As filed with the Securities and Exchange Commission on January 7, 2011

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21210

|

Alpine Income Trust |

(Exact name of registrant as specified in charter) |

|

2500 Westchester Avenue, Suite 215 |

Purchase, NY 10577 |

(Address of principal executive offices) (Zip code) |

|

Samuel A. Lieber |

Alpine Woods Capital Investors, LLC |

2500 Westchester Avenue, Suite 215 |

Purchase, NY 10577 |

(Name and address of agent for service) |

|

Copy to: |

Rose DiMartino |

Attorney at Law |

Willkie Farr & Gallagher |

787 7th Avenue, 40th FL |

New York, NY 10019 |

|

1-888-785-5578 |

Registrant’s telephone number, including area code |

Date of fiscal year end: October 31, 2010

Date of reporting period: October 31, 2010

Item 1. Reports to Stockholders.

EQUITY & INCOME FUNDS

Alpine Dynamic Dividend Fund

Alpine Accelerating Dividend Fund

Alpine Dynamic Financial Services Fund

Alpine Dynamic Innovators Fund

Alpine Dynamic Transformations Fund

Alpine Dynamic Balance Fund

Alpine Ultra Short Tax Optimized Income Fund

Alpine Municipal Money Market Fund

October 31,

2010

Annual Report

|

TABLE OF CONTENTS |

|

|

|

|

|

|

| |

|

|

|

|

| 6 |

| |

|

|

|

|

| 14 |

| |

|

|

|

|

| 19 |

| |

|

|

|

|

| 24 |

| |

|

|

|

|

| 28 |

| |

|

|

|

|

| 32 |

| |

|

|

|

|

|

|

| |

|

|

|

|

| 37 |

| |

|

|

|

|

| 42 |

| |

|

|

|

|

| 44 |

| |

|

|

|

|

| 76 |

| |

|

|

|

|

| 79 |

| |

|

|

|

|

| 82 |

| |

|

|

|

|

| 90 |

| |

|

|

|

|

| 99 |

| |

|

|

|

|

| 114 |

| |

|

|

|

|

Additional Alpine Funds are offered in the Alpine Equity Trust. These funds include: | |||

|

|

| |

Alpine International Real Estate Equity Fund |

|

| |

|

|

| |

Alpine’s Real Estate Funds’ investment objectives, risks, charges and expenses must be considered carefully before investing in funds of the Alpine Equity Trust. The prospectus contains this and other important information about the investment company, and it may be obtained by calling 1-888-785-5578, or visiting www.alpinefunds.com. Read it carefully before investing. | |||

Mutual fund involves risk. Principal loss is possible. | |||

|

|

|

|

|

|

|

|

| Alpine’s Investment Outlook |

|

|

|

|

|

|

|

|

Since the September, 2008 collapse of Lehman Brothers nearly imploded the global financial system in a far reaching credit crisis, investors have understood that the financial markets are in transition, but have been focused on two divergent prospects. Either the world would again descend into financial chaos, or financial normalization would be followed by sustained economic recovery leading to long term growth. Mutual fund flows over the past two years show that some investors have favored the security of U.S. Treasury notes, bonds and gold, while others emphasize the growth opportunities in emerging markets, commodities and industrial metals. Both sets of investors have enjoyed solid returns over both the fiscal year ended October 31, 2010 and since the equity market low point of March 9, 2009. However recent data and even fund flows have supported the view favoring economic growth. Even though headline figures for job growth and household formation have remained soft in the U.S. over the past 18 months, global economic data reinforced the trend of the last 6 years, showing a strong growth rate in emerging economies. While many people in developed countries seek a return to the prior economic order of the world, an increasing number of investors and corporations are embracing opportunities to participate in an ongoing reorganization of the global economy.

CRISIS REMEDIES: PAST, PRESENT AND FUTURE

Opposing outlooks for economic growth have influenced prospective solutions to repairing the economic damage from the crisis, as well as how to safeguard against future failures. However, there has been universal agreement that the principal problems that must be fixed are excessive debt and inadequate stable income. Clearly, income and revenues failed to cover personal, corporate and sovereign debt service, let alone provide for repayment. Since both the solution and future protection can create different winners or losers, various views have been hotly debated focusing on the nexus of financial, regulatory and monetary mechanisms for both capital markets and governments. As a result, the platform of national debates over the merits of near term austerity versus continued monetary and fiscal stimulus has taken on a political dimension.

Budget pressures will continue to force countries to adjust their regulatory, monetary and fiscal structures to match the current prospects for their economy, in light of both aspirations and concerns for the future. Inevitably, many countries will feel compelled to reassess their collective world view regarding the respective roles of both the state and private enterprise in providing for the security, health, education and well being of its populace.

Crisis or near crisis events such as the ‘great recession’ of 2008-2009 are often necessary to initiate such difficult debates. Financial imbalances or weaknesses have been revealed around the world by the credit crises. The dispassionate and free roaming nature of global capital flows highlights distinctions in economic strength and capacity of each country’s markets. This past April, the U.S. was the initial beneficiary of the flight to quality and stability during the depth of the crisis, while Greece became the first sovereign casualty, as its fiscal imbalance created by poor tax collection and imprudent spending could no longer be supported by excessive borrowing. This has spiraled through a fear of contagion within the banking sector and bond markets to other countries around Europe’s core for different local reasons. In addition to financial instability, it has called into question the structure and efficacy of the European Union.

Even in the U.S., we are forced to confront potential imbalances in the entitlement programs which constitute 85% of the U.S. Government’s annual budget, lest our own fiscal shortfalls and long term deficit impair this country’s global standing. Unfortunately, the increased political polarization of our government over the past few decades has prevented our leaders from addressing these issues until now that the structural imbalances have become so critical! High unemployment has reduced incomes in combination with the negative wealth effect from declines in the stock and housing markets, so that tax revenues are lagging far behind government expenditures. As a result, our country’s debt to Gross Domestic Product (GDP) has not been so out of kilter since the end of World War II! Back then, the day was saved by stimulus programs such as the G.I.

1

|

Bill providing financing for education and housing, the Marshall Plan to rebuild Europe giving us huge export markets, while establishing the National Highway System created jobs and laid the foundation for a mobile and efficient economy. A renewed focus on domestic demand after the war, combined with technological innovation (television and transistors) to create new industries, enabled the U.S. to enjoy a sustained period of growth in incomes and output which helped to reduce deficits and spread middle class wealth during the 1950’s. Thus, we should be mindful of how our country has historically succeeded in similar circumstances, as we debate a future course for the U.S.

Once again, the U.S. stands at a crossroads which could influence the course of future economic activity. This time, European nations have initiated a diet of fiscal austerity, slashing annual budgets by up to 5%. Deficit reduction is viewed as an imperative. However, without off-setting economic stimulus the resultant drag on economic growth could prolong a period of low to negative growth for many of those countries constrained by the monetary and currency inflexibility of a unified Euro. While the U.S. has greater flexibility, the Federal Reserve has become the principal branch of our government currently capable of action to provide stimulus to offset the subpar economic recovery. Through its program of quantitative easing, the Federal Reserve is, in effect, inflating equity values in the stock market to substitute for the deflation of home values over the past four years or so. This appears similar with the Fed’s approach during 2002 and 2003 where low interest rates helped to inflate home values to offset the negative wealth effect of a falling stock market during 2001 and 2002. This movable feast of monetary liquidity may also be fueling the rise of commodity markets just like they did in the spring of 1998. Unlike these prior periods which resulted in medium term “bubbles,” unwinding the Fed’s stimulus will have to be more carefully communicated to the markets and executed. It is also safe to say that the central banks of the world probably have more control over the credit markets than they did in 2006 through 2008 as a result of the decimation of the derivative propelled structures which permitted the securitization machinery of Wall Street to disproportionately influence money supply and fund flows. Thus, we are not overly concerned about the emergence of 1970’s level of inflation on a broad basis.

