ANNUAL REPORT

March 31, 2021

EQUITY

Weitz Hickory Fund

Weitz Partners III Opportunity Fund

Weitz Partners Value Fund

Weitz Value Fund

ALLOCATION

Weitz Balanced Fund

FIXED INCOME

Weitz Core Plus Income Fund

Weitz Nebraska Tax-Free Income Fund

Weitz Short Duration Income Fund

Weitz Ultra Short Government Fund

PLEASE NOTE: Beginning January 1, 2021, shareholder reports will no longer be automatically sent by mail. See inside for more information.

2 Q1 2021 Annual Report

THE WEITZ PHILOSOPHY

Finding quality at a discount

There are no shortcuts in value investing. At Weitz, we dig for opportunities using a robust quality scoring process. We analyze hundreds of ideas to find strong, well-managed but undervalued companies that offer reasonable risk-adjusted returns. It’s simple – but it’s not easy. We do the due diligence, analyze, ask tough questions and push for answers. We wait for the right opportunities. Then, and only then, do we invest your money.

Fundamental Research-Driven Process

Our research-driven investment approach means deeply understanding our investable universe so we can capitalize on opportunities that arise out of market inefficiencies. Each of our analysts focuses on finding opportunities in specific industries, ensuring deep, ongoing research within their own areas of expertise. We also encourage a generalist mentality where all investment team members vet new ideas. All investment decisions are backed by thorough analysis, logical strategies, extensive debate and our team’s commitment to long-term growth.

Bottom-Up Focus

Our focus is on finding well-run companies with strong fundamentals and outstanding long-term prospects. Valuation is our North Star. When a security is selling at a significant discount to its intrinsic value, that’s when we buy. And when it’s not selling at a discount, we have the discipline and patience to wait for the price to come our way.

High-Conviction Investing

We believe there are a limited number of great investment ideas and that intrinsic value doesn’t change with the daily ebbs and flows of the market. Our high-conviction approach means we know what we own inside and out, allowing our funds to be highly concentrated.

Today we are responsible for approximately $3 billion in investments for our shareholders – individuals, corporations, pension plans, foundations and endowments. And our commitment remains the same: to put your goals first. Always. We do so through our expertise, our flexibility, and our drive to uncover investments that can help you preserve and grow wealth.

We’re right beside you

Weitz employees have a strong commitment of investing their own assets in our mutual funds. By aligning our goals with yours, you can have confidence that we’re treating your money as if it were our own.

Q1 2021 Annual Report 3

TABLE OF CONTENTS

Beginning on January 1, 2021, paper copies of the Fund’s shareholder reports will no longer be sent by mail unless specifically requested from the Fund or from your financial intermediary (such as a financial adviser). Instead, the reports will be made available at weitzinvestments.com and you will be notified by mail each time a report is posted. You will continue to receive other Fund regulatory documents (such as prospectuses or supplements) in paper unless you have elected to receive all Fund documents electronically.

If you would like to continue to receive the Fund’s future shareholder reports in paper free of charge after January 1, 2021, you may make that request (1) by contacting your financial intermediary; or (2) if you invest directly with the Fund, by calling 800-304-9745.

If you already receive shareholder reports and other Fund documents electronically, you will not be affected by this change, and you need not take any action. If you do not receive shareholder reports and other Fund documents electronically but would like to do so, contact your financial intermediary or, if you invest directly with the Fund, call 800-304-9745. An election to receive shareholder reports electronically will apply to all Funds held with the Weitz Funds and may apply to all funds held with your financial intermediary.

Value Matters | 4 |

Fixed Income Insights | 6 |

Performance Summary | 9 |

Analyst Corner | 10 |

Balanced Fund | 12 |

Core Plus Income Fund | 14 |

Hickory Fund | 18 |

Nebraska Tax-Free Income Fund | 20 |

Partners III Opportunity Fund | 24 |

Partners Value Fund | 26 |

Short Duration Income Fund | 28 |

Ultra Short Government Fund | 32 |

Value Fund | 34 |

Schedule of Investments | 36 |

Financial Statements | 54 |

Notes to Financial Statements | 64 |

Report of Independent Registered | |

Public Accounting Firm | 73 |

Actual and Hypothetical Expenses for | |

Comparison Purposes | 74 |

Other Information | 75 |

Information about the Trustees | |

and Officers | 76 |

Index Descriptions | 78 |

The management of Weitz Funds has chosen paper for the 80 page report from a paper manufacturer certified under the Sustainable Forestry Initiative ® standard.

Portfolio composition is subject to change at any time and references to specific securities, industries, and sectors referenced in this report are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. See the Schedules of Investments included in this report for the percent of assets in each of the Funds invested in particular industries or sectors.

4 Q1 2021 Annual Report

VALUE MATTERS

April 2, 2021

Dear Clients and Fellow Shareholders,

The first quarter of 2021 was a good one for our four stock funds. Gains ranged from +7.11% (for Partners III Opportunity) to +8.71% (for Hickory), and each fund beat its index. Twelve-month numbers were strong: +39.25% (Partners III) to +59.17% (Hickory), as the funds benefitted from an accident of the calendar, with the period beginning near the March 2020 bear market bottom. The Balanced Fund continued its stellar performance among “Conservative Allocation” funds with gains of +3.62% for the quarter and +21.74% for the 12 months.

Our bond funds held up remarkably well in the face of a sharp rise in yields (and drop in bond prices) during the quarter. Our Short Duration and Core Plus Income Funds had anticipated rising yields and held the average maturity of their bonds at the short ends of the ranges allowed by their charters. Short Duration’s total return was +0.66% for the quarter and Core Plus had a negative total return of -0.84%. To put these results in perspective, a seemingly insignificant rise in rates from 0.91% to 1.74% (as the 10-year Treasury bond experienced in the quarter) causes a 10-year bond to drop in price by about 5%. Tom and Nolan provide full details of a tumultuous quarter in the bond market in their latest “Fixed Income Insights.”

We feel good about these results. The past 12 months have been unprecedented in mind-boggling ways, and we think that our focus on Quality at a Discount investing has served us well.

Spring 2021 – How Are We Doing?

As we have written since the beginning of the pandemic, the answer to the question “how are we doing?” depends on who you are and what business you are in. For individuals, could you work from home? Were you an “essential service” worker who had to be in harm’s way? Did you work in travel, hospitality, entertainment, or another industry that was crippled by the pandemic and lose your job? If your livelihood was impaired, did you get by with government payments (that will end), and were your rent and mortgage payments “suspended” (but not forgiven)?

Companies face the same mixed bag. Some were major beneficiaries of the pandemic (Zoom, Netflix, Amazon) and others were nearly (or actually) put out of business (airlines, restaurants, theaters). Strong, liquid companies used the Fed’s cheap credit to extend debt maturities and lower interest costs while badly impacted companies borrowed billions to keep their doors open but will exit the pandemic with impaired balance sheets. Each industry will have its own recovery path, and the pace and strengths of those paths will vary widely.

Investors have been tossed about by extreme volatility in both the stock and bond markets. Savers trying to live on investment income had been suffering from low interest rates for a decade, and the Fed’s redoubled efforts to maintain liquidity exacerbated the income investors’ problem. Stock and bond investors have had to make assessments of the viability of all types of businesses in a post-COVID world. Stock prices tend to reflect expectations rather than current reality, so the task for investors is further complicated by the fact that we have no historical precedent for a pandemic recovery of this magnitude.

In short, it is very hard to generalize about “how we are doing.” The aggregate economic data paint a picture of a fairly robust recovery from recession lows. The “direction” of most indicators is positive, yet Treasury Secretary Yellen and Fed Chair Powell said as recently as late March that the economy needed “even more help” to counter the impact of COVID. The narrative of the bull market seems to be that the economy is so weak that continued low interest rates are assured, justifying high P/E ratios, yet a strong, reopening economy will provide prosperity and strong company earnings. This apparent internal contradiction has always troubled us. Nevertheless, we continue to live with the ambiguity, and we remain focused on individual company business values. In the words of famed value investor Seth Klarman, we worry top-down (macro-economic factors), but we invest bottom-up (one stock at a time).

What’s Next?

The biggest issue for investors is the future path of interest rates. Higher yields on bonds present stiffer competition and lower P/E ratios for stocks. This is why stock investors are so fixated on predicting changes in rates and why the Fed’s “promise” not to raise rates for two more years has made many investors feel that they can “pay up” for stocks with impunity.

Inflationary and deflationary forces have been in a titanic struggle for a long time, and it would be presumptuous of us to make a prediction as to what they will do next. Rates have ranged between (roughly) 0% and 20% over the course of our investment careers. They are near 0% now because of Fed manipulation. We do not try to predict rates, but investors should understand that 0% is probably not the “equilibrium” interest rate for the U.S. economy.

A moderate increase in rates, especially if the change is gradual, is not a problem for us. The stock market would probably wobble, but conservative investors and strong businesses can cope with higher rates. Speculators, though, who have borrowed at these very low rates to leverage their bets could find rising rates problematic. Each bull market spawns its own crop of speculative excesses, and the current version is no exception. Here are thumbnails on a few of the more colorful current examples:

Electric vehicles (along with battery makers and hydrogen fuel cell companies) have captured investors’ imaginations. Much has been written about the valuation of Tesla (its market cap recently approached the value of all other auto companies in the world combined). But at least Tesla has a product on the road. Nikola, Lordstown Motors, and some other startups have ideas for products that have been met with considerable skepticism, yet some have market caps in the billions.

The Robinhood online brokerage firm and Reddit online “communities” have been in the news in connection with “short squeezes” that have sent individual stocks soaring and inflicted losses in the billions on some large hedge funds. GameStop, a retail purveyor of videogames (whose best days are probably behind it), began 2021 at under $20 per share. Three weeks later, it had more than doubled. Then it took off, rising from $43 on Jan 21, to an intraday high of $483 on Jan 27, and closed at $54 on Feb 4. Quite a roundtrip for a two-week period (and the volatility continued during the balance of the quarter).

Bitcoin is a digital “token” based on “blockchain” technology. (We think of blockchain as an accounting ledger in which each transaction adds another increment to the structure, like building a “drip castle” at the beach. Blockchain technology itself is proving to have significant real-world applications.) Bitcoin is one of the best known of many cryptocurrencies. Bitcoin can be used as a

Q1 2021 Annual Report 5

medium of exchange and has value as long as others think it has value. It has serious fans who may be right in predicting that it has an important role as an alternative currency. On the other hand, Seth Klarman calls crypto “catnip for techies” and Warren Buffett has referred to Bitcoin as “probably rat poison squared.” We are skeptical about its future, but as neutral observers, we would suggest that Bitcoin���s price move from $6,446 on March 31, 2020, to $58,275 on March 31, 2021, shows evidence of speculative fever.

Finally, we come to NFTs – “Non-Fungible Tokens.” As an imperfectly informed layperson, we would describe NFTs as digital files (pictures or text) which can be “tokenized” through blockchain technology so that each is “unique.” They are, essentially, nothing… but one can “own” them. Thus, they can be bought and sold. This sounds to us like the made-up card game of TEGWAR (“The Exciting Game Without Any Rules”) that Mark Harris wrote about in his 1950’s novels, Southpaw and Bang the Drum Slowly. In the game, veteran baseball players would fleece the rookies by making up the rules as they went along, counting on the rookies’ embarrassment at not knowing how to play. Well, “harmless fun” at a few dollars per NFT, but a token attached to a collection of digital works by an artist known as Beeple recently sold at Christie’s for $69 million. Surely there is more to this story that will come out over time, but in our opinion, NFTs have a certain Emperor’s New Clothes aura.

Speculation is a natural part of securities markets. It is not evil. We have noticed, though, that in an interconnected world, when a speculative trading vehicle implodes, there can be collateral damage for innocent bystanders. (For example, the Mortgage Crisis of 2007 became the Great Financial Crisis of 2008-09 when the financial problems of some weaker institutions triggered a more general liquidity crisis for the whole economy. No prediction here… we just want to be alert to potential dangers.)

Outlook

Vaccines are here, the reopening of the global economy is proceeding, and corporations are generally finding ways to cope with the impact of the pandemic. We are optimistic about the future in general and, in particular, the growth in business value of our companies.

The issue that gives us pause is the level of stock (and bond!) valuations. We believe that the recovery news will be good, but it may not be as good, or come as quickly, as stock prices seem to be anticipating. This is not a disaster by any means, but some combination of earnings disappointments and rising interest rates may well interrupt the remarkable rebound from March 2020 lows. If something really scares investors and triggers another stock market “demolition derby,” as it did a year ago, our portfolios hold heavily armored vehicles that should bring us safely out the other end. Our returns may, or may not, have borrowed a little from the future, but we believe that our collection of businesses is positioned to serve us well over the next several years. That is what counts.

Thanks again for trusting us with your investments.

Sincerely,

Wally Weitz wally@weitzinvestments.com

Brad Hinton brad@weitzinvestments.com

For funds that offer more than one share class, performance provided herein is for that of the fund’s Investor Class. Please see page 9 for the funds’ Performance Summary.

As of 03/31/2021, the following portfolio company constituted a portion of the net assets of Balanced Fund, Hickory Fund, Partners III Opportunity Fund, Partners Value Fund, and Value Fund as follows:

• Amazon.com, Inc. (AMZN) 0.0%, 0.0 %, 2.5%, 0.0%, 2.8%

• GameStop Corp. (GME) 0.0%, 0.0%, 0.0%, 0.0%, 0.0%

• Lordstown Motors Corp. (RIDE) 0.0%, 0.0%, 0.0%, 0.0%, 0.0%

• Netflix, Inc. (NFLX) 0.0%, 0.0%, 0.0%, 0.0%, 0.0%

• Nikola Corporation (NKLA) 0.0%, 0.0%, 0.0%, 0.0%, 0.0%

• Tesla, Inc. (TSLA) 0.0%, 0.0%, 0.0%, 0.0%, 0.0%

• Zoom Video Communications, Inc. (ZM) 0.0%, 0.0%, 0.0%, 0.0%, 0.0%

Portfolio composition is subject to change at any time. Current and future portfolio holdings are subject to risk.

New Transfer Agent

We recently introduced FIS Investor Services as the Weitz Funds new transfer agent. This transition includes changes to online systems and service options. Of course, our client service colleagues are always ready to help if you need assistance.

6 Q1 2021 Annual Report

FIXED INCOME INSIGHTS

April 2, 2021

Dear Fellow Shareholder,

“What a difference a year makes.” It’s a phrase that might often be considered cliché – except for those with firsthand experience of the investment extremes of the past 12 months. The pessimism and fear so rampant a year ago as an economic hurricane was crashing across the world from a virus-induced global shutdown has been replaced with optimism and hope of economic revival. Stock prices have generally soared, and most bond prices (U.S. Treasuries being the exception) have more than recovered from the markdowns in those darker, scarier days a year ago.

The first quarter continued the positive trend of economic good news – but provided evidence reinforcing our year-end comments and warnings about low forward return prospects and why investment starting points matter. Without so much as a hint of the Federal Reserve withdrawing or tapering its support of the U.S. bond market (namely, keeping short-term interest rates at zero and buying $120 billion a month of primarily government securities), bond investors decided to throw a version of 2013’s taper tantrum and vote with their feet (sell) as economic strength and/or inflation concerns weighed on sentiment. The result was an acceleration of a move upward in longer-term U.S. Treasury interest rates that began last summer, albeit from historically low levels. For context, the 30-year Treasury had the worst first-quarter return since 1919, and investment-grade bonds (whose valuation always begins from a Treasury rate) had their worst first quarter return since 1980.

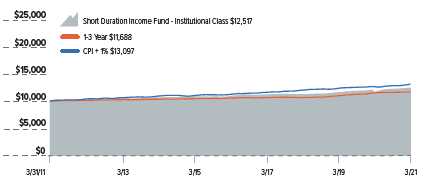

Weitz fixed income funds held their own in the first quarter. The Weitz Short Duration Income Fund posted positive results and the Weitz Core Plus Income Fund, while down modestly, posted strong relative quarterly returns compared to its index. The key driver to both funds’ outperformance in the quarter was having positioned them with historic low duration, in the case of Weitz Short Duration Income, and meaningfully less duration than its index or peers, in the case of Weitz Core Plus Income. Further detail about contributors to performance can be found in each fixed income fund’s quarterly commentary.

Fixed Income Market Update

The graph below shows the changes of select Treasury rates over the past quarter and year.

Source: Bloomberg

Source: BloombergThe Treasury curve steepened meaningfully in the first quarter as longer rates (particularly 10- and 30-year) rose. The 10-year Treasury rate has more than doubled from where it was a year ago and has risen significantly since year-end. The 30-year Treasury rate increased nearly 50% in the quarter, precipitating its worst first-quarter return in over 100 years. Shorter rates (0- to 3-year) remained anchored close to zero given the Fed’s resolve to leave the Fed Funds rate at or near zero.

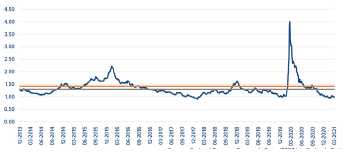

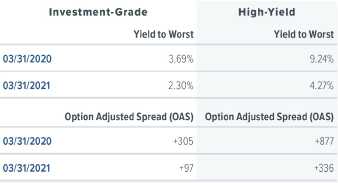

Spreads on corporate bonds continued to decline modestly in the first quarter. A broad measure of investment-grade corporate bond spreads, compiled by ICE BofA, continued their decline in the quarter -- from 103 basis points as of December 31 to 97 basis points on March 31. Declining corporate bond spread resulted in slight relative outperformance compared to U.S. Treasury bonds. This was small comfort for most corporate bond investors as investment-grade bonds still experienced their worst first-quarter return in decades. The chart below depicts the path of investment-grade credit spreads for the past 5 years (blue line) against the one-(orange) and five-year (gray) averages.

Source: Federal Reserve Economic Data (FRED) – St. Louis Fed

Overall, investment-grade corporate bond credit spreads are well below their 1- and 5-year averages and are only 7 basis points above the post-Great Recession lows set in early 2018. Viewed from an even longer time frame of 10 years, investment-grade corporate bond credit spreads have rarely been as low as they were at quarter end. Using daily data from the St. Louis Federal Reserve Economic Data, investment-grade corporate spreads have only been lower than Q1’s 97 basis points 1.6% of the time, or 43 out of 2,610 total observations. Economic optimism could plausibly push spreads even lower, but history is certainly not on its side.

Q1 2021 Annual Report 7

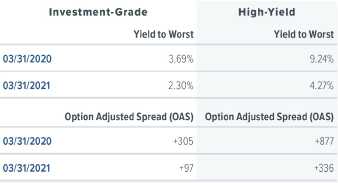

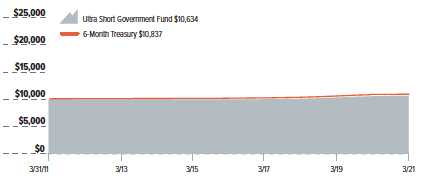

The table below provides a view of the changes for the broad investment-grade and high-yield universes that have transpired over the past year, as reported by ICE BofA. Yields and spreads have declined meaningfully, benefitting bond investors, including our bond funds, but the declines have left forward return prospects in yet another tough starting place.

Outlook

“The future should be viewed not as a fixed outcome that’s destined to happen and capable of being predicted, but as a range of possibilities and, hopefully on a basis of insight into their respective likelihoods, as a probability distribution.” – Howard Marks, Oaktree Capital

“Success in investing doesn’t correlate with I.Q. once you’re above the level of 125. Once you have ordinary intelligence, what you need is the temperament to control the urges that get other people into trouble in investing.” – Warren Buffett, Berkshire Hathaway Inc.

The two quotes above by very successful investors seemed fitting to place within the context of an outlook section. ‘Outlooks,’ by their nature, are simply guesses about a very unpredictable future. But those guesses can and should be informed by the current environment and relative to history. While we have cheered the year-to-date rise in base rates (U.S. Treasury) since it modestly improves forward return prospects, we are sober enough to realize that 10-year Treasury rates of less than 2% are still woefully low by historic standards – especially should inflation rear its long-dormant head. Couple this with credit spreads, especially investment-grade, that are at or near 10-year lows, we think it prudent to remain defensive. With respect to interest rate risk, we believe we have positioned our funds defensively by maintaining low duration. We will continue to strive to maintain the right ‘temperament’ that has historically allowed us to take advantage of the ‘pitches’ (preferably fat ones) that the markets invariably offer us and grow/learn in areas that are complementary to our core investment process.

Our fixed income funds have flexible mandates that allow us to navigate any environment by identifying the most favorable investment opportunities wherever we can find them. Just as important, we have the freedom to avoid areas where price and value appear the least favorable – which have recently been those areas most influenced by price-insensitive index investors and Fed intervention.

Our goals are to (a) preserve capital, (b) maintain a strong liquidity position, (c) understand evolving risks and opportunities, (d) conduct consistent/thorough credit surveillance, and (e) selectively take advantage of favorable risk/reward opportunities. These have long been and will continue to be our investment marching orders. We believe keeping these objectives front of mind while maintaining the ‘temperament,’ as referenced in Mr. Buffett’s quote, should continue to serve us and our fellow investors well in the quarters and years ahead.

For more on our market outlook, we encourage you to read Wally and Brad’s latest Value Matters, and for additional information regarding first quarter portfolio activity and current positioning, please see the fund commentaries later in this report. We remain ready to take advantage of valuation disparities that may develop and hope to continue to earn your trust.

Tom Carney tom@weitzinvestments.com

Nolan Anderson nolan@weitzinvestments.com

Definitions: Investment Grade: We consider investment grade to be those securities rated at least BBB- by one or more credit ratings agencies. Non-Investment Grade: We consider non-investment grade securities (commonly referred to as “high yield” or “junk” bonds) to be those rated BB+ and below. 30-Day SEC Yield represents net investment income earned by a fund over a 30-day period, expressed as an annual percentage rate based on the fund’s share price at the end of the 30-day period. Subsidized yield reflects fee waivers and/or expense reimbursements during the period. Without such fee waivers and/or expense reimbursements, if any; yields would have been lower. Unsubsidized yield does not adjust for any fee waivers and/or expense reimbursements in effect. Option Adjusted Spread: A “spread” compares the interest rate on a particular bond against a “base line” bond (typically a U.S. Treasury bond). When a bond issuer (or bondholder) has the option to exercise a right (for example, if the issuer can call a bond before its stated maturity date), then the “Option Adjusted Spread” takes into account the possibility that this option might be exercised—so a bond’s Option Adjusted Spread may be more (or less) than its regular spread. Yield to worst (YTW) is the lowest potential yield that can be received on a bond portfolio without the underlying issuers defaulting.

8 Q1 2021 Annual Report

DISCLOSURES

Data quoted is past performance and current performance may be lower or higher. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. All investments involve risks, including possible loss of principal. Please visit weitzinvestments. com for the most recent month-end performance.

Investment results reflect applicable fees and expenses and assume all distributions are reinvested but do not reflect the deduction of taxes an investor would pay on distributions or share redemptions. Net and Gross Expense Ratios are as of the Fund’s most recent prospectus. Certain Funds have entered into fee waiver and/or expense reimbursement arrangements with the Investment Advisor. In these cases, the Advisor has contractually agreed to waive a portion of the Advisor’s fee and reimburse certain expenses (excluding taxes, interest, brokerage costs, acquired fund fees and expenses and extraordinary expenses) to limit the total annual fund operating expenses of the Class’s average daily net assets through Contractual Expiration Date of 07/31/2021. The Net Expense Ratio reflects the total annual fund operating expenses of the Fund after taking into account any such fee waiver and/or expense reimbursement, if any; total returns would have been lower had there been no waivers or reimbursements.

Performance quoted for the Balanced, Partners Value and Value Funds’ Institutional Class shares before their inception is derived from the historical performance of the Investor Class shares, which have not been adjusted for the expenses of the Institutional Class shares, had they, returns would have been different.

Performance quoted for the Partners III Opportunity and Short Duration Income Funds’ Investor Class shares before their inception is derived from the historical performance of the Institutional Class shares, which have not been adjusted for the expenses of the Institutional Class shares, had they, returns would have been different.

Index performance is hypothetical and is shown for illustrative purposes only. You cannot invest directly in an index. See page 81 for a description of all indices. The Since Inception return for the Russell 1000 Value and CPI + 1% is from 5/31/1986 and 12/31/1988, respectively. All other indices Since Inception return are since the Fund’s inception. The inception date of the Bloomberg Barclays 1-3 Year U.S. Aggregate and 5-Year Municipal Bond was 12/31/1992 and 1/29/1988, respectively.

On 12/29/2006, the Nebraska Tax-Free Income Fund succeeded to substantially all of the assets of Weitz Income Partners Limited Partnership. On 12/31/1993, Partners Value Fund succeeded to substantially all of the assets of Weitz Partners II Limited Partnership. On 12/30/2005, Partners III Opportunity Fund succeeded to substantially all of the assets of Weitz Partners III Limited Partnership. The investment objectives, policies and restrictions of the Funds are materially equivalent to those of the Partnerships, and the Partnerships were managed at all times with full investment authority by the Investment Adviser. The performance information includes performance for the Partnerships. The Partnerships were not registered under the Investment Company Act of 1940 and, therefore, were not subject to certain investment or other restrictions or requirements imposed by the 1940 Act or the Internal Revenue Code. If the Partnerships had been registered under the 1940 Act, the Partnerships’ performance might have been adversely affected.

Effective 12/16/2016, the Ultra Short Government Fund revised its principal investment strategies. Prior to that date, the Fund operated as a “government money market fund” and maintained a stable net asset value of $1.00 per share. Performance prior to 12/16/2016 reflects the Fund’s prior principal investment strategies and may not be indicative of future performance results.

Effective 12/16/2016, the Short Duration Income Fund revised its principal investment strategies. Since that time the Fund has generally maintained an average effective duration between one to three and a half years. Prior to that date, the Fund maintained a dollar–weighted average maturity of between two to five years. Performance prior to 12/16/2016 reflects the Fund’s prior principal investment strategies and may not be indicative of future performance results.

Effective 03/29/2019, the Hickory Fund invests the majority of its assets in the common stock of medium–sized companies, which the Fund considers to be companies with a market capitalization, at the time of initial purchase, of greater than $1 billion and less than or equal to the market capitalization of the largest company in the Russell Midcap Index. Prior to that date, the Fund invested the majority of its assets in the common stock of smaller– and medium–sized companies, which the Fund considered to be companies with a market capitalization, at the time of initial purchase, of less than $10 billion.

