UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21457

Name of Fund: BlackRock Allocation Target Shares

BATS: Series I Portfolio

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Allocation Target Shares, 50 Hudson Yards, New York, NY 10001

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 09/30/2024

Date of reporting period: 09/30/2024

Item 1 – Reports to Stockholders

(a) The Reports to Shareholders are attached herewith.

BlackRock Allocation Target Shares: Series I Portfolio

Annual Shareholder Report — September 30, 2024

This annual shareholder report contains important information about BlackRock Allocation Target Shares: Series I Portfolio (the “Fund”) for the period of March 6, 2024 to September 30, 2024.You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441-7762.

What were the Fund costs for the period?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| BlackRock Allocation Target Shares: Series I Portfolio | $0Footnote Reference(a) | -%Footnote Reference(b) |

| Footnote | Description |

Footnote(a) | The Fund commenced operations during the reporting period. Expenses for a full reporting would be higher than the amount shown. |

Footnote(b) | Annualized. |

How did the Fund perform last year?

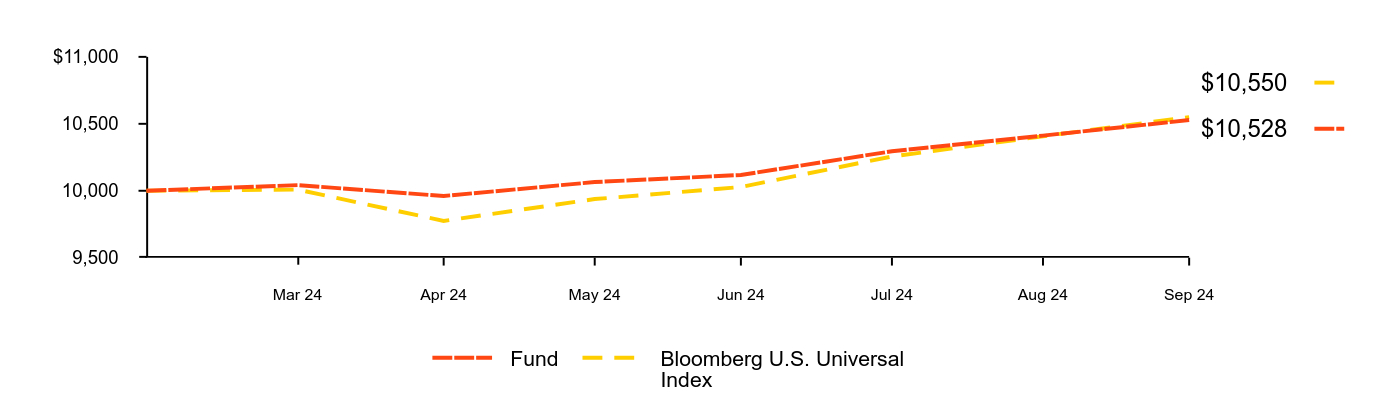

For the abbreviated reporting period starting March 6, 2024 and ended September 30, 2024, the Fund returned 5.28%.

For the same period, the Bloomberg U.S. Universal Index returned 5.50%.

What contributed to performance?

Positive contributions to the Fund’s absolute performance were highlighted by allocations to corporate bonds, including European investment grade, U.S. high yield and U.S. investment grade issues. Exposure to securitized sectors including agency mortgage-backed securities, asset-backed securities, commercial mortgage-backed securities and non-agency mortgage-backed securities also proved additive, along with holdings of floating rate bank loans. Finally, the Fund’s positioning with respect to U.S. duration and corresponding interest rate sensitivity contributed as well. The Fund's cash position had no material impact on performance.

What detracted from performance?

The Fund’s exposure to emerging market bonds was the sole detractor from absolute performance.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Cumulative performance: March 6, 2024 through September 30, 2024

Initial Investment of $10,000

| Fund | Bloomberg U.S. Universal Index |

|---|

| Feb 24 | $10,000 | $10,000 |

| Mar 24 | $10,042 | $10,009 |

| Apr 24 | $9,961 | $9,775 |

| May 24 | $10,065 | $9,938 |

| Jun 24 | $10,118 | $10,028 |

| Jul 24 | $10,295 | $10,256 |

| Aug 24 | $10,412 | $10,407 |

| Sep 24 | $10,528 | $10,550 |

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

As of the date of this report, the Fund does not have a full fiscal year of performance information to report.

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $55,921,373 |

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 676 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $0 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 137% |

The Fund commenced operations on March 6, 2024.

Past performance is not an indication of future results. Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of September 30, 2024)

Credit quality allocation

| Investment Type | Percent of Total InvestmentsFootnote Reference(a) |

|---|

Corporate Bonds........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 54.5% |

Asset-Backed Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 16.8 |

U.S. Government Sponsored Agency Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 13.8 |

Non-Agency Mortgage-Backed Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.6 |

Foreign Government Obligations........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.4 |

Foreign Agency Obligations........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.9 |

|

Credit RatingFootnote Reference(b) | Percent of Total InvestmentsFootnote Reference(a) |

|---|

AAA/AaaFootnote Reference(c)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 32.7% |

AA/Aa........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.2 |

A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.6 |

BBB/Baa........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 12.6 |

BB/Ba........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 26.4 |

B........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 13.0 |

CCC/Caa........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.7 |

N/R........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.8 |

| Footnote | Description |

Footnote(a) | Excludes short-term securities, short investments and options, if any. |

Footnote(b) | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

Footnote(c) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa. |

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (800) 441-7762.

The Fund is not sponsored, endorsed, issued, sold, or promoted by Bloomberg Index Services Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

© 2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Allocation Target Shares: Series I Portfolio

Annual Shareholder Report — September 30, 2024

(b) Not Applicable

Item 2 – Code of Ethics – The registrant (or the “Fund”) has adopted a code of ethics, as of the end of the period covered by this report, applicable to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. During the period covered by this report, the code of ethics was amended to update certain information and to make other non-material changes. During the period covered by this report, there have been no waivers granted under the code of ethics. The registrant undertakes to provide a copy of the code of ethics to any person upon request, without charge, who calls 1-800-441-7762.

Item 3 – Audit Committee Financial Expert – The registrant’s board of directors (the “board of directors”), has determined that (i) the registrant has the following audit committee financial experts serving on its audit committee and (ii) each audit committee financial expert is independent:

Lorenzo A. Flores

Catherine A. Lynch

Arthur P. Steinmetz

Under applicable securities laws, a person determined to be an audit committee financial expert will not be deemed an “expert” for any purpose, including without limitation for the purposes of Section 11 of the Securities Act of 1933, as a result of being designated or identified as an audit committee financial expert. The designation or identification of a person as an audit committee financial expert does not impose on such person any duties, obligations, or liabilities greater than the duties, obligations, and liabilities imposed on such person as a member of the audit committee and board of directors in the absence of such designation or identification. The designation or identification of a person as an audit committee financial expert does not affect the duties, obligations, or liability of any other member of the audit committee or board of directors.

Item 4 – Principal Accountant Fees and Services

The following table presents fees billed by Deloitte & Touche LLP (“D&T”) in each of the last two fiscal years for the services rendered to the Fund:

| | (a) Audit Fees | (b) Audit-Related Fees1 | (c) Tax Fees2 | (d) All Other Fees |

Entity Name | Current Fiscal Year End | Previous Fiscal Year End | Current Fiscal Year End | Previous Fiscal Year End | Current Fiscal Year End | Previous Fiscal Year End | Current Fiscal Year End | Previous Fiscal Year End |

| BATS: Series I Portfolio | $36,720 | $0 | $0 | $0 | $17,600 | $0 | $0 | $0 |

The following table presents fees billed by D&T that were required to be approved by the registrant’s audit committee (the “Committee”) for services that relate directly to the operations or financial reporting of the Fund and that are rendered on behalf of BlackRock Advisors, LLC (the “Investment Adviser” or “BlackRock”) and entities controlling, controlled by, or under common control with BlackRock (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) that provide ongoing services to the Fund (“Affiliated Service Providers”):

| | Current Fiscal Year End | Previous Fiscal Year End |

(b) Audit-Related Fees1 | $0 | $0 |

(c) Tax Fees2 | $0 | $0 |

(d) All Other Fees3 | $2,149,000 | $2,154,000 |

1 The nature of the services includes assurance and related services reasonably related to the performance of the audit or review of financial statements not included in Audit Fees, including accounting consultations, agreed-upon procedure reports, attestation reports, comfort letters, out-of-pocket expenses and internal control reviews not required by regulators.

2 The nature of the services includes tax compliance and/or tax preparation, including services relating to the filing or amendment of federal, state or local income tax returns, regulated investment company qualification reviews, taxable income and tax distribution calculations.

3 Paid in their entirety by BlackRock, relating to a service organization review ("SSAE 18") and subscription to the Deloitte Accounting Research Tool. These amounts represent the aggregate fees paid by BlackRock and were not specifically allocated on a per Fund basis.

(e)(1) Audit Committee Pre-Approval Policies and Procedures:

The Committee has adopted policies and procedures with regard to the pre-approval of services. Audit, audit-related and tax compliance services provided to the registrant on an annual basis require specific pre-approval by the Committee. The Committee also must approve other non-audit services provided to the registrant and those non-audit services provided to the Investment Adviser and Affiliated Service Providers that relate directly to the operations and the financial reporting of the registrant. Certain of these non-audit services that the Committee believes are (a) consistent with the SEC’s auditor independence rules and (b) routine and recurring services that will not impair the independence of the independent accountants may be approved by the Committee without consideration on a specific case-by-case basis (“general pre-approval”). The term of any general pre-approval is 12 months from the date of the pre-approval, unless the Committee provides for a different period. Tax or other non-audit services provided to the registrant which have a direct impact on the operations or financial reporting of the registrant will only be deemed pre-approved provided that any individual project does not exceed $10,000 attributable to the registrant or $50,000 per project. For this purpose, multiple projects will be aggregated to determine if they exceed the previously mentioned cost levels.

Any proposed services exceeding the pre-approved cost levels will require specific pre-approval by the Committee, as will any other services not subject to general pre-approval (e.g., unanticipated but permissible services). The Committee is informed of each service approved subject to general pre-approval at the next regularly scheduled in-person board meeting. At this meeting, an analysis of such services is presented to the Committee for ratification. The Committee may delegate to the Committee Chairman the authority to approve the provision of and fees for any specific engagement of permitted non-audit services, including services exceeding pre-approved cost levels.

(e)(2) None of the services described in each of Items 4(b) through (d) were approved by the Committee pursuant to the de minimis exception in paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Not Applicable

(g) The aggregate non-audit fees, defined as the sum of the fees shown under “Audit-Related Fees,” “Tax Fees” and “All Other Fees,” paid to the accountant for services rendered by the accountant to the registrant, the Investment Adviser and the Affiliated Service Providers were:

Entity Name | Current Fiscal Year End | Previous Fiscal Year End |

| BATS: Series I Portfolio | $17,600 | $0 |

Additionally, the amounts billed by D&T in connection with services provided to the Affiliated Service Providers of the Fund and of other funds sponsored or advised by BlackRock or its affiliates during the current and previous fiscal years for a service organization review and an accounting research tool subscription were:

Current Fiscal Year End | Previous Fiscal Year End |

| $2,149,000 | $2,154,000 |

These amounts represent aggregate fees paid by BlackRock and were not allocated on a per fund basis.

