united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-21237

Unified Series Trust

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Zachary P. Richmond

Ultimus Fund Solutions, LLC

225 Pictoria Drive. Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

Registrant's telephone number, including area code: 513-587-3400

Date of fiscal year end: 03/31

Date of reporting period: 03/31/23

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Dean Small Cap Value Fund

Dean Mid Cap Value Fund

Dean Equity Income Fund

Annual Report

March 31, 2023

| Dean Small Cap Value Fund |

| Management Discussion of Fund Performance (Unaudited) |

| March 31, 2023 |

Management’s Discussion & Analysis

The Dean Small Cap Value Fund (the “Fund”) returned +4.89% net of fees for the twelve months ended March 31, 2023, compared with a -12.96% return for the benchmark Russell 2000 Value Index and a -11.61% return for the broader Russell 2000 Index.

Macro Factors Impacting Performance

Macro factors were a strong tailwind for the portfolio in the past fiscal year. The portfolio benefited from holding stocks that are less volatile than the benchmark (a proxy for quality) and from holding stocks that have lower valuations than the benchmark (value stocks). The rising cost of capital is beginning to have an impact on the market environment leading to more emphasis being placed on valuation and quality. This is causing a shift in investor appetite towards higher-quality, value-oriented stocks which represent the two most important tenets to Dean Capital Management, LLC’s investment philosophy: “Value Driven, Quality Focused.”

Sector Performance (Best/Worst Relative to Benchmark)

The best performing sector relative to the benchmark for the twelve-month period was Industrials. The outperformance resulted from better than benchmark stock selection, especially in the Transportation industry. The portfolio held two conservatively financed and conservatively managed trucking companies that capitalized on late economic cycle dynamics where pricing and volumes continued to be strong. This overweight relative to the benchmark in trucking companies benefited the portfolio this past year.

The second best performing sector relative to the benchmark was Consumer Staples. Given the defensive nature of Consumer Staples companies, the sector outperformed the Russell 2000 Value Index during the period where the benchmark had a -13% total return. Thus, the portfolio benefited from having a larger weight than the benchmark throughout the past year. The portfolio also had better than benchmark stock selection, led by food companies that produced foods such as nuts, eggs, sauces, breads, bananas, pineapples, and sweet treats. As the economy slows and faces a possible recession, the recession resistant end markets of the food producers supported their stock prices.

The worst performing sector relative to the benchmark for the last twelve months was Energy. The underperformance was due to the underweight positioning versus the benchmark in a sector that outperformed in the period. The portfolio’s stock selection was better than the benchmark, but good stock selection could not make up for the underweight stance in the sector. The portfolio is down to one Energy holding, and it is less tied to

| Dean Small Cap Value Fund |

| Management Discussion of Fund Performance (Unaudited) (continued) |

| March 31, 2023 |

the price of oil compared to the benchmark’s holdings, which makes it less volatile compared to the benchmark’s holdings as well. We estimate that most energy companies are currently earning well above their full cycle normalized earning power, which causes them to appear to have low valuations based on historical earnings, but this exposes them to severe earnings revision risk if a hard economic downturn materializes, which would cause demand for oil to fall.

The second worst performing sector relative to the benchmark was Materials. The portfolio actually outperformed the benchmark in the Materials sector this past year; however, the outperformance was less than that of the other sectors, thus landing it as the second worst performing sector slot. Both sector allocation and stock selection were better than the benchmark.

Individual Securities Performance (Best/Worst Absolute Contributors)

The largest contributing company in the fiscal year was Murphy USA (MUSA). MUSA is a gas station operator with many locations located adjacent to Wal-Mart stores. MUSA has benefitted from the recent volatility in gasoline prices as fuel margins have expanded. MUSA is using its robust free cash flow to aggressively buy back its own shares. We sold the position out of the portfolio on the strong stock performance as the stock became expensive relative to our normalized earnings power estimate.

The second largest contributing stock was Tri Pointe Homes Inc. (TPH). TPH is a single-family homebuilder that operates in California, Arizona, Nevada, Colorado, Texas, Oregon, and Virginia. The homebuilding stocks were up late in the period as mortgage rates declined from recent high levels. This, combined with falling input costs from commodities, led to the rally. With a low-cost foothold in California and expansion plans in the Southeast, we believe that TPH is well positioned to continue growing and expanding margins. We took advantage of the rise in the stock price to trim the position; however, the portfolio continues to hold a position in TPH.

The largest detracting stock in the period was Stewart Information Services (STC). STC is a title insurer for the residential and commercial markets. With mortgage rates rising sharply early in the period, industries related to housing sold off on fears over demand destruction as affordability worsened. Given the difficult environment for home affordability, coupled with most homeowners holding mortgages that have rates materially below current levels, housing activity might be constrained for a while. STC’s earnings depend on housing activity remaining high and with it currently earning above our estimate of normalized

| Dean Small Cap Value Fund |

| Management Discussion of Fund Performance (Unaudited) (continued) |

| March 31, 2023 |

earnings, we believe there is a risk of earnings coming down to below normalized levels over the next few quarters. Thus, we sold the STC holding out of the portfolio.

The second largest detracting stock was Washington Trust Bancorp (WASH). WASH offers banking and financial services primarily in Rhode Island, but also in Connecticut and Massachusetts. Steeped in history, the bank was founded in 1800 and was named after George Washington. Given the turmoil from the recent banking crisis, where multiple large banks failed in a short period of time, most small cap bank stock prices were under pressure. WASH scores satisfactorily on a composite of the hot button issues of the day: securities to assets ratio, commercial real estate and construction loans as a percentage of total loans, and the tangible common equity ratio. The portfolio continues to hold a position in WASH.

Current Positioning and Opportunities

The portfolio’s largest overweight sectors relative to the benchmark are currently in the Industrials and Consumer Staples sectors. The largest underweight sectors relative to the benchmark are currently in the Financials and Energy sectors. Throughout the fiscal year, the Industrials and Health Care sectors increased the most in weight, while the Financials and Consumer Staples sectors decreased the most in weight. As always, these relative weights are a residual of our bottom-up opportunities and not based on a top-down macro call on the market or economy.

We remain focused on the fundamentals of the companies we own, and the price we are paying for those fundamentals. We are confident that a steadfast application of our proven and disciplined process should produce favorable results over time.

Thank you for your continued confidence in Dean.

| Investment Results (Unaudited) |

Average Annual Total Returns(a) as of March 31, 2023

| | | One Year | | Five Year | | Ten Year |

| Dean Small Cap Value Fund | | 4.89% | | 7.43% | | 8.68% |

| Russell 2000 Value Index(b) | | (12.96)% | | 4.55% | | 7.22% |

| Russell 2000 Index(b) | | (11.61)% | | 4.71% | | 8.04% |

Total annual operating expenses, which include acquired fund fees and expenses of less than 0.005%, as disclosed in the Dean Small Cap Value Fund (the “Fund”) prospectus dated July 29, 2022, were 1.13% of the Fund’s average daily net assets. The Dean Investment Associates, LLC (the “Adviser”) has contractually agreed to waive its management fee and/or to reimburse certain Fund operating expenses through July 31, 2023, but only to the extent necessary so that total annual operating expenses (excluding portfolio transaction and other investment-related costs (including brokerage fees and commissions); taxes; borrowing costs (such as interest and dividend expenses on securities sold short); acquired fund fees and expenses; fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); any amounts payable pursuant to a distribution or service plan adopted in accordance with Rule 12b-1 under the Investment Company Act of 1940; expenses incurred in connection with any merger or reorganization; extraordinary expenses (such as litigation expenses, indemnification of Trust officers and Trustees and contractual indemnification of Fund service providers)) do not exceed 1.25% of the Fund’s average daily net assets. Each waiver/expense payment by the Adviser is subject to recoupment by the Adviser from the Fund in the three years following the date the particular waiver/expense payment occurred, but only if such recoupment can be achieved without exceeding the annual expense limitation in effect at the time of the waiver/ expense payment and any expense limitation in effect at the time of recoupment. This expense limitation agreement may not be terminated prior to July 31, 2023, except by the Board of Trustees upon sixty (60) days’ written notice to the Adviser. Additional information pertaining to the expense ratios as of March 31, 2023 can be found in the financial highlights.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance quoted. The Fund’s investment objective, risks, charges and expenses should be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 899-8343.

(a) Return figures reflect any change in price per share and assume the reinvestment of all distributions.

(b) The Russell 2000 Index is an equity index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. The Russell 2000 Value Index is an unmanaged index of common stock prices that measures the performance of those Russell 2000 companies with lower price-to-book ratios forecasted growth values. The indices are representative of a broader market and range of securities than are found in the Fund’s portfolio. An individual cannot invest directly in an index or the indices. However, an individual may be able to invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index.

