| UNITED STATES | |

| SECURITIES AND EXCHANGE COMMISSION | |

| Washington, D.C. 20549 | |

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21339 |

|

MORGAN STANLEY INSTITUTIONAL LIQUIDITY FUNDS |

(Exact name of registrant as specified in charter) |

|

1221 AVENUE OF THE AMERICAS 22ND FLOOR NEW YORK, NY | | 10020 |

(Address of principal executive offices) | | (Zip code) |

|

RONALD E. ROBISON

1221 AVENUE OF THE AMERICAS 33RD FLOOR NEW YORK, NY 10020 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1888 378-1630 | |

|

Date of fiscal year end: | 10/31 | |

|

Date of reporting period: | 4/30/05 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

Item 1. Reports to Shareholders.

The Fund’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

| 2005 Semi-Annual Report |

April 30, 2005 |

Morgan Stanley Institutional Liquidity Funds

Money Market Portfolio

Prime Portfolio

Government Portfolio

Treasury Portfolio

Tax-Exempt Portfolio

| 2005 Semi-Annual Report |

| |

| April 30, 2005 |

Table of Contents | |

| 3 |

Shareholder’s Letter | 4 |

Performance Summary | 5 |

Expense Examples | |

Portfolio of Investments | |

Money Market Portfolio | 8 |

Prime Portfolio | 11 |

Government Portfolio | 14 |

Treasury Portfolio | 16 |

Tax-Exempt Portfolio | 17 |

| |

Statements of Assets and Liabilities | 21 |

Statements of Operations | 23 |

Statements of Changes in Net Assets | 24 |

Financial Highlights | 28 |

Notes to Financial Statements | 43 |

Investment Advisory Agreement Approval | 46 |

Trustee and Officer Information | 48 |

This report is authorized for distribution only when preceded or accompanied by prospectuses of the Morgan Stanley Institutional Liquidity Funds. To receive a prospectus and/or SAI, which contains more complete information such as investment objectives, charges, expenses, policies for voting proxies, risk considerations, and describes in detail each of the Portfolio’s investment policies to the prospective investor, please call 1 (888) 378-1630. Please read the prospectus carefully before you invest or send money. Additionally, you can access portfolio information including performance, yields, characteristics, and investment team commentary through Morgan Stanley Investment Management’s website: www.morganstanley.com/im.

1

(This page has been left blank intentionally.)

2

| 2005 Semi-Annual Report |

| |

| April 30, 2005 (unaudited) |

Shareholder’s Letter

Dear Shareholders:

Overview

We are pleased to present the Morgan Stanley Institutional Liquidity Funds (“MSILF”) Semi-Annual Report for the period ended April 30, 2005. The MSILF currently offers five portfolios (Money Market, Prime, Government, Treasury and Tax-Exempt), which together are designed to provide flexible cash management options. MSILF’s portfolios provide investors with a means to help them meet specific cash investment needs, whether they need a rated fund, capital preservation, or tax-efficient returns.

Sincerely, |

|

|

/s/ Ronald E. Robison | |

Ronald E. Robison |

Executive Vice President — |

Principal Executive Officer |

May 2005 |

3

2005 Semi-Annual Report |

| |

April 30, 2005 (unaudited) |

Performance Summary

The seven-day current and seven-day effective yields (which assume an annualization of the current yield with all dividends reinvested) as of April 30, 2005, were as follows:

| | Institutional Class | | Service Class | | Investor Class | | Administrative Class | | Advisory Class | | Participant Class | |

| | 7-day

Current

Yield | | 7-day

Effective

Yield | | 7-day

Current

Yield | | 7-day

Effective

Yield | | 7-day

Current

Yield | | 7-day

Effective

Yield | | 7-day

Current

Yield | | 7-day

Effective

Yield | | 7-day

Current

Yield | | 7-day

Effective

Yield | | 7-day

Current

Yield | | 7-day

Effective

Yield | |

Portfolio: | | | | | | | | | | | | | | | | | | | | | | | | | |

Money Market | | 2.82 | % | 2.86 | % | 2.77 | % | 2.81 | % | 2.72 | % | 2.75 | % | 2.67 | % | 2.70 | % | 2.56 | % | 2.60 | % | 2.42 | % | 2.45 | % |

Prime | | 2.80 | % | 2.84 | % | 2.75 | % | 2.79 | % | 2.70 | % | 2.74 | % | 2.65 | % | 2.69 | % | 2.55 | % | 2.58 | % | 2.40 | % | 2.43 | % |

Government | | 2.85 | % | 2.89 | % | 2.80 | % | 2.84 | % | 2.75 | % | 2.79 | % | 2.70 | % | 2.74 | % | 2.60 | % | 2.64 | % | 2.45 | % | 2.48 | % |

Treasury | | 2.76 | % | 2.80 | % | 2.71 | % | 2.75 | % | 2.66 | % | 2.70 | % | 2.61 | % | 2.64 | % | 2.51 | % | 2.54 | % | 2.36 | % | 2.39 | % |

Tax-Exempt | | 2.74 | % | 2.78 | % | 2.69 | % | 2.72 | % | 2.64 | % | 2.67 | % | 2.59 | % | 2.62 | % | 2.49 | % | 2.52 | % | 2.34 | % | 2.37 | % |

Performance data quoted represent past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. Performance assumes that all dividends and distributions, if any, were reinvested. For the most recent month-end performance figures, please visit www.morganstanley.com/im. Investment return and principal value will fluctuate causing portfolio shares, when redeemed, to be worth more or less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on portfolio distributions or the redemption of portfolio shares.

Investments in the Money Market, Prime, Government, Treasury and Tax-Exempt Portfolios (the “Portfolios”) are neither insured nor guaranteed by the Federal Deposit Insurance Corporation. Although the Portfolios seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these Portfolios. Please read the MSILF’s prospectuses carefully before you invest or send money.

Yield quotation more closely reflect the current earnings of the Portfolios than the total return. As with all money market portfolios, yields will fluctuate as market conditions change and the seven-day yields are not necessarily indicative of future performance.

4

| 2005 Semi-Annual Report |

| |

| April 30, 2005 (unaudited) |

Expense Examples

Expense Examples

As a shareholder of the Portfolio, you incur ongoing costs, including management fees, shareholder administration plan fees (in the case of the Service, Investor, and Administrative Classes), service and shareholder administration plan fees (in the case of the Advisory Class); distribution and shareholder service plan fees (in the case of the Participant Class) and other Portfolio expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the six-month period ended April 30, 2005 and held for the entire six-month period.

Actual Expenses

The first line of the tables below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled ‘‘Expenses Paid During Period’’ to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the tables below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| | Beginning Account Value

November 1, 2004 | | Ending Account Value

April 30, 2005 | | Expenses Paid During Period*

November 1, 2004 — April 30, 2005 | |

| | | | | | | |

Money Market Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,011.50 | | $ | 0.50 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.30 | | 0.50 | |

Service Class | | | | | | | |

Actual | | 1,000.00 | | 1,011.30 | | 0.75 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.05 | | 0.75 | |

Investor Class | | | | | | | |

Actual | | 1,000.00 | | 1,011.00 | | 1.00 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.80 | | 1.00 | |

Administrative Class | | | | | | | |

Actual | | 1,000.00 | | 1,010.80 | | 1.25 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.55 | | 1.25 | |

Advisory Class | | | | | | | |

Actual | | 1,000.00 | | 1,010.30 | | 1.74 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.06 | | 1.76 | |

Participant Class | | | | | | | |

Actual | | 1,000.00 | | 1,009.50 | | 2.49 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,022.32 | | 2.51 | |

| | | | | | | | | | |

* Expenses are equal to Institutional Class’, Service Class’, Investor Class’, Administrative Class’, Advisory Class’ and Participant Class’ annualized net expense ratios of 0.10%, 0.15%, 0.20%, 0.25%, 0.35% and 0.50%, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Prime Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,011.60 | | $ | 0.50 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.30 | | 0.50 | |

Service Class | | | | | | | |

Actual | | 1,000.00 | | 1,011.40 | | 0.75 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.05 | | 0.75 | |

Investor Class | | | | | | | |

Actual | | 1,000.00 | | 1,011.10 | | 1.00 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.80 | | 1.00 | |

| | | | | | | | | | |

5

2005 Semi-Annual Report |

|

April 30, 2005 (unaudited) |

Expense Examples (cont’d)

| | Beginning Account Value

November 1, 2004 | | Ending Account Value

April 30, 2005 | | Expenses Paid During Period*

November 1, 2004 — April 30, 2005 | |

| | | | | | | |

Prime Portfolio (cont’d) | | | | | | | |

Administrative Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,010.90 | | $ | 1.25 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.55 | | 1.25 | |

Advisory Class | | | | | | | |

Actual | | 1,000.00 | | 1,010.40 | | 1.74 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.06 | | 1.76 | |

Participant Class | | | | | | | |

Actual | | 1,000.00 | | 1,009.60 | | 2.49 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,022.32 | | 2.51 | |

| | | | | | | | | | |

* Expenses are equal to Institutional Class’, Service Class’, Investor Class’, Administrative Class’, Advisory Class’ and Participant Class’ annualized net expense ratios of 0.10%, 0.15%, 0.20%, 0.25%, 0.35% and 0.50%, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Government Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,011.90 | | $ | 0.25 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.55 | | 0.25 | |

Service Class | | | | | | | |

Actual | | 1,000.00 | | 1,011.60 | | 0.50 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.30 | | 0.50 | |

Investor Class | | | | | | | |

Actual | | 1,000.00 | | 1,011.40 | | 0.75 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.05 | | 0.75 | |

Administrative Class | | | | | | | |

Actual | | 1,000.00 | | 1,011.10 | | 1.00 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.80 | | 1.00 | |

Advisory Class | | | | | | | |

Actual | | 1,000.00 | | 1,010.60 | | 1.50 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.31 | | 1.51 | |

Participant Class | | | | | | | |

Actual | | 1,000.00 | | 1,009.80 | | 2.24 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,022.56 | | 2.26 | |

| | | | | | | | | | |

* Expenses are equal to Institutional Class’, Service Class’, Investor Class’, Administrative Class’, Advisory Class’ and Participant Class’ annualized net expense ratios of 0.05%, 0.10%, 0.15%, 0.20%, 0.30% and 0.45%, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Treasury Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,011.10 | | $ | 0.25 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.55 | | 0.25 | |

Service Class | | | | | | | |

Actual | | 1,000.00 | | 1,010.90 | | 0.50 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.30 | | 0.50 | |

Investor Class | | | | | | | |

Actual | | 1,000.00 | | 1,010.60 | | 0.75 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.05 | | 0.75 | |

Administrative Class | | | | | | | |

Actual | | 1,000.00 | | 1,010.40 | | 1.00 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.80 | | 1.00 | |

