UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED ANNUAL SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21410

The Weitz Funds

(Exact name of registrant as specified in charter)

Suite 600

1125 South 103 Street

Omaha, NE 68124-6008

(Address of principal executive offices) (Zip code)

Wallace R. Weitz & Company

The Weitz Funds

Suite 600

1125 South 103 Street

Omaha, NE 68124-6008

(Name and address of agent for service)

Registrant’s telephone number, including area code: 402-391-1980

Date of fiscal year end: March 31

Date of reporting period: March 31, 2005

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Stockholders.

Value Fund

Hickory Fund

Partners Value Fund

Balanced Fund

Fixed Income Fund

Government Money Market Fund

ANNUAL REPORT

March 31, 2005

One Pacific Place, Suite 600 • 1125 South 103 Street • Omaha, Nebraska, 68124-6008

402-391-1980 800-304-9745 402-391-2125 FAX

www.weitzfunds.com

Six Funds—One Investment Philosophy Our small “family” of Funds is designed to offer a range of investment options for investors with different objectives and temperaments. There are bond funds, stock funds and a balanced fund. There are differences in fund size, portfolio concentration, volatility, and tax sensitivity. But there are certain common threads which run through all six of the Funds. “We eat our own cooking.” All of our investment professionals have a majority of their families’ liquid net worth invested in our Funds. Our Trustees each have at least $100,000 invested in our family of Funds—some considerably more. This does not guarantee that the Funds will go up, but it means that we win or lose together and that shareholders definitely have our attention. We are patient, long-term investors. When we analyze potential equity investments, we think about the business behind the stock and try to buy shares at a large discount to the company’s underlying business value. Ideally, the business value rises over time and the stock price follows. This often allows us to hold the stock for many years, minimizing transaction costs, taxes, and the need for new investment ideas. We try to stay within our “circle of competence.” “Knowing what you don’t know” is important in all aspects of life, but it is crucial in investing. We think our odds of investment success are much higher when we invest in securities of companies we understand and ideally, where we may have an edge over other investors. As a result, our portfolios are not diversified among all the various sectors of the economy and thus may often be out of step with the general stock market. Risk—we worry about permanent loss of capital—not price volatility. We believe in concentrating our portfolio in the most attractive investment ideas and this can cause short-term price volatility of our portfolios. We think “benchmark risk” is part of investment life. Our firm’s goal is to earn good absolute investment returns over long periods of time without exposing our clients’ capital to undue risk. We do not think about any particular index when we make investment decisions. We also believe that cash is sometimes the most attractive investment. We know this approach causes headaches for some of our favorite consultants and plan sponsors, but we think flexibility and common sense will continue to serve our clients well over the years. |

2

Shareholder Information Meeting |

Please Mark Your Calendars — Our Annual Shareholder Information Meeting will be held on May 31st at the Scott Conference Center at 4:30 p.m.

|

3

(This page has been left blank intentionally.)

4

PORTFOLIO MANAGER LETTER – WEITZ EQUITY FUNDS |

April 13, 2005

Dear Fellow Shareholder:

The first quarter of calendar 2005 was a lackluster one for the stock market and for our Funds. As the table below shows, Value, Hickory and Partners Value were down 4.1%, 4.6%, and 3.8%, respectively, while the S&P500 was down 2.1%. The Russell 2000 and Nasdaq Composite were down 5.3% and 8.0%, respectively.

For the 12 months ended March 31, 2005 (our fiscal year), the Funds showed modest gains. The table below shows comparative results over various periods, up to 20 years, for the Funds (after deducting all expenses), the S&P 500 (larger companies), the Russell 2000 (smaller companies), and the Nasdaq Composite (a proxy for technology companies).

| | Average Annual Total Returns*

(Through 3/31/05) |

| | 1-Year | | 3-Year | | 5-Year | | 10-Year | | 15-Year | | 20-Year |

| |

| |

| |

| |

| |

| |

|

Value Fund | | 5.1 | % | 5.8 | % | 8.0 | % | 16.7 | % | 14.7 | % | N/A |

Hickory Fund | | 9.4 | | 6.0 | | 2.2 | | 15.9 | | N/A | | N/A |

Partners Value** | | 5.5 | | 4.9 | | 7.1 | | 16.6 | | 15.1 | | 14.6 |

S&P 500 | | 6.7 | | 2.7 | | -3.2 | | 10.8 | | 11.0 | | 12.6 |

Russell 2000 | | 5.4 | | 8.1 | | 4.0 | | 10.4 | | N/A | | N/A |

Nasdaq Composite | | 0.8 | | 3.2 | | -14.9 | | 9.8 | | 10.7 | | 10.3 |

This information represents past performance and past performance does not guarantee future results. The investment return and the principal value of an investment in any of the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be higher or lower than the performance data quoted above. Performance data current to the most recent month end may be obtained at www.weitzfunds.com/performance/monthly.asp.

* | All performance numbers are calculated after deducting fees and expenses, and all numbers assume reinvestment of dividends (except for the 15 and 20-year Nasdaq numbers for which reinvestment of dividend information was not available). |

** | The Fund succeeded to substantially all of the assets of Weitz Partners II Limited Partnership (the “Partnership”) as of December 31, 1993. Wallace R. Weitz was General Partner and portfolio manager for the Partnership and is portfolio manager for the Fund. The Fund’s investment objectives, policies and restrictions are materially equivalent to those of the Partnership. The performance information includes performance for the period before the Fund became an investment company registered with the Securities and Exchange Commission. During this time, the Fund was not registered under the Investment Company Act of 1940 and therefore was not subject to certain investment restrictions imposed by the 1940 Act. If the Fund had been registered under the 1940 Act during this time period, the Fund’s performance might have been adversely affected. |

The S&P 500, Russell 2000 and Nasdaq Composite track different segments of the investment universe. As certain industries or groups of industries come in and out of favor, the indices take turns out-performing each other, sometimes for years at a time. Smaller company stocks had a terrible time keeping up with the large- and mega-capitalization stocks in the second half of the 1990’s, and the small-caps have dramatically out-paced the large in the five years since the market top in 2000.

The swings in popularity may have rational roots, but are often carried to extremes by the “bandwagon” effect of investors pulling money out of the under-performing stocks to buy the ones that are “working.” As we have said before, we aim to beat all of the indices over the long run. However, paradoxically, we believe that the way to do that is to sell the popular stocks when their prices are inflated and buy the unpopular when they are temporarily depressed. The implications of this approach are that (1) we will buy stocks with different characteristics (large, small, low P/E, high P/E, etc.) in different periods, and (2) since we are acting in a contrary way, we will almost assuredly under-perform the “hot” sector of the day in the short run.

5

We do not try to anticipate which sectors will be strong or weak next, and there is no magic about 5-year blocks of time, but it may be that the swing from large-cap to small will be reversed in the next year or two. Some statistical studies show that small-cap stocks are as expensive relative to large-caps as they have been in over 20 years. We try not to have preconceived notions of where the next group of bargains will come from, but those who focus exclusively on small- and mid-cap stocks might want to consider broadening their horizons.

Fiscal 2005 in Review

Periodically, lots of stocks are cheap. For years after the bear markets of the 1930’s and early 1970’s, stock valuations were much lower than they are today. Bad memories of losing money in the bear markets made most people very cautious about investing. By the late 1990’s, the last cautious investor threw in the towel and joined the 25-year bull market. That is when the “tech bubble” burst.

We try hard not to have opinions about “the market.” We buy bargains when and where we find them, but after a short period in 2002 and early 2003 when pervasive fear made lots of stocks cheap, we are having trouble finding great bargains again. Thus, when you look at the new stocks that we have added to the portfolios, the only unifying “theme” is that they tend to be companies with good underlying business characteristics that have stumbled for some company- or industry-specific reason. It can be difficult to figure out how significant and how temporary the negative factor is—this is art, not science.

Sometimes the scare passes quickly so we get easy profits without much uncertainty. Real estate investment trusts dipped sharply last April and we were able to buy several old favorites (General Growth, Vornado, Avalon Bay and Capital Automotive). They rebounded almost immediately. It is nice to get a year or two of expected profit in a few months, but the move was too short-lived for us to establish really meaningful positions.

Many of the opportunities which present themselves these days involve “growth stocks” that report disappointing quarterly earnings news. We believe that earnings growth is an important factor in valuing a business, but “growth” investors are usually willing to pay a much higher price for a history of consistent earnings per share growth. When a company “misses its numbers” and shakes the faith of its followers, the stock may drop precipitously. If we can believe that a problem is temporary or that a stock is now under-valued despite an on-going problem, we will buy. InterActiveCorp, Omnicare, Pediatrix, Iron Mountain and Corinthian Colleges were among the growing businesses we’ve recently added to portfolios.

A much trickier situation involves alleged accounting irregularities and regulatory trouble. Integrity of management is non-negotiable, and in situations like Freddie Mac, Fannie Mae, Cardinal Health, etc., we must be convinced that the dishonest managers are gone and that the economics of the business are sound, regardless of the distortions of incorrect accounting. Again, this involves art as well as analysis of the numbers and the business, and we invest in these situations only after careful consideration.

Another category of investment that we keep coming back to are stocks that face the likelihood of cyclical downturn in their business. When the Federal Reserve is raising interest rates, investor reaction is usually negative out of all proportion to economic reality. We bought banks, thrifts and mortgage companies in 1990, 1994, and 1999 as investors followed conventional wisdom and sold them. These investments worked very well. Over the last 12 months, we added to Redwood Trust, Countrywide Financial, and other financial service stocks when they fell on fears of rising interest rates.

