united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-21237

Unified Series Trust

(Exact name of registrant as specified in charter)

Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Zachary P. Richmond

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

Registrant’s telephone number, including area code: 513-587-3400

Date of fiscal year end: 5/31

Date of reporting period: 5/31/23

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| |

| |

|

| |

| |

| |

| |

| NightShares 500 ETF (NSPY) |

| |

| NightShares 2000 ETF (NIWM) |

| |

| NightShares 500 1x/1.5x ETF (NSPL) |

| |

| NYSE Arca, Inc. |

| |

| |

| |

| |

| |

| |

| Annual Report |

| |

| May 31, 2023 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| AlphaTrAI Funds, Inc. |

| 100 Shoreline Highway, Building B, Suite 100 |

| Mill Valley, CA 94941 |

| Telephone: 1-833-NITE-ETF |

| |

| |

| Management Discussion of Fund Performance – (Unaudited) |

| |

The three NightShares ETFs seek to capitalize on the strength of the night effect, a well-researched source of outperformance in securities markets over time.

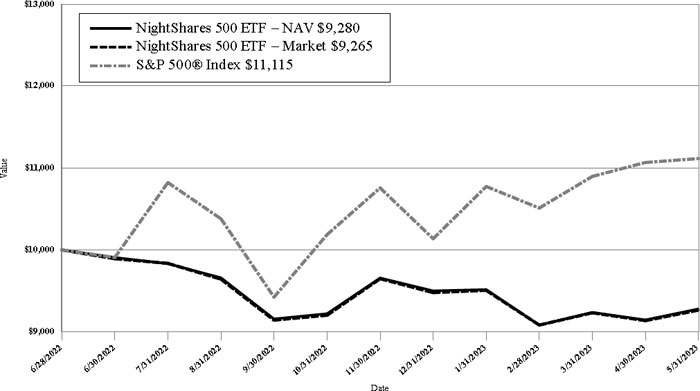

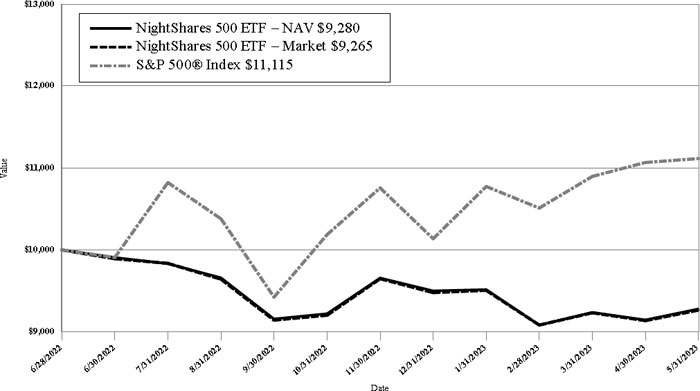

The NightShares 500 ETF (NSPY) seeks to return the night performance of a portfolio of 500 U.S. large cap stock companies. The Fund holds cash and/or U.S. Treasuries during the day, providing no exposure to the equity markets and buys futures each evening to provide overnight exposure to the U.S. equity market. Since its inception on June 28, 2022, the Fund has returned -7.20% versus 11.15% for the S&P 500 Index. As described below, the Fund’s underperformance relative to the index was a function of strong day time markets alongside negative returns overall in the overnight session.

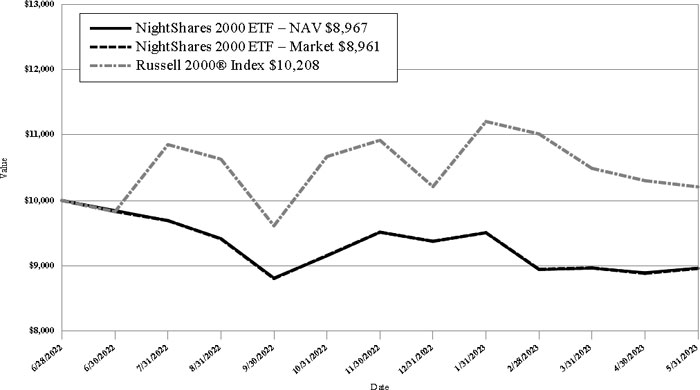

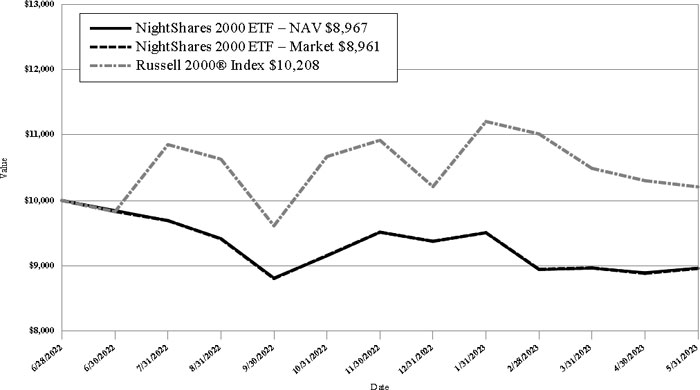

The NightShares 2000 ETF (NIWM) seeks to return the night performance of a portfolio of 2000 U.S. small cap stock companies. The Fund holds cash and/or U.S. Treasuries during the day, providing no exposure to the equity markets and buys futures each evening to provide overnight exposure to the U.S. equity markets. Since its inception on June 28, 2022, the Fund has returned -10.33% versus 2.08% for the Russell 2000 Index. As described below, the Fund’s underperformance relative to the index was a function of strong day time markets alongside negative returns overall in the overnight session.

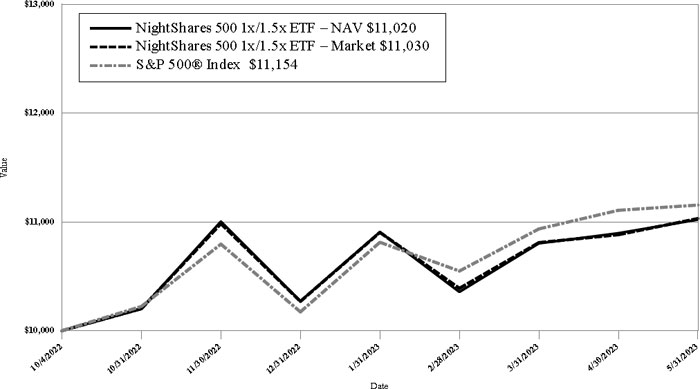

The NightShares 500 1x/1.5x ETF (NSPL) seeks to provide investment results that correspond to 100% (1x) of the performance of a portfolio of 500 large cap U.S. companies during the day and to 150% (1.5x) of the portfolio performance at night for a single day, not for any other period. Since its inception on October 4, 2022, the Fund has returned 10.20% versus 11.54% for the S&P 500 Index. The Fund’s exposure during the day, delivered by holding an S&P 500 ETF (IVV), ensures that the Fund does not “miss out” on the performance of the U.S. equity from market open through to market close.

The return of each of the Funds reflects the dynamics of the day and night sessions since their respective inception dates. Starting in late June through to the end of September, the U.S. large and small cap equity markets were down. However, the day time session was positive during this period, fueled by a “bear market rally” that started at the beginning of July and ran through the middle of August. Once past that mid-August point, both day and night lost steam but the returns from the day’s earlier rally were enough to ensure it stayed positive by the end of September.

The fourth quarter of the year saw equity markets rising, with large caps up both day and night and small caps turning positive at night and down during the day. Across the span of year, starting on June 28, 2022, the markets eked out a small gain with night dragging down the day’s gains and leading to the underperformance of NSPY and NIWM as they were out of the markets between market open and close.

| Management Discussion of Fund Performance – (Unaudited) (continued) |

| |

As for 2023, the market was positive in the first quarter of the year, again led by the daytime session. Night was negative in both large and small caps, further impacting the performance of NSPY and NIWM that avoid the daytime sessions.

The second quarter, as of May 31, 2023, was also up and favorable to both day and night sessions, with daytime returns leading night returns in U.S. large caps and night returns leading daytime returns in U.S. small caps.