Advisory Class | | | | | | | |

Actual | | 1,000.00 | | 1,009.90 | | 1.50 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.31 | �� | 1.51 | |

Participant Class | | | | | | | |

Actual | | 1,000.00 | | 1,009.10 | | 2.24 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,022.56 | | 2.26 | |

| | | | | | | | | | |

* Expenses are equal to Institutional Class’, Service Class’, Investor Class’, Administrative Class’, Advisory Class’ and Participant Class’ annualized net expense ratios of 0.05%, 0.10%, 0.15%, 0.20%, 0.30% and 0.45%, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

6

| 2005 Semi-Annual Report |

| |

| April 30, 2005 (unaudited) |

Expense Examples (cont’d)

| | Beginning Account Value

November 1, 2004 | | Ending Account Value

April 30, 2005 | | Expenses Paid During Period*

November 1, 2004 — April 30, 2005 | |

| | | | | | | |

Tax-Exempt Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,009.10 | | $ | 0.40 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.40 | | 0.40 | |

Service Class | | | | | | | |

Actual | | 1,000.00 | | 1,008.90 | | 0.65 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.15 | | 0.65 | |

Investor Class | | | | | | | |

Actual | | 1,000.00 | | 1,008.60 | | 0.90 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.90 | | 0.90 | |

Administrative Class | | | | | | | |

Actual | | 1,000.00 | | 1,008.40 | | 1.15 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.65 | | 1.15 | |

Advisory Class | | | | | | | |

Actual | | 1,000.00 | | 1,007.90 | | 1.64 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.16 | | 1.66 | |

Participant Class | | | | | | | |

Actual | | 1,000.00 | | 1,007.10 | | 2.39 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,022.41 | | 2.41 | |

| | | | | | | | | | |

* Expenses are equal to Institutional Class’, Service Class’, Investor Class’, Administrative Class’, Advisory Class’ and Participant Class�� annualized net expense ratios of 0.08%, 0.13%, 0.18%, 0.23%, 0.33% and 0.48%, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

7

2005 Semi-Annual Report |

|

April 30, 2005 (unaudited) |

Portfolio of Investments

Money Market Portfolio

| | Face

Amount

(000) | | Value

(000) | |

Certificate of Deposit (23.6%) | | | | | |

International Banks (17.9%) | | | | | |

Calyon North America, Inc./New York | | | | | |

2.80%, 5/3/05 | | $ | 50,000 | | $ | 50,000 | |

2.95%, 8/23/05 | | (b)75,000 | | 74,990 | |

Credit Suisse First Boston | | | | | |

2.80%, 5/2/05 | | 50,000 | | 50,000 | |

Fortis Bank/New York | | | | | |

2.19%, 6/9/05 | | 25,000 | | 24,998 | |

Norinchukin Bank/New York | | | | | |

2.82%, 5/2/05 | | 15,000 | | 15,000 | |

2.86%, 5/2/05 | | 125,000 | | 125,000 | |

UBS AG | | | | | |

1.47%, 5/6/05 | | 25,000 | | 25,000 | |

2.80%, 5/2/05 | | 50,000 | | 50,000 | |

2.81%, 5/2/05 | | 50,000 | | 50,000 | |

Unicredito Italiano /New York | | | | | |

2.37%, 9/12/05 | | 29,500 | | 29,485 | |

3.03%, 12/28/05 | | (b)50,000 | | 49,989 | |

| | | | 544,462 | |

Major Banks (5.7%) | | | | | |

First Tennessee Bank NA | | | | | |

3.04%, 6/27/05 | | 50,000 | | 50,000 | |

Washington Mutual Bank FA | | | | | |

2.81%, 5/2/05 | | 125,000 | | 125,000 | |

| | | | 175,000 | |

Total Certificate of Deposit (Cost $719,462) | | | | 719,462 | |

Commercial Paper (46.4%) | | | | | |

Asset Backed — Automotive (4.1%) | | | | | |

DaimlerChrysler Revolving Auto Conduit LLC | | | | | |

3.01%, 6/20/05 | | 25,000 | | 24,896 | |

3.06%, 6/24/05 | | 50,256 | | 50,026 | |

Fcar Owner Trust | | | | | |

2.79%, 5/5/05 | | 50,000 | | 49,984 | |

| | | | 124,906 | |

Asset Backed — Consumer (4.2%) | | | | | |

Gemini Securitization Corp. | | | | | |

3.04%, 5/31/05 | | (a)25,000 | | 24,937 | |

Old Line Funding LLC | | | | | |

2.82%, 5/2/05 | | (a)10,048 | | 10,047 | |

Pfizer, Inc. | | | | | |

2.70%, 5/6/05 | | (a)24,910 | | 24,901 | |

Sheffield Receivables Corp. | | | | | |

2.80%, 5/2/05 | | (a)67,320 | | 67,315 | |

| | | | 127,200 | |

Asset Backed — Corporate (5.5%) | | | | | |

Amsterdam Funding Corp. | | | | | |

2.79%, 5/2/05 | | (a)40,000 | | 39,997 | |

Atlantis One Funding Corp. | | | | | |

2.90%, 8/1/05 | | $ | (a)43,125 | | $ | 42,808 | |

2.92%, 8/3/05 | | (a)10,919 | | 10,836 | |

2.99%, 6/20/05 | | (a)25,000 | | 24,897 | |

Eureka Securitization, Inc. | | | | | |

3.04%, 6/7/05 | | (a)33,900 | | 33,794 | |

Moat Funding LLC | | | | | |

2.46%, 5/4/05 | | (a)15,000 | | 14,997 | |

| | | | 167,329 | |

Asset Backed — Diversified (0.6%) | | | | | |

CRC Funding LLC | | | | | |

3.04%, 6/6/05 | | (a)20,000 | | 19,939 | |

Asset Backed — Mortgage (1.7%) | | | | | |

Sydney Capital Corp. | | | | | |

2.81%, 5/2/05 | | (a)25,100 | | 25,098 | |

3.05%, 6/30/05 | | (a)27,240 | | 27,102 | |

| | | | 52,200 | |

Asset Backed — Securities (7.5%) | | | | | |

CC USA, Inc. | | | | | |

3.21%, 9/16/05 | | (a)15,000 | | 14,817 | |

Clipper Receivables Co., LLC | | | | | |

2.80%, 5/2/05 | | 81,008 | | 81,002 | |

3.02%, 5/17/05 | | 35,000 | | 34,953 | |

Dorada Finance, Inc. | | | | | |

3.02%, 6/23/05 | | (a)20,000 | | 19,911 | |

Galaxy Funding, Inc. | | | | | |

3.05%, 6/28/05 | | (a)25,000 | | 24,878 | |

3.06%, 6/29/05 | | (a)25,000 | | 24,876 | |

Grampian Funding LLC | | | | | |

2.85%, 6/30/05 | | (a)30,000 | | 29,858 | |

| | | | 230,295 | |

Banking (1.8%) | | | | | |

HSBC USA, Inc. | | | | | |

2.62%, 5/3/05 | | 25,000 | | 24,996 | |

3.01%, 6/28/05 | | 30,000 | | 29,855 | |

| | | | 54,851 | |

Diversified Financial Services (2.6%) | | | | | |

General Electric Capital Corp. | | | | | |

2.89%, 9/9/05 | | 25,000 | | 24,740 | |

General Electric Co. | | | | | |

3.01%, 6/28/05 | | 25,000 | | 24,879 | |

Siemens Capital Co. LLC | | | | | |

2.79%, 5/3/05 | | 30,000 | | 29,995 | |

| | | | 79,614 | |

Finance — Automotive (1.3%) | | | | | |

Toyota Motor Credit Corp. | | | | | |

2.80%, 5/3/05 | | 40,000 | | 39,994 | |

Finance — Consumer (0.8%) | | | | | |

Pfizer, Inc. | | | | | |

2.90%, 8/30/05 | | (a)25,000 | | 24,759 | |

The accompanying notes are an integral part of the financial statements.

8

| 2005 Semi-Annual Report |

| |

| April 30, 2005 (unaudited) |

Portfolio of Investments (cont’d)

Money Market Portfolio

| | Face

Amount

(000) | | Value

(000) | |

Commercial Paper (cont’d) | | | | | |

Finance — Corporate (4.2%) | | | | | |

CIT Group, Inc. | | | | | |

2.83%, 5/4/05 | | $ | 50,000 | | $ | 49,988 | |

2.84%, 5/5/05 | | 25,000 | | 24,992 | |

3.03%, 6/27/05 | | 35,000 | | 34,833 | |

3.05%, 6/22/05 | | 17,301 | | 17,225 | |

| | | | 127,038 | |

Insurance (2.3%) | | | | | |

Irish Life & Permanent plc | | | | | |

3.02%, 6/28/05 | | (a)70,000 | | 69,661 | |

International Banks (9.8%) | | | | | |

Barclays U.S. Funding Corp. | | | | | |

2.55%, 6/3/05 | | 40,000 | | 39,907 | |

CBA Delaware Finance, Inc. | | | | | |

3.54%, 12/14/05 | | 12,325 | | 12,056 | |

KBC Financial Products International Ltd. | | | | | |

3.26%, 9/12/05 | | (a)27,500 | | 27,170 | |

Network Rail CP Finance plc | | | | | |

3.03%, 6/29/05 | | (a)70,000 | | 69,654 | |

San Paolo IMI U.S. Financial Co. | | | | | |

2.78%, 5/2/05 | | 90,000 | | 89,993 | |

Societe Generale North America, Inc. | | | | | |

3.04%, 6/1/05 | | 60,000 | | 59,844 | |

| | | | 298,624 | |

Total Commercial Paper (Cost $1,416,410) | | | | 1,416,410 | |

Corporate Notes (16.4%) | | | | | |

Asset Backed — Securities (2.0%) | | | | | |

CC USA, Inc. | | | | | |

1.82%, 6/17/05 | | (a)20,000 | | 19,993 | |

Dorada Finance, Inc. | | | | | |

2.95%, 8/15/05 | | (b)40,000 | | 40,001 | |

| | | | 59,994 | |

Finance — Automotive (0.7%) | | | | | |

Toyota Motor Credit Corp. | | | | | |

2.98%, 6/22/05 | | (b)20,000 | | 20,000 | |

Financial Services (1.3%) | | | | | |

Metropolitan Life Global Funding I | | | | | |

2.97%, 8/26/05 | | (a)(b)40,000 | | 40,013 | |

International Banks (3.4%) | | | | | |

HBOS Treasury Services plc | | | | | |

3.00%, 6/10/05 | | (a)(b)30,000 | | 30,002 | |

Royal Bank of Scotland plc | | | | | |

2.97%, 5/16/06 | | (a)(b)75,000 | | 75,000 | |

| | | | 105,002 | |

Investment Bankers/Brokers/Services (7.4%) | | | | | |

Bank of America Corp. | | | | | |

3.08%, 2/20/06 | | 75,000 | | 75,000 | |

Goldman Sachs Group, Inc. | | | | | |

2.99%, 9/12/05 - 11/10/05 | | 100,000 | | 100,000 | |

Merrill Lynch & Co., Inc. | | | | | |

3.22%, 10/3/05 | | $ | (b)50,000 | | $ | 50,028 | |

| | | | 225,028 | |

Major Banks (1.6%) | | | | | |

Bank of America NA/Charlotte, NC | | | | | |

2.82%, 12/9/05 | | (b)50,000 | | 50,000 | |

Total Corporate Notes (Cost $500,037) | | | | 500,037 | |

Repurchase Agreement (13.7%) | | | | | |

Goldman Sachs Group, Inc., 2.97%, dated 4/29/05, due 5/2/05, repurchase price $419,544: fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: U.S. Treasury Strips, due 8/15/15 to 5/15/19; Federal Home Loan Mortgage Corp., Adjustable Rate Mortgage: 4.64%, due 12/1/34; Federal National Mortgage Association, Conventional Pools: 4.50% to 6.00%, due 5/1/17 to 10/1/34; Federal National Mortgage Association, Adjustable Rate Mortgage: 4.20%, due 7/1/34, valued at $427,829.

(Cost $419,440) | | 419,440 | | 419,440 | |

Total Investments (100.1%) (Cost $3,055,349) | | | | 3,055,349 | |

Liabilities in Excess of Other Assets (-0.1%) | | | | (2,661 | ) |

Net Assets (100%) | | | | $ | 3,052,688 | |

(a) 144A Security — Certain conditions for public sale may exist. Unless otherwise noted, these securities are deemed to be liquid.

(b) Variable/Floating Rate Security — Interest rate changes on these instruments are based on changes in a designated base rate. The rates shown are those in effect on April 30, 2005.

The accompanying notes are an integral part of the financial statements.

9

2005 Semi-Annual Report |

|

April 30, 2005 (unaudited) |

Portfolio of Investments (cont’d)

Money Market Portfolio

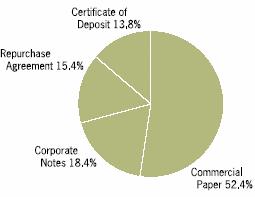

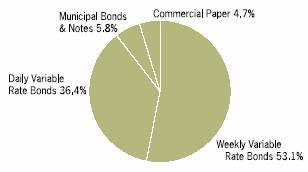

Graphic Presentation of Portfolio Holdings

The following graph depicts the investment type, as a percentage of total investments.

The accompanying notes are an integral part of the financial statements.

10

| 2005 Semi-Annual Report |

| |

| April 30, 2005 (unaudited) |

Portfolio of Investments

Prime Portfolio

| | Face

Amount

(000) | | Value

(000) | |

Certificate of Deposit (14.0%) | | | | | |

Banking (14.0%) | | | | | |

First Tennessee Bank NA | | | | | |

2.80%, 5/2/05 - 5/3/05 | | $ | 350,000 | | $ | 350,000 | |

Key Bank NA | | | | | |

2.98%, 5/2/05 | | 250,000 | | 250,000 | |

M&I Marshall & Isley Bank | | | | | |

3.02%, 6/27/05 | | 100,000 | | 99,998 | |

Regions Bank of Alabama | | | | | |

3.25%, 9/13/05 | | 150,000 | | 150,000 | |

SunTrust Bank | | | | | |

3.04%, 8/5/05 | | (b)130,000 | | 129,993 | |

Washington Mutual Bank FA | | | | | |

2.81%, 5/2/05 | | 250,000 | | 250,000 | |

Wells Fargo Bank NA | | | | | |

2.78%, 5/2/05 | | 350,000 | | 350,000 | |

3.03%, 6/28/05 | | 100,000 | | 99,997 | |

Total Certificate of Deposit (Cost $1,679,988) | | | | 1,679,988 | |

Commercial Paper (53.4%) | | | | | |

Asset Backed — Automotive (3.4%) | | | | | |

DaimlerChrysler Revolving Auto Conduit LLC | | | | | |

2.75%, 5/4/05 | | 92,044 | | 92,023 | |

2.80%, 5/2/05 | | 111,784 | | 111,775 | |

3.04%, 6/2/05 | | 68,448 | | 68,264 | |

3.07%, 6/24/05 | | 55,974 | | 55,717 | |

FCAR Owner Trust | | | | | |

3.01%, 6/15/05 | | 75,000 | | 74,719 | |

| | | | 402,498 | |

Asset Backed — Consumer (11.7%) | | | | | |

Barton Capital Corp. | | | | | |

2.78%, 5/2/05 - 5/3/05 | | (a)179,712 | | 179,685 | |

Delaware Funding Co. LLC | | | | | |

2.79%, 5/3/05 | | (a)50,000 | | 49,992 | |

Gemini Securitization Corp. | | | | | |

3.03%, 6/2/05 | | (a)84,000 | | 83,775 | |

3.04%, 6/1/05 | | (a)70,090 | | 69,907 | |

3.06%, 6/29/05 | | (a)175,000 | | 174,128 | |

Old Line Funding LLC | | | | | |

2.80%, 5/2/05 | | (a)90,243 | | 90,236 | |

3.00%, 5/4/05 | | (a)32,246 | | 32,238 | |

Pfizer, Inc. | | | | | |

2.70%, 5/6/05 | | (a)75,000 | | 74,972 | |

Ranger Funding Corp. | | | | | |

3.04%, 5/25/05 | | (a)105,334 | | 105,121 | |

Sheffield Receivables Corp. | | | | | |

2.80%, 5/2/05 - 5/3/05 | | (a)538,950 | | 538,892 | |

| | | | 1,398,946 | |

Asset Backed — Corporate (6.5%) | | | | | |

Atlantis One Funding Corp. | | | | | |

2.47%, 5/16/05 | | $ | (a)86,000 | | $ | 85,912 | |

2.85%, 7/18/05 | | (a)52,011 | | 51,692 | |

2.90%, 8/1/05 | | (a)135,000 | | 134,007 | |

2.92%, 8/3/05 | | (a)44,000 | | 43,667 | |

2.99%, 6/20/05 | | (a)50,887 | | 50,676 | |

CAFCO LLC | | | | | |

3.05%, 6/27/05 | | 50,000 | | 49,759 | |

Ciesco LLC | | | | | |

2.75%, 5/5/05 | | 75,000 | | 74,977 | |

Eureka Securitization, Inc. | | | | | |

2.72%, 5/4/05 | | (a)100,000 | | 99,977 | |

Moat Funding LLC | | | | | |

2.30%, 5/2/05 | | (a)75,000 | | 74,995 | |

2.46%, 5/4/05 | | (a)58,000 | | 57,988 | |

2.77%, 6/15/05 | | 50,000 | | 49,828 | |

| | | | 773,478 | |

Asset Backed — Diversified (2.0%) | | | | | |

CRC Funding LLC | | | | | |

2.75%, 6/8/05 | | (a)60,000 | | 59,808 | |

Falcon Asset Securitization Corp. | | | | | |

3.04%, 5/27/05 | | (a)100,441 | | 100,222 | |

Fairway Finance Corp. | | | | | |

2.79%, 5/2/05 | | (a)45,560 | | 45,556 | |

Yorktown Capital LLC | | | | | |

3.07%, 6/28/05 | | 36,187 | | 36,009 | |

| | | | 241,595 | |

Asset Backed — Mortgage (2.1%) | | | | | |

Mortgage Interest Networking Trust | | | | | |

2.80%, 5/2/05 | | 75,000 | | 74,994 | |

Sydney Capital Corp. | | | | | |

3.02%, 6/22/05 | | (a)27,260 | | 27,142 | |

3.03%, 6/15/05 | | (a)102,440 | | 102,053 | |

3.04%, 5/27/05 | | (a)43,440 | | 43,345 | |

| | | | 247,534 | |

Asset Backed — Securities (11.1%) | | | | | |

Amstel Funding Corp. | | | | | |

2.79%, 7/11/05 | | (a)64,507 | | 64,155 | |

Cancara Asset Securitization LLC | | | | | |

2.80%, 5/3/05 | | (a)100,230 | | 100,214 | |

3.04%, 5/31/05 | | (a)55,150 | | 55,011 | |

CC USA, Inc. | | | | | |

3.03%, 6/24/05 | | (a)88,500 | | 88,099 | |

3.21%, 9/16/05 | | (a)60,000 | | 59,270 | |

Clipper Receivables Co., LLC | | | | | |

2.80%, 5/2/05 | | 200,000 | | 199,984 | |

2.82%, 5/4/05 | | (a)100,000 | | 99,976 | |

3.02%, 5/17/05 | | 20,000 | | 19,973 | |

Dorada Finance | | | | | |

3.02%, 6/24/05 | | (a)119,000 | | 118,463 | |

Galaxy Funding, Inc. | | | | | |

2.99%, 6/20/05 | | (a)100,000 | | 99,586 | |

The accompanying notes are an integral part of the financial statements.

11

2005 Semi-Annual Report |

|

April 30, 2005 (unaudited) |

Portfolio of Investments (cont’d)

Prime Portfolio

| | Face

Amount

(000) | | Value

(000) | |

Asset Backed — Securities (cont’d) | | | | | |

3.02%, 6/27/05 | | $ | (a)80,000 | | $ | 79,619 | |

3.05%, 6/28/05 | | (a)45,000 | | 44,780 | |

Grampian Funding LLC | | | | | |

2.75%, 6/22/05 | | (a)140,000 | | 139,446 | |

2.85%, 6/30/05 | | (a)130,000 | | 129,385 | |

Scaldis Capital LLC | | | | | |

3.04%, 5/25/05 | | (a)35,514 | | 35,442 | |

| | | | 1,333,403 | |

Banking (1.4%) | | | | | |

HSBC USA, Inc. | | | | | |

2.62%, 5/3/05 | | 50,000 | | 49,993 | |

3.01%, 6/28/05 | | 120,000 | | 119,420 | |

| | | | 169,413 | |

Diversified Financial Services (2.4%) | | | | | |

General Electric Capital Corp. | | | | | |

3.16%, 9/6/05 | | 75,000 | | 74,168 | |

3.21%, 11/17/05 | | 90,000 | | 88,425 | |

General Electric Co. | | | | | |

3.01%, 6/28/05 | | 125,000 | | 124,396 | |

| | | | 286,989 | |

Finance — Automotive (0.9%) | | | | | |

Toyota Motor Credit Corp. | | | | | |

2.56%, 6/1/05 | | 60,000 | | 59,868 | |

3.02%, 6/30/05 | | 50,000 | | 49,750 | |

| | | | 109,618 | |

Finance — Consumer (1.6%) | | | | | |

Pfizer, Inc. | | | | | |

2.60%, 5/3/05 | | (a)83,056 | | 83,044 | |

2.90%, 8/30/05 | | (a)106,750 | | 105,720 | |

| | | | 188,764 | |

Finance — Corporate (2.0%) | | | | | |

CIT Group, Inc. | | | | | |

2.80%, 5/2/05 | | 100,000 | | 99,992 | |

3.04%, 6/13/05 | | 40,500 | | 40,353 | |

3.05%, 6/22/05 | | 50,000 | | 49,781 | |

3.07%, 6/28/05 | | 50,000 | | 49,754 | |

| | | | 239,880 | |

Insurance (1.7%) | | | | | |

AIG Funding, Inc. | | | | | |

2.80%, 5/2/05 | | 75,000 | | 74,994 | |

3.02%, 6/20/05 | | 75,000 | | 74,687 | |

American General Finance Corp. | | | | | |

2.77%, 5/2/05 | | 50,000 | | 49,996 | |

| | | | 199,677 | |

International Banks (1.2%) | | | | | |

Deutsche Bank Financial LLC | | | | | |

2.80%, 5/3/05 | | 150,000 | | 149,977 | |

Investment Bankers/Brokers/Services (5.4%) | | | | | |

Bear Stearns Cos., Inc. (The) | | | | | |

2.79%, 5/2/05 | | 200,000 | | 199,985 | |

Citigroup Global Markets Holdings, Inc. | | | | | |

2.78%, 5/3/05 | | $ | 50,000 | | $ | 49,992 | |

3.04%, 11/28/05 | | (b)250,000 | | 250,000 | |

Goldman Sachs Group, Inc. | | | | | |

2.78%, 5/2/05 | | 150,000 | | 149,988 | |

| | | | 649,965 | |

Total Commercial Paper (Cost $6,391,737) | | | | 6,391,737 | |

Corporate Notes (18.7%) | | | | | |

Asset Backed — Securities (7.0%) | | | | | |

Beta Finance, Inc. | | | | | |

3.07%, 3/14/06 - 3/20/06 | | (a)(b)175,000 | | 175,014 | |

3.20%, 6/13/05 | | (a)(b)30,000 | | 30,005 | |

CC USA, Inc. | | | | | |

1.82%, 6/17/05 | | (a)42,500 | | 42,484 | |

3.04%, 1/17/06 | | (a)(b)115,000 | | 114,984 | |

3.05%, 12/1/05 | | (a)(b)100,000 | | 99,995 | |

3.07%, 9/15/05 | | (a)(b)85,000 | | 84,997 | |

Dorada Finance, Inc. | | | | | |

3.04%, 1/17/06 | | (a)(b)138,000 | | 137,980 | |

3.07%, 9/12/05 | | (a)(b)50,000 | | 49,999 | |

3.09%, 8/15/05 | | (a)(b)100,000 | | 100,004 | |

| | | | 835,462 | |

Banking (1.3%) | | | | | |

Fifth Third Bancorp. | | | | | |

3.05%, 4/21/06 | | (a)(b)150,000 | | 150,000 | |

Financial Services (0.3%) | | | | | |

Metropolitan Life Global Funding I | | | | | |

2.97%, 8/26/05 | | (a)(b)42,000 | | 42,014 | |

Insurance (0.5%) | | | | | |

Mass Mutual Global Funding II | | | | | |

3.19%, 12/13/05 | | (a)(b)65,000 | | 65,077 | |

Investment Bankers/Brokers/Services (5.4%) | | | | | |

Banc of America Securities LLC | | | | | |

3.08%, 2/20/06 | | 273,500 | | 273,500 | |

Goldman Sachs Group, Inc. | | | | | |

2.99%, 9/12/05-11/10/05 | | 325,000 | | 325,000 | |

Merrill Lynch & Co., Inc. | | | | | |

3.40%, 6/13/05 | | (b)52,750 | | 52,776 | |

| | | | 651,276 | |

Major Banks (4.2%) | | | | | |

Bank of America NA/Charlotte, NC | | | | | |

3.07%, 12/9/05 | | (b)150,000 | | 150,000 | |

Chase Manhattan Bank USA NA | | | | | |

3.04%, 5/11/05 | | (b)40,000 | | 40,000 | |

Fifth Third Bank | | | | | |

3.01%, 11/1/05 | | (b)25,000 | | 24,996 | |

Harris Trust & Savings Bank | | | | | |

3.07%, 5/3/06 | | (b)100,000 | | 100,000 | |

La Salle Bancorp, Inc. | | | | | |

2.82%, 5/2/05 | | 150,000 | | 150,000 | |

The accompanying notes are an integral part of the financial statements.

12

| 2005 Semi-Annual Report |

| |

| April 30, 2005 (unaudited) |

Portfolio of Investments (cont’d)

Prime Portfolio

| | Face

Amount

(000) | | Value

(000) | |

Major Banks (cont’d) | | | | | |

US Bank National Association | | | | | |

2.22%, 7/18/05 | | $ | 32,500 | | $ | 32,490 | |

| | | | 497,486 | |

Total Corporate Notes (Cost $2,241,315) | | | | 2,241,315 | |

Repurchase Agreement (15.7%) | | | | | |

Goldman Sachs Group, Inc., 2.97%, dated 4/29/05, due 5/2/05, repurchase price $1,882,571: fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: Federal Home Loan Mortgage Corp., Adjustable Rate Mortgages: 3.89% to 5.35%, due 9/1/32 to 5/1/35; Federal Home Loan Mortgage Corp., Gold Pools: 3.50% to 8.00%, due 10/1/09 to 3/1/35; Federal National Mortgage Association, Conventional Pools: 4.00% to 7.00%, due 5/1/16 to 5/1/35; Federal National Mortgage Association, Adjustable Rate Mortgages: 3.37% to 5.13%, due 4/1/33 to 10/1/44; U.S. Treasury Strips, due 5/15/05 to 8/15/25, valued at $1,919,747.

(Cost $1,882,105) | | 1,882,105 | | 1,882,105 | |

Total Investments (101.8%) (Cost $12,195,145) | | | | 12,195,145 | |

Liabilities in Excess of Other Assets (-1.8%) | | | | (219,130 | ) |

Net Assets (100%) | | | | $ | 11,976,015 | |

| | | | | | | |

(a) 144A security — Certain conditions for public sale may exist. Unless otherwise noted, these securities are deemed to be liquid.

(b) Variable/Floating Rate Security — Interest rate changes on these instruments are based on changes in a designated base rate. The rates shown are those in effect on April 30, 2005.

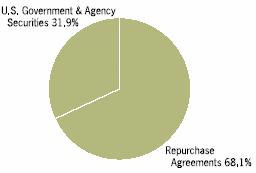

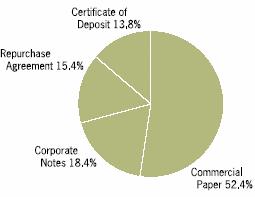

Graphic Presentation of Portfolio Holdings

The following graph depicts the Portfolio’s holdings by investment type, as a percentage of total investments.

The accompanying notes are an integral part of the financial statements.

13

2005 Semi-Annual Report |

|

April 30, 2005 (unaudited) |

Portfolio of Investments

Government Portfolio

| | Face

Amount

(000) | | Value

(000) | |

U.S. Government & Agency Securities (32.0%) | | | | | |

Federal Farm Credit Bank | | | | | |

2.25%, 7/5/05 | | $ | 1,000 | | $ | 996 | |

2.76%, 10/6/06 | | (b)25,000 | | 24,989 | |

2.77%, 8/18/06 | | (b)25,000 | | 24,994 | |

2.78%, 4/20/06 | | (b)15,000 | | 14,999 | |

2.96%, 6/23/05 | | (b)1,350 | | 1,350 | |

Federal Home Loan Bank | | | | | |

1.48%, 6/16/05 | | 1,000 | | 999 | |

2.22%, 6/9/05 | | 250 | | 249 | |

2.23%, 7/8/05 | | 1,000 | | 996 | |

2.68%, 5/16/06 | | (b)6,500 | | 6,495 | |

2.76%, 10/3/05 | | (b)30,000 | | 29,996 | |

2.77%, 8/26/05 | | (b)11,500 | | 11,497 | |

2.78%, 7/15/05 - 1/27/06 | | (b)41,500 | | 41,498 | |

2.83%, 9/8/05 | | (b)30,000 | | 29,991 | |

2.87%, 9/16/05 | | (b)20,000 | | 19,998 | |

2.88%, 9/12/05 | | (b)20,000 | | 19,995 | |

2.89%, 8/21/06 | | (b)25,000 | | 24,981 | |

2.97%, 6/2/06 | | (b)15,000 | | 14,989 | |

3.00%, 8/2/05 - 10/5/05 | | (b)16,670 | | 16,669 | |

3.10%, 8/2/06 | | (b)20,000 | | 19,985 | |

Federal Home Loan Mortgage Corp. | | | | | |

2.29%, 7/26/05 | | 900 | | 895 | |

2.38%, 6/30/05 | | 2,000 | | 1,992 | |

2.44%, 5/17/05 | | 3,000 | | 2,997 | |

2.73%, 6/21/05 | | 4,000 | | 3,985 | |

2.73%, 11/7/05 | | (b)600 | | 600 | |

2.74%, 6/28/05 | | 11,400 | | 11,350 | |

2.75%, 5/3/05 | | 12,729 | | 12,727 | |

2.78%, 8/8/05 | | 4,000 | | 3,970 | |

2.79%, 5/2/05 | | 2,000 | | 2,000 | |

2.88%, 9/15/05 | | 3,000 | | 3,005 | |

2.93%, 9/9/05 | | (b)11,050 | | 11,050 | |

2.97%, 11/15/05 | | 5,000 | | 4,920 | |

3.00%, 9/20/05 | | 16,000 | | 15,813 | |

3.08%, 12/5/05 | | 3,000 | | 2,945 | |

3.21%, 10/26/05 | | 1,702 | | 1,675 | |

3.39%, 12/28/05 | | 7,000 | | 6,845 | |

3.49%, 12/12/05 | | 9,717 | | 9,523 | |

Federal National Mortgage Association | | | | | |

1.40%, 5/3/05 | | 25,000 | | 24,998 | |

2.74%, 5/2/05 | | 21,260 | | 21,258 | |

3.00%, 6/27/05 | | 10,000 | | 9,953 | |

Total U.S. Government & Agency Securities

(Cost $458,167) | | | | 458,167 | |

Repurchase Agreements (68.2%) | | | | | |

Bear Stearns Cos., Inc., 2.98%, dated 4/29/05, due 5/2/05, repurchase price $235,058: fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: Federal Home Loan Mortgage Corp., Adjustable Rate Mortgages: 5.07% to 6.93%, due 3/1/31 to 12/1/32; Federal National Mortgage Association, Adjustable Rate Mortgages: 3.37% to 5.07%, due 5/1/27 to 8/1/42; Federal National Mortgage Association, Conventional Pool: 6.01%, due 5/1/09, valued at $239,702. | | $ | 235,000 | | $ | 235,000 | |

CS First Boston LLC, 2.80%, dated 4/29/05, due 5/2/05, repurchase price $60,014: fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: Federal Home Loan Mortgage Corp., Adjustable Rate Mortgage: 4.19%, due 4/1/35; Federal National Mortgage Association, Adjustable Rate Mortgages: 3.22% to 4.83%, due 8/1/33 to 4/1/35, valued at $61,204. | | 60,000 | | 60,000 | |

CS First Boston LLC, 2.97% dated 4/29/05, due 5/2/05, repurchase price $220,905: fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: Federal Home Loan Mortgage Corp., Adjustable Rate Mortgage: 3.77%, due 7/1/34; Federal National Mortgage Association, Adjustable Rate Mortgages: 3.43% to 4.89%, due 12/1/34 to 7/1/42, valued at $225,270. | | 220,850 | | 220,850 | |

Deutsche Bank Securities, Inc., 2.97%, dated 4/29/05, due 5/2/05, repurchase price $230,057: fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: Federal Home Loan Mortgage Corp., Gold Pools: 5.00% to 5.50%, due 4/1/19 to 4/1/35; Federal National Mortgage Association, Adjustable Rate Mortgages: 3.80% to 4.35%, due 7/1/33 to 4/1/35; Federal National Mortgage Association, Conventional Pools: 4.00% to 6.05%, due 3/1/12 to 6/1/19, valued at $234,600. | | 230,000 | | 230,000 | |

Goldman Sachs Group, Inc., 2.97%, dated 4/29/05, due 5/2/05, repurchase price $130,032: fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: Federal National Mortgage Association, Conventional Pool: 5.00%, due 3/1/34, valued at $132,600. | | 130,000 | | 130,000 | |

The accompanying notes are an integral part of the financial statements.

14

| 2005 Semi-Annual Report |

| |

| April 30, 2005 (unaudited) |

Portfolio of Investments (cont’d)

Government Portfolio

| | Face

Amount

(000) | | Value

(000) | |

UBS Securities LLC, 2.77%, dated 4/29/05, due 5/3/05, repurchase price $55,017: fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: Federal Home Loan Mortgage Corp., Adjustable Rate Mortgages: 3.66% to 4.76%, due 10/1/31 to 4/1/35; Federal National Mortgage Association, Adjustable Rate Mortgages: 3.85% to 4.93%, due 3/1/28 to 12/1/34, valued at $56,102. | | $ | 55,000 | | $ | 55,000 | |

UBS Securities LLC, 2.78%, dated 4/29/05, due 5/2/05, repurchase price $45,010: fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: Federal Home Loan Mortgage Corp., Adjustable Rate Mortgages: 3.75% to 4.49%, due 3/1/34 to 9/1/34; Federal National Mortgage Association, Adjustable Rate Mortgages: 3.88% to 5.11%, due 2/1/34 to 9/1/34, valued at $45,902. | | 45,000 | | 45,000 | |

Total Repurchase Agreements (Cost $975,850) | | | | 975,850 | |

Total Investments (100.2%) (Cost $1,434,017) | | | | 1,434,017 | |

Liabilities in Excess of Other Assets (-0.2%) | | | | (2,492 | ) |

Net Assets (100%) | | | | $ | 1,431,525 | |

| | | | | | | |

(b) Variable/Floating Rate Security — Interest rate changes on these instruments are based on changes in a designated base rate. The rates shown are those in effect on April 30, 2005.

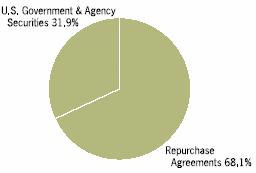

Graphic Presentation of Portfolio Holdings

The following graph depicts the Portfolio’s holdings by investment type, as a percentage of total investments.

The accompanying notes are an integral part of the financial statements.

15

2005 Semi-Annual Report |

|

April 30, 2005 (unaudited) |

Portfolio of Investments

Treasury Portfolio

| | Face

Amount

(000) | | Value

(000) | |

U.S Treasury Securities (3.9%) | | | | | |

U.S. Treasury Bills (1.0%) | | | | | |

U.S. Treasury Bills | | | | | |

2.82%, 7/7/05 | | $ | 1,000 | | $ | 995 | |

U.S. Treasury Notes (2.9%) | | | | | |

U.S. Treasury Notes | | | | | |

1.50%, 7/31/05 | | 1,000 | | 998 | |

2.00%, 8/31/05 | | 2,000 | | 1,998 | |

| | | | 2,996 | |

Total U.S Treasury Securities (Cost $3,991) | | | | 3,991 | |

Repurchase Agreements (96.3%) | | | | | |

CS First Boston LLC, 2.85%, dated 4/29/05, due 5/2/05, repurchase price $23,531; fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: U.S. Treasury Notes, 2.625%, due 3/15/09, valued at $23,999. | | 23,525 | | 23,525 | |

Deutsche Bank Securities, Inc., 2.90%, dated 4/29/05, due 5/2/05, repurchase price $24,006; fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: U.S. Treasury Bonds, 6.375%, due 8/15/27, and U.S. Treasury Strips, due 11/15/20, valued at $24,481. | | 24,000 | | 24,000 | |

Goldman Sachs Group, Inc., 2.70%, dated 4/15/05, due 5/3/05, repurchase price $4,005; fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: U.S. Treasury Notes, 13.875%, due 5/15/11, valued at $4,081. | | 4,000 | | 4,000 | |

J.P. Morgan Securities, Inc., 2.80%, dated 4/29/05, due 5/2/05, repurchase price $22,705; fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: U.S. Treasury Strips, due 11/15/15 to 2/15/21, valued at $23,156. | | 22,700 | | 22,700 | |

UBS Securities LLC, 2.86%, dated 4/29/05, due 5/2/05, repurchase price $24,006; fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: U.S. Treasury Notes, 3.375%, due 2/15/08, valued at $24,482. | | 24,000 | | 24,000 | |

Total Repurchase Agreements (Cost $98,225) | | | | 98,225 | |

Total Investments (100.2%) (Cost $102,216) | | | | 102,216 | |

Liabilities in Excess of Other Assets (-0.2%) | | | | (162 | ) |

Net Assets (100%) | | | | $ | 102,054 | |

| | | | | | | |

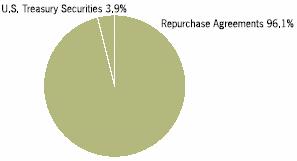

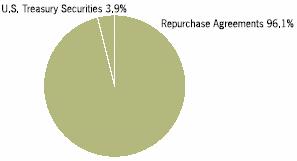

Graphic Presentation of Portfolio Holdings

The following graph depicts the Portfolio’s holdings by investment type, as a percentage of total investments.

The accompanying notes are an integral part of the financial statements.

16

| 2005 Semi-Annual Report |

| |

| April 30, 2005 (unaudited) |

Portfolio of Investments

Tax-Exempt Portfolio

| | Face

Amount

(000) | | Value

(000) | |

Tax-Exempt Instruments (99.6%) | | | | | |

Commercial Paper (4.7%) | | | | | |

Broward County, FL, Sales Tax, Series A | | | | | |

2.06%, 5/10/05 | | $ | 1,650 | | $ | 1,650 | |

Illinois Educational Facilities Authority, Pooled, Series 1995 | | | | | |

2.05%, 5/24/05 | | 2,000 | | 2,000 | |

Illinois Health Facilities Authority, Evanston Hospital Corp., Series 1995 | | | | | |

2.45%, 6/23/05 | | 1,500 | | 1,500 | |

Jacksonville, FL, Series A | | | | | |

2.32%, 5/19/05 | | 2,000 | | 2,000 | |

Massachusetts Health & Educational Facilities Authority, Harvard University, Series EE | | | | | |

2.03%, 5/26/05 | | 1,000 | | 1,000 | |

Ohio State University, General Receipts, Series 2004 F | | | | | |

2.03%, 5/25/05 | | 2,000 | | 2,000 | |

Puerto Rico Government Development Bank, Series 1986 | | | | | |

2.00%, 5/12/05 | | 2,872 | | 2,872 | |

University of Texas Regents, Permanent University Fund, Series A | | | | | |

2.05%, 5/23/05 | | 1,000 | | 1,000 | |

| | | | 14,022 | |

Daily Variable Rate Bonds (36.3%) | | | | | |

Breckinridge County, KY, Kentucky Association of Counties Leasing Trust, 2002, Series A | | | | | |

3.05%, 2/1/32 | | 3,000 | | 3,000 | |

California Health Facilities Financing Authority, Adventist Health System/West, 1998, Series B (MBIA) | | | | | |

3.04%, 9/1/28 | | 8,050 | | 8,050 | |

California Statewide Communities Development Authority, University Retirement Community at Davis, Inc., Series 2003 (Radian) | | | | | |

3.05%, 11/15/30 | | 5,800 | | 5,800 | |

Curators of the University of Missouri, Series 2002 A | | | | | |

3.05%, 11/1/32 | | 1,600 | | 1,600 | |

East Baton Rouge Parish, LA, Exxon Corp., Series 1993 | | | | | |

2.96%, 3/1/22 | | 9,200 | | 9,200 | |

Harris County Health Facilities Development Corp., TX, Methodist Hospital, Series 2002 | | | | | |

3.07%, 12/1/32 | | 7,000 | | 7,000 | |

Harris County Health Facilities Development Corp., TX, Texas Medical Center, Series B (FSA) | | | | | |

3.05%, 5/15/29 | | 300 | | 300 | |

Illinois Finance Authority, Northwestern Memorial Hospital, Series 2004 B, Subseries 2004 B-1 | | | | | |

3.05%, 8/15/38 | | 400 | | 400 | |

Illinois Finance Authority, Northwestern Memorial Hospital, Series 2004 B, Subseries 2004 B-2 | | | | | |

3.02%, 8/15/38 | | 7,800 | | 7,800 | |

Illinois Health Facilities Authority, University of Chicago Hospitals, Series 1998 (MBIA) | | | | | |

3.05%, 8/1/26 | | $ | 9,795 | | $ | 9,795 | |

Massachusetts Health & Educational Facilities Authority, Partners Health Care System, Inc., 2003, Series D-5 | | | | | |

3.03%, 7/1/17 | | 400 | | 400 | |

Montgomery County Public Building Authority, TN, Pooled Financing, Series 2002 | | | | | |

3.05%, 4/1/32 | | 5,100 | | 5,100 | |

Mount Vernon, IN, Pollution Control & Solid Waste Disposal General Electric Co., Series 2004 | | | | | |

