. . .YOUR WINDOW TO THE LATEST, MOST UP-TO-DATE INFORMATION ABOUT THE MANAGED

Cutwater Investor Services Corp. and Guggenheim Investments are continually updating and expanding shareholder information services on the Fund’s website, in an ongoing effort to provide you with the most current information about how your Fund’s assets are managed, and the results of our efforts. It is just one more way we are working to keep you better informed about your investment in the Fund.

We thank you for your investment in Managed Duration Investment Grade Municipal Fund (the “Fund”). This report covers performance for the semiannual fiscal period ended January 31, 2012.

Cutwater Investor Services Corp. (“Cutwater”) serves as the Fund’s Investment Adviser. With $34 billion of fixed income assets under management and supervision as of December 31, 2011, Cutwater is one of the top 50 fixed income specialists in the world. Cutwater’s parent company, MBIA Inc., is listed on the New York Stock Exchange and is a component stock of the S&P 500 Index.

Guggenheim Funds Distributors, LLC, (the “Servicing Agent”) serves as the Servicing Agent to the Fund. The Servicing Agent is an affiliate of Guggenheim Partners, LLC, a global diversified financial services firm with more than $125 billion in assets under management and supervision.

The Fund’s investment objective is to provide high current income exempt from regular federal income tax while seeking to protect the value of the Fund’s assets during periods of interest rate volatility. Under normal market conditions, the Fund seeks to achieve this objective by investing substantially all of its assets in municipal bonds of investment-grade quality.

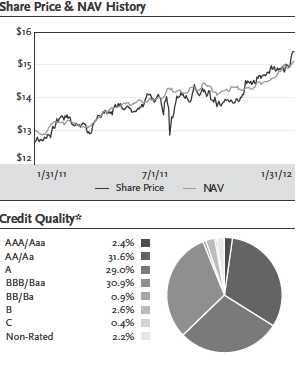

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the six-month period ended January 31, 2012, the Fund provided a total return based on market price of 18.23% and a total return of 11.52% based on NAV. Past performance is not a guarantee of future results. As of January 31, 2012, the Fund’s last closing market price of $15.40 represented a premium of 1.92% to NAV of $15.11. As of July 31, 2011, the Fund’s last closing market price of $13.48 represented a discount of 3.85% to NAV of $14.02. The market value and NAV of the Fund’s shares fluctuate from time to time, and the Fund’s market value may be higher or lower than its NAV.

Dividends of $0.0825 were paid in each month from August 2011 through January 2012. The current dividend represents an annualized distribution rate of 6.43% based on the last closing market price of $15.40 on January 31, 2012.

We encourage shareholders to consider the opportunity to reinvest their distributions from the Fund through the Dividend Reinvestment Plan (“DRIP”), which is described in detail on page 23 of this report. When shares trade at a discount to NAV, the DRIP takes advantage of the discount by reinvesting the monthly dividend distribution in common shares of the Fund purchased in the market at a price less than NAV. Conversely, when the market price of the Fund’s common shares is at a premium above NAV, the DRIP reinvests participants’ dividends in newly-issued common shares at NAV, subject to an IRS limitation that the purchase price cannot be more than 5% below the market price per share. The DRIP provides a cost-effective means to accumulate additional shares and enjoy the benefits of compounding returns over time. Since the Fund endeavors to maintain a steady monthly distribution rate, the DRIP effectively provides an income averaging technique, which causes shareholders to accumulate a larger number of Fund shares when the market price is depressed than when the price is higher.

We appreciate your investment, and we look forward to serving your investment needs in the future. For the most up-to-date information on your investment, please visit the Fund’s website at www.guggenheimfunds.com/mzf.

Clifford D. Corso

| | |

QUESTIONS & ANSWERS | January 31, 2012 |

Clifford D. Corso

Portfolio Manager

Mr. Corso joined the firm in 1994, establishing the company’s asset management platform and building it into one of the largest fixed income managers in the world. With a staff of 120 people, Mr. Corso now oversees the investment of $34 billion in assets as of December 31, 2011, and directs the investment strategies of Cutwater’s clients, including pension funds, global banks, corporations, Taft-Hartley and insurance companies as well as hundreds of municipalities across the United States. Mr. Corso also initiated and managed the expansion of the asset manager’s international asset management business from a principal office in London, now a multi-billion dollar platform.

Prior to joining the firm, Mr. Corso served as co-head of a fixed income division at Alliance Capital Management. In his 27-year career, he has held positions as a credit analyst, restructuring specialist, trader and portfolio manager. He has managed a wide range of fixed income products, including corporate, asset-backed, government, mortgage, municipal, credit default swap and derivative securities. He has developed several unique conduit businesses including East-Fleet, a London based vehicle serving several global banks. He was also an early pioneer in the credit derivatives market, developing several investment programs starting in 2000, and expanding this area to create the MINTS funds, one of the most successful CDS funds ever created with over $1.6 billion in notional value under management.

Mr. Corso began his career in banking positions as an analyst, lender and trader, and has led several notable and large debt restructurings. His analytical skills combine mathematics, game theory, economics, psychology and investment theory.

Mr. Corso graduated from Yale University with a degree in economics and earned an MBA from Columbia University. He has lectured on topics from leadership to finance at many academic institutions, including Columbia University and New York University, where he taught a course on financial derivatives.

He currently holds Series 7, 24, and 63 licenses from the Financial Industry Regulatory Authority (FINRA) and is a member of the Fixed Income Analysts Society, Global Association of Risk Professionals (GARP) and the Investment Management Executive Council. Mr. Corso also serves on the Board of Directors of the MBIA Foundation, a not-for-profit charity.

Mr. Corso is also a member of the Eisenhower Fellowships Board of Trustees. The Eisenhower Fellowships engages emerging leaders from around the world to enhance their professional capabilities, broaden their contacts, deepen their perspectives, and unite them in a diverse, global community - a network where dialogue, understanding, and collaboration lead to a more prosperous, just, and peaceful world.

Jeffrey S. MacDonald, CFA

Portfolio Manager

Mr. MacDonald joined the firm in 2007 and oversees portfolio management for Cutwater’s traditional strategies suite of products. From 2004 to 2007, Mr. MacDonald was a vice president and portfolio manager at Hartford Investment Management Company (HIMCO) where he managed core, core plus, intermediate core, and other broad-based fixed income styles. Prior to joining HIMCO, Mr. MacDonald held portfolio analyst and trading positions at Wellington Management Company and Fidelity Investments. Mr. MacDonald has a bachelor’s degree from Trinity College in Connecticut and a master’s degree from Boston University. He holds the designation of Chartered Financial Analyst (CFA) through the CFA Institute and is a member of the New York Society of Security Analysts.

James B. DiChiaro

Portfolio Manager

Mr. DiChiaro joined Cutwater in 1999 and is a vice president. He currently manages Cutwater’s municipal assets under management (taxable and tax-exempt) and has extensive experience managing money-market portfolios. Mr. DiChiaro began his career at Cutwater working with the conduit group structuring medium-term notes for Meridian Funding Company and performing the treasury role for an MBIA sponsored asset-backed commercial paper conduit, Triple-A One Funding Corporation. Prior to joining Cutwater he worked for Merrill Lynch supporting their asset-backed securities trading desk. Mr. DiChiaro has a bachelor’s degree from Fordham University and a master’s degree from Pace University.

In the following interview Portfolio Managers Clifford D. Corso, Jeffrey S. MacDonald and James B. DiChiaro discuss the market environment and the performance of the Fund for the semiannual period ended January 31, 2012.

Please provide an overview of the municipal market during the six-month period ended January 31, 2012.

In the late summer of 2011, as the period began, market sentiment was generally cautious. August brought political battles regarding the conflicting needs to increase the United States’ debt ceiling and reduce future budget deficits. When the agreement that was reached did not meet the expectations of Standard and Poor’s, the credit rating of the United States was downgraded to AA+. The Federal Reserve (the “Fed”) cited significant downside risks to economic growth at its September meeting, prompting the launch of “Operation Twist,” a program in which the Fed sells treasury securities with maturities of five years or less and uses the proceeds to buy longer dated treasuries. The result was a significant flattening of the taxable yield curve, meaning that yields on longer maturity bonds decreased more than the yields on shorter maturity securities.1 The long-term solvency of certain European nations continued to affect markets, which were quick to react to any news out of Europe, good or bad. The

| | |

| 1 | The yield curve is a curve on a graph in which the yield of fixed-interest securities is plotted against the length of time they have to run to maturity. Spread refers to the difference in yield between securities, in this case the difference between higher quality bonds and riskier bonds. |

4 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT |

| | |

| QUESTIONS & ANSWERS continued | January 31, 2012 |

result was increased market volatility and flight to quality rallies, generally benefitting US Treasury securities and the US dollar.

Economic news improved in the fourth quarter of 2011 and the beginning of 2012. Weekly initial jobless claims were consistently below the closely watched 400,000 level and the unemployment rate impressively decreased to 8.5% in December and 8.3% in January. Annualized real growth in gross domestic product (GDP) was 1.8% in the third quarter of 2011 and 2.8% in the fourth quarter.

During the first few months of the six-month period ended January 2012, municipal bonds underperformed US Treasury securities, as they typically do during flight to quality rallies. As investors began to adjust to the new low yield environment, tax-exempt bonds began to follow the trend of the taxable yield curve, and the municipal yield curve eventually began to flatten, although it remained steeper than the taxable yield curve. During the period there was significant volatility in the municipal market. At one point during the period, the ratio of the yield on 30-year municipal bonds to the yield on 30-year Treasury securities neared 130%, far above the 98% to 99% ratio that has been the norm in recent years.

Despite the low yield environment, the relatively high yield offered by tax-exempt bonds, coupled with tepid primary market supply, drove investors into the municipal bond market towards the end of 2011. Primary market issuance for 2011 amounted to a meager $295 billion, a decrease of more than 30% from the previous year, when the Build America Bonds program drove a high level of issuance. As many issuers remain in “belt tightening” mode, there is reluctance to issue new debt unless absolutely necessary.

For the six-month period ended January 31, 2012, municipal bonds were one of the best performing asset classes, with the Barclays Capital Municipal Bond Index (the “Municipal Index”), a widely used measure of the municipal bond market as a whole, posting a return of 7.37%. For comparison, the Barclays Capital U.S. Aggregate Bond Index returned 4.25% and the Barclays Capital U.S. Treasury Composite Index returned 5.95% for the same period.

How did the Fund perform in this market environment?

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the six-month period ended January 31, 2012, the Fund provided a total return based on market price of 18.23% and a total return of 11.52% based on NAV. Past performance is not a guarantee of future results.

As of January 31, 2012, the Fund’s last closing market price of $15.40 represented a premium of 1.92% to NAV of $15.11. As of July 31, 2011, the Fund’s last closing market price of $13.48 represented a discount of 3.85% to NAV of $14.02. The market value and NAV of the Fund’s shares fluctuate from time to time, and the Fund’s market value may be higher or lower than its NAV.

Dividends of $0.0825 were paid in each month from August 2011 through January 2012. The current dividend represents an annualized distribution rate of 6.43% based on the last closing market price of $15.40 on January 31, 2012.

How is the Fund’s portfolio structured, and what has that structure meant for performance?

The Fund has a high quality portfolio that is diversified across issuers, sectors and states. In selecting securities for the portfolio, the portfolio management team, who together have more than 50 years of experience, are supported by Cutwater’s team of credit analysts, who evaluate the credit quality of sectors and individual issuers, going far beyond the bond ratings provided by rating agencies. Cutwater’s proprietary quantitative models help to evaluate the risk of individual securities as well as the overall portfolio, supplementing the judgment of the experienced team. Thorough quantitative and qualitative analysis helps ensure that the desired level of credit quality is maintained in the Fund’s portfolio while yield is added, as appropriate, by buying higher yielding bonds at what are considered to be attractive prices.

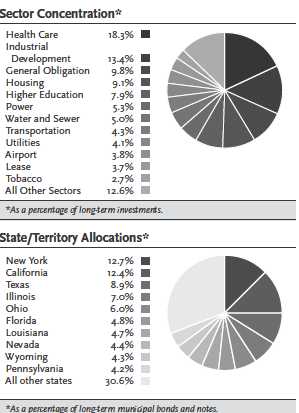

The average credit quality of the Fund’s portfolio has been maintained in the low single-A range, which has helped the Fund keep a stable distribution rate while outperforming its benchmark, the Municipal Index. A modest uptick in the credit quality of the portfolio resulted in part from a reduction in exposure to tobacco bonds. (Tobacco bonds have been sold by states and backed by payments from tobacco companies that flow from legal settlements in the late 1990s.) In addition, some of the Fund’s corporate-backed bonds received credit upgrades. The Fund’s managers believe this increase in credit quality is appropriate, as they believe the spread between risky bonds and bonds that carry little credit risk has significantly narrowed over a short period of time.

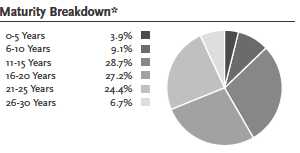

The duration of the portfolio was shortened by approximately six months during the period.2 This meaningful reduction resulted partially from trading activities intended to reduce sensitivity to interest rates and partially from certain securities being pre-refunded.3 As of January 31, 2012, the portfolio’s duration is 6.72 years whereas on July 31, 2011 the duration of the Fund’s portfolio was 7.31 years.

Looking at the sector composition of the Fund, the Fund’s performance benefited from an overweight relative to the Municipal Index in health care bonds, which represented approximately 18% of the Fund’s portfolio at the

| 2 | Duration is a measure of the interest rate sensitivity of a bond or fixed-income portfolio which incorporates time to maturity and coupon size. The longer the duration, the greater the interest rate risk. |

| 3 | A bond is pre-refunded when the issuer has purchased U.S. Treasury or agency securities that provide a stream of cash flow to pay off the bonds on their first call date. |

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 5

| | |

QUESTIONS & ANSWERS continued | January 31, 2012 |

end of the period. The Fund’s investments in the general obligation sector, more specifically state and local general obligation bonds, performed well as that sector recovered from generally oversold conditions, contributing to the Fund’s performance. The Fund’s managers have been very cautious in investing in local general obligation bonds, since local general obligation issuers are heavily reliant on property tax receipts, which have been negatively affected by weakness in the housing market. The Fund’s local general obligation bond holdings are concentrated in large cities such as Chicago, New York and Philadelphia. Corporate-backed bonds, which have a higher correlation to spread movements in the taxable bond market, performed poorly in the August through November period, as markets responded to the downgrade of U.S. debt, then rallied somewhat near the end of the period. Nonetheless, the Fund’s holdings in corporate-backed bonds detracted from performance for the six-month period. Pre-refunded bonds also performed poorly during the period. Although these bonds are perceived as having little credit risk, their duration is generally very short, usually less than five years. With the implementation of Operation Twist and the resulting flattening of the yield curve, longer duration bonds performed better than those with short durations. As mentioned above, the Fund’s managers have been reducing exposure to tobacco bonds, a sector with generally poor fundamentals that underperformed the Municipal Index.

Among the Funds non-investment-grade bond holdings are two series of bonds issued by AMR Corporation (the parent company of American Airlines), which filed for Chapter 11 bankruptcy reorganization on November 29, 2011. These bond issues are in default, as AMR has not made interest payments since the bankruptcy filing. These are issues with relatively short maturities that are secured by lease revenues from certain terminals at New York’s John F. Kennedy International Airport, a major flight hub. As a result, our credit team has a positive opinion on these specific bonds and believes the bonds may make interest payments in the upcoming months.

Please explain the Fund’s leverage strategy and its effect on Fund returns.

The Fund utilizes leverage (borrowing) as part of its investment strategy, to finance the purchase of additional securities that provide increased income and potentially greater appreciation potential to common shareholders than could be achieved from a portfolio that is not leveraged. Leverage adds to performance only when the cost of leverage is less than the total return generated by investments. The use of financial leverage creates an opportunity for increased income and capital appreciation but, at the same time, creates special risks. There can be no assurance that a leveraging strategy will be successful. Financial leverage may cause greater changes in the Fund’s net asset value and returns than if financial leverage had not been used.

As of January 31, 2012, the Fund had $69.45 million of leverage outstanding in the form of Auction Market Preferred Shares (“AMPS”). Since the Fund’s NAV return was positive over the six-month period ended January 31, 2012, leverage contributed to the Fund’s total return.

What is the outlook for the municipal market in the coming months?

The Fund’s managers are cautiously optimistic regarding the economy, and they believe that the credit markets have largely recovered from the severe dislocations experienced in 2008. Although it will be difficult to replicate the strong performance of municipal bonds in 2011, both fundamental and technical factors point to a potentially strong year in the municipal market.

Supply is likely to be very limited as municipalities continue to get their fiscal houses in order. Expectations are that municipal bond issuance in 2012 could near $325 to $350 billion, up slightly from 2011, but well below the record high $440 billion issued in 2010, a year that was boosted by the Build America Bonds program. An important consideration for 2012 is that 2002 was a big year for bond issuance, and many of those bonds contained 10-year call options. Since interest rates are at historic lows, those options are in the money, and there is a high probability that debt issued in 2002 will be called this year. This could mean that as much of 50% of municipal bond issuance in 2012 may be the refinancing of debt issued 10 years ago. As a result, net municipal bond supply is likely to be low, which should bolster demand for tax-exempt bonds. One risk that is gaining increasing attention is “reinvestment risk,” the risk that bonds with relatively high yields are called away from investors, who will be left with much lower yielding alternatives.

Index Definitions

All indices are unmanaged. It is not possible to invest in an index.

The Barclays Capital Municipal Bond Index is a rules-based, market-value weighted index engineered for the long-term tax-exempt bond market. To be included in the index, bonds must be rated investment-grade (Baa3/BBB- or higher) by at least two of the following ratings agencies: Moody’s Investor Services, Inc. (“Moody’s”), Standard & Poor’s Rating Group (“S&P”), Fitch Ratings (“Fitch”).

Barclays Capital U.S. Aggregate Bond Index represents securities that are U.S. domestic, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

The Barclays Capital U.S. Treasury Composite Index measures the performance of the US Treasury bond market, using market capitalization weighting and a standard rule based inclusion methodology.

6 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

January 31, 2012��

MZF Risks And Other Considerations

The views expressed in this report reflect those of the portfolio managers only through the report period as stated on the cover. These views are subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any kind. The material may also include forward looking statements that involve risk and uncertainty, and there is no guarantee that any predictions will come to pass.

There can be no assurance that the Fund will achieve its investment objective. The value of the Fund will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value. An investment in this Fund may not be suitable for investors who are, or as a result of this investment would become, subject to the federal alternative minimum tax because the securities in the Fund may pay interest that is subject to taxation under the federal alternative minimum tax. Special rules apply to corporate holders. Additionally, any capital gains dividends will be subject to capital gains taxes.

The Fund may engage in various portfolio strategies both to seek to hedge its portfolio against adverse effects from movements in interest rates and in the securities markets generally and to seek to increase the return of the Fund. These strategies include the use of derivatives such as exchange traded financial futures and option contracts, options on futures contracts, or over-the-counter dealer transactions in caps, swap agreements or swaptions, the risks of which are summarized below. Such strategies subject the Fund to the risk that, if Cutwater incorrectly forecasts market values, interest rates or other applicable factors, the Fund’s performance could suffer. Certain of these strategies may provide investment leverage to the Fund’s portfolio and result in many of the same risks of leverage to the holders of the Fund’s common shares as discussed above under ‘‘—Leverage.’’ The Fund is not required to use derivatives or other portfolio strategies and may not do so. Distributions by the Fund of any income or gain realized on the Fund’s hedging transactions generally will not be exempt from regular Federal income tax. There can be no assurance that the Fund’s portfolio strategies will be effective.

Derivatives are financial contracts whose value depends on, or is derived from, the value of an underlying asset, reference rate or index, or the relationship between two indices. The Fund may use derivatives as a substitute for taking a position in an underlying security or other asset and/or as part of a strategy designed to reduce exposure to other risks, such as interest rate risk. The Fund also may use derivatives to add leverage to the portfolio. The Fund’s use of derivative instruments involves risks different from, and possibly greater than, the risks associated with investing directly in securities and other traditional investments. Derivatives are subject to a number of risks described elsewhere in this Prospectus, such as liquidity risk, interest rate risk, credit risk, leveraging risk, the risk of ambiguous documentation and selection risk. They also involve the risk of mispricing or improper valuation and the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. Under the terms of certain derivative instruments, the Fund could lose more than the principal amount invested. The use of derivatives also may increase the amount of taxes payable by common shareholders. Also, suitable derivative transactions may not be available in all circumstances and there can be no assurance that the Fund will engage in these transactions to reduce exposure to other risks when that would be beneficial.

There are also specific risks associated with investing in municipal bonds, including but not limited to interest rate and credit risk. Interest rate risk is the risk that prices of municipal bonds generally increase when interest rates decline and decrease when interest rates increase. Prices of longer term securities generally change more in response to interest rate changes than prices of shorter term securities. Credit risk is the risk that the issuer will be unable to pay the interest or principal when due. The degree of credit risk depends on both the financial condition of the issuer and the terms of the obligation. The secondary market for municipal bonds is less liquid than many other securities markets, which may adversely affect the Fund’s ability to sell its bonds at prices approximating those at which the Fund currently values them. The ability of municipal issuers to make timely payments of interest and principal may be diminished during general economic downturns. In addition, laws enacted in the future by the United States Congress or state legislatures or referenda could extend the time for payment of principal and/or interest. In the event of bankruptcy of an issuer, the Fund could experience delays in collecting principal and interest.

Leverage creates certain risks for common shareholders, including higher volatility of both the net asset value and the market value of the common shares, because common shareholders bear the effects of changes in the value of the Fund’s investments. Leverage also creates the risk that the investment return on the Fund’s common shares will be reduced to the extent the dividends paid on preferred shares and other expenses of the preferred shares exceed the income earned by the Fund on its investments. If the Fund is liquidated, preferred shareholders will be entitled to receive liquidating distributions before any distribution is made to common shareholders. When the Fund uses leverage, the fees paid to Cutwater and Guggenheim Funds Distributors, LLC will be higher than if leverage were not used.

There are also risks associated with investing in Auction Market Preferred Shares (“AMPS”). The AMPS are redeemable, in whole or in part, at the option of the Fund on any dividend payment date for the AMPS, and will be subject to mandatory redemption in certain circumstances. The AMPS will not be listed on an exchange. You may only buy or sell AMPS through an order placed at an auction with or through a broker-dealer that has entered into an agreement with the auction agent and the Fund or in a secondary market maintained by certain broker-dealers. These broker-dealers are not required to maintain this market, and it may not provide you with liquidity. The AMPS market continues to remain illiquid as auctions for nearly all AMPS continue to fail. A failed auction is not a default, nor does it require the redemption of a fund’s auction rate preferred shares. Provisions in the Fund’s offering documents provide a mechanism to set a maximum rate in the event of a failed auction, and, thus, investors will continue to be entitled to receive payment for holding these AMPS.

In addition to the risks described above, the Fund is also subject to: Market Risk and Selection Risk, Call and Redemption Risk, Private Activity Bonds, Risks of Tobacco-Related Municipal Bonds, Inflation Risk, Affiliated Insurers, and Anti-takeover Provisions, Market Disruption. Please see the Fund’s website at www.guggenheimfunds.com/mzf for a more detailed discussion about Fund risks and considerations.

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 7

| FUND SUMMARY (Unaudited) | January 31, 2012 |

|

| | |

Fund Information | |

Symbol on New York Stock Exchange: | MZF |

Initial Offering Date: | August 27, 2003 |

Closing Market Price as of 01/31/12: | $15.40 |

Net Asset Value as of 01/31/12: | $15.11 |

Yield on Closing Market Price as of 01/31/12: | 6.43% |

Taxable Equivalent Yield on Closing Market Price | |

as of 01/31/121: | 9.89% |

Monthly Distribution Per Common Share2: | $0.0825 |

Leverage as of 01/31/123: | 41% |

Percentage of total investments subject to | |

alternative minimum tax as of 01/31/12: | 21.8% |

1 Taxable equivalent yield is calculated assuming a 35% federal income tax bracket.

2 Monthly distribution is subject to change.

3 As a percentage of total investments.

| | | |

Total Returns | | |

(Inception 8/27/03) | Market | NAV |

Six Month | 18.23% | 11.52% |

One Year | 30.67% | 24.63% |

Three Year - average annual | 23.70% | 17.95% |

Five Year - average annual | 10.26% | 7.08% |

Since Inception - average annual | 6.44% | 6.34% |

*Ratings shown are assigned by one or more Nationally Recognized Statistical Credit Rating Organizations (“NRSRO”), such as S&P, Moody’s and Fitch. The ratings are an indication of an issuer’s creditworthiness and typically range from AAA or Aaa (highest) to D (lowest). When two or more ratings are available, the lower rating is used; and when only one is available, that rating is used. The Non-Rated category consists of securities that have not been rated by an NRSRO. U.S. Treasury securities and U.S. Government Agency securities are not rated but deemed to be equivalent to securities rated AA+/Aaa.

*As a percentage of long-term investments.

Past performance does not guarantee future results. All portfolio data is subject to change daily. For more current information, please visit www.guggenheim-funds.com/mzf. The above summaries are provided for informational purposes only and should not be viewed as recommendations.

8 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

| | |

PORTFOLIO OF INVESTMENTS (Unaudited) | January 31, 2012 |

| | | | | | | | |

Principal | | | | | | Optional Call | |

Amount | | Description | Rating * | Coupon | Maturity | Provisions** | Value |

| | | Long-Term Investments – 166.7% | | | | | |

| | | Municipal Bonds – 164.6% | | | | | |

| | | Alabama – 2.7% | | | | | |

$ 845,000 | | Courtland Industrial Development Board, AMT, Series B | BBB | 6.25% | 08/01/2025 | 08/01/13 @ 100 | $ 874,677 |

1,890,000 | | Courtland Industrial Development Board, AMT | Baa3 | 6.00% | 08/01/2029 | 08/01/12 @ 100 | 1,891,474 |

| | | | | | | | 2,766,151 |

| | | Alaska – 0.8% | | | | | |

750,000 | | Alaska Municipal Bond Bank Authority, Series 1 | AA | 5.75% | 09/01/2033 | 09/01/18 @ 100 | 866,940 |

| | | California – 20.5% | | | | | |

1,500,000 | | California Health Facilities Financing Authority, Series B | AA– | 5.88% | 08/15/2031 | 08/15/20 @ 100 | 1,793,835 |

1,250,000 | | California Municipal Finance Authority, Series A | Baa2 | 5.50% | 07/01/2030 | 07/01/20 @ 100 | 1,277,788 |

5,000,000 | | California State Public Works Board, Series A | BBB+ | 5.00% | 06/01/2024 | 06/01/14 @ 100 | 5,239,100 |

6,000,000 | | California Various Purpose General Obligation | A– | 5.13% | 11/01/2024 | 11/01/13 @ 100 | 6,463,860 |

2,500,000 | | City of Chula Vista CA, AMT, Series B | A | 5.50% | 12/01/2021 | 06/02/14 @ 102 | 2,700,975 |

1,000,000 | | Golden State Tobacco Securitization Corp., Series A-1 | B– | 5.00% | 06/01/2033 | 06/01/17 @ 100 | 744,430 |

2,525,000 | | Los Angeles Unified School District, Series F | AA– | 5.00% | 01/01/2034 | 07/01/19 @ 100 | 2,753,083 |

| | | | | | | | 20,973,071 |

| | | Delaware – 1.6% | | | | | |

1,500,000 | | Delaware State Economic Development Authority | BBB+ | 5.40% | 02/01/2031 | 08/01/20 @ 100 | 1,599,885 |

| | | District of Columbia – 2.0% | | | | | |

2,000,000 | | District of Columbia Housing Finance Agency, AMT, (FHA) | Aaa | 5.10% | 06/01/2037 | 06/01/15 @ 102 | 2,031,540 |

| | | Florida – 7.9% | | | | | |

2,200,000 | | County of Miami-Dade FL, Aviation Revenue, AMT, (CIFG) | A– | 5.00% | 10/01/2038 | 10/01/15 @ 100 | 2,217,402 |

3,000,000 | | Highlands County Health Facilities Authority, Series D, (Prerefunded @ 11/15/2013)(a) | NR | 5.88% | 11/15/2029 | 11/15/13 @ 100 | 3,278,010 |

1,500,000 | | Miami-Dade County School Board, Series A, (Assured Gty) | AA– | 5.38% | 02/01/2034 | 02/01/19 @ 100 | 1,624,755 |

1,000,000 | | Seminole Indian Tribe of Florida, Series A(b) | BBB– | 5.25% | 10/01/2027 | 10/01/17 @ 100 | 971,860 |

| | | | | | | | 8,092,027 |

| | | Hawaii – 1.0% | | | | | |

1,000,000 | | Hawaii Pacific Health, Series B | BBB+ | 5.63% | 07/01/2030 | 07/01/20 @ 100 | 1,070,060 |

| | | Illinois – 11.5% | | | | | |

1,000,000 | | Chicago Board of Education, General Obligation | AA– | 5.00% | 12/01/2041 | 12/01/21 @ 100 | 1,059,680 |

1,750,000 | | City of Chicago IL O’Hare International Airport Revenue, Series C | A– | 5.50% | 01/01/2031 | 01/01/21 @ 100 | 2,000,057 |

1,115,000 | | City of Chicago IL, O’Hare International Airport Revenue, AMT, Series A-2, (AGM) | AA– | 5.50% | 01/01/2016 | 01/01/14 @ 100 | 1,187,364 |

2,000,000 | | Illinois Finance Authority, Roosevelt University Revenue | Baa2 | 5.50% | 04/01/2037 | 04/01/17 @ 100 | 2,032,120 |

1,000,000 | | Illinois Finance Authority, Rush University Medical Center Revenue, Series C | A– | 6.38% | 11/01/2029 | 05/01/19 @ 100 | 1,175,510 |

2,000,000 | | Illinois, General Obligation, Series A | A+ | 5.00% | 03/01/2028 | 03/01/14 @ 100 | 2,084,880 |

1,120,000 | | Illinois Housing Development Authority, AMT, Series A-2 | AA | 5.00% | 08/01/2036 | 02/01/16 @ 100 | 1,120,638 |

1,000,000 | | Railsplitter Tobacco Settlement Authority | A– | 6.00% | 06/01/2028 | 06/01/21 @ 100 | 1,115,590 |

| | | | | | | | 11,775,839 |

| | | Indiana – 3.3% | | | | | |

1,000,000 | | Indiana Finance Authority | BB | 6.00% | 12/01/2026 | 06/01/20 @ 100 | 1,028,250 |

2,000,000 | | Indianapolis Local Public Improvement Bond Bank, Series A | A+ | 5.50% | 01/01/2029 | 01/01/19 @ 100 | 2,307,240 |

| | | | | | | | 3,335,490 |

| | | Iowa – 3.3% | | | | | |

1,500,000 | | Iowa Higher Education Loan Authority | BBB+ | 5.50% | 09/01/2025 | 09/01/20 @ 100 | 1,613,445 |

2,000,000 | | Iowa Tobacco Settlement Authority, Series B | B+ | 5.60% | 06/01/2034 | 06/01/17 @ 100 | 1,787,100 |

| | | | | | | | 3,400,545 |

See notes to financial statements.

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 9

PORTFOLIO OF INVESTMENTS (Unaudited) continued | January 31, 2012 |

| | | | | | | | |

Principal | | | | | | Optional Call | |

Amount | | Description | Rating * | Coupon | Maturity | Provisions** | Value |

| | | Kentucky – 2.1% | | | | | |

$ 1,000,000 | | County of Owen KY, Waterworks System Revenue, Series B | BBB+ | 5.63% | 09/01/2039 | 09/01/19 @ 100 | $ 1,037,700 |

1,000,000 | | Kentucky Economic Development Finance Authority, Series A | A1 | 5.63% | 08/15/2027 | 08/15/18 @ 100 | 1,140,040 |

| | | | | | | | 2,177,740 |

| | | Louisiana – 7.8% | | | | | |

1,000,000 | | East Baton Rouge Sewerage Commission, Series A | AA– | 5.25% | 02/01/2034 | 02/01/19 @ 100 | 1,120,910 |

3,000,000 | | Louisiana Local Government Environmental Facilities & Community | | | | | |

| | | Development Authority | BBB– | 6.75% | 11/01/2032 | 11/01/17 @ 100 | 3,248,160 |

1,000,000 | | Louisiana Public Facilities Authority, Hospital Revenue | A3 | 5.25% | 11/01/2030 | 05/01/20 @ 100 | 1,073,910 |

1,000,000 | | Parish of DeSoto LA, AMT, Series A | BBB | 5.85% | 11/01/2027 | 11/01/13 @ 100 | 1,029,950 |

1,500,000 | | Parish of St John the Baptist LA, Series A | BBB | 5.13% | 06/01/2037 | 06/01/17 @ 100 | 1,521,870 |

| | | | | | | | 7,994,800 |

| | | Maryland – 0.5% | | | | | |

500,000 | | Maryland Economic Development Corp. | BB | 5.75% | 09/01/2025 | 09/01/20 @ 100 | 524,845 |

| | | Massachusetts – 3.1% | | | | | |

1,000,000 | | Massachusetts Educational Financing Authority, AMT | AA | 5.38% | 07/01/2025 | 07/01/21 @ 100 | 1,087,290 |

1,000,000 | | Massachusetts Health & Educational Facilities Authority, Series A | BBB | 6.25% | 07/01/2030 | 07/01/19 @ 100 | 1,109,870 |

970,000 | | Massachusetts Housing Finance Agency, AMT | AA– | 5.10% | 12/01/2027 | 06/01/17 @ 100 | 1,001,457 |

| | | | | | | | 3,198,617 |

| | | Michigan – 4.6% | | | | | |

1,000,000 | | City of Detroit MI, Sewer Disposal Revenue, Series B, (AGM) | AA– | 7.50% | 07/01/2033 | 07/01/19 @ 100 | 1,263,570 |

1,000,000 | | City of Detroit MI, Water Supply System Revenue, (AGM) | AA– | 7.00% | 07/01/2036 | 07/01/19 @ 100 | 1,205,680 |

1,000,000 | | Michigan Finance Authority, Revenue | AA | 5.00% | 12/01/2031 | 12/01/21 @ 100 | 1,109,730 |

1,000,000 | | Michigan Strategic Fund, Series B-1 | BBB | 6.25% | 06/01/2014 | N/A | 1,107,990 |

| | | | | | | | 4,686,970 |

| | | Mississippi – 1.1% | | | | | |

1,000,000 | | County of Warren MS, Series A | BBB | 6.50% | 09/01/2032 | 09/01/18 @ 100 | 1,118,770 |

| | | Nevada – 7.3% | | | | | |

5,410,000 | | City of Henderson NV, Series A | A | 5.63% | 07/01/2024 | 07/01/14 @ 100 | 5,813,586 |

1,435,000 | | Las Vegas Valley Water District | AA+ | 5.00% | 06/01/2031 | 06/01/21 @ 100 | 1,615,925 |

| | | | | | | | 7,429,511 |

| | | New Jersey – 1.5% | | | | | |

1,500,000 | | New Jersey Health Care Facilities Financing Authority | BBB+ | 5.75% | 07/01/2039 | 07/01/19 @ 100 | 1,568,595 |

| | | New York – 20.9% | | | | | |

2,250,000 | | City of New York NY, General Obligation, Series J | AA | 5.00% | 05/15/2023 | 05/15/14 @ 100 | 2,444,085 |

2,750,000 | | Long Island Power Authority, Series A | A– | 5.10% | 09/01/2029 | 09/01/14 @ 100 | 2,940,245 |

4,000,000 | | Metropolitan Transportation Authority, Series A | AA– | 5.13% | 01/01/2024 | 07/01/12 @ 100 | 4,076,360 |

500,000 | | New York City Industrial Development Agency, American Airlines, | | | | | |

| | | JFK International Airport, AMT(d) | NR | 7.50% | 08/01/2016 | N/A | 447,250 |

750,000 | | New York City Industrial Development Agency, JFK International Airport, | | | | | |

| | | AMT, Series A(d) | C | 8.00% | 08/01/2012 | N/A | 678,510 |

1,750,000 | | New York Municipal Bond Bank Agency, Series C | A+ | 5.25% | 12/01/2022 | 06/01/13 @ 100 | 1,850,940 |

900,000 | | New York State Dormitory Authority, Series B | BBB+ | 5.25% | 07/01/2024 | 07/01/17 @ 100 | 965,988 |

2,500,000 | | Suffolk County Industrial Development Agency, AMT | A– | 5.25% | 06/01/2027 | 06/01/13 @ 100 | 2,546,700 |

3,000,000 | | Tobacco Settlement Financing Corp., Series A-1 | AA– | 5.50% | 06/01/2019 | 06/01/13 @ 100 | 3,210,300 |

1,000,000 | | Troy Capital Resource Corp., Series A | A– | 5.00% | 09/01/2030 | 09/01/20 @ 100 | 1,104,830 |

1,000,000 | | Troy Industrial Development Authority | A– | 5.00% | 09/01/2031 | 09/01/21 @ 100 | 1,107,410 |

| | | | | | | | 21,372,618 |

See notes to financial statements.

10 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

| | |

PORTFOLIO OF INVESTMENTS (Unaudited) continued | January 31, 2012 |

| | | | | | | | |

Principal | | | | | | Optional Call | |

Amount | | Description | Rating * | Coupon | Maturity | Provisions** | Value |

| | | North Carolina – 3.3% | | | | | |

$ 1,000,000 | | North Carolina Eastern Municipal Power Agency, Series D | A– | 5.13% | 01/01/2023 | 01/01/13 @ 100 | $ 1,022,930 |

1,000,000 | | North Carolina Eastern Municipal Power Agency, Series D | A– | 5.13% | 01/01/2026 | 01/01/13 @ 100 | 1,019,570 |

1,315,000 | | North Carolina Housing Finance Agency, AMT, Series 14A, (AMBAC) | AA | 5.35% | 01/01/2022 | 03/05/12 @ 100 | 1,318,721 |

| | | | | | | | 3,361,221 |

| | | Ohio – 9.9% | | | | | |

1,150,000 | | Buckeye Tobacco Settlement Financing Authority, Series A-2 | B– | 5.88% | 06/01/2030 | 06/01/17 @ 100 | 891,331 |

1,465,000 | | County of Cuyahoga OH, Cleveland Clinic Health System, | | | | | |

| | | (Prerefunded @ 7/1/2013)(a) | AA– | 6.00% | 01/01/2020 | 07/01/13 @ 100 | 1,582,713 |

1,535,000 | | County of Cuyahoga OH, Cleveland Clinic Health System, | | | | | |

| | | (Prerefunded @ 7/1/2013)(a) | Aa2 | 6.00% | 01/01/2020 | 07/01/13 @ 100 | 1,658,337 |

3,750,000 | | County of Lorain OH, Series A | AA– | 5.25% | 10/01/2033 | 03/05/12 @ 101 | 3,791,212 |

1,000,000 | | Ohio Air Quality Development Authority, Series A | BBB– | 5.70% | 02/01/2014 | N/A | 1,072,800 |

1,000,000 | | Ohio Air Quality Development Authority | BBB– | 5.63% | 06/01/2018 | N/A | 1,131,140 |

| | | | | | | | 10,127,533 |

| | | Pennsylvania – 6.9% | | | | | |

1,110,000 | | City of Philadelphia PA, General Obligation, Series A, (Assured Gty) | AA– | 5.38% | 08/01/2030 | 08/01/19 @ 100 | 1,230,724 |

1,100,000 | | City of Philadelphia PA, General Obligation | BBB | 5.88% | 08/01/2031 | 08/01/16 @ 100 | 1,208,251 |

2,340,000 | | Pennsylvania Higher Educational Facilities Authority | BBB | 5.25% | 05/01/2023 | 05/01/13 @ 100 | 2,385,864 |

1,000,000 | | Pennsylvania Higher Educational Facilities Authority, Series B | AA– | 6.00% | 08/15/2026 | 08/15/18 @ 100 | 1,189,840 |

1,000,000 | | Pennsylvania Higher Educational Facilities Authority, Series A | BBB | 5.00% | 05/01/2037 | 11/01/17 @ 100 | 1,003,890 |

| | | | | | | | 7,018,569 |

| | | Puerto Rico – 1.3% | | | | | |

1,215,000 | | Puerto Rico Sales Tax Financing Corp. | AA– | 5.25% | 08/01/2040 | 08/01/21 @ 100 | 1,351,250 |

| | | Rhode Island – 1.5% | | | | | |

1,300,000 | | Rhode Island Convention Center Authority, Series A, (Assured Gty) | AA– | 5.50% | 05/15/2027 | 05/15/19 @ 100 | 1,515,774 |

| | | South Carolina – 3.6% | | | | | |

2,500,000 | | County of Florence SC, Series A, (AGM) | AA– | 5.25% | 11/01/2027 | 11/01/14 @ 100 | 2,630,150 |

1,000,000 | | County of Georgetown SC, AMT, Series A | BBB | 5.30% | 03/01/2028 | 03/01/14 @ 100 | 1,007,770 |

| | | | | | | | 3,637,920 |

| | | South Dakota – 5.9% | | | | | |

1,200,000 | | South Dakota Health & Educational Facilities Authority, Series A | AA– | 5.25% | 11/01/2034 | 11/01/14 @ 100 | 1,245,192 |

4,755,000 | | South Dakota Housing Development Authority, AMT, Series K(e) | AAA | 5.05% | 05/01/2036 | 11/01/15 @ 100 | 4,807,923 |

| | | | | | | | 6,053,115 |

| | | Tennessee – 3.2% | | | | | |

2,500,000 | | Knox County Health Educational & Housing Facilities Board | BBB+ | 5.25% | 04/01/2027 | 04/01/17 @ 100 | 2,604,025 |

700,000 | | Metropolitan Nashville Airport Authority | Baa3 | 5.20% | 07/01/2026 | 07/01/20 @ 100 | 703,283 |

| | | | | | | | 3,307,308 |

| | | Texas – 14.7% | | | | | |

2,000,000 | | Bexar County Housing Finance Corp., AMT, (GNMA) | Aa2 | 5.20% | 10/20/2034 | 10/20/14 @ 100 | 2,021,500 |

2,000,000 | | City of Houston TX Utility System Revenue, Series A, (AGM) | AA | 5.00% | 11/15/2033 | 11/15/17 @ 100 | 2,198,580 |

2,000,000 | | Lower Colorado River Authority | A | 6.25% | 05/15/2028 | 05/15/18 @ 100 | 2,403,860 |

1,885,000 | | Matagorda County Navigation District NO 1, AMT, (AMBAC)(c) | A– | 5.13% | 11/01/2028 | N/A | 2,054,970 |

2,000,000 | | North Texas Tollway Authority, Series A | A– | 5.63% | 01/01/2033 | 01/01/18 @ 100 | 2,193,760 |

1,000,000 | | North Texas Tollway Authority, Series L-2(c) | A– | 6.00% | 01/01/2038 | N/A | 1,047,010 |

2,100,000 | | San Leanna Educational Facilities Corp. | BBB+ | 5.13% | 06/01/2036 | 06/01/17 @ 100 | 2,117,850 |

950,000 | | Tarrant County Cultural Education Facilities Finance Corp., Series A, (Assured Gty) | AA– | 5.75% | 07/01/2018 | N/A | 1,039,110 |

| | | | | | | | 15,076,640 |

See notes to financial statements.

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 11

| | |

PORTFOLIO OF INVESTMENTS (Unaudited) | January 31, 2012 |

| | | | | | | | |

Principal | | | | | | Optional Call | |

Amount | | Description | Rating * | Coupon | Maturity | Provisions** | Value |

| | | Virginia – 1.4% | | | | | |

$ 1,250,000 | | Washington County Industrial Development Authority, Series C | BBB+ | 7.50% | 07/01/2029 | 01/01/19 @ 100 | $ 1,468,125 |

| | | Washington – 1.1% | | | | | |

1,000,000 | | Tes Properties, WA, Revenue | AA+ | 5.63% | 12/01/2038 | 06/01/19 @ 100 | 1,101,600 |

| | | Wisconsin – 1.3% | | | | | |

1,250,000 | | Wisconsin Health & Educational Facilities Authority, Series A | AA+ | 5.00% | 11/15/2036 | 11/15/16 @ 100 | 1,302,200 |

| | | Wyoming – 7.0% | | | | | |

4,000,000 | | County of Sweetwater WY, AMT | BBB+ | 5.60% | 12/01/2035 | 12/01/15 @ 100 | 4,054,560 |

3,100,000 | | Wyoming Community Development Authority, AMT, Series 7 | AA+ | 5.10% | 12/01/2038 | 12/01/16 @ 100 | 3,146,903 |

| | | | | | | | 7,201,463 |

| | | Total Municipal Bonds – 164.6% | | | | | |

| | | (Cost $155,625,639) | | | | | 168,506,732 |

Redemption | | | | | | | |

Value | | | | | | | |

| | | Preferred Shares – 2.1% | | | | | |

| | | Diversified Financial Services – 2.1% | | | | | |

$ 2,000,000 | | Centerline Equity Issuer Trust, Series A-4-1(b) | Aaa | 5.75% | 05/15/2015 | N/A | 2,139,380 |

| | | (Cost $2,000,000) | | | | | |

| | | Total Long-Term Investments – 166.7% | | | | | |

| | | (Cost $157,625,639) | | | | | 170,646,112 |

| | | Other Assets in excess of Liabilities – 1.1% | | | | | 1,182,897 |

| | | Preferred Shares, at redemption value – (-67.8% of Net Assets | | | | | |

| | | Applicable to Common Shareholders or -40.7% of Total Investments) | | | | | (69,450,000) |

| | | Net Assets Applicable to Common Shareholders – 100.0% | | | | | $ 102,379,009 |

AGM – Insured by Assured Guaranty Municipal Corporation

AMBAC – Insured by Ambac Assurance Corporation

AMT – Income from this security is a preference item under the Alternative Minimum Tax.

Assured GTY – Insured by Assured Guaranty Corporation

CIFG – Insured by CIFG Assurance North America, Inc.

FHA – Guaranteed by Federal Housing Administration

GNMA – Guaranteed by Ginnie Mae

N/A – Not Applicable

| * | Ratings shown are per Standard & Poor’s Rating Group, Moody’s Investor Services, Inc. or Fitch Ratings. Securities classified as NR are not rated. (For securities not rated by Standard & Poor’s Rating Group, the rating by Moody’s Investor Services, Inc. is provided. Likewise, for securities not rated by Standard & Poor’s Rating Group and Moody’s Investor Services, Inc., the rating by Fitch Ratings is provided.) All ratings are unaudited. The ratings apply to the credit worthiness of the issuers of the underlying securities and not to the Fund or its shares. |

| ** | Date and price of the earliest optional call or put provision. There may be other call provisions at varying prices at later dates. |

| | All percentages shown in the Portfolio of Investments are based on Net Assets Applicable to Common Shareholders, unless otherwise noted. |

| (a) | The bond is prerefunded. U.S. government or U.S. government agency securities, held in escrow, are used to pay interest on this security, as well as to retire the bond in full at the date and price indicated under the Optional Call Provisions. |

| (b) | Securities are exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At January 31, 2012 these securities amounted to $3,111,240, which represents 3.0% of net assets applicable to common shares. |

| (c) | Security is a “Step-up” bond where the coupon increases or steps up at a predetermined date. The rate shown reflects the rate in effect at the end of the reporting period. |

| (d) | Defaulted security. Non-income producing as the issuer is currently in default with respect to interest payments. The value of these securities at January 31, 2012, was $1,125,760 which represents 1.1% of net assets applicable to Common Shareholders. |

| (e) | A portion of this security was segregated as collateral for borrowings outstanding. At January 31, 2012, the total amount segregated was $1,263,913. |

See notes to financial statements.

12 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

| | |

STATEMENT OF ASSETS AND LIABILITIES (Unaudited) | January 31, 2012 |

| | | | |

Assets | | | |

Investments, at value (cost $157,625,639) | | $ | 170,646,112 | |

Interest receivable | | | 1,989,438 | |

Receivable for shares issued through dividend reinvestment | | | 25,385 | |

Cash | | | 3,195 | |

Other assets | | | 12,558 | |

Total assets | | | 172,676,688 | |

Liabilities | | | | |

Borrowings | | | 410,000 | |

Professional fees | | | 308,171 | |

Investment advisory fee payable | | | 43,198 | |

Servicing agent fee payable | | | 28,799 | |

Distributions payable - preferred shareholders | | | 8,482 | |

Administration fee payable | | | 3,572 | |

Accrued expenses | | | 45,457 | |

Total liabilities | | | 847,679 | |

Preferred Shares, at redemption value | | | | |

$.001 par value per share; 2,778 Auction Market Preferred Shares authorized, | | | | |

issued and outstanding at $25,000 per share liquidation preference | | | 69,450,000 | |

Net Assets Applicable to Common Shareholders | | $ | 102,379,009 | |

Composition of Net Assets Applicable to Common Shareholders | | | | |

Common stock, $.001 par value per share; unlimited number of shares authorized, | | | | |

6,777,269 shares issued and outstanding | | $ | 6,777 | |

Additional paid-in capital | | | 96,587,935 | |

Net unrealized appreciation on investments | | | 13,020,473 | |

Accumulated undistributed net investment income | | | 696,763 | |

Accumulated net realized loss on investments | | | (7,932,939 | ) |

Net Assets Applicable to Common Shareholders | | $ | 102,379,009 | |

Net Asset Value Applicable to Common Shareholders (based on 6,777,269 common shares outstanding) | | $ | 15.11 | |

See notes to financial statements.

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 13

| | |

STATEMENT OF OPERATIONS For the six months ended January 31, 2012 (Unaudited) | January 31, 2012 |

| | | | | | | |

Investment Income | | | | | | |

Interest | | | | | $ | 4,404,720 | |

Expenses | | | | | | | |

Investment advisory fee | | $ | 327,083 | | | | | |

Servicing agent fee | | | 218,055 | | | | | |

Professional fees | | | 62,485 | | | | | |

Auction agent fees - preferred shares | | | 60,115 | | | | | |

Fund accounting | | | 31,974 | | | | | |

Printing expenses | | | 23,190 | | | | | |

Administrative fee | | | 23,064 | | | | | |

Trustees’ fees and expenses | | | 22,797 | | | | | |

Custodian fee | | | 12,374 | | | | | |

NYSE listing fee | | | 10,672 | | | | | |

Transfer agent fee | | | 9,562 | | | | | |

Insurance | | | 7,599 | | | | | |

Line of credit fee | | | 648 | | | | | |

Other | | | 16,612 | | | | | |

Total expenses | | | | | | | 826,230 | |

Investment advisory fees waived | | | | | | | (75,481 | ) |

Servicing agent fees waived | | | | | | | (50,320 | ) |

Net expenses | | | | | | | 700,429 | |

Net investment income | | | | | | | 3,704,291 | |

Realized and Unrealized Gain (Loss) on Investments | | | | | | | | |

Net realized loss on investments | | | | | | | (246,887 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | | | | | 7,732,312 | |

Net realized and unrealized gain on investments | | | | | | | 7,485,425 | |

Distributions to Auction Market Preferred Shareholders from | | | | | | | | |

Net investment income | | | | | | | (458,804 | ) |

Net Increase in Net Assets Applicable to Common Shareholders Resulting from Operations | | | | | | $ | 10,730,912 | |

See notes to financial statements.

14 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

| | |

STATEMENTS OF CHANGES IN NET ASSETS | January 31, 2012 |

| | | | | | | |

| | | For the | | | | |

| | | Six Months Ended | | | For the | |

| | | January 31, 2012 | | | Year Ended | |

| | | (unaudited) | | | July 31, 2011 | |

Increase (decrease) in Net Assets Applicable to Common | | | | | | |

Shareholders Resulting from Operations: | | | | | | |

Net investment income | | $ | 3,704,291 | | | $ | 7,562,738 | |

Net realized loss on investments | | | (246,887 | ) | | | (1,130,690 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | 7,732,312 | | | | (1,327,456 | ) |

Distributions to auction market preferred shareholders from net investment income | | | (458,804 | ) | | | (1,001,260 | ) |

Net increase in net assets applicable to common shareholders resulting from operations | | | 10,730,912 | | | | 4,103,332 | |

Distributions to common shareholders from | | | | | | | | |

Net investment income | | | (3,352,313 | ) | | | (6,694,146 | ) |

Capital share transactions | | | | | | | | |

Reinvestment of dividends | | | 87,801 | | | | 313,110 | |

Total change in net assets applicable to common shareholders | | | 7,466,400 | | | | (2,277,704 | ) |

Net assets applicable to common shareholders: | | | | | | | | |

Beginning of period | | | 94,912,609 | | | | 97,190,313 | |

End of period (including undistributed net investment income | | | | | | | | |

of $696,763 and $803,589, respectively) | | $ | 102,379,009 | | | $ | 94,912,609 | |

See notes to financial statements.

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 15

| | |

FINANCIAL HIGHLIGHTS | January 31, 2012 |

| | | | | | | | | | | | | | | | | | |

| | Six Months | | | | | | | | | | | | | | | | |

| | Ended | | | | | | | | | | | | | | | | |

| Per share operating performance | January 31, | | | For the | | | For the | | | For the | | | For the | | | For the | |

for one common share outstanding | 2012 | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

throughout each period | (unaudited) | | | July 31, 2011 | | | July 31, 2010 | | | July 31, 2009 | | | July 31, 2008 | | | July 31, 2007 | |

Net asset value, beginning of period | $ | 14.02 | | | $ | 14.40 | | | $ | 12.73 | | | $ | 13.17 | | | $ | 14.21 | | | $ | 14.25 | |

Investment operations | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (a) | | 0.55 | | | | 1.12 | | | | 1.06 | | | | 1.02 | | | | 0.99 | | | | 0.95 | |

Net realized and unrealized gain (loss) on investments | | | | | | | | | | | | | | | | | | | | | | | |

and swaptions transactions | | 1.11 | | | | (0.36 | ) | | | 1.72 | | | | (0.49 | ) | | | (1.06 | ) | | | (0.10 | ) |

Distributions to preferred shareholders from net investment income | | | | | | | | | | | | | | | | | | | | | | | |

(common share equivalent basis) | | (0.07 | ) | | | (0.15 | ) | | | (0.14 | ) | | | (0.24 | ) | | | (0.35 | ) | | | (0.31 | ) |

Total from investment operations | | 1.59 | | | | 0.61 | | | | 2.64 | | | | 0.29 | | | | (0.42 | ) | | | 0.54 | |

Distributions to common shareholders from net investment income | | (0.50 | ) | | | (0.99 | ) | | | (0.97 | ) | | | (0.73 | ) | | | (0.62 | ) | | | (0.58 | ) |

Net asset value, end of period | $ | 15.11 | | | $ | 14.02 | | | $ | 14.40 | | | $ | 12.73 | | | $ | 13.17 | | | $ | 14.21 | |

Market value, end of period | $ | 15.40 | | | $ | 13.48 | | | $ | 14.53 | | | $ | 11.87 | | | $ | 11.73 | | | $ | 12.63 | |

Total investment return (b) | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value | | 11.52 | % | | | 4.57 | % | | | 21.21 | % | | | 2.83 | % | | | -3.07 | % | | | 3.80 | % |

Market value | | 18.23 | % | | | -0.32 | % | | | 31.45 | % | | | 8.65 | % | | | -2.29 | % | | | 7.93 | % |

Ratios and supplemental data | | | | | | | | | | | | | | | | | | | | | | | |

Net assets end of period (thousands) | $ | 102,379 | | | $ | 94,913 | | | $ | 97,190 | | | $ | 101,016 | | | $ | 104,526 | | | $ | 112,777 | |

| Ratio of expenses to average net assets | | | | | | | | | | | | | | | | | | | | | | | |

(excluding interest expense and net of fee waivers) (d) | | 1.43 | %(c) | | | 1.46 | % | | | 1.35 | % | | | 1.54 | % | | | 1.27 | % | | | 1.28 | % |

| Ratio of expenses to average net assets | | | | | | | | | | | | | | | | | | | | | | | |

(excluding interest expense and excluding fee waivers) (d) | | 1.69 | %(c) | | | 1.72 | % | | | 1.69 | % | | | 1.91 | % | | | 1.61 | % | | | 1.62 | % |

| Ratio of expenses to average net assets | | | | | | | | | | | | | | | | | | | | | | | |

(including interest expense and net of fee waivers) (d) | | 1.43 | %(c) | | | 1.46 | % | | | 1.35 | % | | | 1.54 | % | | | 1.32 | % | | | 1.44 | % |

| Ratio of expenses to average net assets | | | | | | | | | | | | | | | | | | | | | | | |

(including interest expense and excluding fee waivers) (d) | | 1.69 | %(c) | | | 1.72 | % | | | 1.69 | % | | | 1.91 | % | | | 1.66 | % | | | 1.78 | % |

Ratio of net investment income to average net assets (d) | | 7.57 | %(c) | | | 8.09 | % | | | 7.68 | % | | | 8.65 | % | | | 7.15 | % | | | 6.56 | % |

Portfolio turnover | | 4 | % | | | 8 | % | | | 6 | % | | | 21 | % | | | 29 | % | | | 4 | % |

Preferred shares, at redemption value ($25,000 per | | | | | | | | | | | | | | | | | | | | | | | |

share liquidation preference) (thousands) | $ | 69,450 | | | $ | 69,450 | | | $ | 69,450 | | | $ | 69,450 | | | $ | 69,450 | | | $ | 69,450 | |

Preferred shares asset coverage per share | $ | 61,853 | | | $ | 59,166 | | | $ | 59,986 | | | $ | 61,363 | | | $ | 62,626 | | | $ | 65,597 | |

Asset coverage per $1,000 of indebtedness (e) | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | $ | 37,445 | |

N/A Not applicable.

| (a) | Based on average shares outstanding during the period. |

| (b) | Total investment return is calculated assuming a purchase of a common share at the beginning of the period and a sale on the last day of the period reported either at net asset value (NAV) or market price per share. Dividends and distributions are assumed to be reinvested at NAV for returns at NAV or in accordance with the Fund’s dividend reinvestment plan for returns at market value. Total investment return does not reflect brokerage commissions. A return calculated for a period of less than one year is not annualized. |

| (c) | Annualized. |

| (d) | Calculated on the basis of income and expenses applicable to both common and preferred shares relative to average net assets of common shareholders. |

| (e) | Calculated by subtracting the Fund’s total liabilities (not including the floating rate note obligations) from the Fund’s total assets and dividing by the total number of indebtedness units, where one unit equals $1,000 of indebtedness. |

See notes to financial statements.

16 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

| | |

NOTES TO FINANCIAL STATEMENTS (Unaudited) | January 31, 2012 |

Note 1 – Organization:

The Managed Duration Investment Grade Municipal Fund (the “Fund”) was organized as a Delaware statutory trust on May 20, 2003. The Fund is registered as a diversified, closed-end management investment company under the Investment Company Act of 1940, as amended. The Fund’s investment objective is to provide its common shareholders with high current income exempt from regular federal income tax while seeking to protect the value of the Fund’s assets during periods of interest rate volatility. Prior to commencing operations on August 27, 2003, the Fund had no operations other than matters relating to its organization and registration and the sale and issuance of 6,981 common shares of beneficial interest to MBIA Capital Management Corp (now known as Cutwater Asset Management Corp.).

Note 2 – Accounting Policies:

The preparation of financial statements in accordance with U.S. generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund.

(a) Valuation of Investments: The municipal bonds and preferred shares in which the Fund invests are traded primarily in the over-the-counter markets. In determining net asset value, the Fund uses the valuations of portfolio securities furnished by a pricing service approved by the Board of Trustees. The pricing service typically values portfolio securities at the bid price or the yield equivalent when quotations are readily available. Securities for which quotations are not readily available are valued at fair market value on a consistent basis as determined by the pricing service using a matrix system to determine valuations. The procedures of the pricing service and its valuations are reviewed by the officers of the Fund under the general supervision of the Board of Trustees. Positions in futures contracts, interest rate swaps and options on interest rate swaps (“swaptions”) are valued at closing prices for such contracts established by the exchange or dealer market on which they are traded, or if market quotations are not readily available, are valued at fair value on a consistent basis using methods approved in good faith by the Board of Trustees.

For those securities where quotations or prices are not available, the valuations are determined in accordance with procedures established in good faith by management and approved by the Board of Trustees. Valuations in accordance with these procedures are intended to reflect each security’s (or asset’s) “fair value”. Such “fair value” is the amount that the Fund might reasonably expect to receive for the security (or asset) upon its current sale. Each such determination should be based on a consideration of all relevant factors, which are likely to vary from one pricing context to another. Examples of such factors may include, but are not limited to: (i) the type of security, (ii) the initial cost of the security, (iii) the existence of any contractual restrictions on the security’s disposition, (iv) the price and extent of public trading in similar securities of the issuer or of comparable companies, (v) quotations or evaluated prices from broker-dealers and/or pricing services, (vi) information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange traded securities), (vii) an analysis of the issuer’s financial statements, and (viii) an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold (e.g. the existence of pending merger activity, public offerings or tender offers that might affect the value of the security).

Fair value is defined as the price that the Fund would receive to sell an investment or pay to transfer a liability in an orderly transaction with an independent buyer in the principal market, or in the absence of a principal market the most advantageous market for the investment or liability. There are three different categories for valuations. Level 1 valuations are those based upon quoted prices in active markets. Level 2 valuations are those based upon quoted prices in inactive markets or based upon significant observable inputs (e.g. yield curves; benchmark interest rates; indices). Level 3 valuations are those based upon unobservable inputs (e.g. discounted cash flow analysis; non-market based methods used to determine fair valuation).

The Fund values Level 1 securities using readily available market quotations in active markets. The Fund values Level 2 fixed income securities using independent pricing providers who employ matrix pricing models utilizing market prices, broker quotes and prices of securities with comparable maturities and qualities. The Fund did not have any Level 3 securities during the period ended January 31, 2012.

The following table represents the Fund’s investments carried on the Statement of Assets and Liabilities by caption and by level within the fair value hierarchy as of January 31, 2012:

| | | | | | | | | | | | | |

Valuations (in $000s) | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Description | | | | | | | | | | | | |

Assets: | | | | | | | | | | | | |

Preferred Shares | | $ | – | | | $ | 2,139 | | | $ | – | | | $ | 2,139 | |

Municipal Bonds | | | – | | | | 168,507 | | | | – | | | | 168,507 | |

Total | | $ | – | | | $ | 170,646 | | | $ | – | | | $ | 170,646 | |

There were no transfers between levels for the six months ended January 31, 2012.

(b) Investment Transactions and Investment Income: Investment transactions are accounted for on the trade date. Realized gains and losses on investments are determined on the identified cost basis. Interest income and expenses are accrued daily. All discounts/premiums are accreted/amortized for financial reporting purposes over the life of each security.

(c) Dividends and Distributions: The Fund declares and pays on a monthly basis dividends from net investment income to common shareholders. Distributions of net realized capital gains, if any, will be paid at least annually. Dividends and distributions to shareholders are recorded on the ex-dividend date. Dividends and distributions to preferred shareholders are accrued and determined as described in Note 6.

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 17

| | |

NOTES TO FINANCIAL STATEMENTS (Unaudited) continued | January 31, 2012 |

(d) Inverse Floating Rate Investments and Floating Rate Note Obligations: Inverse floating rate instruments are notes whose coupon rate fluctuates inversely to a predetermined interest rate index. These instruments typically involve greater risks than a fixed rate municipal bond. In particular, the holder of these inverse floating rate instruments retain all credit and interest rate risk associated with the full underlying bond and not just the par value of the inverse floating rate instrument. As such, these instruments should be viewed as having inherent leverage and therefore involve many of the risks associated with leverage. Leverage is a speculative technique that may expose the Fund to greater risk and increased costs. Leverage may cause the Fund’s net asset value to be more volatile than if it had not been leveraged because leverage tends to magnify the effect of any increases or decreases in the value of the Fund’s portfolio securities. The use of leverage may also cause the Fund to liquidate portfolio positions when it may not be advantageous to do so in order to satisfy its obligations with respect to inverse floating rate instruments.

The Fund may invest in inverse floating rate securities through either a direct purchase or through the transfer of bonds to a dealer trust in exchange for cash and/or residual interests in the dealer trust. For those inverse floating rate securities purchased directly, the instrument is included in the Portfolio of Investments with income recognized on an accrual basis. The Fund did not invest in inverse floaters during the period ended January 31, 2012.

(e) Recent Accounting Pronouncements: On May 12, 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2011-04, modifying Topic 820, Fair Value Measurements and Disclosures. At the same time, the International Accounting Standards Board (“IASB”) issued International Financial Reporting Standard (“IFRS”) 13, Fair Value Measurement. The objective by the FASB and IASB is convergence of their guidance on fair value measurements and disclosures. Specifically, the ASU requires reporting entities to disclose (i) the amounts of any transfers between Level 1 and Level 2, and the reasons for the transfers, (ii) for Level 3 fair value measurements, quantitative information about significant unobservable inputs used, (iii) a description of the valuation processes used by the reporting entity and, (iv) a narrative description of the sensitivity of the fair value measurement to changes in unobservable inputs if a change in those inputs might result in a significantly higher or lower fair value measurement. The effective date of the ASU is for interim and annual periods beginning after December 15, 2011, and is therefore not effective for the current period. Cutwater Investor Services Corp. (the “Adviser”) is in the process of assessing the impact of the updated standards on the Fund’s financial statements.

Note 3 – Agreements:

Pursuant to an Investment Advisory Agreement (the “Advisory Agreement”) between the Adviser and the Fund, the Adviser is responsible for the daily management of the Fund’s portfolio, which includes buying and selling securities for the Fund, as well as investment research, subject to the direction of the Fund’s Board of Trustees. The Adviser is a subsidiary of Cutwater Holdings, LLC which, in turn, is a wholly-owned subsidiary of MBIA Inc. The Advisory Agreement provides that the Fund shall pay to the Adviser a monthly fee for its services at the annual rate of 0.39% of the sum of the Fund’s average daily managed assets. (“Managed Assets” represent the Fund’s total assets including the assets attributable to the proceeds from any financial leverage but excluding the assets attributable to floating rate note obligations, minus liabilities, other than debt representing financial leverage.) The Adviser voluntarily agreed to waive a portion of the management fees it is entitled to receive from the Fund at the annual rate of 0.09% of the Fund’s average daily Managed Assets.

Pursuant to a Servicing Agreement, Guggenheim Funds Distributors, LLC (the “Servicing Agent”) acts as servicing agent to the Fund. The Servicing Agent receives an annual fee from the Fund, payable monthly in arrears, in an amount equal to 0.26% of the average daily value of the Fund’s Managed Assets. The Servicing Agent voluntarily agreed to waive a portion of the servicing fee it is entitled to receive from the Fund at the annual rate of 0.06% of the average daily value of the Fund’s Managed Assets.

Under a separate Fund Administration agreement, Guggenheim Funds Investment Advisors, LLC, an affiliate of the Servicing Agent, provides fund administration services to the Fund. Guggenheim Funds Investment Advisors, LLC receives a fund administration fee payable monthly at the annual rate set forth below as a percentage of the average daily managed assets of the Fund:

| | |

Managed Assets | Rate |

First $200,000,000 | 0.0275% |

Next $300,000,000 | 0.0200% |

Next $500,000,000 | 0.0150% |

Over $1,000,000,000 | 0.0100% |

For the period ended January 31, 2012, the Fund incurred $23,064 in fund administration fees.

The Bank of New York Mellon (“BNY”) acts as the Fund’s custodian, accounting agent and auction agent. As custodian, BNY is responsible for the custody of the Fund’s assets. As accounting agent, BNY is responsible for maintaining the books and records of the Fund. As auction agent, BNY is responsible for conducting the auction of the preferred shares.

Certain officers and/or trustees of the Fund are officers and/or directors of the Adviser and the Servicing Agent.

The Fund does not compensate its officers or trustees who are officers, directors and/or employees of the aforementioned firms.

Note 4 – Federal Income Taxes:

The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, no provision for U.S. federal income taxes is required. In addition, by distributing substantially all of its ordinary income and long-term capital gains, if any, during each calendar year, the Fund intends not to be subject to U.S. federal excise tax.

18 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

| | |

NOTES TO FINANCIAL STATEMENTS (Unaudited) continued | January 31, 2012 |

Information on the tax components of investments as of January 31, 2012 is as follows:

| | | | |

Cost of | | | Net Tax |

Investments | Gross Tax | Gross Tax | Unrealized |

for Tax | Unrealized | Unrealized | Appreciation on |

Purposes | Appreciation | Depreciation | Investments |

$157,658,849 | $13,596,627 | $(609,364) | $12,987,263 |

The difference between book and tax basis cost of investments is due to book/tax differences on the recognition of partnership/trust income.

As of July 31, 2011 (the most recent fiscal year end for federal income tax purposes), the components of accumulated earnings/(losses) (excluding paid-in capital) on a tax basis were as follows:

| | | | | | | | | | | | | |

| | | Undistributed | | | Undistributed | | | Accumulated | | | Unrealized | |

| | | Tax-Exempt | | | Ordinary | | | Capital and | | | Appreciation/ | |

| | | Income | | | Income | | | Other Losses | | | (Depreciation) | |

2011 | | $ | 851,941 | | | $ | – | | | $ | (7,701,194 | ) | | $ | 5,254,951 | |

The cumulative timing differences under tax basis accumulated capital and other losses as of July 31, 2011 are due to investments in partnerships/trusts.

As of July 31, 2011 (the most recent fiscal year end for federal income tax purposes), the Fund had a capital loss carryforward of $6,477,524 available to offset possible future capital gains. The capital loss carryforward is set to expire as follows: $1,079,795 on July 31, 2013, $625,460 on July 31, 2014 and $4,772,269 on July 31, 2017. Per the Regulated Investment Company Modernization Act of 2010 capital loss carryforwards generated in taxable years beginning after December 22, 2010 must be fully used before capital loss carryforwards generated in taxable years prior to December 22, 2010; therefore, under certain circumstances, capital loss carryforwards available as of the report date, if any, may expire unused.

Distributions paid to shareholders during the tax year ended July 31, 2011 (the most recent fiscal year end for federal income tax purposes), were characterized as follows:

| | | | | | | | | | |

| | | Tax-exempt | | | Ordinary | | | Total | |

| | | income | | | income | | | distributions | |

2011 | | $ | 7,621,698 | | | $ | 73,708 | | | $ | 7,695,406 | |

Capital losses incurred after October 31 (“post-October losses”) within the taxable year are deemed to arise on the first business day of the Fund’s next taxable year. For the year ended July 31, 2011 (the most recent fiscal year end for federal income tax purposes), the Fund incurred and will elect to defer $1,223,670 as post-October losses.

For all open tax years and all major jurisdictions, management of the Fund has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Uncertain tax positions are tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns that would not meet a more-likely-than-not threshold of being sustained by the applicable tax authority and would be recorded as a tax expense in the current year. Open tax years are those years that are open for examination by taxing authorities (i.e. generally the last four tax year ends and the interim tax period since then). Furthermore, management of the Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Note 5 – Investment Transactions:

Purchases and sales of investment securities, excluding short-term investments, for the six months ended January 31, 2012, aggregated $7,346,234 and $6,753,690, respectively.

Note 6 – Capital:

There are an unlimited number of $.001 par value common shares of beneficial interest authorized and 6,777,269 common shares outstanding at January 31, 2012, of which the Adviser owned 11,502 shares.

Transactions in common shares were as follows: | |

| | Six Months Ended | Year Ended |