| OMB APPROVAL |

OMB Number: 3235-0570 Expires: January 31, 2017 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-21260 | |

CM Advisors Family of Funds

(Exact name of registrant as specified in charter)

| 805 Las Cimas Parkway, Suite 430 Austin, Texas | 78746 |

| (Address of principal executive offices) | (Zip code) |

Tina H. Bloom, Esq.

Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246

(Name and address of agent for service)

| Registrant's telephone number, including area code: | (512) 329-0050 | |

| Date of fiscal year end: | February 29, 2016 | |

| | | |

| Date of reporting period: | August 31, 2015 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

CM Advisors Family of Funds

Semi-Annual Report 2015

CM Advisors Fund

CM Advisors Small Cap Value Fund

CM Advisors Fixed Income Fund

August 31, 2015

(Unaudited)

This report and the financial statements contained herein are submitted for the general information of the shareholders of the CM Advisors Family of Funds (the “Funds”). This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus. Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

CM Advisors Fund

Supplementary Portfolio Information

August 31, 2015 (Unaudited)

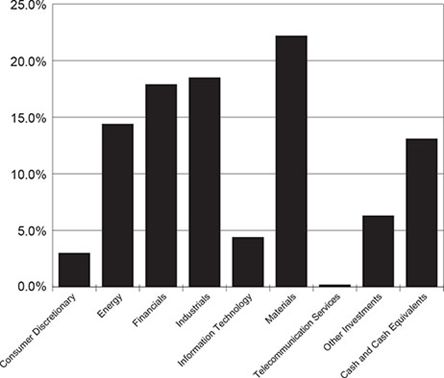

Asset Allocation*

(% of Net Assets)

| * | As of August 31, 2015, the Fund held no securities in the Consumer Staples, Telecommunication Services or Utilities sectors. |

Top 10 Equity Holdings

Security Description | % of Net Assets |

Berkshire Hathaway, Inc. - Class B | 5.3% |

Wells Fargo & Company | 5.3% |

Discovery Communications, Inc. - Series C | 5.1% |

Chicago Bridge & Iron Company N.V. | 4.7% |

Markel Corporation | 4.2% |

Enstar Group Ltd. | 4.1% |

Jacobs Engineering Group, Inc. | 4.1% |

General Motors Company | 4.1% |

InterGroup Corporation (The) | 3.3% |

Orion Marine Group, Inc. | 3.2% |

1

CM Advisors Small Cap Value Fund

Supplementary Portfolio Information

August 31, 2015 (Unaudited)

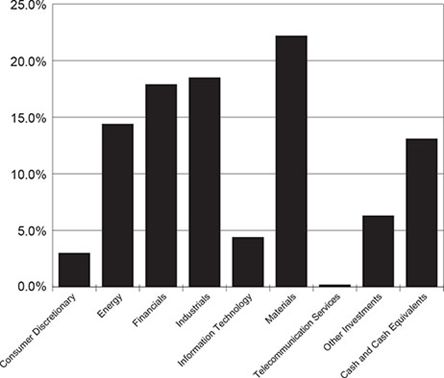

Asset Allocation*

(% of Net Assets)

| * | As of August 31, 2015, the Fund held no securities in the Consumer Staples, Health Care or Utilities sectors. |

Top 10 Equity Holdings

Security Description | % of Net Assets |

White Mountains Insurance Group Ltd. | 6.1% |

Enstar Group Ltd. | 4.4% |

Layne Christensen Company | 4.4% |

Pioneer Energy Services Corporation | 3.9% |

SPDR S&P Regional Banking ETF | 3.7% |

Dynamic Materials Corporation | 3.7% |

Powell Industries, Inc. | 3.4% |

Allegheny Technologies, Inc. | 3.2% |

Avid Technology, Inc. | 2.8% |

SPDR S&P Oil & Gas Exploration & Production ETF | 2.6% |

2

CM Advisors Fixed Income Fund

Supplementary Portfolio Information

August 31, 2015 (Unaudited)

Asset Allocation*

(% of Net Assets)

| * | As of August 31, 2015, the Fund held no securities in the Telecommunication Services sector. |

