UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21279

The Merger Fund VL

(Exact name of registrant as specified in charter)

100 Summit Lake Drive

Valhalla, New York 10595

(Address of principal executive offices) (Zip code)

Roy Behren and Michael T. Shannon

The Merger Fund VL

100 Summit Lake Drive

Valhalla, New York 10595

(Name and address of agent for service)

914-741-5600

Registrant's telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: December 31, 2010

Item 1. Reports to Stockholders.

THE MERGER FUND VL

ANNUAL REPORT

DECEMBER 31, 2010

February 7, 2011

Dear Shareholder:

The Merger Fund VL posted an increase of 1.2% for the quarter ending December 31, 2010, bringing the Fund’s gain to 5.3% for the calendar year, which was below our targeted rate of return. Some mid-year glitches in Australia as well as a sluggish deal environment and an extremely low interest rate climate contributed to the shortfall. The S&P 500, however, surpassed most expectations with a gain of 10.8% for the period, capping a surprising year in which the index logged a +15.1% rate of return and continued its bounce back from early-2009 recession lows. We routinely mention this equity market index in our letters, not just to compare performance, but also to highlight our lack of correlation (although in Q4 correlation would have been a good thing). There were eight broken deals out of 192 arbitrage investments made during the year, a greater than usual proportion. In any event, this quarter produced a positive return for the 20th time in the past 26 quarters (we have had no down years since our inception in 2004), and our standard deviation for the year was 2.95%, compared to the S&P 500’s 22.04%. Standard deviation is a measure of the volatility, or risk, of the Fund’s monthly returns and is a good gauge of our ability to provide our investors with a low volatility product, in both good markets and bad.

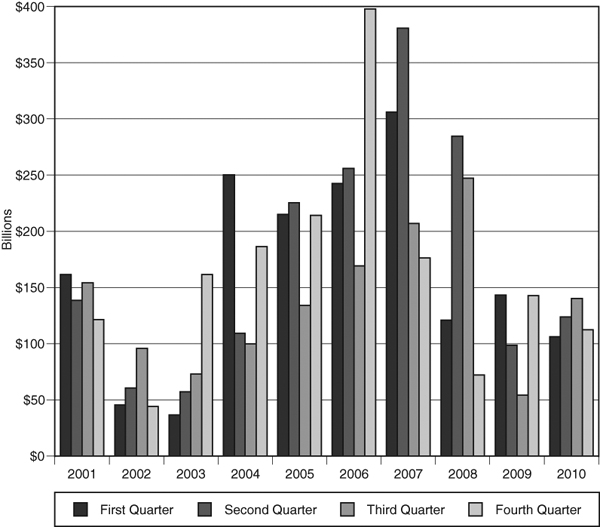

Our winners outnumbered our losers by approximately 4 to 1 during the last three months. We added 40 new positions during the quarter, in such diverse sectors as technology, coal mining, oil and gas production, construction equipment, consumer goods and financials. The portfolio continues to be invested globally. Most recent foreign action has been in Australia, as European activity continues to be tepid at best. In all, deal activity was disappointing in 2010. Consider the following data (by cumulative value):1

| • | Western European deal activity was down 27% from 2009, the third consecutive yearly decline |

| • | North American activity was down 28% from 2009, the third consecutive annual decline |

| • | Asia Pacific regional activity, including China (surprisingly) was down 23% from 2009, the first decline in 3 years |

| • | Activity in the rest of the world was up 30% year-over-year, with the big surprise being that Brazilian transactions, valued at $161 billion USD, outpaced Russian deals by a billion dollars |

However, there are many causes for optimism regarding future transaction activity. For one, interest rates remain at historically low levels, enabling the cheapest borrowing costs in decades. Secondly, equity markets have rebounded smartly, rising 101% since the lows of March 2009, making acquirers’ currencies more valuable should a company want to pay for its acquisition with stock. Additionally, corporate balance sheets are flush with cash. Cash levels at U.S. non-financial companies exceed $2 trillion, which provide incentives for buyers to deploy their excess cash and increase return on equity. This further provides built-in financing when purchasing a cash-rich target company. Finally, many companies had fueled temporary growth by cutting costs during the recession, and now have limited ways of growing their top and bottom lines other than through acquisitions.

Private equity has a role to play as well. There is thought to be in excess of $500 billion in private equity capital commitments that are waiting to be deployed in LBO and “club” acquisitions. Worth noting is that, on average, these commitments expire within 2½ years, providing additional incentive for sponsors to transact in the near term.

A possible harbinger of returning corporate confidence is the increase in unsolicited bids, which totaled 8 percent of global deal flow in 2010, according to Ernst & Young’s year-end merger and acquisition study.2 Gordon Dyal, the global head of mergers and acquisitions at Goldman Sachs, quoted in the New York Times Dealbook, has opined, “…looking at our backlog, we see continued, steady growth.”3

1 Zephyr Annual M&A report 2010, published by BvD

2 NY Times Dealbook, January 3, 2011

3 Ibid.

Regardless of the level of deal activity, it is our job to make intelligent investment decisions. There are times when that entails avoiding a merger altogether or investing in the situation in a more conservative manner. For example, the high profile unsolicited offer for Potash Corp. of Saskatchewan Inc. (“Potash”) by BHP Billiton Limited (“BHP”) provides an illustration of our risk management philosophy.

In August of 2010, BHP announced its intention to make an offer to acquire all of the shares of Potash for $130 per share, or $40 billion USD. Potash, which had traded at $112.15 on the prior day, formed an independent committee of directors to consider the proposal, rejected the offer the following day, and implemented a poison-pill shareholder-rights plan. BHP then commenced its tender offer, but because of the poison pill, it would have been unable to purchase all of the shares without a negotiated agreement in which management cancelled the rights plan. The poison pill would be triggered if any shareholder’s ownership exceeded 20% of the outstanding shares without management approval, making a purchase unacceptably expensive. Thus, the game was on.

BHP dwarfs Potash in market capitalization, revenues and profits and would have had no problem financing its offer. Additionally, BHP had recently been rejected as a suitor of Rio Tinto plc, and its management team was motivated to prove it could successfully complete a large transaction. The parties’ deal, legal and defense teams suited up for a high-stakes battle. Both sides lobbied the press, shareholders and most importantly, the regulators. In addition to typical anti-trust approvals, BHP’s proposal required local Saskatchewan Financial Services Commission approval. Rumors of counter-bidders and Chinese interest in Potash swirled while the parties filed suit against each other. Potash management claimed to be evaluating several undisclosed alternatives for the company, while simultaneously assuring shareholders that its goal was to do what was best for shareholders as well as the company itself.

In the meantime, over a month had passed and a funny thing happened. Fertilizer prices began to lift, corn prices increased, and the underlying value of the target company ballooned. To compress the story a bit, the stock traded up through the offer price and into the mid-$140s. Speculation ran wild that BHP, which could afford to sweeten its offer, would pay as much as $170 per share for Potash.

We, along with our regulatory counsel, had determined by that point that local government approval was not a layup, but that values had indeed gone up significantly and a deal price in excess of $160 would still be accretive to BHP’s earnings. In fact, our assessment was that if there was a way to purchase stock at or below $140, our downside, if any, would be limited, and we were willing to cap our potential profits in order to reduce our risk. While other investors and hedge funds were paying $147 for stock or purchasing call options as a cheap way to take a 3-point shot (to keep the metaphor going), we were happy to purchase stock and sell deep in-the-money 135 and 140 strike call options on Potash. While this strategy could not guarantee a profitable investment, it would have the effect of creating a nice rate of return if the stock was higher than the strike price at expiration but would cap our profits if a deal was struck at an extraordinary price. We thought the risk/reward profile fit our philosophy perfectly, and we were happy with the downside protection we had put in place.

Ultimately, the Saskatchewan government rejected BHP’s bid, and BHP walked away from its prey. Potash stock traded down from $147 to as low as $137 before settling in at approximately $142. Although most event-driven investors lost money on this situation, The Merger Fund VL profited because the stock remained above our strike price beyond the options’ expiration date. Our unique and collaborative approach to portfolio management enabled us to creatively structure an investment with the conservative characteristics that are the hallmark of our Fund.

The quality of the team managing your assets has always been a priority for us. Westchester Capital Management’s infrastructure has continued to expand along with the Fund’s assets, and we have been fortunate to attract talented partners and employees. This year, Bruce Rubin joined us as Chief Operating Officer and Chief Compliance Officer. His wealth of experience in the investment management business should keep the company and its operations running smoothly. We have also hired Jody Harris-Stern as Director of Business Development. In addition to helping to plan our new initiatives, such as possible sister funds in the alternative investment space, Jody’s senior background in client-facing roles at UBS Global Asset Management will allow us to continue to

service investors in the manner to which they have become accustomed for the past 22 years. Our head trader, Abe Cary, has also continued to assume new portfolio-related responsibilities, and with the addition of Ben Kunofsky as our secondary trader, Abe has been able to provide valuable input into our investment process. Needless to say, the strong team that we have assembled in both the front and middle office will continue to allow your portfolio managers to focus on investment management, and nothing but investment management.

We remain optimistic about an upturn in deal activity in 2011. We are close to one hundred percent invested, and the Fund currently holds positions in 65 arbitrage situations around the globe.