Finally, the prospect of a permanent fundamental change in a company’s business can frighten investors and create opportunity. Cardinal Health suffered from an inventory accounting problem, but the bigger problem they face is a change in the way drug distributors do business with drug companies. Inventory profits have historically been a major factor in distributor profitability, and as the industry shifts to a “fee for service” model, the smooth pattern of earnings increases has been interrupted. At our purchase prices in the high $30’s and low $40’s, we believed the stock was cheap enough to discount a period of adjustment to the new reality.

Freddie Mac and Fannie Mae, in addition to their “smoothing of earnings” accounting issues, face the risk that Congress may force dramatic changes to their business models. Increases in their cost of borrowing and capital

6

requirements, and limits on the size of their investment portfolios may cause both to evolve into very different companies. We believe that the economics of guaranteeing mortgage loans and investing in a leveraged portfolio of mortgages can be profitable for Freddie and Fannie, even in the extreme event that the companies are privatized. Others disagree, so the stocks are both depressed and, we think, very attractive.

Outlook

My normal approach to this section of the report is to say, (1) we cannot predict the future, (2) there are lots of things to worry about, and (3) we welcome volatility because it produces opportunities. This time, I’ll say the same thing (so you may stop here if you like), but in a little more detail.

| (1) | We start with the premise that stocks are generally fully-priced. We base this statement both on historical statistics and our own anecdotal evidence gathered in our search for stocks to buy. This does not mean that stocks in general will go down or that we think our stocks are not good investments. It does mean that the odds of earning good investment returns are higher when stock prices are lower. |

| (2) | Short-term interest rates have been rising because of Federal Reserve policy. Commodity inflation has picked up (oil, China, etc.), the dollar has been weak (budget and trade deficits), and it seems likely that long-term interest rates will move up over time. Higher interest rates raise the cost of doing business and mean that bonds provide stiffer investment competition to stocks. |

| (3) | Record low interest rates have made money readily available and very cheap. This money has flowed freely into consumer spending as well as “investments” such as stocks, bonds, hedge funds, new homes, vacation real estate, leveraged buyouts, leveraged mortgage portfolios, etc. It seems clear that there are some speculative excesses in most of these asset classes. |

| (4) | In spite of Greenspan’s uncharacteristically clear warnings that speculators and investors are taking bigger risks than they seem to recognize, human nature is such that the excesses are likely to continue to build until someone feels some real financial pain. |

We have no idea how the future will unfold. Securities and real estate markets may level off gracefully with no serious consequences. Or, financial markets could experience liquidity problems as they did in 1987 and 1998. Stock prices could move sideways or slowly upward while companies’ business values “grow into” their stocks’ prices. Or, the bear market that began in 2000 could resume with another down leg reminiscent of the 1973-74 decline that followed the 1970-72 bear market rally.

As we continue to hunt for bargains, we feel very comfortable holding relatively high amounts of cash. We honestly believe that our long-term investment results will be better if the stock and bond markets experience some shocks and volatility. It will be scary during the periods of uncertainty, but our approach to investing depends on Mr. Market’s periodic mood swings. Thanks for trusting us with your investment capital.

We hope you will join us for our annual shareholder information meeting on Tuesday, May 31. There will be no official business to conduct, so we can spend the whole time answering your questions about investments.

| | | Sincerely, |

| | |

|

| | | Wallace R. Weitz

Portfolio Manager |

Portfolio composition is subject to change at any time and references to specific securities, industries, and sectors referenced in this letter are not recommendations to purchase or sell any particular security. See the Schedules of Investments in Securities included in this report for the percent of assets in each of the Funds invested in particular industries or sectors.

7

FUND PERFORMANCE — VALUE FUND |

The following table summarizes performance information for the Fund as compared to the S&P 500 over the periods indicated.

Period Ended | | Value Fund | | S&P 500 | | Difference

Value Fund – S&P 500 | |

| |

| |

| |

| |

Dec. 31, 1995 | | 38.4 | % | | 37.5 | % | | 0.9 | % | |

Dec. 31, 1996 | | 18.7 | | | 22.9 | | | –4.2 | | |

Dec. 31, 1997 | | 38.9 | | | 33.4 | | | 5.5 | | |

Dec. 31, 1998 | | 28.9 | | | 28.6 | | | 0.3 | | |

Dec. 31, 1999 | | 21.0 | | | 21.0 | | | 0.0 | | |

Dec. 31, 2000 | | 19.6 | | | –9.1 | | | 28.7 | | |

Dec. 31, 2001 | | 0.2 | | | –11.8 | | | 12.0 | | |

Dec. 31, 2002 | | –17.1 | | | –22.1 | | | 5.0 | | |

Dec. 31, 2003 | | 28.7 | | | 28.7 | | | 0.0 | | |

Dec. 31, 2004 | | 15.7 | | | 10.9 | | | 4.8 | | |

Mar. 31, 2005 (3 months) | | –4.1 | | | –2.1 | | | –2.0 | | |

| | | | | | | | | | |

10-Year Cumulative Return ended Mar. 31, 2005 | | 368.8 | | | 178.6 | | | 190.2 | | |

10-Year Average Annual Compound Return ended

Mar. 31, 2005 | | 16.7 | | | 10.8 | | | 5.9 | | |

This chart depicts the change in the value of a $25,000 investment in the Value Fund for the period March 31, 1995, through March 31, 2005, as compared with the growth of the Standard & Poor’s 500 Index during the same period.

The Fund’s average annual total return for the one, five and ten year periods ended March 31, 2005 was 5.1%, 8.0% and 16.7%, respectively. The returns assume redemption at the end of each period and reinvestment of dividends. This information represents past performance and past performance does not guarantee future results. The investment return and the principal value of an investment in this Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained at www.weitzfunds.com/performance/monthly.asp.

Performance information does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