The equity markets have continued to demonstrate that day and night returns are different. Over the almost 12 months since the first NightShares ETFs were launched (6/28/22 - 5/31/23), daytime returns have been strong while nighttime returns have stumbled. That said, 20 years of history (and numerous academic studies) have shown that the Night sessions can provide strong returns.

| Investment Results (Unaudited) |

| |

Average Annual Total Returns(a) as of May 31, 2023

| | Since |

| | Inception |

| | (6/28/22) |

| NightShares 500 ETF – NAV | (7.20)% |

| NightShares 500 ETF – Market Price | (7.35)% |

| S&P 500® Index(b) | 11.15% |

| | |

Total annual operating expenses, as disclosed in the NightShares 500 ETF’s (the “Fund”) prospectus dated May 18, 2022, were 0.55% of the average daily net assets of the Fund. Pursuant to its Management Agreement, AlphaTrAI Funds, Inc. (the “Adviser”) is required to pay all of the operating expenses of the Fund except portfolio transactions and other investment related costs (such as brokerage fees and commissions, and fees and expenses associated with investments in derivative instruments, including futures, option and swap fees and expenses), taxes, borrowing costs (such as interest and dividend expense on securities sold short), extraordinary expenses, and any indirect expenses (such as fees and expenses associated with investment in acquired funds and other collective investment vehicles). Additional information pertaining to the Fund’s expense ratio as of May 31, 2023 can be found in the financial highlights.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or the redemption of the Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objective, risks, charges and expenses should be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (833) NITE-ETF. The Fund’s per share net asset value (“NAV”) is the value of one share of the Fund as calculated in accordance with the standard formula for valuing shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively. Since exchange-traded funds are bought and sold at prices set by the market, which can result in a premium or discount to NAV, the returns calculated using Market Price can differ from those calculated using NAV. For more information about current performance, holdings or historical premiums/discounts, please visit the Fund’s website at www.nightshares.com.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. Total returns for less than one year are not annualized. |

| (b) | The S&P 500® Index is a widely recognized unmanaged index generally representing the performance of the broad domestic economy through changes in the aggregate market value of 500 large capitalization companies and is representative of a broader market and range of securities than are found in the Fund’s portfolio. Index returns do not reflect the deduction of expenses, which have been deducted from the Fund’s returns. Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in an index. |

| Investment Results (Unaudited) (continued) |

| |

The Fund’s investment objective, strategies, risks, charges and expenses should be considered carefully before investing. The Fund’s prospectus contains this and other important information about the Fund and may be obtained by calling (833) NITE-ETF. Please read it carefully before investing.

The Fund is distributed by Northern Lights Distributors, LLC, Member FINRA/SIPC.

| Investment Results (Unaudited) (continued) |

| |

Comparison of the Growth of a $10,000 Investment in the NightShares 500 ETF–NAV, NightShares 500 ETF–Market and the S&P 500® Index (Unaudited)

This graph shows the value of a hypothetical initial investment of $10,000 made on June 28, 2022 (commencement of operations) for the Fund and held through May 31, 2023. The S&P 500® Index is a widely recognized unmanaged index of 500 large capitalization companies and is representative of a broader market and range of securities than are found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual may invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURNS REPRESENTS PAST PERFORMANCE AND DO NOT GUARANTEE OR PREDICT FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (833) NITE-ETF. You should carefully consider the investment objective, risks, charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other important information about the Fund and should be read carefully before investing.

The Fund is distributed by Northern Lights Distributors, LLC, Member FINRA/SIPC.

| Investment Results (Unaudited) (continued) |

| |

Average Annual Total Returns(a) as of May 31, 2023

| | Since |

| | Inception |

| | (6/28/22) |

| NightShares 2000 ETF – NAV | (10.33)% |

| NightShares 2000 ETF – Market Price | (10.39)% |

| Russell 2000® Index(b) | 2.08% |

| | |

Total annual operating expenses, as disclosed in the NightShares 2000 ETF’s (the “Fund”) prospectus dated May 18, 2022, were 0.55% of the average daily net assets of the Fund. Pursuant to its Management Agreement, AlphaTrAI Funds, Inc. (the “Adviser”) is required to pay all of the operating expenses of the Fund except portfolio transactions and other investment related costs (such as brokerage fees and commissions, and fees and expenses associated with investments in derivative instruments, including futures, option and swap fees and expenses), taxes, borrowing costs (such as interest and dividend expense on securities sold short), extraordinary expenses, and any indirect expenses (such as fees and expenses associated with investment in acquired funds and other collective investment vehicles). Additional information pertaining to the Fund’s expense ratio as of May 31, 2023 can be found in the financial highlights.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or the redemption of the Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objective, risks, charges and expenses should be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (833) NITE-ETF. The Fund’s per share net asset value (“NAV”) is the value of one share of the Fund as calculated in accordance with the standard formula for valuing shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively. Since exchange-traded funds are bought and sold at prices set by the market, which can result in a premium or discount to NAV, the returns calculated using Market Price can differ from those calculated using NAV. For more information about current performance, holdings or historical premiums/discounts, please visit the Fund’s website at www.nightshares.com.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. Total returns for less than one year are not annualized. |

| (b) | The Russell 2000® Index (the “Index”) is a widely recognized unmanaged index that measures the performance of the small-cap segment of the US equity universe. The Index includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership, and is representative of a broader market and range of securities than are found in the Fund’s portfolio. Index returns do not reflect the deduction of expenses, which have been deducted |

| Investment Results (Unaudited) (continued) |

| |

from the Fund’s returns. Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in an index.

The Fund’s investment objective, strategies, risks, charges and expenses should be considered carefully before investing. The Fund’s prospectus contains this and other important information about the Fund and may be obtained by calling (833) NITE-ETF. Please read it carefully before investing.

The Fund is distributed by Northern Lights Distributors, LLC, Member FINRA/SIPC.

| Investment Results (Unaudited) (continued) |

| |

Comparison of the Growth of a $10,000 Investment in the NightShares 2000 ETF–NAV, NightShares 2000 ETF–Market and the Russell 2000® Index (Unaudited)

This graph shows the value of a hypothetical initial investment of $10,000 made on June 28, 2022 (commencement of operations) for the Fund and held through May 31, 2023. The Russell 2000® Index is a widely recognized unmanaged index that measure the performance of the small-cap segment of the US equity universe. The Index includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership, and is representative of a broader market and range of securities than are found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual may invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURNS REPRESENTS PAST PERFORMANCE AND DO NOT GUARANTEE OR PREDICT FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (833) NITE-ETF. You should carefully consider the investment objective, risks, charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other important information about the Fund and should be read carefully before investing.

The Fund is distributed by Northern Lights Distributors, LLC, Member FINRA/SIPC.

| Investment Results (Unaudited) (continued) |

| |

Average Annual Total Returns(a) as of May 31, 2023

| | Since |

| | Inception |

| | (10/4/22) |

| NightShares 500 1x/1.5x ETF – NAV | 10.20% |

| NightShares 500 1x/1.5x ETF – Market Price | 10.30% |

| S&P 500® Index(b) | 11.54% |

| | |

Total annual operating expenses, as disclosed in the NightShares 500 1x/1.5x ETF’s (the “Fund”) prospectus dated August 14, 2022, (as supplemented October 3, 2022) were 0.67% of average daily net assets (0.77% before fee waivers/expense reimbursements by AlphaTrAI Funds, Inc. (the “Adviser”)). Pursuant to its Management Agreement, the Adviser is required to pay all of the operating expenses of the Fund except portfolio transactions and other investment related costs (such as brokerage fees and commissions, and fees and expenses associated with investments in derivative instruments, including futures, option and swap fees and expenses), taxes, borrowing costs (such as interest and dividend expense on securities sold short), extraordinary expenses, and any indirect expenses (such as fees and expenses associated with investment in acquired funds and other collective investment vehicles). The Adviser has contractually agreed to waive its unitary management fee and/ or reimburse expenses of the Fund so that total annual Fund operating expenses, excluding portfolio transaction and other investment-related costs (such as brokerage fees and commissions, and fees and expenses associated with investments in derivative instruments, including futures, option and swap fees and expenses), taxes, borrowing costs (such as interest and dividend expense on securities sold short), extraordinary expenses, and any indirect expenses (such as fees and expenses associated with investment in acquired funds and other collective investment vehicles), do not exceed 0.65% through October 31, 2023. Each waiver/expense payment by the Adviser is subject to recoupment by the Adviser from the Fund in the three years following the date the particular waiver/expense payment occurred, but only if such recoupment can be achieved without exceeding the annual expense limitation in effect at the time of the waiver/expense payment and any expense limitation in effect at the time of the recoupment. This expense cap may not be terminated prior to this date except by the Board of Trustees upon sixty (60) days’ written notice to the Adviser. Additional information pertaining to the Fund’s expense ratio as of May 31, 2023 can be found in the financial highlights.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or the redemption of the Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (833) NITE-ETF. The Fund’s per share net asset value (“NAV”) is the value of one share of the Fund as calculated in accordance with the standard formula for valuing shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price

| Investment Results (Unaudited) (continued) |

| |

and NAV, respectively. Since exchange-traded funds are bought and sold at prices set by the market, which can result in a premium or discount to NAV, the returns calculated using Market Price can differ from those calculated using NAV. For more information about current performance, holdings or historical premiums/discounts, please visit the Fund’s website at www.nightshares.com.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. Total returns for less than one year are not annualized. |

| (b) | The S&P 500® Index is a widely recognized unmanaged index generally representing the performance of the broad domestic economy through changes in the aggregate market value of 500 large capitalization companies and is representative of a broader market and range of securities than are found in the Fund’s portfolio. Index returns do not reflect the deduction of expenses, which have been deducted from the Fund’s returns. Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in an index. |