You should consider the Fund’s investment objective, risks, charges and expenses carefully before you invest. The Fund’s prospectus contains important information about the Fund’s investment objective, potential risks, management fees, charges and expenses, and other information and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus or performance data current to the most recent month end by calling (888) 899-8343.

| Investment Results (Unaudited) (continued) |

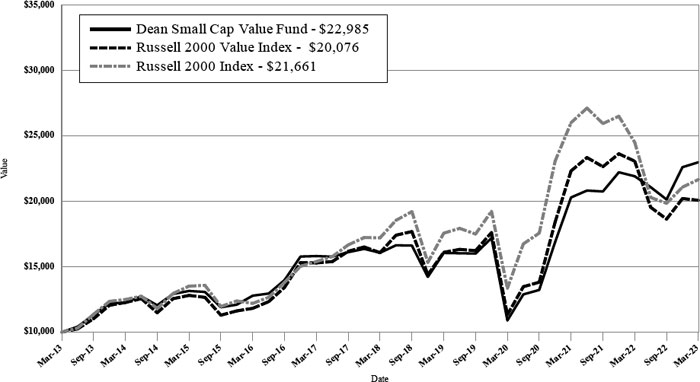

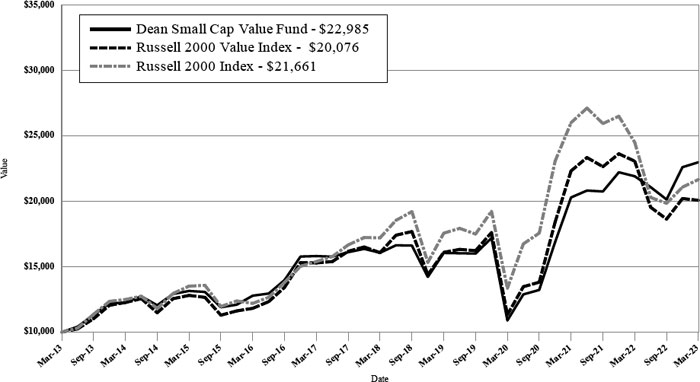

Comparison of the Change in Value of a $10,000 Investment in the Dean Small Cap Value Fund, the Russell 2000 Value Index and the Russell 2000 Index (Unaudited)

The graph shows the value of a hypothetical initial investment of $10,000 in the Fund, the Russell 2000 Value Index and the Russell 2000 Index on March 31, 2013 and held through March 31, 2023.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

The Russell 2000 Index is an equity index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. The Russell 2000 Value Index is an unmanaged index of common stock prices that measures the performance of those Russell 2000 companies with lower price-to-book ratios forecasted growth values. The indices are representative of a broader market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual may invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE OR PREDICT FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (888) 899-8343. You should carefully consider the investment objective, risks, charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund and should be read carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

| Dean Mid Cap Value Fund |

| Management Discussion of Fund Performance (Unaudited) |

| March 31, 2023 |

Management’s Discussion & Analysis

The Dean Mid Cap Value Fund (the “Fund”) returned -.50% net of fees for the twelve months ended March 31, 2023, compared with a -9.22% return for the benchmark Russell Midcap Value Index and an -8.78% return for the broader Russell Midcap Index.

Macro Factors Impacting Performance

Macro style factors were a significant benefit to the Fund in the fiscal year. In a period of uncertainty as monetary policy shifted to a hawkish stance to slow the economy, quality characteristics tended to outperform. The portfolio benefitted from holding stocks with less volatility and lower financial leverage and also benefitted from being overweight stocks with higher profitability than the benchmark. Quality stocks tend to be less volatile, have lower financial leverage and generate higher returns on capital than stocks considered low quality. In addition, the portfolio benefited from stocks with lower valuations outperforming in the period. The rising cost of capital is beginning to have an impact on the market environment leading to more emphasis being placed on valuation and quality. This is causing a shift in investor appetite towards higher-quality, value-oriented stocks which represent the two most important tenets to Dean Capital Management, LLC’s investment philosophy: “Value Driven, Quality Focused.”

Sector Performance (Best/Worst Relative to Benchmark)

The best performing sector relative to the benchmark for the twelve-month period was Consumer Discretionary. Sector allocation was positive as the Fund was overweight an outperforming sector. Stock selection was the primary driver of outperformance with each of the seven names owned throughout the year positively adding to performance. Retail holdings added to performance through auto parts retailers AutoZone (AZO) and Genuine Parts (GPC) benefitting from strong sales as miles driven and age of cars increase and beauty and personal care retailer Ulta Beauty (ULTA), which benefitted from strong category sales and continued market share gains. Homebuilder PulteGroup (PHM) added to performance benefitting from a moderation in mortgage rates later in the year allowing home closings and margins to be better than initially feared. Tier 1 auto supplier BorgWarner (BWA) had a strong year as auto production improved after seeing significant supply chain issues and showed significant progress in their electric vehicle strategy. And finally, shoe maker Skechers (SKX) continued to have strong sell through with product focused on comfort and casual offerings.

The second best performing sector relative to the benchmark was Industrials. The Fund benefitted from being overweight the Industrials sector, which was the top performing sector in the Russell Midcap Value Index. The sector benefitted from broad late cycle industrial

| Dean Mid Cap Value Fund |

| Management Discussion of Fund Performance (Unaudited) (continued) |

| March 31, 2023 |

activity and channel filling to replenish supply chains impacted during COVID-19. For the Fund, the primary driver of outperformance relative to the benchmark was stock selection. While the stocks that outperformed had varying end markets, the key theme was strong demand in niche product lines. Hubbell (HUBB) outperformed as demand from utilities and telecommunications companies was strong, nVent (NVT) benefitted from strength in electrification and automation markets, FTI Consulting (FCN) benefitted from increased demand for advice related to complex capital structures and Curtis-Wright (CW) saw increased demand in its defense products as conflicts worldwide escalated.

The worst performing sector relative to the benchmark for the last twelve months was Energy. Sector allocation was a headwind as the Fund was underweight the Energy sector, which outperformed the Russell Midcap Value Index. Permian Basin exploration and production company Pioneer Natural Resources (PXD) was down -8.8% in the year as declining oil well productivity cast doubt over the company’s growth and capital plans. Oilfield services provider Baker Hughes (BKR) was down -18.8% for the year. Baker Hughes faced headwinds with poor execution within its supply chain, leading to curtailed sales and profitability. The company was also negatively impacted by currency headwinds and significant costs to exit its Russian operations. The company embarked on a reorganization plan late in the year that should reduce costs and better align the sales channels with end markets.

The second worst performing sector relative to the benchmark was Utilities. The Fund benefited by being overweight an outperforming sector. However, stock selection was subpar relative to the benchmark with Michigan based utility CMS Energy (CMS) down -9.6% and Missouri based Ameren (AEE) down -5.4%. Due to capital needs to fund future growth capital spending, the rapid rise of interest rates in the year was a headwind to the Fund’s utility holdings. While regulated utilities, in theory, are allowed to recover invested capital through increased rates, there is a disconnect in timing between capital needs and the period in which rate cases are approved. This often creates short-term pressure on earnings and is magnified in a rising rate environment.

Individual Securities Performance (Best/Worst Absolute Contributors)

Steel Dynamics (STLD), up 37.9% for the year, was the largest contributing stock. The company is the second largest electric arc furnace (EAF) steel producer in the U.S. Key end markets include construction, manufacturing, industrial equipment, and automotive, focusing on specialty value-added production. While steel commodity prices declined throughout the year, the company benefitted from strong end market demand and an advantaged cost position relative to peers. In addition, the company has invested and grown the steel fabrication business, which has seen strong demand in value added finished product, which carries higher gross margins. Construction demand continues to be strong

| Dean Mid Cap Value Fund |

| Management Discussion of Fund Performance (Unaudited) (continued) |

| March 31, 2023 |

supporting a significant backlog for 2023. The Fund has reduced the size of its holding in Steel Dynamics as the stock has outperformed, but the Fund continues to hold a position in the stock.

The second largest contributing stock this quarter was Hubbell (HUBB), up 35.0%. Hubbell is an electric equipment manufacturer with a 50/50 split between utility and electrical end markets. The company has exposure to power distribution and transmission, non-residential construction, and general industrial end markets. The company has less than 10% exposure to residential housing, which has been beneficial as new housing slows due to higher interest rates. North America accounts for 92% of sales. The company had several quarters of exceeding expectations and raising guidance on the back of strong demand from industrial and utility customers. Utilities continue to invest heavily in transmission and distribution while telecom invests heavily in 5G and fiber rollouts. End market demand remains strong on the back of secular investments in infrastructure, and the company should see cost pressures decline as metal prices moderate. The Fund continues to hold Hubbell.

The worst contributing stock for the year was Essex Property Trust (ESS), down -37.1% for the period held. Essex is an apartment focused REIT with property concentrated on the West coast. Forty-two percent of properties are in Southern CA near Los Angeles and San Diego, 42% of properties are in Northern CA near Santa Clara, Oakland, and San Francisco, and 16% are in Seattle. Residential apartment REITs have seen concerns rising as it relates to rent growth as the economy softens and new capacity is added to the market. With Essex’s portfolio focused near West coast technology centers, the stock has been hit harder than most as many tech companies have laid off employees or implemented hiring freezes. The concern is that a deep decline in tech employment may negatively impact rents to the tune of a 20% plus decline, similar to what was seen in the dot.com bust in 2000. While we do not expect a decline in rents of that magnitude, Essex has experienced moderate deceleration in rents. The stock was exited near the end of the Fund’s fiscal year on concerns of deteriorating fundamentals.

Crown Holdings (CCK) was the second largest detracting stock for the year, down -43.2% for the period held. Crown manufactures beverage cans, which account for 60% of revenue, of which metal cans account for 5%, transit packaging 20%, and other metal packaging accounting for the remaining revenue. The company missed its fiscal third quarter earnings expectations and guided fourth quarter earnings 40% lower than estimates. The company saw strong demand for beverage cans, but results were weaker than expected due to inflation, energy prices, rising interest rates, and currency headwinds. While many of the reasons for lower earnings appear to be macro, the company has consistently missed expectations and guided earnings lower over several quarters, all in a period of supposed strong demand.

| Dean Mid Cap Value Fund |

| Management Discussion of Fund Performance (Unaudited) (continued) |

| March 31, 2023 |

We exited the position in October due to the company’s poor operational execution as well as new industry capacity that is slated to come into production in 2023/24, both of which lowered our assumption of normalized earnings and thus, the stock’s fair value.

Current Positioning and Opportunities

At the end of the Fund’s fiscal year, the Fund’s largest overweight sectors relative to the benchmark were the Consumer Staples and Industrial sectors. The largest underweight sectors relative to the benchmark were the Information Technology and Financials sectors. Throughout the fiscal year, the Industrials and Communication Services sectors increased the most in weight, while the Financials and Energy sectors decreased the most in weight.

We remain focused on the fundamentals of the companies we own, and the price we are paying for those fundamentals. We are confident that a steadfast application of our proven and disciplined process should produce favorable results over time.

