UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21279

The Merger Fund VL

(Exact name of registrant as specified in charter)

100 Summit Lake Drive

Valhalla, New York 10595

(Address of principal executive offices) (Zip code)

Roy Behren and Michael T. Shannon

100 Summit Lake Drive

Valhalla, New York 10595

(Name and address of agent for service)

1-800-343-8959

Registrant's telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: December 31, 2014

Item 1. Reports to Stockholders.

December 31, 2014

THE MERGER FUND VL

| | Total Firm AUM: | $5.8 billion |

| STANDARDIZED | Strategy Assets: | |

| PERFORMANCE SUMMARY | Merger Arbitrage1 | $5.5 billion |

| As of December 31, 2014 | Multi-Event2 | $296.7 million |

| | | Average Annual Total Return (%) |

| Merger Arbitrage | QTD | YTD | 1 YR | 3 YR | 5 YR | 10 YR | Life |

| The Merger Fund | | | | | | | |

| (Investor) | -0.56 | 1.43 | 1.43 | 2.88 | 2.74 | 3.41 | 6.60 |

| The Merger Fund | | | | | | | |

| (Institutional) | -0.43 | 1.63 | 1.63 | n/a | n/a | n/a | 2.71 |

| | Annual Operating Expense Ratio (%)3 |

| | Gross | Net | Expenses Before | | |

| Merger Arbitrage | Expense | Expense | Investment Related | Performance | Fund |

| | Ratio | Ratio3 | Expenses4 | Inception | AUM |

| The Merger Fund | | | | | |

| (Investor) | 1.65% | 1.52% | 1.26% | 01/31/1989 | $4.1 b |

| The Merger Fund | | | | | |

| (Institutional) | 1.48% | 1.35% | 1.09% | 08/01/2013 | $1.3 b |

| | Average Annual Total Return (%) |

| Insurance | | | | | | | |

| Dedicated Funds | QTD | YTD | 1 YR | 3 YR | 5 YR | 10 YR | Life |

| The Merger Fund VL | -0.54 | 1.37 | 1.37 | 2.58 | 2.78 | 5.17 | 5.50* |

| | Annual Operating Expense Ratio (%)3 |

| | | | Total Annual | | |

| Insurance | Gross | Net | Operating Expenses | Performance | Fund |

| Dedicated Funds | Expense | Expense | After Expense | Inception | AUM |

| | Ratio | Ratio | Reimbursement5 | | |

| The Merger Fund VL | 3.00 | 1.69 | 1.40 | 05/24/2004 | $23 m |

| | Average Annual Total Return (%) |

| Multi-Event | QTD | YTD | 1 YR | 3 YR | 5 YR | 10 YR | Life |

| Event Driven Fund | 0.16 | 3.87 | 3.87 | n/a | n/a | n/a | 3.87 |

| | Annual Operating Expense Ratio (%)3 |

| | | | Total Annual | | |

| | Gross | Net | Operating Expenses | Performance | Fund |

| Multi-Event | Expense | Expense | After Expense | Inception | AUM |

| | Ratio | Ratio | Reimbursement6 | | |

| Event Driven Fund | 2.51 | 1.98 | 1.74 | 01/02/2014 | $13 m |

| * | Performance is calculated for the period from June 1, 2004, the first full month of the life of the Fund. |

| YTD performance is not annualized. Performance data quoted represent past performance; past performance does not guarantee future results. The performance results portrayed herein reflect the reinvestment of all interest, dividends and distributions. The investment return and principal |

value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data included herein for periods prior to 2011 reflect that of Westchester Capital Management, Inc., the Fund’s prior investment advisor. Messrs. Behren and Shannon, the Fund’s current portfolio managers, have served as co-portfolio managers of the Fund since 2007. Performance data current to the most recent month-end may be obtained by calling (800) 343-8959 or by visiting www.westchestercapitalfunds.com. Short term performance, in particular, is not a good indication of WCEIX’s future performance, and an investment should not be made based solely on returns.

1Includes USD 81.7 million in private funds advised by Westchester Capital Management, LLC’s affiliated invested advisor; 2includes USD 285 million in sub-advised funds. 3Expense ratios are as of a fund’s most recent prospectus. Prospectus dates vary among funds. For The Merger Fund, expense ratios are as of the April 30, 2014. The Advisor has agreed to reduce its management fee until December 31, 2015. For The Merger Fund VL, expense ratios are as of the April 28, 2014 prospectus. For the Event-Driven Fund, expense ratios are as of the December 11, 2013 prospectus. 4Investment related expenses include acquired fund fees and expenses, interest expense, and borrowing expense and dividend expense on securities sold short. 5The Merger Fund VL: The Adviser has contractually agreed to waive its investment advisory fee and to reimburse the Fund for other ordinary operating expenses to the extent necessary to limit ordinary operating expenses to an amount not to exceed 1.40%. The expense limitation is expected to apply until December 31, 2015 except that it may be terminated by the Board of Trustees at any time. 6Event-Driven Fund: The Adviser has contractually agreed to waive its investment advisory fee and to reimburse the Fund for other ordinary operating expenses to the extent necessary to limit ordinary operating expenses to an amount not to exceed 1.74%. The expense limitation is expected to apply until April 30, 2016, except that it may be terminated by the Board of Trustees at any time.

| MARKET INDICES | QTD | YTD | 1 YR | 3 YR | 5 YR | 10 YR |

| Morningstar | | | | | | |

| Category Average: | | | | | | |

| Market Neutral | -0.43% | 0.76% | 0.76% | 1.44% | 1.25% | 1.89% |

| Barclays Aggregate | | | | | | |

| Bond Index | 1.78% | 5.94% | 5.94% | 2.66% | 4.46% | 4.71% |

| MSCI World Index | 1.12% | 5.50% | 5.50% | 16.13% | 10.81% | 6.61% |

| S&P 500 Index | 4.93% | 13.69% | 13.69% | 20.41% | 15.45% | 7.67% |

| HFRX Merger | | | | | | |

| Arbitrage Index | 1.43% | 2.19% | 2.19% | 2.38% | 2.12% | 4.14% |

| HFRX Event | | | | | | |

| Driven Index | -5.45% | -4.06% | -4.06% | 5.00% | 2.34% | 1.95% |

Fellow Shareholders,

The final quarter of 2014 was unusual in many respects. U.S. equities were again the best performing asset class for the quarter but realized volatility spiked significantly.1 During the 4th quarter, the S&P 500 dropped almost 10% at one point, but managed to rally back to finish the quarter ahead by 4.93%. With the S&P 500 tacking on 32% in 2013 and having nearly tripled since the market bottom in March 2009, many expected muted or even negative returns in 2014. Confounding the experts once again, Morningstar calculated that the S&P 500 Index outperformed 80% of active managers in 2014, rising 13.69% and capping three years of consecutive double-digit returns for the Index—the first time since 1995-1999.

Investors similarly expected a rough time for U.S. Treasuries and other rate-sensitive instruments as the Fed began tapering its bond-buying program. Many had predicted that U.S. interest rates had bottomed and there was only one direction left to go—higher. However, somebody switched the script and rates sunk even lower during 2014, with the 10-year ending the year at 2.17%, down from 3.0% a year earlier (note: rates have dropped further as of the date of this letter, astoundingly bringing the 10-year yield to sub-1.8%). As we know, bonds gain value when rates sink, so the Barclays Aggregate Bond Index was a beneficiary, returning 1.78% for the quarter and 5.94% for the year.

Hedge fund strategies, on the other hand, diverged from equity and fixed income performance. The HFRX Merger Arbitrage Index and HFRX Event-Driven Index significantly underperformed major equity benchmarks, causing some pundits to question the value proposition for alternative investments. The spurious comparison between equity market and alternative investments is easy to make but it is important to keep things in perspective. Alternative investments often use short positions and portfolio hedges to try to minimize volatility and maximize risk-adjusted returns. Investors should not be looking for alternative strategies to beat the S&P, but instead to diversify their traditional equity and bond exposure with a complementary risk/return profile. They should be viewed as a tool to help hedge the volatility that may accompany directional investing. We like to think of it as deflating the ball a little—it might not travel as far, but it will be easier to catch.

__________

1 The VIX hit a low of 10.33 on July 3 and tripled to a high of 31.05 on October 15.

In any event, with increased equity volatility and global macroeconomic developments including energy volatility, Middle East unrest, and European economic sluggishness all potentially adding risk, 2015 could be a critical period for liquid alternatives to demonstrate their value. We have successfully navigated these types of periods before and hope to be considered as a manager who is positioned to weather the anticipated capital market turbulence.

STRATEGY UPDATES

Merger Activity

2014 was a busy year for strategic corporate events as a surge in boardroom confidence, continued low interest rates, and a rising stock market resulted in the highest level of deal-making since 2007. As discussed in our prior letter, this trend began in late 2013, as companies began to explore various types of transactions in addition to run-of-the-mill (referred to in the hedge fund community as “plain vanilla”) mergers. Activist investors (at both the buyer and the target company) acted as kerosene on the fire. Investors rewarded companies that opportunistically deployed capital in mergers or even split themselves into independent entities. A metric called deal value creation (which tracks stock price movements before and after deal announcements to measure shareholder value that has been created) recently hit an all-time high with over 80% of acquiring company stock prices reacting positively after announcement.2

Merger activity picked up in 2014 and the size of transactions followed suit, with the big getting bigger as some of the world’s giant corporations rolled up large competitors, from Comcast Corp.’s $68 billion deal for Time Warner Cable Inc. in the first quarter to last month, when Halliburton Co. and Actavis Plc announced a combined $100 billion in takeovers on the same day. In fact, megadeals dominated the scene with approximately 94 deals worth more than $5 billion each, an 81% increase over 2013.3 Mel Brooks would certainly appreciate the current environment.