The Fund’s investment objectives, strategies, risks, charges and expenses should be considered carefully before investing. The Fund’s prospectus contains this and other important information about the Fund and may be obtained by calling (833) NITE-ETF. Please read it carefully before investing.

The Fund is distributed by Northern Lights Distributors, LLC, Member FINRA/SIPC.

| Investment Results (Unaudited) (continued) |

| |

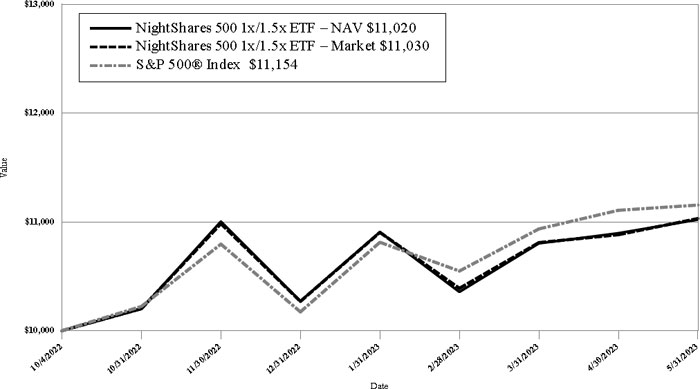

Comparison of the Growth of a $10,000 Investment in the NightShares 500 1x/1.5x ETF–NAV, NightShares 500 1x/1.5x ETF–Market and the S&P 500® Index (Unaudited)

This graph shows the value of a hypothetical initial investment of $10,000 made on October 4, 2022 (commencement of operations) for the Fund and held through May 31, 2023. The S&P 500® Index is a widely recognized unmanaged index of 500 large capitalization companies and is representative of a broader market and range of securities than are found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual may invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURNS REPRESENTS PAST PERFORMANCE AND DO NOT GUARANTEE OR PREDICT FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (833) NITE-ETF. You should carefully consider the investment objective, risks, charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other important information about the Fund and should be read carefully before investing.

The Fund is distributed by Northern Lights Distributors, LLC, Member FINRA/SIPC.

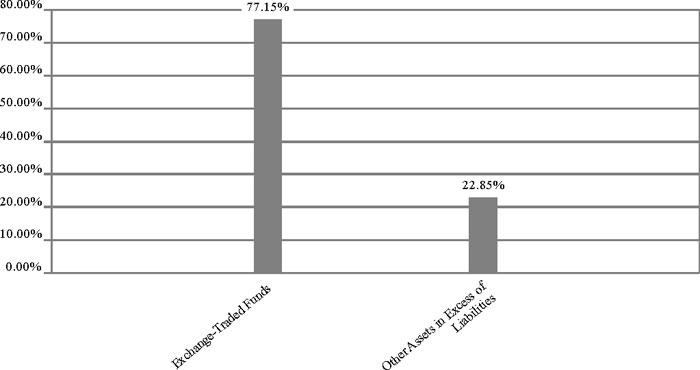

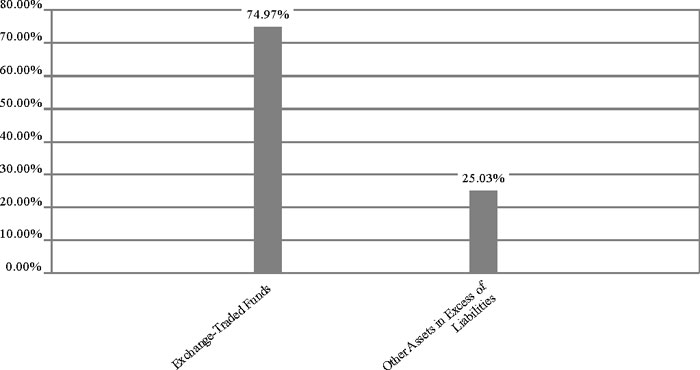

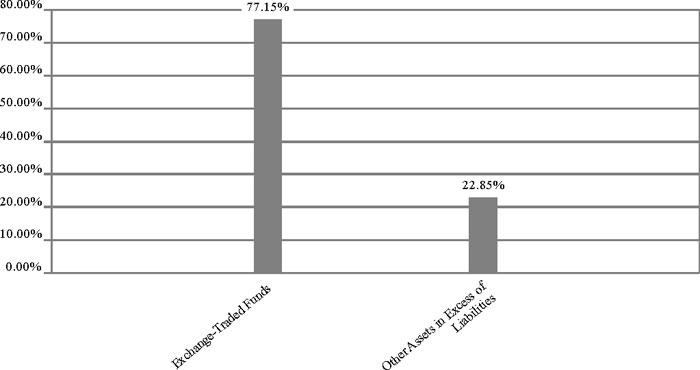

| Fund Holdings (Unaudited) |

| |

NightShares 500 ETF Holdings as of May 31, 2023.*

The NightShares 500 ETF seeks to return the night performance of a portfolio of 500 large cap U.S. companies.

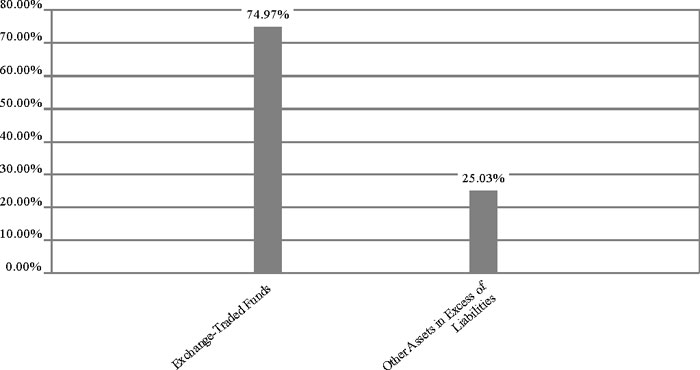

NightShares 2000 ETF Holdings as of May 31, 2023.*

The NightShares 2000 ETF seeks to return the night performance of a portfolio of 2000 small cap U.S. companies.

| * | As a percentage of net assets. |

Percentages shown exclude derivative investments, such as futures contracts.

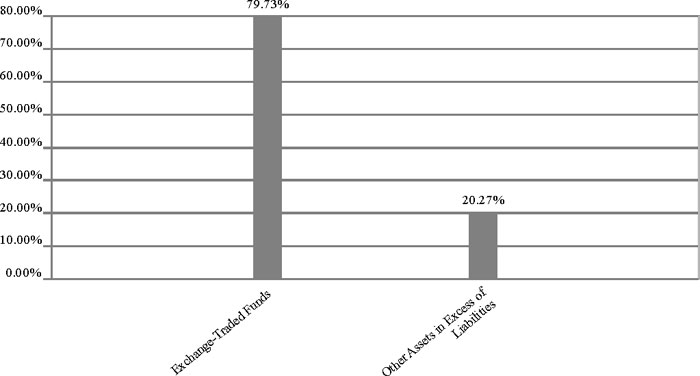

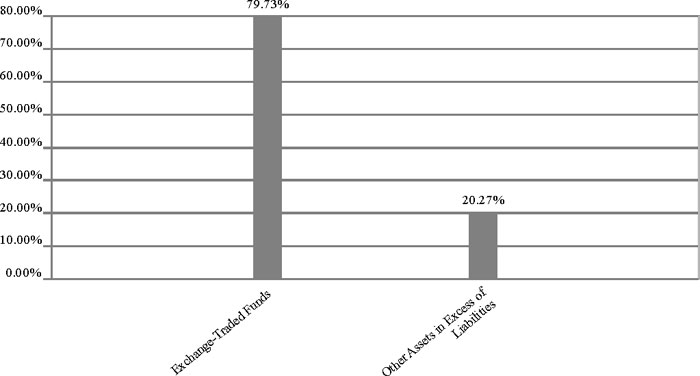

| Fund Holdings (Unaudited) |

| |

NightShares 500 1x/1.5x ETF Holdings as of May 31, 2023.*

| * | As a percentage of net assets. |

Percentages shown exclude derivative investments, such as futures contracts.

