Exhibit 99.2 Business Unit 2018 Funds from Operations (FFO) to Debt Ratio (unaudited) (1 of 2) Funds from Operations (FFO), and thereby the ratio of FFO to Debt, are non-GAAP financial measures. As defined and used by management, FFO, which is comprised of Net Cash Provided by Operating Activities (also referred to as operating cash flows), which we consider to be the most directly comparable GAAP measure, is adjusted to exclude changes in working capital. We believe that FFO is a useful measure and management uses it to evaluate our business because it is one of the key metrics used by rating agencies to evaluate how leveraged a company is, and therefore how much debt a company can issue without negatively impacting its credit rating. It also provides management with a measure of cash available for debt service and for shareholders in the form of potential dividends or potential share repurchases. FFO has limitations due to the fact it does not represent the residual cash flow available for discretionary purposes. For example, FFO does not incorporate dividend payments and debt service. Therefore, we believe it is important to view FFO as a complement to the entire Statement of Cash Flows. Non-GAAP financial measures are supplementary information that should be considered in addition to, but not as a substitute for, the information in accordance with GAAP. The tables below reconcile FFO to Net Cash Provided by Operating Activities, which we consider to be the most directly comparable financial measure calculated in accordance with GAAP, and we provide the ratio of Net Cash Provided by Operating Activities to Debt, which we consider to be the most comparable financial measure calculated in accordance with GAAP to the ratio of FFO to Debt.Exhibit 99.2 Business Unit 2018 Funds from Operations (FFO) to Debt Ratio (unaudited) (1 of 2) Funds from Operations (FFO), and thereby the ratio of FFO to Debt, are non-GAAP financial measures. As defined and used by management, FFO, which is comprised of Net Cash Provided by Operating Activities (also referred to as operating cash flows), which we consider to be the most directly comparable GAAP measure, is adjusted to exclude changes in working capital. We believe that FFO is a useful measure and management uses it to evaluate our business because it is one of the key metrics used by rating agencies to evaluate how leveraged a company is, and therefore how much debt a company can issue without negatively impacting its credit rating. It also provides management with a measure of cash available for debt service and for shareholders in the form of potential dividends or potential share repurchases. FFO has limitations due to the fact it does not represent the residual cash flow available for discretionary purposes. For example, FFO does not incorporate dividend payments and debt service. Therefore, we believe it is important to view FFO as a complement to the entire Statement of Cash Flows. Non-GAAP financial measures are supplementary information that should be considered in addition to, but not as a substitute for, the information in accordance with GAAP. The tables below reconcile FFO to Net Cash Provided by Operating Activities, which we consider to be the most directly comparable financial measure calculated in accordance with GAAP, and we provide the ratio of Net Cash Provided by Operating Activities to Debt, which we consider to be the most comparable financial measure calculated in accordance with GAAP to the ratio of FFO to Debt.

