As filed with the Securities and Exchange Commission on January 25 , 2008

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM SB-2

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CHINA BIOPHARMA, INC.

(Name of Small Business Issuer in its Charter)

Delaware | | 2834 |

(State or Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Code Number) |

75 Shuguang Road, Building B, Hangzhou, China 310007

(609) 651-8588

(Address and Telephone Number of Principal Executive Offices

and Principal Place of Business)

Peter Wang, Chief Executive Officer

75 Shuguang Road, Building B

Hangzhou, China 310007

(609) 651-8588

(Name, Address and Telephone Number of Agent for Service)

With a copy to:

Darren Ofsink, Esq.

Guzov Ofsink LLC

600 Madison Avenue

New York, New York 10022

(212) 371-8008

Approximate date of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If this Form is filed to register securities for an offering to be made on a continuous or delayed basis, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. o

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered | | Amount to be registered | | Proposed maximum offering price per unit(1) | | Proposed maximum aggregate offering price(1) | | Amount of registration fee | |

| Common Stock, par value $0.0001 per share | | | 312,000,000 shares | (2)(3) | $ | 0.0075 | | $ | 2,340,000 | | $ | 92 | |

(1) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities Act of 1933, as amended, based on the average of the closing bid and asked prices on January 23, 2008, as reported by the OTC Bulletin Board.

(2) The 312,000,000 shares of common stock are being registered (i) for resale by the selling stockholders following the issuance of such shares by us on the repayment of principal and interest due on our $3,000,000 Secured Convertible Promissory Notes due December 13, 2008 issued on December 13, 2006 (the “Notes”) and/or (ii) for resale by the selling stockholders following the issuance of such shares by the registrant upon conversion of the Notes by the selling stockholders at an effective conversion price of approximately $0.007 per share 75% of 0.0096 = .007, subject to adjustment in certain circumstances. As of January 9, 2008, the total principal and interest payments payable over the remaining term of the Notes were $2,137,391. The average closing bid price of our common stock for the five days prior to January 9, 2008 was $0.0096.

(3) Pursuant to Rule 416 under the Securities Act of 1933, as amended, the Registrant is also registering such additional indeterminate number of shares as may become necessary to adjust the number of shares as a result of a stock split, stock dividend or similar adjustment of its outstanding common stock.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said section 8(a), may determine.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THE SELLING STOCKHOLDERS MAY NOT SELL THESE SECURITIES PUBLICLY UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE

THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, DATED JANUARY 25, 2008

PRELIMINARY PROSPECTUS

312,000,000 SHARES OF COMMON STOCK

CHINA BIOPHARMA, INC.

This prospectus relates to the sale by the selling stockholders identified in this prospectus of up to 312,000,000 shares of our common stock following the issuance of such shares by us (i) on the repayment of principal and interest on our outstanding $3,000,000 Secured Convertible Promissory Notes due December 13, 2008 issued to the selling stockholders on December 13, 2006 and/or (ii) on the conversion of the Notes by the selling stockholders.

On October 15, 2007, an “event of default” occurred and is continuing because we failed to make our monthly amortization payment due on that date in registered shares of common stock or in cash. We do not have the available cash necessary to make the payments in cash and we had not registered sufficient shares to facilitate payment of the monthly amortization due in shares of our common stock. This event of default has not been waived by the investors and is continuing. Our obligations under the Notes are secured by a security interest on all of our assets. Accordingly at any time that an event of default is continuing our investors could initiate proceedings to force us liquidate our assets and apply the proceeds of the sale to satisfy our payments due on the Notes. To date no investor has instituted or threatened to institute proceedings to enforce their security interest on our assets. Some investors have accepted unregistered shares in payment of the monthly amortization amount due to them. Other investors have been silent. We intend to endeavor to satisfy our past and future amortization payments due under the Notes by delivery of registered shares of our common stock. However there can be no assurance that this will be possible as the investors have the right to request payment in cash following an event of default. We do not have any available cash to make the payments due on the Notes in cash.

Prior to an “event of default” the Notes bear interest at a rate of eight percent (8%) per annum, however, following an “event of default” the Notes bear interest at the rate of 15%. Beginning on March 13, 2007, we became obligated to make monthly amortization payments on the Notes of both principal and accrued interest. The amortization schedule requires the payment, beginning on March 13, 2007 and ending on November 13, 2008, of 21 equal monthly principal payments of approximately $142,857, together with monthly interest payments on the then outstanding principal amounts at the rate of 8% per annum which interest payments total $260,000 over the term of the Notes. We have the option (which we have exercised), so long as we are not in default, to pay the monthly amounts due on the Notes in shares of our common stock (which shares are required to be registered in a registration statement declared effective by the SEC.) The common stock for amortization payment purposes is valued at a conversion rate equal to the lesser of $0.25 per share or seventy five percent (75%) of the average closing bid price of the common stock for the five trading days preceding the applicable repayment date.

As of January 9, 2008, the outstanding principal balance on the Notes was $2,032,216 and we are required to pay interest totaling $105,175 over the remaining term of the Notes. As of January 9, 2008, the average closing bid price for the common stock for the five trading days prior to January 9, 2008, was $0.0096. Accordingly using an effective conversion rate of $0.007 (or 75% of $0.0096) we would be required to issue 305,341,533 additional shares of our common stock to the selling stockholders to pay our obligations over the remaining term of the Notes. We do not know what the effective conversion rate will be in the future. If the market price of our common stock falls we would be required to issue even more shares, which shares are all required to be registered. During the period that an “event of default” has occurred and is continuing the Notes bear interest at a rate of 15%. We do not know if our investors will insist on this interest rate for the period during which we are in default.

On March 19, 2007, we registered 18,000,000 shares of our common stock for resale by the selling stockholders following the issuance of such shares upon the repayment of principal and interest on the Notes and/or for resale by the selling stockholders, following the issuance of such shares on the conversion of the Notes at an initial conversion price of $0.25 per share. We are currently registering 312,000,000 shares for resale by the selling stockholders. See Summary -- The Offering -- Background for a table which sets forth the number of shares of our common stock issued to date to pay our monthly obligations on the Notes and the effective conversion rates for those issuances together with a list of the future amortization monthly payments to be made on the Notes.

We will not receive any of the proceeds from the sale of shares by the selling stockholders. We will receive the benefit of the reduction in our outstanding indebtedness in consideration for the issuance of the Note Shares. See “Use of Proceeds.” We have agreed to pay the expenses in connection with the registration of these shares (estimated to be approximately $75,000). There is a limited trading market for our common stock. Our common stock is quoted on the OTC Bulletin Board (“OTCBB”) under the trading symbol “CBPC.” The last reported bid price for our common stock on the OTCBB on January 9, 2008 was $0.009 per share.

Investing in our common stock involves risk. You should carefully consider the risk factors beginning on page 16 of this prospectus before purchasing share of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is ______, 2007

TABLE OF CONTENTS

| | | Page | |

| About This Prospectus | | | 1 | |

| | | | | |

| Cautionary Note Regarding Forward-Looking Statements And Other Information Contained In This Prospectus | | | 1 | |

| | | | | |

| Summary | | | 2 | |

| | | | | |

| Certain Disclosure Regarding Conversion Of Notes And Exercise Of Warrants | | | 9 | |

| | | | | |

| Risk Factors | | | 16 | |

| | | | | |

| Use Of Proceeds | | | 25 | |

| | | | | |

| Selected Consolidated Financial Data | | | 25 | |

| | | | | |

| Management’s Discussion And Analysis Or Plan Of Operation | | | 26 | |

| | | | | |

| Description Of Business | | | 40 | |

| | | | | |

| Directors And Executive Officers | | | 40 | |

| | | | | |

| Executive Compensation | | | 41 | |

| | | | | |

| Certain Relationships And Related Transactions | | | 46 | |

| | | | | |

| Security Ownership Of Certain Beneficial Owners And Management | | | 47 | |

| | | | | |

| Selling Stockholders | | | 49 | |

| | | | | |

| Plan Of Distribution | | | 51 | |

| | | | | |

| Description Of Securities | | | 53 | |

| | | | | |

| Market for Common Equity and Related Stockholder Matters | | | 54 | |

| | | | | |

| Disclosure Of Commission Position On Indemnification For Securities Act Liabilities | | | 56 | |

| | | | | |

| Legal Matters | | | 56 | |

| | | | | |

| Experts | | | 56 | |

| | | | | |

| Where You Can Find More Information | | | 57 | |

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. The selling stockholders are offering to sell and seeking offers to buy shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. Neither the delivery of this prospectus nor any distribution of securities in accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the date of this prospectus. The prospectus will be updated and updated prospectuses made available for delivery to the extent required by the federal securities laws.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, the selling stockholders, the securities or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us or any selling stockholder. This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy the securities in any circumstances under which the offer or solicitation is unlawful.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND OTHER INFORMATION CONTAINED IN THIS PROSPECTUS

