UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File number: 811-21210

______________________________________________

Alpine Income Trust

______________________________________________________________________________

(Exact name of registrant as specified in charter)

2500 Westchester Avenue, Suite 215

Purchase, New York 10577

______________________________________________________________________________

(Address of principal executive offices)(Zip code)

(Name and Address of Agent for Service)

| Copy to:

|

Samuel A. Lieber Alpine Woods Capital Investors, LLC 2500 Westchester Avenue, Suite 215 Purchase, New York 10152

| Rose DiMartino Attorney at Law Willkie Farr & Gallagher 787 7th Avenue, 40th Floor New York, New York 10019 |

Registrant’s telephone number, including area code: (914) 251-0880

Date of fiscal year end: October 31, 2011

Date of reporting period: November 1, 2010 – October 31, 2011

Item 1: Shareholder Report

Equity & Income Funds

Alpine Dynamic Dividend Fund

Alpine Accelerating Dividend Fund

Alpine Dynamic Financial Services Fund

Alpine Dynamic Innovators Fund

Alpine Dynamic Transformations Fund

Alpine Dynamic Balance Fund

Alpine Ultra Short Tax Optimized Income Fund

Alpine Municipal Money Market Fund

October 31,

2011

Annual Report

|

TABLE OF CONTENTS |

|

|

|

|

|

|

| |

|

|

|

|

| 8 |

| |

|

|

|

|

| 14 |

| |

|

|

|

|

| 18 |

| |

|

|

|

|

| 23 |

| |

|

|

|

|

| 27 |

| |

|

|

|

|

| 31 |

| |

|

|

|

|

|

|

| |

|

|

|

|

| 36 |

| |

|

|

|

|

| 39 |

| |

|

|

|

|

| 45 |

| |

|

|

|

|

| 73 |

| |

|

|

|

|

| 76 |

| |

|

|

|

|

| 79 |

| |

|

|

|

|

| 87 |

| |

|

|

|

|

| 96 |

| |

|

|

|

|

| 112 |

| |

|

|

|

|

Additional Alpine Funds are offered in the Alpine Equity Trust. These funds include: | |||

|

|

| |

Alpine International Real Estate Equity Fund |

|

| |

|

|

| |

Alpine’s Real Estate Funds’ investment objectives, risks, charges and expenses must be considered carefully before investing in funds of the Alpine Equity Trust. The statutory and summary prospectuses contain this and other important information about the investment company, and it may be obtained by calling 1-888-785-5578, or visiting www.alpinefunds.com. Read it carefully before investing. | |||

Mutual fund investing involves risk. Principal loss is possible. | |||

|

|

| Alpine’s Investment Outlook |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dear Investor:

Since the summer of 2007, the world has been experiencing a period of exceptional transformation. The fundamental impacts have been economic, but the implications for social and political structures may be more profound than the world has felt for over 40 years. Economic imbalances ranging from commodity inflation and fragile financial funding to income inequality and unemployment all played a role in fomenting societal eruptions this year. The Jasmine Revolution which begot the ‘Arab Spring’ uprisings have been the most notable, but the ‘Occupy Wall Street’ movement, riots from Greece to China, and the rallies in India and Russia over graft and fraud are among outbursts with political implications stemming largely from economic distress. As we look forward to 2012, elections in France, Egypt, Russia, China, Mexico and, of course, the United States may have long term significance, but in the short term the preceding periods may be notable for the lack of political action or possible missteps which investors might deem problematic for the economy. If economic stability is compromised over the next year, then future social and political stability may also suffer, so investors must be mindful of events both here and abroad. On the other hand, if the sovereign integrity of the Euro Zone is retained, then the prospect of a mere recession in Europe will probably have limited impact on the global economy. Alpine believes that stock prices have already factored in a more disruptive outlook.

Historically, a significant minority of the world’s population has been able to utilize much of the world’s resources with only modest concern for efficiency. Now, with over seven billion inhabitants on the planet, the developed economies are competitively forced to share more of the world’s food, fuel and even economic capital with our neighbors. Up until 2007, the U.S. and Europe stretched the limits of our capital capacity to create debt with an issuance and distribution system which had become increasingly dependent upon lax credit ratings and easy capital reserve ratios. This provided the capacity to buy more or pay higher prices than we might have otherwise been inclined, whether

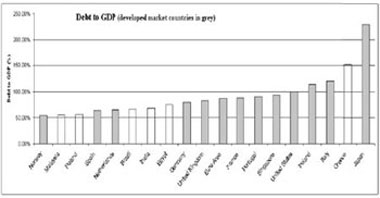

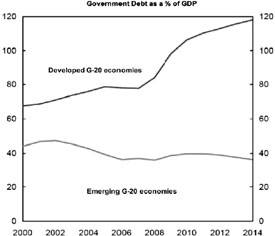

as individuals or collectively as nations. Since then, broad avoidance and mistrust of credit-based risk has forced capital out of the lower rated investment market. Instead, cash has been parked in marginally productive “safe” investments, such as gold and Treasury bills, which do not stimulate economic activity. The potential combination of such risk avoidance with the forced deleveraging of over extended countries, companies and individuals could continue to dramatically impact asset values, reduce capital for investment, decrease consumption and lower economic growth. Europe may well face such a spiraling scenario in 2012, given their already high levels (debt/GDP=80%+) of debt.

The reactionary tendency to stretching too far is to reverse course and, in this case, shrink leverage and practice restraint or even austerity. This approach may speed downsizing in a normal cycle, but when imbalances are as severe as now, purging the excesses could lead to a depression. An alternate approach to halting these deleterious trends would seek to sustain modest growth of the financial system in order to strengthen it while building a better model for allocating, evaluating and distributing capital, before shrinking obligations. In other words, it might be prudent to initially reinforce the dam, rather than let it erode before the next storm. Unfortunately, we have been in a period of transition which finds politicians embracing the safety of ideology when they should be attempting to understand complex economic interactions and debating the implications of any policy responses. We need fresh ideas and honest debate which could educate the public and instill confidence

1

|

that government is leading the way forward. By default, the world’s central bankers and treasury chiefs have been left to set the agenda to fix or replace financial structures and critical systems that have proved inadequate or were simply broken. The following chart shows how the lack of GDP growth from 2007 compromised developed market debt ratios, in contrast with emerging market countries which were able to both grow GDP (denominator) and reduce debt.

The current sovereign debt crisis in Europe is the product of structural limitations of the European Union (EU), which has limited the European Central Bank’s (ECB) monetary capability. Market forces have finally compelled EU politicians to alleviate fiscal constraints and imbalances with new rules to be enacted in 2012. It is notable that the U.S. is the furthest advanced of the major economies in this fundamental struggle to restructure and redirect the capital market system. Nevertheless, our politicians have so far failed on the fiscal front to grow government revenues, shrink expenses or both. Yet deficits, spending and taxes are only part of the problem. People have been losing confidence in our leaders’ ability to control the financial system. In effect, we have to either find a new model or rework existing financial market structures to permit capital to grow and flow efficiently, while also providing meaningful safeguards and firebreaks to control risk from unseen exposures or contagion from derivative or contingent contracts.

2011: When It Rains, It Pours

The extended economic recovery since 2009 has survived a steady string of shocks to the system. No one could have predicted that food and energy price volatility would set off “Arab Spring” revolutions which have been reshaping the political landscape of the Middle East. Similarly, droughts throughout the world and flooding in other areas also hit food prices as did the

destructive floods in Thailand, which further impacted both auto and tech production in that region. These events followed the horrific earthquake and tsunami in Japan, which seriously disrupted the global supply chain utilizing “just in time” production, resulting in slower global industrial production. While these events have combined to slow global economic growth during 2011, the biggest impediment to continuing recovery from the ‘Great Recession’ of 2009 has been Europe’s inability to restructure its financial mechanisms to insure financial integrity.