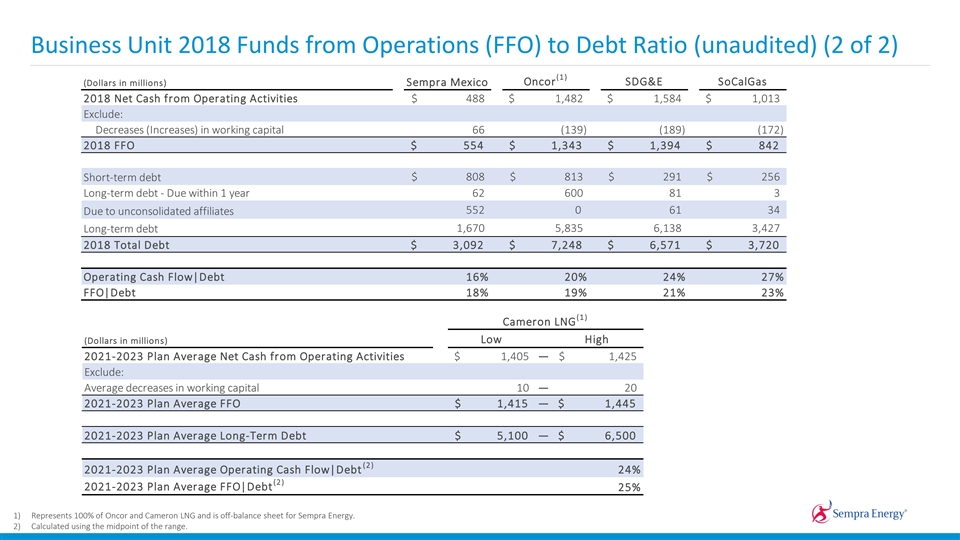

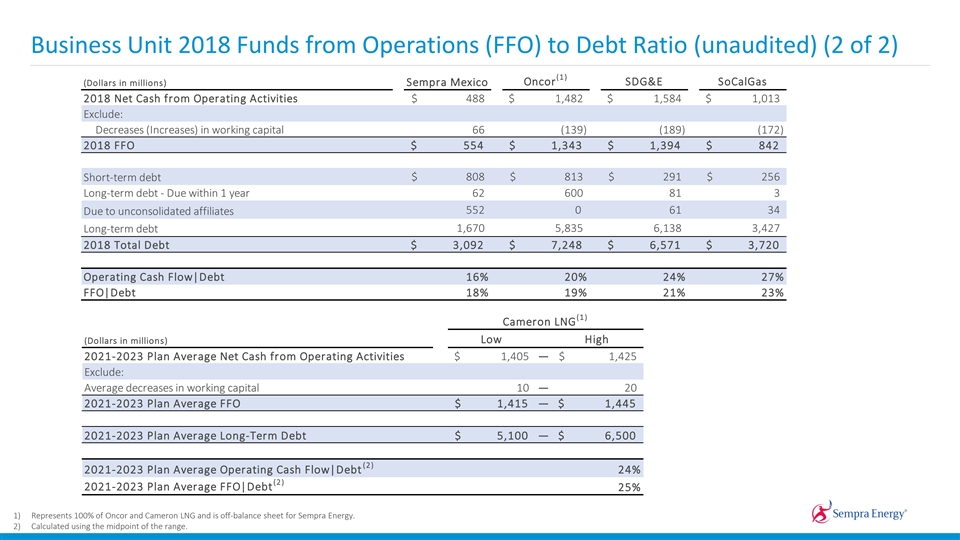

Business Unit 2018 Funds from Operations (FFO) to Debt Ratio (unaudited) (2 of 2) (1) Oncor SDG&E SoCalGas (Dollars in millions) Sempra Mexico 2018 Net Cash from Operating Activities $ 488 $ 1,482 $ 1,584 $ 1,013 Exclude: Decreases (Increases) in working capital 66 (139) (189) (172) 2018 FFO $ 554 $ 1,343 $ 1,394 $ 842 Short-term debt $ 808 $ 813 $ 291 $ 256 Long-term debt - Due within 1 year 62 600 81 3 552 0 61 34 Due to unconsolidated affiliates 1,670 5,835 6,138 3,427 Long-term debt 2018 Total Debt $ 3,092 $ 7,248 $ 6,571 $ 3,720 Operating Cash Flow|Debt 16% 20% 24% 27% FFO|Debt 18% 19% 21% 23% (1) Cameron LNG Low High (Dollars in millions) 2021-2023 Plan Average Net Cash from Operating Activities $ 1,405— $ 1,425 Exclude: Average decreases in working capital 10— 20 2021-2023 Plan Average FFO $ 1,415— $ 1,445 2021-2023 Plan Average Long-Term Debt $ 5,100— $ 6,500 (2) 2021-2023 Plan Average Operating Cash Flow|Debt 24% (2) 2021-2023 Plan Average FFO|Debt 25% 1) Represents 100% of Oncor and Cameron LNG and is off-balance sheet for Sempra Energy. 2) Calculated using the midpoint of the range.Business Unit 2018 Funds from Operations (FFO) to Debt Ratio (unaudited) (2 of 2) (1) Oncor SDG&E SoCalGas (Dollars in millions) Sempra Mexico 2018 Net Cash from Operating Activities $ 488 $ 1,482 $ 1,584 $ 1,013 Exclude: Decreases (Increases) in working capital 66 (139) (189) (172) 2018 FFO $ 554 $ 1,343 $ 1,394 $ 842 Short-term debt $ 808 $ 813 $ 291 $ 256 Long-term debt - Due within 1 year 62 600 81 3 552 0 61 34 Due to unconsolidated affiliates 1,670 5,835 6,138 3,427 Long-term debt 2018 Total Debt $ 3,092 $ 7,248 $ 6,571 $ 3,720 Operating Cash Flow|Debt 16% 20% 24% 27% FFO|Debt 18% 19% 21% 23% (1) Cameron LNG Low High (Dollars in millions) 2021-2023 Plan Average Net Cash from Operating Activities $ 1,405— $ 1,425 Exclude: Average decreases in working capital 10— 20 2021-2023 Plan Average FFO $ 1,415— $ 1,445 2021-2023 Plan Average Long-Term Debt $ 5,100— $ 6,500 (2) 2021-2023 Plan Average Operating Cash Flow|Debt 24% (2) 2021-2023 Plan Average FFO|Debt 25% 1) Represents 100% of Oncor and Cameron LNG and is off-balance sheet for Sempra Energy. 2) Calculated using the midpoint of the range.