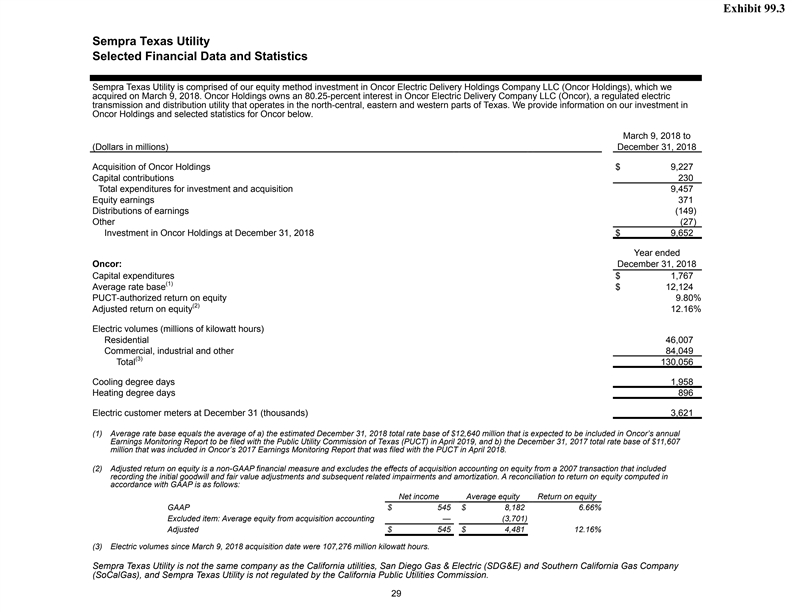

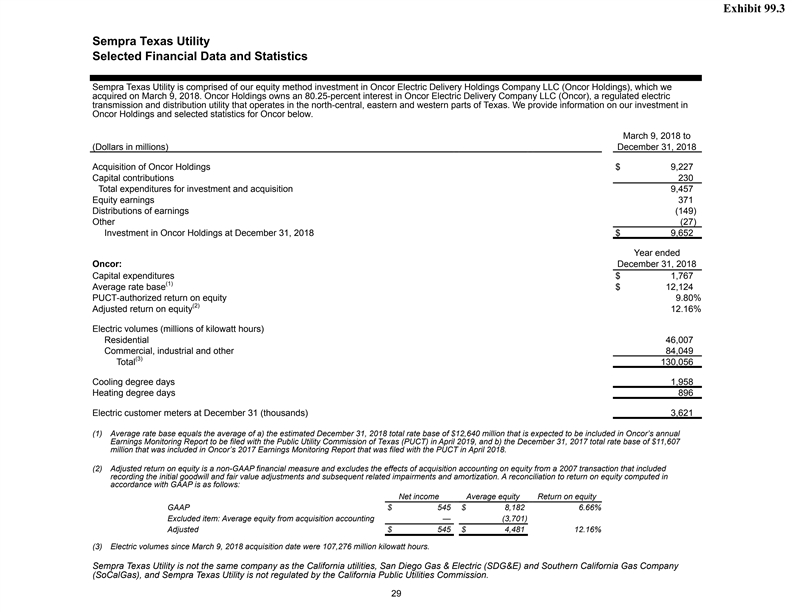

Exhibit 99.3 Sempra Texas Utility Selected Financial Data and Statistics Sempra Texas Utility is comprised of our equity method investment in Oncor Electric Delivery Holdings Company LLC (Oncor Holdings), which we acquired on March 9, 2018. Oncor Holdings owns an 80.25-percent interest in Oncor Electric Delivery Company LLC (Oncor), a regulated electric transmission and distribution utility that operates in the north-central, eastern and western parts of Texas. We provide information on our investment in Oncor Holdings and selected statistics for Oncor below. March 9, 2018 to (Dollars in millions) December 31, 2018 Acquisition of Oncor Holdings $ 9,227 Capital contributions 230 Total expenditures for investment and acquisition 9,457 Equity earnings 371 Distributions of earnings (149) Other (27) Investment in Oncor Holdings at December 31, 2018 $ 9,652 Year ended Oncor: December 31, 2018 Capital expenditures $ 1,767 (1) Average rate base $ 12,124 PUCT-authorized return on equity 9.80% (2) Adjusted return on equity 12.16% Electric volumes (millions of kilowatt hours) Residential 46,007 Commercial, industrial and other 84,049 (3) Total 130,056 Cooling degree days 1,958 Heating degree days 896 Electric customer meters at December 31 (thousands) 3,621 (1) Average rate base equals the average of a) the estimated December 31, 2018 total rate base of $12,640 million that is expected to be included in Oncor’s annual Earnings Monitoring Report to be filed with the Public Utility Commission of Texas (PUCT) in April 2019, and b) the December 31, 2017 total rate base of $11,607 million that was included in Oncor’s 2017 Earnings Monitoring Report that was filed with the PUCT in April 2018. (2) Adjusted return on equity is a non-GAAP financial measure and excludes the effects of acquisition accounting on equity from a 2007 transaction that included recording the initial goodwill and fair value adjustments and subsequent related impairments and amortization. A reconciliation to return on equity computed in accordance with GAAP is as follows: Net income Average equity Return on equity GAAP $ 545 $ 8,182 6.66% Excluded item: Average equity from acquisition accounting — (3,701) Adjusted $ 545 $ 4,481 12.16% (3) Electric volumes since March 9, 2018 acquisition date were 107,276 million kilowatt hours. Sempra Texas Utility is not the same company as the California utilities, San Diego Gas & Electric (SDG&E) and Southern California Gas Company (SoCalGas), and Sempra Texas Utility is not regulated by the California Public Utilities Commission. 