UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED ANNUAL SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21410

The Weitz Funds

(Exact name of registrant as specified in charter)

Suite 200

1125 South 103 Street

Omaha, NE 68124-1071

(Address of principal executive offices) (Zip code)

Weitz Investment Management, Inc.

The Weitz Funds

Suite 200

1125 South 103 Street

Omaha, NE 68124-1071

(Name and address of agent for service)

Registrant’s telephone number, including area code: 402-391-1980

Date of fiscal year end: March 31

Date of reporting period: March 31, 2015

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Stockholders.

THE WEITZ PHILOSOPHY

Value investing the Weitz Way.

There are no shortcuts in value investing. At Weitz, we dig. And dig some more. We look at hundreds of investment ideas. Our goal: find strong, well-managed but undervalued companies and bonds that offer reasonable risk-adjusted returns. It’s no easy task. We do the due diligence. Analyze. Ask tough questions and get the answers. We wait for the right opportunity. Then and only then do we invest your money. Welcome to the Weitz Way.

We’re in it with you:

Our employees have the majority of their investable assets in our mutual funds. This alignment of goals allows us to guarantee that we’re treating clients’ money as if it were our own.

We focus on what we know:

Each of our analysts is a generalist with ever-growing, defined circles of competence. They can spot opportunities anywhere and bring them to the team for consideration.

We think for ourselves:

Our philosophy of independent thinking and high-conviction portfolios enables us to take advantage of value-priced equities and bonds that offer reasonable risk-adjusted returns.

Today we are responsible for approximately $6 billion in investments for our shareholders – individuals, corporations, pension plans, foundations and endowments. And our commitment remains the same: to put our clients first. Always. We do so through our expertise, our flexibility, and our drive to uncover investments that can help them preserve and grow wealth.

Wally Weitz, CFA

President, Portfolio Manager

TABLE OF CONTENTS

| Value Matters | 4 |

| | |

| Performance Summary | 7 |

| | |

| Analyst Corner | 8 |

| | |

| Value Fund | 10 |

| | |

| Partners Value Fund | 12 |

| | |

| Partners III Opportunity Fund | 14 |

| | |

| Research Fund | 16 |

| | |

| Hickory Fund | 18 |

| | |

| Balanced Fund | 20 |

| | |

| Core Plus Income Fund | 22 |

| | |

| Short-Intermediate Income Fund | 25 |

| | |

| Nebraska Tax-Free Income Fund | 28 |

| | |

| Government Money Market Fund | 30 |

| | |

| Schedule of Investments | 32 |

| | |

| Financial Statements | 48 |

| | |

| Notes to Financial Statements | 58 |

| | |

| Report of Independent Registered Public Accounting Firm | 68 |

| | |

| Actual and Hypothetical Expenses for Comparison Purposes | 70 |

| | |

| Other Information | 71 |

| | |

| Information About the Trustees and Officers | 72 |

| | |

| Index Descriptions | 74 |

| The management of Weitz Funds has chosen paper for the 76 page Annual Report from a paper manufacturer certified under the Sustainable Forestry Initiative ® standard. |  |

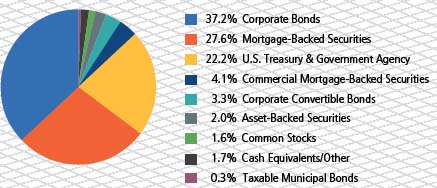

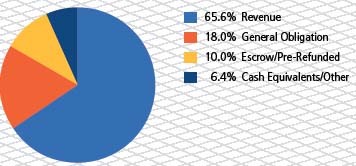

Portfolio composition is subject to change at any time and references to specific securities, industries, and sectors referenced in this report are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. See the Schedules of Investments included in this report for the percent of assets in each of the Funds invested in particular industries or sectors.

3 | Q1 2015 ANNUAL REPORT

VALUE MATTERS

April 9, 2015

Dear Fellow Investor,

The stock market moved roughly sideways during the first quarter of 2015. Our stock funds earned returns of roughly 3-4% vs. 1% for the S&P 500. The bond funds earned positive returns in spite of miniscule yields available on bonds. Results for the fiscal year ended March 31 were in the 7-12% range for the stock funds vs. 12.7% for the S&P 500 and bond fund returns were modest, but positive.

The table following this letter shows results over various time periods for all of our funds and their respective benchmarks. As usual, we would remind readers that investment performance data for short periods is not very meaningful, but we believe our 20- and 30-year numbers reflect the advantage that can accrue to patient value investors.

Market Commentary

Wall Street has been obsessed with the actions of the Federal Reserve for at least as long as the older of us has been investing.

On Thursday afternoons in the 1970’s, everyone watched the Dow Jones news wire for the money supply report that might hold clues about the Fed’s next policy move. More recently, the Fed has been extraordinarily “accommodative” in the six years since the financial crisis, and there is considerable investor anxiety about how stocks will react to a return to “normal” interest rates. It is almost comical to watch the stock market rally or swoon in response to every small bit of economic data. The logic seems to be that a sign of economic strength (good news) is “bad” because it might encourage the Fed to abandon its “zero interest rate policy” (ZIRP). Conversely, a sign of economic weakness often triggers a rally since it may discourage the Fed from tightening.

The Fed’s (and the Treasury’s) actions immediately after the Lehman failure were important and effective. In succeeding years, though, the creation of trillions of new dollars and their use to pump up asset prices (via “quantitative easing” or “QE”) may prove to have been counter-productive. It seems likely that we have “borrowed” investment gains from the future via QE. More importantly, to the extent speculators have used cheap, short-term credit to buy (riskier) higher yielding assets (“carry trades”), they face potential trading losses if rates rise suddenly. Their scramble to exit these trades could trigger market liquidity issues.

Another interesting result of aggressive central bank activity, in Europe and Japan as well as the U.S., is that a significant amount of sovereign debt (bonds issued by countries rather than companies) now carries negative interest rates. This is unprecedented. One might call it surreal. Berkshire Hathaway Vice Chairman Charlie Munger admits to being “flabbergasted” by the negative yields. He says, “…of course I’m confused. Anybody who is intelligent who is not confused doesn’t understand the situation very well. If you find it puzzling, your brain is working correctly.” (Forbes, 3/26/2015) Charlie has a way with words.

Interest rates are important to investors. When rates return to more normal (higher) levels, holders of longer-term bonds may suffer significant declines in the market value of their holdings. Higher bond yields also offer stiffer competition for stocks, and all things being equal, rising rates are negative for stock valuations. Higher rates can also depress corporate profits and companies’ enthusiasm for expansion.

Thus, we are very interested in how the general level of interest rates may change over a period of years. We want to know how our companies are preparing for a higher rate environment. However, we do not make any important investment decisions based on day to day actions or pronouncements of the Fed. We believe that obsessive “Fed-watching” is misplaced effort.

Portfolio Positioning

We often write about wanting to buy stocks at 50-60% of our estimate of business value. Today, we find ourselves (again) holding stocks that are more “fairly” priced—above our “buy” price but with room to appreciate over time.

Berkshire Hathaway is a concrete example of one of our “in-between” stocks. In the 2014 annual report, Warren Buffett was uncharacteristically specific about how he believes investors should think about Berkshire. He has long held that Berkshire’s business value, or “intrinsic value,” was considerably higher than its “book value.” He has stated that the company would be willing to buy back shares of Berkshire at up to 120% of book value since that would still represent a “significant discount” to intrinsic value.

4 | Q1 2015 ANNUAL REPORT

WEITZINVESTMENTS.COM

This year he suggested that Berkshire’s intrinsic value was very likely to rise over time and investors planning to hold shares for many years would probably earn good returns if they bought shares near the 120% of book value level. He went on to say if they paid twice book (200%), that it might be several years before they showed a profit (echoing Ben Graham, a stock may be a bargain at one price but an over-valued speculation at another). Finally, he warned that if investors intended to hold the stock for only a year or two, he could offer “no assurances, whatever the entry price.”

Berkshire’s book value per A share at March 31 is (very) roughly $150,000. Warren’s guidelines would suggest that a $180,000 purchase today (120% of book) should work out well over time and that a purchase at $300,000 (200% of book) might result in “dead money” for several years. At March 31, the stock was selling at $217,500 (about 145% of book). At this price, it trades at a modest discount to our estimate of intrinsic value. We are “comfortable” holding it but not “excited” about buying more. This is how we feel about many of our stocks.

So we face a common dilemma—stocks are not cheap and they face some headwinds. All eyes are on interest rates and they will rise eventually. Another tangible factor that is beginning to have an effect on company earnings is the strong dollar. A strengthening dollar makes U.S. exporters less competitive and depresses the reported earnings of global companies as profits earned in other currencies are converted into a smaller number of dollars. There are other things going on in the world that usually distract investors and it seems possible they will again.

Our game plan has been (1) to place extra emphasis on companies that can “make their own breaks” and continue to grow in a less benign environment, (2) to be disciplined about trimming holdings as prices approach “full value,” and (3) to continue to visit companies and build our “on deck” list for a time when stock prices are cheaper. As a result, some of our core positions sell at relatively high price-to-value (P/V) levels and our cash reserves remain higher than usual. (Trimming successful positions also means realizing some long-term capital gains that have been earned in past years.) This plan has worked reasonably well as the market has risen and we think it will help us deal with (but not be immune from) future volatility and market corrections.

Later in this report, our portfolio managers discuss the specific companies that have contributed to (or detracted from) their funds’ results. They provide capsule comments on portfolio additions and deletions and generally explain what worked and what didn’t. Thanks again for being a supportive group of shareholders.

Sincerely,

|  |

| Wally Weitz | Brad Hinton |

| wally@weitzinvestments.com | brad@weitzinvestments.com |

As of March 31, 2015: Berkshire Hathaway, Inc. – Class B represented 4.7%, 4.6%, 7.6%, 2.7% and 2.3% of the Value, Partners Value, Partners III Opportunity, Research and Balanced Funds’ net assets, respectively.

5 | Q1 2015 ANNUAL REPORT

DISCLOSURES

These performance numbers reflect the deduction of annual operating expenses which as stated in the most recent prospectus, and expressed as a percentage of each Fund’s or Class’ net assets, are: Value – Investor Class, 1.21% (estimated gross); Value – Institutional Class, 1.11% (estimated gross); Partners Value – Investor Class, 1.22% (estimated gross); Partners Value – Institutional Class, 1.08% (estimated gross); Partners III Opportunity – Investor Class, 1.86%; Partners III Opportunity – Institutional Class – 1.45%; Research, 1.59% (gross); Hickory, 1.22%; Balanced, 1.10%; Core Plus Income – Investor Class, 0.97% (estimated gross); Core Plus Income – Institutional Class, 0.74% (estimated gross); Short-Intermediate Income – Investor Class, 0.92% (gross); Short-Intermediate Income – Institutional Class, 0.62%; and Nebraska Tax-Free Income, 0.73%. The returns assume redemption at the end of each period and reinvestment of dividends. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses. This information represents past performance and past performance does not guarantee future results. The investment return and the principal value of an investment in any of the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end may be obtained at www.weitzinvestments.com/funds_and_performance/fund_performance.fs. Index performance is hypothetical and is shown for illustrative purposes only. See page 74 for a description of all indices.

(a) Performance of the Partners Value and Partners III Opportunity Funds is measured from June 1, 1983, the inception of Weitz Partners II Limited Partnership (“Partners II”) and Weitz Partners III Limited Partnership (“Partners III”), respectively. Performance of the Research Fund is measured from April 1, 2005, the inception of Weitz Research Fund, L.P. (“Research L.P.”). Performance of the Nebraska Tax-Free Income Fund is measured from October 1, 1985, the inception of Weitz Income Partners Limited Partnership (“Income Partners”). On the last business day of December 1993, 2005, 2006 and 2010, the Partners Value, Partners III Opportunity, Nebraska Tax-Free Income and Research Funds (the “Funds”) succeeded to substantially all of the assets of Partners II, Partners III, Income Partners and Research L.P. (the“Partnerships”), respectively. The investment objectives, policies and restrictions of the Funds are materially equivalent to those of the respective Partnerships and the Partnerships were managed at all times with full investment authority by Weitz Investment Management, Inc. The performance information includes performance for the period before the Funds became investment companies registered with the Securities and Exchange Commission. During these periods, none of the Partnerships were registered under the Investment Company Act of 1940 and therefore were not subject to certain investment or other restrictions or requirements imposed by the 1940 Act or the Internal Revenue Code. If any of the Partnerships had been registered under the 1940 Act during these periods, the respective Partnerships’ performance might have been adversely affected.

(b) Institutional Class shares of the Value and Partners Value Funds became available for sale on July 31, 2014. For performance prior to that date, these tables include the actual performance of each Fund’s Investor Class (and use the actual expenses of each Fund’s Investor Class) without adjustment. For any such period of time, the performance of each Fund’s Institutional Class would have been similar to the performance of each Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses. The investment adviser has agreed in writing to limit the total annual fund operating expenses of the Investor and Institutional Class shares (excluding taxes, interest, portfolio transaction expenses, acquired fund fees and expenses and extraordinary expenses) to 1.18% and 0.99%, respectively, of each Class’ average daily net assets through July 31, 2015.

(c) Investor Class shares of the Partners III Opportunity and Short-Intermediate Income Funds became available for sale on August 1, 2011. For performance prior to that date, these tables include the actual performance of each Fund’s Institutional Class (and use the actual expenses of each Fund’s Institutional Class) without adjustment. For any such period of time, the performance of each Fund’s Investor Class would have been similar to the performance of each Fund’s Institutional Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses. The investment adviser has agreed in writing to limit the total annual fund operating expenses of the Short-Intermediate Income Fund – Investor Class shares (excluding taxes, interest, portfolio transaction expenses, acquired fund fees and expenses and extraordinary expenses) to 0.85% of the Class’ average daily net assets through July 31, 2015.

(d) Starting January 1, 2011, these tables reflect the deduction of the Research Fund’s actual operating expenses. For periods of time prior to January 1, 2011, these tables reflect the deduction of annual pro forma operating expenses of 1.50%. Annual operating expenses for the Research Fund, as stated in the Research Fund’s Prospectus, are 1.59% (gross) and 0.91% (net) of the Fund’s net assets. The investment adviser has agreed, in writing, to limit the total annual fund operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) to 0.90% of the Fund’s average daily net assets through July 31, 2015.

(e) The investment adviser has agreed in writing to limit the total annual fund operating expenses of the Core Plus Income Fund’s Investor and Institutional Class shares (excluding taxes, interest, portfolio transaction expenses, acquired fund fees and expenses and extraordinary expenses) to 0.85% and 0.65%, respectively, of each Class’ average daily net assets through July 31, 2015.

* Since inception performance for the Russell 1000 Value, Barclays Intermediate Credit and CPI +1% is from May 31, 1986; December 31, 1988; and December 31, 1988, respectively. The inception date of the Barclays 5-Year Muni. Bond was January 29, 1988.

6 | Q1 2015 ANNUAL REPORT

WEITZINVESTMENTS.COM

PERFORMANCE SUMMARY

| | | | Annualized | | | | | | |

| | | | | | | | | | | | | | | | Since Invest- | | | | | | | | | |

| | | | | | | | | | | | | | | | ment Style | | | | | | | | | |

| | Inception | | Since | | | | | | | | | | | Inception | | | | | | | | | |

| Fund Name | Date | | Inception | | 30-year | | 20-year | | 10-year | | (6/30/08) | | 5-year | | 1-year | | Quarter |

Value(b) | 5/09/86 | | | | | | | | | | | | | | | | | | | | | | | | |

| Investor | | | | 10.89 | % | | | — | % | | | 11.27 | % | | | 6.08 | % | | | 10.88 | % | | | 14.34 | % | | | 10.19 | % | | | 3.60 | % |

| Institutional | | | | 10.89 | | | | — | | | | 11.27 | | | | 6.09 | | | | 10.90 | | | | 14.37 | | | | 10.32 | | | | 3.64 | |

| Russell 1000 | | | | 10.31 | | | | — | | | | 9.63 | | | | 8.34 | | | | 9.94 | | | | 14.73 | | | | 12.73 | | | | 1.59 | |

| Russell 1000 Value* | | | | 10.44 | | | | — | | | | 9.97 | | | | 7.21 | | | | 8.90 | | | | 13.75 | | | | 9.33 | | | | (0.72 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Partners Value(a)(b) | 6/01/83 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investor | | | | 12.77 | | | | 12.18 | | | | 11.99 | | | | 7.56 | | | | — | | | | 14.68 | | | | 8.99 | | | | 3.27 | |

| Institutional | | | | 12.77 | | | | 12.18 | | | | 11.99 | | | | 7.57 | | | | — | | | | 14.71 | | | | 9.11 | | | | 3.33 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Partners III | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Opportunity(a)(c) | 6/01/83 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investor | | | | 13.36 | | | | 12.97 | | | | 13.57 | | | | 8.65 | | | | — | | | | 14.40 | | | | 7.38 | | | | 4.26 | |