3.00%, 12/1/14 | | 3,100 | | 3,100 | |

New York City Transitional Finance Authority, NY, Recovery Fiscal 2003 Series 1, Subseries 1D | | | | | |

3.05%, 11/1/22 | | 6,950 | | 6,950 | |

New York City Transitional Finance Authority, NY, Recovery Fiscal 2003 Series 3, Subseries 3F | | | | | |

3.05%, 11/1/22 | | 200 | | 200 | |

New York City, NY, Fiscal 2004 Series H, Subseries H-4 | | | | | |

3.02%, 3/1/34 | | 7,700 | | 7,700 | |

Rhode Island Health & Educational Building Corp., Care New England, Series 2002 A | | | | | |

3.05%, 9/1/32 | | 200 | | 200 | |

Salt Lake County, UT, Service Station Holdings British Petroleum, Series 1994 B | | | | | |

3.05%, 8/1/07 | | 4,200 | | 4,200 | |

Shelby County, KY, Kentucky Association of Counties Leasing Trust, 2004, Series A | | | | | |

3.05%, 9/1/34 | | 5,650 | | 5,650 | |

The University of North Carolina at Chapel Hill, Series 2001 B | | | | | |

3.05%, 2/15/31 | | 4,100 | | 4,100 | |

University of Delaware, 2001, Series B | | | | | |

3.08%, 11/1/26 | | 10,145 | | 10,145 | |

Weber County, UT, IHC Health Services, Inc., Series 2000 C | | | | | |

3.05%, 2/15/35 | | 7,000 | | 7,000 | |

| | | | 107,690 | |

Municipal Bonds & Notes (5.8%) | | | | | |

California, Series 2004-2005 RANs | | | | | |

3.00%, 6/30/05 | | 1,000 | | 1,002 | |

Illinois Finance Authority, Series 2005-A School Notes | | | | | |

3.00%, 12/1/05 | | 630 | | 632 | |

Kentucky Association of Counties Advance Revenue Program, Series 2004 A COPs TRANs | | | | | |

3.00%, 6/30/05 | | 1,000 | | 1,002 | |

Kershaw County School District, SC, Series 2004 BANs | | | | | |

3.00%, 7/15/05 | | 1,275 | | 1,276 | |

New Hampshire, Series 2004 RANs | | | | | |

2.20%, 6/1/05 | | 2,500 | | 2,500 | |

New Jersey, Series Fiscal 2005 A TRANs | | | | | |

3.00%, 6/24/05 | | 1,450 | | 1,451 | |

The accompanying notes are an integral part of the financial statements.

17

2005 Semi-Annual Report |

| |

April 30, 2005 (unaudited) |

Portfolio of Investments (cont’d)

Tax-Exempt Portfolio

| | Face | | | |

| | Amount

(000) | | Value

(000) | |

Municipal Bonds & Notes (cont’d) | | | | | |

Orono Independent School District No. 278, MN, Aid Anticipation Certificates, Series 2004 A | | | | | |

2.75%, 8/29/05 | | $ | 1,000 | | $ | 1,003 | |

Pioneer Valley Transit Authority, MA, Series 2004 RANs | | | | | |

2.75%, 8/5/05 | | 1,000 | | 1,002 | |

Reynoldsburg City School District, OH, Series 2005 BANs | | | | | |

3.00%, 6/24/05 | | 1,000 | | 1,002 | |

South Jefferson Central School District, NY, Series 2005 RANs | | | | | |

3.00%, 6/28/05 | | 1,000 | | 1,001 | |

Spencer-Van Etten Central School District, NY, Series 2004 BANs | | | | | |

3.00%, 6/17/05 | | 515 | | 516 | |

Texas, Series 2004 TRANs | | | | | |

3.00%, 8/31/05 | | 2,215 | | 2,222 | |

Tompkins-Seneca-Tioga Board of Cooperative Educational Services, NY, Series 2005 RANs | | | | | |

3.25%, 6/30/05 | | 1,200 | | 1,202 | |

Troy City School District, OH, Series 2005 BANs | | | | | |

3.00%, 6/28/05 | | 1,305 | | 1,307 | |

| | | | 17,118 | |

Weekly Variable Rate Bonds (52.8%) | | | | | |

American Public Energy Agency, NE, National Public Gas Agency, 2003, Series A | | | | | |

3.00%, 2/1/14 | | 4,930 | | 4,930 | |

Arizona Tourism & Sports Authority, Multi-purpose Stadium, Series 2003 A ROCs II-R, Series 2134 (MBIA) | | | | | |

3.03%, 7/1/21 | | 1,795 | | 1,795 | |

Atlanta, GA, Water & Wastewater, Series 2001 B (FSA) | | | | | |

3.00%, 11/1/38 | | 7,900 | | 7,900 | |

Austin, TX, Water & Wastewater System, Series 2004 (FSA) | | | | | |

3.00%, 5/15/24 | | 200 | | 200 | |

Bexar County Housing Finance Corp., TX, Multi-Family P-FLOATs PT-2082 | | | | | |

3.02%, 1/20/10 | | 1,500 | | 1,500 | |

Centerra Metropolitan District No. 1, CO, Series 2004 | | | | | |

3.02%, 12/1/29 | | 4,900 | | 4,900 | |

Charlotte, NC, Convention Facility, Series 2003 B COPs | | | | | |

3.05%, 12/1/21 | | 5,000 | | 5,000 | |

Chicago Board of Education, IL, Series 2004 D (FSA) | | | | | |

3.01%, 3/1/23 | | 4,000 | | 4,000 | |

Chicago, IL, Neighborhoods Alive, Series 21 B (MBIA) | | | | | |

2.98%, 1/1/37 | | 1,900 | | 1,900 | |

Colorado Health Facilities Authority, Catholic Health Initiatives, Series 2004 B-4 | | | | | |

3.00%, 3/1/23 | | 4,825 | | 4,825 | |

Colorado Springs, CO, Utilities System Sub Lien, Series 2000 A | | | | | |

3.00%, 11/1/29 | | $ | 6,900 | | $ | 6,900 | |

Denver Urban Renewal Authority, CO, Stapleton Senior Tax Increment, Series 2004 A-1 P- FLOATs, Series PT-999 | | | | | |

3.08%, 10/7/06 | | 1,500 | | 1,500 | |

Fort Wayne, IN, Health Quest Realty X, Series 1993 A TOBs (FHA) | | | | | |

3.17%, 8/1/13 | | 1,430 | | 1,430 | |

Glendale Heights, IL, Glendale Lakes, Series 2000 | | | | | |

3.00%, 3/1/30 | | 2,445 | | 2,445 | |

Hamilton County, OH, Twin Towers and Twin Lakes, Series 2003 A | | | | | |

3.07%, 7/1/23 | | 1,500 | | 1,500 | |

Harris County Industrial Development Corp., TX, Baytank, Inc., Series 1998 | | | | | |

3.00%, 2/1/20 | | 10,500 | | 10,500 | |

Houston, TX, Combined Utility System MERLOTs, 2004, Series C13 (MBIA) | | | | | |

3.08%, 5/15/25 | | 1,310 | | 1,310 | |

Kansas Department of Transportation, Highway, Series C-3 | | | | | |

3.00%, 9/1/19 | | 9,300 | | 9,300 | |

Kent Hospital Finance Authority, MI, Metropolitan Hospital, Series 2005 B | | | | | |

3.03%, 7/1/40 | | 1,500 | | 1,500 | |

King County, WA, Harborview Medical Center ROCs II-R, Series 5036 (Ambac) | | | | | |

3.03%, 12/1/13 | | 1,830 | | 1,830 | |

Maine Health & Higher Educational Facilities Authority, VHA of New England Capital Asset Financing, 1985 Series B (Ambac) | | | | | |

2.96%, 12/1/25 | | 1,400 | | 1,400 | |

Massachusetts Health & Educational Facilities Authority, Cape Cod Healthcare Obligated Group, 2004, Series D (Assured Guaranty) | | | | | |

3.06%, 11/15/35 | | 2,000 | | 2,000 | |

Merrillville, IN, Southlake Care Center, Series 1992 A TOBs (FHA) | | | | | |

3.17%, 7/1/11 | | 705 | | 705 | |

Municipal Securities Pooled Trust Receipts, Various States, Series 2004 SG P-18 | | | | | |

3.14%, 1/1/35 | | 4,000 | | 4,000 | |

New Jersey Transportation Trust Fund Authority, Series 2004 A, PUTTERs, Series 503 (FGIC) | | | | | |

3.02%, 6/15/12 | | 2,455 | | 2,455 | |

North Carolina Capital Facilities Finance Agency, Barton College, Series 2004 | | | | | |

3.02%, 7/1/19 | | 700 | | 700 | |

North Carolina Medical Care Commission, Firsthealth of the Carolinas, Series 2002 | | | | | |

2.99%, 10/1/32 | | 2,600 | | 2,600 | |

The accompanying notes are an integral part of the financial statements.

18

| 2005 Semi-Annual Report |

| |

| April 30, 2005 (unaudited) |

Portfolio of Investments (cont’d)

Tax-Exempt Portfolio

| | Face | | | |

| | Amount

(000) | | Value

(000) | |

Weekly Variable Rate Bonds (cont’d) | | | | | |

North Carolina Medical Care Commission, Mission-St. Joseph’s Health System, Series 2003 | | | | | |

3.05%, 10/1/18 | | $ | 5,000 | | $ | 5,000 | |

North Carolina, Series 2002 D | | | | | |

2.95%, 5/1/21 | | 6,200 | | 6,200 | |

Oak Forest, IL, Homewood South Suburban Mayors & Managers Association, Series 1989 | | | | | |

2.99%, 7/1/24 | | 2,050 | | 2,050 | |

Omaha, NE, Eagle #2004001 Class A | | | | | |

3.03%, 4/1/27 | | 1,000 | | 1,000 | |

Orlando Utilities Commission, FL, Water & Electric, Series 2002 A | | | | | |

3.00%, 10/1/17 | | 12,700 | | 12,700 | |

Orlando-Orange County Expressway Authority, FL, Series 2005, Subseries A-1 (Ambac) | | | | | |

3.00%, 7/1/40 | | 2,000 | | 2,000 | |

Palm Beach County, FL, Hospice of Palm Beach County, Inc., Series 2001 | | | | | |

3.03%, 10/1/31 | | 1,900 | | 1,900 | |

Pennsylvania Turnpike Commission, 2002, Series A-2 | | | | | |

3.00%, 12/1/30 | | 400 | | 400 | |

Pima County Industrial Development Authority, AZ, El Dorado Hospital, Series 2004 | | | | | |

3.02%, 4/1/38 | | 1,000 | | 1,000 | |

Portland Housing Authority, OR, New Market West, Series 2004 | | | | | |

3.00%, 4/1/34 | | 675 | | 675 | |

Private Colleges & Universities Authority, GA, Emory University, 2001, Series B | | | | | |

2.95%, 9/1/33 | | 1,900 | | 1,900 | |

Purdue University, IN, Student Facilities System, Series 2005 A | | | | | |

2.97%, 7/1/29 | | 1,600 | | 1,600 | |

Rhode Island Convention Center Authority, Refinancing, 2001, Series A (MBIA) | | | | | |

3.00%, 5/15/27 | | 1,500 | | 1,500 | |

Saline Area Schools, MI, Series 2002 B | | | | | |

3.00%, 5/1/30 | | 12,000 | | 12,000 | |

Sayre Health Care Facilities Authority, PA, VHA of Pennsylvania, Inc., Capital Asset Financing, Series 1985 B (Ambac) | | | | | |

2.96%, 12/1/20 | | 1,700 | | 1,700 | |

South Carolina Jobs Economic Development Authority, Burroughs & Chapin Business Park, Series 2002 | | | | | |

3.05%, 5/1/32 | | 5,300 | | 5,300 | |

South Jordan Municipal Building Authority, UT, Lease, Series 2004 | | | | | |

3.00%, 2/1/29 | | 2,200 | | 2,200 | |

Texas Water Development Board, Revolving Fund Senior Lien, Series 2000 A P-FLOATs PT-2187 | | | | | |

3.01%, 7/15/08 | | 1,040 | | 1,040 | |

University of Minnesota Regents, Series 1999 A | | | | | |

3.07%, 1/1/34 | | $ | 1,065 | | $ | 1,065 | |

University of Texas System, Refinancing, Series 2001 A | | | | | |

3.00%, 8/15/13 | | 1,500 | | 1,500 | |

Utah County, UT, IHC Health Services, Inc., 2002, Series B | | | | | |

3.00%, 5/15/35 | | 2,400 | | 2,400 | |

Virginia Public Building Authority, Series B ROCs II-R Series 6027 | | | | | |

3.03%, 8/1/14 | | 1,395 | | 1,395 | |

Williamsburg, KY, Cumberland College, Series 2002 | | | | | |

2.99%, 9/1/32 | | 1,395 | | 1,395 | |

| | | | 156,945 | |

Total Tax-Exempt Instruments (Cost $295,775) | | | | 295,775 | |

Total Investments (99.6%) (Cost $295,775) | | | | 295,775 | |

Other Assets in Excess of Liabilities (0.4%) | | | | 1,214 | |

Net Assets (100%) | | | | $ | 296,989 | |

Ambac | — Ambac Assurance Corp. |

Assured Guaranty | — Assured Guaranty, Ltd. |

BANs | — Bond Anticipation Notes |

FGIC | — Financial Guaranty Insurance Co. |

FHA | — Federal Housing Administration |

FSA | — Financial Security Assurance, Inc. |

MBIA | — MBIA Insurance Corp. |

Radian | — Radian Group, Inc. |

RANs | — Revenue Anticipation Notes |

TRANs | — Tax and Revenue Anticipation Notes |

The accompanying notes are an integral part of the financial statements.

19

2005 Semi-Annual Report |

|

April 30, 2005 (unaudited) |

Portfolio of Investments (cont’d)

Tax-Exempt Portfolio

SUMMARY OF TAX-EXEMPT INSTRUMENTS BY STATE/TERRITORY

| | | | Percent | |

| | Value | | of Net | |

STATE/TERRITORY | | (000) | | Assets | |

Illinois | | $ | 32,523 | | 11.0 | % |

Texas | | 26,572 | | 9.0 | |

North Carolina | | 23,600 | | 8.0 | |

Florida | | 20,250 | | 6.8 | |

Colorado | | 18,125 | | 6.1 | |

New York | | 17,568 | | 5.9 | |

Utah | | 15,800 | | 5.3 | |

California | | 14,852 | | 5.0 | |

Delaware | | 14,145 | | 4.8 | |

Michigan | | 13,500 | | 4.5 | |

Kentucky | | 11,047 | | 3.7 | |

Georgia | | 9,800 | | 3.3 | |

Kansas | | 9,300 | | 3.1 | |

Louisiana | | 9,200 | | 3.1 | |

Indiana | | 6,835 | | 2.3 | |

South Carolina | | 6,576 | | 2.2 | |

Nebraska | | 5,930 | | 2.0 | |

Ohio | | 5,809 | | 2.0 | |

Tennessee | | 5,100 | | 1.7 | |

New Jersey | | 3,906 | | 1.3 | |

New Hampshire | | 3,500 | | 1.2 | |

Massachusetts | | 3,402 | | 1.1 | |

Puerto Rico | | 2,872 | | 1.0 | |

Arizona | | 2,795 | | 0.9 | |

Pennsylvania | | 2,100 | | 0.7 | |

Minnesota | | 2,068 | | 0.7 | |

Washington | | 1,830 | | 0.6 | |

Rhode Island | | 1,700 | | 0.6 | |

Missouri | | 1,600 | | 0.5 | |

Maine | | 1,400 | | 0.5 | |

Virginia | | 1,395 | | 0.5 | |

Oregon | | 675 | | 0.2 | |

| | $ | 295,775 | | 99.6 | % |

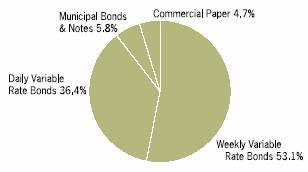

Graphic Presentation of Portfolio Holdings

The following graph depicts the Portfolio’s holdings by investment type, as a percentage of total investments.

The accompanying notes are an integral part of the financial statements.

20

| 2005 Semi-Annual Report |

| |

| April 30, 2005 (unaudited) |

Statements of Assets and Liabilities

| | Money Market | | Prime | | Government | | Treasury | | Tax-Exempt | |

| | Portfolio

(000) | | Portfolio

(000) | | Portfolio

(000) | | Portfolio

(000) | | Portfolio

(000) | |

Assets: | | | | | | | | | | | |

Investments, at Cost: | | $ | 3,055,349 | | $ | 12,195,145 | | $ | 1,434,017 | | $ | 102,216 | | $ | 295,775 | |

Investments, at Value: | | 2,635,909 | | 10,313,040 | | 458,167 | | 3,991 | | 295,775 | |

Repurchase Agreements, at Value | | 419,440 | | 1,882,105 | | 975,850 | | 98,225 | | — | |

Cash | | 5 | | 4 | | 18 | | 30 | | 80 | |

Interest Receivable | | 4,332 | | 10,553 | | 1,211 | | 30 | | 966 | |

Receivable for Investments Sold | | — | | — | | — | | — | | 500 | |

Receivable from Investment Adviser | | — | | — | | 34 | | 6 | | 2 | |

Other Assets | | 31 | | 83 | | 1 | | 3 | | 1 | |

Total Assets | | 3,059,717 | | 12,205,785 | | 1,435,281 | | 102,285 | | 297,324 | |

Liabilities: | | | | | | | | | | | |

Payable for Investments Purchased | | — | | 200,022 | | — | | — | | — | |

Dividends Declared | | 6,766 | | 28,135 | | 3,525 | | 204 | | 305 | |

Investment Advisory Fees Payable | | 59 | | 351 | | — | | — | | — | |

Payable for Administrative Fees | | 123 | | 517 | | 64 | | 4 | | 7 | |

Payable for Custodian Fees | | 45 | | 145 | | 14 | | 7 | | 5 | |

Shareholder Administration Plan Fees Payable — Service Class | | #— | | #— | | 1 | | #— | | #— | |

Shareholder Administration Plan Fees Payable — Investor Class | | #— | | 1 | | 17 | | #— | | #— | |

Shareholder Administration Plan Fees Payable — Administrative Class | | #— | | #— | | 4 | | #— | | #— | |

Service and Shareholder Administration Plan Fees Payable — Advisory Class | | #— | | 5 | | 3 | | #— | | 2 | |

Distribution and Shareholder Service Plan Fees Payable — Participant Class | | #— | | #— | | #— | | #— | | #— | |

Other Liabilities | | 36 | | 594 | | 128 | | 16 | | 16 | |

Total Liabilities | | 7,029 | | 229,770 | | 3,756 | | 231 | | 335 | |

Net Assets | | $ | 3,052,688 | | $ | 11,976,015 | | $ | 1,431,525 | | $ | 102,054 | | $ | 296,989 | |

Net Assets Consist Of: | | | | | | | | | | | |

Paid-in Capital | | $ | 3,052,690 | | $ | 11,976,023 | | $ | 1,431,525 | | $ | 102,054 | | $ | 296,989 | |

Undistributed (Distributions in Excess of) Net Investment Income | | — | | 2 | | — | # | — | | — | |

Accumulated Net Realized Gain (Loss) | | (2 | ) | (10 | ) | — | # | — | # | — | |

Net Assets | | $ | 3,052,688 | | $ | 11,976,015 | | $ | 1,431,525 | | $ | 102,054 | | $ | 296,989 | |

# Amount is less than $500.

21

2005 Semi-Annual Report |

|

April 30, 2005 (unaudited) |

Statements of Assets and Liabilities (cont’d)

| | Money Market | | Prime | | Government | | Treasury | | Tax-Exempt | |

| | Portfolio

(000) | | Portfolio

(000) | | Portfolio

(000) | | Portfolio

(000) | | Portfolio

(000) | |

INSTITUTIONAL CLASS: | | | | | | | | | | | |

Net Assets | | $ | 3,051,880 | | $ | 11,940,660 | | $ | 1,149,008 | | $ | 100,072 | | $ | 284,714 | |

Shares Outstanding $0.01 par value shares of | | | | | | | | | | | |

beneficial interest | | | | | | | | | | | |

(unlimited number of shares authorized) (not in 000’ s) | | 3,051,879,442 | | 11,940,666,768 | | 1,149,008,144 | | 100,072,102 | | 284,714,002 | |

Net Asset Value, Offering and Redemption Price Per Share | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | |

SERVICE CLASS: | | | | | | | | | | | |

Net Assets | | $ | 100 | | $ | 100 | | $ | 17,262 | | $ | 100 | | $ | 100 | |

Shares Outstanding $0.01 par value shares of | | | | | | | | | | | |

beneficial interest | | | | | | | | | | | |

(unlimited number of shares authorized) (not in 000’ s) | | 100,000 | | 100,000 | | 17,261,470 | | 100,000 | | 100,000 | |

Net Asset Value, Offering and Redemption Price Per Share | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | |

INVESTOR CLASS: | | | | | | | | | | | |

Net Assets | | $ | 100 | | $ | 10,000 | | $ | 211,543 | | $ | 100 | | $ | 104 | |

Shares Outstanding $0.01 par value shares of | | | | | | | | | | | |

beneficial interest | | | | | | | | | | | |

(unlimited number of shares authorized) (not in 000’ s) | | 100,000 | | 10,000,000 | | 211,543,300 | | 100,000 | | 104,380 | |

Net Asset Value, Offering and Redemption Price Per Share | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | |

ADMINISTRATIVE CLASS: | | | | | | | | | | | |

Net Assets | | $ | 100 | | $ | 100 | | $ | 31,406 | | $ | 100 | | $ | 100 | |

Shares Outstanding $0.01 par value shares of | | | | | | | | | | | |

beneficial interest | | | | | | | | | | | |

(unlimited number of shares authorized) (not in 000’ s) | | 100,000 | | 100,000 | | 31,405,602 | | 100,000 | | 100,000 | |

Net Asset Value, Offering and Redemption Price Per Share | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | |

ADVISORY CLASS: | | | | | | | | | | | |

Net Assets | | $ | 408 | | $ | 25,055 | | $ | 22,206 | | $ | 1,582 | | $ | 11,869 | |

Shares Outstanding $0.01 par value shares of | | | | | | | | | | | |

beneficial interest | | | | | | | | | | | |

(unlimited number of shares authorized) (not in 000’ s) | | 407,770 | | 25,055,079 | | 22,206,202 | | 1,581,522 | | 11,868,713 | |

Net Asset Value, Offering and Redemption Price Per Share | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | |

PARTICIPANT CLASS: | | | | | | | | | | | |

Net Assets | | $ | 100 | | $ | 100 | | $ | 100 | | $ | 100 | | $ | 102 | |

Shares Outstanding $0.01 par value shares of | | | | | | | | | | | |

beneficial interest | | | | | | | | | | | |

(unlimited number of shares authorized) (not in 000’ s) | | 100,000 | | 100,000 | | 100,000 | | 100,000 | | 101,510 | |

Net Asset Value, Offering and Redemption Price Per Share | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | |

The accompanying notes are an integral part of the financial statements.

22

| 2005 Semi-Annual Report |

| |

| April 30, 2005 (unaudited) |

Statements of Operations

For the Six Months Ended April 30, 2005

| | Money Market | | Prime | | Government | | Treasury | | Tax-Exempt | |

| | Portfolio

(000) | | Portfolio

(000) | | Portfolio

(000) | | Portfolio

(000) | | Portfolio

(000) | |

Investment Income: | | | | | | | | | | | |

Interest | | $ | 37,684 | | $ | 157,170 | | $ | 13,860 | | $ | 1,305 | | $ | 1,478 | |

Expenses: | | | | | | | | | | | |

Investment Advisory Fees (Note B) | | 2,360 | | 9,600 | | 826 | | 88 | | 111 | |

Administrative Fees (Note C) | | 788 | | 3,204 | | 275 | | 29 | | 39 | |

Registration and Filing Fees | | 151 | | 653 | | 270 | | 115 | | 123 | |

Custodian Fees (Note E) | | 69 | | 235 | | 19 | | 13 | | 7 | |

Professional Fees | | 29 | | 96 | | 17 | | 11 | | 12 | |

Trustees’ Fees and Expenses | | 21 | | 71 | | 3 | | 1 | | 1 | |

Shareholder Reporting Fees | | 8 | | 23 | | 1 | | 1 | | 1 | |

Bank Overdraft Expense | | 1 | | 2 | | 2 | | #— | | #— | |

Shareholder Administration Plan Fees — Service Class (Note D) | | #— | | #— | | 4 | | #— | | #— | |

Shareholder Administration Plan Fees — Investor Class (Note D) | | #— | | 8 | | 82 | | #— | | #— | |

Shareholder Administration Plan Fees — Administrative Class (Note D) | | #— | | #— | | 23 | | #— | | #— | |

Service and Shareholder Administration Plan Fees — Advisory Class (Note D) | | 1 | | 34 | | 16 | | 2 | | 33 | |

Distribution and Shareholder Service Plan Fees — Participant Class (Note D) | | #— | | #— | | #— | | #— | | #— | |

Other Expenses | | 72 | | 235 | | 31 | | 28 | | 19 | |

Total Expenses | | 3,500 | | 14,161 | | 1,569 | | 288 | | 346 | |

Waiver of Investment Advisory Fees (Note B) | | (1,924 | ) | (7,470 | ) | (826 | ) | (88 | ) | (111 | ) |

Expenses Reimbursed by Adviser (Note B) | | — | | — | | (340 | ) | (168 | ) | (137 | ) |

Net Expenses | | 1,576 | | 6,691 | | 403 | | 32 | | 98 | |

Net Investment Income (Loss) | | 36,108 | | 150,479 | | 13,457 | | 1,273 | | 1,380 | |

Realized Gain (Loss): | | | | | | | | | | | |

Investments | | #— | | 5 | | #— | | #— | | — | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | 36,108 | | $ | 150,484 | | $ | 13,457 | | $ | 1,273 | | $ | 1,380 | |

# Amount is less than $500.

The accompanying notes are an integral part of the financial statements.

23

2005 Semi-Annual Report |

|

April 30, 2005 (unaudited) |

Statements of Changes in Net Assets

| | Money Market | | Prime | |

| | Portfolio | | Portfolio | |

| | Six Months | | Period from | | Six Months | | Period from | |

| | Ended | | February 2, | | Ended | | February 2, | |

| | April 30, | | 2004* to | | April 30, | | 2004* to | |

| | 2005 | | October 31, | | 2005 | | October 31, | |

| | (unaudited) | | 2004 | | (unaudited) | | 2004 | |

| | (000) | | (000) | | (000) | | (000) | |

Increase (Decrease) in Net Assets Operations: | | | | | | | | | |

Net Investment Income | | $ | 36,108 | | $ | 19,002 | | $ | 150,479 | | $ | 49,256 | |

Net Realized Gain (Loss) | | #— | | (2 | ) | 5 | | (15 | ) |

Net Increase (Decrease) in Net Assets Resulting from Operations | | 36,108 | | 19,000 | | 150,484 | | 49,241 | |

Distributions from and/or in Excess of: | | | | | | | | | |

Institutional Class: | | | | | | | | | |

Net Investment Income | | (36,100 | ) | (18,959 | ) | (150,017 | ) | (49,172 | ) |

Service Class: | | | | | | | | | |

Net Investment Income | | (1 | ) | — | | (1 | ) | — | |

Investor Class: | | | | | | | | | |

Net Investment Income | | (1 | ) | (37 | ) | (165 | ) | — | |

Administrative Class: | | | | | | | | | |

Net Investment Income | | (1 | ) | — | | (1 | ) | — | |

Advisory Class: | | | | | | | | | |

Net Investment Income | | (4 | ) | (6 | ) | (292 | ) | (84 | ) |

Participant Class: | | | | | | | | | |

Net Investment Income | | (1 | ) | — | | (1 | ) | — | |

Total Distributions | | (36,108 | ) | (19,002 | ) | (150,477 | ) | (49,256 | ) |

Capital Share Transactions:(1) | | | | | | | | | |

Institutional Class: | | | | | | | | | |

Subscribed | | 9,783,547 | | 11,439,898 | | 50,468,673 | | 33,974,259 | |

Distributions Reinvested | | 24,104 | | 8,193 | | 82,549 | | 24,233 | |

Redeemed | | (9,832,799 | ) | (8,371,061 | ) | (47,343,431 | ) | (25,265,715 | ) |

Service Class:** | | | | | | | | | |

Subscribed | | 100 | | — | | 100 | | — | |

Distributions Reinvested | | — | | — | | — | | — | |

Redeemed | | — | | — | | — | | — | |

Investor Class:^ | | | | | | | | | |

Subscribed | | 100 | | 50,004 | | 64,800 | | — | |

Distributions Reinvested | | — | | 37 | | 145 | | — | |

Redeemed | | — | | (50,041 | ) | (54,945 | ) | — | |

Administrative Class:** | | | | | | | | | |

Subscribed | | 100 | | — | | 100 | | — | |

Distributions Reinvested | | — | | — | | — | | — | |

Redeemed | | — | | — | | — | | — | |

Advisory Class:† | | | | | | | | | |

Subscribed | | 310 | | 4,832 | | 100,115 | | 70,860 | |

Distributions Reinvested | | — | | — | | 191 | | 62 | |

Redeemed | | (1,407 | ) | (3,327 | ) | (91,601 | ) | (54,572 | ) |

Participant Class:** | | | | | | | | | |

Subscribed | | 100 | | — | | 100 | | — | |

Distributions Reinvested | | — | | — | | — | | — | |

Redeemed | | — | | — | | — | | — | |

Net Increase (Decrease) in Net Assets Resulting from Capital Share Transactions | | (25,845 | ) | 3,078,535 | | 3,226,796 | | 8,749,127 | |

Total Increase (Decrease) in Net Assets | | (25,845 | ) | 3,078,533 | | 3,226,803 | | 8,749,112 | |

Net Assets: | | | | | | | | | |

Beginning of Period | | 3,078,533 | | — | | 8,749,212 | | 100 | |

End of Period | | $ | 3,052,688 | | $ | 3,078,533 | | $ | 11,976,015 | | $ | 8,749,212 | |

Undistributed (Distributions in Excess of) Net Investment Income Included in End of Period Net Assets | | $ | — | | $ | — | | $ | 2 | | $ | — | |

The accompanying notes are an integral part of the financial statements.

24

| 2005 Semi-Annual Report |

| |

| April 30, 2005 (unaudited) |

Statements of Changes in Net Assets (cont’d)

| | | Money Market | | Prime | |

| | | Portfolio | | Portfolio | |

| | | Six Months | | Period from | | Six Months | | Period from | |

| | | Ended | | February 2, | | Ended | | February 2, | |

| | | April 30, | | 2004* to | | April 30, | | 2004* to | |

| | | 2005 | | October 31, | | 2005 | | October 31, | |

| | | (unaudited) | | 2004 | | (unaudited) | | 2004 | |

| | | (000) | | (000) | | (000) | | (000) | |

(1) | Capital Share Transactions: | | | | | | | | | |

| Institutional Class: | | | | | | | | | |

| Shares Subscribed | | 9,783,545 | | 11,439,897 | | 50,468,668 | | 33,974,258 | |

| Shares Issued on Distributions Reinvested | | 24,104 | | 8,193 | | 82,549 | | 24,233 | |

| Shares Redeemed | | (9,832,798 | ) | (8,371,061 | ) | (47,343,429 | ) | (25,265,713 | ) |

| Net Increase (Decrease) in Institutional Class Shares Outstanding | | (25,149 | ) | 3,077,029 | | 3,207,788 | | 8,732,778 | |

| Service Class:** | | | | | | | | | |

| Shares Subscribed | | 100 | | — | | 100 | | — | |

| Shares Issued on Distributions Reinvested | | — | | — | | — | | — | |

| Shares Redeemed | | — | | — | | — | | — | |