The current sentiment of investors reminds me of the lyrics from Bob Dylan’s 1967 classic song called “All Along the Watchtower” which proclaims: “There must be some way out of here…There’s too much confusion, I can’t get no relief. Businessmen they drink my wine and plowmen dig my earth, none of them along the line know what any of it is worth … So let us not talk falsely now, the hour is getting late …” Indeed, the extended period of confusion and helplessness has hurt investors. Consumption and production continue but new investment has focused mostly on either ‘prime’ or ‘safe’ assets. Transaction volumes and prices have eroded across most asset classes because investors have been more concerned with the return of capital rather than returns on capital. Valuation metrics for any amount of risk, and especially for many sub-prime assets, have broken down, and investors no longer have adequate confidence in market prices. Unfortunately, politicians continue to talk falsely and have not been heeding the urgent need to tackle the problems of the 21st century economy. If the New Year brings more constructive engagement, then perhaps we can restore investor confidence, but looking at the current U.S. fiscal condition, it is clear that the hour is getting late.

Similar caution has been evident in the corporate sector over the last few years as companies built up financial liquidity, reduced capital expenditures and delayed hiring. Thus, uncertainty among both investors and the business sector, combined with stretched government fiscal conditions, has reduced capital investment in the economy. Add collapsing confidence in our leaders and we see limited ability to ignite the animal spirits. This is largely responsible for the historically unprecedented delay in recovery from recession. Since the U.S. economy’s peak employment levels of January 2008 through the trough on February 2010, the economy shed roughly 8,750,000 jobs, only to add 2,460,000 over the following 21 months through this past November. If the economy were to sustain the latest three month average monthly gain in payrolls of 143,000 jobs gained per month, we would not reach the old peak of

2

|

employment until July of 2015, or roughly 7.5 years for a full recovery. Such duration without full recovery is already unprecedented except for the Great Depression!

Traditionally, the two great engines of the U.S. economy have been homebuilding and the automobile industry, both of which extended a multiplier effect to other industries producing products used in cars and homes. While car sales are estimated to achieve annual volume of 12.7 million vehicles, this is still roughly 27% below 2005’s peak of trailing 12-month moving average sales. New home sales have been running 77% below the July, 2005 peak levels. Both industries have sought productivity enhancements either through automation of production or prefabrication of components, (further reducing headcounts) add to this cutbacks in the finance sector of the economy, and these industries constitute over 50% of the lower levels of employment since the peak. Clearly our economy has not been running on all cylinders, and we must find new ways of creating goods and services if we cannot currently rekindle historic levels of demand in the near future. Perhaps the downturn has accelerated the transition from an ‘industrial’ economy to a ‘service’ economy.

Europe “…Can’t Get No Relief…”: From Sub-Prime to Sub-Sovereign

While the U.S. is clearly not out of the woods, recent economic activity demonstrated by industrial production numbers and the stability of the financial system are far better than Europe or Japan. Europe’s problems, like ours, began to appear in 2007 as the value of subprime debt and the lack of transparency of derivative investments raised the specter of European banks collapsing under excessive use of leverage. In addition to questionable investments and corporate loans, it has become evident over the past year and a half that these banks also had exposure to the debt of other European banks and European nations, including the weaker peripheral countries.

The economic importance of major financial institutions within the Euro block is reflected by the relative size of their debts, which constitute over 4.5 trillion Euros of bonds outstanding, in contrast with over 6.5 trillion Euros issued by governments. The size of the European banking sector is so significant because over 80% of corporate credit is originated or supported by banks’ balance sheets which require liquidity to inventory loans until they are sold. This contrasts with the U.S., where banks support roughly 40% of all the corporate debt originated while most is, in fact, created directly in the capital markets. In this light, it should be critical for both banks and countries to reduce their debts or increase revenues and raise capital.

“…A Way Out of Here” for Europe

With the Euro Zone’s debt to GDP levels ranging from 80% to 115% (and higher for Greece), the problem at hand is to create a fiscal system to oversee the budget process of each country. Under current conditions, this could mandate either higher taxes or austerity measures, which will likely slow economic activity. While this oversight mechanism may not include the ability to tax EU members, it could provide a level of economic control which would facilitate the ECB acting like an interim EU treasury. Over time, we would expect to see significant asset relief as the ECB may follow the Fed’s lead and provide “quantitative easing” (i.e., buy bonds and other debt in the market place in order to inject more money into the system). It may also be essential to create a treasury for issuance of Euro-denominated bonds backed by all the member nations to cover at least a portion of each individual country’s outstanding debt obligations. This would significantly reduce the interest costs for countries which currently have a high rate imposed upon them by the market, such as Italy, where the cost of five year bonds rose from 4.1% at the beginning of July to 7.7% by late November. By comparison, German five year money rose from under 1% recently to a high of 1.3%, which might be more reflective of overall Euro denominated debt if it were to come into being. Thus, over time, we believe the political desire for stability will likely lead to the creation of a complete financial infrastructure which could enhance long term stability in the Euro Zone.

Assuming the sovereign debt is stabilized, we would anticipate that the next stage will be recapitalization of European banks. These can either take the form of public market equity raises, mergers or some form of nationalization. It is worth noting that the U.S., Australian and U.K banks, insurance companies and real estate companies commenced recapitalizations and asset sales during early 2009. We expect most European financial institutions to finally begin the same process in 2012, some three years behind their Anglo counterparts. In light of this delay and the aforementioned discussion of the role which European banks play in the corporate capital structure, it is apparent that time needed to heal the excessive debt ratios may also significantly constrain corporate activity. Thus, it is not surprising that most economists expect a recession for Europe in 2012 followed by years of limited growth. However, if successful actions are taken, the decline might only last for one year.

Do Investors “Know What Any of It is Worth...”?

A unique aspect of this market in which risk avoidance reigns supreme is that many investors have pulled back

3

|

on historically perceived higher risk investments such as cyclical industries, commodities, junk bonds and forex exposure. Once the overall level of risk subsides, we would expect most investors will gradually begin to focus on achieving returns on invested capital and resume a longer term perspective. They may start asking questions, such as; (1) where are business or economic conditions going to be favorable for corporate earnings growth, and (2) where is the greatest need for new capital investment? They may also analyze differences between short term investments, medium duration as well as multi year opportunities. For example, over the short term, it is pretty evident that global growth has been slowing, although there may be a few countries where 2012 projections are higher than 2011. For example, Japan is slowly in the process of rebuilding following the devastating earthquake last spring, so several domestic oriented companies should benefit from ongoing stimulus to the economy. Several other countries that had been managing inflation via restrictive monetary policies during 2011 have begun to lower interest rates in response to overall slowing global growth. This group would include Australia and New Zealand, as well as Brazil, China and Indonesia. Several other countries such as India, Chile and Mexico will also likely ease rates over the coming few months. This new monetary stimulus contrasts sharply with the extraordinarily low interest rates prevalent in core Europe, U.S. and Japan where rates may already be near bottom.

While interest rate cuts could provide a catalyst for short term equity revaluation, longer term valuations are typically dependent upon prevailing business trends which could enhance earnings growth. While most countries are forecast to enjoy improving GDP growth in 2013 versus 2012, several countries in Southeast Asia and Latin America could offer superior medium-term and multi-year growth outlooks, based on demographic, economic and business trends.

The potential for long-term growth and competitive dynamics leading to a return of inflation and, hence, higher interest rates should eventually focus attention on those companies which deserve premiums based on superior adaptability or pricing power, historical innovation, strong market position and elasticity of demand. Unfortunately, index based exchange traded funds, basket traders and momentum algorithm traders have reduced market behavior to ‘risk-on, risk-off’ single variable daily directional bets. However, as investors return, markets should once again gauge equity and asset valuations in reaction to perceived changes in business prospects and the economy. From currently

depressed valuations, the return of investors to equities as directional uncertainty and confusion is relieved could lead to significant revaluation potential over an extended period of time. For a wide variety of distinct businesses, whose prospects evolve with the business cycle, investors may also take a longer term holding period. The efficiency of capital markets will likely depend upon a normalization of investor behavior.

