UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-21457

| Name of Fund: | | BlackRock Allocation Target Shares |

| Fund Address: | | 100 Bellevue Parkway, Wilmington, DE 19809 |

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Allocation Target Shares, 50 Hudson Yards, New York, NY 10001

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 03/31/2023

Date of reporting period: 03/31/2023

Item 1 – Report to Stockholders

(a) The Report to Shareholders is attached herewith.

| | |

| | MARCH 31, 2023 |

BlackRock Allocation Target Shares

| · | | BATS: Series A Portfolio |

| · | | BATS: Series C Portfolio |

| · | | BATS: Series E Portfolio |

| · | | BATS: Series M Portfolio |

| · | | BATS: Series P Portfolio |

| · | | BATS: Series S Portfolio |

| · | | BATS: Series V Portfolio |

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

The Markets in Review

Dear Shareholder,

Significant economic headwinds emerged during the 12-month reporting period ended March 31, 2023, as investors navigated changing economic conditions and volatile markets. The U.S. economy shrank in the first half of 2022 before returning to modest growth in the second half of the year, marking a shift to a more challenging post-reopening economic environment. Changes in consumer spending patterns and a tight labor market led to elevated inflation, which reached a 40-year high before beginning to moderate.

Equity prices fell as interest rates rose, particularly during the first half of the reporting period. Both large- and small-capitalization U.S. stocks declined, although equities began to recover in the second half of the period as inflation eased and economic growth resumed. Emerging market stocks and international equities from developed markets declined overall, pressured by rising interest rates and volatile commodities prices.

The 10-year U.S. Treasury yield rose during the reporting period, driving its price down, as investors reacted to fluctuating inflation data and attempted to anticipate its impact on future interest rate changes. The corporate bond market also faced inflationary headwinds, and higher interest rates led to rising borrowing costs for corporate issuers.

The U.S. Federal Reserve (the “Fed”), acknowledging that inflation has been more persistent than expected, raised interest rates eight times. Furthermore, the Fed wound down its bond-buying programs and accelerated the reduction of its balance sheet.

Restricted labor supply kept inflation elevated even as other inflation drivers, such as goods prices and energy costs, moderated. While economic growth slowed in the last year, we believe that taming inflation requires a more substantial decline that lowers demand to a level more in line with the economy’s productive capacity. Although the Fed has decelerated the pace of interest rate hikes, we believe that it still seems determined to get inflation back to target. With this in mind, we believe the possibility of a U.S. recession in the near-term is high, but the dimming economic outlook has not yet been fully reflected in current market prices. We believe investors should expect a period of higher volatility as markets adjust to the new economic reality and policymakers attempt to adapt to rapidly changing conditions. Turmoil in the banking sector late in the period highlighted the potential for the knock-on effects of substantially higher interest rates to disrupt markets with little warning.

While we favor an overweight to equities in the long term, we prefer an underweight stance on equities overall in the near term. Expectations for corporate earnings remain elevated, which seems inconsistent with the possibility of a recession. Nevertheless, we are overweight on emerging market stocks as we believe a weakening U.S. dollar provides a supportive backdrop. We also see long-term opportunities in credit, where we believe that valuations are appealing and higher yields provide attractive income, although we are neutral on credit in the near term, as we’re concerned about tightening credit and financial conditions. However, we believe there are still some strong opportunities for a six- to twelve-month horizon, particularly short-term U.S. Treasuries, global inflation-linked bonds, and emerging market bonds denominated in local currency.

Overall, our view is that investors need to think globally, position themselves to be prepared for a decarbonizing economy, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | | | | | |

| Total Returns as of March 31, 2023 | |

| | | 6-Month | | | 12-Month | |

U.S. large cap equities (S&P 500® Index) | | | 15.62% | | | | (7.73)% | |

U.S. small cap equities (Russell 2000® Index) | | | 9.14 | | | | (11.61) | |

International equities (MSCI Europe, Australasia, Far East Index) | | | 27.27 | | | | (1.38) | |

Emerging market equities (MSCI Emerging Markets Index) | | | 14.04 | | | | (10.70) | |

3-month Treasury bills (ICE BofA 3-Month U.S. Treasury Bill Index) | | | 1.93 | | | | 2.52 | |

U.S. Treasury securities (ICE BofA 10-Year U.S. Treasury Index) | | | 4.38 | | | | (6.90) | |

U.S. investment grade bonds (Bloomberg U.S. Aggregate Bond Index) | | | 4.89 | | | | (4.78) | |

Tax-exempt municipal bonds (Bloomberg Municipal Bond Index) | | | 7.00 | | | | 0.26 | |

U.S. high yield bonds (Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index) | | | 7.88 | | | | (3.35) | |

Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | |

| | |

| 2 | | THIS PAGE IS NOT PART OF YOUR FUND REPORT |

Table of Contents

| | |

| Fund Summary as of March 31, 2023 | | BATS: Series A Portfolio |

Investment Objective

BATS: Series A Portfolio’s (the “Fund”) investment objective is to seek a high level of current income consistent with capital preservation.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended March 31, 2023, the Fund outperformed its broad-based benchmark, the Bloomberg U.S. Universal Index, and outperformed its “Reference Benchmark” consisting of 50% Bloomberg U.S. Asset-Backed Securities Index and 50% Bloomberg Non-Agency Investment Grade CMBS Index. Shares of the Fund can be purchased or held only by or on the behalf of (i) certain separately managed account clients; (ii) collective trust funds managed by BlackRock Institutional Trust Company, N.A., an affiliate of the investment adviser; and (iii) mutual funds advised by BlackRock Advisors, LLC or its affiliates. Comparisons of the Fund’s performance versus its benchmark index will differ from comparisons of the benchmark against the performance of the separately managed accounts.

What factors influenced performance?

Positive contributions to the Fund’s performance relative to its benchmark over the reporting period were led by an allocation to commercial mortgage-backed securities (“CMBS”), most notably AAA-rated conduit CMBS, which are backed by pools of similar commercial mortgages. Holdings of lower-rated conduit CMBS were the next largest contributor, followed by AAA-rated collateralized loan obligations (“CLOs”).

The largest detractors from relative performance included asset-backed securities (“ABS”) backed by unsecured consumer loans and newly originated non-agency residential mortgage-backed securities (“RMBS”). Exposure to subordinated private student loans also detracted.

Describe recent portfolio activity.

The Fund rotated opportunistically among securitized assets subsectors during the reporting period, taking advantage of spread widening and market volatility. The Fund decreased its allocations to non-agency RMBS and ABS, particularly to issues backed by consumer loans within the latter category. The Fund also increased its cash-equivalent exposure.

The Fund’s cash position averaged 7.0% during the reporting period and was 8.8% at the end of the period. As market volatility increased on the back of aggressive monetary policy adjustments by the Fed with spreads widening, the Fund tactically reduced risk and allocated to cash equivalent instruments. The Fund’s cash position proved additive to relative performance.

Describe portfolio positioning at period end.

The Fund ended the reporting period underweight duration (and corresponding interest rate sensitivity) relative to the benchmark. The Fund was positioned underweight ABS and CMBS relative to the benchmark and had off-benchmark exposures to non-agency RMBS and CLOs.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 4 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of March 31, 2023 (continued) | | BATS: Series A Portfolio |

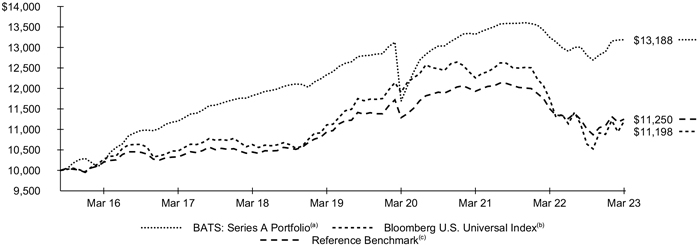

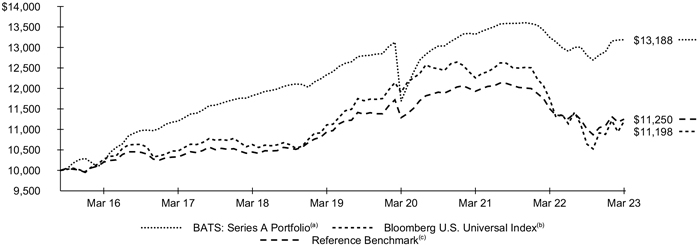

GROWTH OF $10,000 INVESTMENT

The Fund commenced operations on September 21, 2015.