Finally, thanks very much for your continued support. We take our risk-management responsibilities seriously.

Best wishes for a happy and peaceful 2011.

Sincerely,

|  |

| Roy Behren | Mike Shannon |

| | |

| Top Ten Winners for 2010 | | Top Ten Losers for 2010 |

| Deal | Attribution | | Deal | Attribution |

| Chloride Group plc. | 0.81% | | Nufarm Limited/Sinochem | -0.53% |

| KKR Private Equity Investors LP/ | | | Savient Pharmaceuticals Inc. | -0.47% |

| The Blackstone Group | 0.53% | | Infigen Energy | -0.45% |

| Smith International, Inc./ | | | Hillgrove Resources Ltd. | -0.40% |

| Schlumberger NV | 0.32% | | Macarthur Coal Ltd./Peabody Energy | -0.25% |

| Potash Corporation of Saskatchewan/ | | | Perpetual Ltd. | -0.16% |

| BHP Billiton Ltd. | 0.29% | | Indophil Resources NL | -0.13% |

| XTO Energy Inc./Exxon Mobil Corp. | 0.24% | | AXA Asia Pacific Holdings/AMP Ltd. | -0.12% |

| Allegheny Energy Inc./First Energy Inc. | 0.23% | | McAfee Inc./Intel Corp. | -0.11% |

| Undisclosed Chemical Corporation | 0.21% | | California Pizza Kitchen | -0.08% |

| Genzyme Corporation | 0.20% | | | |

| Qwest Communications International/ | | | | |

| CenturyLink, Inc. | 0.18% | | | |

| Undisclosed UK Media | 0.18% | | | |

Note: Before investing in The Merger Fund VL, consider its investment objectives, risks, charges and expenses. For a prospectus containing this and other information, including current performance data that may be lower or higher than the data included herein, contact your life insurance company or The Merger Fund VL c/o U.S. Bancorp Fund Services, LLC at (800) 343-8959. Please read it carefully. The performance data included herein represents past performance and does not guarantee future results. The Merger Fund VL’s share price and return will vary, and investors may have a gain or loss when they redeem their shares.

The S&P 500 Index is an unmanaged index that contains securities typically selected by growth managers as being representative of the U.S. stock market. The Index does not reflect investment management fees, brokerage commission and other expenses associated with investing in equity securities. You cannot invest directly in an index.

Please refer to the Schedule of Investments in this report for holding information. Fund holdings are subject to change at any time and should not be considered recommendations to buy or sell any security. Current and future portfolio holdings are subject to risk.

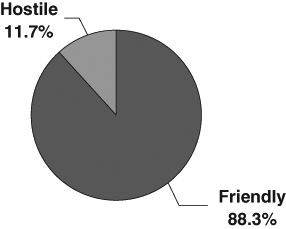

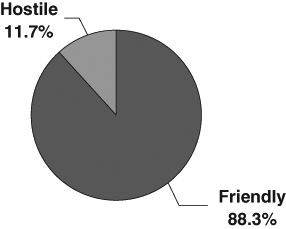

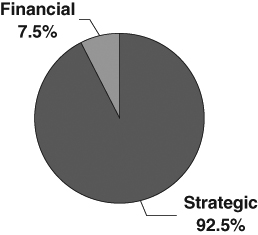

| Chart 1 | Chart 2 |

| | |

| PORTFOLIO COMPOSITION | PORTFOLIO COMPOSITION |

| By Type of Deal* | By Type of Buyer* |

| | |

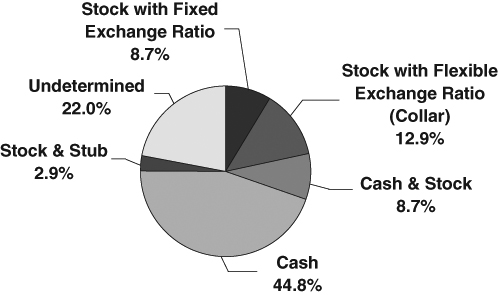

|  |

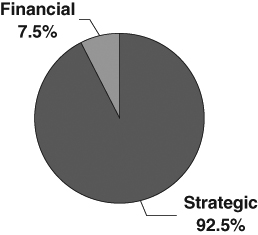

| Chart 3 |

| |

| PORTFOLIO COMPOSITION |

| By Deal Terms* |

| |

|

* Data expressed as a percentage of long equity positions as of December 31, 2010

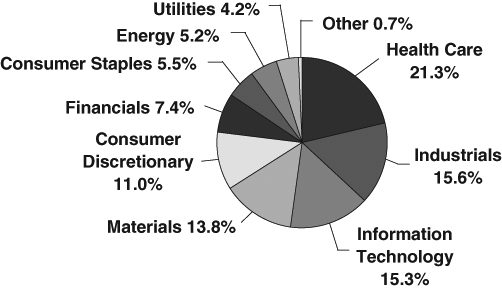

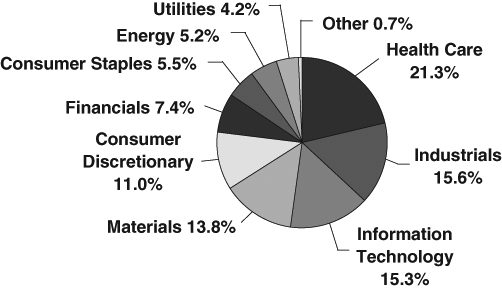

| Chart 4 |

| |

| PORTFOLIO COMPOSITION |

| By Sector* |

| |

|

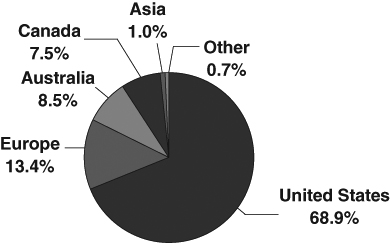

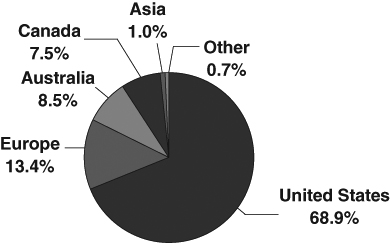

| Chart 5 |

| |

| PORTFOLIO COMPOSITION |

| By Region* |

| |

|

* Data expressed as a percentage of long equity positions as of December 31, 2010

The Global Industry Classifications Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

Chart 6

MERGER ACTIVITY

2001 – 2010

Source: Securities Data Corp.

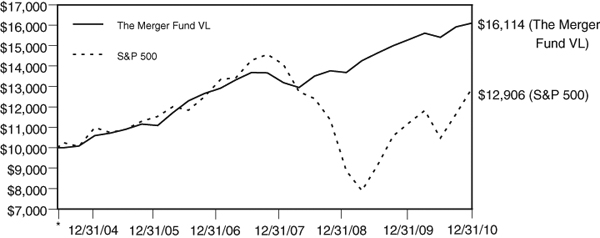

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT

IN THE MERGER FUND VL AND S&P 500

* Inception Date 5/26/04

| | Average Annual Total Return |

| | 1 Year | 3 Year | 5 Year | Since Inception |

| The Merger Fund VL | 5.30% | 6.91% | 7.78% | 7.50% |

| The Standard & Poor’s 500 Index | 15.06% | -2.86% | 2.29% | 3.94% |

The Standard & Poor’s 500 Index (S&P 500) is a capitalization-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. This chart assumes an initial gross investment of $10,000 made on May 26, 2004. Returns shown include the reinvestment of all dividends. Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Merger Fund VL

EXPENSE EXAMPLE

December 31, 2010

(Unaudited)

As a shareholder of the Fund, you incur ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 for the period 7/1/10 – 12/31/10.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. To the extent the Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example below. The example below includes, but is not limited to, management fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning Account | Ending Account | Expenses Paid During |

| | Value 7/1/10 | Value 12/31/10 | Period 7/1/10 – 12/31/10* |

Actual + (1) | $1,000.00 | $1,046.10 | $18.26 |

Hypothetical ++ (2) | $1,000.00 | $1,007.36 | $17.91 |

| + | Excluding dividends on securities sold short, borrowing expense on securities sold short and interest expense, your actual cost of investment in the Fund would be $7.22. |

| ++ | Excluding dividends on securities sold short, borrowing expense on securities sold short and interest expense, your hypothetical cost of investment in the Fund would be $7.12. |

| (1) | Ending account values and expenses paid during period based on a 4.61% return. This actual return is net of expenses. |

| (2) | Ending account values and expenses paid during period based on a 5.00% annual return before expenses. |

| * | Expenses are equal to the Fund’s annualized expense ratio of 3.54%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

The Merger Fund VL

SCHEDULE OF INVESTMENTS

December 31, 2010

| Shares | | | | Value | |

| | | | |

| COMMON STOCKS — 91.33% | | | |

| | | | | | |

| | | AIRLINES — 2.29% | | | |

| | 46,000 | | AirTran Holdings, Inc. (a)(d) | | $ | 339,940 | |

| | | | APPAREL RETAIL — 3.51% | | | | |

| | 10,900 | | J.C. Penney Company, Inc. (c) | | | 352,179 | |

| | 3,900 | | J. Crew Group, Inc. (a)(c) | | | 168,246 | |

| | | | | | | 520,425 | |

| | | | ASSET MANAGEMENT & CUSTODY BANKS — 0.16% | | | | |

| | 1,686 | | The Blackstone Group, LP | | | 23,857 | |

| | | | BIOTECHNOLOGY — 6.48% | | | | |

| | 3,700 | | Crucell NV (a)(f) | | | 116,687 | |

| | 6,900 | | Genzyme Corporation (a)(c) | | | 491,280 | |

| | 8,400 | | Savient Pharmaceuticals Inc. (a) | | | 93,576 | |

| | 11,100 | | Talecris Biotherapeutics Holdings Corp. (a)(d) | | | 258,630 | |

| | | | | | | 960,173 | |

| | | | BROADCASTING — 0.69% | | | | |

| | 1,100 | | CC Media Holdings, Inc. (a)(e) | | | 9,900 | |

| | 1,700 | | Discovery Communications, Inc. Series K (a)(d) | | | 62,373 | |

| | 1,125 | | Promotora De Informaciones S.A. — ADR (a)(f) | | | 9,023 | |

| | 2,250 | | Promotora De Informaciones S.A. Class B — ADR (a)(f) | | | 21,465 | |

| | | | | | | 102,761 | |

| | | | CABLE & SATELLITE — 1.46% | | | | |

| | 10,400 | | Comcast Corporation Special Class A (e) | | | 216,424 | |

| | | | COMMUNICATIONS EQUIPMENT — 2.39% | | | | |

| | 39,100 | | Motorola, Inc. (a)(c) | | | 354,637 | |

| | | | COMPUTER STORAGE & PERIPHERALS — 2.75% | | | | |

| | 2,200 | | Compellent Technologies, Inc. (a) | | | 60,698 | |

| | 5,100 | | EMC Corp. (a) | | | 116,790 | |

| | 15,300 | | Seagate Technology LLC (a)(d)(f) | | | 229,959 | |

| | | | | | | 407,447 | |

| | | | CONSTRUCTION & ENGINEERING — 1.34% | | | | |

| | 3,700 | | Massey Energy Company (c) | | | 198,505 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

December 31, 2010

| Shares | | | | Value | |

| | | CONSTRUCTION, FARM MACHINERY & HEAVY TRUCKS — 6.64% | | | |

| | 11,000 | | Bucyrus International Inc. (b) | | $ | 983,400 | |

| | | | DIVERSIFIED BANKS — 0.23% | | | | |

| | 600 | | Bank of Montreal (c) | | | 34,542 | |

| | | | DIVERSIFIED CHEMICALS — 0.12% | | | | |

| | 1,100 | | Huntsman Corporation | | | 17,171 | |

| | | | DIVERSIFIED METALS & MINING — 3.63% | | | | |

| | 1,800 | | Indophil Resources NL (a)(f) | | | 1,952 | |

| | 600 | | Rio Tinto plc — ADR (f) | | | 42,996 | |

| | 39,800 | | Western Coal Corp. (a)(d)(f) | | | 492,346 | |

| | | | | | | 537,294 | |

| | | | ELECTRIC UTILITIES — 1.91% | | | | |

| | 11,700 | | Allegheny Energy Inc. (d) | | | 283,608 | |

| | | | ELECTRICAL COMPONENTS & EQUIPMENT — 4.08% | | | | |

| | 8,306 | | Baldor Electric Company (d) | | | 523,610 | |

| | 6,570 | | SunPower Corp. Class B (a)(d) | | | 81,534 | |

| | | | | | | 605,144 | |

| | | | ELECTRONIC EQUIPMENT & INSTRUMENTS — 0.25% | | | | |

| | 3,100 | | L-1 Identity Solutions, Inc. (a) | | | 36,921 | |

| | | | FERTILIZERS & AGRICULTURAL CHEMICALS — 4.70% | | | | |

| | 4,500 | | Potash Corporation of Saskatchewan (e)(f) | | | 696,735 | |

| | | | FOOD RETAIL — 0.06% | | | | |

| | 200 | | Casey’s General Stores, Inc. (c) | | | 8,502 | |

| | | | GAS UTILITIES — 1.03% | | | | |

| | 3,050 | | Nicor Inc. | | | 152,256 | |

| | | | HEALTH CARE FACILITIES — 0.44% | | | | |

| | 9,800 | | Tenet Healthcare Corp. (a) | | | 65,562 | |

| | | | HEALTH CARE SERVICES — 0.92% | | | | |

| | 2,100 | | Emergency Medical Services Corporation (a)(c) | | | 135,681 | |

| | | | HEALTH CARE SUPPLIES — 8.06% | | | | |

| | 7,313 | | Alcon Inc. — ADR (c)(f) | | | 1,194,944 | |

| | | | HOUSEWARES & SPECIALTIES — 0.85% | | | | |

| | 2,100 | | Fortune Brands, Inc. (c) | | | 126,525 | |

| | | | INDUSTRIAL GASES — 3.63% | | | | |

| | 8,600 | | Airgas, Inc. (c) | | | 537,156 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

December 31, 2010

| Shares | | | | Value | |

| | | INTERNET SOFTWARE & SERVICES — 0.55% | | | |

| | 4,900 | | Yahoo! Inc. (a) | | $ | 81,487 | |

| | | | LIFE & HEALTH INSURANCE — 0.73% | | | | |

| | 11,318 | | Phoenix Group Holdings (d)(f) | | | 107,814 | |

| | | | MOVIES & ENTERTAINMENT — 0.29% | | | | |

| | 3,000 | | News Corporation Class A | | | 43,680 | |

| | | | OIL & GAS DRILLING — 0.31% | | | | |

| | 1,400 | | Pride International, Inc. (a) | | | 46,200 | |

| | | | OIL & GAS EXPLORATION & PRODUCTION — 3.32% | | | | |

| | 2,800 | | Atlas Energy, Inc. (a) | | | 123,116 | |

| | 18,000 | | EXCO Resources, Inc. (c) | | | 349,560 | |

| | 1,300 | | Quicksilver Resources, Inc. (a) | | | 19,162 | |

| | | | | | | 491,838 | |

| | | | PACKAGED FOODS & MEATS — 1.73% | | | | |

| | 13,600 | | Del Monte Foods Co. (b) | | | 255,680 | |

| | | | PERSONAL PRODUCTS — 1.81% | | | | |

| | 4,300 | | Mead Johnson Nutrition Co. (e) | | | 267,675 | |

| | | | PHARMACEUTICALS — 5.73% | | | | |

| | 60,400 | | King Pharmaceuticals, Inc. (a)(b) | | | 848,620 | |

| | | | REGIONAL BANKS — 2.80% | | | | |

| | 60,000 | | Marshall & lsley Corporation (e) | | | 415,200 | |

| | | | SOFT DRINKS — 2.38% | | | | |

| | 14,100 | | Coca-Cola Enterprises, Inc. (c) | | | 352,923 | |

| | | | SPECIALTY STORES — 1.18% | | | | |

| | 2,896 | | Jo-Ann Stores, Inc. (a) | | | 174,397 | |

| | | | SYSTEMS SOFTWARE — 10.52% | | | | |

| | 25,875 | | McAfee Inc. (a)(e) | | | 1,198,271 | |

| | 43,400 | | Novell, Inc. (a) | | | 256,928 | |

| | 6,200 | | Symantec Corp. (a) | | | 103,788 | |

| | | | | | | 1,558,987 | |

| | | | TRUCKING — 2.36% | | | | |

| | 7,400 | | Dollar Thrifty Automotive Group, Inc. (a)(c) | | | 349,724 | |

| | | | TOTAL COMMON STOCKS (Cost $13,423,139) | | | 13,533,835 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

December 31, 2010

| Shares | | | | Value | |

| WARRANTS — 0.02% | | | |

| | | Kinross Gold Corporation Class D (f) | | | |

| | 668 | | Expiration: September, 2014, Exercise Price: $21.30 (a) | | $ | 3,151 | |

| | | | TOTAL WARRANTS (Cost $2,560) | | | 3,151 | |

| | | | | | | | |

| Principal Amount | | | | |

| CORPORATE BONDS — 1.50% | | | | |

| | | | Mirant Corporation | | | | |

| | $218,000 | | 7.375%, 12/31/2013 (c) | | | 222,107 | |

| | | | TOTAL CORPORATE BONDS (Cost $223,910) | | | 222,107 | |

| | | | | | | | |

| Contracts (100 shares per contract) | | | | |

| PURCHASED PUT OPTIONS — 0.11% | | | | |

| | | | Bank Of Montreal | | | | |

| | 5 | | Expiration: January, 2011, Exercise Price: $50.00 | | | 12 | |

| | 1 | | Expiration: February, 2011, Exercise Price: $50.00 | | | 15 | |

| | | | Coca-Cola Enterprises, Inc. | | | | |

| | 130 | | Expiration: January, 2011, Exercise Price: $23.00 | | | 975 | |

| | | | Compellent Technologies, Inc. | | | | |

| | 22 | | Expiration: January, 2011, Exercise Price: $22.50 | | | 55 | |

| | | | Energy Select Sector SPDR | | | | |

| | 4 | | Expiration: January, 2011, Exercise Price: $69.00 | | | 654 | |

| | | | Fortune Brands, Inc. | | | | |

| | 21 | | Expiration: January, 2011, Exercise Price: $55.00 | | | 105 | |

| | | | Global Alternative Energy ETF | | | | |

| | 13 | | Expiration: January, 2011, Exercise Price: $21.00 | | | 1,397 | |

| | | | J.C. Penney Company, Inc. | | | | |

| | 109 | | Expiration: January, 2011, Exercise Price: $29.00 | | | 2,398 | |

| | | | Market Vectors Agribusiness | | | | |

| | 47 | | Expiration: January, 2011, Exercise Price: $52.00 | | | 1,998 | |

| | | | Massey Energy Company | | | | |

| | 11 | | Expiration: January, 2011, Exercise Price: $38.00 | | | 55 | |

| | | | Materials Select Sector SPDR | | | | |

| | 13 | | Expiration: March, 2011, Exercise Price: $39.00 | | | 2,756 | |

| | | | Mead Johnson Nutrition Co. | | | | |

| | 43 | | Expiration: February, 2011, Exercise Price: $55.00 | | | 3,418 | |

| | | | Nicor Inc. | | | | |

| | 28 | | Expiration: February, 2011, Exercise Price: $45.00 | | | 210 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

December 31, 2010

| Contracts (100 shares per contract) | | Value | |

| | | Pride International, Inc. | | | |

| | 14 | | Expiration: January, 2011, Exercise Price: $27.50 | | $ | 70 | |

| | | | Quicksilver Resources, Inc. | | | | |

| | 13 | | Expiration: January, 2011, Exercise Price: $12.50 | | | 33 | |

| | | | Symantec Corp. | | | | |

| | 62 | | Expiration: January, 2011, Exercise Price: $14.00 | | | 372 | |

| | | | Technology Select Sector SPDR | | | | |

| | 36 | | Expiration: January, 2011, Exercise Price: $25.00 | | | 1,080 | |

| | | | iShares Nasdaq Biotech | | | | |

| | 2 | | Expiration: January, 2011, Exercise Price: $95.00 | | | 470 | |

| | | | | | | 16,073 | |

| PURCHASED CALL OPTIONS — 0.00% | | | | |

| | | | Novartis AG | | | | |

| | 15 | | Expiration: January, 2011, Exercise Price: $65.00 | | | 75 | |

| | | | TOTAL PURCHASED OPTIONS (Cost $39,073) | | | 16,148 | |

| | | | TOTAL INVESTMENTS (Cost $13,688,682) — 92.96% | | $ | 13,775,241 | |

| | | | | | | | |

ADR – American Depository Receipt

| (a) | Non-income producing security. |

| (b) | All or a portion of the shares have been committed as collateral for open securities sold short. |

| (c) | All or a portion of the shares have been committed as collateral for written option contracts. |

| (d) | All or a portion of the shares have been committed as collateral for swap contracts. |

| (e) | All or a portion of the shares have been committed as collateral for forward currency exchange contracts. |

The Global Industry Classifications Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF SECURITIES SOLD SHORT

December 31, 2010

| Shares | | | | Value | |

| | 142 | | AGL Resources Inc. | | $ | 5,091 | |

| | 1,601 | | Avis Budget Group, Inc. | | | 24,912 | |

| | 7,569 | | Bank of Montreal (a) | | | 435,747 | |

| | 1,686 | | The Blackstone Group, LP | | | 23,857 | |

| | 10,400 | | Comcast Corporation Class A | | | 228,488 | |

| | 1,700 | | Discovery Communications, Inc. | | | 70,890 | |

| | 7,835 | | FirstEnergy Corp. | | | 290,052 | |

| | 154 | | Goldcorp Inc. (a) | | | 7,106 | |

| | 7,146 | | Grifols SA (a) | | | 97,402 | |

| | 400 | | Hertz Global Holdings, Inc. | | | 5,796 | |

| | 27 | | Kinross Gold Corporation (a) | | | 513 | |

| | 3,000 | | News Corporation Class B | | | 49,260 | |

| | 6,441 | | Novartis AG - ADR (a) | | | 379,697 | |

| | 601 | | Rio Tinto Ltd. (a)(b) | | | 53,081 | |

| | 3,818 | | Southwest Airlines Co. | | | 49,558 | |

| | 6,570 | | SunPower Corp. Class A | | | 84,293 | |

| | 408 | | VMware Inc. | | | 36,275 | |

| | 1,363 | | Walter Energy Inc. | | | 174,246 | |

| | | | TOTAL SECURITIES SOLD SHORT | | | | |

| | | | (Proceeds $1,942,083) | | $ | 2,016,264 | |

ADR – American Depository Receipt

| (b) | Level 2 Investment (see Note 2). |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF OPTIONS WRITTEN

December 31, 2010

| Contracts (100 shares per contract) | | Value | |

| CALL OPTIONS WRITTEN | | | |

| | | Airgas, Inc. | | | |

| | 45 | | Expiration: January, 2011, Exercise Price: $60.00 | | $ | 12,262 | |

| | 13 | | Expiration: January, 2011, Exercise Price: $62.50 | | | 1,300 | |

| | | | Alcon, Inc. ADR | | | | |

| | 2 | | Expiration: January, 2011, Exercise Price: $160.00 | | | 740 | |

| | | | Bank of Montreal | | | | |

| | 5 | | Expiration: January, 2011, Exercise Price: $55.00 | | | 1,400 | |

| | 1 | | Expiration: February, 2011, Exercise Price: $55.00 | | | 310 | |

| | | | Casey’s General Stores, Inc | | | | |

| | 2 | | Expiration: January, 2011, Exercise Price: $40.00 | | | 560 | |

| | | | Coca-Cola Enterprises, Inc. | | | | |

| | 141 | | Expiration: January, 2011, Exercise Price: $25.00 | | | 7,755 | |

| | | | Compellent Technologies, Inc | | | | |

| | 22 | | Expiration: January, 2011, Exercise Price: $27.50 | | | 440 | |

| | | | Dollar Thrifty Automotive Group, Inc. | | | | |

| | 31 | | Expiration: January, 2011, Exercise Price: $46.00 | | | 4,960 | |

| | 7 | | Expiration: January, 2011, Exercise Price: $48.00 | | | 245 | |

| | 7 | | Expiration: January, 2011, Exercise Price: $49.00 | | | 140 | |

| | | | Emergency Medical Services Corporation | | | | |

| | 21 | | Expiration: January, 2011, Exercise Price: $60.00 | | | 10,920 | |

| | | | EXCO Resources Inc. | | | | |

| | 31 | | Expiration: January, 2011, Exercise Price: $19.00 | | | 2,170 | |

| | | | Fortune Brands, Inc | | | | |

| | 21 | | Expiration: January, 2011, Exercise Price: $60.00 | | | 2,940 | |

| | | | Genzyme Corporation | | | | |

| | 35 | | Expiration: January, 2011, Exercise Price: $70.00 | | | 8,172 | |

| | 26 | | Expiration: January, 2011, Exercise Price: $72.50 | | | 2,080 | |

| | | | J. Crew Group Inc. | | | | |

| | 39 | | Expiration: January, 2011, Exercise Price: $45.00 | | | 195 | |

| | | | J.C. Penney Company, Inc. | | | | |

| | 53 | | Expiration: January, 2011, Exercise Price: $31.00 | | | 9,382 | |

| | 56 | | Expiration: January, 2011, Exercise Price: $32.00 | | | 6,468 | |

| | | | Massey Energy Company | | | | |

| | 37 | | Expiration: January, 2011, Exercise Price: $45.00 | | | 32,560 | |

| | | | Mead Johnson Nutrition Co. | | | | |

| | 43 | | Expiration: February, 2011, Exercise Price: $60.00 | | | 18,576 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF OPTIONS WRITTEN (continued)

December 31, 2010

| Contracts (100 shares per contract) | | Value | |

| | | Motorola, Inc. | | | |

| | 88 | | Expiration: January, 2011, Exercise Price: $7.50 | | $ | 13,816 | |

| | 303 | | Expiration: January, 2011, Exercise Price: $9.00 | | | 8,484 | |

| | | | Nicor Inc | | | | |

| | 28 | | Expiration: February, 2011, Exercise Price: $50.00 | | | 2,520 | |

| | | | Potash Corporation of Saskatchewan | | | | |

| | 28 | | Expiration: January, 2011, Exercise Price: $130.00 | | | 70,000 | |

| | 17 | | Expiration: January, 2011, Exercise Price: $145.00 | | | 18,700 | |

| | | | Pride International, Inc. | | | | |

| | 14 | | Expiration: January, 2011, Exercise Price: $30.00 | | | 4,480 | |

| | | | Quicksilver Resources Inc. | | | | |

| | 13 | | Expiration: January, 2011, Exercise Price: $14.00 | | | 1,235 | |

| | | | Seagate Technology LLC | | | | |

| | 153 | | Expiration: January, 2011, Exercise Price: $14.00 | | | 18,437 | |

| | | | Symantec Corporation | | | | |

| | 62 | | Expiration: January, 2011, Exercise Price: $16.00 | | | 5,580 | |

| | | | Tenet Healthcare Corp. | | | | |

| | 98 | | Expiration: January, 2011, Exercise Price: $6.00 | | | 8,330 | |

| | | | Yahoo! Inc. | | | | |

| | 49 | | Expiration: January, 2011, Exercise Price: $16.00 | | | 4,312 | |

| PUT OPTIONS WRITTEN | | | | |

| | | | Novartis AG | | | | |

| | 15 | | Expiration: January, 2011, Exercise Price: $60.00 | | | 2,100 | |

| | | | TOTAL OPTIONS WRITTEN | | | | |

| | | | (Premiums received $244,754) | | $ | 281,569 | |

ADR – American Depository Receipt

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF FORWARD CONTRACTS

December 31, 2010

| | | | | | | U.S. $ Value at | | | | | | | U.S. $ Value at | | | Unrealized | |

| Settlement | | Currency to | | December 31, | | | Currency to | | December 31, | | | Appreciation | |