ULTIMATELY, IT’S ABOUT JOBS

The just agreed upon extension of Bush-era tax levels, plus other targeted deductions should have a beneficial impact over the next 12-24 months. However, the

potential for sustained job growth as a result of productive capital deployment by either business initiatives or government stimulus is uncertain. Historically, one of the greatest economic triumphs of 20th century America has been our capacity to create productive employment. Job growth helped in the assimilation of immigrants, giving common purpose and aligning the melting pot of diverse cultures, experiences and talents that has helped this country to lead the rest of the world. Currently, non-farm payrolls stand at 130.54 million people, down from the peak of 137.95 million in December, 2007. Although slightly higher than the recent low of 129.59 million last December, current payrolls are virtually flat with the number employed (130.53 million) in December, 1999! During Alpine’s fiscal year, the U. S. added an average of +49,000 new jobs per month, which compares poorly with the monthly averages sustained between September, 2003-September, 2007 (+160,000) and March, 1993-March, 2000 (+252,000) when the economy was strong. Meanwhile, our population has continued to grow between 0.9-1.0% per year as the census just reported 9.7% growth over the past decade. While slower than the long term historical rate, this suggests that the monthly job growth must be well over 100,000, just to keep the unemployment rate flat.

It is worth noting one startling trend in terms of overall unemployment, that the data suggests civilians unemployed for greater than 27 weeks (or roughly half a year) have historically stayed below 15% to 20% of all claimants during most recessions and only once exceeded 25% in the early 1980’s. Unfortunately, long term unemployment now accounts for almost 42% of all unemployed. This reflects not only the slow recovery from the most recent downturn, but perhaps a structural mismatch between the skill set of our work force and jobs which are available. It is notable that the gap between unemployed and underemployed (includes part-time or marginally employed but seeking work) has expanded from roughly 3% during 2000 to 2001, to 7½% today. This suggests that people who have lost jobs are not finding employment which matches their prior job history, so they settle for alternative situations. Updated adult education and retraining programs could adapt many of the underemployed if new skills sets can be linked to new jobs.

Over time, Alpine would hope a balanced program tilted toward greater stimulation in the early years to generate jobs with austerity targets focused on later years could provide confidence by benchmarking progress. Furthermore, public private partnerships and long term leasing (30 to 50 years) of highways, bridges,

2

|

and other infrastructure could accelerate a rebalancing of our nation’s and states’ balance sheets, while adding jobs and enabling future efficiency. Emphasizing capital spending on education, scientific research with a focus on alternative energy sources and healthcare could help the U.S. maintain economic primacy.

EMERGING ECONOMIES: FAST FORWARD TO THE FUTURE

In contrast to the fiscal cash flow and structural deficit problems of the U.S., Europe and Japan, most emerging market countries have benefited from lower indebtedness, higher domestic savings and competitive costs of production. The “Asian Contagion” and “Tequila Crisis” of recent decades, followed by the decline of the internet bubble actually constrained these countries’ banks and financial markets from rewarding excessive risk. Unlike the developed countries which are still fighting a deflationary trend, fast growth has pressured the central banks of Brazil, India, Indonesia and, most recently, China to tighten monetary conditions in order to constrain inflationary pressures. This suggests that they are moving past the recovery phase of the business cycle into a middle period of stable job creation, capacity utilization and wealth creation. Hopefully, the U.S. is only 12-24 months behind the leader’s pace, followed perhaps by Japan and the U.K., while the Euro region may be much further behind in recovery.

It is clear that we are witnessing a two-speed world, where slow recoveries in countries which are facing possible deflation sit in contrast with countries which are reshaping their export-oriented economies to meet the demands of large numbers of upwardly mobile people finally capable of sustaining domestic consumption. Rising local incomes, huge infrastructure expenditures, and growing concerns for the health, welfare and service requirements of expanding middle class consumer populations are creating new jobs to fulfill domestic demand. We do not try to predict the future, but understanding trends is important, and Alpine believes that consumption patterns are evolving rapidly in emerging countries. In 1990, the U.S., Europe and Japan accounted, respectively, for 27%, 34% and 14% of global GDP. By 2008, these geographic contributions were reduced to 24%, 30% and 8%, respectively. All 13% of the aggregate decline in GDP contribution from these countries has been taken up by emerging market output, from 21% in 1990, to 34% today. As a by-product of this trend, emerging market consumption as a share of global private purchases has grown from 17% in 1990 to 27% in 2008, and 29%

today. The U.S. was 31% of global consumption in 1990, peaked at 38% in 2002, then slowed to 30% in 2008 and today. Alpine believes the divergence of global growth rates and consumption patterns will likely continue over this next decade.

While direct exposure to emerging countries should be beneficial, many companies in the developed economies are participating in global growth. U.S. companies as diverse as G.M., Procter & Gamble and Pepsi generated over one-third of their sales from emerging markets last year. Global brands are keen to participate as the impact of globalization and technological integration continues to evolve. Historically, such companies enjoyed enhanced productivity and lower cost goods, then the rebalancing of local labor demand, and now a shift in consumption patterns. The prospects of rising domestic wealth suggests investment patterns could shift as well. This has already been felt in the capital markets, but this may well accelerate. The market capitalization of emerging markets in the MSCI World Index in 1990 was 2% and grew to 12% by 2008. Even though the disparity between market capitalization and the shared proportion of both global consumption and GDP has improved, it may be significantly realigned over the next decade as a result of rising domestic investment patterns in addition to international investment flows and economic growth. Thus, capital market participation in the emerging countries will likely continue to grow. This will create investment opportunities for companies in both the developed and emerging markets.

Alas, capital market concerns are not behind the U.S. yet. Debt maturities and sovereign refinancings loom ahead. Nonetheless, the liquidity crisis seems to be in the past. Alpine will continue to focus on both growth and value opportunities for investment. Broad macro themes, be they domestic or global, will be studied; market inefficiencies or perceived mispricing will be analyzed; technological or scientific advancements and innovation of products, processes or methodologies will be understood; while corporate transformations which rework old business models to better function today will be examined. Such levels of research are all part of Alpine’s focus. We will continue to explore varied opportunities for our Funds, and appreciate your interest in discovering and participating in the potential of these investments.

Before closing, I am delighted to introduce shareholders to our new shareholder service provider, administrator and custodian, State Street Corporation and our new transfer agent, Boston Financial Data Services (BFDS). State Street is listed on the New York Stock Exchange with a market capitalization of more than $23 billion.

3

|

State Street and BFDS are widely regarded for their advanced technological systems, depth of experienced personnel and State Street’s strong global custody network. Alpine believes that by consolidating both our open-end and closed-end funds multiple service providers with one entity, we will be able to ensure a high level of service while minimizing operating costs for the Funds shareholders. The conversion of all accounts and records took place in early December, so do not hesitate to contact info@alpinefunds.com with any questions, comments or concerns. As always, we appreciate your interest and support.

Sincerely,

President

|

The letter and those that follow represent the opinion of Alpine Funds management and are subject to change, are not guaranteed, and should not be considered investment advice

Past performance is not a guarantee of future results.

Please refer to the schedule of investments for fund holding information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. Current and future portfolio holdings are subject to risk.

The MSCI World is a stock market index of 1,500 ‘world’ stocks. It is maintained by MSCI Inc., formerly Morgan Stanley Capital International, and is often used as a common benchmark for ‘world’ or ‘global’ stock funds

An investor cannot invest directly in an index.

Must be preceded or accompanied by a prospectus.

Quasar Distributors, LLC, distributor.

4

|

|

|

| Alpine Dynamic Dividend Fund | |

|

| |

| Alpine Accelerating Dividend Fund | |

|

| |

| Alpine Dynamic Financial Services Fund | |

|

| |

| Alpine Dynamic Innovators Fund | |

|

| |

| Alpine Dynamic Transformations Fund | |

|

| |

| Alpine Dynamic Balance Fund |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Comparative Annualized Returns as of 10/31/10 (Unaudited) | ||||||||||||||||

|

| 6 Months(1) |

| 1 Year |

| 3 Years |

| 5 Years |

| Since Inception |

| |||||

Alpine Dynamic Dividend Fund |

| 0.29 | % |

| 12.72 | % |

| -15.08 | % |

| -2.43 | % |

| 3.99 | % |

|

S&P 500 Index |

| 0.74 | % |

| 16.52 | % |

| -6.49 | % |

| 1.73 | % |

| 4.14 | % |

|

STOXX Europe 600 Index(2) |

| 9.40 | % |

| 9.80 | % |

| -9.56 | % |

| 4.92 | % |

| 9.89 | % |

|

Lipper Global Multi-Cap Core Funds Average(3) |

| 0.29 | % |

| 12.72 | % |

| -15.08 | % |

| -2.43 | % |

| 3.99 | % |

|

Lipper Global Multi-Cap Core Funds Ranking(3) |

| N/A | (4) |

| 1/1 |

|

| 1/1 |

|

| 1/1 |

|

| 1/1 |

|

|

Alpine Dynamic Dividend Fund 30 Day SEC Yield (as of 10/31/10): 1.26% |

|

| ||||||||||||||

Gross Expense Ratio: 1.21%(5) |

|

|

|

|

| |||||||||||

Net Expense Ratio: 1.21%(5) |

|

|

| |||||||||||||

|

(1) Not annualized. |

(2) The since inception return represents the annualized return for the period beginning 9/30/2003. |

(3) The since inception data represents the period beginning 9/25/2003. |

(4) FINRA does not recognize rankings for less than one year. |

(5) As disclosed in the prospectus dated February 27, 2010. |

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 2 months. If it did, total returns would be reduced.

The S&P 500 Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The STOXX Europe 600 Index is derived from the STOXX Europe Total Market Index (TMI) and is a subset of the STOXX Global 1800 Index. With a fixed number of 600 components, the STOXX Europe 600 Index represents large, mid and small capitalization companies across 18 countries of the European region: Austria, Belgium, Denmark, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and the United Kingdom. The Lipper Global Multi-Cap Core Funds Average is an average of funds that, by portfolio practice, invest in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time. Lipper Rankings for the periods shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges. The S&P 500 Index, the STOXX Europe 600 Index and the Lipper Global Multi-Cap Core Funds Average are unmanaged and do not reflect the deduction of direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Global Multi-Cap Core Funds Average reflects fees charged by the underlying funds. The performance for the Dynamic Dividend Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

To the extent that the Fund’s historical performance resulted from gains derived from participation in initial public offerings (“IPOs”) and/or secondary offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary allocations in the future.

6

|

|

Alpine Dynamic Dividend Fund |

|

|

|

|

|

|

|

|

|

| ||||||||

| ||||||||||||||||

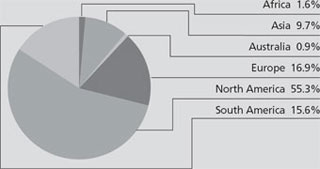

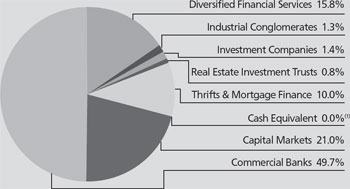

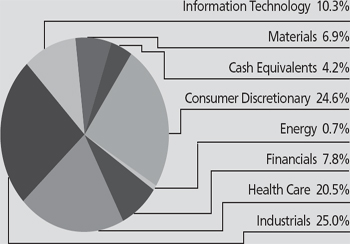

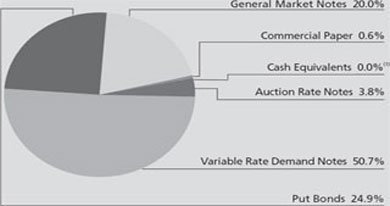

Portfolio Distributions* (Unaudited) |

| Top 10 Holdings* (Unaudited) | ||||||||||||||

|

| 1. |

| Hypermarcas SA | 2.90 | % | ||||||||||

2. |

| ITC Holdings Corp. | 2.87 | % | ||||||||||||

3. |

| Hyundai Motor Co. | 2.46 | % | ||||||||||||

4. |

| Atlas Copco AB | 2.40 | % | ||||||||||||

5. |

| SeaDrill, Ltd. | 2.38 | % | ||||||||||||

6. |

| International Business Machines Corp. | 2.25 | % | ||||||||||||

7. |

| Occidental Petroleum Corp. | 2.24 | % | ||||||||||||

8. |

| Ryanair Holdings PLC | 2.21 | % | ||||||||||||

9. |

| Abbott Laboratories | 2.19 | % | ||||||||||||

10. |

| Freeport-McMoRan Copper & Gold, Inc. | 2.19 | % | ||||||||||||

|

|

| ||||||||||||||

|

|

|

| |||||||||||||

| * | Portfolio holdings and sector distributions are as of 10/31/10 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. Top 10 Holdings do not include short-term investments. Portfolio Distributions percentages are based on total investments and Top 10 Holdings percentages are based on total net assets. | ||||||||||||||

| ||||||||||||||||

| ||||||||||||||||

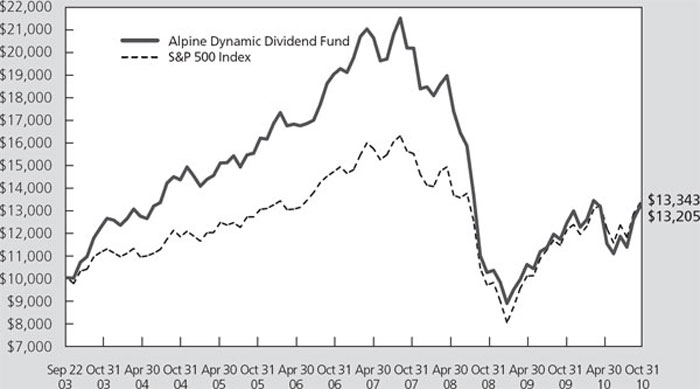

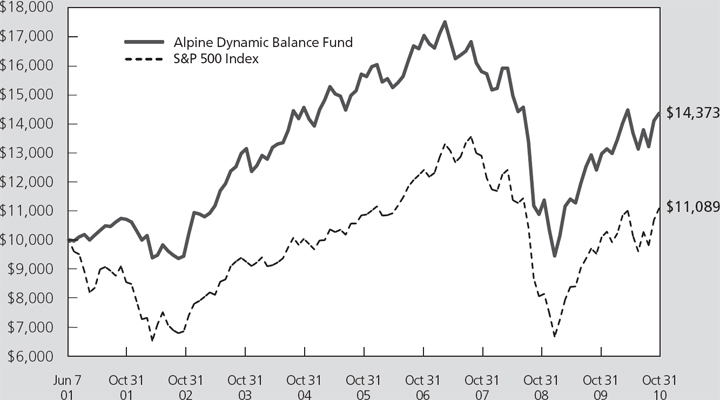

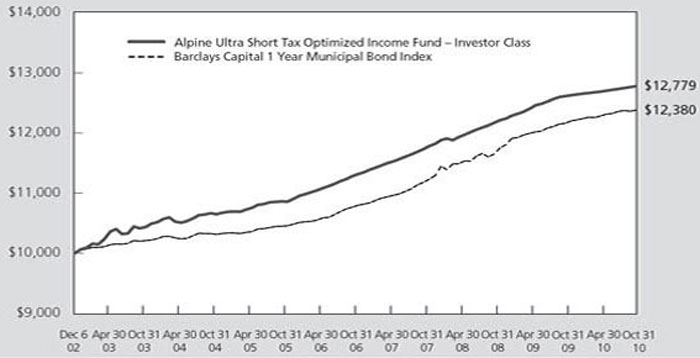

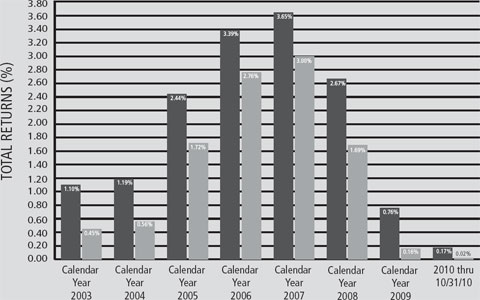

Value of a $10,000 Investment (Unaudited) | ||||||||||||||||

| ||||||||||||||||

| ||||||||||||||||

| ||||||||||||||||

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmark. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees. Without the waiver and recovery of fees, the Fund’s total return would have differed.

7

|

|

Alpine Dynamic Dividend Fund |

|

|

Commentary |

Fiscal year 2010 was very challenging for the Alpine Dynamic Dividend Fund (ADVDX) and its strategies. After renewed asset value growth and sustained dividend payout through the first five months of the fiscal year, the Fund encountered a sudden and difficult challenge between April 15th, and May 25th 2010. That challenge was the decline of 8.17% in the value of the Euro currency and the decline of 13.53% in Euro terms for the equity markets in Europe as represented by the Euro STOXX 600 Index, resulting in a decline in US Dollar terms of 21.70% during this period. With a substantial portion of our holdings in high-dividend paying European securities at that time, the Fund was adversely affected with a substantial fall in net asset value and, thus, reduction of dividend paying capacity.

Our response was to reduce the dividend to $0.042 per share per month, an approximate 12% payout on the net asset value prevailing in mid June, 2010. Further, we revised our operating policy to a greater emphasis on achieving capital appreciation in order to restore asset values. Thus, in the final quarter of our fiscal year from 7/30/10 through 10/31/10, we achieved an 8.21% growth in net asset value while sustaining the dividend payout of $0.042 per share per month.

For the fiscal year ended 10/31/10, ADVDX provided a total return of 12.72% including dividend reinvestment compared to a 16.52% increase in the S&P 500 Index and a 9.80% increase in the STOXX Europe 600 Index in U.S. dollar terms for the same period. The Fund’s investment policies remain intact and our goal remains high current income with capital growth.

ADVDX provided a high dividend yield in a still challenging equity income environment

The Fund’s primary goal continues to seek high current dividend income that qualifies for the reduced federal tax rates on dividends while also focusing on total return for long-term growth of capital. We have strived to achieve our goals despite a difficult dividend investment environment and tremendous market volatility over the past several years. ADVDX’s NAV had been severely impacted by the global financial crisis and recession in 2008 and 2009 and then again by the European debt crisis in April and May of 2010. From April 1, 2010 through the low on June 7, 2010 the Euro currency declined by over 12% and the S&P 500 Index recorded one of its worst May’s on record with an 8% decline.

The timing of the crisis in Europe was particularly detrimental for ADVDX since that region has become one of our primary dividend markets, as European companies have traditionally paid out attractive annual

dividends during the first half of the year. Also impacting our dividend capture program had been the decline in dividends paid globally as a result of the Great Recession of 2008/09 as well as the decline in liquidity available for our dividend trades. One of our risk management disciplines for dividend capture is sufficient liquidity to allow the fund to exit the holding in case of negative market or company specific news flow during our targeted holding period.

As discussed in our semi-annual letter, this difficult investment environment and the decline in dividends paid globally contributed to the decision on June 24, 2010 to reduce the dividend of ADVDX to a level that was viewed to be more in line with market conditions and that would provide greater flexibility for the NAV to appreciate if market conditions improved. A number of factors were considered before making this decision, including uncertain equity prospects, particularly in our largest dividend region in Europe, equity liquidity, volatility, level of assets in the Fund, and the dividend yield of the Fund.

The regular monthly distribution for ADVDX was reduced to $0.042 per share versus the previous minimum distribution rate of $0.07. Annualized, the new dividend rate of $0.504 per share represents a dividend yield of 11.25% on ADVDX’s closing NAV of $4.48 per share on 10/29/10. During fiscal 2010, the Fund distributed total dividends of $0.858 per share, representing a trailing twelve-month dividend yield of 19.15% based on the fiscal year end NAV of $4.48. Since inception, ADVDX has paid a total of $9.47 per share in earned dividend income. Since the dividend reduction on 6/24/10, ADVDX has appreciated by 15.17% including dividend reinvestment through fiscal year end 10/30/10 versus 10.94% for the S&P 500 Index and 20.57% for the STOXX Europe 600 Index as global equity markets rebounded from the 52-week lows hit in early July 2010.

ADVDX posted a solid total return in fiscal 2010 despite the mid-year collapse of European markets

While we are encouraged by our total return performance since the dividend cut in late June, the Fund’s results lagged the broader U.S. S&P 500 Index for the full fiscal year 2010 due to its international exposure and specifically in our European equities. We have continued to find attractive growth opportunities and significantly larger dividend payouts overseas than in the U.S. The U.S. is one of the lowest yielding countries in the group of G20 nations with a 1.94% dividend yield (S&P 500) versus for example 4.02% for Australia, 3.63% in France, 3.32% in Britain and 3.24% in Brazil for the

8

|

|

Alpine Dynamic Dividend Fund |

|

12 month period ending 10/31/10. In addition, we expect economic growth in many emerging markets to be substantially higher than the 2.6%-3.5% Gross Domestic Product (GDP) growth forecasted for the U.S. in 2011 while also receiving attractive dividends. Therefore, we have invested a significant portion of ADVDX’s assets in overseas markets to help achieve our goal of high dividends and capital appreciation in comparison to the S&P 500 Index and most of our equity income peers.

As of 10/31/10, the Fund had invested 51.8% of its holdings in companies based in 18 different countries and 48.1% of its value in domestic U.S. companies, with 0.1% in cash and equivalents. At fiscal year end the Fund had 22.2% of the portfolio invested in emerging market countries including Brazil, South Korea, South Africa, Russia, and India. Following the United States, our current top five countries are Brazil, Sweden, Japan, Ireland, and Canada. The average dividend yield for the major indices in these five countries, for the 12 month period ending 10/31/10, is 2.70% versus the average dividend yield on the S&P 500 Index of 1.94%.

The global equity markets were hit in the first half of 2010 by the sovereign debt crisis in Europe and the slowing of the global growth engine of the Chinese economy. Unfortunately, the timing of these issues and subsequent market correction in April and May occurred when we had our highest dividend capture opportunities in the European region. We ended April 30th with about 23% of net assets invested in Europe, so the Fund was particularly hard hit at the end of fiscal first half 2010 by the Euro decline.. During the same time, the U.S. markets outperformed as investors looked for relative safety in the U.S. dollar and the U.S. economy.

Given the continued uncertain outlook that still remains for the Euro region, we have diversified our exposure in the region away from companies with Euro denominated currencies. On 10/31/10, approximately 16.9% of the Fund’s assets were invested in Europe, but only 4.11% in Euro denominated currencies, with the rest being in Sweden, Ireland, Denmark, Norway, France, Russia, and the UK. We did hedge a portion of our currency exposure in Europe as a result of the crisis and we continue to diversify the portfolio globally with investments in Asia, South America, and Australia. While the currency hedges had a negative impact on total return, the losses on these hedges were offset by currency gains in equity positions in these currencies held by the Fund. Our dividend capture strategy tends to be seasonally focused in Europe in the spring. Our recently lowered dividend payment does provide more

flexibility and we will assess increasing our investment in that region at that time based on market conditions.

The global equity markets have reversed their declines since their mid-year lows, with international markets outperforming the U.S. This is a reflection of the stabilizing of the crisis in European debt as the European Central Bank (ECB) stepped in and provided funding for the troubled EU nations, Chinese GDP growth reaccelerating, and the Fed in the U.S. announcing its willingness for additional quantitative easing to support U.S. economic growth. This has helped ADVDX return to a period of outperformance relative to the S&P 500 Index since its 52-week low on July 1, 2010 through fiscal year end, with a 19.54% total return for ADVDX versus 15.90% for the S&P 500 Index

Portfolio Construction Illustrated by Top Ten Holdings

Throughout fiscal 2010, it remained challenging to balance our portfolio in an attempt to continue to provide a high level of current income while also investing our assets for capital appreciation. We will continue to scan the globe searching for the most attractive dividend investment opportunities for our investors within these volatile markets. And we will continue to execute on our goals with our three research-driven investment strategies; Dividend Capture, Growth and Income, and Value / Restructuring, in an effort to maximize the amount of our earned dividend income and to identify companies globally with the potential for dividend increases and capital appreciation. The following sections focus on these strategies using out top ten holdings as examples. The top ten holdings constituted 24.09% of assets as of 10/31/10.

Our “Dividend Capture Strategy” seeks to enhance the dividend income generated by the Fund

We run a portion of our portfolio with a dividend capture strategy, where we invest in high dividend stocks or in special situations where large cash balances are being returned to shareholders as one-time special dividends. We then look to enhance our dividend return by rotating a portion of our high yielding holdings after receiving the dividend. Our increased rotation strategy has, while increasing our dividend yield, also reduced the amount of dividend income to be eligible for the reduced 15% Federal dividend tax rate. QDI tax benefits have recently been extended by Congress through December 31, 2012. As a result, we will continue to pursue the Fund’s primary objective of high current dividend income that qualifies for the reduced federal tax rates on dividend.

9

|

|

Alpine Dynamic Dividend Fund |

|

As mentioned earlier, our dividend capture strategy was negatively impacted during fiscal 2010 by the European debt crisis in April and May 2010 which resulted in a sharp decline in our dividend capture trades in the region during that time. In addition, continuing depressed levels of dividends and liquidity has also made our dividend capture strategy more challenging in fiscal 2010. However, we are encouraged to see companies beginning to raise dividends globally as the economy has improved, credit markets are open, and balance sheets are strong. In addition, the number of special dividends that we participated in fiscal 2010 rebounded from the depressed levels experienced in 2008 and 2009 as companies distributed some of their record cash levels ahead of potential dividend tax hikes in the U.S. in 2011. ADVDX participated in a total of 46 special dividends in fiscal 2010 versus about 60 in fiscal 2007, 30 in fiscal 2008 and 16 in fiscal 2009.

One of the Fund’s top ten holdings by weight at fiscal year end was Ryanair Holdings PLC (RYA ID) which announced a special dividend payment associated with a return of excess cash on its balance sheet in June 2010, representing 9.5% of its market value at the time. Based in Dublin, Ireland, Ryanair provides low fare airline services to destinations in Europe and has benefited from strong passenger volumes and pricing. We began purchasing shares in early July at a price of €3.73, we received the special dividend of €0.34 per share in September and began selling shares in early November at about €4.00. This produced a total return for the Fund of 37.7% for the period of 7/5/10 through fiscal year end on 10/31/10, recouping the entire special dividend payment plus an equal amount in capital appreciation.

Our “Growth and Income Strategy” targets capital appreciation in addition to yield

Our second strategy identifies core growth and income stocks that may have slightly lower but still attractive dividend yields plus an outlook for strong and predictable earnings streams that should support additional future dividend increases. We feel several of the Fund’s top ten largest holdings are industry leaders with strong growth in their categories and the potential for attractive and rising dividend payouts. These include Hypermarcas SA, ITC Holdings, IBM, and Abbott Laboratories.

ADVDX’s largest holding by weight on 10/31/10 was Hypermarcas SA (HYPE3 BZ), which as the largest independent consumer products company in Latin America offers an excellent way for investors to participate in the secular growth story of the emerging market consumer. Hypermarcas sells more than 200 brands of personal care and cosmetics, pharmaceutical,

home care, and food products to wholesalers and retailers throughout Brazil. HYPE3 is estimated to produce a 25% compound annual growth in its earnings per share from 2010 through 2014 and is forecasted to initiate a 1% dividend yield in early 2011, which is expected to grow strongly with the growth in earnings. Hypermarcas was a top performer in the Fund with a 58.0% total return for the twelve months ended 10/31/10.

The Fund’s second largest position by weight at fiscal year end was ITC Holdings (ITC), based in Michigan. It is the largest U.S. independent electric transmission company with 15,000 miles of transmission lines that span five Midwestern states. As the only pure-play transmission company in the U.S., we believe that ITC is well positioned to participate in the upgrade of the nation’s electric grid, a key priority for the Obama administration. ITC raised its dividend by 4.7% in 2010 and as of 12/16/10 generated a 2.2% dividend yield. It is forecasted to possibly deliver 20% compound annual earnings per share growth in the next several years thanks to favorable regulatory treatment of electric transmission and its ambitious capital spending plan. ITC provided a 44.6% total return for ADVDX in fiscal 2010.

We have found attractive growth and income opportunities in the technology sector in fiscal 2010 with one of the Fund’s top 10 holdings by weight being the bellwether International Business Machines (IBM). Based in Armonk, NY, IBM is one of the world’s largest providers of enterprise solutions, offering a broad range of IT hardware, business and IT services, and software. We believe IBM can be a steady double-digit earnings grower as it enhances its services and software offerings to add more revenue opportunities. In addition, it has benefited from its emerging markets growth, large cost cutting efforts, and share repurchases. IBM raised its dividend by 18% in 2010 and as of 12/16/10 offered a 1.8% dividend yield. IBM provided an 18.3% total return for ADVDX in fiscal 2010.

We look to diversify our portfolio and sectors and identified what we thought was an attractive growth and income opportunity in the healthcare sector, being Abbott Laboratories (ABT), which was in our top 10 holdings by weight. We believe that ABT’s five year growth outlook is attractive based on the strength of its new cholesterol products as well as its Humira arthritis and Xience drug stent franchises. However, the stock declined toward the end of the fiscal year on concerns about potential approval of a competitor to its Humira drug several years from now, which we think is overblown. We anticipate 10% sustainable EPS growth over the next several years supported by limited generic risk relative to its peer group, smart acquisitions

10

|

|

Alpine Dynamic Dividend Fund |

|

including recently the largest pharmaceutical company in India, and solid earnings visibility. In addition, ABT raised its dividend by 10% in 2010 and offered a 3.8% dividend yield as of 12/16/10. ABT provided a 5.28% total return for ADVDX in fiscal 2010.

The Fund’s “Value/Restructuring Strategy” looks for attractively valued or restructuring dividend payers

Our third major strategy is what we call “value with a catalyst or restructuring strategy”, where our research points to under-valued or mis-priced companies with, in our opinion, attractive dividend yields. We also look for turnaround situations or depressed earnings where we believe there is a catalyst for an earnings recovery or a restructuring or corporate action that is expected to add value. With many companies having responded to the global recession with significant corporate restructurings and are still trading at discounted valuations, it is not surprising to find several of our top 10 largest holdings in this strategy including Hyundai Motor, Atlas Copco, Seadrill, Occidental Petroleum, and Freeport-McMoRan.

The Fund’s top value holding and a top 10 holding by weight on 10/31/10 was also an outstanding performer in fiscal 2010, with a 63.9% total return, Hyundai Motor Company (005380 KS). Based in Seoul, Hyundai is the largest auto maker in Korea. It also owns 38% of KIA Motors, which combined have over 80% of the domestic Korean market and are the world’s fifth-largest auto manufacturer. Hyundai has reaped the benefits of its global expansion strategy started in 2002 and quality improvements have helped it gain overall share, particularly from Toyota, in its key China, India and U.S. markets. Auto demand is rebounding from the depressed levels of 2008/9 and secular growth is occurring in Asia and other emerging markets. Hyundai trades at less than 9 times forward earnings, as of 12/16/10, which is a deep discount to its Japanese and European peers and its historical peak.

Another top performing stock in fiscal 2010 and one of the Fund’s top 10 holdings by weight in the value/restructuring strategy was Seadrill, with a total return of 58.0%. Seadrill Ltd. (SDRL NO), based in Bermuda and traded in Norway, is Europe’s largest offshore driller. Its aggressive newbuild program and acquisition strategy has given it one of the world’s youngest fleets. Seadrill is a leader in the high-growth and technologically advanced deepwater and ultra-deepwater rig markets which have experienced strong demand in regions like Brazil, West Africa, and the U.S. Gulf of Mexico as oil is getting harder to find and exploration is moving further out to sea. The company reinstated its quarterly dividend in November 2009,

providing a very attractive annual dividend yield of 8.0% as of 12/16/10 and yet the stock is trading at less than 10 times forward earnings.

In addition to Seadrill in the energy sector, the Fund also owned Occidental Petroleum (OXY) as a top value holding at fiscal year end and a top 10 holding by weight. We believe crude oil fundamentals are compelling over the next several years as growing demand from emerging economies and limited new supply should offset weakness in the developed world economies. OXY is one of the most well positioned of the U.S. large cap oil companies, we believe, based on its large exposure to oil versus gas, its 3.2 billion barrels of proven reserves, and it ability to grow production at about a 5% annual rate when other companies are experiencing declining production. It also has substantial free cash flow to fund growth opportunities, including its recent discovery in California which should warrant a multiple expansion relative to its peers. OXY raised its dividend by 15% in 2010 and offered a 1.7% dividend yield as of 12/16/10. The holding provided a 3.18% negative total return for the Fund in our holding period from 6/8/10 through fiscal year end on 10/31/10, but the stock has had strong appreciation in the beginning of fiscal 2011.

One of our top performing stocks with a 74.39% total return for the fiscal year 2010 and a top 10 holding by weight was Atlas Copco AB (ATCOA SS). Based in Sweden, Atlas Copco is a global industrial conglomerate that manufactures air compressors and generators, construction and mining equipment, and industrial power tools to various industries including mining, construction, manufacturing, auto, industrial processing, and utilities. The company has benefited from strong growth in global industrial production and manufacturing as its products are sold and rented under different brands through a worldwide sales and service network reaching 150 countries. In addition, a high percentage of revenues were derived from aftermarket business which offered strong cash flows and greater earnings resilience than many of its peers. The stock offered a 1.8% dividend as of 12/16/10 which we believe will rise in 2011 in line with earnings growth.

A top 10 holding in the Fund by weight was Freeport-McMoRan Copper & Gold (FCX) in the material sector. Based in Arizona, FCX is a world’s largest miner of copper with a 10% share of the global market. It also mines gold and molybdenum from locations in North America, South America, Africa, and Indonesia. We believe copper should be one of the most desirable commodity investments over the next several years as strong demand from emerging markets, particularly China which is a net importer, and constrained supply

11

|

|

Alpine Dynamic Dividend Fund |

|

conditions should continue to drive copper prices higher. FCX’s strong balance sheet and cash flow provides flexibility to fund growth investments and return capital to shareholders, with it recently increasing its annual dividend by 67%, to $2.00 per share, providing a 1.8% dividend yield as of 12/16/10. FCX provided a 27.6% total return total return for the Fund in our holding period from 8/2/10 through fiscal year end on 10/31/10.

Dividend Investors Should Still Benefit from QDI

The investment process for ADVDX has not changed and the Fund intends to continue generating dividend payouts consisting of net investment income. However the dividend cut allows for a more balanced approach for high dividend income plus capital appreciation within our three sub strategies: Dividend Capture, Growth and Income, and Value with a Catalyst. Historically, a significant portion of the Fund’s dividends had been comprised of income benefiting from lower federal tax rates called Qualified Dividend Income (QDI), which requires a minimum holding period of 61-days. In order for ADVDX to maintain its dividend level during these difficult market conditions, the Fund utilized a more rapid rotation of holdings in its dividend capture program. This is reflected in the substantial increase in our portfolio turnover for the Fund from 323% in fiscal 2008 to 506% in fiscal 2010.

The result of our reduced holding period in our dividend capture portfolio has been a decline in the percentage of QDI distributable by the Fund. We will not have an estimate of our QDI for fiscal 2010 until the end of the tax year. However at this time we estimate between 30% and 40% of income distributed in calendar 2010 will be QDI. This is only an estimate and the actual amount may be higher or lower at year end. QDI tax benefits have been extended through December 31, 2012. As a result, we will continue to pursue the Fund’s primary objective of high current dividend income that qualifies for the reduced federal tax rates on dividend.

We do not expect any material capital gains tax implications from our increased turnover due to a substantial amount of tax loss carry-forwards. The escalation of our portfolio turnover naturally increased our aggregate transaction expenses. We have also utilized leveraged total return equity swap transactions in the Fund to gain efficiencies and reduce transactional costs associated with the increased rotation in its international holdings. The implied leverage in the swaps increased volatility in the trade; however, we mitigated the risk by having generally short holding periods in the swap transaction. While the income from these swaps does not qualify for QDI, their use was limited to

transactions shorter than 61 days which were not otherwise eligible for QDI. With a normalized turnover, the Fund is expected to achieve its QDI objectives.

Outlook for 2011: We remain positive on global growth and dividends, but volatility will remain

We believe that a global economic recovery is still solidly in place heading into 2011 following the Great Recession of 2008/09 and the economic rebound experienced in 2010. We remain particularly optimistic about tapping opportunities to invest in growth in emerging markets like Brazil and China where strong employment and wage growth is helping to propel millions of people each year from a subsistence existence to an emerging consumer of everything form durable goods to discretionary items to healthcare. Brazil has also benefited from large infrastructure spending in its energy sector in addition to hosting the soccer World Cup games in 2014 and the summer Olympics in 2016. The International Monetary Fund forecasts China will grow far faster than the rest of the world for the next five years, with approximately 10% compound annual GDP growth on average through 2014 compared to 6% for all emerging nations like Brazil and 2.5% for the developed markets.

As we look into 2011, we would also expect continued volatility in equity markets as many countries in Europe face austerity measures to curb sovereign debt concerns and as the U.S. economy is struggling with sluggish economic growth and stubbornly high unemployment. However, companies in the U.S. and around the world are expected to produce continued attractive corporate profit growth in 2011 based on solid demand trends, strong margin improvements, and productivity initiatives. In addition, corporate balance sheet quality is at all time highs and companies are sitting on record amounts of cash which should support capital growth initiatives, mergers and acquisitions, and the return of cash to shareholders via share buybacks and dividend increases.

The U.S. Federal Reserve initiating additional quantitative easing and clarity on many tax issues following the mid-term elections in November also help to increase CEO confidence and support U.S. economic growth, even as consumer confidence is still impacted by depressed housing and employment markets. The consensus S&P 500 earnings are forecasted to grow 13% in 2011 on U.S. GDP growth estimated at 3.0% in 2011 according to Credit Suisse research. Based on this earnings outlook, we believe equity valuations still appear attractive relative to historical averages and particularly relative to bonds, which should support capital flows into equities.

12

|

|

Alpine Dynamic Dividend Fund |

|

Over the long term, we continue to remain optimistic that dividend stocks will attract increasing amounts of capital as investors around the world search for income. With companies sitting on record amounts of cash and many corporate profits at all time highs, we are hopeful that dividend increases will occur in 2011 and beyond. In addition, as global demographics point to an aging population in the industrialized world, these millions of savers are facing zero to low interest rates for quarters or potentially years to come. For example, the U.S. in the 1930’s and Japan in the past 20 years have shown that when interest rates go close to zero they can stay there for extended periods of time until structural economic issues are resolved. We see dividend income as an attractive investment opportunity for this increasingly large population of retirees, particularly if interest rates rise and bond valuations suffer.

In summary, we see both opportunities and risks in 2011. The Fund’s approach during these uncertain times is to remain broadly diversified within the dividend-paying universe while actively scanning the globe for undervalued opportunities and high quality cash flow generators. We are confident that we should be able to continue to distribute attractive dividend payouts by capitalizing on our research driven approach to identifying value opportunities as well as through our active management of the portfolio.

Thank you for your support of the Alpine Dynamic Dividend Fund and we look forward to more prosperous years in 2011 and beyond.

Sincerely,

Jill K. Evans and Kevin Shacknofsky

Co-Portfolio Managers

|

Past performance is not a guarantee of future results. |

|

Please refer to the schedule of portfolio investments for fund holding information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. Current and future portfolio holdings are subject to risk. |

|

Please refer to the prospectus for special risks associated with investing in the Fund, including, but not limited to, risks involved with illiquid, foreign and restricted securities, and short-term trading. Investing in small and mid cap stocks involves additional risks such as limited liquidity and greater volatility as compared to large cap stocks. Investing in foreign securities tends to involve greater volatility and political, economic and currency risks and differences in accounting methods. The risks of investing in foreign securities can be intensified in the case of investments in issuers domiciled or operating in emerging market countries. |

|

Stocks are subject to fluctuation. The stock or other security of a company may not perform as well as expected, and may decrease in value, because of a variety of factors including those related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry) or due to other factors such as a rise in interest rates, for example. |

|

The information provided is not intended to be a forecast of future events a guarantee of future results or investment advice. Views expressed may vary from those of the firm as a whole. |

|

Favorable tax treatment of Fund distributions may be adversely affected, changed or repealed by future changes in tax laws. Alpine may not be able to anticipate the level of dividends that companies will pay in any given timeframe. |

|

Neither the Fund nor any of its representatives may give tax advice. Investors should consult their tax advisor for information concerning their particular situation. |

|

Diversification does not assure a profit or protect against loss in a declining market. |

|

Earnings Per Share: The portion of a company’s profit allocated to each outstanding share of common stock. Earnings per share serves as an indicator of a company’s profitability. |

|

Earnings or Earnings Per Share Growth is a measure of a company’s net income over a specific period, generally one year, is a key indicator for measuring a company’s success, and the driving force behind stock price appreciation. |

|

Free cash flow is a measure of financial performance calculated as operating cash flow minus capital expenditures. Free cash flow (FCF) represents the cash that a company is able to generate after laying out the money required to maintain or expand its asset base. Free cash flow is important because it allows a company to pursue opportunities that enhance shareholder value. |

|

Forward earnings are a company’s forecasted, or estimated, earnings made by analysts or by the company itself. Forward earnings differ from trailing earnings (which is the figure that is quoted more often) in that they are a projection and not a fact. |

13

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| ||

| ||||||||||||

Comparative Annualized Returns as of 10/31/10 (Unaudited) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

| ||

|

| 6 Months(1) |

| 1 Year |

| Since Inception |

| |||||

Alpine Accelerating Dividend Fund |

| 3.16 | % |

| 16.06 | % |

| 15.54 | % |

| ||

S&P 500 Index |

| 0.74 | % |

| 16.52 | % |

| 14.12 | % |

| ||

Dow Jones Industrial Average |

| 2.39 | % |

| 17.62 | % |

| 13.74 | % |

| ||

Lipper Equity Income Funds Average(2) |

| 2.11 | % |

| 16.51 | % |

| 16.09 | % |

| ||

Lipper Equity Income Funds Ranking(2) |

| N/A | (3) |

| 134/276 |

| 134/270 |

| ||||

Gross Expense Ratio: 5.33%(4) |

|

|

|

|

|

|

|

|

|

| ||

Net Expense Ratio: 1.42%(4) |

|

|

|

|

|

|

|

|

|

| ||

(1) Not annualized.

(2) The since inception data represents the period beginning 11/6/2008.

(3) FINRA does not recognize rankings for less than one year.

(4) As disclosed in the prospectus dated February 27, 2010.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 2 months. If it did, total returns would be reduced.

The S&P 500 Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The Dow Jones Industrial Average is a price weighted average of 30 actively traded shares of large cap U.S. industrial corporations. The Lipper Equity Income Funds Average is an average of Funds that seek relatively high current income and income growth through investing 60% or more of their respective portfolios in equities. The S&P 500 Index, the Dow Jones Industrial Average, and the Lipper Equity Income Funds Average are unmanaged and do not reflect direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Equity Income Funds Average reflects fees charged by the underlying funds. The performance for the Accelerating Dividend Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

The adviser contractually agreed to waive a portion of its fees and to absorb certain fund expenses. This arrangement will remain in effect unless and until the Board of Trustees approves its modification or termination.

To the extent that the Fund’s historical performance resulted from gains derived from participation in initial public offerings (“IPOs”) and/or secondary offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary allocations in the future.

|

|

|

|

|

|

|

|

| |

| |||||||||

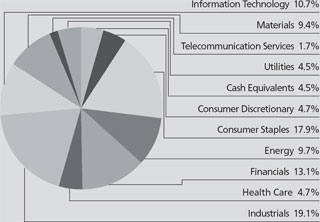

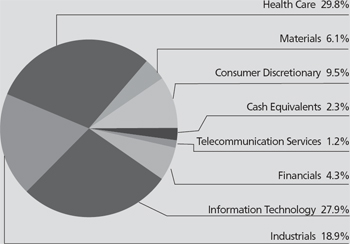

Portfolio Distributions* (Unaudited) |

| Top 10 Holdings* (Unaudited) | |||||||

|

| 1. |

| Schlumberger, Ltd. | 2.92 | % | |||

| 2. |

| Vale SA - ADR | 2.75 | % | ||||

| 3. |

| PepsiCo, Inc. | 2.73 | % | ||||

| 4. |

| Chevron Corp. | 2.59 | % | ||||

| 5. |

| Snap-On, Inc. | 2.50 | % | ||||

| 6. |

| Air Products & Chemicals, Inc. | 2.49 | % | ||||

| 7. |

| Linear Technology Corp. | 2.42 | % | ||||

| 8. |

| International Business Machines Corp. | 2.40 | % | ||||

| 9. |

| United Technologies Corp. | 2.34 | % | ||||

| 10. |

| Norfolk Southern Corp. | 2.31 | % | ||||

|

|

| |||||||

|

|

|

| ||||||

| * | Portfolio holdings and sector distributions are as of 10/31/10 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. Top 10 Holdings do not include short-term investments. Portfolio Distributions percentages are based on total investments and Top 10 Holdings percentages are based on total net assets. | |||||||

| |||||||||

14

|

|

Alpine Accelerating Dividend Fund |

|

|

|

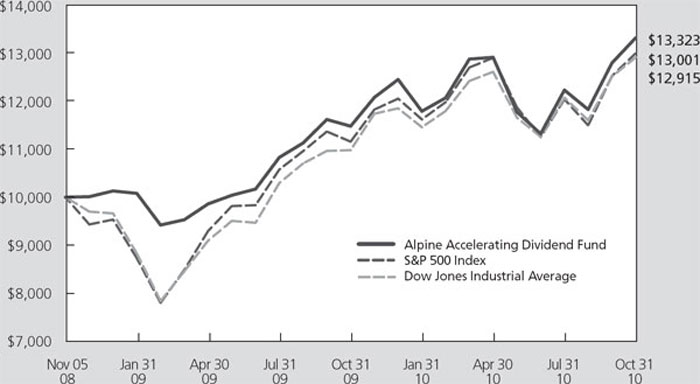

Value of a $10,000 Investment (Unaudited) |

|

|

|

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmark. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees. Without the waiver and recovery of fees, the Fund’s total return would have differed.

|

Commentary |

The Alpine Accelerating Dividend Fund, initially launched on November 5, 2008, just completed a successful second year. In fiscal 2010, ending on October 31, 2010, the Fund provided a total return of 16.06%. This compares with a total return of 16.52% for the Standard & Poor’s 500 Average and 17.62% for the Dow Jones Industrial Average for the same period. Since inception, the Accelerating Dividend Fund has generated an annualized total return of 15.54%. This compares with an annualized return of 14.12% for the Standard & Poor’s 500 Average and 13.74% for the Dow Jones Industrial Average. During the year, the Fund steadily increased its monthly payout from $0.035 to $0.0371 a share.

The objective of the Accelerating Dividend Fund is to invest in dividend-paying companies which have the potential to increase or accelerate their dividends in the future, based on our analysis of their growth prospects and cash flow generating capabilities. The Fund aims to achieve a sustainable and rising stream of dividend income as well as long-term capital appreciation. We

believe that companies with strong franchises characterized by defensible margins and a solid balance sheet are best positioned to increase, and even accelerate, their dividends over time. Among the Fund’s current holdings that have met our criteria and accelerated their dividends over the past year, ending October 31, 2010, include: Air Products & Chemicals Incorporated, Comcast Corporation, Guess? Incorporated, Light SA, Microsoft, UnitedHealth Group, and VF Corporation. These companies represent a broad cross-section of industries including apparel, technology, utilities, media, health care, and industrials. While the Fund concentrates its investment in the US, we believe there is great potential for accelerating dividend ideas in the developing world as well. Brazilian utility operator Light SA illustrates the potential for accelerating dividends globally. At the end of the fiscal year, our Brazilian holdings totaled 5.6% of the portfolio.

Portfolio Analysis

The top five contributors to the Fund’s total return over the past twelve months were Tegma Gestao Logistica

15

|

|

Alpine Accelerating Dividend Fund |

|

(+88.1%), Cliffs Natural Resources (+71.8%), El Paso Pipeline Partners L.P. (+62.0%), Burlington Northern (+32.0%), and Snap-On (+45.8%). Tegma, a leading Brazilian logistics company has benefited from rising auto sales in Brazil as the emerging middle class continued to grow. While we still like the outlook for the company and its potential to increase its dividend payout over time, we did take some profits given the strong performance of the stock. Cliffs, a mining company, has been a beneficiary of the global demand for iron ore and metallurgical coal. Natural gas pipeline operator, El Paso, continued to benefit from the purchase of assets from its parent company, which resulted in increased cash flow and higher dividend payouts. Berkshire Hathaway announced the acquisition of Burlington Northern in late 2009 leading to a 32% total return on the shares during the fiscal year. Finally, Snap-on has enjoyed a nice recovery in its end markets throughout 2010, which led to the first dividend increase for the shares in three years.