__________

| 2 | MKM Partners, Event-Driven Research: Weekly Report, December 5, 2014 |

| 3 | Allen & Overy, M&A Index | 2014 |

Among public deals with an equity value of $400 million or greater (our typical universe of deals) the average size was $7.1 billion, well ahead of the previous record of $5.2 billion in 1998.4 The re-emergence of megamergers has been accompanied by increased volatility, which have widened deal spreads. Average transaction spreads increased throughout the year from approximately 3% in Q1 to over 7% in Q4, reflecting not just increased risk but increased risk aversion by investors. Many large deals encountered challenges from antitrust scrutiny, to oil price concerns, to the government’s battle against tax inversion transactions (re-domiciling offshore)—sometimes resulting in terminated or delayed transactions. The most glaring example is AbbVie Inc.’s decision to walk away from its $55 billion purchase of Shire Plc in October after the U.S. Treasury proposed rules limiting the attractiveness of inversions. Ironically, we and most other arbitrage/event managers thought that the Shire deal was highly likely to successfully complete. The merger agreement was tight and AbbVie management went out of their way to emphasize that the transaction was highly strategic and not merely driven by the tax benefits of moving offshore. Unfortunately the Treasury department’s bluster and proposed rulemaking made management nervous about possible additional shoes to drop. Many event-driven funds were caught in the carnage, some of which ended the year with negative performance even as equities surged.

According to a recent Reuters article, “Following the Shire deal collapse, merger arbitrage spreads, or the difference between a company’s share price and the price at which it may be bought, …. widened by 2.5 percent on average as a number of hedge funds liquidated positions, presenting an investment opportunity for others.”5 Additionally, equity investors were caught in two mini-corrections, dropping the S&P 500 Index by almost 8% in October and 5% in December. As discussed in our Q3 letter, we were able to utilize the increased volatility by adding to our highest-conviction investments, benefiting from our diversification discipline and measured approach. Our conservative nature caused us to be smaller than most of our peers in the Shire transaction, but by living to fight

__________

| 4 | U.S. M&A Review: 2014 and 4Q 2014, UBS |

| 5 | Reuters, Scuttled deals worth $580 billion put hedge funds on back foot, November 13, 2014 |

another day, we were able to avoid a year-destroying drawdown and deploy capital set aside for market and arbitrage dislocations.

We are optimistic that merger and acquisition (“M&A”) activity will continue to rebound, as it appears that the deal pipeline is as full as the world’s current oil pipeline.

Portfolio Performance Summary

The Merger Fund® ended the year ahead by 1.43%, after losing money for only the 21st time in 104 quarters. The Merger Fund VL, its insurance-dedicated fund counterpart, gave back 0.54% finishing the year up 1.37%.

The Fund ended the year 95% invested and held positions in approximately 106 deals, with one broken deal during the quarter—the collapse of UK drugmaker Shire’s acquisition of U.S. peer AbbVie, discussed above. We added 14 new positions in Q4, including deals in Canada (Brookfield Residential Properties Inc. being bought by majority-owner Brookfield Asset Management Inc.), France (Lafarge SA acquisition by Holcim Ltd.) and Germany (E.ON SE’s public spin-off of its Power Generation, Global Energy Trading, and Exploration assets). Deal market capitalizations varied from the $650 mm purchase of QEP Midstream Partners, LP to the $28 bln acquisition of oil service company Baker Hughes Inc. by Halliburton Co. Seven deals were in excess of $5 bln, including E.ON ($34 bln USD), Baker Hughes ($28 bln), Lafarge ($19.8 bln USD), CareFusion Corp/Becton Dickinson and Co. ($11.5 bln), Cubist Pharmaceuticals, Inc./Merck &CO., Inc. ($7.7 bln), and Covance Inc./Laboratory Corp. of America ($5.7 bln). Additionally, a legacy position for our funds and the largest deal by far was Actavis Plc’s $67 bln purchase of Allergan Inc., announced in November in a successful defensive maneuver by Allergan against a hostile bid from the Valeant Pharmaceuticals/Pershing Square group.

The Fund benefited from its wide diversification. Although 32 positions produced negative marks, winners outnumbered losers by a 2:1 ratio. Aside from the Fund’s 98 basis point loss in Shire, the remainder of the top ten detractors from performance ranged from 27 basis points to 8 basis points. The top 10 winners for the quarter contributed anywhere from 7 bps to 34 bps, with Allergan being the biggest winner as the bidding war finally came to an end. The majority of the transactions in the portfolio were strategic in nature with very few highly-levered private equity deals.

More than $100 bln worth of transactions were completed during the quarter, led by the gigantic $52 bln (enterprise value) buy-in of Kinder Morgan Energy Partners LP by Kinder Morgan, Inc., with a Secretariat-like

lead over the $14.5 bln buyout of Canadian Tim Hortons, Inc. by Burger King Worldwide. Additional closed deals included TW Telecom/Inc./Level 3 Communications ($7.5 bln); URS Corporation/ADCOM Technology ($5.6 bln); gaming device manufacturer Bally Technologies Inc/Scientific Games Corp. on which we had the pleasure of engaging in some on-site research ($5.1 bln); Kodiak Oil & Gas Corp./Whiting Petroleum which was governed by an extremely tight merger agreement and closed despite a 50% drop in energy prices ($4 bln); Banco Santander Brasil SA/Banco Santander SA ($3.2 bln USD) and several others.

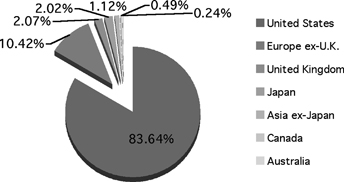

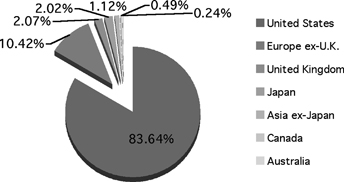

| SECTOR EXPOSURE | REGIONAL EXPOSURE |

| | |

|  |

| Type of Buyer | | | | | Deal Terms* | | |

| Strategic | 99.76% | | | | Cash | 31.01% | |

| Financial | 0.24% | | | | Stock and Stub(1) | 20.99% | |

| | | | | | Cash & Stock | 19.94% | |

| By Deal Type | | | | | Stock with Fixed Exchange Ratio | 11.96% | |

| Friendly | 92.60% | | | | Undetermined(2) | 10.20% | |

| Hostile | 7.40% | | | | Stock with Flexible | | |

| | | | | | Exchange Ratio (Collar) | 5.90% | |

| * | Data expressed as a percentage of long common stock, convertible, corporate and municipal bonds and swap contract positions as of December 31, 2014. |

| (1) | “Stub” includes assets other than cash and stock (e.g., escrow notes). |

| (2) | The compensation is undetermined because the compensation to be received (e.g., stock, cash, escrow notes, other) will be determined at later date, potentially at the option of the Fund’s investment adviser. |

Event-Driven

In addition to an upturn in megadeals, 2014 also continued the spin-off trend. Successful spinoffs have generated outsized shareholder returns, reinforcing the value of such “corporate optimization” and encouraging further spin-off activity. A recent New York Times article opined, “the studies repeatedly show that spinoffs and divestitures create value in both the short and long term. Some studies show that companies that are involved in a spinoff outperform the market by 15 to 30 percent over three years. Even the announcement of a spinoff seems to push stock prices higher. According to the Boston Consulting Group, `55% of all divestitures created value, as measured by the average cumulative abnormal return’ over seven days.”6

The value of spinoffs has risen dramatically since 2010 where the total market value of spun off assets was approximately $130 billion. Fast forward to 2014 where it is estimated that $664 billion worth of businesses and assets were divested—more than a fivefold increase.7 In 2014, the industries that were most active in breakups have been the utility and energy sectors. Oil prices declined precipitously, causing energy stocks to decline across the board.8 Because there was so much spin-off and restructuring activity in the sector, we had as much as 8-9 percent of our assets in the energy space and experienced some mark-to-market declines on those positions. However, because our positions are structured with option hedges such that the delta to the sector and the market in general is significantly reduced, we were able to avoid significant damage and in fact preserved positive performance for the year with a fraction of the market and indices’ volatility.

We intend to continue using various parts of the capital structure for hedging purposes. As mentioned in prior letters, we anticipate that by managing the event-driven strategy consistent with our firm-wide investment discipline, we will be positioned towards the conservative end of the spectrum, from both a risk and return perspective. Accordingly, our focus will remain on risk-adjusted, rather than notional returns in all market environments. However, even from a rate of return perspective, the Fund’s positive (albeit modest) absolute return for the quarter and year outpaced the relevant indices, many of which were negative (WCEIX returned 0.16% QTD and 3.87% YTD vs the HFRX Event Driven Index return of -5.45% and

__________

6 New York Times, The Mergers and Acquisition Cycle: Buy. Divide. Conquer, December 10, 2014

7 New York Times, Corporate Spinoffs Expected To Grow Next Yr. Study Finds, December 11, 2014

8 For example, the XLE Energy Select Sector ETF declined by 12.5% during the quarter.

-4.06% respectively). Whether equities resume their upward trajectory or not, we believe the success of our investments essentially continues to be dependent upon the completion of the transactions in which we have invested. Our three year beta, which includes market downturns, continues to be sub 0.20 for our merger arbitrage vehicles and approximately 0.25 for the event-driven funds that we manage.