| Institutional | | | | 13.40 | | | | 13.01 | | | | 13.63 | | | | 8.76 | | | | — | | | | 14.64 | | | | 7.76 | | | | 4.34 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Research(a)(d) | 4/01/05 | | | 8.86 | | | | — | | | | — | | | | 8.86 | | | | — | | | | 14.17 | | | | 12.22 | | | | 3.30 | |

| Russell 3000 | | | | — | | | | 10.99 | | | | 9.58 | | | | 8.38 | | | | — | | | | 14.71 | | | | 12.37 | | | | 1.80 | |

| Russell 3000 Value | | | | — | | | | 11.25 | | | | 10.01 | | | | 7.24 | | | | — | | | | 13.66 | | | | 8.94 | | | | (0.51 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Hickory | 4/01/93 | | | 10.72 | | | | — | | | | 11.56 | | | | 7.37 | | | | 12.54 | | | | 14.56 | | | | 8.31 | | | | 4.50 | |

| Russell 2500 | | | | 10.87 | | | | — | | | | 11.09 | | | | 9.62 | | | | 11.40 | | | | 15.48 | | | | 10.07 | | | | 5.17 | |

| Russell 2500 Value | | | | 11.29 | | | | — | | | | 11.72 | | | | 8.46 | | | | 10.85 | | | | 14.06 | | | | 6.58 | | | | 3.02 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| S&P 500 | | | | — | | | | 11.03 | | | | 9.39 | | | | 8.01 | | | | 9.74 | | | | 14.47 | | | | 12.73 | | | | 0.95 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balanced | 10/01/03 | | | 5.84 | | | | — | | | | — | | | | 5.33 | | | | — | | | | 8.30 | | | | 3.73 | | | | 1.37 | |

| Blended Index | | | | 7.09 | | | | — | | | | — | | | | 6.82 | | | | — | | | | 10.20 | | | | 9.10 | | | | 1.23 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

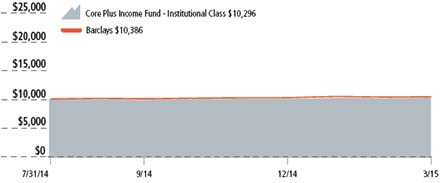

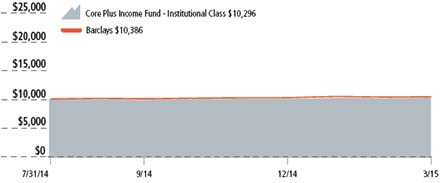

Core Plus Income(e) | 7/31/14 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investor | | | | 2.90 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 1.80 | |

| Institutional | | | | 2.96 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 1.77 | |

| Barclays U.S. Aggregate Bond | | | 3.86 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 1.61 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Short-Intermediate | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income(c) | 12/23/88 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investor | | | | 5.51 | | | | — | | | | 4.99 | | | | 3.84 | | | | — | | | | 2.35 | | | | 1.64 | | | | 0.70 | |

| Institutional | | | | 5.55 | | | | — | | | | 5.03 | | | | 3.92 | | | | — | | | | 2.51 | | | | 1.88 | | | | 0.75 | |

| Barclays Intermediate Credit* | | | 6.22 | | | | — | | | | 5.46 | | | | 4.34 | | | | — | | | | 3.52 | | | | 3.58 | | | | 1.45 | |

| CPI + 1%* | | | | 3.62 | | | | — | | | | 3.27 | | | | 3.04 | | | | — | | | | 2.66 | | | | 0.93 | | | | 0.81 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

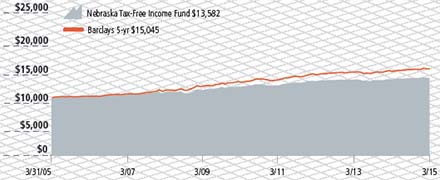

| Nebraska Tax- | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Free Income(a) | 10/01/85 | | | 4.99 | | | | — | | | | 4.16 | | | | 3.11 | | | | — | | | | 2.48 | | | | 2.14 | | | | 0.36 | |

| Barclays 5-Year Muni. Bond* | | | — | | | | — | | | | 4.73 | | | | 4.17 | | | | — | | | | 3.44 | | | | 2.95 | | | | 0.76 | |

7 | Q1 2015 ANNUAL REPORT | UNAUDITED

ANALYST CORNER

A Perspective On Range Resources

By David Perkins, CFA

Range Resources (RRC) is a domestic producer of natural gas and natural gas liquids (NGLs) based in Fort Worth, Texas. Range is the 14th largest natural gas producer in the continental United States, with average daily production of approximately 1.3 billion cubic feet of gas equivalent (BCFE). The company drilled its first discovery well in southwest Pennsylvania just over 10 years ago, discovering what is today North America’s most prolific natural gas field – the Marcellus shale. Range controls roughly 1.6 million acres in the Appalachian basin which include both the northeast and southwest portions of the Marcellus as well as the Upper Devonian and Utica shales in southwestern PA.

Why own any commodity business?

This is a thoughtful question, and one we often ask ourselves. Our answer in the vast majority of cases is “don’t bother.” However, we believe there are unique windows of opportunity to take advantage of volatility, whether with the commodity itself, producers’ stocks, or both. In energy in particular, we are often struck by the sharp difference in investment horizon between those we share meetings with on field trips and at industry conferences (6-9 months, in some cases even shorter) and our own (3-5 years). While this is often the case, it is perhaps most acute in energy. Our goal, in all sectors of the market, is to take advantage of volatility and inefficiencies that result in temporary mispricing. Crude oil, natural gas and NGLs have all suffered material declines in price over the past 9 months. With uncertainty around near-term price levels, the timing and ultimate pace of recovery, and where mid-cycle prices will settle for all three fuels, we believe portions of the public energy market are rife with opportunity for investors with a multi-year time horizon.

When analyzing energy producers, there are several structural questions we must answer before putting shareholder capital at risk:

1) Are the target company’s assets advantaged - do they sit at or near the low end of the industry cost curve and are they likely to stay there?

2) What does the company’s reinvestment runway look like? How much visibility do we have into where our capital will be going over the next 3, 5 and 10 years?

3) Do we know and understand the company’s capital structure and capital needs over our investment horizon?

4) Is management focused on debt-adjusted per share growth?

5) Do we have upside optionality with the commodity (is it trading below our notion of marginal cost)?

The answers to the first four questions eliminate the majority of exploration and production (E&P) businesses from consideration. The final question helps us frame risk in an inherently cyclical industry. At roughly $55/share, Range Resources looks particularly attractive through this lens.

Valuable Assets

As with any commodity business, a low cost position is both critical for survival and necessary if one hopes to earn better than average returns over time. Range’s cost position among North American natural gas and NGL producers is very attractive, owing largely to the quality of its leasehold acreage in the Marcellus. Range has driven overall production and cash operating costs down by 43% and 53% per thousand cubic feet of gas equivalent (MCFE), respectively, since 2008. We expect additional cost reductions in the coming years as the company continues to gain scale, enabling Range to generate top decile cash margins at or above $2.50/MCFE in all but the most dire price environments.

With the advent of unconventional production methods (i.e. fracking) in the U.S. and the repeatable nature of shale development, “resource potential” has become an important consideration for investors. It is effectively a company’s estimate of the reserves it has an opportunity to capitalize on in the future, including those beyond the five-year window the SEC allows for public reporting. Range estimates its resource potential to be somewhere between 66 and 87 trillion cubic feet of gas equivalent (TCFE), excluding the 400,000 acres it controls in the emerging Utica formation. For context, if all of these hydrocarbons were to become a reality, the company would be able to grow its current production base at a mid-teens compounded annual rate for the next 15-20 years. In short, we know where our capital is going to be reinvested well beyond five years from now.

8 | Q1 2015 ANNUAL REPORT

WEITZINVESTMENTS.COM

Having significant resource potential is great, but the quality of a company’s future runway is paramount. Per Credit Suisse, Range’s Marcellus “liquids rich” wells earn among the very highest returns available to a domestic E&P investor (35-40%) assuming West Texas Intermediate (WTI) oil prices stay at or below $70 going forward and domestic natural gas prices don’t reach $4.00/MCFE until 2018. In higher price environments, Range’s returns look even more compelling. As the company’s capital efficiency continues to improve via more optimal completions and greater penetration of pad drilling, we believe Range should sustain if not enhance its return profile over time. In addition, Range has consistently lowered the cost of replacing its existing reserves to industry-best levels ($0.54/MCFE), which allows the company to allocate more of its cash flow toward generating future growth.

Appalachian basin natural gas and NGL producers have fallen sharply out of favor with investors over the past several quarters, in many ways becoming victims of their own success. As supply has swelled in the northeast, transportation infrastructure has been unable to keep pace. A milder 2014/2015 winter season further exacerbated regional oversupply, driving gas and NGL prices materially lower. We see the beginnings of a more constructive backdrop emerging, however, especially for northeast producers like RRC. New regional pipeline capacity should begin to allow lower-cost Marcellus gas to displace declining higher-cost legacy gas production across a broad swath of the Midwest and Southeast. As well, the drop in crude oil prices and resulting decrease in oil-focused drilling activity should also lead to a decline in “associated gas” production beginning this fall. Long-awaited demand growth from LNG exports, Mexican exports, coal plant retirements and new industrial plants should begin this year and increase each year between now and 2019. A more balanced supply-demand picture should lead prices back toward our ~$4 marginal cost framework.

We believe the combination of rising per share production and reserves, higher natural gas and NGL prices, and improved cash flow and earnings will continue to drive Range’s valuation higher over the coming years. Successful delineation of the company’s Utica acreage over the next 12 months provides additional potential optionality. Any rebound in investor sentiment, which we believe is likely, only further enhances the stock’s present appeal. Our $100-105 base case intrinsic value estimate represents a blend of our internal net asset value scenarios and what we believe is a reasonable multiple of Range’s normalized cash flow in 2017 discounted back to today. We believe shares of Range Resources offer a compelling risk-reward to the patient investor.

As of March 31, 2015: Range Resources represented 3.7%, 2.8%, 1.4%, 7.0%, 1.7% and 2.1% of the Value, Partners Value, Partners III Opportunity, Research, Hickory and Balanced Funds’ net assets, respectively.

David Perkins, CFA®, joined Weitz |

| in January 2004. Dave is a Research |

| Analyst and a Co-Portfolio |

| Manager of the Value and Research |

| Funds. He graduated from Taylor |

| University in Upland, IN and |

| previously spent three years as an |

| equity analyst with McCarthy Group |

| Asset Management. Dave has been a |

CFA® charterholder since 2009. |

9 | Q1 2015 ANNUAL REPORT | UNAUDITED

VALUE FUND

Investment Style: Large-Cap Value

Co-Portfolio Managers: Wally Weitz, CFA; Brad Hinton, CFA; & Dave Perkins, CFA

Top Quarterly Contributors

Endo International – is a specialty healthcare company engaged in developing, manufacturing, marketing and distributing branded pharmaceutical and generic products as well as medical devices. In late January, management completed its previously announced $2.6 billion acquisition of Auxilium Pharmaceuticals. Auxilium strengthens Endo’s branded pharmaceutical platform, provides immediate scale in an attractive niche market (urology), and is roughly 10% accretive to our base case estimate of intrinsic value. Roughly a month later, the company agreed to sell the men’s health portion of its integrated medical systems surgical business to Boston Scientific for $1.6 billion. We anticipate the proceeds supporting future business development initiatives.

Martin Marietta Materials – is a producer of granite, limestone, sand, gravel and aggregates products for the construction industry. In February, management reported strong aggregates volume growth and price increases across each of its geographic markets and issued robust 2015 guidance. In addition, Martin increased its synergy target for the Texas Industries acquisition from $70 million to $100 million annually and announced a new share buyback plan. If the plan is completed it would represent approximately 30% of the company’s outstanding shares.

Top Fiscal Year Contributors

Valeant Pharmaceuticals International – is a specialty pharmaceutical and medical device company that develops, manufactures, and markets a range of generic and branded generic pharmaceuticals, over-the-counter products and medical devices. During an eventful fiscal year, Valeant’s strong underlying business performance carried the day as the company battled Allergan’s aggressive negative public relations campaign. Valeant’s dermatology business performed well ahead of our expectations, driven by broad-based strength across its portfolio as well as the successful launch of fungal treatment Jublia. In February, Valeant announced a definitive agreement to acquire Salix Pharmaceuticals for slightly over $15 billion. We anticipate Salix earning attractive high teens returns for Valeant over time. The combination of healthy double-digit organic sales growth and falling acquisition-related cash restructuring expenditures drove a noticeable increase in excess cash generation, creating the capacity for the company’s transaction with Salix.

Liberty Global – through its subsidiaries provides video, broadband internet, fixed-line telephone and mobile services across 14 countries. Liberty Global announced solid operational results in the Big 5 geographies: UK, Germany, Switzerland, Belgium and The Netherlands; and successfully closed the acquisition of their largest cable competitor in Holland, Ziggo. Additionally, Virgin Media in the UK (a subsidiary of Liberty Global as of June 2013) announced “Project Lightning.” Virgin intends to invest 3 billion pounds to connect four million additional homes to its network resulting in broadband speeds substantially faster than telco-based competitors. We believe the project represents a very good use of capital and should generate attractive future returns.

Endo International – Fiscal year results were driven by first quarter contributions as described above.

New Positions This Quarter

No new positions were added in the first quarter of 2015.

Top Quarterly Detractors

Twenty-First Century Fox – is a diversified media and entertainment company. Shares declined during the first quarter as management reduced 2016 earnings guidance. Reported ratings across the industry have been consistently negative as viewers transition to additional, unmeasured distribution methods and alternative content. Furthermore, Fox’s international channel is pressured on a reporting basis by headwinds from the strengthening of the U.S. dollar. We increased our position size as the stock price declined.

United Parcel Service – is a package delivery organization and a provider of supply chain management solutions. Despite significant investment during 2014 in anticipation of strong holiday e-commerce volumes, UPS’s peak shopping season struggles continued as e-commerce parcels once again crowded into a tight shipping window. We believe the company’s efforts toward a more streamlined holiday shopping experience will bear fruit in time, and we expect the company’s stock price will eventually reflect this stepped up commitment to its customers.

Top Fiscal Year Detractors

Range Resources – is a Texas-based independent natural gas, natural liquids, and oil company engaged in the exploration, development and acquisition of primarily gas properties. Falling domestic natural gas and natural gas liquids (NGL) prices in addition to regional oversupply in the northeast portion of the United States continue to be stiff headwinds for Range Resources in the near term. Absent a demand shock from a worsening U.S. economy, we expect the present supply/demand imbalance will work itself out over the next 18-24 months. In the interim, we believe Range will continue to grow per share production and reserves in a highly capital efficient manner.

Discovery Communications – is a world-class provider of non-fiction, global pay-tv programming. Weakness in U.S. television advertising, foreign currency headwinds and increased investments in niche European sports rights muted the company’s 2015 outlook and pressured Discovery’s shares during the quarter. We think the company’s investments are strategically sound and should earn solid returns over the next several years. We also believe that the core business will prove more resilient than many investors fear, especially overseas.

Apache Corporation – is an independent energy company that explores, develops and produces natural gas, crude oil and natural gas liquids. Apache shares suffered alongside most of the energy sector as oil and natural gas prices fell sharply. We sold our stake in Apache during the fourth quarter to focus our capital in two higher conviction producers, Range Resources and Pioneer Natural Resources, with better assets trading at similar discounts to our calculated intrinsic value.

Positions Eliminated This Quarter

Texas Instruments – Our sale of Texas Instruments was bittersweet, bringing to a close a very successful investment for the Fund. With a holding period just shy of five years, Texas Instruments generated an annualized internal rate of return of approximately 25% thanks in part to its “best in sector” capital allocation prowess. We continue to think favorably of its business, the company’s future prospects and its able management team, but sold when Texas Instruments shares rose above our estimate of intrinsic value.

DIRECTV – We have trimmed our DIRECTV position several times since the acquisition by AT&T was announced last May. We sold our remaining shares as the stock price approached our estimate of business value.

These performance numbers reflect the deduction of the Fund’s Investor and Institutional Class’ annual operating expenses which as stated in its most recent prospectus are 1.21% (estimated gross) and 1.11% (estimated gross), respectively, of each Class’ net assets. The returns assume redemption at the end of each period and reinvestment of dividends. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses. This information represents past performance and past performance does not guarantee future results. The investment return and the principal value of an investment in this Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained at www.weitzinvestments.com/funds_and_performance/fund_performance.fs.

See page 6 for additional performance disclosures. See page 74 for a description of all indices.

Performance information does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

10 | Q1 2015 ANNUAL REPORT

WEITZINVESTMENTS.COM

| Returns | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Annualized | | | | | | |

| | | | | | | | | Since Investment | | | | | | | | | | | | |

| | | Since Inception | | | | | | | | | | | | | | | | | | | | |

| | | (5/9/1986) | | 20-year | | 10-year | | (6/30/08) | | 5-year | | 3-year | | 1-year | | Quarter |

| WVALX - Investor Class | | | 10.89 | % | | | 11.27 | % | | | 6.08 | % | | | 10.88 | % | | | 14.34 | % | | | 15.61 | % | | | 10.19 | % | | | 3.60 | % |

| WVAIX - Institutional Class | | 10.89 | | | | 11.27 | | | | 6.09 | | | | 10.90 | | | | 14.37 | | | | 15.66 | | | | 10.32 | | | | 3.64 | |

| S&P 500 | | | 10.25 | | | | 9.39 | | | | 8.01 | | | | 9.74 | | | | 14.47 | | | | 16.11 | | | | 12.73 | | | | 0.95 | |

| Russell 1000 | | | 10.31 | | | | 9.63 | | | | 8.34 | | | | 9.94 | | | | 14.73 | | | | 16.45 | | | | 12.73 | | | | 1.59 | |

| Russell 1000 Value | | | 10.44 | * | | | 9.97 | | | | 7.21 | | | | 8.90 | | | | 13.75 | | | | 16.44 | | | | 9.33 | | | | (0.72 | ) |

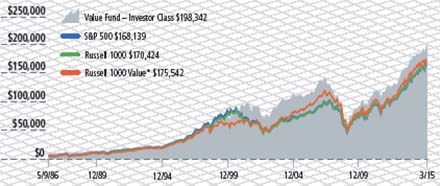

Growth of $10,000

This chart depicts the change in the value of a $10,000 investment in the Value Fund – Investor Class for the period since inception (5/9/86) through March 31, 2015, as compared with the growth of the Standard & Poor’s 500, Russell 1000 and Russell 1000 Value Indices during the same period. Index performance is hypothetical and is shown for illustrative purposes only.

* Since 5/31/1986

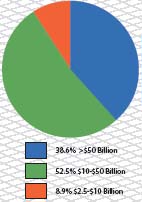

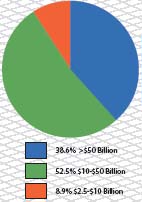

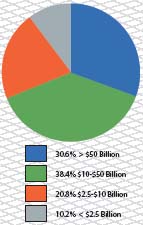

Capitalization

Top 10 Stock Holdings

| | | % of Net Assets |

| Liberty Global plc - Series C | | | 6.7 | |

| Valeant Pharmaceuticals International, Inc. | | | 5.9 | |

| Berkshire Hathaway, Inc. - Class B | | | 4.7 | |

| Liberty Interactive Corp. - Series A | | | 3.9 | |

| Range Resources Corp. | | | 3.7 | |

| Express Scripts Holding Co. | | | 3.6 | |

| Pioneer Natural Resources Co. | | | 3.2 | |

| Liberty Media Corp. - Series C | | | 3.2 | |

| Endo International plc | | | 3.1 | |

| Discovery Communications, Inc. - Class C | | | 3.0 | |

| | | | 41.0 | |

Industry Breakdown

| | | % of Net Assets |

| Consumer Discretionary | | | 24.5 | |

| Health Care | | | 16.7 | |

| Information Technology | | | 11.0 | |

| Financials | | | 9.4 | |

| Industrials | | | 7.1 | |

| Energy | | | 6.9 | |

| Materials | | | 3.3 | |

| Consumer Staples | | | 1.1 | |

| Cash Equivalents/Other | | | 20.0 | |

| | | | 100.0 | |

Top Performers

| | | | | | Average | | | | |

| Security Name | | Return | | | Weight | | | Contribution | |

| Valeant Pharmaceuticals International, Inc. | | | 38.8 | % | | | 6.4 | % | | | 2.19 | % |

| Endo International plc | | | 24.4 | | | | 3.0 | | | | 0.65 | |

| Martin Marietta Materials, Inc. | | | 27.1 | | | | 1.8 | | | | 0.44 | |

| Catamaran Corp. | | | 15.1 | | | | 2.4 | | | | 0.37 | |

| Pioneer Natural Resources Co. | | | 9.9 | | | | 3.1 | | | | 0.31 | |

Bottom Performers

| | | | | | Average | | | | |

| Security Name | | Return | | | Weight | | | Contribution | |

| Twenty-First Century Fox, Inc. - Class A | | | (11.5 | )% | | | 3.0 | % | | | (0.41 | )% |

| Discovery Communications, Inc. - Class C | | | (12.6 | ) | | | 3.0 | | | | (0.39 | ) |

| United Parcel Service, Inc. - Class B | | | (12.2 | ) | | | 2.0 | | | | (0.27 | ) |

| Precision Castparts Corp. | | | (12.8 | ) | | | 2.6 | | | | (0.25 | ) |

| Berkshire Hathaway, Inc. - Class B | | | (3.9 | ) | | | 5.0 | | | | (0.19 | ) |

Contributions to Fund performance are based on actual daily holdings. Securities may have been bought or sold during the quarter. Source: FactSet Portfolio Analytics

Return shown is the actual quarterly return of the security.

11 | Q1 2015 ANNUAL REPORT | UNAUDITED

PARTNERS VALUE FUND

Investment Style: Multi-Cap Value

Co-Portfolio Managers: Wally Weitz, CFA & Brad Hinton, CFA

Top Quarterly Contributors

Interval Leisure Group – is a provider of non-traditional lodging, encompassing a portfolio of leisure businesses from exchange and vacation rental to vacation ownership. Interval’s stock rebounded after the company posted solid quarterly results and issued encouraging 2015 guidance. Revenue per member is rising again as the company anniversaries the four large contract re-pricings from early last year. Management also better articulated plans for its recent timeshare acquisition, raised the dividend and increased its share repurchase authorization.

Martin Marietta Materials – is a producer of granite, limestone, sand, gravel and aggregates products for the construction industry. In February, management reported strong aggregates volume growth and price increases across each of its geographic markets and issued robust 2015 guidance. In addition, Martin increased its synergy target for the Texas Industries acquisition from $70 million to $100 million annually and announced a new share buyback plan. If the plan is completed it would represent approximately 30% of the company’s outstanding shares.

Top Fiscal Year Contributors

Valeant Pharmaceuticals International – is a specialty pharmaceutical and medical device company that develops, manufactures, and markets a range of generic and branded generic pharmaceuticals, over-the-counter products and medical devices. During an eventful fiscal year, Valeant’s strong underlying business performance carried the day as the company battled Allergan’s aggressive negative public relations campaign. Valeant’s dermatology business performed well ahead of our expectations, driven by broad-based strength across its portfolio as well as the successful launch of fungal treatment Jublia. In February, Valeant announced a definitive agreement to acquire Salix Pharmaceuticals for slightly over $15 billion. We anticipate Salix earning attractive high teens returns for Valeant over time. The combination of healthy double-digit organic sales growth and falling acquisition-related cash restructuring expenditures drove a noticeable increase in excess cash generation, creating the capacity for the company’s transaction with Salix.

Liberty Global – through its subsidiaries provides video, broadband internet, fixed-line telephone and mobile services across 14 countries. Liberty Global announced solid operational results in the Big 5 geographies: UK, Germany, Switzerland, Belgium and The Netherlands; and successfully closed the acquisition of their largest cable competitor in Holland, Ziggo. Additionally, Virgin Media in the UK (a subsidiary of Liberty Global as of June 2013) announced “Project Lightning.” Virgin intends to invest 3 billion pounds to connect four million additional homes to its network resulting in broadband speeds substantially faster than telco-based competitors. We believe the project represents a very good use of capital and should generate attractive future returns.

XO Group – is a life stage media company. It serves its audience with information, products, and services during critical life stages: planning a wedding, sharing life as a couple for the first time, and planning for the birth of a first child. In early 2014 new management announced a period of heightened infrastructure investment. Since then, management has clearly articulated the company’s intended path and investors have shown confidence in their plan.

New Positions This Quarter

No new positions were added in the first quarter of 2015.

Top Quarterly Detractors

Discovery Communications – is a world-class provider of non-fiction, global pay-tv programming. Weakness in U.S. television advertising, foreign currency headwinds and increased investments in niche European sports rights muted the company’s 2015 outlook and pressured Discovery’s shares during the quarter. We think the company’s investments are strategically sound and should earn solid returns over the next several years. We also believe that the core business will prove more resilient than many investors fear, especially overseas.

Redwood Trust – Redwood Trust’s fourth quarter earnings fell short of expectations due in part to lower commercial mortgage banking income and decreased valuations for mortgage servicing rights (MSR’s). The company’s 2015 volume expectations for jumbo residential, conforming residential and commercial lending point to increased earnings potential this year. In the meantime, Redwood pays a healthy dividend that yields more than 6% at the current stock price.

Top Fiscal Year Detractors

Range Resources – is a Texas-based independent natural gas, natural liquids, and oil company engaged in the exploration, development and acquisition of primarily gas properties. Falling domestic natural gas and natural gas liquids (NGL) prices in addition to regional oversupply in the northeast portion of the United States continue to be stiff headwinds for Range Resources in the near term. Absent a demand shock from a worsening U.S. economy, we expect the present supply/demand imbalance will work itself out over the next 18-24 months. In the interim, we believe Range will continue to grow per share production and reserves in a highly capital efficient manner.

Avon Products – is a manufacturer and marketer of beauty and related products. Last year, investors became quite concerned by worse-than-expected results in the company’s North American business as well as missteps in Brazil, which is Avon’s top market. Later in the year Avon demonstrated some progress in its long turnaround, but worries over the transactional impact of the rapid rise of the U.S. dollar against the Brazilian Real and the Russian Ruble erased the positives from the operational improvement.

Apache Corporation – is an independent energy company that explores, develops and produces natural gas, crude oil and natural gas liquids. Apache shares suffered alongside most of the energy sector as oil and natural gas prices fell sharply. We sold our stake in Apache during the fourth quarter to focus our capital in two higher conviction producers, Range Resources and Pioneer Natural Resources, with better assets trading at similar discounts to our calculated intrinsic value.

Positions Eliminated This Quarter

No positions were eliminated in the first quarter of 2015.

These performance numbers reflect the deduction of the Fund’s Investor and Institutional Class’ annual operating expenses which as stated in its most recent prospectus are 1.22% (estimated gross) and 1.08% (estimated gross), respectively, of each Class’ net assets. The returns assume redemption at the end of each period and reinvestment of dividends. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses. This information represents past performance and past performance does not guarantee future results. The investment return and the principal value of an investment in this Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained at www.weitzinvestments.com/funds_and_performance/fund_performance.fs.

See page 6 for additional performance disclosures. See page 74 for a description of all indices.

Performance information does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

12 | Q1 2015 ANNUAL REPORT

WEITZINVESTMENTS.COM

| Returns | | | | | | | | | | | | | | | | | | | | | |

| | | Annualized | | | | | | |

| | | Since Inception | | | | | | | | | | | | | | | | | | |

| | | (6/1/1983) | | 20-year | | 10-year | | 5-year | | 3-year | | 1-year | | Quarter |

| WPVLX - Investor Class | | | 12.77 | % | | | 11.99 | % | | | 7.56 | % | | | 14.68 | % | | | 15.89 | % | | | 8.99 | % | | | 3.27 | % |

| WPVIX - Institutional Class | | | 12.77 | | | | 11.99 | | | | 7.57 | | | | 14.71 | | | | 15.93 | | | | 9.11 | | | | 3.33 | |

| S&P 500 | | | 11.02 | | | | 9.39 | | | | 8.01 | | | | 14.47 | | | | 16.11 | | | | 12.73 | | | | 0.95 | |

| Russell 3000 | | | 10.84 | | | | 9.58 | | | | 8.38 | | | | 14.71 | | | | 16.43 | | | | 12.37 | | | | 1.80 | |

| Russell 3000 Value | | | 11.40 | | | | 10.01 | | | | 7.24 | | | | 13.66 | | | | 16.30 | | | | 8.94 | | | | (0.51 | ) |

Growth of $10,000

This chart depicts the change in the value of a $10,000 investment in the Partners Value Fund - Investor Class for the period since inception (6/1/83) through March 31, 2015, as compared with the growth of the Standard & Poor’s 500, Russell 3000 and Russell 3000 Value Indices during the same period. Index performance is hypothetical and is shown for illustrative purposes only.

Top 10 Stock Holdings

| | % of Net Assets |

| Liberty Global plc - Series C | | 5.4 | |

| Berkshire Hathaway, Inc. - Class B | | 4.6 | |

| Valeant Pharmaceuticals International, Inc. | | 4.5 | |

| Express Scripts Holding Co. | | 3.9 | |

| Liberty Media Corp. - Series C | | 3.4 | |

| Liberty Interactive Corp. - Series A | | 3.2 | |

| Range Resources Corp. | | 2.8 | |

| Redwood Trust, Inc. | | 2.7 | |

| Wells Fargo & Co. | | 2.7 | |

| Laboratory Corp. of America Holdings | | 2.6 | |

| | | 35.8 | |

Industry Breakdown

| | % of Net Assets |

| Consumer Discretionary | | 27.4 | |

| Financials | | 14.8 | |

| Health Care | | 13.0 | |

| Information Technology | | 12.7 | |

| Industrials | | 4.7 | |

| Energy | | 4.7 | |

| Materials | | 2.5 | |

| Consumer Staples | | 1.4 | |

| Cash Equivalents/Other | | 18.8 | |

| | | 100.0 | |

Top Performers

| | | | | Average | | | | |

| Security Name | Return | | | Weight | | | Contribution | |

| Valeant Pharmaceuticals International, Inc. | | 38.8 | % | | | 4.3 | % | | | 1.47 | % |

| Interval Leisure Group, Inc. | | 26.0 | | | | 2.3 | | | | 0.59 | |

| Martin Marietta Materials, Inc. | | 27.1 | | | | 2.3 | | | | 0.57 | |

| Laboratory Corp. of America Holdings | | 16.9 | | | | 2.5 | | | | 0.38 | |

| Liberty Media Corp. - Series C | | 9.0 | | | | 3.4 | | | | 0.32 | |

Bottom Performers

| | | | | Average | | | | |

| Security Name | Return | | | Weight | | | Contribution | |

| Discovery Communications, Inc. - Class C | | (12.6 | )% | | | 2.2 | % | | | (0.27 | )% |

| Avon Products, Inc. | | (14.3 | ) | | | 1.5 | | | | (0.26 | ) |

| Redwood Trust, Inc. | | (7.9 | ) | | | 3.0 | | | | (0.24 | ) |

| Twenty-First Century Fox, Inc. - Class A | | (11.5 | ) | | | 1.5 | | | | (0.20 | ) |

| Berkshire Hathaway, Inc. - Class B | | (3.9 | ) | | | 4.7 | | | | (0.18 | ) |

Contributions to Fund performance are based on actual daily holdings. Securities may have been bought or sold during the quarter. Source: FactSet Portfolio Analytics

Return shown is the actual quarterly return of the security.

13 | Q1 2015 ANNUAL REPORT | UNAUDITED

PARTNERS III OPPORTUNITY FUND

Investment Style: Multi-Cap Alternative

Portfolio Manager: Wally Weitz, CFA

Top Quarterly Contributors

Martin Marietta Materials – is a producer of granite, limestone, sand, gravel and aggregates products for the construction industry. In February, management reported strong aggregates volume growth and price increases across each of its geographic markets and issued robust 2015 guidance. In addition, Martin increased its synergy target for the Texas Industries acquisition from $70 million to $100 million annually and announced a new share buyback plan. If the plan is completed it would represent approximately 30% of the company’s outstanding shares.

Interval Leisure Group – is a provider of non-traditional lodging, encompassing a portfolio of leisure businesses from exchange and vacation rental to vacation ownership. Interval’s stock rebounded after the company posted solid quarterly results and issued encouraging 2015 guidance. Revenue per member is rising again as the company anniversaries the four large contract re-pricings from early last year. Management also better articulated plans for its recent timeshare acquisition, raised the dividend and increased its share repurchase authorization.

Top Fiscal Year Contributors

Valeant Pharmaceuticals International – is a specialty pharmaceutical and medical device company that develops, manufactures, and markets a range of generic and branded generic pharmaceuticals, over-the-counter products and medical devices. During an eventful fiscal year, Valeant’s strong underlying business performance carried the day as the company battled Allergan’s aggressive negative public relations campaign. Valeant’s dermatology business performed well ahead of our expectations, driven by broad-based strength across its portfolio as well as the successful launch of fungal treatment Jublia. In February, Valeant announced a definitive agreement to acquire Salix Pharmaceuticals for slightly over $15 billion. We anticipate Salix earning attractive high teens returns for Valeant over time. The combination of healthy double-digit organic sales growth and falling acquisition-related cash restructuring expenditures drove a noticeable increase in excess cash generation, creating the capacity for the company’s transaction with Salix.

TransDigm Group – is a designer, producer and supplier of engineered aircraft components for use on commercial and military aircraft in service. TransDigm enjoyed a strong year, capped by the acquisition of Telair Cargo Group from AAR Corp. The company’s core commercial aftermarket business generated healthy double-digit organic sales growth, fueling the cash flow engine that has proven to be a valuable shareholder wealth creator over time. The Telair deal looks tailor made for TransDigm, boasting a high percentage of proprietary, sole source aerospace components and systems with significant and reliable replacement demand.

Liberty Global – through its subsidiaries provides video, broadband internet, fixed-line telephone and mobile services across 14 countries. Liberty Global announced solid operational results in the Big 5 geographies: UK, Germany, Switzerland, Belgium and The Netherlands; and successfully closed the acquisition of their largest cable competitor in Holland, Ziggo. Additionally, Virgin Media in the UK (a subsidiary of Liberty Global as of June 2013) announced “Project Lightning.” Virgin intends to invest 3 billion pounds to connect four million additional homes to its network resulting in broadband speeds substantially faster than telco-based competitors. We believe the project represents a very good use of capital and should generate attractive future returns.

New Positions This Quarter

No new long positions were added in the first quarter of 2015.

Top Quarterly Detractors

Cumulus Media – is a radio broadcasting company. Cumulus reported lower than expected revenue and earnings, as political advertising revenues were weaker than the company’s expectation. Sales of non-core real estate appear to be taking longer to close than anticipated, though the company believes they remain on track. Furthermore, Cumulus declined to offer first quarter 2015 guidance, adding additional uncertainty to the mix.

Berkshire Hathaway – is a conglomerate holding company owning subsidiaries engaged in a number of business activities. Troubles at Berkshire’s BNSF Railroad subsidiary which has been plagued with congestion, confusion and delay caused some disappointment despite continued strong results in Berkshire’s Insurance units. BNSF is spending aggressively to fix its problems and remains a premier railroad in an excellent industry.

Top Fiscal Year Detractors

Cumulus Media – In addition to the political advertising challenges, Cumulus has seen declining ratings in four of its larger markets as these stations undergo generational transitions in on air talent. Such transitions are inevitable and management has successfully handled such changes in the past. Additionally, as advertisers have flocked toward digital and online platforms, investors fear that radio will disproportionately lose wallet share. Overall listening hours, however, have remained stable and we believe radio will continue to be a cost effective advertising medium, particularly for local businesses.

Avon Products – is a manufacturer and marketer of beauty and related products. Last year, investors became quite concerned by worse-than-expected results in the company’s North American business as well as missteps in Brazil, which is Avon’s top market. Later in the year Avon demonstrated some progress in its long turnaround, but worries over the transactional impact of the rapid rise of the U.S. dollar against the Brazilian Real and the Russian Ruble erased the positives from the operational improvement.

Range Resources – is a Texas-based independent natural gas, natural liquids, and oil company engaged in the exploration, development and acquisition of primarily gas properties. Falling domestic natural gas and natural gas liquids (NGL) prices in addition to regional oversupply in the northeast portion of the United States continue to be stiff headwinds for Range Resources in the near term. Absent a demand shock from a worsening U.S. economy, we expect the present supply/demand imbalance will work itself out over the next 18-24 months. In the interim, we believe Range will continue to grow per share production and reserves in a highly capital efficient manner.

Positions Eliminated This Quarter

Allison Transmission – We sold Allison at a gain as we were not able to build a meaningful position during October’s decline, and the stock rebounded quickly.

Motorola Solutions – We sold our modest holdings in Motorola Solutions as portfolio manager conviction was not strong enough to build a core position.

These performance numbers reflect the deduction of the Fund’s Investor and Institutional Class’ annual operating expenses which as stated in its most recent prospectus are 1.86% and 1.45%, respectively, of each Class’ net assets. The returns assume redemption at the end of each period and reinvestment of dividends. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses. This information represents past performance and past performance does not guarantee future results. The investment return and the principal value of an investment in this Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained at www.weitzinvestments.com/funds_and_performance/fund_performance.fs.

See page 6 for additional performance disclosures. See page 74 for a description of all indices.

Performance information does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

14 | Q1 2015 ANNUAL REPORT

WEITZINVESTMENTS.COM

| Returns | | | | | | | | | | | | | | | | | | | | | |

| | | Annualized | | | | | | |

| | | Since Inception | | | | | | | | | | | | | | | | | | |

| | | (6/1/1983) | | 20-year | | 10-year | | 5-year | | 3-year | | 1-year | | Quarter |

| WPOIX - Investor Class | | | 13.36 | % | | | 13.57 | % | | | 8.65 | % | | | 14.40 | % | | | 14.59 | % | | | 7.38 | % | | | 4.26 | % |

| WPOPX - Institutional Class | | | 13.40 | | | | 13.63 | | | | 8.76 | | | | 14.64 | | | | 14.90 | | | | 7.76 | | | | 4.34 | |

| S&P 500 | | | 11.02 | | | | 9.39 | | | | 8.01 | | | | 14.47 | | | | 16.11 | | | | 12.73 | | | | 0.95 | |

| Russell 3000 | | | 10.84 | | | | 9.58 | | | | 8.38 | | | | 14.71 | | | | 16.43 | | | | 12.37 | | | | 1.80 | |

| Russell 3000 Value | | | 11.40 | | | | 10.01 | | | | 7.24 | | | | 13.66 | | | | 16.30 | | | | 8.94 | | | | (0.51 | ) |

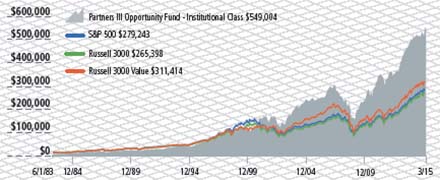

Growth of $10,000

This chart depicts the change in the value of a $10,000 investment in the Partners III Opportunity Fund - Institutional Class for the period since inception (6/1/83) through March 31, 2015, as compared with the growth of the Standard & Poor’s 500, Russell 3000 and Russell 3000 Value Indices during the same period. Index performance is hypothetical and is shown for illustrative purposes only.

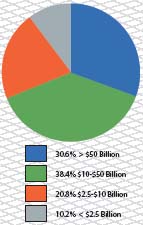

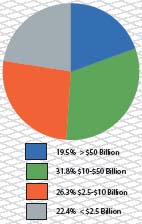

Capitalization

Top 10 Stock Holdings

| | % of Net Assets |

| Berkshire Hathaway, Inc. - Class B | | 7.6 | |

| Liberty Global plc - Series C | | 6.9 | |

| TransDigm Group, Inc. | | 5.0 | |

| Liberty Media Corp. - Series C | | 4.9 | |

| Valeant Pharmaceuticals International, Inc. | | 4.6 | |

| Liberty Interactive Corp. - Series A | | 3.6 | |

| Liberty Broadband Corp. - Series C | | 3.6 | |

| Wells Fargo & Co. | | 3.5 | |

| Wesco Aircraft Holdings, Inc. | | 3.3 | |

| Martin Marietta Materials, Inc. | | 3.0 | |

| | | 46.0 | |

Industry Breakdown

| | % of Net Assets |

| Consumer Discretionary | | 36.3 | |

| Financials | | 13.9 | |

| Industrials | | 13.0 | |

| Health Care | | 11.0 | |

| Information Technology | | 8.1 | |

| Energy | | 5.4 | |

| Materials | | 3.0 | |

| Consumer Staples | | 2.4 | |

| Securities Sold Short | | (25.3 | ) |

| Short Proceeds/Other | | 32.2 | |

| | | 100.0 | |

Top Performers

| | | | | | Average | | | | |

| Security Name | | Return | | | Weight | | | Contribution | |

| Valeant Pharmaceuticals International, Inc. | | | 38.8 | % | | | 5.0 | % | | | 1.74 | % |

| Martin Marietta Materials, Inc. | | | 27.1 | | | | 2.7 | | | | 0.67 | |

| Interval Leisure Group, Inc. | | | 26.0 | | | | 2.5 | | | | 0.61 | |

| TransDigm Group, Inc. | | | 11.4 | | | | 4.8 | | | | 0.54 | |

| Laboratory Corp. of America Holdings | | | 16.9 | | | | 2.5 | | | | 0.47 | |

Bottom Performers

| | | | | | Average | | | | |

| Security Name | | Return | | | Weight | | | Contribution | |

| Cumulus Media, Inc. - Class A | | | (41.6 | )% | | | 0.8 | % | | | (0.37 | )% |

| Avon Products, Inc. | | | (14.3 | ) | | | 2.3 | | | | (0.30 | ) |

| Berkshire Hathaway, Inc. - Class B | | | (3.9 | ) | | | 7.7 | | | | (0.30 | ) |

| Discovery Communications, Inc. - Class C | | | (12.6 | ) | | | 2.4 | | | | (0.30 | ) |

| Ishares Russell 2000 Fund (short) | | | 4.2 | | | | (6.7 | ) | | | (0.28 | ) |

Contributions to Fund performance are based on actual daily holdings. Securities may have been bought or sold during the quarter. Source: FactSet Portfolio Analytics

Return shown is the actual quarterly return of the security.

15 | Q1 2015 ANNUAL REPORT | UNAUDITED

RESEARCH FUND

Investment Style: Multi-Cap Value

Co-Portfolio Managers: Jon Baker, CFA; Barton Hooper, CFA; Dave Perkins, CFA; & Drew Weitz

Top Quarterly Contributors

Catamaran Corporation – is a provider of pharmacy benefit management services and healthcare IT solutions to the healthcare benefit management industry. On March 30th, UnitedHealth Group announced a definitive agreement to purchase Catamaran for $61.50 per share in cash. While we find the Catamaran board’s timing interesting in light of the company’s future growth opportunities, the price is consistent with our valuation work.

ADT Corporation – is engaged in providing monitored security, interactive home and business automation and related monitoring services in the United States and Canada. Management’s efforts to reduce overall costs and improve the quality of their new subscriber base, combined with improving customer attrition metrics, have driven better results at ADT, suggesting their business is more durable than skeptics believed. Furthermore, observers have begun to speculate how ADT could partner with other technology companies that feature DIY (Do-It-Yourself) home automation products to drive incremental business opportunities.

Top Fiscal Year Contributors

XO Group – is a life stage media company. It serves its audience with information, products, and services during critical life stages: planning a wedding, sharing life as a couple for the first time, and planning for the birth of a first child. In early 2014 new management announced a period of heightened infrastructure investment. Since then, management has clearly articulated the company’s intended path and investors have shown confidence in their plan.

ADT Corporation – After reporting disappointing earnings for the quarter ended December 31, 2013 (in January 2014) results have slowly but steadily improved as management’s actions to improve the quality of its new customers and lower overall costs have gained traction.

Valeant Pharmaceuticals International – is a specialty pharmaceutical and medical device company that develops, manufactures, and markets a range of generic and branded generic pharmaceuticals, over-the-counter products and medical devices. During an eventful fiscal year, Valeant’s strong underlying business performance carried the day as the company battled Allergan’s aggressive negative public relations campaign. Valeant’s dermatology business performed well ahead of our expectations, driven by broad-based strength across its portfolio as well as the successful launch of fungal treatment Jublia. In February, Valeant announced a definitive agreement to acquire Salix Pharmaceuticals for slightly over $15 billion. We anticipate Salix earning attractive high teens returns for Valeant over time. The combination of healthy double-digit organic sales growth and falling acquisition-related cash restructuring expenditures drove a noticeable increase in excess cash generation, creating the capacity for the company’s aforementioned transaction with Salix.

New Positions This Quarter

Swatch Group – Swatch Group AG manufactures and sells finished watches, jewelry, watch movements and components. As fear over the dominance of the Apple Watch mounts, Swatch’s stock price has declined. We believe these fears are overdone. Despite current economic slowdowns in China and the Middle East we believe these markets will provide continued growth opportunities for Swatch’s luxury watches over the longer term.

Discovery Communications – is a world-class provider of non-fiction, global pay-tv programming. Non-fiction content is a wonderful business. It is cheap to produce and portable across geographies positioned to benefit from the long-tailed wave of increasing pay-tv adoption outside the U.S. The company generally owns the full rights to its content, providing bargaining power as the distribution ecosystem evolves. From today’s prices, we think the stock’s return potential is adequate-to-exceptional with solid downside protection.

Core Laboratories – is a service provider to the oil and gas industry that helps producers identify resource potential and enhance production of existing reservoirs. Core Labs is a business of the highest quality regardless of industry. While its business will suffer as a result of the fall in oil prices, Core’s wide moat will continue to exist.

Top Quarterly Detractors

Twenty-First Century Fox – is a diversified media and entertainment company. Shares declined during the first quarter as management reduced 2016 earnings guidance. Reported ratings across the industry have been consistently negative as viewers transition to additional, unmeasured distribution methods and alternative content. Furthermore, Fox’s international channel is pressured on a reporting basis by headwinds from the strengthening of the U.S. dollar. We added to our position as the stock price declined.

MRC Global – along with its subsidiaries is an industrial distributor of pipe, valves and fittings and related products and services to the upstream, midstream and downstream energy industries. Global energy-related spending has fallen at an unprecedented rate during the first three months of 2015. We did not anticipate the depth of the present decline, nor the speed with which North American producers in particular would respond. As such, we were too early in buying MRC Global shares during the fourth quarter. At its present price, however, we believe MRC offers patient owners the potential for compelling returns over our three to five year investment horizon.

Top Fiscal Year Detractors

Angie’s List – operates a national local services consumer review service and marketplace. Angie’s List’s shares kept on a downward track for much of the past year as the lack of current earnings has increasingly tested investors’ resolve. Management has continued to focus on the acquisition of new consumer and corporate relationships. We continue to see a path to sustainably higher margins and positive reported earnings as a result.

Avon Products – is a manufacturer and marketer of beauty and related products. Last year, investors became quite concerned by worse-than-expected results in the company’s North American business as well as missteps in Brazil, which is Avon’s top market. Later in the year Avon demonstrated some progress in its long turnaround, but worries over the transactional impact of the rapid rise of the U.S. dollar against the Brazilian Real and the Russian Ruble erased the positives from the operational improvement.

MRC Global – This quarter’s performance was significant, as described above, and therefore detracted from the fiscal year returns.

Positions Eliminated This Quarter

World Fuel Services – We closed the position to focus on names with greater discounts between stock price and our estimate of intrinsic value.

Disney – We closed the position as the stock price exceeded our estimate of intrinsic value.

eBay – We closed the position for a modest gain and focused on names with greater discounts between stock price and our estimate of intrinsic value.

Oracle – We closed the position as the stock price approached our estimate of intrinsic value.

Omnicom – We closed the position as the stock price approached our estimate of intrinsic value.

DIRECTV – We have trimmed our DIRECTV position several times since the acquisition by AT&T was announced last May. We sold our remaining shares as the stock price approached our estimate of business value.

Annual operating expenses for the Fund as stated in its most recent prospectus are 1.59% (gross) and 0.91% (net) of the Fund’s net assets. The returns assume redemption at the end of each period and reinvestment of dividends. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses. Starting January 1, 2011, these performance numbers reflect the deduction of the Fund’s actual operating expenses. For periods of time prior to January 1, 2011, the performance numbers reflect the deduction of annual pro forma operating expenses of 1.50%. This information represents past performance and past performance does not guarantee future results. The investment return and the principal value of an investment in this Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained at www.weitzinvestments.com/funds_and_performance/fund_performance.fs.

See page 6 for additional performance disclosures. See page 74 for a description of all indices.

Performance information does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

16 | Q1 2015 ANNUAL REPORT

WEITZINVESTMENTS.COM

| Returns | | | | | | | | | | | | | | | |

| | | Annualized | | | | | | |

| | | Since Inception | | | | | | | | | | | | |

| | | (4/1/2005) | | 5-year | | 3-year | | 1-year | | Quarter |

| WRESX | | | 8.86 | % | | | 14.17 | % | | | 13.39 | % | | | 12.22 | % | | | 3.30 | % |

| S&P 500 | | | 8.01 | | | | 14.47 | | | | 16.11 | | | | 12.73 | | | | 0.95 | |

| Russell 3000 | | | 8.37 | | | | 14.71 | | | | 16.43 | | | | 12.37 | | | | 1.80 | |

| Russell 3000 Value | | | 7.23 | | | | 13.66 | | | | 16.30 | | | | 8.94 | | | | (0.51 | ) |

Growth of $10,000

This chart depicts the change in the value of a $10,000 investment in the Research Fund for the period since inception (4/1/05) through March 31, 2015, as compared with the growth of the Standard & Poor’s 500, Russell 3000 and Russell 3000 Value Indices during the same period. Index performance is hypothetical and is shown for illustrative purposes only.

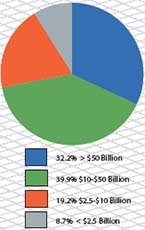

Capitalization

Top 10 Stock Holdings

| | % of Net Assets |

| Range Resources Corp. | | 7.0 | |

| Catamaran Corp. | | 6.4 | |

| Liberty Global plc - Series C | | 6.2 | |

| Angie’s List, Inc. | | 5.7 | |

| The ADT Corp. | | 4.5 | |

| Liberty Interactive Corp. - Series A | | 4.3 | |

| National CineMedia, Inc. | | 3.9 | |

| Valeant Pharmaceuticals International, Inc. | | 3.8 | |

| Liberty Media Corp. - Series C | | 3.7 | |

| MRC Global Inc. | | 3.0 | |

| | | 48.5 | |