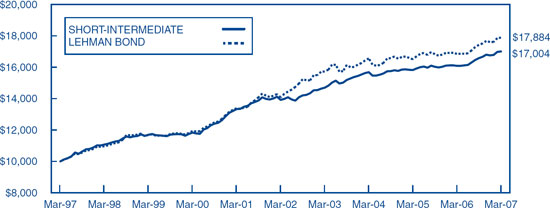

Despite increased volatility in the March quarter, our fiscal year ending March 31, 2007 was a very good one. Our four stock funds earned total returns ranging from 16.4% to 19.1% compared to gains of 11.8% for the S&P 500, 5.9% for the Russell 2000 and 4.2% for the Nasdaq Composite.

The table below shows returns, after fees and expenses, for each of our equity Funds and for the S&P 500 (larger companies), the Russell 2000 (smaller companies) and the Nasdaq Composite (a proxy for technology companies).

Profits last year came from all corners of the portfolio. A wide variety of companies that fall under the category of “media content and distribution” enjoyed strong rebounds from depressed levels. Within the Liberty Media “complex,” Liberty Global rose 55%, Discovery Holdings was up 28%, and Liberty Media, which was split into two companies, Liberty Interactive and Liberty Capital, appreciated 40%.

Financial services stocks were well-represented in the “contributor” column, despite the problems in the subprime mortgage sector. Redwood Trust, a holding since 1994 when we provided some of their initial capital, earned a total return of 34% and is better positioned than ever for future growth. Newcastle, another company we have owned since its founding in the late 1990’s, returned 27%. Newcastle has done an excellent job of investing opportunistically in many areas of mortgage finance. We think that they, like Redwood, have the access to capital, the expertise, and the discipline to take advantage of the credit and liquidity problems that are beginning to emerge in world financial markets. Berkshire Hathaway (our largest holding in 3 of 4 funds) was +21% as its operations and investments performed very well and Warren Buffett was able to make several significant acquisitions. Fannie Mae (+9%), Freddie Mac (+1%), and Countrywide (-7%) were not major factors.

Other important contributions came from Tyco (+19%), Cabela’s (+21%), and Telephone and Data Systems. Investors love to criticize management of Telephone and Data Systems (which controls the company with super-voting shares) for being too conservative—refusing to use more leverage to do larger stock buybacks. Yet the company continues to add profitable wireless subscribers and to generate strong cash flows from its rural wireline business. Periodically, investors recognize the company’s achievements, and this year the stock was up 49%.

During the year, we added several new stocks to the portfolios. The number of new positions is partly a function of changing market conditions, but it also reflects the maturing of our staff of young analysts (and the willingness of an old portfolio manager to admit they are very good at what they do).

Dell is a direct marketer of computers and other electronic equipment that we have discussed in previous letters. Our bet is that Dell’s self-inflicted problems are fixable and that its highly efficient business model is not broken.

Apollo is a leader in for-profit higher education. Apollo’s (and its peers’) earnings growth rate has slowed, but it still generates a growing stream of free cash flow which it can use for expansion and share buybacks. We believe that Apollo sells at a discount to its private market value. We would be happy to own it for many years and to participate in the growth in the value of the business, but the company might also find its way into a private equity portfolio at a healthy premium to its current price.

Mohawk and USG (formerly U.S. Gypsum, when companies had names that meant something) are building materials companies that hold dominant positions in their industries (flooring and wallboard, respectively). Both are diversified among new home, remodel, and commercial construction markets, but are clearly cyclical businesses. Their stocks are depressed because of the current slowdown in residential construction and fears of a recession that would affect commercial construction. Both have demonstrated the ability to earn high returns and increase market share over the course of a business cycle.

TD Ameritrade is a leading online discount brokerage firm based in Omaha. Their recent merger with TD Waterhouse helps diversify their business, adds meaningful scale, and provides the opportunity for significant cost savings in consolidation. We believe the stock is very cheap based on post-merger earnings power.

American Express returned to our portfolios this year. Amex is a great business with a dominant payments franchise, a wonderful consumer brand, and an entrenched competitive position. The business earns over 30% on equity, has high-return reinvestment opportunities and returns substantial amounts of cash to shareholders through dividends and share repurchases.

UPS is another wonderful business that we have admired for a long time. UPS dominates the U.S. ground parcel market and has a growing global transportation and logistics network that would be nearly impossible for a new entrant to replicate. The company continues to invest in that network (at high rates of return) to help cement its competitive advantage. The stock has declined lately due to a temporary slowdown in earnings, and while not quite cheap enough to take a full position, we have bought a modest number of shares and are hopeful that near-term economic weakness may give us the opportunity to buy more.

We have also eliminated several positions we have held for many years. We hate to see them go, but we had to make room for other holdings with more attractive valuations. Our US Bancorp position has its roots in an early

5

1990’s purchase of Omaha National Bank stock when its price was depressed due to (unfounded) fears of credit problems in its commercial loan portfolio. Host and Harrah’s date back to the late 1990’s and we lived through real estate recessions and 9/11 with them. Both have terrific managements and have been wonderful investments for us. With luck we’ll be able to own them again.

Finally, a review of fiscal 2007 would not be complete without a comment on the subprime mortgage crisis that was brewing all year and has recently hit the front pages. We have been concerned about credit quality in the mortgage markets for several years and have focused our holdings on players that we believe have the sophistication, discipline and financial strength to participate profitably. (More on this later in the letter.) In the section that follows, we will explain some of the terms and practices that have been in the news lately. There are plenty of risks associated with borrowing and lending, but some of the press coverage has been incomplete, at best. Hopefully, some clarification and context will be helpful to concerned shareholders.

Subprime Mortgage Meltdown—What’s really going on here?

Many people think of bankers and other lenders as dour curmudgeons who will lend only to those who do not need a loan—who are more concerned with the return “of” their capital than the return “on” their capital. There are still some lenders who fit this mold, and they are the ones we like to invest with. However, loans are “earning assets” that have value and the creators of these assets (“originators”) can get greedy, sloppy, or just plain over-zealous in their work, especially if they are paid by the loan and do not plan to keep the loans on their own balance sheets.

In the subprime arena, the care with which many originators “underwrite” their loans has deteriorated over the past few years. Careful study of the prospective borrower’s job history and income level gave way to “stated income” loans (cynically nicknamed “liar loans”). Lenders offered to lend higher percentages of the purchase price (“loan to value” ratio or LTV) and the quality of the appraisal of the home’s value received less scrutiny. Adjustable rate mortgages (ARMs) were extended to borrowers who could (barely) afford the initial “teaser” interest rates but not the higher rates that would take effect when the interest rate “reset.”

The buyers of these loans are typically financial institutions and other investors who depend on the “representations and warranties” of the originators that the loans have been properly underwritten. If it turns out that the originator misrepresented the quality of the loans, the buyer may “put” the loans back to the originator. The originator repurchases the loans at the buyer’s cost, then recovers whatever he can through sale of the loan (at a discount from face value) or through foreclosure.

The recent series of bankruptcies has occurred among mortgage brokers that did not have, and could not borrow, the capital necessary to buy back all the loans that were put to them. These firms depended on banks and securities firms for both the warehouse loans used to fund the mortgages they originated and for the secondary markets into which they sold the loans they made. When either or both ends of this chain disappeared, the broker/originators were out of luck.

The burning questions on the minds of our shareholders are, “How much worse will the credit problems get?” and “What does this mean for our Funds’ portfolios?” We regularly reassess both the financial strength of our portfolio companies and the evolution of their business models. In some cases, we have sold entire positions, in others we have gradually reduced them, and in a few, we have added to our holdings on weakness. Here are a few examples of our tactical approach over the past few years.

We participated in the recapitalization of a subprime mortgage company after it faced a liquidity crisis in 1998 and we made roughly 10-20 times our money over the next five years as it recovered and prospered. We sold the last of our stock in 2004 as industry lending terms became more aggressive and the housing market became more speculative.

6

We first bought Countrywide Financial and Washington Mutual (WaMu) in the early 1990’s. Countrywide has gained market share through internal growth and very efficient operations. Washington Mutual grew through acquisitions, and while it was not as strong as Countrywide from an operating perspective, it grew steadily and treated shareholders well with a combination of generous dividends and stock buybacks. Both have been very good investments for us. We sold our WaMu in the first quarter of (calendar) 2007 because of its exposure to subprime and Alt-A (what some refer to as “the mysterious middle ground between subprime and prime”) and because we had less confidence in management’s ability to successfully cope with a crisis in the mortgage industry.

Since rising interest rates hurt Countrywide’s origination volumes, earnings have been on a plateau around $4 per share for three years. The stock has traded between $30 and $45 during that time and we have regularly bought more shares in the low-to-mid $30’s and reduced our position in the $40’s. As fears deepen and the possibility of a temporary, but severe, hit to Countrywide’s earnings looms, we have chosen to hold our position. Our rationale is that we do not know that it will go much lower, and we strongly believe that it should sell at much higher levels in the future. The alternative is to sell our position now with the hope of avoiding some temporary markdowns but risk missing our chance to repurchase the position before the stock recovers. Stocks have a way of bottoming long before the bad news is over and the good news appears. We sold some Berkshire Hathaway A shares in the 1970’s at $510 per share for some short-term reason, and with the stock now at $109,800 per share we’re beginning to think we are not going to get it back for $510.

Fannie Mae and Freddie Mac have some subprime exposure, but primarily in the form of AAA bonds backed by subprime mortgages. Both have strong balance sheets and in a crisis, they should be able to buy assets at very attractive prices. Also, if a capital shortage were to develop in the mortgage markets, Freddie and Fannie would be able to provide liquidity to the market and thus score points with a Congress that has recently been inclined to restrain the growth of their businesses. This could help reduce the “political” risk that causes these stocks to sell at depressed valuations.