Thank you for your continued confidence in Dean.

| Investment Results (Unaudited) |

Average Annual Total Returns(a) as of March 31, 2023

| | | One Year | | Five Year | | Ten Year |

| Dean Mid Cap Value Fund | | (0.50)% | | 7.28% | | 9.08% |

| Russell Midcap Value Index(b) | | (9.22)% | | 6.54% | | 8.80% |

| Russell Midcap Index(b) | | (8.78)% | | 8.05% | | 10.05% |

The Total annual operating expenses, which included acquired fund fees and expenses of less than 0.005%, as disclosed in the Fund prospectus dated July 29, 2022, were 1.06% of the Fund’s average daily net assets (0.85% after fee waivers/expense reimbursements by Dean Investment Associates, LLC (the “Adviser”)). The Adviser has contractually agreed to waive its management fee and/or reimburse expenses so that total annual Fund operating expenses (excluding portfolio transaction and other investment-related costs (including brokerage fees and commissions); taxes; borrowing costs (such as interest and dividend expenses on securities sold short); acquired fund fees and expenses; fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); any amounts payable pursuant to a distribution or service plan adopted in accordance with Rule 12b-1 under the Investment Company Act of 1940; expenses incurred in connection with any merger or reorganization; extraordinary expenses (such as litigation expenses, indemnification of Trust officers and Trustees and contractual indemnification of Fund service providers)) do not exceed 0.85% of the Fund’s average daily net assets through July 31, 2023. Each waiver/expense payment by the Adviser is subject to recoupment by the Adviser from the Fund in the three years following the date the particular waiver/expense payment occurred, but only if such recoupment can be achieved without exceeding the annual expense limitation in effect at the time of the waiver/expense payment and any expense limitation in effect at the time of recoupment. This expense limitation agreement may not be terminated prior to July 31, 2023, except by the Board of Trustees upon sixty (60) days’ written notice to the Adviser. Additional information pertaining to the expense ratios as of March 31, 2023 can be found in the financial highlights.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance quoted. The Fund’s investment objective, risks, charges and expenses should be considered carefully before investing. Performance data current to the most recent month-end may be obtained by calling (888) 899-8343.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. |

| (b) | The Russell Midcap Index is a market capitalization weighted index representing the smallest 800 companies in the Russell 1000 Index. The Russell Midcap Value Index is an unmanaged index of common stock prices that measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values. The indices are representative of a broader market and range of securities than are found in the Fund’s portfolio. An individual cannot invest directly in an index. However, an individual may be able to invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. |

You should consider the Fund’s investment objective, risks, charges and expenses carefully before you invest. The Fund’s prospectus contains important information about the Fund’s investment objective, potential risks, management fees, charges and expenses, and other information and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus or performance data current to the most recent month end by calling (888) 899-8343.

| Investment Results (Unaudited) (continued) |

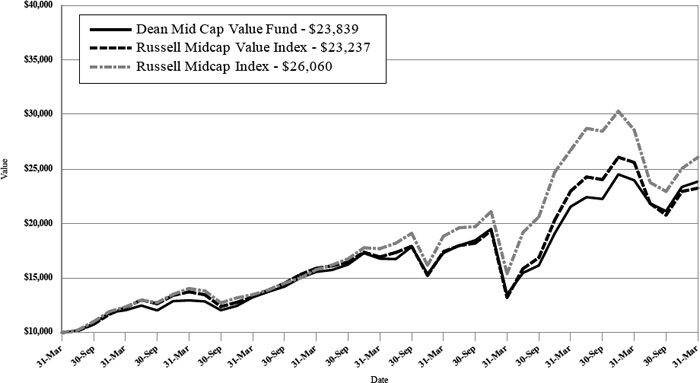

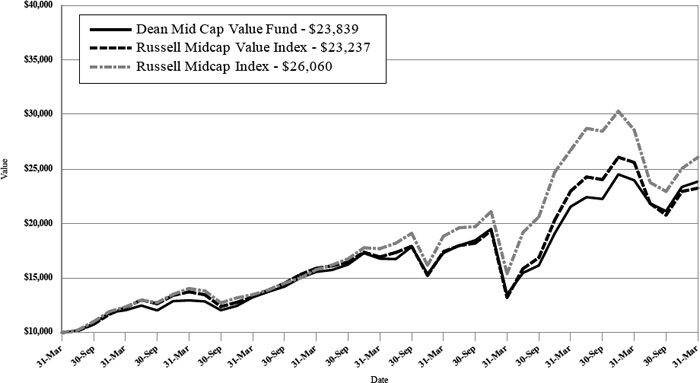

Comparison of the Change in the Value of a $10,000 Investment in the Dean Mid Cap Value Fund, the Russell Midcap Value Index, and the Russell Midcap Index (Unaudited)

The graph shows the value of a hypothetical initial investment of $10,000 in the Fund, the Russell Midcap Value Index and the Russell Midcap Index on March 31, 2013 and held through March 31, 2023.

The Russell Midcap Index is a market capitalization weighted index representing the smallest 800 companies in the Russell 1000 Index. The Russell Midcap Value Index is an unmanaged index of common stock prices that measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values. The indices are representative of a broader market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual may invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE OR PREDICT FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (888) 899-8343. You should carefully consider the investment objective, risks, charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund and should be read carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

| Dean Equity Income Fund |

| Management Discussion of Fund Performance (Unaudited) |

| March 31, 2023 |

Management’s Discussion & Analysis

The Dean Equity Income Fund (the “Fund”) returned -2.66% (net of fees) for the period ended March 31, 2023 since the fund inception, compared with the Russell 1000 Value Index, down -1.62%.

Macro Factors Impacting Performance

Broad market factors acted largely as headwinds for the Fund since inception. Most importantly for the Fund’s relative performance, higher dividend yielding stocks underperformed the market. Additionally, stocks exhibiting the most earnings variability and growth performed well in the period while the Fund was under-exposed to these factors. On the other hand, the portfolio’s lower beta, volatility, and valuation were positive factors in the period.

Sector Performance (Best/Worst Relative to Benchmark)

The best performing sector relative to the benchmark since inception was Utilities. The strength was driven by allocation with the Utility sector the largest overweight sector and Utilities outperforming the benchmark Russell 1000 Value in the period. Additionally, new Utility sector investments were strong contributors outperforming since purchase. These included Alliant Energy (LNT) up 7.0% and Eversource Energy (ES) up 5.8% since purchase in the first quarter of 2023. Both utilities held up well in the volatile market.

The second best performing sector relative to the benchmark was Consumer Staples. Similar to the Utility sector, Consumer Staples performed well since inception principally due to being overweight in an outperforming sector. Household and Personal Product leader Kimberly-Clark (KMB) also added to the sector strength, up 3.7% in the period. Also, tobacco manufacturers Philip Morris International (PM) and Altria Group (MO) were relatively strong up 3.6% and 2.9%, respectively.

The worst performing sector relative to the benchmark since inception was Financials. Security selection drove the Financial sector weakness. Regional banks PNC Financial Group (PNC, -26.1% since inception) and US Bancorp (USB, -17.0%) underperformed in the period principally due to fear of contagion and fallout from the banking failures at Silicon Valley Bank and Signature Bank. While risks remain, we feel that both PNC and USB remain on solid footing and added modestly to the PNC position and continue to hold USB. For similar reasons, insurance holdings Prudential Financial (PRU, -21.2%) and Principal Financial Group (PFG, -18.7%) lagged the benchmark and the overall Financial sector in the period. And, again, similar to the portfolio bank positions, we remain confident in the insurers’ liquidity and long-term fundamentals and continue to hold the positions. See further discussion of PNC and PRU below.

| Dean Equity Income Fund |

| Management Discussion of Fund Performance (Unaudited) (continued) |

| March 31, 2023 |

The second worst performing sector relative to the benchmark was Communication Services. Stock selection drove the weakness. This is despite a strong performance from advertising leader Omnicom (OMC), up 21.0% in the period. See further discussion of OMC below. The biggest contributors to the benchmark strength came from wide range of outcome stocks that do not pay a dividend and are thus not an investment option for the Equity Income portfolio.

Individual Securities Performance (Best/Worst Absolute Contributors)

Omnicom Group (OMC) was the highest contributing stock during the since inception period. Omnicom is the second largest advertising company in terms of worldwide billings. OMC returned 21.0% since inception. The portfolio holds OMC due to its strong market share and highly variable cost structure, which allows the company to flex its P&L in times of financial hardship, while OMC’s top line mix shift to less cyclical, more digitally led advertising end markets has resulted in a steadier growth profile through the cycle. This was demonstrated by management’s provision of strong forward guidance, above Wall Street analyst estimates, even in the face of a wider range of outcomes economic environment. With supply chains easing and health care innovation continuing, the global market for ad spend continues to grow, with OMC a primary beneficiary. While the OMC position was trimmed in the first quarter on the outperformance, the portfolio maintains a position.

The second highest contributing holding was Broadcom Inc. (AVGO). Broadcom is a global designer and developer of semiconductor and infrastructure software solutions. AVGO returned 19.3% since inception as market sentiment seemed to have bottomed out late in 2022 on forecasted weaker handset shipments and high radio frequency component inventory until the second half of 2023 when headwinds should ease. On top of that, management posted a healthy first quarter earnings report and guided to a soft landing in the second half that should see the company post year-over-year growth in the back half due to high quality revenue mix and aggressive backlog scrubbing. AVGO has been rewarded by the market for its defensive characteristics and its consistency in results. The company’s strong revenue and free cash flow allow for continued research and development spending through the cycle. A staple of the equity income process, the portfolio continues to hold a position in AVGO.

The most detracting security was PNC Financial Services Group (PNC). PNC is a diversified financial services organization deriving >90% of its revenues from banking with the remainder coming from asset management. The Company was down -25.5% since the fund inception. It was a bumpy quarter for PNC as well, with disappointing net interest income and higher costs, but as the report was digested, the stock leveled off on management’s guidance for better-than-expected cost control. However, PNC was not

| Dean Equity Income Fund |

| Management Discussion of Fund Performance (Unaudited) (continued) |

| March 31, 2023 |

immune to the banking crisis and took a heavy fall with the rest of the banking industry. Management has put forth clear guardrails for managing its duration risk and was one of the first to access FHLB borrowings to have access to liquidity should it be needed, which was initially regarded as a red flag but was a defensive maneuver to take advantage of favorable spreads. With full faith in management’s ability to weather this storm due to its foresight and prudence in managing its balance sheet, the portfolio added a small weight to the existing position in the period.