Portfolio Performance Summary

| Strategy | Allocations | |

| Arbitrage | 61.53% | |

| Special Situations | 20.46% | |

| Extraordinary Events | 12.92% | |

| Non-directional Credit | 5.09% | |

| Total | 100.00% | |

Strategy allocations are the direct result of our bottom-up research; our investment decisions are based on the unique characteristics of each opportunity. Every investment must be public and have a defined timeline and expected return. Outside of these factors, the strategy is designed to “go where the events are.” We are, therefore, more reactive than proactive when it comes to making specific allocations to macro-factors like strategy, sector and even country.

WCEIX turned in a positive performance for the quarter, inching ahead by 0.16% and finishing the year with a 3.87% gain, well ahead of its peers and relevant indices. As of December 31st, the Fund was 114% invested and held 94 individual investments across all several categories of events. Gains were driven by our investments in (restructuring/extraordinary (event), General Motors (special situation), Starwood Property Trust (extraordinary Allergan (merger arbitrage), Covidien (merger arbitrage), Lamar Advertising (REIT conversion), Vivendi SA (event) and Tim Hortons, Inc. (merger arb).

Aside from the terminated Shire transaction, which cost the Fund 100 bps this quarter, a majority of the top ten performance detractors were event-driven investments in the energy sector. These included QEP Resources Inc., Anadarko Petroleum Corp., Hess Corp., Occidental Petroleum Corp., Williams Companies, Inc. and Noble Corporation plc, which combined cost the Fund approximately 110 bps. Another losing position was the Time Warner Cable Inc./Comcast Corp., a pending merger which is awaiting regulatory approval and cost the Fund 10 bps. Fortunately, our conservative positioning of these transactions allowed us to mitigate some of the downside experienced by the sector.

Consistent with that mindset, we will continue to seek idiosyncratic catalyst-driven investments in a variety of industries. The criteria for these investments include low correlation with markets or macro environments as well as the potential for attractive risk-adjusted returns.

OUR COMPANY

Westchester Capital manages a total of four SEC-registered mutual funds. On the conservative end of the spectrum, we have The Merger Fund® and its insurance-dedicated counterpart, The Merger Fund VL (for Variable Life and Annuity investors); moving up the ladder modestly in terms of both historic volatility and return is the Dunham Monthly Distribution Fund (which we manage as a sub-adviser), which provides an alternative market-neutral profile to The Merger Fund® with an income-oriented slant; and now passing its one-year anniversary, we also offer an institutional class of the WCM Alternatives: Event-Driven Fund (symbol: WCEIX). It is a complementary product which invests in the more dynamic event-driven space. As mentioned previously, WCEIX’s mandate is broader and more aggressively defined than either The Merger Fund® or the Dunham Fund. It will not provide a monthly distribution, and will be positioned to potentially provide higher returns along with a possible higher standard deviation.

As usual, quarterly statistical summaries for any of our vehicles are provided within two weeks of the end of the quarter, typically one month prior to the release of the quarterly letter. They are available electronically on our website, and we would be happy to arrange for a scheduled email as soon as the data becomes available. For convenience, investors can arrange for e-alerts of important Fund communications. Through our website at www.westchestercapitalfunds.com, you can check direct account balances, make purchases and sales, and sign up for notification of trade confirmations, statements and shareholder communications via e-mail.

Stay warm. Daylight hours are starting to get longer already!

|  |

| Roy Behren | Mike Shannon |

IMPORTANT DISCLOSURES

Before investing in The Merger Fund® and/or WCM Alternatives: Event-Driven Fund, carefully consider the investment objectives, risks, charges and expenses. For a prospectus or summary prospectus containing this and other information, please call (800) 343-8959. Please read the prospectus carefully before investing. The Merger Fund VL is available through variable products offered by third-party insurance companies. For a prospectus containing information for any variable annuity or variable life product that invests in The

Merger Fund VL, contact your financial advisor or the offering insurance company for a contract prospectus and prospectus for the underlying funds. To obtain a prospectus for the Dunham Monthly Distribution Fund, please visit www.dunham.com. Please read it carefully before investing.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. The Ten Largest Positions as a Percent of Net Assets for The Merger Fund as of December 31, 2014 were: Time Warner Cable Inc. (5.11%), DIRECTV (5.07%), Covidien PLC (4.81%), Allergan, Inc. (4.69%), TRW Automotive Holdings Corp. (4.66%), American International Group, Inc. (3.13%), Vivendi SA (3.12%), CareFusion Corporation (2.99%), Lamar Advertising Company (2.69%), Dresser-Rand Group (2.60%). The Ten Largest Positions as a Percent of Net Assets for The Merger Fund VL as of December 31, 2014 were: Time Warner Cable Inc. (4.62%), DIRECTV (4.57%), TRW Automotive Holdings Corp. (4.33%), Allergan, Inc. (4.33%), Covidien PLC (4.31%), Dresser-Rand Group (2.98%), CareFusion Corporation (2.86%), Vivendi SA (2.80%), American International Group, Inc. (2.62%), Lamar Advertising Company (2.37%). The Ten Largest Positions as a Percent of Net Assets for WCM Alternatives Event-Driven Fund as of December 31, 2014 were: DIRECTV (4.69%), Time Warner Cable Inc. (4.64%), Allergan, Inc. (4.54%), Lamar Advertising Company (4.31%), Covidien PLC (4.31%), Hudson City Bancorp, Inc. (3.60%).TRW Automotive Holdings Corp. (3.35%), American International Group, Inc. (3.35%), General Motors Co. (3.33%) Huntsman Corporation (3.14%).

Diversification does not assure a profit, nor does it protect against a loss in a declining market.

Mutual fund investing involves risk. Principal loss is possible. Merger‐arbitrage and event‐driven investing involves the risk that the adviser’s evaluation of the outcome of a proposed event, whether it be a merger, reorganization, regulatory issue or other event, will prove incorrect and that the Fund’s return on the investment will be negative. Investments in foreign companies may entail political, cultural, regulatory, legal, and tax risks different from those associated with comparable transactions in the United States. The frequency of the Fund’s transactions will vary from year to year, though merger arbitrage portfolios typically have higher turnover rates than portfolios of typical long‐only funds. Increased portfolio turnover may result in higher brokerage commissions, dealer mark‐ups and other transaction costs. The higher costs associated with increased portfolio turnover may offset gains in the Fund’s performance. The Fund may enter into short sale transactions for, among other reasons, purposes of protecting against a decline in the market value of the acquiring company’s shares prior to the acquisition completion. If the price of a security sold short increases between the time of the short sale and the time the Fund covers its short position, the Fund will incur a loss. The amount of a potential loss on an uncovered short sale transaction is theoretically unlimited. Debt securities may fluctuate in value due to, among other things, changes in interest rates, general economic conditions, industry fundamentals, market sentiment and the financial condition of the issuer, including the issuer’s credit rating or financial performance. Derivatives may create leverage which will amplify the effect of the performance of those instruments on the Fund and may produce significant losses. The Fund’s hedging strategy will be subject to the Fund’s investment adviser’s ability to assess correctly the degree of correlation between the performance of the instruments used in the hedging strategy and the performance of the investments in the portfolio being hedged.

References to other mutual funds do not construe an offer of those securities. Any tax or legal information provided is merely a summary of our understanding and interpretation of some of the current income tax regulations and is not exhaustive. Investors must consult their tax advisor or legal counsel for advice and information concerning their particular situation. Neither the Fund nor any of its representatives may give legal or tax advice.

The views expressed are as of February 10, 2015 and are a general guide to the views of Westchester Capital Management, are subject to change, are not guaranteed and should

not be considered recommendations to buy or sell any security. This document does not replace portfolio and fund-specific materials.

For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating™ based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.) As of December 31, 2014, The Merger Fund® was rated against the following numbers of U.S.-domiciled Market Neutral funds over the following time periods: 110 funds in the last three years, 64 funds in the last five years, and 27 funds in the last ten years. With respect to these Market Neutral funds, The Merger Fund® received a Morningstar Rating of 4 stars, 4 stars and 4 stars for the three-, five- and ten-year periods, respectively. © 2014 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Definitions: The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general; The MSCI World Index is a free float-adjusted market capitalization index designed to measure the equity market performance of developed economies; The Barclays Aggregate Bond Index is an intermediate term index comprised of investment grade bonds; The Morningstar Category: Market Neutral is an index comprised of a universe of funds with similar investment objectives. Indices are unavailable for direct investment. The HFRX Merger Arbitrage Index is comprised of strategies which employ an investment process primarily focused on opportunities in equity and equity related instruments of companies which are currently engaged in a corporate transaction. Standard Deviation is the degree by which returns vary relative to the average return. The higher the standard deviation, the greater the variability of the investment; Beta is a measure of the fund’s sensitivity to market movements. A portfolio with a beta greater than 1 is more volatile than the market and a portfolio with a beta less than 1 is less volatile than the market; A basis point (often denoted as bp) is a unit equal to 1/100 of a percentage point and can be summarized as follows: 1% change = 100 basis points and 0.01% = 1 basis point; Correlation is calculated using R-Squared; which is a measure that represents the percentage of a fund’s movements that can be explained by movements in a benchmark index. A fund with low R-squared doesn’t act much like the index. The VIX or CBOE Volatility Index is often referred to as “the fear gauge,” reflects expected 30-day volatility of the S&P 500. The VIX typically is inversely related to equity markets, as declining markets are viewed as more risky (or volatile) than rising markets. Delta is the ratio of the change in price of an option to the change in price of the underlying asset. Also called the hedge ratio. Applies to derivative products. For a call option on a stock, a delta of 0.50 means that for every $1.00 that the stock goes up, the option price rises by $0.50. As options near expiration, in-the-money call option contracts approach a delta of 1.0, while in-the-money put options approach a delta of -1.

