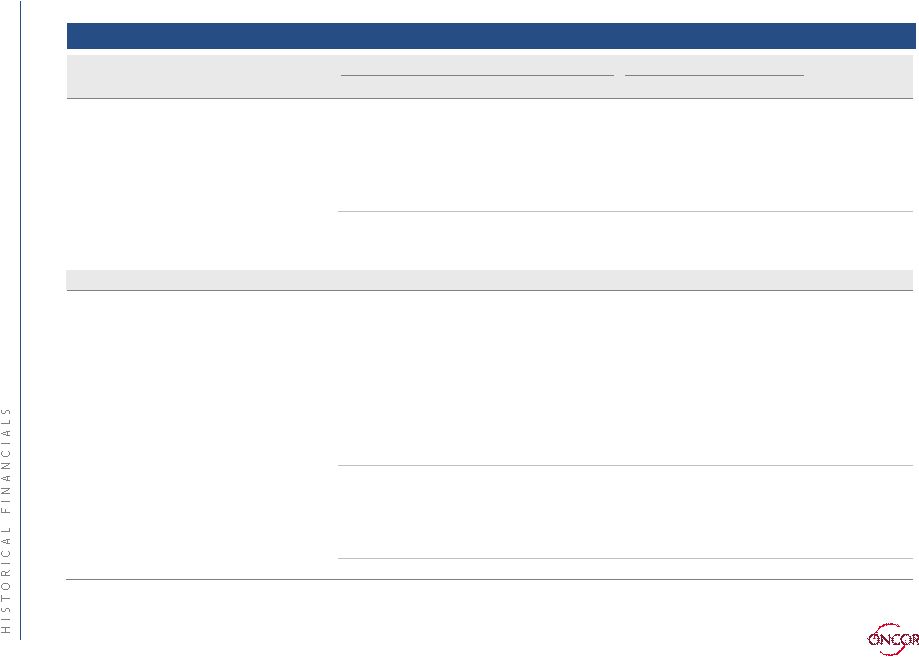

Summary financials ($ millions) Oncor historical financials Year ended December 31, 6 months ended June 30, 2004 2005 2006 2006 2007 LTM June 30, 2007 Total operating revenues $2,226 $2,394 $2,449 $1,166 $1,195 $2,478 Total operating expenses $1,697 $1,805 $1,838 $893 $909 $1,854 Operating income $529 $589 $611 $273 $286 $624 EBITDA $1,057 $1,241 $1,276 $597 $602 $1,281 Less: Securitization revenue (106) (153) (154) (74) (72) (152) Adjusted EBITDA $951 $1,088 $1,122 $523 $530 $1,129 Capital expenditures 600 733 840 452 382 770 Balance sheet Cash and cash equivalents $ - $15 $1 $1 $1 $1 Total assets 9,493 9,911 10,709 10,296 10,949 10,949 Property, plant and equipment—net 6,609 7,067 7,608 7,377 7,847 7,847 Capitalization Long-term debt, less current amounts $4,199 $4,107 $3,811 $4,059 $4,562 $4,562 Excluding transition bonds 3,032 3,033 2,833 3,033 3,634 3,634 Transition bonds, less current amounts 1,167 1,074 978 1,026 928 928 Shareholders' equity 2,687 2,935 2,975 2,949 2,947 2,947 Total $6,886 $7,042 $6,786 $7,008 $7,509 $7,509 Capitalization ratios Long-term debt, less current amounts 61.0% 58.3% 56.2% 57.9% 60.8%¹ 60.8%¹ Shareholders' equity 39.0% 41.7% 43.8% 42.1% 39.2% 39.2% Total 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% Note: Oncor’s financial statements include its wholly-owned, bankruptcy remote financing subsidiary, Oncor Electric Delivery Transition Bond Company LLC. Oncor Electric Delivery Transition Bond Company LLC was organized for the limited purpose of issuing securitization bonds to recover generation-related regulatory asset stranded costs and other qualified costs 1 The debt to equity ratio for regulatory purposes as of June 30, 2007 was 56.5% debt / 43.5% equity 22 |