The NightShares 500 1x/1.5x ETF seeks to provide investment results that, before fees and expenses, correspond to 100% (1x) of the performance of a portfolio of 500 large cap U.S. companies during the day and to 150% (1.5x) of the portfolio performance at night for a single day, not for any other period. A “single day” is measured from the time the Fund calculates its net asset value (“NAV”) to the time of the Fund’s next NAV calculation.

| Availability of Portfolio Schedule (Unaudited) |

| |

The Funds file a complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year as an exhibit to their reports on Form N-PORT. The Funds’ Form N-PORT reports are available on the SEC’s website at www.sec.gov or on the Funds’ website at www.nightshares.com.

| NightShares 500 ETF |

| Schedule of Investments |

| May 31, 2023 |

| Exchange-Traded Funds — 77.15% | | Shares | | | Fair Value | |

| BondBloxx Bloomberg One Year Target Duration U.S. Treasury ETF | | | 7,000 | | | $ | 348,250 | |

| BondBloxx Bloomberg Six Month Target Duration U.S. Treasury ETF(a) | | | 48,746 | | | | 2,449,974 | |

| | | | | | | | | |

| Total Exchange-Traded Funds (Cost $2,794,577) | | | | | | | 2,798,224 | |

| | | | | | | | | |

| Total Investments — 77.15% (Cost $2,794,577) | | | | | | | 2,798,224 | |

| Other Assets in Excess of Liabilities — 22.85%(b) | | | | | | | 828,826 | |

| Net Assets — 100.00% | | | | | | $ | 3,627,050 | |

| | | | | | | | | |

| (a) | Represents an investment greater than 25% of the Fund’s net assets. Performance of the Fund may be adversely impacted by concentrated investments in securities. As of May 31, 2023, the percentage of net assets invested in BondBloxx Bloomberg Six Month Target Duration U.S. Treasury ETF was 67.55% of the Fund. The financial statements and portfolio holdings for this security can be found at |

| (b) | Includes cash held as margin for futures contracts. |

See accompanying notes which are an integral part of these financial statements.

| NightShares 500 ETF |

| Schedule of Futures Contracts |

| May 31, 2023 |

| | | | | | | | | | Value and | |

| | | | | | | | | | Unrealized | |

| | | | | Expiration | | Notional | | | Appreciation | |

| | | Contracts | | Date | | Value | | | (Depreciation) | |

| LONG CONTRACTS | | | | | | | | | | | | |

| CME E-Mini Standard & Poor’s 500 Index Futures | | 17 | | June 2023 | | $ | 3,561,925 | | | $ | 188 | |

| | | | | | | | | | | $ | 188 | |

| | | | | | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| NightShares 2000 ETF |

| Schedule of Investments |

| May 31, 2023 |

| Exchange-Traded Funds — 74.97% | | Shares | | | Fair Value | |

| BondBloxx Bloomberg One Year Target Duration U.S. Treasury ETF(a) | | | 11,007 | | | $ | 547,598 | |

| BondBloxx Bloomberg Six Month Target Duration U.S. Treasury ETF(a) | | | 9,435 | | | | 474,203 | |

| | | | | | | | | |

| Total Exchange-Traded Funds (Cost $1,022,854) | | | | | | | 1,021,801 | |

| | | | | | | | | |

| Total Investments — 74.97% (Cost $1,022,854) | | | | | | | 1,021,801 | |

| Other Assets in Excess of Liabilities — 25.03%(b) | | | | | | | 341,206 | |

| Net Assets — 100.00% | | | | | | $ | 1,363,007 | |

| | | | | | | | | |

| (a) | Represents an investment greater than 25% of the Fund’s net assets. Performance of the Fund may be adversely impacted by concentrated investments in securities. As of May 31, 2023, the percentage of net assets invested in BondBloxx Bloomberg One Year Target Duration U.S. Treasury ETF and BondBloxx Bloomberg Six Month Target Duration U.S. Treasury ETF were 40.18% and 34.79%, respectively, of the Fund. The financial statements and portfolio holdings for these securities can be found at |

| (b) | Includes cash held as margin for futures contracts. |

See accompanying notes which are an integral part of these financial statements.

| NightShares 2000 ETF |

| Schedule of Futures Contracts |

| May 31, 2023 |

| | | | | | | | | | Value and | |

| | | | | | | | | | Unrealized | |

| | | | | Expiration | | Notional | | | Appreciation | |

| | | Contracts | | Date | | Value | | | (Depreciation) | |

| LONG CONTRACTS | | | | | | | | | | | | |

| CME E-Mini Russell 2000 Index Futures | | 15 | | June 2023 | | $ | 1,313,850 | | | $ | (80 | ) |

| | | | | | | | | | | $ | (80 | ) |

| | | | | | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| NightShares 500 1x/1.5x ETF |

| Schedule of Investments |

| May 31, 2023 |

| Exchange-Traded Funds — 79.73% | | Shares | | | Fair Value | |

| BondBloxx Bloomberg One Year Target Duration U.S. Treasury ETF | | | 27,550 | | | $ | 1,370,613 | |

| iShares Core S&P 500 ETF(a) | | | 24,831 | | | | 10,414,866 | |

| | | | | | | | | |

| Total Exchange-Traded Funds (Cost $11,386,394) | | | | | | | 11,785,479 | |

| | | | | | | | | |

| Total Investments — 79.73% (Cost $11,386,394) | | | | | | | 11,785,479 | |

| Other Assets in Excess of Liabilities — 20.27%(b) | | | | | | | 2,997,078 | |

| Net Assets — 100.00% | | | | | | $ | 14,782,557 | |

| | | | | | | | | |

| (a) | Represents an investment greater than 25% of the Fund’s net assets. Performance of the Fund may be adversely impacted by concentrated investments in securities. As of May 31, 2023, the percentage of net assets invested in iShares Core S&P 500 ETF was 70.45% of the Fund. The financial statements and portfolio holdings for this security can be found at www.sec.gov. |

| (b) | Includes cash held as margin for futures contracts. |

See accompanying notes which are an integral part of these financial statements.

| NightShares 500 1x/1.5x ETF |

| Schedule of Futures Contracts |

| May 31, 2023 |

| | | | | | | | | | Value and | |

| | | | | | | | | | Unrealized | |

| | | | | Expiration | | | | | Appreciation | |

| | | Contracts | | Date | | Notional Value | | | (Depreciation) | |

| LONG CONTRACTS | | | | | | | | | | | | |

| CME E-Mini Standard & Poor’s 500 Index Futures | | 56 | | June 2023 | | $ | 11,733,400 | | | $ | 304,592 | |

| | | | | | | | | | | $ | 304,592 | |

| | | | | | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| NightShares Funds |

| Statements of Assets and Liabilities |

| May 31, 2023 |

| | | | | | | | | NightShares | |

| | | NightShares | | | NightShares | | | 500 1x/1.5x | |

| | | 500 ETF | | | 2000 ETF | | | ETF | |

| Assets | | | | | | | | | | | | |

| Investments in securities, at fair value (cost $2,794,577, $1,022,854 and $11,386,394) | | $ | 2,798,224 | | | $ | 1,021,801 | | | $ | 11,785,479 | |

| Cash held at broker for futures contract transactions | | | 437,055 | | | | 209,604 | | | | 1,411,013 | |

| Cash | | | 409,792 | | | | 138,799 | | | | 1,625,234 | |

| Interest receivable | | | 1,362 | | | | 1,051 | | | | 5,472 | |

| Total Assets | | | 3,646,433 | | | | 1,371,255 | | | | 14,827,198 | |

| | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | |

| Payable to Adviser, net of waiver | | | 1,683 | | | | 1,423 | | | | 8,116 | |

| Payable for net variation margin on futures contracts | | | 17,700 | | | | 6,825 | | | | 36,525 | |