| | (a) | The Fund will principally invest its assets in fixed-income securities, such as ABS, CMBS and RMBS issued or guaranteed by the U.S. Government, various agencies of the U.S. Government or various instrumentalities that have been established or sponsored by the U.S. Government, CMBS and RMBS issued by banks and other financial institutions, collateralized mortgage obligations, loans backed by commercial or residential real estate, derivatives, repurchase agreements and reverse repurchase agreements. | |

| | (b) | Bloomberg U.S. Universal Index, an index that measures the performance of U.S. dollar-denominated taxable bonds that are rated either investment-grade or high yield. The index includes U.S. Treasury bonds, investment-grade and high yield U.S. corporate bonds, mortgage-backed securities, and Eurodollar bonds. | |

| | (c) | A customized weighted index comprised of the returns of the Bloomberg U.S. Asset-Backed Securities Index (50%)/Bloomberg Non-Agency Investment Grade CMBS Index (50%). The Bloomberg U.S. Asset-Backed Securities Index is composed of debt securities backed by credit card, auto and home equity loans that are rated investment grade or higher by Moody’s Investors Service (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings, Inc. (“Fitch”). Issues must have at least one year to maturity and an outstanding par value of at least $50 million. The Bloomberg Non-Agency Investment Grade CMBS Index measures the market of conduit and fusion CMBS deals with a minimum current deal size of $300 million that are rated investment grade or higher using the middle rating of Moody’s, S&P, and Fitch after dropping the highest and lowest available ratings. Securities must have a remaining average life of at least one year and must be fixed-rate, weighted average coupon (“WAC”), or capped WAC securities. | |

Performance

| | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns(a) | |

| | | | | | 1 Year | | | 5 Years | | | Since

Inception(b) | |

BATS: Series A Portfolio | | | | | | | (0.42 | )% | | | 2.21 | % | | | 3.75% | |

Bloomberg U.S. Universal Index | | | | | | | (4.61 | ) | | | 1.05 | | | | 1.51 | |

Reference Benchmark | | | | | | | (2.19 | ) | | | 1.49 | | | | 1.58 | |

| (a) | See “About Fund Performance” for a detailed description of performance related information. | |

| (b) | The Fund commenced operations on September 21, 2015. | |

| | Past performance is not an indication of future results. | |

| | Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. | |

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual | | | | | | Hypothetical 5% Return | | | | |

| Beginning

Account Value (10/01/22) |

| |

| Ending

Account Value

(03/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(10/01/22) |

| |

| Ending

Account Value

(03/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | $ 1,000.00 | | | | $ 1,030.00 | | | | $ 0.00 | | | | | | | | $ 1,000.00 | | | | $ 1,024.93 | | | | $ 0.00 | | | | 0.00 | % |

| (a) | For shares of the Fund, expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). BlackRock has contractually agreed to waive all fees and pay or reimburse all direct expenses, except extraordinary expenses, incurred by the Fund. Extraordinary expenses may include dividend expense, interest expense, acquired fund fees and expenses and certain other Fund expenses. This agreement has no fixed term. | |

See “Disclosure of Expenses” for further information on how expenses were calculated.

| | |

| Fund Summary as of March 31, 2023 (continued) | | BATS: Series A Portfolio |

Portfolio Information

PORTFOLIO COMPOSITION

| | | | |

| | |

Asset Type | |

| Percent of

Total Investments |

(a) |

Asset-Backed Securities | | | 51.9 | % |

Non-Agency Mortgage-Backed Securities | | | 46.0 | |

U.S. Government Sponsored Agency Securities | | | 1.3 | |

Floating Rate Loan Interests | | | 0.8 | |

Corporate Bonds | | | — | (b) |

CREDIT QUALITY ALLOCATION

| | | | |

| | |

Credit Rating(c) | |

| Percent of

Total Investments |

(a) |

AAA/Aaa(d) | | | 36.8 | % |

AA/Aa | | | 4.9 | |

A | | | 4.6 | |

BBB/Baa | | | 2.9 | |

BB/Ba | | | 4.2 | |

B | | | 1.8 | |

CCC/Caa | | | 2.3 | |

CC/Ca | | | 2.1 | |

C | | | 0.5 | |

N/R | | | 39.9 | |

| (a) | Total investments exclude short-term securities and TBA sale commitments. |

| (b) | Amount is less than 0.1%. |

| (c) | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service (“Moody’s”) if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (d) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa. |

| | |

| 6 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of March 31, 2023 | | BATS: Series C Portfolio |

Investment Objective

BATS: Series C Portfolio’s (the “Fund”) investment objective is to seek to maximize total return, consistent with income generation and prudent investment management.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended March 31, 2023, the Fund outperformed its benchmark, the Bloomberg U.S. Credit Index. Shares of the Fund can be purchased or held only by or on behalf of certain separately managed account clients. Comparisons of the Fund’s performance versus its benchmark index will differ from comparisons of the benchmark against the performance of the separately managed accounts.

What factors influenced performance?

Security selection in the banking industry was the leading contributor to performance, followed by duration/yield curve positioning and an underweight in utilities. (Duration is a measure of interest rate sensitivity.) The Fund’s allocation to capital securities was the largest detractor from returns, followed by an underweight in the emerging markets and an overweight in wireline telecommunications. (Capital securities are dividend-paying securities that combine some features of both corporate bonds and preferred stocks, while generally providing higher yields to compensate for being less senior in the issuers’ capital structures.)

Describe recent portfolio activity.

Early in the reporting period, the investment adviser’s activity was centered on rotating towards higher-quality and less cyclical sectors as tighter monetary policy appeared to be having a negative impact on economic growth. It also focused on selectively adjusting the Fund’s overweights and underweights on the belief that performance dispersion among the sectors/issuers in the investment-grade corporate universe would increase due to tighter financial conditions. Specifically, the investment adviser reduced the Fund’s allocations to European banks, technology, fallen angels, emerging market government bonds and consumer discretionary issuers. (A fallen angel is a bond whose rating has been downgraded below investment grade.) The investment adviser redeployed the proceeds of these sales into non-cyclical sectors such as food and beverage, pharmaceuticals, taxable municipals and utilities.

The concerns about banks that emerged toward the end of the period roiled markets and, in the investment adviser’s view, significantly increased the probability of a pronounced slowdown in economic growth. In response, the investment adviser shifted to an even more defensive posture by overweighting utilities whose yield spreads had widened due to heavy new issuance. Additionally, it further reduced the portfolio’s allocation to cyclical sectors. It also took advantage of volatility in the banking industry to increase the extent of the Fund’s underweight in regional banks and trim its overweight in U.S. banks. At the same time, it moved to an overweight in European banks whose spreads had widened significantly.

With respect to duration, the Fund held both overweight and underweight positions during the reporting period. It ended with an underweight, and it had a bias toward a steepening yield curve.

Describe portfolio positioning at period end.

The Fund’s largest overweights were in the banking, midstream energy, technology and wireless sectors, while its largest underweights were in the sovereign, media and entertainment, healthcare and life insurance sectors. The Fund’s duration was shorter than that of its benchmark.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Fund Summary as of March 31, 2023 (continued) | | BATS: Series C Portfolio |

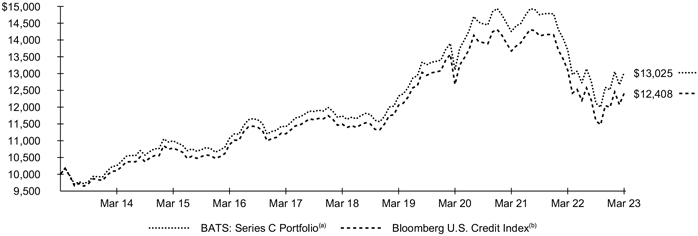

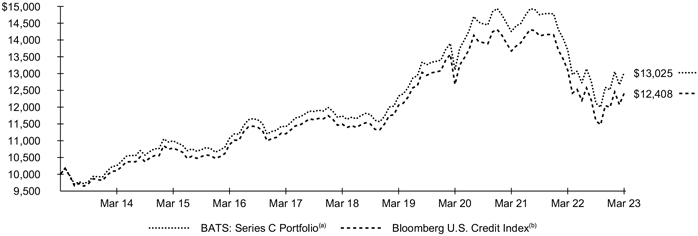

GROWTH OF $10,000 INVESTMENT

| | (a) | The Fund will principally invest its assets in investment grade fixed-income securities, such as corporate bonds, notes and debentures, ABS, CMBS and RMBS, obligations of non-U.S. governments and supranational organizations which are chartered to promote economic development, collateralized mortgage obligations, U.S. Treasury and agency securities, cash equivalent investments, when-issued and delayed delivery securities, derivatives, repurchase agreements and reverse repurchase agreements. | |

| | (b) | Bloomberg U.S. Credit Index, an index that measures the investment grade, US dollar-denominated, fixed-rate, taxable corporate and government related bond markets. It is composed of the US Corporate Index and a non-corporate component that includes foreign agencies, sovereigns, supranationals and local authorities. | |

