UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21339 |

|

MORGAN STANLEY INSTITUTIONAL LIQUIDITY FUNDS |

(Exact name of registrant as specified in charter) |

|

1221 AVENUE OF THE AMERICAS 5th FLOOR NEW YORK, NY | | 10020 |

(Address of principal executive offices) | | (Zip code) |

|

RONALD E. ROBISON

1221 AVENUE OF THE AMERICAS 5th FLOOR NEW YORK, NY 10020 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-888-378-1630 | |

|

Date of fiscal year end: | 10/31 | |

|

Date of reporting period: | 4/30/07 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The Fund’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Morgan Stanley | 2007 Semi-Annual Report |

|

April 30, 2007 |

Morgan Stanley Institutional Liquidity Funds

Money Market Portfolio

Prime Portfolio

Government Portfolio

Treasury Portfolio

Tax-Exempt Portfolio

| 2007 Semi-Annual Report |

| |

| April 30, 2007 |

Table of Contents

Shareholder’s Letter | | 3 |

| | |

Investment Advisory Agreement Approval | | 4 |

| | |

Performance Summary | | 6 |

| | |

Expense Examples | | 7 |

| | |

Portfolio of Investments | | |

| | |

Money Market Portfolio | | 10 |

| | |

Prime Portfolio | | 14 |

| | |

Government Portfolio | | 20 |

| | |

Treasury Portfolio | | 22 |

| | |

Tax-Exempt Portfolio | | 23 |

| | |

Statements of Assets and Liabilities | | 29 |

| | |

Statements of Operations | | 31 |

| | |

Statements of Changes in Net Assets | | 32 |

| | |

Financial Highlights | | 36 |

| | |

Notes to Financial Statements | | 42 |

| | |

Trustee and Officer Information | | 45 |

This report is authorized for distribution only when preceded or accompanied by prospectuses of the Morgan Stanley Institutional Liquidity Funds. To receive a prospectus and/or SAI, which contains more complete information such as investment objectives, charges, expenses, policies for voting proxies, risk considerations, and describes in detail each of the Portfolio’s investment policies to the prospective investor, please call 1 (888) 378-1630. Please read the prospectus carefully before you invest or send money. Additionally, you can access portfolio information including performance, yields, characteristics, and investment team commentary through Morgan Stanley Investment Management’s website: www.morganstanley.com/im.

1

(This page has been left blank intentionally.)

2

| 2007 Semi-Annual Report |

| |

| April 30, 2007 (unaudited) |

Shareholder’s Letter

Dear Shareholders:

Overview

We are pleased to present the Morgan Stanley Institutional Liquidity Funds (“MSILF”) Semi-Annual Report for the period ended April 30, 2007. MSILF currently offers five portfolios (Money Market, Prime, Government, Treasury and Tax-Exempt), which together are designed to provide flexible cash management options. MSILF’s portfolios provide investors with a means to help them meet specific cash investment needs, whether they need a rated fund, capital preservation, or tax-efficient returns.

Sincerely,

Ronald E. Robison

President & Principal Executive Officer

May 2007

3

2007 Semi-Annual Report | |

| |

April 30, 2007 (unaudited) | |

Investment Advisory Agreement Approval

MORGAN STANLEY INSTITUTIONAL LIQUIDITY FUNDS

Nature, Extent and Quality of Services: The Board reviewed and considered the nature and extent of the investment advisory services provided by the Investment Adviser under the Advisory Agreement, including portfolio management, investment research and fixed income securities trading. The Board reviewed similar information and factors regarding the Sub-Adviser, to the extent applicable. The Board also reviewed and considered the nature and extent of the non-advisory, administrative services provided by the Portfolios’ Administrator under the Administration Agreement, including accounting, clerical, bookkeeping, compliance, business management and planning, and the provision of supplies, office space and utilities at the Investment Adviser’s expense. (The Investment Adviser, Sub-Adviser and Administrator together are referred to as the “Adviser” and the Advisory, Sub-Advisory and Administration Agreements together are referred to as the “Management Agreement.”) The Board also compared the nature of the services provided by the Adviser with similar services provided by non-affiliated advisers as reported to the Board by Lipper Inc. (“Lipper”).

The Board reviewed and considered the qualifications of the portfolio managers, the senior administrative managers and other key personnel of the Adviser who provide the administrative and advisory services to the Portfolios. The Board determined that the Adviser’s portfolio managers and key personnel are well qualified by education and/or training and experience to perform the services in an efficient and professional manner. The Board concluded that the nature and extent of the advisory and administrative services provided were necessary and appropriate for the conduct of the business and investment activities of each Portfolio. The Board also concluded that the overall quality of the advisory and administrative services was satisfactory.

Performance Relative to Comparable Funds Managed by Other Advisers: On a regular basis, the Board reviews the performance of all funds in the Morgan Stanley Fund Complex, including the Portfolios, compared to their peers, paying specific attention to the underperforming funds. In addition, the Board specifically reviewed each Portfolio’s performance for the one-year period ended November 30, 2006 and for the period since the end of February 2004 with respect to the Money-Market, Prime and Tax-Exempt Portfolios and for the period since the end of August 2004 with respect to the Government and Treasury Portfolios, the month of each Portfolio’s inception, as shown in a report provided by Lipper (the “Lipper Report”), compared to the performance of comparable funds selected by Lipper (the “performance peer group”). The Board also discussed with the Adviser the performance goals and the actual results achieved in managing each Portfolio. The Board concluded that each Portfolio’s performance was competitive with that of its performance peer group.

Fees Relative to Other Proprietary Funds Managed by the Adviser with Comparable Investment Strategies: The Board noted that the Adviser did not manage any other proprietary funds with investment strategies comparable to the Portfolios.

Fees and Expenses Relative to Comparable Funds Managed by Other Advisers: The Board reviewed the advisory and administrative fee (together, the “management fee”) rate and total expense ratio of each Portfolio as compared to the average management fee rate and average total expense ratio for funds, selected by Lipper (the “expense peer group”), managed by other advisers with investment strategies comparable to those of the Portfolios, as shown in the Lipper Reports. The Board concluded that each Portfolio’s management fee rate and total expense ratio were competitive with those of its expense peer group.

Breakpoints and Economies of Scale: The Board reviewed the structure of each Portfolio’s management fee schedule under the Management Agreement and noted that it does not include any breakpoints. The Board also reviewed the level of each Portfolio’s management fee and concluded that the fee, compared to the Portfolio’s expense peer group, was sufficiently low, and there is a cap in the total expense ratio of each Portfolio, so that, in effect, economies of scale were built into the management fee structure.

Profitability of the Adviser and Affiliates: The Board considered information concerning the costs incurred and profits realized by the Adviser and affiliates during the last year from their relationship with each Portfolio and during the last two years from their relationship with the Morgan Stanley Fund Complex and reviewed with the Adviser the cost allocation methodology used to determine the profitability of the Adviser and affiliates. Based on its review of the information it received, the Board concluded that the profits earned by the Adviser and affiliates were not excessive in light of the advisory, administrative and other services provided to the Portfolios.

Fall-Out Benefits: The Board considered so-called “fall-out benefits” derived by the Adviser and affiliates from their relationship with each Portfolio and the Morgan Stanley Fund Complex, such as “float” benefits derived from handling of checks for purchases and sales of Portfolio shares, through a broker-dealer affiliate of the Adviser. The Board concluded that the float benefits were relatively small.

4

| 2007 Semi-Annual Report |

| |

| April 30, 2007 (unaudited) |

Investment Advisory Agreement Approval (cont’d)

Soft Dollar Benefits: The Board considered whether the Adviser realizes any benefits from commissions paid to brokers who execute securities transactions for the Portfolios (“soft dollars”). The Board noted that the Portfolios invest only in fixed income securities, which do not generate soft dollars.

Adviser Financially Sound and Financially Capable of Meeting the Portfolio’s Needs: The Board considered whether the Adviser is financially sound and has the resources necessary to perform its obligations under the Management Agreement. The Board concluded that the Adviser has the financial resources necessary to fulfill its obligations under the Management Agreement.

Historical Relationship Between the Portfolio and the Adviser: The Board also reviewed and considered the historical relationship between the Portfolios and the Adviser, including the organizational structure of the Adviser, the policies and procedures formulated and adopted by the Adviser for managing the Portfolios’ operations and the Board’s confidence in the competence and integrity of the senior managers and key personnel of the Adviser. The Board concluded that it is beneficial for the Portfolios to continue their relationship with the Adviser.

Other Factors and Current Trends: The Board considered the controls and procedures adopted and implemented by the Adviser and monitored by the Portfolios’ Chief Compliance Officer and concluded that the conduct of business by the Adviser indicates a good faith effort on its part to adhere to high ethical standards in the conduct of each Portfolio’s business.

General Conclusion: After considering and weighing all of the above factors, the Board concluded that it would be in the best interest of each Portfolio and its shareholders to approve renewal of the Management Agreement for another year.

5

2007 Semi-Annual Report | |

| |

April 30, 2007 (unaudited) | |

Performance Summary

The seven-day current and seven-day effective yields (effective yield assumes an annualization of the current yield with all dividends reinvested) as of April 30, 2007, were as follows:

| | Institutional | | Service | | Investor | | Administrative | | Advisory | | Participant | | Cash Management Class | |

| | Class | | Class | | Class | | Class | | Class | | Class | | |

| | 7-day | | 7-day | | 7-day | | 7-day | | 7-day | | 7-day | | 7-day | | 7-day | | 7-day | | 7-day | | 7-day | | 7-day | | 7-day | | 7-day | |

| | Current | | Effective | | Current | | Effective | | Current | | Effective | | Current | | Effective | | Current | | Effective | | Current | | Effective | | Current | | Effective | |

| | Yield | | Yield | | Yield | | Yield | | Yield | | Yield | | Yield | | Yield | | Yield | | Yield | | Yield | | Yield | | Yield | | Yield | |

Portfolio: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Money Market | | 5.27 | % | 5.41 | % | 5.22 | % | 5.36 | % | 5.17 | % | 5.30 | % | 5.12 | % | 5.25 | % | 5.02 | % | 5.15 | % | 4.77 | % | 4.88 | % | 4.97 | % | 5.09 | % |

Prime | | 5.26 | % | 5.40 | % | 5.21 | % | 5.35 | % | 5.16 | % | 5.30 | % | 5.11 | % | 5.24 | % | 5.01 | % | 5.14 | % | 4.76 | % | 4.87 | % | — | | — | |

Government | | 5.18 | % | 5.31 | % | 5.13 | % | 5.26 | % | 5.08 | % | 5.21 | % | 5.03 | % | 5.15 | % | 4.93 | % | 5.05 | % | 4.68 | % | 4.79 | % | — | | — | |

Treasury | | 5.17 | % | 5.30 | % | 5.12 | % | 5.25 | % | 5.07 | % | 5.20 | % | 5.02 | % | 5.15 | % | 4.92 | % | 5.04 | % | 4.67 | % | 4.78 | % | 4.87 | % | 4.99 | % |

Tax-Exempt | | 3.80 | % | 3.87 | % | 3.75 | % | 3.82 | % | 3.70 | % | 3.77 | % | 3.65 | % | 3.72 | % | 3.55 | % | 3.61 | % | 3.30 | % | 3.36 | % | 3.50 | % | 3.56 | % |

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. Performance information for the 7-day effective yield assumes that all dividends and distributions, if any, were reinvested. For the most recent month-end performance figures, please visit www.morganstanley.com/im. Investment return and principal value will fluctuate causing portfolio shares, when redeemed, to be worth more or less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on portfolio distributions or the redemption of portfolio shares.

Investments in the Money Market, Prime, Government, Treasury and Tax-Exempt Portfolios (the “Portfolios”) are neither insured nor guaranteed by the Federal Deposit Insurance Corporation. Although the Portfolios seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these Portfolios. Please read MSILF’s prospectuses carefully before you invest or send money.

Yield quotation more closely reflects the current earnings of the Portfolios than the total return. As with all money market

portfolios, yields will fluctuate as market conditions change and the seven-day yields are not necessarily indicative of future

performance.

6

| 2007 Semi-Annual Report |

| |

| April 30, 2007 (unaudited) |

Expense Examples

Expense Examples

As a shareholder of a Portfolio, you incur ongoing costs, including management fees, shareholder administration plan fees (in the case of the Service, Investor, and Administrative Classes), service and shareholder administration plan fees (in the case of the Advisory Class); distribution and shareholder service plan fees (in the case of the Participant and Cash Management Classes) and other Portfolio expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in each Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the six-month period ended April 30, 2007 and held for the entire six-month period.

Actual Expenses

The first line of the tables below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled ‘‘Expenses Paid During Period’’ to estimate the expenses you paid on your account during this period.

Please note that “Expenses Paid During Period” are grossed up to reflect Portfolio expenses prior to the effect of Expense Offset (See Note E in the Notes to Financial Statements). Therefore, the annualized net expense ratios may differ from the ratio of expenses to average net assets shown in the Financial Highlights.

Hypothetical Example for Comparison Purposes

The second line of the tables below provides information about hypothetical account values and hypothetical expenses based on a Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| | Beginning Account Value

November 1, 2006 | | Ending Account Value

April 30, 2007 | | Expenses Paid During Period* November 1, 2006 — April 30, 2007 | |

Money Market Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,026.48 | | $ | 0.60 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.20 | | 0.60 | |

Service Class | | | | | | | |

Actual | | 1,000.00 | | 1,026.23 | | 0.85 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.95 | | 0.85 | |

Investor Class | | | | | | | |

Actual | | 1,000.00 | | 1,025.98 | | 1.11 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.70 | | 1.10 | |

Administrative Class | | | | | | | |

Actual | | 1,000.00 | | 1,025.72 | | 1.36 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.46 | | 1.35 | |

Advisory Class | | | | | | | |

Actual | | 1,000.00 | | 1,025.21 | | 1.86 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,022.96 | | 1.86 | |

Participant Class | | | | | | | |

Actual | | 1,000.00 | | 1,023.94 | | 3.06 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,021.77 | | 3.06 | |

Cash Management Class | | | | | | | |

Actual | | 1,000.00 | | 1,025.00 | | 2.11 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,022.71 | | 2.11 | |

| | | | | | | | | | |

* | Expenses are equal to Institutional Class’, Service Class’, Investor Class’, Administrative Class’, Advisory Class’, Participant Class’ and Cash Management Class’ annualized net expense ratios of 0.12%, 0.17%, 0.22%, 0.27%, 0.37%, 0.61% and 0.42%, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

7

2007 Semi-Annual Report | |

| |

April 30, 2007 (unaudited) | |

Expense Examples (cont’d)

| | Beginning Account Value

November 1, 2006 | | Ending Account Value

April 30, 2007 | | Expenses Paid During Period*

November 1, 2006 — April 30, 2007 | |

Prime Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,026.42 | | $ | 0.60 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.20 | | 0.60 | |

Service Class | | | | | | | |

Actual | | 1,000.00 | | 1,026.16 | | 0.85 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.95 | | 0.85 | |

Investor Class | | | | | | | |

Actual | | 1,000.00 | | 1,025.91 | | 1.11 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.70 | | 1.10 | |

Administrative Class | | | | | | | |

Actual | | 1,000.00 | | 1,025.66 | | 1.36 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.46 | | 1.35 | |

Advisory Class | | | | | | | |

Actual | | 1,000.00 | | 1,025.15 | | 1.86 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,022.96 | | 1.86 | |

Participant Class | | | | | | | |

Actual | | 1,000.00 | | 1,023.88 | | 3.11 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,021.72 | | 3.11 | |

| | | | | | | | | | |

* | Expenses are equal to Institutional Class’, Service Class’, Investor Class’, Administrative Class’, Advisory Class’ and Participant Class’ annualized net expense ratios of 0.12%, 0.17%, 0.22%, 0.27%, 0.37% and 0.62%, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

Government Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,026.20 | | $ | 0.60 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.20 | | 0.60 | |

Service Class | | | | | | | |

Actual | | 1,000.00 | | 1,026.00 | | 0.85 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.95 | | 0.85 | |

Investor Class | | | | | | | |

Actual | | 1,000.00 | | 1,025.70 | | 1.05 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.75 | | 1.05 | |

Administrative Class | | | | | | | |

Actual | | 1,000.00 | | 1,025.40 | | 1.36 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.46 | | 1.35 | |

Advisory Class | | | | | | | |

Actual | | 1,000.00 | | 1,024.90 | | 1.86 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,022.96 | | 1.86 | |

Participant Class | | | | | | | |

Actual | | 1,000.00 | | 1,023.70 | | 3.11 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,021.72 | | 3.11 | |

| | | | | | | | | | |

* | Expenses are equal to Institutional Class’, Service Class’, Investor Class’, Administrative Class’, Advisory Class’ and Participant Class’ annualized net expense ratios of 0.12%, 0.17%, 0.21%, 0.27%, 0.37% and 0.62%, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

Treasury Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,026.30 | | $ | 0.30 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.50 | | 0.30 | |

Service Class | | | | | | | |

Actual | | 1,000.00 | | 1,026.10 | | 0.55 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.25 | | 0.55 | |

Investor Class | | | | | | | |

Actual | | 1,000.00 | | 1,025.80 | | 0.80 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.00 | | 0.80 | |

Administrative Class | | | | | | | |

Actual | | 1,000.00 | | 1,025.50 | | 1.05 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.75 | | 1.05 | |

Advisory Class | | | | | | | |

Actual | | 1,000.00 | | 1,025.00 | | 1.56 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.26 | | 1.56 | |

| | | | | | | | | | |

8

| 2007 Semi-Annual Report |

| |

| April 30, 2007 (unaudited) |

Expenses Examples (cont’d)

| | Beginning Account Value

November 1, 2006 | | Ending Account Value

April 30, 2007 | | Expenses Paid During Period*

November 1, 2006 — April 30, 2007 | |

Treasury Portfolio (cont’d) | | | | | | | |

Participant Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,023.80 | | $ | 2.81 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,022.02 | | 2.81 | |

Cash Management Class | | | | | | | |

Actual | | 1,000.00 | | 1,024.80 | | 1.81 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.01 | | 1.81 | |

| | | | | | | | | | |

* | Expenses are equal to Institutional Class’, Service Class’, Investor Class’, Administrative Class’, Advisory Class’, Participant Class’ and Cash Management Class’ annualized net expense ratios of 0.06%, 0.11%, 0.16%, 0.21%, 0.31%, 0.56% and 0.36%, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

Tax-Exempt Portfolio | | | | | | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,017.80 | | $ | 0.50 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.30 | | 0.50 | |

Service Class | | | | | | | |

Actual | | 1,000.00 | | 1,017.50 | | 0.80 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,024.00 | | 0.80 | |

Investor Class | | | | | | | |

Actual | | 1,000.00 | | 1,017.30 | | 1.00 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.80 | | 1.00 | |

Administrative Class | | | | | | | |

Actual | | 1,000.00 | | 1,017.00 | | 1.30 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.51 | | 1.30 | |

Advisory Class | | | | | | | |

Actual | | 1,000.00 | | 1,016.50 | | 1.75 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,023.06 | | 1.76 | |

Participant Class | | | | | | | |

Actual | | 1,000.00 | | 1,015.30 | | 3.00 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,021.82 | | 3.01 | |

Cash Management Class | | | | | | | |

Actual | | 1,000.00 | | 1,016.30 | | 2.00 | |

Hypothetical (5% average annual return before expenses) | | 1,000.00 | | 1,022.81 | | 2.01 | |

| | | | | | | | | | |

* | Expenses are equal to Institutional Class’, Service Class’, Investor Class’, Administrative Class’, Advisory Class’, Participant Class’ and Cash Management Class’ annualized net expense ratios of 0.10%, 0.16%, 0.20%, 0.26%, 0.35%, 0.60% and 0.40%, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

9

2007 Semi-Annual Report | |

| |

April 30, 2007 (unaudited) | |

Portfolio of Investments

Money Market Portfolio

| | Face

Amount

(000) | | Value

(000) | |

Certificates of Deposit (7.3%) | | | | | |

Banking (0.4%) | | | | | |

Union Bank of California | | | | | |

5.33%, 8/3/07 | | $ | 35,000 | | $ | 35,000 | |

International Banks (6.9%) | | | | | |

Banco Bilbao Vizcaya Argentaria S.A. | | | | | |

5.30%, 4/3/08 | | (b)125,000 | | 124,959 | |

Barclays Bank plc/New York | | | | | |

5.35%, 4/14/08 | | 25,000 | | 25,000 | |

Calyon/New York | | | | | |

5.31%, 9/13/07 | | 35,000 | | 35,000 | |

Credit Suisse/New York | | | | | |

5.33%, 2/26/08 | | (b)75,000 | | 75,000 | |

Depfa Bank plc | | | | | |

5.35%, 8/15/07 | | 30,000 | | 30,000 | |

Natixis/New York | | | | | |

5.32%, 12/11/07 | | 20,000 | | 20,000 | |

Norinchukin Bank Ltd. | | | | | |

5.32%, 6/5/07 | | 50,000 | | 50,000 | |

5.35%, 6/14/07 - 7/10/07 | | 125,000 | | 125,000 | |

5.36%, 7/12/07 - 8/15/07 | | 150,000 | | 150,000 | |

| | | | 634,959 | |

Total Certificates of Deposit (Cost $669,959) | | | | 669,959 | |

Commercial Paper (47.6%) (e) | | | | | |

Asset Backed — Consumer (0.3%) | | | | | |

Three Rivers Funding | | | | | |

5.31%, 6/28/07 | | (a)25,000 | | 24,788 | |

Asset Backed — Corporate (16.5%) | | | | | |

Atlantis One Funding Corp. | | | | | |

5.35%, 7/24/07 - 7/30/07 | | (a)41,732 | | 41,210 | |

Buckingham CDO LLC | | | | | |

5.33%, 6/8/07 | | (a)29,750 | | 29,585 | |

Buckingham CDO II LLC | | | | | |

5.31%, 5/25/07 | | (a)50,000 | | 49,824 | |

Buckingham CDO III LLC | | | | | |

5.31%, 5/22/07 | | (a)50,000 | | 49,846 | |

5.32%, 5/24/07 | | (a)105,648 | | 105,291 | |

Citius I Funding Ltd. | | | | | |

5.32%, 5/3/07 | | (a)23,910 | | 23,903 | |

5.34%, 7/17/07 | | (a)53,000 | | 52,403 | |

Citius II Funding Ltd. | | | | | |

5.32%, 5/3/07 | | (a)37,673 | | 37,662 | |

5.35%, 6/14/07 | | (a)30,000 | | 29,806 | |

Davis Square Funding IV | | | | | |

5.33%, 5/15/07 | | (a)40,000 | | 39,918 | |

5.34%, 6/11/07 | | (a)25,000 | | 24,849 | |

Davis Square Funding V | | | | | |

5.33%, 6/6/07 | | (a)20,000 | | 19,894 | |

Davis Square Funding VI | | | | | |

5.33%, 5/14/07 - 5/15/07 | | (a)105,000 | | 104,795 | |

Kaiserplatz Funding Ltd. | | | | | |

5.32%, 7/26/07 | | (a)50,000 | | 49,373 | |

5.33%, 5/8/07 - 7/16/07 | | (a)309,718 | | 307,677 | |

Klio Funding Corp. | | | | | |

5.33%, 5/23/07 | | (a)19,684 | | 19,620 | |

Klio III Funding Corp. | | | | | |

5.33%, 6/22/07 - 7/24/07 | | (a)77,000 | | 76,171 | |

5.34%, 6/13/07 | | (a)32,092 | | 31,890 | |

Liberty Harbour II CDO LLC | | | | | |

5.32%, 5/9/07 - 5/11/07 | | (a)139,965 | | 139,788 | |

5.33%, 7/13/07 | | 50,000 | | 49,466 | |

5.34%, 5/25/07 | | (a)20,000 | | 19,930 | |

Nieuw Amsterdam Receivables Corp. | | | | | |

5.33%, 9/27/07 | | (a)14,686 | | 14,370 | |

5.35%, 5/9/07 | | (a)20,540 | | 20,516 | |

Pasa Funding 2007, Ltd. | | | | | |

5.35%, 7/6/07 - 7/20/07 | | (a)188,100 | | 186,019 | |

| | | | 1,523,806 | |

Asset Backed — Diversified (0.4%) | | | | | |

Atlantic Asset Securitization Corp. | | | | | |

5.32%, 6/26/07 | | (a)40,000 | | 39,672 | |

Asset Backed — Mortgage (1.5%) | | | | | |

Sydney Capital Corp. | | | | | |

5.31%, 6/20/07 | | (a)50,000 | | 49,634 | |

5.32%, 5/29/07 | | (a)16,250 | | 16,183 | |

5.33%, 5/4/07 - 7/16/07 | | (a)75,000 | | 74,434 | |

| | | | 140,251 | |

Asset Backed — Securities (10.7%) | | | | | |

Amstel Funding Corp. | | | | | |

5.32%, 6/29/07 | | (a)25,000 | | 24,785 | |

5.33%, 6/13/07 | | (a)25,000 | | 24,845 | |

5.34%, 5/11/07 | | (a)45,000 | | 44,935 | |

5.35%, 5/9/07 | | (a)25,000 | | 24,971 | |

Atlas Capital Funding Corp. | | | | | |

5.32%, 6/25/07 | | (a)50,000 | | 49,598 | |

5.33%, 9/7/07 - 9/12/07 | | (a)60,000 | | 58,865 | |

Beethoven Funding Corp. | | | | | |

5.31%, 6/20/07 | | (a)66,402 | | 65,916 | |

5.33%, 7/20/07 | | (a)61,879 | | 61,156 | |

Beta Finance, Inc. | | | | | |

5.30%, 6/15/07 | | (a)20,000 | | 19,871 | |

Cancara Asset Securitization LLC | | | | | |

5.32%, 6/29/07 | | (a)32,119 | | 31,843 | |

Cullinan Finance Corp. | | | | | |

5.45%, 2/1/08 | | (a)20,000 | | 20,000 | |

Curzon Funding LLC | | | | | |

5.32%, 6/29/07 | | (a)30,000 | | 29,742 | |

5.34%, 5/17/07 | | (a)15,000 | | 14,965 | |

Giro Funding U.S. Corp. | | | | | |

5.16%, 6/1/07 | | (a)(f)17,584 | | 17,504 | |

5.32%, 5/31/07 | | (a)100,000 | | 99,559 | |

Giro Lion Funding Ltd. | | | | | |

5.22%, 7/30/07 - 7/31/07 | | (a)(f)38,097 | | 37,598 | |

5.34%, 7/20/07 | | (a)74,200 | | 73,331 | |

Grampian Funding LLC | | | | | |

5.34%, 5/16/07 | | (a)36,000 | | 35,922 | |

5.35%, 7/20/07 - 8/3/07 | | (a)146,500 | | 144,585 | |

| | | | | | | |

The accompanying notes are an integral part of the financial statements.

10

| 2007 Semi-Annual Report |

| |

| April 30, 2007 (unaudited) |

Portfolio of Investments (cont’d)

Money Market Portfolio

| | Face

Amount

(000) | | Value

(000) | |

Asset Backed — Securities (cont’d) | | | | | |

Links Finance LLC | | | | | |

5.32%, 10/23/07 | | $ | (a)50,000 | | $ | 48,741 | |

Scaldis Capital LLC | | | | | |

5.34%, 7/13/07 | | (a)14,675 | | 14,520 | |

Solitaire Funding LLC | | | | | |

5.35%, 7/23/07 | | (a)45,000 | | 44,459 | |

| | | | 987,711 | |

Banking (4.4%) | | | | | |

Bank of America Corp. | | | | | |

5.32%, 6/11/07 | | 20,000 | | 19,882 | |

Capital Markets Access Co. | | | | | |

5.39%, 10/1/31 | | (b)4,085 | | 4,085 | |

Citigroup Funding, Inc. | | | | | |

5.31%, 6/27/07 | | 5,000 | | 4,958 | |

5.32%, 6/8/07 | | 50,000 | | 49,723 | |

5.33%, 6/12/07 | | 58,500 | | 58,141 | |

5.34%, 5/23/07 - 8/15/07 | | 210,000 | | 208,610 | |

HSBC USA, Inc. | | | | | |

5.21%, 7/24/07 - 8/8/07 | | 54,000 | | 53,300 | |

Kamps Capital LLC | | | | | |

5.37%, 9/1/33 | | (b)6,680 | | 6,680 | |

| | | | 405,379 | |

Diversified Financial Services (0.5%) | | | | | |

General Electric Capital Corp. | | | | | |

5.30%, 6/29/07 | | 20,000 | | 19,831 | |

Nestle Capital Corp. | | | | | |

5.46%, 7/31/07 | | (a)25,000 | | 24,672 | |

| | | | 44,503 | |

Electric Utilities (0.2%) | | | | | |

State of New York | | | | | |

5.32%, 6/12/07 | | (a)20,104 | | 19,981 | |

Integrated Oil Companies (4.9%) | | | | | |

BP Capital Markets plc | | | | | |

5.32%, 5/1/07 | | 449,597 | | 449,597 | |

International Banks (5.3%) | | | | | |

Natexis Banques Populaires | | | | | |

5.31%, 5/1/07 | | 227,400 | | 227,400 | |

Skandinaviska Enskilda Banken | | | | | |

5.35%, 8/13/07 | | (a)20,000 | | 19,699 | |

Societe Generale North America, Inc. | | | | | |

5.32%, 5/1/07 | | 216,555 | | 216,555 | |

Swedbank Hypotek AB | | | | | |

5.30%, 9/21/07 | | 25,000 | | 24,488 | |

| | | | 488,142 | |

Investment Bankers/Brokers/Services (2.9%) | | | | | |

Bear Stearns Cos., Inc. | | | | | |

5.33%, 6/27/07 | | 20,000 | | 19,835 | |

5.38%, 6/28/07 - 8/6/07 | | 250,000 | | 250,000 | |

| | | | 269,835 | |

Total Commercial Paper (Cost $4,393,665) | | | | 4,393,665 | |

Corporate Notes (4.3%) | | | | | |

Asset Backed — Securities (1.6%) | | | | | |

Cullinan Finance Corp. | | | | | |

5.40%, 4/25/08 | | $ | (a)65,000 | | $ | 65,000 | |

Links Finance LLC | | | | | |

5.32%, 12/20/07 - 3/25/08 | | (a)(b)65,000 | | 64,994 | |

5.37%, 5/2/07 | | (a)15,000 | | 15,000 | |

| | | | 144,994 | |

Banking (0.9%) | | | | | |

American Immigration Lawyers Association | | | | | |

5.39%, 6/1/38 | | (b)3,600 | | 3,600 | |

Bank of America Corp. | | | | | |

5.30%, 12/27/07 | | 25,000 | | 25,000 | |

Charter Lakes Capital LLC | | | | | |

5.32%, 10/1/46 | | (b)6,150 | | 6,150 | |

Conestoga Wood Specialties Corp. | | | | | |

5.32%, 3/1/14 | | (b)9,210 | | 9,210 | |

Helmholdt Capital LLC | | | | | |

5.37%, 4/1/47 | | (b)9,000 | | 9,000 | |

Washington Road Properties & WR Partners LLC | | | | | |

5.39%, 12/1/26 | | (b)7,000 | | 7,000 | |

Woerner Holdings, Inc. | | | | | |

5.44%, 6/1/33 | | (b)17,840 | | 17,840 | |

| | | | 77,800 | |

International Banks (0.9%) | | | | | |

Australia & New Zealand Bank | | | | | |

5.32%, 12/21/07 | | (a)25,000 | | 25,000 | |

Royal Bank of Canada | | | | | |

5.31%, 3/1/12 | | (a)60,000 | | 60,000 | |

| | | | 85,000 | |

Investment Bankers/Brokers/Services (0.9%) | | | | | |

Goldman Sachs Group, Inc. | | | | | |

5.36%, 4/10/08 | | 50,000 | | 50,000 | |

Merrill Lynch & Co., Inc. | | | | | |

5.33%, 9/14/07 | | 30,000 | | 30,004 | |

| | | | 80,004 | |

Total Corporate Notes (Cost $387,798) | | | | 387,798 | |

Extendible Floating Rate Notes (13.0%) | | | | | |

Banking (0.4%) | | | | | |

Westpac Banking Corp. | | | | | |

5.30%, 12/6/11 | | (a)(b)35,000 | | 35,000 | |

Diversified Financial Services (1.2%) | | | | | |

General Electric Capital Corp. | | | | | |

5.45%, 6/16/07 - 10/17/07 | | (b)110,200 | | 110,186 | |

International Banks (10.5%) | | | | | |

Banque Federative Credit Mutuel | | | | | |

5.32%, 9/13/07 - 7/13/11 | | (a)(b)180,130 | | 180,130 | |

Caixa d’Estavlis | | | | | |

5.40%, 3/7/08 | | (a)(b)170,000 | | 170,000 | |

Caja de Ahorros y Monte de Piedad de Madrid | | | | | |

5.36%, 10/19/11 | | (b)120,000 | | 120,000 | |

The accompanying notes are an integral part of the financial statements.

11

2007 Semi-Annual Report | |

| |

April 30, 2007 (unaudited) | |

Portfolio of Investments (cont’d)

Money Market Portfolio

| | Face

Amount

(000) | | Value

(000) | |

International Banks (cont’d) | | | | | |

Commercial Bank Australia Ltd. | | | | | |

5.29%, 8/24/10 | | $ | (b)50,000 | | $ | 50,000 | |

Depfa Bank plc | | | | | |

5.31%, 9/21/07 | | (a)(b)30,000 | | 29,392 | |

5.39%, 6/15/09 | | (a)(b)59,000 | | 59,017 | |

Kommunalkredit A.G. | | | | | |

5.34%, 2/22/12 | | (a)(b)150,000 | | 150,000 | |

Royal Bank of Scotland plc | | | | | |

5.33%, 4/21/10 | | (a)(b)135,000 | | 135,000 | |

Societe Generale | | | | | |

5.31%, 2/29/08 - 11/2/10 | | (a)(b)75,000 | | 74,998 | |

| | | | 968,537 | |

Investment Bankers/Brokers/Services (0.9%) | | | | | |

Merrill Lynch & Co., Inc. | | | | | |

5.33%, 9/15/10 | | (b)50,000 | | 50,000 | |

5.57%, 7/11/07 | | (b)35,000 | | 35,000 | |

| | | | 85,000 | |

Total Extendible Floating Rate Notes (Cost $1,198,723) | | | | 1,198,723 | |

Floating Rate Notes (9.8%) | | | | | |

Asset Backed — Securities (7.4%) | | | | | |

Atlas Capital Funding Corp. | | | | | |

5.31%, 4/25/08 | | (a)(b)50,000 | | 50,000 | |

CC USA, Inc. | | | | | |

5.31%, 5/17/07 - 7/18/07 | | (a)(b)145,000 | | 144,998 | |

5.37%, 1/25/08 | | (a)(b)44,000 | | 44,012 | |

Cullinan Finance Corp. | | | | | |

5.32%, 9/28/07 - 4/28/08 | | (a)(b)202,000 | | 201,984 | |

Dorada Finance, Inc. | | | | | |

5.32%, 8/6/07 - 8/7/07 | | (a)(b)90,000 | | 89,998 | |

5.37%, 1/25/08 | | (a)(b)41,000 | | 41,012 | |

Links Finance LLC | | | | | |

5.32%, 4/24/08 | | (a)(b)50,000 | | 49,995 | |

5.33%, 8/8/07 | | (a)(b)60,000 | | 60,000 | |

| | | | 681,999 | |

Banking (1.6%) | | | | | |

Counts Trust | | | | | |

5.35%, 2/6/08 | | (a)(b)95,000 | | 95,000 | |

HSBC USA, Inc. | | | | | |

5.36%, 7/27/07 | | (b)25,000 | | 25,002 | |

Union Hamilton Special Funding LLC | | | | | |

5.35%, 6/15/07 | | (a)(b)28,000 | | 28,000 | |

| | | | 148,002 | |

Investment Bankers/Brokers/Services (0.8%) | | | | | |

Banc of America Corp. | | | | | |

5.39%, 2/20/49 | | (b)75,000 | | 75,000 | |

Total Floating Rate Notes (Cost $905,001) | | | | 905,001 | |

Municipal Bonds (0.6%) | | | | | |

Banking (0.6%) | | | | | |

Catholic University of America | | | | | |

5.46%, 4/1/34 | | $ | (b)25,000 | | $ | 25,000 | |

Urban Campus Environments LLC | | | | | |

5.32%, 10/1/25 | | (b)32,990 | | 32,990 | |

Total Municipal Bonds (Cost $57,990) | | | | 57,990 | |

Promissory Notes (3.2%) | | | | | |

Investment Bankers/Brokers/Services (3.2%) | | | | | |

Goldman Sachs Group, Inc. | | | | | |

5.37%, 12/14/07 | | 35,000 | | 35,000 | |

5.41%, 11/30/07 | | 100,000 | | 100,000 | |

5.43%, 8/9/07 | | 100,000 | | 100,000 | |

Merrill Lynch & Co., Inc. | | | | | |

5.36%, 12/28/07 | | 59,000 | | 59,000 | |

Total Promissory Notes (Cost $294,000) | | | | 294,000 | |

Time Deposits (9.2%) | | | | | |

International Banks (9.2%) | | | | | |

Dexia Credit Local | | | | | |

5.33%, 5/1/07 | | 400,000 | | 400,000 | |

National Bank of Canada | | | | | |

5.32%, 5/1/07 | | 450,000 | | 450,000 | |

Total Time Deposits (Cost $850,000) | | | | 850,000 | |

Repurchase Agreements (5.5%) | | | | | |

Bank of America Corp., 5.32%, dated 4/30/07, due 5/1/07, repurchase price $303,745; fully collateralized by discount commercial paper at the date of this Portfolio of Investments as follows: Alliance & Leicester, due 8/28/07; Avon Capital Corp., due 5/18/07; CBA de Finance, Inc., due 8/30/07; IBM Capital, due 5/24/07; MINT II LLC Securities Liquidation, due 5/11/07; Nelnet Student Association, due 5/24/07; Yorkshire Building, due 8/14/07, valued at $309,774. | | 303,700 | | 303,700 | |

Merrill Lynch & Co., Inc., 5.32%, dated 4/30/07, due 5/1/07, repurchase price $200,030; fully collateralized by discount commercial paper at the date of this Portfolio of Investments as follows: CentreStar Capital No. 1 LLC, due 7/16/07 to 7/25/07; Rhineland Funding Capital Corp., due 5/29/07, valued at $204,002. | | 200,000 | | 200,000 | |

Total Repurchase Agreements (Cost $503,700) | | | | 503,700 | |

Total Investments (100.5%) (Cost $9,260,836) | | | | 9,260,836 | |

Liabilities in Excess of Other Assets (-0.5%) | | | | (45,955 | ) |

Net Assets (100%) | | | | $ | 9,214,881 | |

The accompanying notes are an integral part of the financial statements.

12

| 2007 Semi-Annual Report |

| |

| April 30, 2007 (unaudited) |

Portfolio of Investments (cont’d)

Money Market Portfolio

(a) 144A Security — Certain conditions for public sale may exist. Unless otherwise noted, these securities are deemed to be liquid.

(b) Variable/Floating Rate Security — Interest rate changes on these instruments are based on changes in a designated base rate. The rates shown are those in effect on April 30, 2007.

(e) The rates shown are the effective yields at the date of purchase.

(f) Rate shown is the Yield to Maturity at April 30, 2007.

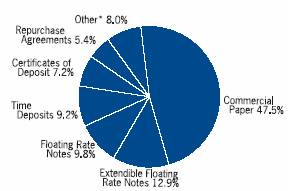

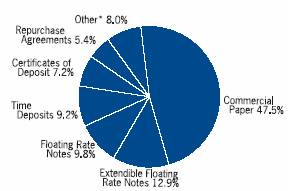

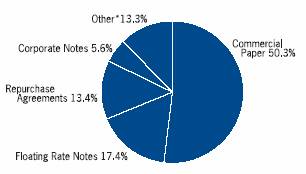

Graphic Presentation of Portfolio Holdings

The following graph depicts the Portfolio’s holdings by investment type, as a percentage of total investments.

* | Investment types which do not appear in the above graph, as well as those which represent less than 5% of total investments, if applicable, are included in the category labeled “Other”. |

The accompanying notes are an integral part of the financial statements.

13

2007 Semi-Annual Report |

|

April 30, 2007 (unaudited) |

Portfolio of Investments

Prime Portfolio

| | Face

Amount

(000) | | Value

(000) | |

Certificates of Deposit (3.4%) | | | | | |

Banking (3.4%) | | | | | |

Charter One Bank NA | | | | | |

5.33%, 5/29/07 | | $ | 150,000 | | $ | 150,000 | |

Citizens Bank | | | | | |

5.32%, 6/18/07 | | 215,000 | | 215,000 | |

HSBC Bank USA, Inc. | | | | | |

5.32%, 12/15/11 | | (b)130,000 | | 130,000 | |

Union Bank of California | | | | | |

5.33%, 8/3/07 | | 475,000 | | 475,000 | |

Total Certificates of Deposit (Cost $970,000) | | | | 970,000 | |

Commercial Paper (51.5%) (e) | | | | | |

Asset Backed — Consumer (3.8%) | | | | | |

Barton Capital Corp. | | | | | |

5.32%, 5/1/07 | | (a)52,153 | | 52,153 | |

Gemini Securitization Corp. | | | | | |

5.31%, 5/22/07 - 6/11/07 | | (a)104,750 | | 104,210 | |

Park Avenue Receivables Corp. | | | | | |

5.32%, 5/24/07 | | (a)278,066 | | 277,128 | |

Ranger Funding LLC | | | | | |

5.32%, 5/24/07 | | (a)150,000 | | 149,494 | |

Sheffield Receivables Corp. | | | | | |

5.32%, 6/11/07 | | (a)77,200 | | 76,739 | |

Thames Asset Global Securitization, Inc. | | | | | |

5.30%, 6/15/07 | | (a)40,000 | | 39,738 | |

5.31%, 5/8/07 - 6/26/07 | | (a)120,059 | | 119,651 | |

Three Rivers Funding LLC | | | | | |

5.31%, 6/28/07 | | (a)185,719 | | 184,148 | |

5.32%, 6/12/07 | | (a)77,057 | | 76,583 | |

| | | | 1,079,844 | |

Asset Backed — Corporate (17.9%) | | | | | |

Atlantis One Funding Corp. | | | | | |

5.34%, 8/23/07 | | (a)133,332 | | 131,136 | |

5.35%, 7/24/07 - 7/30/07 | | (a)210,920 | | 208,303 | |

Buckingham CDO LLC | | | | | |

5.31%, 5/24/07 - 5/25/07 | | (a)253,077 | | 252,213 | |

5.32%, 5/29/07 | | (a)22,500 | | 22,408 | |

Ciesco LLC | | | | | |

5.31%, 5/1/07 | | (a)302,100 | | 302,100 | |

Citius I Funding LLC | | | | | |

5.32%, 5/3/07 - 5/7/07 | | (a)157,001 | | 156,922 | |

5.34%, 5/18/07 | | (a)22,745 | | 22,688 | |

5.35%, 6/13/07 | | (a)148,428 | | 147,492 | |

Citius II Funding LLC | | | | | |

5.32%, 5/2/07 | | (a)41,750 | | 41,744 | |

5.34%, 6/4/07 - 6/26/07 | | (a)149,012 | | 147,854 | |

Corporate Asset Funding Co., Inc. | | | | | |

5.31%, 5/1/07 | | (a)200,000 | | 200,000 | |

Davis Square Funding IV Corp. | | | | | |

5.33%, 5/15/07 - 6/11/07 | | (a)200,000 | | 199,391 | |

5.34%, 6/11/07 | | (a)100,000 | | 99,398 | |

Davis Square Funding V Corp. | | | | | |

5.33%, 5/15/07 - 6/6/07 | | $ | (a)306,060 | | $ | 305,241 | |

Davis Square Funding VI Corp. | | | | | |

5.33%, 5/14/07 - 6/6/07 | | (a)245,000 | | 244,451 | |

5.34%, 6/11/07 | | (a)20,472 | | 20,349 | |

Kaiserplatz Funding LLC | | | | | |

5.32%, 7/26/07 | | (a)37,913 | | 37,438 | |

5.33%, 5/8/07 - 7/16/07 | | (a)1,351,907 | | 1,344,898 | |

Klio III Funding Corp. | | | | | |

5.32%, 6/5/07 | | (a)35,927 | | 35,744 | |

5.33%, 6/13/07 - 7/24/07 | | (a)117,070 | | 116,107 | |

Liberty Harbour II CDO LLC | | | | | |

5.33%, 7/13/07 | | (a)50,291 | | 49,754 | |

5.34%, 5/25/07 | | (a)80,506 | | 80,223 | |

Nieuw Amsterdam Receivables Corp. | | | | | |

5.31%, 5/15/07 - 6/12/07 | | (a)228,404 | | 227,439 | |

5.32%, 5/11/07 | | (a)140,834 | | 140,627 | |

North Sea Funding LLC | | | | | |

5.32%, 6/21/07 | | (a)13,151 | | 13,053 | |

Pasa Funding Ltd. | | | | | |

5.35%, 6/21/07 - 7/20/07 | | (a)290,905 | | 288,049 | |

Simba Funding Corp. | | | | | |

5.31%, 6/18/07 | | (a)100,000 | | 99,300 | |

Variable Funding Co. LLC | | | | | |

5.30%, 5/4/07 | | (a)100,000 | | 99,955 | |

| | | | 5,034,277 | |

Asset Backed — Diversified (2.0%) | | | | | |

Atlantic Asset Securitization Corp. | | | | | |

5.31%, 6/12/07 | | (a)80,712 | | 80,216 | |

5.32%, 5/1/07 - 6/26/07 | | (a)155,274 | | 154,940 | |

Falcon Asset Securitization Co. LLC | | | | | |

5.32%, 5/24/07 | | (a)66,633 | | 66,408 | |

5.33%, 5/1/07 | | (a)183,239 | | 183,239 | |

Jupiter Securitization Co. LLC | | | | | |

5.33%, 5/1/07 | | (a)83,469 | | 83,469 | |

| | | | 568,272 | |

Asset Backed — Mortgage (2.0%) | | | | | |

Sydney Capital Corp. | | | | | |

5.31%, 6/14/07 - 6/20/07 | | (a)177,740 | | 176,547 | |

5.32%, 5/14/07 - 6/19/07 | | (a)259,580 | | 258,594 | |

5.33%, 5/4/07 - 7/16/07 | | (a)121,690 | | 120,872 | |

| | | | 556,013 | |

Asset Backed — Securities (16.9%) | | | | | |

Amstel Funding Corp. | | | | | |

5.32%, 5/21/07 - 6/29/07 | | (a)229,000 | | 227,902 | |

5.33%, 6/13/07 | | (a)118,563 | | 117,828 | |

5.34%, 5/11/07 | | (a)165,000 | | 164,761 | |

5.35%, 5/9/07 | | (a)75,000 | | 74,913 | |

Atlas Capital Funding Corp. | | | | | |

5.29%, 9/19/07 - 9/28/07 | | (a)250,000 | | 244,758 | |

5.30%, 7/12/07 | | (a)64,000 | | 63,333 | |

5.31%, 6/29/07 | | (a)75,000 | | 74,355 | |

5.32%, 6/12/07 | | (a)200,000 | | 198,775 | |

The accompanying notes are an integral part of the financial statements.

14

| 2007 Semi-Annual Report |

| |

| April 30, 2007 (unaudited) |

Portfolio of Investments (cont’d)

Prime Portfolio

| | Face | | | |

| | Amount | | Value | |

| | (000) | | (000) | |

Asset Backed — Securities (cont’d) | | | | | |

5.33%, 9/7/07 - 9/12/07 | | $ | (a)225,000 | | $ | 220,727 | |

5.34%, 8/7/07 | | (a)48,000 | | 47,319 | |

Beethoven Funding Corp. | | | | | |

5.31%, 6/20/07 | | (a)23,386 | | 23,215 | |

5.33%, 7/20/07 | | (a)75,000 | | 74,123 | |

Beta Finance, Inc. | | | | | |

5.30%, 6/15/07 | | (a)80,000 | | 79,484 | |

5.32%, 7/10/07 | | (a)50,000 | | 49,496 | |

Cancara Asset Securitization LLC | | | | | |

5.31%, 6/14/07 | | (a)39,154 | | 38,903 | |

5.32%, 6/28/07 - 6/29/07 | | (a)223,269 | | 221,363 | |

Curzon Funding LLC | | | | | |

5.32%, 6/29/07 - 7/10/07 | | (a)290,000 | | 287,329 | |

5.34%, 5/17/07 | | (a)110,000 | | 109,746 | |

5.35%, 5/8/07 - 8/8/07 | | (a)110,000 | | 108,757 | |

Dorada Finance, Inc. | | | | | |

5.35%, 5/8/07 | | (a)35,500 | | 35,464 | |

Giro Funding U.S. Corp. | | | | | |

5.30%, 5/4/07 | | 98,015 | | 97,972 | |

5.32%, 5/31/07 - 6/5/07 | | (a)400,000 | | 398,127 | |

5.34%, 7/20/07 | | 125,000 | | 123,536 | |

Grampian Funding LLC | | | | | |

5.30%, 6/25/07 | | (a)65,000 | | 64,481 | |

5.31%, 7/16/07 - 9/12/07 | | (a)275,000 | | 270,310 | |

5.32%, 7/11/07 | | (a)34,000 | | 33,799 | |

5.33%, 6/15/07 | | (a)203,000 | | 201,683 | |

5.34%, 5/16/07 | | (a)100,000 | | 99,783 | |

5.35%, 7/20/07 - 8/3/07 | | (a)526,000 | | 519,134 | |

Scaldis Capital LLC | | | | | |

5.31%, 6/15/07 | | (a)31,880 | | 31,671 | |

5.33%, 7/10/07 - 9/11/07 | | (a)86,009 | | 84,640 | |

5.34%, 7/13/07 | | (a)60,000 | | 59,367 | |

Solitaire Funding LLC | | | | | |

5.32%, 6/27/07 | | (a)150,000 | | 148,753 | |

5.35%, 7/23/07 | | (a)120,000 | | 118,559 | |

| | | | 4,714,366 | |

Banking (6.2%) | | | | | |

Bank of America Corp. | | | | | |

5.32%, 6/11/07 | | 115,000 | | 114,319 | |

Citigroup Funding, Inc. | | | | | |

5.31%, 6/27/07 | | 95,000 | | 94,211 | |

5.32%, 6/8/07 | | (a)200,000 | | 198,891 | |

5.32%, 6/22/07 - 7/25/07 | | 90,000 | | 88,982 | |

5.33%, 6/12/07 - 7/30/07 | | 270,000 | | 267,857 | |

5.34%, 5/23/07 - 8/15/07 | | 640,000 | | 637,196 | |

HSBC Bank USA, Inc. | | | | | |

5.31%, 6/15/07 | | 150,000 | | 149,016 | |

5.35%, 7/24/07 - 8/8/07 | | 200,000 | | 197,395 | |

| | | | 1,747,867 | |

Diversified Financial Services (1.0%) | | | | | |

General Electric Capital Corp. | | | | | |

5.30%, 6/29/07 | | 205,000 | | 203,263 | |

Nestle Capital Corp. | | | | | |

5.46%, 7/30/07 - 7/31/07 | | $ | (a)85,000 | | $ | 83,892 | |

| | | | 287,155 | |

Insurance (0.4%) | | | | | |

Allianz Finance Corp. | | | | | |

5.32%, 6/22/07 | | (a)100,000 | | 99,242 | |

Investment Bankers/Brokers/Services (1.3%) | | | | | |

Bear Stearns Co. Inc, | | | | | |

5.32%, 6/28/07 | | 300,000 | | 300,000 | |

5.33%, 6/27/07 | | 65,000 | | 64,465 | |

| | | | 364,465 | |

Total Commercial Paper (Cost $14,451,501) | | | | 14,451,501 | |

Corporate Notes (5.6%) | | | | | |

Asset Backed — Securities (1.2%) | | | | | |

Cullinan Finance Corp. | | | | | |

5.40%, 4/25/08 | | (a)185,000 | | 185,000 | |

5.45%, 2/1/08 | | (a)79,000 | | 79,000 | |

Links Finance LLC | | | | | |

5.37%, 5/2/07 | | (a)65,000 | | 65,000 | |

| | | | 329,000 | |

Banking (2.1%) | | | | | |

Bank of America Corp. | | | | | |

5.30%, 12/27/07 | | 150,000 | | 150,000 | |

5.36%, 2/8/08 | | 300,000 | | 300,000 | |

Wells Fargo Bank NA | | | | | |

5.30%, 5/8/07 | | 140,000 | | 140,000 | |

| | | | 590,000 | |

Diversified Financial Services (0.4%) | | | | | |

General Electric Capital Corp. | | | | | |

5.45%, 10/17/07 | | 125,000 | | 125,000 | |

Investment Bankers/Brokers/Services (1.9%) | | | | | |

Goldman Sachs Group, Inc. | | | | | |

5.35%, 11/30/07 | | 275,000 | | 275,000 | |

5.39%, 12/17/07 | | 250,000 | | 250,000 | |

| | | | 525,000 | |

Total Corporate Notes (Cost $1,569,000) | | | | 1,569,000 | |

Extendible Floating Rate Notes (2.5%) | | | | | |

Banking (0.5%) | | | | | |

Fifth Third Bancorp. | | | | | |

5.32%, 11/23/09 | | (a)(b)150,000 | | 150,000 | |

Diversified Financial Services (1.0%) | | | | | |

General Electric Capital Corp. | | | | | |

5.45%, 7/9/07 | | (b)275,000 | | 275,025 | |

Investment Bankers/Brokers/Services (1.0%) | | | | | |

Merrill Lynch & Co., Inc. | | | | | |

5.33%, 9/14/07 - 9/15/10 | | (b)215,000 | | 215,005 | |

5.57%, 7/11/07 | | (b)75,000 | | 75,000 | |

| | | | 290,005 | |

Total Extendible Floating Rate Notes (Cost $715,030) | | | | 715,030 | |

The accompanying notes are an integral part of the financial statements.

15

2007 Semi-Annual Report | |

| |

April 30, 2007 (unaudited) | |

Portfolio of Investments (cont’d)

Prime Portfolio

| | Face | | | |

| | Amount | | Value | |

| | (000) | | (000) | |

Floating Rate Notes (17.4%) | | | | | |

Asset Backed — Securities (8.2%) | | | | | |

Beta Finance, Inc. | | | | | |

5.34%, 4/11/08 | | $ | (b)50,000 | | $ | 50,009 | |

CC USA, Inc. | | | | | |

5.31%, 5/18/07 - 7/18/07 | | (a)(b)380,000 | | 379,989 | |

Cullinan Finance Corp. | | | | | |

5.28%, 9/17/07 | | (a)(b)250,000 | | 249,986 | |

5.32%, 9/28/07 - 1/23/08 | | (a)(b)670,000 | | 669,959 | |

Dorada Finance, Inc. | | | | | |

5.31%, 5/25/07 | | (a)(b)100,000 | | 99,999 | |

5.32%, 8/7/07 | | (a)(b)110,000 | | 109,997 | |

Links Finance LLC | | | | | |

5.31%, 3/31/08 | | (a)(b)150,000 | | 149,986 | |

5.32%, 7/12/07 - 4/24/08 | | (a)(b)385,000 | | 384,973 | |

5.33%, 8/8/07 - 10/9/07 | | (a)(b)115,000 | | 114,997 | |

5.35%, 5/25/07 | | (a)(b)100,000 | | 99,999 | |

| | | | 2,309,894 | |

Banking (2.5%) | | | | | |

HSBC Bank USA, Inc. | | | | | |

5.36%, 7/27/07 | | (b)70,950 | | 70,956 | |

U.S. Trust Co. of New York | | | | | |

5.31%, 7/13/07 | | (b)90,000 | | 90,000 | |

Union Hamilton Special Funding LLC | | | | | |

5.35%, 6/15/07 | | (a)(b)170,000 | | 170,000 | |

Wachovia Bank NA | | | | | |

5.31%, 11/30/07 | | (b)27,000 | | 27,002 | |

5.34%, 9/28/07 | | (b)40,000 | | 40,004 | |

5.36%, 5/22/07 | | (b)85,100 | | 85,100 | |

5.40%, 11/30/07 | | (b)225,000 | | 225,058 | |

| | | | 708,120 | |

Finance - Automotive (1.8%) | | | | | |

American Honda Finance Corp. | | | | | |

5.33%, 4/14/08 | | (a)(b)140,000 | | 140,000 | |

Toyota Motor Credit Corp. | | | | | |

5.32%, 6/28/07 - 5/12/08 | | (b)250,000 | | 250,004 | |

5.33%, 8/3/07 | | (b)125,000 | | 125,004 | |

| | | | 515,008 | |

Insurance (0.7%) | | | | | |

AIG Matched Funding Corp. | | | | | |

5.32%, 1/9/08 | | (b)200,000 | | 200,000 | |

Investment Bankers/Brokers/Services (4.2%) | | | | | |

Banc of America Corp. | | | | | |

5.39%, 2/20/49 | | (b)273,500 | | 273,500 | |

JPMorgan Chase & Co. | | | | | |

5.30%, 4/11/12 | | (b)75,000 | | 75,000 | |

Lehman Brothers Holdings, Inc. | | | | | |

5.36%, 5/7/07 | | (b)100,000 | | 100,000 | |

5.37%, 5/31/07 | | (b)110,000 | | 110,006 | |

Merrill Lynch & Co., Inc. | | | | | |

5.33%, 5/29/07 | | $ | (b)90,000 | | $ | 89,997 | |

5.36%, 5/29/07 | | (b)365,000 | | 364,998 | |

5.44%, 7/6/07 | | (b)150,000 | | 150,019 | |

| | | | 1,163,520 | |

Total Floating Rate Notes (Cost $4,896,542) | | | | 4,896,542 | |

Promissory Notes (3.3%) | | | | | |

Investment Bankers/Brokers/Services (3.3%) | | | | | |

Goldman Sachs Group, Inc. | | | | | |

5.36%, 4/10/08 | | 175,000 | | 175,000 | |

5.37%, 12/14/07 - 2/29/08 | | 365,000 | | 365,000 | |

5.43%, 8/9/07 | | 150,000 | | 150,000 | |

Merrill Lynch & Co., Inc. | | | | | |

5.36%, 12/28/07 | | (b)241,000 | | 241,000 | |

Total Promissory Notes (Cost $931,000) | | | | 931,000 | |

Time Deposits (3.0%) | | | | | |

Banking (3.0%) | | | | | |

Regions Bank/Birmingham AL | | | | | |

5.28%, 5/1/07 | | 600,000 | | 600,000 | |

Suntrust Bank | | | | | |

5.25%, 5/1/07 | | 240,760 | | 240,760 | |

Total Time Deposits (Cost $840,760) | | | | 840,760 | |

Repurchase Agreements (13.4%) | | | | | |

Banc of America Securities LLC, 5.32%, dated 4/30/07, due 5/1/07, repurchase price $696,403; fully collateralized by discount commercial paper at the date of this Portfolio of Investments as follows: Abbot Lab., due 5/2/07; Alcoa, Inc., due 8/13/07; Aluminum Co. of America, due 8/13/07; American Honda Finance Corp., due 6/1/07 to 6/12/07; Aquifer Funding, due 5/3/07; ASB Finance Ltd., due 5/22/07; Aspen Funding Corp., due 5/21/07 to 8/13/07; Autobahn Funding, due 5/1/07 to 5/31/07; Avon Capital Corp., due 5/7/07; Barclays Funding, due 8/21/07; Berkeley SQ Funding, due 5/10/07; Broadhollow Funding, due 5/1/07 to 5/22/07; Caisse Nationale d’Epargne et de Provoyance, due 7/23/07; Calyon North America, Inc., due 5/16/07 to 6/11/07; Catapult Pmx Funding, due 5/3/07 to 5/25/07; Cedar Spring Capital Co., due 6/11/07 to 7/23/07; Centrica plc, due 5/11/07 to 6/4/07; Coca Cola Enterprise, Inc., due 5/3/07 to 5/4/07; Corporate Asset Funding Corp., due 5/8/07; County of Wake, North Carolina, due 5/2/07; Deer Valley Funding LLC, due 5/18/07; DNB NOR Bank ASA, | | | | | |

The accompanying notes are an integral part of the financial statements.

16

| 2007 Semi-Annual Report |

| |

| April 30, 2007 (unaudited) |

Portfolio of Investments (cont’d)

Prime Portfolio

| | Face | | | |

| | Amount | | Value | |

| | (000) | | (000) | |

due 6/5/07 to 6/6/07; Depfa Bank plc, due 7/10/07; Delaware Group, due 6/28/07; Eaton Corp., due 6/1/07 to 6/14/07; Ebury Finance LLC, due 6/4/07; Emerson Electric Corp., due 5/14/07; Fenway Funding LLC, due 5/22/07; Foxboro, due 5/4/07; FPL Group Capital, due 5/9/07 to 5/10/07; Freedom Park Capital LLC, due 6/4/07 to 6/25/07; General Electric Capital Corp., due 6/8/07; Genworth Financial, Inc., due 5/24/07; Halkin Finance, due 7/3/07; HBOS Treasury Services plc, due 6/18/07 to 7/20/07; Honeywell International, due 11/20/07; ING Funding LLC, due 5/14/07 to 6/4/07; Intesa Funding LLC, due 5/7/07 to 5/31/07; Liquid Funding, Ltd., due 8/20/07 to 9/6/07; Luminent STR Funding, due 5/8/07; McKinley Funding Ltd., due 5/18/07; McKinley II Funding Ltd., due 5/21/07 to 5/29/07; McKinley Funding Corp., due 5/29/07; McKinley Funding, Ltd., due 7/19/07; Melnet Student, due 7/25/07; Mint II Securitization LLC, due 5/30/07; Mitsui Co., due 7/26/07; Mortgage Interest Network, due 5/2/07; Natixis Corp., due 6/5/07; New Center Asset Trust, due 7/11/07; North Sea Funding, due 5/25/07 to 7/19/07; Northwestern University, due 6/6/07; Old Line Funding, due 5/23/07; Oracle Corp., due 7/12/07; Paccar Financial Corp., due 5/7/07; Parker Finance Corp., due 5/10/07; Raiffeisen Zentralbank Oesterreich A.G., due 7/31/07; Ranger Funding LLC, due 6/1/07 to 6/11/07; Societe Generale, Inc., due 5/8/07 to 8/7/07; Southern Colorado Funding Corp., due 5/3/07 to 5/21/07; Statens Finance, due 5/14/07; Swedbank Hypotek AB, due 5/2/07 to 6/21/07; Ticonderoga Funding LLC, due 5/17/07 to 5/24/07, UBS Finance LLC, due 5/11/07 to 6/25/07; Voyager Funding, due 5/1/07; Westpac Banking Corp., due 5/1/07 to 7/12/07; Xtra, Inc., due 5/15/07 to 5/17/07; Yorkshire Building Soc., due 7/16/07; Yorktown Capital LLC, due 5/15/07; valued at $710,226. | | $ | 696,300 | | $ | 696,300 | |

Credit Suisse First Boston 5.31%, dated 4/30/07, due 5/1/07, repurchase price $500,074; fully collateralized by discount commercial paper and U.S. government securities at the date of this Portfolio of Investments as follows: Alcon Capital Corp., due 5/10/07 to 5/21/07; Alpine Securitization Corp., due 5/1/07 to 5/31/07; Aquinas Funding LLC, due 5/24/07 to 5/30/07; ASB Finance, Ltd. due 5/8/07 to 8/2/07; Atlantis One Funding, due 5/1/07 to 8/13/07; Axon Financial Funding LLC, due 6/25/07; Carrera Capital Finance, due 5/7/07 to 5/18/07; CBA Financial, due 9/28/07; Ciesco LLC, due 5/14/07 to 5/21/07; Corporate Asset Funding Co., Inc., due 5/23/07 to 6/25/07; Eaton LLC, due 5/3/07 to 8/21/07; EVVLF LLC, due 5/1/07 to 7/23/07; ING America Insurance Holdings, due 5/7/07; Ixis Commercial Paper, due 5/2/07 to 8/27/07; Federal Home Loan Mortgage Corp., Gold Pool, Adjustable Rate Mortgage: 5.09% to 5.84%, due 7/1/34 to 4/1/37; Federal National Mortgage Association, Adjustable Rate Mortgage: 6.05%, due 10/1/33; GE2, due 5/14/07; General Electric Capital Corp., due 1/26/11 to 2/15/17; Mitten Residential, due 5/2/07; Natexis Commercial Paper Corp., due 6/5/07; Old Line Funding LLC, due 5/15/07; Santander Central Hispano, Inc., due 5/14/07; Sigma Finance Inc., due 7/25/07; Stanfield Victoria Funding, due 6/1/07; Swedish National Housing, due 5/14/07; Times Square Funding, due 7/20/07; valued at $510,003. | | $ | 500,000 | | $ | 500,000 | |

Deutsche Bank Securities, Inc., 5.31%, dated 4/30/07, due 5/1/07, repurchase price $500,074; fully collateralized by discount commercial paper at the date of this Portfolio of Investments as follows: Austria Corp., due 5/14/07; Air Products & Chemistry, due 5/14/07 to 5/15/07; BASF Aktiengesellschaft, due 6/12/07; Belmont Funding LLC, due 5/25/07; Berkeley Square Finance, due 5/1/07 to 5/10/07; Britannia Building Soc., due 7/25/07; Deutsche Bank A.G., due 5/3/07; Ebury Finance LLC, due 7/5/07; Fox Tror CDO, Ltd., due 7/12/07; Gemini Securitization Corp., due 5/22/07 to 6/13/07; Giro Balanced Funding Corp., due 5/7/07; Henkel Corp., due 6/19/07; Johnson & Johnson, due 5/23/07; Keel Capital, Inc., due 5/9/07 to 5/10/07; KFW International Finance, due 5/4/07; Lake Con Funding, due 5/3/07; Long Lane Master Trust IV, due 5/17/07; Mica Funding LLC, due 5/15/07; | | | | | |

The accompanying notes are an integral part of the financial statements.

17

2007 Semi-Annual Report | |

| |

April 30, 2007 (unaudited) | |

Portfolio of Investments (cont’d)

Prime Portfolio

| | Face | | | |

| | Amount | | Value | |

| | (000) | | (000) | |

Prudential plc, due 7/11/07; Rhein Main, due 5/4/07 to 10/1/07; Rheingold Securitization, Ltd., due 5/4/07 to 9/4/07; Stanfield Victoria Funding LLC, due 7/25/07; Transamerica Asset, due 5/8/07; St. Germain Holdings, due 5/4/07 to 5/24/07; TSL USA, Inc., due 5/14/07 to 7/26/07; Versailles CDS LLC, due 5/7/07 to 5/24/07, valued at $510,000. | | $ | 500,000 | | $ | 500,000 | |

Goldman Sachs Group, Inc., 5.31%, dated 4/30/07, due 5/1/07, repurchase price $280,041; fully collateralized by discount commercial paper at the date of this Portfolio of Investments as follows: Air Liquide U.S. LLC, due 5/16/07; ING Funding Corp., due 7/31/07; Nestle Capital Corp., due 6/4/07; Netjets, Inc., due 5/1/07; Pitney Bowes, Inc., due 5/21/07; Sheffield Receivables Corp., due 5/8/07, valued at $285,600. | | 280,000 | | 280,000 | |

J.P. Morgan Securities, 5.32% dated 4/30/07, due 5/1/07, repurchase price $900,133; fully collateralized by discount commercial paper at the date of this Portfolio of Investments as follows: Abbington Square, due 5/9/07 to 7/6/07; Alcoa, Inc., due 7/25/07; Black Diamond Funding, due 5/1/07 to 7/26/07; BMW U.S. Capital, due 5/21/07; Conoco Phillips, due 5/2/07; Deer Valley Funding, due 5/18/07 to 6/4/07; Fenway Funding, due 5/31/07; Hypo Real Estate, due 5/10/07; Jupiter Securitization Co., due 5/25/07; New Center Asset Trust, due 10/17/07; Nieuw Amsterdam Receivables Corp., due 5/31/07; Park Avenue Receivables Corp., due 5/21/07 to 5/24/07; Raiffeisen Zentralba, due 7/31/07; Thunder Bay DTC, due 5/31/07; Verizon Communications, due 5/29/07 to 6/6/07; Zane Funding LLC, due 5/14/07 to 5/24/07, valued at $918,005. | | 900,000 | | 900,000 | |

Lehman Brothers, Inc., 5.31%, dated 4/30/07, due 5/1/07, repurchase price $400,059; fully collateralized by discount commercial paper at the date of this Portfolio of Investments as follows: Alliance & Leicester plc, due 8/28/07; American General Capital LLC, due 8/15/07 to 11/15/07; Amsterdam Funding Corp., due 5/25/07 to 6/4/07; Anglesea Funding plc, due 5/8/07 to 10/16/07; Bavaria Universal Funding, due 6/12/07 to 7/26/07; Belmont Funding LLC, due 5/1/07; Brown-Forman Corp., due 5/7/07; Catapult Communications Corp., due 5/3/07; Cintas Executive Services, Inc., due 5/1/07; Coral, Inc., due 5/15/07; East-Fleet Finance Ltd., due 5/10/07; Erste Finance LLC, due 7/30/07; FLP Group Capital, Inc., due 5/16/07; Fairway Finance Corp., due 5/1/07 to 6/8/07; Fenway Funding LLC, due 5/1/07 to 5/3/07; Gannett Co., Inc., due 5/7/07; Gotham Funding, due 5/3/07; Hannover Funding Co., LLC due 5/15/07 to 6/7/07; Hewlett-Packard Co., due 5/11/07 to 5/15/07; Intesa Funding LLC, due 5/9/07 to 6/15/07; Jupiter Securitization Co., LLC, due 5/25/07; Koch Industries, due 5/10/07; Koch Resources LLC, due 5/11/07; Mica Funding LLC, due 5/1/07 to 5/14/07; Midamerican Energy Co., due 5/1/07; National Rural Utilities Cooperative Finance Corp., due 5/3/07; Nieuw Amsterdam Receivables Corp., due 5/4/07 to 7/25/07; Northern Rock plc, due 5/23/07; Public Service Co., due 5/31/07; SBLI USA Mutual Life Insurance Co., Inc., due 5/31/07; Silver Tower U.S. Funding, 6/8/07; Skandinaviska Enskilda Banken AB, due 6/29/07 to 1/25/08; Southern Co. Funding Corp., due 5/1/07 to 5/29/07; Swedbank AB, due 5/7/07 to 5/8/07; Swedbank Hypotek AB, due 6/5/07 to 6/21/07; Versailles CDS LLC, due 5/9/07 to 5/14/07, valued at $408,002. | | $ | 400,000 | | $ | 400,000 | |

Merrill Lynch & Co., Inc., 5.32%, dated 4/30/07, due 5/1/07, repurchase price $350,052; fully collateralized by discount commercial paper at the date of this Portfolio of Investments as follows: 7-Eleven, due 5/1/07 to 5/15/07; Athos Fund (The), due 5/31/07; Axon Financial Funding LLC, due 6/18/07 to 10/23/07; Barton Capital Corp., due 5/9/07 to 5/23/07; BNP Paribas, due 5/11/07; Carrera Capital Finance LLC, due 5/2/07; Cooperative Association TRA, due 5/25/07; Davenport CDO, due 5/2/07; Depfa Bank plc, due 6/8/07; Five Finance, Inc., due 7/16/07; General Electric Capital Corp., due 5/4/07 to 5/7/07; George Street Finance LLC, due 5/29/07; Golden Key Ltd., due 7/16/07 to 7/25/07; Greyhawk Funding LLC, due 5/8/07 | | | | | |

The accompanying notes are an integral part of the financial statements.

18

| 2007 Semi-Annual Report |

| |

| April 30, 2007 (unaudited) |

Portfolio of Investments (cont’d)

Prime Portfolio

| | Face | | | |

| | Amount | | Value | |

| | (000) | | (000) | |

to 6/5/07; HBOS Treasury Services plc, due 5/1/07 to 7/19/07; Hudson-Thames Capital, due 5/25/07; Klio III Funding Corp., due 7/11/07; Liberty CDO, due 5/18/07; Medtronic, Inc., due 5/21/07; Natixis, due 5/7/07; Nestle Capital Corp., due 5/15/07 to 6/14/07; NYSE Euronext, due 5/14/07 to 7/10/07; Old Line Funding LLC, due 5/15/07; Raffles Holdings Ltd., due 5/29/07; Ranger Funding Corp., due 5/16/07; SBA Bancorp, Inc., due 5/10/07; Southeast Corp. Federal Credit Union, due 5/15/07 to 5/25/07; Svenska Handelsbanken AB, due 5/9/07; Sydney Capital Corp., due 5/29/07 to 5/30/07; Tasman Funding, Inc., due 5/7/07; Ticonderoga Capital, due 6/1/07; Transamerica Asset Funding Corp., due 5/17/07; UBS Americas, Inc., due 5/1/07; UBS Finance Delaware LLC, due 5/1/07 to 7/19/07; Westpac Banking Corp., due 10/15/07; Westpac Securities NZ Ltd., due 10/18/07; White Pine Finance LLC, due 5/15/07 to 5/23/07; Windmill Funding I Corp., due 6/13/07; Yorktown Capital LLC, due 5/30/07, valued at $357,004. | | $ | 350,000 | | $ | 350,000 | |

Wachovia Capital Market LLC, 5.36%, dated 4/30/07, due 5/1/07, repurchase price $150,022; fully collateralized by discount commercial paper at the date of this Portfolio of Investments as follows: Air Products & Chemistry, due 5/3/07; Atlas Capital Funding Corp., due 7/5/07; Kaiserplatz Funding LLC, due 5/30/07; MICA Funding LLC, due 5/25/07 valued at $153,000. | | 150,000 | | 150,000 | |

Total Repurchase Agreements (Cost $3,776,300) | | | | 3,776,300 | |

Total Investments (100.1%) (Cost $28,150,133) | | | | 28,150,133 | |

Liabilities in Excess of Other Assets (-0.1%) | | | | (28,111 | ) |

Net Assets (100%) | | | | $ | 28,122,022 | |

| | | | | | | |

(a) 144A Security — Certain conditions for public sale may exist. Unless otherwise noted, these securities are deemed to be liquid.

(b) Variable/Floating Rate Security — Interest rate changes on these instruments are based on changes in a designated base rate. The rates shown are those in effect on April 30, 2007.

(e) The rates shown are the effective yields at the date of purchase.

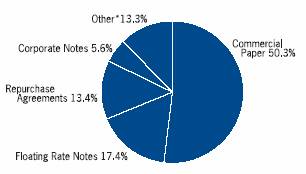

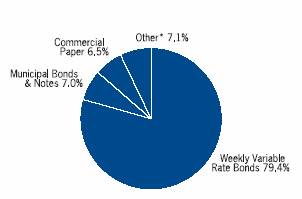

Graphic Presentation of Portfolio Holdings

The following graph depicts the Portfolio’s holdings by investment type, as a percentage of total investments.

* | Investment types which do not appear in the above graph, as well as those which represent less than 5% of total investments, if applicable, are included in the category labeled “Other”. |

The accompanying notes are an integral part of the financial statements.

19

2007 Semi-Annual Report |

|

April 30, 2007 (unaudited) |

Portfolio of Investments

Government Portfolio

| | Face | | | |

| | Amount | | Value | |

| | (000) | | (000) | |

U.S. Government & Agency Securities (17.8%) | | | | | |

Federal Farm Credit Bank | | | | | |

5.23%, 6/16/08 | | $ | (b)40,000 | | $ | 39,987 | |

Federal Home Loan Bank | | | | | |

3.25%, 12/17/07 | | 2,100 | | 2,074 | |

3.75%, 5/15/07 | | 5,000 | | 4,997 | |

4.00%, 6/13/07 - 7/13/07 | | 6,500 | | 6,489 | |

4.13%, 7/20/07 | | 3,100 | | 3,092 | |

5.18%, 6/18/08 | | (b)30,000 | | 29,985 | |

5.19%, 1/10/08 - 4/10/08 | | (b)55,000 | | 54,978 | |

5.22%, 8/10/07 | | (b)10,000 | | 9,999 | |

5.30%, 11/19/07 - 3/19/08 | | 64,000 | | 64,000 | |

5.38%, 4/18/08 | | 15,000 | | 15,000 | |

5.40%, 2/25/08 | | 10,000 | | 10,000 | |

Federal Home Loan Mortgage Corp. | | | | | |

2.88%, 5/15/07 | | 3,210 | | 3,207 | |

3.00%, 7/27/07 | | 20,000 | | 19,894 | |

4.50%, 5/17/07 | | (b)4,359 | | 4,358 | |

5.04%, 5/29/07 | | (d)23,000 | | 22,910 | |

5.05%, 5/4/07 | | (d)1,410 | | 1,409 | |

5.07%, 8/3/07 | | (d)13,900 | | 13,719 | |

5.10%, 6/22/07 | | (d)7,000 | | 6,949 | |

5.13%, 8/20/07 | | (d)7,541 | | 7,424 | |

5.16%, 9/21/07 | | (d)9,500 | | 9,309 | |

5.20%, 11/30/07 - 12/11/07 | | (d)24,000 | | 23,278 | |

5.21%, 10/16/07 | | (d)2,000 | | 1,952 | |

5.22%, 6/22/07 - 7/6/07 | | (b)75,000 | | 74,996 | |

5.35%, 3/26/08 | | 20,000 | | 20,000 | |

Federal National Mortgage Association | | | | | |

2.75%, 7/23/07 | | 10,750 | | 10,689 | |

3.25%, 5/11/07 | | 5,000 | | 4,997 | |

3.88%, 5/15/07 | | 4,000 | | 3,998 | |

4.25%, 9/15/07 | | 4,912 | | 4,892 | |

4.75%, 8/3/07 | | 3,185 | | 3,181 | |

5.04%, 5/2/07 | | (d)5,817 | | 5,816 | |

5.05%, 5/8/07 | | (d)7,000 | | 6,993 | |

5.09%, 6/29/07 | | (d)15,900 | | 15,769 | |

5.15%, 8/22/07 | | (d)10,000 | | 9,841 | |

5.15%, 9/21/07 | | 1,750 | | 1,750 | |

5.17%, 8/29/07 - 11/30/07 | | (d)26,157 | | 25,531 | |

5.19%, 12/28/07 | | (d)5,000 | | 4,832 | |

5.20%, 10/5/07 | | (d)13,377 | | 13,081 | |

6.63%, 10/15/07 | | 2,280 | | 2,294 | |

Total U.S. Government & Agency Securities (Cost $563,670) | | | | 563,670 | |

| | | | | |

Repurchase Agreements (82.1%) | | | | | |

Barclays Inc., 5.24%, dated 4/30/07, due 5/1/07, repurchase price $384,056; fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: Federal Home Loan Mortgage Corp., Gold Pools: 5.00% to 6.00%, due 5/1/33 to 3/1/37; Federal National Mortgage Association, Fixed Rate Mortgages: 5.00% to 6.00%, due 2/1/35 to 3/1/37, valued at $391,680. | | $ | 384,000 | | $ | 384,000 | |

Barclays Inc., 5.26%, dated 3/26/07, due 7/24/07, repurchase price $40,701; fully collateralized by a U.S. government security at the date of this Portfolio of Investments as follows: Federal National Mortgage Association, Adjustable Rate Mortgage: 5.93%, due 11/1/36, valued at $40,800. | | 40,000 | | 40,000 | |

Barclays Inc., 5.27%, dated 3/27/07, due 7/25/07, repurchase price $20,351; fully collateralized by a U.S. government security at the date of this Portfolio of Investments as follows: Federal Home Loan Mortgage Corp., Adjustable Rate Mortgage: 5.07%, due 12/1/35, valued at $20,400. | | 20,000 | | 20,000 | |

Bear Stearns Cos., Inc., 5.24%, dated 4/30/07, due 5/1/07, repurchase price $585,085; fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: Federal Home Loan Mortgage Corp., Gold Pools: 5.00% to 6.00%, due 9/1/35 to 2/1/37; Federal National Mortgage Association, Fixed Rate Mortgages: 4.00% to 7.00%, due 11/1/08 to 4/1/37, valued at $596,703. | | 585,000 | | 585,000 | |

CS First Boston LLC, 5.25%, dated 4/30/07, due 5/1/07, repurchase price $255,037; fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: Federal Home Loan Mortgage Corp., Gold Pool: 5.00%, due 9/1/35; Federal National Mortgage Association, Fixed Rate Mortgages: 5.00% to 6.50%, due 10/1/08 to 3/1/37, valued at $255,003. | | 250,000 | | 250,000 | |

CS First Boston LLC, 5.28%, dated 2/23/07, due 7/23/07, repurchase price $25,550; fully collateralized by a U.S. government security at the date of this Portfolio of Investments as follows: Federal National Mortgage Association, Fixed Rate Mortgage: 6.50%, due 3/1/37, valued at $25,502. | | 25,000 | | 25,000 | |

The accompanying notes are an integral part of the financial statements.

20

| 2007 Semi-Annual Report |

| |

| April 30, 2007 (unaudited) |

Portfolio of Investments (cont’d)

Government Portfolio

| | Face | | | |

| | Amount | | Value | |

| | (000) | | (000) | |

Deutsche Bank Securities, Inc., 5.24%, dated 4/30/07, due 5/1/07, repurchase price $575,179; fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: Federal Home Loan Mortgage Corp., Adjustable Rate Mortgages, 5.56% to 7.43%, due 11/1/32 to 4/1/37; Federal Home Loan Mortgage Corp., Gold Pools: 5.00% to 6.50%, due 7/1/35 to 4/1/37; Federal National Mortgage Association, Adjustable Rate Mortgages: 4.03% to 7.39%, due 12/1/09 to 4/1/44, valued at $587,413. | | $ | 575,095 | | $ | 575,095 | |

UBS Securities LLC, 5.22%, dated 4/30/07, due 5/1/07, repurchase price $51,007; fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: Federal Home Loan Mortgage Corp., Gold Pool: 6.00%, due 2/1/37; Federal National Mortgage Association, Fixed Rate Mortgage: 6.50%, due 3/1/29, valued at $52,021. | | 51,000 | | 51,000 | |

UBS Securities LLC, 5.24%, dated 4/30/07, due 5/1/07, repurchase price $315,046; fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: Federal Home Loan Mortgage Corp., Gold Pools: 5.50% to 9.00%, due 4/1/25 to 4/1/37; Federal National Mortgage Association, Fixed Rate Mortgages: 5.00% to 8.00%, due 9/1/17 to 3/1/37, valued at $321,301. | | 315,000 | | 315,000 | |

UBS Securities LLC, 5.25%, dated 3/22/07, due 8/10/07, repurchase price $25,514; fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: Federal Home Loan Mortgage Corp., Gold Pool: 6.00%, due 2/1/37; Federal National Mortgage Association, Fixed Rate Mortgage: 6.00%, due 4/1/37, valued at $25,504. | | 25,000 | | 25,000 | |

UBS Securities LLC, 5.26%, dated 3/14/07, due 6/12/07, repurchase price $25,329; fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: Federal Home Loan Mortgage Corp., Gold Pool: 5.50%, due 6/1/26; Federal National Mortgage Association, Fixed Rate Mortgages: 5.50% to 6.00%, due 12/1/32 to 7/1/33, valued at $25,500. | | 25,000 | | 25,000 | |

UBS Securities LLC, 5.28%, dated 1/11/07, due 6/11/07, repurchase price $30,664; fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: Federal National Mortgage Association, Fixed Rate Mortgages: 5.50% to 6.00%, due 3/1/33 to 4/1/37, valued at $30,604. | | 30,000 | | 30,000 | |

UBS Securities LLC, 5.30%, dated 2/2/07, due 8/1/07, repurchase price $25,663; fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: Federal Home Loan Mortgage Corp., Gold Pool: 5.50%, due 9/1/19; Federal National Mortgage Association, Fixed Rate Mortgages: 6.00% to 6.50%, due 3/1/29 to 4/1/36, valued at $25,502. | | $ | 25,000 | | $ | 25,000 | |

Wachovia Capital Markets LLC, 5.24%, dated 4/30/07, due 5/1/07, repurchase price $250,036; fully collateralized by U.S. government securities at the date of this Portfolio of Investments as follows: Federal National Mortgage Association, Fixed Rate Mortgages: Zero Coupon to 5.00%, due 5/1/07 to 5/1/36, valued at $255,000. | | 250,000 | | 250,000 | |

Total Repurchase Agreements (Cost $2,600,095) | | | | 2,600,095 | |

Total Investments (99.9%) (Cost $3,163,765) | | | | 3,163,765 | |