| Total Liabilities | | | 19,383 | | | | 8,248 | | | | 44,641 | |

| Net Assets | | $ | 3,627,050 | | | $ | 1,363,007 | | | $ | 14,782,557 | |

| | | | | | | | | | | | | |

| Net Assets consist of: | | | | | | | | | | | | |

| Paid-in capital | | $ | 3,921,897 | | | $ | 1,916,670 | | | $ | 14,412,163 | |

| Accumulated earnings (deficit) | | | (294,847 | ) | | | (553,663 | ) | | | 370,394 | |

| Net Assets | | $ | 3,627,050 | | | $ | 1,363,007 | | | $ | 14,782,557 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 125,000 | | | | 50,000 | | | | 450,000 | |

| Net asset value per share | | $ | 29.02 | | | $ | 27.26 | | | $ | 32.85 | |

| | | | | | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| NightShares Funds |

| Statements of Operations |

| For the period ended May 31, 2023 |

| | | | | | | | | NightShares | |

| | | NightShares | | | NightShares | | | 500 1x/1.5x | |

| | | 500 ETF(a) | | | 2000 ETF(a) | | | ETF(a) | |

| Investment Income | | | | | | | | | | | | |

| Dividend income | | $ | 20,229 | | | $ | 57,829 | | | $ | 73,200 | |

| Interest income | | | 79,149 | | | | 54,802 | | | | 28,219 | |

| Total investment income | | | 99,378 | | | | 112,631 | | | | 101,419 | |

| | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | |

| Adviser | | | 21,771 | | | | 20,129 | | | | 43,608 | |

| Total expenses | | | 21,771 | | | | 20,129 | | | | 43,608 | |

| Fees waived by Adviser | | | — | | | | — | | | | (6,559 | ) |

| Net operating expenses | | | 21,771 | | | | 20,129 | | | | 37,049 | |

| Net investment income | | | 77,607 | | | | 92,502 | | | | 64,370 | |

| | | | | | | | | | | | | |

| Net Realized and Change in Unrealized Gain (Loss) on Investments | | | | | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | | | | | |

| Investment securities | | | (1,458 | ) | | | (3,910 | ) | | | (9,053 | ) |

| Futures contracts | | | (335,843 | ) | | | (619,724 | ) | | | (369,230 | ) |

| Change in unrealized appreciation (depreciation) on: | | | | | | | | | | | | |

| Investment securities | | | 3,647 | | | | (1,053 | ) | | | 399,085 | |

| Futures contracts | | | 188 | | | | (80 | ) | | | 304,592 | |

| Net realized and change in unrealized gain (loss) on investment securities and futures contracts | | | (333,466 | ) | | | (624,767 | ) | | | 325,394 | |

| Net increase (decrease) in net assets resulting from operations | | $ | (255,859 | ) | | $ | (532,265 | ) | | $ | 389,764 | |

| | | | | | | | | | | | | |

| (a) | For the period June 28, 2022 (commencement of operations) through May 31, 2023. |

| (b) | For the period October 4, 2022 (commencement of operations) through May 31, 2023. |

See accompanying notes which are an integral part of these financial statements.

| NightShares Funds |

| Statements of Changes in Net Assets |

| | | NightShares | |

| | | 500 ETF | |

| | | For the Period | |

| | | Ended May | |

| | | 31, 2023(a) | |

| Increase (Decrease) in Net Assets due to: | | | | |

| Operations | | | | |

| Net investment income | | $ | 77,607 | |

| Net realized loss on investment securities and futures contracts | | | (337,301 | ) |

| Change in unrealized appreciation on investment securities and futures contracts | | | 3,835 | |

| Net decrease in net assets resulting from operations | | | (255,859 | ) |

| | | | | |

| Distributions to Shareholders From: | | | | |

| Earnings | | | (38,988 | ) |

| Total distributions | | | (38,988 | ) |

| | | | | |

| Capital Transactions | | | | |

| Proceeds from shares sold | | | 7,766,401 | |

| Amount paid for shares redeemed | | | (3,844,504 | ) |

| Net increase in net assets resulting from capital transactions | | | 3,921,897 | |

| Total Increase in Net Assets | | | 3,627,050 | |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | $ | — | |

| End of period | | $ | 3,627,050 | |

| | | | | |

| Share Transactions | | | | |

| Shares sold | | | 250,000 | |

| Shares redeemed | | | (125,000 | ) |

| Net increase in shares outstanding | | | 125,000 | |

| | | | | |

| (a) | For the period June 28, 2022 (commencement of operations) through May 31, 2023. |

See accompanying notes which are an integral part of these financial statements.

| NightShares Funds |

| Statements of Changes in Net Assets (continued) |

| | | NightShares | |

| | | 2000 ETF | |

| | | For the Period | |

| | | Ended May | |

| | | 31, 2023(a) | |

| Increase (Decrease) in Net Assets due to: | | | | |

| Operations | | | | |

| Net investment income | | $ | 92,502 | |

| Net realized loss on investment securities and futures contracts | | | (623,634 | ) |

| Change in unrealized depreciation on investment securities and futures contracts | | | (1,133 | ) |

| Net decrease in net assets resulting from operations | | | (532,265 | ) |

| | | | | |

| Distributions to Shareholders From: | | | | |

| Earnings | | | (21,398 | ) |

| Total distributions | | | (21,398 | ) |

| | | | | |

| Capital Transactions | | | | |

| Proceeds from shares sold | | | 8,141,469 | |

| Amount paid for shares redeemed | | | (6,224,799 | ) |

| Net increase in net assets resulting from capital transactions | | | 1,916,670 | |

| Total Increase in Net Assets | | | 1,363,007 | |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | $ | — | |

| End of period | | $ | 1,363,007 | |

| | | | | |

| Share Transactions | | | | |

| Shares sold | | | 275,000 | |

| Shares redeemed | | | (225,000 | ) |

| Net increase in shares outstanding | | | 50,000 | |

| | | | | |

| (a) | For the period June 28, 2022 (commencement of operations) through May 31, 2023. |

See accompanying notes which are an integral part of these financial statements.

| NightShares Funds |

| Statements of Changes in Net Assets (continued) |

| | | NightShares | |

| | | 500 1x/1.5x | |

| | | ETF | |

| | | For the Period | |

| | | Ended May | |

| | | 31, 2023(a) | |

| Increase (Decrease) in Net Assets due to: | | | | |

| Operations | | | | |

| Net investment income | | $ | 64,370 | |

| Net realized loss on investment securities and futures contracts | | | (378,283 | ) |

| Change in unrealized appreciation on investment securities and futures contracts | | | 703,677 | |

| Net increase in net assets resulting from operations | | | 389,764 | |

| | | | | |

| Distributions to Shareholders From: | | | | |

| Earnings | | | (19,370 | ) |

| Total distributions | | | (19,370 | ) |

| | | | | |

| Capital Transactions | | | | |

| Proceeds from shares sold | | | 17,587,223 | |

| Amount paid for shares redeemed | | | (3,175,060 | ) |

| Net increase in net assets resulting from capital transactions | | | 14,412,163 | |

| Total Increase in Net Assets | | | 14,782,557 | |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | $ | — | |

| End of period | | $ | 14,782,557 | |

| | | | | |

| Share Transactions | | | | |

| Shares sold | | | 550,000 | |

| Shares redeemed | | | (100,000 | ) |

| Net increase in shares outstanding | | | 450,000 | |

| | | | | |

| (a) | For the period October 4, 2022 (commencement of operations) through May 31, 2023. |

See accompanying notes which are an integral part of these financial statements.