Redwood and Newcastle, as mentioned earlier, are nimble, entrepreneurial companies that are well-positioned to take advantage of any distress in the mortgage markets—subprime or otherwise. Rising foreclosures and forced home sales will affect all residential mortgage investors, but on balance, we expect Redwood and Newcastle to be beneficiaries of any resulting liquidity crisis. These are positions we might want to add to if generalized concerns cause their stocks to fall. (For readers who are interested in learning more about how a sophisticated mortgage investor approaches its work, we highly recommend the Redwood Review, available quarterly on Redwood Trust’s web site.)

Outlook

Subprime loans occupy a small corner of the world’s financial markets. They happen to be in the spotlight at the moment, but the same availability of credit, derivative and structured finance technology, and human motivations that led to subprime mortgage problems will probably cause other financial accidents from time to time. There is also a reasonable chance that the slowdown in the housing industry will spill over into other areas of the economy and cause corporate earnings disappointments, if not a recession. This does not mean that we should withdraw to the sidelines and wait for “normal” times—financial markets will always be subject to these uncertainties. It does mean that common sense and investing discipline are more important than ever.

We believe that our companies are very well positioned to withstand adversity, and that many of them have the excess liquidity necessary to take market share and make acquisitions in a period of stress in the economy or financial markets. We have no idea what the stock market will do over the next several quarters, but we feel very good about the businesses we own and their prospects for growth in value over the next few years.

7

Annual Shareholder Information Meeting—Tuesday, May 22, 2007.

Please plan to join us at the Scott Conference Center in Omaha at 4:30 p.m. on May 22. The center is located at 6450 Pine Street on the Aksarben campus. There will be no formal business to conduct, so we can devote the entire meeting to answering your questions. Maps and driving directions are available from our client service representatives. We look forward to seeing you there.

| |

Sincerely, | |

| |

|

|

| |

Wallace R. Weitz | Bradley P. Hinton |

Co-manager Value and Partners Value | Co-manager Value and Partners Value |

Portfolio Manager Hickory and Partners III | |

Portfolio composition is subject to change at any time and references to specific securities, industries, and sectors referenced in this letter are not recommendations to purchase or sell any particular security. See the Schedules of Investments in Securities included in this report for the percent of assets in each of the Funds invested in particular industries or sectors.

8

(This page has been left blank intentionally.)

9

FUND PERFORMANCE — VALUE FUND

(Unaudited)

The following table summarizes performance information for the Fund as compared to the S&P 500 over the periods indicated.

| | | | | | | | | | | | | |

Period Ended | | Value Fund | | S&P 500 | | Difference

Value Fund – S&P 500 | |

| |

| |

| |

| |

Dec. 31, 1997 | | | 38.9 | % | | | 33.4 | % | | | 5.5 | % | |

Dec. 31, 1998 | | | 28.9 | | | | 28.6 | | | | 0.3 | | |

Dec. 31, 1999 | | | 21.0 | | | | 21.0 | | | | 0.0 | | |

Dec. 31, 2000 | | | 19.6 | | | | –9.1 | | | | 28.7 | | |

Dec. 31, 2001 | | | 0.2 | | | | –11.8 | | | | 12.0 | | |

Dec. 31, 2002 | | | –17.1 | | | | –22.1 | | | | 5.0 | | |

Dec. 31, 2003 | | | 28.7 | | | | 28.7 | | | | 0.0 | | |

Dec. 31, 2004 | | | 15.7 | | | | 10.9 | | | | 4.8 | | |

Dec. 31, 2005 | | | –2.8 | | | | 4.9 | | | | –7.7 | | |

Dec. 31, 2006 | | | 21.8 | | | | 15.8 | | | | 6.0 | | |

Mar. 31, 2007 (3 months) | | | –0.4 | | | | 0.6 | | | | –1.0 | | |

| | | | | | | | | | | | | |

10-Year Cumulative Return ended Mar. 31, 2007 | | | 271.4 | | | | 119.9 | | | | 151.5 | | |

10-Year Average Annual Compound Return ended Mar. 31, 2007 | | | 14.0 | | | | 8.2 | | | | 5.8 | | |

This chart depicts the change in the value of a $10,000 investment in the Value Fund for the period March 31, 1997, through March 31, 2007, as compared with the growth of the Standard & Poor’s 500 Index during the same period. Index performance is hypothetical and is shown for illustrative purposes only.

The Fund’s average annual total return for the one, five and ten year periods ended March 31, 2007 was 18.3%, 7.8% and 14.0%, respectively. These performance numbers reflect the deduction of the Fund’s annual operating expenses, which as stated in its most recent prospectus are 1.12% of the Fund’s net assets. The returns assume redemption at the end of each period and reinvestment of dividends. This information represents past performance and past performance does not guarantee future results. The investment return and the principal value of an investment in this Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained at www.weitzfunds.com/performance/monthly.asp.

Performance information does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

10

PORTFOLIO PROFILE — VALUE FUND

(Unaudited)

Top Ten Stocks*

| | | | |

Berkshire Hathaway | | | 7.3 | % |

Countrywide Financial | | | 6.2 | |

UnitedHealth Group | | | 5.6 | |

Tyco International | | | 4.9 | |

Liberty Media - Interactive | | | 4.7 | |

Liberty Media - Capital | | | 4.6 | |

Liberty Global | | | 4.5 | |

Wal-Mart | | | 4.2 | |

Washington Post | | | 4.0 | |

American International Group | | | 4.0 | |

| |

|

| |

| | | 50.0 | % |

| |

|

| |

Industry Sectors*

| | | | |

Media Content and Distribution | | | 19.5 | % |

Mortgage Services | | | 16.6 | |

Consumer Products and Services | | | 14.4 | |

Financial Services | | | 13.6 | |

Healthcare | | | 9.8 | |

Diversified Industries | | | 4.9 | |

Telecommunications | | | 3.4 | |

Technology | | | 2.4 | |

Building and Construction Products | | | 1.1 | |

Transportation | | | 1.0 | |

Gaming, Lodging and Leisure | | | 0.3 | |

Short-Term Securities/Other | | | 13.0 | |

| |

|

| |

| | | 100.0 | % |

| |

|

| |

Largest Net Purchases and Sales for Year Ended March 31, 2007

Net Purchases ($mil)

| | | | |

UnitedHealth Group | | $ | 150 | |

Dell (new) | | | 76 | |

American Express (new) | | | 71 | |

Apollo Group (new) | | | 65 | |

WellPoint | | | 57 | |

| |

|

| |

| | $ | 419 | |

| |

|

| |

Net Sales ($mil)

| | | | |

Comcast | | $ | 149 | |

Washington Mutual (eliminated) | | | 101 | |

Host Hotels & Resorts (eliminated) | | | 89 | |

News Corp. | | | 76 | |

Tyco International | | | 64 | |

Other (net) | | | 226 | |

| |

|

| |

| | $ | 705 | |

| |

|

| |

| | | | |

Net Portfolio Sales | | $ | 286 | |

| |

|

| |

Largest Net Contributions to Investment Results for Year Ended March 31, 2007

Positive ($mil)

| | | | |

| | | | |

Liberty Media - Interactive & Capital # | | $ | 83 | |

Liberty Global | | | 59 | |

Comcast | | | 53 | |

Telephone & Data Systems | | | 46 | |

Berkshire Hathaway | | | 43 | |

Other (net) | | | 237 | |

| |

|

| |

| | $ | 521 | |

| |

|

| |

| | | | |

Net Portfolio Gains | | $ | 504 | |

| |

|

| |

Negative ($mil)

| | | | |

Countrywide Financial | | $ | (8 | ) |

Six Flags | | | (3 | ) |

Opteum | | | (3 | ) |

Cumulus Media | | | (2 | ) |

USG Corp. | | | (1 | ) |

| |

|

| |

| | $ | (17 | ) |

| |

|

| |

| |

# | For presentation purposes, securities combined due to merger and/or spin-off during the year |

11

VALUE FUND

Schedule of Investments in Securities

March 31, 2007

| | | | | | | |

| | Shares | | Value | |

| |

| |

| |

COMMON STOCKS — 87.0% | | | | | | | |

| | | | | | | |

Media Content and Distribution — 19.5% | | | | | | | |

| | | | | | | |

Newspaper, Television, Radio and Programming — 12.5% | | | | | | | |

Liberty Media Corp. - Capital - Series A* | | | 1,285,000 | | $ | 142,108,150 | |

The Washington Post Co. - CL B | | | 164,060 | | | 125,259,810 | |

Discovery Holding Co. - Series A* | | | 2,480,000 | | | 47,442,400 | |

CBS Corp. - CL B | | | 1,409,400 | | | 43,113,546 | |

News Corp. - CL A | | | 800,000 | | | 18,496,000 | |

Cumulus Media, Inc. - CL A* | | | 1,500,000 | | | 14,070,000 | |

| | | | |

|

| |

| | | | | | 390,489,906 | |

Cable Television — 7.0% | | | | | | | |

Liberty Global, Inc. - Series C* | | | 3,435,157 | | | 105,253,210 | |

Liberty Global, Inc. - Series A* | | | 1,062,520 | | | 34,988,784 | |

Comcast Corp. - CL A* | | | 3,050,000 | | | 79,147,500 | |

Adelphia Recovery Trust, Series ACC-7* # | | | 3,535,000 | | | 70,700 | |

| | | | |

|

| |

| | | | | | 219,460,194 | |

| | | | |

|

| |

| | | | | | 609,950,100 | |

Mortgage Services — 16.6% | | | | | | | |

| | | | | | | |

Originating and Investing — 11.8% | | | | | | | |

Countrywide Financial Corp. | | | 5,750,000 | | | 193,430,000 | |

Redwood Trust, Inc.† | | | 2,345,000 | | | 122,362,100 | |

Newcastle Investment Corp. | | | 1,100,000 | | | 30,503,000 | |

CBRE Realty Finance, Inc.# | | | 1,350,000 | | | 17,860,500 | |

Opteum, Inc. | | | 700,000 | | | 3,150,000 | |

| | | | |

|

| |

| | | | | | 367,305,600 | |

Government Agency — 4.8% | | | | | | | |

Fannie Mae | | | 2,084,000 | | | 113,744,720 | |

Freddie Mac | | | 588,700 | | | 35,021,763 | |

| | | | |

|

| |

| | | | | | 148,766,483 | |

| | | | |

|

| |

| | | | | | 516,072,083 | |

| | | | | | | |

Consumer Products and Services — 14.4% | | | | | | | |

| | | | | | | |

Retailing — 12.2% | | | | | | | |

Liberty Media Corp. - Interactive - Series A* | | | 6,205,000 | | | 147,803,100 | |

Wal-Mart Stores, Inc. | | | 2,760,000 | | | 129,582,000 | |

IAC/InterActiveCorp* | | | 1,450,000 | | | 54,679,500 | |

Expedia, Inc.* | | | 2,100,000 | | | 48,678,000 | |

| | | | |

|

| |

| | | | | | 380,742,600 | |

The accompanying notes form an integral part of these financial statements.

