UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21295

JPMorgan Trust I

(Exact name of registrant as specified in charter)

270 Park Avenue

New York, NY 10017

(Address of principal executive offices) (Zip code)

Frank J. Nasta

270 Park Avenue

New York, NY 10017

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: August 31

Date of reporting period: September 1, 2016 through February 28, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Semi-Annual Report

J.P. Morgan Funds

February 28, 2017 (Unaudited)

JPMorgan Diversified Real Return Fund

CONTENTS

Investments in the Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of the Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of the Fund.

Prospective investors should refer to the Fund’s prospectus for a discussion of the Fund’s investment objective, strategies and risks. Call J.P. Morgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about the Fund, including management fees and other expenses. Please read it carefully before investing.

CEO’S LETTER

March 22, 2017 (Unaudited)

Dear Shareholders,

The U.S. economy continued its steady expansion over the past six months and by the end of February 2017, the world’s leading economies were growing in a more synchronized manner that could accelerate global growth.

| | |

| | “In the U.S., the pace of economic expansion was sufficient to persuade the Federal Reserve Bank to raise interest rates in December 2016 and again in March 2017.” |

By early 2017, the World Bank estimated that global economic growth in 2017 will rise by 2.7% compared with 2.3% in 2016 and economists generally expect each of the world’s 20 largest economies will see an increase in gross domestic product in 2017.

In the 19-nation euro zone, manufacturing activity rose in February 2017 for the sixth consecutive month and reached levels not seen in nearly six years. Economic confidence surveys have been the strongest since 2011. While unemployment across the euro zone remained nearly twice that of the U.S., the jobless rate fell faster than expected in early 2017 to its lowest level since 2009. Importantly, euro zone inflation reached the European Central Bank’s (ECB) target of 2.0% in February 2017, which provided further evidence that the risk of a painful deflationary spiral had receded.

Meanwhile, Chinese factory activity was stronger than economists expected in February 2017 and more broadly, Chinese economic stimulus measures initiated in 2016 appeared to bolster trade throughout Asia. In Japan, corporate profits were estimated at record highs even in the face of a stronger yen. South Korean exports grew in February 2017 for the fourth consecutive month. Economic data from Australia and India showed signs of stronger growth.

To a certain extent, the healthier global economy was supported by a rebound in global oil prices, which reached 15-month highs in October 2016. Prices for other commodities also rose in the latter half of 2016, helping growth in those emerging market nations reliant on natural resource exports.

In the U.S., the pace of economic expansion was sufficient to persuade the Federal Reserve Bank to raise interest rates in December 2016 and again in March 2017. Meanwhile, leading

stock market indexes hit record highs in late 2016 and early 2017 amid strength in corporate profits and the broader U.S. economy. Investor expectations that the Republican Party’s newly-won control of the U.S. presidency along with its continuing majorities in both houses of the U.S. Congress would bolster economic growth while lowering certain taxes further supported U.S. financial assets.

While the global economy appeared to grow more synchronized during the six months ended February 2017, there also emerged political uncertainties in the U.S. and Europe. Britain’s planned exit from the European Union — and its immigration and trade policies — brought investor uncertainty and was seen as a drag on the U.K. economy. In November 2016, Donald Trump won the U.S. presidency after campaigning on a platform that included new restrictions on immigration and protective trade policies. While voters in the Netherlands declined to give the anti-immigrant Party for Freedom a majority in the lower house of Parliament, populist parties were also vying for power in Italy, France, Germany and elsewhere.

Each of these parties and their leaders — both in the U.S. and elsewhere — share broad policy goals that prioritize restricting immigration and shunning supranational trade agreements. Given that immigration and free trade are key drivers of economic growth in advanced, post-industrial nations, it remains to be seen how much electoral support these shared agendas would earn.

In the face of all this, U.S. and foreign financial markets generally rewarded investors with positive returns for the six months through February 2017. Over time, we believe financial markets will continue to reward those investors who maintain patience and discipline in the context of a properly diversified portfolio.

We look forward to managing your investment needs for years to come. Should you have any questions, please visit www.jpmorganfunds.com or contact the J.P. Morgan Funds Service Center at 1-800-480-4111.

Sincerely yours,

George C.W. Gatch

CEO, Investment Funds Management,

J.P. Morgan Asset Management

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | J.P. MORGAN FUNDS | | | | | 1 | |

JPMorgan Diversified Real Return Fund

FUND COMMENTARY

SIX MONTHS ENDED FEBRUARY 28, 2017 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Class I Shares)1* | | | 2.76% | |

| Bloomberg Barclays 1-10 Year U.S. TIPS Index (formerly Barclays 1-10 Year U.S. TIPS Index) | | | 0.26% | |

| Consumer Price Index for All Urban Consumers — Seasonally Adjusted | | | 1.69% | |

| JPMorgan Diversified Real Return Composite Benchmark | | | 3.61% | |

| Net Assets as of 2/28/2017 | | $ | 83,527,075 | |

INVESTMENT OBJECTIVE**

The JPMorgan Diversified Real Return Fund (the “Fund”) seeks to maximize long-term real return.

HOW DID THE MARKET PERFORM?

U.S. financial markets overall provided mixed returns for the six months ended February 28, 2017. Equity markets rose along with bond yields amid a backdrop of low but rising interest rates and price inflation, as well as improved corporate profits.

Commodities prices stabilized during the reporting period and global oil prices reached 15-month highs in October 2016. Oil prices were further bolstered by the Organization of Petroleum Exporting Countries’ decision to curb production.

The November 8, 2016 election handed Donald Trump the U.S. presidency and the Republican Party a majority in both houses of the U.S. Congress. In the following months, key U.S. equity benchmarks reached multiple closing record highs. U.S. Treasury bonds underperformed other bond market sectors and high yield bonds (also known as “junk bonds”) outperformed the broader bond market.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

For the six months ended February 28, 2017, the Fund’s Class I Shares outperformed the Bloomberg Barclays 1-10 Year U.S. TIPS Index (the “Index”). The Index only tracks Treasury Inflation Protected Securities (“TIPS”), while the Fund is invested in a broad range of assets. The Fund underperformed the JPMorgan Diversified Real Return Composite Benchmark (45% MSCI World Index, 55% Bloomberg Barclays U.S. TIPS 1-10 Year Index).

During the six month reporting period, real estate investment trusts (REITs) came under pressure against the backdrop of higher U.S. interest rates. The Fund’s exposure to REITs detracted from relative performance. Meanwhile, the Fund’s allocations to traditional equities and global natural resources equities were positive contributors to relative performance as the pickup in global growth and inflation during the period was well-received by investors.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund was positioned with the goal of delivering real return.

Particularly since the U.S. election, the portfolio managers believed that the “lower for longer” economic environment seemed to be largely over and the U.S. had entered a reflationary environment with upward pressure on interest rates. While portfolio managers expected U.S. inflation to normalize, they expressed a more positive view on inflation within equity securities rather than within fixed income securities. As a result, the portfolio managers preferred allocating to traditional equity securities as well as to U.S. Consumer Price Index swaps to maintain inflation-sensitivity. The portfolio managers also preferred credit such as high yield securities over traditional TIPS given their expectation that rates would rise, which would hurt traditional TIPS performance. At the end of the reporting period, the Fund’s asset allocation consisted of the following weights: 8% in TIPS; 15% in other inflation-managed fixed income securities; 5% in floating rate securities; 15% in high yield debt; 14% in traditional equities; 12% in REITs; 9% in global natural resources equities; 5% in global infrastructure equities; and 10% in commodities.

| | | | | | |

| | | |

| 2 | | | | J.P. MORGAN FUNDS | | FEBRUARY 28, 2017 |

| | | | | | | | |

| TOP TEN HOLDINGS OF THE PORTFOLIO*** | |

| | 1. | | | JPMorgan Floating Rate Income Fund, Class R6 Shares | | | 5.6 | % |

| | 2. | | | Vanguard REIT Fund | | | 5.3 | |

| | 3. | | | JPMorgan Opportunistic Equity Long/Short Fund, Class R6 Shares | | | 2.0 | |

| | 4. | | | iShares TIPS Bond Fund | | | 1.6 | |

| | 5. | | | Renaissance Home Equity Loan Trust, Series 2003-2, Class A, VAR, 1.658%, 08/25/33 | | | 0.7 | |

| | 6. | | | Wells Fargo Mortgage-Backed Securities Trust, Series 2006-2, Class 1A12, 5.750%, 03/25/36 | | | 0.6 | |

| | 7. | | | Fremont Home Loan Trust, Series 2004-B, Class M1, VAR, 1.648%, 05/25/34 | | | 0.6 | |

| | 8. | | | CHL Mortgage Pass-Through Trust, Series 2003-21, Class A1, VAR, 3.243%, 05/25/33 | | | 0.5 | |

| | 9. | | | Alternative Loan Trust, Series 2006-14CB, Class A1, 6.000%, 06/25/36 | | | 0.5 | |

| | 10. | | | GSAMP Trust, Series 2003-HE1, Class M1, VAR, 2.024%, 06/20/33 | | | 0.5 | |

| | | | |

PORTFOLIO COMPOSITION*** | |

| Common Stocks | | | 33.9 | % |

| Corporate Bonds | | | 29.8 | |

| Investment Companies | | | 7.6 | |

| U.S. Treasury Obligations | | | 7.4 | |

| Exchange-Traded Funds | | | 6.8 | |

| Asset-Backed Securities | | | 2.6 | |

| Collateralized Mortgage Obligations | | | 2.3 | |

| Others (each less than 1.0%) | | | 0.0 | (a) |

| Short-Term Investments | | | 9.6 | |

| 1 | | Effective April 3, 2017, the Fund’s Select Class Shares were renamed Class I Shares. |

| * | | The return shown is based on the net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of February 28, 2017. The Fund’s portfolio composition is subject to change. |

| (a) | | Amount rounds to less than 0.05%. |

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | J.P. MORGAN FUNDS | | | | | 3 | |

JPMorgan Diversified Real Return Fund

FUND COMMENTARY

SIX MONTHS ENDED FEBRUARY 28, 2017 (Unaudited) (continued)

| | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF FEBRUARY 28, 2017 |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | INCEPTION DATE OF

CLASS | | | 6 MONTH* | | | 1 YEAR | | | 5 YEAR | | | SINCE

INCEPTION | |

CLASS A SHARES | | | March 31, 2011 | | | | | | | | | | | | | | | | | |

With Sales Charge** | | | | | | | (1.94 | )% | | | 6.53 | % | | | (0.49 | )% | | | 0.07 | % |

Without Sales Charge | | | | | | | 2.65 | | | | 11.59 | | | | 0.43 | | | | 0.86 | |

CLASS C SHARES | | | March 31, 2011 | | | | | | | | | | | | | | | | | |

With CDSC*** | | | | | | | 1.42 | | | | 10.03 | | | | (0.08 | ) | | | 0.35 | |

Without CDSC | | | | | | | 2.42 | | | | 11.03 | | | | (0.08 | ) | | | 0.35 | |

CLASS R2 SHARES | | | March 31, 2011 | | | | 2.56 | | | | 11.36 | | | | 0.18 | | | | 0.61 | |

CLASS R5 SHARES | | | March 31, 2011 | | | | 2.81 | | | | 12.00 | | | | 0.77 | | | | 1.21 | |

CLASS I SHARES (FORMERLY SELECT CLASS SHARES) | | | March 31, 2011 | | | | 2.76 | | | | 11.82 | | | | 0.67 | | | | 1.10 | |

| ** | | Sales Charge for Class A Shares is 4.50%. |

| *** | | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

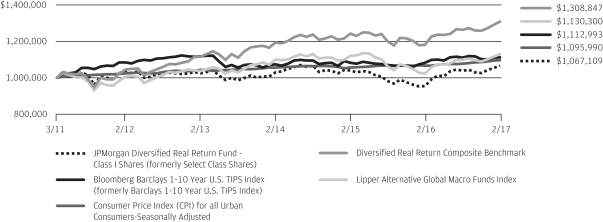

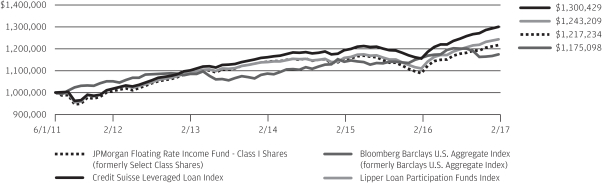

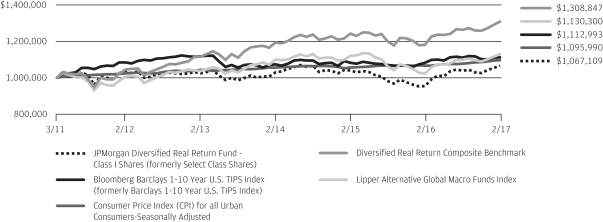

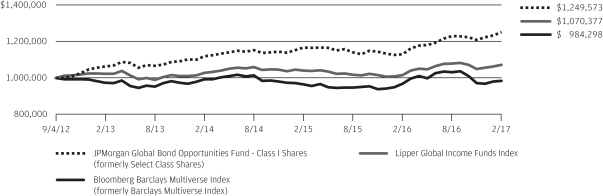

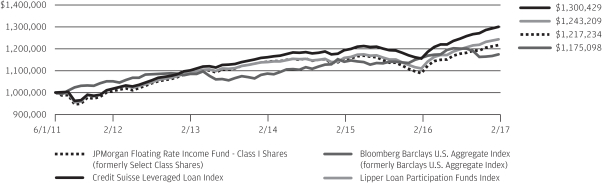

LIFE OF FUND PERFORMANCE (3/31/11 — 2/28/17)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-800-480-4111.

The Fund commenced operations on March 31, 2011.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Diversified Real Return Fund, the Bloomberg Barclays 1-10 Year U.S. TIPS Index, the Consumer Price Index (CPI) for All Urban Consumers-Seasonally Adjusted, the Diversified Real Return Composite Benchmark and the Lipper Alternative Global Macro Funds Index from March 31, 2011 to February 28, 2017. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Bloomberg Barclays 1-10 Year U.S. TIPS Index, the Consumer Price Index (CPI) for All Urban Consumers-Seasonally Adjusted and the Diversified Real Return Composite Benchmark does not reflect the deduction of expenses or a sales charge associated with a mutual fund. The performance of the Bloomberg Barclays 1-10 Year U.S. TIPS Index has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper Alternative Global Macro Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Bloomberg Barclays 1-10 Year U.S. TIPS Index represents the performance of intermediate (1-10 year) U.S. Treasury Inflation Protection Securities. The Consumer Price Index (CPI) for

All Urban Consumers-Seasonally Adjusted is a measure of the change in prices of goods and services purchased by urban consumers. Seasonal adjustment removes the effects of recurring seasonal influences from many economic series, including consumer prices. The adjustment process quantifies seasonal patterns and then factors them out of the series to permit analysis of non-seasonal price movements. Changing climatic conditions, production cycles, model changeovers, holidays, and sales can cause seasonal variation in prices. The Diversified Real Return Composite Benchmark is comprised of the Bloomberg Barclays 1-10 Year U.S. TIPS Index (55%) and the MSCI World Index (45%). The Lipper Alternative Global Macro Funds Index is an index based on total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an Index.

Effective July 29, 2016, the Fund’s investment strategies changed. The Fund’s past performance would have been different if the Fund was managed using the current strategies.

Class I Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 4 | | | | J.P. MORGAN FUNDS | | FEBRUARY 28, 2017 |

JPMorgan Diversified Real Return Fund

CONSOLIDATED SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF FEBRUARY 28, 2017 (Unaudited)

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Asset-Backed Securities — 2.5% | |

| | 504,502 | | | Fremont Home Loan Trust, Series 2004-B, Class M1, VAR, 1.648%, 05/25/34 | | | 469,258 | |

| | 436,808 | | | GSAMP Trust, Series 2003-HE1, Class M1, VAR, 2.024%, 06/20/33 | | | 427,268 | |

| | 450,536 | | | RAMP Trust, Series 2003-RS10, Class MII1, VAR, 1.753%, 11/25/33 | | | 419,851 | |

| | 598,466 | | | Renaissance Home Equity Loan Trust, Series 2003-2, Class A, VAR, 1.658%, 08/25/33 | | | 559,329 | |

| | 205,284 | | | Structured Asset Securities Corp. Trust,

Series 2005-AR1, Class M1, VAR, 1.208%, 09/25/35 | | | 201,250 | |

| | | | | | | | |

| | | | Total Asset-Backed Securities

(Cost $2,043,550) | | | 2,076,956 | |

| | | | | | | | |

| | Collateralized Mortgage Obligations — 2.2% | |

| | 495,828 | | | Alternative Loan Trust, Series 2006-14CB, Class A1, 6.000%, 06/25/36 | | | 429,389 | |

| | | | CHL Mortgage Pass-Through Trust, | | | | |

| | 438,446 | | | Series 2003-21, Class A1, VAR, 3.243%, 05/25/33 | | | 437,868 | |

| | 389,924 | | | Series 2005-31, Class 2A1, VAR, 3.143%, 01/25/36 | | | 353,953 | |

| | 125,328 | | | GSR Mortgage Loan Trust, Series 2004-11, Class 2A2, VAR, 3.325%, 09/25/34 | | | 123,608 | |

| | 474,192 | | | Wells Fargo Mortgage-Backed Securities Trust, Series 2006-2, Class 1A12, 5.750%, 03/25/36 | | | 476,556 | |

| | | | | | | | |

| | | | Total Collateralized Mortgage Obligations

(Cost $1,820,069) | | | 1,821,374 | |

| | | | | | | | |

| | |

| SHARES | | | | | | |

| | Common Stocks — 32.7% | |

| | | | Consumer Discretionary — 2.0% | |

| | | | Auto Components — 0.0% (g) | |

| | 143 | | | Continental AG, (Germany) | | | 28,984 | |

| | | | | | | | |

| | | | Automobiles — 0.1% | |

| | 700 | | | Honda Motor Co. Ltd., (Japan) | | | 21,684 | |

| | 430 | | | Renault SA, (France) | | | 38,168 | |

| | 1,100 | | | Suzuki Motor Corp., (Japan) | | | 42,993 | |

| | 105 | | | Tesla, Inc. (a) | | | 26,249 | |

| | | | | | | | |

| | | | | | | 129,094 | |

| | | | | | | | |

| | | | Distributors — 0.1% | |

| | 301 | | | Genuine Parts Co. | | | 28,809 | |

| | 1,095 | | | LKQ Corp. (a) | | | 34,580 | |

| | | | | | | | |

| | | | | | | 63,389 | |

| | | | | | | | |

| | | | Hotels, Restaurants & Leisure — 0.4% | |

| | 393 | | | Brinker International, Inc. | | | 16,600 | |

| | 852 | | | Hilton Grand Vacations, Inc. (a) | | | 25,509 | |

| | 2,602 | | | Hilton Worldwide Holdings, Inc. | | | 148,834 | |

| | 385 | | | InterContinental Hotels Group plc, (United Kingdom) | | | 18,142 | |

| | 1,086 | | | La Quinta Holdings, Inc. (a) | | | 15,052 | |

| | | | | | | | |

SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | |

| | | | Hotels, Restaurants & Leisure — continued | | | | |

| | 648 | | | Norwegian Cruise Line Holdings Ltd. (a) | | | 32,854 | |

| | 400 | | | Oriental Land Co. Ltd., (Japan) | | | 22,484 | |

| | 338 | | | Red Rock Resorts, Inc., Class A | | | 7,426 | |

| | 730 | | | Starbucks Corp. | | | 41,515 | |

| | | | | | | | |

| | | | | | | 328,416 | |

| | | | | | | | |

| | | | Household Durables — 0.1% | |

| | 429 | | | Mohawk Industries, Inc. (a) | | | 97,108 | |

| | 386 | | | Newell Brands, Inc. | | | 18,926 | |

| | 8,200 | | | Taylor Wimpey plc, (United Kingdom) | | | 18,308 | |

| | | | | | | | |

| | | | | | | 134,342 | |

| | | | | | | | |

| | | | Internet & Direct Marketing Retail — 0.4% | |

| | 199 | | | Amazon.com, Inc. (a) | | | 168,163 | |

| | 249 | | | Expedia, Inc. | | | 29,641 | |

| | 271 | | | Netflix, Inc. (a) | | | 38,517 | |

| | 42 | | | Priceline Group, Inc. (The) (a) | | | 72,414 | |

| | 540 | | | Wayfair, Inc., Class A (a) | | | 20,417 | |

| | | | | | | | |

| | | | | | | 329,152 | |

| | | | | | | | |

| | | | Media — 0.3% | |

| | 473 | | | CBS Corp. (Non-Voting), Class B | | | 31,180 | |

| | 103 | | | Charter Communications, Inc., Class A (a) | | | 33,275 | |

| | 1,466 | | | Clear Channel Outdoor Holdings, Inc., Class A | | | 7,037 | |

| | 500 | | | Dentsu, Inc., (Japan) | | | 27,744 | |

| | 896 | | | DISH Network Corp., Class A (a) | | | 55,552 | |

| | 982 | | | Entercom Communications Corp., Class A | | | 15,368 | |

| | 314 | | | Nexstar Media Group, Inc., Class A | | | 21,674 | |

| | 419 | | | Sinclair Broadcast Group, Inc., Class A | | | 16,718 | |

| | 222 | | | Time Warner, Inc. | | | 21,803 | |

| | | | | | | | |

| | | | | | | 230,351 | |

| | | | | | | | |

| | | | Multiline Retail — 0.2% | |

| | 550 | | | Dollar General Corp. | | | 40,161 | |

| | 500 | | | Izumi Co. Ltd., (Japan) | | | 22,316 | |

| | 742 | | | Kohl’s Corp. | | | 31,624 | |

| | 1,600 | | | Marui Group Co. Ltd., (Japan) | | | 22,105 | |

| | 513 | | | Nordstrom, Inc. | | | 23,937 | |

| | | | | | | | |

| | | | | | | 140,143 | |

| | | | | | | | |

| | | | Specialty Retail — 0.3% | |

| | 43 | | | AutoZone, Inc. (a) | | | 31,672 | |

| | 524 | | | Bed Bath & Beyond, Inc. | | | 21,169 | |

| | 598 | | | Best Buy Co., Inc. | | | 26,390 | |

| | 6,876 | | | Dixons Carphone plc, (United Kingdom) | | | 25,859 | |

| | 752 | | | Gap, Inc. (The) | | | 18,665 | |

| | 223 | | | Home Depot, Inc. (The) | | | 32,315 | |

| | 3,458 | | | Kingfisher plc, (United Kingdom) | | | 14,105 | |

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | J.P. MORGAN FUNDS | | | | | 5 | |

JPMorgan Diversified Real Return Fund

CONSOLIDATED SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF FEBRUARY 28, 2017 (Unaudited) (continued)

| | | | | | | | |

SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Common Stocks — continued | |

| | | | Specialty Retail — continued | | | | |

| | 123 | | | Murphy USA, Inc. (a) | | | 7,835 | |

| | 415 | | | Tiffany & Co. | | | 38,126 | |

| | 91 | | | Ulta Beauty, Inc. (a) | | | 24,882 | |

| | | | | | | | |

| | | | | | | 241,018 | |

| | | | | | | | |

| | | | Textiles, Apparel & Luxury Goods — 0.1% | |

| | 175 | | | adidas AG, (Germany) | | | 29,357 | |

| | 379 | | | Columbia Sportswear Co. | | | 20,822 | |

| | 892 | | | Hanesbrands, Inc. | | | 17,849 | |

| | 99 | | | Kering, (France) | | | 24,089 | |

| | | | | | | | |

| | | | | | | 92,117 | |

| | | | | | | | |

| | | | Total Consumer Discretionary | | | 1,717,006 | |

| | | | | | | | |

| | | | Consumer Staples — 1.1% | |

| | | | Beverages — 0.2% | |

| | 425 | | | Anheuser-Busch InBev SA/NV, (Belgium) | | | 46,489 | |

| | 292 | | | Dr Pepper Snapple Group, Inc. | | | 27,285 | |

| | 147 | | | Molson Coors Brewing Co., Class B | | | 14,757 | |

| | 527 | | | Monster Beverage Corp. (a) | | | 21,839 | |

| | 246 | | | Pernod Ricard SA, (France) | | | 28,153 | |

| | 500 | | | Suntory Beverage & Food Ltd., (Japan) | | | 20,982 | |

| | | | | | | | |

| | | | | | | 159,505 | |

| | | | | | | | |

| | | | Food & Staples Retailing — 0.2% | |

| | 198 | | | Casey’s General Stores, Inc. | | | 22,687 | |

| | 470 | | | CVS Health Corp. | | | 37,873 | |

| | 3,708 | | | Distribuidora Internacional de Alimentacion SA, (Spain) | | | 20,552 | |

| | 1,863 | | | Koninklijke Ahold Delhaize NV, (Netherlands) (a) | | | 39,658 | |

| | 828 | | | Kroger Co. (The) | | | 26,330 | |

| | | | | | | | |

| | | | | | | 147,100 | |

| | | | | | | | |

| | | | Food Products — 0.5% | |

| | 2,603 | | | Archer-Daniels-Midland Co. | | | 122,263 | |

| | 849 | | | Associated British Foods plc, (United Kingdom) | | | 27,592 | |

| | 652 | | | Bunge Ltd. | | | 53,366 | |

| | 65,600 | | | Golden Agri-Resources Ltd., (Singapore) | | | 17,756 | |

| | 287 | | | Ingredion, Inc. | | | 34,696 | |

| | 350 | | | Post Holdings, Inc. (a) | | | 28,655 | |

| | 352 | | | TreeHouse Foods, Inc. (a) | | | 29,948 | |

| | 396 | | | Tyson Foods, Inc., Class A | | | 24,774 | |

| | 35,700 | | | Wilmar International Ltd., (Singapore) | | | 92,568 | |

| | | | | | | | |

| | | | | | | 431,618 | |

| | | | | | | | |

| | | | Household Products — 0.1% | |

| | 308 | | | Energizer Holdings, Inc. | | | 16,897 | |

| | 468 | | | Procter & Gamble Co. (The) | | | 42,621 | |

| | | | | | | | |

| | | | | | | 59,518 | |

| | | | | | | | |

| | | | | | | | |

SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | |

| | | | Personal Products — 0.1% | |

| | 965 | | | Coty, Inc., Class A | | | 18,122 | |

| | 1,017 | | | Unilever NV, (United Kingdom), CVA | | | 48,143 | |

| | | | | | | | |

| | | | | | | 66,265 | |

| | | | | | | | |

| | | | Tobacco — 0.0% (g) | |

| | 893 | | | British American Tobacco plc, (United Kingdom) | | | 56,406 | |

| | | | | | | | |

| | | | Total Consumer Staples | | | 920,412 | |

| | | | | | | | |

| | | | Energy — 4.2% | |

| | | | Energy Equipment & Services — 0.2% | |

| | 410 | | | Baker Hughes, Inc. | | | 24,715 | |

| | 723 | | | Halliburton Co. | | | 38,651 | |

| | 1,106 | | | Schlumberger Ltd. | | | 88,878 | |

| | 946 | | | TechnipFMC plc, (United Kingdom) (a) | | | 30,512 | |

| | | | | | | | |

| | | | | | | 182,756 | |

| | | | | | | | |

| | | | Oil, Gas & Consumable Fuels — 4.0% | |

| | 599 | | | AltaGas Ltd., (Canada) | | | 13,981 | |

| | 495 | | | Anadarko Petroleum Corp. | | | 32,002 | |

| | 556 | | | Apache Corp. | | | 29,240 | |

| | 39,880 | | | BP plc, (United Kingdom) | | | 224,870 | |

| | 2,481 | | | Canadian Natural Resources Ltd., (Canada) | | | 71,150 | |

| | 793 | | | Cheniere Energy, Inc. (a) | | | 38,104 | |

| | 1,465 | | | Chevron Corp. | | | 164,812 | |

| | 34,000 | | | CNOOC Ltd., (China) | | | 40,222 | |

| | 308 | | | Concho Resources, Inc. (a) | | | 40,795 | |

| | 1,557 | | | ConocoPhillips | | | 74,066 | |

| | 479 | | | Devon Energy Corp. | | | 20,769 | |

| | 562 | | | Ecopetrol SA, (Colombia), ADR (a) | | | 5,069 | |

| | 3,068 | | | Enbridge, Inc., (Canada) | | | 129,123 | |

| | 2,376 | | | Enbridge, Inc., (Canada) | | | 99,451 | |

| | 5,715 | | | Eni SpA, (Italy) | | | 88,167 | |

| | 803 | | | EOG Resources, Inc. | | | 77,883 | |

| | 449 | | | EQT Corp. | | | 26,891 | |

| | 4,451 | | | Exxon Mobil Corp. | | | 361,955 | |

| | 12,827 | | | Gazprom PJSC, (Russia), ADR | | | 57,254 | |

| | 575 | | | Imperial Oil Ltd., (Canada) | | | 17,962 | |

| | 1,125 | | | Inter Pipeline Ltd., (Canada) | | | 23,589 | |

| | 7,573 | | | Kinder Morgan, Inc. | | | 161,381 | |

| | 222 | | | Koninklijke Vopak NV, (Netherlands) | | | 9,402 | |

| | 925 | | | LUKOIL PJSC, (Russia), ADR | | | 49,047 | |

| | 682 | | | Marathon Petroleum Corp. | | | 33,827 | |

| | 146 | | | Novatek PJSC, (Russia), Reg. S, GDR | | | 18,925 | |

| | 653 | | | Occidental Petroleum Corp. | | | 42,804 | |

| | 2,928 | | | Oil Search Ltd., (Australia) | | | 15,637 | |

| | 746 | | | ONEOK, Inc. | | | 40,321 | |

| | 837 | | | PBF Energy, Inc., Class A | | | 20,498 | |

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 6 | | | | J.P. MORGAN FUNDS | | FEBRUARY 28, 2017 |

| | | | | | | | |

SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Common Stocks — continued | |

| | | | Oil, Gas & Consumable Fuels — continued | |

| | 1,292 | | | Pembina Pipeline Corp., (Canada) | | | 41,750 | |

| | 3,212 | | | Petroleo Brasileiro SA, (Brazil), ADR (a) | | | 32,377 | |

| | 844 | | | Phillips 66 | | | 65,992 | |

| | 124 | | | Pioneer Natural Resources Co. | | | 23,060 | |

| | 2,427 | | | Repsol SA, (Spain) | | | 35,903 | |

| | 2,234 | | | Rosneft Oil Co. PJSC, (Russia), Reg. S, GDR | | | 12,675 | |

| | 242 | | | Rosneft Oil Co. PJSC, (Russia), Reg. S, GDR | | | 1,391 | |

| | 9,190 | | | Royal Dutch Shell plc, (Netherlands), Class A | | | 237,817 | |

| | 3,068 | | | Royal Dutch Shell plc, (Netherlands), Class A | | | 79,492 | |

| | 2,235 | | | Statoil ASA, (Norway) | | | 39,406 | |

| | 3,544 | | | Suncor Energy, Inc., (Canada) | | | 110,333 | |

| | 604 | | | Targa Resources Corp. | | | 34,126 | |

| | 6,022 | | | TOTAL SA, (France) | | | 300,474 | |

| | 2,645 | | | TransCanada Corp., (Canada) | | | 121,596 | |

| | 1,362 | | | Ultrapar Participacoes SA, (Brazil), ADR | | | 28,262 | |

| | 434 | | | Valero Energy Corp. | | | 29,490 | |

| | 1,068 | | | Veresen, Inc., (Canada) | | | 10,871 | |

| | 2,226 | | | Williams Cos., Inc. (The) | | | 63,085 | |

| | 1,530 | | | Woodside Petroleum Ltd., (Australia) | | | 36,700 | |

| | 1,324 | | | Z Energy Ltd., (New Zealand) | | | 6,872 | |

| | | | | | | | |

| | | | | | | 3,340,869 | |

| | | | | | | | |

| | | | Total Energy | | | 3,523,625 | |

| | | | | | | | |

| | | | Financials — 2.6% | |

| | | | Banks — 1.3% | |

| | 2,016 | | | Australia & New Zealand Banking Group Ltd., (Australia) | | | 47,715 | |

| | 4,603 | | | Bank of America Corp. | | | 113,602 | |

| | 699 | | | BNP Paribas SA, (France) | | | 40,899 | |

| | 795 | | | Citigroup, Inc. | | | 47,549 | |

| | 1,008 | | | Citizens Financial Group, Inc. | | | 37,669 | |

| | 752 | | | East West Bancorp, Inc. | | | 40,698 | |

| | 985 | | | Fifth Third Bancorp | | | 27,028 | |

| | 543 | | | First Republic Bank | | | 50,950 | |

| | 573 | | | HDFC Bank Ltd., (India), ADR | | | 41,078 | |

| | 3,122 | | | ING Groep NV, (Netherlands) | | | 43,011 | |

| | 298 | | | M&T Bank Corp. | | | 49,757 | |

| | 7,800 | | | Mitsubishi UFJ Financial Group, Inc., (Japan) | | | 51,603 | |

| | 3,187 | | | Nordea Bank AB, (Sweden) | | | 37,262 | |

| | 493 | | | PNC Financial Services Group, Inc. (The) | | | 62,724 | |

| | 279 | | | Signature Bank (a) | | | 43,945 | |

| | 2,859 | | | Standard Chartered plc, (United Kingdom) (a) | | | 25,627 | |

| | 1,200 | | | Sumitomo Mitsui Financial Group, Inc., (Japan) | | | 46,749 | |

| | 720 | | | SunTrust Banks, Inc. | | | 42,833 | |

| | 828 | | | US Bancorp | | | 45,540 | |

| | 2,828 | | | Wells Fargo & Co. | | | 163,685 | |

| | | | | | | | |

| | | | | | | 1,059,924 | |

| | | | | | | | |

| | | | | | | | |

SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | |

| | | | Capital Markets — 0.6% | |

| | 255 | | | Affiliated Managers Group, Inc. | | | 42,822 | |

| | 95 | | | BlackRock, Inc. | | | 36,809 | |

| | 2,512 | | | Charles Schwab Corp. (The) | | | 101,510 | |

| | 275 | | | Deutsche Boerse AG, (Germany) (a) | | | 23,569 | |

| | 619 | | | Invesco Ltd. | | | 19,925 | |

| | 531 | | | Lazard Ltd., Class A | | | 22,865 | |

| | 724 | | | Morgan Stanley | | | 33,065 | |

| | 400 | | | Nasdaq, Inc. | | | 28,444 | |

| | 254 | | | Northern Trust Corp. | | | 22,187 | |

| | 370 | | | S&P Global, Inc. | | | 47,904 | |

| | 623 | | | T Rowe Price Group, Inc. | | | 44,364 | |

| | 2,427 | | | UBS Group AG, (Switzerland) | | | 37,414 | |

| | | | | | | | |

| | | | | | | 460,878 | |

| | | | | | | | |

| | | | Consumer Finance — 0.1% | |

| | 1,183 | | | Ally Financial, Inc. | | | 26,606 | |

| | 1,028 | | | Capital One Financial Corp. | | | 96,488 | |

| | | | | | | | |

| | | | | | | 123,094 | |

| | | | | | | | |

| | | | Diversified Financial Services — 0.0% (g) | |

| | 2,700 | | | ORIX Corp., (Japan) | | | 42,012 | |

| | | | | | | | |

| | | | Insurance — 0.6% | |

| | 16 | | | Alleghany Corp. (a) | | | 10,333 | |

| | 538 | | | Allied World Assurance Co. Holdings AG | | | 28,417 | |

| | 1,004 | | | American International Group, Inc. | | | 64,176 | |

| | 1,342 | | | AXA SA, (France) | | | 31,695 | |

| | 273 | | | Chubb Ltd. | | | 37,720 | |

| | 825 | | | CNO Financial Group, Inc. | | | 17,251 | |

| | 878 | | | Hartford Financial Services Group, Inc. (The) | | | 42,926 | |

| | 1,756 | | | Loews Corp. | | | 82,497 | |

| | 168 | | | Marsh & McLennan Cos., Inc. | | | 12,345 | |

| | 194 | | | Prudential Financial, Inc. | | | 21,445 | |

| | 1,483 | | | Prudential plc, (United Kingdom) | | | 29,638 | |

| | 700 | | | Sompo Holdings, Inc., (Japan) | | | 26,167 | |

| | 1,000 | | | Tokio Marine Holdings, Inc., (Japan) | | | 43,823 | |

| | 318 | | | Travelers Cos., Inc. (The) | | | 38,872 | |

| | 523 | | | Unum Group | | | 25,538 | |

| | | | | | | | |

| | | | | | | 512,843 | |

| | | | | | | | |

| | | | Total Financials | | | 2,198,751 | |

| | | | | | | | |

| | | | Health Care — 1.5% | |

| | | | Biotechnology — 0.4% | |

| | 369 | | | Celgene Corp. (a) | | | 45,575 | |

| | 700 | | | Exact Sciences Corp. (a) | | | 15,064 | |

| | 220 | | | Genmab A/S, (Denmark) (a) | | | 43,508 | |

| | 543 | | | Gilead Sciences, Inc. | | | 38,271 | |

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | J.P. MORGAN FUNDS | | | | | 7 | |

JPMorgan Diversified Real Return Fund

CONSOLIDATED SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF FEBRUARY 28, 2017 (Unaudited) (continued)

| | | | | | | | |

SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Common Stocks — continued | |

| | | | Biotechnology — continued | |

| | 170 | | | Intercept Pharmaceuticals, Inc. (a) | | | 21,690 | |

| | 489 | | | Kite Pharma, Inc. (a) | | | 34,606 | |

| | 702 | | | Shire plc | | | 42,330 | |

| | 338 | | | Spark Therapeutics, Inc. (a) | | | 21,558 | |

| | 416 | | | Vertex Pharmaceuticals, Inc. (a) | | | 37,698 | |

| | | | | | | | |

| | | | | | | 300,300 | |

| | | | | | | | |

| | | | Health Care Providers & Services — 0.5% | |

| | 1,337 | | | Acadia Healthcare Co., Inc. (a) | | | 59,790 | |

| | 522 | | | Aetna, Inc. | | | 67,213 | |

| | 102 | | | Cigna Corp. | | | 15,188 | |

| | 399 | | | Fresenius SE & Co. KGaA, (Germany) | | | 31,678 | |

| | 387 | | | HCA Holdings, Inc. (a) | | | 33,762 | |

| | 200 | | | Humana, Inc. | | | 42,250 | |

| | 979 | | | UnitedHealth Group, Inc. | | | 161,907 | |

| | | | | | | | |

| | | | | | | 411,788 | |

| | | | | | | | |

| | | | Health Care Technology — 0.0% (g) | |

| | 448 | | | Veeva Systems, Inc., Class A (a) | | | 19,573 | |

| | | | | | | | |

| | | | Life Sciences Tools & Services — 0.1% | |

| | 217 | | | Illumina, Inc. (a) | | | 36,326 | |

| | 449 | | | VWR Corp. (a) | | | 12,617 | |

| | | | | | | | |

| | | | | | | 48,943 | |

| | | | | | | | |

| | | | Pharmaceuticals — 0.5% | |

| | 104 | | | Allergan plc | | | 25,461 | |

| | 576 | | | AstraZeneca plc, (United Kingdom) | | | 33,195 | |

| | 1,698 | | | GlaxoSmithKline plc, (United Kingdom) | | | 34,746 | |

| | 170 | | | Jazz Pharmaceuticals plc (a) | | | 22,545 | |

| | 533 | | | Johnson & Johnson | | | 65,138 | |

| | 936 | | | Merck & Co., Inc. | | | 61,654 | |

| | 2,821 | | | Pfizer, Inc. | | | 96,253 | |

| | 635 | | | Revance Therapeutics, Inc. (a) | | | 13,335 | |

| | 264 | | | Roche Holding AG, (Switzerland) | | | 64,259 | |

| | 242 | | | Sanofi, (France) | | | 20,875 | |

| | 2,204 | | | TherapeuticsMD, Inc. (a) | | | 13,841 | |

| | | | | | | | |

| | | | | | | 451,302 | |

| | | | | | | | |

| | | | Total Health Care | | | 1,231,906 | |

| | | | | | | | |

| | | | Industrials — 3.4% | |

| | | | Aerospace & Defense — 0.1% | |

| | 518 | | | Airbus SE, (France) | | | 38,061 | |

| | 346 | | | Thales SA, (France) | | | 34,085 | |

| | 401 | | | United Technologies Corp. | | | 45,132 | |

| | | | | | | | |

| | | | | | | 117,278 | |

| | | | | | | | |

| | | | Air Freight & Logistics — 0.0% (g) | |

| | 1,500 | | | Yamato Holdings Co. Ltd., (Japan) | | | 32,743 | |

| | | | | | | | |

| | | | | | | | |

SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | |

| | | | Airlines — 0.2% | |

| | 1,936 | | | Delta Air Lines, Inc. | | | 96,664 | |

| | 1,200 | | | Japan Airlines Co. Ltd., (Japan) | | | 39,215 | |

| | 1,025 | | | Southwest Airlines Co. | | | 59,245 | |

| | | | | | | | |

| | | | | | | 195,124 | |

| | | | | | | | |

| | | | Building Products — 0.2% | |

| | 400 | | | Daikin Industries Ltd., (Japan) | | | 37,962 | |

| | 709 | | | Fortune Brands Home & Security, Inc. | | | 41,001 | |

| | 288 | | | Lennox International, Inc. | | | 47,411 | |

| | | | | | | | |

| | | | | | | 126,374 | |

| | | | | | | | |

| | | | Commercial Services & Supplies — 0.1% | |

| | 1,257 | | | Waste Connections, Inc., (Canada) | | | 109,849 | |

| | | | | | | | |

| | | | Construction & Engineering — 0.1% | |

| | 5,000 | | | Kajima Corp., (Japan) | | | 32,589 | |

| | 634 | | | OCI NV, (Netherlands) (a) | | | 12,604 | |

| | | | | | | | |

| | | | | | | 45,193 | |

| | | | | | | | |

| | | | Electrical Equipment — 0.1% | |

| | 217 | | | Acuity Brands, Inc. | | | 45,852 | |

| | | | | | | | |

| | | | Industrial Conglomerates — 0.2% | |

| | 615 | | | Carlisle Cos., Inc. | | | 63,529 | |

| | 341 | | | Honeywell International, Inc. | | | 42,455 | |

| | 435 | | | Siemens AG, (Germany) | | | 56,550 | |

| | | | | | | | |

| | | | | | | 162,534 | |

| | | | | | | | |

| | | | Machinery — 0.3% | |

| | 912 | | | CNH Industrial NV, (United Kingdom) | | | 8,426 | |

| | 1,900 | | | DMG Mori Co. Ltd., (Japan) | | | 30,027 | |

| | 376 | | | Dover Corp. | | | 30,118 | |

| | 227 | | | Illinois Tool Works, Inc. | | | 29,966 | |

| | 186 | | | Middleby Corp. (The) (a) | | | 25,800 | |

| | 415 | | | Stanley Black & Decker, Inc. | | | 52,767 | |

| | 339 | | | WABCO Holdings, Inc. (a) | | | 38,063 | |

| | 467 | | | Wartsila OYJ Abp, (Finland) | | | 23,979 | |

| | | | | | | | |

| | | | | | | 239,146 | |

| | | | | | | | |

| | | | Professional Services — 0.0% (g) | |

| | 249 | | | Equifax, Inc. | | | 32,646 | |

| | | | | | | | |

| | | | Road & Rail — 0.0% (g) | |

| | 360 | | | Old Dominion Freight Line, Inc. (a) | | | 33,034 | |

| | | | | | | | |

| | | | Trading Companies & Distributors — 0.2% | |

| | 808 | | | HD Supply Holdings, Inc. (a) | | | 34,744 | |

| | 1,800 | | | Mitsubishi Corp., (Japan) | | | 40,633 | |

| | 190 | | | United Rentals, Inc. (a) | | | 24,326 | |

| | 539 | | | Wolseley plc, (Switzerland) | | | 32,888 | |

| | | | | | | | |

| | | | | | | 132,591 | |

| | | | | | | | |

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 8 | | | | J.P. MORGAN FUNDS | | FEBRUARY 28, 2017 |

| | | | | | | | |

SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Common Stocks — continued | |

| | | | Transportation Infrastructure — 1.9% | |

| | 8,256 | | | Abertis Infraestructuras SA, (Spain) | | | 120,956 | |

| | 1,030 | | | Aena SA, (Spain) (e) | | | 147,133 | |

| | 451 | | | Aeroports de Paris, (France) | | | 51,164 | |

| | 6,813 | | | Atlantia SpA, (Italy) | | | 159,522 | |

| | 12,817 | | | Auckland International Airport Ltd., (New Zealand) | | | 67,683 | |

| | 12,851 | | | BBA Aviation plc, (United Kingdom) | | | 48,614 | |

| | 18,000 | | | Beijing Capital International Airport Co. Ltd., (China), Class H | | | 19,289 | |

| | 10,000 | | | China Merchants Port Holdings Co. Ltd., (China) | | | 27,883 | |

| | 22,000 | | | COSCO SHIPPING Ports Ltd., (China) | | | 24,502 | |

| | 268 | | | Flughafen Zuerich AG, (Switzerland) | | | 54,110 | |

| | 526 | | | Fraport AG Frankfurt Airport Services Worldwide, (Germany) | | | 32,907 | |

| | 7,744 | | | Groupe Eurotunnel SE, (France) | | | 72,249 | |

| | 577 | | | Grupo Aeroportuario del Pacifico SAB de CV, (Mexico), ADR | | | 49,882 | |

| | 257 | | | Grupo Aeroportuario del Sureste SAB de CV, (Mexico), ADR | | | 40,688 | |

| | 73,000 | | | Hutchison Port Holdings Trust, (Hong Kong) | | | 27,747 | |

| | 800 | | | Japan Airport Terminal Co. Ltd., (Japan) | | | 27,980 | |

| | 16,000 | | | Jiangsu Expressway Co. Ltd., (China), Class H | | | 21,107 | |

| | 2,000 | | | Kamigumi Co. Ltd., (Japan) | | | 18,766 | |

| | 6,242 | | | Macquarie Atlas Roads Group, (Australia) | | | 23,420 | |

| | 1,054 | | | Macquarie Infrastructure Corp. | | | 81,095 | |

| | 2,000 | | | Mitsubishi Logistics Corp., (Japan) | | | 28,721 | |

| | 17,076 | | | Qube Holdings Ltd., (Australia) | | | 30,200 | |

| | 8,900 | | | SATS Ltd., (Singapore) | | | 31,754 | |

| | 12,500 | | | Shenzhen International Holdings Ltd., (China) | | | 17,922 | |

| | 939 | | | Societa Iniziative Autostradali e Servizi SpA, (Italy) | | | 8,227 | |

| | 2,000 | | | Sumitomo Warehouse Co. Ltd. (The), (Japan) | | | 11,535 | |

| | 15,867 | | | Sydney Airport, (Australia) | | | 73,707 | |

| | 24,814 | | | Transurban Group, (Australia) | | | 209,849 | |

| | 740 | | | Wesco Aircraft Holdings, Inc. (a) | | | 8,954 | |

| | 820 | | | Westshore Terminals Investment Corp., (Canada) | | | 16,669 | |

| | | | | | | | |

| | | | | | | 1,554,235 | |

| | | | | | | | |

| | | | Total Industrials | | | 2,826,599 | |

| | | | | | | | |

| | | | Information Technology — 2.5% | |

| | | | Communications Equipment — 0.2% | |

| | 276 | | | Arista Networks, Inc. (a) | | | 32,841 | |

| | 1,383 | | | Cisco Systems, Inc. | | | 47,271 | |

| | 286 | | | Harris Corp. | | | 31,431 | |

| | 184 | | | Palo Alto Networks, Inc. (a) | | | 27,950 | |

| | | | | | | | |

| | | | | | | 139,493 | |

| | | | | | | | |

| | | | | | | | |

SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | Electronic Equipment, Instruments & Components — 0.2% | |

| | 716 | | | Amphenol Corp., Class A | | | 49,555 | |

| | 375 | | | Arrow Electronics, Inc. (a) | | | 27,075 | |

| | 1,634 | | | Corning, Inc. | | | 45,115 | |

| | 200 | | | Keyence Corp., (Japan) | | | 77,336 | |

| | | | | | | | |

| | | | | | | 199,081 | |

| | | | | | | | |

| | | | Internet Software & Services — 0.6% | |

| | 312 | | | Alphabet, Inc., Class C (a) | | | 256,842 | |

| | 1,155 | | | Facebook, Inc., Class A (a) | | | 156,549 | |

| | 1,239 | | | GoDaddy, Inc., Class A (a) | | | 45,657 | |

| | 600 | | | Tencent Holdings Ltd., (China) | | | 15,922 | |

| | | | | | | | |

| | | | | | | 474,970 | |

| | | | | | | | |

| | | | IT Services — 0.4% | |

| | 388 | | | Capgemini SA, (France) | | | 33,233 | |

| | 632 | | | Mastercard, Inc., Class A | | | 69,811 | |

| | 1,548 | | | PayPal Holdings, Inc. (a) | | | 65,016 | |

| | 891 | | | Vantiv, Inc., Class A (a) | | | 58,253 | |

| | 867 | | | Visa, Inc., Class A | | | 76,244 | |

| | | | | | | | |

| | | | | | | 302,557 | |

| | | | | | | | |

| | | | Semiconductors & Semiconductor Equipment — 0.4% | |

| | 894 | | | Applied Materials, Inc. | | | 32,381 | |

| | 288 | | | ASML Holding NV, (Netherlands) | | | 35,009 | |

| | 244 | | | Broadcom Ltd. | | | 51,467 | |

| | 310 | | | Cavium, Inc. (a) | | | 20,308 | |

| | 1,953 | | | Infineon Technologies AG, (Germany) | | | 34,716 | |

| | 235 | | | KLA-Tencor Corp. | | | 21,178 | |

| | 256 | | | Lam Research Corp. | | | 30,346 | |

| | 392 | | | NVIDIA Corp. | | | 39,780 | |

| | 501 | | | QUALCOMM, Inc. | | | 28,297 | |

| | 640 | | | Texas Instruments, Inc. | | | 49,037 | |

| | | | | | | | |

| | | | | | | 342,519 | |

| | | | | | | | |

| | | | Software — 0.5% | |

| | 372 | | | Adobe Systems, Inc. (a) | | | 44,022 | |

| | 914 | | | Electronic Arts, Inc. (a) | | | 79,061 | |

| | 364 | | | Guidewire Software, Inc. (a) | | | 19,889 | |

| | 2,363 | | | Microsoft Corp. | | | 151,185 | |

| | 427 | | | salesforce.com, Inc. (a) | | | 34,736 | |

| | 435 | | | ServiceNow, Inc. (a) | | | 37,810 | |

| | 450 | | | Splunk, Inc. (a) | | | 27,779 | |

| | | | | | | | |

| | | | | | | 394,482 | |

| | | | | | | | |

| | | | Technology Hardware, Storage & Peripherals — 0.2% | |

| | 1,304 | | | Apple, Inc. | | | 178,635 | |

| | 1,148 | | | Hewlett Packard Enterprise Co. | | | 26,197 | |

| | | | | | | | |

| | | | | | | 204,832 | |

| | | | | | | | |

| | | | Total Information Technology | | | 2,057,934 | |

| | | | | | | | |

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | J.P. MORGAN FUNDS | | | | | 9 | |

JPMorgan Diversified Real Return Fund

CONSOLIDATED SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF FEBRUARY 28, 2017 (Unaudited) (continued)

| | | | | | | | |

SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Common Stocks — continued | |

| | | | Materials — 5.6% | |

| | | | Chemicals — 1.4% | |

| | 425 | | | AdvanSix, Inc. (a) | | | 11,594 | |

| | 1,290 | | | Agrium, Inc., (Canada) | | | 124,367 | |

| | 923 | | | CF Industries Holdings, Inc. | | | 29,001 | |

| | 435 | | | Chr Hansen Holding A/S, (Denmark) | | | 25,937 | |

| | 624 | | | FMC Corp. | | | 35,955 | |

| | 4,818 | | | Israel Chemicals Ltd., (Israel) | | | 20,529 | |

| | 1,858 | | | K+S AG, (Germany) | | | 43,392 | |

| | 1,932 | | | Monsanto Co. | | | 219,920 | |

| | 1,486 | | | Mosaic Co. (The) | | | 46,348 | |

| | 8,134 | | | Potash Corp. of Saskatchewan, Inc., (Canada) | | | 141,099 | |

| | 851 | | | Syngenta AG, (Switzerland) (a) | | | 365,567 | |

| | 1,706 | | | Yara International ASA, (Norway) | | | 64,766 | |

| | | | | | | | |

| | | | | | | 1,128,475 | |

| | | | | | | | |

| | | | Construction Materials — 0.1% | |

| | 399 | | | Eagle Materials, Inc. | | | 41,380 | |

| | 126 | | | Martin Marietta Materials, Inc. | | | 27,210 | |

| | 220 | | | Vulcan Materials Co. | | | 26,534 | |

| | | | | | | | |

| | | | | | | 95,124 | |

| | | | | | | | |

| | | | Containers & Packaging — 0.7% | |

| | 11,230 | | | Amcor Ltd., (Australia) | | | 120,871 | |

| | 457 | | | Avery Dennison Corp. | | | 36,885 | |

| | 555 | | | Ball Corp. | | | 40,809 | |

| | 1,498 | | | Graphic Packaging Holding Co. | | | 19,998 | |

| | 1,837 | | | International Paper Co. | | | 96,810 | |

| | 475 | | | Packaging Corp. of America | | | 43,904 | |

| | 786 | | | Sealed Air Corp. | | | 36,533 | |

| | 2,293 | | | Smurfit Kappa Group plc, (Ireland) | | | 60,902 | |

| | 1,757 | | | WestRock Co. | | | 94,386 | |

| | | | | | | | |

| | | | | | | 551,098 | |

| | | | | | | | |

| | | | Metals & Mining — 3.0% | |

| | 820 | | | Alcoa Corp. | | | 28,364 | |

| | 7,795 | | | Anglo American plc, (United Kingdom) (a) | | | 122,393 | |

| | 2,134 | | | Antofagasta plc, (Chile) | | | 21,444 | |

| | 10,472 | | | ArcelorMittal, (Luxembourg) (a) | | | 92,146 | |

| | 6,540 | | | Barrick Gold Corp., (Canada) | | | 121,513 | |

| | 17,815 | | | BHP Billiton Ltd., (Australia) | | | 337,204 | |

| | 875 | | | Franco-Nevada Corp., (Canada) | | | 56,399 | |

| | 6,819 | | | Freeport-McMoRan, Inc. (a) | | | 91,375 | |

| | 1,026 | | | Fresnillo plc, (Mexico) | | | 18,827 | |

| | 67,146 | | | Glencore plc, (Switzerland) (a) | | | 267,682 | |

| | 4,702 | | | Goldcorp, Inc., (Canada) | | | 74,520 | |

| | 3,200 | | | JFE Holdings, Inc., (Japan) | | | 60,491 | |

| | | | | | | | |

SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | Metals & Mining — continued | |

| | 70 | | | Korea Zinc Co. Ltd., (South Korea) (a) | | | 25,743 | |

| | 3,773 | | | MMC Norilsk Nickel PJSC, (Russia), ADR | | | 60,077 | |

| | 4,231 | | | Newcrest Mining Ltd., (Australia) | | | 71,671 | |

| | 2,914 | | | Newmont Mining Corp. | | | 99,775 | |

| | 6,400 | | | Nippon Steel & Sumitomo Metal Corp., (Japan) | | | 157,322 | |

| | 13,845 | | | Norsk Hydro ASA, (Norway) | | | 78,385 | |

| | 462 | | | Novolipetsk Steel PJSC, (Russia), GDR | | | 8,855 | |

| | 1,768 | | | Nucor Corp. | | | 110,624 | |

| | 445 | | | POSCO, (South Korea) | | | 111,276 | |

| | 2,360 | | | Rio Tinto Ltd., (United Kingdom) | | | 111,889 | |

| | 1,185 | | | Rio Tinto plc, (United Kingdom) | | | 48,569 | |

| | 952 | | | Severstal PJSC, (Russia), Reg. S, GDR | | | 13,560 | |

| | 2,468 | | | Silver Wheaton Corp., (Canada) | | | 48,070 | |

| | 29,466 | | | South32 Ltd., (Australia) | | | 56,100 | |

| | 959 | | | Southern Copper Corp., (Peru) | | | 35,157 | |

| | 4,000 | | | Sumitomo Metal Mining Co. Ltd., (Japan) | | | 55,570 | |

| | 2,418 | | | thyssenkrupp AG, (Germany) | | | 60,356 | |

| | 7,239 | | | Vale SA, (Brazil), ADR | | | 74,924 | |

| | 598 | | | voestalpine AG, (Austria) | | | 25,126 | |

| | | | | | | | |

| | | | | | | 2,545,407 | |

| | | | | | | | |

| | | | Paper & Forest Products — 0.4% | |

| | 2,205 | | | Fibria Celulose SA, (Brazil), ADR | | | 18,853 | |

| | 680 | | | KapStone Paper and Packaging Corp. | | | 15,368 | |

| | 3,559 | | | Mondi plc, (South Africa) | | | 82,952 | |

| | 8,000 | | | Oji Holdings Corp., (Japan) | | | 38,319 | |

| | 5,520 | | | Stora Enso OYJ, (Finland), Class R | | | 59,198 | |

| | 6,453 | | | UPM-Kymmene OYJ, (Finland) | | | 153,044 | |

| | | | | | | | |

| | | | | | | 367,734 | |

| | | | | | | | |

| | | | Total Materials | | | 4,687,838 | |

| | | | | | | | |

| | | | Real Estate — 7.3% | |

| | | | Equity Real Estate Investment Trusts (REITs) — 7.1% | |

| | 1,262 | | | American Homes 4 Rent, Class A | | | 29,998 | |

| | 3,450 | | | Apartment Investment & Management Co., Class A | | | 160,528 | |

| | 1,620 | | | AvalonBay Communities, Inc. | | | 297,724 | |

| | 1,400 | | | Boston Properties, Inc. | | | 194,642 | |

| | 5,500 | | | Brandywine Realty Trust | | | 91,630 | |

| | 4,991 | | | Brixmor Property Group, Inc. | | | 116,490 | |

| | 2,340 | | | Camden Property Trust | | | 198,081 | |

| | 2,680 | | | Corporate Office Properties Trust | | | 91,361 | |

| | 3,020 | | | CubeSmart | | | 82,295 | |

| | 1,580 | | | CyrusOne, Inc. | | | 80,422 | |

| | 1,630 | | | Digital Realty Trust, Inc. | | | 176,040 | |

| | 1,560 | | | Duke Realty Corp. | | | 39,998 | |

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 10 | | | | J.P. MORGAN FUNDS | | FEBRUARY 28, 2017 |

| | | | | | | | |

SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Common Stocks — continued | |

| | | | Equity Real Estate Investment Trusts (REITs) — continued | |

| | 250 | | | EastGroup Properties, Inc. | | | 18,585 | |

| | 420 | | | Equinix, Inc. | | | 157,949 | |

| | 1,730 | | | Equity LifeStyle Properties, Inc. | | | 137,743 | |

| | 2,840 | | | Equity One, Inc. | | | 89,914 | |

| | 770 | | | Essex Property Trust, Inc. | | | 180,719 | |

| | 6,100 | | | GGP, Inc. | | | 151,646 | |

| | 7,498 | | | Goodman Group, (Australia) | | | 43,370 | |

| | 8,630 | | | HCP, Inc. | | | 282,978 | |

| | 1,200 | | | Highwoods Properties, Inc. | | | 62,988 | |

| | 6,690 | | | Host Hotels & Resorts, Inc. | | | 120,353 | |

| | 2,110 | | | Hudson Pacific Properties, Inc. | | | 77,184 | |

| | 3,900 | | | Invitation Homes, Inc. (a) | | | 84,981 | |

| | 1,020 | | | Kilroy Realty Corp. | | | 78,693 | |

| | 9,340 | | | Kimco Realty Corp. | | | 226,495 | |

| | 1,013 | | | Klepierre, (France) | | | 37,624 | |

| | 1,560 | | | Liberty Property Trust | | | 61,526 | |

| | 1,900 | | | Macerich Co. (The) | | | 128,022 | |

| | 2,150 | | | National Health Investors, Inc. | | | 162,798 | |

| | 909 | | | Outfront Media, Inc. | | | 23,589 | |

| | 3,028 | | | Park Hotels & Resorts, Inc. | | | 77,335 | |

| | 420 | | | Pennsylvania REIT | | | 6,930 | |

| | 7,580 | | | Prologis, Inc. | | | 386,959 | |

| | 1,432 | | | Public Storage | | | 325,723 | |

| | 3,942 | | | Quality Care Properties, Inc. (a) | | | 74,819 | |

| | 1,763 | | | Rayonier, Inc. | | | 50,492 | |

| | 3,480 | | | Realty Income Corp. | | | 213,254 | |

| | 800 | | | Senior Housing Properties Trust | | | 16,400 | |

| | 1,510 | | | Simon Property Group, Inc. | | | 278,444 | |

| | 1,640 | | | SL Green Realty Corp. | | | 184,795 | |

| | 15,500 | | | Spirit Realty Capital, Inc. | | | 170,345 | |

| | 1,290 | | | STORE Capital Corp. | | | 32,134 | |

| | 5,830 | | | Sunstone Hotel Investors, Inc. | | | 85,992 | |

| | 1,150 | | | Ventas, Inc. | | | 74,808 | |

| | 1,700 | | | Vornado Realty Trust | | | 186,779 | |

| | 3,887 | | | Weyerhaeuser Co. | | | 131,070 | |

| | | | | | | | |

| | | | | | | 5,982,645 | |

| | | | | | | | |

| | | | Real Estate Management & Development — 0.2% | |

| | 1,835 | | | CBRE Group, Inc., Class A (a) | | | 65,363 | |

| | 12,000 | | | China Resources Land Ltd., (China) | | | 32,739 | |

| | 2,000 | | | Mitsui Fudosan Co. Ltd., (Japan) | | | 45,254 | |

| | | | | | | | |

| | | | | | | 143,356 | |

| | | | | | | | |

| | | | Total Real Estate | | | 6,126,001 | |

| | | | | | | | |

| | | | | | | | |

SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | Telecommunication Services — 0.2% | |

| | | | Diversified Telecommunication Services — 0.1% | |

| | 900 | | | Nippon Telegraph & Telephone Corp., (Japan) | | | 38,069 | |

| | 34,880 | | | Telecom Italia SpA, (Italy) (a) | | | 28,149 | |

| | 649 | | | Verizon Communications, Inc. | | | 32,210 | |

| | | | | | | | |

| | | | | | | 98,428 | |

| | | | | | | | |

| | | | Wireless Telecommunication Services — 0.1% | |

| | 295 | | | T-Mobile US, Inc. (a) | | | 18,446 | |

| | 16,695 | | | Vodafone Group plc, (United Kingdom) | | | 41,811 | |

| | | | | | | | |

| | | | | | | 60,257 | |

| | | | | | | | |

| | | | Total Telecommunication Services | | | 158,685 | |

| | | | | | | | |

| | | | Utilities — 2.3% | |

| | | | Electric Utilities — 1.6% | |

| | 1,699 | | | American Electric Power Co., Inc. | | | 113,782 | |

| | 4,000 | | | CLP Holdings Ltd., (Hong Kong) | | | 40,684 | |

| | 736 | | | CPFL Energia SA, (Brazil), ADR | | | 11,975 | |

| | 1,742 | | | Duke Energy Corp. | | | 143,802 | |

| | 1,151 | | | Edison International | | | 91,781 | |

| | 748 | | | Enel Americas SA, (Chile), ADR | | | 7,293 | |

| | 24,723 | | | Enel SpA, (Italy) | | | 106,103 | |

| | 1,123 | | | Eversource Energy | | | 65,875 | |

| | 2,046 | | | Exelon Corp. | | | 75,109 | |

| | 14,090 | | | Iberdrola SA, (Spain) | | | 93,554 | |

| | 1,281 | | | NextEra Energy, Inc. | | | 167,811 | |

| | 1,079 | | | PG&E Corp. | | | 72,023 | |

| | 1,456 | | | PPL Corp. | | | 53,697 | |

| | 2,162 | | | Southern Co. (The) | | | 109,873 | |

| | 2,215 | | | SSE plc, (United Kingdom) | | | 42,321 | |

| | 2,087 | | | Xcel Energy, Inc. | | | 91,223 | |

| | | | | | | | |

| | | | | | | 1,286,906 | |

| | | | | | | | |

| | | | Gas Utilities — 0.0% (g) | |

| | 4,000 | | | China Gas Holdings Ltd., (Hong Kong) | | | 5,933 | |

| | 8,000 | | | China Resources Gas Group Ltd., (China) | | | 24,433 | |

| | | | | | | | |

| | | | | | | 30,366 | |

| | | | | | | | |

| | | | Independent Power & Renewable Electricity

Producers — 0.0% (g) | |

| | 4,000 | | | China Resources Power Holdings Co. Ltd., (China) | | | 7,239 | |

| | | | | | | | |

| | | | Multi-Utilities — 0.7% | |

| | 12,029 | | | Centrica plc, (United Kingdom) | | | 33,886 | |

| | 712 | | | Consolidated Edison, Inc. | | | 54,852 | |

| | 1,331 | | | Dominion Resources, Inc. | | | 103,339 | |

| | 4,402 | | | E.ON SE, (Germany) | | | 34,144 | |

| | 3,545 | | | Engie SA, (France) | | | 43,374 | |

| | 8,543 | | | National Grid plc, (United Kingdom) | | | 103,783 | |

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | J.P. MORGAN FUNDS | | | | | 11 | |

JPMorgan Diversified Real Return Fund

CONSOLIDATED SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF FEBRUARY 28, 2017 (Unaudited) (continued)

| | | | | | | | |

SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Common Stocks — continued | |

| | | | Multi-Utilities — continued | |

| | 1,112 | | | Public Service Enterprise Group, Inc. | | | 51,130 | |

| | 817 | | | Sempra Energy | | | 90,107 | |

| | 736 | | | WEC Energy Group, Inc. | | | 44,359 | |

| | | | | | | | |

| | | | | | | 558,974 | |

| | | | | | | | |

| | | | Water Utilities — 0.0% (g) | |

| | 10,000 | | | Beijing Enterprises Water Group Ltd., (China) | | | 7,139 | |

| | 766 | | | Cia de Saneamento Basico do Estado de Sao Paulo, (Brazil), ADR | | | 8,112 | |

| | 4,000 | | | Guangdong Investment Ltd., (China) | | | 5,449 | |

| | | | | | | | |

| | | | | | | 20,700 | |

| | | | | | | | |

| | | | Total Utilities | | | 1,904,185 | |

| | | | | | | | |

| | | | Total Common Stocks

(Cost $25,836,758) | | | 27,352,942 | |

| | | | | | | | |

| | |

PRINCIPAL

AMOUNT($) | | | | | | |

| | Corporate Bonds — 28.8% | |

| | | | Consumer Discretionary — 3.3% | |

| | | | Auto Components — 0.2% | |

| | | | American Axle & Manufacturing, Inc., | | | | |

| | 11,000 | | | 6.250%, 03/15/21 | | | 11,316 | |

| | 33,000 | | | 6.625%, 10/15/22 | | | 34,155 | |

| | 7,000 | | | Cooper-Standard Automotive, Inc., 5.625%, 11/15/26 (e) | | | 7,088 | |

| | 46,000 | | | Dana, Inc., 5.500%, 12/15/24 | | | 48,070 | |

| | 50,000 | | | Goodyear Tire & Rubber Co. (The), 5.000%, 05/31/26 | | | 51,000 | |

| | | | Icahn Enterprises LP, | | | | |

| | 15,000 | | | 5.875%, 02/01/22 | | | 15,300 | |

| | 4,000 | | | 6.250%, 02/01/22 (e) | | | 4,130 | |

| | 4,000 | | | 6.750%, 02/01/24 (e) | | | 4,155 | |

| | 25,000 | | | Tenneco, Inc., 5.375%, 12/15/24 | | | 26,125 | |

| | | | | | | | |

| | | | | | | 201,339 | |

| | | | | | | | |

| | | | Automobiles — 0.2% | |

| | 150,000 | | | Daimler Finance North America LLC, (Germany), 1.875%, 01/11/18 (e) | | | 150,313 | |

| | 35,000 | | | Ford Motor Co., 4.346%, 12/08/26 | | | 35,913 | |

| | | | | | | | |

| | | | | | | 186,226 | |

| | | | | | | | |

| | | | Distributors — 0.1% | |

| | 10,000 | | | Global Partners LP, 6.250%, 07/15/22 | | | 9,800 | |

| | 59,000 | | | LKQ Corp., 4.750%, 05/15/23 | | | 59,092 | |

| | | | | | | | |

| | | | | | | 68,892 | |

| | | | | | | | |

| | | | Diversified Consumer Services — 0.0% (g) | |

| | 22,000 | | | Service Corp. International, 5.375%, 05/15/24 | | | 23,307 | |

| | | | | | | | |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | |

| | | | Hotels, Restaurants & Leisure — 0.8% | |

| | 18,000 | | | 1011778 BC ULC, (Canada), 6.000%, 04/01/22 (e) | | | 18,770 | |

| | 18,000 | | | Boyd Gaming Corp., 6.875%, 05/15/23 | | | 19,440 | |

| | 60,000 | | | Choice Hotels International, Inc., 5.750%, 07/01/22 | | | 65,100 | |

| | 15,000 | | | Downstream Development Authority of the Quapaw Tribe of Oklahoma, 10.500%, 07/01/19 (e) | | | 14,887 | |

| | 10,000 | | | ESH Hospitality, Inc., 5.250%, 05/01/25 (e) | | | 10,087 | |

| | 10,000 | | | Gateway Casinos & Entertainment Ltd., (Canada), 8.250%, 03/01/24 (e) | | | 10,163 | |

| | | | GLP Capital LP, | | | | |

| | 72,000 | | | 5.375%, 11/01/23 | | | 77,220 | |

| | 57,000 | | | 5.375%, 04/15/26 | | | 59,636 | |

| | 10,000 | | | Hilton Domestic Operating Co., Inc., 4.250%, 09/01/24 (e) | | | 9,890 | |

| | 4,000 | | | Hilton Grand Vacations Borrower LLC, 6.125%, 12/01/24 (e) | | | 4,220 | |

| | 10,000 | | | Jack Ohio Finance LLC, 6.750%, 11/15/21 (e) | | | 10,375 | |

| | 30,000 | | | Landry’s, Inc., 6.750%, 10/15/24 (e) | | | 31,200 | |

| | 81,000 | | | MGM Resorts International, 6.000%, 03/15/23 | | | 88,290 | |

| | 13,000 | | | NCL Corp. Ltd., 4.750%, 12/15/21 (e) | | | 13,276 | |

| | 7,000 | | | Sabre GLBL, Inc., 5.375%, 04/15/23 (e) | | | 7,123 | |

| | | | Scientific Games International, Inc., | | | | |

| | 55,000 | | | 7.000%, 01/01/22 (e) | | | 58,438 | |

| | 25,000 | | | 10.000%, 12/01/22 | | | 26,531 | |

| | 2,000 | | | Seminole Hard Rock Entertainment, Inc., 5.875%, 05/15/21 (e) | | | 2,050 | |

| | 40,000 | | | Six Flags Entertainment Corp., 4.875%, 07/31/24 (e) | | | 40,400 | |

| | 29,000 | | | Wynn Las Vegas LLC, 5.375%, 03/15/22 | | | 29,798 | |

| | 30,000 | | | Yum! Brands, Inc., 3.750%, 11/01/21 | | | 30,525 | |

| | | | | | | | |

| | | | | | | 627,419 | |

| | | | | | | | |

| | | | Household Durables — 0.1% | |

| | 9,000 | | | American Greetings Corp., 7.875%, 02/15/25 (e) | | | 9,439 | |

| | 25,000 | | | CalAtlantic Group, Inc., 5.875%, 11/15/24 | | | 26,812 | |

| | 10,000 | | | M/I Homes, Inc., 6.750%, 01/15/21 | | | 10,500 | |

| | | | Mattamy Group Corp., (Canada), | | | | |

| | 13,000 | | | 6.500%, 11/15/20 (e) | | | 13,357 | |

| | 3,000 | | | 6.875%, 12/15/23 (e) | | | 3,135 | |

| | | | Tempur Sealy International, Inc., | | | | |

| | 29,000 | | | 5.500%, 06/15/26 | | | 28,384 | |

| | 8,000 | | | 5.625%, 10/15/23 | | | 8,080 | |

| | 10,000 | | | Toll Brothers Finance Corp., 4.875%, 11/15/25 | | | 10,150 | |

| | | | | | | | |

| | | | | | | 109,857 | |

| | | | | | | | |

| | | | Internet & Direct Marketing Retail — 0.0% (g) | |

| | | | Netflix, Inc., | | | | |

| | 15,000 | | | 4.375%, 11/15/26 (e) | | | 14,869 | |

| | 10,000 | | | 5.875%, 02/15/25 | | | 10,850 | |

| | | | | | | | |

| | | | | | | 25,719 | |

| | | | | | | | |

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 12 | | | | J.P. MORGAN FUNDS | | FEBRUARY 28, 2017 |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Corporate Bonds — continued | |

| | | | Media — 1.6% | |

| | 40,000 | | | AMC Networks, Inc., 4.750%, 12/15/22 | | | 40,400 | |

| | 46,000 | | | Cablevision Systems Corp., 8.000%, 04/15/20 | | | 50,830 | |

| | | | Charter Communications Operating LLC, | | | | |

| | 45,000 | | | 4.464%, 07/23/22 | | | 47,281 | |

| | 40,000 | | | 4.908%, 07/23/25 | | | 42,200 | |

| | 49,000 | | | Cinemark USA, Inc., 4.875%, 06/01/23 | | | 50,225 | |

| | | | Clear Channel Worldwide Holdings, Inc., | | | | |

| | 65,000 | | | Series B, 6.500%, 11/15/22 | | | 67,315 | |

| | 20,000 | | | Series B, 7.625%, 03/15/20 | | | 20,150 | |

| | 90,000 | | | Comcast Corp., 3.150%, 03/01/26 | | | 88,724 | |

| | | | CSC Holdings LLC, | | | | |

| | 30,000 | | | 6.750%, 11/15/21 | | | 33,000 | |

| | 30,000 | | | 8.625%, 02/15/19 | | | 33,169 | |

| | 20,000 | | | Discovery Communications LLC, 3.800%, 03/13/24 (w) | | | 19,962 | |

| | | | DISH DBS Corp., | | | | |

| | 5,000 | | | 5.875%, 07/15/22 | | | 5,359 | |

| | 2,000 | | | 5.875%, 11/15/24 | | | 2,135 | |

| | 107,000 | | | 6.750%, 06/01/21 | | | 117,433 | |

| | 7,000 | | | 7.750%, 07/01/26 | | | 8,225 | |

| | 20,000 | | | Gray Television, Inc., 5.875%, 07/15/26 (e) | | | 20,281 | |

| | 75,000 | | | iHeartCommunications, Inc., 9.000%, 12/15/19 | | | 65,540 | |

| | 30,000 | | | Live Nation Entertainment, Inc., 4.875%, 11/01/24 (e) | | | 30,000 | |

| | 15,000 | | | Mediacom Broadband LLC, 6.375%, 04/01/23 | | | 15,750 | |

| | 25,000 | | | Nexstar Broadcasting, Inc., 5.625%, 08/01/24 (e) | | | 25,562 | |

| | 55,000 | | | Nielsen Finance LLC, 5.000%, 04/15/22 (e) | | | 56,513 | |

| | 45,000 | | | Outfront Media Capital LLC, 5.875%, 03/15/25 | | | 47,306 | |

| | 5,000 | | | Quebecor Media, Inc., (Canada), 5.750%, 01/15/23 | | | 5,331 | |

| | 55,000 | | | Regal Entertainment Group, 5.750%, 03/15/22 | | | 57,544 | |

| | 25,000 | | | Sinclair Television Group, Inc., 5.625%, 08/01/24 (e) | | | 25,719 | |

| | | | Sirius XM Radio, Inc., | | | | |

| | 4,000 | | | 4.625%, 05/15/23 (e) | | | 4,090 | |

| | 50,000 | | | 5.375%, 04/15/25 (e) | | | 51,141 | |

| | 5,000 | | | 5.750%, 08/01/21 (e) | | | 5,209 | |

| | 40,000 | | | TEGNA, Inc., 6.375%, 10/15/23 | | | 42,600 | |

| | 20,000 | | | Time Warner, Inc., 2.950%, 07/15/26 | | | 18,565 | |

| | | | Univision Communications, Inc., | | | | |

| | 60,000 | | | 5.125%, 05/15/23 (e) | | | 60,000 | |

| | 5,000 | | | 5.125%, 02/15/25 (e) | | | 4,931 | |

| | 25,000 | | | Viacom, Inc., 2.250%, 02/04/22 | | | 23,888 | |

| | 60,000 | | | Videotron Ltd., (Canada), 5.000%, 07/15/22 | | | 63,150 | |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | |

| | | | Media — continued | |

| | | | WMG Acquisition Corp., | | | | |

| | 5,000 | | | 4.875%, 11/01/24 (e) | | | 5,063 | |

| | 10,000 | | | 5.000%, 08/01/23 (e) | | | 10,225 | |

| | 23,000 | | | 5.625%, 04/15/22 (e) | | | 23,920 | |

| | | | | | | | |

| | | | | | | 1,288,736 | |

| | | | | | | | |

| | | | Multiline Retail — 0.1% | |

| | 35,000 | | | Dollar Tree, Inc., 5.750%, 03/01/23 | | | 37,012 | |

| | 20,000 | | | JC Penney Corp., Inc., 5.875%, 07/01/23 (e) | | | 20,038 | |

| | 10,000 | | | Neiman Marcus Group Ltd. LLC, 8.000%, 10/15/21 (e) | | | 6,275 | |

| | | | | | | | |

| | | | | | | 63,325 | |

| | | | | | | | |

| | | | Specialty Retail — 0.2% | |

| | 10,000 | | | Caleres, Inc., 6.250%, 08/15/23 | | | 10,475 | |

| | 58,000 | | | CST Brands, Inc., 5.000%, 05/01/23 | | | 60,175 | |

| | 25,000 | | | L Brands, Inc., 5.625%, 10/15/23 | | | 26,150 | |

| | 12,000 | | | Penske Automotive Group, Inc., 5.500%, 05/15/26 | | | 11,918 | |

| | 15,000 | | | PetSmart, Inc., 7.125%, 03/15/23 (e) | | | 14,719 | |

| | 35,000 | | | Sally Holdings LLC, 5.500%, 11/01/23 | | | 35,525 | |

| | | | | | | | |

| | | | | | | 158,962 | |

| | | | | | | | |

| | | | Textiles, Apparel & Luxury Goods — 0.0% (g) | |

| | 20,000 | | | Levi Strauss & Co., 5.000%, 05/01/25 | | | 20,425 | |

| | | | | | | | |

| | | | Total Consumer Discretionary | | | 2,774,207 | |

| | | | | | | | |

| | | | Consumer Staples — 1.7% | |

| | | | Beverages — 0.3% | |

| | 180,000 | | | Anheuser-Busch InBev Finance, Inc., (Belgium), 3.650%, 02/01/26 | | | 182,627 | |

| | 19,000 | | | Cott Beverages, Inc., (Canada), 5.375%, 07/01/22 | | | 19,475 | |

| | 45,000 | | | PepsiCo, Inc., 2.750%, 03/01/23 | | | 45,214 | |

| | | | | | | | |

| | | | | | | 247,316 | |

| | | | | | | | |

| | | | Food & Staples Retailing — 0.5% | |

| | | | Albertsons Cos. LLC, | | | | |

| | 10,000 | | | 5.750%, 03/15/25 (e) | | | 10,019 | |

| | 57,000 | | | 6.625%, 06/15/24 (e) | | | 60,277 | |

| | | | CVS Health Corp., | | | | |

| | 65,000 | | | 2.800%, 07/20/20 | | | 66,067 | |

| | 35,000 | | | 3.875%, 07/20/25 | | | 36,143 | |

| | 33,000 | | | Ingles Markets, Inc., 5.750%, 06/15/23 | | | 34,072 | |

| | 35,000 | | | Kroger Co. (The), 2.650%, 10/15/26 | | | 32,568 | |

| | 44,000 | | | New Albertsons, Inc., 8.000%, 05/01/31 | | | 43,670 | |

| | 35,000 | | | Rite Aid Corp., 6.125%, 04/01/23 (e) | | | 37,088 | |

| | | | SUPERVALU, Inc., | | | | |

| | 27,000 | | | 6.750%, 06/01/21 | | | 26,932 | |

| | 55,000 | | | 7.750%, 11/15/22 | | | 54,313 | |

| | 11,000 | | | US Foods, Inc., 5.875%, 06/15/24 (e) | | | 11,550 | |

| | | | | | | | |

| | | | | | | 412,699 | |

| | | | | | | | |

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | J.P. MORGAN FUNDS | | | | | 13 | |

JPMorgan Diversified Real Return Fund

CONSOLIDATED SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF FEBRUARY 28, 2017 (Unaudited) (continued)

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Corporate Bonds — continued | |

| | | | Food Products — 0.3% | |

| | 23,000 | | | Bumble Bee Holdings, Inc., 9.000%, 12/15/17 (e) | | | 22,914 | |

| | 18,000 | | | Dean Foods Co., 6.500%, 03/15/23 (e) | | | 18,765 | |

| | | | JBS USA LUX SA, (Brazil), | | | | |

| | 20,000 | | | 5.750%, 06/15/25 (e) | | | 20,600 | |

| | 31,000 | | | 5.875%, 07/15/24 (e) | | | 32,395 | |

| | 25,000 | | | 7.250%, 06/01/21 (e) | | | 25,750 | |

| | 90,000 | | | Kraft Heinz Foods Co., 3.000%, 06/01/26 | | | 84,979 | |

| | 11,000 | | | Pilgrim’s Pride Corp., 5.750%, 03/15/25 (e) | | | 11,302 | |

| | | | Post Holdings, Inc., | | | | |

| | 12,000 | | | 5.000%, 08/15/26 (e) | | | 11,557 | |

| | 12,000 | | | 5.500%, 03/01/25 (e) | | | 12,240 | |

| | 11,000 | | | 5.750%, 03/01/27 (e) | | | 11,131 | |

| | | | | | | | |

| | | | | | | 251,633 | |

| | | | | | | | |

| | | | Household Products — 0.1% | |

| | 12,000 | | | Kronos Acquisition Holdings, Inc., (Canada), 9.000%, 08/15/23 (e) | | | 12,255 | |

| | 25,000 | | | Spectrum Brands, Inc., 5.750%, 07/15/25 | | | 26,615 | |

| | | | | | | | |

| | | | | | | 38,870 | |

| | | | | | | | |

| | | | Personal Products — 0.1% | |

| | 39,000 | | | Nature’s Bounty Co. (The), 7.625%, 05/15/21 (e) | | | 41,194 | |

| | | | Revlon Consumer Products Corp., | | | | |

| | 27,000 | | | 5.750%, 02/15/21 | | | 27,202 | |

| | 15,000 | | | 6.250%, 08/01/24 | | | 15,413 | |

| | | | | | | | |

| | | | | | | 83,809 | |

| | | | | | | | |

| | | | Tobacco — 0.4% | |

| | 130,000 | | | Altria Group, Inc., 2.850%, 08/09/22 | | | 130,021 | |

| | 12,000 | | | BAT International Finance plc, (United Kingdom), 3.950%, 06/15/25 (e) | | | 12,324 | |

| | 120,000 | | | Philip Morris International, Inc., 2.125%, 05/10/23 | | | 114,538 | |

| | 90,000 | | | Reynolds American, Inc., 4.450%, 06/12/25 | | | 95,154 | |

| | | | | | | | |

| | | | | | | 352,037 | |

| | | | | | | | |

| | | | Total Consumer Staples | | | 1,386,364 | |

| | | | | | | | |

| | | | Energy — 2.9% | |

| | | | Energy Equipment & Services — 0.5% | |

| | 4,000 | | | Ensco plc, 5.200%, 03/15/25 | | | 3,540 | |

| | 18,000 | | | Nabors Industries, Inc., 5.500%, 01/15/23 (e) | | | 18,574 | |

| | | | Noble Holding International Ltd., (United Kingdom), | | | | |

| | 4,000 | | | 6.200%, 08/01/40 | | | 3,140 | |

| | 4,000 | | | 7.750%, 01/15/24 | | | 3,890 | |

| | 22,000 | | | Parker Drilling Co., 6.750%, 07/15/22 | | | 20,350 | |

| | 13,000 | | | Rowan Cos., Inc., 7.375%, 06/15/25 | | | 13,487 | |

| | 24,000 | | | SESI LLC, 7.125%, 12/15/21 | | | 24,660 | |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | Energy Equipment & Services — continued | |

| | 10,000 | | | Summit Midstream Holdings LLC, 5.500%, 08/15/22 | | | 10,125 | |

| | 73,000 | | | Transocean Proteus Ltd., 6.250%, 12/01/24 (e) | | | 75,281 | |

| | | | Transocean, Inc., | | | | |

| | 7,000 | | | 5.550%, 10/15/22 | | | 6,506 | |

| | 84,000 | | | 6.800%, 03/15/38 | | | 67,620 | |

| | 2,000 | | | 7.500%, 04/15/31 | | | 1,795 | |

| | 53,000 | | | 9.000%, 07/15/23 (e) | | | 57,240 | |

| | 7,000 | | | 9.100%, 12/15/41 | | | 6,912 | |

| | 18,000 | | | Trinidad Drilling Ltd., (Canada), 6.625%, 02/15/25 (e) | | | 18,540 | |

| | 1,000 | | | Weatherford International LLC, 6.800%, 06/15/37 | | | 943 | |

| | | | Weatherford International Ltd., | | | | |

| | 4,000 | | | 5.950%, 04/15/42 | | | 3,350 | |

| | 8,000 | | | 6.500%, 08/01/36 | | | 7,380 | |

| | 2,000 | | | 6.750%, 09/15/40 | | | 1,820 | |

| | 3,000 | | | 7.000%, 03/15/38 | | | 2,828 | |

| | 12,000 | | | 7.750%, 06/15/21 | | | 12,945 | |

| | 67,000 | | | 9.875%, 02/15/24 (e) | | | 77,385 | |

| | 5,000 | | | Western Refining Logistics LP, 7.500%, 02/15/23 | | | 5,425 | |

| | | | | | | | |

| | | | | | | 443,736 | |

| | | | | | | | |

| | | | Oil, Gas & Consumable Fuels — 2.4% | |

| | | | Antero Resources Corp., | | | | |

| | 6,000 | | | 5.000%, 03/01/25 (e) | | | 5,820 | |

| | 55,000 | | | 5.125%, 12/01/22 | | | 55,275 | |

| | 24,000 | | | 5.375%, 11/01/21 | | | 24,540 | |

| | 5,000 | | | Blue Racer Midstream LLC, 6.125%, 11/15/22 (e) | | | 5,087 | |