_____________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

__________________________

FORM 10-Q

T QUARTERLY REPORT PURSUANT TO SECTION 13 or 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2008

- OR - -

£ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

__________________________

Commission File No. 333-103749

MAINE & MARITIMES CORPORATION

A Maine Corporation

I.R.S. Employer Identification No. 30-0155348

209 STATE STREET, PRESQUE ISLE, MAINE 04769

(207) 760-2499

__________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes T. No £.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | Large accelerated filer £. | Accelerated filer £. |

| | Non-accelerated filer £ | Smaller reporting company T. |

| | (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes £. No T.

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of May 12, 2008.

Common Stock, $7.00 par value – 1,677,862 shares

Glossary of Terms

| AMEX | American Stock Exchange |

| Ashford | Ashford Investments, Inc. |

| CES | Competitive Energy Supplier |

| Cornwallis | Cornwallis Court Developments Ltd. |

| CPCN | Certificate of Public Convenience and Necessity |

| FAME | Finance Authority of Maine |

| FASB | Financial Accounting Standards Board |

| FERC | Federal Energy Regulatory Commission |

| FIN | FASB Interpretation Number |

| MAM | Maine & Maritimes Corporation |

| MAM USG | MAM Utility Services Group |

| Me&NB | Maine & New Brunswick Electrical Power Company, Ltd |

| Mecel | Mecel Properties Ltd |

| MEPCO | Maine Electric Power Company, Inc. |

| MPC | Maine Power Connection |

| MPS | Maine Public Service Company |

| MPUC | Maine Public Utilities Commission |

| MTI | Maricor Technologies, Inc. |

| OATT | Open Access Transmission Tariff |

| OCI | Other Comprehensive Income |

| PCB | Poly Chlorinated Bi-phenol |

| SFAS | Statement of Financial Accounting Standards |

| SOS | Standard Offer Service |

| TMGC | The Maricor Group, Canada Ltd |

| TMGNE | The Maricor Group New England |

PART 1. FINANCIAL INFORMATION

Item 1. Financial Statements

See the following exhibits: Maine & Maritimes Corporation ("MAM" or the "Company") and subsidiaries Consolidated Financial Statements, including (1) an unaudited statement of consolidated operations for the quarter ended March 31, 2008, and for the corresponding period of the preceding year; (2) an unaudited statement of consolidated cash flows for the period January 1 (beginning of the fiscal year) through March 31, 2008, and for the corresponding period of the preceding year; (3) an unaudited consolidated balance sheet as of March 31, 2008; (4) an audited consolidated balance sheet as of December 31, 2007, the end of MAM's preceding fiscal year; and (5) an unaudited statement of consolidated common shareholders’ equity for the period January 1 (beginning of the fiscal year) through March 31, 2008.

In the opinion of Management, the accompanying unaudited consolidated financial statements present fairly the financial position of the Company and its Subsidiaries at March 31, 2008; the results of their operations for the three months ended March 31, 2008 and 2007; and their cash flows for the three months ended March 31, 2008, and 2007.

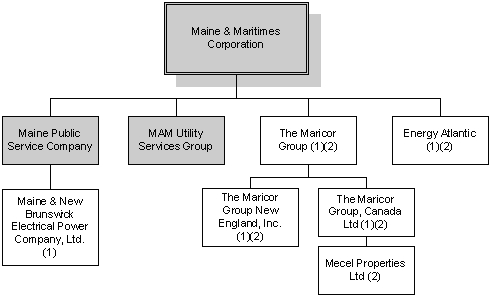

MAM is the parent holding company for the following wholly-owned subsidiaries:

| | 1. | Maine Public Service Company (“MPS”) and its wholly-owned inactive Canadian subsidiary Maine & New Brunswick Electrical Power Company, Ltd (“Me&NB”); |

| | 2. | MAM Utility Services Group (“MAM USG”), a wholly-owned United States subsidiary; |

| | 3. | The Maricor Group (“TMG”) and its wholly-owned United States subsidiary The Maricor Group New England (“TMGNE”) and TMG’s wholly-owned Canadian subsidiary The Maricor Group, Canada Ltd (“TMGC”) and TMGC’s wholly-owned Canadian subsidiary, Mecel Properties Ltd (“Mecel”), all of which are classified as discontinued operations; and |

| | 4. | Energy Atlantic, LLC (“EA”), an inactive subsidiary. |

Maine & Maritimes Corporation and Subsidiaries

| | (1) Indicates inactive companies |

| | (2) Companies classified as Discontinued Operations in these financial statements. |

General Descriptions of the Parent Company and its Subsidiaries:

Continuing Operations:

| | • | Maine & Maritimes Corporation is a holding company incorporated in the State of Maine, and is the ultimate parent company for all business segments. MAM maintains investments in a regulated electric transmission and distribution utility and an unregulated utility services company, both operating within the State of Maine and classified for financial reporting purposes as continuing operations. MAM is headquartered in Presque Isle, Maine. |

| | • | Maine Public Service Company is a regulated electric transmission and distribution utility serving all of Aroostook County and a portion of Penobscot County in northern Maine. Since March 1, 2000, the date retail electric competition in Maine commenced, customers in MPS’s service territory have been purchasing energy from suppliers other than MPS. This energy comes from Competitive Electricity Suppliers (“CES”) or, if customers are unable or do not wish to choose a competitive supplier, the Standard Offer Service (“SOS”) provider. SOS providers are determined through a bid process conducted by the Maine Public Utilities Commission (“MPUC”). MPS provides the transportation through its transmission and distribution wires infrastructure. Its service area covers approximately 3,600 square miles, with a population of 73,000. The utility is regulated by the Federal Energy Regulatory Commission (“FERC”) and the MPUC. MPS is headquartered in Presque Isle, Maine. |

Electric sales in the Company’s territory are seasonal, and the Company’s results of operations reflect this seasonal nature. The highest usage occurs during the five heating season months, from November through March, due to heating-related requirements and shorter daylight hours. The rate year is divided into two periods, with higher rates in place in the winter months to encourage conservation. Also, due to the climate in the northern Maine area, the majority of MPS’s construction program is completed during the spring, summer and fall months.

| | • | Maine & New Brunswick Electrical Power Company, Ltd., is an inactive Canadian subsidiary of MPS, which, prior to deregulation and generation divestiture, owned MPS’s Canadian electric generation assets. |

| | • | MAM Utility Services Group is a wholly-owned subsidiary of MAM, incorporated in the State of Maine on September 27, 2007. MAM USG provides utility-related services to clients on projects that MPS could not or would not be required to provide under State and Federal regulations. These services include transmission line and substation design and build services for generator projects outside the MPS service territory and contract work within MPS’s territory. MAM USG is focused on areas such as transmission infrastructure to support renewable generation, utility asset maintenance contracts and other utility-related services. |

Equity Investments

| | • | MAM was a 50% owner of Maricor Properties Ltd, a Canadian company formerly wholly-owned by MAM, and its wholly-owned Canadian subsidiary Cornwallis Court Developments Ltd. (“Cornwallis”). MAM divested its 50% ownership of Maricor Properties on March 31, 2008, through a share redemption agreement with Ashford Investments, Inc. (“Ashford”). |

| | • | MAM was also a 50% owner of Maricor Ashford, an inactive joint venture with Ashford. As of September 12, 2007, MAM sold its 50% ownership of Maricor Ashford to Ashford. |

Discontinued Operations

| | • | The Maricor Group was a facilities engineering and solutions company providing mechanical, electrical and plumbing/fire protection engineering consulting design services, energy efficiency solutions, facilities condition assessments, lifecycle asset management solutions, and emissions reduction services. TMG operated primarily within the New England region of the United States and the eastern Canadian provinces, particularly Atlantic Canada, through its subsidiaries TMGNE and TMGC. The legal entities of TMG, TMGNE and TMGC are expected to be dissolved upon sale of Mecel Properties. |

| | • | TMGC is also the parent company of Mecel Properties Ltd. Mecel was formerly a Canadian subsidiary of Maricor Properties Ltd and owns the office building that housed the Halifax, Nova Scotia, operating division of The Maricor Group, Canada Ltd. TMGC is seeking to divest its ownership of Mecel during the first half of 2008. |

| | • | Energy Atlantic, LLC is a licensed, but currently inactive, CES of retail electricity. |

| | • | Maricor Technologies, Inc. (“MTI”) was a former wholly-owned subsidiary of MAM. Substantially all of the assets of MTI were sold on April 13, 2007, and the legal entity of MTI was dissolved on June 28, 2007. The activity of MTI through dissolution of the company is reported in discontinued operations |

MAINE & MARITIMES CORPORATION AND SUBSIDIARIES

Statements of Consolidated Operations (Unaudited)

| (In thousands of dollars except shares and per share amounts) | | Three Months Ended March 31, | |

| | | 2008 | | | 2007 | |

| Operating Revenues | | | | | | |

| Regulated Revenues | | $ | 10,891 | | | $ | 10,915 | |

| Unregulated Utility Services Revenues | | | 1,296 | | | | - | |

| Total Operating Revenues | | | 12,187 | | | | 10,915 | |

| Operating Expenses | | | | | | | | |

| Regulated Operation and Maintenance | | | 3,337 | | | | 3,377 | |

| Unregulated Utility Services Operation and Maintenance | | | 1,180 | | | | - | |

| Other Unregulated Operation and Maintenance (1) | | | 95 | | | | 492 | |

| Depreciation | | | 755 | | | | 711 | |

| Amortization of Stranded Costs | | | 2,728 | | | | 2,804 | |

| Amortization | | | 53 | | | | 55 | |

| Taxes Other Than Income | | | 454 | | | | 444 | |

| Provision for Income Taxes—Regulated | | | 1,364 | | | | 1,317 | |

| Benefit of Income Taxes—Unregulated | | | (2 | ) | | | (241 | ) |

| Total Operating Expenses | | | 9,964 | | | | 8,959 | |

| Operating Income | | | 2,223 | | | | 1,956 | |

| Other Income (Deductions) | | | | | | | | |

| Equity in Income of Associated Companies | | | 25 | | | | (72 | ) |

| Interest and Dividend Income | | | 4 | | | | 7 | |

| Provision for Income Taxes | | | (29 | ) | | | (1 | ) |

| Other—Net | | | 5 | | | | (25 | ) |

| Total Other Income (Deductions) | | | 5 | | | | (91 | ) |

| Income Before Interest Charges | | | 2,228 | | | | 1,865 | |

| Interest Charges | | | | | | | | |

| Long-Term Debt and Notes Payable | | | 655 | | | | 761 | |

| Less Stranded Costs Carrying Charge | | | (402 | ) | | | (456 | ) |

| Total Interest Charges | | | 253 | | | | 305 | |

| Net Income from Continuing Operations | | | 1,975 | | | | 1,560 | |

| Discontinued Operations | | | | | | | | |

| Loss from Operations | | | (15 | ) | | | (350 | ) |

| Income Tax Benefit | | | 6 | | | | 141 | |

| Loss from Discontinued Operations | | | (9 | ) | | | (209 | ) |

| Net Income Available for Common Stockholders | | $ | 1,966 | | | $ | 1,351 | |

| Average Shares of Common Stock Outstanding | | | 1,677,862 | | | | 1,646,823 | |

| Basic Earnings Per Share of Common Stock From Continuing Operations | | $ | 1.18 | | | $ | 0.95 | |

| Basic Loss Per Share of Common Stock From Discontinued Operations | | | (0.01 | ) | | | (0.13 | ) |

| Basic Earnings Per Share of Common Stock From Net Income | | $ | 1.17 | | | $ | 0.82 | |

| Diluted Earnings Per Share of Common Stock From Continuing Operations | | $ | 1.18 | | | $ | 0.94 | |

| Diluted Loss Per Share of Common Stock From Discontinued Operations | | | (0.01 | ) | | | (0.13 | ) |

| Diluted Earnings Per Share of Common Stock From Net Income | | $ | 1.17 | | | $ | 0.81 | |

(1) Other unregulated operation and maintenance expense is the activity of the holding company, including corporate costs directly associated with unregulated operations and common costs not allocated to the regulated utility or unregulated utility services.

See Notes to Consolidated Financial Statements

MAINE & MARITIMES CORPORATION AND SUBSIDIARIES

Statements of Consolidated Cash Flows (Unaudited)

| (In thousands of dollars) | | Three Months Ended March 31, | |

| | | 2008 | | | 2007 | |

| Cash Flow From Operating Activities | | | | | | |

| Net Income | | $ | 1,966 | | | $ | 1,351 | |

| Adjustments to Reconcile Net Income to Net Cash Provided by Operations: | | | | | | | | |

| Depreciation | | | 755 | | | | 711 | |

| Amortization of Intangibles | | | 53 | | | | 55 | |

| Amortization of Seabrook | | | 278 | | | | 278 | |

| Amortization of Cancelled Transmission Plant | | | 64 | | | | 64 | |

| Deferred Income Taxes—Net | | | 1,588 | | | | 1,083 | |

| Deferred Investment Tax Credits | | | (5 | ) | | | (21 | ) |

| Change in Deferred Regulatory and Debt Issuance Costs | | | 1,299 | | | | 1,222 | |

| Change in Benefit Obligations | | | 97 | | | | (90 | ) |

| Change in Current Assets and Liabilities: | | | | | | | | |

| Accounts Receivable and Unbilled Revenue from Utility | | | (970 | ) | | | 114 | |

| Other Current Assets | | | (180 | ) | | | (101 | ) |

| Accounts Payable | | | 353 | | | | (2,022 | ) |

| Other Current Liabilities | | | 292 | | | | 257 | |

| Other—Net | | | 6 | | | | 1,043 | |

| Operating Cash Flows from Continuing Operations | | | 5,596 | | | | 3,944 | |

| Operating Cash Flows from Discontinued Operations | | | 103 | | | | (414 | ) |

| Net Cash Flow Provided By Operating Activities | | | 5,699 | | | | 3,530 | |

| Cash Flow From Financing Activities | | | | | | | | |

| Repayments of Long-Term Debt | | | (2,876 | ) | | | (157 | ) |

| Additions of Long-Term Debt | | | - | | | | 89 | |

| Short-Term Debt Repayments, Net | | | (3,000 | ) | | | (2,420 | ) |

| Net Cash Flow Used For Financing Activities | | | (5,876 | ) | | | (2,488 | ) |

| Cash Flow From Investing Activities | | | | | | | | |

| Cash Paid for Stock Contingencies from Acquisition Agreements | | | - | | | | (69 | ) |

| Change in Restricted Investments | | | 2,243 | | | | 1 | |

| Investment in Fixed Assets | | | (1,914 | ) | | | (1,157 | ) |

| Net Cash Flow Provided by (Used For) Investing Activities | | | 329 | | | | (1,225 | ) |

| Increase (Decrease) in Cash and Cash Equivalents | | | 152 | | | | (183 | ) |

| Cash and Cash Equivalents at Beginning of Period | | | 910 | | | | 898 | |

| Cash and Cash Equivalents at End of Period | | $ | 1,062 | | | $ | 715 | |

| Supplemental Disclosure of Cash Flow Information: | | | | | | | | |

| Cash Paid During the Period for: | | | | | | | | |

| Interest | | $ | 701 | | | $ | 789 | |

| Income Taxes | | $ | 16 | | | $ | 136 | |

| Non-Cash Activities: | | | | | | | | |

| Fair Market Value of Stock Issued to Directors | | $ | 7 | | | $ | 6 | |

| Capital Leases | | $ | - | | | $ | 117 | |

See Notes to Consolidated Financial Statements

MAINE & MARITIMES CORPORATION AND SUBSIDIARIES

Consolidated Balance Sheets

| (In Thousands of Dollars) | | March 31, | | | December 31, | |

| | | 2008 | | | 2007 | |

| ASSETS | | (Unaudited) | | | (Audited) | |

| Plant: | | | | | | |

| Electric Plant in Service | | $ | 105,860 | | | $ | 104,289 | |

| Non-Utility Plant | | | 59 | | | | 3 | |

| Less Accumulated Depreciation | | | (44,983 | ) | | | (44,212 | ) |

| Net Plant in Service | | | 60,936 | | | | 60,080 | |

| Construction Work-in-Progress | | | 3,180 | | | | 3,035 | |

| Total Plant Assets | | | 64,116 | | | | 63,115 | |

| Investments in Associated Companies | | | 871 | | | | 940 | |

| Net Plant and Investments in Associated Companies | | | 64,987 | | | | 64,055 | |

| Current Assets: | | | | | | | | |

| Cash and Cash Equivalents | | | 1,062 | | | | 910 | |

| Accounts Receivable (less allowance for uncollectible accounts of $244 in 2008 and $247 in 2007) | | | 8,743 | | | | 7,921 | |

| Accounts Receivable from Associated Companies | | | 529 | | | | 377 | |

| Unbilled Revenue from Utility | | | 911 | | | | 1,170 | |

| Inventory | | | 1,110 | | | | 819 | |

| Unbilled Contract Revenue | | | 255 | | | | - | |

| Prepayments | | | 316 | | | | 427 | |

| Current Assets of Discontinued Operations | | | 628 | | | | 756 | |

| Total Current Assets | | | 13,554 | | | | 12,380 | |

| Regulatory Assets: | | | | | | | | |

| Uncollected Maine Yankee Decommissioning Costs | | | 4,093 | | | | 4,774 | |

| Recoverable Seabrook Costs | | | 9,171 | | | | 9,449 | |

| Regulatory Assets—Deferred Income Taxes | | | 5,374 | | | | 5,481 | |

| Regulatory Assets—Post-Retirement Medical Benefits | | | 2,568 | | | | 2,574 | |

| Deferred Fuel and Purchased Energy Costs | | | 29,696 | | | | 30,859 | |

| Cancelled Transmission Plant | | | 191 | | | | 254 | |

| Unamortized Premium on Early Retirement of Debt | | | 841 | | | | 893 | |

| Deferred Regulatory Costs | | | 1,181 | | | | 1,302 | |

| Total Regulatory Assets | | | 53,115 | | | | 55,586 | |

| Other Assets: | | | | | | | | |

| Unamortized Debt Issuance Costs | | | 237 | | | | 289 | |

| Restricted Investments (at cost, which approximates market) | | | 223 | | | | 2,466 | |

| Other Assets | | | 857 | | | | 849 | |

| Total Other Assets | | | 1,317 | | | | 3,604 | |

| Total Assets | | $ | 132,973 | | | $ | 135,625 | |

See Notes to Consolidated Financial Statements

MAINE & MARITIMES CORPORATION AND SUBSIDIARIES

Capitalization and Liabilities

| (In Thousands of Dollars) | | March 31, | | | December 31, | |

| | | 2008 | | | 2007 | |

| Capitalization (see accompanying statement): | | (Unaudited) | | | (Audited) | |

| Shareholders’ Equity | | $ | 44,658 | | | $ | 42,941 | |

| Long-Term Debt | | | 26,488 | | | | 27,427 | |

| Total Capitalization | | | 71,146 | | | | 70,368 | |

| Current Liabilities: | | | | | | | | |

| Long-Term Debt Due Within One Year | | | 2,226 | | | | 4,163 | |

| Notes Payable to Banks | | | 5,000 | | | | 8,000 | |

| Accounts Payable | | | 5,284 | | | | 4,699 | |

| Accounts Payable—Associated Companies | | | 228 | | | | 234 | |

| Accrued Employee Benefits | | | 1,151 | | | | 1,377 | |

| Customer Deposits | | | 61 | | | | 61 | |

| Taxes Accrued | | | 260 | | | | 116 | |

| Interest Accrued | | | 155 | | | | 201 | |

| Unearned Revenue | | | 235 | | | | 42 | |

| Current Liabilities of Discontinued Operations | | | 527 | | | | 537 | |

| Total Current Liabilities | | | 15,127 | | | | 19,430 | |

| Deferred Credits and Other Liabilities: | | | | | | | | |

| Accrued Removal Obligations | | | 5,650 | | | | 5,699 | |

| Carrying Value of Interest Rate Hedge | | | 2,647 | | | | 2,255 | |

| Uncollected Maine Yankee Decommissioning Costs | | | 4,093 | | | | 4,774 | |

| Other Regulatory Liabilities | | | 252 | | | | 343 | |

| Deferred Income Taxes | | | 23,186 | | | | 21,864 | |

| Accrued Postretirement Benefits and Pension Costs | | | 8,317 | | | | 8,226 | |

| Investment Tax Credits | | | 54 | | | | 59 | |

| Miscellaneous | | | 2,501 | | | | 2,607 | |

| Total Deferred Credits and Other Liabilities | | | 46,700 | | | | 45,827 | |

| Commitments, Contingencies, and Regulatory Matters (Note 8) | | | | | | | | |

| Total Capitalization and Liabilities | | $ | 132,973 | | | $ | 135,625 | |

See Notes to Consolidated Financial Statements

MAINE & MARITIMES CORPORATION AND SUBSIDIARIES

Statement of Consolidated Shareholders’ Equity (Unaudited)

(In thousands of dollars, except share information)

| | | | | | Common Shares | | | | | | | | | | |

| | | Common Shares Issued and Outstanding | | | Par Value Issued ($7/Share) | | | Paid-In Capital | | | Retained Earnings | | | Accumulated Other Compre-hensive Income (Loss) | | | Total | |

| Balance, December 31, 2007 | | | 1,677,664 | | | $ | 11,744 | | | $ | 1,954 | | | $ | 29,898 | | | $ | (655 | ) | | $ | 42,941 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock Issued | | | 198 | | | | 1 | | | | 5 | | | | | | | | | | | | 6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Income | | | | | | | | | | | | | | | 1,966 | | | | | | | | 1,966 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Other Comprehensive Loss: | | | | | | | | | | | | | | | | | | | | | | | | |

| Changes in Value of Foreign Exchange Translation Loss, Net of Tax Benefit of $11 | | | | | | | | | | | | | | | | | | | (17 | ) | | | (17 | ) |

| Unrealized Gain on Investments Available for Sale, Net of Tax Benefit of $2 | | | | | | | | | | | | | | | | | | | (3 | ) | | | (3 | ) |

| Change in Fair Value of Interest Rate Hedge, Net of Tax Benefit of $157 | | | | | | | | | | | | | | | | | | | (235 | ) | | | (235 | ) |

| Total Other Comprehensive Loss | | | | | | | | | | | | | | | | | | | | | | | (255 | ) |

| Total Comprehensive Income | | | | | | | | | | | | | | | | | | | | | | | 1,711 | |

| Balance, March 31, 2008 | | | 1,677,862 | | | $ | 11,745 | | | $ | 1,959 | | | $ | 31,864 | | | $ | (910 | ) | | $ | 44,658 | |

MAM had five million shares of $7 par value per share common stock authorized, with 1,677,862 and 1,677,664 shares issued and outstanding as of March 31, 2008, and December 31, 2007, respectively. At March 31, 2008, and December 31, 2007, MAM had 500,000 shares of $0.01 per share preferred stock authorized, with none issued or outstanding.

See Notes to Consolidated Financial Statements.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

1. ACCOUNTING POLICIES

Consolidation and Basis of Presentation

The accompanying consolidated financial statements include the accounts of Maine & Maritimes Corporation (“MAM” or the “Company”) and the following wholly-owned subsidiaries and affiliates:

| 1. | Maine Public Service Company (“MPS”) and its wholly-owned inactive Canadian subsidiary Maine & New Brunswick Electrical Power Company, Ltd (“Me&NB”); |

| 2. | MAM Utility Services Group (“MAM USG”), a wholly-owned United States subsidiary; |

| 3. | The Maricor Group (“TMG”) and its wholly-owned United States subsidiary The Maricor Group New England, Inc. (“TMGNE”) and TMG’s wholly-owned Canadian subsidiary The Maricor Group, Canada Ltd (“TMGC”) and TMGC’s wholly-owned Canadian subsidiary Mecel Properties Ltd. (“Mecel”), all of which are classified as discontinued operations; and |

| 4. | Energy Atlantic, LLC (“EA”), an inactive subsidiary. |

Maricor Technologies, Inc. (“MTI”) was a former wholly-owned subsidiary of MAM. Substantially all of the assets of MTI were sold on April 13, 2007, and the legal entity of MTI was dissolved on June 28, 2007. The activity of MTI through dissolution of the company is reported in discontinued operations.

MAM was a 50% owner of Maricor Properties Ltd, a Canadian company formerly wholly-owned by MAM, and its wholly-owned Canadian subsidiary Cornwallis Court Developments Ltd. (“Cornwallis”). MAM divested its 50% ownership of Maricor Properties on March 31, 2008, through a share redemption agreement with Ashford Investments, Inc. (“Ashford”).

MAM was also a 50% owner of Maricor Ashford, an inactive joint venture with Ashford. As of September 12, 2007, MAM sold its 50% ownership of Maricor Ashford to Ashford.

MAM is listed on the American Stock Exchange (“AMEX”) under the symbol “MAM.”

All inter-company transactions between MAM and its subsidiaries have been eliminated in consolidation.

Accounting Policies

The Company’s accounting policies are those disclosed in its 2007 Annual Report on Form 10-K, which is hereby incorporated by this reference.

New Accounting Pronouncements

On March 19, 2008, the Financial Accounting Standards Board (“FASB”) issued FASB Statement of Financial Accounting Standards (“SFAS”) No. 161, Disclosures about Derivative Instruments and Hedging Activities – an Amendment of FASB Statement 133. This statement enhances the required disclosures about derivatives and hedging activities, including how an entity uses derivative instruments, how the entity accounts for these instruments, and how the derivative instruments and hedging activities affect an entity’s financial position, financial performance and cash flows. Specific enhancements from this new standard include disclosure of:

| · | The objectives for using derivative instruments, disclosed in terms of underlying risk and accounting designation; |

| · | The fair values of derivative instruments and their gains and losses in a tabular format; and |

| · | Information about contingent features related to credit risk. |

This standard also requires a cross-reference from the derivative footnote to other footnotes in which derivative-related information is disclosed. SFAS 161 is effective for fiscal years and interim periods beginning after November 15, 2008. MAM’s use of derivatives is limited to cash flow interest rate derivatives to fix the interest rates on MPS’s two remaining variable rate long-term debt issues. The additional disclosure requirements are not expected to have a material impact on MAM’s financial statements.

2. INCOME TAXES

A summary of Federal, Canadian and State income taxes charged (credited) to income is presented below. For accounting and ratemaking purposes, income tax provisions (benefits) included in “Operating Expenses” reflect taxes applicable to revenues and expenses allowable for ratemaking purposes on MPS regulated activities and unregulated activities for MAM, MAM USG, TMG and MTI. The tax effect of items not included in rate base or normal operating activities is allocated as “Other Income (Deductions).”

The foreign income taxes include only the Canadian income taxes for Maine & New Brunswick and Mecel. The Canadian operations of TMG are consolidated in the MAM US tax return as a division, and are included in Federal income taxes.

| (In thousands of dollars) | | For the Quarters Ending March 31, | |

| | | 2008 | | | 2007 | |

| Current income taxes | | | | | | |

| Federal | | $ | - | | | $ | - | |

| State | | | - | | | | - | |

| Foreign | | | - | | | | 4 | |

| Total current income taxes | | | - | | | | 4 | |

| Deferred income taxes | | | | | | | | |

| Federal | | | 1,043 | | | | 647 | |

| State | | | 347 | | | | 290 | |

| Total deferred income taxes | | | 1,390 | | | | 937 | |

| Investment credits, net | | | (5 | ) | | | (5 | ) |

| Total income taxes | | $ | 1,385 | | | $ | 936 | |

| Allocated to: | | | | | | | | |

| Operating income | | | | | | | | |

| - Regulated | | $ | 1,364 | | | $ | 1,317 | |

| - Unregulated | | | (2 | ) | | | (241 | ) |

| Subtotal | | | 1,362 | | | | 1,076 | |

| Discontinued Operations | | | (6 | ) | | | (141 | ) |

| Total Operating | | | 1,356 | | | | 935 | |

| Other income | | | 29 | | | | 1 | |

| Total | | $ | 1,385 | | | $ | 936 | |

For the three months ended March 31, 2008, and 2007, the effective income tax rates were 41.3% and 40.9%, respectively. The principal reason for the effective tax rate differing from the US federal income tax rate is the earnings from investments, which is partly offset by the empowerment zone credit adjustment and investment tax credit amortization.

The Company has not accrued U.S. income taxes on the undistributed earnings of Me&NB, as the withholding taxes due on the distribution of any remaining amount would be principally offset by foreign tax credits. No dividends were received from Me&NB in the first quarters of 2008 or 2007.

In June 2006, the FASB issued FASB Interpretation Number (“FIN”) 48, “Accounting for Uncertainty in Income Taxes, an Interpretation of FASB Statement 109.” This statement clarifies the criteria that an individual tax position must satisfy for some of all of the benefits of that position to be recognized in a company’s financial statements. FIN 48 requires a tax position must be more-likely-than-not in order for the position to be recognized in the financial statements.

Effective January 1, 2007, the Company adopted the provisions of FIN 48. There were no adjustments required to the reported tax benefits from the adoption of this standard. The Company does not expect that the amounts of unrecognized tax benefits will change significantly in the next twelve months. As of March 31, 2008 and 2007, the Company has accrued no interest or penalties related to uncertain tax positions.

In the first quarter of 2008, the Company was under audit by the State of Maine for its 2005 and 2006 State income and sales tax returns. This review was completed during the first quarter of 2008, with no material adjustments. These returns could remain subject to audit, if the US Federal income tax returns for those years are selected for audit. The statutes of limitations for audits by Federal, Maine, Massachusetts and Canadian tax authorities have expired for all tax years ending December 31, 2003, or earlier.

As required by SFAS 109 and FIN 48, Management of the Company has evaluated the positive and negative evidence bearing upon the realizability of the Company’s deferred tax assets, which consist principally of pension and post-retirement benefits, net operating loss carryforwards, earnings on investments, and accumulated Other Comprehensive Income (“OCI”) on MPS’s interest rate hedges. For the quarter ended March 31, 2008, and the year ended December 31, 2007, Management evaluated the deferred tax assets and determined a valuation allowance was needed on the earnings on investments. Certain distributions from MPS’s investments have been treated for tax purposes as dividend income, resulting in a deferred tax asset. As this will become a capital loss for tax purposes, the Company cannot be assured capital gains will exist to allow for the use of this loss, and a valuation allowance has been provided.

The following summarizes accumulated deferred income tax (assets) and liabilities established on temporary differences under SFAS 109 as of March 31, 2008, and December 31, 2007:

| (In thousands of dollars) | | | | | | |

| | | March 31, 2008 | | | December 31, 2007 | |

| Seabrook | | $ | 4,970 | | | $ | 5,124 | |

| Property | | | 9,584 | | | | 9,527 | |

| Flexible pricing revenue | | | 354 | | | | 403 | |

| Deferred fuel | | | 11,847 | | | | 12,311 | |

| Pension and post-retirement benefits | | | (2,201 | ) | | | (2,173 | ) |

| Net Operating Loss Carryforwards | | | (10 | ) | | | (2,095 | ) |

| Other Comprehensive Income | | | (1,013 | ) | | | (853 | ) |

| Deferred Directors' Compensation | | | (335 | ) | | | (388 | ) |

| Other | | | (10 | ) | | | 8 | |

| Net Accumulated Deferred Income Tax Liability from Continuing Operations | | $ | 23,186 | | | $ | 21,864 | |

| Other Comprehensive Income | | | 528 | | | | 538 | |

| Other | | | (16 | ) | | | (11 | ) |

| Net Accumulated Deferred Income Tax Liability of Discontinued Operations | | $ | 512 | | | $ | 527 | |

| Net Accumulated Deferred Income Tax Liability | | $ | 23,698 | | | $ | 22,391 | |

3. SEGMENT INFORMATION

The Company is organized based on products and services. Management monitors the operations of the Company in the following operating segments:

| · | Regulated electric utility: MPS and its inactive wholly-owned Canadian subsidiary, Me&NB; |

| · | Unregulated utility services: MAM USG; |

| · | Unregulated engineering services: TMG and its subsidiaries and product and service lines, classified as discontinued operations; |

| · | Unregulated software technology: MTI, classified as discontinued operations; and |

| · | Other: Corporate costs directly associated with the unregulated subsidiaries, common costs not allocated to the regulated utility and inter-company eliminations. |

The accounting policies of the segments are the same as those described in Note 1, “Accounting Policies.” MAM provides certain administrative support services to MPS and MAM USG, and provided similar services to TMG, and MTI and their subsidiaries. The costs of services provided to MPS and MAM USG are billed to MPS and MAM USG based on a combination of direct charges and allocations. The cost of corporate services provided to the other unregulated entities remains at the holding company, and is not allocated or charged to the various subsidiaries.

MPS also provides services to MAM and other affiliates, including administrative services, such as information technology, human resources and accounting, and operational services. The administrative services are billed to MAM at cost through inter-company transactions. Operational services for which MPS has an established rate for charging third parties are charged at those established rates.

| | | | | | (In thousands of dollars) | | | | |

| | | | | | Quarter Ended March 31, 2008 | | | | |

| | | | | | Unregulated | | | | |

| | | Regulated Electric Utility | | | Utility Services | | | Engineering Services | | | Software Technology | | | Other | | | Total | |

| Revenues from External Customers | | | | | | | | | | | | | | | | | | |

| Regulated Operating Revenues | | $ | 10,901 | | | $ | - | | | $ | - | | | $ | - | | | $ | (10 | ) | | $ | 10,891 | |

| Unregulated Utility Operating Revenues | | | - | | | | 1,296 | | | | - | | | | - | | | | - | | | | 1,296 | |

| Total Operating Revenues | | | 10,901 | | | | 1,296 | | | | - | | | | - | | | | (10 | ) | | | 12,187 | |

| Operating Expenses | | | | | | | | | | | | | | | | | | | | | | | | |

| Regulated Operation & Maintenance | | | 3,337 | | | | - | | | | - | | | | - | | | | - | | | | 3,337 | |

| Unregulated Operation & Maintenance | | | - | | | | 1,180 | | | | - | | | | - | | | | 95 | | | | 1,275 | |

| Depreciation | | | 754 | | | | 1 | | | | - | | | | - | | | | - | | | | 755 | |

| Amortization of Stranded Costs | | | 2,728 | | | | - | | | | - | | | | - | | | | - | | | | 2,728 | |

| Amortization | | | 53 | | | | - | | | | - | | | | - | | | | - | | | | 53 | |

| Taxes Other than Income | | | 453 | | | | 2 | | | | - | | | | - | | | | (1 | ) | | | 454 | |

| Income Taxes | | | 1,364 | | | | 64 | | | | - | | | | - | | | | (66 | ) | | | 1,362 | |

| Total Operating Expenses | | | 8,689 | | | | 1,247 | | | | - | | | | - | | | | 28 | | | | 9,964 | |

| Operating Income (Loss) | | | 2,212 | | | | 49 | | | | - | | | | - | | | | (38 | ) | | | 2,223 | |

| Other Income (Deductions) | | | | | | | | | | | | | | | | | | | | | | | | |

| Equity in Income (Loss) of Associated Companies | | | 33 | | | | - | | | | - | | | | - | | | | (8 | ) | | | 25 | |

| Interest and Dividend Income | | | 13 | | | | - | | | | - | | | | - | | | | (9 | ) | | | 4 | |

| Other (Deductions) Income | | | (72 | ) | | | 46 | | | | - | | | | - | | | | 2 | | | | (24 | ) |

| Total Other (Deductions) Income | | | (26 | ) | | | 46 | | | | - | | | | - | | | | (15 | ) | | | 5 | |

| Income (Loss) Before Interest Charges | | | 2,186 | | | | 95 | | | | - | | | | - | | | | (53 | ) | | | 2,228 | |

| Interest Charges | | | 199 | | | | - | | | | - | | | | - | | | | 54 | | | | 253 | |

| Income (Loss) from Continuing Operations | | | 1,987 | | | | 95 | | | | - | | | | - | | | | (107 | ) | | | 1,975 | |

| Loss from Discontinued Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Loss From Operations | | | - | | | | - | | | | (15 | ) | | | - | | | | - | | | | (15 | ) |

| Benefit of Income Taxes | | | - | | | | - | | | | 6 | | | | - | | | | - | | | | 6 | |

| Loss from Discontinued Operations | | | - | | | | - | | | | (9 | ) | | | - | | | | - | | | | (9 | ) |

| Net Income (Loss) | | $ | 1,987 | | | $ | 95 | | | $ | (9 | ) | | $ | - | | | $ | (107 | ) | | $ | 1,966 | |

| Total Assets | | $ | 130,543 | | | $ | 1,614 | | | $ | 638 | | | $ | - | | | $ | 178 | | | $ | 132,973 | |

| | | | | | (In thousands of dollars) | | | | |

| | | | | | Quarter Ended March 31, 2007 | | | | |

| | | | | | Unregulated | | | | |

| | | Regulated Electric Utility | | | Utility Services | | | Engineering Services | | | Software Technology | | | Other | | | Total | |

| Revenues from External Customers | | | | | | | | | | | | | | | | | | |

| Regulated Operating Revenues | | $ | 10,915 | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | 10,915 | |

| Operating Expenses | | | | | | | | | | | | | | | | | | | | | | | | |

| Regulated Operation & Maintenance | | | 3,377 | | | | - | | | | - | | | | - | | | | - | | | | 3,377 | |

| Unregulated Operation & Maintenance | | | - | | | | - | | | | - | | | | - | | | | 492 | | | | 492 | |

| Depreciation | | | 711 | | | | - | | | | - | | | | - | | | | - | | | | 711 | |

| Amortization of Stranded Costs | | | 2,804 | | | | - | | | | - | | | | - | | | | - | | | | 2,804 | |

| Amortization | | | 55 | | | | - | | | | - | | | | - | | | | - | | | | 55 | |

| Taxes Other than Income | | | 441 | | | | - | | | | - | | | | - | | | | 3 | | | | 444 | |

| Income Taxes | | | 1,317 | | | | - | | | | - | | | | - | | | | (241 | ) | | | 1,076 | |

| Total Operating Expenses | | | 8,705 | | | | - | | | | - | | | | - | | | | 254 | | | | 8,959 | |

| Operating Income (Loss) | | | 2,210 | | | | - | | | | - | | | | - | | | | (254 | ) | | | 1,956 | |

| Other Income (Deductions) | | | | | | | | | | | | | | | | | | | | | | | | |

| Equity in Loss of Associated Companies | | | (38 | ) | | | - | | | | - | | | | - | | | | (34 | ) | | | (72 | ) |

| Interest and Dividend Income | | | 17 | | | | - | | | | - | | | | - | | | | (10 | ) | | | 7 | |

| Other Deductions | | | (20 | ) | | | - | | | | - | | | | - | | | | (6 | ) | | | (26 | ) |

| Total Other Deductions | | | (41 | ) | | | - | | | | - | | | | - | | | | (50 | ) | | | (91 | ) |

| Income (Loss) Before Interest Charges | | | 2,169 | | | | - | | | | - | | | | - | | | | (304 | ) | | | 1,865 | |

| Interest Charges | | | 214 | | | | - | | | | - | | | | - | | | | 91 | | | | 305 | |

| Income (Loss) from Continuing Operations | | | 1,955 | | | | - | | | | - | | | | - | | | | (395 | ) | | | 1,560 | |

| Loss from Discontinued Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Loss From Operations | | | - | | | | - | | | | (142 | ) | | | (208 | ) | | | - | | | | (350 | ) |

| Benefit of Income Taxes | | | - | | | | - | | | | 63 | | | | 78 | | | | - | | | | 141 | |

| Loss from Discontinued Operations | | | - | | | | - | | | | (79 | ) | | | (130 | ) | | | - | | | | (209 | ) |

| Net Income (Loss) | | $ | 1,955 | | | $ | - | | | $ | (79 | ) | | $ | (130 | ) | | $ | (395 | ) | | $ | 1,351 | |

| Total Assets | | $ | 136,488 | | | $ | - | | | $ | 7,555 | | | $ | 1,272 | | | $ | 650 | | | $ | 145,965 | |

4. INVESTMENTS IN ASSOCIATED COMPANIES

Maricor Properties Ltd

On March 31, 2008, MAM divested its 50% interest in Maricor Properties and its subsidiary Cornwallis and settled all accounts receivables from associated companies for $535,000 Canadian or $529,000 US. This divestiture resulted in a $3,000 gain, reported in the Consolidated Statement of Operations within “Other-Net.” This transaction also released the $1.7 million letter of credit from Bank of America and released MAM from any obligations associated with the long-term debt of Maricor Properties and Cornwallis. The divestiture was accomplished through a Redemption Agreement signed with Ashford, the other 50% owner of Maricor Properties. On April 22, 2008, the proceeds from this sale and other available funds were used to repay the remaining $850,000 balance of MAM’s term note with Bank of America.

For the first quarter of 2008, MAM recorded equity in the loss of Maricor Properties of $8,000.

Maine Yankee and MEPCO

MPS owns 5% of the common stock of Maine Yankee Atomic Power Company (“Maine Yankee”), a jointly-owned nuclear electric power company, and 7.49% of the common stock of MEPCO, a jointly-owned electric transmission company. Although MPS’s ownership percentage of these entities is relatively low, it does have influence over the operating and financial decisions of these companies through board representation, and therefore MPS records its investment in MEPCO and Maine Yankee using the equity method. This is consistent with industry practice for similar jointly-owned units.

No dividends were paid by Maine Yankee in the first quarters of 2008 or 2007. MPS received dividends of $2,000 from MEPCO in both the first quarters of 2008 and 2007.

Substantially all earnings of Maine Yankee and MEPCO are distributed to investor companies.

5. STOCK COMPENSATION PLAN

Upon approval by MPS’s shareholders in June 2002, MPS adopted the 2002 Stock Option Plan (the “Plan”). The Plan was subsequently adopted by MAM after its formation. The Plan is administered by the members of the Performance and Compensation Committee of the Board of Directors, who are not employees of the Company or its subsidiaries. The Company may grant options to its employees for up to 150,000 shares of common stock, provided that the maximum aggregate number of incentive shares which may be issued under the Plan pursuant to incentive stock options shall be 120,000 shares. The exercise price for shares to be issued under any incentive stock option shall not be less than one-hundred percent (100%) of the fair market value of such shares on the date the option is granted. An option’s maximum term is ten years.

As of March 31, 2008, the former CEO has been the only employee to receive stock options, with 3,932 options outstanding for the remainder of the original ten-year term of these options.

The Company accounts for the fair value of its grants under the Plan in accordance with the expense provisions of SFAS 123(R), “Accounting for Stock-Based Compensation.”

The fair value of each option grant is estimated on the date of grant using the Black-Scholes option-pricing model with the following weighted-average assumptions used for the grants:

| Year of Issuance | | 2003 | | | 2002 | |

| Number of Options Granted | | | 1,966 | | | | 1,966 | |

| Vesting Period | | 3 years | | | 3 years | |

| Number of Options Vested and Exercisable | | | 1,966 | | | | 1,966 | |

| Dividend Yield | | | 4.60 | % | | | 4.70 | % |

| Volatility | | | 20.00 | % | | | 20.00 | % |

| Risk-Free Interest Rate | | | 3.00 | % | | | 4.60 | % |

| Expected Life | | 7 years | | | 7 years | |

A summary of the status of the Company’s stock option plan as of March 31, 2008, and changes during the year then ended is presented below:

| | | Shares | | | Average Exercise Price | |

| Options | | 2008 | | | 2008 | |

| Outstanding at December 31, 2007 | | | 3,932 | | | $ | 30.28 | |

| Granted | | | - | | | | - | |

| Exercised | | | - | | | | - | |

| Expired | | | - | | | | - | |

| Forfeited | | | - | | | | - | |

| Outstanding at March 31, 2008 | | | 3,932 | | | $ | 30.28 | |

| Options exercisable at March 31, 2008 | | | 3,932 | | | $ | 30.28 | |

| Weighted-average fair value of options granted | | $ | 4.17 | | | | | |

The following table summarizes information about fixed stock options outstanding at March 31, 2008:

| | | | Options Outstanding | | | Options Exercisable | |

Range of Exercise Prices | | | Number Outstanding at 3/31/08 | | Weighted- Average Remaining Contractual Life | | Weighted- Average Exercise Price | | | Number Exercisable at 3/31/08 | | | Weighted- Average Exercise Price | |

| $ | 30.10 - $30.45 | | | | 3,932 | | 4.67 yrs | | $ | 30.28 | | | | 3,932 | | | $ | 30.28 | |

Dilutive earnings per share impact of outstanding stock options:

| | | Quarters Ended March 31, | |

| | | 2008 | | | 2007 | |

| Net Income (in thousands) | | $ | 1,966 | | | $ | 1,351 | |

| Shares Used in Computation of Earnings | | | | | | | | |

| Weighted-Average Common Shares Outstanding in Computation of Basic Earnings per Share | | | 1,677,862 | | | | 1,646,823 | |

| Dilutive Effect of Common Stock Options | | | 176 | | | | - | |

| Dilutive Effect of Preferred Shares | | | - | | | | 8,211 | |

| Shares Used in Computation of Earnings per Common Share Assuming Dilution | | | 1,678,038 | | | | 1,655,034 | |

| Net Income per Share (Basic) | | $ | 1.17 | | | $ | 0.82 | |

| Net Income per Share (Diluted) | | $ | 1.17 | | | $ | 0.81 | |

6. DEFERRED DIRECTORS’ COMPENSATION

The compensation program for the MAM Board of Directors includes an option for the director to defer some or all of his or her fees, rather than taking those fees in cash each quarter. The first deferral option grants the director a number of phantom shares of stock, with the number granted equivalent to the fees earned for the quarter, divided by the closing share price on the last day of that quarter. The cumulative deferred phantom shares are marked to the closing share price on the last day of each quarter, and the adjustment is recorded as expense. If applicable, any dividends paid are also converted to an equivalent number of phantom shares, and are added to the cumulative deferred total.

During the first quarter of 2008, the equivalent of 1,331 shares was deferred, bringing the total deferred through March 31, 2008, to the equivalent of 32,649 shares. The share price on that date was $27.80, resulting in a $908,000 liability recorded on the Consolidated Balance Sheet under “Miscellaneous Liabilities.” A $1 increase in MAM's stock price would increase this liability by approximately $33,000. A $1 decrease in MAM's stock price would decrease this liability by approximately $33,000. This unfunded liability is payable upon termination of services of the director. The plan allows for a lump sum distribution or a monthly payment over ten years. All directors currently participating in this deferral plan have elected the ten-year payment option.

The second deferral option allows directors to postpone payment of their fees in cash, and earn interest on the deferred amounts at a rate adjusted quarterly to the five-year Treasury Note rate. The unfunded obligation under this deferral program is $20,000, and is also recorded under “Miscellaneous Liabilities” on the Consolidated Balance Sheets.”

7. BENEFIT PROGRAMS

The Company provides certain pension, post-retirement and welfare benefit programs to its employees. Benefit programs are an integral part of the Company’s commitment to hiring and retaining employees, providing market-based compensation that rewards individual and corporate performance. The Company offers welfare benefit plans to all employees, consisting of health care, life insurance, long-term disability, and accidental disability insurance. The Company also offers a retirement savings program to most employees in the form of a 401(k) plan. This plan allows voluntary contributions by the employee and may contain a contribution by the Company.

On August 17, 2006, the Pension Protection Act was signed into law. Included in this legislation are new minimum funding rules that will go into effect for plan years beginning in 2008. The funding target is 100% of a plan’s liability, with any shortfall amortized over seven years. There are lower funding targets, between 92% and 100%, available to well-funded plans during the transition period.

U. S. Defined Benefit Pension Plan

The Company has a non-contributory defined benefit pension plan covering MPS and certain former MAM employees. No employees of other unregulated businesses are eligible for this benefit plan. Benefits under the plan are based on employees’ years of service and compensation prior to retirement.

On December 31, 2006, future salary and service accruals for current participants in the plan ceased, and any new employees hired on or after January 1, 2006, are not eligible for the pension plan. The Company agreed to additional employer contributions to the Retirement Savings Plan to compensate employees in part or in full, depending on their number of years of service, for this lost benefit. This additional contribution ranges from 5% to 25% of each eligible employee’s gross base pay, and is immediately fully vested. This contribution was $171,000 and $201,000 in the first quarters of 2008 and 2007, respectively.

The Company’s policy has been to fund pension costs accrued. The Company expects to contribute approximately $41,000 per quarter during 2008 for 2008 plan year estimated payments, and does not anticipate any additional contributions for the 2007 plan year.

The following table sets forth the plans’ net periodic benefit cost:

| (In thousands of dollars) | | Pension Benefits | |

| | | Quarters Ended March 31, | |

| | | 2008 | | | 2007 | |

| Interest cost | | $ | 268 | | | $ | 301 | |

| Expected return on plan assets | | | (305 | ) | | | (271 | ) |

| Recognized net actuarial (gain) | | | 19 | | | | - | |

| Net periodic benefit cost | | $ | (18 | ) | | $ | 30 | |

Health Care Benefits

The Company provides certain health care benefits to eligible employees. Eligible employees share in the cost of their medical benefits, in addition to plan deductibles and coinsurance payments. The plan also covers retiree medical coverage for employees of Maine Public Service Company, the regulated utility. Employees hired on or after October 1, 2005, are not eligible for post-retirement medical coverage.

The following table sets forth the plans’ net periodic benefit cost:

| (In thousands of dollars) | | Health Care Benefits | |

| | | Quarters Ended March 31, | |

| | | 2008 | | | 2007 | |

| Service cost | | $ | 51 | | | $ | 45 | |

| Interest cost | | | 137 | | | | 124 | |

| Expected return on plan assets | | | (56 | ) | | | (53 | ) |

| Amortization of transition obligation | | | 18 | | | | 18 | |

| Amortization of prior service cost | | | (15 | ) | | | (15 | ) |

| Recognized net actuarial (gain) | | | 49 | | | | 45 | |

| Net periodic benefit cost | | $ | 184 | | | $ | 164 | |

8. COMMITMENTS, CONTINGENCIES AND REGULATORY MATTERS

Federal Energy Regulatory Commission 2007 Open Access Transmission Tariff Formula Rate Filing

On May 21, 2007, MPS filed its updated rates under the 2007 Open Access Transmission Tariff (“OATT”) formula pursuant to Docket ER00-1053 for both wholesale and retail customers. The revenue increases were approximately $54,000 for wholesale customers, effective June 1, 2007, and $345,000 for retail customers, effective July 1, 2007. The parties have reached a settlement in principle, with no material change to the rates in the original filing.

Stakeholder Initiative Regarding the Competitiveness and Reliability of the Northern Maine Power Grid

On November 16, 2006, the MPUC issued an Order in Docket No. 2006-513 concluding that northern Maine lacks a competitive power market. In an effort to deal with this lack of competition and the system reliability issues raised by the Company’s unsuccessful bid to secure a certificate for the construction of a new transmission line, the MPUC held a three-day stakeholders conference in December 2006, in an attempt to resolve, on a collaborative basis, the issues raised in these cases. As a result of this effort, two parallel initiatives have been launched:

(a) the stakeholders were asked to develop a protocol allowing for the possibility of generation suppliers obtaining long-term power delivery commitments through the Standard Offer process and not through the Company. This could encourage the construction of new generation in the Company’s service territory, and/or secure the availability of existing on-system generating sources on a long-term (multi-year) basis. In September 2007, the MPUC provided a Report to the Maine Legislature stating that “a long-term standard offer solicitation, without a transmission line development component, is not sufficiently likely to address the lack of competition in the area and may be counterproductive.” At this time, the Company cannot predict whether all of the stakeholders will reach agreement on any such protocol initiative, or whether it will be finalized and accepted by the MPUC;

(b) the stakeholders were asked to address the feasibility of one or more proposals for transmission projects interconnecting the northern Maine grid with the ISO New England (“ISO-NE”) grid, possibly by means of a tap into the MEPCO 345 kV transmission line that connects the high voltage systems of Maine and New Brunswick, Canada.

On July 26, 2007, MPS and Central Maine Power (“CMP”), pursuant to Section II 46-48 of the ISO-NE OATT, requested that ISO-NE study a transmission upgrade that would interconnect MPS with the ISO-NE operated transmission system. The preliminary study results indicate there would be economic and reliability benefits for Maine and the entire New England region as a result of constructing a new high-voltage transmission line that would interconnect MPS with ISO-NE. Accordingly, while the results remain preliminary, MPS and CMP have begun preparations to file for approval of the new line with the MPUC during 2008.

Coincident with this effort, on February 26, 2008, MPS conditionally requested ISO-NE’s consent for MPS to become a member of ISO-NE, more specifically an Additional Participating Transmission Owner as set forth in Section 11.05 of the Transmission Operating Agreement. The request was conditioned on a number of significant factors and necessary approvals, including (a) that the costs of new line and portions of MPS’s existing transmission system be included in New England regional rates in a manner such that northern Maine consumers will obtain economic benefits from joining ISO-NE that outweigh the costs to them; (b) that the new line be constructed, energized and included in the ISO-NE Regional Network Service transmission rate; and (c) that the MPUC grant a Certificate of Public Convenience and Necessity (“CPCN”) for the project and concur with MPS becoming an Additional Participating Transmission Owner.

Due to the impending CPCN filing expected to be filed with the MPUC during the third quarter of 2008, on April 11, 2008, MPS petitioned the MPUC to terminate MPUC Docket No. 2006-513. MPS expects a decision in this Docket in the near future, but cannot predict the outcome of this effort.

MPUC Investigation of Maine Utilities Continued Participation in ISO-NE

On April 8, 2008, the MPUC initiated an investigation in Docket No. 2008-156 of Maine utilities continued participation in ISO-NE and the New England Regional Transmission Organization. MPS is not currently a member of ISO-NE. However, as noted in the Stakeholder Initiative Regarding the Competitiveness and Reliability of the Northern Maine Power Grid discussed above, the Company has requested to become a member of ISO-NE if certain conditions are met. MPS will be an active participant in this Docket.

Wheelabrator-Sherman

MPS was ordered into a Power Purchase Agreement with Wheelabrator-Sherman in 1986, which required the purchase of the entire output (up to 126,582 MWH per year) of a 17.6 MW biomass plant through December 31, 2006. Total stranded costs included as regulatory assets under the caption “Deferred Fuel and Purchased Energy Costs” in the Consolidated Balance Sheet related to this contract are $29.7 million and $30.9 million at March 31, 2008, and December 31, 2007, respectively.

Poly Chlorinated Bi-Phenol Transformers

In response to a Maine environmental regulation to phase out Poly Chlorinated Bi-phenol (“PCB”) transformers, MPS has a program to eliminate transformers on its system that do not meet the State environmental guidelines. The Company is in the process of inspecting almost 13,000 distribution transformers over a ten-year period. MPS is currently in its eighth year of this ten-year program. Approximately 35% of the transformers inspected require “in service” PCB oil sampling. In addition, transformers that pass the inspection criteria will be refitted with new lightning arrestors and animal guards, where necessary. The current total estimated cost of the project is $3.0 million; as of March 31, 2008, $2.4 million of this total has been spent. The remaining cost of the project has been accrued on the Consolidated Balance Sheet as “Accrued Removal Obligations.”

Off-Balance Sheet Arrangements

The Company has several operating leases for office and field equipment, vehicles and office space, accounted for in accordance with SFAS 13, Accounting for Leases. The following summarizes payments for leases for a period in excess of one year for the quarters ended March 31, 2008, and 2007:

| (In thousands of dollars) | | 2008 | | | 2007 | |

| Equipment | | $ | 5 | | | $ | 6 | |

| Building | | | 32 | | | | 77 | |

| Vehicles | | | - | | | | 9 | |

| Rights of Way | | | - | | | | 26 | |

| Total | | $ | 37 | | | $ | 118 | |

The future minimum lease payments have not changed materially from the amounts reported as of December 31, 2007. Please refer to MAM’s 2007 Form 10-K for these future lease payments.

Financial Information System Hosting Agreement

In 2007, the Company renegotiated its Financial Information System hosting agreement with OneNeck IT Services to host and provide technical and functional support for the integrated Oracle Financial Information System. The base hosting fees are $537,500 per year for 2007 through 2013.

9. FAIR VALUE DISCLOSURES

On January 1, 2008, the Company adopted SFAS 157, “Fair Value Measurements.” SFAS 157 defines fair value, establishes a framework for measuring fair value, and expands disclosures requirements about fair value measurements. This standard applies to reported balances that are required or permitted to be measured at fair value under existing accounting pronouncements. The standard does not require any new fair value measurements.

SFAS 157 emphasizes that fair value is a market-based measurement, not an entity-specific measurement. Therefore, a fair value measurement should be determined based on the assumptions that market participants would use in pricing the asset or liability. SFAS 157 establishes a three-level fair value hierarchy as the basis for considering market participant assumptions in fair value measurements. The input levels are defined as follows:

| · | Level 1 inputs: Unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the ability to access. |

| · | Level 2 inputs: Inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly, including quoted prices for similar assets and liabilities in active markets, as well as other observable inputs for the asset or liability, such as interest rates, foreign exchange rates, and yield curves that are observable at commonly quoted intervals. |

| · | Level 3 inputs: Unobservable inputs for the asset or liability, typically based on an entity’s own assumptions, as there is little, if any, related market activity. |

In instances where the determination of the fair value measurement is based on inputs from different levels of the fair value hierarchy, the level in the fair value hierarchy within which the entire fair value measurement falls is based on the lowest level input that is significant to the fair value measurement in its entirety. The Company’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the asset or liability.

Currently, the Company uses interest rate swaps to manage its interest rate risk. The valuation of these instruments is determined using widely accepted valuation techniques including discounted cash flow analysis on the expected cash flows of each derivative. This analysis reflects the contractual terms of the derivatives, including the period to maturity, and uses observable market-based inputs. This valuation relies on Level 2 inputs.

The fair value of the interest rate hedges, as of March 31, 2008, was a liability of $2.65 million, compared to a liability of $2.26 million at December 31, 2007, a loss in fair value of $392,000. This loss, less the deferred income tax benefit of $157,000, from December 31, 2007, to March 31, 2008, has been reported as “Other Comprehensive Income (Loss)” on the Consolidated Statement of Shareholders’ Equity.

10. CAPITAL LEASES

MPS financed certain of its 2006 and 2007 vehicle and computer equipment purchases through capital leases, totaling $820,000. The remaining liability as of March 31, 2008, for these capital lease arrangements is approximately $600,000, and is recorded within “Miscellaneous Liabilities” on the Consolidated Balance Sheet. Future minimum lease payments have not changed from the amounts reported as of December 31, 2007. Please refer to MAM’s 2007 Form 10-K for these future lease payments.

11. DISCONTINUED OPERATIONS

The Maricor Group

The operations of TMG largely ceased during 2007, with the sale of substantially all of the assets of TMGC in June 2007, and the closure of TMGNE in August 2007. The activity presented in discontinued operations is primarily the activity of Mecel, a wholly-owned Canadian subsidiary of TMGC which MAM is actively working to sell.

The net loss for unregulated engineering services is composed of the following:

| (in thousands of dollars) | | Quarters Ended March 31, | |

| | | 2008 | | | 2007 | |

| Loss From Operations: | | | | | | |

| Operating Revenue | | $ | 20 | | | $ | 1,667 | |

| Expenses | | | (35 | ) | | | (1,809 | ) |

| Loss from Operations | | | (15 | ) | | | (142 | ) |

| Benefit of Income Taxes | | | 6 | | | | 63 | |

| Net Loss — Unregulated Engineering Services | | $ | (9 | ) | | $ | (79 | ) |

The unregulated engineering services balance sheets as of March 31, 2008, and December 31, 2007, were as follows:

| (in thousands of dollars) | | March 31, | | | December 31, | |

| | | 2008 | | | 2007 | |

| Assets: | | | | | | |

| Cash and Cash Equivalents | | $ | 56 | | | $ | 48 | |

| Accounts Receivable, Net | | | 7 | | | | 15 | |

| Other Current Assets | | | 18 | | | | 114 | |

| Current Assets | | | 81 | | | | 177 | |

| Fixed Assets, Net of Depreciation | | | 557 | | | | 578 | |

| Total Assets | | $ | 638 | | | $ | 755 | |

| Shareholder's Equity and Liabilities: | | | | | | | | |

| Shareholder's (Deficit) Equity | | $ | (4,990 | ) | | $ | (4,966 | ) |

| Accounts Payable and Accrued Employee Benefits | | | 10 | | | | 6 | |

| Intercompany Accounts Payable | | | 1,308 | | | | 1,402 | |

| Other Current Liabilities | | | 528 | | | | 531 | |

| Current Liabilities | | | 1,846 | | | | 1,939 | |

| Intercompany Notes Payable | | | 3,782 | | | | 3,782 | |

| Total Shareholder's Equity and Liabilities | | $ | 638 | | | $ | 755 | |

Maricor Technologies

MAM divested all of the assets reported as Unregulated Software Technology during 2007. The operations for this segment have been classified as discontinued operations.

The operating revenue and net loss for unregulated software technology for the first quarters of 2007 was as follows:

| (in thousands of dollars) | | March 31, | |

| | | 2007 | |

| Loss From Operations: | | | |

| Operating Revenue | | $ | 102 | |

| Expenses | | | (310 | ) |

| Loss From Operations | | | (208 | ) |

| Benefit of Income Taxes | | | 78 | |

| Net Loss — Unregulated Software Technology | | $ | (130 | ) |

There was no impact on earnings in the first quarter of 2008, and no assets, liabilities or equity remaining in MTI at December 31, 2007, or March 31, 2008.

12. SUBSEQUENT EVENTS

Bank of America Financing

In February 2008, MPS reached terms on amendments to its debt agreements with Bank of America. These amendments were approved by the MPUC on May 1, 2008, and formalized and implemented effective May 2, 2008. The amendments include various reductions in interest rates on the lines of credit and decreased letter of credit fees on the MPS financing with Bank of America. MAM USG also executed a $500,000 line of credit with Bank of America, effective in early May 2008. This line of credit will be used to fund working capital needs.

PART 1. FINANCIAL INFORMATION

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

This filing contains certain “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995, related to the expected future performance of our plans and objectives, such as forecasts and projections of expected future performance or statements of Management’s plans and objectives. These forward-looking statements may be contained in filings with the SEC and in press releases and oral statements. We use words such as “anticipate,” “estimate,” “predict,” “expect,” “project,” “intend,” “plan,” “believe,” and other words and terms of similar meaning in connection with any discussion of future operating or financial performance. These statements are based on the current expectations, estimates or projections of Management and are not guarantees of future performance. Some or all of these forward-looking statements may not turn out to be what the Company expected. Actual results will differ, and some of the differences may be material.

Factors that could cause actual results to differ materially from our projections include, among other matters, legislation and regulation; construction of new transmission facilities; development of MAM USG; attraction and retention of qualified employees; economy of the region and general economic conditions; competitive conditions; holding company structures; interest rate and debt covenant risk; pension plan investments; information technology; environmental risks; aging infrastructure and reliability; weather; vandalism, terrorism and other illegal acts; alternative generation options; professional liability; final settlement of remaining obligations of discontinued operations; divestiture of unregulated real estate; and foreign operations. Therefore, no assurances can be given that the outcomes stated in such forward-looking statements and estimates will be achieved.

Accounting Policies

Critical accounting policies are disclosed in the Company’s 2007 Annual Report on Form 10-K.

Results of Operations and Executive Overview

Net Income and Earnings Per Share

| | | Quarters Ended March 31, | |

| (Dollars in Thousands Except per Share Amounts) | | 2008 | | | 2007 | |

| Income (Loss) from Continuing Operations | | | | | | |

| Regulated Electric Utility | | $ | 1,987 | | | $ | 1,955 | |

| Unregulated Utility Services | | | 95 | | | | - | |

| Other* | | | (107 | ) | | | (395 | ) |

| Income from Continuing Operations | | | 1,975 | | | | 1,560 | |

| Loss from Discontinued Operations | | | | | | | | |

| Unregulated Engineering Services | | | (9 | ) | | | (79 | ) |

| Unregulated Software Technology | | | - | | | | (130 | ) |

| Loss from Discontinued Operations | | | (9 | ) | | | (209 | ) |

| Net Income | | $ | 1,966 | | | $ | 1,351 | |

| Basic Income Per Share | | $ | 1.17 | | | $ | 0.82 | |

*The “Other” line includes corporate costs directly associated with the unregulated subsidiaries, common costs not allocated to the regulated utility or unregulated utility services and inter-company eliminations.

Net income above is allocated based upon the segments as presented in Note 3, “Segment Information,” of the Consolidated Financial Statements. The results by segment are explained more fully in the following sections.

The trend of improved financial performance that began in 2007 has continued into 2008, with $614,000 more consolidated net income, an increase of 46%, and $0.35 more earnings per share in the first quarter of 2008 than in the first quarter of 2007. The first quarter results of continuing operations were $2.0 million in 2008, compared to $1.6 million in 2007, with the focus on core utility competencies, including cost reductions at MPS and the first significant activity for MAM USG. With the divestiture of all but one office building of the former unregulated operations during 2007, the loss from discontinued operations was reduced from $209,000 or $0.13 per share in the first quarter of 2007, to just $9,000 and $0.01 per share in the first quarter of 2008.

This quarter is the first time we have differentiated MAM USG as a separate segment of our business. We have made good progress in obtaining electrical procurement, construction, engineering, and project management work within this segment. We expect this trend to continue as we complete these projects and pursue additional opportunities. We continue to view this segment as a way to leverage our core utility competencies as a means to provide incremental income and growth.

Our work also continues with the Maine Power Connection (“MPC”) project to develop, with our partner CMP, a high capacity transmission line connecting our service territory, with its existing and proposed generation, including renewable generation, to the New England power grid. During April of 2008, we filed a Form 8-K and a related press release outlining the details of this proposed project. Some facts about the MPC project:

| | · | A proposed a 345 kV transmission line to support interconnection requests for more than 800 MW of potential renewable generation; |

| | · | Line length between 150 and 200 miles; and |

| | · | Total estimated cost $400-$500 million |

There are several potential benefits of this proposed line including:

| | · | Introduce / increase of competition in Northern Maine electricity market; |

| | · | Provide economic benefits for region from potentially lower rates, now and in the future; |

| | · | Enhance overall market access to renewable energy sources; |

| | · | Increase system reliability; |

| | · | Reduce overall greenhouse gases and compliance with the regional greenhouse gas initiative; |

| | · | Stimulate local economy; |

| | · | Enhance State and local tax base; and |

| | · | Provide shareholders additional investment in income-producing assets. |

We are expecting to file for regulatory approvals and are completing required electrical and economic costs and benefits analyses, expecting completion this summer. During this time, we continue to secure regional support for the project with stakeholders in Maine and New England and are working toward a targeted operational date in late 2010.

On March 31, 2008, MAM successfully divested its 50% interest in Maricor Properties and its subsidiary Cornwallis for $535,000 Canadian or $529,000 US. This transaction also released the $1.7 million letter of credit from Bank of America and freed MAM of any obligations associated with the long-term debt of Maricor Properties and Cornwallis. The divestiture was accomplished through a Redemption Agreement signed with Ashford, the other 50% owner of Maricor Properties. On April 22, 2008, the proceeds from this sale and other available funds were used to repay the remaining $850,000 balance of MAM’s term note with Bank of America.

Interest Expense

Interest charges for continuing operations fell from $305,000 in the first quarter of 2007 to $253,000 in the first quarter of 2008. The decrease is primarily due to lower debt balances, with almost $5.9 million of short- and long-term debt repaid in just the first quarter of 2008. This reduction in debt is in accordance with the cash priorities outlined in the 2007 MAM Form 10-K.

Income Tax Expense / Benefit

The regulated provision for income taxes increased $47,000 from 2007 to 2008. Most of this increase is attributable to the increase in the effective tax rate, from 40.9% in 2007 to 41.3% in 2008, due to earnings from investments. The remainder of the increase, approximately $12,000, is due to the increase in net income at MPS.

The benefit of income taxes for unregulated continuing operations decreased from $241,000 in the first quarter of 2007 to $2,000 in the first quarter of 2008. The decrease is a result of the combination of lower costs at the holding company and income from MAM USG.

Taxes Other Than Income

Taxes other than income are primarily payroll and property taxes. These taxes increased $10,000 from prior year to $454,000 for the quarter ended March 31, 2008.

Regulated Operations

Regulated operations include MPS and Me&NB, the Company’s regulated subsidiary and its inactive unregulated Canadian subsidiary:

| | | Quarters Ended | |

| | | March 31, | |

| | | 2008 | | | 2007 | |

| Net Income — Regulated Electric Utility (In thousands) | | $ | 1,987 | | | $ | 1,955 | |

| Earnings Per Share from Regulated Electric Utilities | | $ | 1.18 | | | $ | 1.19 | |

Regulated Operating Revenue

Consolidated revenues (in thousands of dollars) and Megawatt Hours (“MWH”) for the quarters ended March 31, 2008, and 2007, are as follows:

| | | 2008 | | | 2007 | |

| | | Dollars | | | MWH | | | Dollars | | | MWH | |

| Residential | | $ | 4,345 | | | | 51,422 | | | $ | 4,337 | | | | 51,997 | |

| Large Commercial | | | 1,347 | | | | 38,004 | | | | 1,483 | | | | 42,733 | |

| Medium Commercial | | | 1,854 | | | | 26,346 | | | | 1,948 | | | | 27,834 | |

| Small Commercial | | | 2,488 | | | | 25,929 | | | | 2,516 | | | | 26,555 | |

| Other Retail | | | 233 | | | | 850 | | | | 228 | | | | 847 | |

| Total Regulated Retail | | | 10,267 | | | | 142,551 | | | | 10,512 | | | | 149,966 | |

| Other Regulated Operating Revenue | | | 634 | | | | | | | | 403 | | | | | |

| Total Regulated Revenue | | $ | 10,901 | | | | | | | $ | 10,915 | | | | | |

MPS revenue decreased slightly, $14,000 or 0.1% from the first quarter of 2007 to the first quarter of 2008. Large commercial customer revenue fell $136,000, approximately $130,000 of which is due to mill closures and cutbacks in the area. The duration of these cutbacks and closures and their ultimate impact on MPS revenue is unknown at this time; however, there have been no changes in the status of these operations to date in the second quarter.

Medium and small commercial customer revenue also decreased, down approximately $122,000. The decrease is due to a 2,114 MWH or 3.9% decrease in volume, which reduced revenue by approximately $163,000. This reduction in revenue is due to small and medium commercial customers who have ceased or cut back their operations since last year, or implemented conservation efforts. Prices for these customers were up on average, contributing $41,000 more revenue than prior year. Revenue from residential and other retail customers increased, up $13,000.

Other regulated operating revenue continued to grow in the first quarter of 2008, up $234,000 or 58%. Wheeling revenue was up $279,000 for the first three months of 2008 compared to the first three months of 2007. This increase was partly offset by smaller decreases in other types of other regulated operating revenue.

MPS’s transmission rates are based on the Company’s revenue requirement (transmission expenses plus the allowed return on assets) less the wheeling revenue earned. The rates go into effect on July 1 each year, and are calculated from the financial results of the previous calendar year. Similar to the increase in wheeling revenue in 2007 over 2006, the additional wheeling revenue earned during 2008 will offset the revenue requirement in the establishment of the rates that will go into effect on July 1, 2009.

For more information on regulatory orders approving the most recent rate increases, see Part II, Item 1, “Legal Proceedings.”

Regulated Utility Expenses

For the quarters ended March 31, 2008, and 2007, regulated operation and maintenance expenses are as follows:

| (In thousands of dollars) | | 2008 | | | 2007 | |

| Regulated Operation and Maintenance | | | | | | |

| Labor | | $ | 1,263 | | | $ | 1,119 | |

| Benefits | | | 395 | | | | 446 | |

| Outside Services | | | 261 | | | | 199 | |

| Holding Company Management Costs | | | 275 | | | | 436 | |

| Insurance | | | 131 | | | | 142 | |

| Regulatory Expenses | | | 311 | | | | 253 | |

| Transportation | | | 241 | | | | 315 | |

| Other | | | 460 | | | | 467 | |

| Total Regulated Operation and Maintenance | | $ | 3,337 | | | $ | 3,377 | |