As filed with the Securities and Exchange Commission on March 19, 2007 Registration No. 333-140133

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 2 TO

FORM SB-2

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CHINA BIOPHARMA, INC.

(Name of Small Business Issuer in its Charter)

| Delaware | 2834 |

(State or Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) |

31 Airpark Road, Princeton, New Jersey 08540

(609) 651-8588

(Address and Telephone Number of Principal Executive Offices

and Principal Place of Business)

Peter Wang, Chief Executive Officer

31 Airpark Road

Princeton, New Jersey 08540

(609) 651-8588

(Name, Address and Telephone Number of Agent for Service)

Mitchell S. Nussbaum, Esq.

Angela M. Dowd, Esq.

Loeb & Loeb LLP

345 Park Avenue

New York, New York 10154

(212) 407-4000

Approximate date of proposed sale to the public: From time to time after this registration statement becomes effective.

Approximate date of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If this Form is filed to register securities for an offering to be made on a continuous or delayed basis, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. o

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered | | Amount to be registered | | Proposed maximum offering price per unit(1) | | Proposed maximum aggregate offering price(1) | | Amount of registration fee | |

| Common Stock, par value $0.0001 per share | | | 18,000,000 shares | (2)(3) | $ | 0.383 | | $ | 6,894,000 | | $ | 737.66 | |

| Common Stock, par value $0.0001 per share | | | 14,400,000 shares | (3)(4) | $ | 0.383 | | $ | 5,512,200 | | $ | 589.80 | |

| Total | | | 32,400,000 shares | (3) | | | | | | | $ | 1,327.46 | (5) |

(1) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities Act of 1933, as amended, based on the average of the closing bid and asked prices on January 18, 2007, as reported by the OTC Bulletin Board.

(2) The 18,000,000 shares of common stock are being registered (i) for resale by the Selling Stockholders named in this registration statement following the issuance of such shares by the registrant upon the repayment of principal and interest on $3,000,000 aggregate principal amount outstanding of China Biopharma, Inc.’s Secured Convertible Promissory Notes due December 13, 2008 (the “Notes”) and/or (ii) for resale by the Selling Stockholders named in this registration statement, following the issuance of such shares by the registrant upon the conversion of the Notes by the holders thereof at an initial conversion price of $0.25 per share, subject to adjustment in certain circumstances.

(3) Pursuant to Rule 416 under the Securities Act of 1933, as amended, the Registrant is also registering such additional indeterminate number of shares as may become necessary to adjust the number of shares as a result of a stock split, stock dividend or similar adjustment of its outstanding common stock.

(4) The 14,400,000 shares of common stock are being registered for resale by the Selling Stockholders named in this registration statement, which shares are issuable by the registrant upon the exercise of warrants to purchase the registrant’s Common Stock.

(5) Previously paid.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said section 8(a), may determine.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THE SELLING STOCKHOLDERS MAY NOT SELL THESE SECURITIES PUBLICLY UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, DATED MARCH 19, 2007

PRELIMINARY PROSPECTUS

32,400,000 SHARES OF COMMON STOCK

CHINA BIOPHARMA, INC.

COMMON STOCK

This prospectus relates to the sale by the Selling Stockholders identified in this prospectus of up to a total of 18,000,000 shares of our common stock following the issuance of such shares by the Company (i) upon the repayment of principal and interest on the outstanding $3,000,000 aggregate principal amount of our Secured Convertible Promissory Notes due December 13, 2008 (the “Notes”) and/or (ii) upon the conversion of the Notes by the holders thereof at an initial conversion price of $0.25 per share subject to adjustment under certain circumstances (collectively, the “Note Shares”).

This prospectus also relates to the sale by the Selling Stockholders identified in this prospectus of up to an aggregate of 14,400,000 shares of our common stock issuable upon the exercise of common stock purchase warrants (collectively, the “Warrant Shares”), which includes:

| · | 6,000,000 shares of our common stock issuable upon the exercise of Class A Warrants to purchase our common stock. The Class A Warrants were issued in connection with the issuance and sale of the Notes and have an exercise price of $0.30 per share subject to adjustment under certain circumstances; |

| · | 6,000,000 shares of our common stock issuable upon the exercise of Class B Warrants to purchase our common stock. The Class B Warrants were issued in connection with the issuance and sale of the Notes and have an exercise price of $0.40 per share subject to adjustment under certain circumstances; and |

| · | 2,400,000 shares of our common stock issuable upon the exercise of Finders Warrants to purchase our common stock. The Finders Warrants were issued in connection with the issuance and sale of the Notes and have an exercise price of $0.30 per share subject to adjustment under certain circumstances. |

We will not receive any of the proceeds from the sale of shares by the Selling Stockholders. However, we will receive the proceeds from any exercise of warrants to purchase the Warrant Shares to be sold hereunder to the extent that the Selling Stockholders do not perform cashless exercises. We will also receive the benefit of the reduction in our outstanding indebtedness in consideration for the issuance of the Note Shares to be sold hereunder. See “Use of Proceeds.”

We have agreed to pay the expenses in connection with the registration of these shares.

Our common stock is quoted on the OTC Bulletin Board (“OTCBB”) under the trading symbol “CBPC.” The last reported bid price for our common stock on the OTCBB on March 14, 2007 was $0.14 per share.

Investing in our common stock involves risk. You should carefully consider the risk factors beginning on page 12 of this prospectus before purchasing share of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is [ ], 2007

TABLE OF CONTENTS

| | Page |

| SUMMARY | 1 |

| | |

| NOTE REGARDING FORWARD-LOOKING STATEMENTS | 5 |

| | |

| THE OFFERING | 6 |

| | |

| CERTAIN DISCLOSURE REGARDING CONVERSION OF NOTES AND EXERCISE OF WARRANTS | 6 |

| | |

| RISK FACTORS | 12 |

| | |

| USE OF PROCEEDS | 25 |

| | |

| SELECTED CONSOLIDATED FINANCIAL DATA | 26 |

| | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION | 27 |

| | |

| DESCRIPTION OF BUSINESS | 35 |

| | |

| DIRECTORS AND EXECUTIVE OFFICERS | 43 |

| | |

| EXECUTIVE COMPENSATION | 44 |

| | |

| BUSINESS RELATIONSHIPS AND RELATED TRANSACTIONS | 51 |

| | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 52 |

| | |

| SELLING STOCKHOLDERS | 54 |

| | |

| PLAN OF DISTRIBUTION | 58 |

| | |

| DESCRIPTION OF SECURITIES | 60 |

| | |

| DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES | 62 |

| | |

| LEGAL MATTERS | 63 |

| | |

| EXPERTS | 63 |

| | |

| WHERE YOU CAN FIND MORE INFORMATION | 63 |

SUMMARY

This summary highlights material information about us that is described more fully elsewhere in this prospectus. It may not contain all of the information that you find important. You should carefully read this entire document, including the “Risk Factors” section beginning on page 12 of this prospectus and our financial statements and their related notes to those statements appearing elsewhere in this prospectus before making a decision to invest in our common stock. Unless otherwise indicated in this prospectus or the context otherwise requires, references to “we,” “us,” “Techedge,” “the Company” or “our Company” refer to China Biopharma, Inc. and its consolidated subsidiaries.

The Company is a provider of biopharmaceutical products with its focus mainly in human vaccines. Currently, the Company develops its products in China and distributes these products in China and in one other country. The Company has established its distribution and development platform in China through its acquisition of its interest in its subsidiary, Hainan CITIC Bio-pharmaceutical Development Co., Ltd. (“HCBD”) and through its joint venture with Zhejiang Tianyuan Bio-pharmaceutical Co., Ltd.

The emphasis of the Company’s business is on the development of technology and the marketing of products rather than on manufacturing. It is the Company’s goal to operate efficiently and in compliance with applicable regulations and to reduce the risk of any potential factory contaminations with respect to its products. The Company believes that to date, it has been successful in establishing business relationships with a number of local and global manufacturers with the goal of introducing the most advanced technologies and best products to the market in a timely fashion. The Company believes that it has built an experienced and capable management team that will be able to work toward successfully implementing its business plan. As of December 31, 2006, we employed 57 individuals in the United States and China.

Products and Services

The Company’s products are mainly human vaccines for preventing and treating various diseases and illnesses. Currently, the Company provides and distributes its products in China and also exports them to Macedonia.

Preventive Vaccines

The Company currently distributes influenza vaccines manufactured by its joint venture partner, Zhejiang Tianyuan Bio-pharmaceutical Co., Ltd. Flu vaccine is a seasonal product that is used mainly during late the fall and early winter seasons. Every year, the World Health Organization makes recommendations as to what virus strain should be used for the upcoming season and vaccines are manufactured based upon such recommendations.

The Company plans to distribute more preventive vaccines in China once they becoming available, including vaccines for Japanese encephalitis, hepatitis B, allergies, and rabies.

Immunotherapy Products

Immunotherapy (also known as biologic therapy or biotherapy) is a treatment that focuses on certain parts of the immune system to fight various diseases, including cancer. This may be done by either:

| · | Stimulating a patient’s own immune system to work harder or smarter; or |

| · | Giving a patient’s immune system certain natural or man-made components, such as synthetic immune system proteins |

Immunotherapy is sometimes used by itself to treat cancer and other illness, but it is most often used along with or after another type of treatment to add to its effects.

Currently, the Company is working with several international companies on a number of immunotherapy products, including therapeutic vaccines to treat cancers and other illnesses for the Chinese and international markets. In order to bring such product into a country, the local regulations usually require the performance of specific clinical studies and the registration of the subject products.

Other Products and Services

Through its subsidiary, HCBD, the Company may also utilize its distribution platforms and logistics to distribute other medical products and to provide logistic services for other biopharmaceutical companies.

Corporate Summary

The Company was incorporated as Techedge, Inc. (“Techedge”) in Delaware in July 2002 to serve as the successor to the business and interests of BSD Development Partners, LTD. (“BSD”). BSD was a Delaware limited partnership formed in 1997 for the purpose of investing in the intellectual property of emerging and established companies BSD endeavored to continue the business of BSD and sought to enhance the liquidity of the securities owned by its investors merged with Techedge in September 2002. From September 2002 until June 2004, Techedge endeavored to continue the business of BSD and sought to enhance the liquidity of the securities owned by its investors by becoming subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and by seeking to have its common stock quoted on the OTC Bulletin Board, or “OTCBB."

On June 9, 2004, Techedge acquired all of the issued and outstanding stock of China Quantum Communication Limited (“CQCL”) pursuant to a share exchange agreement, by and among Techedge, certain of its stockholders, CQCL and its stockholders (the “Share Exchange”). Following the Share Exchange, Techedge refocused its business efforts on developing and providing its IP-based Personal Communication Service, a regional mobile VoIP service delivered on unlicensed low power PCS frequencies through IP-enabled local transceiver and IP centric soft-switched networks, operating on an advanced proprietary software centric multi-service global communication service platform and management system. Techedge continued operating CQCL’s communications service business through CQCL and CQCL’s wholly-owned subsidiaries, China Quantum Communications Inc., a Delaware corporation, and Guang Tong Wang Luo (China) Co. Ltd. (also known as Quantum Communications (China) Co., Ltd.), a Chinese company (“QCCN”).

On January 26, 2006, the Company announced its plans to re-position itself for bio-pharmaceutical and other high growth opportunities in China, while continuing its commercialization of its high potential Mobile Voice over IP solutions.

In conjunction with the Company’s re-positioning plans, on February 27, 2006 the Company entered into an agreement to transfer ownership of its Chinese subsidiary Zheiiang Guang Tong Wang Luo Co., Ltd (ZJQC) to third parties. On January 1, 2006, the Company also entered into an agreement to transfer ownership of its U.S. subsidiary China Quantum Communications, Inc. to a former employee.

During the quarter ended June 30, 2006, the Company entered into a Share Exchange Agreement for the purpose of acquiring 100% of the outstanding capital stock of China BioPharma Limited (“CBL”) a Cayman Islands Company, which has rights to invest in Tianyuan Bio-Pharmaceuticals Company, Ltd. and Zhejiang Tianyuan Biotech Co., Ltd. (“ZTBC”). In exchange for 100% of the outstanding capital of CBL, the Company issued a total of 3,000,000 shares of restricted common stock.

On July 14, 2006, Techedge and China Biopharma, Inc, a Delaware corporation and a wholly-owned subsidiary of Techedge (“CB”) executed and delivered a Plan and Agreement of Merger whereby the parties agreed to merge CB with and into Techedge, with Techedge being the surviving corporation (the “Merger”). By virtue of, and effective upon the consummation of the Merger, the Certificate of Incorporation of the Company was amended to change its name from “Techedge, Inc.” to “China Biopharma, Inc.” The Merger became effective on August 10, 2006.

Subsidiaries

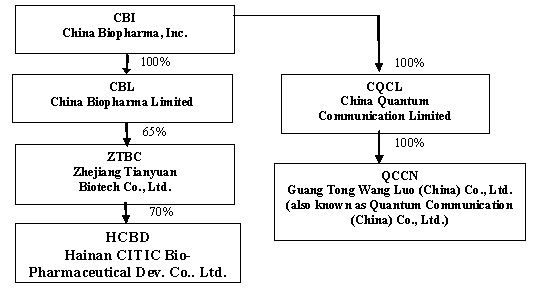

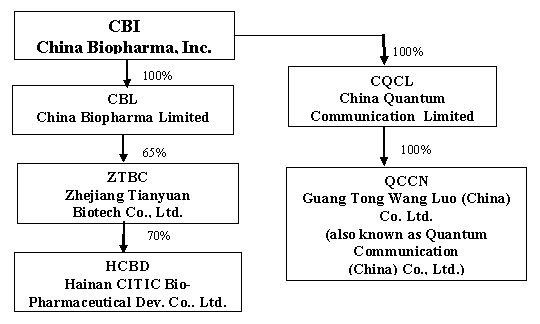

The Company currently has two operational segments. One segment, consisting of CBL and its subsidiaries, provides biopharmaceutical products. The other segment, which consists of CQCL and its subsidiary, was engaged in the business of providing telecommunications services and developing related technology. Following the Company’s re-positioning of its business focus from telecommunications to biopharmaceutical operations, CQCL ceased carrying on any daily business activities and is currently looking for strategic partners in order to continue its business. Set forth below is a graphic representation of the current organizational structure of the Company and its subsidiaries.

RECENT DEVELOPMENTS

Acquisitions and Investments

Zhejiang Tianyuan Biotech Co., Ltd.