Seven Billion and Counting

Towards the end of October the world population officially went over 7 billion people and it is expected to exceed 8 billion by 2025 and 9 billion by 2050. The current sentiment favoring austerity is antithetical to the pressures of this reality, and austerity measures may remain limited to Europe, where population growth is projected to be negligible. However, social and economic pressure for government and business led capital investment may stimulate expansion for much of the world. Not only must the world find food and shelter for the next generation, but we must make this a more efficient and more understandable world. Technology promised to do the latter, and it has made the world a much smaller place in many ways, but information flow has added complexity and sometimes confusion. Resolving this credit crisis, reorganizing our banking structures and perhaps redefining the priorities of our political representatives, should be very important if developed countries hope to participate in meeting the needs of growing cities in the emerging economies. Economic, social and political change are often inter-related so it is not surprising to see the pressures finally boiling over, whether in the Middle East, Greece or even Russia and the U.S. The hopeful emergence of more democratic economies focused on providing individual rights and human needs, will likely be dependent upon the U.S. leading an effective global capital market system. The bottom line is that demographic trends should sustain demand for goods and services, although the nature and timing of this potential will be subject to how the complex web of global development evolves.

“…Now the Hour is Getting Late”, Focus on What is Most Important

We believe the markets will remain volatile, but to a lesser degree than experienced during 2008 and, of course, 2011. While the exact nature of the economic and political environment to which we are transitioning is not fully clear, what is evident is the need for action and responsible dialogue and debate over the economic realities we face. Individuals and markets should always do better when there is more transparency and

4

|

|

|

|

understanding. We can each determine our own view of the road ahead if we have enough data and information.

Alpine believes that the economic world should continue with the U.S. as the dominant player, while acknowledging that the other players are changing, particularly as so-called Emerging Markets sustain faster growth and, thus, are set to become a larger force. For now, the U.S. Federal Reserve is the guiding light for most other central banks, as is our economy. This is a world that in most cases merely aspires to what we already have. In our opinion, the U.S. must sustain its competitive advantage through technological innovations which is dependent upon our best educational institutions sustaining top global standards. Vocational schools should be elevated to artisanal standards and encourage apprenticeship for craftsmen. By combining technology and artisanship, our corporations can create better ways of designing, building and delivering superior goods and services. Ideally, these are the companies in which we all seek to invest.

Even when it is dark with storm clouds overhead, Alpine will endeavor to find investment opportunities on your behalf. We look forward to keeping you up to date on our progress and, in this regard, we have embarked on a new approach to streamline the information provided in our individual fund manager reports to shareholders. We are using a simpler format, which we will supplement with commentary from portfolio managers and analysts on our website. In particular, we believe this will allow our message to be focused on both timely and germane topics of discussion. Thus, we encourage shareholders to periodically click on the Alpine Funds

website to keep up to date with our thinking and reactions to the capital markets, as well as the world at large. Our goal is to aid in your understanding of the factors which may influence investment decisions for all of us.

Effective January 3, 2012, the names of four of the Funds in the Series Trust will be changing as follows: the Alpine Dynamic Balance Fund will be known as the Alpine Foundation Fund, the Alpine Dynamic Financial Services Fund will be known as the Alpine Financial Services Fund, the Alpine Dynamic Innovators Fund will be known as the Alpine Innovators Fund, and the Alpine Dynamic Transformations Fund will be known as the Alpine Transformations Fund. Please note that the investment objectives and strategies of each of these Funds are not changing.

In closing, let me express my great appreciation and admiration for Laurence Ashkin, who has retired from his role as a director of Alpine’s Mutual Funds. Larry has been supporting and guiding us since we opened our doors in 1998. He has always set Alpine’s fiduciary responsibilities first and offered his insights to all board members. His presence, counsel and commitment shall be missed. We wish him well.

Thank you for your continued support and interest.

Sincerely,

Samuel A. Lieber

President

|

|

| |

| |

Past performance is not a guarantee of future results. The specific market, sector or investment conditions that contribute to a Fund’s performance may not be replicated in future periods. | |

| |

Mutual fund investing involves risk. Principal loss is possible. Please refer to the individual fund letters for risks specific to each fund. | |

| |

This letter and the letters that follow represent the opinion of Alpine Funds’ management and are subject to change, are not guaranteed, and should not be considered investment advice. | |

| |

Please refer to the schedule of investments for fund holding information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. Current and future portfolio holdings are subject to risk. | |

5

|

|

Disclosures and Definitions |

|

Disclosure

Mutual fund investing involves risk. Principal loss is possible. Please refer to the individual fund letters for risks specific to each fund.

The President’s Letter and those that follow represent the opinion of the Funds’ management and are subject to change, are not guaranteed, and should not be considered investment advice. The information provided is not intended to be a forecast of future events. Views expressed may vary from those of the firm as a whole.

Past performance is not a guarantee of future results.

Please refer to the schedule of investments for each fund’s holding information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. Current and future portfolio holdings are subject to risk.

Favorable tax treatment of Fund distributions may be adversely affected, changed or repealed by future changes in tax laws. Alpine may not be able to anticipate the level of dividends that companies will pay in any given timeframe.

Neither the Fund nor any of its representatives may give tax advice. Investors should consult their tax advisor for information concerning their particular situation.

Diversification does not assure a profit or protect against loss in a declining market.

Must be preceded or accompanied by a prospectus. Quasar Distributors, LLC, distributor.

Definitions

Book value is the net asset value of a company, calculated by subtracting total liabilities from total assets.

Build America Bonds are taxable municipal bonds that carry special tax credits and federal subsidies for either the bond issuer or the bondholder. Build America Bonds were created under Section 1531 of Title I of Division B of the American Recovery and Reinvestment Act that U.S. President Barack Obama signed into law on February 17, 2009.

Cash flow measures the cash generating capability of a company by adding non-cash charges (e.g. depreciation) and interest expense to pretax income.

Dividend Yield (Funds) represents the trailing 12-month dividend yield aggregating all income distributions per share over the past year, divided by the period ending fund share price. It does not reflect capital gains distributions.

Dividend Yield: The yield a company pays out to its shareholders in the form of dividends. It is calculated by taking the amount of dividends paid per share over a specific period of time and dividing by the stock’s price.

Earnings or Earnings Per Share Growth is a measure of a company’s net income over a specific period, generally one year, is a key indicator for measuring a company’s success, and the driving force behind stock price appreciation.

Free cash flow is a measure of financial performance calculated as operating cash flow minus capital expenditures. Free cash flow (FCF) represents the cash that a company is able to generate after laying out the money required to maintain or expand its asset base. Free cash flow is important because it allows a company to pursue opportunities that enhance shareholder value.

Price/Earnings Ratio (P/E) is a valuation ratio of a company’s current share price compared to its per-share earnings. Normalized earnings – earnings metric that shows you want earnings look like smoothed out in the long run, taking into account the cyclical changes in an economy or stock.

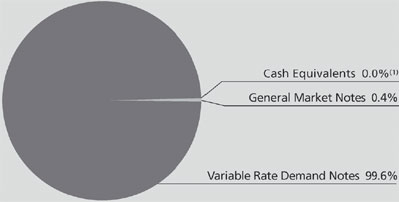

Variable Rate Demand Note (VRDN): A debt instrument that represents borrowed funds that are payable on demand and accrue interest based on a prevailing money market rate, such as the prime rate. The interest rate applicable to the borrowed funds is specified from the outset of the debt, and is typically equal to the specified money market rate plus an extra margin.

Dow Jones Industrial Average – is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry.

Each Lipper Average represents a universe of Funds with similar invest objectives.

The MSCI World is a stock market index of 1,500 ‘world’ stocks. It is maintained by MSCI Inc., formerly Morgan Stanley Capital International, and is often used as a common benchmark for ‘world’ or ‘global’ stock funds.