(h) The Committee has considered and determined that the provision of non-audit services that were rendered to the Investment Adviser, and the Affiliated Service Providers that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence.

(i) – Not Applicable

(j) – Not Applicable

Item 5 – Audit Committee of Listed Registrant – Not Applicable

Item 6 – Investments

(a) The registrant’s Schedule of Investments is included as part of the Financial Statement and Financial Highlights for Open-End Management Investment Companies filed under Item 7(a) of this Form.

(b) Not Applicable due to no such divestments during the semi-annual period covered since the previous Form N-CSR filing.

Item 7 – Financial Statements and Financial Highlights for Open-End Management Investment Companies

(a) The registrant’s Financial Statements are attached herewith.

(b) The registrant’s Financial Highlights are attached herewith.

Not

FDIC

Insured

-

May

Lose

Value

-

No

Bank

Guarantee

2024

Annual

Financial

Statements

and

Additional

Information

BlackRock

Allocation

Target

Shares

BATS:

Series

I

Portfolio

The

Benefits

and

Risks

of

Leveraging

..........................................................................................

3

Derivative

Financial

Instruments

.............................................................................................

3

Schedule

of

Investments

..................................................................................................

4

Statement

of

Assets

and

Liabilities

............................................................................................

24

Statement

of

Operations

..................................................................................................

26

Statement

of

Changes

in

Net

Assets

...........................................................................................

27

Financial

Highlights

.....................................................................................................

28

Notes

to

Financial

Statements

...............................................................................................

29

Report

of

Independent

Registered

Public

Accounting

Firm

..............................................................................

39

Important

Tax

Information

.................................................................................................

40

Additional

Information

....................................................................................................

41

Glossary

of

Terms

Used

in

This

Report

.........................................................................................

43

The

Benefits

and

Risks

of

Leveraging

The

Benefits

and

Risks

of

Leveraging

/

Derivative

Financial

Instruments

The

Fund

may

utilize

leverage

to

seek

to

enhance

returns

and

net

asset

value

(“NAV”).

However,

there

is

no

guarantee

that

these

objectives

can

be

achieved

in

all

interest

rate

environments.

In

general,

the

concept

of

leveraging

is

based

on

the

premise

that

the

financing

cost

of

leverage,

which

is

based

on

short-term

interest

rates,

is

normally

lower

than

the

income

earned

by

the

Fund

on

its

longer-term

portfolio

investments

purchased

with

the

proceeds

from

leverage.

To

the

extent

that

the

total

assets

of

the

Fund

(including

the

assets

obtained

from

leverage)

are

invested

in

higher-yielding

portfolio

investments,

the

Fund’s

shareholders

benefit

from

the

incremental

net

income.

The

interest

earned

on

securities

purchased

with

the

proceeds

from

leverage

is

distributed

to

the

Fund’s

shareholders,

and

the

value

of

these

portfolio

holdings

is

reflected

in

the

Fund’s

per

share

NAV.

However,

in

order

to

benefit

shareholders,

the

return

on

assets

purchased

with

leverage

proceeds

must

exceed

the

ongoing

costs

associated

with

the

leverage.

If

interest

and

other

ongoing

costs

of

leverage

exceed

the

Fund’s

return

on

assets

purchased

with

leverage

proceeds,

income

to

shareholders

is

lower

than

if

the

Fund

had

not

used

leverage.

Furthermore,

the

value

of

the

Fund’s

portfolio

investments

generally

varies

inversely

with

the

direction

of

long-term

interest

rates,

although

other

factors

can

also

influence

the

value

of

portfolio

investments.

As

a

result,

changes

in

interest

rates

can

influence

the

Fund’s

NAV

positively

or

negatively

in

addition

to

the

impact

on

the

Fund’s

performance

from

leverage.

Changes

in

the

direction

of

interest

rates

are

difficult

to

predict

accurately,

and

there

is

no

assurance

that

the

Fund’s

leveraging

strategy

will

be

successful.

The

use

of

leverage

also

generally

causes

greater

changes

in

the

Fund’s

NAV

and

dividend

rates

than

comparable

portfolios

without

leverage.

In

a

declining

market,

leverage

is

likely

to

cause

a

greater

decline

in

the

NAV

of the

Fund’s

shares

than

if

the

Fund

were

not

leveraged.

In

addition,

the

Fund

may

be

required

to

sell

portfolio

securities

at

inopportune

times

or

at

distressed

values

in

order

to

comply

with

regulatory

requirements

applicable

to

the

use

of

leverage

or

as

required

by

the

terms

of

the

leverage

instruments,

which

may

cause

the

Fund

to

incur

losses.

The

use

of

leverage

may

limit the

Fund’s

ability

to

invest

in

certain

types

of

securities

or

use

certain

types

of

hedging

strategies.

The

Fund

incurs

expenses

in

connection

with

the

use

of

leverage,

all

of

which

are

borne

by

the

Fund’s

shareholders

and

may

reduce

income.

Derivative

Financial

Instruments

The

Fund

may

invest

in

various

derivative

financial

instruments.

These

instruments

are

used

to

obtain

exposure

to

a

security,

commodity,

index,

market,

and/or

other

assets

without

owning

or

taking

physical

custody

of

securities,

commodities

and/or

other

referenced

assets

or

to

manage

market,

equity,

credit,

interest

rate,

foreign

currency

exchange

rate,

commodity

and/or

other

risks.