On December 22, 2006, the Company paid $1,950,000 as consideration for a 65% interest in ZTBC. ZTBC is a Sino-US joint venture between CBL and Zhejiang Tianyuan Bio-pharmaceutical Co., Ltd. which owns the remaining 35% interest. ZTBC was formed to engage in the business of developing and marketing vaccines. The Company’s joint venture partner, Zhejiang Tianyuan Bio-pharmaceutical Co., Ltd, has agreed to perform all of the manufacturing functions on behalf of ZTBC.

Hainan CITIC Bio-pharmaceutical Development Co., Ltd.

In April 2006, ZTBC acquired 20% of the outstanding stock of HCBD from three individuals in consideration for a payment of $600,000; In August 2006, ZTBC acquired an additional 40% of the outstanding stock of HCBD from CITIC Pharmaceutical and China Biological Engineering Corporation in consideration for a payment of $1,200,000; In December 2006, ZTBC acquired another 10% of the outstanding stock of HCBD from one individual in consideration for a payment of $300,000. The remaining 30% of HCBD is owned by Zhejiang Tianyuan Bio-pharmaceutical Co., Ltd. (20%) and by one of its original owners (10%).

HCBD is a nationwide bio-pharmaceutical distributor in China and has established a distribution platform including “cold-chain” logistics which are the refrigeration logistics in the distribution chain. HCBD distributes the vaccines provided by local vaccine manufacturers, including ZTBC and Zhejiang Tianyuan Bio-pharmaceutical Co., Ltd and other bio-pharmaceutical products made by large global drug manufactures, such as Merck.

Financing Transaction

On December 13, 2006, the Company entered into a Subscription Agreement with respect to the issuance and sale of $3,000,000 aggregate principal amount of its Secured Convertible Promissory Notes due December 13, 2008. The Notes are convertible at the option of the holders at any time into shares of the Company’s common stock. Prior to the occurrence of an Event of Default (as defined in the Notes), the Notes are convertible at a per share conversion price equal to $0.25 per share. Following the occurrence of an Event of Default (as defined in the Notes), the Notes are convertible at the lesser of $0.25 per share and 75% of the average of the closing bid prices for the common stock for the five trading days prior to the date of conversion. The Notes bear interest at a rate of eight percent (8%) per annum. The Company’s obligation to make monthly payments, consisting of principal of and accrued interest on the Notes commenced on March 13, 2007. The Company may, at its option pay the monthly payments in the form of either cash or shares of common stock. In the event that the Company elects to pay the monthly amount in cash, the Company shall be obligated to pay 115% of the principal amount component of the monthly amount and 100% of all other components of the monthly amount. In the event that the Company elects to pay the monthly amount in shares of common stock, the stock shall be valued at an applicable conversion rate equal to the lesser of $0.25 per share or seventy five percent (75%) of the average of the closing bid price of the common stock on the principal market on which the common stock is then traded or included for quotation for the five trading days preceding the applicable repayment date. Provided that an Event of Default has not occurred, the Company may, at its option, prepay the outstanding principal amount of the Notes, in whole or in part, at any time upon 30 days written notice to the holders by paying 120% of the principal amount to be repaid together with accrued interest plus any other sums due thereon to the date of redemption. The Notes are secured by a Security Agreement entered into by and among the Company, CQCL, CBL, and QCCN and Barbara R. Mittman, as collateral agent for the purchasers of the Notes. The obligations of the Company under the Subscription Agreement with respect to the Notes and the Notes are guaranteed by the CQCL, CBL and QCCN pursuant to a Guaranty, dated as of December 13, 2006, entered into by the CQCL, CBL and QCCN, for the benefit of the purchasers of the Notes.

In connection with the sale of the Notes, the Company also issued to the purchasers of the Notes, Class A Warrants to purchase up to an aggregate of 6,000,000 shares of common stock and Class B Warrants to purchase up to an aggregate of 6,000,000 shares of common stock (each a “Warrant” and collectively, the “Warrants”). One Class A Warrant and one Class B Warrant were issued for each two shares of common stock that would have been issuable on the closing date assuming the complete conversion of the Notes on such date. The Class A Warrants have an exercise price of $0.30 per share and the Class B Warrants have an exercise price of $0.40.

Melton Management Ltd. acted as the finder with respect to the issuance and sale of the Notes and received a warrant to purchase 2,400,000 shares of our common stock at an exercise price of $0.30 per share.

As of March 14, 2007, the Company had 85,520,000 shares of common stock issued and outstanding.

Our principal executive offices are located at 31 Airpark Road, Princeton, New Jersey 08540. Our telephone number at that address is (609) 651-8588. Our corporate website is www.chinabiopharma.net. Information contained on or accessed through our website is not intended to constitute and shall not be deemed to constitute part of this prospectus.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

The statements contained in this Form SB-2 that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. These include statements about the Company’s expectations, beliefs, intentions or strategies for the future, which are indicated by words or phrases such as “anticipate,” “expect,” “intend,” “plan,” “will,” “the Company believes,” “management believes” and similar words or phrases. The forward-looking statements are based on the Company’s current expectations and are subject to certain risks, uncertainties and assumptions. The Company’s actual results could differ materially from results anticipated in these forward-looking statements. All forward-looking statements included in this document are based on information available to the Company on the date hereof, and the Company assumes no obligation to update any such forward-looking statements.

THE OFFERING

| Common stock being offered by Selling Stockholders | Up to 32,400,000 shares |

| | |

| OTCBB Symbol | CBPC |

| | |

| Risk Factors | The securities offered by this prospectus are speculative and involve a high degree of risk and investors purchasing securities should not purchase the securities unless they can afford the loss of their entire investment. See “Risk Factors” beginning on page 12. |

CERTAIN DISCLOSURE REGARDING CONVERSION OF NOTES AND EXERCISE OF WARRANTS

The maximum aggregate dollar value of the common stock underlying the convertible notes that the Company has registered for resale is $7,740,000. This number is based on the contractually agreed minimum number of underlying securities to be registered for resale (18,000,000) and the market price per share ($0.43) for the Company’s common stock on December 13, 2006, the date of issuance of the convertible notes.

The market price for the Company’s common stock on March 14, 2007 was $0.14 per share. Using this market price per share, the maximum aggregate dollar value of the common stock underlying the convertible notes that the Company has registered for resale (18,000,000 shares) is $2,520,000.

The following are tables disclosing the dollar amount of each payment required to be made by the Company to any selling shareholder or any affiliate of a selling shareholder. There are no other persons with whom any selling shareholder has a contractual relationship with regarding the transactions.

| Gross proceeds from issuance of the convertible notes: | | $ | 3,000,000.00 | |

| Payments in connection with the transaction that the Company has made or will make: | | | | |

| Finder's fee | | $ | 300,000.00 | |

| Legal fees | | $ | 90,000.00 | |

| Filing, printing and shipping fees | | $ | 3,750.00 | |

Total Payments made by the Company: | | $ | 393,750.00 | |

Net proceeds to issuer: | | $ | 2,606,250.00 | |

The following is a table disclosing the interest payments required to be made to the selling shareholders during the life of the convertible notes.

Date | Interest Payment Amount | Date | Interest Payment Amount |

| 3/13/2007 | $ 60,000.00 | 1/13/2008 | $ 10,476.19 |

| 4/13/2007 | $ 19,047.62 | 2/13/2008 | $ 9,523.81 |

| 5/13/2007 | $ 18,095.24 | 3/13/2008 | $ 8,571.43 |

| 6/13/2007 | $ 17,142.86 | 4/13/2008 | $ 7,619.05 |

| 7/13/2007 | $ 16,190.48 | 5/13/2008 | $ 6,666.67 |

| 8/13/2007 | $ 15,238.10 | 6/13/2008 | $ 5,714.29 |

| 9/13/2007 | $ 14,285.71 | 7/13/2008 | $ 4,761.90 |

| 10/13/2007 | $ 13,333.33 | 8/13/2008 | $ 3,809.52 |

| 11/13/2007 | $ 12,380.95 | 9/13/2008 | $ 2,857.14 |

| 12/13/2007 | $ 11,428.57 | 10/13/2008 | $ 1,904.76 |

| | | 11/13/2008 | $ 952.38 |

| | | | |

Total Interest Payments: $ 260,000.00 | |

The net proceeds to the Company from the sale of the convertible notes was $2,606,250 on December 13, 2006, such amount includes the payment of fees, including legal fees, finder’s fees and filing, printing and shipping fees, associated with the placement of the convertible notes and warrants. The total amount of possible payments, including interest payments but excluding the repayment of principal, to the selling shareholders and any of their affiliates in the first year following December 13, 2006, the date of sale of the convertible notes, and assuming that none of the notes are converted into common stock would be $197,142.86.

The following is a table disclosing the aggregate amount of possible profit which could be realized by the selling shareholders as a result of the conversion discount for the securities underlying the convertible notes.

The conversion price of $0.25 represents a discount of $0.18 to $0.43 which was the market price per share for our common stock on December 13, 2006, the date of issuance of the convertible notes.

| Market price per share on December 13, 2006 of securities underlying the convertible notes: | | $ | 0.43 | |

| Conversion price per share on December 13, 2006 of securities underlying the convertible notes: | | $ | 0.25 | |

| Total shares underlying convertible notes (at a conversion price of $0.25) | | | 12,000,000 | |

| Combined market price of the total number of shares (12,000,000) underlying the convertible note using $0.43 market price | | $ | 5,160,000 | |

| Combined conversion price of shares underlying convertible notes | | $ | 3,000,000 | |

Total possible discount to market price: | | $ | 2,160,000 | |

The following table shows the possible discount to market price based on the market price on March 14, 2007 which was $0.14 per share which results in, a conversion price, after considering the lesser of (A) $0.25, or (B) the seventy-five percent (75%) of the average of the closing bid price of the common stock of $0.105 per share.

| Market price per share on March 14, 2007 of securities underlying the convertible notes: | | $ | 0.14 | |

| Conversion price per share on March 14, 2007 of securities underlying the convertible notes: | | $ | 0.105 | |

| Total number of shares underlying the convertible notes (at a conversion price of $0.105) | | | 28,571,429 | |

| Combined market price of the total number of shares (28,571,429) underlying the convertible note using $0.14 market price | | $ | 4,000,000 | |

| Combined conversion price of shares underlying convertible notes | | $ | 3,000,000 | |

Total possible discount to market price: | | $ | 1,000,000 | |

Pursuant to the terms of the convertible notes, after the occurrence of an Event of Default with respect to the notes, the fixed conversion price of the notes shall be the lesser of $0.25 or 75% of the average of the closing bid prices of the Company’s common stock for the five trading days prior to a conversion date.

In the event that the Company elects to pay its monthly amortization of principal and interest in shares of common stock, the terms of the convertible notes provide that such common stock shall be valued at an applied conversion rate that is equal to the lesser of (A) $0.25, or (B) seventy-five percent (75%) of the average of the closing bid price of the common stock as reported by Bloomberg L.P. for the principal market for the five trading days preceding the date a notice of conversion, if any, is given to the Company by the noteholder after the Company notifies the noteholder of its election to pay its monthly payment obligation with shares of Common Stock.

The following is a table disclosing the aggregate amount of possible profit which could be realized by the selling shareholders or its affiliates as a result of any exercise price discounts for the securities underlying the warrants. The only warrants, options notes or other securities of the issuer that are held by the selling shareholders or any of their affiliates are the Class A Warrants, the Class B Warrants and the Finder’s Warrants that were issued in connection with the Company’s issuance and sale of the convertible notes.

6,000,000 shares of our common stock are issuable upon the exercise of 6,000,000 Class A Warrants to purchase our common stock. The Class A Warrants have an exercise price of $0.30 per share subject to adjustment under certain circumstances and represent a discount of $0.13 to the $0.43 market price per share for our common stock on December 13, 2006, the date of issuance of the convertible notes.

6,000,000 shares of our common stock are issuable upon the exercise of 6,000,000 Class B Warrants to purchase our common stock. The Class B Warrants have an exercise price of $0.40 per share subject to adjustment under certain circumstances and represent a discount of $0.03 to the $0.43 market price per share for our common stock on December 13, 2006, the date of issuance of the convertible notes.

2,400,000 shares of our common stock are issuable upon the exercise of 2,400,000 Finder’s Warrants to purchase our common stock. The Finder’s Warrants have an exercise price of $0.30 per share subject to adjustment under certain circumstances and represent a discount of $0.13 to the $0.43 market price per share for our common stock on December 13, 2006, the date of issuance of the convertible notes.

| Market price per share of underlying shares of common stock | | $ | 0.43 | |

| Exercise price per share: Class A Warrant | | $ | 0.30 | |

| Exercise price per share: Class B Warrant | | $ | 0.40 | |

| Exercise price per share: Finder’s Warrant | | $ | 0.30 | |

| Total possible shares under Class A Warrant | | | 6,000,000 | |

| Total possible shares under Class B Warrant | | | 6,000,000 | |

| Total possible shares under Finder’s Warrant | | | 2,400,000 | |

| Combined market price of underlying under Class A Warrant | | $ | 2,580,000 | |

| Combined market price of underlying under Class B Warrant | | $ | 2,580,000 | |

| Combined market price of underlying under Finder’s Warrant | | $ | 1,032,000 | |

| Combined exercise price under Class A Warrant | | $ | 1,800,000 | |

| Combined exercise price under Class B Warrant | | $ | 2,400,000 | |

| Combined exercise price under Finder’s Warrant | | $ | 720,000 | |

Total possible discount to market price: Class A Warrant | | $ | 780,000 | |

Total possible discount to market price: Class B Warrant | | $ | 180,000 | |

Total possible discount to market price: Finder’s Warrant | | $ | 312,000 | |

Total possible discount to market price: All Warrants | | $ | 1,272,000 | |

The following table shows the possible discount to market price based on the market price on March 14, 2007 which was $0.14 per share.

| Market price per share of underlying shares of common stock | | $ | 0.14 | |

| Exercise price per share: Class A Warrant | | $ | 0.30 | |

| Exercise price per share: Class B Warrant | | $ | 0.40 | |

| Exercise price per share: Finder’s Warrant | | $ | 0.30 | |

| Total possible shares under Class A Warrant | | | 6,000,000 | |

| Total possible shares under Class B Warrant | | | 6,000,000 | |

| Total possible shares under Finder’s Warrant | | | 2,400,000 | |

| Combined market price of underlying under Class A Warrant | | $ | 840,000 | |

| Combined market price of underlying under Class B Warrant | | $ | 840,000 | |

| Combined market price of underlying under Finder’s Warrant | | $ | 336,000 | |

| Combined exercise price under Class A Warrant | | $ | 1,800,000 | |

| Combined exercise price under Class B Warrant | | $ | 2,400,000 | |

| Combined exercise price under Finder’s Warrant | | $ | 720,000 | |

Total possible discount to market price: Class A Warrant | | $ | 0 | |

Total possible discount to market price: Class B Warrant | | $ | 0 (1 | ) |

Total possible discount to market price: Finder’s Warrant | | $ | 0 | |

Total possible discount to market price: All Warrants | | $ | 0 (1 | ) |

(1) The result of an exercise of the warrants at the exercise price and a sale at the market price would be a loss to the selling shareholder. Therefore, the possible discount of the exercise price to market price is zero.

The following is a table disclosing the gross proceeds paid or payable to the Company in connection with the financing transaction along with the payments required to be made by the issuer, the resulting net proceeds and the aggregate potential profit realizable by the selling shareholders as a result of discounts to the market price relating to the conversion price of the convertible notes and the exercise price of the warrants issued in connection with the financing transaction:

| | | Amount | | % of Net Proceeds | |

| Gross proceeds paid to issuer: | | $ | 3,000,000 | | | - | |

| All payments that have been made by issuer: | | $ | 393,750 | | | 15.1 | % |

| Net proceeds to issuer: | | $ | 2,606,250 | | | 100 | % |

| Combined total possible profit as a result of discounted conversion price of the convertible notes | | $ | 2,160,000 | | | 82.9 | % |

| Combined total possible profit as a result of discounted exercise price of the warrants | | $ | 1,272,000 | | | 48.8 | % |

The following table shows the total possible profit as a result of the discounted exercise price to market price based on the market price on March 14, 2007 which was $0.14 per share.

| | | Amount | | % of Net Proceeds | |

| Gross proceeds paid to issuer: | | $ | 3,000,000 | | | - | |

| All payments that have been made by issuer: | | $ | 393,750 | | | 15.1 | % |

| Net proceeds to issuer: | | $ | 2,606,250 | | | 100 | % |

| Combined total possible profit as a result of discounted conversion price of the convertible notes | | $ | 1,000,000 | | | 38.4 | % |

| Combined total possible profit as a result of discounted exercise price of the warrants | | $ | 0 (1 | ) | | 0% (1 | ) |

(1) The result of an exercise of the warrants at the exercise price and a sale at the market price would be a loss to the selling shareholder. Therefore, the possible profit as a result of the discounted exercise price to market price is zero and the corresponding percentage is zero.

The following is a table comparing the shares outstanding prior to the financing transaction, number of shares registered by the selling shareholders, or their affiliates, in prior registration statements (along with that number still held and number sold pursuant to such prior registration statement) and the number of shares registered for resale in this Registration Statement relating to the financing transaction.

| Number of shares outstanding prior to convertible note transaction held by persons other than the selling shareholders, affiliates of the Company and affiliates of the selling shareholders | | | 59,314,470 | |

| Number of shares registered for resale by selling shareholders or affiliates in prior registration statements | | | 0 | |

| Number of shares registered for resale by selling shareholders or affiliates of selling shareholders continue to be held by selling shareholders or affiliates of selling shareholder | | | 0 | |

| Number of shares have been sold in registered resale by selling shareholders or affiliates of selling shareholders | | | 0 | |

| Number of shares registered for resale on behalf of selling shareholders or affiliates of selling shareholders in current transaction (i) | | | 32,400,000 | |

(i) Includes the contractually agreed minimum number (18,000,000) of shares of our common stock to be registered which shares may be issued either (i) in connection with the repayment by the Company of the principal of and interest on the outstanding $3,000,000 aggregate principal amount of the convertible notes and/or (ii) upon the conversion of the convertible notes by the holders thereof at an initial conversion price of $0.25 per share. Also includes 14,400,000 shares of our common stock issuable upon the exercise of the Class A Warrants, Class B Warrants and Finder’s Warrants.

The Company has the intention, and the reasonable basis to believe, that it will have the financial ability to make all payments on the convertible notes when they become due and payable. The Company believes that as a result of the revenues generated by the capital investment it made in Zhejiang Tianyuan Biotech Co., Ltd. utilizing the proceeds it received from the issuance of the convertible notes, it will have sufficient cash flow to satisfy its obligations under the convertible notes.

Other than its issuance and sale of the convertible notes and the warrants to the selling shareholders, the Company has not in the past three years engaged in any securities transaction with any of the selling shareholders, any affiliates of the selling shareholders, or, after due inquiry and investigation, to the knowledge of the management of the Company, any person with whom any selling shareholder has a contractual relationship regarding the transaction (or any predecessors of those persons). In addition, other than in connection with the contractual obligations set forth in (i) the subscription agreements entered into between the Company, on one hand and each of the selling shareholders on the other hand, (ii) the convertible notes and the warrants and (iii) the security documents entered into in connection with the financing transaction, the Company does not have any agreements or arrangements with the selling shareholders with respect to the performance of any current or future obligations.

RISK FACTORS

An investment in our common stock is speculative and involves a high degree of risk and uncertainty. You should carefully consider the risks described below, together with the other information contained in this prospectus, including the consolidated financial statements and notes thereto of our company, before deciding to invest in our common stock. The risks described below are not the only ones facing our Company. Additional risks not presently known to us or that we presently consider immaterial may also adversely affect our Company. If any of the following risks occur, our business, financial condition and results of operations and the value of our common stock could be materially and adversely affected.

Risks Related to Our Business

We have reported losses from operations in every year of our operating history.

We have never generated profits from operations in any year. At December 31, 2006, we had an accumulated deficit of $12.3 million. We will need to significantly increase our annual revenue to achieve profitability. We may not be able to do so. Even if we do achieve profitability, we cannot assure you that we will be able to sustain or increase profitability on a quarterly or annual basis in the future.

We have incurred significant expenses in the past. Although we cannot quantify the amount, we expect expenses to continue to increase for the remainder of 2007 and to continue to incur losses.

We may not be able to obtain sufficient funds to grow our business.

We are a development stage company. Due to the nature and the stage of our Company, we require additional capital to fund some or all of the following:

| · | Commercialization of our products and services; |

| · | Marketing and sales expenses targeting market segments; |

| · | Unanticipated opportunities; |

| · | Changing business conditions; and |

| · | Unanticipated competitive pressures. |

There can be no assurance that we will be able to raise such capital on favorable terms or at all. If we are unable to obtain such additional capital, we may be required to reduce the scope of our business, which could have a material adverse effect on our business, financial condition and results of operations.

The market in which we compete is highly competitive, fast-paced and fragmented, and we may not be able to maintain market share.

We compete with other companies, many of whom are developing or can be expected to develop products similar to ours. Our market is a large market with many competitors. Many of our competitors are more established than we are, and have significantly greater financial, technical, marketing and other resources than we presently possess. Many of our competitors also have greater name recognition and a larger customer base.

We expect competition to persist and intensify in the future. Our principal competitors are bio-pharmaceutical companies such as Tiantan Bio-Pharmaceutical Co., Ltd. in China and large multi-national corporations such as Merck and GlaxoSmithKline. We also compete with a number of other, smaller local distributors including local government owned companies. We face the risk that new competitors with greater resources than ours will enter our market, and that increasing competition will result in lower prices. If we must significantly reduce our prices, the decrease in revenues could adversely affect our profitability. We also face the risks that our competitors may be able to respond more quickly to new or changing opportunities and customer requirements and may be able to undertake more extensive promotional activities, offer more attractive terms to customers, and adopt more aggressive pricing policies.

Our products must keep pace with developments in our industry or they may be displaced by competitors’ products. Our industry is characterized by rapid product development, with significant competitive advantages gained by companies that introduce products that are first to market, deliver constant innovation in products and techniques, offer frequent new product introductions and have competitive prices. Our future growth partially depends on our ability to develop products that are more effective in meeting consumer needs. In addition, we must be able to manufacture and effectively market those products. The sales of our existing products may decline if a competing product is introduced by other companies.

The success of our new product offerings depends upon a number of factors, including our ability to accurately anticipate consumer needs, innovate and develop new products, successfully commercialize new products in a timely manner, price our products competitively, manufacture and deliver our products in sufficient volumes and in a timely manner and differentiate our product offerings from those of our competitors. If we fail to make sufficient investments in research and pay close attention to consumer needs or we focus on technologies that do not lead to more effective products, our current and future products could be surpassed by more effective or advanced products of others.

Establishing and expanding international operations requires significant management attention.

Substantially all of our current revenues are derived from China. We intend to expand our international operations, which, if not planned and managed properly, could materially adversely affect our business, financial condition and operating results. Expanding internationally exposes us to legal uncertainties, new regulatory requirements, liability, export and import restrictions, tariffs and other trade barriers, difficulties in managing operations across disparate geographic areas, foreign currency fluctuations, dependence on local distributors and potential disruptions in sales or manufacturing due to military or terrorist acts, as well as longer customer payment cycles and greater difficulties in collecting accounts receivable. We may also face challenges in protecting our intellectual property or avoiding infringement of others’ rights, and in complying with potentially uncertain or adverse tax laws.

Risks related to our strategy and risks related to our inability to carry out such strategy

Our strategy may be based on wrong assumptions may be seriously flawed and may even damage our performance, competitive position in the market and our ability to survive in the market place. Even if our strategy is correct, we may never be able to successfully implement our strategy or to implement it in the desired fashion.

Risks related to the implementation of our operational and marketing plan

Our operational plan and marketing plan may be seriously flawed and may damage our performance, competitive position in the market and even our ability to survive in the market place. Even if our operational plan and marketing plan are correct, we may never be able to successfully implement these plans or implement our strategy in the desired fashion.

Risks related to our products and services

Our products and services involve direct or indirect impact on human health and life. The drugs, products and services provided may be flawed and cause dangerous side effects and even fatality in certain cases and lead to major business losses and legal and other liabilities and damages to us.

Risks related to product liability claims

We face the risk of loss resulting from, and adverse publicity associated with, product liability lawsuits, whether or not such claims are valid. We may not be able to avoid such claims. In addition, our product liability insurance may not be adequate to cover such claims and we may not be able to obtain adequate insurance coverage in the future at acceptable costs. A successful product liability claim that exceeds our policy limits could require us to pay substantial sums.

Risks related to our technology and our platforms

Our technologies and platforms may be seriously defective and flawed producing wrong and harmful results, exposing us to significant liabilities. Even if they are not defective or flawed, these technologies and platforms may become outdated, losing their value and thus affect our competitive advantages.

Marketing risks

Newly developed drugs and technologies may not be compatible with market needs. Because markets for drugs differentiate geographically inside China, we must develop and manufacture our products to accurately target specific markets to ensure product sales. If we fail to invest in extensive market research to understand the health needs of consumers in different geographic areas, we may face limited market acceptance of our products, which could have material adverse effect on our sales and earning.

Risks relating to difficulty in defending intellectual property rights from infringement

Our success depends on our ability to protect our current and future technologies and products and to defend our intellectual property rights. If we fail to protect our intellectual property adequately, competitors may manufacture and market products similar to ours. We expect to file patent applications seeking to protect newly developed technologies and products in various countries, including China. Some patent applications in China are maintained in secrecy until the patent is issued. Because the publication of discoveries tends to follow their actual discovery by many months, we may not be the first to invent, or file patent applications on any of our discoveries. Patents may not be issued with respect to any of our patent applications and existing or future patents issued to or licensed by us may not provide competitive advantages for our products. Patents that are issued may be challenged, invalidated or circumvented by our competitors. Furthermore, our patent rights may not prevent our competitors from developing, using or commercializing products that are similar or functionally equivalent to our products.

We also rely on trade secrets, non-patented proprietary expertise and continuing technological innovation that we shall seek to protect, in part, by entering into confidentiality agreements with licensees, suppliers, employees and consultants. These agreements may be breached and there may not be adequate remedies in the event of a breach. Disputes may arise concerning the ownership of intellectual property or the applicability of confidentiality agreements. Moreover, our trade secrets and proprietary technology may otherwise become known or be independently developed by our competitors. If patents are not issued with respect to products arising from research, we may not be able to maintain the confidentiality of information relating to these products.

Risks relating to third parties that may claim that we infringe on their proprietary rights and may prevent us from manufacturing and selling certain of our products

There has been substantial litigation in the pharmaceutical industry with respect to the manufacturing, use and sale of new products. These lawsuits relate to the validity and infringement of patents or proprietary rights of third parties. We may be required to commence or defend against charges relating to the infringement of patent or proprietary rights. Any such litigation could:

| · | require us to incur substantial expense, even if we are insured or successful in the litigation; |

| · | require us to divert significant time and effort of our technical and management personnel; |

| · | result in the loss of our rights to develop or make certain products; and |

| · | require us to pay substantial monetary damages or royalties in order to license proprietary rights from third parties. |

Although patent and intellectual property disputes within the pharmaceutical industry have often been settled through licensing or similar arrangements, costs associated with these arrangements may be substantial and could include the long-term payment of royalties. These arrangements may be investigated by regulatory agencies and, if improper, may be invalidated. Furthermore, the required licenses may not be made available to us on acceptable terms. Accordingly, an adverse determination in a judicial or administrative proceeding or a failure to obtain necessary licenses could prevent us from manufacturing and selling some of our products or increase our costs to market these products.

In addition, when seeking regulatory approval for some of our products, we are required to certify to regulatory authorities, including the PRC State Food and Drug Administration (the “SFDA”), that such products do not infringe upon third party patent rights. Filing a certification against a patent gives the patent holder the right to bring a patent infringement lawsuit against us. Any lawsuit would delay the receipt of regulatory approvals. A claim of infringement and the resulting delay could result in substantial expenses and even prevent us from manufacturing and selling certain of our products.

Our launch of a product prior to a final court decision or the expiration of a patent held by a third party may result in substantial damages to us. If we are found to infringe a patent held by a third party and become subject to such damages, these damages could have a material adverse effect on the results of our operations and financial condition.

Risks related to acquisitions

Part of our strategy involves acquisitions of other companies and products and technologies. We may not be able to complete successfully such acquisitions due to the lack of capital and other factors. Even if we can complete such acquisitions, we may not be able to absorb and integrate the acquired operation and assets successfully into our currently operation. We may even make acquisitions that ultimately do not enhance our business.

Risks related to financial reports and estimates

Our Company is subject to critical accounting policies and actual results may vary from our estimates. Our Company follows generally accepted accounting principles for the United States in preparing its financial statements. As part of this work, we must make many estimates and judgments concerning future events. These affect the value of the assets and liabilities, contingent assets and liabilities, and revenue and expenses reported in our financial statements. We believe that these estimates and judgments are reasonable, and we make them in accordance with our accounting policies based on information available at the time. However, actual results could differ from our estimates, and this could require us to record adjustments to expenses or revenues that could be material to our financial position and results of operations in the future.

Risks related to significant financing needs

We need significant amount of capital to invest in our research and development, in our acquisitions and in our operations. We may not be able to identify and raise sufficient capital in a timely manner to finance our research and development activity, operation, acquisitions, growth and even survival. Even if such financings are available, they may not be timely or sufficient or on the terms desirable, acceptable or not harmful to our existing stockholders.

Risks related to growth and the ability to manage growth

For our Company to survive and to succeed, we have to consistently grow. However, the management and we may not be able to achieve or manage such growth. The inability to achieve and maintain and manage growth will significantly affect our survival and market position.

Risks related to our capital structure

Insiders have substantial control over us, and they could delay or prevent a change in our corporate control even if our other stockholders wanted it to occur.

Our executive officers, directors, and principal stockholders who hold 5% or more of the outstanding common stock and their affiliates beneficially owned as of March 14, 2007, in the aggregate, approximately 80.82% of our outstanding common stock. These stockholders will be able to exercise significant control over all matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions. This could delay or prevent an outside party from acquiring or merging with us even if our other stockholders wanted it to occur.

Dependence on key personnel

We depend on our key management and technological personnel. The unavailability or departure of such key personnel may seriously disrupt and harm our operations, business and the implementation of our business strategy and plans. Although most of these personnel are founders and stockholders of our Company, there can be no assurance that we can be successful in retaining them.

Risks related to not declaring or paying any dividends to our stockholders

We did not declare any dividends for the years ended December 31, 2005 or 2006. Our board of directors does not intend to distribute dividends in the near future. The declaration, payment and amount of any future dividends will be made at the discretion of the board of directors, and will depend upon, among other things, the results of our operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and if dividends are paid, there is no assurance with respect to the amount of any such dividend.

Most of our assets are located in China, any dividends of proceeds from liquidation is subject to the approval of the relevant Chinese government agencies.

Our assets are predominantly located inside China. Under the laws governing foreign invested enterprises in China, dividend distribution and liquidation are allowed but subject to special procedures under the relevant laws and rules. Any dividend payment will be subject to the decision of the board of directors and subject to foreign exchange rules governing such repatriation. Any liquidation is subject to both the relevant government agency’s approval and supervision as well the foreign exchange control. This may generate additional risk for our investors in case of dividend payment and liquidation.

Risks Associated With Doing Business in China

We are subject to the risks associated with doing business in the People’s Republic of China.

Because most of our operations are conducted in China, we are subject to special considerations and significant risks not typically associated with companies operating in North America and Western Europe. These include risks associated with, among others, the political, economic and legal environments and foreign currency exchange. Our results may be adversely affected by changes in the political and social conditions in China, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

Although the majority of productive assets in China are owned by the Chinese government, in the past several years the government has implemented economic reform measures that emphasize decentralization and encourage private economic activity. Because these economic reform measures may be inconsistent or ineffectual, there are no assurances that:

| · | We will be able to capitalize on economic reforms; |

| · | The Chinese government will continue its pursuit of economic reform policies; |

| · | The economic policies, even if pursued, will be successful; |

| · | Economic policies will not be significantly altered from time to time; and |

| · | Business operations in China will not become subject to the risk of nationalization. |

Economic reform policies or nationalization could result in a total investment loss in our common stock.

Since 1979, the Chinese government has reformed its economic systems. Because many reforms are unprecedented or experimental, they are expected to be refined and improved. Other political, economic and social factors, such as political changes, changes in the rates of economic growth, unemployment or inflation, or in the disparities in per capita wealth between regions within China, could lead to further readjustment of the reform measures. This refining and readjustment process may negatively affect our operations.

Over the last few years, China’s economy has registered a high growth rate. Recently, there have been indications that rates of inflation have increased. In response, the Chinese government has taken measures to curb this excessively expansive economy. These measures include restrictions on the availability of domestic credit, reducing the purchasing capability of certain of its customers, and limited re-centralization of the approval process for purchases of some foreign products. The Chinese government may adopt additional measures to further combat inflation, including the establishment of freezes or restraints on certain projects or markets. These measures may adversely affect our manufacturing operations.

To date, reforms to China’s economic system have not adversely impacted our operations and are not expected to adversely impact operations in the foreseeable future. However, we cannot assure you that the reforms to China’s economic system will continue or that we will not be adversely affected by changes in China’s political, economic, and social conditions and by changes in policies of the Chinese government, such as changes in laws and regulations, measures which may be introduced to control inflation and changes in the rate or method of taxation.

On November 11, 2001, China signed an agreement to become a member of the World Trade Organization (“WTO”), the international body that sets most trade rules, further integrating China into the global economy and significantly reducing the barriers to international commerce. China’s membership in the WTO was effective on December 11, 2001. China has agreed upon its accession to the WTO to reduce tariffs and non-tariff barriers, remove investment restrictions and provide trading and distribution rights for foreign firms. The tariff rate reductions and other enhancements will enable us to develop better investment strategies. In addition, the WTO’s dispute settlement mechanism provides a credible and effective tool to enforce members’ commercial rights. Also, with China’s entry to the WTO, it is believed that the relevant laws on foreign investment in China will be amplified and will follow common practices.

The Chinese legal system is not fully developed and has inherent uncertainties that could limit the legal protections available to investors.

The Chinese legal system is a system based on written statutes and their interpretation by the Supreme People’s Court. Prior court decisions may be cited for reference but have limited legal precedents. Since 1979, the Chinese government has been developing a comprehensive system of commercial laws, and considerable progress has been made in introducing laws and regulations dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade. Two examples are the promulgation of the Contract Law of the People’s Republic of China to unify the various economic contract laws into a single code, which went into effect on October 1, 1999, and the Securities Law of the People’s Republic of China, which went into effect on July 1, 1999. However, because these laws and regulations are relatively new, and because of the limited volume of published cases and their non-binding nature, interpretation and enforcement of these laws and regulations involve uncertainties. In addition, as the Chinese legal system develops, changes in such laws and regulations, their interpretation or their enforcement may have a material adverse effect on our business operations.

Enforcement of regulations in China may be inconsistent.

Although the Chinese government has introduced new laws and regulations to modernize its securities and tax systems on January 1, 1994, China does not yet possess a comprehensive body of business law. As a result, the enforcement, interpretation and implementation of regulations may prove to be inconsistent and it may be difficult to enforce contracts.

We may experience lengthy delays in resolution of legal disputes.

As China has not developed a dispute resolution mechanism similar to the Western court system, dispute resolution over Chinese projects and joint ventures can be difficult and we cannot assure you that any dispute involving our business in China can be resolved expeditiously and satisfactorily.

Impact of the United States Foreign Corrupt Practices Act on our business.

We are subject to the United States Foreign Corrupt Practices Act, which generally prohibits United States companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some that may compete with us, are not subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in mainland China. We have attempted to implement safeguards to prevent and discourage such practices by our employees and agents. We cannot assure you, however, that our employees or other agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences that may have a material adverse effect on our business, financial condition and results of operations.

Impact of governmental regulation on our operations.

We may be subjected to liability for product safety that could lead to a product recall. Our operations and properties are subject to regulation by various Chinese government entities and agencies, in particular, the SFDA. Our operations are also subject to production, packaging, quality, labeling and distribution standards. In addition, our facilities are also subject to various local environmental laws and workplace regulations. We believe that our current legal and environmental compliance programs adequately address such concerns and that we are in substantial compliance with applicable laws and regulations. However, compliance with, or any violation of, current and future laws or regulations could require material expenditures or otherwise adversely effect our business and financial results.

We may be liable if the use of any of our products causes injury, illness or death. We may also be required to recall certain of our products that become contaminated or are damaged. Any product liability judgment or a product recall could have a material adverse effect on our business or financial results.

Moreover, the laws and regulations regarding acquisitions of the pharmaceutical industry in the PRC may also change and may significantly impact our ability to grow through acquisitions.

It may be difficult to serve us with legal process or enforce judgments against our management or us.

Most of our assets are located in China. In addition, most of our directors and officers are non-residents of the United States, and all, or substantial portions of the assets of such non-residents, are located outside the United States. As a result, it may not be possible to effect service of process within the United States upon such persons. Moreover, there is doubt as to whether the courts of China would enforce:

| · | Judgments of United States courts against us, our directors or our officers based on the civil liability provisions of the securities laws of the United States or any state; or |

| · | Original actions brought in China relating to liabilities against non-residents or us based upon the securities laws of the United States or any state. |

The Chinese government could change its policies toward private enterprise or even nationalize or expropriate it, which could result in the total loss of your investment.

Our business is subject to significant political and economic uncertainties and may be adversely affected by political, economic and social developments in China. Over the past several years, the Chinese government has pursued economic reform policies including the encouragement of private economic activity and greater economic decentralization. The Chinese government may not continue to pursue these policies or may significantly alter them to our detriment from time to time with little, if any, prior notice. Changes in policies, laws and regulations or in their interpretation or the imposition of confiscatory taxation, restrictions on currency conversion, restrictions or prohibitions on dividend payments to stockholders, devaluations of currency or the nationalization or other expropriation of private enterprises could have a material adverse effect on our business. Nationalization or expropriation could even result in the total loss of our investment in China and in the total loss of your investment.

If political relations between the United States and China worsen, our stock price may decrease and we may have difficulty accessing U.S. capital markets.

At various times during recent years, the United States and China have had significant disagreements over political and economic issues. Controversies may arise in the future between these two countries. Any political or trade controversies between the United States and China, whether or not directly related to our business, could adversely affect the market price of our common stock and our ability to access U.S. capital markets.

Foreign Exchange Control Risks

Fluctuations in the value of the Chinese Renminbi relative to foreign currencies could affect our operating results.

Substantially all our revenues and expenses are currently denominated in the Chinese Renminbi. However, we use denominations in United States dollar for financial reporting purposes. The value of Chinese Renminbi against the United States dollar and other currencies may fluctuate and is affected by, among other things, changes in China’s political and economic conditions. The Chinese government recently announced that it is valuing the exchange rate of the Chinese Renminbi against a number of currencies, rather than just exclusively to the United States dollar. Although the Chinese government has stated its intention to support the value of the Chinese Renminbi, we cannot assure you that the government will not revalue it. As our operations are primarily in China, any significant revaluation of the Chinese Renminbi may materially and adversely affect our cash flows, revenues and financial condition. For example, to the extent that we need to convert United States dollars into Chinese Renminbi for our operations, appreciation of this currency against the United States dollar could have a material adverse effect on our business, financial condition and results of operations. Conversely, if we decide to convert our Chinese Renminbi into United States dollars for other business purposes and the United States dollar appreciates against this currency, the United States dollar equivalent of the Chinese Renminbi we convert would be reduced. To date, we have not engaged in any hedging transactions in connection with our operations.

The PRC government imposes control over the conversion of the Chinese Renminbi into foreign currencies. Under the current unified floating exchange rate system, the People’s Bank of China publishes an exchange rate, which we refer to as the PBOC exchange rate, based on the previous day’s dealings in the inter-bank foreign exchange market. Financial institutions authorized to deal in foreign currency may enter into foreign exchange transactions at exchange rates within an authorized range above or below the PBOC exchange rate according to market conditions.

Pursuant to the Foreign Exchange Control Regulations of the PRC issued by the State Council which came into effect on April 1, 1996, and the Regulations on the Administration of Foreign Exchange Settlement, Sale and Payment of the PRC which came into effect on July 1, 1996, regarding foreign exchange control, conversion of Renminbi into foreign exchange by Foreign Investment Enterprises, or FIEs for use on current account items, including the distribution of dividends and profits to foreign investors, is permissible. FIEs are permitted to convert their after-tax dividends and profits to foreign exchange and remit such foreign exchange to their foreign exchange bank accounts in the PRC.

Conversion of Renminbi into foreign currencies for capital account items, including direct investment, loans, and security investment, is still subject to certain restrictions. On January 14, 1997, the State Council amended the Foreign Exchange Control Regulations and added, among other things, an important provision, which provides that the PRC government shall not impose restrictions on recurring international payments and transfers under current account items.

Enterprises in the PRC (including FIEs) which require foreign exchange for transactions relating to current account items, may, without approval of the State Administration of Foreign Exchange, or SAFE, effect payment from their foreign exchange account or convert and pay at the designated foreign exchange banks by providing valid receipts and proofs.

Convertibility of foreign exchange in respect of capital account items, such as direct investment and capital contribution, is still subject to certain restrictions, and prior approval from the SAFE or its relevant branches must be sought.

Risks Related to Common Stock

Risks of lack of liquidity and volatility

Currently our common stock is quoted in the OTC Bulletin Board market, the liquidity of our common stock may be very limited and affected by its limited trading market. The OTC Bulletin Board market is an inter-dealer market much less regulated than the major exchanges and are subject to abuses and volatilities and shorting. There is currently no broadly followed and established trading market for our common stock. An established trading market may never develop or be maintained. Active trading markets generally result in lower price volatility and more efficient execution of buy and sell orders. Absence of an active trading market reduces the liquidity of the shares traded there.

The trading volume of our common stock may be limited and sporadic. As a result of such trading activity, the quoted price for our common stock on the OTC Bulletin Board may not necessarily be a reliable indicator of its fair market value. Further, if we cease to be quoted, holders would find it more difficult to dispose of, or to obtain accurate quotations as to the market value of our common stock and as a result, the market value of our common stock likely would decline.

Risks related to penny stocks

Our common stock may be subject to regulations prescribed by the Securities and Exchange Commission (the “SEC”) relating to “Penny Stocks.” The SEC has adopted regulations that generally define a penny stock to be any equity security that has a market price (as defined in such regulations) of less than $5.00 per share, subject to certain exceptions. If our common stock meets the definition of a penny stock, it will be subject to these regulations, which impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investor, generally institutions with assets in excess of $5,000,000 and individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 (individually) or $300,000 (jointly with their spouse).

Existing stockholders may experience some dilution

We have issued the Notes and, in conjunction with the Notes, the Class A Warrants, the Class B Warrants and the Finder’s Warrants to purchase, collectively, up to 14,400,000 shares of our common stock, subject to adjustment. We have also previously issued a total of 6,860,616 options and 1,089,118 warrants to purchase our common stock to different investors. Pursuant to the terms of the Notes, we have the right, at our option, to repay the outstanding principal of and interest on the Notes in the form of shares of our common stock. Any such issuance of shares for the purpose of the repayment of the Notes as well as any issuances of shares upon any conversion of the Notes, exercise of the Class A Warrants, the Class B Warrants and the Finder’s Warrants, exercise of outstanding options and exercise of our other outstanding warrants will cause dilution in the interests of our stockholders

Moreover, we may need to raise additional funds in the future to finance new developments or expand existing operations. If we raise additional funds through the issuance of new equity or equity-linked securities, other than on a pro rata basis to our existing stockholders, the percentage ownership of the existing stockholders may be reduced.

Future sales of our common stock may depress our stock price.