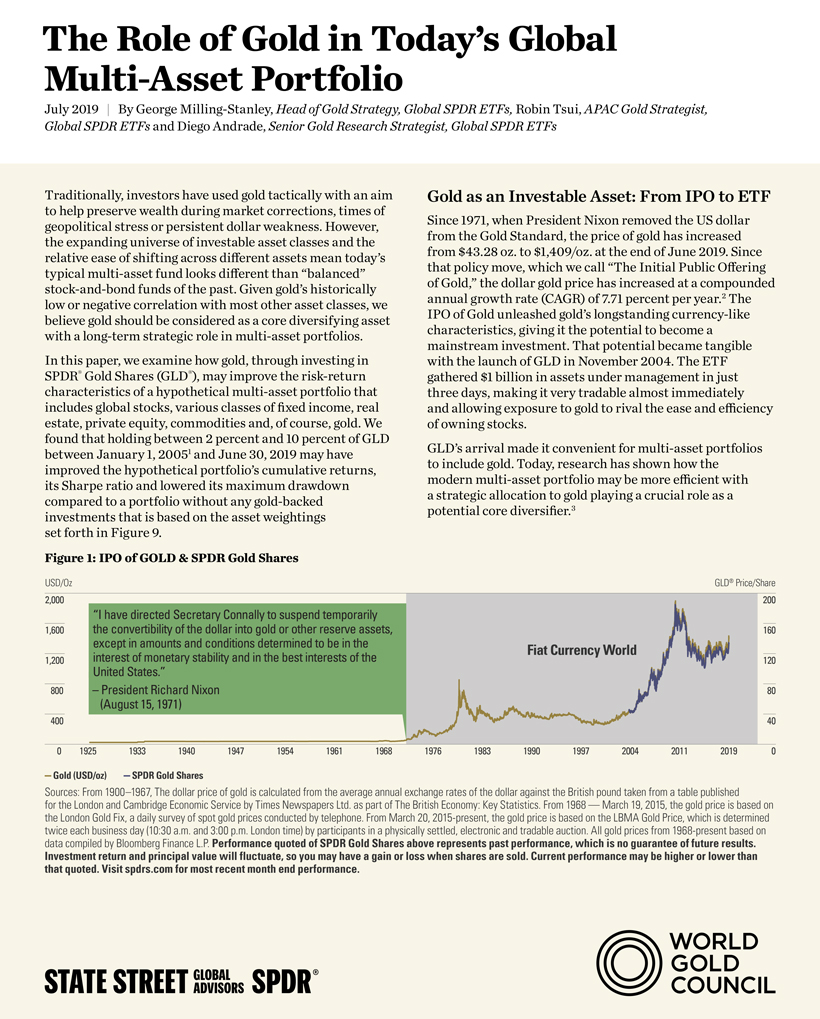

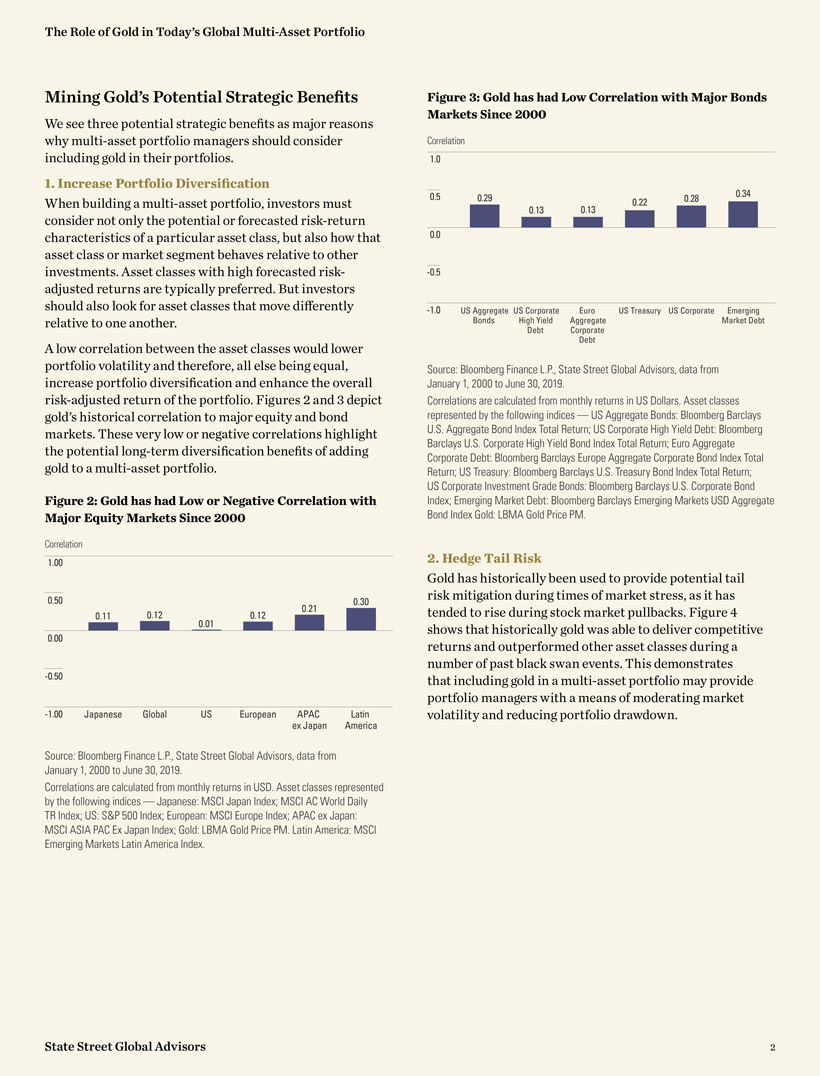

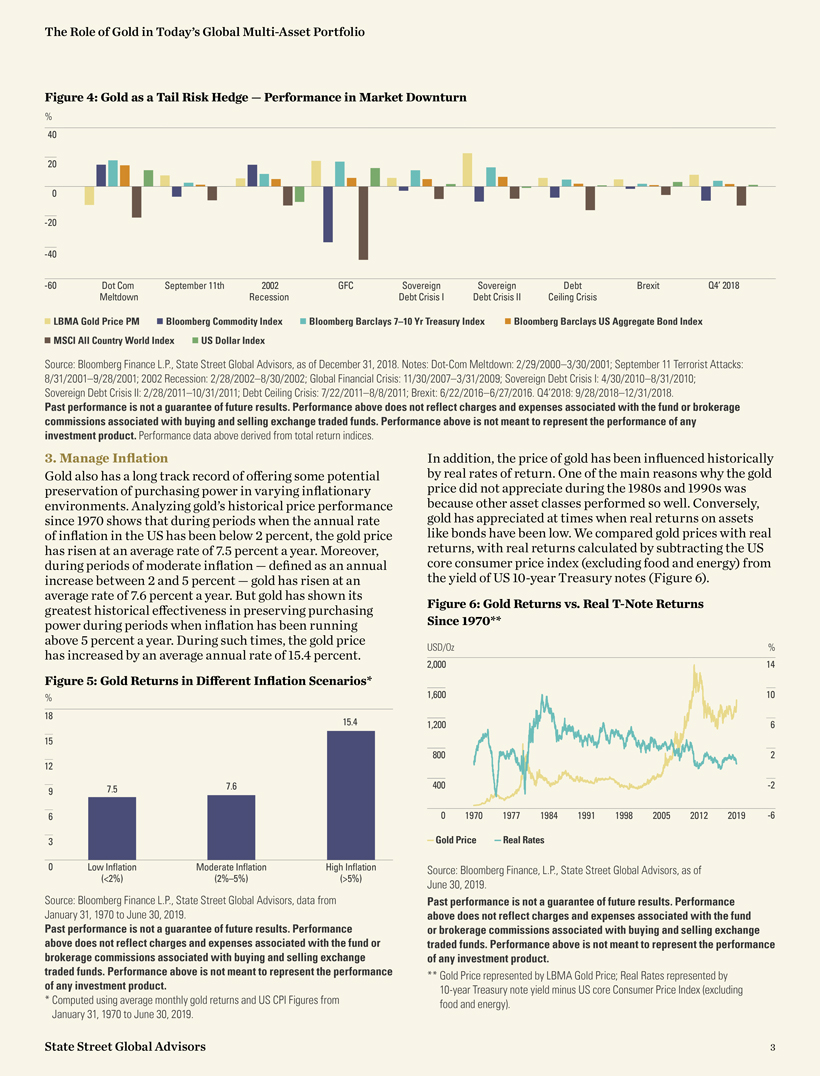

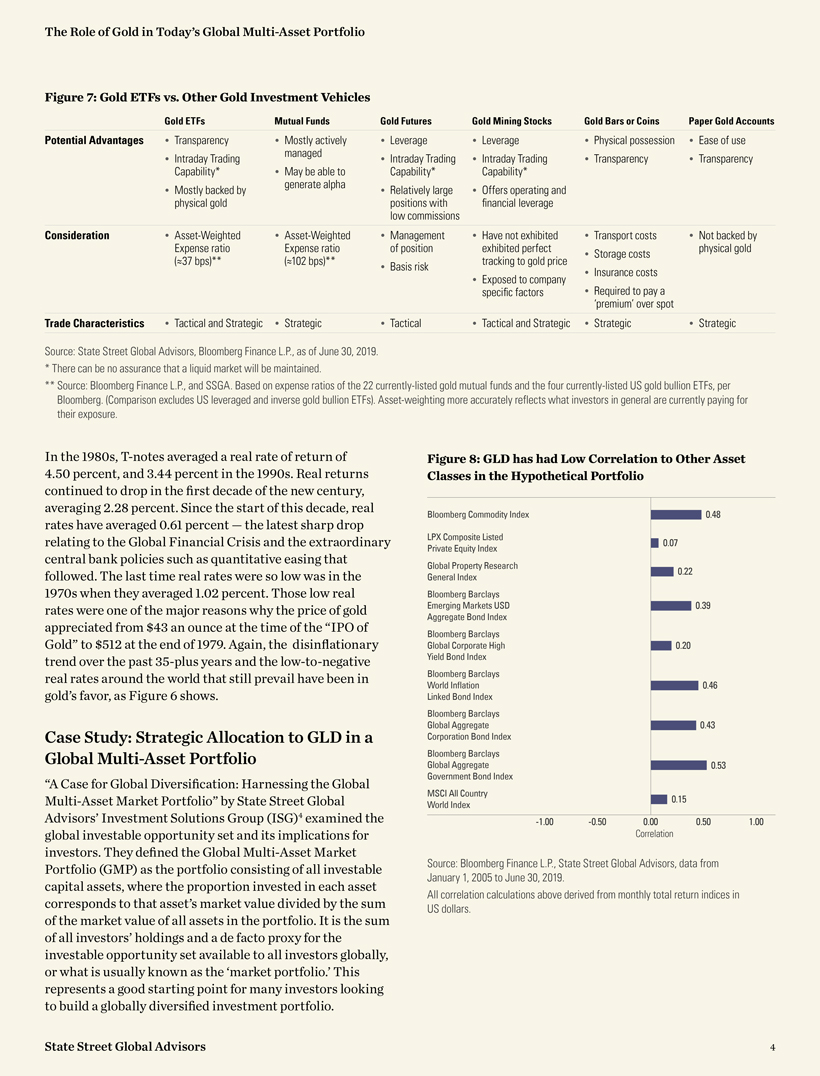

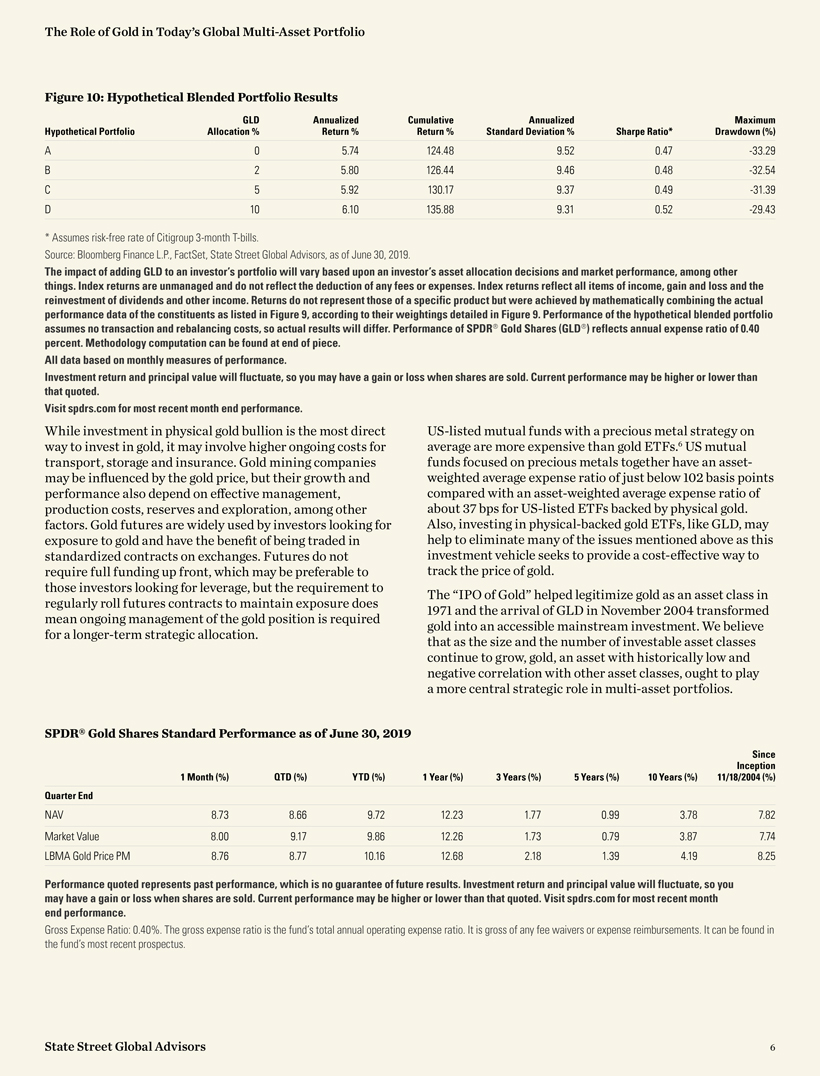

State Street Global Advisors 7 The Role of Gold in Today’s Global Multi-Asset Portfolio 1 SPDR Gold Shares was listed on the New York Stock Exchange on November 18, 2004, so returns of our hypothetical blended portfolio began with the first full year of GLD’s existence. 2 Bloomberg Finance L.P., State Street Global Advisors, August 13, 1971–June 30, 2019.3 Frederic Dodard and Abigail Greenway, A Case For Global Diversification: Harnessing the Global Multi-Asset Market Portfolio, IQ Insights, State Street Global Advisors, ISG EMEA, 2015.4 Ibid. 5 Maximum portfolio loss for Portfolio A, B, C and D occurred during 2007–2009, at the height of the global financial crisis. 6 Source: Bloomberg Finance L.P. and State Street Global Advisors. Based on expenseratios of the 22 currently-listed gold mutual funds and the four currently-listed USgold bullion ETFs, per Bloomberg. (Comparison excludes US leveraged and inversegold bullion ETFs). Asset-weighting more accurately reflects what investors in general are currently paying for their exposure. Glossary10-Year U.S. Treasury Note A debt obligation issued by the US government that matures in 10 years. The debt pays interest at a fixed rate once every six months and pays the face value to the holder at maturity. Black Swan An event that is beyond what is normally in the realm of what is expected and is thus very difficult to foresee. The term was made popular by Nassim Nicholas Taleb, a finance professor