UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21359

Managed Duration Investment Grade Municipal Fund

(Exact name of registrant as specified in charter)

2455 Corporate West Drive, Lisle, IL 60532

(Address of principal executive offices) (Zip code)

Kevin M. Robinson

2455 Corporate West Drive, Lisle, IL 60532

(Name and address of agent for service)

Registrant's telephone number, including area code: (630) 505-3700

Date of fiscal year end: July 31

Date of reporting period: August 1, 2010 to July 31, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

Item 1. Reports to Stockholders.

The registrant's annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

www.guggenheimfunds.com/mzf

... your stream to the LATEST,

most up-to-date INFORMATION about the

Managed Duration Investment Grade Municipal Fund

The shareholder report you are reading right now is just the beginning of the story. Online at www.guggenheimfunds.com/mzf, you will find:

| · | Daily, weekly and monthly data on share prices, distributions and more |

| · | Portfolio overviews and performance analyses |

| · | Announcements, press releases and special notices and tax characteristics |

Cutwater Asset Management and Guggenheim Funds are continually updating and expanding shareholder information services on the Fund’s website, in an ongoing effort to provide you with the most current information about how your Fund’s assets are managed, and the results of our efforts. It is just one more way we are working to keep you better informed about your investment in the Fund.

2 l Annual Report l July 31, 2011

MZF l Managed Duration Investment Grade Municipal Fund

Dear Shareholder l

We thank you for your investment in Managed Duration Investment Grade Municipal Fund (the “Fund”).This report covers performance for the fiscal year ended July 31, 2011.

Cutwater Investor Services Corp. (“Cutwater”) serves as the Fund’s Investment Adviser.With $39 billion of fixed income assets under management and supervision as of July 31, 2011, Cutwater is one of the top 50 fixed income specialists in the world. Cutwater’s parent company, MBIA Inc., is listed on the NewYork Stock Exchange and is a component stock of the S&P 500 Index.

Guggenheim Funds Distributors, Inc., (“GFDI”) serves as the Servicing Agent to the Fund. GFDI is an indirect subsidiary of Guggenheim Partners, LLC, a global diversified financial services firm with more than $100 billion in assets under management and supervision.

The Fund’s investment objective is to provide high current income exempt from regular Federal income tax while seeking to protect the value of the Fund’s assets during periods of interest rate volatility. Under normal market conditions, the Fund seeks to achieve this objective by investing substantially all of its assets in municipal bonds of investment-grade quality.

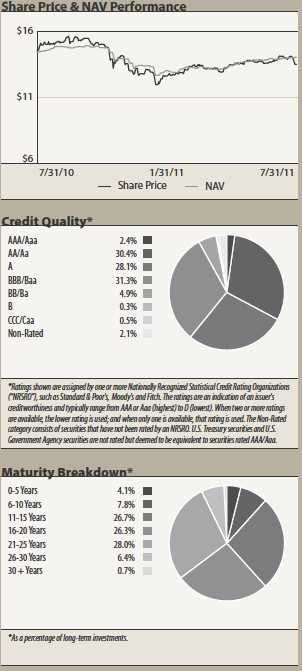

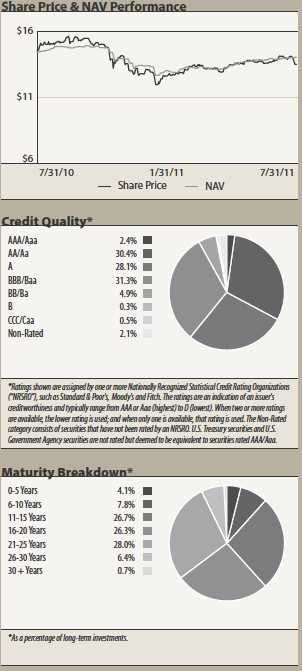

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the 12-month period ended July 31, 2011, the Fund provided a total return based on market price of -0.32% and a total return of 4.57% based on NAV. Past performance is not a guarantee of future results.As of July 31, 2011, the Fund’s last closing market price of $13.48 represented a discount of 3.85% to NAV of $14.02.As of July 31, 2010, the Fund’s market price of $14.53 represented a premium of 0.90% to NAV of $14.40.The market value and NAV of the Fund’s shares fluctuate from time to time, and the Fund’s market value may be higher or lower than its NAV.

Dividends of $0.0825 were paid in each month from August 2010 through July 2011.The current dividend represents an annualized distribution rate of 7.34% based on the market price of $13.48 on July 31, 2011.

We encourage shareholders to consider the opportunity to reinvest their distributions from the Fund through the Dividend Reinvestment Plan (“DRIP”), which is described in detail on page 25 of this report.When shares trade at a discount to NAV, the DRIP takes advantage of the discount by reinvesting the monthly dividend distribution in common shares of the Fund purchased in the market at a price less than NAV. Conversely, when the market price of the Fund’s common shares is at a premium above NAV, the DRIP reinvests participants’ dividends in newly-issued common shares at NAV, subject to an IRS limitation that the purchase price cannot be more than 5% below the market price per share.The DRIP provides a cost-effective means to accumulate additional shares and enjoy the benefits of compounding returns over time. Since the Fund endeavors to maintain a steady monthly distribution rate, the DRIP effectively provides an income averaging technique, which causes shareholders to accumulate a larger number of Fund shares when the market price is depressed than when the price is higher.

To learn more about the Fund’s performance, we encourage you to read the Questions & Answers section of the report, which begins on page 5.You will find information about how the Fund is managed, what affected the performance of the Fund during the fiscal year ended July 31, 2011, and Cutwater’s views on the market environment.

Annual Report l July 31, 2011 l 3

MZF l Managed Duration Investment Grade Municipal Fund l Dear Shareholder continued

We appreciate your investment, and we look forward to serving your investment needs in the future. For the most up-to-date information on your investment, please visit the Fund’s website at www.guggenheimfunds.com/mzf.

Sincerely,

Clifford D. Corso

President

Managed Duration Investment Grade Municipal Fund

4 l Annual Report l July 31, 2011

MZF l Managed Duration Investment Grade Municipal Fund

Questions & Answers l

Clifford D. Corso

Portfolio Manager

Clifford D. Corso is Chief Executive Officer and Chief Investment Officer of Cutwater Investor Services Corp. (“Cutwater”), Chief Investment Officer of MBIA Insurance Corp. and Executive Vice President & Chief Investment Officer of MBIA Inc. His responsibilities include oversight and direction of the investments of MBIA Inc. and its subsidiaries. He manages Cutwater’s fixed income asset management platform, directs the investment of all fixed income assets under management, and oversees the portfolios of MBIA Insurance Corp. and its affiliates. In addition, Mr. Corso’s responsibilities include the direction of investments for outside clients such as pension funds, sovereign governments, state and local governments, and institutional investors. Mr. Corso is also an active member of the Board of Directors for the MBIA Foundation, Inc. Before joining MBIA in 1994, he was the co-head of fixed income at a subsidiary of Alliance Capital Management.Throughout his 25-year career, Mr. Corso has managed a wide array of fixed income products, including corporate, asset-backed, government, mortgage and derivative products. Mr. Corso has a bachelor’s degree fromYale University and a master’s degree from Columbia University. He holds his Series 7, 24, and 63 licenses from the Financial Industry Regulatory Authority (FINRA).

Jeffrey S. MacDonald,

CFA Portfolio Manager

Mr. MacDonald, who joined MBIA in 2007, is a Director of Cutwater and has extensive experience in the fixed income markets across a variety of sectors with particular emphasis on core and core plus strategies. He was previously a vice president and portfolio manager at Hartford Investment Management Company (HIMCO), where he managed core, core plus, intermediate core, and other broad-based fixed income styles. He was also instrumental in designing some of HIMCO’s fixed-income-based products, including a number of “alternative” strategies. Prior to joining HIMCO, Mr. MacDonald was a fixed income portfolio analyst specializing in taxable/insurance portfolios at Wellington Management Company. He began his career with Fidelity Investments as a fixed-income trader and lead systems analyst. Mr. MacDonald earned his bachelor’s degree from Trinity College in Connecticut and his master’s degree from Boston University. He holds the designation of Chartered Financial Analyst (CFA) through the CFA Institute and is a member of the Hartford Security Analysts Society.

James B. DiChiaro

Portfolio Manager

Mr. DiChiaro joined MBIA in 1999 and is a Vice President of Cutwater. He currently manages the company’s municipal bond portfolios (taxable and tax-exempt) and has extensive experience managing money market portfolios. Mr. DiChiaro began his career at MBIA working with the conduit group structuring medium-term notes for Meridian Funding Company and performing the treasury role for an MBIA-sponsored asset-backed commercial paper conduit,Triple-A One Funding Corporation. Prior to joining MBIA, he worked for Merrill Lynch supporting their asset-backed securities trading desk. Mr. DiChiaro has a bachelor’s degree from Fordham University and a master’s degree from Pace University.

In the following interview Portfolio Managers Clifford D. Corso, Jeffrey S. MacDonald and James B. DiChiaro discuss the market environment and the performance of the Managed Duration Investment Grade Municipal Fund (the “Fund”) for the fiscal year ended July 31, 2011.

Please provide an overview of the municipal market during the 12-month period ended July 31, 2011.

During the second half of 2010 the U.S. economy demonstrated considerable strength, as it continued to emerge from the recent recession. Real gross domestic product (“Real GDP,” or growth in the overall U.S. economy, adjusted for inflation) increased at a rate of 2.5% in the third quarter of 2010 and 2.3% in the fourth quarter. Real GDP rose 2.9% for the full year 2010, after falling 2.6% in 2009.The pace of growth slowed considerably in 2011, to an annual rate of 0.4% in the first quarter and a preliminary reading of 1.3% in the second quarter.

State tax revenues are on the rise and posted their sixth consecutive quarter of growth in the second quarter of 2011, nearing the 2008 peak.The timing was impeccable as budget season neared and looming budget gaps required widespread expenditure reductions. Some of the revenue gains at the state level are attributable to tax rate increases, but the majority of the increase comes from improvement within the employment sector and a stabilization of consumer spending.Tax receipts at the local level have declined in recent months largely because of their reliance on property taxes. The real estate market has yet to find solid footing, and assessments continue to slump, the consequences of which are felt in property taxes revenues.

Political battles are abundant, with parties disagreeing on whether to focus on increasing taxes or slashing expenses.Waning federal stimulus funds will have a negative impact on state and local revenues in the months ahead, but on the whole, cumulative state budget deficits are expected to decrease in the coming year.A combination of improved revenues and recently enacted expense controls has structurally improved states’ budgets, alleviating some of the default concerns that were prevalent within the municipal sector at the end of 2010.

Bond holders are generally well insulated against the states’ budgetary issues, as debt service payments on state general obligation bonds reside in a senior position in each state’s priority of payments and generally constitute a small percentage of general fund revenues. Of more concern are the debts of smaller local governments that depend largely on state aid payments.As states look to rectify their own deficits, they may scale back their appropriated payments to local governments.

Annual Report l July 31, 2011 l 5

MZF l Managed Duration Investment Grade Municipal Fund l Questions & Answers continued

For most of 2010, the municipal bond market performed very well.A positive influence on the market was the “Build America Bonds” (or “BAB”) program. BABs, which represented more than 25% of the municipal bonds issued in 2010, are taxable municipal securities issued on behalf of state and local governments with interest payments subsidized by the U.S.Treasury.The success of the BAB program, which expired December 31, 2010, resulted in a substantial decline in the issuance of long-dated tax exempt bonds, which may have contributed to a rise in prices and decline in the yields of tax-exempt bonds during 2010.

In late 2010 and early 2011, the municipal bond market became quite volatile and there was a significant decline in prices of tax-exempt bonds.There were several reasons for this drop, including uncertainty surrounding the credit worthiness of municipal issuers, the expiration of the BAB program, and rising interest rates (taxable and tax-exempt).As municipal bonds cheapened, they attracted the attention of taxable institutional investors that do not normally invest in municipal bonds.The entry of these investors into the market eventually resulted in a rally in the municipal market, resulting in a more normal ratio of yields on municipal bonds relative to Treasury securities with similar maturities. For the calendar quarter ended July 31, 2011, municipal bonds were one of the best performing asset classes, with the Barclays Capital Municipal Bond Index (the “Municipal Index”), a widely used measure of the municipal bond market as a whole, posting a return of 3.11%, compared with 2.61% for the Barclays Capital U.S.Aggregate Bond Index.

For the 12-month period ended July 31, 2011, the Municipal Index posted a return of 3.24%.This return compares with a return of 4.44 % from the Barclays Capital U.S.Aggregate Bond Index and 3.39% from the Barclays Capital U.S.Treasury Composite Index for the same period.

How did the Fund perform in this market environment?

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the 12-month period ended July 31, 2011, the Fund provided a total return based on market price of -0.32% and a total return of 4.57% based on NAV. Past performance is not a guarantee of future results.

As of July 31, 2011, the Fund’s last closing market price of $13.48 represented a discount of 3.85% to NAV of $14.02.As of July 31, 2010, the Fund’s market price of $14.53 represented a premium of 0.90% to NAV of $14.40.The market value and NAV of the Fund’s shares fluctuate from time to time, and the Fund’s market value may be higher or lower than its NAV.

Dividends of $0.0825 were paid in each month from August 2010 through July 2011.The current dividend represents an annualized distribution rate of 7.34% based on the market price of $13.48 on July 31, 2011.

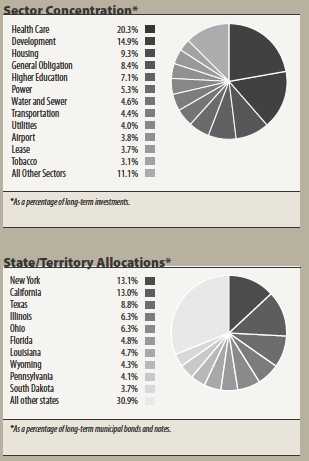

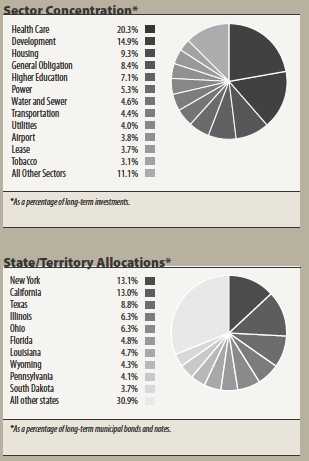

How is the Fund’s portfolio structured, and what has that structure meant for performance?

The Fund has a high quality portfolio that is diversified across issuers, sectors and states. In selecting securities for the portfolio, the portfolio management team, who together have more than 50 years of experience, are supported by Cutwater’s team of credit analysts, who evaluate the credit quality of sectors and individual issuers, going far beyond the bond ratings provided by rating agencies. Cutwater’s proprietary quantitative models help to evaluate the risk of individual securities as well as the overall portfolio, supplementing the judgment of the experienced team. Thorough quantitative and qualitative analysis helps ensure that the desired level of credit quality is maintained in the Fund’s portfolio while yield is added, as appropriate, by buying higher yielding bonds at what are considered to be attractive prices.

During most of 2010, the Fund achieved attractive returns by being invested mainly in intermediate to longer term bonds; however, these investments performed poorly in November and December of 2010 and January of 2011, as the municipal market weakened, the yield curve became steeper and credit spreads widened.1 During this period, the Fund’s return was less than that of the Municipal Index, largely because the Fund had a higher risk profile than the Municipal Index; positions in health care, corporate-backed bonds and tobacco bonds detracted from performance. In subsequent months, spreads narrowed and the Fund’s higher risk profile was positive for performance. For the full fiscal year ended July 31, 2011, the Fund’s position in higher risk bonds contributed to performance.

At the beginning of the period, the Fund had significant exposure to bonds with maturities of 25 years or longer. Over the past year, the Fund’s managers have reduced the Fund’s duration and shortened its average maturity profile by selling some of the bonds with maturities of more than 25 years and changing the emphasis to the 15 to 20-year portion of the yield curve.2 As of July 31, 2011 the average duration of the Fund’s portfolio is 7.31 years, compared with 8.03 years as of July 31, 2010; these figures do not reflect the effects of leverage or any hedging strategies that may be undertaken within the portfolio. Under current market conditions, there is a limited audience for bonds with maturities of 25 to 30 years.Aware of this situation, issuers have directed their financings towards the intermediate range of the yield curve, issuing bonds with maturities of 20 years or less. Over the longer term, the Fund’s managers believe rates are more likely to rise than to fall; accordingly, they believe it is prudent to reduce duration in order to lessen the interest rate risk.

| 1 | The yield curve is a curve on a graph in which the yield of fixed-interest securities is plotted against the length of time they have to run to maturity. Spread refers to the difference in yield between securities, in this case the difference between higher quality bonds and riskier bonds. |

| 2 | Duration is a measure of the interest rate sensitivity of a bond or fixed-income portfolio which incorporates time to maturity and coupon size. The longer the duration, the greater the interest rate risk. |

6 l Annual Report l July 31, 2011

MZF l Managed Duration Investment Grade Municipal Fund l Questions & Answers continued

The Fund’s performance benefited from its positions in state general obligation bonds, water/sewer bonds, and electric power bonds.The Fund maintains a large position in essential service bonds, which are backed by a dedicated stream of revenues generated by water/sewer or power utility systems which tend to be more resistant to economic downturns.The strong performance of state general obligation bonds illustrates the value of Cutwater’s rigorous credit analysis of each bond under consideration. Based on careful credit analysis, the Fund’s managers made the decision to invest in bonds issued by Illinois and California, states whose budget problems have gained the attention of the media.These states have announced plans to rectify their budgets by raising taxes and/or slashing expenses, and the bonds have performed well, and the Fund’s performance has benefited.

A detractor from the Fund’s performance was a relatively small position in pre-refunded securities.3 Since most pre-refunded bonds are collateralized with U.S.Treasury securities, they performed poorly near the end of the period, when the quality of these securities came into question because of federal legislative problems with budgetary matters and a potential downgrade.

The Fund’s small position in tobacco bonds detracted from performance for the year, as this sector underperformed.The tobacco sector has been under pressure in recent months largely because of negative fundamentals created by declining consump-tion.The Fund’s managers have become increasingly bearish on the sector and have reduced exposure to tobacco bonds.

Please explain the Fund’s leverage strategy and its effect on Fund returns.

The Fund utilizes leverage (borrowing) as part of its investment strategy, to finance the purchase of additional securities that provide increased income and potentially greater appreciation potential to common shareholders than could be achieved from a portfolio that is not leveraged. Leverage adds to performance only when the cost of leverage is less than the total return generated by investments.The use of financial leverage creates an opportunity for increased income and capital appreciation but, at the same time, creates special risks.There can be no assurance that a leveraging strategy will be utilized or will be successful. Financial leverage may cause greater changes in the Fund’s net asset value and returns than if financial leverage had not been used.

As of July 31, 2011, the Fund had $69.45 million of leverage outstanding in the form of Auction Market Preferred Shares (“AMPS”). Since the Fund’s NAV return exceeded the cost of leverage over the 12-month period ended July 31, 2011, leverage contributed to the Fund’s total return.

What is the outlook for the municipal market in the coming months?

At mid-year 2011, the economic picture is looking less positive than a few months ago, following a significant downward revision to economic growth in the first quarter of 2011 and relatively slow growth in the second quarter. Because of debt ceiling issues and the extreme volatility of the stock market, consumers may be hesitant to make discretionary purchases. States and localities, which rely on federal funding for a significant portion of their revenue, are likely to be hurt by any reductions in federal funds. That may put continued pressure on state budgets which will require additional spending cuts and revenue generating ideas. State revenues have been on the rise for more than a year, but it is important to keep a careful watch on credit and the impact of federal spending cuts on states and local governments.

Municipal bond issuance is likely to be below trend for the foreseeable future, and the lack of supply may help this technical rally to persist. Rising individual income tax rates are a strong possibility in the near future, and investors’ desire for income that is exempt from federal income taxes may continue to support the municipal market.

Index Definitions

All indices are unmanaged. It is not possible to invest in an index.

The Barclays Capital Municipal Bond Index is a rules-based, market-value weighted index engineered for the long-term tax-exempt bond market. To be included in the index, bonds must be rated investment-grade (Baa3/BBB- or higher) by at least two of the following ratings agencies: Moody’s, S&P, Fitch.

Barclays Capital U.S. Aggregate Bond Index represents securities that are U.S. domestic, taxable, and dollar denominated.The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

The Barclays Capital U.S. Treasury Composite Index measures the performance of the US Treasury bond market, using market capitalization weighting and a standard rule based inclusion methodology.

MZF Risks And Other Considerations

The views expressed in this report reflect those of the portfolio managers only through the report period as stated on the cover. These views are subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any kind.The material may also include forward looking statements that involve risk and uncertainty, and there is no guarantee that any predictions will come to pass.

There can be no assurance that the Fund will achieve its investment objective. The value of the Fund will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value. An investment in this Fund may not be suitable for

| 3 | A bond is pre-refunded when the issuer has purchased U. S. Treasury or agency securities that provide a stream of cash flow to pay off the bonds on their first call date. |

Annual Report l July 31, 2011 l 7

MZF l Managed Duration Investment Grade Municipal Fund l Questions & Answers continued

investors who are, or as a result of this investment would become, subject to the federal alternative minimum tax because the securities in the Fund may pay interest that is subject to taxation under the federal alternative minimum tax. Special rules apply to corporate holders. Additionally, any capital gains dividends will be subject to capital gains taxes.

There can be no guarantee that hedging strategies will be employed or will be successful. The premium paid for entering into such hedging strategies will result in a reduction in the net asset value of the Funds and a subsequent reduction of income to the Fund. Any income generated from hedging transactions will not be exempt from income taxes.

Certain risks are associated with the leveraging of common shares of the Fund. Both the net asset value and the market value of shares of the Fund’s shares may be subject to higher volatility and a decline in value.

There are also specific risks associated with investing in municipal bonds, including but not limited to interest rate and credit risk. Interest rate risk is the risk that prices of Municipal Bonds generally increase when interest rates decline and decrease when interest rates increase. Prices of longer term securities generally change more in response to interest rate changes than prices of shorter term securities. Credit risk is the risk that the issuer will be unable to pay the interest or principal when due. The degree of credit risk depends on both the financial condition of the issuer and the terms of the obligation. The secondary market for municipal bonds is less liquid than many other securities markets, which may adversely affect the Fund’s ability to sell its bonds at prices approximating those at which the Fund currently values them. The ability of municipal issuers to make timely payments of interest and principal may be diminished during general economic downturns. In addition, laws enacted in the future by Congress or state legislatures or referenda could extend the time for payment of principal and/or interest. In the event of bankruptcy of an issuer, the Fund could experience delays in collecting principal and interest.

Leverage creates certain risks for common shareholders, including higher volatility of both the net asset value and the market value of the common shares, because common shareholders bear the effects of changes in the value of the Fund’s investments. Leverage also creates the risk that the investment return on the Fund’s common shares will be reduced to the extent the dividends paid on preferred shares and other expenses of the preferred shares exceed the income earned by the Fund on its investments. If the Fund is liquidated, preferred shareholders will be entitled to receive liquidating distributions before any distribution is made to common shareholders. When the Fund uses leverage, the fees paid to Cutwater and Guggenheim Funds Distributors, Inc. will be higher than if leverage were not used.

There are also risks associated with investing in Auction Market Preferred Shares or AMPS.The AMPS are redeemable, in whole or in part, at the option of the Fund on any dividend payment date for the AMPS, and will be subject to mandatory redemption in certain circumstances. The AMPS will not be listed on an exchange. You may only buy or sell AMPS through an order placed at an auction with or through a broker-dealer that has entered into an agreement with the auction agent and the Fund or in a secondary market maintained by certain broker-dealers. These broker-dealers are not required to maintain this market, and it may not provide you with liquidity. The AMPS market continues to remain illiquid as auctions for nearly all AMPS continue to fail. A failed auction is not a default, nor does it require the redemption of a fund’s auction rate preferred shares. Provisions in the Fund’s offering documents provide a mechanism to set a maximum rate in the event of a failed auction, and, thus, investors will continue to be entitled to receive payment for holding these AMPS.

In addition to the risks described above, the Fund is also subject to: Market Risk and Selection Risk, Call and Redemption Risk, Private Activity Bonds, Risks of Tobacco-Related Municipal Bonds, Leverage, Inflation Risk, Derivatives Risk, Affiliated Insurers, and Anti-takeover Provisions, Market Disruption. Please see Fund’s website at www.guggenheimfunds.com/mzf for a more detailed discussion about Fund risks and considerations.

8 l Annual Report l July 31, 2011

MZF l Managed Duration Investment Grade Municipal Fund

Fund Summary l As of July 31, 2011 (unaudited)

| | | |

| Fund Information | | |

| Symbol on New York Stock Exchange: | | MZF |

| Initial Offering Date: | | August 27, 2003 |

| Closing Market Price as of 07/31/11: | | $13.48 |

| Net Asset Value as of 07/31/11: | | $14.02 |

| Yield on Closing Market Price as of 07/31/11: | | 7.34% |

| Taxable Equivalent Yield on Closing Market Price | |

as of 07/31/111: | | 11.30% |

Monthly Distribution Per Common Share2: | | $0.0825 |

Leverage as of 07/31/113: | | 43% |

| Percentage of total investments subject to alternative | |

| minimum tax as of 07/31/11: | | 22.1% |

| 1 Taxable equivalent yield is calculated assuming a 35% federal income tax bracket. |

| 2 Monthly distribution is subject to change. | | |

| 3 As a percentage of total investments. | | |

| | | |

| Total Returns | | |

| (Inception 8/27/03) | Market | NAV |

| One Year | -0.32% | 4.57% |

| Three Year - average annual | 12.49% | 9.23% |

| Five Year - average annual | 8.46% | 5.57% |

| Since Inception - average annual | 4.63% | 5.29% |

Past performance does not guarantee future results. All portfolio data is subject to change daily. For more current information, please visit www.guggenheimfunds.com/mzf. The above summaries are provided for informational purposes only and should not be viewed as recommendations.

Annual Report l July 31, 2011 l 9

MZF l Managed Duration Investment Grade Municipal Fund | | | | | |

Portfolio of Investments l July 31, 2011 | | | | | |

| Principal | | | Rating | | | Optional Call | |

| Amount | | Description | (S&P)* | Coupon | Maturity | Provisions** | Value |

| | | Long-Term Investments – 171.3% | | | | | |

| | | Municipal Bonds – 169.1% | | | | | |

| | | Alabama – 2.9% | | | | | |

| $ 845,000 | | Courtland Industrial Development Board, AMT, Series B | BBB | 6.25% | 08/01/2025 | 08/01/13 @ 100 | $ 863,843 |

| 1,890,000 | | Courtland Industrial Development Board, AMT | Baa3 | 6.00% | 08/01/2029 | 08/01/12 @ 100 | 1,890,246 |

| | | | | | | | 2,754,089 |

| | | Alaska – 0.8% | | | | | |

| 750,000 | | Alaska Municipal Bond Bank Authority, Series 1 | A+ | 5.75% | 09/01/2033 | 09/01/18 @ 100 | 795,068 |

| | | California – 21.9% | | | | | |

| 1,500,000 | | California Health Facilities Financing Authority, Series B | AA- | 5.88% | 08/15/2031 | 08/15/20 @ 100 | 1,604,565 |

| 1,250,000 | | California Municipal Finance Authority, Series A | Baa1 | 5.50% | 07/01/2030 | 07/01/20 @ 100 | 1,242,675 |

| 5,000,000 | | California State Public Works Board, Series A | BBB+ | 5.00% | 06/01/2024 | 06/01/14 @ 100 | 5,053,450 |

| 6,000,000 | | California Various Purpose General Obligation | A- | 5.13% | 11/01/2024 | 11/01/13 @ 100 | 6,242,640 |

| 2,500,000 | | City of Chula Vista CA, AMT, Series B | A | 5.50% | 12/01/2021 | 06/02/14 @ 102 | 2,624,000 |

| 2,065,000 | | Golden State Tobacco Securitization Corp., Series A-1 | BB+ | 5.00% | 06/01/2033 | 06/01/17 @ 100 | 1,471,395 |

| 2,525,000 | | Los Angeles Unified School District, Series F | AA- | 5.00% | 01/01/2034 | 07/01/19 @ 100 | 2,559,466 |

| | | | | | | | 20,798,191 |

| | | Delaware – 1.6% | | | | | |

| 1,500,000 | | Delaware State Economic Development Authority | BBB+ | 5.40% | 02/01/2031 | 08/01/20 @ 100 | 1,504,230 |

| | | District of Columbia – 2.0% | | | | | |

| 2,000,000 | | District of Columbia Housing Finance Agency, AMT, (FHA) | Aaa | 5.10% | 06/01/2037 | 06/01/15 @ 102 | 1,892,840 |

| | | Florida – 8.1% | | | | | |

| 2,200,000 | | County of Miami-Dade FL, Aviation Revenue, AMT, (CIFG) | A- | 5.00% | 10/01/2038 | 10/01/15 @ 100 | 1,879,240 |

| 3,000,000 | | Highlands County Health Facilities Authority, Series D, (Prerefunded @ 11/15/2013)(a) | NR | 5.88% | 11/15/2029 | 11/15/13 @ 100 | 3,347,400 |

| 1,500,000 | | Miami-Dade County School Board, Series A, (Assured Gty) | AA+ | 5.38% | 02/01/2034 | 02/01/19 @ 100 | 1,515,195 |

| 1,000,000 | | Seminole Indian Tribe of Florida, Series A(b) | BBB- | 5.25% | 10/01/2027 | 10/01/17 @ 100 | 914,300 |

| | | | | | | | 7,656,135 |

| | | Hawaii – 1.0% | | | | | |

| 1,000,000 | | Hawaii Pacific Health, Series B | BBB+ | 5.63% | 07/01/2030 | 07/01/20 @ 100 | 980,000 |

| | | Illinois – 10.7% | | | | | |

| 1,750,000 | | Chicago IL O’Hare International Airport Revenue, Series C | A- | 5.50% | 01/01/2031 | 01/01/21 @ 100 | 1,812,300 |

| 1,115,000 | | City of Chicago IL, O’Hare International Airport Revenue,AMT, Series A-2, (AGM) | AA+ | 5.50% | 01/01/2016 | 01/01/14 @ 100 | 1,188,178 |

| 2,000,000 | | Illinois Finance Authority, Roosevelt University Revenue | Baa2 | 5.50% | 04/01/2037 | 04/01/17 @ 100 | 1,917,660 |

| 1,000,000 | | Illinois Finance Authority, Rush University Medical Center Revenue, Series C | A- | 6.38% | 11/01/2029 | 05/01/19 @ 100 | 1,057,050 |

| 1,155,000 | | Illinois Housing Development Authority, AMT, Series A-2 | AA | 5.00% | 08/01/2036 | 02/01/16 @ 100 | 1,149,756 |

| 2,000,000 | | Illinois, General Obligation, Series A | A+ | 5.00% | 03/01/2028 | 03/01/14 @ 100 | 2,001,360 |

| 1,000,000 | | Railsplitter Tobacco Settlement Authority | A- | 6.00% | 06/01/2028 | 06/01/21 @ 100 | 1,028,300 |

| | | | | | | | 10,154,604 |

| | | Indiana – 3.3% | | | | | |

| 1,000,000 | | Indiana Finance Authority | BB | 6.00% | 12/01/2026 | 06/01/20 @ 100 | 1,014,260 |

| 2,000,000 | | Indianapolis Local Public Improvement Bond Bank, Series A | A+ | 5.50% | 01/01/2029 | 01/01/19 @ 100 | 2,128,660 |

| | | | | | | | 3,142,920 |

| | | Iowa – 3.4% | | | | | |

| 1,500,000 | | Iowa Higher Education Loan Authority | BBB+ | 5.50% | 09/01/2025 | 09/01/20 @ 100 | 1,547,505 |

| 2,000,000 | | Iowa Tobacco Settlement Authority, Series B | BBB | 5.60% | 06/01/2034 | 06/01/17 @ 100 | 1,630,360 |

| | | | | | | | 3,177,865 |

See notes to financial statements.

10 l Annual Report l July 31, 2011

MZF l Managed Duration Investment Grade Municipal Fund l Portfolio of Investments continued

| | | | | | | | |

| Principal | | | Rating | | | Optional Call | |

| Amount | | Description | (S&P)* | Coupon | Maturity | Provisions** | Value |

| | | Kentucky – 2.2% | | | | | |

| $ 1,000,000 | | County of Owen KY, Waterworks System Revenue, Series B | BBB+ | 5.63% | 09/01/2039 | 09/01/19 @ 100 | $ 1,005,420 |

| 1,000,000 | | Kentucky Economic Development Finance Authority, Series A | Aa3 | 5.63% | 08/15/2027 | 08/15/18 @ 100 | 1,068,170 |

| | | | | | | | 2,073,590 |

| | | Louisiana – 8.0% | | | | | |

| 1,000,000 | | East Baton Rouge Sewerage Commission, Series A | AA- | 5.25% | 02/01/2034 | 02/01/19 @ 100 | 1,045,320 |

| 3,000,000 | | Louisiana Local Government Environmental Facilities & Community Development Authority | BBB- | 6.75% | 11/01/2032 | 11/01/17 @ 100 | 3,123,300 |

| 1,000,000 | | Louisiana Public Facilities Authority, Hospital Revenue | A3 | 5.25% | 11/01/2030 | 05/01/20 @ 100 | 993,930 |

| 1,000,000 | | Parish of DeSoto LA, AMT, Series A | BBB | 5.85% | 11/01/2027 | 11/01/13 @ 100 | 1,007,200 |

| 1,500,000 | | Parish of St John Baptist LA, Series A | BBB | 5.13% | 06/01/2037 | 06/01/17 @ 100 | 1,436,745 |

| | | | | | | | 7,606,495 |

| | | Maryland – 1.5% | | | | | |

| 500,000 | | Maryland Economic Development Corp. | BB | 5.75% | 09/01/2025 | 09/01/20 @ 100 | 495,645 |

| 1,000,000 | | Maryland Health & Higher Educational Facilities Authority | BBB- | 5.75% | 01/01/2038 | 01/01/18 @ 100 | 959,350 |

| | | | | | | | 1,454,995 |

| | | Massachusetts – 3.2% | | | | | |

| 1,000,000 | | Massachusetts Educational Financing Authority, AMT | AA | 5.38% | 07/01/2025 | 07/01/21 @ 100 | 996,460 |

| 1,000,000 | | Massachusetts Health & Educational Facilities Authority, Series A | BBB | 6.25% | 07/01/2030 | 07/01/19 @ 100 | 1,068,010 |

| 1,000,000 | | Massachusetts Housing Finance Agency, AMT | AA- | 5.10% | 12/01/2027 | 06/01/17 @ 100 | 1,000,980 |

| | | | | | | | 3,065,450 |

| | | Michigan – 5.7% | | | | | |

| 1,000,000 | | City of Detroit MI, Sewer Disposal Revenue, Series B, (AGM) | AA+ | 7.50% | 07/01/2033 | 07/01/19 @ 100 | 1,155,980 |

| 1,000,000 | | City of Detroit MI, Water Supply System Revenue, (AGM) | AA+ | 7.00% | 07/01/2036 | 07/01/19 @ 100 | 1,139,110 |

| 1,000,000 | | Michigan Strategic Fund, Series B-1 | BBB | 6.25% | 06/01/2014 | N/A | 1,102,590 |

| 2,000,000 | | Michigan Strategic Fund, Series C | A | 5.45% | 09/01/2029 | 09/01/11 @ 100 | 2,003,520 |

| | | | | | | | 5,401,200 |

| | | Mississippi – 1.1% | | | | | |

| 1,000,000 | | County of Warren MS, Series A | BBB | 6.50% | 09/01/2032 | 09/01/18 @ 100 | 1,084,110 |

| | | Nevada – 5.9% | | | | | |

| 5,410,000 | | City of Henderson NV, Series A | A | 5.63% | 07/01/2024 | 07/01/14 @ 100 | 5,596,483 |

| | | New Jersey – 1.6% | | | | | |

| 1,500,000 | | New Jersey Health Care Facilities Financing Authority | BBB+ | 5.75% | 07/01/2039 | 07/01/19 @ 100 | 1,474,740 |

| | | New York – 22.2% | | | | | |

| 2,250,000 | | City of New York NY, General Obligation, Series J | AA | 5.00% | 05/15/2023 | 05/15/14 @ 100 | 2,387,160 |

| 1,000,000 | | City of Troy NY, Series A | A- | 5.00% | 09/01/2030 | 09/01/20 @ 100 | 1,009,410 |

| 2,750,000 | | Long Island Power Authority, Series A | A- | 5.10% | 09/01/2029 | 09/01/14 @ 100 | 2,794,468 |

| 4,000,000 | | Metropolitan Transportation Authority, Series A | AA- | 5.13% | 01/01/2024 | 07/01/12 @ 100 | 4,068,480 |

| 750,000 | | New York City Industrial Development Agency, JFK International Airport, AMT, Series A | B- | 8.00% | 08/01/2012 | N/A | 771,712 |

| 500,000 | | New York City Industrial Development Agency, American Airlines, JFK International Airport, AMT | B- | 7.50% | 08/01/2016 | N/A | 517,380 |

| 1,000,000 | | New York City Municipal Water Finance Authority, Series EE | AA+ | 5.38% | 06/15/2043 | 12/15/20 @ 100 | 1,057,600 |

| 1,750,000 | | New York Municipal Bond Bank Agency, Series C | A+ | 5.25% | 12/01/2022 | 06/01/13 @ 100 | 1,853,478 |

| 900,000 | | New York State Dormitory Authority, Series B | BBB+ | 5.25% | 07/01/2024 | 07/01/17 @ 100 | 947,052 |

| 2,500,000 | | Suffolk County Industrial Development Agency, AMT | A- | 5.25% | 06/01/2027 | 06/01/13 @ 100 | 2,455,025 |

| 3,000,000 | | Tobacco Settlement Financing Corp., Series A-1 | AA- | 5.50% | 06/01/2019 | 06/01/13 @ 100 | 3,224,520 |

| | | | | | | | 21,086,285 |

See notes to financial statements.

Annual Report l July 31, 2011 l 11

| | | | | | | |

MZF l Managed Duration Investment Grade Municipal Fund l Portfolio of Investments continued | | | | | |

| Principal | | | Rating | | | Optional Call | |

| Amount | | Description | (S&P)* | Coupon | Maturity | Provisions** | Value |

| | | North Carolina – 3.6% | | | | | |

| $ 1,000,000 | | North Carolina Eastern Municipal Power Agency, Series D | A- | 5.13% | 01/01/2023 | 01/01/13 @ 100 | $ 1,015,800 |

| 1,000,000 | | North Carolina Eastern Municipal Power Agency, Series D | A- | 5.13% | 01/01/2026 | 01/01/13 @ 100 | 1,009,770 |

| 1,390,000 | | North Carolina Housing Finance Agency, AMT, Series 14A, (AMBAC) | AA | 5.35% | 01/01/2022 | 07/01/12 @ 100 | 1,392,919 |

| | | | | | | | 3,418,489 |

| | | Ohio – 10.6% | | | | | |

| 1,150,000 | | Buckeye Tobacco Settlement Financing Authority, Series A-2 | BB- | 5.88% | 06/01/2030 | 06/01/17 @ 100 | 895,585 |

| 3,000,000 | | County of Cuyahoga OH, Series A | AA- | 6.00% | 01/01/2020 | 07/01/13 @ 100 | 3,217,980 |

| 3,750,000 | | County of Lorain OH, Series A | AA- | 5.25% | 10/01/2033 | 10/01/11 @ 101 | 3,753,525 |

| 1,000,000 | | Ohio Air Quality Development Authority, Series A | BBB- | 5.70% | 02/01/2014 | N/A | 1,085,260 |

| 1,000,000 | | Ohio Air Quality Development Authority | BBB- | 5.63% | 06/01/2018 | N/A | 1,103,100 |

| | | | | | | | 10,055,450 |

| | | Pennsylvania – 7.0% | | | | | |

| 1,110,000 | | City of Philadelphia PA, General Obligation, Series A, (Assured Gty) | AA+ | 5.38% | 08/01/2030 | 08/01/19 @ 100 | 1,140,092 |

| 1,100,000 | | City of Philadelphia PA, General Obligation | BBB | 5.88% | 08/01/2031 | 08/01/16 @ 100 | 1,141,580 |

| 2,340,000 | | Pennsylvania Higher Educational Facilties Authority | BBB | 5.25% | 05/01/2023 | 05/01/13 @ 100 | 2,348,307 |

| 1,000,000 | | Pennsylvania Higher Educational Facilties Authority, Series B | AA- | 6.00% | 08/15/2026 | 08/15/18 @ 100 | 1,088,930 |

| 1,000,000 | | Pennsylvania Higher Educational Facilties Authority, Series A | BBB | 5.00% | 05/01/2037 | 11/01/17 @ 100 | 875,540 |

| | | | | | | | 6,594,449 |

| | | Rhode Island – 1.5% | | | | | |

| 1,300,000 | | Rhode Island Convention Center Authority, Series A, (Assured Gty) | AA+ | 5.50% | 05/15/2027 | 05/15/19 @ 100 | 1,407,536 |

| | | South Carolina – 3.7% | | | | | |

| 2,500,000 | | County of Florence SC, Series A, (AGM) | AA+ | 5.25% | 11/01/2027 | 11/01/14 @ 100 | 2,557,350 |

| 1,000,000 | | County of Georgetown SC, AMT, Series A | BBB | 5.30% | 03/01/2028 | 03/01/14 @ 100 | 973,080 |

| | | | | | | | 3,530,430 |

| | | South Dakota – 6.3% | | | | | |

| 1,200,000 | | South Dakota Health & Educational Facilities Authority, Series A | AA- | 5.25% | 11/01/2034 | 11/01/14 @ 100 | 1,208,076 |

| 4,990,000 | | South Dakota Housing Development Authority, AMT, Series K | AAA | 5.05% | 05/01/2036 | 11/01/15 @ 100 | 4,720,141 |

| | | | | | | | 5,928,217 |

| | | Tennessee – 3.3% | | | | | |

| 2,500,000 | | Knox County Health Educational & Housing Facilities Board | BBB+ | 5.25% | 04/01/2027 | 04/01/17 @ 100 | 2,442,450 |

| 700,000 | | Metropolitan Nashville Airport Authority | Baa3 | 5.20% | 07/01/2026 | 07/01/20 @ 100 | 662,431 |

| | | | | | | | 3,104,881 |

| | | Texas – 14.9% | | | | | |

| 2,000,000 | | Bexar County Housing Finance Corp., AMT, (GNMA) | Aa2 | 5.20% | 10/20/2034 | 10/20/14 @ 100 | 1,947,260 |

| 2,000,000 | | City of Houston TX, Series A, (AGM) | AA+ | 5.00% | 11/15/2033 | 11/15/17 @ 100 | 2,059,580 |

| 2,000,000 | | Lower Colorado River Authority | A | 6.25% | 05/15/2028 | 05/15/18 @ 100 | 2,248,460 |

| 1,885,000 | | Matagorda County Navigation District NO 1, AMT, (AMBAC)(c) | BBB+ | 5.13% | 11/01/2028 | N/A | 1,870,994 |

| 2,000,000 | | North Texas Tollway Authority, Series A | A- | 5.63% | 01/01/2033 | 01/01/18 @ 100 | 2,058,900 |

| 1,000,000 | | North Texas Tollway Authority, Series L-2(c) | A- | 6.00% | 01/01/2038 | N/A | 1,070,320 |

| 2,100,000 | | San Leanna Educational Facilities Corp. | BBB+ | 5.13% | 06/01/2036 | 06/01/17 @ 100 | 1,876,560 |

| 950,000 | | Tarrant County Cultural Education Facilities Finance Corp., Series A, (Assured Gty) | AA+ | 5.75% | 07/01/2018 | N/A | 1,043,955 |

| | | | | | | | 14,176,029 |

| | | Virginia – 1.5% | | | | | |

| 1,250,000 | | Washington County Industrial Development Authority, Series C | BBB+ | 7.50% | 07/01/2029 | 01/01/19 @ 100 | 1,417,475 |

| | | Washington – 1.1% | | | | | |

| 1,000,000 | | Tes Properties, WA Revenue | AA+ | 5.63% | 12/01/2038 | 06/01/19 @ 100 | 1,019,880 |

See notes to financial statements.

12 l Annual Report l July 31, 2011

MZF l Managed Duration Investment Grade Municipal Fund l Portfolio of Investments continued

| | | | | | | | |

| Principal | | | Rating | | | Optional Call | |

| Amount | | Description | (S&P)* | Coupon | Maturity | Provisions** | Value |

| | | Wisconsin – 1.3% | | | | | |

| $ 1,250,000 | | Wisconsin Health & Educational Facilities Authority, Series A | AA+ | 5.00% | 11/15/2036 | 11/15/16 @ 100 | $ 1,239,275 |

| | | Wyoming – 7.2% | | | | | |

| 4,000,000 | | County of Sweetwater WY, AMT | BBB+ | 5.60% | 12/01/2035 | 12/01/15 @ 100 | 3,916,440 |

| 3,100,000 | | Wyoming Community Development Authority, AMT, Series 7 | AA+ | 5.10% | 12/01/2038 | 12/01/16 @ 100 | 2,957,493 |

| | | | | | | | 6,873,933 |

| | | Total Municipal Bonds – 169.1% | | | | | |

| | | (Cost $155,253,713) | | | | | 160,465,334 |

| Redemption | | | | | | | |

| Value | | | | | | | |

| | | Preferred Shares – 2.2% | | | | | |

| | | Diversified Financial Services – 2.2% | | | | | |

| $2,000,000 | | Centerline Equity Issuer Trust, AMT, Series A-4-1 144A(b) | Aaa | 5.75% | 05/15/2015 | N/A | 2,076,540 |

| | | (Cost $2,000,000) | | | | | |

| | | Total Long-Term Investments – 171.3% | | | | | |

| | | (Cost $157,253,713) | | | | | 162,541,874 |

| | | | | | | | |

| | | Short-Term Investments – 0.2% | | | | | |

| | | | | | | | |

| Number | | | | | | | |

| of Shares | | Description | | | | | Value |

| | | Money Market – 0.2% | | | | | |

| 195,067 | | JPMorgan Tax Free Money Market | | | | | |

| | | (Cost $195,067) | | | | | 195,067 |

| | | Total Investments – 171.5% | | | | | |

| | | (Cost $157,448,780) | | | | | 162,736,941 |

| | | Other Assets in excess of Liabilities – 1.7% | | | | | 1,625,668 |

| | | Preferred Shares, at redemption value – (-73.2% of Net Assets Applicable to Common Shareholders or -42.7% of Total Investments) | | (69,450,000) |

| | | Net Assets – 100.0% | | | | | $ 94,912,609 |

AGM – Insured by Assured Guaranty Municipal Corporation

AMBAC – Insured by Ambac Assurance Corporation

AMT – Income from this security is a preference item under the Alternative Minimum Tax.

Assured GTY – Insured by Assured Guaranty Corporation

CIFG – Insured by CIFG Assurance North America, Inc.

FHA – Guaranteed by Federal Housing Administration

GNMA – Guaranteed by Ginnie Mae

N/A – Not Applicable

| * | Ratings shown are per Standard & Poor’s, Moody’s or Fitch. Securities classified as NR are not rated. (For securities not rated by Standard & Poor’s Rating Group, the rating by Moody’s Investor Services, Inc. is provided. Likewise, for securities not rated by Standard & Poor’s Rating Group and Moody’s Investor Services, Inc., the rating by Fitch Ratings is provided.) All ratings are unaudited. The ratings apply to the credit worthiness of the issuers of the underlying securities and not to the Fund or its shares. |

| ** | Date and price of the earliest optional call or put provision. There may be other call provisions at varying prices at later dates. |

| | All percentages shown in the Portfolio of Investments are based on Net Assets Applicable to Common Shareholders, unless otherwise noted. |

| (a) | The bond is prerefunded. U.S. government or U.S. government agency securities, held in escrow, are used to pay interest on this security, as well as to retire the bond in full at the date and price indicated under the Optional Call Provisions. |

| (b) | Securities are exempt from registration under Rule 144A of the Securities Act of 1933.These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At July 31, 2011 these securities amounted to $2,990,840, which represents 3.2% of net assets applicable to common shares. |

| (c) | Security is a “Step-up” bond where the coupon increases or steps up at a predetermined date. The rate shown reflects the rate in effect at the end of the reporting period. |

See notes to financial statements.

Annual Report l July 31, 2011 l 13

| | |

MZF l Managed Duration Investment Grade Municipal Fund | |

Statement of Assets and Liabilities l July 31, 2011 | |

| Assets | | |

| Investments, at value (cost $157,448,780) | $ | 162,736,941 | |

| Interest receivable | | 2,020,153 | |

| Other assets | | 13,465 | |

| Total assets | | 164,770,559 | |

| Liabilities | | | |

| Professional fees | | 282,477 | |

| Investment advisory fee payable | | 41,728 | |

| Dividends payable - preferred shareholders | | 28,703 | |

| Servicing agent fee payable | | 27,819 | |

| Administration fee payable | | 3,437 | |

| Accrued expenses and other liabilities | | 23,786 | |

| Total liabilities | | 407,950 | |

| Preferred Shares, at redemption value | | | |

| $.001 par value per share; 2,778 Auction Market Preferred Shares authorized, | | | |

| issued and outstanding at $25,000 per share liquidation preference | | 69,450,000 | |

| Net Assets Applicable to Common Shareholders | $ | 94,912,609 | |

| Composition of Net Assets Applicable to Common Shareholders | | | |

| Common stock, $.001 par value per share; unlimited number of shares authorized, | | | |

| 6,771,263 shares issued and outstanding | $ | 6,771 | |

| Additional paid-in capital | | 96,500,140 | |

| Net unrealized appreciation on investments | | 5,288,161 | |

| Accumulated undistributed net investment income | | 803,589 | |

| Accumulated net realized loss on investments | | (7,686,052 | ) |

| Net Assets Applicable to Common Shareholders | $ | 94,912,609 | |

Net Asset Value Applicable to Common Shareholders (based on 6,771,263 common shares outstanding) | $ | 14.02 | |

See notes to financial statements.

14 l Annual Report l July 31, 2011

| | | |

MZF l Managed Duration Investment Grade Municipal Fund | | |

Statement of Operations lFor the year ended July 31, 2011 | | |

| Investment Income | | | |

| Interest | | $ | 8,927,136 | |

| Expenses | | | | |

| Investment advisory fee | $ | 635,418 | | | |

| Servicing agent fee | | 423,612 | | | |

| Auction agent fees - preferred shares | | 119,247 | | | |

| Professional fees | | 118,670 | | | |

| Fund accounting | | 62,694 | | | |

| Administrative fee | | 44,805 | | | |

| Trustees’fees and expenses | | 44,143 | | | |

| Printing expenses | | 41,245 | | | |

| Custodian fee | | 25,070 | | | |

| NYSE listing fee | | 21,170 | | | |

| Transfer agent fee | | 20,086 | | | |

| Insurance | | 13,066 | | | |

| Line of credit fee | | 2,264 | | | |

| Other | | 37,300 | | | |

| Total expenses | | | | 1,608,790 | |

| Investment advisory fees waived | | | | (146,635 | ) |

| Servicing agent fees waived | | | | (97,757 | ) |

| Net expenses | | | | 1,364,398 | |

| Net investment income | | | | 7,562,738 | |

| Realized and Unrealized Loss on Investments | | | | | |

| Net realized loss on investments | | | | (1,130,690 | ) |

| Net change in unrealized appreciation (depreciation) on investments | | | | (1,327,456 | ) |

| Net realized and unrealized loss on investments | | | | (2,458,146 | ) |

| Distributions to Auction Market Preferred Shareholders from | | | | | |

| Net investment income | | | | (1,001,260 | ) |

| Net Decrease in Net Assets Applicable to Common Shareholders Resulting from Operations | | | $ | 4,103,332 | |

See notes to financial statements.

Annual Report l July 31, 2011 l 15

| | | |

MZF l Managed Duration Investment Grade Municipal Fund | | |

Statement of Changes in Net Assets l | | |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | July 31, 2011 | | | July 31, 2010 | |

| Increase in Net Assets Applicable to Common Shareholders Resulting from Operations: | | | | | | |

| Net investment income | | $ | 7,562,738 | | | $ | 7,980,723 | |

| Net realized gain (loss) on investments | | | (1,130,690 | ) | | | 585,739 | |

| Net change in unrealized appreciation (depreciation) on investments | | | (1,327,456 | ) | | | 12,207,098 | |

| Distributions to auction market preferred shareholders from net investment income | | | (1,001,260 | ) | | | (1,028,788 | ) |

| Net increase in net assets applicable to common shareholders resulting from operations | | | 4,103,332 | | | | 19,744,772 | |

| Distributions to common shareholders from | | | | | | | | |

| Net investment income | | | (6,694,146 | ) | | | (7,284,872 | ) |

| Capital share transactions | | | | | | | | |

| Cost of common shares repurchased | | | – | | | | (16,343,117 | ) |

| Reinvestment of dividends | | | 313,110 | | | | 57,703 | |

| Net increase (decrease) from capital share transactions | | | 313,110 | | | | (16,285,414 | ) |

| Total change in net assets applicable to common shareholders | | | (2,277,704 | ) | | | (3,825,514 | ) |

| Net assets applicable to common shareholders: | | | | | | | | |

| Beginning of period | | | 97,190,313 | | | | 101,015,827 | |

| End of period (including undistributed net investment income of $803,589 and $936,257, respectively.) | | $ | 94,912,609 | | | $ | 97,190,313 | |

See notes to financial statements.

16 l Annual Report l July 31, 2011

| | | | | | |

MZF l Managed Duration Investment Grade Municipal Fund | | | | | |

Financial Highlights l | | | | | |

| | | For the | | | For the | | | For the | | | For the | | | For the | |

| Per share operating performance for one common share | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| outstanding throughout each period | | July 31, 2011 | | | July 31, 2010 | | | July 31, 2009 | | | July 31, 2008 | | | July 31, 2007 | |

| Net asset value, beginning of period | | $ | 14.40 | | | $ | 12.73 | | | $ | 13.17 | | | $ | 14.21 | | | $ | 14.25 | |

| Investment operations | | | | | | | | | | | | | | | | | | | | |

Net investment income (a) | | | 1.12 | | | | 1.06 | | | | 1.02 | | | | 0.99 | | | | 0.95 | |

| Net realized and unrealized gain/(loss) on investments | | | | | | | | | | | | | | | | | | | | |

| and swaptions transactions | | | (0.36 | ) | | | 1.72 | | | | (0.49 | ) | | | (1.06 | ) | | | (0.10 | ) |

| Distributions to preferred shareholders from net investment income | | | | | | | | | | | | | | | | | | | | |

| (common share equivalent basis) | | | (0.15 | ) | | | (0.14 | ) | | | (0.24 | ) | | | (0.35 | ) | | | (0.31 | ) |

| Total from investment operations | | | 0.61 | | | | 2.64 | | | | 0.29 | | | | (0.42 | ) | | | 0.54 | |

| Distributions to common shareholders from net investment income | | | (0.99 | ) | | | (0.97 | ) | | | (0.73 | ) | | | (0.62 | ) | | | (0.58 | ) |

| Net asset value, end of period | | $ | 14.02 | | | $ | 14.40 | | | $ | 12.73 | | | $ | 13.17 | | | $ | 14.21 | |

| Market value, end of period | | $ | 13.48 | | | $ | 14.53 | | | $ | 11.87 | | | $ | 11.73 | | | $ | 12.63 | |

Total investment return(b) | | | | | | | | | | | | | | | | | | | | |

| Net asset value | | | 4.57 | % | | | 21.21 | % | | | 2.83 | % | | | -3.07 | % | | | 3.80 | % |

| Market value | | | -0.32 | % | | | 31.45 | % | | | 8.65 | % | | | -2.29 | % | | | 7.93 | % |

| Ratios and supplemental data | | | | | | | | | | | | | | | | | | | | |

| Net assets end of period (thousands) | | $ | 94,913 | | | $ | 97,190 | | | $ | 101,016 | | | $ | 104,526 | | | $ | 112,777 | |

| Ratio of expenses to average net assets (excluding interest expense | | | | | | | | | | | | | | | | | | | | |

and net of fee waivers) (c) | | | 1.46 | % | | | 1.35 | % | | | 1.54 | % | | | 1.27 | % | | | 1.28 | % |

| Ratio of expenses to average net assets (excluding interest expense | | | | | | | | | | | | | | | | | | | | |

and excluding fee waivers) (c) | | | 1.72 | % | | | 1.69 | % | | | 1.91 | % | | | 1.61 | % | | | 1.62 | % |

| Ratio of expenses to average net assets (including interest expense | | | | | | | | | | | | | | | | | | | | |

and net of fee waivers) (c) | | | 1.46 | % | | | 1.35 | % | | | 1.54 | % | | | 1.32 | % | | | 1.44 | % |

| Ratio of expenses to average net assets (including interest expense | | | | | | | | | | | | | | | | | | | | |

and excluding fee waivers) (c) | | | 1.72 | % | | | 1.69 | % | | | 1.91 | % | | | 1.66 | % | | | 1.78 | % |

Ratio of net investment income to average net assets (c) | | | 8.09 | % | | | 7.68 | % | | | 8.65 | % | | | 7.15 | % | | | 6.56 | % |

| Portfolio turnover | | | 8 | % | | | 6 | % | | | 21 | % | | | 29 | % | | | 4 | % |

| Preferred shares, at redemption value ($25,000 per share | | | | | | | | | | | | | | | | | | | | |

| liquidation preference) (thousands) | | $ | 69,450 | | | $ | 69,450 | | | $ | 69,450 | | | $ | 69,450 | | | $ | 69,450 | |

| Preferred shares asset coverage per share | | $ | 59,166 | | | $ | 59,986 | | | $ | 61,363 | | | $ | 62,626 | | | $ | 65,597 | |

Asset coverage per $1,000 of indebtedness (d) | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | $ | 37,445 | |

| N/A Not applicable. | | | | | | | | | | | | | | | | | | | | |

| (a) | Based on average shares outstanding during the period. |

| (b) | Total investment return is calculated assuming a purchase of a common share at the beginning of the period and a sale on the last day of the period reported either at net asset value (NAV) or market price per share. Dividends and distributions are assumed to be reinvested at NAV for returns at NAV or in accordance with the Fund’s dividend reinvestment plan for returns at market value. Total investment return does not reflect brokerage commissions. |

| (c) | Calculated on the basis of income and expenses applicable to both common and preferred shares relative to average net assets of common shareholders. |

| (d) | Calculated by subtracting the Fund’s total liabilities (not including the floating rate note obligations) from the Fund’s total assets and dividing by the total number of indebtedness units, where one unit equals $1,000 of indebtedness. |

See notes to financial statements.

Annual Report l July 31, 2011 l 17

MZF l Managed Duration Investment Grade Municipal Fund

Notes to Financial Statements l July 31, 2011

Note 1 – Organization:

The Managed Duration Investment Grade Municipal Fund (the“Fund”), formerly known as MBIA Capital/Claymore Managed Duration Investment Grade Municipal Fund, was organized as a Delaware statutory trust on May 20, 2003. The Fund is registered as a diversified, closed-end management investment company under the Investment Company Act of 1940, as amended. The Fund’s investment objective is to provide its common shareholders with high current income exempt from regular federal income tax while seeking to protect the value of the Fund’s assets during periods of interest rate volatility. Prior to commencing operations on August 27, 2003, the Fund had no operations other than matters relating to its organization and registration and the sale and issuance of 6,981 common shares of beneficial interest to MBIA Capital Management Corp.

On September 24, 2010, Claymore Advisors, LLC changed its name to Guggenheim Funds Investment Advisors, LLC. Also, on September 24, 2010, Claymore Securities, Inc. changed its name to Guggenheim Funds Distributors, Inc.

Note 2 – Accounting Policies:

The preparation of financial statements in accordance with U.S. generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund.

(a) Valuation of Investments: The municipal bonds and preferred shares in which the Fund invests are traded primarily in the over-the-counter markets. In determining net asset value, the Fund uses the valuations of portfolio securities furnished by a pricing service approved by the Board of Trustees. The pricing service typically values portfolio securities at the bid price or the yield equivalent when quotations are readily available. Securities for which quotations are not readily available are valued at fair market value on a consistent basis as determined by the pricing service using a matrix system to determine valuations. The procedures of the pricing service and its valuations are reviewed by the officers of the Fund under the general supervision of the Board of Trustees. Positions in futures contracts, interest rate swaps and options on interest rate swaps (“swaptions”) are valued at closing prices for such contracts established by the exchange or dealer market on which they are traded, or if market quotations are not readily available, are valued at fair value on a consistent basis using methods approved in good faith by the Board of Trustees.

For those securities where quotations or prices are not available, the valuations are determined in accordance with procedures established in good faith by management and approved by the Board of Trustees. Valuations in accordance with these procedures are intended to reflect each security’s (or asset’s)“fair value”. Such“fair value”is the amount that the Fund might reasonably expect to receive for the security (or asset) upon its current sale. Each such determination should be based on a consideration of all relevant factors, which are likely to vary from one pricing context to another. Examples of such factors may include, but are not limited to: (i) the type of security, (ii) the initial cost of the security, (iii) the existence of any contractual restrictions on the security’s disposition, (iv) the price and extent of public trading in similar securities of the issuer or of comparable companies, (v) quotations or evaluated prices from broker-dealers and/or pricing services, (vi) information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange traded securities), (vii) an analysis of the issuer’s financial statements, and (viii) an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold (e.g. the existence of pending merger activity, public offerings or tender offers that might affect the value of the security).

Fair value is defined as the price that the Fund would receive to sell an investment or pay to transfer a liability in an orderly transaction with an independent buyer in the principal market, or in the absence of a principal market the most advantageous market for the investment or liability. There are three different categories for valuations. Level 1 valuations are those based upon quoted prices in active markets. Level 2 valuations are those based upon quoted prices in inactive markets or based upon significant observable inputs (e.g. yield curves; benchmark interest rates; indices). Level 3 valuations are those based upon unobservable inputs (e.g. discounted cash flow analysis; non-market based methods used to determine fair valuation).

The Fund has adopted the Accounting Standards Update (“ASU”), Fair Value Measurements and Disclosures (Topic 820): Improving Disclosures about Fair Value Measurements which provides guidance on how investment assets and liabilities are to be valued and disclosed. Specifically, the amendment requires reporting entities to disclose i) the input and valuation techniques used to measure fair value for both recurring and nonrecurring fair value measurements, for Level 2 or Level 3 positions ii) transfers between all levels (including Level 1 and Level 2) on a gross basis (i.e. transfers out must be disclosed separately from transfers in) as well as the reason(s) for the transfer and iii) purchases, sales, issuances and settlements must be shown on a gross basis in the Level 3 rollforward rather than as one net number. The Fund has adopted the disclosures required by this amendment, which did not have a material impact on the financial statements.

The Fund values Level 1 securities using readily available market quotations in active markets. The Fund values Level 2 fixed income securities using independent pricing providers who employ matrix pricing models utilizing market prices, broker quotes and prices of securities with comparable maturities and qualities. The Fund did not have any Level 3 securities during the year ended July 31, 2011.

The following table represents the Fund’s investments carried on the Statement of Assets and Liabilities by caption and by level within the fair value hierarchy as of July 31, 2011:

| Valuations (in $000s) | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Description | | | | | | | | | | | | |

| Assets: | | | | | | | | | | | | |

| Preferred Shares | | $ | – | | | $ | 2,077 | | | $ | – | | | $ | 2,077 | |

| Municipal Bonds | | | – | | | | 160,465 | | | | – | | | | 160,465 | |

| Money Market | | | 195 | | | | – | | | | – | | | | 195 | |

| Total | | $ | 195 | | | $ | 162,542 | | | $ | – | | | $ | 162,737 | |

There were no transfers between levels for the year ended July 31, 2011.

(b) Investment Transactions and Investment Income: Investment transactions are accounted for on the trade date. Realized gains and losses on investments are determined on the identified cost basis. Interest income and expenses are accrued daily. All discounts/premiums are accreted/amortized for financial reporting purposes over the life of each security.

(c) Dividends and Distributions: The Fund declares and pays on a monthly basis dividends from net investment income to common shareholders. Distributions of net realized capital gains, if any, will be paid at least annually. Dividends and distributions to shareholders are recorded on the ex-dividend date. Dividends and distributions to preferred shareholders are accrued and determined as described in Note 6.

18 l Annual Report l July 31, 2011

MZF l Managed Duration Investment Grade Municipal Fund l Notes to Financial Statements continued

(d) Inverse Floating Rate Investments and Floating Rate Note Obligations: Inverse floating rate instruments are notes whose coupon rate fluctuates inversely to a predetermined interest rate index. These instruments typically involve greater risks than a fixed rate municipal bond. In particular, the holder of these inverse floating rate instruments retain all credit and interest rate risk associated with the full underlying bond and not just the par value of the inverse floating rate instrument. As such, these instruments should be viewed as having inherent leverage and therefore involve many of the risks associated with leverage. Leverage is a speculative technique that may expose the Fund to greater risk and increased costs. Leverage may cause the Fund’s net asset value to be more volatile than if it had not been leveraged because leverage tends to magnify the effect of any increases or decreases in the value of the Fund’s portfolio securities. The use of leverage may also cause the Fund to liquidate portfolio positions when it may not be advantageous to do so in order to satisfy its obligations with respect to inverse floating rate instruments.

The Fund may invest in inverse floating rate securities through either a direct purchase or through the transfer of bonds to a dealer trust in exchange for cash and/or residual interests in the dealer trust. For those inverse floating rate securities purchased directly, the instrument is included in the Portfolio of Investments with income recognized on an accrual basis. The Fund did not invest in inverse floaters during the year ended July 31, 2011.

(e) Recent Accounting Pronouncements: On May 12, 2011, the Financial Accounting Standards Board (“FASB”) issued ASU 2011-04, modifying Topic 820, Fair Value Measurements and Disclosures. At the same time, the International Accounting Standards Board (“IASB”) issued International Financial Reporting Standard (“IFRS”) 13, Fair Value Measurement. The objective by the FASB and IASB is convergence of their guidance on fair value measurements and disclosures. Specifically, the ASU requires reporting entities to disclose (i) the amounts of any transfers between Level 1 and Level 2, and the reasons for the transfers, (ii) for Level 3 fair value measurements, quantitative information about significant unobservable inputs used, (iii) a description of the valuation processes used by the reporting entity and, (iv) a narrative description of the sensitivity of the fair value measurement to changes in unobservable inputs if a change in those inputs might result in a significantly higher or lower fair value measurement. The effective date of the ASU is for interim and annual periods beginning after December 15, 2011, and is therefore not effective for the current fiscal year. The Adviser is in the process of assessing the impact of the updated standards on the Fund’s financial statements.

Note 3 – Agreements:

Pursuant to an Investment Advisory Agreement (the“Advisory Agreement”) between Cutwater Asset Management Corp. (the“Adviser”) and the Fund, the Adviser is responsible for the daily management of the Fund’s portfolio, which includes buying and selling securities for the Fund, as well as investment research, subject to the direction of the Fund’s Board of Trustees. The Adviser is a subsidiary of MBIA Asset Management, LLC which, in turn, is a wholly-owned subsidiary of MBIA, Inc. The Advisory Agreement provides that the Fund shall pay to the Adviser a monthly fee for its services at the annual rate of 0.39% of the sum of the Fund’s average daily managed assets. (“Managed Assets”represent the Fund’s total assets including the assets attributable to the proceeds from any financial leverage but excluding the assets attributable to floating rate note obligations, minus liabilities, other than debt representing financial leverage.) The Adviser contractually agreed to waive a portion of the management fees it is entitled to receive from the Fund at the annual rate of 0.09% of the Fund’s average daily Managed Assets from the commencement of the Fund’s operations through September 1, 2008 and at the annual rate of 0.042% thereafter through September 1, 2009. Effective June 16, 2006, the Adviser voluntarily agreed to waive an additional 0.0375% of advisory fees and has since agreed to forego the scheduled step down in the contractual waiver scheduled for September 1, 2008 and September 1, 2009. Effective June 1, 2010, the Adviser discontinued the 0.0375% voluntary fee waiver.

Pursuant to a Servicing Agreement, Guggenheim Funds Distributors, Inc. (the“Servicing Agent”) acts as servicing agent to the Fund. The Servicing Agent receives an annual fee from the Fund, payable monthly in arrears, in an amount equal to 0.26% of the average daily value of the Fund’s Managed Assets. The Servicing Agent contractually agreed to waive a portion of the servicing fee it is entitled to receive from the Fund at the annual rate of 0.06% of the average daily value of the Fund’s Managed Assets from the commencement of the Fund’s operations through September 1, 2008 and at the annual rate of 0.028% thereafter through September 1, 2009. Effective June 16, 2006, the Servicing Agent voluntarily agreed to waive an additional 0.025% of servicing fees and has since agreed to forego the scheduled step down in the contractual waiver scheduled for September 1, 2008 and September 1, 2009. Effective June 1, 2010, the Servicing Agent discontinued the 0.025% voluntary fee waiver.

Under a separate Fund Administration agreement, Guggenheim Funds Investment Advisors, LLC, an affiliate of the Servicing Agent, provides fund administration services to the Fund. Guggenheim Funds Investment Advisors, LLC receives a fund administration fee payable monthly at the annual rate set forth below as a percentage of the average daily managed assets of the Fund:

| Managed Assets | Rate |

| First $200,000,000 | 0.0275% |

| Next $300,000,000 | 0.0200% |

| Next $500,000,000 | 0.0150% |

| Over $1,000,000,000 | 0.0100% |

For the year ended July 31, 2011, the Fund incurred $44,805 in fund administration fees.

The Bank of New York Mellon (“BNY”) acts as the Fund’s custodian, accounting agent, auction agent and transfer agent. As custodian, BNY is responsible for the custody of the Fund’s assets. As accounting agent, BNY is responsible for maintaining the books and records of the Fund. As auction agent, BNY is responsible for conducting the auction of the preferred shares. As transfer agent, BNY is responsible for performing transfer agency services for the Fund.

Certain officers and/or trustees of the Fund are officers and/or directors of the Adviser and the Servicing Agent.

The Fund does not compensate its officers or trustees who are officers, directors and/or employees of the aforementioned firms.

Note 4 – Federal Income Taxes:

The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, no provision for U.S. federal income taxes is required. In addition, by distributing substantially all of its ordinary income and long-term capital gains, if any, during each calendar year, the Fund intends not to be subject to U.S. federal excise tax.

Information on the tax components of investments as of July 31, 2011 is as follows:

| Cost of | | | |

| Investments | Gross Tax | Gross Tax | Net Tax Unrealized |

| for Tax | Unrealized | Unrealized | Appreciation on |

| Purposes | Appreciation | Depreciation | Investments |

| $157,481,990 | $7,213,627 | $(1,958,676) | $5,254,951 |

Annual Report l July 31, 2011 l 19

MZF l Managed Duration Investment Grade Municipal Fund l Notes to Financial Statements continued

The difference between book and tax basis cost of investments is due to book/tax differences on the recognition of partnership/trust income.

As of July 31, 2011, the components of accumulated earnings/(losses) (excluding paid-in capital) on a tax basis were as follows:

| | Undistributed | Undistributed | Accumulated | Unrealized |

| | Tax-Exempt | Ordinary | Capital and | Appreciation/ |

| | Income | Income | Other Losses | (Depreciation) |

| 2011 | $851,941 | $ – | $(7,701,194) | $5,254,951 |

The cumulative timing differences under tax basis accumulated capital and other losses as of July 31, 2011 are due to investments in partnerships/trusts.

As of July 31, 2011, for federal income tax purposes, the Fund had a capital loss carryforward of $6,477,524 available to offset possible future capital gains. The capital loss carryforward is set to expire as follows: $1,079,795 on July 31, 2013, $625,460 on July 31, 2014 and $4,772,269 on July 31, 2017.

Distributions paid to shareholders during the tax years ended July 31, 2011 and 2010, were characterized as follows:

| | Tax-exempt | Ordinary | Long-term | Total |

| | income | income | capital gain | distributions |

| 2011 | $7,621,698 | $73,708 | $ – | $7,695,406 |

| 2010 | $8,245,149 | $68,511 | $ – | $8,313,660 |

Capital losses incurred after October 31 (“post-October losses”) within the taxable year are deemed to arise on the first business day of the Fund’s next taxable year. For the year ended July 31, 2011, the Fund incurred and will elect to defer $1,223,670 as post-October losses.

For all open tax years and all major jurisdictions, management of the Fund has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Open tax years are those years that are open for examination by taxing authorities (i.e. generally the last four tax year ends and the interim tax period since then). Furthermore, management of the Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Note 5 – Investment Transactions:

Purchases and sales of investment securities, excluding short-term investments, for the year ended July 31, 2011, aggregated $13,701,649 and $14,986,468, respectively.

Note 6 – Capital:

There are an unlimited number of $.001 par value common shares of beneficial interest authorized and 6,771,263 common shares outstanding at July 31, 2011, of which the Adviser owned 11,114 shares.

| Transactions in common shares were as follows: | | |

| | Year Ended | Year Ended |

| | July 31, 2011 | July 31, 2010 |

| Beginning shares | 6,749,259 | 7,935,591 |

| Shares issued through dividend reinvestment | 22,004 | 4,007 |