| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

|

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| |

| MANAGEMENT INVESTMENT COMPANIES |

| |

| Investment Company Act file number 811- 21416 |

| |

| John Hancock Tax-Advantaged Dividend Income Fund |

| (Exact name of registrant as specified in charter) |

| |

| 601 Congress Street, Boston, Massachusetts 02210 |

| (Address of principal executive offices) (Zip code) |

|

| Salvatore Schiavone |

| Treasurer |

| |

| 601 Congress Street |

| |

| Boston, Massachusetts 02210 |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: 617-663-4497 |

| |

| |

| Date of fiscal year end: | December 31 |

| |

| |

| Date of reporting period: | June 30, 2009 |

ITEM 1. REPORT TO SHAREHOLDERS.

Portfolio summary

| | | | |

| Top 10 holdings1 | | | | |

|

| Progress Energy, Inc. | 3.3% | | DTE Energy Co. | 2.8% |

| |

|

| OGE Energy Corp. | 3.2% | | Atmos Energy Corp. | 2.7% |

| |

|

| Bank of America Corp., 8.625%, | | | Vectren Corp. | 2.7% |

| Ser MER | 3.2% | |

|

| | Duquesne Light Co., 6.500% | 2.6% |

| NSTAR | 2.9% | |

|

| | CH Energy Group, Inc. | 2.6% |

| Spectra Energy Corp. | 2.9% | |

|

| | |

| |

| Industry composition1,2 | | | | |

|

| Multi-utilities | 33% | | Diversified banks | 4% |

| |

|

| Electric utilities | 21% | | Oil & gas storage & transportation | 3% |

| |

|

| Diversified financial services | 18% | | Life & health insurance | 2% |

| |

|

| Gas utilities | 8% | | Oil & gas exploration & production | 2% |

| |

|

| Wireless telecommunication services | 4% | | Short-term investments & other sectors | 5% |

| |

|

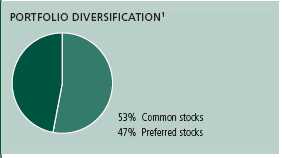

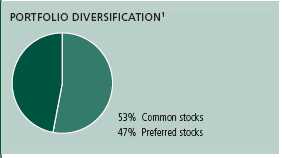

1 As a percentage of the Fund’s total investments on June 30, 2009.

2 Investments concentrated in one industry may fluctuate more widely than investments diversified across industries. Because the Fund may focus on particular industries, its performance may depend on the performance of those industries.

| |

| 6 | Tax-Advantaged Dividend Income Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

Fund’s investments

Securities owned by the Fund on 6-30-09 (unaudited)

