UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21359

Managed Duration Investment Grade Municipal Fund

(Exact name of registrant as specified in charter)

2455 Corporate West Drive, Lisle, IL 60532

(Address of principal executive offices) (Zip code)

Amy J. Lee

2455 Corporate West Drive, Lisle, IL 60532

(Name and address of agent for service)

Registrant's telephone number, including area code: (630) 505-3700

Date of fiscal year end: July 31

Date of reporting period: August 1, 2013 through January 31, 2014

Item 1. Reports to Stockholders.

The registrant's annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

GUGGENHEIMINVESTMENTS.COM/MZF

. . .YOUR WINDOW TO THE LATEST, MOST UP-TO-DATE INFORMATION ABOUT THE MANAGED

DURATION INVESTMENT GRADE MUNICIPAL FUND

The shareholder report you are reading right now is just the beginning of the story. Online at guggenheiminvestments.com/mzf, you will find:

| · | Daily, weekly and monthly data on share prices, distributions and more |

| · | Portfolio overviews and performance analyses |

| · | Announcements, press releases and special notices and tax characteristics |

Cutwater Investor Services Corp. and Guggenheim Investments are continually updating and expanding shareholder information services on the Fund’s website, in an ongoing effort to provide you with the most current information about how your Fund’s assets are managed, and the results of our efforts. It is just one more way we are working to keep you better informed about your investment in the Fund.

DEAR SHAREHOLDER

We thank you for your investment in Managed Duration Investment Grade Municipal Fund (the “Fund”). This report covers performance for the semiannual period ended January 31, 2014.

The Fund’s investment objective is to provide high current income exempt from regular federal income tax while seeking to protect the value of the Fund’s assets during periods of interest rate volatility. Under normal market conditions, the Fund seeks to achieve this objective by investing substantially all of its assets in municipal bonds of investment-grade quality.

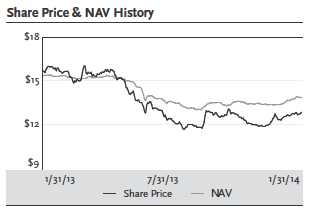

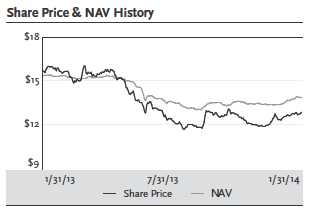

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the six-month period ended January 31, 2014, the Fund provided a total return based on market price of 7.12% and a total return of 5.53% based on NAV. Past performance is not a guarantee of future results. As of January 31, 2014, the Fund’s last closing market price of $12.89 represented a discount of 7.33% to NAV of $13.91. As of July 31, 2013, the Fund’s last closing market price of $12.46 represented a discount of 8.45% to NAV of $13.61. The market value and NAV of the Fund’s shares fluctuate from time to time, and the Fund’s market value may be higher or lower than its NAV. The Fund’s NAV performance data reflects fees and expenses of the Fund.

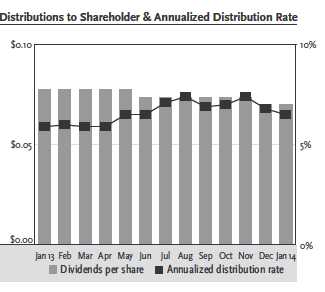

Distributions of $0.0735 were paid in each month from August 2013 through November 2013, and $0.0700 from December 2013 through January 2014. The current distribution represents an annualized distribution rate of 6.52% based on the last closing market price of $12.89 on January 31, 2014.

Cutwater Investor Services Corp. (“Cutwater”) serves as the Fund’s Investment Adviser. With approximately $24 billion in assets under management as of January 31, 2014, Cutwater Asset Management is one of the largest institutional fixed income investment managers in the world. Cutwater’s parent company, MBIA Inc., is listed on the New York Stock Exchange.

Guggenheim Funds Distributors, LLC (“GFD”) serves as the Servicing Agent to the Fund. GFD is part of Guggenheim Investments. Guggenheim Investments represents the investment management division of Guggenheim Partners, LLC.

We encourage shareholders to consider the opportunity to reinvest their distributions from the Fund through the Dividend Reinvestment Plan (“DRIP”), which is described in detail on page 25 of this report. When shares trade at a discount to NAV, the DRIP takes advantage of the discount by reinvesting the monthly dividend distribution in common shares of the Fund purchased in the market at a price less than NAV. Conversely, when the market price of the Fund’s common shares is at a premium above NAV, the DRIP reinvests participants’ dividends in newly-issued common shares at the greater of NAV per share or 95% of the market price per share. The DRIP provides a cost-effective means to accumulate additional shares and enjoy the benefits of compounding returns over time. Since the Fund endeavors to maintain a steady monthly distribution rate, the DRIP effectively provides an income averaging technique, which causes shareholders to accumulate a larger number of Fund shares when the market price is depressed than when the price is higher.

To learn more about the Fund’s performance, we encourage you to read the Questions & Answers section of this report, which begins on page 4 of this report. You will find information about how the Fund is managed, what affected the performance of the Fund during the six-month period ended January 31, 2014, and Cutwater’s views on the market environment.

We appreciate your investment, and we look forward to serving your investment needs in the future. For the most up-to-date information on your investment, please visit the Fund’s website at guggenheiminvestments.com/mzf.

Sincerely,

Clifford D. Corso

President and Chief Executive Officer

Managed Duration Investment Grade Municipal Fund

February 28, 2014

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 3

QUESTIONS & ANSWERS | January 31, 2014 |

Clifford D. Corso

Portfolio Manager

Mr. Corso joined the firm in 1994, establishing the company’s asset management platform and building it into one of the largest fixed income managers in the world. With a staff of 85 people, he now oversees the investment of over $24 billion in assets as of January 31, 2014, and directs the investment strategies of Cutwater’s clients, including pension funds, global banks, corporations, Taft Hartley and insurance companies as well as hundreds of municipalities across the U.S. Mr. Corso also initiated and managed the expansion of the asset manager’s international asset management business from a principal office in London, now a multi-billion dollar platform.

Prior to joining the firm, Mr. Corso served as co-head of a fixed income division at Alliance Capital Management. In his 28-year career, he has held positions as a credit analyst, restructuring specialist, trader and portfolio manager. Mr. Corso graduated from Yale University with a degree in economics and earned an MBA from Columbia University. He has lectured on topics from leadership to finance at many academic institutions, including Columbia University and New York University, where he taught a course on financial derivatives.

James B. DiChiaro

Portfolio Manager

Mr. DiChiaro joined Cutwater in 1999 and is a director. He currently manages Cutwater’s municipal assets under management (taxable and tax-exempt) and has extensive experience managing money-market portfolios. He constructs and implements portfolio strategies for a diverse client base including insurance companies, separately managed accounts and closed-end bond funds. Mr. DiChiaro began his career at Cutwater working with the conduit group structuring medium-term notes for Meridian Funding Company and performing the treasury role for an MBIA sponsored asset-backed commercial paper conduit, Triple-A One Funding Corporation.

Prior to joining Cutwater he worked for Merrill Lynch supporting their asset-backed securities trading desk. Mr. DiChiaro has a bachelor’s degree from Fordham University and a master’s degree from Pace University.

Matthew J. Bodo

Portfolio Manager

Mr. Bodo joined the firm in 2002 and is a vice president in Cutwater’s portfolio management group. He participates in biweekly corporate credit and portfolio strategy meetings and supports the portfolio managers’ implementation of those strategies for Cutwater’s third-party accounts. As part of his daily responsibilities, Mr. Bodo actively manages the local government investment pool portfolios, specializing in high-grade commercial paper, investment grade corporates, U.S. Treasury and instrumentality bonds. Prior to this role, Mr. Bodo served as an investment accountant performing accounting related functions for mutual funds and MBIA insurance portfolios. He has a bachelor’s degree from the State University of New York at Albany.

In the following interview Portfolio Managers Clifford D. Corso, James B. DiChiaro and Matthew J. Bodo discuss the market environment and the performance of the Managed Duration Investment Grade Municipal Fund (the “Fund”) for the semiannual period ended January 31, 2014.

Please provide an overview of the economy and the municipal market during the six-month period ended January 31, 2014.

U.S. economic growth is accelerating, as evidenced by annualized gross domestic product growth of 4.1% in the third quarter, then 2.4% in the fourth quarter. The unemployment rate dipped to 6.7% and domestic equity markets rose to near-record levels in December 2013, and the Federal Reserve (Fed) was sufficiently encouraged by positive economic data that it began tapering its monthly bond purchases.

The tone of markets changed suddenly in January 2014, which many analysts attributed to extreme winter weather in much of the U.S. Concerns about the health of emerging markets and some weaker U.S. economic data contributed to a fall in equity markets for the month, while fixed income markets served as a safe haven and prices rose.

Despite some improvement in employment and consumer spending, many inflation indicators remain benign, perhaps due to a low velocity of money. The Federal Open Market Committee (FOMC) has cited well-anchored long-term inflation expectations as a reason that the target federal funds rate will remain at its exceptionally accommodative level of 0% to 0.25% for an extended period. Inflation, as measured by the Consumer Price Index, has been consistently below the FOMC’s 2% target level. The housing market, which had been a drag on economic growth, improved meaningfully in 2013. Price appreciation was helped by low inventories and low interest rates.