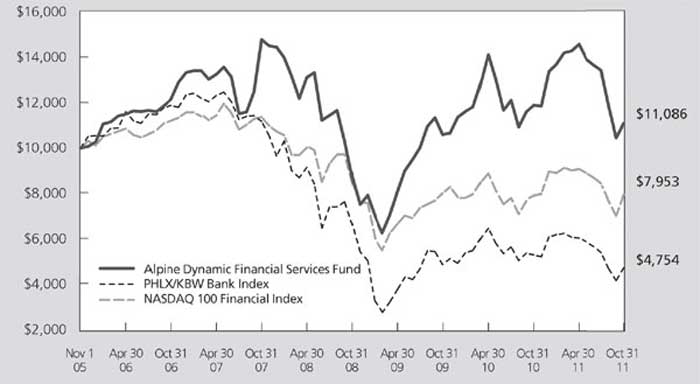

The NASDAQ-100 Financial Index is a capitalization-weighted index of the 100 largest financial companies, as well as foreign issues, including American Depository Receipts (ADRs), traded on the NASDAQ National Market System (NASDAQ NMS) and Small Cap Market.

The PHLX/KBW Bank Index is a modified cap-weighted index consisting of 24 exchange-listed and National Market System stocks, representing national money center banks and leading regional institutions. The index is intended to reflect the evolving financial sector.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general.

The MSCI All Country World Index (ex Japan) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging market country indices (excluding Japan).The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general.

The STOXX Europe 600 (Price) Index is a broad based capitalization-weighted index of European stocks designed to provide a broad yet liquid representation of companies in the European region. The equities use free float shares in the index calculation. The index was developed with a base value of 100 as of December 31, 1991. This index uses float shares.

Bovespa Index is a total return index weighted by traded volume and is comprised of the most liquid stocks traded on the Sao Paulo Stock Exchange.

Hong Kong Hang Sen Index includes the largest and most liquid stocks listed on the Main Board of the Stock Exchange of Hong Kong.

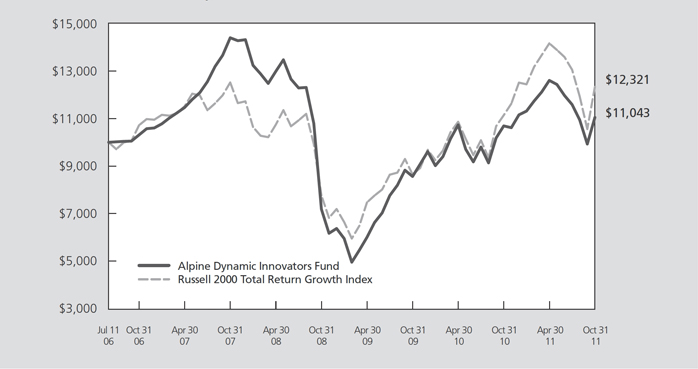

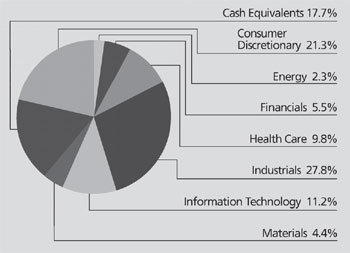

Russell 2000 Total Return Growth Index is an index measuring the performance of the 2,000 smallest companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. The Russell 2000 serves as a benchmark for small-cap stocks in the United States.

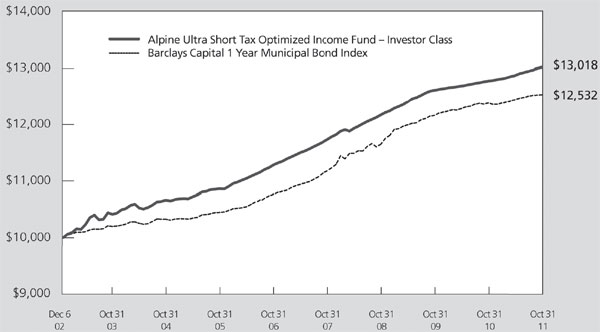

Barclays Capital Municipal 1 Year Bond Index is a total return benchmark of BAA3 ratings or better designed to measure returns for tax exempt assets.

6

|

|

| Alpine Dynamic Dividend Fund |

|

|

| Alpine Accelerating Dividend Fund |

|

|

| Alpine Dynamic Financial Services Fund |

|

|

| Alpine Dynamic Innovators Fund |

|

|

| Alpine Dynamic Transformations Fund |

|

|

| Alpine Dynamic Balance Fund |

7

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Comparative Annualized Returns as of 10/31/11 | |||||||||||||

|

|

|

|

|

|

|

|

|

| ||||

|

| 1 Year |

| 3 Years |

| 5 Years |

| Since Inception |

| ||||

Alpine Dynamic Dividend Fund |

| -3.48 | % |

| 5.08 | % |

| -6.38 | % |

| 3.04 | % |

|

S&P 500 Index |

| 8.09 | % |

| 11.41 | % |

| 0.24 | % |

| 4.45 | % |

|

STOXX Europe 600 Index(1) |

| -4.92 | % |

| 10.42 | % |

| -2.00 | % |

| 5.62 | % |

|

Lipper Global Multi-Cap Core Funds Average(2) |

| 0.27 | % |

| 12.32 | % |

| -1.38 | % |

| 5.24 | % |

|

Lipper Global Multi-Cap Core Funds Ranking(2) |

| 104/126 |

| 100/102 |

| 59/59 |

| 35/35 |

| ||||

Gross Expense Ratio: 1.22%(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Expense Ratio: 1.22%(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) The since inception return represents the annualized return for the period beginning 9/30/2003. |

(2) The since inception return represents the annualized return for the period beginning 9/25/2003. |

(3) As disclosed in the prospectus dated March 1, 2011. |

|

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced. |

|

The S&P 500 Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The STOXX Europe 600 Index is derived from the STOXX Europe Total Market Index (TMI) and is a subset of the STOXX Global 1800 Index. With a fixed number of 600 components, the STOXX Europe 600 Index represents large, mid and small capitalization companies across 18 countries of the European region: Austria, Belgium, Denmark, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and the United Kingdom. The Lipper Global Multi-Cap Core Funds Average is an average of funds that, by portfolio practice, invest in a variety of market capitalization ranges without concentrating 75% of their equity assets in any one market capitalization range over an extended period of time. Lipper Rankings for the periods shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges. The S&P 500 Index, the STOXX Europe 600 Index and the Lipper Global Multi-Cap Core Funds Average are unmanaged and do not reflect the deduction of direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Global Multi-Cap Core Funds Average reflects fees charged by the underlying funds. The performance for the Dynamic Dividend Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index. |

|

To the extent that the Fund’s historical performance resulted from gains derived from participation in initial public offerings (“IPOs”) and/or secondary offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary allocations in the future. |

|

|

|

|

|

|

|

|

|

| ||||||||

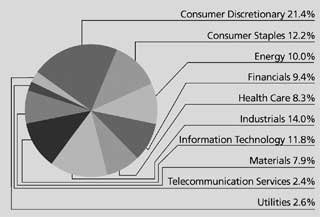

Portfolio Distributions* |

| Top 10 Holdings* |

|

| ||||

|

| 1. |

| International Business |

|

| ||

|

|

|

| Machines Corp. | 2.51 | % | ||

|

| 2. |

| GlaxoSmithKline PLC-ADR | 2.25 | % | ||

| 3. |

| JPMorgan Chase & Co. | 2.11 | % | |||

| 4. |

| McDonald’s Corp. | 2.02 | % | |||

| 5. |

| The Coca-Cola Co. | 2.02 | % | |||

| 6. |

| ITC Holdings Corp. | 2.00 | % | |||

| 7. |

| Seadrill, Ltd. | 1.94 | % | |||

| 8. |

| The Boeing Co. | 1.83 | % | |||

| 9. |

| CVS Caremark Corp. | 1.75 | % | |||

| 10. |

| Oracle Corp. | 1.72 | % | |||

|

|

|

|

|

| |||

|

|

|

| |||||

| * | Portfolio holdings and sector distributions are as of 10/31/11 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. Top 10 Holdings do not include short-term investments. Portfolio Distributions percentages are based on total investments and Top 10 Holdings percentages are based on total net assets. |