The five largest detractors to the Fund’s total return for the fiscal year were Bank of America (-31.3%), Monsanto (-35.6%), Guess (-17.7%), State Street (-18.4%), and E.ON (-19.2%). We have chosen to continue holding Bank of America and Guess, while selling Monsanto, State Street, and E.ON. In the case of Bank of America, we believe a combination of adverse developments has resulted in extremely poor investor sentiment and pushed back the time to normalized earnings. We currently view the shares as attractively valued at less than 1.0x tangible book and less than 6x consensus 2012 Earnings Per Share (EPS), and we believe that patient investors will be well rewarded at these levels. Guess, which generates a meaningful portion of its earnings in Europe, suffered in the wake of the European sovereign debt crisis in May. As the Dollar strengthened against the Euro in May and the early part of June, investors rushed to sell companies with exposure to the Euro. We viewed the sell-off as an overreaction given Guess’ strong global profile and growth potential. Guess shares have rallied subsequent to the Fund’s fiscal year end and in November, the company accelerated its quarterly dividend and declared a $2/sh special dividend. We sold Monsanto after a disappointing restructuring announcement that dented management’s credibility, in our view. Additionally, we didn’t feel that the shares offered a compelling valuation on the lowered earnings expectations. For State Street, we decided to sell the shares given our view that short-term interest rates are likely to remain extremely low for the foreseeable future. Finally, we decided to sell E.ON after the company kept its dividend

unchanged from last year rather than raise it as it had done every year since 2001.

After the recent debt crisis, a number of companies have sought to recapitalize their balance sheets. As a result, during the fiscal year, there have been a large number of attractively priced secondary offerings in which the fund has participated. The fund has realized substantial short term capital gains in these secondary offerings, which has provided a significant contribution to the Fund’s total return during the fiscal year. We cannot predict how long, if at all, these opportunities will continue to exist, but to the extent we consider secondary offerings to be attractively priced and available, the fund may continue to participate in them. In addition, our participation in these offerings has led to increased turnover for the fiscal year.

Portfolio Adjustments

We made several changes to the portfolio over the past few months. In the healthcare sector, the Fund no longer holds shares of medical device maker Medtronic. The company is battling price competition for its main products, which is likely to hinder its ability to grow going forward. In its place, we added HMO-provider UnitedHealth. UNH is positioned to benefit from improving sentiment in the healthcare sector as a result of the November elections and the company accelerated its dividend payment in mid-2010.

In the consumer area, we bought apparel-manufacturer VF Corp and Brazilian consumer products firm Hypermarcas. VF Corp recently accelerated its quarterly dividend payout by $0.03 a share. We expect VFC’s core brands, The North Face and Vans, to continue to experience strong growth on a global basis. Hypermarcas is the largest consumer products company in Brazil and the company has grown its bottom line by over 20% annually. Due to Brazilian regulations, its dividend payout should grow at least as fast as earnings in the future. On the sell side of the ledger, we sold our positions in Campbell Soup and lightened up on our Kimberly Clark holding. Given the headwinds these companies face, we no longer expect to earn accelerating dividends from these stocks.

We added Brazilian software provider Totvs and U.S. networking equipment maker Cisco to our technology holdings. Totvs is the largest small and medium business software provider in Brazil. Business software penetration is relatively low in Brazil and Totvs has a commanding market share. Our Cisco holding is in anticipation of the introduction of a dividend payment in early 2011 as per management’s commentary. In

16

|

|

Alpine Accelerating Dividend Fund |

|

addition, we believe that at the current valuation, Cisco offers an attractive entry point given its long-term positioning in the networking space.

In the utility space, we initiated new positions in Avista, PPL, and UGI in the US as well as Light in Brazil and EVN in Austria. Avista is a regulated utility in the northwest with an attractive valuation and an accelerating dividend. We have a favorable view of PPL’s recent acquisition of a pair of Kentucky utilities that will improve the mix of regulated and unregulated businesses, and find the valuation and dividend yield attractive. UGI recently raised its quarterly dividend by 25% and has attractive growth opportunities in the Marcellus natural gas shale. Light has been a strong dividend payer in the Brazilian utility space, and we like the robust dividend, attractive valuation, and potential for its generation business to grow earnings as contracts are repriced in 2013 and beyond. Finally, we began buying a small position in EVN, an Austrian utility. We think EVN is an undiscovered value in the European utility space, offering an attractive combination of mid-single digit earnings growth, a below-average Price/Earning (P/E) multiple, and the potential for accelerating dividends.

In the energy sector, we increased our holding in Schlumberger at the end of August given our bullish view on oil prices and weakness in the share price. We think Schlumberger is extremely well positioned to participate in the upcoming energy capex cycle that should translate into strong EPS and dividend growth. In the industrials sector, we purchased shares of Rocky Mountain Dealerships, a small Canadian retailer of agricultural equipment. We think Rocky Mountain Dealerships is a great play on the agriculture theme when high soft commodity prices lead to strong farmer profits and ultimately, higher equipment sales.

Outlook

As we enter 2011, we maintain a cautious view of the US and world economies given the many challenges we see. In the US, unemployment has remained stubbornly high despite the best efforts of the Federal Reserve. Despite passage of the tax deal in December, we remain concerned that gridlock in Congress will prevent the administration from taking the additional actions necessary to boost employment and further support aggregate demand should the economic recovery stall in 2011.

Our base case outlook assumes below average Gross Domestic Product (GDP) growth for the next few years as the inventory cycle peaks out, residential investment remains at low levels, and consumer sentiment, while

improving, remains cautious. In such an environment, we will continue to focus on companies with strong balance sheets and strategies that we feel enable them to grow despite this difficult backdrop.

Outside the US, we are concerned that the sovereign debt crisis in Europe could lead to a difficult period of economic growth for the region, and in a worst-case scenario, lead to the breakup of the European Union. Our exposure to Europe is currently limited to two stocks that derive the majority of their earnings from regulated activities. Nonetheless, we are always on the lookout for good opportunities wherever they may be.

Given the slow growth environment we expect to prevail in much of the developed world, we continue to allocate a modest portion of the Fund to stocks in emerging markets where the outlook is less gloomy. Brazil is a country that Alpine currently favors given the strong demographic trends, healthy banking system, and strong dividend culture. One notable aspect of Brazilian corporate law is a requirement that companies pay a dividend of at least 25% of their earnings, and many companies opt for much higher payout ratios. We also believe there are some attractive opportunities in Asia, although we are cognizant of the risk of overheating in the region.

In closing, we believe a strategy to identify stocks with rising dividends as well as those with the potential to not only increase the dividend, but to do so at an accelerating pace, has the potential to succeed in the turbulent market environment in which we currently find ourselves. From a top down perspective, we think that companies are in a strong overall position to initiate or boost dividends given high levels of cash on the balance sheet coupled with historically low dividend payout ratios.

We thank our shareholders for their support over the past 12 months and look forward to continuing to seek success over the next year.

Sincerely,

Stephen A. Lieber

Bryan Keane

Andrew Kohl

Co-Portfolio Managers

17

|

|

Alpine Accelerating Dividend Fund |

|

Please refer to the schedule of portfolio investments for fund holding information. Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future holdings are subject to risk.

Investing in small and mid cap stocks involves additional risks such as limited liquidity and greater volatility as compared to large cap stocks. Investing in foreign securities tends to involve greater volatility and political, economic and currency risks and differences in accounting methods. Diversification does not assure a profit or protect against loss in a declining market.

The Fund may include equity-linked securities and various other derivative instruments, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Leverage may magnify gains or increase losses in the Fund’s portfolio.

Stocks are subject to fluctuation. The stock or other security of a company may not perform as well as expected, and may decrease in value, because of a variety of factors including those related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry) or due to other factors such as a rise in interest rates, for example.

The information provided is not intended to be a forecast of future events a guarantee of future results or investment advice. Views expressed may vary from those of the firm as a whole.

Favorable tax treatment of Fund distributions may be adversely affected, changed or repealed by future changes in tax laws. Alpine may not be able to anticipate the level of dividends that companies will pay in any given timeframe.

Cash flow measures the cash generating capability of a company by adding non-cash charges (e.g. depreciation) and interest expense to pretax income.

Earnings Per Share is the portion of a company’s profit allocated to each outstanding share of common stock. Earnings per share serves as an indicator of a company’s profitability.

Price/Earnings Ratio (P/E) is a valuation ratio of a company’s current share price compared to its per-share earnings.

Normalized earnings — earnings metric that shows you want earnings look like smoothed out in the long run, taking into account the cyclical changes in an economy or stock.