Municipal finances improved during the period as tax revenues increased alongside improvement in the labor market. Municipalities have faced unprecedented budgetary stresses in recent years and reacted by reducing payrolls, issuing far less debt, and reducing other expenses. Having behaved in a fiscally conservative manner, the improving economy is giving many municipalities a rapid turnaround in their finances.

Gross supply for 2013 came in short of many analyst estimates and amounted to approximately $330 billion, a decline of approximately 12% from 2012. The spike in interest rates in mid-2013 appears to have deterred some issuers from refinancing their debt.

Mutual fund cash flows, which are indicative of retail activity and tend to be a leading indicator of tax-exempt rate movements, will be watched closely by municipal bond investors. Tax-exempt mutual funds saw redemptions in excess of $60 billion during 2013, spurred by negative headlines about Detroit and Puerto Rico, rising interest rates, and potential changes to the tax code. These fund redemptions pressured credit spreads wider on lower rated tax-exempt bonds as well.

The Fed’s decision to begin tapering bond purchases implies confidence that the U.S. is in the midst of a sustainable economic recovery—and fixed income markets have reacted accordingly. Over the summer, fixed income market participants began to anticipate a winding down of quantitative easing, which resulted in an acute spike in interest rates. It had been no secret that the trajectory of interest rates was likely upward, but investors’

4 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

QUESTIONS & ANSWERS continued | January 31, 2014 |

focus became avoiding the segments of the interest rate curve most likely to be penalized. Since the December 2013 taper announcement, the 3 to 5-year part of the interest rate curve has experienced the largest rate rise.

The second half of 2013 saw modestly positive total returns for the tax-exempt market, even though major indices were down for all of 2013. For the six-month period ended January 31, 2014, the Barclays Municipal Bond Index, a widely used measure of the municipal bond market as a whole, returned 2.99%. For comparison, the broader Barclays U.S. Aggregate Bond Index returned 1.78%.

How did the Fund perform in this market environment?

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the six-month period ended January 31, 2014, the Fund provided a total return based on market price of 7.12% and a total return of 5.53% based on NAV. Past performance is not a guarantee of future results. As of January 31, 2014, the Fund’s last closing market price of $12.89 represented a discount of 7.33% to NAV of $13.91. As of July 31, 2013, the Fund’s last closing market price of $12.46 represented a discount of 8.45% to NAV of $13.61.

The market value and NAV of the Fund’s shares fluctuate from time to time, and the Fund’s market value may be higher or lower than its NAV. The Fund’s NAV performance data reflects fees and expenses of the Fund.

Distributions of $0.0735 were paid in each month from August 2013 through November 2013, and $0.0700 from December 2013 through January 2014. The current distribution represents an annualized distribution rate of 6.52% based on the last closing market price of $12.89 on January 31, 2014.

How is the Fund’s portfolio structured, and what has that structure meant for performance?

The Fund has a high quality portfolio that is diversified across issuers, sectors and states. In selecting securities for the portfolio, the portfolio management team is supported by Cutwater’s team of credit analysts, who evaluate the credit quality of sectors and individual issuers, going far beyond the bond ratings provided by rating agencies. Cutwater’s proprietary quantitative models help to evaluate the risk of individual securities as well as the overall portfolio, supplementing the judgment of the experienced team. Thorough quantitative and qualitative analysis helps ensure that the desired level of credit quality is maintained in the Fund’s portfolio while yield is added, as appropriate, by buying higher-yielding bonds at what are considered to be attractive prices.

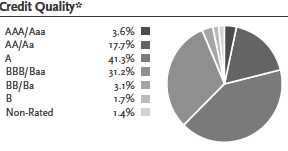

The relatively high average credit quality of the Fund’s portfolio has helped the Fund maintain a high distribution rate while outperforming its benchmark, the Barclays Capital Municipal Bond Index, which has a higher quality profile. In recent months, the average quality has been increased, with increases to AAA-rated bonds as a result of certain securities having been prerefunded and economically defeased with U.S. Treasury securities. Investments in AA bonds also increased as selective exposures to high quality healthcare corporations were added, while positions in single-A and BBB-rated bonds decreased modestly.

The improvement in the credit quality of the portfolio was achieved in part from a reduction in exposure to Puerto Rico. Puerto Rico has been under scrutiny given the Commonwealth’s severely underfunded pension and six-year-old recession. The Fund’s non-investment grade exposure to Puerto Rico’s aqueduct and sewer authority was liquidated in early 2014.

Also contributing to the Fund’s higher average credit quality was the liquidation of a position in California’s general obligation bonds. California was put on positive outlook by a Nationally Recognized Statistical Credit Rating Organization (NRSRO) during the period, which resulted in a compression of credit spreads for its issues, beyond what was justified by their fundamental improvement. We viewed this as an opportune time to liquidate the Fund’s holdings.

There were no significant changes to the Fund’s sector composition, although there were meaningful rotations within certain sectors. We maintained an approximately 18% exposure to healthcare but chose to migrate up in quality within this sector, as the roll out of the Affordable Care Act may pressure hospital revenues due to lower reimbursement rates. This may have a more profound impact on smaller hospitals with lower operating margins.

Exposure to higher education was increased during the period and is now nearly 11% of the Fund. Credit spreads have widened for this sector, given rising tuition costs, lower endowments and robust competition. We selectively added high quality investments within this sector at what are historically high yields.

The Fund’s investment in transportation-related securities also increased during the period from 4.8% to 7.1%. Transportation is a sector that exhibits cyclical characteristics and stands to perform well given Cutwater’s thesis for sustainable growth of the U.S. economy. Increased business spending, business travel, and lower unemployment should help increase the revenues of toll roads and mass transit systems.

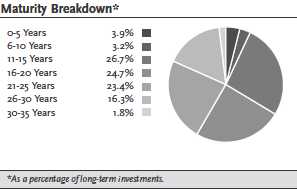

The Fund’s duration decreased from 8.10 to 7.72 during the period, and the Fund maintained a shorter duration than the index throughout the period. Some of this shortening was a function of lower interest rates inferring a greater probability of a bond option being exercised, but the majority of the shortening was intentional. Cutwater has structured this Fund with a barbelled-duration positioning versus the index meaning that the Fund has more exposure to the short (less than 2 years) and long (over eight years) end of the curve versus the index. We have selectively added an approximately 10% exposure to floating-rate securities, which should benefit the performance of the Fund as interest rates begin to rise, and we also increased the Fund’s exposure to the 30-year part of the curve, which we expect will outperform the belly of the curve given our rate forecast.

The Fund outperformed its benchmark during the period. Our duration call was accurate but our overweight to BBB-rated securities detracted from performance during the period. The municipal bond market underwent a two standard deviation rise in rates during May and June, which resulted in a “sell everything” attitude among retail investors. Over $60 billion was redeemed from the tax-exempt market during 2013, possibly attributable to the fear that rising rates could erode fixed income asset values. This overreaction dried up dealer liquidity, resulting in widening credit spreads despite improving fundamentals. The Detroit bankruptcy and financial stress facing Puerto Rico also pressured credit spreads, driving them wider throughout the period. The market improved in January as relative value seekers have seemingly returned to the market.

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 5

QUESTIONS & ANSWERS continued | January 31, 2014 |

The Fund holds $2 million par in City of Detroit water and sewer bonds. What is the status of the bonds?

The Fund’s exposure to the City of Detroit resides in two securities issued by the City of Detroit’s Water and Sewer Department (DWSD). The City of Detroit recently filed a Plan of Adjustment (the “Plan”) that must ultimately be approved by the U.S. Bankruptcy court. The Plan classifies securities issued from the DSWD as “secured” with no proposed haircut for investors and to be paid in full (100 percent recovery). However these securities could be subjected to a restructuring that may have adverse ramifications for the current holders. These secured DWSD bonds are backed by revenues from the City (one-third) and surrounding suburbs (two-thirds). The bonds continue to perform, continue to pay interest, and have not been impaired, thus continuing to benefit shareholders. We expect that DWSD creditors will continue to receive timely interest payments and will receive 100% of the principal owed to investors despite fluctuations in the market value of these securities in reaction to the volatile events surrounding the bankruptcy. We importantly point out that the Fund’s DWSD bonds benefit from a financial guarantee in the form of an insurance policy provided by a monoline insurer whose rating was recently upgraded from AA- to AA. This insurance policy guarantees the timely payment of principal and interest on the Fund’s DWSD securities (regardless of a restructuring) and serves to mitigate the risk of default on a DWSD security, thus insulating the Fund from the bankruptcy.

A potentially market-changing part of the Plan is the classification of unlimited-tax and limited-tax general obligation bonds as “unsecured.” General Obligation bonds have long been regarded as the safest of investments within the municipal bond asset glass and senior to other creditors of a state or locality. Detroit’s Plan gives preferential treatment to pensioners who are proposed to receive a 90 percent recovery compared with an expected 20 percent recovery for unsecured General Obligation bond holders. The Fund does not hold General Obligation Bonds issued from the City of Detroit.