| |||||

|

|

|

|

| ||||

8

|

|

Alpine Dynamic Dividend Fund |

|

|

|

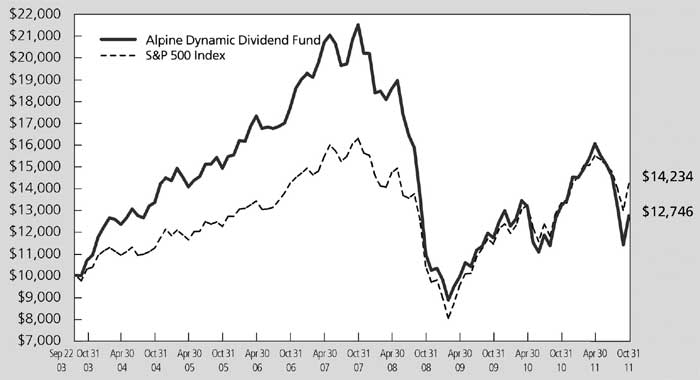

Value of a $10,000 Investment (Unaudited) |

|

|

|

|

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmark. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees. Without the waiver and recovery of fees, the Fund’s total return would have differed.

|

Commentary |

Performance

The Alpine Dynamic Dividend Fund’s 2011 fiscal year return was -3.48%, including dividend reinvestments. The Fund achieved its primary objective of distributing a high level of dividend income in fiscal 2011 by distributing a regular monthly dividend of $0.042 per share, or $0.504 per share annualized, plus a special year end payment of $0.036 per share on 12/30/10, with approximately 55% of the distribution estimated to be qualified for reduced Federal income tax rates (Qualified Dividend Income or “QDI”). The comparative returns of relevant indices were +8.09% for the Standard & Poor’s 500 Index, a total return of -4.92% for the Euro STOXX 600 Index in U.S. dollar terms, and a +0.68% return for the MSCI All World Index (ex-Japan) in U.S. dollar terms for the same time period.

Drivers of Performance

Fiscal year performance represented a significant change from the first half of the fiscal year when we

reported a 21.75% total return, which compared with a 16.36% gain for the S&P 500 Index, a 15.50% gain for the of the Euro STOXX 600 in U.S dollar terms and a 14.89% gain for the MSCI All World Index (ex Japan) in U.S. dollar terms for the same time period. The principal change which reversed the positive performance from the first half of the fiscal year had to do with the Fund’s investment positions in international markets. In comparison to the S&P 500 Index, ADVDX has a larger portion of its assets invested overseas to help achieve our goals of high dividends and capital appreciation since the U.S. is one of the lowest yielding global equity markets. We do not actively manage our country weightings – we pick our holdings on a stock by stock basis based on dividend potential and total return. This bottom-up approach led to more investments in Europe, where the dividend payout ratios remain higher than in any other region. We also have found numerous compelling growth and income stories that have led us to invest more in Asia and Latin America.

9

|

|

Alpine Dynamic Dividend Fund |

|

Renewed economic uncertainty in the U.S., challenges in important emerging markets such as Brazil and China and growing apprehension about the European sovereign debt crisis led to overall negative performance on our investment portfolio in the second half of fiscal 2011. With the U.S. being viewed as a safe haven during the crisis, international markets significantly underperformed. From the market highs on April 29, 2011 at the end of first half fiscal 2011 to the market lows on October 3, 2011, the S&P 500 Index declined by 18.64% as the Brazilian Bovespa Index declined by 36.05%, the Euro STOXX 600 Index declined by 28.13%, and the Hong Kong Hang Sen Index declined by 27.56%. This particularly impacted the portfolio because of our long term emphasis on the search for high yielding, high quality securities overseas, which declined in value despite what we believed to be attractive fundamentals and positive longer term growth and income opportunities.

Our dividend capture strategy tends to be seasonally focused in Europe in the first half of the calendar year, with peak exposure occurring during the spring. Due to our concern that the sovereign debt crisis would adversely impact the euro, we hedged our currency exposure in Europe. This concern, regarding the currency, did not materialize before we exited our hedge position after the conclusion of our peak exposure during the dividend capture period.

The Fund also has the flexibility to leverage up to 10% of its total assets if management believes there are opportunities for either dividend capture or capital appreciation, and we generally employ leverage during our dividend capture periods. During the fiscal year ending October 31, 2011 the Fund has used its leverage line on several occasions.

With our portfolio positioned to take account of the macro challenges in international markets, the Fund ended fiscal year 2011 with 70.1% of assets in U.S. based companies versus an average of 58% invested in the U.S. throughout the year. These holdings at fiscal year end reflected our view that many U.S. companies could continue to report strong earnings and cash flow in the months ahead and the U.S. should likely maintain its safe haven status as global macro volatility is likely to persist into 2012. Given the continued uncertain outlook that remains for the Euro region, we have ended the fiscal year with less than 1% of our assets invested in Euro denominated currencies. Further, we intend to seek the high level of income generation which has characterized the Fund’s objectives since its inception.

Top Five Contributors

The top five contributors to the Fund’s performance over the past twelve months based on contribution to the Fund’s total return ranked by contribution were Dollar Thrifty Auto (52.12%), Walter Energy (59.66%), IBM (30.81%), Tupperware (28.93%), and ITC Holdings (18.40%).

|

|

|

| • | Dollar Thrifty Automotive Group, a car rental business, was the top contributor to the Fund’s performance. The share price benefited from rising second hand car prices and a takeover battle for the company between Hertz and Budget that was expected to produce a special dividend. We felt the stock got to full value based on the takeover premium and we locked in the profits on this investment. |

|

|

|

| • | Walter Energy is a US based metallurgical coal company that benefited from flooding related supply disruptions in Australia which resulted in a 50% increase in prices. Due to the strong performance we took profits and are no longer a shareholder. |

|

|

|

| • | IBM’s earnings growth exceeded Wall Street targets for much of the past year, driven by a combination of strong top line growth, good expense management and generous shareholder returns. The company’s strong free cash flow recurring revenue streams have allowed them to grow their 1.7% dividend yield at 21% per annum. We have been a long term shareholder in this position. |

|

|

|

| • | Tupperware is global direct seller of kitchen and personal care products that has benefited from strong overseas growth as 80% of sales are international and 55% are exposed to developing markets and the emerging market consumer. Due to the strong performance and concerns about the negative impact of a strengthening U.S. dollar on its earnings, we took profits and are no longer a shareholder. |

|

|

|

| • | ITC Holdings is the largest U.S. independent electric transmission company with 15,000 miles of lines that span five Midwestern states. As the only pure transmission company in the U.S., ITC has produced strong earnings and dividend growth as it benefits from the upgrading of the investment in the nation’s electric grid. We have been long term shareholders of ITC. |

Bottom Five Contributors

The bottom five contributors that had the largest adverse impact, in order of contribution, on the performance of the Fund over the fiscal year were Pandora (-74.09%), Hypermarcas (-37.25%), China National Building Materials (-54.54%), Migros Ticaret (-40.88%), and BBMG (-49.90%).