The SEC does not endorse, indemnify, approve nor disapprove of any security.

The Merger Fund® and WCM Alternatives: Event-Driven Fund is distributed by Quasar Distributors, LLC. The Merger VL is available through variable products offered by third-party insurance companies and is not affiliated with Quasar Distributors, LLC. The Dunham Monthly Distribution Fund, which is sub-advised by Westchester Capital Management, LLC, is distributed by Dunham and Associates Investment Counsel, which have no affiliation with Quasar Distributors, LLC.

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT

IN THE MERGER FUND VL AND S&P 500

| | | Average Annual Total Return |

| | 1 Year | 3 Year | 5 Year | 10 Year |

| The Merger Fund VL | 1.37% | 2.59% | 2.78% | 5.17% |

| The Standard & | | | | |

| Poor’s 500 Index | 13.69% | 20.41% | 15.45% | 7.67% |

The Standard & Poor’s 500 Index (“S&P 500”) is a capitalization-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. This chart assumes an initial gross investment of $10,000 made on December 31, 2004. Returns shown include the reinvestment of all dividends. Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Merger Fund VL

EXPENSE EXAMPLE

December 31, 2014 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs as described below and (2) ongoing costs, including management fees, distribution and/or service fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 for the period 7/1/14 – 12/31/14.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. The example below includes, among other fees, management fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, and extraordinary expenses as determined under generally accepted accounting principles.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

The Merger Fund VL

EXPENSE EXAMPLE

December 31, 2014 (Unaudited)

| | | | | Expenses |

| | | | | Paid |

| | Beginning | Ending | | During |

| | Account | Account | Annualized | Period |

| | Value | Value | Expense | 7/1/14 — |

| | 7/1/14 | 12/31/14 | Ratio | 12/31/14* |

Actual+(1) | $1,000.00 | $ 984.90 | 1.86% | $9.31 |

Hypothetical+(2) | $1,000.00 | $1,015.83 | 1.86% | $9.45 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| + | Excluding dividends and borrowing expense on securities sold short, your actual cost of investment in and your hypothetical cost of investment in the Fund would have been $7.00 and $7.12, respectively. |

| (1) | Ending account values and expenses paid during the period based on a -1.51% return. This actual return is net of expenses. |

| (2) | Ending account values and expenses paid during period based on a 5.00% annual return before expenses. |

The Merger Fund VL

SCHEDULE OF INVESTMENTS

December 31, 2014

| Shares | | | | Value | |

| | |

| COMMON STOCKS — 70.77% | |

| | | ADVERTISING — 2.37% | | | |

| | 10,100 | | Lamar Advertising Company Class A (f) | | $ | 541,764 | |

| | | | | | | | |

| | | | AEROSPACE & DEFENSE — 2.05% | | | | |

| | 5,958 | | B/E Aerospace, Inc. (a)(f) | | | 345,683 | |

| | 2,979 | | KLX, Inc. (a) | | | 122,884 | |

| | | | | | | 468,567 | |

| | | | ALTERNATIVE CARRIERS — 0.02% | | | | |

| | 81 | | Level 3 Communications, Inc. (a) | | | 4,000 | |

| | | | | | | | |

| | | | AUTO PARTS & EQUIPMENT — 0.07% | | | | |

| | 155 | | TRW Automotive Holdings Corporation (a) | | | 15,942 | |

| | | | | | | | |

| | | | BIOTECHNOLOGY — 1.10% | | | | |

| | 2,488 | | Cubist Pharmaceuticals, Inc. (a) | | | 250,417 | |

| | | | | | | | |

| | | | BROADCASTING & CABLE TV — 0.04% | | | | |

| | 1,100 | | iHeartMedia, Inc. (a) | | | 8,085 | |

| | | | | | | | |

| | | | CABLE & SATELLITE TV — 11.35% | | | | |

| | 7,942 | | DIRECTV (a)(e) | | | 688,571 | |

| | 4,400 | | DISH Network Corporation Class A (a)(f) | | | 320,716 | |

| | 2,137 | | Liberty Global plc Series C (a)(b) | | | 103,238 | |

| | 121,859 | | Sirius XM Holdings, Inc. (a)(f) | | | 426,507 | |

| | 6,932 | | Time Warner Cable, Inc. (e) | | | 1,054,080 | |

| | | | | | | 2,593,112 | |

| | | | CASINOS & GAMING — 1.02% | | | | |

| | 13,541 | | International Game Technology (f) | | | 233,582 | |

| | | | | | | | |

| | | | COMMUNICATIONS EQUIPMENT — 0.10% | | | | |

| | 1,134 | | Riverbed Technology, Inc. (a) | | | 23,145 | |

| | | | | | | | |

| | | | DIVERSIFIED CHEMICALS — 4.65% | | | | |

| | 7,300 | | The Dow Chemical Company (f) | | | 332,953 | |

| | 3,500 | | E.I. Du Pont de Nemours & Company | | | 258,790 | |

| | 20,718 | | Huntsman Corporation (f) | | | 471,956 | |

| | | | | | | 1,063,699 | |

| | | | FOOD RETAIL — 1.03% | | | | |

| | 6,706 | | Safeway, Inc. (f) | | | 235,515 | |

| | | | | | | | |

| | | | GENERAL MERCHANDISE STORES — 2.35% | | | | |

| | 6,788 | | Family Dollar Stores, Inc. (f) | | | 537,677 | |

| | | | | | | | |

| | | | GOLD — 0.41% | | | | |

| | 4,985 | | Newmont Mining Corporation (f) | | | 94,216 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

December 31, 2014

| Shares | | | | Value | |

| | | | | | |

| | | HEALTH CARE EQUIPMENT — 4.30% | | | |

| | 9,609 | | Covidien plc (b)(e) | | $ | 982,809 | |

| | | | | | | | |

| | | | HOME BUILDING — 0.32% | | | | |

| | 2,987 | | Brookfield Residential Properties, Inc. (a)(b) | | | 71,867 | |

| | | | | | | | |

| | | | INDUSTRIAL MACHINERY — 0.19% | | | | |

| | 1,000 | | The Timken Company | | | 42,680 | |

| | | | | | | | |

| | | | INTEGRATED OIL & GAS — 3.76% | | | | |

| | 3,900 | | BP plc — ADR (f) | | | 148,668 | |

| | 5,700 | | Hess Corporation (f) | | | 420,774 | |

| | 3,607 | | Occidental Petroleum Corporation (f) | | | 290,760 | |

| | | | | | | 860,202 | |

| | | | INTERNET SOFTWARE & SERVICES — 0.69% | | | | |

| | 1,600 | | eBay, Inc. (a)(f) | | | 89,792 | |

| | 300 | | Equinix, Inc. (f) | | | 68,019 | |

| | | | | | | 157,811 | |

| | | | IT CONSULTING & OTHER SERVICES — 0.44% | | | | |

| | 4,013 | | Sapient Corporation (a)(g) | | | 99,843 | |

| | | | | | | | |

| | | | LEISURE FACILITIES — 0.10% | | | | |

| | 400 | | LIFE TIME FITNESS, Inc. (a)(f) | | | 22,648 | |

| | | | | | | | |

| | | | LIFE & HEALTH INSURANCE — 0.83% | | | | |

| | 2,707 | | Protective Life Corporation | | | 188,543 | |

| | | | | | | | |

| | | | LIFE SCIENCES TOOLS & SERVICES — 0.67% | | | | |

| | 1,484 | | Covance, Inc. (a) | | | 154,099 | |

| | | | | | | | |

| | | | MOVIES & ENTERTAINMENT — 0.02% | | | | |

| | 1,000 | | SFX Entertainment, Inc. (a) | | | 4,530 | |

| | | | | | | | |

| | | | MULTI-LINE INSURANCE — 2.61% | | | | |

| | 10,664 | | American International Group, Inc. (f) | | | 597,291 | |

| | | | | | | | |

| | | | OIL & GAS DRILLING — 0.32% | | | | |

| | 4,376 | | Noble Corporation plc (b)(f) | | | 72,510 | |

| | | | | | | | |

| | | | OIL & GAS EQUIPMENT & SERVICES — 3.66% | | | | |

| | 2,402 | | Amec Foster Wheeler plc — ADR | | | 31,082 | |

| | 4,230 | | Baker Hughes, Inc. (f) | | | 237,176 | |

| | 6,950 | | Dresser-Rand Group, Inc. (a)(e) | | | 568,510 | |

| | | | | | | 836,768 | |

| | | | OIL & GAS EXPLORATION & PRODUCTION — 1.64% | | | | |

| | 4,400 | | Anadarko Petroleum Corporation (f) | | | 363,000 | |

| | 842 | | California Resources Corporation (a) | | | 4,639 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