| | |

| | Shares | Value |

|

| Common stocks 79.58% | | $356,328,420 |

|

| (Cost $433,895,281) | | |

| | | |

| Electric Utilities 14.37% | | 64,333,350 |

|

| American Electric Power Co., Inc. (Z) | 540,000 | 15,600,600 |

|

| Duke Energy Corp. (Z) | 685,000 | 9,994,150 |

|

| Great Plains Energy, Inc. (Z) | 40,000 | 622,000 |

|

| Pinnacle West Capital Corp. (Z) | 215,000 | 6,482,250 |

|

| Progress Energy, Inc. (Z) | 585,000 | 22,130,550 |

|

| Southern Co. (Z) | 305,000 | 9,503,800 |

| | | |

| Gas Utilities 8.86% | | 39,671,072 |

|

| Atmos Energy Corp. (Z) | 741,800 | 18,574,672 |

|

| Northwest Natural Gas Co. (Z) | 130,000 | 5,761,600 |

|

| ONEOK, Inc. (Z) | 520,000 | 15,334,800 |

| | | |

| Industrial Conglomerates 1.20% | | 5,391,200 |

|

| General Electric Co. (Z) | 460,000 | 5,391,200 |

| | | |

| Integrated Oil & Gas 2.19% | | 9,779,700 |

|

| BP PLC, SADR | 80,000 | 3,814,400 |

|

| Total SA ADR (Z) | 110,000 | 5,965,300 |

| | | |

| Integrated Telecommunication Services 0.93% | | 4,177,249 |

|

| Alaska Communications Systems Group, Inc. (Z) | 55,000 | 402,600 |

|

| AT&T, Inc. | 90,000 | 2,235,600 |

|

| Fairpoint Communications, Inc. | 4,248 | 2,549 |

|

| Verizon Communications, Inc. | 50,000 | 1,536,500 |

| | | |

| Multi-Utilities 45.94% | | 205,714,214 |

|

| Ameren Corp. (Z) | 555,000 | 13,813,950 |

|

| Black Hills Corp. (Z) | 535,000 | 12,299,650 |

|

| CH Energy Group, Inc. (Z) | 375,000 | 17,512,500 |

|

| Consolidated Edison, Inc. (Z) | 310,000 | 11,600,200 |

|

| Dominion Resources, Inc. (Z) | 375,000 | 12,532,500 |

|

| DTE Energy Co. (Z) | 600,000 | 19,200,000 |

|

| Integrys Energy Group, Inc. (Z) | 580,000 | 17,394,200 |

|

| NiSource, Inc. (Z) | 790,500 | 9,217,230 |

|

| NSTAR (Z) | 610,000 | 19,587,100 |

|

| OGE Energy Corp. (Z) | 775,000 | 21,948,000 |

|

| PNM Resources, Inc. (Z) | 58,000 | 621,180 |

|

| Public Service Enterprise Group, Inc. (Z) | 330,000 | 10,767,900 |

|

| TECO Energy, Inc. (Z) | 387,800 | 4,626,454 |

|

| Vectren Corp. (Z) | 785,000 | 18,392,550 |

|

| Xcel Energy, Inc. (Z) | 880,000 | 16,200,800 |

See notes to financial statements

| |

| Semiannual report | Tax-Advantaged Dividend Income Fund | 7 |

F I N A N C I A L S T A T E M E N T S

| | |

| | Shares | Value |

| Oil & Gas Storage & Transportation 4.37% | | $19,542,600 |

|

| Spectra Energy Corp. (Z) | 1,155,000 | 19,542,600 |

| | | |

| Publishing 0.00% | | 995 |

|

| Idearc, Inc. (I) | 26,830 | 995 |

| | | |

| Wireless Telecommunication Services 1.72% | | 7,718,040 |

|

| Vodafone Group PLC, ADR (Z) | 396,000 | 7,718,040 |

| |

| | Shares | Value |

|

| Preferred stocks 71.07% | | $318,263,264 |

|

| (Cost $398,443,644) | | |

| | | |

| Broadcasting & Cable TV 0.59% | | 2,631,749 |

|

| CBS Corp., 7.250% | 145,000 | 2,631,749 |

| | | |

| Cable & Satellite 0.64% | | 2,876,460 |

|

| Comcast Corp., 7.000% (Z) | 125,500 | 2,876,460 |

| | | |

| Consumer Finance 1.13% | | 5,074,750 |

|

| HSBC Finance Corp., 6.360%, Depositary | | |

| Shares, Ser B (Z) | 150,000 | 2,385,000 |

|

| HSBC Holdings, 8.125% (Z) | 50,000 | 1,189,500 |

|

| SLM Corp., 6.970%, Ser A (Z) | 42,500 | 1,500,250 |

| | | |

| Diversified Banks 5.36% | | 24,016,995 |

|

| Royal Bank of Scotland Group PLC, 5.750%, | | |

| SADR, Ser L | 858,500 | 8,370,375 |

|

| USB Capital VIII, 6.350%, Ser 1 | 55,000 | 1,198,450 |

|

| Wells Fargo & Co., 8.000% (Z) | 647,900 | 14,448,170 |

| | | |

| Diversified Financial Services 27.64% | | 123,761,738 |

|

| ABN AMRO Capital Funding Trust VII, 6.080%, | | |

| Ser G | 983,000 | 11,255,350 |

|

| Bank of America Corp., 6.204%, Depositary | | |

| Shares, Ser D (Z) | 240,000 | 4,420,800 |

|

| Bank of America Corp., 6.375%, Ser 3 (Z) | 139,000 | 2,267,090 |

|

| Bank of America Corp., 6.625%, Ser I (Z) | 355,000 | 5,946,250 |

|

| Bank of America Corp., 6.700% (Z) | 500,000 | 8,500,000 |

|

| Bank of America Corp., 8.200% (Z) | 185,000 | 3,653,750 |

|

| Bank of America Corp., 8.625%, Ser MER | 1,057,800 | 21,452,184 |

|

| Citigroup Capital VIII, 6.950% | 522,300 | 8,090,427 |

|

| Citigroup, Inc., 8.125%, Depositary Shares, Ser AA | 343,050 | 6,408,174 |

|

| Citigroup, Inc., 8.500%, Ser F | 125,000 | 2,335,000 |

|

| Deutsche Bank Capital Funding Trust VIII, | | |

| 6.375% (Z) | 282,000 | 5,183,160 |

|

| Deutsche Bank Contingent Capital Trust II, | | |

| 6.550% (Z) | 310,000 | 5,573,800 |

|

| Deutsche Bank Contingent Capital Trust III, | | |

| 7.600% (Z) | 797,893 | 15,750,409 |

|

| ING Groep NV, 6.200% (Z) | 109,100 | 1,617,953 |

|

| ING Groep NV, 7.050% (Z) | 140,000 | 2,308,600 |

|

| JPMorgan Chase & Co., 5.490%, Ser G (Z) | 256,100 | 10,500,100 |

|

| JPMorgan Chase & Co., 5.720%, Ser F (Z) | 15,100 | 622,271 |

|

| JPMorgan Chase & Co., 6.150%, Ser E (Z) | 98,000 | 4,238,500 |

|

| JPMorgan Chase & Co., 8.625% (Z) | 143,000 | 3,637,920 |

See notes to financial statements

| |

| 8 | Tax-Advantaged Dividend Income Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

| | |

| | Shares | Value |

| Electric Utilities 17.52% | | $78,435,843 |

|

| Alabama Power Co., 5.300%, Class A (Z) | 176,500 | 3,657,080 |

|

| Carolina Power & Light Co., 5.440% (Z) | 111,493 | 9,577,951 |

|

| Duquesne Light Co., 6.500% (Z) | 427,000 | 17,547,053 |

|

| Entergy Arkansas, Inc., 4.560% (Z) | 9,388 | 640,438 |

|

| Entergy Arkansas, Inc., 4.560%, Ser 1965 (Z) | 9,818 | 669,772 |

|

| Entergy Arkansas, Inc., 6.450% (Z) | 110,000 | 2,227,500 |

|

| Entergy Mississippi, Inc., 4.920% (Z) | 8,190 | 588,913 |

|

| Entergy Mississippi, Inc., 6.250% (Z) | 197,500 | 4,912,812 |

|

| FPC Capital I, 7.100%, Ser A (Z) | 70,000 | 1,704,500 |

|

| FPL Group Capital Trust I, 5.875% (Z) | 260,000 | 6,136,000 |

|

| Interstate Power & Light Co., 7.100%, Ser C (Z) | 20,700 | 513,567 |

|

| Interstate Power & Light Co., 8.375%, Ser B (Z) | 233,000 | 6,139,550 |

|

| PPL Electric Utilities Corp., 6.250%, Depositary Shares (Z) | 300,000 | 6,459,390 |

|

| PPL Energy Supply LLC, 7.000% (Z) | 297,512 | 7,476,477 |

|

| Southern California Edison Co., 6.000%, Ser C (Z) | 30,000 | 2,236,875 |

|

| Southern California Edison Co., 6.125% (Z) | 50,000 | 3,851,565 |

|

| Xcel Energy, Inc., 4.560%, Ser G (Z) | 53,900 | 4,096,400 |

| | | |

| Gas Utilities 3.17% | | 14,217,693 |

|

| Southern Union Co., 7.550%, Ser A | 602,700 | 14,217,693 |

| | | |

| Investment Banking & Brokerage 0.01% | | 29,699 |

|

| Lehman Brothers Holdings, Inc., 5.670%, | | |

| Depositary Shares, Ser D (H) | 65,000 | 3,900 |

|

| Lehman Brothers Holdings, Inc., 5.940%, | | |

| Depositary Shares, Ser C (H) | 274,760 | 13,738 |

|

| Lehman Brothers Holdings, Inc., 6.500%, | | |

| Depositary Shares, Ser F (H) | 219,300 | 12,061 |

| | | |

| Life & Health Insurance 3.58% | | 16,029,000 |

|

| Metlife, Inc., 6.500%, Ser B (Z) | 780,000 | 16,029,000 |

| | | |

| Multi-Utilities 3.73% | | 16,710,030 |

|

| BGE Capital Trust II, 6.200% | 147,100 | 2,794,900 |

|

| Constellation Energy Group, Inc., 8.625% | 300,000 | 6,579,000 |

|

| Pacific Enterprises, 4.500% (Z) | 45,000 | 3,330,000 |

|

| Public Service Electric & Gas Co., 5.050%, Ser D | 22,987 | 1,953,895 |

|

| Public Service Electric & Gas Co., 5.280%, Ser E | 22,930 | 2,052,235 |

| | | |

| Oil & Gas Exploration & Production 3.40% | | 15,228,675 |

|

| Nexen, Inc., 7.350% | 742,500 | 15,228,675 |

| | | |

| Specialized Finance 0.49% | | 2,216,500 |

|

| CIT Group, Inc., 6.350%, Ser A | 310,000 | 2,216,500 |

| | | |

| U.S. Government Agency 0.02% | | 80,400 |

|

| Federal National Mortgage Assn. (8.250% to | | |

| 12-31-10 then variable) (I) | 60,000 | 80,400 |

| | | |

| Wireless Telecommunication Services 3.79% | | 16,953,732 |

|

| Telephone & Data Systems, Inc., 7.600%, Ser A | 430,000 | 8,836,500 |

|

| United States Cellular Corp., 7.500% | 398,294 | 8,117,232 |

See notes to financial statements

| |

| Semiannual report | Tax-Advantaged Dividend Income Fund | 9 |

F I N A N C I A L S T A T E M E N T S

| | | | |

| | | Maturity | | |

| | Rate | date | Shares | Value |

|

| Short-term investments 0.51% | | | | $2,300,000 |

| (Cost $2,300,000) | | | | |

| | | | | |

| U.S. Government Agency 0.51% | | | | 2,300,000 |

|

| Federal Home Loan Bank Discount Notes | 0.010% | 7/1/09 | 2,300,000 | 2,300,000 |

|

| Total investments (Cost $834,638,925)† 151.16% | | | $676,891,684 |

|

| Other assets and liabilities, net (51.16%) | | | ($229,099,829) |

|

| Total net assets 100.00% | | | | $447,791,855 |

|

The percentage shown for each investment category is the total value of that category as a percentage of the net assets.

ADR American Depositary Receipts

SADR Sponsored American Depositary Receipts

(H) Non-income-producing issuer that has filed for protection under the Federal Bankruptcy Code and/or is in default of interest payment.

(I) Non-income-producing security.

(Z) All or a portion of this security is pledged as collateral for the Committed Facility Agreement (see Note 9). Total collateral value at June 30, 2009 was $507,427,652.

† At June 30, 2009, the aggregate cost of investment securities for federal income tax purposes was $845,273,909. Net unrealized depreciation aggregated $168,382,225, of which $115,685,667 related to appreciated investment securities and $284,067,892 related to depreciated investment securities.

See notes to financial statements

| |

| 10 | Tax-Advantaged Dividend Income Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

Financial statements

Statement of assets and liabilities 6-30-09 (unaudited)

This Statement of Assets and Liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value for each common share.

| |

| Assets | |

|

| Investments, at value (Cost $834,638,925) | $676,891,684 |

| Dividends and interest receivable | 2,939,207 |

| Due from adviser | 938 |

| Prepaid trustee expenses | 27,122 |

| Other receivables and prepaid assets | 9,193 |

| Total assets | 679,868,144 |

|

| Liabilities | |

|

| Due to custodian | 254,014 |

| Payable for investments purchased | 641,886 |

| Committed facility agreement payable (Note 9) | 226,300,000 |

| Unrealized depreciation of swap contracts (Note 3) | 4,742,562 |

| Interest payable | 18,724 |

| Payable to affiliates | |

| Accounting and legal services fees | 29,257 |

| Management fees | 4,691 |

| Other liabilities and accrued expenses | 85,155 |

| Total liabilities | 232,076,289 |

| |

| Net assets | |

|

| Capital paid-in | 726,751,902 |

| Accumulated distributions in excess of net investment income | (5,215,018) |

| Accumulated net realized gain (loss) on investments and swap agreements | (111,255,226) |

| Net unrealized appreciation (depreciation) on investments and swap | |

| agreements | (162,489,803) |

| Net assets | $447,791,855 |

| |

| Net asset value per share | |

|

| Based on 38,400,117 shares of beneficial interest outstanding — | |

| Unlimited number of shares authorized with no par value. | $11.66 |

See notes to financial statements

| |

| Semiannual report | Tax-Advantaged Dividend Income Fund | 11 |

F I N A N C I A L S T A T E M E N T S

Statement of operations For the period ended 6-30-09 (unaudited)1

This Statement of Operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| |

| Investment income | |

|

| Dividends (net of foreign withholding taxes of $26,099) | $25,638,339 |

| Interest | 2,666 |

| Total investment income | 25,641,005 |

| |

| Expenses | |

|

| Investment management fees (Note 6) | 2,337,096 |

| Transfer agent fees (Note 6) | 18,660 |

| Accounting and legal services fees (Note 6) | 82,374 |

| Trustees’ fees (Note 6) | 22,546 |

| Printing and postage fees (Note 6) | 122,613 |

| Professional fees | 67,181 |

| Custodian fees | 48,755 |

| Registration and filing fees | 20,315 |

| Interest expense (Note 9) | 1,961,297 |

| Miscellaneous | 2,911 |

| | |

| Total expenses | 4,683,748 |

| Less expense reductions (Note 6) | (520,970) |

| | |

| Net expenses | 4,162,778 |

| |

| Net investment income | 21,478,227 |

| |

| Realized and unrealized gain (loss) | |

|

| Net realized gain (loss) on | |

| Investments | (90,349,075) |

| Swap contracts | (329,294) |

| | (90,678,369) |

| Change in net unrealized appreciation (depreciation) of | |

| Investments | 64,370,708 |

| Swap contracts | (116,832) |

| | 64,253,876 |

| Net realized and unrealized loss | (26,424,493) |

| Decrease in net assets from operations | ($4,946,266) |

1 Semiannual period from 1-1-09 to 6-30-09.

See notes to financial statements

| |

| 12 | Tax-Advantaged Dividend Income Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

Statements of changes in net assets

These Statements of Changes in Net Assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| | |

| | Six months | Year |

| | ended | ended |

| | 6-30-091 | 12-31-08 |

|

| Increase (decrease) in net assets | | |

| From operations | | |

| Net investment income | $21,478,227 | $45,341,667 |

| Net realized loss | (90,678,369) | (10,172,908) |

| Change in net unrealized appreciation (depreciation) | 64,253,876 | (273,056,724) |

| Distributions to APS | — | (6,127,843) |

| | | |

| Decrease in net assets resulting from operations | (4,946,266) | (244,015,808) |

| | | |

| Distributions to shareholders | | |

| From net investment income | (26,672,127)2 | (39,254,688) |

| From net realized gain | — | (6,140,997) |

| From tax return of capital | — | (17,698,324) |

| | | |

| Total distributions | (26,672,127) | (63,094,009) |

| | | |

| From Fund share transactions (Note 7) | (859,412) | (53,556,991) |

| | | |

| Total decrease | (32,477,805) | (360,666,808) |

| |

| Net assets | | |

|

| Beginning of period | 480,269,660 | 840,936,468 |

| End of period | $447,791,855 | $480,269,660 |

| Accumulated distributions in excess of net investment income | ($5,215,018) | ($21,118) |

1 Semiannual period from 1-1-09 to 6-30-09. Unaudited.

2 A portion of the distributions may be deemed a tax return of capital at year-end.

See notes to financial statements

| |

| Semiannual report | Tax-Advantaged Dividend Income Fund | 13 |

F I N A N C I A L S T A T E M E N T S

Statement of cash flows 6-30-09 (unaudited)

This statement of cash flows shows cash flow from operating and financing activities for the period stated.

| |

| | For the |

| | period ended |

| | 6-30-09 |

|

| Cash flows from operating activities | |

|

| Net decrease in net assets from operations | ($4,946,266) |

| | |

| Net decrease in net assets from operations excluding distributions to | (4,946,266) |

| preferred shareholders | |

| | |

| Adjustments to reconcile net decrease in net assets from operations to net | |

| cash provided by operating activities: | |

| Investments purchased | (616,918,149) |

| Investments sold | 641,347,247 |

| Net amortization of premium (discount) | (39,106) |

| Decrease in dividends and interest receivable | (129,011) |

| Decrease in receivable from affiliates | (9,234) |

| Increase in payable for investments purchased | 386,911 |

| Increase in receivable for investments sold | 11,723,642 |

| Decrease in prepaid Committed Facility Agreement administration fees | (107,250) |

| Decrease in unrealized depreciation of swap contracts | (116,832) |

| Decrease in payable to affiliates | (24,892) |

| Increase in interest payable | 3,508 |

| Decrease in accrued expenses | (67,764) |

| Net change in unrealized (appreciation) depreciation on investments | (64,370,708) |

| Net realized gain on investments | 90,349,075 |

| | |

| Net cash provided by operating activities | $57,081,171 |

|

| Cash flows from financing activities | |

|

| Repayments of committed facility agreement payable | (40,900,000) |

| Repurchase of common shares | (859,412) |

| Distributions to common shareholders | (26,672,127) |

| | |

| Net cash used in financing activities | ($68,431,539) |

| | |

| Net decrease in cash | ($11,350,368) |

| | |

| Cash at beginning of period | $11,096,354 |

| | |

| Cash at end of period | ($254,014) |

|

| Supplemental disclosure of cash flow information | |

|

| Cash paid for interest | $7,575,010 |

See notes to financial statements

| |

| 14 | Tax-Advantaged Dividend Income Fund | Semiannual report |

F I N A N C I A L S T A T E M E N T S

Financial highlights

The Financial Highlights show how the Fund’s net asset value for a share has changed since the end of the previous period.

| | | | | | |

| COMMON SHARES | | | | | | |

| Period ended | 6-30-091 | 12-31-08 | 12-31-07 | 12-31-06 | 12-31-052 | 12-31-042,3 |

| Per share operating performance | | | | | |

|

| Net asset value, beginning | | | | | | |

| of year | $12.48 | $19.99 | $22.90 | $19.93 | $20.48 | 19.104 |

| Net investment income5 | 0.56 | 1.13 | 1.26 | 1.436 | 1.22 | 1.14 |

| Net realized and unrealized | | | | | | |

| gain (loss) on investments | (0.69) | (7.07) | (1.98) | 3.62 | (0.23) | 1.54 |

| Distribution to APS | — | (0.15) | (0.41) | (0.39) | (0.29) | (0.29) |

| Total from investment | | | | | | |

| operations | (0.13) | (6.09) | (1.13) | 4.66 | 0.70 | 2.39 |

| Less distributions to common | | | | | | |

| shareholders | | | | | | |

| From net investment income | (0.69)20 | (0.99) | (1.19) | (1.16) | (1.16) | (0.87) |

| From net realized gain | — | (0.15) | (0.59) | (0.53) | (0.09) | — |

| From tax return of capital | — | (0.44) | — | — | — | — |

| Total distributions | (0.69) | (1.58) | (1.78) | 1.69 | (1.25) | (0.87) |

| Anti-dilutive impact of | | | | | | |

| repurchase plan | —7 | 0.167 | — | — | — | — |

| Capital charges | | | | | | |

| Offering costs related to | | | | | | |

| common shares | — | — | — | — | — | (0.02) |

| Offering costs and underwriting | | | | | | |

| discounts related to APS | — | — | — | — | — | (0.12) |

| Net asset value, end of year | $11.66 | $12.48 | $19.99 | $22.90 | $19.93 | 20.48 |

| Per share market value, end | | | | | | |

| of year | $10.04 | $10.30 | $17.90 | $20.32 | $16.81 | $17.99 |

| Total return at net asset value | | | | | | |

| (%)8,11 | 1.299 | (29.97) | (4.19) | (25.67)10 | 4.4410 | 12.859,10 |

| Total return at market value | | | | | | |

| (%)8 | 5.689 | (35.46) | (3.32) | (32.21) | 0.28 | (5.47)9,12 |

|

| Ratios and supplemental data | | | | | | |

|

| Net assets applicable to | | | | | | |

| common shares, end of year | | | | | | |

| (in millions) | $448 | $480 | $841 | $964 | $838 | $862 |

| Ratios (as a percentage of | | | | | | |

| average net assets): | | | | | | |

| Expenses before reductions | | | | | | |

| (excluding interest expense) | 1.4113 | 1.42 | 1.2714 | 1.2814 | 1.3214 | 1.2313,14 |

| Interest expense (Note 10) | 1.0113 | 0.87 | — | — | — | — |

| Expenses before reductions | | | | | | |

| (including interest expense) | 2.4213 | 2.29 | 1.2714 | 1.2814 | 1.3214 | 1.2313,14 |

| Expenses net of all fee | | | | | | |

| waivers (excluding interest | | | | | | |

| expense) | 1.1413 | 1.12 | 0.99 | 1.00 | 1.03 | 0.9513 |

| Expenses net of all fee | | | | | | |

| waivers (including interest | | | | | | |

| expense) | 2.1513 | 1.99 | 0.9915 | 1.0015 | 1.0315 | 0.9513,15 |

| Net investment income | 11.0813 | 7.02 | 5.6516 | 6.7616 | 5.9716 | 6.1113,16 |

| Portfolio turnover (%) | 9 | 29 | 26 | 41 | 24 | 42 |

See notes to financial statements

| |

| Semiannual report | Tax-Advantaged Dividend Income Fund | 15 |

F I N A N C I A L S T A T E M E N T S

Financial highlights (continued)

| | | | | | |

| Period ended | 6-30-091 | 12-31-08 | 12-31-07 | 12-31-06 | 12-31-052 | 12-31-042,3 |

|

| Senior securities | | | | | | |

|

| Total value of APS outstanding | | | | | |

| (in millions) | — | — | $380 | $380 | $380 | $380 |

| Involuntary liquidation | | | | | | |

| preference per unit (in | | | | | | |

| thousands) | — | — | $25 | $25 | $25 | $25 |

| Average market value per unit | | | | | | |

| (in thousands) | — | — | $25 | $25 | $25 | $25 |

| Asset coverage per unit17 | — | — | $81,737 | $88,352 | $79,901 | $79,542 |

| Total debt outstanding end of | | | | | |

| period (in millions) (Note 9) | $226 | $267 | — | — | — | — |

| Asset coverage per $1,000 of | | | | | | |

| APS18 | — | — | $3,212 | $3,536 | $3,207 | $3,268 |

| Asset coverage per $1,000 of | | | | | | |

| debt19 | $2,979 | $2,797 | — | — | — | — |

| |

1 Semiannual period from 1-1-09 to 6-30-09. Unaudited.

2 Audited by previous Independent Registered Public Accounting Firm.

3 Commencement of operations period from 2-27-04 to 12-31-04.

4 Reflects the deduction of a $0.90 per share sales load.

5 Based on the average of the shares outstanding.

6 Net investment income per share and the ratio of net investment income to average net assets reflects a special dividend received by the Fund for the periods ended June 30 and December 31, 2008, which amounted to $0.13 per share and 0.63% of average net assets, respectively.

7 The repurchase plan was completed at an average repurchase price of $9.79 and $14.92, respectively, for 87,800 shares and 3,589,570 shares, respectively. The redemptions for the periods ended June 30, 2009 and December 31, 2008 were $859,412 and $53,556,991, respectively, and had a less than $0.005 and $0.16 NAV impact, respectively.

8 Total return based on net asset value reflects changes in the Fund’s net asset value during each period. Total return based on market value reflects changes in market value. Each figure assumes that dividend and capital gain distributions, if any, were reinvested. These figures will differ depending upon the level of any discount from or premium to net asset value at which the Fund’s shares traded during the period.

9 Not annualized.

10 Unaudited.

11 Total returns would have been lower had certain expenses not been reduced during the periods shown.

12 Assumes dividend reinvestment and a purchase at $20.01 per share on the inception date and a sale at the current market price on the last day of the period.

13 Annualized.

14 Ratios calculated on the basis of gross expenses relative to the average net assets of common shares that does not take into consideration expense reductions during the periods shown. Without the exclusion of preferred shares, the annualized ratios of expenses would have been 0.89%, 0.91%, 0.90% and 0.90% for the years ended 12-31-04, 12-31-05, 12-31-06 and 12-31-07, respectively.

15 Ratios calculated on the basis of net expenses relative to the average net assets of common shares. Without the exclusion of preferred shares, the annualized ratios of expenses would have been 0.69%, 0.71%, 0.70% and 0.70% for the years ended 12-31-04, 12-31-05, 12-31-06 and 12-31-07, respectively.

16 Ratios calculated on the basis of net investment income relative to the average net assets of common shares. Without the exclusion of preferred shares, the annualized ratio of net investment income would have been 4.42%, 4.14%, 4.74% and 4.03% for the years ended 12-31-04, 12-31-05, 12-31-06 and 12-31-07, respectively.

17 Calculated by subtracting the Fund’s total liabilities from the Fund’s total assets and dividing that amount by the number of APS outstanding, as of the applicable 1940 Act Evaluation Date, which may differ from the financial reporting date.

18 Asset coverage equals the total net assets plus APS divided by the APS of the Fund outstanding at period end (Note 8).

19 Asset coverage equals the total net assets plus borrowings divided by the committed facility agreement of the Fund outstanding at period end (Note 8).

20 A portion of the distributions may be deemed a tax return of capital at year-end.

See notes to financial statements

| |

| 16 | Tax-Advantaged Dividend Income Fund | Semiannual report |

Notes to financial statements (unaudited)

Note 1 Organization

John Hancock Tax-Advantaged Dividend Income Fund (the Fund) is a closed-end diversified management investment company registered under the Investment Company Act of 1940, as amended. The Fund began operations February 27, 2004.

Note 2

Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. The following summarizes the significant accounting policies of the Fund:

Security valuation

Investments are stated at value as of the close of the regular trading on the New York Stock Exchange (NYSE), normally at 4:00 p.m., Eastern Time. Equity securities held by the Fund are valued at the last sale price or official closing price (closing bid price or last evaluated price if no sale has occurred) as of the close of business on the principal securities exchange (domestic or foreign) on which they trade. Debt obligations are valued based on the evaluated prices provided by an independent pricing service, which utilizes both dealer-supplied and electronic data processing techniques, which take into account factors such as institutional-size trading in similar groups of secur ities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rates supplied by an independent pricing service. Securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Equity and debt obligations, for which there are no prices available from an independent pricing service, are valued based on broker quotes or fair valued as described below. Certain short-term debt instruments are valued at amor tized cost.

Other portfolio securities and assets for which market quotations are not readily available are valued at fair value as determined in good faith by the Fund’s Pricing Committee in accordance with procedures adopted by the Board of Trustees. Generally, trading in non-U.S. securities is substantially completed each day at various times prior to the close of trading on the NYSE. The values of such securities used in computing the net asset value of the Fund’s shares are generally determined as of such times. Occasionally, significant events that affect the values of such securities may occur between the times at which such values are generally determined and the close of the NYSE. Upon such an occurrence, these securities will be valued at fair value as determined in good faith under consistently applied procedures established by and under the general supervision of the Board of Trustees.

Valuations change in response to many factors including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general economic and market conditions, interest rates, investor perceptions and market liquidity.

Fair value measurements

The Fund uses a three-tier hierarchy to prioritize the assumptions, referred to as inputs, used in valuation techniques to measure fair value. The three-tier hierarchy of inputs and the valuation techniques used are summarized below:

Level 1 – Exchange traded prices in active markets for identical securities. This technique is used for exchange-traded domestic common and preferred equities, certain foreign equities, warrants, rights, options and futures. In addition, investment companies, including mutual funds, are valued using this technique.

| |

| Semiannual report | Tax-Advantaged Dividend Income Fund | 17 |

Level 2 – Prices determined using significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk. Prices for securities valued using these techniques are received from independent pricing vendors and are based on an evaluation of the inputs described. These techniques are used for certain domestic preferred equities, certain foreign equities, unlisted rights and warrants, and fixed income securities. Also, over-the-counter derivative contracts, including swaps, foreign forward currency contracts, and certain options use these techniques.

Level 3 – Prices determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable, such as when there is little or no market activity for an investment, unobservable inputs may be used. Unobservable inputs reflect the Fund’s Pricing Committee’s own assumptions about the factors that market participants would use in pricing an investment and would be based on the best information available. Securities using this technique are generally thinly traded or privately placed, and may be valued using broker quotes, which may not only use observable or unobservable inputs but may also include the use of the brokers’ own judgments about the assumptions that market participants would use.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Funds’ investments as of June, 30, 2009, by major security category or security type. Other financial instruments are derivative instruments not reflected in the Portfolio of Investments, such as futures, forwards, options and swap contracts, which are stated at market value.

| | | | |

| Investments in Securities | LEVEL 1 | LEVEL 2 | LEVEL 3 | TOTALS |

|

| Consumer Discretionary | $5,509,205 | — | — | $5,509,205 |

|

| Energy | 58,768,668 | — | — | 58,768,668 |

|

| Financials | 171,209,082 | — | — | 171,209,082 |

|

| Industrials | 5,391,200 | — | — | 5,391,200 |

|

| Telecommunications | 28,849,020 | — | — | 28,849,020 |

|

| Utilities | 356,152,240 | $48,712,269 | — | 404,864,509 |

|

| Short-term | — | 2,300,000 | — | 2,300,000 |

|

| Totals | $625,879,415 | $51,012,269 | — | $676,891,684 |

| Other Financial | — | ($4,742,562) | — | ($4,742,562) |

| Instruments | | | | |

|

| Total | $625,879,416 | $46,269,707 | — | $672,149,122 |

Security transactions and related

investment income

Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Foreign dividends are recorded on the ex-date or when the Fund becomes aware of the dividends from cash collections. Discounts/premiums are accreted/ amortized for financial reporting purposes.

Non-cash dividends are recorded at the fair market value of the securities received. Debt obligations may be placed in a non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful. The Fund uses identified cost method for determining realized gain or loss on investments for both financial statement and federal income tax reporting purposes.

| |

| 18 | Tax-Advantaged Dividend Income Fund | Semiannual report |

Overdrafts

Pursuant to the custodian agreement, the Custodian may, in its discretion, advance funds to the Fund to make properly authorized payments. When such payments result in an overdraft, the Fund is obligated to repay the Custodian for any overdraft, including any costs or expenses associated with the overdraft. The Custodian has a lien, security interest or security entitlement in any Fund property, that is not segregated, to the maximum extent permitted by law to the extent of any overdraft.

Expenses

The majority of expenses are directly identifi-able to an individual fund. Fund expenses that are not readily identifiable to a specific fund are allocated in such a manner as deemed equitable, taking into consideration, among other things, the nature and type of expense and the relative size of the funds. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Statement of cash flows

The cash amount shown in the Statement of cash flows of a Fund is the amount included in the Fund’s Statement of Assets and Liabilities and represents the cash on hand at its custodian and does not include any short-term investments.

Federal income taxes

The Fund qualifies as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

For federal income tax purposes, the Fund has $9,941,872 of a capital loss carryforward available, to the extent provided by regulations, to offset future net realized capital gains. To the extent that such carryforward is used by the Fund, it will reduce the amount of capital gain distribution to be paid. The loss carryforward expires as follows: December 31, 2016 — $9,941,872.

As of June 30, 2009, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition, or disclosure. Each of the Fund’s federal tax returns filed in the 3-year period ended December 31, 2008 remains subject to examination by the Internal Revenue Service.

Distribution of income and gains

The Fund records distributions to shareholders from net investment income and net realized gains, if any, on the ex-dividend date. The Fund generally declares and pays dividends monthly. Capital gains, if any, are distributed annually. During the year ended December 31, 2008, the tax character of distributions paid was as follows: ordinary income $49,582,867, long-term capital gain $1,940,661 and return of capital $17,698,324.

Such distributions, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capital. The final determination of tax characteristics of the Fund’s distributions will occur at the end of the year at which time it will be reported to shareholders.

Note 3

Financial instruments

The Fund has adopted the provisions of Statement of Financial Accounting Standards No. 161, Disclosures about Derivative Instruments and Hedging Activities (FAS 161). This new standard requires the Fund to disclose information to assist investors in understanding how the Fund uses derivative instruments, how derivative instruments are accounted for under Statement of Financial Accounting Standards No. 133, Accounting for Derivative Instruments and Hedging Activities (FAS 133) and how derivative instruments affect the Fund’s financial position, results of operations and Statements of Changes in net assets. This disclosure for the period ended June 30, 2009 is presented in accordance with FAS 161 and is included as part of the Notes to the Financial Statements.

| |

| Semiannual report | Tax-Advantaged Dividend Income Fund | 19 |

Swap contracts

The Fund may enter interest rate, credit default, cross-currency, and other forms of swaps to manage its exposure to credit, currency and interest rate risks, to gain exposure in lieu of buying in the physical market, or to enhance income. Swaps are privately negotiated agreements between counterparties to exchange cash flows, assets, foreign currencies or market-linked returns at specified intervals. In connection with these agreements, the Fund will hold cash and/ or liquid securities equal to the net amount of the Fund’s exposure, in order to satisfy the Fund’s obligations in the event of default or bankruptcy/insolvency.

Swaps are marked to market daily based upon values from third party vendors or quotations from market makers to the extent available, and the change in value, if any, is recorded as unrealized appreciation/depreciation on the Fund’s Statement of Assets and Liabilities. If market quotations are not readily available or not deemed reliable, certain swaps may be fair valued in good faith by the Fund’s Pricing Committee in accordance with procedures adopted by the Board of Trustees.

Entering into swaps involves, to varying degrees, elements of credit, market and documentation risk in excess of the amounts recognized on the Statement of Assets and Liabilities. Such risks involve the possibility that there will be no liquid market for these agreements that a counterparty may default on its obligation under the swap or disagree as to the meaning of the swap’s terms, and that there may be unfavorable interest rate changes. The Fund may also suffer losses if it is unable to terminate outstanding swaps or reduce its exposure through offsetting transactions.

The Fund is a party to International Swap Dealers Association, Inc., Master Agreements (“ISDA Master Agreements”) with select counterparties that govern over the counter derivative transactions, which may include foreign exchange derivative transactions, entered into by the Fund and those counterparties. The ISDA Master Agreements typically include standard representations and warranties, as well as a Credit Support Annex (“CSA”) that accompanies a schedule to ISDA master agreements provisions outlining the general obligations of the Fund and counterparties relating to events of default, termination events and other standard provisions. Termination events may include a decline in the Fund’s net asset value below a certain point over a certain period of time that is specified in the Schedule to the ISDA Mas ter Agreement; such an event may entitle the counterparty to elect to terminate early and calculate damages based on that termination, with respect to some or all outstanding transactions under the applicable damage calculation provisions of the ISDA Master Agreement. An election by one or more counterparties to terminate ISDA Master Agreements could have a material impact in the financial statements of the Fund.

Interest rate swap agreements

Interest rate swaps represent an agreement between two counterparties to exchange cash flows based on the difference in the two interest rates, applied to the notional principal amount for a specified period. The payment flows are usually netted against each other, with the difference being paid by one party to the other. The Fund settles accrued net receivable or payable under the swap contracts on a periodic basis.

The Fund had the following interest rate swap contract open on June 30, 2009:

| | | | | |

| | FIXED PAYMENTS | VARIABLE PAYMENTS | TERMINATION | | UNREALIZED |

| NOTIONAL AMOUNT | MADE BY FUND | RECEIVED BY FUND | DATE | COUNTERPARTY | DEPRECIATION |

|

| $95,000,000 | 3.600% | 3-month LIBOR (a) | Jan 2011 | Bank of America | ($4,742,562) |

| (a) At June 30, 2009, the 3-month LIBOR rate was 0.590%. | | |

| |

| 20 | Tax-Advantaged Dividend Income Fund | Semiannual report |

During the period ended June 30, 2009, the Fund used interest rate swaps to manage against interest rate changes. Notional amounts of interest rate swaps at June 30, 2009 are representative of the interest rate swap activity.

Fair value of derivative instruments by risk category

The table below summarizes the fair values of derivatives held by the Fund at June 30, 2009 by risk category:

| | | | |

| DERIVATIVES NOT ACCOUNTED FOR | STATEMENT OF ASSETS | FINANCIAL | ASSET | LIABILITY |

| AS HEDGING INSTRUMENTS UNDER | AND LIABILITIES | INSTRUMENTS | DERIVATIVES FAIR | DERIVATIVES |

| FAS 133 | LOCATION | LOCATION | VALUE | FAIR VALUE |

|

| Interest rate contracts | Unrealized | Interest rate | — | ($4,742,562) |

| | depreciation of | swap contracts | | |

| | swap contracts | | | |

|

| Total | | | — | ($4,742,562) |

Effect of derivative instruments on the Statement of Operations

The table below summarizes the realized gain (loss) recognized in the net increase (decrease) in net assets from operations, classified by derivative instrument and risk category for the period ended June 30, 2009:

| | |

| DERIVATIVES NOT ACCOUNTED | | |

| FOR AS HEDGING INSTRUMENTS | | |

| UNDER FAS 133 | SWAPS | TOTAL |

|

| Statement of Operations location — Net realized | | |

| gain (loss) on | Swap contracts | |

| Interest rate contracts | ($329,294) | ($329,294) |

| Total | ($329,294) | ($329,294) |

The table below summarizes the change in unrealized appreciation (depreciation) recognized in the net increase (decrease) in net assets from operations, classified by derivative instrument and risk category for the period ended June 30, 2009:

| | |

| DERIVATIVES NOT ACCOUNTED | | |

| FOR AS HEDGING INSTRUMENTS | | |

| UNDER FAS 133 | SWAPS | TOTAL |

|

| Statement of Operations location — Change in | | |

| unrealized appreciation (depreciation) on | Swap contracts | |

| Interest rate contracts | ($116,832) | ($116,832) |

| Total | ($116,832) | ($116,832) |

Note 4

Risk and uncertainties

Derivatives and counterparty risk

The use of derivative instruments may involve risks different from, or potentially greater than, the risks associated with investing directly in securities. Specifically, derivative instruments expose the Fund to the risk that the counterparty to an over-the-counter (OTC) derivatives contract will be unable or unwilling to make timely settlement payments or otherwise to honor its obligations. OTC derivatives transactions typically can only be closed out with the other party to the transaction. If the counterparty defaults, the Fund will have contractual remedies, but there is no assurance that the counterparty will meet its contractual obligations or that, in the event of default, the Fund will succeed in enforcing them.

Sector risk — utilities industry

Fund performance will be closely tied to a single sector of the economy, which may underperform other sectors over any given period of time. Utilities can be hurt by higher interest costs in connection

| |

| Semiannual report | Tax-Advantaged Dividend Income Fund | 21 |

with capital construction programs, costs associated with environmental and other regulations and the effects of economic declines, surplus capacity and increased competition. Accordingly, the concentration may make the Fund’s value more volatile and investment values may rise and fall more rapidly.

Sector risk — financial services

The Fund may concentrate investments in a particular industry, sector of the economy or invest in a limited number of companies. The concentration is closely tied to a single sector of the economy which may cause the Fund to underperform other sectors. Specifically, financial services companies can be hurt by economic declines, changes in interest rates, regulatory and market impacts. Accordingly, the concentration may make the Fund’s value more volatile and investment values may rise and fall more rapidly.

Leverage utilization risk

The Fund utilizes leverage to increase assets available for investment. See Note 8 for risks associated with the utilization of leverage.

Note 5

Guarantees and indemnifications

Under the Fund’s organizational documents, its Officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

Note 6

Management fee and transactions with

affiliates and others

The Fund has an investment management contract with John Hancock Advisers, LLC (the Adviser), a wholly owned subsidiary of John Hancock Financial Services, Inc., a subsidiary of Manulife Financial Corporation (MFC). Under the investment management contract, the Fund pays a daily management fee to the Adviser at an annual rate of 0.75% of the Fund’s average daily net asset value and the value attributed to the committed facility agreement (see Note 8) (collectively, managed assets). The Fund and the Adviser have subadvisory agreements with MFC Global Investment Management (U.S.), LLC, a subsidiary of John Hancock Financial Services, Inc., and Analytic Investors, LLC. The Fund is not responsible for payment of subadvisory fees.

Effective July 2009, the Fund has implemented a covered call options strategy (“options strategy”), which is managed by Analytic Investors, LLC. The Fund is limited to writing options on no more than 30% of its total assets.

The Adviser has contractually agreed to limit the Fund’s management fee to the following: 0.55% of the Fund’s average daily managed assets until the fifth anniversary of the commencement of the Fund’s operations, 0.60% of such assets in the sixth year, 0.65% of such assets in the seventh year and 0.70% of average daily managed assets in the eighth year. After the eighth year, the Adviser will no longer waive a portion of the management fee. Accordingly, the expense reductions related to the reduction in the management fee amounted to $520,970 for the period ended June 30, 2009. The effective rate for the period ended June 30, 2009 is 0.58% of the Fund’s average daily net asset value.

The Fund has an agreement with the Adviser and affiliates to perform necessary tax, accounting, compliance, legal and other administrative services of the Fund. The accounting and legal services fees incurred for the period ended June 30, 2009, were equivalent to an annual effective rate of less than 0.03% of the Fund’s average daily net assets.

Mr. James R. Boyle is Chairman of the Adviser, as well as affiliated Trustee of the Fund, and is compensated by the Adviser and/or its affiliates. Mr. John G. Vrysen is a Board member of the Adviser, as well as affiliated Trustee of the Fund, and is compensated by the Adviser and/or its affiliates. The compensation of unaffiliated Trustees is borne by the Fund. The unaffiliated Trustees may elect to defer, for tax purposes, their receipt of this compensation under the John Hancock Group of Funds

| |

| 22 | Tax-Advantaged Dividend Income Fund | Semiannual report |

Deferred Compensation Plan. The Fund makes investments into other John Hancock funds, as applicable, to cover its liability for the deferred compensation. Investments to cover the Fund’s deferred compensation liability are recorded on the Fund’s books as an other asset. The deferred compensation liability and the related other asset are always equal and are marked to market on a periodic basis to reflect any income earned by the investments, as well as any unrealized gains or losses. The Deferred Compensation Plan investments had no impact on the operations of the Fund.

The Fund is listed for trading on the NYSE and has filed with the NYSE its chief executive officer certification regarding compliance with the NYSE’s listing standards. The Fund also files with the Securities and Exchange Commission the certification of its chief executive officer and chief financial officer required by Section 302 of the Sarbanes-Oxley Act.

Note 7

Fund share transactions

Common shares

In December 2007, the Board of Trustees approved a share repurchase plan. Under the plan, the Fund may repurchase in the open market up to 10% of its outstanding common shares. The plan was in effect until December 31, 2008. On December 8, 2008, the Board of Trustees approved a subsequent repurchase plan. Under the plan, the Fund may repurchase in the open market up to 10% of its outstanding common shares. The plan will remain in effect until December 31, 2009.

During the periods ended June 30, 2009 and December 31, 2008, the Fund repurchased 87,800 (0.22% of shares outstanding) and 3,589,570 (8.53% of shares outstanding) of its common shares, respectively. The corresponding dollar amount of the share repurchase amounted to $859,412 and $53,556,991 for the periods ended June 30, 2009 and December 31, 2008, respectively.

Note 8

Leverage

The Fund utilizes a Committed Facility Agreement (CFA) to increase its assets available for investment. In prior fiscal periods, the Fund used Auctioned Preferred Shares (APS) for leverage. When the Fund leverages its assets, common shareholders pay all fees associated with and have the potential to benefit from leverage. Consequently, the Fund and the Adviser may have differing interests in determining whether to leverage the Fund’s assets. Leverage creates risks which may adversely affect the return for the holders of common shares, including:

• the likelihood of greater volatility of net asset value and market price of common shares

• fluctuations in the interest rate paid for the use of the credit facility

• increased operating costs, which may reduce the Fund’s total return to the holders of common shares

• the potential for a decline in the value of an investment acquired through leverage, while the Fund’s obligations under such leverage remains fixed

• the fund is more likely to have to sell securities in a volatile market in order to meet asset coverage or other debt compliance requirements

To the extent the income or capital appreciation derived from securities purchased with funds received from leverage exceeds the cost of leverage, the Fund’s return will be greater than if leverage had not been used, conversely, return would be lower if the cost of the leverage exceeds the income or capital appreciation derived.

The Fund issued total of 15,200 APS on May 3, 2004. In May 2008, the Fund’s Trustees approved a plan whereby the Fund’s form of leverage was changed from APS to a CFA. A third party commercial bank has agreed to provide this credit facility that enabled the refinancing of the Fund’s APS to debt. The redemption of all series was completed on May 28, 2008. Below is a comparison of the leverage methods utilized by the Fund:

| |

| Semiannual report | Tax-Advantaged Dividend Income Fund | 23 |

| | |

| | APS | CFA |

|

| Required Asset Coverage | 200% | 200% (300% at time of draw) |

| | | |

| Maximum Leverage | $380 million | $351 million |

| amount | | |

| | | |

| Costs Associated | Dividends paid to preferred | Interest expense (one month LIBOR |

| with Leverage | shareholders (maximum rate | (reset daily) plus 0.85%) |

| | equals the overnight commercial | |

| | paper rate plus 1.25%) | |

| |

| | APS auction fees | Arrangement fee* |

| |

| | Auction agent expenses | Commitment fees (0.60% of the |

| | | unused portion of the CFA) |

| |

| | Preferred share transfer | |

| | agent expenses | |

*Arrangement fee is $877,500 amortized over the first 270 days of the CFA.

Note 9

Committed facility agreement

Effective May 7, 2008, the Fund entered into the CFA with a third party commercial bank that allows it to borrow up to an initial limit of $351 million and to invest the borrowings in accordance with its investment practices. Borrowings under the CFA are secured by the assets of the Fund as disclosed in the Schedule of Investments. Prior to January 1, 2009, interest was charged at the overnight LIBOR rate plus 0.70%, payable monthly. Effective January 1, 2009, interest charged is one month LIBOR (reset daily) plus 0.85%. Under the terms of the CFA, the Fund also pays an arrangement fee of 0.25% in the first year of the agreement on the committed financing and commitment fees of 0.60% per annum on the unused portion of the facility. Arrangement and commitment fees for the period ended June 30, 2009 totaled $342,676 and $107,250, respectively, and are included in interest expense in the Statement of Operations. As of June 30, 2009, the Fund had borrowings of $226,300,000 at an interest rate of 1.159% which are reflected in the CFA payable on the Statement of Asset and Liabilities. The Fund may reduce or terminate the amount of the CFA upon 270 days’ notice to the lender, and it may terminate the agreement with 60 days’ notice if the Board of Trustees has determined that the elimination of all indebtedness leveraging the Fund’s investments are in the best interests of the Fund’s shareholders. In certain circumstances, the CFA may automatically termi nate, and in other specified circumstances it may be reduced to a 30-day facility. In addition, upon the occurrence of certain defaults, the lender may terminate the agreement, and it may modify or terminate the agreement upon 270 days’ notice.

Note 10

Purchase and sale of securities

Purchases and proceeds from sales or maturities of securities, other than short-term securities and obligations of the U.S. government, during the period ended June 30, 2009, aggregated $59,019,812 and $85,756,712, respectively.

Note 11

Change in fiscal year end

The Board of Trustees approved a change in the Fund’s fiscal year end from December 31 to October 31. The fiscal year end change is effective October 31, 2009.

Note 12 Subsequent events

The Fund has adopted the provisions of Statement of Financial Accounting Standards No. 165, Subsequent Events (FAS 165). The objective of FAS 165 is to establish general standards of accounting for and disclosure of events that occur after the balance sheet date but before financial statements are issued or are available to be issued.

| |

| 24 | Tax-Advantaged Dividend Income Fund | Semiannual report |

For the period ended June 30, 2009, Management has evaluated subsequent events until August 27, 2009, which is the date the financial statements were available to be issued. As of August 27, 2009, there were no material events that required adjustments or additional disclosures within the financial statements.

| |

| Semiannual report | Tax-Advantaged Dividend Income Fund | 25 |

Investment objective and policy

The Fund’s investment objective is to provide a high level of after-tax total return from dividend income and gains and capital appreciation.

Under normal market conditions, the Fund will invest at least 80% of its assets (net assets plus borrowings for investment purposes) in dividend-paying common and preferred securities that the Adviser believes at the time of acquisition are eligible to pay dividends which, for individual shareholders, qualify for U.S. federal income taxation at rates applicable to long-term capital gains, which currently are taxed at a maximum rate of 15% (“tax-advantaged dividends”). Tax-advantaged dividends generally include dividends from domestic corporations and dividends from foreign corporations that meet certain specified criteria. The Fund generally can pass the tax treatment of tax-advantaged dividends it receives through to its common shareholders.

The fund may write (sell) covered call index options on up to 30% of the value of the fund’s total assets.

On March 31, 2008, the shareholders approved the following changes to the Fund’s investment policy: To eliminate the Fund’s “concentration” policy (i.e., investing at least 25% of its net assets) with respect to securities issued by finan-cial securities corporations; to modify the Fund’s concentration policy with respect to investing in the utilities sector by permitting the Fund to invest in both U.S. and foreign utilities corporations, rather than only U.S. utilities corporations (as required under the current policy).

Dividends and distributions

During the period ended June 30, 2009, dividends from net investment income totaling $0.693 per share were paid to shareholders. The dates of payments and the amounts per share were as follows:

| | | |

| | INCOME | | |

| PAYMENT DATE | DIVIDEND1 | | |

| | |

| January 30, 2009 | $0.140 | | |

| February 27, 2009 | 0.140 | | |

| March 31, 2009 | 0.140 | | |

| April 30, 2009 | 0.091 | | |

| May 29, 2009 | 0.091 | | |

| June 30, 2009 | 0.091 | | |

| Total | $0.693 | | |

1A portion of the distributions may be deemed a tax return of capital at year-end.

Dividend reinvestment plan

The Fund offers its shareholders a Dividend Reinvestment Plan (the Plan), which offers the opportunity to earn compounded yields. Each holder of common shares may elect to have all distributions of dividends and capital gains reinvested by Mellon Investor Services, as plan agent for the common shareholders (the Plan Agent). Holders of common shares who do not elect to participate in the Plan will receive all distributions in cash, paid by check mailed directly to the shareholder of record (or, if the common shares are held in street or other nominee name, then to the nominee) by the Plan Agent, as dividend disbursing agent.

Shareholders may join the Plan by filling out and mailing an authorization card, by notifying the Plan Agent by telephone or by visiting the Plan Agent’s Web site at www.melloninvestor.com. Shareholders must indicate an election to reinvest all or a portion of dividend payments. If received in proper form by the Plan Agent before the record date of a dividend, the election will be effective with respect to all dividends paid after such record date. Shareholders whose shares are held in the name of a broker or nominee should contact the broker or nominee to determine whether and how they may participate in the Plan.

If the Fund declares a dividend payable either in common shares or in cash, nonparticipants will receive cash, and participants in the Plan will receive the equivalent in common shares.

If the market price of the common shares on the payment date of the dividend is equal to or exceeds their net asset value as determined on the payment date, participants will be issued common shares (out of authorized but

| |

| 26 | Tax-Advantaged Dividend Income Fund | Semiannual report |

unissued shares) at a value equal to the higher of net asset value or 95% of the market price. If the net asset value exceeds the market price of the common shares at such time, or if the Board of Trustees declares a dividend payable only in cash, the Plan Agent will, as agent for Plan participants, buy shares in the open market, on the New York Stock Exchange or elsewhere, for the participants’ accounts. Such purchases will be made promptly after the payable date for such dividend and, in any event, prior to the next ex-dividend date after such date, except where necessary to comply with federal securities laws. If, before the Plan Agent has completed its purchases, the market price exceeds the net asset value of the common shares, the average per share purchase price paid by the Plan Agent may exceed the net asset value of the common shares, resulting in the acquisition of fewer shares than if the dividend had been paid in shares issued by the Fund.

Each participant will pay a pro rata share of brokerage commissions incurred with respect to the Plan Agent’s open market purchases in connection with the reinvestment of dividends and distributions. In each case, the cost per share of the shares purchased for each participant’s account will be the average cost, including brokerage commissions, of any shares purchased on the open market plus the cost of any shares issued by the Fund. There will be no brokerage charges with respect to common shares issued directly by the Fund. There are no other charges to participants for reinvesting dividends or capital gain distributions.

Participants in the Plan may withdraw from the Plan at any time by contacting the Plan Agent by telephone, in writing or by visiting the Plan Agent’s Web site at www.melloninvestor.com. Such withdrawal will be effective immediately if received not less than ten days prior to a dividend record date; otherwise, it will be effective for all subsequent dividend record dates. When a participant withdraws from the Plan or upon termination of the Plan, as provided below, certificates for whole common shares credited to his or her account under the Plan will be issued, and a cash payment will be made for any fraction of a share credited to such account.

The Plan Agent maintains each shareholder’s account in the Plan and furnishes monthly written confirmations of all transactions in the accounts, including information needed by the shareholders for personal and tax records. The Plan Agent will hold common shares in the account of each Plan participant in noncertifi-cated form in the name of the participant. Proxy material relating to the shareholders’ meetings of the Fund will include those shares purchased as well as shares held pursuant to the Plan.

The reinvestment of dividends and distributions will not relieve participants of any federal income tax that may be payable or required to be withheld on such dividends or distributions. Participants under the Plan will receive tax information annually. The amount of dividend to be reported on 1099-DIV should be (1) in the case of shares issued by the Fund, the fair market value of such shares on the dividend payment date and (2) in the case of shares purchased by the Plan Agent in the open market, the amount of cash used by the Plan Agent to purchase shares in the open market, including the amount of cash allocated to brokerage commissions paid on such purchases.

Experience under the Plan may indicate that changes are desirable. Accordingly, the Fund reserves the right to amend or terminate the Plan as applied to any dividend or distribution paid subsequent to written notice of the change sent to all shareholders of the Fund at least 90 days before the record date for the dividend or distribution. The Plan may be amended or terminated by the Plan Agent after at least 90 days’ written notice to all shareholders of the Fund. All correspondence or additional information concerning the Plan should be directed to the Plan Agent, Mellon Bank, N.A., c/o Mellon Investor Services, P.O. Box 3338, South Hackensack, NJ 07606-1938 (Telephone: 1-800-852-0218).

| |

| Semiannual report | Tax-Advantaged Dividend Income Fund | 27 |

Shareholder communication and assistance

If you have any questions concerning the Fund, we will be pleased to assist you. If you hold shares in your own name and not with a brokerage firm, please address all notices, correspondence, questions or other communications regarding the Fund to the transfer agent at:

Mellon Investor Services

Newport Office Center VII

480 Washington Boulevard

Jersey City, NJ 07310

Telephone: 1-800-852-0218

If your shares are held with a brokerage firm, you should contact that firm, bank or other nominee for assistance.

Shareholder meeting (unaudited)

On April 28, 2009, an adjourned session of the Annual Meeting of the Shareholders of John Hancock Tax-Advantaged Dividend Income Fund was held at 601 Congress Street, Boston, Massachusetts for the purpose of considering and voting upon the proposals listed below:

Proposal 1: Election of six Trustees to serve until their respective successors have been duly elected and qualified.

PROPOSAL 1 PASSED FOR ALL TRUSTEES ON APRIL 28, 2009.

| | |

| | | WITHHELD |

| | FOR | AUTHORITY |

|

| Charles L. Ladner | 20,024,167 | 1,160,108 |

| Stanley Martin | 20,048,566 | 1,135,709 |

| John A. Moore | 20,030,946 | 1,153,329 |

| Gregory A. Russo | 20,063,140 | 1,121,135 |

| Deborah C. Jackson | 20,011,128 | 1,173,147 |

| John G. Vrysen | 20,058,284 | 1,125,991 |

Proposal 2: To adopt a new form of investment advisory agreement.

PROPOSAL 2 PASSED ON APRIL 28, 2009.

| | |

| For | 16,322,454 | |

| Against | 796,827 | |

| Withheld | 542,230 | |

| Broker Non-Votes | 3,522,764 | |

Proposal 3: To approve Analytic Investors, LLC as a subadviser to John Hancock Tax-Advantaged Dividend Income Fund.

PROPOSAL 3 PASSED ON APRIL 28, 2009.

| | |

| For | 16,329,593 | |

| Against | 790,532 | |

| Withheld | 541,386 | |

| Broker Non-Votes | 3,522,764 | |

| |

| 28 | Tax-Advantaged Dividend Income Fund | Semiannual report |

Evaluation by the Board of

Investment Advisory Agreement

and Subadvisory Agreements

The Investment Company Act of 1940 (the 1940 Act) requires the Board of Trustees (the Board) of John Hancock Tax-Advantaged Dividend Income Fund (the Fund), including a majority of the Trustees who have no direct or indirect interest in the investment advisory agreement and are not “interested persons” of the Fund, as defined in the 1940 Act (the Independent Trustees), annually to meet in person to review and consider the continuation of existing advisory and subadvisory agreements. At meetings held on May 6–7 and June 8–9, 2009, the Board considered the renewal of:

(i) the investment advisory agreement (the Advisory Agreement) with John Hancock Advisers, LLC (the Adviser) and

(ii) the investment subadvisory agreement (the Subadvisory Agreement) with MFC Global Investment Management (U.S.), LLC (MFC Global) for the Fund.

The Advisory Agreement and the Subadvisory Agreements are collectively referred to as the Advisory Agreements. The Board considered the factors and reached the conclusions described below relating to the selection of the Adviser and MFC Global and the continuation of the Advisory Agreements. During such meetings, the Board’s Contracts/Operations Committee and the Independent Trustees also met in executive sessions with their independent legal counsel.

In evaluating the Advisory Agreements, the Board, including the Contracts/Operations Committee and its Independent Trustees, reviewed a broad range of information requested for this purpose. The Independent Trustees considered the legal advice of independent legal counsel and relied on their own business judgment in determining the factors to be considered in evaluating the materials that were presented to them and the weight to be given to each such factor. The Board’s review and conclusions were based on a comprehensive consideration of all information presented to the Board and not the result of any single controlling factor. The key factors considered by the Board and the conclusions reached are described below.

Nature, extent and quality of services

The Board considered the ability of the Adviser and MFC Global, based on their resources, reputation and other attributes, to attract and retain qualified investment professionals, including research, advisory, and supervisory personnel. It considered the background and experience of senior management and investment professionals responsible for managing the Fund. The Board considered the investment philosophy, research and investment decision-making processes of the Adviser and MFC Global, which are responsible for the investment activities of the Fund. The Board considered MFC Global’s history and experience with the Fund. The Board considered the Adviser’s execution of its oversight responsibilities. The Board further considered the culture of compliance, resources dedicated to compliance, compliance programs, record of compliance with applicable laws and regulation, with the Fund’s investment policies and restrictions and with the applicable Code of Ethics, and the responsibilities of the Adviser’s and MFC Global’s compliance department. In addition, the Board took into account the administrative and other non-advisory services provided to the Fund by the Adviser and its affiliates.

Based on the above factors, together with those referenced below, the Board concluded that, within the context of its full deliberations, the nature, extent and quality of the investment advisory services provided to the Fund by the Adviser and MFC Global supported renewal of the Advisory Agreements.

Fund performance

The Board noted that the Fund had less than five full years of operational history and considered the performance results for the Fund over 1- and 3-year time periods ended December 31, 2008. The Board also considered these results in comparison to the performance of a category of relevant funds (the Category), a peer group of comparable funds (the Peer Group) and a benchmark index. The funds within each Category and Peer Group were selected by Morningstar Inc. (Morningstar), an independent provider of

| |

| Semiannual report | Tax-Advantaged Dividend Income Fund | 29 |

investment company data. The Board reviewed the methodology used by Morningstar to select the funds in the Category and the Peer Group, and noted the imperfect comparability of the Peer Group. The Board also considered updated performance information at its May and June 2009 meetings. Performance and other information may be quite different as of the date of this shareholders report.

The Board viewed favorably that the Fund’s performance for the time periods under review was higher than the performance of the Peer Group and Category medians, and appreciably higher than the performance of its benchmark index, the Merrill Lynch Preferred Stock DRD Eligible Index.

Investment advisory fee and subadvisory fee

rates and expenses

The Board reviewed and considered the contractual investment advisory fee rate payable by the Fund to the Adviser for investment advisory services (the Advisory Agreement Rate). The Board received and considered information comparing the Advisory Agreement Rate with the advisory fees for the Category and Peer Group. The Board noted that the Advisory Agreement Rate was inline with the Category median and not appreciably higher than the Peer Group median.

The Board received and considered expense information regarding the Fund’s various components, including advisory fees, and other non-advisory fees, including transfer agent fees, custodian fees, and other miscellaneous fees (e.g., fees for accounting and legal services). The Board considered comparisons of these expenses to the Peer Group median. The Board also received and considered expense information regarding the Fund’s total operating expense ratio (Gross Expense Ratio) and total operating expense ratio after taking the fee waiver arrangement applicable to the Advisory Agreement Rate into account (Net Expense Ratio). The Board received and considered information comparing the Gross Expense Ratio and Net Expense Ratio of the Fund to that of the Category and Peer Group medians. The Board noted that Gross Expense Ratio was higher than the Category and Peer Group medians. The Board also n oted that the Net Expense Ratio was equal to the Category median and inline with the Peer Group median.

The Adviser also discussed the Morningstar data and rankings, and other relevant information, for the Fund. Based on the above-referenced considerations and other factors, the Board concluded that the Fund’s overall performance and expense results supported the re-approval of the Advisory Agreements.

The Board also received information about the investment subadvisory fee rate (the Subadvisory Agreement Rate) payable by the Adviser to MFC Global for investment subad-visory services. The Board concluded that the Subadvisory Agreement Rates were fair and equitable, based on its consideration of the factors described here.

Profitability

The Board received and considered a detailed profitability analysis of the Adviser based on the Advisory Agreements, as well as on other relationships between the Fund and the Adviser and its affiliates, including MFC Global. The Board also considered a comparison of the Adviser’s profitability to that of other similar investment advisers whose profit-ability information is publicly available. The Board concluded that, in light of the costs of providing investment management and other services to the Fund, the profits and other ancillary benefits reported by the Adviser were not unreasonable.

Economies of scale

The Board received and considered general information regarding economies of scale with respect to the management of the Fund, including the Fund’s ability to appropriately benefit from economies of scale under the Fund’s fee structure. The Board recognized the inherent limitations of any analysis of economies of scale, stemming largely from the Board’s understanding that most of the Adviser’s and MFC Global’s costs are not specific to individual Funds, but rather are incurred across a variety of products and services.

The Board observed that the Advisory Agreements did not offer breakpoints. However, the Board considered the limited relevance of economies of scale in the context