This prospectus contains some forward-looking statements. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Forward-looking statements involve risks and uncertainties. Forward-looking statements include statements regarding, among other things, (a) our projected sales, profitability, and cash flows, (b) our growth strategies, (c) anticipated trends in our industries, (d) our future financing plans and (e) our anticipated needs for working capital. They are generally identifiable by use of the words "may," "will," "should," "anticipate," "estimate," "plans," “potential," "projects," "continuing," "ongoing," "expects," "management believes," "we believe," "we intend" or the negative of these words or other variations on these words or comparable terminology. These statements may be found under "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Business," as well as in this prospectus generally. In particular, these include statements relating to future actions, prospective products or product approvals, future performance or results of current and anticipated products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, and financial results.

Any or all of our forward-looking statements in this report may turn out to be inaccurate. They can be affected by inaccurate assumptions we might make or by known or unknown risks or uncertainties. Consequently, no forward-looking statement can be guaranteed. Actual future results may vary materially as a result of various factors, including, without limitation, the risks outlined under "Risk Factors" and matters described in this prospectus generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking statements.

The forward-looking statements speak only as of the date on which they are made, and, except to the extent required by federal securities laws, we undertake no obligation to publicly update any forward-looking statements, whether as the result of new information, future events, or otherwise.

Currency

Unless otherwise noted, all currency figures in this filing are in U.S.dollars. References to "yuan" or "RMB" are to the Chinese yuan (also known as the Renminbi). According to Xe.com as of January 14, 2007, $1 = 7.24270.

SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read the entire prospectus, including "Risk Factors" and the consolidated financial statements and the related notes before making an investment decision. Unless otherwise indicated in this prospectus or the context otherwise requires, references to “we,” “us,” “Techedge,” “the Company” or “our company” refer to China Biopharma, Inc. and its consolidated subsidiaries.

THE COMPANY

Business Overview

We are a distributor of human vaccines and other biopharmaceutical products. Currently, we distribute products in China.

We have established a distribution and development network in China through the acquisition of our interest in our subsidiary, Hainan CITIC Bio-pharmaceutical Development Co., Ltd. (“HCBD”) and through our joint venture with Zhejiang Tianyuan Bio-pharmaceutical Co., Ltd (‘ZTBC”).

Our emphasis is on the introduction and the marketing and distribution of products rather than on manufacturing. Most of our operations are in China and until recently we were involved mainly in the distribution of human vaccines.

Approximately 80% of our revenues for 2006 were derived from the distribution of vaccine products and all of our sales revenues were made to PRC based customers.

Over the past couple of years the vaccine business has become more competitive. In addition, in July 2007 the former head of China's State Food And Drug Administration, was executed by shooting for taking bribes from various firms in exchange for state licenses. The SFDA is currently reviewing all licenses granted over the last 8 years and there is a large backlog over the issuance of new licenses. In order to improve our operating performance and cope with this changing environment, we have changed our business strategy and formulated a new business plan to conserve cash, lower expenses and increase profitability. Beginning in 2007 we started to distribute a few specialty drug products, such as Serrapeptase. We plan to take more control on the available cash in our subsidiaries and move into areas with higher market potential and higher margin specialty pharmaceutical products.

Move Away from the Low Margin Vaccine Business

We plan to move away from the low margin vaccine business and focus on higher margin vaccine and specialty drugs.

Due to the recent changes in vaccine sectors, more and more vaccine manufacturers have entered the low margin vaccine business such as distribution of flu vaccine, which has created severe competition among, and squeezed the profit margin of the vaccine distributors. To avoid this direct competition, we are currently negotiating with a few global vaccine manufacturers for carrying their higher margin products. We cannot assure you that we be successful in entering into an agreement.

Commence Distribution of Specialty Pharmaceutical Products

In February we began distributing on a trial basis certain specialty pharmaceutical products of Takeda Pharmaceutical Company, Ltd. (“Takeda”), the largest pharmaceutical company in Japan. Takeda specializes in the research and development of breakthrough drugs, and has marketing operations throughout U.S., Europe, and Asia. In Japan, Takeda has also built a strong presence in the over-the-counter (OTC) drugs market, and holds the second largest share of that domestic market.

After distributing its products for about ten months on a trial basis, both parties have agreed to continue this relationship and we intend to commit more resources and increase our ability to distribute Takeda’s products. Currently we have an agreement to distribute Serrapeptase tablets manufactured by Takeda.

Antiviral Products

In October 2007 we began working with Soonfast Pharmaceutical Science & Technology Co., Ltd. (“Soonfast”) to introduce a new antiviral medicine to the overseas market (including the United States and other overseas markets). This all-natural product has been approved in China for external use to treat human papillomavirus (“HPV”) and herpes simplex virus (“HSV”). The commercial product was released in November 2007, and we will begin to distribute this product in certain regions in China and have the right to distribute it in all overseas markets, including the United States. We are working with existing distribution channels in China and will work with existing distribution channels in the United States to sell these products. We expect to have distribution margin in excess of 30% and 35% in China and in the United States, respectively.

Take Closer Control on Subsidiaries

We are working to take direct control of our subsidiaries’ operations and financial management instead of relying on our joint venture partner’s performance. Recently we reached agreement with our joint venture partner to increase our shareholding in our joint venture in China, Zhejiang Tianyuan Biotech Co., Ltd., and eventually to have 100% control and ownership in this joint venture and its subsidiary, Hainan CITIC. We plan to change its name to Zhejiang Baicon Pharmaceutical Co., Ltd. We did not need to raise additional capital to complete this transaction. We expect that this will help to preserve our available cash, increase our operating stability, provide us with more operation flexibility, and improve our current performance.

Improve Current Operation Results

After almost a year of endeavoring to establish our footing into China, we have adjusted to this complicated market environment and business landscape. In an effort to improve our current operating results, we have begun taking the steps outlined above with a view to strengthen our control over our operating subsidiaries, preserve cash, apply available resources to, and refocus on, higher margin, less competitive products with greater market potential. We cannot assure you that we will be successful with any of these objectives.

As of January 9, 2008, we employed 42 individuals in China and overseas.

Product Development

We are currently working with a number of international companies as partners to develop new drug markets.

Soonfast: In October 2007 we began working with Soonfast Pharmaceutical Science & Technology Co., Ltd. (“Soonfast”) to introduce a new antiviral medicine to the overseas market (including the United States and other overseas markets). This all-natural product has been approved in China for external use to treat human papillomavirus (“HPV”) and herpes simplex virus (“HSV”). The commercial product was released in November 2007, and we will begin to distribute this product in certain regions in China and have the right to distribute it in all overseas markets, including the United States. We are working with existing distribution channels in China and will work with existing distribution channels in the United States to sell these products. We expect to have distribution margin in excess of 30% and 35% in China and in the United States, respectively. Tests have shown an inhibitory effect on the growth of HPV and HSV. The medicine can reduce the incidence of infection from HPV and HSV by 90 per cent for only 2-3 days.

HYTE Reseach: We have an agreement with HYTE Research LLC, a New Jersey-based biotechnology research company. Under the agreement, both companies will jointly develop and commercialize nano-poly enhancement technology for improving the effectiveness and reducing the side effects of human vaccines.

We recently postponed our development effort to introduce an immunotherapeutic vaccine Staphage Lysate in China that treats diseases of staphylococcal infection. Due to the recent problems caused by the delay at the SFDA in the drug approval processes in China, we decided to postpone our clinical trial effort until the environment improves.

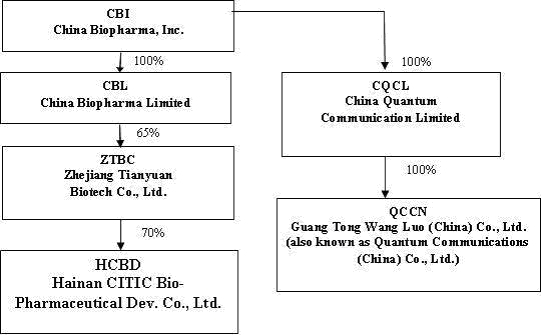

Corporate History and Corporate Structure

See “The Company - Corporate History” for a description of our corporate history.

See “The Company - Corporate Structure” for a description of our corporate structure.

RECENT DEVELOPMENTS

Acquisitions and Investments

Zhejiang Tianyuan Biotech Co., Ltd. (ZTBC)

On December 22, 2006, we acquired a 65% interest in ZTBC for $1,950,000. ZTBC is a Sino-US joint venture between China Biopharma, Limited (CBL) a wholly owned subsidiary of the Company, and Zhejiang Tianyuan Bio-pharmaceutical Co., Ltd. which owns the remaining 35% interest. ZTBC was formed to engage in the business of developing and marketing vaccines. Our joint venture partner, Zhejiang Tianyuan Bio-pharmaceutical Co., Ltd, performs all of the manufacturing functions for ZTBC. As part of our recently adopted business we recently we reached agreement with our joint venture partner to increase our shareholding in ZTBC and eventually to have 100% control and ownership in this joint venture and its subsidiary, Hainan CITIC Bio-pharmaceutical Development Co., Ltd.(HCBD).

Hainan CITIC Bio-pharmaceutical Development Co., Ltd.(HCBD)

We currently own 70% of the equity interest of HCBD. The remaining 30% of HCBD is owned by Zhejiang Tianyuan Bio-pharmaceutical Co., Ltd. (20%) and by one of its original owners (10%).

HCBD is a China based national distributor of pharmaceutical products. HCBD distributes the vaccines provided by local vaccine manufacturers, including ZTBC and Zhejiang Tianyuan Bio-pharmaceutical Co., Ltd and other pharmaceutical products.

HCBD has established a distribution platform including “cold-chain” logistics (which are the refrigeration logistics in the distribution chain.)

Recent Financing Transaction

On December 13, 2006, we entered into a Subscription Agreement with a number of investors (the selling stockholders named in this prospectus) for the sale of $3,000,000 aggregate principal amount of our Secured Convertible Promissory Notes due December 13, 2008. “For more information on the terms of this financing, reference is made to SUMMARY - The Offering - Background.”

Issuance of Significant Amounts of Additional Shares.

Under the terms of the Securities Purchase Agreement dated April 29, 2005, as amended, between us and Alpha Capital AG (“Alpha”) and Whalehaven Capital Fund Limited (“Whalehaven”), if after that date we issued any common stock or securities convertible into or exercisable for shares of common stock at a price per share which is less than $0.50 we are required to issue additional shares of common stock to the investors so that the average per share purchase price of the shares of common stock then owned by the investors equals such other lower price per share. During 2007, we had issued shares prices below $0.50 per share in each month for repayment of convertible note. Accordingly, pursuant to the terms of the April 2005 Securities Purchase Agreement we issued the following shares to the following investors.

| · | On June 6, 2007 we issued an aggregate of 5,517,784 additional shares of our common stock to Alpha Capital AG (“Alpha”). |

| · | On June 6, 2007 we issued 5,289,180 additional shares of our common stock to Whalehaven Capital Fund Limited (“Whalehaven”). |

| · | On July 23, 2007 we issued 2,078,431 additional shares of our common stock to Alpha. |

| · | On August 22, 2007 we issued 5,754,986 additional shares of our common stock to Whalehaven. |

| · | On September 21, 2007 we issued 8,453,096 additional shares of our common stock to Alpha. |

| · | On October 16, 2007 we issued 4,624,554 additional shares of our common stock to Alpha. |

| · | On October 16, 2007 we issued 17,072,996 additional shares of our common stock to Whalehaven. |

We will also be required to issue significant additional shares to Alpha and Whalehaven as we continue to pay down the monthly amortization payments due on the Notes. The exact number of shares will depend on the effective conversion rate used to calculate the number of shares to be issued to the noteholders which in turn will depend on the market price of our common shares.

As of January 9, 2008, we had 159,377,774 shares of common stock issued and outstanding.

Risk Factors

An investment in our stock involves a high degree of risk. You should purchase our stock only if you can afford to lose your entire investment. Among the risk factors which you should consider in this regard are the following:

| · | We are currently in default under the terms of the Notes. Our obligations under the Notes are secured by a security interest on all of our assets. The investors have the right at anytime to institute proceeding to force us to liquidate our assets and apply the proceeds thereof to the payment of our obligations under the Notes. |

| | |

| · | We do not have sufficient cash to fund our operations beyond three months. If we are unable to raise additional financing we my not be able to continue as a going concern. |

| | |

| · | We recently adopted a new business strategy designed to achieve profitability. We cannot assure you that we will be able to implement it successfully or that even if we are able to successfully implement it that it will result in profitability. |

| · | We are an early stage company that has never earned a profit and which operates on a negative cash flow basis. |

| · | We have depended upon the sale of securities to sustain our operations. We may not be able to successfully sell any more as our common stock is trading at a very low price. |

| · | We face intense competition from a number of companies, some of whom have proven products, long established customer relationships and substantially greater resources than ours. |

| · | Our management team lacks experience running a public company. |

| · | Our stock is thinly traded and subject to the volatility associated with small-cap stocks. |

| · | Our common stock is subject to substantial downward price pressure based on the large number of shares which are required to be issued to make the amortization payments on the Notes and that may be issued pursuant to outstanding warrants and options. |

You should carefully consider the more complete information set forth under “Risk Factors” beginning on page 16 of this Prospectus before investing in our common stock.

Executive Offices

Our principal executive offices are located at 75 Shuguang Road, Building B, Hangzhou, China 310007 and our telephone number is (609) 651-8588

THE OFFERING

| Common stock being offered | | Up to 312,000,000 shares by selling stockholders |

| | | |

| Offering price | | Market Price |

| | | |

| OTCBB Symbol | | CBPC.OB |

| | | |

| Risk Factors | | The shares of common stock offered by this prospectus are speculative and involve a high degree of risk and investors should not purchase our common stock unless they can afford the loss of their entire investment. See “Risk Factors” beginning on page [_]. |

| | | |

| Terms of the Offering | | The selling stockholders will determine how and when they will sell the common stock offered in this prospectus. |

| | | |

| Termination of offering | | The offering will conclude when all of the 312,000,000 shares of common stock have been sold or registration is no longer required to sell the shares. |

We have 159,377,774 shares of our common stock currently issued and outstanding. Of these shares 133,172,244 are held by non affiliates. We are registering up to 312,000,000 shares of our common stock for sale by the selling stockholders identified in the section of this Prospectus entitled "Selling Security Holders." The shares being registered included in the table identifying the selling stockholders represent shares of our common stock that we have issued or that we intend to issue to the selling stockholders in satisfaction of our monthly amortization payments required to be made on the Notes. Beginning in October 2007 we failed to make our monthly amortization payments due on the Notes by failing to deliver the monthly payments in cash or registered shares. We intend to endeavor to satisfy our past and future amortization payments due under the Notes by delivery of registered shares of our common stock. These shares have been identified in the footnotes to the “Selling Security Holders” table. We intend to make our monthly amortization payments in registered shares of common stock. However, there can be no assurance that this will be possible as the investors have the right to request payment in cash following an event of default. We do not have any available cash to make the payments due on the Notes in cash.

Background

On December 13, 2006, we entered into a Subscription Agreement with a number of investors (the selling stockholders listed in this prospectus) for the sale of $3,000,000 aggregate principal amount of our Secured Convertible Promissory Notes due December 13, 2008.

The following is a summary of the material terms of the Notes:

Conversion: The Notes are convertible at the option of the holders at any time into common stock. Prior to the occurrence of an “event of default” (as defined in the Notes) the notes were convertible at a price of $.25 per share. After the occurrence of an event of default the Notes are convertible at the lesser of $0.25 per share and 75% of the average closing bid prices for the common stock for the five trading days prior to the date of conversion. On October 15, 2007, an event of default occurred as a result of our failure to make our monthly amortization payment due on that date in registered shares of common stock or in cash. Accordingly the effective conversion price is 75% of the average closing bid prices for the common stock for the five trading days prior to the date of conversion. As of January 9, 2008 none of the Notes have been converted at the option of the holders.

Prepayment: Provided no event of default has occurred we may prepay the Notes, in whole or in part, at any time on 30 days written notice to the holders by paying a 20% premium on the principal amount to be repaid together with accrued interest and any other sums due to the date of prepayment. As an event of default occurred on October 15, 2007 and is continuing the terms of the notes prohibit us for prepaying the Notes.

Security/Guarantee: The Notes are secured by a by a security interest in the Company’s assets. The Notes are also guaranteed by our subsidiaries CQCL, CBL and QCCN.

Warrants: We also issued to the selling stockholders as purchasers of the Notes, (i) Class A Warrants to purchase up to 6,000,000 shares of our common stock with an exercise price of $0.30 per share (subject to adjustment) and (ii) Class B Warrants to purchase up to 6,000,000 shares of common stock with an exercise price of $0.40 per share (subject to adjustment). The 12,000,000 shares underlying the Class A Warrants and Class B Warrants were registered for resale in a registration statement declared effective on March 23, 2007. The warrants contain full ratchet anti-dilution provisions.

Finder’s Warrants: Melton Management Ltd. acted as the finder with respect to the issuance and sale of the Notes and received warrants to purchase 2,400,000 shares of common stock at an exercise price of $0.30 per share (subject to adjustment). The 2,400,000 shares underlying the finder’s warrants were registered for resale in a registration statement declared effective on March 23, 2007. These warrants also contain full ratchet anti-dilution provisions.

As of January 9, 2008, the closing price of our common stock was $0.0099 and none of these warrants have been exercised.

Registration Rights: In connection with the issuance of the Notes we granted the investors and the finder certain registration rights. Accordingly, on January 22, 2007 we filed an initial registration statement on Form SB-2 covering 18,000,000 shares issuable on conversion and/or repayment of the Notes (which number represented a contractually agreed amount), 12,000,000 shares underlying the Class A Warrants and Class B Warrants, and the 2,400,000 shares underlying the finders’ warrants. That registration statement was declared effective on March 23, 2007. In order to make our monthly amortization payments in shares of our common stock we are required to deliver registered shares or pay cash. We are registering 312,000,000 additional shares in this prospectus to facilitate payment of those obligations is registered shares of our common stock.

Interest/Amortization: Prior to an event of default the Notes bear interest at a rate of eight percent (8%) per annum. After an event of default the rate increases to 15%. Provided we are not in default we have the option to make the monthly payments due on the Notes in cash or common stock. If we elect to pay cash, we must pay 115% of the principal component and 100% of all other components of the monthly amount due. We do not currently have sufficient cash flow to make the payments due on the Notes in cash when they become due and payable. If we elect to pay the monthly amounts due in common stock, the stock is valued at an effective conversion rate equal to the lesser of $0.25 per share or seventy five percent (75%) of the average closing bid price of the common stock for the five trading days preceding the applicable repayment date. Under the terms of the Notes we are not permitted to continue to make our monthly amortization payments due on the Notes without the consent of the holders after an event of default has occurred and is continuing. We cannot assure you that the investors will permit us to make the future monthly payments due on the Notes in shares of our common stock.

Beginning on March 13, 2007, we became obligated to make monthly payments on the Notes of both principal and accrued interest. The amortization schedule is set forth below. We have limited cash and have been paying and intend to continue to pay the monthly amounts due on the Notes in shares of our common stock.

To date we have issued an aggregate of 25,041,747 shares of our common stock to the selling stockholders to satisfy our payment obligations under the Notes, based on average effective conversion rates of $0.141 (for March 2007), $0.1056 (for April 2007), $0.075 (for May 2007), $0.052 (for June 2007), $0.059 (for July 2007), $0.038 (for August 2007), $0.021 (for September 2007), $0.0164 (for October 2007) and $0.0091 (for December 2007). As of January 9, 2008, the outstanding principal balance on the Notes was $2,032,216 and we are required to pay interest totaling $105,175 over the remaining term of the Notes. As of January 9, 2008, the average closing bid prices for the common stock for the five trading days prior to January 9, 2008, was $0.0096. Accordingly using an assumed effective conversion rate of $0.007 (or 75% of $0.0096) we would be required to issue 305,341,533 additional shares of our common stock to the selling stockholders to pay off the principal and pay the interest due over the remaining term of the Notes. If the market price of our common stock falls we would be required to issue even more shares. We previously registered 18,000,000 shares of our common stock for resale by the selling stockholders following the issuance of such shares upon the repayment of principal and interest on the Notes and/or for resale by the selling stockholders, following the issuance of such shares on the conversion of the Notes at an initial conversion price of $0.25 per share. We are currently registering 312,000,000 additional shares of common stock for resale by the selling stockholders.

The table below sets forth the amortization schedule. The table also sets forth the number of shares of our common stock previously issued in payment of our obligations on the Notes, the effective conversion rates, and the number of shares to be issued in the future at an assumed conversion price of $0.007 per share.

| | | Repayment | | Outstanding | | Shares issued as Payment of Principal and Interest due on | | Shares to be issued as Payment of Principal and Interest Due at assumed effective conversion price of $0.007 per | |

Date | | Principal | | Interest | | Principal | | Notes | | share | |

| 12/13/2006 | | | | | | | | $ | 3,000,000.00 | | | | | | | |

| 3/13/2007 | | $ | 142,857.14 | | $ | 60,000.00 | | $ | 2,857,142.86 | | | 1,438,703 | (1) | | | |

| 4/13/2007 | | $ | 142,857.14 | | $ | 19,047.62 | | $ | 2,714,285.71 | | | 1,533,189 | (2) | | | |

| 5/13/2007 | | $ | 142,857.14 | | $ | 18,095.24 | | $ | 2,571,428.57 | | | 1,611,790 | (3) | | | |

| 6/13/2007 | | $ | 142,857.14 | | $ | 17,142.86 | | $ | 2,428,571.43 | | | 3,866,541 | (4) | | | |

| 7/13/2007 | | $ | 142,857.14 | | $ | 16,190.48 | | $ | 2,285,714.29 | | | 2,218,464 | (5) | | 4,165,533 | (10) |

| 8/13/2007 | | $ | 142,857.14 | | $ | 15,238.10 | | $ | 2,142,857.14 | | | 2,557,839 | (6) | | 5,841,256 | (10) |

| 9/13/2007 | | $ | 142,857.14 | | $ | 14,285.71 | | $ | 2,000,000.00 | | | 6,363,615 | (7) | | 4,115,648 | (10) |

| 10/13/2007 | | $ | 142,857.14 | | $ | 13,333.33 | | $ | 1,857,142.86 | | | 3,221,786 | (8) | | 15,745,176 | (10) |

| 11/13/2007 | | $ | 142,857.14 | | $ | 12,380.95 | | $ | 1,714,285.71 | | | - | | | 20,698,414 | (10) |

| 12/13/2007 | | $ | 142,857.14 | | $ | 11,428.57 | | $ | 1,571,428.57 | | | 2,229,820 | (9) | | 21,306,122 | (10) |