In addition, while the Plan considers water and sewer creditors as “secured,” it provides for two alternatives on restructuring the Detroit Water and Sewer Department: the first alternative is to permit Detroit to continue to own the DWSD and then either reinstate outstanding bonds or issue new bonds with equal principal but perhaps a lower interest rate; the second is to establish a regional water and sewer authority to replace DWSD that would lease and operate Detroit’s water and sewer assets in exchange for annual payments. The resultant restructuring of water/sewer debt may also require that bondholders accept a subordinated position to lease payments made by the water/sewer authority to the City’s general fund.

We expect the proposals detailed within the Plan to be widely and lengthily contested, and indeed the U.S. bankruptcy judge recently postponed the trial of the Plan by a month to give creditors more time to prepare their case.

However, as developments continue to be disseminated, market participants should expect volatility among Detroit related credits, whether secured or unsecured municipal bonds. The complex situation confronting Detroit will be widely followed as the outcome of this bankruptcy, particularly regarding potential preferential treatment of pensioners, may set a precedent for the municipal market.

Please explain the Fund’s leverage strategy and its effect on Fund returns.

The Fund utilizes leverage (borrowing) as part of its investment strategy, to finance the purchase of additional securities that provide increased income and potentially greater appreciation potential to common shareholders than could be achieved from a portfolio that is not leveraged. Leverage adds to performance only when the cost of leverage is less than the total return generated by investments. The use of financial leverage creates an opportunity for increased income and capital appreciation but, at the same time, creates special risks. There can be no assurance that a leveraging strategy will be utilized or will be successful. Financial leverage may cause greater changes in the Fund’s net asset value and returns than if financial leverage had not been used.

As of January 31, 2014, the Fund had $69.45 million of leverage outstanding in the form of Auction Market Preferred Shares (“AMPS”). Since the Fund’s NAV return was greater than the cost of leverage during the period, leverage was a contributor to the Fund’s total return.

Management and the Board of Trustees of the Fund (the “Board of Trustees”) review the AMPS on a regular basis and continuously evaluate alternative forms of leverage. To date, after analyzing various alternatives, Management and the Board of Trustees have not found a more viable form of leverage to replace the AMPS. Management and the Board of Trustees will continue to examine leverage alternatives to replace the AMPS, which are consistent with the investment objectives of the Fund and in the best interests of shareholders.

Index Definitions

All indices are unmanaged. It is not possible to invest in an index.

The Barclays Municipal Bond Index is a rules-based, market-value weighted index engineered for the long-term tax-exempt bond market. To be included in the index, bonds must be rated investment-grade (Baa3/BBB- or higher) by at least two of the following ratings agencies: Moody’s Investor Services, Inc., Standard & Poor’s Rating Group or Fitch Ratings, Inc.

The Barclays U.S. Aggregate Bond Index represents securities that are U.S. domestic, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

Risks And Other Considerations

The views expressed in this report reflect those of the portfolio managers only through the report period as stated on the cover. These views are subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any kind. The material may also include forward looking statements that involve risk and uncertainty, and there is no guarantee that any predictions will come to pass.

There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities. Closed-end funds often trade at a discount to their net asset value. There can be no assurance that the Fund will achieve its investment objectives.

Risk is inherent in all investing, including the loss of your entire principal. Therefore, before investing you should consider the risks carefully. Please see guggenheiminvestments.com/mzf for a detailed discussion of the Fund’s risks and considerations.

6 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

FUND SUMMARY (Unaudited) | January 31, 2014 |

Fund Information | |

Symbol on New York Stock Exchange: | MZF |

Initial Offering Date: | August 27, 2003 |

Closing Market Price as of 1/31/14: | $12.89 |

Net Asset Value as of 1/31/14: | $13.91 |

Yield on Closing Market Price as of 1/31/14: | 6.52% |

Taxable Equivalent Yield on Closing Market Price

as of 1/31/141: | 11.51% |

Monthly Distribution Per Common Share2: | $0.0700 |

Leverage as of 1/31/143: | 43% |

Percentage of total investments subject to alternative minimum tax as of 1/31/14: | 18.2% |

1 Taxable equivalent yield is calculated assuming a 43.4% federal income tax bracket.

2 Monthly distribution is subject to change.

3 As a percentage of total investments.

Total Returns | | |

(Inception 8/27/03) | Market | NAV |

Six Month | 7.12% | 5.53% |

One Year | -12.45% | -3.81% |

Three Year - average annual | 7.61% | 9.20% |

Five Year - average annual | 12.54% | 11.39% |

Ten Year - average annual | 4.65% | 5.38% |

Since Inception - average annual | 4.70% | 5.54% |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. NAV total returns reflect fees and expenses of the Fund. For the most recent month-end performance figures, please visit guggenheiminvestments.com/mzf. The investment return and principal value of an investment will fluctuate with changes in the market conditions and other factors so that an investor’s shares, when sold, may be worth more or less than their original cost.

*Ratings shown are assigned by one or more Nationally Recognized Statistical Credit Rating Organizations (“NRSRO”), such as S&P, Moody’s and Fitch. The ratings are an indication of an issuer’s creditworthiness and typically range from AAA or Aaa (highest) to D (lowest). When two or more ratings are available, the lower rating is used; and when only one is available, that rating is used. The Non-Rated category consists of securities that have not been rated by an NRSRO. US Treasury securities and US Government Agency securities are not rated but deemed to be equivalent to securities rated AA+/Aaa.

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 7

PORTFOLIO OF INVESTMENTS (Unaudited) | January 31, 2014 |

| | Description | Rating* | Coupon | Maturity | Optional Call

Provisions** | Value |

| | | Long-Term Investments – 171.2%*** | | | | | |

| | | Municipal Bonds – 169.3% | | | | | |

| | | Alabama – 2.9% | | | | | |

$ 845,000 | | Courtland Industrial Development Board, AMT, Series B | BBB | 6.250% | 08/01/2025 | 08/01/14 @ 100 | $ 847,417 |

1,890,000 | | Courtland Industrial Development Board, AMT | Baa3 | 6.000% | 08/01/2029 | 08/01/14 @ 100 | 1,891,871 |

| | | | | | | | 2,739,288 |

| | | Alaska – 0.9% | | | | | |

750,000 | | Alaska Municipal Bond Bank Authority, General Obligation, Series 1 | AA+ | 5.750% | 09/01/2033 | 09/01/18 @ 100 | 835,792 |

| | | Arizona – 6.6% | | | | | |

2,500,000 | | Arizona Health Facilities Authority(a) | AA– | 0.975% | 01/01/2037 | 01/01/17 @ 100 | 1,949,850 |

2,000,000 | | Arizona Health Facilities Authority, Series A3(a) | BBB+ | 1.890% | 02/01/2048 | 08/05/22 @ 100 | 1,944,120 |

1,250,000 | | Glendale Municipal Property Corp., General Obligation, Series B | AA+ | 5.000% | 07/01/2033 | 01/01/23 @ 100 | 1,314,125 |

1,000,000 | | Industrial Development Authority of the city of Phoenix | A+ | 5.250% | 06/01/2034 | 06/01/22 @ 100 | 1,030,510 |

| | | | | | | | 6,238,605 |

| | | California – 16.4% | | | | | |

1,000,000 | | Bay Area Toll Authority, Series A(a) | AA | 1.290% | 04/01/2036 | 10/01/26 @ 100 | 996,910 |

1,500,000 | | California Health Facilities Financing Authority, Series B | AA– | 5.875% | 08/15/2031 | 08/15/20 @ 100 | 1,703,460 |

1,000,000 | | California Pollution Control Financing Authority, AMT(b) | Baa3 | 5.000% | 07/01/2030 | 07/01/22 @ 100 | 948,440 |

2,500,000 | | California Statewide Communities Development Authority(a) | A+ | 0.943% | 04/01/2036 | 02/21/14 @ 100 | 1,871,000 |

2,500,000 | | City of Chula Vista CA, AMT, Series B | A | 5.500% | 12/01/2021 | 06/02/14 @ 102 | 2,567,650 |

1,000,000 | | Los Angeles County Public Works Financing Authority | AA | 4.000% | 08/01/2042 | 08/01/22 @ 100 | 855,470 |

2,525,000 | | Los Angeles Unified School District, Series F | AA– | 5.000% | 01/01/2034 | 07/01/19 @ 100 | 2,739,751 |

3,500,000 | | Sacramento County Sanitation Districts Financing Authority, Series B, (AGC-ICC FGIC)(a) | AA | 0.690% | 12/01/2035 | 06/01/17 @ 100 | 2,714,530 |

1,000,000 | | San Bernardino City Unified School District, Series A, (AGM) | AA– | 5.000% | 08/01/2028 | 08/01/23 @ 100 | 1,080,770 |

| | | | | | | | 15,477,981 |

| | | Colorado – 2.2% | | | | | |

1,000,000 | | City & County of Denver CO Airport System Revenue, Series B | A | 5.000% | 11/15/2043 | 11/15/23 @ 100 | 1,013,830 |

1,000,000 | | Colorado Health Facilities Authority, Series A | A+ | 5.250% | 01/01/2045 | 01/01/23 @ 100 | 1,017,740 |

| | | | | | | | 2,031,570 |

| | | Connecticut – 1.8% | | | | | |

1,750,000 | | Connecticut Housing Finance Authority, Series D 2 | AAA | 4.000% | 11/15/2034 | 05/15/21 @ 100 | 1,699,355 |

| | | Delaware – 1.7% | | | | | |

1,500,000 | | Delaware State Economic Development Authority | BBB+ | 5.400% | 02/01/2031 | 08/01/20 @ 100 | 1,598,670 |

| | | District of Columbia – 2.1% | | | | | |

2,000,000 | | District of Columbia Housing Finance Agency, AMT, (FHA) | Aaa | 5.100% | 06/01/2037 | 06/01/15 @ 102 | 2,011,380 |

| | | Florida – 11.9% | | | | | |

1,000,000 | | County of Broward FL, AMT, Series A, (AGM) | AA– | 5.000% | 04/01/2038 | 04/01/23 @ 100 | 999,930 |

2,200,000 | | County of Miami-Dade FL, Aviation Revenue, AMT, Series A, (CIFG) | A | 5.000% | 10/01/2038 | 10/01/15 @ 100 | 2,202,618 |

1,500,000 | | JEA Water & Sewer System Revenue, Series B | AA | 4.000% | 10/01/2041 | 10/01/17 @ 100 | 1,359,870 |

2,000,000 | | Miami-Dade County Educational Facilities Authority, Series A | A– | 5.000% | 04/01/2042 | 04/01/23 @ 100 | 2,008,620 |

1,500,000 | | Miami-Dade County School Board Foundation, Inc., Series A, (Assured Gty) | AA– | 5.375% | 02/01/2034 | 02/01/19 @ 100 | 1,592,445 |

1,000,000 | | Seminole Tribe of Florida, Inc., Series A(b) | BBB– | 5.250% | 10/01/2027 | 10/01/17 @ 100 | 1,024,280 |

1,000,000 | | Tampa-Hillsborough County Expressway Authority, Series B | A | 5.000% | 07/01/2042 | 07/01/22 @ 100 | 1,024,780 |

1,000,000 | | Town of Davie FL, Series A | BBB | 6.000% | 04/01/2042 | 04/01/23 @ 100 | 1,052,400 |

| | | | | | | | 11,264,943 |

| | | Hawaii – 1.1% | | | | | |

1,000,000 | | Hawaii Pacific Health, Series B | A– | 5.625% | 07/01/2030 | 07/01/20 @ 100 | 1,074,620 |

See notes to financial statements. | | | | | |

8 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT | | | | | |

PORTFOLIO OF INVESTMENTS (Unaudited) continued | January 31, 2014 |

Principal

Amount | | Description | Rating* | Coupon | Maturity | Optional Call

Provisions** | Value |

| | | Illinois – 12.5% | | | | | |

$ 1,000,000 | | Chicago Board of Education, General Obligation, Series A | A+ | 5.000% | 12/01/2041 | 12/01/21 @ 100 | $ 967,830 |

1,750,000 | | Chicago O’Hare International Airport, Series C | A– | 5.500% | 01/01/2031 | 01/01/21 @ 100 | 1,879,657 |

2,000,000 | | Illinois Finance Authority, Roosevelt University Revenue | Baa3 | 5.500% | 04/01/2037 | 04/01/17 @ 100 | 1,899,520 |

1,000,000 | | Illinois Finance Authority, Rush University Medical Center Revenue, Series C | A | 6.375% | 11/01/2029 | 05/01/19 @ 100 | 1,134,410 |

760,000 | | Illinois Housing Development Authority, AMT, Series A-2 | AA | 5.000% | 08/01/2036 | 02/01/16 @ 100 | 763,618 |

2,000,000 | | Metropolitan Pier & Exposition Authority, Series A | AAA | 5.000% | 06/15/2042 | 06/15/22 @ 100 | 2,035,440 |

1,000,000 | | Railsplitter Tobacco Settlement Authority | A– | 6.000% | 06/01/2028 | 06/01/21 @ 100 | 1,117,730 |

2,000,000 | | State of Illinois, General Obligation, Series A | A– | 5.000% | 03/01/2028 | 03/07/14 @ 100 | 2,002,760 |

| | | | | | | | 11,800,965 |

| | | Indiana – 1.1% | | | | | |

1,000,000 | | Indiana Finance Authority | BB– | 6.000% | 12/01/2026 | 06/01/20 @ 100 | 1,014,060 |

| | | Iowa – 6.2% | | | | | |

1,090,000 | | Iowa Finance Authority | A+ | 5.000% | 08/15/2029 | 08/15/22 @ 100 | 1,146,364 |

1,650,000 | | Iowa Finance Authority | BBB– | 4.750% | 08/01/2042 | 08/01/22 @ 100 | 1,422,168 |

1,500,000 | | Iowa Higher Education Loan Authority | BB | 5.500% | 09/01/2025 | 09/01/20 @ 100 | 1,540,665 |

2,000,000 | | Iowa Tobacco Settlement Authority, Series B | B+ | 5.600% | 06/01/2034 | 06/01/17 @ 100 | 1,721,800 |

| | | | | | | | 5,830,997 |

| | | Kentucky – 2.2% | | | | | |

1,000,000 | | County of Owen KY, Waterworks System Revenue, Series B | A– | 5.625% | 09/01/2039 | 09/01/19 @ 100 | 1,024,170 |

1,000,000 | | Kentucky Economic Development Finance Authority, Series A | A2 | 5.625% | 08/15/2027 | 08/15/18 @ 100 | 1,081,730 |

| | | | | | | | 2,105,900 |

| | | Louisiana – 10.1% | | | | | |

1,000,000 | | East Baton Rouge Sewerage Commission, Series A | AA– | 5.250% | 02/01/2034 | 02/01/19 @ 100 | 1,075,200 |

3,000,000 | | Louisiana Local Government Environmental Facilities & Community | | | | | |

| | | Development Authority | BBB | 6.750% | 11/01/2032 | 11/01/17 @ 100 | 3,209,400 |

1,000,000 | | Louisiana Public Facilities Authority, Hospital Revenue | A3 | 5.250% | 11/01/2030 | 05/01/20 @ 100 | 1,025,020 |

1,000,000 | | Parish of DeSoto LA, AMT, Series A | BBB | 5.850% | 11/01/2027 | 11/01/14 @ 100 | 1,000,140 |

1,500,000 | | Parish of St John the Baptist LA, Series A | BBB | 5.125% | 06/01/2037 | 06/01/17 @ 100 | 1,503,105 |

1,600,000 | | State of Louisiana Gasoline & Fuels Tax Revenue, Series C1 | AA | 5.000% | 05/01/2043 | 05/01/23 @ 100 | 1,689,552 |

| | | | | | | | 9,502,417 |

| | | Maryland – 0.6% | | | | | |

500,000 | | Maryland Economic Development Corp. | BB | 5.750% | 09/01/2025 | 09/01/20 @ 100 | 524,760 |

| | | Massachusetts – 5.9% | | | | | |

1,800,000 | | Commonwealth of Massachusetts, General Obligation, (BHAC-CR FGIC)(a) | AA+ | 0.729% | 05/01/2037 | 05/01/17 @ 100 | 1,556,460 |

970,000 | | Massachusetts Educational Financing Authority, AMT | AA | 5.375% | 07/01/2025 | 07/01/21 @ 100 | 1,019,169 |

955,000 | | Massachusetts Educational Financing Authority, AMT | AA | 4.700% | 07/01/2026 | 07/01/21 @ 100 | 962,086 |

1,000,000 | | Massachusetts Health & Educational Facilities Authority, Series A | BBB | 6.250% | 07/01/2030 | 07/01/19 @ 100 | 1,083,090 |

950,000 | | Massachusetts Housing Finance Agency, AMT | AA– | 5.100% | 12/01/2027 | 06/01/17 @ 100 | 965,913 |

| | | | | | | | 5,586,718 |

| | | Michigan – 5.0% | | | | | |

1,000,000 | | City of Detroit MI, Sewer Disposal Revenue, Series B, (AGM) | AA– | 7.500% | 07/01/2033 | 07/01/19 @ 100 | 1,077,360 |

1,000,000 | | City of Detroit MI, Water Supply System Revenue, (AGM) | AA– | 7.000% | 07/01/2036 | 07/01/19 @ 100 | 1,061,590 |

500,000 | | Detroit Wayne County Stadium Authority, (AGM) | AA– | 5.000% | 10/01/2026 | 10/01/22 @ 100 | 518,455 |

1,000,000 | | Michigan Finance Authority Revenue | AA– | 5.000% | 12/01/2031 | 12/01/21 @ 100 | 1,056,220 |

1,000,000 | | Michigan Strategic Fund, Series B-1 | A-2 | 6.250% | 06/01/2014 | N/A | 1,016,070 |

| | | | | | | | 4,729,695 |

See notes to financial statements. | | | | | |

| | | MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 9 |

PORTFOLIO OF INVESTMENTS (Unaudited) continued | January 31, 2014 |

| | Description | Rating* | Coupon | Maturity | Optional Call

Provisions** | Value |

| | | Minnesota – 1.3% | | | | | |

$ 1,500,000 | | St. Paul Port Authority, AMT | BBB– | 4.500% | 10/01/2037 | 10/01/22 @ 100 | $ 1,182,495 |

| | | Mississippi – 1.2% | | | | | |

1,000,000 | | County of Warren MS, Series A | BBB | 6.500% | 09/01/2032 | 09/01/18 @ 100 | 1,091,260 |

| | | Nevada – 1.6% | | | | | |

1,435,000 | | Las Vegas Valley Water District, Series C | AA+ | 5.000% | 06/01/2031 | 06/01/21 @ 100 | 1,545,050 |

| | | New Hampshire – 1.0% | | | | | |

1,000,000 | | New Hampshire Health and Education Facilities Authority Act | BBB | 5.000% | 01/01/2034 | 01/01/22 @ 100 | 990,010 |

| | | New Jersey – 7.8% | | | | | |

3,000,000 | | New Jersey Economic Development Authority, Series I(a) | A+ | 1.640% | 03/01/2028 | 03/01/23 @ 100 | 2,981,280 |

500,000 | | New Jersey Economic Development Authority, Series C | BBB– | 5.000% | 07/01/2032 | 07/01/22 @ 100 | 468,515 |

1,500,000 | | New Jersey Health Care Facilities Financing Authority, (Prerefunded @ 7/1/2019)(c) | Baa2 | 5.750% | 07/01/2039 | 07/01/19 @ 100 | 1,842,930 |

2,000,000 | | New Jersey Transportation Trust Fund Authority, Series A | A+ | 5.000% | 06/15/2042 | 06/15/22 @ 100 | 2,057,700 |

| | | | | | | | 7,350,425 |

| | | New York – 12.1% | | | | | |

1,895,000 | | City of New York NY, Series J, (Prerefunded @ 5/15/2014)(c) | NR | 5.000% | 05/15/2023 | 05/15/14 @ 100 | 1,920,620 |

2,750,000 | | Long Island Power Authority, Series A, (Prerefunded @ 9/1/2014)(c) | A– | 5.100% | 09/01/2029 | 09/01/14 @ 100 | 2,827,330 |

2,000,000 | | Metropolitan Transportation Authority, Series E | A | 5.000% | 11/15/2043 | 11/15/23 @ 100 | 2,062,280 |

300,000 | | New York City Industrial Development Agency, American Airlines, | | | | | |

| | | JFK International Airport, AMT | NR | 7.500% | 08/01/2016 | N/A | 318,810 |

1,000,000 | | New York State Dormitory Authority, Series A | BBB | 5.000% | 07/01/2032 | 07/01/22 @ 100 | 1,022,680 |

700,000 | | New York State Dormitory Authority, Series B | A– | 5.250% | 07/01/2024 | 07/01/17 @ 100 | 749,672 |

1,500,000 | | Suffolk County Industrial Development Agency, AMT | A– | 5.250% | 06/01/2027 | 06/01/14 @ 100 | 1,510,470 |

1,000,000 | | Troy Industrial Development Authority | A– | 5.000% | 09/01/2031 | 09/01/21 @ 100 | 1,048,760 |

| | | | | | | | 11,460,622 |

| | | Ohio – 4.3% | | | | | |

2,000,000 | | American Municipal Power, Inc., Series B | A | 5.000% | 02/15/2042 | 02/15/22 @ 100 | 2,047,760 |

1,000,000 | | Ohio Air Quality Development Authority | BBB– | 5.625% | 06/01/2018 | N/A | 1,085,750 |

1,000,000 | | Ohio Air Quality Development Authority, Series A | BBB– | 5.700% | 2/1/14 | N/A | 1,000,000 |

| | | | | | | | 4,133,510 |

| | | Oklahoma – 1.1% | | | | | |

1,000,000 | | Oklahoma Development Finance Authority | A+ | 5.000% | 02/15/2034 | 02/15/22 @ 100 | 1,038,140 |

| | | Pennsylvania – 7.8% | | | | | |

1,110,000 | | City of Philadelphia PA, General Obligation, Series A, (Assured Gty) | AA– | 5.375% | 08/01/2030 | 08/01/19 @ 100 | 1,190,764 |

1,100,000 | | City of Philadelphia PA, General Obligation | A+ | 5.875% | 08/01/2031 | 08/01/16 @ 100 | 1,158,256 |

1,000,000 | | County of Lehigh PA | A+ | 4.000% | 07/01/2043 | 07/01/22 @ 100 | 837,540 |

1,500,000 | | Delaware River Port Authority | BBB | 5.000% | 01/01/2027 | 01/01/23 @ 100 | 1,552,245 |

1,000,000 | | Pennsylvania Higher Educational Facilities Authority, Series A | BBB | 5.000% | 05/01/2037 | 11/01/17 @ 100 | 998,560 |

1,000,000 | | Pennsylvania Higher Educational Facilities Authority, Series B | AA– | 6.000% | 08/15/2026 | 08/15/18 @ 100 | 1,150,790 |

500,000 | | State Public School Building Authority | A+ | 5.000% | 04/01/2032 | 04/01/22 @ 100 | 514,815 |

| | | | | | | | 7,402,970 |

| | | Puerto Rico – 1.0% | | | | | |

1,215,000 | | Puerto Rico Sales Tax Financing Corp., General Obligation | AA– | 5.250% | 08/01/2040 | 08/01/21 @ 100 | 960,336 |

| | | Rhode Island – 1.5% | | | | | |

1,300,000 | | Rhode Island Convention Center Authority, Series A, (Assured Gty) | AA– | 5.500% | 05/15/2027 | 05/15/19 @ 100 | 1,412,476 |

See notes to financial statements. | | | | | |

10 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT | | | | | |

PORTFOLIO OF INVESTMENTS (Unaudited) continued | January 31, 2014 |

| | Description | Rating* | Coupon | Maturity | Optional Call

Provisions** | Value |

| | | South Carolina – 4.8% | | | | | |

$ 2,500,000 | | County of Florence SC, Series A, (AGM) | AA– | 5.250% | 11/01/2027 | 11/01/14 @ 100 | $ 2,550,300 |

1,000,000 | | County of Georgetown SC, AMT, Series A | BBB | 5.300% | 03/01/2028 | 03/01/15 @ 100 | 1,000,130 |

1,000,000 | | South Carolina State Public Service Authority, Series E | AA– | 5.000% | 12/01/2048 | 12/01/23 @ 100 | 1,023,320 |

| | | | | | | | 4,573,750 |

| | | South Dakota – 1.3% | | | | | |

1,200,000 | | South Dakota Health & Educational Facilities Authority, Series A | A+ | 5.250% | 11/01/2034 | 11/01/14 @ 100 | 1,206,204 |

| | | Tennessee – 3.4% | | | | | |

2,500,000 | | Knox County Health Educational & Housing Facility Board | BBB+ | 5.250% | 04/01/2027 | 04/01/17 @ 100 | 2,556,650 |

650,000 | | Metropolitan Nashville Airport Authority | Baa3 | 5.200% | 07/01/2026 | 07/01/20 @ 100 | 677,255 |

| | | | | | | | 3,233,905 |

| | | Texas – 13.4% | | | | | |

1,000,000 | | Fort Bend County Industrial Development Corp., Series B | Baa3 | 4.750% | 11/01/2042 | 11/01/22 @ 100 | 893,550 |

2,000,000 | | Lower Colorado River Authority | A | 6.250% | 05/15/2028 | 05/15/18 @ 100 | 2,285,800 |

2,315,000 | | Matagorda County Navigation District No. 1, AMT, (AMBAC) | A | 5.125% | 11/01/2028 | N/A | 2,464,341 |

2,000,000 | | North Texas Tollway Authority, Series A | A– | 5.625% | 01/01/2033 | 01/01/18 @ 100 | 2,148,520 |

2,100,000 | | San Leanna Educational Facilities Corp. | BBB+ | 5.125% | 06/01/2036 | 06/01/17 @ 100 | 2,105,880 |

720,000 | | Tarrant County Cultural Education Facilities Finance Corp., (Assured Gty) | AA– | 5.750% | 07/01/2018 | N/A | 796,766 |

2,000,000 | | Tarrant County Cultural Education Facilities Finance Corp. | AA– | 5.000% | 10/01/2043 | 10/01/23 @ 100 | 2,016,640 |

| | | | | | | | 12,711,497 |

| | | Vermont – 2.9% | | | | | |

2,800,000 | | Vermont Student Assistance Corp., AMT, Series B-A2(a) | A | 3.238% | 12/03/2035 | 03/03/14 @ 100 | 2,778,776 |

| | | Virginia – 1.5% | | | | | |

1,250,000 | | Washington County Industrial Development Authority, Series C | BBB+ | 7.500% | 07/01/2029 | 01/01/19 @ 100 | 1,426,925 |

| | | Washington – 3.3% | | | | | |

1,000,000 | | Spokane Public Facilities District, Series A | A+ | 5.000% | 12/01/2038 | 06/01/23 @ 100 | 1,036,120 |

1,000,000 | | Tes Properties | AA+ | 5.625% | 12/01/2038 | 06/01/19 @ 100 | 1,063,840 |

1,000,000 | | Washington Higher Education Facilities Authority, Series A | A3 | 5.250% | 04/01/2043 | 04/01/23 @ 100 | 1,034,460 |

| | | | | | | | 3,134,420 |

| | | Wisconsin – 2.5% | | | | | |

1,250,000 | | Wisconsin Health & Educational Facilities Authority, Series A | AA+ | 5.000% | 11/15/2036 | 11/15/16 @ 100 | 1,271,613 |

1,000,000 | | WPPI Energy, Series A | A | 5.000% | 07/01/2037 | 07/01/23 @ 100 | 1,043,420 |

| | | | | | | | 2,315,033 |

| | | Wyoming – 4.3% | | | | | |

4,000,000 | | County of Sweetwater WY, AMT | A– | 5.600% | 12/01/2035 | 12/01/15 @ 100 | 4,056,280 |

| | | Total Municipal Bonds – 169.3% | | | | | |

| | | (Cost $156,007,347) | | | | | 160,071,800 |

| | | Preferred Shares – 2.2% | | | | | |

| | | Diversified Financial Services – 2.2% | | | | | |

$ 2,000,000 | | Centerline Equity Issuer Trust(b) | Aaa | 5.750% | 05/15/2015 | N/A | 2,084,780 |

| | | (Cost $2,000,000) | | | | | |

| | | Total Long-Term Investments – 171.5% | | | | | |

| | | (Cost $158,007,347) | | | | | 162,156,580 |

See notes to financial statements. | | | | | |

| | MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 11 |

PORTFOLIO OF INVESTMENTS (Unaudited) continued | January 31, 2014 |

| | Description | Value |

| | | Money Market – 0.1% | |

86,499 | | JPMorgan Tax Free Money Market | $ 86,499 |

| | | (Cost $86,499) | |

| | | Total Investments – 171.6% | |

| | | (Cost $158,093,846) | 162,243,079 |

| | | Other Assets in excess of Liabilities – 1.8% | 1,772,538 |

| | | Preferred Shares, at redemption value – (-73.4% of Net Assets | |

| | | Applicable to Common Shareholders or -42.8% of Total Investments) | (69,450,000) |

| | | Net Assets Applicable to Common Shareholders – 100.0% | $ 94,565,617 |

AGM – Insured by Assured Guaranty Municipal Corporation |

AMBAC – Insured by Ambac Assurance Corporation |

AMT – Income from this security is a preference item under the Alternative Minimum Tax. |

Assured Gty – Insured by Assured Guaranty Corporation |

CIFG – Insured by CIFG Assurance North America, Inc. |

FHA – Guaranteed by Federal Housing Administration |

N/A – Not Applicable |

| * | Ratings shown are per Standard & Poor’s Rating Group (“S&P”), Moody’s Investor Services, Inc. (“Moody”) or Fitch Ratings (“Fitch”). Securities classified as NR are not rated. (For securities not rated by S&P, the rating by Moody’s is provided. Likewise, for securities not rated by S&P and Moody’s the rating by Fitch is provided.) All ratings are unaudited. The ratings apply to the credit worthiness of the issuers of the underlying securities and not to the Fund or its shares. |

| ** | Date and price of the earliest optional call or put provision. There may be other call provisions at varying prices at later dates. |

| *** | All percentages shown in the Portfolio of Investments are based on Net Assets Applicable to Common Shareholders, unless otherwise noted. |

| (a) | Floating or variable rate coupon. The rate shown is as of January 31, 2014. |

| (b) | Securities are exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At January 31, 2014 these securities amounted to $4,057,500, which represents 4.3% of net assets applicable to common shares. |

| (c) | The bond is prerefunded. U.S. government or U.S. government agency securities, held in escrow, are used to pay interest on this security, as well as to retire the bond in full at the date and price indicated under the Optional Call Provisions. |

See notes to financial statements.

12 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

PORTFOLIO OF INVESTMENTS continued | January 31, 2014 |

Portfolio composition and holdings are subject to change daily. For more information, please visit guggenheiminvestments.com/mzf. The above summaries are provided for informational purposes only and should not be viewed as recommendations. Past performance does not guarantee future results.

See notes to financial statements.

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 13

STATEMENT OF ASSETS AND LIABILITIES (Unaudited) | January 31, 2014 |

Assets | | | |

Investments, at value (cost $158,093,846) | | $ | 162,243,079 | |

Interest receivable | | | 1,980,062 | |

Other assets | | | 16,125 | |

Total assets | | | 164,239,266 | |

Liabilities | | | | |

Investment advisory fee payable | | | 41,447 | |

Servicing agent fee payable | | | 27,591 | |

Distributions payable - preferred shareholders | | | 14,886 | |

Administration fee payable | | | 3,409 | |

Custodian bank | | | 242 | |

Accrued expenses and other liabilities | | | 136,074 | |

Total liabilities | | | 223,649 | |

Preferred Shares, at redemption value | | | | |

$.001 par value per share; 2,778 Auction Market Preferred Shares authorized, | | | | |

issued and outstanding at $25,000 per share liquidation preference | | | 69,450,000 | |

Net Assets Applicable to Common Shareholders | | $ | 94,565,617 | |

Composition of Net Assets Applicable to Common Shareholders | | | | |

Common stock, $.001 par value per share; unlimited number of shares authorized, | | | | |

6,800,476 shares issued and outstanding | | $ | 6,800 | |

Additional paid-in capital | | | 95,864,447 | |

Net unrealized appreciation on investments | | | 4,149,233 | |

Accumulated undistributed net investment income | | | 57,783 | |

Accumulated net realized loss on investments | | | (5,512,646 | ) |

Net Assets Applicable to Common Shareholders | | $ | 94,565,617 | |

Net Asset Value Applicable to Common Shareholders (based on 6,800,476 common shares outstanding) | | $ | 13.91 | |

See notes to financial statements.

14 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

STATEMENT OF OPERATIONS For the six months ended January 31, 2014 (Unaudited) | January 31, 2014 |

Investment Income | | |

Interest | | $ 3,988,889 |

Expenses | | |

Investment advisory fee | $ 316,514 | |

Servicing agent fee | 211,009 | |

Auction agent fees - preferred shares | 60,100 | |

Professional fees | 58,790 | |

Fund accounting | 32,793 | |

Trustees’ fees and expenses | 22,549 | |

Administrative fee | 22,318 | |

Printing expenses | 17,693 | |

NYSE listing fee | 10,672 | |

Transfer agent fee | 9,482 | |

Insurance | 9,069 | |

Custodian fee | 3,834 | |

Line of credit fee | 416 | |

Miscellaneous | 3,498 | |

Total expenses | | 778,737 |

Investment advisory fee waived | | (73,042) |

Servicing agent fee waived | | (48,694) |

Net expenses | | 657,001 |

Net investment income | | 3,331,888 |

Realized and Unrealized Gain on Investments | | |

Net realized gain | | 108,983 |

Net change in unrealized appreciation | | 1,936,192 |

Net realized and unrealized gain on investments | | 2,045,175 |

Distributions to Auction Market Preferred Shareholders from | | |

Net investment income | | (433,515) |

Net Increase in Net Assets Applicable to Common Shareholders Resulting from Operations | | $ 4,943,548 |

See notes to financial statements.

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 15

STATEMENTS OF CHANGES IN NET ASSETS | January 31, 2014 |

| | | For the

Six Months Ended

January 31, 2014

(Unaudited) | | | For the

Year Ended

July 31, 2013 | |

Increase (decrease) in Net Assets Applicable to Common

Shareholders Resulting from Operations: | | | | | | |

Net investment income | | $ | 3,331,888 | | | $ | 6,912,678 | |

Net realized gain on investments | | | 108,983 | | | | 1,224,194 | |

Net change in unrealized appreciation (depreciation) on investments | | | 1,936,192 | | | | (13,043,021 | ) |

Distributions to auction market preferred shareholders from net investment income | | | (433,515 | ) | | | (942,583 | ) |

Net increase (decrease) in net assets applicable to common shareholders

resulting from operations | | | 4,943,548 | | | | (5,848,732 | ) |

Distributions to common shareholders from | | | | | | | | |

Net investment income | | | (2,951,407 | ) | | | (6,400,922 | ) |

Capital share transactions | | | | | | | | |

Reinvestment of dividends | | | – | | | | 200,761 | |

Total change in net assets applicable to common shareholders | | | 1,992,141 | | | | (12,048,893 | ) |

Net assets applicable to common shareholders: | | | | | | | | |

Beginning of period | | | 92,573,476 | | | | 104,622,369 | |

End of period (including undistributed net investment income

of $57,783 and $110,817, respectively) | | $ | 94,565,617 | | | $ | 92,573,476 | |

See notes to financial statements.

16 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

FINANCIAL HIGHLIGHTS | January 31, 2014 |

Per share operating performance for one common

share outstanding throughout each period | | For the

Six Months Ended

January 31, 2014

(Unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 13.61 | | | $ | 15.41 | | | $ | 14.02 | | | $ | 14.40 | | | $ | 12.73 | | | $ | 13.17 | |

Investment operations | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (a) | | | 0.49 | | | | 1.02 | | | | 1.09 | | | | 1.12 | | | | 1.06 | | | | 1.02 | |

Net realized and unrealized gain/(loss) on investments | | | 0.30 | | | | (1.74 | ) | | | 1.43 | | | | (0.36 | ) | | | 1.72 | | | | (0.49 | ) |

Distributions to preferred shareholders from net investment income (common share equivalent basis) | | | (0.06 | ) | | | (0.14 | ) | | | (0.14 | ) | | | (0.15 | ) | | | (0.14 | ) | | | (0.24 | ) |

Total from investment operations | | | 0.73 | | | | (0.86 | ) | | | 2.38 | | | | 0.61 | | | | 2.64 | | | | 0.29 | |

Distributions to common shareholders from net investment income | | | (0.43 | ) | | | (0.94 | ) | | | (0.99 | ) | | | (0.99 | ) | | | (0.97 | ) | | | (0.73 | ) |

Net asset value, end of period | | $ | 13.91 | | | $ | 13.61 | | | $ | 15.41 | | | $ | 14.02 | | | $ | 14.40 | | | $ | 12.73 | |

Market value, end of period | | $ | 12.89 | | | $ | 12.46 | | | $ | 16.21 | | | $ | 13.48 | | | $ | 14.53 | | | $ | 11.87 | |

Total investment return (b) | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value | | | 5.53 | % | | | -6.01 | % | | | 17.50 | % | | | 4.57 | % | | | 21.21 | % | | | 2.83 | % |

Market value | | | 7.12 | % | | | -18.13 | % | | | 28.56 | % | | | -0.32 | % | | | 31.45 | % | | | 8.65 | % |

Ratios and supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (thousands) | | $ | 94,566 | | | $ | 92,573 | | | $ | 104,622 | | | $ | 94,913 | | | $ | 97,190 | | | $ | 101,016 | |

Ratio of expenses to average net assets (excluding interest expense and net of fee waivers) (d) | | | 1.42 | %(c) | | | 1.33 | % | | | 1.36 | % | | | 1.46 | % | | | 1.35 | % | | | 1.54 | % |

Ratio of expenses to average net assets (excluding

interest expense and excluding fee waivers) (d) | | | 1.69 | %(c) | | | 1.58 | % | | | 1.62 | % | | | 1.72 | % | | | 1.69 | % | | | 1.91 | % |

Ratio of expenses to average net assets (including

interest expense and net of fee waivers) (d) | | | 1.42 | %(c) | | | 1.33 | % | | | 1.36 | % | | | 1.46 | % | | | 1.35 | % | | | 1.54 | % |

Ratio of expenses to average net assets (including

interest expense and excluding fee waivers) (d) | | | 1.69 | %(c) | | | 1.58 | % | | | 1.62 | % | | | 1.72 | % | | | 1.69 | % | | | 1.91 | % |

Ratio of net investment income to average net assets (d) | | | 7.22 | %(c) | | | 6.70 | % | | | 7.38 | % | | | 8.09 | % | | | 7.68 | % | | | 8.65 | % |

Portfolio turnover | | | 11 | % | | | 23 | % | | | 15 | % | | | 8 | % | | | 6 | % | | | 21 | % |

Preferred shares, at redemption value ($25,000 per share liquidation preference) (thousands) | | $ | 69,450 | | | $ | 69,450 | | | $ | 69,450 | | | $ | 69,450 | | | $ | 69,450 | | | $ | 69,450 | |

Preferred shares asset coverage per share | | $ | 59,041 | | | $ | 58,324 | | | $ | 62,661 | | | $ | 59,166 | | | $ | 59,986 | | | $ | 61,363 | |

| (a) | Based on average shares outstanding during the period. |

| (b) | Total investment return is calculated assuming a purchase of a common share at the beginning of the period and a sale on the last day of the period reported either at net asset value (NAV) or market price per share. Dividends and distributions are assumed to be reinvested at NAV for returns at NAV or in accordance with the Fund’s dividend reinvestment plan for returns at market value. Total investment return does not reflect brokerage commissions. A return calculated for a period of less than one year is not annualized. |

| (c) | Annualized. |

| (d) | Calculated on the basis of income and expenses applicable to both common and preferred shares relative to average net assets of common shareholders. |

See notes to financial statements.

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 17

NOTES TO FINANCIAL STATEMENTS (Unaudited) | January 31, 2014 |

Note 1 – Organization:

The Managed Duration Investment Grade Municipal Fund (the “Fund”) was organized as a Delaware statutory trust on May 20, 2003. The Fund is registered as a diversified, closed-end management investment company under the Investment Company Act of 1940, as amended. The Fund’s investment objective is to provide its common shareholders with high current income exempt from regular federal income tax while seeking to protect the value of the Fund’s assets during periods of interest rate volatility. Prior to commencing operations on August 27, 2003, the Fund had no operations other than matters relating to its organization and registration and the sale and issuance of 6,981 common shares of beneficial interest to MBIA Capital Management Corp. (now known as Cutwater Investor Services Corp.).

Note 2 – Accounting Policies:

The preparation of financial statements in accordance with US generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund.

(a) Valuation of Investments: The municipal bonds and preferred shares in which the Fund invests are traded primarily in the over-the-counter markets. In determining net asset value, the Fund uses the valuations of portfolio securities furnished by a pricing service approved by the Board of Trustees. The pricing service typically values portfolio securities at the bid price or the yield equivalent when quotations are readily available. Securities for which quotations are not readily available are valued at fair market value on a consistent basis as determined by the pricing service using a matrix system to determine valuations. The procedures of the pricing service and its valuations are reviewed by the officers of the Fund under the general supervision of the Board of Trustees. Positions in futures contracts, interest rate swaps and options on interest rate swaps (“swaptions”) are valued at closing prices for such contracts established by the exchange or dealer market on which they are traded.

For those securities where quotations or prices are not available, the valuations are determined in accordance with procedures established in good faith by management and approved by the Board of Trustees. Valuations in accordance with these procedures are intended to reflect each security’s (or asset’s) “fair value”. Fair value is defined as the price that the Fund would receive to sell an investment or pay to transfer a liability in an orderly transaction with an independent buyer in the principal market, or in the absence of a principal market, the most advantageous market for the investment or liability. Each such determination should be based on a consideration of all relevant factors, which are likely to vary from one pricing context to another. Examples of such factors may include, but are not limited to: (i) the type of security, (ii) the initial cost of the security, (iii) the existence of any contractual restrictions on the security’s disposition, (iv) the price and extent of public trading in similar securities of the issuer or of comparable issuers, (v) quotations or evaluated prices from broker-dealers and/or pricing services, (vi) information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange traded securities), (vii) an analysis of the company’s financial statements, and (viii) an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold (e.g. the existence of pending merger activity, public offerings or tender offers that might affect the value of the security).

There are three different categories for valuations. Level 1 valuations are those based upon quoted prices in active markets. Level 2 valuations are those based upon quoted prices in inactive markets or based upon significant observable inputs (e.g. yield curves; benchmark interest rates; indices). Level 3 valuations are those based upon unobservable inputs (e.g. discounted cash flow analysis; non-market based methods used to determine fair valuation).

The Fund values Level 1 securities using readily available market quotations in active markets. Money market funds are valued at net asset value. The Fund values Level 2 fixed income securities using independent pricing providers who employ matrix pricing models utilizing market prices, broker quotes and prices of securities with comparable maturities and qualities. The Fund values Level 2 equity securities using various observable market inputs as described above. The Fund did not have any Level 3 securities during the period ended January 31, 2014.

Transfers between valuation levels, if any, are in comparison to the valuation levels at the end of the previous fiscal year, and are effective using the fair value as of the end of the current fiscal period.

The following table represents the Fund’s investments carried on the Statement of Assets and Liabilities by caption and by level within the fair value hierarchy as of January 31, 2014:

Valuations (in $000s) | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Description | | | | | | | | | | | | |

Assets: | | | | | | | | | | | | |

Municipal Bonds | | $ | – | | | $ | 160,072 | | | $ | – | | | $ | 160,072 | |

Preferred Shares | | | – | | | | 2,085 | | | | – | | | | 2,085 | |

Money Market | | | 86 | | | | – | | | | – | | | | 86 | |

Total | | $ | 86 | | | $ | 162,157 | | | $ | – | | | $ | 162,243 | |

There were no transfers between levels for the six months ended January 31, 2014.

(b) Investment Transactions and Investment Income: Investment transactions are accounted for on the trade date. Realized gains and losses on investments are determined on the identified cost basis. Interest income and expenses are accrued daily. All discounts/premiums are accreted/amortized for financial reporting purposes over the life of each security.

(c) Dividends and Distributions: The Fund declares and pays on a monthly basis dividends from net investment income to common shareholders. Distributions of net realized capital gains, if any, will be paid at least annually. Dividends and distributions to shareholders are recorded on the ex-dividend date. Dividends and distributions to preferred shareholders are accrued and determined as described in Note 6.

18 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

NOTES TO FINANCIAL STATEMENTS (Unaudited) continued | January 31, 2014 |

(d) Inverse Floating Rate Investments and Floating Rate Note Obligations: Inverse floating rate instruments are notes whose coupon rate fluctuates inversely to a predetermined interest rate index. These instruments typically involve greater risks than a fixed rate municipal bond. In particular, the holder of these inverse floating rate instruments retain all credit and interest rate risk associated with the full underlying bond and not just the par value of the inverse floating rate instrument. As such, these instruments should be viewed as having inherent leverage and therefore involve many of the risks associated with leverage. Leverage is a speculative technique that may expose the Fund to greater risk and increased costs. Leverage may cause the Fund’s net asset value to be more volatile than if it had not been leveraged because leverage tends to magnify the effect of any increases or decreases in the value of the Fund’s portfolio securities. The use of leverage may also cause the Fund to liquidate portfolio positions when it may not be advantageous to do so in order to satisfy its obligations with respect to inverse floating rate instruments.

The Fund may invest in inverse floating rate securities through either a direct purchase or through the transfer of bonds to a dealer trust in exchange for cash and/or residual interests in the dealer trust. For those inverse floating rate securities purchased directly, the instrument is included in the Portfolio of Investments with income recognized on an accrual basis. The Fund did not invest in inverse floating rate securities during the period ended January 31, 2014.

Note 3 – Agreements:

Pursuant to an Investment Advisory Agreement (the “Advisory Agreement”) between Cutwater Investor Services Corp. (the “Adviser” or “Cutwater”) and the Fund, the Adviser is responsible for the daily management of the Fund’s portfolio, which includes buying and selling securities for the Fund, as well as investment research, subject to the direction of the Fund’s Board of Trustees. The Adviser is a subsidiary of Cutwater Holdings, LLC which, in turn, is a wholly-owned subsidiary of MBIA, Inc. The Advisory Agreement provides that the Fund shall pay to the Adviser a monthly fee for its services at the annual rate of 0.39% of the sum of the Fund’s average daily managed assets. (“Managed Assets” represent the Fund’s total assets including the assets attributable to the proceeds from any financial leverage but excluding the assets attributable to floating rate note obligations, minus liabilities, other than debt representing financial leverage.) The Adviser contractually agreed to waive a portion of the management fees it is entitled to receive from the Fund at the annual rate of 0.09% of the Fund’s average daily Managed Assets for a one-year period set to expire June 30, 2014.

Pursuant to a Servicing Agreement, Guggenheim Funds Distributors, LLC (the “Servicing Agent”) acts as servicing agent to the Fund. The Servicing Agent receives an annual fee from the Fund, payable monthly in arrears, in an amount equal to 0.26% of the average daily value of the Fund’s Managed Assets. The Servicing Agent contractually agreed to waive a portion of the servicing fee it is entitled to receive from the Fund at the annual rate of 0.06% of the average daily value of the Fund’s Managed Assets for a one-year period set to expire June 30, 2014.

Prior to May 14, 2013, under a separate Fund Administration Agreement, (“the Administration Agreement”) Guggenheim Funds Investment Advisors, LLC (“GFIA”), an affiliate of the Servicing Agent, provided Fund Administration services to the Fund. Effective May 14, 2013, the Board of Trustees approved Rydex Fund Services, LLC (“RFS”) to replace GFIA as the Administrator of the Fund. Both RFS and GFIA are affiliates of Guggenheim Partners, LLC, a global diversified financial services firm. There is no impact to the Fund as a result of this change. As compensation for services under the Administration Agreement, GFIA previously received and RFS currently receives a fund administration fee payable monthly at the annual rate set forth below as a percentage of the average daily managed assets of the Fund:

Managed Assets | Rate |

First $200,000,000 | 0.0275% |

Next $300,000,000 | 0.0200% |

Next $500,000,000 | 0.0150% |

Over $1,000,000,000 | 0.0100% |

The Bank of New York Mellon (“BNY”) acts as the Fund’s custodian, accounting agent and auction agent. As custodian, BNY is responsible for the custody of the Fund’s assets. As accounting agent, BNY is responsible for maintaining the books and records of the Fund. As auction agent, BNY is responsible for conducting the auction of the preferred shares.

Certain officers and/or trustees of the Fund are officers and/or directors of the Adviser and the Servicing Agent. The Fund does not compensate its officers or trustees who are officers, directors and/or employees of the aforementioned firms.

Note 4 – Federal Income Taxes:

The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, no provision for US federal income taxes is required. In addition, by distributing substantially all of its ordinary income and long-term capital gains, if any, during each calendar year, the Fund intends not to be subject to U.S. federal excise tax.

Information on the tax components of investments as of January 31, 2014 is as follows:

| | | |

$158,127,056 | $7,559,650 | $(3,443,627) | $4,116,023 |

The difference between book and tax basis cost of investments is due to book/tax differences on the recognition of partnership/trust income.

As of July 31, 2013 (the most recent fiscal year end for federal income tax purposes), the components of accumulated earnings/(losses) on a tax basis were as follows:

| | | | | |

2013 | $159,169 | $0 | $(5,636,771) | $2,179,831 |

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT l 19

NOTES TO FINANCIAL STATEMENTS (Unaudited) continued | January 31, 2014 |

The cumulative timing differences under tax basis accumulated capital and other losses as of July 31, 2013 are due to investments in partnerships/trusts.

As of July 31, 2013 (the most recent fiscal year end for federal income tax purposes), the Fund had a capital loss carryforward of $5,636,771 available to offset possible future capital gains. The capital loss carryforward is set to expire as follows: $625,460 on July 31, 2014, $4,772,269 on July 31, 2017. Additionally, the Fund has available long-term capital losses of $239,042 that do not have an expiration. Per the Regulated Investment Company Modernization Act of 2010, capital loss carryforwards generated in taxable years beginning after December 22, 2010 must be fully used before capital loss carryforwards generated in taxable years prior to December 22, 2010, therefore, under certain circumstances, capital loss carryforwards available as of the report date may expire unused.

Distributions paid to shareholders during the tax years ended July 31, 2013 (the most recent fiscal year end for federal income tax purposes), were characterized as follows:

| | | | |

2013 | $7,336,722 | $6,783 | $7,343,505 |

For all open tax years and all major jurisdictions, management of the Fund has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Uncertain tax positions are tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns that would not meet a more-likely-than-not threshold of being sustained by the applicable tax authority and would be recorded as a tax expense in the current year. Open tax years are those years that are open for examination by taxing authorities (i.e. generally the last four tax year ends and the interim tax period since then). Furthermore, management of the Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Note 5 – Investment Transactions:

Purchases and sales of investment securities, excluding short-term investments, for the six months ended January 31, 2014, aggregated $17,405,682 and $17,517,739, respectively.

Note 6 – Capital:

There are an unlimited number of $.001 par value common shares of beneficial interest authorized and 6,800,476 common shares outstanding at January 31, 2014, of which the Adviser owned 13,102 shares.

Transactions in common shares were as follows: | |

| | Six Months Ended January 31, 2014 | |

Beginning shares | 6,800,476 | 6,787,494 |

Shares issued through dividend reinvestment | – | 12,982 |

Ending shares | 6,800,476 | 6,800,476 |

On October 27, 2003, the Fund issued 1,389 shares of Auction Market Preferred Shares (“AMPS”), Series M7 and 1,389 shares of Auction Market Preferred Shares, Series W28. The preferred shares have a liquidation value of $25,000 per share plus any accumulated unpaid dividends. As of January 31, 2014, the Fund had 1,389 shares each of AMPS, Series M7 and W28, outstanding. Dividends on the preferred shares are cumulative at a rate that is set by auction procedures. Distributions of net realized capital gains, if any, are made annually.

The broad auction-rate preferred securities market, including the Fund’s AMPS, has experienced considerable disruption since mid-February 2008. The result has been failed auctions on nearly all auction-rate preferred shares, including the Fund’s AMPS. A failed auction is not a default, nor does it require the redemption of the Fund’s AMPS.

Provisions in the AMPS offering documents establish a maximum rate in the event of a failed auction. The AMPS reference rate is the higher of LIBOR or 90% of the taxable equivalent of the short-term municipal bond rate. The maximum rate, for auctions for which the Fund has not given notice that the auction will consist of net capital gains or other taxable income, is the higher of the reference rate times 110% or the reference rate plus 1.10%.

Previously, the taxable equivalent of the short-term municipal bond rate was calculated based on an index called the S&P Weekly High Grade Index. In October 2012, the Fund was notified that the Standard & Poor’s Evaluation Services was discontinuing the publication of the S&P Weekly High Grade Index effective December 31, 2012. After evaluating various indices as a potential successor to the S&P Weekly High Grade Index, the Advisor and Servicing Agent determined that an index called the S&P Municipal Bond 7-Day High Grade Rate Index most closely resembled the S&P Weekly High Grade Index and would be the least disruptive selection to the Fund’s current AMPS holders. After analyzing various alternatives, the Board of Trustees approved the Fund to utilize the S&P Municipal Bond 7-Day High Grade Rate Index as the successor to the S&P Weekly High Grade Index.

Management will continue to monitor events in the marketplace and continue to evaluate the Fund’s leverage as well as any alternative that may be available.

The range of dividend rates on the Fund’s AMPS for the six months ended January 31, 2014, were as follows:

Series | Low | High | At 1/31/14 | |

M7 | 1.218% | 1.252% | 1.218% | 2/3/14 |

W28 | 1.218% | 1.258% | 1.218% | 2/19/14 |

The Fund is subject to certain limitations and restrictions while the AMPS are outstanding. Failure to comply with these limitations and restrictions could preclude the Fund from declaring any dividends or distributions to common shareholders or repurchasing common shares and/or could trigger the mandatory redemption of AMPS at their liquidation value plus any accrued dividends.

20 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND SEMIANNUAL REPORT

NOTES TO FINANCIAL STATEMENTS (Unaudited) continued | January 31, 2014 |