Top 10 Long-Term Holdings

Security Description | % of Net Assets |

U.S. Treasury Notes, 0.75%, due 12/31/17 | 8.9% |

U.S. Treasury Notes, 2.75%, due 11/15/23 | 5.8% |

U.S. Treasury Notes, 2.375%, due 12/31/20 | 5.8% |

U.S. Treasury Notes, 2.00%, due 07/31/20 | 5.5% |

U.S. Treasury Notes, 0.875%, due 05/15/17 | 5.4% |

U.S. Treasury Notes, 0.375%, due 04/30/16 | 5.3% |

U.S. Treasury Notes, 4.625%, due 02/15/17 | 4.7% |

U.S. Treasury Notes, 0.375%, due 01/15/16 | 4.4% |

Great Lakes Dredge & Dock Company, 7.375%, due 02/01/19 | 1.5% |

Alcoa, Inc., 5.87%, due 02/23/22 | 1.1% |

3

CM Advisors Fund Schedule of Investments

August 31, 2015 (Unaudited) | |

COMMON STOCKS — 90.8% | | Shares | | | Value | |

Consumer Discretionary — 12.4% | | | | | | |

Automobiles — 4.1% | | | | | | |

General Motors Company | | | 122,975 | | | $ | 3,620,384 | |

| | | | | | | | | |

Media — 8.3% | | | | | | | | |

Discovery Communications, Inc. - Series C * | | | 179,188 | | | | 4,544,208 | |

Liberty Media Corporation - Series C * | | | 58,100 | | | | 2,104,382 | |

Reading International, Inc. - Class A * | | | 62,853 | | | | 806,404 | |

| | | | | | | | 7,454,994 | |

Energy — 8.7% | | | | | | | | |

Energy Equipment & Services — 7.7% | | | | | | | | |

Atwood Oceanics, Inc. | | | 78,865 | | | | 1,507,110 | |

CARBO Ceramics, Inc. | | | 1,890 | | | | 51,824 | |

Era Group, Inc. * | | | 130,999 | | | | 2,213,883 | |

Halliburton Company | | | 35,700 | | | | 1,404,795 | |

Key Energy Services, Inc. * | | | 892,063 | | | | 634,435 | |

Pioneer Energy Services Corporation * | | | 6,505 | | | | 21,532 | |

Unit Corporation * | | | 71,305 | | | | 1,083,836 | |

| | | | | | | | 6,917,415 | |

Oil, Gas & Consumable Fuels — 1.0% | | | | | | | | |

Apache Corporation | | | 18,990 | | | | 859,107 | |

| | | | | | | | | |

Financials — 27.4% | | | | | | | | |

Banks — 8.3% | | | | | | | | |

U.S. Bancorp | | | 63,466 | | | | 2,687,785 | |

Wells Fargo & Company | | | 88,387 | | | | 4,713,679 | |

| | | | | | | | 7,401,464 | |

Diversified Financial Services — 7.5% | | | | | | | | |

Berkshire Hathaway, Inc. - Class B * | | | 35,590 | | | | 4,770,484 | |

PICO Holdings, Inc. * | | | 149,211 | | | | 1,932,282 | |

| | | | | | | | 6,702,766 | |

Insurance — 8.3% | | | | | | | | |

Enstar Group Ltd. * | | | 25,159 | | | | 3,675,981 | |

Markel Corporation * | | | 4,613 | | | | 3,799,959 | |

| | | | | | | | 7,475,940 | |

Real Estate Management & Development — 3.3% | | | | | | | | |

InterGroup Corporation (The) * | | | 103,079 | | | | 2,989,291 | |

| | | | | | | | | |

Health Care — 2.4% | | | | | | | | |

Health Care Providers & Services — 2.4% | | | | | | | | |

DaVita HealthCare Partners, Inc. * | | | 28,135 | | | | 2,128,131 | |

| | | | | | | | | |

Industrials — 20.0% | | | | | | | | |

Building Products — 0.1% | | | | | | | | |

Insteel Industries, Inc. | | | 5,235 | | | | 90,618 | |

4

CM Advisors Fund Schedule of Investments (Continued) | |

COMMON STOCKS — 90.8% (Continued) | | Shares | | | Value | |

Industrials — 20.0% (Continued) | | | | | | |

Construction & Engineering — 14.8% | | | | | | |

Chicago Bridge & Iron Company N.V. | | | 95,015 | | | $ | 4,207,264 | |

Jacobs Engineering Group, Inc. * | | | 90,095 | | | | 3,640,739 | |

Layne Christensen Company * | | | 339,304 | | | | 2,531,208 | |

Orion Marine Group, Inc. * | | | 394,937 | | | | 2,835,648 | |

| | | | | | | | 13,214,859 | |

Electrical Equipment — 1.8% | | | | | | | | |

Emerson Electric Company | | | 11,550 | | | | 551,166 | |

Powell Industries, Inc. | | | 38,060 | | | | 1,117,442 | |

| | | | | | | | 1,668,608 | |

Machinery — 3.3% | | | | | | | | |

Colfax Corporation * | | | 44,693 | | | | 1,733,641 | |

Dynamic Materials Corporation | | | 107,864 | | | | 1,222,099 | |

| | | | | | | | 2,955,740 | |

Information Technology — 4.2% | | | | | | | | |

Communications Equipment — 0.1% | | | | | | | | |

Cisco Systems, Inc. | | | 3,910 | | | | 101,191 | |

| | | | | | | | | |

Electronic Equipment, Instruments & Components — 1.3% | | | | | | | | |

Maxwell Technologies, Inc. * | | | 227,760 | | | | 1,216,238 | |

| | | | | | | | | |

Internet Software & Services — 0.3% | | | | | | | | |

SpendSmart Networks, Inc. * | | | 473,599 | | | | 236,800 | |

| | | | | | | | | |

Technology Hardware, Storage & Peripherals — 2.5% | | | | | | | | |

Avid Technology, Inc. * | | | 268,794 | | | | 2,233,678 | |

| | | | | | | | | |

Materials — 15.7% | | | | | | | | |

Chemicals — 0.7% | | | | | | | | |

American Vanguard Corporation | | | 5,380 | | | | 71,877 | |

Chase Corporation | | | 13,936 | | | | 550,472 | |

| | | | | | | | 622,349 | |

Metals & Mining — 15.0% | | | | | | | | |

Agnico Eagle Mines Ltd. | | | 77,545 | | | | 1,898,301 | |

Allegheny Technologies, Inc. | | | 145,665 | | | | 2,812,791 | |

Banro Corporation * | | | 581,050 | | | | 104,938 | |

Comstock Mining, Inc. * | | | 2,729,623 | | | | 1,501,838 | |

Eldorado Gold Corporation | | | 187,605 | | | | 562,815 | |

Randgold Resources Ltd. - ADR | | | 33,940 | | | | 2,046,243 | |

Real Industry, Inc. * | | | 5,758 | | | | 55,737 | |

Seabridge Gold, Inc. * | | | 377,122 | | | | 2,413,581 | |

Synalloy Corporation | | | 60,072 | | | | 586,303 | |

5

CM Advisors Fund Schedule of Investments (Continued) | |

COMMON STOCKS — 90.8% (Continued) | | Shares | | | Value | |

Materials — 15.7% (Continued) | | | | | | |

Metals & Mining — 15.0% (Continued) | | | | | | |

Yamana Gold, Inc. | | | 749,850 | | | $ | 1,409,718 | |

| | | | | | | | 13,392,265 | |

| | | | | | | | | |

Total Common Stocks (Cost $89,271,386) | | | | | | $ | 81,281,838 | |

CLOSED-END FUNDS — 0.5% | | Shares | | | Value | |

ASA Gold and Precious Metals Ltd. (Cost $621,395) | | | 51,310 | | | $ | 412,019 | |

EXCHANGE-TRADED FUNDS — 4.7% | | Shares | | | Value | |

iShares MSCI Hong Kong ETF | | | 22,000 | | | $ | 424,160 | |

Market Vectors® Junior Gold Miners ETF | | | 91,985 | | | | 1,870,055 | |

SPDR S&P Oil & Gas Exploration & Production ETF | | | 50,345 | | | | 1,924,186 | |

Total Exchange-Traded Funds (Cost $4,694,469) | | | | | | $ | 4,218,401 | |

WARRANTS — 0.0% | | Shares | | | Value | |

SpendSmart Payment Company (The) *(a) (Cost $0) | | | 542,100 | | | $ | 0 | |

MONEY MARKET FUNDS — 5.6% | | Shares | | | Value | |

Wells Fargo Advantage Treasury Plus Money Market Fund - Institutional Class, 0.01% (b) (Cost $4,981,878) | | | 4,981,878 | | | $ | 4,981,878 | |

| | | | | | | | | |

Total Investments at Value — 101.6% (Cost $99,569,128) | | | | | | $ | 90,894,136 | |

| | | | | | | | | |

Liabilities in Excess of Other Assets — (1.6%) | | | | | | | (1,410,502 | ) |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 89,483,634 | |

ADR - American Depositary Receipt.

| * | Non-income producing security. |

| (a) | Security value has been determined in good faith pursuant to procedures adopted by the Board of Trustees. The total value of such securities is $0 at August 31, 2015, representing 0.0% of net assets. |

| (b) | The rate shown is the 7-day effective yield as of August 31, 2015. |

See accompanying notes to financial statements. |

6

CM Advisors Small Cap Value Fund Schedule of Investments

August 31, 2015 (Unaudited) | |

COMMON STOCKS — 80.7% | | Shares | | | Value | |

Consumer Discretionary — 3.0% | | | | | | |

Auto Components — 2.0% | | | | | | |

Superior Industries International, Inc. | | | 42,995 | | | $ | 821,205 | |

| | | | | | | | | |

Media — 1.0% | | | | | | | | |

Reading International, Inc. - Class A * | | | 30,022 | | | | 385,182 | |

| | | | | | | | | |

Energy — 14.4% | | | | | | | | |

Energy Equipment & Services — 12.6% | | | | | | | | |

Atwood Oceanics, Inc. | | | 47,385 | | | | 905,527 | |

CARBO Ceramics, Inc. | | | 16,700 | | | | 457,914 | |

Era Group, Inc. * | | | 45,943 | | | | 776,437 | |

Key Energy Services, Inc. * | | | 702,925 | | | | 499,920 | |

Pioneer Energy Services Corporation * | | | 480,251 | | | | 1,589,631 | |

Profire Energy, Inc. * | | | 129,800 | | | | 141,482 | |

Unit Corporation * | | | 46,870 | | | | 712,424 | |

| | | | | | | | 5,083,335 | |

Oil, Gas & Consumable Fuels — 1.8% | | | | | | | | |

Ardmore Shipping Corporation | | | 1,900 | | | | 21,318 | |

Bill Barrett Corporation * | | | 63,455 | | | | 347,099 | |

Stone Energy Corporation * | | | 61,660 | | | | 349,612 | |

| | | | | | | | 718,029 | |

Financials — 17.9% | | | | | | | | |

Banks — 3.6% | | | | | | | | |

Old National Bancorp | | | 64,191 | | | | 885,836 | |

Trustmark Corporation | | | 24,875 | | | | 572,871 | |

| | | | | | | | 1,458,707 | |

Diversified Financial Services — 2.1% | | | | | | | | |

PICO Holdings, Inc. * | | | 63,999 | | | | 828,787 | |

| | | | | | | | | |

Insurance — 10.5% | | | | | | | | |

Enstar Group Ltd. * | | | 12,325 | | | | 1,800,806 | |

White Mountains Insurance Group Ltd. | | | 3,400 | | | | 2,445,654 | |

| | | | | | | | 4,246,460 | |

Real Estate Management & Development — 1.7% | | | | | | | | |

InterGroup Corporation (The) * | | | 23,515 | | | | 681,935 | |

| | | | | | | | | |

Industrials — 18.5% | | | | | | | | |

Commercial Services & Supplies — 1.9% | | | | | | | | |

Brady Corporation - Class A | | | 33,848 | | | | 743,302 | |

7

CM Advisors Small Cap Value Fund Schedule of Investments (Continued) | |

COMMON STOCKS — 80.7% (Continued) | | Shares | | | Value | |

Industrials — 18.5% (Continued) | | | | | | |

Construction & Engineering — 7.1% | | | | | | |

Layne Christensen Company * | | | 240,095 | | | $ | 1,791,109 | |

Orion Marine Group, Inc. * | | | 148,495 | | | | 1,066,194 | |

| | | | | | | | 2,857,303 | |

Electrical Equipment — 3.4% | | | | | | | | |

Powell Industries, Inc. | | | 46,735 | | | | 1,372,139 | |

| | | | | | | | | |

Machinery — 5.8% | | | | | | | | |

Altra Industrial Motion Corporation | | | 8,005 | | | | 200,205 | |

Dynamic Materials Corporation | | | 130,190 | | | | 1,475,053 | |

Lydall, Inc. * | | | 24,200 | | | | 657,272 | |

| | | | | | | | 2,332,530 | |

Trading Companies & Distributors — 0.3% | | | | | | | | |

Houston Wire & Cable Company | | | 18,017 | | | | 137,650 | |

| | | | | | | | | |

Information Technology — 4.4% | | | | | | | | |

Electronic Equipment, Instruments & Components — 1.3% | | | | | | | | |

Maxwell Technologies, Inc. * | | | 96,168 | | | | 513,537 | |

| | | | | | | | | |

Internet Software & Services — 0.1% | | | | | | | | |

SpendSmart Networks, Inc. * | | | 53,900 | | | | 26,950 | |

| | | | | | | | | |

Technology Hardware, Storage & Peripherals — 3.0% | | | | | | | | |

Avid Technology, Inc. * | | | 134,681 | | | | 1,119,199 | |

Xplore Technologies Corporation * | | | 17,700 | | | | 99,563 | |

| | | | | | | | 1,218,762 | |

Materials — 22.3% | | | | | | | | |

Chemicals — 4.3% | | | | | | | | |

American Vanguard Corporation | | | 35,058 | | | | 468,375 | |

Chase Corporation | | | 9,271 | | | | 366,204 | |

CVR Partners, L.P. | | | 79,316 | | | | 883,580 | |

| | | | | | | | 1,718,159 | |

Metals & Mining — 18.0% | | | | | | | | |

Allegheny Technologies, Inc. | | | 67,000 | | | | 1,293,770 | |

Asanko Gold, Inc. * | | | 521,310 | | | | 860,162 | |

B2Gold Corporation * | | | 400,000 | | | | 476,000 | |

Compañia de Minas Buenaventura S.A. - ADR | | | 70,000 | | | | 442,400 | |

Comstock Mining, Inc. * | | | 1,629,664 | | | | 896,641 | |

Eldorado Gold Corporation | | | 130,000 | | | | 390,000 | |

Kinross Gold Corporation * | | | 270,000 | | | | 483,300 | |

Real Industry, Inc. * | | | 77,596 | | | | 751,129 | |

8

CM Advisors Small Cap Value Fund Schedule of Investments (Continued) | |

COMMON STOCKS — 80.7% (Continued) | | Shares | | | Value | |

Materials — 22.2% (Continued) | | | | | | |

Metals & Mining — 18.0% (Continued) | | | | | | |

Seabridge Gold, Inc. * | | | 110,000 | | | $ | 704,000 | |

Synalloy Corporation | | | 65,758 | | | | 641,798 | |

Yamana Gold, Inc. | | | 160,000 | | | | 300,800 | |

| | | | | | | | 7,240,000 | |

Telecommunication Services — 0.2% | | | | | | | | |

Diversified Telecommunication Services — 0.2% | | | | | | | | |

Fusion Telecommunications International, Inc. * | | | 39,411 | | | | 83,551 | |

| | | | | | | | | |

Total Common Stocks (Cost $38,463,133) | | | | | | $ | 32,467,523 | |

EXCHANGE-TRADED FUNDS — 6.3% | | Shares | | | Value | |

SPDR S&P Oil & Gas Exploration & Production ETF | | | 27,935 | | | $ | 1,067,676 | |

SPDR S&P Regional Banking ETF | | | 36,000 | | | | 1,478,520 | |

Total Exchange-Traded Funds (Cost $2,691,221) | | | | | | $ | 2,546,196 | |

WARRANTS — 0.0% | | Shares | | | Value | |

SpendSmart Payment Company (The) *(a) (Cost $0) | | | 57,900 | | | $ | 0 | |

MONEY MARKET FUNDS — 12.8% | | Shares | | | Value | |

Wells Fargo Advantage Treasury Plus Money Market Fund - Institutional Class, 0.01% (b) (Cost $5,137,158) | | | 5,137,158 | | | $ | 5,137,158 | |

| | | | | | | | | |

Total Investments at Value — 99.8% (Cost $46,291,512) | | | | | | $ | 40,150,877 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.2% | | | | | | | 102,552 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 40,253,429 | |

ADR - American Depositary Receipt.

| * | Non-income producing security. |

| (a) | Security value has been determined in good faith pursuant to procedures adopted by the Board of Trustees. The total value of such securities is $0 at August 31, 2015, representing 0.0% of net assets. |

| (b) | The rate shown is the 7-day effective yield as of August 31, 2015. |

See accompanying notes to financial statements. |

9

CM Advisors Fixed Income Fund Schedule of Investments

August 31, 2015 (Unaudited) | |

CORPORATE BONDS — 28.5% | | Par Value | | | Value | |

Consumer Discretionary — 3.6% | | | | | | |

Auto Components — 0.9% | | | | | | |

Johnson Controls, Inc., 5.50%, due 01/15/16 | | $ | 1,002,000 | | | $ | 1,019,290 | |

| | | | | | | | | |

Hotels, Restaurants & Leisure — 0.4% | | | | | | | | |

Marriott International, Inc., 6.375%, due 06/15/17 | | | 400,000 | | | | 432,442 | |

| | | | | | | | | |

Household Durables — 0.7% | | | | | | | | |

MDC Holdings, Inc., 5.625%, due 02/01/20 | | | 500,000 | | | | 525,000 | |

Newell Rubbermaid, Inc., 6.25%, due 04/15/18 | | | 185,000 | | | | 204,177 | |

| | | | | | | | 729,177 | |

Media — 1.1% | | | | | | | | |

Comcast Corporation, | | | | | | | | |

6.30%, due 11/15/17 | | | 200,000 | | | | 220,426 | |

5.70%, due 05/15/18 | | | 400,000 | | | | 442,076 | |

McGraw-Hill Companies, Inc. (The),

5.90%, due 11/15/17 | | | 200,000 | | | | 216,727 | |

Tele-Communications, Inc., 10.125%, due 04/15/22 | | | 300,000 | | | | 406,166 | |

| | | | | | | | 1,285,395 | |

Specialty Retail — 0.5% | | | | | | | | |

Home Depot, Inc. (The), 5.40%, due 03/01/16 | | | 600,000 | | | | 614,487 | |

| | | | | | | | | |

Consumer Staples — 0.6% | | | | | | | | |

Beverages — 0.3% | | | | | | | | |

PepsiCo, Inc., 5.00%, due 06/01/18 | | | 300,000 | | | | 327,601 | |

| | | | | | | | | |

Household Products — 0.3% | | | | | | | | |

Clorox Company (The), 3.55%, due 11/01/15 | | | 335,000 | | | | 336,661 | |

| | | | | | | | | |

Energy — 3.5% | | | | | | | | |

Energy Equipment & Services — 2.2% | | | | | | | | |

Rowan Companies, Inc., 7.875%, due 08/01/19 | | | 910,000 | | | | 976,920 | |

Transocean, Inc., 7.375%, due 04/15/18 | | | 855,000 | | | | 835,763 | |

Weatherford International Ltd., | | | | | | | | |

6.35%, due 06/15/17 | | | 370,000 | | | | 381,909 | |

6.00%, due 03/15/18 | | | 300,000 | | | | 303,115 | |

| | | | | | | | 2,497,707 | |

Oil, Gas & Consumable Fuels — 1.3% | | | | | | | | |

Cloud Peak Energy, Inc., 8.50%, due 12/15/19 | | | 1,243,000 | | | | 854,562 | |

Valero Energy Corporation, 6.125%, due 06/15/17 | | | 570,000 | | | | 613,527 | |

| | | | | | | | 1,468,089 | |

10

CM Advisors Fixed Income Fund Schedule of Investments (Continued) | |

CORPORATE BONDS — 28.5% (Continued) | | Par Value | | | Value | |

Financials — 1.5% | | | | | | |

Commercial Banks — 0.5% | | | | | | |

Wells Fargo & Company, 5.625%, due 12/11/17 | | $ | 500,000 | | | $ | 544,279 | |

| | | | | | | | | |

Consumer Finance — 1.0% | | | | | | | | |

American Express Company, | | | | | | | | |

7.00%, due 03/19/18 | | | 800,000 | | | | 901,855 | |

8.125%, due 05/20/19 | | | 200,000 | | | | 240,580 | |

| | | | | | | | 1,142,435 | |

Health Care — 1.4% | | | | | | | | |

Health Care Providers & Services — 0.8% | | | | | | | | |

UnitedHealth Group, Inc., 6.00%, due 02/15/18 | | | 800,000 | | | | 881,479 | |

| | | | | | | | | |

Pharmaceuticals — 0.6% | | | | | | | | |

Johnson & Johnson, 5.15%, due 07/15/18 | | | 570,000 | | | | 629,490 | |

| | | | | | | | | |

Industrials — 8.8% | | | | | | | | |

Aerospace & Defense — 0.2% | | | | | | | | |

United Technologies Corporation,

5.375%, due 12/15/17 | | | 200,000 | | | | 217,402 | |

| | | | | | | | | |

Building Products — 0.7% | | | | | | | | |

Masco Corporation, | | | | | | | | |

6.125%, due 10/03/16 | | | 300,000 | | | | 311,544 | |

5.85%, due 03/15/17 | | | 400,000 | | | | 422,300 | |

| | | | | | | | 733,844 | |

Communications Equipment — 0.9% | | | | | | | | |

Juniper Networks, Inc., 3.10%, due 03/15/16 | | | 1,007,000 | | | | 1,018,361 | |

| | | | | | | | | |

Construction & Engineering — 1.5% | | | | | | | | |

Great Lakes Dredge & Dock Company,

7.375%, due 02/01/19 | | | 1,705,000 | | | | 1,713,525 | |

| | | | | | | | | |

Electrical Equipment — 0.7% | | | | | | | | |

Eaton Corporation, 8.10%, due 08/15/22 | | | 150,000 | | | | 190,590 | |

Emerson Electric Company, 5.25%, due 10/15/18 | | | 570,000 | | | | 628,628 | |

| | | | | | | | 819,218 | |

Health Care Providers & Services — 0.9% | | | | | | | | |

Laboratory Corporation of America Holdings,

3.125%, due 05/15/16 | | | 1,038,000 | | | | 1,050,839 | |

| | | | | | | | | |

Machinery — 0.9% | | | | | | | | |

Dover Corporation, 5.45%, due 03/15/18 | | | 115,000 | | | | 125,725 | |

Harsco Corporation, 2.70%, due 10/15/15 | | | 885,000 | | | | 882,788 | |

| | | | | | | | 1,008,513 | |

11

CM Advisors Fixed Income Fund Schedule of Investments (Continued) | |

CORPORATE BONDS — 28.5% (Continued) | | Par Value | | | Value | |

Industrials — 8.8% (Continued) | | | | | | |

Road & Rail — 2.4% | | | | | | |

Canadian Pacific Railroad Company,

7.25%, due 05/15/19 | | $ | 790,000 | | | $ | 923,439 | |

CSX Corporation, 6.25%, due 03/15/18 | | | 500,000 | | | | 555,139 | |

Norfolk Southern Corporation, 5.75%, due 01/15/16 | | | 947,000 | | | | 963,456 | |

Union Pacific Corporation, 5.70%, due 08/15/18 | | | 200,000 | | | | 224,134 | |

| | | | | | | | 2,666,168 | |

Semiconductors & Semiconductor Equipment — 0.6% | | | | | | | | |

Applied Materials, Inc., 2.65%, due 06/15/16 | | | 633,000 | | | | 641,342 | |

| | | | | | | | | |

Information Technology — 2.9% | | | | | | | | |

Electronic Equipment, Instruments & Components — 1.0% | | | | | | | | |

Avnet, Inc., 6.625%, due 09/15/16 | | | 500,000 | | | | 524,344 | |

Corning, Inc., 7.25%, due 08/15/36 | | | 500,000 | | | | 610,286 | |

| | | | | | | | 1,134,630 | |

IT Services — 1.0% | | | | | | | | |

International Business Machines Corporation,

7.625%, due 10/15/18 | | | 420,000 | | | | 492,982 | |

Western Union Company (The), 5.93%, due 10/01/16 | | | 600,000 | | | | 626,410 | |

| | | | | | | | 1,119,392 | |

Software — 0.9% | | | | | | | | |

Intuit, Inc., 5.75%, due 03/15/17 | | | 946,000 | | | | 1,002,463 | |

| | | | | | | | | |

Materials — 5.6% | | | | | | | | |

Chemicals — 0.8% | | | | | | | | |

Cytec Industries, Inc., 8.95%, due 07/01/17 | | | 325,000 | | | | 361,497 | |

E.I. du Pont de Nemours and Company,

6.00%, due 07/15/18 | | | 475,000 | | | | 528,132 | |

| | | | | | | | 889,629 | |

Construction Materials — 0.5% | | | | | | | | |

Vulcan Materials Company, 7.50%, due 06/15/21 | | | 500,000 | | | | 571,250 | |

| | | | | | | | | |

Metals & Mining — 4.3% | | | | | | | | |

Alcoa, Inc., | | | | | | | | |

5.72%, due 02/23/19 | | | 800,000 | | | | 840,000 | |

5.87%, due 02/23/22 | | | 1,200,000 | | | | 1,242,000 | |

Allegheny Technologies, Inc., 9.375%, due 06/01/19 | | | 355,000 | | | | 380,737 | |

ArcelorMittal, 5.25% (a), due 02/25/17 | | | 960,000 | | | | 976,800 | |

Commercial Metals Company, | | | | | | | | |

6.50%, due 07/15/17 | | | 420,000 | | | | 434,700 | |

7.35%, due 08/15/18 | | | 230,000 | | | | 244,950 | |

12

CM Advisors Fixed Income Fund Schedule of Investments (Continued) | |

CORPORATE BONDS — 28.5% (Continued) | | Par Value | | | Value | |

Materials — 5.6% (Continued) | | | | | | |

Metals & Mining — 4.3% (Continued) | | | | | | |

Nucor Corporation, 5.85%, due 06/01/18 | | $ | 300,000 | | | $ | 329,764 | |

Reliance Steel & Aluminum Company,

6.20%, due 11/15/16 | | | 360,000 | | | | 374,395 | |

| | | | | | | | 4,823,346 | |

Utilities — 0.6% | | | | | | | | |

Multi-Utilities — 0.6% | | | | | | | | |

Consolidated Edison Company of New York, Inc.,

5.85%, due 04/01/18 | | | 570,000 | | | | 629,271 | |

| | | | | | | | | |

Total Corporate Bonds (Cost $30,494,627) | | | | | | $ | 31,947,725 | |

U.S. GOVERNMENT OBLIGATIONS — 60.1% | | Par Value | | | Value | |

U.S. Treasury Bills (b)— 14.3% | | | | | | |

0.07%, due 11/12/15 | | $ | 6,000,000 | | | $ | 5,999,880 | |

0.105%, due 12/31/15 | | | 10,000,000 | | | | 9,995,790 | |

| | | | | | | | 15,995,670 | |

U.S. Treasury Notes — 45.8% | | | | | | | | |

0.375%, due 01/15/16 | | | 5,000,000 | | | | 5,001,495 | |

0.375%, due 04/30/16 | | | 6,000,000 | | | | 6,001,638 | |

4.625%, due 02/15/17 | | | 5,000,000 | | | | 5,289,520 | |

0.875%, due 05/15/17 | | | 6,000,000 | | | | 6,019,998 | |

0.75%, due 12/31/17 | | | 10,000,000 | | | | 9,967,190 | |

2.00%, due 07/31/20 | | | 6,000,000 | | | | 6,125,310 | |

2.375%, due 12/31/20 | | | 6,250,000 | | | | 6,475,587 | |

2.75%, due 11/15/23 | | | 6,250,000 | | | | 6,570,475 | |

| | | | | | | | 51,451,213 | |

Total U.S. Government Obligations (Cost $66,614,421) | | | | | | $ | 67,446,883 | |

13

CM Advisors Fixed Income Fund Schedule of Investments (Continued) | |

MONEY MARKET FUNDS — 11.0% | | Shares | | | Value | |

Wells Fargo Advantage Treasury Plus Money Market Fund - Institutional Class, 0.01% (c) (Cost $12,369,409) | | | 12,369,409 | | | $ | 12,369,409 | |

| | | | | | | | | |

Total Investments at Value — 99.6% (Cost $109,478,457) | | | | | | $ | 111,764,017 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.4% | | | | | | | 503,386 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 112,267,403 | |

| (a) | Variable rate security. The rate shown is the effective interest rate as of August 31, 2015. |

| (b) | Rate shown is the annualized yield at time of purchase, not a coupon rate. |

| (c) | The rate shown is the 7-day effective yield as of August 31, 2015. |

See accompanying notes to financial statements. |

14

CM Advisors Family of Funds Statements of Assets and Liabilities

August 31, 2015 (Unaudited) |

| | CM Advisors Fund | | | CM Advisors Small Cap Value Fund | |

ASSETS | | | | | | |

Investments in securities: | | | | | | |

At cost | | $ | 99,569,128 | | | $ | 46,291,512 | |

At value (Note 2) | | $ | 90,894,136 | | �� | $ | 40,150,877 | |

Dividends receivable | | | 77,343 | | | | 37,691 | |

Receivable for investment securities sold | | | 555 | | | | 147,417 | |

Receivable for capital shares sold | | | 16,620 | | | | 1,200 | |

Other assets | | | 19,511 | | | | 34,748 | |

TOTAL ASSETS | | | 91,008,165 | | | | 40,371,933 | |

| | | | | | | | | |

LIABILITIES | | | | | | | | |

Payable for investment securities purchased | | | 1,416,973 | | | | 45,543 | |

Payable for capital shares redeemed | | | — | | | | 39,030 | |

Payable to Advisor (Note 5) | | | 77,345 | | | | 24,396 | |

Payable to administrator (Note 5) | | | 14,730 | | | | 6,655 | |

Other accrued expenses | | | 15,483 | | | | 2,880 | |

TOTAL LIABILITIES | | | 1,524,531 | | | | 118,504 | |

| | | | | | | | | |

NET ASSETS | | $ | 89,483,634 | | | $ | 40,253,429 | |

| | | | | | | | | |

Net assets consist of: | | | | | | | | |

Paid-in capital | | $ | 121,464,059 | | | $ | 47,395,798 | |

Accumulated net investment loss | | | (413,210 | ) | | | (86,833 | ) |

Accumulated net realized losses from security transactions and options contracts (Note 6) | | | (22,892,223 | ) | | | (914,901 | ) |

Net unrealized depreciation on investments (Note 6) | | | (8,674,992 | ) | | | (6,140,635 | ) |

Net assets | | $ | 89,483,634 | | | $ | 40,253,429 | |

| | | | | | | | | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) | | | 8,780,571 | | | | 4,518,631 | |

| | | | | | | | | |

Net asset value, redemption price and offering price per share (a) | | $ | 10.19 | | | $ | 8.91 | |

| (a) | Redemption price may differ from the net asset value per share depending upon the length of time the shares are held (Note 2). |

See accompanying notes to financial statements. |

15

CM Advisors Family of Funds Statements of Assets and Liabilities (Continued)

August 31, 2015 (Unaudited) | |

| | CM Advisors Fixed Income Fund | |

ASSETS | | | |

Investments in securities: | | | |

At cost | | $ | 109,478,457 | |

At value (Note 2) | | $ | 111,764,017 | |

Dividends and interest receivable | | | 570,303 | |

Receivable for capital shares sold | | | 3,900 | |

Other assets | | | 16,413 | |

TOTAL ASSETS | | | 112,354,633 | |

| | | | | |

LIABILITIES | | | | |

Payable to Advisor (Note 5) | | | 49,090 | |

Payable to administrator (Note 5) | | | 12,368 | |

Other accrued expenses | | | 25,772 | |

TOTAL LIABILITIES | | | 87,230 | |

| | | | | |

NET ASSETS | | $ | 112,267,403 | |

| | | | | |

Net assets consist of: | | | | |

Paid-in capital | | $ | 109,610,925 | |

Accumulated net investment income | | | 256,507 | |

Accumulated net realized gains from security transactions | | | 114,411 | |

Net unrealized appreciation on investments | | | 2,285,560 | |

Net assets | | $ | 112,267,403 | |

| | | | | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) | | | 9,865,977 | |

| | | | | |

Net asset value, redemption price and offering price per share (Note 2) | | $ | 11.38 | |

See accompanying notes to financial statements. |

16

CM Advisors Family of Funds Statements of Operations

Six Months Ended August 31, 2015 (Unaudited) | |

| | CM Advisors

Fund | | | CM Advisors

Small Cap

Value Fund | |

INVESTMENT INCOME | | | | | | |

Dividends | | $ | 400,834 | | | $ | 250,984 | |

Foreign tax witholding | | | (15,130 | ) | | | (2,245 | ) |

TOTAL INVESTMENT INCOME | | | 385,704 | | | | 248,739 | |

| | | | | | | | | |

EXPENSES | | | | | | | | |

Investment advisory fees (Note 5) | | | 509,481 | | | | 244,591 | |

Administration fees (Note 5) | | | 40,719 | | | | 19,535 | |

Fund accounting fees (Note 5) | | | 39,090 | | | | 13,942 | |

Professional fees | | | 24,391 | | | | 20,938 | |

Registration and filing fees | | | 13,323 | | | | 29,615 | |

Transfer agent fees (Note 5) | | | 10,956 | | | | 9,000 | |

Trustees’ fees and expenses (Note 5) | | | 9,401 | | | | 6,869 | |

Custody and bank service fees | | | 7,893 | | | | 3,563 | |

Postage and supplies | | | 6,145 | | | | 3,676 | |

Insurance expense | | | 5,645 | | | | 919 | |

Printing of shareholder reports | | | 4,186 | | | | 1,365 | |

Pricing fees | | | 2,199 | | | | 542 | |

Compliance support services fees | | | 1,578 | | | | 756 | |

Distributor service fees (Note 5) | | | 1,000 | | | | 1,000 | |

Other expenses | | | 8,146 | | | | 3,737 | |

TOTAL EXPENSES | | | 684,153 | | | | 360,048 | |

Advisory fees waived by Advisor (Note 5) | | | — | | | | (54,309 | ) |

NET EXPENSES | | | 684,153 | | | | 305,739 | |

| | | | | | | | | |

NET INVESTMENT LOSS | | | (298,449 | ) | | | (57,000 | ) |

| | | | | | | | | |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS AND OPTION CONTRACTS | | | | | | | | |

Net realized losses from: | | | | | | | | |

Security transactions | | | (3,006,922 | ) | | | (647,550 | ) |

Option contracts (Note 6) | | | (1,042,860 | ) | | | — | |

Net change in unrealized appreciation/depreciation on: | | | | | | | | |

Investments | | | (12,054,046 | ) | | | (6,837,430 | ) |

Option contracts (Note 6) | | | 895,196 | | | | — | |

| | | | | | | | | |

NET REALIZED AND UNREALIZED LOSSES ON INVESTMENTS AND OPTION CONTRACTS | | | (15,208,632 | ) | | | (7,484,980 | ) |

| | | | | | | | | |

NET DECREASE IN NET ASSETS FROM OPERATIONS | | $ | (15,507,081 | ) | | $ | (7,541,980 | ) |

See accompanying notes to financial statements. |

17

CM Advisors Family of Funds Statements of Operations (Continued)

Six Months Ended August 31, 2015 (Unaudited) | |

| | CM Advisors

Fixed Income

Fund | |

INVESTMENT INCOME | | | |

Dividends | | $ | 568 | |

Interest | | | 1,211,857 | |

TOTAL INVESTMENT INCOME | | | 1,212,425 | |

| | | | | |

EXPENSES | | | | |

Investment advisory fees (Note 5) | | | 300,189 | |

Administration fees (Note 5) | | | 48,051 | |

Professional fees | | | 21,159 | |

Fund accounting fees (Note 5) | | | 18,006 | |

Registration and filing fees | | | 15,014 | |

Trustees’ fees and expenses (Note 5) | | | 9,979 | |

Transfer agent fees (Note 5) | | | 9,000 | |

Insurance expense | | | 5,715 | |

Custody and bank service fees | | | 5,617 | |

Pricing fees | | | 5,178 | |

Postage and supplies | | | 3,379 | |

Printing of shareholder reports | | | 2,310 | |

Compliance support services fees | | | 1,866 | |

Distributor service fees (Note 5) | | | 1,000 | |

Other expenses | | | 15,764 | |

TOTAL EXPENSES | | | 462,227 | |

| | | | | |

NET INVESTMENT INCOME | | | 750,198 | |

| | | | | |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | |

Net realized gains from security transactions | | | 140,884 | |

Net change in unrealized appreciation/depreciation on investments | | | (1,301,185 | ) |

| | | | | |

NET REALIZED AND UNREALIZED LOSSES ON INVESTMENTS | | | (1,160,301 | ) |

| | | | | |

NET DECREASE IN NET ASSETS FROM OPERATIONS | | $ | (410,103 | ) |

See accompanying notes to financial statements. |

18

CM Advisors Fund Statements of Changes in Net Assets | |

| | Six Months Ended

August 31, 2015

(Unaudited) | | | Year Ended

February 28,

2015 | |

FROM OPERATIONS | | | | | | |

Net investment loss | | $ | (298,449 | ) | | $ | (493,539 | ) |

Net realized gains (losses) from: | | | | | | | | |

Security transactions | | | (3,006,922 | ) | | | 9,682,318 | |

Option contracts (Note 6) | | | (1,042,860 | ) | | | 286,545 | |

Net change in unrealized appreciation/ depreciation on: | | | | | | | | |

Investments | | | (12,054,046 | ) | | | (25,275,411 | ) |

Option contracts (Note 6) | | | 895,196 | | | | (895,196 | ) |

Net decrease in net assets from operations | | | (15,507,081 | ) | | | (16,695,283 | ) |

| | | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

From net investment income, Class I | | | — | | | | (300,838 | ) |

| | | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS (NOTE 7) | | | | | | | | |

CLASS I (NOTE 1) | | | | | | | | |

Proceeds from shares sold | | | 5,262,519 | | | | 9,616,626 | |

Net asset value of shares issued in reinvestment of distributions to shareholders | | | — | | | | 290,748 | |

Proceeds from redemption fees collected (Note 2) | | | 1,268 | | | | 2,436 | |

Payments for shares redeemed | | | (11,941,401 | ) | | | (18,000,574 | ) |

Net decrease in net assets from Class I share transactions | | | (6,677,614 | ) | | | (8,090,764 | ) |

| | | | | | | | | |

CLASS R (NOTE 1) | | | | | | | | |

Proceeds from shares sold | | | — | | | | 29,323 | |

Proceeds from redemption fees collected (Note 2) | | | — | | | | 268 | |

Payments for shares redeemed | | | — | | | | (184,045 | ) |

Net decrease in net assets from Class R share transactions | | | — | | | | (154,454 | ) |

| | | | | | | | | |

TOTAL DECREASE IN NET ASSETS | | | (22,184,695 | ) | | | (25,241,339 | ) |

| | | | | | | | | |

NET ASSETS | | | | | | | | |

Beginning of period | | | 111,668,329 | | | | 136,909,668 | |

End of period | | $ | 89,483,634 | | | $ | 111,668,329 | |

| | | | | | | | | |

ACCUMULATED NET INVESTMENT LOSS | | $ | (413,210 | ) | | $ | (114,761 | ) |

See accompanying notes to financial statements. |

19

CM Advisors Small Cap Value Fund Statements of Changes in Net Assets | |

| | Six Months Ended

August 31, 2015

(Unaudited) | | | Year Ended

February 28,

2015 | |

FROM OPERATIONS | | | | | | |

Net investment loss | | $ | (57,000 | ) | | $ | (90,309 | ) |

Net realized gains (losses) from: | | | | | | | | |

Security transactions | | | (647,550 | ) | | | 339,785 | |

Option contracts (Note 6) | | | — | | | | (46,654 | ) |

Net change in unrealized appreciation/ depreciation on investments | | | (6,837,430 | ) | | | (2,363,500 | ) |

Net decrease in net assets from operations | | | (7,541,980 | ) | | | (2,160,678 | ) |

| | | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

From net realized gains, Class I | | | — | | | | (1,496,887 | ) |

From net realized gains, Class R | | | — | | | | (12,942 | ) |

Decrease in net assets from distributions to shareholders | | | — | | | | (1,509,829 | ) |

| | | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS (NOTE 7) | | | | | | | | |

CLASS I (NOTE 1) | | | | | | | | |

Proceeds from shares sold | | | 548,086 | | | | 46,796,943 | |

Net asset value of shares issued in reinvestment of distributions to shareholders | | | — | | | | 1,323,322 | |

Proceeds from redemption fees collected (Note 2) | | | 28,440 | | | | 23,831 | |

Payments for shares redeemed | | | (6,772,605 | ) | | | (3,374,562 | ) |

Net increase (decrease) in net assets from

Class I share transactions | | | (6,196,079 | ) | | | 44,769,534 | |

| | | | | | | | | |

CLASS C (NOTE 1) | | | | | | | | |

Net asset value of shares issued in reinvestment of distributions to shareholders | | | — | | | | — | |

Payments for shares redeemed | | | — | | | | (109,333 | ) |

Net decrease in net assets from Class C share transactions | | | — | | | | (109,333 | ) |

| | | | | | | | | |

CLASS R (NOTE 1) | | | | | | | | |

Proceeds from shares sold | | | — | | | | 132,642 | |

Net asset value of shares issued in reinvestment of distributions to shareholders | | | — | | | | 12,943 | |

Proceeds from redemption fees collected (Note 2) | | | — | | | | 11 | |

Payments for shares redeemed | | | — | | | | (214,070 | ) |

Net decrease in net assets from Class R share transactions | | | — | | | | (68,474 | ) |

| | | | | | | | | |

TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (13,738,059 | ) | | | 40,921,220 | |

| | | | | | | | | |

NET ASSETS | | | | | | | | |

Beginning of period | | | 53,991,488 | | | | 13,070,268 | |

End of period | | $ | 40,253,429 | | | $ | 53,991,488 | |

| | | | | | | | | |

ACCUMULATED NET INVESTMENT LOSS | | $ | (86,833 | ) | | $ | (29,833 | ) |

See accompanying notes to financial statements. |

20

CM Advisors Fixed Income Fund Statements of Changes in Net Assets | |

| | Six Months Ended

August 31, 2015

(Unaudited) | | | Year Ended

February 28,

2015 | |

FROM OPERATIONS | | | | | | |

Net investment income | | $ | 750,198 | | | $ | 1,573,991 | |

Net realized gains from security transactions | | | 140,884 | | | | 249,740 | |

Net change in unrealized appreciation/ depreciation on investments | | | (1,301,185 | ) | | | (578,721 | ) |

Net increase (decrease) in net assets from operations | | | (410,103 | ) | | | 1,245,010 | |

| | | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

From net investment income | | | (750,795 | ) | | | (1,603,075 | ) |

From net realized gains | | | — | | | | (572,865 | ) |

Decrease in net assets from distributions to shareholders | | | (750,795 | ) | | | (2,175,940 | ) |

| | | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Proceeds from shares sold | | | 8,660,529 | | | | 8,796,108 | |

Net asset value of shares issued in reinvestment of distributions to shareholders | | | 662,521 | | | | 1,908,816 | |

Payments for shares redeemed | | | (15,799,100 | ) | | | (18,036,143 | ) |

Net decrease in net assets from capital share transactions | | | (6,476,050 | ) | | | (7,331,219 | ) |

| | | | | | | | | |

TOTAL DECREASE IN NET ASSETS | | | (7,636,948 | ) | | | (8,262,149 | ) |

| | | | | | | | | |

NET ASSETS | | | | | | | | |

Beginning of period | | | 119,904,351 | | | | 128,166,500 | |

End of period | | $ | 112,267,403 | | | $ | 119,904,351 | |

| | | | | | | | | |

ACCUMULATED NET INVESTMENT INCOME | | $ | 256,507 | | | $ | 257,104 | |

| | | | | | | | | |

CAPITAL SHARE ACTIVITY | | | | | | | | |

Shares sold | | | 754,309 | | | | 761,435 | |

Shares reinvested | | | 57,885 | | | | 166,147 | |

Shares redeemed | | | (1,381,791 | ) | | | (1,562,151 | ) |

Net decrease in shares outstanding | | | (569,597 | ) | | | (634,569 | ) |

Shares outstanding, beginning of period | | | 10,435,574 | | | | 11,070,143 | |

Shares outstanding, end of period | | | 9,865,977 | | | | 10,435,574 | |

See accompanying notes to financial statements. |

21

CM Advisors Fund Financial Highlights | |

Per share data for a share outstanding throughout each period: | |

| | Six Months Ended

August 31, 2015

(Unaudited) | |

Years Ended

| |

| February 28, 2015 | | February 28, 2014 | | February 28, 2013 | | February 29, 2012 | | February 28, 2011 | |

Net asset value at

beginning of period | $ | 11.95 | | $ | 13.68 | | $ | 11.83 | | $ | 10.65 | | $ | 10.56 | | $ | 8.95 | |

| | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | (0.03 | ) | | (0.06 | ) | | (0.01 | ) | | 0.05 | | | 0.02 | | | 0.04 | |

Net realized and unrealized gains (losses) on investments | | (1.73 | ) | | (1.64 | ) | | 1.86 | | | 1.18 | | | 0.10 | | | 1.61 | |

Total from investment operations | | (1.76 | ) | | (1.70 | ) | | 1.85 | | | 1.23 | | | 0.12 | | | 1.65 | |

| | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | — | | | (0.03 | ) | | — | | | (0.05 | ) | | (0.03 | ) | | (0.04 | ) |

Distributions in excess of net investment income | | — | | | — | | | — | | | (0.00 | )(a) | | — | | | — | |

Total distributions | | — | | | (0.03 | ) | | — | | | (0.05 | ) | | (0.03 | ) | | (0.04 | ) |

| | | | | | | | | | | | | | | | | | | |

Proceeds from redemption fees collected (Note 2) | | 0.00 | (a) | | 0.00 | (a) | | 0.00 | (a) | | 0.00 | (a) | | 0.00 | (a) | | 0.00 | (a) |

| | | | | | | | | | | | | | | | | | | |

Net asset value at end of period | $ | 10.19 | | $ | 11.95 | | $ | 13.68 | | $ | 11.83 | | $ | 10.65 | | $ | 10.56 | |

| | | | | | | | | | | | | | | | | | | |

Total return (b) | | (14.73% | )(c) | | (12.46 | %) | | 15.64 | % | | 11.61 | % | | 1.11 | % | | 18.43 | % |

| | | | | | | | | | | | | | | | | | | |

Ratios and supplemental data: | | | | | | | | | | | | | | | | | | |

Net assets at end of period (000's) | $ | 89,484 | | $ | 111,668 | | $ | 136,714 | | $ | 125,422 | | $ | 128,461 | | $ | 142,659 | |

| | | | | | | | | | | | | | | | | | | |

Ratio of total expenses to average net assets | | 1.34 | %(d) | | 1.31 | % | | 1.29 | % | | 1.31 | % | | 1.53 | % | | 1.52 | % |

| | | | | | | | | | | | | | | | | | | |

Ratio of net expenses to average net assets (e) | | 1.34 | %(d) | | 1.31 | % | | 1.29 | % | | 1.31 | % | | 1.50 | % | | 1.50 | % |

| | | | | | | | | | | | | | | | | | | |

Ratio of net investment income (loss) to average net assets (e) | | (0.59 | %)(d) | | (0.39 | %) | | (0.07 | %) | | 0.40 | % | | 0.18 | % | | 0.39 | % |

| | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | 36 | %(c) | | 53 | % | | 34 | % | | 32 | % | | 45 | % | | 15 | % |

| (a) | Amount rounds to less than $0.01 per share. |

| (b) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (e) | Ratio was determined after investment advisory fee waivers (Note 5). |

See accompanying notes to financial statements. |

22

CM Advisors Small Cap Value Fund Financial Highlights | |

Per share data for a share outstanding throughout each period: | |

| Six Months

Ended

August 31,

2015

(Unaudited) | | Year Ended February 28, 2015 | | Year Ended February 28, 2014 | | Year Ended February 28, 2013 | | Period Ended February 29, 2012(a) | |

Net asset value at beginning of period | $ | 10.47 | | $ | 12.90 | | $ | 11.25 | | $ | 9.84 | | $ | 10.00 | |

| | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | |

Net investment income (loss) | | (0.01 | ) | | (0.07 | )(b) | | (0.05 | )(b) | | 0.13 | | | 0.02 | |

Net realized and unrealized gains (losses) on investments | | (1.56 | ) | | (1.73 | ) | | 2.34 | | | 1.56 | | | (0.05 | ) |

Total from investment operations | | (1.57 | ) | | (1.80 | ) | | 2.29 | | | 1.69 | | | (0.03 | ) |

| | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | |

Dividends from net investment income | | — | | | — | | | — | | | (0.12 | ) | | (0.01 | ) |

Distributions in excess of net investment income | | — | | | — | | | — | | | (0.02 | ) | | — | |

Distributions from net realized gains | | — | | | (0.64 | ) | | (0.64 | ) | | (0.14 | ) | | (0.12 | ) |

Total distributions | | — | | | (0.64 | ) | | (0.64 | ) | | (0.28 | ) | | (0.13 | ) |

| | | | | | | | | | | | | | | | |

Proceeds from redemption fees collected (Note 2) | | 0.01 | | | 0.01 | | | 0.00 | (c) | | — | | | 0.00 | (c) |

| | | | | | | | | | | | | | | | |

Net asset value at end of period | $ | 8.91 | | $ | 10.47 | | $ | 12.90 | | $ | 11.25 | | $ | 9.84 | |

| | | | | | | | | | | | | | | | |

Total return (d) | | (14.90% | )(e) | | (13.95 | %) | | 20.53 | % | | 17.42 | % | | (0.17% | )(e) |

| | | | | | | | | | | | | | | | |

Ratios and supplemental data: | | | | | | | | | | | | | | | |

Net assets at end of period (000’s) | $ | 40,253 | | $ | 53,991 | | $ | 12,790 | | $ | 11,094 | | $ | 8,953 | |

| | | | | | | | | | | | | | | | |

Ratio of total expenses to average net assets | | 1.47 | %(f) | | 1.96 | % | | 2.56 | % | | 2.92 | % | | 4.35 | %(f) |

| | | | | | | | | | | | | | | | |

Ratio of net expenses to average net assets (g) | | 1.25 | %(f) | | 1.25 | % | | 1.25 | % | | 1.25 | % | | 1.25 | %(f) |

| | | | | | | | | | | | | | | | |

Ratio of net investment income (loss) to average net assets (g) | | (0.23 | %)(f) | | (0.45 | %) | | (0.40 | %) | | 1.32 | % | | 0.09 | %(f) |

| | | | | | | | | | | | | | | | |

Portfolio turnover rate | | 35 | %(e) | | 62 | % | | 42 | % | | 44 | % | | 44 | %(e) |

| (a) | Represents the period from commencement of operations (April 15, 2011) through February 29, 2012. |

| (b) | Net investment loss per share is based on average shares outstanding during the year. |

| (c) | Amount rounds to less than $0.01 per share. |

| (d) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (g) | Ratio was determined after investment advisory fee waivers and expense reimbursements (Note 5). |

See accompanying notes to financial statements. |

23

CM Advisors Fixed Income Fund Financial Highlights | |

Per share data for a share outstanding throughout each period: | |

| | Six Months Ended

August 31, 2015

(Unaudited) | |

Years Ended

| |

| February 28, 2015 | | February 28, 2014 | | February 28, 2013 | | February 29, 2012 | | February 28, 2011 | |

Net asset value at

beginning of period | $ | 11.49 | | $ | 11.58 | | $ | 11.64 | | $ | 11.74 | | $ | 11.51 | | $ | 11.14 | |

| | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | |

Net investment income | | 0.07 | | | 0.15 | | | 0.14 | | | 0.17 | | | 0.20 | | | 0.24 | |

Net realized and unrealized gains (losses) on investments | | (0.11 | ) | | (0.04 | ) | | (0.06 | ) | | 0.04 | | | 0.53 | | | 0.49 | |

Total from investment operations | | (0.04 | ) | | 0.11 | | | 0.08 | | | 0.21 | | | 0.73 | | | 0.73 | |

| | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | (0.07 | ) | | (0.15 | ) | | (0.14 | ) | | (0.17 | ) | | (0.21 | ) | | (0.26 | ) |

Distributions from net realized gains | | — | | | (0.05 | ) | | (0.00 | )(a) | | (0.14 | ) | | (0.29 | ) | | (0.10 | ) |

Total distributions | | (0.07 | ) | | (0.20 | ) | | (0.14 | ) | | (0.31 | ) | | (0.50 | ) | | (0.36 | ) |

| | | | | | | | | | | | | | | | | | | |

Proceeds from redemption fees collected (Note 2) | | — | | | — | | | — | | | 0.00 | (a) | | 0.00 | (a) | | 0.00 | (a) |

| | | | | | | | | | | | | | | | | | | |

Net asset value at end of period | $ | 11.38 | | $ | 11.49 | | $ | 11.58 | | $ | 11.64 | | $ | 11.74 | | $ | 11.51 | |

| | | | | | | | | | | | | | | | | | | |

Total return (b) | | (0.33% | )(c) | | 0.98 | % | | 0.71 | % | | 1.83 | % | | 6.37 | % | | 6.63 | % |

| | | | | | | | | | | | | | | | | | | |

Ratios and supplemental data: | | | | | | | | | | | | | | | | | | |

Net assets at end of period (000’s) | $ | 112,267 | | $ | 119,904 | | $ | 128,167 | | $ | 107,993 | | $ | 94,317 | | $ | 79,935 | |

| | | | | | | | | | | | | | | | | | | |

Ratio of total expenses to average net assets | | 0.77 | %(d) | | 0.77 | % | | 0.78 | % | | 0.79 | % | | 0.81 | % | | 0.90 | % |

| | | | | | | | | | | | | | | | | | | |

Ratio of net investment income to average net assets | | 1.25 | %(d) | | 1.26 | % | | 1.22 | % | | 1.39 | % | | 1.76 | % | | 2.13 | % |

| | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | 9 | %(c) | | 1 | % | | 6 | % | | 23 | % | | 25 | % | | 21 | % |

| (a) | Amount rounds to less than $0.01 per share. |

| (b) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

See accompanying notes to financial statements. |

24

CM Advisors Family of Funds

Notes to Financial Statements

August 31, 2015 (Unaudited)

1. Organization

CM Advisors Fund, CM Advisors Small Cap Value Fund, and CM Advisors Fixed Income Fund (collectively the “Funds” and individually a “Fund”) are each a separate diversified no-load series of CM Advisors Family of Funds (the “Trust”), which was organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940 as an open-end management investment company.

CM Advisors Fund commenced operations on May 13, 2003. The investment objective of the Fund is long-term growth of capital.

CM Advisors Small Cap Value Fund commenced operations on April 15, 2011. The investment objective of the Fund is long-term growth of capital.

CM Advisors Fixed Income Fund commenced operations on March 24, 2006. The investment objective of the Fund is to preserve capital and maximize total return.

CM Advisors Fund currently offers one class of shares which is sold without any sales loads or distribution fees. Prior to February 28, 2015, the Fund offered Class I and Class R shares. On February 28, 2015, the Class R shares of the Fund were discontinued and all outstanding shares were converted into Class I shares. After the conversion, the Class I designation no longer applies to shares of the Fund. Class R shares were sold without any sales load but subject to a distribution and/or service fee of up to 0.25% of the average daily net assets attributable to Class R shares.

CM Advisors Small Cap Value Fund currently offers one class of shares which is sold without any sales loads or distribution fees. Prior to February 28, 2015, the Fund offered Class I and Class R shares. On February 28, 2015, the Class R shares of the Fund were discontinued and all outstanding shares were converted into Class I shares. After the conversion, the Class I designation no longer applies to shares of the Fund. Class R shares were sold without any sales loads but subject to a distribution and/or service fee of up to 0.25% of the average daily net assets attributable to the Class R shares. Prior to July 31, 2014, the Fund also offered Class C shares. Class C shares were sold without any sales loads but subject to a distribution and/or service fee of up to 1.00% of the average daily net assets attributable to the Class C shares. On July 31, 2014, the Class C shares of the CM Advisors Small Cap Value Fund were discontinued and all outstanding Class C shares were redeemed.

CM Advisors Fixed Income Fund currently offers one class of shares which is sold without any sales loads and distribution fees.

2. Significant Accounting Policies

The following is a summary of the Funds’ significant accounting policies used in the preparation of their financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). As an investment company, as defined in Financial Accounting Standards Board (“FASB”) Accounting Standards Update 2013-08, the Fund follows accounting and reporting guidance under FASB Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.”

25

CM Advisors Family of Funds

Notes to Financial Statements (Continued)

Investment Valuation – The Funds’ portfolio securities are generally valued at their market values determined on the basis of available market quotations as of the close of regular trading on the New York Stock Exchange (typically 4:00 p.m. Eastern time). Securities listed on an exchange or quoted on a national market system are valued at the last sales price. Securities which are quoted by NASDAQ are valued at the NASDAQ Official Closing Price. Securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the most recent bid price. Options on securities and options on indexes listed on an exchange are valued at the mean of the closing bid and ask price on the exchange on which they are traded on the day of valuation. Securities and assets for which representative market quotations are not readily available (e.g., if the exchange on which the portfolio security is principally traded closes early or if trading of the particular portfolio security is halted during the day and does not resume prior to the Funds’ net asset value calculations) or which cannot be accurately valued using the Funds’ normal pricing procedures are valued at fair value as determined in good faith under policies approved by the Board of Trustees and will be classified as Level 2 or 3 within the fair value hierarchy (see below), depending on the inputs used. A portfolio security’s “fair value” price may differ from the price next available for that portfolio security using the Funds’ normal pricing procedures.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires disclosures about fair value measurements.

Various inputs are used in determining the value of the Funds’ investments. These inputs are summarized in the three broad levels listed below:

● | Level 1 – quoted prices in active markets for identical securities |

● | Level 2 – other significant observable inputs |

● | Level 3 – significant unobservable inputs |

Corporate Bonds and U.S. Government Obligations held by CM Advisors Fixed Income Fund are classified as Level 2 since values are based on prices provided by an independent pricing service that utilizes various “other significant observable inputs” including bid and ask quotations, prices of similar securities and interest rates, among other factors.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure the fair value of a particular security may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement of that security falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

26

CM Advisors Family of Funds

Notes to Financial Statements (Continued)

The following is a summary of the inputs used to value the Funds’ investments as of August 31, 2015 by security type:

CM Advisors Fund | |

| | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks | | $ | 81,281,838 | | | $ | — | | | $ | — | | | $ | 81,281,838 | |

Closed-End Funds | | | 412,019 | | | | — | | | | — | | | | 412,019 | |

Exchange-Traded Funds | | | 4,218,401 | | | | — | | | | — | | | | 4,218,401 | |

Warrants | | | — | | | | 0 | * | | | — | | | | 0 | * |

Money Market Funds | | | 4,981,878 | | | | — | | | | — | | | | 4,981,878 | |

Total | | $ | 90,894,136 | | | $ | 0 | * | | $ | — | | | $ | 90,894,136 | |

CM Advisors Small Cap Value Fund | |

| | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks | | $ | 32,467,523 | | | $ | — | | | $ | — | | | $ | 32,467,523 | |

Exchange-Traded Funds | | | 2,546,196 | | | | — | | | | — | | | | 2,546,196 | |

Warrants | | | — | | | | 0 | * | | | — | | | | 0 | * |

Money Market Funds | | | 5,137,158 | | | | — | | | | — | | | | 5,137,158 | |

Total | | $ | 40,150,877 | | | $ | 0 | * | | $ | — | | | $ | 40,150,877 | |

CM Advisors Fixed Income Fund | |

| | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Corporate Bonds | | $ | — | | | $ | 31,947,725 | | | $ | — | | | $ | 31,947,725 | |

U.S. Government Obligations | | | — | | | | 67,446,883 | | | | — | | | | 67,446,883 | |

Money Market Funds | | | 12,369,409 | | | | — | | | | — | | | | 12,369,409 | |

Total | | $ | 12,369,409 | | | $ | 99,394,608 | | | $ | — | | | $ | 111,764,017 | |

* | CM Advisors Fund and CM Advisors Small Cap Value Fund each hold Warrants which have been fair valued at $0. |

Refer to each Fund’s Schedule of Investments for a listing of the securities by security type and sector or industry type. As of August 31, 2015, the Funds did not have any transfers into and out of any Level. The Funds did not hold any derivative instruments or assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) as of August 31, 2015. It is the Funds’ policy to recognize transfers into and out of any Level at the end of the reporting period.

Share Valuation and Redemption Fees – The net asset value per share of each Fund is calculated on each business day by dividing the total value of the Fund’s assets, less liabilities, by the number of shares outstanding. The offering price and redemption price per share of each Fund is equal to the net asset value per share, except that shares of CM Advisors Fund and CM Advisors Small Cap Value Fund are subject to a redemption fee of 1%, payable to the applicable Fund, if redeemed within 180 days of the date of

27

CM Advisors Family of Funds

Notes to Financial Statements (Continued)

purchase. No redemption fee, however, will be imposed on the exchange of shares of CM Advisors Fund or CM Advisors Small Cap Value Fund for shares of another Fund within the Trust. Shares of CM Advisors Fixed Income Fund are not subject to a redemption fee.

During the periods ended August 31, 2015 and February 28, 2015, proceeds from redemption fees were as follows:

| | Six Months Ended August 31, 2015 | | | Year Ended

February 28, 2015 | |

CM Advisors Fund | | $ | 1,268 | | | $ | 2,704 | |

CM Advisors Small Cap Value | | $ | 28,440 | | | $ | 23,842 | |

Investment Transactions and Investment Income – Investment transactions are accounted for on trade date. Dividend income is recorded on the ex-dividend date. Interest income is accrued as earned. Discounts and premiums on fixed income securities purchased are amortized using the effective interest method. Gains and losses on securities sold are determined on a specific identification basis, which is the same basis used for federal income tax purposes. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates.

Expenses – The Funds bear expenses incurred specifically on their behalf as well as a portion of general Trust expenses, which are allocated according to methods authorized by the Board of Trustees.

Dividends and Distributions – Dividends arising from net investment income, if any, are declared and paid quarterly to shareholders of each Fund. Distributions from capital gains, if any, are generally declared and distributed annually. The amount of distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are either temporary or permanent in nature and are primarily due to differing treatments of net short-term capital gains. Dividends and distributions are recorded on the ex-dividend date.

The tax character of distributions paid during the periods ended August 31, 2015 and February 28, 2015 was as follows:

Period Ended | | Ordinary Income | | | Long-Term Capital Gains | | | Total Distributions | |

CM Advisors Fund - Class I | | | | | | | | | |

August 31, 2015 | | $ | — | | | $ | — | | | $ | — | |

February 28, 2015 | | $ | 300,838 | | | $ | — | | | $ | 300,838 | |

CM Advisors Small Cap Value Fund - Class I | | | | | | | | | | | | |

August 31, 2015 | | $ | — | | | $ | — | | | $ | — | |

February 28, 2015 | | $ | — | | | $ | 1,496,887 | | | $ | 1,496,887 | |

28

CM Advisors Family of Funds

Notes to Financial Statements (Continued)

Period Ended | | Ordinary Income | | | Long-Term Capital Gains | | | Total Distributions | |

CM Advisors Small Cap Value Fund - Class R | | | | | | | | | |

August 31, 2015 | | $ | — | | | $ | — | | | $ | — | |

February 28, 2015 | | $ | — | | | $ | 12,942 | | | $ | 12,942 | |

CM Advisors Fixed Income Fund | | | | | | | | | | | | |

August 31, 2015 | | $ | 750,795 | | | $ | — | | | $ | 750,795 | |

February 28, 2015 | | $ | 1,603,075 | | | $ | 572,865 | | | $ | 2,175,940 | |

On September 30, 2015, an ordinary income distribution of $0.0382 per share was declared for CM Advisors Fixed Income Fund. The distribution was paid on September 30, 2015 to shareholders of record on September 29, 2015.

Option Transactions – CM Advisors Fund and CM Small Cap Value Fund may purchase and write put and call options on securities or stock indices. The Funds may write a call or put option only if the option is “covered” by the Fund’s holding a position in the underlying securities or by other means which would permit immediate satisfaction of the Fund’s obligation as writer of the option. A call option written by the Funds obligates the Fund to sell specified securities to the holder of the option at a predetermined price if the option is exercised on or before its expiration date. An index call option written by the Funds obligates the Fund to make a cash payment to the holder of the option if the option is exercised and the value of the index has risen above a predetermined level on or before the expiration date of the option. Writing covered call options provides the Funds with opportunities to increase the returns earned from portfolio securities through the receipt of premiums paid by the purchasers of the options. By purchasing a put option on an individual stock, the Funds could hedge the risk of a devaluation of that individual stock. By purchasing a put option on a stock index, the Funds could hedge the risk of a general market decline. The value of the put option would be expected to rise as a result of a market decline and thus could offset all or a portion of losses resulting from declines in the prices of individual securities held by the Fund. However, option premiums tend to decrease over time as the expiration date nears. Therefore, because of the cost of the option (in the form of premium and transaction costs), the Fund would suffer a loss in the put option if prices do not decline sufficiently to offset the deterioration in the value of the option premium. By purchasing a call option on a stock index, the Fund would attempt to participate in potential price increases of the underlying index, with results similar to those obtainable from purchasing a futures contract, but with risk limited to the cost of the option if stock prices fell. At the same time, the Fund would suffer a loss if stock prices do not rise sufficiently to offset the cost of the option. When a Fund writes or purchases an option, an amount equal to the premium received or paid by the Fund is recorded as a liability or an asset and is subsequently adjusted to the current market value of the option written or purchased. Premiums received or paid from writing or purchasing options that expire unexercised are treated by the Fund on the expiration date as realized gains or losses. The difference between the premium and the amount paid or received on a closing purchase or sale transaction, including brokerage commissions, is also treated as a realized gain or loss.

29

CM Advisors Family of Funds

Notes to Financial Statements (Continued)

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

3. Federal Income Tax

Each Fund has qualified and intends to continue to qualify each year as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986 (the

“Code”). Qualification generally will relieve the Funds of liability for federal income taxes to the extent 100% of their net investment income and net realized capital gains are distributed in accordance with the Code. Accordingly, no provision for income taxes has been made.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also each Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

The following information is computed on a tax basis for each item as of August 31, 2015:

| | CM Advisors Fund | | | CM Advisors Small Cap Value Fund | | | CM Advisors Fixed Income Fund | |

Tax cost of portfolio investments | | $ | 100,076,707 | | | $ | 46,380,170 | | | $ | 109,478,457 | |

Gross unrealized appreciation | | $ | 10,365,220 | | | $ | 1,756,500 | | | $ | 2,722,196 | |

Gross unrealized depreciation | | | (19,547,791 | ) | | | (7,985,793 | ) | | | (436,636 | ) |

Net unrealized appreciation (depreciation) | | | (9,182,571 | ) | | | (6,229,293 | ) | | | 2,285,560 | |

Accumulated ordinary income (loss) | | | (365,768 | ) | | | (57,000 | ) | | | 256,507 | |

Capital loss carryforwards | | | (18,385,708 | ) | | | — | | | | — | |

Other gains (losses) | | | (4,046,378 | ) | | | (856,076 | ) | | | 114,411 | |

Accumulated earnings (deficit) | | $ | (31,980,425 | ) | | $ | (7,142,369 | ) | | $ | 2,656,478 | |

The difference between the federal income tax cost of portfolio investments and the financial statement cost for CM Advisors Fund and CM Advisors Small Cap Value Fund is due to certain timing differences in the recognition of capital gains or losses under income tax regulations and GAAP. These “book/tax” differences are temporary in nature and are due to the tax deferral of losses on wash sales and holdings classified as passive foreign investment companies (PFICs).

As of February 28, 2015, CM Advisors Fund had $18,835,708 of short-term capital loss carryforwards, which expire February 28, 2018. These capital loss carryfowards may be utilized in the current and future years to offset net realized capital gains, if any, prior to distributing such gains to shareholders.

30

CM Advisors Family of Funds

Notes to Financial Statements (Continued)

The Funds recognize the benefits or expenses of uncertain tax positions only if the position is “more-likely-than-not” of being sustained assuming examination by tax authorities. Management has reviewed the tax positions taken on federal income tax returns for the current and all open tax years (tax years ended February 29, 2012 through February 28, 2015) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements.

4. Investment Transactions

During the six months ended August 31, 2015, cost of purchases and proceeds from sales and maturities of investment securities, other than short-term investments, options and U.S. government securities, were as follows:

| | CM Advisors Fund | | | CM Advisors Small Cap Value Fund | | | CM Advisors Fixed Income Fund | |

Cost of purchases of investment securities | | $ | 33,769,924 | | | $ | 14,728,830 | | | $ | 7,239,447 | |

Proceeds from sales and maturities of investment securities | | $ | 34,473,304 | | | $ | 23,805,351 | | | $ | 17,500,271 | |

5. Transactions with Related Parties

INVESTMENT ADVISORY AGREEMENT

The Funds pay a monthly advisory fee to Van Den Berg Management I, Inc. (the “Advisor”) based upon the average daily net assets of each Fund and calculated at the annual rate of 1.00% for CM Advisors Fund and CM Advisors Small Cap Value Fund, and 0.50% for CM Advisors Fixed Income Fund. The Advisor has entered into agreements (the “Expense Limitation Agreements”) with each Fund under which it has agreed to waive its fees and to assume other expenses of the Funds, if necessary, in an amount that limits the Funds’ total operating expenses (exclusive of interest, taxes, brokerage commissions, extraordinary expenses, and payments, if any, under a Rule 12b-1 plan) to not more than 1.50% of the average daily net assets of CM Advisors Fund and CM Advisors Fixed Income Fund and not more than 1.25% of the average daily net assets of CM Advisors Small Cap Value Fund, each until July 1, 2016. There can be no assurance that the Expense Limitation Agreements will continue beyond July 1, 2016. During the six months ended August 31, 2015, with respect to CM Advisors Small Cap Value Fund, the Advisor waived $54,309 of its investment advisory fees. During the six months ended August 31, 2015, there were no advisory fees waived or expenses reimbursed by the Advisor with respect to CM Advisors Fund and CM Advisors Fixed Income Fund.

Certain Trustees and officers of the Trust are also officers of the Advisor.

31

CM Advisors Family of Funds

Notes to Financial Statements (Continued)

OTHER SERVICE PROVIDERS

Ultimus Fund Solutions, LLC (“Ultimus”) provides fund administration, fund accounting, and transfer agency services to the Funds. The Funds pay Ultimus fees in accordance with the agreements for its services. In addition, the Funds pay out-of-pocket expenses including, but not limited to, postage, supplies and costs of pricing the Funds’ portfolio securities. Certain officers of the Trust are also officers of Ultimus, or of Ultimus Fund Distributors, LLC (the “Distributor”), the principal underwriter of the Funds’ shares and an affiliate of Ultimus.

Pursuant to the terms of a Distribution Agreement with the Trust, the Distributor serves as the Funds’ principal underwriter. The Distributor is a wholly-owned subsidiary of Ultimus. The Distributor receives compensation from the Funds for such services.

COMPENSATION OF TRUSTEES

Trustees and officers affiliated with the Advisor or Ultimus are not compensated by the Funds for their services. Each Trustee who is not an affiliated person of the Advisor or Ultimus receives an annual retainer of $10,000, paid quarterly; a fee of $2,000 per Fund for attendance at each in-person meeting of the Board of Trustees; and a fee of $500 per Fund for attendance at each telephonic meeting of the Board of Trustees. The Funds reimburse each Trustee and officer for his or her travel and other expenses relating to attendance at Board or committee meetings.

6. Derivatives Risk and Transactions

Investing in derivatives, including options, involves the risk of sustaining large and sudden losses. The use of derivatives by CM Advisors Fund and CM Advisors Small Cap Value Fund may reduce their returns and/or increase their volatility, and fluctuations in the value of a derivative may not correlate perfectly with the overall securities markets.

The locations in the Statements of Assets and Liabilities of the derivative positions of CM Advisors Fund are as follows:

CM Advisors Fund

| | |

Fair Value

| Gross Notional Amount Outstanding August 31, 2015 | Average Monthly Notional Amount During the Six Months Ended August 31, 2015 |

Type of

Derivative | Location | Asset

Derivatives | Liability Derivatives |

Index put options purchased | Investments in securities at value | $ — | $ — | $ — | $ 27,817,261 |

There were no option contracts written by the Funds during the six months ended August 31, 2015.

32

CM Advisors Family of Funds