8

PORTFOLIO PROFILE – VALUE FUND |

Top Ten Stocks* | | | | | Industry Sectors* | | | |

|

|

| | |

|

|

| |

| | | | | | | | |

Berkshire Hathaway | | 6.7 | % | | Media Content and Distribution | | 19.4 | % |

Liberty Media Corp. | | 6.2 | | | Mortgage Services | | 14.6 | |

Comcast | | 6.1 | | | Banking and Insurance | | 9.8 | |

Fannie Mae | | 5.0 | | | Gaming, Lodging and Leisure | | 9.7 | |

Countrywide Financial | | 4.3 | | | Telecommunications | | 4.5 | |

Host Marriot | | 3.7 | | | Consumer Products and Services | | 3.2 | |

Washington Post | | 3.7 | | | Healthcare | | 2.6 | |

Caesars Entertainment | | 3.1 | | | Real Estate | | 1.3 | |

IAC/InterActiveCorp | | 2.9 | | | Commercial Services | | 0.4 | |

Telephone & Data Systems | | 2.9 | | | Corporate Bonds | | 0.1 | |

| |

| | | | | | |

| | 44.6 | % | | Government Agency Securities | | 0.1 | |

| |

| | | | | | |

| | | | | Short-Term Securities/Other | | 34.3 | |

| | | | | | |

| |

| | | | | | | 100.0 | % |

| | | | | | |

| |

* As of March 31, 2005

Largest Net Purchases and Sales for Year Ended March 31, 2005 |

|

Net Purchases ($mil) | | | | | Net Sales ($mil) | | | |

|

|

| | |

|

|

|

|

| | | | | | | | | | |

Fannie Mae | | $ | 170 | | | Caesars Entertainment | | $ | 177 | |

IAC/InterActiveCorp (new) | | | 119 | | | Citizens Communications | | | 158 | |

Cardinal Health (new) | | | 45 | | | Hilton Hotels | | | 69 | |

Liberty Media Corp. | | | 25 | | | Alltel (eliminated) | | | 68 | |

Liberty Media International (new) | | | 23 | | | Host Marriot | | | 62 | |

| |

|

| | | | |

|

| |

| | $ | 382 | | | | | $ | 534 | |

| |

|

| | | | |

|

| |

Largest Net Contributions to Investment Results for Year Ended March 31, 2005 |

|

Positive ($mil) | | | | | Negative ($mil) | | | |

|

|

| | |

|

|

|

|

| | | | | | | | | | |

Caesars Entertainment | | $ | 85 | | | Charter Communications | | $ | (54 | ) |

Liberty Media Corp. & International | | | 48 | | | Fannie Mae | | | (43 | ) |

Host Marriott | | | 47 | | | Berkshire Hathaway | | | (23 | ) |

Comcast | | | 43 | | | Six Flags | | | (21 | ) |

Citizens Communications | | | 34 | | | Novastar Financial | | | (15 | ) |

| |

|

| | | | |

|

| |

| | $ | 257 | | | | | $ | (156 | ) |

| |

|

| | | | |

|

| |

| | | | | | | | |

Net Portfolio Gains | | $ | 237 | | | | | | |

| |

|

| | | | | | |

| | | | | | | | | | | |

9

Schedule of Investments in Securities

March 31, 2005

| | Shares | | Value |

| |

| |

|

COMMON STOCKS — 65.5% | | | | | |

| | | | | |

Media Content and Distribution — 19.4% | | | | | |

| | | | | |

Newspaper, Television, Radio and Content — 9.9% | | | | | |

Liberty Media Corp. - A* | | 24,600,000 | | $ | 255,102,000 |

Washington Post Co. CL B | | 172,000 | | | 153,768,000 |

| | | |

|

|

| | | | | 408,870,000 |

Cable Television — 9.5% | | | | | |

Comcast Corp. - Special CL A* | | 7,500,000 | | | 250,500,000 |

Liberty Media International, Inc. - A* | | 1,820,328 | | | 79,621,147 |

Insight Communications Co.* | | 3,533,000 | | | 41,866,050 |

Charter Communications, Inc. CL A* | | 10,606,500 | | | 16,970,400 |

Adelphia Communications Corp. CL A* # | | 9,893,000 | | | 2,374,320 |

| | | |

|

|

| | | | | 391,331,917 |

| | | |

|

|

| | | | | 800,201,917 |

Mortgage Services — 14.6% | | | | | |

| | | | | |

Government Agency — 7.5% | | | | | |

Fannie Mae | | 3,800,000 | | | 206,910,000 |

Freddie Mac | | 1,600,000 | | | 101,120,000 |

| | | |

|

|

| | | | | 308,030,000 |

Originating and Investing — 7.1% | | | | | |

Countrywide Financial Corp. | | 5,500,000 | | | 178,530,000 |

Redwood Trust, Inc.† | | 2,000,000 | | | 102,360,000 |

Newcastle Investment Corp. | | 300,000 | | | 8,880,000 |

Bimini Mortgage Management, Inc. | | 400,000 | | | 5,540,000 |

Imperial Credit Industries, Inc.* | | 2,100,000 | | | 1,050 |

| | | |

|

|

| | | | | 295,311,050 |

| | | |

|

|

| | | | | 603,341,050 |

Banking and Insurance — 9.8% | | | | | |

| | | | | |

Insurance — 6.7% | | | | | |

Berkshire Hathaway, Inc. CL B* | | 67,000 | | | 191,352,000 |

Berkshire Hathaway, Inc. CL A* | | 1,000 | | | 87,000,000 |

| | | |

|

|

| | | | | 278,352,000 |

Banking — 3.1% | | | | | |

Washington Mutual, Inc. | | 2,340,000 | | | 92,430,000 |

U.S. Bancorp | | 1,200,000 | | | 34,584,000 |

| | | |

|

|

| | | | | 127,014,000 |

| | | |

|

|

| | | | | 405,366,000 |

The accompanying notes form an integral part of these financial statements.

10

Schedule of Investments in Securities, Continued

| | Shares | | Value |

| |

| |

|

Gaming, Lodging and Leisure — 9.7% | | | | | |

| | | | | |

Host Marriott Corp. | | 9,300,000 | | $ | 154,008,000 |

Caesars Entertainment, Inc.* | | 6,500,000 | | | 128,635,000 |

Hilton Hotels Corp. | | 2,400,000 | | | 53,640,000 |

Harrah’s Entertainment, Inc. | | 650,000 | | | 41,977,000 |

Six Flags, Inc.* † | | 5,150,000 | | | 21,218,000 |

| | | |

|

|

| | | | | 399,478,000 |

| | | | | |

Telecommunications — 4.5% | | | | | |

| | | | | |

Telephone and Data Systems, Inc. | | 1,450,000 | | | 118,320,000 |

Qwest Communications International, Inc.* | | 14,578,000 | | | 53,938,600 |

Citizens Communications Co. | | 1,064,300 | | | 13,772,042 |

| | | |

|

|

| | | | | 186,030,642 |

| | | | | |

Consumer Products and Services - Retailing — 3.2% | | | | | |

| | | | | |

IAC/InterActiveCorp* | | 5,400,000 | | | 120,258,000 |

Costco Wholesale Corp.(a) | | 300,000 | | | 13,254,000 |

| | | |

|

|

| | | | | 133,512,000 |

| | | | | |

Healthcare — 2.6% | | | | | |

| | | | | |

Suppliers and Distributors — 1.8% | | | | | |

Cardinal Health, Inc.(a) | | 1,200,000 | | | 66,960,000 |

Omnicare, Inc. | | 200,000 | | | 7,090,000 |

| | | |

|

|

| | | | | 74,050,000 |

Managed Care — 0.4% | | | | | |

WellPoint, Inc.* | | 90,000 | | | 11,281,500 |

UnitedHealth Group, Inc. | | 60,000 | | | 5,722,800 |

| | | |

|

|

| | | | | 17,004,300 |

Providers — 0.4% | | | | | |

Laboratory Corporation of America Holdings* | | 200,000 | | | 9,640,000 |

Triad Hospitals, Inc.* | | 100,000 | | | 5,010,000 |

| | | |

|

|

| | | | | 14,650,000 |

| | | |

|

|

| | | | | 105,704,300 |

Real Estate — 1.3% | | | | | |

| | | | | |

Construction and Development — 1.2% | | | | | |

Forest City Enterprises, Inc. CL A | | 771,200 | | | 49,202,560 |

| | | | | |

Property Ownership and Management — 0.1% | | | | | |

Capital Automotive REIT | | 150,000 | | | 4,968,000 |

| | | |

|

|

| | | | | 54,170,560 |

The accompanying notes form an integral part of these financial statements.

11

Schedule of Investments in Securities, Continued

| | Principal

amount

or shares | | | | Value | |

| |

| | | |

| |

Commercial Services — 0.4% | | | | | | | | | |

| | | | | | | | | |

Cenveo, Inc.* † | | | 2,601,800 | | | | $ | 14,674,152 | |

Intelligent Systems Corp.* | | | 32,835 | | | | | 76,177 | |

| | | | | | |

|

| |

| | | | | | | | 14,750,329 | |

| | | | | | |

|

| |

Total Common Stocks (Cost $2,050,588,880) | | | | | | | | 2,702,554,798 | |

| | | | | | | | | |

CORPORATE BONDS — 0.1% | | | | | | | | | |

| | | | | | | | | |

Charter Communications Holdings, LLC 10.75% 10/01/09 | | $ | 2,000,000 | | | | | 1,650,000 | |

Charter Communications Holdings, LLC 9.625% 11/15/09 | | | 3,000,000 | | | | | 2,362,500 | |

Charter Communications Holdings, LLC 9.92% 4/01/11 | | | 2,000,000 | | | | | 1,545,000 | |

| | | | | | |

|

| |

Total Corporate Bonds (Cost $4,938,264) | | | | | | | | 5,557,500 | |

| | | | | | | | | |

GOVERNMENT AGENCY SECURITIES — 0.1% | | | | | | | | | |

| | | | | | | | | |

Federal Home Loan Bank 6.04% 9/08/05 | | | 3,000,000 | | | | | 3,039,027 | |

Federal Home Loan Bank 6.44% 11/28/05 | | | 1,000,000 | | | | | 1,019,492 | |

| | | | | | |

|

| |

Total Government Agency Securities (Cost $4,000,125) | | | | | | | | 4,058,519 | |

| | | | | | | | | |

SHORT-TERM SECURITIES — 33.9% | | | | | | | | | |

| | | | | | | | | |

Milestone Treasury Obligations Portfolio | | | 42,294,426 | | | | | 42,294,426 | |

Wells Fargo Government Money Market Fund | | | 51,550,165 | | | | | 51,550,165 | |

Federal Home Loan Bank Discount Note 2.489% due 4/11/05(b) | | $ | 150,000,000 | | | | | 149,888,550 | |

U.S. Treasury Bills, 2.367% to 2.803%, due 4/07/05 to 6/30/05(b) | | | 1,155,000,000 | | | | | 1,152,066,253 | |

| | | | | | |

|

| |

Total Short-Term Securities (Cost $1,395,778,160) | | | | | | | | 1,395,799,394 | |

| | | | | | |

|

| |

Total Investments in Securities (Cost $3,455,305,429) | | | | | | | | 4,107,970,211 | |

Covered Call Options Written — (0.0%) | | | | | | | | (1,243,800 | ) |

Other Assets in Excess of Other Liabilities — 0.4% | | | | | | | | 17,766,868 | |

| | | | | | |

|

| |

Net Assets — 100% | | | | | | | $ | 4,124,493,279 | |

| | | | | | |

|

| |

Net Asset Value Per Share | | | | | | | $ | 36.14 | |

| | | | | | |

|

| |

The accompanying notes form an integral part of these financial statements.

12

Schedule of Investments in Securities, Continued

| | Expiration date/

Strike price | | Shares

subject

to option | | Value | |

| |

| |

| |

| |

COVERED CALL OPTIONS WRITTEN* | | | | | | | | |

| | | | | | | | |

Cardinal Health, Inc. | | June 2005 / $60 | | 374,000 | | $ | (448,800 | ) |

Costco Wholesale Corp. | | October 2005 / $45 | | 300,000 | | | (795,000 | ) |

| | | | | |

|

| |

Total Call Options Written

(premiums received $2,322,318) | | | | | | $ | (1,243,800 | ) |

| | | | | |

|

| |

| † | Non-controlled affiliate |

| # | Illiquid and/or restricted security that has been fair valued. |

| (a) | Fully or partially pledged as collateral on outstanding written options. |

| (b) | Interest rates presented for Treasury bills and discount notes represent the yield to maturity at the date of purchase. |

The accompanying notes form an integral part of these financial statements.

13

FUND PERFORMANCE — HICKORY FUND |

The following table summarizes performance information for the Fund as compared to the S&P 500 over the periods indicated.

Period Ended | | Hickory Fund | | S&P 500 | | Difference

Hickory Fund – S&P 500 |

| |

| |

| |

|

Dec. 31, 1995 | | 40.5 | % | | 37.5 | % | | 3.0 | % |

Dec. 31, 1996 | | 35.4 | | | 22.9 | | | 12.5 | |

Dec. 31, 1997 | | 39.2 | | | 33.4 | | | 5.8 | |

Dec. 31, 1998 | | 33.0 | | | 28.6 | | | 4.4 | |

Dec. 31, 1999 | | 36.7 | | | 21.0 | | | 15.7 | |

Dec. 31, 2000 | | –17.2 | | | –9.1 | | | –8.1 | |

Dec. 31, 2001 | | –4.6 | | | –11.8 | | | 7.2 | |

Dec. 31, 2002 | | –29.3 | | | –22.1 | | | –7.2 | |

Dec. 31, 2003 | | 47.9 | | | 28.7 | | | 19.2 | |

Dec. 31, 2004 | | 22.6 | | | 10.9 | | | 11.7 | |

Mar. 31, 2005 (3 months) | | –4.6 | | | –2.1 | | | –2.5 | |

| | | | | | | | | |

10-Year Cumulative Return ended Mar. 31, 2005 | | 337.9 | | | 178.6 | | | 159.3 | |

10-Year Average Annual Compound Return ended Mar. 31, 2005 | | 15.9 | | | 10.8 | | | 5.1 | |

This chart depicts the change in the value of a $25,000 investment in the Hickory Fund for the period March 31, 1995, through March 31, 2005, as compared with the growth of the Standard & Poor’s 500 Index during the same period.

The Fund’s average annual total return for the one, five and ten year periods ended March 31, 2005 was 9.4%, 2.2% and 15.9%, respectively. The returns assume redemption at the end of each period and reinvestment of dividends. This information represents past performance and past performance does not guarantee future results. The investment return and the principal value of an investment in this Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained at www.weitzfunds.com/performance/monthly.asp.

Performance information does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

14

PORTFOLIO PROFILE – HICKORY FUND |

Top Ten Stocks* | | | | | Industry Sectors* | | | |

|

|

|

| |

|

|

| |

Berkshire Hathaway | | 7.9 | % | | Mortgage Services | | 22.8 | % |

Fannie Mae | | 7.5 | | | Media Content and Distribution | | 19.4 | |

Liberty Media Corp. | | 6.9 | | | Consumer Products and Services | | 11.1 | |

Countrywide Financial | | 6.4 | | | Healthcare | | 8.9 | |

Comcast | | 6.1 | | | Banking and Insurance | | 8.2 | |

Redwood Trust | | 5.6 | | | Telecommunications | | 7.1 | |

IAC/InterActiveCorp | | 4.4 | | | Gaming, Lodging and Leisure | | 6.6 | |

Cabela’s | | 4.1 | | | Commercial Services | | 4.4 | |

Liberty Media International | | 3.5 | | | Short-Term Securities/Other | | 11.5 | |

| | 3.5 | | | | |

| |

Omnicare | |

| | | | | 100.0 | % |

| | 55.6 | % | | | |

| |

| |

| | | | | | |

| | | | | | | | |

* As of March 31, 2005

Largest Net Purchases and Sales for Year Ended March 31, 2005 | |

| |

Net Purchases ($mil) | | | Net Sales ($mil) | |

| | |

| |

Countrywide Financial (new) | | $ | 20.7 | | | Citizens Communications (eliminated) | | $ | 11.7 | |

Fannie Mae | | | 18.5 | | | Insurance Auto (eliminated) | | | 10.7 | |

IAC/InterActiveCorp (new) | | | 14.1 | | | Laboratory Corp. | | | 9.3 | |

Berkshire Hathaway | | | 12.8 | | | Caesars Entertainment | | | 8.9 | |

Qwest Communications (new) | | | 8.6 | | | First Health (eliminated) | | | 8.0 | |

| |

|

| | | | |

|

| |

| | $ | 74.7 | | | | | $ | 48.6 | |

| |

|

| | | | |

|

| |

Largest Net Contributions to Investment Results for Year Ended March 31, 2005 | |

|

|

|

| |

Positive ($mil) | | | Negative ($mil) | |

|

|

|

| | |

|

|

|

| |

Caesars Entertainment | | $ | 5.0 | | | Fannie Mae | | $ | (4.7) | |

Cabela’s | | | 4.6 | | | Six Flags | | | (3.5) | |

Liberty Media Corp. & International | | | 4.5 | | | Charter Communications | | | (3.0) | |

Corinthian Colleges | | | 3.3 | | | First Health | | | (1.9) | |

Comcast | | | 3.3 | | | Adelphia Communications | | | (1.1) | |

| |

|

| | | | |

|

| |

Net Portfolio Gains | | $ | 20.7 | | | | | $ | (14.2) | |

| |

|

| | | | |

|

| |

| | | | | | | | | | |

| | $ | 29.9 | | | | | | | |

| |

|

| | | | | | | |

15

Schedule of Investments in Securities

March 31, 2005

| | Shares | | Value | |

| |

| |

| |

COMMON STOCKS — 88.5% | | | | | | |

| | | | | | |

Mortgage Services — 22.8% | | | | | | |

| | | | | | |

Originating and Investing — 14.4% | | | | | | |

Countrywide Financial Corp. | | 650,000 | | $ | 21,099,000 | |

Redwood Trust, Inc. | | 360,000 | | | 18,424,800 | |

Newcastle Investment Corp. | | 140,000 | | | 4,144,000 | |

Bimini Mortgage Management, Inc. | | 250,000 | | | 3,462,500 | |

Imperial Credit Industries, Inc.* † | | 3,435,400 | | | 1,718 | |

| | | |

|

| |

| | | | | 47,132,018 | |

Government Agency — 8.4% | | | | | | |

Fannie Mae | | 450,000 | | | 24,502,500 | |

Freddie Mac | | 50,000 | | | 3,160,000 | |

| | | |

|

| |

| | | | | 27,662,500 | |

| | | |

|

| |

| | | | | 74,794,518 | |

Media Content and Distribution — 19.4% | | | | | | |

| | | | | | |

Cable Television — 10.5% | | | | | | |

Comcast Corp. - Special CLA* | | 600,000 | | | 20,040,000 | |

Liberty Media International, Inc. - A* | | 260,000 | | | 11,372,400 | |

Insight Communications Co.* | | 250,000 | | | 2,962,500 | |

Adelphia Communications Corp. CLA* # | | 800,000 | | | 192,000 | |

| | | |

|

| |

| | | | | 34,566,900 | |

Newspaper, Television, Radio and Content — 8.9% | | | | | | |

Liberty Media Corp. - A* | | 2,200,000 | | | 22,814,000 | |

Cumulus Media, Inc. - CLA* | | 450,000 | | | 6,412,500 | |

| | | |

|

| |

| | | | | 29,226,500 | |

| | | |

|

| |

| | | | | 63,793,400 | |

Consumer Products and Services — 11.1% | | | | | | |

| | | | | | |

Retailing — 10.1% | | | | | | |

IAC/InterActiveCorp* | | 650,000 | | | 14,475,500 | |

Cabela’s, Inc. CLA* # | | 660,600 | | | 13,628,178 | |

AutoZone, Inc.* | | 60,000 | | | 5,142,000 | |

| | | |

|

| |

| | | | | 33,245,678 | |

Education — 1.0% | | | | | | |

ITT Educational Services, Inc.* (a) | | 65,000 | | | 3,152,500 | |

| | | |

|

| |

| | | | | 36,398,178 | |

The accompanying notes form an integral part of these financial statements.

16

Schedule of Investments in Securities, Continued

| | Shares | | Value | |

| |

| |

| |

Healthcare — 8.9% | | | | | | |

| | | | | | |

Suppliers and Distributors — 4.9% | | | | | | |

Omnicare, Inc. | | 300,000 | | $ | 10,635,000 | |

Cardinal Health, Inc.(a) | | 100,000 | | | 5,580,000 | |

| | | |

|

| |

| | | | | 16,215,000 | |

Providers — 3.4% | | | | | | |

Pediatrix Medical Group, Inc.* | | 120,000 | | | 8,230,800 | |

Laboratory Corporation of America Holdings* | | 60,000 | | | 2,892,000 | |

| | | |

|

| |

| | | | | 11,122,800 | |

Managed Care — 0.6% | | | | | | |

WellPoint, Inc.* | | 15,000 | | | 1,880,250 | |

| | | |

|

| |

| | | | | 29,218,050 | |

| | | | | | |

Banking and Insurance — 8.2% | | | | | | |

| | | | | | |

Insurance — 8.0% | | | | | | |

Berkshire Hathaway, Inc. CLA* | | 300 | | | 26,100,000 | |

| | | | | | |

Banking — 0.2% | | | | | | |

People’s Bank | | 19,000 | | | 778,050 | |

| | | |

|

| |

| | | | | 26,878,050 | |

| | | | | | |

Telecommunications — 7.1% | | | | | | |

| | | | | | |

Qwest Communications International, Inc.* | | 2,209,000 | | | 8,173,300 | |

Telephone and Data Systems, Inc. | | 90,000 | | | 7,344,000 | |

Leap Wireless International, Inc.* | | 210,000 | | | 5,470,500 | |

Lynch Interactive Corp.* | | 100,000 | | | 2,400,000 | |

| | | |

|

| |

| | | | | 23,387,800 | |

| | | | | | |

Gaming, Lodging and Leisure — 6.6% | | | | | | |

| | | | | | |

Caesars Entertainment, Inc.* | | 396,000 | | | 7,836,840 | |

Host Marriott Corp. | | 400,000 | | | 6,624,000 | |

Harrah’s Entertainment, Inc. | | 70,000 | | | 4,520,600 | |

Six Flags, Inc.* | | 700,000 | | | 2,884,000 | |

| | | |

|

| |

| | | | | 21,865,440 | |

The accompanying notes form an integral part of these financial statements.

17

Schedule of Investments in Securities, Continued

| | Principal

amount

or shares | | Value | |

| |

| |

| |

Commercial Services — 4.4% | | | | | | | |

| | | | | | | |

Cenveo, Inc.* | | | 976,700 | | $ | 5,508,588 | |

Iron Mountain, Inc.* | | | 180,000 | | | 5,191,200 | |

Coinstar, Inc.* | | | 180,000 | | | 3,816,000 | |

| | | | |

|

| |

| | | | | | 14,515,788 | |

| | | | |

|

| |

Total Common Stocks (Cost $255,405,360) | | | | | | 290,851,224 | |

| | | | | | | |

| | | | | | | |

SHORT-TERM SECURITIES — 12.9% | | | | | | | |

| | | | | | | |

Wells Fargo Government Money Market Fund | | | 10,020,164 | | | 10,020,164 | |

Federal Home Loan Bank Discount Note 2.489% due 4/11/05(b) | | $ | 9,000,000 | | | 8,993,313 | |

U.S. Treasury Bills, 2.369% to 2.803%, due 4/07/05 to 6/30/05(b) | | | 23,500,000 | | | 23,438,862 | |

| | | | |

|

| |

Total Short-Term Securities (Cost $42,451,770) | | | | | | 42,452,339 | |

| | | | |

|

| |

Total Investments in Securities (Cost $297,857,130) | | | | | | 333,303,563 | |

Covered Call Options Written — (0.3%) | | | | | | (925,750 | ) |

Other Liabilities in Excess of Other Assets — (1.1%) | | | | | | (3,741,353 | ) |

| | | | |

|

| |

Net Assets — 100% | | | | | $ | 328,636,460 | |

| | | | |

|

| |

Net Asset Value Per Share | | | | | $ | 31.36 | |

| | | | |

|

| |

The accompanying notes form an integral part of these financial statements.