The second largest detracting security was Prudential Financial (PRU). Prudential was down -22.3% since inception. Prudential is a diversified insurance and financial services company offering annuities, life insurance, retirement plan services, and asset management products. Prudential is the second largest life insurance company in the U.S. The company, like other life insurers, is operationally leveraged to the capital markets, however its asset management unit reported weaker than expected earnings and net flow as clients repositioned their exposures to fixed income strategies as interest rates rose. Nevertheless, its continued pivot towards capital-light businesses should better position PRU to compete domestically and generate above-peer return on equities while providing capital allocation flexibility to pursue mergers and acquisitions or share repurchases. With a yield above 6%, the portfolio continues to hold PRU.

Current Positioning and Opportunities

The portfolio’s largest overweight sectors relative to the benchmark are currently in the Industrials and Consumer Staples sectors. The largest underweight sectors relative to the benchmark are currently in the Financials and Energy sectors. Throughout the fiscal year, the Industrials and Health Care sectors increased the most in weight, while the Financials and Consumer Staples sectors decreased the most in weight. As always, these relative weights are a residual of our bottom-up opportunities and not based on a top-down macro call on the market or economy.

We remain focused on the fundamentals of the companies we own, and the price we are paying for those fundamentals. We are confident that a steadfast application of our proven and disciplined process should produce favorable results over time.

Thank you for your continued confidence in Dean.

| Investment Results (Unaudited) |

Average Annual Total Returns(a) as of March 31, 2023

| | | Since |

| | | Inception |

| | | (11/22/2022) |

| Dean Equity Income Fund(b) | | (2.66)% |

| Russell 1000 Value Index(b) | | (1.62)% |

The Total annual operating expenses, which included acquired fund fees and expenses of 0%, as disclosed in the Fund’s prospectus dated November 21, 2022, were 1.01% of the Fund’s average daily net assets (0.70% after fee waivers/expense reimbursements by Dean Investment Associates, LLC (the “Adviser”)). The Adviser has contractually agreed to waive its management fee and/or reimburse expenses so that total annual Fund operating expenses (excluding portfolio transaction and other investment-related costs (including brokerage fees and commissions); taxes; borrowing costs (such as interest and dividend expenses on securities sold short); acquired fund fees and expenses; fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); any amounts payable pursuant to a distribution or service plan adopted in accordance with Rule 12b-1 under the Investment Company Act of 1940; expenses incurred in connection with any merger or reorganization; extraordinary expenses (such as litigation expenses, indemnification of Trust officers and Trustees and contractual indemnification of Fund service providers)) do not exceed 0.70% of the Fund’s average daily net assets through July 31, 2024. Each waiver/expense payment by the Adviser is subject to recoupment by the Adviser from the Fund in the three years following the date the particular waiver/expense payment occurred, but only if such recoupment can be achieved without exceeding the annual expense limitation in effect at the time of the waiver/expense payment and any expense limitation in effect at the time of recoupment. This expense limitation agreement may not be terminated prior to July 31, 2024, except by the Board of Trustees upon sixty (60) days’ written notice to the Adviser. Additional information pertaining to the expense ratios as of March 31, 2023 can be found in the financial highlights.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance quoted. The Fund’s investment objective, risks, charges and expenses should be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 899-8343.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. Total returns for less than one year are not annualized. |

| (b) | The Russell 1000 Value Index (the “Index”) is an unmanaged market capitalization weighted index of the 1,000 largest U.S. companies with lower price-to-book ratios and lower forecasted growth values. The Index is a widely recognized unmanaged index of equity prices and are representative of a broader market and range of securities than are found in the Fund’s portfolio. An individual cannot invest directly in an index. However, an individual may be able to invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. |

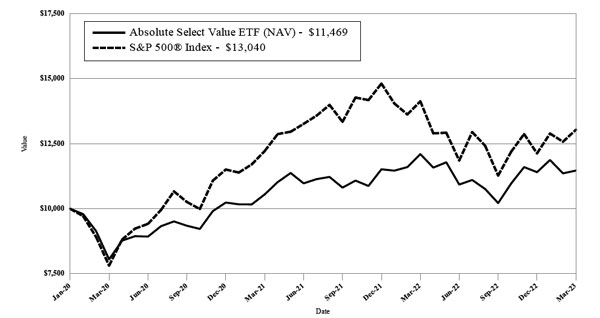

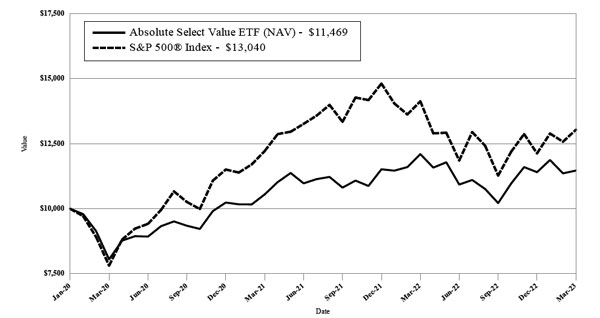

| Investment Results (Unaudited) (continued) |

You should consider the Fund’s investment objective, risks, charges and expenses carefully before you invest. The Fund’s prospectus contains important information about the Fund’s investment objective, potential risks, management fees, charges and expenses, and other information and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus or performance data current to the most recent month end by calling (888) 899-8343.

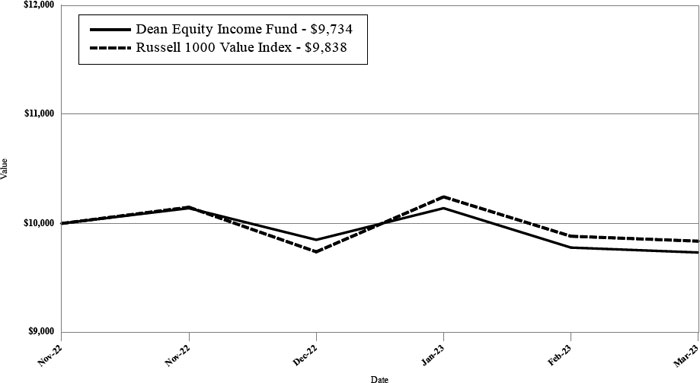

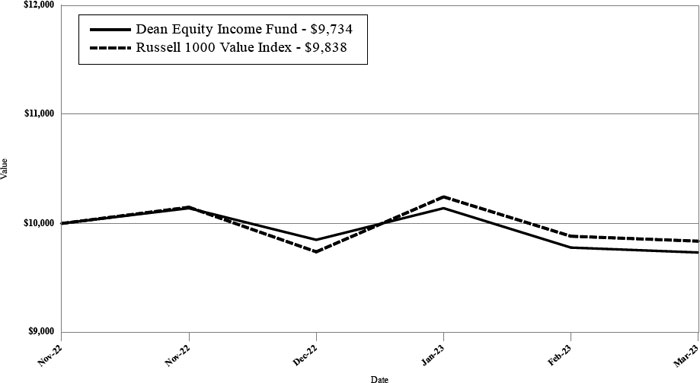

Comparison of the Change in the Value of a $10,000 Investment in the Dean Equity Income Fund and the Russel 1000 Value Index (Unaudited)

The graph shows the value of a hypothetical initial investment of $10,000 in the Fund, the Russell 1000 Value Index on November 22, 2022 and held through March 31, 2023.

The Russell 1000 Value Index is a widely recognized unmanaged index of common stock prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual may invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE OR PREDICT FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (888) 899-8343. You should carefully consider the investment objective, risks, charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund and should be read carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