| 1/13/2008 | | $ | 142,857.14 | | $ | 10,476.19 | | $ | 1,428,571.43 | | | - | | | 21,904,761 | (10) |

| 2/13/2008 | | $ | 142,857.14 | | $ | 9,523.81 | | $ | 1,285,714.29 | | | - | | | 21,768,707 | |

| 3/13/2008 | | $ | 142,857.14 | | $ | 8,571.43 | | $ | 1,142,857.14 | | | - | | | 21,632,653 | |

| 4/13/2008 | | $ | 142,857.14 | | $ | 7,619.05 | | $ | 1,000,000.00 | | | - | | | 21,496,599 | |

| 5/13/2008 | | $ | 142,857.14 | | $ | 6,666.67 | | $ | 857,142.86 | | | - | | | 21,360,544 | |

| 6/13/2008 | | $ | 142,857.14 | | $ | 5,714.29 | | $ | 714,285.71 | | | - | | | 21,224,490 | |

| 7/13/2008 | | $ | 142,857.14 | | $ | 4,761.90 | | $ | 571,428.57 | | | - | | | 21,088,434 | |

| 8/13/2008 | | $ | 142,857.14 | | $ | 3,809.52 | | $ | 428,571.43 | | | - | | | 20,952,380 | |

| 9/13/2008 | | $ | 142,857.14 | | $ | 2,857.14 | | $ | 285,714.29 | | | - | | | 20,816,326 | |

| 10/13/2008 | | $ | 142,857.14 | | $ | 1,904.76 | | $ | 142,857.14 | | | - | | | 20,680,271 | |

| 11/13/2008 | | $ | 142,857.14 | | $ | 952.38 | | $ | - | | | - | | | 20,544,217 | |

| 12/13/2008 | | | | | | | | | | | | | | | | |

Total | | $ | 3,000,000.00 | | $ | 260,000.00 | | | | | | | | | | |

| (1) Effective conversion rate was $0.141 |

| |

| (2) Effective conversion rate was $0.1056 |

| |

| (3) Effective conversion rate was $0.075 |

| |

| (4) Effective conversion rate was $0.052 |

| |

| (5) Effective conversion rate was $0.059 |

| |

| (6) Effective conversion rate was $0.038 |

| |

| (7) Effective conversion rate was $0.021 |

| |

| (8) Effective conversion rate was $0.0164 |

| |

| (9) Effective conversion rate was $0.0091 |

| |

| (10) Represent payments which have been deferred in previous months at the option of the Noteholders or due to lack of sufficient registered shares after October 2007. |

CERTAIN DISCLOSURE REGARDING CONVERSION OF NOTES AND EXERCISE OF WARRANTS

The closing market price for our common stock on January 9, 2008 was $0.0099 per share. Using this market price per share, the maximum aggregate dollar value of the 312,000,000 shares of common stock underlying the Notes that we are registering for resale is $3,088,800 (312,000 000 times 0.0099)

The maximum aggregate dollar possible profit on the 312,000,000 shares of common stock to be issued by us on payment of the principal and interest due on the Notes that we have registered for resale is $0.0029 per share or $904,800 in the aggregate. This number represents the 29% discount ($0.0029) to the market price per share ($0.0099) on January 9, 2008 used to calculate the number of shares that we need to issue to satisfy our obligations under the Notes (or 312,000,000 times $0.0029). The conversion price to be used to calculate the number of shares to be issued to make the monthly amortization payments is based on the average closing bid price ($0.0096) which is lower than the closing market price ($0.0099).

The following are tables disclosing the dollar amount of each payment required to be made by us to any selling stockholder (or any affiliate of a selling stockholder). There are no other persons with whom any selling stockholder has a contractual relationship with regarding the transactions.

| Gross proceeds from issuance of the convertible notes: | | $ | 3,000,000.00 | |

| Payments in connection with the transaction that we made: | | | | |

| Finder's fee | | $ | 300,000.00 | |

| Legal fees | | $ | 90,000.00 | |

| Filing, printing and shipping fees | | $ | 3,750.00 | |

| Total Payments made by us: | | $ | 393,750.00 | |

| Net proceeds to us: | | $ | 2,606,250.00 | |

The net proceeds to us from the sale of the Notes were $2,606,250. This amount includes the payment of fees, including legal fees, finder’s fees and filing, printing and shipping fees, associated with the placement of the Notes and warrants.

The following is a table disclosing the interest payments required to be made to the selling stockholders during the life of the convertible notes.

Date | | Interest Payment Amount | | Date | | Interest Payment Amount | |

| 3/13/2007 | | $ | 60,000.00 | | | 1/13/2008 | | $ | 10,476.19 | |

| 4/13/2007 | | $ | 19,047.62 | | | 2/13/2008 | | $ | 9,523.81 | |

| 5/13/2007 | | $ | 18,095.24 | | | 3/13/2008 | | $ | 8,571.43 | |

| 6/13/2007 | | $ | 17,142.86 | | | 4/13/2008 | | $ | 7,619.05 | |

| 7/13/2007 | | $ | 16,190.48 | | | 5/13/2008 | | $ | 6,666.67 | |

| 8/13/2007 | | $ | 15,238.10 | | | 6/13/2008 | | $ | 5,714.29 | |

| 9/13/2007 | | $ | 14,285.71 | | | 7/13/2008 | | $ | 4,761.90 | |

| 10/13/2007 | | $ | 13,333.33 | | | 8/13/2008 | | $ | 3,809.52 | |

| 11/13/2007 | | $ | 12,380.95 | | | 9/13/2008 | | $ | 2,857.14 | |

| 12/13/2007 | | $ | 11,428.57 | | | 10/13/2008 | | $ | 1,904.76 | |

| 11/13/2008 | | | | | | | | $ | 952.38 | |

| | | | | | | | | | | |

Total Interest Payments: $ 260,000.00 | |

The total amount of possible payments, including interest payments (but excluding the repayment of principal) to the selling stockholders and their affiliates in the first year following December 13, 2006 (the date of sale of the Notes) and assuming that none of the notes are converted into common stock was $197,142.86.

The following is a table disclosing the aggregate amount of possible profit which could have been realized by the selling stockholders if they had converted the Notes at the conversion discount on the date of issuance and sold the underlying common stock.

The conversion price of the Notes of $0.25 per share at the time of issuance represented a discount of $0.18 to the $0.43 which was the market price for our common stock on December 13, 2006, the date of issuance of the Notes.

| Market price per share on December 13, 2006 of common stock underlying the Notes: | | $ | 0.43 | |

| Conversion price per share on December 13, 2006 of common stock underlying the Notes: | | $ | 0.25 | |

| Total shares of common stock underlying the Notes (at a conversion price of $0.25) | | | 12,000,000 | |

| Combined market price of the total number of shares (12,000,000) underlying the Note using $0.43 market price | | $ | 5,160,000 | |

| Combined conversion price of shares underlying the Notes | | $ | 3,000,000 | |

Total possible discount to market price at time of issuance: | | $ | 2,160,000 | |

In the event we elect to pay the monthly amortization payments of principal and interest due on the Notes in shares of common stock, the common stock is valued at an effective conversion rate equal to the lesser of (A) $0.25 or (B) seventy-five percent (75%) of the average of the closing bid price of the common stock for the five trading days preceding the date of payment.

The following is a table disclosing the aggregate amount of possible profit which could be realized by the selling stockholders as a result of the conversion discount used for calculating the number of shares of common stock that we are required to issue to pay the principal and interest due on the Notes over the life of the Notes.