10

|

|

Alpine Dynamic Dividend Fund |

|

|

|

|

| • | Pandora is a Danish provider of jewelry whose dramatic global expansion of their charm jewelry product was disrupted by silver price inflation they were unable to pass on to their consumers. We are no longer a shareholder of this company. |

|

|

|

| • | Hypermarcas’ management’s decision to implement more stringent payment terms in early 2011 led to an inventory correction at its customers. As growth slowed, the shares have languished. |

|

|

|

| • | China National Building Company is one of China’s largest cement manufacturers. The company is a beneficiary of China’s aggressive fixed asset investment program and was expected to be boosted by the 10 million new home starts announced as part of the China’s new social housing program. However aggressive macroeconomic tightening and negative rhetoric and policy by the government against real estate resulted in a severe sell off in real estate related stocks. Despite this, the company reported earnings that beat consensus and provided stable guidance. We exited this investment. |

|

|

|

| • | Migros is a Turkish operator of supermarkets whose share price was affected by inside selling and the restructuring costs of their discount stores. We are no longer a shareholder of this company. |

|

|

|

| • | BBMG Corp is a Beijing based social housing homebuilder and cement supplier. The company was expected to be a beneficiary of China’s social housing policy which targeted to build 36 million homes in 5 years with 10 million starts targeted for 2011. The stock sold off when macro- economic tightening and negative rhetoric and policy by the Chinese government against the real estate sector resulted in a severe sell off in real estate related stocks and doubts arose over the financing model for the sector. |

Summary

History of the Fund With Positioning

ADVDX offers what we believe is a dynamic approach to achieving both dividend income and long-term growth of capital while offering investors diversification through international equity exposure where we believe we can find attractive growth plus generally higher dividend yields. While our focus is on total return, a significant proportion of the return has come from dividend income. We scan the globe looking for the best dividend opportunities for our investors.

The Fund was initiated in September 2003 to provide investors with a vehicle to try to benefit from the reduced U.S. Federal tax rates on dividends or QDI. This tax benefit is set to expire on December 31, 2012, and

there is uncertainty surrounding the level of taxation for dividends going forward. However, even if the tax benefits are not renewed, we do not believe that our dividend capture efforts will be hindered or that our strategy will materially change. If the QDI benefit is eliminated, we would not have the constraint of the 61-day holding period required to be eligible for the tax benefit. In addition, we could look to expand our dividend capture opportunities to different non-tax qualified equity markets (i.e. Hong Kong, Taiwan) or non-qualified equity payers such as most REITS and Master Limited Partnerships.

Outlook for the Market and Economy

As we look into 2012, we remain cautious in the short-term but we believe that the longer term outlook for dividend paying equities is more bullish. We expect continued volatility in equity markets and below trend economic growth in 2012 as many countries in Europe face austerity measures to curb sovereign debt concerns and as the U.S. and global economies are struggling with sluggish growth, high food and energy inflation, and stubbornly high unemployment. Plus, political headline risk could continue to drive market swings with the ongoing sovereign debt issues in Europe and the U.S. Presidential election in 2012. However, while sovereign nations are struggling with large debt burdens, corporate balance sheet quality is high and companies are sitting on record amounts of cash, which should support capital growth initiatives, mergers and acquisitions, and the return of cash to shareholders via share buybacks and dividend increases if some clarity comes out of Europe and volatility declines.

Over the long-term, we continue to remain optimistic that dividend stocks will attract increasing amounts of capital, despite the recent volatility in equity prices, as investors around the world search for income. Global demographics point to an aging population in the industrialized world and these millions of savers are facing zero to low interest rates for quarters, or potentially, years to come. For example, the U.S. in the 1930’s and Japan in the past 20 years have shown that when interest rates go close to zero they can stay there for extended periods of time until structural economic issues are resolved. Since the year 2000, dividends—not stock price appreciation—are the reason for the S&P 500’s positive return. Without dividends, the price of the S&P 500 Index declined by -14.70% but with reinvested dividends the total return for the S&P 500 is +5.95%.

In summary, we see both opportunities and risks in 2012. The Fund’s approach during these uncertain times is to remain broadly diversified within the dividend-paying

11

|

|

Alpine Dynamic Dividend Fund |

|

universe. We strive to keep our portfolio balanced and maintain our “barbell” approach to our stock selections. On one end, we look for attractive investment opportunities in more defensive companies with sustainable earnings and cash flow growth and the potential for increasing dividends. At the other end of the barbell, we search for attractive value opportunities in more cyclical sectors where prices had been punished during the economic downturn and where we believe long-term growth prospects are still attractive.

Our goals remain clear. We seek to provide a strong dividend yield and grow our NAV over the long term and we seek to achieve these goals with lower volatility than we have seen over the past several years as we strive to be the dividend income fund of choice for investors. Thank you for your support of the Alpine Dynamic Dividend Fund.

Sincerely,

Jill K. Evans and Kevin Shacknofsky

Co-Portfolio Managers

|

|

| |

| |

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to the following risks: | |

Dividend Strategy Risk – The Fund’s strategy of investing in dividend-paying stocks involves the risk that such stocks may fall out of favor with investors and underperform the market. Companies that issue dividend paying-stocks are not required to continue to pay dividends on such stocks. Therefore, there is the possibility that such companies could reduce or eliminate the payment of dividends in the future.

Emerging Market Securities Risk – The risks of investing in foreign securities can be intensified in the case of investments in issuers domiciled or operating in emerging market countries. These risks include lack of liquidity and greater price volatility, greater risks of expropriation, less developed legal systems and less reliable custodial services and settlement practices.

Equity Securities Risk – The stock or other security of a company may not perform as well as expected, and may decrease in value, because of factors related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry).

Foreign Securities Risk – Public information available concerning foreign issuers may be more limited than would be with respect to domestic issuers. Different accounting standards may be used by foreign issuers, and foreign trading markets may not be as liquid as U.S. markets. Currency fluctuations could erase investment gains or add to investment losses. Additionally, foreign securities also involve possible imposition of withholding or confiscatory taxes and adverse political or economic developments. These risks may be greater in emerging markets.

Management Risk – The Adviser’s judgment about the quality, relative yield or value of, or market trends affecting, a particular security or sector, or about interest rates generally, may be incorrect. The Adviser’s security selections and other investment decisions might produce losses or cause the Fund to underperform when compared to other funds with similar investment objectives and strategies.

Portfolio Turnover Risk – High portfolio turnover necessarily results in greater transaction costs which may reduce Fund performance.

Qualified Dividend Tax Risk – Favorable U.S. Federal tax treatment of Fund distributions may be adversely affected, changed or repealed by future changes in tax laws.

Undervalued Stock Risk – Undervalued stocks may perform differently from the market as a whole and may continue to be undervalued by the market for long periods of time. Although the Fund will not concentrate its investments in any one industry or industry groups, it may weigh its investments towards certain industries, thus increasing its exposure to factors adversely affecting issues within these industries.

Leverage Risk – Leverage creates the likelihood of greater volatility of net asset value; the possibility either that share income will fall if the interest rate on any borrowings rises, or that share income and distributions will fluctuate because the interest rate on any borrowings varies; and if the Fund leverages through borrowings, the Fund may not be permitted to declare dividends or other distributions with respect to its common shares or purchase its capital stock, unless at the time thereof the Fund meets certain asset coverage requirements. The Adviser in its best judgment nevertheless may determine to maintain the Fund’s leveraged position if it deems such action to be appropriate in the circumstances.

12

|

|

Alpine Dynamic Dividend Fund |

|

Initial Public Offerings Risk – The Fund may invest a portion of its assets in shares of IPOs. IPOs may have a magnified impact on the performance of a Fund with a small asset base. The impact of IPOs on a Fund’s performance likely will decrease as the Fund’s asset size increases, which could reduce the Fund’s returns. IPOs may not be consistently available to a Fund for investing. IPO shares frequently are volatile in price due to the absence of a prior public market, the small number of shares available for trading and limited information about the issuer. Therefore, a Fund may hold IPO shares for a very short period of time. This may increase the turnover of a Fund and may lead to increased expenses for a Fund, such as commissions and transaction costs. In addition, IPO shares can experience an immediate drop in value if the demand for the securities does not continue to support the offering price.

Please refer to page 6 for other important disclosures and definitions

13

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Comparative Annualized Returns as of 10/31/11 | |||||||

|

|

|

|

|

|

|

|

|

| 1 Year |

| Since Inception |

| ||

Alpine Accelerating Dividend Fund |

|

| 6.43% |

| 12.40% |

|

|

S&P 500 Index |

|

| 8.09% |

| 10.06% |

|

|

Dow Jones Industrial Average |

|

| 10.39% |

| 10.70% |

|

|

Lipper Equity Income Funds Average(1) |

|

| 7.13% |

| 13.14% |

|

|

Lipper Equity Income Funds Ranking(1) |

|

| 172/286 |

| 163/252 |

|

|

Gross Expense Ratio: 2.71%(2) |

|

|

|

|

|

|

|

Net Expense Ratio: 1.36%(2) |

|

|

|

|

|

|

|

(2) As disclosed in the prospectus dated March 1, 2011.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced.