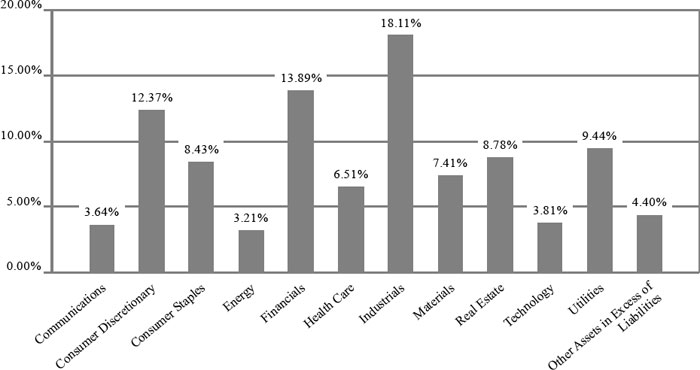

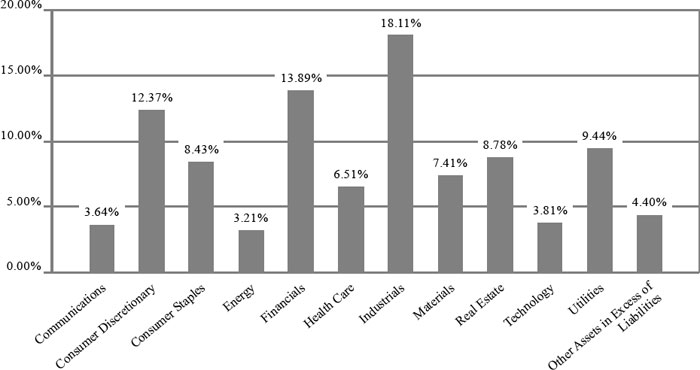

| Fund Holdings (Unaudited) |

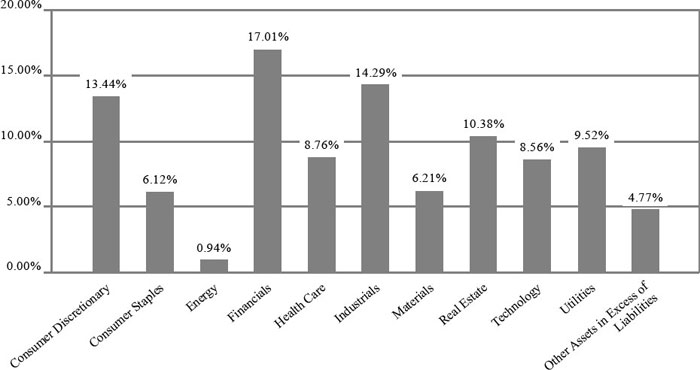

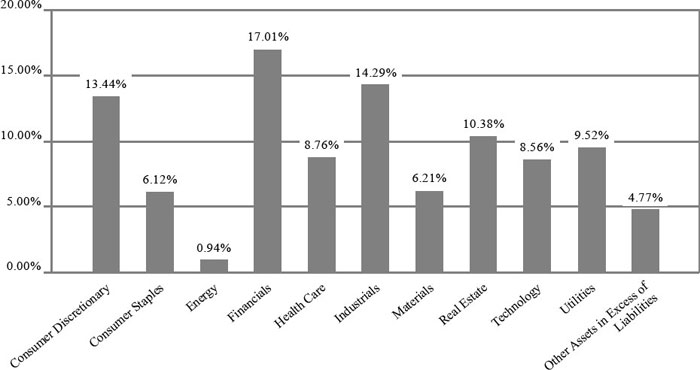

Dean Small Cap Value Fund Holdings as of March 31, 2023*

| * | As a percentage of net assets |

The investment objective of the Dean Small Cap Value Fund is long-term capital appreciation and, secondarily, dividend income. Portfolio holdings are subject to change.

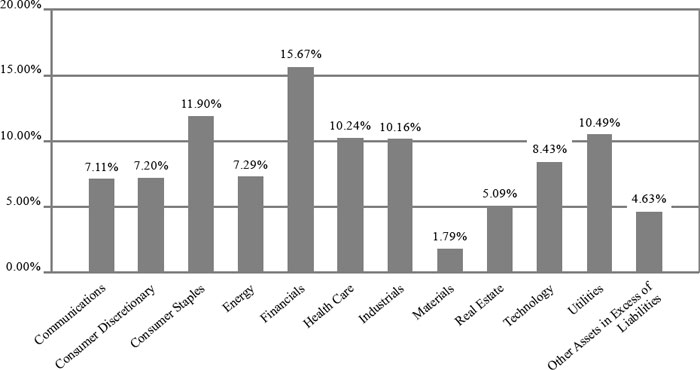

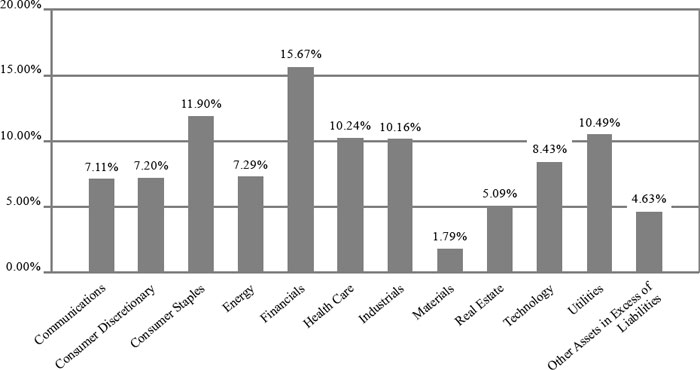

| Fund Holdings (Unaudited) |

Dean Mid Cap Value Fund Holdings as of March 31, 2023*

| * | As a percentage of net assets. |

The investment objective of the Dean Mid Cap Value Fund is long-term capital appreciation and, secondarily, dividend income. Portfolio holdings are subject to change.

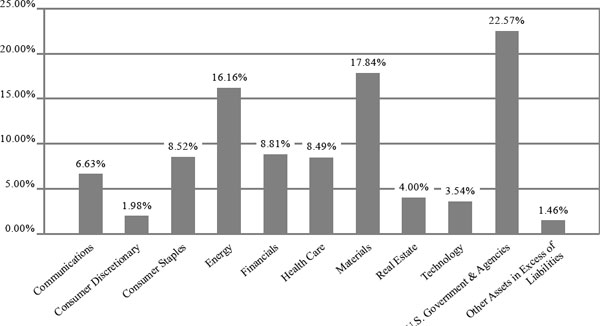

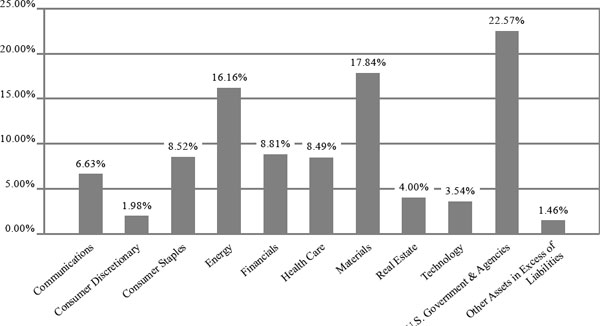

| Fund Holdings (Unaudited) |

Dean Equity Income Fund Holdings as of March 31, 2023*

| * | As a percentage of net assets. |

The investment objective of the Dean Equity Income Fund is long-term capital appreciation with an income focus. Portfolio holdings are subject to change.

| Availability of Portfolio Schedule (Unaudited) |

Each Fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Funds’ Form N-PORT reports are available on the SEC’s website at www. sec.gov and on the Funds’ website at www.deanmutualfunds.com.

| Dean Small Cap Value Fund |

| Schedule of Investments |

| March 31, 2023 |

| COMMON STOCKS — 95.23% | | Shares | | | Fair Value | |

| Consumer Discretionary — 13.44% | | | | | | | | |

| American Woodmark Corp.(a) | | | 43,190 | | | $ | 2,248,903 | |

| Carter’s, Inc. | | | 35,395 | | | | 2,545,608 | |

| Fox Factory Holding Corp.(a) | | | 11,117 | | | | 1,349,270 | |

| Johnson Outdoors, Inc., Class A | | | 38,590 | | | | 2,431,556 | |

| Medifast, Inc. | | | 28,751 | | | | 2,980,616 | |

| Methode Electronics, Inc. | | | 50,090 | | | | 2,197,949 | |

| Miller Industries, Inc. | | | 105,930 | | | | 3,744,626 | |

| Standard Motor Products, Inc. | | | 154,487 | | | | 5,702,116 | |

| TRI Pointe Group, Inc.(a) | | | 138,897 | | | | 3,516,872 | |

| Wendy’s Co. (The) | | | 98,391 | | | | 2,142,956 | |

| | | | | | | | 28,860,472 | |

| Consumer Staples — 6.12% | | | | | | | | |

| Cal-Maine Foods, Inc. | | | 63,379 | | | | 3,859,147 | |

| Fresh Del Monte Produce, Inc. | | | 55,457 | | | | 1,669,810 | |

| John B. Sanfilippo & Son, Inc. | | | 52,646 | | | | 5,102,451 | |

| Lancaster Colony Corp. | | | 12,395 | | | | 2,514,698 | |

| | | | | | | | 13,146,106 | |

| Energy — 0.94% | | | | | | | | |

| World Fuel Services Corp. | | | 79,096 | | | | 2,020,903 | |

| | | | | | | | | |

| Financials — 17.01% | | | | | | | | |

| Camden National Corp. | | | 99,285 | | | | 3,593,124 | |

| Capitol Federal Financial, Inc. | | | 528,117 | | | | 3,554,227 | |

| Cathay General Bancorp | | | 38,590 | | | | 1,332,127 | |

| Diamond Hill Investment Group, Inc. | | | 15,717 | | | | 2,586,704 | |

| Employers Holdings, Inc. | | | 81,396 | | | | 3,393,399 | |

| Federated Hermes, Inc., Class B | | | 31,051 | | | | 1,246,387 | |

| Great Southern Bancorp, Inc. | | | 23,639 | | | | 1,198,025 | |

| Nelnet, Inc., Class A | | | 37,823 | | | | 3,475,555 | |

| QCR Holdings, Inc. | | | 60,568 | | | | 2,659,541 | |

| Safety Insurance Group, Inc. | | | 51,368 | | | | 3,827,944 | |

| Washington Federal, Inc. | | | 88,041 | | | | 2,651,795 | |

| Washington Trust Bancorp, Inc. | | | 92,258 | | | | 3,197,662 | |

| Waterstone Financial, Inc. | | | 193,076 | | | | 2,921,240 | |

| White Mountains Insurance Group Ltd. | | | 639 | | | | 880,216 | |

| | | | | | | | 36,517,946 | |

| Health Care — 8.76% | | | | | | | | |

| Haemonetics Corp.(a) | | | 7,539 | | | | 623,852 | |

| National Healthcare Corp. | | | 79,735 | | | | 4,630,211 | |

| Perrigo Co. PLC | | | 44,979 | | | | 1,613,397 | |

| Phibro Animal Health Corp., A | | | 171,737 | | | | 2,631,011 | |

| Premier, Inc., Class A | | | 178,765 | | | | 5,786,623 | |

| Prestige Consumer Healthcare, Inc.(a) | | | 56,479 | | | | 3,537,280 | |

| | | | | | | | 18,822,374 | |

| Industrials — 14.29% | | | | | | | | |

| Advanced Energy Industries, Inc. | | | 16,484 | | | | 1,615,432 | |

| Argan, Inc. | | | 144,136 | | | | 5,833,184 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| Dean Small Cap Value Fund |

| Schedule of Investments (continued) |

| March 31, 2023 |

| COMMON STOCKS — 95.23% - continued | | Shares | | | Fair Value | |

| Industrials — 14.29% - continued | | | | | | | | |

| AZZ, Inc. | | | 101,458 | | | $ | 4,184,128 | |

| Brady Corp., Class A | | | 101,330 | | | | 5,444,461 | |

| Heartland Express, Inc. | | | 222,466 | | | | 3,541,659 | |

| John Bean Technologies Corp. | | | 17,378 | | | | 1,899,242 | |

| Kennametal, Inc. | | | 59,674 | | | | 1,645,809 | |

| Mueller Water Products, Inc. | | | 164,454 | | | | 2,292,488 | |

| Werner Enterprises, Inc. | | | 93,152 | | | | 4,237,484 | |

| | | | | | | | 30,693,887 | |

| Materials — 6.21% | | | | | | | | |

| Alamos Gold, Inc., Class A | | | 178,637 | | | | 2,184,731 | |

| NewMarket Corp. | | | 2,811 | | | | 1,025,959 | |

| Sensient Technologies Corp. | | | 68,618 | | | | 5,253,394 | |

| SSR Mining, Inc. | | | 92,769 | | | | 1,402,667 | |

| Stepan Co. | | | 33,734 | | | | 3,475,614 | |

| | | | | | | | 13,342,365 | |

| Real Estate — 10.38% | | | | | | | | |

| Alexander’s, Inc. | | | 9,711 | | | | 1,881,506 | |

| CareTrust REIT, Inc. | | | 40,890 | | | | 800,626 | |

| Cousins Properties, Inc. | | | 195,376 | | | | 4,177,139 | |

| Equity Commonwealth | | | 216,716 | | | | 4,488,188 | |

| Getty Realty Corp. | | | 59,929 | | | | 2,159,242 | |

| Physicians Realty Trust | | | 399,953 | | | | 5,971,298 | |

| Universal Health Realty Income Trust | | | 58,651 | | | | 2,821,700 | |

| | | | | | | | 22,299,699 | |

| Technology — 8.56% | | | | | | | | |

| Benchmark Electronics, Inc. | | | 92,385 | | | | 2,188,601 | |

| CSG Systems International, Inc. | | | 61,079 | | | | 3,279,942 | |

| MAXIMUS, Inc. | | | 60,568 | | | | 4,766,701 | |

| NextGen Healthcare, Inc.(a) | | | 49,707 | | | | 865,399 | |

| Viavi Solutions, Inc.(a) | | | 338,363 | | | | 3,664,471 | |

| Vishay Intertechnology, Inc. | | | 160,109 | | | | 3,621,666 | |

| | | | | | | | 18,386,780 | |

| Utilities — 9.52% | | | | | | | | |

| American States Water Co. | | | 43,318 | | | | 3,850,537 | |

| Avista Corp. | | | 87,913 | | | | 3,731,907 | |

| Northwest Natural Holding Co. | | | 15,845 | | | | 753,588 | |

| NorthWestern Corp. | | | 57,118 | | | | 3,304,847 | |

| Portland General Electric Co. | | | 106,441 | | | | 5,203,901 | |

| Spire, Inc. | | | 51,368 | | | | 3,602,952 | |

| | | | | | | | 20,447,732 | |

| | | | | | | | | |

| Total Common Stocks/Investments — 95.23% (Cost $200,062,430) | | | | | | | 204,538,264 | |

| Other Assets in Excess of Liabilities — 4.77% | | | | | | | 10,245,426 | |

| NET ASSETS — 100.00% | | | | | | $ | 214,783,690 | |

| | | | | | | | | |

| (a) | Non-income producing security. |

See accompanying notes which are an integral part of these financial statements.

| Dean Mid Cap Value Fund |

| Schedule of Investments |

| March 31, 2023 |

| COMMON STOCKS — 95.60% | | Shares | | | Fair Value | |

| Communications — 3.64% | | | | | | | | |

| Omnicom Group, Inc. | | | 16,635 | | | $ | 1,569,346 | |

| Take-Two Interactive Software, Inc.(a) | | | 9,546 | | | | 1,138,838 | |

| | | | | | | | 2,708,184 | |

| Consumer Discretionary — 12.37% | | | | | | | | |

| AutoZone, Inc.(a) | | | 613 | | | | 1,506,846 | |

| BorgWarner, Inc. | | | 27,079 | | | | 1,329,850 | |

| Genuine Parts Co. | | | 7,987 | | | | 1,336,305 | |

| Masco Corp. | | | 22,531 | | | | 1,120,241 | |

| PulteGroup, Inc. | | | 21,503 | | | | 1,253,195 | |

| Skechers U.S.A., Inc., Class A(a) | | | 26,796 | | | | 1,273,346 | |

| Ulta Beauty, Inc.(a) | | | 2,552 | | | | 1,392,550 | |

| | | | | | | | 9,212,333 | |

| Consumer Staples — 8.43% | | | | | | | | |

| BJ’s Wholesale Club Holdings, Inc.(a) | | | 15,737 | | | | 1,197,113 | |

| Casey’s General Stores, Inc. | | | 5,482 | | | | 1,186,634 | |

| Conagra Brands, Inc. | | | 39,488 | | | | 1,483,169 | |

| Flowers Foods, Inc. | | | 53,894 | | | | 1,477,236 | |

| US Foods Holding Corp.(a) | | | 25,223 | | | | 931,738 | |

| | | | | | | | 6,275,890 | |

| Energy — 3.21% | | | | | | | | |

| Baker Hughes Co. | | | 40,264 | | | | 1,162,019 | |

| Pioneer Natural Resources Co. | | | 6,002 | | | | 1,225,849 | |

| | | | | | | | 2,387,868 | |

| Financials — 13.89% | | | | | | | | |

| Ameriprise Financial, Inc. | | | 4,865 | | | | 1,491,122 | |

| Assurant, Inc. | | | 9,258 | | | | 1,111,608 | |

| Fifth Third Bancorp | | | 34,073 | | | | 907,705 | |

| Globe Life, Inc. | | | 12,760 | | | | 1,403,855 | |

| Raymond James Financial, Inc. | | | 15,737 | | | | 1,467,790 | |

| Regions Financial Corp. | | | 63,704 | | | | 1,182,346 | |

| Reinsurance Group of America, Inc. | | | 9,777 | | | | 1,297,995 | |

| W.R. Berkley Corp. | | | 23,759 | | | | 1,479,235 | |

| | | | | | | | 10,341,656 | |

| Health Care — 6.51% | | | | | | | | |

| Chemed Corp. | | | 2,263 | | | | 1,216,928 | |

| Encompass Health Corp. | | | 24,184 | | | | 1,308,354 | |

| Quest Diagnostics, Inc. | | | 7,987 | | | | 1,130,001 | |

| Zimmer Biomet Holdings, Inc. | | | 9,215 | | | | 1,190,578 | |

| | | | | | | | 4,845,861 | |

| Industrials — 18.11% | | | | | | | | |

| Curtiss-Wright Corp. | | | 8,365 | | | | 1,474,415 | |

| Dover Corp. | | | 8,648 | | | | 1,313,977 | |

| FTI Consulting, Inc.(a) | | | 7,514 | | | | 1,482,888 | |

| Hubbell, Inc. | | | 5,671 | | | | 1,379,811 | |

| ITT, Inc. | | | 14,981 | | | | 1,292,860 | |

| Littelfuse, Inc. | | | 4,820 | | | | 1,292,194 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements

| Dean Mid Cap Value Fund |

| Schedule of Investments (continued) |

| March 31, 2023 |

| COMMON STOCKS — 95.60% - continued | | Shares | | | Fair Value | |

| Industrials — 18.11% - continued | | | | | | | | |

| MSC Industrial Direct Co., Inc., Class A | | | 14,556 | | | $ | 1,222,704 | |

| nVent Electric PLC | | | 38,374 | | | | 1,647,779 | |

| Regal Rexnord Corp. | | | 4,395 | | | | 618,508 | |

| Republic Services, Inc. | | | 10,255 | | | | 1,386,681 | |

| Stanley Black & Decker, Inc. | | | 4,679 | | | | 377,034 | |

| | | | | | | | 13,488,851 | |

| Materials — 7.41% | | | | | | | | |

| Avery Dennison Corp. | | | 6,333 | | | | 1,133,164 | |

| Eagle Materials, Inc. | | | 7,231 | | | | 1,061,149 | |

| Eastman Chemical Co. | | | 13,226 | | | | 1,115,481 | |

| FMC Corp. | | | 11,153 | | | | 1,362,116 | |

| Steel Dynamics, Inc. | | | 7,467 | | | | 844,219 | |

| | | | | | | | 5,516,129 | |

| Real Estate — 8.78% | | | | | | | | |

| Alexandria Real Estate Equities, Inc. | | | 5,999 | | | | 753,414 | |

| AvalonBay Communities, Inc. | | | 7,132 | | | | 1,198,604 | |

| CBRE Group, Inc., Class A(a) | | | 14,839 | | | | 1,080,428 | |

| Regency Centers Corp. | | | 18,573 | | | | 1,136,296 | |

| STAG Industrial, Inc. | | | 36,247 | | | | 1,225,874 | |

| Welltower, Inc. | | | 15,973 | | | | 1,145,104 | |

| | | | | | | | 6,539,720 | |

| Technology — 3.81% | | | | | | | | |

| Arrow Electronics, Inc.(a) | | | 12,045 | | | | 1,504,059 | |

| Broadridge Financial Solutions, Inc. | | | 9,121 | | | | 1,336,865 | |

| | | | | | | | 2,840,924 | |

| Utilities — 9.44% | | | | | | | | |

| Ameren Corp. | | | 15,832 | | | | 1,367,726 | |

| Atmos Energy Corp. | | | 13,091 | | | | 1,470,905 | |

| CenterPoint Energy, Inc. | | | 45,841 | | | | 1,350,476 | |

| CMS Energy Corp. | | | 22,117 | | | | 1,357,541 | |

| Xcel Energy, Inc. | | | 22,022 | | | | 1,485,164 | |

| | | | | | | | 7,031,812 | |

| | | | | | | | | |

| Total Common Stocks/Investments — 95.60% (Cost $56,252,652) | | | | | | | 71,189,228 | |

| Other Assets in Excess of Liabilities — 4.40% | | | | | | | 3,278,029 | |

| NET ASSETS — 100.00% | | | | | | $ | 74,467,257 | |

| | | | | | | | | |

| (a) | Non-income producing security. |

See accompanying notes which are an integral part of these financial statements.

