Weitz Investment Management, Inc.

The Weitz Funds

Suite 200

1125 South 103 Street

Omaha, NE 68124-1071

(Name and address of agent for service)

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N‑CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Stockholders.

THE WEITZ PHILOSOPHY

Value investing the Weitz Way.

There are no shortcuts in value investing. At Weitz, we dig. And dig some more. We look at hundreds of investment ideas. Our goal: find strong, well-managed but undervalued companies that offer reasonable risk-adjusted returns. It’s no easy task. We do the due diligence. Analyze. Ask tough questions and get the answers. We wait for the right opportunity. Then and only then do we invest your money. Welcome to the Weitz Way.

We’re in it with you:

Our employees have the majority of their investable assets in our mutual funds. This alignment of goals allows us to guarantee that we’re treating clients’ money as if it were our own.

We focus on what we know:

Each of our analysts is a generalist with ever-growing, defined circles of competence. They can spot opportunities anywhere and bring them to the team for consideration.

We think for ourselves:

Our philosophy of independent thinking and high-conviction portfolios enables us to take advantage of value-priced equities and bonds that offer reasonable risk-adjusted returns.

Today we are responsible for approximately $4 billion in investments for our shareholders – individuals, corporations, pension plans, foundations and endowments. And our commitment remains the same: to put our clients first. Always. We do so through our expertise, our flexibility, and our drive to uncover investments that can help them preserve and grow wealth.

Drew Weitz

Portfolio Manager

Wally Weitz, CFA

President, Portfolio Manager

Brad Hinton, CFA

Portfolio Manager

2 | Q1 2019 ANNUAL REPORT

WEITZINVESTMENTS.COM

Beginning on January 1, 2021, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary (such as a financial adviser). Instead, the reports will be made available on the Fund’s website https://weitzinvestments.com/our_funds/default.fs. and you will be notified by mail each time a report is posted, and the mailing will provide a website link to access the report. You will continue to receive other Fund regulatory documents (such as prospectuses or supplements) in paper unless you have elected to receive all Fund documents electronically as described below.

If you would like to continue to receive the Fund’s future shareholder reports in paper free of charge after January 1, 2021, you can make that request (1) by contacting your financial intermediary, if you invest through a financial intermediary; or (2) if you invest directly with the Fund, by calling 800-304-9745.

If you already receive shareholder reports and other Fund documents electronically, you will not be affected by this change and you need not take any action. If you do not receive shareholder reports and other Fund documents electronically but would like to do so, contact your financial intermediary or, if you invest directly with the Fund, call 800-304-9745. An election to receive shareholder reports in paper will apply to all Funds held with the Weitz Funds and may apply to all funds held with your financial intermediary.

TABLE OF CONTENTS

Value Matters | 4 |

Performance Summary | 7 |

Fixed Income Insights | 8 |

Analyst Corner | 10 |

Value Fund | 12 |

Partners Value Fund | 14 |

Partners III Opportunity Fund | 16 |

Hickory Fund | 18 |

Balanced Fund | 20 |

Core Plus Income Fund | 22 |

Short Duration Income Fund | 24 |

Ultra Short Government Fund | 26 |

Nebraska Tax-Free Income Fund | 28 |

Schedule of Investments | 30 |

Financial Statements | 46 |

Notes to Financial Statements | 56 |

Report of Independent Registered | |

Public Accounting Firm | 65 |

Actual and Hypothetical Expenses for | |

Comparison Purposes | 66 |

Other Information | 67 |

Index Descriptions | 70 |

The management of Weitz Funds has chosen paper for the 72 page report from a paper manufacturer certified under the Sustainable Forestry Initiative ® standard.

Portfolio composition is subject to change at any time and references to specific securities, industries, and sectors referenced in this report are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. See the Schedules of Investments included in this report for the percent of assets in each of the Funds invested in particular industries or sectors.

3 | Q1 2019 ANNUAL REPORT

VALUE MATTERS

April 2, 2019

Dear Fellow Investor,

It Was a Good Quarter

In 2018, business values generally rose, but a nearly 20% decline in the fourth quarter brought stock market indices into negative territory for the year and made stock valuations much more attractive. We thought the stage was set for good returns going forward, but we would not have guessed that a rebound would be immediate.

Market sentiment changed dramatically as the new year began, and the S&P 500 charged ahead by 13.65% in the first quarter. Our stocks participated and all four stock funds earned double-digit gains that outpaced the S&P 500. The Balanced Fund, with less than 50% of assets currently invested in stocks, earned a very strong return as well. Our bond funds also turned in very solid results for the quarter and fiscal year. Tom and Nolan elaborate in their separate Fixed Income Insights. March 31 is the fiscal year end for all our funds, so this quarter’s Quarterly Commentaries will include detailed analysis of results for both the three- and twelve-month periods.

The first-quarter equity numbers would make for good annual returns, so we will not expect this pace to continue. But the year is off to a good start, and it would seem fair for shareholders to celebrate a little. The performance table following this letter shows year-to-date returns as well as the annualized returns for longer periods. As usual, we suggest investors focus on much longer time frames. Ten-, twenty- and thirty-year compounded returns don’t guarantee future success, but we believe they support the idea that our version of value investing works over time.

It was a good quarter. We look forward to an interesting year and hope to build on the first quarter’s results.

Interest Rates Matter and Won’t Always Be This Low

The buyer of a business focuses on two key questions: How much cash will the business generate in the future for its owners? And how much should she pay today for that stream of cash? The first is about earnings (E). The second is about valuation or price in relation to earnings (P/E).

Choosing the appropriate P/E involves comparisons among investment alternatives, current and future. One of the choices available to a prospective business (or stock) buyer is an investment in “safe” bonds such as Treasury securities. If interest rates on these bonds are relatively low (as they are today), they pose little competition to stocks, and stock buyers will feel tempted (or compelled) to “pay up” for a company’s earnings. Thus, the P/E rises. But if interest rates rise substantially, a dollar of stock earnings becomes less attractive relative to the return available from the safer bond. Thus, some shareholders sell stocks to buy bonds, and P/E ratios decline. Since long-term investors generally plan to hold their shares over a period of years, the average level of interest rates over time is more important to them than the current level. Hence, investors’ fascination with “Fed watching” and other strategies to try to predict the future path of interest rates.

A combination of factors has produced historically low interest rates over the past ten years, the Fed’s monetary policy being the most visible. The tepid recovery from the last recession and the deflationary forces unleashed by the Internet (Amazon, Uber, Airbnb, etc.) also help explain why rates have remained low. Many believe that today’s rates represent a new normal in which low rates are relatively permanent and historically high stock valuations are justified. Skeptics (including us) suspect that cheap and widely available credit produced by the Fed’s quantitative easing, along with stimulative fiscal policy in the form of tax cuts and increased deficit spending, will eventually lead to increases in the price of credit, i.e., higher interest rates. We are not predicting hyper-inflation or even a return to the double-digit rates of the 1980s. Rather, we expect modestly higher rates, on average, that would act as a bit of a headwind for stock valuations.

We Don’t Know What the Economy Will Do Next, But We Don’t NEED to Know

The current slowdown in the U.S. economy may turn into a recession and cause interest rates to move even lower. Or the economy could regain momentum, continue to grow for several more years and set off inflationary forces that lead to higher rates. We believe that both will happen, possibly multiple times, over the next 10-20 years. We cannot predict how these changes will unfold, but the nice thing about investing in good businesses is that we do not need to know. Companies with strong competitive positions, able management and liquid balance sheets will take advantage of whatever opportunities come along.

In fact, periods of economic adversity can accelerate a company’s business value growth. The mortgage crisis and recession in 2007-09 allowed Berkshire Hathaway to make some very high-return investments in companies such as Goldman Sachs and Bank of America. When SiriusXM was facing bankruptcy in 2009, Liberty Media came to its rescue with a loan of about $430 million that not only bore a double-digit interest rate but came with virtually free shares of a preferred stock convertible into 40% of the company. Their stake in SiriusXM is worth over $18 billion today. Comcast and Danaher were able to help GE with its periodic need to shore up its balance sheet by buying businesses from GE on favorable terms.

4 | Q1 2019 ANNUAL REPORT

WEITZINVESTMENTS.COM

Further, when uncertainty over economic growth, Fed policy, etc. plagues nervous investors, the resulting volatility often creates opportunities for us to sell the expensive and buy the cheap. Price moves of individual stocks and of the market in general often carry much further in both directions than is justified by changes in underlying business values. We welcome the volatility.

Companies and Industries Evolve, But Basic Investing Principles Still Hold

Our focus on business value growth over the next 5-10 years does not mean that we ignore changing business models and industry structures. We have owned some companies for long periods. For example, Berkshire has been in our portfolios continuously since our opening day in 1983. However, we have tried to recognize changing business realities in building our portfolios. Newspapers were great businesses at one time. Then they were not. The economics of TV and radio stations have ebbed and flowed. Cable was primarily a video business, but now its broadband services are more important. Traditional advertising agencies were once essentially collectors of royalties on (rising) consumer spending. Now, TV, radio and print advertising sales have been badly eroded by the advent of Google, Facebook and other digital advertisers. These relative newcomers can offer sophisticated targeting of ads and greater clarity as to the return on an advertiser’s investment. Software and online commerce and services have changed almost every type of business. Estimating future cash flows in this arena is a challenge, but for companies with superior products and entrenched competitive positions, we believe that the 5-10 year outlook can be predictable enough to make intelligent valuation estimates.

The business plans and accounting for these companies can be very different from those of traditional old economy businesses. Many technology companies spend massive amounts of capital on R&D and customer acquisition, and these costs are written off as they are incurred. This depresses current earnings, and some growing, successful businesses can appear unprofitable and unfit to be considered value stocks. Yet, this is not so different from cable companies in the 1980s and ‘90s that spent huge amounts of capital up front to build cable and broadband plant while waiting for subscribers to sign up for their services. When the number of customers reached critical mass—paying growing amounts of recurring cable fees—and spending on plant tapered off, these companies gushed free cash flow. We still aspire to buy shares of a company’s stock at a significant discount to what an informed investor would pay per share for the whole business. If we can do this, we will have Ben Graham’s “margin of safety” to improve our odds of success.

Outlook

Brexit and a fragile EU, trade wars with China, global tensions and shooting wars, and the spectacle of political wrangling at home will undoubtedly cause anxious moments for investors from time to time. The world can be a messy and dangerous place, but from the narrow point of view of stock and bond investors, we think our prospects are good. Economic, political and regulatory changes usually unfold gradually enough that intelligent managements (and investors) can cope with adversity and find ways to take advantage of opportunities. We look forward to an interesting year and hope to build on the first quarter’s results.

Thank you again for allowing us to invest for you. We look forward to seeing you at our annual meeting at the Omaha Regency Marriott on May 22. The meeting will begin at 4:30, and there will be plenty of time for Q&A.

Sincerely,

| | |

Wally Weitz

wally@weitzinvestments.com | Brad Hinton

brad@weitzinvestments.com |

As of March 31, 2019, each of the following portfolio companies constituted a portion of the net assets of Value Fund, Partners Value Fund, Partners III Opportunity Fund, Hickory Fund, and Balanced Fund as follows: Alphabet, Inc. (Parent of Google)-Class C: 6.1%, 5.6%, 5.0%, 0%, and 2.1%. Amazon.com, Inc.: 2.1%, 0%, 1.7%, 0%, and 0%. Berkshire Hathaway Inc.-Class B: 6.9%, 5.8%, 10.4%, 0%, and 2.4%. Comcast Corp.-Class A: 3.0%, 2.4%, 0%, 0%, and 1.4%. Danaher Corp.: 3.1%, 0%, 0%, 0%, and 1.6%. Facebook, Inc.-Class A: 3.9%, 3.2%, 3.3%, 0%, and 0%. Liberty Broadband Corp.-Series A & C: 0%, 5.7%, 6.8%, 8.7%, and 0%. Liberty Broadband Corp.-Series C: 6.9%, 0%, 0%, 0%, and 0%. Liberty Formula One Group-Series A & C: 0%, 0%, 1.1%, 2.5%, and 0%. Liberty SiriusXM Group-Series A & C: 0%, 3.9%, 3.6%, 4.2%, and 0%. Liberty SiriusXM Group-Series C: 3.0%, 0%, 0%, 0%, and 0%. Portfolio composition is subject to change at any time. Current and future portfolio holdings are subject to risk.

Included is a reference to the term “margin of safety”. This term refers to purchasing securities at a price that is less than our estimate of intrinsic value. A potential “margin of safety” may limit downside risk and optimize the potential for growth.

5 | Q1 2019 ANNUAL REPORT

DISCLOSURES

These performance numbers reflect the deduction of annual operating expenses which as stated in the most recent prospectus, and expressed as a percentage of each Fund’s or Class’s net assets, are: Value – Investor Class, 1.22%; Value – Institutional Class, 1.09% (gross); Partners Value – Investor Class, 1.25%; Partners Value – Institutional Class, 1.07% (gross); Partners III Opportunity – Investor Class, 2.14%; Partners III Opportunity – Institutional Class – 1.63%; Hickory, 1.24%; Balanced –Investor Class, 1.30% (gross); Core Plus Income – Investor Class, 1.65% (gross); Core Plus Income – Institutional Class, 1.09% (gross); Short Duration Income – Investor Class, 0.91% (gross); Short Duration Income – Institutional Class, 0.62% (gross); Ultra Short Government, 0.60% (gross); and Nebraska Tax-Free Income, 0.85%. See the Financial Highlights on pages 52 and 54 for more current expense ratios. The returns assume reinvestment of dividends and redemption at the end of each period. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waivers and/or reimbursements.

Performance data represents past performance, which does not guarantee future results. The investment return and the principal value of an investment in any of the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end may be obtained at www.weitzinvestments.com/funds_and_performance/ fund_performance.fs. Index performance is hypothetical and is shown for illustrative purposes only. See page 70 for a description of all indices.

(a) On the last business day of 1993, 2005 and 2006, the Partners Value, Partners III Opportunity and Nebraska Tax-Free Income Funds (the “Funds”) succeeded to substantially all of the assets of Weitz Partners II Limited Partnership, Weitz Partners III Limited Partnership and Weitz Income Partners Limited Partnership (the“Partnerships”), respectively. The investment objectives, policies and restrictions of the Funds are materially equivalent to those of their respective Partnership and the Partnerships were managed at all times with full investment authority by the investment adviser. The performance information includes performance for the Partnerships. The Partnerships were not registered under the Investment Company Act of 1940 and, therefore, were not subject to certain investment or other restrictions or requirements imposed by the 1940 Act or the Internal Revenue Code. If the Partnerships had been registered under the 1940 Act, the Partnerships’ performance might have been adversely affected.

(b) Institutional Class shares of the Value, Partners Value and Balanced Funds became available for sale on July 31, 2014; July 31, 2014; and March 29, 2019, respectively. For performance prior to those dates, these tables include the actual performance of each Fund’s Investor Class (and use the actual expenses of each Fund’s Investor Class) without adjustment. For any such period of time, the performance of each Fund’s Institutional Class would have been similar to the performance of each Fund’s Investor Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses. The investment adviser has agreed in writing to limit the total annual fund operating expenses (excluding taxes, interest, brokerage costs, acquired fund fees and expenses and extraordinary expenses) to 1.30% and 0.99%, respectively, of each Class’s average daily net assets for the Investor and Institutional Class shares of the Value and Partners Value Funds through July 31, 2019; and to 0.85% and 0.70%, respectively, of each Class’s average daily net assets for the Investor and Institutional Class shares of the Balanced Fund through July 31, 2020.

(c) Investor Class shares of the Partners III Opportunity and Short Duration Income Funds became available for sale on August 1, 2011. For performance prior to that date, these tables include the actual performance of each Fund’s Institutional Class (and use the actual expenses of each Fund’s Institutional Class) without adjustment. For any such period of time, the performance of each Fund’s Investor Class would have been similar to the performance of each Fund’s Institutional Class, because the shares of both classes are invested in the same portfolio of securities, but the classes bear different expenses. The investment adviser has agreed in writing to limit the total annual fund operating expenses of the Short Duration Income Fund’s – Investor and Institutional Class shares (excluding taxes, interest, brokerage costs, acquired fund fees and expenses and extraordinary expenses) to 0.68% and 0.48%, respectively, of each Class’s average daily net assets through July 31, 2019.

(d) The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. From and after March 29, 2019, the Fund has generally invested the majority of its assets in the common stock of medium-sized companies, which the Fund considers to be companies with a market capitalization, at the time of initial purchase, of greater than $1 billion and less than or equal to the market capitalization of the largest company in the Russell Midcap Index. Prior to that date, the Fund invested the majority of its assets in the common stock of smaller- and medium-sized companies, which the Fund considered to be companies with a market capitalization, at the time of initial purchase, of less than $10 billion.

(e) The investment adviser has agreed in writing to limit the total annual fund operating expenses of the Core Plus Income Fund’s Investor and Institutional Class shares (excluding taxes, interest, brokerage costs, acquired fund fees and expenses and extraordinary expenses) to 0.60% and 0.40%, respectively, of each Class’s average daily net assets through July 31, 2019.

(f) The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. From and after December 16, 2016, the Fund has generally maintained an average effective duration between one to three and a half years. Prior to that date, the Fund maintained a dollar-weighted average maturity of between two to five years.

(g) The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. Effective December 16, 2016, the Fund revised its principal investment strategies and policies to permit the Fund to invest in a diversified portfolio of short-term debt securities and to have a fluctuating net asset value. Prior to that date, the Fund operated as a “government money market fund” as defined under Rule 2a-7 of the Investment Company Act of 1940 and maintained a stable net asset value of $1.00 per share. The Fund’s past performance reflects the Fund’s prior principal investment strategies and policies. The investment adviser has agreed in writing to limit the total annual fund operating expenses of the Ultra Short Government Fund (excluding taxes, interest, brokerage costs, acquired fund fees and expenses and extraordinary expenses) to 0.20% of the Fund’s average daily net assets through July 31, 2019.

(h) Since inception performance for the Russell 1000 Value and CPI +1% is from May 31, 1986 and December 31, 1988, respectively. The inception date of the Bloomberg Barclays 1-3 Year U.S. Aggregate and 5-Year Municipal Bond was December 31, 1992 and January 29, 1988, respectively.

6 | Q1 2019 ANNUAL REPORT

WEITZINVESTMENTS.COM

PERFORMANCE SUMMARY

| | | | | | | | | | |

| | | | | Annualized | | | | | |

| | Inception | Since | | | | | | | |

Fund Name | Date | Inception | 30-year | 20-year | 10-year | 5-year | 3-year | 1-year | Quarter |

Value(b) | 5/09/86 | | | | | | | | |

Investor | | 10.12% | 10.23% | 6.45% | 13.81% | 5.79% | 9.36% | 9.04% | 15.32% |

Institutional | | 10.15 | 10.26 | 6.51 | 13.92 | 6.01 | 9.62 | 9.32 | 15.42 |

| Russell 1000 | | 10.28 | 10.29 | 6.33 | 16.05 | 10.63 | 13.52 | 9.30 | 14.00 |

Russell 1000 Value(h) | | 10.05 | 9.92 | 6.68 | 14.52 | 7.72 | 10.45 | 5.67 | 11.93 |

| |

Partners Value(a)(b) | 6/01/83 | | | | | | | | |

Investor | | 11.45 | 10.39 | 6.35 | 12.56 | 2.95 | 5.89 | 2.50 | 15.26 |

Institutional | | 11.48 | 10.43 | 6.41 | 12.69 | 3.18 | 6.17 | 2.78 | 15.36 |

| |

Partners III | | | | | | | | | |

Opportunity(a)(c) | 6/01/83 | | | | | | | | |

Investor | | 12.10 | 11.47 | 8.62 | 13.40 | 3.51 | 6.95 | 10.63 | 19.37 |

Institutional | | 12.20 | 11.58 | 8.79 | 13.74 | 3.99 | 7.52 | 11.25 | 19.48 |

| Russell 3000 | | 10.73 | 10.20 | 6.48 | 16.00 | 10.36 | 13.48 | 8.77 | 14.04 |

| Russell 3000 Value | | 10.92 | 9.93 | 6.87 | 14.50 | 7.56 | 10.50 | 5.30 | 11.93 |

| |

Hickory(d) | 4/01/93 | 9.24 | — | 4.90 | 12.92 | 2.81 | 5.26 | 2.30 | 16.65 |

| Russell Midcap | | 10.76 | — | 9.33 | 16.88 | 8.81 | 11.82 | 6.47 | 16.54 |

| Russell 2500 | | 10.30 | — | 9.59 | 16.23 | 7.79 | 12.56 | 4.48 | 15.82 |

| |

| S&P 500 | | — | 10.17 | 6.04 | 15.92 | 10.91 | 13.51 | 9.50 | 13.65 |

| |

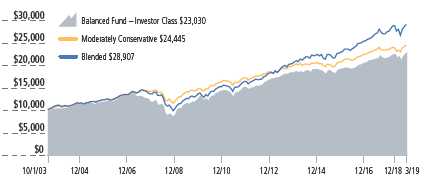

Balanced(b) | 10/01/03 | 5.53 | — | — | 9.52 | 4.46 | 6.52 | 6.18 | 8.18 |

| Moderately Conservative | | 5.94 | — | — | 7.40 | 4.43 | 6.16 | 4.62 | 6.72 |

| Blended Index | | 7.08 | — | — | 10.86 | 7.48 | 8.79 | 7.69 | 9.05 |

| |

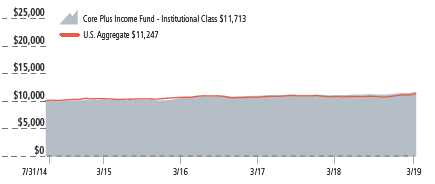

Core Plus Income(e) | 7/31/14 | | | | | | | | |

Investor | | 3.22 | — | — | — | — | 3.45 | 4.78 | 2.62 |

Institutional | | 3.44 | — | — | — | — | 3.68 | 5.07 | 2.76 |

| U.S. Aggregate Bond | | 2.55 | — | — | — | — | 2.03 | 4.48 | 2.94 |

| |

Short Duration | | | | | | | | | |

Income(c)(f) | 12/23/88 | | | | | | | | |

Investor | | 4.98 | 4.97 | 3.76 | 2.81 | 1.55 | 1.84 | 2.95 | 1.47 |

Institutional | | 5.04 | 5.03 | 3.85 | 2.98 | 1.78 | 2.06 | 3.18 | 1.53 |

1-3 Year U.S. Aggregate(h) | | — | — | 3.21 | 1.65 | 1.24 | 1.34 | 3.05 | 1.22 |

CPI + 1%(h) | | 3.52 | 3.50 | 3.21 | 2.82 | 2.49 | 3.23 | 2.88 | 1.43 |

| |

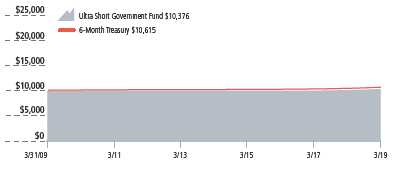

Ultra Short | | | | | | | | | |

Government(g) | 8/01/91 | 2.36 | — | 1.62 | 0.37 | 0.68 | 1.12 | 2.17 | 0.69 |

| 6-Month Treasury | | 2.93 | — | 2.14 | 0.60 | 0.90 | 1.33 | 2.26 | 0.65 |

| |

Nebraska Tax-Free | | | | | | | | | |

Income(a) | 10/01/85 | 4.51 | 4.17 | 3.06 | 2.14 | 1.23 | 0.93 | 3.46 | 1.85 |

5-Year Municipal Bond(h) | | — | 4.98 | 3.90 | 3.12 | 2.23 | 1.79 | 4.42 | 2.11 |

7 | Q1 2019 ANNUAL REPORT

FIXED INCOME INSIGHTS

April 8, 2019

Dear Fellow Investor,

If the Federal Reserve was the market’s “boogie man” in 2018 for raising short-term interest rates, it didn’t take long for it to become the “Candy Man” (a la Sammy Davis Jr.) in 2019. On January 4, Fed Chairman Jerome Powell told a conference for economists that the central bank would be patient in deciding whether to continue raising short-term interest rates. This message, which signaled at least a pause in any further rate increases, was an immediate balm (like “a groovy lemon pie” from the famous crooner’s lyrics) to jittery investors fresh off a tough 2018. Equity markets jumped over 3 percent on that day, and fixed income credit markets firmed up (lower credit spreads and higher prices). That set the stage for what became further gains for both stock and bond investors in this year’s first quarter. The S&P 500, for example, closed out its best quarter in nearly a decade. And fixed income investors experienced meaningful price gains as a result of declining U.S. Treasury interest rates and shrinking credit spreads.

Weitz equity and balanced funds delivered particularly strong first quarter results. Please see Wally and Brad’s Value Matters Letter and the equity and Balanced funds’ Quarterly Commentaries for detailed analysis of results.

Weitz fixed income funds also delivered good results in the year’s first quarter and during the past twelve months. Further detail about contributors to performance can be found in the fixed income funds’ Quarterly Commentaries.

The only gray cloud to the quarter’s otherwise silver lining was precipitated by late March manufacturing reports out of Germany that dealt a blow to Europe’s economic outlook, triggering fresh concerns about the global economy and tripping the alarm on one of the market’s more reliable recession indicators. The news reverberated through markets, sending Germany’s 10-year bund yield below zero for the first time since 2016. In the U.S., investors drove the yield for the 10-year Treasury lower than the 3-month Treasury bill for the first time since just before the Great Recession. Such an inversion of the yield curve, where interest rates on 3-month Treasury bills are higher than 10-year Treasury bonds, has historically been a reasonably reliable recession indicator if it persists long enough. While not a perfect indicator, a consecutive 10-day inversion of the 3-month/10-year Treasury yield has preceded, by a year or two, each of the last seven recessions. The first quarter’s inversion lasted for five days before ending slightly positive and has remained positive into early April.

The graph below shows the changes of select Treasury rates over the past quarter and year.

A distinct outcome in the first quarter as evidenced in the graph above has been an inversion of a portion of the U.S. Treasury yield curve, particularly between 2-year and 5-year bond rates. Time will tell whether this flat-to-inverted yield curve is the “canary in the coal mine” signaling recession risk. At present, though, domestic economic signals continue to appear sound (e.g., consumer and business confidence, and employment and wage growth, to name a few). Some to much of the Treasury rate reaction/progression in the first quarter can be traced to the surprisingly dovish, or neutral, stance on interest rates by the Federal Reserve and by market participants’ anticipation of when/if the Fed may start cutting/lowering short-term interest rates.

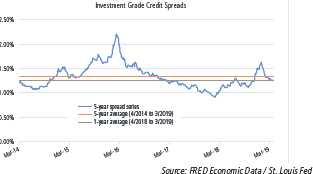

As mentioned, corporate bonds and other credit-sensitive securities had strong quarterly performance and outperformed Treasury bonds as credit spreads narrowed, particularly for non-investment-grade or high-yield bonds. A broad measure of investment-grade1 corporate bond spreads, compiled by ICE BofAML, decreased to 127 basis points as of March 31, down 32 basis points in the quarter. Spreads remain marginally higher (10 basis points) than they were a year ago.

The charts that follow highlight a couple variables that we use to help inform our investment process. The core of that process is to do fundamental credit work, one security at a time, identifying those companies/credits that we believe provide reasonable-to-good risk adjusted returns for any incremental risk assumed. However, those potential returns are ebbing and flowing based on whether a company/ credit is becoming more or less credit worthy—and based on investor perceptions (i.e., the behavioral aspects of fear and greed).

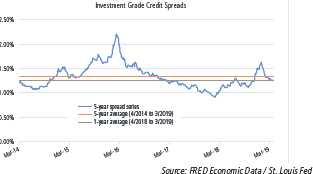

The first chart graphs broad investment grade spreads over the past five years as well as the one- and five-year average. Besides identifying favorable credit opportunities one at a time by fundamental credit analysis, our future/forward returns are enhanced when we can invest when others are more fearful (i.e., when credit spreads are above a 5-year average, for example). Our credit investments in 2015/16 are the most recent example of overlaying deep fundamental work, when credit spreads were at the high end of a historical range. Conversely, our caution in 2017/18, which resulted in shrinking corporate credit exposure in 2017/18, was the result of the marketplace being greedier/ less fearful. We again took advantage of a more favorable investment environment in late 2018, but the duration of the dislocation was too short to make meaningful headway. Overall, we believe this macro data, in conjunction with our fundamental credit work, will help enhance long-term returns by taking advantage of what the market presents us.

8 | Q1 2019 ANNUAL REPORT

WEITZINVESTMENTS.COM

The next chart graphs the relative attractiveness of investing in corporate credit as compared to the “risk free” alternative, again using the past five years as a baseline. Since our investment mandate is not predicated on mimicking a particular index, we have the flexibility either to own a high percentage of credit investments (such as corporate bonds) or none at all. The graph below provides a framework to help inform that decision by depicting the incremental return an investor receives for taking credit risk – in this case across the broad investment-grade corporate universe. Like with investment spreads, our goal is to invest more heavily in credit when our incremental unit of return is high, or at least higher than a longer-term average, so the prospects for outsized forward returns are enhanced. Again, the graph helps explain why we were more constructive on credit investments in 2015/16 and less so in 2017/18.

U.S. Investment Grade: Spread as a % of Yield to Worst1 (Spread/YTW)

Structured / Asset-Backed Securities (ABS): A Growing Area of Expertise

One area in which we have meaningfully exercised our willingness to be index agnostic is in the approximately $1.7 trillion asset-backed securities market. This segment of the nearly $43 trillion fixed income marketplace is not represented in most fixed income indexes yet includes a broad array of investment opportunities secured by autos, credit cards, fleet equipment, commercial mortgages, student loans, mobile phones, cellular towers, other consumer loans and many other assets.

We have spent nearly 10 years becoming more familiar with this segment of the bond market, particularly since the arrival of teammate Nolan Anderson. Our approach to this asset class has been no different than any other credit investment—namely, developing a thorough understanding of the asset class backing each security before making any investment, whether its autos, fleet equipment, etc. Additionally, we have spent significant time conducting due diligence with the sponsors/issuers of each investment (either by phone or shoe-leather contact). To date, this work has culminated in due diligence on nearly 50 different sponsors/issuers, with current investments across approximately two dozen in our taxable fixed income funds.

Asset-backed securities, by their nature, are constructed with a senior-to-subordinate structure. A significant majority of this roughly $1.7 trillion segment is rated the highest (AAA) by one of the independent rating agencies and has been the primary area in which we have focused our investment efforts to date. We purposefully started at the top (the most structurally protected) to enhance/ensure capital preservation, but our aperture to accept properly priced credit risk further down the capital structure has improved over the years.

Why invest in this segment? The short answer is we believe ABS presents opportunities to deploy capital on behalf of our shareholders in assets and cash flows that we understand and that enhance returns over comparable corporate bond alternatives. Stay tuned for the long answer, as we plan to produce white papers on various segments of this asset class in the coming quarters.

Please see all the fund commentaries for additional information regarding first quarter 2019 portfolio activity and current positioning. Our fixed income investment philosophy is straightforward. We believe the key to winning is not losing. Permanent losses of capital are a bane to long-term compounding—and especially so in fixed income investing. We avoid making bold or specific predictions about the direction and pace at which interest rates or credit spreads might move in the future. Caution has arguably always been our calling card in managing fixed income assets on behalf of clients—we want to be properly compensated for any risks we assume. We are index agnostic and prefer to individually select assets. We concentrate in the ideas that we believe best represent attractive risk-adjusted returns, taking into consideration the general level of interest rates and the credit quality of each investment.

This year has certainly started off strong for equity and fixed income investors. It seems plausible that the first quarter’s robust returns have been partly borrowed from the future. And time will tell whether the Fed’s dovish tilt on interest rates coupled with progress on the trade dispute between the U.S. and China may help the global outlook: “make the world taste good” (to continue the Candy Man theme). In the meantime, we intend to stick to our knitting and welcome any volatility that may ensue, particularly when it results in a disconnect between price and value. We look forward to taking advantage of any valuation disparities that may develop in 2019 and hope to continue to earn your investing trust.

Sincerely,

1Definitions: Investment Grade: We consider investment grade to be those securities rated at least BBB- by one or more credit ratings agencies. Yield-to-worst (YTW): the lowest potential yield (most conservative yield) that can be received on a bond without the issuer actually defaulting. YTW is calculated by using worst-case scenario provisions, including prepayments, calls and sinking funds. Furthermore, YTW is a forward-looking estimate that ignores capital gains.

9 | Q1 2019 ANNUAL REPORT

ANALYST CORNER

An Introduction to CarMax, Inc.

By Jon Baker, CFA

CarMax is the largest used-car retailer in the United States, with a growing network of over 200 locations across 100 television markets. The company spent its first nine years as a subsidiary of parent company, Circuit City, before being spun out on its own in 2002. For both the past 5- and 10-year periods, CarMax has grown its used-vehicle unit sales in excess of 7% compounded (and at a faster pace prior). Despite decades of greater-than-industry growth, the company still sells only a low-single-digit percentage share of U.S. used vehicles up to 10 years old and has a credible glide path to much higher share over the coming years.

Selling used cars is a competitive business, yet CarMax has grown profitably over the decades by disassociating itself from the behaviors that earn used-car dealers their spotty reputations. All vehicle pricing is “no haggle.” CarMax sales associates are paid fixed commissions, regardless of the vehicle sold. Additionally, CarMax makes a cash offer on every car presented at their door, telling consumers, “We’ll buy your car even if you don’t buy ours.” Each piece of their consumer offer–vehicle pricing, trade-in, financing and service plan–competes on its own merit.

Over the past decade, same-store unit sales growth for CarMax stores open one year or more has averaged about +4%. Still, the most recent two-year period has seen the lowest rate of same-store growth since the Great Recession. We see a couple contributing headwinds. First, recent data from Manheim’s wholesale auctions suggests used-vehicle pricing remains near historic highs relative to that of new vehicles. Such a narrow gap between new- and used-vehicle pricing is likely indicative of cyclically aggressive competitive behavior, an issue we’ve seen before and that we expect will again revert to CarMax’s benefit.

Second, we have seen the growth of online offerings such as that of Carvana. Though selling only about one-seventh of CarMax’s recent volumes, Carvana is growing rapidly and has likely taken some wind out of CarMax’s sails in common markets. Admittedly later to the e-commerce game, CarMax has spent the past few years developing an online buying option to enhance its best-in-class physical store experience. We believe the resultant physical-online hybrid will be a step-change improvement in an already advantaged CarMax consumer experience, allowing CarMax to serve the greatest percentage of shoppers in the manner of their choice. Crucially, this evolution rides the same rail of customer primacy CarMax has ridden since the opening of its first store in 1993.

Already shipping upwards of 2 million vehicles per year within its network, CarMax has the procurement heft, refurbishment capacity, IT budget, advertising scale and brand awareness to layer on a compelling e-commerce option for those consumers who prefer it. In testing for the past few years, CarMax’s first commercial omni-channel market was launched in the Atlanta area in December, and these capabilities will roll out to the bulk of their footprint in the coming year.

Early returns from the first live market have been promising, with same-market volumes up double digits. Also encouraging is the way the company talks about future investment. Three customer experience centers will be added this year, each serving multi-state regions and each more efficiently performing work currently tasked to local store associates. The removal of operating expense incurred by physical stores combined with the ability to conduct the entire car-buying experience from home—including test drives, financing and taking delivery of a vehicle—means that future physical consumer “touchpoints” can eventually be far different from those of the legacy store base. Those touchpoints can be much less costly, less time consuming to develop and can quickly allow for a physical presence in new, smaller markets or greater coverage and convenience in existing markets than the legacy store model alone can afford.

10 | Q1 2019 ANNUAL REPORT

WEITZINVESTMENTS.COM

This evolution may begin to take some wind from Carvana’s sails, or it may not. But with a combined low-single-digit share of used-vehicle sales between them, it may not matter. By better adapting their physical presence to consumers’ evolving preferences and by pressing the advantages a national network confers, we believe the other 95%+ of the market can keep both companies happy and growing for many years to come. Carvana has burned cash every year of its existence, including over half a billion dollars in 2018 alone. We have opted instead for the long-profitable CarMax, trading at 14 times forward earnings and buying back its undervalued shares. We value CarMax in the low-to-mid $90s per share.

As of March 31, 2019, each of the following portfolio companies constituted a portion of the net assets of Value Fund, Partners Value Fund, Partners III Opportunity Fund, and Hickory Fund as follows: CarMax, Inc. 3.9%, 3.9%, 2.8%, and 3.3%. Current and future portfolio holdings are subject to risk.

Jon Baker, CFA®, joined Weitz Investment Management, Inc. in 1997. Prior to joining Weitz, Jon audited equity funds as a certified public accountant at McGladrey & Pullen. He holds a bachelor’s degree in accounting and computer applications from the University of Notre Dame. Jon has been a CFA® charterholder since 2001.

11 | Q1 2019 ANNUAL REPORT

VALUE FUND

Investment Style: Large-Cap Value Portfolio Manager: Brad Hinton, CFA

The Value Fund’s Institutional Class returned +15.42% for the first quarter compared to +14.00% for the Russell 1000. For the fiscal year, the Fund’s Institutional Class returned +9.32% compared to +9.30% for the Russell 1000. Fund investors enjoyed a very strong finish to an all-around solid fiscal year.

One of our core investing beliefs is that human behavior and market sentiment are more volatile than intrinsic business values. This tenet has been on full display in the past nine months. Two quarters ago, we wrote about it being the “best of times” for domestic equity investors. Last quarter, we wrote about a late 2018 environment where almost all stock prices were hammered. This quarter, stocks are off to one of their best starts in a decade as risk assets roared higher. Since last summer, Mr. Market’s mood swings have put investors on a roller-coaster ride, and not one for the faint of heart.

Our job is to take advantage of these swings in emotion. As you would expect, we have actively reshaped the portfolio throughout this extended market turmoil. Portfolio turnover for the fiscal year was 32%, well above the prior two years. During the quarter, we sold Twenty-First Century Fox as the stock approached our value estimate, before the Disney deal closed. We also reversed course and eliminated Mohawk Industries and Allergan at losses. We simply paid too much for these companies, primarily because we overestimated parts of both businesses. While the stocks trade at low valuations, their growth and durability outlooks are too opaque for our taste, so we sold them. We added JPMorgan Chase, a global financial services leader with several dominant franchises across business lines. We were able to purchase shares at an estimated price-to-value cheaper than the rest of the Fund’s portfolio. We also materially increased our positions in Booking Holdings, CarMax, Liberty Sirius XM Group and TransDigm Group at attractive prices.

Top contributors for the fiscal year were Visa and Mastercard (payment networks), TransDigm Group (aircraft components) and Thermo Fisher Scientific (life science tools and diagnostics). Visa and Mastercard posted strong results with robust underlying business-value growth. We have happily maintained large core positions at fair prices in these competitively advantaged payment card networks. TransDigm Group delivered solid revenue and cash flow results. We expect the recently closed Esterline Technologies acquisition to add another growth engine to the story. Thermo Fisher continues to pair strong operating results with savvy capital allocation. This durable compounder is gaining share within profitable, growing markets, leading to persistent, double-digit earnings growth.

Liberty Global (European broadband) and a trio of subsequently sold positions (Mohawk Industries, DXC Technologies and Allergan) were the largest detractors for the fiscal year. While Liberty Global’s operating results remain mixed, the announced sale of its troubled Swiss business, at an attractive price, was yet another strategic positive. We continue to think the stock is undervalued, perhaps materially so if the pending sale of German and Eastern European assets to Vodafone Group is approved and closed this year. We “cleared the decks” with the sales mentioned above, as we were able to make several quality upgrades at reasonable prices due to increased market volatility. While remaining disciplined on valuation, we have tried to better follow Peter Lynch’s famous advice to avoid “cutting the flowers and watering the weeds” within the portfolio.

A rundown of the Fund’s top and bottom first quarter contributors is shown in the table on the following page. As always, we encourage investors to focus on longer-term results. Since adopting its large-company mandate on June 30, 2008, the Fund’s Institutional Class has generated average annual returns of +8.65% compared to +10.00% for the Russell 1000. While our large-cap stock picking has been quite good, average cash levels over this 10-year period of nearly 18% tamped down realized returns.

Our primary value add for investors is stock picking, period. We have done it well for nearly thirty-six years, and that is how we intend to generate excess returns going forward. Several process enhancements (quality scoring, discount rate, sell discipline, focus on durability) have given us the tools to invest effectively in better businesses. The Fund has become more fully invested, on our terms, patiently and without compromising on valuation. Now, investors should expect cash levels as a percentage of net assets in the single digits going forward. We expect cash levels to remain below 5% of net assets under a broad range of market conditions.

Your portfolio is focused, more fully invested and well aligned with our vision for successful large-cap investing. We have ownership stakes in 26 companies, with the top ten representing nearly half of the portfolio. Each position is significant enough to matter, yet none can individually make or break our results. The collection trades at less than 90% of our value estimate, offering adequate return potential from both value growth and by closing the gap between price and value. We think the three-to-five-year outlook is bright, and we look forward to reporting on the Fund’s progress throughout the year. Thank you once again for your investment and continued confidence in Weitz and our large-cap strategy.

12 | Q1 2019 ANNUAL REPORT

WEITZINVESTMENTS.COM

| | | | | | | | |

Returns | | | Annualized | | | | |

| | Since | | | | | | |

| | Inception | | | | | | |

| | (5/9/1986) | 20-year | 10-year | 5-year | 3-year | 1-year | Quarter |

WVALX - Investor Class | 10.12% | 6.45% | 13.81% | 5.79% | 9.36% | 9.04% | 15.32% |

WVAIX - Institutional Class | 10.15 | 6.51 | 13.92 | 6.01 | 9.62 | 9.32 | 15.42 |

| S&P 500 | 10.27 | 6.04 | 15.92 | 10.91 | 13.51 | 9.50 | 13.65 |

| Russell 1000 | 10.28 | 6.33 | 16.05 | 10.63 | 13.52 | 9.30 | 14.00 |

| Russell 1000 Value | 10.05 | 6.68 | 14.52 | 7.72 | 10.45 | 5.67 | 11.93 |

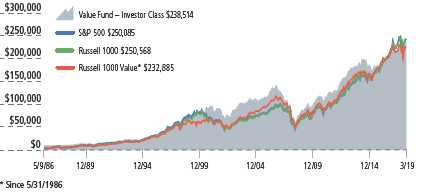

Growth of $10,000

This chart depicts the change in the value of a $10,000 investment in the Value Fund – Investor Class for the period since inception (5/9/86) through March 31, 2019, as compared with the growth of the Standard & Poor’s 500, Russell 1000 and Russell 1000 Value Indices during the same period. Index performance is hypothetical and is shown for illustrative purposes only.

Top 10 Stock Holdings | | | |

| | | | % of Net Assets |

| Berkshire Hathaway Inc. - Class B | | | 6.9 |

| Liberty Broadband Corp. - Series C | | | 6.9 |

| Alphabet, Inc. - Class C | | | 6.1 |

| Laboratory Corp. of America Holdings | | | 5.0 |

| Visa Inc. - Class A | | | 4.2 |

| Mastercard Inc. - Class A | | | 4.1 |

| Booking Holdings Inc. | | | 4.0 |

| Facebook, Inc. - Class A | | | 3.9 |

| CarMax, Inc. | | | 3.9 |

| Dollar Tree, Inc. | | | 3.8 |

| | | | 48.8 |

Top Performers | Average | |

| | Return | Weight | Contribution |

| Liberty Broadband Corp. - Series C | 27.4% | 7.3% | 1.93% |

| Facebook, Inc. - Class A | 27.2 | 3.8 | 0.99 |

| Laboratory Corp. of America Holdings | 21.1 | 4.8 | 0.98 |

| Mastercard Inc. - Class A | 25.0 | 4.0 | 0.95 |

| Oracle Corp. | 19.4 | 4.3 | 0.88 |

| | | | |

Industry Breakdown | | | |

| | | | % of Net Assets |

| Communication Services | | | 25.7 |

| Information Technology | | | 17.1 |

| Financials | | | 15.8 |

| Consumer Discretionary | | | 13.8 |

| Health Care | | | 11.5 |

| Materials | | | 6.2 |

| Industrials | | | 3.0 |

| Consumer Staples | | | 2.4 |

| Cash Equivalents/Other | | | 4.5 |

| | | | 100.0 |

| |

Bottom Performers | Average | |

| | Return | Weight | Contribution |

| Berkshire Hathaway Inc. - Class B | (1.6)% | 7.2% | (0.15)% |

| JPMorgan Chase & Co. | 4.6 | 0.8 | (0.07) |

Contributions to Fund performance are based on actual daily holdings. Securities may have been bought or sold during the quarter. Source: FactSet Portfolio Analytics Return shown is the actual quarterly return of the security or combination of share classes.

Returns assume reinvestment of dividends and redemption at the end of each period, and reflect the deduction of annual operating expenses which as stated in its most recent prospectus are 1.22% and 1.09% (gross) of the Fund’s Investor and Institutional Class net assets, respectively. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waivers and/or reimbursements.Performance data represents past performance, which does not guarantee future results. The investment return and the principal value of an investment in this Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end may be obtained at www.weitzinvestments.com/funds_and_ performance/fund_ performance.fs.

See page 6 for additional performance disclosures. See page 70 for a description of all indices.

Performance information does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

13 | Q1 2019 ANNUAL REPORT

PARTNERS VALUE FUND

Investment Style: Multi-Cap Value

Co-Portfolio Managers: Wally Weitz, CFA & Brad Hinton, CFA

The Partners Value Fund’s Institutional Class returned +15.36% during the first quarter compared to +14.04% for the Russell 3000. For the fiscal year, the Fund’s Institutional Class returned +2.78% compared to +8.77% for the Russell 3000. We liked the valuation setup at year end but would not have predicted the quick reversal. Stocks rebounded sharply as fears about trade conflicts, Fed actions and global growth subsided. We were well positioned to benefit, and Fund investors enjoyed a very strong finish to an otherwise lackluster fiscal year.

Last quarter we described a general environment where the smaller the business, the more punishing the short-term markdown. Let’s take a closer look at what has happened since then with the three small companies we highlighted.

Total returns | Q4 18 | Q1 19 | Q4 18-Q1 19 |

| Colfax Corporation | -42.0% | +42.0% | -17.7% |

| Summit Materials | -31.8% | +28.0% | -12.7% |

| Liberty Latin America | -29.4% | +33.5% | -5.7% |

Several observations:

• Despite the outsized first-quarter gains, we think there is more return potential in the tank. We liked these stocks before the V-shaped turmoil began last fall; after rechecking our assumptions, we still think they are cheap.

• If a stock goes down by 42% and then goes up by 42%, you are not back to where you started. Not even close. Percentage moves can be deceiving.

• We can add value by making good decisions in volatile times. We bought more Colfax shares in November and December when the stock swooned. Then we sold some of our holdings at higher prices in March after the stock bounced back sharply. These transactions allowed us to generate incremental economic gains by buying low and selling higher, while also realizing tax losses by selling older, higher-cost shares.

• These decisions are not one-size-fits-all. While we bought more Summit shares in the fourth quarter at progressively lower prices, we continue to hold them all because the valuation is so compelling. With Liberty Latin America, we did not transact during this six-month period, as we viewed our position size as appropriate for the risk-return profile of the stock.

These are just extreme examples from one corner of our portfolio, but they do highlight the noise that comes along with quarterly reporting. Most stock prices moved far more than their underlying business values, in both directions. A full rundown of this quarter’s top contributors and detractors is shown in the table on the following page.

For the fiscal year, the Fund’s top contributors were Visa and Mastercard (payment networks), Discovery (non-fiction entertainment) and TransDigm Group (aircraft components). Visa and Mastercard posted strong results with robust underlying business-value growth. We have happily maintained large core positions at fair prices in these competitively advantaged payment card networks. Our patience with Discovery was rewarded when the company announced deals for additional skinny bundle carriage that cheered investors. We exited the position last fall when the stock hit $30 per share, near our value estimate. Recent addition TransDigm Group has been a quick winner due to solid revenue and cash flow results coupled with warranted enthusiasm over the recently closed Esterline Technologies acquisition.

Liberty Global, Qurate Retail and DXC Technologies were the largest detractors for the fiscal year. While Liberty Global’s operating results remain mixed, the announced sale of its troubled Swiss business, at an attractive price, was yet another strategic positive. We continue to think the stock is undervalued, perhaps materially so if the pending sale of German and Eastern European assets to Vodafone Group is approved and closed this year. While top-line trends stabilized at Qurate’s flagship QVC business, margins dipped and so did the stock price. The company continues to generate free cash flow, but any near-term growth will likely come from HSN synergy harvesting and share repurchases. Not particularly inspiring, but the stock is cheap and the business is more resilient than many believe. DXC Technology is a different type of “return-to-par” story. Our investment thesis laid out in last fall’s Analyst Corner remains intact, though it may take time for the market to respond as the company repositions and improves its business mix.

We have been active over the past six months, investing aggressively while upgrading portfolio quality along the way. New adds this quarter included software companies Box and Guidewire Software. Box provides enterprise-grade, cloud content management solutions. While the market opportunity is large, and Box has a healthy early lead, billings and revenue growth have decelerated as the company moves from point product selling to solution selling. We think they are on the right strategic path and expect growth to reaccelerate, driving longer-term margin expansion and significant return potential. Guidewire is the leader in next-generation core processing systems for insurance companies. Guidewire’s strength in policy, billing and claims systems has created an enviable moat, and the company is leveraging that strength to provide other services to their customers, such as analytics and digital portals. Our research suggests a long growth runway at increasingly attractive margins. Allergan’s business value progression has disappointed investors, multiple times on multiple fronts. While the stock trades at a low valuation, we sold our position at a loss to focus on higher-conviction ideas.

The resulting multi-cap portfolio is focused, concentrated and more fully invested while staying true to our valuation discipline. We own 30 businesses, with position sizes generally ranging from 2% to 6% (average position size: 3.2%). The Fund’s top ten holdings represent 47% of net assets. While the Fund may screen as a large-cap offering, we think the extra edge will likely be our sizeable small- and mid-sized company holdings. For context, over half of the Fund is invested in companies with market caps under $20 billion.

Valuation remains our North Star, and in our team’s view, our stocks are reasonably priced even after sizeable first quarter gains. The estimated price-to-value of the portfolio is in the very low 80s. From these levels, we have a chance to earn healthy long-term returns both from business value growth and by closing the gap between price and value. We look forward to reporting on the Fund’s progress in future quarters. Thank you once again for your investment and continued confidence in Weitz and our multi-cap strategy.

14 | Q1 2019 ANNUAL REPORT

WEITZINVESTMENTS.COM

| | | | | | | | |

Returns | | | Annualized | | | | |

| | Since | | | | | | |

| | Inception | | | | | | |

| | (6/1/1983) | 20-year | 10-year | 5-year | 3-year | 1-year | Quarter |

WPVLX - Investor Class | 11.45% | 6.35% | 12.56% | 2.95% | 5.89% | 2.50% | 15.26% |

WPVIX - Institutional Class | 11.48 | 6.41 | 12.69 | 3.18 | 6.17 | 2.78 | 15.36 |

| S&P 500 | 10.95 | 6.04 | 15.92 | 10.91 | 13.51 | 9.50 | 13.65 |

| Russell 3000 | 10.73 | 6.48 | 16.00 | 10.36 | 13.48 | 8.77 | 14.04 |

| Russell 3000 Value | 10.92 | 6.87 | 14.50 | 7.56 | 10.50 | 5.30 | 11.93 |

Growth of $10,000

This chart depicts the change in the value of a $10,000 investment in the Partners Value Fund - Investor Class for the period since inception (6/1/83) through March 31, 2019, as compared with the growth of the Standard & Poor’s 500, Russell 3000 and Russell 3000 Value Indices during the same period. Index performance is hypothetical and is shown for illustrative purposes only.

| | | | |

Top 10 Stock Holdings | | | |

| | | | % of Net Assets |

| Berkshire Hathaway Inc. - Class B | | | 5.8 |

| Liberty Broadband Corp. - Series A & C | | | 5.7 |

| Alphabet, Inc. - Class C | | | 5.6 |

| Mastercard Inc. - Class A | | | 4.7 |

| Laboratory Corp. of America Holdings | | | 4.7 |

| Visa Inc. - Class A | | | 4.7 |

| Liberty Global plc - Class C | | | 4.1 |

| Liberty SiriusXM Group - Series A & C | | | 3.9 |

| CarMax, Inc. | | | 3.9 |

| Redwood Trust, Inc. | | | 3.7 |

| | | | 46.8 |

Top Performers | Average | |

| | Return | Weight | Contribution |

| Liberty Broadband Corp. - Series A & C | 27.5% | 5.9% | 1.57% |

| Colfax Corp. | 42.0 | 3.1 | 1.14 |

| Mastercard Inc. - Class A | 25.0 | 4.6 | 1.08 |

| Laboratory Corp. of America Holdings | 21.1 | 4.6 | 0.92 |

| Facebook, Inc. - Class A | 27.2 | 3.4 | 0.88 |

| | | | |

Industry Breakdown | | | |

| | | | % of Net Assets |

| Communication Services | | | 27.3 |

| Information Technology | | | 27.1 |

| Financials | | | 14.5 |

| Materials | | | 8.3 |

| Industrials | | | 7.9 |

| Consumer Discretionary | | | 5.9 |

| Health Care | | | 4.7 |

| Cash Equivalents/Other | | | 4.3 |

| | | | 100.0 |

| |

| |

Bottom Performers | Average | |

| | Return | Weight | Contribution |

| Qurate Retail, Inc. - Series A | (18.1)% | 2.6% | (0.41)% |

| Berkshire Hathaway Inc. - Class B | (1.6) | 5.6 | (0.12) |

| Box, Inc.- Class A | 14.4 | 0.4 | (0.05) |

Contributions to Fund performance are based on actual daily holdings. Securities may have been bought or sold during the quarter. Source: FactSet Portfolio Analytics Return shown is the actual quarterly return of the security or combination of share classes.

Returns assume reinvestment of dividends and redemption at the end of each period, and reflect the deduction of annual operating expenses which as stated in its most recent prospectus are 1.25% and 1.07% (gross) of the Fund’s Investor and Institutional Class net assets, respectively. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waivers and/or reimbursements.Performance data represents past performance, which does not guarantee future results. The investment return and the principal value of an investment in this Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end may be obtained at www.weitzinvestments.com/funds_and_ performance/fund_ performance.fs.

See page 6 for additional performance disclosures. See page 70 for a description of all indices.

Performance information does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

15 | Q1 2019 ANNUAL REPORT

PARTNERS III OPPORTUNITY FUND

Investment Style: Multi-Cap Alternative

Portfolio Manager: Wally Weitz, CFA

The Partners III Opportunity Fund’s Institutional Class returned +19.48% in the first calendar quarter compared to +13.65% for the S&P 500 and +14.04% for the Russell 3000. For the fiscal year ended March 31, the Partners III Opportunity Fund’s Institutional Class returned +11.25% compared to +9.50% for the S&P 500 and +8.77% for the Russell 3000.

Investors flipped the script between the final quarter of 2018 and the first quarter of 2019. At the start of the year, we believed conditions were favorable for good returns going forward but were surprised by the strength and speed of the current rebound. We are nevertheless pleased to deliver strong absolute and relative performance for both the quarter and fiscal year periods. As we wrote in Value Matters, these first quarter results would make for good annual returns, so we will not expect this pace to continue. That said, we still feel that conditions warrant a more assertive posture, and the Fund’s effective net long position remains in the low 80% range.

The performance discussion for both the calendar quarter and fiscal year is dominated by Intelligent Systems ( “INS,” +147% in the first quarter; +525% for the fiscal year). Until somewhat recently, Intelligent Systems was a small, unknown technology company, whose CoreCard operation provides processing for credit card providers and software that helps clients manage various credit programs. Although not a traditional start-up (INS has created or incubated technology businesses for over 35 years), its CoreCard operation has recently disclosed the signing of several new important client relationships that have transformed the company’s trajectory. Despite an under the radar profile, CoreCard’s doubling of revenue and transition from loss making to profit generating has not gone unnoticed by investors or, lately, the press. Growth comparisons are always skewed by the onboarding of new clients, and while we (and management) believe CoreCard’s growth prospects remain strong, the pace of growth will certainly slow. Nevertheless, the financial results clearly demonstrate the profile of the business has changed and has captured Wall Street’s imagination.

Beyond INS, quarterly performance by our other equity holdings was generally strong and broad-based. Core positions Liberty Broadband (+27%) and Mastercard (+25%) joined INS on the honor roll, as did prior quarter laggards Liberty Global (+17%) and Colfax (+42%). This broad strength was more than sufficient to overcome the headwind created by the quarter’s top detractor, our index short position against the S&P 500 (+14%). Berkshire Hathaway (-2%) simply didn’t participate in the rally, but its outsized portfolio weighting lands it in the detractors’ ledger. Qurate Retail’s (-18%) decline was more meaningful, as investors fret its investment in online and digital commerce is too late, too expensive and can’t compete with Amazon. We agree that retail competition is fierce, but we feel the stock’s decline has been too punitive.

For the fiscal year, payments companies Mastercard (+35%) and Visa (+31%) joined INS as top contributors, thanks to their continued strong results. Liberty Global (-20%) and DXC Technology (-25%) joined Qurate Retail (-36%) and our short against the S&P500 (+9%) as the top detractors. Liberty Global recently announced an agreement to sell its troubled Swiss business at a very attractive price. This transaction, along with the pending sale of its German and Eastern European businesses to Vodafone, has the potential to unlock significant value for shareholders if and when they close. Our “return-to-par” investment thesis for DXC Technologies (an Analyst Corner feature in 2018) remains intact, though it may take time for the market to respond as it repositions and improves its business mix.

We were fairly active in the first quarter. The net of this activity left the Fund’s long and short books relatively unchanged from a percentage of gross assets perspective, but we believe better positions the portfolio going forward. In broad strokes, we trimmed to manage the position size of several large, high-conviction holdings such as Liberty Broadband and Berkshire Hathaway while exiting our remaining small positions in Liberty Braves and Discovery. We also sold our remaining Allergan shares in order to continue building initial positions in newer portfolio entrants such as Amazon and Black Knight.

We also initiated new positions in online travel agency Booking Holdings and enterprise content control platform provider Box. Both are examples of opportunities the Internet has unleashed upon our economy. Shareholders are likely familiar with (and probably have used) one of Booking’s many online consumer-oriented platforms (Priceline.com, Booking.com, OpenTable, Kayak, etc.). The tailwind of travel and leisure bookings transitioning from offline to online models, while no longer in the early stages, still has plenty of runway left, and Booking will continue to be a primary beneficiary of this secular growth. Box provides software solutions that help businesses transition to the cloud with services such as enabling collaboration between groups, managing access to sensitive data and helping secure against threats, to name a few. As the complexity of Box’s solutions has grown, so has the selling process for its sales force, and investors have grown impatient as new sales bookings have recently slowed. We believe the slowdown is temporary. Box’s market opportunity is huge, and we believe they’re on the right path to capture it.

Looking ahead, we think it unlikely that the stock market can keep up the first quarter’s breakneck pace, though we can’t know for certain. Regardless, we remain focused on investing in good businesses with strong competitive positions, able management and strong balance sheets that can capitalize on whatever opportunities come their way. We like our collection of businesses and feel that the conditions are still favorable for good long-term shareholder returns. As always, we appreciate your trust and the opportunity to invest our capital alongside yours.

Effective Net Long means (i) the sum of a portfolio’s long positions (such as common stocks, or derivatives where the price increases when an index or position rises), minus (ii) the sum of a portfolio’s short positions (such as, derivatives where the price increases when an index or position falls).

16 | Q1 2019 ANNUAL REPORT

WEITZINVESTMENTS.COM

| | | | | | | | |

Returns | | | Annualized | | | | |

| | Since | | | | | | |

| | Inception | | | | | | |

| | (6/1/1983) | 20-year | 10-year | 5-year | 3-year | 1-year | Quarter |

WPOIX - Investor Class | 12.10% | 8.62% | 13.40% | 3.51% | 6.95% | 10.63% | 19.37% |

WPOPX - Institutional Class | 12.20 | 8.79 | 13.74 | 3.99 | 7.52 | 11.25 | 19.48 |

| S&P 500 | 10.95 | 6.04 | 15.92 | 10.91 | 13.51 | 9.50 | 13.65 |

| Russell 3000 | 10.73 | 6.48 | 16.00 | 10.36 | 13.48 | 8.77 | 14.04 |

| Russell 3000 Value | 10.92 | 6.87 | 14.50 | 7.56 | 10.50 | 5.30 | 11.93 |

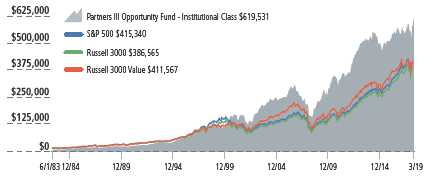

Growth of $10,000

This chart depicts the change in the value of a $10,000 investment in the Partners III Opportunity Fund - Institutional Class for the period since inception (6/1/83) through March 31, 2019, as compared with the growth of the Standard & Poor’s 500, Russell 3000 and Russell 3000 Value Indices during the same period. Index performance is hypothetical and is shown for illustrative purposes only.

| | |

Top 10 Stock Holdings | |

| | % of Net Assets |

| Intelligent Systems Corp. | 11.4 |

| Berkshire Hathaway Inc. - Class B | 10.4 |

| Liberty Broadband Corp. - Series A & C | 6.8 |

| Liberty Global plc - Class C | 6.3 |

| Mastercard Inc. - Class A | 5.0 |

| Alphabet, Inc. - Class C | 5.0 |

| Visa Inc. - Class A | 4.9 |

| Laboratory Corp. of America Holdings | 3.6 |

| Liberty SiriusXM Group - Series A & C | 3.6 |

| DXC Technology Co. | 3.5 |

| | 60.5 |

| |

Top Performers | Average | |

| | Return | Weight | Contribution |

| Intelligent Systems Corp. | 147.2% | 8.0% | 7.80% |

| Liberty Broadband Corp. - Series A & C | 27.5 | 8.6 | 2.50 |

| Mastercard Inc. - Class A | 25.0 | 5.2 | 1.28 |

| Liberty Global plc - Class C | 17.3 | 6.4 | 1.12 |

| Colfax Corp. | 42.0 | 2.9 | 1.10 |

| | |

Industry Breakdown | |

| | % of Net Assets |

| Information Technology | 33.6 |

| Communication Services | 29.0 |

| Financials | 17.3 |

| Consumer Discretionary | 6.8 |

| Industrials | 4.4 |

| Health Care | 3.6 |

| Materials | 2.0 |

| Securities Sold Short | (15.0) |

| Short Proceeds/Other | 18.3 |

| | 100.0 |

| |

Bottom Performers | Average | |

| | Return | Weight | Contribution |

| SPDR S&P 500 ETF Trust (short) | 13.5% | (15.5)% | (2.17)% |

| Berkshire Hathaway Inc. - Class B | (1.6) | 11.9 | (0.31) |

| Box, Inc. - Class A | 14.4 | 0.4 | (0.28) |

| Qurate Retail, Inc. - Series A | (18.1) | 1.7 | (0.27) |

| Markel Corp. | (4.0) | 1.9 | (0.09) |

Contributions to Fund performance are based on actual daily holdings. Securities may have been bought or sold during the quarter. Source: FactSet Portfolio Analytics Return shown is the actual quarterly return of the security or combination of share classes.

Returns assume reinvestment of dividends and redemption at the end of each period, and reflect the deduction of annual operating expenses which as stated in its most recent prospectus are 2.14% and 1.63% of the Fund’s Investor and Institutional Class net assets, respectively. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waivers and/or reimbursements. Performance data represents past performance, which does not guarantee future results. The investment return and the principal value of an investment in this Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end may be obtained at www.weitzinvestments.com/funds_and_ performance/fund_ performance.fs.See page 6 for additional performance disclosures. See page 70 for a description of all indices.

Performance information does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

17 | Q1 2019 ANNUAL REPORT

HICKORY FUND

Investment Style: Mid-Cap Value

Co-Portfolio Managers: Wally Weitz, CFA & Drew Weitz

The Hickory Fund returned +16.65% in the first calendar quarter compared to +16.54% for the Russell Midcap Index (the Fund’s primary benchmark) and +15.82% for the Russell 2500 Index. For the fiscal year ended March 31, the Fund returned +2.30% compared to +6.47% for the Russell Midcap and +4.48% for the Russell 2500.

The stock market performance of the last six months reminds us of the old joke, “If you don’t like the weather, wait a minute and it will change.” Tempestuous investor sentiment at year end turned suddenly serene in the first quarter, particularly as the Federal Reserve struck a more accommodative tone and fears of imminent recession receded to the background. We certainly had not forecast such a rapid recovery (we avoid such predictions altogether) but were pleased to deliver strong absolute performance in the first quarter (and a very modest relative performance “win,” as well).

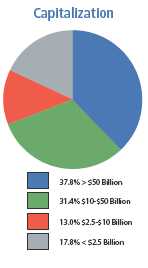

Price declines in the fourth quarter were sufficient to drive a number of potential new and existing investments into our desired “strike zone.” Although the recovery off the December low has been swift, we continue to find the valuation environment constructive and were again net buyers during the quarter. Looking back over the full fiscal year, the degree of recent portfolio activity stands out. Our residual cash position declined from nearly 21% a year ago to under 3% at March 31, leaving the Fund nearly fully invested for the first time in many years.

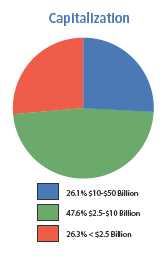

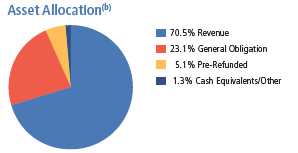

Buying stocks at attractive prices is always more fun than the alternative, but equally important is the quality of the businesses being bought. We attempt to quantify the quality for each investment by assigning a numeric value from one (highest) to seven (lowest) that considers factors, such as managerial acumen, competitive position, returns on investment, etc. (Importantly, investors should know that “quality” isn’t a proxy for “safety”; even the highest-quality business can see its share price suffer.) This Quality Score is one of many attributes we consider when determining the price at which an investment looks attractive. But all else equal, when two businesses trade at comparable valuations, we likely will be more drawn to the higher-quality company. Like price-to-value (P/V) estimates, our Quality Scores (QS) can also be aggregated at the portfolio level, and we are pleased to report that as the Fund’s invested level has risen, the portfolio’s overall QS estimate has improved, too. Hence, although our portfolio P/V is largely unchanged from the start of the fiscal year (in the high 70s), we are happily more invested in what we deem to be a higher-quality portfolio.