| Date | | be Delivered | | 2010 | | | be Received | | 2010 | | | (Depreciation) | |

| 1/14/11 | | | 45,992 | | Australian Dollars | | $ | 46,954 | | | | 42,543 | | U.S. Dollars | | $ | 42,543 | | | $ | (4,411 | ) |

| 1/14/11 | | | 44,531 | | U.S. Dollars | | | 44,531 | | | | 45,992 | | Australian Dollars | | | 46,954 | | | | 2,423 | |

| 1/19/11 | | | 237,666 | | Australian Dollars | | | 242,468 | | | | 230,541 | | U.S. Dollars | | | 230,541 | | | | (11,927 | ) |

| 1/19/11 | | | 11,631 | | U.S. Dollars | | | 11,631 | | | | 11,955 | | Australian Dollars | | | 12,197 | | | | 566 | |

| 1/27/11 | | | 91,599 | | Australian Dollars | | | 93,345 | | | | 89,154 | | U.S. Dollars | | | 89,154 | | | | (4,191 | ) |

| 1/27/11 | | | 91,533 | | U.S. Dollars | | | 91,533 | | | | 91,599 | | Australian Dollars | | | 93,345 | | | | 1,812 | |

| 1/31/11 | | | 602,575 | | Australian Dollars | | | 613,729 | | | | 589,328 | | U.S. Dollars | | | 589,328 | | | | (24,401 | ) |

| 1/31/11 | | | 144,815 | | U.S. Dollars | | | 144,815 | | | | 146,633 | | Australian Dollars | | | 149,347 | | | | 4,532 | |

| 2/1/11 | | | 23,985 | | Australian Dollars | | | 24,426 | | | | 23,217 | | U.S. Dollars | | | 23,217 | | | | (1,209 | ) |

| 2/1/11 | | | 2,498 | | U.S. Dollars | | | 2,498 | | | | 2,525 | | Australian Dollars | | | 2,571 | | | | 73 | |

| 2/2/11 | | | 72,600 | | Australian Dollars | | | 73,927 | | | | 72,266 | | U.S. Dollars | | | 72,266 | | | | (1,661 | ) |

| 2/2/11 | | | 72,651 | | U.S. Dollars | | | 72,651 | | | | 72,600 | | Australian Dollars | | | 73,927 | | | | 1,276 | |

| 2/3/11 | | | 155,386 | | Australian Dollars | | | 158,207 | | | | 151,834 | | U.S. Dollars | | | 151,834 | | | | (6,373 | ) |

| 2/15/11 | | | 132,578 | | Australian Dollars | | | 134,795 | | | | 128,203 | | U.S. Dollars | | | 128,203 | | | | (6,592 | ) |

| 2/16/11 | | | 188,000 | | Australian Dollars | | | 191,121 | | | | 183,046 | | U.S. Dollars | | | 183,046 | | | | (8,075 | ) |

| 2/16/11 | | | 42,491 | | U.S. Dollars | | | 42,491 | | | | 44,000 | | Australian Dollars | | | 44,730 | | | | 2,239 | |

| 3/30/11 | | | 123,035 | | Australian Dollars | | | 124,437 | | | | 119,078 | | U.S. Dollars | | | 119,078 | | | | (5,359 | ) |

| 1/6/11 | | | 66,300 | | Canadian Dollars | | | 66,672 | | | | 66,279 | | U.S. Dollars | | | 66,279 | | | | (393 | ) |

| 2/25/11 | | | 382,757 | | Canadian Dollars | | | 384,510 | | | | 376,815 | | U.S. Dollars | | | 376,815 | | | | (7,695 | ) |

| 2/25/11 | | | 61,940 | | U.S. Dollars | | | 61,940 | | | | 62,370 | | Canadian Dollars | | | 62,656 | | | | 716 | |

| 1/4/11 | | | 272,250 | | Euro | | | 363,810 | | | | 378,446 | | U.S. Dollars | | | 378,446 | | | | 14,636 | |

| 1/4/11 | | | 357,592 | | U.S. Dollars | | | 357,592 | | | | 272,250 | | Euro | | | 363,810 | | | | 6,218 | |

| 2/8/11 | | | 249,975 | | Euro | | | 334,012 | | | | 327,124 | | U.S. Dollars | | | 327,124 | | | | (6,888 | ) |

| 3/29/11 | | | 88,015 | | Euro | | | 117,578 | | | | 116,379 | | U.S. Dollars | | | 116,379 | | | | (1,199 | ) |

| 1/13/11 | | | 4,433 | | British Pounds | | | 6,911 | | | | 7,028 | | U.S. Dollars | | | 7,028 | | | | 117 | |

| 1/13/11 | | | 6,857 | | U.S. Dollars | | | 6,857 | | | | 4,433 | | British Pounds | | | 6,911 | | | | 54 | |

| 1/21/11 | | | 85,600 | | British Pounds | | | 133,437 | | | | 135,924 | | U.S. Dollars | | | 135,924 | | | | 2,487 | |

| 3/3/11 | | | 263,515 | | British Pounds | | | 410,648 | | | | 418,348 | | U.S. Dollars | | | 418,348 | | | | 7,700 | |

| 3/3/11 | | | 12,910 | | U.S. Dollars | | | 12,910 | | | | 8,400 | | British Pounds | | | 13,090 | | | | 180 | |

| 1/19/11 | | | 12,088,800 | | Japanese Yen | | | 148,928 | | | | 147,824 | | U.S. Dollars | | | 147,824 | | | | (1,104 | ) |

| 1/19/11 | | | 13,398 | | U.S. Dollars | | | 13,398 | | | | 1,122,229 | | Japanese Yen | | | 13,825 | | | | 427 | |

| 1/20/11 | | | 2,997,000 | | Japanese Yen | | | 36,922 | | | | 36,433 | | U.S. Dollars | | | 36,433 | | | | (489 | ) |

| 1/20/11 | | | 23,909 | | U.S. Dollars | | | 23,909 | | | | 1,998,000 | | Japanese Yen | | | 24,615 | | | | 706 | |

| | | | | | | | $ | 4,593,593 | | | | | | | | $ | 4,547,788 | | | $ | (45,805 | ) |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF SWAP CONTRACTS

December 31, 2010

| | | | | | | | | | | Unrealized | | |

| Termination | | | | | | | | | | Appreciation | | |

| Date | | Security | | Shares | | | Notional | | | (Depreciation) | | Counterparty |

| 1/3/11 | | Andean Resources Ltd. | | | 1,100 | | | | 7,030 | | | | 551 | | JPMorgan Chase & Co. Inc. |

| 3/31/11 | | AXA Asia Pacific Holdings Ltd. | | | 82,300 | | | | 527,963 | | | | 46,860 | | JPMorgan Chase & Co. Inc. |

| 6/30/11 | | British Sky Broadcasting Group | | | 10,000 | | | | 113,501 | | | | 10,278 | | Merrill Lynch & Co. Inc. |

| 6/30/11 | | British Sky Broadcasting Group | | | 26,445 | | | | 303,444 | | | | 13,336 | | JPMorgan Chase & Co. Inc. |

| 2/22/11 | | Crucell NV | | | 6,400 | | | | 200,978 | | | | (6,465 | ) | JPMorgan Chase & Co. Inc. |

| 5/2/11 | | Hillgrove Resources Ltd. | | | 331,444 | | | | 96,019 | | | | (26,365 | ) | JPMorgan Chase & Co. Inc. |

| 2/28/11 | | Indophil Resources NL | | | 223,119 | | | | 234,766 | | | | 12,727 | | JPMorgan Chase & Co. Inc. |

| 12/31/11 | | Infigen Energy | | | 32,700 | | | | 18,449 | | | | (18,281 | ) | JPMorgan Chase & Co. Inc. |

| 3/31/11 | | ING Industrial Fund | | | 223,700 | | | | 120,530 | | | | 6,655 | | JPMorgan Chase & Co. Inc. |

| 12/31/11 | | Panasonic Electric Works Co. | | | 900 | | | | 11,713 | | | | (32 | ) | JPMorgan Chase & Co. Inc. |

| 8/31/11 | | Perpetual Ltd. | | | 3,600 | | | | 115,105 | | | | (15,870 | ) | JPMorgan Chase & Co. Inc. |

| 4/29/11 | | SANYO Electric Co., Ltd. | | | 94,300 | | | | 152,540 | | | | 2,119 | | JPMorgan Chase & Co. Inc. |