29Exhibit 99.3 Sempra Texas Utility Selected Financial Data and Statistics Sempra Texas Utility is comprised of our equity method investment in Oncor Electric Delivery Holdings Company LLC (Oncor Holdings), which we acquired on March 9, 2018. Oncor Holdings owns an 80.25-percent interest in Oncor Electric Delivery Company LLC (Oncor), a regulated electric transmission and distribution utility that operates in the north-central, eastern and western parts of Texas. We provide information on our investment in Oncor Holdings and selected statistics for Oncor below. March 9, 2018 to (Dollars in millions) December 31, 2018 Acquisition of Oncor Holdings $ 9,227 Capital contributions 230 Total expenditures for investment and acquisition 9,457 Equity earnings 371 Distributions of earnings (149) Other (27) Investment in Oncor Holdings at December 31, 2018 $ 9,652 Year ended Oncor: December 31, 2018 Capital expenditures $ 1,767 (1) Average rate base $ 12,124 PUCT-authorized return on equity 9.80% (2) Adjusted return on equity 12.16% Electric volumes (millions of kilowatt hours) Residential 46,007 Commercial, industrial and other 84,049 (3) Total 130,056 Cooling degree days 1,958 Heating degree days 896 Electric customer meters at December 31 (thousands) 3,621 (1) Average rate base equals the average of a) the estimated December 31, 2018 total rate base of $12,640 million that is expected to be included in Oncor’s annual Earnings Monitoring Report to be filed with the Public Utility Commission of Texas (PUCT) in April 2019, and b) the December 31, 2017 total rate base of $11,607 million that was included in Oncor’s 2017 Earnings Monitoring Report that was filed with the PUCT in April 2018. (2) Adjusted return on equity is a non-GAAP financial measure and excludes the effects of acquisition accounting on equity from a 2007 transaction that included recording the initial goodwill and fair value adjustments and subsequent related impairments and amortization. A reconciliation to return on equity computed in accordance with GAAP is as follows: Net income Average equity Return on equity GAAP $ 545 $ 8,182 6.66% Excluded item: Average equity from acquisition accounting — (3,701) Adjusted $ 545 $ 4,481 12.16% (3) Electric volumes since March 9, 2018 acquisition date were 107,276 million kilowatt hours. Sempra Texas Utility is not the same company as the California utilities, San Diego Gas & Electric (SDG&E) and Southern California Gas Company (SoCalGas), and Sempra Texas Utility is not regulated by the California Public Utilities Commission. 29