THE WEITZ PHILOSOPHY

Value investing the Weitz Way.

There are no shortcuts in value investing. At Weitz, we dig. And dig some more. We look at hundreds of investment ideas. Our goal: find strong, well-managed but undervalued companies and bonds that offer reasonable risk-adjusted returns. It's no easy task. We do the due diligence. Analyze. Ask tough questions and get the answers. We wait for the right opportunity. Then and only then do we invest your money. Welcome to the Weitz Way.

We're in it with you:

Our employees have the majority of their investable assets in our mutual funds. This alignment of goals allows us to guarantee that we're treating clients' money as if it were our own.

We focus on what we know:

Each of our analysts is a generalist with ever-growing, defined circles of competence. They can spot opportunities anywhere and bring them to the team for consideration.

We think for ourselves:

Our philosophy of independent thinking and high-conviction portfolios enables us to take advantage of value-priced equities and bonds that offer reasonable risk-adjusted returns.

Today we are responsible for over $4 billion in investments for our shareholders – individuals, corporations, pension plans, foundations and endowments. And our commitment remains the same: to put our clients first. Always. We do so through our expertise, our flexibility, and our drive to uncover investments that can help them preserve and grow wealth.

Wally Weitz, CFA

President, Portfolio Manager

2 | Q1 2017 ANNUAL REPORT

WEITZINVESTMENTS.COM

TABLE OF CONTENTS

| Value Matters | 4 |

| | |

| Performance Summary | 7 |

| | |

| Analyst Corner | 8 |

| | |

| Value Fund | 10 |

| | |

| Partners Value Fund | 12 |

| | |

| Partners III Opportunity Fund | 14 |

| | |

| Research Fund | 16 |

| | |

| Hickory Fund | 18 |

| | |

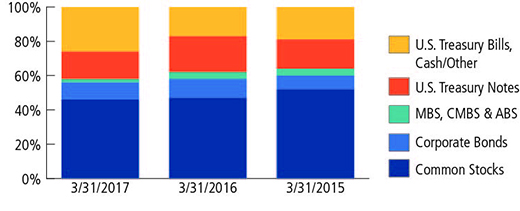

| Balanced Fund | 20 |

| | |

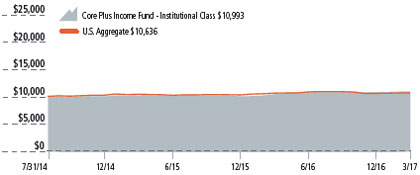

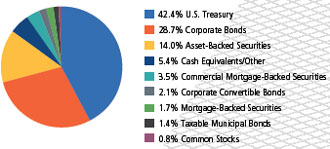

| Core Plus Income Fund | 22 |

| | |

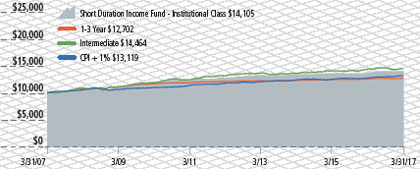

| Short Duration Income Fund | 25 |

| | |

| Ultra Short Government Fund | 28 |

| | |

| Nebraska Tax-Free Income Fund | 29 |

| | |

| Schedule of Investments | 31 |

| | |

| Financial Statements | 46 |

| | |

| Notes to Financial Statements | 56 |

| | |

| Report of Independent Registered Public Accounting Firm | 66 |

| | |

| Actual and Hypothetical Expenses for Comparison Purposes | 68 |

| | |

| Other Information | 69 |

| | |

| Information About the Trustees and Officers | 70 |

| | |

| Index Descriptions | 74 |

| The management of Weitz Funds has chosen paper for the 76 page report from a paper manufacturer certified under the Sustainable Forestry Initiative ® standard. | |

Portfolio composition is subject to change at any time and references to specific securities, industries, and sectors referenced in this report are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. See the Schedules of Investments included in this report for the percent of assets in each of the Funds invested in particular industries or sectors.

3 | Q1 2017 ANNUAL REPORT

VALUE MATTERS

April 3, 2017

Dear Fellow Investor:

News in the first quarter of 2017 was dominated by the initial activities of the new administration. Since the election in November, investors have been anticipating tax cuts, repatriation of stranded corporate profits, the announcement of massive infrastructure spending projects, and the dismantling of troublesome and expensive environmental and financial service regulations. The "Trump Bump" has propelled stocks higher, and our portfolios have participated.

As the quarter ended, however, a heated showdown between the newcomers and the DC establishment ended with a failure to "repeal and replace" Obamacare. Confidence was further shaken by foreign policy miscues and a widening investigation of Russian meddling in the U.S. election. Parts of the president's agenda will undoubtedly be enacted, but for now, confusion reigns.

Nevertheless, it was a good quarter for our funds. The five stock funds performed well. Our fixed income funds earned positive returns in a turbulent bond market. Core Plus is approaching its third anniversary and maintains its strong performance. Balanced Fund also turned in a strong quarter and continues to be a good alternative for individuals and institutions who want to delegate the stock/bond allocation decision.

The table following this letter shows performance of our funds over various measuring periods since our founding in 1983. We remind investors that we believe the longer measuring periods are more meaningful.

Valuation—the Gravitational Force

In our last letter, we showed a graph of aggregate U.S. stock market value as a percentage of GDP. This ratio offers a very rough proxy for stock valuation levels. At year end, the ratio was near the high end of its historical range, and after a strong first quarter, it is even higher. This does not mean that stock prices must go down tomorrow—as we said, this indicator is a very blunt instrument for making market timing decisions. Nevertheless, knowing that stocks are expensive on a historical basis gives us some perspective on the attractiveness of available opportunities.

Our investment philosophy is based on the idea that a company's business value "reality" is measurable and evolves gradually (hopefully upward) over time, while its stock price may fluctuate widely based on investors' hopes and fears about the future. We believe that in recent years, money creation by the Fed and extremely low interest rates have fostered excess investor enthusiasm. Hence the relatively high level of stock prices.

We like to buy stocks at 60-70% of our estimate of business value, but in today's market, our portfolios are closer to full value in the mid-80% range. We believe that a company's business value exerts a "gravitational pull" on its stock price, so when stocks are expensive, we tend to invest more defensively and hold cash reserves.

Our investment team of ten analysts and portfolio managers continues to read, travel and "kick tires" in search of new investment ideas. Even in a generally expensive market, there are always individual companies undergoing business and/or price changes that offer us opportunity. In the meantime, we will be patient and disciplined about deploying your (along with our) capital.

Indexing—Active vs. Passive InvestingOver the past few years, the financial press has been obsessed with the relative merits of active vs. passive investing. As a result, we have been receiving lots of questions about indexing and ETFs (exchange traded funds). So, in this letter we will address some of the pros and cons of passive investing.

To simplify, an active stock fund manager is trying to beat a market index (e.g., S&P 500), while a passive investor is trying to match the index returns. Actively managed funds generally have higher expense ratios than index funds or ETF's, so mathematically, to the extent active and passive managers both, as groups, produce average results, the passive group will outperform the active group over time by the amount of the expense differential. In an extended period of steadily rising stock prices, where cash holdings penalize active managers, index funds and index ETFs tend to show good relative performance and attract investors.

Index funds can be part of a sensible solution for the individual or institutional investor who is not willing or able to select securities or fund managers on their own. Warren Buffett, one of the greatest active managers of all time, has endorsed the S&P 500 index fund as a good alternative to hiring active managers to try to beat the index. In addition to expense savings, buying and holding any fund eliminates the likelihood of reducing returns by "chasing performance." Studies of mutual fund investors consistently show that the tendency to sell last year's "loser" to buy last year's "winner" can seriously detract from long-term results.

As active managers, we acknowledge the paradox of asking our clients to believe we can remain among the minority of managers who have beaten the S&P 500 over the past 30+ year period. In The Super Investors of Graham and Doddsville (available online—15 pages and we highly recommend it), Warren Buffett

4 | Q1 2017 ANNUAL REPORT

WEITZINVESTMENTS.COM

wrote about a group of professional investors who consistently beat the market. Their portfolios were very different from each other, but the common denominator among the group was that each had studied with, or had been heavily influenced by, Benjamin Graham. The idea that a patient investor could do well by buying shares of a business at a significant discount to its value ("margin of safety") to a long-term owner was the basis of their success. We do not claim to belong in the pantheon that Warren wrote about, but the common sense application of Graham's method has served us well for a long time.

As long as human nature does not change, we believe that there will always be opportunities for value investors to buy mispriced securities.

Indexing—Other Observations

In thinking about index funds and ETFs, there are a number of considerations that receive less coverage in the press:

| | | |

| | (1) | The discussion of index funds above focuses on broadly diversified indices, such as the S&P 500, and anticipates that an investor would hold the fund for a period of years. There are sector ETFs that contain a narrowly defined "basket" of stocks from one industry, such as banking, biotech, airlines, home building, etc. Trading among sector ETFs, or even trading in and out of a broader index, is not "passive" investing. It involves active investment decision-making. That is not good or bad, per se, but it is not the subject at hand; |

| | | |

| | (2) | To state the obvious, "matching" the index means losing money when the index goes down. A few years ago, the director of research for a large investment firm charged with creating active and passive fund models for his clients lamented to us, "Investors were surprised to find that in the 2008-09 bear market, indexing didn't protect them on the downside." Amazing. |

| | | |

| | (3) | The construction of stock index funds and ETFs can also create unintended consequences. The fund is a basket of stocks, and investor capital is allocated among the component securities in a fixed proportion (usually based on the relative market capitalizations of the component stocks). When new funds arrive to be invested, shares of each stock are purchased in those proportions. So the largest companies receive the lion's share of new money, making their market caps even larger. This structural phenomenon caused extreme distortions during the tech stock bubble, which ended in 2000. When mechanical buying and selling exacerbates mispricing of stocks, opportunities are created for active investors. |

| | | |

| | (4) | Another structural quirk of index funds or ETFs is that when investor buy or sell orders come to the fund sponsor, it must buy or sell shares of the component companies that day. The parties on the other sides of those trades can "see them coming" and may take advantage of the fund. In less liquid markets, the fund may get poor executions of their trades. This is not good for the index investor but can create opportunities for the active manager. |

Index funds are an important part of the investment landscape. They can be useful to investors who understand their virtues and limitations. Nevertheless, we believe there is a case to be made for active management, and we intend to continue to do our best to add some extra value to our clients' long term investment results.

Outlook

These are not normal times (!). The stock market has moved in one direction for the last eight years, with barely a 10% correction. Going forward, we expect more volatility and a market that makes meaningful moves in both directions. This should create buying opportunities for us, but we will be guided by valuation, not news headlines. We appreciate the patience our investors have shown over the past couple of years, and we look forward to rewarding that patience.

Sincerely,

| |

| | |

| Wally Weitz | Brad Hinton |

| wally@weitzinvestments.com | brad@weitzinvestments.com |

Included above is a reference to the term "margin of safety". This term refers to purchasing securities at a price that is less than our estimate of intrinsic value. A potential "margin of safety" may limit downside risk and optimize the potential for growth.

5 | Q1 2017 ANNUAL REPORT

DISCLOSURES

These performance numbers reflect the deduction of annual operating expenses which as stated in the most recent prospectus, and expressed as a percentage of each Fund's or Class's net assets, are: Value – Investor Class, 1.23%; Value – Institutional Class, 1.08% (gross); Partners Value – Investor Class, 1.26%; Partners Value – Institutional Class, 1.07% (gross); Partners III Opportunity – Investor Class, 2.33%; Partners III Opportunity – Institutional Class – 1.95%; Research, 1.64% (gross); Hickory, 1.24%; Balanced, 1.11%; Core Plus Income – Investor Class, 2.36% (gross); Core Plus Income – Institutional Class, 1.38% (gross); Short Duration Income – Investor Class, 0.92% (gross); Short Duration Income – Institutional Class, 0.63%; Ultra Short Government, 0.60% (gross); and Nebraska Tax-Free Income, 0.78%. The returns assume reinvestment of dividends and redemption at the end of each period. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waivers and/or reimbursements. Past performance does not guarantee future results. The investment return and the principal value of an investment in any of the Funds will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end may be obtained at www.weitzinvestments.com/ funds_and_performance/fund_performance.fs. Index performance is hypothetical and is shown for illustrative purposes only. See page 74 for a description of all indices.

(a) On the last business day of 1993, 2005, 2006 and 2010, the Partners Value, Partners III Opportunity, Nebraska Tax-Free Income and Research Funds (the "Funds") succeeded to substantially all of the assets of Weitz Partners II Limited Partnership, Weitz Partners III Limited Partnership, Weitz Income Partners Limited Partnership and Weitz Research Fund L.P. (the"Partnerships"), respectively. The investment objectives, policies and restrictions of the Funds are materially equivalent to those of their respective Partnership and the Partnerships were managed at all times with full investment authority by the investment adviser. The performance information includes performance for the Partnerships. The Partnerships were not registered under the Investment Company Act of 1940 and, therefore, were not subject to certain investment or other restrictions or requirements imposed by the 1940 Act or the Internal Revenue Code. If the Partnerships had been registered under the 1940 Act, the Partnerships' performance might have been adversely affected.

(b) Institutional Class shares of the Value and Partners Value Funds became available for sale on July 31, 2014. For performance prior to that date, these tables include the actual performance of each Fund's Investor Class (and use the actual expenses of each Fund's Investor Class) without adjustment. For any such period of time, the performance of each Fund's Institutional Class would have been similar to the performance of each Fund's Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses. The investment adviser has agreed in writing to limit the total annual fund operating expenses of the Investor and Institutional Class shares (excluding taxes, interest, brokerage costs, acquired fund fees and expenses and extraordinary expenses) to 1.30% and 0.99%, respectively, of each Class's average daily net assets through July 31, 2017.

(c) Investor Class shares of the Partners III Opportunity and Short Duration Income Funds became available for sale on August 1, 2011. For performance prior to that date, these tables include the actual performance of each Fund's Institutional Class (and use the actual expenses of each Fund's Institutional Class) without adjustment. For any such period of time, the performance of each Fund's Investor Class would have been similar to the performance of each Fund's Institutional Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses. The investment adviser has agreed in writing to limit the total annual fund operating expenses of the Short Duration Income Fund's – Investor and Institutional Class shares (excluding taxes, interest, brokerage costs, acquired fund fees and expenses and extraordinary expenses) to 0.68% and 0.48%, respectively, of each Class's average daily net assets through July 31, 2018.

(d) Starting January 1, 2011, these tables reflect the deduction of the Research Fund's actual operating expenses. For periods of time prior to January 1, 2011, these tables reflect the deduction of annual pro forma operating expenses of 1.50%. Annual operating expenses for the Research Fund, as stated in the Research Fund's Prospectus, are 1.64% (gross) and 0.92% (net) of the Fund's net assets. The investment adviser has agreed, in writing, to limit the total annual fund operating expenses (excluding taxes, interest, brokerage costs, acquired fund fees and expenses and extraordinary expenses) to 0.90% of the Fund's average daily net assets through July 31, 2017.

(e) The investment adviser has agreed in writing to limit the total annual fund operating expenses of the Core Plus Income Fund's Investor and Institutional Class shares (excluding taxes, interest, brokerage costs, acquired fund fees and expenses and extraordinary expenses) to 0.60% and 0.40%, respectively, of each Class's average daily net assets through July 31, 2018.

(f) The Fund's past performance is not necessarily an indication of how the Fund will perform in the future. Effective December 16, 2016, the Fund revised its principal investment strategies and policies to permit the Fund to invest in a diversified portfolio of short-term debt securities and to have a fluctuating net asset value. Prior to December 16, 2016, the Fund operated as a "government money market fund" as defined under Rule 2a-7 of the Investment Company Act of 1940 and maintained a stable net asset value of $1.00 per share. The Fund's past performance reflects the Fund's prior principal investment strategies and policies. The investment adviser has agreed in writing to limit the total annual fund operating expenses of the Ultra Short Government Fund (excluding taxes, interest, brokerage costs, acquired fund fees and expenses and extraordinary expenses) to 0.20% of the Fund's average daily net assets through July 31, 2018.

(g) Since inception performance for the Russell 1000 Value, Bloomberg Barclays Intermediate U.S. Government/Credit and CPI +1% is from May 31, 1986; December 31, 1988; and December 31, 1988, respectively. The inception date of the Bloomberg Barclays U.S. Aggregate 1-3 Year and 5-Year Municipal Bond was December 31, 1992 and January 29, 1988, respectively.

6 | Q1 2017 ANNUAL REPORT

WEITZINVESTMENTS.COM

PERFORMANCE SUMMARY

| | | | | | | Annualized | | | | | |

| | | | | | | | | | | | | | | | | | | Since Invest- | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | ment Style | | | | | | | | | |

| | | | Inception | | Since | | | | | | | | | | | Inception | | | | | | | | | |

| Fund Name | | | Date | | Inception | | 30-year | | 20-year | | 10-year | | (6/30/08) | | 5-year | | 1-year | | Quarter |

Value(b) | | | 5/09/86 | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investor | | | | | | 10.18 | % | | 10.23 | % | | 8.90 | % | | 4.00 | % | | 8.41 | % | | 9.30 | % | | 9.81 | % | | 6.43 | % |

| Institutional | | | | | | 10.20 | | | 10.25 | | | 8.93 | | | 4.06 | | | 8.48 | | | 9.42 | | | 10.06 | | | 6.47 | |

| Russell 1000 | | | | | | 10.20 | | | 9.76 | | | 8.09 | | | 7.58 | | | 9.63 | | | 13.26 | | | 17.43 | | | 6.03 | |

Russell 1000 Value(g) | | | | | | 10.30 | | | 9.96 | | | 8.37 | | | 5.93 | | | 8.77 | | | 13.13 | | | 19.22 | | | 3.27 | |

Partners Value(a)(b) | | | 6/01/83 | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investor | | | | | | 11.94 | | | 10.70 | | | 9.54 | | | 5.12 | | | — | | | 9.09 | | | 11.06 | | | 6.37 | |

| Institutional | | | | | | 11.96 | | | 10.72 | | | 9.57 | | | 5.18 | | | — | | | 9.22 | | | 11.39 | | | 6.48 | |

| Partners III | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Opportunity(a)(c) | | | 6/01/83 | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investor | | | | | | 12.48 | | | 11.48 | | | 10.51 | | | 6.25 | | | — | | | 8.19 | | | 8.94 | | | 5.14 | |

| Institutional | | | | | | 12.54 | | | 11.55 | | | 10.62 | | | 6.46 | | | — | | | 8.57 | | | 9.52 | | | 5.24 | |

Research(a)(d) | | | 4/01/05 | | | 7.41 | | | — | | | — | | | 6.45 | | | — | | | 8.03 | | | 10.62 | | | 5.15 | |

| Russell 3000 | | | | | | — | | | 9.66 | | | 8.11 | | | 7.54 | | | — | | | 13.18 | | | 18.07 | | | 5.74 | |

| Russell 3000 Value | | | | | | — | | | 9.97 | | | 8.44 | | | 5.94 | | | — | | | 13.08 | | | 19.97 | | | 2.99 | |

| Hickory | | | 4/01/93 | | | 9.85 | | | — | | | 8.40 | | | 4.95 | | | 9.73 | | | 8.39 | | | 11.60 | | | 4.24 | |

| Russell 2500 | | | | | | 10.47 | | | — | | | 9.85 | | | 7.71 | | | 10.17 | | | 12.60 | | | 21.53 | | | 3.76 | |

| Russell 2500 Value | | | | | | 11.01 | | | — | | | 10.31 | | | 6.79 | | | 10.20 | | | 12.92 | | | 23.13 | | | 1.62 | |

| S&P 500 | | | | | | — | | | 9.65 | | | 7.86 | | | 7.51 | | | 9.61 | | | 13.30 | | | 17.17 | | | 6.07 | |

| Balanced | | | 10/01/03 | | | 5.36 | | | — | | | — | | | 4.11 | | | — | | | 5.75 | | | 6.32 | | | 3.89 | |

| Blended Index | | | | | | 6.94 | | | — | | | — | | | 6.30 | | | — | | | 8.74 | | | 10.25 | | | 3.94 | |

Core Plus Income(e) | | | 7/31/14 | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investor | | | | | | 3.41 | | | — | | | — | | | — | | | — | | | — | | | 4.41 | | | 0.99 | |

| Institutional | | | | | | 3.61 | | | — | | | — | | | — | | | — | | | — | | | 4.61 | | | 1.04 | |

| U.S. Aggregate Bond | | | | | | 2.34 | | | — | | | — | | | — | | | — | | | — | | | 0.44 | | | 0.82 | |

| Short Duration | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income(c) | | | 12/23/88 | | | | | | | | | | | | | | | | | | �� | | | | | | | |

| Investor | | | | | | 5.21 | | | — | | | 4.41 | | | 3.37 | | | — | | | 1.65 | | | 2.15 | | | 0.57 | |

| Institutional | | | | | | 5.26 | | | — | | | 4.47 | | | 3.50 | | | — | | | 1.86 | | | 2.38 | | | 0.62 | |

U.S. Aggregate 1-3 Year(g) | | | | | | — | | | — | | | 3.73 | | | 2.42 | | | — | | | 0.95 | | | 0.74 | | | 0.41 | |

Intermediate U.S. Govt/Credit(g) | | | | | | 5.86 | | | — | | | 4.87 | | | 3.76 | | | — | | | 1.88 | | | 0.42 | | | 0.78 | |

CPI + 1%(g) | | | | | | 3.55 | | | — | | | 3.15 | | | 2.75 | | | — | | | 2.24 | | | 3.41 | | | 1.23 | |

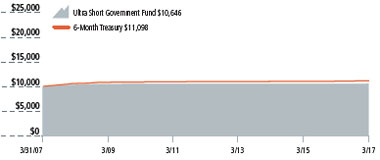

| Ultra Short | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Government(f) | | | 8/01/91 | | | 2.43 | | | — | | | 1.95 | | | 0.63 | | | — | | | 0.07 | | | 0.25 | | | 0.13 | |

| 6 Month Treasury | | | | | | 3.03 | | | — | | | 2.51 | | | 1.05 | | | — | | | 0.30 | | | 0.58 | | | 0.13 | |

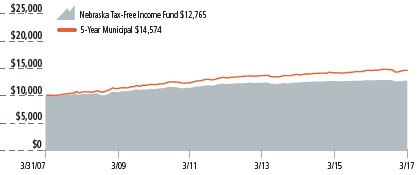

| Nebraska Tax-Free | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income(a) | | | 10/01/85 | | | 4.69 | | | — | | | 3.58 | | | 2.47 | | | — | | | 1.03 | | | (0.54 | ) | | 0.78 | |

5-Year Municipal Bond(g) | | | | | | — | | | — | | | 4.32 | | | 3.84 | | | — | | | 2.06 | | | 0.35 | | | 1.90 | |

7 | Q1 2017 ANNUAL REPORT

ANALYST CORNER

A Perspective on Dollar Tree, Inc.

By Dave Perkins, CFA

Dollar Tree operates a network of approximately 14,400 discount variety stores across the United States and Canada under the Dollar Tree, Dollar Tree Canada and Family Dollar brands. During the summer of 2015, Dollar Tree completed a transformational acquisition of competitor Family Dollar Stores for $8.8 billion and now operates under two distinct banners. The legacy Dollar Tree segment operates 6,400 stores, offering everyday basics, seasonal, closeout and promotional merchandise at a fixed $1 price point ($1.25 CAD in Canada). The Family Dollar segment operates approximately 8,000 general merchandise discount retail stores focused on providing customers basic necessities such as diapers, food and paper products as well as seasonal merchandise at prices between $1 and $10.

Value & Convenience

The dollar store model was born in the 1950s, targeting small ticket (typically less than $10), weekly "fill-in" visits between larger trips to the grocery store (and later, mass merchants like Wal-Mart). Small stores (6,000-10,000 square-feet) with a narrower selection of lower priced goods allowed dollar stores to operate economically in close proximity to customers. This combination of value and convenience resonated with lower- to middle-income American consumers, leading to a doubling in the number of dollar stores across the country since 2003. As their reach expanded, dollar stores generated sales comparable to that of grocers and mass merchants on the 7,000 items stocked, providing the opportunity to buy those same products at similar discounts. At the same time, low-cost, efficient store footprints allowed dollar stores to build local density, lowering logistics costs. As a result, dollar stores offer convenience at equal or lower prices versus their larger grocery and mass store competitors. They also match the relative ease of drug and convenience stores, but with 20-40% lower prices. These twin advantages have proven a durable niche, allowing dollar stores to generate consistent growth, attractive returns on capital and significant excess cash flow.

The Giving Tree

The legacy Dollar Tree banner is the last remaining true dollar store where every item is a dollar. Dollar Tree prides itself on being a 'variety store,' aiming to strike a balance between consumables such as food and toilet paper and more discretionary items such as toys, stationery, party supplies and holiday décor. Dollar Tree describes its core customer as "a woman on the go, with household income of $40,000+ balancing work, home and family". The Dollar Tree concept has proven effective in serving this core customer in communities of all sizes, with remarkably consistent and attractive financial results. Same-store sales have risen in 22 of the past 23 years with store payback periods between two and three years (pre-tax), among the most attractive in retail. Dollar Tree has intentionally shared a meaningful portion of these scale benefits with customers in the form of higher quantity and/or better quality for the customers' dollar. We believe the company should comfortably grow square footage at a 3-5% annual clip over the next 5-10 years, driving solid mid-single-digit profit growth.

Improving Family Dollar

For most of the past decade, Family Dollar's operating performance has lagged that of peers Dollar General and Dollar Tree. Much of that underperformance can be traced to two costly strategic errors. First, in response to burgeoning demand following the '08-09 financial crisis, the company embarked upon an aggressive multi-year store expansion plan by increasing density in existing markets and introducing new Family Dollar stores into middle and upper-middle class suburban markets. The expansion cannibalized its existing store base, raised costs and pressured margins. With same-store sales falling and store productivity declining, Family Dollar made its second mistake–abandoning its everyday low price (EDLP) model in favor of a 'high-low' promotional pricing strategy aimed at reigniting store traffic. Gross margins fell further, leading to unsustainable cost cuts including maintenance deferral and already thin in-store labor. Pressure to sell the company mounted, culminating in activist investor Carl Icahn purchasing a 10% stake in the company and demanding its sale.

Dollar Tree ultimately won the ensuing and well-chronicled battle for Family Dollar. A key question for Dollar Tree investors is whether the problems it inherited at Family Dollar are structural–a combination of a suboptimal real estate footprint, damaged brand and undifferentiated product offering–or the result of a series of strategic missteps that can be gradually undone. Answering this question is nuanced, but we believe Family Dollar should return to historical operating margin levels (roughly 8%) over the next several years under the Dollar Tree leadership team's care. Returning Family Dollar to an EDLP pricing model,

8 | Q1 2017 ANNUAL REPORT

WEITZINVESTMENTS.COM

improving its store merchandise (more private label and $1 price points) and in-stock levels, catching up on deferred maintenance, fixing in-store staffing levels and rebannering underperforming stores should lead to a gradual improvement in profitability. Longer-term, supply chain opportunities could result in Family Dollar closing the margin gap with consumable-heavy peer Dollar General.

Durable Retail?

Retailing is a notoriously difficult business. Creating lasting value requires continual reinvestment, extreme cost consciousness, painful evolution and competitive paranoia. We believe Dollar Tree demonstrates these traits. Discount retail is becoming more competitive with low-margin, hard discounters like Aldi expanding rapidly and Lidl planning a major push into the U.S. over the next five years. Amazon (which we also own in Value Fund and Research Fund) continues to invest significant sums into its already formidable fulfillment network, with an eye toward daily–even hourly–delivery. The combined Dollar Tree is unlikely to be entirely immune to competitive encroachment, but our working thesis is that the company's combination of convenience and low average ticket are underappreciated competitive weapons in serving the low- to middle-income U.S. consumer. In short, we continue to see Dollar Tree as one of the 'disruptors,' with an attractive runway of store growth and self-help opportunities at Family Dollar. We believe Dollar Tree's stock provides long-term investors with a healthy margin of safety in the low $70s. Our base case estimate of intrinsic value falls between $100 and $105 per share.

Included above is a reference to the term "margin of safety". This term refers to purchasing securities at a price that is less than our estimate of intrinsic value. A potential "margin of safety" may limit downside risk and optimize the potential for growth.

As of March 31, 2017: Dollar Tree, Inc. represented 1.6% and 2.0% of the Value and Research Funds' net assets, respectively. Dollar General Corp. represented 1.1% of the Research Fund's net assets. Amazon.com, Inc. represented 1.2% and 2.3% of the Value and Research Funds' net assets, respectively.

David Perkins, CFA®, joined Weitz Investment Management in 2004 as a research analyst and became co-manager of Value Fund in December 2011. Prior to his time with Weitz, Dave was an equity analyst at McCarthy Group Asset Management. Dave has a bachelor's degree in business systems from Taylor University in Upland, Indiana. He has been a CFA® charterholder since 2009.

9 | Q1 2017 ANNUAL REPORT

VALUE FUND

Investment Style: Large-Cap Value

Co-Portfolio Managers: Brad Hinton, CFA & Dave Perkins, CFA

Fiscal Year Contributors

Liberty Broadband's principal asset consists of its interest in Charter Communications. Shares of Charter, and cable companies broadly, have performed well in the wake of the U.S. election. Although much remains to be seen, investors generally believe that regulatory pressures will ease as a result of a presumably more "industry friendly" Federal Communications Commission (FCC) as well as a Justice Department that may look more favorably on further industry consolidation. We have invested in Liberty Broadband because we like the operating strategy at Charter, and while regulatory relief would certainly be a benefit, it's not an explicit part of our investment thesis. Liberty Broadband shares trade at a discount to their underlying Charter investment due to the added complexity of Liberty's involvement. We are confident Liberty Broadband's management will ultimately collapse this discount, thereby making Liberty Broadband a cheaper opportunity to invest in Charter's future.

Liberty SiriusXM is a tracking stock, with its principal asset being Liberty Media's 67% ownership of satellite radio operator SiriusXM. Thanks to the continued strength of new car sales in the U.S., SiriusXM has enjoyed very robust operating results in recent quarters, as 75% of all new cars sold feature a satellite radio built directly into the dashboard. New car buyers are offered a free trial of the service and typically convert to paying subscribers at a healthy rate. Recently, SiriusXM has opened a new channel for customer growth by partnering with used car dealers as well as service providers to offer trial subscriptions. Although we don't anticipate these trials will convert at the same rate as those associated with new car sales, we believe it provides an excellent opportunity to remarket to existing car radios as well as lessen the company's reliance on the cyclical new car market. Shares of Liberty SiriusXM mirrored most of SiriusXM stock price gain of the prior twelve months but still trades at a discount to our intrinsic value of standalone SiriusXM.

Berkshire Hathaway is a conglomerate holding company owning subsidiaries engaged in a number of business activities. Shares benefited from optimism that a combination of higher interest rates, lower taxes and increased domestic activity would increase earnings at Berkshire's insurance and industrial businesses. We believe Berkshire will compound wealth for its shareholders for the foreseeable future.

Quarterly Contributors

Liberty Broadband's principal asset consists of its interest in Charter Communications. In late January, rumors broke that Verizon Communications had made an informal acquisition offer to Charter Communications, sending both Charter and Liberty Broadband shares higher. We acknowledge that such a combination makes strategic sense for Verizon as it searches for an efficient means to deploy 5G wireless technology (which will require very dense, wired networks). However, we suspect shareholders can reap greater value from Charter continuing to integrate its Time Warner Cable and Bright House Networks acquisitions on a stand-alone basis. That said, we believe management will pursue the right course (stand-alone or M&A) that will maximize long-term shareholder value.

Liberty Global is the largest international cable company, with operations in 14 countries providing video, broadband Internet, fixed-line telephone and mobile services to its customers. Liberty Global's shares were strong in the first calendar quarter and made up some of the ground that had been lost during the prior year. The company's quarterly results were solid, but shares have likely been driven upward as speculation of deals in the media industry has heated up of late, including revived speculation of a potential Vodafone transaction. We view Liberty Global as a standalone provider of broadband and Pay-TV services as an attractive opportunity, and although a potential acquisition by Vodafone may create value for shareholders, our investment thesis is not dependent on such an event.

Allergan is a global specialty pharmaceutical company focusing on the development, manufacturing, marketing and distribution of brand name, biosimilar and over-the-counter pharmaceutical products. Allergan's stock rebounded as the company reported stronger-than-expected fourth quarter results following a string of disappointing quarters. The company's initial outlook for 2017 came in ahead of our forecasts, with strong growth across six of its seven therapeutic areas expected to result in high single-digit revenue growth and high teens adjusted cash earnings per share growth. Allergan closed its $2.9 billion acquisition of LifeCell in February and also announced an agreement to acquire body sculpting device manufacturer ZELTIQ Aesthetics for $2.5 billion. If ZELTIQ shareholders approve the merger, Allergan will add two durable assets to its aesthetics portfolio that together should generate roughly $1.0 billion in annual sales with attractive organic growth profiles. We continue to believe Allergan shares have attractive upside potential from current prices.

New Holdings

Dollar Tree

Fiscal Year Detractors

QVC Group is a tracking stock issued by Liberty Interactive which includes subsidiaries QVC, zulily and its interest in HSN. QVC Group operates an American television network and also operates televised and online shopping experiences in other countries. In the third calendar quarter of 2016, shares of QVC Group fell after management indicated that its QVC U.S. business had experienced a significant sales headwind. QVC's U.S. business, which had not seen a decline since the Great Recession, saw sales fall nearly 6% in the third quarter and 7% in the fourth quarter, as several categories simultaneously slowed. Importantly, we don't view these issues as a sign of the QVC model suddenly being broken, and management has indicated sales results have begun to stabilize. QVC's customer retention and loyalty remain strong, as does viewership of their network. Furthermore, the international businesses appear unaffected by the current U.S.-centric slowdown. Although the decline in QVC shares has been disappointing, management has taken advantage by accelerating their share repurchase to foster per share value growth.

Endo International is a specialty healthcare company engaged in developing, manufacturing, marketing and distributing branded pharmaceutical and generic products and medical devices. Endo experienced significantly worse-than-anticipated erosion at Qualitest, its legacy generic drug platform. The competitive environment changed quickly, and we were slow to recognize it. After conversations with both management and a couple of the larger drug buying consortiums, we could not gain comfort in the durability of Endo's now lower earnings base. The company's balance sheet and potential legal obligations (liabilities relating to the company's legacy vaginal mesh products) left less room for error given growth challenges on the branded side of Endo's business. Considering the erosion in our investment thesis, questions about management's ability to identify and navigate risk, and a growing list of unknowns surrounding the business, we elected to close our position in the second calendar quarter of 2016 and refocus our capital in more attractive opportunities.

Allergan is a global specialty pharmaceutical company focusing on the development, manufacturing, marketing and distribution of brand name, biosimilar and over-the-counter pharmaceutical products. Allergan shares finished 2016 on a higher note, following an otherwise challenging year. While revenues and earnings were shy of expectations and drug price regulation dominated headlines throughout much of the past year, the health of Allergan's core underlying growth drivers gave us confidence to continue buying shares at increasingly attractive discounts during the fourth calendar quarter. Encouragingly, recent operating results have come in ahead of internal forecasts, and the company's initial outlook for 2017 exceeded our expectations. Growth across Allergan's therapeutic segment looks healthy, with the global aesthetics franchise demonstrating notable strength. Headwinds from legislative and regulatory developments continue to bear monitoring, but from today's vantage point, we believe any impact to long-term business value should be manageable. We continue to believe Allergan shares have attractive upside potential from current prices.

Quarterly Detractors

Range Resources is an independent producer of natural gas and natural gas liquids (NGLs) based in Fort Worth, Texas, with operations in the Marcellus shale and emerging Terryville field. Range Resources stock weakened during the first quarter as mild winter weather once again put downward pressure on natural gas prices. The company's higher-than-projected 2017 drilling budget and 20% 2018 production growth target likely also raised fears that Range's balance sheet could once again deteriorate in the event of a prolonged downturn in gas prices. March supply/demand was kinder than January and February, however, leaving natural gas storage levels in better shape entering injection season than a year ago (approximately 20% lower). Longer-term demand fundamentals for gas remain attractive, and improving oil prices together with international transport capacity have provided a spark for natural gas liquids prices that should benefit Range's cash flow. We believe Range shares are undervalued, assuming mid-cycle natural gas prices of $2.75 or higher.

TransDigm Group is a designer, producer and supplier of engineered aircraft components for use on commercial and military aircraft. The prospect of rising interest rates and accusations of rigged/fake bids from a critical short report pressured TransDigm's stock during January. The company's levered balance sheet, while married with historically consistent cash flows, increases the company's sensitivity to potential declines in profitability. In his first several weeks in office, President Trump targeted the cost of specific programs at several of TransDigm's larger peers. While it remains to be seen what, if any, lasting impact this scrutiny will have on growth and cash flow, with TransDigm's shares close to our estimate of intrinsic value, we elected to close our position in the stock with a nice gain.

United Parcel Service (UPS) is a package delivery company and a provider of supply chain management solutions. Over the past several years, the growth of e-commerce has created challenges for UPS during its peak holiday shipping season. While the market can not quite decide whether the onslaught of less profitable residential delivery volume is beneficial, UPS has announced plans to significantly accelerate capital spending in anticipation of even more residential delivery volume. Investors' lack of faith in management's intended path led to this most recent sell off. We believe the company's efforts toward a more streamlined holiday shipping experience will bear fruit in time, and we expect the company's stock price will eventually reflect this stepped-up commitment to its customers.

Eliminated Holdings

Motorola Solutions and TransDigm Group

Please visit the Fund's commentary section on our website for additional information.

10 | Q1 2017 ANNUAL REPORT

WEITZINVESTMENTS.COM

Returns

| | | | Annualized | | | | | | | |

| | | | | | | | | | | | | Since Invest- | | | | | | | | | | | | |

| | | | Since | | | | | | | | ment Style | | | | | | | | | | | | |

| | | | Inception | | | | | | | | Inception | | | | | | | | | | | | |

| | | | (5/9/1986) | 20-year | | 10-year | | (6/30/08) | | 5-year | | 3-year | | 1-year | | Quarter |

| WVALX - Investor Class | | | 10.18 | % | | 8.90 | % | | 4.00 | % | | 8.41 | % | | 9.30 | % | | 3.62 | % | | 9.81 | % | | 6.43 | % |

| WVAIX - Institutional Class | | | 10.20 | | | 8.93 | | | 4.06 | | | 8.48 | | | 9.42 | | | 3.81 | | | 10.06 | | | 6.47 | |

| S&P 500 | | | 10.18 | | | 7.86 | | | 7.51 | | | 9.61 | | | 13.30 | | | 10.37 | | | 17.17 | | | 6.07 | |

| Russell 1000 | | | 10.20 | | | 8.09 | | | 7.58 | | | 9.63 | | | 13.26 | | | 9.99 | | | 17.43 | | | 6.03 | |

| Russell 1000 Value | | | 10.30 | * | | 8.37 | | | 5.93 | | | 8.77 | | | 13.13 | | | 8.67 | | | 19.22 | | | 3.27 | |

Growth of $10,000

This chart depicts the change in the value of a $10,000 investment in the Value Fund – Investor Class for the period since inception (5/9/86) through March 31, 2017, as compared with the growth of the Standard & Poor's 500, Russell 1000 and Russell 1000 Value Indices during the same period. Index performance is hypothetical and is shown for illustrative purposes only.

* Since 5/31/1986

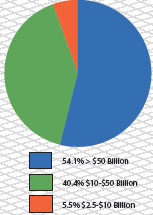

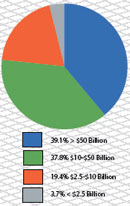

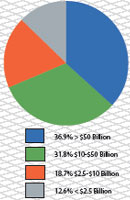

Capitalization

Top 10 Stock Holdings

| | % of Net Assets |

| Liberty Broadband Corp. - Series C | 7.5 | |

| Berkshire Hathaway Inc. - Class B | 7.2 | |

| Liberty Global Group - Class C | 5.8 | |

| Allergan plc | 5.4 | |

| Twenty-First Century Fox, Inc. - Class A | 4.0 | |

| Alphabet, Inc. - Class C | 3.9 | |

| Mastercard Inc. - Class A | 3.8 | |

| Laboratory Corp. of America Holdings | 3.7 | |

| QVC Group - Series A | 3.4 | |

| Oracle Corp. | 3.4 | |

| | 48.1 | |

Top Performers

| | | | | | Average | | | | |

| | | | Return | | | Weight | | | Contribution | |

| Liberty Broadband Corp. - Series C | | | 16.6 | % | | 7.2 | % | | 1.11 | % |

| Liberty Global Group - Class C | | | 18.0 | | | 5.6 | | | 0.91 | |

| Allergan plc | | | 14.1 | | | 5.3 | | | 0.75 | |

| Twenty-First Century Fox, Inc. - Class A | | | 16.2 | | | 4.0 | | | 0.69 | |

| Oracle Corp. | | | 16.5 | | | 3.1 | | | 0.48 | |

Industry Breakdown

| | % of Net Assets |

| Consumer Discretionary | 30.2 | |

| Information Technology | 15.5 | |

| Financials | 12.4 | |

| Health Care | 11.3 | |

| Materials | 5.0 | |

| Energy | 3.4 | |

| Consumer Staples | 2.6 | |

| Industrials | 1.9 | |

| Cash Equivalents/Other | 17.7 | |

| | 100.0 | |

Bottom Performers

| | | | | | | Average | | | | |

| | | | Return | | | Weight | | | Contribution | |

| Range Resources Corp. | | | (15.2 | )% | | 1.2 | % | | (0.20 | )% |

| TransDigm Group, Inc. | | | (11.6 | ) | | 0.4 | | | (0.17 | ) |

| United Parcel Service, Inc. - Class B | | | (5.7 | ) | | 1.9 | | | (0.11 | ) |

| Halliburton Co. | | | (8.7 | ) | | 0.8 | | | (0.07 | ) |

| QVC Group - Series A | | | 0.2 | | | 3.3 | | | 0.00 | |

Contributions to Fund performance are based on actual daily holdings. Securities may have been bought or sold during the quarter. Source: FactSet Portfolio Analytics Return shown is the actual quarterly return of the security or combination of share classes.

Returns assume reinvestment of dividends and redemption at the end of each period, and reflect the deduction of annual operating expenses which as stated in its most recent prospectus are 1.23% and 1.08% (gross) of the Fund's Investor and Institutional Class net assets, respectively. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waivers and/or reimbursements. Past performance does not guarantee future results. The investment return and the principal value of an investment in this Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end may be obtained at www.weitzinvestments.com/funds_and_performance/fund_ performance.fs.

See page 6 for additional performance disclosures. See page 74 for a description of all indices.

Performance information does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

11 | Q1 2017 ANNUAL REPORT

PARTNERS VALUE FUND

Investment Style: Multi-Cap Value

Co-Portfolio Managers: Wally Weitz, CFA & Brad Hinton, CFA

Liberty Broadband's principal asset consists of its interest in Charter Communications. Shares of Charter, and cable companies broadly, have performed well in the wake of the U.S. election. Although much remains to be seen, investors generally believe that regulatory pressures will ease as a result of a presumably more "industry friendly" Federal Communications Commission (FCC) as well as a Justice Department that may look more favorably on further industry consolidation. We have invested in Liberty Broadband because we like the operating strategy at Charter, and while regulatory relief would certainly be a benefit, it's not an explicit part of our investment thesis. Liberty Broadband shares trade at a discount to their underlying Charter investment due to the added complexity of Liberty's involvement. We are confident Liberty Broadband's management will ultimately collapse this discount, thereby making Liberty Broadband a cheaper opportunity to invest in Charter's future.

Berkshire Hathaway is a conglomerate holding company owning subsidiaries engaged in a number of business activities. Shares benefited from optimism that a combination of higher interest rates, lower taxes and increased domestic activity would increase earnings at Berkshire's insurance and industrial businesses. We believe Berkshire will compound wealth for its shareholders for the foreseeable future.

ILG, Inc. is a provider of non-traditional lodging, encompassing a portfolio of leisure businesses, from exchange and vacation rental to vacation ownership. A year ago, the stock price was suffering under the combined weight of both a general market swoon and a share overhang from ILG's imminent merger with Starwood's timeshare business. That merger ultimately put over half (70+ million shares) of this small-cap company's stock in the hands of large-cap hotel investors. One year later, the market has marched steadily higher, and the bulk of those shares have likely found homes in the portfolios of more appropriate investors. As such, the stock price has rebounded and reclaimed much of what it had lost in the year prior. We continue to like the prospects and valuation of the newly combined entity.

Liberty Broadband's principal asset consists of its interest in Charter Communications. In late January, rumors broke that Verizon Communications had made an informal acquisition offer to Charter Communications, sending both Charter and Liberty Broadband shares higher. We acknowledge that such a combination makes strategic sense for Verizon as it searches for an efficient means to deploy 5G wireless technology (which will require very dense, wired networks). However, we suspect shareholders can reap greater value from Charter continuing to integrate its Time Warner Cable and Bright House Networks acquisitions on a stand-alone basis. That said, we believe management will pursue the right course (stand-alone or M&A) that will maximize long-term shareholder value.

Liberty Global is the largest international cable company, with operations in 14 countries providing video, broadband Internet, fixed-line telephone and mobile services to its customers. Liberty Global's shares were strong in the first calendar quarter and made up some of the ground that had been lost during the prior year. The company's quarterly results were solid, but shares have likely been driven upward as speculation of deals in the media industry has heated up of late, including revived speculation of a potential Vodafone transaction. We view Liberty Global as a standalone provider of broadband and Pay-TV services as an attractive opportunity, and although a potential acquisition by Vodafone may create value for shareholders, our investment thesis is not dependent on such an event.

Allergan is a global specialty pharmaceutical company focusing on the development, manufacturing, marketing and distribution of brand name, biosimilar and over-the-counter pharmaceutical products. Allergan's stock rebounded as the company reported stronger-than-expected fourth quarter results following a string of disappointing quarters. The company's initial outlook for 2017 came in ahead of our forecasts, with strong growth across six of its seven therapeutic areas expected to result in high single-digit revenue growth and high teens adjusted cash earnings per share growth. Allergan closed its $2.9 billion acquisition of LifeCell in February and also announced an agreement to acquire body sculpting device manufacturer ZELTIQ Aesthetics for $2.5 billion. If ZELTIQ shareholders approve the merger, Allergan will add two durable assets to its aesthetics portfolio that together should generate roughly $1.0 billion in annual sales with attractive organic growth profiles. We continue to believe Allergan shares have attractive upside potential from current prices.

No new equity holdings were added in the first quarter 2017.

QVC Group is a tracking stock issued by Liberty Interactive which includes subsidiaries QVC, zulily and its interest in HSN. QVC Group operates an American television network and also operates televised and online shopping experiences in other countries. In the third calendar quarter of 2016, shares of QVC Group fell after management indicated that its QVC U.S. business had experienced a significant sales headwind. QVC's U.S. business, which had not seen a decline since the Great Recession, saw sales fall nearly 6% in the third quarter and 7% in the fourth quarter, as several categories simultaneously slowed. Importantly, we don't view these issues as a sign of the QVC model suddenly being broken, and management has indicated sales results have begun to stabilize. QVC's customer retention and loyalty remain strong, as does viewership of their network. Furthermore, the international businesses appear unaffected by the current U.S.-centric slowdown. Although the decline in QVC shares has been disappointing, management has taken advantage by accelerating their share repurchase to foster per share value growth.

Fossil Group is the fourth-largest producer of watches and the largest licenser of watches and jewelry globally. Fossil continues to experience the same headwinds from the previous year: weak foot traffic as consumers shift to e-commerce, revenue headwinds from a strong U.S. dollar, and a difficult wholesale channel environment that has been exacerbated by inventory de-stocking. Despite growth in Fossil Group's owned brands, Skagen and Fossil, weakness in the licensed brand portfolio, in particular Michael Kors, has weighed on watch sales. During the fourth calendar quarter earnings release, management guided 2017 earnings well below consensus expectations. In addition, management notified the market of another year of elevated investments in wearables and omni-channel initiatives as well as restructuring charges as Fossil reduces their store footprint. Fossil's wearable technology launches in fourth quarter were successful, but 2017 will be the first year the segment will be material to results as management expands SKU's (distinct types of items for sale) and extends to additional licensed brands.

Endo International is a specialty healthcare company engaged in developing, manufacturing, marketing and distributing branded pharmaceutical and generic products and medical devices. Endo experienced significantly worse-than-anticipated erosion at Qualitest, its legacy generic drug platform. The competitive environment changed quickly, and we were slow to recognize it. After conversations with both management and a couple of the larger drug buying consortiums, we could not gain comfort in the durability of Endo's now lower earnings base. The company's balance sheet and potential legal obligations (liabilities relating to the company's legacy vaginal mesh products) left less room for error given growth challenges on the branded side of Endo's business. Considering the erosion in our investment thesis, questions about management's ability to identify and navigate risk, and a growing list of unknowns surrounding the business, we elected to close our position in the second calendar quarter of 2016 and refocus our capital in more attractive opportunities.

Fossil Group - Please refer to the Fiscal Year synopsis.

Range Resources is an independent producer of natural gas and natural gas liquids (NGLs) based in Fort Worth, Texas, with operations in the Marcellus shale and emerging Terryville field. Range Resources stock weakened during the first quarter as mild winter weather once again put downward pressure on natural gas prices. The company's higher-than-projected 2017 drilling budget and 20% 2018 production growth target likely also raised fears that Range's balance sheet could once again deteriorate in the event of a prolonged downturn in gas prices. March supply/demand was kinder than January and February, however, leaving natural gas storage levels in better shape entering injection season than a year ago (approximately 20% lower). Longer-term demand fundamentals for gas remain attractive, and improving oil prices together with international transport capacity have provided a spark for natural gas liquids prices that should benefit Range's cash flow. We believe Range shares are undervalued, assuming mid-cycle natural gas prices of $2.75 or higher.

TransDigm Group is a designer, producer and supplier of engineered aircraft components for use on commercial and military aircraft. The prospect of rising interest rates and accusations of rigged/fake bids from a critical short report pressured TransDigm's stock during January. The company's levered balance sheet, while married with historically consistent cash flows, increases the company's sensitivity to potential declines in profitability. In his first several weeks in office, President Trump targeted the cost of specific programs at several of TransDigm's larger peers. While it remains to be seen what, if any, lasting impact this scrutiny will have on growth and cash flow, with TransDigm's shares close to our estimate of intrinsic value, we elected to close our position in the stock with a nice gain.

Avon Products, Fossil Group and TransDigm Group

Please visit the Fund's commentary section on our website for additional information.

12 | Q1 2017 ANNUAL REPORT

WEITZINVESTMENTS.COM

Returns

| | | | Annualized | | | | | | |

| | | | Since | | | | | | | | | | | | | | | | | | |

| | | | Inception | | | | | | | | | | | | | | | | | | |

| | | | (6/1/1983) | | 20-year | | 10-year | | 5-year | | 3-year | | 1-year | | Quarter |

| WPVLX - Investor Class | | | 11.94 | % | | 9.54 | % | | 5.12 | % | | 9.09 | % | | 2.66 | % | | 11.06 | % | | 6.37 | % |

| WPVIX - Institutional Class | | | 11.96 | | | 9.57 | | | 5.18 | | | 9.22 | | | 2.86 | | | 11.39 | | | 6.48 | |

| S&P 500 | | | 10.91 | | | 7.86 | | | 7.51 | | | 13.30 | | | 10.37 | | | 17.17 | | | 6.07 | |

| Russell 3000 | | | 10.70 | | | 8.11 | | | 7.54 | | | 13.18 | | | 9.76 | | | 18.07 | | | 5.74 | |

| Russell 3000 Value | | | 11.22 | | | 8.44 | | | 5.94 | | | 13.08 | | | 8.58 | | | 19.97 | | | 2.99 | |

Growth of $10,000

This chart depicts the change in the value of a $10,000 investment in the Partners Value Fund - Investor Class for the period since inception (6/1/83) through March 31, 2017, as compared with the growth of the Standard & Poor's 500, Russell 3000 and Russell 3000 Value Indices during the same period. Index performance is hypothetical and is shown for illustrative purposes only.

Capitalization

Top 10 Stock Holdings

| | % of Net Assets |

| Liberty Broadband Corp. - Series A & C | 8.3 | |

| Liberty Global Group - Class C | 7.4 | |

| Berkshire Hathaway Inc. - Class B | 7.1 | |

| Allergan plc | 5.2 | |

| Twenty-First Century Fox, Inc. - Class A | 4.4 | |

| Laboratory Corp. of America Holdings | 3.9 | |

| Visa Inc. - Class A | 3.5 | |

| Colfax Corp. | 3.2 | |

| QVC Group - Series A | 3.1 | |

| Redwood Trust, Inc. | 3.0 | |

| | 49.1 | |

Top Performers

| | | | | | | Average | | | | |

| | | | Return | | | Weight | | | Contribution | |

| Liberty Broadband Corp. - Series A & C | | | 17.0 | % | | 7.9 | % | | 1.23 | % |

| Liberty Global Group - Class C | | | 18.0 | | | 7.1 | | | 1.15 | |

| Allergan plc | | | 14.1 | | | 5.0 | | | 0.65 | |

| Twenty-First Century Fox, Inc. - Class A | | | 16.2 | | | 4.1 | | | 0.64 | |

| Liberty SiriusXM Group - Series A & C | | | 13.5 | | | 3.2 | | | 0.44 | |

Industry Breakdown

| | % of Net Assets |

| Consumer Discretionary | 32.6 | |

| Financials | 16.3 | |

| Information Technology | 15.5 | |

| Health Care | 9.1 | |

| Industrials | 5.2 | |

| Energy | 2.9 | |

| Cash Equivalents/Other | 18.4 | |

| | 100.0 | |

Bottom Performers

| | | | | | | Average | | | | |

| | | | Return | | | Weight | | | Contribution | |

| Fossil Group, Inc. | | | (32.5 | )% | | 1.0 | % | | (0.47 | )% |

| Range Resources Corp. | | | (15.2 | ) | | 1.8 | | | (0.27 | ) |

| TransDigm Group, Inc. | | | (11.6 | ) | | 0.5 | | | (0.22 | ) |

| Avon Products, Inc. | | | (12.7 | ) | | 0.8 | | | (0.17 | ) |

| QVC Group - Series A | | | 0.2 | | | 3.0 | | | 0.00 | |

Contributions to Fund performance are based on actual daily holdings. Securities may have been bought or sold during the quarter. Source: FactSet Portfolio Analytics Return shown is the actual quarterly return of the security or combination of share classes.

Returns assume reinvestment of dividends and redemption at the end of each period, and reflect the deduction of annual operating expenses which as stated in its most recent prospectus are 1.26% and 1.07% (gross) of the Fund's Investor and Institutional Class net assets, respectively. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waivers and/or reimbursements. Past performance does not guarantee future results. The investment return and the principal value of an investment in this Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end may be obtained at www.weitzinvestments.com/funds_and_performance/fund_ performance.fs.

See page 6 for additional performance disclosures. See page 74 for a description of all indices.

Performance information does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

13 | Q1 2017 ANNUAL REPORT

PARTNERS III OPPORTUNITY FUND

Investment Style: Multi-Cap Alternative

Portfolio Manager: Wally Weitz, CFA

Fiscal Year Contributors

Liberty Broadband's principal asset consists of its interest in Charter Communications. Shares of Charter, and cable companies broadly, have performed well in the wake of the U.S. election. Although much remains to be seen, investors generally believe that regulatory pressures will ease as a result of a presumably more "industry friendly" Federal Communications Commission (FCC) as well as a Justice Department that may look more favorably on further industry consolidation. We have invested in Liberty Broadband because we like the operating strategy at Charter, and while regulatory relief would certainly be a benefit, it's not an explicit part of our investment thesis. Liberty Broadband shares trade at a discount to their underlying Charter investment due to the added complexity of Liberty's involvement. We are confident Liberty Broadband's management will ultimately collapse this discount, thereby making Liberty Broadband a cheaper opportunity to invest in Charter's future.

Liberty SiriusXM is a tracking stock, with its principal asset being Liberty Media's 67% ownership of satellite radio operator SiriusXM. Thanks to the continued strength of new car sales in the U.S., SiriusXM has enjoyed very robust operating results in recent quarters, as 75% of all new cars sold feature a satellite radio built directly into the dashboard. New car buyers are offered a free trial of the service and typically convert to paying subscribers at a healthy rate. Recently, SiriusXM has opened a new channel for customer growth by partnering with used car dealers as well as service providers to offer trial subscriptions. Although we don't anticipate these trials will convert at the same rate as those associated with new car sales, we believe it provides an excellent opportunity to remarket to existing car radios as well as lessen the company's reliance on the cyclical new car market. Shares of Liberty SiriusXM mirrored most of SiriusXM stock price gain of the prior twelve months but still trades at a discount to our intrinsic value of standalone SiriusXM.

Berkshire Hathaway is a conglomerate holding company owning subsidiaries engaged in a number of business activities. Shares benefited from optimism that a combination of higher interest rates, lower taxes and increased domestic activity would increase earnings at Berkshire's insurance and industrial businesses. We believe Berkshire will compound wealth for its shareholders for the foreseeable future.

Quarterly Contributors

Liberty Broadband's principal asset consists of its interest in Charter Communications. In late January, rumors broke that Verizon Communications had made an informal acquisition offer to Charter Communications, sending both Charter and Liberty Broadband shares higher. We acknowledge that such a combination makes strategic sense for Verizon as it searches for an efficient means to deploy 5G wireless technology (which will require very dense, wired networks). However, we suspect shareholders can reap greater value from Charter continuing to integrate its Time Warner Cable and Bright House Networks acquisitions on a stand-alone basis. That said, we believe management will pursue the right course (stand-alone or M&A) that will maximize long-term shareholder value.

Liberty Global is the largest international cable company, with operations in 14 countries providing video, broadband Internet, fixed-line telephone and mobile services to its customers. Liberty Global's shares were strong in the first calendar quarter and made up some of the ground that had been lost during the prior year. The company's quarterly results were solid, but shares have likely been driven upward as speculation of deals in the media industry has heated up of late, including revived speculation of a potential Vodafone transaction. We view Liberty Global as a standalone provider of broadband and Pay-TV services as an attractive opportunity, and although a potential acquisition by Vodafone may create value for shareholders, our investment thesis is not dependent on such an event.

Allergan is a global specialty pharmaceutical company focusing on the development, manufacturing, marketing and distribution of brand name, biosimilar and over-the-counter pharmaceutical products. Allergan's stock rebounded as the company reported stronger-than-expected fourth quarter results following a string of disappointing quarters. The company's initial outlook for 2017 came in ahead of our forecasts, with strong growth across six of its seven therapeutic areas expected to result in high single-digit revenue growth and high teens adjusted cash earnings per share growth. Allergan closed its $2.9 billion acquisition of LifeCell in February and also announced an agreement to acquire body sculpting device manufacturer ZELTIQ Aesthetics for $2.5 billion. If ZELTIQ shareholders approve the merger, Allergan will add two durable assets to its aesthetics portfolio that together should generate roughly $1.0 billion in annual sales with attractive organic growth profiles. We continue to believe Allergan shares have attractive upside potential from current prices.

New Holdings

No new equity holdings were added in the first quarter 2017.

Fiscal Year Detractors

LiLAC Group is a tracking stock distributed by Liberty Global with respect to its businesses in Latin America and the Caribbean. LiLAC's stock has struggled throughout the last year as management revealed additional unanticipated headaches with the May 2016 acquisition of Cable & Wireless Communications. After meeting with management, we believe the company understands the nature of the problem and is set to grow from this reset base. We anticipate that in the coming quarters, LiLAC will demonstrate the benefits they saw in this acquisition, beginning with identifying operating synergies for investors. Management further demonstrated their confidence in their revised outlook by announcing a $300 million stock repurchase authorization.

Wesco Aircraft Holdings is the world's leading distributor and provider of supply chain services to the global aerospace industry. During the past year, the company has continued its transition to a "One Wesco" culture, which includes an implementation of continuous improvement initiatives. In addition, the company has won several new contracts. These new contracts have required funding of upfront inventory and preparation expenses, temporarily depressing free cash flow. We believe Wesco is making significant progress in transforming its business, which we expect to soon be reflected in reported results.

SPDR S&P 500 ETF Trust, PowerShares QQQ Trust and iShares Russell 2000 ETF Partners III Opportunity Fund has the broadest toolkit of our equity funds. The Fund invests in companies of all sizes and typically maintains short positions. Effective shorts include small- and large-cap stock ETFs. Broad market short positions in a rising market environment caused a detraction in performance. The average effective short position for the fiscal year was approximately -33%. As of March 31, 2017, the Fund had an effective short position of -33%, an effective long position of 90% resulting in an effective net position of 57%. Our positioning reflects our belief that, while we like the companies we own and believe they will outperform the market in the long-run, the broad market is fully valued to overvalued.

Quarterly Detractors

SPDR S&P 500 ETF Trust, PowerShares QQQ Trust and iShares Russell 2000 ETF - Please refer to the Fiscal Year synopsis.

Wesco Aircraft Holdings - Please refer to the Fiscal Year synopsis.

TransDigm Group is a designer, producer and supplier of engineered aircraft components for use on commercial and military aircraft. The prospect of rising interest rates and accusations of rigged/fake bids from a critical short report pressured TransDigm's stock during January. The company's levered balance sheet, while married with historically consistent cash flows, increases the company's sensitivity to potential declines in profitability. In his first several weeks in office, President Trump targeted the cost of specific programs at several of TransDigm's larger peers. While it remains to be seen what, if any, lasting impact this scrutiny will have on growth and cash flow, with TransDigm's shares close to our estimate of intrinsic value, we elected to close our position in the stock with a nice gain.

Eliminated Holdings

TransDigm Group

Please visit the Fund's commentary section on our website for additional information.

14 | Q1 2017 ANNUAL REPORT

WEITZINVESTMENTS.COM

Returns

| | | | Annualized | | | | | | |

| | | | Since | | | | | | | | | | | | | | | | | | |

| | | | Inception | | | | | | | | | | | | | | | | | | |

| | | | (6/1/1983) | | 20-year | | 10-year | | 5-year | | 3-year | | 1-year | | Quarter |

| WPOIX - Investor Class | | | 12.48 | % | | 10.51 | % | | 6.25 | % | | 8.19 | % | | 1.90 | % | | 8.94 | % | | 5.14 | % |

| WPOPX - Institutional Class | | | 12.54 | | | 10.62 | | | 6.46 | | | 8.57 | | | 2.33 | | | 9.52 | | | 5.24 | |

| S&P 500 | | | 10.91 | | | 7.86 | | | 7.51 | | | 13.30 | | | 10.37 | | | 17.17 | | | 6.07 | |

| Russell 3000 | | | 10.70 | | | 8.11 | | | 7.54 | | | 13.18 | | | 9.76 | | | 18.07 | | | 5.74 | |

| Russell 3000 Value | | | 11.22 | | | 8.44 | | | 5.94 | | | 13.08 | | | 8.58 | | | 19.97 | | | 2.99 | |

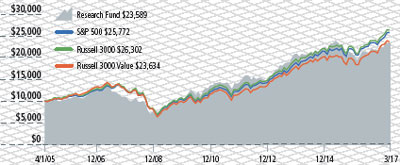

Growth of $10,000

This chart depicts the change in the value of a $10,000 investment in the Partners III Opportunity Fund - Institutional Class for the period since inception (6/1/83) through March 31, 2017, as compared with the growth of the Standard & Poor's 500, Russell 3000 and Russell 3000 Value Indices during the same period. Index performance is hypothetical and is shown for illustrative purposes only.

Capitalization

Top 10 Stock Holdings

| | | |

| | % of Net Assets |

| Liberty Broadband Corp. - Series A & C | 9.8 | |

| Berkshire Hathaway Inc. - Class B | 9.7 | |

| Liberty Global Group - Class C | 8.6 | |

| Mastercard Inc. - Class A | 4.9 | |

| Colfax Corp. | 4.6 | |

| Allergan plc | 4.5 | |

| Liberty SiriusXM Group - Series A & C | 4.5 | |

| Redwood Trust, Inc. | 4.1 | |

| Liberty Ventures Group - Series A | 3.9 | |

| Laboratory Corp. of America Holdings | 3.5 | |

| | 58.1 | |

Top Performers

| | | | | | | Average | | | | |

| | | | Return | | | Weight | | | Contribution | |

| Liberty Broadband Corp. - Series A & C | | | 17.0 | % | | 9.4 | % | | 1.45 | % |

| Liberty Global Group - Class C | | | 18.0 | | | 8.4 | | | 1.37 | |

| Allergan plc | | | 14.1 | | | 4.8 | | | 0.70 | |

| Liberty Ventures Group - Series A | | | 20.6 | | | 3.7 | | | 0.69 | |

| Liberty SiriusXM Group - Series A & C | | | 13.5 | | | 4.4 | | | 0.58 | |

Industry Breakdown

| | % of Net Assets |

| Consumer Discretionary | 40.8 | |

| Information Technology | 17.4 | |

| Financials | 15.8 | |

| Health Care | 8.0 | |

| Industrials | 7.9 | |

| Securities Sold Short | (32.7 | ) |

| Short Proceeds/Other | 42.8 | |

| | 100.0 | |

Bottom Performers

| | | | | | | Average | | | | |

| | | | Return | | | Weight | | | Contribution | |

| PowerShares QQQ Trust, Series 1 (short) | | | 12.0 | % | | (9.3 | )% | | (1.08 | )% |

| SPDR S&P 500 ETF Trust (short) | | | 5.9 | | | (16.8 | ) | | (0.98 | ) |

| Wesco Aircraft Holdings, Inc. | | | (23.7 | ) | | 3.6 | | | (0.90 | ) |

| TransDigm Group, Inc. | | | (11.6 | ) | | 0.7 | | | (0.26 | ) |

| iShares Russell 2000 Fund (short) | | | 2.2 | | | (5.9 | ) | | (0.14 | ) |

Contributions to Fund performance are based on actual daily holdings. Securities may have been bought or sold during the quarter. Source: FactSet Portfolio Analytics Return shown is the actual quarterly return of the security or combination of share classes.

Returns assume reinvestment of dividends and redemption at the end of each period, and reflect the deduction of annual operating expenses which as stated in its most recent prospectus are 2.33% and 1.95% of the Fund's Investor and Institutional Class net assets, respectively. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waivers and/or reimbursements. Past performance does not guarantee future results. The investment return and the principal value of an investment in this Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end may be obtained at www.weitzinvestments.com/funds_and_performance/fund_performance.fs.

See page 6 for additional performance disclosures. See page 74 for a description of all indices.

Performance information does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

15 | Q1 2017 ANNUAL REPORT

RESEARCH FUND

Investment Style: Multi-Cap Value

Co-Portfolio Managers: Nathan Ritz, CFA; Jon Baker, CFA;

Dan Walker, CFA; & Barton Hooper, CFA

Fiscal Year Contributors

Liberty Broadband's principal asset consists of its interest in Charter Communications. Shares of Charter, and cable companies broadly, have performed well in the wake of the U.S. election. Although much remains to be seen, investors generally believe that regulatory pressures will ease as a result of a presumably more "industry friendly" Federal Communications Commission (FCC) as well as a Justice Department that may look more favorably on further industry consolidation. We have invested in Liberty Broadband because we like the operating strategy at Charter, and while regulatory relief would certainly be a benefit, it's not an explicit part of our investment thesis. Liberty Broadband shares trade at a discount to their underlying Charter investment due to the added complexity of Liberty's involvement. We are confident Liberty Broadband's management will ultimately collapse this discount, thereby making Liberty Broadband a cheaper opportunity to invest in Charter's future.

Range Resources is an independent producer of natural gas and natural gas liquids (NGLs) based in Fort Worth, Texas, with operations in the Marcellus shale and emerging Terryville field. Following a strong rebound in natural gas prices during the spring of 2016, we pared our position in Range as the stock approached our $47 intrinsic value estimate. Even as healthy summer demand drove natural gas prices higher, investors began shifting their focus to the possibility of a supply overhang as oil-related drilling activity resumed. Range shares cooled off as a result. The Fund eliminated its position as part of Research Fund's manager transition in December.