Performance

| | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns(a) | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

BATS: Series C Portfolio | | | | | | | (4.92 | )% | | | 2.10 | % | | | 2.68% | |

Bloomberg U.S. Credit Index | | | | | | | (5.31 | ) | | | 1.54 | | | | 2.18 | |

| (a) | See “About Fund Performance” for a detailed description of performance related information. | |

| Past | performance is not an indication of future results. | |

| Performance | results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. | |

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual | | | | | | Hypothetical 5% Return | | | | |

| Beginning

Account Value

(10/01/22) |

| |

| Ending

Account Value

(03/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(10/01/22) |

| |

| Ending

Account Value

(03/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | $ 1,000.00 | | | | $ 1,075.10 | | | | $ 0.01 | | | | | | | | $ 1,000.00 | | | | $ 1,024.92 | | | | $ 0.00 | | | | 0.00 | % |

| (a) | For shares of the Fund, expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). BlackRock has contractually agreed to waive all fees and pay or reimburse all direct expenses, except extraordinary expenses, incurred by the Fund. Extraordinary expenses may include dividend expense, interest expense, acquired fund fees and expenses and certain other Fund expenses. This agreement has no fixed term. | |

See “Disclosure of Expenses” for further information on how expenses were calculated.

| | |

| 8 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of March 31, 2023 (continued) | | BATS: Series C Portfolio |

Portfolio Information

PORTFOLIO COMPOSITION

| | | | |

| | |

Asset Type | |

| Percent of

Total Investments |

(a) |

Corporate Bonds | | | 90.5 | % |

Preferred Securities | | | 2.9 | |

Municipal Bonds | | | 2.4 | |

U.S. Treasury Obligations | | | 2.3 | |

Foreign Government Obligations | | | 1.7 | |

Foreign Agency Obligations | | | 0.2 | |

CREDIT QUALITY ALLOCATION

| | | | |

| | |

Credit Rating(b) | |

| Percent of

Total Investments |

(a) |

AAA/Aaa(c) | | | 3.6 | % |

AA/Aa | | | 5.3 | |

A | | | 35.5 | |

BBB/Baa | | | 54.3 | |

BB/Ba | | | 1.3 | |

| (a) | Total investments exclude short-term securities. |

| (b) | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (c) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa. |

| | |

| Fund Summary as of March 31, 2023 | | BATS: Series E Portfolio |

Investment Objective

BATS: Series E Portfolio’s (the “Fund”) investment objective is to seek to maximize Federal tax-free yield with a secondary goal of total return.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended March 31, 2023, the Fund outperformed its broad-based benchmark, the Bloomberg Municipal High Yield Bond Index, but it underperformed its customized weighted index comprised of 65% Bloomberg Municipal Bond Index Total Return Index Value Unhedged/35% Bloomberg Municipal Bond: High Yield (non-Investment Grade) Total Return Index the (“Customized Reference Benchmark”). Shares of the Fund can be purchased or held only by or on behalf of certain separately managed account clients. Comparisons of the Fund’s performance versus its benchmark index will differ from comparisons of the benchmark against the performance of the separately managed accounts.

What factors influenced performance?

The Fund actively sought to manage interest rate risk using U.S. Treasury futures. Since Treasury yields rose in response to the Fed’s shift to tighter monetary policy, this strategy contributed to results. (Prices and yields move in opposite directions.) The Fund’s position in cash, while limited, nonetheless contributed given the negative return for the broader market. The Fund’s use of derivatives contributed to performance.

The Fund’s long duration positioning (above-average interest rate sensitivity) detracted in the rising-rate environment. Yield curve positioning also detracted due to holdings in bonds with maturities of 20 years and longer. An overweight in high yield bonds was an additional detractor, as was the Fund’s position in Puerto Rico.

Describe recent portfolio activity.

The investment adviser’s activity was centered on reducing portfolio duration, swapping out of lower-yielding positions and improving the Fund’s tax efficiency. The investment adviser also raised cash above typical levels to reduce duration, position the portfolio more conservatively, and provide greater flexibility in times of market stress and volatility. In addition, the investment adviser reduced both leverage and the Fund’s risk-management strategy with respect to interest rates.

Describe portfolio positioning at period end.

Education and healthcare were the Fund’s largest sector overweights. It was slightly underweight in transportation, although the category remained a large weighting in absolute terms. The Fund held a long duration relative to the benchmark, and it was overweight in bonds with maturities of 20 years and above.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 10 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of March 31, 2023 (continued) | | BATS: Series E Portfolio |

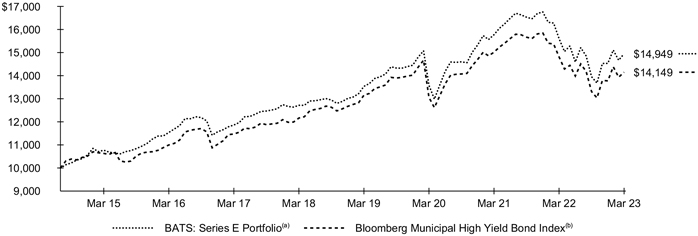

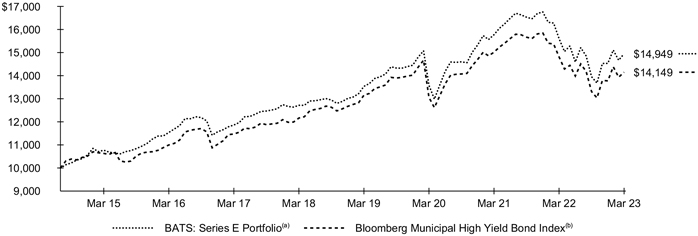

GROWTH OF $10,000 INVESTMENT

The Fund commenced operations on August 4, 2014.

| | (a) | The Fund will invest in investment grade and non-investment grade municipal bonds. | |

| | (b) | An index designed to measure the performance of U.S. dollar-denominated high-yield municipal bonds issued by U.S. states, the District of Columbia, U.S. territories and local governments or agencies. | |

Performance

| | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns(a) | |

| | | | | | 1 Year | | | 5 Years | | | Since

Inception(b) | |

BATS: Series E Portfolio | | | | | | | (4.21 | )% | | | 3.29 | % | | | 4.76% | |

Bloomberg Municipal High Yield Bond Index | | | | | | | (4.49 | ) | | | 3.07 | | | | 4.09 | |

Customized Reference Benchmark(c) | | | | | | | (1.41 | ) | | | 2.42 | | | | N/A | |

| (a) | See “About Fund Performance” for a detailed description of performance related information. | |

| (b) | The Fund commenced operations on August 4, 2014. | |

| (c) | The Customized Reference Benchmark is comprised of the Bloomberg Municipal Bond Index Total Return Index Value Unhedged (65%) and the Bloomberg Municipal Bond: High Yield (non-Investment Grade) Total Return Index (35%). The Customized Reference Benchmark commenced on September 30, 2016. | |

| | Past performance is not an indication of future results. | |

| | Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. | |

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual | | | | | | Hypothetical 5% Return | |

| | | | | | | Including

Interest Expense and Fees | | | Excluding

Interest Expense and Fees | | | | | | | | | Including

Interest Expense and Fees | | | Excluding Interest Expense and Fees | |

| Beginning

Account Value

(10/01/22) |

| |

| Ending

Account Value

(03/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Expenses

Paid During

the Period |

(b) | | | | | |

| Beginning

Account Value

(10/01/22) |

| |

| Ending

Account Value

(03/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Ending

Account Value

(03/31/23) |

| |

| Expenses

Paid During

the Period |

(b) |

| $ | 1,000.00 | | | $ | 1,071.40 | | | $ | 0.74 | | | $ | 0.00 | | | | | | | $ | 1,000.00 | | | $ | 1,024.21 | | | $ | 0.71 | | | $ | 1,024.90 | | | $ | 0.00 | |

| (a) | For shares of the Fund, expenses are equal to the annualized expense ratio of 0.11%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). BlackRock has contractually agreed to waive all fees and pay or reimburse all direct expenses, except extraordinary expenses, incurred by the Fund. Extraordinary expenses may include dividend expense, interest expense, acquired fund fees and expenses and certain other Fund expenses. This agreement has no fixed term. | |

| (b) | For shares of the Fund, expenses are equal to the annualized expense ratio of 0.00%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). BlackRock has contractually agreed to waive all fees and pay or reimburse all direct expenses, except extraordinary expenses, incurred by the Fund. Extraordinary expenses may include dividend expense, interest expense, acquired fund fees and expenses and certain other Fund expenses. This agreement has no fixed term. | |