December 31, 2014

| Shares | | | | Value | |

| | | | | | |

| | | OIL & GAS EXPLORATION | | | |

| | | & PRODUCTION — 1.64% (continued) | | | |

| | 339 | | QEP Resources, Inc. (h) | | $ | 6,855 | |

| | | | | | | 374,494 | |

| | | | OIL & GAS STORAGE & TRANSPORTATION — 2.09% | | | | |

| | 4,272 | | Kinder Morgan, Inc. (f) | | | 180,768 | |

| | 6,600 | | The Williams Companies, Inc. | | | 296,604 | |

| | | | | | | 477,372 | |

| | | | PAPER PACKAGING — 1.44% | | | | |

| | 3,300 | | MeadWestvaco Corporation (f) | | | 146,487 | |

| | 3,000 | | Rock-Tenn Company Class A | | | 182,940 | |

| | | | | | | 329,427 | |

| | | | PAPER PRODUCTS — 1.71% | | | | |

| | 7,300 | | International Paper Company (f) | | | 391,134 | |

| | | | | | | | |

| | | | PHARMACEUTICALS — 5.38% | | | | |

| | 4,643 | | Allergan, Inc. (f) | | | 987,055 | |

| | 105 | | Auxilium Pharmaceuticals, Inc. (a)(h) | | | 3,611 | |

| | 7,633 | | Pfizer, Inc. (f) | | | 237,768 | |

| | | | | | | 1,228,434 | |

| | | | REGIONAL BANKS — 0.12% | | | | |

| | 2,532 | | Investors Bancorp, Inc. | | | 28,422 | |

| | | | | | | | |

| | | | REITS — 1.99% | | | | |

| | 11,151 | | Equity Commonwealth (f) | | | 286,246 | |

| | 5,980 | | Starwood Property Trust, Inc. | | | 138,975 | |

| | 1,090 | | Starwood Waypoint Residential Trust | | | 28,744 | |

| | | | | | | 453,965 | |

| | | | RESTAURANTS — 0.15% | | | | |

| | 900 | | Restaurant Brands International, Inc. (a)(b) | | | 35,136 | |

| | | | | | | | |

| | | | SEMICONDUCTOR EQUIPMENT — 1.93% | | | | |

| | 23,140 | | Tokyo Electron Ltd. — ADR (e) | | | 441,511 | |

| | | | | | | | |

| | | | SEMICONDUCTORS — 2.22% | | | | |

| | 6,401 | | International Rectifier Corporation (a) | | | 255,400 | |

| | 9,114 | | TriQuint Semiconductor, Inc. (a) | | | 251,091 | |

| | | | | | | 506,491 | |

| | | | SPECIALTY CHEMICALS — 1.99% | | | | |

| | 3,311 | | Sigma-Aldrich Corporation (e) | | | 454,501 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

December 31, 2014

| | Shares | | | | Value | |

| | | | | | | |

| | | | THRIFTS & MORTGAGE FINANCE — 1.98% | | | |

| | | 9,109 | | Beneficial Mutual Bancorp, Inc. (a) | | $ | 111,767 | |

| | | 33,665 | | Hudson City Bancorp, Inc. (f) | | | 340,690 | |

| | | | | | | | 452,457 | |

| | | | | TRADING COMPANIES & DISTRIBUTORS — 0.01% | | | | |

| | | 59 | | Veritiv Corporation (a) | | | 3,060 | |

| | | | | | | | | |

| | | | | TRUCKING — 1.34% | | | | |

| | | 12,312 | | Hertz Global Holdings, Inc. (a)(f) | | | 307,061 | |

| | | | | | | | | |

| | | | | WIRELESS TELECOMMUNICATION SERVICES — 2.31% | | | | |

| | | 15,651 | | T-Mobile U.S., Inc. (a) | | | 421,638 | |

| | | 3,101 | | Vodafone Group plc — ADR | | | 105,961 | |

| | | | | | | | 527,599 | |

| | | | | TOTAL COMMON STOCKS (Cost $15,727,475) | | | 16,172,386 | |

| | | | | | | | | |

| PREFERRED STOCKS — 1.05% | | | | |

| | | 9,490 | | State Street Corporation, 6.000% | | | 239,528 | |

| | | | | TOTAL PREFERRED STOCKS (Cost $236,775) | | | 239,528 | |

| | | | | | | | | |

| CONTINGENT VALUE RIGHTS — 0.00% | | | | |

| | | 268 | | Leap Wireless International, Inc. (a)(d)(l) | | | 837 | |

| | | | | TOTAL CONTINGENT VALUE RIGHTS (Cost $0) | | | 837 | |

| | | | | | | | | |

| Principal Amount | | | | | | |

| | | | | |

| CONVERTIBLE BONDS — 0.07% | | | | |

| | | | | Cubist Pharmaceuticals, Inc. | | | | |

| | $ | 12,000 | | 1.875%, 9/1/2020 | | | 16,350 | |

| | | | | TOTAL CONVERTIBLE BONDS (Cost $15,900) | | | 16,350 | |

| | | | | | | | | |

| CORPORATE BONDS — 3.91% | | | | |

| | | | | Dresser-Rand Group, Inc. | | | | |

| | | 100,000 | | 6.500%, 5/1/2021 | | | 108,000 | |

| | | | | Drill Rigs Holdings, Inc. | | | | |

| | | 74,000 | | 6.500%, 10/1/2017 (Acquired 5/27/14 | | | | |

| | | | | through 5/28/14, cost $76,633) (b)(i) | | | 61,790 | |

| | | | | Energy Future Intermediate Holding Company LLC | | | | |

| | | 59,000 | | 11.750%, 3/1/2022 (Acquired 10/7/14, cost $69,620) (i)(j) | | | 70,210 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

December 31, 2014

| Principal Amount | | | | Value | |

| | | | Gentiva Health Services, Inc. | | | |

| | $ | 171,000 | | 11.500%, 9/1/2018 | | $ | 182,158 | |

| | | | | KCG Holdings, Inc. | | | | |

| | | 240,000 | | 8.250%, 6/15/2018 (Acquired 12/2/14, cost $248,545) (i) | | | 247,200 | |

| | | | | Kodiak Oil & Gas Corporation | | | | |

| | | 28,000 | | 5.500%, 1/15/2021 (b) | | | 28,210 | |

| | | 195,000 | | 5.500%, 2/1/2022 (b) | | | 196,462 | |

| | | | | TOTAL CORPORATE BONDS (Cost $908,728) | | | 894,030 | |

| | | | | | | | | |

| MUNICIPAL BONDS — 0.74% | | | | |

| | | | | Louisiana Public Facilities | | | | |

| | | 170,000 | | 9.750%, 8/1/2015 | | | 169,985 | |

| | | | | TOTAL MUNICIPAL BONDS (Cost $170,000) | | | 169,985 | |

| | | | | | | | | |

| Contracts (100 shares per contract) | | | | |

| | | | | |

| PURCHASED PUT OPTIONS — 0.61% | | | | |

| | | | | American International Group, Inc. | | | | |

| | | 60 | | Expiration: February 2015, Exercise Price: $50.00 | | | 1,620 | |

| | | 5 | | Expiration: March 2015, Exercise Price: $52.50 | | | 420 | |

| | | | | Anadarko Petroleum Corporation | | | | |

| | | 34 | | Expiration: January 2015, Exercise Price: $85.00 | | | 14,195 | |

| | | | | B/E Aerospace, Inc. | | | | |

| | | 50 | | Expiration: January 2015, Exercise Price: $70.00 | | | 1,150 | |

| | | | | Baker Hughes, Inc. | | | | |

| | | 7 | | Expiration: January 2015, Exercise Price: $55.00 | | | 756 | |

| | | 14 | | Expiration: January 2015, Exercise Price: $57.50 | | | 3,241 | |

| | | | | Bayer AG | | | | |

| | | 6 | | Expiration: January 2015, Exercise Price: EUR 100.00 (k) | | | 189 | |

| | | 3 | | Expiration: February 2015, Exercise Price: EUR 96.00 (k) | | | 221 | |

| | | 6 | | Expiration: February 2015, Exercise Price: EUR 105.00 (k) | | | 1,198 | |

| | | | | BP plc — ADR | | | | |

| | | 31 | | Expiration: April 2015, Exercise Price: $32.00 | | | 1,488 | |

| | | | | CBS Corporation Class B | | | | |

| | | 30 | | Expiration: March 2015, Exercise Price: $50.00 | | | 3,150 | |

| | | | | DISH Network Corporation Class A | | | | |

| | | 28 | | Expiration: January 2015, Exercise Price: $52.50 | | | 140 | |

| | | 7 | | Expiration: January 2015, Exercise Price: $55.00 | | | 87 | |

| | | 36 | | Expiration: March 2015, Exercise Price: $62.50 | | | 5,220 | |

| | | | | The Dow Chemical Company | | | | |

| | | 55 | | Expiration: March 2015, Exercise Price: $40.00 | | | 3,657 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