The S&P 500 Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The Dow Jones Industrial Average is a price weighted average of 30 actively traded shares of large cap U.S. industrial corporations. The Lipper Equity Income Funds Average is an average of Funds that seek relatively high current income and income growth through investing 60% or more of their respective portfolios in equities. The S&P 500 Index, the Dow Jones Industrial Average, and the Lipper Equity Income Funds Average are unmanaged and do not reflect direct fees associated with a mutual fund, such as investment adviser fees; however, the Lipper Equity Income Funds Average reflects fees charged by the underlying funds. The performance for the Accelerating Dividend Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

The adviser contractually agreed to waive a portion of its fees and to absorb certain fund expenses. This arrangement will remain in effect unless the Board of Trustees approves its modification or termination.

To the extent that the Fund’s historical performance resulted from gains derived from participation in initial public offerings (“IPOs”) and/or secondary offerings, there is no guarantee that these results can be replicated in future periods or that the Fund will be able to participate to the same degree in IPO/Secondary allocations in the future.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

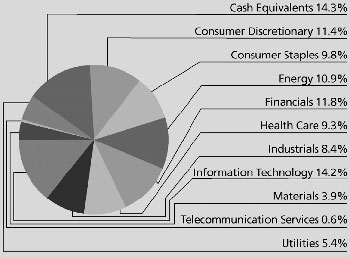

Portfolio Distributions* |

| Top 10 Holdings* |

|

| |||

|

| 1. |

| PepsiCo, Inc. | 1.96% |

| |

| 2. |

| Avago Technologies, Ltd. | 1.84% |

| ||

| 3. |

| Air Products & Chemicals, Inc. | 1.77% |

| ||

| 4. |

| Comcast Corp. - Class A | 1.75% |

| ||

| 5. |

| International Business |

|

| ||

|

|

| Machines Corp. | 1.72% |

| ||

| 6. |

| Intel Corp. | 1.72% |

| ||

| 7. |

| Schlumberger, Ltd. | 1.71% |

| ||

| 8. |

| Xcel Energy, Inc. | 1.69% |

| ||

| 9. |

| The J.M. Smucker Co. | 1.68% |

| ||

| 10. |

| Microsoft Corp. | 1.66% |

| ||

|

|

|

| ||||

| * | Portfolio holdings and sector distributions are as of 10/31/11 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. Top 10 Holdings do not include short-term investments. Portfolio Distributions percentages are based on total investments and Top 10 Holdings percentages are based on total net assets. |

| ||||

|

|

|

|

| |||

14

|

|

Alpine Accelerating Dividend Fund |

|

|

|

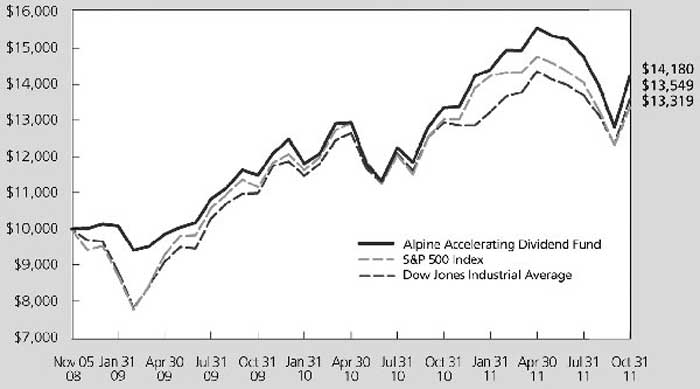

Value of a $10,000 Investment (Unaudited) |

|

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmark. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees. Without the waiver and recovery of fees, the Fund’s total return would have differed.

|

Commentary |

For the fiscal year ended October 31, 2011, the Alpine Accelerating Dividend Fund generated a total return of 6.43%. This compares with a total return of 8.09% for the Standard & Poor’s 500 and 10.39% for the Dow Jones Industrial Average for the same period. Since inception on November 5, 2008, the Alpine Accelerating Dividend Fund has generated an annualized total return of 12.40%. This compares with an annualized return of 10.06% for the Standard & Poor’s 500 and 10.70% for the Dow Jones Industrial Average. During the last twelve months, the Fund steadily increased its monthly payout from $0.0371 to $0.0385 per share.

Performance Drivers

Fiscal 2011 was a year of two halves. The November 2010 – April 2011 period was a robust trading environment where our cyclical holdings were in favor. The May 2011 – October 2011 period was characterized by severe bouts of volatility where financials and cyclicals underperformed as concerns about debt sustainability in Europe and a global slowdown took hold.

|

|

|

| • | The Fund’s sector exposures were one of the main drivers of returns during the fiscal year. Our |

|

|

|

|

| exposure to Industrial and Energy securities were the top contributors as investors focused on the US economic recovery in the first half of the fiscal year, and our individual stock selections enjoyed strong performance. Information Technology and Health Care were also meaningful contributors. Meanwhile, the Consumer Staples group was the main laggard. Our 5.9% average cash position also negatively impacted our total return. |

|

|

|

| • | The uncertainty of the global macroeconomic environment resulted in a substantial amount of volatility in the marketplace. Stocks exhibited wide swings as they reacted to headlines regarding the sovereign debt crisis in Europe, as well as economic releases in China and the United States. Our US exposure, which averaged 75.5%, somewhat insulated the Fund from the disappointing market performance abroad. Nevertheless, our international holdings were a drag on overall returns in the fiscal year. |

|

|

|

| • | Our 6.9% average exposure to Brazilian equities was an important driver of the Fund’s overall performance. The Fund’s holdings in Brazil had a |

15

|

|

Alpine Accelerating Dividend Fund |

|

|

|

|

|

| combined return of -12.5% during the fiscal year. By way of comparison, the Bovespa Index declined 17.45% during the same period as concerns about inflation and then a global slowdown pressured the market lower and led to a sharp sell-off in August. |

|

|

|

Portfolio Analysis | ||

|

|

|

The top five contributors to the Fund’s performance during the fiscal year ended October 31, 2011, based on contribution to total return were VF Corp (+71.08%), Chevron (+32.60%), Danvers Bancorp (+40.78%), IBM (+30.62%),and Intel (+26.41%). | ||

|

|

|

| • | VF Corporation was the top contributor to the Fund’s performance over the year as the company’s brands continued to receive broad acceptance from consumers around the globe. |

|

|

|

| • | Chevron benefited from the rise in crude oil prices and vastly improved refining margins during the past twelve months. Also, the company increased its dividend per share twice during that period. |

|

|

|

| • | We purchased shares of Danvers Bancorp in November 2010 based on a compelling valuation and the potential for increasing dividends. People’s United Financial, a New England bank, announced the acquisition of Danvers in January 2011 for a 30% premium. |

|

|

|

| • | IBM’s earnings growth exceeded Wall Street targets for much of the past year, driven by a combination of strong top line growth, good expense management and generous shareholder returns. |

|

|

|

| • | Despite a weak industry backdrop, Intel shares were able to outperform the overall market as the company drove costs out of its model and posted better-than-expected earnings growth over the period. |

|

|

|

Hypermarcas (-68.32%), Pace PLC (-50.25%) Lazard (-31.69%), Chatham Lodging Trust (-27.38%) and Hewlett Packard (-34.62%) had the largest adverse impact on the performance of the Fund over the fiscal year. | ||

|

|

|

| • | Hypermarcas management’s decision to implement more stringent payment terms in early 2011 led its customers to reduce their inventory levels. As growth slowed, the shares have languished. |

|

|

|

| • | Pace, one of the largest manufacturers of digital TV set-top boxes, saw its shares decline substantially in the wake of the Japan earthquake and tsunami due to supply chain disruptions. Also, it announced disappointing margins in its European division. |

|

|

|

| • | Shares of Lazard were pressured by the external environment. The sovereign debt crisis in Europe impacted Lazard’s advisory unit, and the choppy international equity markets took their toll on the equity-focused asset management group. |

|

|

|

| • | Chatham Lodging Trust shares fell over 25% in the final three months of the fiscal year as fears of a new recession sparked a sharp sell-off in extended stay hotel stocks like Chatham. |

|

|

|

| • | At Hewlett Packard, management turmoil and mis-execution led to earnings disappointments over the past year which resulted in the underperformance of shares, despite a dividend acceleration in mid 2011. |