12

VALUE FUND

Schedule of Investments in Securities, Continued

| | | | | | | |

| | Shares | | Value | |

| |

| |

| |

Education — 2.2% | | | | | | | |

Apollo Group, Inc. - CL A* | | | 1,550,000 | | $ | 68,045,000 | |

| | | | | | | |

Consumer Goods — 0.0% | | | | | | | |

Mohawk Industries, Inc.* | | | 21,500 | | | 1,764,075 | |

| | | | |

|

| |

| | | | | | 450,551,675 | |

| | | | | | | |

Financial Services — 13.6% | | | | | | | |

| | | | | | | |

Insurance — 11.3% | | | | | | | |

Berkshire Hathaway, Inc. - CL B* | | | 63,000 | | | 229,320,000 | |

American International Group, Inc. | | | 1,850,000 | | | 124,357,000 | |

| | | | |

|

| |

| | | | | | 353,677,000 | |

Consumer Finance — 2.3% | | | | | | | |

American Express Co. | | | 1,250,000 | | | 70,500,000 | |

| | | | |

|

| |

| | | | | | 424,177,000 | |

| | | | | | | |

Healthcare — 9.8% | | | | | | | |

| | | | | | | |

Managed Care — 8.3% | | | | | | | |

UnitedHealth Group, Inc. | | | 3,300,000 | | | 174,801,000 | |

WellPoint, Inc.* | | | 1,013,000 | | | 82,154,300 | |

| | | | |

|

| |

| | | | | | 256,955,300 | |

Suppliers and Distributors — 1.5% | | | | | | | |

Omnicare, Inc. | | | 1,200,000 | | | 47,724,000 | |

| | | | |

|

| |

| | | | | | 304,679,300 | |

| | | | | | | |

Diversified Industries — 4.9% | | | | | | | |

| | | | | | | |

Tyco International Ltd. | | | 4,860,000 | | | 153,333,000 | |

| | | | | | | |

| | | | | | | |

Telecommunications — 3.4% | | | | | | | |

| | | | | | | |

Telephone and Data Systems, Inc. - Special | | | 1,647,700 | | | 92,106,430 | |

Telephone and Data Systems, Inc. | | | 250,000 | | | 14,905,000 | |

| | | | |

|

| |

| | | | | | 107,011,430 | |

| | | | | | | |

Technology — 2.4% | | | | | | | |

| | | | | | | |

Dell, Inc.* | | | 3,240,000 | | | 75,200,400 | |

The accompanying notes form an integral part of these financial statements.

13

VALUE FUND

Schedule of Investments in Securities, Continued

| | | | | | | |

| | Principal

amount

or shares | | Value | |

| |

| |

| |

Building and Construction Products — 1.1% | | | | | | | |

| | | | | | | |

USG Corp.* | | | 723,000 | | $ | 33,749,640 | |

| | | | | | | |

Transportation — 1.0% | | | | | | | |

| | | | | | | |

United Parcel Service, Inc. | | | 450,000 | | | 31,545,000 | |

| | | | | | | |

Gaming, Lodging and Leisure — 0.3% | | | | | | | |

| | | | | | | |

Six Flags, Inc.* | | | 1,574,500 | | | 9,462,745 | |

| | | | |

|

| |

Total Common Stocks (Cost $2,012,697,027) | | | | | | 2,715,732,373 | |

| | | | | | | |

SHORT-TERM SECURITIES — 13.7% | | | | | | | |

| | | | | | | |

Wells Fargo Advantage Government Money Market Fund 5.3%(a) | | | 102,272,569 | | | 102,272,569 | |

Milestone Treasury Obligations Portfolio 5.2%(a) | | | 46,014,565 | | | 46,014,565 | |

Federal Home Loan Bank Discount Notes, 5.2% to 5.3%,

4/04/07 to 6/27/07(b) | | $ | 182,000,000 | | | 180,542,186 | |

U.S. Treasury Bill 5.0% 6/21/07(b) | | | 100,000,000 | | | 98,912,200 | |

| | | | |

|

| |

Total Short-Term Securities (Cost $427,685,162) | | | | | | 427,741,520 | |

| | | | |

|

| |

Total Investments in Securities (Cost $2,440,382,189) | | | | | | 3,143,473,893 | |

Other Liabilities in Excess of Other Assets — (0.7%) | | | | | | (21,692,301 | ) |

| | | | |

|

| |

Net Assets — 100% | | | | | $ | 3,121,781,592 | |

| | | | |

|

| |

Net Asset Value Per Share | | | | | $ | 40.09 | |

| | | | |

|

| |

| |

* | Non-income producing |

| |

† | Non-controlled affiliate |

| |

# | Illiquid and/or restricted security that has been fair valued. |

| |

(a) | Rate presented represents the annualized 7-day yield at March 31, 2007. |

| |

(b) | Interest rate presented represents the yield to maturity at the date of purchase. |

The accompanying notes form an integral part of these financial statements.

14

(This page has been left blank intentionally.)

15

FUND PERFORMANCE — PARTNERS VALUE FUND

(Unaudited)

The following table summarizes performance information for the Fund as compared to the S&P 500 over the periods indicated.

| | | | | | | | | | |

Period Ended | | Partners Value Fund | | S&P 500 | | Difference

Partners Value – S&P 500 | |

| |

| |

| |

| |

Dec. 31, 1997 | | 40.6 | % | | 33.4 | % | | 7.2 | % | |

Dec. 31, 1998 | | 29.1 | | | 28.6 | | | 0.5 | | |

Dec. 31, 1999 | | 22.1 | | | 21.0 | | | 1.1 | | |

Dec. 31, 2000 | | 21.1 | | | –9.1 | | | 30.2 | | |

Dec. 31, 2001 | | –0.9 | | | –11.8 | | | 10.9 | | |

Dec. 31, 2002 | | –17.0 | | | –22.1 | | | 5.1 | | |

Dec. 31, 2003 | | 25.4 | | | 28.7 | | | –3.3 | | |

Dec. 31, 2004 | | 15.0 | | | 10.9 | | | 4.1 | | |

Dec. 31, 2005 | | –2.4 | | | 4.9 | | | –7.3 | | |

Dec. 31, 2006 | | 22.5 | | | 15.8 | | | 6.7 | | |

Mar. 31, 2007 (3 months) | | 0.4 | | | 0.6 | | | –0.2 | | |

| | | | | | | | | | |

10-Year Cumulative Return ended Mar. 31, 2007 | | 275.5 | | | 119.9 | | | 155.6 | | |

10-Year Average Annual Compound Return ended Mar. 31, 2007 | | 14.1 | | | 8.2 | | | 5.9 | | |

This chart depicts the change in the value of a $10,000 investment in the Partners Value Fund for the period March 31, 1997, through March 31, 2007, as compared with the growth of the Standard & Poor’s 500 Index during the same period. Index performance is hypothetical and is shown for illustrative purposes only.

The Fund’s average annual total return for the one, five and ten year periods ended March 31, 2007 was 19.1%, 7.6% and 14.1%, respectively. These performance numbers reflect the deduction of the Fund’s annual operating expenses which as stated in its most recent prospectus are 1.14% of the Fund’s net assets. The returns assume redemption at the end of each period and reinvestment of dividends. This information represents past performance and past performance does not guarantee future results. The investment return and the principal value of an investment in this Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained at www.weitzfunds.com/performance/monthly.asp.

Performance information does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

16

PORTFOLIO PROFILE — PARTNERS VALUE FUND

(Unaudited)

Top Ten Stocks*

| | | | |

Berkshire Hathaway | | | 7.4 | % |

Countrywide Financial | | | 6.2 | |

UnitedHealth Group | | | 5.6 | |

Tyco International | | | 4.9 | |

Liberty Media - Interactive | | | 4.6 | |

Liberty Media - Capital | | | 4.5 | |

Liberty Global | | | 4.4 | |

Wal-Mart | | | 4.2 | |

Telephone & Data Systems | | | 4.1 | |

American International Group | | | 4.0 | |

| |

|

| |

| | | 49.9 | % |

| |

|

| |

Industry Sectors*

| | | | |

Media Content and Distribution | | | 18.9 | % |

Consumer Products and Services | | | 17.9 | |

Financial Services | | | 13.5 | |

Mortgage Services | | | 13.2 | |

Healthcare | | | 9.9 | |

Diversified Industries | | | 4.9 | |

Telecommunications | | | 4.1 | |

Technology | | | 2.4 | |

Building and Construction Products | | | 1.1 | |

Transportation | | | 1.0 | |

Commercial Services | | | 0.7 | |

Gaming, Lodging and Leisure | | | 0.2 | |

Short-Term Securities/Other | | | 12.2 | |

| |

|

| |

| | | 100.0 | % |

| |

|

| |

Largest Net Purchases and Sales for Year Ended March 31, 2007

Net Purchases ($mil)

| | | | |

UnitedHealth Group (new) | | $ | 99 | |

Dell (new) | | | 49 | |

American Express (new) | | | 46 | |

WellPoint (new) | | | 45 | |

Apollo Group (new) | | | 42 | |

| |

|

| |

| | $ | 281 | |

| |

|

| |

Net Sales ($mil)

| | | | |

Comcast | | $ | 105 | |

Washington Mutual (eliminated) | | | 65 | |

Host Hotels & Resorts (eliminated) | | | 56 | |

News Corp. | | | 48 | |

Tyco International | | | 41 | |

Other (net) | | | 195 | |

| |

|

| |

| | $ | 510 | |

| |

|

| |

| | | | |

Net Portfolio Sales | | $ | 229 | |

| |

|

| |

Largest Net Contributions to Investment Results for Year Ended March 31, 2007

Positive ($mil)

| | | | |

Liberty Media - Interactive & Capital# | | $ | 53 | |

Liberty Global | | | 37 | |

Comcast | | | 35 | |

Telephone & Data Systems | | | 29 | |

Berkshire Hathaway | | | 28 | |

Other (net) | | | 170 | |

| |

|

| |

| | $ | 352 | |

| |

|

| |

| | | | |

Net Portfolio Gains | | $ | 342 | |

| |

|

| |

Negative ($mil)

| | | | |

Countrywide Financial | | $ | (6 | ) |

Six Flags | | | (2 | ) |

Laboratory Corp. of America | | | (2 | ) |

| |

|

| |

| | $ | (10 | ) |

| |

|

| |

| |

# | For presentation purposes, securities combined due to merger and/or spin-off during the year |

17

PARTNERS VALUE FUND

Schedule of Investments in Securities

March 31, 2007

| | | | | | | |

| | Shares | | Value | |

| |

| |

| |

COMMON STOCKS — 87.8% | | | | | | | |

| | | | | | | |

Media Content and Distribution — 18.9% | | | | | | | |

| | | | | | | |

Newspaper, Television, Radio and Programming — 12.3% | | | | | | | |

Liberty Media Corp. - Capital - Series A* | | | 815,000 | | $ | 90,130,850 | |

The Washington Post Co. - CL B | | | 105,540 | | | 80,579,790 | |

Discovery Holding Co. - Series A* | | | 1,844,758 | | | 35,290,220 | |

CBS Corp. - CL B | | | 914,000 | | | 27,959,260 | |

News Corp. - CL A | | | 500,000 | | | 11,560,000 | |

Daily Journal Corp.* † | | | 116,000 | | | 4,699,160 | |

| | | | |

|

| |

| | | | | | 250,219,280 | |

Cable Television — 6.6% | | | | | | | |

Liberty Global, Inc. - Series C* | | | 2,410,168 | | | 73,847,548 | |

Liberty Global, Inc. - Series A* | | | 491,996 | | | 16,201,428 | |

Comcast Corp. - CL A* | | | 1,650,000 | | | 42,817,500 | |

Adelphia Recovery Trust, Series ACC-7* # | | | 2,310,000 | | | 46,200 | |

| | | | |

|

| |

| | | | | | 132,912,676 | |

| | | | |

|

| |

| | | | | | 383,131,956 | |

| | | | | | | |

Consumer Products and Services — 17.9% | | | | | | | |

| | | | | | | |

Retailing — 13.7% | | | | | | | |

Liberty Media Corp. - Interactive - Series A* | | | 3,935,000 | | | 93,731,700 | |

Wal-Mart Stores, Inc. | | | 1,800,000 | | | 84,510,000 | |

IAC/InterActiveCorp* | | | 921,000 | | | 34,730,910 | |

Cabela’s, Inc. - CL A* | | | 1,350,000 | | | 33,493,500 | |

Expedia, Inc.* | | | 1,350,000 | | | 31,293,000 | |

| | | | |

|

| |

| | | | | | 277,759,110 | |

Education — 2.2% | | | | | | | |

Apollo Group, Inc. - CL A* | | | 1,000,000 | | | 43,900,000 | |

| | | | | | | |

Consumer Goods — 2.0% | | | | | | | |

Mohawk Industries, Inc.* | | | 500,000 | | | 41,025,000 | |

| | | | |

|

| |

| | | | | | 362,684,110 | |

| | | | | | | |

Financial Services — 13.5% | | | | | | | |

| | | | | | | |

Insurance — 11.3% | | | | | | | |

Berkshire Hathaway, Inc. - CL B* | | | 31,900 | | | 116,116,000 | |

Berkshire Hathaway, Inc. - CL A* | | | 300 | | | 32,697,000 | |

American International Group, Inc. | | | 1,200,000 | | | 80,664,000 | |

| | | | |

|

| |

| | | | | | 229,477,000 | |

The accompanying notes form an integral part of these financial statements.

18

PARTNERS VALUE FUND

Schedule of Investments in Securities, Continued

| | | | | | | |

| | Shares | | Value | |

| |

| |

| |

Consumer Finance — 2.2% | | | | | | | |

American Express Co. | | | 800,000 | | $ | 45,120,000 | |

| | | | |

|

| |

| | | | | | 274,597,000 | |

| | | | | | | |

Mortgage Services — 13.2% | | | | | | | |

| | | | | | | |

Originating and Investing — 9.1% | | | | | | | |

Countrywide Financial Corp. | | | 3,725,000 | | | 125,309,000 | |

Redwood Trust, Inc. | | | 1,110,000 | | | 57,919,800 | |

| | | | |

|

| |

| | | | | | 183,228,800 | |

Government Agency — 4.1% | | | | | | | |

Fannie Mae | | | 1,327,000 | | | 72,427,660 | |

Freddie Mac | | | 192,300 | | | 11,439,927 | |

| | | | |

|

| |

| | | | | | 83,867,587 | |

| | | | |

|

| |

| | | | | | 267,096,387 | |

| | | | | | | |

Healthcare — 9.9% | | | | | | | |

| | | | | | | |

Managed Care — 8.2% | | | | | | | |

UnitedHealth Group, Inc. | | | 2,140,000 | | | 113,355,800 | |

WellPoint, Inc.* | | | 647,000 | | | 52,471,700 | |

| | | | |

|

| |

| | | | | | 165,827,500 | |

Suppliers and Distributors — 1.7% | | | | | | | |

Omnicare, Inc. | | | 860,000 | | | 34,202,200 | |

| | | | |

|

| |

| | | | | | 200,029,700 | |

| | | | | | | |

Diversified Industries — 4.9% | | | | | | | |

| | | | | | | |

Tyco International Ltd. | | | 3,140,000 | | | 99,067,000 | |

| | | | | | | |

Telecommunications — 4.1% | | | | | | | |

| | | | | | | |

Telephone and Data Systems, Inc. - Special | | | 1,473,300 | | | 82,357,470 | |

| | | | | | | |

Technology — 2.4% | | | | | | | |

| | | | | | | |

Dell, Inc.* | | | 2,070,000 | | | 48,044,700 | |

| | | | | | | |

Building and Construction Products — 1.1% | | | | | | | |

| | | | | | | |

USG Corp.* | | | 468,800 | | | 21,883,584 | |

The accompanying notes form an integral part of these financial statements.

19

PARTNERS VALUE FUND

Schedule of Investments in Securities, Continued

| | | | | | | |

| | Principal

amount

or shares | | Value | |

| |

| |

| |

Transportation — 1.0% | | | | | | | |

| | | | | | | |

United Parcel Service, Inc. | | | 300,000 | | $ | 21,030,000 | |

| | | | | | | |

Commercial Services — 0.7% | | | | | | | |

| | | | | | | |

Coinstar, Inc.* | | | 432,900 | | | 13,549,770 | |

| | | | | | | |

Gaming, Lodging and Leisure — 0.2% | | | | | | | |

| | | | | | | |

Six Flags, Inc.* | | | 564,600 | | | 3,393,246 | |

| | | | |

|

| |

Total Common Stocks (Cost $1,308,924,516) | | | | | | 1,776,864,923 | |

| | | | | | | |

SHORT-TERM SECURITIES — 12.4% | | | | | | | |

| | | | | | | |

Wells Fargo Advantage Government Money Market Fund 5.3%(a) | | | 75,801,130 | | | 75,801,130 | |

Milestone Treasury Obligations Portfolio 5.2%(a) | | | 46,100,867 | | | 46,100,867 | |

Federal Home Loan Bank Discount Notes, 5.2% to 5.3%, 4/04/07 to 6/01/07(b) | | $ | 70,000,000 | | | 69,775,345 | |

U.S. Treasury Bill 5.0% 6/21/07(b) | | | 60,000,000 | | | 59,347,320 | |

| | | | |

|

| |

Total Short-Term Securities (Cost $251,001,790) | | | | | | 251,024,662 | |

| | | | |

|

| |

Total Investments in Securities (Cost $1,559,926,306) | | | | | | 2,027,889,585 | |

Other Liabilities in Excess of Other Assets — (0.2%) | | | | | | (4,052,412 | ) |

| | | | |

|

| |

Net Assets — 100% | | | | | $ | 2,023,837,173 | |

| | | | |

|

| |

Net Asset Value Per Share | | | | | $ | 24.53 | |

| | | | |

|

| |

| |

* | Non-income producing |

| |

† | Non-controlled affiliate |

| |

# | Illiquid and/or restricted security that has been fair valued. |

| |

(a) | Rate presented represents the annualized 7-day yield at March 31, 2007. |

| |

(b) | Interest rate presented represents the yield to maturity at the date of purchase. |

The accompanying notes form an integral part of these financial statements.

20

(This page has been left blank intentionally.)

21

FUND PERFORMANCE — HICKORY FUND

(Unaudited)

The following table summarizes performance information for the Fund as compared to the S&P 500 over the periods indicated.

| | | | | | | | | | |

Period Ended | | Hickory Fund | | S&P 500 | | Difference

Hickory Fund – S&P 500 | |

| |

| |

| |

| |

Dec. 31, 1997 | | 39.2 | % | | 33.4 | % | | 5.8 | % | |

Dec. 31, 1998 | | 33.0 | | | 28.6 | | | 4.4 | | |

Dec. 31, 1999 | | 36.7 | | | 21.0 | | | 15.7 | | |

Dec. 31, 2000 | | –17.2 | | | –9.1 | | | –8.1 | | |

Dec. 31, 2001 | | –4.6 | | | –11.8 | | | 7.2 | | |

Dec. 31, 2002 | | –29.3 | | | –22.1 | | | –7.2 | | |

Dec. 31, 2003 | | 47.9 | | | 28.7 | | | 19.2 | | |

Dec. 31, 2004 | | 22.6 | | | 10.9 | | | 11.7 | | |

Dec. 31, 2005 | | –0.2 | | | 4.9 | | | –5.1 | | |

Dec. 31, 2006 | | 22.8 | | | 15.8 | | | 7.0 | | |

Mar. 31, 2007 (3 months) | | –0.7 | | | 0.6 | | | –1.3 | | |

| | | | | | | | | | |

10-Year Cumulative Return ended Mar. 31, 2007 | | 209.9 | | | 119.9 | | | 90.0 | | |

10-Year Average Annual Compound Return ended Mar. 31, 2007 | | 12.0 | | | 8.2 | | | 3.8 | | |

This chart depicts the change in the value of a $10,000 investment in the Hickory Fund for the period March 31, 1997, through March 31, 2007, as compared with the growth of the Standard & Poor’s 500 Index during the same period. Index performance is hypothetical and is shown for illustrative purposes only.

The Fund’s average annual total return for the one, five and ten year periods ended March 31, 2007 was 16.6%, 8.7% and 12.0%, respectively. These performance numbers reflect the deduction of the Fund’s annual operating expenses which as stated in its most recent prospectus are 1.20% of the Fund’s net assets. The returns assume redemption at the end of each period and reinvestment of dividends. This information represents past performance and past performance does not guarantee future results. The investment return and the principal value of an investment in this Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained at www.weitzfunds.com/performance/monthly.asp.

Performance information does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

22

PORTFOLIO PROFILE — HICKORY FUND

(Unaudited)

Top Ten Stocks*

| | | | |

Countrywide Financial | | | 6.1 | % |

Redwood Trust | | | 6.1 | |

Berkshire Hathaway | | | 5.9 | |

UnitedHealth Group | | | 5.2 | |

Tyco International | | | 4.5 | |

Liberty Media - Interactive | | | 4.3 | |

Liberty Media - Capital | | | 4.2 | |

Liberty Global | | | 3.7 | |

Coinstar | | | 3.6 | |

American International Group | | | 3.5 | |

| | |

| |

| | | 47.1 | % |

| | |

| |

Industry Sectors*

| | | | |

Consumer Products and Services | | | 19.0 | % |

Mortgage Services | | | 18.5 | |

Media Content and Distribution | | | 13.2 | |

Financial Services | | | 12.5 | |

Healthcare | | | 9.4 | |

Diversified Industries | | | 4.5 | |

Commercial Services | | | 3.9 | |

Telecommunications | | | 3.2 | |

Gaming, Lodging and Leisure | | | 2.1 | |

Technology | | | 1.5 | |

Building and Construction Products | | | 0.9 | |

Short-Term Securities/Other | | | 11.3 | |

| | |

| |

| | | 100.0 | % |

| | |

| |

* As of March 31, 2007

Largest Net Purchases and Sales for Year Ended March 31, 2007

Net Purchases ($mil)

| | | | |

UnitedHealth Group (new) | | $ | 17.8 | |

American International Group (new) | | | 12.7 | |

Omnicare (new) | | | 10.0 | |

Mohawk Industries (new) | | | 8.8 | |

Six Flags | | | 7.5 | |

| |

|

| |

| | $ | 56.8 | |

| |

|

| |

Net Sales ($mil)

| | | | |

Comcast | | $ | 16.1 | |

IAC/InterActiveCorp | | | 9.5 | |

Cabela’s | | | 9.4 | |

Wal-Mart | | | 9.1 | |

Berkshire Hathaway | | | 8.3 | |

Other (net) | | | 24.6 | |

| |

|

| |

| | $ | 77.0 | |

| |

|

| |

| | | | |

Net Portfolio Sales | | $ | 20.2 | |

| |

|

| |

Largest Net Contributions to Investment Results for Year Ended March 31, 2007

Positive ($mil)

| | | | |

Liberty Media - Interactive & Capital# | | $ | 9.5 | |

Redwood Trust | | | 8.6 | |

Liberty Global | | | 6.1 | |

Comcast | | | 4.4 | |

Berkshire Hathaway | | | 4.1 | |

Other (net) | | | 29.4 | |

| |

|

| |

| | $ | 62.1 | |

| |

|

| |

| | | | |

Net Portfolio Gains | | $ | 54.9 | |

| |

|

| |

Negative ($mil)

| | | | |

Cumulus Media | | $ | (2.3 | ) |

Career Education | | | (1.9 | ) |

Convera | | | (1.8 | ) |

Countrywide Financial | | | (0.8 | ) |

Cost Plus | | | (0.4 | ) |

| |

|

| |

| | $ | (7.2 | ) |

| |

|

| |

# For presentation purposes, securities combined due to merger and/or spin-off during the year

23

HICKORY FUND

Schedule of Investments in Securities

March 31, 2007

| | | | | | | |

| | Shares | | Value | |

| |

| |

| |

COMMON STOCKS — 88.7% | | | | | | | |

| | | | | | | |

Consumer Products and Services — 19.0% | | | | | | | |

| | | | | | | |

Retailing— 12.5% | | | | | | | |

Liberty Media Corp. - Interactive - Series A* | | | 700,000 | | $ | 16,674,000 | |

Cabela’s, Inc. - CL A* | | | 450,000 | | | 11,164,500 | |

Wal-Mart Stores, Inc. | | | 150,000 | | | 7,042,500 | |

AutoZone, Inc.* (b) | | | 50,000 | | | 6,407,000 | |

Expedia, Inc.* | | | 230,000 | | | 5,331,400 | |

IAC/InterActiveCorp* (b) | | | 40,200 | | | 1,515,942 | |

| | | | |

|

| |

| | | | | | 48,135,342 | |

Education — 4.0% | | | | | | | |

Apollo Group, Inc. - CL A* | | | 200,000 | | | 8,780,000 | |

Corinthian Colleges, Inc.* | | | 475,600 | | | 6,539,500 | |

| | | | |

|

| |

| | | | | | 15,319,500 | |

Consumer Goods — 2.5% | | | | | | | |

Mohawk Industries, Inc.* | | | 120,000 | | | 9,846,000 | |

| | | | |

|

| |

| | | | | | 73,300,842 | |

| | | | | | | |

Mortgage Services — 18.5% | | | | | | | |

| | | | | | | |

Originating and Investing — 16.0% | | | | | | | |

Countrywide Financial Corp. | | | 700,000 | | | 23,548,000 | |

Redwood Trust, Inc. | | | 450,400 | | | 23,501,872 | |

CBRE Realty Finance, Inc.# | | | 450,000 | | | 5,953,500 | |

CBRE Realty Finance, Inc. | | | 255,400 | | | 3,378,942 | |

Newcastle Investment Corp. | | | 195,700 | | | 5,426,761 | |

| | | | |

|

| |

| | | | | | 61,809,075 | |

Government Agency — 2.5% | | | | | | | |

Fannie Mae | | | 180,000 | | | 9,824,400 | |

| | | | |

|

| |

| | | | | | 71,633,475 | |

| | | | | | | |

Media Content and Distribution — 13.2% | | | | | | | |

| | | | | | | |

Newspaper, Television, Radio and Programming — 8.7% | | | | | | | |

Liberty Media Corp. - Capital - Series A* | | | 145,000 | | | 16,035,550 | |

Cumulus Media, Inc. - CL A* | | | 1,387,000 | | | 13,010,060 | |

CBS Corp. - CL B | | | 145,000 | | | 4,435,550 | |

| | | | |

|

| |

| | | | | | 33,481,160 | |

Cable Television — 4.5% | | | | | | | |

Liberty Global, Inc. - Series C* | | | 461,852 | | | 14,151,145 | |

Comcast Corp. - CL A Special* | | | 125,000 | | | 3,183,750 | |

| | | | |

|

| |

| | | | | | 17,334,895 | |

| | | | |

|

| |

| | | | | | 50,816,055 | |

The accompanying notes form an integral part of these financial statements.

24

HICKORY FUND

Schedule of Investments in Securities, Continued

| | | | | | | |

| | Shares | | Value | |

| |

| |

| |

Financial Services — 12.5% | | | | | | | |

| | | | | | | |

Insurance — 9.4% | | | | | | | |

Berkshire Hathaway, Inc. - CL A* | | | 210 | | $ | 22,887,900 | |

American International Group, Inc. | | | 200,000 | | | 13,444,000 | |

| | | | |

|

| |

| | | | | | 36,331,900 | |

Consumer Finance — 2.1% | | | | | | | |

SLM Corp.(b) | | | 100,000 | | | 4,090,000 | |

American Express Co. | | | 70,000 | | | 3,948,000 | |

| | | | |

|

| |

| | | | | | 8,038,000 | |

Brokers — 1.0% | | | | | | | |

TD Ameritrade Holding Corp.* | | | 255,000 | | | 3,794,400 | |

| | | | |

|

| |

| | | | | | 48,164,300 | |

| | | | | | | |

Healthcare — 9.4% | | | | | | | |

| | | | | | | |

Managed Care — 6.8% | | | | | | | |

UnitedHealth Group, Inc. | | | 380,000 | | | 20,128,600 | |

WellPoint, Inc.* | | | 75,000 | | | 6,082,500 | |

| | | | |

|

| |

| | | | | | 26,211,100 | |

Suppliers and Distributors — 2.6% | | | | | | | |

Omnicare, Inc. | | | 250,000 | | | 9,942,500 | |

| | | | |

|

| |

| | | | | | 36,153,600 | |

| | | | | | | |

Diversified Industries — 4.5% | | | | | | | |

| | | | | | | |

Tyco International Ltd. | | | 550,000 | | | 17,352,500 | |

| | | | | | | |

Commercial Services — 3.9% | | | | | | | |

| | | | | | | |

Coinstar, Inc.* | | | 440,000 | | | 13,772,000 | |

Convera Corp.* | | | 370,000 | | | 1,161,800 | |

| | | | |

|

| |

| | | | | | 14,933,800 | |

| | | | | | | |

Telecommunications — 3.2% | | | | | | | |

| | | | | | | |

Telephone and Data Systems, Inc. - Special | | | 160,000 | | | 8,944,000 | |

LICT Corp.* # | | | 1,005 | | | 3,386,850 | |

| | | | |

|

| |

| | | | | | 12,330,850 | |

| | | | | | | |

Gaming, Lodging and Leisure — 2.1% | | | | | | | |

| | | | | | | |

Six Flags, Inc.* | | | 1,350,000 | | | 8,113,500 | |

The accompanying notes form an integral part of these financial statements.

25

HICKORY FUND

Schedule of Investments in Securities, Continued

| | | | | | | |

| | Shares | | Value | |

| |

| |

| |

Technology — 1.5% | | | | | | | |

| | | | | | | |

Dell, Inc.* | | | 250,000 | | $ | 5,802,500 | |

| | | | | | | |

| | | | | | | |

Building and Construction Products — 0.9% | | | | | | | |

| | | | | | | |

USG Corp.* | | | 78,000 | | | 3,641,040 | |

| | | | |

|

| |

Total Common Stocks (Cost $289,118,538) | | | | | | 342,242,462 | |

| | | | | | | |

| | | | | | | |

SHORT-TERM SECURITIES — 13.1% | | | | | | | |

| | | | | | | |

Wells Fargo Advantage Government Money Market Fund 5.3%(a)

(Cost $50,777,748) | | | 50,777,748 | | | 50,777,748 | |

| | | | |

|

| |

Total Investments in Securities (Cost $339,896,286) | | | | | | 393,020,210 | |

Options Written — (0.1%) | | | | | | (372,770 | ) |

Other Liabilities in Excess of Other Assets — (1.7%) | | | | | | (6,585,925 | ) |

| | | | |

|

| |

Net Assets — 100% | | | | | $ | 386,061,515 | |

| | | | |

|

| |

Net Asset Value Per Share | | | | | $ | 39.69 | |

| | | | |

|

| |

| | | | | | | | | | |

| | Expiration date/

Strike price | | Shares

subject

to option | | Value | |

| |

| |

| |

| |

OPTIONS WRITTEN* | | | | | | | | | | |

| | | | | | | | | | |

Covered Call Options | | | | | | | | | | |

| | | | | | | | | | |

AutoZone, Inc. | | | June 2007 / $125 | | | 25,000 | | $ | (187,500 | ) |

IAC/InterActiveCorp | | | July 2007 / $40 | | | 40,000 | | | (48,000 | ) |

SLM Corp. | | | July 2007 / $45 | | | 51,800 | | | (46,620 | ) |

| | | | | | | |

|

| |

| | | | | | | | | (282,120 | ) |

Put Options | | | | | | | | | | |

| | | | | | | | | | |

SLM Corp. | | | July 2007 / $40 | | | 51,800 | | | (90,650 | ) |

| | | | | | | |

|

| |

Total Options Written (premiums received $511,289) | | | | | | | | $ | (372,770 | ) |

| | | | | | | |

|

| |

| |

* | Non-income producing |

| |

# | Illiquid and/or restricted security that has been fair valued. |

| |

(a) | Rate presented represents the annualized 7-day yield at March 31, 2007. |

| |

(b) | Fully or partially pledged as collateral on outstanding written options. |

The accompanying notes form an integral part of these financial statements.

26

(This page has been left blank intentionally.)

27

FUND PERFORMANCE — PARTNERS III OPPORTUNITY FUND

(Unaudited)

The following table summarizes performance information for the Partners III Opportunity Fund (“Partners III”) and its predecessor, Weitz Partners III-Limited Partnership (the “Partnership”). Partners III succeeded to substantially all of the assets of the Partnership, a Nebraska investment limited partnership as of December 30, 2005. The investment objectives, policies, guidelines and restrictions of Partners III are materially equivalent to those of the Partnership and the Partnership was managed at all times with full investment authority by Wallace R. Weitz & Company.

| | | | | | | | | | |

Period Ended | | Partners III | | S&P 500 | | Difference

Partners III – S&P 500 | |

| |

| |

| |

| |

Dec. 31, 1997 | | 37.1 | % | | 33.4 | % | | 3.7 | % | |

Dec. 31, 1998 | | 10.9 | | | 28.6 | | | –17.7 | | |

Dec. 31, 1999 | | 10.6 | | | 21.0 | | | –10.4 | | |

Dec. 31, 2000 | | 32.4 | | | –9.1 | | | 41.5 | | |

Dec. 31, 2001 | | 6.6 | | | –11.8 | | | 18.4 | | |

Dec. 31, 2002 | | –16.1 | | | –22.1 | | | 6.0 | | |

Dec. 31, 2003 | | 42.6 | | | 28.7 | | | 13.9 | | |

Dec. 31, 2004 | | 22.1 | | | 10.9 | | | 11.2 | | |

Dec. 31, 2005 | | –0.7 | | | 4.9 | | | -5.6 | | |

Dec. 31, 2006 | | 20.4 | | | 15.8 | | | 4.6 | | |

Mar. 31, 2007 (3 months) | | –0.9 | | | 0.6 | | | –1.5 | | |

| | | | | | | | | | |

10-Year Cumulative Return ended Mar. 31, 2007 | | 302.3 | | | 119.9 | | | 182.4 | | |

10-Year Average Annual Compound Return ended Mar. 31, 2007 | | 14.9 | | | 8.2 | | | 6.7 | | |

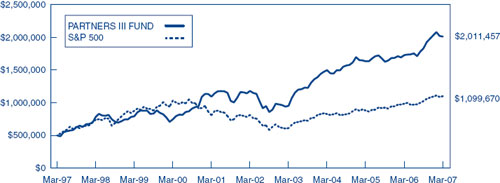

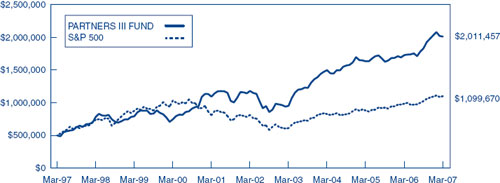

This chart depicts the change in the value of a $500,000 investment in Partners III for the period March 31, 1997, through March 31, 2007 as compared with the growth of the Standard & Poor’s 500 Index during the same period. Index performance is hypothetical and is shown for illustrative purposes only.

The average annual total return of Partners III for the one, five and ten year periods ended March 31, 2007 was 16.4%, 11.3% and 14.9%, respectively. These performance numbers reflect the deduction of the Fund’s annual operating expenses which as stated in its most recent prospectus are 1.56% of the Fund’s net assets. The returns assume redemption at the end of each period and reinvestment of dividends. This information represents past performance and past performance does not guarantee future results. The investment return and the principal value of an investment in Partners III will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. The performance data presented includes performance for the period before Partners III became an investment company registered with the Securities and Exchange Commission. During this time, Partners III was not registered under the Investment Company Act of 1940 and therefore was not subject to certain investment restrictions imposed by the 1940 Act. If Partners III had been registered under the 1940 Act during this time period, the performance of Partners III might have been adversely affected. Performance data current to the most recent month-end may be obtained at www.weitzfunds.com/performance/monthly.asp.

Performance information does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

28

PORTFOLIO PROFILE — PARTNERS III OPPORTUNITY FUND

(Unaudited)

Top Ten Stocks*

| | | | |

Berkshire Hathaway | | | 7.8 | % |

Redwood Trust | | | 6.5 | |

Countrywide Financial | | | 6.2 | |

UnitedHealth Group | | | 5.4 | |

Tyco International | | | 4.8 | |

Cabela’s | | | 4.6 | |

Liberty Media - Interactive | | | 4.1 | |

Liberty Global | | | 4.0 | |

Coinstar | | | 3.6 | |

Fannie Mae | | | 3.5 | |

| |

|

| |

| | | 50.5 | % |

| |

|

| |

| | | | |

Industry Sectors* |

| | | | |

Consumer Products and Services | | | 22.9 | % |

Mortgage Services | | | 17.7 | |

Media Content and Distribution | | | 15.6 | |

Financial Services | | | 14.2 | |

Healthcare | | | 10.0 | |

Commercial Services | | | 5.1 | |

Diversified Industries | | | 4.8 | |

Telecommunications | | | 3.1 | |

Gaming, Lodging and Leisure | | | 2.3 | |

Technology | | | 2.2 | |

Building and Construction Products | | | 0.9 | |

| |

|

| |

Total Long Positions | | | 98.8 | |

Securities Sold Short | | | (16.5 | ) |

| |

|

| |

Net Long Positions | | | 82.3 | |

Short Proceeds/Other | | | 17.7 | |

| |

|

| |

| | | 100.0 | % |

| |

|

| |

| |

* | Percentage of net assets as of March 31, 2007 |

Largest Net Purchases and Sales for Year Ended March 31, 2007

| | | | |

Net Purchases ($mil) |

| | | | |

UnitedHealth Group | | $ | 13.5 | |

Omnicare (new) | | | 10.0 | |

Mohawk Industries (new) | | | 7.3 | |

Six Flags | | | 7.2 | |

Dell (new) | | | 6.7 | |

Other (net) | | | 2.7 | |

| |

|

| |

| | $ | 47.4 | |

| |

|

| |

| | | | |

Net Portfolio Purchases | | $ | 7.9 | |

| |

|

| |

| | | | |

Net Sales ($mil) |

| | | | |

Hudson City Bancorp (eliminated) | | $ | 11.0 | |

Comcast | | | 9.9 | |

IAC/InterActiveCorp | | | 6.6 | |

Liberty Global | | | 6.6 | |

Host Hotels & Resorts (eliminated) | | | 5.4 | |

| |

|

| |

| | $ | 39.5 | |

| |

|

| |

Largest Net Contributions to Investment Results for Year Ended March 31, 2007

| | | | |

Positive ($mil) |

| | | | |

Redwood Trust | | $ | 7.4 | |

Liberty Media - Interactive & Capital# | | | 6.2 | |

Liberty Global | | | 5.5 | |

Comcast | | | 4.5 | |

Telephone & Data Systems | | | 3.4 | |

Other (net) | | | 27.8 | |

| |

|

| |

| | $ | 54.8 | |

| |

|

| |

| | | | |

Net Portfolio Gains | | $ | 45.3 | |

| |

|

| |

| | | | |

Negative ($mil) |

| | | | |

Short Positions | | $ | (4.3 | ) |

Cumulus Media | | | (1.9 | ) |

Career Education | | | (1.1 | ) |

Countrywide Financial | | | (1.1 | ) |

Convera | | | (1.1 | ) |

| |

|

| |

| | $ | (9.5 | ) |

| |

|

| |

| |

# | For presentation purposes, securities combined due to merger and/or spin-off during the year |

29

PARTNERS III OPPORTUNITY FUND

Schedule of Investments in Securities

March 31, 2007

| | | | | | | |

| | Shares | | Value | |

| |

| |

| |

COMMON STOCKS — 98.8% | | | | | | | |

| | | | | | | |

Consumer Products and Services — 22.9% | | | | | | | |

| | | | | | | |

Retailing — 17.0% | | | | | | | |

Cabela’s, Inc. - CL A*(b) | | | 600,000 | | $ | 14,886,000 | |

Liberty Media Corp. - Interactive - Series A* | | | 560,000 | | | 13,339,200 | |

Wal-Mart Stores, Inc. | | | 240,000 | | | 11,268,000 | |

Expedia, Inc.* | | | 300,000 | | | 6,954,000 | |

AutoZone, Inc.*(b) | | | 50,000 | | | 6,407,000 | |

IAC/InterActiveCorp*(b) | | | 55,000 | | | 2,074,050 | |

| | | | |

|

| |

| | | | | | 54,928,250 | |

Education — 3.4% | | | | | | | |

Apollo Group, Inc. - CL A* | | | 150,000 | | | 6,585,000 | |

Corinthian Colleges, Inc.* | | | 310,600 | | | 4,270,750 | |

| | | | |

|

| |

| | | | | | 10,855,750 | |

Consumer Goods — 2.5% | | | | | | | |

Mohawk Industries, Inc.* | | | 100,000 | | | 8,205,000 | |

| | | | |

|

| |

| | | | | | 73,989,000 | |

| | | | | | | |

Mortgage Services — 17.7% | | | | | | | |

| | | | | | | |

Originating and Investing — 14.2% | | | | | | | |

Redwood Trust, Inc. | | | 400,000 | | | 20,872,000 | |

Countrywide Financial Corp. | | | 600,000 | | | 20,184,000 | |

Newcastle Investment Corp. | | | 176,000 | | | 4,880,480 | |

| | | | |

|

| |

| | | | | | 45,936,480 | |

Government Agency — 3.5% | | | | | | | |

Fannie Mae | | | 209,000 | | | 11,407,220 | |

| | | | |

|

| |

| | | | | | 57,343,700 | |

| | | | | | | |

Media Content and Distribution — 15.6% | | | | | | | |

| | | | | | | |

Newspaper, Television, Radio and Programming — 9.7% | | | | | | | |

Cumulus Media, Inc. - CL A* | | | 1,187,000 | | | 11,134,060 | |

Liberty Media Corp. - Capital - Series A* | | | 92,000 | | | 10,174,280 | |

The Washington Post Co. - CL B | | | 7,000 | | | 5,344,500 | |

CBS Corp. - CL B | | | 150,000 | | | 4,588,500 | |

| | | | |

|

| |

| | | | | | 31,241,340 | |

Cable Television — 5.9% | | | | | | | |

Liberty Global, Inc. - Series C* | | | 419,865 | | | 12,864,663 | |

Comcast Corp. - - CL A* | | | 245,000 | | | 6,357,750 | |

| | | | |

|

| |

| | | | | | 19,222,413 | |

| | | | |

|

| |

| | | | | | 50,463,753 | |

The accompanying notes form an integral part of these financial statements.

30

PARTNERS III OPPORTUNITY FUND

Schedule of Investments in Securities, Continued

| | | | | | | |

| | Shares | | Value | |

| |

| |

| |

Financial Services — 14.2% | | | | | | | |

| | | | | | | |

Insurance — 10.9% | | | | | | | |

Berkshire Hathaway, Inc. - CL A* | | | 130 | | $ | 14,168,700 | |

Berkshire Hathaway, Inc. - CL B* | | | 3,000 | | | 10,920,000 | |

American International Group, Inc. | | | 150,000 | | | 10,083,000 | |

| | | | |

|

| |

| | | | | | 35,171,700 | |

Consumer Finance — 2.3% | | | | | | | |

SLM Corp.(b) | | | 100,000 | | | 4,090,000 | |

American Express Co. | | | 60,000 | | | 3,384,000 | |

| | | | |

|

| |

| | | | | | 7,474,000 | |

Brokers — 1.0% | | | | | | | |

TD Ameritrade Holding Corp.* | | | 212,000 | | | 3,154,560 | |

| | | | |

|

| |

| | | | | | 45,800,260 | |

| | | | | | | |

Healthcare — 10.0% | | | | | | | |

| | | | | | | |

Managed Care — 6.9% | | | | | | | |

UnitedHealth Group, Inc. | | | 330,000 | | | 17,480,100 | |

WellPoint, Inc.* | | | 60,000 | | | 4,866,000 | |

| | | | |

|

| |

| | | | | | 22,346,100 | |

Suppliers and Distributors — 3.1% | | | | | | | |

Omnicare, Inc. | | | 250,000 | | | 9,942,500 | |

| | | | |

|

| |

| | | | | | 32,288,600 | |

| | | | | | | |

Commercial Services — 5.1% | | | | | | | |

| | | | | | | |

Coinstar, Inc.* | | | 370,000 | | | 11,581,000 | |

Intelligent Systems Corp.* # † | | | 883,999 | | | 3,801,196 | |

Convera Corp.* | | | 300,000 | | | 942,000 | |

Continental Resources# | | | 700 | | | 140,000 | |

| | | | |

|

| |

| | | | | | 16,464,196 | |

| | | | | | | |

Diversified Industries — 4.8% | | | | | | | |

| | | | | | | |

Tyco International Ltd. | | | 490,000 | | | 15,459,500 | |

| | | | | | | |

| | | | | | | |

Telecommunications — 3.1% | | | | | | | |

| | | | | | | |

Telephone and Data Systems, Inc. - Special | | | 180,000 | | | 10,062,000 | |

The accompanying notes form an integral part of these financial statements.

31

PARTNERS III OPPORTUNITY FUND

Schedule of Investments in Securities, Continued

| | | | | | | |

| | Shares | | Value | |

| |

| |

| |

Gaming, Lodging and Leisure — 2.3% | | | | | | | |

| | | | | | | |

Six Flags, Inc.* | | | 1,250,000 | | $ | 7,512,500 | |

| | | | | | | |

| | | | | | | |

Technology — 2.2% | | | | | | | |

| | | | | | | |

Dell, Inc.* | | | 300,000 | | | 6,963,000 | |

| | | | | | | |

| | | | | | | |

Building and Construction Products — 0.9% | | | | | | | |

| | | | | | | |

USG Corp.* | | | 65,000 | | | 3,034,200 | |

| | | | |

|

| |

Total Common Stocks (Cost $252,456,282) | | | | | | 319,380,709 | |

| | | | | | | |

SHORT-TERM SECURITIES — 1.5% | | | | | | | |

| | | | | | | |

Wells Fargo Advantage Government Money Market Fund 5.3%(a)

(Cost $4,878,163) | | | 4,878,163 | | | 4,878,163 | |

| | | | |

|

| |

Total Investments in Securities (Cost $257,334,445) | | | | | | 324,258,872 | |

Due From Broker(b) — 17.2% | | | | | | 55,669,765 | |

Securities Sold Short — (16.3%) | | | | | | (52,791,200 | ) |

Options Written — (0.2%) | | | | | | (515,035 | ) |

Other Liabilities in Excess of Other Assets — (1.0%) | | | | | | (3,384,777 | ) |

| | | | |

|

| |

Net Assets — 100% | | | | | $ | 323,237,625 | |

| | | | |

|

| |

Net Asset Value Per Share | | | | | $ | 11.28 | |

| | | | |

|

| |

| | | | | | | |

SECURITIES SOLD SHORT | | | | | | | |

| | | | | | | |

Ishares Russell 2000 | | | 420,000 | | $ | (33,373,200 | ) |

Ishares Russell 2000 Value | | | 30,000 | | | (2,428,500 | ) |

Midcap SPDR Trust Series 1 | | | 110,000 | | | (16,989,500 | ) |

| | | | |

|

| |

Total Securities Sold Short (proceeds $48,455,301) | | | | | $ | (52,791,200 | ) |

| | | | |

|

| |

The accompanying notes form an integral part of these financial statements.

