UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-Q

T QUARTERLY REPORT PURSUANT TO SECTION 13 or 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2007

- OR -

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Commission File No. 333-103749

MAINE & MARITIMES CORPORATION

A Maine Corporation

I.R.S. Employer Identification No. 30-0155348

209 STATE STREET, PRESQUE ISLE, MAINE 04769

(207) 760-2499

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes T. No o.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o. Accelerated filer o. Non-accelerated filer T.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o. No T.

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of November 9, 2007

Common Stock, $7.00 par value – 1,677,664 shares

1

Glossary of Terms | |

| AMEX | American Stock Exchange |

| Ashford | Ashford Investments Inc. |

| CES | Competitive Energy Supplier |

| Cornwallis | Cornwallis Court Developments Ltd |

| EA | Energy Atlantic, LLC |

| EBIT | Earnings Before Interest and Taxes |

| FAME | Finance Authority of Maine |

| FERC | Federal Energy Regulatory Commission |

| FIN | FASB Interpretation Number |

| HCI | HCI Systems Asset Management, LLC |

| Maine Yankee | Maine Yankee Atomic Power Company |

| MAM | Maine & Maritimes Corporation |

| MAM USG | MAM Utility Services Group |

| Me&NB | Maine & New Brunswick Electrical Power Company, Ltd |

| Mecel | Mecel Properties Ltd |

| MEPCO | Maine Electric Power Company, Inc. |

| MPS | Maine Public Service Company |

| MPUC | Maine Public Utilities Commission |

| MTI | Maricor Technologies, Inc. |

| MW | Megawatt |

| MWH | Megawatt hour |

| NOI | Notice of Inquiry |

| OATT | Open Access Transmission Tariff |

| OCI | Other Comprehensive Income |

| PCB | Poly Chlorinated Bi-phenol |

| PPA | Power Purchase Agreement |

| SFAS | Statement of Financial Accounting Standards |

| SOS | Standard Offer Service |

| T&D | Transmission and distribution |

| TMG | The Maricor Group |

| TMGC | The Maricor Group, Canada Ltd |

| TMGNE | The Maricor Group New England |

| WS | Wheelabrator-Sherman |

2

PART 1. FINANCIAL INFORMATION

Item 1. Financial Statements

See the following exhibits: Maine & Maritimes Corporation ("MAM" or the "Company") and subsidiaries Consolidated Financial Statements, including

(1) an unaudited statement of consolidated operations for the quarter and nine months ended September 30, 2007, and for the corresponding period of the preceding year;

(2) an unaudited statement of consolidated cash flows for the period January 1 (beginning of the fiscal year) through September 30, 2007, and for the corresponding period of the preceding year;

(3) an unaudited consolidated balance sheet as of September 30, 2007;

(4) an audited consolidated balance sheet as of December 31, 2006, the end of Maine & Maritimes Corporation's preceding fiscal year; and

(5) an unaudited statement of consolidated common shareholders’ equity for the period January 1 (beginning of the fiscal year) through September 30, 2007.

In the opinion of Management, the accompanying consolidated financial statements present fairly the financial position of the Company and its Subsidiaries at September 30, 2007 (unaudited), and December 31, 2006 (audited); the unaudited results of their operations for the three and nine months ended September 30, 2007 and 2006; and their unaudited cash flows for the nine months ended September 30, 2007, and 2006.

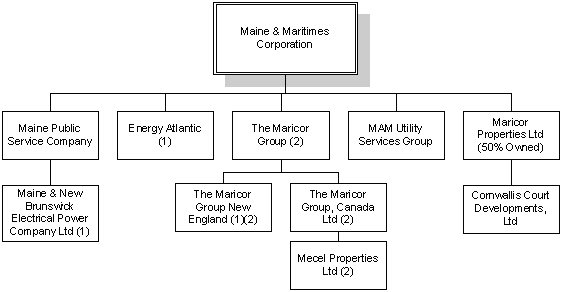

MAM is the parent holding company for the following wholly-owned subsidiaries:

| 1. | Maine Public Service Company (“MPS”) and its wholly-owned inactive Canadian subsidiary Maine & New Brunswick Electrical Power Company, Ltd (“Me&NB”); |

| 2. | Energy Atlantic, LLC (“EA”), an inactive subsidiary; |

| 3. | The Maricor Group (“TMG”) and its wholly-owned United States subsidiary The Maricor Group New England (“TMGNE”) and TMG’s wholly-owned Canadian subsidiary The Maricor Group, Canada Ltd (“TMGC”), all of which are classified as discontinued operations. As described later in this document, the operations of TMGNE ceased August 31, 2007. Substantially all of the assets of TMGC were sold in June 2007. In September 2007, TMGC purchased the shares of Mecel Properties Ltd from Maricor Properties Ltd. |

| 4. | MAM Utility Services Group (“MAM USG”), a wholly-owned United States subsidiary, incorporated on September 27, 2007. MAM USG will provide utility-related services to external customers under the strategy announced in the 2006 Form 10-K. |

Maricor Technologies, Inc. (“MTI”) was a former wholly-owned subsidiary of MAM. Substantially all of the assets of MTI were sold on April 13, 2007, and the legal entity of MTI was dissolved on June 28, 2007. The activity of MTI through dissolution of the company is reported in discontinued operations.

In addition to these wholly-owned subsidiaries, MAM is a 50% owner of Maricor Properties Ltd, (“Maricor Properties”), a Canadian company formerly wholly-owned by MAM, and its wholly-owned Canadian subsidiary Cornwallis Court Developments, Ltd (“Cornwallis”). MAM was also a 50% owner of Maricor Ashford, an inactive joint venture with Ashford Investments Inc. (“Ashford”). As of September 12, 2007, MAM sold its 50% ownership of Maricor Ashford to Ashford.

3

Maine & Maritimes Corporation and Subsidiaries as of September 30, 2007

(1) Indicates inactive companies

(2) Companies classified as Discontinued Operations in these financial statements.

General Descriptions of the Parent Company and its Subsidiaries:

| · | Maine & Maritimes Corporation is a holding company incorporated in the State of Maine, and is the ultimate parent company for all business segments. MAM maintains investments in a regulated electric transmission and distribution utility operating within the State of Maine, United States of America, classified for financial reporting purposes as continuing operations. MAM is headquartered in Presque Isle, Maine. |

| · | Maine Public Service Company is a regulated electric transmission and distribution utility serving all of Aroostook County and a portion of Penobscot County in northern Maine. Since March 1, 2000, the date retail electric competition in Maine commenced, customers in MPS’s service territory have been purchasing energy from suppliers other than MPS. This energy comes from Competitive Electricity Suppliers (“CES”) or, if customers are unable or do not wish to choose a competitive supplier, the Standard Offer Service (“SOS”) provider. SOS providers are determined through a bid process conducted by the Maine Public Utilities Commission (“MPUC”). MPS provides the transportation through its transmission and distribution wires infrastructure. Its service area covers approximately 3,600 square miles, with a population of 72,000. The utility is regulated by the Federal Energy Regulatory Commission (“FERC”) and the MPUC. MPS is headquartered in Presque Isle, Maine. |

Electric sales in the Company’s territory are seasonal, and the Company’s results of operations reflect this seasonal nature. The highest usage occurs during the five heating season months, from November through March, due to heating-related requirements and shorter daylight hours. The rate year is divided into two periods, with higher rates in place in the winter months to encourage conservation. Also, due to the climate in the northern Maine area, the majority of MPS’s construction program is completed during the spring, summer, and fall months.

| · | Maine & New Brunswick Electrical Power Company, Ltd., is an inactive Canadian subsidiary of MPS, which, prior to deregulation and generation divestiture, owned MPS’s Canadian electric generation assets. Me&NB was incorporated in 1903 under the laws of the Province of New Brunswick, Canada. |

| · | The Maricor Group was a facilities engineering and solutions company providing mechanical, electrical and plumbing/fire protection engineering consulting design services. TMG operated primarily within the New England region of the United States through its subsidiary The Maricor Group New England, and in Canada through The Maricor Group, Canada Ltd. TMG was formed in November 2003, and was headquartered in Presque Isle, Maine. MAM has divested its TMG operations through sales of substantially all operating assets owned in Canada and closure of the New England operations as part of an overall shift in strategy described more fully in Item 7, “Management’s Discussion and Analysis” of MAM’s 2006 Form 10-K and updated in each of the 2007 10-Q filings. |

On September 12, 2007, in order to fulfill the requirements of the June 2006 sale of 50% of Maricor Properties to Ashford, TMGC purchased MAM’s shares of Mecel. TMGC is seeking to divest its ownership of Mecel by the end of 2007.

4

| · | MAM Utility Services Group is a newly-formed wholly-owned subsidiary of MAM. MAM USG was incorporated in the State of Maine on September 27, 2007. The purpose of MAM USG is to provide utility-related services to clients on projects that MPS would not seek or would not be required to provide under a separate subsidiary in accordance with MPUC Rules. This includes transmission line and substation design and build service for generator projects outside the MPS service territory and contract work within MPS’s territory that MPS is not required to provide. MAM USG will focus on such areas as transmission infrastructure to support wind generation, utility asset maintenance contracts and other utility-related services. In compliance with the MPUC’s Rules and its Reorganization Order in Docket 2002-676, these services must be provided under a separate subsidiary. MAM USG is in the business development stage and currently has no employees. |

| · | Maricor Properties Ltd, 50% owned by MAM, is a Canadian real estate development, redevelopment, and investment company. Maricor Properties Ltd was organized by MAM on May 28, 2004, in Nova Scotia, Canada, and acquired Mecel on June 1, 2004. Maricor Properties purchased a building in Moncton, New Brunswick, Canada, in August 2004, and Cornwallis Court Developments Ltd, a wholly-owned Canadian subsidiary, on October 7, 2005. On June 30, 2006, Maricor Properties issued stock to Ashford, resulting in 50% ownership for both MAM and Ashford. Ashford is an Atlantic Canadian real estate development, investment and management firm, which provides management services to Maricor Properties and its subsidiaries. |

| · | MAM retained 100% “economic ownership” of Mecel as part of the sale of the share to Ashford. The sale agreement allowed for MAM to transfer Mecel to another of MAM’s subsidiaries or for Ashford to purchase 50% of Mecel. In order to satisfy this requirement of the sale, MAM sold its shares of Mecel to TMGC on September 12, 2007. |

MAM is currently seeking to divest its ownership of Maricor Properties.

| · | Energy Atlantic, LLC is a licensed, but currently inactive, CES of retail electricity, classified as discontinued operations. |

5

MAINE & MARITIMES CORPORATION AND SUBSIDIARIES

Statements of Consolidated Operations (Unaudited)

(In thousands of dollars except shares and per share amounts) | Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2007 | 2006 | 2007 | 2006 | |||||||||||||

Operating Revenues | ||||||||||||||||

| Regulated Revenues | $ | 8,016 | $ | 8,033 | $ | 26,882 | $ | 25,499 | ||||||||

Operating Expenses | ||||||||||||||||

| Regulated Operation & Maintenance | 4,392 | 4,056 | 10,936 | 11,297 | ||||||||||||

| Unregulated Operation & Maintenance (1) | 185 | 1,032 | 1,032 | 1,649 | ||||||||||||

| Depreciation | 697 | 719 | 2,104 | 2,164 | ||||||||||||

| Amortization of Stranded Costs | 2,648 | 2,991 | 8,099 | 8,369 | ||||||||||||

| Amortization | 57 | 63 | 173 | 92 | ||||||||||||

| Taxes Other Than Income | 440 | 446 | 1,325 | 1,383 | ||||||||||||

| (Benefit of) Provision for Income Taxes—Regulated | (218 | ) | (148 | ) | 1,419 | 645 | ||||||||||

| Benefit of Income Taxes—Unregulated (1) | (111 | ) | (452 | ) | (533 | ) | (769 | ) | ||||||||

Total Operating Expenses | 8,090 | 8,707 | 24,555 | 24,830 | ||||||||||||

Operating (Loss) Income | (74 | ) | (674 | ) | 2,327 | 669 | ||||||||||

Other Income (Deductions) | ||||||||||||||||

| Equity in Income of Associated Companies | 28 | 16 | (6 | ) | 143 | |||||||||||

| Interest and Dividend Income | 3 | 2 | 16 | 14 | ||||||||||||

| Benefit of (Provision for) Income Taxes | - | 32 | (5 | ) | 10 | |||||||||||

| Other—Net | (13 | ) | (86 | ) | (57 | ) | (137 | ) | ||||||||

Total Other Income (Deductions) | 18 | (36 | ) | (52 | ) | 30 | ||||||||||

(Loss) Income Before Interest Charges | (56 | ) | (710 | ) | 2,275 | 699 | ||||||||||

Interest Charges | ||||||||||||||||

| Long-Term Debt and Notes Payable | 735 | 749 | 2,218 | 2,184 | ||||||||||||

| Less Stranded Costs Carrying Charge | (429 | ) | (386 | ) | (1,327 | ) | (1,201 | ) | ||||||||

Total Interest Charges | 306 | 363 | 891 | 983 | ||||||||||||

(Loss) Income from Continuing Operations | (362 | ) | (1,073 | ) | 1,384 | (284 | ) | |||||||||

Discontinued Operations | ||||||||||||||||

| Gain (Loss) on Sales of Discontinued Operations | 208 | - | (154 | ) | - | |||||||||||

| Goodwill Impairment Loss | - | (2,546 | ) | - | (2,546 | ) | ||||||||||

| Loss from Operations | (369 | ) | (865 | ) | (1,292 | ) | (1,837 | ) | ||||||||

| Income Tax Benefit | 53 | 1,374 | 565 | 1,780 | ||||||||||||

Loss from Discontinued Operations | (108 | ) | (2,037 | ) | (881 | ) | (2,603 | ) | ||||||||

Net (Loss) Income Available for Common Stockholders | $ | (470 | ) | $ | (3,110 | ) | $ | 503 | $ | (2,887 | ) | |||||

Average Shares of Common Stock Outstanding | 1,677,430 | 1,638,027 | 1,667,147 | 1,637,627 | ||||||||||||

Basic (Loss) Earnings Per Share of Common Stock From Continuing Operations | $ | (0.22 | ) | $ | (0.66 | ) | $ | 0.83 | $ | (0.17 | ) | |||||

Basic Loss Per Share of Common Stock From Discontinued Operations | (0.06 | ) | (1.24 | ) | (0.53 | ) | (1.59 | ) | ||||||||

Basic (Loss) Earnings Per Share of Common Stock From Net (Loss) Income | $ | (0.28 | ) | $ | (1.90 | ) | $ | 0.30 | $ | (1.76 | ) | |||||

Diluted (Loss) Earnings Per Share of Common Stock From Continuing Operations | $ | (0.22 | ) | $ | (0.66 | ) | $ | 0.83 | $ | (0.17 | ) | |||||

Diluted Loss Per Share of Common Stock From Discontinued Operations | (0.06 | ) | (1.24 | ) | (0.53 | ) | (1.59 | ) | ||||||||

Diluted (Loss) Earnings Per Share of Common Stock From Net (Loss) Income | $ | (0.28 | ) | $ | (1.90 | ) | $ | 0.30 | �� | $ | (1.76 | ) | ||||

| (1) Unregulated operation and maintenance expense and income tax benefit included in continuing operations is the activity of the holding company, including corporate costs directly associated with unregulated operations and common costs not allocated to the regulated utility. | ||||||||||||||||

See Notes to Consolidated Financial Statements

6

MAINE & MARITIMES CORPORATION AND SUBSIDIARIES

Statements of Consolidated Cash Flows (Unaudited)

(In thousands of dollars) | Nine Months Ended September 30, | |||||||

2007 | 2006 | |||||||

Cash Flow From Operating Activities | ||||||||

| Net Income (Loss) | $ | 503 | $ | (2,887 | ) | |||

| Adjustments to Reconcile Net Income (Loss) to Net Cash Provided by Operations: | ||||||||

| Depreciation | 2,104 | 2,164 | ||||||

| Amortization of Intangibles | 173 | 92 | ||||||

| Amortization of Seabrook | 833 | 833 | ||||||

| Amortization of Cancelled Transmission Plant | 191 | 271 | ||||||

| Deferred Income Taxes—Net | (502 | ) | 2,387 | |||||

| Deferred Investment Tax Credits | (15 | ) | (19 | ) | ||||

| Change in Deferred Regulatory and Debt Issuance Costs | 3,781 | (3,621 | ) | |||||

| Amortization of W/S Upfront Payment | - | 1,088 | ||||||

| Change in Benefit Obligations | (1,115 | ) | 261 | |||||

| Gain from Sale of Stock in Subsidiary | - | (429 | ) | |||||

| Change in Current Assets and Liabilities: | ||||||||

| Accounts Receivable and Unbilled Revenue | 586 | 1,310 | ||||||

| Other Current Assets | (255 | ) | (120 | ) | ||||

| Accounts Payable | (985 | ) | 581 | |||||

| Other Current Liabilities | 296 | (162 | ) | |||||

| Other—Net | 1,020 | (371 | ) | |||||

| Adjustments to Operating Cash Flows from Continuing Operations | 6,615 | 1,378 | ||||||

| Operating Cash Flows from Discontinued Operations | 42 | 383 | ||||||

Net Cash Flow Provided By Operating Activities | 6,657 | 1,761 | ||||||

Cash Flow From Financing Activities | ||||||||

| Retirements of Long-Term Debt | (1,154 | ) | (1,340 | ) | ||||

| Retirements of Long-Term Debt of Discontinued Operations | (1,750 | ) | - | |||||

| Additions of Long-Term Debt | 3,499 | - | ||||||

| Payments of Capital Lease Obligations | (62 | ) | - | |||||

| Short-Term Debt (Repayments) Borrowings, Net | (3,970 | ) | 1,640 | |||||

| Short-Term Debt Repayments of Discontinued Operations | (1,000 | ) | - | |||||

Net Cash Flow (Used For) Provided by Financing Activities | (4,437 | ) | 300 | |||||

Cash Flow From Investing Activities | ||||||||

| Cash Paid for Stock Contingencies from Acquisition Agreements | (413 | ) | (244 | ) | ||||

| Gain from Sale of Stock of Subsidiary | - | 429 | ||||||

| Cash Received from Sale of Discontinued Operations | 1,821 | - | ||||||

| Change in Restricted Investments | (6 | ) | (5 | ) | ||||

| Investment in Fixed Assets | (4,621 | ) | (2,483 | ) | ||||

| Stock Redemption from Associated Company | 500 | 600 | ||||||

| Investing Activities of Discontinued Operations | - | (254 | ) | |||||

Net Cash Flow Used For Investing Activities | (2,719 | ) | (1,957 | ) | ||||

(Decrease) Increase in Cash and Cash Equivalents | (499 | ) | 104 | |||||

Cash and Cash Equivalents at Beginning of Period | 898 | 273 | ||||||

Cash and Cash Equivalents at End of Period | $ | 399 | $ | 377 | ||||

Supplemental Disclosure of Cash Flow Information: | ||||||||

Cash Paid During the Period for: | ||||||||

| Interest | $ | 2,459 | $ | 2,294 | ||||

| Income Taxes | $ | 153 | $ | 53 | ||||

Non-Cash Activities: | ||||||||

| Fair Market Value of Stock Issued to Directors | $ | 19 | $ | 19 | ||||

| Fixed Assets Acquired by Capital Lease | $ | 500 | $ | 57 | ||||

See Notes to Consolidated Financial Statements

7

MAINE & MARITIMES CORPORATION AND SUBSIDIARIES

Consolidated Balance Sheets

(In thousands of dollars) | September 30, | December 31, | ||||||

2007 | 2006 | |||||||

ASSETS | (Unaudited) | (Audited) | ||||||

Plant | ||||||||

| Electric Plant in Service | $ | 102,531 | $ | 101,085 | ||||

| Non-Utility Plant | 3 | 3 | ||||||

| Less Accumulated Depreciation | (43,826 | ) | (41,948 | ) | ||||

| Net Plant in Service | 58,708 | 59,140 | ||||||

| Construction Work-in-Progress | 3,491 | 499 | ||||||

Total Plant Assets | 62,199 | 59,639 | ||||||

Investments in Associated Companies | 1,155 | 1,500 | ||||||

Net Plant and Investments in Associated Companies | 63,354 | 61,139 | ||||||

Current Assets: | ||||||||

| Cash and Cash Equivalents | 399 | 898 | ||||||

| Accounts Receivable (less allowance for uncollectible accounts of $127 in 2007 and $114 in 2006) | 6,482 | 6,709 | ||||||

| Accounts Receivable from Associated Companies | 377 | 281 | ||||||

| Unbilled Revenue - Utility | 695 | 1,150 | ||||||

| Inventory | 745 | 646 | ||||||

| Prepayments | 429 | 273 | ||||||

| Current Assets of Discontinued Operations | 3,709 | 8,658 | ||||||

Total Current Assets | 12,836 | 18,615 | ||||||

Regulatory Assets: | ||||||||

| Uncollected Maine Yankee Decommissioning Costs | 5,503 | 7,743 | ||||||

| Recoverable Seabrook Costs | 9,726 | 10,559 | ||||||

| Regulatory Assets—Deferred Income Taxes | 5,603 | 5,923 | ||||||

| Regulatory Assets—Post-Retirement Medical Benefits | 2,187 | 2,205 | ||||||

| Deferred Fuel and Purchased Energy Costs | 31,796 | 34,689 | ||||||

| Cancelled Transmission Plant | 318 | 508 | ||||||

| Unamortized Premium on Early Retirement of Debt | 945 | 1,100 | ||||||

| Deferred Regulatory Costs | 1,039 | 1,677 | ||||||

Total Regulatory Assets | 57,117 | 64,404 | ||||||

Other Assets | ||||||||

| Unamortized Debt Issuance Costs | 342 | 502 | ||||||

| Restricted Investments (at cost, which approximates market) | 2,463 | 2,458 | ||||||

| Other Assets | 1,413 | 1,049 | ||||||

Total Other Assets | 4,218 | 4,009 | ||||||

Total Assets | $ | 137,525 | $ | 148,167 | ||||

See Notes to Consolidated Financial Statements

8

MAINE & MARITIMES CORPORATION AND SUBSIDIARIES

Capitalization and Liabilities

(In thousands of dollars) | September 30, | December 31, | ||||||

2007 | 2006 | |||||||

Capitalization (see accompanying statement): | (Unaudited) | (Audited) | ||||||

| Shareholders’ Equity | $ | 42,029 | $ | 41,527 | ||||

| Long-Term Debt | 27,067 | 27,840 | ||||||

| Long-Term Debt of Discontinued Operations | 1,164 | 2,182 | ||||||

Total Capitalization | 70,260 | 71,549 | ||||||

Current Liabilities: | ||||||||

| Long-Term Debt Due Within One Year | 4,785 | 2,685 | ||||||

| Notes Payable to Banks | 7,000 | 11,970 | ||||||

| Accounts Payable | 4,231 | 5,018 | ||||||

| Accounts Payable—Associated Companies | 248 | 247 | ||||||

| Accrued Employee Benefits | 1,224 | 1,424 | ||||||

| Customer Deposits | 97 | 149 | ||||||

| Taxes Accrued | 404 | 7 | ||||||

| Interest Accrued | 228 | 246 | ||||||

| Other Current Liabilities | - | 30 | ||||||

| Current Liabilities of Discontinued Operations | 821 | 3,195 | ||||||

Total Current Liabilities | 19,038 | 24,971 | ||||||

Deferred Credits and Other Liabilities: | ||||||||

| Accrued Removal Obligations | 5,508 | 5,572 | ||||||

| Carrying Value of Interest Rate Hedge | 1,533 | 1,636 | ||||||

| Uncollected Maine Yankee Decommissioning Costs | 5,503 | 7,743 | ||||||

| Other Regulatory Liabilities | 316 | 382 | ||||||

| Deferred Income Taxes | 24,804 | 26,360 | ||||||

| Accrued Postretirement Benefits and Pension Costs | 7,497 | 8,631 | ||||||

| Investment Tax Credits | 67 | 81 | ||||||

| Miscellaneous | 2,999 | 1,242 | ||||||

Total Deferred Credits and Other Liabilities | 48,227 | 51,647 | ||||||

Commitments, Contingencies, and Regulatory Matters (Note 8) | ||||||||

Total Capitalization and Liabilities | $ | 137,525 | $ | 148,167 | ||||

See Notes to Consolidated Financial Statements

9

MAINE & MARITIMES CORPORATION AND SUBSIDIARIES

Statement of Consolidated Shareholders’ Equity (Unaudited)

(In thousands of dollars, except share information) | ||||||||||||||||||||||||||||||||||||

Shares Issued and Outstanding | Common | Preferred | ||||||||||||||||||||||||||||||||||

Common | Preferred | Par Value Issued ($7/Share) | Paid-In Capital | Par Value Issued ($0.01/ Share) | Paid-In Capital | Retained Earnings | Accumulated Other Compre-hensive Income (Loss) | Total | ||||||||||||||||||||||||||||

Balance, December 31, 2006 | 1,638,379 | 9,500 | $ | 11,469 | $ | 1,254 | $ | — | $ | 950 | $ | 28,266 | $ | (412 | ) | $ | 41,527 | |||||||||||||||||||

| Common Stock Issued | 973 | 7 | 12 | 19 | ||||||||||||||||||||||||||||||||

| Conversion of Preferred Shares | 38,078 | (9,500 | ) | 267 | 683 | - | (950 | ) | - | |||||||||||||||||||||||||||

| Stock Contingency from Acquisitions | (413 | ) | (413 | ) | ||||||||||||||||||||||||||||||||

| Net Income | 503 | 503 | ||||||||||||||||||||||||||||||||||

| Other Comprehensive Income (Loss): | ||||||||||||||||||||||||||||||||||||

| Changes in Value of Foreign Exchange Translation Loss, Net of Tax Provision of $197 | 296 | 296 | ||||||||||||||||||||||||||||||||||

| Unrealized Loss on Investments Available for Sale, Net of Tax Benefit of $4 | (6 | ) | (6 | ) | ||||||||||||||||||||||||||||||||

| Change in Fair Value of Interest Rate Hedge, Net of Tax Provision of $69 | 103 | 103 | ||||||||||||||||||||||||||||||||||

| Total Other Comprehensive Income | 393 | |||||||||||||||||||||||||||||||||||

| Total Comprehensive Income | 896 | |||||||||||||||||||||||||||||||||||

Balance, September 30, 2007 | 1,677,430 | - | $ | 11,743 | $ | 1,536 | $ | - | $ | - | $ | 28,769 | $ | (19 | ) | $ | 42,029 | |||||||||||||||||||

MAM had five million shares of $7 per share par value common stock authorized, with 1,677,430 and 1,638,379 shares issued and outstanding as of September 30, 2007, and December 31, 2006, respectively. At December 31, 2006, MAM had 500,000 shares of $0.01 per share par value preferred stock authorized, with 9,500 shares issued and outstanding. There were no preferred shares issued or outstanding at September 30, 2007, as these shares were converted to common shares on April 13, 2007.

See Notes to Consolidated Financial Statements.

10

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

1. ACCOUNTING POLICIES

Consolidation and Basis of Presentation

The accompanying consolidated financial statements include the accounts of Maine & Maritimes Corporation (“MAM” or the “Company”) and the following wholly-owned subsidiaries and affiliates:

| 1. | Maine Public Service Company (“MPS”) and its wholly-owned inactive Canadian subsidiary Maine & New Brunswick Electrical Power Company, Ltd (“Me&NB”); |

| 2. | Energy Atlantic, LLC (“EA”), an inactive subsidiary; |

| 3. | The Maricor Group (“TMG”) and its wholly-owned United States subsidiary The Maricor Group New England (“TMGNE”) and TMG’s wholly-owned Canadian subsidiary The Maricor Group, Canada Ltd (“TMGC”), all of which are classified as discontinued operations. As described later in this document, the operations of TMGNE ceased August 31, 2007. Substantially all of the assets of TMGC were sold in June 2007. In September 2007, TMGC purchased the shares of Mecel Properties from Maricor Properties. |

| 4. | MAM Utility Services Group (“MAM USG”), a wholly-owned United States subsidiary, incorporated on September 27, 2007. MAM USG will provide utility-related services to external clients under the strategy announced in the 2006 Form 10-K. |

Maricor Technologies, Inc. (“MTI”) was a former wholly-owned subsidiary of MAM. Substantially all of the assets of MTI were sold on April 13, 2007, and the legal entity of MTI was dissolved on June 28, 2007. The activity of MTI through dissolution of the company is reported in discontinued operations.

In addition to these wholly-owned subsidiaries, MAM is a 50% owner of Maricor Properties Ltd, (“Maricor Properties”), a Canadian company formerly wholly-owned by MAM, and its wholly-owned Canadian subsidiary Cornwallis Court Developments, Ltd (“Cornwallis”). MAM was also a 50% owner of Maricor Ashford, an inactive joint venture with Ashford Investments Inc. (“Ashford”). As of September 12, 2007, MAM sold its 50% ownership of Maricor Ashford to Ashford.

MAM, a utility holding company organized effective June 30, 2003, owns all of the common stock of the above primary subsidiaries. Primary subsidiaries, including MPS, TMG, and Maricor Properties Ltd, own all the common stock of their secondary subsidiaries. MAM is listed on the American Stock Exchange (“AMEX”) under the symbol “MAM.”

All inter-company transactions between MAM and its subsidiaries have been eliminated in consolidation.

Accounting Policies

The Company’s accounting policies are those disclosed in its 2006 Annual Report on Form 10-K and its March 31, 2007, and June 30, 2007, Forms 10-Q, which are hereby incorporated by this reference.

Reclassifications

Following the sale of Mecel to TMGC on September 12, 2007, Mecel has been reclassified to the unregulated engineering services segment for the current period and all prior periods. The unregulated engineering services segment and the operations of Mecel from continuing operations were reclassified to discontinued operations in the 2006 financial statement amounts in order to conform to the 2007 presentation. Further, the unregulated real estate segment reported in the 2006 financial statements, excluding Mecel, has been reclassified to the equity method, instead of consolidated, also to conform to the 2007 presentation.

11

2. INCOME TAXES

A summary of Federal, Canadian and State income taxes charged (credited) to income is presented below. For accounting and ratemaking purposes, income tax provisions (benefits) included in “Operating Expenses” reflect taxes applicable to revenues and expenses allowable for ratemaking purposes on MPS regulated activities and unregulated activities for MAM, TMG, Mecel, and MTI. The tax effect of items not included in rate base or normal operating activities is allocated as “Other Income (Deductions).” The foreign income taxes include only the Canadian income taxes for the Canadian operations of TMG and Maine & New Brunswick.

(In thousands of dollars) | For the Quarter Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||

2007 | 2006 | 2007 | 2006 | |||||||||||||

| Current income taxes | ||||||||||||||||

| Federal | $ | - | $ | (896 | ) | $ | - | $ | (941 | ) | ||||||

| State | - | (248 | ) | - | (292 | ) | ||||||||||

| Foreign | 5 | 29 | 13 | 71 | ||||||||||||

| Total current income taxes provision (benefit) | 5 | (1,115 | ) | 13 | (1,162 | ) | ||||||||||

| Deferred income taxes | ||||||||||||||||

| Federal | (88 | ) | (744 | ) | 279 | (618 | ) | |||||||||

| State | (294 | ) | (141 | ) | 49 | (116 | ) | |||||||||

| Total deferred income taxes provision (benefit) | (382 | ) | (885 | ) | 328 | (734 | ) | |||||||||

| Investment credits, net | (5 | ) | (6 | ) | (15 | ) | (18 | ) | ||||||||

| Total income taxes provision (benefit) | $ | (382 | ) | $ | (2,006 | ) | $ | 326 | $ | (1,914 | ) | |||||

| Total income taxes allocated to: | ||||||||||||||||

| Operating income | ||||||||||||||||

| - Regulated | $ | (218 | ) | $ | (148 | ) | $ | 1,419 | $ | 645 | ||||||

| - Unregulated | (111 | ) | (452 | ) | (533 | ) | (769 | ) | ||||||||

| Subtotal | (329 | ) | (600 | ) | 886 | (124 | ) | |||||||||

| Discontinued operations | (53 | ) | (1,374 | ) | (565 | ) | (1,780 | ) | ||||||||

| Total operating income | (382 | ) | (1,974 | ) | 321 | (1,904 | ) | |||||||||

| Other income | - | (32 | ) | 5 | (10 | ) | ||||||||||

| Total income taxes provision (benefit) | $ | (382 | ) | $ | (2,006 | ) | $ | 326 | $ | (1,914 | ) | |||||

For the nine months ended September 30, 2007, and 2006, the effective income tax rates were 39.3% and 39.9%, respectively. The principal reasons for the effective tax rates differing from the US federal income tax rate are equity earnings in joint venture companies and investment tax credit amortization.

The Company has not accrued U.S. income taxes on the undistributed earnings of Me&NB, as the withholding taxes due on the distribution of any remaining amount would be principally offset by foreign tax credits. No dividends were received from Me&NB in the first nine months of 2007 or 2006.

In June 2006, the FASB issued FIN 48, “Accounting for Uncertainty in Income Taxes, an Interpretation of FASB Statement 109.” This statement clarifies the criteria that an individual tax position must satisfy for some or all of the benefits of that position to be recognized in a company’s financial statements. FIN 48 requires a tax position to be more likely than not in order for the position to be recognized in the financial statements.

Effective January 1, 2007, the Company adopted the provisions of FIN 48. There were no adjustments required to the reported tax benefits at January 1, or September 30, 2007, from the adoption of this standard. Further, the Company does not expect that the amounts of unrecognized tax benefits will change significantly in the next twelve months. As of January 1, and September 30, 2007, the Company has accrued no interest or penalties related to uncertain tax positions.

Currently, the Company is under audit by the State of Maine for its 2005 and 2006 state income tax returns. We anticipate this review will be completed within the next twelve months. There are no reserves associated with these returns. The statutes of limitations for audits by Federal, Maine, Massachusetts and Canadian tax authorities have expired for all tax years ending December 31, 2003, or earlier.

As required by SFAS No. 109 and FIN 48, Management of the Company has evaluated the positive and negative evidence bearing upon the likelihood of the Company realizing its deferred tax assets, which consist principally of the estimated losses on the divestiture of unregulated operations, pension and post-retirement benefits and accumulated Other Comprehensive Income (“OCI”) associated with the interest rate hedge. For the quarter ended September 30, 2007, and the year ended December 31, 2006, Management evaluated the deferred tax asset valuation allowance and determined no adjustment was needed.

12

The following summarizes accumulated deferred income tax (assets) and liabilities established on temporary differences under SFAS 109 as of September 30, 2007, and December 31, 2006:

(In thousands of dollars) | ||||||||

September 30, 2007 | December 31, 2006 | |||||||

| Seabrook | $ | 5,277 | $ | 5,737 | ||||

| Property | 9,653 | 9,526 | ||||||

| Flexible pricing revenue | 452 | 596 | ||||||

| Deferred fuel | 12,685 | 13,839 | ||||||

| Pension and post-retirement benefits | (1,882 | ) | (1,992 | ) | ||||

| Net Operating Loss Carryforwards of Continuing Operations | - | (1,055 | ) | |||||

| Other Comprehensive Income | (561 | ) | (602 | ) | ||||

| Other | (820 | ) | 311 | |||||

| Net Accumulated Deferred Income Tax Liability from Continuing Operations | $ | 24,804 | $ | 26,360 | ||||

| Goodwill Impairment Loss | (1,018 | ) | (1,018 | ) | ||||

| Estimated Loss on Sale of Discontinued Operations | (1,816 | ) | (2,485 | ) | ||||

| Net Operating Loss Carryforwards of Discontinued Operations | (722 | ) | (1,204 | ) | ||||

| Amortization of Goodwill | 375 | 375 | ||||||

| Other Comprehensive Income | 506 | 287 | ||||||

| Other | (68 | ) | (14 | ) | ||||

| Net Accumulated Deferred Income Tax Asset from Discontinued Operations | $ | (2,743 | ) | $ | (4,059 | ) | ||

| Net Accumulated Deferred Income Tax Liability | $ | 22,061 | $ | 22,301 | ||||

3. DISCONTINUED OPERATIONS

The Maricor Group

As described in the MAM 2006 Form 10-K, the Company has executed a strategy that resulted in the divestiture of substantially all of the assets reported as the Unregulated Engineering Services operating segment within 2007. As a result, the operations for this segment have been reflected as discontinued operations. During the second quarter of 2007, MAM divested substantially all of the assets and liabilities of The Maricor Group, Canada Ltd. The operations of TMGNE ceased in August 2007. Refer to Note 10 for more information regarding this sale.

The net loss for unregulated engineering services is composed of the following:

(In thousands of dollars) | Quarter Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2007 | 2006 | 2007 | 2006 | |||||||||||||

| Loss From Operations: | ||||||||||||||||

| Operating Revenue | $ | 82 | $ | 1,465 | $ | 2,374 | $ | 4,238 | ||||||||

| Third Party Expenses | (451 | ) | (1,970 | ) | (3,256 | ) | (5,306 | ) | ||||||||

| Loss from Operations | (369 | ) | (505 | ) | (882 | ) | (1,068 | ) | ||||||||

| Gain (Loss) from Sale of Assets | 208 | - | (154 | ) | - | |||||||||||

| Goodwill Impairment Loss | - | (2,546 | ) | - | (2,546 | ) | ||||||||||

| Benefit of Income Taxes | 53 | 1,234 | 402 | 1,477 | ||||||||||||

| Net Loss — Unregulated Engineering Services | $ | (108 | ) | $ | (1,817 | ) | $ | (634 | ) | $ | (2,137 | ) | ||||

13

The unregulated engineering services balance sheets as of September 30, 2007, and December 31, 2006, were as follows:

(In thousands of dollars) | ||||||||

September 30, | December 31, | |||||||

2007 | 2006 | |||||||

| Assets: | ||||||||

| Cash & Cash Equivalents | $ | 82 | $ | 210 | ||||

| Accounts Receivable, Net | 169 | 1,715 | ||||||

| Unbilled Contract Revenue | - | 1,155 | ||||||

| Other Assets | 144 | 108 | ||||||

| Fixed Assets, Net of Depreciation | 575 | 733 | ||||||

| Intangible Assets and Goodwill | - | 162 | ||||||

| Income Taxes Receivable | 722 | 875 | ||||||

| Deferred Tax Assets | 2,017 | 2,495 | ||||||

| Total Assets | $ | 3,709 | $ | 7,453 | ||||

| Shareholder's Deficit and Liabilities: | ||||||||

| Shareholder's Deficit | $ | (4,902 | ) | $ | (4,115 | ) | ||

| Notes Payable to Banks | - | 1,000 | ||||||

| Accounts Payable and Accrued Employee Benefits | 529 | 1,613 | ||||||

| Intercompany Accounts Payable | 2,844 | 1,676 | ||||||

| Unearned Revenue | - | 139 | ||||||

| Current Portion of Long-Term Debt | 286 | 18 | ||||||

| Other Liabilities | 6 | 50 | ||||||

| Intercompany Notes Payable | 3,782 | 4,890 | ||||||

| Long-Term Debt | 1,164 | 2,182 | ||||||

| Total Liabilities | 8,611 | 11,568 | ||||||

| Total Shareholder's Deficit and Liabilities | $ | 3,709 | $ | 7,453 | ||||

Assets and liabilities of discontinued operations at December 31, 2006, as presented on the Consolidated Balance Sheet, also included the assets and liabilities of MTI, EA and intercompany eliminations. These companies had no assets or liabilities at September 30, 2007.

On July 9, 2007, $750,000 was paid to Katahdin Trust Company on the $2.2 million TMG term note from the proceeds of the sale of the Moncton Division of The Maricor Group, Canada Ltd.

Maricor Technologies, Inc.

On April 13, 2007, MAM divested substantially all of the assets reported as Unregulated Software Technology. Consistent with the classification at December 31, 2006, the operations for this segment have been reclassified to discontinued operations.

The operating revenue and net loss for unregulated software technology for the third quarters and year-to-date 2007 and 2006 are as follows:

(In thousands of dollars) | Quarter Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2007 | 2006 | 2007 | 2006 | |||||||||||||

| Loss From Operations: | ||||||||||||||||

| Operating Revenue | $ | - | $ | 32 | $ | 135 | $ | 152 | ||||||||

| Expenses | - | (339 | ) | (546 | ) | (905 | ) | |||||||||

| Loss from Operations | - | (307 | ) | (411 | ) | (753 | ) | |||||||||

| Benefit of Income Taxes | - | 131 | 164 | 304 | ||||||||||||

| Net Loss — Unregulated Software Technology | $ | - | $ | (176 | ) | $ | (247 | ) | $ | (449 | ) | |||||

4. SEGMENT INFORMATION

The Company is organized based on products and services. Management monitors the operations of the Company in the following operating segments:

| · | Regulated electric utility: MPS and its inactive wholly-owned Canadian subsidiary, Me&NB; |

14

| · | Unregulated engineering services: TMG and all of its subsidiaries and product and service lines, classified as discontinued operations; |

| · | Unregulated software technology: MTI, classified as discontinued operations; |

| · | Unregulated energy marketing: EA, an inactive subsidiary classified as discontinued operations; and |

| · | Other: Corporate costs directly associated with the unregulated subsidiaries, common costs not allocated to the regulated utility, MAM USG results and inter-company eliminations classified as continuing operations. |

The segment information for 2006 has been reclassified to conform to the 2007 presentation.

The accounting policies of the segments are the same as those described in Note 1, “Summary of Significant Accounting Policies.” MAM provides certain administrative support services to MPS, TMG, and MAM USG and their subsidiaries. The cost of services provided to MPS is billed to MPS based on a combination of direct charges and allocations. The cost of corporate services provided to TMG and MTI remained at the holding company, and was not allocated or charged to the various subsidiaries. MPS also provides services to MAM and other affiliates. These services are billed to MAM and its affiliates at cost through intercompany transactions.

(In thousands of dollars) | ||||||||||||||||||||||||

Quarter Ended September 30, 2007 | ||||||||||||||||||||||||

Unregulated | ||||||||||||||||||||||||

Regulated Electric Utility | Engineering Services | Software Technology | Energy Marketing | Other | Total | |||||||||||||||||||

| Revenue from External Customers | ||||||||||||||||||||||||

| Regulated Operating Revenue | $ | 8,016 | $ | - | $ | - | $ | - | $ | - | $ | 8,016 | ||||||||||||

| Operating Expenses | ||||||||||||||||||||||||

| Regulated Operation & Maintenance | 4,392 | - | - | - | - | 4,392 | ||||||||||||||||||

| Unregulated Operation & Maintenance | - | - | - | - | 185 | 185 | ||||||||||||||||||

| Depreciation | 697 | - | - | - | - | 697 | ||||||||||||||||||

| Amortization of Stranded Costs | 2,648 | - | - | - | - | 2,648 | ||||||||||||||||||

| Amortization | 57 | - | - | - | - | 57 | ||||||||||||||||||

| Taxes Other than Income | 439 | - | - | - | 1 | 440 | ||||||||||||||||||

| Income Taxes | (218 | ) | - | - | - | (111 | ) | (329 | ) | |||||||||||||||

| Total Operating Expenses | 8,015 | - | - | - | 75 | 8,090 | ||||||||||||||||||

| Operating Income (Loss) | 1 | - | - | - | (75 | ) | (74 | ) | ||||||||||||||||

| Other Income (Deductions) | ||||||||||||||||||||||||

| Equity in Income of Associated Companies | 31 | - | - | - | (3 | ) | 28 | |||||||||||||||||

| Interest and Dividend Income | 13 | - | - | - | (10 | ) | 3 | |||||||||||||||||

| Other Deductions | (6 | ) | - | - | - | (7 | ) | (13 | ) | |||||||||||||||

| Total Other Income (Deductions) | 38 | - | - | - | (20 | ) | 18 | |||||||||||||||||

| Income (Loss) Before Interest Charges | 39 | - | - | - | (95 | ) | (56 | ) | ||||||||||||||||

| Interest Charges | 229 | - | - | - | 77 | 306 | ||||||||||||||||||

| Loss from Continuing Operations | (190 | ) | - | - | - | (172 | ) | (362 | ) | |||||||||||||||

| Loss from Discontinued Operations: | ||||||||||||||||||||||||

| Gain on Sales of Discontinued Operations | - | 208 | - | - | - | 208 | ||||||||||||||||||

| Loss From Operations | - | (369 | ) | - | - | - | (369 | ) | ||||||||||||||||

| Benefit of Income Taxes | - | 53 | - | - | - | 53 | ||||||||||||||||||

| Loss from Discontinued Operations | - | (108 | ) | - | - | - | (108 | ) | ||||||||||||||||

| Net Loss | $ | (190 | ) | $ | (108 | ) | $ | - | $ | - | $ | (172 | ) | $ | (470 | ) | ||||||||

15

(In thousands of dollars) | ||||||||||||||||||||||||

Quarter Ended September 30, 2006 | ||||||||||||||||||||||||

Unregulated | ||||||||||||||||||||||||

Regulated Electric Utility | Engineering Services | Software Technology | Energy Marketing | Other | Total | |||||||||||||||||||

| Revenue from External Customers | ||||||||||||||||||||||||

| Regulated Operating Revenue | $ | 8,033 | $ | - | $ | - | $ | - | $ | - | $ | 8,033 | ||||||||||||

| Operating Expenses | ||||||||||||||||||||||||

| Regulated Operation & Maintenance | 4,056 | - | - | - | - | 4,056 | ||||||||||||||||||

| Unregulated Operation & Maintenance | - | - | - | - | 1,032 | 1,032 | ||||||||||||||||||

| Depreciation | 719 | - | - | - | - | 719 | ||||||||||||||||||

| Amortization of Stranded Costs | 2,991 | - | - | - | - | 2,991 | ||||||||||||||||||

| Amortization | 63 | - | - | - | - | 63 | ||||||||||||||||||

| Taxes Other than Income | 441 | - | - | - | 5 | 446 | ||||||||||||||||||

| Income Taxes | (148 | ) | - | - | - | (452 | ) | (600 | ) | |||||||||||||||

| Total Operating Expenses | 8,122 | - | - | - | 585 | 8,707 | ||||||||||||||||||

| Operating Loss | (89 | ) | - | - | - | (585 | ) | (674 | ) | |||||||||||||||

| Other Income (Deductions) | ||||||||||||||||||||||||

| Equity in Income of Associated Companies | 43 | - | - | - | (27 | ) | 16 | |||||||||||||||||

| Interest and Dividend Income | 16 | - | - | - | (14 | ) | 2 | |||||||||||||||||

| Other (Deductions) Income | (56 | ) | - | - | - | 2 | (54 | ) | ||||||||||||||||

| Total Other Income (Deductions) | 3 | - | - | - | (39 | ) | (36 | ) | ||||||||||||||||

| Loss Before Interest Charges | (86 | ) | - | - | - | (624 | ) | (710 | ) | |||||||||||||||

| Interest Charges | 287 | - | - | - | 76 | 363 | ||||||||||||||||||

| Loss from Continuing Operations | (373 | ) | - | - | - | (700 | ) | (1,073 | ) | |||||||||||||||

| Loss from Discontinued Operations: | ||||||||||||||||||||||||

| Goodwill Impairment Loss | - | (2,546 | ) | - | - | - | (2,546 | ) | ||||||||||||||||

| Loss From Operations | - | (505 | ) | (360 | ) | - | - | (865 | ) | |||||||||||||||

| Benefit of Income Taxes | - | 1,234 | 140 | - | - | 1,374 | ||||||||||||||||||

| Loss from Discontinued Operations | - | (1,817 | ) | (220 | ) | - | - | (2,037 | ) | |||||||||||||||

| Net Loss | $ | (373 | ) | $ | (1,817 | ) | $ | (220 | ) | $ | - | $ | (700 | ) | $ | (3,110 | ) | |||||||

16

(In thousands of dollars) | ||||||||||||||||||||||||

Nine Months Ended September 30, 2007 | ||||||||||||||||||||||||

Unregulated | ||||||||||||||||||||||||

Regulated Electric Utility | Engineering Services | Software Technology | Energy Marketing | Other | Total | |||||||||||||||||||

| Revenue from External Customers | ||||||||||||||||||||||||

| Regulated Operating Revenue | $ | 26,882 | $ | - | $ | - | $ | - | $ | - | $ | 26,882 | ||||||||||||

| Operating Expenses | ||||||||||||||||||||||||

| Regulated Operation & Maintenance | 10,936 | - | - | - | - | 10,936 | ||||||||||||||||||

| Unregulated Operation & Maintenance | - | - | - | - | 1,032 | 1,032 | ||||||||||||||||||

| Depreciation | 2,104 | - | - | - | - | 2,104 | ||||||||||||||||||

| Amortization of Stranded Costs | 8,099 | - | - | - | - | 8,099 | ||||||||||||||||||

| Amortization | 173 | - | - | - | - | 173 | ||||||||||||||||||

| Taxes Other than Income | 1,320 | - | - | - | 5 | 1,325 | ||||||||||||||||||

| Income Taxes | 1,419 | - | - | - | (533 | ) | 886 | |||||||||||||||||

| Total Operating Expenses | 24,051 | - | - | - | 504 | 24,555 | ||||||||||||||||||

| Operating Income (Loss) | 2,831 | - | - | - | (504 | ) | 2,327 | |||||||||||||||||

| Other Income (Deductions) | ||||||||||||||||||||||||

| Equity in Income of Associated Companies | 33 | - | - | - | (39 | ) | (6 | ) | ||||||||||||||||

| Interest and Dividend Income | 47 | - | - | - | (31 | ) | 16 | |||||||||||||||||

| Other Deductions | (48 | ) | - | - | - | (14 | ) | (62 | ) | |||||||||||||||

| Total Other Income (Deductions) | 32 | - | - | - | (84 | ) | (52 | ) | ||||||||||||||||

| Income (Loss) Before Interest Charges | 2,863 | - | - | - | (588 | ) | 2,275 | |||||||||||||||||

| Interest Charges | 640 | - | - | - | 251 | 891 | ||||||||||||||||||

| Income (Loss) from Continuing Operations | 2,223 | - | - | - | (839 | ) | 1,384 | |||||||||||||||||

| Loss from Discontinued Operations: | ||||||||||||||||||||||||

| Loss on Sales of Discontinued Operations | - | (154 | ) | - | - | - | (154 | ) | ||||||||||||||||

| Loss From Operations | - | (881 | ) | (411 | ) | - | - | (1,292 | ) | |||||||||||||||

| Benefit of Income Taxes | - | 401 | 164 | - | - | 565 | ||||||||||||||||||

| Loss from Discontinued Operations | - | (634 | ) | (247 | ) | - | - | (881 | ) | |||||||||||||||

| Net Income (Loss) | $ | 2,223 | $ | (634 | ) | $ | (247 | ) | $ | - | $ | (839 | ) | $ | 503 | |||||||||

| Total Assets | $ | 133,964 | $ | 3,709 | $ | - | $ | - | $ | (148 | ) | $ | 137,525 | |||||||||||

17

(In thousands of dollars) | ||||||||||||||||||||||||

Nine Months Ended September 30, 2006 | ||||||||||||||||||||||||

Unregulated | ||||||||||||||||||||||||

Regulated Electric Utility | Engineering Services | Software Technology | Energy Marketing | Other | Total | |||||||||||||||||||

| Revenue from External Customers | ||||||||||||||||||||||||

| Regulated Operating Revenue | $ | 25,499 | $ | - | $ | - | $ | - | $ | - | $ | 25,499 | ||||||||||||

| Operating Expenses | ||||||||||||||||||||||||

| Regulated Operation & Maintenance | 11,297 | - | - | - | - | 11,297 | ||||||||||||||||||

| Unregulated Operation & Maintenance | - | - | - | - | 1,649 | 1,649 | ||||||||||||||||||

| Depreciation | 2,164 | - | - | - | - | 2,164 | ||||||||||||||||||

| Amortization of Stranded Costs | 8,369 | - | - | - | - | 8,369 | ||||||||||||||||||

| Amortization | 92 | - | - | - | - | 92 | ||||||||||||||||||

| Taxes Other than Income | 1,357 | - | - | - | 26 | 1,383 | ||||||||||||||||||

| Income Taxes | 645 | - | - | - | (769 | ) | (124 | ) | ||||||||||||||||

| Total Operating Expenses | 23,924 | - | - | - | 906 | 24,830 | ||||||||||||||||||

| Operating Income (Loss) | 1,575 | - | - | - | (906 | ) | 669 | |||||||||||||||||

| Other Income (Deductions) | ||||||||||||||||||||||||

| Equity in Income of Associated Companies | 140 | - | - | - | 3 | 143 | ||||||||||||||||||

| Interest and Dividend Income | 36 | - | - | - | (22 | ) | 14 | |||||||||||||||||

| Other Deductions | (127 | ) | - | - | - | - | (127 | ) | ||||||||||||||||

| Total Other Income (Deductions) | 49 | - | - | - | (19 | ) | 30 | |||||||||||||||||

| Income (Loss) Before Interest Charges | 1,624 | - | - | - | (925 | ) | 699 | |||||||||||||||||

| Interest Charges | 780 | - | - | - | 203 | 983 | ||||||||||||||||||

| Income (Loss) from Continuing Operations | 844 | - | - | - | (1,128 | ) | (284 | ) | ||||||||||||||||

| Loss from Discontinued Operations: | ||||||||||||||||||||||||

| Goodwill Impairment Loss | - | (2,546 | ) | - | - | - | (2,546 | ) | ||||||||||||||||

| (Loss) Income From Operations | - | (1,068 | ) | (771 | ) | 2 | - | (1,837 | ) | |||||||||||||||

| Benefit of (Provision for) Income Taxes | - | 1,477 | 304 | (1 | ) | - | 1,780 | |||||||||||||||||

| (Loss) Income from Discontinued Operations | - | (2,137 | ) | (467 | ) | 1 | - | (2,603 | ) | |||||||||||||||

| Net Income (Loss) | $ | 844 | $ | (2,137 | ) | $ | (467 | ) | $ | 1 | $ | (1,128 | ) | $ | (2,887 | ) | ||||||||

| Total Assets | $ | 135,567 | $ | 10,628 | $ | 2,018 | $ | - | $ | (54 | ) | $ | 148,159 | |||||||||||

5. INVESTMENTS IN ASSOCIATED COMPANIES

Maricor Properties Ltd

On June 30, 2006, Maricor Properties sold one share of stock representing a 50% ownership interest to Ashford. This sale specifically excluded the economic ownership of Mecel, with MAM retaining 100% of the economic ownership of Mecel. Management reviewed the characteristics of Maricor Properties subsequent to this transaction in accordance with Financial Accounting Standards Board Interpretation No. (“FIN”) 46(R), “Consolidation of Variable Interest Entities, an Interpretation of ARB 51,” and determined that MAM remained the primary beneficiary of Mecel, but is not the primary beneficiary of Maricor Properties, including the Vaughan Harvey building and Cornwallis, as of the date of this transaction. Therefore, the assets and liabilities of Mecel remained consolidated in these financial statements, while the assets and liabilities of the other components of Maricor Properties are no longer consolidated. MAM’s investment in Maricor Properties is reported within “Investments in Associated Companies,” and receivables from Maricor Properties and its subsidiaries payable to MAM and its wholly-owned subsidiaries are presented within the line “Accounts Receivable from Associated Companies.” On September 12, 2007, the shares of Mecel were sold from Maricor Properties to TMGC, and Mecel is consolidated in these financial statements within the unregulated engineering services segment in discontinued operations.

18

As of September 30, 2007, condensed financial information for the components of Maricor Properties not consolidated in these financial statements is as follows:

(in thousands of dollars) | ||||

| Total Assets | $ | 9,151 | ||

| Less: | ||||

| Long-term Debt | 6,155 | |||

| Short-term Debt | 2,165 | |||

| Other Liabilities | 631 | |||

| Net Assets | $ | 200 | ||

| MAM’s Equity in Net Assets | $ | 100 | ||

MAM recorded equity in the loss of Maricor Properties of $3,000 in the third quarter of 2007 and $25,000 year-to-date.

Maricor Ashford Ltd

As of March 21, 2007, MAM became an equal partner in Maricor Ashford Ltd, an inactive real estate development and redevelopment joint venture with Ashford, an unaffiliated real estate management company. Prior to this date, Maricor Properties was an equal partner in this joint venture with Ashford. On September 12, 2007, MAM sold its shares of Maricor Ashford to Ashford for a $50,000 note receivable. This note is recorded in “Accounts Receivable from Associated Companies.” MAM also incurred a loss on this sale of $8,000, recorded in “Other – Net” on the Statement of Operations.

Maine Yankee and MEPCO

MPS owns 5% of the common stock of Maine Yankee Atomic Power Company (“Maine Yankee”), a jointly-owned nuclear electric power company, and 7.49% of the common stock of MEPCO, a jointly-owned electric transmission company. Although MPS’s ownership percentage of these entities is relatively low, it does have influence over the operating and financial decisions of these companies through board representation. Therefore, MPS records its investment in MEPCO and Maine Yankee using the equity method. This is consistent with industry practice for similar joint-owned units.

Substantially all earnings of Maine Yankee and MEPCO are distributed to investor companies. MPS’s portion of dividends declared, dividends received in cash, and stock redemptions declared and received in cash are presented in the following table:

(In thousands of dollars) | Quarter Ending September 30, | Nine Months Ending September 30, | ||||||||||||||

2007 | 2006 | 2007 | 2006 | |||||||||||||

Maine Yankee | ||||||||||||||||

| Dividends Declared | $ | 20 | $ | 60 | $ | 40 | $ | 60 | ||||||||

| Dividends Received in Cash | - | - | 20 | 41 | ||||||||||||

| Stock Redemptions Declared | - | - | 250 | 600 | ||||||||||||

| Stock Redemptions Received in Cash | 250 | 400 | 500 | 600 | ||||||||||||

MEPCO | ||||||||||||||||

| Dividends Declared | $ | 2 | $ | 2 | $ | 6 | $ | 6 | ||||||||

| Dividends Received in Cash | 2 | 2 | 6 | 173 | ||||||||||||

6. STOCK COMPENSATION PLAN

Upon approval by MPS’s shareholders in June 2002, MPS adopted the 2002 Stock Option Plan (the “Plan”). The Plan was subsequently adopted by MAM after its formation. The Plan is administered by the members of the Performance and Compensation Committee of the Board of Directors, who are not employees of the Company or its subsidiaries. The Company may grant options to its employees for up to 150,000 shares of common stock, provided that the maximum aggregate number of shares which may be issued under the Plan pursuant to incentive stock options shall be 120,000 shares. The exercise price for shares to be issued under any incentive stock option shall not be less than one-hundred percent (100%) of the fair market value of such shares on the date the option is granted. An option’s maximum term is ten years.

As of September 30, 2007, the former CEO has been the only employee to receive stock options, with 3,932 options outstanding for the remainder of the original ten-year term of these options.

19

The Company accounts for the fair value of its grants under the Plan in accordance with the expense provisions of Statement of Financial Accounting Standards No. 123(R), “Accounting for Stock-Based Compensation.”

The fair value of each option grant is estimated on the date of the grant using the Black-Scholes option-pricing model with the following weighted-average assumptions used for the grants:

| Year of Issuance | 2003 | 2002 |

| Number of Options Granted | 1,966 | 1,966 |

| Vesting Period | 3 years | 3 years |

| Number of Options Vested and Exercisable | 1,966 | 1,966 |

| Dividend Yield | 4.60% | 4.70% |

| Volatility | 20.00% | 20.00% |

| Risk-Free Interest Rate | 3.00% | 4.60% |

| Expected Life | 7 years | 7 years |

The status of the Company’s stock option plan as of September 30, 2007, and changes during the year then ended is presented below:

Shares | Average Exercise Price | |||||||

2007 | 2007 | |||||||

| Outstanding at December 31, 2006 | 3,932 | $ | 30.28 | |||||

| Granted | - | - | ||||||

| Exercised | - | - | ||||||

| Expired | - | - | ||||||

| Forfeited | - | - | ||||||

| Outstanding at September 30, 2007 | 3,932 | $ | 30.28 | |||||

| Options exercisable at September 30, 2007 | 3,932 | $ | 30.28 | |||||

| Weighted-average fair value of options granted | $ | 4.17 | ||||||

The following table summarizes information about fixed stock options outstanding at September 30, 2007:

Options Outstanding | Options Exercisable | |||||||||

Range of Exercise Prices | Number Outstanding at 9/30/07 | Weighted- Average Remaining Contractual Life | Weighted- Average Exercise Price | Number Exercisable at 9/30/07 | Weighted- Average Exercise Price | |||||

| $30.10 - $30.45 | 3,932 | 5.17 yrs | $30.28 | 3,932 | $30.28 | |||||

The dilutive earnings per share impact of outstanding stock options is:

Quarter Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

2007 | 2006 | 2007 | 2006 | |||||||||||||

| Net (Loss) Income (in thousands) | $ | (470 | ) | $ | (3,110 | ) | $ | 503 | $ | (2,887 | ) | |||||

| Shares Used in Computation of Earnings | ||||||||||||||||

| Weighted-Average Common Shares Outstanding in Computation of Basic Earnings per Share | 1,677,430 | 1,638,027 | 1,667,147 | 1,637,627 | ||||||||||||

| Dilutive Effect of Common Stock Options | - | - | - | - | ||||||||||||

| Dilutive Effect of Preferred Shares | - | - | - | - | ||||||||||||

| Shares Used in Computation of Earnings per Common Share Assuming Dilution | 1,677,430 | 1,638,027 | 1,667,147 | 1,637,627 | ||||||||||||

| Net (Loss) Income per Share (Basic) | $ | (0.28 | ) | $ | (1.90 | ) | $ | 0.30 | $ | (1.76 | ) | |||||

| Net (Loss) Income per Share (Diluted) | $ | (0.28 | ) | $ | (1.90 | ) | $ | 0.30 | $ | (1.76 | ) | |||||

20

The common stock options and preferred shares were anti-dilutive during the quarters ended September 30, 2007, and 2006, and the nine months ended September 30, 2006. Therefore, these shares have been omitted from the calculation of diluted earnings per share above. The weighted-average potentially dilutive shares outstanding during those periods were:

Quarter Ended September 30, | Nine Months Ended September 30, | |||||||

2007 | 2006 | 2007 | 2006 | |||||

| Common Stock Options | - | 25 | - | - | ||||

| Preferred Shares | - | 9,500 | - | 9,500 | ||||

| Potentially Dilutive Shares | - | 9,525 | - | 9,500 | ||||

7. BENEFIT PROGRAMS

The Company provides certain pension, post-retirement and welfare benefit programs to its employees. Benefit programs are an integral part of the Company’s commitment to hiring and retaining employees, providing market-based compensation that rewards individual and corporate performance. The Company offers welfare benefit plans to all employees, consisting of healthcare, life insurance, long-term disability, and accidental disability insurance. The Company also offers a retirement savings program to employees in the form of a 401(k) plan. This plan allows voluntary contributions by the employee and a contribution by the Company.

U. S. Defined Benefit Pension Plan

The Company has a non-contributory defined benefit pension plan covering Maine Public Service and certain former MAM employees. No employees of other unregulated businesses are eligible for this benefit plan. Benefits under the plan are based on employees’ years of service and compensation prior to retirement. New employees hired on or after January 1, 2006, are not eligible for the pension plan.

On December 31, 2006, future salary and service accruals for current participants in the plan ceased. In conjunction with this pension freeze, MPS recorded a one-time curtailment expense of approximately $98,000 in the fourth quarter of 2006. The Company agreed to additional employer contributions to the Retirement Savings Plan to compensate employees, in part or in full depending on their number of years of service, for this lost benefit. This additional contribution ranges from 5% to 25% of each eligible employee’s gross base pay, and is immediately fully vested.

The Company’s policy has been to fund pension costs accrued. In accordance with that policy, the Company contributed approximately $214,000 to the pension plan for 2006 in January 2007, and another $824,000 for 2006 in September 2007, prior to the filing of its 2006 corporate income tax return. The Company also contributed approximately $500,000 in the first three quarters of 2007 for the 2007 plan year. An additional contribution of approximately $21,000 was made in October. No further contributions to the pension plan are required to be made for the 2007 plan year.

The following table sets forth the plan’s net periodic benefit cost:

(In thousands of dollars) | Pension Benefits | |||||||||||||||

Quarter Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

2007 | 2006 | 2007 | 2006 | |||||||||||||

| Service cost | $ | - | $ | 140 | $ | - | $ | 421 | ||||||||

| Interest cost | 265 | 290 | 795 | 870 | ||||||||||||

| Expected return on plan assets | (290 | ) | (271 | ) | (870 | ) | (814 | ) | ||||||||

| Amortization of prior service cost | - | 23 | - | 68 | ||||||||||||

| Recognized net actuarial (gain) | 16 | 43 | 48 | 130 | ||||||||||||

| Net periodic benefit cost | $ | (9 | ) | $ | 225 | $ | (27 | ) | $ | 675 | ||||||

Health Care Benefits

The Company provides certain health care benefits to eligible employees. Eligible employees share in the cost of their medical benefits, in addition to plan deductibles and coinsurance payments. The plan also covers retiree medical coverage for Maine Public Service Company employees, the regulated utility. In 2005, certain amendments were made to the plan, including the following: employees hired on or after October 1, 2005, are ineligible for post-retirement medical coverage. Effective January 1, 2006, certain retiree co-pays increased and spousal contributions commenced.

21

The following table sets forth the plan’s net periodic benefit cost:

(In thousands of dollars) | Health Care Benefits | |||||||||||||||

Quarter Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

2007 | 2006 | 2007 | 2006 | |||||||||||||

| Service cost | $ | 45 | $ | 45 | $ | 135 | $ | 136 | ||||||||

| Interest cost | 124 | 126 | 372 | 378 | ||||||||||||

| Expected return on plan assets | (53 | ) | (54 | ) | (159 | ) | (161 | ) | ||||||||

| Amortization of transition obligation | 18 | 36 | 54 | 107 | ||||||||||||

| Amortization of prior service cost | (15 | ) | (15 | ) | (45 | ) | (45 | ) | ||||||||

| Recognized net actuarial (gain) | 45 | 42 | 135 | 127 | ||||||||||||

| Net periodic benefit cost | $ | 164 | $ | 180 | $ | 492 | $ | 542 | ||||||||

8. COMMITMENTS, CONTINGENCIES AND REGULATORY MATTERS

Legal Proceedings

Surplec, Inc.

On April 30, 2007, Surplec, Inc., (“Surplec”), the supplier of a transformer for a substation constructed by MPS in connection with a 42 MW wind project owned by Evergreen Wind Power, LLC (“Evergreen”), brought suit against MPS, UPC Wind Management LLC, and Evergreen Wind Power, LLC, (collectively “Defendants”) in the United States District Court District of Maine, (located in Bangor, Maine) seeking collection of approximately $227,795 it claims is still owed for the transformer, plus interest, attorney fees and punitive damages in a stated amount. MPS had contracted with Surplec to purchase a 30/40/50 MVA Transformer (“the Transformer”) on behalf of Evergreen. Surplec alleged that MPS breached the contract and committed fraud by failing to pay Surplec the third and final installment and shipping charges for the Transformer and Defendants’ use of the Transformer constitutes conversion. MPS has denied these allegations.

MPS had previously collected from Evergreen the remaining amount owed on the Transformer, which is recorded on the Consolidated Balance Sheet under “Miscellaneous Liabilities.” Accordingly, MPS is holding this amount pending the outcome of the litigation.

On June 21, 2007, MPS filed a Counterclaim against Surplec seeking an award of $199,000 (the amount MPS has already paid for the Transformer on behalf of Evergreen) as well as consequential and incidental damages, and MPS has subsequently moved to dismiss Surplec’s claims for punitive damages and attorney fees. MPS alleged that Surplec failed to deliver the Transformer by the date indicated in the Contract and that the Transformer delivered was defective and nonconforming. Surplec and the Defendants have reached a settlement agreement in this matter, under which all claims would be dismissed with prejudice and MPS will remit the remaining $219,000 owed on the Transformer. Accordingly, MPS would incur no liability associated with the claims, except that it has agreed to share equally with Evergreen the nominal cost of transportation and inspection expenses associated with returning the Transformer to Surplec for refurbishment.

Regulatory Matters

Notice of Inquiry Regarding Allowance of Electric Utilities in Maine to Reenter Energy Supply Business

On July 25, 2007, the Maine Public Utilities Commission issued a Notice of Inquiry (“NOI”) regarding the reentry of electric utilities into the energy supply business. The NOI was issued based on a State of Maine Legislative Resolve that directs the MPUC to undertake a review of the issues involved with transmission and distribution (“T&D”) utilities entering the energy supply business. The Resolve specifies that for purposes of the review, “energy supply business” includes owning, operating, or having an interest in electric generation facilities, load management activities or demand-side management activities. The Resolve requires that the MPUC submit a report containing its findings and recommendations for further action and legislation to implement its recommendations to the Joint Standing Committee on Utilities and Energy no later than January 15, 2008. The MPUC initiated this Inquiry to obtain information, viewpoints and recommendations from interested persons on the issues raised in the Resolve. MPS will actively participate in the NOI process.

Federal Energy Regulatory Commission 2007 Open Access Transmission Tariff Formula Rate Filing

On May 21, 2007, MPS filed its updated rates under the 2007 Open Access Transmission Tariff (“OATT”) formula pursuant to Docket ER00-1053 for both wholesale and retail customers. The revenue increases were approximately $54,000 for wholesale customers and $345,000 for retail customers. These new transmission rates are subject to a customer refund that may occur as a result of the proceeding and potential settlement negotiations.

22

Stakeholder Initiative Regarding the Competitiveness and Reliability of the Northern Maine Power Grid

On November 16, 2006, the MPUC issued an Order concluding that northern Maine lacks a competitive power market. In an effort to deal with this lack of competition, and the system reliability issues raised by the Company’s unsuccessful bid to secure a certificate for the construction of a new transmission line, the MPUC held a three-day stakeholders conference in mid-December 2006, in an attempt to resolve, on a collaborative basis, the issues raised in these cases. As a result of this effort, two parallel initiatives have been launched:

(a) the stakeholders were asked to develop a protocol allowing for the possibility of generation suppliers obtaining long-term power delivery commitments through the Standard Offer process and not through the Company. This could encourage the construction of new generation in the Company’s service territory, and/or secure the availability of existing on-system generating sources on a long-term (multi-year) basis. The Company cannot at this time predict whether all of the stakeholders will reach agreement on any such protocol initiative, or whether it will be finalized and accepted by the MPUC;

(b) the stakeholders were asked to address the feasibility of one or more proposals for transmission projects interconnecting the northern Maine grid with the ISO New England grid, possibly by means of a tap into the MEPCO 345 kV transmission line that connects the high voltage systems of Maine and New Brunswick, Canada.

In early 2007, the Company announced that it has joined with Central Maine Power Company in an effort to determine the feasibility of such a line.

Wheelabrator-Sherman

MPS was ordered into a Power Purchase Agreement (“PPA”) with Wheelabrator-Sherman (“WS”) in 1986, which required the purchase of the entire output (up to 126,582 MWH per year) of a 17.6 MW biomass plant through December 31, 2006. Total stranded costs included as regulatory assets under the caption “Deferred Fuel and Purchased Energy Costs” in the accompanying balance sheet related to this contract are $31.8 million and $34.7 million at September 30, 2007, and December 31, 2006, respectively.

Poly Chlorinated Bi-Phenol Transformers

In response to a Maine environmental regulation to phase out Poly Chlorinated Bi-phenol (“PCB”) transformers, MPS has implemented a program to eliminate transformers on its system that do not meet the State environmental guidelines. The Company is in the process of inspecting almost 13,000 distribution transformers over a ten-year period. MPS is currently in its sixth year of this ten-year program. Approximately 35% of the transformers inspected require “in service” PCB oil sampling. In addition, transformers that pass the inspection criteria will be refitted with new lightning arrestors and animal guards, where necessary. The current total estimated cost of the project is $2.6 million. As of September 30, 2007, $2.0 million of this total has been spent on this effort. The remaining cost of the project has been accrued on the Balance Sheet as “Accrued Removal Obligations.”

Off-Balance Sheet Arrangements

Maricor Properties is a variable interest entity, as defined by Financial Accounting Standards Board Interpretation No. 46(R), “Consolidation of Variable Interest Entities,” (“FIN 46(R)”) promulgated on January 17, 2003. Management has determined Ashford, not MAM, is the primary beneficiary of Maricor Properties. Therefore, Maricor Properties is not consolidated with these financial statements.

23

The Company has several operating leases for office equipment, field equipment, vehicles, and office space, accounted for in accordance with Statement of Financial Accounting Standards No. 13, “Accounting for Leases,” (“SFAS 13”). The following summarizes payments for leases for a period in excess of one year:

Nine Months Ended September 30, | ||||||||

(In thousands of dollars) | 2007 | 2006 | ||||||

| Equipment | $ | 33 | $ | 15 | ||||

| Building | 160 | 140 | ||||||

| Vehicles | 28 | 17 | ||||||

| Rights of Way | 41 | 1 | ||||||

| Field Equipment | 8 | 21 | ||||||

| Total | $ | 270 | $ | 194 | ||||

The future minimum lease payments for the items listed above for the next five years are as follows (in thousands of dollars):

Future Minimum Lease Payments by Year for All Items

Years | Minimum Lease Payments | ||

| 2007 | $ | 46 | |

| 2008 | $ | 221 | |

| 2009 | $ | 185 | |

| 2010 | $ | 107 | |

| 2011 | $ | 37 | |

Financial Information System Hosting Agreement

In December 2003, the Company entered into a ten-year agreement with Delinea Corporation (now OneNeck IT Services) to host and provide technical and functional support for the integrated Oracle Financial Information System. The base hosting fees were $450,000 for 2004, $510,000 for 2005, and $575,000 per year for years 2006 through 2013. This contract was re-negotiated effective January 1, 2007. The annual fee was reduced to $537,500 per year from 2007 through 2013, plus reimbursement for travel costs. Further, based on certain service quality targets, OneNeck could earn contingent payments of $8,000 per quarter.

9. CAPITAL LEASES

MPS financed certain of its 2006 and 2007 vehicle and computer equipment purchases through capital leases totaling $820,000. As of September 30, 2007, the remaining liability for these capital lease arrangements is approximately $709,000, and is recorded within “Miscellaneous Liabilities” on the Consolidated Balance Sheet. Future minimum lease payments in thousands of dollars are:

Years | Minimum Lease Payments | ||

| 2007 | $ | 18 | |

| 2008 | $ | 182 | |

| 2009 | $ | 184 | |

| 2010 | $ | 165 | |

| 2011 | $ | 103 | |

| Thereafter | $ | 57 | |

10. DIVESTITURE OF UNREGULATED OPERATIONS

Termination of TMGNE Operations

The operations of TMGNE ceased on August 31, 2007, with the closure of the Boston office. As of September 30, 2007, TMGNE had approximately $154,000 of net accounts receivable and $22,000 of cash. TMGNE also has accrued obligations of approximately $40,000 for resolution of five pending project contracts and $186,000 of accrued rent obligations for the office spaces in Hudson and Boston, Massachusetts.

24

PART 1. FINANCIAL INFORMATION

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

This filing contains certain “forward-looking statements,” as defined in the Private Securities Litigation Reform Act of 1995, related to the expected future performance of our plans and objectives, such as forecasts and projections of expected future performance or statements of Management’s plans and objectives. These forward-looking statements may be contained in filings with the SEC and in press releases and oral statements. We use words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” and other words and terms of similar meaning in connection with any discussion of future operating or financial performance. These statements are based on the current expectations, estimates or projections of Management and are not guarantees of future performance. Some or all of these forward-looking statements may not turn out to be what the Company expected. Actual results will differ, and some of the differences may be material.

Factors that could cause actual results to differ materially from our projections include, among other matters, strategic risk, liquidity and capital formation risk, interest rate and debt covenant risk, attraction and retention of qualified employees, equity price risk, legislation and regulation, divestiture of unregulated segments, general economic conditions, collections risk, information technology risks, economy of the region, environmental risks, aging infrastructure and reliability, weather, vandalism, terrorism and other illegal acts, alternative generation options, foreign operations, franchises and competition, professional liability and technological obsolescence. Therefore, no assurances can be given that the outcomes stated in such forward-looking statements and estimates will be achieved.

Accounting Policies

Critical accounting policies are disclosed in the Company’s 2006 Annual Report on Form 10-K and its March 31, 2007, and June 30, 2007, Forms 10-Q.

Executive Overview

As more fully described in our previous filings, the Company is transitioning away from non-utility business segments in favor of focusing on our core competencies in and related to the regulated utility, MPS. To that end, we have classified our utility business and the holding company, MAM, as “Continuing Operations.” The segments we have divested, “Software Technology” and “Unregulated Engineering,” as well as the final one to be divested, “Unregulated Real Estate,” are classified as “Discontinued Operations.”