See “Disclosure of Expenses” for further information on how expenses were calculated.

| | |

| Fund Summary as of March 31, 2023 (continued) | | BATS: Series E Portfolio |

Portfolio Information

SECTOR ALLOCATION

| | | | |

Sector | |

| Percent of

Total Investments |

(a) |

County/City/Special District/School District | | | 28.5 | % |

Education | | | 19.2 | |

Utilities | | | 15.1 | |

Health Care | | | 13.7 | |

Transportation | | | 12.7 | |

Housing | | | 5.6 | |

Tobacco | | | 5.2 | |

CREDIT QUALITY ALLOCATION

| | | | |

Credit Rating(b) | |

| Percent of

Total Investments |

(c) |

AAA/Aaa | | | 2.5 | % |

AA/Aa | | | 8.3 | |

A | | | 19.7 | |

BBB/Baa | | | 10.0 | |

BB/Ba | | | 8.9 | |

B | | | 1.6 | |

N/R | | | 49.0 | |

| (a) | Total investments exclude money market funds. |

| (b) | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service (“Moody’s”) if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (c) | Total investments exclude short-term securities. |

| | |

| 12 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of March 31, 2023 | | BATS: Series M Portfolio |

Investment Objective

BATS: Series M Portfolio’s (the “Fund”) investment objective is to seek to maximize total return, consistent with income generation and prudent investment management.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended March 31, 2023, the Fund outperformed its benchmark, the Bloomberg MBS Index. Shares of the Fund can be purchased or held only by or on behalf of certain separately managed account clients. Comparisons of the Fund’s performance versus its benchmark index will differ from comparisons of the benchmark against the performance of the separately managed accounts.

What factors influenced performance?

The Fund’s active benchmark strategy, which implements relative value decisions between specified pools and to-be-announced securities (“TBAs”) versus the benchmark contributed positively. In addition, the Fund’s active positioning with respect to duration and corresponding interest rate sensitivity added to performance relative to the benchmark.

The most significant detractors from the Fund’s relative performance were out-of-benchmark allocations, such as those to commercial mortgage-backed securities (“CMBS”). In addition, interest rate volatility strategies weighed on performance.

Describe recent portfolio activity.

The Fund’s allocation to CMBS was modestly decreased over the reporting period, while the investment adviser continued to favor senior conduit paper and single-asset/single-borrower (“SASB”) issues. Allocations to fixed rate collateral mortgage obligations (“CMOs”) were little changed over the period. Within agency MBS, the Fund favored specified pools versus TBAs. The Fund actively managed exposures within the coupon stack, ending the period with a tilt toward lower coupons.

Describe portfolio positioning at period end.

Spreads for agency MBS relative to U.S. Treasuries closed March 2023 at attractive levels, and the Fund continued to favor specified pools over the TBA market, with a down-in-coupon preference. The Fund had a cautious stance toward CMBS, emphasizing credit selection across sub-sectors, property types and the capital stack given the recent banking crisis, which has pressured the small and regional banks that are heavily involved in commercial real estate activity. In this vein, the Fund was positioned with a preference for AAA-rated tranches which appear attractive after seeing some spread widening.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Fund Summary as of March 31, 2023 (continued) | | BATS: Series M Portfolio |

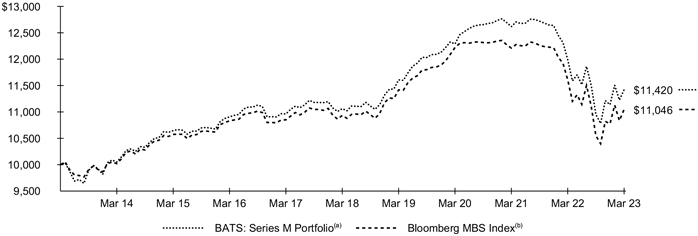

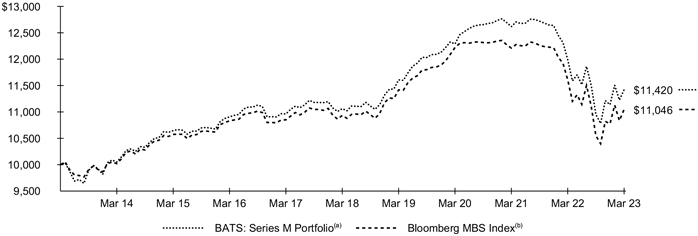

GROWTH OF $10,000 INVESTMENT

| | (a) | The Fund will principally invest its assets in investment grade CMBS and RMBS, ABS, collateralized mortgage obligations, U.S. Treasury and agency securities, cash equivalent investments, when-issued and delayed delivery securities, derivatives and dollar rolls. | |

| | (b) | Bloomberg MBS Index, an unmanaged market value-weighted index, which covers the mortgage-backed securities component of the Bloomberg U.S. Aggregate Bond Index. It is comprised of agency mortgage-backed pass-through securities of the Government National Mortgage Association (Ginnie Mae), the Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (Freddie Mac) with a minimum $150 million par amount outstanding and a weighted-average maturity of at least 1 year. The index includes reinvestment of income. | |

Performance

| | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns(a) | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

BATS: Series M Portfolio | | | | | | | (4.76 | )% | | | 0.64 | % | | | 1.34% | |

Bloomberg MBS Index | | | | | | | (4.85 | ) | | | 0.20 | | | | 1.00 | |

| (a) | See “About Fund Performance” for a detailed description of performance related information. | |

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual | | | | | | Hypothetical 5% Return | | | | |

| Beginning

Account Value

(10/01/22) |

| |

| Ending

Account Value

(03/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(10/01/22) |

| |

| Ending

Account Value

(03/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | $ 1,000.00 | | | $ | 1,042.90 | | | $ | 0.00 | | | | | | | $ | 1,000.00 | | | $ | 1,024.93 | | | $ | 0.00 | | | | 0.00 | % |

| (a) | For shares of the Fund, expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). BlackRock has contractually agreed to waive all fees and pay or reimburse all direct expenses, except extraordinary expenses, incurred by the Fund. Extraordinary expenses may include dividend expense, interest expense, acquired fund fees and expenses and certain other Fund expenses. This agreement has no fixed term. | |

See “Disclosure of Expenses” for further information on how expenses were calculated.

| | |

| 14 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of March 31, 2023 (continued) | | BATS: Series M Portfolio |

Portfolio Information

PORTFOLIO COMPOSITION

| | | | |

Asset Type | |

| Percent of

Total Investments |

(a) |

U.S. Government Sponsored Agency Securities | | | 92.2 | % |

Non-Agency Mortgage-Backed Securities | | | 7.4 | |

Asset-Backed Securities | | | 0.4 | |

CREDIT QUALITY ALLOCATION

| | | | |

Credit Rating(b) | |

| Percent of

Total Investments |

(a) |

AAA/Aaa(c) | | | 96.9 | % |

AA/Aa | | | 1.2 | |

A | | | 0.4 | |

BBB/Baa | | | 0.1 | |

N/R | | | 1.4 | |

| (a) | Total investments exclude short-term securities and TBA sale commitments. |

| (b) | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (c) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa. |

| | |

| Fund Summary as of March 31, 2023 | | BATS: Series P Portfolio |

Investment Objective

BATS: Series P Portfolio’s (the “Fund”) investment objective is to seek to provide a duration that is the inverse of its benchmark.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended March 31, 2023 the Fund outperformed its benchmark, the Bloomberg U.S. Treasury 7-10 Year Bond Index and the Bloomberg U.S. Bellwether 10 Year Swap Index. Shares of the Fund can be purchased or held only by or on behalf of certain separately managed account clients. Comparisons of the Fund’s performance versus its benchmark index will differ from comparisons of the benchmark against the performance of the separately managed accounts.

What factors influenced performance?

The use and cost of derivatives will result in a negative contribution to returns when interest rates fall; however, the Fund’s strategy is designed to offset these costs by holding shares of BlackRock Allocation Target Shares: Series S Portfolio (“Series S Portfolio”), a short-term proprietary fund. The use of derivatives is necessary to achieve the Fund’s objective and should therefore be evaluated in a portfolio context and not as a standalone strategy. The Fund held cash as collateral in conjunction with its investments in U.S. Treasury futures and interest rate swaps. The cash position had no material impact on performance. The Fund’s use of derivatives contributed to performance.

The Fund’s position in the Series S Portfolio—which was hurt by its holdings in the bond market’s spread sectors—detracted from performance.

Describe recent portfolio activity.

The Fund actively managed interest rate risk on the seven- to ten-year part of the yield curve by using derivatives as described above. The Fund maintained its allocation to Series S Portfolio in order to offset the cost of the derivatives. Since this is an overlay strategy designed to manage interest-rate risk, the portfolio’s positioning is relatively static.

Describe portfolio positioning at period end.

The Fund held positions in U.S. Treasury futures and interest rate swaps, and it had an out-of-benchmark allocation to Series S Portfolio.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 16 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

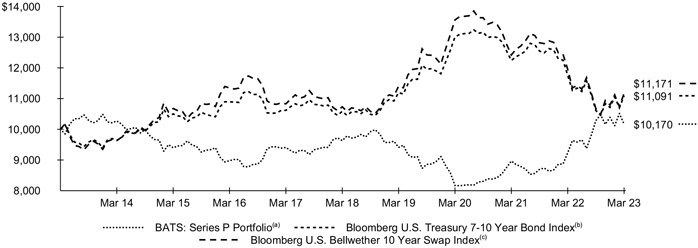

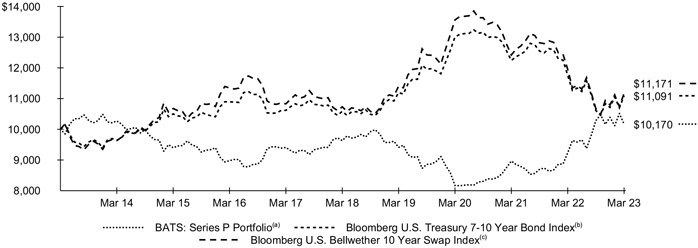

| Fund Summary as of March 31, 2023 (continued) | | BATS: Series P Portfolio |

GROWTH OF $10,000 INVESTMENT

| | (a) | The Fund may invest in a portfolio of securities and other financial instruments, including derivative instruments, in an attempt to provide returns that are the inverse of its benchmark index, the Bloomberg U.S. Treasury 7-10 Year Bond Index. | |

| | (b) | Bloomberg U.S. Treasury 7-10 Year Bond Index, an index that measures the performance of the U.S. Government bond market and includes public obligations of the U.S. Treasury with a maturity of between seven and up to (but not including) ten years. Securities must be fixed rate and rated investment grade, as defined by the Index methodology. | |

| | (c) | Bloomberg U.S. Bellwether 10 Year Swap Index, an index that provides total returns for swaps with varying maturities. For example, the 10-year swap index measures the total return of investing in 10-year par swaps over time. | |

Performance

| | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Returns(a) | |

| | | | | | 1 Year | | | 5 Years | | | 10 Years | |

BATS: Series P Portfolio | | | | | | | 10.14 | % | | | 1.09 | % | | | 0.17% | |

Bloomberg U.S. Treasury 7-10 Year Bond Index | | | | | | | (5.65 | ) | | | 0.94 | | | | 1.04 | |

Bloomberg U.S. Bellwether 10 Year Swap Index | | | | | | | (6.53 | ) | | | 0.80 | | | | 1.11 | |

| (a) | See “About Fund Performance” for a detailed description of performance related information. | |

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual | | | | | | Hypothetical 5% Return | | | | |

| Beginning

Account Value

(10/01/22) |

| |

| Ending

Account Value

(03/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(10/01/22) |

| |

| Ending

Account Value

(03/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | $ 1,000.00 | | | $ | 988.70 | | | $ | 0.00 | | | | | | | $ | 1,000.00 | | | $ | 1,024.93 | | | $ | 0.00 | | | | 0.00 | % |

| (a) | For shares of the Fund, expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). BlackRock has contractually agreed to waive all fees and pay or reimburse all direct expenses, except extraordinary expenses, incurred by the Fund. Extraordinary expenses may include dividend expense, interest expense, acquired fund fees and expenses and certain other Fund expenses. This agreement has no fixed term. | |

See “Disclosure of Expenses” for further information on how expenses were calculated.

Portfolio Information

PORTFOLIO COMPOSITION

| | | | |

Asset Type | |

| Percent of

Total Investments |

|

Fixed-Income Funds | | | 100 | % |

| | |

| Fund Summary as of March 31, 2023 | | BATS: Series S Portfolio |

Investment Objective

BATS: Series S Portfolio’s (the “Fund”) investment objective is to seek to maximize total return, consistent with income generation and prudent investment management.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended March 31, 2023, the Fund outperformed its benchmark, the ICE BofA 1-3 Year U.S. Treasury Index. Shares of the Fund can be purchased or held only by or on behalf of certain separately managed account clients. Comparisons of the Fund’s performance versus its benchmark index will differ from comparisons of the benchmark against the performance of the separately managed accounts.

What factors influenced performance?

The Fund’s allocations to high yield bonds, investment-grade corporate issues, collateralized loan obligations (“CLOs”), asset-backed securities (“ABS”), and commercial mortgage-backed securities (“CMBS”) were the primary contributors to performance. The Fund’s cash position detracted, as did an allocation to non-agency residential mortgage-backed securities. The Fund used derivatives to manage risk and adjust the portfolio’s interest-rate sensitivity, which marginally detracted from results.

Describe recent portfolio activity.

The investment adviser increased the Fund’s allocation to ABS and reduced its weighting in CMBS. In the former, the additions were largely prime auto loans and CLOs. The investment adviser preferred issuers with higher levels of credit enhancement and quality collateral. It views CLOs as a way to invest in floating rate securities without sacrificing quality, and it sees them as a way to augment portfolio income over the long term. Conversely, the investment adviser notably decreased the Fund’s allocation to CMBS. There are various factors that have contributed to wider yield spreads and increased volatility across the various subsectors, including higher interest rates, office vacancies, and the more recent increase in the “risk-off” market tone brought about by headlines surrounding U.S. regional banks.

Describe portfolio positioning at period end.

The Fund was positioned with a short duration bias versus the benchmark (i.e., a lower sensitivity to interest-rate movements). Since the index is comprised solely of U.S. Treasuries, the Fund was overweight in all spread sectors but underweight in U.S. Treasuries.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 18 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

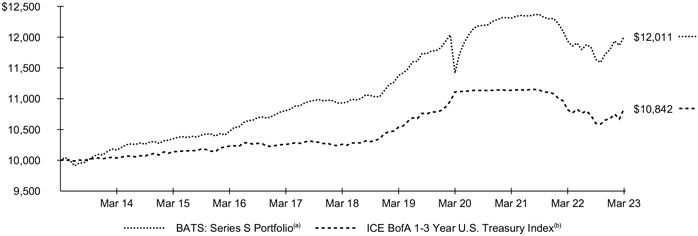

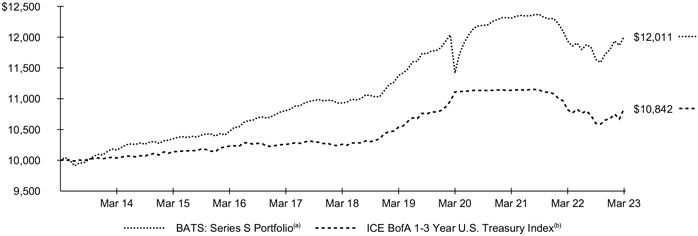

| Fund Summary as of March 31, 2023 (continued) | | BATS: Series S Portfolio |

GROWTH OF$10,000 INVESTMENT

| | (a) | The Fund will principally invest its assets in investment grade fixed-income securities, such as CMBS and RMBS, obligations of non-U.S. governments and supranational organizations, which are chartered to promote economic development, obligations of domestic and non-U.S. corporations, ABS, collateralized mortgage obligations, U.S. Treasury and agency securities, cash equivalent investments, when-issued and delayed delivery securities, derivatives, repurchase agreements, reverse repurchase agreements and dollar rolls. | |

| | (b) | An unmanaged index comprised of Treasury securities with maturities ranging from one to three years. On 3/1/2021 the Fund began to track the 4pm pricing variant of the ICE BofA 1-3 Year U.S. Treasury Index (the “Index”). Historical index data prior to 3/1/2021 is for the 3pm pricing variant of the Index. Index data on and after 3/1/2021 is for the 4pm pricing variant of the Index. | |

Performance

| | | | | | | | | | | | |

| | | Average Annual Total Returns(a) | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

BATS: Series S Portfolio | | | 0.62 | % | | | 1.90 | % | | | 1.85% | |

ICE BofA 1-3 Year U.S. Treasury Index | | | 0.27 | | | | 1.11 | | | | 0.81 | |

| (a) | See “About Fund Performance” for a detailed description of performance related information. | |

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual | | | | | | Hypothetical 5% Return | | | | |

| Beginning

Account Value

(10/01/22) |

| |

| Ending

Account Value

(03/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(10/01/22) |

| |

| Ending

Account Value

(03/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| $ | 1,000.00 | | | $ | 1,032.20 | | | $ | 0.00 | | | | | | | $ | 1,000.00 | | | $ | 1,024.93 | | | $ | 0.00 | | | | 0.00 | % |

| (a) | For shares of the Fund, expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). BlackRock has contractually agreed to waive all fees and pay or reimburse all direct expenses, except extraordinary expenses, incurred by the Fund. Extraordinary expenses may include dividend expense, interest expense, acquired fund fees and expenses and certain other Fund expenses. This agreement has no fixed term. | |

See “Disclosure of Expenses” for further information on how expenses were calculated.

| | |

| Fund Summary as of March 31, 2023 (continued) | | BATS: Series S Portfolio |

Portfolio Information

PORTFOLIO COMPOSITION

| | | | |

Asset Type | |

| Percent of

Total Investments |

(a) |

Corporate Bonds | | | 33.2 | % |

Asset-Backed Securities | | | 30.3 | |

U.S. Government Sponsored Agency Securities | | | 16.9 | |

Non-Agency Mortgage-Backed Securities | | | 12.3 | |

U.S. Treasury Obligations | | | 6.5 | |

Foreign Agency Obligations | | | 0.4 | |

Preferred Securities | | | 0.4 | |

Foreign Government Obligations | | | — | (b) |

CREDIT QUALITY ALLOCATION

| | | | |

Credit Rating(c) | |

| Percent of

Total Investments |

(a) |

AAA/Aaa(d) | | | 60.2 | % |

AA/Aa | | | 4.7 | |

A | | | 15.1 | |

BBB/Baa | | | 14.5 | |

BB/Ba | | | 0.1 | |

N/R | | | 5.4 | |

| (a) | Total investments exclude short-term securities and TBA sale commitments. | |

| (b) | Amount is less than 0.1%. | |

| (c) | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (d) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa. |

| | |

| 20 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of March 31, 2023 | | BATS: Series V Portfolio |

Investment Objective

BATS: SeriesV Portfolio’s (the “Fund”) investment objective is to seek as high a level of income exempt from federal income tax consistent with preservation of capital while seeking to minimize price volatility.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended March 31, 2023, the Fund performed in line with its benchmark, the SIFMA Municipal Swap Index. Shares of the Fund can be purchased or held only by or on behalf of certain separately managed account clients. Comparisons of the Fund’s performance versus its benchmark index will differ from comparisons of the benchmark against the performance of the separately managed accounts.

What factors influenced performance?

Positive contributors to the Fund’s performance relative to the benchmark included holdings of variable rate demand notes (“VRDNs”) which quickly and efficiently repriced coupons in line with expected Fed rate increases. The Fund’s cash position had no material impact on performance.

Detractors from the Fund’s performance relative to the benchmark included a slightly longer stance with respect to duration (and corresponding interest rate sensitivity) driven by fixed rate exposure to tax-backed local and school district issues.

Describe recent portfolio activity.

The Fund initially focused on laddering commercial paper maturities along with selective maturity extension trades but moved to a more defensive position as the Fed became increasingly hawkish in its efforts to combat inflation. As Fed rate hikes weighed on the performance of fixed-rate instruments, the Fund reduced both municipal note and commercial paper holdings while increasing exposure to VRDNs in order to prioritize maintaining a high level of liquidity.

In March 2023, the Fund concentrated on reducing duration as heightened regional banking concerns drove VRDN yields higher, furthering the case for daily and weekly reset VRDNs over longer-dated commercial paper and municipal note holdings.

Describe portfolio positioning at period end.

The Fund’s duration position at period end remained slightly longer than the benchmark.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

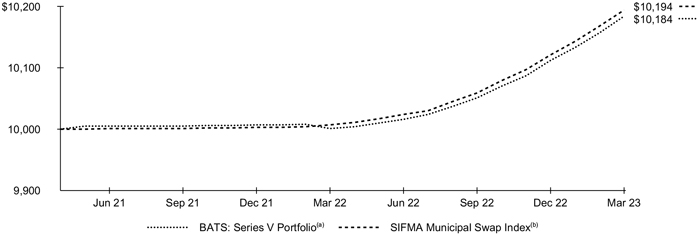

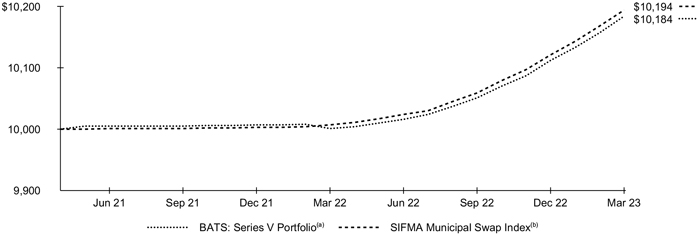

| Fund Summary as of March 31, 2023 (continued) | | BATS: Series V Portfolio |

GROWTH OF$10,000 INVESTMENT

The Fund commenced operations on May 5, 2021.

| | (a) | The Fund will principally invest in a broad range of short-term obligations issued by or on behalf of states, territories and possessions of the United States, the District of Columbia, and their respective authorities, agencies, instrumentalities and political subdivisions, the interest of which, in the opinion of counsel to the issuer of the obligation, is exempt from regular federal income tax. | |

| | (b) | A 7-day high-grade market index comprised of tax-exempt variable rate demand obligations with certain characteristics. The index is calculated and published by Bloomberg. | |

Performance

| | | | | | | | | | | | |

| | | | | | Average Annual Total Returns(a) | |

| | | | | | 1 Year | | | Since Inception(b) | |

BATS: Series V Portfolio | | | | | | | 1.83 | % | | | 0.96% | |

SIFMA Municipal Swap Index | | | | | | | 1.87 | | | | 1.01 | |

| (a) | See “About Fund Performance” for a detailed description of performance related information. | |

| (b) | The Fund commenced operations on May 5, 2021. | |

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual | | | | | | Hypothetical 5% Return | | | | |

| Beginning

Account Value

(10/01/22) |

| |

| Ending

Account Value

(03/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | | | | | |

| Beginning

Account Value

(10/01/22) |

| |

| Ending

Account Value

(03/31/23) |

| |

| Expenses

Paid During

the Period |

(a) | |

| Annualized

Expense

Ratio |

|

| | $ 1,000.00 | | | $ | 1,013.20 | | | $ | 0.00 | | | | | | | $ | 1,000.00 | | | $ | 1,024.93 | | | $ | 0.00 | | | | 0.00 | % |

| (a) | For shares of the Fund, expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). BlackRock has contractually agreed to waive all fees and pay or reimburse all direct expenses, except extraordinary expenses, incurred by the Fund. Extraordinary expenses may include dividend expense, interest expense, acquired fund fees and expenses and certain other Fund expenses. This agreement has no fixed term. | |

See “Disclosure of Expenses” for further information on how expenses were calculated.

Portfolio Information

SECTOR ALLOCATION

| | | | |

Sector | |

| Percent of

Total Investments |

|

County/City/Special District/School District | | | 21.6 | % |

Health Care | | | 21.1 | |

Utilities | | | 18.2 | |

Education | | | 16.8 | |

Housing | | | 16.8 | |

Transportation | | | 5.5 | |

| | |

| 22 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

About Fund Performance

Past performance is not an indication of future results. Financial markets have experienced extreme volatility and trading in many instruments has been disrupted. These circumstances may continue for an extended period of time and may continue to affect adversely the value and liquidity of each Fund’s investments. As a result, current performance may be lower or higher than the performance data quoted. Refer to blackrock.com to obtain performance data current to the most recent month-end. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Figures shown in the performance tables assume reinvestment of all distributions, if any, at net asset value (“NAV”) on the ex-dividend date or payable date, as applicable. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

The performance information also reflects fee waivers and reimbursements that subsidize and reduce the total operating expenses of each Fund. The Funds’ returns would have been lower if there were no such waivers and reimbursements.

Disclosure of Expenses

Shareholders of each Fund may incur the following charges: (a) transactional expenses and (b) operating expenses, including administration fees and other fund expenses. The expense examples shown (which are based on a hypothetical investment of $1,000 invested at the beginning of the period and held through the end of the period) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. Annualized expense ratios reflect contractual and voluntary fee waivers, if any. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund under the heading entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect transactional expenses, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

The Benefits and Risks of Leveraging

The Funds may utilize leverage to seek to enhance returns and NAV. However, there is no guarantee that these objectives can be achieved in all interest rate environments.

Series E Portfolio may leverage its assets through the use of proceeds received in tender option bond (“TOB”) transactions, as described in the Notes to Financial Statements. In a TOB Trust transaction, the Fund transfers municipal bonds or other municipal securities into a special purpose entity (a “TOB Trust”). TOB investments generally provide the Fund with economic benefits in periods of declining short-term interest rates but expose the Fund to risks during periods of rising short-term interest rates. Additionally, fluctuations in the market value of municipal bonds deposited into a TOB Trust may adversely affect the Fund’s NAV per share.

In general, the concept of leveraging is based on the premise that the financing cost of leverage, which is based on short-term interest rates, is normally lower than the income earned by each Fund on its longer-term portfolio investments purchased with the proceeds from leverage. To the extent that the total assets of each Fund (including the assets obtained from leverage) are invested in higher-yielding portfolio investments, each Fund’s shareholders benefit from the incremental net income.

The interest earned on securities purchased with the proceeds from leverage is distributed to each Fund’s shareholders, and the value of these portfolio holdings is reflected in each Fund’s per share NAV. However, in order to benefit shareholders, the return on assets purchased with leverage proceeds must exceed the ongoing costs associated with the leverage. If interest and other ongoing costs of leverage exceed a Fund’s return on assets purchased with leverage proceeds, income to shareholders is lower than if the Funds had not used leverage.

Furthermore, the value of each Fund’s portfolio investments generally varies inversely with the direction of long-term interest rates, although other factors can also influence the value of portfolio investments. As a result, changes in interest rates can influence each Fund’s NAV positively or negatively in addition to the impact on each Fund’s performance from leverage. Changes in the direction of interest rates are difficult to predict accurately, and there is no assurance that a Fund’s leveraging strategy will be successful.

The use of leverage also generally causes greater changes in each Fund’s NAV and dividend rates than comparable portfolios without leverage. In a declining market, leverage is likely to cause a greater decline in the NAV of a Fund’s shares than if the Fund were not leveraged. In addition, each Fund may be required to sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of the leverage instruments, which may cause the Funds to incur losses. The use of leverage may limit a Fund’s ability to invest in certain types of securities or use certain types of hedging strategies. Each Fund incurs expenses in connection with the use of leverage, all of which are borne by each Fund’s shareholders and may reduce income.

| | |

ABOUT FUND PERFORMANCE / DISCLOSURE OF EXPENSES / THE BENEFITS AND RISKS OF LEVERAGING | | 23 |

| | |

| Derivative Financial Instruments | | |

The Funds may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the instrument. Pursuant to Rule 18f-4 under the 1940 Act, among other things, the Funds must either use derivative financial instruments with embedded leverage in a limited manner or comply with an outer limit on fund leverage risk based on value-at-risk. The Funds’ successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Funds’ investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

| | |

| 24 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

Schedule of Investments March 31, 2023 | | BATS: Series A Portfolio (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

| | |

Asset-Backed Securities | | | | | | | | |

510 Loan Acquisition Trust, Series 2020-1, Class A, 5.11%, 09/25/60(a)(b) | | | USD 576 | | | $ | 554,898 | |

522 Funding CLO Ltd. | | | | | | | | |

Series 2018-3A, Class CR, (3-mo. LIBOR US + 2.05%), 6.86%, 10/20/31(a)(c) | | | 500 | | | | 470,394 | |

Series 2019-5A, Class AR, (3-mo. CME Term SOFR + 1.33%), 5.99%, 04/15/35(a)(c) | | | 430 | | | | 418,079 | |

ABFC Trust, Series 2007-WMC1, Class A2B, (1- mo. LIBOR US + 1.00%), 5.85%, 06/25/37(c) | | | 2,914 | | | | 2,225,818 | |

AccessLex Institute, Series 2007-A, Class A3, (3- mo. LIBOR US + 0.30%), 5.26%, 05/25/36(c) | | | 3,051 | | | | 2,944,934 | |

ACRES Commercial Realty Ltd., Series 2021-FL1, Class A, (1-mo. LIBOR US + 1.20%), 5.91%, 06/15/36(a)(c) | | | 652 | | | | 631,955 | |

AGL CLO 12 Ltd., Series 2021-12A, Class A1, (3-mo. LIBOR US + 1.16%), 5.97%, 07/20/34(a)(c) | | | 4,000 | | | | 3,909,419 | |

AGL CLO 14 Ltd., Series 2021-14A, Class A, (3- mo. LIBOR US + 1.15%), 5.97%, 12/02/34(a)(c) AGL CLO 3 Ltd. | | | 15,870 | | | | 15,498,198 | |

Series 2020-3A, Class A, (3-mo. LIBOR US + 1.30%), 6.09%, 01/15/33(a)(c) | | | 250 | | | | 246,414 | |

Series 2020-3A, Class D, (3-mo. LIBOR US + 3.30%), 8.09%, 01/15/33(a)(c) | | | 1,250 | | | | 1,170,699 | |

AGL Core CLO 4 Ltd., Series 2020-4A, Class A1R, (3-mo. LIBOR US + 1.07%), 5.88%, 04/20/33(a)(c) | | | 4,350 | | | | 4,280,323 | |

AGL Static CLO 18 Ltd., Series 2022-18A, Class B, (3-mo. CME Term SOFR + 2.00%), 6.65%, 04/21/31(a)(c) | | | 1,840 | | | | 1,768,137 | |

AIG CLO Ltd., Series 2018-1A, Class A1R, (3-mo. LIBOR US + 1.12%), 5.93%, 04/20/32(a)(c) | | | 1,740 | | | | 1,714,034 | |

AIMCO CLO | | | | | | | | |

Series 2017-AA, Class AR, (3-mo. LIBOR US + 1.05%), 5.86%, 04/20/34(a)(c) | | | 2,500 | | | | 2,447,677 | |

Series 2018-BA, Class AR, (3-mo. LIBOR US + 1.10%), 5.89%, 01/15/32(a)(c) | | | 1,000 | | | | 984,507 | |

Allegro CLO II-S Ltd. | | | | | | | | |

Series 2014-1RA, Class A1, (3-mo. LIBOR US + 1.08%), 5.90%, 10/21/28(a)(c) | | | 1,423 | | | | 1,411,874 | |

Series 2014-1RA, Class B, (3-mo. LIBOR US + 2.15%), 6.97%, 10/21/28(a)(c) | | | 300 | | | | 291,674 | |

Series 2014-1RA, Class C, (3-mo. LIBOR US + 3.00%), 7.82%, 10/21/28(a)(c) | | | 750 | | | | 699,842 | |

Allegro CLO IV Ltd., Series 2016-1A, Class BR2, (3-mo. LIBOR US + 1.55%), 6.34%, 01/15/30(a)(c) | | | 350 | | | | 341,250 | |

Allegro CLO VI Ltd., Series 2017-2A, Class A, (3- mo. LIBOR US + 1.13%), 5.92%, 01/17/31(a)(c) | | | 1,000 | | | | 986,276 | |

Allegro CLO XI Ltd. | | | | | | | | |

Series 2019-2A, Class A2A, (3-mo. LIBOR US + 1.85%), 6.65%, 01/19/33(a)(c) | | | 250 | | | | 244,448 | |

Series 2019-2A, Class C, (3-mo. LIBOR US + 3.00%), 7.80%, 01/19/33(a)(c) | | | 250 | | | | 244,240 | |

ALM Ltd. | | | | | | | | |

Series 2020-1A, Class A2, (3-mo. LIBOR US + 1.85%), 6.64%, 10/15/29(a)(c) | | | 250 | | | | 244,853 | |

Series 2020-1A, Class B, (3-mo. LIBOR US + 2.00%), 6.79%, 10/15/29(a)(c) | | | 350 | | | | 336,734 | |

AMMC CLO XIII Ltd., Series 2013-13A, Class A1R2, (3-mo. LIBOR US + 1.05%), 5.87%, 07/24/29(a)(c) | | | 632 | | | | 627,944 | |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

|

Asset-Backed Securities (continued) | |

AMSR Trust | | | | | | | | |

Series 2020-SFR4, Class F, 2.86%, 11/17/37(a) | | | USD 4,000 | | | $ | 3,572,540 | |

Series 2020-SFR4, Class G2, 4.87%, 11/17/37(a) | | | 2,537 | | | | 2,352,499 | |

Series 2021-SFR1, Class F, 3.60%, 06/17/38(a)(c) | | | 2,872 | | | | 2,393,589 | |

Series 2021-SFR2, Class F1, 3.28%, 08/17/38(a) | | | 3,756 | | | | 3,258,611 | |

Anchorage Capital CLO 16 Ltd., Series 2020-16A, Class A1R, (3-mo. LIBOR US + 1.20%), 6.00%, 01/19/35(a)(c) | | | 380 | | | | 369,790 | |