| 4/30/11 | | Whitehaven Coal Limited | | | 23,000 | | | | 158,771 | | | | 35,605 | | JPMorgan Chase & Co. Inc. |

| 2/15/11 | | Wellstream Holdings PLC | | | 10,700 | | | | 130,852 | | | | 3,101 | | JPMorgan Chase & Co. Inc. |

| 3/31/11 | | AMP Ltd. | | | (15,259 | ) | | | (82,839 | ) | | | (5,145 | ) | JPMorgan Chase & Co. Inc. |

| 4/29/11 | | Panasonic Corp. | | | (1,771 | ) | | | (25,024 | ) | | | (700 | ) | JPMorgan Chase & Co. Inc. |

| | | | | | | | | | | | | $ | 58,374 | | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2010

| ASSETS: | | | | | | |

| Investments, at value (Cost $13,688,682) | | | | | $ | 13,775,241 | |

| Cash held in foreign currency | | | | | | 66,279 | |

| Deposits at brokers | | | | | | 2,122,761 | |

| Receivable from brokers | | | | | | 1,942,083 | |

| Receivable for investments sold | | | | | | 1,521,838 | |

| Receivable for forward currency exchange contracts | | | | | | 46,162 | |

| Receivable for swap contracts | | | | | | 58,374 | |

| Receivable from the investment adviser | | | | | | 11,124 | |

| Dividends and interest receivable | | | | | | 1,765 | |

| Swap dividends receivable | | | | | | 2,133 | |

| Prepaid expenses and other receivables | | | | | | 3,360 | |

| Total Assets | | | | | | 19,551,120 | |

| LIABILITIES: | | | | | | | |

| Securities sold short, at value (proceeds of $1,942,083) | | $ | 2,016,264 | | | | | |

| Written option contracts, at value (premiums received $244,754) | | | 281,569 | | | | | |

| Payable to custodian | | | 1,494,197 | | | | | |

| Payable for forward currency exchange contracts | | | 91,967 | | | | | |

| Payable for swap interest | | | 696 | | | | | |

| Payable for investments purchased | | | 804,908 | | | | | |

| Payable for fund shares redeemed | | | 320 | | | | | |

| Payable to independent trustees | | | 1,440 | | | | | |

| Dividends and interest payable | | | 10 | | | | | |

| Accrued expenses and other liabilities | | | 42,421 | | | | | |

| Total Liabilities | | | | | | | 4,733,792 | |

| NET ASSETS | | | | | | $ | 14,817,328 | |

| NET ASSETS CONSIST OF: | | | | | | | | |

| Accumulated undistributed net investment loss | | | | | | $ | (17,904 | ) |

| Accumulated undistributed net realized gain on investments, securities | | | | | | | | |

| sold short, written option contracts expired or closed, swap contracts, | | | | | | | | |

| foreign currency translation and forward currency exchange contracts | | | | | | | 602,715 | |

| Net unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments | | | 86,559 | | | | | |

| Securities sold short | | | (74,181 | ) | | | | |

| Written option contracts | | | (36,815 | ) | | | | |

| Swap contracts | | | 58,374 | | | | | |

| Forward currency exchange contracts | | | (45,805 | ) | | | | |

| Net unrealized depreciation | | | | | | | (11,868 | ) |

| Paid-in capital | | | | | | | 14,244,385 | |

| Total Net Assets | | | | | | $ | 14,817,328 | |

| NET ASSET VALUE and offering price per share, | | | | | | | | |

| ($14,817,328 / 1,343,196 shares of beneficial interest outstanding) | | | | | | $ | 11.03 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2010

| INVESTMENT INCOME: | | | | | | |

| Interest | | | | | $ | 27,609 | |

| Dividend income on long positions (net of foreign withholding taxes of $2,473) | | | | | | 80,689 | |

| Total investment income | | | | | | 108,298 | |

| EXPENSES: | | | | | | | |

| Investment advisory fees | | $ | 138,780 | | | | | |

| Transfer agent and shareholder servicing agent fees | | | 29,237 | | | | | |

| Federal and state registration fees | | | 850 | | | | | |

| Professional fees | | | 120,020 | | | | | |

| Trustees’ fees and expenses | | | 5,663 | | | | | |

| Custody fees | | | 2,700 | | | | | |

| Administration fees | | | 38,728 | | | | | |

| Fund accounting expense | | | 44,281 | | | | | |

| Reports to shareholders | | | 7,225 | | | | | |

| Miscellaneous expenses | | | 719 | | | | | |

| Borrowing expense on securities sold short | | | 44,051 | | | | | |

| Dividends on securities sold short | | | 152,007 | | | | | |

| Total expenses before expense waiver by adviser | | | | | | | 584,261 | |

| Less: Expense reimbursed by Adviser (Note 3) | | | | | | | (232,770 | ) |

| Net expenses | | | | | | | 351,491 | |

| NET INVESTMENT LOSS | | | | | | | (243,193 | ) |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | | | | | |

| Realized gain (loss) on: | | | | | | | | |

| Investments | | | 885,807 | | | | | |

| Securities sold short | | | (135,765 | ) | | | | |

| Written option contracts expired or closed | | | 174,710 | | | | | |

| Swap contracts | | | 252,960 | | | | | |

| Foreign currency translation | | | 803 | | | | | |

| Forward currency exchange contracts | | | (257,666 | ) | | | | |

| Net realized gain | | | | | | | 920,849 | |

| Change in unrealized appreciation / (depreciation) on: | | | | | | | | |

| Investments | | | (50,946 | ) | | | | |

| Securities sold short | | | 2,613 | | | | | |

| Written option contracts | | | (50,923 | ) | | | | |

| Swap contracts | | | 57,352 | | | | | |

| Foreign currency translation | | | (2,424 | ) | | | | |

| Forward currency exchange contracts | | | (53,861 | ) | | | | |

| Net unrealized depreciation | | | | | | | (98,189 | ) |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | | | | | 822,660 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | | | | $ | 579,467 | |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended | | | Year Ended | |

| | | December 31, 2010 | | | December 31, 2009 | |

| Net investment loss | | $ | (243,193 | ) | | $ | (133,417 | ) |

| Net realized gain on investments, securities sold short, | | | | | | | | |

| written option contracts expired or closed, swap contracts, | | | | | | | | |

| foreign currency translation and forward currency | | | | | | | | |

| exchange contracts | | | 920,849 | | | | 458,764 | |

| Change in unrealized appreciation (depreciation) | | | | | | | | |

| on investments, securities sold short, written option | | | | | | | | |

| contracts, swap contracts, foreign currency translation | | | | | | | | |

| and forward currency exchange contracts | | | (98,189 | ) | | | 362,955 | |

| Net increase in net assets resulting from operations | | | 579,467 | | | | 688,302 | |

| | | | | | | | | |

| Distributions to shareholders from: | | | | | | | | |

| Net investment income | | | — | | | | (305,678 | ) |

| Net realized gains | | | (303,267 | ) | | | (7,130 | ) |

| Total dividends and distributions | | | (303,267 | ) | | | (312,808 | ) |

| Net increase in net assets from | | | | | | | | |

| capital share transactions (Note 4) | | | 4,831,452 | | | | 4,436,488 | |

| Net increase in net assets | | | 5,107,652 | | | | 4,811,982 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 9,709,676 | | | | 4,897,694 | |

| End of year (including accumulated undistributed | | | | | | | | |

| net investment loss of $(17,904) | | | | | | | | |

| and $(27,721), respectively) | | $ | 14,817,328 | | | $ | 9,709,676 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

FINANCIAL HIGHLIGHTS

| | | Year Ended December 31, | |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| Per Share Data: | | | | | | | | | | | | | | | |

| Net Asset Value, beginning of year | | $ | 10.70 | | | $ | 9.88 | | | $ | 9.96 | | | $ | 11.56 | | | $ | 10.96 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.02 | (1) | | | (0.35 | )(1) | | | (0.13 | )(2) | | | 0.03 | (1) | | | (0.02 | )(1) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain on investments | | | 0.54 | | | | 1.53 | | | | 0.50 | | | | 0.20 | | | | 1.83 | |

| Total from investment operations | | | 0.56 | | | | 1.18 | | | | 0.37 | | | | 0.23 | | | | 1.81 | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| Distributions from net investment income | | | — | | | | (0.35 | ) | | | — | | | | — | | | | — | |

| Distributions from net realized gains | | | (0.23 | ) | | | (0.01 | ) | | | (0.45 | ) | | | (1.83 | ) | | | (1.21 | ) |

| Total distributions | | | (0.23 | ) | | | (0.36 | ) | | | (0.45 | ) | | | (1.83 | ) | | | (1.21 | ) |

| Net Asset Value, end of year | | $ | 11.03 | | | $ | 10.70 | | | $ | 9.88 | | | $ | 9.96 | | | $ | 11.56 | |

| Total Return | | | 5.30 | % | | | 11.80 | % | | | 3.79 | %(3) | | | 2.11 | % | | | 16.55 | % |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | | $ | 14,817 | | | $ | 9,710 | | | $ | 4,898 | | | $ | 4,484 | | | $ | 3,794 | |

| Ratio of operating expenses to average | | | | | | | | | | | | | | | | | | | | |

| net assets including interest expense, | | | | | | | | | | | | | | | | | | | | |

| borrowing expense on securities sold short | | | | | | | | | | | | | | | | | | | | |

| and dividends on securities sold short: | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | 5.26 | % | | | 7.82 | % | | | 7.85 | % | | | 8.53 | % | | | 8.06 | % |

| After expense waiver | | | 3.16 | % | | | 4.28 | % | | | 2.98 | % | | | 4.27 | % | | | 3.43 | % |

| Ratio of operating expenses to average | | | | | | | | | | | | | | | | | | | | |

| net assets excluding interest expense, | | | | | | | | | | | | | | | | | | | | |

| borrowing expense on securities sold short | | | | | | | | | | | | | | | | | | | | |

| and dividends on securities sold short: | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | 3.50 | % | | | 4.94 | % | | | 6.27 | % | | | 5.66 | % | | | 6.03 | % |

| After expense waiver | | | 1.40 | % | | | 1.40 | % | | | 1.40 | % | | | 1.40 | % | | | 1.40 | % |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | (4.29 | )% | | | (5.69 | )% | | | (6.28 | )% | | | (5.52 | )% | | | (5.99 | )% |

| After expense waiver | | | (2.19 | )% | | | (2.15 | )% | | | (1.41 | )% | | | (1.26 | )% | | | (1.36 | )% |