Under the terms of the Notes we have the option to make the monthly payments due on the Notes in cash or common stock. If we elect to pay the monthly amount due in common stock, the stock is valued at an effective conversion rate equal to the lesser of $0.25 per share or seventy five percent (75%) of the average closing bid price of the common stock for the five trading days preceding the applicable repayment date. To date we have issued an aggregate of 25,041,747 shares of our common stock to satisfy our payment obligations under the Notes. As of January 9, 2008, the average closing bid price for the common stock for the five trading days prior to January 9, 2008, was $0.0096. Accordingly using an effective conversion rate of $0.007 (or 75% of $0.0096) we would be required to issue 305,341,533 additional shares

| | | Repayment | | Shares issued as Payment of Principal and Interest due on | | Aggregate Dollar Value of 25% Discount to Closing Bid | | Number of Shares to be issued as Payment of Principal and Interest due at assumed effective conversion price of $0.007 per | | Aggregate Dollar Value of Shares at 25% Discountto Closing | |

Date | | Principal | | Interest | | Notes | | Price | | share | | Bid | |

| 12/13/2006 | | | - | | | - | | | - | | | - | | | - | | | | |

| 3/13/2007 | | $ | 142,857.14 | | $ | 60,000.00 | | | 1,438,703 | | $ | 67,619 | | | - | | | | |

| 4/13/2007 | | $ | 142,857.14 | | $ | 19,047.62 | | | 1,533,189 | | $ | 53,968 | | | - | | | | |

| 5/13/2007 | | $ | 142,857.14 | | $ | 18,095.24 | | | 1,611,790 | | $ | 40,238 | | | - | | | | |

| 6/13/2007 | | $ | 142,857.14 | | $ | 17,142.86 | | | 3,866,541 | | $ | 66,746 | | | - | | | | |

| 7/13/2007 | | $ | 142,857.14 | | $ | 16,190.48 | | | 2,218,464 | | $ | 43,296 | | | 4,165,533 | | $ | 12,080 | |

| 8/13/2007 | | $ | 142,857.14 | | $ | 15,238.10 | | | 2,557,839 | | $ | 32,497 | | | 5,841,256 | | $ | 16,940 | |

| 9/13/2007 | | $ | 142,857.14 | | $ | 14,285.71 | | | 6,363,615 | | $ | 45,434 | | | 4,115,648 | | $ | 11,935 | |

| 10/13/2007 | | $ | 142,857.14 | | $ | 13,333.33 | | | 3,221,786 | | $ | 17,612 | | | 15,745,176 | | $ | 45,661 | |

| 11/13/2007 | | $ | 142,857.14 | | $ | 12,380.95 | | | - | | | - | | | 20,698,414 | | $ | 60,025 | |

| 12/13/2007 | | $ | 142,857.14 | | $ | 11,428.57 | | | 2,229,820 | | $ | 6,764 | | | 21,306,122 | | $ | 61,788 | |

| 1/13/2008 | | $ | 142,857.14 | | $ | 10,476.19 | | | - | | | - | | | 21,904,761 | | $ | 63,524 | |

| 2/13/2008 | | $ | 142,857.14 | | $ | 9,523.81 | | | - | | | - | | | 21,768,707 | | $ | 63,129 | |

| 3/13/2008 | | $ | 142,857.14 | | $ | 8,571.43 | | | - | | | - | | | 21,632,653 | | $ | 62,735 | |

| 4/13/2008 | | $ | 142,857.14 | | $ | 7,619.05 | | | - | | | - | | | 21,496,599 | | $ | 62,340 | |

| 5/13/2008 | | $ | 142,857.14 | | $ | 6,666.67 | | | - | | | - | | | 21,360,544 | | $ | 61,946 | |

| 6/13/2008 | | $ | 142,857.14 | | $ | 5,714.29 | | | - | | | - | | | 21,224,490 | | $ | 61,551 | |

| 7/13/2008 | | $ | 142,857.14 | | $ | 4,761.90 | | | - | | | - | | | 21,088,434 | | $ | 61,156 | |

| 8/13/2008 | | $ | 142,857.14 | | $ | 3,809.52 | | | - | | | - | | | 20,952,380 | | $ | 60,762 | |

| 9/13/2008 | | $ | 142,857.14 | | $ | 2,857.14 | | | - | | | - | | | 20,816,326 | | $ | 60,367 | |

| 10/13/2008 | | $ | 142,857.14 | | $ | 1,904.76 | | | - | | | - | | | 20,680,271 | | $ | 59,973 | |

| 11/13/2008 | | $ | 142,857.14 | | $ | 952.38 | | | - | | | - | | | 20,544,217 | | $ | 59,578 | |

| 12/13/2008 | | | | | | | | | | | | | | | | | | | |

Total | | $ | 3,000,000.00 | | $ | 260,000.00 | | | 25,041,747 | | $ | 330,428 | | | 305,341,533 | | $ | 885,490 | |

The following table shows the possible discount to market price based on the market price on January 9, 2008 which was $0.0099 per share, and the conversion price of $0.007 which represents seventy-five percent (75%) of the average of the closing bid price of the common stock $0.0096 per share and a 29% discount to closing market price of $0.0099.

| Market price per share on January 9, 2008 of common stock underlying the Notes: | | $ | 0.0099 | |

| Conversion price per share on January 9, 2008 of common stock underlying the Notes: | | $ | 0. 007 | |

| Total number of shares underlying the Notes (at a conversion price of $0.007) | | | 305,341,533 | |

| Combined market price of the total number of shares (305,341,533) underlying the Note using $0.0099 market price | | $ | 3,022,881 | |

| Combined conversion price of shares underlying the Notes | | $ | 2,137,391 | |

Total possible discount to market price: | | $ | 885,490 | |

Warrants

Class A Warrants: 6,000,000 shares of common stock are issuable on exercise of the Class A Warrants. The Class A Warrants have a five year term and have an exercise price of $0.30 per share (subject to adjustment). The initial exercise price represented a discount of $0.13 per share to the $0.43 market price of our common stock on December 13, 2006, the date of issuance. As of January 9, 2008, the closing price for the common stock was $0.0099. Accordingly the Class A Warrants are significantly out of the money.

Class B Warrants: 6,000,000 shares of common stock are issuable on exercise of Class B Warrants. The Class B Warrants have an exercise price of $0.40 per share (subject to adjustment). The initial exercise price represented a discount of $0.03 to the $0.43 market price for our common stock on December 13, 2006, the date of issuance. As of January 9, 2008, the closing price for the common stock was $0.0099. Accordingly the Class B Warrants are significantly out of the money.

Finder’s Warrant: 2,400,000 shares of common stock are issuable on the exercise of the finder’s warrants to purchase our common stock. The finder’s warrants have an exercise price of $0.30 per share (subject to adjustment) and represent a discount of $0.13 to the $0.43 market price for our common stock on December 13, 2006, the date of issuance. As of January 9, 2008, the closing price for the common stock was $0.0099. Accordingly the finder’s warrants are significantly out of the money.

The following is a table disclosing the aggregate amount of possible profit which could be realized by the selling stockholders (or its affiliates) as a result of any exercise price discounts for the common stock underlying the warrants. The only warrants, options, notes or other securities of the issuer that are held by the selling stockholders or any of their affiliates are the Class A Warrants, the Class B Warrants and the Finder’s Warrants that were issued in connection with the issuance and sales of the Notes.

| Market price on December 13, 2006 (date of issuance) of common stock underlying warrants, per share | | $ | 0.43 | |

| Exercise price per share: Class A Warrant | | $ | 0.30 | |

| Exercise price per share: Class B Warrant | | $ | 0.40 | |

| Exercise price per share: Finder’s Warrant | | $ | 0.30 | |

| No. of shares issuable under Class A Warrant | | | 6,000,000 | |

| No. of shares issuable under Class B Warrant | | | 6,000,000 | |

| No. of shares issuable under Finder’s Warrant | | | 2,400,000 | |

| Market price on date of issuance of total number of shares underlying under Class A Warrants | | $ | 2,580,000 | |

| Market price on date of issuance of total number of shares underlying under Class B Warrants | | $ | 2,580,000 | |

| Market price on date of issuance of total number of shares underlying under Finder’s Warrant | | $ | 1,032,000 | |

| Combined exercise price of Class A Warrants | | $ | 1,800,000 | |

| Combined exercise price of Class B Warrants | | $ | 2,400,000 | |

| Combined exercise price of Finder’s Warrant | | $ | 720,000 | |

Total discount to market price on date of issuance: Class A Warrant | | $ | 780,000 | |

Total discount to market price on date of issuance: Class B Warrant | | $ | 180,000 | |