and trader who has authored a number of books on uncertainty, including “The Black Swan,” a discussion on the impact of random events. Bloomberg Barclays Emerging Markets USD Aggregate Index A hard currency emerging markets debt benchmark that includes US dollar-denominated debt from sovereign, quasi-sovereign, and corporate issuers in the developing markets. Bloomberg Barclays Euro-Aggregate Corporate Bond Index A rules-based benchmark measuring investment grade, euro-denominated, fixed rate issued by corporations. Only bonds with a maturity of 1 year and above are eligible. Bloomberg Barclays Global Aggregate Corporate Bond Index A benchmark of global investment-grade, fixed-rate corporate debt. This multi-currency benchmark includes bonds from developed and emerging markets issuers within the industrial, utility and financial sectors. Bloomberg Barclays Global Aggregate Government Bond Index A benchmark that provides a broad-based measure of the global investment-grade fixed income markets, with a focus on Treasuries and government-related debt from both developed- and emerging-market issuers. Bloomberg Barclays Global Corporate High Yield Bond Index A multi-currencyfixed-income benchmark of the global high yield debt market. The index represents the union of the US High Yield, thePan-European High Yield, and Emerging Markets (EM) Hard Currency High Yield Indices. The high yield and emerging markets subcomponentsare mutually exclusive. Bloomberg Barclays World Inflation Linked Bond Index A fixed-income benchmark that measures the performance of investment grade, government inflation-linked debt from 12 different developed-market countries. Bloomberg Barclays U.S. Aggregate Bond Index A benchmark that provides ameasure of the performance of the U.S. dollar denominated investment grade bond market. The “Agg” includes investment-grade government bonds, investment-grade corporate bonds, mortgage pass through securities, commercial mortgage backed securities and asset backed securities that are publicly for sale in the US.Bloomberg Barclays U.S. Corporate Bond Index A fixed-income benchmark that measures the investment-grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US andnon-US industrial, utility and financial issuers. Bloomberg Barclays Emerging Markets USD Aggregate Index A hard currency emerging markets debt benchmark that includes US dollar-denominated debtfrom sovereign, quasi-sovereign, and corporate issuers in the developing markets. Bloomberg Barclays U.S. High Yield Corporate Bond Index The BarclaysU.S. High Yield Index covers the universe of fixed rate,non-investment grade debt.Eurobonds and debt issues from countries designated as emerging markets (sovereignrating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch)are excluded, but Canadian and global bonds (SEC registered) of issuers innon-EMGcountries are included. The index includes both corporate andnon-corporate sectors. Bloomberg Barclays U.S. Treasury Bond Index A benchmark of US dollardenominated,fixed-rate, nominal debt issued by the US Treasury. Treasury bills areexcluded by the maturity constraint, but are part of a separate Short Treasury Index. Bloomberg Commodity Index A broadly diversified commodity price indexdistributed by Bloomberg Indexes that tracks 22 commodity futures and sevensectors. No one commodity can compose less than 2 percent or more than 15percent of the index, and no sector can represent more than 33 percent of the index.Brexit An abbreviation of the term “British Exit” referring to the UK referendumon June 23, 2016 that resulted in the country’s decision to withdraw from theEuropean Union. CPI, or Consumer Price Index A widely used measure of inflation at the consumerlevel that helps to evaluate changes in cost of living. Debt Ceiling Crisis A contentious debate in July 2011 regarding the maximumamount of money that the US government should be allowed to borrow. Congressdid end up immediately raising the “debt ceiling” by $400 billion, from $14.3 trillionto $14.7 trillion, with the possibility of future increases included in the agreement aswell, but the contentious nature of the debate led Standard and Poor’s to downgradethe US’credit rating from AAA to AA+, even though the U.S. did not default. Fiat Currency Currency that a government declares to be legal tender, but that it isnot backed by a physical commodity. The value of fiat money is linked to supply anddemand rather than the value of the material that the money is made of, such as goldor silver historically. Fiat money’s value is instead based solely on the faith and creditof the economy. Global Financial Crisis The economic crisis that occurred from 2007-2009 that isgenerally considered biggest economic challenge since the Great Depression of the1930s. The GFC was triggered largely by thesub-prime mortgage crisis, which ledto the collapse of systemically vital US investment banks such as Lehman Brothers.The crisis began with the collapse of two Bear Stearns hedge funds in June 2007,and the stabilization period began in late 2008 and continued until the end of 2009. Global Property Research General Index A broad-based global real estatebenchmark that contains all listed real estate companies that conform to GeneralProperty Research’s index-qualification rules, bringing the number of indexconstituents to more than 650. The index’s inception date was Dec. 31 1983.Gold Standard A monetary standard under which the basic unit of currency isdefined by a stated quantity of gold. In 1971 US President Richard Nixon endedthe ability to convert US dollars into gold at the fixed price of $35 per ounce. LBMA Gold Price The LBMA Gold Price is determined twice each business day —10:30 a.m. London time (i.e., the LBMA Gold Price AM) and 3:00 p.m. London time(i.e., the LBMA Gold Price PM) by the participants in a physically settled, electronicand tradable auction. LPX Composite Listed Private Equity Index A broad global listed private equityindex whose number of constituents is not limited. The LPX Composite includesall major private equity companies listed on global stock exchanges that fulfils theindex provider’s liquidity criteria. The index composition is well diversified acrosslisted private equity categories, styles, regions and vintage years. The index hastwo versions: a price index (PI) and a total return index (TR) that includes all payouts. MSCI ACWI Index, or MSCI All Country World Index A free-float weightedglobal equity index that includes companies in 23 emerging market countries and 23developed market countries and is designed to be a proxy for most of the investableequities universe around the world.