Q1 2021 Annual Report 9

PERFORMANCE SUMMARY

| | | | | | | | | | |

| | | | ANNUALIZED | | | |

| | | | | | Since Fund | Inception | Net | Gross |

| EQUITY | QTD | YTD | 1 YR | 5 YR | 10 YR | Inception*

| Date | Expense

| Expense

|

| Hickory Fund (WEHIX) | 8.71% | 8.71% | 59.17% | 9.38% | 8.06% | 9.70% | 4/1/1993* | 1.09% | 1.13% |

Russell Midcap® | 8.14 | 8.14 | 73.64 | 14.67 | 12.47 | 11.34 |

|

|

|

| Partners III Opportunity Fund - Investor (WPOIX) | 7.11 | 7.11 | 39.25 | 9.78 | 8.55 | 12.21 | 8/1/2011 | 2.03 | 2.03 |

| Partners III Opportunity Fund - Institutional (WPOPX) | 7.30 | 7.30 | 40.11 | 10.40 | 9.01 | 12.33 | 6/1/1983* | 1.44 | 1.44 |

S&P 500® | 6.17 | 6.17 | 56.35 | 16.29 | 13.91 | 11.44 |

|

|

|

Russell 3000® | 6.35 | 6.35 | 62.53 | 16.64 | 13.79 | 11.27 |

|

|

|

| Partners Value Fund - Investor (WPVLX) | 8.34 | 8.34 | 58.17 | 9.85 | 8.90 | 11.69 | 6/1/1983* | 1.09 | 1.13 |

| Partners Value Fund - Institutional (WPVIX) | 8.37 | 8.37 | 58.43 | 10.12 | 9.07 | 11.73 | 7/31/2014 | 0.89 | 0.93 |

S&P 500® | 6.17 | 6.17 | 56.35 | 16.29 | 13.91 | 11.44 |

|

|

|

Russell 3000® | 6.35 | 6.35 | 62.53 | 16.64 | 13.79 | 11.27 |

|

|

|

| Value Fund - Investor (WVALX) | 7.38 | 7.38 | 56.97 | 14.11 | 11.69 | 10.74 | 5/9/1986* | 1.08 | 1.08 |

| Value Fund - Institutional (WVAIX) | 7.42 | 7.42 | 57.28 | 14.37 | 11.85 | 10.79 | 7/31/2014 | 0.89 | 0.94 |

S&P 500® | 6.17 | 6.17 | 56.35 | 16.29 | 13.91 | 10.84 |

|

|

|

Russell 1000® | 5.91 | 5.91 | 60.59 | 16.66 | 13.97 | 10.90 |

|

|

|

|

| | | | ANNUALIZED | | | |

|

|

|

|

|

| Since Fund | Inception | Net | Gross |

| ALLOCATION | QTD | YTD | 1 YR | 5 YR | 10 YR | Inception*

| Date | Expense

| Expense |

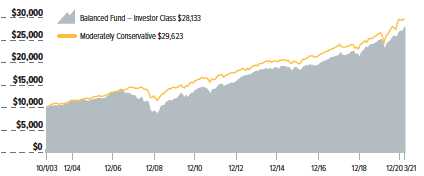

| Balanced Fund - Investor (WBALX) | 3.62% | 3.62% | 21.74% | 8.11% | 6.91% | 6.08% | 10/1/2003* | 0.85% | 1.14% |

| Balanced Fund - Institutional (WBAIX) | 3.69 | 3.69 | 21.93 | 8.16 | 6.94 | 6.10 | 3/29/2019 | 0.70 | 0.95 |

Morningstar Moderately Conservative Target Risk | 0.31 | 0.31 | 22.18 | 7.71 | 6.21 | 6.40 |

|

|

|

|

| | | | ANNUALIZED | | | |

| | | | | | Since Fund | Inception | Net | Gross |

| FIXED INCOME | QTD | YTD | 1 YR | 5 YR | 10 YR

| Inception* | Date | Expense | Expense

|

| Core Plus Income Fund - Investor (WCPNX) | (0.84)% | (0.84)% | 12.79% | 4.83% | N/A% | 4.32% | 7/31/2014* | 0.50% | 1.18% |

| Core Plus Income Fund - Institutional (WCPBX) | (0.73) | (0.73) | 12.88 | 5.03 | N/A | 4.52 | 7/31/2014* | 0.40 | 0.80 |

Bloomberg Barclays U.S. Aggregate Bond | (3.37) | (3.37) | 0.71 | 3.10 | N/A | 3.20 |

|

|

|

| Nebraska Tax-Free Income Fund (WNTFX) | (0.56) | (0.56) | 2.67 | 1.60 | 1.97 | 4.40 | 10/1/1985* | 0.45 | 1.10 |

Bloomberg Barclays 5-Year Municipal Bond | (0.31) | (0.31) | 5.07 | 2.52 | 2.93 | N/A |

|

|

|

| Short Duration Income Fund - Investor (WSHNX) | 0.66 | 0.66 | 6.29 | 2.40 | 2.08 | 4.87 | 8/1/2011 | 0.55 | 0.95 |

| Short Duration Income Fund - Institutional (WEFIX) | 0.67 | 0.67 | 6.32 | 2.57 | 2.27 | 4.93 | 12/23/1988* | 0.48 | 0.64 |

Bloomberg Barclays 1-3 Year U.S. Aggregate | (0.07) | (0.07) | 1.19 | 1.96 | 1.57 | N/A |

|

|

|

U.S. Consumer Price Index (CPI) Plus 1.00% | 1.94 | 1.94 | 3.65 | 3.18 | 2.73 | 3.49 |

|

|

|

| Ultra Short Government Fund (SAFEX) | 0.03 | 0.03 | 0.29 | 1.22 | 0.62 | 2.29 | 8/1/1991* | 0.20 | 0.71 |

ICE BofA U.S. 6-Month Treasury Bill | 0.04 | 0.04 | 0.16 | 1.40 | 0.81 | 2.84 |

|

|

|

* | Denotes the Funds inception date and the date from which Since Inception Performance is calculated. |

10 Q1 2021 Annual Report

ANALYST CORNER

AutoZone (AZO)

By Jon Baker, CFA,

Research Analyst

Downshifting Into 2021 With the Straightaway in Sight

Over the past 40 years, AutoZone has grown into the largest retailer of aftermarket auto parts in the U.S. As the company continues to serve the do-it-yourself auto repair market, its commercial supply business has also begun to turn the corner.

AutoZone (AZO) will be a familiar name to most readers – not only for its well-known slogan (“Get in the zone – AutoZone”) but for its expansive retail presence. It is the largest retailer of aftermarket automotive parts in the U.S. and plans to open its landmark 6,000th store this year.

AutoZone’s history began in 1979 when entrepreneur Joseph R. “Pitt” Hyde III opened its first location – then named Auto Shack. In 1984, Hyde and private equity firm KKR took Auto Shack’s parent company private, and within four years had divested its sibling operations to focus on the growing auto parts chain. Rebranded as AutoZone, the business returned to public equity markets in 1991.

The aftermarket auto parts industry encompasses the direct sale of parts to consumers as well as commercial sales to auto repair shops. AutoZone holds a sub-15% share of the estimated $90-100 billion relevant parts market, similar to that of competitor O’Reilly Auto Parts. AutoZone and its three largest competitors (O’Reilly, Advance Auto Parts, and Genuine Parts) collectively claim less than half of the domestic market, and we expect them to continue to chip away at the remaining share over time.

As vehicles age, rack up miles, and lose value, they tend to pass from higher to lower-income owners. This transition often entails maintenance and repair work performed by franchised dealers for newer, especially warrantied, vehicles; do-it-for-me (DIFM) repair shops for middle-aged vehicles; and do-it-yourself (DIY) consumers for higher-mileage vehicles. Over time, as vehicles have become more technologically advanced, maintenance and repairs have become more complex in turn, spurring DIFM to grow somewhat faster than DIY – a trend we expect to continue. This trend toward DIFM is typically muted during recessions, as the ranks of the value-conscious swell and then reaccelerates in improving environments as vehicle owners begin to spend more freely on third-party services.

Among AutoZone’s largest competitors, O’Reilly Auto Parts has long made its DIFM business a cultural priority. DIFM accounts for roughly 40% of O’Reilly’s sales compared to a little over 20% for AutoZone. O’Reilly’s commercial focus, along with more recent and impactful acquisitiveness, has served its shareholders well over the years. Commercial accounts require speedy delivery, and that means having a robust supply chain that positions inventory – even sporadically purchased items – nearer to purchasers. For the past several years, AutoZone has grown its number of hub stores, mega-hub stores, and distribution centers, resulting in a physical network that more closely resembles that of O’Reilly. AutoZone’s commercial sales were already perking up pre-COVID, and we expect that the company is much better situated today to benefit from a post-recession shift from DIY back to DIFM volumes. Company management says they believe they are “in the early innings of a transformational growth story.”

Still, the DIY side of the house remains AutoZone’s bread and butter, and this area of the business showed particular strength during the COVID pandemic. For those who live or work outside of large urban areas, having a working vehicle is critical to maintaining one’s income, especially if one’s job cannot be done remotely. With stimulus payments in hand, AutoZone’s customers poured more money into their vehicles than in prior recessions. This resulted in a level of DIY sales we believe AutoZone is unlikely to repeat this year.

While last year’s DIY volumes may prove difficult to achieve again in 2021, we believe the medium-term prospects remain good for AutoZone’s consumer-facing business. New car sales fell substantially leading up to and during 2009. Fewer new vehicles sold during that time naturally created a lack of older vehicles as the years passed. The population of older vehicles (for example, those 6-12 years old) typically addressed by AutoZone’s DIY business has shrunk approximately 20% over the past decade, but it stopped declining in 2020 and we believe is likely to increase by 25% over the coming several years. A more plentiful supply of older vehicles should make them relatively cheaper in time and help shift more of them into DIY customers’ hands.

Like many companies, AutoZone held onto excess cash until the fog of COVID had largely lifted. The company entered 2021 with financial leverage well below its target. At the time of the Funds’ investment, we estimated that AutoZone’s near-term free cash flow and incremental borrowing (to achieve its leverage target) could fund the repurchase of approximately 20% of the company’s outstanding shares.

We believe AutoZone’s DIY and DIFM businesses can both perform better over the next several years than they have in the past. While the COVID-related sales windfall of 2020 may result in 2021 sales that appear weak in comparison, we expect sustained revenue growth to resume thereafter. AutoZone’s improving long-term operating fundamentals should result in a continued ability to deploy substantial amounts of capital on behalf of shareholders. The expected growth ‘pause’ helped knock some price out of the stock and created an opportunity for us to purchase a high-quality business at an attractive price; a great example of our Quality at a Discount investing approach in action.

As of 03/31/2021, each of the following portfolio companies constituted a portion of the net assets of Balanced Fund, Hickory Fund, Partners III Opportunity Fund, Partners Value Fund, and Value Fund as follows: Advance Auto Parts, Inc. (AAP) 0.0%, 0.0%, 0.0%, 0.0%, 0.0%; AutoZone, Inc. (AZO) 1.7%, 4.1%, 1.1%, 2.3%, 2.7%; Genuine Parts Company (GPC) 0.0%, 0.0%, 0.0%, 0.0%, 0.0%; O’Reilly Automotive, Inc. (ORLY) 0.0%, 0.0%, 0.0%, 0.0%, 0.0%.

Jon Baker, CFA, joined Weitz Investments in 1997. Prior to joining the firm, he audited equity funds (including the Weitz Funds) as a certified public accountant at McGladrey & Pullen. Jon has a bachelor’s in accounting and computer applications from the University of Notre Dame.

Q1 2021 Annual Report 11

This page intentionally left blank

12 Q1 2021 Annual Report

BALANCED FUND

Portfolio Manager: Brad Hinton, CFA

Investment Style: Conservative Allocation

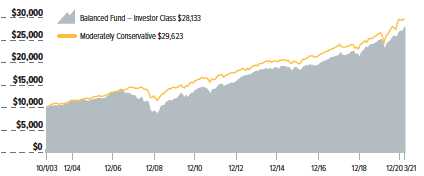

The Balanced Fund’s Institutional Class returned +3.69% for the first quarter compared to +0.31% for the Morningstar Moderately Conservative Target Risk Index. For the fiscal year ending March 31, 2021, the Fund’s Institutional Class returned +21.93% compared to +22.18% for the index.

Total returns well above inflation have helped our investors retain, and steadily build, wealth. Over a 10-year period, the Fund’s Institutional Class has returned 6.94% annualized compared to 6.21% for the index.

The “economic reopening” trade continued in the first quarter with some vigor. Smaller companies, cyclical businesses and other value-oriented fare were the strongest beneficiaries. Aggressive growth stocks, which had dominated the return scoreboard for several years, lagged considerably. Against this backdrop, the Fund’s stocks delivered strong returns, leading the Fund to outperform its index for the quarter.

Bonds generally declined in value as the 10-year Treasury yield nearly doubled from 0.91% to 1.74% during the quarter. As yields rise, bond prices fall. For example, here is the quarterly performance for three bond ETFs – these markdowns are not for the faint of heart:

• The iShares 20+ Year Treasury Bond ETF (ticker TLT) returned -13.98%,

• The iShares iBoxx $ Investment Grade corporate bond ETF (ticker LQD) returned -5.51%,

• The iShares Core U.S. Aggregate Bond ETF (ticker AGG) returned -3.39%.

In contrast, the Fund’s short-maturity collection of high-quality bonds did not lose value in the quarter, fulfilling its role as dull, but effective, portfolio ballast.

Financial stocks enjoyed healthy first-quarter gains. Charles Schwab and JPMorgan Chase were outsized contributors as investors refocused on earning power in “normal” times. Google parent Alphabet provided new disclosures that highlighted the profitability of its services businesses and the upside potential of its Cloud Platform. Companies far removed from the mega-cap glare, such as LabCorp, AutoZone, and Vulcan Materials, also delivered exceptional returns; we can often develop more of a research edge in businesses that are not under the constant attention of the industry and financial media. Charter Communications, Visa and Thermo Fisher Scientific were modest quarterly detractors. All have been significant long-term winners, and all continue to have bright outlooks.

Stocks rebounded from their pandemic lows throughout the Fund’s fiscal year, with most soaring higher. LabCorp and Thermo Fisher Scientific experienced revenue growth from helping society deal with the COVID-19 outbreak, and their core businesses showed resilience. Charles Schwab’s stock nearly doubled, and the TD Ameritrade acquisition solidified the company’s strategic position. Alphabet and Microsoft both posted terrific results and enjoy sustained long-term tailwinds. Not surprisingly given the strength of the overall market, the Fund had no equity detractors for the fiscal year.

Our team is continually working to improve the portfolio as we process new information. Timely additions to AutoZone, Comcast, and Markel enhanced quarterly returns. We trimmed position sizes in Thermo Fisher and Alphabet on stock price strength. This type of limited, periodic rebalancing is disciplined but not mechanical. Decisions are based on stock prices relative to our value estimates, fundamental progress at each business, quality score considerations, and analyst conviction.

We wrote last quarter about the fixed income “winter” caused by extremely low interest rates. As described above, bonds indeed suffered an “arctic blast” to start the year. While modestly higher starting yields are welcome green shoots, investors should not confuse them with a return to full springtime glory. We added some four- to five-year Treasuries as yields increased, but our overall positioning remains quite defensive. If base rates and/ or spreads continue to rise, expect us to increase risk exposure prudently and with due caution.

The Fund’s portfolio continues to evolve with market conditions. We own common equity stakes in 29 companies totaling 44.6% of net assets. High-yielding, hybrid securities represent another 2.7% of the Fund. Fixed income holdings include investment-grade corporate bonds (3.9%), securitized debt (10.9%), Treasury securities (26.3%), and cash equivalents (11.6%). We have plenty of capacity to lean into new opportunities as our team uncovers them.

We think the Fund remains well-positioned to provide long-term capital appreciation and capital preservation. Meaningful current income will be more challenging for the time being. As always, we encourage investors to evaluate the strategy on a total-return basis over longer time horizons. Thank you for your investment and continued confidence in the Fund and our firm.

Definitions: Investment Grade Bonds are those securities rated at least BBB-.

Q1 2021 Annual Report 13

| Returns | | | | | | | | | |

| | | | | Annualized | | | | |

|

|

|

|

|

|

| Since Fund |

|

|

|

|

|

|

|

|

| Inception | Net | Gross |

| QTD | YTD | 1 YR | 3 YR | 5 YR | 10 YR | (10/1/2003) | Expense | Expense |

| WBALX - Investor Class | 3.62% | 3.62% | 21.74% | 9.06% | 8.11% | 6.91% | 6.08% | 0.85% | 1.14% |

| WBAIX - Institutional Class | 3.69 | 3.69 | 21.93 | 9.16 | 8.16 | 6.94 | 6.10 | 0.70 | 0.95 |

| Moderately Conservative | 0.31 | 0.31 | 22.18 | 8.23 | 7.71 | 6.21 | 6.40 |

|

|

Growth of $10,000 Investment Since Inception

| Top 10 Stock Holdings | |

| % of Net Assets |

| Aon plc - Class A | 2.2 |

| Berkshire Hathaway Inc. - Class B | 2.2 |

| The Charles Schwab Corp. | 2.2 |

| Laboratory Corp. of America Holdings | 2.1 |

| Microsoft Corp. | 2.0 |

| Alphabet, Inc. - Class C | 1.9 |

| Vulcan Materials Co. | 1.8 |

| Markel Corp. | 1.8 |

| Thermo Fisher Scientific Inc. | 1.8 |

| AutoZone, Inc. | 1.7 |

| | 19.7 |

| Top Stock Performers | | | |

| | Average | |

| Return

| Weight

| Contribution |

| The Charles Schwab Corp. | 23.3% | 2.1% | 0.46% |

| Laboratory Corp. of America Holdings | 25.3 | 2.0 | 0.45 |

| Alphabet, Inc. - Class C | 18.1 | 1.9 | 0.34 |

| AutoZone, Inc. | 18.5 | 1.3 | 0.28 |

| JPMorgan Chase & Co. | 20.7 | 1.4 | 0.27 |

| | | | |

| Bottom Stock Performers | | | |

| Average | |

| Return

| Weight

| Contribution |

| Charter Communications, Inc. - Class A | (6.7)% | 1.6% | (0.12)% |

| Visa Inc. - Class A | (3.1) | 1.6 | (0.05) |

| Thermo Fisher Scientific Inc. | (2.0) | 1.9 | (0.02) |

| Mastercard Inc. - Class A | (0.1) | 1.6 | – |

| Fidelity National Information Services, Inc. | (0.3) | 1.5 | – |

| 30-Day SEC Yield | | |

Share Class | Subsidized

| Unsubsidized |

| Investor | (0.09)% | (0.35)% |

| Institutional | 0.06 | (0.09) |

| Industry Breakdown | |

| % of Net Assets |

| Information Technology | 11.6 |

| Financials | 11.6 |

| Health Care | 5.5 |

| Communication Services | 5.0 |

| Materials | 4.4 |

| Industrials | 3.3 |

| Consumer Discretionary | 1.7 |

| Consumer Staples | 1.5 |

| Total Common Stocks | 44.6 |

| U.S. Treasury Notes | 26.3 |

| Asset-Backed Securities | 7.2 |

| Corporate Bonds | 3.9 |

| Mortgage-Backed Securities | 3.3 |

| Non-Convertible Preferred Stocks | 1.7 |

| Corporate Convertible Bonds | 1.0 |

| Commercial Mortgage-Backed Securities | 0.4 |

| Cash Equivalents/Other | 11.6 |

| Total Bonds & Cash Equivalents | 55.4 |

| | 100.0 |

| Fixed Income Attributes | |

Portfolio Summary | |

| Average Maturity | 1.7 years |

| Average Effective Maturity | 1.8 years |

| Average Duration | 1.5 years |

| Average Effective Duration | 1.5 years |

| Average Coupon | 1.7% |

| Credit Quality | |

Underlying Securities | % of Bond Portfolio |

| U.S. Treasury | 47.5 |

| U.S. Government Agency Mortgage Related Securities | 3.3 |

| AAA | 13.0 |

| AA | 3.2 |

| A | 0.6 |

| BBB | 6.7 |

| BB | 3.1 |

| Non-Rated | 1.8 |

| Cash Equivalents | 20.8 |

| | 100.0 |

Data quoted is past performance and current performance may be lower or higher. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. All investments involve risks, including possible loss of principal. Please visit weitzinvestments.com for the most recent month-end performance.

Investment results reflect applicable fees and expenses and assume all distributions are reinvested but do not reflect the deduction of taxes an investor would pay on distributions or share redemptions. Net and Gross Expense Ratios are as of the Fund’s most recent prospectus. The Fund has entered into fee waiver and/or expense reimbursement arrangements with the Investment Advisor. The Advisor has contractually agreed to waive a portion of the Advisor’s fee and reimburse certain expenses (excluding taxes, interest, brokerage costs, acquired fund fees and expenses and extraordinary expenses) to limit the total annual fund operating expenses of the Class’s average daily net assets through 07/31/2021. The Net Expense Ratio reflects the total annual fund operating expenses of the Fund after taking into account any such fee waiver and/or expense reimbursement, if any; total returns would have been lower had there been no waivers or reimbursements.

See page 8 for additional performance disclosures. See page 81 for a description of all indices.

Credit ratings are assigned to underlying securities utilizing ratings from a Nationally Recognized Statistical Rating Organization (NRSRO) such as Moody’s and Fitch, or other rating agencies and applying the following hierarchy: security is determined to be Investment Grade if it has been rated at least BBB- by one credit rating agency; once determined to be Investment Grade (BBB- and above) or Non-Investment Grade (BB+ and below) where multiple ratings are available, the lowest rating is assigned. Mortgage-related securities issued and guaranteed by government-sponsored agencies such as Fannie Mae and Freddie Mac are generally not rated by rating agencies. Securities that are not rated do not necessarily indicate low quality. Ratings are shown in the Fitch scale (e.g., AAA). Ratings and portfolio credit quality may change over time. The Fund itself has not been rated by a credit rating agency.

Contributions to Fund performance are based on actual daily holdings. Securities may have been bought or sold during the quarter. Return shown is the actual quarterly return of the security or combination of share classes.

Source (Fixed Income Attributes, Credit Quality, and Maturity Distribution): Bloomberg Analytics

Source (Top Performers, Bottom Performers): FactSet Analytics

14 Q1 2021 Annual Report

CORE PLUS INCOME FUND

Portfolio Managers: Tom Carney, CFA & Nolan Anderson

Investment Style: Intermediate-Term Bond

The Core Plus Income Fund’s Institutional Class returned -0.73% for the first quarter compared to -3.37% for the Bloomberg Barclays U.S. Aggregate Bond Index. For the fiscal year ending March 31, 2021, the Fund’s Institutional Class returned +12.88% compared to +0.71% for the index. Our significantly lower-than-index duration profile of 4.5 years, versus 6.3 years for the index, drove outperformance, while strong sector and security selection, led by high-yield securities, drove our strong absolute and relative performance over the past 12 months.

Given the significant rise in longer-term interest rates during the quarter, the Fund’s overall yield to worst (YTW) declined to 2.4% as of March 31, 2021, from 2.7% as of December 31, 2020. As a reminder, YTW has historically been a reasonable predictor of forward returns. And while prospective returns in fixed income remain challenging, our YTW at quarter-end remains quite favorable compared to the index’s YTW of 1.6%.

Last quarter we discussed the myriad of challenges fixed income investors faced with near-record-low yields across U.S. fixed income markets. Moreover, we discussed the risk/ return imbalance in the U.S. corporate bond market given its 20-year high sensitivity to movements in interest rates while the compensation in yield hit an all-time record low of less than 1.75%. While the timing was not expected, we are not surprised that U.S. corporate bonds – as measured by the Bloomberg Barclays U.S. Investment Grade Corporate Bond Index – had their worst quarter of performance since the Great Financial Crisis with a return of -4.65%. Positively, rising interest rates have led to a greater than 50 bps increase in the YTW for the Bloomberg Barclays U.S. Investment Grade Corporate Bond Index, ending the quarter at 2.28%. Despite this improvement, the overall investment-grade market remains far from a target-rich environment.

Portfolio Positioning

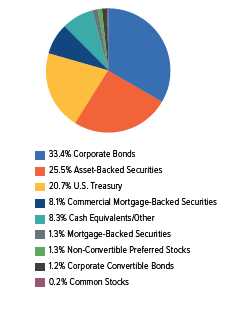

The table below shows how we have allocated portfolio capital to various sectors, from the time periods of December 31, 2020, to March 31, 2021, and from March 31, 2020, to March 31, 2021. Since our goal is to invest in sectors that we believe offer the best risk-adjusted returns, our allocations may change significantly over time.

| |

|

|

|

|

|

|

|

| Qtr Over Qtr |

| Yr Over Yr |

| Sector (% of Net Assets) | 3/31/2021 | 12/31/2020

| Change | 3/31/2020

| Change |

| Corporate Bonds | 33.4 | 35.4 | -2.0 | 35.0 | -1.6 |

| Corporate Convertible Bonds | 1.2 | 1.4 | -0.2 | 1.2 | +0.0 |

| Asset-Backed Securities (ABS) | 25.5 | 26.1 | -0.6 | 28.8 | -3.3 |

| Corporate Collateralized | 6.9 | 3.8 | +3.1 | 0.0 | +6.9 |

| Loan Obligations (CLOs)* |

|

|

|

|

|

| Commercial Mortgage-Backed | 8.1 | 7.5 | +0.6 | 11.0 | -2.9 |

| Securities (CMBS) |

|

|

|

|

|

| Agency Mortgage-Backed (MBS) | 0.5 | 0.7 | -0.2 | 1.6 | -1.1 |

| Non-Agency Mortgage Backed |

|

|

|

|

|

| (RMBS) | 0.8 | 1.3 | -0.5 | 2.6 | -1.8 |

| Non-Convertible Preferred Stock | 1.3 | 1.5 | -0.2 | 0.0 | +1.3 |

| Taxable Municipal Bonds | 0.0 | 0.0 | +0.0 | 0.4 | -0.4 |

| U.S. Treasury | 20.7 | 15.2 | +5.5 | 18.1 | +2.6 |

| Common Stock | 0.2 | 0.2 | +0.0 | 0.1 | +0.1 |

| Cash & Equivalents | 8.3 | 10.7 | -2.4 | 1.2 | +7.1 |

| Total | 100.0 | 100.0 |

| 100.0 |

|

| High Yield** | 16.8 | 14.8 | +2.0 | 12.5 | +4.3 |

| |

| Effective duration (years) | 4.5 | 4.2 | +0.3 | 4.6 | -0.1 |

| Effective maturity (years) | 6.3 | 5.3 | +1.0 | 5.8 | +0.5 |

* | Corporate CLOs are included in the ABS segment in the Fund’s schedule of investments but are additionally called out separately for the purposes of the discussion. |

** | High-Yield exposure (as of 03/31/2021) consists of investments in the Corporate, Corporate Convertible, ABS, and CMBS sectors. |

First quarter investment activity was led by U.S. Treasuries and corporate (CLOs). The largest declines in sector allocation were asset-backed securities (ABS), cash, and corporate bonds. Given the material increase in interest rates during the quarter, we increased our allocation to intermediate and longer-term U.S. Treasuries. Within corporate CLOs, we added to our middle-market CLO positions, which now represents approximately 7% of assets. We invested in AA-rated tranches issued by Blackstone, Cerberus, Fortress, and Golub. We also participated in two broadly syndicated loan transactions, purchasing the AA-rated tranches issued by Fidelity and Palmer Square. We maintain a positive view on investment-grade CLO tranches and believe the risk/reward remains attractive, especially relative to short-intermediate duration corporate bonds.

As of March 31, 2021, our high-yield exposure as a percent of net assets was 16.8%, up from 14.8% on December 31, 2020, (the portfolio’s high-yield limit is 25%). In terms of overall portfolio metrics, the average effective maturity increased to 6.3 years from 5.3 years, and the average effective duration increased to 4.5 years from 4.2 years on December 31, 2020. These measures provide a guide to the Fund’s interest rate sensitivity. A lower average effective maturity and shorter average effective duration reduce the Fund’s price sensitivity to changes in interest rates (either up or down).

Top Quarterly Contributors

Sector allocation and security selection were the key drivers of performance.

• High-Yield Corporate Bonds: Our high-yield corporate bond segment was the largest positive contributor during the quarter as credit spreads tightened, particularly in cyclical sectors such as energy, airlines, leisure, and retail. NGL Energy was the largest positive contributor, followed by American Airlines, VistaJet, and Limited Brands.

• Commercial Mortgage-Backed Securities (CMBS): Our CMBS segment experienced modest price appreciation and solid coupon income in the quarter as overall credit performance remains solid across our various commercial real estate CLOs and single-asset, single-borrower holdings.

• Asset-Backed Securities (ABS): Our ABS investments across all categories (e.g., auto, consumer, equipment, and fleet lease) provided solid coupon income and capital appreciation while also continuing to exhibit better-than-anticipated credit performance.

Top Quarterly Detractors

• U.S. Treasury Bonds: Our U.S. Treasury holdings were the primary detractor to performance. With an effective duration of approximately 13 years, our Treasury portfolio was negatively impacted by rising longer-term (20-30 year) interest rates as the yield curve steepened during the quarter.

Q1 2021 Annual Report 15

Top Fiscal Year Contributors

• Corporate Bonds: Our investments in a wide variety of corporate bonds, including high yield, were the largest positive contributors to performance during the fiscal year ending March 31, 2021.

• Asset-Backed Securities (ABS): Our ABS investments across all categories (e.g., auto, consumer, equipment, fleet lease) provided solid coupon income and capital appreciation while also continuing to exhibit better-than-anticipated credit performance.

• Commercial Mortgage-Backed Securities (CMBS): Our CMBS segment experienced modest price appreciation and solid coupon income in the fiscal year as overall credit performance remains solid across our various commercial real estate CLOs and single-asset, single-borrower holdings.

Top Fiscal Year Detractors

• U.S. Treasury Bonds: Our U.S. Treasury holdings were the primary detractor to performance during the fiscal year ending March 31, 2021. With an effective duration of approximately 13 years, our Treasury portfolio was negatively impacted by rising longer-term (20-30 year) interest rates as the yield curve steepened

Fund Strategy

Our approach consists primarily of investing in a diversified portfolio of high-quality bonds while maintaining an overall portfolio average duration of 3.5 years to 7 years. Our goal is to capture attractive coupon income and potential price appreciation by investing in longer-duration and lower-quality bonds when attractively priced. We may invest up to 25% in fixed-income securities that are not considered investment-grade (such as high-yield and convertible bonds as well as preferred and convertible preferred stock) but have favorable risk/reward characteristics.

We do not, and will not, try to mimic any particular index as we construct our portfolio. We believe our flexible mandate and concentrated portfolio will benefit investors over the long term. We utilize a bottom-up, research-driven approach and select portfolio assets one security at a time based on our view of opportunities in the marketplace. Our fixed income research is not dependent on, but often benefits from, the due diligence work our equity teammates conduct on companies and industries.

Overall, we strive to be adequately compensated for the risks assumed in order to maximize investment (or reinvestment) yield and to avoid making interest rate bets, particularly ones that depend on interest rates going down. We have often maintained a lower duration profile than the index, particularly in very low-yield environments. Our shorter duration profile has benefited shareholders in periods of rising interest rates.

Maintaining a diversified portfolio and liquidity reserves is a key element of our risk management approach. As a result, we have not held back from owning U.S. Treasury bonds, and at times like now, ample cash reserves. We believe this approach has served clients well, particularly in extreme market environments like the pandemic brought upon us in March 2020.

Definitions: Average effective duration provides a measure of a fund’s interest-rate sensitivity. The longer a fund’s duration, the more sensitive the fund is to shifts in interest rates. Average effective maturity is the weighted average of the maturities of a fund’s underlying bonds. Investment Grade Bonds are those securities rated at least BBB-. Non-Investment Grade Bonds are those securities (commonly referred to as “high yield” or “junk” bonds) rated BB+ and below. Middle market CLOs refer to collateralized loan obligations backed by loans made to smaller companies, which companies generally have earnings before interest, taxes, and amortization of less than $75 million. Yield to worst (YTW) is the lowest potential yield that can be received on a bond portfolio without the underlying issuers defaulting.

16 Q1 2021 Annual Report

| Returns | | | | | | | | |

| | | | | Annualized | | | |

|

|

|

|

|

| Since Fund |

|

|

|

|

|

|

|

| Inception | Net | Gross |

| QTD | YTD | 1 YR | 3 YR | 5 YR | (7/31/2014) | Expense | Expense |

| WCPNX - Investor Class | (0.84)% | (0.84)% | 12.79% | 6.21% | 4.83% | 4.32% | 0.50% | 1.18% |

| WCPBX - Institutional Class | (0.73) | (0.73) | 12.88 | 6.40 | 5.03 | 4.52 | 0.40 | 0.80 |

| Bloomberg Barclays U.S. Aggregate Bond | (3.37) | (3.37) | 0.71 | 4.65 | 3.10 | 3.20 |

|

|

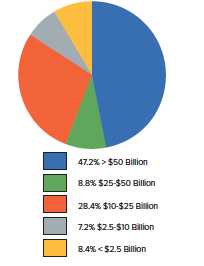

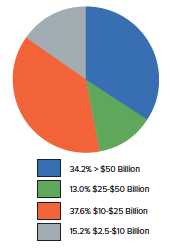

Growth of $10,000 Investment Since Inception

| | |

| Fixed Income Attributes | |

Portfolio Summary | |

| Average Maturity | 6.4 years |

| Average Effective Maturity | 6.3 years |

| Average Duration | 4.5 years |

| Average Effective Duration | 4.5 years |

| Average Coupon | 3.3% |

| |

| Maturity Distribution | |

Maturity Type | % of Portfolio |

| Cash Equivalents | 7.7 |

| Less than 1 Year | 18.2 |

| 1 - 3 Years | 20.4 |

| 3 - 5 Years | 7.1 |

| 5 - 7 Years | 20.6 |

| 7 - 10 Years | 8.2 |

| 10 - 20 Years | 8.0 |

| 20 Years or more | 9.6 |

| Common Stocks | 0.2 |

| 100.0 |

| | |

| Credit Quality | |

Underlying Securities | % of Portfolio |

| U.S. Treasury | 20.8 |

| U.S. Government Agency Mortgage | |

| Related Securities | 0.5 |

| AAA | 4.5 |

| AA | 8.2 |

| A | 13.2 |

| BBB | 27.9 |

| BB | 9.0 |

| B | 3.5 |

| CCC | 3.2 |

| Non-Rated | 1.3 |

| Common Stocks | 0.2 |

| Cash Equivalents | 7.7 |

| | 100.0 |

| | | |

| 30-Day SEC Yield |

|

|

Share Class | Subsidized

| Unsubsidized

|

| Investor | 2.18% | 1.68% |

| Institutional | 2.28 | 1.74 |

Asset Allocation

% of Net Assets

Data quoted is past performance and current performance may be lower or higher. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. All investments involve risks, including possible loss of principal. Please visit weitzinvestments.com for the most recent month-end performance.

Investment results reflect applicable fees and expenses and assume all distributions are reinvested but do not reflect the deduction of taxes an investor would pay on distributions or share redemptions. Net and Gross Expense Ratios are as of the Fund’s most recent prospectus. The Fund has entered into fee waiver and/or expense reimbursement arrangements with the Investment Advisor. The Advisor has contractually agreed to waive a portion of the Advisor’s fee and reimburse certain expenses (excluding taxes, interest, brokerage costs, acquired fund fees and expenses and extraordinary expenses) to limit the total annual fund operating expenses of the Class’s average daily net assets through 07/31/2021. The Net Expense Ratio reflects the total annual fund operating expenses of the Fund after taking into account any such fee waiver and/or expense reimbursement, if any; total returns would have been lower had there been no waivers or reimbursements.

See page 8 for additional performance disclosures. See page 81 for a description of all indices.

Credit ratings are assigned to underlying securities utilizing ratings from a Nationally Recognized Statistical Rating Organization (NRSRO) such as Moody’s and Fitch, or other rating agencies and applying the following hierarchy: security is determined to be Investment Grade if it has been rated at least BBB- by one credit rating agency; once determined to be Investment Grade (BBB- and above) or Non-Investment Grade (BB+ and below) where multiple ratings are available, the lowest rating is assigned. Mortgage-related securities issued and guaranteed by government-sponsored agencies such as Fannie Mae and Freddie Mac are generally not rated by rating agencies. Securities that are not rated do not necessarily indicate low quality. Ratings are shown in the Fitch scale (e.g., AAA). Ratings and portfolio credit quality may change over time. The Fund itself has not been rated by a credit rating agency.

Source (Fixed Income Attributes, Credit Quality, and Maturity Distribution): Bloomberg Analytics

Q1 2021 Annual Report 17

This page intentionally left blank

18 Q1 2021 Annual Report

HICKORY FUND

Portfolio Managers: Wally Weitz, CFA & Drew Weitz

Investment Style: Mid-Cap Value

The Hickory Fund returned +8.71% in the first quarter, compared to +8.14% for the Russell Midcap Index. For the fiscal year ending March 31, 2021, the Fund returned +59.17% compared to +73.64% for the benchmark.

The “reopening” trade that began in earnest with positive vaccine trial results in November continued into the first quarter of the new year. Cyclical businesses that depend on a stronger economy, as well as industries that depend on the customers’ ability to be physically present (travel, hospitality, and live events to name a few), have been leading the market higher. At the same time, the stronger economic outlook and potential for faster inflation has forced investors to contemplate an increase in interest rates. As we wrote last quarter, higher interest rates diminish the present value of future cash flows and reduce investors’ appetite to pay up for faster growing companies.

With these market dynamics on display within the portfolio, the Fund delivered strong results in the first quarter. Beyond the benefit of “reopening,” gains were led by companies experiencing positive, company-specific developments. Used car dealer CarMax was our top contributor, as the nationwide roll-out of its omnichannel car buying experience (at a dealership, online, or a combination of the two) continues to win fans in the form of new customers and investors alike. Summit Materials shares rallied as the market began to anticipate how the new presidential administration’s infrastructure plans may result in healthy incremental demand for years to come. And shares of LabCorp rose after management announced it would review the company’s structure and capital allocation strategy, acquiescing to pressure from an activist shareholder.

The broad rally resulted in very few portfolio holdings with a negative return for the quarter. Enterprise software providers CoStar Group, Black Knight and Guidewire Software lagged as software companies generally fell out of favor, while Liberty Broadband’s modest decline reflects investors’ general belief that a government controlled by Democrats (specifically, the Federal Communications Commission) may create a less friendly regulatory environment for cable/broadband providers. Broadband providers have been a popular “political football” for many years, but we judge drastic regulatory changes that negatively impact our investments to be unlikely.

With the benefit of hindsight, we can see the recent fiscal year began near the pandemic market trough. Given the powerful market rally, twelve-month returns across nearly the entire portfolio were very strong. Our top 12-month contributors feature four investments that nearly, or more than, doubled in the past twelve months: CarMax, LabCorp, Qurate Retail and Ingersoll Rand. Liberty Broadband’s largest position size magnified its more modest return making it a top quarterly contributor as well. EverArc experienced a very modest decline. As an acquisition vehicle holding cash and without an operating business, its shares did not participate in the COVID-induced sell-off and have remained largely unchanged during the subsequent recovery. We sold Liberty Formula One at a slight loss as we opted to reinvest that capital into more attractive investment opportunities as the economy began to show signs of recovery.

As the rally has continued, portfolio activity skewed modestly toward trimming our strongest performers (including CarMax, Summit Materials, Qurate Retail and First Hawaiian) and our larger portfolio holdings (including Liberty Broadband, LabCorp and LICT Corp). On the buy side, we modestly increased our positions in LKQ, Box and Markel, but most notably we initiated a new position in AutoZone, a specialty retailer of auto parts and accessories. AutoZone continues to have success with its traditional do-it-yourself customers, and it is still in the early stages of rolling out its commercial account business that reaches do-it-for-me customers. We believe both efforts have significant growth potential for years to come and are led by a management team that has demonstrated a consistent ability to grow the per-share value of their business. Investors can learn more about our investment thesis in Jon Baker’s Analyst Corner feature.

Looking ahead, we remain encouraged by the prospects for our portfolio. Trading at an estimated price-to-value ratio in the low-to-mid 90’s, it seems likely to us that the pace of returns may slow as the economic recovery plays “catch up” to the stock market. Nevertheless, we feel our businesses can still generate acceptable returns. Meanwhile, our Quality at a Discount investment philosophy remains hard at work; our investment team continues to investigate additional high-quality businesses, and we will be ready to acquire those companies’ shares when they trade at a discount to our value estimates.

Q1 2021 Annual Report 19

| Returns | | | | | | Annualized | | | | |

|

|

|

|

|

|

|

| Since Fund |

|

|

|

|

|

|

|

|

|

| Inception | Net | Gross |

| QTD | YTD | 1 YR | 3 YR | 5 YR | 10 YR | 20 YR | (4/1/1993) | Expense | Expense |

| WEHIX | 8.71% | 8.71% | 59.17% | 11.15% | 9.38% | 8.06% | 6.72% | 9.70% | 1.09% | 1.13% |

| Russell Midcap | 8.14 | 8.14 | 73.64 | 14.73 | 14.67 | 12.47 | 10.48 | 11.34 |

|

|

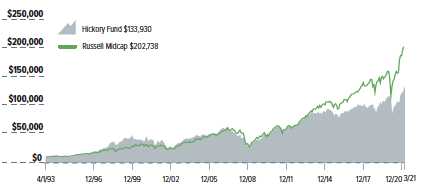

Growth of $10,000 Investment Since Inception

Capitalization

| Top 10 Stock Holdings | |

| % of Net Assets |

| Liberty Broadband Corp. - Series A & C | 8.0 |

| LICT Corp. | 5.2 |

| Laboratory Corp. of America Holdings | 5.1 |

| Liberty SiriusXM Group - Series A & C | 4.8 |

| LKQ Corp. | 4.5 |

| CarMax, Inc. | 4.4 |

| Markel Corp. | 4.3 |

| AutoZone, Inc. | 4.1 |

| Liberty Global plc - Class C | 3.6 |

| Axalta Coating Systems Ltd. | 3.5 |

| | 47.5 |

| Industry Breakdown | |

| % of Net Assets |

| Communication Services | 26.3 |

| Consumer Discretionary | 14.6 |

| Information Technology | 13.2 |

| Materials | 11.5 |

| Industrials | 10.7 |

| Financials | 8.8 |

| Health Care | 5.1 |

| Other Common Stock & Warrants | 3.4 |

| Non-Convertible Preferred Stocks | 1.7 |

| Cash Equivalents/Other | 4.7 |

| | 100.0 |

| Top Stock Performers | | | |

| Average |

|

| Return | Weight | Contribution |

| CarMax, Inc. | 40.4% | 4.5% | 1.61% |

| Summit Materials, Inc. - Class A | 39.5 | 2.9 | 1.19 |

| Laboratory Corp. of America Holdings | 25.3 | 4.8 | 1.15 |

| LICT Corp. | 22.9 | 5.3 | 1.14 |

| LKQ Corp. | 20.1 | 4.2 | 0.77 |

| | | | |

| Bottom Stock Performers | | | |

| Average |

|

| Return | Weight | Contribution |

| Guidewire Software, Inc. | (21.1)% | 3.3% | (0.78)% |

| Liberty Broadband Corp. - Series A & C | (6.5) | 8.5 | (0.53) |

| Black Knight, Inc. | (16.3) | 2.7 | (0.49) |

| CoStar Group, Inc. | (11.1) | 3.5 | (0.43) |

| HEICO Corp. - Class A | (2.9) | 2.9 | (0.09) |

Data quoted is past performance and current performance may be lower or higher. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. All investments involve risks, including possible loss of principal. Please visit weitzinvestments.com for the most recent month-end performance.

Investment results reflect applicable fees and expenses and assume all distributions are reinvested but do not reflect the deduction of taxes an investor would pay on distributions or share redemptions. Net and Gross Expense Ratios are as of the Fund’s most recent prospectus. The Fund has entered into fee waiver and/or expense reimbursement arrangements with the Investment Advisor. The Advisor has contractually agreed to waive a portion of the Advisor’s fee and reimburse certain expenses (excluding taxes, interest, brokerage costs, acquired fund fees and expenses and extraordinary expenses) to limit the total annual fund operating expenses of the Class’s average daily net assets through 07/31/2021. The Net Expense Ratio reflects the total annual fund operating expenses of the Fund after taking into account any such fee waiver and/or expense reimbursement, if any; total returns would have been lower had there been no waivers or reimbursements.

See page 8 for additional performance disclosures. See page 81 for a description of all indices.

Contributions to Fund performance are based on actual daily holdings. Securities may have been bought or sold during the quarter. Return shown is the actual quarterly return of the security or combination of share classes.

Source (Top Performers, Bottom Performers): FactSet Analytics

20 Q1 2021 Annual Report

NEBRASKA TAX-FREE INCOME FUND

Portfolio Manager: Tom Carney, CFA

Investment Style: Municipal-State Bond

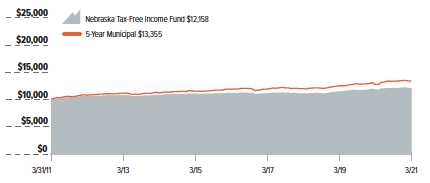

The Nebraska Tax-Free Income Fund returned -0.56% in the first quarter compared to a -0.31% return for the Bloomberg Barclays 5-Year Municipal Bond Index. For the fiscal year ending March 31, 2021, the Fund’s total return was +2.67% compared to a +5.07% return for the index. The Fund has underperformed the index year-to-date due to the Fund’s holdings in longer maturity, longer duration investments, where rising interest rates had more of a price impact in the first quarter. The Fund underperformed for the fiscal year due to the higher weighting in bonds maturing in under 5 years (approximately 63% of Fund assets) which proved to be a detractor for much of 2020. While the Fund has an overall duration comparable to the index, the Fund’s investments are distributed across the yield curve, with bonds maturing in less than a year as well as those maturing in more than 10 years. The index only includes bonds that mature within a 4-to-6-year timeframe.

Overview