32

PARTNERS III OPPORTUNITY FUND

Schedule of Investments in Securities, Continued

| | | | | | | | | | |

| | Expiration date/

Strike price | | Shares

subject

to option | | Value | |

| |

| |

| |

| |

OPTIONS WRITTEN* | | | | | | | | | | |

| | | | | | | | | | |

Covered Call Options | | | | | | | | | | |

| | | | | | | | | | |

AutoZone, Inc. | | June 2007 / $125 | | | 25,000 | | $ | (187,500 | ) |

Cabela’s, Inc. - CL A | | June 2007 / $25 | | | 100,000 | | | (130,000 | ) |

IAC/InterActiveCorp | | July 2007 / $40 | | | 50,000 | | | (60,000 | ) |

SLM Corp. | | July 2007 / $45 | | | 51,900 | | | (46,710 | ) |

| | | | | | | |

|

| |

| | | | | | | | | (424,210 | ) |

| | | | | | | |

|

| |

| | | | | | | | | | |

Put Options | | | | | | | | | | |

| | | | | | | | | | |

SLM Corp. | | July 2007 / $40 | | | 51,900 | | | (90,825 | ) |

| | | | | | | |

|

| |

Total Options Written

(premiums received $727,917) | | | | | | | | $ | (515,035 | ) |

| | | | | | | |

|

| |

| |

* | Non-income producing |

| |

† | Non-controlled affiliate |

| |

# | Illiquid and/or restricted security that has been fair valued. |

| |

(a) | Rate presented represents the annualized 7-day yield at March 31, 2007. |

| |

(b) | Fully or partially pledged as collateral on securities sold short and outstanding written options

(see Note 9). |

The accompanying notes form an integral part of these financial statements.

33

BALANCED FUND

March 31, 2007

Dear Fellow Shareholder:

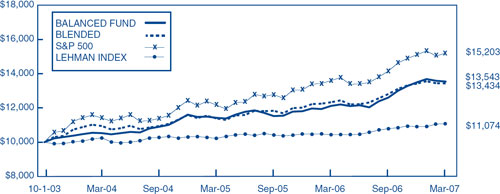

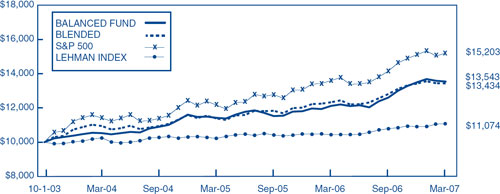

The Balanced Fund had a solid fiscal year ended March 31, 2007, with a total return of 11.8% versus 9.5% for our primary benchmark, the Blended Index†. For the first calendar quarter both the Fund and the Blended Index† posted modest positive returns.

The table below shows the results of the Balanced Fund over various time periods through March 31, 2007, along with the Blended Index†, the S&P 500 (stocks) and the Lehman Brothers Intermediate U.S. Government/Credit Index (bonds).

| | | | | | | | | | | | | | | | |

| | Total Returns* | | Average Annual

Total Returns* | |

| |

| |

| |

| | 3-Mos. | | 1-Year. | | 2-Year | | 3-Year | | Since

Inception | |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | |

Balanced Fund | | 0.3 | % | | 11.8 | % | | 8.9 | % | | 8.8 | % | | 9.0 | % | |

| | | | | | | | | | | | | | | | |

Blended Index†# | | 1.0 | | | 9.5 | | | 8.7 | | | 7.1 | | | 8.8 | | |

S&P 500# | | 0.6 | | | 11.8 | | | 11.8 | | | 10.1 | | | 12.7 | | |

Lehman Brothers Intermediate U.S. Government/Credit Index# | | 1.6 | | | 6.1 | | | 4.1 | | | 2.6 | | | 3.0 | | |

These performance numbers reflect the deduction of the Fund’s annual operating expenses which as stated in its most recent Prospectus are 1.15% of the Fund’s net assets. This information represents past performance and past performance does not guarantee future results. The investment return and the principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be higher or lower than the performance data quoted above. Performance data current to the most recent month end may be obtained at www.weitzfunds.com/performance/monthly.asp.

| |

* | Fund inception date: October 1, 2003. All performance numbers assume reinvestment of dividends. |

| |

† | The Blended Index reflects an unmanaged portfolio of 60% of the S&P 500, which is an unmanaged index of common stock prices, and 40% of the Lehman Brothers Intermediate U.S. Government/Credit Index, which is an unmanaged index consisting of government securities and publicly issued corporate debt with maturities from one to ten years. |

| |

# | Index performance is hypothetical and is for illustrative purposes only. |

Fiscal 2007 in Review

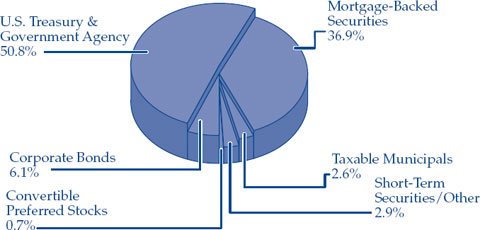

By all measures it was a very good fiscal year. The Balanced Fund posted strong double-digit returns, outpacing the Blended Index† by a comfortable margin and nearly matching the return of the all-stock S&P 500. Relatively broad-based gains in the Fund’s stocks accounted for the vast majority of our returns. Bonds contributed modestly to results as we maintained our conservative stance on interest rate and credit risk.

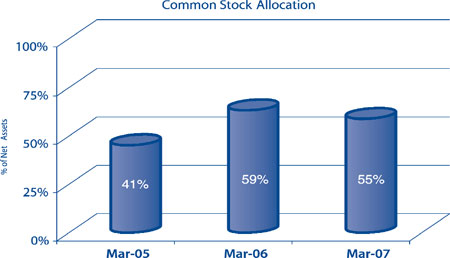

Several media and retail companies were among the Fund’s biggest gainers for the fiscal year. Cable companies Comcast and Liberty Global rose 49% and 55%, respectively, as both grew cash flow at healthy double-digit rates and their stocks rebounded from severely depressed levels. Liberty Media issued two tracking stocks that both had good years, yet remain cheap. Together their combined return was 40% for the fiscal year. Retailers AutoZone (+29%), Cabela’s (+21%) and IAC/InterActiveCorp (+28%) all grew business values at least in line with expectations. After a year of strong gains, we trimmed our aggregate exposure to media and consumer stocks from 30% of the portfolio a year ago to 20% today.

34

Redwood Trust (+34%) was another of the Fund’s best performers despite the recent turmoil in the mortgage markets. The company has navigated difficult industry conditions extremely well to date, limiting exposure to the most at-risk corners of the mortgage market and building excess capital. Redwood’s existing investments will not be immune if housing conditions materially worsen. Still, we think the company should have the staying power to ride out storms, and the firepower to opportunistically purchase new assets as warranted. We have concentrated our mortgage-related investments in companies like Redwood that we think may find ways to benefit over the long term from market disruptions.

Other companies that contributed to the Fund’s results ranged from the very large (Berkshire Hathaway +21%) to the very small (Coinstar +21%). Tyco International quietly returned 19% as management prepared to split the business into three separate companies next quarter. Telephone and Data Systems continued to grow wireless subscribers and collect cash from its rural wireline customers. Along the way, investors rediscovered telecom services and sent the stock up 49% for the year.

In the midst of this mostly upbeat news, we did book a permanent loss on our investment in Career Education Corporation. Our initial investment thesis overestimated the resilience of the company’s business in the face of intense competitive and regulatory pressures. When this became clear we sold the stock, which has since rebounded, at a loss. Fortunately, the tuition for this humbling experience was modest.

Portfolio Update

Last month our research group had the unique opportunity to spend a full day offsite with the Fund’s Board of Trustees. The centerpiece of the day was an investment discussion highlighting the work of our analysts. Our aim was to provide the Board with a better understanding of the often behind-the-scenes efforts that help form our investment decisions. Analysts presented a diverse collection of company case studies, which underscored the wide-ranging contributions of our talented team. The following snapshots of our recent purchases provide a flavor for the group’s latest efforts.

David Perkins is the primary analyst on American Express, this quarter’s largest addition to the portfolio at 1.6% of assets. Amex is among the best businesses we own. The company has a dominant payments franchise, a gold-plated consumer brand and a solidly entrenched competitive position. The company’s largely fee-based, spend-centric business is less capital intensive and more stable than the more common lend-centric credit model. Amex’s closed loop architecture also allows it to collect complete transaction data, information that is useful both to Amex and its merchants in tailoring rewards and customer offers. The overall business has a greater than 30% return on equity and generates substantial cash flow. American Express returns roughly two-thirds of capital generated to shareholders via share repurchases and dividends. The company is reinvesting the other third in three segments with even better financial returns, which is uncommon for a company of this size. We think the three- to five-year total return potential for this unique and durable business is exceptional.

Dave is also the primary analyst for TD Ameritrade, a leading online discount broker headquartered here in Omaha. The company has strong brand recognition, scale in a business where it matters, tremendous operating leverage and a business that throws off cash flow. While the trading platform is still the company’s calling card, last year’s merger with TD Waterhouse helped diversify the business mix. The deal added a sizable pool of long-term investor accounts and assets, a physical branch network and a platform to serve the back-office needs of independent financial advisors. We believe the combined company has significant revenue growth prospects in attractive markets, plus additional cost saving opportunities from integrating operations. The stock appears to be very cheap compared to earnings potential looking out a year or two, and in the meantime the company continues to use its cash flow to buy back stock.

35

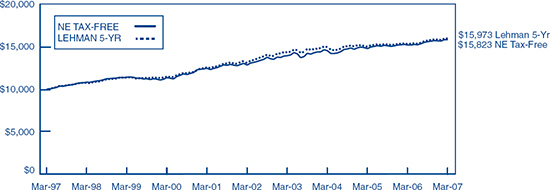

Since last summer our team has spent quite a bit of time sifting through a variety of housing-related companies. The current residential housing environment is depressed, and the pain may last longer and cut deeper than people anticipate. Still, demographic trends combined with our nation’s aging housing stock seem to point to the possibility of a more favorable long-term outlook. Our approach has been to focus strictly on top-tier businesses, those with strong market positions, high returns on capital through cycles and abundant reinvestment opportunities. Two in particular have compelling multi-year prospects that we think should trump the near-term challenges reflected in their stock prices.