| NightShares 500 ETF |

| Financial Highlights |

| |

| (For a share outstanding during the period) |

| | | For the | |

| | | Period | |

| | | Ended May | |

| | | 31, 2023(a) | |

| Selected Per Share Data: | | | | |

| Net asset value, beginning of year | | $ | 31.60 | |

| | | | | |

| Investment operations: | | | | |

| Net investment income(b) | | | 0.62 | |

| Net realized and unrealized loss on investments | | | (2.89 | ) |

| Total from investment operations | | | (2.27 | ) |

| | | | | |

| Less distributions to shareholders from: | | | | |

| Net investment income | | | (0.31 | ) |

| Total distributions | | | (0.31 | ) |

| | | | | |

| Net asset value, end of year | | $ | 29.02 | |

| Market price, end of year | | $ | 29.00 | |

| | | | | |

| Total Return(c) | | | (7.20 | %) (d) |

| | | | | |

| Ratios and Supplemental Data: | | | | |

| Net assets, end of year (000 omitted) | | $ | 3,627 | |

| Ratio of net expenses to average net assets(e) | | | 0.55 | % (f) |

| Ratio of net investment income to average net assets(e) | | | 1.96 | % (f) |

| Portfolio turnover rate(g) | | | — | % (d) |

| | | | | |

| (a) | For the period June 28, 2022 (commencement of operations) through May 31, 2023. |

| (b) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying funds in which the Fund invests. |

| (c) | Total return is calculated assuming a purchase of shares at net asset value on the first day and a sale at net asset value on the last day of the period. Distributions are assumed, for the purpose of this calculation, to be reinvested at the ex-dividend date net asset value per share on their respective payment dates. |

| (e) | These ratios exclude the impact of expenses of the underlying funds in which the Fund invests as represented in the Schedule of Investments. |

| (g) | Portfolio turnover rate excludes securities received or delivered from in-kind processing of creations or redemptions. |

See accompanying notes which are an integral part of these financial statements.

| NightShares 2000 ETF |

| Financial Highlights |

| |

| (For a share outstanding during the period) |

| | | For the | |

| | | Period | |

| | | Ended May | |

| | | 31, 2023(a) | |

| Selected Per Share Data: | | | | |

| Net asset value, beginning of year | | $ | 30.50 | |

| | | | | |

| Investment operations: | | | | |

| Net investment income(b) | | | 1.52 | |

| Net realized and unrealized loss on investments | | | (4.66 | ) |

| Total from investment operations | | | (3.14 | ) |

| | | | | |

| Less distributions to shareholders from: | | | | |

| Net investment income | | | (0.10 | ) |

| Total distributions | | | (0.10 | ) |

| | | | | |

| Net asset value, end of year | | $ | 27.26 | |

| Market price, end of year | | $ | 27.25 | |

| | | | | |

| Total Return(c) | | | (10.33 | %) (d) |

| | | | | |

| Ratios and Supplemental Data: | | | | |

| Net assets, end of year (000 omitted) | | $ | 1,363 | |

| Ratio of net expenses to average net assets(e) | | | 0.55 | % (f) |

| Ratio of net investment income to average net assets(e) | | | 2.52 | % (f) |

| Portfolio turnover rate(g) | | | 147 | % (d) |

| | | | | |

| (a) | For the period June 28, 2022 (commencement of operations) through May 31, 2023. |

| (b) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying funds in which the Fund invests. |

| (c) | Total return is calculated assuming a purchase of shares at net asset value on the first day and a sale at net asset value on the last day of the period. Distributions are assumed, for the purpose of this calculation, to be reinvested at the ex-dividend date net asset value per share on their respective payment dates. |

| (e) | These ratios exclude the impact of expenses of the underlying funds in which the Fund invests as represented in the Schedule of Investments. |

| (g) | Portfolio turnover rate excludes securities received or delivered from in-kind processing of creations or redemptions. |

See accompanying notes which are an integral part of these financial statements.

| NightShares 500 1x/1.5x ETF |

| Financial Highlights |

| |

| (For a share outstanding during the period) |

| | | For the | |

| | | Period | |

| | | Ended May | |

| | | 31, 2023(a) | |

| Selected Per Share Data: | | | | |

| Net asset value, beginning of year | | $ | 30.00 | |

| | | | | |

| Investment operations: | | | | |

| Net investment income(b) | | | 0.21 | |

| Net realized and unrealized gain on investments | | | 2.83 | |

| Total from investment operations | | | 3.04 | |

| | | | | |

| Less distributions to shareholders from: | | | | |

| Net investment income | | | (0.09 | ) |

| Net realized gains | | | (0.10 | ) |

| Total distributions | | | (0.19 | ) |

| | | | | |

| Net asset value, end of year | | $ | 32.85 | |

| Market price, end of year | | $ | 32.88 | |

| | | | | |

| Total Return(c) | | | 10.20 | % (d) |

| | | | | |

| Ratios and Supplemental Data: | | | | |

| Net assets, end of year (000 omitted) | | $ | 14,783 | |

| Ratio of net expenses to average net assets(e) | | | 0.65 | % (f) |

| Ratio of expenses to average net assets before waiver(e) | | | 0.75 | % (f) |

| Ratio of net investment income to average net assets(e) | | | 1.13 | % (f) |

| Portfolio turnover rate(g) | | | 6 | % (d) |

| | | | | |

| (a) | For the period October 4, 2022 (commencement of operations) through May 31, 2023. |

| (b) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying funds in which the Fund invests. |

| (c) | Total return is calculated assuming a purchase of shares at net asset value on the first day and a sale at net asset value on the last day of the period. Distributions are assumed, for the purpose of this calculation, to be reinvested at the ex-dividend date net asset value per share on their respective payment dates. |

| (e) | These ratios exclude the impact of expenses of the underlying funds in which the Fund invests as represented in the Schedule of Investments. |

| (g) | Portfolio turnover rate excludes securities received or delivered from in-kind processing of creations or redemptions. |

See accompanying notes which are an integral part of these financial statements.

| NightShares Funds |

| Notes to the Financial Statements |

| May 31, 2023 |

NOTE 1. ORGANIZATION

NightShares 500 ETF, NightShares 2000 ETF and NightShares 500 1x/1.5x ETF (each a “Fund” and collectively the “Funds”) are registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as diversified series of Unified Series Trust (the “Trust”). The Trust is an open-end investment company established under the laws of Ohio by an Agreement and Declaration of Trust dated October 14, 2002, as amended (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees of the Trust (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series. Each Fund is one of a series of funds currently authorized by the Board. The Funds’ investment adviser is AlphaTrAI Funds, Inc. (the “Adviser”). The Adviser has retained Exchange Traded Concepts, LLC (the “Sub-Adviser”) to serve as sub-adviser to the Funds. The Sub-Adviser is paid by the Adviser, not the Funds. The investment objective of the NightShares 500 ETF is to seek to return the night performance of a portfolio of 500 large cap U.S. companies. The investment objective of the NightShares 2000 ETF is to seek to return the night performance of a portfolio of 2000 small cap U.S. companies. The investment objective of the NightShares 500 1x/1.5x ETF is to seek to provide investment results, before fees and expenses, that correspond to 100% (1x) of the performance of a portfolio of 500 large cap U.S. companies during the day and to 150% (1.5x) of the portfolio performance at night for a single day, not for any other period. A “single day” is measured from the time the Fund calculates its net asset value (“NAV”) to the time of the Fund’s next NAV calculation.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Funds are investment companies and follow accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies followed by the Funds in the preparation of their financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Funds make no provision for federal income or excise tax. Each Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended,

| NightShares Funds |

| Notes to the Financial Statements (continued) |

| May 31, 2023 |

by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. Each Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Funds could incur a tax expense.

As of and during the fiscal period ended May 31, 2023, the Funds did not have any liabilities for any unrecognized tax benefits. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statements of Operations when incurred. During the period, the Funds did not incur any interest or penalties. Management of the Funds has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the interim tax period since inception, as applicable) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements and does not expect this to change over the next twelve months.

Expenses – Expenses incurred by the Trust that do not relate to a specific Fund are allocated to the individual funds of the Trust based on each Fund’s relative net assets or another appropriate basis (as determined by the Board).

Security Transactions and Related Income – The Funds follow industry practice and record security transactions on the trade date for financial reporting purposes. The specific identification method is used for determining gains or losses for financial statement and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are accreted or amortized using the effective interest method.

