UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21359

Managed Duration Investment Grade Municipal Fund

(Exact name of registrant as specified in charter)

227 West Monroe Street, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Amy J. Lee

227 West Monroe Street, Chicago, IL 60606

(Name and address of agent for service)

Registrant's telephone number, including area code: (312) 827-0100

Date of fiscal year end: July 31

Date of reporting period: August 1, 2014 through January 31, 2015

Item 1. Reports to Stockholders.

The registrant's semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

GUGGENHEIMINVESTMENTS.COM/MZF

...YOUR WINDOW TO THE LATEST, MOST UP-TO-DATE

INFORMATION ABOUT THE MANAGED DURATION

INVESTMENT GRADE MUNICIPAL FUND

The shareholder report you are reading right now is just the beginning of the story.

Online at guggenheiminvestments.com/mzf, you will find:

• | Daily, weekly and monthly data on share prices, distributions and more |

• | Portfolio overviews and performance analyses |

• | Announcements, press releases and special notices and tax characteristics |

Cutwater Investor Services Corp. and Guggenheim Investments are continually updating and expanding shareholder information services on the Fund’s website, in an ongoing effort to provide you with the most current information about how your Fund’s assets are managed, and the results of our efforts. It is just one more way we are working to keep you better informed about your investment in the Fund.

DEAR SHAREHOLDER

We thank you for your investment in Managed Duration Investment Grade Municipal Fund (the “Fund”). This report covers performance for the six-month period ended January 31, 2015.

The Fund’s investment objective is to provide high current income exempt from regular federal income tax while seeking to protect the value of the Fund’s assets during periods of interest rate volatility. Under normal market conditions, the Fund seeks to achieve this objective by investing substantially all of its assets in municipal bonds of investment-grade quality.

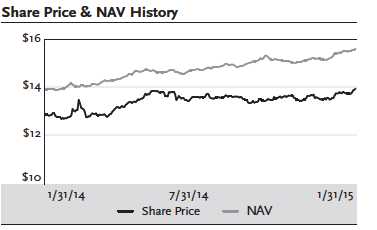

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the six-month period ended January 31, 2015, the Fund provided a total return based on market price of 5.83% and a total return of 8.71% based on NAV. As of January 31, 2015, the Fund’s last closing market price of $13.96 represented a discount of 10.51% to NAV of $15.60. Past performance is not a guarantee of future results. The market value and NAV of the Fund’s shares fluctuate from time to time, and the Fund’s market value may be higher or lower than its NAV. The Fund’s NAV performance data reflects fees and expenses of the Fund.

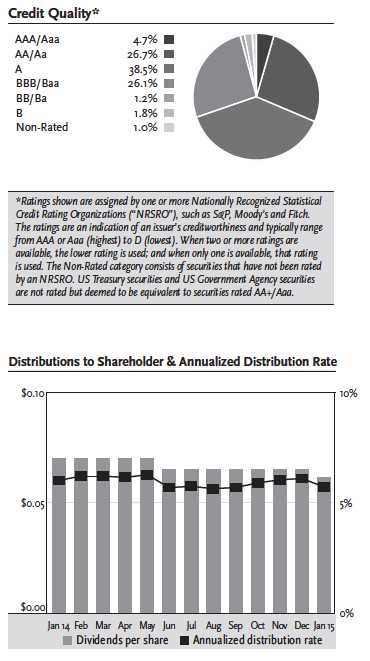

A distribution of $0.0650 was paid in each of the first five months of the period and a distribution of $0.0616 was paid in the final month of the period. The current distribution represents an annualized distribution rate of 5.30% based on the last closing market price of $13.96 on January 31, 2015.

Cutwater Investor Services Corp. (“Cutwater”), a unit of Cutwater Asset Management, serves as the Fund’s Investment Adviser (“Investment Adviser” or “Adviser”). On January 2, 2015, BNY Mellon acquired Cutwater Asset Management. BNY Mellon is a global investments company that delivers investment management and investment services in 35 countries and more than 100 markets. As of December 31, 2014 it had more than $28.5 trillion in assets under custody and/or administration and $1.7 trillion in assets under management through its multi-boutique investment management business. Cutwater Asset Management will work closely with, and be administered by, Insight Investment, a leading European asset manager and one of BNY Mellon’s largest investment firms.

As a result of the acquisition, the Adviser became an indirect wholly-owned subsidiary of BNY Mellon. Under the Investment Company Act of 1940, as amended, the closing of this transaction resulted in the assignment and automatic termination of the Fund's investment advisory agreement with the Adviser (the "Terminated Agreement"). In anticipation of the closing, the Fund's shareholders approved a new investment advisory agreement (the "New Agreement") between the Fund and the Adviser at a special meeting of the shareholders of the Fund held on December 10, 2014. The New Agreement is identical to the Terminated Agreement in all material aspects, except for the dates of its execution and its termination, and became effective as of the closing of the transaction on January 2, 2015.

Guggenheim Funds Distributors, LLC (“GFD”) serves as the Servicing Agent to the Fund. GFD is part of Guggenheim Investments. Guggenheim Investments represents the investment management division of Guggenheim Partners, LLC.

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 3

We encourage shareholders to consider the opportunity to reinvest their distributions from the Fund through the Dividend Reinvestment Plan (“DRIP”), which is described in detail on page 37 of this report. When shares trade at a discount to NAV, the DRIP takes advantage of the discount by reinvesting the monthly dividend distribution in common shares of the Fund purchased in the market at a price less than NAV. Conversely, when the market price of the Fund’s common shares is at a premium above NAV, the DRIP reinvests participants’ dividends in newly-issued common shares at the greater of NAV per share or 95% of the market price per share. The DRIP provides a cost-effective means to accumulate additional shares and enjoy the benefits of compounding returns over time. Since the Fund endeavors to maintain a steady monthly distribution rate, the DRIP effectively provides an income averaging technique, which causes shareholders to accumulate a larger number of Fund shares when the market price is depressed than when the price is higher.

To learn more about the Fund’s performance, we encourage you to read the Questions & Answers section of this report, which begins on page 5 of this report. You will find information about how the Fund is managed, what affected the performance of the Fund during the six-month period ended January 31, 2015, and Cutwater’s views on the market environment.

We appreciate your investment, and we look forward to serving your investment needs in the future. For the most up-to-date information on your investment, please visit the Fund’s website at guggenheiminvestments.com/mzf.

Sincerely,

Clifford D. Corso

Chief Executive Officer

Managed Duration Investment Grade Municipal Fund

February 28, 2015

4 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

| | |

QUESTIONS & ANSWERS | January 31, 2015 |

Clifford D. Corso

Chief Executive Officer

Mr. Corso joined Cutwater in 1994, establishing the company's asset management platform and building it into one of the largest fixed income managers in the world. He oversees the investment of over $20 billion in assets, and directs the investment strategies of Cutwater's clients including pension funds, global banks, corporations, Taft Hartley and insurance companies, as well as hundreds of municipalities across the United States. Following BNY Mellon’s acquisition of Cutwater Asset Management in January 2015, Cliff joined the Executive Management Committee of Insight Investment Group. Insight is one of BNY Mellon’s premier investment management boutiques and one of Europe’s leading investment managers. Prior to joining the firm, Mr. Corso served as co-head of a fixed income division at Alliance Capital Management.

Beginning his career in 1984, Mr. Corso has held positions as a credit analyst, restructuring specialist, trader and portfolio manager. He has managed a wide range of fixed income products including corporate, asset-backed, government, mortgage, municipal, credit default swap and derivative securities. Mr. Corso has developed several unique conduit businesses including East-Fleet, a London based vehicle which served several global banks. He was also an early pioneer in the credit derivatives market, developing several investment programs starting in 2000 and expanding this area to create the MINTS funds, one of the most successful CDS funds ever created with over $1.6 billion in notional value under management.

Mr. Corso's analytical skills combine mathematics, game theory, economics, psychology and investment theory. He is a frequent guest host on CNBC's “Squawk Box” and has also lectured on topics from leadership to finance at many leading academic institutions including Columbia University, as well as New York University where he taught a course on financial derivatives.

Mr. Corso holds a Bachelor of Arts (BA) degree in economics from Yale University and a Master of Business Administration (MBA) degree from Columbia University. He holds Series 7, 24, and 63 licenses from the Financial Industry Regulatory Authority (FINRA) and is a member of the Fixed Income Analysts Society and Global Association of Risk Professionals (GARP).

James B. DiChiaro

Portfolio Manager

Mr. DiChiaro joined Cutwater in 1999 and is a director. He currently manages Cutwater’s municipal assets under management (taxable and tax-exempt) and has extensive experience managing money-market portfolios. He constructs and implements portfolio strategies for a diverse client base including insurance companies, separately managed accounts and closed-end bond funds. Mr. DiChiaro began his career at Cutwater working

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 5

| | |

QUESTIONS & ANSWERS continued | January 31, 2015 |

with the conduit group structuring medium-term notes for Meridian Funding Company and performing the treasury role for an MBIA sponsored asset-backed commercial paper conduit, Triple-A One Funding Corporation.

Prior to joining Cutwater he worked for Merrill Lynch supporting their asset-backed securities trading desk. Mr. DiChiaro has a bachelor’s degree from Fordham University and a master’s degree from Pace University.

Matthew J. Bodo

Portfolio Manager

Mr. Bodo joined Cutwater in 2002 and is a vice president in Cutwater’s portfolio management group. He participates in biweekly corporate credit and portfolio strategy meetings and supports the portfolio managers’ implementation of those strategies for Cutwater’s third-party accounts. As part of his daily responsibilities, Mr. Bodo actively manages the local government investment pool portfolios, specializing in high-grade commercial paper, investment grade corporates, U.S. Treasury and instrumentality bonds. Prior to this role, Mr. Bodo served as an investment accountant performing accounting related functions for mutual funds and MBIA insurance portfolios. He has a bachelor’s degree from the State University of New York at Albany.

In the following interview Portfolio Managers Clifford D. Corso, James B. DiChiaro, and Matthew J. Bodo discuss the market environment and the performance of the Managed Duration Investment Grade Municipal Fund (the “Fund”) for the semiannual period ended January 31, 2015.

Please provide an overview of the economy and the municipal market during the six-month period ended January 31, 2015.

U.S. Gross Domestic Product (“GDP”) accelerated further in the second half of 2014, although some viewed the preliminary reading of 2.6% growth in the fourth quarter as a disappointment, given the 5.0% pace of growth in the third quarter. The U.S. added 260,000 jobs per month on average in 2014, alleviating fears of a slowdown in economic growth and validating Cutwater’s checkmark recovery thesis for this economy.

The unemployment rate dropped to 5.7% as of the end of the period, which is below the Federal Reserve’s expectation; however, the Core Personal Consumption Expenditure Index has been increasing at a meager rate, well below the Federal Reserve’s inflation target. The Federal Open Market Committee (“FOMC”) has completed its program of asset purchases, and the lack of inflation may allow the FOMC to take a measured approach in addressing and adjusting monetary policy in the coming year. The market currently anticipates an increase in the benchmark Federal Funds Target Rate as early as mid-2015.

One year ago many market pundits, including Cutwater, expressed concerns about the ability to generate positive total returns in the municipal market when faced with the headwind of rising

6 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

| | |

QUESTIONS & ANSWERS continued | January 31, 2015 |

interest rates. Looking back on 2014, the Barclays Municipal Index returned 9.05%. Interest rates today are significantly lower than were projected one year ago, and also aiding returns in 2014 was scant new issue supply. News from high profile issuers such as Puerto Rico, Detroit, and Stockton was mostly negative, and the market quickly realized that municipal bankruptcy can be especially punitive for bond holders given preferential treatment for pensioners. The market shrugged off much of the negative news and honed in on the upward trajectory of the U.S. economy. Consumer spending has improved, wage growth is increasing, and plummeting oil prices could accelerate the growth of the economy.

These developments could benefit municipalities, as higher wages and increased spending will eventually lead to additional tax revenue for states and local governments. The fiscally conservative agenda which many political leaders recently campaigned on is beginning to wane. State and local government revenues are now above pre-recession levels and, with budget gaps diminishing, there will likely be an increase in the issuance of debt used to fund domestic infrastructure projects. This country’s infrastructure is in desperate need of renovation and repair which is largely a function of capital expenditures being postponed while municipalities dealt with declining revenues associated with the recession. These projects include the rebuilding of schools, roads, drinking water facilities, and airports. Although tax receipts have increased, some of the weaker issuers continue to struggle from the years of overpaying employees and offering unaffordable pension benefits.

How did the Fund perform in this market environment?

All Fund returns cited—whether based on NAV or market price—assume the reinvestment of all distributions. For the six-month period ended January 31, 2015, the Fund provided a total return based on market price of 5.83% and a total return of 8.71% based on NAV. As of January 31, 2015, the Fund’s last closing market price of $13.96 represented a discount of 10.51% to NAV of $15.60. As of July 31, 2014, the Fund’s last closing market price of $13.57 represented a discount of 7.81% to NAV of $14.72.

Past performance is not a guarantee of future results. The market value and NAV of the Fund’s shares fluctuate from time to time, and the Fund’s market value may be higher or lower than its NAV. The Fund’s NAV performance data reflects fees and expenses of the Fund.

A distribution of $0.0650 was paid in each of the first five months of the period and a distribution of $0.0616 was paid in the final month of the period. The distribution at period end represents an annualized distribution rate of 5.30% based on the last closing market price of $13.96 on January 31, 2015.

What stood out about the Fund’s performance for the period?

The NAV of the Fund returned 8.71%, compared with 4.52% for the Barclays Municipal Index. The index’s performance exhibited an investor preference for the long-end of the curve and A-rated and BBB-rated securities.

The Fund maintained a barbelled duration position throughout the period. Although Cutwater had been calling for a bear flattener where short maturity interest rates increase (which had driven it to

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 7

| | |

QUESTIONS & ANSWERS continued | January 31, 2015 |

overweight floating-rate securities during the period), the long (30-year) part of the barbell was the most beneficial for the Fund’s performance throughout the period.

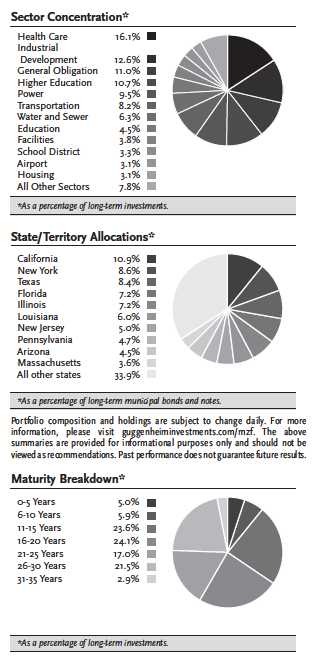

The Fund’s down-in-quality-rated (A and BBB) securities also outperformed their higher quality counterparts. From a sector perspective, healthcare was the top performer, returning over 6% during the period. Lagging the healthcare sector by approximately 100 basis points were corporate-backed industrial development bonds and the transportation sector, both which outperformed the index. So, the Fund’s top sector allocations were beneficial for performance despite scaling risk back during the period.

Security selection was also beneficial to the Fund’s performance during the period. The Fund’s floating-rate securities, although not currently yielding as much as fixed rate securities, saw material price appreciation for a sector with little duration.

Detracting from the Fund’s performance was its shorter duration relative to its benchmark. Interest rates staged an impressive rally during the period (30-year treasury bonds lost nearly 100 basis points in yield) and the Fund’s defensive position toward higher interest rates was negative for performance. Also negative for performance was the Fund’s allocation to high-quality (AAA/AA) credits (even though the allocation was lower than that of the benchmark), as investors flocked to higher-yielding securities in an effort to preserve investment income.

How did the Fund’s positioning change over the period?

Average credit quality improved during the period, with reductions in A-rated securities in favor of double-A rated ones. The impetus for this improvement was tight valuations for lower quality bonds, and the low interest rate environment which encouraged investors to reach for yield, driving credit spreads below historic averages.

Part of the risk reduction strategy included a decrease in exposure to the healthcare sector (from 18.4% to 16.1%), which is predominantly rated A/BBB.

We increased the Fund’s allocation to the power and transportation sectors, which we regard as essential service sectors, and were cheaper on a risk-adjusted basis to the more credit-sensitive sectors of the market. We maintain a positive outlook and have over-weighted the transportation sector as low oil prices and the growing economy bolster business and personal travel (i.e., airports, toll roads).

As for the general obligation (“GO”) sector of the market, we believe that it may be oversold. While municipal bankruptcies have generally not treated bondholders very well, GOs are still a high quality sector with a low incidence of default. There may be select opportunities to increase the Fund’s yield by increasing allocations to the GO sector while improving the Fund’s risk metrics.

Any comment on duration?

We sought to reduce the Fund’s duration during the period. Although this was not beneficial for performance given the significant rate rally, the Fund is well-positioned to outperform the benchmark and the peers once the FOMC tightens monetary policy in the coming year.

8 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

| | |

QUESTIONS & ANSWERS continued | January 31, 2015 |

Unfortunately, our initiative to lessen interest rate exposure and reduce risk did cause the distribution rate of the Fund to decrease during the period.

What about the Fund’s investments in bonds issued by Detroit and Puerto Rico?

We tendered the Fund’s investment in the Detroit water and sewer authority during the period. The authority offered a price that was attractive to the Fund’s shareholders.

We also liquidated a Puerto Rico (COFINA) position during the period. These sales-tax-supported bonds were liquidated prior to S&P’s downgrade of the securities to non-investment-grade.

What effect did the Fund’s leverage have on Fund return?

The Fund utilizes leverage (borrowing) as part of its investment strategy, to finance the purchase of additional securities that provide increased income and potentially greater appreciation potential to common shareholders than could be achieved from a portfolio that is not leveraged.

Leverage adds to performance only when the cost of leverage is less than the total return generated by investments. The use of financial leverage creates an opportunity for increased income and capital appreciation but, at the same time, creates special risks. There can be no assurance that a leveraging strategy will be utilized or will be successful. Financial leverage may cause greater changes in the Fund’s NAV and returns than if financial leverage had not been used.

As of January 31, 2015, the Fund maintained leverage of about 40% in the form of Auction Market Preferred Shares (“AMPS”). Since the Fund’s NAV return was greater than the cost of leverage during the period, leverage was a contributor to the Fund’s total return.

Do you have any other comments on the Fund?

The municipal asset class appears to be attractive relative to some other taxable fixed-income sectors to start 2015. The yield relationship of tax-exempt to taxable bonds with maturities longer than five years is above historic averages and may serve as a buffer against rising rates. The Federal Reserve is expected to tighten monetary policy during the year, and short-term interest rates should move higher driving a further flattening of the yield curve. Careful portfolio construction can help overcome the headwind of rising interest rates through prudent curve positioning.

New issue supply for the coming year is expected to increase modestly but should not rise by more than 10%. Rising interest rates will play a role in the primary market; the lower rates are the more refunding activity that will come to market. Net supply (new issuance minus maturities and called bonds), which had been negative for the last four years, will likely turn slightly positive this year but should not have any meaningful impact on the current supply/demand dynamic.

One theme that is expected to resonate is investors’ preference for debt backed by dedicated revenue streams. The recent bankruptcies in Detroit and Stockton have placed bondholders in a subordinated position to pensioners despite state statute and indenture language. Municipalities cannot be pressured into bankruptcy and, should they choose to file, their creditors cannot force a

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 9

| | |

QUESTIONS & ANSWERS continued | January 31, 2015 |

liquidation, nor are they collateralized by specific assets. There is no mathematic formula in determining the ultimate recovery on a defaulted municipal bond as the assets are valued by the municipality based upon the service they provide to their residents. Revenue bonds have fared far better in bankruptcy and in many instances remain unimpaired. As such they can be regarded as a way of investing in the municipal asset class without being subjected to political decision making. Bonds backed by water and sewer revenues, and sales taxes have dedicated revenue streams that are separate from a municipality’s general fund and should remain uninterrupted during a municipal bankruptcy provided the asset is still performing. We note that bonds in default decreased during 2014 and were a minute portion of the size of the market.

Index Definitions

All indices are unmanaged. It is not possible to invest in an index.

The Barclays Municipal Bond Index is a rules-based, market-value weighted index engineered for the long-term tax-exempt bond market. To be included in the index, bonds must be rated investment-grade (Baa3/BBB- or higher) by at least two of the following ratings agencies: Moody’s Investor Services, Inc., Standard & Poor’s Rating Group, or Fitch Ratings, Inc.

Risks and Other Considerations

The views expressed in this report reflect those of the portfolio managers only through the report period as stated on the cover. These views are subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any kind. The material may also include forward looking statements that involve risk and uncertainty, and there is no guarantee that any predictions will come to pass.

There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities. Closed-end funds often trade at a discount to their net asset value. There can be no assurance that the Fund will achieve its investment objectives. Risk is inherent in all investing, including the loss of your entire principal. Therefore, before investing you should consider the risks carefully.

Please see guggenheiminvestments.com/mzf for a detailed discussion of the Fund’s risks and considerations.

10 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

| | |

FUND SUMMARY (Unaudited) | January 31, 2015 |

Fund Statistics | |

Symbol on New York Stock Exchange | MZF |

Initial Offering Date | August 27, 2003 |

Share Price | $13.96 |

Net Asset Value | $15.60 |

Yield on Closing Market Price | 5.30% |

Taxable Equivalent Yield on Closing Market Price1 | 9.36% |

Monthly Distribution Per Common Share2 | $0.0616 |

Leverage3 | 40% |

Percentage of total investments subject to alternative minimum tax | 16.5% |

1 Taxable equivalent yield is calculated assuming a 43.4% federal income tax bracket. | |

2 Monthly distribution is subject to change. | |

3 As a percentage of total investments. | |

AVERAGE ANNUAL TOTAL RETURNS | | | | |

FOR THE PERIOD ENDED JANUARY 31, 2015 | | | | |

| | Six Month | One | Three | Five | Ten | Since |

| | (non-annualized) | Year | Year | Year | Year | Inception |

Managed Duration | | | | | | |

Investment Grade | | | | | | |

Municipal Fund | | | | | | |

NAV | 8.71% | 18.34% | 7.33% | 9.21% | 6.51% | 6.60% |

Market | 5.83% | 14.88% | 3.08% | 7.80% | 6.77% | 5.55% |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. NAV total returns reflect fees and expenses of the Fund. For the most recent month-end performance figures, please visit guggenheiminvestments.com/mzf. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when sold, may be worth more or less than their original cost.

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 11

| | |

FUND SUMMARY (Unaudited) continued | January 31, 2015 |

12 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

| | |

PORTFOLIO OF INVESTMENTS (Unaudited) | January 31, 2015 |

| | | |

| | Shares | Value |

SHORT TERM INVESTMENTS† – 0.7% | | |

JPMorgan Tax Free Money Market | 694,500 | $ 694,500 |

Total Short Term Investments | | |

(Cost $694,500) | | 694,500 |

| |

| | Face | |

| | Amount | Value |

MUNICIPAL BONDS†† – 161.3% | | |

California – 17.7% | | |

Sacramento County Sanitation Districts Financing Authority, (AGC-ICC FGIC) | | |

0.69% due 12/01/351 | $ 3,500,000 | 3,165,470 |

Los Angeles Unified School District | | |

5.00% due 01/01/34 | 2,525,000 | 2,887,817 |

City of Chula Vista CA, AMT | | |

5.50% due 12/01/21 | 2,500,000 | 2,558,825 |

California Statewide Communities Development Authority | | |

0.95% due 04/01/361 | 2,500,000 | 2,146,300 |

California Health Facilities Financing Authority | | |

5.88% due 08/15/31 | 1,500,000 | 1,830,105 |

San Bernardino City Unified School District, (AGM) | | |

5.00% due 08/01/28 | 1,000,000 | 1,185,160 |

California Pollution Control Financing Authority, AMT | | |

5.00% due 07/01/302 | 1,000,000 | 1,125,580 |

Los Angeles County Public Works Financing Authority | | |

4.00% due 08/01/42 | 1,000,000 | 1,054,280 |

San Diego Unified School District General Obligation Unlimited | | |

0.00% due 07/01/383 | 3,145,000 | 1,032,220 |

Bay Area Toll Authority | | |

1.27% due 04/01/361 | 1,000,000 | 1,021,040 |

Desert Community College District General Obligation Unlimited, (AGM) | | |

0.00% due 08/01/463 | 3,750,000 | 717,825 |

Total California | | 18,724,622 |

New York – 14.0% | | |

New York State Dormitory Authority Revenue Bonds | | |

5.00% due 03/15/44 | 4,000,000 | 4,685,881 |

New York City Water & Sewer System Revenue Bonds | | |

5.00% due 06/15/45 | 1,930,000 | 2,209,329 |

5.00% due 06/15/47 | 1,000,000 | 1,152,000 |

Metropolitan Transportation Authority | | |

5.00% due 11/15/43 | 2,000,000 | 2,316,720 |

New York State Dormitory Authority | | |

5.00% due 07/01/32 | 1,000,000 | 1,112,280 |

5.25% due 07/01/174 | 600,000 | 653,634 |

Suffolk County Industrial Development Agency, AMT | | |

5.25% due 06/01/27 | 1,500,000 | 1,503,015 |

See notes to financial statements.

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 13

| | |

PORTFOLIO OF INVESTMENTS (Unaudited) continued | January 31, 2015 |

| | | |

| | Face | |

| | Amount | Value |

MUNICIPAL BONDS†† – 161.3% (continued) | | |

New York – 14.0% (continued) | | |

Troy Industrial Development Authority | | |

5.00% due 09/01/31 | $ 1,000,000 | $ 1,144,820 |

Total New York | | 14,777,679 |

Texas – 13.6% | | |

Matagorda County Navigation District No. 1, AMT, (AMBAC) | | |

5.13% due 11/01/28 | 2,515,000 | 2,970,366 |

Lower Colorado River Authority Revenue Bonds | | |

6.25% due 05/15/28 | 1,995,000 | 2,315,297 |

6.25% due 05/15/184 | 5,000 | 5,900 |

Tarrant County Cultural Education Facilities Finance Corp. | | |

5.00% due 10/01/43 | 2,000,000 | 2,283,280 |

North Texas Tollway Authority | | |

5.63% due 01/01/33 | 2,000,000 | 2,229,040 |

San Leanna Educational Facilities Corp. | | |

5.13% due 06/01/36 | 2,100,000 | 2,205,693 |

Fort Bend County Industrial Development Corp. | | |

4.75% due 11/01/42 | 1,000,000 | 1,061,080 |

Tarrant County Cultural Education Facilities Finance Corp. Revenue Bonds | | |

5.75% due 07/01/18 | 480,000 | 531,619 |

5.75% due 07/01/164 | 150,000 | 153,645 |

North Texas Tollway Authority Revenue Bonds | | |

5.00% due 01/01/24 | 500,000 | 615,415 |

Total Texas | | 14,371,335 |

Illinois – 11.6% | | |

Metropolitan Pier & Exposition Authority | | |

5.00% due 06/15/42 | 2,000,000 | 2,230,280 |

Illinois Finance Authority, Roosevelt University Revenue | | |

5.50% due 04/01/37 | 2,000,000 | 2,062,160 |

City of Chicago IL O’Hare International Airport Revenue | | |

5.50% due 01/01/31 | 1,750,000 | 2,055,568 |

State of Illinois, General Obligation | | |

5.00% due 03/01/28 | 2,000,000 | 2,006,960 |

Illinois Finance Authority, Rush University Medical Center Revenue | | |

6.38% due 05/01/194 | 1,000,000 | 1,225,930 |

Railsplitter Tobacco Settlement Authority | | |

6.00% due 06/01/28 | 1,000,000 | 1,196,430 |

Chicago Board of Education, General Obligation | | |

5.00% due 12/01/41 | 1,000,000 | 1,051,840 |

Illinois Housing Development Authority, AMT | | |

5.00% due 08/01/36 | 555,000 | 557,808 |

Total Illinois | | 12,386,976 |

See notes to financial statements.

14 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

| | |

PORTFOLIO OF INVESTMENTS (Unaudited) continued | January 31, 2015 |

| | | |

| | Face | |

| | Amount | Value |

MUNICIPAL BONDS†† – 161.3% (continued) | | |

Florida – 11.5% | | |

Miami-Dade County Educational Facilities Authority | | |

5.00% due 04/01/42 | $ 2,000,000 | $ 2,261,220 |

County of Miami-Dade FL, Aviation Revenue, AMT, (CIFG) | | |

5.00% due 10/01/38 | 2,200,000 | 2,257,728 |

Miami-Dade County School Board Foundation, Inc., (Assured Gty) | | |

5.38% due 02/01/34 | 1,500,000 | 1,709,385 |

JEA Water & Sewer System Revenue | | |

4.00% due 10/01/41 | 1,500,000 | 1,524,930 |

Town of Davie FL | | |

6.00% due 04/01/42 | 1,000,000 | 1,173,710 |

Tampa-Hillsborough County Expressway Authority | | |

5.00% due 07/01/42 | 1,000,000 | 1,131,240 |

County of Broward FL, AMT, (AGM) | | |

5.00% due 04/01/38 | 1,000,000 | 1,126,780 |

Seminole Indian Tribe of Florida | | |

5.25% due 10/01/272 | 1,000,000 | 1,064,420 |

Total Florida | | 12,249,413 |

Louisiana – 9.6% | | |

Louisiana Local Government Environmental Facilities & Community | | |

Development Authority | | |

6.75% due 11/01/32 | 3,000,000 | 3,407,520 |

State of Louisiana Gasoline & Fuels Tax Revenue | | |

5.00% due 05/01/43 | 1,600,000 | 1,853,568 |

Parish of St John the Baptist LA | | |

5.13% due 06/01/37 | 1,500,000 | 1,586,250 |

East Baton Rouge Sewerage Commission | | |

5.25% due 02/01/194 | 1,000,000 | 1,173,190 |

Louisiana Public Facilities Authority, Hospital Revenue | | |

5.25% due 11/01/30 | 1,000,000 | 1,164,720 |

Parish of DeSoto LA, AMT | | |

5.85% due 11/01/27 | 1,000,000 | 1,001,020 |

Total Louisiana | | 10,186,268 |

New Jersey – 8.1% | | |

New Jersey Economic Development Authority | | |

1.62% due 03/01/281 | 3,000,000 | 2,993,700 |

5.00% due 07/01/32 | 500,000 | 473,805 |

New Jersey Transportation Trust Fund Authority | | |

5.00% due 06/15/42 | 3,000,000 | 3,283,650 |

New Jersey Health Care Facilities Financing Authority | | |

5.75% due 07/01/194 | 1,500,000 | 1,809,390 |

Total New Jersey | | 8,560,545 |

See notes to financial statements.

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 15

| | |

PORTFOLIO OF INVESTMENTS (Unaudited) continued | January 31, 2015 |

| | | |

| | Face | |

| | Amount | Value |

MUNICIPAL BONDS†† – 161.3% (continued) | | |

Pennsylvania – 7.5% | | |

Pennsylvania Higher Educational Facilities Authority | | |

6.00% due 08/15/26 | $ 1,000,000 | $ 1,164,300 |

5.00% due 05/01/37 | 1,000,000 | 1,051,950 |

Delaware River Port Authority | | |

5.00% due 01/01/27 | 1,500,000 | 1,716,585 |

City of Philadelphia PA, General Obligation, (Assured Gty) | | |

5.38% due 08/01/30 | 1,110,000 | 1,288,821 |

City of Philadelphia PA, General Obligation | | |

5.88% due 08/01/31 | 1,100,000 | 1,182,104 |

County of Lehigh PA | | |

4.00% due 07/01/43 | 1,000,000 | 1,038,310 |

State Public School Building Authority Revenue Bonds | | |

5.00% due 04/01/32 | 500,000 | 556,135 |

Total Pennsylvania | | 7,998,205 |

Arizona – 7.3% | | |

Arizona Health Facilities Authority Revenue Bonds | | |

0.98% due 01/01/371 | 3,500,000 | 3,140,235 |

Arizona Health Facilities Authority | | |

1.87% due 02/01/481 | 2,000,000 | 2,027,400 |

Glendale Municipal Property Corp. | | |

5.00% due 07/01/33 | 1,250,000 | 1,426,700 |

Phoenix Industrial Development Authority | | |

5.25% due 06/01/34 | 1,000,000 | 1,138,470 |

Total Arizona | | 7,732,805 |

Massachusetts – 5.8% | | |

Massachusetts Educational Financing Authority, AMT | | |

4.70% due 07/01/26 | 1,235,000 | 1,350,510 |

5.38% due 07/01/25 | 860,000 | 988,518 |

Commonwealth of Massachusetts, General Obligation | | |

0.74% due 05/01/371 | 1,800,000 | 1,719,216 |

Massachusetts Health & Educational Facilities Authority | | |

6.25% due 07/01/30 | 1,000,000 | 1,179,380 |

Massachusetts Housing Finance Agency | | |

5.10% due 12/01/27 | 950,000 | 978,681 |

Total Massachusetts | | 6,216,305 |

Connecticut – 4.6% | | |

City of Bridgeport Connecticut General Obligation Unlimited, (AGM) | | |

5.00% due 10/01/25 | 2,535,000 | 3,092,776 |

Connecticut Housing Finance Authority | | |

4.00% due 11/15/34 | 1,750,000 | 1,806,893 |

Total Connecticut | | 4,899,669 |

See notes to financial statements.

16 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

| | |

PORTFOLIO OF INVESTMENTS (Unaudited) continued | January 31, 2015 |

| | | |

| | Face | |

| | Amount | Value |

MUNICIPAL BONDS†† – 161.3% (continued) | | |

Iowa – 4.5% | | |

Iowa Tobacco Settlement Authority | | |

5.60% due 06/01/34 | $ 2,000,000 | $ 1,906,820 |

Iowa Higher Education Loan Authority | | |

5.50% due 09/01/25 | 1,500,000 | 1,623,855 |

Iowa Finance Authority | | |

5.00% due 08/15/29 | 1,090,000 | 1,267,855 |

Total Iowa | | 4,798,530 |

Wyoming – 3.9% | | |

County of Sweetwater WY, AMT | | |

5.60% due 12/01/355 | 4,000,000 | 4,056,720 |

Washington – 3.3% | | |

Tes Properties Revenue Bonds | | |

5.63% due 12/01/38 | 1,000,000 | 1,176,230 |

Washington Higher Education Facilities Authority | | |

5.25% due 04/01/43 | 1,000,000 | 1,150,780 |

Spokane Public Facilities District | | |

5.00% due 12/01/38 | 1,000,000 | 1,144,740 |

Total Washington | | 3,471,750 |

Ohio – 3.2% | | |

American Municipal Power, Fremont Energy Center | | |

5.00% due 02/15/42 | 2,000,000 | 2,249,140 |

Ohio Air Quality Development Authority | | |

5.63% due 06/01/18 | 1,000,000 | 1,121,160 |

Total Ohio | | 3,370,300 |

Tennessee – 3.1% | | |

Knox County Health Educational & Housing Facility Board | | |

5.25% due 04/01/27 | 2,500,000 | 2,691,100 |

Metropolitan Nashville Airport Authority | | |

5.20% due 07/01/26 | 620,000 | 676,612 |

Total Tennessee | | 3,367,712 |

Michigan – 2.7% | | |

Michigan Finance Authority, Revenue | | |

5.00% due 12/01/31 | 1,000,000 | 1,175,820 |

Michigan Finance Authority Revenue Bonds | | |

5.00% due 07/01/44 | 1,030,000 | 1,137,264 |

Detroit Wayne County Stadium Authority Revenue Bonds, (AGM) | | |

5.00% due 10/01/26 | 500,000 | 566,485 |

Total Michigan | | 2,879,569 |

See notes to financial statements.

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 17

| | |

PORTFOLIO OF INVESTMENTS (Unaudited) continued | January 31, 2015 |

| | | |

| | Face | |

| | Amount | Value |

MUNICIPAL BONDS†† – 161.3% (continued) | | |

Vermont – 2.7% | | |

Vermont Student Assistance Corp. | | |

3.25% due 12/03/351,5 | $ 2,800,000 | $ 2,821,420 |

Wisconsin – 2.4% | | |

Wisconsin Health & Educational Facilities Authority | | |

5.00% due 11/15/36 | 1,250,000 | 1,335,475 |

WPPI Energy | | |

5.00% due 07/01/37 | 1,000,000 | 1,150,040 |

Total Wisconsin | | 2,485,515 |

Colorado – 2.2% | | |

City & County of Denver CO Airport System Revenue | | |

5.00% due 11/15/43 | 1,000,000 | 1,155,840 |

Colorado Health Facilities Authority | | |

5.25% due 01/01/45 | 1,000,000 | 1,145,210 |

Total Colorado | | 2,301,050 |

Kentucky – 2.1% | | |

Kentucky Economic Development Finance Authority | | |

5.63% due 08/15/27 | 1,000,000 | 1,149,890 |

County of Owen KY, Waterworks System Revenue | | |

5.63% due 09/01/39 | 1,000,000 | 1,105,560 |

Total Kentucky | | 2,255,450 |

South Carolina – 2.0% | | |

South Carolina State Public Service Authority | | |

5.00% due 12/01/48 | 1,000,000 | 1,144,010 |

County of Georgetown SC, AMT | | |

5.30% due 03/01/28 | 1,000,000 | 1,001,000 |

Total South Carolina | | 2,145,010 |

District of Columbia – 1.9% | | |

District of Columbia Housing Finance Agency, AMT, (FHA) | | |

5.10% due 06/01/37 | 2,000,000 | 2,043,800 |

Alaska – 1.9% | | |

City of Anchorage Alaska Electric Revenue Revenue Bonds | | |

5.00% due 12/01/41 | 1,000,000 | 1,167,200 |

Alaska Municipal Bond Bank Authority | | |

5.75% due 09/01/33 | 750,000 | 876,525 |

Total Alaska | | 2,043,725 |

Delaware – 1.6% | | |

Delaware State Economic Development Authority | | |

5.40% due 02/01/31 | 1,500,000 | 1,706,235 |

See notes to financial statements.

18 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

| | |

PORTFOLIO OF INVESTMENTS (Unaudited) continued | January 31, 2015 |

| | | |

| | Face | |

| | Amount | Value |

MUNICIPAL BONDS†† – 161.3% (continued) | | |

Nevada – 1.6% | | |

Las Vegas Valley Water District | | |

5.00% due 06/01/31 | $ 1,435,000 | $ 1,703,603 |

Minnesota – 1.4% | | |

St Paul Port Authority, AMT | | |

4.50% due 10/01/37 | 1,500,000 | 1,517,370 |

Rhode Island – 1.4% | | |

Rhode Island Convention Center Authority, (Assured Gty) | | |

5.50% due 05/15/27 | 1,300,000 | 1,503,086 |

Virginia – 1.4% | | |

Washington County Industrial Development Authority | | |

7.50% due 07/01/29 | 1,250,000 | 1,489,013 |

Hawaii – 1.1% | | |

Hawaii Pacific Health | | |

5.63% due 07/01/30 | 1,000,000 | 1,201,400 |

Mississippi – 1.1% | | |

County of Warren MS | | |

6.50% due 09/01/32 | 1,000,000 | 1,159,370 |

Indiana – 1.1% | | |

Indiana Finance Authority | | |

6.00% due 12/01/26 | 1,000,000 | 1,132,380 |

Oklahoma – 1.1% | | |

Oklahoma Development Finance Authority | | |

5.00% due 02/15/34 | 1,000,000 | 1,132,010 |

New Hampshire – 1.0% | | |

New Hampshire Health & Education Facilities Authority | | |

5.00% due 01/01/34 | 1,000,000 | 1,063,530 |

Alabama – 0.8% | | |

Courtland Industrial Development Board | | |

6.25% due 08/01/25 | 845,000 | 848,422 |

Maryland – 0.5% | | |

Maryland Economic Development Corp. | | |

5.75% due 09/01/25 | 500,000 | 559,470 |

Total Municipal Bonds | | |

(Cost $155,465,905) | | 171,160,262 |

See notes to financial statements.

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 19

| | |

PORTFOLIO OF INVESTMENTS (Unaudited) continued | January 31, 2015 |

| | | |

| | Face | |

| | Amount | Value |

PREFERRED STOCKS†† – 1.9% | | |

Centerline Equity Issuer Trust | | |

5.75% due 05/15/152 | $ 2,000,000 | $ 2,016,940 |

Total Preferred Stocks | | |

(Cost $2,000,000) | | 2,016,940 |

Total Investments – 163.9% | | |

(Cost $158,160,405) | | $173,871,702 |

Other Assets & Liabilities, net – (63.9)% | | (67,763,117) |

Total Net Assets – 100.0% | | $106,108,585 |

| | † | Value determined based on Level 1 inputs — See Note 2. |

| | †† | Value determined based on Level 2 inputs — See Note 2. |

| | 1 | Variable rate security. Rate indicated is rate effective at January 31, 2015. |

| | 2 | Security is a 144A or Section 4(a)(2) security. The total market value of 144A or Section 4(a)(2) |

| | | securities is $4,206,940 (cost $4,038,664), or 4.0% of total net assets. |

| | 3 | Zero coupon rate security. |

| | 4 | The bond is prerefunded. U.S. government or U.S. government agency securities, held in escrow, are |

| | | used to pay interest on this security, as well as to retire the bond in full at the date and price indicated |

| | | under the Optional Call Provisions. |

| | 5 | All or a portion of these securities have been physically segregated as collateral for borrowings |

| | | outstanding, of which there were none as of year end. As of January 31, 2015, the total amount |

| | | segregated was $6,878,140. |

See notes to financial statements.

20 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

| | |

PORTFOLIO OF INVESTMENTS continued | January 31, 2015 |

See notes to financial statements.

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 21

| | |

STATEMENT OF ASSETS AND LIABILITIES (Unaudited) | January 31, 2015 |

| | | | |

ASSETS: | | | |

Investments, at value | | $ | 173,871,702 | |

Receivables: | | | | |

Interest | | | 1,824,426 | |

Other assets | | | 13,892 | |

Total assets | | | 175,710,020 | |

LIABILITIES: | | | | |

Payable for: | | | | |

Investment advisory fee | | | 44,477 | |

Servicing agent fee | | | 29,612 | |

Distributions – preferred shareholders | | | 18,620 | |

Administration fee | | | 3,687 | |

Accrued expenses and other liabilities | | | 55,039 | |

Total liabilities | | | 151,435 | |

PREFERRED SHARES, at redemption value: | | | | |

$0.001 par value per share; 2,778 Auction Market Preferred Shares authorized, | | | | |

issued and outstanding at $25,000 per share liquidated preference | | | 69,450,000 | |

NET ASSETS | | $ | 106,108,585 | |

NET ASSETS CONSIST OF: | | | | |

Common stock, $0.001 par value per share; unlimited number of shares | | | | |

authorized, 6,800,476 shares issued and outstanding | | $ | 6,800 | |

Additional paid-in capital | | | 95,359,485 | |

Net unrealized appreciation on investments | | | 15,711,297 | |

Accumulated net investment loss | | | (41,744 | ) |

Accumulated net realized loss on investments | | | (4,927,253 | ) |

NET ASSETS | | $ | 106,108,585 | |

Shares outstanding ($0.01 par value with unlimited amount authorized) | | | 6,800,476 | |

Net asset value, offering price and repurchase price per share | | $ | 15.60 | |

Investments in securities, at cost | | | 158,160,405 | |

See notes to financial statements.

22 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

| | |

STATEMENT OF OPERATIONS | January 31, 2015 |

For the Six Months Ended January 31, 2015 (Unaudited) | | | |

| | | | |

INVESTMENT INCOME: | | | |

Interest | | $ | 3,775,199 | |

EXPENSES: | | | | |

Management fees | | | 338,531 | |

Servicing fee | | | 225,688 | |

Auction agent fees – preferred shares | | | 60,100 | |

Professional fee | | | 59,103 | |

Fund accounting | | | 34,309 | |

Administration fee | | | 23,871 | |

Trustee fees | | | 23,368 | |

Printing | | | 17,195 | |

NYSE listing fee | | | 11,960 | |

Transfer agent | | | 10,013 | |

Custodian fee | | | 4,568 | |

Insurance | | | 4,381 | |

Line of credit fee | | | 224 | |

Other fees | | | 3,211 | |

Total expenses | | | 816,522 | |

Management fees waived | | | (78,123 | ) |

Servicing fee waived | | | (52,082 | ) |

Net expenses | | | 686,317 | |

Net investment income | | | 3,088,882 | |

NET REALIZED AND UNREALIZED GAIN (LOSS): | | | | |

Net realized gain (loss) on: | | | | |

Investments | | | (84,062 | ) |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | 6,088,592 | |

Net realized and unrealized gain | | | 6,004,530 | |

Distributions to Auction Market Preferred Shareholders from | | | | |

Net Investment Income | | | (481,185 | ) |

Net increase in net assets resulting from operations | | $ | 8,612,227 | |

See notes to financial statements.

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 23

| | |

STATEMENTS OF CHANGES IN NET ASSETS | January 31, 2015 |

| | | | | | |

| | Period Ended | | | | |

| | January 31, 2015 | | | Year Ended | |

| | (Unaudited) | | | July 31, 2014 | |

INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS: | | | | | |

Net investment income | $ | 3,088,882 | | | $ | 6,494,435 | |

Net realized (loss) gain on investments | | (84,062 | ) | | | 273,476 | |

Net change in unrealized appreciation on investments | | 6,088,592 | | | | 7,409,664 | |

Net increase in net assets resulting from operations | | 9,093,412 | | | | 14,177,575 | |

DISTRIBUTIONS TO PREFERRED SHAREHOLDERS FROM: | | | | | | | |

Net investment income | | (481,185 | ) | | | (886,027 | ) |

Net increase in net assets applicable to common shareholders | | | | | | | |

resulting from operations | | 8,612,227 | | | | 13,291,548 | |

DISTRIBUTIONS TO SHAREHOLDERS FROM: | | | | | | | |

Net investment income | | (2,629,064 | ) | | | (5,739,602 | ) |

Net increase in net assets | | 5,983,163 | | | | 7,551,946 | |

NET ASSETS: | | | | | | | |

Beginning of period | | 100,125,422 | | | | 92,573,476 | |

End of period | $ | 106,108,585 | | | $ | 100,125,422 | |

Distributions in excess of net investment income | $ | (41,744 | ) | | $ | (20,377 | ) |

See notes to financial statements.

24 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

| | | |

FINANCIAL HIGHLIGHTS | January 31, 2015 |

| | |

| | For the Period Ended

January 31, 2015 (Unaudited) | | | | | | | | | | | | | | | | |

Per Share Data: | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | $ | 14.72 | | | $ | 13.61 | | | $ | 15.41 | | | $ | 14.02 | | | $ | 14.40 | | | $ | 12.73 | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income(a) | | 0.45 | | | | 0.95 | | | | 1.02 | | | | 1.09 | | | | 1.12 | | | | 1.06 | |

Net gain (loss) on investments (realized and unrealized) | | 0.89 | | | | 1.13 | | | | (1.74 | ) | | | 1.43 | | | | (0.36 | ) | | | 1.72 | |

Distributions to preferred shareholders from net investment income (common share equivalent basis) | | (0.07 | ) | | | (0.13 | ) | | | (0.14 | ) | | | (0.14 | ) | | | (0.15 | ) | | | (0.14 | ) |

Total from investment operations | | 1.27 | | | | 1.95 | | | | (0.86 | ) | | | 2.38 | | | | 0.61 | | | | 2.64 | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | (0.39 | ) | | | (0.84 | ) | | | (0.94 | ) | | | (0.99 | ) | | | (0.99 | ) | | | (0.97 | ) |

Net asset value, end of period | $ | 15.60 | | | $ | 14.72 | | | $ | 13.61 | | | $ | 15.41 | | | $ | 14.02 | | | $ | 14.40 | |

Market Value, end of period | $ | 13.96 | | | $ | 13.57 | | | $ | 12.46 | | | $ | 16.21 | | | $ | 13.48 | | | $ | 14.53 | |

Total Return(b) | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value | | 8.71 | % | | | 14.87 | % | | | (6.01 | %) | | | 17.50 | % | | | 4.57 | % | | | 21.21 | % |

Market value | | 5.83 | % | | | 16.29 | % | | | (18.13 | %) | | | 28.56 | % | | | (0.32 | %) | | | 31.45 | % |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | $ | 106,109 | | | $ | 100,125 | | | $ | 92,573 | | | $ | 104,622 | | | $ | 94,913 | | | $ | 97,190 | |

Preferred shares, at redemption value ($25,000 per share liquidation preference) (thousands) | $ | 69,450 | | | $ | 69,450 | | | $ | 69,450 | | | $ | 69,450 | | | $ | 69,450 | | | $ | 69,450 | |

Preferred shares asset coverage per share | $ | 63,196 | | | $ | 61,042 | | | $ | 58,324 | | | $ | 62,661 | | | $ | 59,166 | | | $ | 59,986 | |

Ratio to average net assets of: | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income(c) | | 5.96 | %(f) | | | 6.86 | % | | | 6.70 | % | | | 7.38 | % | | | 8.09 | % | | | 7.68 | % |

Expenses (including interest expense and net of fee waivers) (c) (d) | | 1.33 | %(f) | | | 1.40 | % | | | 1.33 | % | | | 1.36 | % | | | 1.46 | % | | | 1.35 | % |

Expenses (including interest expense and excluding fee waivers) (c) (d) | | 1.58 | %(f) | | | 1.66 | % | | | 1.58 | % | | | 1.62 | % | | | 1.72 | % | | | 1.69 | % |

Portfolio turnover rate(e) | | 6 | % | | | 15 | % | | | 23 | % | | | 15 | % | | | 8 | % | | | 6 | % |

(a) | Based on average shares outstanding. |

(b) | Total investment return is calculated assuming a purchase of a common share at the beginning of the period and a sale on the last day of the period reported either at net asset value (“NAV”) or market price per share. Dividends and distributions are assumed to be reinvested at NAV for NAV returns or the prices obtained under the Fund’s Dividend Reinvestment Plan for market value returns. Total investment return does not reflect brokerage commissions. A return calculated for a period of less than one year is not annualized. |

(c) | Calculated on the basis of income and expense applicable to both common and preferred shares relative to average net assets of common shareholders. |

(d) | The impact of interest expense is less than 0.01%. |

(e) | Portfolio turnover is not annualized for periods less than one year. |

| (f) | Annualized. |

See notes to financial statements.

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 25

| | |

NOTES TO FINANCIAL STATEMENTS (Unaudited) | January 31, 2015 |

Note 1 – Organization:

The Managed Duration Investment Grade Municipal Fund (the “Fund”) was organized as a Delaware statutory trust on May 20, 2003. The Fund is registered as a diversified, closed-end management investment company under the Investment Company Act of 1940, as amended. The Fund’s investment objective is to provide its common shareholders with high current income exempt from regular federal income tax while seeking to protect the value of the Fund’s assets during periods of interest rate volatility. Prior to commencing operations on August 27, 2003, the Fund had no operations other than matters relating to its organization and registration and the sale and issuance of 6,981 common shares of beneficial interest to MBIA Capital Management Corp. (now known as Cutwater Investor Services Corp.).

Note 2 – Accounting Policies:

The preparation of financial statements in accordance with US generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund.

(a) Valuation of Investments

The Board of Trustees of the Fund (the “Board”) has adopted policies and procedures for the valuation of the Fund’s investments (the “Valuation Procedures”). Pursuant to the Valuation Procedures, while the Board retains responsibility for the valuation process, the Board has delegated to Cutwater’s valuation committee (the “Valuation Committee”), the day-to-day responsibility for implementing the Valuation Procedures, including, under most circumstances, the responsibility for determining the fair value of the Fund’s securities or other assets.

The municipal bonds and preferred shares in which the Fund invests are traded primarily in the over-the-counter markets. In determining net asset value, the Fund uses the valuations of portfolio securities furnished by a pricing service approved by the Board. The pricing service typically values portfolio securities at the bid price or the yield equivalent when quotations are readily available. Securities for which quotations are not readily available are valued at fair market value on a consistent basis as determined by the pricing service using a matrix system to determine valuations. The procedures of the pricing service and its valuations are reviewed by the officers of the Fund under the general supervision of the Board.

Investments for which market quotations are not readily available are fair valued as determined in good faith by Cutwater Investor Services Corp. (the “Adviser”), pursuant to methods established or ratified by the Board. Valuations in accordance with these methods are intended to reflect each security’s (or asset’s) “fair value.” Each such determination is based on a consideration of all relevant factors, which are likely to vary from one pricing context to another. Examples of such factors may include, but are not limited to: (i) the type of security, (ii) the initial cost of the security, (iii) the existence of any contractual restrictions on the security’s disposition, (iv) the price and extent of public trading in similar securities of the issuer or of comparable companies, (v) quotations or evaluated prices from broker-dealers and/or pricing services, (vi) information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange traded securities), (vii) an

26 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

| | |

NOTES TO FINANCIAL STATEMENTS (Unaudited) continued | January 31, 2015 |

analysis of the company’s financial statements, and (viii) an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold (e.g. the existence of pending merger activity, public offerings or tender offers that might affect the value of the security).

There are three different categories for valuations. Level 1 valuations are those based upon quoted prices in active markets. Level 2 valuations are those based upon quoted prices in inactive markets or based upon significant observable inputs (e.g. yield curves; benchmark interest rates; indices). Level 3 valuations are those based upon unobservable inputs (e.g. discounted cash flow analysis; non-market based methods used to determine fair valuation).

The Fund values Level 1 securities using readily available market quotations in active markets. Money market funds are valued at net asset value. The Fund values Level 2 fixed income securities using independent pricing providers who employ matrix pricing models utilizing market prices, broker quotes and prices of securities with comparable maturities and qualities. The Fund values Level 2 equity securities using various observable market inputs as described above. The Fund did not have any Level 3 securities during the period ended January 31, 2015.

Transfers between valuation levels, if any, are in comparison to the valuation levels at the end of the previous fiscal year, and are effective using the fair value as of the end of the current fiscal period.

The following table represents the Fund’s investments carried on the Statement of Assets and Liabilities by caption and by level within the fair value hierarchy as of January 31, 2015:

Valuations | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Description | | | | | | | | | | | | |

Assets: | | | | | | | | | | | | |

Municipal Bonds | | $ | – | | | $ | 171,160,262 | | | $ | – | | | $ | 171,160,262 | |

Preferred Shares | | | – | | | | 2,016,940 | | | | – | | | | 2,016,940 | |

Money Market | | | 694,500 | | | | – | | | | – | | | | 694,500 | |

Total | | $ | 694,500 | | | $ | 173,177,202 | | | $ | – | | | $ | 173,871,702 | |

There were no transfers between levels for the six months ended January 31, 2015.

(b) Investment Transactions and Investment Income

Investment transactions are accounted for on the trade date. Realized gains and losses on investments are determined on the identified cost basis. Interest income, including the amortization of premiums and accretion of discount, is accrued daily.

(c) Dividends and Distributions

The Fund declares and pays on a monthly basis dividends from net investment income to common shareholders. Distributions of net realized capital gains, if any, will be paid at least annually. Dividends and distributions to shareholders are recorded on the ex-dividend date. Dividends and distributions to preferred shareholders are accrued and determined as described in Note 6.

(d) Inverse Floating Rate Investments and Floating Rate Note Obligations

Inverse floating rate instruments are notes whose coupon rate fluctuates inversely to a predetermined interest rate index. These instruments typically involve greater risks than a fixed rate municipal bond. In particular, the holder of these inverse floating rate instruments retain all credit

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 27

| | |

NOTES TO FINANCIAL STATEMENTS (Unaudited) continued | January 31, 2015 |

and interest rate risk associated with the full underlying bond and not just the par value of the inverse floating rate instrument. As such, these instruments should be viewed as having inherent leverage and therefore involve many of the risks associated with leverage. Leverage is a speculative technique that may expose the Fund to greater risk and increased costs. Leverage may cause the Fund’s net asset value to be more volatile than if it had not been leveraged because leverage tends to magnify the effect of any increases or decreases in the value of the Fund’s portfolio securities. The use of leverage may also cause the Fund to liquidate portfolio positions when it may not be advantageous to do so in order to satisfy its obligations with respect to inverse floating rate instruments.

The Fund may invest in inverse floating rate securities through either a direct purchase or through the transfer of bonds to a dealer trust in exchange for cash and/or residual interests in the dealer trust. For those inverse floating rate securities purchased directly, the instrument is included in the Portfolio of Investments with income recognized on an accrual basis. The Fund did not invest in inverse floating rate securities during the period ended January 31, 2015.

Note 3 – Agreements:

Pursuant to an Investment Advisory Agreement (the “Advisory Agreement”) between the Adviser and the Fund, the Adviser is responsible for the daily management of the Fund’s portfolio, which includes buying and selling securities for the Fund, as well as investment research, subject to the direction of the Fund’s Board of Trustees. The Adviser is a subsidiary of Cutwater Holdings, LLC which, in turn, is a wholly-owned subsidiary of MBIA, Inc. The Advisory Agreement provides that the Fund shall pay to the Adviser a monthly fee for its services at the annual rate of 0.39% of the sum of the Fund’s average daily managed assets. (“Managed Assets” represent the Fund’s total assets including the assets attributable to the proceeds from any financial leverage but excluding the assets attributable to floating rate note obligations, minus liabilities, other than debt representing financial leverage.) The Adviser contractually agreed to waive a portion of the management fees it is entitled to receive from the Fund at the annual rate of 0.09% of the Fund’s average daily Managed Assets.

On January 2, 2015, BNY Mellon acquired Cutwater Asset Management. As a result of this acquisition, the Adviser became an indirect wholly-owned subsidiary of BNY Mellon. Under the Investment Company Act of 1940, as amended, this transaction resulted in the assignment and automatic termination of the Fund’s investment advisory agreement with the Adviser (the “Terminated Agreement”). In anticipation of the closing of the transaction, the Fund’s shareholders approved a new investment advisory agreement (the “New Agreement”) between the Fund and the Adviser at a special meeting of the shareholders of the Fund held on December 10, 2014. The New Agreement is identical to the Terminated Agreement in all material respects, except for the dates of its execution and its termination, and became effective as of the closing of the transaction on January 2, 2015.

Pursuant to a Servicing Agreement, Guggenheim Funds Distributors, LLC (the “Servicing Agent”) acts as servicing agent to the Fund. The Servicing Agent receives an annual fee from the Fund, payable monthly in arrears, in an amount equal to 0.26% of the average daily value of the Fund’s Managed Assets. The Servicing Agent contractually agreed to waive a portion of the servicing fee it is entitled to receive from the Fund at the annual rate of 0.06% of the average daily value of the Fund’s Managed Assets.

28 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

| | |

NOTES TO FINANCIAL STATEMENTS (Unaudited) continued | January 31, 2015 |

Rydex Fund Services, LLC (“RFS”), an affiliate of the Servicing Agent, provides fund administration services to the Fund. As compensation for these services RFS receives a fund administration fee payable monthly at the annual rate set forth below as a percentage of the average daily managed assets of the Fund:

Managed Assets | Rate |

First $200,000,000 | 0.0275% |

Next $300,000,000 | 0.0200% |

Next $500,000,000 | 0.0150% |

Over $1,000,000,000 | 0.0100% |

The Bank of New York Mellon (“BNY”) acts as the Fund’s custodian, accounting agent and auction agent. As custodian, BNY is responsible for the custody of the Fund’s assets. As accounting agent, BNY is responsible for maintaining the books and records of the Fund. As auction agent, BNY is responsible for conducting the auction of the preferred shares.

Certain officers and/or trustees of the Fund are officers and/or directors of the Adviser and the Servicing Agent. The Fund does not compensate its officers or trustees who are officers, directors and/or employees of the aforementioned firms.

Note 4 – Federal Income Taxes:

The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, no provision for US federal income taxes is required. In addition, by distributing substantially all of its ordinary income and long-term capital gains, if any, during each calendar year, the Fund intends not to be subject to U.S. federal excise tax.

Information on the tax components of investments as of January 31, 2015, is as follows:

| | | | Net Tax |

| | Gross Tax | Gross | Unrealized |

Cost of Investments | Unrealized | Tax Unrealized | Appreciation |

for Tax Purposes | Appreciation | Depreciation | on Investments |

$158,193,615 | $15,766,668 | $(88,581) | $15,678,087 |

The difference between book and tax basis cost of investments is due to book/tax differences on the recognition of partnership/trust income.

As of July 31, 2014 (the most recent fiscal year end for federal income tax purposes), the components of accumulated earnings/(losses) on a tax basis were as follows:

| | Undistributed | | Accumulated | | Other |

| | Tax-Exempt | Undistributed | Capital | Unrealized | Temporary |

| | Income | Ordinary Income | and Other Losses | Appreciation | Differences |

2014 | $59,450 | $ – | $(4,858,333) | $9,589,495 | $(31,475) |

The cumulative timing differences under tax basis accumulated capital and other losses as of July 31, 2014 are due to investments in partnerships/trusts.

As of July 31, 2014 (the most recent fiscal year end for federal income tax purposes), the Fund had a capital loss carryforward of $4,772,269 available to offset possible future capital gains. For the year

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 29

| | |

NOTES TO FINANCIAL STATEMENTS (Unaudited) continued | January 31, 2015 |

ended July 31, 2014, $864,502 of the capital loss carryforward was utilized or expired. The $4,772,269 capital loss carryforward is set to expire on July 31, 2017. Per the Regulated Investment Company Modernization Act of 2010, capital loss carryforwards generated in taxable years beginning after December 22, 2010, must be fully used before capital loss carryforwards generated in taxable years prior to December 22, 2010, therefore, under certain circumstances, capital loss carryforwards available as of the report date may expire unused.

Distributions paid to common and preferred shareholders during the tax year ended July 31, 2014 (the most recent fiscal year end for federal income tax purposes), were characterized as follows:

| | Tax-exempt | Ordinary | Total |

| | income | income | distributions |

2014 | $6,510,284 | $115,345 | $6,625,629 |

For all open tax years and all major jurisdictions, management of the Fund has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Uncertain tax positions are tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns that would not meet a more-likely-than-not threshold of being sustained by the applicable tax authority and would be recorded as a tax expense in the current year. Open tax years are those years that are open for examination by taxing authorities (i.e. generally the last four tax year ends and the interim tax period since then). Furthermore, management of the Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Note 5 – Investment Transactions:

Purchases and sales of investment securities, excluding short-term investments, for the period ended January 31, 2015, aggregated $10,270,054 and $10,218,384, respectively.

Note 6 – Capital:

There are an unlimited number of $.001 par value common shares of beneficial interest authorized and 6,800,476 common shares outstanding at January 31, 2015.

In connection with the Fund’s dividend reinvestment plan, the Fund did not issue any shares during the six months ended January 31, 2015, or the year ended July 31, 2014.

On October 27, 2003, the Fund issued 1,389 shares of Auction Market Preferred Shares (“AMPS”), Series M7 and 1,389 shares of AMPS, Series W28. The preferred shares have a liquidation value of $25,000 per share plus any accumulated unpaid dividends. As of January 31, 2015, the Fund had 1,389 shares each of AMPS, Series M7 and W28, outstanding. Dividends on the preferred shares are cumulative at a rate that is set by auction procedures. Distributions of net realized capital gains, if any, are made annually.

The broad auction-rate preferred securities market, including the Fund’s AMPS, has experienced considerable disruption since mid-February 2008. The result has been failed auctions on nearly all auction-rate preferred shares, including the Fund’s AMPS. A failed auction is not a default, nor does it require the redemption of the Fund’s AMPS.

30 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

| | |

NOTES TO FINANCIAL STATEMENTS (Unaudited) continued | January 31, 2015 |

Provisions in the AMPS offering documents establish a maximum rate in the event of a failed auction. The AMPS reference rate is the higher of LIBOR or 90% of the taxable equivalent of the short-term municipal bond rate. The maximum rate, for auctions for which the Fund has not given notice that the auction will consist of net capital gains or other taxable income, is the higher of the reference rate times 125% or the reference rate plus 1.25%.

Management will continue to monitor events in the marketplace and continue to evaluate the Fund’s leverage as well as any alternative that may be available.

The range of dividend rates on the Fund’s AMPS for the period ended January 31, 2015, were as follows:

| | | | | Next |

Series | Low | High | At 1/31/15 | Auction Date |

M7 | 1.369% | 1.387% | 1.387% | 2/2/15 |

W28 | 1.368% | 1.386% | 1.386% | 2/18/15 |

The Fund is subject to certain limitations and restrictions while the AMPS are outstanding. Failure to comply with these limitations and restrictions could preclude the Fund from declaring any dividends or distributions to common shareholders or repurchasing common shares and/or could trigger the mandatory redemption of AMPS at their liquidation value plus any accrued dividends.

On April 1, 2014, Standard & Poor’s Ratings Services (“S&P”) notified the Servicing Agent and Cutwater that S&P downgraded the Fund’s AMPS from ‘AAA’ to ‘AA’.

The Fund’s AMPS, which are entitled to one vote per share, generally vote with the common shares but vote separately as a class to elect two Trustees and on any matters affecting the rights of the Fund’s AMPS.

Note 7 – Borrowings:

The Fund has an uncommitted $2,000,000 line of credit with BNY. Interest on the amount borrowed is based on the Federal Funds Rate plus a spread on outstanding balances. At January 31, 2015, there was a $0 balance in connection with the Fund’s uncommitted line of credit. The average daily amount of borrowings during the six months ended January 31, 2015, was $50,951 with a related weighted average interest rate of 0.86%. The maximum amount outstanding during the six months ended January 31, 2015, was $825,000.

Note 8 – Indemnifications:

In the normal course of business, the Fund enters into contracts that contain a variety of representations, which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would require future claims that may be made against the Fund that have not yet occurred. However, the Fund expects the risk of loss to be remote.

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 31

| | |

NOTES TO FINANCIAL STATEMENTS (Unaudited) continued | January 31, 2015 |

Note 9 – Subsequent Event:

The Fund evaluated subsequent events through the date the financial statements were available for issue and determined there were no additional material events that would require disclosure in the Fund’s financial statements, except as noted below.

Distribution Declarations – Common Shareholders

The Fund has declared the following distributions to common shareholders:

Rate Per | Declaration | Ex-Dividend | Record | Payable |

Share | Date | Date | Date | Date |

$0.0616 | 2/02/15 | 2/11/15 | 2/13/15 | 2/27/15 |

$0.0616 | 3/02/15 | 3/11/15 | 3/13/15 | 3/31/15 |

32 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

| | |

SUPPLEMENTAL INFORMATION (Unaudited) | January 31, 2015 |

Results of Shareholder Votes

A Special Meeting of Shareholders of Managed Duration Investment Grade Municipal Fund (the “Fund”) was held on December 10, 2014. Shareholders voted on the approval of a new Investment Advisory Agreement between the Fund and Cutwater Investor Services Corp.

With regards to the approval of the new Investment Advisory Agreement between the Fund and Cutwater Investor Services Corp.:

| | Total Shares Voted | # of Shares Voted For | # of Shares Voted Against | |

| | 3,494,648 | 3,203,716 | 57,692 | |

The Trustees of the Managed Duration Investment Grade Municipal Fund and their principal occupations during the past five years:

Name, Address* and Year of Birth | | Term of Office and Length | Principal Occupation(s) during Past Five Years | | Other Directorships Held by Trustees |

Independent Trustees: | | | | |

| | Since 2006 | Current: Private Investor (2001-present). Former: Senior Vice President and Treasurer, PepsiCo, Inc. (1993-1997); President, Pizza Hut International (1991-1993); Senior Vice President, Strategic Planning and New Business Development, PepsiCo, Inc. (1987-1990). | 91 | Current: Trustee, Purpose Investments, Inc. (2014-present). |

| | Since 2003 | Current: Partner, Nyberg & Cassioppi, LLC (2000-present). Former: Executive Vice President, General Counsel, and Corporate Secretary, Van Kampen Investments (1982-1999). | 93 | Current: Edward-Elmhurst Healthcare System (2012-present). |

| | Since 2003 | Current: Portfolio Consultant (2010-present). Former: Vice President, Manager and Portfolio Manager, Nuveen Asset Management (1998-1999); Vice President, Nuveen Investment Advisory Corp. (1992-1999); Vice President and Manager, Nuveen Unit Investment Trusts (1991-1999); and Assistant Vice President and Portfolio Manager, Nuveen Unit Investment Trusts (1988-1999), each of John Nuveen & Co., Inc. (1982-1999). | 90 | Former: Bennett Group of Funds (2011-2013). |

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 33

| | |

SUPPLEMENTAL INFORMATION (Unaudited) (continued) | January 31, 2015 |

Name, Address* and Year of Birth | | Term of Office and Length | Principal Occupation(s) during Past Five Years | | Other Directorships Held by Trustees |

Interested Trustees: | | | | |

| Trustee | Since 2012 | Current: President and CEO, certain other funds in the Fund Complex (2012-present); Vice Chairman, Guggenheim Investments (2010-present). Former: Chairman and CEO, Channel Capital Group, Inc. (2002-2010). | 221 | Current: Guggenheim Partners Japan, Ltd. (2014-present); Delaware Life (2013-present); Guggenheim Life and Annuity Company (2011-present); Paragon Life Insurance Company of Indiana (2011-present). |

| Trustee, ChiefExecutive Officer and President | Since 2003 | Executive Vice President & Chief Investment Officer (2008-present), Vice President (2004-2008), MBIA Inc. Chief Executive Officer & Chief Investment Officer (2010-present), President (2004-2010), Managing Director (2000-2004), Cutwater Holdings, LLC. Chief Executive Officer & Chief Investment Officer (2010-present), President and Investment Officer (2000-2010), Cutwater Asset Management Corp. | 1 | None |

* | The business address of each Trustee unless otherwise noted is c/o Guggenheim Investments, 227 West Monroe Street, Chicago, IL 60606. |

** | Each Trustee is expected to serve a three-year term concurrent with the class of Trustees for which he serves: |

| | -Mr. Donald Cacciapaglia is a Class II Trustee. A Class II Trustee is expected to stand for re-election at the Fund’s annual meeting of shareholders to be held in 2015. |