Derivative

financial

instruments

may

give

rise

to

a

form

of

economic

leverage

and

involve

risks,

including

the

imperfect

correlation

between

the

value

of

a

derivative

financial

instrument

and

the

underlying

asset,

possible

default

of

the

counterparty

to

the

transaction

or

illiquidity

of

the

instrument. Pursuant

to Rule

18f-4

under

the

1940

Act,

among

other

things,

the

Fund

must

either

use

derivative

financial

instruments

with

embedded

leverage

in

a

limited

manner

or

comply

with

an

outer

limit

on

fund

leverage

risk

based

on

value-at-risk.

The

Fund’s

successful

use

of

a

derivative

financial

instrument

depends

on

the

investment

adviser’s

ability

to

predict

pertinent

market

movements

accurately,

which

cannot

be

assured.

The

use

of

these

instruments

may

result

in

losses

greater

than

if

they

had

not

been

used,

may

limit

the

amount

of

appreciation the

Fund

can

realize

on

an

investment

and/or

may

result

in

lower

distributions

paid

to

shareholders.

The

Fund’s

investments

in

these

instruments,

if

any,

are

discussed

in

detail

in

the

Notes

to

Financial

Statements.

2024

BlackRock

Annual

Financial

Statements

and

Additional

Information

Schedule

of

Investments

September

30,

2024

(Percentages

shown

are

based

on

Net

Assets)

Security

Par

(000)

Pa

r

(

000)

Value

Asset-Backed

Securities

Cayman

Islands

—

11.2%

(a)(b)

Anchorage

Capital

CLO

6

Ltd.,

Series

2015-6A,

Class

AR3,

(3-mo.

CME

Term

SOFR

at

1.44%

Floor

+

1.44%),

6.72%,

04/22/34

.......

USD

250

$

250,070

Apidos

CLO

XXII,

Series

2015-22A,

Class

A1R,

(3-mo.

CME

Term

SOFR

at

0.00%

Floor

+

1.32%),

6.60%,

04/20/31

.................

126

126,242

Apidos

CLO

XXV,

Series

2016-25A,

Class

A1R2,

(3-mo.

CME

Term

SOFR

at

1.15%

Floor

+

1.15%),

6.43%,

10/20/31

............

193

192,948

Barings

CLO

Ltd.,

Series

2019-3A,

Class

A1R,

(3-mo.

CME

Term

SOFR

at

1.07%

Floor

+

1.33%),

6.61%,

04/20/31

.................

246

246,965

Benefit

Street

Partners

CLO

XIX

Ltd.,

Series

2019-19A,

Class

AR,

(3-mo.

CME

Term

SOFR

at

1.18%

Floor

+

1.18%),

6.48%,

01/15/33

.......

250

250,191

Benefit

Street

Partners

CLO

XXI

Ltd.,

Series

2020-21A,

Class

A1R,

(3-mo.

CME

Term

SOFR

at

1.17%

Floor

+

1.43%),

6.73%,

10/15/34

.......

250

250,127

Betony

CLO

2

Ltd.,

Series

2018-1A,

Class

A1,

(3-mo.

CME

Term

SOFR

at

1.08%

Floor

+

1.34%),

6.60%,

04/30/31

.................

169

168,984

BlueMountain

CLO

Ltd.

Series

2013-2A,

Class

A1R,

(3-mo.

CME

Term

SOFR

at

0.00%

Floor

+

1.44%),

6.72%,

10/22/30

...

70

69,896

Series

2018-3A,

Class

A1R,

(3-mo.

CME

Term

SOFR

at

1.19%

Floor

+

1.19%),

6.47%,

10/25/30

...

208

208,447

Series

2018-3A,

Class

BR,

(3-mo.

CME

Term

SOFR

at

1.85%

Floor

+

1.85%),

7.13%,

10/25/30

...

100

100,196

Carlyle

Global

Market

Strategies

CLO

Ltd.,

Series

2014-1A,

Class

A1R2,

(3-mo.

CME

Term

SOFR

at

0.97%

Floor

+

1.23%),

6.52%,

04/17/31

.

130

130,398

CBAM

Ltd.

Series

2019-10A,

Class

A1R,

(3-mo.

CME

Term

SOFR

at

1.12%

Floor

+

1.38%),

6.66%,

04/20/32

...

235

234,842

Series

2020-13A,

Class

A,

(3-mo.

CME

Term

SOFR

at

1.43%

Floor

+

1.69%),

6.97%,

01/20/34

...

250

250,182

Cedar

Funding

XIV

CLO

Ltd.,

Series

2021-14A,

Class

A,

(3-mo.

CME

Term

SOFR

at

1.10%

Floor

+

1.36%),

6.66%,

07/15/33

.......

250

252,116

CIFC

Funding

2013-IV

Ltd.,

Series

2013-4A,

Class

A1RR,

(3-mo.

CME

Term

SOFR

at

1.06%

Floor

+

1.32%),

6.59%,

04/27/31

.......

134

134,332

CIFC

Funding

2018-III

Ltd.,

Series

2018-3A,

Class

A,

(3-mo.

CME

Term

SOFR

at

0.00%

Floor

+

1.36%),

6.64%,

07/18/31

............

209

208,677

CIFC

Funding

Ltd.,

Series

2018-1A,

Class

A,

(3-mo.

CME

Term

SOFR

at

0.00%

Floor

+

1.26%),

6.54%,

04/18/31

.................