| Dean Equity Income Fund |

| Schedule of Investments |

| March 31, 2023 |

| COMMON STOCKS — 95.37% | | Shares | | | Fair Value | |

| Communications — 7.11% | | | | | | | | |

| BCE, Inc. | | | 45,558 | | | $ | 2,040,543 | |

| Omnicom Group, Inc. | | | 12,120 | | | | 1,143,401 | |

| Verizon Communications, Inc. | | | 52,706 | | | | 2,049,736 | |

| | | | | | | | 5,233,680 | |

| Consumer Discretionary — 7.20% | | | | | | | | |

| Advance Auto Parts, Inc. | | | 9,137 | | | | 1,111,151 | |

| Home Depot, Inc. (The) | | | 4,351 | | | | 1,284,067 | |

| Packaging Corp. of America | | | 12,244 | | | | 1,699,834 | |

| Whirlpool Corp. | | | 9,137 | | | | 1,206,267 | |

| | | | | | | | 5,301,319 | |

| Consumer Staples — 11.90% | | | | | | | | |

| Altria Group, Inc. | | | 51,525 | | | | 2,299,045 | |

| Flowers Foods, Inc. | | | 52,457 | | | | 1,437,846 | |

| Kimberly-Clark Corp. | | | 16,222 | | | | 2,177,317 | |

| PepsiCo, Inc. | | | 6,899 | | | | 1,257,688 | |

| Philip Morris International, Inc. | | | 16,346 | | | | 1,589,649 | |

| | | | | | | | 8,761,545 | |

| Energy — 7.29% | | | | | | | | |

| Chevron Corp. | | | 14,606 | | | | 2,383,115 | |

| EOG Resources, Inc. | | | 10,753 | | | | 1,232,616 | |

| Kinder Morgan, Inc., Class P | | | 100,253 | | | | 1,755,430 | |

| | | | | | | | 5,371,161 | |

| Financials — 15.67% | | | | | | | | |

| BlackRock, Inc. | | | 1,740 | | | | 1,164,269 | |

| Canadian Imperial Bank of Commerce | | | 29,958 | | | | 1,270,818 | |

| JPMorgan Chase & Co. | | | 10,877 | | | | 1,417,382 | |

| PNC Financial Services Group, Inc. (The) | | | 10,504 | | | | 1,335,058 | |

| Principal Financial Group, Inc. | | | 19,205 | | | | 1,427,315 | |

| Prudential Financial, Inc. | | | 16,471 | | | | 1,362,811 | |

| T. Rowe Price Group, Inc. | | | 18,832 | | | | 2,126,132 | |

| U.S. Bancorp | | | 39,902 | | | | 1,438,467 | |

| | | | | | | | 11,542,252 | |

| Health Care — 10.24% | | | | | | | | |

| Amgen, Inc. | | | 7,458 | | | | 1,802,971 | |

| Bristol-Myers Squibb Co. | | | 13,922 | | | | 964,934 | |

| Johnson & Johnson | | | 14,295 | | | | 2,215,725 | |

| Merck & Co., Inc. | | | 13,612 | | | | 1,448,181 | |

| Pfizer, Inc. | | | 27,161 | | | | 1,108,169 | |

| | | | | | | | 7,539,980 | |

| Industrials — 10.16% | | | | | | | | |

| Fastenal Co. | | | 32,444 | | | | 1,750,029 | |

| Lockheed Martin Corp. | | | 2,300 | | | | 1,087,279 | |

| Paychex, Inc. | | | 9,572 | | | | 1,096,855 | |

| Union Pacific Corp. | | | 7,023 | | | | 1,413,449 | |

| United Parcel Service, Inc., Class B | | | 11,001 | | | | 2,134,085 | |

| | | | | | | | 7,481,697 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| Dean Equity Income Fund |

| Schedule of Investments (continued) |

| March 31, 2023 |

| COMMON STOCKS — 95.37% - continued | | Shares | | | Fair Value | |

| Materials — 1.79% | | | | | | | | |

| Air Products & Chemicals, Inc. | | | 4,599 | | | $ | 1,320,879 | |

| | | | | | | | | |

| Real Estate — 5.09% | | | | | | | | |

| Digital Realty Trust, Inc. | | | 15,103 | | | | 1,484,776 | |

| Essex Property Trust, Inc. | | | 5,283 | | | | 1,104,887 | |

| Lamar Advertising Co., Class A | | | 11,623 | | | | 1,161,021 | |

| | | | | | | | 3,750,684 | |

| Technology — 8.43% | | | | | | | | |

| Broadcom, Inc. | | | 3,294 | | | | 2,113,234 | |

| Cisco Systems, Inc. | | | 39,405 | | | | 2,059,896 | |

| Texas Instruments, Inc. | | | 10,939 | | | | 2,034,763 | |

| | | | | | | | 6,207,893 | |

| Utilities — 10.49% | | | | | | | | |

| Alliant Energy Corp. | | | 21,319 | | | | 1,138,435 | |

| American Electric Power Co., Inc. | | | 16,657 | | | | 1,515,620 | |

| Duke Energy Corp. | | | 19,640 | | | | 1,894,671 | |

| Eversource Energy | | | 15,973 | | | | 1,250,047 | |

| WEC Energy Group, Inc. | | | 20,324 | | | | 1,926,512 | |

| | | | | | | | 7,725,285 | |

| | | | | | | | | |

| Total Common Stocks/Investments — 95.37% (Cost $71,849,374) | | | | | | | 70,236,375 | |

| Other Assets in Excess of Liabilities — 4.63% | | | | | | | 3,410,456 | |

| NET ASSETS — 100.00% | | | | | | $ | 73,646,831 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| Dean Funds |

| Statements of Assets and Liabilities |

| March 31, 2023 |

| | | Dean Small Cap | | | Dean Mid Cap | | | Dean Equity | |

| | | Value Fund | | | Value Fund | | | Income Fund | |

| Assets | | | | | | | | | | | | |

| Investments in securities at value (cost $200,062,430, $56,252,652 and $71,849,374) | | $ | 204,538,264 | | | $ | 71,189,228 | | | $ | 70,236,375 | |

| Cash and cash equivalents | | | 9,387,268 | | | | 3,436,362 | | | | 4,029,891 | |

| Receivable for fund shares sold | | | 4,946,358 | | | | 1,445 | | | | 60,419 | |

| Receivable for investments sold | | | 1,068,213 | | | | 3,870,429 | | | | — | |

| Dividends receivable | | | 330,617 | | | | 156,583 | | | | 197,135 | |

| Prepaid expenses | | | 26,685 | | | | 15,973 | | | | 8,312 | |

| Total Assets | | | 220,297,405 | | | | 78,670,020 | | | | 74,532,132 | |

| Liabilities | | | | | | | | | | | | |

| Payable for investments purchased | | | 5,289,143 | | | | 4,128,292 | | | | 841,380 | |

| Payable for fund shares redeemed | | | 2,984 | | | | 6,169 | | | | — | |

| Payable to Adviser | | | 158,396 | | | | 34,693 | | | | 11,583 | |

| Payable to affiliates | | | 22,906 | | | | 9,818 | | | | 9,030 | |

| Other accrued expenses | | | 40,286 | | | | 23,791 | | | | 23,308 | |

| Total Liabilities | | | 5,513,715 | | | | 4,202,763 | | | | 885,301 | |

| Net Assets | | $ | 214,783,690 | | | $ | 74,467,257 | | | $ | 73,646,831 | |

| Net Assets consist of: | | | | | | | | | | | | |

| Paid-in capital | | $ | 210,721,528 | | | $ | 55,932,685 | | | $ | 74,740,432 | |

| Accumulated earnings (deficit) | | | 4,062,162 | | | | 18,534,572 | | | | (1,093,601 | ) |

| Net Assets | | $ | 214,783,690 | | | $ | 74,467,257 | | | $ | 73,646,831 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 11,437,019 | | | | 3,311,218 | | | | 3,794,754 | |

| Net asset value, offering and redemption price per share | | $ | 18.78 | | | $ | 22.49 | | | $ | 19.41 | |

| | | | | | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| Dean Funds |

| Statements of Operations |

| For the Year or Period Ended March 31, 2023 |

| | | Dean Small Cap | | | Dean Mid Cap | | | Dean Equity | |

| | | Value Fund | | | Value Fund | | | Income Fund(a) | |

| Investment Income | | | | | | | | | | | | |

| Dividend income (net of foreign taxes withheld of $5,128, $– and $8,819) | | $ | 5,518,101 | | | $ | 1,503,240 | | | $ | 576,686 | |

| Interest income | | | 232,797 | | | | 87,213 | | | | 48,648 | |

| Total investment income | | | 5,750,898 | | | | 1,590,453 | | | | 625,334 | |

| | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | |

| Adviser | | | 1,697,866 | | | | 567,956 | | | | 72,377 | |

| Administration | | | 153,292 | | | | 68,565 | | | | 12,449 | |

| Custodian | | | 51,778 | | | | 13,594 | | | | 13,976 | |

| Transfer agent | | | 36,213 | | | | 10,079 | | | | 3,208 | |

| Fund accounting | | | 31,469 | | | | 20,117 | | | | 5,076 | |

| Registration | | | 30,015 | | | | 23,308 | | | | 589 | |

| Report printing | | | 26,055 | | | | 7,515 | | | | 2,439 | |

| Legal | | | 23,419 | | | | 23,419 | | | | 5,682 | |

| Audit and tax preparation | | | 17,810 | | | | 17,810 | | | | 17,400 | |

| Trustee | | | 17,477 | | | | 17,477 | | | | 4,169 | |

| Compliance services | | | 11,028 | | | | 11,028 | | | | 3,222 | |

| Insurance | | | 4,522 | | | | 3,304 | | | | — | |

| Pricing | | | 1,466 | | | | 1,140 | | | | 282 | |

| Miscellaneous | | | 55,721 | | | | 30,769 | | | | 9,236 | |

| Total expenses | | | 2,158,131 | | | | 816,081 | | | | 150,105 | |

| Fees waived by Adviser | | | — | | | | (172,518 | ) | | | (48,814 | ) |

| Net operating expenses | | | 2,158,131 | | | | 643,563 | | | | 101,291 | |

| Net investment income | | | 3,592,767 | | | | 946,890 | | | | 524,043 | |

| | | | | | | | | | | | | |

| Net Realized and Change in Unrealized Gain (Loss) on Investments | | | | | | | | | | | | |

| Net realized gain on investment securities transactions | | | 17,593,024 | | | | 3,226,530 | | | | 45,737 | |

| Net realized gain on foreign currency translations | | | — | | | | — | | | | 146 | |

| Net change in unrealized appreciation (depreciation) of investment securities | | | (11,956,951 | ) | | | (4,524,099 | ) | | | (1,612,999 | ) |

| Foreign currency | | | — | | | | — | | | | 432 | |

| Net realized and change in unrealized gain (loss) on investments | | | 5,636,073 | | | | (1,297,569 | ) | | | (1,566,684 | ) |

| Net increase (decrease) in net assets resulting from operations | | $ | 9,228,840 | | | $ | (350,679 | ) | | $ | (1,042,641 | ) |

| | | | | | | | | | | | | |

| (a) | For the period November 22, 2022 (commencement of operations) to March 31, 2023. |