Dividends and Distributions – Each Fund intends to distribute its net investment income and net realized long-term and short-term capital gains, if any, at least annually. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified among the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or NAV per share of the Funds.

| NightShares Funds |

| Notes to the Financial Statements (continued) |

| May 31, 2023 |

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Each Fund values its portfolio securities at fair value as of the close of regular trading on the New York Stock Exchange (“NYSE”) (normally 4:00 p.m. Eastern time) on each business day the NYSE is open for business. Fair value is defined as the price that a Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of each Fund’s investments. These inputs are summarized in the three broad levels listed below.

| • | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| • | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| • | Level 3 – significant unobservable inputs (including the Funds’ own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

| NightShares Funds |

| Notes to the Financial Statements (continued) |

| May 31, 2023 |

Equity securities that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange-traded security is generally valued at its last bid price. Securities traded in the Nasdaq over-the-counter market are generally valued at the Nasdaq Official Closing Price. When using market quotations and when the market is considered active, the security is classified as a Level 1 security. In the event that market quotations are not readily available or are considered unreliable due to market or other events, securities are valued in good faith by the Adviser, as Valuation Designee, under the oversight of the Board’s Pricing & Liquidity Committee. The Adviser has adopted written policies and procedures for valuing securities and other assets in circumstances where market quotes are not readily available in conformity with guidelines adopted by the Board. In the event that market quotes are not readily available, and the security or asset cannot be valued pursuant to one of the valuation methods, the value of the security or asset will be determined in good faith by the Valuation Designee pursuant to its policies and procedures. To assist the Valuation Designee in carrying out the responsibility to determine the fair value of any securities or other assets for which market quotations are not readily available, the Trust has created a fair valuation pricing committee (the “Fair Value Committee”). The Fair Value Committee consists of the following standing members: (a) the Trust’s Treasurer or designee, (b) a representative of Ultimus and (c) on an ad hoc basis at a particular valuation time for which a fair valuation method is being determined for a Fund, a representative of the Adviser, which is the Valuation Designee. The Fair Value Committee will review any fair value provided by the Valuation Designee, subject to the ultimate review of the pricing methodology by the Pricing & Liquidity Committee of the Board on a quarterly basis. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

Debt securities are valued by using the mean between the closing bid and ask prices provided by a pricing service. If the closing bid and ask prices are not readily available, the pricing service may provide a price determined by a matrix pricing method. Matrix pricing is a mathematical technique used to value fixed income securities without relying exclusively on quoted prices. Matrix pricing takes into consideration recent transactions, yield, liquidity, risk, credit quality, coupon, maturity, type of issue and any other factors or market data the pricing service deems relevant for the actual security being priced and for other securities with similar characteristics. These securities will generally be categorized as Level 2 securities. If the Adviser, as Valuation Designee, decides that a price provided by the pricing service does not accurately reflect the fair value of the securities or when prices are not readily available from a pricing service or when prices are not readily available from a pricing service, securities are valued at fair value as determined by the Valuation

| NightShares Funds |

| Notes to the Financial Statements (continued) |

| May 31, 2023 |

Designee, in conformity with guidelines adopted by and subject to review of the Board. These securities will generally be categorized as Level 3 securities.

Investments in mutual funds, including money market mutual funds, are generally priced at the ending NAV provided by the service agent of the mutual funds. These securities are categorized as Level 1 securities.

Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they are traded, and when the market is considered active, will generally be categorized as Level 1 securities.

In accordance with the Trust’s valuation policies and fair value determinations pursuant to Rule 2a-5 under the 1940 Act, the Valuation Designee is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single method exists for determining fair value because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of a security being valued by the Valuation Designee would be the amount that a Fund might reasonably expect to receive upon the current sale. Methods that are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair-value pricing is permitted if, in the Valuation Designee’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before a Fund’s NAV calculation that may affect a security’s value, or the Valuation Designee is aware of any other data that calls into question the reliability of market quotations.

| NightShares Funds |

| Notes to the Financial Statements (continued) |

| May 31, 2023 |

The following is a summary of the inputs used to value the Funds’ investments as of May 31, 2023:

| NightShares 500 ETF | | | | | Valuation Inputs | | | | | | | |

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Exchange-Traded Funds | | $ | 2,798,224 | | | $ | — | | | $ | — | | | $ | 2,798,224 | |

| Long Futures Contracts | | | 188 | | | | — | | | | — | | | | 188 | |

| Total | | $ | 2,798,412 | | | $ | — | | | $ | — | | | $ | 2,798,412 | |

| | | | | | | | | | | | | | | | | |

| NightShares 2000 ETF | | | | | Valuation Inputs | | | | | | | |

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Exchange-Traded Funds | | | 1,021,801 | | | | — | | | | — | | | | 1,021,801 | |

| Long Futures Contracts | | | (80 | ) | | | — | | | | — | | | | (80 | ) |

| Total | | $ | 1,021,721 | | | $ | — | | | $ | — | | | $ | 1,021,721 | |

| | | | | | | | | | | | | | | | | |

| NightShares 500 1x/1.5x ETF | | | | | Valuation Inputs | | | | | | | |

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Exchange-Traded Funds | | | 11,785,479 | | | | — | | | | — | | | | 11,785,479 | |

| Long Futures Contracts | | | 304,592 | | | | — | | | | — | | | | 304,592 | |

| Total | | $ | 12,090,071 | | | $ | — | | | $ | — | | | $ | 12,090,071 | |

| (a) | The amount shown represents the net unrealized appreciation/depreciation of the futures contracts. |

The Funds did not hold any investments at the end of the reporting period in which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period.

NOTE 4. DERIVATIVE TRANSACTIONS

Futures Contracts – The Funds may invest in futures contracts to hedge or manage risks associated with each Fund’s securities investments or to obtain market exposure in an effort to generate returns. During the period the futures contracts are open, changes in the value of the contracts are recognized as unrealized gains or losses by “marking to market” on a daily basis to reflect the market value of the contracts at the end of each day’s trading. Variation margin payments are received or made depending upon whether unrealized gains or losses are incurred. When the contracts are closed, the Fund recognizes a realized gain or loss equal to the difference between the proceeds from, or cost of, the closing transaction and the Fund’s basis in the contract. If the Fund is unable to liquidate a futures contract and/or enter into an offsetting closing transaction, each Fund would continue to be subject to market risk with respect to the value of the contracts and continue to be required to maintain the margin deposits on the futures contracts.

| NightShares Funds |

| Notes to the Financial Statements (continued) |

| May 31, 2023 |

The following tables identify the location and fair value of derivative instruments on the Statements of Assets and Liabilities as of May 31, 2023, and the effect of derivative instruments on the Statements of Operations for the fiscal period ended May 31, 2023.

At May 31, 2023:

| | | Assets | | | Liabilities | |

| | | Unrealized | | | Unrealized | |

| | | Appreciation on | | | Depreciation on | |

| Contract Type/ Primary Risk Exposure | | Futures Contracts* | | | Futures Contracts* | |

| Equity Contracts | | | | | | | | |

| NightShares 500 ETF | | $ | 188 | | | $ | — | |

| NightShares 2000 ETF | | | — | | | | (80 | ) |

| NightShares 500 1x/1.5x ETF | | | 304,592 | | | | — | |

| * | Includes cumulative appreciation/(depreciation) on futures contracts, as reported in the Schedules of Future Contracts. Only current day’s variation margin is reported within the Statements of Assets and Liabilities. |

For the fiscal period ended May 31, 2023:

| | | NightShares 500 | | | NightShares 2000 | | | NightShares 500 | |

| Location | | ETF | | | ETF | | | 1x/1.5x ETF | |

| Net Realized Gain (loss) on: | | | | | | | | | | | | |

| Futures contracts | | $ | (335,843 | ) | | $ | (619,724 | ) | | $ | (369,230 | ) |

| Net change in unrealized appreciation (depreciation) on: | | | | | | | | | | | | |

| Futures contracts | | | 188 | | | | (80 | ) | | | 304,592 | |

The following table summarizes the average ending monthly fair value/notional value of derivatives outstanding during the fiscal period ended May 31, 2023:

| | | Average Ending | |

| | | Monthly Fair Value/ | |

| Derivatives | | Notional Value | |

| Long Futures Contracts | | | | |

| NightShares 500 ETF(a) | | $ | 3,868,266 | |

| NightShares 2000 ETF(a) | | | 4,062,323 | |

| NightShares 500 1x/1.5x ETF(b) | | | 7,737,461 | |

| (a) | Average based on the 10 months during the period that had activity. |

| (b) | Average based on the 8 months during the period that had activity. |

| NightShares Funds |

| Notes to the Financial Statements (continued) |

| May 31, 2023 |

The following table provides a summary of offsetting financial liabilities and derivatives and the effect of derivative instruments on the Statement of Assets and Liabilities as of May 31, 2023:

| | | | | | | | | | | | Gross Amounts Not Offset | | | | |

| | | | | | | | | | | | in Statements of Assets | | | | |

| | | | | | | | | | | | and Liabilities | | | | |

| | | | | | | | | Net Amounts | | | | | | | | | | |

| | | | | | Gross Amounts | | | of Liabilities | | | | | | | | | | |

| | | Gross | | | Offset in | | | Presented in | | | | | | | | | | |

| | | Amounts of | | | Statements | | | Statements | | | | | | | | | | |

| | | Recognized | | | of Assets and | | | of Assets and | | | Financial | | | Collateral | | | Net | |

| | | Liabilities | | | liabilities | | | Liabilities | | | Instruments | | | Pledged | | | Amount | |

| Variation Margin on Futures Contracts | | | | | | | | | | | | | | | | | | | | | | | | |

| NightShares 500 ETF | | $ | 17,700 | | | $ | — | | | $ | 17,700 | | | $ | — | | | $ | — | * | | $ | — | |

| NightShares 2000 ETF | | | 6,825 | | | | — | | | | 6,825 | | | | — | | | | — | * | | | — | |

| NightShares 500 1x/1.5x ETF | | | 36,525 | | | | — | | | | 36,525 | | | | — | | | | — | * | | | — | |

| * | Any over-collateralization of total financial instruments is not shown. Collateral amounts can be found on the Statements of Assets and Liabilities as Cash held at broker for futures contracts transactions. |