December 31, 2014

| Contracts (100 shares per contract) | | Value | |

| | | E.I. Du Pont de Nemours & Company | | | |

| | 18 | | Expiration: January 2015, Exercise Price: $60.00 | | $ | 45 | |

| | 9 | | Expiration: January 2015, Exercise Price: $62.50 | | | 27 | |

| | 17 | | Expiration: February 2015, Exercise Price: $67.50 | | | 909 | |

| | | | eBay, Inc. | | | | |

| | 15 | | Expiration: February 2015, Exercise Price: $50.00 | | | 652 | |

| | | | Equinix, Inc. | | | | |

| | 1 | | Expiration: January 2015, Exercise Price: $180.00 | | | 37 | |

| | | | General Motors Company | | | | |

| | 6 | | Expiration: January 2015, Exercise Price: $27.00 | | | 12 | |

| | 10 | | Expiration: January 2015, Exercise Price: $28.00 | | | 30 | |

| | 15 | | Expiration: January 2015, Exercise Price: $29.00 | | | 30 | |

| | 3 | | Expiration: January 2015, Exercise Price: $30.00 | | | 15 | |

| | 6 | | Expiration: March 2015, Exercise Price: $30.00 | | | 216 | |

| | | | Hertz Global Holdings, Inc. | | | | |

| | 26 | | Expiration: January 2015, Exercise Price: $18.00 | | | 65 | |

| | 55 | | Expiration: January 2015, Exercise Price: $20.00 | | | 275 | |

| | 6 | | Expiration: January 2015, Exercise Price: $21.00 | | | 54 | |

| | 26 | | Expiration: March 2015, Exercise Price: $20.00 | | | 1,170 | |

| | | | Hess Corporation | | | | |

| | 46 | | Expiration: February 2015, Exercise Price: $67.50 | | | 7,406 | |

| | | | Huntsman Corporation | | | | |

| | 4 | | Expiration: January 2015, Exercise Price: $22.00 | | | 100 | |

| | 7 | | Expiration: February 2015, Exercise Price: $22.00 | | | 595 | |

| | 54 | | Expiration: February 2015, Exercise Price: $23.00 | | | 7,155 | |

| | 86 | | Expiration: February 2015, Exercise Price: $24.00 | | | 16,340 | |

| | | | International Paper Company | | | | |

| | 57 | | Expiration: January 2015, Exercise Price: $45.00 | | | 827 | |

| | | | Kinder Morgan, Inc. | | | | |

| | 30 | | Expiration: January 2015, Exercise Price: $50.00 | | | 23,100 | |

| | 13 | | Expiration: January 2015, Exercise Price: $55.00 | | | 16,510 | |

| | | | Lamar Advertising Company Class A | | | | |

| | 8 | | Expiration: January 2015, Exercise Price: $45.00 | | | 60 | |

| | 2 | | Expiration: January 2015, Exercise Price: $47.00 | | | 10 | |

| | 9 | | Expiration: January 2015, Exercise Price: $48.00 | | | 68 | |

| | | | LIFE TIME FITNESS, Inc. | | | | |

| | 3 | | Expiration: February 2015, Exercise Price: $45.00 | | | 90 | |

| | | | MeadWestvaco Corporation | | | | |

| | 26 | | Expiration: March 2015, Exercise Price: $37.50 | | | 715 | |

| | | | Noble Corporation plc | | | | |

| | 9 | | Expiration: January 2015, Exercise Price: $19.00 | | | 2,264 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

December 31, 2014

| Contracts (100 shares per contract) | | Value | |

| | | Occidental Petroleum Corporation | | | |

| | 4 | | Expiration: January 2015, Exercise Price: $77.50 | | $ | 250 | |

| | 13 | | Expiration: January 2015, Exercise Price: $82.50 | | | 2,529 | |

| | 12 | | Expiration: February 2015, Exercise Price: $72.50 | | | 1,188 | |

| | | | Pfizer, Inc. | | | | |

| | 11 | | Expiration: January 2015, Exercise Price: $27.00 | | | 28 | |

| | | | Restaurant Brands International, Inc. | | | | |

| | 9 | | Expiration: January 2015, Exercise Price: $40.00 | | | 1,620 | |

| | | | Rock-Tenn Company Class A | | | | |

| | 9 | | Expiration: January 2015, Exercise Price: $40.00 | | | 90 | |

| | 16 | | Expiration: January 2015, Exercise Price: $45.00 | | | 160 | |

| | | | SPDR S&P 500 ETF Trust | | | | |

| | 8 | | Expiration: January 2015, Exercise Price: $200.00 | | | 976 | |

| | 43 | | Expiration: January 2015, Exercise Price: $201.00 | | | 5,805 | |

| | 10 | | Expiration: February 2015, Exercise Price: $201.00 | | | 3,190 | |

| | | | The Timken Company | | | | |

| | 8 | | Expiration: March 2015, Exercise Price: $40.00 | | | 900 | |

| | | | T-Mobile U.S., Inc. | | | | |

| | 7 | | Expiration: January 2015, Exercise Price: $24.00 | | | 98 | |

| | 125 | | Expiration: January 2015, Exercise Price: $25.00 | | | 3,375 | |

| | | | Vodafone Group plc — ADR | | | | |

| | 8 | | Expiration: January 2015, Exercise Price: $32.00 | | | 160 | |

| | | | The Williams Companies, Inc. | | | | |

| | 41 | | Expiration: February 2015, Exercise Price: $40.00 | | | 3,526 | |

| | 11 | | Expiration: February 2015, Exercise Price: $41.00 | | | 1,133 | |

| | | | TOTAL PURCHASED PUT OPTIONS (Cost $221,354) | | | 140,537 | |

| | | | | | | | |

| Principal Amount | | | | |

| | | | | | | | |

| ESCROW NOTES — 0.07% | | | | |

| | $7,668 | | AMR Corporation (a)(d)(l) | | | | |

| | | | TOTAL ESCROW NOTES (Cost $4,196) | | | 15,911 | |

| | | | | | | 15,911 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

December 31, 2014

| Shares | | | | Value | |

| | | | |

| SHORT-TERM INVESTMENTS — 17.85% | | | |

| | 1,378,000 | | Fidelity Institutional Government Portfolio, | | | |

| | | | Institutional Share Class, 0.01% (c) | | $ | 1,378,000 | |

| | 1,322,366 | | Goldman Sachs Financial Square Money Market Fund, | | | | |

| | | | Institutional Share Class, 0.07% (c) | | | 1,322,366 | |

| | 1,378,000 | | The Liquid Asset Portfolio, | | | | |

| | | | Institutional Share Class, 0.07% (c) | | | 1,378,000 | |

| | | | TOTAL SHORT-TERM INVESTMENTS (Cost $4,078,366) | | | 4,078,366 | |

| | | | TOTAL INVESTMENTS — 95.07% | | | | |

| | | | (Cost $21,362,794) | | $ | 21,727,930 | |

ADR – American Depository Receipt

ETF – Exchange-Traded Fund

EUR – Euro

plc – Public Limited Company

REIT – Real Estate Investment Trust

| (a) | Non-income producing security. |

| (b) | Foreign security. |

| (c) | The rate quoted is the annualized seven-day yield as of December 31, 2014. |

| (d) | Security fair valued by the Adviser in good faith in accordance with the policies adopted by the Board of Trustees. |

| (e) | All or a portion of the shares have been committed as collateral for open securities sold short. |

| (f) | All or a portion of the shares have been committed as collateral for written option contracts. |

| (g) | All or a portion of the shares have been committed as collateral for swap contracts. |

| (h) | All or a portion of the shares have been committed as collateral for forward currency exchange contracts. |

| (i) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutional buyers. As of December 31, 2014, these securities represented 1.66% of total net assets. |

| (j) | Default or other conditions exist and the security is not presently accruing income. |

| (k) | Level 2 Security. Please see Note 2 on the Notes to the Financial Statements. |

| (l) | Level 3 Security. Please see Note 2 on the Notes to the Financial Statements. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF SECURITIES SOLD SHORT

December 31, 2014

| Shares | | | | Value | |

| | | | |

| COMMON STOCKS | | | |

| | 1,524 | | Actavis plc (a) | | $ | 392,293 | |

| | 402 | | American Airlines Group, Inc. | | | 21,559 | |

| | 18,801 | | Applied Materials, Inc. | | | 468,521 | |

| | 15,382 | | AT&T, Inc. | | | 516,681 | |

| | 16,123 | | Comcast Corporation Class A | | | 935,295 | |

| | 3,241 | | Comcast Corporation Special Class A | | | 186,568 | |

| | 405 | | Dollar Tree, Inc. | | | 28,504 | |

| | 32 | | Endo International plc (a) | | | 2,308 | |

| | 900 | | General Motors Company | | | 31,419 | |

| | 2,050 | | Halliburton Company | | | 80,627 | |

| | 399 | | Laboratory Corporation of America Holdings | | | 43,052 | |

| | 2,038 | | Liberty Global plc Class A (a) | | | 102,318 | |

| | 2,835 | | M&T Bank Corporation | | | 356,133 | |

| | 2 | | Media General, Inc. | | | 33 | |

| | 9,142 | | Medtronic plc | | | 660,052 | |

| | 15,266 | | RF Micro Devices, Inc. | | | 253,263 | |

| | | | TOTAL SECURITIES SOLD SHORT (Proceeds $3,628,366) | | $ | 4,078,626 | |

| plc – | Public Limited Company |

| (a) | Foreign security. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF OPTIONS WRITTEN

December 31, 2014

| Contracts (100 shares per contract) | | Value | |

| | | | |

| CALL OPTIONS WRITTEN | | | |

| | | Allergan, Inc. | | | |

| | 5 | | Expiration: January 2015, Exercise Price: $210.00 | | $ | 2,850 | |

| | | | American International Group, Inc. | | | | |

| | 16 | | Expiration: February 2015, Exercise Price: $52.50 | | | 6,640 | |

| | 81 | | Expiration: February 2015, Exercise Price: $55.00 | | | 18,589 | |

| | 9 | | Expiration: March 2015, Exercise Price: $57.50 | | | 1,215 | |

| | | | Anadarko Petroleum Corporation | | | | |

| | 11 | | Expiration: January 2015, Exercise Price: $92.50 | | | 418 | |

| | 33 | | Expiration: January 2015, Exercise Price: $95.00 | | | 759 | |

| | | | B/E Aerospace, Inc. | | | | |

| | 14 | | Expiration: January 2015, Exercise Price: $75.00 | | | 6,230 | |

| | 46 | | Expiration: January 2015, Exercise Price: $80.00 | | | 5,750 | |

| | | | Baker Hughes, Inc. | | | | |

| | 7 | | Expiration: January 2015, Exercise Price: $60.00 | | | 140 | |

| | 17 | | Expiration: January 2015, Exercise Price: $62.50 | | | 170 | |

| | | | Bayer AG | | | | |

| | 8 | | Expiration: January 2015, Exercise Price: EUR 110.00 (a) | | | 4,201 | |

| | 3 | | Expiration: February 2015, Exercise Price: EUR 105.00 (a) | | | 3,510 | |

| | 6 | | Expiration: February 2015, Exercise Price: EUR 115.00 (a) | | | 2,360 | |