18

Schedule of Investments in Securities, Continued

| | Expiration date/

Strike price | | Shares

subject

to option | | Value | |

| |

| |

| |

| |

| | | | | | | | |

COVERED CALL OPTIONS WRITTEN* | | | | | | | | |

| | | | | | | | |

Cardinal Health, Inc. | | June 2005 / $60 | | 37,500 | | $ | (45,000 | ) |

ITT Educational Services, Inc. | | April 2005 / $35 | | 65,000 | | | (880,750 | ) |

| | | | | |

|

| |

Total Call Options Written | | | | | | $ | (925,750 | ) |

| | | | | |

|

| |

(premiums received $426,927) | | | | | | | | |

| † | Non-controlled affiliate |

| # | Illiquid and/or restricted security that has been fair valued. |

| (a) | Fully or partially pledged as collateral on outstanding written options. |

| (b) | Interest rates presented for Treasury bills and discount notes represent the yield to maturity at the date of purchase. |

The accompanying notes form an integral part of these financial statements.

19

FUND PERFORMANCE — PARTNERS VALUE FUND |

The following table summarizes performance information for the Fund as compared to the S&P 500 over the periods indicated.

Period Ended | | Partners Value Fund | | S&P 500 | | Difference

Partners Value – S&P 500 |

| |

| |

| |

|

Dec. 31, 1995 | | 38.7 | % | | 37.5 | % | | 1.2 | % |

Dec. 31, 1996 | | 19.2 | | | 22.9 | | | –3.7 | |

Dec. 31, 1997 | | 40.6 | | | 33.4 | | | 7.2 | |

Dec. 31, 1998 | | 29.1 | | | 28.6 | | | 0.5 | |

Dec. 31, 1999 | | 22.1 | | | 21.0 | | | 1.1 | |

Dec. 31, 2000 | | 21.1 | | | –9.1 | | | 30.2 | |

Dec. 31, 2001 | | –0.9 | | | –11.8 | | | 10.9 | |

Dec. 31, 2002 | | –17.0 | | | –22.1 | | | 5.1 | |

Dec. 31, 2003 | | 25.4 | | | 28.7 | | | –3.3 | |

Dec. 31, 2004 | | 15.0 | | | 10.9 | | | 4.1 | |

Mar. 31, 2005 (3 months) | | –3.8 | | | –2.1 | | | –1.7 | |

| | | | | | | | | |

10-Year Cumulative Return ended Mar. 31, 2005 | | 364.4 | | | 178.6 | | | 185.8 | |

10-Year Average Annual Compound Return ended Mar. 31, 2005 | | 16.6 | | | 10.8 | | | 5.8 | |

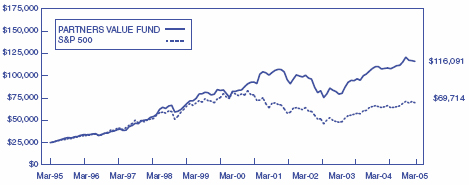

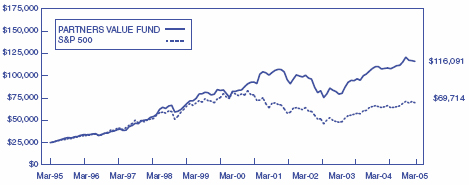

This chart depicts the change in the value of a $25,000 investment in the Partners Value Fund for the period March 31, 1995, through March 31, 2005, as compared with the growth of the Standard & Poor’s 500 Index during the same period.

The Fund’s average annual total return for the one, five and ten year periods ended March 31, 2005 was 5.5%, 7.1% and 16.6%, respectively. The returns assume redemption at the end of each period and reinvestment of dividends. This information represents past performance and past performance does not guarantee future results. The investment return and the principal value of an investment in this Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained at www.weitzfunds.com/performance/monthly.asp.

Performance information does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

20

PORTFOLIO PROFILE – PARTNERS VALUE FUND |

Top Ten Stocks* | | | Industry Sectors* | |

| | |

| |

Berkshire Hathaway | | | 7.3 | % | | Media Content and Distribution | | | 20.5 | % |

Liberty Media Corp. | | | 6.4 | | | Mortgage Services | | | 13.8 | |

Comcast | | | 5.7 | | | Banking and Insurance | | | 12.2 | |

Fannie Mae | | | 5.0 | | | Gaming, Lodging and Leisure | | | 10.6 | |

Countrywide Financial | | | 4.4 | | | Telecommunications | | | 4.4 | |

Washington Post | | | 4.2 | | | Consumer Products and Services | | | 3.4 | |

Host Marriott | | | 4.0 | | | Healthcare | | | 3.3 | |

Caesars Entertainment | | | 3.8 | | | Real Estate | | | 0.9 | |

Telephone & Data Systems | | | 3.1 | | | Commercial Services | | | 0.5 | |

IAC/InterActiveCorp | | | 3.0 | | | Corporate Bonds | | | 0.1 | |

| | |

| | | Government Agency Securities | | | 0.1 | |

| | | 46.9 | % | | Short-Term Securities/Other | | | 30.2 | |

| | |

| | | | | |

| |

| | | | | | | | | 100.0 | % |

| | | | | | | | |

| |

| | | | | | | | | | |

| | | | | | | | | | |

* As of March 31, 2005

Largest Net Purchases and Sales for Year Ended March 31, 2005 | |

| |

Net Purchases ($mil) | | | Net Sales ($mil) | |

| | |

| |

Fannie Mae | | $ | 104 | | | Citizens Communications (eliminated) | | $ | 128 | |

IAC/InterActiveCorp (new) | | | 79 | | | Caesars Entertainment | | | 121 | |

Cardinal Health (new) | | | 31 | | | Greenpoint Financial | | | 54 | |

Liberty Media International (new) | | | 16 | | | Hilton Hotels | | | 50 | |

WellPoint (new) | | | 7 | | | Host Marriott | | | 48 | |

| |

|

| | | | |

|

| |

| | $ | 237 | | | | | $ | 401 | |

| |

|

| | | | |

|

| |

Largest Net Contributions to Investment Results for Year Ended March 31, 2005 | |

| |

Positive ($mil) | | | Negative ($mil) | |

| | |

| |

Caesars Entertainment | | $ | 60 | | | Charter Communications | | $ | (37 | ) |

Liberty Media Corp. & International | | | 32 | | | Fannie Mae | | | (27 | ) |

Host Marriott | | | 32 | | | Berkshire Hathaway | | | (16 | ) |

Comcast | | | 30 | | | Six Flags | | | (15 | ) |

Hilton Hotels | | | 22 | | | Qwest Communications | | | (8 | ) |

| |

|

| | | | |

|

| |

| | $ | 176 | | | | | $ | (103 | ) |

| |

|

| | | | |

|

| |

Net Portfolio Gains | | $ | 165 | | | | | | | |

| |

|

| | | | | | | |

| | | | | | | | | | |

21

Schedule of Investments in Securities

March 31, 2005

| | Shares | | Value |

| |

| |

|

COMMON STOCKS — 69.6% | | | | | |

| | | | | |

Media Content and Distribution — 20.5% | | | | | |

| | | | | |

Newspaper, Television, Radio and Content — 10.9% | | | | | |

Liberty Media Corp. - A* | | 16,300,000 | | $ | 169,031,000 |

Washington Post Co. CLB | | 125,000 | | | 111,750,000 |

Daily Journal Corp.* † | | 114,800 | | | 5,029,388 |

| | | |

|

|

| | | | | 285,810,388 |

Cable Television — 9.6% | | | | | |

Comcast Corp. - Special CLA* | | 4,500,000 | | | 150,300,000 |

Liberty Media International, Inc. - A* | | 1,320,000 | | | 57,736,800 |

Insight Communications Co.* | | 2,834,439 | | | 33,588,102 |

Charter Communications, Inc. CLA* | | 6,407,000 | | | 10,251,200 |

Adelphia Communications Corp. CLA* # | | 6,494,000 | | | 1,558,560 |

| | | |

|

|

| | | | | 253,434,662 |

| | | |

|

|

| | | | | 539,245,050 |

Mortgage Services — 13.8% | | | | | |

| | | | | |

Government Agency — 7.4% | | | | | |

Fannie Mae | | 2,400,000 | | | 130,680,000 |

Freddie Mac | | 1,000,000 | | | 63,200,000 |

| | | |

|

|

| | | | | 193,880,000 |

Originating and Investing — 6.4% | | | | | |

Countrywide Financial Corp. | | 3,580,000 | | | 116,206,800 |

Redwood Trust, Inc. | | 1,050,000 | | | 53,739,000 |

Imperial Credit Industries, Inc.* | | 1,486,500 | | | 743 |

| | | |

|

|

| | | | | 169,946,543 |

| | | |

|

|

| | | | | 363,826,543 |

Banking and Insurance — 12.2% | | | | | |

| | | | | |

Insurance — 7.3% | | | | | |

Berkshire Hathaway, Inc. CLB* | | 34,000 | | | 97,104,000 |

Berkshire Hathaway, Inc. CLA* | | 1,100 | | | 95,700,000 |

| | | |

|

|

| | | | | 192,804,000 |

Banking — 4.9% | | | | | |

Washington Mutual, Inc. | | 1,800,000 | | | 71,100,000 |

U.S. Bancorp | | 1,100,000 | | | 31,702,000 |

North Fork Bancorporation, Inc. | | 900,000 | | | 24,966,000 |

| | | |

|

|

| | | | | 127,768,000 |

| | | |

|

|

| | | | | 320,572,000 |

The accompanying notes form an integral part of these financial statements.

22

Schedule of Investments in Securities, Continued

| | Shares | | Value |

| |

| |

|

Gaming, Lodging and Leisure — 10.6% | | | | | |

| | | | | |

Host Marriott Corp. | | 6,300,000 | | $ | 104,328,000 |

Caesars Entertainment, Inc.* | | 5,000,000 | | | 98,950,000 |

Hilton Hotels Corp. | | 2,000,000 | | | 44,700,000 |

Harrah’s Entertainment, Inc. | | 250,000 | | | 16,145,000 |

Six Flags, Inc.* | | 3,700,000 | | | 15,244,000 |

| | | |

|

|

| | | | | 279,367,000 |

| | | | | |

Telecommunications — 4.4% | | | | | |

| | | | | |

Telephone and Data Systems, Inc. | | 1,010,000 | | | 82,416,000 |

Qwest Communications International, Inc.* | | 9,019,000 | | | 33,370,300 |

| | | |

|

|

| | | | | 115,786,300 |

| | | | | |

Consumer Products and Services — Retailing — 3.4% | | | | | |

| | | | | |

IAC/InterActiveCorp* | | 3,600,000 | | | 80,172,000 |

Costco Wholesale Corp.(a) | | 200,000 | | | 8,836,000 |

| | | |

|

|

| | | | | 89,008,000 |

| | | | | |

Healthcare — 3.3% | | | | | |

| | | | | |

Suppliers and Distributors — 1.8% | | | | | |

Cardinal Health, Inc.(a) | | 800,000 | | | 44,640,000 |

Omnicare, Inc. | | 100,000 | | | 3,545,000 |

| | | |

|

|

| | | | | 48,185,000 |

Providers — 1.1% | | | | | |

Laboratory Corporation of America Holdings* | | 400,000 | | | 19,280,000 |

Triad Hospitals, Inc.* | | 200,000 | | | 10,020,000 |

| | | |

|

|

| | | | | 29,300,000 |

Managed Care — 0.4 % | | | | | |

WellPoint, Inc.* | | 60,000 | | | 7,521,000 |

UnitedHealth Group, Inc. | | 40,000 | | | 3,815,200 |

| | | |

|

|

| | | | | 11,336,200 |

| | | |

|

|

| | | | | 88,821,200 |

The accompanying notes form an integral part of these financial statements.

23

Schedule of Investments in Securities, Continued

| | Principal

amount

or shares | | Value |

| |

| |

|

Real Estate — Construction and Development — 0.9% | | | | | | |

| | | | | | |

Forest City Enterprises, Inc. CLA | | | 360,000 | | $ | 22,968,000 |

| | | | | | |

| | | | | | |

Commercial Services — 0.5% | | | | | | |

| | | | | | |

Cenveo, Inc.* | | | 2,181,300 | | | 12,302,532 |

Intelligent Systems Corp.* | | | 130,409 | | | 302,549 |

| | | | |

|

|

| | | | | | 12,605,081 |

| | | | |

|

|

Total Common Stocks (Cost $1,350,059,417) | | | | | | 1,832,199,174 |

| | | | | | |

| | | | | | |

CORPORATE BONDS — 0.1% | | | | | | |

| | | | | | |

Charter Communications Holdings, LLC 10.75% 10/01/09 | | $ | 3,000,000 | | | 2,475,000 |

Charter Communications Holdings, LLC 9.92% 4/01/11 | | | 2,000,000 | | | 1,545,000 |

| | | | |

|

|

Total Corporate Bonds (Cost $3,944,018) | | | | | | 4,020,000 |

| | | | | | |

| | | | | | |

GOVERNMENT AGENCY SECURITIES — 0.1% | | | | | | |

| | | | | | |

Federal Home Loan Bank 6.44% 11/28/05 (Cost $2,500,312) | | | 2,500,000 | | | 2,548,730 |

The accompanying notes form an integral part of these financial statements.

24

Schedule of Investments in Securities, Continued

| | Principal

amount

or shares | | Value | |

| |

| |

| |

SHORT-TERM SECURITIES — 30.4% | | | | | | | |

| | | | | | | |

Milestone Treasury Obligations Portfolio | | | 42,373,751 | | $ | 42,373,751 | |

Wells Fargo Government Money Market Fund | | | 49,247,168 | | | 49,247,168 | |

Federal Home Loan Bank Discount Note 2.489% 4/11/05(b) | | $ | 69,000,000 | | | 68,948,733 | |

U.S. Treasury Bills, 2.355% to 2.803%, due 4/07/05 to 6/30/05(b) | | | 640,500,000 | | | 639,020,984 | |

| | | | |

|

| |

Total Short-Term Securities (Cost $799,573,226) | | | | | | 799,590,636 | |

| | | | |

|

| |

Total Investments in Securities (Cost $2,156,076,973) | | | | | | 2,638,358,540 | |

Covered Call Options Written — (0.0%) | | | | | | (829,400 | ) |

Other Liabilities in Excess of Other Assets — (0.2%) | | | | | | (3,915,821 | ) |

| | | | |

|

| |

Net Assets — 100% | | | | | $ | 2,633,613,319 | |

| | | | |

|

| |

Net Asset Value Per Share | | | | | $ | 22.98 | |

| | | | |

|

| |

| | Expiration date/

Strike price | | Shares

Subject

to option | | Value | |

| |

| |

| |

| |

COVERED CALL OPTIONS WRITTEN* | | | | | | | | |

| | | | | | | | |

Cardinal Health, Inc. | | June 2005 / $60 | | 249,500 | | $ | (299,400 | ) |

Costco Wholesale Corp. | | October 2005 / $45 | | 200,000 | | | (530,000 | ) |

| | | | | |

|

| |

Total Call Options Written | | | | | | $ | (829,400 | ) |

| | | | | |

|

| |

(premiums received $1,548,708) | | | | | | | | |

| † | Non-controlled affiliate |

| # | Illiquid and/or restricted security that has been fair valued. |

| (a) | Fully or partially pledged as collateral on outstanding written options. |

| (b) | Interest rates presented for Treasury bills and discount notes represent the yield to maturity at the date of purchase. |

The accompanying notes form an integral part of these financial statements.

25

PORTFOLIO MANAGER LETTER – WEITZ BALANCED FUND |

April 12, 2005

Dear Fellow Shareholder:

We are pleased to report very good results for the fiscal year ended March 31, 2005. The Balanced Fund’s total return for the fiscal year was 8.5% versus 3.9% for our primary benchmark, the Blended Index†. For the quarter, both the Balanced Fund and the Blended Index† declined 1.6%.

The table below shows the performance of the Balanced Fund, along with the Blended Index†, the S&P 500 (stocks) and the Lehman Brothers Intermediate U.S. Government/Credit Index (bonds).

| | Total Returns*

(Through 3/31/05) | |

| | 1st Quarter | | 1-Year | |

| |

| |

| |

Weitz Balanced Fund | | –1.6 | % | | 8.5 | % | |

| | | | | | | |

Blended Index† | | –1.6 | | | 3.9 | | |

S&P 500 | | –2.1 | | | 6.7 | | |

Lehman Brothers Intermediate U.S. Government/Credit Index | | –0.9 | | | –0.3 | | |

This information represents past performance and past performance does not guarantee future results. The investment return and the principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be higher or lower than the performance data quoted above. Performance data current to the most recent month end may be obtained at www.weitzfunds.com/performance/monthly.asp.

* | Fund inception date: October 1, 2003. All performance numbers are calculated after deducting fees and expenses, and all numbers assume reinvestment of dividends. |

† | The Blended Index reflects an unmanaged portfolio of 60% of the S&P 500, which is an unmanaged index of common stock prices, and 40% of the Lehman Brothers Intermediate U.S. Government/Credit Index, which is an unmanaged index consisting of government securities and publicly issued corporate debt with maturities from one to ten years. |

Portfolio Review

The Balanced Fund’s fiscal year performance was driven by gains in the stock portfolio. A healthy mix of recent investments and old favorites fueled the Fund’s returns. Among the former, the stand-outs were health care and consumer companies. Among the latter, media and gaming companies made significant contributions.

Five of the top ten contributors to overall Fund performance were health care companies (Triad Hospitals, Omnicare, Cardinal Health, Pediatrix Medical Group and Laboratory Corporation of America). Despite our initial success in the health care area, we continue to proceed with caution. Among other risks, the government’s role as a significant payer for many services presents unique analytical challenges. Health care valuations are less compelling today, and we have trimmed or eliminated several holdings. We remain optimistic about the business outlook for those we still own.

Consumer companies in the for-profit education, consumer goods and retail areas also contributed to Fund performance. We purchased ITT Educational and Corinthian Colleges at depressed prices in the face of negative headlines, and both rebounded quickly. Flooring company Mohawk Industries absorbed multiple increases in oil-based input costs without a hitch, but faces a similar stiff challenge this year. Premium spirits maker Diageo continues to generate free cash and return it to shareholders. Outdoor retailer Cabela’s should be a core holding as long as the stock price doesn’t get too far ahead of the business, while AutoZone is more likely to be a long-term trade.

26

Many of the old favorites had a very good year. Business value continued to build at our larger media holdings, and the stocks followed suit. Liberty Media and its spin-off Liberty Media International together accounted for the largest single contribution to Fund performance, and business prospects appear bright at both companies. Cable companies Comcast and Cox continued to deliver on the promise of growth through advanced services. The soon-to-close combination of gaming companies Harrah’s and Caesars also benefited the Fund. Interestingly, the bulk of our gains came from buying more Harrah’s in the mid-$40’s after the deal was announced.

On the negative side of the ledger, company-specific problems at Fannie Mae precipitated a 27% stock price decline. Management’s alleged misconduct and the company’s ongoing accounting challenges are disturbing. However, we continue to think that Fannie Mae’s underlying business will have substantial core earnings power under all but the most draconian, low probability scenarios. If we are correct, this earnings power should limit our permanent downside and support a much higher stock price in time.

Our defensive stance on bonds (high credit quality, short duration and low overall invested level) helped preserve capital without missing much, if any, upside. The Lehman Brothers Intermediate U.S. Government/Credit Index, our gauge for the bond market, actually declined slightly for the fiscal year. At the same time, returns on our cash reserves, while still low, increased throughout the year as the Federal Reserve hiked the Fed Funds target from 1.00% a year ago to 2.75% today.

Turning briefly to the topic of “what’s new” with the Fund, we added five companies to the stock portfolio and eliminated four others in the March quarter. The additions are managed care companies UnitedHealth Group and WellPoint, radio broadcaster Cumulus Media, records management provider Iron Mountain and commercial service provider Coinstar. We sold Triad Hospitals, HCA and Caesars Entertainment at healthy gains, and we eliminated Pfizer at a modest loss.

UnitedHealth and WellPoint may not look like typical Weitz investments at first glance. The stocks are up substantially since last fall’s election, and the companies trade at higher headline multiples than we typically pay. Still, both businesses are available at a discount to our underlying value estimate. In each case, the key driver of this discount is our above-average growth outlook for the next three to five years.

We think these businesses have the necessary ingredients to grow value per share rapidly. Both companies have entrenched market positions, good long-term demographic demand drivers, exceptional free cash flows, limited capital requirements and a demonstrated willingness to aggressively repurchase shares. In addition, UnitedHealth has multiple business lines that can thrive in different environments, while WellPoint has an ongoing opportunity to cut substantial costs after its recent merger with Anthem.

Outlook

The Balanced Fund remains conservatively positioned with an asset allocation of 41% stocks, 24% bonds and 35% cash and reserves. This allocation results from our bottom-up search for value, which remains challenging. We continue to focus on downside protection before turning our attention to an individual investment’s potential upside. We think a patient, well executed defense will create attractive offensive opportunities.

With the addition of two analysts in 2004, we now have more people looking for investment ideas in more places than ever before. Each brings a unique perspective to the process, but all are bound by the Weitz value investing philosophy. The analyst team sourced virtually all of our health care and consumer ideas over the past eighteen months, and we look forward to continued contributions from the group.

27

We hope you will join us for our annual shareholder information meeting on Tuesday, May 31. There will be no official business to conduct, so we can spend the whole time answering your questions about investments.

Regards, | | | |

| | | |

| |

| |

| | | |

Bradley P. Hinton

Co-Portfolio Manager | | Wallace R. Weitz

Co-Portfolio Manager | |

Portfolio composition is subject to change at any time and references to specific securities, industries, and sectors referenced in this letter are not recommendations to purchase or sell any particular security. See the Schedule of Investments in Securities included in this report for the percent of assets of the Fund invested in particular industries or sectors.

Industry Sectors*

Media Content and Distribution | | 8.3 | % |

Mortgage Services | | 7.4 | |

Consumer Products and Services | | 7.0 | |

Healthcare | | 5.8 | |

Banking and Insurance | | 5.7 | |

Commercial Services | | 3.9 | |

Gaming, Lodging and Leisure | | 2.1 | |

Telecommunications | | 0.8 | |

Real Estate | | 0.3 | |

Corporate Bonds | | 2.2 | |

Mortgage-Backed Securities | | 0.7 | |

U.S. Treasury and Government Agency | | 20.7 | |

Short-Term Securities/Other | | 35.1 | |

| |

| |

| | 100.0 | % |

| |

| |

| | | |

*As of March 31, 2005 | | | |

28

FUND PERFORMANCE – BALANCED FUND |

The chart below depicts the change in the value of a $25,000 investment for the period since inception of the Balanced Fund (October 1, 2003) through March 31, 2005, as compared with the growth of the Blended Index during the same period. The Blended Index reflects an unmanaged portfolio of 60% of the S&P 500 (“S&P 500”), which is an unmanaged index of common stock prices, and 40% of the Lehman Brothers Intermediate U.S. Government/Credit Index (“Lehman Index”), which is an unmanaged index consisting of government securities and publicly issued corporate debt with maturities from one to ten years. The chart also includes information about the growth of the S&P 500 and the Lehman Index for the period. The information assumes reinvestment of dividends and capital gains distributions. A$25,000 investment in the Balanced Fund on October 1, 2003, would have been valued at $28,557 on March 31, 2005.

Average Annual Total Returns

| | 1-Year | | Since

Inception

(Oct. 1, 2003) |

| |

| |

|

Balanced Fund | | 8.5 | % | | 9.3 | % |

Blended Index | | 3.9 | | | 9.0 | |

S&P 500 Index | | 6.7 | | | 14.0 | |

Lehman Brothers Intermediate U.S. Government/Credit Index | | –0.3 | | | 1.5 | |

The returns assume redemption at the end of each period and reinvestment of dividends. This information represents past performance and past performance does not guarantee future results. The investment return and the principal value of an investment in this Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained at www.weitzfunds.com/performance/monthly.asp.

Performance information does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

29

Schedule of Investments in Securities

March 31, 2005

| | Shares | | Value |

| |

| |

|

COMMON STOCKS — 41.3% | | | | | |

| | | | | |

Media Content and Distribution — 8.3% | | | | | |

| | | | | |

Newspaper, Television, Radio and Content — 4.2% | | | | | |

Liberty Media Corp. - A* | | 150,000 | | $ | 1,555,500 |

Cumulus Media, Inc. - CLA* | | 50,000 | | | 712,500 |

| | | |

|

|

| | | | | 2,268,000 |

Cable Television — 4.1% | | | | | |

Comcast Corp. - Special CLA* | | 44,000 | | | 1,469,600 |

Liberty Media International, Inc. - A* | | 17,500 | | | 765,450 |

| | | |

|

|

| | | | | 2,235,050 |

| | | |

|

|

| | | | | 4,503,050 |

Mortgage Services — 7.4% | | | | | |

| | | | | |

Originating and Investing — 4.3% | | | | | |

Countrywide Financial Corp. | | 47,500 | | | 1,541,850 |

Redwood Trust, Inc. | | 15,000 | | | 767,700 |

| | | |

|

|

| | | | | 2,309,550 |

Government Agency — 3.1% | | | | | |

Fannie Mae | | 22,000 | | | 1,197,900 |

Freddie Mac | | 8,000 | | | 505,600 |

| | | |

|

|

| | | | | 1,703,500 |

| | | |

|

|

| | | | | 4,013,050 |

Consumer Products and Services — 7.0% | | | | | |

| | | | | |

Retailing — 4.2% | | | | | |

IAC/InterActiveCorp* | | 47,000 | | | 1,046,690 |

Cabela’s, Inc. CLA* | | 22,320 | | | 460,462 |

Cabela’s, Inc. CLA* # | | 14,680 | | | 302,848 |

AutoZone, Inc.* | | 5,500 | | | 471,350 |

| | | |

|

|

| | | | | 2,281,350 |

Consumer Goods — 1.9% | | | | | |

Mohawk Industries, Inc.* | | 7,000 | | | 590,100 |

Diageo PLC - Sponsored ADR | | 7,500 | | | 426,750 |

| | | |

|

|

| | | | | 1,016,850 |

Education — 0.9% | | | | | |

ITT Educational Services, Inc.* | | 10,000 | | | 485,000 |

| | | |

|

|

| | | | | 3,783,200 |

The accompanying notes form an integral part of these financial statements.

30

Schedule of Investments in Securities, Continued

| | Shares | | Value |

| |

| |

|

Healthcare — 5.8% | | | | | |

| | | | | |

Managed Care — 2.4% | | | | | |

UnitedHealth Group, Inc. | | 7,000 | | $ | 667,660 |

WellPoint, Inc.* | | 5,000 | | | 626,750 |

| | | | | 1,294,410 |

| | | |

|

|

Providers — 2.2% | | | | | |

Pediatrix Medical Group, Inc.* | | 9,500 | | | 651,605 |

Laboratory Corporation of America Holdings* | | 11,500 | | | 554,300 |

| | | |

|

|

| | | | | 1,205,905 |

Suppliers and Distributors — 1.2% | | | | | |

Omnicare, Inc. | | 18,500 | | | 655,825 |

| | | |

|

|

| | | | | 3,156,140 |

| | | | | |

Banking and Insurance — 5.7% | | | | | |

| | | | | |

Insurance — 3.0% | | | | | |

Berkshire Hathaway, Inc. CLB* | | 570 | | | 1,627,920 |

| | | | | |

Banking — 2.7% | | | | | |

Wells Fargo & Co. | | 9,000 | | | 538,200 |

Washington Mutual, Inc. | | 13,000 | | | 513,500 |

U.S. Bancorp | | 14,000 | | | 403,480 |

| | | |

|

|

| | | | | 1,455,180 |

| | | |

|

|

| | | | | 3,083,100 |

Commercial Services — 3.9% | | | | | |

| | | | | |

Coinstar, Inc.* | | 34,000 | | | 720,800 |

Iron Mountain, Inc.* | | 20,000 | | | 576,800 |

Republic Services, Inc. | | 13,000 | | | 435,240 |

First Data Corp. | | 10,500 | | | 412,755 |

| | | |

|

|

| | | | | 2,145,595 |

| | | | | |

Gaming, Lodging and Leisure — 2.1% | | | | | |

| | | | | |

Harrah’s Entertainment, Inc. | | 17,470 | | | 1,128,213 |

The accompanying notes form an integral part of these financial statements.

31

Schedule of Investments in Securities, Continued

| | Principal

amount

or shares | | Value |

| |

| |

|

Telecommunications — 0.8% | | | | | | |

| | | | | | |

Telephone and Data Systems, Inc. | | | 5,500 | | $ | 448,800 |

| | | | | | |

Real Estate — Property Ownership and Management — 0.3% | | | | | | |

| | | | | | |

Capital Automotive REIT | | | 5,000 | | | 165,600 |

| | | | |

|

|

Total Common Stocks (Cost $20,442,721) | | | | | | 22,426,748 |

| | | | | | |

CORPORATE BONDS — 2.2% | | | | | | |

| | | | | | |

Telephone and Data Systems, Inc. 7.0% 8/01/06 | | $ | 500,000 | | | 515,501 |

Liberty Media Corp. 3.5% 9/25/06 | | | 125,000 | | | 123,241 |

Berkshire Hathaway Finance Corp. 4.2% 12/15/10 | | | 300,000 | | | 291,706 |

Harrah’s Operating Co., Inc. 5.375% 12/15/13 | | | 250,000 | | | 248,267 |

| | | | |

|

|

Total Corporate Bonds (Cost $1,192,080) | | | | | | 1,178,715 |

| | | | | | |

MORTGAGE-BACKED SECURITIES — 0.7%(a) | | | | | | |

| | | | | | |

Federal Agency CMO and REMIC — 0.7% | | | | | | |

| | | | | | |

Freddie Mac 6.0% 4/15/27 (Estimated Average Life 0.8 years) | | | 94,468 | | | 94,829 |

Fannie Mae 4.25% 6/25/33 (Estimated Average Life 1.5 years) | | | 291,446 | | | 290,438 |

| | | | |

|

|

Total Mortgage-Backed Securities (Cost $392,708) | | | | | | 385,267 |

| | | | | | |

U.S. TREASURY AND GOVERNMENT AGENCY — 20.7% | | | | | | |

| | | | | | |

U.S. Treasury — 14.1% | | | | | | |

| | | | | | |

U.S. Treasury Note 1.625% 9/30/05 | | | 300,000 | | | 297,914 |

U.S. Treasury Note 3.5% 11/15/06 | | | 300,000 | | | 299,156 |

U.S. Treasury Note 3.75% 3/31/07 | | | 500,000 | | | 499,766 |

U.S. Treasury Note 3.0% 11/15/07 | | | 300,000 | | | 293,578 |

U.S. Treasury Note 3.375% 2/15/08 | | | 1,250,000 | | | 1,231,641 |

U.S. Treasury Note 3.125% 10/15/08 | | | 300,000 | | | 291,106 |

U.S. Treasury Note 3.0% 2/15/09 | | | 400,000 | | | 384,797 |

U.S. Treasury Note 2.625% 3/15/09 | | | 500,000 | | | 473,907 |

U.S. Treasury Note 3.625% 7/15/09 | | | 500,000 | | | 490,489 |

U.S. Treasury Note 6.5% 2/15/10 | | | 400,000 | | | 440,578 |

U.S. Treasury Note 4.0% 3/15/10 | | | 1,000,000 | | | 992,501 |

U.S. Treasury Note 5.0% 2/15/11 | | | 400,000 | | | 415,578 |

The accompanying notes form an integral part of these financial statements.

32

Schedule of Investments in Securities, Continued

| | Principal

amount

or shares | | Value |

| |

| |

|

U.S. Treasury — 14.1% (continued) | | | | | | |

| | | | | | |

U.S. Treasury Note 5.0% 8/15/11 | | $ | 500,000 | | $ | 519,609 |

U.S. Treasury Note 4.375% 8/15/12 | | | 500,000 | | | 501,329 |

U.S. Treasury Inflation-Indexed Note 2.0% 1/15/14 | | | 516,000 | | | 528,321 |

| | | | |

|

|

| | | | | | 7,660,270 |

| | | | | | |

Government Agency Securities — 6.6% | | | | | | |

| | | | | | |

Fannie Mae 4.0% 11/27/07 | | | 500,000 | | | 497,797 |

Fannie Mae 3.25% 12/21/07(b) | | | 400,000 | | | 397,255 |

Federal Home Loan Bank 3.55% 4/15/08 | | | 500,000 | | | 491,197 |

Freddie Mac 4.0% 4/28/09 | | | 240,000 | | | 236,641 |

Freddie Mac 4.7% 5/19/09 | | | 835,000 | | | 836,399 |

Fannie Mae 4.01% 10/21/09 | | | 400,000 | | | 392,594 |

Federal Home Loan Bank 4.16% 12/08/09 | | | 400,000 | | | 392,544 |

Fannie Mae 5.5% 7/18/12 | | | 300,000 | | | 301,897 |

| | | | |

|

|

| | | | | | 3,546,324 |

| | | | |

|

|

Total U.S. Treasury and Government Agency (Cost $11,278,821) | | | | | | 11,206,594 |

| | | | | | |

| | | | | | |

SHORT-TERM SECURITIES — 34.5% | | | | | | |

| | | | | | |

Wells Fargo Government Money Market Fund | | | 788,361 | | | 788,361 |

U.S. Treasury Bills, 2.369% to 2.803%, due 4/07/05 to 6/30/05(c) | | $ | 18,000,000 | | | 17,937,016 |

| | | | |

|

|

Total Short-Term Securities (Cost $18,724,056) | | | | | | 18,725,377 |

| | | | |

|

|

Total Investments in Securities (Cost $52,030,386) | | | | | | 53,922,701 |

Other Assets Less Other Liabilities — 0.6% | | | | | | 311,446 |

| | | | |

|

|

Net Assets — 100% | | | | | $ | 54,234,147 |

| | | | |

|

|

Net Asset Value Per Share | | | | | $ | 11.17 |

| | | | |

|

|

| # | Illiquid and/or restricted security that has been fair valued. |

| (a) | Estimated average life of mortgage-backed securities are unaudited. |

| (b) | Security is a “step-up” bond where the coupon rate increases or steps up at a predetermined date. Coupon rate disclosed represents rate as of March 31, 2005. |

| (c) | Interest rates presented for Treasury bills represent the yield to maturity at the date of purchase. |

The accompanying notes form an integral part of these financial statements.

33

PORTFOLIO MANAGER LETTER – FIXED INCOME FUND AND

GOVERNMENT MONEY MARKET FUND |

April 13, 2005

Dear Fellow Shareholder:

Fixed Income Fund Overview

The Fixed Income Fund’s total return for the first quarter of 2005 was -0.2%, which consisted of approximately +0.8% from net interest income (after deducting fees and expenses) and -1.0% from (net unrealized) depreciation of our bonds and other investments. Our first quarter return exceeded the -0.9% return of the Lehman Brothers Intermediate U.S. Government / Credit Index, our Fund’s primary benchmark.

Total returns for longer periods of time are listed in the table below. Two additional Lehman Brothers Indexes (1-3 and 1-5 year) are included in the table for added perspective, given our Fund’s defensive propensity (i.e. a shorter average life than the Lehman Intermediate Index).

| | Average Annual Total Returns**

(Through 3/31/05) | |

| | 1-Year | | 3-Year | | 5-Year | | 10-Year | |

| |

| |

| |

| |

| |

Fixed Income Fund | | 0.9 | % | | 4.4 | % | | 6.0 | % | | 6.2 | % | |

Lehman Brothers Intermediate U.S. Government/Credit Index * | | -0.3 | | | 5.5 | | | 6.7 | | | 6.6 | | |

Lehman Brothers 1-5 Year U.S. Government/Credit Index * | | -0.5 | | | 4.2 | | | 5.8 | | | 6.0 | | |

Lehman Brothers 1-3 Year U.S. Government/Credit Index* | | -0.2 | | | 3.3 | | | 5.1 | | | 5.6 | | |

This information represents past performance and past performance does not guarantee future results. The investment return and the principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be higher or lower than the performance data quoted above. Performance data current to the most recent month end may be obtained at www.weitzfunds.com/performance/monthly.asp.

* | Source: Lehman Brothers, Inc. |

** | All performance numbers are calculated after deducting fees and expenses, and all numbers assume reinvestment of dividends. |

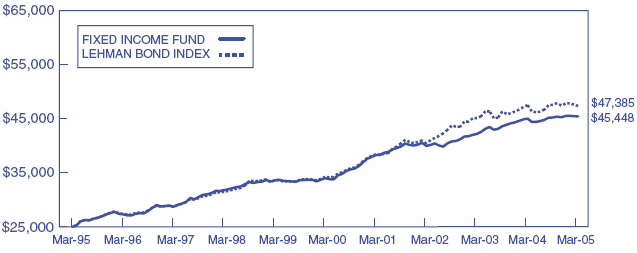

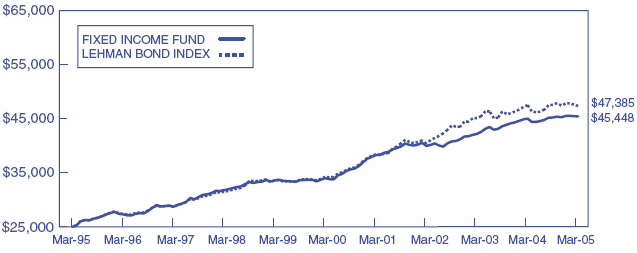

The following table and chart shows a profile of our portfolio and asset allocation as of March 31:

| | | |