170

170,161

Security

Par

(000)

Par

(000)

Value

Cayman

Islands

(continued)

Galaxy

XVIII

CLO

Ltd.,

Series

2018-

28A,

Class

A1,

(3-mo.

CME

Term

SOFR

at

1.10%

Floor

+

1.36%),

6.66%,

07/15/31

............

USD

139

$

139,363

Madison

Park

Funding

XVII

Ltd.,

Series

2015-17A,

Class

AR2,

(3-mo.

CME

Term

SOFR

at

0.00%

Floor

+

1.26%),

6.54%,

07/21/30

.......

175

175,222

Neuberger

Berman

CLO

XIV

Ltd.,

Series

2013-14A,

Class

AR2,

(3-mo.

CME

Term

SOFR

at

1.03%

Floor

+

1.29%),

6.56%,

01/28/30

.......

107

107,163

Neuberger

Berman

Loan

Advisers

CLO

40

Ltd.,

Series

2021-40A,

Class

A,

(3-mo.

CME

Term

SOFR

at

1.06%

Floor

+

1.32%),

6.61%,

04/16/33

.

248

248,690

OCP

CLO

Ltd.

Series

2014-7A,

Class

A1RR,

(3-mo.

CME

Term

SOFR

at

0.00%

Floor

+

1.38%),

6.66%,

07/20/29

...

60

60,309

Series

2016-11A,

Class

A1R2,

(3-

mo.

CME

Term

SOFR

at

1.42%

Floor

+

1.42%),

6.70%,

04/26/36

250

250,065

Series

2019-17A,

Class

AR2,

(3-mo.

CME

Term

SOFR

at

1.40%

Floor

+

1.40%),

6.70%,

07/20/37

...

250

250,619

OHA

Credit

Funding

5

Ltd.

Series

2020-5A,

Class

AR,

(3-mo.

CME

Term

SOFR

at

1.35%

Floor

+

1.35%),

0.00%,

10/18/37

...

250

250,000

Series

2020-5A,

Class

B1R,

(3-mo.

CME

Term

SOFR

at

1.70%

Floor

+

1.70%),

0.00%,

10/18/37

...

250

250,000

OHA

Loan

Funding

Ltd.,

Series

2015-

1A,

Class

AR3,

(3-mo.

CME

Term

SOFR

at

1.15%

Floor

+

1.41%),

6.69%,

01/19/37

............

250

250,253

Palmer

Square

Loan

Funding

Ltd.,

Series

2022-2A,

Class

A1,

(3-mo.

CME

Term

SOFR

at

1.27%

Floor

+

1.27%),

6.57%,

10/15/30

.......

125

125,359

Regatta

XXVIII

Funding

Ltd.,

Series

2024-2A,

Class

A1,

(3-mo.

CME

Term

SOFR

at

1.55%

Floor

+

1.55%),

6.83%,

04/25/37

.......

250

250,630

Trestles

CLO

II

Ltd.,

Series

2018-2A,

Class

A1R,

(3-mo.

CME

Term

SOFR

at

1.57%

Floor

+

1.57%),

6.89%,

07/25/37

.................

250

251,456

Trestles

CLO

III

Ltd.,

Series

2020-3A,

Class

A1,

(3-mo.

CME

Term

SOFR

at

1.33%

Floor

+

1.59%),

6.87%,

01/20/33

.................

250

250,269

Voya

CLO

Ltd.,

Series

2019-1A,

Class

AR,

(3-mo.

CME

Term

SOFR

at

1.06%

Floor

+

1.32%),

6.62%,

04/15/31

.................

138

138,218

6,242,390

Jersey,

Channel

Islands

—

0.5%

Benefit

Street

Partners

CLO

XXXV

Ltd.,

Series

2024-35A,

Class

D,

(3-mo.

CME

Term

SOFR

at

3.30%

Floor

+

3.30%),

8.63%,

04/25/37

(a)

(b)

....

250

253,519

Schedule

of

Investments

(continued)

September

30,

2024

(Percentages

shown

are

based

on

Net

Assets)

Security

Par

(000)

Par

(000)

Value

United

States

—

6.2%

(a)

ARI

Fleet

Lease

Trust,

Series

2023-B,

Class

A3,

5.89%,

07/15/32

.....

USD

100

$

103,591

College

Avenue

Student

Loans

LLC

Series

2021-A,

Class

A1,

(1-mo.

CME

Term

SOFR

at

1.10%

Floor

+

1.21%),

6.07%,

07/25/51

(b)

..

44

43,532

Series

2021-C,

Class

A2,

2.32%,

07/26/55

...............

129

116,895

Series

2023-A,

Class

A2,

5.33%,

05/25/55

...............

92

92,912

EDvestinU

Private

Education

Loan

Issue

No.

LLC,

Series

2021-A,

Class

A,

1.80%,

11/25/45

..........

66

60,378

ELFI

Graduate

Loan

Program

LLC,

Series

2023-A,

Class

A,

6.37%,

02/04/48

.................

92

95,624

Enterprise

Fleet

Financing

LLC,

Series

2022-3,

Class

A3,

4.29%,

07/20/29

132

131,922

Lendmark

Funding

Trust,

Series

2024-

1A,

Class

D,

7.21%,

06/21/32

...

110

112,674

Mariner

Finance

Issuance

Trust,

Series

2021-AA,

Class

A,

1.86%,

03/20/36

100

95,189

Navient

Private

Education

Loan

Trust

Series

2014-AA,

Class

A3,

(1-mo.

CME

Term

SOFR

at

0.00%

Floor

+

1.71%),

6.81%,

10/15/31

(b)

..

44

44,489

Series

2017-A,

Class

B,

3.91%,

12/16/58

...............