| | | | BP plc — ADR | | | | |

| | 39 | | Expiration: April 2015, Exercise Price: $37.00 | | | 9,477 | |

| | | | CBS Corporation Class B | | | | |

| | 4 | | Expiration: February 2015, Exercise Price: $52.50 | | | 1,680 | |

| | 29 | | Expiration: February 2015, Exercise Price: $55.00 | | | 7,627 | |

| | 27 | | Expiration: March 2015, Exercise Price: $57.50 | | | 5,467 | |

| | | | DISH Network Corporation Class A | | | | |

| | 44 | | Expiration: March 2015, Exercise Price: $67.50 | | | 37,180 | |

| | | | The Dow Chemical Company | | | | |

| | 29 | | Expiration: March 2015, Exercise Price: $45.00 | | | 7,946 | |

| | 10 | | Expiration: March 2015, Exercise Price: $46.00 | | | 2,210 | |

| | 34 | | Expiration: March 2015, Exercise Price: $47.00 | | | 5,984 | |

| | | | E.I. Du Pont de Nemours & Company | | | | |

| | 12 | | Expiration: January 2015, Exercise Price: $70.00 | | | 5,010 | |

| | 23 | | Expiration: February 2015, Exercise Price: $72.50 | | | 6,612 | |

| | | | eBay, Inc. | | | | |

| | 16 | | Expiration: February 2015, Exercise Price: $55.00 | | | 4,480 | |

| | | | Equinix, Inc. | | | | |

| | 1 | | Expiration: January 2015, Exercise Price: $200.00 | | | 3,525 | |

| | | | Equity Commonwealth | | | | |

| | 13 | | Expiration: January 2015, Exercise Price: $27.50 | | | 65 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF OPTIONS WRITTEN (continued)

December 31, 2014

| Contracts (100 shares per contract) | | Value | |

| | | Family Dollar Stores, Inc. | | | |

| | 6 | | Expiration: January 2015, Exercise Price: $80.00 | | $ | 480 | |

| | | | General Motors Company | | | | |

| | 22 | | Expiration: January 2015, Exercise Price: $32.00 | | | 6,633 | |

| | 63 | | Expiration: January 2015, Exercise Price: $33.00 | | | 13,230 | |

| | 14 | | Expiration: January 2015, Exercise Price: $34.00 | | | 1,792 | |

| | 12 | | Expiration: March 2015, Exercise Price: $34.00 | | | 2,616 | |

| | | | Hertz Global Holdings, Inc. | | | | |

| | 36 | | Expiration: January 2015, Exercise Price: $22.00 | | | 11,340 | |

| | 7 | | Expiration: January 2015, Exercise Price: $23.00 | | | 1,592 | |

| | 80 | | Expiration: March 2015, Exercise Price: $23.00 | | | 25,600 | |

| | | | Hess Corporation | | | | |

| | 57 | | Expiration: February 2015, Exercise Price: $72.50 | | | 25,793 | |

| | | | Huntsman Corporation | | | | |

| | 7 | | Expiration: January 2015, Exercise Price: $25.00 | | | 70 | |

| | 9 | | Expiration: February 2015, Exercise Price: $25.00 | | | 405 | |

| | 72 | | Expiration: February 2015, Exercise Price: $26.00 | | | 2,520 | |

| | 115 | | Expiration: February 2015, Exercise Price: $27.00 | | | 2,300 | |

| | | | International Game Technology | | | | |

| | 39 | | Expiration: January 2015, Exercise Price: $17.00 | | | 975 | |

| | | | International Paper Company | | | | |

| | 73 | | Expiration: January 2015, Exercise Price: $49.00 | | | 35,223 | |

| | | | Kinder Morgan, Inc. | | | | |

| | 30 | | Expiration: January 2015, Exercise Price: $50.00 | | | 30 | |

| | 13 | | Expiration: January 2015, Exercise Price: $55.00 | | | 26 | |

| | | | Koninklijke (Royal) KPN NV | | | | |

| | 69 | | Expiration: January 2015, Exercise Price: EUR 2.60 (a) | | | 585 | |

| | 282 | | Expiration: February 2015, Exercise Price: EUR 2.60 (a) | | | 4,095 | |

| | 20 | | Expiration: February 2015, Exercise Price: EUR 2.70 (a) | | | 169 | |

| | 66 | | Expiration: March 2015, Exercise Price: EUR 2.60 (a) | | | 1,198 | |

| | | | Lamar Advertising Company Class A | | | | |

| | 98 | | Expiration: January 2015, Exercise Price: $52.50 | | | 16,170 | |

| | | | LIFE TIME FITNESS, Inc. | | | | |

| | 4 | | Expiration: February 2015, Exercise Price: $50.00 | | | 2,980 | |

| | | | MeadWestvaco Corporation | | | | |

| | 33 | | Expiration: March 2015, Exercise Price: $42.50 | | | 10,230 | |

| | | | Newmont Mining Corporation | | | | |

| | 9 | | Expiration: March 2015, Exercise Price: $19.00 | | | 1,296 | |

| | 4 | | Expiration: March 2015, Exercise Price: $20.00 | | | 400 | |

| | | | Noble Corporation plc | | | | |

| | 11 | | Expiration: January 2015, Exercise Price: $22.00 | | | 11 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF OPTIONS WRITTEN (continued)

December 31, 2014

| Contracts (100 shares per contract) | | Value | |

| | | Occidental Petroleum Corporation | | | |

| | 5 | | Expiration: January 2015, Exercise Price: $82.50 | | $ | 1,088 | |

| | 16 | | Expiration: January 2015, Exercise Price: $87.50 | | | 64 | |

| | 15 | | Expiration: February 2015, Exercise Price: $80.00 | | | 5,715 | |

| | | | Pfizer, Inc. | | | | |

| | 20 | | Expiration: January 2015, Exercise Price: $31.00 | | | 1,140 | |

| | 4 | | Expiration: February 2015, Exercise Price: $31.00 | | | 358 | |

| | 44 | | Expiration: March 2015, Exercise Price: $30.00 | | | 7,414 | |

| | | | Restaurant Brands International, Inc. | | | | |

| | 9 | | Expiration: January 2015, Exercise Price: $40.00 | | | 495 | |

| | | | Rock-Tenn Company Class A | | | | |

| | 12 | | Expiration: January 2015, Exercise Price: $47.50 | | | 16,680 | |

| | 18 | | Expiration: January 2015, Exercise Price: $50.00 | | | 20,250 | |

| | | | Sirius XM Holdings, Inc. | | | | |

| | 159 | | Expiration: January 2015, Exercise Price: $3.50 | | | 795 | |

| | 26 | | Expiration: February 2015, Exercise Price: $3.50 | | | 312 | |

| | 89 | | Expiration: March 2015, Exercise Price: $3.50 | | | 1,246 | |

| | | | The Timken Company | | | | |

| | 10 | | Expiration: March 2015, Exercise Price: $42.50 | | | 2,025 | |

| | | | T-Mobile U.S., Inc. | | | | |

| | 9 | | Expiration: January 2015, Exercise Price: $26.00 | | | 1,296 | |

| | 51 | | Expiration: February 2015, Exercise Price: $29.00 | | | 4,284 | |

| | 53 | | Expiration: February 2015, Exercise Price: $30.00 | | | 3,021 | |

| | | | TRW Automotive Holdings Corporation | | | | |

| | 8 | | Expiration: January 2015, Exercise Price: $105.00 | | | 20 | |

| | | | Vivendi SA | | | | |

| | 68 | | Expiration: January 2015, Exercise Price: EUR 20.00 (a) | | | 6,582 | |

| | 131 | | Expiration: January 2015, Exercise Price: EUR 19.50 (a) | | | 18,705 | |

| | 14 | | Expiration: February 2015, Exercise Price: EUR 19.50 (a) | | | 2,338 | |

| | 26 | | Expiration: February 2015, Exercise Price: EUR 20.00 (a) | | | 3,146 | |

| | 15 | | Expiration: March 2015, Exercise Price: EUR 19.00 (a) | | | 3,467 | |

| | | | Vodafone Group plc — ADR | | | | |

| | 23 | | Expiration: January 2015, Exercise Price: $34.00 | | | 2,013 | |

| | 3 | | Expiration: January 2015, Exercise Price: $35.00 | | | 129 | |

| | | | The Williams Companies, Inc. | | | | |

| | 26 | | Expiration: February 2015, Exercise Price: $44.00 | | | 7,748 | |

| | 14 | | Expiration: February 2015, Exercise Price: $45.00 | | | 3,381 | |

| | 26 | | Expiration: February 2015, Exercise Price: $46.00 | | | 4,992 | |

| | | | | | | 436,558 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF OPTIONS WRITTEN (continued)

December 31, 2014

| Contracts (100 shares per contract) | | Value | |

| | | | |

| PUT OPTIONS WRITTEN | | | |

| | | SPDR S&P 500 ETF Trust | | | |

| | 21 | | Expiration: January 2015, Exercise Price: $194.00 | | $ | 1,302 | |

| | 12 | | Expiration: January 2015, Exercise Price: $195.00 | | | 822 | |

| | 10 | | Expiration: February 2015, Exercise Price: $195.00 | | | 2,050 | |

| | | | | | | 4,174 | |

| | | | TOTAL OPTIONS WRITTEN (Premiums received $394,329) | | $ | 440,732 | |

ADR – American Depository Receipt

ETF – Exchange-Traded Fund

EUR – Euro

| plc – | Public Limited Company |

| (a) | Level 2 Security. Please see Note 2 on the Notes to the Financial Statements. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF FORWARD CURRENCY EXCHANGE CONTRACTS*

