shares did not exceed 0.20%. This expense limitation arrangement cannot be terminated prior to December 31, 2017 without the Board of Trustees’ consent. |

| 8 | Excludes the value of securities received in lieu of cash proceeds from the sale of Underlying Funds and the subsequent sale of those securities. |

See Notes to Financial Statements.

| | |

| QS Variable Asset Allocation Series 2016 Semi-Annual Report | | 13 |

Financial highlights (cont’d)

QS Variable Moderate Growth

| | | | | | | | | | | | | | | | | | | | | | | | |

| For a share of beneficial interest outstanding throughout each year ended December 31, unless otherwise noted: | |

| | | 20161,2 | | | 20151 | | | 20141 | | | 20131 | | | 20121 | | | 2011 | |

| | | | | | |

| Net asset value, beginning of period | | | $13.95 | | | | $14.46 | | | | $14.05 | | | | $11.71 | | | | $10.47 | | | | $10.74 | |

| | | | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.05 | | | | 0.21 | | | | 0.21 | | | | 0.15 | | | | 0.21 | 3 | | | 0.22 | 3 |

Net realized and unrealized gain (loss) | | | 0.21 | | | | (0.46) | | | | 0.48 | | | | 2.40 | | | | 1.31 | | | | (0.28) | |

Total income (loss) from operations | | | 0.26 | | | | (0.25) | | | | 0.69 | | | | 2.55 | | | | 1.52 | | | | (0.06) | |

| | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.04) | | | | (0.26) | | | | (0.28) | | | | (0.21) | | | | (0.28) | | | | (0.21) | |

Net realized gains | | | (0.11) | | | | — | | | | — | | | | — | | | | — | | | | — | |

Total distributions | | | (0.15) | | | | (0.26) | | | | (0.28) | | | | (0.21) | | | | (0.28) | | | | (0.21) | |

| | | | | | |

| Net asset value, end of period | | | $14.06 | | | | $13.95 | | | | $14.46 | | | | $14.05 | | | | $11.71 | | | | $10.47 | |

Total return4 | | | 1.83 | % | | | (1.79) | % | | | 4.91 | % | | | 21.82 | % | | | 14.60 | % | | | (0.58) | % |

| | | | | | |

| Net assets, end of period (000s) | | | $37,823 | | | | $39,620 | | | | $47,643 | | | | $52,761 | | | | $52,113 | | | | $56,301 | |

| | | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses5 | | | 0.23 | %6 | | | 0.27 | % | | | 0.16 | % | | | 0.18 | % | | | 0.17 | % | | | 0.14 | % |

Net expenses5,7 | | | 0.20 | 6,8 | | | 0.20 | 8 | | | 0.16 | | | | 0.18 | | | | 0.17 | 8 | | | 0.14 | |

Net investment income | | | 0.75 | 6 | | | 1.43 | | | | 1.44 | | | | 1.17 | | | | 1.90 | 3 | | | 1.83 | 3 |

| | | | | | |

| Portfolio turnover rate | | | 6 | % | | | 57 | %9 | | | 17 | % | | | 9 | % | | | 11 | % | | | 30 | % |

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | For the six months ended June 30, 2016 (unaudited). |

| 3 | Net investment income includes short-term capital gain distributions from Underlying Funds. |