See accompanying notes which are an integral part of these financial statements.

| Dean Funds |

| Statements of Changes in Net Assets |

| March 31, 2023 |

| | | Dean Small Cap Value Fund | | | Dean Mid Cap Value Fund | |

| | | For the Year | | | For the Year | | | For the Year | | | For the Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | |

| | | March 31, 2023 | | | March 31, 2022 | | | March 31, 2023 | | | March 31, 2022 | |

| Increase (Decrease) in Net Assets due to: | | | | | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | | | |

| Net investment income | | $ | 3,592,767 | | | $ | 2,025,719 | | | $ | 946,890 | | | $ | 614,373 | |

| Net realized gain on investment securities transactions | | | 17,593,024 | | | | 25,615,419 | | | | 3,226,530 | | | | 6,557,053 | |

| Net change in unrealized appreciation (depreciation) of investment securities | | | (11,956,951 | ) | | | (14,232,164 | ) | | | (4,524,099 | ) | | | 1,509,860 | |

| Net increase (decrease) in net assets resulting from operations | | | 9,228,840 | | | | 13,408,974 | | | | (350,679 | ) | | | 8,681,286 | |

| Distributions to Shareholders From: | | | | | | | | | | | | | | | | |

| Earnings | | | (2,517,470 | ) | | | (1,786,178 | ) | | | (3,867,873 | ) | | | (4,319,680 | ) |

| Total distributions | | | (2,517,470 | ) | | | (1,786,178 | ) | | | (3,867,873 | ) | | | (4,319,680 | ) |

| Capital Transactions | | | | | | | | | | | | | | | | |

| Proceeds from shares sold | | | 64,099,879 | | | | 33,284,225 | | | | 7,559,031 | | | | 6,797,142 | |

| Reinvestment of distributions | | | 2,018,672 | | | | 1,447,112 | | | | 3,748,284 | | | | 4,205,623 | |

| Amount paid for shares redeemed | | | (38,311,897 | ) | | | (35,136,353 | ) | | | (13,001,231 | ) | | | (14,560,546 | ) |

| Net increase (decrease) in net assets resulting from capital transactions | | | 27,806,654 | | | | (405,016 | ) | | | (1,693,916 | ) | | | (3,557,781 | ) |

| Total Increase (Decrease) in Net Assets | | | 34,518,024 | | | | 11,217,780 | | | | (5,912,468 | ) | | | 803,825 | |

| Net Assets | | | | | | | | | | | | | | | | |

| Beginning of year | | | 180,265,666 | | | | 169,047,886 | | | | 80,379,725 | | | | 79,575,900 | |

| End of year | | $ | 214,783,690 | | | $ | 180,265,666 | | | $ | 74,467,257 | | | $ | 80,379,725 | |

| | | | | | | | | | | | | | | | | |

| Share Transactions | | | | | | | | | | | | | | | | |

| Shares sold | | | 3,487,527 | | | | 1,880,020 | | | | 333,562 | | | | 286,213 | |

| Shares issued in reinvestment of distributions | | | 107,376 | | | | 80,934 | | | | 166,368 | | | | 177,378 | |

| Shares redeemed | | | (2,101,158 | ) | | | (1,984,393 | ) | | | (567,825 | ) | | | (608,393 | ) |

| Net increase (decrease) in shares outstanding | | | 1,493,745 | | | | (23,439 | ) | | | (67,895 | ) | | | (144,802 | ) |

| | | | | | | | | | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| Dean Funds |

| Statements of Changes in Net Assets (continued) |

| March 31, 2023 |

| | | Dean Equity | |

| | | Income Fund | |

| | | For the Period | |

| | | Ended March | |

| | | 31, 2023(a) | |

| Increase (Decrease) in Net Assets due to: | | | | |

| Operations | | | | |

| Net investment income | | $ | 524,043 | |

| Net realized gain on investment securities transactions | | | 45,883 | |

| Net change in unrealized depreciation of investment securities | | | (1,612,567 | ) |

| Net decrease in net assets resulting from operations | | | (1,042,641 | ) |

| Distributions to Shareholders From: | | | | |

| Earnings | | | (50,960 | ) |

| Total distributions | | | (50,960 | ) |

| Capital Transactions | | | | |

| Proceeds from shares sold | | | 75,338,469 | |

| Reinvestment of distributions | | | 50,891 | |

| Amount paid for shares redeemed | | | (648,928 | ) |

| Net increase in net assets resulting from capital transactions | | | 74,740,432 | |

| Total Increase in Net Assets | | | 73,646,831 | |

| | | | | |

| Net Assets | | | | |

| Beginning of year | | | — | |

| End of year | | $ | 73,646,831 | |

| | | | | |

| Share Transactions | | | | |

| Shares sold | | | 3,825,371 | |

| Shares issued in reinvestment of distributions | | | 2,533 | |

| Shares redeemed | | | (33,150 | ) |

| Net increase in shares outstanding | | | 3,794,754 | |

| | | | | |

| (a) | For the period November 22, 2022 (commencement of operations) to March 31, 2023. |

See accompanying notes which are an integral part of these financial statements.

| Dean Small Cap Value Fund |

| Financial Highlights |

| |

| (For a share outstanding during each period) |

| | | For the Years Ended March 31, | |

| | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| Selected Per Share Data: | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 18.13 | | | $ | 16.96 | | | $ | 9.25 | | | $ | 14.19 | | | $ | 14.63 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.32 | | | | 0.20 | | | | 0.27 | | | | 0.16 | | | | 0.15 | |

| Net realized and unrealized gain (loss) | | | 0.57 | | | | 1.15 | | | | 7.67 | | | | (4.51 | ) | | | (0.18 | ) |

| Total from investment operations | | | 0.89 | | | | 1.35 | | | | 7.94 | | | | (4.35 | ) | | | (0.03 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.24 | ) | | | (0.18 | ) | | | (0.23 | ) | | | (0.19 | ) | | | (0.20 | ) |

| Net realized gains | | | — | | | | — | | | | — | | | | (0.40 | ) | | | (0.21 | ) |

| Total distributions | | | (0.24 | ) | | | (0.18 | ) | | | (0.23 | ) | | | (0.59 | ) | | | (0.41 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 18.78 | | | $ | 18.13 | | | $ | 16.96 | | | $ | 9.25 | | | $ | 14.19 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return(a) | | | 4.89 | % | | | 7.98 | % | | | 86.33 | % | | | (32.14 | )% | | | (0.08 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000 omitted) | | $ | 214,784 | | | $ | 180,266 | | | $ | 169,048 | | | $ | 226,564 | | | $ | 321,178 | |

| Ratio of net expenses to average net assets | | | 1.14 | % | | | 1.13 | % | | | 1.19 | % | | | 1.15 | % | | | 1.12 | % |

| Ratio of gross expenses to average net assets before waiver or recoupment | | | 1.14 | % | | | 1.13 | % | | | 1.19 | % | | | 1.15 | % | | | 1.12 | % |

| Ratio of net investment income to average net assets | | | 1.90 | % | | | 1.15 | % | | | 1.16 | % | | | 1.14 | % | | | 1.04 | % |

| Portfolio turnover rate | | | 77 | % | | | 57 | % | | | 181 | % | | | 157 | % | | | 120 | % |

| | | | | | | | | | | | | | | | | | | | | |

| (a) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

See accompanying notes which are an integral part of these financial statements.

| Dean Mid Cap Value Fund |

| Financial Highlights |

| |

| (For a share outstanding during each period) |

| | | For the Years Ended March 31, | |

| | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| Selected Per Share Data: | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 23.79 | | | $ | 22.58 | | | $ | 14.26 | | | $ | 19.83 | | | $ | 19.87 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.29 | | | | 0.19 | | | | 0.16 | | | | 0.22 | | | | 0.22 | |

| Net realized and unrealized gain (loss) | | | (0.41 | ) | | | 2.34 | | | | 8.34 | | | | (4.08 | ) | | | 0.36 | |

| Total from investment operations | | | (0.12 | ) | | | 2.53 | | | | 8.50 | | | | (3.86 | ) | | | 0.58 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.21 | ) | | | (0.20 | ) | | | (0.18 | ) | | | (0.22 | ) | | | (0.16 | ) |

| Net realized gains | | | (0.97 | ) | | | (1.12 | ) | | | — | | | | (1.49 | ) | | | (0.46 | ) |

| Total distributions | | | (1.18 | ) | | | (1.32 | ) | | | (0.18 | ) | | | (1.71 | ) | | | (0.62 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 22.49 | | | $ | 23.79 | | | $ | 22.58 | | | $ | 14.26 | | | $ | 19.83 | |