December 31, 2014

| | | | U.S. | | | U.S. | |

| | | | $ Value at | | | $ Value at | Unrealized |

| Settlement | Currency to | December 31, | Currency to | December 31, | Appreciation |

| Date | be Delivered | 2014 | be Received | 2014 | (Depreciation)** |

| 3/26/15 | 122,904 | AUD | $ 99,714 | 112,703 | USD | $ 112,703 | $12,989 |

| 3/26/15 | 49,384 | USD | 49,384 | 56,938 | AUD | 46,195 | (3,189) |

| 3/27/15 | 65,519 | AUD | 53,152 | 57,410 | USD | 57,410 | 4,258 |

| 3/27/15 | 55,541 | USD | 55,541 | 64,810 | AUD | 52,577 | (2,964) |

| 5/22/15 | 22,596 | AUD | 18,262 | 18,209 | USD | 18,209 | (53) |

| 1/21/15 | 525,834 | CAD | 452,398 | 473,107 | USD | 473,107 | 20,709 |

| 1/21/15 | 3,474 | USD | 3,474 | 4,051 | CAD | 3,485 | 11 |

| 1/21/15 | 126,574 | EUR | 153,196 | 160,104 | USD | 160,104 | 6,908 |

| 1/21/15 | 16,119 | USD | 16,119 | 12,679 | EUR | 15,346 | (773) |

| 2/11/15 | 499,508 | EUR | 604,683 | 615,742 | USD | 615,742 | 11,059 |

| 2/18/15 | 188,500 | EUR | 228,202 | 235,314 | USD | 235,314 | 7,112 |

| 3/17/15 | 125,840 | EUR | 152,379 | 158,004 | USD | 158,004 | 5,625 |

| 3/25/15 | 18,368 | EUR | 22,243 | 22,985 | USD | 22,985 | 742 |

| 3/19/15 | 61,978 | GBP | 96,537 | 105,291 | USD | 105,291 | 8,754 |

| 3/19/15 | 99,768 | USD | 99,768 | 61,978 | GBP | 96,537 | (3,231) |

| 6/15/15 | 64,674 | GBP | 100,665 | 103,075 | USD | 103,075 | 2,410 |

| 6/25/15 | 248,444 | SGD | 187,130 | 188,035 | USD | 188,035 | 905 |

| | | | $2,392,847 | | | $ 2,464,119 | $71,272 |

AUD – Australian Dollar

CAD – Canadian Dollar

EUR – Euro

GBP – British Pound

SGD – Singapore Dollar

USD – U.S. Dollar

| * | JPMorgan Chase & Co. Inc. is the counterparty for all open forward currency exchange contracts held by the Fund as of December 31, 2014. |

| ** | Unrealized appreciation is a receivable and unrealized depreciation is a payable on the Statement of Assets and Liabilities. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF SWAP CONTRACTS

December 31, 2014

| | | | | | | | | | Unrealized | | |

| Termination | | | | | | | | | Appreciation | | Counter- |

| Date | Security | | Shares | | | Notional | | | (Depreciation)* | | party |

| | | | | | | | | | | |

| LONG TOTAL RETURN SWAP CONTRACTS | | | | | | | | | | |

| 9/19/15 | Bayer AG | | | 1,700 | | | $ | 232,451 | | | $ | (5,121 | ) | JPM |

| 10/6/15 | CareFusion Corporation | | | 6,770 | | | | 401,732 | | | | 16,624 | | JPM |

| 10/6/15 | CareFusion Corporation | | | 4,246 | | | | 251,958 | | | | 10,209 | | BAML |

| 10/1/15 | CBS Corporation Class B | | | 6,053 | | | | 334,973 | | | | 13,376 | | BAML |

| 10/16/15 | CSR plc | | | 7,186 | | | | 95,873 | | | | (529 | ) | JPM |

| 10/7/15 | DIRECTV | | | 4,075 | | | | 353,302 | | | | (3,947 | ) | JPM |

| 10/16/15 | Dresser-Rand Group, Inc. | | | 49 | | | | 4,008 | | | | 132 | | JPM |

| 12/16/15 | E.ON SE | | | 1,148 | | | | 19,719 | | | | 407 | | JPM |

| 9/29/15 | General Motors Company | | | 12,000 | | | | 418,920 | | | | 23,445 | | BAML |

| 1/5/15 | GrainCorp, Ltd. Class A | | | 83 | | | | 559 | | | | (110 | ) | JPM |

| 9/29/15 | Hillgrove Resources, Ltd. | | | 14,160 | | | | 5,202 | | | | (3,469 | ) | JPM |

| 10/16/15 | Jazztel plc | | | 9,680 | | | | 147,002 | | | | (5,325 | ) | JPM |

| 3/3/15 | Koninklijke (Royal) KPN NV | | | 43,729 | | | | 139,059 | | | | (17,750 | ) | JPM |

| 12/11/15 | Lafarge SA (a) | | | 1,707 | | | | 119,968 | | | | 1,485 | | JPM |

| 10/16/15 | Protective Life Corporation | | | 71 | | | | 4,945 | | | | 39 | | JPM |

| 6/3/15 | SAI Global, Ltd. | | | 14,659 | | | | 47,870 | | | | (21,685 | ) | JPM |

| 10/2/15 | TRW Automotive | | | | | | | | | | | | | |

| | Holdings Corporation | | | 9,449 | | | | 971,830 | | | | 12,843 | | JPM |

| 12/9/15 | United Envirotech, Ltd. | | | 150,572 | | | | 183,008 | | | | 233 | | BAML |

| 1/21/15 | Vivendi SA | | | 25,482 | | | | 637,967 | | | | (23,333 | ) | JPM |

| | | | | | | | | | | | | | |

| SHORT TOTAL RETURN SWAP CONTRACTS | | | | | | | | | | | | | |

| 11/14/15 | Amec Foster Wheeler plc | | | (2,402 | ) | | | (31,934 | ) | | | 12,200 | | JPM |

| 10/6/15 | Becton, Dickinson | | | | | | | | | | | | | |

| | and Company | | | (528 | ) | | | (73,476 | ) | | | (7,901 | ) | JPM |

| 10/6/15 | Becton, Dickinson | | | | | | | | | | | | | |

| | and Company | | | (330 | ) | | | (45,923 | ) | | | (4,966 | ) | BAML |

| 7/17/15 | GTECH Holdings S.p.A. | | | (659 | ) | | | (14,744 | ) | | | 1,398 | | BAML |

| 12/11/15 | GTECH Holdings S.p.A. | | | (112 | ) | | | (2,506 | ) | | | (12 | ) | JPM |

| 12/17/15 | GTECH Holdings | | | | | | | | | | | | | |

| | S.p.A. Rights (a) | | | (428 | ) | | | — | | | | — | | BAML |

| 12/11/15 | Holcim, Ltd. (a) | | | (1,707 | ) | | | (122,505 | ) | | | (1,270 | ) | JPM |

| | | | | | | | | | | | $ | (3,027 | ) | |

BAML – Bank of America Merrill Lynch & Co., Inc.

JPM – JPMorgan Chase & Co., Inc.

plc – Public Limited Company

| * | Based on the net swap contract value held at each counterparty, unrealized appreciation is a receivable and unrealized depreciation is a payable on the Statement of Assets and Liabilities. |

| (a) | Security fair valued by the Adviser in good faith in accordance with the policies adopted by the Board of Trustees. |

The accompanying notes are an integral part of these financial statements.

(This Page Intentionally Left Blank.)

The Merger Fund VL

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2014

| ASSETS: | | | | | | |

| Investments, at value (Cost $21,362,794) | | | | | $ | 21,727,930 | |

| Cash held in foreign currency (Cost $447,806) | | | | | | 449,174 | |

| Receivable from brokers | | | | | | 3,628,366 | |

| Deposits at brokers | | | | | | 1,364,480 | |

| Receivable for forward currency exchange contracts | | | | | | 81,482 | |

| Receivable for swap contracts | | | | | | 43,695 | |

| Receivable for investments sold | | | | | | 173,071 | |

| Dividends and interest receivable | | | | | | 39,587 | |

| Receivable for fund shares issued | | | | | | 37,674 | |

| Swap dividends receivable | | | | | | 17,141 | |

| Prepaid expenses and other receivables | | | | | | 704 | |

| Total Assets | | | | | | 27,563,304 | |

| | | | | | | | |

| LIABILITIES: | | | | | | | |

| Securities sold short, at value (proceeds of $3,628,366) | | $ | 4,078,626 | | | | | |

| Written option contracts, at value | | | | | | | | |

| (premiums received $394,329) | | | 440,732 | | | | | |

| Payable for forward currency exchange contracts | | | 10,210 | | | | | |

| Payable for swap contracts | | | 46,722 | | | | | |

| Accrued expenses and other liabilities | | | 76,875 | | | | | |

| Payable for investments purchased | | | 41,636 | | | | | |

| Dividends and interest payable | | | 5,992 | | | | | |

| Payable to the investment adviser | | | 5,851 | | | | | |

| Payable for closed swap contracts | | | 1,720 | | | | | |

| Swap dividends payable | | | 1,114 | | | | | |

| Payable for fund shares redeemed | | | 135 | | | | | |

| Total Liabilities | | | | | | | 4,709,613 | |

| NET ASSETS | | | | | | $ | 22,853,691 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

STATEMENT OF ASSETS AND LIABILITIES (continued)

December 31, 2014

| NET ASSETS CONSISTS OF: | | | | | | |

| Accumulated undistributed net investment income | | | | | $ | 666,851 | |

| Accumulated net realized loss on investments, securities | | | | | | | |

| sold short, written option contracts expired or closed, | | | | | | | |

| swap contracts, foreign currency translation | | | | | | | |