NOTE 5. FEES AND OTHER TRANSACTIONS WITH AFFILIATES AND OTHER SERVICE PROVIDERS

The Adviser, under the terms of the management agreement with the Trust with respect to each Fund (each an “Agreement”), manages the Funds’ investments. Pursuant to its Agreement, the Adviser is required to pay all other expenses of each Fund except portfolio transaction and other investment related costs (such as brokerage fees and commissions, and fees and expenses associated with investments in derivative instruments, including futures, option and swap fees and expenses), taxes, borrowing costs (such as interest and dividend expense on securities sold short), extraordinary expenses, and any indirect expenses (such as fees and expenses associated with investment in acquired funds and other collective investment vehicles). As compensation for its management services, each Fund is obligated to pay the Adviser a management fee computed and accrued daily and paid monthly as follows:

| | | NightShares 500 | | NightShares 2000 | | NightShares 500 |

| | | ETF | | ETF | | 1x/1.5x ETF |

| Management fee rate | | 0.55% | | 0.55% | | 0.75% |

| Management fees earned | | $21,771 | | $20,129 | | $43,608 |

| NightShares Funds |

| Notes to the Financial Statements (continued) |

| May 31, 2023 |

The Adviser has contractually agreed to waive its unitary management fee and/or reimburse expenses of the NightShares 500 1x/1.5x ETF so that total annual fund operating expenses, excluding portfolio transaction and other investment-related costs (such as brokerage fees and commissions, and fees and expenses associated with investments in derivative instruments, including futures, option and swap fees and expenses), taxes, borrowing costs (such as interest and dividend expense on securities sold short), extraordinary expenses, and any indirect expenses (such as fees and expenses associated with investment in acquired funds and other collective investment vehicles), do not exceed 0.65% through October 31, 2023. This expense cap may not be terminated prior to this date except by the Board on 60 days’ notice to the Adviser. Each waiver/expense payment by the Adviser is subject to recoupment by the Adviser from the NightShares 500 1x/1.5x ETF in the three years following the date the particular waiver/expense payment occurred, but only if such recoupment can be achieved without exceeding the annual expense limitation in effect at the time of the waiver/expense payment and any expense limitation in effect at the time of the recoupment. For the fiscal period ended May 31, 2023, the Adviser waived fees of $6,559. At May 31, 2023 the NightShares 500 1x/1.5x ETF owed the Adviser $8,116. As of May 31, 2023, the Adviser may seek repayment of management fees waived pursuant to the aforementioned conditions, from the NightShares 500 1x/1.5x ETF no later than May 31, 2026.

Ultimus Fund Solutions, LLC (“Ultimus”) provides administration and fund accounting services to the Funds. The Adviser pays Ultimus fees in accordance with the agreements for such services.

Northern Lights Compliance Services, LLC (“NLCS”), an affiliate of Ultimus, provides a Chief Compliance Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives fees from the Adviser, which are approved annually by the Board.

Under the terms of a Distribution Agreement with the Trust, Northern Lights Distributors, LLC (the “Distributor”) serves as principal underwriter to the Funds. The Distributor is a wholly-owned subsidiary of Ultimus. The Distributor is compensated by the Adviser (not the Funds) for acting as principal underwriter.

Certain officers of the Trust are also employees of Ultimus and such persons are not paid by the Funds for serving in such capacities. One Trustee is a former employee of Ultimus who is not currently paid by the Funds for serving in such capacity.

The Board supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires, or is removed. The Chair of the Board and more than 75% of the Trustees are “Independent Trustees,” which

NightShares Funds |

| Notes to the Financial Statements (continued) |

| May 31, 2023 |

means that they are not “interested persons” as defined in the 1940 Act. The Independent Trustees review and establish compensation at least annually, which is an established amount paid quarterly per Fund in the Trust at the time of the regular quarterly Board meetings. The Chair of the Board receives the highest compensation, commensurate with his additional duties and each Chair of a committee receives additional compensation as well. Independent Trustees also receive $1,000 for attending any special meeting that requires an in-person approval of a contract and $250 for the first hour and $200 for each additional hour for attending other special meetings. In addition, the Trust reimburses Independent Trustees for out-of-pocket expenses incurred in conjunction with attendance at meetings.

NOTE 6. PURCHASES AND SALES OF SECURITIES

For the fiscal period ended May 31, 2023, purchases and sales of investment securities, other than short-term investments, were as follows:

| | | | | | | | | U.S. | | | U.S. | |

| | | | | | | | | Government | | | Government | |

| | | Purchases | | | Sales | | | Purchases | | | Sales | |

| NightShares 500 ETF | | $ | 2,794,576 | | | $ | — | | | $ | — | | | $ | — | |

| NightShares 2000 ETF | | | 4,556,846 | | | | 3,529,834 | | | | — | | | | — | |

| NightShares 500 1x/1.5x ETF | | | 11,809,250 | | | | 413,804 | | | | — | | | | — | |

For the fiscal period ended May 31, 2023, there were no purchases and sales for in-kind transactions.

For the fiscal period ended May 31, 2023, there were no net realized gains on in-kind redemptions.

NOTE 7. CAPITAL SHARE TRANSACTIONS

Shares are not individually redeemable and may be redeemed by each Fund at NAV only in large blocks known as “Creation Units.” Only Authorized Participants or transactions done through an Authorized Participant are permitted to purchase or redeem Creation Units from a Fund. An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a Depository Trust Company participant and, in each case, must have executed a Participant Agreement with the Distributor. Such transactions are generally permitted on an in-kind basis, with a balancing cash component to equate the transaction to the NAV per share of the Fund on the transaction date. Cash may be substituted equivalent to the value of certain securities generally when they are not available in sufficient quantity for delivery, not eligible for trading by the Authorized Participant or as a result of other market circumstances. In addition, a Fund may impose

| NightShares Funds |

| Notes to the Financial Statements (continued) |

| May 31, 2023 |

transaction fees on purchases and redemptions of Fund shares to cover the custodial and other costs incurred by the Fund in effecting trades. A fixed fee payable to the Custodian may be imposed on each creation and redemption transaction regardless of the number of Creation Units involved in the transaction (“Fixed Fee”). Purchases and redemptions of Creation Units for cash or involving cash-in-lieu are required to pay an additional variable charge to compensate a Fund and its ongoing shareholders for brokerage and market impact expenses relating to Creation Unit transactions (“Variable Charge,” and together with the Fixed Fee, the “Transaction Fees”). Transactions in capital shares for each Fund are disclosed in the Statements of Changes in Net Assets. For the fiscal period ended May 31, 2023, NightShares 500 ETF, NightShares 2000 ETF and NightShares 500 1x/1.5x ETF received $1,500, $1,250 and $4,250 in fixed fees, respectively. The Transaction Fees for each Fund are listed in the table below:

| | | | | Variable |

| | | Fixed Fee | | Charge |

| NightShares 500 ETF | | $250 | | 2.00%* |

| NightShares 2000 ETF | | $250 | | 2.00%* |

| NightShares 5001x/1.5x ETF | | $250 | | 2.00%* |

| * | The maximum Transaction Fee may be up to 2.00% of the amount invested. |

NOTE 8. FEDERAL TAX INFORMATION

At May 31, 2023, the net unrealized appreciation (depreciation) and tax cost of investments for tax purposes was as follows: