UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-21331

Wells Fargo Multi-Sector Income Fund

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

Catherine Kennedy

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code:800-222-8222

Date of fiscal year end: October 31

Date of reporting period: April 30, 2020

ITEM 1. REPORT TO STOCKHOLDERS

Semi-Annual Report

April 30, 2020

Wells Fargo

Multi-Sector Income Fund (ERC)

Beginning on January 1, 2021, as permitted by new regulations adopted by the Securities and Exchange Commission, paper copies of the Wells Fargo Funds’ annual and semi-annual shareholder reports issued after this date will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website, and you will be notified by mail each time a report is posted and provided with a website address to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically at any time by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-800-730-6001.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports; if you invest directly with the Fund, you can call 1-800-730-6001. Your election to receive reports in paper will apply to all Wells Fargo Funds held in your account with your financial intermediary or, if you are a direct investor, to all Wells Fargo Funds that you hold.

|

|

|

Reduce clutter. Save trees. |

Sign up for electronic delivery of prospectuses and shareholder reports atwellsfargo.com/advantagedelivery |

The views expressed and any forward-looking statements are as of April 30, 2020, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Asset Management. Discussions of individual securities, or the markets generally, or any Wells Fargo Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Asset Management and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

INVESTMENT PRODUCTS: NOT FDIC INSURED ◾ NO BANK GUARANTEE ◾ MAY LOSE VALUE

Wells Fargo Multi-Sector Income Fund | 1

Letter to shareholders (unaudited)

Andrew Owen

President

Wells Fargo Funds

“The period began with a tailwind created by central bank support.”

Dear Shareholder:

We are pleased to offer you this semi-annual report for the Wells Fargo Multi-Sector Income Fund for the six-month period that ended April 30, 2020. Global stock markets saw earlier gains erased in February and March as governments took unprecedented measures to stop the spread of the coronavirus at the expense of short-term economic output. Markets rebounded in April to lessen the losses as central banks attempted to bolster capital markets and confidence. Fixed-income markets performed better, with the exception of high-yield bonds, as U.S. bonds overall achieved modest gains.

For the six-month period, U.S. stocks, based on the S&P 500 Index,1 returned -3.16% and international stocks, as measured by the MSCI ACWI ex USA Index (Net),2 fell 13.22%. The MSCI EM Index (Net)3 lost 10.50%. For bond investors, the Bloomberg Barclays U.S. Aggregate Bond Index4 added 4.86%, the Bloomberg Barclays Global Aggregate ex-USD Index5 returned -0.97%, the Bloomberg Barclays Municipal Bond Index6 returned -1.33%, and the ICE BofA U.S. High Yield Index7 lost 7.68%.

The period began with a tailwind created by central bank support.

The period began with a tailwind that had been created by U.S. Federal Reserve (Fed) rate cuts in the summer and early fall. Equity markets rallied in November despite ongoing geopolitical risks. Hopes for a U.S.-China trade deal buoyed investor confidence. U.S. business sentiment edged up, and manufacturing and services activity rose. With that positive backdrop, developed market equities outpaced those in emerging markets, and U.S. stocks outperformed non-U.S. stocks overall. While consumer confidence and purchasing manager activity rose in the eurozone, China reported weakening manufacturing and consumer data. Bond yields rose marginally, leading to slightly negative returns for global government and investment-grade corporate bonds.

Financial markets ended 2019 with a boost from the U.S. and China accord on a Phase One trade deal. That, along with the landslide win by the pro-Brexit U.K. Conservative Party in a national election and ongoing central bank support, gave investors greater confidence. U.S. economic indicators were positive overall, with the exception of manufacturing activity and business confidence. Consumer confidence was resilient, fed by a robust labor market, tame inflation, and lower interest rates, which boosted housing affordability and stimulated homebuyer activity. The impeachment of U.S. President Donald Trump had little impact on markets. Meanwhile, slowing Chinese economic activity, partly attributable to the trade war, led to further government stimulus at year-end through lower reserve ratios, allowing banks to lend more money.

The year-end rally continued in early January 2020. However, capital market volatility spiked in late January on concerns over the potential impact of the coronavirus on the

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the United States. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market performance of emerging markets. You cannot invest directly in an index. |

| 4 | The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Barclays Global Aggregate ex-USD Index is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S. dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Barclays Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofA U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2020. ICE Data Indices, LLC. All rights reserved. |

2 | Wells Fargo Multi-Sector Income Fund

Letter to shareholders (unaudited)

global economy and stock markets. With sentiment somewhat souring, perceived safe havens did well in January. The U.S. dollar and Japanese yen both rose, and government bonds outperformed equities. While the S&P 500 Index held its ground, emerging market equities tumbled, including those in Asia.

In February, the coronavirus became the major market focus. Fears of the virus’s impact on global growth led to expectations of increased global central bank monetary policy support. That led the 10-year U.S. Treasury yield to fall to an all-time low of 1.1% by the end of the month. Although equity markets initially shrugged off concerns about the outbreak, focusing instead on strong fourth-quarter earnings and improving business confidence in January, market sentiment turned sharply lower toward month-end. Oil prices tumbled as Russia and the Organization of the Petroleum Exporting Countries compounded a major decline in oil demand with a brutal price war, causing the price of West Texas Intermediate crude oil to fall 13% in February alone.

The global spread of the coronavirus led many countries to clamp down on social and business-related activity in order to contain the virus from causing even greater devastation and overwhelming the health care system. This abrupt stoppage of economic activity led to the sharp deceleration of global output, sending economies into a deep contraction. Central bank responses were swift, as they slashed interest rates and expanded quantitative easing programs to restore liquidity and confidence to the markets. In the U.S., the Fed launched several lending programs, funding investment-grade bonds, money market mutual funds, and commercial paper while purchasing Treasuries, mortgage-backed securities, and overnight repurchase agreements. Meanwhile, stock markets tumbled quickly into a bear market, ending the longest bull stock market in U.S. history.

Markets rebounded strongly in April after the extreme volatility of the previous two months, with the S&P 500 Index gaining 12.8% for the month and the MSCI ACWI ex USA Index (Net) returning 7.6%. The rebound was fueled by unprecedented stimulus measures taken by governments and central banks to buffer the economic damage created by mass shutdowns to try to contain the virus’s spread. The U.S. economy contracted by an annualized 4.8% pace in the first quarter, with 30 million new unemployment insurance claims in six weeks. In the eurozone, first-quarter real gross domestic product (GDP) shrank 3.8%, with the composite April Flash Purchasing Managers’ Index, a monthly survey of purchasing managers, falling to an all-time low of 13.5. The European Central Bank expanded its quantitative easing to include the purchase of additional government bonds of countries with the greatest virus-related need, including Italy and Spain. China’s first-quarter GDP fell by 6.8% year over year. However, retail sales, production, and investment showed signs of recovery. Extreme oil price volatility continued as global supply far exceeded demand.

Don’t let short-term uncertainty derail long-term investment goals.

Periods of investment uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest with Wells Fargo Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs.

Sincerely,

Andrew Owen

President

Wells Fargo Funds

“The global spread of the coronavirus led many countries to clamp down on social and business-related activity in order to contain the virus from causing even greater devastation and overwhelming the health care system.”

|

|

|

For further information about your Fund, contact your investment professional, visit our website at wfam.com, or call us directly at1-800-222-8222. |

Wells Fargo Multi-Sector Income Fund | 3

Letter to shareholders (unaudited)

Notice to Shareholders

| | ∎ | | On November 22, 2019, the Fund announced a renewal of its open-market share repurchase program (the “Buyback Program”). Under the renewed Buyback Program, the Fund may repurchase up to 10% of its outstanding shares in open- market transactions during the period beginning January 1, 2020 and ending on December 31, 2020. The Fund’s Board of Trustees has delegated to Wells Fargo Funds Management, LLC, the Fund’s adviser, discretion to administer the Buyback Program, including the determination of the amount and timing of repurchases in accordance with the best interests of the Fund and subject to applicable legal limitations. |

| | ∎ | | The Fund’s managed distribution plan provides for the declaration of monthly distributions to common shareholders of the Fund at an annual minimum fixed rate of 9% based on the Fund’s average monthly net asset value per share over the prior 12 months. Under the managed distribution plan, monthly distributions may be sourced from income,paid-in capital, and/or capital gains, if any. To the extent that sufficient investment income is not available on a monthly basis, the Fund may distributepaid-in capital and/or capital gains, if any, in order to maintain its managed distribution level. You should not draw any conclusions about the Fund’s investment performance from the amount of the Fund’s distributions or from the terms of the managed distribution plan. Shareholders may elect to reinvest distributions received pursuant to the managed distribution plan in the Fund under the existing dividend reinvestment plan, which is described later in this report. |

4 | Wells Fargo Multi-Sector Income Fund

This page is intentionally left blank.

Performance highlights (unaudited)

Investment objective

The Fund seeks a high level of current income consistent with limiting its overall exposure to domestic interest rate risk.

Strategy summary

The Fund allocates its assets between three separate investment strategies, or sleeves. Under normal market conditions, the Fund will allocate approximately30%-70% of its total assets to a sleeve consisting of noninvestment-grade (high yield) corporate debt, including floating-rate high yield bank loan securities; approximately10%-40% to a sleeve of foreign debt securities, including emerging market debt; and approximately10%-30% to a sleeve of adjustable-rate and fixed-rate mortgage-backed securities, and investment grade corporate bonds.

Adviser

Wells Fargo Funds Management, LLC

Subadvisers

Wells Capital Management Incorporated

Wells Fargo Asset Management (International), Limited

Portfolio managers

Christopher Y. Kauffman, CFA®‡

Michael Lee

Niklas Nordenfelt, CFA®‡

Alex Perrin

Phillip Susser

Lauren van Biljon, CFA®‡

Peter Wilson

Noah Wise, CFA®‡

Average annual total returns (%) as of April 30, 20201

| | | | | | | | | | | | | | | | |

| | | | |

| | | 6 months | | | 1 year | | | 5 year | | | 10 year | |

| | | | | |

| Based on market value | | | -16.73 | | | | -10.69 | | | | 3.67 | | | | 4.59 | |

| | | | | |

| Based on net asset value (NAV) | | | -11.21 | | | | -7.50 | | | | 3.14 | | | | 5.34 | |

| | | | | |

| Multi-Sector Income Blended Index2 | | | -6.02 | | | | -2.01 | | | | 2.83 | | | | 4.25 | |

| | | | | |

| Bloomberg Barclays Credit Bond Index3 | | | 1.77 | | | | 9.37 | | | | 4.33 | | | | 5.04 | |

| | | | | |

| Bloomberg Barclays U.S. Securitized Index4 | | | 3.65 | | | | 7.66 | | | | 3.07 | | | | 3.36 | |

| | | | | |

| ICE BofA U.S. Cash Pay High Yield Index5 | | | -7.64 | | | | -5.21 | | | | 3.20 | | | | 5.66 | |

| | | | | |

| ICE BofA U.S. High Yield Constrained Index6 | | | -7.69 | | | | -5.27 | | | | 3.20 | | | | 5.65 | |

| | | | | |

| J.P. MorganGBI-EM Global Diversified Composite Index7 | | | -9.91 | | | | -2.68 | | | | 0.44 | | | | 0.72 | |

| | | | | |

| J.P. Morgan Global Government Bond Index (ex U.S.)8 | | | -0.73 | | | | 4.60 | | | | 2.52 | | | | 1.78 | |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Performance figures of the Fund do not reflect brokerage commissions that a shareholder would pay on the purchase and sale of shares. If taxes and such brokerage commissions had been reflected, performance would have been lower. To obtain performance information current to the most recentmonth-end, please call1-800-222-8222.

The Fund’s annualized expense ratio for the six months ended April 30, 2020, was 2.16% which includes 1.17% of interest expense.

|

|

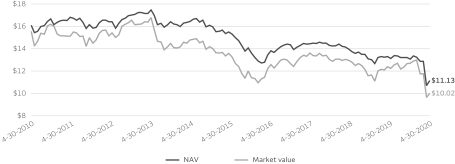

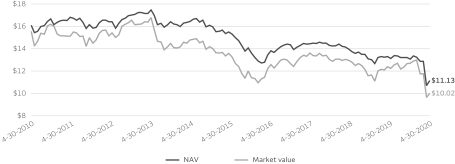

| Comparison of NAV vs. market value9 |

|

|

The Fund is leveraged through a revolving credit facility and also may incur leverage by issuing preferred shares in the future. The use of leverage results in certain risks, including, among others, the likelihood of greater volatility of the net asset value and the market value of common shares. Foreign investments are especially volatile and can rise or fall dramatically due to differences in the political and economic conditions of the host country. These risks are generally intensified in emerging markets. Derivatives involve additional risks, including interest rate risk, credit risk, the risk of improper valuation, and the risk ofnon-correlation to the relevant instruments that they are designed to hedge or closely track. Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liquidity for certain bonds held by the Fund. In general, when interest rates rise, bond values fall and investors may lose principal value. Interest rate changes and their impact on the Fund and its share price can be sudden and unpredictable. High-yield securities have a greater risk of default and tend to be more volatile than higher-rated debt securities. The Fund is exposed to mortgage- and asset-backed securities risk. Thisclosed-end fund is no longer available as an initial public offering and is only offered through broker/dealers on the secondary market. Aclosed-end fund is not required to buy back its shares from investors upon request.

Please see footnotes on page 9.

6 | Wells Fargo Multi-Sector Income Fund

Performance highlights (unaudited)

MANAGERS’ DISCUSSION

The Fund’s return based on market value was-16.73% for thesix-month period that ended April 30, 2020. During the same period, the Fund’s return based on its net asset value (NAV) was-11.21%. Based on its NAV based returns, the Fund underperformed the Multi-Sector Income Blended Index, which returned-6.02% for thesix-month period.

Tumultuous period led to wide-scale investment losses.

The reporting period covered a tumultuous period in international markets, with the slow grind of 2019 morphing into a dramatic economic collapse in the first quarter of 2020 as several market-moving events hit at once. The spread of the coronavirus caused cascading economic and societal shutdowns. Oil prices nosedived in the wake of a Saudi Arabia-Russia disagreement on production targets. Finally, a global shortage of U.S. dollars caused severe dislocations in market pricing and liquidity. These events took a heavy toll on risk assets—including emerging markets—with currencies materially underperforming local-currency bond markets.

There were several changes to the Fund’s positioning within international and emerging market bonds. Thinner valuations and concerns over external accounts prompted a reduction in exposure to Colombia (5.9% decline in exposure), Brazil(-3.8%), and Peru(-4.6%). This allowed increased allocations to sovereign bonds in India (+9.5%) and Romania (+5.2%). Changes to interest rate positioning were echoed at the currency level. Overall duration was reduced as a defensive measure.

The Fund’s international/emerging market return based on market value was-8.19% for thesix-month period that ended April 30, 2020.

During the period, high-yield bonds returned-7.69% (as measured by the ICE BofA U.S. High Yield Constrained Index) with a positive return in three months through January 2020 followed by a decline in February and a fall of more than 11.5% in March and a mild rebound in April. Spread widening over the period more than offset a decline in Treasury yields and the yield on the index increased. Not surprisingly in thisrisk-off environment, lower-rated bonds underperformed higher-rated high-yield bonds.

For thesix-month period, corporate bonds andnon-agency securitized sectors significantly underperformed U.S. Treasuries. Spreads in all risk products widened in March as a result of escalating concern over the economic impact of the coronavirus pandemic, then retraced a portion of the underperformance in April due to large-scale U.S. Federal Reserve (Fed) intervention. Over the period, the Bloomberg Barclays U.S. Corporate Bond Index10 widened 92 basis points (bps; 100 bps equal 1.00%), underperforming like-duration U.S. Treasuries by 7.20%. TheBBB-rated component of the index widened 123 bps, trailing like-duration Treasuries by 9.23%. Securitized sectors delivered mixed performance over the period, with agency mortgage-backed securities tightening 10 bps with 0.22% excess returns (over like-duration Treasuries) driven by massive Fed bond buying in the sector, while credit securitized sectors all materially underperformed like-duration Treasuries. Conduit commercial mortgage-backed securities (CMBS) spreads widened 149 bps, withBBB-rated bonds widening by more than 800 bps.AAA-rated asset-backed securities (ABS) and residential mortgage-backed securities (MBS) sectors widened 118 bps and 160 bps, respectively.

| | | | |

|

| Ten largest holdings(%) as of April 30, 202011 | |

| | |

India, 7.32%,1-28-2024 | | | 3.03 | |

| | |

Romania, 3.25%,4-29-2024 | | | 3.03 | |

| | |

Mexico, 8.50%,5-31-2029 | | | 2.80 | |

| | |

Malaysia, 4.23%,6-30-2031 | | | 2.79 | |

| | |

Indonesia, 8.38%,9-15-2026 | | | 2.27 | |

| | |

Colombia, 7.50%,8-26-2026 | | | 1.83 | |

| | |

Russia, 6.90%,5-23-2029 | | | 1.72 | |

| | |

Russia, 6.50%,2-28-2024 | | | 1.62 | |

| | |

Malaysia, 4.18%,7-15-2026 | | | 1.47 | |

| | |

Mexico, 5.75%,3-5-2026 | | | 1.44 | |

|

|

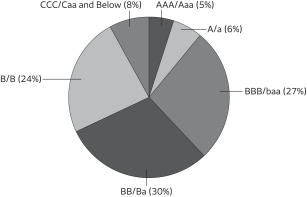

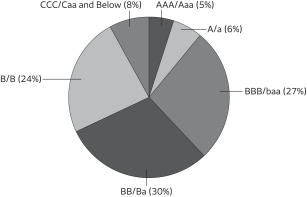

| Credit qualityas of April 30, 202012 |

|

|

Detractors from performance included high-yield energy credits, emerging market securities, and various securitized sectors.

Energy exploration and production, cable/satellite,oil-field services, midstream, and media/entertainment were the largest detractors from performance. Longer-dated and lower-rated credits, as discussed above, underperformed.

Please see footnotes on page 9.

Wells Fargo Multi-Sector Income Fund | 7

Performance highlights (unaudited)

Emerging market currencies struggled over the reporting period. Exposure to the Brazilian real, Mexican peso, and South African rand were drags on performance. Positions in the bond markets of Brazil, Indonesia, Colombia, and South Africa underperformed.

Within securitized sectors, the largest detractor was the Fund’s allocation to subordinatenon-agency CMBS. Allocations tonon-agency residential MBS and ABS sectors also detracted. Within corporate sectors, the Fund’s overweight to financials andBBB-rated bonds detracted. The Fund’s use of leverage had a negative impact on total return performance during this reporting period.

Contributors to performance were led by high-yield wireless and pharmaceutical issues and select countries.

Wireless, pharmaceuticals, and wireline companies were the largest contributors to performance over thesix-month period that ended April 30, 2020. In general, higher-quality and lower-yielding bonds outperformed the broader portfolio.

Exposure to the bond markets of Malaysia, Mexico, India, and Russia added value as yields fell. The Malaysian ringgit held its ground versus the U.S. dollar better than its emerging market peers, and exposure added to performance.

Within securitized sectors,out-of-benchmark holdings in agency collateralized mortgage obligations and MBS were small contributors. In corporate sectors, an overweight to industrials and utilities also contributed.

The Fund’s management teams see a mix of concerns, risks, and opportunities.

Going into 2020, the market was supported by solid and consistent gross domestic product growth, lack of aggressive issuance over the past several years, and a relatively low default rate. As a result, spreads were tighter than long-term averages as they generally have been over the past few years. However, as is often the case, these periods of calm end with an unexpected surprise.

This January, the surprise came in the form of the coronavirus. The reaction to the spread of the coronavirus has raised fears that consumer behavior will be altered, resulting in a global economic recession. To the extent that consumers and businesses adjust their behavior to avoid social interaction whether byshelter-in-place orders or by many individual decisions, the more likely that economic activity slows. Indeed, this behavior can be self-reinforcing as slower economic activity reduces personal income, which can further reduce demand. In response, the government and central banks have engaged in unprecedented fiscal and monetary stimulus. At this point, there is significant uncertainty regarding the length and severity of the health crisis and the medium- to long-term impact of the stimulus and money printing. Most, if not all, businesses have been affected by the virus and most have been hurt. However, with the large economic stimulus, liquidity is available for those companies that investors believe are solvent. For example, net issuance in the high-yield bond market in April was $37.7 billion, the third-largest month on record.

The high-yield bond market, which has a meaningful exposure to the energy sector, was also hurt by a poorly timed oil price war, leading Saudi Arabia to significantly increase production at a time of a coronavirus-induced demand shock. This led to a significant fall in oil prices and energy bond prices. More recently, Organization of the Petroleum Exporting Countries has agreed to supply reductions, which we believe will gradually reduce the oversupply of oil and help the recovery in energy bond prices.

The Fund’s high-yield bond management team expects more volatility as market expectations for the length and severity of theshelter-in-place orders, changes in behavior, recession probabilities, and individual company results vary through the year. Ultimately, the team is optimistic that life will return to “normal” ideally as a result of a cure or vaccine, and at that point the team would expect the high-yield and equity markets to return to long-term trading levels.

The Fund’s international and emerging market bond sleeve management team sees a highly uncertain global outlook, with investors and governments alike revising forecasts daily and working with assumptions that are close to ethereal. It appears that increased accommodation from central banks and governments is here to stay. Emerging market yield curves have steepened materially as lower short-term rates and increased longer-term issuance collide. Sustained gains on emerging market currencies would likely need equity markets to find a floor and start to recover. Renewed U.S.-China frictions pose a material risk to the already poor global economic outlook.

While there is still substantial uncertainty regarding the pace and extent to which the U.S. economy will begin to open, the Fund’s mortgage/corporate bond sleeve management team believes that current valuations in certain corporate and securitized sectors reflect overly pessimistic outcomes and represent attractive risk-adjusted opportunities. Within securitized sectors, the team sees value in certain CMBS securities collateralized by property types likely to withstand the current economic downturn. They also see opportunities in residential MBS and ABS securities where structural enhancements make credit losses unlikely.

The mortgage/corporate bond sleeve has an overweight allocation to credit due to historically attractive valuations that compensate for a wide range of downside scenarios. While spread recovery may take time to realize, adding credit opportunistically at current levels has historically resulted in very good long-term returns.

The management team continues to favor financials over industrials within the mortgage/corporate bond segment, given the former’s favorable fundamentals and the latter’s higher leverage levels. Lower event risk in the financial space is also favorable.

Please see footnotes on page 9.

8 | Wells Fargo Multi-Sector Income Fund

Performance highlights (unaudited)

Utilities have lagged this year due to deteriorating credit metrics, elevated issuance, and ongoing regulatory risks, and this may present a pocket of opportunity. The taxable municipal sector is beginning to look a bit more attractive following market dislocations.

Approximately 64% of the mortgage/corporate sleeve’s exposure is in corporate credit and around 36% is in fixed-rate and floating-rate mortgage securities. The largest industry exposures in the credit sector include insurance, energy, banking, and technology companies.

|

|

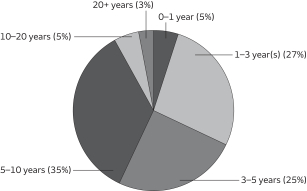

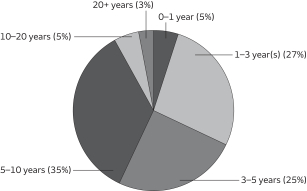

| Effective maturity distributionas of April 30, 202013 |

|

|

|

|

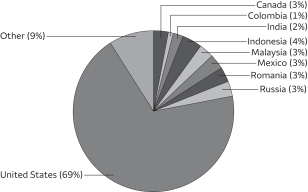

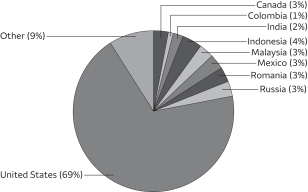

| Country allocation as of April 30, 202014 |

|

|

| ‡ | CFA® and Chartered Financial Analyst®are trademarks owned by CFA Institute. |

| 1 | Total returns based on market value are calculated assuming a purchase of common stock on the first day and a sale on the last day of the period reported. Total returns based on NAV are calculated based on the NAV at the beginning of the period and at the end of the period. Dividends and distributions, if any, are assumed for the purposes of these calculations to be reinvested at prices obtained under the Fund’s Automatic Dividend Reinvestment Plan. |

| 2 | Source: Wells Fargo Funds Management, LLC. The Multi-Sector Income Blended Index is composed of 60% ICE BofA U.S. High Yield Constrained Index, 18% J.P. MorganGBI-EM Global Diversified Composite Index, 7.5% Bloomberg Barclays Credit Bond Index, 7.5% Bloomberg Barclays U.S. Securitized Index, and 7% J.P. Morgan Global Government Bond Index (ex U.S.). Prior to October 15, 2019, the Multi-Sector Income Blended Index was composed of 60% ICE BofA U.S. Cash Pay High Yield Index, 18% J.P. MorganGBI-EM Global Diversified Composite Index, 7.5% Bloomberg Barclays Credit Bond Index, 7.5% Bloomberg Barclays U.S. Securitized Index, and 7% J.P. Morgan Global Government Bond Index (ex U.S.). You cannot invest directly in an index. |

| 3 | The Bloomberg Barclays Credit Bond Index is an unmanaged index of fixed income securities composed of securities from the Bloomberg Barclays Government/Corporate Bond Index, Mortgage-Backed Securities Index, and the Asset-Backed Securities Index. You cannot invest directly in an index. |

| 4 | The Bloomberg Barclays U.S. Securitized Index is an unmanaged composite of asset-backed securities, collateralized mortgage-backed securities (ERISA eligible), and fixed-rate mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The ICE BofA U.S. Cash Pay High Yield Index tracks the performance of U.S. dollar-denominated below investment grade corporate debt, currently in a coupon paying period, that is publicly issued in the U.S. domestic market. You cannot invest directly in an index. |

| 6 | The ICE BofA U.S. High Yield Constrained Index is a market-value-weighted index of all domestic and Yankee high-yield bonds, including deferred interest bonds andpayment-in-kind securities. Issues included in the index have maturities of one year or more and have a credit rating lower thanBBB-/Baa3 but are not in default. The ICE BofA U.S. High Yield Constrained Index limits any individual issuer to a maximum of 2% benchmark exposure. You cannot invest directly in an index. Copyright 2020. ICE Data Indices, LLC. All rights reserved. |

| 7 | The J.P. MorganGBI-EM Global Diversified Composite Index is an unmanaged index of debt instruments of 31 emerging countries. You cannot invest directly in an index. |

| 8 | The J.P. Morgan Global Government Bond Index (ex U.S.) measures the total return from investing in 12 developed government bond markets: Australia, Belgium, Canada, Denmark, France, Germany, Italy, Japan, the Netherlands, Spain, Sweden, and the U.K. You cannot invest directly in an index. |

| 9 | This chart does not reflect any brokerage commissions charged on the purchase and sale of the Fund’s common stock. Dividends and distributions paid by the Fund are included in the Fund’s average annual total returns but have the effect of reducing the Fund’s NAV. |

| 10 | The Bloomberg Barclays U.S. Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD-denominated securities publically issued by U.S. and non-U.S. industrial, utility and financial issuers. You cannot invest directly in an index. |

| 11 | The ten largest holdings, excluding cash, cash equivalents and any money market funds, are calculated based on the value of the investments divided by total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

| 12 | The credit quality distribution of portfolio holdings reflected in the chart is based on ratings from Standard & Poor’s, Moody’s Investors Service, and/or Fitch Ratings Ltd. Credit quality ratings apply to the underlying holdings of the Fund and not to the Fund itself. The percentages of the Fund’s portfolio with the ratings depicted in the chart are calculated based on the total market value of fixed income securities held by the Fund. If a security was rated by all three rating agencies, the middle rating was utilized. If rated by two of three rating agencies, the lower rating was utilized, and if rated by one of the rating agencies, that rating was utilized. Standard & Poor’s rates the creditworthiness of bonds, ranging from AAA (highest) to D (lowest). Ratings from A to CCC may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the rating categories. Standard & Poor’s rates the creditworthiness of short-term notes fromSP-1 (highest) toSP-3 (lowest). Moody’s rates the creditworthiness of bonds, ranging from Aaa (highest) to C (lowest). Ratings Aa to B may be modified by the addition of a number 1 (highest) to 3 (lowest) to show relative standing within the ratings categories. Moody’s rates the creditworthiness of short-term U.S.tax-exempt municipal securities from MIG 1/VMIG 1 (highest) to SG (lowest). Fitch rates the creditworthiness of bonds, ranging from AAA (highest) to D (lowest). Credit quality distribution is subject to change and may have changed since the date specified. |

| 13 | Amounts are calculated based on the fixed income securities held by the Fund. These amounts are subject to change and may have changed since the date specified. |

| 14 | Amounts are calculated based on the total long-term investments of the Fund. These amounts are subject to change and may have changed since the date specified. |

Wells Fargo Multi-Sector Income Fund | 9

Portfolio of investments—April 30, 2020 (unaudited)

| | | | | | | | | | | | | | | | |

| | | Interest

rate | | | Maturity

date | | | Principal | | | Value | |

| Agency Securities: 1.18% | |

FHLMC (5 Year Treasury Constant Maturity +2.07%)± | | | 3.56 | % | | | 9-1-2032 | | | $ | 603,772 | | | $ | 607,461 | |

FHLMC | | | 8.50 | | | | 7-1-2028 | | | | 20,380 | | | | 23,423 | |

FHLMC Series 1383 (1 Year Treasury Constant Maturity +2.25%)± | | | 3.98 | | | | 2-1-2037 | | | | 130,096 | | | | 136,258 | |

FHLMC Series2012-K17 Class B 144A±± | | | 4.47 | | | | 12-25-2044 | | | | 675,000 | | | | 693,758 | |

FHLMC Series2012-K18 Class B 144A±± | | | 4.39 | | | | 1-25-2045 | | | | 810,000 | | | | 811,439 | |

FHLMC Series2013-K30 Class B 144A±± | | | 3.67 | | | | 6-25-2045 | | | | 700,000 | | | | 720,408 | |

FHLMC Series 2390 Class FD (1 Month LIBOR +0.45%)± | | | 1.26 | | | | 12-15-2031 | | | | 13,309 | | | | 13,045 | |

FHLMC Series 2567 Class FH (1 Month LIBOR +0.40%)± | | | 1.21 | | | | 2-15-2033 | | | | 38,761 | | | | 37,797 | |

FHLMC Series 3987 Class CI (c) | | | 3.50 | | | | 6-15-2026 | | | | 3,916,880 | | | | 141,913 | |

FHLMC Series K016 Class X1±±(c) | | | 1.63 | | | | 10-25-2021 | | | | 319,824 | | | | 5,647 | |

FHLMC Series K020 Class X1±±(c) | | | 1.50 | | | | 5-25-2022 | | | | 5,957,193 | | | | 138,431 | |

FNMA (6 Month LIBOR +1.64%)± | | | 3.52 | | | | 9-1-2037 | | | | 29,989 | | | | 30,206 | |

FNMA | | | 6.00 | | | | 4-1-2033 | | | | 54,211 | | | | 56,660 | |

FNMA | | | 7.50 | | | | 2-1-2030 | | | | 14,297 | | | | 14,404 | |

FNMA | | | 7.50 | | | | 9-1-2030 | | | | 19,296 | | | | 19,442 | |

FNMA Series1996-46 Class FA (1 Month LIBOR +0.50%)± | | | 0.99 | | | | 8-25-2021 | | | | 67 | | | | 67 | |

FNMA Series1997-20 Class IO±±(c) | | | 1.84 | | | | 3-25-2027 | | | | 191,544 | | | | 4,194 | |

FNMA Series2001-25 Class Z | | | 6.00 | | | | 6-25-2031 | | | | 61,093 | | | | 69,125 | |

FNMA Series2001-35 Class F (1 Month LIBOR +0.60%)± | | | 1.09 | | | | 7-25-2031 | | | | 3,139 | | | | 3,067 | |

FNMA Series2001-57 Class F (1 Month LIBOR +0.50%)± | | | 0.99 | | | | 6-25-2031 | | | | 3,161 | | | | 3,168 | |

FNMA Series2002-77 Class FH (1 Month LIBOR +0.40%)± | | | 1.12 | | | | 12-18-2032 | | | | 21,326 | | | | 20,796 | |

FNMA Series2002-97 Class FR (1 Month LIBOR +0.55%)± | | | 1.04 | | | | 1-25-2033 | | | | 5,258 | | | | 5,115 | |

FNMA SeriesG91-16 Class F (1 Month LIBOR +0.45%)± | | | 0.94 | | | | 6-25-2021 | | | | 337 | | | | 336 | |

FNMA SeriesG92-17 Class F (1 Month LIBOR +1.05%)± | | | 1.54 | | | | 3-25-2022 | | | | 4,356 | | | | 4,350 | |

GNMA | | | 6.50 | | | | 6-15-2028 | | | | 16,647 | | | | 18,456 | |

GNMA Series2019-H06 Class HI±±(c) | | | 1.69 | | | | 4-20-2069 | | | | 7,312,309 | | | | 361,192 | |

| |

Total Agency Securities (Cost $3,787,832) | | | | 3,940,158 | |

| | | | | |

|

| Asset-Backed Securities: 0.77% | |

Asset-Backed Funding Certificates Series 2003-AHL1 Class A1 | | | 4.18 | | | | 3-25-2033 | | | | 135,236 | | | | 134,615 | |

Bear Stearns Asset Backed Securities Series2002-2 Class A1 (1 Month LIBOR +0.66%)± | | | 1.61 | | | | 10-25-2032 | | | | 116,144 | | | | 112,798 | |

CVS Pass-Through Trust Series T | | | 6.04 | | | | 12-10-2028 | | | | 412,175 | | | | 452,198 | |

Exeter Automobile Receivables Trust Series15-3A Class D 144A | | | 6.55 | | | | 10-17-2022 | | | | 432,011 | | | | 432,442 | |

Five Guys Funding LLC Series17-1A Class A2 144A | | | 4.60 | | | | 7-25-2047 | | | | 992,500 | | | | 938,844 | |

Mesa Trust Asset Backed Certificates Series2001-5 Class A (1 Month LIBOR +0.80%) 144A± | | | 1.75 | | | | 12-25-2031 | | | | 7,825 | | | | 7,587 | |

MMAF Equipment Finance LLC Series2017-AA Class A4 144A | | | 2.41 | | | | 8-16-2024 | | | | 170,000 | | | | 170,607 | |

Saxon Asset Securities Trust Series2002-1 Class AF5 | | | 5.56 | | | | 12-25-2030 | | | | 97,094 | | | | 97,017 | |

Structured Asset Securities Corporation Series1998-2 Class A (1 Month LIBOR +0.52%)± | | | 1.47 | | | | 2-25-2028 | | | | 6,024 | | | | 5,992 | |

Structured Asset Securities Corporation Series2002-9 Class A2 (1 Month LIBOR +0.60%)± | | | 1.55 | | | | 10-25-2027 | | | | 18,531 | | | | 18,319 | |

Student Loan Consolidation Center Series2011-1 Class A (1 Month LIBOR +1.22%) 144A± | | | 2.17 | | | | 10-25-2027 | | | | 212,639 | | | | 212,326 | |

| |

Total Asset-Backed Securities (Cost $2,683,517) | | | | 2,582,745 | |

| | | | | |

| | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | Shares | | | | |

| Common Stocks: 0.17% | |

|

Energy: 0.17% | |

|

| Energy Equipment & Services: 0.17% | |

Bristow Group Incorporated (a)† | | | | 42,370 | | | | 326,709 | |

Bristow Group Incorporated (a)† | | | | 30,068 | | | | 231,851 | |

| | | | |

| | | | | | | | | | | | | | | 558,560 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

10 | Wells Fargo Multi-Sector Income Fund

Portfolio of investments—April 30, 2020 (unaudited)

| | | | | | | | | | | | | | | | |

| | | | | | | | | Shares | | | Value | |

|

Materials: 0.00% | |

|

| Chemicals: 0.00% | |

LyondellBasell Industries NV Class A | | | | 9 | | | $ | 522 | |

| | | | | | | | | |

| |

Total Common Stocks (Cost $5,851,782) | | | | 559,082 | |

| | | | | |

| | | | |

| | | | | | | | | | | | | | | | |

| | | Interest

rate | | | Maturity

date | | | Principal | | | | |

| Corporate Bonds and Notes: 68.84% | |

|

Communication Services: 11.91% | |

|

| Diversified Telecommunication Services: 0.88% | |

AT&T Incorporated | | | 4.00 | % | | | 1-15-2022 | | | $ | 750,000 | | | | 782,265 | |

Level 3 Financing Incorporated | | | 5.13 | | | | 5-1-2023 | | | | 975,000 | | | | 972,563 | |

Level 3 Financing Incorporated | | | 5.38 | | | | 1-15-2024 | | | | 700,000 | | | | 705,250 | |

Level 3 Financing Incorporated | | | 5.63 | | | | 2-1-2023 | | | | 500,000 | | | | 500,760 | |

| | | | |

| | | | | | | | | | | | | | | 2,960,838 | |

| | | | | | | | | | | | | | | | |

|

| Interactive Media & Services: 0.04% | |

Match Group Incorporated 144A | | | 4.13 | | | | 8-1-2030 | | | | 125,000 | | | | 121,250 | |

| | | | | | | | | | | | | | | | |

|

| Media: 9.06% | |

Block Communications Incorporated 144A | | | 4.88 | | | | 3-1-2028 | | | | 150,000 | | | | 149,250 | |

CCO Holdings LLC 144A | | | 4.00 | | | | 3-1-2023 | | | | 100,000 | | | | 100,710 | |

CCO Holdings LLC 144A | | | 4.50 | | | | 8-15-2030 | | | | 550,000 | | | | 552,750 | |

CCO Holdings LLC 144A | | | 4.50 | | | | 5-1-2032 | | | | 250,000 | | | | 248,359 | |

CCO Holdings LLC 144A | | | 5.00 | | | | 2-1-2028 | | | | 150,000 | | | | 154,500 | |

CCO Holdings LLC 144A | | | 5.13 | | | | 5-1-2027 | | | | 450,000 | | | | 467,258 | |

CCO Holdings LLC 144A | | | 5.38 | | | | 5-1-2025 | | | | 3,550,000 | | | | 3,640,303 | |

CCO Holdings LLC 144A | | | 5.75 | | | | 2-15-2026 | | | | 2,500,000 | | | | 2,606,500 | |

CCO Holdings LLC 144A | | | 5.88 | | | | 4-1-2024 | | | | 200,000 | | | | 205,740 | |

Charter Communications Operating LLC | | | 5.05 | | | | 3-30-2029 | | | | 675,000 | | | | 791,836 | |

Cinemark USA Incorporated 144A | | | 8.75 | | | | 5-1-2025 | | | | 75,000 | | | | 75,563 | |

CSC Holdings LLC 144A | | | 5.38 | | | | 7-15-2023 | | | | 745,000 | | | | 753,381 | |

CSC Holdings LLC 144A | | | 5.38 | | | | 2-1-2028 | | | | 425,000 | | | | 443,721 | |

CSC Holdings LLC 144A | | | 5.50 | | | | 5-15-2026 | | | | 1,275,000 | | | | 1,319,625 | |

CSC Holdings LLC 144A | | | 7.75 | | | | 7-15-2025 | | | | 2,030,000 | | | | 2,117,046 | |

Diamond Sports Group LLC 144A | | | 5.38 | | | | 8-15-2026 | | | | 175,000 | | | | 133,000 | |

Diamond Sports Group LLC 144A | | | 6.63 | | | | 8-15-2027 | | | | 175,000 | | | | 95,813 | |

DISH Network Corporation | | | 3.38 | | | | 8-15-2026 | | | | 1,300,000 | | | | 1,053,780 | |

Gray Television Incorporated 144A | | | 5.13 | | | | 10-15-2024 | | | | 450,000 | | | | 443,250 | |

Gray Television Incorporated 144A | | | 5.88 | | | | 7-15-2026 | | | | 3,875,000 | | | | 3,720,000 | |

Gray Television Incorporated 144A | | | 7.00 | | | | 5-15-2027 | | | | 325,000 | | | | 327,340 | |

Interpublic Group of Companies | | | 4.00 | | | | 3-15-2022 | | | | 750,000 | | | | 766,810 | |

Lamar Media Corporation 144A | | | 3.75 | | | | 2-15-2028 | | | | 800,000 | | | | 736,500 | |

Lamar Media Corporation 144A | | | 4.00 | | | | 2-15-2030 | | | | 800,000 | | | | 736,000 | |

Lamar Media Corporation | | | 5.75 | | | | 2-1-2026 | | | | 100,000 | | | | 101,710 | |

Nexstar Broadcasting Incorporated 144A | | | 5.63 | | | | 7-15-2027 | | | | 2,000,000 | | | | 1,910,000 | |

Nielsen Finance LLC 144A | | | 5.00 | | | | 4-15-2022 | | | | 1,725,000 | | | | 1,699,315 | |

Outfront Media Capital Corporation 144A | | | 4.63 | | | | 3-15-2030 | | | | 675,000 | | | | 615,938 | |

Outfront Media Capital Corporation 144A | | | 5.00 | | | | 8-15-2027 | | | | 25,000 | | | | 23,873 | |

Outfront Media Capital Corporation | | | 5.63 | | | | 2-15-2024 | | | | 20,000 | | | | 19,850 | |

QVC Incorporated | | | 4.75 | | | | 2-15-2027 | | | | 150,000 | | | | 137,250 | |

Salem Media Group Incorporated 144A | | | 6.75 | | | | 6-1-2024 | | | | 2,600,000 | | | | 2,028,000 | |

Scripps Escrow Incorporated 144A | | | 5.88 | | | | 7-15-2027 | | | | 100,000 | | | | 84,500 | |

The E.W. Scripps Company 144A | | | 5.13 | | | | 5-15-2025 | | | | 2,460,000 | | | | 2,074,272 | |

| | | | |

| | | | | | | | | | | | | | | 30,333,743 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Multi-Sector Income Fund | 11

Portfolio of investments—April 30, 2020 (unaudited)

| | | | | | | | | | | | | | | | |

| | | Interest

rate | | | Maturity

date | | | Principal | | | Value | |

| Wireless Telecommunication Services: 1.93% | |

Connect U.S. Finco LLC 144A | | | 6.75 | % | | | 10-1-2026 | | | $ | 375,000 | | | $ | 358,125 | |

Sprint Capital Corporation | | | 6.88 | | | | 11-15-2028 | | | | 175,000 | | | | 210,761 | |

Sprint Capital Corporation | | | 8.75 | | | | 3-15-2032 | | | | 975,000 | | | | 1,369,875 | |

Sprint Spectrum Company 144A | | | 5.15 | | | | 9-20-2029 | | | | 750,000 | | | | 828,750 | |

T-Mobile USA Incorporated | | | 4.50 | | | | 2-1-2026 | | | | 125,000 | | | | 128,788 | |

T-Mobile USA Incorporated | | | 4.75 | | | | 2-1-2028 | | | | 425,000 | | | | 446,259 | |

T-Mobile USA Incorporated | | | 5.13 | | | | 4-15-2025 | | | | 425,000 | | | | 430,313 | |

T-Mobile USA Incorporated | | | 5.38 | | | | 4-15-2027 | | | | 1,500,000 | | | | 1,597,350 | |

T-Mobile USA Incorporated | | | 6.38 | | | | 3-1-2025 | | | | 975,000 | | | | 1,000,594 | |

T-Mobile USA Incorporated | | | 6.50 | | | | 1-15-2024 | | | | 80,000 | | | | 81,792 | |

| | | | |

| | | | | | | | | | | | | | | 6,452,607 | |

| | | | | | | | | | | | | | | | |

|

Consumer Discretionary: 8.77% | |

|

| Auto Components: 1.63% | |

Allison Transmission Incorporated 144A | | | 4.75 | | | | 10-1-2027 | | | | 650,000 | | | | 604,500 | |

Allison Transmission Incorporated 144A | | | 5.00 | | | | 10-1-2024 | | | | 2,250,000 | | | | 2,160,000 | |

Allison Transmission Incorporated 144A | | | 5.88 | | | | 6-1-2029 | | | | 400,000 | | | | 387,812 | |

Cooper Tire & Rubber Company | | | 7.63 | | | | 3-15-2027 | | | | 1,710,000 | | | | 1,701,450 | |

Goodyear Tire & Rubber Company | | | 8.75 | | | | 8-15-2020 | | | | 468,000 | | | | 469,755 | |

Panther BF Aggregator 2 LP 144A | | | 6.25 | | | | 5-15-2026 | | | | 125,000 | | | | 125,350 | |

| | | | |

| | | | | | | | | | | | | | | 5,448,867 | |

| | | | | | | | | | | | | | | | |

|

| Automobiles: 0.34% | |

Ford Motor Company | | | 4.75 | | | | 1-15-2043 | | | | 1,500,000 | | | | 956,250 | |

Ford Motor Company | | | 9.00 | | | | 4-22-2025 | | | | 100,000 | | | | 97,250 | |

Ford Motor Company | | | 9.63 | | | | 4-22-2030 | | | | 100,000 | | | | 98,250 | |

| | | | |

| | | | | | | | | | | | | | | 1,151,750 | |

| | | | | | | | | | | | | | | | |

|

| Diversified Consumer Services: 2.06% | |

Carriage Services Incorporated 144A | | | 6.63 | | | | 6-1-2026 | | | | 1,700,000 | | | | 1,676,370 | |

Service Corporation International | | | 4.63 | | | | 12-15-2027 | | | | 650,000 | | | | 664,437 | |

Service Corporation International | | | 7.50 | | | | 4-1-2027 | | | | 3,400,000 | | | | 3,672,000 | |

Service Corporation International | | | 8.00 | | | | 11-15-2021 | | | | 850,000 | | | | 892,500 | |

| | | | |

| | | | | | | | | | | | | | | 6,905,307 | |

| | | | | | | | | | | | | | | | |

|

| Hotels, Restaurants & Leisure: 1.68% | |

CCM Merger Incorporated 144A | | | 6.00 | | | | 3-15-2022 | | | | 3,698,000 | | | | 3,494,610 | |

Hilton Domestic Operating Company Incorporated | | | 4.88 | | | | 1-15-2030 | | | | 100,000 | | | | 95,750 | |

Wyndham Hotels & Resorts Company 144A | | | 5.38 | | | | 4-15-2026 | | | | 1,875,000 | | | | 1,715,625 | |

Yum! Brands Incorporated 144A | | | 4.75 | | | | 1-15-2030 | | | | 150,000 | | | | 153,000 | |

Yum! Brands Incorporated 144A | | | 7.75 | | | | 4-1-2025 | | | | 150,000 | | | | 163,519 | |

| | | | |

| | | | | | | | | | | | | | | 5,622,504 | |

| | | | | | | | | | | | | | | | |

|

| Internet & Direct Marketing Retail: 0.23% | |

Expedia Incorporated | | | 5.95 | | | | 8-15-2020 | | | | 750,000 | | | | 755,541 | |

| | | | | | | | | | | | | | | | |

|

| Multiline Retail: 0.17% | |

Macy’s Retail Holdings Incorporated | | | 3.88 | | | | 1-15-2022 | | | | 600,000 | | | | 493,872 | |

Nordstrom Incorporated 144A | | | 8.75 | | | | 5-15-2025 | | | | 55,000 | | | | 59,017 | |

| | | | |

| | | | | | | | | | | | | | | 552,889 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

12 | Wells Fargo Multi-Sector Income Fund

Portfolio of investments—April 30, 2020 (unaudited)

| | | | | | | | | | | | | | | | |

| | | Interest

rate | | | Maturity

date | | | Principal | | | Value | |

| Specialty Retail: 2.03% | |

Advance Auto Parts Incorporated | | | 4.50 | % | | | 1-15-2022 | | | $ | 600,000 | | | $ | 618,108 | |

Asbury Automotive Group Incorporated 144A | | | 4.50 | | | | 3-1-2028 | | | | 400,000 | | | | 335,880 | |

Asbury Automotive Group Incorporated 144A | | | 4.75 | | | | 3-1-2030 | | | | 387,000 | | | | 324,248 | |

Group 1 Automotive Incorporated | | | 5.00 | | | | 6-1-2022 | | | | 200,000 | | | | 190,500 | |

Lithia Motors Incorporated 144A | | | 5.25 | | | | 8-1-2025 | | | | 945,000 | | | | 914,288 | |

Lithia Motors Incorporated 144A | | | 4.63 | | | | 12-15-2027 | | | | 150,000 | | | | 141,750 | |

Penske Auto Group Incorporated | | | 3.75 | | | | 8-15-2020 | | | | 540,000 | | | | 535,275 | |

Penske Auto Group Incorporated | | | 5.38 | | | | 12-1-2024 | | | | 2,150,000 | | | | 1,977,355 | |

Penske Auto Group Incorporated | | | 5.75 | | | | 10-1-2022 | | | | 1,155,000 | | | | 1,105,913 | |

Sonic Automotive Incorporated | | | 6.13 | | | | 3-15-2027 | | | | 775,000 | | | | 666,500 | |

| | | | |

| | | | | | | | | | | | | | | 6,809,817 | |

| | | | | | | | | | | | | | | | |

|

| Textiles, Apparel & Luxury Goods: 0.63% | |

The William Carter Company 144A | | | 5.63 | | | | 3-15-2027 | | | | 825,000 | | | | 836,352 | |

Wolverine World Wide Incorporated 144A | | | 5.00 | | | | 9-1-2026 | | | | 1,326,000 | | | | 1,271,455 | |

| | | | |

| | | | | | | | | | | | | | | 2,107,807 | |

| | | | | | | | | | | | | | | | |

|

Consumer Staples: 1.21% | |

|

| Beverages: 0.20% | |

Cott Beverages Incorporated 144A | | | 5.50 | | | | 4-1-2025 | | | | 675,000 | | | | 678,375 | |

| | | | | | | | | | | | | | | | |

|

| Food & Staples Retailing: 0.09% | |

Albertsons Companies Incorporated 144A | | | 4.63 | | | | 1-15-2027 | | | | 150,000 | | | | 150,750 | |

Albertsons Companies Incorporated 144A | | | 4.88 | | | | 2-15-2030 | | | | 150,000 | | | | 152,063 | |

| | | | |

| | | | | | | | | | | | | | | 302,813 | |

| | | | | | | | | | | | | | | | |

|

| Food Products: 0.71% | |

Darling Ingredients Incorporated 144A | | | 5.25 | | | | 4-15-2027 | | | | 500,000 | | | | 503,800 | |

Pilgrim’s Pride Corporation 144A | | | 5.75 | | | | 3-15-2025 | | | | 1,305,000 | | | | 1,318,220 | |

Pilgrim’s Pride Corporation 144A | | | 5.88 | | | | 9-30-2027 | | | | 150,000 | | | | 151,793 | |

Prestige Brands Incorporated 144A | | | 5.13 | | | | 1-15-2028 | | | | 100,000 | | | | 101,150 | |

Prestige Brands Incorporated 144A | | | 6.38 | | | | 3-1-2024 | | | | 280,000 | | | | 287,700 | |

| | | | |

| | | | | | | | | | | | | | | 2,362,663 | |

| | | | | | | | | | | | | | | | |

|

| Household Products: 0.02% | |

Spectrum Brands Incorporated | | | 5.75 | | | | 7-15-2025 | | | | 50,000 | | | | 49,875 | |

| | | | | | | | | | | | | | | | |

|

| Tobacco: 0.19% | |

Reynolds American Incorporated | | | 6.88 | | | | 5-1-2020 | | | | 650,000 | | | | 650,000 | |

| | | | | | | | | | | | | | | | |

|

Energy: 12.70% | |

|

| Energy Equipment & Services: 2.00% | |

Bristow Group Incorporated (a)† | | | 6.25 | | | | 10-15-2022 | | | | 3,855,000 | | | | 0 | |

Diamond Offshore Drilling Incorporated † | | | 4.88 | | | | 11-1-2043 | | | | 1,325,000 | | | | 142,703 | |

Era Group Incorporated | | | 7.75 | | | | 12-15-2022 | | | | 2,350,000 | | | | 2,138,500 | |

Hilcorp Energy Company 144A | | | 5.00 | | | | 12-1-2024 | | | | 1,450,000 | | | | 819,250 | |

Hilcorp Energy Company 144A | | | 5.75 | | | | 10-1-2025 | | | | 1,875,000 | | | | 1,045,313 | |

Hilcorp Energy Company 144A | | | 6.25 | | | | 11-1-2028 | | | | 350,000 | | | | 181,125 | |

NGPL PipeCo LLC 144A | | | 4.38 | | | | 8-15-2022 | | | | 350,000 | | | | 351,009 | |

NGPL PipeCo LLC 144A | | | 7.77 | | | | 12-15-2037 | | | | 410,000 | | | | 450,690 | |

Oceaneering International Incorporated | | | 6.00 | | | | 2-1-2028 | | | | 1,725,000 | | | | 886,219 | |

USA Compression Partners LP | | | 6.88 | | | | 4-1-2026 | | | | 850,000 | | | | 684,250 | |

| | | | |

| | | | | | | | | | | | | | | 6,699,059 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Multi-Sector Income Fund | 13

Portfolio of investments—April 30, 2020 (unaudited)

| | | | | | | | | | | | | | | | |

| | | Interest

rate | | | Maturity

date | | | Principal | | | Value | |

| Oil, Gas & Consumable Fuels: 10.70% | |

Antero Midstream Partners LP 144A | | | 5.75 | % | | | 1-15-2028 | | | $ | 1,830,000 | | | $ | 1,345,050 | |

Antero Resources Corporation | | | 5.38 | | | | 11-1-2021 | | | | 400,000 | | | | 357,750 | |

Apache Corporation | | | 4.25 | | | | 1-15-2030 | | | | 40,000 | | | | 30,752 | |

Apache Corporation | | | 4.38 | | | | 10-15-2028 | | | | 750,000 | | | | 596,184 | |

Apache Corporation | | | 4.75 | | | | 4-15-2043 | | | | 1,700,000 | | | | 1,161,296 | |

Archrock Partners LP 144A | | | 6.25 | | | | 4-1-2028 | | | | 150,000 | | | | 111,750 | |

Archrock Partners LP 144A | | | 6.88 | | | | 4-1-2027 | | | | 500,000 | | | | 375,000 | |

Boardwalk Pipelines LP | | | 4.80 | | | | 5-3-2029 | | | | 750,000 | | | | 659,603 | |

Buckeye Partners LP | | | 5.85 | | | | 11-15-2043 | | | | 1,125,000 | | | | 821,250 | |

Callon Petroleum Company | | | 8.25 | | | | 7-15-2025 | | | | 1,760,000 | | | | 316,800 | |

Callon Petroleum Company | | | 6.25 | | | | 4-15-2023 | | | | 350,000 | | | | 69,650 | |

Cheniere Corpus Christi Holdings LLC | | | 5.13 | | | | 6-30-2027 | | | | 900,000 | | | | 897,361 | |

Cheniere Energy Partners LP 144A | | | 4.50 | | | | 10-1-2029 | | | | 400,000 | | | | 369,000 | |

Cheniere Energy Partners LP | | | 5.25 | | | | 10-1-2025 | | | | 3,075,000 | | | | 2,935,395 | |

Cheniere Energy Partners LP | | | 5.63 | | | | 10-1-2026 | | | | 300,000 | | | | 286,680 | |

Denbury Resources Incorporated | | | 6.38 | | | | 12-31-2024 | | | | 802,000 | | | | 105,491 | |

Denbury Resources Incorporated 144A | | | 7.75 | | | | 2-15-2024 | | | | 1,123,000 | | | | 202,140 | |

Denbury Resources Incorporated 144A | | | 9.00 | | | | 5-15-2021 | | | | 2,400,000 | | | | 432,000 | |

Denbury Resources Incorporated 144A | | | 9.25 | | | | 3-31-2022 | | | | 676,000 | | | | 121,680 | |

Energy Transfer Partners LP | | | 5.20 | | | | 2-1-2022 | | | | 750,000 | | | | 756,110 | |

EnLink Midstream LLC | | | 5.38 | | | | 6-1-2029 | | | | 2,225,000 | | | | 1,379,500 | |

EnLink Midstream Partners LP | | | 4.40 | | | | 4-1-2024 | | | | 450,000 | | | | 283,500 | |

EnLink Midstream Partners LP | | | 5.05 | | | | 4-1-2045 | | | | 1,575,000 | | | | 637,875 | |

EnLink Midstream Partners LP | | | 5.45 | | | | 6-1-2047 | | | | 950,000 | | | | 385,938 | |

EnLink Midstream Partners LP | | | 5.60 | | | | 4-1-2044 | | | | 750,000 | | | | 300,000 | |

Enviva Partners LP 144A | | | 6.50 | | | | 1-15-2026 | | | | 1,025,000 | | | | 1,073,688 | |

Gulfport Energy Corporation | | | 6.00 | | | | 10-15-2024 | | | | 2,150,000 | | | | 1,069,625 | |

Kinder Morgan Energy Partners LP | | | 3.95 | | | | 9-1-2022 | | | | 750,000 | | | | 776,803 | |

Kinder Morgan Incorporated | | | 6.50 | | | | 9-15-2020 | | | | 285,000 | | | | 288,280 | |

Kinder Morgan Incorporated | | | 7.42 | | | | 2-15-2037 | | | | 800,000 | | | | 855,917 | |

MPLX LP 144A | | | 6.38 | | | | 5-1-2024 | | | | 450,000 | | | | 459,293 | |

Murphy Oil Corporation | | | 4.75 | | | | 9-15-2029 | | | | 75,000 | | | | 77,228 | |

Murphy Oil Corporation | | | 5.75 | | | | 8-15-2025 | | | | 185,000 | | | | 127,650 | |

Murphy Oil Corporation | | | 5.88 | | | | 12-1-2027 | | | | 150,000 | | | | 101,805 | |

Nabors Industries Incorporated | | | 4.63 | | | | 9-15-2021 | | | | 78,000 | | | | 49,429 | |

Occidental Petroleum Corporation | | | 4.63 | | | | 6-15-2045 | | | | 1,825,000 | | | | 1,117,813 | |

Occidental Petroleum Corporation | | | 5.55 | | | | 3-15-2026 | | | | 700,000 | | | | 541,520 | |

Occidental Petroleum Corporation | | | 6.20 | | | | 3-15-2040 | | | | 425,000 | | | | 303,875 | |

Occidental Petroleum Corporation | | | 6.45 | | | | 9-15-2036 | | | | 4,000,000 | | | | 2,920,000 | |

Occidental Petroleum Corporation | | | 6.60 | | | | 3-15-2046 | | | | 500,000 | | | | 370,000 | |

Phillips 66 | | | 4.30 | | | | 4-1-2022 | | | | 625,000 | | | | 651,798 | |

Pioneer Natural Resources Company | | | 3.95 | | | | 7-15-2022 | | | | 750,000 | | | | 761,058 | |

Rockies Express Pipeline LLC 144A | | | 3.60 | | | | 5-15-2025 | | | | 750,000 | | | | 676,875 | |

Rockies Express Pipeline LLC 144A | | | 4.80 | | | | 5-15-2030 | | | | 750,000 | | | | 641,250 | |

Rockies Express Pipeline LLC 144A | | | 4.95 | | | | 7-15-2029 | | | | 475,000 | | | | 422,750 | |

Rockies Express Pipeline LLC 144A | | | 6.88 | | | | 4-15-2040 | | | | 2,024,000 | | | | 1,778,590 | |

Rockies Express Pipeline LLC 144A | | | 7.50 | | | | 7-15-2038 | | | | 240,000 | | | | 210,600 | |

Southwestern Energy Company | | | 7.50 | | | | 4-1-2026 | | | | 400,000 | | | | 358,192 | |

Southwestern Energy Company | | | 7.75 | | | | 10-1-2027 | | | | 975,000 | | | | 848,445 | |

Tallgrass Energy Partners LP 144A | | | 5.50 | | | | 9-15-2024 | | | | 3,850,000 | | | | 2,926,000 | |

Ultra Resources Incorporated 144A† | | | 7.13 | | | | 4-15-2025 | | | | 2,425,000 | | | | 243 | |

Western Midstream Operating LP | | | 4.05 | | | | 2-1-2030 | | | | 600,000 | | | | 547,500 | |

Western Midstream Operating LP | | | 5.25 | | | | 2-1-2050 | | | | 45,000 | | | | 35,438 | |

Western Midstream Operating LP | | | 5.30 | | | | 3-1-2048 | | | | 1,000,000 | | | | 752,500 | |

Whiting Petroleum Corporation † | | | 1.25 | | | | 4-1-2020 | | | | 1,833,000 | | | | 164,970 | |

| | | | |

| | | | | | | | | | | | | | | 35,846,890 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

14 | Wells Fargo Multi-Sector Income Fund

Portfolio of investments—April 30, 2020 (unaudited)

| | | | | | | | | | | | | | | | |

| | | Interest

rate | | | Maturity

date | | | Principal | | | Value | |

| Financials: 7.76% | |

|

| Banks: 1.29% | |

Bank of America Corporation | | | 5.70 | % | | | 1-24-2022 | | | $ | 250,000 | | | $ | 268,242 | |

Citigroup Incorporated | | | 4.50 | | | | 1-14-2022 | | | | 250,000 | | | | 262,479 | |

Citigroup Incorporated (U.S. SOFR +3.23%)±(s) | | | 4.70 | | | | 1-30-2025 | | | | 750,000 | | | | 652,500 | |

Citigroup Incorporated | | | 6.13 | | | | 3-9-2028 | | | | 75,000 | | | | 76,875 | |

City National Bank | | | 5.38 | | | | 7-15-2022 | | | | 500,000 | | | | 537,819 | |

International Finance Corporation | | | 7.50 | | | | 5-9-2022 | | | | 4,000,000 | | | | 790,460 | |

International Finance Corporation | | | 7.50 | | | | 5-9-2022 | | | | 5,000,000 | | | | 988,074 | |

JPMorgan Chase & Company (3 Month LIBOR +3.25%)± | | | 5.15 | | | | 12-29-2049 | | | | 750,000 | | | | 738,750 | |

| | | | |

| | | | | | | | | | | | | | | 4,315,199 | |

| | | | | | | | | | | | | | | | |

|

| Capital Markets: 0.25% | |

ACE Securities Corporation (1 Month LIBOR +2.63%)± | | | 3.57 | | | | 6-25-2033 | | | | 52,102 | | | | 52,070 | |

Goldman Sachs Group Incorporated | | | 5.75 | | | | 1-24-2022 | | | | 750,000 | | | | 802,681 | |

| | | | |

| | | | | | | | | | | | | | | 854,751 | |

| | | | | | | | | | | | | | | | |

|

| Consumer Finance: 2.12% | |

Discover Financial Services | | | 5.20 | | | | 4-27-2022 | | | | 750,000 | | | | 776,465 | |

FirstCash Incorporated 144A | | | 5.38 | | | | 6-1-2024 | | | | 300,000 | | | | 300,750 | |

Ford Motor Credit Company LLC | | | 4.39 | | | | 1-8-2026 | | | | 1,450,000 | | | | 1,247,000 | |

Ford Motor Credit Company LLC | | | 5.11 | | | | 5-3-2029 | | | | 2,175,000 | | | | 1,870,500 | |

Springleaf Finance Corporation | | | 5.38 | | | | 11-15-2029 | | | | 625,000 | | | | 518,869 | |

Springleaf Finance Corporation | | | 6.13 | | | | 3-15-2024 | | | | 750,000 | | | | 703,208 | |

Springleaf Finance Corporation | | | 6.63 | | | | 1-15-2028 | | | | 100,000 | | | | 88,250 | |

Springleaf Finance Corporation | | | 7.13 | | | | 3-15-2026 | | | | 925,000 | | | | 857,336 | |

Synchrony Financial | | | 5.15 | | | | 3-19-2029 | | | | 750,000 | | | | 741,765 | |

| | | | |

| | | | | | | | | | | | | | | 7,104,143 | |

| | | | | | | | | | | | | | | | |

|

| Diversified Financial Services: 1.10% | |

LPL Holdings Incorporated 144A | | | 5.75 | | | | 9-15-2025 | | | | 3,700,000 | | | | 3,672,250 | |

| | | | | | | | | | | | | | | | |

|

| Insurance: 2.95% | |

American International Group Incorporated | | | 4.88 | | | | 6-1-2022 | | | | 750,000 | | | | 800,030 | |

AmWINS Group Incorporated 144A | | | 7.75 | | | | 7-1-2026 | | | | 1,625,000 | | | | 1,673,750 | |

Assurant Incorporated | | | 3.70 | | | | 2-22-2030 | | | | 750,000 | | | | 716,778 | |

Athene Holding Limited | | | 4.13 | | | | 1-12-2028 | | | | 750,000 | | | | 709,203 | |

Brighthouse Financial Incorporated | | | 4.70 | | | | 6-22-2047 | | | | 850,000 | | | | 731,634 | |

HUB International Limited 144A | | | 7.00 | | | | 5-1-2026 | | | | 550,000 | | | | 542,548 | |

Liberty Mutual Group Incorporated 144A | | | 4.57 | | | | 2-1-2029 | | | | 750,000 | | | | 840,235 | |

ProAssurance Corporation | | | 5.30 | | | | 11-15-2023 | | | | 750,000 | | | | 808,753 | |

Prudential Financial Incorporated (3 Month LIBOR +2.38%)± | | | 4.50 | | | | 9-15-2047 | | | | 750,000 | | | | 716,250 | |

Sammons Financial Group Incorporated 144A | | | 4.45 | | | | 5-12-2027 | | | | 750,000 | | | | 808,678 | |

USI Incorporated 144A | | | 6.88 | | | | 5-1-2025 | | | | 850,000 | | | | 852,125 | |

W.R. Berkley Corporation | | | 4.63 | | | | 3-15-2022 | | | | 650,000 | | | | 676,308 | |

| | | | |

| | | | | | | | | | | | | | | 9,876,292 | |

| | | | | | | | | | | | | | | | |

|

| Thrifts & Mortgage Finance: 0.05% | |

Ladder Capital Finance LLLP 144A | | | 4.25 | | | | 2-1-2027 | | | | 50,000 | | | | 34,750 | |

Ladder Capital Finance LLLP 144A | | | 5.25 | | | | 3-15-2022 | | | | 150,000 | | | | 123,750 | |

| | | | |

| | | | | | | | | | | | | | | 158,500 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Multi-Sector Income Fund | 15

Portfolio of investments—April 30, 2020 (unaudited)

| | | | | | | | | | | | | | | | |

| | | Interest

rate | | | Maturity

date | | | Principal | | | Value | |

| Health Care: 6.27% | |

|

| Health Care Equipment & Supplies: 1.04% | |

Hill-Rom Holdings Incorporated 144A | | | 4.38 | % | | | 9-15-2027 | | | $ | 475,000 | | | $ | 480,938 | |

Hill-Rom Holdings Incorporated 144A | | | 5.00 | | | | 2-15-2025 | | | | 400,000 | | | | 408,000 | |

Hologic Incorporated 144A | | | 4.38 | | | | 10-15-2025 | | | | 1,925,000 | | | | 1,933,855 | |

Hologic Incorporated 144A | | | 4.63 | | | | 2-1-2028 | | | | 225,000 | | | | 228,375 | |

Surgery Center Holdings Incorporated 144A | | | 6.75 | | | | 7-1-2025 | | | | 500,000 | | | | 427,225 | |

| | | | |

| | | | | | | | | | | | | | | 3,478,393 | |

| | | | | | | | | | | | | | | | |

|

| Health Care Providers & Services: 4.16% | |

Centene Corporation 144A | | | 5.38 | | | | 8-15-2026 | | | | 125,000 | | | | 133,138 | |

Cigna Corporation 144A | | | 3.90 | | | | 2-15-2022 | | | | 315,000 | | | | 327,841 | |

CommonSpirit Health AGM Insured | | | 3.82 | | | | 10-1-2049 | | | | 750,000 | | | | 750,599 | |

Community Health Systems Incorporated 144A | | | 6.63 | | | | 2-15-2025 | | | | 1,925,000 | | | | 1,766,188 | |

Encompass Health Corporation | | | 4.50 | | | | 2-1-2028 | | | | 125,000 | | | | 125,238 | |

Encompass Health Corporation | | | 4.75 | | | | 2-1-2030 | | | | 125,000 | | | | 125,016 | |

HCA Incorporated | | | 5.25 | | | | 6-15-2026 | | | | 325,000 | | | | 362,150 | |

HealthSouth Corporation | | | 5.75 | | | | 9-15-2025 | | | | 575,000 | | | | 583,625 | |

MEDNAX Incorporated 144A | | | 6.25 | | | | 1-15-2027 | | | | 550,000 | | | | 497,992 | |

MPH Acquisition Holdings LLC 144A | | | 7.13 | | | | 6-1-2024 | | | | 2,861,000 | | | | 2,549,780 | |

MPT Operating Partnership LP | | | 4.63 | | | | 8-1-2029 | | | | 325,000 | | | | 323,174 | |

MPT Operating Partnership LP | | | 5.00 | | | | 10-15-2027 | | | | 1,100,000 | | | | 1,122,000 | |

MPT Operating Partnership LP | | | 5.25 | | | | 8-1-2026 | | | | 1,575,000 | | | | 1,590,750 | |

MPT Operating Partnership LP | | | 6.38 | | | | 3-1-2024 | | | | 110,000 | | | | 113,596 | |

Polaris Intermediate Corporation 144A | | | 8.50 | | | | 12-1-2022 | | | | 475,000 | | | | 397,813 | |

Select Medical Corporation 144A | | | 6.25 | | | | 8-15-2026 | | | | 900,000 | | | | 859,500 | |

Tenet Healthcare Corporation | | | 4.63 | | | | 7-15-2024 | | | | 436,000 | | | | 430,245 | |

Tenet Healthcare Corporation 144A | | | 4.88 | | | | 1-1-2026 | | | | 1,025,000 | | | | 1,015,058 | |

Tenet Healthcare Corporation 144A | | | 5.13 | | | | 11-1-2027 | | | | 225,000 | | | | 222,188 | |

Tenet Healthcare Corporation | | | 7.00 | | | | 8-1-2025 | | | | 300,000 | | | | 278,880 | |

Tenet Healthcare Corporation 144A | | | 7.50 | | | | 4-1-2025 | | | | 150,000 | | | | 161,325 | |

Vizient Incorporated 144A | | | 6.25 | | | | 5-15-2027 | | | | 175,000 | | | | 183,873 | |

| | | | |

| | | | | | | | | | | | | | | 13,919,969 | |

| | | | | | | | | | | | | | | | |

|

| Health Care Technology: 0.84% | |

Change Healthcare Holdings Incorporated 144A | | | 5.75 | | | | 3-1-2025 | | | | 2,375,000 | | | | 2,322,085 | |

IQVIA Incorporated 144A | | | 5.00 | | | | 10-15-2026 | | | | 225,000 | | | | 231,930 | |

IQVIA Incorporated 144A | | | 5.00 | | | | 5-15-2027 | | | | 250,000 | | | | 256,798 | |

| | | | |

| | | | | | | | | | | | | | | 2,810,813 | |

| | | | | | | | | | | | | | | | |

|

| Life Sciences Tools & Services: 0.11% | |

Charles River Laboratories Incorporated 144A | | | 4.25 | | | | 5-1-2028 | | | | 75,000 | | | | 75,656 | |

Charles River Laboratories Incorporated 144A | | | 5.50 | | | | 4-1-2026 | | | | 150,000 | | | | 154,260 | |

Ortho-Clinical Diagnostics Incorporated 144A | | | 7.25 | | | | 2-1-2028 | | | | 150,000 | | | | 134,625 | |

| | | | |

| | | | | | | | | | | | | | | 364,541 | |

| | | | | | | | | | | | | | | | |

|

| Pharmaceuticals: 0.12% | |

Bausch Health Companies Incorporated 144A | | | 8.50 | | | | 1-31-2027 | | | | 375,000 | | | | 413,400 | |

| | | | | | | | | | | | | | | | |

|

| Industrials: 6.40% | |

|

| Aerospace & Defense: 1.43% | |

L3Harris Technologies Incorporated 144A | | | 4.95 | | | | 2-15-2021 | | | | 750,000 | | | | 762,631 | |

RBS Global & Rexnord LLC 144A | | | 4.88 | | | | 12-15-2025 | | | | 1,704,000 | | | | 1,661,400 | |

Signature Aviation US Holdings Incorporated 144A | | | 4.00 | | | | 3-1-2028 | | | | 600,000 | | | | 510,000 | |

Signature Aviation US Holdings Incorporated 144A | | | 5.38 | | | | 5-1-2026 | | | | 2,025,000 | | | | 1,868,063 | |

| | | | |

| | | | | | | | | | | | | | | 4,802,094 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

16 | Wells Fargo Multi-Sector Income Fund

Portfolio of investments—April 30, 2020 (unaudited)

| | | | | | | | | | | | | | | | |

| | | Interest

rate | | | Maturity

date | | | Principal | | | Value | |

| Air Freight & Logistics: 0.12% | |

Cargo Aircraft Management Company 144A | | | 4.75 | % | | | 2-1-2028 | | | $ | 425,000 | | | $ | 396,844 | |

| | | | | | | | | | | | | | | | |

|

| Airlines: 0.08% | |

Delta Air Lines Incorporated | | | 4.75 | | | | 11-7-2021 | | | | 251,938 | | | | 251,757 | |

| | | | | | | | | | | | | | | | |

|

| Commercial Services & Supplies: 2.89% | |

Advanced Disposal Services Incorporated 144A | | | 5.63 | | | | 11-15-2024 | | | | 1,750,000 | | | | 1,811,250 | |

Covanta Holding Corporation | | | 5.88 | | | | 3-1-2024 | | | | 1,530,000 | | | | 1,503,225 | |

Covanta Holding Corporation | | | 5.88 | | | | 7-1-2025 | | | | 515,000 | | | | 498,263 | |

Covanta Holding Corporation | | | 6.00 | | | | 1-1-2027 | | | | 575,000 | | | | 552,000 | |

IAA Spinco Incorporated 144A | | | 5.50 | | | | 6-15-2027 | | | | 1,700,000 | | | | 1,696,260 | |

KAR Auction Services Incorporated 144A | | | 5.13 | | | | 6-1-2025 | | | | 4,200,000 | | | | 3,622,542 | |

| | | | |

| | | | | | | | | | | | | | | 9,683,540 | |

| | | | | | | | | | | | | | | | |

|

| Industrial Conglomerates: 0.21% | |

General Electric Capital Corporation | | | 4.65 | | | | 10-17-2021 | | | | 187,000 | | | | 194,231 | |

General Electric Company | | | 4.63 | | | | 1-7-2021 | | | | 505,000 | | | | 513,463 | |

| | | | |

| | | | | | | | | | | | | | | 707,694 | |

| | | | | | | | | | | | | | | | |

|

| Machinery: 1.05% | |

Navistar International Corporation 144A | | | 9.50 | | | | 5-1-2025 | | | | 125,000 | | | | 130,938 | |

Stevens Holding Company Incorporated 144A | | | 6.13 | | | | 10-1-2026 | | | | 1,425,000 | | | | 1,428,135 | |

Trimas Corporation 144A | | | 4.88 | | | | 10-15-2025 | | | | 1,997,000 | | | | 1,954,564 | |

| | | | |

| | | | | | | | | | | | | | | 3,513,637 | |

| | | | | | | | | | | | | | | | |

|

| Professional Services: 0.16% | |

Verisk Analytics Incorporated | | | 5.80 | | | | 5-1-2021 | | | | 530,000 | | | | 551,302 | |

| | | | | | | | | | | | | | | | |

|

| Trading Companies & Distributors: 0.46% | |

Fortress Transportation & Infrastructure Investors LLC 144A | | | 6.50 | | | | 10-1-2025 | | | | 1,875,000 | | | | 1,537,500 | |

| | | | | | | | | | | | | | | | |

|

| Information Technology: 5.78% | |

|

| Communications Equipment: 0.23% | |

CommScope Technologies Finance LLC 144A | | | 6.00 | | | | 6-15-2025 | | | | 825,000 | | | | 734,168 | |

CommScope Technologies Finance LLC 144A | | | 8.25 | | | | 3-1-2027 | | | | 50,000 | | | | 48,000 | |

| | | | |

| | | | | | | | | | | | | | | 782,168 | |

| | | | | | | | | | | | | | | | |

|

| Electronic Equipment, Instruments & Components: 0.20% | |

Keysight Technologies | | | 4.60 | | | | 4-6-2027 | | | | 600,000 | | | | 670,765 | |

| | | | | | | | | | | | | | | | |

|

| IT Services: 1.47% | |

Cardtronics Incorporated 144A | | | 5.50 | | | | 5-1-2025 | | | | 2,850,000 | | | | 2,707,500 | |

Gartner Incorporated 144A | | | 5.13 | | | | 4-1-2025 | | | | 1,525,000 | | | | 1,572,656 | |

Infor US Incorporated | | | 6.50 | | | | 5-15-2022 | | | | 550,000 | | | | 550,495 | |

Tempo Acquisition LLC 144A%% | | | 5.75 | | | | 6-1-2025 | | | | 75,000 | | | | 75,000 | |

| | | | |

| | | | | | | | | | | | | | | 4,905,651 | |

| | | | | | | | | | | | | | | | |

|

| Semiconductors & Semiconductor Equipment: 0.28% | |

Broadcom Corporation | | | 3.50 | | | | 1-15-2028 | | | | 750,000 | | | | 759,865 | |

Qorvo Incorporated 144A | | | 4.38 | | | | 10-15-2029 | | | | 175,000 | | | | 174,344 | |

| | | | |

| | | | | | | | | | | | | | | 934,209 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Multi-Sector Income Fund | 17

Portfolio of investments—April 30, 2020 (unaudited)

| | | | | | | | | | | | | | | | |

| | | Interest

rate | | | Maturity

date | | | Principal | | | Value | |

| Software: 0.91% | |

CDK Global Incorporated 144A | | | 5.25 | % | | | 5-15-2029 | | | $ | 175,000 | | | $ | 178,500 | |

Fair Isaac Corporation 144A | | | 4.00 | | | | 6-15-2028 | | | | 100,000 | | | | 99,250 | |

Fair Isaac Corporation 144A | | | 5.25 | | | | 5-15-2026 | | | | 1,000,000 | | | | 1,032,500 | |

NortonLifeLock Incorporated 144A | | | 5.00 | | | | 4-15-2025 | | | | 475,000 | | | | 477,969 | |

SS&C Technologies Incorporated 144A | | | 5.50 | | | | 9-30-2027 | | | | 500,000 | | | | 512,500 | |

VMware Incorporated | | | 3.90 | | | | 8-21-2027 | | | | 750,000 | | | | 759,665 | |

| | | | |

| | | | | | | | | | | | | | | 3,060,384 | |

| | | | | | | | | | | | | | | | |

|

| Technology Hardware, Storage & Peripherals: 2.69% | |

Dell International LLC 144A | | | 7.13 | | | | 6-15-2024 | | | | 3,200,000 | | | | 3,315,840 | |

Diamond 1 Finance Corporation 144A | | | 6.02 | | | | 6-15-2026 | | | | 750,000 | | | | 811,470 | |

Hewlett-Packard Company | | | 4.05 | | | | 9-15-2022 | | | | 750,000 | | | | 783,280 | |

NCR Corporation | | | 6.38 | | | | 12-15-2023 | | | | 3,900,000 | | | | 3,948,750 | |

NCR Corporation 144A | | | 8.13 | | | | 4-15-2025 | | | | 150,000 | | | | 159,000 | |

| | | | |

| | | | | | | | | | | | | | | 9,018,340 | |

| | | | | | | | | | | | | | | | |

|

Materials: 2.56% | |

|

| Chemicals: 0.05% | |

Valvoline Incorporated 144A | | | 4.25 | | | | 2-15-2030 | | | | 175,000 | | | | 170,188 | |

| | | | | | | | | | | | | | | | |

|

| Containers & Packaging: 2.16% | |

Ball Corporation | | | 5.00 | | | | 3-15-2022 | | | | 25,000 | | | | 26,188 | |

Ball Corporation | | | 5.25 | | | | 7-1-2025 | | | | 190,000 | | | | 209,475 | |

Berry Global Incorporated 144A | | | 4.88 | | | | 7-15-2026 | | | | 500,000 | | | | 510,719 | |

Berry Global Incorporated | | | 5.13 | | | | 7-15-2023 | | | | 350,000 | | | | 352,188 | |

Berry Global Incorporated 144A | | | 5.63 | | | | 7-15-2027 | | | | 175,000 | | | | 180,688 | |