Portfolio turnover rate(4) | | | 187.18 | % | | | 373.07 | % | | | 743.72 | % | | | 418.22 | % | | | 555.55 | % |

| | | | | | | | | | | | | | | | | | | | | |

| (1) | Net investment income per share is calculated using ending balance after consideration of adjustments for permanent book and tax differences. |

| (2) | Net investment income (loss) per share is calculated using ending balances prior to consideration of adjustments for permanent book and tax differences. |

| (3) | The return would have been 3.06% without the expense credit from the service provider. |

| (4) | The numerator for the portfolio turnover rate includes the lesser of purchases or sales (excluding securities sold short). The denominator includes the average long positions throughout the period. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS

December 31, 2010

Note 1 — ORGANIZATION

The Merger Fund VL (the “Fund”) is a no-load, open-end, non-diversified investment company organized as a statutory trust under the laws of Delaware on November 22, 2002, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund commenced operations on May 26, 2004. The investment objective of the Fund is to seek to achieve capital growth by engaging in merger arbitrage. Merger arbitrage is a highly specialized investment approach generally designed to profit from the successful completion of proposed mergers, takeovers, tender offers, leveraged buyouts, liquidations and other types of corporate reorganizations. Shares of the Fund are not offered directly to the public. The Fund’s shares are currently offered only to separate accounts funding variable annuity and variable life insurance contracts. At December 31, 2010, 96.7% of the shares outstanding of the Fund were owned by three insurance companies.

Note 2 — SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles.

Securities listed on the NASDAQ Global Market and the NASDAQ Global Select Market are valued at the NASDAQ Official Closing Price (“NOCP”). Other listed securities are valued at the last sale price on the exchange on which such securities are primarily traded or, in the case of options, at the last sale price. Securities not listed on an exchange and securities for which there are no transactions are valued at the average of the closing bid and asked prices. When pricing options, if no sales are reported or if the last sale is outside the bid and asked parameters, the higher of the intrinsic value of the option or the mean between the last reported bid and asked prices will be used. Securities for which there are no such valuations are valued at fair value as determined in good faith by management under the supervision of the Board of Trustees. The Adviser (as defined herein) reserves the right to value securities, including options, at prices other than last-sale prices, intrinsic value prices, or the average of closing bid and asked prices, when such prices are believed unrepresentative of fair market value as determined in good faith by the Adviser. When fair-value pricing is employed, the prices of securities used by the Fund to calculate its NAV may differ from quoted or published prices for the same securities. In addition, due to the subjective and variable nature of fair-value pricing, it is possible that the value determined for a particular asset may be materially different from the value realized upon such asset’s sale. At December 31, 2010, the Fund did not have any fair valued securities. Investments in United States government securities (other than short-term securities) are valued at the average of the quoted bid and asked prices in the over-the-counter market. Short-term investments are carried at amortized cost, which approximates market value.

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS (continued)

December 31, 2010

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

The Fund has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determination. Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| | Level 1 — | Quoted prices in active markets for identical securities. |

| | Level 2 — | Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| | Level 3 — | Model derived valuations in which one or more significant inputs or significant value drivers are unobservable. Unobservable inputs are those inputs that reflect the Fund’s own assumptions that market participants would use to price the asset or liability based on the best available information. |

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following tables provide the fair value measurements of applicable Fund assets and liabilities by level within the fair value hierarchy for the Fund as of December 31, 2010. These assets and liabilities are measured on a recurring basis.

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | Assets | | | | | | | | | | | | |

| | Common Stocks* | | $ | 13,533,835 | | | $ | — | | | $ | — | | | $ | 13,533,835 | |

| | Warrants | | | — | | | | 3,151 | | | | — | | | | 3,151 | |

| | Corporate Bonds | | | — | | | | 222,107 | | | | — | | | | 222,107 | |

| | Purchased Options | | | 16,148 | | | | — | | | | — | | | | 16,148 | |

| | Swap Contracts** | | | — | | | | 58,374 | | | | — | | | | 58,374 | |

| | Forward Currency Exchange Contracts** | | | — | | | | 46,162 | | | | — | | | | 46,162 | |

| | Liabilities | | | | | | | | | | | | | | | | |

| | Securities Sold Short | | $ | 1,963,183 | | | $ | 53,081 | | | $ | — | | | $ | 2,016,264 | |

| | Written Options | | | 281,569 | | | | — | | | | — | | | | 281,569 | |

| | Forward Currency Exchange Contracts** | | | — | | | | 91,967 | | | | — | | | | 91,967 | |

| * | Please refer to the Schedule of Investments to view common stocks segregated by industry type. |

| ** | Swap contracts and forward currency exchange contracts are valued at the net unrealized depreciation on the instrument. |

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS (continued)

December 31, 2010

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

Level 3 Reconciliation Disclosure

Following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value.

| | | | Investments | |

| | Description | | in Securities | |

| | Balance as of December 31, 2009 | | $ | 7,869 | |

| | Accrued discounts/premiums | | | — | |

| | Realized gain (loss) | | | 317 | |

| | Change in unrealized appreciation (depreciation) | | | — | |

| | Net purchases (sales) | | | (8,186 | ) |

| | Transfers in and/or out of Level 3 | | | — | |

| | Balance as of December 31, 2010 | | $ | — | |

The Fund did not invest in new Level 3 Securities at December 31, 2010. There were no transfers into or out of Level 1 or 2 during the period.

The Fund may sell securities or currencies short for economic hedging purposes. For financial statement purposes, an amount equal to the settlement amount is initially included in the Statement of Assets and Liabilities as an asset and an equivalent liability. The amount of the liability is subsequently marked-to-market to reflect the current value of the short position. Subsequent fluctuations in the market prices of securities or currencies sold, but not yet purchased, may require purchasing the securities or currencies at prices which may differ from the market value reflected on the Statement of Assets and Liabilities. Short sale transactions result in off balance sheet risk because the ultimate obligation may exceed the related amounts shown in the Statement of Assets and Liabilities. The Fund will incur a loss if the price of the security increases between the date of the short sale and the date on which the Fund replaces the borrowed security. The Fund’s loss on a short sale is potentially unlimited because there is no upward limit on the price a borrowed security could attain.

The Fund is liable for any dividends payable on securities while those securities are sold short. Until the security is replaced, the Fund is required to pay to the lender any income earned which is recorded as an expense by the Fund. As collateral for its securities sold short, the Fund is required under the 1940 Act to maintain assets consisting of cash, cash equivalents or liquid securities. These assets are required to be adjusted daily to reflect changes in the value of the securities or currencies sold short.

| C. | Transactions with Brokers for Securities Sold Short |

The Fund’s receivables from brokers for proceeds on securities sold short and deposit at brokers for securities sold short are with two securities dealers. The Fund does not require the brokers to maintain collateral in support of the receivable from the brokers for proceeds on securities sold short. The Fund maintains cash deposits at brokers beyond the receivable for short sales. These cash deposits are presented as deposits at brokers on the Statement of Assets and Liabilities.

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS (continued)

December 31, 2010

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

No provision for federal income taxes has been made since the Fund has complied to date with the provisions Subchapter M of the Internal Revenue Code applicable to regulated investment companies and intends to continue to so comply in future years and to distribute investment company net taxable income and net capital gains to shareholders. Additionally, the Fund intends to make all required distributions to avoid federal excise tax.