Total discount to market price on date of issuance: Finder’s Warrant | | $ | 312,000 | |

Total discount to market price on date of issuance: All Warrants | | $ | 1,272,000 | |

The following table shows the possible premium to market price based on the market price on January 9, 2008 which was $0.0099 per share.

| Market price per share of underlying shares of common stock | | $ | 0.0099 | |

| Exercise price per share: Class A Warrant | | $ | 0.30 | |

| Exercise price per share: Class B Warrant | | $ | 0.40 | |

| Exercise price per share: Finder’s Warrant | | $ | 0.30 | |

| No. of shares issuable under Class A Warrant | | | 6,000,000 | |

| No. of shares issuable under Class B Warrant | | | 6,000,000 | |

| No. of shares issuable under Finder’s Warrant | | | 2,400,000 | |

| Market price of total shares underlying under Class A Warrant | | $ | 59,400 | |

| Market price of total shares underlying under Class B Warrant | | $ | 59,400 | |

| Market price of total shares underlying under Finder’s Warrant | | $ | 23,760 | |

| Combined exercise price under Class A Warrant | | $ | 1,800,000 | |

| Combined exercise price under Class B Warrant | | $ | 2,400,000 | |

| Combined exercise price under Finder’s Warrant | | $ | 720,000 | |

Total loss if Class A Warrants exercised and sold at market price on January 9, 2008 | | $ | (1,740,600) | |

Total loss if Class B Warrant exercised and sold at market on January 9, 2008 | | $ | (2,340,600) | |

Total loss if Finder’s Warrant exercised and sold at market on January 9, 2008 | | $ | (696,240) | |

Total loss if all Warrants exercised and sold at market on January 9, 2008 | | $ | (4,777,440) | |

The following is a table disclosing (i) the gross proceeds paid to us in connection with the financing transaction, (ii) the payments made by us, (iii) the resulting net proceeds and (iv) the aggregate potential profit realizable by the selling stockholders as a result of discounts to the market price on December 13, 2006 ( the date of issuance) relating to the conversion price of the Notes and the exercise price of the warrants issued in connection with the financing transaction:

| | | Amount | | % of Net Proceeds | |

| Gross proceeds paid to us: | | $ | 3,000,000 | | | - | |

| All payments that have been made by us: | | $ | 393,750 | | | - | |

| Net proceeds to issuer: | | $ | 2,606,250 | | | 100 | % |

| Combined total possible profit assuming conversion of the Notes at $.25 and resale of the 12,000,000 shares underlying the Notes at the market price at time of issuance of $.43 per share. | | $ | 2,160,000 | | | 82.9 | % |

| Combined total possible profit as a result of discounted exercise price of the warrants on the date of issuance | | $ | 1,272,000 | | | 48.8 | % |

The following table shows the total possible profit as a result of the exercise price to market price based on the market price on January 9, 2008 which was $0.0099 per share.

| | | Amount | | % of Net Proceeds | |

| Gross proceeds paid to issuer: | | $ | 3,000,000 | | | - | |

| All payments that have been made by issuer: | | $ | 393,750 | | | | % |

| Net proceeds to issuer: | | $ | 2,606,250 | | | 100 | % |

| Combined total possible profit as a result of discounted conversion price of the Notes (1) | | $ | 1,242,857 | | | 47.69 | % |

| Combined total possible profit as a result of discounted exercise price of the warrants | | $ | 0 (2 | ) | | 0% (2 | ) |

| (1) | Prior to the occurrence of an “event of default” (as defined in the Notes) the notes were convertible at a price of $.25 per share. After the occurrence of an event of default the Notes are convertible at the lesser of $0.25 per share and 75% of the average closing bid prices for the common stock for the five trading days prior to the date of conversion. On October 15, 2007, an event of default occurred as a result of our failure to make our monthly amortization payment due on that date in registered shares of common stock or in cash. Accordingly the effective conversion price is 75% of the average closing bid prices for the common stock for the five trading days prior to the date of conversion. As of January 9, 2008 an aggregate of $1,122,609.22 for principal and interest of the Notes have been paid down. |

| (2) | The result of an exercise of the warrants at the exercise price and a sale at the market price would be a loss to the selling stockholder. Therefore, the possible profit as a result of the discounted exercise price to market price is zero and the corresponding percentage is zero. |

The following is a table comparing the shares outstanding prior to the financing transaction, number of shares registered by the selling stockholders (or their affiliates) in prior registration statements (along with that number still held and number sold pursuant to such prior registration statements) and the number of shares registered for resale in this Registration Statement relating to the financing transaction.

| Number of shares outstanding on December 13, 2006 held by persons other than the selling stockholders, affiliates of the Company and affiliates of the selling stockholders | | | 59,314,470 | |

| Number of shares outstanding on December 31, 2007 held by persons other than the selling stockholders, affiliates of the Company and affiliates of the selling stockholders | | | 127,917,746 | |

| Number of shares registered for resale by selling stockholders or affiliates in prior registration statements (1) | | | 32,400,000 | |

| Number of shares previously registered for resale by selling stockholders (or affiliates of selling stockholders) that continue to be held by selling stockholders (or affiliates of selling stockholders) | | | 5,254,498 | |

| Number of shares previously registered for resale that have been sold by selling stockholders or affiliates of selling stockholders | | | 17,314,588 | |

| Number of shares registered for resale on behalf of selling stockholders or affiliates of selling stockholders in this prospectus (2) | | | 312,000,000 | |

(1) Represents (i) the contractually agreed minimum number (18,000,000) of shares of common stock which shares may be issued either (A) in connection with the repayment by us of the principal of and interest on the Notes and/or (B) upon the conversion of the Notes by the holders and (ii) 14,400,000 shares of our common stock issuable upon the exercise of the Class A Warrants, Class B Warrants and Finder’s Warrants, all of which was registered in a registration statement filed on January 22, 2007 which was declared effective on March 23, 2007.

(2) We do not currently have sufficient cash flow to satisfy our payment obligations under the Notes in cash. Accordingly we are required to satisfy our payment obligations on the Notes in registered shares of our common stock. As the effective conversion rate for the shares of common stock be issued by us to make the monthly payments due on the Notes is based on a 25% discount to then five day average closing bid price, we will be required to issue additional shares should the market price of our common stock continue to fall.

Other than the issuance and sale of the Notes and the warrants to the selling stockholders, we have not in the past three years engaged in any securities transaction with any of the selling stockholders, any affiliates of the selling stockholders, or, after due inquiry and investigation, to the knowledge of the our management, any person with whom any selling stockholder has a contractual relationship regarding the transaction (or any predecessors of those persons).

In addition, other than in connection with the contractual obligations set forth in (i) the subscription agreements entered into by us, on the one hand and each of the selling stockholders on the other hand, (ii) the Notes and the warrants and (iii) the security documents entered into in connection with the financing transaction, we do not have any agreement or arrangement with the selling stockholders with respect to the performance of any current or future obligations.

RISK FACTORS

An investment in our common stock is speculative and involves a high degree of risk and uncertainty. You should carefully consider the risks described below, together with the other information contained in this prospectus, including the consolidated financial statements and notes thereto, before deciding to invest in our common stock. The risks described below are not the only ones facing us. Additional risks not presently known to us or that we presently consider immaterial may also harm us. If any of the following risks occur, our business, financial condition and results of operations and the value of our common stock could be materially harmed.

Risks Related to Our Business

We are in default on our Notes and the holders of the Notes may force us to liquidate our assets to pay off the Notes

On October 15, 2007, an “event of default” occurred and is continuing because we failed to make our monthly amortization payment due on that date in registered shares of common stock or in cash. We do not have the available cash necessary to make the payments in cash and we had not registered sufficient shares to facilitate payment of the monthly amortization due in shares of our common stock. This event of default has not been waived by the investors and is continuing. Our obligations under the Notes are secured by a security interest on all of our assets. Accordingly at any time that an event of default is continuing we may be forced to liquidate our assets and apply the proceeds of the sale to satisfy our payments due on the Notes. To date no investor has instituted or threatened to institute proceedings to enforce their security interest on our assets. Some investors have accepted unregistered shares in payment of the monthly amortization amount due to them. Other investors have been silent. We intend to endeavor to satisfy our past and future amortization payments due under the Notes by delivery of registered shares of our common stock. However there can be no assurance that this will be possible as the investors have the right to request payment in cash following an event of default. We do not have any available cash to make the payments due on the Notes in cash.