78

77,171

Navient

Private

Education

Refi

Loan

Trust

Series

2021-A,

Class

A,

0.84%,

05/15/69

...............

168

152,755

Series

2021-DA,

Class

A,

(US

Prime

Rate

at

0.00%

Floor

-

1.99%),

6.51%,

04/15/60

(b)

.........

51

49,974

Navient

Student

Loan

Trust,

Series

2023-BA,

Class

A1B,

(SOFR

30

day

Average

at

0.00%

Floor

+

1.70%),

7.04%,

03/15/72

(b)

...........

79

79,332

Nelnet

Student

Loan

Trust

Series

2021-A,

Class

APT2,

1.36%,

04/20/62

...............

43

40,022

Series

2021-BA,

Class

AFL,

(1-mo.

CME

Term

SOFR

at

0.00%

Floor

+

0.89%),

5.86%,

04/20/62

(b)

..

86

85,316

Series

2021-CA,

Class

AFL,

(1-mo.

CME

Term

SOFR

at

0.00%

Floor

+

0.85%),

5.82%,

04/20/62

(b)

..

87

86,115

NYMT

Trust,

Series

2024-RR1,

Class

A,

7.37%,

05/25/64

(c)

...........

98

96,914

OneMain

Financial

Issuance

Trust

Series

2023-2A,

Class

A2,

(SOFR

30

day

Average

at

0.00%

Floor

+

1.50%),

6.84%,

09/15/36

(b)

...

125

126,897

Series

2023-2A,

Class

B,

6.17%,

09/15/36

...............

125

130,784

PRET

LLC,

Series

2024-NPL4,

Class

A1,

7.00%,

07/25/54

(c)

........

99

100,210

Regional

Management

Issuance

Trust

Series

2021-1,

Class

A,

1.68%,

03/17/31

...............

55

54,172

Series

2021-2,

Class

A,

1.90%,

08/15/33

...............

100

93,427

Series

2024-1,

Class

A,

5.83%,

07/15/36

...............

100

103,496

Security

Par

(000)

Par

(000)

Value

United

States

(continued)

SMB

Private

Education

Loan

Trust

Series

2018-C,

Class

A2A,

3.63%,

11/15/35

...............

USD

54

$

53,038

Series

2021-A,

Class

A2A1,

(1-mo.

CME

Term

SOFR

at

0.00%

Floor

+

0.84%),

5.94%,

01/15/53

(b)

..

90

88,865

Series

2021-A,

Class

A2B,

1.59%,

01/15/53

...............

90

82,203

Series

2021-C,

Class

APT1,

1.39%,

01/15/53

...............

52

46,917

Series

2021-C,

Class

B,

2.30%,

01/15/53

...............

142

135,884

Series

2022-A,

Class

APT,

2.85%,

11/16/54

...............

91

84,774

Series

2022-D,

Class

B,

6.15%,

10/15/58

...............

77

79,139

Series

2023-A,

Class

A1B,

(SOFR

30

day

Average

at

1.50%

Floor

+

1.50%),

6.84%,

01/15/53

(b)

...

89

89,589

Series

2023-B,

Class

A1B,

(SOFR

30

day

Average

at

1.80%

Floor

+

1.80%),

7.14%,

10/16/56

(b)

...

102

103,911

Series

2023-C,

Class

A1A,

5.67%,

11/15/52

...............

146

150,788

Series

2024-A,

Class

A1A,

5.24%,

03/15/56

...............

128

131,703

Series

2024-A,

Class

A1B,

(SOFR

30

day

Average

at

1.45%

Floor

+

1.45%),

6.79%,

03/15/56

(b)

...

95

95,756

SoFi

Professional

Loan

Program

LLC,

Series

2017-E,

Class

B,

3.49%,

11/26/40

..................

79

78,044

Tricon

Residential

Trust,

Series

2024-

SFR3,

Class

A,

4.50%,

08/17/41

.

100

99,476

3,493,878

Total

Asset-Backed

Securities

—

17.9%

(Cost:

$

9,906,082

)

..............................

9,989,787

Corporate

Bonds

Australia

—

0.4%

(a)

FMG

Resources

August

2006

Pty.

Ltd.

,

6.13%

,

04/15/32

............

100

102,286

Mineral

Resources

Ltd.

,

8.00%

,

11/01/27

..................

100

102,716

205,002

Austria

—

0.2%

ams-OSRAM

AG

,

10.50%

,

03/30/29

(d)

EUR

100

115,184

Canada

—

1.1%

1011778

BC

ULC

,

4.00%

,

10/15/30

(a)

USD

100

92,214

Air

Canada

,

3.88%

,

08/15/26

(a)

.....

2

1,948

Bombardier,

Inc.

,

8.75%

,

11/15/30

(a)

.

100

109,808

Enbridge,

Inc.

,

6.70%

,

11/15/53

....

10

11,579

Methanex

Corp.

,

5.13%

,

10/15/27

...

100

98,951

NOVA

Chemicals

Corp.

,

4.25%

,

05/15/29

(a)

................

100

92,973

Open

Text

Corp.

,

3.88%

,

02/15/28

(a)

.

100

95,504

Parkland

Corp.

,

4.63%

,

05/01/30

(a)

..

100

94,305

597,282

2024

BlackRock

Annual

Financial

Statements

and

Additional

Information

Schedule

of

Investments

(continued)

September

30,

2024

(Percentages

shown

are

based

on

Net

Assets)

Security

Par

(000)

Par

(000)

Value

Czech

Republic

—

0.2%

Allwyn

Entertainment

Financing

UK

plc

,

7.25%

,

04/30/30

(d)

...........

EUR

100

$

117,994

Denmark

—

0.2%

Danske

Bank

A/S

,

(3-mo.

EURIBOR

+

0.65%),

4.35%

,

04/10/27

(b)

(d)

....

100

111,543

Finland

—

0.2%

Citycon

Treasury

BV

,

1.63%

,

03/12/28

(d)

100

102,610

France

—

3.4%

(d)

Altice

France

SA

,

5.88%

,

02/01/27

..

100

87,207

Banijay

Entertainment

SAS

,

7.00%

,

05/01/29

.................

100

117,020

Banque

Federative

du

Credit

Mutuel

SA

,

(3-mo.

EURIBOR

+

0.64%),

4.10%

,

03/05/27

(b)

...........

200

223,632

Bertrand

Franchise

Finance

SAS

,

(3-mo.

EURIBOR

at

0.00%

Floor

+

3.75%),

7.49%

,

07/18/30

(b)

.....

100

112,108

BPCE

SA

(b)

(3-mo.

EURIBOR

+

0.39%),

3.84%

,

03/06/26

...............

100

111,395

(3-mo.

EURIBOR

+

0.61%),

4.08%

,

03/08/27

...............

100

111,765

Credit

Agricole

SA

,

3.75%

,

01/22/34

.

100

115,323

Goldstory

SAS

,

(3-mo.

EURIBOR

at

0.00%

Floor

+

4.00%),

7.63%

,

02/01/30

(b)

................

100

111,446

Iliad

Holding

SASU

,

6.88%

,

04/15/31

100

118,272

iliad

SA

,

5.38%

,

02/15/29

........

100

116,324

Lion/Polaris

Lux

4

SA

,

(3-mo.

EURIBOR

at

0.00%

Floor

+

3.63%),

7.33%

,

07/01/29

(b)

...........

100

111,872

RCI

Banque

SA

,

(5-Year

EURIBOR

ICE

Swap

Rate

+

2.75%),

5.50%

,

10/09/34

(b)

................

200

227,394

Societe

Generale

SA

,

(3-mo.

EURIBOR

+

0.50%),

4.18%

,

01/19/26

(b)

....

100

111,649

Worldline

SA

0.00%

,

07/30/26

(e)

(f)

..........

100

101,018

4.13%

,

09/12/28

............

100

108,454

1,884,879

Germany

—

5.6%

(d)

ADLER

Real

Estate

GmbH

,

3.00%

,

04/27/26

.................

100

106,001

Bayer

AG

(b)

(5-Year

EURIBOR

ICE

Swap

Rate

+

3.27%),

5.50%

,

09/13/54

....

100

111,291

(5-Year

EUR

Swap

Annual

+

3.75%),

4.50%

,

03/25/82

....

100

110,004

Cheplapharm

Arzneimittel

GmbH

,

7.50%

,

05/15/30

............

100

117,194

Commerzbank

AG

(b)

(5-Year

EUR

Swap

Annual

+

6.36%),

6.13%

(g)

..........

200

223,260

(3-mo.

EURIBOR

+

0.70%),

4.16%

,

03/12/27

...............

100

111,740

EnBW

International

Finance

BV

,

3.85%

,

05/23/30

.................

23

26,683

Gruenenthal

GmbH

,

6.75%

,

05/15/30

100

119,360

Heidelberg

Materials

Finance

Luxembourg

SA

,

4.88%

,

11/21/33

100

121,392

HT

Troplast

GmbH

,

9.38%

,

07/15/28

.

100

114,787

Security

Par

(000)

Par

(000)

Value

Germany

(continued)

IHO

Verwaltungs

GmbH

(h)

3.75%

,

(

3.75

%

Cash

or

4.50

%

PIK),

09/15/26

...............

EUR

100

$

111,009

8.75%

,

(

8.75

%

Cash

or

9.50

%

PIK),

05/15/28

(b)

..............

100

116,912

Mahle

GmbH

,

2.38%

,

05/14/28

....

100

96,316

Merck

KGaA

,

(5-Year

EURIBOR

ICE

Swap

Rate

+

1.54%),

3.88%

,

08/27/54

(b)

................

100

111,341

Nidda

Healthcare

Holding

GmbH

,

7.00%

,

02/21/30

............

100

116,046

Sartorius

Finance

BV

,

4.88%

,

09/14/35

100

119,468

TK

Elevator

Holdco

GmbH

,

6.63%

,

07/15/28

.................

90

99,933

Traton

Finance

Luxembourg

SA

,

(3-mo.

EURIBOR

at

0.00%

Floor

+

1.00%),

4.69%

,

01/21/26

(b)

...........

100

111,988

TUI

AG

,

5.88%

,

03/15/29

........

100

115,977

TUI

Cruises

GmbH

,

6.50%

,

05/15/26

90

102,115

Volkswagen

International

Finance

NV

(b)

(3-mo.

EURIBOR

+

0.65%),

4.00%

,

03/27/26

...............

100

111,714

(9-Year

EUR

Swap

Annual

+

3.96%),

3.88%

(g)

..........

100

103,547

Volkswagen

Leasing

GmbH

,

4.75%

,

09/25/31

.................

100

117,238

Wintershall

Dea

Finance

BV

1.33%

,

09/25/28

............

200

205,391

4.36%

,

10/03/32

............

100

111,772

ZF

Europe

Finance

BV

4.75%

,

01/31/29

............

100

107,864

6.13%

,

03/13/29

............

100

113,444

3,133,787

Greece

—

0.2%

National

Bank

of

Greece

SA

,

(5-Year

EURIBOR

ICE

Swap

Rate

+

3.15%),

5.88%

,

06/28/35

(b)

(d)

..........

100

115,927

Ireland

—

0.6%

(d)

Bank

of

Ireland

Group

plc

,

(5-Year

EUR

Swap

Annual

+

6.43%),

6.00%

(b)

(g)

200

224,344

Kerry

Group

Financial

Services

Unltd

Co.

,

3.38%

,

03/05/33

.........

100

112,616

336,960

Israel

—

0.5%

Teva

Pharmaceutical

Finance

Netherlands

II

BV

7.38%

,

09/15/29

............

100

124,951

7.88%

,

09/15/31

............

100

131,769

256,720

Italy

—

3.4%

Azzurra

Aeroporti

SpA

,

2.63%

,

05/30/27

(d)

................

100

107,093

Banca

Monte

dei

Paschi

di

Siena

SpA

,

(5-Year

EURIBOR

ICE

Swap

Rate

at

0.00%

Floor

+

5.01%),

7.71%

,

01/18/28

(b)

(d)

...............

100

121,202

Bubbles

Bidco

SpA

,

(3-mo.

EURIBOR

+

4.25%),

7.53%

,

09/30/31

(b)

(d)

....

100

111,037

Cedacri

Mergeco

SpA

,

(3-mo.

EURIBOR

at

0.00%

Floor

+

5.50%),

9.04%

,

05/15/28

(b)

(d)

..........

100

111,565

Schedule

of

Investments

(continued)

September

30,

2024

(Percentages

shown

are

based

on

Net

Assets)

Security

Par

(000)

Par

(000)

Value

Italy

(continued)

Engineering

-

Ingegneria

Informatica

-

SpA

,

11.13%

,

05/15/28

(d)

.......

EUR

100

$

112,985

Eni

SpA

,

3.88%

,

01/15/34

(d)

.......

100

114,208

FIS

Fabbrica

Italiana

Sintetici

SpA

,

5.63%

,

08/01/27

(d)

...........

100

111,048

Intesa

Sanpaolo

SpA

,

(5-Year

EUR

Swap

Annual

+

5.85%),

5.50%

(b)

(d)

(g)

250

276,896

Lottomatica

SpA

,

5.38%

,

06/01/30

(d)

.

100

115,265

Nexi

SpA

,

0.00%

,

02/24/28

(d)

(e)

(f)

....

200

193,694

Optics

Bidco

SpA

,

7.20%

,

07/18/36

(a)

USD

200

215,234

Pachelbel

Bidco

SpA

,

(3-mo.

EURIBOR

at

0.00%

Floor

+

4.25%),

8.07%

,

05/17/31

(b)

(d)

...............

EUR

100

112,039

Rossini

SARL

,

(3-mo.

EURIBOR

at

0.00%

Floor

+

3.88%),

7.22%

,

12/31/29

(b)

(d)

...............

100

112,264

Snam

SpA

,

(5-Year

EURIBOR

ICE

Swap

Rate

+

2.16%),

4.50%

(b)

(d)

(g)

.

100

112,484

1,927,014

Japan

—

0.4%

SoftBank

Group

Corp.

(d)

4.00%

,

09/19/29

............

100

107,319

3.88%

,

07/06/32

............

100

102,250

209,569

Jersey,

Channel

Islands

—

0.2%

Aston

Martin

Capital

Holdings

Ltd.

,

10.38%

,

03/31/29

(d)

..........

GBP

100

133,087

Luxembourg

—

1.3%

Altice

Financing

SA

,

9.63%

,

07/15/27

(a)

USD

200

194,794

Cidron

Aida

Finco

SARL

,

6.25%

,

04/01/28

(d)

................

GBP

100

126,910

Ephios

Subco

3

SARL

,

7.88%

,

01/31/31

(d)

................

EUR

100

120,007

INEOS

Finance

plc

,

6.38%

,

04/15/29

(d)

100

114,991

Intelsat

Jackson

Holdings

SA

,

6.50%

,

03/15/30

(a)

................

USD

100

95,677

Kleopatra

Finco

SARL

,

4.25%

,

03/01/26

(d)

................

EUR

100

104,408

756,787

Netherlands

—

2.5%

Boels

Topholding

BV

,

5.75%

,

05/15/30

(d)

100

114,399

Cooperatieve

Rabobank

UA

,

(3-mo.

EURIBOR

+

1.15%),

4.23%

,

04/25/29

(b)

(d)

...............

100

115,832

IMCD

NV

,

3.63%

,

04/30/30

(d)

......

100

111,572

ING

Groep

NV

(b)(d)

(3-mo.

EURIBOR

+

1.60%),

4.50%

,

05/23/29

...............

100

116,339

(USISSO05

+

4.36%),

8.00%

(g)

..

USD

200

214,764

Q-Park

Holding

I

BV

,

5.13%

,

02/15/30

(d)

EUR

100

113,541

REWE

International

Finance

BV

,

4.88%

,

09/13/30

(d)

...........

100

119,140

Titan

Holdings

II

BV

,

5.13%

,

07/15/29

(d)

100

112,985

VZ

Secured

Financing

BV

,

5.00%

,

01/15/32

(a)

................

USD

200

184,049

VZ

Vendor

Financing

II

BV

,

2.88%

,

01/15/29

(d)

................

EUR

100

102,837

Ziggo

BV

,

2.88%

,

01/15/30

(d)

......

100

102,856

1,408,314

Security

Par

(000)

Par

(000)

Value

Norway

—

0.2%

Var

Energi

ASA

,

(5-Year

EURIBOR

ICE

Swap

Rate

+

4.77%),

7.86%

,