The Fund has reviewed all open tax years and major jurisdictions and concluded that there is no impact on the Fund’s net assets and there is no tax liability resulting from unrecognized tax benefits relating to income tax positions taken or expected to be taken on a tax return. The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. As of December 31, 2010, open Federal and New York tax years include the tax years ended December 31, 2007 through 2010. The Fund has no examination in progress.

| E. | Written Option Contracts |

The Fund is subject to equity price risk in the normal course of pursuing its investment objectives. The Fund writes (sells) call options to hedge portfolio investments. Uncovered put options can also be written by the Fund as part of a merger arbitrage strategy involving a pending corporate reorganization. When the Fund writes (sells) an option, an amount equal to the premium received by the Fund is included in the Statement of Assets and Liabilities as an asset and an equivalent liability. The amount of the liability is subsequently marked-to-market to reflect the current value of the written option contracts. By writing an option, the Fund may become obligated during the term of the option to deliver or purchase the securities underlying the option at the exercise price if the option is exercised. Written option contracts are valued at the higher of the intrinsic value of the option or the last sales price reported on the date of valuation. If no sale is reported or if the last sale is outside the parameters of the closing bid and asked prices, the written option contract is valued at the higher of the intrinsic value of the option or the mean of the last reported bid and asked prices on the day of valuation. When an option expires on its stipulated expiration date or the Fund enters into a closing purchase transaction, the Fund realizes a gain or loss if the cost of the closing purchase transaction differs from the premium received when the option was sold without regard to any unrealized gain or loss on the underlying security, and the liability related to such option is eliminated. When an option is exercised, the premium originally received decreases the cost basis of the security (or increases the proceeds on a sale of the security), and the Fund realizes a gain or loss from the sale of the underlying security. With written option contracts, there is minimal counterparty credit risk to the Fund since written option contracts are exchange traded.

The Fund is subject to equity price risk in the normal course of pursuing its investment objectives. The Fund purchases put or call options to hedge portfolio investments. Premiums paid for option contracts purchased are included in the Statement of Assets and Liabilities as an asset. Option contracts are valued daily at the higher of the intrinsic value of the option or the last sales price reported

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS (continued)

December 31, 2010

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

on the date of valuation. If no sale is reported or if the last sale is outside the parameters of the closing bid and asked prices, the option contract purchased is valued at the higher of the intrinsic value of the option or the mean between the last reported bid and asked prices on the day of valuation. When option contracts expire or are closed, realized gains or losses are recognized without regard to any unrealized gains or losses on the underlying securities. With purchased options, there is minimal counterparty credit risk to the Fund since purchased options are exchange traded.

| G. | Forward Currency Exchange Contracts |

The Fund is subject to foreign currency exchange rate risk in the normal course of pursuing its investment objectives. The Fund may use forward currency exchange contracts to hedge against changes in the value of foreign currencies. The Fund may enter into forward currency exchange contracts obligating the Fund to deliver or receive a currency at a specified future date. Forward contracts are valued daily, and unrealized appreciation or depreciation is recorded daily as the difference between the contract exchange rate and the closing forward rate applied to the face amount of the contract. A realized gain or loss is recorded at the time the forward contract expired. With forward contracts, there is minimal counterparty credit risk to the Fund since forward contracts are exchange traded.

The use of forward currency exchange contracts does not eliminate fluctuations in the underlying prices of the Fund’s investment securities; however, it does establish a rate of exchange that can be achieved in the future. The use of forward currency exchange contracts involves the risk that anticipated currency movements will not be accurately predicted. A forward currency exchange contract would limit the risk of loss due to a decline in the value of a particular currency; however it would also limit any potential gain that might result should the value of the currency increase instead of decrease. These contracts may involve market risk in excess of the amount of receivable or payable reflected on the Statement of Assets and Liabilities.

The Fund is subject to equity price risk and interest rate risk in the normal course of pursuing its investment objectives. The Fund has entered into both long and short equity swap contracts with multiple broker- dealers. A long equity swap contract entitles the Fund to receive from the counterparty any appreciation and dividends paid on an individual security, while obligating the Fund to pay the counterparty any depreciation on the security as well as interest on the notional amount of the contract at a rate equal to LIBOR plus 25 to 100 basis points. A short equity swap contract obligates the Fund to pay the counterparty any appreciation and dividends paid on an individual security, while entitling the Fund to receive from the counterparty any depreciation on the security as well as interest on the notional value of the contract at a rate equal to LIBOR less 25 to 100 basis points.

The Fund may also enter into equity swap contracts whose value is determined by the spread between a long equity position and a short equity position. This type of swap contract obligates the Fund to pay the counterparty an amount tied to any increase in the spread between the two securities over the term of the contract. The Fund is also obligated to pay the counterparty any dividends paid on the short equity holding as well as any net financing costs. This type of swap contract entitles the Fund

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS (continued)

December 31, 2010

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

to receive from the counterparty any gains based on a decrease in the spread as well as any dividends paid on the long equity holding and any net interest income.

Fluctuations in the value of an open contract are recorded daily as a net unrealized gain or loss. The Fund will realize a gain or loss upon termination or reset of the contract. Either party, under certain conditions, may terminate the contract prior to the contract’s expiration date.

Credit risk may arise as a result of the failure of the counterparty to comply with the terms of the contract. The Fund considers the creditworthiness of each counterparty to a contract in evaluating potential credit risk quarterly. The counterparty risk to the Fund is limited to the net unrealized gain, if any, on the contract, along with dividends receivable on long equity contracts and interest receivable on short equity contracts. Additionally, risk may arise from unanticipated movements in interest rates or in the value of the underlying securities.

| I. | Distributions to Shareholders |

Dividends from net investment income and net realized capital gains, if any, are declared and paid annually. Income and capital gain distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles. These differences are due primarily to wash sale-loss deferrals, constructive sales, straddle-loss deferrals, adjustments on swap contracts, and unrealized gains or losses on Section 1256 contracts, which were realized, for tax purposes, at December 31, 2010. Accordingly, reclassifications are made within the net asset accounts for such amounts, as well as amounts related to permanent differences in the character of certain income and expense items for income tax and financial reporting purposes. The Fund increased net investment income by $253,010, reduced realized accumulated gains by $253,010, and did not change paid-in capital.

Investing in securities of foreign companies and foreign governments involves special risks and considerations not typically associated with investing in U.S. companies and the U.S. government. These risks include revaluation of currencies and adverse political and economic developments. Moreover, securities of many foreign companies and foreign governments and their markets may be less liquid and their prices more volatile than those of securities of comparable U.S. companies and the U.S. government.

| K. | Foreign Currency Translations |

The books and records of the Fund are maintained in U.S. dollars. Foreign currency transactions are translated into U.S. dollars on the following basis: (i) market value of investment securities, assets and liabilities at the daily rates of exchange, and (ii) purchases and sales of investment securities, dividend and interest income and certain expenses at the rates of exchange prevailing on the respective dates of such transactions. For financial reporting purposes, the Fund does not isolate changes in the exchange rate of investment securities from the fluctuations arising from changes in the market prices of securities. However, for federal income tax purposes, the Fund does isolate and treat as ordinary income the effect of changes in foreign exchange rates on realized gain or loss from the sale of investment securities and payables and receivables arising from trade-date and settlement-date differences.

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS (continued)

December 31, 2010

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

The Fund may engage in security transactions on a when-issued or delayed-delivery basis. Although the payment and interest terms of these securities are established at the time the Fund enters into the agreement, these securities may be delivered for cash proceeds at a future date. During this period, the securities are subject to market fluctuation. The Fund records sales of when-issued securities and reflects the values of such securities in determining net asset value in the same manner as other open short-sale positions. When delayed-delivery purchases are outstanding, the Fund segregates and maintains at all times cash, cash equivalents or other liquid securities in an amount at least equal to the market value.

The Fund considers highly liquid temporary cash investments purchased with an original maturity of less than three months to be cash equivalents. Cash equivalents are included in short-term investments on the Schedule of Investments as well as in investments on the Statement of Assets and Liabilities.

| N. | Guarantees and Indemnifications |

In the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Investment and shareholder transactions are recorded on the trade date. Realized gains and losses from security transactions are recorded on the identified cost basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest is accounted for on the accrual basis and includes amortization of premiums and discounts on the interest method. Expenses include $44,051 of borrowing expense on securities sold short. The Fund may utilize derivative instruments including options, forward currency exchange contracts and other instruments with similar characteristics to the extent that they are consistent with the Fund’s investment objectives and limitations. The use of these instruments may involve additional investment risks, including the possibility of illiquid markets or imperfect correlation between the value of the instruments and the underlying securities.

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS (continued)

December 31, 2010

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

The Fund helps manage counterparty credit risk by entering into agreements only with counterparties the Adviser believes have the financial resources to honor their obligations and by having the Adviser monitor the financial stability of the counterparties. Collateral pledges are monitored and subsequently adjusted if and when the valuations fluctuate, either up or down, by at least the predetermined threshold amount.

Financial assets and liabilities as well as cash collateral received and posted are offset by the counterparty, and the net amount is reported in the consolidated statement of financial condition when the Fund believes there exists a legally enforceable right to set off the recognized amounts.

The Fund has adopted authoritative standards regarding disclosure about derivatives and hedging activities and how they affect the Fund’s Statement of Assets and Liabilities and Statement of Operations. For the year ended December 31, 2010: long option contracts (1,484 contracts) were purchased and $243,412 premiums were paid, written option contracts (8,275 contracts) were opened and $1,442,104 premiums were received, equity swap contracts were opened for a notional value of $2,721,987 and closed for a notional value of $1,716,305 and an average of 18 forward currency exchange contract positions were open during the year.

Statement of Assets and Liabilities:

Fair values of derivative instruments as of December 31, 2010:

| | | Asset Derivatives | | | Liability Derivatives | |

| | | Balance | | | | | | Balance | | | | |