Anchorage Capital CLO 3-R Ltd. | | | | | | | | |

Series 2014-3RA, Class A, (3-mo. LIBOR US + 1.05%), 5.85%, 01/28/31(a)(c) | | | 1,224 | | | | 1,207,529 | |

Series 2014-3RA, Class B, (3-mo. LIBOR US + 1.50%), 6.30%, 01/28/31(a)(c) | | | 1,250 | | | | 1,204,450 | |

Series 2014-3RA, Class C, (3-mo. LIBOR US + 1.85%), 6.65%, 01/28/31(a)(c) | | | 500 | | | | 479,144 | |

Anchorage Capital CLO 4-R Ltd. | | | | | | | | |

Series 2014-4RA, Class A, (3-mo. LIBOR US + 1.05%), 5.85%, 01/28/31(a)(c) | | | 2,494 | | | | 2,465,965 | |

Series 2014-4RA, Class D, (3-mo. LIBOR US + 2.60%), 7.40%, 01/28/31(a)(c) | | | 750 | | | | 651,083 | |

Anchorage Capital CLO 5-R Ltd. | | | | | | | | |

Series 2014-5RA, Class B, (3-mo. LIBOR US + 1.45%), 6.24%, 01/15/30(a)(c) | | | 2,070 | | | | 2,034,176 | |

Series 2014-5RA, Class C, (3-mo. LIBOR US + 1.85%), 6.64%, 01/15/30(a)(c) | | | 3,500 | | | | 3,398,197 | |

Series 2014-5RA, Class E, (3-mo. LIBOR US + 5.40%), 10.19%, 01/15/30(a)(c) | | | 1,000 | | | | 896,541 | |

Anchorage Capital CLO 7 Ltd. | | | | | | | | |

Series 2015-7A, Class AR2, (3-mo. LIBOR US + 1.09%), 5.89%, 01/28/31(a)(c) | | | 749 | | | | 742,251 | |

Series 2015-7A, Class BR2, (3-mo. LIBOR US + 1.75%), 6.55%, 01/28/31(a)(c) | | | 1,500 | | | | 1,459,799 | |

Series 2015-7A, Class CR2, (3-mo. LIBOR US + 2.20%), 7.00%, 01/28/31(a)(c) | | | 625 | | | | 604,332 | |

Series 2015-7A, Class D1R2, (3-mo. LIBOR US + 3.50%), 8.30%, 01/28/31(a)(c) | | | 1,000 | | | | 883,908 | |

Anchorage Capital CLO 8 Ltd. | | | | | | | | |

Series 2016-8A, Class AR2A, (3-mo. LIBOR US + 1.20%), 6.02%, 10/27/34(a)(c) | | | 5,000 | | | | 4,862,571 | |

Series 2016-8A, Class BR2, (3-mo. LIBOR US + 1.80%), 6.62%, 10/27/34(a)(c) | | | 1,000 | | | | 958,149 | |

Series 2016-8A, Class CR2, (3-mo. LIBOR US + 2.40%), 7.22%, 10/27/34(a)(c) | | | 1,000 | | | | 973,117 | |

Anchorage Capital CLO Ltd. | | | | | | | | |

Series 2013-1A, Class A1R, (3-mo. LIBOR US + 1.25%), 6.07%, 10/13/30(a)(c) | | | 330 | | | | 327,038 | |

Series 2013-1A, Class BR, (3-mo. LIBOR US + 2.15%), 6.97%, 10/13/30(a)(c) | | | 500 | | | | 479,681 | |

Series 2013-1A, Class DR, (3-mo. LIBOR US + 6.80%), 11.62%, 10/13/30(a)(c) | | | 1,000 | | | | 901,311 | |

Series 2018-10A, Class A2, (3-mo. LIBOR US + 1.50%), 6.29%, 10/15/31(a)(c) | | | 450 | | | | 440,462 | |

Apidos CLO XII, Series 2013-12A, Class AR, (3-mo. LIBOR US + 1.08%), 5.87%, 04/15/31(a)(c) | | | 1,387 | | | | 1,371,232 | |

Apidos CLO XV, Series 2013-15A, Class A1RR, | | | | | | | | |

(3-mo. LIBOR US + 1.01%), 5.82%, 04/20/31(a)(c) | | | 1,000 | | | | 989,788 | |

| | |

SCHEDULES OF INVESTMENTS | | 25 |

| | |

Schedule of Investments (continued) March 31, 2023 | | BATS: Series A Portfolio (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

|

Asset-Backed Securities (continued) | |

Apidos CLO XX, Series 2015-20A, Class A1RA, (3-mo. LIBOR US + 1.10%), 5.89%, 07/16/31(a)(c) | | | USD 360 | | | $ | 355,159 | |

Apidos CLO XXVI, Series 2017-26A, Class BR, (3-mo. LIBOR US + 1.95%), 6.75%, 07/18/29(a)(c) | | | 2,830 | | | | 2,756,354 | |

Apidos CLO XXX, Series XXXA, Class A1A, (3-mo. LIBOR US + 1.14%), 5.94%, 10/18/31(a)(c) | | | 400 | | | | 395,272 | |

Apidos CLO XXXIX, Series 2022-39A, Class A1, (3-mo. CME Term SOFR + 1.30%), 5.95%, 04/21/35(a)(c) | | | 5,000 | | | | 4,883,539 | |

Apidos CLO XXXVI, Series 2021-36A, Class B, (3-mo. LIBOR US + 1.60%), 6.41%, 07/20/34(a)(c) | | | 250 | | | | 241,940 | |

Apidos CLO XXXVII, Series 2021-37A, Class A, (3-mo. LIBOR US + 1.13%), 5.95%, 10/22/34(a)(c) | | | 1,780 | | | | 1,736,741 | |

Apollo Credit Funding IV Ltd., Series 4A, Class A2R, (3-mo. LIBOR US + 1.60%), 6.39%, 07/15/30(a)(c) | | | 500 | | | | 488,125 | |

Aqua Finance Trust | | | | | | | | |

Series 2021-A, Class A, 1.54%, 07/17/46(a) | | | 279 | | | | 250,059 | |

Series 2021-A, Class B, 2.40%, 07/17/46(a) | | | 5,500 | | | | 4,566,625 | |

Arbor Realty Commercial Real Estate Notes Ltd. | | | | | | | | |

Series 2021-FL4, Class A, (1-mo. LIBOR US + 1.35%), 6.03%, 11/15/36(a)(c) | | | 546 | | | | 534,427 | |

Series 2022-FL2, Class A, (1-mo. CME Term SOFR + 1.85%), 6.68%, 05/15/37(a)(c) | | | 5,112 | | | | 5,021,603 | |

Ares L CLO Ltd., Series 2018-50A, Class BR, (3- mo. LIBOR US + 1.60%), 6.39%, 01/15/32(a)(c) | | | 1,000 | | | | 972,670 | |

Ares LIX CLO Ltd., Series 2021-59A, Class A, (3-mo. LIBOR US + 1.03%), 5.85%, 04/25/34(a)(c) | | | 250 | | | | 244,530 | |

Ares LVI CLO Ltd. | | | | | | | | |

Series 2020-56A, Class AR, (3-mo. LIBOR US + 1.16%), 5.98%, 10/25/34(a)(c) | | | 2,130 | | | | 2,075,518 | |

Series 2020-56A, Class ER, (3-mo. LIBOR US + 6.50%), 11.32%, 10/25/34(a)(c) | | | 250 | | | | 231,546 | |

Ares XLI CLO Ltd., Series 2016-41A, Class BR, (3-mo. LIBOR US + 1.45%), 6.24%, 04/15/34(a)(c) | | | 2,500 | | | | 2,395,369 | |

Ares XLVIII CLO Ltd., Series 2018-48A, Class B, (3-mo. LIBOR US + 1.58%), 6.39%, 07/20/30(a)(c) | | | 680 | | | | 663,286 | |

Ares XXXIIR CLO Ltd., Series 2014-32RA, Class A1A, (3-mo. LIBOR US + 0.94%), 5.80%, 05/15/30(a)(c) | | | 750 | | | | 739,112 | |

Ares XXXVII CLO Ltd., Series 2015-4A, Class A1R, (3-mo. LIBOR US + 1.17%), 5.96%, 10/15/30(a)(c) | | | 600 | | | | 594,530 | |

Argent Mortgage Loan Trust, Series 2005-W1, Class A2, (1-mo. LIBOR US + 0.48%), 5.33%, 05/25/35(c) | | | 42 | | | | 36,583 | |

ARM Master Trust LLC Agricultural Loan Backed Notes, Series 2021-T1, Class A, 2.43%, 11/15/27(a) | | | 138 | | | | 128,782 | |