We have limited cash to continue our operations

The management of the Company acknowledges that its existing cash and cash equivalents may not be sufficient to fund its operations beyond the next three (3) months. Therefore, the ability of the Company to continue as a going concern will be dependent on whether the Company can generate sufficient revenue or obtain funding from alternative sources. The Company has not currently lined up any additional financing and we can’t assure you that we will be successful in finding additional financing on any terms.

We may not successfully implement our recently adopted new business plan; and the business plan even if successfully implemented may not result in increased profitability.

We have reported losses from operations in every year of our operating history. In order to achieve profitability and improve operating performance we recently changed our business strategy and formulated a new business plan. Under our newly adopted business plan we plan to move away from the low margin vaccine business and focus on higher margin vaccine and specialty drugs, to commence distribution of specialty pharmaceutical products, and antiviral products. We are also working to take direct control on subsidiaries’ operation and financial management instead of relying on the joint venture partner’s performance. We cannot assure you that we will be able to successfully implement our new business plan or that even if successfully implemented that we will achieve profitability.

We have reported losses from operations in every year of our operating history.

We have never generated profits from operations in any year. At December 31, 2006, we had an accumulated deficit of approximately $12.3 million. For the fiscal year ended December 31, 2006 we had an operating loss of approximately $3.7 million. For the nine months ended September 30, 2007 we had an operating loss of approximately $1.4 million. We will need to significantly increase our annual revenue to achieve profitability. We may not be able to do so. Even if we do achieve profitability for any period, we cannot assure you that we will be able to sustain or increase profitability on a quarterly or annual basis in the future.

We have incurred significant expenses in the past. Although we cannot quantify the amount, we expect expenses to continue to increase for the remainder of 2007 and we expect to continue to incur losses.

Our consolidated financial statements have been prepared assuming that the Company will continue as a going concern.

The factors described below raise substantial doubt about our ability to continue as a going concern. Our consolidated financial statements do not include any adjustments that might result from this uncertainty. Our independent registered public accounting firm has included an explanatory paragraph expressing doubt about our ability to continue as a going concern in their audit report for the fiscal year ended December 31, 2006.

We have relied upon outside financing to fund our operations. As a result, our ability to sustain and build our business has depended upon our ability to raise capital from investors and we do not know if we will be able to continue to raise sufficient funds from investors.

We have operated on a negative cash flow basis since our inception and we have never earned a profit. We anticipate that we will continue to incur losses and that we will continue to operate on a negative cash flow basis for at least the next 12 months. We have financed our operations to date through the sale of stock, other securities and certain borrowings.

In December 2006 we received net proceeds of approximately $2.6 million through the sale of the Notes. We believe such funds will be sufficient to sustain our operations for the next three months based upon our current expectations. If, as expected, we continue to operate on a negative cash flow basis at the end of such period, then we will need to raise additional funds through the sale of securities. However, the terms of the December 13, 2006 financing impose significant restrictions on our ability to raise additional financing. See “Effect of the Notes.”

If we raise additional funds through the issuance of equity securities, this will cause significant additional dilution of our common stock, and holders of the additional equity securities may have rights senior to those of the current holders of our common stock. If we obtain additional financing by issuing debt securities, the terms of those securities could restrict or prevent us from paying dividends and could limit our flexibility in making business decisions. The market price of our common stock has decreased from $0.43 on December 13, 2006, the date of issuance of the Notes to $0.0125 on January 9, 2008. If the market price of our common stock continues to decline our common stock may be worthless and this may adversely affect our ability to raise additional capital. Moreover, the terms of the agreements that we entered into on December 13, 2006 relating to issuance of the Note may impede our ability to raise additional capital. To the extent that we are able to raise additional capital through the sale of equity or convertible debt securities, the issuance of such securities could result in further dilution of the shares held by existing stockholders. If additional funds are raised through the issuance of debt securities, such securities may provide the holders certain rights, preferences, and privileges senior to those of our current stockholders, and the terms of such debt could impose restrictions on our operations. We cannot assure you that additional capital, if required, will be available on acceptable terms, or at all. If we are unable to obtain sufficient amounts of additional capital, we may not be able to continue as a going concern.

We do not have sufficient cash to make the payments on the Notes, so we are required to pay off the debt in shares of our common stock.

As of January 9, 2008, we had approximately $2.0 million of debt outstanding on the Notes secured by all our assets. We do not currently have the ability to service this debt in cash so we are required to pay off the debt in shares of our common stock. On October 15, 2007, we failed to pay our monthly amortization payment due on that date in that we failed to pay cash or deliver “registered” shares to the holders to satisfy our monthly amortization payment due on that date. This was due to the fact that that we had not registered a sufficient number of shares to facilitate the issuance of registered shares. This failure to pay amounts to an “event of default” under the terms of the Notes. We have not received a written waiver from the investors. Our obligations under the Notes are secured by a security interest all of our assets. As a result of the continuing event of default our assets, remain subject to foreclosure and our common stock may become worthless.

Effect of the Notes

The Notes (and Warrants issued therewith) may have an adverse impact on the market value of our common stock.

The resale of stock issuable on repayment or conversion of the Notes and on exercise of the warrants issued in connection with our December 13, 2006, or even the possibility of their resale, may adversely affect the trading market for our common stock and adversely affect the prevailing market price of our common stock. Since December 13, 2006, the market price of our common stock has decreased from $0.43 to $0.0125 on January 9, 2008.

The existence of rights under such Notes and warrants to acquire our common stock at prices with full ratchet anti-dilution clauses may prove a hindrance to our efforts to raise future equity and debt funding, and the exercise of such rights will dilute the percentage ownership interest of our stockholders and will dilute the value of their stock.

The Notes and Warrants may adversely affect our financial flexibility.

The Notes impose a significant debt burden on us that could have adverse consequences on our business. The amount of the Notes could adversely affect us in a number of ways, including the following:

· we may be unable to obtain additional financing for working capital, capital expenditures, acquisitions and general corporate purposes;

· debt-service requirements if paid in cash would reduce the amount of cash we have available for other purposes;

· we may be restricted in our ability to make strategic acquisitions and to exploit business opportunities;

Under the terms of the Notes we can elect to make the monthly payments due on the Notes in cash or common stock. Our ability to make payments of principal and interest on our debt in cash depends on the amount of cash flow from operations, our future performance, general economic conditions and financial, business and other factors affecting our operations, many of which are beyond our control. We currently are cash flow negative and have limited cash available to us and so have elected to make the monthly payments due in common stock. We will continue to do so unless we are able to raise additional capital or generate sufficient cash flow from operations in the future to service our debt in cash. The future issuance of shares of common stock to the holders of the Notes to pay the monthly amortization payments at the 25% discount to market price will further dilute the percentage ownership interest of our stockholders and will dilute the value of their stock.

The Notes may adversely affect our operational flexibility.

The terms of the December 13, 2006 financing impose restrictions on us that may affect our ability to successfully operate our business. The transaction documents contain a number of covenants that may restrict our ability to operate, including, among other things, covenants that restrict our ability:

· to incur additional indebtedness;

· to pay dividends on our capital stock (except for our preferred stock);

· to redeem or repurchase our common stock;

· to issue shares of common stock, or securities convertible into common stock;

· to use our assets as security in other transactions;

· to create liens on our assets; and

· to enter into certain transactions with affiliates.

Further, the Notes limit our ability to enter into any acquisition, merger exchange or sale or other transaction. A material breach of any of our obligations on the Notes constitutes an “event of default” under the Notes. An event of default could result in acceleration of our indebtedness and permit the investor to foreclose on our assets.

Risks related to our business strategy and risks related to our inability to carry out such strategy