Summary & Outlook

The Accelerating Dividend Fund seeks to invest in dividend-paying companies which have the potential to increase or accelerate their dividends in the future, based on our analysis of their growth prospects and cash flow generating capabilities. The Fund aims to achieve a sustainable and rising stream of dividend income as well as long-term capital appreciation. We believe that companies with strong franchises characterized by defensible margins and a solid balance sheet are best positioned to increase, and even accelerate, their dividends over time. While the Fund concentrates its investment in the US, we believe there is also great potential for accelerating dividend ideas in the developing world. In fiscal 2011, the Fund had an average exposure to Brazil of 6.9%. Overall, we aim to manage the fund conservatively by limiting our international exposure, eschewing the use of leverage, and avoiding large sector bets when possible.

As we look towards 2012, we remain cautious in our investment stance. The geopolitical environment remains unsettled and there is a great deal of uncertainty as to the strength and durability of the economic recovery underway in the US and Europe. As such, we believe that dividend income may become a key signpost for investors to gauge the true financial strength of companies. In a world currently offering low single digit yields on safe investments, companies with track records of increasing dividends could be the winners in the equity market, in our view. As a result, we our sticking to our knitting – we believe a strategy that seeks to identify stocks with rising dividends as well as those with the potential to not only increase the dividend, but to do so at an accelerating pace, is well positioned to succeed in the uncertain market environment in which we currently find ourselves and to potentially outperform over time. Likewise, we think the Fund offers investors an attractive combination of current yield with the potential for increasing payouts over time.

We thank our shareholders for their support and look forward to continued success over the next year.

Sincerely,

Stephen A. Lieber

Bryan Keane

Andrew Kohl

Co-Portfolio Managers

16

|

|

Alpine Accelerating Dividend Fund |

|

|

|

| |

Mutual fund investing involves risk. Principal loss is possible. The Fund is subject to the following risks: | |

Dividend Strategy Risk – The Fund’s strategy of investing in dividend-paying stocks involves the risk that such stocks may fall out favor with investors and underperform the market. Companies that issue dividend paying-stocks are not required to continue to pay dividends on such stocks.Therefore, there is the possibility that such companies could reduce or eliminate the payment of dividends in the future.

Emerging Market Securities Risk – The risks of investing in foreign securities can be intensified in the case of investments in issuers domiciled or operating in emerging market countries. These risks include lack of liquidity and greater price volatility, greater risks of expropriation, less developed legal systems and less reliable custodial services and settlement practices.

Equity Securities Risk – The stock or other security of a company may not perform as well as expected, and may decrease in value, because of factors related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry).

Foreign Securities Risk – Public information available concerning foreign issuers may be more limited than would be with respect to domestic issuers. Different accounting standards may be used by foreign issuers, and foreign trading markets may not be as liquid as U.S. markets. Currency fluctuations could erase investment gains or add to investment losses. Additionally, foreign securities also involve possible imposition of withholding or confiscatory taxes and adverse political or economic developments. These risks may be greater in emerging markets.

Growth Stock Risk – Growth stocks typically are very sensitive to market movements because their market prices tend to reflect future expectations. When it appears those expectations will not be met, the prices of growth stocks typically fall. Growth stocks as a group may be out of favor and underperform the overall equity market while the market concentrates on undervalued stocks. Although the Fund will not concentrate its investments in any one industry or industry group, it may, like many growth funds, weight its investments toward certain industries, thus increasing its exposure to factors adversely affecting issuers within those industries.

Investment Company Risk – To the extent that the Fund invests in other investment companies, there will be some duplication of expenses because the Fund would bear its pro rata portion of such funds’ management fees and operational expenses.

Management Risk – The Adviser’s judgment about the quality, relative yield or value of, or market trends affecting, a particular security or sector, or about interest rates generally, may be incorrect. The Adviser’s security selections and other investment decisions might produce losses or cause the Fund to underperform when compared to other funds with similar investment objectives and strategies.

Portfolio Turnover Risk – High portfolio turnover necessarily results in greater transaction costs which may reduce Fund performance.

Small and Medium Capitalization Company Risk – Securities of small or medium capitalization companies are more likely to experience sharper swings in market values, less liquid markets, in which it may be more difficult for the Adviser to sell at times and at prices that the Adviser believes appropriate and generally are more volatile than those of larger companies.

Undervalued Stock Risk – Undervalued stocks may perform differently from the market as a whole and may continue to be undervalued by the market for long periods of time. Although the Fund will not concentrate its investments in any one industry or industry groups, it may weigh its investments towards certain industries, thus increasing its exposure to factors adversely affecting issues within these industries.

Initial Public Offerings Risk– The Fund may invest a portion of its assets in shares of IPOs. IPOs may have a magnified impact on the performance of a Fund with a small asset base. The impact of IPOs on a Fund’s performance likely will decrease as the Fund’s asset size increases, which could reduce the Fund’s returns. IPOs may not be consistently available to a Fund for investing. IPO shares frequently are volatile in price due to the absence of a prior public market, the small number of shares available for trading and limited information about the issuer. Therefore, a Fund may hold IPO shares for a very short period of time. This may increase the turnover of a Fund and may lead to increased expenses for a Fund, such as commissions and transaction costs. In addition, IPO shares can experience an immediate drop in value if the demand for the securities does not continue to support the offering price.

Please refer to page 6 for other important disclosures and definitions

17

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

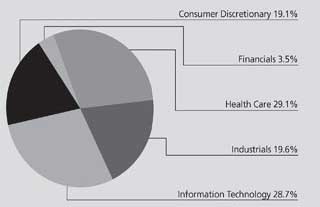

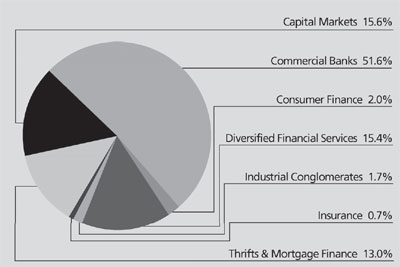

Comparative Annualized Returns as of 10/31/11 |

|

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1 Year |

| 3 Years |

| 5 Years |

| Since Inception |

| ||||

Alpine Dynamic Financial Services Fund |

| -6.77 | % |

| 8.44 | % |

| -1.81 | % |

| 1.73 | % |

|

NASDAQ 100 Financial Index |

| 0.48 | % |

| -2.06 | % |

| -6.60 | % |

| -3.74 | % |

|

PHLX/KBW Bank Index |

| -10.46 | % |

| -10.34 | % |

| -16.66 | % |

| -11.66 | % |

|

S&P 500 Index |

| 8.09 | % |

| 11.41 | % |

| 0.24 | % |

| 9.31 | % |

|

Lipper Financial Services Funds Average(1) |

| -5.31 | % |

| 0.34 | % |

| -10.18 | % |

| -6.23 | % |

|

Lipper Financial Services Funds Ranking(1) |

| 53/77 |

|

| 10/69 |

|

| 4/64 |

|

| 3/55 |

|

|

Gross Expense Ratio: 1.87%(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Expense Ratio: 1.45%(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) The since inception data represents the period beginning 11/03/2005. |

(2) As disclosed in the prospectus dated March 1, 2011. |

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced.