UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number_811-21306

_Franklin Mutual Recovery Fund

(Exact name of registrant as specified in charter)

_101 John F. Kennedy Parkway, Short Hills, NJ 07078-2705

Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: (973) 912-2000

Date of fiscal year end: 03/31

Date of reporting period: 9/30/10__

Item 1. Reports to Stockholders.

SPECIALIZED EXPERTISE

TRUE DIVERSIFICATION

RELIABILITY YOU CAN TRUST

MUTUAL FUNDS |

Franklin Templeton Investments

Gain From Our Perspective®

Franklin Templeton’s distinct multi-manager structure combines the specialized expertise of three world-class investment management groups—Franklin, Templeton and Mutual Series.

Each of our portfolio management groups operates autonomously, relying on its own research and staying true to the unique investment disciplines that underlie its success.

Franklin. Founded in 1947, Franklin is a recognized leader in fixed income investing and also brings expertise in growth- and value-style U.S. equity investing.

Templeton. Founded in 1940, Templeton pioneered international investing and, in 1954, launched what has become the industry’s oldest global fund. Today, with offices in over 25 countries, Templeton offers investors a truly global perspective.

Mutual Series. Founded in 1949, Mutual Series is dedicated to a unique style of value investing, searching aggressively for opportunity among what it believes are undervalued stocks, as well as arbitrage situations and distressed securities.

Because our management groups work independently and adhere to different investment approaches, Franklin, Templeton and Mutual Series funds typically have distinct portfolios. That’s why our funds can be used to build truly diversified allocation plans covering every major asset class.

At Franklin Templeton Investments, we seek to consistently provide investors with exceptional risk-adjusted returns over the long term, as well as the reliable, accurate and personal service that has helped us become one of the most trusted names in financial services.

RETIREMENT PLANS | 529 COLLEGE SAVINGS PLANS | SEPARATE ACCOUNTS

| Not part of the semiannual report |

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

Not part of the semiannual report | 1

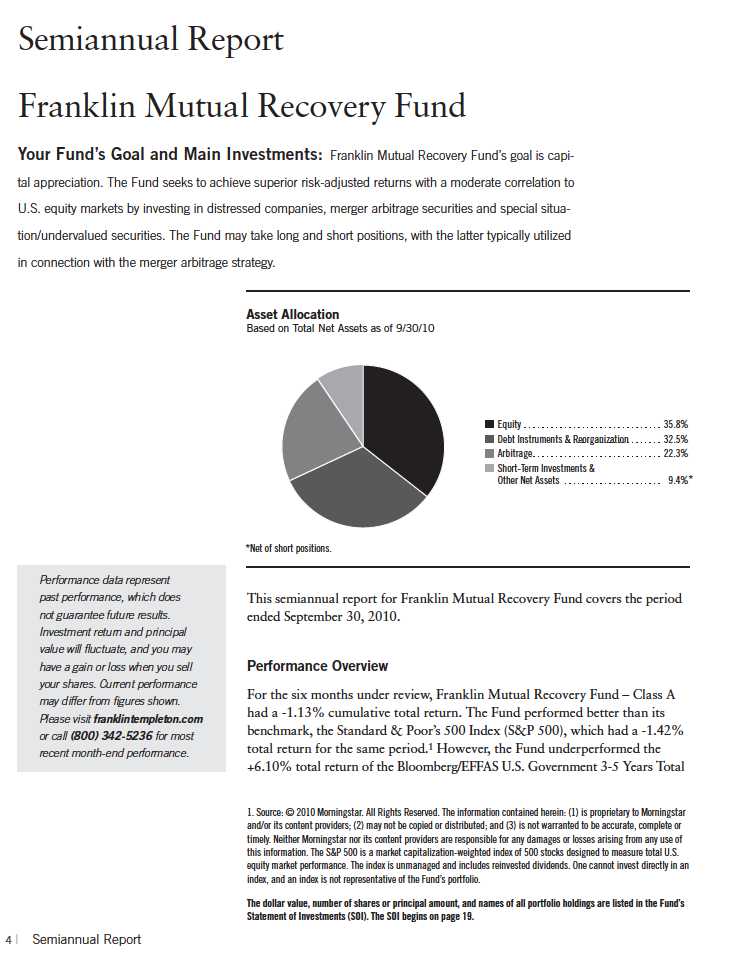

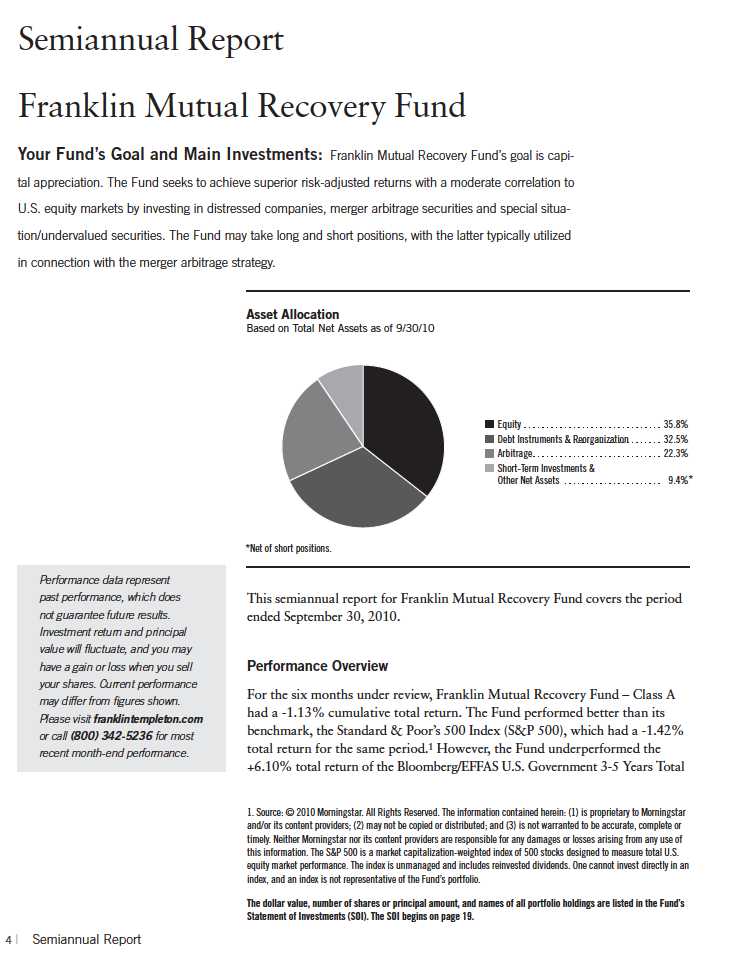

Investment Strategy

We follow a distinctive investment approach and can seek investments in distressed companies, merger arbitrage and special situations/undervalued stocks. The availability of investments at attractive prices in each of these categories varies with market cycles. Therefore, the percentage of the Fund’s assets invested in each of these areas will fluctuate as we attempt to take advantage of opportunities afforded by cyclical changes. We employ rigorous, fundamental analysis to find investment opportunities. In choosing investments, we look at the market price of an individual company’s securities relative to our evaluation of its asset value based on such factors as book value, cash flow potential, long-term earnings and earnings multiples. We may invest in distressed companies if we believe the market overreacted to adverse developments or failed to appreciate positive changes.

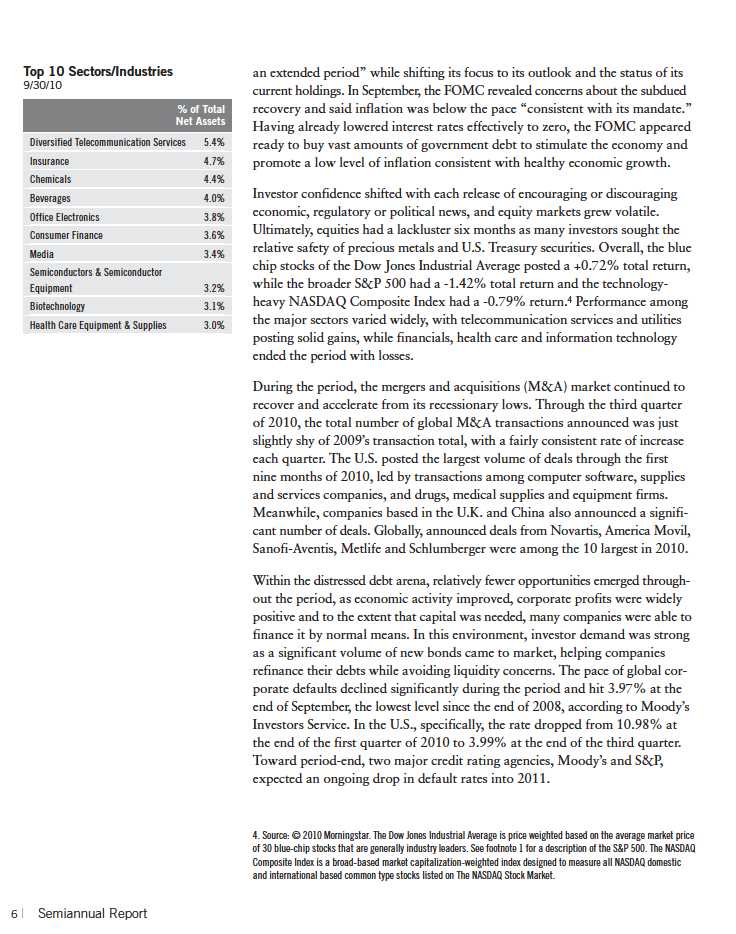

Manager’s Discussion

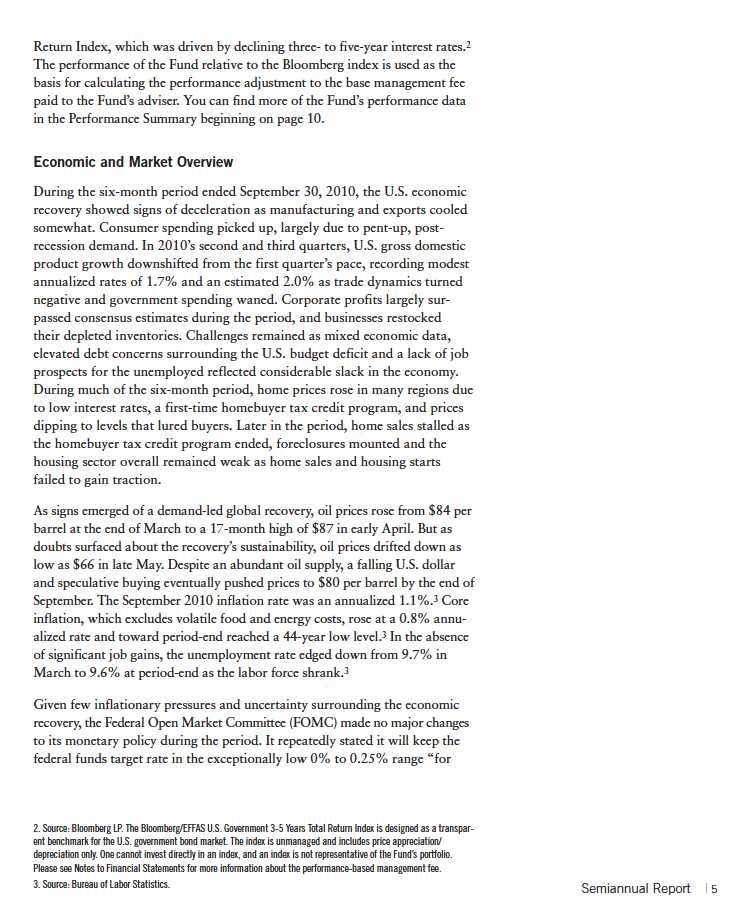

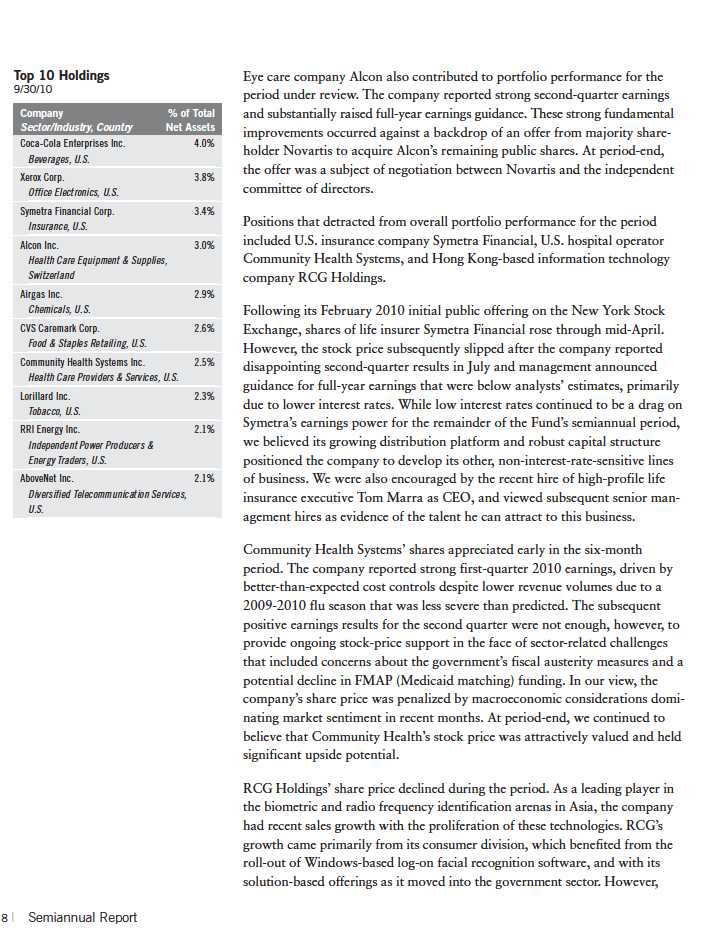

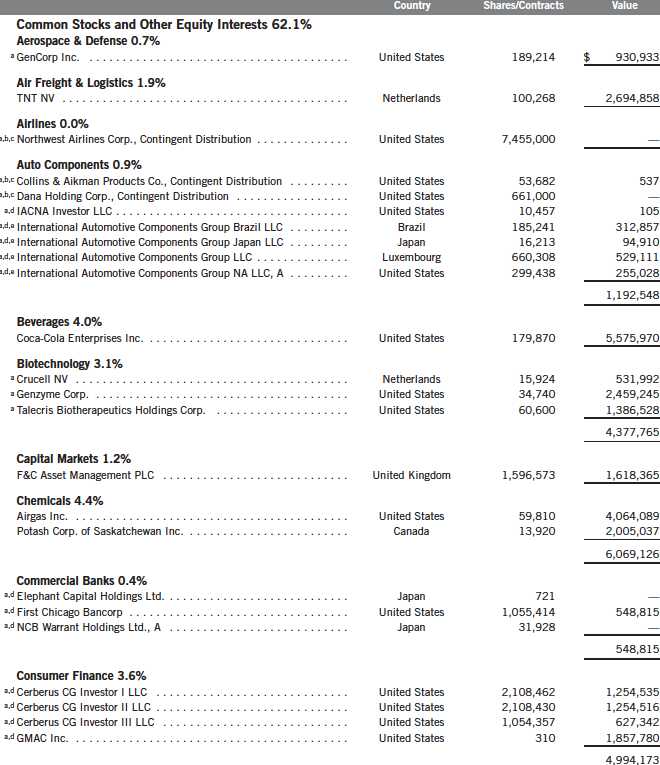

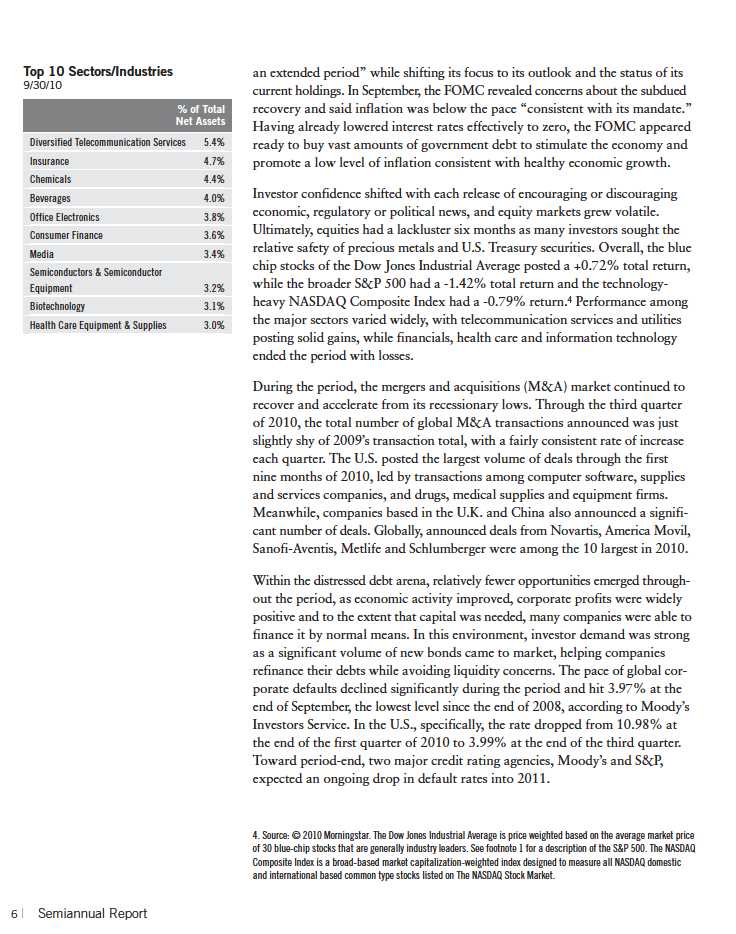

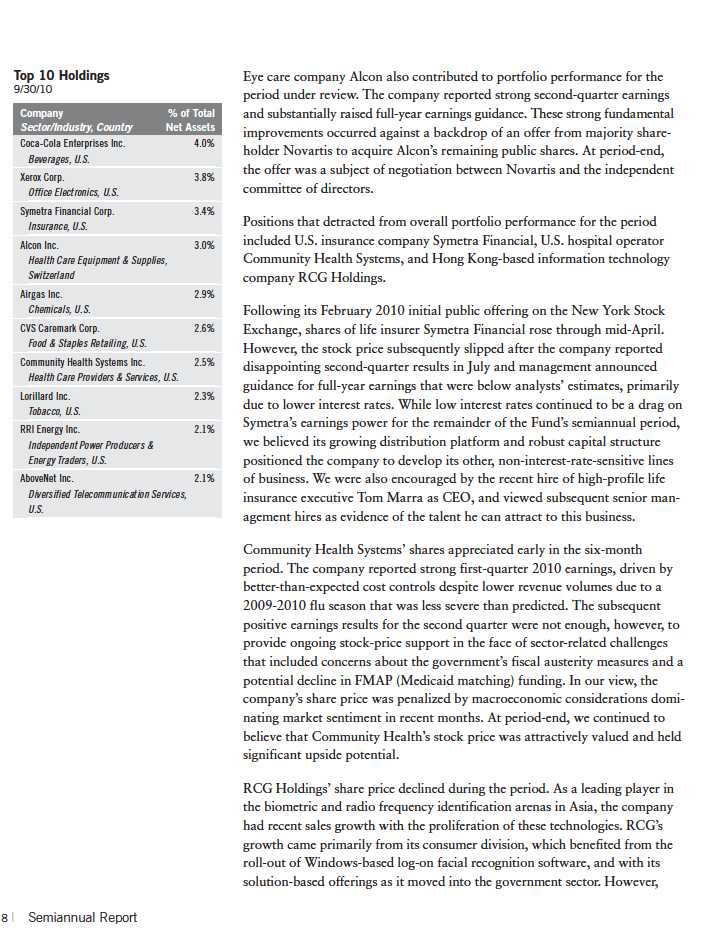

The six months ended September 30, 2010, featured strong performances from several of the Fund’s holdings. Key contributors included our private equity position in U.S. car manufacturer Chrysler (via Cerberus Capital Management), Coca Cola Enterprises (CCE), a U.S. bottler, and Alcon, a U.S.-based medical specialty company focusing on eye care products.

Our private equity investment in Chrysler Financial (Cerberus in the Statement of Investments) was originally in the consolidated business of Chrysler, which included the automotive and finance operations. However, following the company’s 2009 restructuring, which included transfer of control of the automotive manufacturing business to Fiat, we were left with an equity stake in Chrysler Financial. Although initially it was an illiquid position, we recently began to see renewed investor interest in Chrysler Financial from a pricing perspective, and as cash flows from the portfolio performed well, the securities became increasingly liquid and the position rose in value. We think there is still more value to be gained going forward and will continue to hold the position until we feel it has reached its full worth.

The Fund’s investment in CCE also appreciated for the period. CCE is the leading western European marketer, distributor and producer of bottled and canned beverages and the world’s third-largest independent Coca-Cola bottler. It is also the exclusive distributor of Coca-Cola products in Belgium, France, Great Britain, Luxembourg, Monaco, the Netherlands, Norway and Sweden. Just prior to the beginning of this reporting period, CCE reached an agreement to sell its North American bottling operations to Coca-Cola and acquire bottling assets in Norway and Sweden. As part of the arrangement, CCE will retain its name and will operate as a new public company running its existing European business, as well as the bottling operations in Norway and Sweden that were acquired from Coca-Cola. CCE’s share price rose in anticipation of the completion of this value-creating deal.

RCG’s sales have yet to be fully accompanied by receipts as the company has extended credit to its customers. Concerns over this policy pressured its stock price. We still held RCG in the Fund’s portfolio at period-end, believing as the company more efficiently collects receipts due, its share-price decline should reverse.

Thank you for your interest and participation in Franklin Mutual Recovery Fund. We look forward to serving your future investment needs.

Portfolio Management Team

Franklin Mutual Recovery Fund |

CFA® is a trademark owned by CFA Institute.

The foregoing information reflects our analysis, opinions and portfolio holdings as of September 30, 2010, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

Semiannual Report | 9

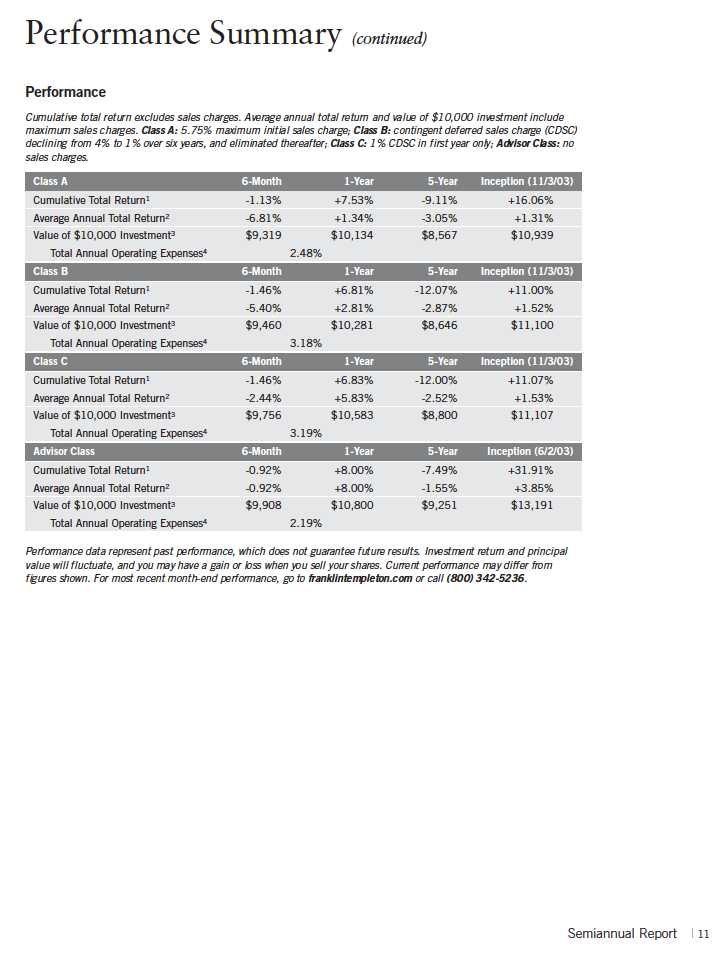

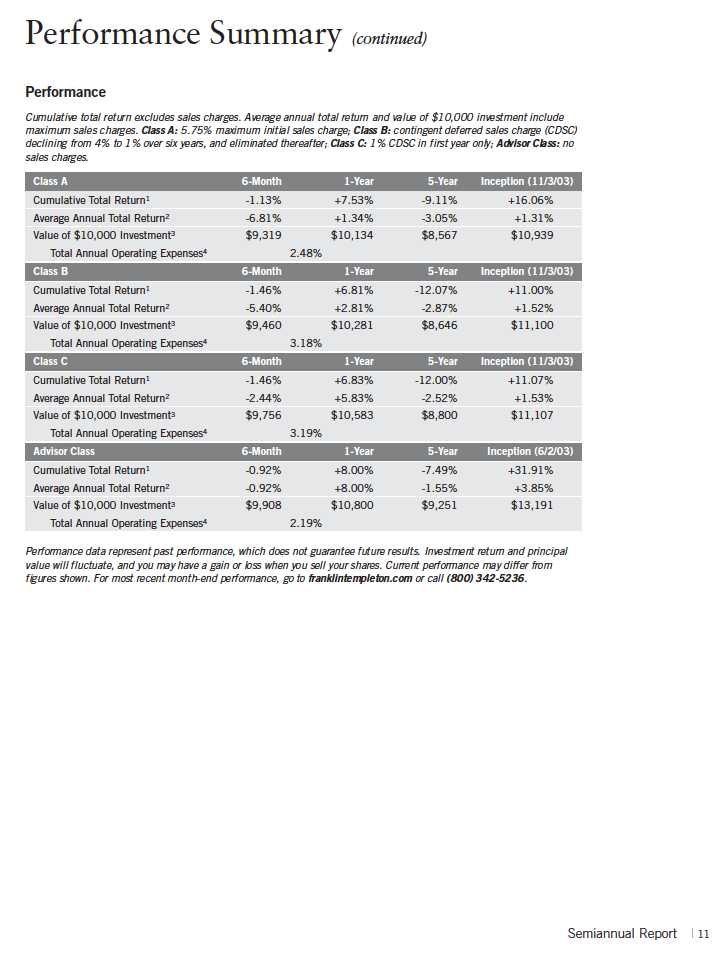

Performance Summary as of 9/30/10

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

10 | Semiannual Report

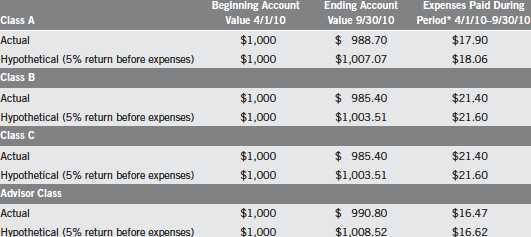

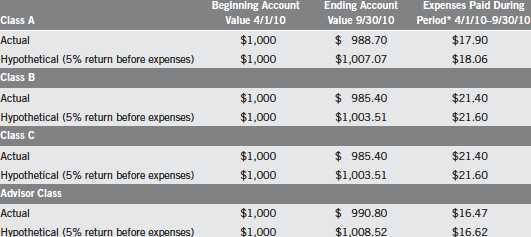

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 3.59%; B: 4.30%; C: 4.30%; and Advisor: 3.30%), multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period.

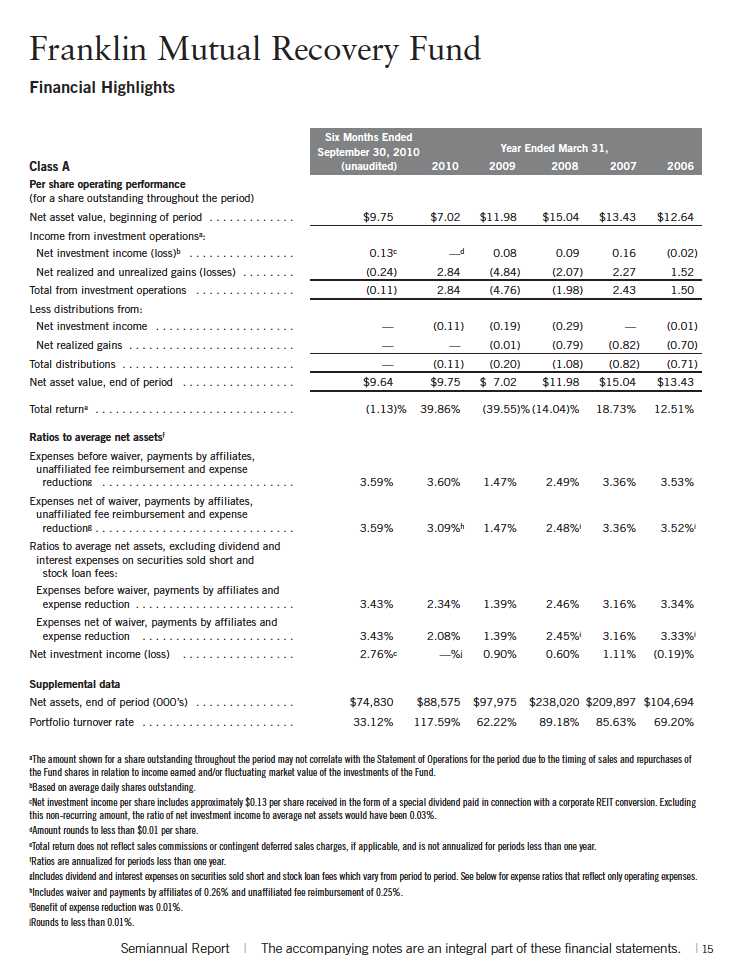

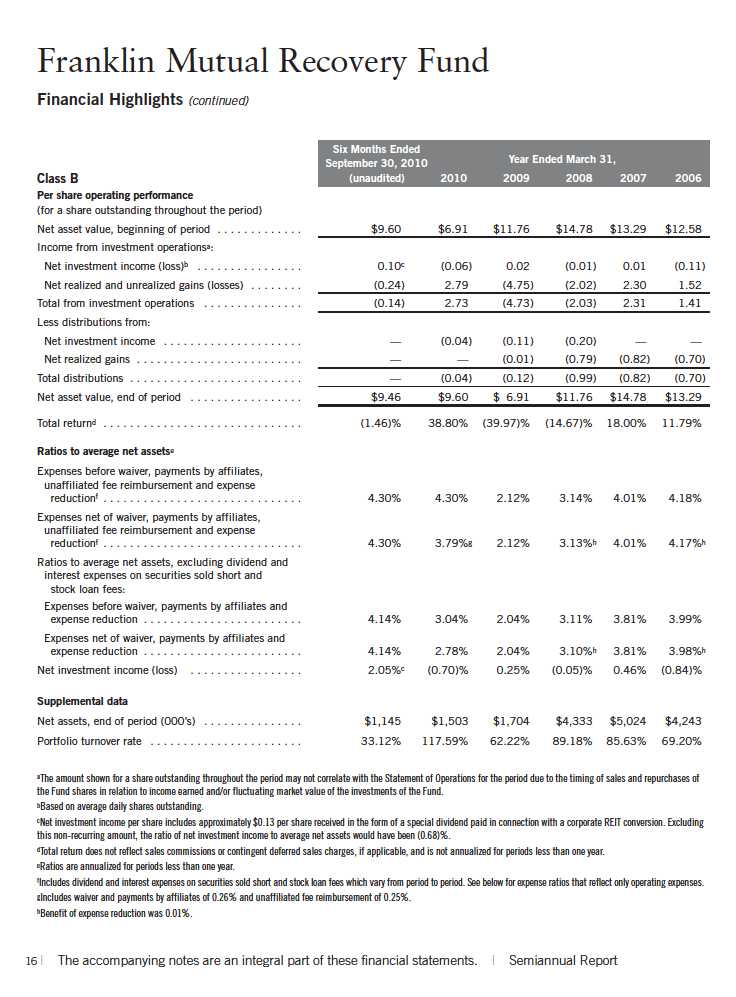

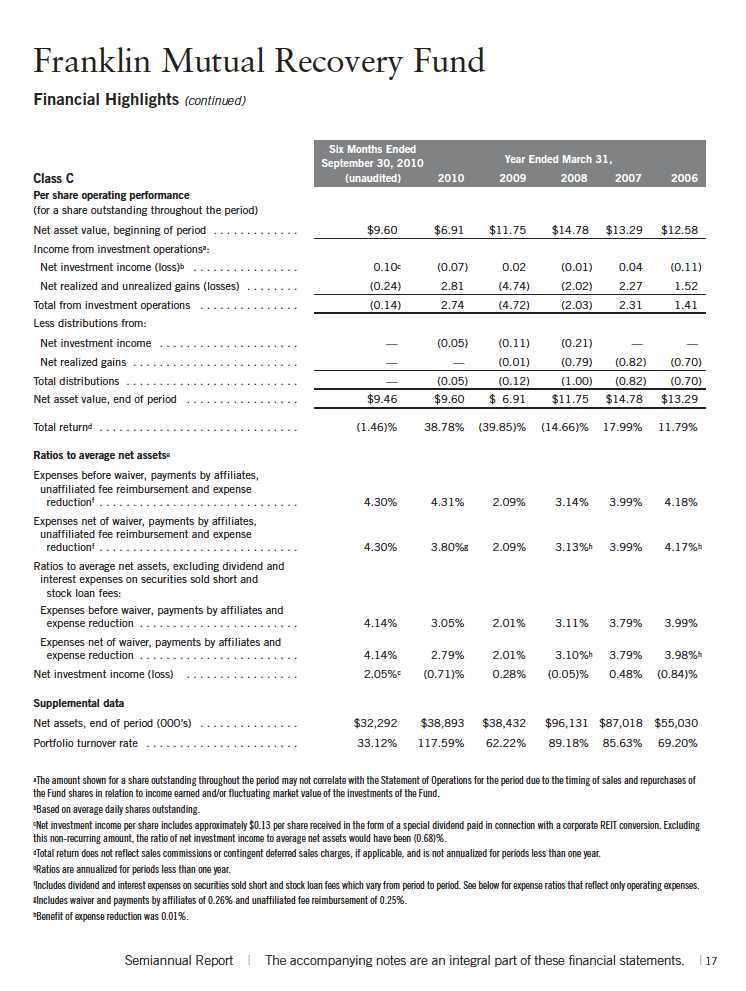

14 | Semiannual Report

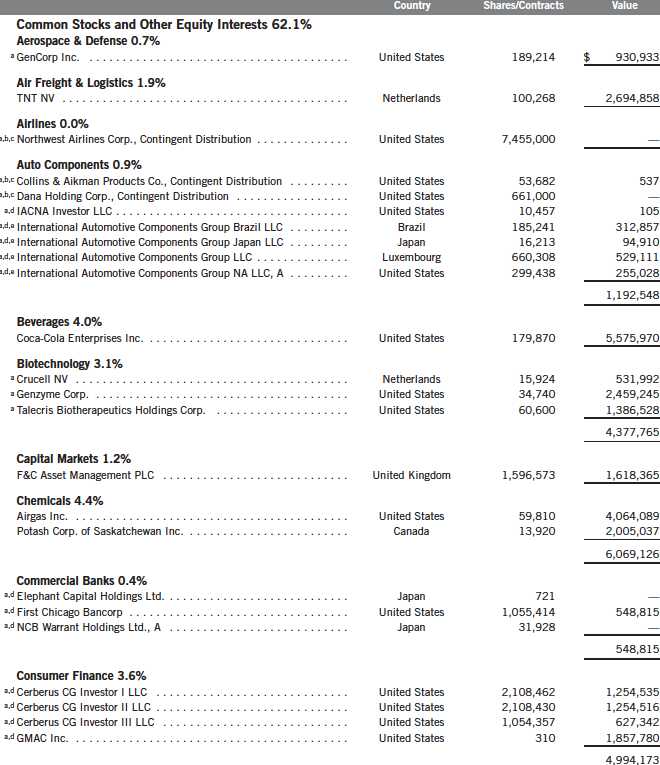

Franklin Mutual Recovery Fund

Statement of Investments, September 30, 2010 (unaudited)

Semiannual Report | 19

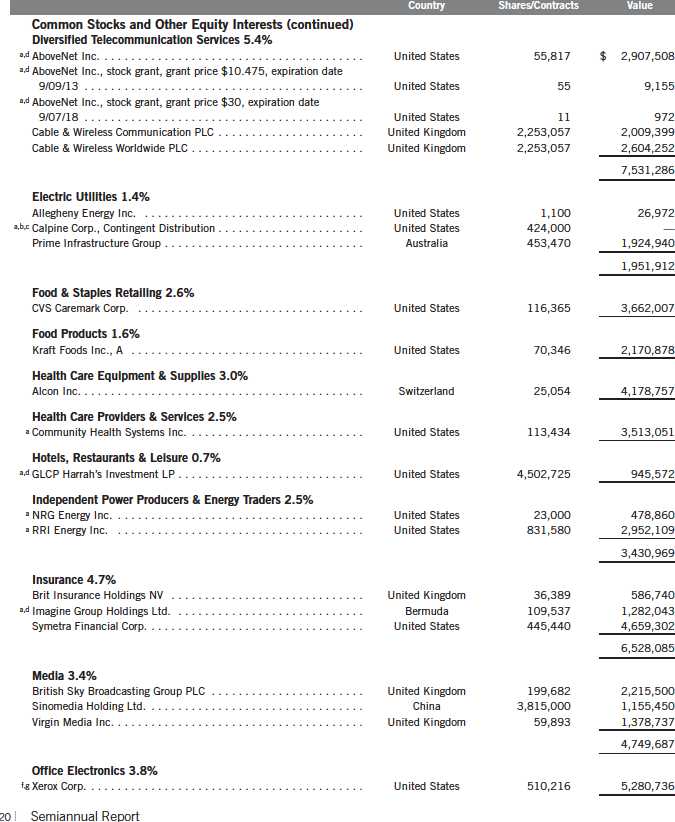

Franklin Mutual Recovery Fund

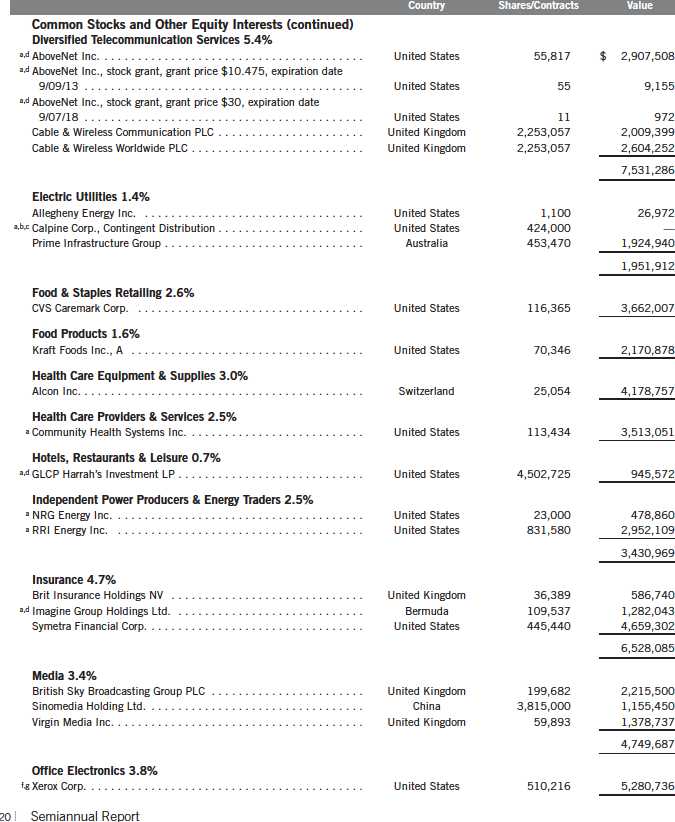

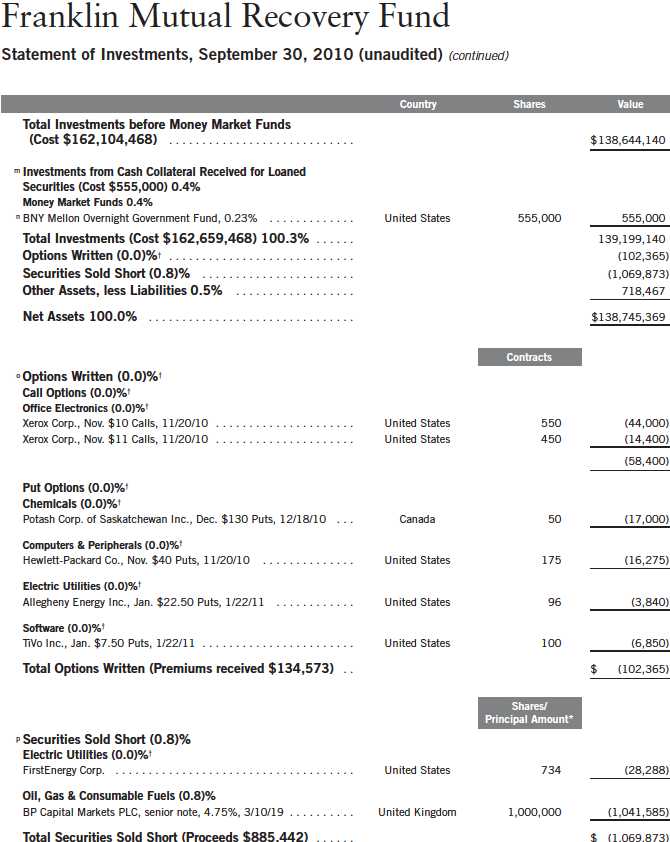

Statement of Investments, September 30, 2010 (unaudited) (continued)

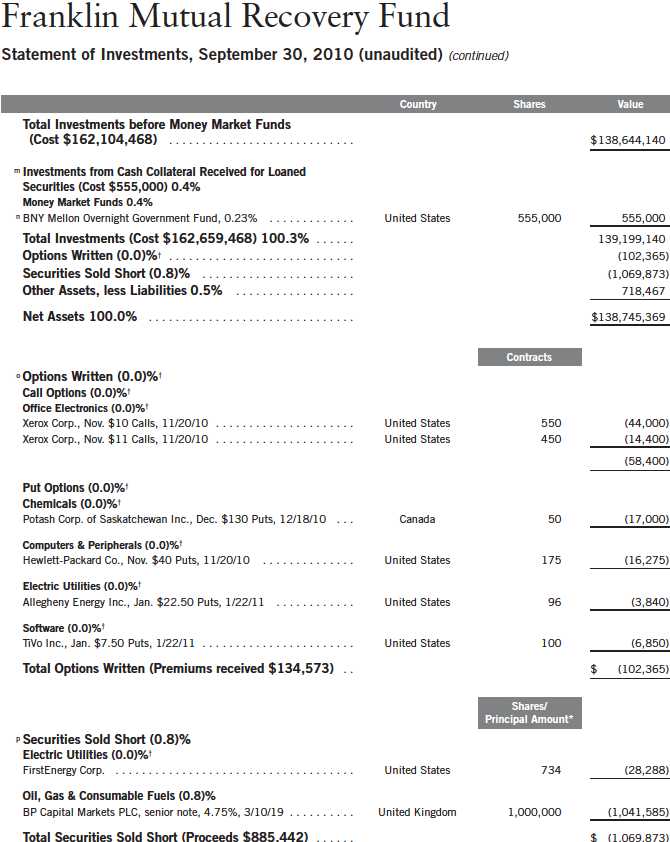

Franklin Mutual Recovery Fund

Statement of Investments, September 30, 2010 (unaudited) (continued)

Semiannual Report | 23

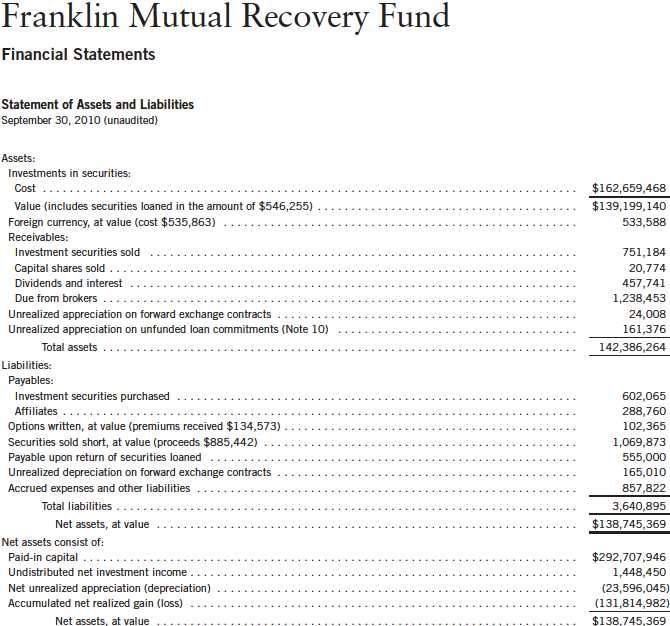

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 25

26 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

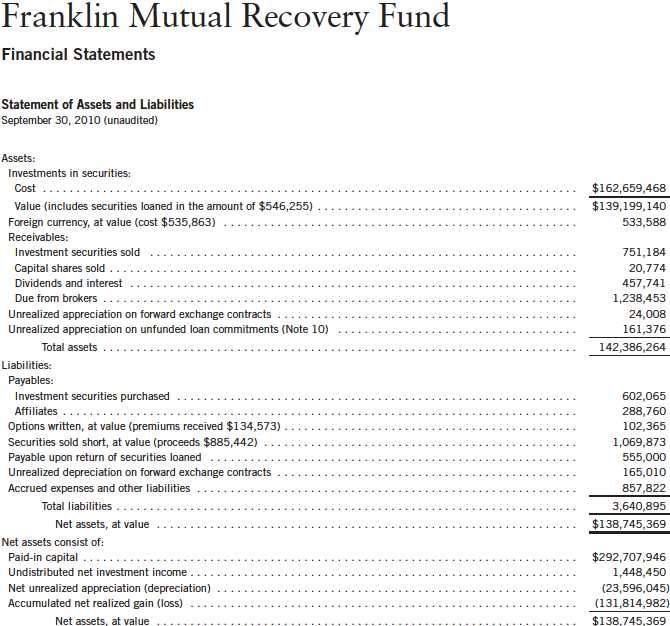

Franklin Mutual Recovery Fund

Financial Statements (continued)

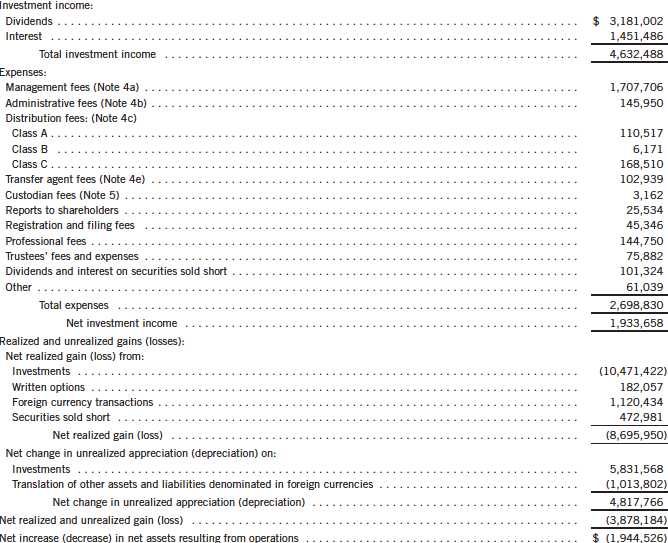

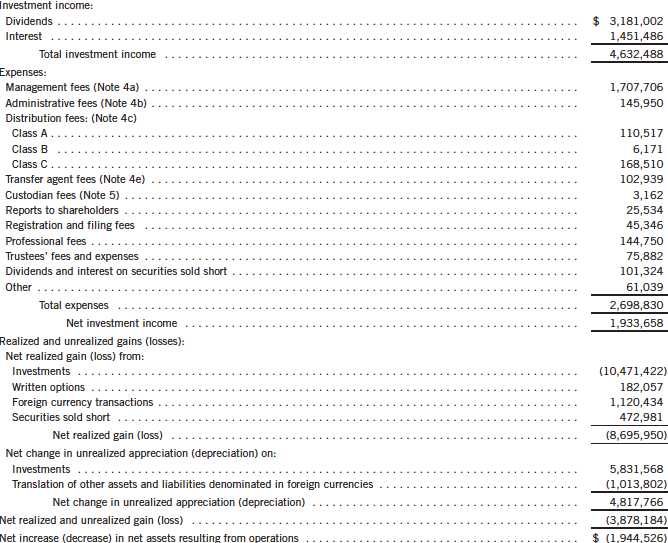

Statement of Operations

for the six months ended September 30, 2010 (unaudited) |

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 27

28 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

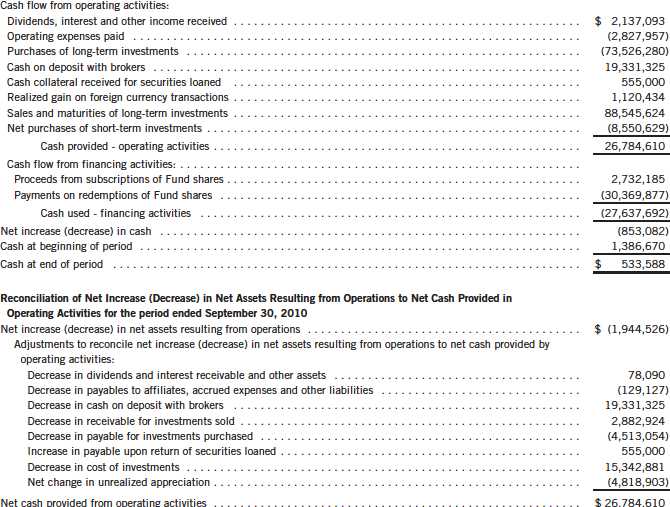

Franklin Mutual Recovery Fund

Financial Statements (continued)

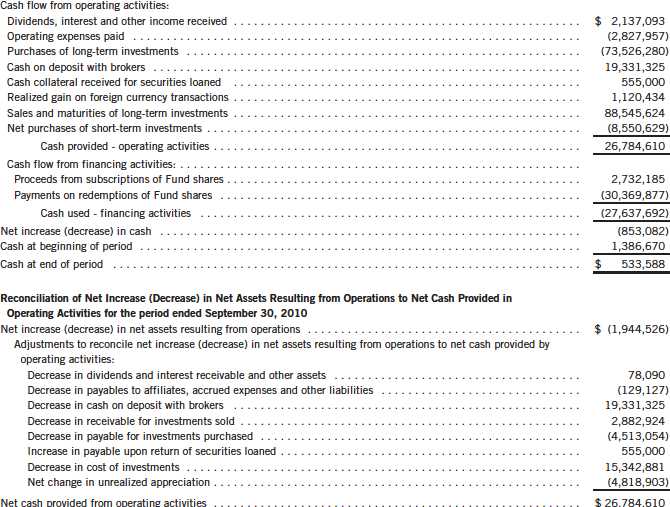

Statement of Cash Flows

for the six months ended September 30, 2010 (unaudited) |

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 29

Franklin Mutual Recovery Fund

Notes to Financial Statements (unaudited)

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

The Franklin Mutual Recovery Fund (Fund) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as a closed-end, continuously offered investment company. The Fund offers four classes of shares: Class A, Class B, Class C, and Advisor Class. Each class of shares differs by its initial sales load, contingent deferred sales charges, distribution fees, voting rights on matters affecting a single class and its exchange privilege.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund values its investments in securities and other assets and liabilities carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Under procedures approved by the Fund’s Board of Trustees, the Fund may utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities and derivative financial instruments (derivatives) listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Foreign equity securities are valued as of the close of trading on the foreign stock exchange on which the security is primarily traded, or the NYSE, whichever is earlier. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the close of the NYSE on the day that the value of the security is determined. Over-the-counter securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities. Investments in non-registered money market funds are valued at the closing net asset value.

Debt securities generally trade in the over-the-counter market rather than on a securities exchange. The Fund’s pricing services use multiple valuation techniques to determine fair value. In instances where sufficient market activity exists, the pricing services may utilize a market-based approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the pricing services also utilize proprietary valuation models which may consider market characteristics such as benchmark yield curves, option-adjusted spreads, credit spreads, estimated default rates, coupon rates, anticipated timing of principal repayments, underlying collateral, and other unique security features in order to estimate the relevant cash flows, which are then discounted to calculate the fair value. Securities denominated in a foreign currency are converted into their U.S. dollar equivalent at the foreign exchange rate in effect at the close of the NYSE on the date that the values of the foreign debt securities are determined.

30 | Semiannual Report

Franklin Mutual Recovery Fund

Notes to Financial Statements (unaudited) (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| a. | Financial Instrument Valuation (continued) |

Certain derivatives trade in the over-the-counter market. The Fund’s pricing services use various techniques including industry standard option pricing models and proprietary discounted cash flow models to determine the fair value of those instruments. The Fund’s net benefit or obligation under the derivative contract, as measured by the fair market value of the contract, is included in net assets.

The Fund has procedures to determine the fair value of securities and other financial instruments for which market prices are not readily available or which may not be reliably priced. Under these procedures, the Fund primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. The Fund may also use an income-based valuation approach in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed.

Trading in securities on foreign exchanges and over-the-counter markets may be completed before the daily close of business on the NYSE. Occasionally, events occur between the time at which trading in a foreign security is completed and the close of the NYSE that might call into question the reliability of the value of a portfolio security held by the Fund. As a result, differences may arise between the value of the Fund’s portfolio securities as determined at the foreign market close and the latest indications of value at the close of the NYSE. In order to minimize the potential for these differences, the investment manager monitors price movements following the close of trading in foreign stock markets through a series of country specific market proxies (such as baskets of American Depository Receipts, futures contracts and exchange traded funds). These price movements are measured against established trigger thresholds for ea ch specific market proxy to assist in determining if an event has occurred that may call into question the reliability of the values of the foreign securities held by the Fund. If such an event occurs, the securities may be valued using fair value procedures, which may include the use of independent pricing services.

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Fund may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Portfolio securities and assets and liabilities denominated in foreign currencies contain risks that those currencies will decline in value relative to the U.S. dollar. Occasionally, events may impact the availability or reliability of foreign exchange rates

Semiannual Report | 31

Franklin Mutual Recovery Fund

Notes to Financial Statements (unaudited) (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| b. | Foreign Currency Translation (continued) |

used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Fund’s Board of Trustees.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments on the Statement of Operations.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

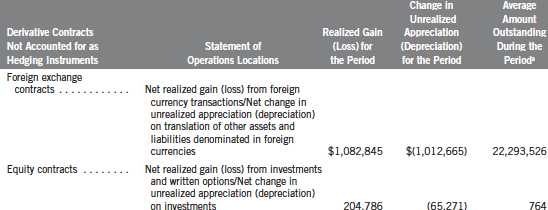

c. Derivative Financial Instruments

The Fund invests in derivatives in order to manage risk or gain exposure to various other investments or markets. Derivatives are financial contracts based on an underlying or notional amount, require no initial investment or an initial net investment that is smaller than would normally be required to have a similar response to changes in market factors, and require or permit net settlement. Derivatives may contain various risks including the potential inability of the counterparty to fulfill their obligations under the terms of the contract, the potential for an illiquid secondary market, unfavorable movements in the value of a foreign currency relative to U.S. dollar, and the potential for market movements which expose the Fund to gains or losses in excess of the amounts shown on the Statement of Assets and Liabilities. Realized gain and loss and unrealized appreciation and depreciation on these contracts for the period are include d in the Statement of Operations.

The Fund enters into forward exchange contracts primarily to manage exposure to certain foreign currencies. A forward exchange contract is an agreement between the Fund and a counterparty to buy or sell a foreign currency for a specific exchange rate on a future date. Pursuant to the terms of the forward exchange contracts, cash or securities may be required to be deposited as collateral. Unrestricted cash may be invested according to the Fund’s investment objectives.

The Fund enters into total return swap contracts primarily to manage equity price risk of an underlying asset. A total return swap is an agreement between the Fund and a counterparty to exchange a market linked return for a floating rate payment, both based upon a notional principal amount. Over the term of the contract, contractually required payments to be paid or received are accrued daily and recorded as unrealized depreciation or appreciation until the payments are made, at which time they are realized. Payments received or paid to recognize changes in the value of the underlying asset are recorded as realized gain or loss. Pursuant to the terms of the total return swap contract,

32 | Semiannual Report

Franklin Mutual Recovery Fund

Notes to Financial Statements (unaudited) (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| c. | Derivative Financial Instruments (continued) |

cash or securities may be required to be deposited as collateral. Unrestricted cash may be invested according to the Fund’s investment objectives.

The Fund purchases or writes option contracts primarily to manage and/or gain exposure to equity price risk. An option is a contract entitling the holder to purchase or sell a specific amount of shares or units of a particular security, currency or index, or notional amount of a swap (swaption), at a specified price. Options purchased are recorded as an asset while options written are recorded as a liability. Upon exercise of an option, the acquisition cost or sales proceeds of the security is adjusted by any premium paid or received. Upon expiration of an option, any premium paid or received is recorded as a realized loss or gain. Upon closing an option other than through expiration or exercise, the difference between the premium and the cost to close the position is recorded as a realized gain or loss.

See Note 12 regarding other derivative information.

d. Securities Sold Short

The Fund is engaged in selling securities short, which obligates the Fund to replace a borrowed security with the same security at current market value. The Fund incurs a loss if the price of the security increases between the date of the short sale and the date on which the Fund replaces the borrowed security. The Fund realizes a gain if the price of the security declines between those dates. Gains are limited to the price at which the Fund sold the security short, while losses are potentially unlimited in size.

The Fund is required to establish a margin account with the broker lending the security sold short. While the short sale is outstanding, the broker retains the proceeds of the short sale and the Fund must maintain a deposit with broker consisting of cash and/or securities having a value equal to a specified percentage of the value of the securities sold short. The Fund is obligated to pay stock loan fees for borrowing the securities sold short and is required to pay the counterparty any dividends or interest due on securities sold short. Such dividends or interest and any stock loan fees are recorded as an expense to the Fund.

e. Securities Lending

The Fund participates in an agency based security lending program. The Fund receives cash collateral against the loaned securities in an amount equal to at least 102% of the market value of the loaned securities. Collateral is maintained over the life of the loan in an amount not less than 100% of the market value of loaned securities, as determined at the close of Fund business each day; any additional collateral required due to changes in security values is delivered to the Fund on the next business day. The collateral is invested in a non-registered money fund managed by the Fund’s custodian on the Fund’s behalf. The Fund receives income from the investment of cash

Semiannual Report | 33

Franklin Mutual Recovery Fund

Notes to Financial Statements (unaudited) (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| e. | Securities Lending (continued) |

collateral, in addition to lending fees and rebates paid by the borrower. The Fund bears the market risk with respect to the collateral investment, securities loaned, and the risk that the agent may default on its obligations to the Fund. The securities lending agent has agreed to indemnify the fund in the event of default by a third party borrower.

f. Income Taxes

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code and to distribute to shareholders substantially all of its taxable income and net realized gains. As a result, no provision for U.S. federal income taxes is required. The Fund files U.S. income tax returns as well as tax returns in certain other jurisdictions. The Fund recognizes in its financial statements the effects including penalties and interest, if any, of a tax position taken on a tax return (or expected to be taken) when it’s more likely than not (a greater than 50% probability), based on the technical merits, that the tax position will be sustained upon examination by the tax authorities. As of September 30, 2010, and for all open tax years, the Fund has determined that no provision for income tax is required in the Fund’s financial statements. Open tax years are those that remain subject to examination and ar e based on each tax jurisdiction statute of limitation. The Fund is not aware of any tax position for which it is reasonably possible that the total amounts of unrecognized tax effects will significantly change in the next twelve months.

Foreign securities held by the Fund may be subject to foreign taxation on income received. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests. The Fund may be subject to a tax imposed on net realized gains on securities of certain foreign countries.

g. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Amortization of premium and accretion of discount on debt securities are included in interest income. Dividend income and dividends declared on securities sold short are recorded on the ex-dividend date except that certain dividends from foreign securities are recognized as soon as the Fund is notified of the ex-dividend date. Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified amon g capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

34 | Semiannual Report

Franklin Mutual Recovery Fund

Notes to Financial Statements (unaudited) (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| g. | Security Transactions, Investment Income, Expenses and Distributions (continued) |

Realized and unrealized gains and losses and net investment income, not including class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class. Differences in per share distributions, by class, are generally due to differences in class specific expenses.

h. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

i. Guarantees and Indemnifications

Under the Fund’s organizational documents, its officers and trustees are indemnified by the Fund against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Currently, the Fund expects the risk of loss to be remote.

2. SHARES OF BENEFICIAL INTEREST

At September 30, 2010, there were an unlimited number of shares authorized ($0.01 par value).

Transactions in the Fund’s shares were as follows:

Semiannual Report | 35

Franklin Mutual Recovery Fund

Notes to Financial Statements (unaudited) (continued)

| 4. | TRANSACTIONS WITH AFFILIATES (continued) |

| a. | Management Fees (continued) |

The performance adjustment rate is equal to 0.01% for each additional 0.05% that the Fund performance differential exceeds 1.00%. The performance adjustment amount is determined by multiplying the performance adjustment rate by the average daily net assets of the performance period. The performance adjustment rate may not exceed 1.00% annualized, either upwards or downwards. At the end of each month, an annualized investment management fee ratio is calculated (total investment management fees divided by fiscal year to date average daily net assets). In accordance with the Investment Management Agreement, the investment management fee ratio may not exceed 2.50% or fall below 0.50% for the fiscal year. For the period, the total annualized management fee rate, including the performance adjustment, was 2.34% of the average daily net assets of the Fund.

b. Administrative Fees

The Fund pays an administrative fee to FT Services of 0.20% per year of the average daily net assets of the Fund.

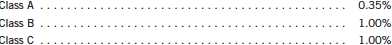

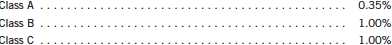

c. Distribution Fees

The Fund’s Board of Trustees has adopted distribution plans for each share class, with the exception of Advisor Class shares, pursuant to Rule 12b-1 under the 1940 Act. Under the Fund’s Class A reimbursement distribution plan, the Fund reimburses Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate. Under the Class A reimbursement distribution plan, costs exceeding the maximum for the current plan year cannot be reimbursed in subsequent periods.

In addition, under the Fund’s Class B and C compensation distribution plans, the Fund pays Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate for each class.

The maximum annual plan rates, based on the average daily net assets, for each class, are as follows:

The Board of Trustees has set the current rate at 0.30% per year for Class A shares until further notice and approval by the Board.

Semiannual Report | 37

Franklin Mutual Recovery Fund

Notes to Financial Statements (unaudited) (continued)

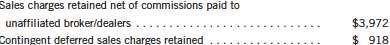

| 4. | TRANSACTIONS WITH AFFILIATES (continued) |

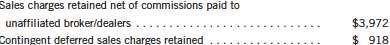

| d. | Sales Charges/Underwriting Agreements |

Distributors has advised the Fund of the following commission transactions related to the sales and redemptions of the Fund’s shares for the period:

e. Transfer Agent Fees

For the period ended September 30, 2010, the Fund paid transfer agent fees of $102,939 of which $52,076 was retained by Investor Services.

5. EXPENSE OFFSET ARRANGEMENT

The Fund has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Fund’s custodian expenses. During the period ended September 30, 2010, there were no credits earned.

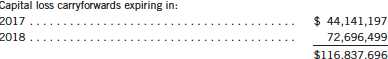

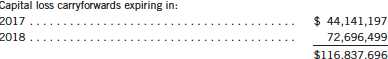

6. INCOME TAXES

For tax purposes, capital losses may be carried over to offset future capital gains, if any. At March 31, 2010, the capital loss carryforwards were as follows:

For tax purposes, realized capital losses and realized currency losses occurring subsequent to October 31, may be deferred and treated as occurring on the first day of the following fiscal year. At March 31, 2010, the Fund deferred realized capital losses and realized currency losses of $4,361,933 and $40,878 respectively.

At September 30, 2010, the cost of investments and net unrealized appreciation (depreciation) for income tax purposes were as follows:

38 | Semiannual Report

Franklin Mutual Recovery Fund

Notes to Financial Statements (unaudited) (continued)

6. INCOME TAXES (continued)

Net investment income (loss) differs for financial statement and tax purposes primarily due to differing treatments of defaulted securities, foreign currency transactions, passive foreign investment company shares, payments-in-kind, bond discounts and premiums, certain dividends on securities sold short, swaps, tax straddles, certain corporate action adjustments, non-deductible expenses, partnership distributions and recognition of partnership income.

Net realized gains (losses) differ for financial statement and tax purposes primarily due to differing treatments of wash sales, foreign currency transactions, passive foreign investment company shares, payments-in-kind, bond discounts and premiums, swaps, tax straddles, certain corporate action adjustments, certain dividends on securities sold short, partnership distributions and recognition of partnership income.

7. INVESTMENT TRANSACTIONS

Purchases and sales of investments (excluding short term securities and securities sold short) for the period ended September 30, 2010, aggregated $45,799,837 and $75,901,749, respectively.

Transactions in options written during the period ended September 30, 2010, were as follows:

8. CREDIT RISK AND DEFAULTED SECURITIES

The Fund may purchase the pre-default or defaulted debt of distressed companies. Distressed companies are financially troubled and are about to be or are already involved in financial restructuring or bankruptcy. Risks associated with purchasing these securities include the possibility that the bankruptcy or other restructuring process takes longer than expected, or that distributions in restructuring are less than anticipated, either or both of which may result in unfavorable consequences to the Fund. If it becomes probable that the income on debt securities, including those of distressed companies, will not be collected, the Fund discontinues accruing income and recognizes an adjustment for uncollectible interest.

At September 30, 2010, the aggregate value of distressed company securities for which interest recognition has been discontinued was $4,356,435, representing 3.14% of the Fund’s net assets. For information as to specific securities, see the accompanying Statement of Investments.

Semiannual Report | 39

Franklin Mutual Recovery Fund

Notes to Financial Statements (unaudited) (continued)

9. RESTRICTED SECURITIES

The Fund may invest in securities that are restricted under the Securities Act of 1933 (1933 Act) or which are subject to legal, contractual, or other agreed upon restrictions on resale. Restricted securities are often purchased in private placement transactions, and cannot be sold without prior registration unless the sale is pursuant to an exemption under the 1933 Act. Disposal of these securities may require greater effort and expense, and prompt sale at an acceptable price may be difficult. The Fund may have registration rights for restricted securities. The issuer generally incurs all registration costs.

At September 30, 2010, the Fund held investments in restricted securities, excluding certain securities exempt from registration under the 1933 Act deemed to be liquid, as follows:

40 | Semiannual Report

Franklin Mutual Recovery Fund

aThe Fund also invests in unrestricted securities or other investments in the issuer, valued at $59,381 as of September 30, 2010.

10. UNFUNDED LOAN COMMITMENTS

The Fund may enter into certain credit agreements, all or a portion of which may be unfunded. The Fund is obligated to fund these loan commitments at the borrowers’ discretion. Funded portions of credit agreements are presented on the Statement of Investments.

At September 30, 2010, unfunded commitments were as follows:

Unfunded loan commitments and funded portions of credit agreements are marked to market daily and any unrealized appreciation or depreciation is included in the Statement of Assets and Liabilities and Statement of Operations.

11. UNFUNDED CAPITAL COMMITMENTS

The Fund may enter into certain capital commitments and may be obligated to perform on such agreements at a future date. The Fund monitors these commitments and assesses the probability of required performance. For any agreements whose probability of performance is determined to be greater than remote, the Fund assesses the fair value of the commitment. In instances where the probability of performance is greater than remote and the performance under the commitment would result in an unrealized loss, the Fund recognizes such losses on the Statement of Assets and Liabilities and the Statement of Operations.

At September 30, 2010, the Fund had aggregate unfunded capital commitments of $160,651, for which no depreciation has been recognized.

Semiannual Report | 41

Franklin Mutual Recovery Fund

Notes to Financial Statements (unaudited) (continued)

12. OTHER DERIVATIVE INFORMATION

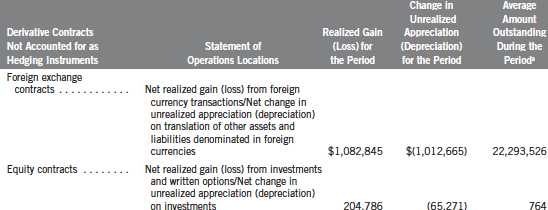

At September 30, 2010, the Fund has invested in derivative contracts which are reflected on the Statement of Assets and Liabilities as follows:

For the period ended September 30, 2010, the effect of derivative contracts on the Fund’s Statement of Operations was as follows:

aRepresents the average number of option contracts or notional amount for other derivative contracts outstanding during the period. For derivative contracts denominated in foreign currencies, notional amounts are converted into U.S. dollars.

See Note 1(c) regarding derivative financial instruments.

13. CREDIT FACILITY

The Fund participates in a $20 million senior unsecured revolving credit facility to fund shareholder redemptions or meet unfunded loan commitments. Under the terms of the current credit facility, which expires on May 27, 2011, and may or may not be extended for subsequent periods on the same or different terms, the Fund shall, in addition to interest charged on any borrowings made by the Fund, pay an annual commitment fee based upon the unused portion of the credit facility. During the period, the Fund incurred commitment fees of $20,111, which is reflected in other expenses on the Statement of Operations.

During the period ended September 30, 2010, the Fund did not use the facility.

42 | Semiannual Report

Franklin Mutual Recovery Fund

Notes to Financial Statements (unaudited) (continued)

14. FAIR VALUE MEASUREMENTS

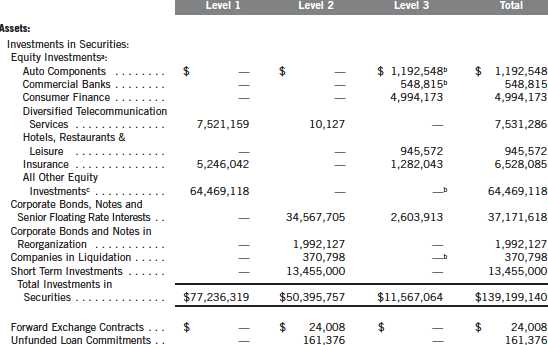

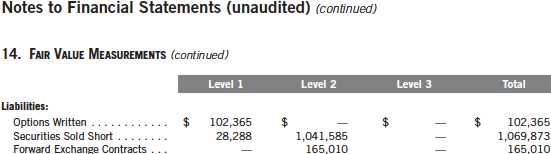

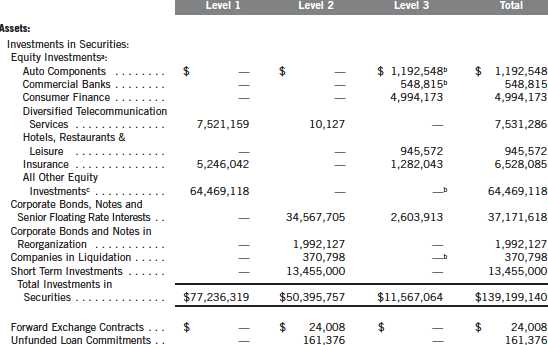

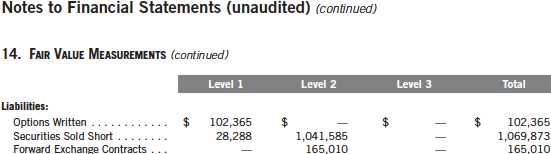

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund’s investments and are summarized in the following fair value hierarchy:

Level 1 – quoted prices in active markets for identical securities

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speed, credit risk, etc.)

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

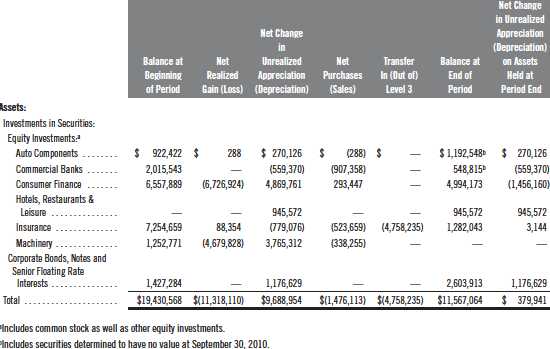

The following is a summary of the inputs used as of September 30, 2010, in valuing the Fund’s assets and liabilities carried at fair value:

Semiannual Report | 43

Franklin Mutual Recovery Fund

aIncludes common stock as well as other equity investments. bIncludes securities determined to have no value at September 30, 2010. cFor detailed industry descriptions, see the accompanying Statement of Investments.

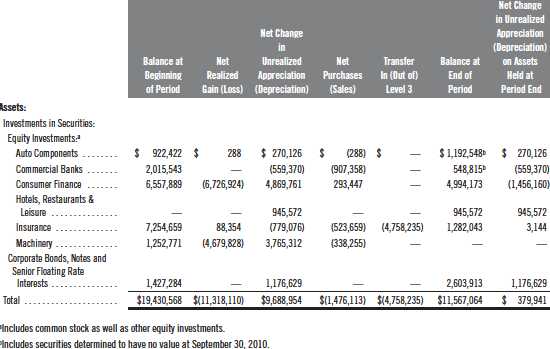

At September 30, 2010, the reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value, is as follows:

15. SUBSEQUENT EVENTS

The Fund has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

44 | Semiannual Report

Franklin Mutual Recovery Fund

Shareholder Information

Board Review of Investment Management Agreement

The Board of Trustees (Board), including the independent trustees, at a Board meeting held on May 18, 2010, unanimously approved renewal of the Fund’s investment management agreement, as well as the Fund’s administrative services agreement. Prior to a meeting of all the trustees for the purpose of considering such renewals, the independent trustees held three meetings dedicated to the renewal process (those trustees unable to attend in person were present by telephonic conference means). Throughout the process, the independent trustees received assistance and advice from and met separately with independent counsel. The independent trustees met with and interviewed officers of the investment manager (including portfolio managers), the transfer agent and shareholder services group and the distributor. In approving the renewal of the investment management agreement and the administrative services agreement for the Fund, the Bo ard, including the independent trustees, determined that the existing investment management fee structure was fair and reasonable and that continuance of the agreements was in the best interests of the Fund and its shareholders.

In reaching their decision on the investment management agreement (as well as the administrative services agreement), the trustees took into account information furnished throughout the year at regular Board meetings, as well as information specifically requested and furnished for the renewal process, which culminated in the meetings referred to above for the specific purpose of considering such agreements. Information furnished throughout the year included, among others, reports on the Fund’s investment performance, expenses, portfolio composition, portfolio brokerage execution, soft dollars/client commission arrangements, derivatives, securities lending, portfolio turnover, Rule 12b-1 plans, distribution, shareholder servicing, compliance, pricing of securities and sales and redemptions, along with related financial statements and other information about the scope and quality of services provided by the investment manager and its affiliates and enhancements to such services over the past year. In addition, the trustees received periodic reports throughout the year and during the renewal process relating to compliance with the Fund’s investment policies and restrictions. During the renewal process, the independent trustees considered the investment manager’s methods of operation within the Franklin Templeton group and its activities on behalf of other clients.

Over the past year, the Board and counsel to the independent trustees continued to receive reports on management’s handling of recent regulatory and pending legal actions against the investment manager and its affiliates. The independent trustees were satisfied with the actions taken to date by management in response to such regulatory and legal proceedings.

Particular attention was given to management’s diligent risk management procedures, including continuous monitoring of counterparty credit risk and attention given to derivatives and other complex instruments. The Board also took into account, among other things, the strong financial position of the investment manager’s parent company and its commitment to the mutual fund business as evidenced by its subsidization of money market funds. The trustees also noted management’s efforts to

46 | Semiannual Report

Franklin Mutual Recovery Fund

Shareholder Information (continued)

Board Review of Investment Management Agreement (continued)

minimize any negative impact on the nature and quality of services provided to the Fund arising from Franklin Templeton Investments’ implementation of a hiring freeze and employee reductions in response to market conditions during the latter part of 2008 and early 2009.

In addition to the above and other matters considered by the trustees throughout the course of the year, the following discussion relates to certain primary factors relevant to the Board’s decision. This discussion of the information and factors considered by the Board (as well as the discussion above) is not intended to be exhaustive, but rather summarizes certain factors considered by the Board. In view of the wide variety of factors considered, the Board did not, unless otherwise noted, find it practicable to quantify or otherwise assign relative weights to the foregoing factors. In addition, individual trustees may have assigned different weights to various factors.

NATURE, EXTENT AND QUALITY OF SERVICES. The trustees reviewed the nature, extent and quality of the services provided by the investment manager. In this regard, they reviewed the Fund’s investment approach and concluded that, in their view, it continues to differentiate the Fund from typical core investment products in the mutual fund field. The trustees cited the investment manager’s ability to implement the Fund’s disciplined value investment approach and its relationship with the Fund since the Fund’s inception six and one-half years ago as reasons that shareholders choose to invest, and remain invested, in the Fund. The trustees reviewed the Fund’s portfolio management team, including its performance, staffing, skills and compensation program. With respect to portfolio manager compensation, management assured the trus tees that the Fund’s longer-term performance is a significant component of incentive-based compensation and noted that a portion of a portfolio manager’s incentive-based compensation is paid in shares of predesignated funds from the portfolio manager’s fund management area. The trustees noted that the portfolio manager compensation program aligned the interests of the portfolio managers with that of Fund shareholders. The trustees discussed with management various other products, portfolios and entities that are advised by the investment manager and the allocation of assets and expenses among and within them, as well as their relative fees and reasons for differences with respect thereto and any potential conflicts. During regular Board meetings and the aforementioned meetings of the independent trustees, the trustees received reports and presentations on the investment manager’s best execution trading policies. The trustees considered periodic reports provided to them showing that the in vestment manager complied with the investment policies and restrictions of the Fund as well as other reports periodically furnished to the Board covering matters such as the compliance of portfolio managers and other management personnel with the code of ethics covering the investment management personnel, the adherence to fair value pricing procedures established by the Board and the accuracy of net asset value calculations. The Board noted the extent of the benefits provided to Fund shareholders from being part of the Franklin Templeton group, including the right to exchange investments between funds (same class) without a sales charge, the ability to reinvest Fund dividends into other funds and the right to combine holdings of other funds to obtain reduced sales

Semiannual Report | 47

Franklin Mutual Recovery Fund

Shareholder Information (continued)

Board Review of Investment Management Agreement (continued)

charges. The trustees considered the significant recent efforts to develop, test and implement compliance procedures established in accordance with SEC requirements. The trustees also reviewed the nature, extent and quality of the Fund’s other service agreements to determine that, on an overall basis, Fund shareholders were well served. In this connection, the Board also took into account administrative and transfer agent and shareholder services provided to Fund shareholders by affiliates of the investment manager, noting continuing expenditures by management to increase and improve the scope of such services and favorable periodic reports on shareholder services conducted by independent third parties. While such considerations directly affected the trustees’ decision in renewing the Fund’s administrative services and transfer agent and shareholder services agreement, the Board also considered these commitments as inc idental benefits to Fund shareholders deriving from the investment management relationship.

Based on their review, the trustees were satisfied with the nature and quality of the overall services provided by the investment manager and its affiliates to the Fund and its shareholders and were confident in the abilities of the management team to continue the disciplined value investment approach of the Fund and to provide quality services to the Fund and its shareholders.

INVESTMENT PERFORMANCE. The trustees reviewed and placed significant emphasis on the investment performance of the Fund. In this context, the trustees believed that it is difficult to find open or closed-end funds that are truly comparable to the Fund due, in part, to the unique nature of the Fund as a closed-end interval fund investing in the categories of bankruptcy and distressed companies, merger arbitrage and undervalued stocks and debt instruments. They considered the performance of the Fund over the past six and one-half years since formation of the Fund relative to various benchmarks. As part of their review, they inquired of management regarding benchmarks (including the benchmark on which the Fund’s performance adjustment fee is based), style drift and restrictions on permitted investments. Consideration was also given to performan ce in the context of available levels of cash during the periods.

The trustees had meetings during the year, including the meetings referred to above held in connection with the renewal process, with the Fund’s portfolio managers to discuss performance. The trustees noted that the Fund’s total return (Class A shares) on an annualized basis for the period beginning on the Fund’s inception date and ended December 31, 2009, was approximately 2.19%. The trustees concluded that such performance was acceptable.

COMPARATIVE EXPENSES AND MANAGEMENT PROFITABILITY. The trustees considered the cost of the services provided and to be provided and the profits realized by the investment manager and its affiliates from their respective relationships with the Fund. As part of the approval process, they explored with management the trends in expense ratios over the past three fiscal years and the reasons for any increase in the Fund’s expenses ratios (both including and excluding the performance adjustment fee). The independent trustees noted that the Fund’s performance adjustment

48 | Semiannual Report

Franklin Mutual Recovery Fund

Shareholder Information (continued)

Board Review of Investment Management Agreement (continued)

fee is calculated based upon the Fund’s performance compared against the Bloomberg/EFFAS U.S. Government 3-5 Years Total Return Index. The independent trustees concluded that, in the context of the above-described uniqueness of the Fund, the expenses for the Fund were satisfactory, taking into account factors relating to its operation, including, but not limited to, the quality and experience of the Fund’s portfolio managers and research staff and the nature of the disciplined value investment approach followed for the Fund. The trustees also compared the Fund’s fees to the fees charged to other accounts managed by the manager.

The trustees also reviewed the profitability study addressing profitability of Franklin Resources, Inc., from its overall U.S. fund business, as well as profitability of the investment manager to the Fund, from providing investment management and other services to the Fund during the 12-month period ended September 30, 2009, the then most recent fiscal year end of Franklin Resources, Inc. The trustees noted that this analysis is reviewed every other year by independent accountants based on agreed-upon methodologies. The trustees reviewed the basis on which such reports are prepared and the reasonableness of the cost allocation methodology utilized in the profitability study, it being recognized that allocation methodologies may each be reasonable while producing different results. The independent trustees reviewed the investment manager’s method of assignment and allocation of actual expenses to the Fund, allocations for other a ccounts managed by the investment manager and the method of allocations in the profitability study.

The independent trustees met with management to discuss the profitability study. This included, among other things, a comparison of investment management income with investment management expenses of the Fund; comparison of underwriting revenues and expenses; the relative relationship of investment management and underwriting expenses; shareholder servicing profitability (losses); economies of scale; and the relative contribution of the Fund to the profitability of the investment manager and its parent. In discussing the profitability study with the Board, the investment manager stated its belief that the costs incurred in establishing the infrastructure necessary to operate the type of mutual fund operations conducted by it and its affiliates may not be fully reflected in the expenses allocated to the Fund in determining its profitability.

The trustees considered a study by Lipper, Inc., an independent third-party analyst, analyzing the profitability of the parent of the investment manager as compared to other publicly held investment managers, which also aided the trustees in considering profitability excluding distribution costs. The Board also took into account management’s expenditures in improving shareholder services provided to the Fund as well as the need to meet additional regulatory and compliance requirements resulting from the Sarbanes-Oxley Act and recent SEC and other regulatory requirements. The trustees also considered the extent to which the investment manager may derive ancillary benefits from Fund operations, including those derived from economies of scale, discussed below, the allocation of Fund brokerage and the use of commission dollars to pay for research and other similar services.

Semiannual Report | 49

Franklin Mutual Recovery Fund

Shareholder Information (continued)

Board Review of Investment Management Agreement (continued)

Based upon their consideration of all these factors, the trustees determined that the level of profits realized by the manager and its affiliates in providing services to the Fund was not excessive in view of the nature, quality and extent of services provided.

ECONOMIES OF SCALE. The Board considered that economies of scale may be realized by the manager and its affiliates as the Fund grows larger; however, since the amount of assets under management remains relatively small, the trustees concluded that economies of scale are difficult to consider at this time.

Proxy Voting Policies and Procedures

The Fund’s investment manager has established Proxy Voting Policies and Procedures (Policies) that the Fund uses to determine how to vote proxies relating to portfolio securities. Shareholders may view the Fund’s complete Policies online at franklintempleton.com. Alternatively, shareholders may request copies of the Policies free of charge by calling the Proxy Group collect at (954) 527-7678 or by sending a written request to: Franklin Templeton Companies, LLC, 500 East Broward Boulevard, Suite 1500, Fort Lauderdale, FL 33394, Attention: Proxy Group. Copies of the Fund’s proxy voting records are also made available online at franklintempleton.com and posted on the U.S. Securities and Exchange Commission’s website at sec.gov and reflect the most recent 12-month period ended June 30.

Quarterly Statement of Investments

The Fund files a complete statement of investments with the U.S. Securities and Exchange Commission for the first and third quarters for each fiscal year on Form N-Q. Shareholders may view the filed Form N-Q by visiting the Commission’s website at sec.gov. The filed form may also be viewed and copied at the Commission’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling (800) SEC-0330.

50 | Semiannual Report

This page intentionally left blank.

This page intentionally left blank.

Item 2. Code of Ethics.

(a) The Registrant has adopted a code of ethics that applies to its principal executive officers and principal financial and accounting officer.

(c) N/A

(d) N/A

(f) Pursuant to Item 12(a)(1), the Registrant is attaching as an exhibit a copy of its code of ethics that applies to its principal executive officers and principal financial and accounting officer.

Item 3. Audit Committee Financial Expert.

(a)(1) The Registrant has an audit committee financial expert serving on its audit committee.

(2) The audit committee financial expert is Ann Torre Bates and she is "independent" as defined under the relevant Securities and Exchange Commission Rules and Releases.

Item 4. Principal Accountant Fees and Services. N/A

Item 5. Audit Committee of Listed Registrants.

Members of the Audit Committee are: Edward I. Altman, Ann Torre Bates and Robert E. Wade.

Item 6. Schedule of Investments. N/A

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

The board of trustees of the Fund has delegated the authority to vote proxies related to the portfolio securities held by the Fund to the Fund’s manager Franklin Mutual Advisers, LLC in accordance with the Proxy Voting Policies and Procedures (Policies) adopted by the manager.

The manager has delegated its administrative duties with respect to the voting of proxies to the Proxy Group within Franklin Templeton Companies, LLC (Proxy Group), an affiliate and wholly owned subsidiary of Franklin Resources, Inc. All proxies received by the Proxy Group will be voted based upon the manager’s instructions and/or policies. The manager votes proxies solely in the interests of the Fund and its shareholders.

To assist it in analyzing proxies, the manager subscribes to RiskMetrics Group (RiskMetrics), an unaffiliated third-party corporate governance research service that provides in-depth analyses of shareholder meeting agendas, vote recommendations, recordkeeping and vote disclosure services. In addition, the manager subscribes to Glass, Lewis & Co., LLC (Glass Lewis), an unaffiliated third-party analytical research firm, to receive analyses and vote recommendations on the shareholder meetings of publicly held U.S. companies. Although RiskMetrics’ and/or Glass Lewis’ analyses are thoroughly reviewed and considered in making a final voting decision, the manager does not consider recommendations from RiskMetrics, Glass Lewis or any other third party to be determinative of the manager’s ultimate decision. As a matter of policy, the officers, directors/trustees and employees of the manager and the Proxy Group will not be influenced by outside sources whose interests conflict with the interests of the Fund and its shareholders. Efforts are made to resolve all conflicts in the interests of the manager’s clients. Material conflicts of interest are identified by the Proxy Group based upon analyses of client, distributor, broker dealer and vendor lists, information periodically gathered from directors and officers, and information derived from other sources, including public filings. In situations where a material conflict of interest is identified, the Proxy Group may defer to the voting recommendation of RiskMetrics, Glass Lewis or those of another independent third-party provider of proxy services; or send the proxy directly to the Fund with the manager’s recommendation regarding the vote for approval. If the conflict is not resolved by the Fund, the Proxy Group may refer the matter, along with the recommended course of action by the manager, if any, to an interdepartmental Proxy Review Committee (which may include portfolio managers and/or research analysts employed by the manager), for evaluation and voting instructions. The Proxy Review Committee may defer to the voting recommendation of RiskMetrics, Glass Lewis or those of another independent third-party provider of proxy services; or send the proxy directly to the Fund. Where the Proxy Group or the Proxy Review Committee refers a matter to the Fund, it may rely upon the instructions of a representative of the Fund, such as the board or a committee of the board.

Where a material conflict of interest has been identified, but the items on which the manager’s vote recommendations differ from Glass Lewis, RiskMetrics, or another independent third-party provider of proxy services relate specifically to (1) shareholder proposals regarding social or environmental issues or political contributions, (2) “Other Business” without describing the matters that might be considered, or (3) items the manager wishes to vote in opposition to the recommendations of an issuer’s management, the Proxy Group may defer to the vote recommendations of the manager rather than sending the proxy directly to the Fund for approval.

To avoid certain potential conflicts of interest, the manager will employ echo voting, if possible, in the following instances: (1) when the Fund invests in an underlying fund in reliance on any one of Sections 12(d)(1)(E), (F), or (G) of the 1940 Act, or pursuant to any SEC exemptive orders therunder; (2) when the Fund invests uninvested cash in affiliated money market funds pursuant to the rules under the 1940 Act or any exemptive orders thereunder (“cash sweep arrangement”); or (3) when required pursuant to the Fund’s governing documents or applicable law. Echo voting means that the investment manager will vote the shares in the same proportion as the vote of all of the other holders of the Fund’s shares.

The recommendation of management on any issue is a factor that the manager considers in determining how proxies should be voted. However, the manager does not consider recommendations from management to be determinative of the manager’s ultimate decision. As a matter of practice, the votes with respect to most issues are cast in accordance with the position of the company's management. Each issue, however, is considered on its own merits, and the manager will not support the position of the company's management in any situation where it deems that the ratification of management’s position would adversely affect the investment merits of owning that company’s shares.

Manager’s proxy voting policies and principles The manager has adopted general proxy voting guidelines, which are summarized below. These guidelines are not an exhaustive list of all the issues that may arise and the manager cannot anticipate all future situations. In all cases, each proxy will be considered based on the relevant facts and circumstances.

Board of directors. The manager supports an independent board of directors, and prefers that key committees such as audit, nominating, and compensation committees be comprised of independent directors. The manager will generally vote against management efforts to classify a board and will generally support proposals to declassify the board of directors. The manager may withhold votes from directors who have attended less than 75% of meetings without a valid reason. While generally in favor of separating Chairman and CEO positions, the manager will review this issue as well as proposals to restore or provide for cumulative voting on a case-by-case basis, taking into consideration factors such as the company’s corporate governance guidelines or provisions and performance.

Ratification of auditors of portfolio companies. The manager will closely scrutinize the role and performance of auditors. On a case-by-case basis, the manager will examine proposals relating to non-audit relationships and non-audit fees. The manager will also consider, on a case-by-case basis, proposals to rotate auditors, and will vote against the ratification of auditors when there is clear and compelling evidence of accounting irregularities or negligence.

Management and director compensation. A company’s equity-based compensation plan should be in alignment with the shareholders’ long-term interests. The manager believes that executive compensation should be directly linked to the performance of the company. The manager evaluates plans on a case-by-case basis by considering several factors to determine whether the plan is fair and reasonable, including the RiskMetrics quantitative model utilized to assess such plans and/or the Glass Lewis evaluation of the plans. The manager will generally oppose plans that have the potential to be excessively dilutive, and will almost always oppose plans that are structured to allow the repricing of underwater options, or plans that have an automatic share replenishment “evergreen” feature. The manager will generally support employee stock option plans in which the purchase price is at least 85% of fair market value, and when potential dilution is 10% or less.

Severance compensation arrangements will be reviewed on a case-by-case basis, although the manager will generally oppose “golden parachutes” that are considered to be excessive. The manager will normally support proposals that require a percentage of directors’ compensation to be in the form of common stock, as it aligns their interests with those of shareholders.

Anti-takeover mechanisms and related issues. The manager generally opposes anti-takeover measures since they tend to reduce shareholder rights. However, as with all proxy issues, the manager conducts an independent review of each anti-takeover proposal. On occasion, the manager may vote with management when the research analyst has concluded that the proposal is not onerous and would not harm the Fund or its shareholders’ interests. The manager generally supports proposals that require shareholder rights’ plans (“poison pills”) to be subject to a shareholder vote and will closel y evaluate such plans on a case-by-case basis to determine whether or not they warrant support. In addition, the manager will generally vote against any proposal to issue stock that has unequal or subordinate voting rights. The manager generally opposes any supermajority voting requirements as well as the payment of “greenmail.” The manager generally supports “fair price” provisions and confidential voting.

Changes to capital structure. The manager realizes that a company's financing decisions have a significant impact on its shareholders, particularly when they involve the issuance of additional shares of common or preferred stock or the assumption of additional debt. The manager will review, on a case-by-case basis, proposals by companies to increase authorized shares and the purpose for the increase. The manager will generally not vote in favor of dual-class capital structures to increase the number of authorized shares where that cla ss of stock would have superior voting rights. The manager will generally vote in favor of the issuance of preferred stock in cases where the company specifies the voting, dividend, conversion and other rights of such stock and the terms of the preferred stock issuance are deemed reasonable.

Mergers and corporate restructuring. Mergers and acquisitions will be subject to careful review by the research analyst to determine whether they would be beneficial to shareholders. The manager will analyze various economic and strategic factors in making the final decision on a merger or acquisition. Corporate restructuring proposals are also subject to a thorough examination on a case-by-case basis.

Social and corporate policy issues. The manager will generally give management discretion with regard to social, environmental and ethical issues, although the manager may vote in favor of those that are believed to have significant economic benefits or implications for the Fund and its shareholders.

Global corporate governance. Many of the tenets discussed above are applied to the manager’s proxy voting decisions for international investments. However, the manager must be flexible in these instances and must be mindful of the varied market practices of each region.

The manager will attempt to process every proxy it receives for all domestic and foreign issuers. However, there may be situations in which the manager cannot process proxies, for example, where a meeting notice was received too late, or sell orders preclude the ability to vote. If a security is on loan, the manager may determine that it is not in the best interests of the Fund to recall the security for voting purposes. Also, the manager may abstain from voting under certain circumstances or vote against items such as “Other Business” when the manager is not given adequate information from the company.

Shareholders may view the complete Policies online at franklintempleton.com. Alternatively, shareholders may request copies of the Policies free of charge by calling the Proxy Group collect at (954)527-7678 or by sending a written request to: Franklin Templeton Companies, LLC, 500 East Broward Boulevard, Suite 1500, Fort Lauderdale, FL 33394, Attention: Proxy Group. Copies of the Fund’s proxy voting records are available online at franklintempleton.com and posted on the SEC website at sec.gov. The proxy voting records are updated each year by August 31 to reflect the most recent 12-month period ended June 30.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

N/A

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers. N/A

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no changes to the procedures by which shareholders may recommend nominees to the Registrant's Board of Trustees that would require disclosure herein.

Item 11. Controls and Procedures.

(a) Evaluation of Disclosure Controls and Procedures. The Registrant maintains disclosure controls and procedures that are designed to ensure that information required to be disclosed in the Registrant’s filings under the Securities Exchange Act of 1934 and the Investment Company Act of 1940 is recorded, processed, summarized and reported within the periods specified in the rules and forms of the Securities and Exchange Commission. Such information is accumulated and communicated to the Registrant’s management, including its principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure. The Registrant’s management, including the principal executive officer and the principal financial officer, recognizes that any set of controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives.

Within 90 days prior to the filing date of this Shareholder Report on Form N-CSR, the Registrant had carried out an evaluation, under the supervision and with the participation of the Registrant’s management, including the Registrant’s principal executive officer and the Registrant’s principal financial officer, of the effectiveness of the design and operation of the Registrant’s disclosure controls and procedures. Based on such evaluation, the Registrant’s principal executive officer and principal financial officer concluded that the Registrant’s disclosure controls and procedures are effective.

(b) Changes in Internal Controls. There have been no significant changes in the Registrant’s internal controls or in other factors that could significantly affect the internal controls subsequent to the date of their evaluation in connection with the preparation of this Shareholder Report on Form N-CSR.

Item 12. Exhibits.

(a)(1) Code of Ethics

(a)(2) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 of Laura F. Fergerson, Chief Executive Officer - Finance and Administration, and Matthew T. Hinkle, Chief Financial Officer and Chief Accounting Officer

(b) Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 of Laura F. Fergerson, Chief Executive Officer - Finance and Administration, and Matthew T. Hinkle, Chief Financial Officer and Chief Accounting Officer

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

FRANKLIN MUTUAL RECOVERY FUND

By /s/ LAURA F. FERGERSON

Laura F. Fergerson

Chief Executive Officer –

Finance and Administration

Date November 24, 2010

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By /s/ LAURA F. FERGERSON

Laura F. Fergerson

Chief Executive Officer –

Finance and Administration

Date November 24, 2010

By /s/ MATTHEW T. HINKLE

Matthew T. Hinkle

Chief Financial Officer and

Chief Accounting Officer

Date November 24, 2010